0000891478ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossClassifiedAsHeldForTradingCategoryMembersan:OtherValuationTechniquesMembersan:IRSMembersan:FavourableScenarioMemberifrs-full:Level3OfFairValueHierarchyMember2021-12-310000891478san:MrLuisIsasiFernandezDeBobadillaMembersan:ResponsibleBankingSustainabilityAndCultureCommitteeMember2021-01-012021-12-310000891478ifrs-full:GrossCarryingAmountMemberifrs-full:CountryOfDomicileMember2021-12-310000891478san:DepositsCustomersMembersrt:SouthAmericaMember2020-12-310000891478san:InterestRateAndExchangeRateRiskMemberifrs-full:CurrencySwapContractMemberifrs-full:FairValueHedgesMember2021-01-012021-12-310000891478ifrs-full:InterestRateRiskMembersan:GrupoSantanderUkMemberifrs-full:LaterThanThreeMonthsAndNotLaterThanOneYearMemberifrs-full:FairValueHedgesMember2019-12-310000891478san:SharesavePlanMembersan:SantanderUKPLCMember2008-01-012008-12-310000891478ifrs-full:CountryOfDomicileMemberifrs-full:FinancialInstrumentsNotCreditimpairedMembersan:SpeculationGradeMemberifrs-full:LifetimeExpectedCreditLossesMember2021-12-310000891478san:ForborneLoanPortfolioMember2021-01-012021-12-31

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the year ended December 31, 2021

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

BANCO SANTANDER, S.A.

TABLE OF CONTENTS

Y

A Under this title we include information that updates 'Part 3. Supplemental information - 6. Supplement to the operating and financial review disclosure in the directors’ report. Consolidated income statement. Variations 2020 compared to 2019 for the Group and by primary and secondary segments' in our 2021 Form 20-F which incorporated by reference (i) 'Part 1. Consolidated Directors´ Report-Economic and Financial review. Section 3.2' in our 2020 Form 20-F; and (ii) 'Section 1. Certain financial information included in Banco Santander, S.A.’s 2020 Form 20-F retrospectively recast as a result of certain changes in the primary and secondary segments of Banco Santander, S.A. and its subsidiaries. Item 4. Financial information by segment. 2020 vs 2019' in our 6-K filed with the SEC on 14 April 2021.

Section1

Certain financial information included in Banco Santander, S.A.’s 2021 Form 20-F retrospectively recast as a result of certain changes in the primary and secondary segments of Banco Santander, S.A. and its subsidiaries.

1.Cross reference to Form 20-F

| | | | | | | | | | | |

| Form 20-F Item Number and Caption | Location | Page |

| Presentation of Financial and Other Information | Section 1. 2 Presentation of financial and other information | |

| Cautionary Statement Regarding Forward-Looking Statements | Section 1. 3 Cautionary statement regarding forward- looking statements | |

| PART I | | | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | | |

| A. Directors and Senior Management | Not required for Annual Report on Form 20-F | - |

| B. Advisers | Not required for Annual Report on Form 20-F | - |

| C. Auditors | Not required for Annual Report on Form 20-F | - |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | | |

| A. Offer Statistics | Not required for Annual Report on Form 20-F | - |

| B. Method and Expected Timetable | Not required for Annual Report on Form 20-F | - |

| ITEM 3. | KEY INFORMATION | | |

| Selected financial data | No material changes derived from the recast | - |

| A. [Reserved] | | |

| B. Capitalization and indebtedness | Not required for Annual Report on Form 20-F | - |

| C. Reasons for the offer and use of proceeds | Not required for Annual Report on Form 20-F | - |

| D. Risk factors | No material changes derived from the recast | - |

| ITEM 4. | INFORMATION ON THE COMPANY | | |

| A. History and development of the company | No material changes derived from the recast | - |

| Acquisitions, Dispositions, Reorganizations | No material changes derived from the recast | - |

| Capital Increases | No material changes derived from the recast | - |

| Recent Events | No material changes derived from the recast | - |

| B. Business overview | Section 1. 4 Financial information by segment: 2021 vs 2020 | |

| | Section 1. 5 Financial information by segment: 2020 vs 2019 | |

| Selected Statistical information | No material changes derived from the recast | - |

| Competition in Spain | No material changes derived from the recast | - |

| Supervision and Regulation | No material changes derived from the recast | - |

| C. Organizational structure | No material changes derived from the recast | - |

| D. Property, plant and equipment | No material changes derived from the recast | - |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | No material changes derived from the recast | - |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | |

| A. Operating results | Section 1. 4 Financial information by segment: 2021 vs 2020 | |

| | Section 1. 5 Financial information by segment: 2020 vs 2019 | |

| B. Liquidity and capital resources | No material changes derived from the recast | - |

| Tabular disclosure of contractual obligations | No material changes derived from the recast | - |

| Off balance sheet arrangements | No material changes derived from the recast | - |

| C. Research and development, patents and licenses, etc. | No material changes derived from the recast | - |

| D. Trend information | No material changes derived from the recast | - |

| E. Critical accounting estimates | No material changes derived from the recast | - |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | |

| A. Directors and senior management | No material changes derived from the recast | - |

| B. Compensation | No material changes derived from the recast | - |

| C. Board practices | No material changes derived from the recast | - |

| D. Employees | No material changes derived from the recast | - |

| E. Share ownership | No material changes derived from the recast | - |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | |

| A. Major shareholders | No material changes derived from the recast | - |

| | | | | | | | | | | |

| Form 20-F Item Number and Caption | Location | Page |

| B. Related party transactions | No material changes derived from the recast | - |

| C. Interests of experts and counsel | Not required for Annual Report on Form 20-F | - |

| ITEM 8. | FINANCIAL INFORMATION | | |

| A. Consolidated statements and other financial information | | |

| Financial statements | No material changes derived from the recast | |

| Legal proceedings | No material changes derived from the recast | - |

| Shareholders remuneration | No material changes derived from the recast | - |

| B. Significant Changes | Not applicable | - |

| ITEM 9. | THE OFFER AND LISTING | | |

| A. Offer and listing details | No material changes derived from the recast | - |

| B. Plan of distribution | Not required for Annual Report on Form 20-F | - |

| C. Markets | No material changes derived from the recast | - |

| D. Selling shareholders | Not required for Annual Report on Form 20-F | - |

| E. Dilution | Not required for Annual Report on Form 20-F | - |

| F. Expenses of the issue | Not required for Annual Report on Form 20-F | - |

| ITEM 10. | ADDITIONAL INFORMATION | | |

| A. Share capital | Not required for Annual Report on Form 20-F | - |

| B. Memorandum and articles of association | No material changes derived from the recast | - |

| C. Material contracts | No material changes derived from the recast | - |

| D. Exchange controls | No material changes derived from the recast | - |

| E. Taxation | No material changes derived from the recast | - |

| F. Dividends and paying agents | Not required for Annual Report on Form 20-F | - |

| G. Statement by experts | Not required for Annual Report on Form 20-F | - |

| H. Documents on display | No material changes derived from the recast | - |

| I. Subsidiary information | Not required for Annual Report on Form 20-F | - |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | Section 1. 7 Other segment information | |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | |

| A. Debt securities | Not required for Annual Report on Form 20-F | - |

| B. Warrants and rights | Not required for Annual Report on Form 20-F | - |

| C. Other securities | Not required for Annual Report on Form 20-F | - |

| D. American Depositary Shares | No material changes derived from the recast | - |

| PART II | | | |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | Not applicable | - |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | Not applicable | - |

| ITEM 15. | CONTROLS AND PROCEDURES | No material changes derived from the recast | - |

| ITEM 16 | [Reserved] | | |

| A. Audit committee financial expert | No material changes derived from the recast | - |

| B. Code of ethics | No material changes derived from the recast | - |

| C. Principal accountant fees and services | No material changes derived from the recast | - |

| D. Exemptions from the listing standards for audit committees | Not applicable | - |

| E. Purchases of equity securities by the issuer and affiliated purchasers | No material changes derived from the recast | - |

| F. Change in registrant’s certifying accountant | Not applicable | - |

| G. Corporate governance | No material changes derived from the recast | - |

| H. Mine safety disclosure | Not applicable | - |

| I. Disclosure regarding foreign jurisdictions that prevent inspections | Not applicable | - |

| PART III | | | |

| ITEM 17. | FINANCIAL STATEMENTS | Section 2. Consolidated financial statements | |

| ITEM 18. | FINANCIAL STATEMENTS | Section 2. Consolidated financial statements | |

| | | | | | | | | | | |

| Form 20-F Item Number and Caption | Location | Page |

| ITEM 19 | EXHIBITS | Exhibits | |

| | | |

2. Presentation of financial and other information

Explanatory Note

We are filing this report on Form 6-K to recast our segment financial information and related disclosure for the three years ended 31 December 2021 which were included in our annual report on Form 20-F for the fiscal year ended 31 December 2021 filed with the Securities and Exchange Commission (SEC) on 1 March 2022 (the '2021 Form 20-F'), in order to reflect our new reporting structure.

On 4 April 2022, we announced that, starting and effective with the financial information for the first quarter of 2022, we will carry out changes in our reportable segments to reflect our new reporting structure.

These changes in our reportable segments aim to align the segment information to how segments and units are managed and have no impact at the Group level. The main changes, which have been applied to segment information for all periods included in the consolidated financial statements, are the following:

1.Reallocation of certain financial costs from the Corporate Centre to the country units.

•Further clarity in the minimum requirement for own funds and eligible liabilities (MREL) and total loss absorbing capacity (TLAC) regulation makes it possible to allocate the cost of the eligible debt issuances to the country units.

•Other financial costs, primarily associated with the cost of funding the excess capital held by the country units above the Group's CET1 ratio, have been reassigned from the Corporate Centre to the country units.

2.Downsizing of Other Europe

•The Corporate & Investment Banking branches of Banco Santander, S.A. in Europe and other business lines previously reported under 'Other Europe' have been now integrated into the Spain unit to reflect how the business will be managed and supervised.

The Group recast the corresponding information of earlier periods to reflect these changes in the structure of its internal organization.

In addition to these changes, we have done the annual adjustment of the perimeter of the Global Customer Relationship Model between Retail Banking and Santander Corporate & Investment Banking and between Retail Banking and Wealth Management & Insurance.

In this report we have included only such disclosure as was impacted by the revisions described above and have only revised such disclosure to reflect such revisions. This report does not, and does not purport to, recast the information in any other part of the 2021 Form 20-F filed on 1 March 2022 or update any information in such Form 20-F to reflect any events that have occurred after its filing. References in this report to our consolidated financial statements shall be deemed to refer to our recast consolidated financial statements and related notes that are also included in this Form 6-K. This Form 6-K should be read in conjunction with the above mentioned 2021 Form 20-F and our other filings with the SEC.

Accounting principles

Under Regulation (EC) No. 1606/2002 of the European Parliament and of the Council of 19 July 2002, all companies governed by the law of an EU Member State (a 'Member State') and whose securities are admitted to trading on a regulated market of any Member State must prepare their consolidated financial statements in conformity with the International Financial Reporting Standards as previously adopted by the European Union ('EU-IFRS'). The Bank of Spain Circular 4/2004 of 22 December 2004 on Public and Confidential Financial Reporting Rules and Formats ('Circular 4/2004') required Spanish credit institutions to adapt their accounting systems to the principles derived from the adoption by the European Union of International Financial Reporting Standards. This Circular was repealed on 1 January 2018 by Bank of Spain Circular 4/2017, of 27 November 2017 on Public and Confidential Financial Reporting Rules and Formats ('Circular 4/2017'). Therefore, Grupo Santander (the 'Group' or 'Santander') is required to prepare its consolidated financial statements for the years ended 31 December 2021, 31 December 2020 and 31 December 2019 in conformity with EU-IFRS and Bank of Spain’s Circular 4/2017. Differences between EU-IFRS, Bank of Spain’s Circulars and International Financial Reporting Standards as issued by the International Accounting Standards Board ('IFRS-IASB') are not material. Therefore, we assert that the financial information contained in this report on Form 6-K complies with IFRS-IASB.

Our auditors, PricewaterhouseCoopers Auditores, S.L., an independent registered public accounting firm, have audited our consolidated financial statements in respect of the years ended 31 December 2021, 2020 and 2019 in accordance with IFRS-IASB. See pages 76, 77 and 78 in Section 2 of this Form 6-K for the audit report issued by PricewaterhouseCoopers Auditores, S.L.

We have presented our financial information according to the classification format for banks used in Spain. We have not reclassified the line items to comply with Article 9 of Regulation S-X. Article 9 is a regulation of the U.S. Securities and Exchange Commission that contains presentation requirements for bank holding company financial statements.

General information

Our consolidated financial statements included in Section 2 of this Form 6-K are in Euros, which are denoted 'euro', 'euros', 'EUR' or '€' throughout this annual report. Also, throughout this annual report, when we refer to:

•'we', 'us', 'our', the 'Group', 'Grupo Santander' or 'Santander', we mean Banco Santander, S.A. and its subsidiaries, unless the context otherwise requires;

•'dollars', 'USD', 'US$' or '$', we mean United States dollars; and

•'pounds', 'GBP' or '£', we mean United Kingdom pounds.

When we refer to 'net interest income' we mean 'interest income/(charges)'.

When we refer to 'staff costs' we mean 'personnel expenses'.

When we refer to 'profit before tax' we mean 'operating profit/(loss) before tax'.

When we refer to 'average balances' for a particular period, we mean the average of the month-end balances for that period, unless otherwise noted. We do not believe that monthly averages present trends that are materially different from trends that daily

averages would show. In calculating our interest income, we include any interest payments we received on non-accruing loans if they were received in the period when due.

When we refer to 'loans', we mean loans, leases, discounted bills and accounts receivable, unless otherwise noted. The loan to value 'LTV' ratios disclosed in this report refer to LTV ratios calculated as the ratio of the outstanding amount of the loan to the most recent available appraisal value of the mortgaged asset. Additionally, if a loan shows signs of impairment, we update the appraisals which are then used to estimate allowances for loan losses.

When we refer to the non-performing loans ratio ('NPL ratio'), we mean credit impaired loans and advances to customers, customer guarantees and customer commitments granted divided by total risk (total loans and advances to customers, customer guarantees and customer commitments granted, including those that are credit impaired).

When we refer to 'credit impaired balances', unless otherwise noted, we mean credit impaired loans and advances to customers, customer guarantees and customer commitments granted.

When we refer to 'allowances for credit losses', unless otherwise noted, we mean allowances for inherent losses of impaired assets. Allowances reflect expected credit losses.

When we refer to 'perimeter effect', we mean growth or reduction derived from changes in the companies that we consolidate resulting from acquisitions, dispositions or other reasons.

Where a translation of foreign exchange is given for any financial data, we use the exchange rates of the relevant period (as of the end of such period for balance sheet data and the average exchange rate of such period for income statement data) as published by the European Central Bank (ECB), unless otherwise noted.

Management makes use of certain financial measures in local currency to help in the assessment of ongoing operating performance. These non-GAAP financial measures include the results of operations of our subsidiary banks located outside the eurozone, excluding the impact of foreign exchange. We analyse these banks’ performance on a local currency basis to better measure the comparability of results between periods. Because changes in foreign currency exchange rates have a non-operating impact on the results of operations, we believe that evaluating their performance on a local currency basis provides an additional and meaningful assessment of performance to both management and the company’s investors. Variances in financial metrics, excluding the exchange rate impact, are calculated by translating the components of the financial metrics to our euro presentation currency using the same foreign currency exchange rate for both periods presented. For a discussion of the accounting principles used in translation of foreign currency-denominated assets and liabilities to euros, see note 2(a) to our consolidated financial statements included in Section 2 of this Form 6-K. In addition, throughout this report on Form 6-K we make use of other alternative performance measures. See more information in 'Section 1.6. Alternative Performance Measures (APMs)', in this Form 6-K.

3. Cautionary statement regarding forward-looking statements

Banco Santander advises that this report on Form 6-K contains statements that constitute 'forward-looking statements' within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, information regarding:

•exposure to various types of market risks;

•management strategy;

•capital expenditures;

•earnings and other targets; and

•asset portfolios.

Forward-looking statements may be identified by words such as 'expect,' 'project,' 'anticipate,' 'should,' 'intend,' 'probability,' 'risk,' 'VaR,' 'RoRAC,' 'RoRWA,' 'TNAV,' 'target,' 'goal,' 'objective,' 'estimate,' 'future' and similar expressions, which are found throughout this report on Form 6-K. We include forward-looking statements throughout this Form 6-K, including but not limited to, the 'Operating and Financial Review and Prospects' and 'Quantitative Analysis About Market Risk' sections. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements.

Written and/or oral forward-looking statements may also be made in the periodic reports to the U.S. Securities and Exchange Commission, shareholder' and investors' reports, offering circulars, prospectuses, press releases and other written materials, and in oral statements made by our directors, officers or employees to third parties, including financial analysts.

You should understand that the following important factors, in addition to those discussed in 'Section 4. Risk Factors', 'Section 5. Information on the Company', 'Consolidated Directors’ Report -Economic and Financial Review' , 'Section 6. Supplement to the Operating and Financial Review Disclosure in the Directors’ Report-Consolidated Income Statement' in Part 1 of the 2021 Form 20-F, elsewhere in the 2021 Form 20-F and in this Form 6-K, could affect our future results and could cause those results or other outcomes to differ materially from those anticipated in any forward-looking statement:

Economic and Industry Conditions

•general economic or industry conditions in Spain, the UK, the U.S., other European countries, Brazil, other Latin American countries and the other areas where we have significant operations or investments;

•effects of the covid-19 pandemic in the global economy;

•exposure to various market risks, principally including interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices;

•a worsening of the economic environment in Spain, the UK, the U.S., other European countries, Brazil, other Latin American countries and the other areas where we have significant operations or investments, and increase of the volatility in the capital markets;

•the effects of a decline in real estate prices, particularly in Spain and the UK;

•the effects of results of UK political developments, including the UK’s exit from the European Union;

•monetary and interest rate policies of the ECB and various central banks;

•inflation or deflation;

•the effects of non-linear market behaviour that cannot be captured by linear statistical models, such as the VaR model we use;

•changes in competition and pricing environments;

•the inability to hedge some risks economically;

•changes in demographics, consumer spending, investment or saving habits;

•potential losses from early repayments on our loan and investment portfolio, declines in value of collateral securing our loan portfolio, and counterparty risk; and

•changes in competition and pricing environments as a result of the progressive adoption of the internet for conducting financial services and/or other factors.

Political and Governmental Factors

•political stability in Spain, the UK, the U.S., other European countries, Brazil, other Latin American countries and the other areas where we have significant operations or investments;

•changes in Spanish, UK, EU, U.S., Latin American, or other jurisdictions’ legislation, regulations or taxes, including changes in regulatory capital and liquidity requirements, especially in view of the UK exit of the EU; and

•increased regulation in response to financial crises.

Transaction and Commercial Factors

•damage to our reputation;

•acquisitions or restructurings of businesses that may not perform in accordance with our expectations and our ability to integrate successfully our acquisitions and related challenges that result from the inherent diversion of management’s focus and resources from other strategic opportunities and operational matters; and

•the outcome of our negotiations with business partners and governments.

Operating Factors

•the adequacy of loss reserves;

•potential losses associated with an increase in the level of impairment by counterparties to other types of financial instruments;

•technical difficulties and/or failure to improve or upgrade our information technology;

•changes in our access to liquidity and funding on acceptable terms, including as a result of credit spread shifts or downgrades in our credit ratings or those of our more significant subsidiaries;

•our exposure to operational losses (e.g., failed internal or external processes, people and systems);

•changes in our ability to recruit, retain and develop appropriate senior management and skilled personnel;

•the occurrence of force majeure, such as natural disasters, epidemics and pandemics, including the covid-19 pandemic, that impact our operations or impair the asset quality of our loan portfolio;

•the impact of changes in the composition of our balance sheet on future interest income / (charges); and

•potential losses associated with cyber-attacks.

The forward-looking statements contained in this report on Form 6-K speak only as of the date of this report. We do not undertake to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events.

4. Financial information by segment: 2021 vs 2020

4.1 Description of segments

We base segment reporting on financial information presented to the chief operating decision maker, which excludes certain statutory results items that distort year-on-year comparisons and are not considered for management reporting. This financial information (underlying basis) is computed by adjusting reported results for the effects of certain gains and losses (e.g. capital gains, write-downs, impairment of goodwill, etc.). These gains and losses are items that management and investors ordinarily identify and consider separately to better understand the underlying trends in the business (see also note 51.c to the Santander financial statements). Santander has aligned the information in this chapter with the underlying information used internally for management reporting and with that presented in the Group's other public documents.

Santander's executive committee has been selected to be its chief operating decision maker. The Group's operating segments reflect its organizational and managerial structures. The executive committee reviews internal reporting based on these segments to assess performance and allocate resources.

The segments are split by geographic area in which profits are earned and type of business. We prepare the information by aggregating the figures for Santander’s various geographic areas and business units, relating it to both the accounting data of the business units integrated in each segment and that provided by management information systems. The same general principles as those used in the Group are applied.

With the aim of increasing transparency and improving capital allocation to continue enhancing our profitability, on 4 April 2022, we announced that, starting and effective with the financial information for the first quarter of 2022, we will carry out the following modifications to our reporting.

a.Main changes in the composition of Santander's segments made in April 2022

The main changes, which have been applied to management information for all periods included in the consolidated financial statements, are the following:

1.Reallocation of certain financial costs from the Corporate Centre to the country units:

•Further clarity in the MREL/TLAC regulation makes it possible to allocate the cost of eligible debt issuances to the country units.

•Other financial costs, primarily associated with the cost of funding the excess capital held by the country units above the Group's CET1 ratio, have been reassigned from the Corporate Centre to the country units.

2.Downsizing of Other Europe.

•The Corporate & Investment Banking branches of Banco Santander, S.A. in Europe and other business lines previously reported under 'Other Europe' have been now integrated into the Spain unit to reflect how the business will be managed and supervised.

The Group recast the corresponding information of earlier periods considering the changes included in this section.

Apart from these changes, we completed the usual annual adjustment of the perimeter of the Global Customer Relationship Model between Retail Banking and Santander Corporate & Investment Banking and between Retail Banking and Wealth Management & Insurance.

All these changes have no impact on the Group’s reported consolidated financial figures.

b. Current composition of Group segments

Primary segments

This primary level of segmentation, which is based on the Group’s management structure, comprises five reportable segments: four operating areas plus the Corporate Centre. The operating areas are:

Europe: which comprises all business activity carried out in the region, except that included in Digital Consumer Bank. Detailed financial information is provided on Spain, the UK, Portugal and Poland.

North America: which comprises all the business activities carried out in Mexico and the US, which includes the holding company (SHUSA) and the businesses of Santander Bank, Santander Consumer USA, the specialized business unit Banco Santander International, Santander Investment Securities (SIS) and the New York branch.

South America: includes all the financial activities carried out by Santander through its banks and subsidiary banks in the region. Detailed information is provided on Brazil, Chile, Argentina, Uruguay, Peru and Colombia.

Digital Consumer Bank: includes Santander Consumer Finance, which incorporates the entire consumer finance business in Europe, Openbank and ODS.

Secondary segments

At this secondary level, Santander is structured into Retail Banking, Santander Corporate & Investment Banking (SCIB), Wealth Management & Insurance (WM&I) and PagoNxt.

Retail Banking: this covers all customer banking businesses, including consumer finance, except those of corporate banking which are managed through Santander Corporate & Investment Banking, asset management, private banking and insurance, which are managed by Wealth Management & Insurance. The results of the hedging positions in each country are also included, conducted within the sphere of their respective assets and liabilities committees.

Santander Corporate & Investment Banking (SCIB): this business reflects revenue from global corporate banking, investment banking and markets worldwide including treasuries managed globally (always after the appropriate distribution with Retail Banking customers), as well as equity business.

Wealth Management & Insurance: includes the asset management business (Santander Asset Management), the corporate unit of Private Banking and International Private Banking in Miami and Switzerland and the insurance business (Santander Insurance).

PagoNxt: this includes digital payment solutions, providing global technology solutions for our banks and new customers in the open market. It is structured in three businesses: Merchant Acquiring, International Trade and Consumer.

In addition to these operating units, both primary and secondary segments, the Group continues to maintain the area of Corporate Centre, that includes the centralized activities relating to equity stakes in financial companies, financial management of the structural exchange rate position, assumed within the sphere of the Group’s assets and liabilities committee, as well as management of liquidity and of shareholders’ equity via issuances, adapting this management to the changes described above.

As the Group’s holding entity, this area manages all capital and reserves and allocations of capital and liquidity with the rest of businesses. It also incorporates goodwill impairment but not the costs related to the Group’s central services (charged to the areas), except for corporate and institutional expenses related to the Group’s functioning.

| | | | | | | | |

| | |

| The businesses included in each of the primary segments in this report and the accounting principles under which their results are presented here may differ from the businesses included and accounting principles applied in the financial information separately prepared and disclosed by our subsidiaries (some of which are publicly listed) which in name or geographical description may seem to correspond to the business areas covered in this report. Accordingly, the results of operations and trends shown for our business areas in this document may differ materially from those of such subsidiaries. The results of our business areas presented below are provided on the basis of underlying results only and generally including the impact of foreign exchange rate fluctuations. However, for a better understanding of the changes in the performance of our business areas, we also provide and discuss the year-on-year changes to our results excluding such exchange rate impacts. The statements included in this section regarding Santander's competitiveness and that of its subsidiaries have been produced by the Group based on public information (corporate websites of competing entities and information published by national banking institutions). | |

| | |

4.2 Summary of the Group's main business areas' income statements

| | | | | | | | | | | | | | | | | | | | |

| 2021 |

| Main items of the underlying income statement |

| EUR million | | | | | | |

| Primary segments | Net interest income | Net fee

income | Total

income | Net operating income | Profit before tax | Underlying profit attributable to the parent |

| Europe | 10,574 | | 4,344 | | 15,934 | | 7,615 | | 4,034 | | 2,750 | |

| Spain | 4,166 | | 2,789 | | 7,748 | | 3,696 | | 863 | | 627 | |

| United Kingdom | 4,383 | | 434 | | 4,815 | | 2,223 | | 2,149 | | 1,537 | |

| Portugal | 722 | | 441 | | 1,313 | | 750 | | 685 | | 462 | |

| Poland | 1,020 | | 518 | | 1,617 | | 955 | | 351 | | 140 | |

| Other | 282 | | 163 | | 441 | | (9) | | (15) | | (16) | |

| North America | 8,072 | | 1,644 | | 10,853 | | 5,886 | | 4,531 | | 2,960 | |

| US | 5,298 | | 782 | | 7,277 | | 4,080 | | 3,546 | | 2,252 | |

| Mexico | 2,773 | | 828 | | 3,553 | | 1,910 | | 1,100 | | 816 | |

| Other | 0 | | 34 | | 23 | | (104) | | (114) | | (108) | |

| South America | 11,307 | | 3,721 | | 15,337 | | 9,958 | | 6,232 | | 3,317 | |

| Brazil | 7,867 | | 2,728 | | 10,876 | | 7,641 | | 4,610 | | 2,320 | |

| Chile | 1,982 | | 394 | | 2,455 | | 1,513 | | 1,156 | | 636 | |

| Argentina | 1,065 | | 420 | | 1,388 | | 583 | | 306 | | 270 | |

| Other | 393 | | 179 | | 618 | | 221 | | 160 | | 91 | |

| Digital Consumer Bank | 4,041 | | 821 | | 5,099 | | 2,694 | | 1,973 | | 1,164 | |

| Corporate Centre | (624) | | (28) | | (819) | | (1,165) | | (1,510) | | (1,535) | |

| TOTAL GROUP | 33,370 | | 10,502 | | 46,404 | | 24,989 | | 15,260 | | 8,654 | |

| | | | | | |

| Secondary segments | | | | | | |

| Retail Banking | 30,596 | | 7,045 | | 38,869 | | 21,766 | | 12,632 | | 7,389 | |

| Corporate & Investment Banking | 2,921 | | 1,744 | | 5,619 | | 3,240 | | 3,071 | | 2,113 | |

| Wealth Management & Insurance | 476 | | 1,247 | | 2,240 | | 1,326 | | 1,294 | | 941 | |

| PagoNxt | 1 | | 493 | | 495 | | (178) | | (227) | | (253) | |

| Corporate Centre | (624) | | (28) | | (819) | | (1,165) | | (1,510) | | (1,535) | |

| TOTAL GROUP | 33,370 | | 10,502 | | 46,404 | | 24,989 | | 15,260 | | 8,654 | |

| | | | | | | | | | | | | | | | | | | | |

| 2020 |

| Main items of the underlying income statement |

| EUR million | | | | | | |

| Primary segments | Net interest

income | Net fee

income | Total

income | Net operating

income | Profit before tax | Underlying profit attributable to the parent |

| Europe | 9,518 | | 4,000 | | 14,280 | | 6,006 | | 1,692 | | 1,138 | |

| Spain | 4,083 | | 2,542 | | 7,208 | | 2,968 | | 367 | | 255 | |

| United Kingdom | 3,466 | | 494 | | 3,942 | | 1,403 | | 470 | | 364 | |

| Portugal | 765 | | 388 | | 1,274 | | 684 | | 461 | | 323 | |

| Poland | 1,011 | | 452 | | 1,498 | | 869 | | 344 | | 144 | |

| Other | 193 | | 123 | | 358 | | 82 | | 50 | | 52 | |

| North America | 8,394 | | 1,684 | | 10,958 | | 6,280 | | 2,231 | | 1,419 | |

| US | 5,580 | | 889 | | 7,296 | | 4,216 | | 1,186 | | 685 | |

| Mexico | 2,813 | | 772 | | 3,639 | | 2,087 | | 1,070 | | 754 | |

| Other | 1 | | 24 | | 23 | | (23) | | (25) | | (20) | |

| South America | 10,710 | | 3,589 | | 14,855 | | 9,498 | | 5,253 | | 2,898 | |

| Brazil | 7,618 | | 2,824 | | 10,859 | | 7,317 | | 4,037 | | 2,108 | |

| Chile | 1,786 | | 335 | | 2,262 | | 1,362 | | 784 | | 431 | |

| Argentina | 910 | | 273 | | 1,125 | | 493 | | 197 | | 177 | |

| Other | 397 | | 158 | | 609 | | 325 | | 236 | | 182 | |

| Digital Consumer Bank | 4,014 | | 771 | | 4,917 | | 2,588 | | 1,680 | | 958 | |

| Corporate Centre | (643) | | (29) | | (410) | | (739) | | (1,181) | | (1,332) | |

| TOTAL GROUP | 31,994 | | 10,015 | | 44,600 | | 23,633 | | 9,674 | | 5,081 | |

| | | | | | |

| Secondary segments | | | | | | |

| Retail Banking | 29,401 | | 6,986 | | 37,368 | | 20,082 | | 7,212 | | 3,962 | |

| | | | | | |

| Corporate & Investment Banking | 2,842 | | 1,542 | | 5,256 | | 3,218 | | 2,613 | | 1,745 | |

| Wealth Management & Insurance | 394 | | 1,153 | | 2,030 | | 1,159 | | 1,132 | | 823 | |

| PagoNxt | (1) | | 362 | | 356 | | (86) | | (101) | | (116) | |

| Corporate Centre | (643) | | (29) | | (410) | | (739) | | (1,181) | | (1,332) | |

| TOTAL GROUP | 31,994 | | 10,015 | | 44,600 | | 23,633 | | 9,674 | | 5,081 | |

| | | | | | | | | | | |

| Europe | | Underlying attributable profit |

| EUR 2,750 | Mn |

Business performance

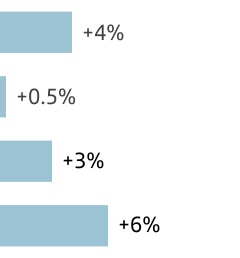

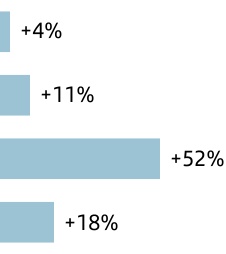

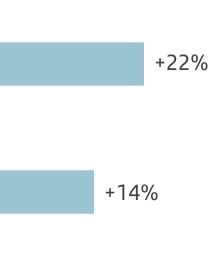

Loans and advances to customers were 5% higher year-on-year. In gross terms, excluding reverse repurchase agreements and the exchange rate impact, they rose 3%. We saw broad-based growth in all countries especially in mortgages in the UK, individuals in Spain, mortgages and SMEs in Portugal and individuals, SMEs and CIB in Poland.

Customer deposits increased by 6% compared to 2020. Excluding repurchase agreements and the FX impact, they were up 5%, as demand deposits offset the drop in time deposits.

Mutual funds grew 16% in constant euros, with broad-based growth across countries, with customer funds up 6% (excluding the exchange rate impact).

Results

Underlying attributable profit in 2021 was EUR 2,750 million (27% of the Group's total operating areas). Compared to 2020, underlying attributable profit was up 142% and 140% in constant euros, as follows:

•Total income was up 11%, with increased net interest income (+10%), benefitting from higher volumes, interest rate management and the positive TLTRO impact. Net fee income rose 9% spurred by greater commercial activity and business growth in WM&I and CIB.

•Despite inflation, increased activity and necessary investments in IT, significant restructuring efforts in all countries and cost control left administrative expenses and amortizations flat by year-end. As a result, net operating income rose 26%.

•Net loan-loss provisions dropped 32% compared to 2020, due to covid-19-related provisions recorded in 2020 that were partially released in 2021.

•NPL ratio improved 22 bps to 3.12% and cost of credit decreased 19 bps to 0.39%. Coverage ratio decreased to 49%.

•Other gains (losses) and provisions increased 32%, mainly due to Swiss franc mortgage-related charges.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Europe. Business performance |

| December 2021. EUR billion and YoY % change in constant euros | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross loans and advances to customers excl. reverse repos | | Customer deposits excl.

repos + mutual funds |

| | | | | | | | | | | | | | | |

| Europe. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 15,934 | 14,280 | | +12 | +11 |

| Expenses | | -8,319 | -8,274 | | +1 | 0 |

| Net operating income | | 7,615 | 6,006 | | +27 | +26 |

| LLPs | | -2,293 | -3,344 | | -31 | -32 |

| PBT | | 4,034 | 1,692 | | +138 | +138 |

| Underlying attrib. profit | | 2,750 | | 1,138 | | +142 | +140 |

| | | | | | | | |

| Spain | Underlying attributable profit |

| EUR 627 | Mn |

Business performance

Loans and advances to customers rose 4% versus 2020. In gross terms, excluding reverse repurchase agreements, growth was also 4%, driven by individuals and institutions.

Customer deposits increased 7% compared to 2020. Excluding repos, growth was also 7%. Mutual funds grew 16% driven by sustained net positive inflows in the last seven quarters. Customer funds rose 9%.

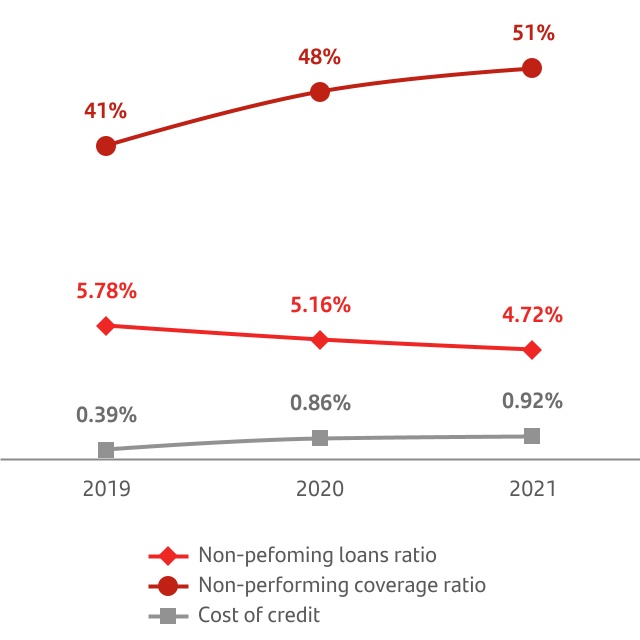

Results

Underlying attributable profit amounted to EUR 627 million (6% of the Group’s total operating areas), 146% higher than 2020. By line:

•Total income increased 7% propelled by the positive performance in net fee income (+10%), driven by transactional fees, insurance, and mutual funds, and, to a lesser extent, net interest income (+2%), supported by TLTROs.

•Our cost reduction efforts continued to bear fruit (-4% year-on-year), improving the efficiency ratio by 6.5 pp to 52.3%. Net operating income increased 25%.

•Net loan-loss provisions were up 9%, and cost of credit increased 6 bps year-on-year to 0.92%. NPL ratio improved 44 bps to 4.72% and coverage ratio increased 4 pp to 51%.

•Other gains (losses) and provisions increased due to higher operational risks and contingencies.

| | | | | | | | | | | | | |

| Spain. Underlying income statement | |

| EUR million and % change |

| | | | / 2020 | |

| | | | | |

| | 2021 | 2020 | | % | |

| | | | | |

| Revenue | | 7,748 | | 7,208 | | +7 | |

| Expenses | | -4,052 | | -4,240 | | -4 | |

| Net operating income | | 3,696 | | 2,968 | | +25 | |

| LLPs | | -2,320 | | -2,123 | | +9 | |

| PBT | | 863 | | 367 | | +135 | |

| Underlying attrib. profit | | 627 | | 255 | | +146 | | |

Detailed financial information in section 4.6 'Appendix'

| | | | | | | | |

| United Kingdom | Underlying attributable profit |

| EUR 1,537 | Mn |

Business performance

In gross terms excluding repos and the FX impact, loans and advances to customers were 0.5% higher. Strong mortgage growth, with GBP 7.5 bn net mortgage lending (GBP 30.7 bn of gross new lending) in a buoyant housing market. This performance was not reflected in total lending balances due to the transfer of the CIB business to the London branch.

Customer deposits rose 5%. Excluding repurchase agreements and the exchange rate impact, customer deposits and total customer funds saw no material change. Mutual funds were 6% higher.

Results

Underlying attributable profit was EUR 1,537 million in 2021 (15% of the Group’s total operating areas), more than four times that of 2020. In constant euros, growth was 308%, as follows:

•Total income was up 18%, driven by net interest income growth (+22%) from increased lending volumes and lower cost of funding.

•Administrative expenses and amortizations dropped 1%, due to efficiency savings from our transformation programme, offsetting ongoing investments in IT and the business, as well as costs related to greater activity. As a result, net operating income was up 53%.

•We recorded a net credit impairment write-back of EUR 245 million, due to the improved economic outlook and partial release of covid-19 provisions from 2020.

•NPL ratio increased 19 bps to 1.43% and coverage ratio decreased 19 pp. to 26%. Cost of risk decrease 36 bps to -0.09% (negative reflecting releases)

•The negative impact from other gains (losses) and provisions increased compared to 2020, owing to legal contingencies.

| | | | | | | | | | | | | | | |

| United Kingdom. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 4,815 | 3,942 | | +22 | +18 |

| Expenses | | -2,592 | -2,539 | | +2 | -1 |

| Net operating income | | 2,223 | 1,403 | | +58 | +53 |

| LLPs | | 245 | -677 | | — | — |

| PBT | | 2,149 | 470 | | +357 | +342 |

| Underlying attrib. profit | | 1,537 | | 364 | | +322 | +308 |

Detailed financial information in section 4.6 'Appendix'

| | | | | | | | |

| Portugal | Underlying attributable profit |

| EUR 462 | Mn |

Business performance

Loans and advances to customers rose 3%, as well as in gross terms and excluding reverse repurchase agreements.

We focused on ensuring the funds we capture are efficient in terms of costs and return on capital, recording strong growth in both mutual funds and insurance premiums.

Customer deposits increased 6% boosted by the jump in demand deposits. Mutual funds grew 33%. As a result, customer funds increased 8% versus 2020.

Results

Underlying attributable profit amounted to EUR 462 million (5% of the Group’s total operating areas), 43% more year-on-year, backed by our efficiency (43%) and improved cost of credit.

•Total income was up 3%, underpinned by net fee income (+14%) that was boosted by transactional fees, insurance and mutual funds, and ALCO portfolio sales.

•We continued to implement our operating model transformation plan and improve the productivity of our network, leading to a 5% reduction in administrative expenses and amortizations. As a result, net operating income rose 10%.

•Credit quality improvement enabled loan-loss provisions to fall to EUR 38 million, driving the cost of credit to a low of 9 bps and coverage ratio increased 5 pp to 72%. NPL ratio improved to 3.4% (-45 bps).

•Other gains (losses) and provisions amounted to a loss of -EUR 26 million compared to -EUR 29 million in 2020.

| | | | | | | | | | | | | |

| Portugal. Underlying income statement |

| EUR million and % change |

| | | | | |

| | | | | |

| | | | / 2020 | |

| | 2021 | 2020 | | % | |

| | | | | |

| Revenue | | 1,313 | 1,274 | | +3 | |

| Expenses | | -563 | -590 | | -5 | |

| Net operating income | | 750 | 684 | | +10 | |

| LLPs | | -38 | -193 | | -80 | |

| PBT | | 685 | 461 | | +49 | |

| Underlying attrib. profit | | 462 | | 323 | | +43 | |

Detailed financial information in section 4.6 'Appendix'

| | | | | | | | |

| Poland | Underlying attributable profit |

| EUR 140 | Mn |

Business performance

Loans and advances to customers rose 6%. In gross terms, excluding reverse repurchase agreements and exchange rate impact, growth was also 6%, driven by retail, where we hit record highs in mortgage sales, digital loans, bancassurance and SME lending. In CIB, we consolidated our market leadership as one of the country's preferred banks for executing capital market transactions.

Customer deposits increased 9% compared to 2020, +10% excluding repos and the exchange rate impact. Demand deposits spiked in wholesale banking, individuals and SMEs. Mutual fund growth remained positive, boosting growth in customer funds (+10% in constant euros).

Results

Underlying attributable profit amounted to EUR 140 million (1% of the Group’s total operating areas). Compared to 2020, profit dropped 3% but remained flat in constant euros, as follows:

•Total income was 11% higher driven by transactional and WM&I fee income, and net interest income, as NII pressures eased following interest rate hikes in Q4.

•Administrative expenses and amortizations were up 8% affected by high inflation and costs related to the rebound in activity. Net operating income rose 13%.

•Loan-loss provisions plummeted, which enabled cost of credit to improve.

•NPL ratio improved 113 bps to 3.61% and cost of credit decreased 42 bps to 0.67%. The coverage ratio increased to 74%.

•The negative impact from other gains (losses) and provisions (including the charges related to Swiss franc mortgages which distort the year-on-year comparison) increased 113% to -EUR 404 million.

| | | | | | | | | | | | | | | |

| Poland. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 1,617 | 1,498 | | +8 | +11 |

| Expenses | | -663 | -629 | | +5 | +8 |

| Net operating income | | 955 | 869 | | +10 | +13 |

| LLPs | | -200 | -330 | | -39 | -38 |

| PBT | | 351 | 344 | | +2 | +5 |

| Underlying attrib. profit | | 140 | | 144 | | -3 | 0 |

Detailed financial information in section 4.6 'Appendix'

| | | | | | | | | | | |

| North America | | Underlying attributable profit |

| EUR 2,960 | Mn |

Business performance

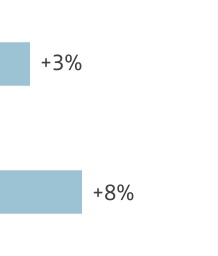

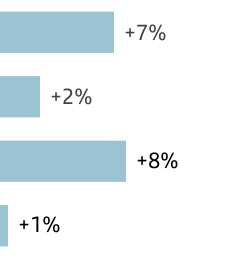

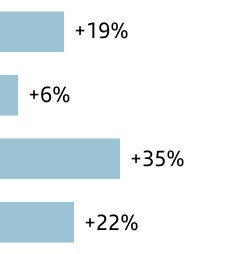

Loans and advances to customers grew strongly year-on-year, up 14%. In gross terms, excluding reverse repurchase agreements and the exchange rate impact, they rose 3% boosted by overall growth in Mexico (except SMEs) and lending growth in auto in the US. Without the impact of the Bluestem portfolio disposal, growth was 4%.

Customer deposits grew significantly compared to 2020 (+19%). Excluding repurchase agreements and the exchange rate impact, growth was 7% driven by retail and corporate deposits in the US and demand deposits in Mexico.

Mutual funds were up 15% in constant euros owing to our strong performances in both countries, reflecting the high level of liquidity in the market and success with our customer attraction and loyalty strategy. As a result, customer funds increased 9% in constant euros.

Results

Underlying attributable profit in 2021 was EUR 2,960 million (29% of the Group's total operating areas).

Compared to 2020, underlying attributable profit more than doubled; +109% in euros (+110% in constant euros). The year-on-year comparison by line was distorted due to the impact of the Bluestem portfolio and Puerto Rico disposals. Without them and the exchange rate impact, growth was 112%, as follows:

•Total income was up 5%. Net interest income was 2% higher as price management and hedging in the US more than offset lower net interest income in Mexico due to the negative impact of lower interest rates and ALCO portfolio sales in 2020. Net fee income increased 6%;

•Administrative expenses and amortizations rose 10% primarily due to inflation and investments in digitalization. The efficiency ratio stood around 46%;

•As a result, net operating income increased 1%;

•Net loan-loss provisions plummeted 66% due to better market outlooks and a healthier operating environment, following heavy covid-19-related provisioning in 2020. Cost of credit improved notably to 0.93%, the NPL ratio stood at 2.42% and coverage was 135%.;

•Other gains (losses) and provisions were more negative in 2021 mainly due to the early amortization of buildings and integration costs in the US.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| North America. Business performance |

December 2021. EUR billion and YoY % change in constant euros A | |

| | | | | | | | | | |

| | 134 | | +4% | | | | | 137 | | +9% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross loans and advances to customers excl. reverse repos | | Customer deposits excl.

repos + mutual funds |

A. Excluding Bluestem portfolio impact.

| | | | | | | | | | | | | | | |

| North America. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 10,853 | 10,958 | | -1 | +1 |

| Expenses | | -4,967 | -4,677 | | +6 | +8 |

| Net operating income | | 5,886 | 6,280 | | -6 | -5 |

| LLPs | | -1,210 | -3,917 | | -69 | -68 |

| PBT | | 4,531 | 2,231 | | +103 | +105 |

| Underlying attrib. profit | | 2,960 | | 1,419 | | +109 | +110 |

Detailed financial information in section 4.6 'Appendix'

| | | | | | | | |

| United States | Underlying attributable profit |

| EUR 2,252 | Mn |

Business performance

Loans and advances to customers increased 14% compared to 2020. In gross terms and excluding reverse repurchase agreements and the impacts of both the exchange rate and the Bluestem portfolio disposal, they grew 3% year-on-year as lending growth in CIB and auto more than offset tepid corporate demand. Considering the Bluestem portfolio disposal impact, loans increased 2%.

Customer deposits soared 23% year-on-year. Excluding repurchase agreements and the exchange rate impact, customer deposits grew strongly (8% higher), boosted by retail deposits.

Mutual funds also increased 23% excluding the exchange rate impact.

Results

Underlying attributable profit in the year was EUR 2,252 million (22% of the Group's total operating areas), up 229% year-on-year in euros.

On a like-for-like basis, excluding the Puerto Rico and Bluestem portfolio disposals and the exchange rate impact, growth was 248%. By line, excluding divestiture impacts:

•Total income was up 10%. Though net interest income was impacted by loan volumes and interest rate pressure, it increased 5% due to focused deposit price management. Net fee income increased 6%. Other operating income improved 53%, primarily due to outstanding auto lease results;

•Administrative expenses and amortizations increased 10% due to increased activity and investments in strategic initiatives (such as digital transformation), as well as a USD 60 million donation to our community foundation in Q3 and Q4;

•Net loan-loss provisions plummeted 85% on the back of lower net charge-offs, better macroeconomic conditions and strong used vehicle prices;

•Cost of credit improved notably to 0.43%, the NPL ratio increased at 2.33% and the coverage ratio was 150%;

•The negative impact of other gains (losses) and provisions increased by 31%, mainly due to the early amortization of buildings and integration costs.

| | | | | | | | | | | | | | | |

| United States. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 7,277 | 7,296 | | 0 | +3 |

| Expenses | | -3,197 | -3,079 | | +4 | +8 |

| Net operating income | | 4,080 | 4,216 | | -3 | 0 |

| LLPs | | -419 | -2,937 | | -86 | -85 |

| PBT | | 3,546 | 1,186 | | +199 | +210 |

| Underlying attrib. profit | | 2,252 | | 685 | | +229 | +241 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | |

| Mexico | Underlying attributable profit |

| EUR 816 | Mn |

Business performance

Loans and advances to customers increased 15% year-on-year. In gross terms and excluding reverse repurchase agreements and the exchange rate impact, they climbed 8% year-on-year, driven by loans to individuals (mortgages +13%, consumption +17% and cards +3%) as well as corporates (companies +4% and CIB +14% offset a 15% decline in SMEs).

Customer deposits grew 9% year-on-year. Excluding repos and the impact of exchange rates, they rose by 5%, propelled by demand deposits (+8%).

Mutual funds were up 8% in constant euros, a sign of the success of our customer attraction and loyalty strategies, as well as efforts to reduce the cost of funding.

Results

Underlying attributable profit in 2021 was EUR 816 million (8% of the Group’s total operating areas), 8% higher than 2020. Excluding the exchange rate impact, it increased 7%. By line:

•Total income fell 4%, impacted by lower gains on financial transactions (sales of ALCO portfolios in 2020) and net interest income (-3%), the latter a result of interest rate cuts and lower ALCO portfolio volumes. Net fee income increased by 6%, mainly due to transactional fees and insurance;

•Administrative expenses and amortizations increased 4%, well below inflation, mainly driven by technology costs and the increase in amortizations;

•As we move to a more normal operating environment, net loan-loss provisions were down 21%, following the high levels recorded in 2020 due to the pandemic;

•NPL ratio improved 8 bps to 2.73% and cost of credit decreased 59 bps to 2.44%. Coverage ratio decreased to 95%.

•Other gains (losses) and provisions improved 49% mainly due to the sale of foreclosed assets and lower contingencies charges.

| | | | | | | | | | | | | | | |

| Mexico. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 3,553 | 3,639 | | -2 | -4 |

| Expenses | | -1,643 | -1,552 | | +6 | +4 |

| Net operating income | | 1,910 | 2,087 | | -8 | -10 |

| LLPs | | -791 | -979 | | -19 | -21 |

| PBT | | 1,100 | 1,070 | | +3 | +1 |

| Underlying attrib. profit | | 816 | | 754 | | +8 | +7 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | | | | |

| South America | | Underlying attributable profit |

| EUR 3,317 | Mn |

Business performance

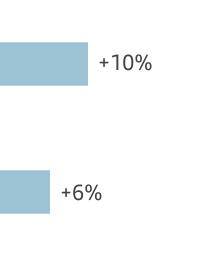

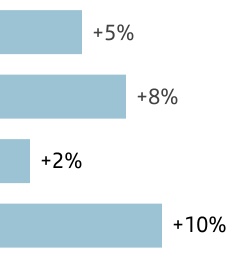

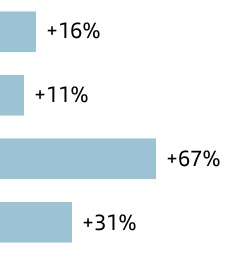

Loans and advances to customers climbed 9% year-on-year. Excluding reverse repos and the exchange rate impact, gross loans were 12% higher, with increases in all entities.

Customer deposits rose 8% in euros compared to 2020. Excluding repurchase agreements and the exchange rate impact, they rose 11% (increasing across all our markets) driven by demand and time deposits. As mutual funds were up 4% (excluding the FX impact), customer funds were 9% higher in constant euros.

Results

Underlying attributable profit in the year was EUR 3,317 million (33% of the Group's total operating areas), 14% higher compared to 2020, 24% excluding the exchange rate impact. By line:

•Total income increased 12% underpinned by strong customer revenue, driven by larger volumes and customer acquisition.

Net interest income was 14% higher and net fee income increased by 13%, while gains on financial transactions remained stable.

•Administrative expenses and amortizations increased 8% at a slower pace than inflation.

•Net loan-loss provisions dropped by 10% driven by covid-19 related provisions recorded in 2020. The cost of credit improved 72 bps to 2.60% and the NPL ratio increased 11 bps to 4.50%. Coverage ratio stood at 98%

•Losses in other income and provisions increased in the year, owing mainly to Argentina and Brazil.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| South America. Business performance |

| December 2021. EUR billion and YoY % change in constant euros | |

| | | | | | | | | | |

| | 129 | | +12% | | | | | 162 | | +9% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross loans and advances to customers excl. reverse repos | | Customer deposits excl.

repos + mutual funds |

| | | | | | | | | | | | | | | |

| South America. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 15,337 | 14,855 | | +3 | +12 |

| Expenses | | -5,380 | -5,357 | | 0 | +8 |

| Net operating income | | 9,958 | | 9,498 | | +5 | +13 |

| LLPs | | -3,251 | -3,924 | | -17 | -10 |

| PBT | | 6,232 | 5,253 | | +19 | +28 |

| Underlying attrib. profit | | 3,317 | | 2,898 | | +14 | +24 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | |

| Brazil | Underlying attributable profit |

| EUR 2,320 | Mn |

Business performance

Loans and advances to customers increased 14% year-on-year. In gross terms, excluding reverse repos and the exchange rate impact, they rose 13%, underscored by individuals (+22%), consumer finance (+12%) and SMEs (+15%).

Customer deposits increased 6% in euros with respect to 2020. Excluding repos and the exchange rate impact, growth was 4% driven by the increase in demand deposits (+5%). As mutual funds were 3% higher excluding the exchange rate impact, customer funds rose 4% at constant exchange rates.

Results

Underlying attributable profit was EUR 2,320 million in 2021 (23% of the Group's total operating areas), 10% higher compared to 2020. Excluding the exchange rate impact, it was 21% higher. By line:

•Total income rose 10% boosted by 11% higher net interest income plus net fee income, benefitting from higher volumes and a larger customer base.

•Administrative expenses and amortizations had no material change through efficient cost management and higher productivity despite average inflation of 8%. The annual efficiency ratio improved to an all-time record of 29.7%, while net operating income was 14% higher.

•Net loan-loss provisions fell 1%, enabling cost of credit to improve 62 bps year-on-year to 3.73%. The NPL ratio was 4.88% and coverage stood at 111%.

•The negative impact of other gains (losses) and provisions rose due to higher tax provisions in 2021 and releases in 2020.

| | | | | | | | | | | | | | | |

| Brazil. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 10,876 | 10,859 | | 0 | +10 |

| Expenses | | -3,236 | -3,541 | | -9 | 0 |

| Net operating income | | 7,641 | 7,317 | | +4 | +14 |

| LLPs | | -2,715 | -3,018 | | -10 | -1 |

| PBT | | 4,610 | 4,037 | | +14 | +25 |

| Underlying attrib. profit | | 2,320 | | 2,108 | | +10 | +21 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | |

| Chile | Underlying attributable profit |

| EUR 636 | Mn |

Business performance

Loans and advances to customers decreased 4% year-on-year in euros. Excluding reverse repurchase agreements and the exchange rate impact, gross loans and advances to customers rose 6%. By segment, individuals grew 8% (boosted by mortgages), CIB by 17%, and corporates and institutions by 4%, which more than offset the fall in SMEs (-6%, affected by state-backed loans granted in 2020).

Customer deposits rose 4% year-on-year, up 15% excluding repurchase agreements and the exchange rate impact (on the back of demand deposits, +23%). Mutual funds fell 3% and customer funds rose 11% in constant euros.

Results

Underlying attributable profit was EUR 636 million in 2021 (6% of the Group’s total operating areas), up 47% compared to 2020.

Excluding the exchange rate impact it was also 47% higher. By line:

•Total income rose 8%, spurred on by 10% higher net interest income, driven by inflation and margin management, and by the 17% increase in net fee income, mainly due to payment methods.

•Administrative expenses and amortizations rose 4% (below inflation) which resulted in 10% higher net operating income and an efficiency ratio of 38.4%.

•Net loan-loss provisions dropped 43% due to covid-19-related charges in 2020, placing the cost of credit at 0.85%. The NPL ratio improved to 4.43% and coverage was 63%.

•Other gains (losses) and provisions totalled -EUR 16 million (+EUR 16 million in 2020) due to contingencies in 2021.

| | | | | | | | | | | | | | | |

| Chile. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 2,455 | 2,262 | | +9 | +8 |

| Expenses | | -942 | -900 | | +5 | +4 |

| Net operating income | | 1,513 | 1,362 | | +11 | +10 |

| LLPs | | -341 | -594 | | -43 | -43 |

| PBT | | 1,156 | 784 | | +48 | +47 |

| Underlying attrib. profit | | 636 | | 431 | | +47 | +47 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | |

| Argentina | Underlying attributable profit |

| EUR 270 | Mn |

Business performance

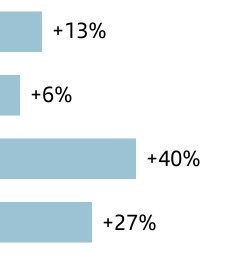

Loans and advances to customers rose 25%. Excluding reverse repurchase agreements and the exchange rate impact, gross loans and advances to customers were 40% higher driven by lending to individuals, SMEs and corporates.

Customer deposits increased 28% compared to 2020 in euros. Excluding repurchase agreements and the exchange rate impact, deposits grew 44% and mutual funds +90%.

Results

Underlying attributable profit was EUR 270 million in the year (3% of the Group’s total operating areas).

Compared to 2020, underlying attributable profit was 53% higher. Excluding the exchange rate impact, it rose 72%. In particular:

•Total income grew 39% underpinned by net interest income (+32%) and 74% higher net fee income, driven by transactional fees. Gains on financial transactions were 168% higher.

•Administrative expenses and amortizations increased 44%, affected by inflation and the salary agreement. The efficiency ratio stood at 58.0% and net operating income rose 33%.

•Net loan-loss provisions fell 30% due to covid-19-related provisioning in 2020. The NPL ratio stood at 3.61% and the coverage ratio decreased to 154%. Cost of credit decreased 292 bps to 3.01%.

•Other gains (losses) and provisions increased their loss due to charges relating to downsizing.

| | | | | | | | | | | | | | | | | |

| Argentina. Underlying income statement | | |

| EUR million and % change | | |

| | | | / | 2020 | | |

| | 2021 | 2020 | | % | % excl. FX | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Revenue | | 1,388 | 1,125 | | +23 | +39 | | |

| Expenses | | -805 | -632 | | +27 | +44 | | |

| Net operating income | | 583 | 493 | | +18 | +33 | | |

| LLPs | | -140 | -226 | | -38 | -30 | | |

| PBT | | 306 | 197 | | +55 | +75 | | |

| Underlying attrib. profit | | 270 | | 177 | | +53 | +72 | | |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | |

| Uruguay | Underlying attributable profit |

| EUR 110 | Mn |

Business performance

Loans and advances to customers increased 17% year-on-year in euros. Excluding reverse repurchase agreements and the exchange rate impact, gross loans and advances to customers rose 14%, due to lending to individuals, (mainly due to auto segment growth well above market rates).

Customer deposits were 18% higher in euros compared to 2020. Excluding the exchange rate impact and repurchase agreements, they increased 15% backed by demand deposits (+20%). Mutual funds were up 22% excluding the exchange rate impact.

Results

In 2021, underlying attributable profit was EUR 110 million (1% of the Group's total operating areas).

Compared to 2020, it fell 18% in euros. Excluding the exchange rate impact, it declined 12%. By line:

•Total income declined 3% mainly due to the 6% lower net interest income, due heavily to lower interest rates, but partly offset by 9% growth in net fee income.

•Administrative expenses and amortizations rose 11%, affected by the salary agreement under the collective labour agreement signed in 2021, and by higher costs from business growth. The efficiency ratio stood at 47.4%.

•Net loan-loss provisions decreased 43%, due to covid-19-related provisioning in 2020. The cost of credit improved 111 bps to 1.19%, the NPL ratio stood at 2.65% and coverage at 107%.

| | | | | | | | | | | | | | | |

| Uruguay. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 342 | 380 | | -10 | -3 |

| Expenses | | -162 | -157 | | +3 | +11 |

| Net operating income | | 180 | 223 | | -19 | -13 |

| LLPs | | -32 | -61 | | -47 | -43 |

| PBT | | 145 | 161 | | -10 | -3 |

| Underlying attrib. profit | | 110 | | 134 | | -18 | -12 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | |

| Peru | Underlying attributable profit |

| EUR 62 | Mn |

Business performance

Loans and advances to customers rose 23% year-on-year (+26% on a gross basis, excluding reverse repurchase agreements and the exchange rate impact).

Customer deposits surged 18% (+20% excluding the exchange rate impact and repurchase agreements), with growth in both demand and time deposits.

Results

Underlying attributable profit of EUR 62 million in 2021 was 18% higher year-on-year. Excluding the exchange rate impact, it soared 36%:

•Total income grew 32% mainly led by customer revenue and gains on financial transactions stemming from higher customer activity.

•Administrative expenses and amortizations were 35% higher, mainly driven by the launch of new businesses. Net operating income increased 31%.

•Net loan-loss provisions increased slightly, although the cost of credit remained low at 0.58%, the NPL ratio stood at 0.87% and the coverage ratio at 165%.

| | | | | | | | |

| Colombia | Underlying attributable profit |

| EUR 24 | Mn |

Business performance

Loans and advances to customers rose 38% year-on-year in euros. In gross terms, excluding reverse repurchase agreements and the exchange rate impact growth was 51%.

Customer deposits rose 28% in euros and 40% excluding the exchange rate impact and repurchase agreements, driven by 71% growth in demand deposits.

Results

Underlying attributable profit of EUR 24 million in the year was 27% higher than in 2020. Excluding the exchange rate impact, underlying attributable profit rose 34%. By line:

•Total income grew 25% spurred by higher customer revenue.

•Administrative expenses and amortizations rose 30% and net operating income was 21% higher.

•Net loan-loss provisions fell 8% and the cost of credit declined year-on-year to 0.40%, the NPL ratio stood at 0.48% and the coverage ratio at 179%.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other South America. Underlying income statement | | |

| EUR million and % change | | |

| | Net operating income | | Underlying attributable profit |

| | | | / | 2020 | | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX | | 2021 | 2020 | | % | % excl. FX |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Peru | | 104 | 92 | +14 | +31 | | 62 | 52 | +18 | +36 |

| Colombia | | 42 | 36 | +15 | +21 | | 24 | 19 | +27 | +34 |

| | | | | | | | | | | |

| DCB | Digital Consumer Bank | | Underlying attributable profit |

| EUR 1,164 | Mn |

Business performance

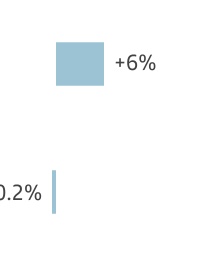

The stock of loans and advances to customers increased 1% year-on-year. In gross terms, excluding reverse repos and the exchange rate impact, it fell 1% to EUR 117 billion.

Customer deposits increased 8% in euros and 7% excluding repos and the exchange rate impact. Mutual funds grew significantly. Our recourse to wholesale funding markets remained strong and diversified, with funding costs, rates and spreads remaining near all-time lows.

Results

Underlying attributable profit in 2021 was EUR 1,164 million (11% of the Group’s total operating areas).

Compared to 2020, underlying profit increased 21% in euros. In constant euros the increase was 20% as follows:

•Total income was up 3% driven by growth in net fee income (+6% due to increased new business volumes) and leasing. Net interest remained flat.

•Administrative expenses and amortizations increased 3% due to perimeter effects and digital transformation investments. Net operating income increased 3% and the efficiency ratio stood at 47.2%.

Without perimeter effects, costs were flat year-on-year and 4% lower than in 2019.

•Net loan-loss provisions dropped 45% driven by covid-19 provisioning in 2020. Positive credit quality performance, with a 38 bp reduction in the cost of credit of credit to 0.46% and an NPL ratio of 2.13% (-4 bps year-on-year). Coverage remained high (108%).

•Negative impact from other gains (losses) and provisions due to charges related to Swiss franc mortgages.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Digital Consumer Bank. Activity |

| December 2021. EUR billion and % change in constant euros | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | -1% | | | | | | | |

| 117 | | YoY | | | | | | | |

| | | | | | | 58 | | +10% | |

| | | | | | | | | YoY | |

| | | | | | | | | | |

| Gross loans and advances to customers excl. reverse repos | | Customer deposits excl.

repos + mutual funds |

| | | | | | | | | | | | | | | |

| Digital Consumer Bank. Underlying income statement |

| EUR million and % change |

| | | | / | 2020 |

| | 2021 | 2020 | | % | % excl. FX |

| | | | | |

| | | | | |

| | | | | |

| Revenue | | 5,099 | 4,917 | | +4 | +3 |

| Expenses | | -2,405 | -2,329 | | +3 | +3 |

| Net operating income | | 2,694 | | 2,588 | | +4 | +3 |

| LLPs | | -527 | -957 | | -45 | -45 |

| PBT | | 1,973 | 1,680 | | +17 | +16 |

| Underlying attrib. profit | | 1,164 | | 958 | | +21 | +20 |

Detailed financial information in section 4.6 'Appendix

| | | | | | | | | | | |

| Corporate Centre | | Underlying attributable profit |

| -EUR 1,535 | Mn |

Results

In 2021, underlying attributable loss of EUR 1,535 million was 15% higher than in 2020 (-EUR 1,332 million) because:

•Gains on financial transactions were lower (EUR 427 million less than in 2020) dampened by negative foreign currency hedging results in 2021 and positive results in 2020. Net interest income improved 3%.

•Administrative expenses and amortizations, however, increased by 5% compared to 2020, due to general inflation upturn in 2021. Excluding this impact, they would have remained stable.

•Net loan-loss provisions grew from EUR 31 million in 2020 to EUR 155 million in 2021.

•The net impact of other gains (losses) and provisions (which include provisions, intangible assets impairment, cost of the state guarantee on deferred tax assets, pensions, litigation, one-off provisions for stakes whose value was affected by the crisis, etc.) went from -EUR 412 million in 2020 to -EUR 190 million in 2021.

| | | | | | | | | | | | | | | |

| Corporate Centre | | | | | |

| EUR million | | | | | |

| Underlying income statement | | | 2021 | 2020 | % |

| | | | | |

| Net interest income | | | (624) | | (643) | | (3.0) | |

| Net fee income | | | (28) | | (29) | | (5.4) | |

Gains (losses) on financial transactions A | | | (140) | | 287 | | — | |

| Other operating income | | | (28) | | (25) | | 12.2 | |

| Total income | | | (819) | | (410) | | 99.7 | |

| Administrative expenses and amortizations | | | (346) | | (329) | | 5.2 | |

| Net operating income | | | (1,165) | | (739) | | 57.7 | |

| Net loan-loss provisions | | | (155) | | (31) | | 399.1 | |

| Other gains (losses) and provisions | | | (190) | | (412) | | (53.8) | |

| Profit before tax | | | (1,510) | | (1,181) | | 27.8 | |

| Tax on profit | | | (24) | | (151) | | (84.2) | |

| Profit from continuing operations | | | (1,534) | | (1,332) | | 15.2 | |

| Net profit from discontinued operations | | | — | | — | | — | |

| Consolidated profit | | | (1,534) | | (1,332) | | 15.2 | |

| Non-controlling interests | | | (1) | | 0 | | 489.2 | |

| Underlying profit attributable to the parent | | | (1,535) | | (1,332) | | 15.3 | |

| | | | | |

| Balance sheet | | | | | |

| Loans and advances to customers | | | 6,787 | | 5,044 | | 34.6 | |

| Cash, central banks and credit institutions | | | 88,918 | | 61,173 | | 45.4 | |

| Debt instruments | | | 1,555 | | 1,918 | | (18.9) | |

| Other financial assets | | | 2,203 | | 1,645 | | 33.9 | |

| Other asset accounts | | | 116,007 | | 112,807 | | 2.8 | |

| Total assets | | | 215,470 | | 182,587 | | 18.0 | |

| Customer deposits | | | 1,042 | | 825 | | 26.3 | |