FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 For the month of April, 2022 Commission File Number: 001-12518 Banco Santander, S.A. (Exact name of registrant as specified in its charter) Ciudad Grupo Santander 28660 Boadilla del Monte (Madrid) Spain (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ☐ No ☒ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☒

BANCO SANTANDER, S.A. ________________________ TABLE OF CONTENTS Item 1. January - March 2022 Earnings presentation

Q1’22 Earnings Presentation 26 April 2022 It's time to build together a better future for you

2 Important information Non-IFRS and alternative performance measures This presentation contains, in addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) and derived from our financial statements, alternative performance measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 (ESMA/2015/1415en) and other non-IFRS measures (“Non-IFRS Measures”). These financial measures that qualify as APMs and non-IFRS measures have been calculated with information from Santander Group; however those financial measures are not defined or detailed in the applicable financial reporting framework nor have been audited or reviewed by our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs and non-IFRS measures to be useful metrics for our management and investors to compare operating performance between accounting periods, as these measures exclude items outside the ordinary course performance of our business, which are grouped in the “management adjustment” line and are further detailed in Section 3.2 of the Economic and Financial Review in our Directors’ Report included in our Annual Report on Form 20-F for the year ended 31 December 2021. Nonetheless, these APMs and non-IFRS measures should be considered supplemental information to, and are not meant to substitute IFRS measures. Furthermore, companies in our industry and others may calculate or use APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. For further details on APMs and Non-IFRS Measures, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2021 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on 1 March 2022, as updated by the Form 6-K filed with the SEC on 8 April 2022 in order to reflect our new organizational and reporting structure, as well as the section “Alternative performance measures” of the annex to the Banco Santander, S.A. (“Santander”) Q1 2022 Financial Report, published as Inside Information on 26 April 2022. These documents are available on Santander’s website (www.santander.com). Underlying measures, which are included in this presentation, are non-IFRS measures. The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included businesses and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries. Forward-looking statements Santander advises that this presentation contains “forward-looking statements” as per the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future” and similar expressions. Found throughout this presentation, they include (but are not limited to) statements on our future business development, economic performance and shareholder remuneration policy. However, a number of risks, uncertainties and other important factors may cause actual developments and results to differ materially from our expectations. The following important factors, in addition to others discussed elsewhere in this presentation, could affect our future results and could cause materially different outcomes from those anticipated in forward-looking statements: (1) general economic or industry conditions of areas where we have significant operations or investments (such as a worse economic environment; higher volatility in the capital markets; inflation or deflation; changes in demographics, consumer spending, investment or saving habits; and the effects of the war in Ukraine or the COVID-19 pandemic in the global economy); (2) exposure to various market risks (particularly interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices); (3) potential losses from early repayments on our loan and investment portfolio, declines in value of collateral securing our loan portfolio, and counterparty risk; (4) political stability in Spain, the United Kingdom, other European countries, Latin America and the US (5) changes in legislation, regulations, taxes, including regulatory capital and liquidity requirements, especially in view of the UK exit of the European Union and increased regulation in response to financial crises; (6) our ability to integrate successfully our acquisitions and related challenges that result from the inherent diversion of management’s focus and resources from other strategic opportunities and operational matters; and (7) changes in our access to liquidity and funding on acceptable terms, in particular if resulting from credit spreads shifts or downgrade in credit ratings for the entire Group or significant subsidiaries.

3 Important information Numerous factors could affect our future results and could cause those results deviating from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date of this presentation and are informed by the knowledge, information and views available on such date. Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or otherwise. No offer The information contained in this presentation is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document published by Santander. Any person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in this presentation. No investment activity should be undertaken on the basis of the information contained in this presentation. In making this presentation available Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Historical performance is not indicative of future results Statements about historical performance or accretion must not be construed to indicate that future performance, share price or results (including earnings per share) in any future period will necessarily match or exceed those of any prior period. Nothing in this presentation should be taken as a profit forecast. Third Party Information In particular, regarding the data provided by third parties, neither Santander, nor any of its administrators, directors or employees, either explicitly or implicitly, guarantees that these contents are exact, accurate, comprehensive or complete, nor are they obliged to keep them updated, nor to correct them in the case that any deficiency, error or omission were to be detected. Moreover, in reproducing these contents in by any means, Santander may introduce any changes it deems suitable, may omit partially or completely any of the elements of this document, and in case of any deviation between such a version and this one, Santander assumes no liability for any discrepancy.

4 Index 1 Appendix 3 Business areas review Final remarks 2 4 Highlights and Group performance

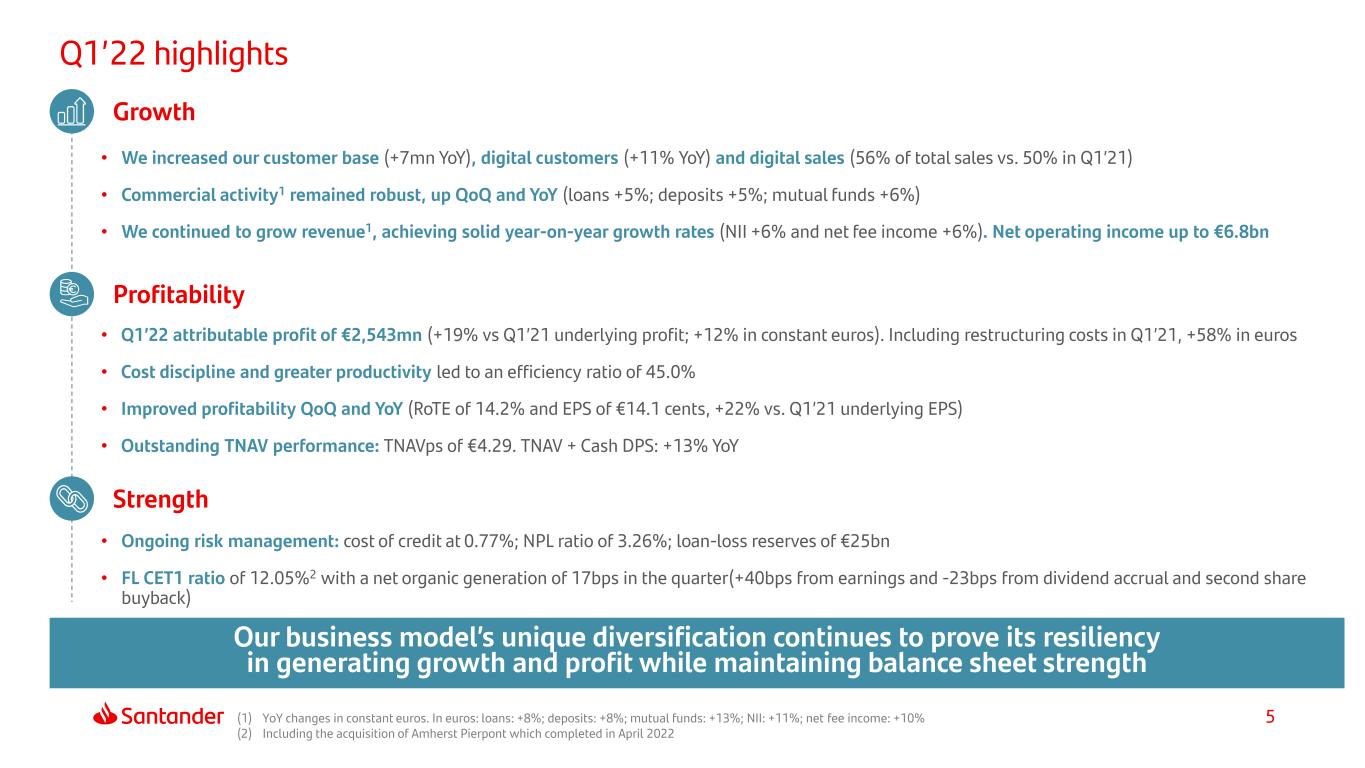

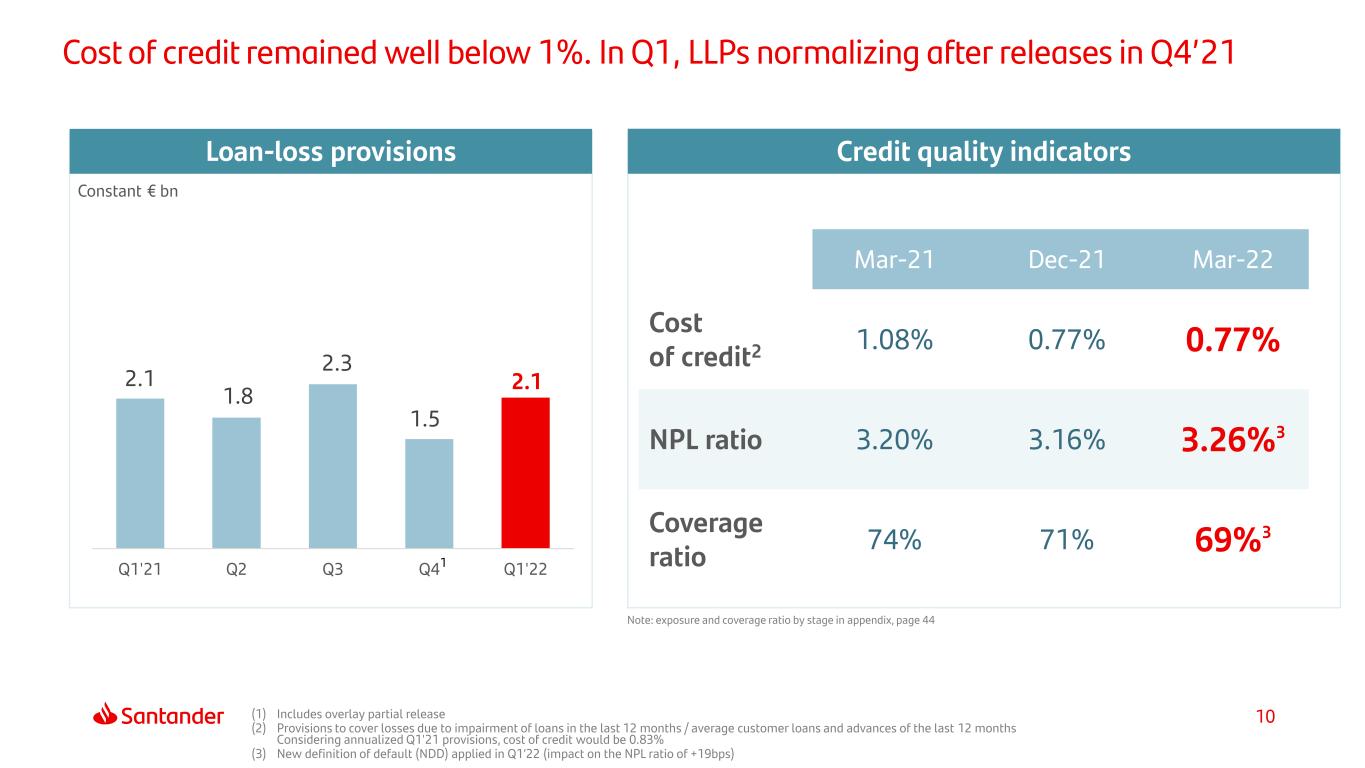

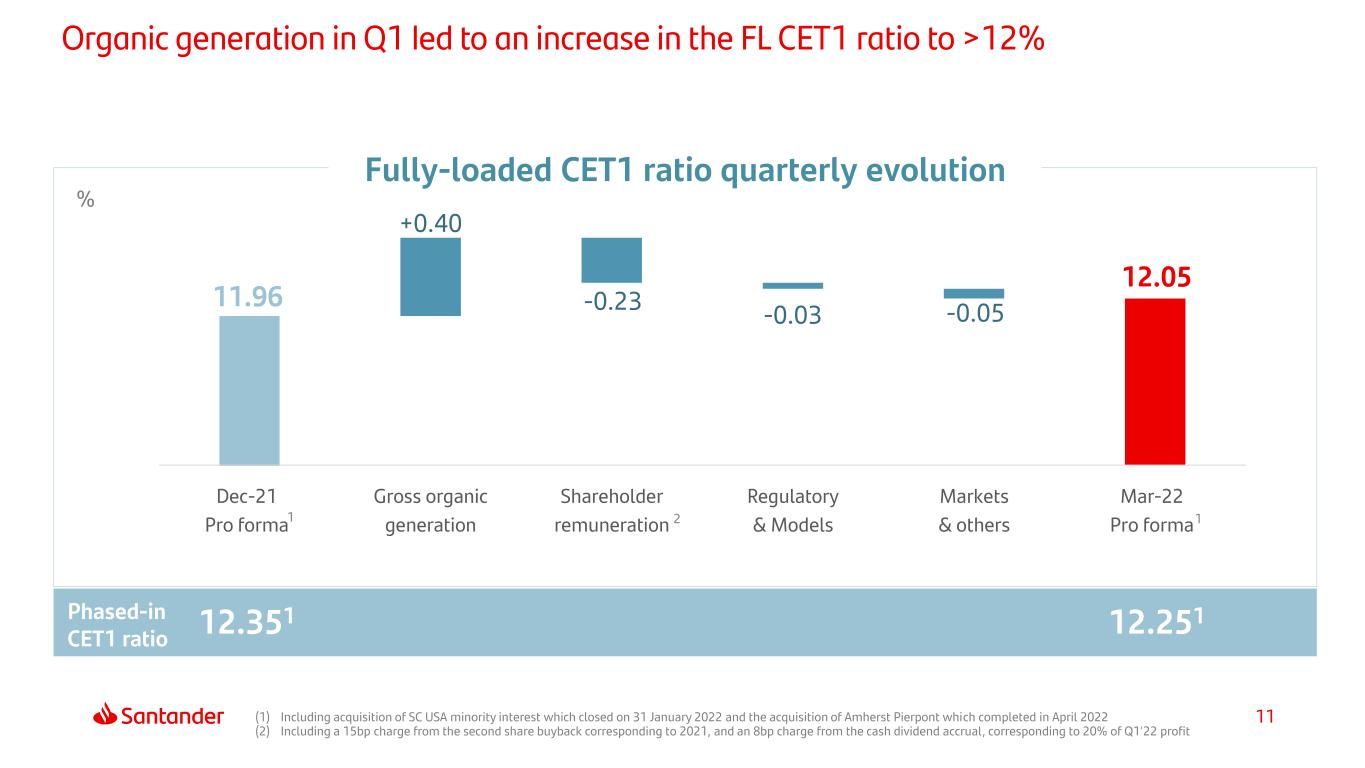

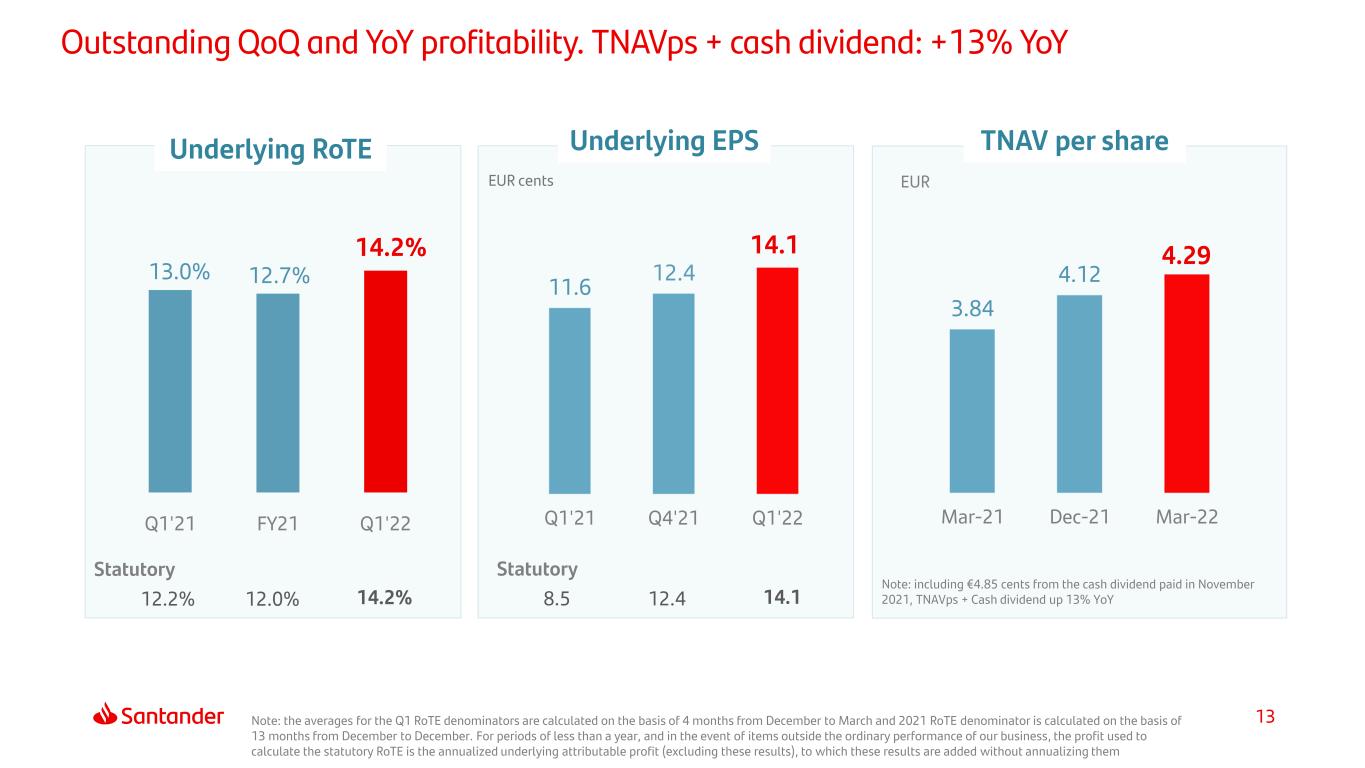

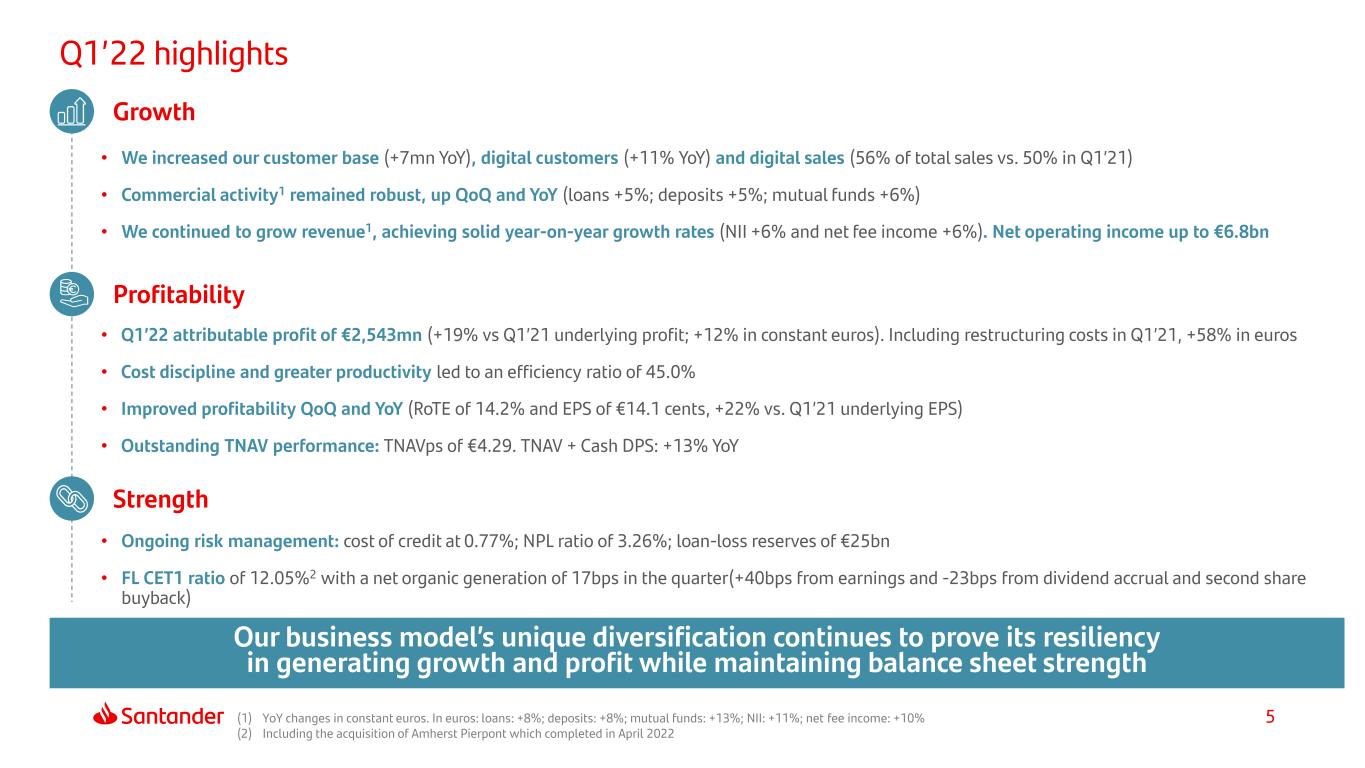

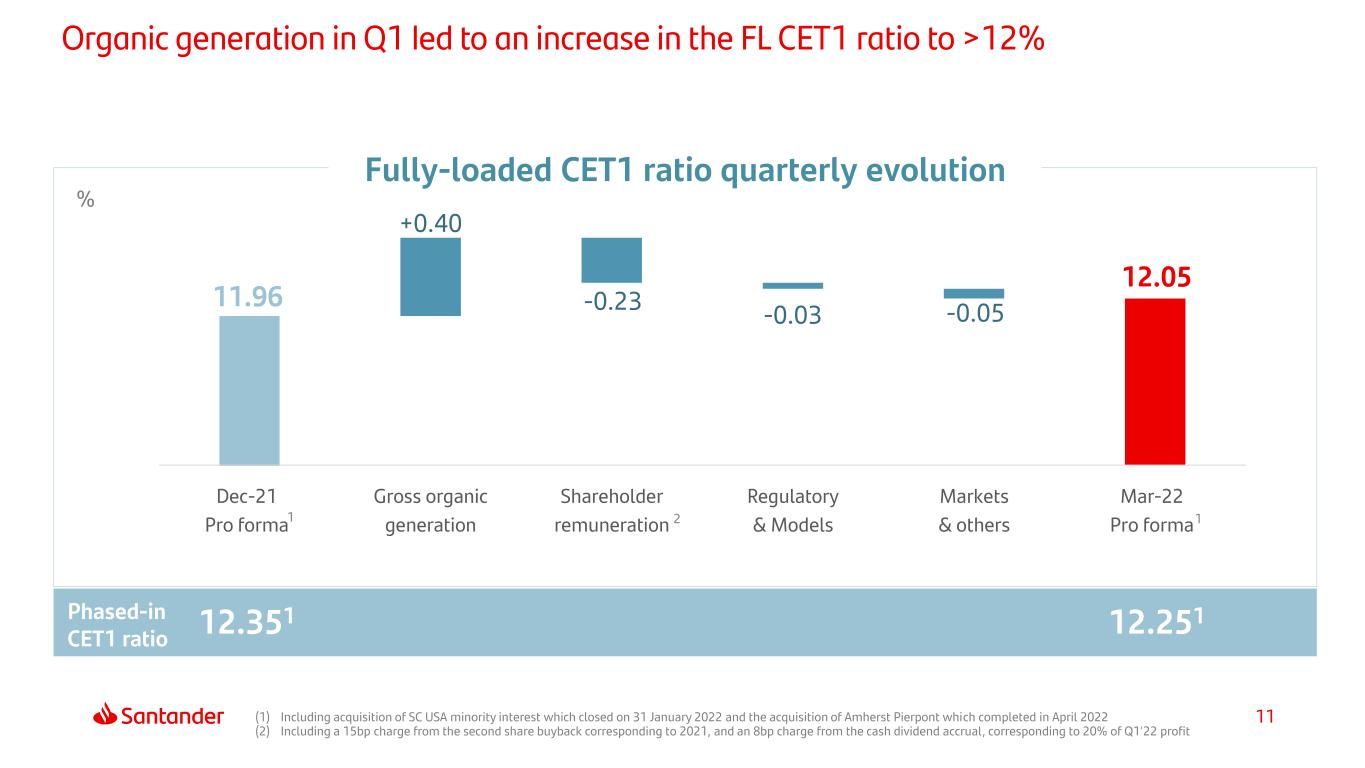

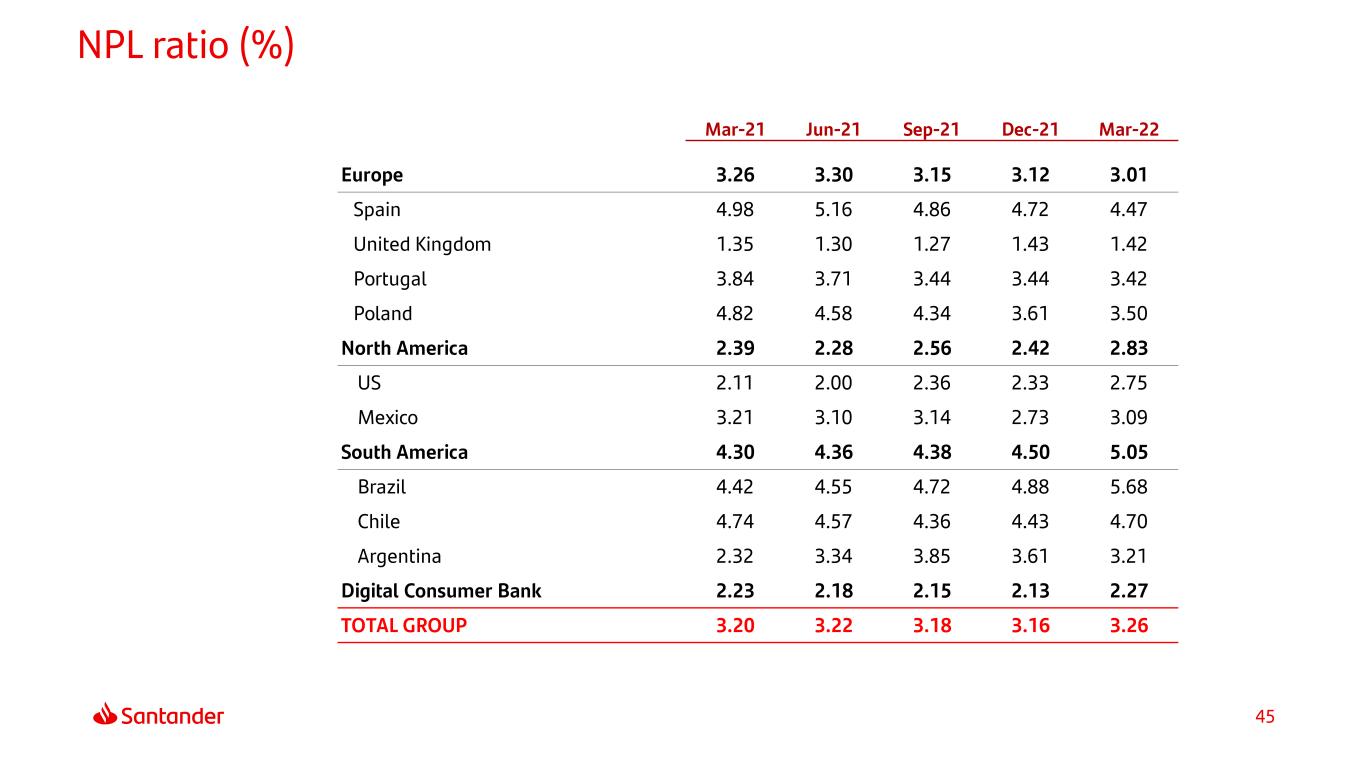

5 Q1’22 highlights • We increased our customer base (+7mn YoY), digital customers (+11% YoY) and digital sales (56% of total sales vs. 50% in Q1’21) • Commercial activity1 remained robust, up QoQ and YoY (loans +5%; deposits +5%; mutual funds +6%) • We continued to grow revenue1, achieving solid year-on-year growth rates (NII +6% and net fee income +6%). Net operating income up to €6.8bn Growth Profitability • Q1’22 attributable profit of €2,543mn (+19% vs Q1’21 underlying profit; +12% in constant euros). Including restructuring costs in Q1’21, +58% in euros • Cost discipline and greater productivity led to an efficiency ratio of 45.0% • Improved profitability QoQ and YoY (RoTE of 14.2% and EPS of €14.1 cents, +22% vs. Q1’21 underlying EPS) • Outstanding TNAV performance: TNAVps of €4.29. TNAV + Cash DPS: +13% YoY Strength • Ongoing risk management: cost of credit at 0.77%; NPL ratio of 3.26%; loan-loss reserves of €25bn • FL CET1 ratio of 12.05%2 with a net organic generation of 17bps in the quarter(+40bps from earnings and -23bps from dividend accrual and second share buyback) (1) YoY changes in constant euros. In euros: loans: +8%; deposits: +8%; mutual funds: +13%; NII: +11%; net fee income: +10% (2) Including the acquisition of Amherst Pierpont which completed in April 2022 Our business model’s unique diversification continues to prove its resiliency in generating growth and profit while maintaining balance sheet strength

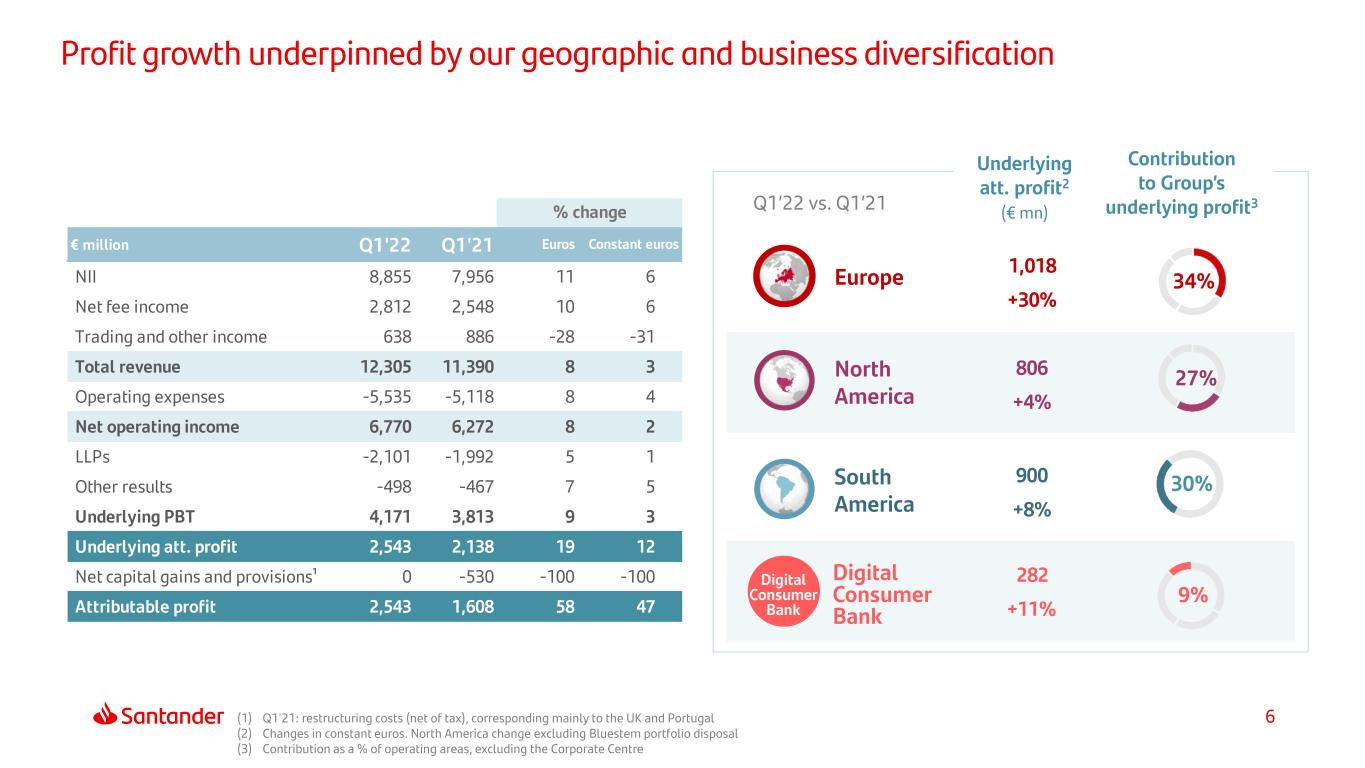

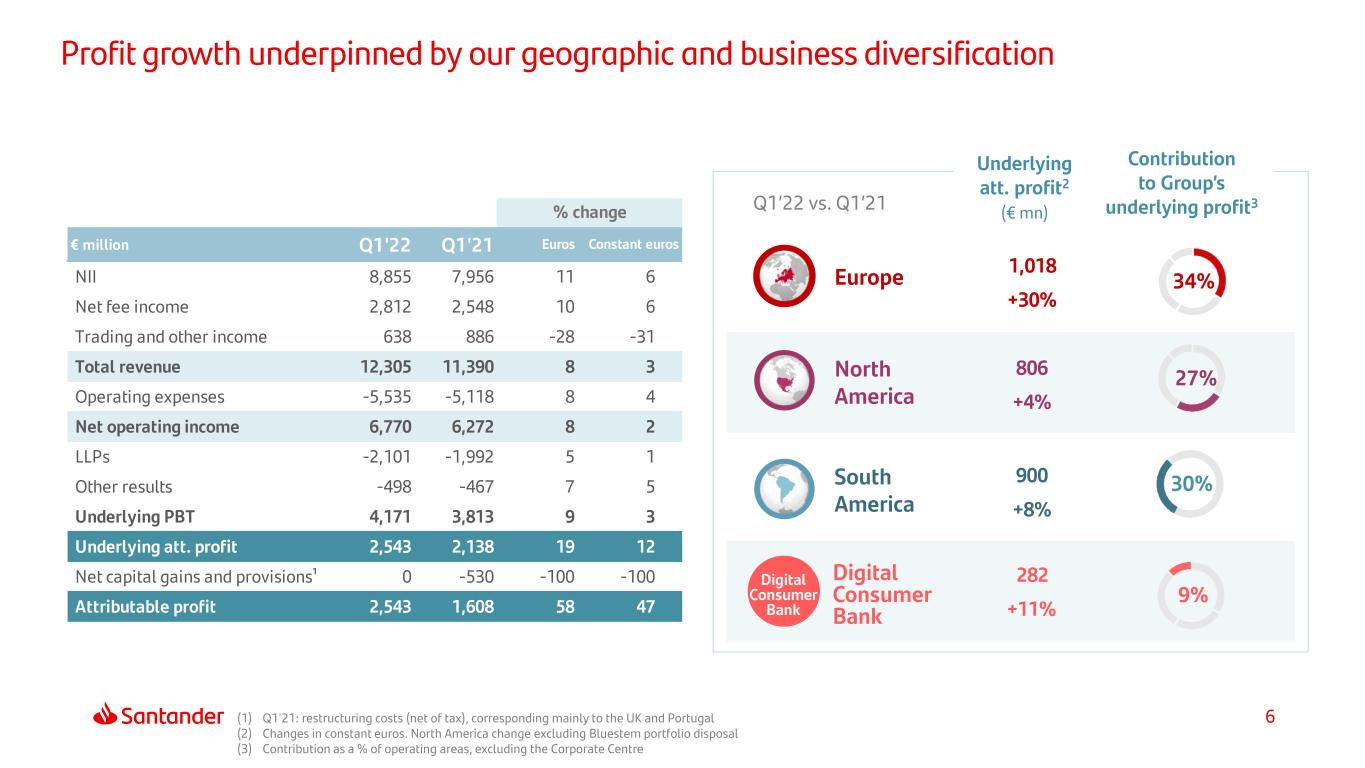

6(1) Q1'21: restructuring costs (net of tax), corresponding mainly to the UK and Portugal (2) Changes in constant euros. North America change excluding Bluestem portfolio disposal (3) Contribution as a % of operating areas, excluding the Corporate Centre Europe South America North America Q1’22 vs. Q1’21 Digital Consumer Bank Digital Consumer Bank Underlying att. profit2 (€ mn) Contribution to Group’s underlying profit3 € million Q1'22 Q1'21 Euros NII 8,855 7,956 11 6 Net fee income 2,812 2,548 10 6 Trading and other income 638 886 -28 -31 Total revenue 12,305 11,390 8 3 Operating expenses -5,535 -5,118 8 4 Net operating income 6,770 6,272 8 2 LLPs -2,101 -1,992 5 1 Other results -498 -467 7 5 Underlying PBT 4,171 3,813 9 3 Underlying att. profit 2,543 2,138 19 12 Net capital gains and provisions¹ 0 -530 -100 -100 Attributable profit 2,543 1,608 58 47 % change Constant euros 1,018 +30% 806 +4% 900 +8% 282 +11% 34% 27% 30% 9% Profit growth underpinned by our geographic and business diversification

7 Positive profit trend backed by higher revenue, cost discipline and flat LLPs 1,608 2,067 2,174 2,275 2,543 1,732 2,194 2,245 2,357 2,543 2,275 Q1'21 Q2 Q3 Q4 Q1'22 2,086 1,824 2,287 1,524 2,101 Q1'21 Q2 Q3 Q4 Q1'22 5,297 5,413 5,514 5,765 5,535 Costs LLPs 2,655 2,706 2,689 2,766 2,812 8,335 8,551 8,685 8,986 8,855 Net fee income NII Other income Revenue 928 474 858 375 638 Constant € mn Attributable profit (current € mn) Constant € mn +47% YoY +58% YoY Attributable profit +6% YoY +6% YoY +4% YoY +1% YoY Underlying profit (1) Includes overlay partial release 1

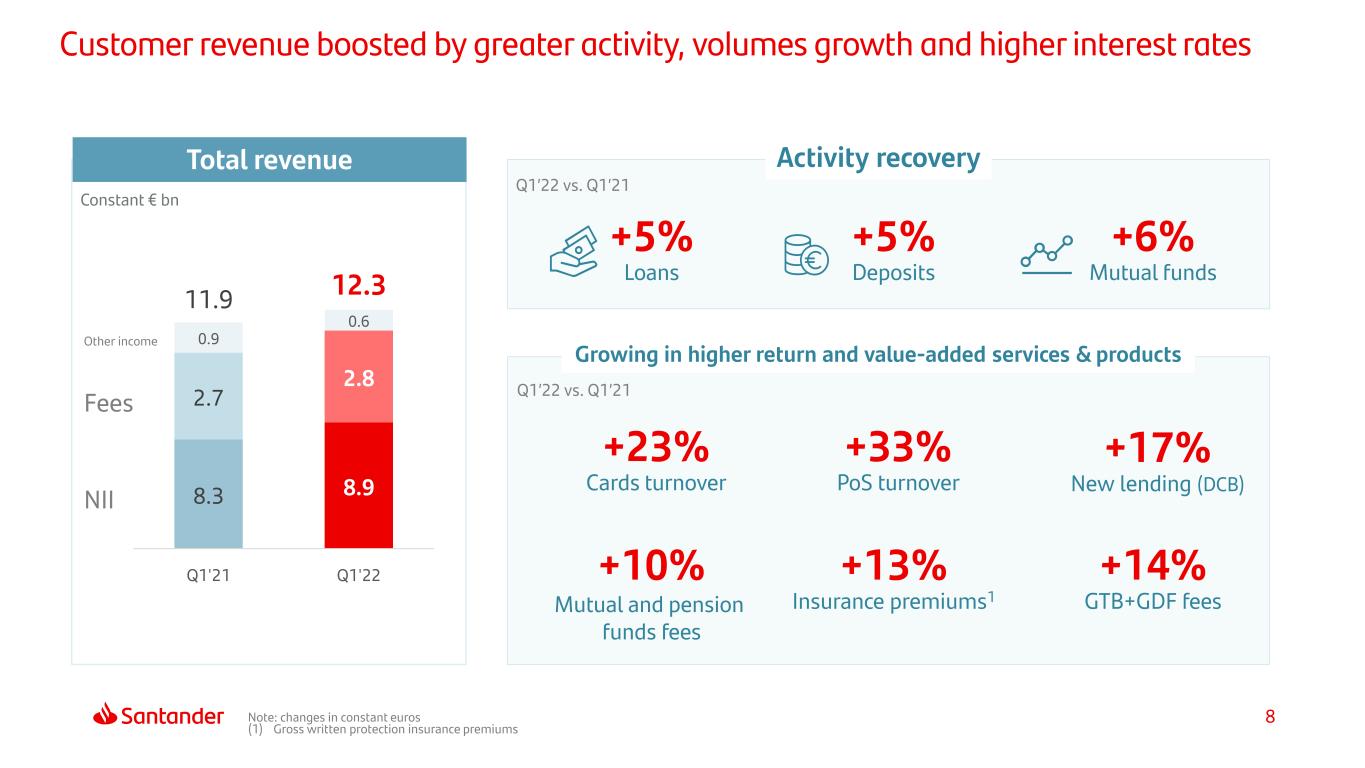

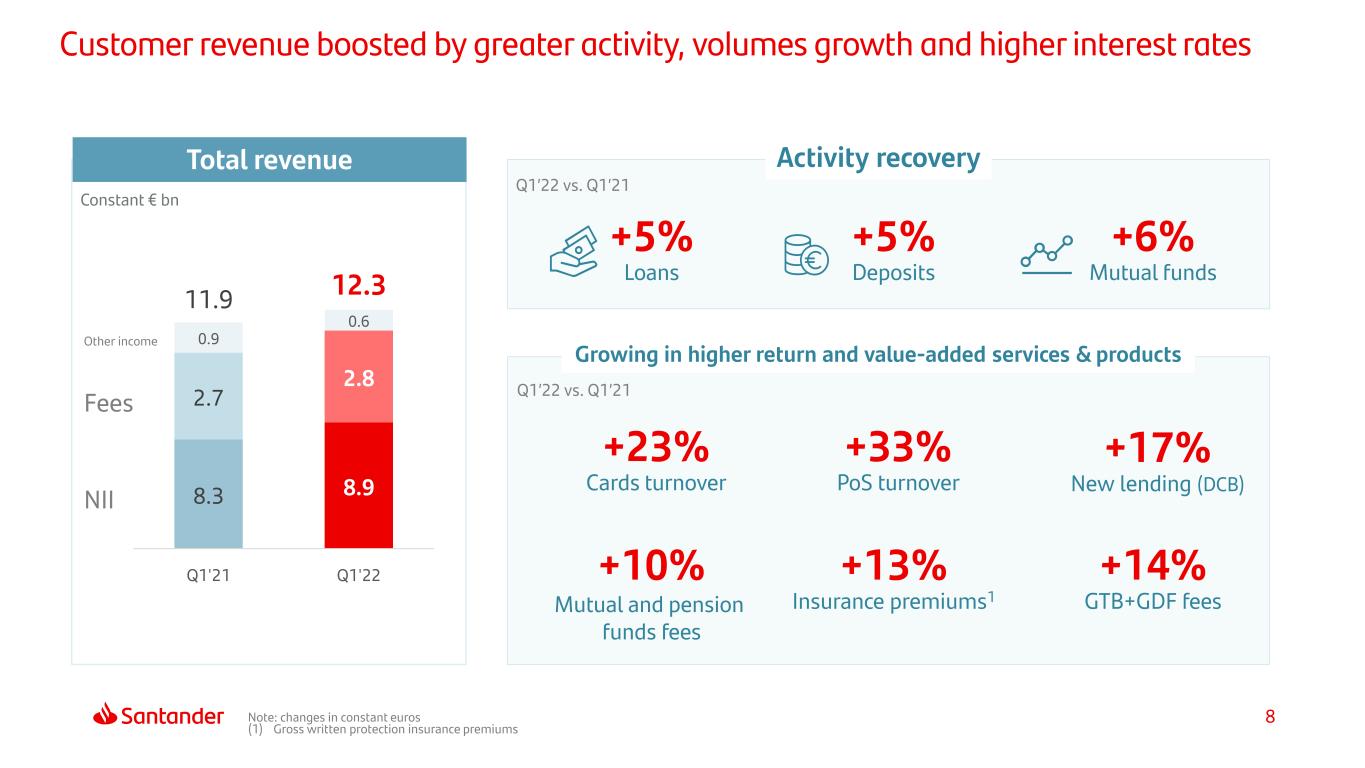

8 8.3 8.9 2.7 2.8 0.9 0.6 11.9 12.3 Q1'21 Q1'22 Customer revenue boosted by greater activity, volumes growth and higher interest rates Note: changes in constant euros (1) Gross written protection insurance premiums Total revenue +33% PoS turnover Activity recovery +5% Loans +5% Deposits +6% Mutual funds Growing in higher return and value-added services & products Q1’22 vs. Q1’21 Q1’22 vs. Q1’21 +23% Cards turnover +17% New lending (DCB) +10% Mutual and pension funds fees +13% Insurance premiums1 +14% GTB+GDF fees Constant € bn Other income Fees NII

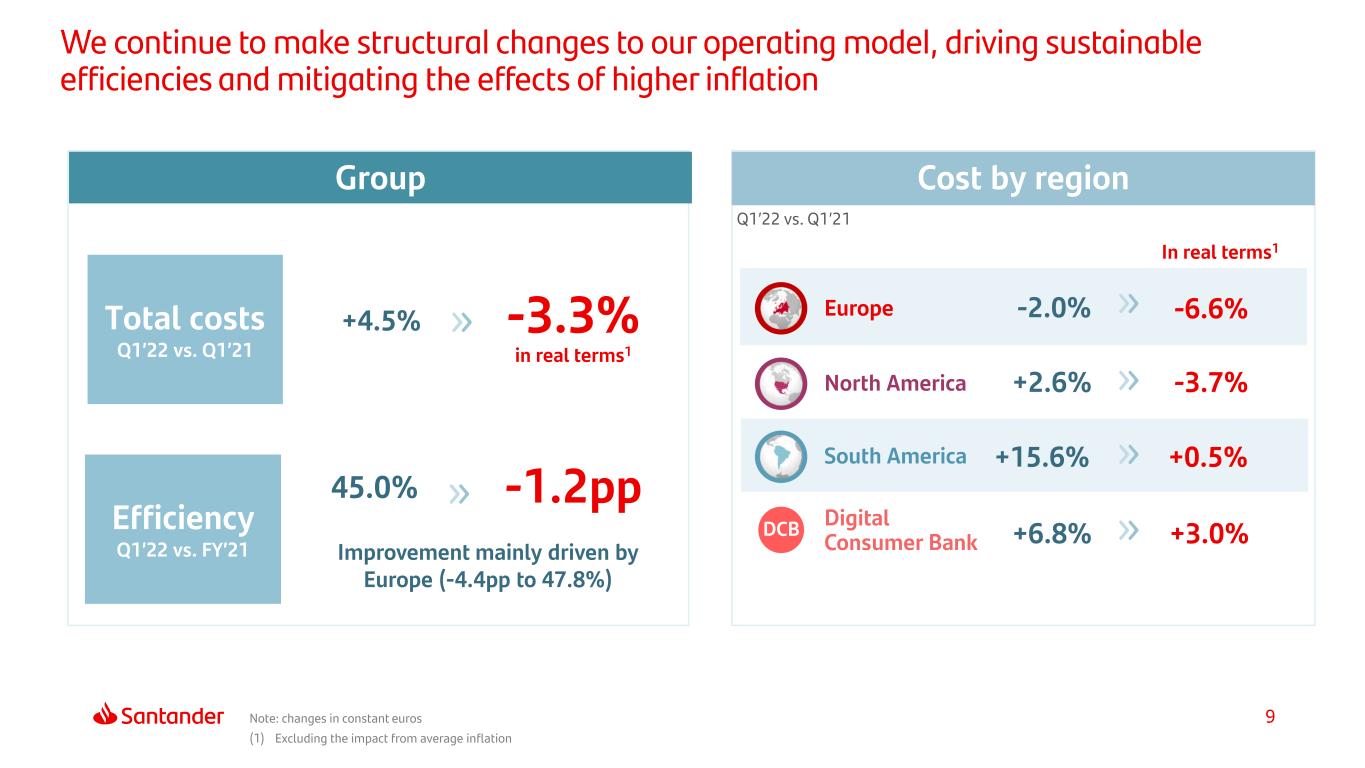

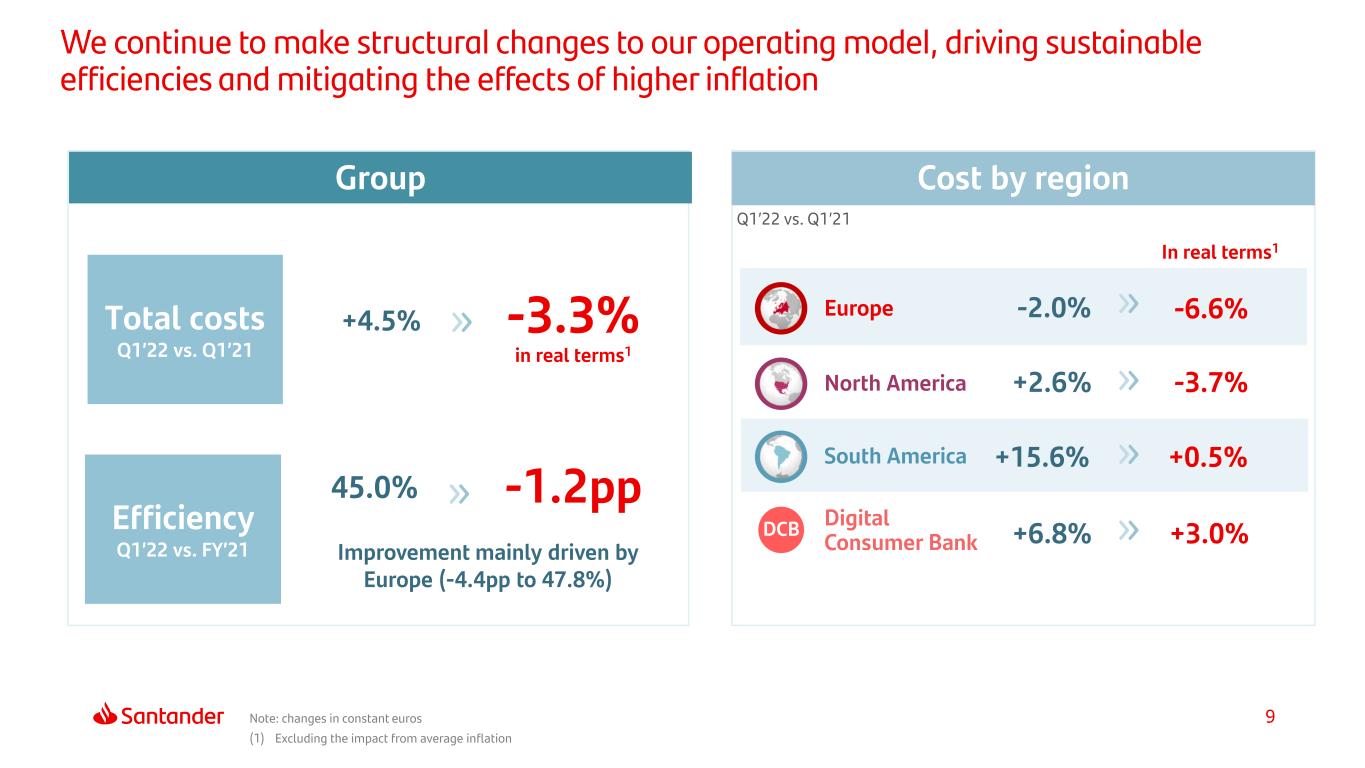

9 We continue to make structural changes to our operating model, driving sustainable efficiencies and mitigating the effects of higher inflation 45.0% -1.2pp Efficiency Q1’22 vs. FY’21 Note: changes in constant euros (1) Excluding the impact from average inflation +4.5% -3.3% in real terms1 Total costs Q1’22 vs. Q1’21 Europe North America South America Digital Consumer Bank DCB -2.0% +2.6% +15.6% +6.8% -6.6% -3.7% +0.5% +3.0% Group Cost by region Improvement mainly driven by Europe (-4.4pp to 47.8%) In real terms1 Q1’22 vs. Q1’21

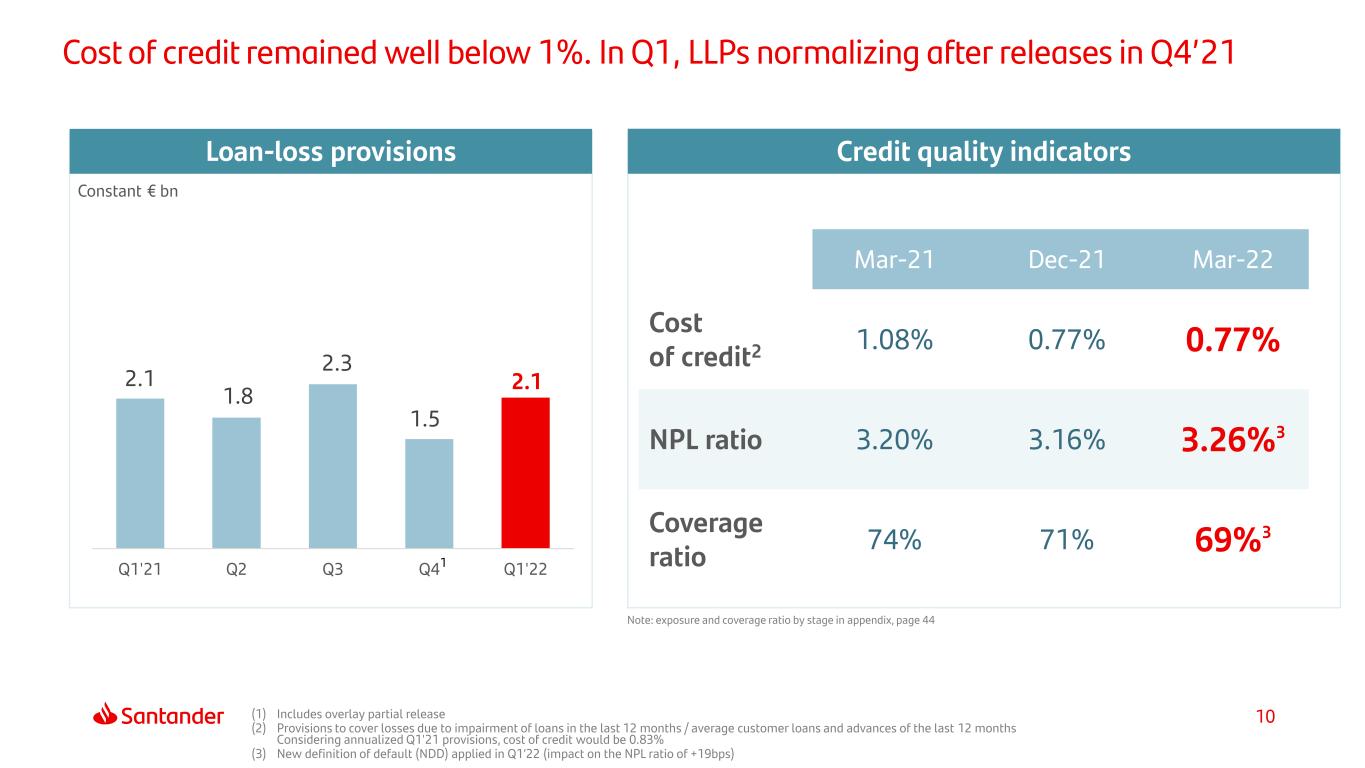

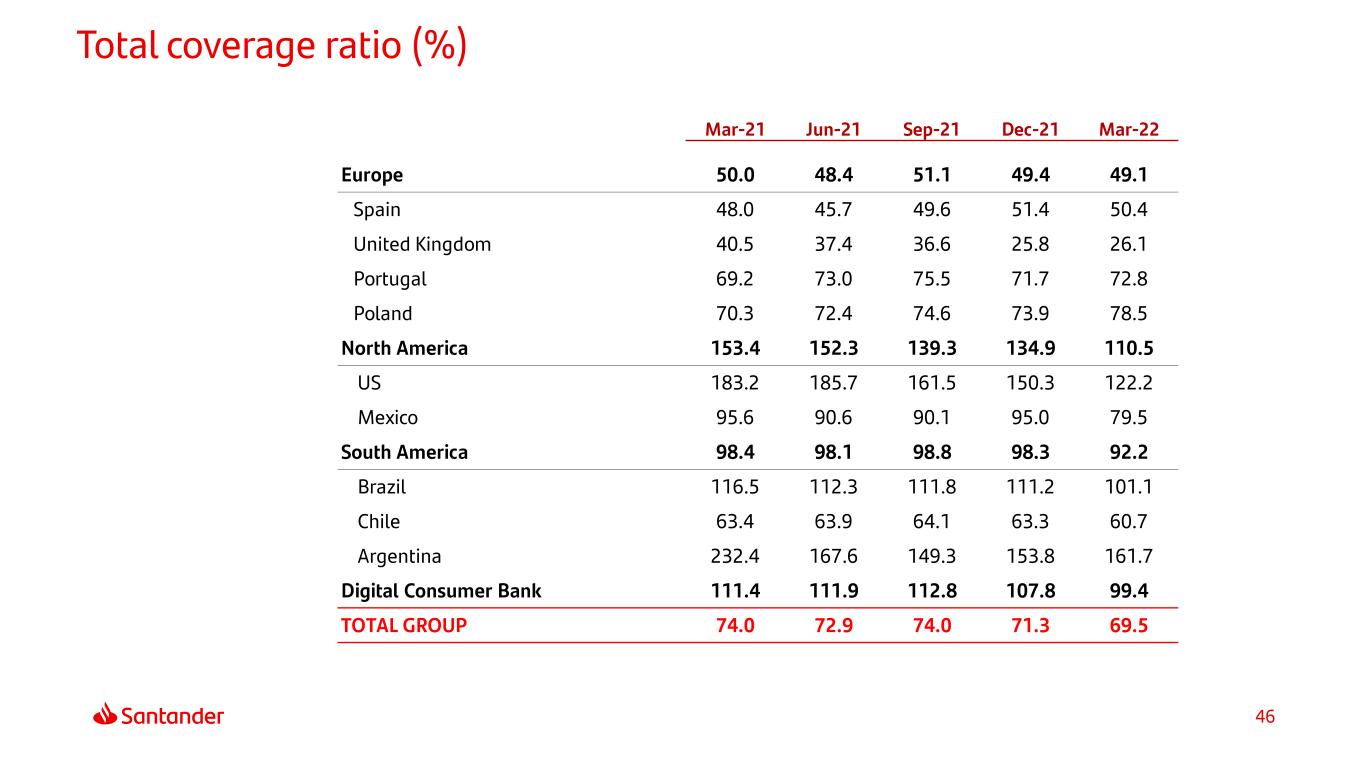

10 2.1 1.8 2.3 1.5 2.1 Q1'21 Q2 Q3 Q4 Q1'22 Constant € bn Note: exposure and coverage ratio by stage in appendix, page 44 (1) Includes overlay partial release (2) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months Considering annualized Q1'21 provisions, cost of credit would be 0.83% (3) New definition of default (NDD) applied in Q1’22 (impact on the NPL ratio of +19bps) Cost of credit remained well below 1%. In Q1, LLPs normalizing after releases in Q4’21 Loan-loss provisions Mar-21 Dec-21 Mar-22 Cost of credit2 1.08% 0.77% 0.77% NPL ratio 3.20% 3.16% 3.26%3 Coverage ratio 74% 71% 69%3 Credit quality indicators 1

11 Organic generation in Q1 led to an increase in the FL CET1 ratio to >12% Fully-loaded CET1 ratio quarterly evolution % Phased-in CET1 ratio 12.351 12.251 2 12.05 -0.23 -0.03 -0.05 11.96 +0.40 Dec-21 Pro forma Gross organic generation Shareholder remuneration Regulatory & Models Markets & others Mar-22 Pro forma (1) Including acquisition of SC USA minority interest which closed on 31 January 2022 and the acquisition of Amherst Pierpont which completed in April 2022 (2) Including a 15bp charge from the second share buyback corresponding to 2021, and an 8bp charge from the cash dividend accrual, corresponding to 20% of Q1'22 profit 1 1

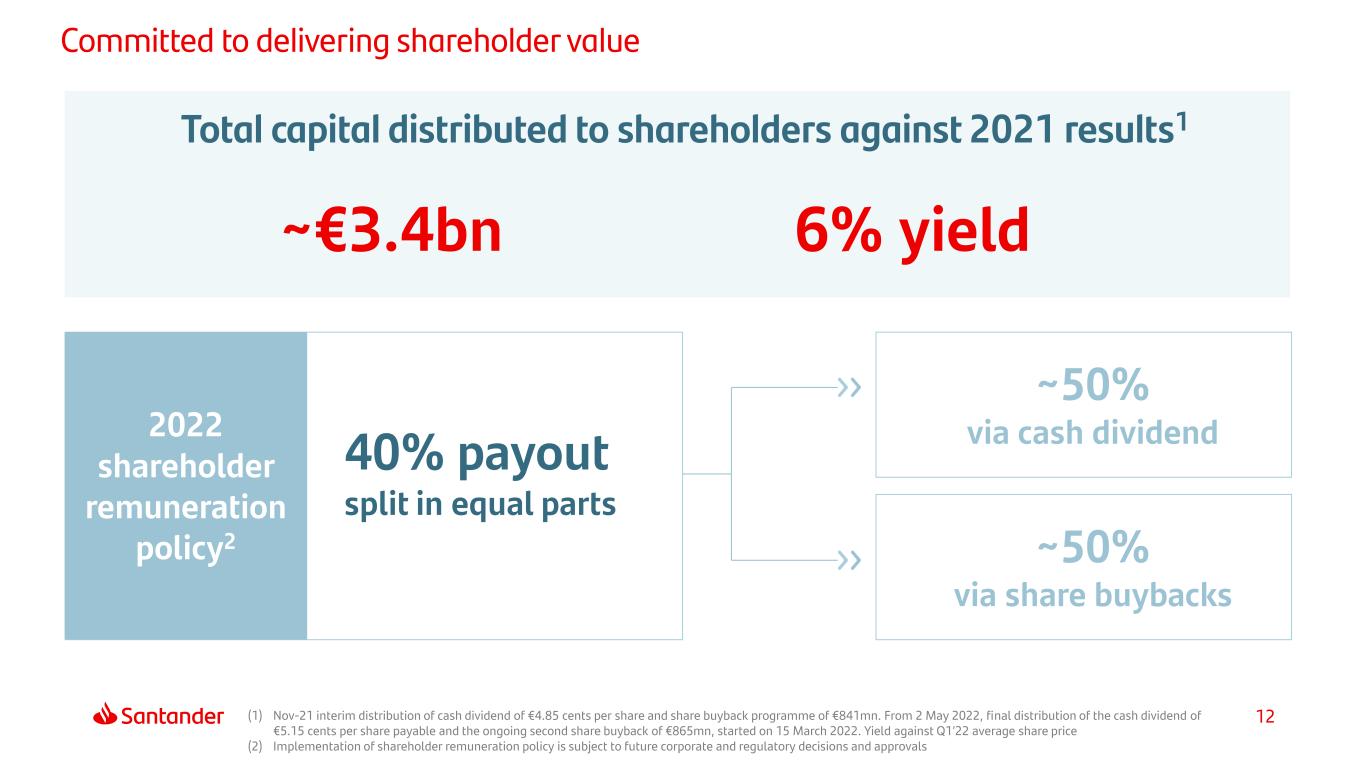

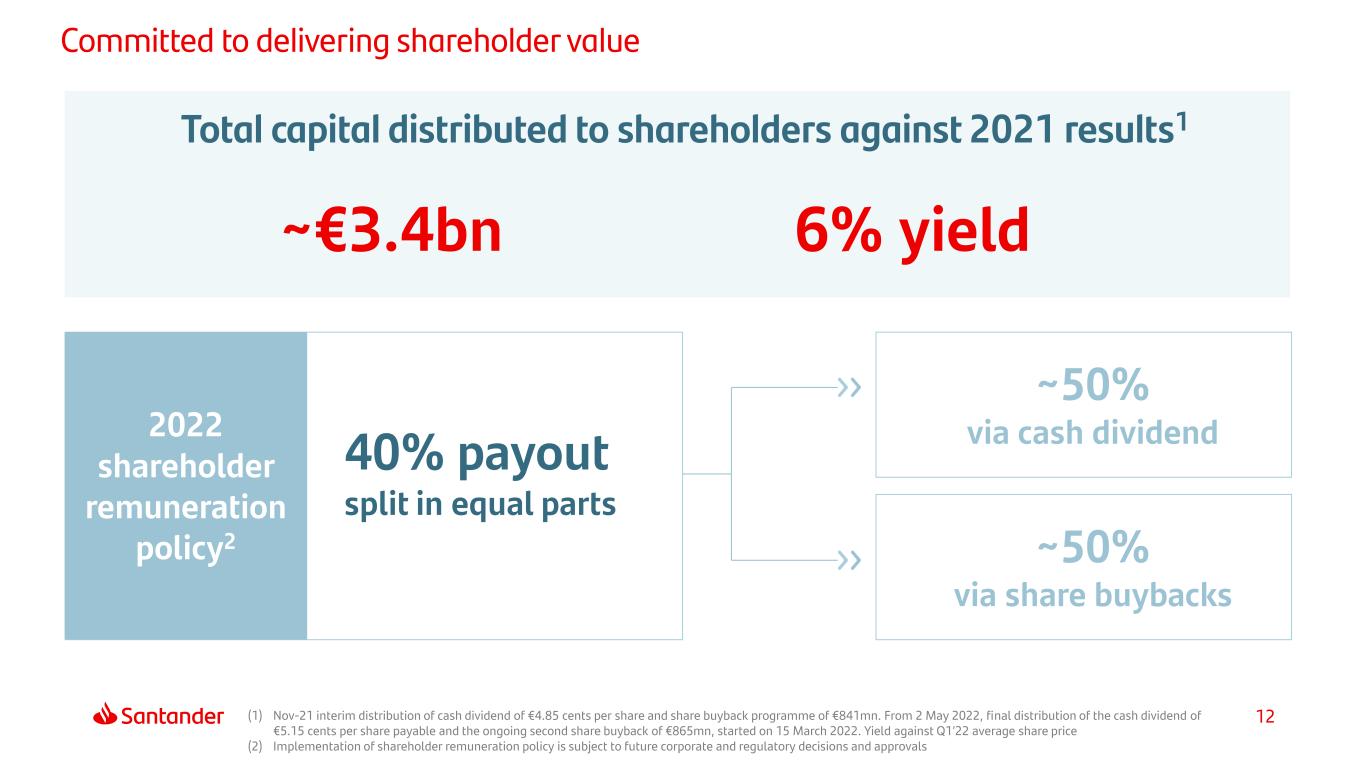

12 Committed to delivering shareholder value ~50% via cash dividend 40% payout split in equal parts Total capital distributed to shareholders against 2021 results1 2022 shareholder remuneration policy2 ~€3.4bn 6% yield ~50% via share buybacks (1) Nov-21 interim distribution of cash dividend of €4.85 cents per share and share buyback programme of €841mn. From 2 May 2022, final distribution of the cash dividend of €5.15 cents per share payable and the ongoing second share buyback of €865mn, started on 15 March 2022. Yield against Q1’22 average share price (2) Implementation of shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals

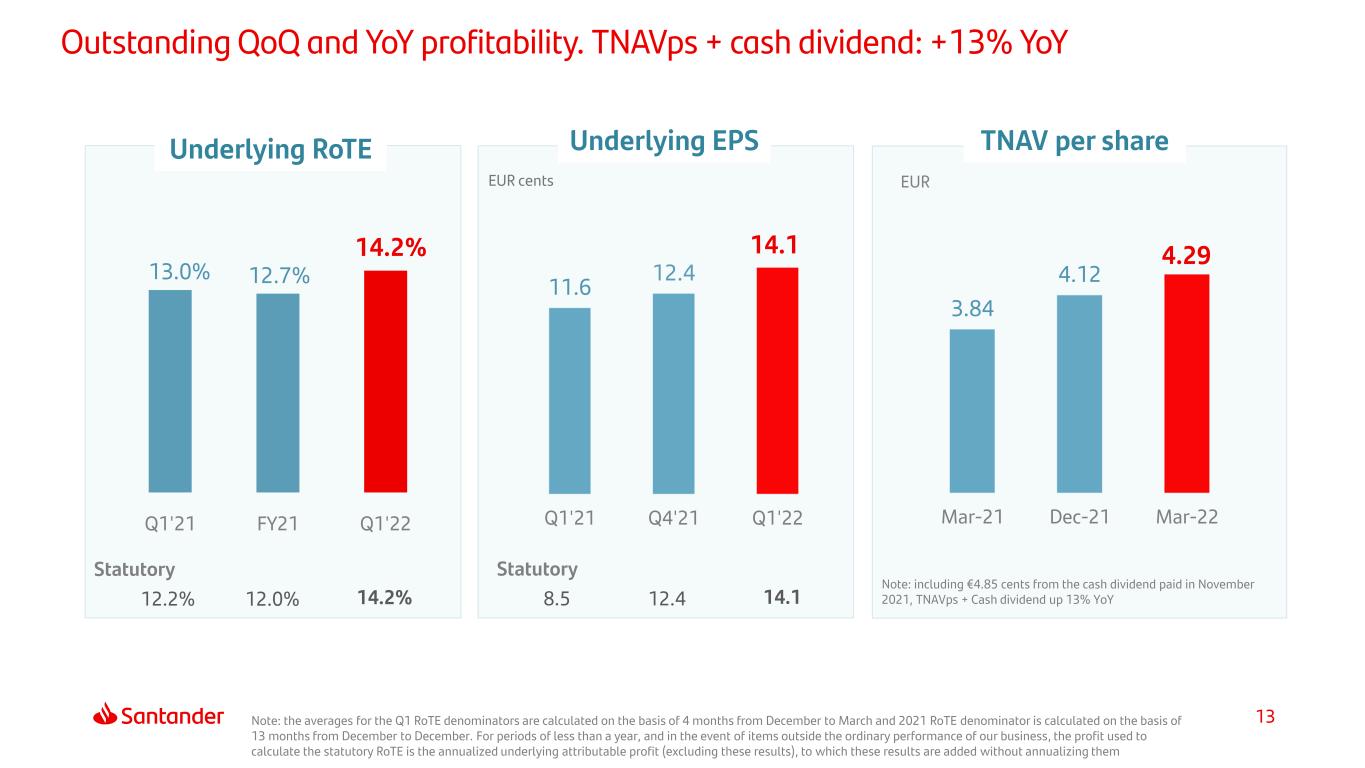

13 Outstanding QoQ and YoY profitability. TNAVps + cash dividend: +13% YoY Note: the averages for the Q1 RoTE denominators are calculated on the basis of 4 months from December to March and 2021 RoTE denominator is calculated on the basis of 13 months from December to December. For periods of less than a year, and in the event of items outside the ordinary performance of our business, the profit used to calculate the statutory RoTE is the annualized underlying attributable profit (excluding these results), to which these results are added without annualizing them 13.0% 12.7% 14.2% Q1'21 FY21 Q1'22 €cents 11.6 12.4 14.1 Q1'21 Q4'21 Q1'22 3.84 4.12 4.29 Mar-21 Dec-21 Mar-22 Note: including €4.85 cents from the cash dividend paid in November 2021, TNAVps + Cash dividend up 13% YoY TNAV per shareUnderlying EPS EUR cents Statutory 12.2% 12.0% 14.2% Statutory 8.5 12.4 14.1 Underlying RoTE EUR

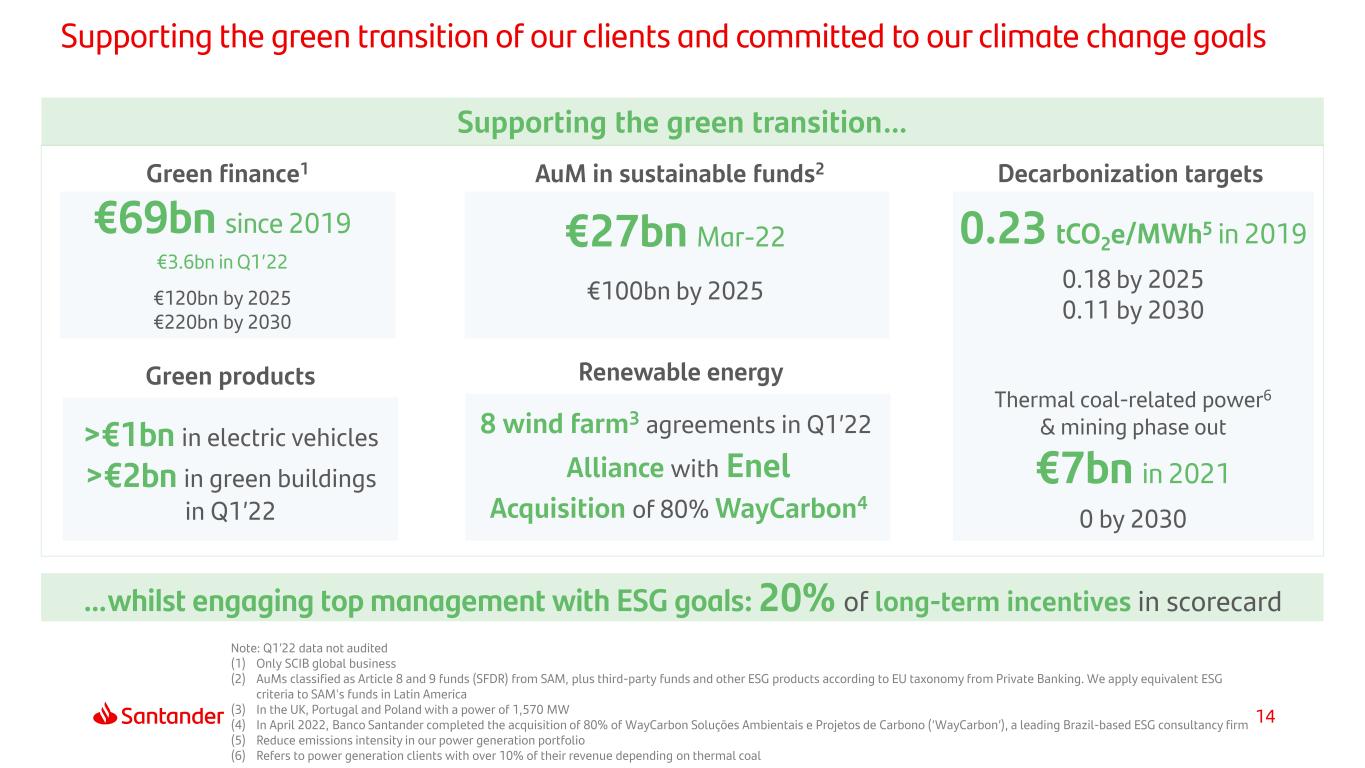

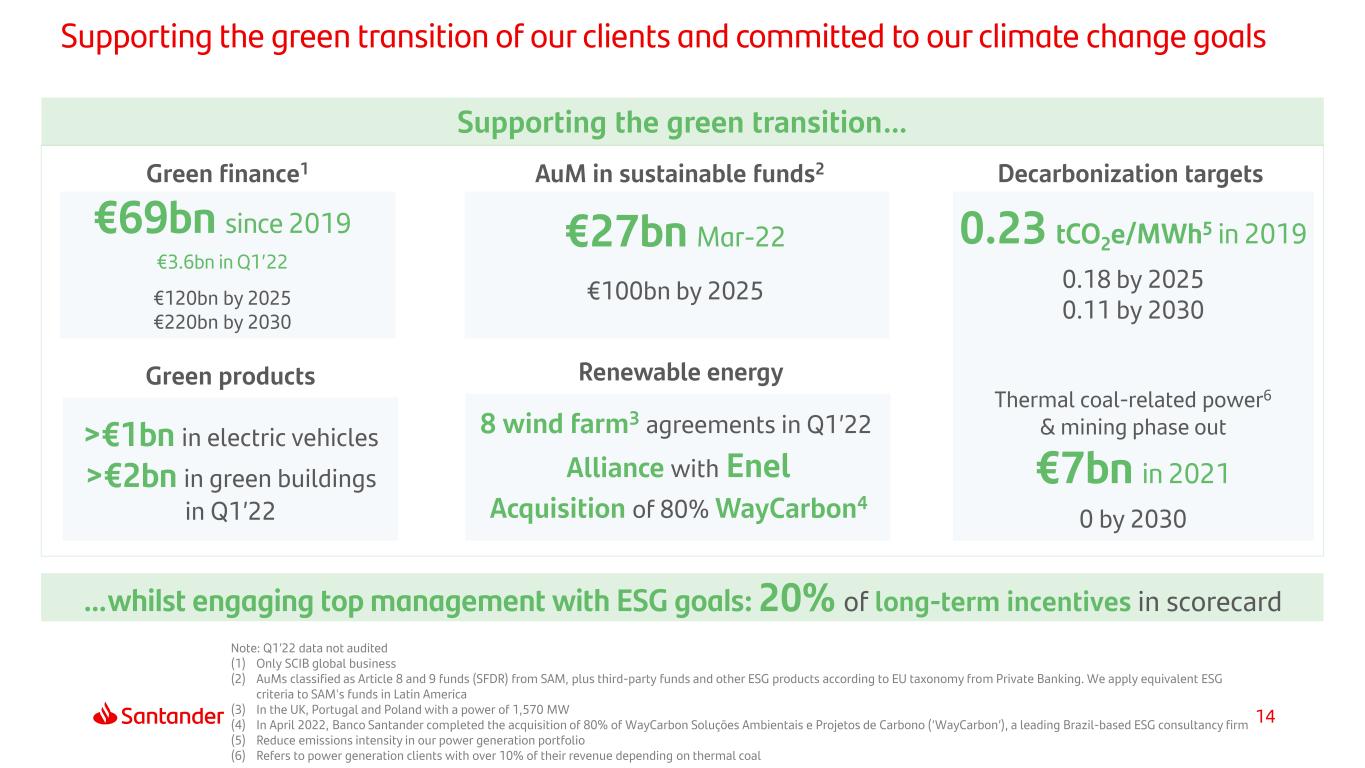

14 Supporting the green transition of our clients and committed to our climate change goals Note: Q1’22 data not audited (1) Only SCIB global business (2) AuMs classified as Article 8 and 9 funds (SFDR) from SAM, plus third-party funds and other ESG products according to EU taxonomy from Private Banking. We apply equivalent ESG criteria to SAM's funds in Latin America (3) In the UK, Portugal and Poland with a power of 1,570 MW (4) In April 2022, Banco Santander completed the acquisition of 80% of WayCarbon Soluções Ambientais e Projetos de Carbono (‘WayCarbon’), a leading Brazil-based ESG consultancy firm (5) Reduce emissions intensity in our power generation portfolio (6) Refers to power generation clients with over 10% of their revenue depending on thermal coal 8 wind farm3 agreements in Q1’22 Alliance with Enel Acquisition of 80% WayCarbon4 Supporting the green transition… Green finance1 €69bn since 2019 €3.6bn in Q1’22 €120bn by 2025 €220bn by 2030 Green products >€1bn in electric vehicles >€2bn in green buildings in Q1’22 AuM in sustainable funds2 €27bn Mar-22 €100bn by 2025 Renewable energy Thermal coal-related power6 & mining phase out €7bn in 2021 0 by 2030 Decarbonization targets …whilst engaging top management with ESG goals: 20% of long-term incentives in scorecard 0.23 tCO2e/MWh5 in 2019 0.18 by 2025 0.11 by 2030

15 Index 1 Appendix 3 Business areas review Final remarks 2 4 Highlights and Group performance

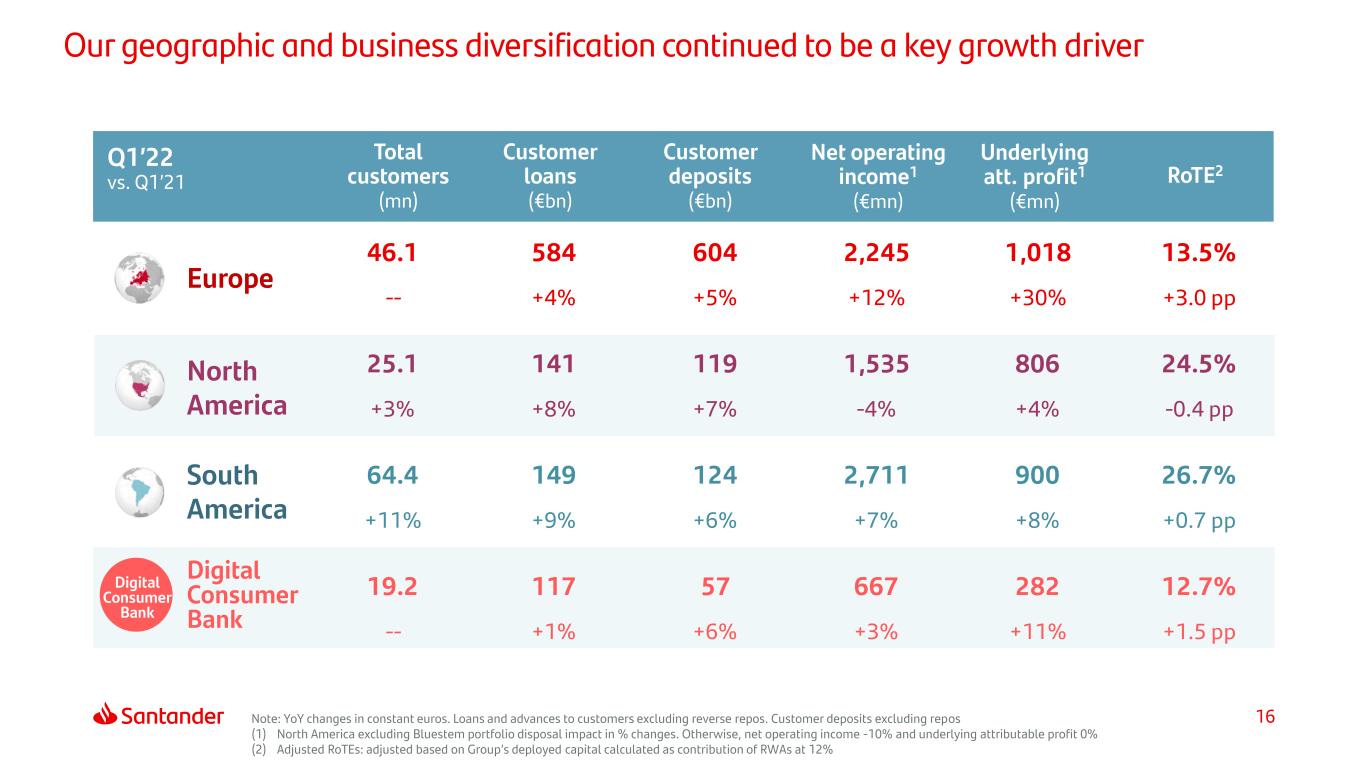

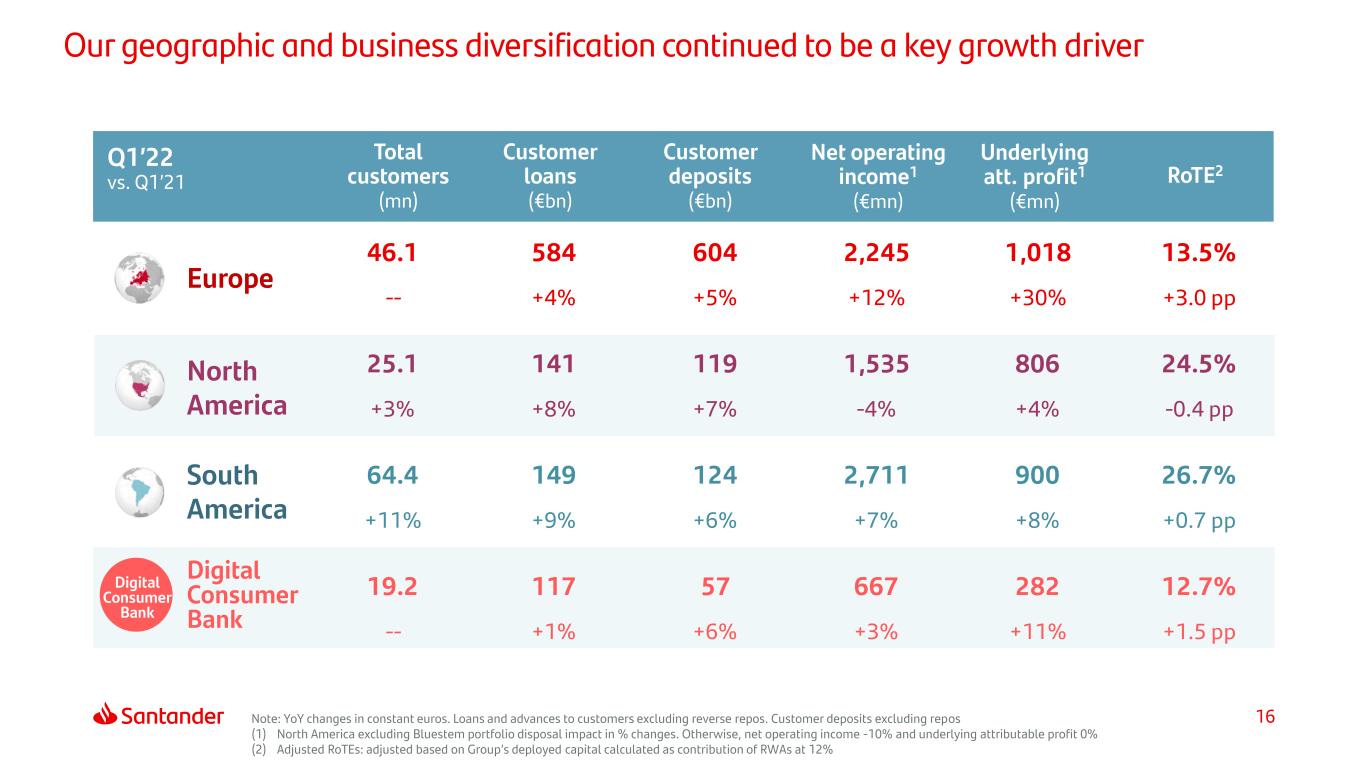

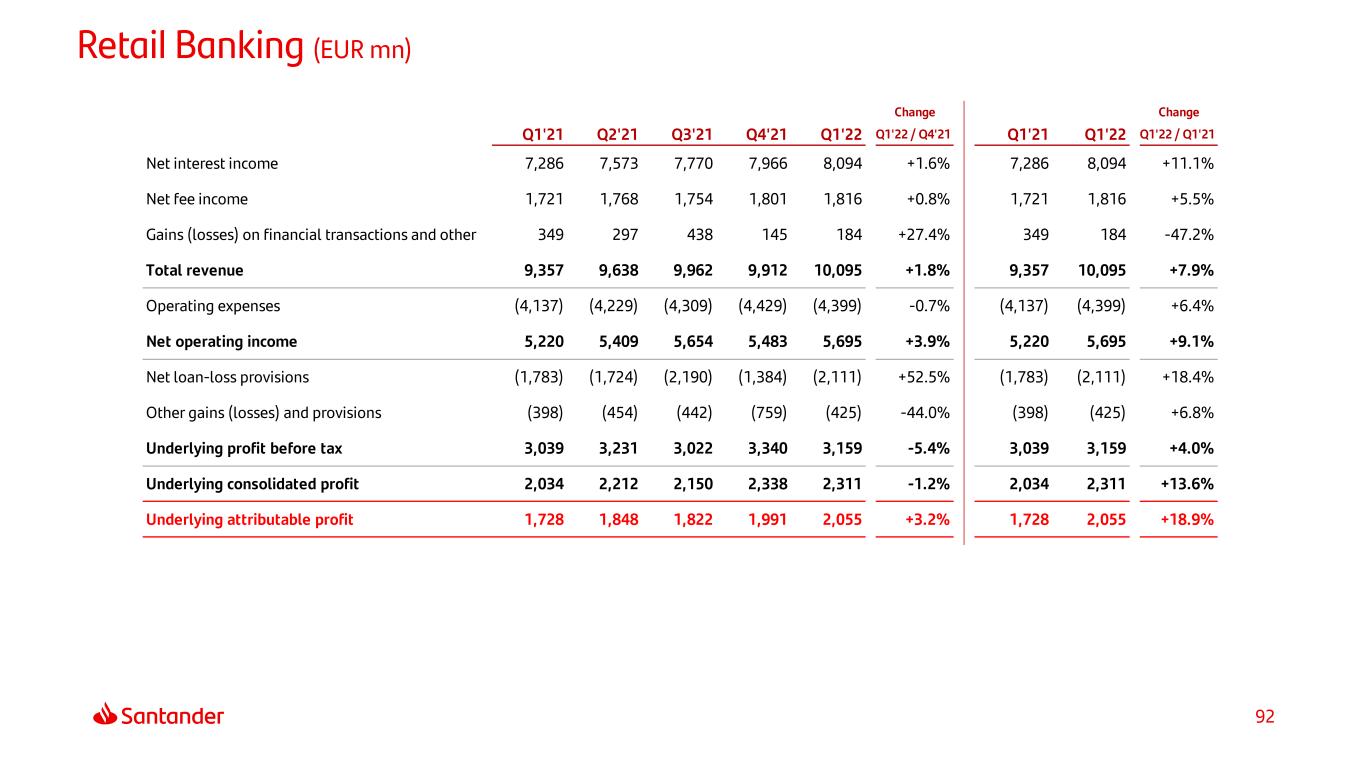

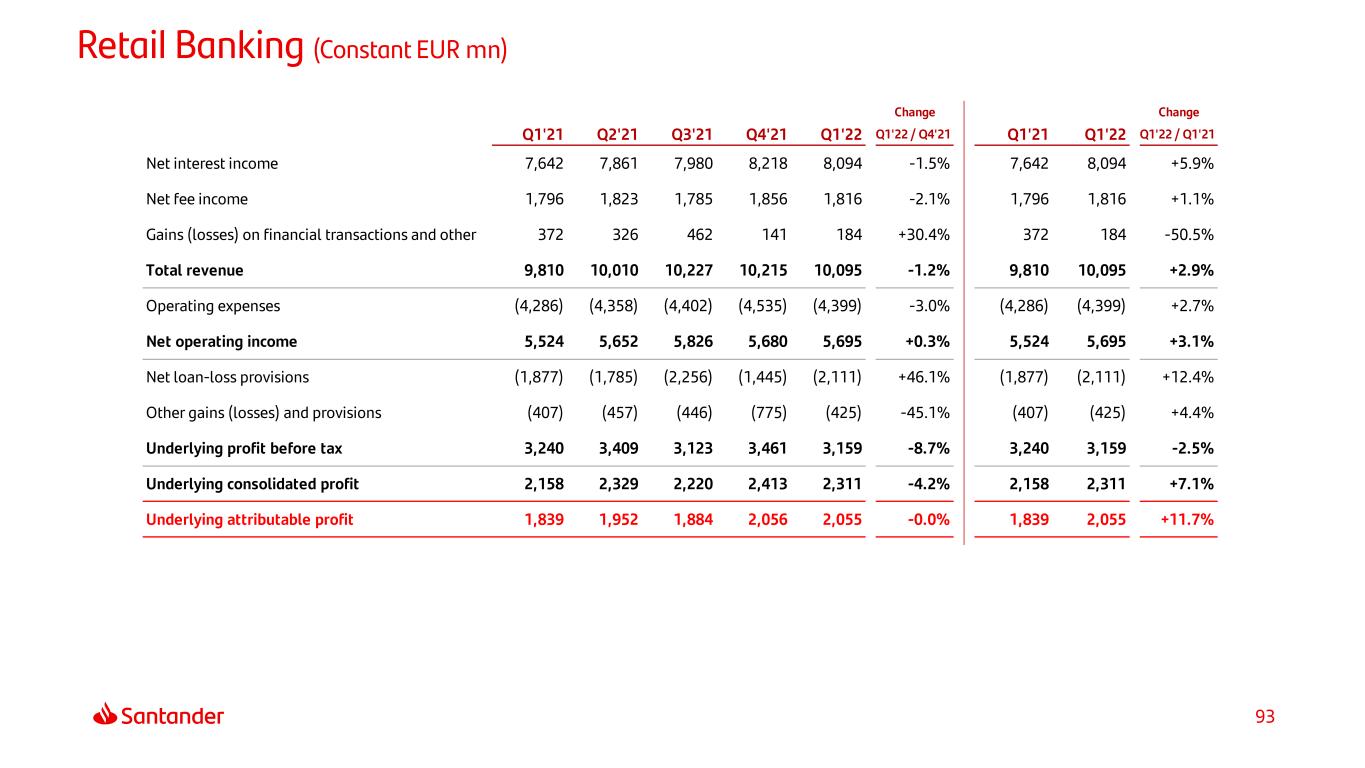

16 Our geographic and business diversification continued to be a key growth driver Underlying att. profit1 (€mn) Net operating income1 (€mn) Europe South America North America Q1’22 vs. Q1’21 RoTE2 Customer deposits (€bn) Customer loans (€bn) Digital Consumer Bank Total customers (mn) Digital Consumer Bank Note: YoY changes in constant euros. Loans and advances to customers excluding reverse repos. Customer deposits excluding repos (1) North America excluding Bluestem portfolio disposal impact in % changes. Otherwise, net operating income -10% and underlying attributable profit 0% (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12% 46.1 584 604 2,245 1,018 13.5% -- +4% +5% +12% +30% +3.0 pp 25.1 141 119 1,535 806 24.5% +3% +8% +7% -4% +4% -0.4 pp 64.4 149 124 2,711 900 26.7% +11% +9% +6% +7% +8% +0.7 pp 19.2 117 57 667 282 12.7% -- +1% +6% +3% +11% +1.5 pp

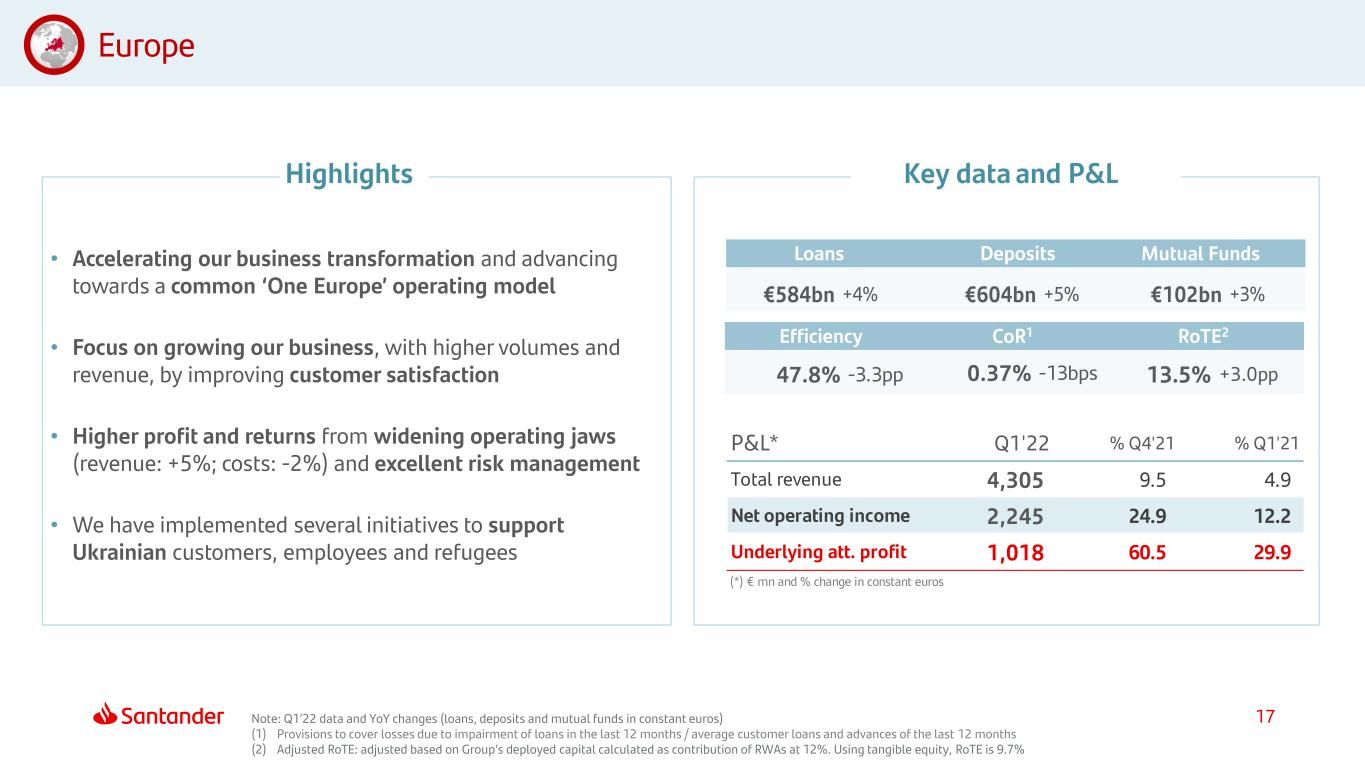

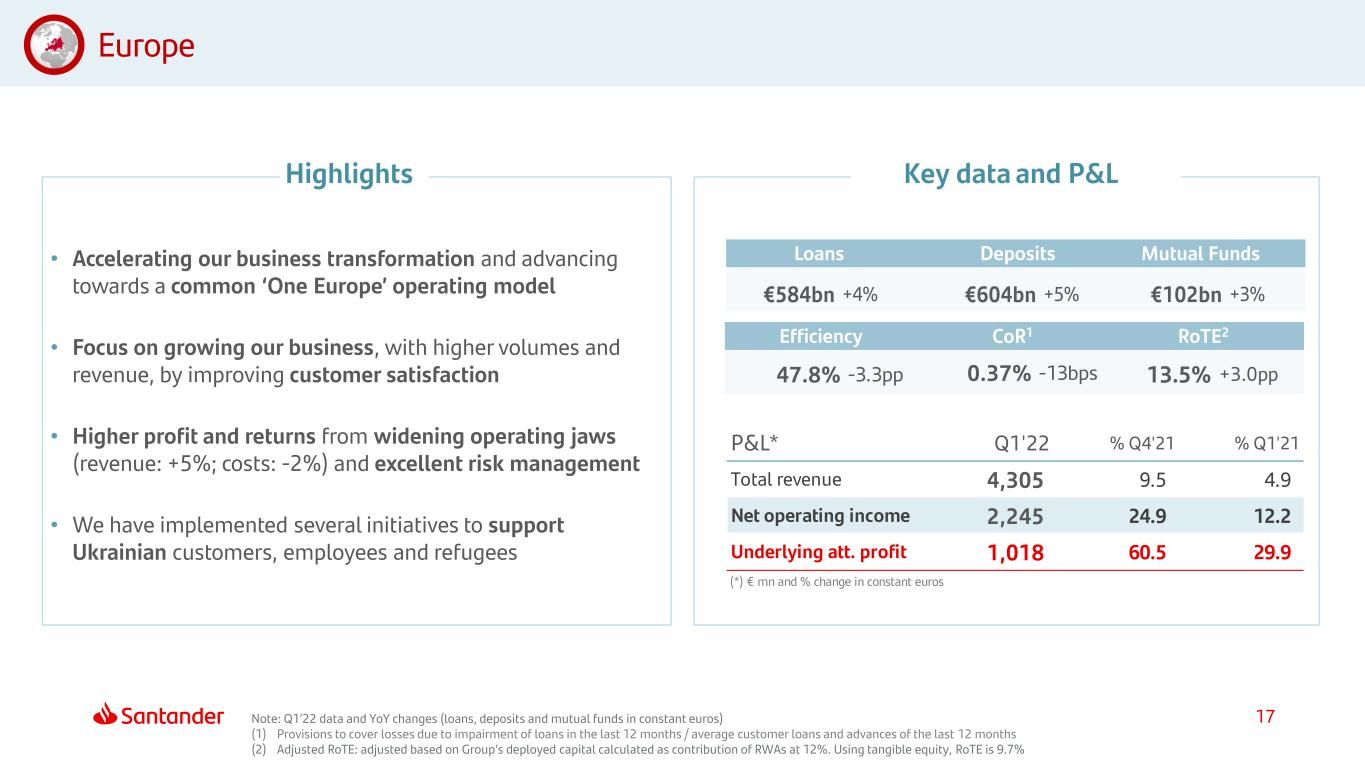

17 Europe Highlights Key data and P&L P&L* Q1'22 % Q4'21 % Q1'21 Total revenue 4,305 9.5 4.9 Net operating income 2,245 24.9 12.2 Underlying att. profit 1,018 60.5 29.9 (*) € mn and % change in constant euros Loans Deposits Mutual Funds Efficiency CoR1 RoTE2 €584bn +4% €604bn +5% €102bn +3% 47.8% -3.3pp 0.37% -13bps 13.5% +3.0pp Note: Q1’22 data and YoY changes (loans, deposits and mutual funds in constant euros) (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTE: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 9.7% • Accelerating our business transformation and advancing towards a common ‘One Europe’ operating model • Focus on growing our business, with higher volumes and revenue, by improving customer satisfaction • Higher profit and returns from widening operating jaws (revenue: +5%; costs: -2%) and excellent risk management • We have implemented several initiatives to support Ukrainian customers, employees and refugees

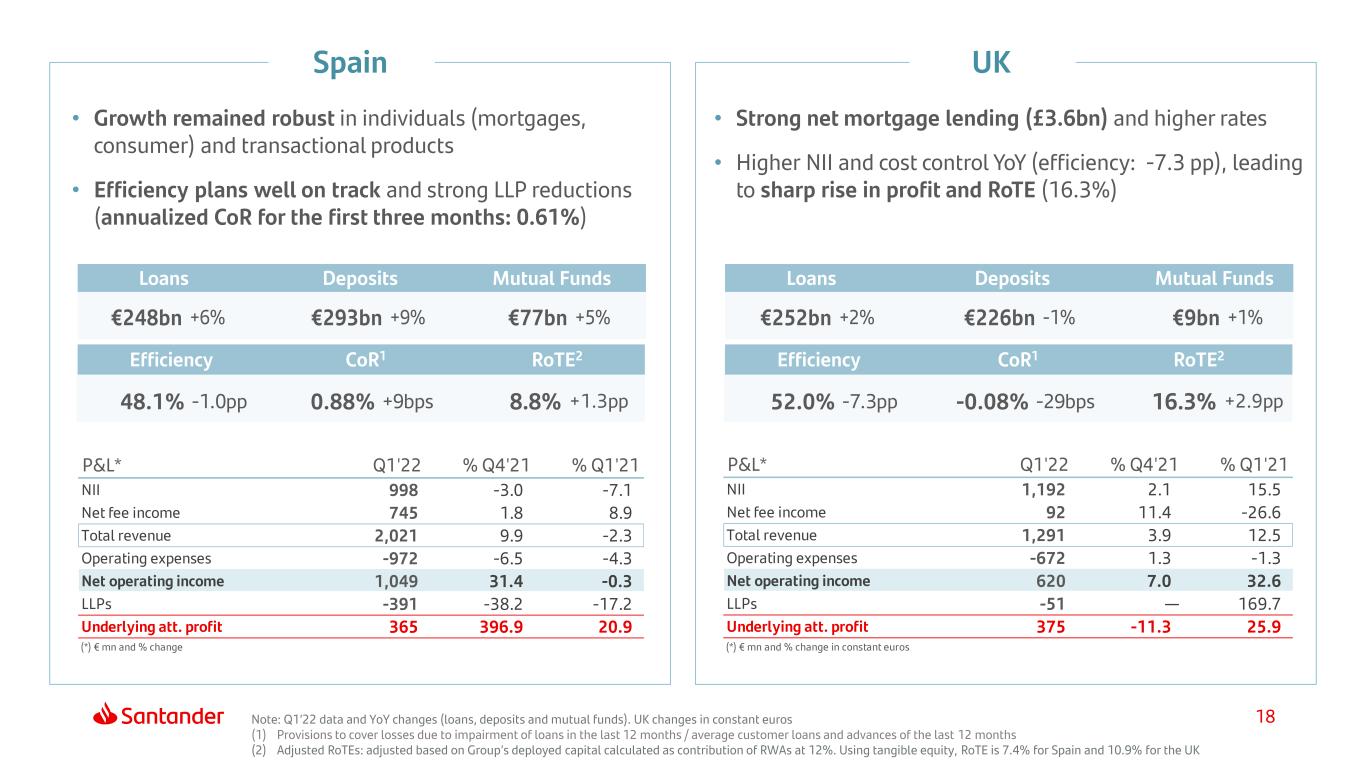

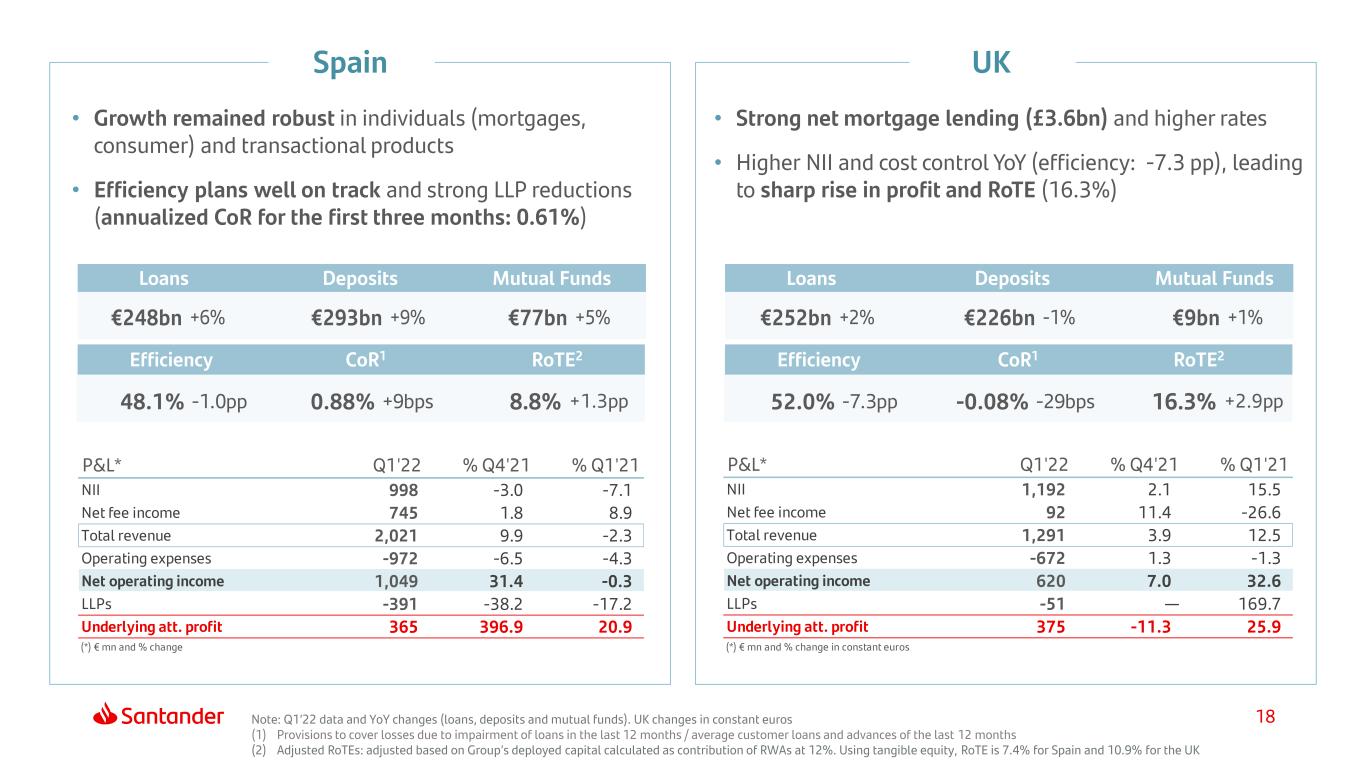

18 Efficiency CoR1 RoTE2 P&L* Q1'22 % Q4'21 % Q1'21 NII 998 -3.0 -7.1 Net fee income 745 1.8 8.9 Total revenue 2,021 9.9 -2.3 Operating expenses -972 -6.5 -4.3 Net operating income 1,049 31.4 -0.3 LLPs -391 -38.2 -17.2 Underlying att. profit 365 396.9 20.9 (*) € mn and % change P&L* Q1'22 % Q4'21 % Q1'21 NII 1,192 2.1 15.5 Net fee income 92 11.4 -26.6 Total revenue 1,291 3.9 12.5 Operating expenses -672 1.3 -1.3 Net operating income 620 7.0 32.6 LLPs -51 — 169.7 Underlying att. profit 375 -11.3 25.9 (*) € mn and % change in constant euros €248bn +6% €293bn +9% €77bn +5% Loans Deposits Mutual Funds 48.1% -1.0pp 0.88% +9bps 8.8% +1.3pp Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds €252bn +2% €226bn -1% €9bn +1% 52.0% -7.3pp -0.08% -29bps 16.3% +2.9pp Note: Q1’22 data and YoY changes (loans, deposits and mutual funds). UK changes in constant euros (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 7.4% for Spain and 10.9% for the UK • Growth remained robust in individuals (mortgages, consumer) and transactional products • Efficiency plans well on track and strong LLP reductions (annualized CoR for the first three months: 0.61%) • Strong net mortgage lending (£3.6bn) and higher rates • Higher NII and cost control YoY (efficiency: -7.3 pp), leading to sharp rise in profit and RoTE (16.3%) Spain UK

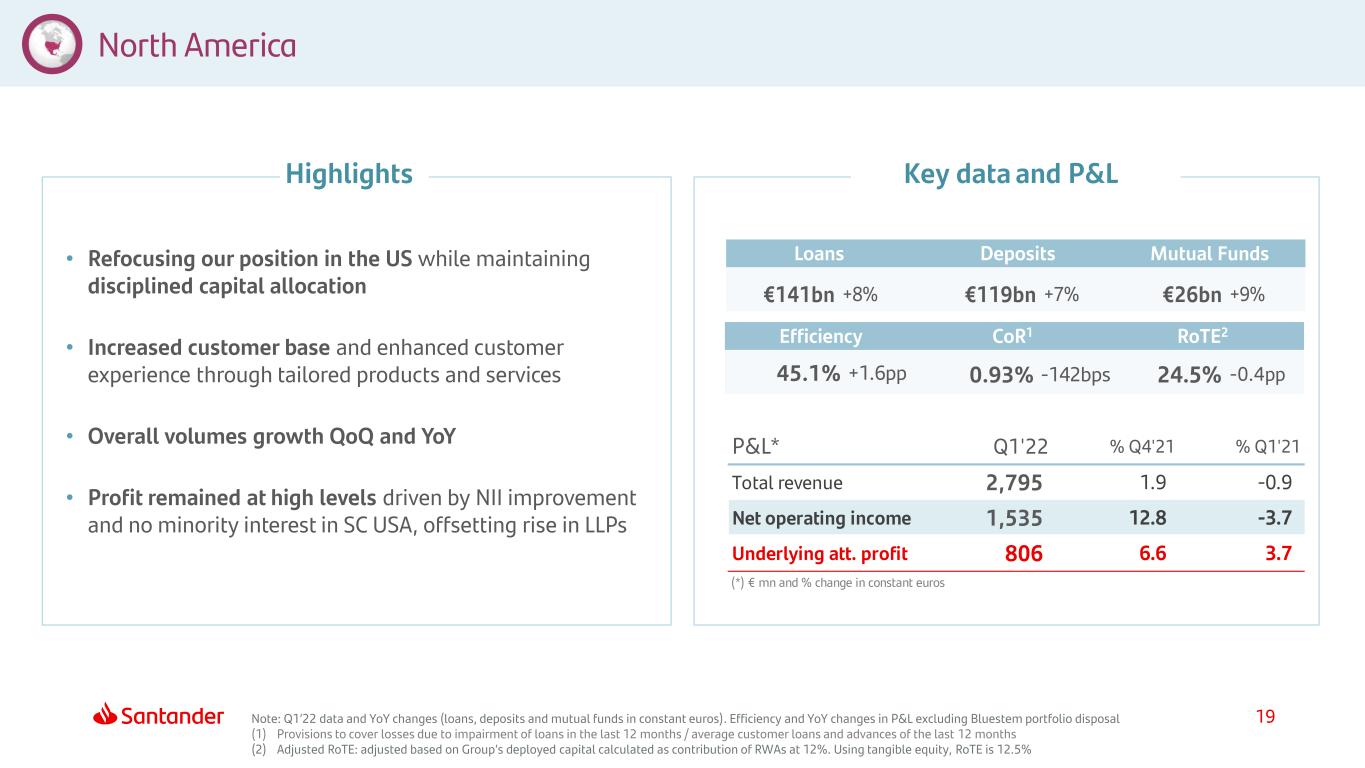

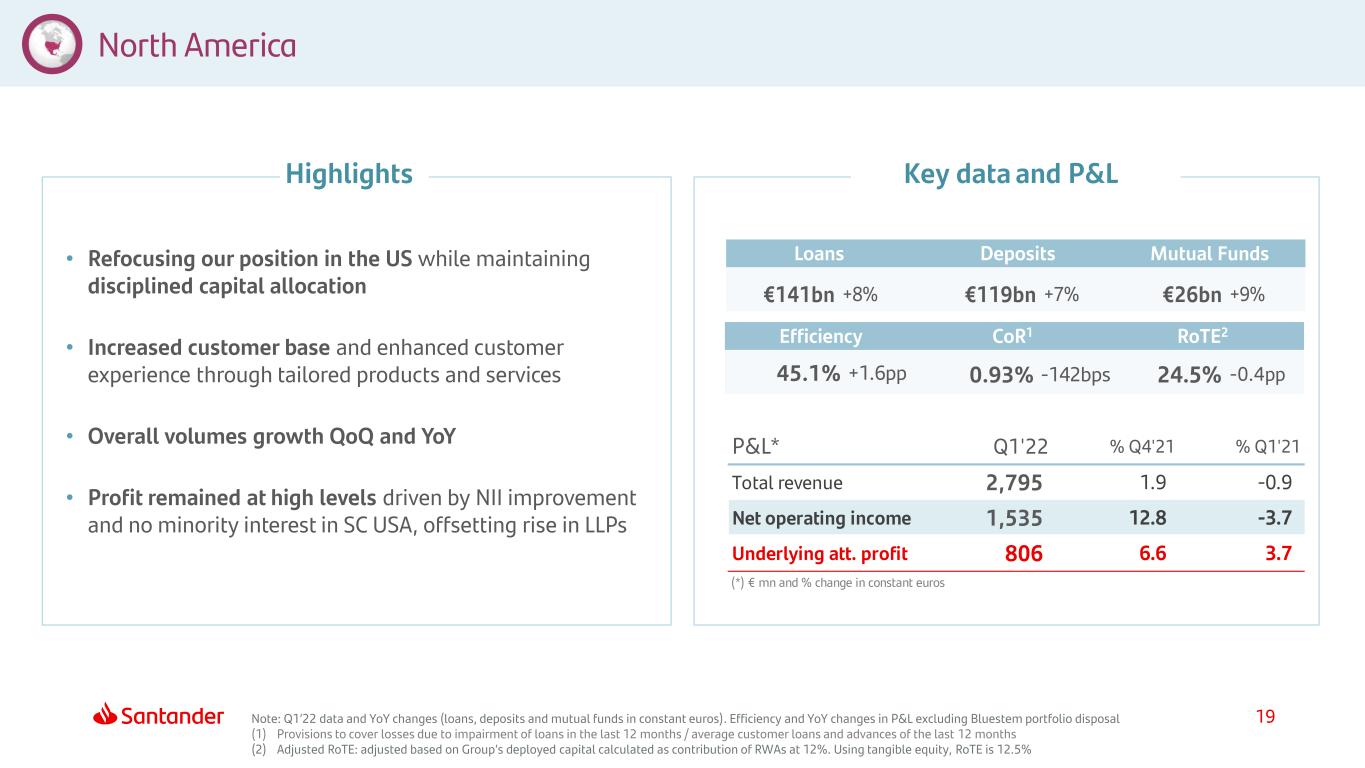

19 North America Note: Q1’22 data and YoY changes (loans, deposits and mutual funds in constant euros). Efficiency and YoY changes in P&L excluding Bluestem portfolio disposal (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTE: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 12.5% Highlights Key data and P&L • Refocusing our position in the US while maintaining disciplined capital allocation • Increased customer base and enhanced customer experience through tailored products and services • Overall volumes growth QoQ and YoY • Profit remained at high levels driven by NII improvement and no minority interest in SC USA, offsetting rise in LLPs Loans Deposits Mutual Funds Efficiency CoR1 RoTE2 €141bn +8% €119bn +7% €26bn +9% 45.1% +1.6pp 0.93% -142bps 24.5% -0.4pp P&L* Q1'22 % Q4'21 % Q1'21 Total revenue 2,795 1.9 -0.9 Net operating income 1,535 12.8 -3.7 Underlying att. profit 806 6.6 3.7 (*) € mn and % change in constant euros

20 • Simpler and more integrated structure across four core businesses: Consumer, Commercial, CIB and WM • Profit levels remained high supported by solid top line despite YoY decline due to normalization of leasing and LLPs • Successful customer attraction strategy (+1mn customers YoY) reflected in volumes growth • Improved profitability with solid profit growth YoY driven by customer revenue and lower LLPs €104bn +8% €85bn +8% €14bn +13% 44.1% +2.0pp 0.49% -163bps 23.6% -2.4pp P&L* Q1'22 % Q4'21 % Q1'21 NII 1,378 -0.1 1.4 Net fee income 197 10.5 -9.8 Total revenue 1,811 0.8 -4.9 Operating expenses -798 -7.9 -0.4 Net operating income 1,013 8.9 -8.1 LLPs -256 — 119.9 Underlying att. profit 583 11.0 -5.0 (*) € mn and % change in constant euros €37bn +9% €34bn +4% €13bn +5% 44.0% +0.6pp 2.22% -79bps 30.8% +6.0pp P&L* Q1'22 % Q4'21 % Q1'21 NII 753 0.0 6.9 Net fee income 245 12.9 12.9 Total revenue 982 4.6 7.3 Operating expenses -432 -10.2 8.8 Net operating income 549 20.1 6.2 LLPs -183 22.3 -24.5 Underlying att. profit 249 5.6 31.7 (*) € mn and % change in constant euros Note: Q1’22 data and YoY changes (loans, deposits and mutual funds in constant euros). USA efficiency and YoY changes in P&L excluding Bluestem portfolio disposal (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 12.4% for the US and 14.7% for Mexico Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds USA Mexico

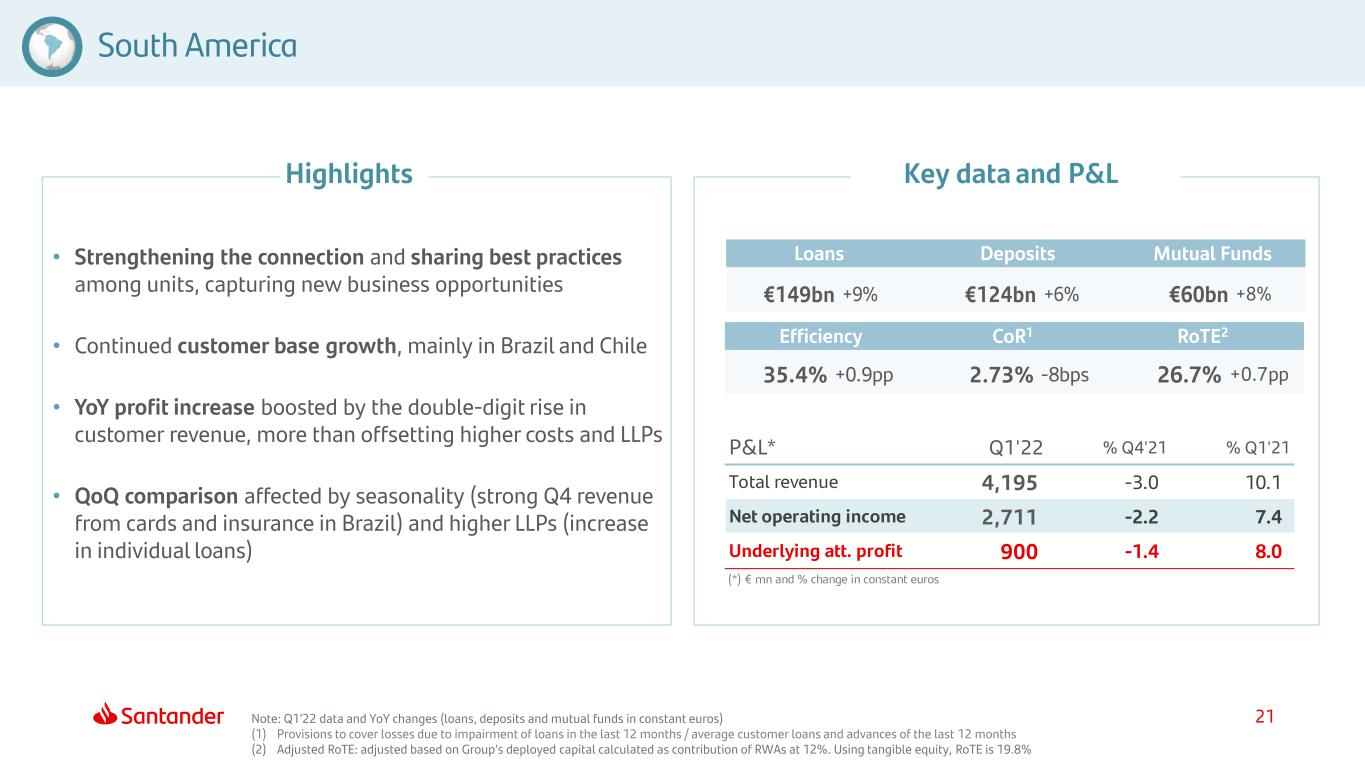

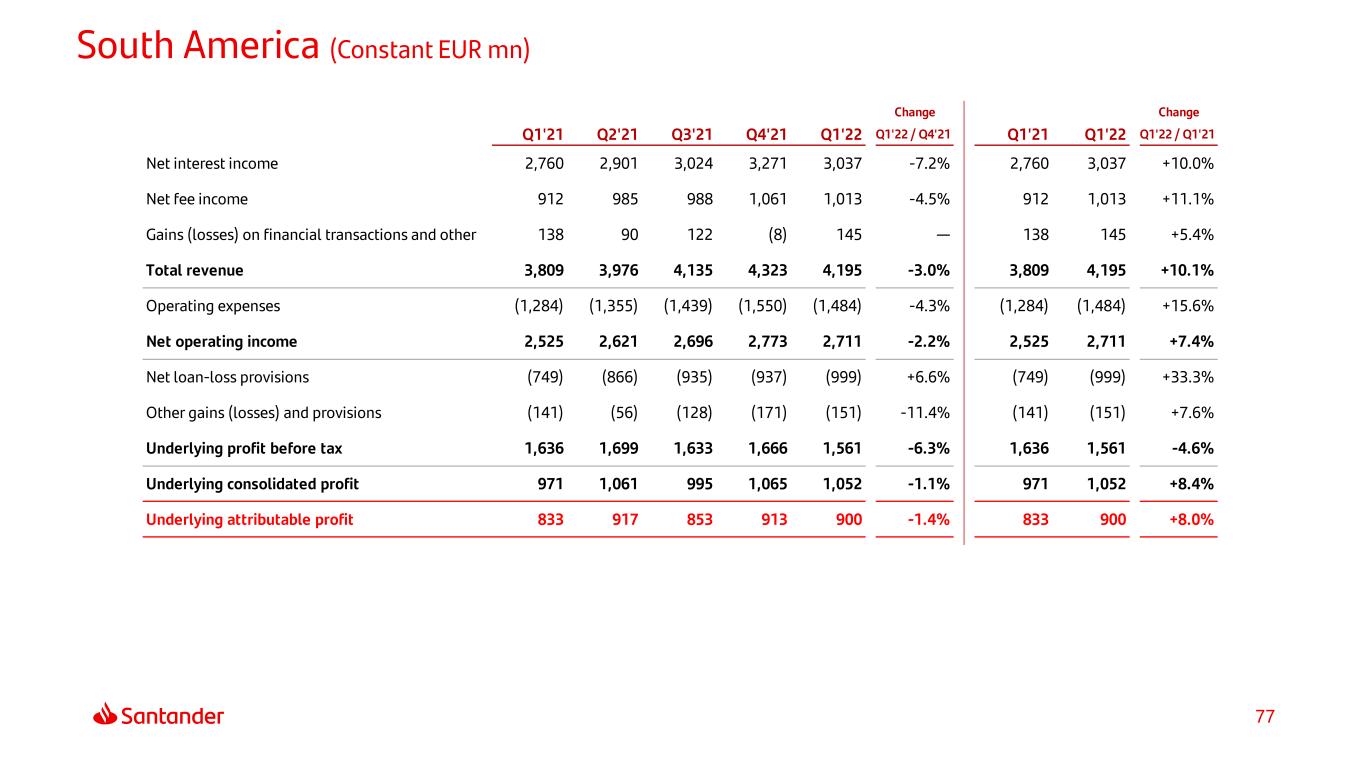

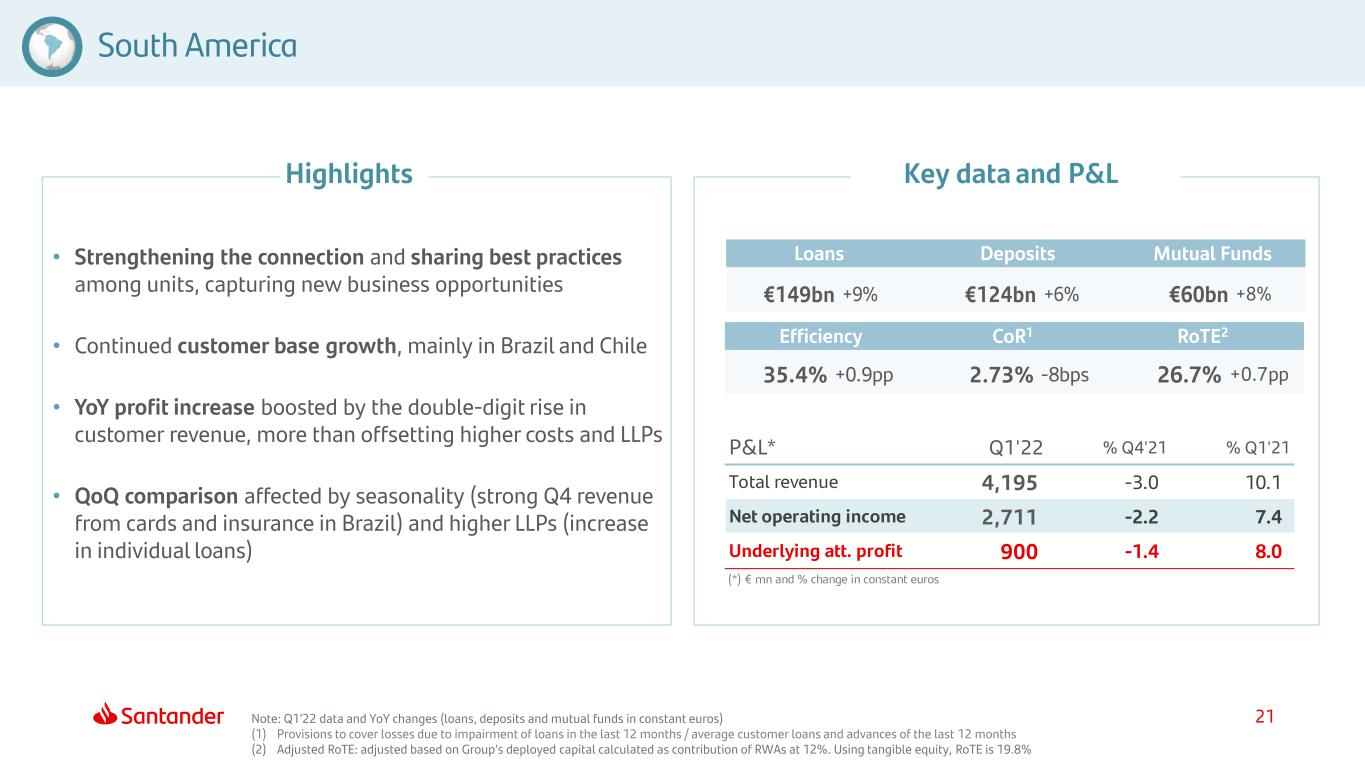

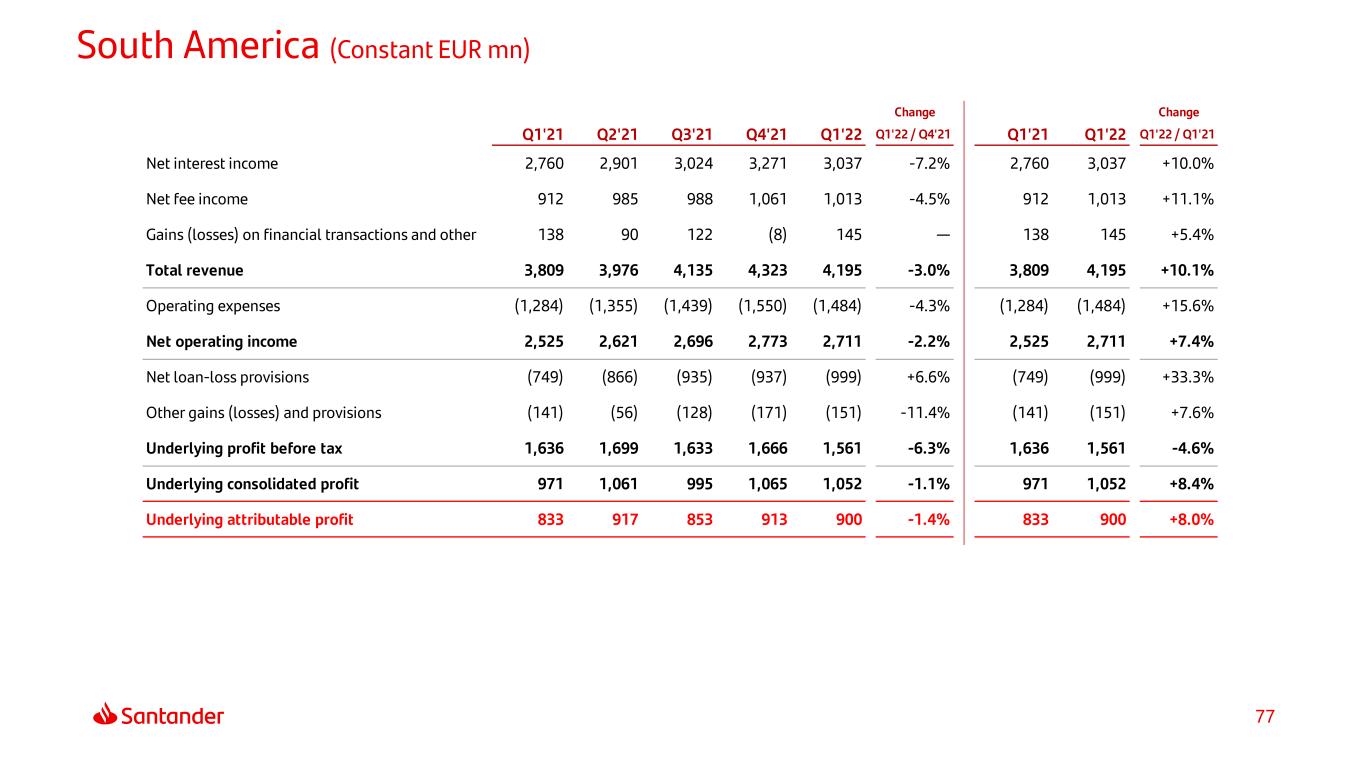

21 South America Note: Q1’22 data and YoY changes (loans, deposits and mutual funds in constant euros) (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTE: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 19.8% Highlights Key data and P&L Loans Deposits Mutual Funds Efficiency CoR1 RoTE2 €149bn +9% €124bn +6% €60bn +8% 35.4% +0.9pp 2.73% -8bps 26.7% +0.7pp P&L* Q1'22 % Q4'21 % Q1'21 Total revenue 4,195 -3.0 10.1 Net operating income 2,711 -2.2 7.4 Underlying att. profit 900 -1.4 8.0 (*) € mn and % change in constant euros • Strengthening the connection and sharing best practices among units, capturing new business opportunities • Continued customer base growth, mainly in Brazil and Chile • YoY profit increase boosted by the double-digit rise in customer revenue, more than offsetting higher costs and LLPs • QoQ comparison affected by seasonality (strong Q4 revenue from cards and insurance in Brazil) and higher LLPs (increase in individual loans)

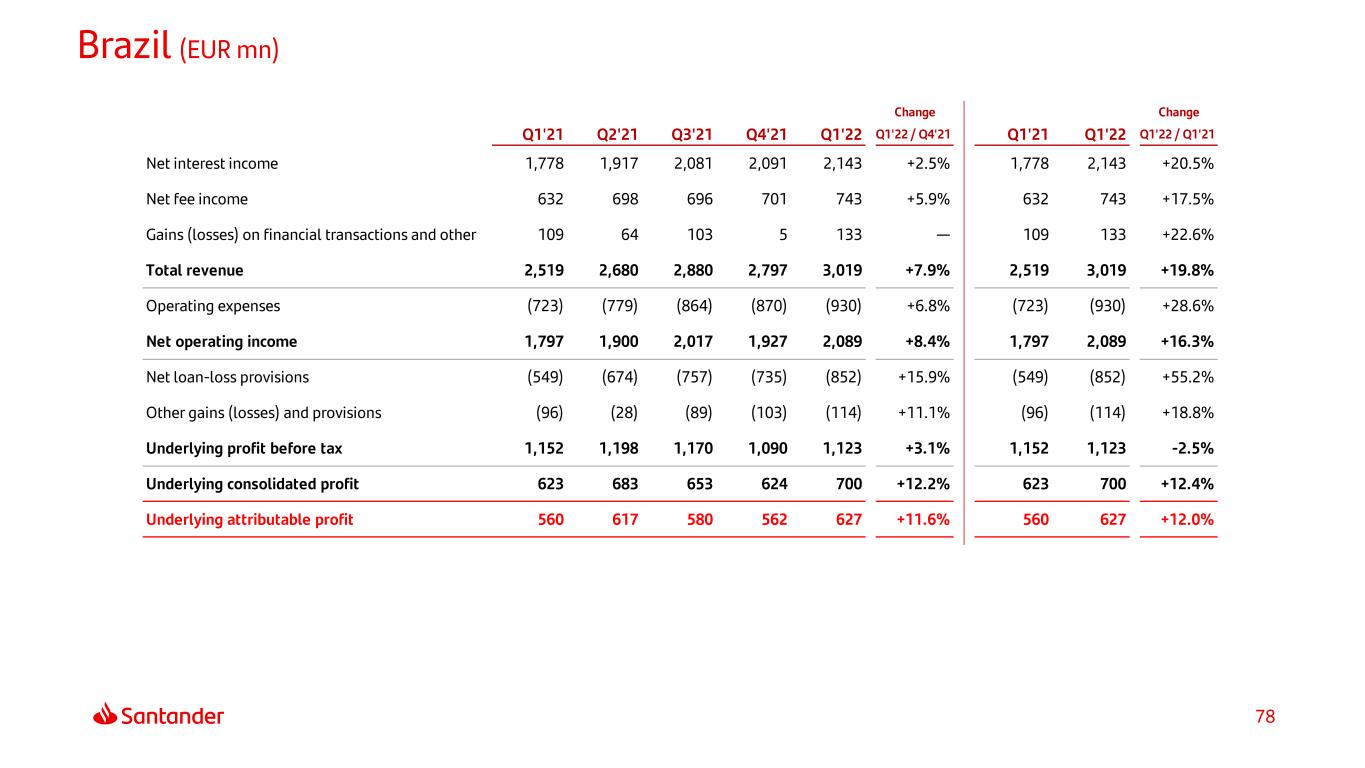

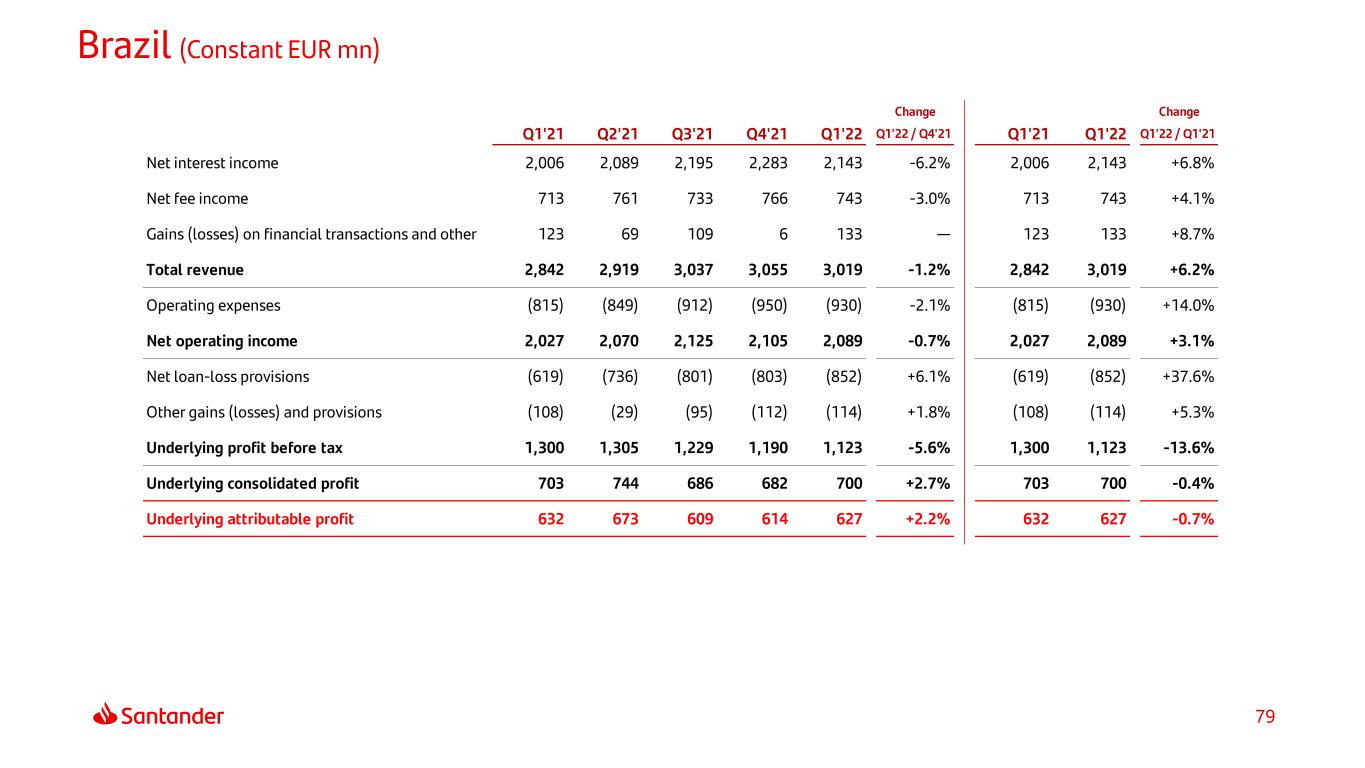

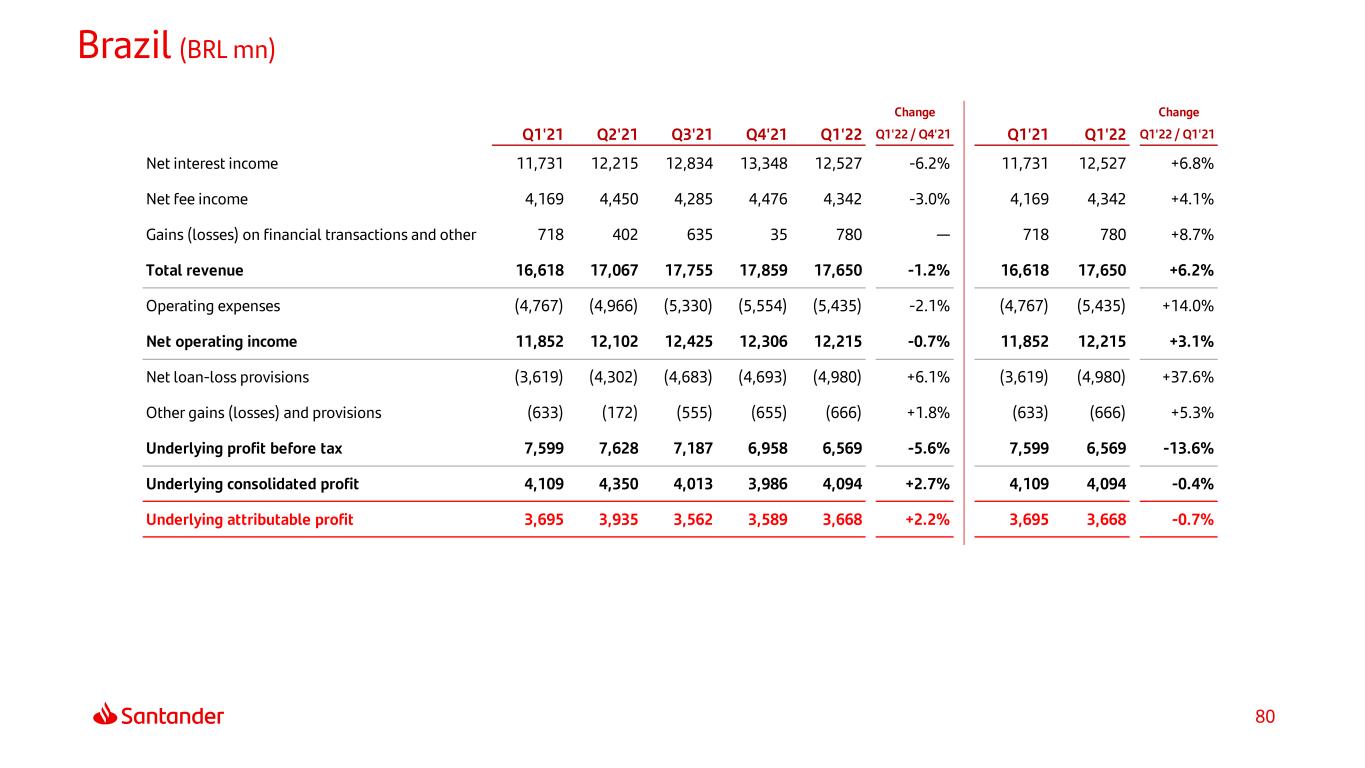

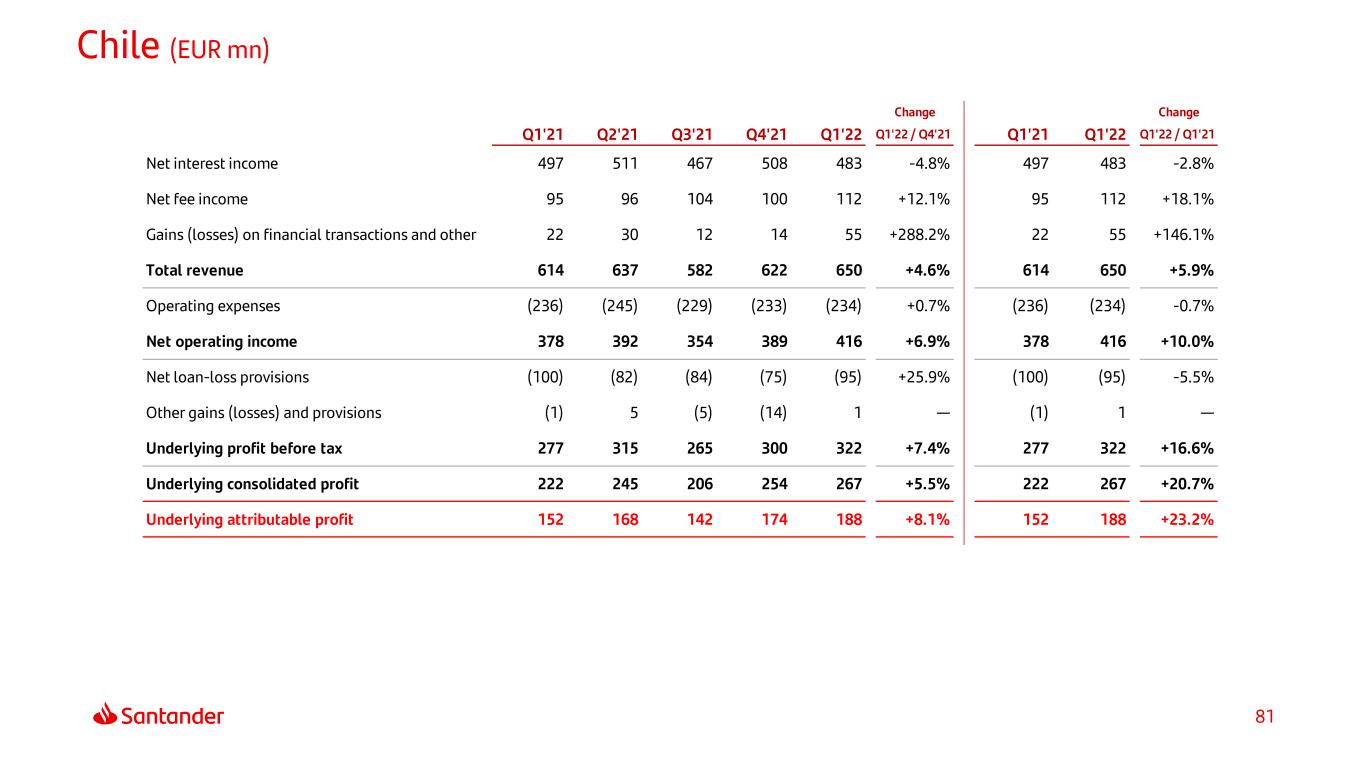

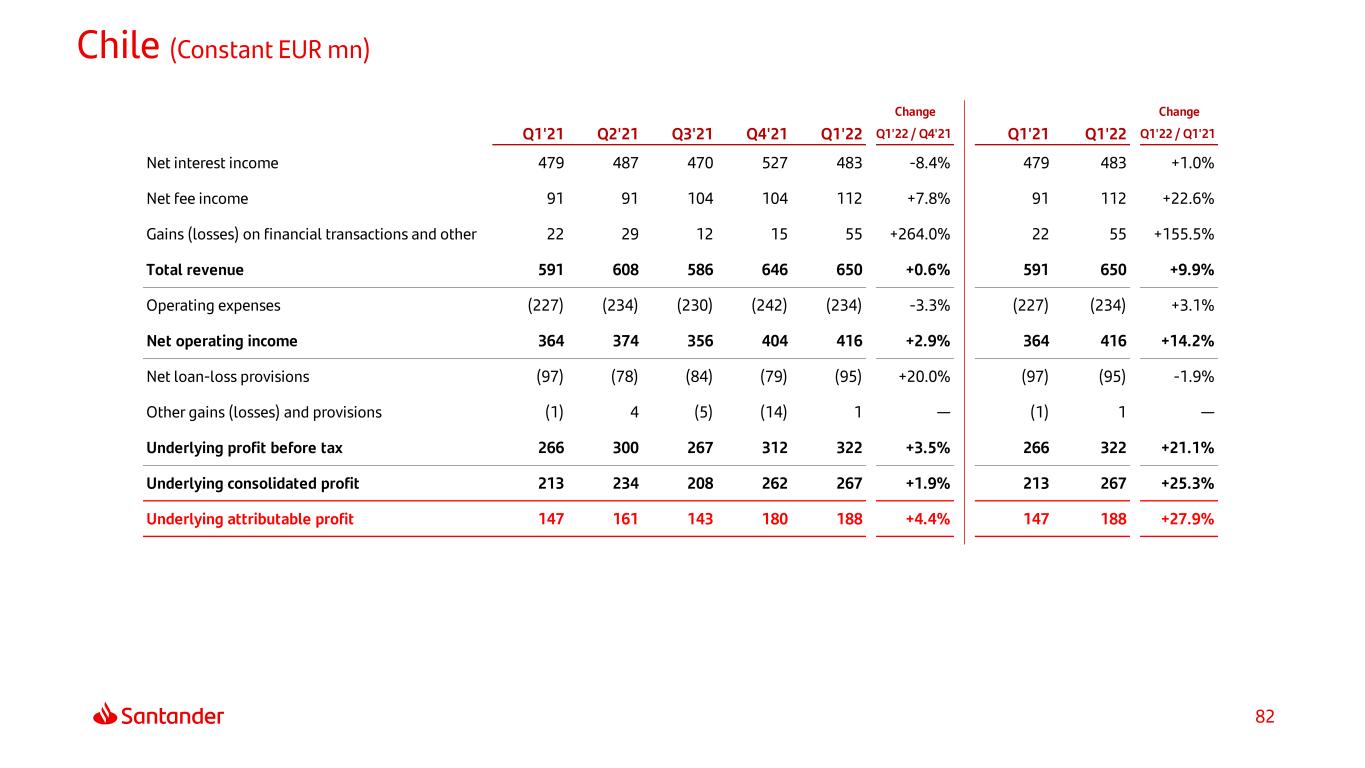

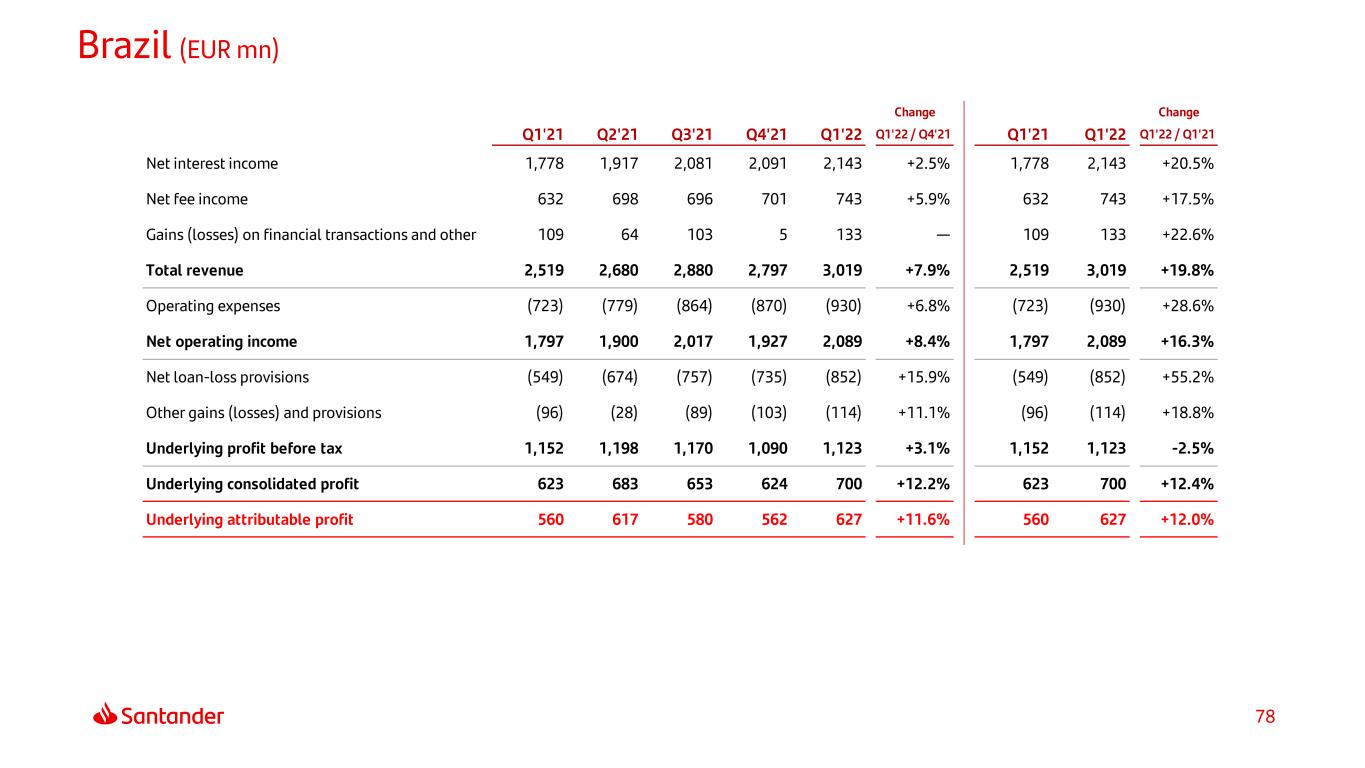

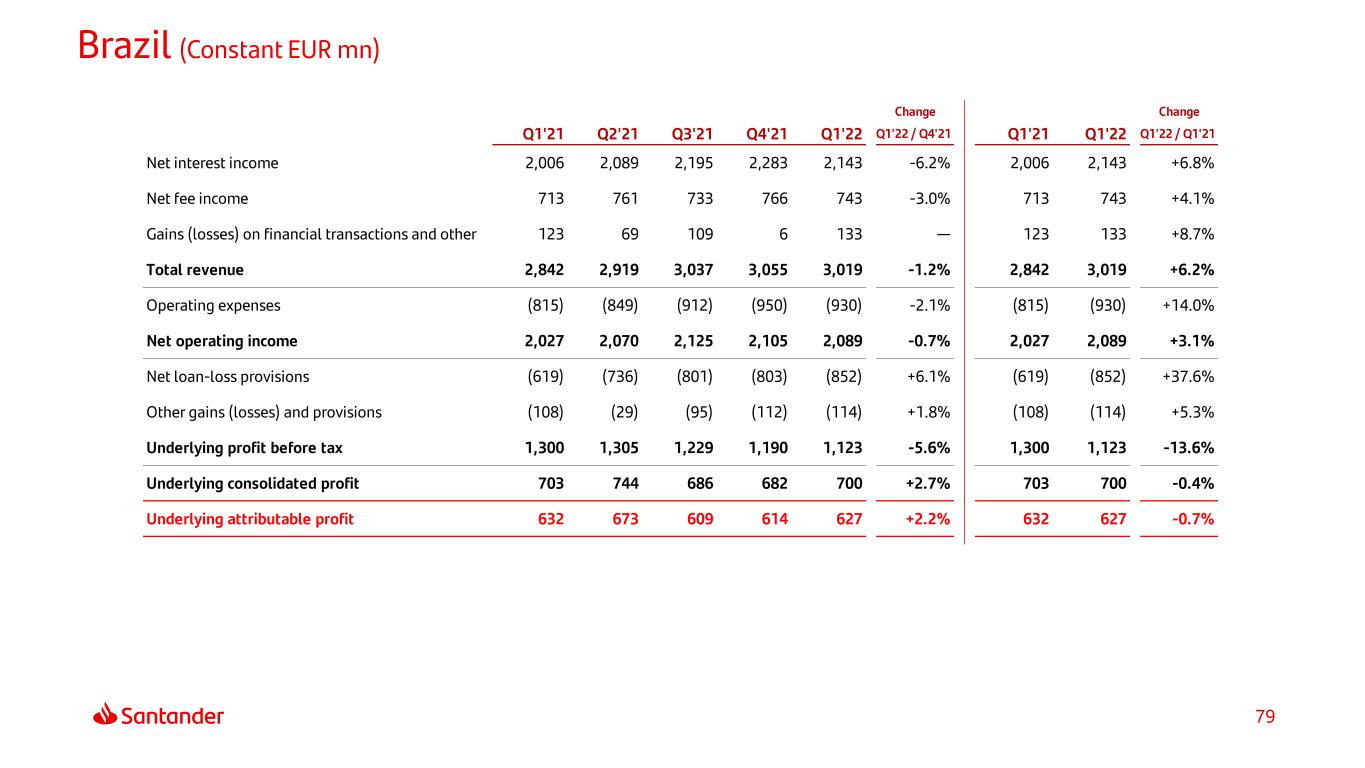

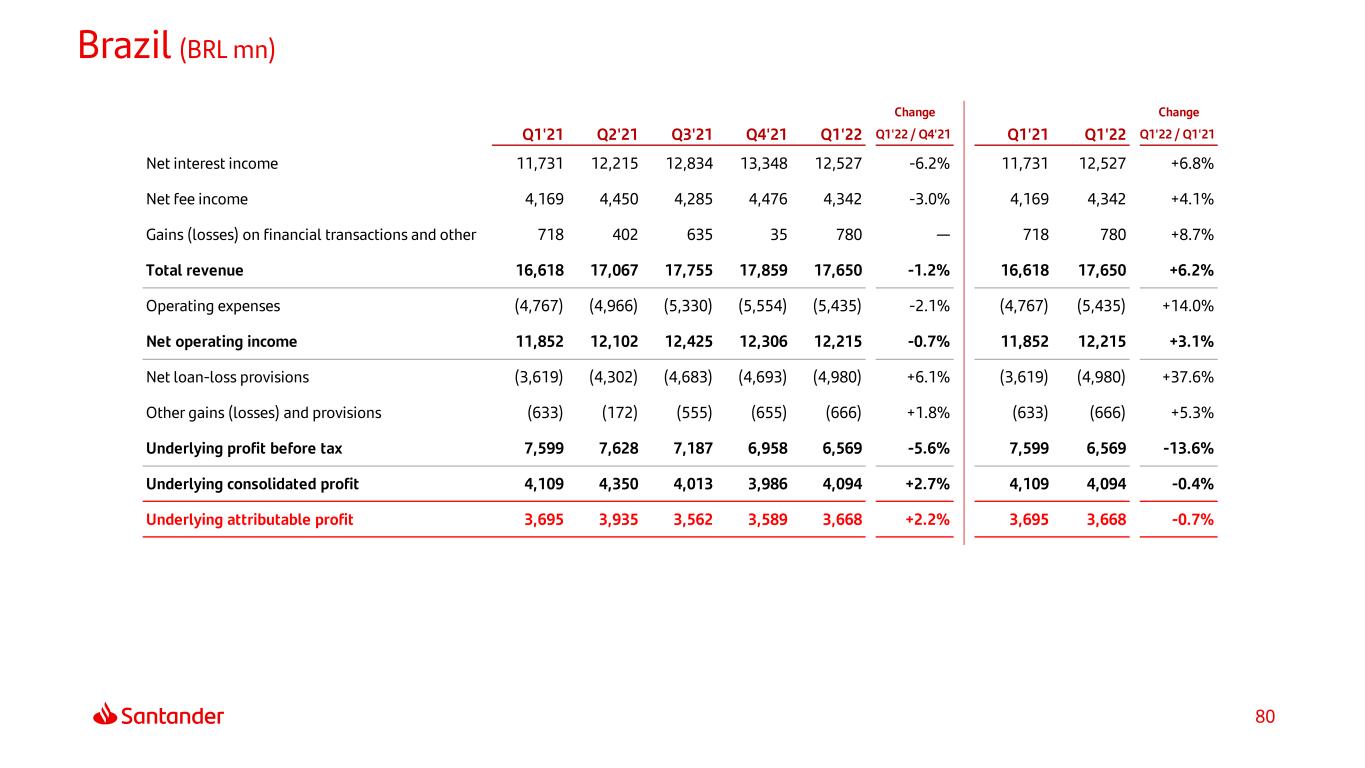

22 €91bn +8% €75bn +3% €47bn +5% 30.8% +2.1pp 3.94% +15bps 27.4% -2.0pp P&L* Q1'22 % Q4'21 % Q1'21 NII 2,143 -6.2 6.8 Net fee income 743 -3.0 4.1 Total revenue 3,019 -1.2 6.2 Operating expenses -930 -2.1 14.0 Net operating income 2,089 -0.7 3.1 LLPs -852 6.1 37.6 Underlying att. profit 627 2.2 -0.7 (*) € mn and % change in constant euros P&L* Q1'22 % Q4'21 % Q1'21 NII 483 -8.4 1.0 Net fee income 112 7.8 22.6 Total revenue 650 0.6 9.9 Operating expenses -234 -3.3 3.1 Net operating income 416 2.9 14.2 LLPs -95 20.0 -1.9 Underlying att. profit 188 4.4 27.9 (*) € mn and % change in constant euros €43bn +6% €31bn +6% €8bn -7% 36.0% -2.4pp 0.83% -51bps 31.7% +8.5pp Note: Q1’22 data and YoY changes (loans, deposits and mutual funds in constant euros) (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 21.0% for Brazil and 21.4% for Chile Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds • Sharp growth in loyal customer base and solid volumes dynamics • Strong top line performance (transactionality). Costs affected by inflation (salary agreement: +11%) and higher LLPs (loans to individuals) • Focus on customer acquisition and expanding Getnet, Superdigital and Life. Launch of Prospera in the quarter • Profit up YoY backed by the main P&L lines and improved efficiency and cost of risk Brazil Chile

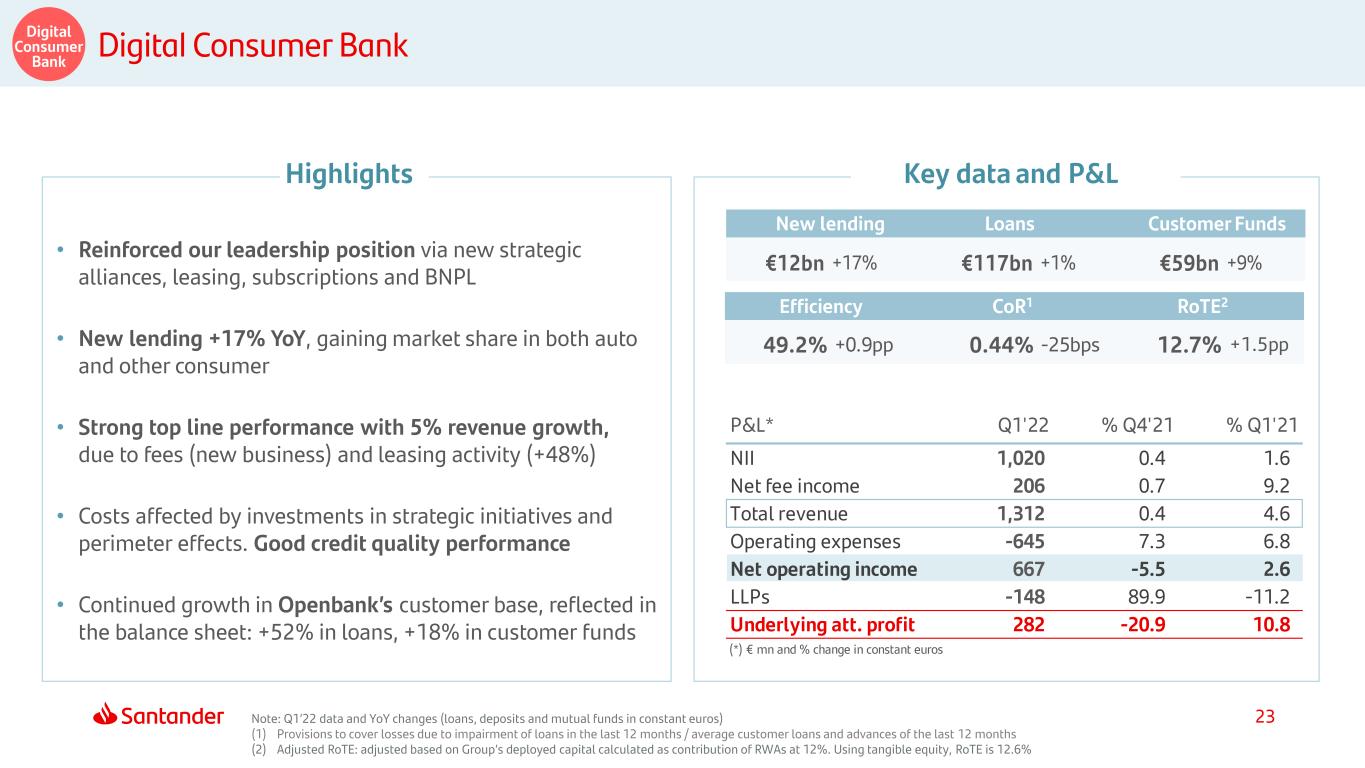

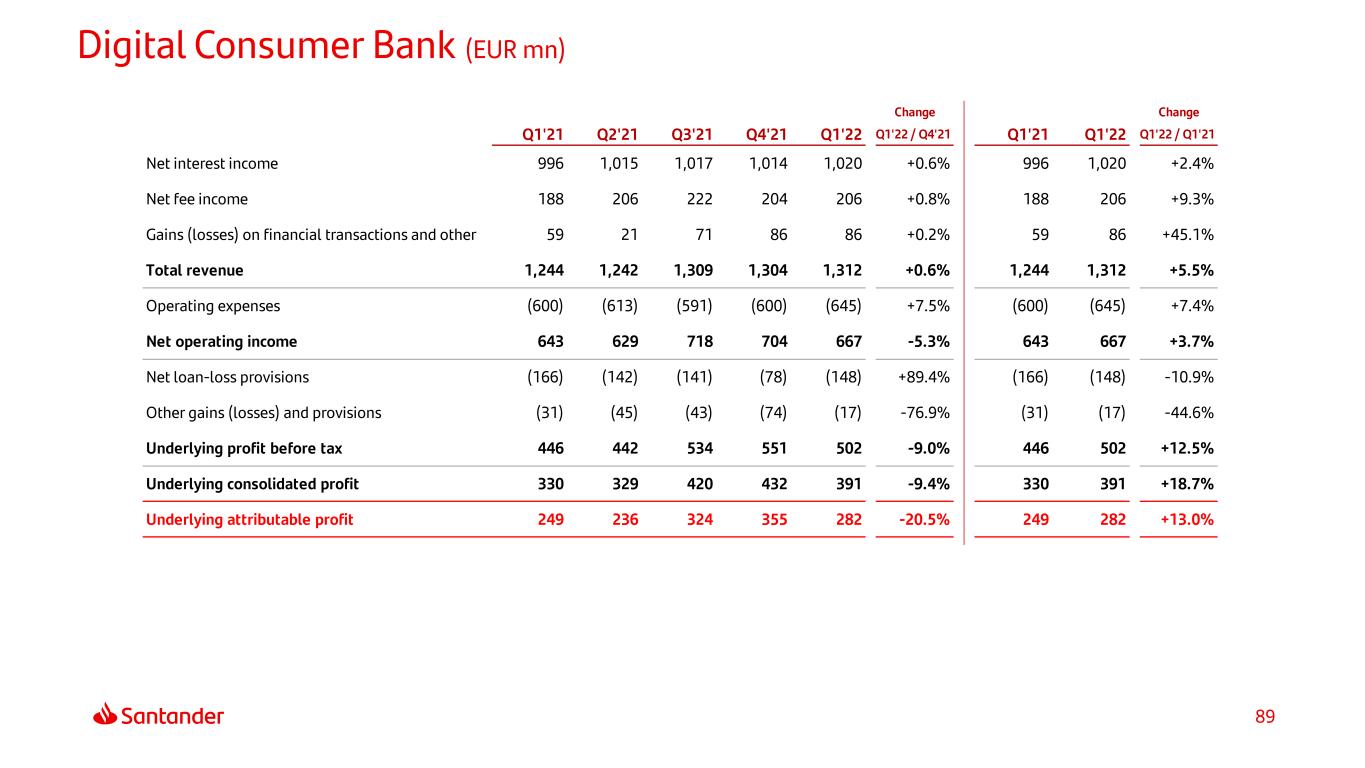

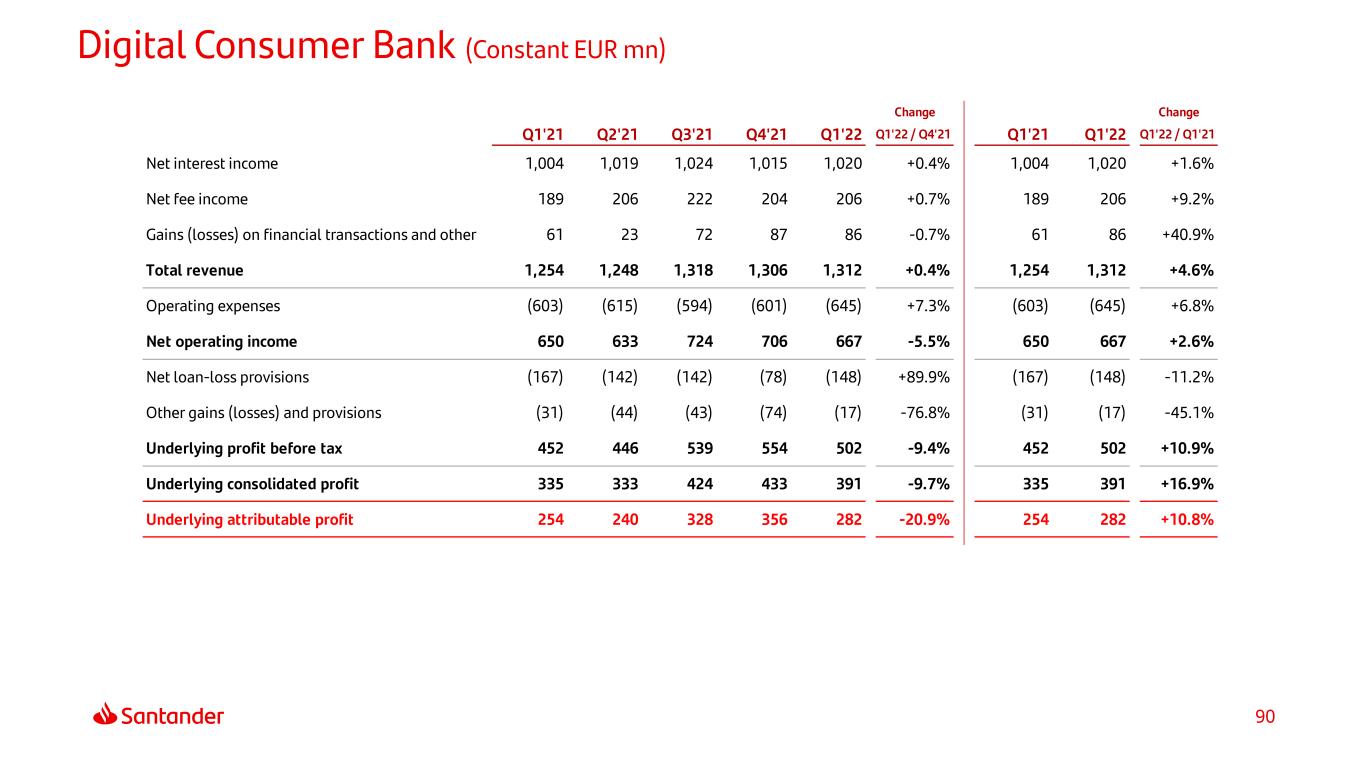

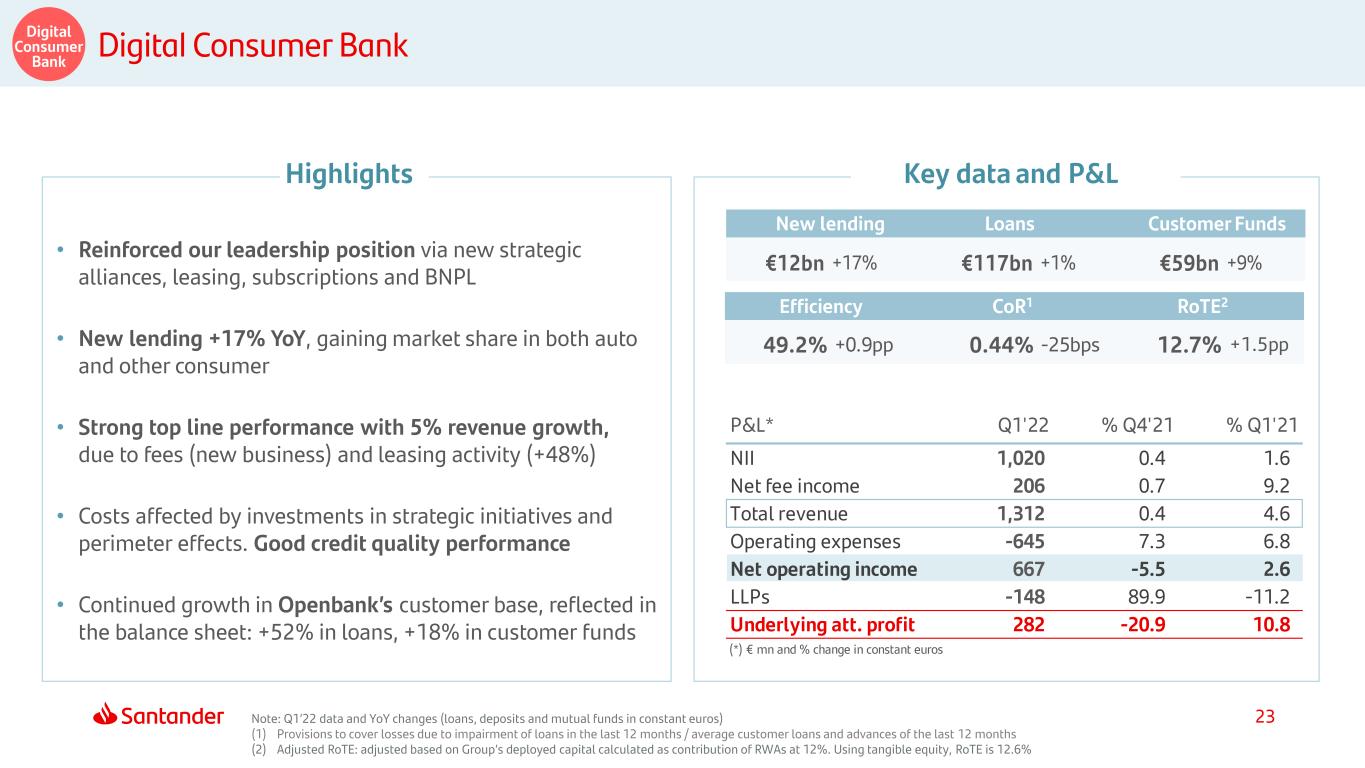

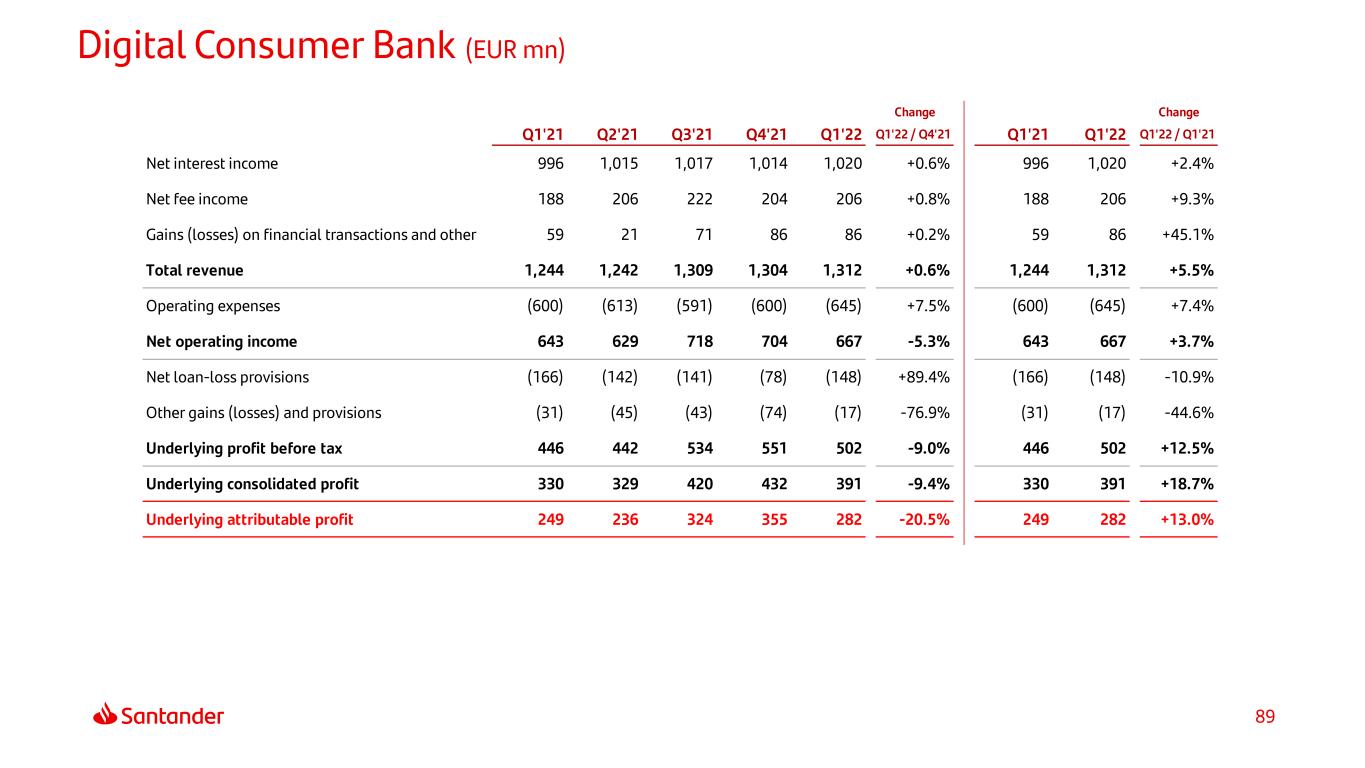

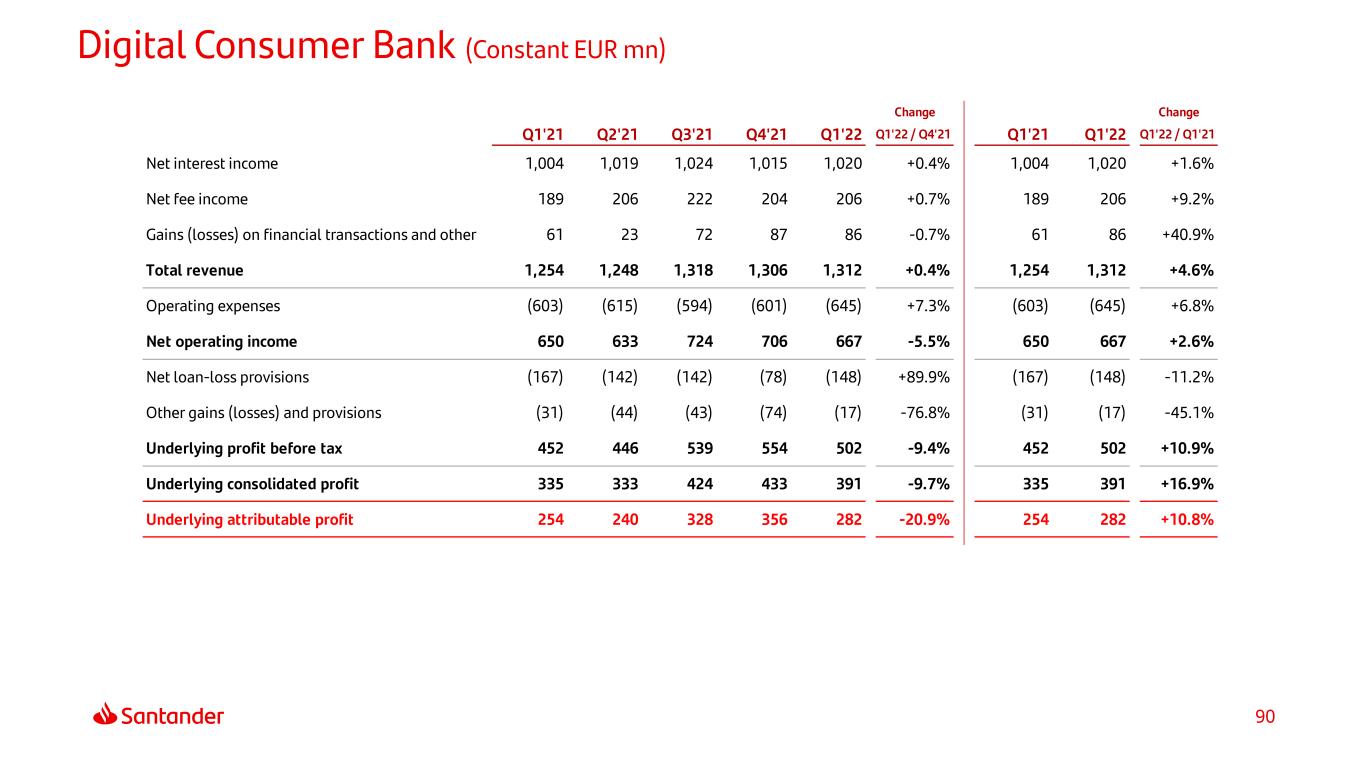

23 Digital Consumer Bank Digital Consumer Bank Note: Q1’22 data and YoY changes (loans, deposits and mutual funds in constant euros) (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTE: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 12.6% Highlights Key data and P&L New lending Loans Customer Funds Efficiency CoR1 RoTE2 €117bn +1% €59bn +9% 49.2% +0.9pp 0.44% -25bps 12.7% +1.5pp P&L* Q1'22 % Q4'21 % Q1'21 NII 1,020 0.4 1.6 Net fee income 206 0.7 9.2 Total revenue 1,312 0.4 4.6 Operating expenses -645 7.3 6.8 Net operating income 667 -5.5 2.6 LLPs -148 89.9 -11.2 Underlying att. profit 282 -20.9 10.8 (*) € mn and % change in constant euros €12bn +17% • Reinforced our leadership position via new strategic alliances, leasing, subscriptions and BNPL • New lending +17% YoY, gaining market share in both auto and other consumer • Strong top line performance with 5% revenue growth, due to fees (new business) and leasing activity (+48%) • Costs affected by investments in strategic initiatives and perimeter effects. Good credit quality performance • Continued growth in Openbank’s customer base, reflected in the balance sheet: +52% in loans, +18% in customer funds

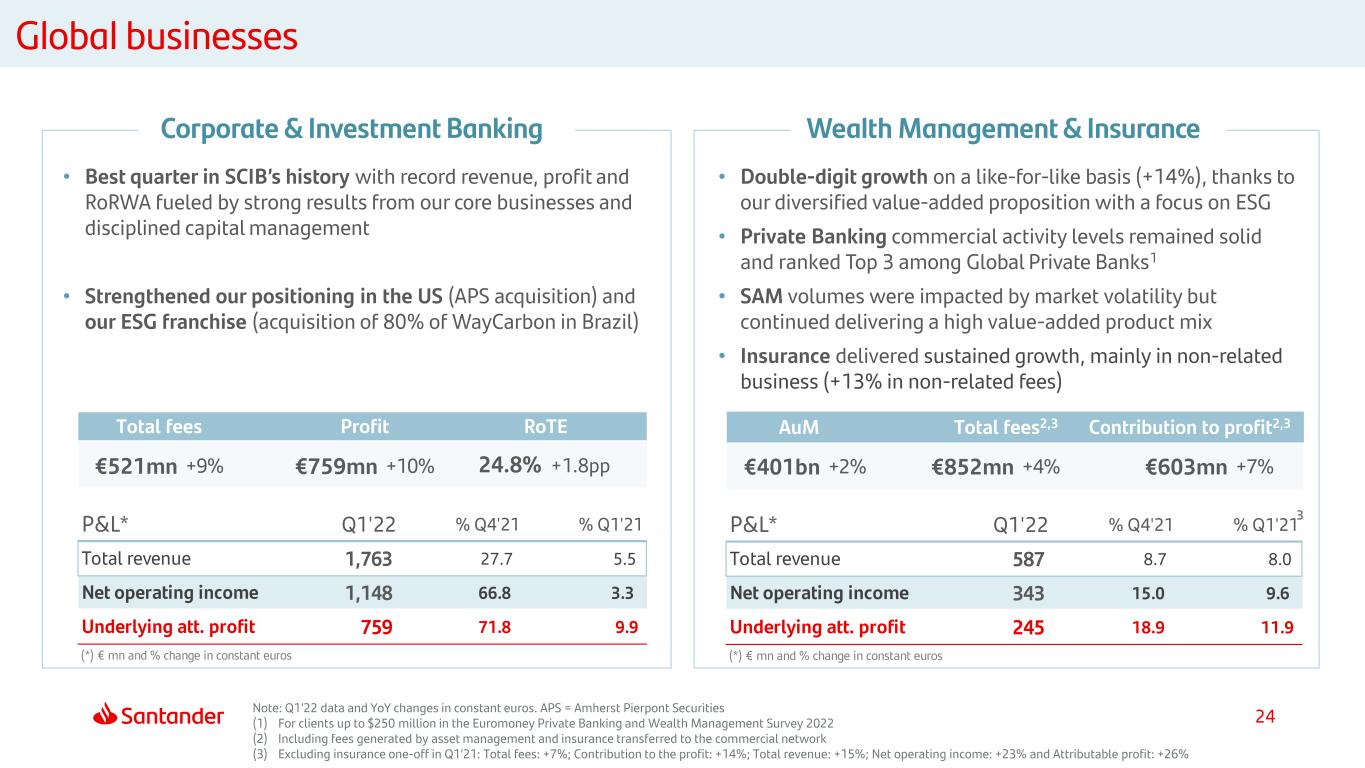

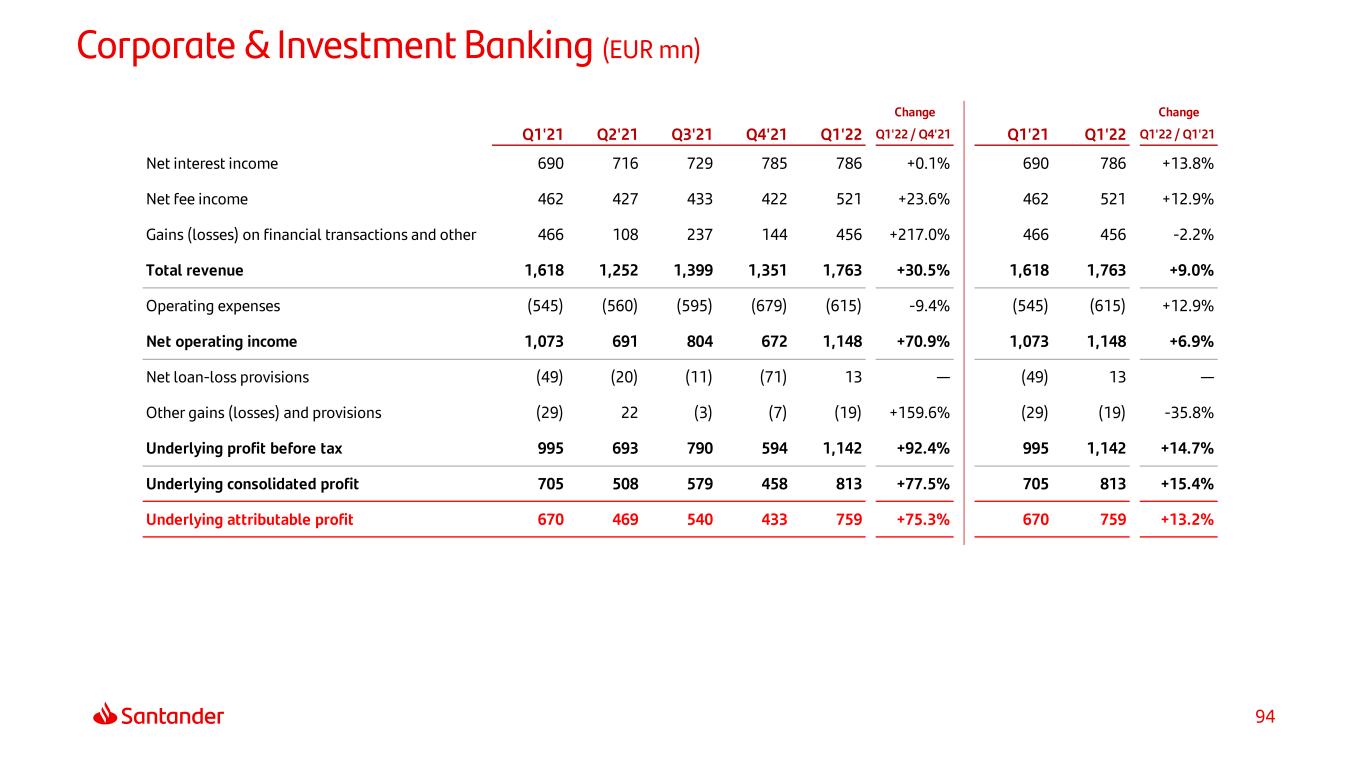

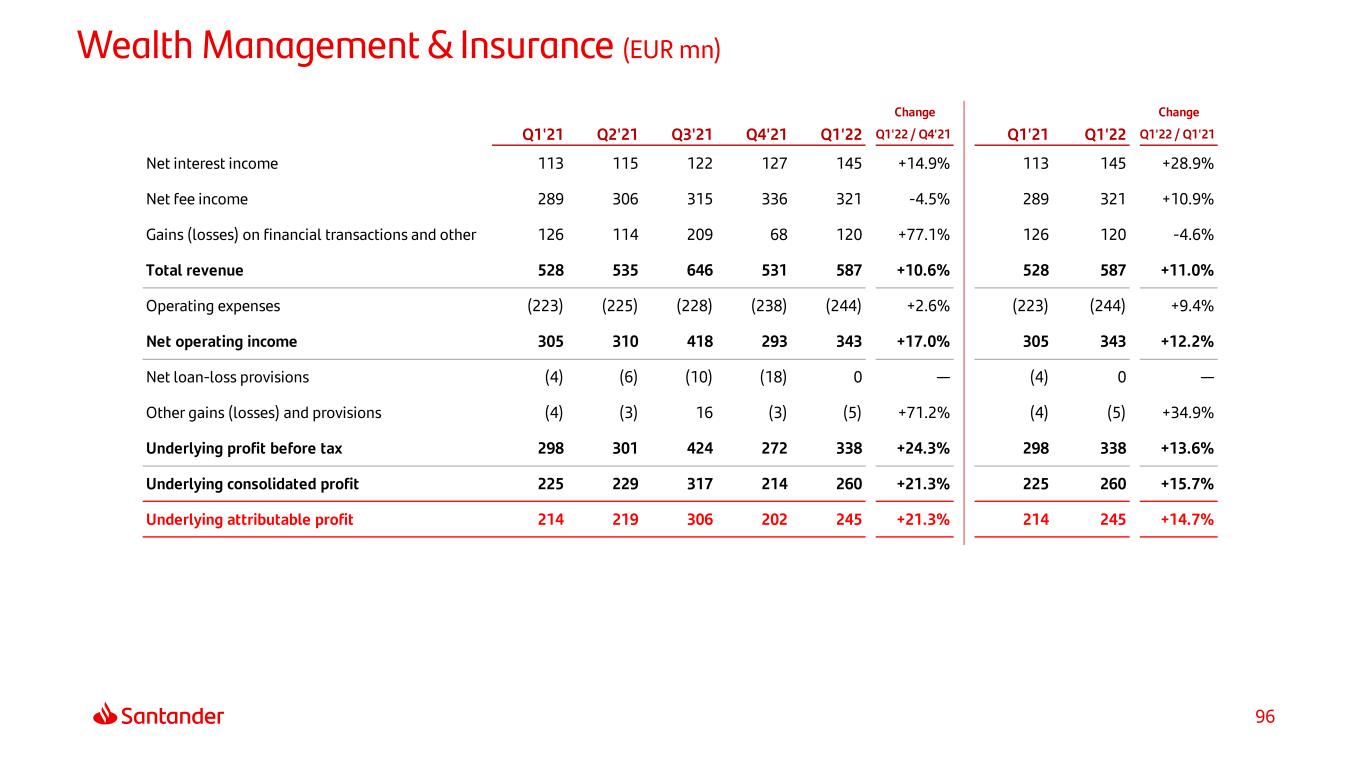

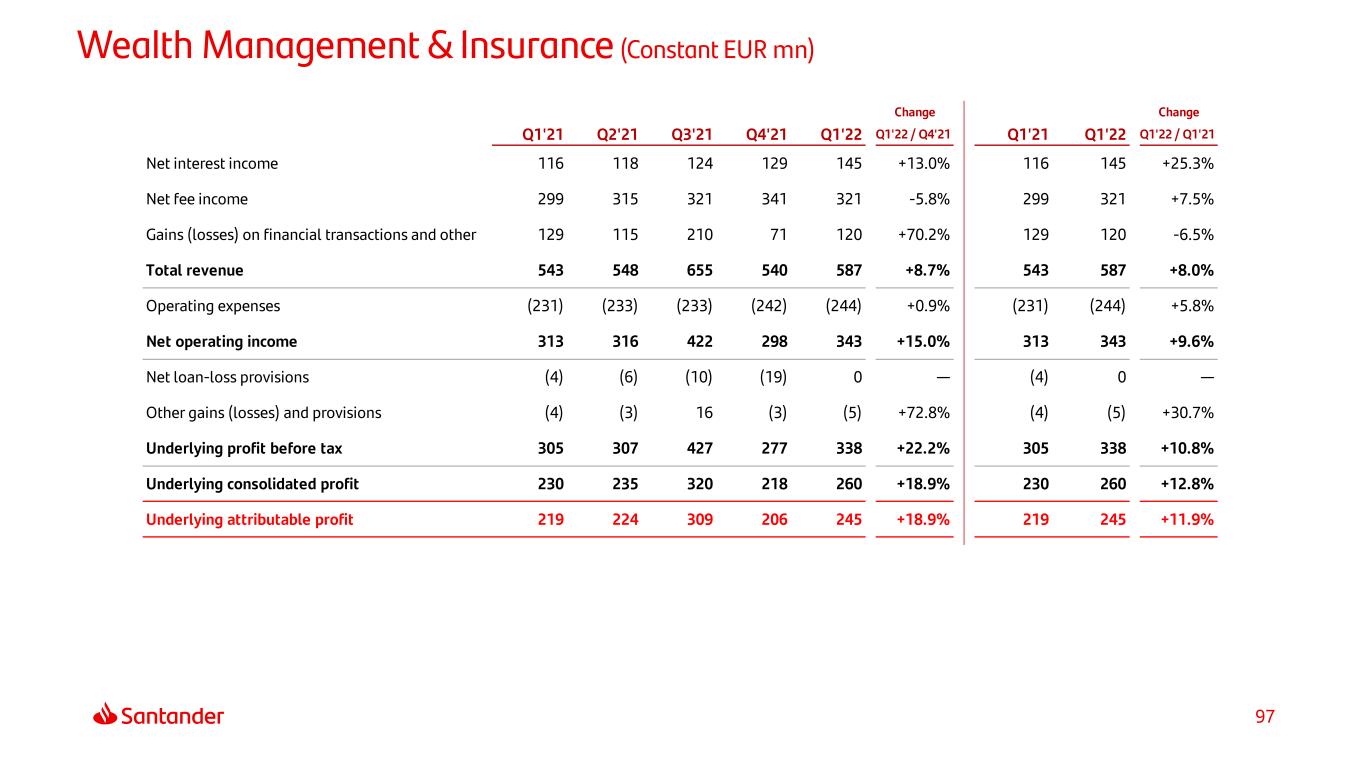

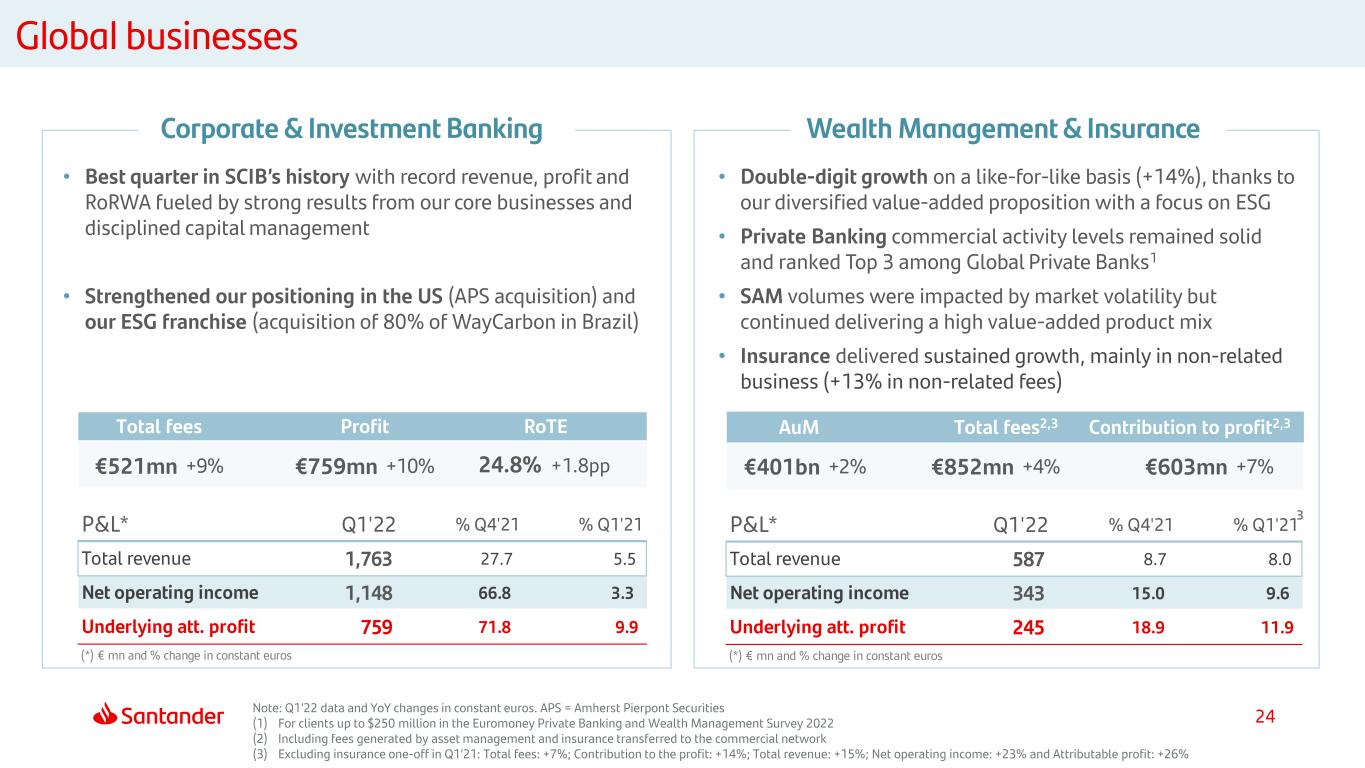

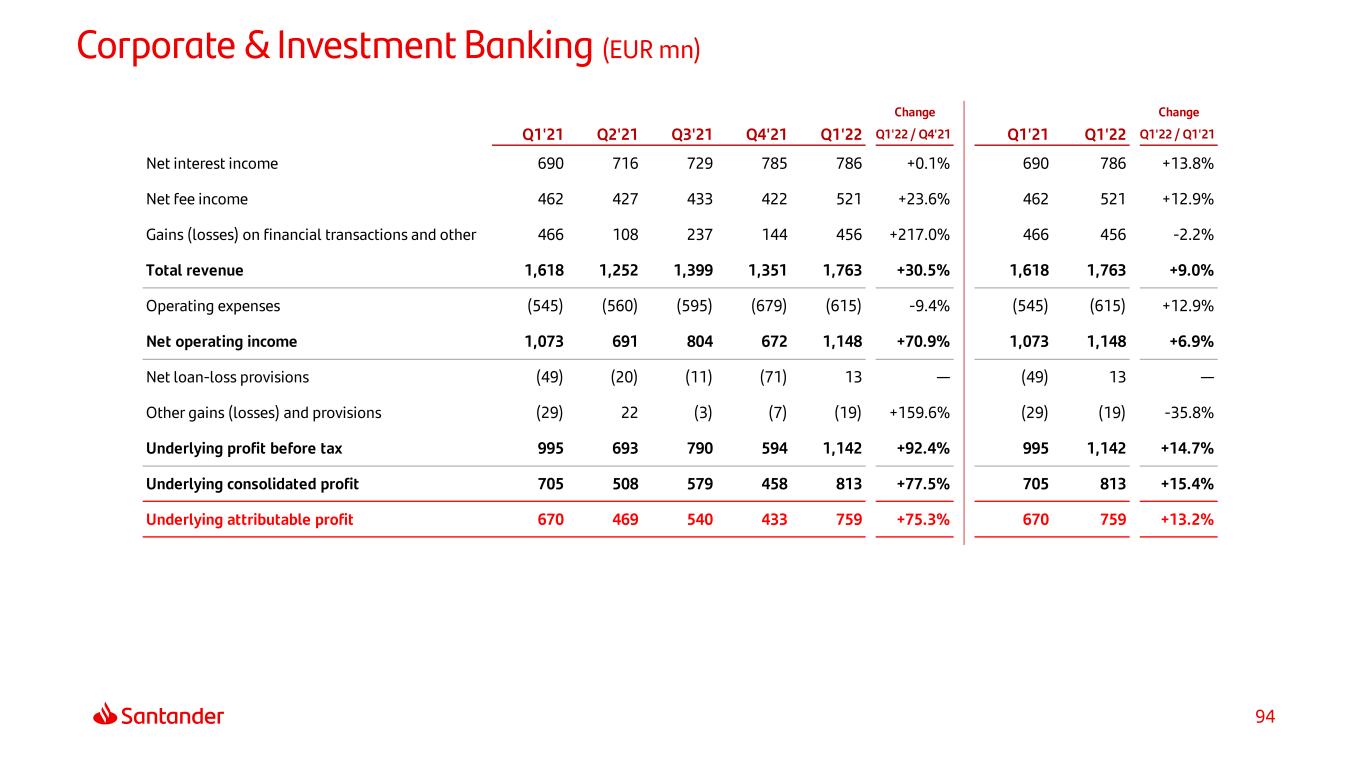

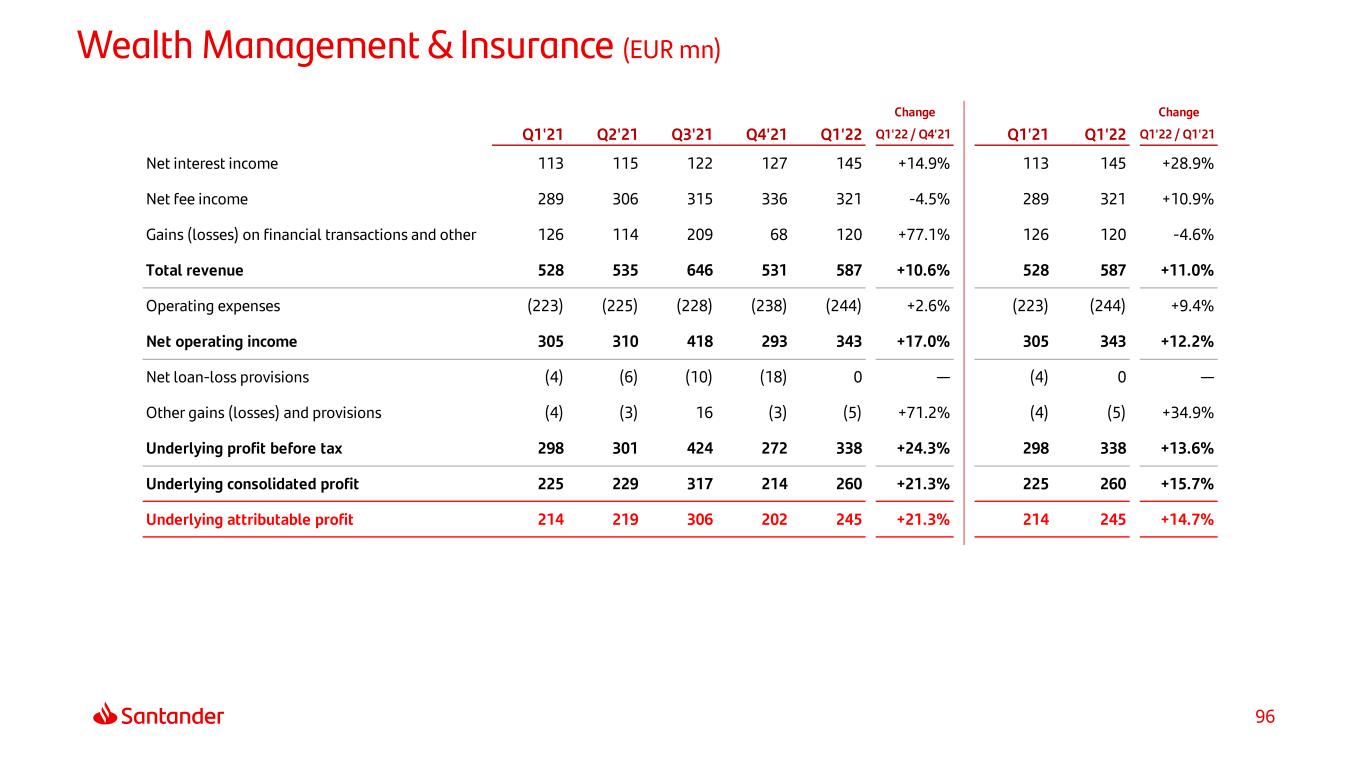

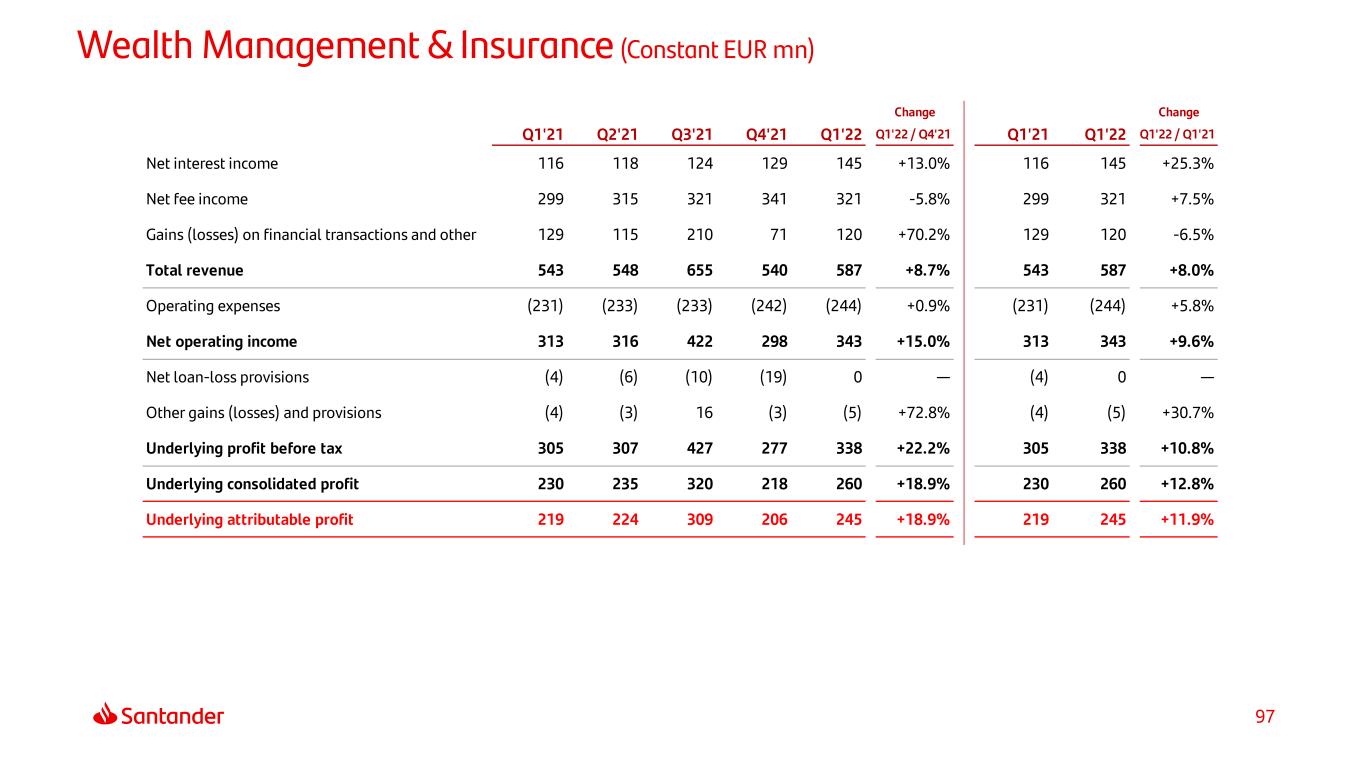

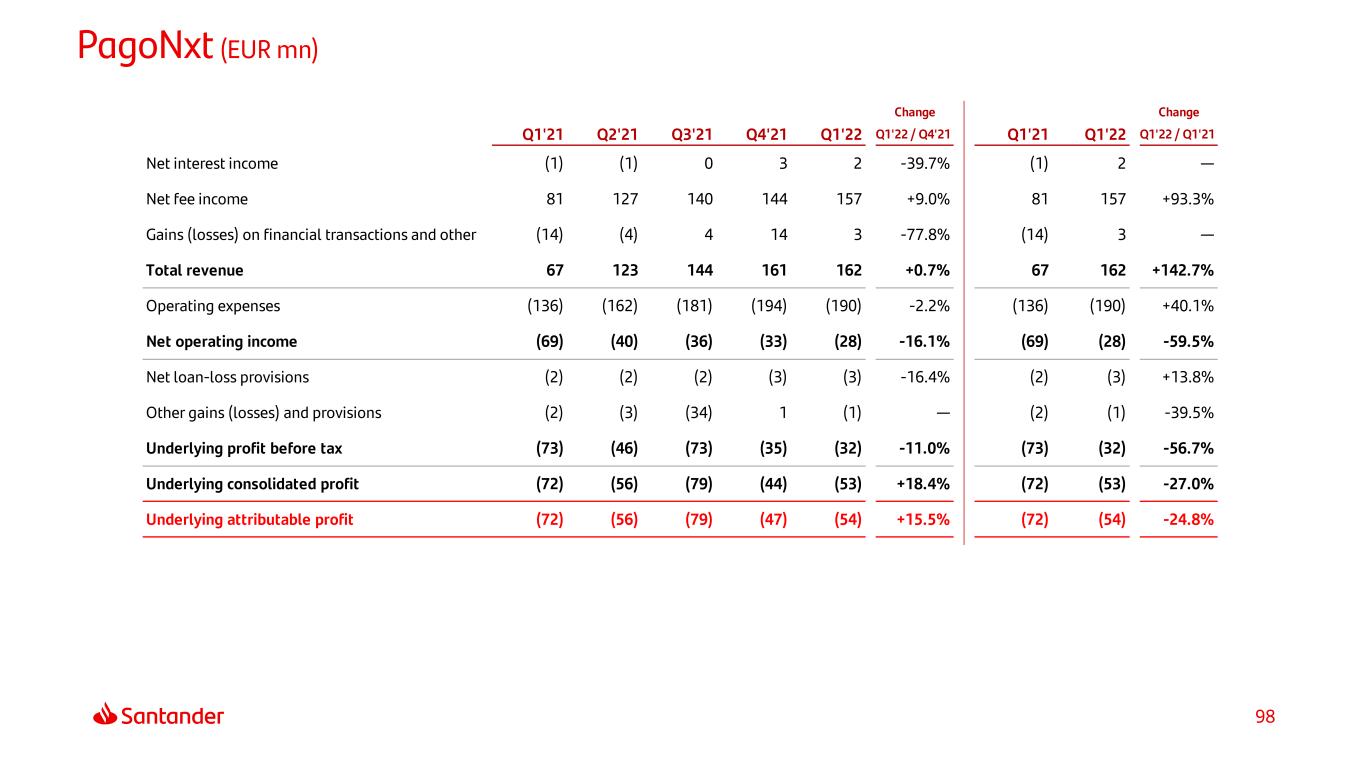

24 Note: Q1’22 data and YoY changes in constant euros. APS = Amherst Pierpont Securities (1) For clients up to $250 million in the Euromoney Private Banking and Wealth Management Survey 2022 (2) Including fees generated by asset management and insurance transferred to the commercial network (3) Excluding insurance one-off in Q1’21: Total fees: +7%; Contribution to the profit: +14%; Total revenue: +15%; Net operating income: +23% and Attributable profit: +26% Total fees Profit RoTE P&L* Q1'22 % Q4'21 % Q1'21 Total revenue 1,763 27.7 5.5 Net operating income 1,148 66.8 3.3 Underlying att. profit 759 71.8 9.9 (*) € mn and % change in constant euros AuM Total fees2,3 Contribution to profit2,3 P&L* Q1'22 % Q4'21 % Q1'21 Total revenue 587 8.7 8.0 Net operating income 343 15.0 9.6 Underlying att. profit 245 18.9 11.9 (*) € mn and % change in constant euros • Double-digit growth on a like-for-like basis (+14%), thanks to our diversified value-added proposition with a focus on ESG • Private Banking commercial activity levels remained solid and ranked Top 3 among Global Private Banks1 • SAM volumes were impacted by market volatility but continued delivering a high value-added product mix • Insurance delivered sustained growth, mainly in non-related business (+13% in non-related fees) Global businesses Corporate & Investment Banking Wealth Management & Insurance 3 €521mn +9% €401bn +2% €852mn +4% €603mn +7% • Best quarter in SCIB’s history with record revenue, profit and RoRWA fueled by strong results from our core businesses and disciplined capital management • Strengthened our positioning in the US (APS acquisition) and our ESG franchise (acquisition of 80% of WayCarbon in Brazil) €759mn +10% 24.8% +1.8pp

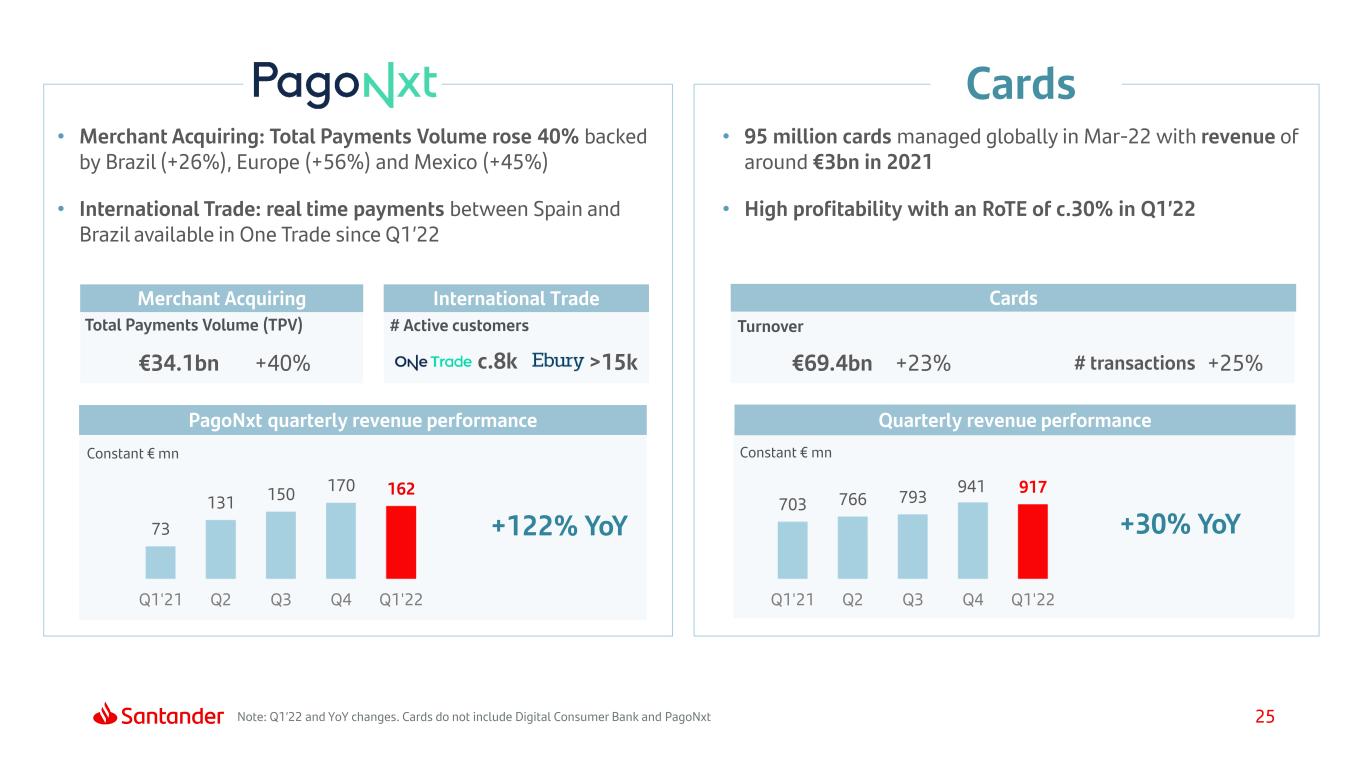

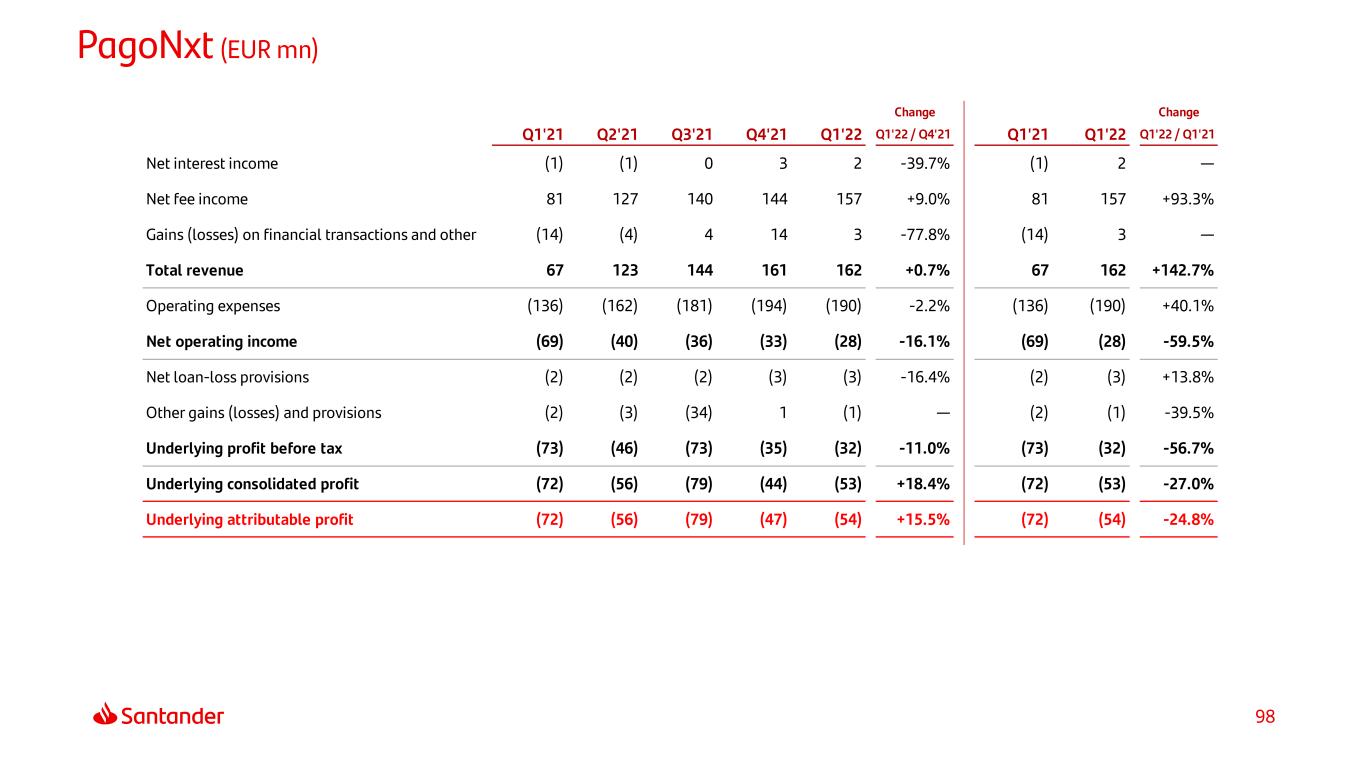

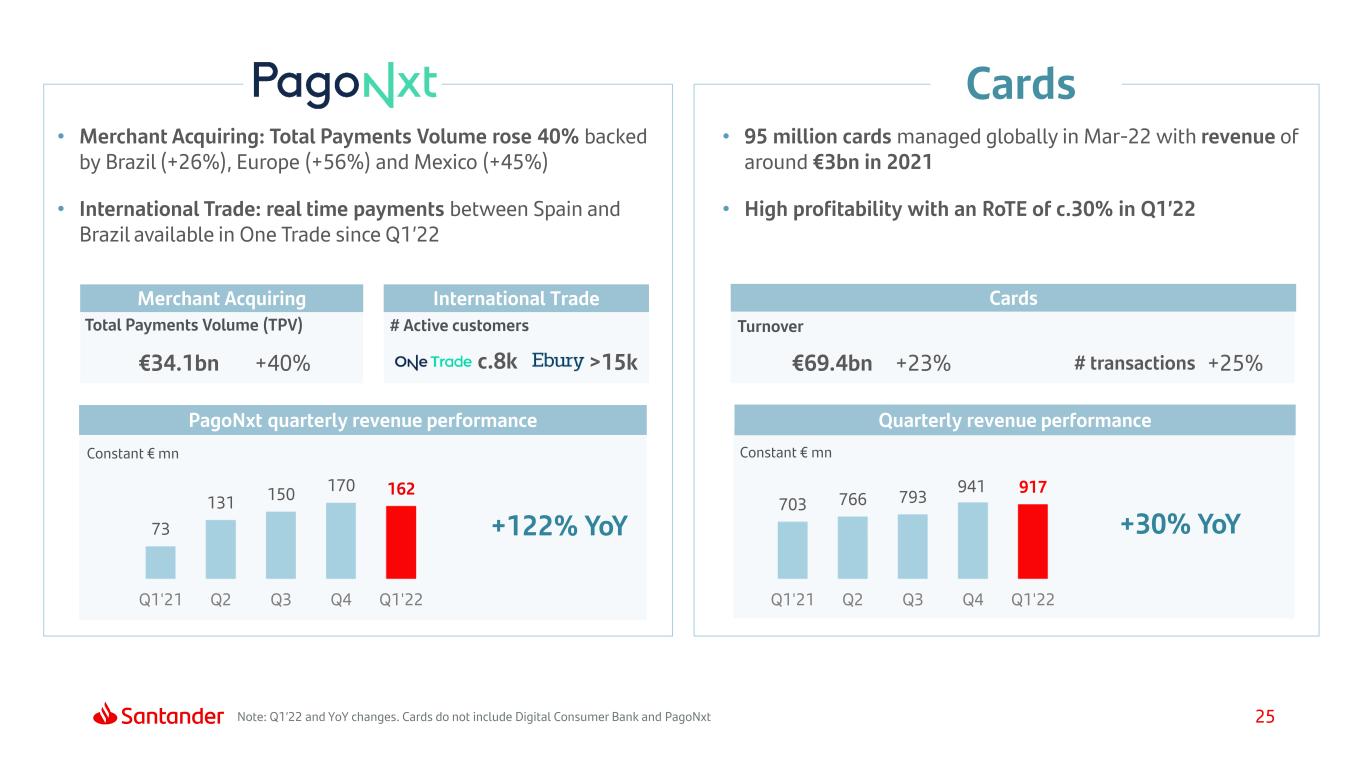

25Note: Q1’22 and YoY changes. Cards do not include Digital Consumer Bank and PagoNxt Cards PagoNxt quarterly revenue performance +122% YoY Merchant Acquiring €34.1bn +40% International Trade c.8k 73 131 150 170 162 Q1'21 Q2 Q3 Q4 Q1'22 • Merchant Acquiring: Total Payments Volume rose 40% backed by Brazil (+26%), Europe (+56%) and Mexico (+45%) • International Trade: real time payments between Spain and Brazil available in One Trade since Q1’22 Cards €69.4bn +23% # transactions +25% Quarterly revenue performance +30% YoY 703 766 793 941 917 Q1'21 Q2 Q3 Q4 Q1'22 • 95 million cards managed globally in Mar-22 with revenue of around €3bn in 2021 • High profitability with an RoTE of c.30% in Q1’22 >15k Total Payments Volume (TPV) # Active customers Turnover Constant € mn Constant € mn

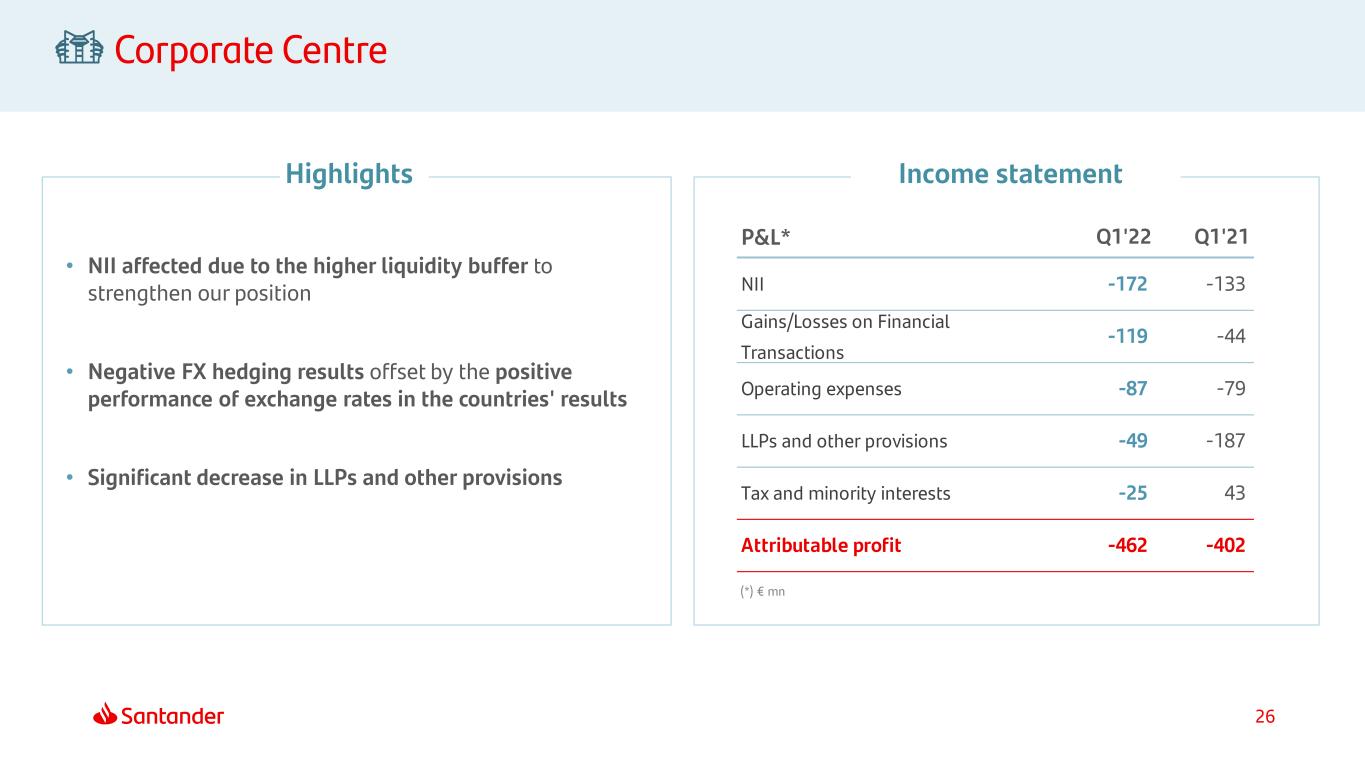

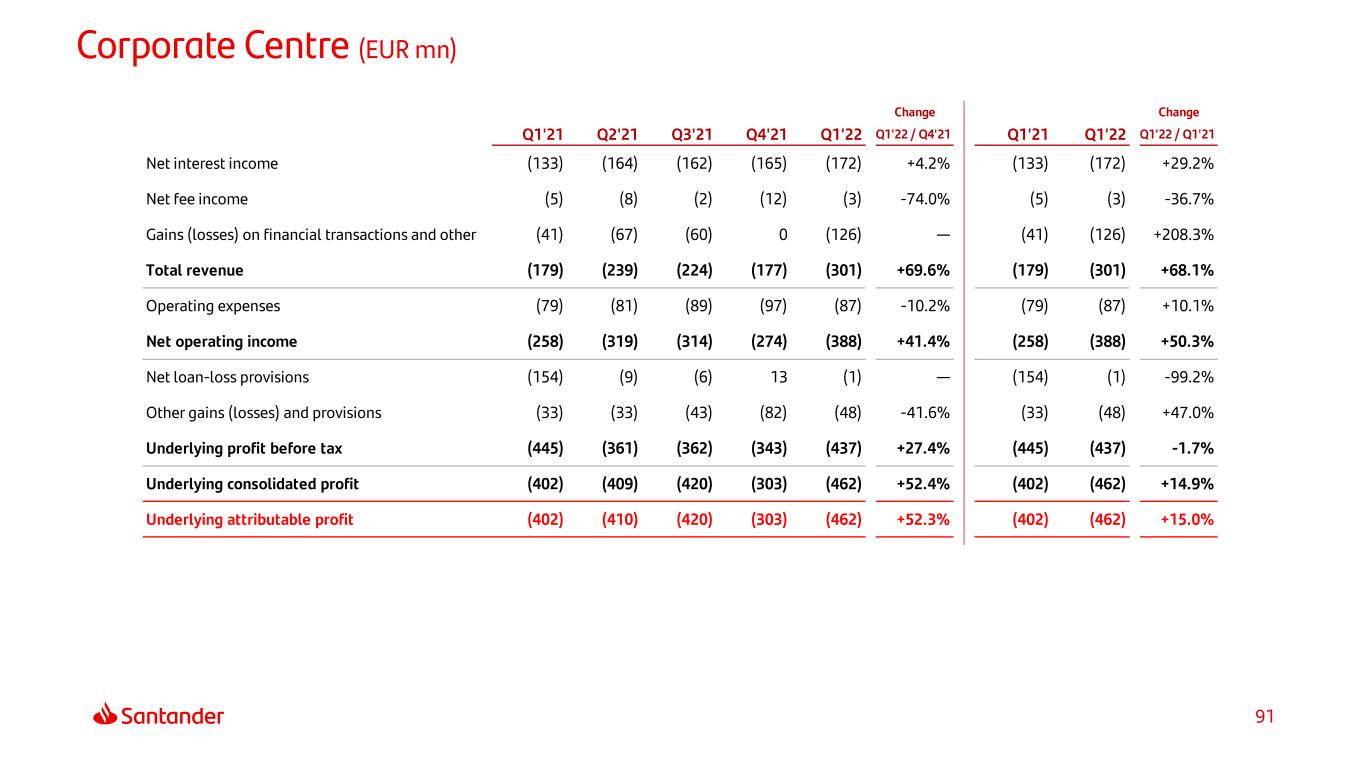

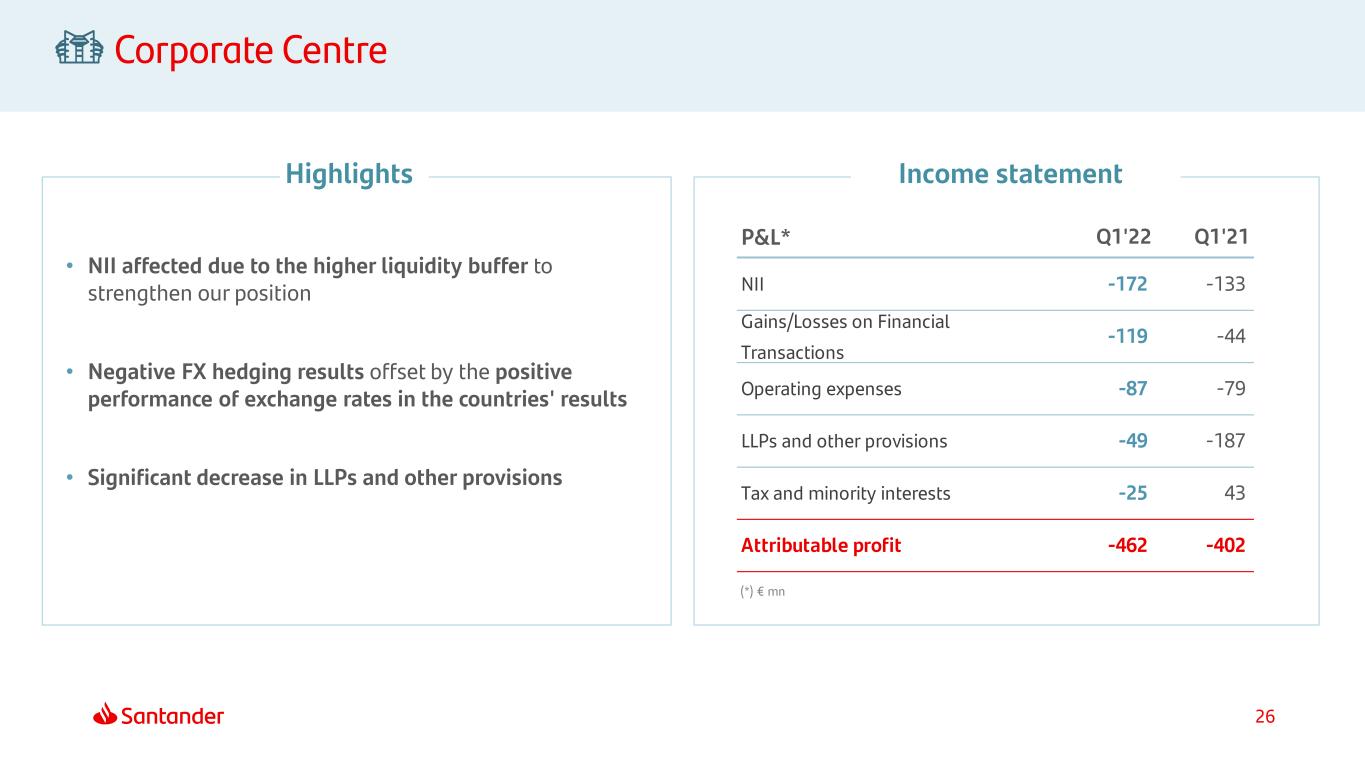

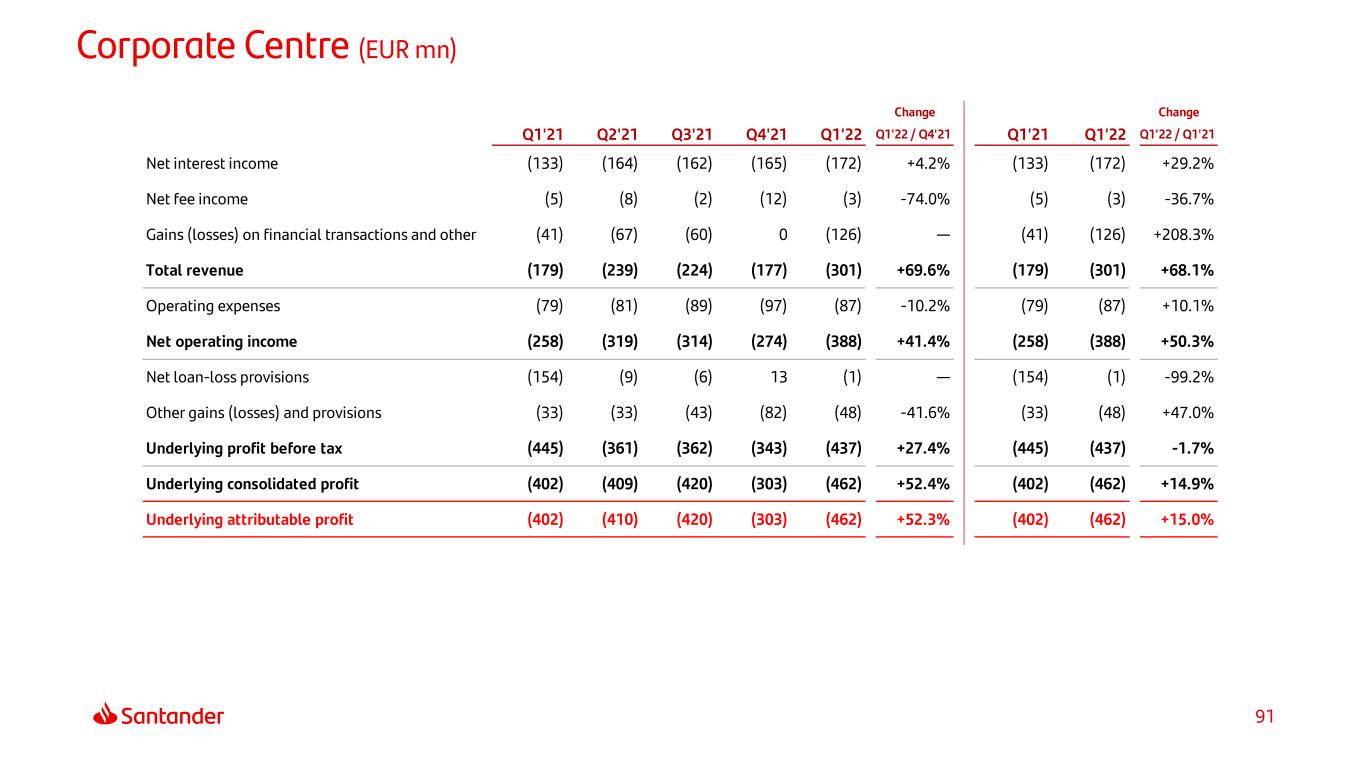

26 Corporate Centre Highlights Income statement • NII affected due to the higher liquidity buffer to strengthen our position • Negative FX hedging results offset by the positive performance of exchange rates in the countries' results • Significant decrease in LLPs and other provisions P&L* Q1'22 Q1'21 NII -172 -133 Gains/Losses on Financial Transactions -119 -44 Operating expenses -87 -79 LLPs and other provisions -49 -187 Tax and minority interests -25 43 Attributable profit -462 -402 (*) € mn

27 Index 1 Appendix 3 Final remarks 4 Highlights and Group performance Business areas review 2

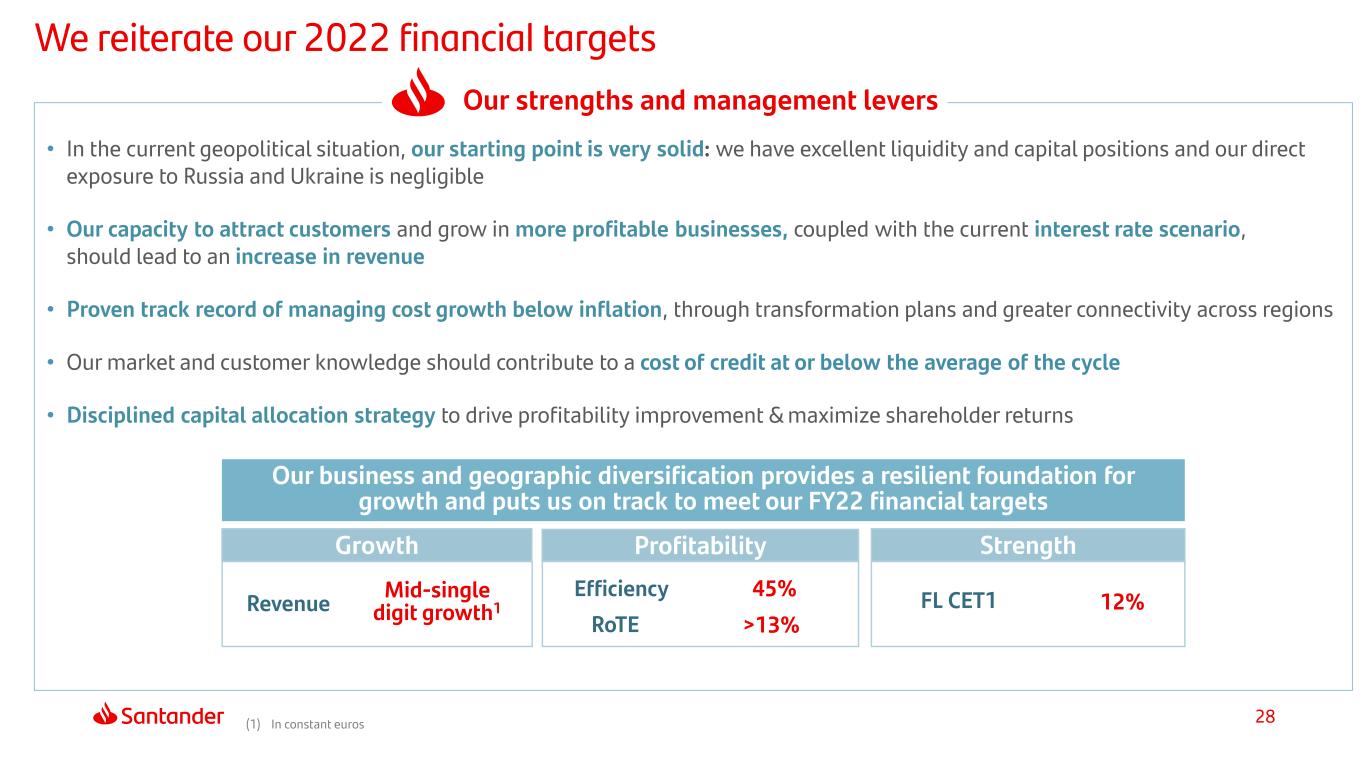

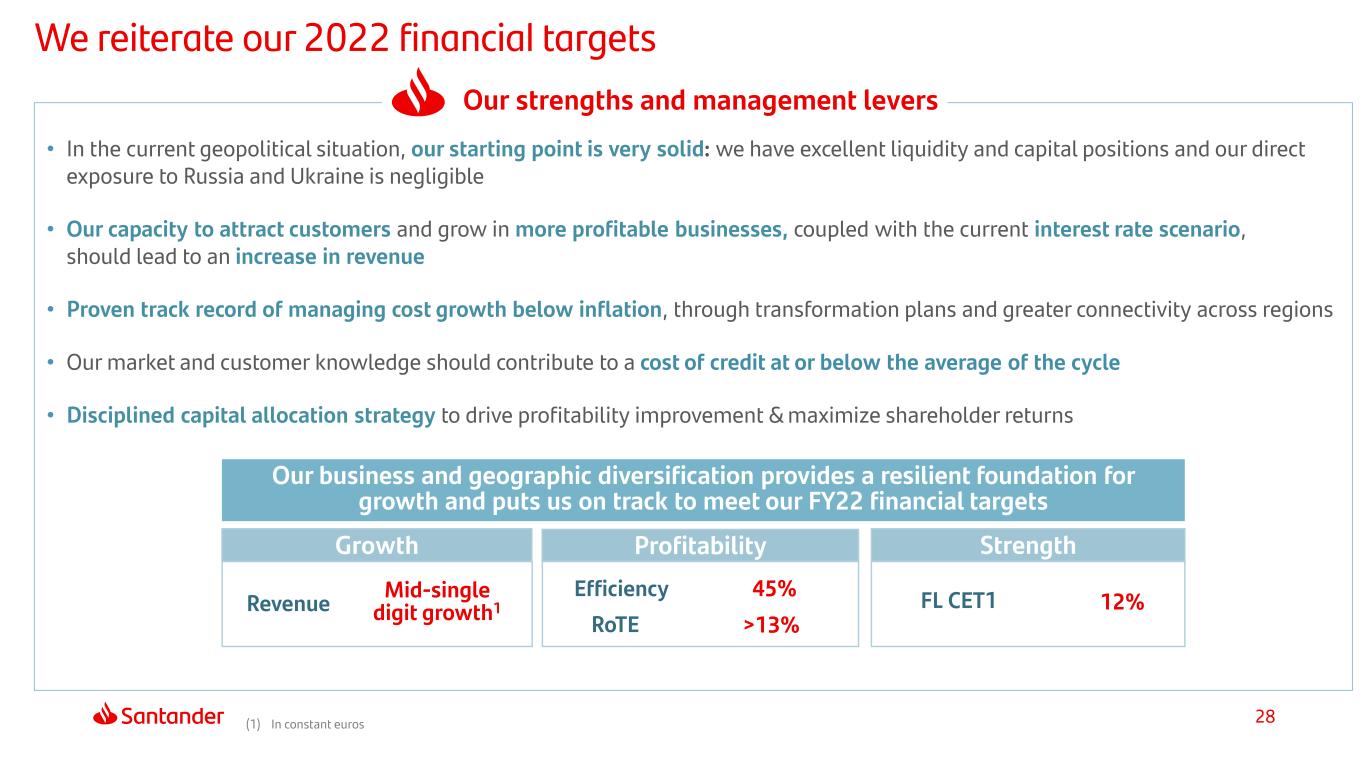

28 • In the current geopolitical situation, our starting point is very solid: we have excellent liquidity and capital positions and our direct exposure to Russia and Ukraine is negligible • Our capacity to attract customers and grow in more profitable businesses, coupled with the current interest rate scenario, should lead to an increase in revenue • Proven track record of managing cost growth below inflation, through transformation plans and greater connectivity across regions • Our market and customer knowledge should contribute to a cost of credit at or below the average of the cycle • Disciplined capital allocation strategy to drive profitability improvement & maximize shareholder returns We reiterate our 2022 financial targets Our strengths and management levers (1) In constant euros FL CET1 12% RoTE >13% 45%Efficiency Revenue Mid-single digit growth1 Growth StrengthProfitability Our business and geographic diversification provides a resilient foundation for growth and puts us on track to meet our FY22 financial targets

29 Index 1 Appendix 3 Final remarks 4 Highlights and Group performance Business areas review 2

30 Appendix Other countries Balance sheet and capital management Yield on loans and cost of deposits NPL and coverage ratios and cost of credit Responsible Banking Quarterly income statements Glossary

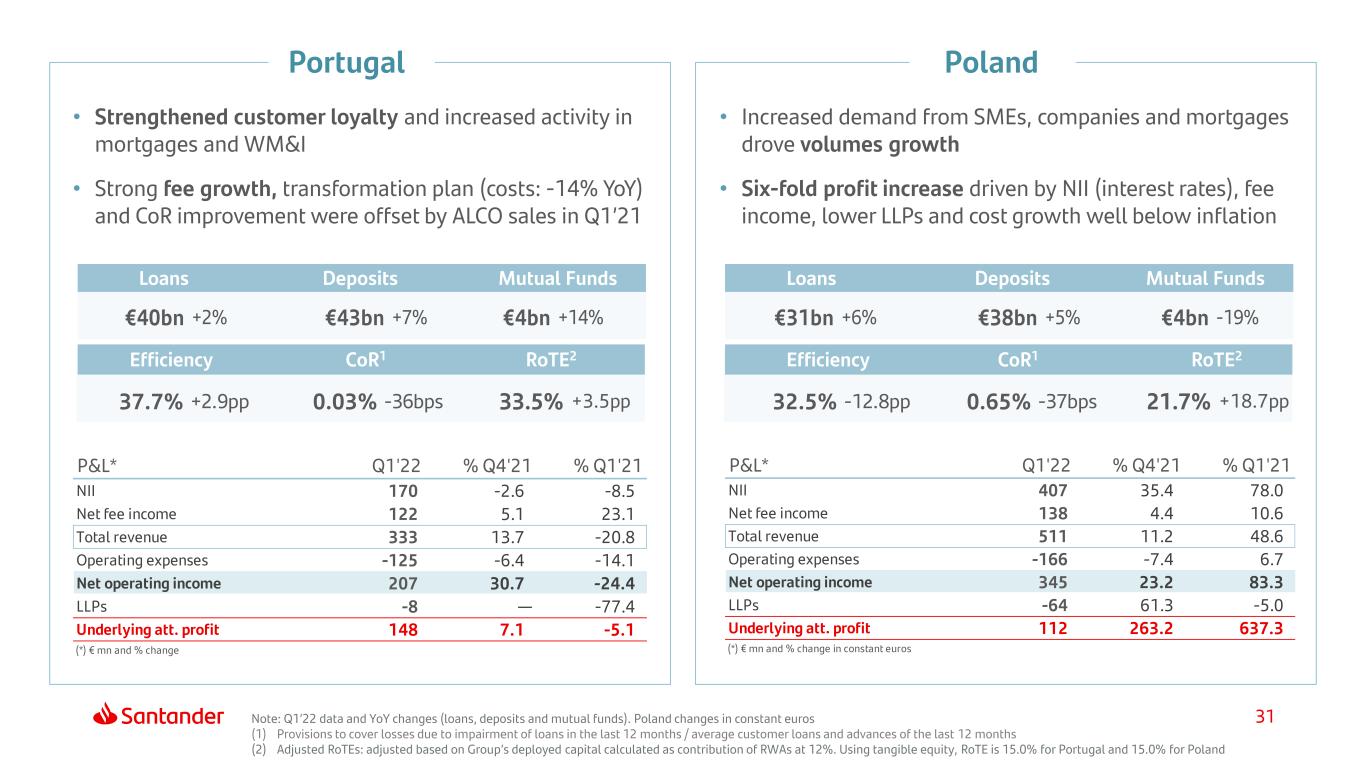

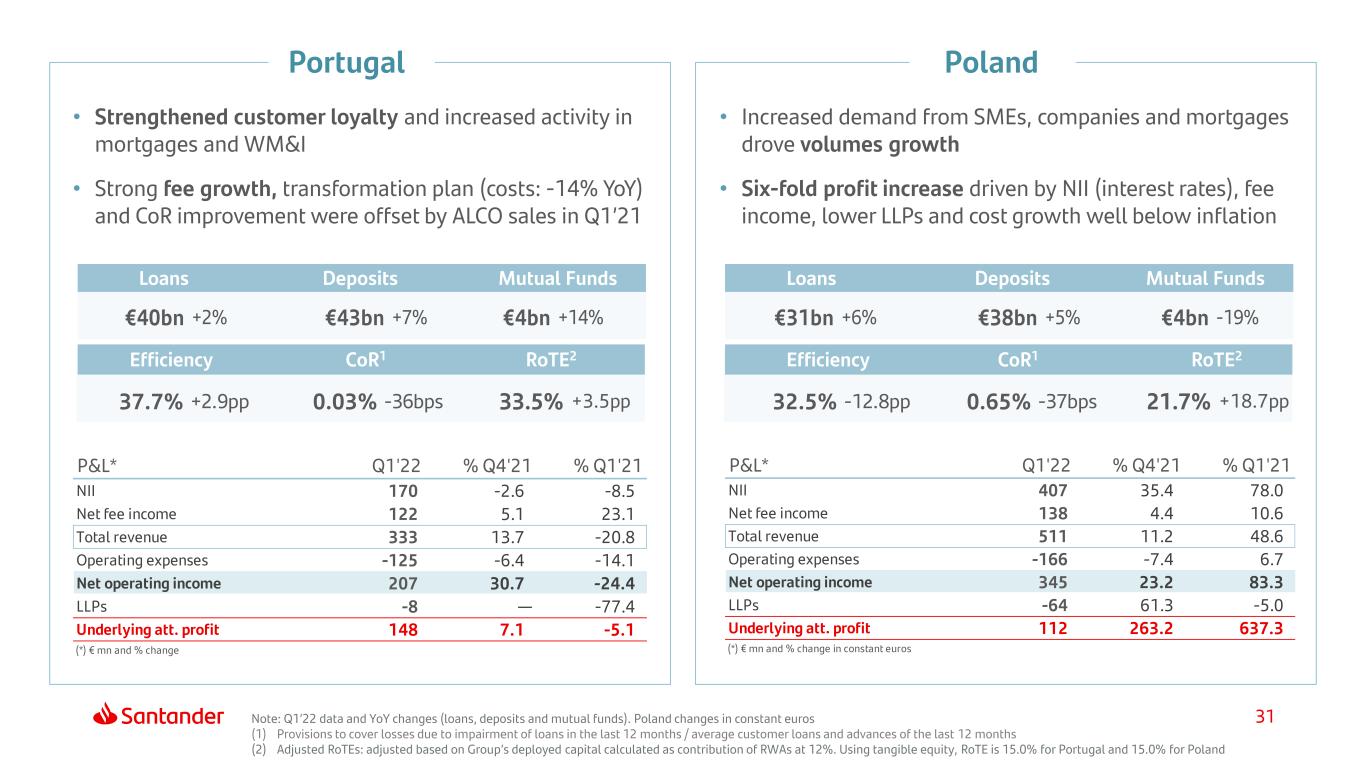

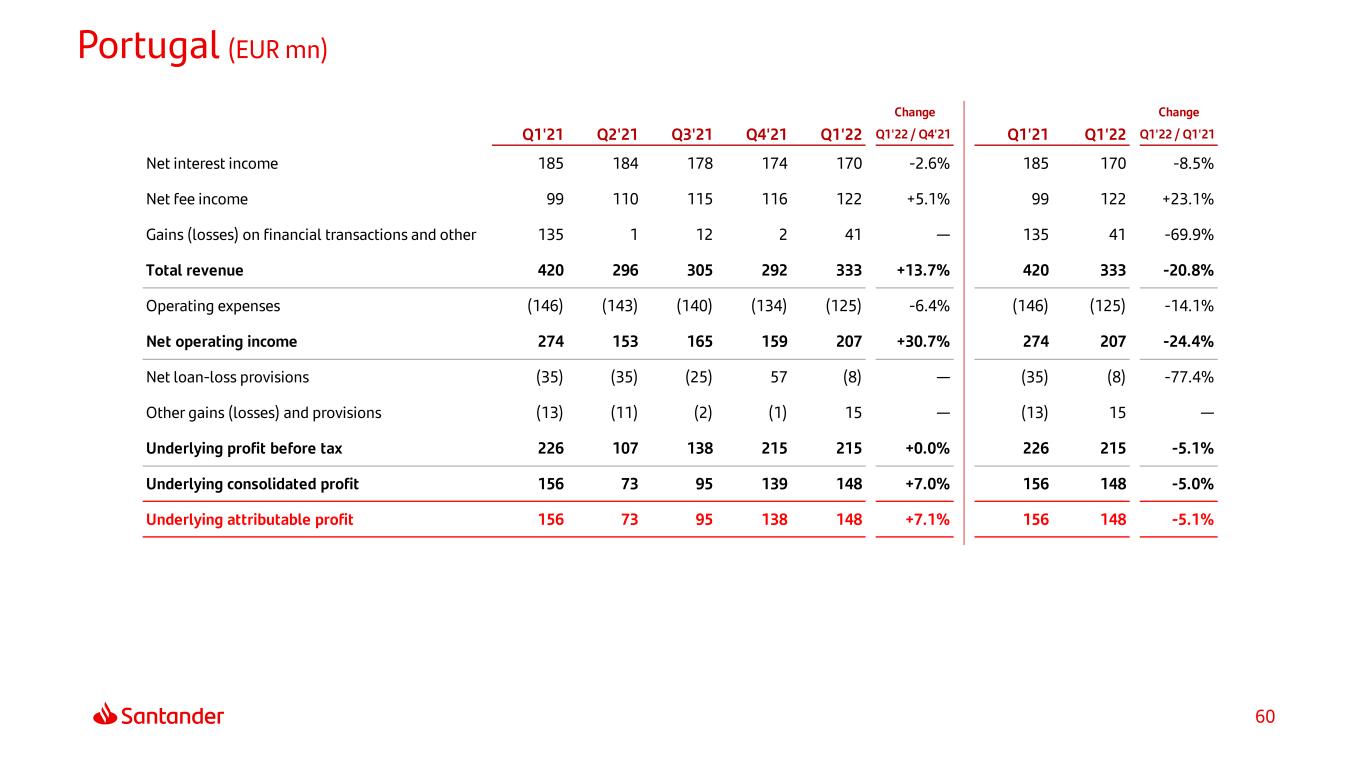

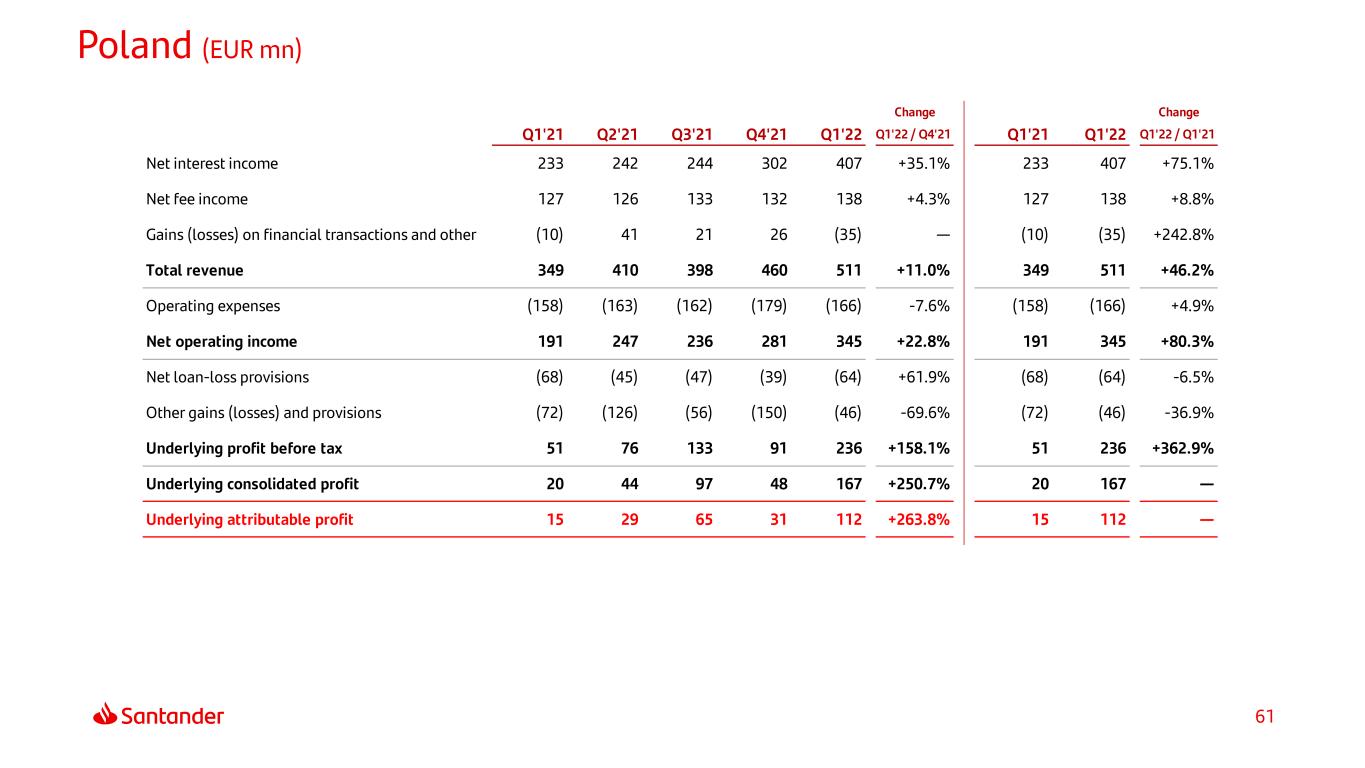

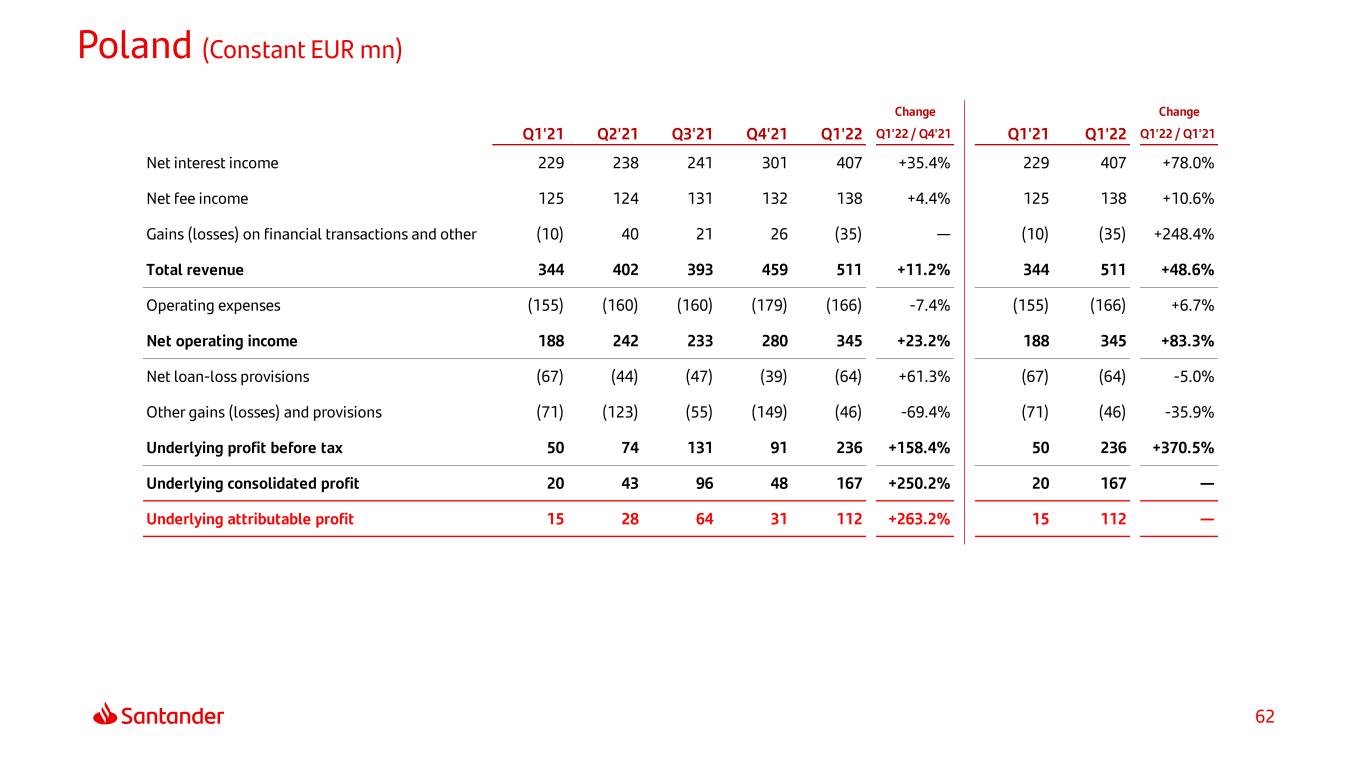

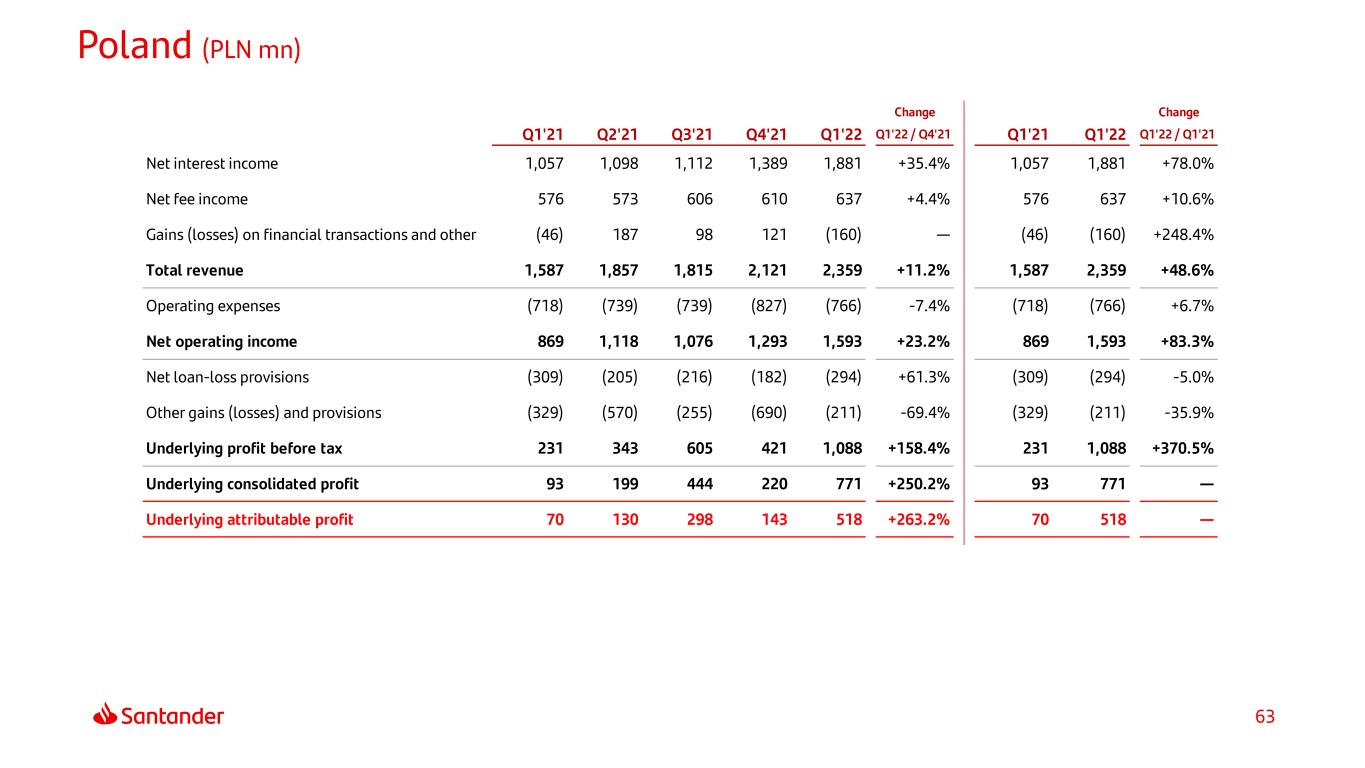

31 Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds €40bn +2% €43bn +7% €4bn +14% 37.7% +2.9pp 0.03% -36bps 33.5% +3.5pp €31bn +6% €38bn +5% €4bn -19% 32.5% -12.8pp 0.65% -37bps 21.7% +18.7pp P&L* Q1'22 % Q4'21 % Q1'21 NII 170 -2.6 -8.5 Net fee income 122 5.1 23.1 Total revenue 333 13.7 -20.8 Operating expenses -125 -6.4 -14.1 Net operating income 207 30.7 -24.4 LLPs -8 — -77.4 Underlying att. profit 148 7.1 -5.1 (*) € mn and % change P&L* Q1'22 % Q4'21 % Q1'21 NII 407 35.4 78.0 Net fee income 138 4.4 10.6 Total revenue 511 11.2 48.6 Operating expenses -166 -7.4 6.7 Net operating income 345 23.2 83.3 LLPs -64 61.3 -5.0 Underlying att. profit 112 263.2 637.3 (*) € mn and % change in constant euros Note: Q1’22 data and YoY changes (loans, deposits and mutual funds). Poland changes in constant euros (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 15.0% for Portugal and 15.0% for Poland • Strengthened customer loyalty and increased activity in mortgages and WM&I • Strong fee growth, transformation plan (costs: -14% YoY) and CoR improvement were offset by ALCO sales in Q1’21 • Increased demand from SMEs, companies and mortgages drove volumes growth • Six-fold profit increase driven by NII (interest rates), fee income, lower LLPs and cost growth well below inflation Portugal Poland

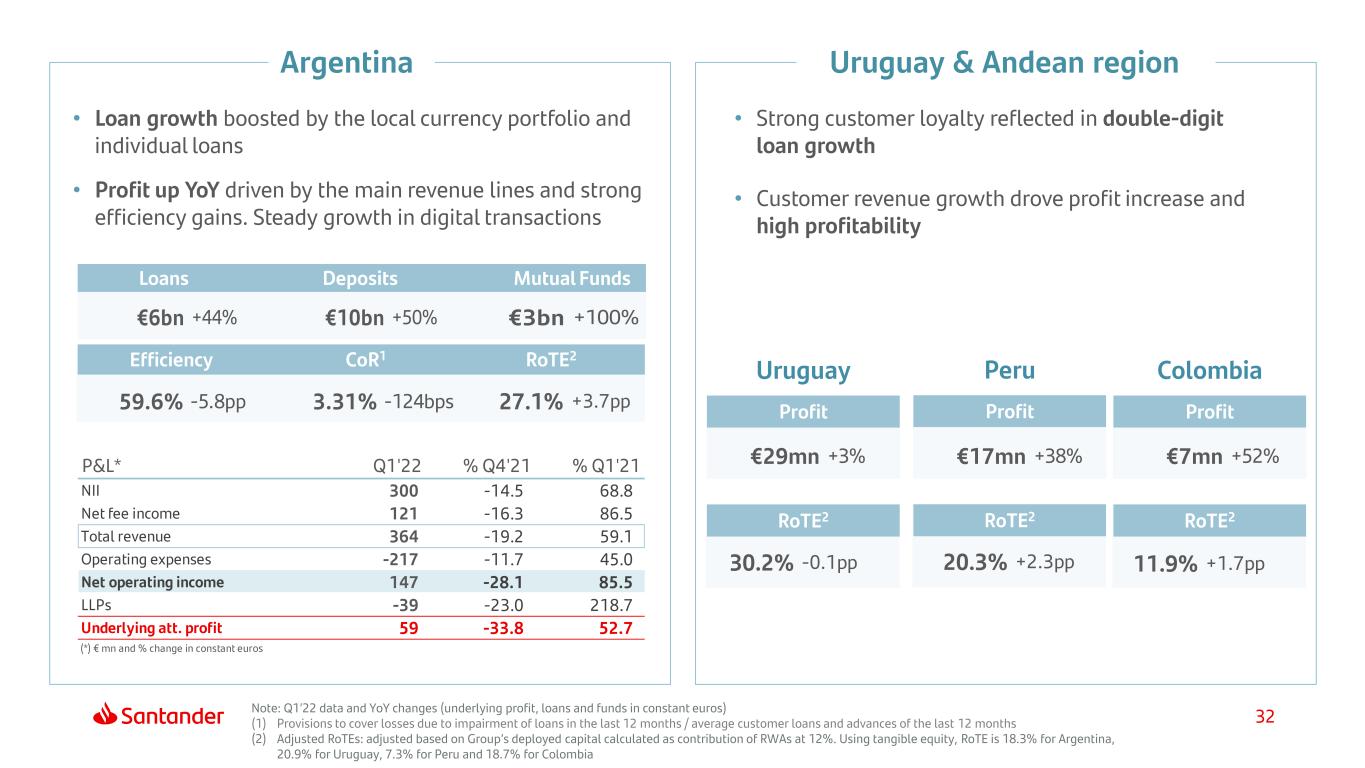

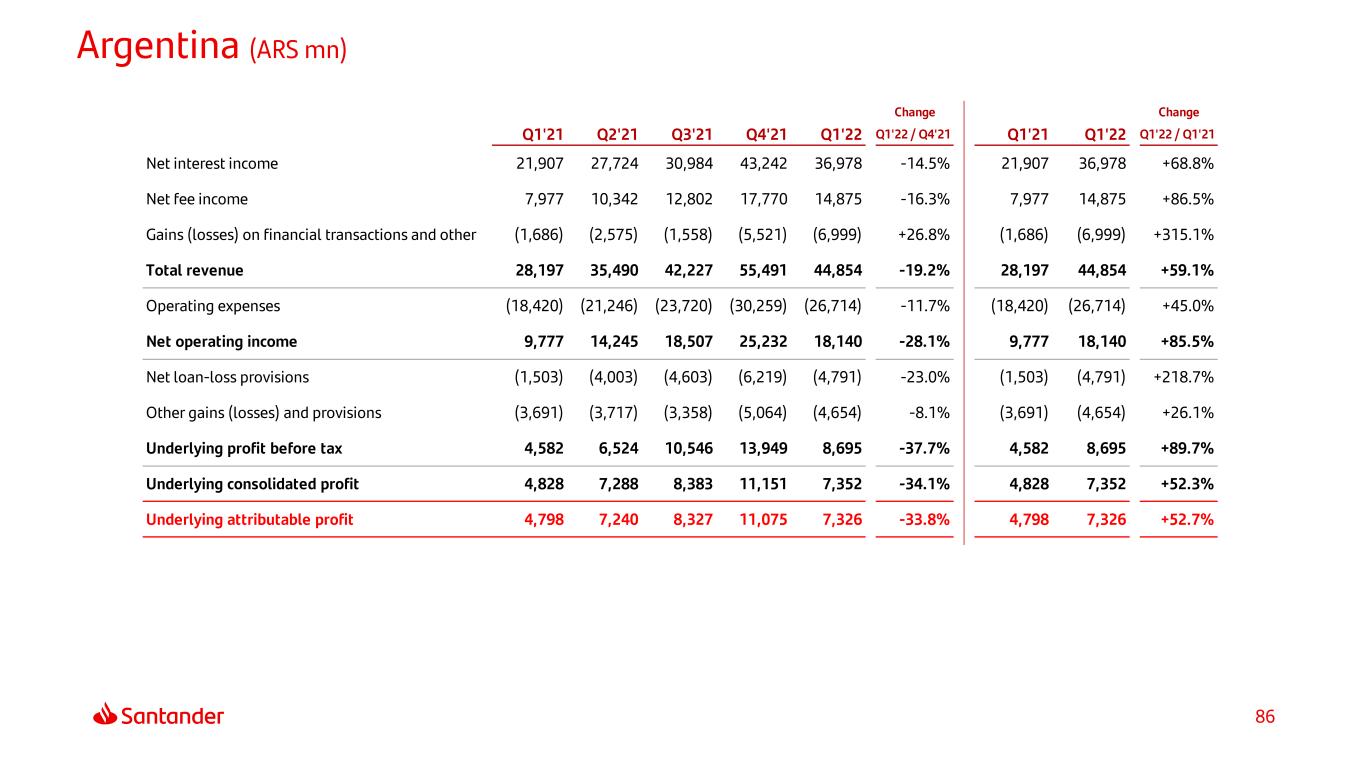

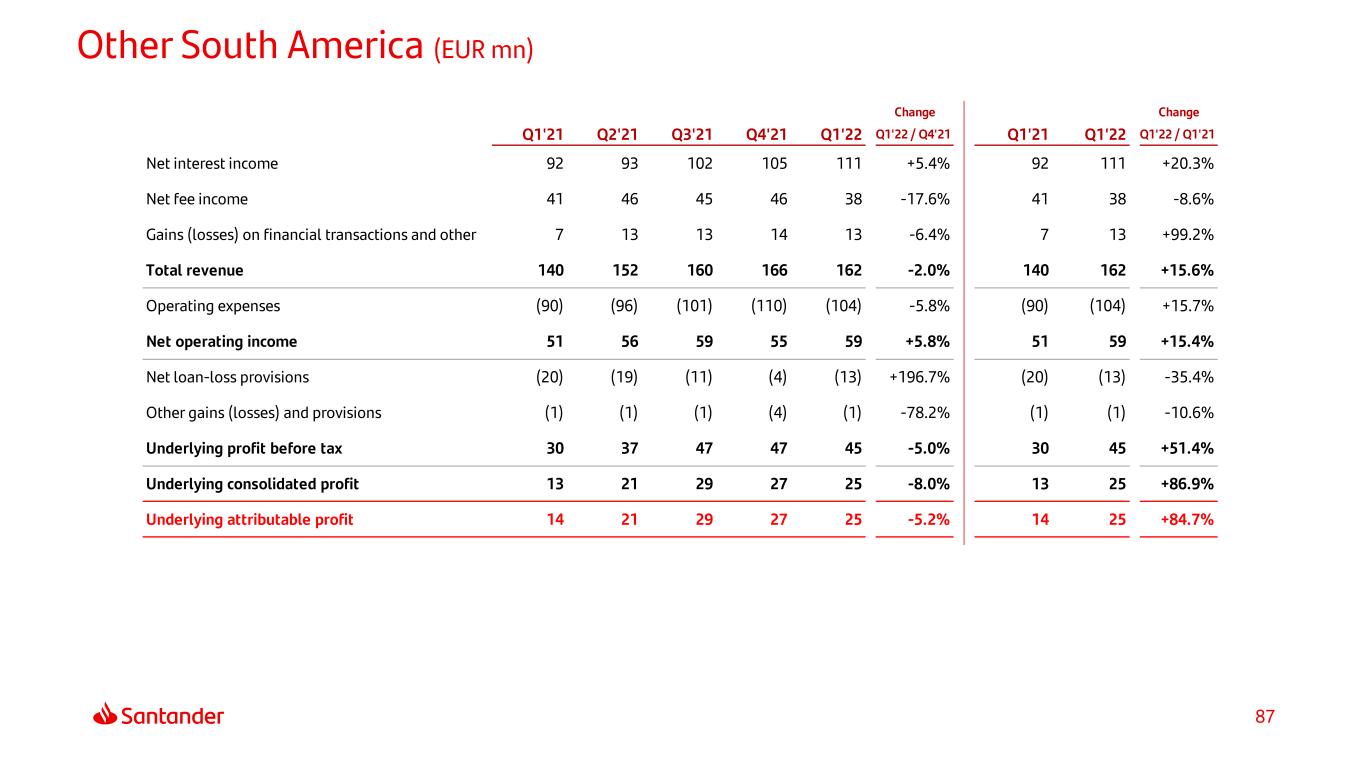

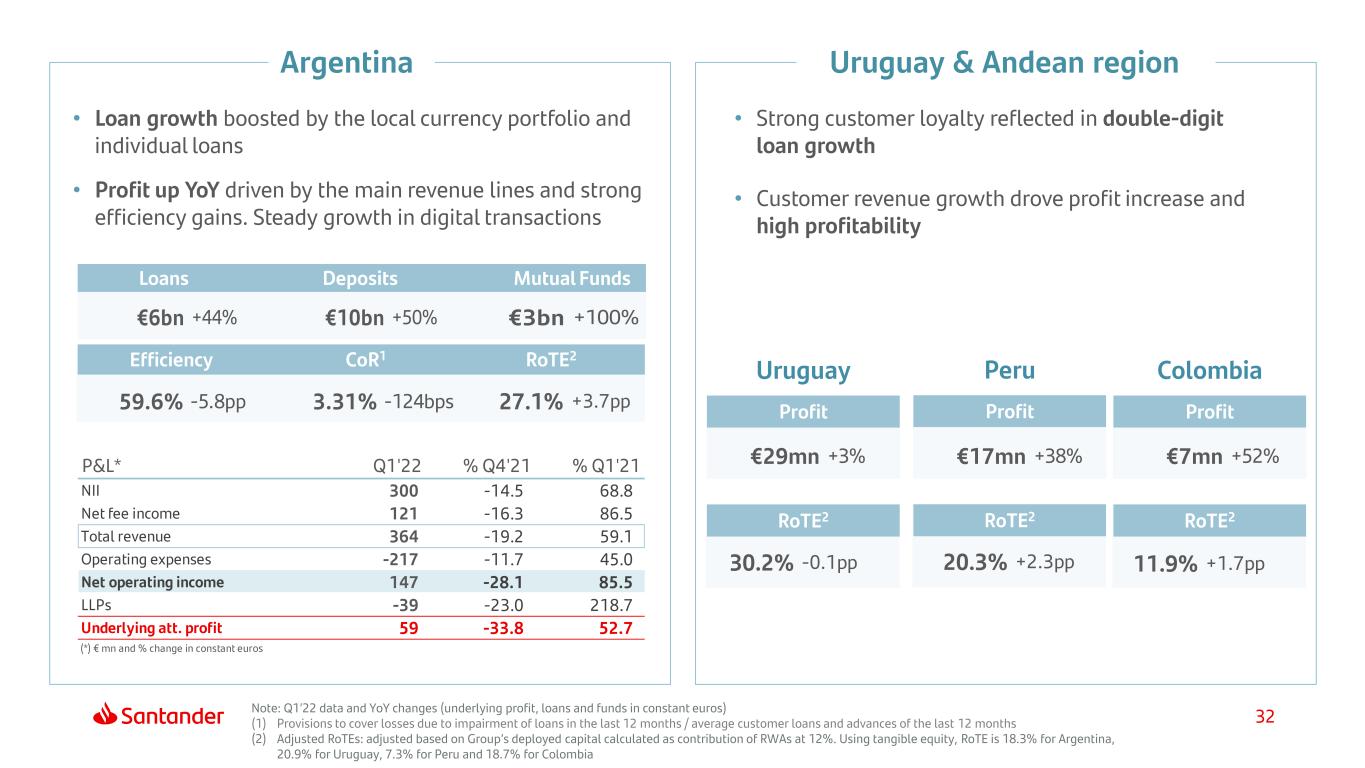

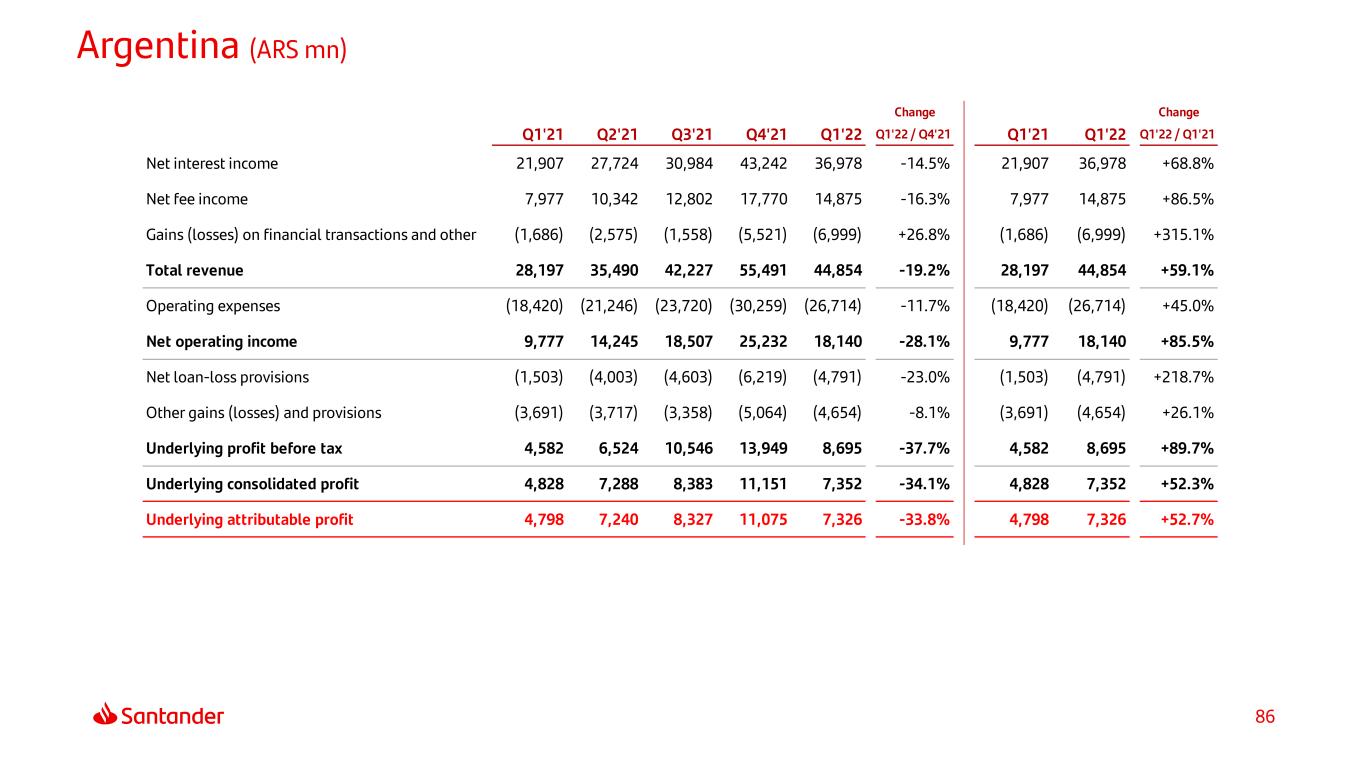

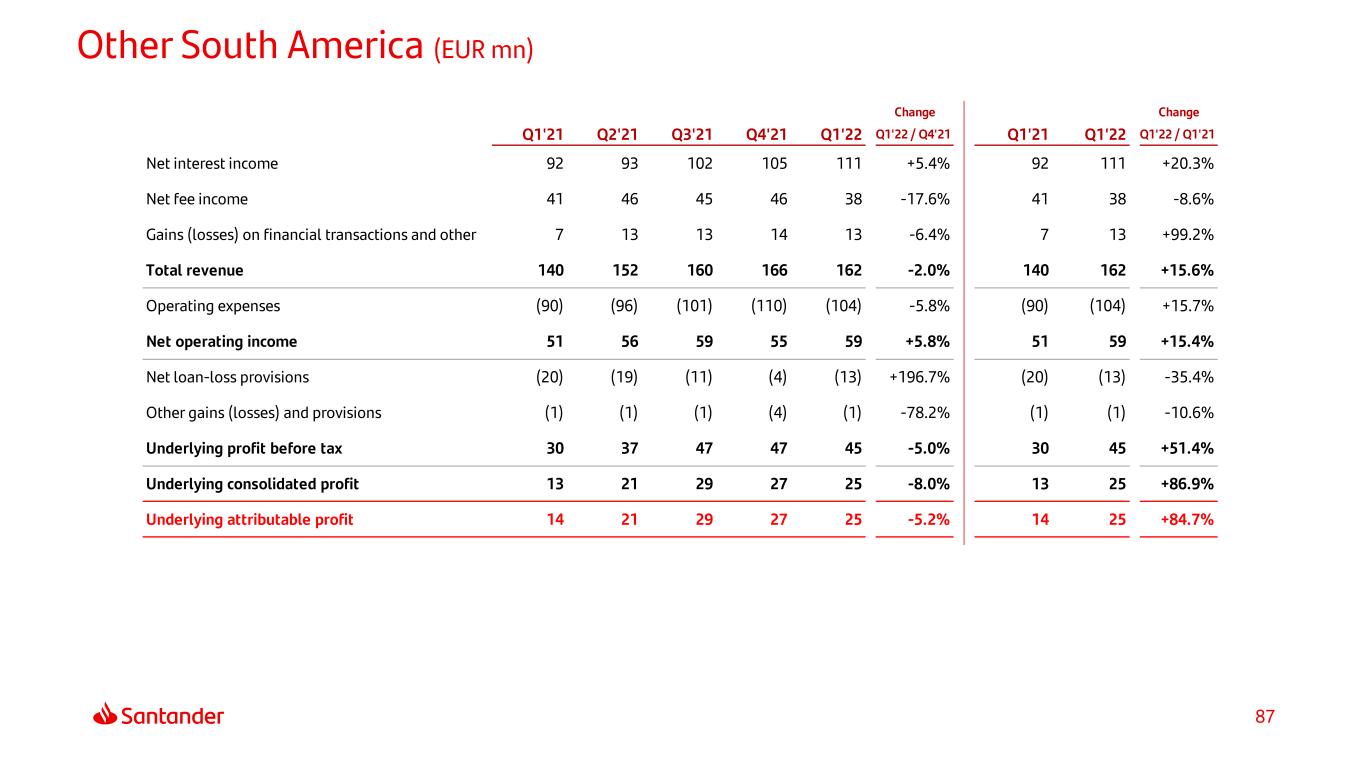

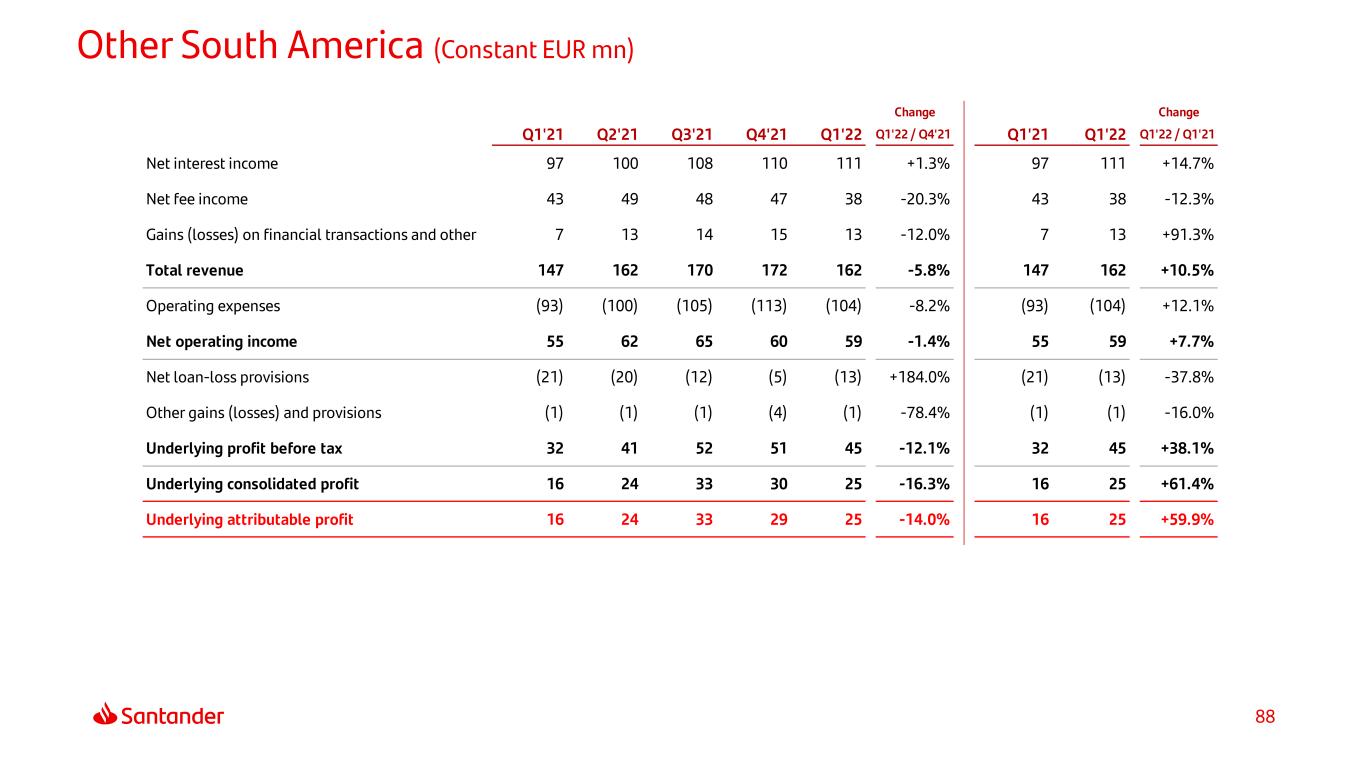

32 Efficiency CoR1 RoTE2 Loans Deposits Mutual Funds €6bn +44% €10bn +50% €3bn +100% 59.6% -5.8pp 3.31% -124bps 27.1% +3.7pp P&L* Q1'22 % Q4'21 % Q1'21 NII 300 -14.5 68.8 Net fee income 121 -16.3 86.5 Total revenue 364 -19.2 59.1 Operating expenses -217 -11.7 45.0 Net operating income 147 -28.1 85.5 LLPs -39 -23.0 218.7 Underlying att. profit 59 -33.8 52.7 (*) € mn and % change in constant euros Uruguay Profit €29mn +3% RoTE2 Peru Profit RoTE2 Colombia Profit RoTE2 €17mn +38% €7mn +52% Note: Q1’22 data and YoY changes (underlying profit, loans and funds in constant euros) (1) Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 18.3% for Argentina, 20.9% for Uruguay, 7.3% for Peru and 18.7% for Colombia • Loan growth boosted by the local currency portfolio and individual loans • Profit up YoY driven by the main revenue lines and strong efficiency gains. Steady growth in digital transactions • Strong customer loyalty reflected in double-digit loan growth • Customer revenue growth drove profit increase and high profitability Argentina Uruguay & Andean region 30.2% -0.1pp 20.3% +2.3pp 11.9% +1.7pp

33 Appendix Other countries Balance sheet and capital management Yield on loans and cost of deposits NPL and coverage ratios and cost of credit Responsible Banking Quarterly income statements Glossary

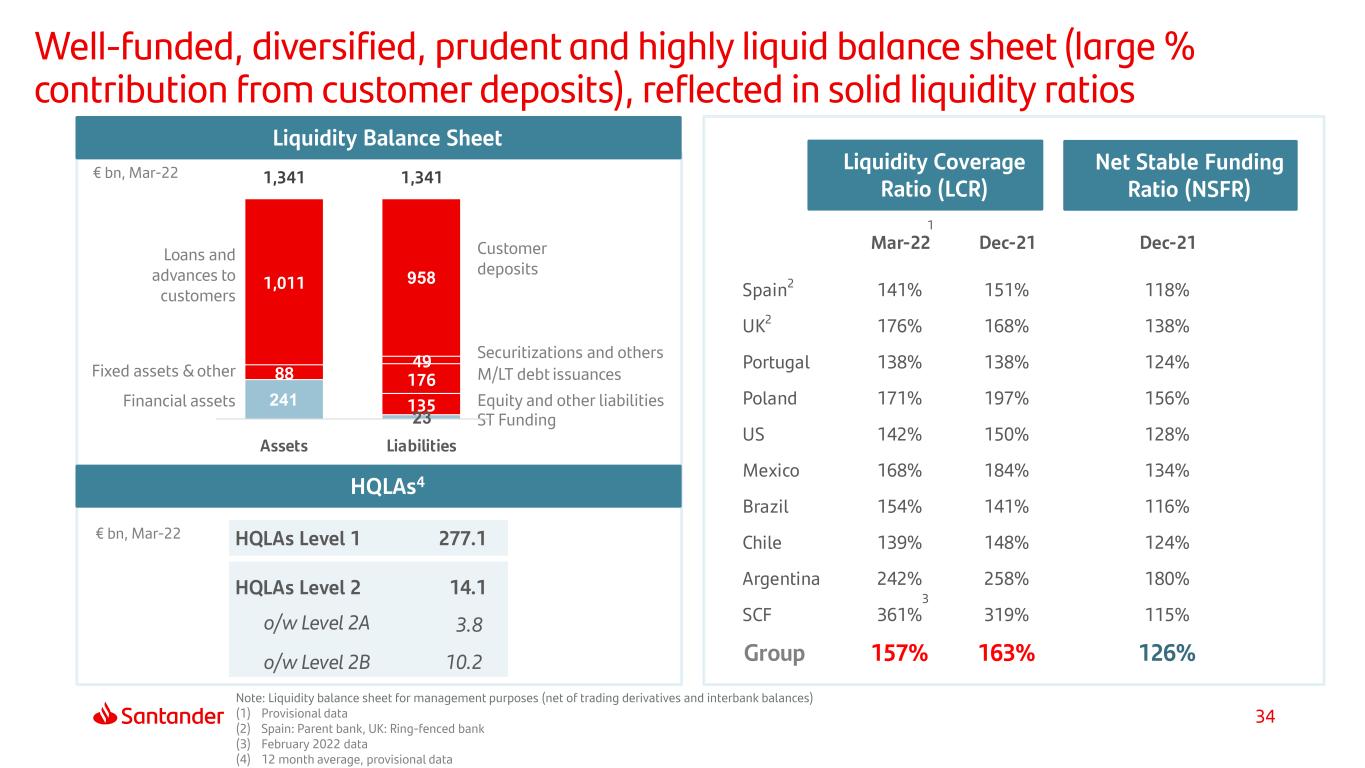

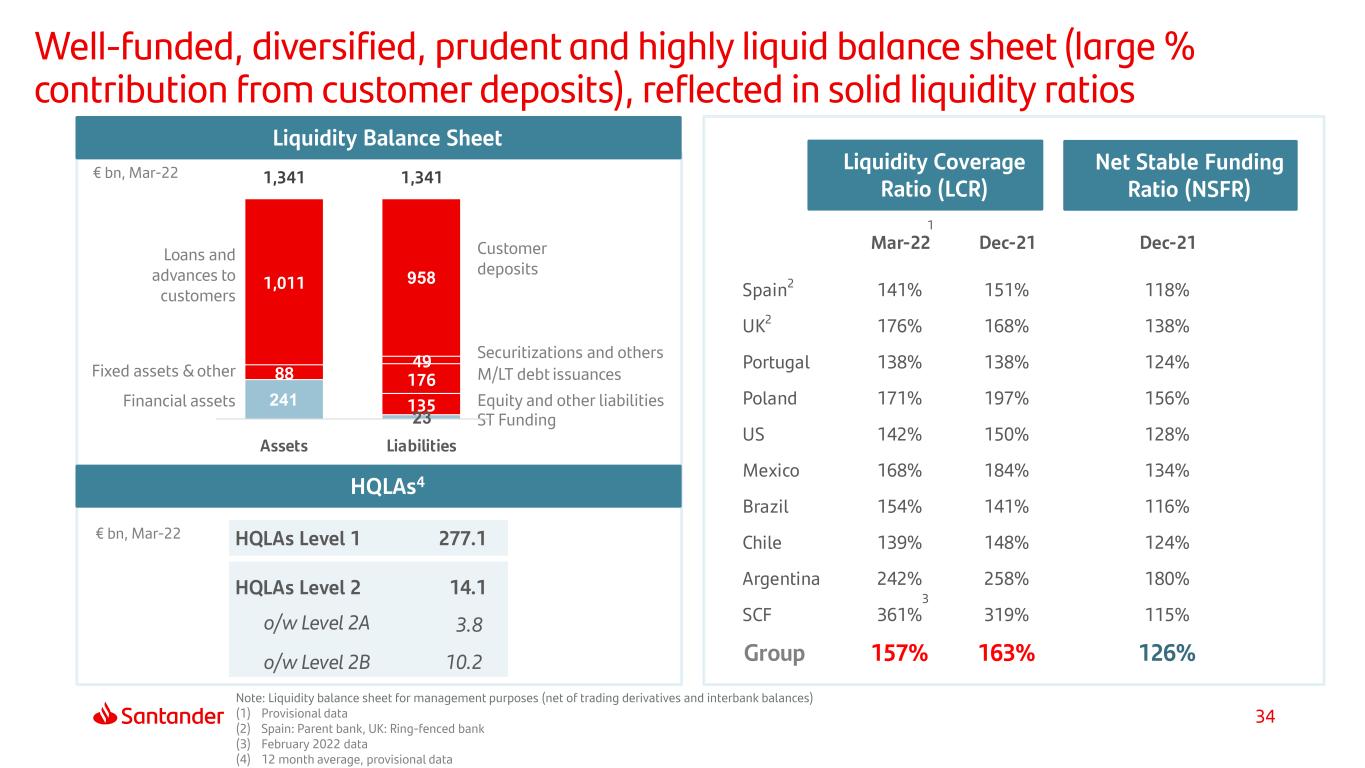

34 Well-funded, diversified, prudent and highly liquid balance sheet (large % contribution from customer deposits), reflected in solid liquidity ratios Liquidity Balance Sheet ST Funding Securitizations and others Loans and advances to customers Fixed assets & other Customer deposits M/LT debt issuances Note: Liquidity balance sheet for management purposes (net of trading derivatives and interbank balances) (1) Provisional data (2) Spain: Parent bank, UK: Ring-fenced bank (3) February 2022 data (4) 12 month average, provisional data € bn, Mar-22 € bn, Mar-22 1 Equity and other liabilitiesFinancial assets HQLAs4 HQLAs Level 1 277.1 HQLAs Level 2 14.1 o/w Level 2A 3.8 o/w Level 2B 10.2 Liquidity Coverage Ratio (LCR) Net Stable Funding Ratio (NSFR) 241 23 88 135 1,011 176 49 958 1,341 1,341 Assets Liabilities 3 Mar-22 Dec-21 Spain2 141% 151% UK2 176% 168% Portugal 138% 138% Poland 171% 197% US 142% 150% Mexico 168% 184% Brazil 154% 141% Chile 139% 148% Argentina 242% 258% SCF 361% 319% Group 157% 163% 118% 115% 116% 124% 180% 138% 124% 156% 128% 134% Dec-21 126%

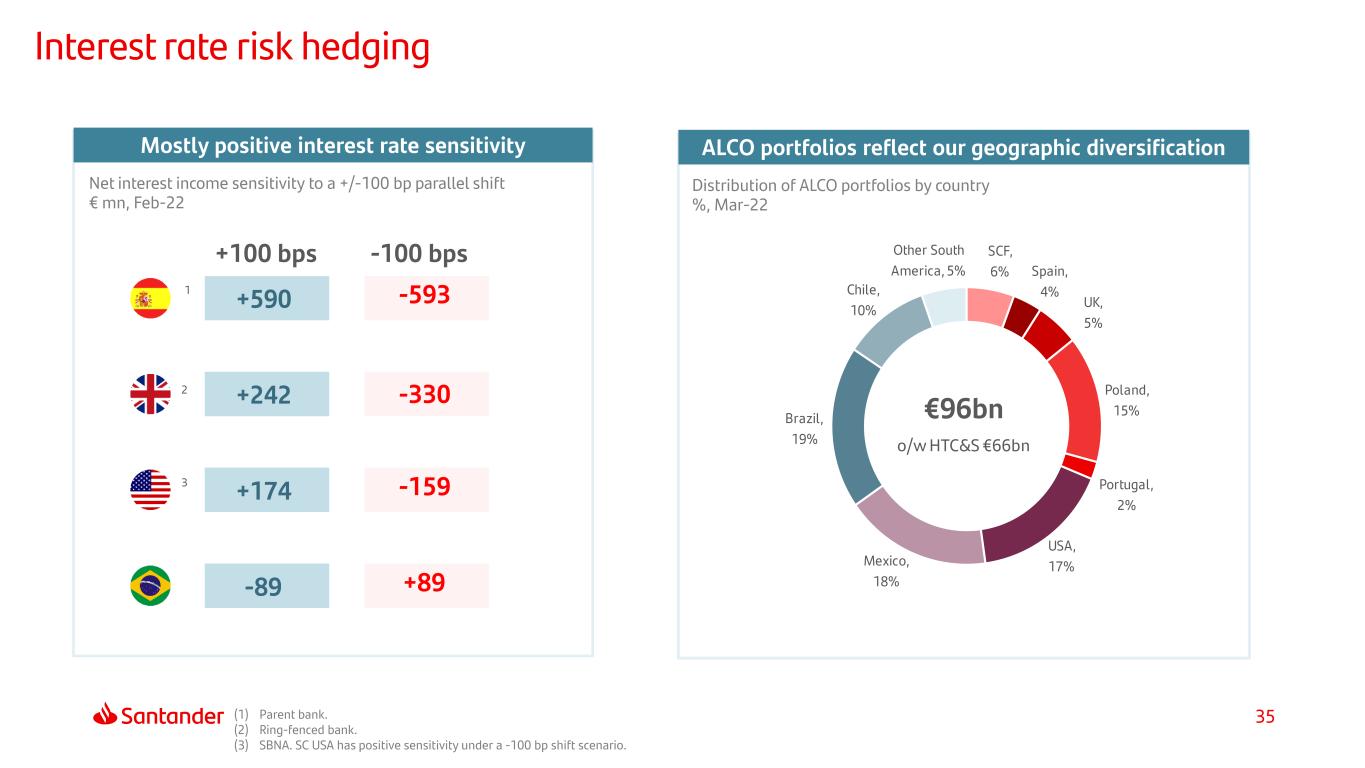

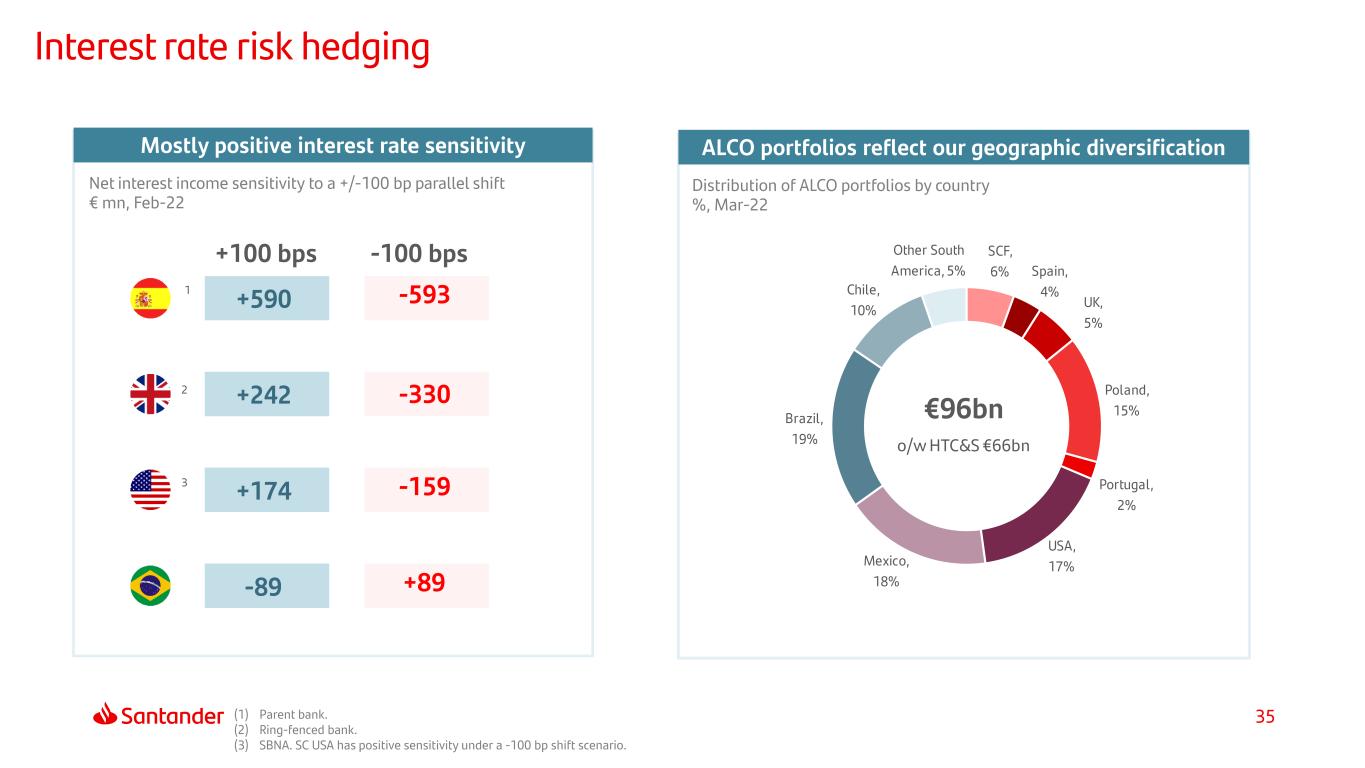

35 Interest rate risk hedging ALCO portfolios reflect our geographic diversification Distribution of ALCO portfolios by country %, Mar-22 Mostly positive interest rate sensitivity SCF, 6% Spain, 4% UK, 5% Poland, 15% Portugal, 2% USA, 17%Mexico, 18% Brazil, 19% Chile, 10% Other South America, 5% Net interest income sensitivity to a +/-100 bp parallel shift € mn, Feb-22 1 2 3 +100 bps (1) Parent bank. (2) Ring-fenced bank. (3) SBNA. SC USA has positive sensitivity under a -100 bp shift scenario. +590 +242 +174 -89 €96bn o/w HTC&S €66bn -100 bps -593 -330 -159 +89

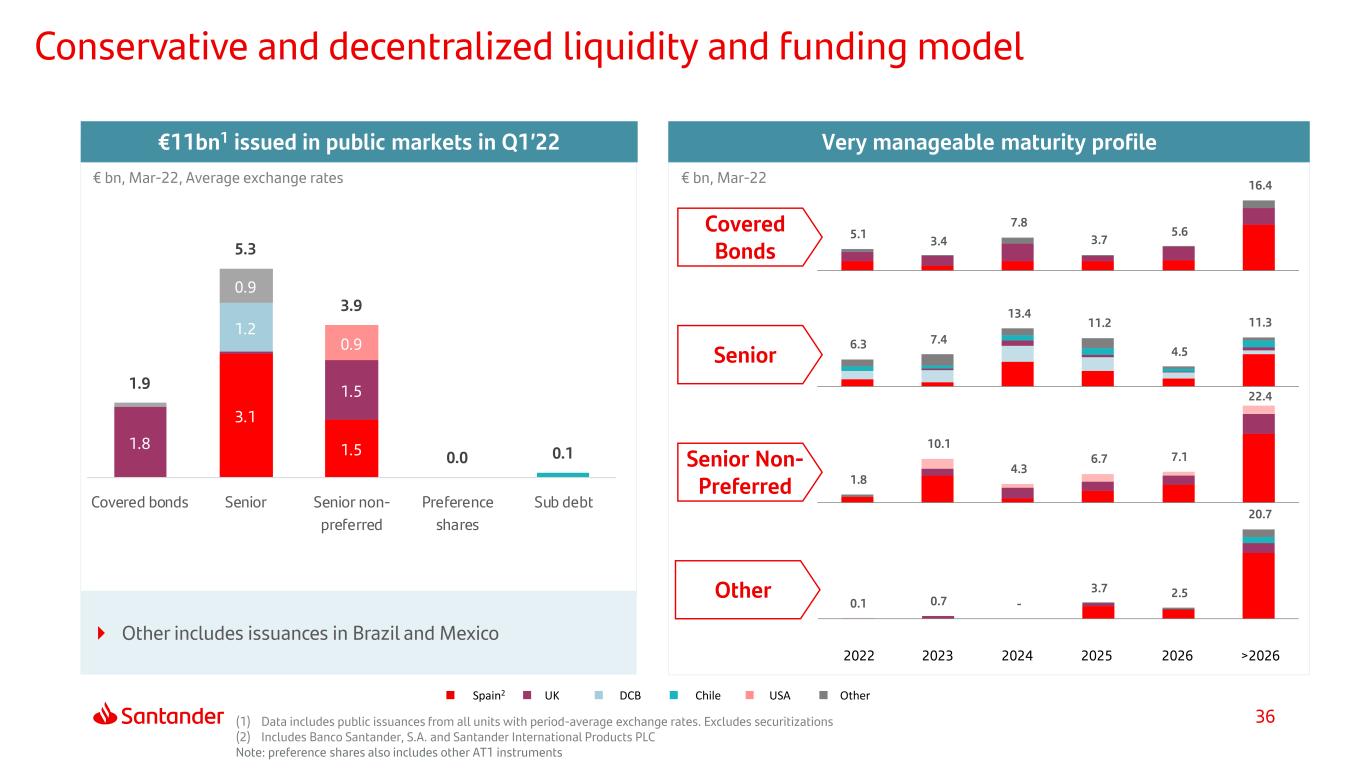

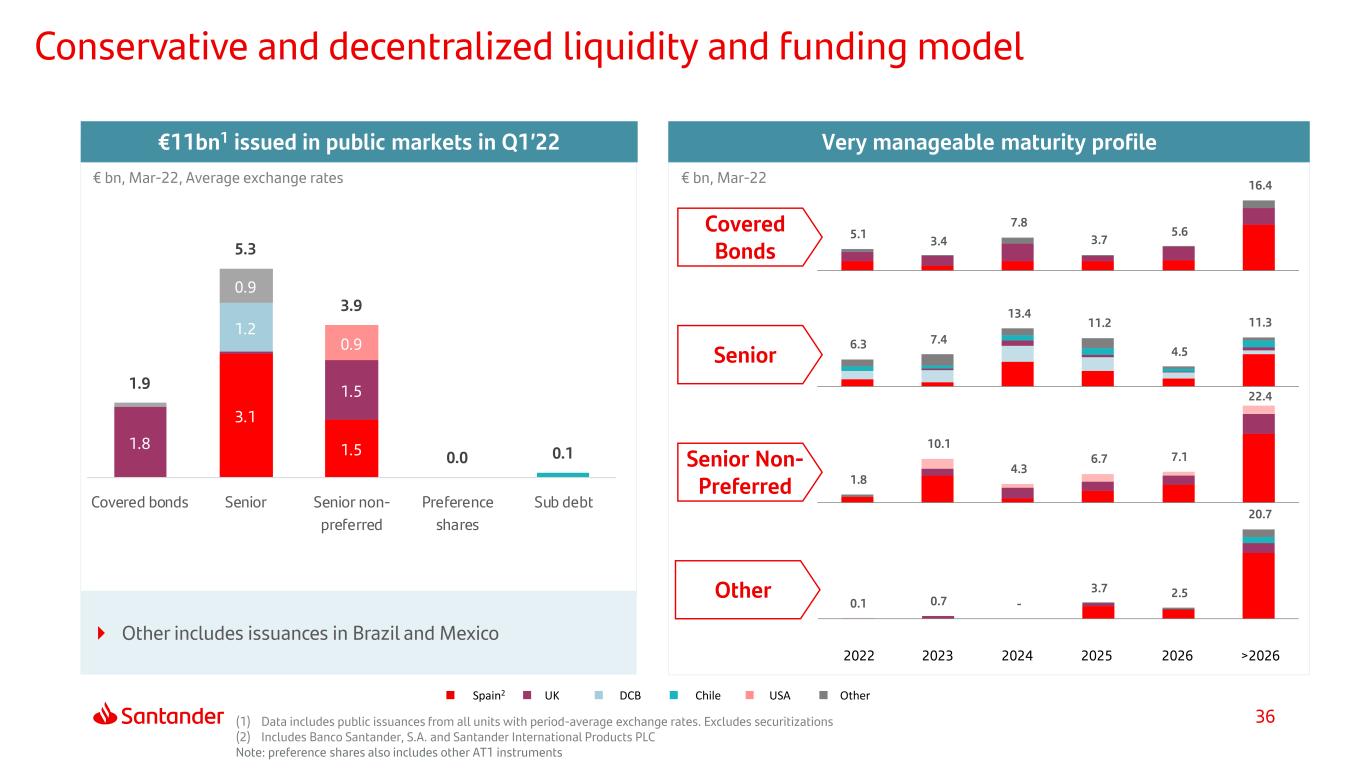

36 Conservative and decentralized liquidity and funding model €11bn1 issued in public markets in Q1’22 Very manageable maturity profile € bn, Mar-22 Covered Bonds Senior Non- Preferred Senior Other Other includes issuances in Brazil and Mexico (1) Data includes public issuances from all units with period-average exchange rates. Excludes securitizations (2) Includes Banco Santander, S.A. and Santander International Products PLC Note: preference shares also includes other AT1 instruments 2022 2023 2024 2025 2026 >2026 3.1 1.5 1.2 0.9 0.9 1.9 5.3 3.9 0.0 0.1 1.8 1.5 Covered bonds Senior Senior non- preferred Preference shares Sub debt 5.1 3.4 7.8 3.7 5.6 16.4 6.3 7.4 13.4 11.2 4.5 11.3 1.8 10.1 4.3 6.7 7.1 22.4 0.1 0.7 - 3.7 2.5 20.7 Spain2 UK DCB Chile USA Other € bn, Mar-22, Average exchange rates

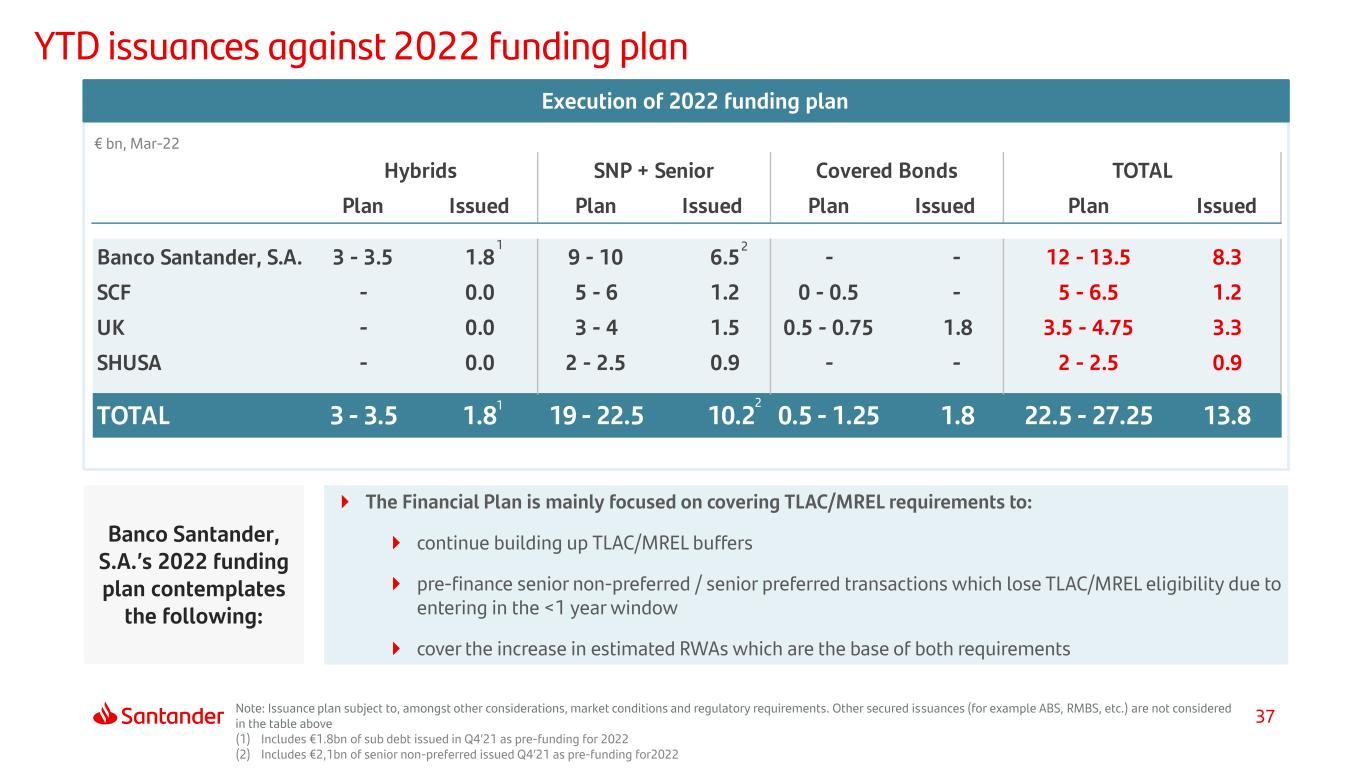

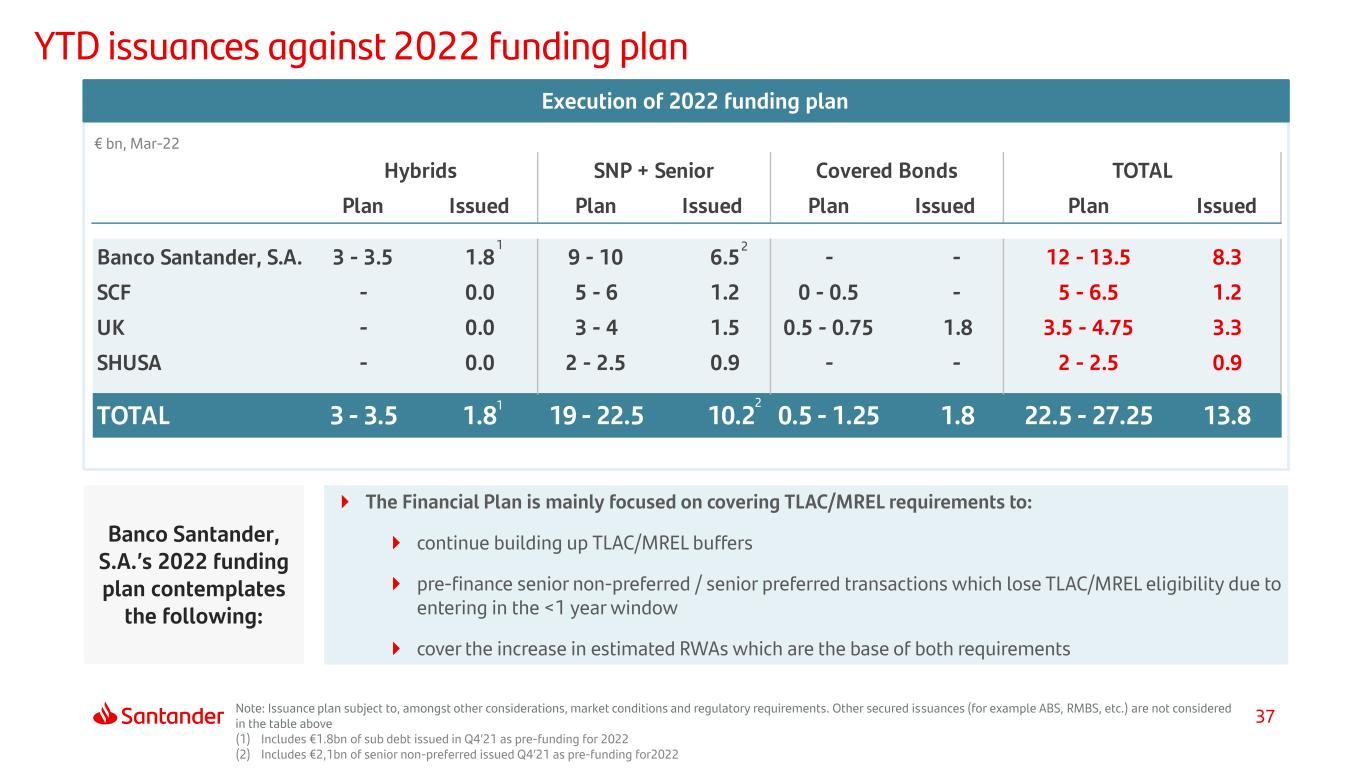

37 YTD issuances against 2022 funding plan Execution of 2022 funding plan € bn, Mar-22 Banco Santander, S.A.’s 2022 funding plan contemplates the following: Note: Issuance plan subject to, amongst other considerations, market conditions and regulatory requirements. Other secured issuances (for example ABS, RMBS, etc.) are not considered in the table above (1) Includes €1.8bn of sub debt issued in Q4’21 as pre-funding for 2022 (2) Includes €2,1bn of senior non-preferred issued Q4’21 as pre-funding for2022 The Financial Plan is mainly focused on covering TLAC/MREL requirements to: continue building up TLAC/MREL buffers pre-finance senior non-preferred / senior preferred transactions which lose TLAC/MREL eligibility due to entering in the <1 year window cover the increase in estimated RWAs which are the base of both requirements Plan Issued Plan Issued Plan Issued Plan Issued Banco Santander, S.A. 3 - 3.5 1.8 9 - 10 6.5 - - 12 - 13.5 8.3 SCF - 0.0 5 - 6 1.2 0 - 0.5 - 5 - 6.5 1.2 UK - 0.0 3 - 4 1.5 0.5 - 0.75 1.8 3.5 - 4.75 3.3 SHUSA - 0.0 2 - 2.5 0.9 - - 2 - 2.5 0.9 TOTAL 3 - 3.5 1.8 19 - 22.5 10.2 0.5 - 1.25 1.8 22.5 - 27.25 13.8 Hybrids SNP + Senior Covered Bonds TOTAL 1 2 1 2

38 Santander’s capital levels, both phased-in and fully loaded, exceed minimum regulatory requirements 4.50% 12.33% 0.84% 2.50% 1.00% CCyB, 0.01% 1.78% 1.52% 2.38% 2.54% 13.01% 16.39% Regulatory Requirement 2022 Group ratios Mar-22 4.50% 12.05% 11-12% 0.84% 2.50% 1.00% CCyB, 0.01% 1.78% 1.52% 1.50% 2.38% 2.51% 2.00%13.01% 16.08% >15% Assumed regulatory requirement 2022 Group ratios Mar-22 Medium-term target ratios SREP capital requirements and MDA* CET1 CCoB Pillar 2 R Pillar 1 AT1 G-SIB buffer T2 T2 AT1 Assumed capital requirements (fully-loaded)** Mar-22 Mar-22 CCoB Pillar 2 R Pillar 1 AT1 G-SIB buffer T2 CET1 T2 AT1 1 Following regulatory changes in response to the covid-19 crisis, the minimum CET1 to be maintained by the Group is 8.85% (was 9.69% pre-changes) As of Mar-22, the distance to the MDA is 321 bps2 and the CET1 management buffer is 347 bps AT1 and T2 ratios are planned to be above 1.5% and 2% of RWAs respectively +319 bps +306 bps+321 bps +338 bps +347 bps 1 Assu ed capital require ents (fu ly-loaded)2 3 4 s (1) The phased-in ratio includes the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Capital Requirements Regulation (CRR2) and subsequent modifications introduced by Regulation 2020/873 of the European Union. Total phased-in capital ratios include the transitory treatment according to chapter 4, title 1, part 10 of the CRR2. (2) Fully-loaded CRR and fully-loaded IFRS 9. Pro forma including the acquisition of Amherst Pierpont which completed in April 2022 (3) Countercyclical buffer as of Dec-21. (4) MDA trigger = 3.47% - 0.26% = 3.21% (26 bps of AT1 shortfall is covered with CET1). +319 bps293 s

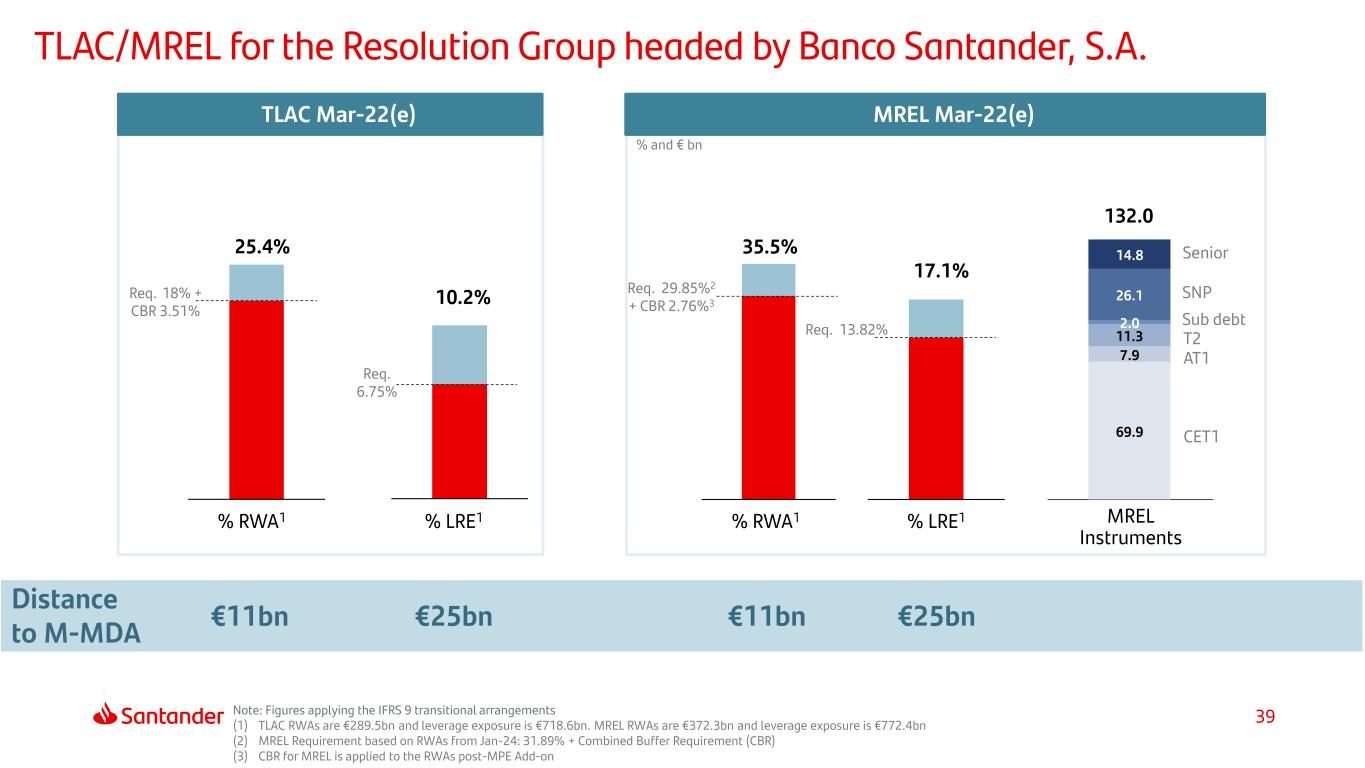

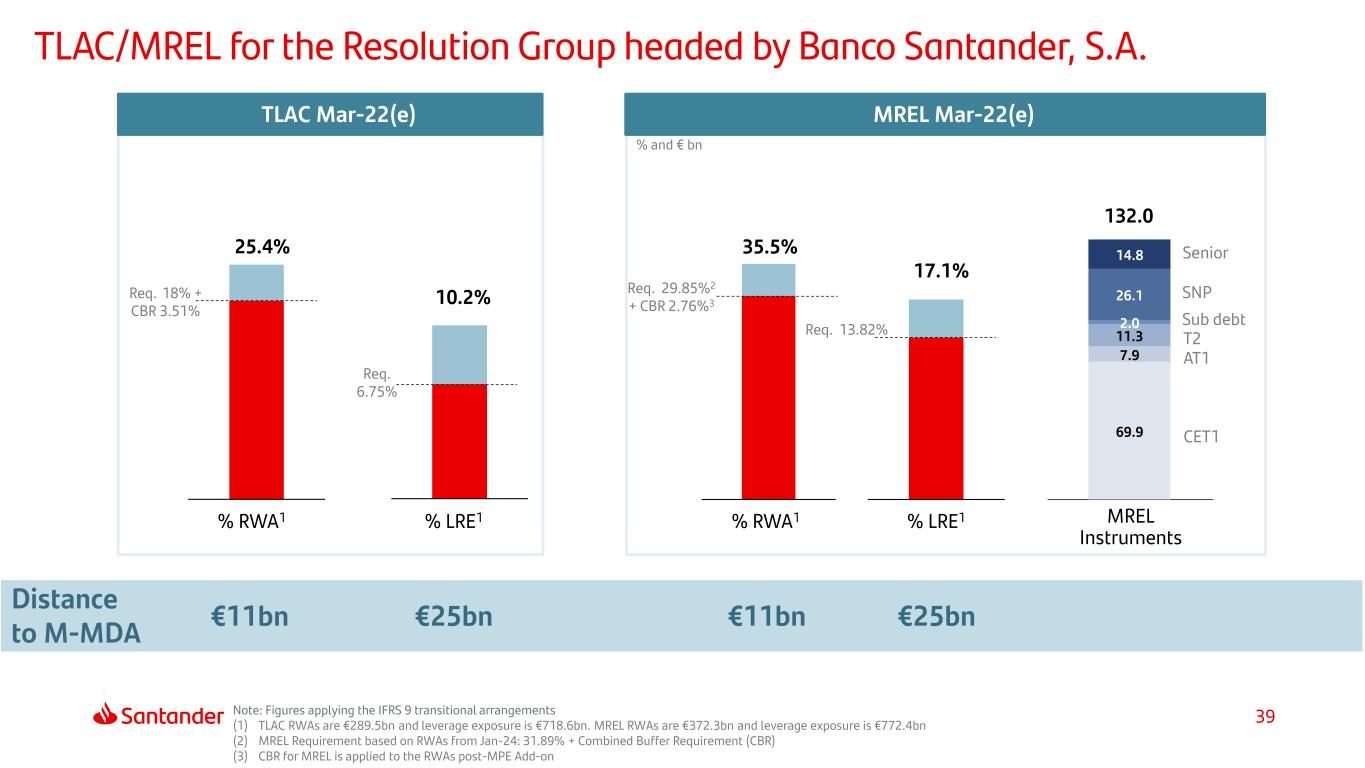

39 TLAC/MREL for the Resolution Group headed by Banco Santander, S.A. Note: Figures applying the IFRS 9 transitional arrangements (1) TLAC RWAs are €289.5bn and leverage exposure is €718.6bn. MREL RWAs are €372.3bn and leverage exposure is €772.4bn (2) MREL Requirement based on RWAs from Jan-24: 31.89% + Combined Buffer Requirement (CBR) (3) CBR for MREL is applied to the RWAs post-MPE Add-on TLAC Mar-22(e) MREL Mar-22(e) €11bn % RWA1 % LRE1 €25bn Distance to M-MDA MREL Instruments €11bn €25bn % and € bn % RWA1 % LRE1 25.4% 10.2%Req. 18% + CBR 3.51% Req. 6.75% 35.5% Req. 29.85%2 + CBR 2.76%3 17.1% Req. 13.82% 132.0 SNP T2 CET1 Senior AT1 69.9 7.9 11.3 2.0 26.1 14.8 Sub debt

40 Appendix Other countries Balance sheet and capital management Yield on loans and cost of deposits NPL and coverage ratios and cost of credit Responsible Banking Quarterly income statements Glossary

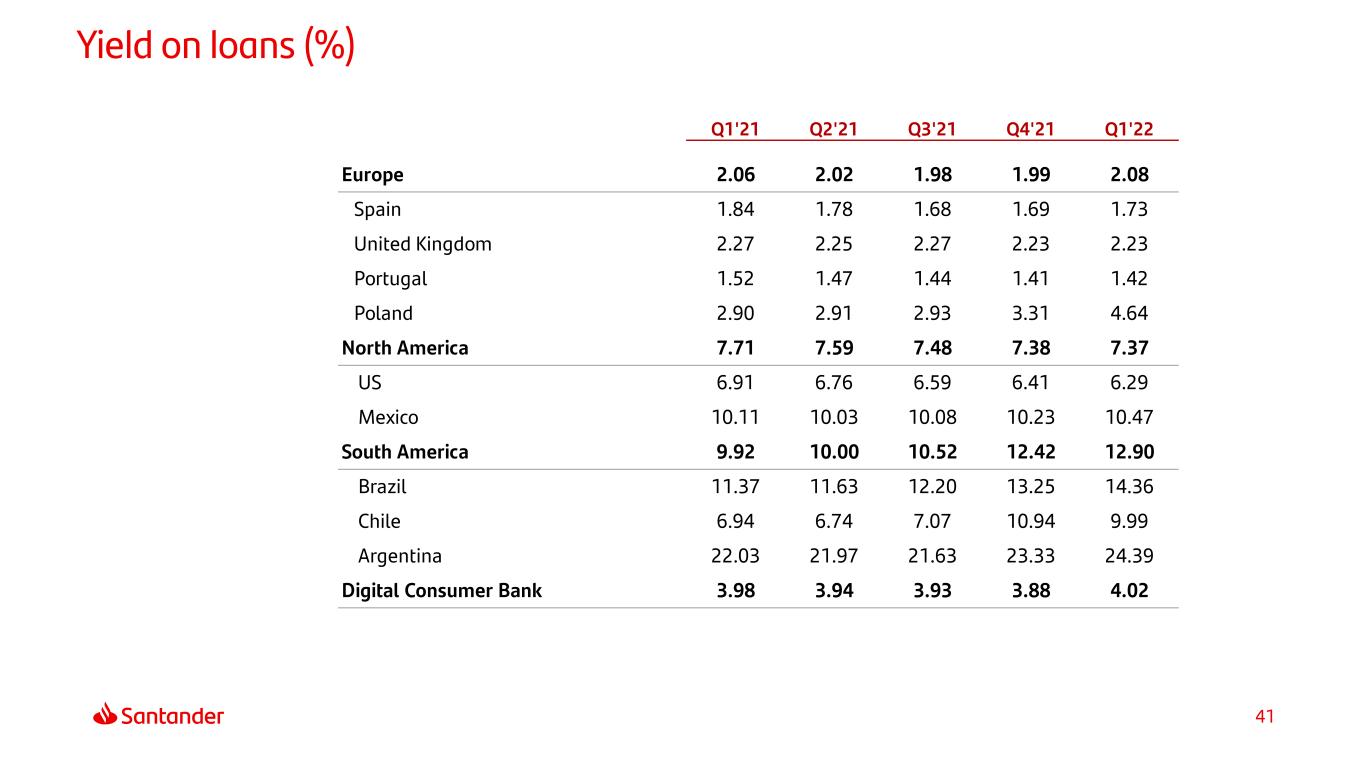

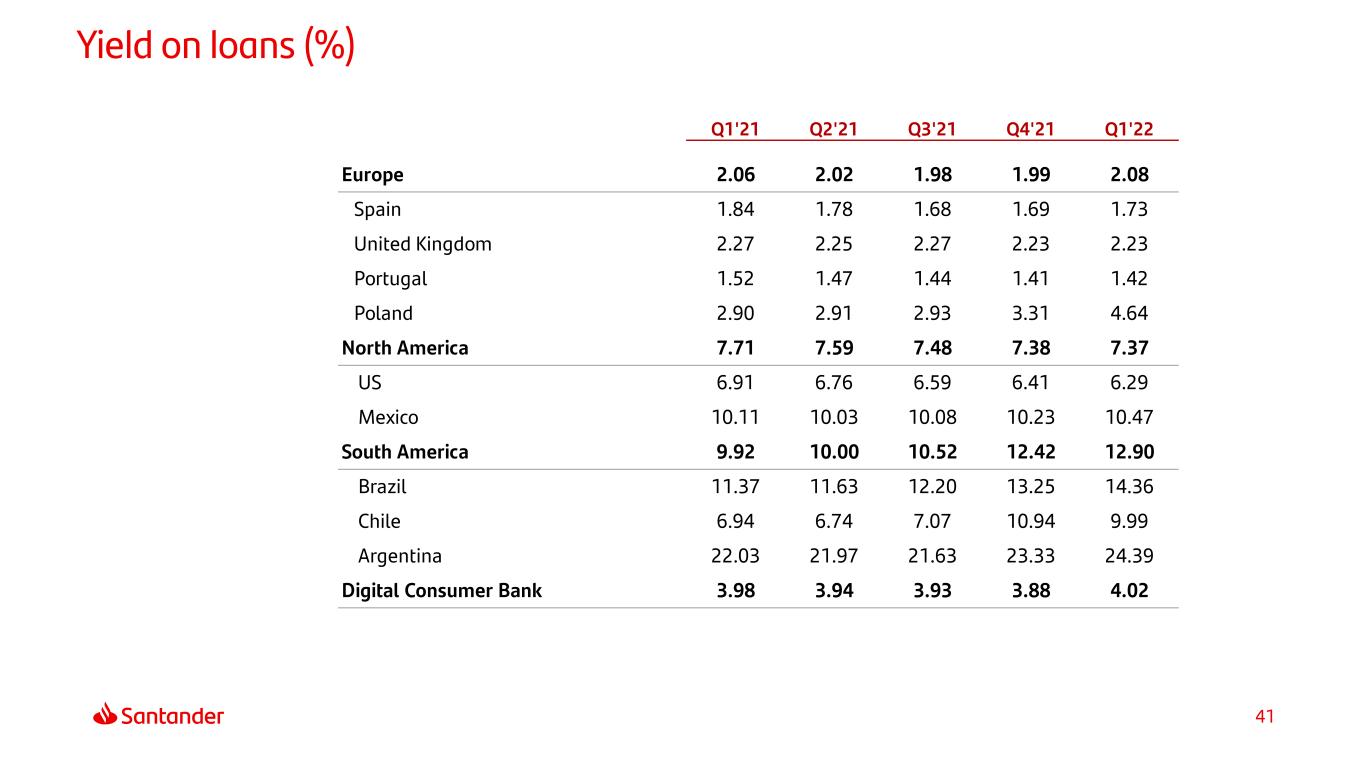

41 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Europe 2.06 2.02 1.98 1.99 2.08 Spain 1.84 1.78 1.68 1.69 1.73 United Kingdom 2.27 2.25 2.27 2.23 2.23 Portugal 1.52 1.47 1.44 1.41 1.42 Poland 2.90 2.91 2.93 3.31 4.64 North America 7.71 7.59 7.48 7.38 7.37 US 6.91 6.76 6.59 6.41 6.29 Mexico 10.11 10.03 10.08 10.23 10.47 South America 9.92 10.00 10.52 12.42 12.90 Brazil 11.37 11.63 12.20 13.25 14.36 Chile 6.94 6.74 7.07 10.94 9.99 Argentina 22.03 21.97 21.63 23.33 24.39 Digital Consumer Bank 3.98 3.94 3.93 3.88 4.02 Yield on loans (%)

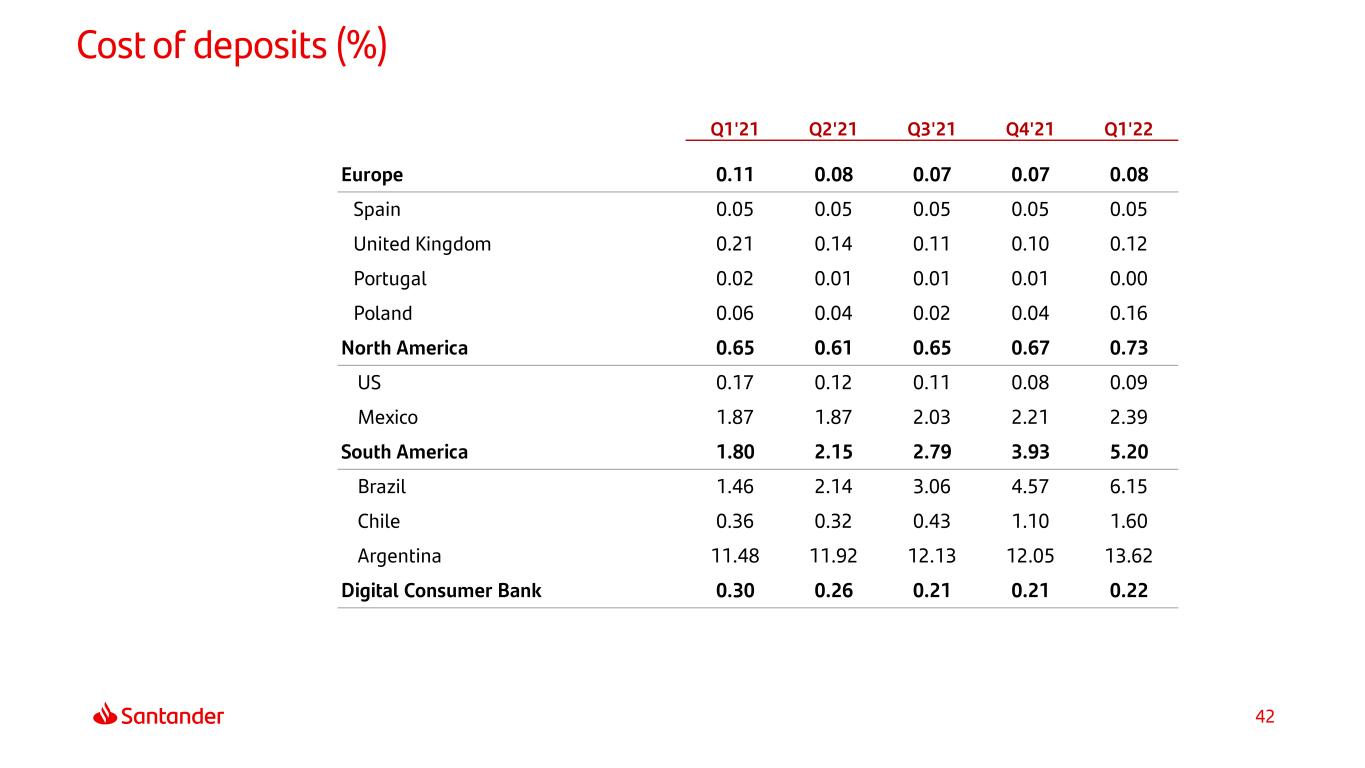

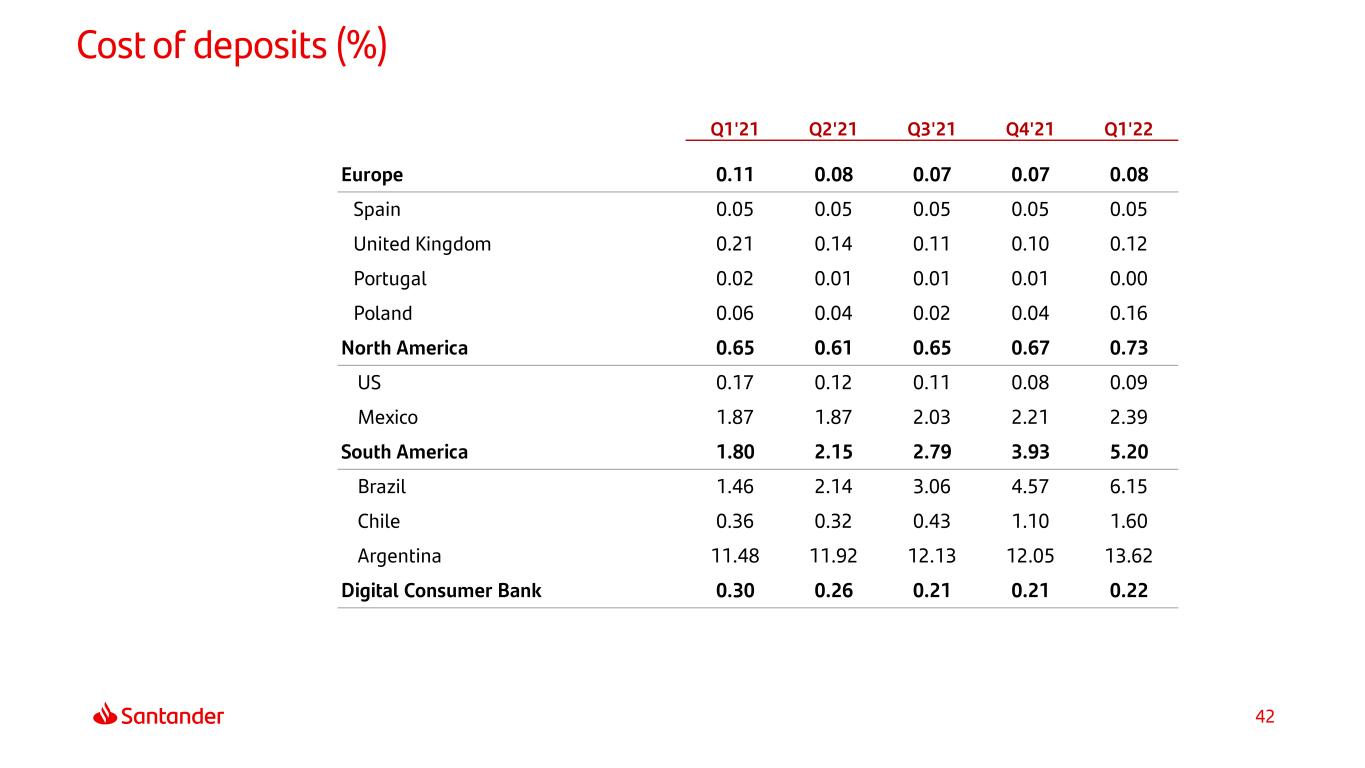

42 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Europe 0.11 0.08 0.07 0.07 0.08 Spain 0.05 0.05 0.05 0.05 0.05 United Kingdom 0.21 0.14 0.11 0.10 0.12 Portugal 0.02 0.01 0.01 0.01 0.00 Poland 0.06 0.04 0.02 0.04 0.16 North America 0.65 0.61 0.65 0.67 0.73 US 0.17 0.12 0.11 0.08 0.09 Mexico 1.87 1.87 2.03 2.21 2.39 South America 1.80 2.15 2.79 3.93 5.20 Brazil 1.46 2.14 3.06 4.57 6.15 Chile 0.36 0.32 0.43 1.10 1.60 Argentina 11.48 11.92 12.13 12.05 13.62 Digital Consumer Bank 0.30 0.26 0.21 0.21 0.22 Cost of deposits (%)

43 Appendix Other countries Balance sheet and capital management Yield on loans and cost of deposits NPL and coverage ratios and cost of credit Responsible Banking Quarterly income statements Glossary

44 Exposure ¹ Coverage Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Stage 1 885 904 912 929 967 0.5% 0.5% 0.5% 0.5% 0.5% Stage 2 70 70 67 71 68 8.1% 8.2% 8.6% 7.7% 8.0% Stage 3 32 33 33 33 36 42.5% 42.2% 43.0% 41.3% 41.0% Stage coverage (1) Exposure subject to impairment in € bn Additionally, customer loans not subject to impairment recorded at mark to market with changes through P&L (€27bn in March 2021,€26bn in June 2021, €27bn in September 2021, €18bn in December 2021 and €22bn in March 2022)

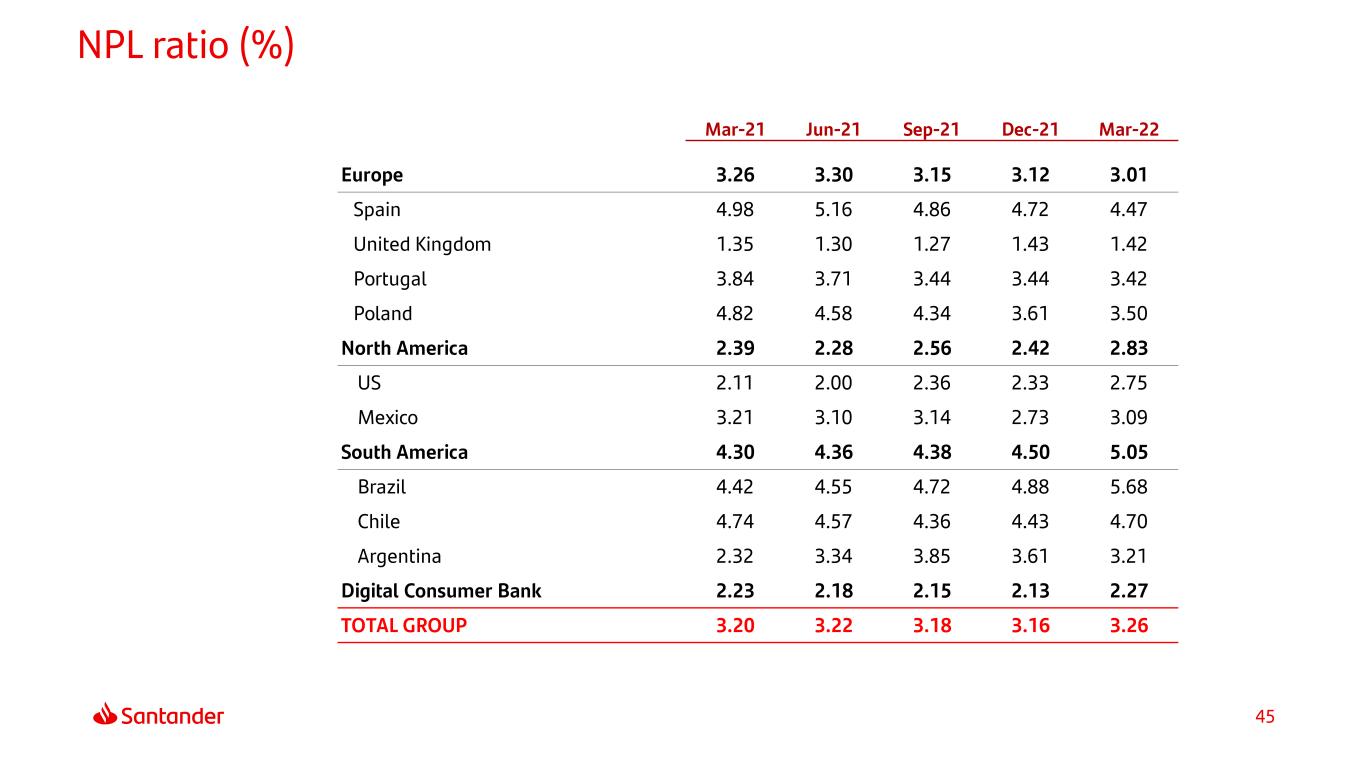

45 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Europe 3.26 3.30 3.15 3.12 3.01 Spain 4.98 5.16 4.86 4.72 4.47 United Kingdom 1.35 1.30 1.27 1.43 1.42 Portugal 3.84 3.71 3.44 3.44 3.42 Poland 4.82 4.58 4.34 3.61 3.50 North America 2.39 2.28 2.56 2.42 2.83 US 2.11 2.00 2.36 2.33 2.75 Mexico 3.21 3.10 3.14 2.73 3.09 South America 4.30 4.36 4.38 4.50 5.05 Brazil 4.42 4.55 4.72 4.88 5.68 Chile 4.74 4.57 4.36 4.43 4.70 Argentina 2.32 3.34 3.85 3.61 3.21 Digital Consumer Bank 2.23 2.18 2.15 2.13 2.27 TOTAL GROUP 3.20 3.22 3.18 3.16 3.26 NPL ratio (%)

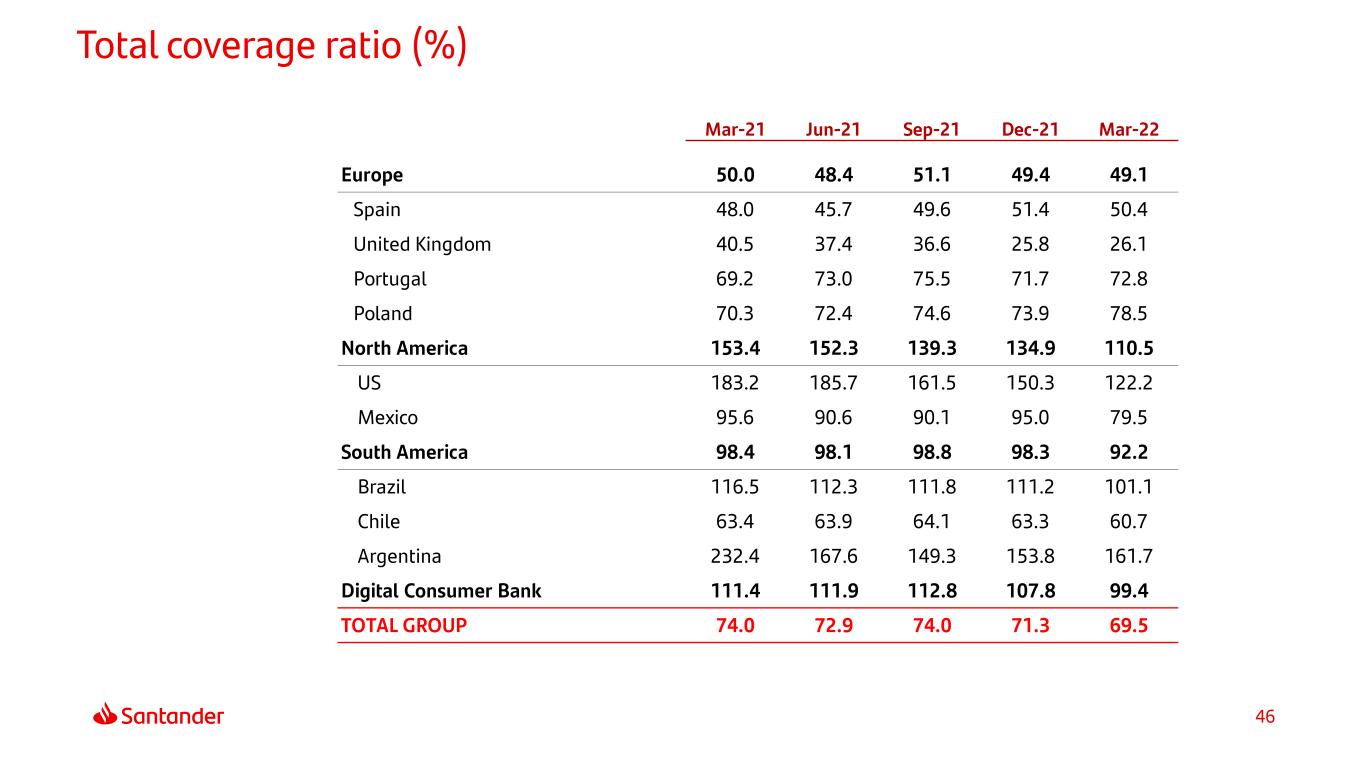

46 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Europe 50.0 48.4 51.1 49.4 49.1 Spain 48.0 45.7 49.6 51.4 50.4 United Kingdom 40.5 37.4 36.6 25.8 26.1 Portugal 69.2 73.0 75.5 71.7 72.8 Poland 70.3 72.4 74.6 73.9 78.5 North America 153.4 152.3 139.3 134.9 110.5 US 183.2 185.7 161.5 150.3 122.2 Mexico 95.6 90.6 90.1 95.0 79.5 South America 98.4 98.1 98.8 98.3 92.2 Brazil 116.5 112.3 111.8 111.2 101.1 Chile 63.4 63.9 64.1 63.3 60.7 Argentina 232.4 167.6 149.3 153.8 161.7 Digital Consumer Bank 111.4 111.9 112.8 107.8 99.4 TOTAL GROUP 74.0 72.9 74.0 71.3 69.5 Total coverage ratio (%)

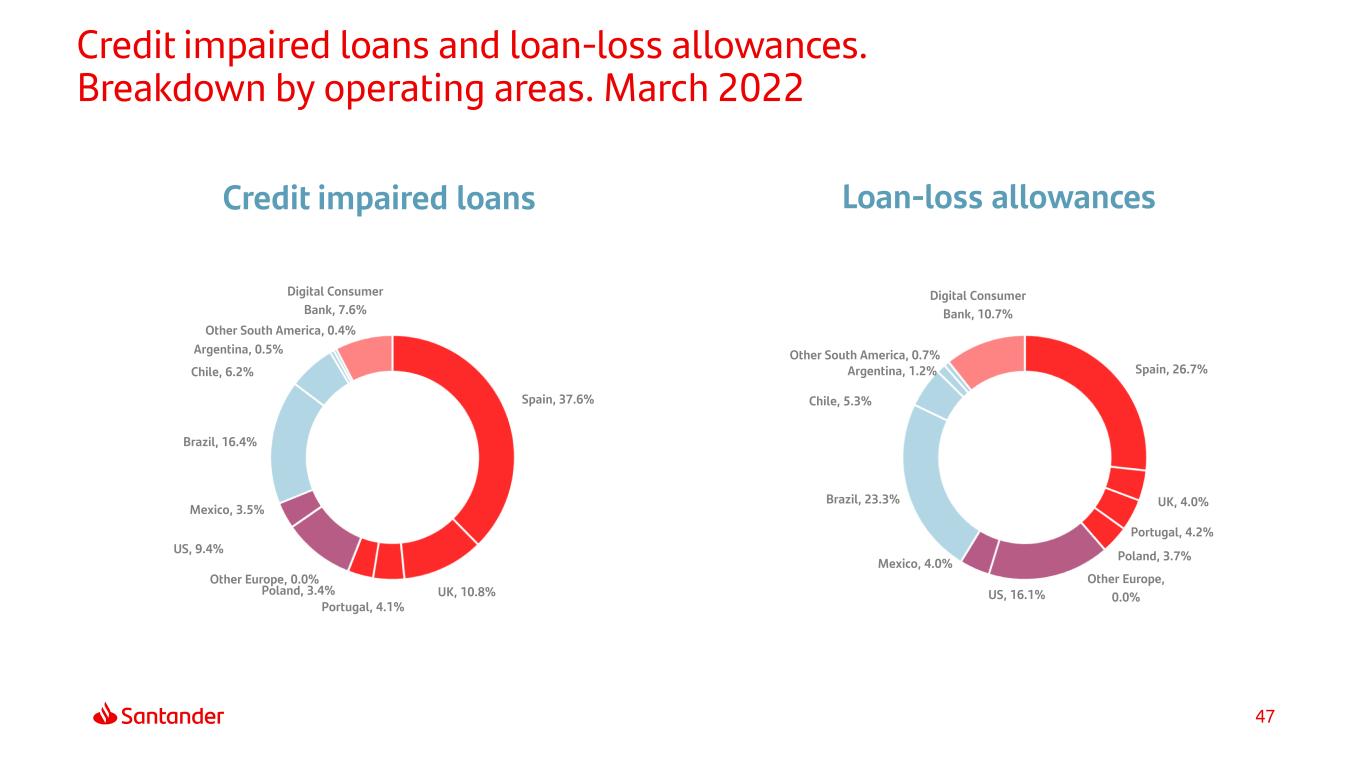

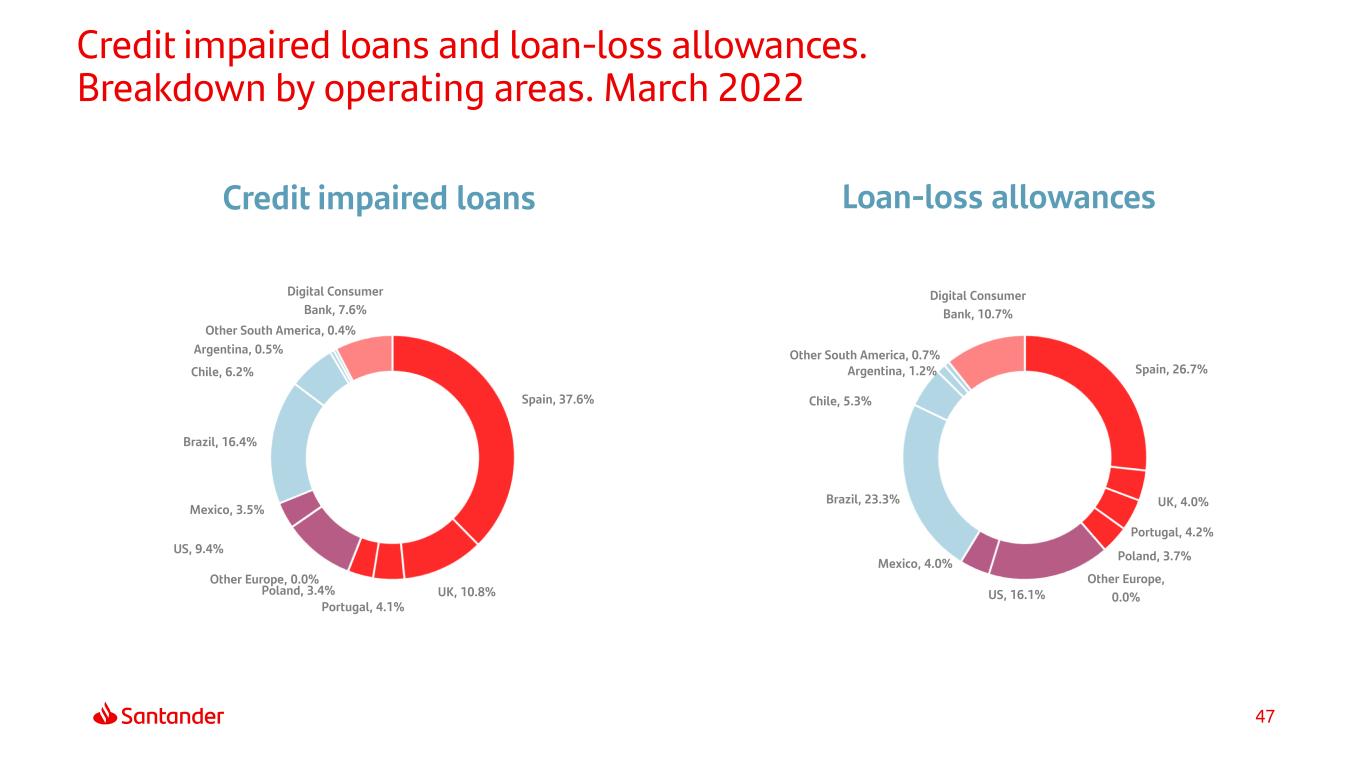

47 Spain, 26.7% UK, 4.0% Portugal, 4.2% Poland, 3.7% Other Europe, 0.0%US, 16.1% Mexico, 4.0% Brazil, 23.3% Chile, 5.3% Argentina, 1.2% Other South America, 0.7% Digital Consumer Bank, 10.7% Spain, 37.6% UK, 10.8% Portugal, 4.1% Poland, 3.4% Other Europe, 0.0% US, 9.4% Mexico, 3.5% Brazil, 16.4% Chile, 6.2% Argentina, 0.5% Other South America, 0.4% Digital Consumer Bank, 7.6% Loan-loss allowancesCredit impaired loans Credit impaired loans and loan-loss allowances. Breakdown by operating areas. March 2022

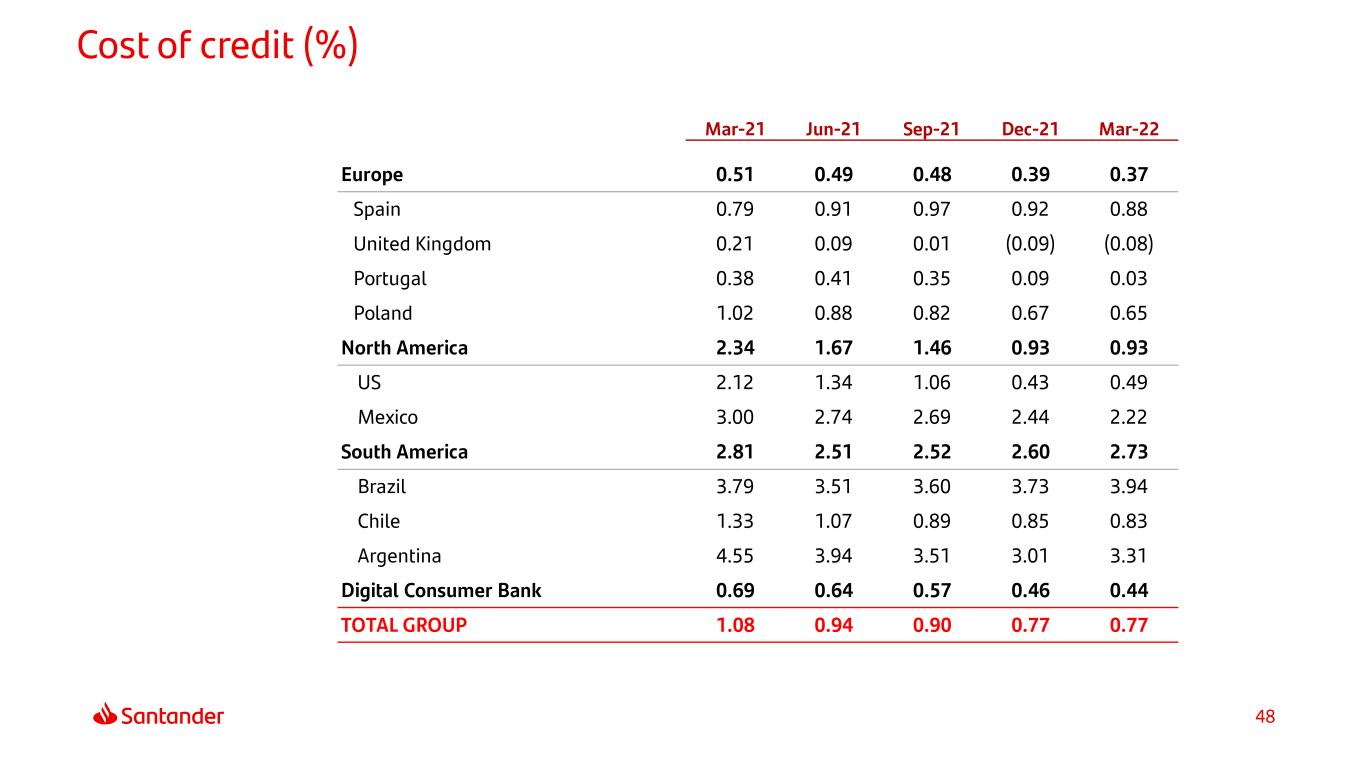

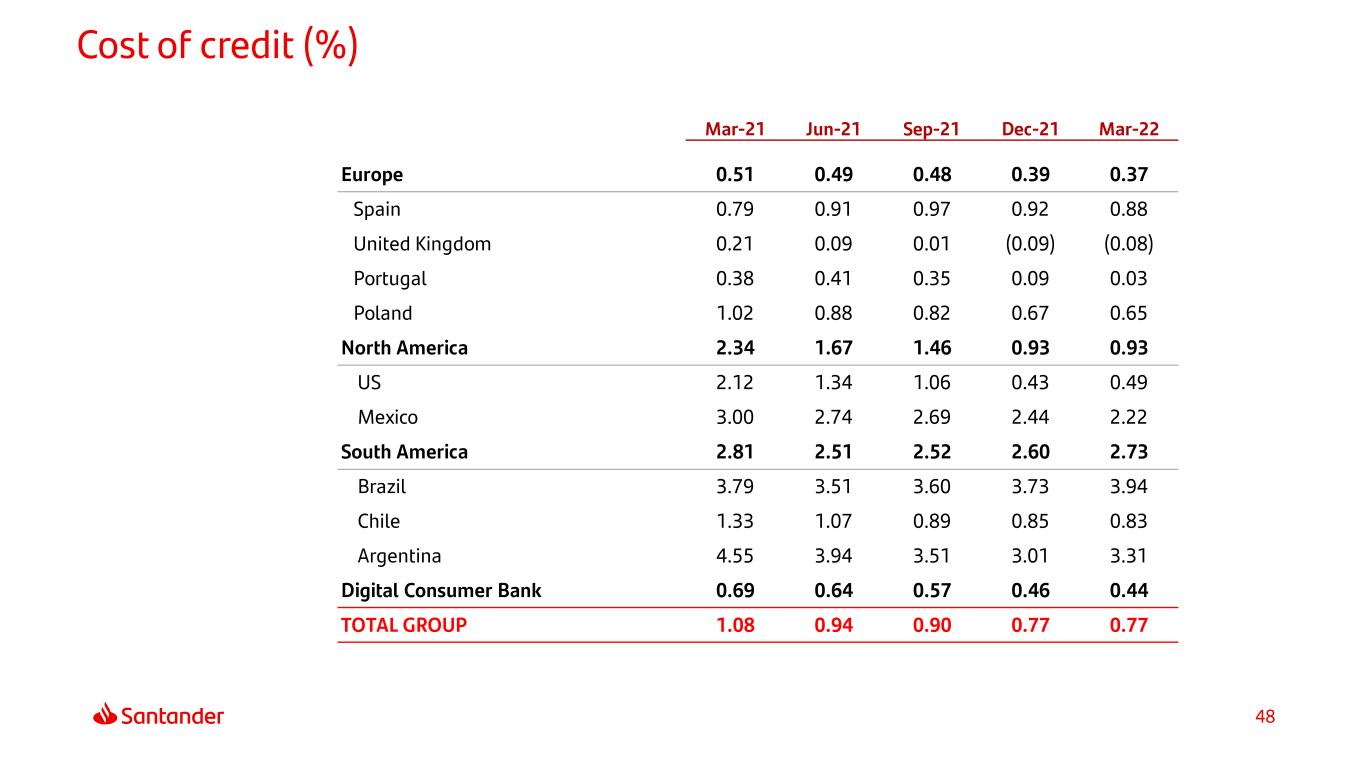

48 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Europe 0.51 0.49 0.48 0.39 0.37 Spain 0.79 0.91 0.97 0.92 0.88 United Kingdom 0.21 0.09 0.01 (0.09) (0.08) Portugal 0.38 0.41 0.35 0.09 0.03 Poland 1.02 0.88 0.82 0.67 0.65 North America 2.34 1.67 1.46 0.93 0.93 US 2.12 1.34 1.06 0.43 0.49 Mexico 3.00 2.74 2.69 2.44 2.22 South America 2.81 2.51 2.52 2.60 2.73 Brazil 3.79 3.51 3.60 3.73 3.94 Chile 1.33 1.07 0.89 0.85 0.83 Argentina 4.55 3.94 3.51 3.01 3.31 Digital Consumer Bank 0.69 0.64 0.57 0.46 0.44 TOTAL GROUP 1.08 0.94 0.90 0.77 0.77 Cost of credit (%)

49 Appendix Other countries Balance sheet and capital management Yield on loans and cost of deposits NPL and coverage ratios and cost of credit Responsible Banking Quarterly income statements Glossary

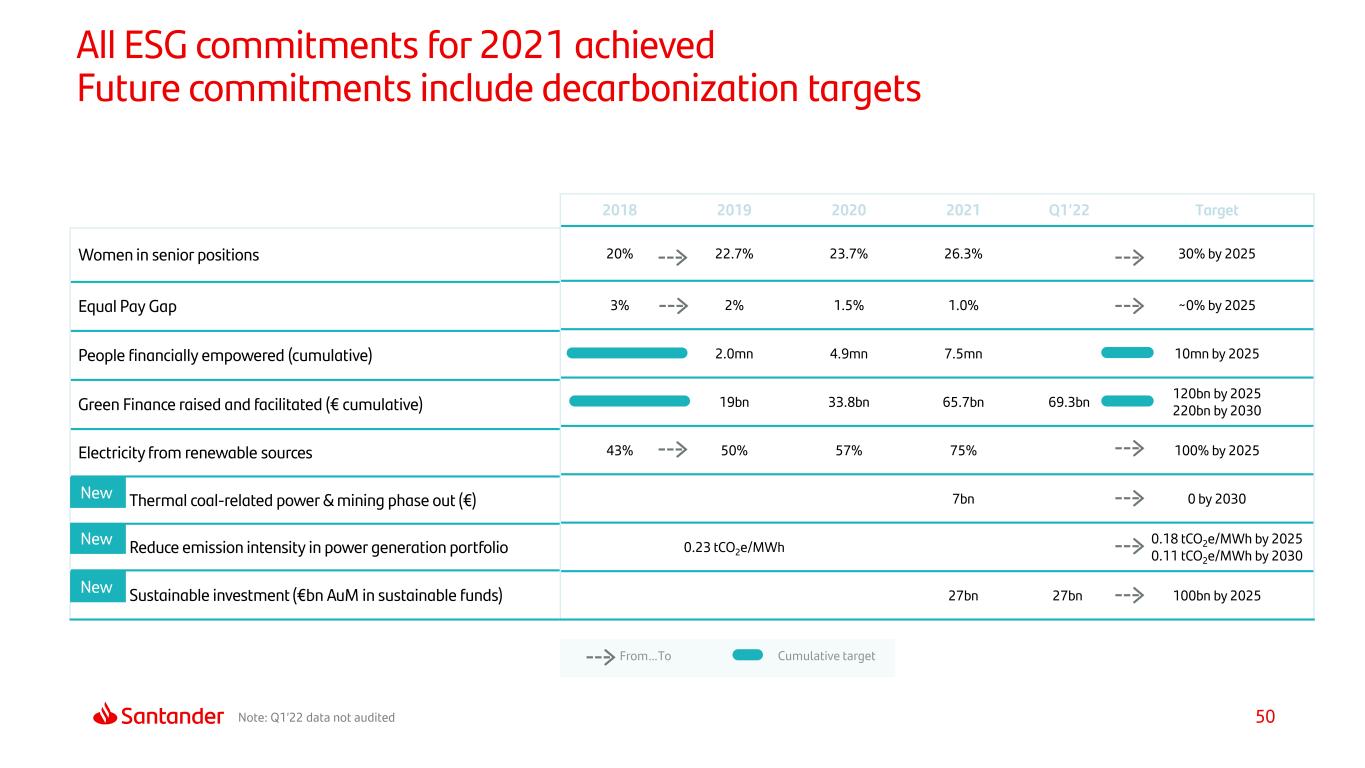

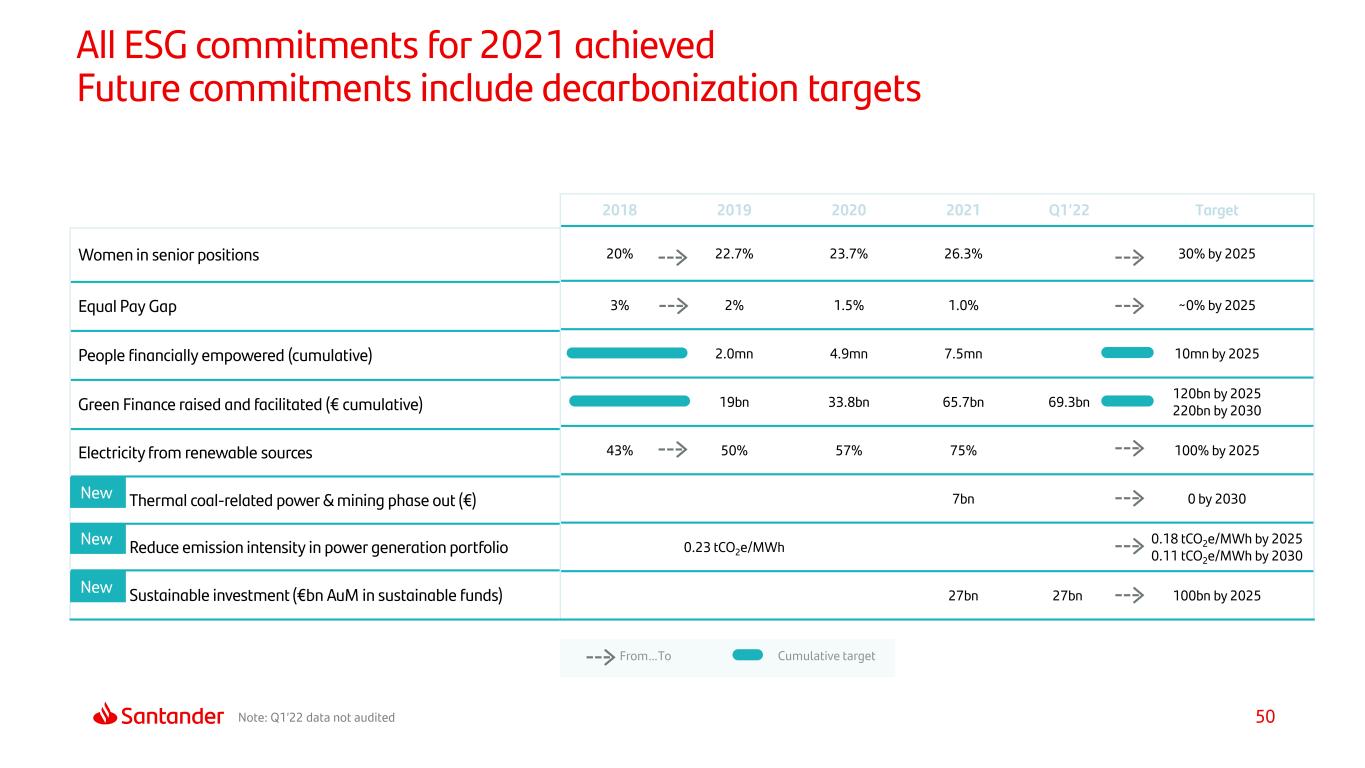

50 All ESG commitments for 2021 achieved Future commitments include decarbonization targets Women in senior positions Equal Pay Gap People financially empowered (cumulative) Green Finance raised and facilitated (€ cumulative) Electricity from renewable sources Thermal coal-related power & mining phase out (€) Reduce emission intensity in power generation portfolio Sustainable investment (€bn AuM in sustainable funds) New 2018 2019 2020 2021 Q1’22 Target 20% 22.7% 23.7% 26.3% 30% by 2025 3% 2% 1.5% 1.0% ~0% by 2025 2.0mn 4.9mn 7.5mn 10mn by 2025 19bn 33.8bn 65.7bn 69.3bn 120bn by 2025 220bn by 2030 43% 50% 57% 75% 100% by 2025 7bn 0 by 2030 0.23 tCO2e/MWh 0.18 tCO2e/MWh by 2025 0.11 tCO2e/MWh by 2030 27bn 27bn 100bn by 2025 From…To Cumulative target New New Note: Q1’22 data not audited

51 Appendix Other countries Balance sheet and capital management Yield on loans and cost of deposits NPL and coverage ratios and cost of credit Responsible Banking Quarterly income statements Glossary

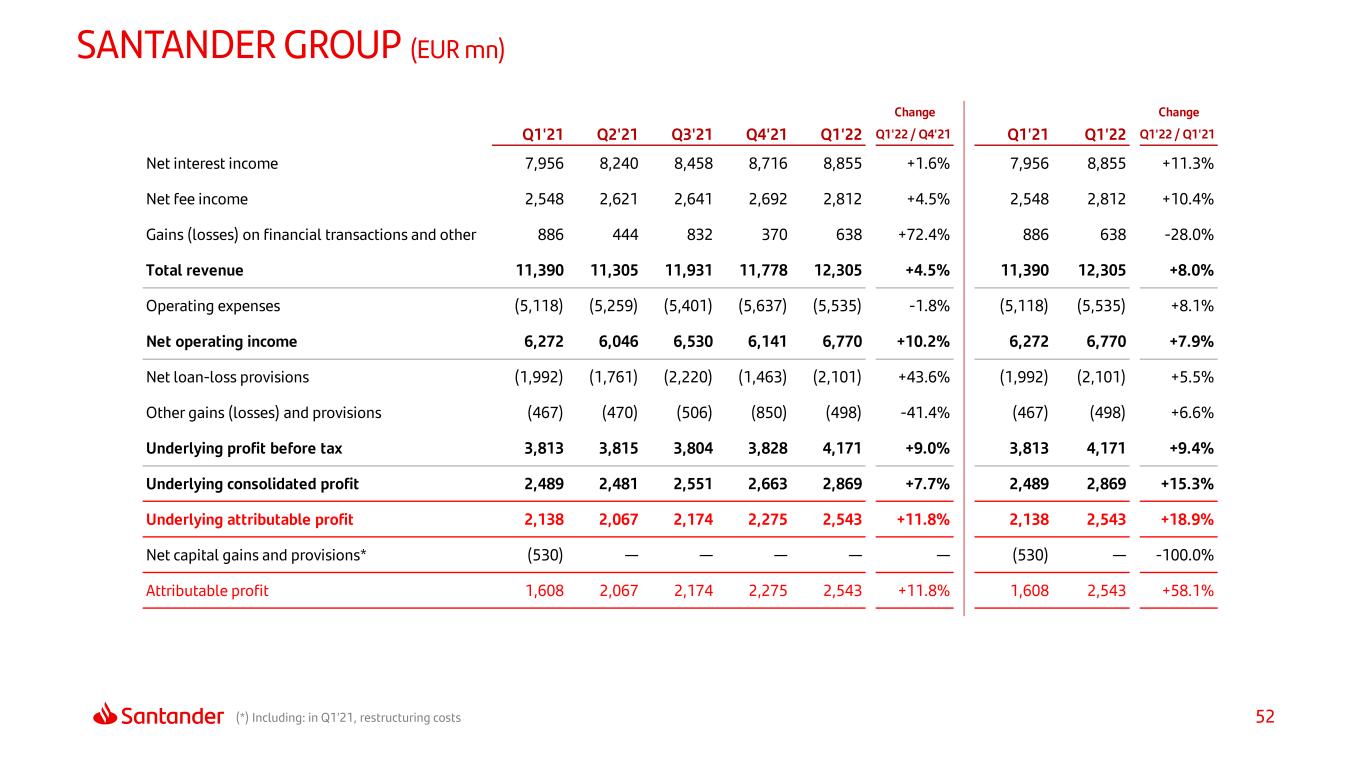

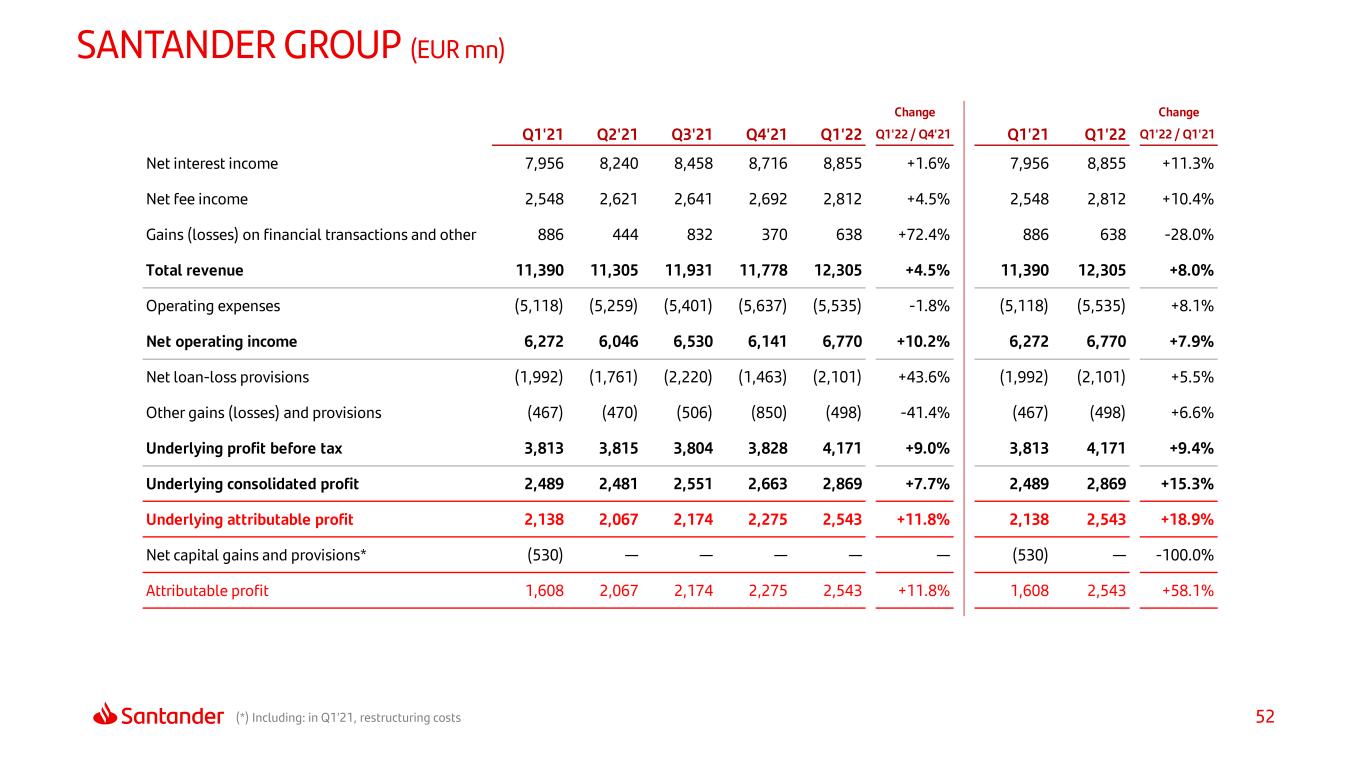

52 SANTANDER GROUP (EUR mn) (*) Including: in Q1’21, restructuring costs Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 7,956 8,240 8,458 8,716 8,855 +1.6% 7,956 8,855 +11.3% Net fee income 2,548 2,621 2,641 2,692 2,812 +4.5% 2,548 2,812 +10.4% Gains (losses) on financial transactions and other 886 444 832 370 638 +72.4% 886 638 -28.0% Total revenue 11,390 11,305 11,931 11,778 12,305 +4.5% 11,390 12,305 +8.0% Operating expenses (5,118) (5,259) (5,401) (5,637) (5,535) -1.8% (5,118) (5,535) +8.1% Net operating income 6,272 6,046 6,530 6,141 6,770 +10.2% 6,272 6,770 +7.9% Net loan-loss provisions (1,992) (1,761) (2,220) (1,463) (2,101) +43.6% (1,992) (2,101) +5.5% Other gains (losses) and provisions (467) (470) (506) (850) (498) -41.4% (467) (498) +6.6% Underlying profit before tax 3,813 3,815 3,804 3,828 4,171 +9.0% 3,813 4,171 +9.4% Underlying consolidated profit 2,489 2,481 2,551 2,663 2,869 +7.7% 2,489 2,869 +15.3% Underlying attributable profit 2,138 2,067 2,174 2,275 2,543 +11.8% 2,138 2,543 +18.9% Net capital gains and provisions* (530) — — — — — (530) — -100.0% Attributable profit 1,608 2,067 2,174 2,275 2,543 +11.8% 1,608 2,543 +58.1%

53 SANTANDER GROUP (Constant EUR mn) (*) Including: in Q1’21, restructuring costs Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 8,335 8,551 8,685 8,986 8,855 -1.5% 8,335 8,855 +6.2% Net fee income 2,655 2,706 2,689 2,766 2,812 +1.7% 2,655 2,812 +5.9% Gains (losses) on financial transactions and other 928 474 858 375 638 +70.3% 928 638 -31.2% Total revenue 11,918 11,731 12,232 12,127 12,305 +1.5% 11,918 12,305 +3.3% Operating expenses (5,297) (5,413) (5,514) (5,765) (5,535) -4.0% (5,297) (5,535) +4.5% Net operating income 6,621 6,318 6,718 6,362 6,770 +6.4% 6,621 6,770 +2.3% Net loan-loss provisions (2,086) (1,824) (2,287) (1,524) (2,101) +37.8% (2,086) (2,101) +0.7% Other gains (losses) and provisions (475) (470) (511) (867) (498) -42.6% (475) (498) +4.8% Underlying profit before tax 4,060 4,024 3,920 3,971 4,171 +5.0% 4,060 4,171 +2.7% Underlying consolidated profit 2,641 2,620 2,630 2,754 2,869 +4.2% 2,641 2,869 +8.6% Underlying attributable profit 2,275 2,191 2,244 2,356 2,543 +7.9% 2,275 2,543 +11.8% Net capital gains and provisions* (543) 2 1 1 — -100.0% (543) — -100.0% Attributable profit 1,732 2,194 2,245 2,357 2,543 +7.9% 1,732 2,543 +46.8%

54 Europe (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 2,551 2,656 2,650 2,717 2,839 +4.5% 2,551 2,839 +11.3% Net fee income 1,072 1,086 1,080 1,107 1,154 +4.2% 1,072 1,154 +7.7% Gains (losses) on financial transactions and other 432 107 385 93 312 +235.4% 432 312 -27.8% Total revenue 4,055 3,848 4,114 3,917 4,305 +9.9% 4,055 4,305 +6.2% Operating expenses (2,072) (2,071) (2,049) (2,126) (2,060) -3.1% (2,072) (2,060) -0.6% Net operating income 1,983 1,777 2,065 1,790 2,245 +25.4% 1,983 2,245 +13.2% Net loan-loss provisions (596) (606) (675) (416) (515) +23.8% (596) (515) -13.6% Other gains (losses) and provisions (249) (346) (257) (436) (236) -45.9% (249) (236) -5.4% Underlying profit before tax 1,138 825 1,133 938 1,494 +59.3% 1,138 1,494 +31.3% Underlying consolidated profit 771 561 842 647 1,073 +65.9% 771 1,073 +39.1% Underlying attributable profit 769 542 809 629 1,018 +61.9% 769 1,018 +32.3%

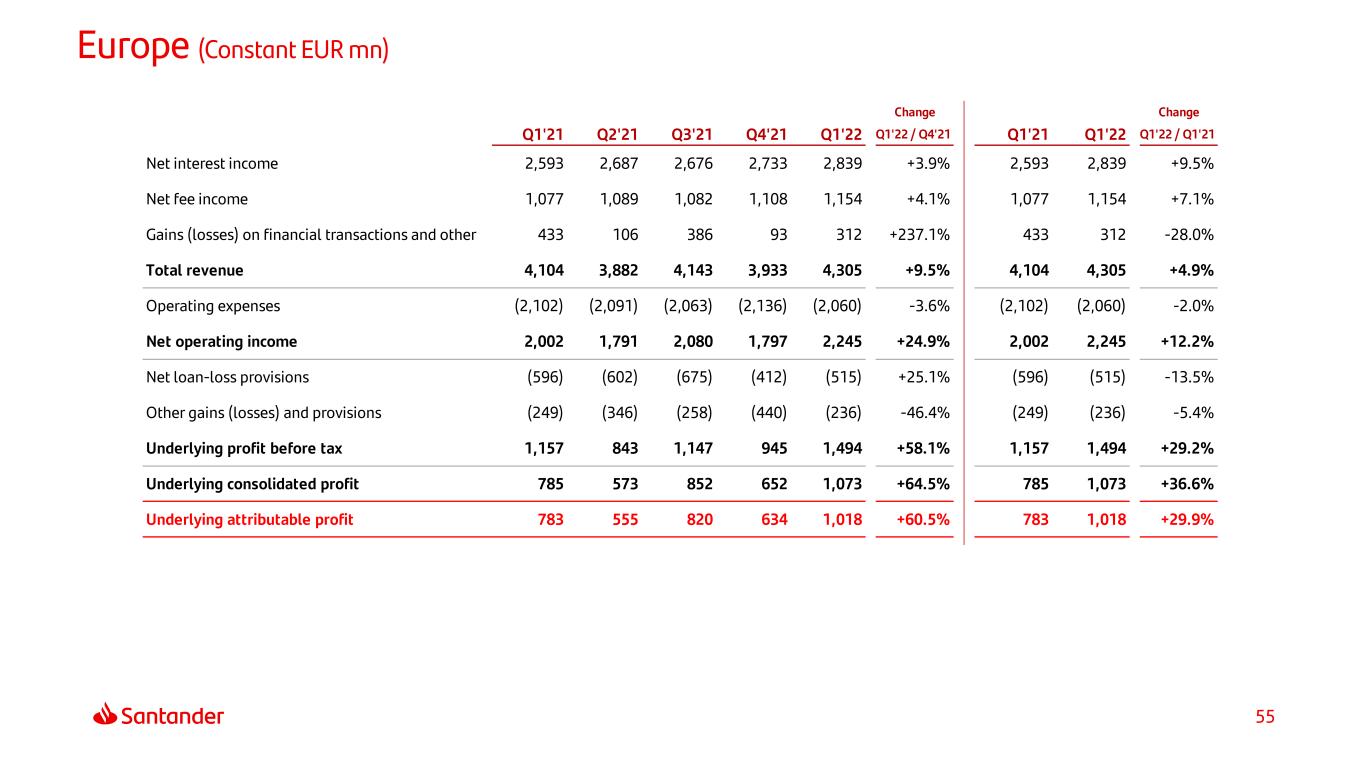

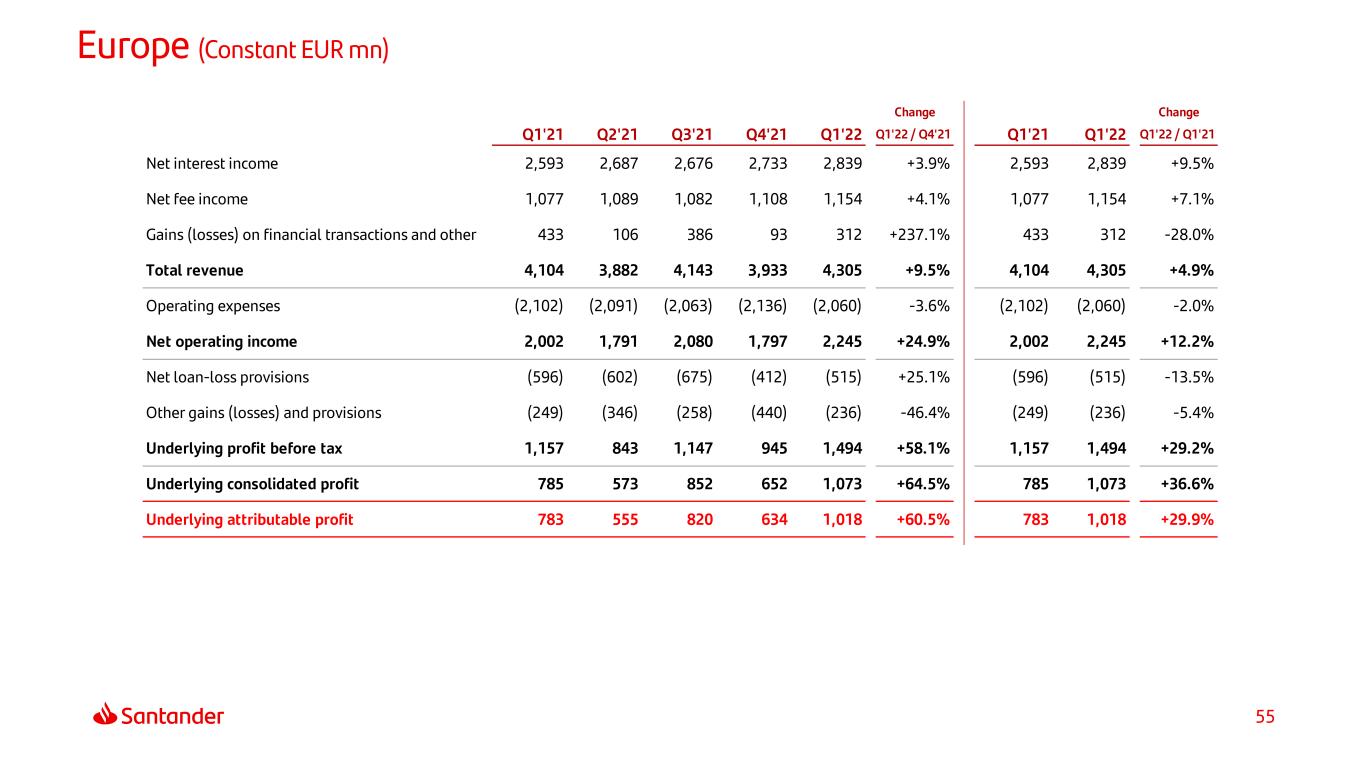

55 Europe (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 2,593 2,687 2,676 2,733 2,839 +3.9% 2,593 2,839 +9.5% Net fee income 1,077 1,089 1,082 1,108 1,154 +4.1% 1,077 1,154 +7.1% Gains (losses) on financial transactions and other 433 106 386 93 312 +237.1% 433 312 -28.0% Total revenue 4,104 3,882 4,143 3,933 4,305 +9.5% 4,104 4,305 +4.9% Operating expenses (2,102) (2,091) (2,063) (2,136) (2,060) -3.6% (2,102) (2,060) -2.0% Net operating income 2,002 1,791 2,080 1,797 2,245 +24.9% 2,002 2,245 +12.2% Net loan-loss provisions (596) (602) (675) (412) (515) +25.1% (596) (515) -13.5% Other gains (losses) and provisions (249) (346) (258) (440) (236) -46.4% (249) (236) -5.4% Underlying profit before tax 1,157 843 1,147 945 1,494 +58.1% 1,157 1,494 +29.2% Underlying consolidated profit 785 573 852 652 1,073 +64.5% 785 1,073 +36.6% Underlying attributable profit 783 555 820 634 1,018 +60.5% 783 1,018 +29.9%

56 Spain (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,074 1,065 998 1,028 998 -3.0% 1,074 998 -7.1% Net fee income 684 693 679 732 745 +1.8% 684 745 +8.9% Gains (losses) on financial transactions and other 310 74 331 78 278 +255.6% 310 278 -10.3% Total revenue 2,068 1,833 2,009 1,839 2,021 +9.9% 2,068 2,021 -2.3% Operating expenses (1,016) (1,011) (984) (1,040) (972) -6.5% (1,016) (972) -4.3% Net operating income 1,052 822 1,024 798 1,049 +31.4% 1,052 1,049 -0.3% Net loan-loss provisions (472) (612) (603) (633) (391) -38.2% (472) (391) -17.2% Other gains (losses) and provisions (131) (147) (161) (74) (139) +86.9% (131) (139) +6.1% Underlying profit before tax 449 63 260 91 519 +468.5% 449 519 +15.6% Underlying consolidated profit 302 48 203 74 365 +396.6% 302 365 +21.0% Underlying attributable profit 302 49 203 73 365 +396.9% 302 365 +20.9%

57 United Kingdom (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 989 1,088 1,156 1,151 1,192 +3.6% 989 1,192 +20.6% Net fee income 120 117 114 82 92 +12.2% 120 92 -23.3% Gains (losses) on financial transactions and other (10) (6) 21 (7) 7 — (10) 7 — Total revenue 1,099 1,199 1,291 1,226 1,291 +5.3% 1,099 1,291 +17.5% Operating expenses (652) (648) (638) (655) (672) +2.6% (652) (672) +3.0% Net operating income 447 551 653 571 620 +8.4% 447 620 +38.5% Net loan-loss provisions (18) 86 (1) 178 (51) — (18) (51) +181.6% Other gains (losses) and provisions (31) (63) (39) (187) (66) -64.8% (31) (66) +112.4% Underlying profit before tax 398 575 613 563 503 -10.7% 398 503 +26.2% Underlying consolidated profit 286 391 443 417 375 -10.0% 286 375 +31.4% Underlying attributable profit 286 391 443 417 375 -10.0% 286 375 +31.4%

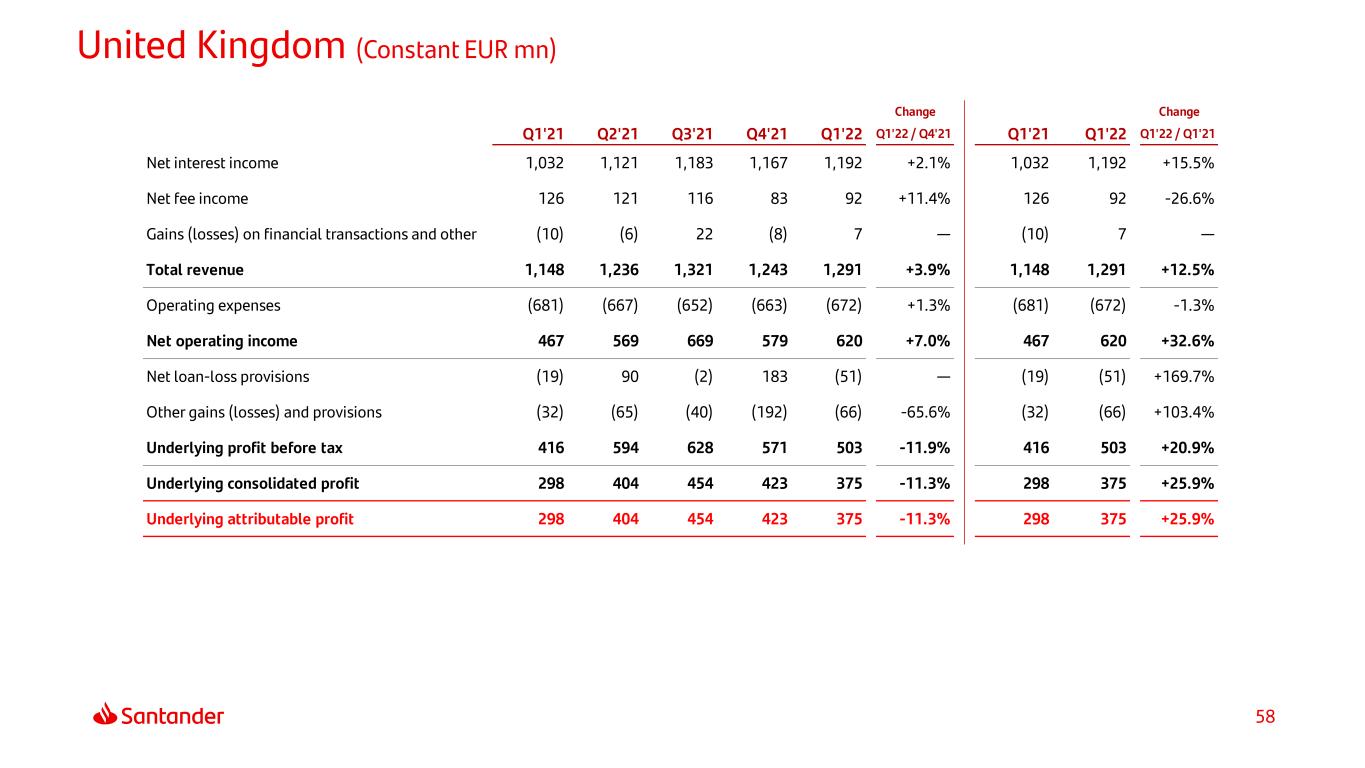

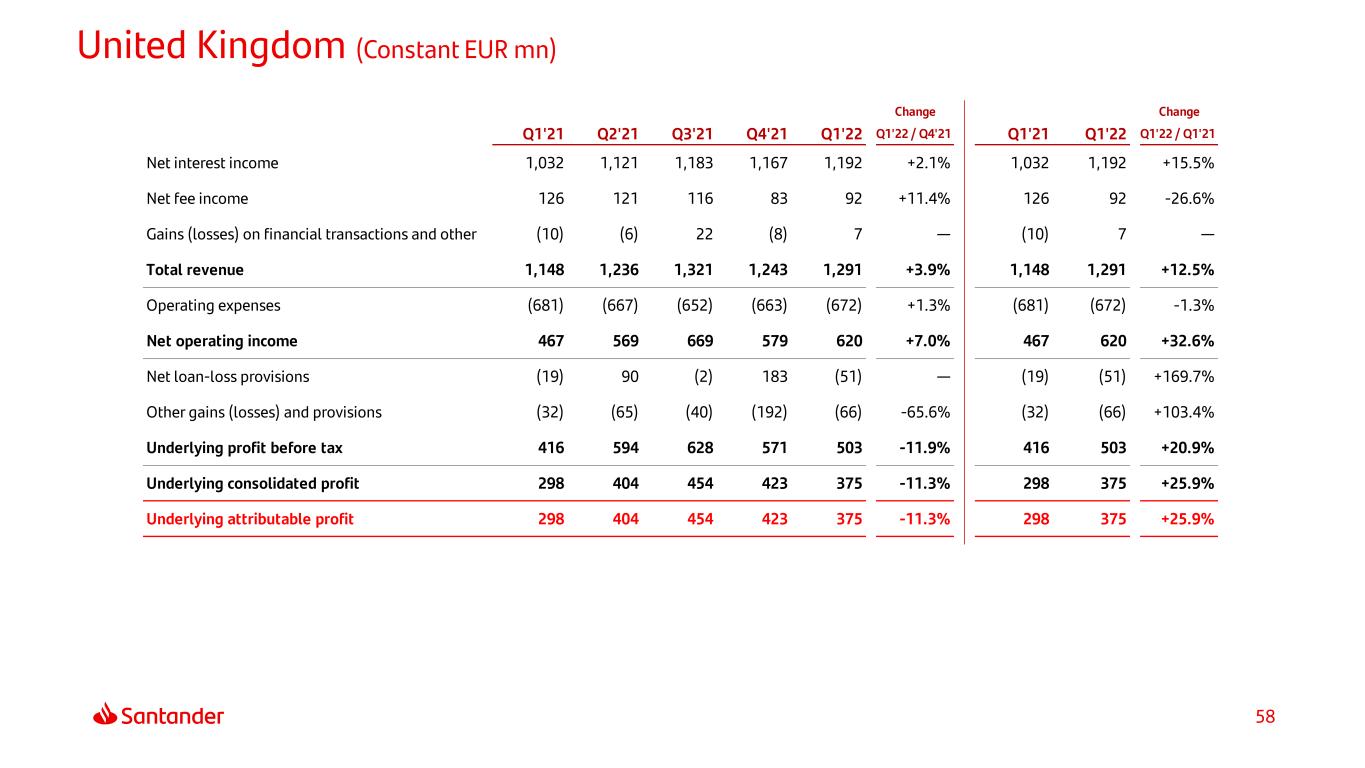

58 United Kingdom (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,032 1,121 1,183 1,167 1,192 +2.1% 1,032 1,192 +15.5% Net fee income 126 121 116 83 92 +11.4% 126 92 -26.6% Gains (losses) on financial transactions and other (10) (6) 22 (8) 7 — (10) 7 — Total revenue 1,148 1,236 1,321 1,243 1,291 +3.9% 1,148 1,291 +12.5% Operating expenses (681) (667) (652) (663) (672) +1.3% (681) (672) -1.3% Net operating income 467 569 669 579 620 +7.0% 467 620 +32.6% Net loan-loss provisions (19) 90 (2) 183 (51) — (19) (51) +169.7% Other gains (losses) and provisions (32) (65) (40) (192) (66) -65.6% (32) (66) +103.4% Underlying profit before tax 416 594 628 571 503 -11.9% 416 503 +20.9% Underlying consolidated profit 298 404 454 423 375 -11.3% 298 375 +25.9% Underlying attributable profit 298 404 454 423 375 -11.3% 298 375 +25.9%

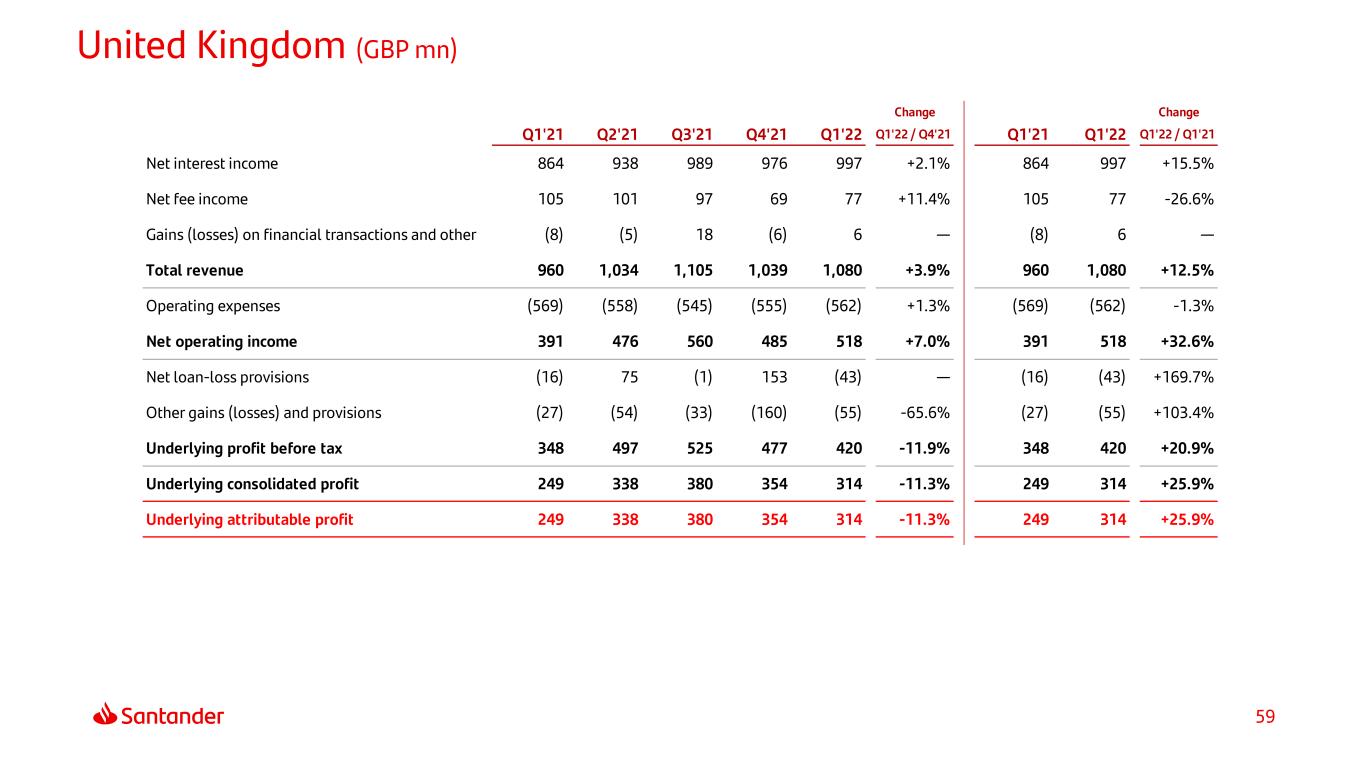

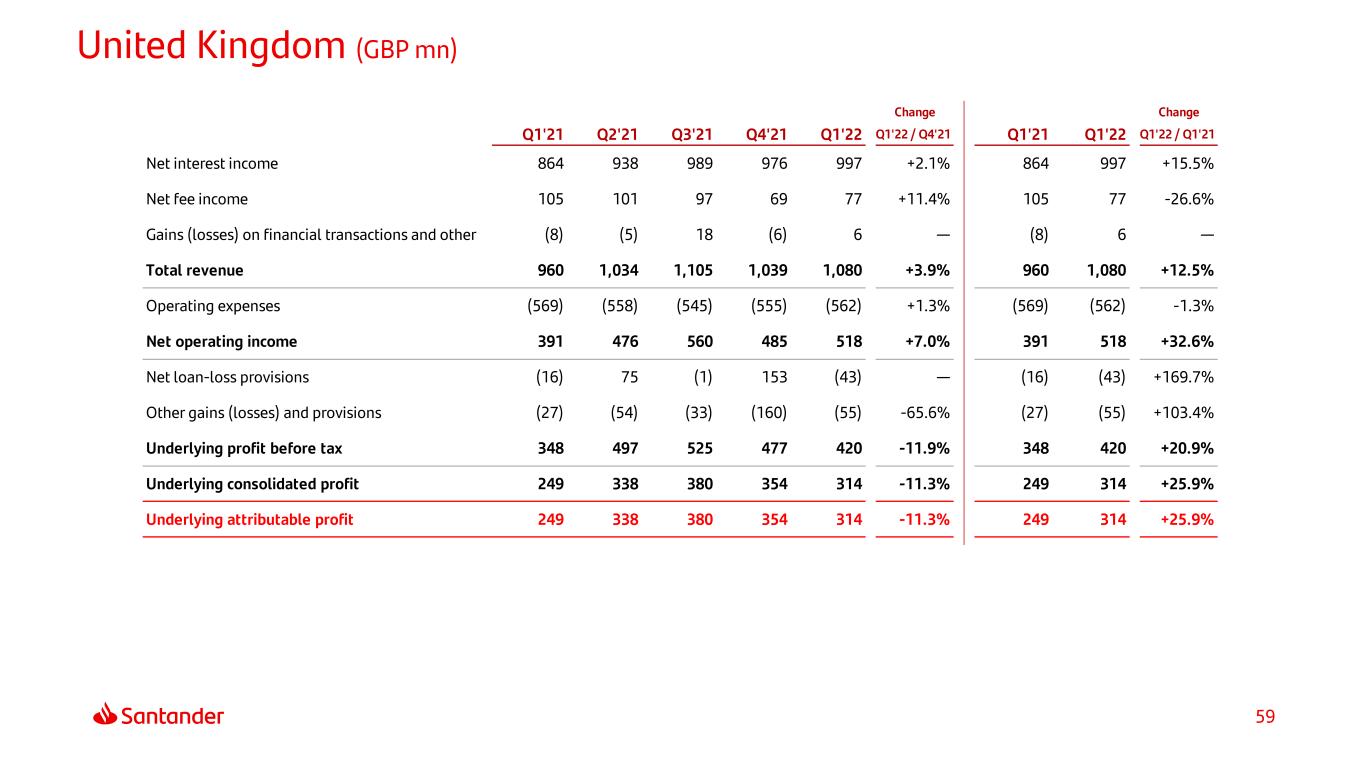

59 United Kingdom (GBP mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 864 938 989 976 997 +2.1% 864 997 +15.5% Net fee income 105 101 97 69 77 +11.4% 105 77 -26.6% Gains (losses) on financial transactions and other (8) (5) 18 (6) 6 — (8) 6 — Total revenue 960 1,034 1,105 1,039 1,080 +3.9% 960 1,080 +12.5% Operating expenses (569) (558) (545) (555) (562) +1.3% (569) (562) -1.3% Net operating income 391 476 560 485 518 +7.0% 391 518 +32.6% Net loan-loss provisions (16) 75 (1) 153 (43) — (16) (43) +169.7% Other gains (losses) and provisions (27) (54) (33) (160) (55) -65.6% (27) (55) +103.4% Underlying profit before tax 348 497 525 477 420 -11.9% 348 420 +20.9% Underlying consolidated profit 249 338 380 354 314 -11.3% 249 314 +25.9% Underlying attributable profit 249 338 380 354 314 -11.3% 249 314 +25.9%

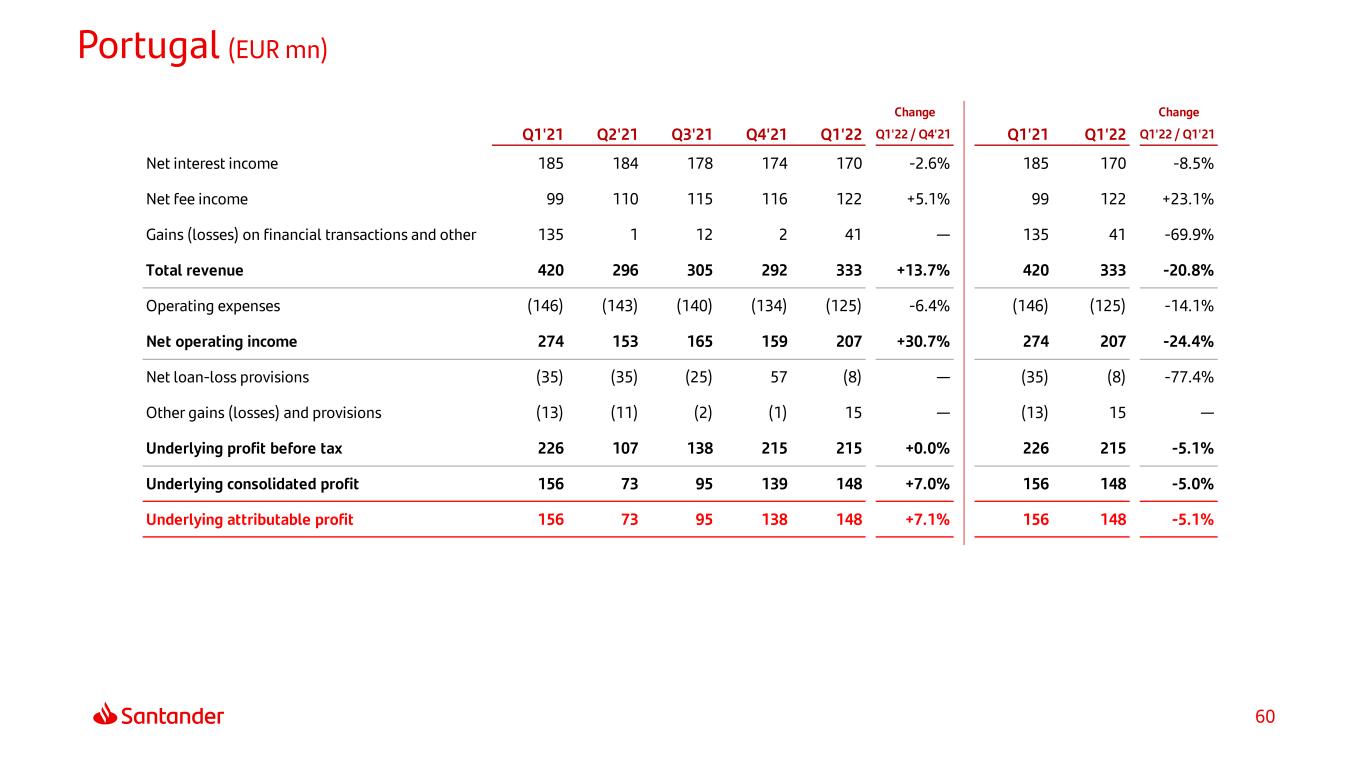

60 Portugal (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 185 184 178 174 170 -2.6% 185 170 -8.5% Net fee income 99 110 115 116 122 +5.1% 99 122 +23.1% Gains (losses) on financial transactions and other 135 1 12 2 41 — 135 41 -69.9% Total revenue 420 296 305 292 333 +13.7% 420 333 -20.8% Operating expenses (146) (143) (140) (134) (125) -6.4% (146) (125) -14.1% Net operating income 274 153 165 159 207 +30.7% 274 207 -24.4% Net loan-loss provisions (35) (35) (25) 57 (8) — (35) (8) -77.4% Other gains (losses) and provisions (13) (11) (2) (1) 15 — (13) 15 — Underlying profit before tax 226 107 138 215 215 +0.0% 226 215 -5.1% Underlying consolidated profit 156 73 95 139 148 +7.0% 156 148 -5.0% Underlying attributable profit 156 73 95 138 148 +7.1% 156 148 -5.1%

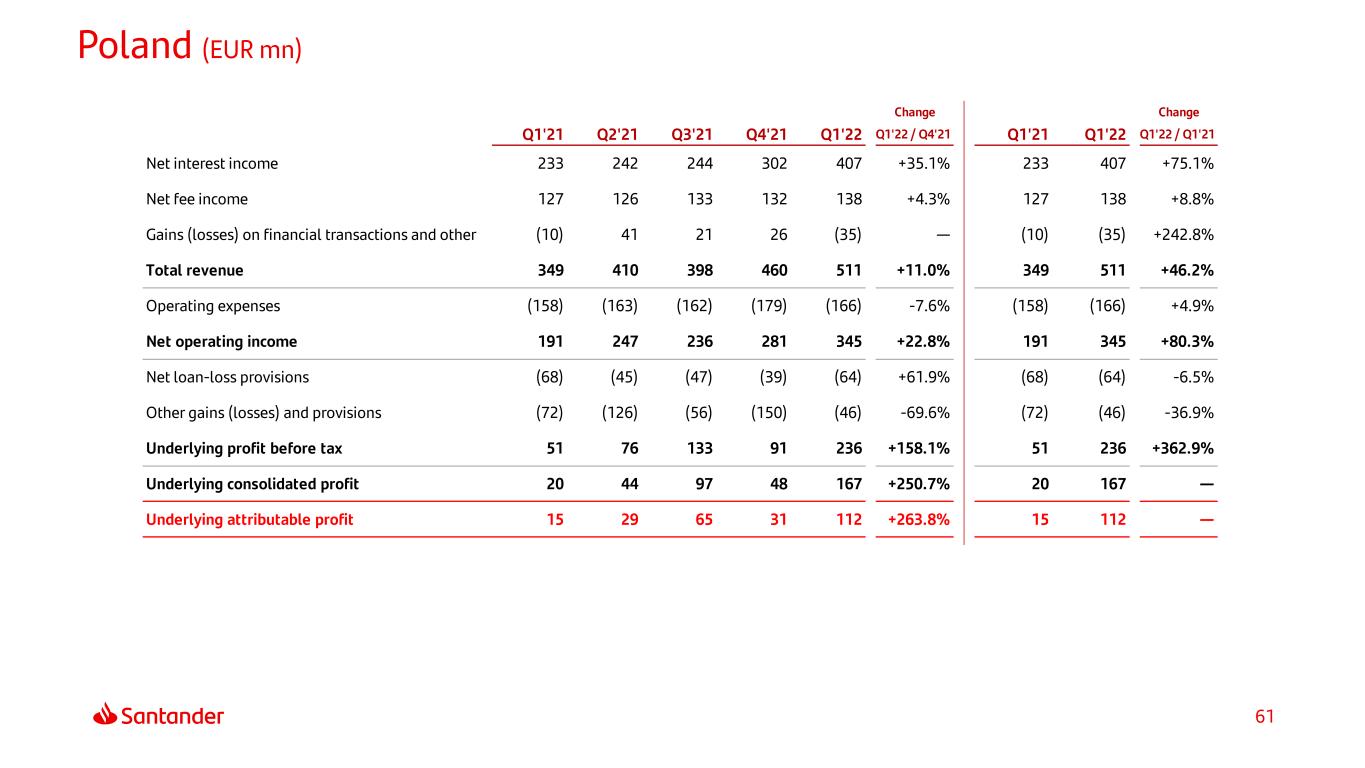

61 Poland (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 233 242 244 302 407 +35.1% 233 407 +75.1% Net fee income 127 126 133 132 138 +4.3% 127 138 +8.8% Gains (losses) on financial transactions and other (10) 41 21 26 (35) — (10) (35) +242.8% Total revenue 349 410 398 460 511 +11.0% 349 511 +46.2% Operating expenses (158) (163) (162) (179) (166) -7.6% (158) (166) +4.9% Net operating income 191 247 236 281 345 +22.8% 191 345 +80.3% Net loan-loss provisions (68) (45) (47) (39) (64) +61.9% (68) (64) -6.5% Other gains (losses) and provisions (72) (126) (56) (150) (46) -69.6% (72) (46) -36.9% Underlying profit before tax 51 76 133 91 236 +158.1% 51 236 +362.9% Underlying consolidated profit 20 44 97 48 167 +250.7% 20 167 — Underlying attributable profit 15 29 65 31 112 +263.8% 15 112 —

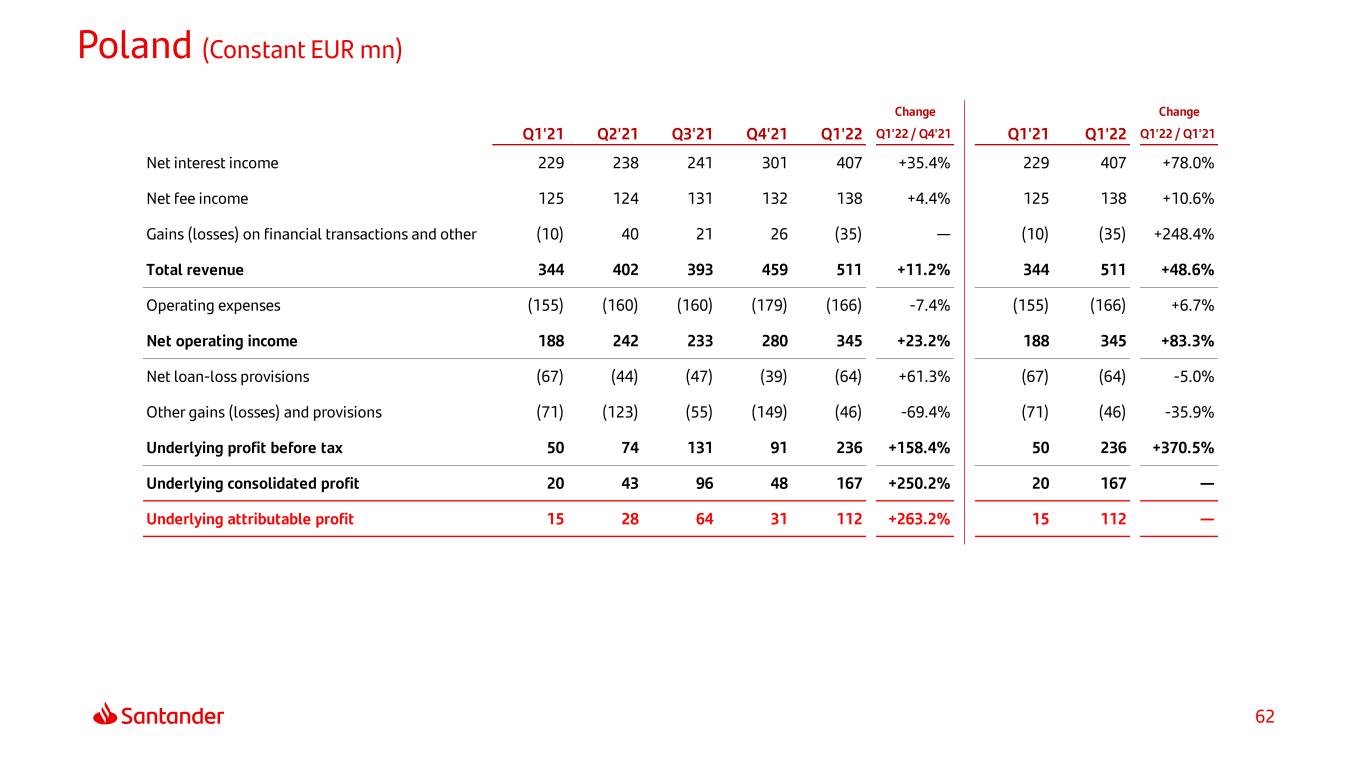

62 Poland (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 229 238 241 301 407 +35.4% 229 407 +78.0% Net fee income 125 124 131 132 138 +4.4% 125 138 +10.6% Gains (losses) on financial transactions and other (10) 40 21 26 (35) — (10) (35) +248.4% Total revenue 344 402 393 459 511 +11.2% 344 511 +48.6% Operating expenses (155) (160) (160) (179) (166) -7.4% (155) (166) +6.7% Net operating income 188 242 233 280 345 +23.2% 188 345 +83.3% Net loan-loss provisions (67) (44) (47) (39) (64) +61.3% (67) (64) -5.0% Other gains (losses) and provisions (71) (123) (55) (149) (46) -69.4% (71) (46) -35.9% Underlying profit before tax 50 74 131 91 236 +158.4% 50 236 +370.5% Underlying consolidated profit 20 43 96 48 167 +250.2% 20 167 — Underlying attributable profit 15 28 64 31 112 +263.2% 15 112 —

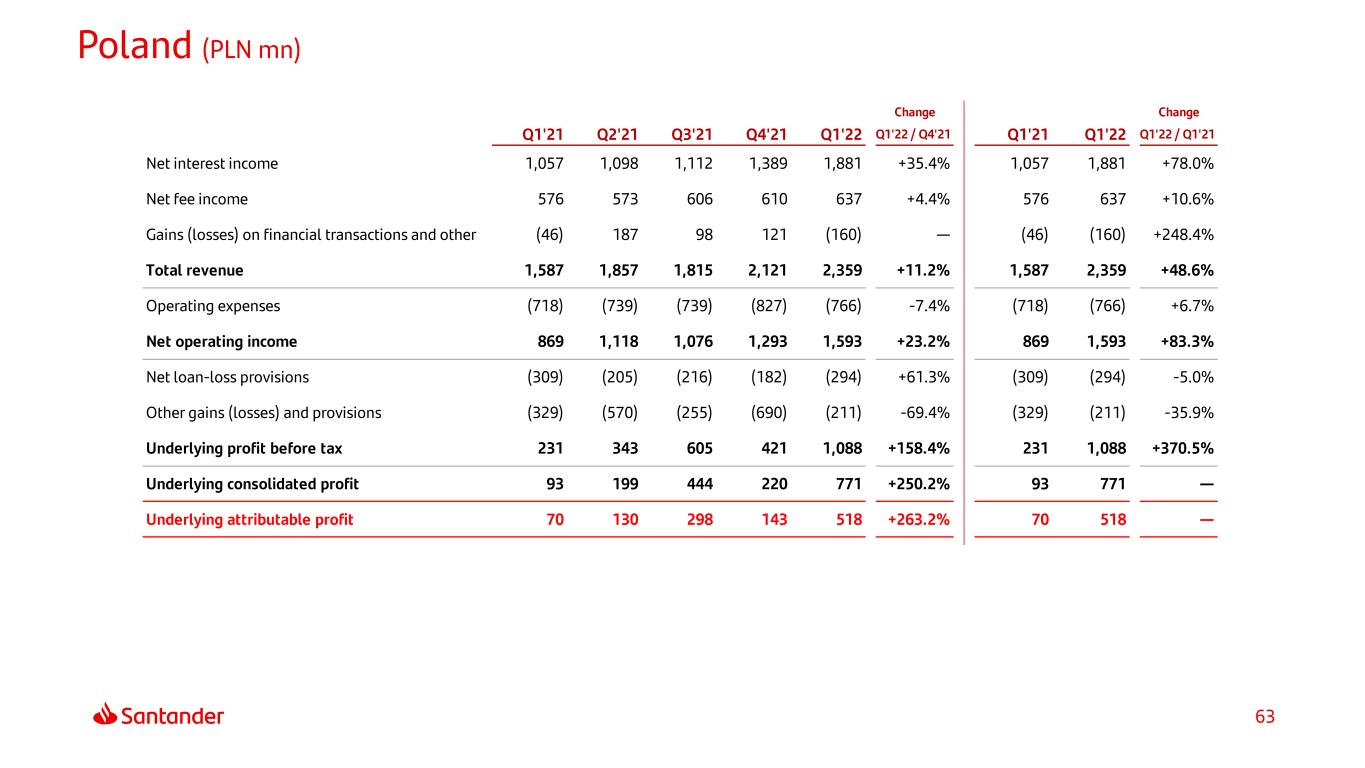

63 Poland (PLN mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,057 1,098 1,112 1,389 1,881 +35.4% 1,057 1,881 +78.0% Net fee income 576 573 606 610 637 +4.4% 576 637 +10.6% Gains (losses) on financial transactions and other (46) 187 98 121 (160) — (46) (160) +248.4% Total revenue 1,587 1,857 1,815 2,121 2,359 +11.2% 1,587 2,359 +48.6% Operating expenses (718) (739) (739) (827) (766) -7.4% (718) (766) +6.7% Net operating income 869 1,118 1,076 1,293 1,593 +23.2% 869 1,593 +83.3% Net loan-loss provisions (309) (205) (216) (182) (294) +61.3% (309) (294) -5.0% Other gains (losses) and provisions (329) (570) (255) (690) (211) -69.4% (329) (211) -35.9% Underlying profit before tax 231 343 605 421 1,088 +158.4% 231 1,088 +370.5% Underlying consolidated profit 93 199 444 220 771 +250.2% 93 771 — Underlying attributable profit 70 130 298 143 518 +263.2% 70 518 —

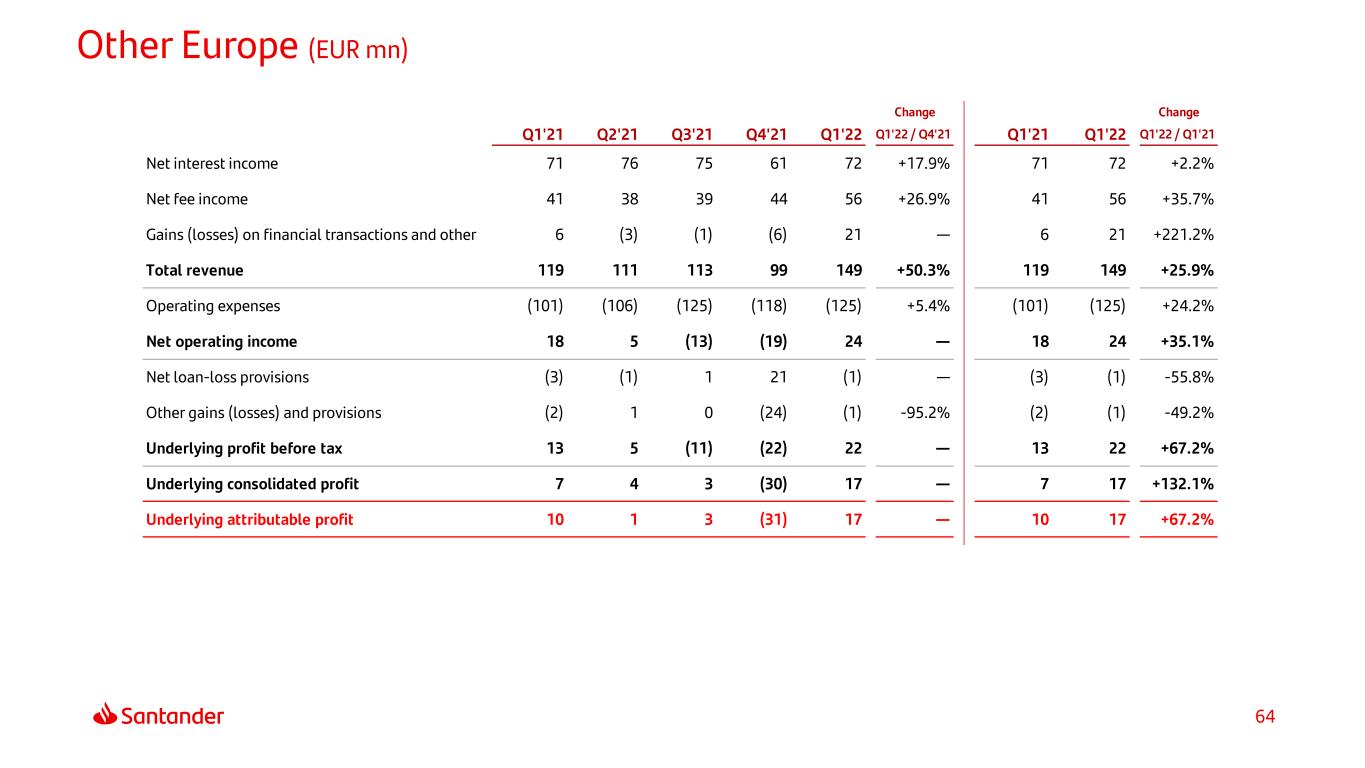

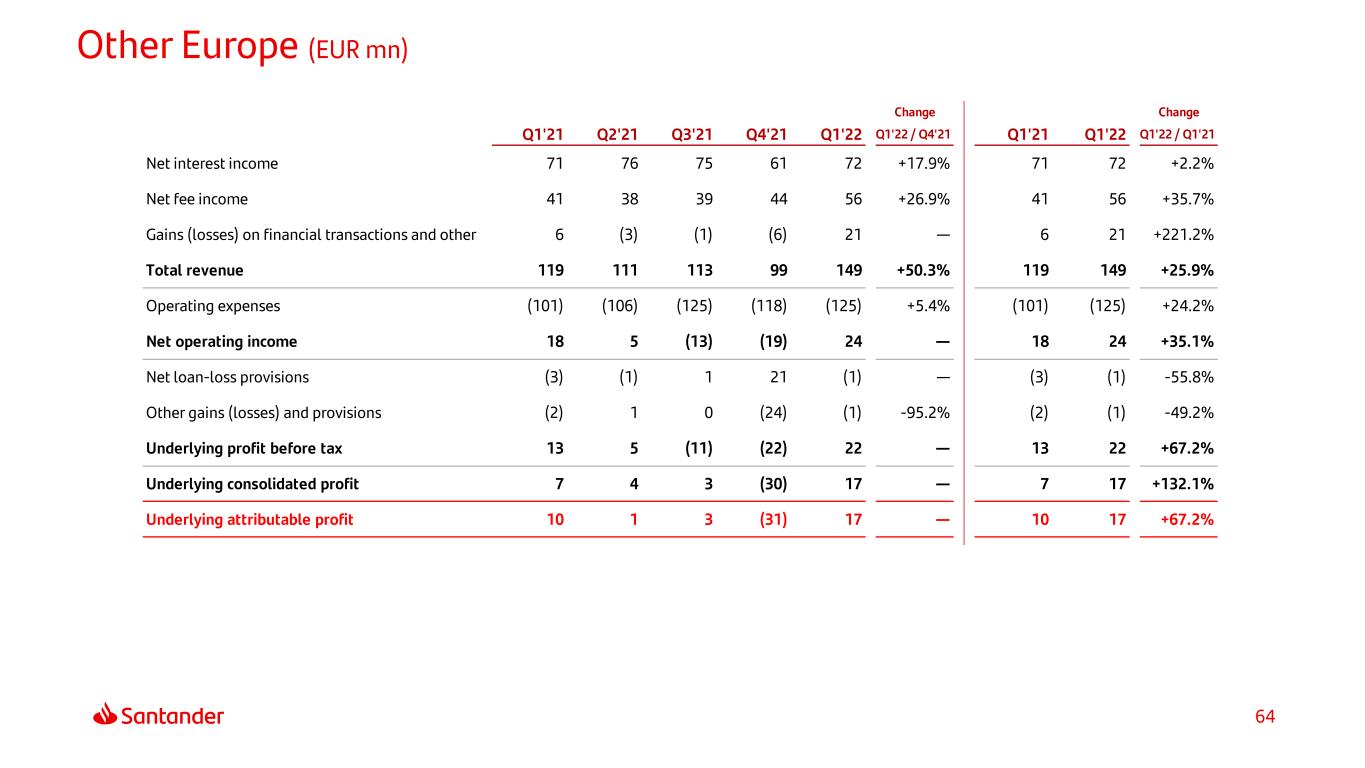

64 Other Europe (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 71 76 75 61 72 +17.9% 71 72 +2.2% Net fee income 41 38 39 44 56 +26.9% 41 56 +35.7% Gains (losses) on financial transactions and other 6 (3) (1) (6) 21 — 6 21 +221.2% Total revenue 119 111 113 99 149 +50.3% 119 149 +25.9% Operating expenses (101) (106) (125) (118) (125) +5.4% (101) (125) +24.2% Net operating income 18 5 (13) (19) 24 — 18 24 +35.1% Net loan-loss provisions (3) (1) 1 21 (1) — (3) (1) -55.8% Other gains (losses) and provisions (2) 1 0 (24) (1) -95.2% (2) (1) -49.2% Underlying profit before tax 13 5 (11) (22) 22 — 13 22 +67.2% Underlying consolidated profit 7 4 3 (30) 17 — 7 17 +132.1% Underlying attributable profit 10 1 3 (31) 17 — 10 17 +67.2%

65 Other Europe (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 73 78 76 62 72 +16.6% 73 72 -0.4% Net fee income 44 40 40 45 56 +25.3% 44 56 +28.8% Gains (losses) on financial transactions and other 8 (3) (0) (6) 21 — 8 21 +153.1% Total revenue 124 115 116 100 149 +48.6% 124 149 +20.0% Operating expenses (104) (109) (128) (120) (125) +4.4% (104) (125) +20.2% Net operating income 21 6 (12) (19) 24 — 21 24 +18.5% Net loan-loss provisions (3) (1) 2 21 (1) — (3) (1) -58.0% Other gains (losses) and provisions (2) 1 0 (24) (1) -95.4% (2) (1) -49.3% Underlying profit before tax 16 6 (10) (22) 22 — 16 22 +41.6% Underlying consolidated profit 9 5 4 (31) 17 — 9 17 +87.6% Underlying attributable profit 12 2 4 (31) 17 — 12 17 +43.0%

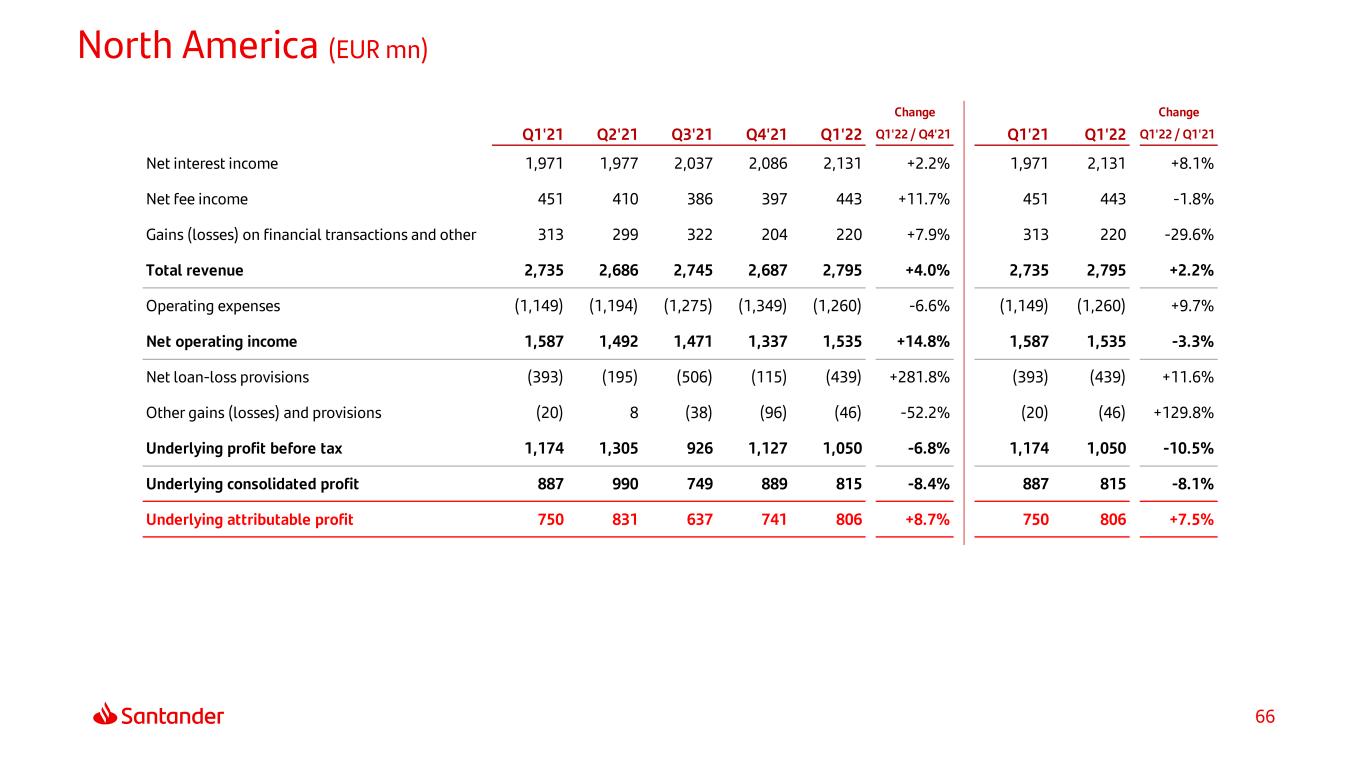

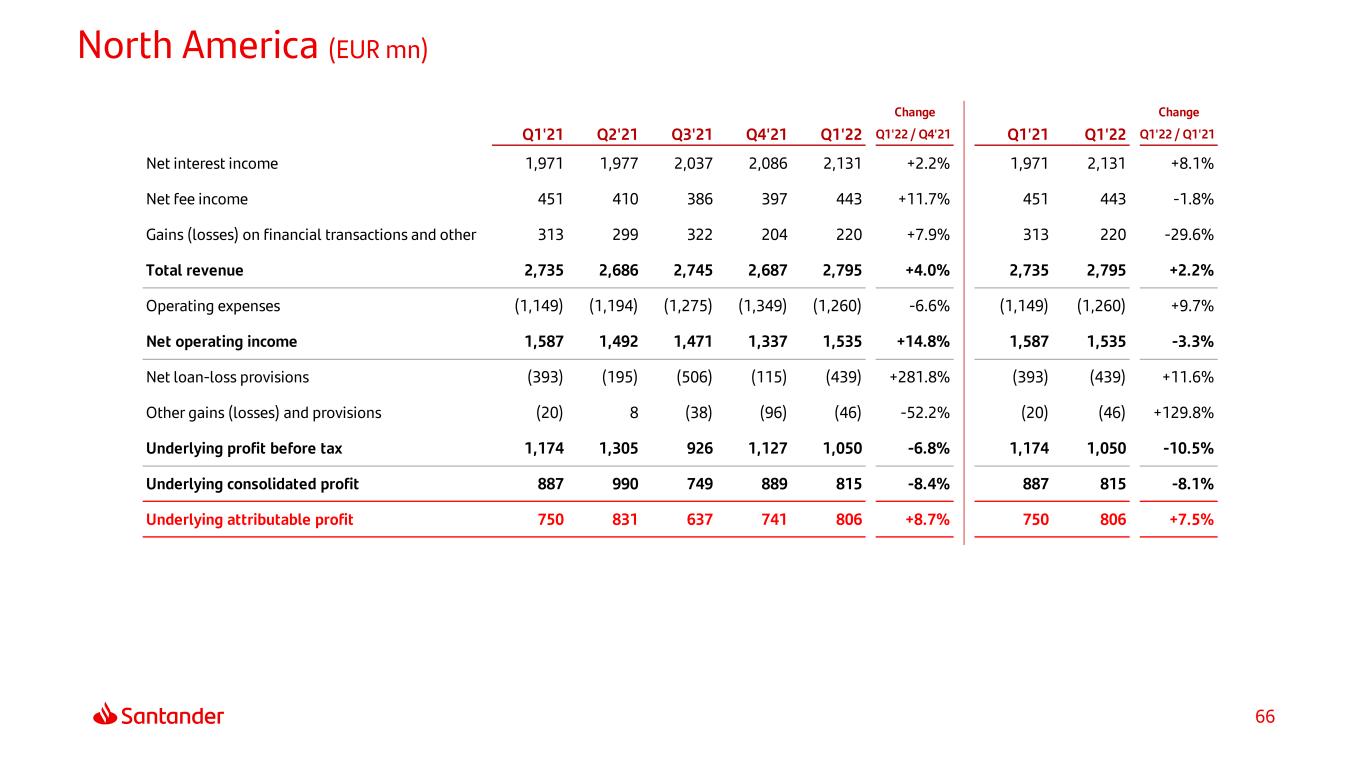

66 North America (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,971 1,977 2,037 2,086 2,131 +2.2% 1,971 2,131 +8.1% Net fee income 451 410 386 397 443 +11.7% 451 443 -1.8% Gains (losses) on financial transactions and other 313 299 322 204 220 +7.9% 313 220 -29.6% Total revenue 2,735 2,686 2,745 2,687 2,795 +4.0% 2,735 2,795 +2.2% Operating expenses (1,149) (1,194) (1,275) (1,349) (1,260) -6.6% (1,149) (1,260) +9.7% Net operating income 1,587 1,492 1,471 1,337 1,535 +14.8% 1,587 1,535 -3.3% Net loan-loss provisions (393) (195) (506) (115) (439) +281.8% (393) (439) +11.6% Other gains (losses) and provisions (20) 8 (38) (96) (46) -52.2% (20) (46) +129.8% Underlying profit before tax 1,174 1,305 926 1,127 1,050 -6.8% 1,174 1,050 -10.5% Underlying consolidated profit 887 990 749 889 815 -8.4% 887 815 -8.1% Underlying attributable profit 750 831 637 741 806 +8.7% 750 806 +7.5%

67 North America (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 2,111 2,107 2,122 2,133 2,131 -0.1% 2,111 2,131 +0.9% Net fee income 482 434 399 405 443 +9.3% 482 443 -8.2% Gains (losses) on financial transactions and other 336 322 338 204 220 +8.0% 336 220 -34.5% Total revenue 2,930 2,863 2,859 2,742 2,795 +1.9% 2,930 2,795 -4.6% Operating expenses (1,228) (1,271) (1,328) (1,381) (1,260) -8.8% (1,228) (1,260) +2.6% Net operating income 1,702 1,593 1,532 1,361 1,535 +12.8% 1,702 1,535 -9.8% Net loan-loss provisions (420) (204) (530) (111) (439) +294.0% (420) (439) +4.4% Other gains (losses) and provisions (21) 9 (39) (100) (46) -54.5% (21) (46) +114.6% Underlying profit before tax 1,260 1,397 962 1,149 1,050 -8.6% 1,260 1,050 -16.7% Underlying consolidated profit 952 1,061 779 908 815 -10.2% 952 815 -14.5% Underlying attributable profit 806 890 663 756 806 +6.6% 806 806 +0.0%

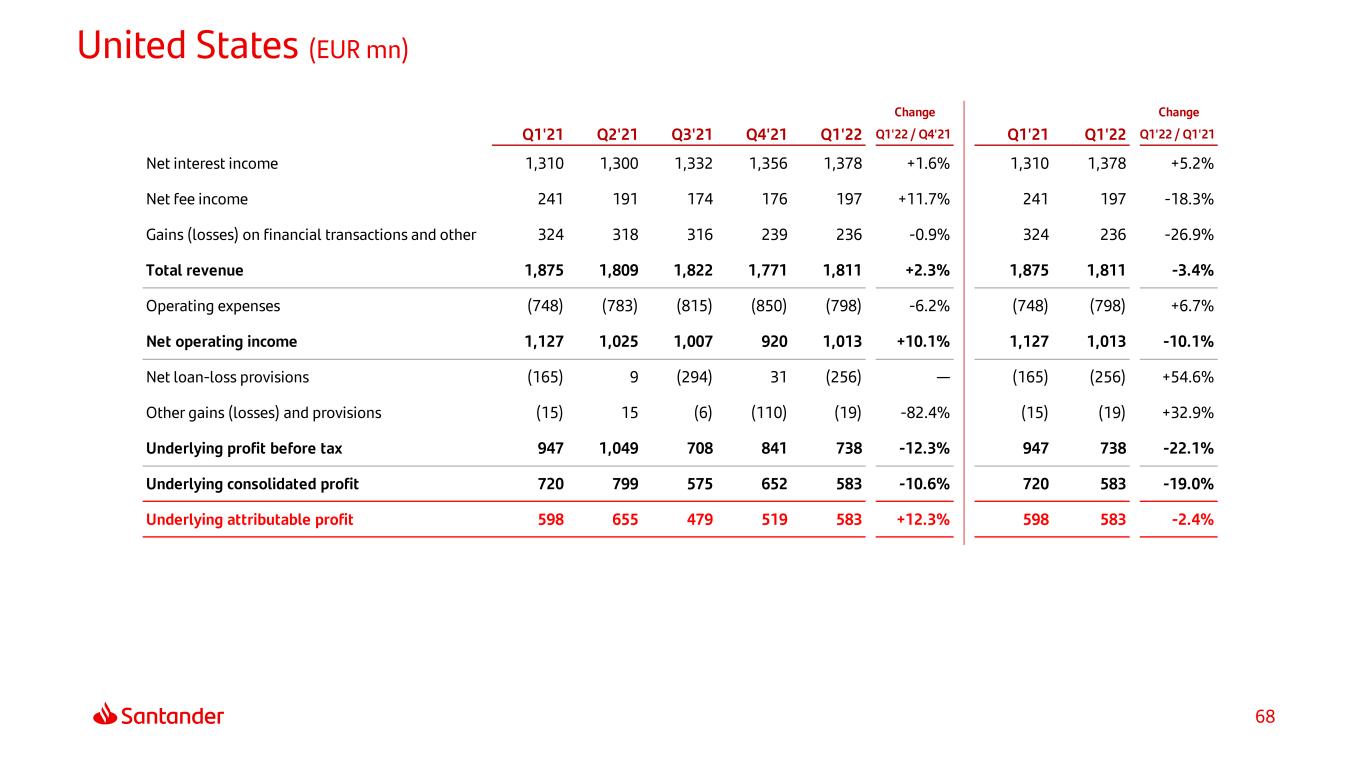

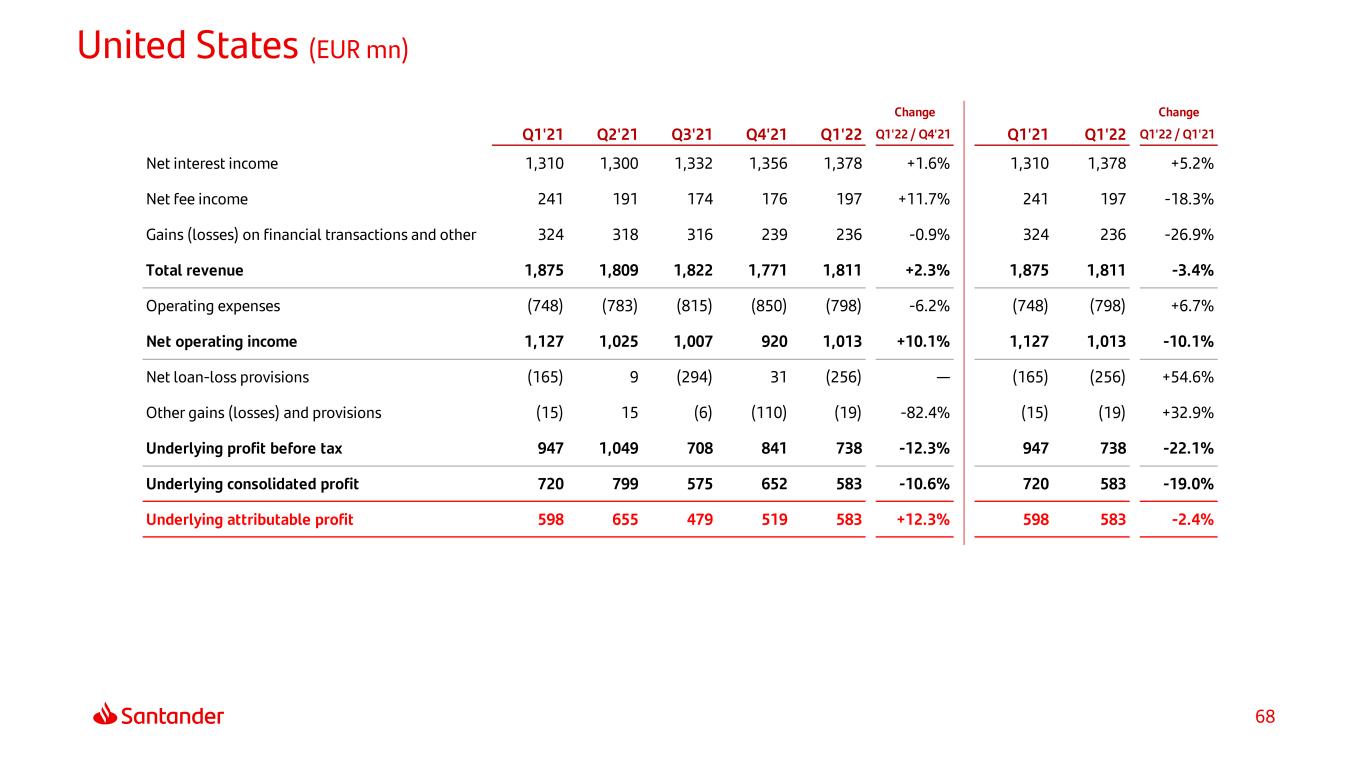

68 United States (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,310 1,300 1,332 1,356 1,378 +1.6% 1,310 1,378 +5.2% Net fee income 241 191 174 176 197 +11.7% 241 197 -18.3% Gains (losses) on financial transactions and other 324 318 316 239 236 -0.9% 324 236 -26.9% Total revenue 1,875 1,809 1,822 1,771 1,811 +2.3% 1,875 1,811 -3.4% Operating expenses (748) (783) (815) (850) (798) -6.2% (748) (798) +6.7% Net operating income 1,127 1,025 1,007 920 1,013 +10.1% 1,127 1,013 -10.1% Net loan-loss provisions (165) 9 (294) 31 (256) — (165) (256) +54.6% Other gains (losses) and provisions (15) 15 (6) (110) (19) -82.4% (15) (19) +32.9% Underlying profit before tax 947 1,049 708 841 738 -12.3% 947 738 -22.1% Underlying consolidated profit 720 799 575 652 583 -10.6% 720 583 -19.0% Underlying attributable profit 598 655 479 519 583 +12.3% 598 583 -2.4%

69 United States (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,407 1,397 1,399 1,380 1,378 -0.1% 1,407 1,378 -2.1% Net fee income 259 206 182 178 197 +10.5% 259 197 -23.9% Gains (losses) on financial transactions and other 348 342 332 240 236 -1.3% 348 236 -32.0% Total revenue 2,013 1,944 1,912 1,797 1,811 +0.8% 2,013 1,811 -10.0% Operating expenses (803) (842) (856) (867) (798) -7.9% (803) (798) -0.6% Net operating income 1,210 1,102 1,056 930 1,013 +8.9% 1,210 1,013 -16.3% Net loan-loss provisions (178) 10 (312) 39 (256) — (178) (256) +44.0% Other gains (losses) and provisions (16) 16 (6) (116) (19) -83.3% (16) (19) +23.8% Underlying profit before tax 1,017 1,128 738 853 738 -13.5% 1,017 738 -27.4% Underlying consolidated profit 773 858 600 661 583 -11.8% 773 583 -24.6% Underlying attributable profit 642 704 500 526 583 +11.0% 642 583 -9.1%

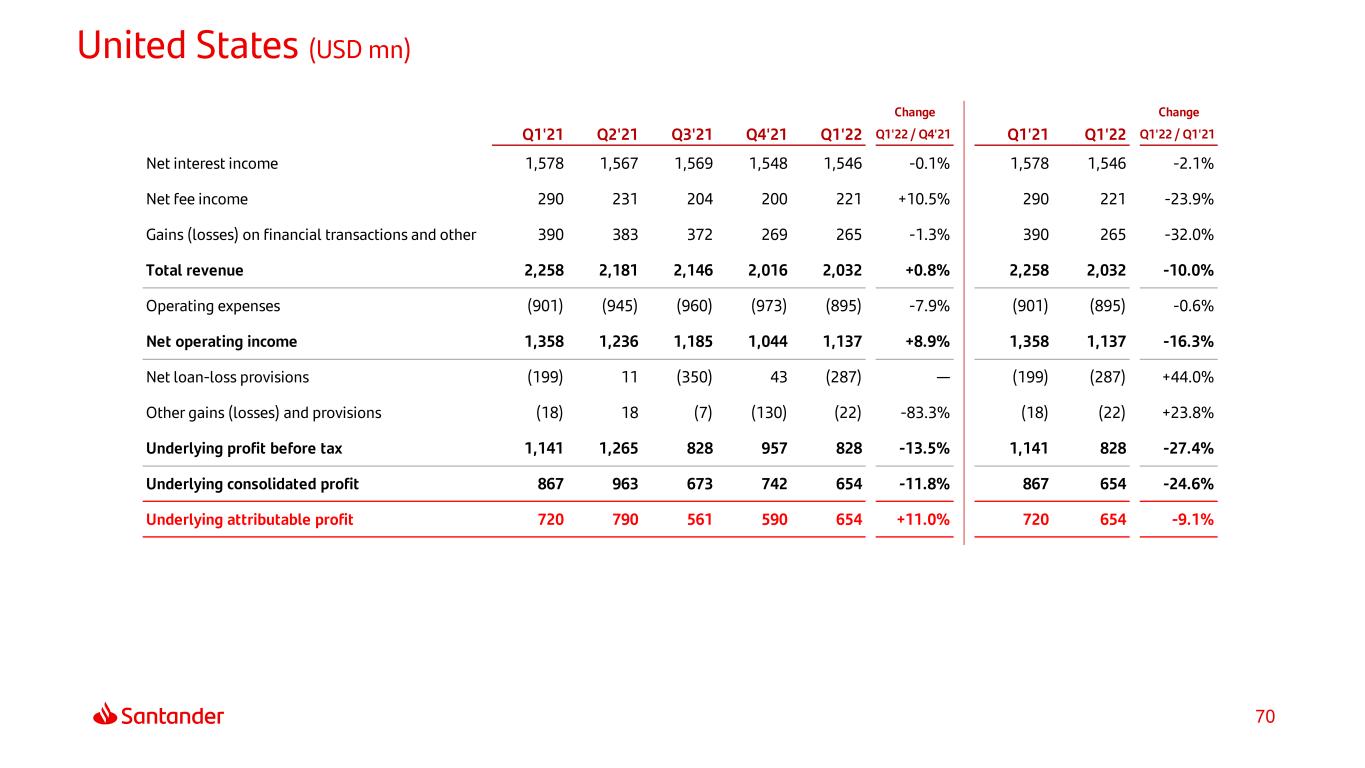

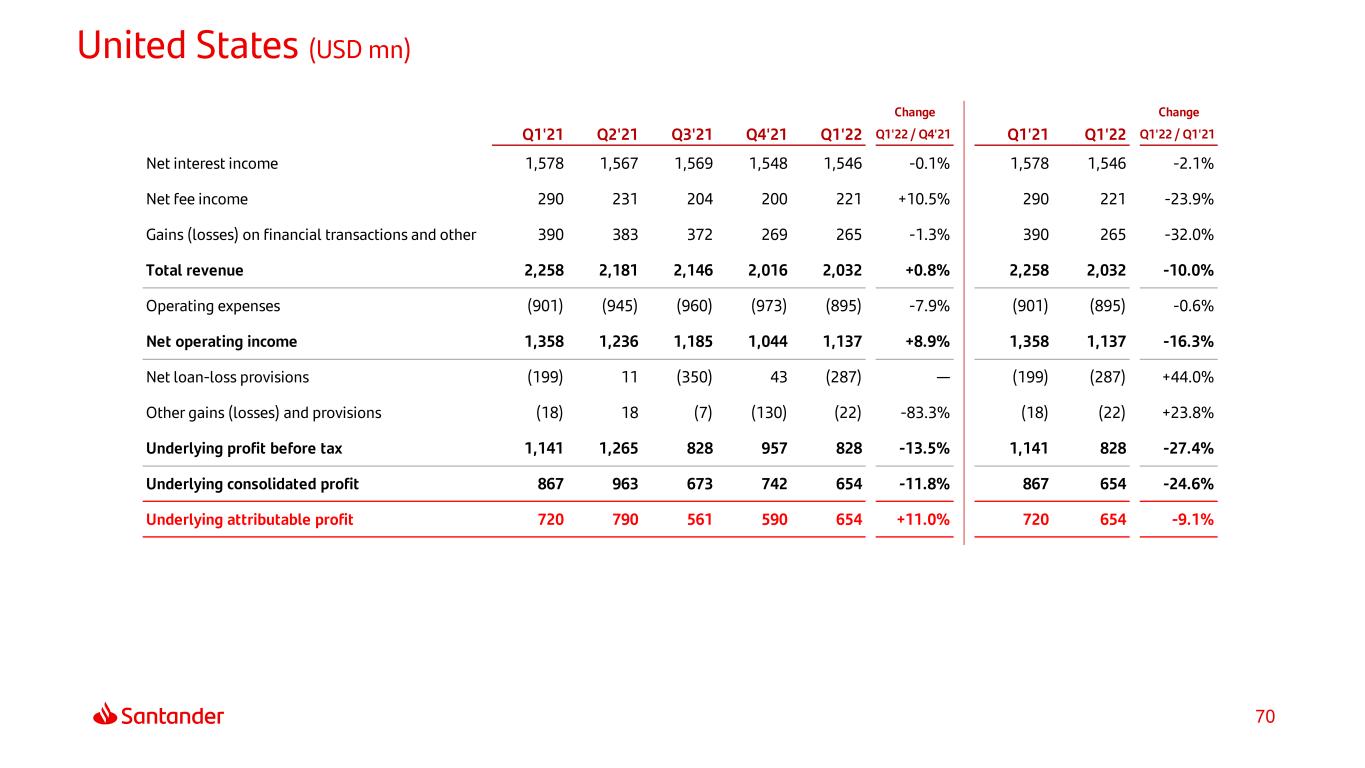

70 United States (USD mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,578 1,567 1,569 1,548 1,546 -0.1% 1,578 1,546 -2.1% Net fee income 290 231 204 200 221 +10.5% 290 221 -23.9% Gains (losses) on financial transactions and other 390 383 372 269 265 -1.3% 390 265 -32.0% Total revenue 2,258 2,181 2,146 2,016 2,032 +0.8% 2,258 2,032 -10.0% Operating expenses (901) (945) (960) (973) (895) -7.9% (901) (895) -0.6% Net operating income 1,358 1,236 1,185 1,044 1,137 +8.9% 1,358 1,137 -16.3% Net loan-loss provisions (199) 11 (350) 43 (287) — (199) (287) +44.0% Other gains (losses) and provisions (18) 18 (7) (130) (22) -83.3% (18) (22) +23.8% Underlying profit before tax 1,141 1,265 828 957 828 -13.5% 1,141 828 -27.4% Underlying consolidated profit 867 963 673 742 654 -11.8% 867 654 -24.6% Underlying attributable profit 720 790 561 590 654 +11.0% 720 654 -9.1%

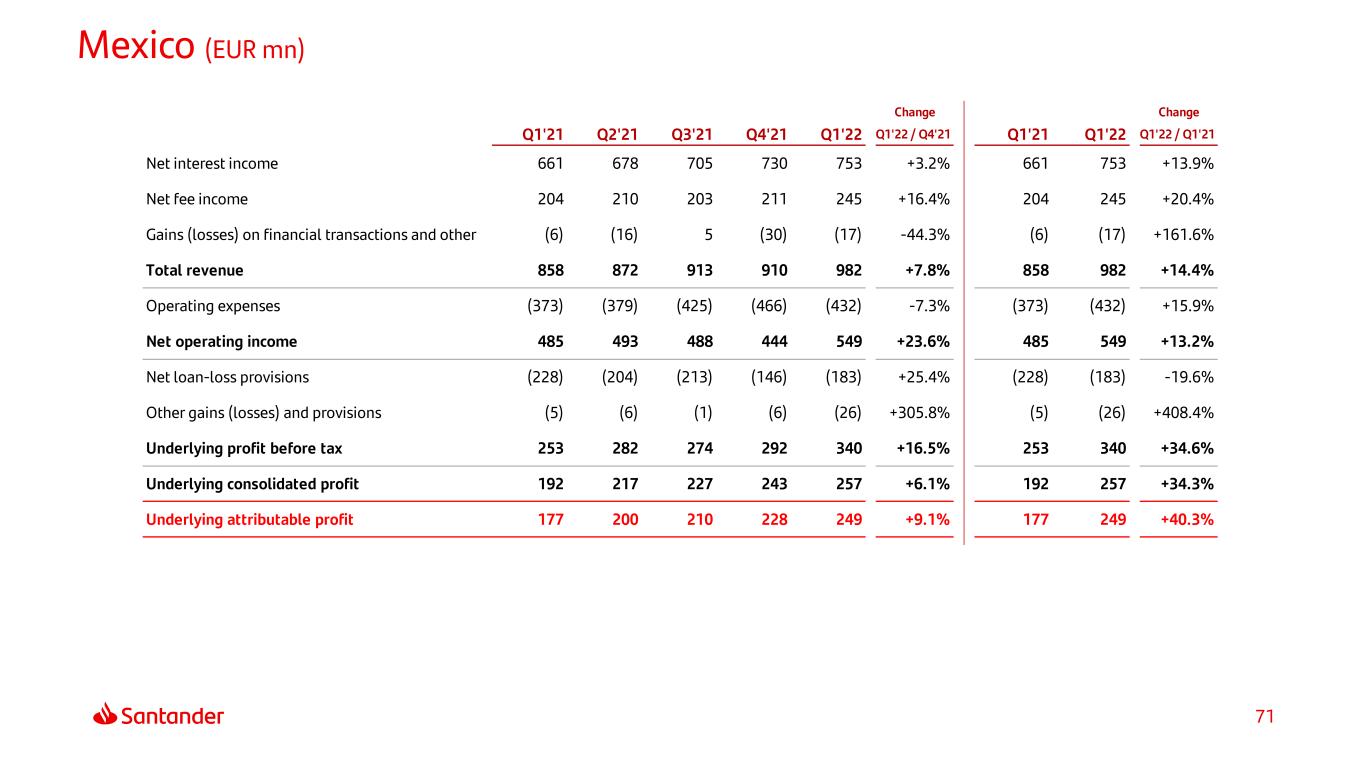

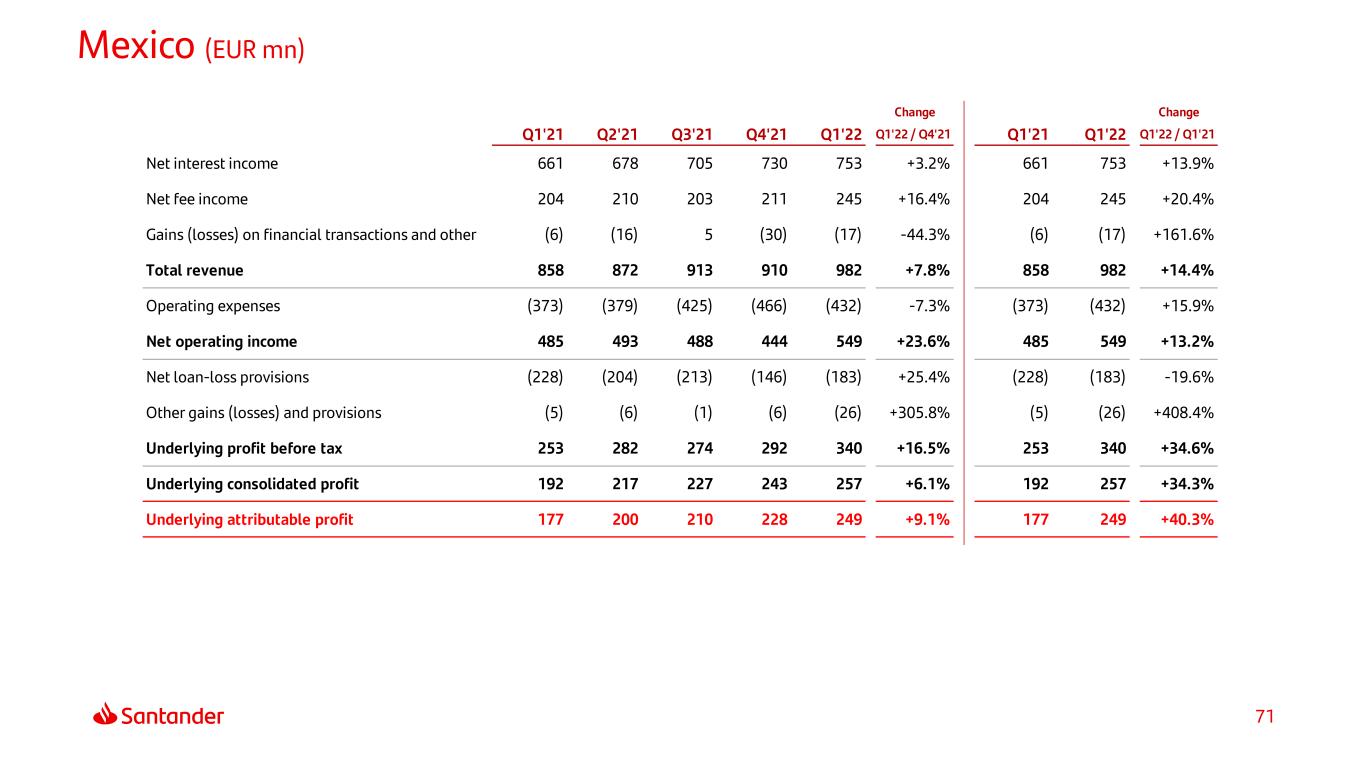

71 Mexico (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 661 678 705 730 753 +3.2% 661 753 +13.9% Net fee income 204 210 203 211 245 +16.4% 204 245 +20.4% Gains (losses) on financial transactions and other (6) (16) 5 (30) (17) -44.3% (6) (17) +161.6% Total revenue 858 872 913 910 982 +7.8% 858 982 +14.4% Operating expenses (373) (379) (425) (466) (432) -7.3% (373) (432) +15.9% Net operating income 485 493 488 444 549 +23.6% 485 549 +13.2% Net loan-loss provisions (228) (204) (213) (146) (183) +25.4% (228) (183) -19.6% Other gains (losses) and provisions (5) (6) (1) (6) (26) +305.8% (5) (26) +408.4% Underlying profit before tax 253 282 274 292 340 +16.5% 253 340 +34.6% Underlying consolidated profit 192 217 227 243 257 +6.1% 192 257 +34.3% Underlying attributable profit 177 200 210 228 249 +9.1% 177 249 +40.3%

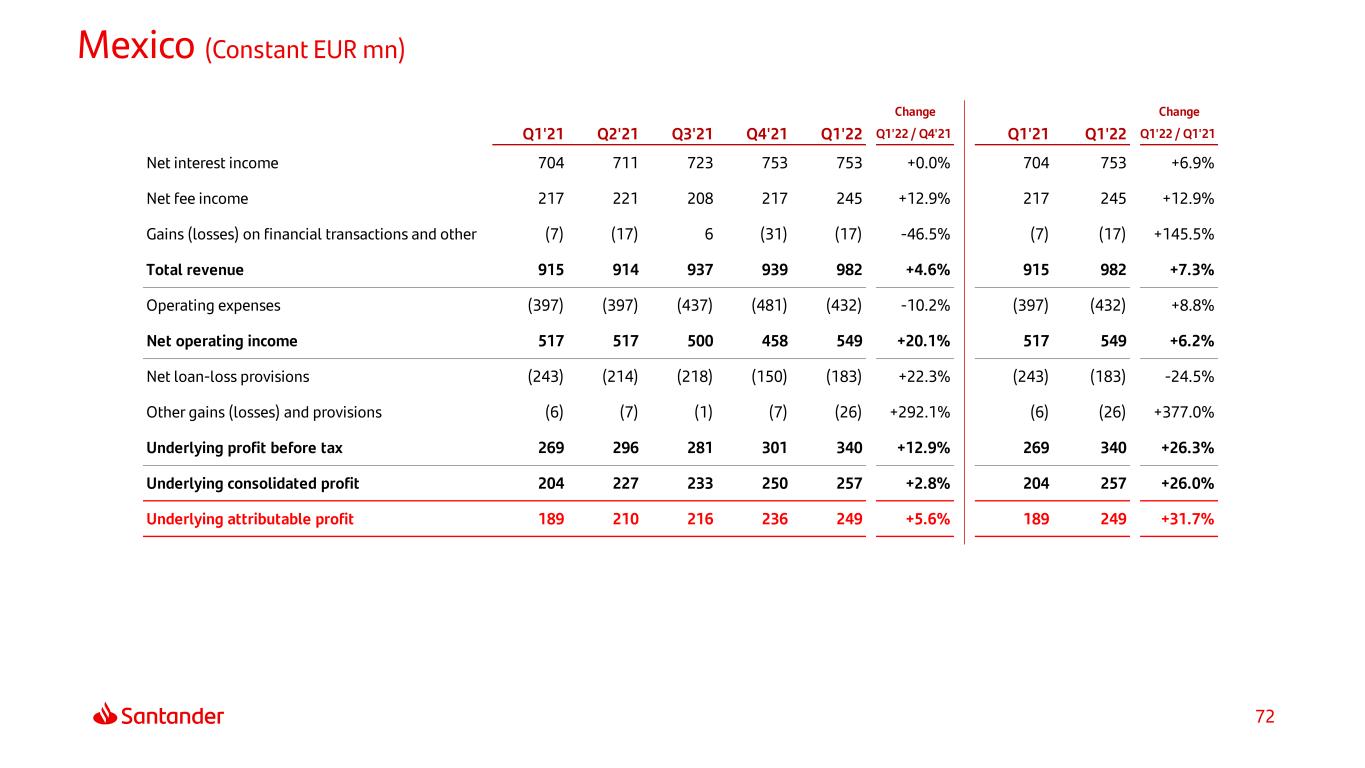

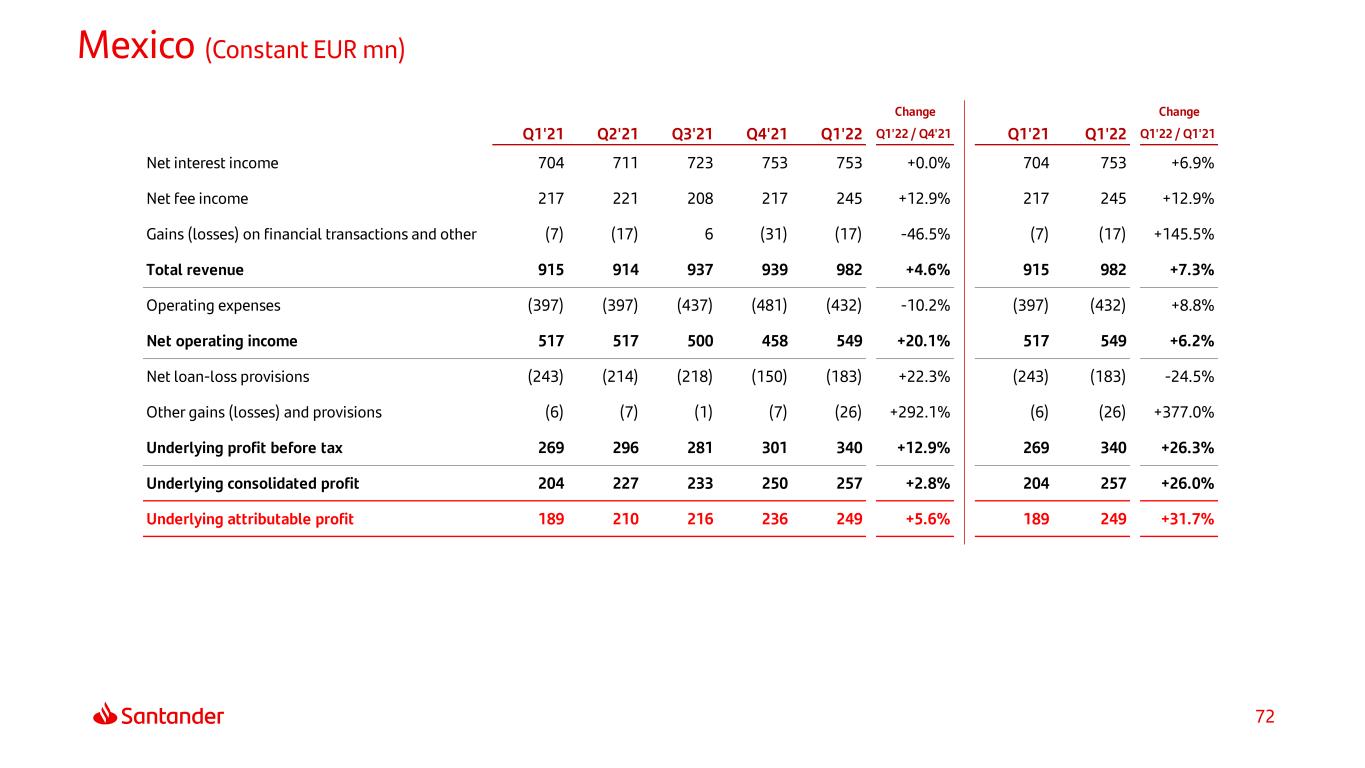

72 Mexico (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 704 711 723 753 753 +0.0% 704 753 +6.9% Net fee income 217 221 208 217 245 +12.9% 217 245 +12.9% Gains (losses) on financial transactions and other (7) (17) 6 (31) (17) -46.5% (7) (17) +145.5% Total revenue 915 914 937 939 982 +4.6% 915 982 +7.3% Operating expenses (397) (397) (437) (481) (432) -10.2% (397) (432) +8.8% Net operating income 517 517 500 458 549 +20.1% 517 549 +6.2% Net loan-loss provisions (243) (214) (218) (150) (183) +22.3% (243) (183) -24.5% Other gains (losses) and provisions (6) (7) (1) (7) (26) +292.1% (6) (26) +377.0% Underlying profit before tax 269 296 281 301 340 +12.9% 269 340 +26.3% Underlying consolidated profit 204 227 233 250 257 +2.8% 204 257 +26.0% Underlying attributable profit 189 210 216 236 249 +5.6% 189 249 +31.7%

73 Mexico (MXN mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 16,201 16,346 16,630 17,312 17,319 +0.0% 16,201 17,319 +6.9% Net fee income 4,995 5,077 4,781 4,998 5,641 +12.9% 4,995 5,641 +12.9% Gains (losses) on financial transactions and other (156) (399) 134 (717) (384) -46.5% (156) (384) +145.5% Total revenue 21,039 21,024 21,544 21,592 22,576 +4.6% 21,039 22,576 +7.3% Operating expenses (9,139) (9,140) (10,048) (11,067) (9,939) -10.2% (9,139) (9,939) +8.8% Net operating income 11,900 11,884 11,497 10,525 12,638 +20.1% 11,900 12,638 +6.2% Net loan-loss provisions (5,582) (4,921) (5,012) (3,445) (4,212) +22.3% (5,582) (4,212) -24.5% Other gains (losses) and provisions (127) (151) (30) (154) (606) +292.1% (127) (606) +377.0% Underlying profit before tax 6,192 6,813 6,455 6,926 7,820 +12.9% 6,192 7,820 +26.3% Underlying consolidated profit 4,699 5,229 5,354 5,761 5,921 +2.8% 4,699 5,921 +26.0% Underlying attributable profit 4,347 4,837 4,972 5,419 5,724 +5.6% 4,347 5,724 +31.7%

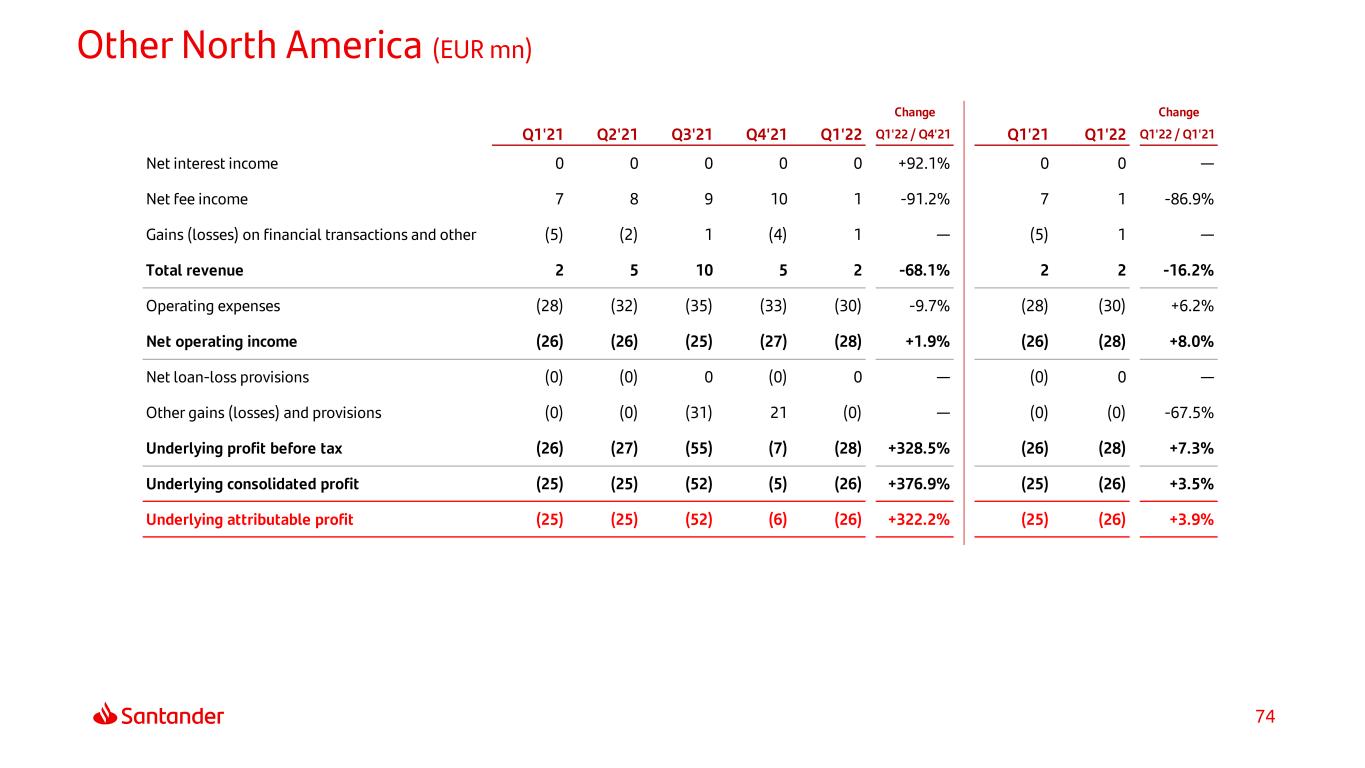

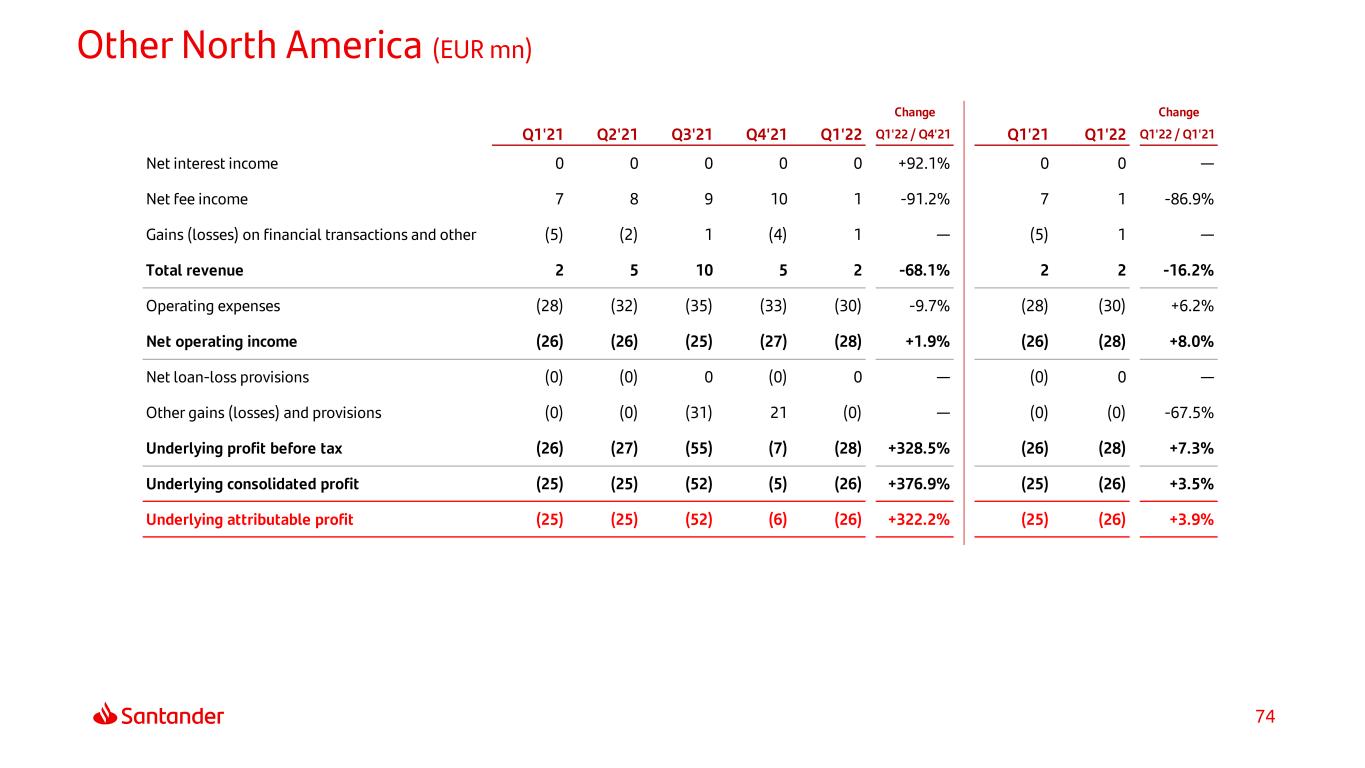

74 Other North America (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 0 0 0 0 0 +92.1% 0 0 — Net fee income 7 8 9 10 1 -91.2% 7 1 -86.9% Gains (losses) on financial transactions and other (5) (2) 1 (4) 1 — (5) 1 — Total revenue 2 5 10 5 2 -68.1% 2 2 -16.2% Operating expenses (28) (32) (35) (33) (30) -9.7% (28) (30) +6.2% Net operating income (26) (26) (25) (27) (28) +1.9% (26) (28) +8.0% Net loan-loss provisions (0) (0) 0 (0) 0 — (0) 0 — Other gains (losses) and provisions (0) (0) (31) 21 (0) — (0) (0) -67.5% Underlying profit before tax (26) (27) (55) (7) (28) +328.5% (26) (28) +7.3% Underlying consolidated profit (25) (25) (52) (5) (26) +376.9% (25) (26) +3.5% Underlying attributable profit (25) (25) (52) (6) (26) +322.2% (25) (26) +3.9%

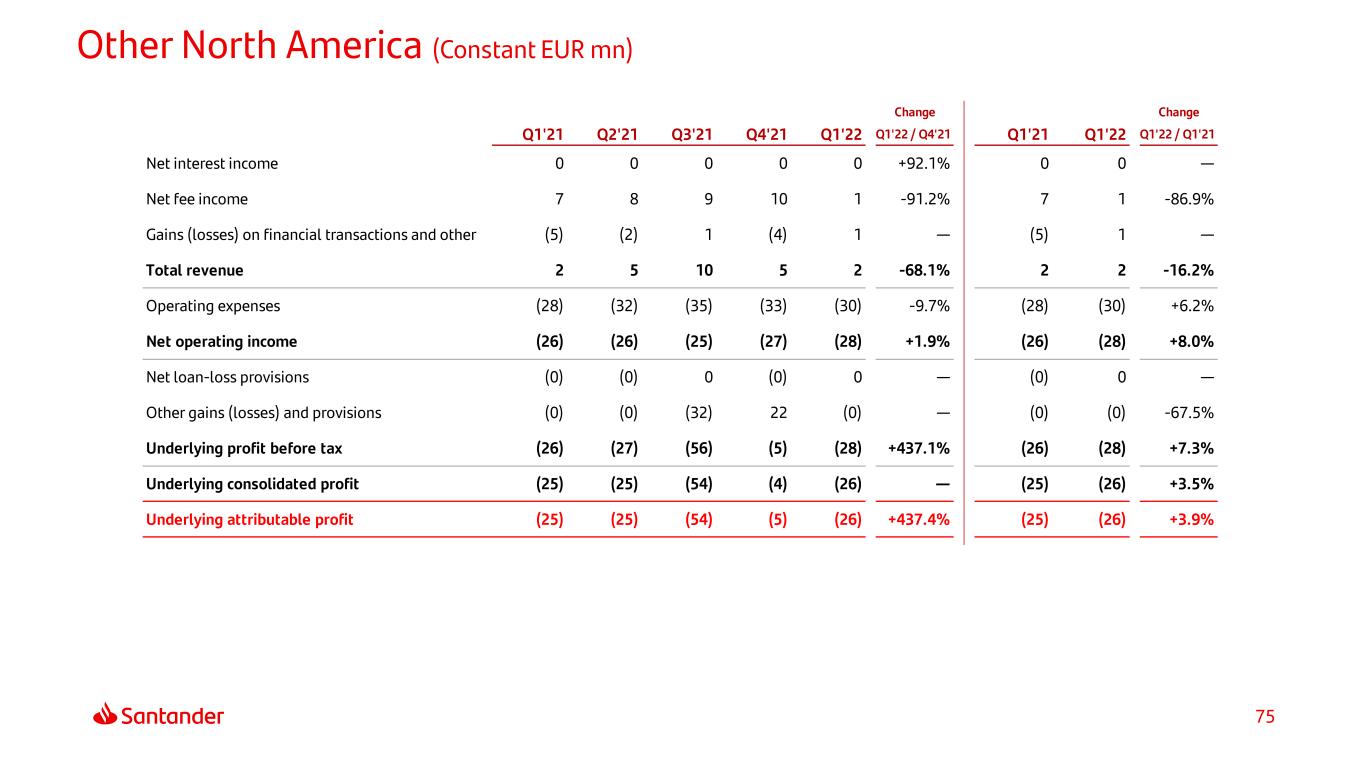

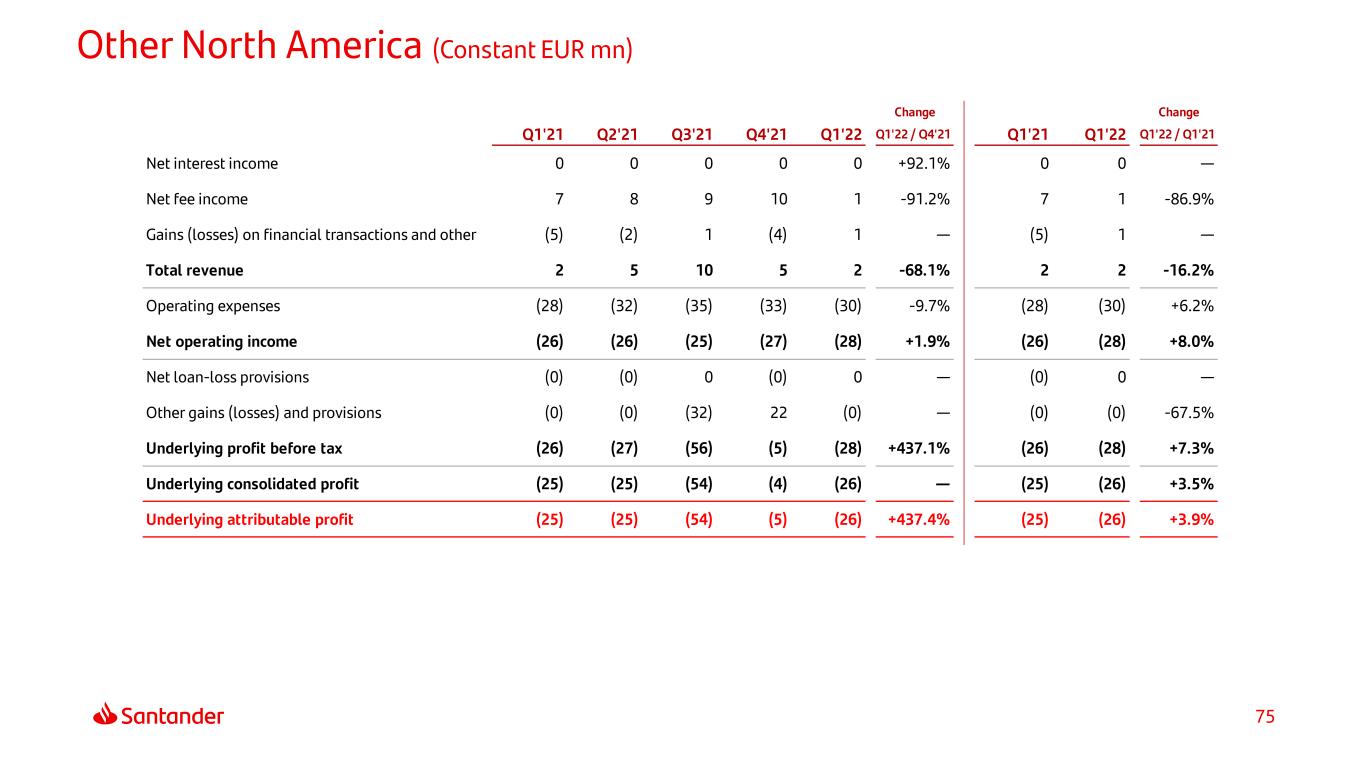

75 Other North America (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 0 0 0 0 0 +92.1% 0 0 — Net fee income 7 8 9 10 1 -91.2% 7 1 -86.9% Gains (losses) on financial transactions and other (5) (2) 1 (4) 1 — (5) 1 — Total revenue 2 5 10 5 2 -68.1% 2 2 -16.2% Operating expenses (28) (32) (35) (33) (30) -9.7% (28) (30) +6.2% Net operating income (26) (26) (25) (27) (28) +1.9% (26) (28) +8.0% Net loan-loss provisions (0) (0) 0 (0) 0 — (0) 0 — Other gains (losses) and provisions (0) (0) (32) 22 (0) — (0) (0) -67.5% Underlying profit before tax (26) (27) (56) (5) (28) +437.1% (26) (28) +7.3% Underlying consolidated profit (25) (25) (54) (4) (26) — (25) (26) +3.5% Underlying attributable profit (25) (25) (54) (5) (26) +437.4% (25) (26) +3.9%

76 South America (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 2,570 2,756 2,916 3,065 3,037 -0.9% 2,570 3,037 +18.1% Net fee income 842 928 956 995 1,013 +1.8% 842 1,013 +20.3% Gains (losses) on financial transactions and other 122 85 115 (13) 145 — 122 145 +18.7% Total revenue 3,535 3,768 3,987 4,048 4,195 +3.6% 3,535 4,195 +18.7% Operating expenses (1,219) (1,299) (1,398) (1,464) (1,484) +1.4% (1,219) (1,484) +21.8% Net operating income 2,316 2,469 2,589 2,583 2,711 +4.9% 2,316 2,711 +17.0% Net loan-loss provisions (683) (809) (892) (867) (999) +15.2% (683) (999) +46.1% Other gains (losses) and provisions (132) (55) (124) (162) (151) -6.9% (132) (151) +14.1% Underlying profit before tax 1,500 1,605 1,573 1,554 1,561 +0.5% 1,500 1,561 +4.0% Underlying consolidated profit 903 1,011 961 998 1,052 +5.4% 903 1,052 +16.6% Underlying attributable profit 770 868 823 855 900 +5.3% 770 900 +16.8%

77 South America (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 2,760 2,901 3,024 3,271 3,037 -7.2% 2,760 3,037 +10.0% Net fee income 912 985 988 1,061 1,013 -4.5% 912 1,013 +11.1% Gains (losses) on financial transactions and other 138 90 122 (8) 145 — 138 145 +5.4% Total revenue 3,809 3,976 4,135 4,323 4,195 -3.0% 3,809 4,195 +10.1% Operating expenses (1,284) (1,355) (1,439) (1,550) (1,484) -4.3% (1,284) (1,484) +15.6% Net operating income 2,525 2,621 2,696 2,773 2,711 -2.2% 2,525 2,711 +7.4% Net loan-loss provisions (749) (866) (935) (937) (999) +6.6% (749) (999) +33.3% Other gains (losses) and provisions (141) (56) (128) (171) (151) -11.4% (141) (151) +7.6% Underlying profit before tax 1,636 1,699 1,633 1,666 1,561 -6.3% 1,636 1,561 -4.6% Underlying consolidated profit 971 1,061 995 1,065 1,052 -1.1% 971 1,052 +8.4% Underlying attributable profit 833 917 853 913 900 -1.4% 833 900 +8.0%

78 Brazil (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 1,778 1,917 2,081 2,091 2,143 +2.5% 1,778 2,143 +20.5% Net fee income 632 698 696 701 743 +5.9% 632 743 +17.5% Gains (losses) on financial transactions and other 109 64 103 5 133 — 109 133 +22.6% Total revenue 2,519 2,680 2,880 2,797 3,019 +7.9% 2,519 3,019 +19.8% Operating expenses (723) (779) (864) (870) (930) +6.8% (723) (930) +28.6% Net operating income 1,797 1,900 2,017 1,927 2,089 +8.4% 1,797 2,089 +16.3% Net loan-loss provisions (549) (674) (757) (735) (852) +15.9% (549) (852) +55.2% Other gains (losses) and provisions (96) (28) (89) (103) (114) +11.1% (96) (114) +18.8% Underlying profit before tax 1,152 1,198 1,170 1,090 1,123 +3.1% 1,152 1,123 -2.5% Underlying consolidated profit 623 683 653 624 700 +12.2% 623 700 +12.4% Underlying attributable profit 560 617 580 562 627 +11.6% 560 627 +12.0%

79 Brazil (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 2,006 2,089 2,195 2,283 2,143 -6.2% 2,006 2,143 +6.8% Net fee income 713 761 733 766 743 -3.0% 713 743 +4.1% Gains (losses) on financial transactions and other 123 69 109 6 133 — 123 133 +8.7% Total revenue 2,842 2,919 3,037 3,055 3,019 -1.2% 2,842 3,019 +6.2% Operating expenses (815) (849) (912) (950) (930) -2.1% (815) (930) +14.0% Net operating income 2,027 2,070 2,125 2,105 2,089 -0.7% 2,027 2,089 +3.1% Net loan-loss provisions (619) (736) (801) (803) (852) +6.1% (619) (852) +37.6% Other gains (losses) and provisions (108) (29) (95) (112) (114) +1.8% (108) (114) +5.3% Underlying profit before tax 1,300 1,305 1,229 1,190 1,123 -5.6% 1,300 1,123 -13.6% Underlying consolidated profit 703 744 686 682 700 +2.7% 703 700 -0.4% Underlying attributable profit 632 673 609 614 627 +2.2% 632 627 -0.7%

80 Brazil (BRL mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 11,731 12,215 12,834 13,348 12,527 -6.2% 11,731 12,527 +6.8% Net fee income 4,169 4,450 4,285 4,476 4,342 -3.0% 4,169 4,342 +4.1% Gains (losses) on financial transactions and other 718 402 635 35 780 — 718 780 +8.7% Total revenue 16,618 17,067 17,755 17,859 17,650 -1.2% 16,618 17,650 +6.2% Operating expenses (4,767) (4,966) (5,330) (5,554) (5,435) -2.1% (4,767) (5,435) +14.0% Net operating income 11,852 12,102 12,425 12,306 12,215 -0.7% 11,852 12,215 +3.1% Net loan-loss provisions (3,619) (4,302) (4,683) (4,693) (4,980) +6.1% (3,619) (4,980) +37.6% Other gains (losses) and provisions (633) (172) (555) (655) (666) +1.8% (633) (666) +5.3% Underlying profit before tax 7,599 7,628 7,187 6,958 6,569 -5.6% 7,599 6,569 -13.6% Underlying consolidated profit 4,109 4,350 4,013 3,986 4,094 +2.7% 4,109 4,094 -0.4% Underlying attributable profit 3,695 3,935 3,562 3,589 3,668 +2.2% 3,695 3,668 -0.7%

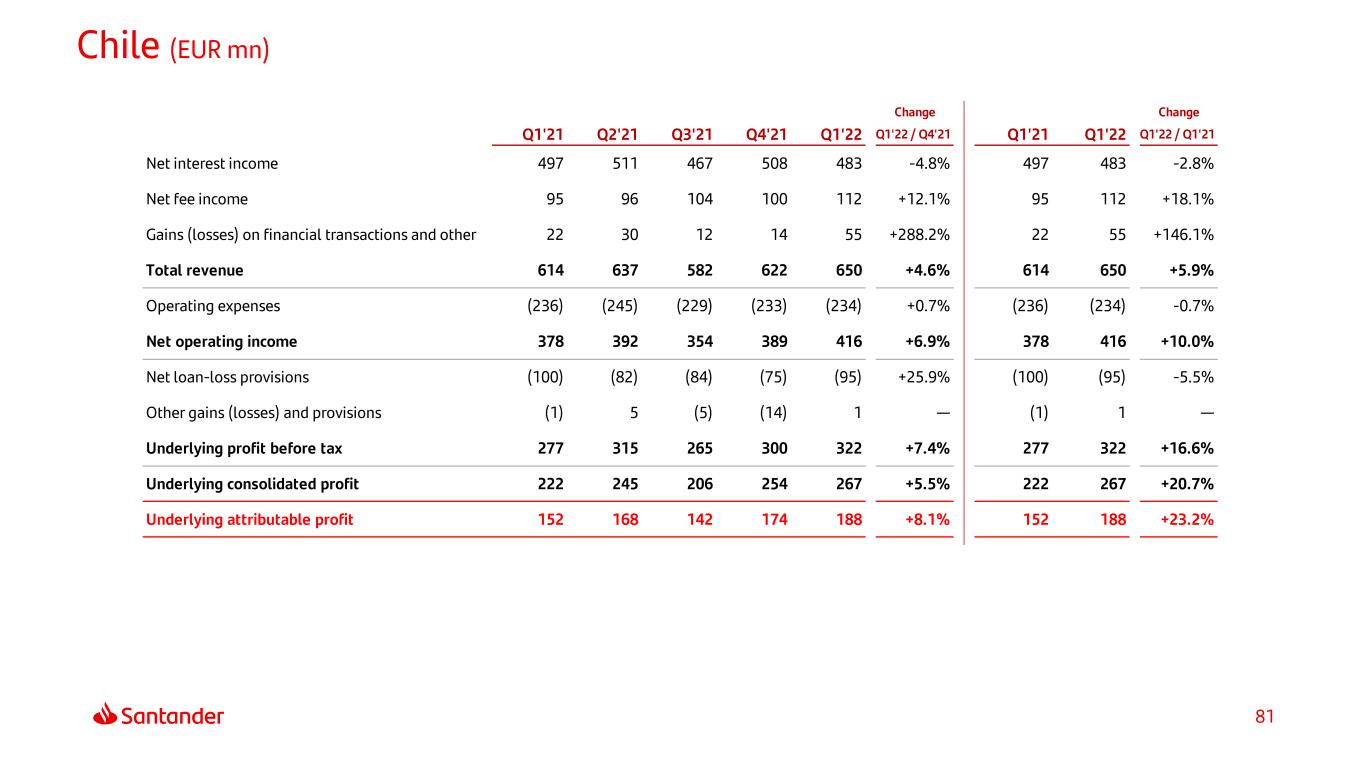

81 Chile (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 497 511 467 508 483 -4.8% 497 483 -2.8% Net fee income 95 96 104 100 112 +12.1% 95 112 +18.1% Gains (losses) on financial transactions and other 22 30 12 14 55 +288.2% 22 55 +146.1% Total revenue 614 637 582 622 650 +4.6% 614 650 +5.9% Operating expenses (236) (245) (229) (233) (234) +0.7% (236) (234) -0.7% Net operating income 378 392 354 389 416 +6.9% 378 416 +10.0% Net loan-loss provisions (100) (82) (84) (75) (95) +25.9% (100) (95) -5.5% Other gains (losses) and provisions (1) 5 (5) (14) 1 — (1) 1 — Underlying profit before tax 277 315 265 300 322 +7.4% 277 322 +16.6% Underlying consolidated profit 222 245 206 254 267 +5.5% 222 267 +20.7% Underlying attributable profit 152 168 142 174 188 +8.1% 152 188 +23.2%

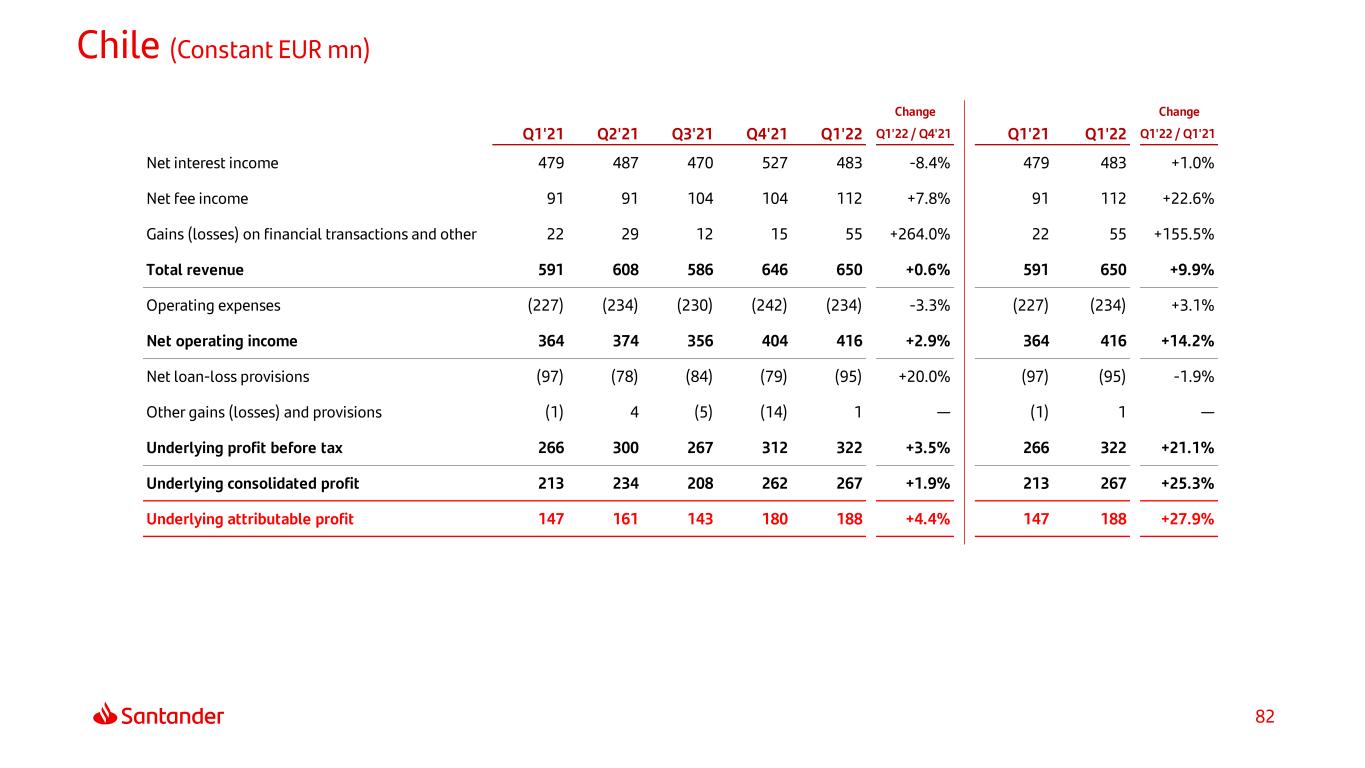

82 Chile (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 479 487 470 527 483 -8.4% 479 483 +1.0% Net fee income 91 91 104 104 112 +7.8% 91 112 +22.6% Gains (losses) on financial transactions and other 22 29 12 15 55 +264.0% 22 55 +155.5% Total revenue 591 608 586 646 650 +0.6% 591 650 +9.9% Operating expenses (227) (234) (230) (242) (234) -3.3% (227) (234) +3.1% Net operating income 364 374 356 404 416 +2.9% 364 416 +14.2% Net loan-loss provisions (97) (78) (84) (79) (95) +20.0% (97) (95) -1.9% Other gains (losses) and provisions (1) 4 (5) (14) 1 — (1) 1 — Underlying profit before tax 266 300 267 312 322 +3.5% 266 322 +21.1% Underlying consolidated profit 213 234 208 262 267 +1.9% 213 267 +25.3% Underlying attributable profit 147 161 143 180 188 +4.4% 147 188 +27.9%

83 Chile (CLP mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 433,496 441,440 425,810 477,726 437,644 -8.4% 433,496 437,644 +1.0% Net fee income 82,698 82,631 94,239 94,052 101,410 +7.8% 82,698 101,410 +22.6% Gains (losses) on financial transactions and other 19,479 26,231 11,153 13,672 49,773 +264.0% 19,479 49,773 +155.5% Total revenue 535,673 550,302 531,201 585,451 588,826 +0.6% 535,673 588,826 +9.9% Operating expenses (205,743) (211,816) (208,503) (219,346) (212,156) -3.3% (205,743) (212,156) +3.1% Net operating income 329,930 338,486 322,698 366,105 376,671 +2.9% 329,930 376,671 +14.2% Net loan-loss provisions (87,495) (70,398) (76,361) (71,581) (85,876) +20.0% (87,495) (85,876) -1.9% Other gains (losses) and provisions (1,155) 4,015 (4,609) (12,242) 1,288 — (1,155) 1,288 — Underlying profit before tax 241,279 272,103 241,729 282,282 292,083 +3.5% 241,279 292,083 +21.1% Underlying consolidated profit 193,299 212,074 188,354 237,659 242,277 +1.9% 193,299 242,277 +25.3% Underlying attributable profit 132,850 145,483 129,423 162,734 169,969 +4.4% 132,850 169,969 +27.9%

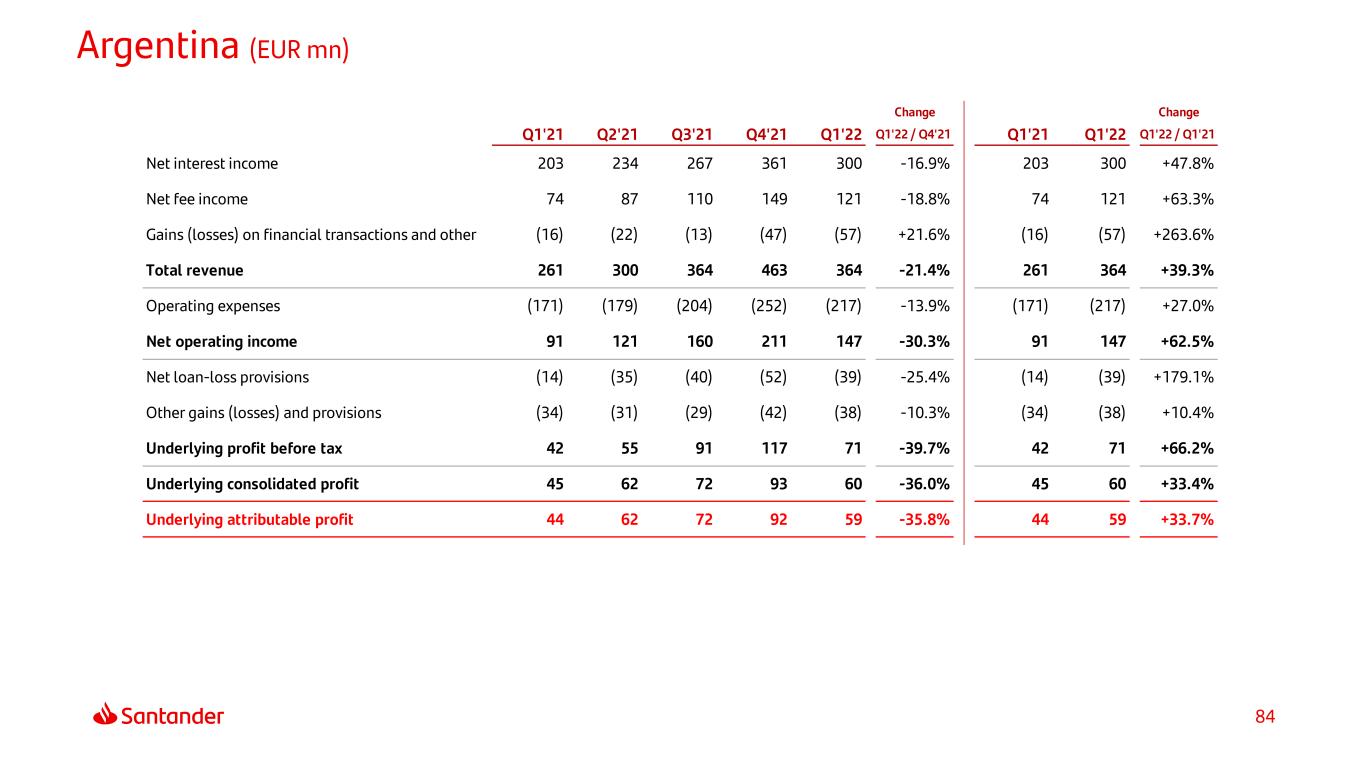

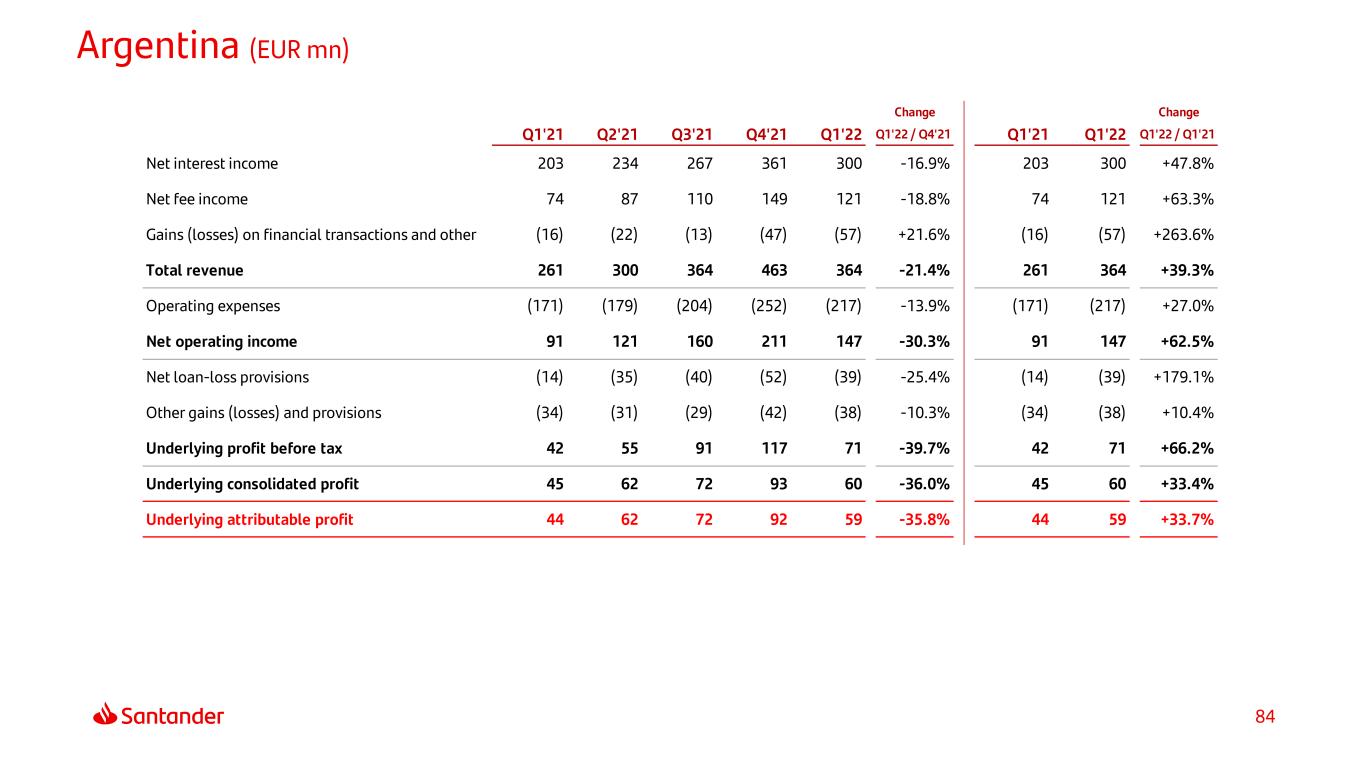

84 Argentina (EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 203 234 267 361 300 -16.9% 203 300 +47.8% Net fee income 74 87 110 149 121 -18.8% 74 121 +63.3% Gains (losses) on financial transactions and other (16) (22) (13) (47) (57) +21.6% (16) (57) +263.6% Total revenue 261 300 364 463 364 -21.4% 261 364 +39.3% Operating expenses (171) (179) (204) (252) (217) -13.9% (171) (217) +27.0% Net operating income 91 121 160 211 147 -30.3% 91 147 +62.5% Net loan-loss provisions (14) (35) (40) (52) (39) -25.4% (14) (39) +179.1% Other gains (losses) and provisions (34) (31) (29) (42) (38) -10.3% (34) (38) +10.4% Underlying profit before tax 42 55 91 117 71 -39.7% 42 71 +66.2% Underlying consolidated profit 45 62 72 93 60 -36.0% 45 60 +33.4% Underlying attributable profit 44 62 72 92 59 -35.8% 44 59 +33.7%

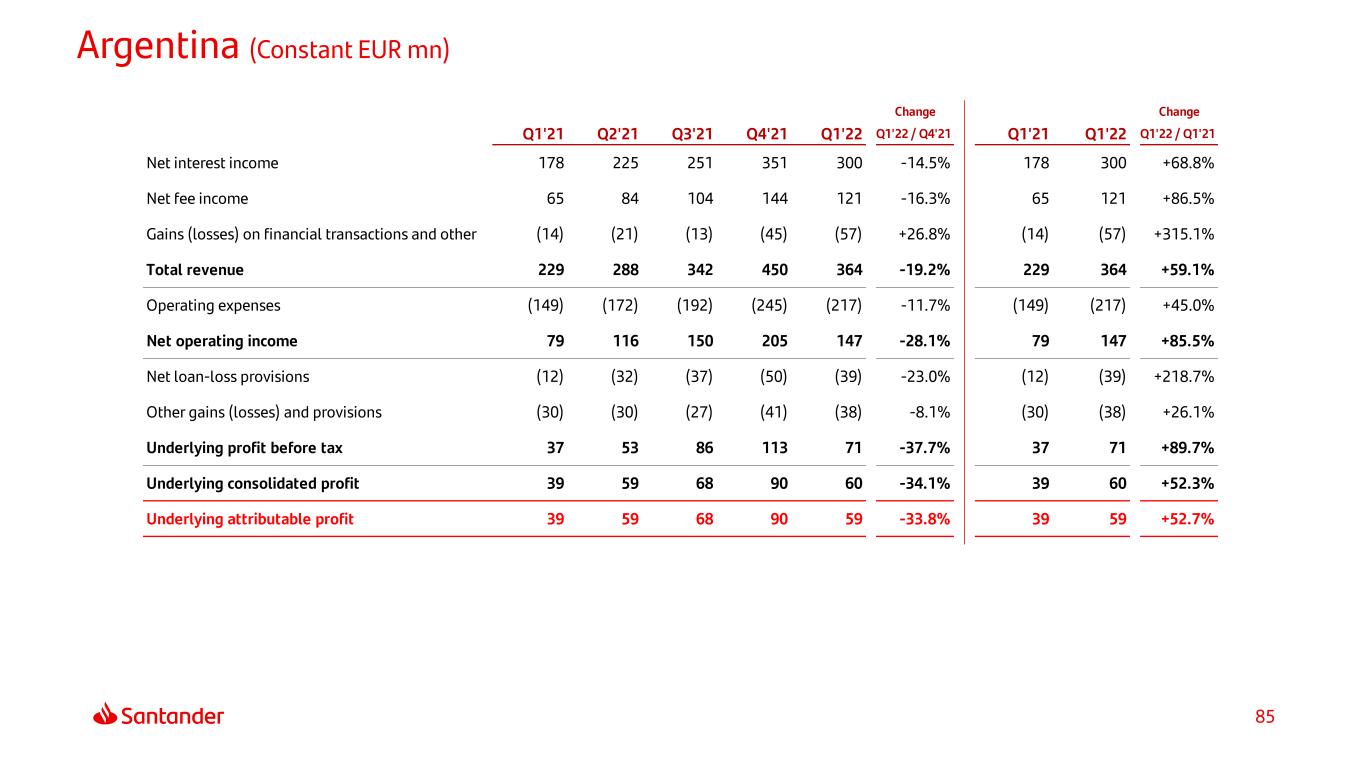

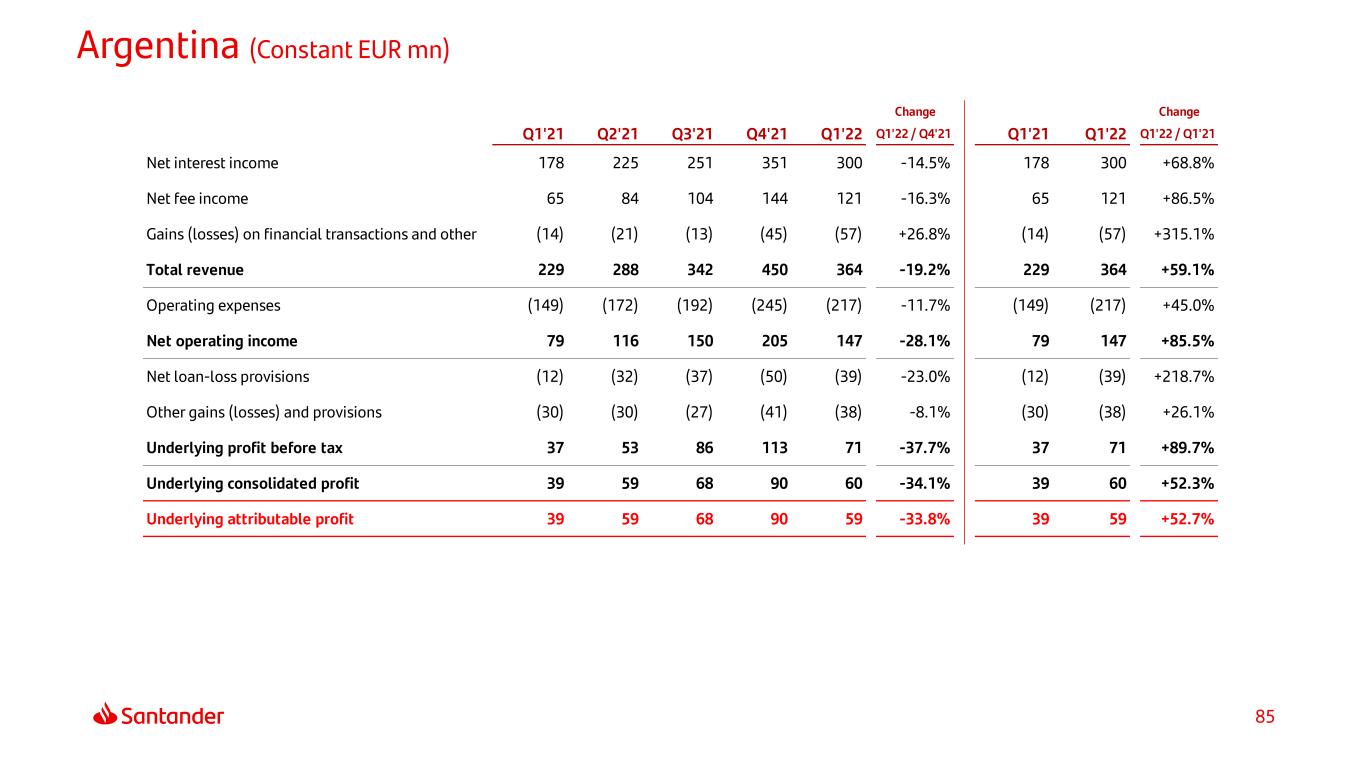

85 Argentina (Constant EUR mn) Change Change Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q1'22 / Q4'21 Q1'21 Q1'22 Q1'22 / Q1'21 Net interest income 178 225 251 351 300 -14.5% 178 300 +68.8% Net fee income 65 84 104 144 121 -16.3% 65 121 +86.5% Gains (losses) on financial transactions and other (14) (21) (13) (45) (57) +26.8% (14) (57) +315.1% Total revenue 229 288 342 450 364 -19.2% 229 364 +59.1% Operating expenses (149) (172) (192) (245) (217) -11.7% (149) (217) +45.0% Net operating income 79 116 150 205 147 -28.1% 79 147 +85.5% Net loan-loss provisions (12) (32) (37) (50) (39) -23.0% (12) (39) +218.7% Other gains (losses) and provisions (30) (30) (27) (41) (38) -8.1% (30) (38) +26.1% Underlying profit before tax 37 53 86 113 71 -37.7% 37 71 +89.7% Underlying consolidated profit 39 59 68 90 60 -34.1% 39 60 +52.3% Underlying attributable profit 39 59 68 90 59 -33.8% 39 59 +52.7%