FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March, 2023

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Banco Santander, S.A.

TABLE OF CONTENTS

Pillar 3 - Disclosure Report 2022

Towards profitable capital generation

[THIS PAGE INTENTIONALLY LEFT BLANK]

Capital (Ch. 2) | |||||

| Other appendices available on the Santander website. | ||||||||

| Access 2022 Pillar 3 Disclosures Report available on the Santander Group website | |||||||

Note: Document translated from Spanish. In the event of a discrepancy, the Spanish version prevails.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Note: Document translated from Spanish. In the event of a discrepancy, the Spanish version prevails.

| 1 | |||||

| Introduction | |||||

Note: Document translated from Spanish. In the event of a discrepancy, the Spanish version prevails.

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

1.Introduction

1.1. Santander overview

Everything we do must be Simple, Personal & Fair

| Our aim and purpose | ||

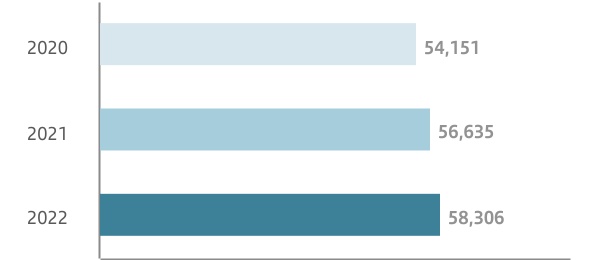

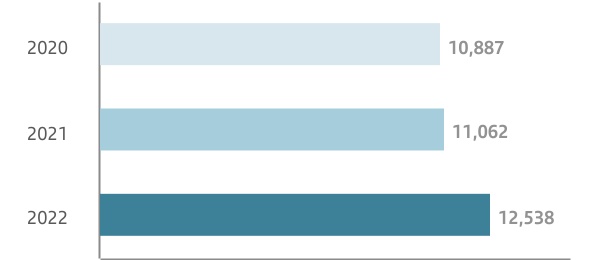

Santander is one of the largest banks in the eurozone. As of December 2022, we had EUR 1,734,659 million in assets and EUR 1,255,660 million in total funds. Our market capitalization reached EUR 47,066 million.

Santander aims to be the best open financial service platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. Our purpose is to help people and businesses prosper.

| Our business model | ||

| 01. Customer focus | 02. Our scale | 03. Diversification | |||||||||||||||||||||||||||||||||

| Digital bank with branches | Local and global scale | Geographic and business diversification | |||||||||||||||||||||||||||||||||

Top 3 NPS1 Top 3 NPS1in 8 markets | Top 3 in lending2 in 10 of our markets  | Balanced profit distribution3  | |||||||||||||||||||||||||||||||||

160 mn 160 mntotal customers | |||||||||||||||||||||||||||||||||||

| Transform our business and operating model through global technology initiatives with the aim to build a Digital bank with branches which provides access to financial services for our customers through several channels. | In-market scale in each of our core markets in volumes in each of our core markets combine with our global capabilities drive in-market and Group profitable growth and provide a competitive advantage over local peers. | Our balanced diversification across developing and mature markets as well as for business and segments delivers recurrent pre-provision profit with low volatility. | |||||||||||||||||||||||||||||||||

1.NPS – internal benchmark of individual customers' satisfaction audited by Stiga/Deloitte H2'22. | 2. Market share data latest available. Spain includes Santander España + Hub Madrid + SCF España + Openbank and Other Resident sectors in deposits. The UK: includes mortgages and retail deposits. Poland: including SCF business in Poland. The US: retail auto loans includes Santander Consumer USA and Chrysler Capital combined. Deposits considering all states where Santander Bank operates. Brazil: deposits including debenture, LCA (agribusiness notes), LCI (real estate credit notes), financial bills (letras financeiras) and COE (certificates of structured operations). | 3.2022 underlying attributable profit by region percentage of operating areas excluding Corporate Centre. | |||||||||||||||||||||||||||||||||

| Our business model remains a source of great strength and resilience | ||

| 6 | ||||

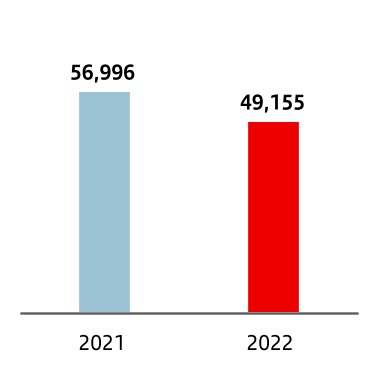

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

| Economic and regulatory landscape | ||

During 2022, Santander operated in an environment dominated by:

| 1 | Global inflation accelerating to levels not seen in several decades | ||||

| 2 | Major geopolitical tensions arising from the war in Ukraine | ||||

| 3 | Persistent (although decreasing in recent months) bottlenecks and global supply chain disruptions resulting from the covid pandemic and geopolitical tensions | ||||

The world's major central banks have raised interest rates in an attempt to contain inflationary pressures. We expect the monetary normalisation to continue in certain countries during 2023, leading to a gradual slowdown in the level of global economic activity.

Public policy

Santander has always supported the need for robust, high-quality regulation that reinforces the banking system strength and solvency, establishes strong consumer protection and market stability standards, and favours transparency regarding risk and resilience for investors and supervisors.

We are committed to engaging constructively and transparently with public policy makers and regulators on the aims, design and implementation of banking rules and policy frameworks that impact our banks' or our customers' interests.

| Capital and bank resilience | |||||

| We believe that the reforms of the last decade have made financial institutions more robust in terms of capital. However, the covid crisis raised some issues regarding the functioning of the regulatory framework that need to be carefully assessed. Additionally, the EU still has work to do to build the foundations of a true banking union. We continue to advocate for: | |||||

|  |  |  | ||||||||

| An approach to continue working on the implementation of Basel III standards that does not materially increase new post-crisis capital requirements and takes into account the demands of digitalization, the green transformation and the post-covid recovery. | The need for a stable and predictable framework to facilitate management by institutions and investors' understanding of this agenda. | Banking regulation needs to recognize some of the realities of banks with a global footprint, such as the recognition of the Multiple Point of Entry resolution framework. | A common deposit insurance scheme for EU banks that breaks the bank/sovereign loop. | ||||||||

| 7 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

| Santander main results | ||

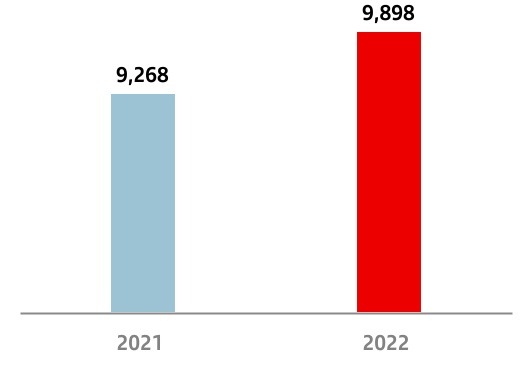

Strong operating performance in 2022: EUR 9,605 mn of underlying profit

2022 (vs. 2021) | ||||||||||||||

| GROWTH | PROFITABILITY | STRENGTH | ||||||||||||

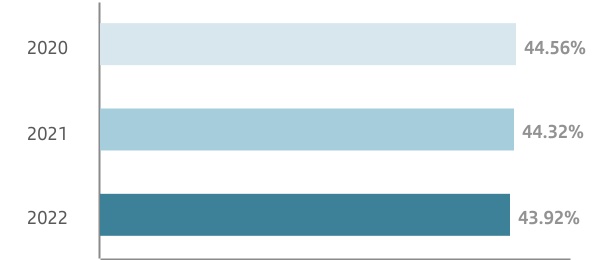

| Total customers | RoTE B | FL CET1 B | ||||||||||||

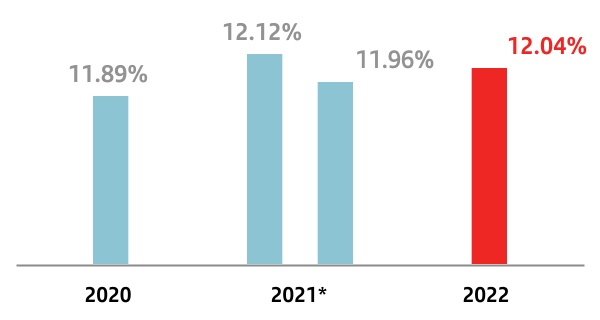

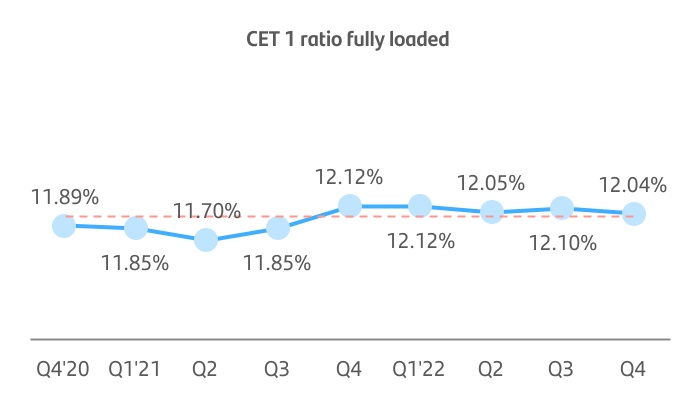

160 mn (+7mn) | 13.4% (+141bps) | 12.04% (+8ps) | ||||||||||||

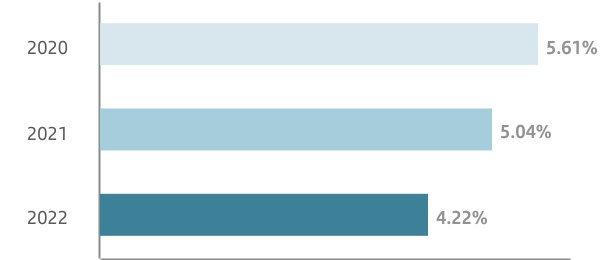

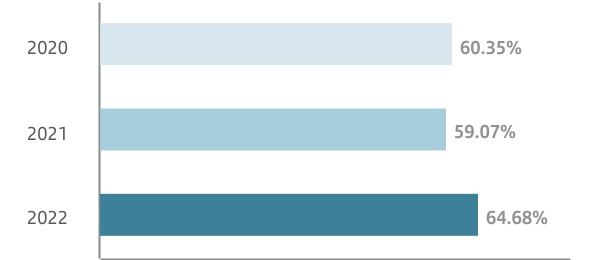

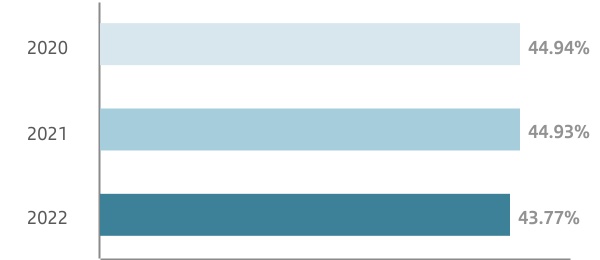

Total revenue A | Efficiency ratio | Cost of risk C | ||||||||||||

EUR 52.2 bn (+12%) | 45.8% (-40bps) | 0.99% (+22bps) | ||||||||||||

2022 Shareholder value creation: +20%D | ||||||||||||||

A. Changes in euros. Change in constant euros +6%.

B. Including acquisition of SC USA minority interest and the acquisition of Amherst Pierpont Securities in 2021.

C. Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months.

D. TNAV per share + cash DPS +6% vs. 2021.

| We achieved our Group financial targets set over the last three years | ||

| 2019 | 2022 | 2022 | ||||||||||||||||||

medium-term targets | targets | actual | ||||||||||||||||||

| Revenue | Mid-single digit growthA | +6% | ||||||||||||||||||

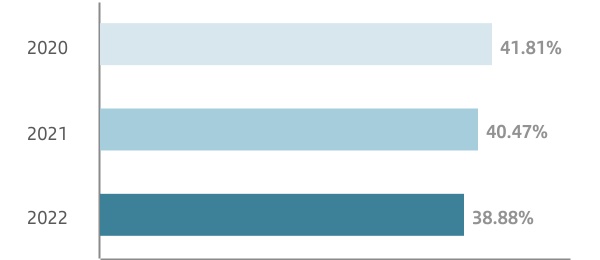

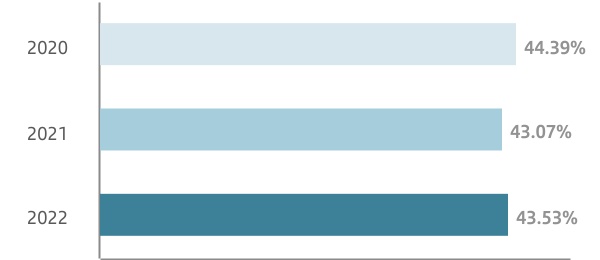

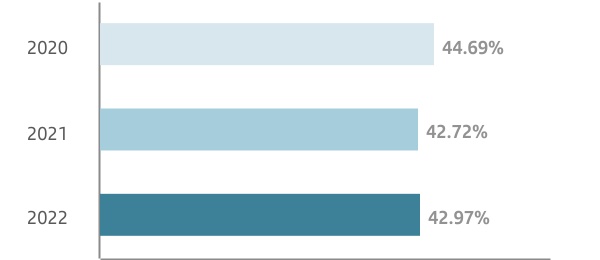

| Efficiency ratio | 42-45% | ~45% | 45.80% | |||||||||||||||||

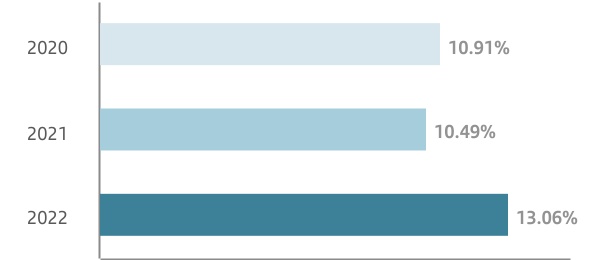

| CoR | <1% | 0.99% | ||||||||||||||||||

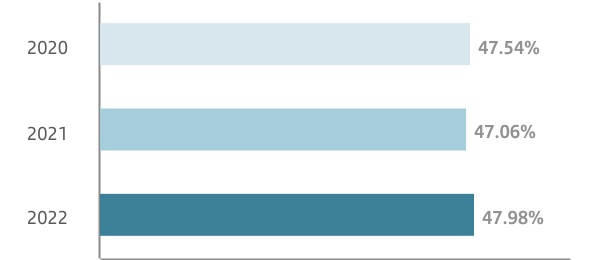

| RoTE | 13-15% | >13% | 13.40% | |||||||||||||||||

| FL CET1 | 11-12% | ~12% | 12.04% | |||||||||||||||||

| Payout | 40-50% | 40% | 40%B | |||||||||||||||||

A In constant euros. B Has been submitted to the 2023 AGM for approval. Includes cash dividend and share buybacks. | ||||||||||||||||||||

| 8 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

| Executive summary | ||

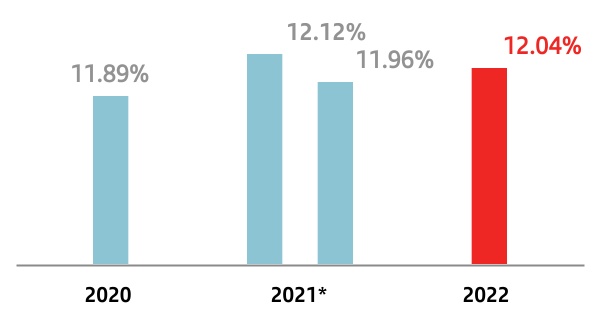

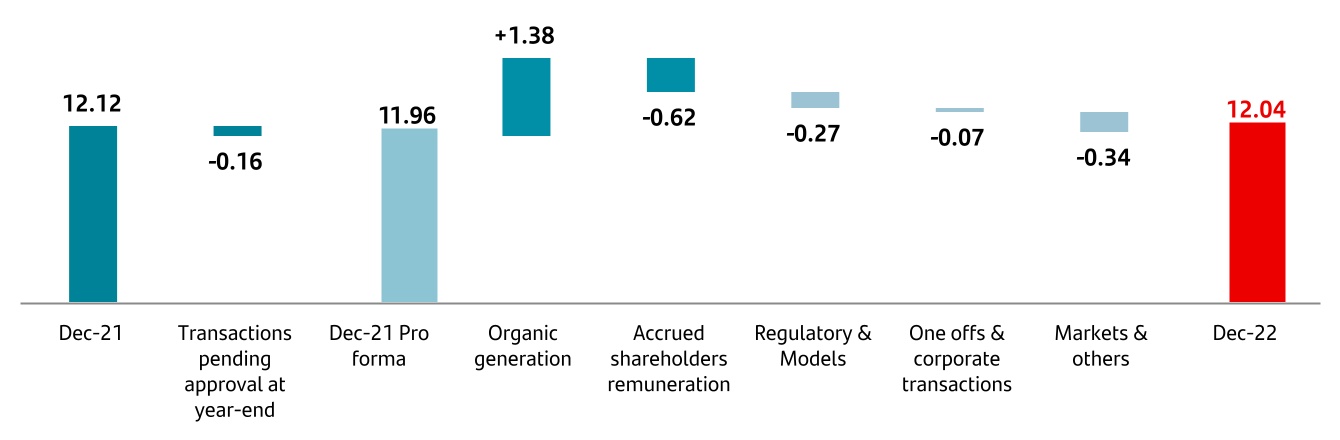

Despite the difficult and uncertain global economic environment, we achieved our objectives and strengthened our capital position.

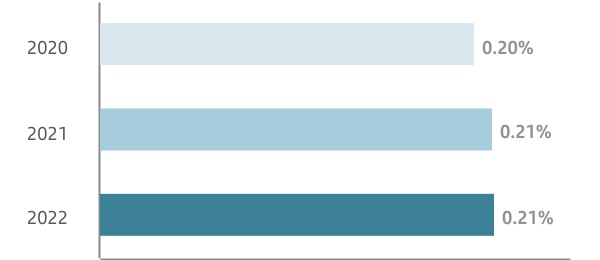

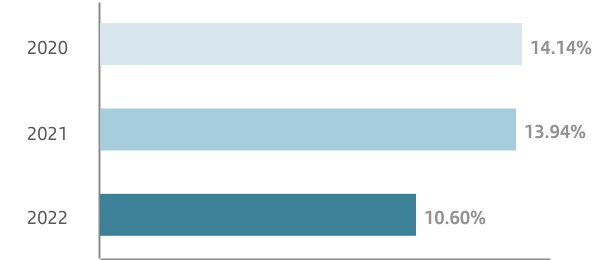

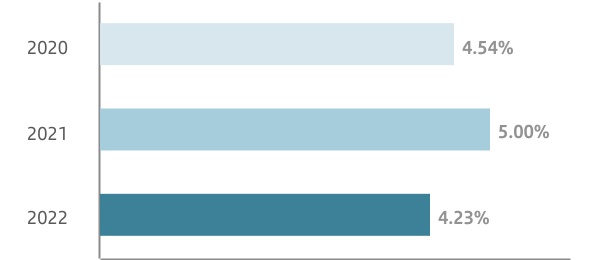

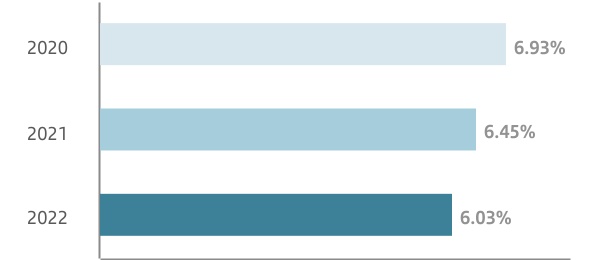

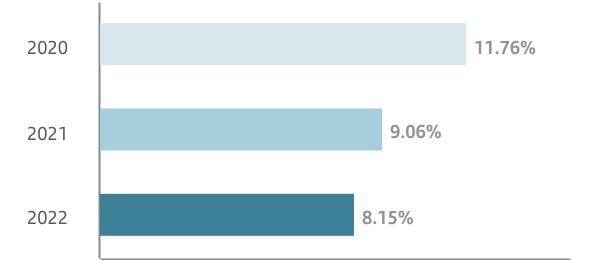

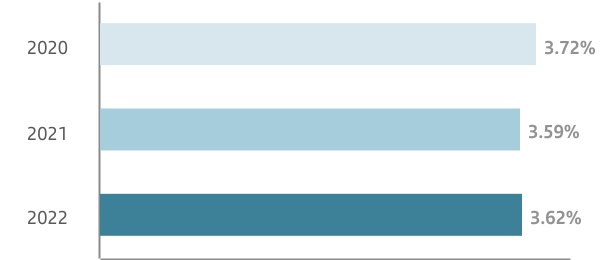

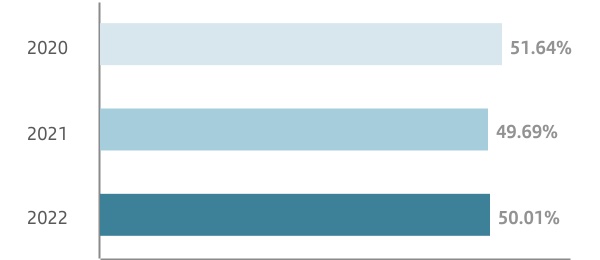

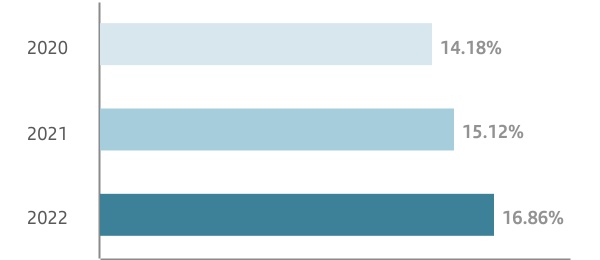

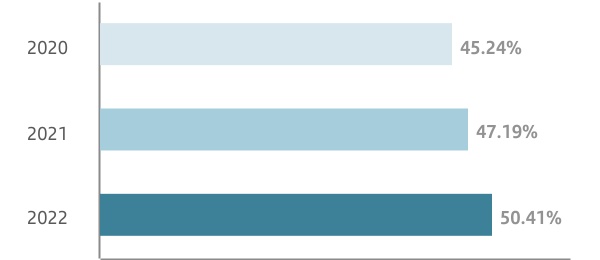

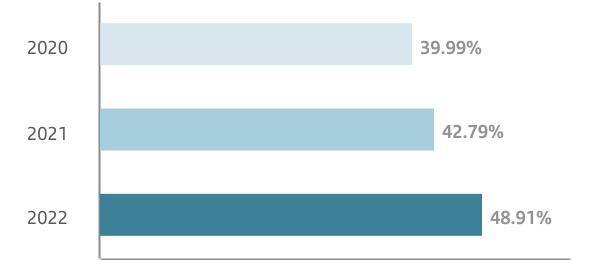

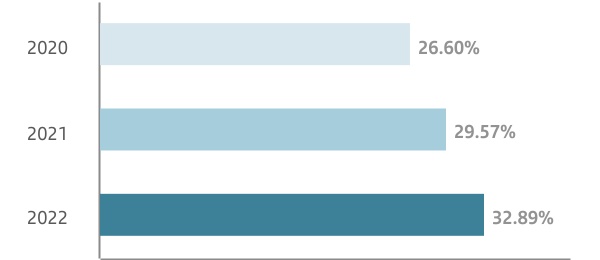

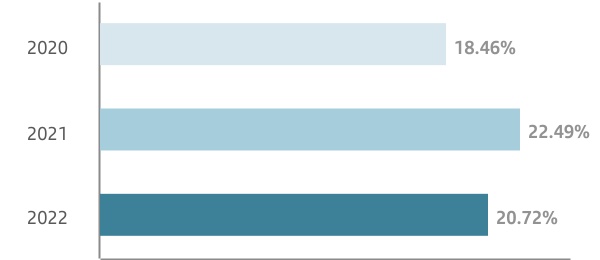

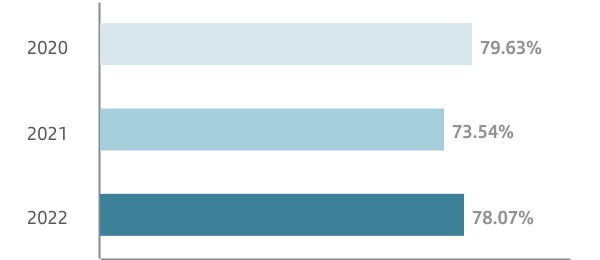

| Fully-loaded CET1 ratio | |||||

| *Including corporate transactions pending approval at year-end: -0.16% | ||||||||||||||

| Regulatory CET1 ratio (Phased-in)1 | ||||||||||||||

| 2020 | 2021 | 2022 | ||||||||||||

| 12.34 | % | 12.51 | % | 12.18 | % | |||||||||

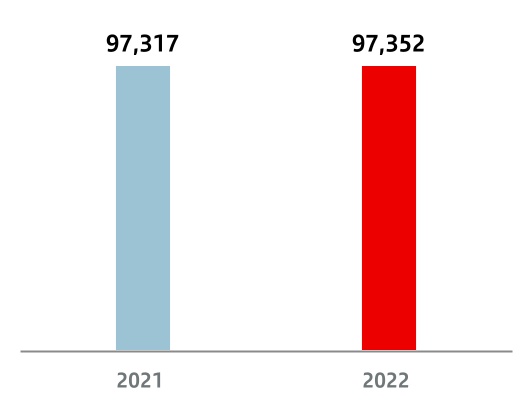

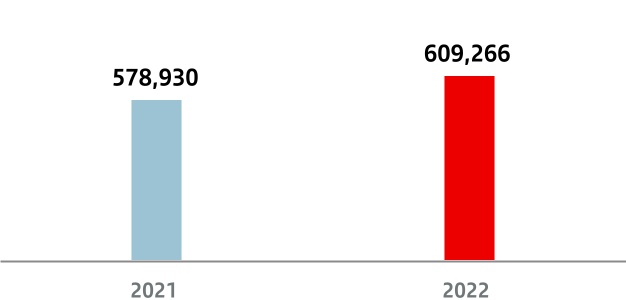

| Main capital figures and capital adequacy ratios. | ||||||||||||||

| EUR million | ||||||||||||||

| Fully-loaded | Phased-in | |||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||

| Common Equity (CET1) | 73,390 | 70,208 | 74,202 | 72,402 | ||||||||||

| Tier 1 | 82,221 | 79,939 | 83,033 | 82,452 | ||||||||||

| Total capital | 96,373 | 95,078 | 97,392 | 97,317 | ||||||||||

| Risk weighted assets | 609,702 | 579,478 | 609,266 | 578,930 | ||||||||||

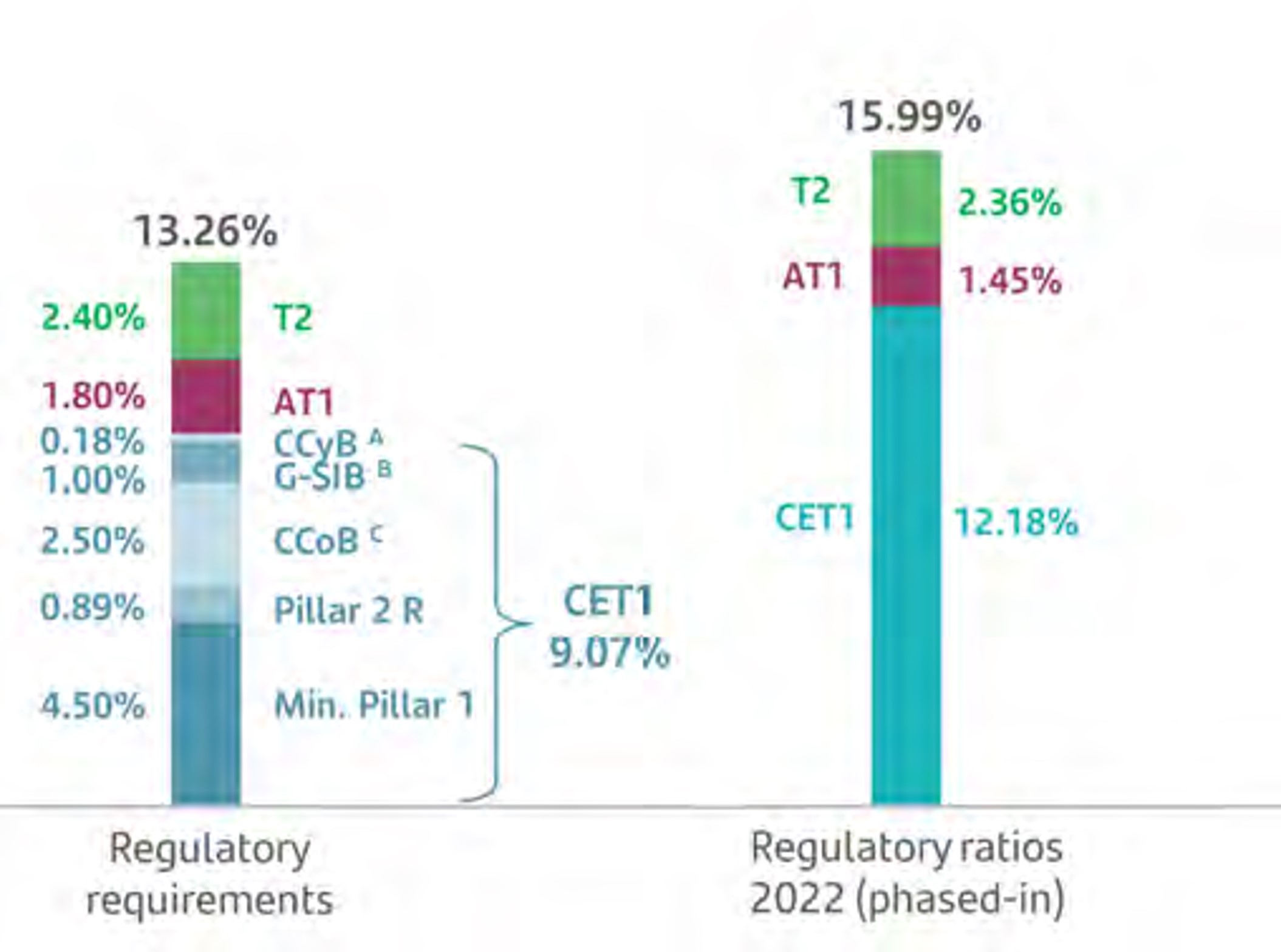

| CET1 Ratio | 12.04 | % | 12.12 | % | 12.18 | % | 12.51 | % | ||||||

| Tier 1 Ratio | 13.49 | % | 13.79 | % | 13.63 | % | 14.24 | % | ||||||

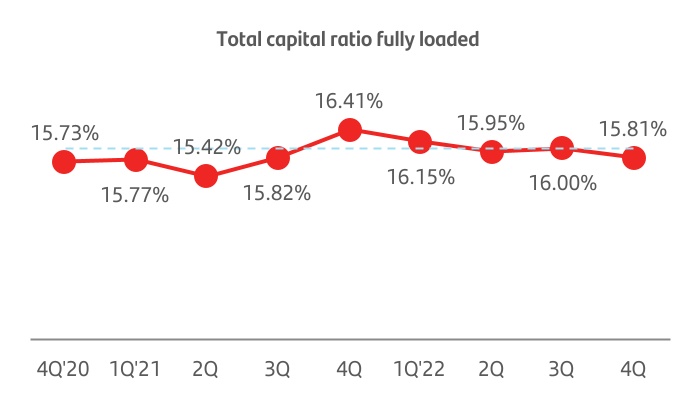

| Total capital ratio | 15.81 | % | 16.41 | % | 15.99 | % | 16.81 | % | ||||||

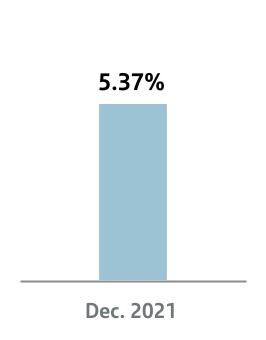

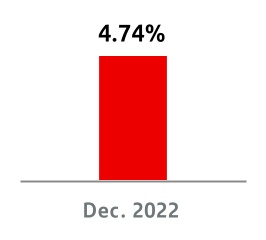

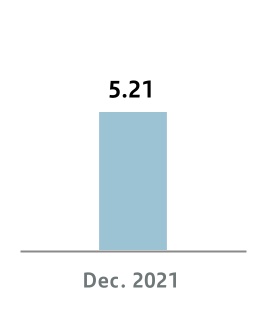

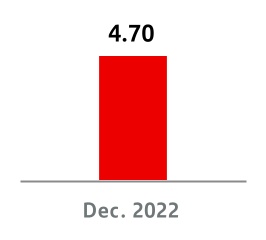

| Leverage Ratio | 4.70 | % | 5.21 | % | 4.74 | % | 5.37 | % | ||||||

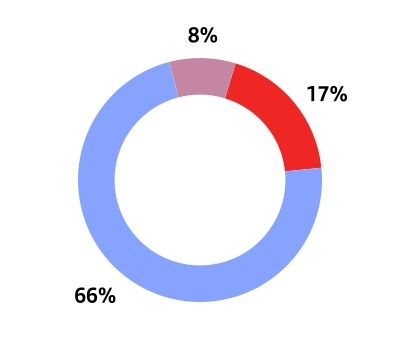

| Disciplined capital allocation strategy | ||||||||

| 2022 TARGETS | 2022 ACHIEVEMENT | |||||||

RWAs rising below loan growth (excluding FX impact) | RWAs +1% < Loans +5% | |||||||

| 2022 front book RoRWA: 2.2% | 2.6% | |||||||

| % of RWAs with RoE > CoE: 80% | 80% (70% in FY’21) | |||||||

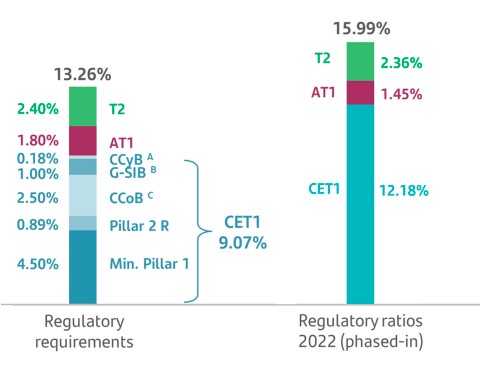

Santander's CET1 ratio exceed minimum regulatory requirements

1 The phased-in ratios include the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Regulation on Capital Requirements (CRR2) and

subsequent amendments introduced by Regulation 2020/873 of the European Union. Additionally, the Tier 1 and total phased-in capital ratios include the

transitory treatment according to chapter 2, title 1, part 10 of the aforementioned CRR2.

| 9 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

Regulatory Capital vs Regulatory requirement (Phased-in IFRS 9)A | ||||||||||||||

| 2022 | ||||||||||||||

A The phased-in ratios include the transitory treatment of IRFS 9, calculed in accordance with article 473 bis of the Regulation on Capital Requirements (CRR2) and subsequent amendments introduced by Regulation 2020/873 of the European Union. Additionally, the total phased-in capital ratios include the transitory treatment according to chapter 4, title 1, part 10 of the aforementioned CRR2. | ||||||||||||||

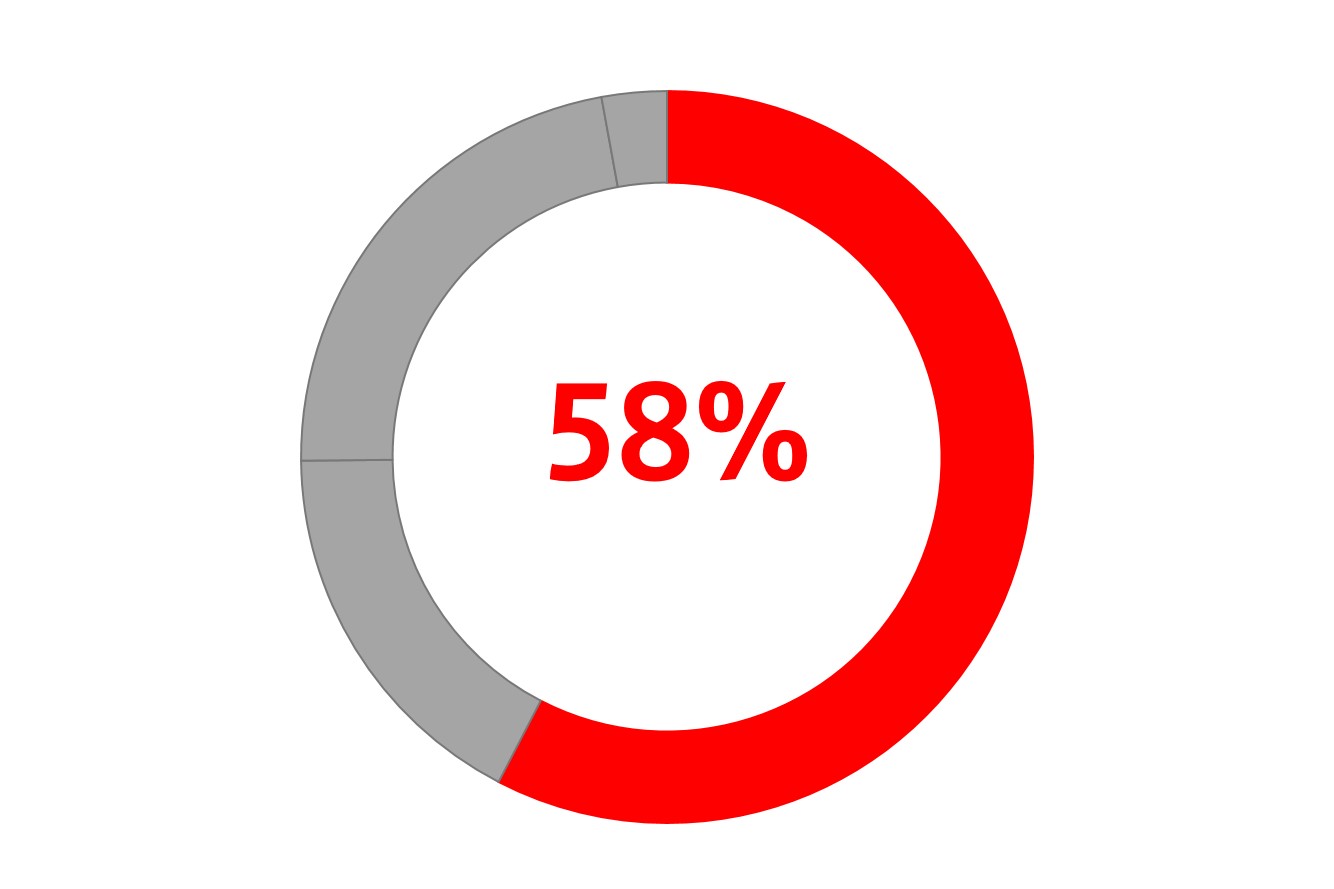

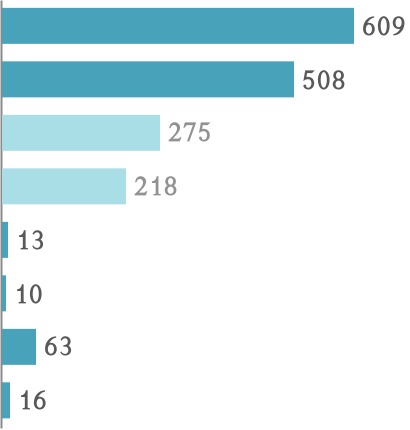

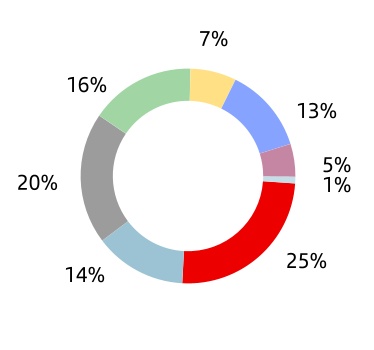

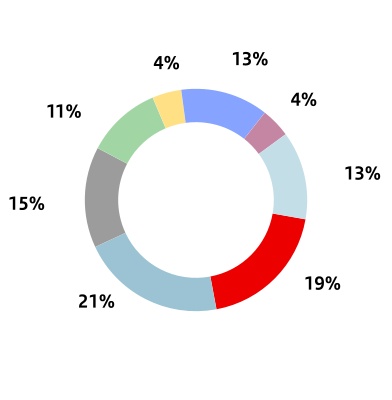

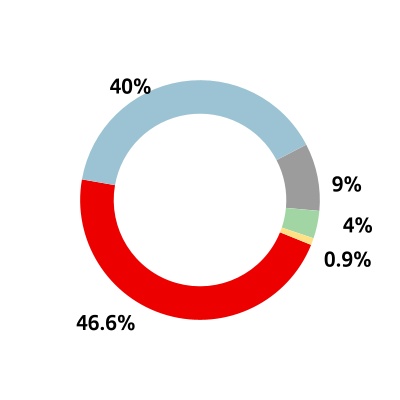

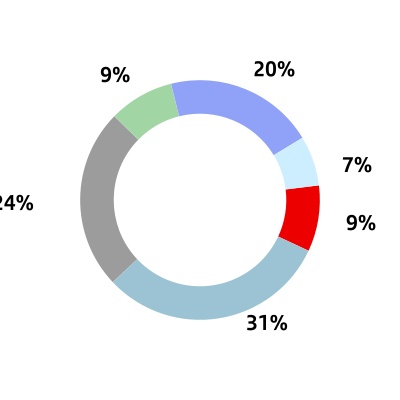

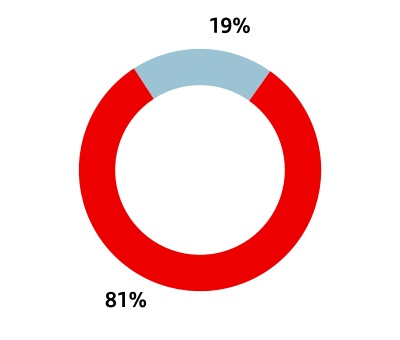

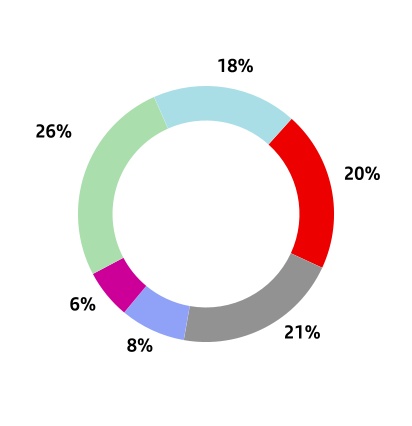

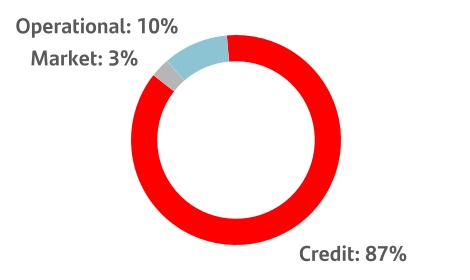

RWA distribution by risk type A B | ||||||||||||||

| 2022 | ||||||||||||||

A Doesn't include settlement risk and securitisation exposures in the banking book. For more information, see Table 9. OV1 | ||||||||||||||

B CRR Phased-in, IFRS9 Phased-in | ||||||||||||||

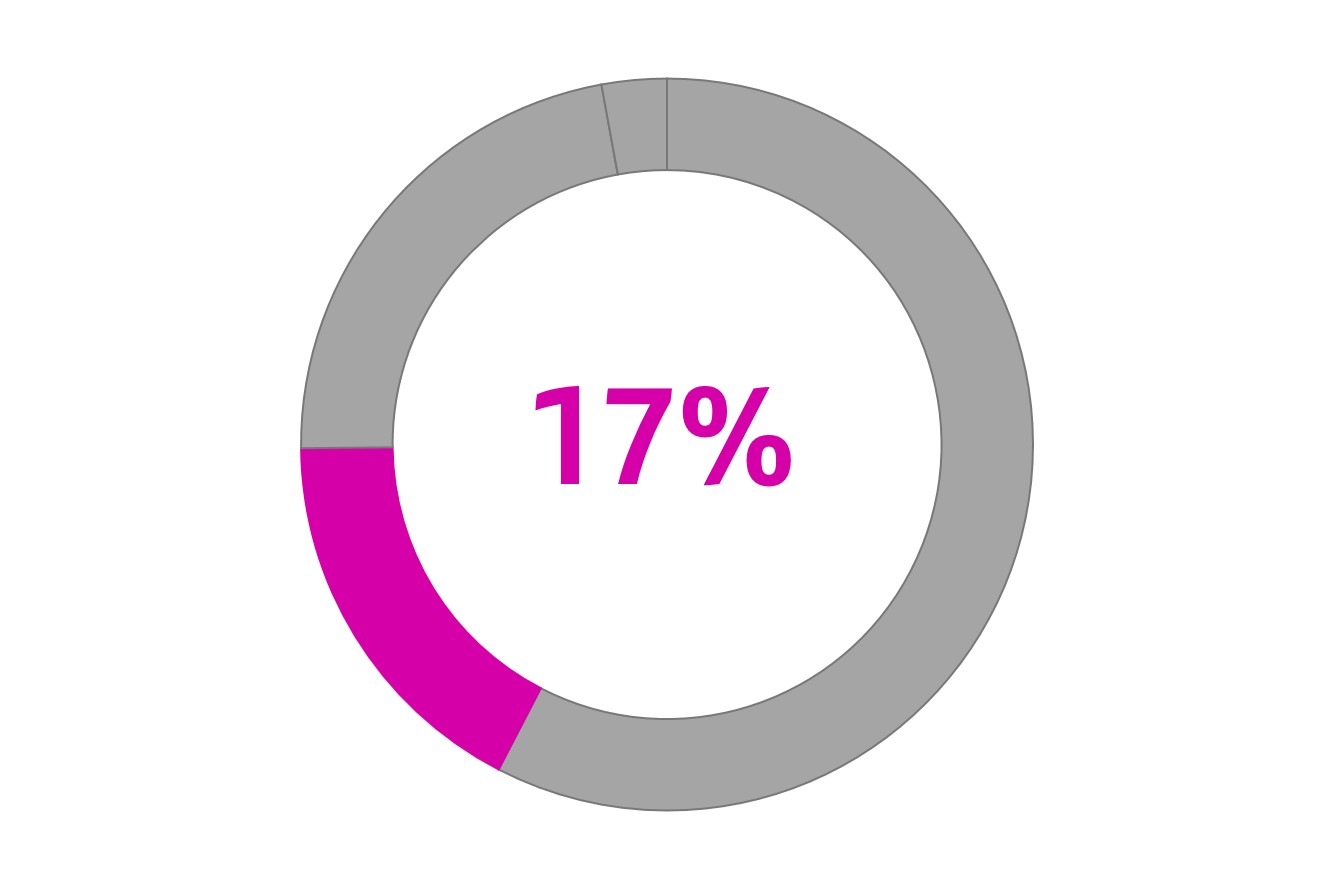

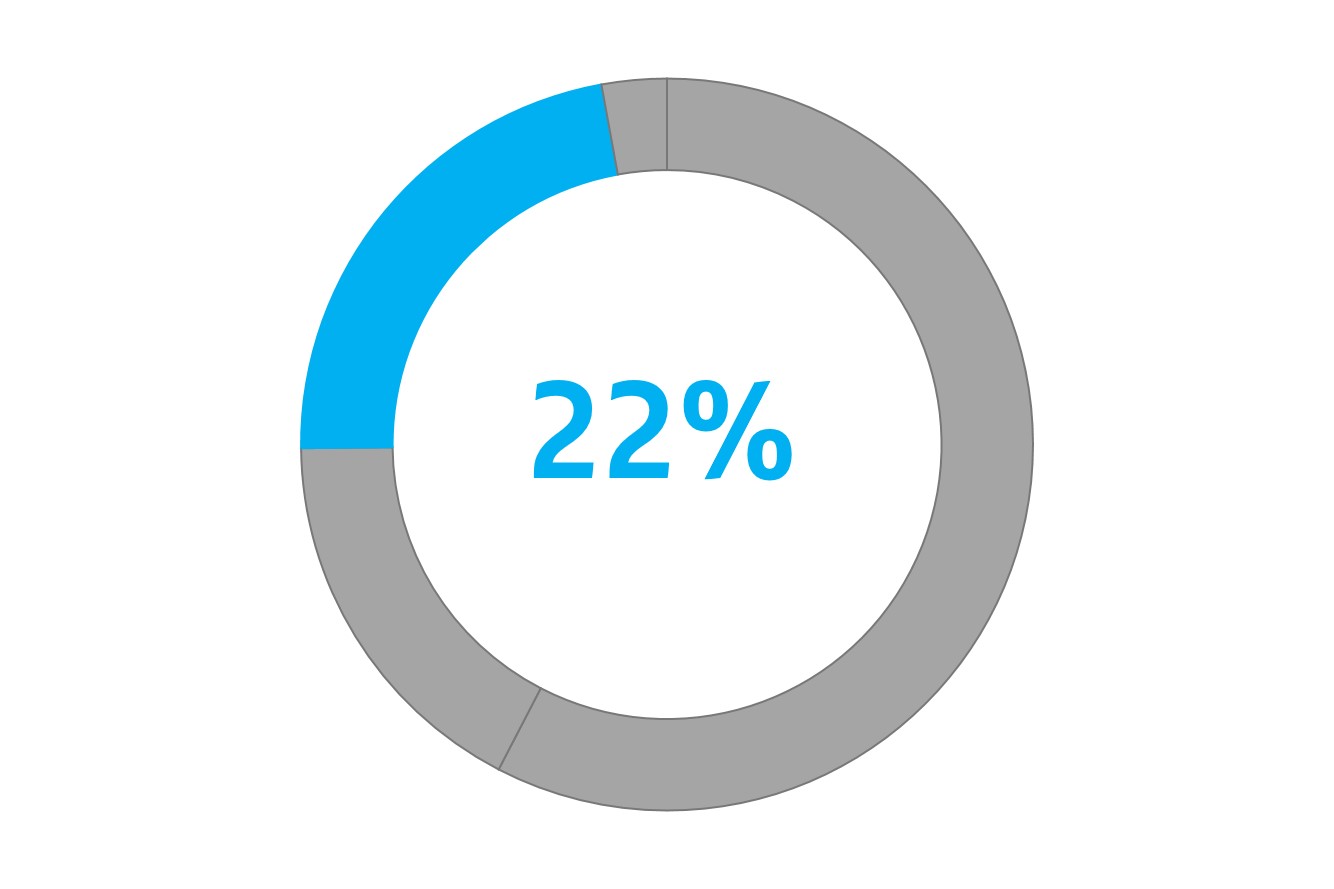

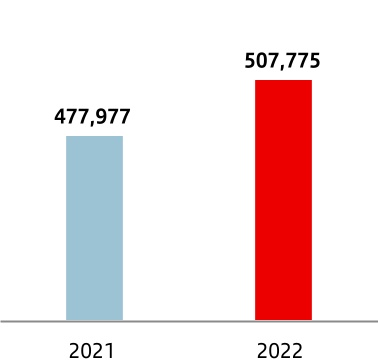

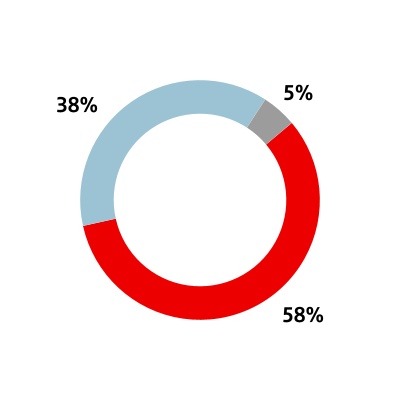

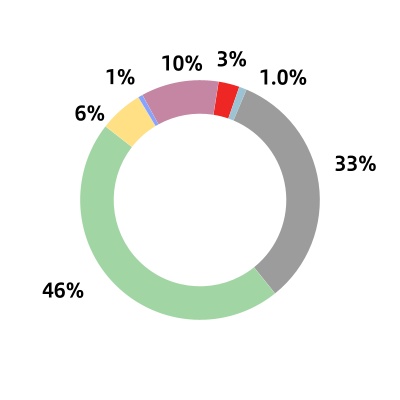

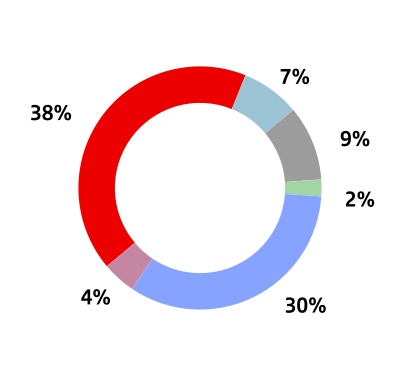

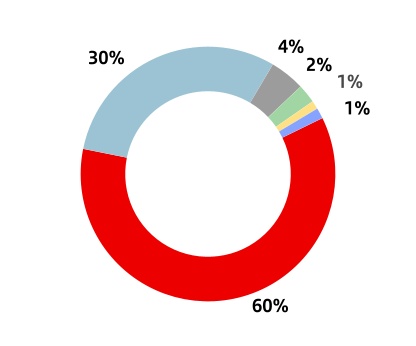

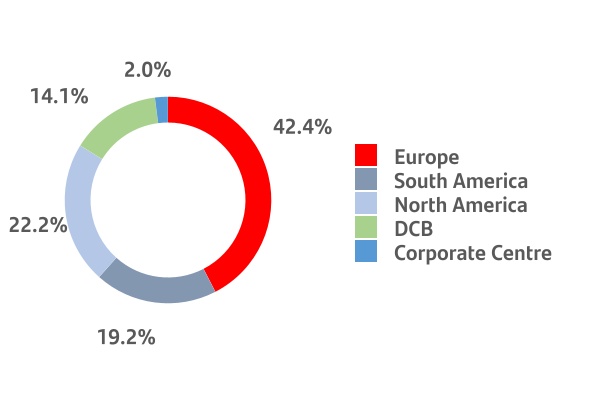

RWA distribution by geographical region A B | ||||||||||||||

| 2022 | ||||||||||||||

| EUR million | ||||||||||||||||||||

| Group |  | 609,266 | |||||||||||||||||

| Europe |  | 349,799 | |||||||||||||||||

| North America |  | 104,626 | |||||||||||||||||

| South America |  | 135,144 | |||||||||||||||||

A Doesn't include others. For more information, see Table 10. RWAs by geographical region

B CRR Phased-in, Phased-in IFRS 9

| 10 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

| Table 1.KM1 - Key metrics template | ||||||||||||||||||||

| EUR million | ||||||||||||||||||||

| a | b | c | d | e | ||||||||||||||||

| Dec'22 | Sep'22 | Jun'22 | Mar'22 | Dec'21 | ||||||||||||||||

| Available own funds (amounts) | ||||||||||||||||||||

| 1 | Common Equity Tier 1 (CET 1) capital | 74,202 | 75,499 | 74,091 | 73,817 | 72,402 | ||||||||||||||

| 2 | Tier 1 capital | 83,033 | 84,513 | 82,885 | 82,917 | 82,452 | ||||||||||||||

| 3 | Total capital | 97,392 | 99,773 | 97,843 | 98,130 | 97,317 | ||||||||||||||

| Risk-weighted exposure amounts | ||||||||||||||||||||

| 4 | Total risk-weighted exposure amount | 609,266 | 616,738 | 604,977 | 598,789 | 578,930 | ||||||||||||||

| Capital ratios (as a percentage of risk-weighted exposure amount) | ||||||||||||||||||||

| 5 | Common Equity Tier 1 ratio (%) | 12.18 | % | 12.24 | % | 12.25 | % | 12.33 | % | 12.51 | % | |||||||||

| 6 | Tier 1 ratio (%) | 13.63 | % | 13.70 | % | 13.70 | % | 13.85 | % | 14.24 | % | |||||||||

| 7 | Total capital ratio (%) | 15.99 | % | 16.18 | % | 16.17 | % | 16.39 | % | 16.81 | % | |||||||||

| Additional own funds requirements to address risks other than the risk of excessive leverage (as a percentage of risk-weighted exposure amount) | ||||||||||||||||||||

| EU 7a | Additional own funds requirements to address risks other than the risk of excessive leverage (%) | 1.58 | % | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | |||||||||

| EU 7b | of which: to be made up of CET1 capital (percentage points) | 0.89 | % | 0.84 | % | 0.84 | % | 0.84 | % | 0.84 | % | |||||||||

| EU 7c | of which: to be made up of Tier 1 capital (percentage points) | 1.19 | % | 1.13 | % | 1.13 | % | 1.13 | % | 1.13 | % | |||||||||

| EU 7d | Total SREP own funds requirements (%) | 9.58 | % | 9.50 | % | 9.50 | % | 9.50 | % | 9.50 | % | |||||||||

| Combined buffer requirement (as a percentage of risk-weighted exposure amount) | ||||||||||||||||||||

| 8 | Capital conservation buffer (%) | 2.50 | % | 2.50 | % | 2.50 | % | 2.50 | % | 2.50 | % | |||||||||

| EU 8a | Conservation buffer due to macro-prudential or systemic risk identified at the level of a Member State (%) | — | % | — | % | — | % | — | % | — | % | |||||||||

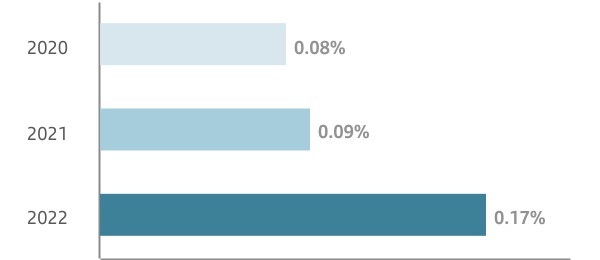

| 9 | Institution specific countercyclical capital buffer (%) | 0.18 | % | 0.03 | % | 0.01 | % | 0.01 | % | 0.01 | % | |||||||||

| EU 9a | Systemic risk buffer (%) | — | % | — | % | — | % | — | % | — | % | |||||||||

| 10 | Global Systemically Important Institution buffer (%) | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | |||||||||

| EU 10a | Other Systemically Important Institution buffer | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | |||||||||

| 11 | Combined buffer requirement (%) | 3.68 | % | 3.53 | % | 3.51 | % | 3.51 | % | 3.51 | % | |||||||||

| EU 11a | Overall capital requirements (%) | 13.26 | % | 13.03 | % | 13.01 | % | 13.01 | % | 13.01 | % | |||||||||

| 12 | CET1 available after meeting the total SREP own funds requirements (%) | 6.41 | % | 6.58 | % | 6.58 | % | 6.72 | % | 7.12 | % | |||||||||

| Leverage ratio | ||||||||||||||||||||

| 13 | Total exposure measure | 1,750,626 | 1,823,762 | 1,751,029 | 1,624,479 | 1,536,516 | ||||||||||||||

| 14 | Leverage ratio (%) | 4.74 | % | 4.63 | % | 4.73 | % | 5.10 | % | 5.37 | % | |||||||||

| Additional own funds requirements to address risks of excessive leverage (as a percentage of leverage ratio total exposure amount) | ||||||||||||||||||||

| EU 14a | Additional own funds requirements to address the risk of excessive leverage (%) | — | % | — | % | — | % | — | % | — | % | |||||||||

| EU 14b | of which: to be made up of CET1 capital (percentage points) | — | % | — | % | — | % | — | % | — | % | |||||||||

| EU 14c | Total SREP leverage ratio requirements (%) | 3.00 | % | 3.00 | % | 3.00 | % | 3.06 | % | 3.06 | % | |||||||||

| Leverage ratio buffer and overall leverage ratio requirement (as a percentage of total exposure measure) | ||||||||||||||||||||

| EU 14d | Leverage ratio buffer requirement (%) | — | % | — | % | — | % | — | % | — | % | |||||||||

| EU 14e | Overall leverage ratio requirements (%) | 3.00 | % | 3.00 | % | 3.00 | % | 3.06 | % | 3.06 | % | |||||||||

| Liquidity Coverage Ratio | ||||||||||||||||||||

| 15 | Total high-quality liquid assets (HQLA) (Weighted value - average) | 303,330 | 298,243 | 290,113 | 285,611 | 281,783 | ||||||||||||||

| EU 16a | Cash outflows - Total weighted value | 257,311 | 248,463 | 241,497 | 233,905 | 224,876 | ||||||||||||||

| EU 16b | Cash inflows - Total weighted value | 69,185 | 65,469 | 61,559 | 57,272 | 54,114 | ||||||||||||||

| 16 | Total net cash outflows (adjusted value) | 188,126 | 182,994 | 179,938 | 176,633 | 170,762 | ||||||||||||||

| 17 | Liquidity coverage ratio (%)* | 161.23 | % | 162.98 | % | 161.23 | % | 161.70 | % | 165.01 | % | |||||||||

| Net Stable Funding Ratio | ||||||||||||||||||||

| 18 | Total available stable funding | 1,121,194 | 1,152,350 | 1,124,973 | 1,146,509 | 1,123,411 | ||||||||||||||

| 19 | Total required stable funding | 923,018 | 950,226 | 929,646 | 932,560 | 891,442 | ||||||||||||||

| 20 | NSFR ratio (%) | 121.47 | % | 121.27 | % | 121.01 | % | 122.94 | % | 126.02 | % | |||||||||

| CRR Phased-in, Phased-in IFRS9 | ||||||||||||||||||||

| * Liquidity coverage ratio is the average of 12 months | ||||||||||||||||||||

| 11 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

1.2. Santander Pillar 3 report overview

Within the Basel framework, three Pillars can be distinguished:

•Minimum capital requirements (Pillar 1)

•Supervisory review (Pillar 2)

•Market discipline (Pillar 3).

Pillar 3 includes a set of disclosure requirements which are intended to provide analysts, investors, shareholders and other market agents with key capital and risk information to improve their ability of assessing banks’ risk profile and capital adequacy.

The timely publication of this information is considered as a booster of transparency within financial institutions and it contributes to the adequate functioning of financial markets.

Santander Pillar 3 Disclosure Report is a public document that is published in the Group's corporate website in order to fulfil one of the regulatory requirements within the scope of Basel. Specifically, the reporting standards are set by Part Eighth of the Capital Requirements Regulation (CRR) 575/2013 and complementary European Banking Authority (EBA) Guidelines. In addition, the Report considers the Regulation (CRR2) 2019/876 amending Regulation 575/2013.

This document should be read in conjunction with the Annexes of Pillar 3 and the Annual Report, which have been published on our website (www.santander.com).

In recent years, the Basel Committee on Banking Supervision (BCBS) and the European Banking Authority (EBA), seeking to enhance the consistency and comparability of institutions’

regulatory disclosures, have published several documents which establish the minimum requirements frequency, format and type of information that must be disclosed. Grupo Santander, as a Global Systematically Important Bank (G-SIB), has prepared its Pillar 3 Disclosure Report to the requirements defined by Regulation Authorities, and a simplified version of the Report is published on a quarterly-basis.

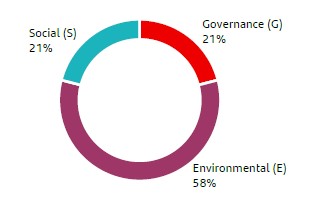

Following recent updates to the regulatory frameworks for credit institutions and investment firms, and the 2018 publication of the European Commission’s action plan on sustainable finance, the EBA is implementing a new policy strategy on institutions’ Pillar 3 disclosures that seeks to increase efficiency of institutions’ disclosures and reinforce market discipline by developing a comprehensive framework with consistent and comparable disclosures. In addition, the EBA aims to promote transparency on Environmental, Social or Governance (ESG) risks, encouraging institutions to strengthen their management of these risks and promoting awareness of their key role in the transition to a green economy.

1.2.1. Background information on Santander

Banco Santander, S.A. is a legal entity subject to the rules and regulations applicable to banks operating in Spain. In addition to its direct operations, Banco Santander, S.A. is the holding company of a group of banking subsidiaries engaged in a range of business activities. The Capital Requirements Regulation (CRR) and its modifications (hereinafter referred to as CRR), Capital Requirements Directive (CRD) and its modifications, and its transposition through Banco de España Circular 2/2016, on supervision and capital adequacy, are applicable at a consolidated level to the entire Santander Group.

See Appendix II, CRR Mapping, for all aspects for which disclosure is required under Part Eight of the CRR, as amended but that are not applicable to Santander. These are reported as “N/A” (not applicable).

Disclosures by Santander subsidiaries

In addition to the information contained in this report, Santander subsidiaries that are considered to have significant importance for their local market (under article 13 of the CRR, Application of disclosure requirements on a consolidated basis) publish information at the individual level on their websites.

Santander subsidiaries in Argentina, Mexico, Santander Consumer Nordics, Santander Consumer Germany, Portugal, Poland, United Kingdom and Uruguay publish their Pillar 3 reports in accordance with local regulations, as well as Chile from 2023 onwards.

| 12 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

1.2.2. Disclosure criteria used in this report

This report has been prepared in accordance with current European regulations on capital requirements (CRR).

The ratios presented in this report have been calculated using the transitional CRR and IFRS 9 implementation schedules.

Details of the types of information where there are differences between the regulatory information shown in this report and the information in the annual report and accounting information are as follows.

•The credit risk exposure measurements used for calculating regulatory capital requirements include:

◦Current and future risk exposures arising from future commitments (contingent liabilities and commitments) and changes in market risk factors (derivative instruments).

◦The mitigating factors for these exposures (netting agreements and collateral agreements for derivative exposures, and collateral and personal guarantees for on-balance-sheet exposures).

•The criteria used in classifying non-performing exposures in portfolios subject to advanced models for calculating regulatory capital are more conservative than those used for preparing the disaggregated information provided in the annual report.

•ESG disclosure in Pillar 3 follows the Implementing Technical Standards (ITS) defined by the EBA for this purpose and it is not necessarily aligned with the management criteria reported in other Group’s ESG reports.

1.2.3. Governance: policy, review and approval

Santander Group has a formal policy on Pillar 3 disclosures with the aim of defining requirements, elaboration process, frequency and associated governance in accordance with the Directive 2013/36/EU, Regulation (EU) no. 2019/876 of 20 May 2019 (the EU Regulation or CRR2) amending Regulation (EU) no. 575/2013, as well as the law on supervision and capital requirements (10/2014) of the Bank of Spain.

This policy has been prepared in compliance with the criteria established in the Guidelines on Materiality, Proprietary, Confidentiality and Frequency of the Information by European Banking Authority in accordance with Article 432, sections 1 and 2 and Article 433 of Regulation (EU) 575/2013.

The Pillar 3 disclosures report relies on a range of defined processes relating to the internal control framework, with duties and responsibilities for review and certification of the information contained in the report at several levels of the organisation.

Further information on Santander´s internal control model (ICM) can be found in section VIII of the chapter on Corporate governance of the 2022 Annual report.

| Access 2022 Annual Report available on the Santander Group website | ||||

The information contained in this report has been subject to an ex-ante review by the External Auditor (PwC) which has not declared any findings in its report in relation to the reasonableness of the information detailed and the compliance with the information requirements established in the European Capital Directive and Regulation.

The conclusions are presented to the audit committee prior to its approval. In addition, this report is included in the recurring annual plan review of internal audit.

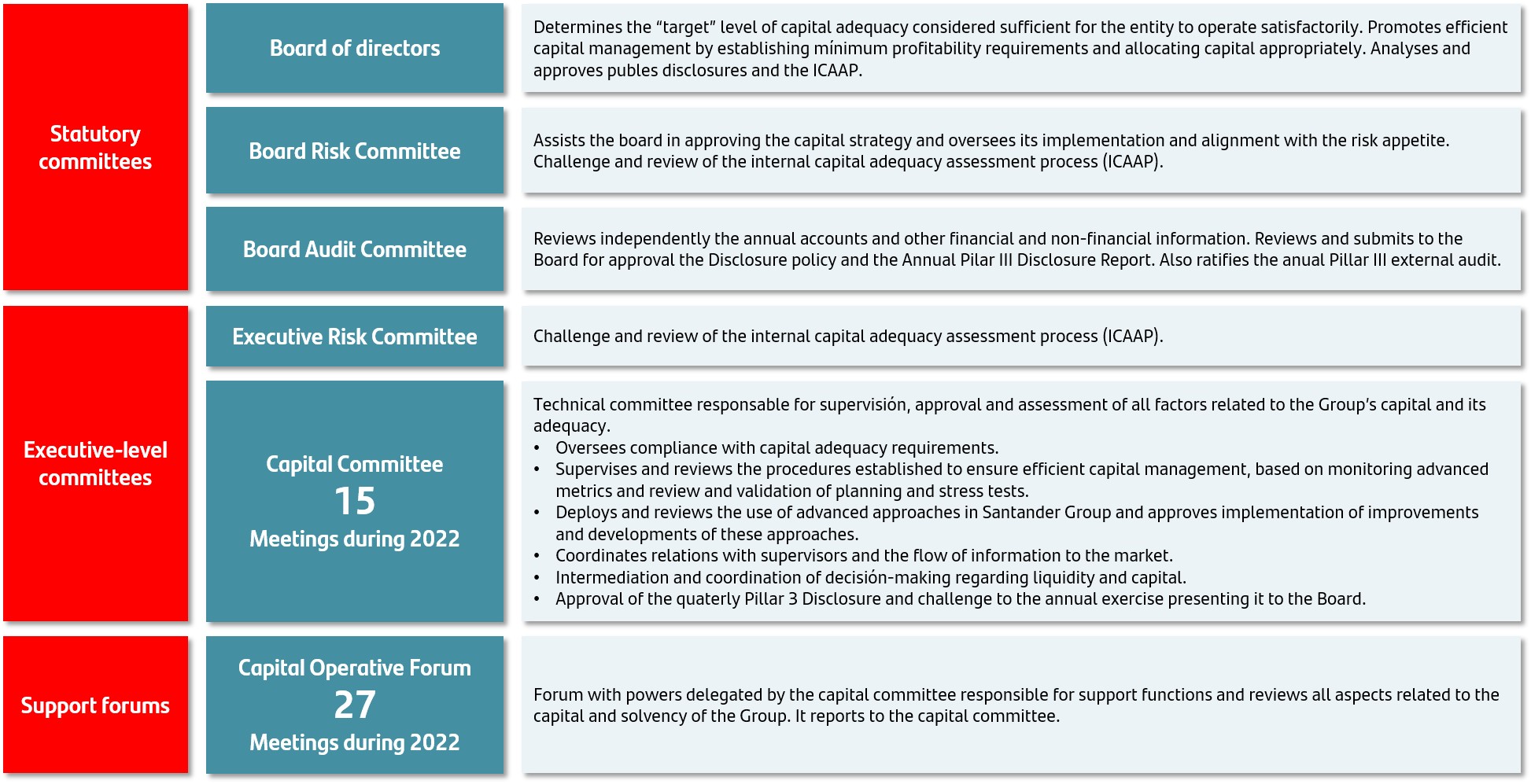

Approval by governing bodies

The report was reviewed by the Capital Committee held on 18 February 2023 and the Audit Committee during its session on the 21 February 2023, for its approval during the board of directors session on the 23 February 2023.

The board of directors of Santander certifies that the publication of the Pillar 3 disclosures report is compliant with the guidelines in Part Eight of Regulation (EU) 575/2013 and consistent with the “Pillar 3 Disclosures Policy” adopted by the board of directors.

No exceptions have been applied for the publication of information considered proprietary or confidential.

Furthermore, a quarterly report is published which includes a set of information complying with the internal policy and criteria established in the European Banking Authority guidelines about disclosure frequency.

The Pillar 3 disclosures report is available in the Shareholders and Investors section of the Santander website (www.santander.com), under "Financial and economic information".

| Access 2022 Pillar 3 Disclosures Report available on the Santander Group website | ||||

| 13 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

1.2.4. Developments in relation to the report

Santander takes into account all reporting requirements regarding market transparency published by the EBA, the BCBS and the Commission. Appendices I and II contain details on the various relevant documents.

Appendix I shows compliance with the various applicable in relation to disclosure, and Appendix II lists the location of the information disclosed in accordance with the relevant articles of Part Eight of the Regulation.

Some of the main transparency enhancements include the following:

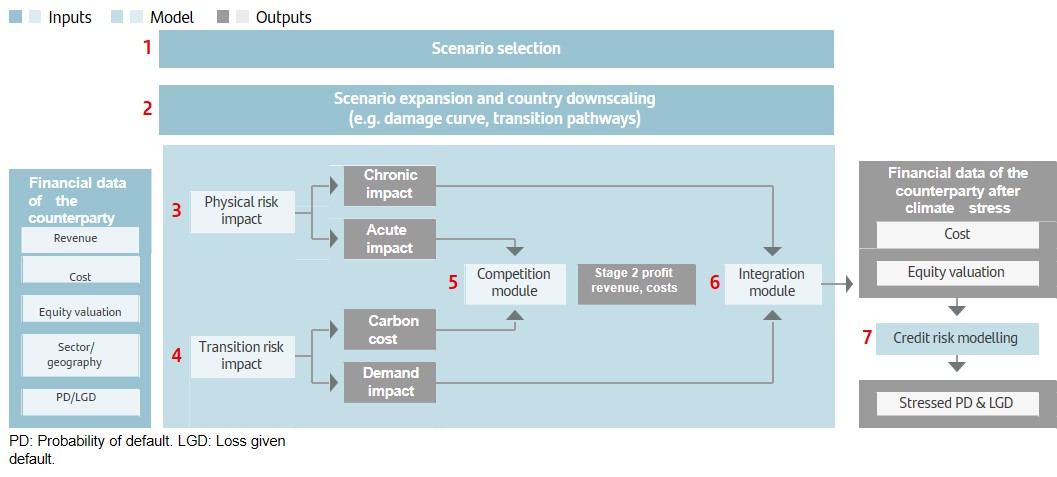

•Pillar 3 includes from 2022 onwards new mandatory disclosure requirements in relation to environmental, social and governance risks, as set out in Article 449 of CRR II. The content of these requirements involves qualitative reporting on environmental, social and governance information, as well as quantitative reporting on transition risk and physical climate change risk, and climate change-related measures applied including the Green Asset Ratio.

•The implementing technical standard on the disclosure and reporting of the minimum requirement for own funds and eligible liabilities (MREL) and the total loss absorbing capacity (TLAC).

•As a result of the global health crisis, the EBA published a guide to the impact of covid-19 entitled "EBA GLs on reporting and disclosure of exposures subject to measures applied in response to the covid-19 crisis", which specifies that three quantitative templates with information on the scope of the moratoria must be published every six months. In January 2023 the EBA confirms that this report will be the last to publish information on the COVID-19 pandemic.

•The EBA also published another ITS on Pillar 3 disclosure on interest rate risk arising from the non-trading book activities (IRRBB).

See Appendix I Transparency Enhancements and Appendix II CRR Mapping for further information on improvements in transparency.

In the Financial and economic information / Pillar 3 section of the Group's website, we also publish all the tables shown in this document in editable format for easier processing, as well as the appendices.

| Access 2022 Pillar 3 Disclosures Report available on the Santander Group website | ||||

| 14 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

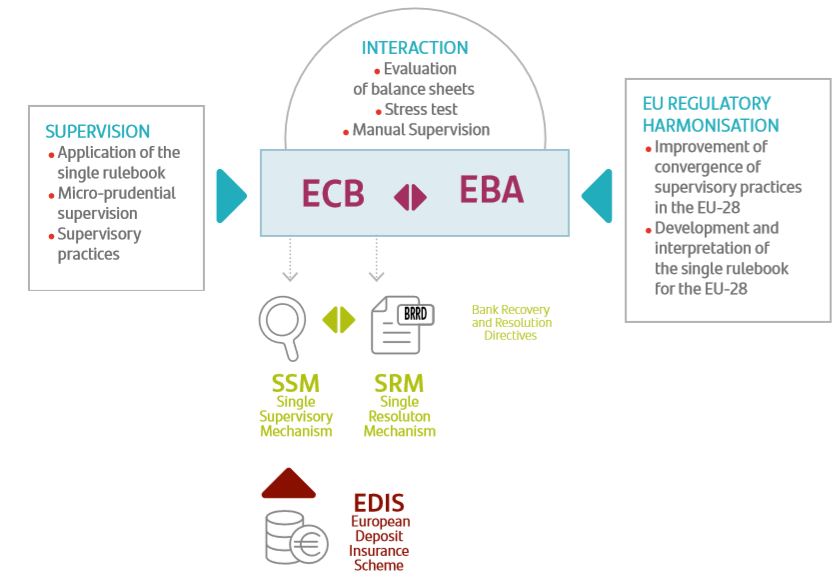

1.3. Regulatory framework

1.3.1. Prudential framework 2022: Capital Adequacy and Resolution key points

Credit institutions must meet a number of minimum capital and liquidity requirements. These minimum requirements are governed by the Capital Requirements Regulation (hereinafter CRR), and the Capital Requirements Directive (hereinafter CRD). In June 2019, these regulations were significantly amended.

As the Directives need to be transposed into the legal systems of the different Member States in order to be applicable, in the case of Spain, Royal Legislative Decree 7/2021 and Royal Decree 970/2021 were published for this purpose in 2021. In 2022, the transposition of the CRD into Spanish law has been completed with the publication of Bank of Spain Circular 3/2022, which amends Circular 2/2016, on supervision and solvency; Circular 2/2014, on the exercise of various regulatory options of the CRR and Circular 5/2012, addressed to credit institutions and payment service providers, on transparency of banking services and responsibility in the granting of loans.

The CRD introduced important modifications such as Pillar 2G regulation ('P2 Guidance' supervisory recommendation on Pillar 2 requirements).

On 27 October 2021, the European Commission published the draft review of the European banking legislation: CRR and CRD.

This review completes the implementation of the Basel III reform, which was agreed at the end of 2017 and aims to reduce the variability of risk-weighted assets and improve comparability between banks.

Progress was made in 2022 on discussions about the new texts and the final proposal is expected to be approved in 2023.

The banking package consists of the following elements: 1) Implementation of the final Basel III reforms, 2) Contribution to sustainability and green transition and 3) Stronger supervision: ensuring sound management of EU banks and better protection of financial stability.

The first element is reflected in the Commission's proposal to amend the text of the CRR. This proposal contains changes concerning, among other things, key risk factors, standardised credit risk, internal models, the output floor and operational risk.

The second element, relating to the contribution to sustainability and green transition, is reflected in the fact that the legislative proposals continue to incorporate ESG (environmental, social and governance) factors into the various areas of prudential regulation: governance, supervision, risk management, reporting obligations to competent authorities and disclosure requirements, among other topics. In this regard, it is important to note the Commission's mandate to the European Banking Authority (EBA) to assess whether specific prudential treatment is required for environmental and social risks. In line with this mandate, in 2022, the EBA issued the first consultation on the role of environmental risks within the prudential framework. Based on the feedback received in said consultation, and

depending on the final wording of the CRR/CRD, the EBA shall publish a report on the matter.

Finally, the third element, which refers to stronger supervision and protection of financial stability, is expressed in a series of provisions concerning: fit-and-proper requirements, the extension of the scope by revising certain definitions that would cover groups managed by fintechs, and the establishment of third-country branches in the EU in order to achieve greater harmonisation of rules and better supervision of this type of entity.

The European Council's proposal on CRR and CRD was published on 8 November 2022. During 2023, it is expected that the Parliament makes its position text public, which will be followed by the beginning of the trialogues process that will eventually result in the final versions of the regulations.

The new CRR/CRD regulations are expected to enter into force from 1 January 2025.

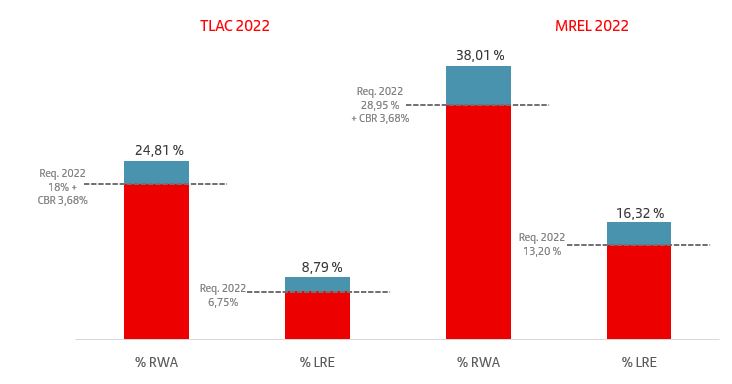

With regard to the resolution framework, institutions must have an adequate funding structure to ensure that, in the event of financial distress, the institution has sufficient liabilities to absorb losses in order to recover its position or be resolved, while ensuring the protection of depositors and financial stability. The entities must therefore meet several minimum loss-absorbing requirements, named Total Loss-Absorbing Capacity (TLAC) and Minimum Requirement for own funds and Eligible Liabilities (MREL), which are regulated by the CRR and by the Bank Recovery and Resolution Directive (BRRD).

In June 2019, the CRR introduced the minimum TLAC requirement, which only applies to global systemically important banks (G-SIBs). This requirement involves two metrics, the first is a minimum requirement for own funds and eligible liabilities in terms of a percentage of the total risk exposure amount (TREA), set at 18% from 1 January 2022 once the transition period ended. The second is a metric to set a minimum requirement for own funds and eligible liabilities in terms of a percentage of the average exposure to the Basel III Tier I leverage ratio of 6.75% from 1 January 2022 once the transition period ended.

For large banks (defined as banks with total assets of more than EUR 100 billion) or banks deemed to be systemically important by the resolution authority, the BRRD sets a minimum subordination requirement that will be higher between a 13.5% of risk-weighted assets and 5% of the leverage ratio. For the remaining institutions, the subordination requirement is set by the resolution authority on a case-by-case basis.

On 25 October 2022, the regulation on prudential treatment for global systemically important banks was published. This modifies both the CRR and the BRRD as regards prudential treatment of global systemically important banks (G-SIBs) with a multiple point of entry (MPE) resolution strategy, as well as methodologies for the indirect subscription of instruments (Daisy Chains) eligible for meeting the minimum requirement for own funds and eligible liabilities. This Regulation, known as the 'Quick Fix', covers the following objectives:

•Inclusion in the BRRD and CRR of references to third countries that allow adjustment of the deduction applied for the TLAC holding instruments issued by subsidiaries in third countries based on excess TLAC/MREL at the said subsidiaries, as well as the adjustment where the sum of

| 15 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

the requirements for own funds and eligible liabilities of G-SIBs under an MPE strategy exceed the theoretical requirements for the same group under a single point of entry (SPE) strategy. In other words, the latter adjustment is based on a comparison between the two possible resolution strategies.

For subsidiaries in jurisdictions without a resolution regime in place, the Regulation provides for a transitional period until 31 December 2024. Duringthis transitional period the entities may adjust the deductions based on excess above capital requirements in subsidiaries in third countries, if they meet certain requirements.

•Inclusion of a deduction scheme for MREL instrument holdings through entities of the same resolution group other than the resolution entity. This Regulation sets a deduction for the intermediate entity (Daisy Chains) that buy instruments issued by another entity as a result of this the deduction. The intermediate entity is obligated to issue the same amount that is repurchasing to the Resolution Entity, transferring internal MREL needs to the Resolution Entity, which will finally cover the required amount with external MREL.

This Regulation is applicable since the 14th November 2022, except for the provisions relating to Daisy Chains, which apply since the 1st January 2024.

Finally, Deposit Guarantee Schemes (DGSs) are regulated by the Deposit Guarantee Schemes Directive (DSGD), which has not undergone any significant changes since its publication in 2014. It aims to harmonise the deposit guarantee schemes of the Member States, thus ensuring stability and balance in different countries. It creates an appropriate framework for depositors to have better access to DGSs than was the case before the publication of this Directive through clear coverage, shorter repayment periods, better information and robust funding requirements. This Directive is transposed into Spanish law by Royal Decree 2606/1996, with its amendments set forth in Royal Decree 1041/2021.

To ensure that depositors' funds are secured, the DGSs collect funds available through contributions that must be made by their members at least once a year; a target level of 0.8% of the guaranteed deposits total must be met by 3 July 2024. These annual collections are set depending on the guaranteed deposits total and the degree of risk faced by the entities involved in the DGS. The method for calculating contributions is stated in the EBA Guidelines (EBA/GL/2015/10). A review and evaluation process was opened for these Guidelines by the EBA in 2022 (EBA/CP/2022/10).

Other regulatory developments in 2022:

Recent market developments have caused substantial increases in energy prices, which have consequently generated increases in the margins required by central counterparty entities (CCPs) to cover exposures. In response to this issue, Delegated Regulation (EU) 2022/2311 was published in November this year, amending Delegated Regulation (EU) 153/2013, which sets forth regulatory technical standards on the requirements that CCPs must meet. The new Regulation broadens the catalogue of guarantees that CCPs can accept as eligible collateral until November 2023.

In relation to the measures applied across Europe during the pandemic, we noted, in 2022, the repeal of the Guidelines on reporting and disclosure of exposures subject to measures

applied in response to the covid-19 crisis. As a result of the measures applied by the EBA in response to covid-19 (moratoria and public guarantees), Guidelines on reporting and disclosure of exposures subject to measures applied in response to the covid-19 crisis (EBA/GL/2020/07) were established in June 2020. The guidelines, which were initially expected to apply for a period of 18 months, were extended in January 2022 for a further year to ensure the monitoring of exposure and credit quality for loans with public support measures in the member states where these are still relevant. The decreasing relevance of public support measures prompted the EBA to take the decision, in December, to repeal the guidelines as of 1 January 2023.

1.3.2. Other regulations: Sustainability

The development of sustainable finances and, in particular, 'Fit 55: Compliance with the EU climate target for 2030 on the path towards climate neutrality' has continued this year and are key topics of debate and regulatory developments.

From the finance sector's perspective, 2022 has been a year with important regulatory milestones regarding sustainability that either supplement other regulatory components, pending development or making progress towards holistically integrating sustainability into the operations of financial institutions, non-financial institutions and their stakeholders.

The Taxonomy Regulation (2020/852) which establishes the criteria for classifying an economic activity as environmentally sustainable, identifies six environmental objectives on the basis of which technical criteria for qualifying an activity as environmentally sustainable have to be developed. In 2021, the European Commission published the final selection criteria for the identification of sustainable activities that contribute towards the first two environmental objectives set forth in the Taxonomy Regulation relating to climate change mitigation and adaptation, which were finally adopted in December 2021.

During 2022, discussions on the development of the four remaining objectives (sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystems) continued to make progress, but the technical screening criteria for the selection of activities based on these remaining objectives have not been reflected in the corresponding Delegated Regulation by the end of the year— their definition will continue in 2023. As a noteworthy aspect in the development of the Taxonomy Regulation, it is remarkable the publication of the Delegated Regulation 2022/1214 which incorporates, under certain strict criteria, in what circumstances activities related to the generation of nuclear energy and electricity and heat and production of cold from fossil gas, are considered as activities that contribute to the mitigation or adaptation to climate change and establishes specific disclosure requirements for these activities in order to ensure transparency. These additional disclosure requirements complement those applicable since January 2022 for both financial and non-financial institutions, being the Green Asset Ratio (percentage of exposures aligned with environmentally sustainable activities identified and specified in the corresponding Delegated Regulations underlying the Taxonomy Regulation) the most relevant indicator for the banking sector.

| 16 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

In relation to the disclosure obligations regarding sustainability, it is important to note that the final Pillar 3 disclosure framework defined by the EBA was approved in 2022 and establishes disclosure obligations relating to climate risks (both physical and transitional) for large banks that trade securities on regulated markets of any Member State and will be published from 2023; however, the application of the obligation to disclose certain information or indicators will have a phased application.

At the supervisory level, the European Central Bank, which published its guidelines on supervisory expectations for climate and environmental risks in November 2020 and subsequently integrated them into the supervisory dialogue during 2021, conducted a thematic review in 2022 of institutions' capabilities to manage their risk strategies and climate and environmental risk profiles. Additionally, the ECB also carried out the first climate stress test, demonstrating its determination to continue making progress in the implementation of its supervisory expectations.

At international level, the Basel Committee published in June 2022, the principles for the effective management and supervision of climate-related financial risks. This document is part of the holistic approach adopted by the Committee to address these risks within the global banking system and seeks to improve both risk management by the entities as well as supervisory practices in this regard.

In December 2022, the Basel Committee published some Frequently Asked Questions (FAQs) to clarify how climate-related financial risks may be captured in existing Pillar 1 standards, in particular, concerning credit, market, operational and liquidity coverage ratio risks. This list of FAQs may be supplemented in the future, if the Basel Committee deems it necessary.

1.3.3. Other regulations: Digital

Parallel to the climate agenda, the goal of ensuring that Europe is prepared for the digital age has led regulators to make significant progress in adapting the regulatory framework to accommodate new realities and technologies, competitors and risks associated with new business models.

In 2022, a number of key regulatory pieces have been approved or are in the final stage of approval by the European institutions, to implement the digital finance plan announced by the European Commission in 2020. Specifically, we highlight the following:

•MICA (Markets in cryptoassets), which establishes a common framework within Europe for the issue, custody and trading of these assets.

•The DORA (Digital Operational Resilience Act) regulation, with the aim of managing the risks generated by information technology (ICT) service providers when they interact with finance sector players. DORA establishes a common supervisory framework for technology providers who provide services to financial institutions, in addition to imposing common cybersecurity requirements.

•DMA (Digital Markets Act), which establishes obligations and restrictions to those digital platforms that are considered as gatekeepers, to ensure that the EU digital market remains competitive. During 2023, the development of the delegated regulations will continue to

supplement the DMA on specific aspects that are still pending for further development.

•Internationally, we highlight the publication launched by the Basel Committee with the principles for prudential treatment of banks' cryptoassets exposures. The final version includes more granular classification of cryptoassets, which was added in the second consultation published in June 2022, based on intrinsic risks to cryptoassets; discretion for the competent authorities to establish an add-on for technology infrastructure risk; the decoupling of the prudential treatment from the accounting treatment in the case of cryptoassets; and a flexible approach to the exposure limit for Group 2 cryptoassets (which receive a more punitive treatment because they do not fulfil the classification conditions of Group 1, which is reserved for tokenized traditional assets and stablecoins).

Other regulatory initiatives still under discussion at 2022 year-end include:

•The proposal for a European regulation on Artificial Intelligence that regulates the use of this technology for both public and private entities. The proposal focuses on applications that are considered high-risk, including the customers' creditworthiness assessment and human resources management.

•Data Act: Regulation intended to promote harmonised rules regarding fair use and access to data in Europe. The developments covered by this Regulation include adopting measures to aid access to data generated by connected devices (IoT), minimum requirements to aid interoperability, minimum rights for users of data processing services when changing provider, among other such aspects.

•Central banks have continued to explore issuing digital currencies (CBDCs). In Europe in particular, the European Central Bank continues to make progress in the investigation phase for designing and implementing the digital euro, which is expected to conclude by the end of October 2023.

Lastly, the Financial Stability Board (FSB) has launched a consultation to establish a series of recommendations to promote consistency and comprehensiveness in approaches to regulation, supervision and control of activities involving cryptoassets and enhance international cooperation. In parallel, the FSB has also launched a consultation on a series of high-level recommendations for the regulation, supervision and surveillance of global stablecoins to address the associated financial stability risks.

1.3.4. Other regulations: Anti-money laundering and countering the financing of terrorism (AML/FT)

In July 2021, the European Commission published a proposal for an Anti-Money Laundering and Countering the Financing of Terrorism (AML/FT) regulatory package that aims to strengthen existing EU rules, improve the detection of suspicious transactions and activities, and close loopholes in the current regulatory framework. It consists of four legislative proposals:

1.Regulation establishing a new European AML/FT Authority that will coordinate national AML/FT authorities and directly supervise certain financial sector institutions. The

| 17 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

Authority is expected to become operational in 2024 and to start its supervisory activities in 2026.

2.AML/FT Regulation. Parts of the current Directive will be transferred to this Regulation, which will be directly applicable in all Member States without the need for local transposition. This will harmonise EU requirements in areas such as customer due diligence, among others. Expected to be implemented by the end of 2025.

3.Sixth AML/FT Directive, which will repeal the current Directive. It contains provisions that must be transposed into national law, in particular on national supervisory authorities and Financial Intelligence Units (FIUs).

4.Recast of the Regulation on Transfers of Funds, with a particular focus on the tracking of transfers of crypto-assets. This revision introduces new requirements in relation to Virtual Asset Service Providers (VASPs) by requiring these actors to collect and make available data on the originators and beneficiaries of the transfers of virtual or crypto assets they operate. The European Council and the Parliament have come to a provisional agreement on updating the EU Regulation, but confirmation from these institutions is still required for the Regulation to be formally adopted.

On 14 July 2022, the EBA published Guidelines specifying the role and responsibilities to be assumed by the Compliance Officer in the fight against money laundering and terrorism financing. The Guidelines also specify that the entities must appoint a member of their board of directors to be responsible for ensuring compliance with those obligations; being a single responsible in the event that the entity is part of a group.

This then creates a shared understanding between the competent authorities and the lending or financial institutions in line with the requirements of the EU Directive on the prevention of the use of the financial system for the purposes of money laundering and terrorist financing.

1.4. Scope of consolidation

This section covers the qualitative requirements LIA - Explanations of differences between accounting and regulatory exposure amounts and LIB - Other qualitative information on the scope of application.

The Group companies included in the scope of consolidation for calculating the capital adequacy ratio under the CRR are the same as those included in the scope of consolidation for accounting purposes under Banco de España Circular 2/2018.

1.4.1. Substantial amendments due to a change in the perimeter and corporate transactions

Following is a summary of the main acquisitions and disposals of ownership interests in the share capital of other entities and other significant corporate transactions performed in the last three years or pending to be completed:

i.Tender offer for shares of Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México.

ii.Agreement for the acquisition of a significant stake in Ebury Partners Limited.

iii.Purchase by SHUSA for shares of Santander Consumer USA.

iv.Acquisition of Amherst Pierpont Securitires LLC, a U.S. fixed-income broker dealer.

v.Reorganization of the banking insurance business, asset management and pension plans in Spain.

For more information on the main acquisitions and disposals of holdings in other companies and other major corporate transactions by Santander last year, refer to section 3 of the Notes in the Audit Report section of the 2022 Annual Report.

| Access 2022 Annual Report available on the Santander Group website | ||||

| 18 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

1.4.2. Differences between the accounting consolidation method and the consolidation method for calculating regulatory capital

In application of Part I (General Provisions) of the CRR, some Santander entities are consolidated using a different method for accounting consolidation.

For the purposes of calculating the capital adequacy ratio based on the nature of their business activities, the Group companies included in the prudential scope of consolidation are consolidated using the full consolidation method, with the exception of jointly controlled entities, which use proportionate consolidation. All companies that cannot be consolidated based on their business activities are accounted for using the equity method and so are treated as equity exposures.

The basis of the information used for accounting purposes differs from that used for calculating regulatory capital requirements. Risk exposure measurements may differ depending on the purpose for which they are calculated, such as financial reporting, regulatory capital reporting and management information. The exposure data included in the quantitative disclosures in this document are used for calculating regulatory capital or leverage ratio.

The companies for which different consolidation methods are used, depending on the regulations applied (table LI3), are listed in Appendix V of the 2021 Pillar 3 Report file available on the Santander website.

| Access 2022 Pillar 3 Disclosures Report available on the Santander Group website | ||||

| 19 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

The following table shows the relationship between the categories in the financial statements and the risk categories in accordance with prudential requirements.

| Table 2.LI1 - Differences between accounting and regulatory scopes of consolidation and mapping of financial statement categories with regulatory risk categories | ||||||||||||||||||||||||||

| EUR million | ||||||||||||||||||||||||||

| 2022 | ||||||||||||||||||||||||||

| a | b | c | d | e | f | g | ||||||||||||||||||||

| Carrying values as reported in published financial statements | Carrying values under scope of regulatory consolidation | Carrying values of items: | ||||||||||||||||||||||||

| Subject to credit risk framework | Subject to the CCR framework | Subject to securitisation framework | Subject to market risk framework | Not subject to capital requirements or subject to deduction from capital | ||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| 1 | Cash and cash balances at central banks | 223,073 | 223,193 | 223,193 | — | — | — | — | ||||||||||||||||||

| 2 | Financial assets held for trading | 156,118 | 155,932 | — | 92,679 | 33 | 155,899 | — | ||||||||||||||||||

| 3 | Non-trading financial assets mandatorily measured at fair value through profit or loss | 5,713 | 4,201 | 1,002 | — | 863 | 2,335 | — | ||||||||||||||||||

| 4 | Financial assets not held for trading valued mandatorily at fair value through profit or loss | 8,989 | 7,030 | — | 815 | — | 7,030 | — | ||||||||||||||||||

| 5 | Financial assets designated at fair value through profit or loss | 85,239 | 72,437 | 63,352 | — | 9,086 | — | — | ||||||||||||||||||

| 6 | Financial assets at amortised cost | 1,147,044 | 1,151,081 | 1,097,583 | 40,240 | 13,209 | — | 49 | ||||||||||||||||||

| 7 | Derivatives - Hedge accounting | 8,069 | 8,335 | — | 8,335 | — | — | — | ||||||||||||||||||

| 8 | Fair value changes of the hedged items in portfolio hedge of interest rate risk | (3,749) | (3,749) | — | — | — | — | (3,749) | ||||||||||||||||||

| 9 | Investments in subsidiaries, joint ventures and associates | 7,615 | 8,658 | — | — | — | — | 8,658 | ||||||||||||||||||

| 10 | Reinsurance assets | 308 | — | — | — | — | — | — | ||||||||||||||||||

| 11 | Tangible assets | 34,073 | 31,000 | 31,000 | — | — | — | — | ||||||||||||||||||

| 12 | Intangible assets | 18,645 | 18,724 | 2,156 | — | — | — | 16,568 | ||||||||||||||||||

| 13 | Tax assets | 29,987 | 29,969 | 28,186 | — | — | — | 1,783 | ||||||||||||||||||

| 14 | Other assets | 10,082 | 10,219 | 8,874 | — | — | — | 1,345 | ||||||||||||||||||

| 15 | Non-current assets and disposal groups classified as held for sale | 3,453 | 3,608 | 3,608 | — | — | — | — | ||||||||||||||||||

| 16 | Total assets | 1,734,659 | 1,720,638 | 1,458,953 | 142,070 | 23,191 | 165,264 | 24,654 | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| 1 | Financial liabilities held for trading | (115,185) | (115,051) | — | (92,535) | — | (115,051) | — | ||||||||||||||||||

| 2 | Financial liabilities designated at fair value through profit or loss | (55,947) | (40,600) | — | — | — | (40,600) | — | ||||||||||||||||||

| 3 | Financial liabilities measured at amortised cost | (1,423,858) | (1,426,165) | — | — | — | — | (1,426,165) | ||||||||||||||||||

| 4 | Derivatives - Hedge accounting | (9,228) | (9,282) | — | (9,282) | — | — | — | ||||||||||||||||||

| 5 | Fair value changes of the hedged items in portfolio hedge of interest rate risk | 117 | 117 | — | — | — | — | 117 | ||||||||||||||||||

| 6 | Liabilities under insurance contracts | (747) | — | — | — | — | — | — | ||||||||||||||||||

| 7 | Provisions | (8,149) | (8,179) | (734) | — | — | — | (7,446) | ||||||||||||||||||

| 8 | Tax liabilities | (9,468) | (9,440) | — | — | — | — | (9,440) | ||||||||||||||||||

| 9 | Other liabilities | (14,609) | (14,508) | — | — | — | — | (14,508) | ||||||||||||||||||

| 10 | Total | (1,637,074) | (1,623,108) | (734) | (101,818) | — | (155,651) | (1,457,442) | ||||||||||||||||||

| 20 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

The difference in total assets between the public and the reserved scopes is not material (-EUR 14,023 billion) and corresponds to the exclusion of non financial institutions (-EUR 23,519 billion) and the inclusion of jointly controlled (+EUR 13,252 billion) and intra group entities (-EUR 3,756 billion).

In addition, the sum of the carrying amounts of certain items is greater than the carrying amounts under the scope of prudential consolidation, as the financial assets held for

trading and the financial assets at fair value through profit or loss are subject to the capital requirements of more than one risk category under the regulatory scope.

The main differences between the carrying amounts in the financial statements and the exposures for prudential purposes are shown below:

| Table 3.LI2 - Main sources of differences between regulatory exposure amounts and carrying values in financial statements | ||||||||||||||||||||

| EUR million | ||||||||||||||||||||

| 2022 | ||||||||||||||||||||

| a | b | c | d | e | ||||||||||||||||

| Total | Items subject to: | |||||||||||||||||||

| Credit risk framework | CCR framework | Securitisation framework | Market risk framework | |||||||||||||||||

| 1 | Asset carrying value amount under scope of regulatory consolidation (as per template EU LI1) | 1,789,477 | 1,458,953 | 142,070 | 23,191 | 165,264 | ||||||||||||||

| 2 | Liabilities carrying value amount under regulatory scope of consolidation (as per template EU LI1) | (258,203) | (734) | (101,818) | — | (155,651) | ||||||||||||||

| 3 | Total net amount under regulatory scope of consolidation | 1,531,275 | 1,458,219 | 40,252 | 23,191 | 9,613 | ||||||||||||||

| 4 | Off-balance sheet amounts | 358,398 | 358,398 | — | — | |||||||||||||||

| Regulatory Add-on | 51,349 | 51,349 | — | |||||||||||||||||

| 5 | Differences in valuations | — | — | |||||||||||||||||

| 6 | Differences due to different netting rules, other than those already included in row 2 | (14,918) | (5,305) | (9,613) | ||||||||||||||||

| Non-eligibility of the balances corresponding to accounting hedges (derivatives) | (8,335) | (8,335) | — | |||||||||||||||||

| 10 | Securitisations with risk transfer | 16,047 | 21,850 | (5,803) | — | |||||||||||||||

| 11 | Other | (11,880) | (52,257) | 40,377 | — | |||||||||||||||

| 7 | Differences due to consideration of provisions | (16,359) | (16,035) | — | (324) | — | ||||||||||||||

| 8 | Differences due to CRMs | (49,452) | (10,207) | (38,822) | (423) | — | ||||||||||||||

| 9 | Differences due to CCFs | (273,230) | (273,230) | — | — | — | ||||||||||||||

| 12 | Exposure amounts considered for regulatory purposes (EAD) | 1,582,895 | 1,486,739 | 39,138 | 57,018 | — | ||||||||||||||

This table shows a breakdown of the differences between the amounts of exposures for prudential purposes and the carrying amounts according to various parameters

The main causes in this case, result from the amount of off-balance sheet items +EUR 358.398 billion) and the application of CCFs (-EUR 273.230 billion). The regulatory add-on (+EUR 51.349 billion) and the differences resulting from the various offsetting rules (-EUR 14.918 billion).

The reconciliation of the public and non-public balance sheets (table CC2) is shown in Appendix VI, which is available on the Santander website.

| Access 2022 Pillar 3 Disclosures Report available on the Santander Group website | ||||

| 21 |  | ||||

[THIS PAGE INTENTIONALLY LEFT BLANK]

| Capital | |||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

2. Capital

| Fully-loaded CET1 ratio | ||

| *Including corporate transactions pending approval at year-end: -0.16% | ||||||||||||||

| Regulatory CET1 ratio (Phased-in)2 | ||||||||||||||

| 2020 | 2021 | 2022 | ||||||||||||

| 12.34 | % | 12.51 | % | 12.18 | % | |||||||||

2.1. Introduction

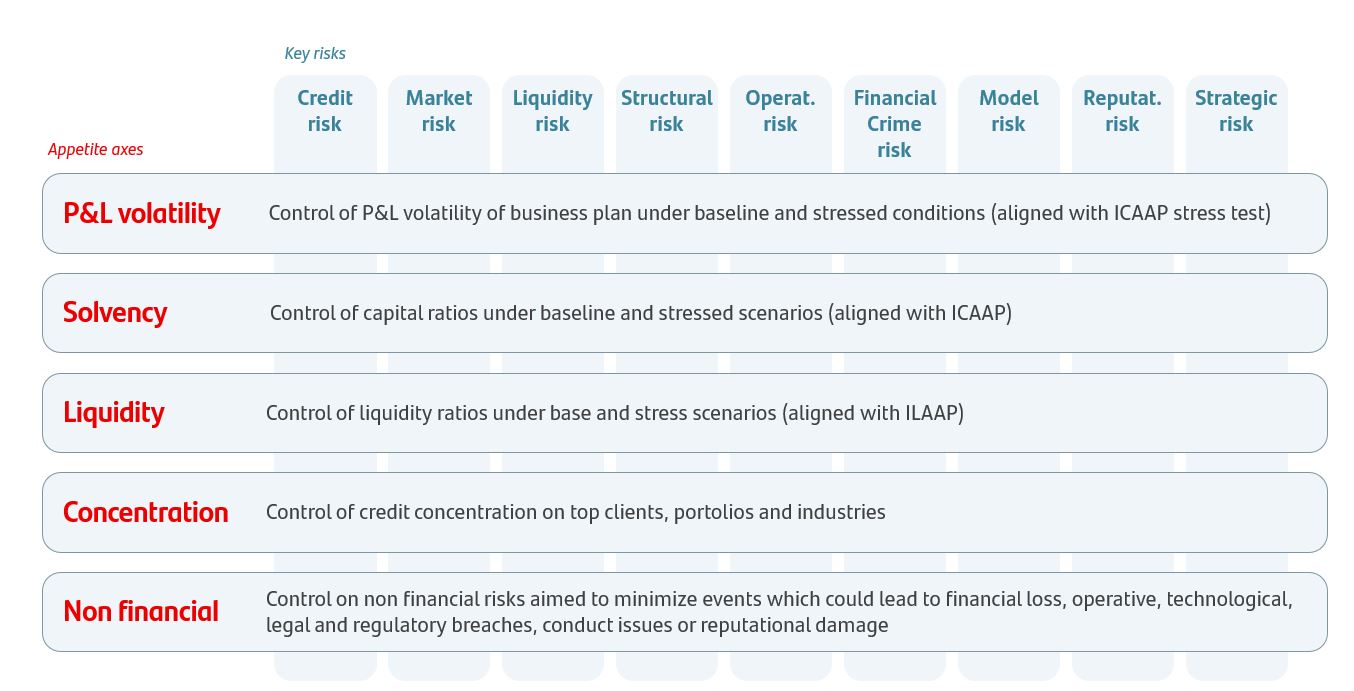

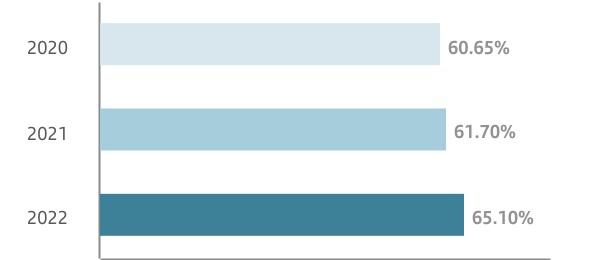

Capital management and adequacy at Santander aims to guarantee solvency and maximize profitability, while complying with internal capital targets and regulatory requirements.

It is determined by the strategic objectives and risk appetite set by the board of directors. To achieve this, the following policies have been established that shape the approach that the Group applies to capital management:

•Adequate capital planning, to meet current needs and provide the necessary resources to meet the needs of the business plans, regulatory requirements and the associated risks in the short and medium term, while maintaining the risk profile approved by the board of directors.

•Ensure that Santander and its subsidiaries have adequate capital to cover needs resulting from increased risks due to deteriorating macroeconomic conditions under stress scenarios.

•Optimise capital use through appropriate allocation among businesses, based on the relative return on regulatory and economic capital and taking into account risk appetite, growth and strategic objectives.

Santander Group manages capital and its value creation through six main blocks, placing profitability and capital at the forefront of its decisions, with the aim of improving the CET1 ratio and reinvesting freed up capital in profitable growth, shareholder remuneration and strategic investments. These blocks are:

•Capital strategy, which sets an ambitious Group-wide target including a capital buffer above requirements, and takes into account a holistic market perspective with regard to competitors and supervisory authorities.

•Increasing risk-adjusted returns through better allocation, analysing the performance of portfolios and carrying out both the organic (front-book) and inorganic capital allocation process.

•The detailed tracking and monitoring of performance across all geographies is reviewed and discussed at regular meetings to generate profitability-improvement actions.

•Portfolio management by identifying, prioritising and executing risk sharing and risk transfer across geographies.

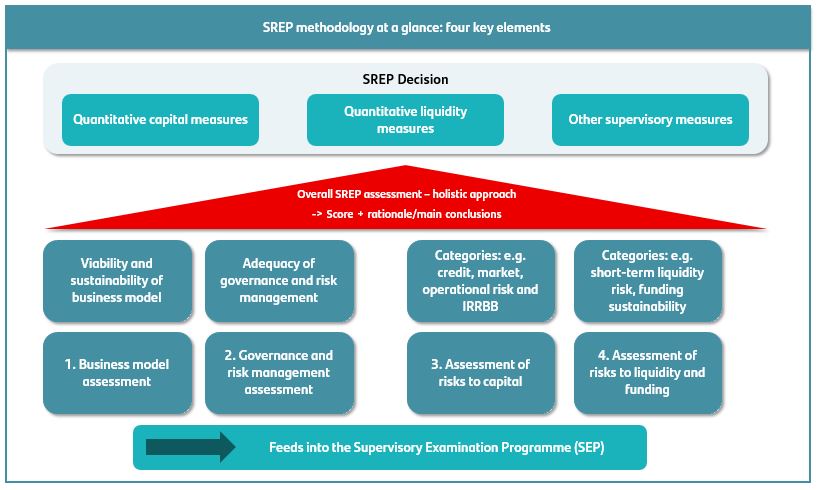

•Precise capital calculation identifying opportunities to optimise the numerator (CET1) and denominator (RWA), as well as greater industrialisation and standardisation of the Group's processes. In addition, the Group is working towards the overall optimisation of capital requirements (SREP framework, stress tests, MREL, TLAC).

•Existence of technological infrastructure and systems, capital tools and other optimisers are cross-cutting elements and factors that allow for proper capital management.

2 The phased-in ratios include the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Regulation on Capital Requirements (CRR) and

subsequent amendments introduced by Regulation 2020/873 of the European Union. Additionally, the Tier 1 and total phased-in capital ratios include the

transitory treatment according to chapter 2, title 1, part 10 of the aforementioned CRR.

| 24 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

Focus on disciplined capital allocation and shareholder remuneration while we established our fully-loaded CET1 target between 11% and 12%.

At December 31, 2022, the fully-loaded CET1 ratio (without applying the IFRS9 or CRR transitional arrangements) stood at 12.04% and the phased-in CET1 ratio was 12.18%. Only applying the IFRS9 transitional arrangements (CRR fully-loaded), the ratio remains at 12.18%. The following table shows the impact of the CRR transitional arrangements under a IFRS9 phased-in scenario:

| Table 4.Main capital figures and capital adequacy ratios (Phased-in IFRS 9). | |||||||||||||||||||||||||||||||||||

| EUR million | |||||||||||||||||||||||||||||||||||

| Fully-loaded CRR | Phased-in CRR | ||||||||||||||||||||||||||||||||||

| Dec'22 | Sep'22 | Jun'22 | Mar'22 | Dec'21 | Dec'22 | Sep'22 | Jun'22 | Mar'22 | Dec'21 | ||||||||||||||||||||||||||

| Common Equity (CET1) | 74,202 | 75,499 | 74,091 | 73,817 | 72,402 | 74,202 | 75,499 | 74,091 | 73,817 | 72,402 | |||||||||||||||||||||||||

| Tier 1 | 83,033 | 84,513 | 82,885 | 82,917 | 82,133 | 83,033 | 84,513 | 82,885 | 82,917 | 82,452 | |||||||||||||||||||||||||

| Total capital | 97,185 | 99,547 | 97,631 | 97,931 | 97,013 | 97,392 | 99,773 | 97,843 | 98,130 | 97,317 | |||||||||||||||||||||||||

| Risk weighted assets | 609,266 | 616,738 | 604,977 | 598,789 | 578,930 | 609,266 | 616,738 | 604,977 | 598,789 | 578,930 | |||||||||||||||||||||||||

| CET1 Ratio | 12.18 | % | 12.24 | % | 12.25 | % | 12.33 | % | 12.51 | % | 12.18 | % | 12.24 | % | 12.25 | % | 12.33 | % | 12.51 | % | |||||||||||||||

| Tier 1 Ratio | 13.63 | % | 13.70 | % | 13.70 | % | 13.85 | % | 14.19 | % | 13.63 | % | 13.70 | % | 13.71 | % | 13.85 | % | 14.24 | % | |||||||||||||||

| Total capital ratio | 15.95 | % | 16.14 | % | 16.14 | % | 16.35 | % | 16.76 | % | 15.99 | % | 16.18 | % | 16.18 | % | 16.39 | % | 16.81 | % | |||||||||||||||

| Leverage Ratio | 4.74 | % | 4.63 | % | 4.73 | % | 5.10 | % | 5.35 | % | 4.74 | % | 4.63 | % | 4.73 | % | 5.10 | % | 5.37 | % | |||||||||||||||

| Table 4 bis. Main capital figures and capital adequacy ratios (IFRS9 Fully-loaded). | |||||||||||||||||||||||||||||||||||

| EUR million | |||||||||||||||||||||||||||||||||||

| Fully-loaded CRR | Phased-in CRR | ||||||||||||||||||||||||||||||||||

| Dec'22 | Sep'22 | Jun'22 | Mar'22 | Dec'21 | Dec'22 | Sep'22 | Jun'22 | Mar'22 | Dec'21 | ||||||||||||||||||||||||||

| Common Equity (CET1) | 73,390 | 74,653 | 72,964 | 72,658 | 70,208 | 73,390 | 74,653 | 72,964 | 72,658 | 72,402 | |||||||||||||||||||||||||

| Tier 1 | 82,221 | 83,667 | 81,758 | 81,758 | 79,939 | 82,221 | 83,667 | 81,758 | 81,758 | 82,452 | |||||||||||||||||||||||||

| Total capital | 96,373 | 98,724 | 96,579 | 96,837 | 95,078 | 96,581 | 98,950 | 96,790 | 97,036 | 97,317 | |||||||||||||||||||||||||

| Risk weighted assets | 609,702 | 617,116 | 605,605 | 599,445 | 579,478 | 609,702 | 617,116 | 605,605 | 599,445 | 578,930 | |||||||||||||||||||||||||

| CET1 Ratio | 12.04 | % | 12.10 | % | 12.05 | % | 12.12 | % | 12.12 | % | 12.04 | % | 12.10 | % | 12.05 | % | 12.12 | % | 12.51 | % | |||||||||||||||

| Tier 1 Ratio | 13.49 | % | 13.56 | % | 13.50 | % | 13.64 | % | 13.79 | % | 13.49 | % | 13.56 | % | 13.50 | % | 13.64 | % | 14.24 | % | |||||||||||||||

| Total capital ratio | 15.81 | % | 16.00 | % | 15.95 | % | 16.15 | % | 16.41 | % | 15.84 | % | 16.03 | % | 15.98 | % | 16.19 | % | 16.81 | % | |||||||||||||||

| Leverage Ratio | 4.70 | % | 4.59 | % | 4.67 | % | 5.03 | % | 5.21 | % | 4.70 | % | 4.59 | % | 4.67 | % | 5.03 | % | 5.37 | % | |||||||||||||||

| 25 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

2.2. Capital function

Core principles establish the underlying guidelines governing the actions of Santander entities in capital management, monitoring and control processes.

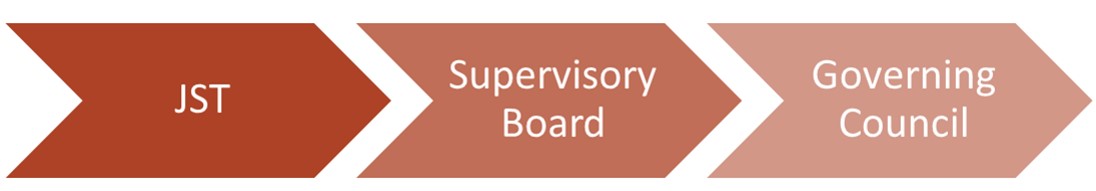

2.2.1. Organisation

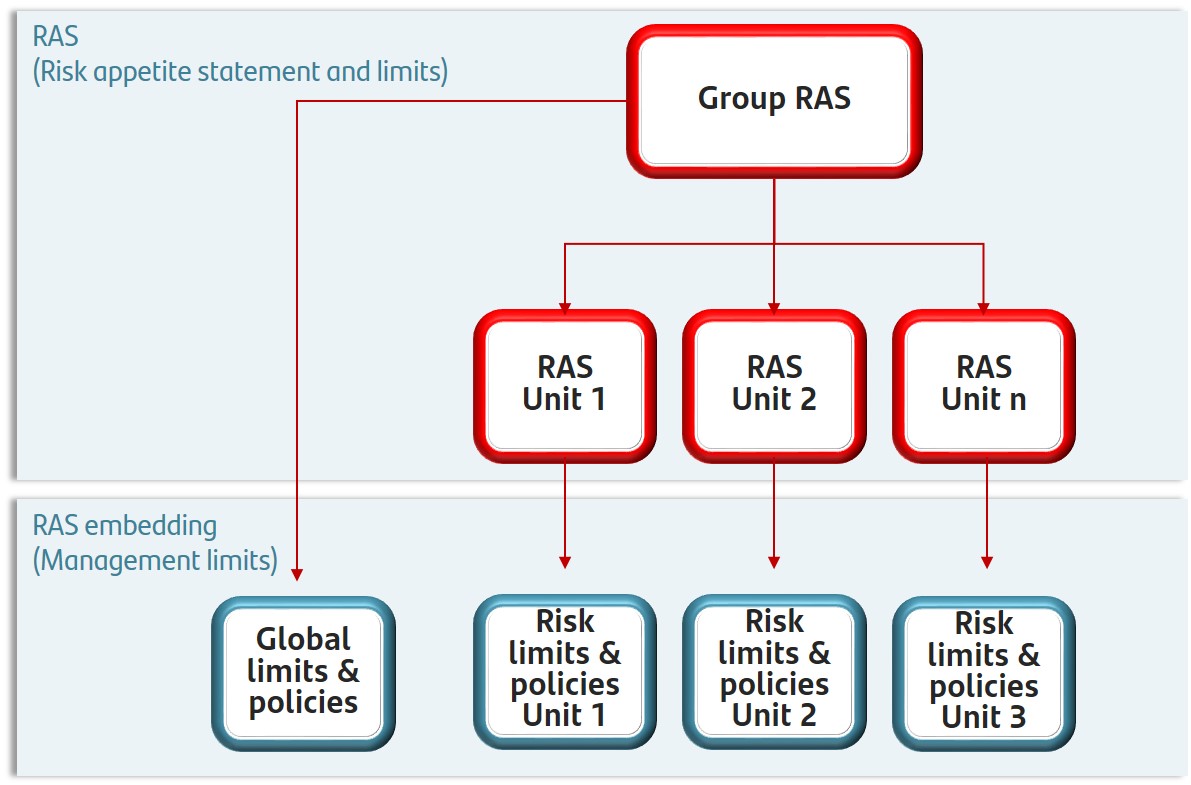

The organisational structure has been defined with the aim of guaranteeing compliance with the core principles in relation to capital and ensuring that the relationship between the subsidiaries and the Corporate centre is maintained. This function allows dual objectives to be met: comply with the subsidiary’s financial autonomy while at the same time retaining coordinated monitoring at group level.

2.2.2. Capital governance

Santander developed a structure of agile and efficient governing bodies, ensuring that the Capital function operates properly when it comes to decision-making and supervision and control. This ensures involvement of all relevant business areas and involvement of senior management as necessary.

Santander's characteristic subsidiary-based structure has a strong capital governance where there are various committees with responsibilities at regional level and also for coordination at group level. The local committees must report to the corporate committees in due time and proper form on any relevant aspects of their activity that may affect capital, to ensure proper coordination between the subsidiaries and the corporate centre.

| 26 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

2.2.3. Capital targets

Focus ahead will center on disciplined capital allocation and shareholder remuneration accomplishing our fully-loaded CET1 target between 11 and 12%.

The continuous improvement in the capital ratios reflects our profitable growth strategy and a culture of active capital management at all levels of the organization.

The 'Capital and Profitability Management’ team is in charge of our capital analysis, adequacy and management, coordination with subsidiaries on all matters related to capital and monitoring returns.

All countries and business units have developed individual capital plans focused on attaining a business that maximizes the return on equity.

Grupo Santander gives significant weight to the long-term sustainability of the entity and the efficient use of capital in the incentives of the Group's main executives. In this regard, certain aspects related to capital management and its profitability are taken into account in the 2022 variable remuneration of the members of senior management:

•Among the metrics taken into account are return on equity (RoTE), return on risk-weighted assets (RoRWA) and customer-related aspects.

•Among the qualitative adjustments considered are the efficient management of solvency metrics, the appropriate management of operational risk and risk appetite, and the sustainability and soundness of results and efficient cost management.

Action plans

In addition, we are developing an action plan for the continuous improvement of infrastructures, processes and methodologies that support all aspects related to capital, with the aim of further enhancing active capital management, responding more quickly to the numerous and increasing regulatory requirements and efficiently carrying out all associated activities.

2.3. Capital management, adequacy and profitability

Capital management and adequacy at Santander aims to guarantee solvency and maximize profitability, while complying with internal capital targets and regulatory requirements.

Capital management is a key strategic tool for decision-making at both the subsidiary and corporate levels.

We have a common framework that covers capital management actions, criteria, policies, functions, metrics and processes.

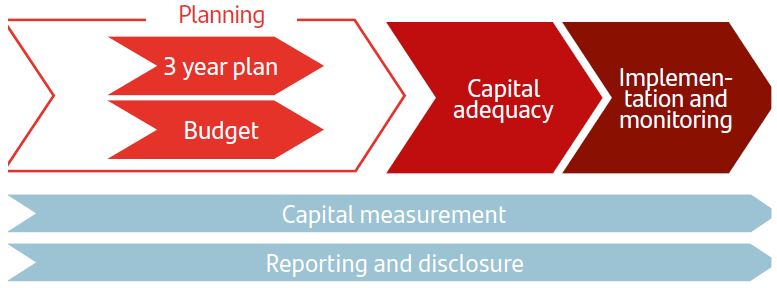

Our most notable capital management activities are:

•Establishing capital adequacy and capital contribution targets that align with minimum regulatory requirements and internal policies, to guarantee robust capital levels consistent with our risk profile and efficient use of capital to maximize shareholder value;

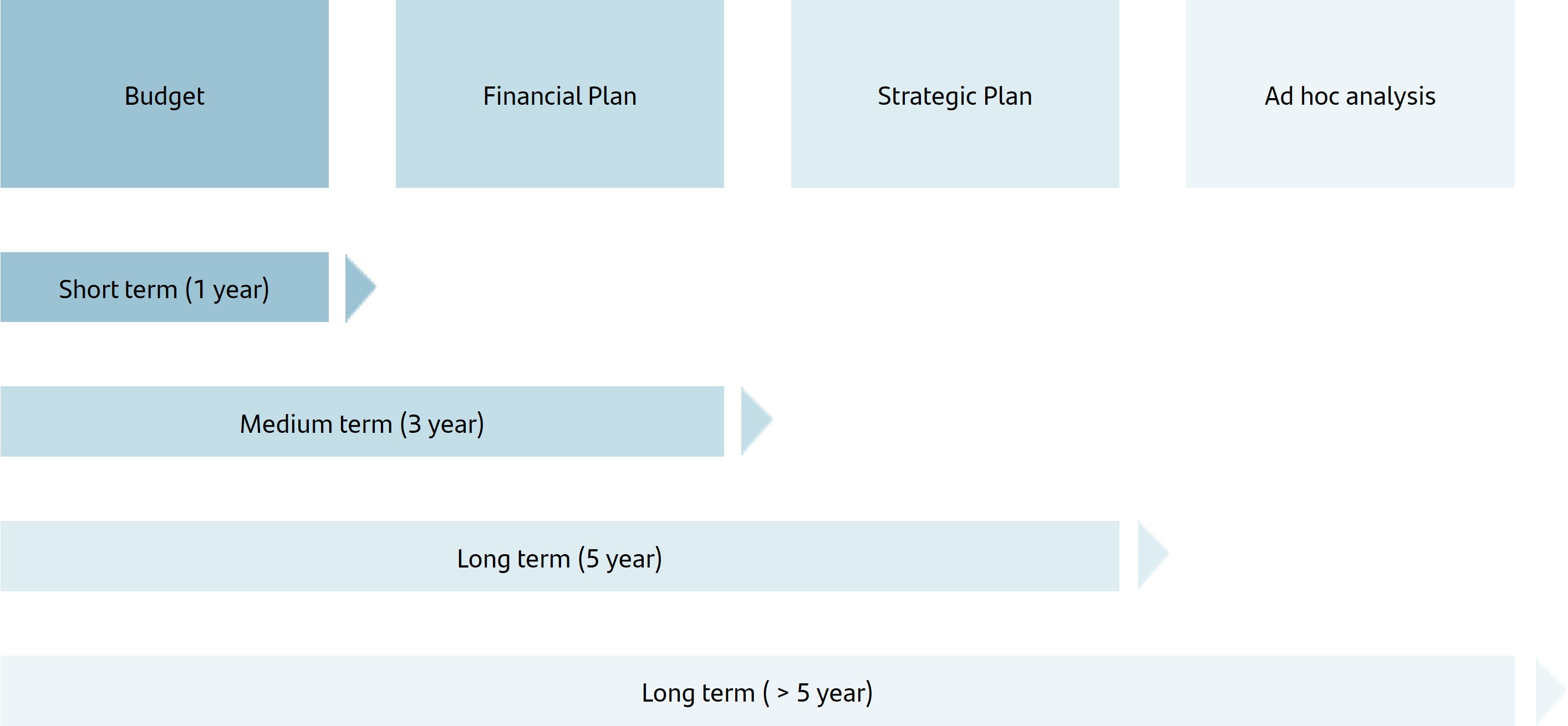

•Drawing up a capital plan to meet our strategic plan objectives. Capital planning is an essential part of executing the three-year strategic plan;

•Assessing capital adequacy to ensure the capital plan is also consistent with our risk profile and risk appetite framework and in stress scenarios;

•Developing the annual capital budget as part of the Group's budgeting process;

•Monitoring and controlling budget execution at Group and subsidiary level and drawing up action plans to correct any deviations;

•Integrating capital metrics into our business management to ensure alignment with the Group's objectives;

•Preparing internal capital reports, and reports for the supervisory authorities and the market; and

•Planning and managing other loss absorbing instruments (MREL and TLAC).

| 27 |  | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

The Group's capital function is carried out on three levels:

| → | Regulatory capital | |||||||||||||

| The first step in managing regulatory capital is to analyse the capital base, the capital adequacy ratios under the current regulatory criteria and the scenarios used in capital planning in order to make the capital structure as efficient as possible, both in terms of cost and compliance with regulatory requirements. Active capital management includes strategies for capital allocation and its efficient usage, together with securitisations, asset sales and issuances of equity instruments (hybrid equity instruments and subordinated debt). | ||||||||||||||

| → | Economic capital | |||||||||||||

| The objective of the economic capital model is to ensure that we adequately allocate our capital to cover all the risks to which we are exposed as a result of our activity and risk appetite. It also aims to optimise value creation in the Group and all of the business units. | ||||||||||||||

| → | Profitability and pricing | |||||||||||||

| Creating value and maximizing profitability is one of Santander's main objectives by carefully selecting the most appropriate markets and portfolios based on profitability and risk. Profitability and pricing are therefore integral parts of the key capital model processes. | ||||||||||||||

Disciplined capital allocation, prioritizing organic growth and shareholder remuneration is always present in our capital management.

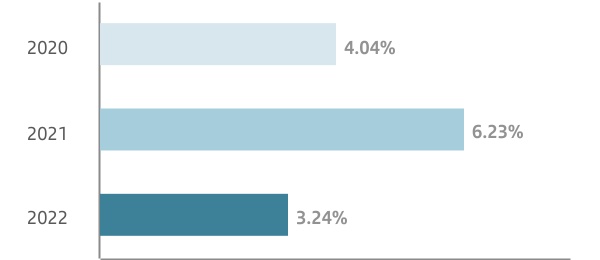

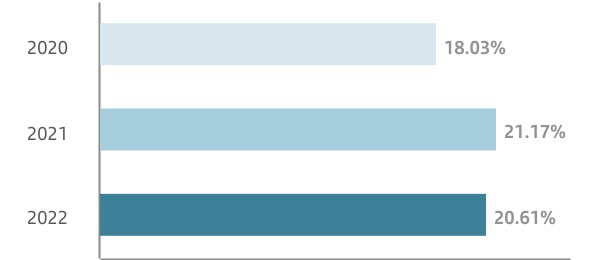

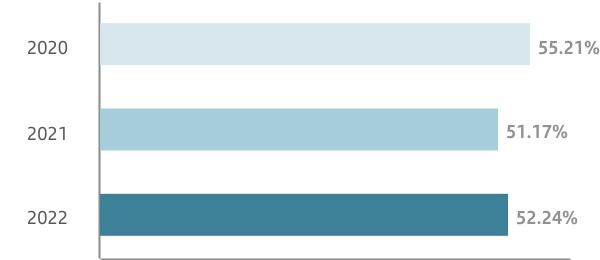

2.3.1. Profitability

One of the main priorities in the Group is capital management, to ensure profitable capital adequacy in all our activities.

Our strategy includes allocating capital to those markets and portfolios with the best capital returns, to ensure strong value creation for shareholders in a sustainable manner.

Identifying and managing underperforming businesses is part of this process where we aim to optimize Group's capital by targeting customers, portfolios and markets with an attractive capital return. This process is dynamic and actively reviewed and monitored.

Encourage new business development and growth within capital and profitability targets through adequate and efficient capital allocation.

Our strength is our business model, diversified in business activities and geographically with strong results in terms of risk-adjusted profitability. Metrics such as RoTE, RoRWA and RoRAC are part of our business admission and monitoring policies.

The combination with a correct pricing adjusted to the risk taken with maintaining a medium-low risk profile is the key to success, having in every moment (including stress scenarios) the needed capital to execute our corporate strategy.

| 28 | ||

| 28 | ||||

| 2022 Pillar 3 Disclosures Report | Introduction | Capital | Risks | Additional information | ||||

Disciplined capital allocation

A disciplined execution of our capital allocation strategy...

...leads to growth, profitability and strength...

|  |  | ||||||||||||||||||

| — | — | — | ||||||||||||||||||

| GROWTH | PROFITABILITY | BALANCE SHEET STRENGTH | ||||||||||||||||||

| Focused on business that generate high RoTE and high capital generation, along with meaningful potential for growth. | Focused on maintaining high and sustainable levels through scale in the markets in which we operate, leading to efficiency, and allowing us to provide value to our customers and high returns to our shareholders. | After years of regulatory capital accumulation, we are focused on maintaining capital levels around 11-12% on a fully-loaded basis. | ||||||||||||||||||

Maintaining high levels of solvency and delivering high returns with an optimized capital allocation process are main goals of Grupo Santander. To this end, it is key priority to improve capital profitability and achieve value creation across all customers.

Santander is accelerating the path to a new model to maximize its capital productivity and shareholder value by:

•Focusing on value generation and profitability

•Ensuring capital efficiency at origination

•Increasing balance sheet rotation and velocity

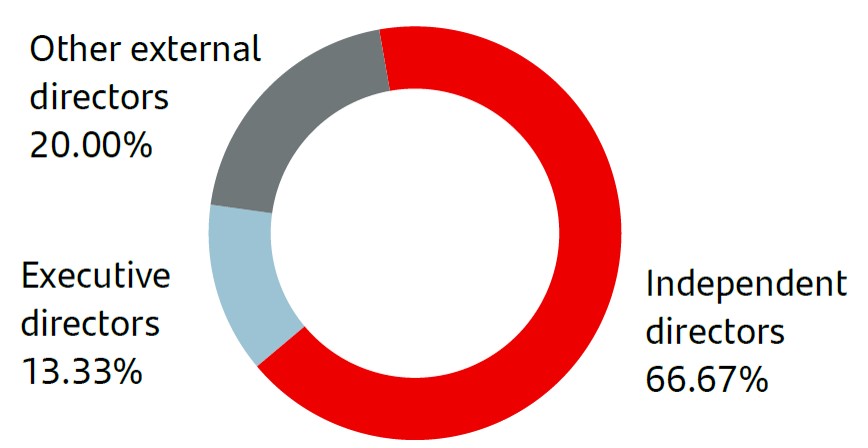

Based on these pillars, the Groups Senior Management has promoted several key initiatives in 2022 that have been monitored monthly in local and Corporate ALCO Committees: