Banco Santander (SAN) 6-KCurrent report (foreign)

Filed: 24 Jul 24, 6:09am

| Item 1. January - June 2024 Financial Report | |||||

| January - June | 2024 | ||||

| BALANCE SHEET (EUR million) | Jun-24 | Mar-24 | % | Jun-24 | Jun-23 | % | Dec-23 | ||||||||||||||||

| Total assets | 1,786,261 | 1,800,006 | (0.8) | 1,786,261 | 1,780,493 | 0.3 | 1,797,062 | ||||||||||||||||

| Loans and advances to customers | 1,065,596 | 1,049,533 | 1.5 | 1,065,596 | 1,045,044 | 2.0 | 1,036,349 | ||||||||||||||||

| Customer deposits | 1,037,646 | 1,044,453 | (0.7) | 1,037,646 | 1,013,778 | 2.4 | 1,047,169 | ||||||||||||||||

| Total funds | 1,309,903 | 1,315,779 | (0.4) | 1,309,903 | 1,255,783 | 4.3 | 1,306,942 | ||||||||||||||||

| Total equity | 103,648 | 105,025 | (1.3) | 103,648 | 102,044 | 1.6 | 104,241 | ||||||||||||||||

| Note: total funds includes customer deposits, mutual funds, pension funds and managed portfolios. | |||||||||||||||||||||||

| INCOME STATEMENT (EUR million) | Q2'24 | Q1'24 | % | H1'24 | H1'23 | % | 2023 | ||||||||||||||||

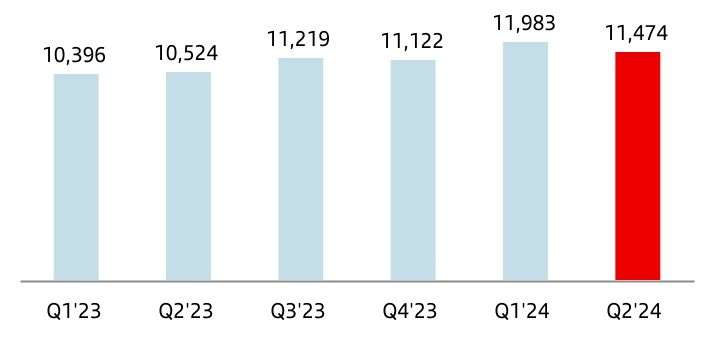

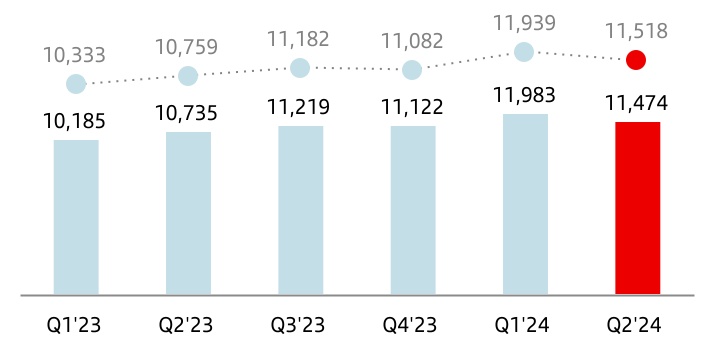

| Net interest income | 11,474 | 11,983 | (4.2) | 23,457 | 20,920 | 12.1 | 43,261 | ||||||||||||||||

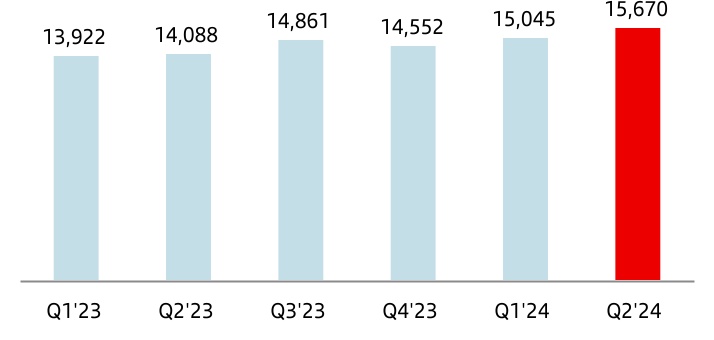

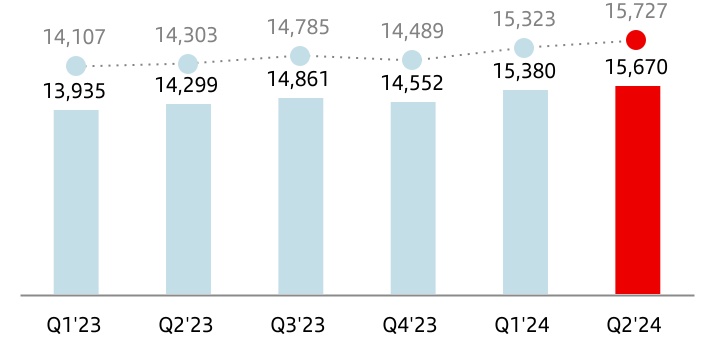

| Total income | 15,670 | 15,045 | 4.2 | 30,715 | 28,010 | 9.7 | 57,423 | ||||||||||||||||

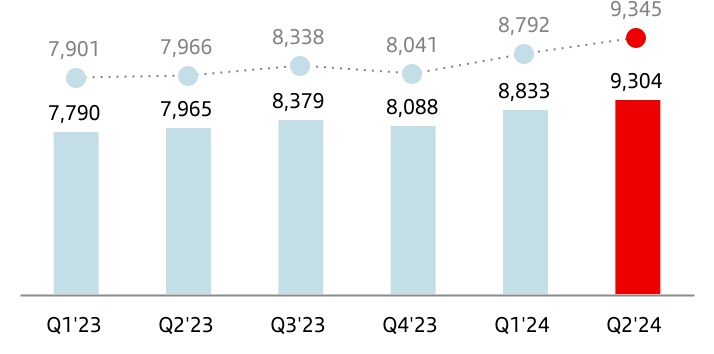

| Net operating income | 9,304 | 8,498 | 9.5 | 17,802 | 15,531 | 14.6 | 31,998 | ||||||||||||||||

| Profit before tax | 4,925 | 4,583 | 7.5 | 9,508 | 8,090 | 17.5 | 16,459 | ||||||||||||||||

| Profit attributable to the parent | 3,207 | 2,852 | 12.4 | 6,059 | 5,241 | 15.6 | 11,076 | ||||||||||||||||

EPS, PROFITABILITY AND EFFICIENCY (%) 1 | Q2'24 | Q1'24 | % | H1'24 | H1'23 | % | 2023 | ||||||||||||||||

| EPS (euros) | 0.20 | 0.17 | 15.4 | 0.37 | 0.31 | 19.2 | 0.65 | ||||||||||||||||

| RoE | 13.4 | 11.8 | 12.6 | 11.5 | 11.9 | ||||||||||||||||||

| RoTE | 16.8 | 14.9 | 15.9 | 14.5 | 15.1 | ||||||||||||||||||

| RoA | 0.78 | 0.69 | 0.74 | 0.67 | 0.69 | ||||||||||||||||||

| RoRWA | 2.18 | 1.96 | 2.07 | 1.88 | 1.96 | ||||||||||||||||||

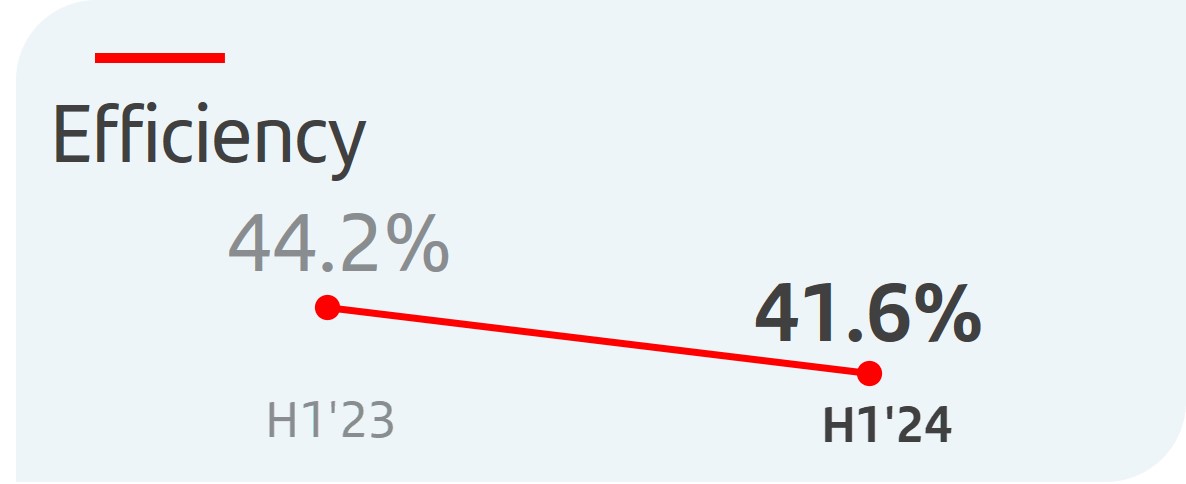

Efficiency ratio 2 | 40.6 | 42.6 | 41.6 | 44.2 | 44.1 | ||||||||||||||||||

UNDERLYING INCOME STATEMENT 2 (EUR million) | Q2'24 | Q1'24 | % | H1'24 | H1'23 | % | 2023 | ||||||||||||||||

| Net interest income | 11,474 | 11,983 | (4.2) | 23,457 | 20,920 | 12.1 | 43,261 | ||||||||||||||||

| Total income | 15,670 | 15,380 | 1.9 | 31,050 | 28,234 | 10.0 | 57,647 | ||||||||||||||||

| Net operating income | 9,304 | 8,833 | 5.3 | 18,137 | 15,755 | 15.1 | 32,222 | ||||||||||||||||

| Profit before tax | 4,925 | 4,583 | 7.5 | 9,508 | 8,329 | 14.2 | 16,698 | ||||||||||||||||

| Profit attributable to the parent | 3,207 | 2,852 | 12.4 | 6,059 | 5,241 | 15.6 | 11,076 | ||||||||||||||||

| Changes in constant euros: | |||||||||||||||||||||||

| Q2'24 / Q1'24: NII: -3.5%; Total income: +2.6%; Net operating income: +6.3%; Profit before tax: +8.2%; Attributable profit: +13.1%. | |||||||||||||||||||||||

| H1'24 / H1'23: NII: +11.2%; Total income: +9.3%; Net operating income: +14.3%; Profit before tax: +13.3%; Attributable profit: +14.7%. | |||||||||||||||||||||||

Note: for Argentina and any grouping which includes it, the variations in constant euros have been calculated considering the Argentine peso exchange rate on the last working day for each of the periods presented. Additionally, from Q2 2024 onwards, a theoretical rate, which differs from official exchange rate, has been used for the Argentine peso as it better reflects the evolution of inflation (we continue to apply the official ARS exchange rate to all prior periods). For further information, see the section 'Alternative performance measures' in the appendix to this report. | ||

January - June 2024 |  | 3 | ||||||

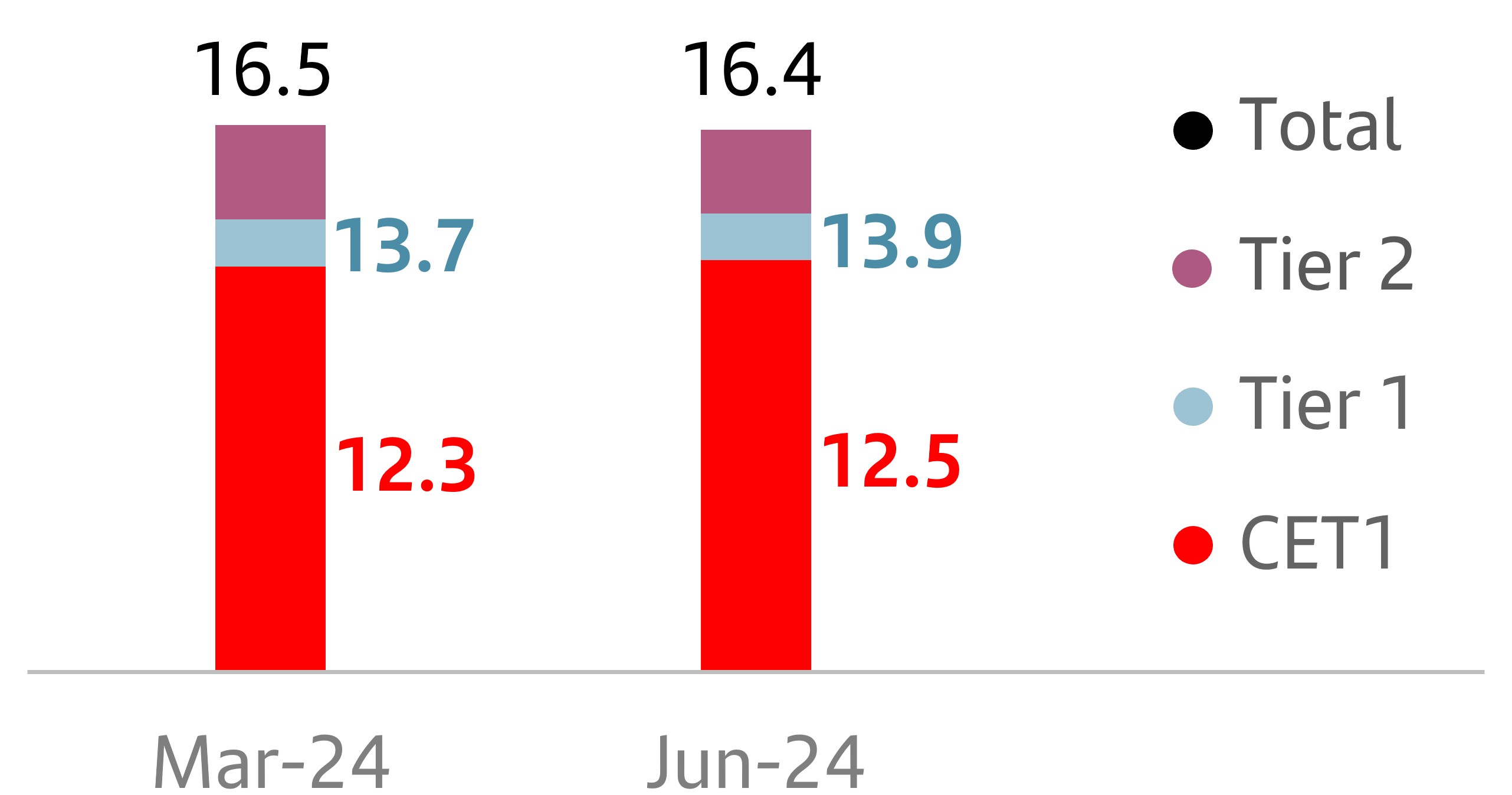

| SOLVENCY (%) | Jun-24 | Mar-24 | Jun-24 | Jun-23 | Dec-23 | ||||||||||||||||||

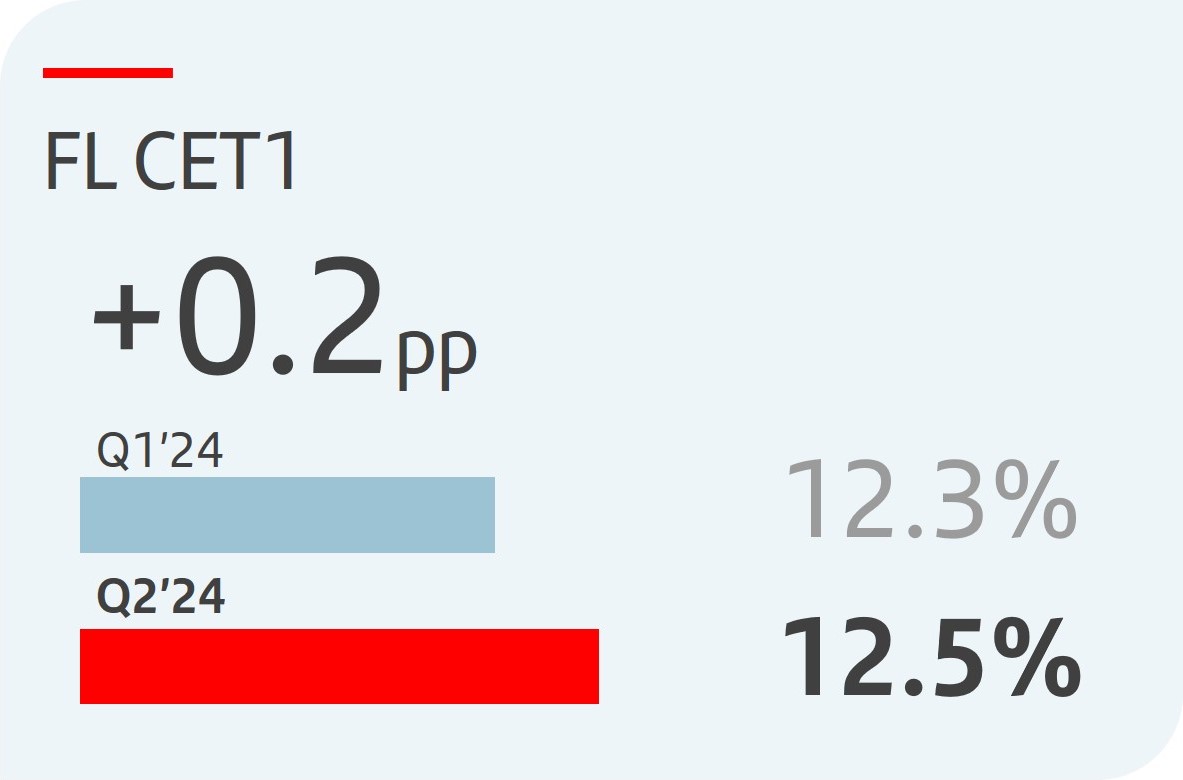

| Fully-loaded CET1 ratio | 12.5 | 12.3 | 12.5 | 12.2 | 12.3 | ||||||||||||||||||

| Fully-loaded total capital ratio | 16.4 | 16.5 | 16.4 | 15.9 | 16.3 | ||||||||||||||||||

| CREDIT QUALITY (%) | Q2'24 | Q1'24 | H1'24 | H1'23 | 2023 | ||||||||||||||||||

Cost of risk 2, 3 | 1.21 | 1.20 | 1.21 | 1.08 | 1.18 | ||||||||||||||||||

| NPL ratio | 3.02 | 3.10 | 3.02 | 3.07 | 3.14 | ||||||||||||||||||

| NPL coverage ratio | 66 | 66 | 66 | 68 | 66 | ||||||||||||||||||

| MARKET CAPITALIZATION AND SHARES | Jun-24 | Mar-24 | % | Jun-24 | Jun-23 | % | Dec-23 | ||||||||||||||||

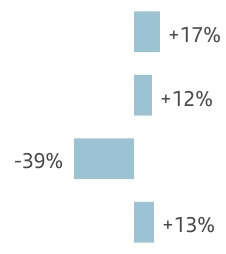

| Shares (millions) | 15,494 | 15,826 | (2.1) | 15,494 | 16,184 | (4.3) | 16,184 | ||||||||||||||||

| Share price (euros) | 4.331 | 4.522 | (4.2) | 4.331 | 3.385 | 27.9 | 3.780 | ||||||||||||||||

| Market capitalization (EUR million) | 67,098 | 71,555 | (6.2) | 67,098 | 54,783 | 22.5 | 61,168 | ||||||||||||||||

| Tangible book value per share (euros) | 4.94 | 4.86 | 4.94 | 4.57 | 4.76 | ||||||||||||||||||

| Price / Tangible book value per share (X) | 0.88 | 0.93 | 0.88 | 0.74 | 0.79 | ||||||||||||||||||

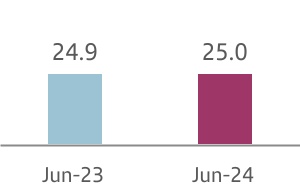

| CUSTOMERS (thousands) | Q2'24 | Q1'24 | % | H1'24 | H1'23 | % | 2023 | ||||||||||||||||

| Total customers | 168,243 | 165,752 | 1.5 | 168,243 | 163,756 | 2.7 | 164,542 | ||||||||||||||||

| Active customers | 101,277 | 100,092 | 1.2 | 101,277 | 99,472 | 1.8 | 99,503 | ||||||||||||||||

| Digital customers | 57,000 | 55,305 | 3.1 | 57,000 | 52,517 | 8.5 | 54,161 | ||||||||||||||||

| OTHER DATA | Jun-24 | Mar-24 | % | Jun-24 | Jun-23 | % | Dec-23 | ||||||||||||||||

| Number of shareholders | 3,526,649 | 3,584,294 | (1.6) | 3,526,649 | 3,802,161 | (7.2) | 3,662,377 | ||||||||||||||||

| Number of employees | 209,553 | 211,141 | (0.8) | 209,553 | 212,410 | (1.3) | 212,764 | ||||||||||||||||

| Number of branches | 8,285 | 8,405 | (1.4) | 8,285 | 8,823 | (6.1) | 8,518 | ||||||||||||||||

| 1. | For further information, see the section 'Alternative performance measures' in the appendix to this report. | ||||

| 2. | In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures, including the figures related to “underlying” results, which do not include factors that are outside the ordinary course of our business, or have been reclassified within the underlying income statement. Further details are provided in the 'Alternative performance measures' section of the appendix to this report. For further details on the APMs and non-IFRS measures used, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the annual consolidated financial statements prepared under IFRS, please see our 2023 Annual Financial Report, published in the CNMV on 19 February 2024, our 20-F report for the year ending 31 December 2023 filed with the SEC in the United States on 21 February 2024 as well as the 'Alternative performance measures' section of the appendix to this report. | ||||

| 3. | Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months. | ||||

| 4 |  | January - June 2024 | ||||||

| Group financial information | Financial information by segment | Responsible banking Corporate governance Santander share | Appendix | ||||||||||||||||||||||||||

| Customer focus | ||||||||||||||||||||||||||

| Building a digital bank with branches | → New operating model to build a digital bank with branches, with a multichannel offer to fulfil all our customers' financial needs. | 168 mn | 101 mn | |||||||||||||||||||||||

| total customers | active customers | |||||||||||||||||||||||||

| Scale | ||||||||||||||||||||||||||

→ Our global and in-market scale helps us to improve our local banks' profitability, adding value and network benefits. → Our activities are organized under five global businesses: Retail & Commercial Banking (Retail), Digital Consumer Bank (Consumer), Corporate & Investment Banking (CIB), Wealth Management & Insurance (Wealth) and Payments. → Our five global businesses and our presence in Europe, DCB Europe, North America and South America support value creation based on the profitable growth and operational leverage that ONE Santander provides. | ||||||||||||||||||||||||||

| Global and in-market scale |  | |||||||||||||||||||||||||

| Diversification | ||||||||||||||||||||||||||

| Business, geographical and balance sheet | → Well-balanced diversification between businesses and markets with a solid and simple balance sheet that gives us recurrent net operating income with low volatility and more predictable results. | |||||||||||||||||||||||||

Our purpose To help people and businesses prosper. |  | ||||||||||

Our aim To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. | |||||||||||

Our how Everything we do should be Simple, Personal and Fair. | |||||||||||

January - June 2024 |  | 5 | ||||||

| Country | GDP Change1 | Economic performance | |||||||||

| Eurozone | +0.4% | Having stagnated in 2023, the economy has entered a phase of soft recovery driven by external demand. Inflation continued to moderate (+2.5% year-on-year in June), which allowed for a 25 bp interest rate cut in June. The ECB is expected to make further interest rate cuts in the second half of the year, but it will depend on whether inflation continues to approach the ECB's target. | ||||||||

| Spain | +2.5% | In Q1 2024, GDP grew 2.5% year-on-year, supported by strong exports of services, while investment remained below pre-pandemic levels. The labour market remains strong, with the number of people enrolled in social security at record levels. In June, inflation was rose 3.4% year-on-year, while core inflation remained at 3%, due to persistently high inflation in services sector. | ||||||||

| United Kingdom | +0.3% | The economy grew in Q1 2024, ending the technical recession that began in H2 2023. The outlook has also improved, with increased business and consumer confidence and real wage growth. The unemployment rate remained low, although it increased to 4.4% in April. Inflation continues to decline (2.0% year-on-year in June) due to lower food prices. Inflationary pressures on wages and services led the Bank of England to hold the official interest rate at 5.25%. | ||||||||

| Portugal | +1.5% | Growth in Q1 2024 surprised positively due to the contribution from external demand. On the other hand, the contribution from domestic demand decreased, due to the slowdown in investment and private consumption. Labour market data remained strong with employment rising and unemployment at low levels (6.5% in May). After moderating in recent months, inflation rose slightly in June (2.8% year-on-year). | ||||||||

| Poland | +2.0% | In Q1 2024, GDP rose supported by private consumption. Supply constraints in the labour market and resilient labour demand kept the unemployment rate low (4.9% in June), supporting higher wages (+11.4% year-on-year in May). Inflation is within the central bank’s target range (2.6% year-on-year in June). However, core inflation remained high (+3.8% year-on-year in May) and, as such, the central bank decided to hold interest rates at 5.75%. | ||||||||

| United States | +2.9% | Domestic demand grew at a good pace in Q1 2024, but private consumption showed signs of slowdown in Q2 2024. The unemployment rate rose to 4.1% in June. Inflation, which had increased in Q1 2024, has since declined (3.0% year-on-year in June). | ||||||||

| Mexico | +1.6% | After having started the year with slight growth, the economy is now showing signs of weakening, though the labour market remains resilient. Year-on-year inflation rebounded to 5.0% in June. After a first 25 bp interest rate cut in Q1 2024, the central bank held interest rates at 11% in Q2 2024. | ||||||||

| Brazil | +2.5% | The economy recovered dynamism in early 2024, driven by private consumption, investment and a strong labour market. Year-on-year inflation rebounded to 4.2% in June and medium-term expectations rose, moving away from the target. Following the latest interest rate cut in May (-25 bps to 10.5%), the central bank held interest rates in June. | ||||||||

| Chile | +2.3% | After a weak 2023, the economy is recovering with growth in mining, industry and services sectors. Inflation rose slightly to 4.2% year-on-year in June. The central bank continued its process of rapid interest rate cuts, with a 150 bp reduction in Q2 2024 to 5.75%, though it said that interest rate cuts will slow down. | ||||||||

| Argentina | -5.1% | The economy remained weak at the beginning of the year, due to the impact of the fiscal and monetary adjustments and high inflation, although inflation has moderated faster than expected as the year has progressed (down to a monthly average of 5.9% during Q2 2024). The external sector is showing signs of recovery, with increases in exports and trade surpluses, in contrast to the 2023 deficit. | ||||||||

| 6 |  | January - June 2024 | ||||||

Main figures | |||||||||||

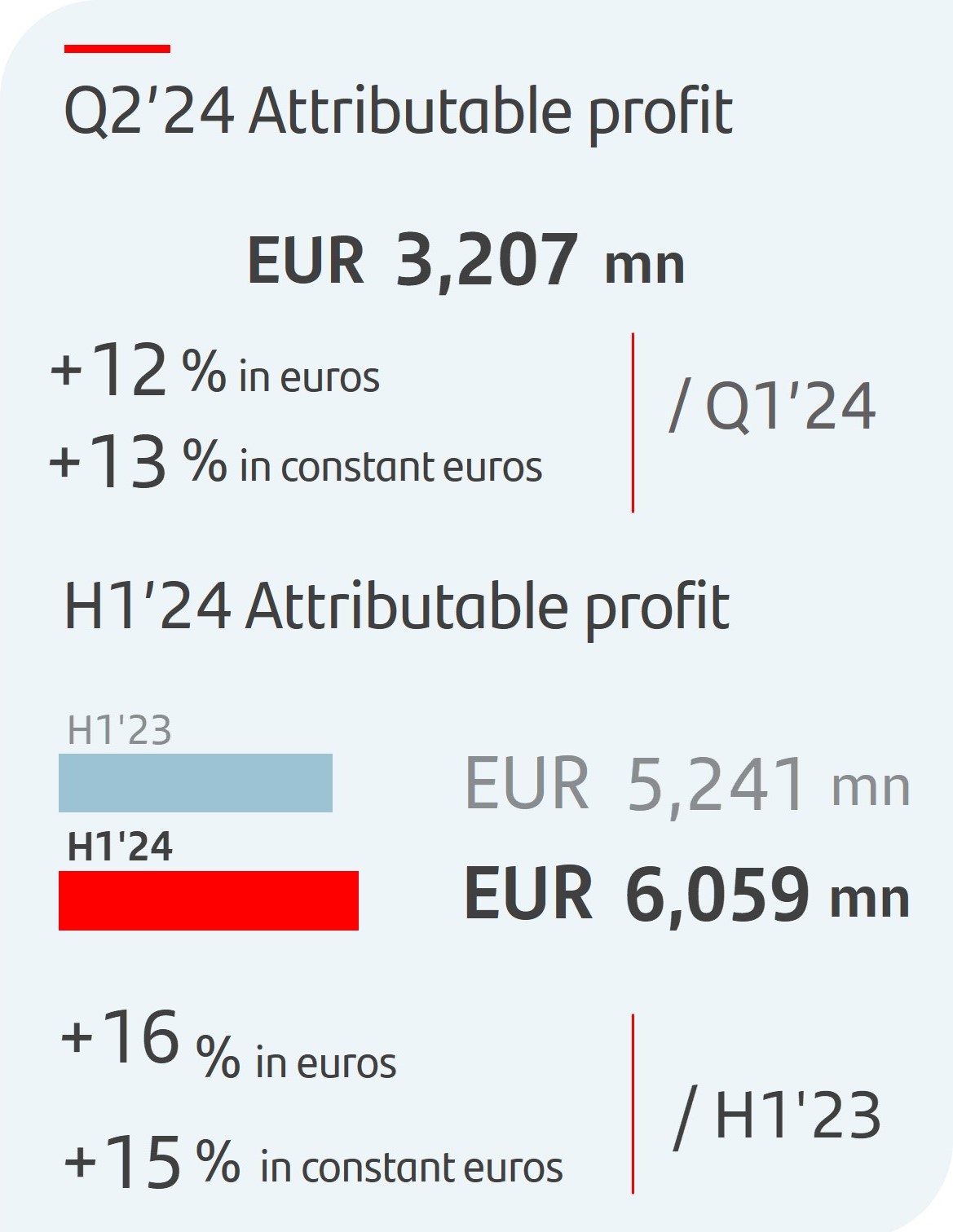

| u | In Q2 2024, profit attributable to the parent was EUR 3,207 million, a new record quarter, despite charges totalling EUR 452 million (provisions relating to our CHF mortgage portfolio in Poland and write-downs after discontinuing our merchant platform in Germany and Superdigital in Latin America). | |||||||||

| u | Attributable profit was 12% higher compared to Q1 2024 (+13% in constant euros), mainly driven by the good performance in Retail, Consumer and Wealth, and after having recorded the temporary levy on revenue obtained in Spain in Q1 2024 and the aforementioned charges in Q2 2024. | ||||||||||

| u | Attributable profit increased 20% (in both euros and constant euros) compared to Q2 2023, with Retail, Wealth and Consumer growing. No contribution to the Single Resolution Fund (SRF) has been recorded in 2024, as contributions ended in 2023. | ||||||||||

| u | In H1 2024, attributable profit was EUR 6,059 million, 16% higher than in the same period of 2023 (+15% in constant euros) boosted by solid revenue growth across all global businesses and regions. | ||||||||||

| u | These positive results enabled us to improve the targets we had set for the year in revenue (from mid-single digit growth to high-single digit growth), efficiency (from less than 43% to close to 42%) and profitability (from 16% RoTE to more than 16%), while maintaining our objectives in capital and cost of risk. | ||||||||||

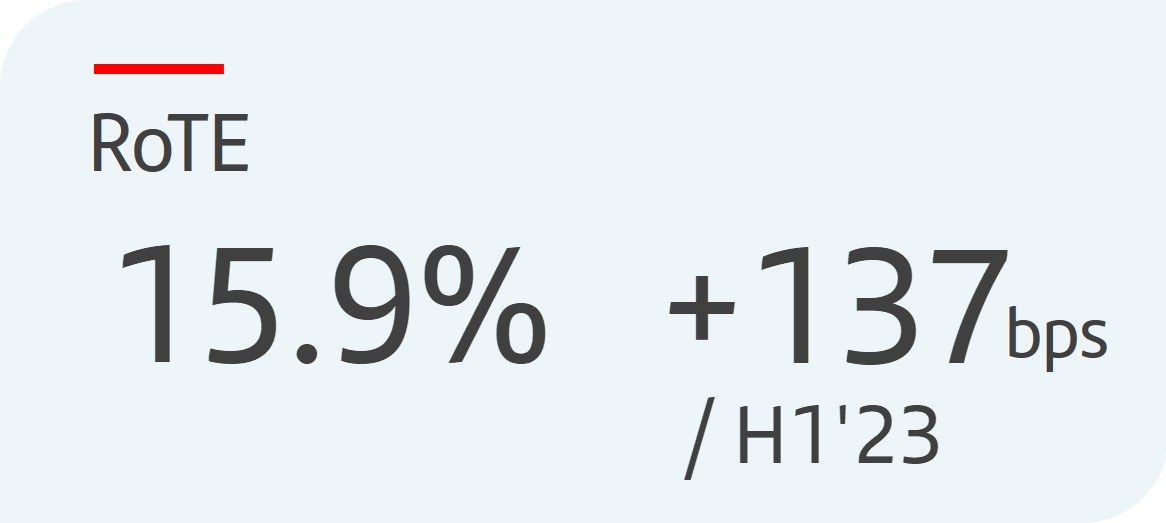

| u | Profitability improved year-on-year and quarter-on-quarter. RoTE stood at 15.9% in H1 2024, compared to 14.5% in the same period of 2023. Annualizing the impact of the temporary levy on revenue obtained in Spain, RoTE was 16.3%, boosted by strong revenue growth. | |||||||||

| u | Sustained earnings per share growth in H1 2024, which rose 19% compared to H1 2023 to EUR 36.7 cents, supported by the positive performance in results and the share buybacks in the last 12 months. | ||||||||||

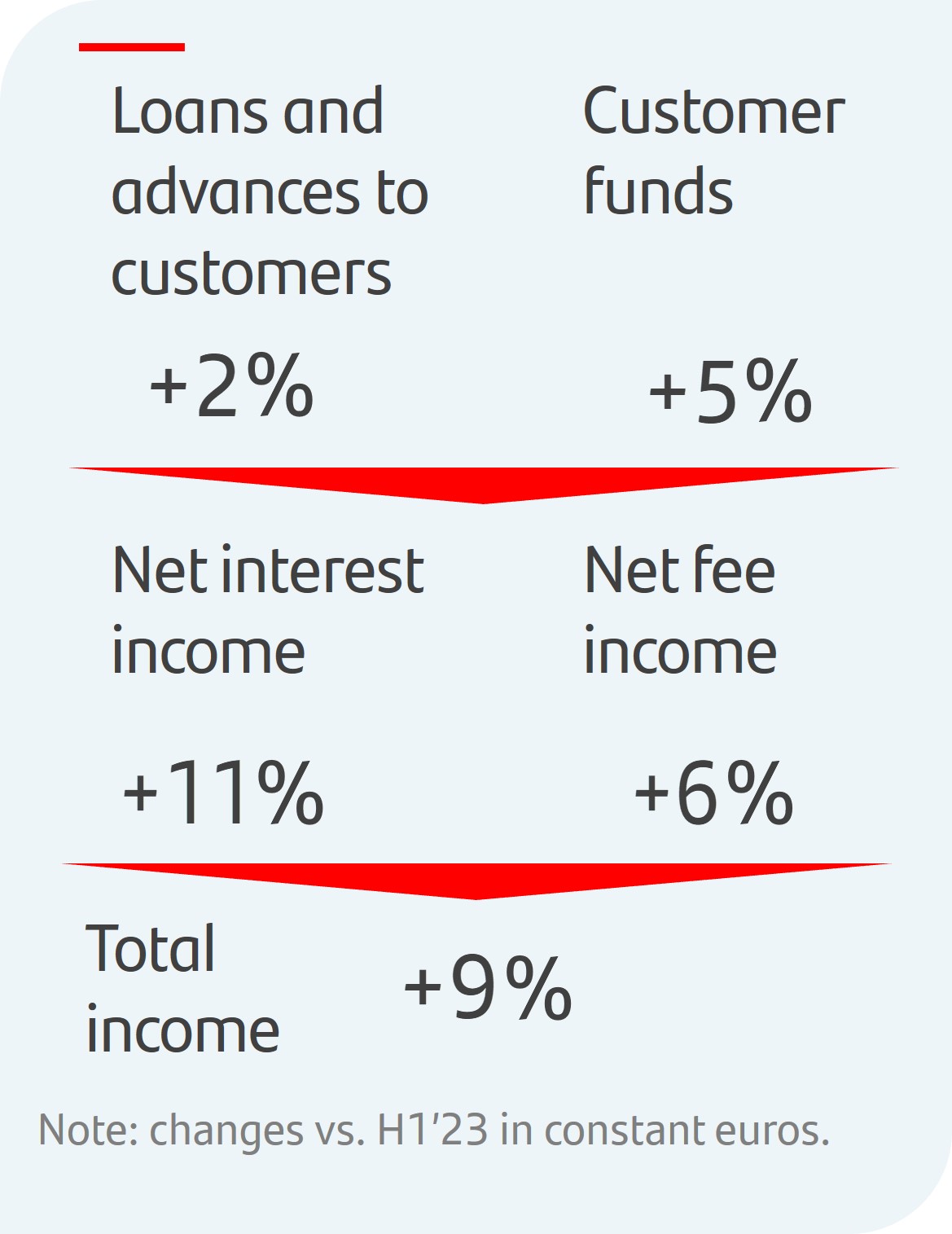

| u | Business volumes continued to reflect the impact that the economic and interest rate environment had on customer behaviour and our active and disciplined capital management. Gross loans and advances to customers (excluding reverse repos) increased 2% year-on-year in constant euros, with all businesses growing except Retail, which decreased slightly as higher volumes in South America and Mexico largely offset lower loans in Europe and the US. Customer funds (customer deposits excluding repurchase agreements plus mutual funds) rose 5% year-on-year in constant euros, with deposits growing across all businesses except CIB (lower volumes in Spain and the US), while mutual funds rose double digits. | |||||||||

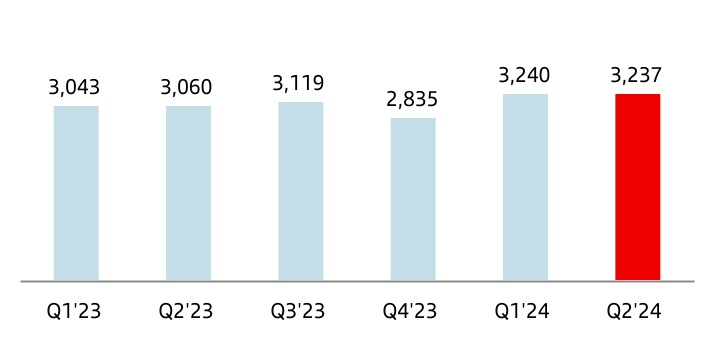

| u | The benefits from our global scale, margin management and higher customer activity were reflected in year-on-year increases in net interest income (+12% in euros, +11% in constant euros) and net fee income (+6% both in euros and constant euros), resulting in total income growth of 10% in euros (+9% in constant euros). | ||||||||||

| u | Structural changes towards a simpler and more integrated model through ONE Transformation are contributing to efficiency gains and profitable growth. The efficiency ratio improved 2.6 pp compared to H1 2023 to 41.6%, driven mainly by Retail and Consumer. | |||||||||

| u | Credit quality remains robust, driven by the strong macroeconomic environment and employment across our footprint. The NPL ratio was 3.02%, improving 5 bps year-on-year. Total loan-loss reserves reached EUR 23,323 million, resulting in a total coverage ratio of 66%. | |||||||||

| u | The Group's cost of risk stood at 1.21% (1.18% in December 2023 and 1.08% in June 2023), in line with our expectations. Retail and Consumer accounted for 85% of Group's net loan-loss provisions. In Retail, the cost of risk remained under control at 1.03%. In Consumer, CoR continued to normalize (to 2.17%) and remained at controlled levels and in line with expectations. | ||||||||||

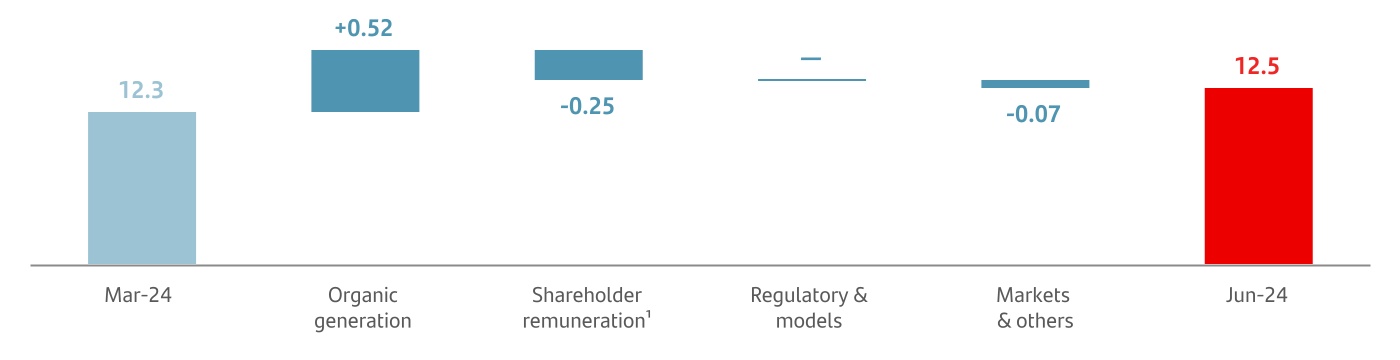

| u | As at end June 2024, the fully-loaded CET1 ratio stood at 12.5%. In the quarter, we generated 52 bps organically, including a 7 bp positive contribution from RWAs, as RWA growth was more than offset by significant risk transfer and asset rotation initiatives. We also recorded a 25 bp charge for shareholder remuneration against profit earned in Q2 2024 in line with our 50% payout target1. Additionally, we recorded charges of -7 bps relating to deductions, mainly intangible assets and held to collect and sell portfolio valuations. There were no significant regulatory charges in the quarter. | |||||||||

January - June 2024 |  | 7 | ||||||

| Think Value | |||||||

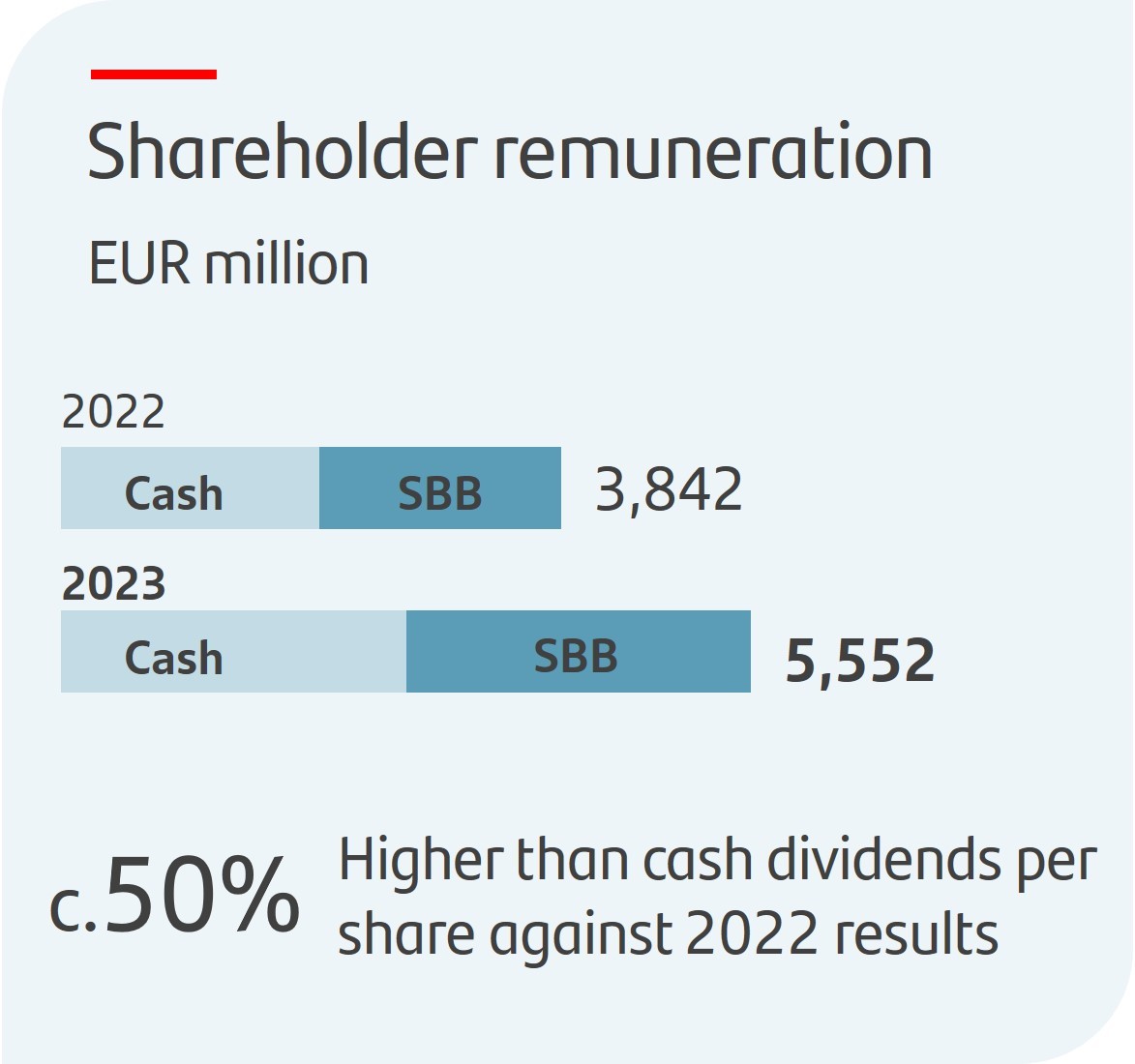

| u | The AGM approved a cash dividend of EUR 9.50 cents per share that was paid in May. Including the cash dividend per share paid in November 2023 (EUR 8.10 cents), the total cash dividend per share paid against 2023 results was EUR 17.60 cents, around 50% more than the dividends per share paid against 2022 results. | |||||||||

| u | In addition to this payment, there were two share buyback programmes which have been completed for a total of EUR 2,769 million. Including purchases made under such buyback programmes, the Group has repurchased c.11% of its outstanding shares since we began our buybacks in 2021. | ||||||||||

| u | Total shareholder remuneration against 2023 results totalled EUR 5,552 million, 45% higher than the remuneration against 2022 results, distributed approximately equally between cash dividends and share buybacks. | ||||||||||

| |||||||||||

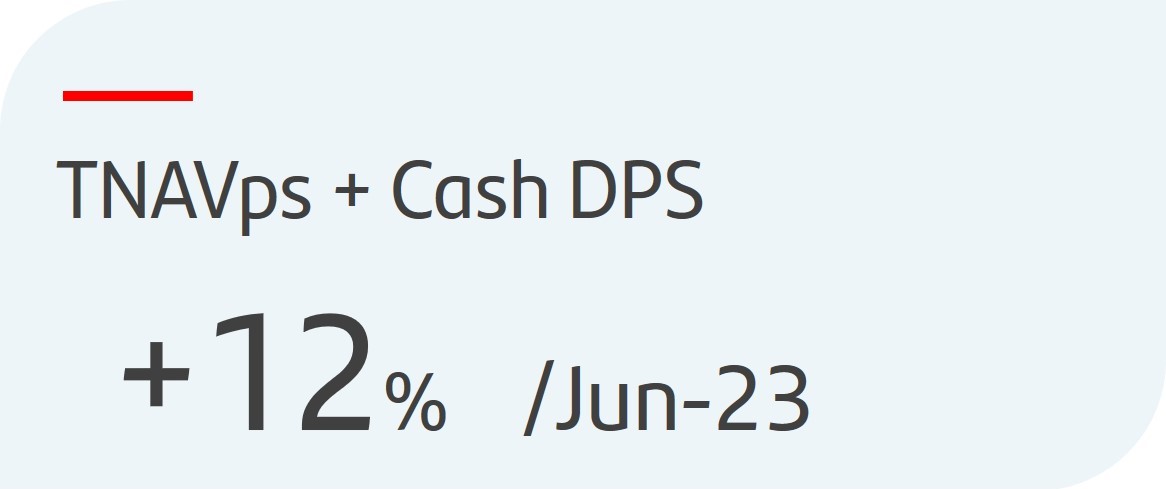

| u | As at end June 2024, TNAV per share was EUR 4.94. Including both cash dividends charged against 2023 results, the TNAV per share + cash dividend per share increased 12% year-on-year. | ||||||||||

| Think Customer | |||||||

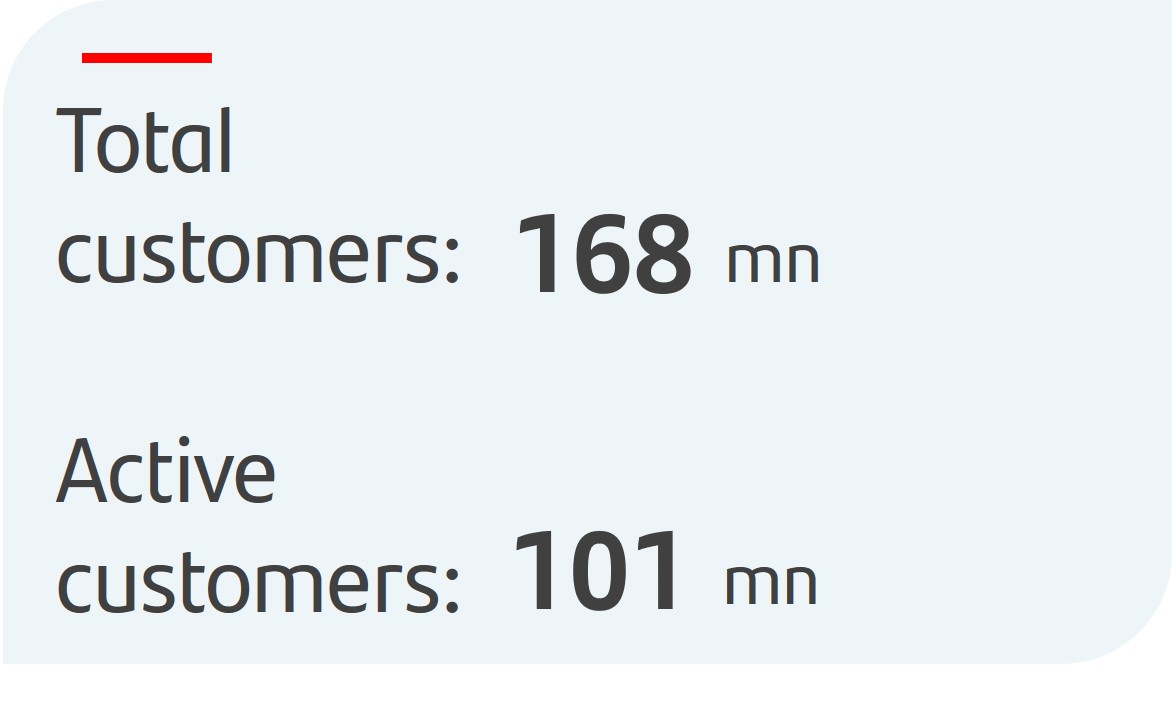

| u | Our efforts to simplify and improve our product offering and quality of service were reflected in a more than 4 million year-on-year increase in total customers to 168 million, while active customers reached 101 million, up almost 2 million year-on-year. | |||||||||

| u | Transaction volumes per active customer rose 9% year-on-year in H1 2024. | ||||||||||

| u | We continue to deliver great customer experience and improve our service quality, ranking in the top 3 in NPS1 in seven of our markets. | ||||||||||

| Think Global | |||||||

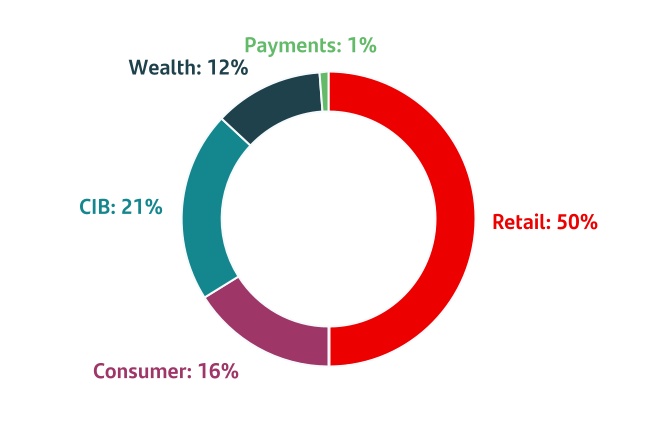

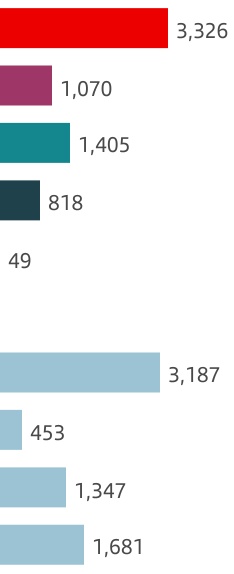

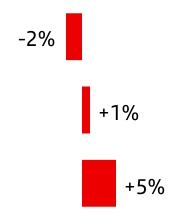

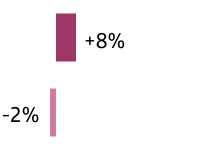

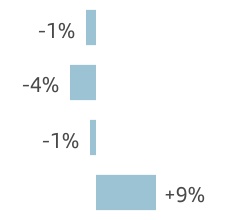

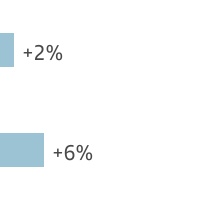

Contribution to Group revenue2 | Year-on-year changes in constant euros | |||||||||||||

| u | In Retail, attributable profit was EUR 3,326 million (+35%) driven by double-digit growth in total income and the good performance in costs (due to our transformation efforts) and provisions. | ||||||||||||

| u | Efficiency improved 4.8 pp to 39.5%, cost of risk remained controlled (1.03%) and RoTE increased to 17.4% (18.1% annualizing the impact of the temporary levy). | |||||||||||||

| u | In Consumer, net operating income increased 12%, supported by total income growth (+7%) and good cost management, reaching an attributable profit of EUR 1,070 million, (+4%) despite higher LLPs (CHF mortgages, cost of risk normalization, higher volumes and some regulatory impacts). | ||||||||||||

| u | Efficiency stood at 40.6%, improving 2.7 pp, cost of risk was 2.17% and RoTE stood at 12.8% (13.0% annualizing the impact of the temporary levy). | |||||||||||||

| u | In CIB, revenue continued to grow, reaching record figures for H1 2024. However, attributable profit (EUR 1,405 million), declined 5%, impacted by costs relating to our transformation investments and lower gains on financial transactions in Brazil. | ||||||||||||

| u | The efficiency ratio was 43.4%, remaining one the best in the sector. RoTE was 19.0% (19.1% annualizing the impact of the temporary levy). | |||||||||||||

| u | In Wealth, attributable profit amounted to EUR 818 million (+14%) driven by higher activity and margin management, boosted especially by Private Banking. | ||||||||||||

| u | Efficiency improved 2.3 pp to 34.4% and RoTE was 79.3% (80.4% annualizing the impact of the temporary levy). | |||||||||||||

| u | In Payments, attributable profit reached EUR 49 million, impacted by write-downs in PagoNxt related to the discontinuation of our merchant platform in Germany and Superdigital in Latin America. Excluding it, profit would be 30% higher than in H1 2023, due to revenue growth and lower LLPs. | ||||||||||||

| u | Cost of risk slightly improved 8 bps to 7.03%. In PagoNxt, EBITDA margin was 20.1% (+8.9 pp year-on-year). | |||||||||||||

| 8 |  | January - June 2024 | ||||||

| Grupo Santander. Summarized income statement | ||||||||||||||||||||||||||

| EUR million | ||||||||||||||||||||||||||

| Change | Change | |||||||||||||||||||||||||

| Q2'24 | Q1'24 | % | H1'24 | H1'23 | % | |||||||||||||||||||||

| Net interest income | 11,474 | 11,983 | (4.2) | 23,457 | 20,920 | 12.1 | ||||||||||||||||||||

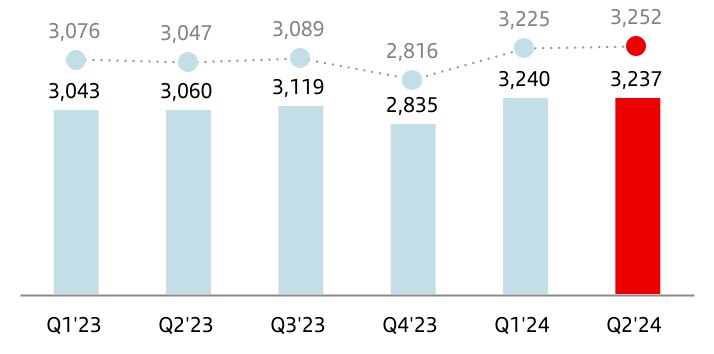

Net fee income1 | 3,237 | 3,240 | (0.1) | 6,477 | 6,103 | 6.1 | ||||||||||||||||||||

Gains or losses on financial assets and liabilities and exchange differences2 | 334 | 623 | (46.4) | 957 | 1,302 | (26.5) | ||||||||||||||||||||

| Dividend income | 400 | 93 | 330.1 | 493 | 382 | 29.1 | ||||||||||||||||||||

| Share of results of entities accounted for using the equity method | 180 | 123 | 46.3 | 303 | 296 | 2.4 | ||||||||||||||||||||

Other operating income/expenses3 (net) | 45 | (1,017) | — | (972) | (993) | (2.1) | ||||||||||||||||||||

| Total income | 15,670 | 15,045 | 4.2 | 30,715 | 28,010 | 9.7 | ||||||||||||||||||||

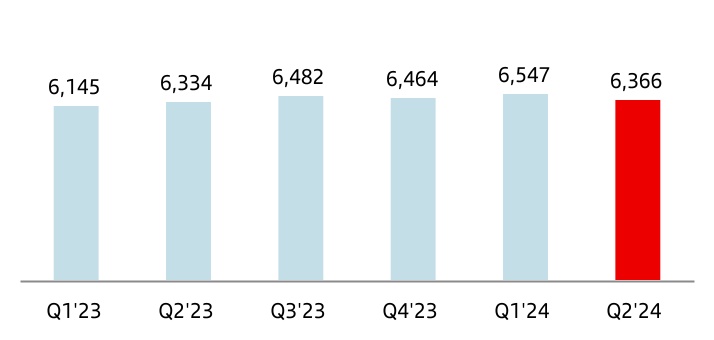

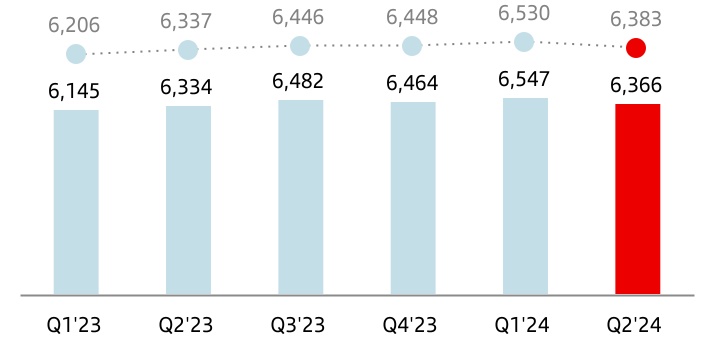

| Operating expenses | (6,366) | (6,547) | (2.8) | (12,913) | (12,479) | 3.5 | ||||||||||||||||||||

| Administrative expenses | (5,538) | (5,719) | (3.2) | (11,257) | (10,873) | 3.5 | ||||||||||||||||||||

| Staff costs | (3,467) | (3,594) | (3.5) | (7,061) | (6,603) | 6.9 | ||||||||||||||||||||

| Other general administrative expenses | (2,071) | (2,125) | (2.5) | (4,196) | (4,270) | (1.7) | ||||||||||||||||||||

| Depreciation and amortization | (828) | (828) | 0.0 | (1,656) | (1,606) | 3.1 | ||||||||||||||||||||

| Provisions or reversal of provisions | (1,129) | (633) | 78.4 | (1,762) | (1,330) | 32.5 | ||||||||||||||||||||

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (3,443) | (3,134) | 9.9 | (6,577) | (6,237) | 5.5 | ||||||||||||||||||||

| Impairment on other assets (net) | (161) | (129) | 24.8 | (290) | (92) | 215.2 | ||||||||||||||||||||

| Gains or losses on non-financial assets and investments, net | 364 | 2 | — | 366 | 277 | 32.1 | ||||||||||||||||||||

| Negative goodwill recognized in results | — | — | — | — | — | — | ||||||||||||||||||||

| Gains or losses on non-current assets held for sale not classified as discontinued operations | (10) | (21) | (52.4) | (31) | (59) | (47.5) | ||||||||||||||||||||

| Profit or loss before tax from continuing operations | 4,925 | 4,583 | 7.5 | 9,508 | 8,090 | 17.5 | ||||||||||||||||||||

| Tax expense or income from continuing operations | (1,448) | (1,468) | (1.4) | (2,916) | (2,281) | 27.8 | ||||||||||||||||||||

| Profit from the period from continuing operations | 3,477 | 3,115 | 11.6 | 6,592 | 5,809 | 13.5 | ||||||||||||||||||||

| Profit or loss after tax from discontinued operations | — | — | — | — | — | — | ||||||||||||||||||||

| Profit for the period | 3,477 | 3,115 | 11.6 | 6,592 | 5,809 | 13.5 | ||||||||||||||||||||

| Profit attributable to non-controlling interests | (270) | (263) | 2.7 | (533) | (568) | (6.2) | ||||||||||||||||||||

| Profit attributable to the parent | 3,207 | 2,852 | 12.4 | 6,059 | 5,241 | 15.6 | ||||||||||||||||||||

| EPS (euros) | 0.20 | 0.17 | 15.4 | 0.37 | 0.31 | 19.2 | ||||||||||||||||||||

| Diluted EPS (euros) | 0.20 | 0.17 | 15.4 | 0.37 | 0.31 | 19.2 | ||||||||||||||||||||

| Memorandum items: | ||||||||||||||||||||||||||

| Average total assets | 1,780,522 | 1,804,334 | (1.3) | 1,792,428 | 1,754,207 | 2.2 | ||||||||||||||||||||

| Average stockholders' equity | 95,994 | 96,308 | (0.3) | 96,151 | 91,368 | 5.2 | ||||||||||||||||||||

| Note: the summarized income statement groups some lines of the consolidated statutory income statement on page 90 as follows: | |||||

1.‘Commission income’ and ‘Commission expense’. | |||||

2.‘Gain or losses on financial assets and liabilities not measured at fair value through profit or loss, net’; ‘Gain or losses on financial assets and liabilities held for trading, net’; ‘Gains or losses on non-trading financial assets and liabilities mandatorily at fair value through profit or loss’; ‘Gain or losses on financial assets and liabilities measured at fair value through profit or loss, net’; ‘Gain or losses from hedge accounting, net’; and ‘Exchange differences, net’. | |||||

3.‘Other operating income’; ‘Other operating expenses’; ’Income from insurance and reinsurance contracts’; and ‘Expenses from insurance and reinsurance contracts’. | |||||

January - June 2024 |  | 9 | ||||||

| Statutory income statement | ||||||||||||||||||||||||||||||||||||||

| Net interest income | |||||

| EUR million | |||||

| Net fee income | |||||

| EUR million | |||||

| Total income | |||||

| EUR million | |||||

| 10 |  | January - June 2024 | ||||||

| Operating expenses | |||||

| EUR million | |||||

January - June 2024 |  | 11 | ||||||

| Underlying income statement | ||||||||||||||||||||||||||||||||||||||

→ Record profit in the quarter and first half of the year, with solid revenue growth in all our global businesses and regions. → Efficiency improvement and profitable growth, supported by the operational leverage resulting from ONE Transformation. → Risk indicators were robust, due to good risk management, the economic environment and low unemployment. → Positive 2024 results enabled us to improve our targets for the year in revenue, efficiency and profitability. | ||||||||||||||||||||

| Attributable profit | RoTE | RoRWA | ||||||||||||||||||

| EUR 6,059 million | +16% in euros | 15.9% | 2.07% | |||||||||||||||||

| +15% in constant euros | +1.4 pp | +0.2 pp | ||||||||||||||||||

| Note: changes vs. H1 2023. | ||||||||||||||||||||

| Summarized underlying income statement | ||||||||||||||||||||||||||

| EUR million | Change | Change | ||||||||||||||||||||||||

| Q2'24 | Q1'24 | % | % excl. FX | H1'24 | H1'23 | % | % excl. FX | |||||||||||||||||||

| Net interest income | 11,474 | 11,983 | (4.2) | (3.5) | 23,457 | 20,920 | 12.1 | 11.2 | ||||||||||||||||||

| Net fee income | 3,237 | 3,240 | (0.1) | 0.8 | 6,477 | 6,103 | 6.1 | 5.8 | ||||||||||||||||||

Gains (losses) on financial transactions 1 | 334 | 623 | (46.4) | (46.4) | 957 | 1,302 | (26.5) | (25.7) | ||||||||||||||||||

| Other operating income | 625 | (466) | — | — | 159 | (91) | — | — | ||||||||||||||||||

| Total income | 15,670 | 15,380 | 1.9 | 2.6 | 31,050 | 28,234 | 10.0 | 9.3 | ||||||||||||||||||

| Administrative expenses and amortizations | (6,366) | (6,547) | (2.8) | (2.3) | (12,913) | (12,479) | 3.5 | 3.0 | ||||||||||||||||||

| Net operating income | 9,304 | 8,833 | 5.3 | 6.3 | 18,137 | 15,755 | 15.1 | 14.3 | ||||||||||||||||||

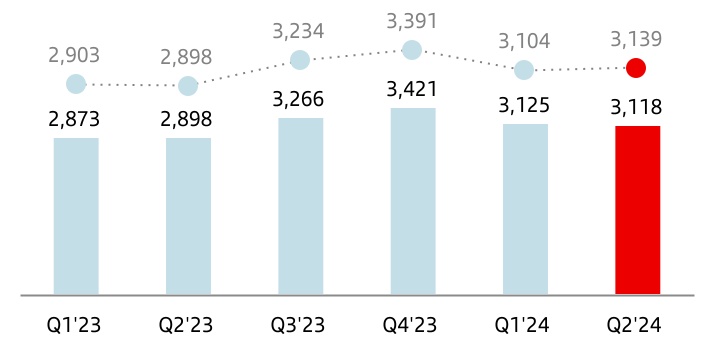

| Net loan-loss provisions | (3,118) | (3,125) | (0.2) | 1.1 | (6,243) | (5,771) | 8.2 | 7.6 | ||||||||||||||||||

| Other gains (losses) and provisions | (1,261) | (1,125) | 12.1 | 12.8 | (2,386) | (1,655) | 44.2 | 42.7 | ||||||||||||||||||

| Profit before tax | 4,925 | 4,583 | 7.5 | 8.2 | 9,508 | 8,329 | 14.2 | 13.3 | ||||||||||||||||||

| Tax on profit | (1,448) | (1,468) | (1.4) | (0.4) | (2,916) | (2,494) | 16.9 | 15.6 | ||||||||||||||||||

| Profit from continuing operations | 3,477 | 3,115 | 11.6 | 12.2 | 6,592 | 5,835 | 13.0 | 12.3 | ||||||||||||||||||

| Net profit from discontinued operations | — | — | — | — | — | — | — | — | ||||||||||||||||||

| Consolidated profit | 3,477 | 3,115 | 11.6 | 12.2 | 6,592 | 5,835 | 13.0 | 12.3 | ||||||||||||||||||

| Non-controlling interests | (270) | (263) | 2.7 | 2.9 | (533) | (594) | (10.3) | (9.3) | ||||||||||||||||||

| Net capital gains and provisions | — | — | — | — | — | — | — | — | ||||||||||||||||||

| Profit attributable to the parent | 3,207 | 2,852 | 12.4 | 13.1 | 6,059 | 5,241 | 15.6 | 14.7 | ||||||||||||||||||

Underlying profit attributable to the parent 2 | 3,207 | 2,852 | 12.4 | 13.1 | 6,059 | 5,241 | 15.6 | 14.7 | ||||||||||||||||||

| 12 |  | January - June 2024 | ||||||

| Net interest income | |||||

| EUR million | |||||

| constant euros | ||||

| Net fee income | |||||

| EUR million | |||||

| constant euros | ||||

| Total income | |||||

| EUR million | |||||

| constant euros | ||||

January - June 2024 |  | 13 | ||||||

| Operating expenses | |||||

| EUR million | |||||

| constant euros | ||||

| Net operating income | |||||

| EUR million | |||||

| constant euros | ||||

| Net loan-loss provisions | |||||

| EUR million | |||||

| constant euros | ||||

| Profit attributable to the parent | |||||

| EUR million | |||||

| constant euros | ||||

| 14 |  | January - June 2024 | ||||||

January - June 2024 |  | 15 | ||||||

| Grupo Santander. Condensed balance sheet | |||||||||||||||||

| EUR million | |||||||||||||||||

| Change | |||||||||||||||||

| Assets | Jun-24 | Jun-23 | Absolute | % | Dec-23 | ||||||||||||

| Cash, cash balances at central banks and other demand deposits | 156,234 | 207,546 | (51,312) | (24.7) | 220,342 | ||||||||||||

| Financial assets held for trading | 206,874 | 183,834 | 23,040 | 12.5 | 176,921 | ||||||||||||

| Debt securities | 71,523 | 55,823 | 15,700 | 28.1 | 62,124 | ||||||||||||

| Equity instruments | 16,764 | 13,349 | 3,415 | 25.6 | 15,057 | ||||||||||||

| Loans and advances to customers | 19,899 | 11,051 | 8,848 | 80.1 | 11,634 | ||||||||||||

| Loans and advances to central banks and credit institutions | 39,760 | 35,998 | 3,762 | 10.5 | 31,778 | ||||||||||||

| Derivatives | 58,928 | 67,613 | (8,685) | (12.8) | 56,328 | ||||||||||||

Financial assets designated at fair value through profit or loss1 | 15,335 | 15,441 | (106) | (0.7) | 15,683 | ||||||||||||

| Loans and advances to customers | 6,601 | 6,782 | (181) | (2.7) | 7,201 | ||||||||||||

| Loans and advances to central banks and credit institutions | 444 | 627 | (183) | (29.2) | 459 | ||||||||||||

| Other (debt securities an equity instruments) | 8,290 | 8,032 | 258 | 3.2 | 8,023 | ||||||||||||

| Financial assets at fair value through other comprehensive income | 82,270 | 86,756 | (4,486) | (5.2) | 83,308 | ||||||||||||

| Debt securities | 71,160 | 76,010 | (4,850) | (6.4) | 73,565 | ||||||||||||

| Equity instruments | 1,842 | 1,729 | 113 | 6.5 | 1,761 | ||||||||||||

| Loans and advances to customers | 8,933 | 8,714 | 219 | 2.5 | 7,669 | ||||||||||||

| Loans and advances to central banks and credit institutions | 335 | 303 | 32 | 10.6 | 313 | ||||||||||||

| Financial assets measured at amortized cost | 1,217,341 | 1,180,302 | 37,039 | 3.1 | 1,191,403 | ||||||||||||

| Debt securities | 114,347 | 91,559 | 22,788 | 24.9 | 103,559 | ||||||||||||

| Loans and advances to customers | 1,030,163 | 1,018,497 | 11,666 | 1.1 | 1,009,845 | ||||||||||||

| Loans and advances to central banks and credit institutions | 72,831 | 70,246 | 2,585 | 3.7 | 77,999 | ||||||||||||

| Investments in subsidiaries, joint ventures and associates | 8,235 | 7,679 | 556 | 7.2 | 7,646 | ||||||||||||

| Tangible assets | 33,709 | 34,159 | (450) | (1.3) | 33,882 | ||||||||||||

| Intangible assets | 19,359 | 19,528 | (169) | (0.9) | 19,871 | ||||||||||||

| Goodwill | 13,668 | 14,126 | (458) | (3.2) | 14,017 | ||||||||||||

| Other intangible assets | 5,691 | 5,402 | 289 | 5.3 | 5,854 | ||||||||||||

Other assets2 | 46,904 | 45,248 | 1,656 | 3.7 | 48,006 | ||||||||||||

| Total assets | 1,786,261 | 1,780,493 | 5,768 | 0.3 | 1,797,062 | ||||||||||||

| Liabilities and shareholders' equity | |||||||||||||||||

| Financial liabilities held for trading | 133,856 | 134,888 | (1,032) | (0.8) | 122,270 | ||||||||||||

| Customer deposits | 23,729 | 19,921 | 3,808 | 19.1 | 19,837 | ||||||||||||

| Debt securities issued | — | — | — | — | — | ||||||||||||

| Deposits by central banks and credit institutions | 28,213 | 30,356 | (2,143) | (7.1) | 25,670 | ||||||||||||

| Derivatives | 52,261 | 62,259 | (9,998) | (16.1) | 50,589 | ||||||||||||

| Other | 29,653 | 22,352 | 7,301 | 32.7 | 26,174 | ||||||||||||

| Financial liabilities designated at fair value through profit or loss | 34,493 | 36,220 | (1,727) | (4.8) | 40,367 | ||||||||||||

| Customer deposits | 24,809 | 27,297 | (2,488) | (9.1) | 32,052 | ||||||||||||

| Debt securities issued | 6,726 | 5,684 | 1,042 | 18.3 | 5,371 | ||||||||||||

| Deposits by central banks and credit institutions | 2,942 | 3,239 | (297) | (9.2) | 2,944 | ||||||||||||

| Other | 16 | — | 16 | — | — | ||||||||||||

| Financial liabilities measured at amortized cost | 1,454,896 | 1,446,882 | 8,014 | 0.6 | 1,468,703 | ||||||||||||

| Customer deposits | 989,108 | 966,560 | 22,548 | 2.3 | 995,280 | ||||||||||||

| Debt securities issued | 305,136 | 285,869 | 19,267 | 6.7 | 303,208 | ||||||||||||

| Deposits by central banks and credit institutions | 117,752 | 149,348 | (31,596) | (21.2) | 130,028 | ||||||||||||

| Other | 42,900 | 45,105 | (2,205) | (4.9) | 40,187 | ||||||||||||

| Liabilities under insurance contracts | 17,592 | 17,584 | 8 | 0.0 | 17,799 | ||||||||||||

| Provisions | 8,401 | 8,389 | 12 | 0.1 | 8,441 | ||||||||||||

Other liabilities3 | 33,375 | 34,486 | (1,111) | (3.2) | 35,241 | ||||||||||||

| Total liabilities | 1,682,613 | 1,678,449 | 4,164 | 0.2 | 1,692,821 | ||||||||||||

| Shareholders' equity | 132,836 | 127,258 | 5,578 | 4.4 | 130,443 | ||||||||||||

| Capital stock | 7,747 | 8,092 | (345) | (4.3) | 8,092 | ||||||||||||

Reserves (including treasury stock)4 | 119,030 | 113,925 | 5,105 | 4.5 | 112,573 | ||||||||||||

| Profit attributable to the Group | 6,059 | 5,241 | 818 | 15.6 | 11,076 | ||||||||||||

| Less: dividends | — | — | — | — | (1,298) | ||||||||||||

| Other comprehensive income | (36,963) | (33,789) | (3,174) | 9.4 | (35,020) | ||||||||||||

| Minority interests | 7,775 | 8,575 | (800) | (9.3) | 8,818 | ||||||||||||

| Total equity | 103,648 | 102,044 | 1,604 | 1.6 | 104,241 | ||||||||||||

| Total liabilities and equity | 1,786,261 | 1,780,493 | 5,768 | 0.3 | 1,797,062 | ||||||||||||

| Note: The condensed balance sheet groups some lines of the consolidated balance sheet on pages 88 and 89 as follows: | ||

1.'Non-trading financial assets mandatorily at fair value through profit or loss' and 'Financial assets designated at fair value through profit or loss'. | ||

2.‘Hedging derivatives’; ‘Changes in the fair value of hedged items in portfolio hedges of interest risk’; 'Assets under reinsurance contracts'; ‘Tax assets’; ‘Other assets’; and 'Non-current assets held for sale’. | ||

3.‘Hedging derivatives’; ‘Changes in the fair value of hedged items in portfolio hedges of interest rate risk’; ‘Tax liabilities’; ‘Other liabilities’; and ‘Liabilities associated with non-current assets held for sale‘. | ||

4.‘Share premium’; ‘Equity instruments issued other than capital’; ‘Other equity’; ‘Accumulated retained earnings’; ‘Revaluation reserves’; ‘Other reserves’; and ‘Own shares (-)’. | ||

| 16 |  | January - June 2024 | ||||||

| Balance sheet | ||||||||||||||||||||||||||||||||||||||

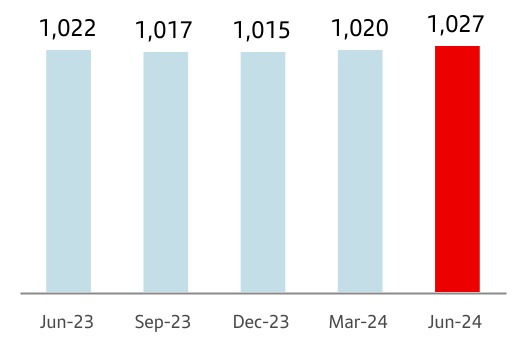

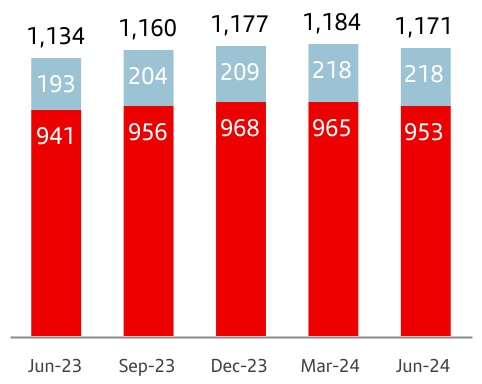

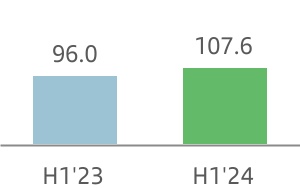

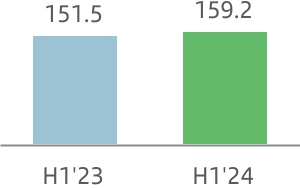

Gross loans and advances to customers (excl. reverse repos) | Customer funds (deposits excl. repos + mutual funds) | |||||||||||||||||||

| Lending volumes rose 2% year-on-year. Quarter-on-quarter, lending volumes also increased 2%, with growth across most businesses and regions. | Customer funds grew year-on-year and remained flat quarter-on-quarter, as the decline in corporate deposits was offset by higher mutual funds. | |||||||||||||||||||

Gross loans and advances to customers (excl. reverse repos) | Customer funds (deposits excl. repos + mutual funds) | |||||||||||||||||||

| 1,027 | +2% QoQ | 1,171 | 0% QoQ | |||||||||||||||||

| EUR billion | +2% YoY | EUR billion | +5% YoY | |||||||||||||||||

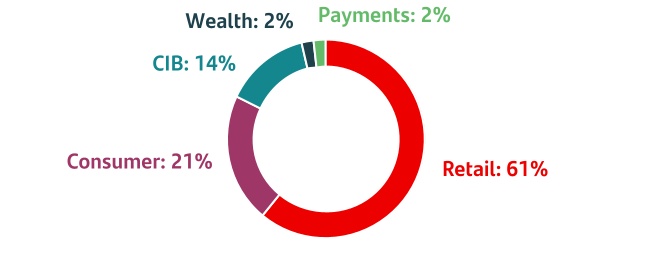

è By segment: | è By product: | |||||||||||||||||||

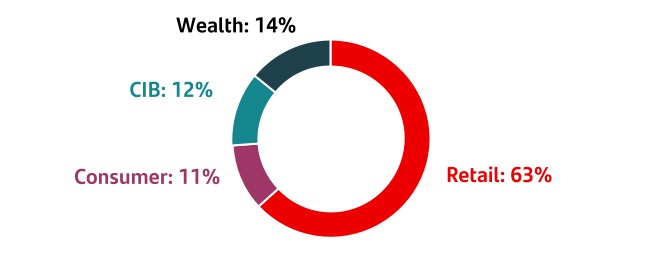

| Solid growth year-on-year in our Consumer and CIB businesses, with a slight decrease in Retail. | Year-on-year growth in time deposits and mutual funds at the expense of demand deposits. | |||||||||||||||||||

| Retail | Consumer | CIB | Demand | Time | Mutual funds | |||||||||||||||

| -1% | +6% | +7% | -1% | +12% | +17% | |||||||||||||||

| Note: changes in constant euros. | ||||||||||||||||||||

| Gross loans and advances to customers (excl. reverse repos) | |||||

| EUR billion | |||||

| +1 | % | 1 | |||

| Jun-24 / Jun-23 | |||||

| Gross loans and advances to customers (excl. reverse repos) | ||

| % operating areas. June 2024 | ||

January - June 2024 |  | 17 | ||||||

| Customer funds | ||

| EUR billion | ||

| +3 | % | 1a | ||||||

| +13 | % | |||||||

| +1 | % | |||||||

•Total | ||||||||

• Mutual funds | ||||||||

•Deposits exc. repos | ||||||||

| Jun-24 / Jun-23 | ||||||||

| Rating agencies | |||||||||||

| Long term | Short term | Outlook | |||||||||

| Fitch Ratings | A-(Senior A) | F2 (Senior F1) | Stable | ||||||||

| Moody's | A2 | P-1 | Positive | ||||||||

| Standard & Poor's | A+ | A-1 | Stable | ||||||||

| DBRS | A (High) | R-1 (Middle) | Stable | ||||||||

| Customer funds | ||

| % operating areas. June 2024 | ||

| 18 |  | January - June 2024 | ||||||

| Executive summary | ||||||||||||||||||||||||||||||||||||||

| Fully-loaded capital ratio | Fully-loaded CET1 ratio | |||||||||||||||||||

| The fully-loaded CET1 ratio remained above 12% at the end of June, in line with the Group's objective. | We continued to generate capital organically in the quarter, backed by profit growth. | |||||||||||||||||||

| Fully-loaded CET1 performance (%) | Organic generation | +52 bps | ||||||||||||||||||

| ||||||||||||||||||||

Accrual for shareholder remuneration1 | -25 bps | |||||||||||||||||||

| TNAV per share | ||||||||||||||||||||

TNAV per share was EUR 4.94, increasing 12% year-on-year including the cash dividends. | ||||||||||||||||||||

Eligible capital. June 2024 | ||||||||

| EUR million | ||||||||

| Fully-loaded | Phased-in | |||||||

| CET1 | 77,848 | 77,975 | ||||||

| Basic capital | 86,681 | 86,809 | ||||||

| Eligible capital | 102,419 | 104,420 | ||||||

| Risk-weighted assets | 625,017 | 624,831 | ||||||

| % | % | |||||||

| CET1 capital ratio | 12.5 | 12.5 | ||||||

| Tier 1 capital ratio | 13.9 | 13.9 | ||||||

| Total capital ratio | 16.4 | 16.7 | ||||||

| Fully-loaded CET1 ratio performance | ||

| % | ||

January - June 2024 |  | 19 | ||||||

| Executive summary | ||||||||||||||||||||||||||||||||||||||

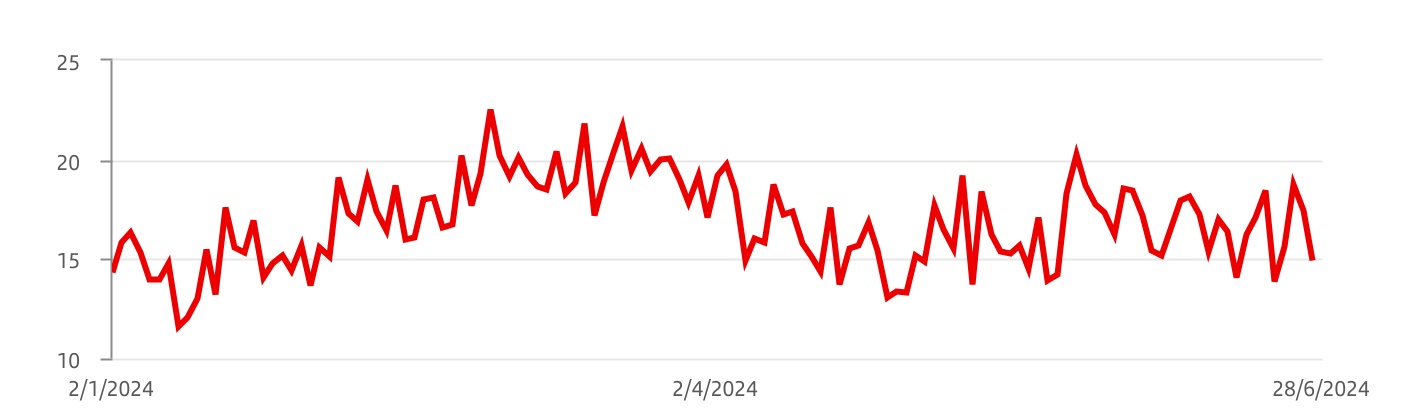

| Credit risk | Market risk | |||||||||||||||||||

| Credit quality indicators remain within expected levels due to proactive risk management, despite the macroeconomic and geopolitical environment. | Stability in our risk profile. VaR remained at moderate levels in an economic environment with persistent inflation and greater geopolitical risk. | |||||||||||||||||||

| Cost of risk | NPL ratio | Coverage ratio | Average VaR | |||||||||||||||||

| 1.21% | 3.02% | 66% | Q2'24 | EUR 16 million | -EUR 1 mn / Q1'24 | |||||||||||||||

| +1 bps vs. Q1'24 | -8 bps vs. Q1'24 | 0 pp vs. Q1'24 | ||||||||||||||||||

| Structural and liquidity risk | Operational risk | |||||||||||||||||||

| Robust and diversified liquidity buffer, with ratios well above regulatory requirements. | The operational risk profile deteriorated slightly in Q2 2024, caused by an increase in execution and cyber risk. Operational losses have increased compared to Q1 2024. | |||||||||||||||||||

| Liquidity Coverage Ratio (LCR) | ||||||||||||||||||||

| 163% | +5 pp vs. Q1'24 | |||||||||||||||||||

| Key risk metrics | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Net loan-loss provisions 2 | Cost of risk (%) 3 | NPL ratio (%) | NPL coverage ratio (%) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Q2'24 | H1'24 | Chg (%) / H1'23 | Chg (%) / Q1'24 | H1'24 | Chg (bps) / H1'23 | Chg (bps) / Q1'24 | H1'24 | Chg (bps) / H1'23 | Chg (bps) / Q1'24 | H1'24 | Chg (pp) / H1'23 | Chg (pp) / Q1'24 | |||||||||||||||||||||||||||||||||||||||||

| Retail | 1,564 | 3,087 | (1.3) | 4.6 | 1.03 | 11 | 0 | 3.15 | (7) | (9) | 60.4 | (2.8) | 0.3 | ||||||||||||||||||||||||||||||||||||||||

| Consumer | 1,055 | 2,193 | 21.4 | (7.0) | 2.17 | 31 | 4 | 4.81 | 63 | (5) | 75.9 | (12.0) | (0.2) | ||||||||||||||||||||||||||||||||||||||||

| CIB | 56 | 96 | — | 39.4 | 0.15 | (4) | 1 | 1.05 | (33) | (9) | 45.0 | 8.2 | (1.3) | ||||||||||||||||||||||||||||||||||||||||

| Wealth | 10 | 14 | — | 147.9 | 0.05 | 6 | 11 | 0.77 | (5) | 14 | 64.6 | 11.4 | 3.0 | ||||||||||||||||||||||||||||||||||||||||

| Payments | 434 | 852 | (2.8) | 6.0 | 7.03 | (8) | 14 | 5.00 | (13) | 15 | 149.5 | 7.4 | 4.6 | ||||||||||||||||||||||||||||||||||||||||

| TOTAL GROUP | 3,118 | 6,243 | 7.6 | 1.1 | 1.21 | 13 | 1 | 3.02 | (5) | (8) | 66.5 | (1.9) | 0.4 | ||||||||||||||||||||||||||||||||||||||||

| Europe | 532 | 1,017 | (22.7) | 9.6 | 0.39 | (3) | (2) | 2.25 | (11) | (7) | 49.1 | (1.9) | 0.0 | ||||||||||||||||||||||||||||||||||||||||

| DCB Europe | 308 | 584 | 39.5 | 12.0 | 0.72 | 17 | 5 | 2.31 | 28 | 5 | 85.4 | (9.0) | (0.7) | ||||||||||||||||||||||||||||||||||||||||

| North America | 908 | 1,893 | 21.2 | (8.1) | 2.23 | 54 | 9 | 3.93 | 70 | (14) | 74.3 | (15.7) | 0.1 | ||||||||||||||||||||||||||||||||||||||||

| South America | 1,370 | 2,748 | 9.5 | 2.7 | 3.50 | 18 | 5 | 5.30 | (58) | (7) | 81.5 | 3.7 | 1.2 | ||||||||||||||||||||||||||||||||||||||||

| TOTAL GROUP | 3,118 | 6,243 | 7.6 | 1.1 | 1.21 | 13 | 1 | 3.02 | (5) | (8) | 66.5 | (1.9) | 0.4 | ||||||||||||||||||||||||||||||||||||||||

| 20 |  | January - June 2024 | ||||||

| Coverage ratio by stage | |||||||||||||||||||||||

| EUR billion | |||||||||||||||||||||||

Exposure1 | Coverage | ||||||||||||||||||||||

| Jun-24 | Mar-24 | Jun-23 | Jun-24 | Mar-24 | Jun-23 | ||||||||||||||||||

| Stage 1 | 1,008 | 1,007 | 1,011 | 0.4 | % | 0.4 | % | 0.4 | % | ||||||||||||||

| Stage 2 | 94 | 83 | 75 | 5.6 | % | 6.3 | % | 7.2 | % | ||||||||||||||

| Stage 3 | 35 | 36 | 35 | 41.2 | % | 40.5 | % | 41.0 | % | ||||||||||||||

| Credit impaired loans and loan-loss allowances | |||||||||||

| EUR million | |||||||||||

| Change (%) | |||||||||||

| Q2'24 | QoQ | YoY | |||||||||

| Balance at beginning of period | 35,637 | — | 3.5 | ||||||||

| Net additions | 3,296 | 4.1 | 4.8 | ||||||||

| Increase in scope of consolidation | 13 | — | — | ||||||||

| Exchange rate differences and other | (611) | — | — | ||||||||

| Write-offs | (3,244) | 1.5 | 6.0 | ||||||||

| Balance at period-end | 35,091 | (1.5) | 0.4 | ||||||||

| Loan-loss allowances | 23,323 | (0.9) | (2.4) | ||||||||

| For impaired assets | 14,461 | 0.1 | 0.9 | ||||||||

| For other assets | 8,862 | (2.6) | (7.5) | ||||||||

| Retail & Commercial Banking | Credit risk exposure | |||||||||

| 56% of total Group | |||||||||||

| Digital Consumer Bank | Credit risk exposure | |||||||||

| 18% of total Group | |||||||||||

January - June 2024 |  | 21 | ||||||

| Corporate & Investment Banking | Credit risk exposure | |||||||||

| 21% of total Group | |||||||||||

| Payments | Credit risk exposure | |||||||||

| 2% of total Group | |||||||||||

Trading portfolios.1 VaR by region | ||||||||||||||

| EUR million | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Second quarter | Average | Last | Average | |||||||||||

| Total | 16.4 | 14.9 | 12.1 | |||||||||||

| Europe | 12.2 | 12.0 | 9.4 | |||||||||||

| North America | 7.7 | 8.1 | 3.5 | |||||||||||

| South America | 7.9 | 10.6 | 8.5 | |||||||||||

Trading portfolios.1 VaR by market factor | ||||||||||||||

| EUR million | ||||||||||||||

| Second quarter 2024 | Min. | Avg. | Max. | Last | ||||||||||

| VaR total | 13.0 | 16.4 | 20.2 | 14.9 | ||||||||||

| Diversification effect | (12.0) | (17.2) | (23.7) | (19.0) | ||||||||||

| Interest rate VaR | 13.6 | 17.4 | 22.3 | 16.4 | ||||||||||

| Equity VaR | 2.8 | 3.8 | 5.1 | 5.1 | ||||||||||

| FX VaR | 2.8 | 5.2 | 7.7 | 5.2 | ||||||||||

| Credit spreads VaR | 3.6 | 4.3 | 5.2 | 4.3 | ||||||||||

| Commodities VaR | 2.3 | 2.9 | 3.7 | 2.8 | ||||||||||

| 22 |  | January - June 2024 | ||||||

Trading portfolios1. VaR performance | ||

| EUR million | ||

January - June 2024 |  | 23 | ||||||

| 24 |  | January - June 2024 | ||||||

The businesses included in each of the segments in this report and the accounting principles under which their results are presented here may differ from the businesses included and accounting principles applied in the financial information separately prepared and disclosed by our subsidiaries (some of which are publicly listed) which in name or geographical description may seem to correspond to the business areas covered in this report. Accordingly, the results of operations and trends shown for our business areas in this document may differ materially from those of such subsidiaries. As explained on the previous page, the results of our segments presented below are provided on the basis of underlying results only and include the impact of foreign exchange rate fluctuations. However, for a better understanding of the changes in the performance of our business areas, we also provide and discuss the year-on-year changes to our results excluding such exchange rate impacts (i.e. in constant euros), except for Argentina, and any grouping which includes it. Additionally, from Q2 2024 onwards, a theoretical exchange rate has been used for the Argentine peso. For further information, see methodology in the 'Alternative performance measures' section in the appendix to this report. Certain figures contained in this report, have been subject to rounding to enhance their presentation. Accordingly, in certain instances, the sum of the numbers in a column or a row in tables contained in this report may not conform exactly to the total figure given for that column or row. | ||

January - June 2024 |  | 25 | ||||||

| January-June 2024 | ||||||||||||||||||||

| Main items of the underlying income statement | ||||||||||||||||||||

| EUR million | ||||||||||||||||||||

| Primary segments | Net interest income | Net fee income | Total income | Net operating income | Profit before tax | Profit attributable to the parent | ||||||||||||||

| Retail & Commercial Banking | 14,015 | 2,366 | 16,274 | 9,851 | 5,187 | 3,326 | ||||||||||||||

| Digital Consumer Bank | 5,364 | 742 | 6,449 | 3,831 | 1,341 | 1,070 | ||||||||||||||

| Corporate & Investment Banking | 2,031 | 1,280 | 4,188 | 2,371 | 2,151 | 1,405 | ||||||||||||||

| Wealth Management & Insurance | 827 | 719 | 1,789 | 1,173 | 1,130 | 818 | ||||||||||||||

| Payments | 1,320 | 1,371 | 2,701 | 1,435 | 306 | 49 | ||||||||||||||

| PagoNxt | 62 | 456 | 583 | (18) | (286) | (304) | ||||||||||||||

| Cards | 1,258 | 915 | 2,117 | 1,452 | 592 | 353 | ||||||||||||||

| Corporate Centre | (100) | 1 | (350) | (524) | (606) | (609) | ||||||||||||||

| TOTAL GROUP | 23,457 | 6,477 | 31,050 | 18,137 | 9,508 | 6,059 | ||||||||||||||

| Secondary segments | ||||||||||||||||||||

| Europe | 8,288 | 2,368 | 11,718 | 7,116 | 4,983 | 3,187 | ||||||||||||||

| Spain | 3,656 | 1,484 | 6,065 | 3,999 | 2,681 | 1,756 | ||||||||||||||

| United Kingdom | 2,381 | 142 | 2,516 | 1,065 | 849 | 630 | ||||||||||||||

| Portugal | 844 | 242 | 1,142 | 874 | 834 | 563 | ||||||||||||||

| Poland | 1,384 | 339 | 1,711 | 1,245 | 779 | 386 | ||||||||||||||

| Other | 24 | 161 | 284 | (68) | (159) | (147) | ||||||||||||||

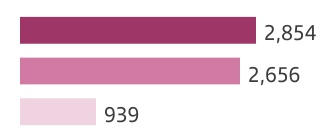

| DCB Europe | 2,187 | 451 | 2,854 | 1,534 | 757 | 453 | ||||||||||||||

| North America | 5,247 | 1,300 | 7,039 | 3,686 | 1,586 | 1,347 | ||||||||||||||

| US | 2,824 | 539 | 3,769 | 1,866 | 612 | 664 | ||||||||||||||

| Mexico | 2,421 | 733 | 3,244 | 1,901 | 1,149 | 840 | ||||||||||||||

| Other | 2 | 27 | 26 | (82) | (175) | (158) | ||||||||||||||

| South America | 7,835 | 2,358 | 9,790 | 6,324 | 2,788 | 1,681 | ||||||||||||||

| Brazil | 5,235 | 1,734 | 6,984 | 4,719 | 1,935 | 1,141 | ||||||||||||||

| Chile | 824 | 265 | 1,187 | 721 | 450 | 253 | ||||||||||||||

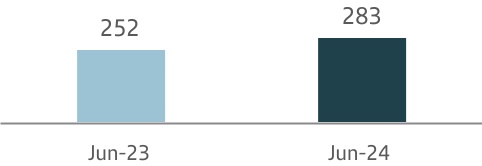

| Argentina | 1,423 | 204 | 1,020 | 606 | 332 | 266 | ||||||||||||||

| Other | 353 | 154 | 599 | 278 | 71 | 22 | ||||||||||||||

| Corporate Centre | (100) | 1 | (350) | (524) | (606) | (609) | ||||||||||||||

| TOTAL GROUP | 23,457 | 6,477 | 31,050 | 18,137 | 9,508 | 6,059 | ||||||||||||||

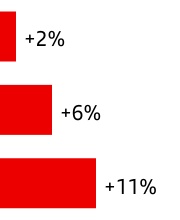

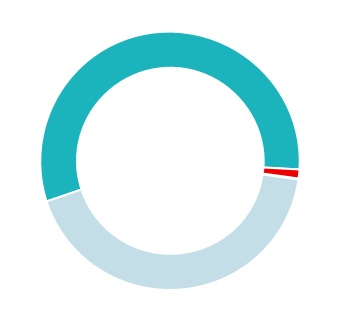

Profit attributable to the parent distribution1 | ||

| H1 2024 | ||

Profit attributable to the parent. H1 2024 | ||

| EUR million. % change YoY | ||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| Var | Var2 | ||||

| +37 | % | +35 | % | ||

| +4 | % | +4 | % | ||

| -5 | % | -5 | % | ||

| +15 | % | +14 | % | ||

| -78 | % | -78 | % | ||

| +26 | % | +24 | % | ||

| -13 | % | -13 | % | ||

| 0 | % | -3 | % | ||

| +15 | % | +19 | % | ||

| 26 |  | January - June 2024 | ||||||

| January-June 2023 | ||||||||||||||||||||

| Main items of the underlying income statement | ||||||||||||||||||||

| EUR million | ||||||||||||||||||||

| Primary segments | Net interest income | Net fee income | Total income | Net operating income | Profit before tax | Profit attributable to the parent | ||||||||||||||

| Retail & Commercial Banking | 12,400 | 2,286 | 14,392 | 8,018 | 3,638 | 2,421 | ||||||||||||||

| Digital Consumer Bank | 5,024 | 584 | 6,026 | 3,419 | 1,504 | 1,027 | ||||||||||||||

| Corporate & Investment Banking | 1,670 | 1,142 | 3,956 | 2,444 | 2,305 | 1,478 | ||||||||||||||

| Wealth Management & Insurance | 726 | 625 | 1,589 | 1,005 | 985 | 711 | ||||||||||||||

| Payments | 1,194 | 1,472 | 2,613 | 1,400 | 498 | 223 | ||||||||||||||

| PagoNxt | 31 | 446 | 521 | (51) | (77) | (103) | ||||||||||||||

| Cards | 1,162 | 1,026 | 2,092 | 1,452 | 574 | 326 | ||||||||||||||

| Corporate Centre | (94) | (7) | (342) | (531) | (601) | (620) | ||||||||||||||

| TOTAL GROUP | 20,920 | 6,103 | 28,234 | 15,755 | 8,329 | 5,241 | ||||||||||||||

| Secondary segments | ||||||||||||||||||||

| Europe | 7,565 | 2,244 | 10,464 | 6,081 | 3,888 | 2,536 | ||||||||||||||

| Spain | 3,161 | 1,413 | 5,113 | 3,074 | 1,679 | 1,132 | ||||||||||||||

| United Kingdom | 2,583 | 167 | 2,759 | 1,395 | 1,127 | 818 | ||||||||||||||

| Portugal | 575 | 235 | 824 | 559 | 484 | 321 | ||||||||||||||

| Poland | 1,209 | 289 | 1,509 | 1,105 | 657 | 321 | ||||||||||||||

| Other | 37 | 140 | 259 | (52) | (59) | (57) | ||||||||||||||

| DCB Europe | 2,040 | 394 | 2,658 | 1,344 | 928 | 521 | ||||||||||||||

| North America | 4,931 | 1,077 | 6,417 | 3,357 | 1,739 | 1,346 | ||||||||||||||

| US | 2,901 | 390 | 3,624 | 1,825 | 762 | 667 | ||||||||||||||

| Mexico | 2,027 | 663 | 2,763 | 1,600 | 1,048 | 760 | ||||||||||||||

| Other | 3 | 23 | 30 | (68) | (71) | (81) | ||||||||||||||

| South America | 6,477 | 2,395 | 9,037 | 5,504 | 2,376 | 1,458 | ||||||||||||||

| Brazil | 4,285 | 1,675 | 6,281 | 4,073 | 1,410 | 823 | ||||||||||||||

| Chile | 727 | 316 | 1,229 | 708 | 531 | 330 | ||||||||||||||

| Argentina | 1,138 | 282 | 1,029 | 508 | 308 | 252 | ||||||||||||||

| Other | 327 | 122 | 499 | 214 | 127 | 53 | ||||||||||||||

| Corporate Centre | (94) | (7) | (342) | (531) | (601) | (620) | ||||||||||||||

| TOTAL GROUP | 20,920 | 6,103 | 28,234 | 15,755 | 8,329 | 5,241 | ||||||||||||||

January - June 2024 |  | 27 | ||||||

| Retail & Commercial Banking | Underlying attributable profit | |||||||||

| EUR 3,326 mn | |||||||||||

→ To support our vision of becoming a digital bank with branches, we continued to drive our ONE Transformation programme forwards with the implementation of a common operating model and the rollout of our global technological platform. → Loans decreased 1% year-on-year in constant euros due to lower mortgage and SME balances in Europe, partially offset by increases in South America and Mexico. Deposits rose 2% in constant euros. → Attributable profit of EUR 3,326 million, increasing 37% year-on-year (+35% in constant euros) driven by the good revenue performance, efficiency gains from our transformation programme and lower provisions in Europe. | |||||||||||

Retail. Customers. June 2024 | ||||||||||||||||||||||||||||||||

| Thousands and year-on-year change | ||||||||||||||||||||||||||||||||

| Europe |  |  | North America |  | South America |  | ||||||||||||||||||||||||||||||||||

| Total customers | 142,913 | 46,239 | 14,972 | 22,430 | 20,960 | 20,946 | 75,715 | 65,834 | |||||||||||||||||||||||||||||||||

| +4% | +2% | +3% | 0% | +3% | +3% | +5% | +5% | ||||||||||||||||||||||||||||||||||

| Active customers | 77,176 | 28,585 | 8,488 | 13,714 | 10,592 | 10,578 | 37,999 | 31,344 | |||||||||||||||||||||||||||||||||

| +3% | +2% | +6% | -1% | +7% | +7% | +2% | 0% | ||||||||||||||||||||||||||||||||||

| 28 |  | January - June 2024 | ||||||

Retail. Business performance. June 2024 | ||||||||||||||||||||||||||

| EUR billion and YoY % change in constant euros | ||||||||||||||||||||||||||

| 619 | -1% | 729 | +4% | |||||||||||||||||||||||

| ||

| ||

| ||

| ||

| ||

| ||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||||||||

Retail. Total income. June 2024 | ||||||||||||||||||||||||||||||||

| EUR million and YoY % change in constant euros | ||||||||||||||||||||||||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| Others | |||||||||||

| Var | |||||

| +22% | |||||

| -12% | |||||

| +7% | |||||

| +20% | |||||

| +14% | |||||

| EUR 16,274 mn | +12% | |||||||||

| Retail. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 8,226 | +2 | +3 | 16,274 | +13 | +12 | ||||||||||||||||||||

| Expenses | -3,119 | -6 | -5 | -6,423 | +1 | 0 | ||||||||||||||||||||

| Net operating income | 5,107 | +8 | +9 | 9,851 | +23 | +21 | ||||||||||||||||||||

| LLPs | -1,564 | +3 | +5 | -3,087 | -1 | -1 | ||||||||||||||||||||

| PBT | 2,810 | +18 | +19 | 5,187 | +43 | +40 | ||||||||||||||||||||

| Attributable profit | 1,824 | +21 | +22 | 3,326 | +37 | +35 | ||||||||||||||||||||

January - June 2024 |  | 29 | ||||||

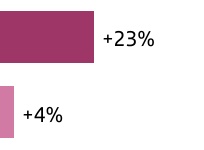

| Digital Consumer Bank | Underlying attributable profit | |||||||||

| EUR 1,070 mn | |||||||||||

→ Our priority is to continue expanding our leadership in consumer finance across our footprint, converging towards a more digital global operating model and implementing enhanced solutions (check-out lending, digital journeys in auto lending and operational leasing) through common platforms. → Loans increased 6% year-on-year in constant euros, +8% in auto in a market that is starting to recover. Deposits rose 14% in constant euros, in line with our strategy aimed at lowering funding costs and reducing net interest income volatility across the cycle, to be able to offer our customers better pricing. → Attributable profit reached EUR 1,070 million in H1 2024, a 4% increase year-on-year in both euros and constant euros, mainly driven by the solid net interest income and net fee income performances and cost control, despite the cost of risk normalization towards pre-pandemic levels. | |||||||||||

| Consumer. Total Customers | ||

| Millions | ||

| 0% | ||||||||

| 30 |  | January - June 2024 | ||||||

Consumer. Business. June 2024 | |||||||||||||||||||||||||||||

| EUR billion and YoY % change in constant euros | |||||||||||||||||||||||||||||

| 213 | +6% | 130 | +14% | ||||||||||||||||||||||||||

| DCB Europe | |||||

| US | |||||

| DCB Europe | |||||

| US | |||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||||||||

Consumer. Leasing portfolio. June 2024 | |||||||||||

| EUR billion and YoY % change in constant euros | |||||||||||

| Total leasing | 17 | +2% | |||||||||

Consumer. Total income. June 2024 | ||||||||||||||||||||||||||||||||

| EUR million and YoY % change in constant euros | ||||||||||||||||||||||||||||||||

| DCB Europe | |||||||||||

| US* | |||||||||||

| Other | |||||||||||

| Var | |||||

| +7 | % | ||||

| -1 | % | ||||

| +36 | % | ||||

| Consumer. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 3,264 | +2 | +3 | 6,449 | +7 | +7 | ||||||||||||||||||||

| Expenses | -1,307 | 0 | 0 | -2,618 | 0 | 0 | ||||||||||||||||||||

| Net operating income | 1,957 | +4 | +5 | 3,831 | +12 | +12 | ||||||||||||||||||||

| LLPs | -1,055 | -7 | -7 | -2,193 | +22 | +21 | ||||||||||||||||||||

| PBT | 722 | +17 | +17 | 1,341 | -11 | -11 | ||||||||||||||||||||

| Attributable profit | 606 | +31 | +31 | 1,070 | +4 | +4 | ||||||||||||||||||||

January - June 2024 |  | 31 | ||||||

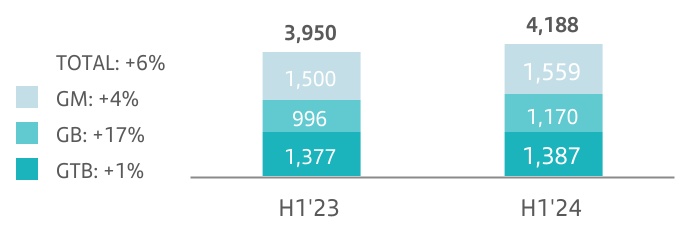

| Corporate & Investment Banking | Underlying attributable profit | |||||||||

| EUR 1,405 mn | |||||||||||

→ We continue making our centres of expertise more sophisticated, deepening client relationships with focus on our Global Markets plan to build institutional wallet share, the US Banking Build-Out strategy, and actively managing capital. → Strong activity year-on-year, mainly supported by Global Banking (Global Debt Finance and Corporate Finance) and Global Markets as we execute our growth initiatives, and, to a lesser extent, in Global Transaction Banking. → Attributable profit reached EUR 1,405 million, a 5% drop year-on-year (in euros and in constant euros). A record first half revenue was offset by higher costs related to investments in the development of new capabilities, and higher provisions. Nevertheless, we maintained a leading position in efficiency and profitability. | |||||||||||

| Recent awards | Leading positions in League Tables H1 2024 |  | |||||||||||||||||||||

| IJ Global | PFI | Structured Finance | Debt Capital Markets | ||||||||||||||||||||

Gigafactory Deal of the Year in Europe Renewables Deal of the Year (onshore and offshore wind) in North America | Bank of the Year in Europe Petrochemical Deal of the Year in APAC and EMEA |  |  | ||||||||||||||||||||

| Proximo | Global Finance | Equity Capital Markets | ECAs | M&A | |||||||||||||||||||

LatAm Bank of the Year LatAm PPP Deal of the Year | Best Bank for Cash Management and for Payments in LatAm |  |  |  | |||||||||||||||||||

| 32 |  | January - June 2024 | ||||||

CIB. Total income by region. June 2024. | ||||||||||||||||||||||||||||||||

| EUR million and % change in constant euros | ||||||||||||||||||||||||||||||||

| Europe | |||||||||||

| North America | |||||||||||

| South America | |||||||||||

| Var | |||||

| +9 | % | ||||

| +31 | % | ||||

| -11 | % | ||||

CIB. Total income by business. June 2024. | ||||||||||||||||||||||||||||||||

| EUR million and % change in constant euros | ||||||||||||||||||||||||||||||||

| Note: total income includes less material revenue from other activities (EUR 76 million in H1'23 and EUR 72 million in H1'24). | |||||||||||

| CIB. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 2,076 | -2 | -1 | 4,188 | +6 | +6 | ||||||||||||||||||||

| Expenses | -930 | +5 | +5 | -1,817 | +20 | +20 | ||||||||||||||||||||

| Net operating income | 1,146 | -6 | -6 | 2,371 | -3 | -3 | ||||||||||||||||||||

| LLPs | -56 | +38 | +39 | -96 | — | — | ||||||||||||||||||||

| PBT | 1,044 | -6 | -5 | 2,151 | -7 | -6 | ||||||||||||||||||||

| Attributable profit | 700 | -1 | 0 | 1,405 | -5 | -5 | ||||||||||||||||||||

January - June 2024 |  | 33 | ||||||

| Wealth Management & Insurance | Underlying attributable profit | |||||||||

| EUR 818 mn | |||||||||||

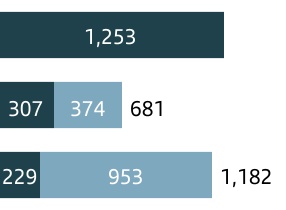

→ We continue building the best wealth and insurance manager in Europe and the Americas supported by our leading global private banking platform and our best-in-class funds and insurance product factories that leverage our scale and global capabilities to offer the best value proposition to our customers. → Total assets under management at record levels of EUR 480 billion, +13% year-on-year, due to excellent commercial dynamics both in Private Banking and SAM. In Insurance, gross written premiums reached EUR 6.1 billion in H1 2024. → Attributable profit amounted to EUR 818 million, 15% higher year-on-year (+14% in constant euros), with an RoTE of 79%. | |||||||||||

| Private Banking clients | ||

| Thousands | ||

| +13% | ||||||||

| Wealth awards | ||

| 34 |  | January - June 2024 | ||||||

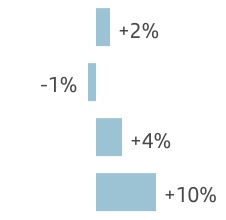

Wealth. Business performance. June 2024. | ||||||||||||||||||||

| EUR billion and % change in constant euros | ||||||||||||||||||||

| Total AuMs | ||

| Funds and investment* | ||

| - SAM | ||

| - Private Banking | ||

| Custody | ||

| Customer deposits | ||

| Customer loans | ||

| GWPs | ||

| vs. Mar-24 | vs. Jun-23 | ||||

| +2 | % | +13 | % | ||

| +3 | % | +13 | % | ||

| +3 | % | +14 | % | ||

| +3 | % | +18 | % | ||

| -2 | % | +17 | % | ||

| +3 | % | +6 | % | ||

| +1 | % | +2 | % | ||

| +11 | % | -1 | % | ||

Wealth. Total income. H1 2024. | ||||||||||||||||||||||||||||||||

| EUR million and % change in constant euros | ||||||||||||||||||||||||||||||||

| PB | |||||||||||

| SAM | |||||||||||

| Insurance | |||||||||||

| Total income | Revenue + ceded fees | ||||

| +13% | +13% | ||||

| +17% | +14% | ||||

| +1% | +8% | ||||

| Total income | Fees ceded to the commercial network | ||||||||||

| Wealth. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 897 | +1 | +1 | 1,789 | +13 | +12 | ||||||||||||||||||||

| Expenses | -309 | +1 | +1 | -615 | +5 | +5 | ||||||||||||||||||||

| Net operating income | 588 | 0 | +1 | 1,173 | +17 | +16 | ||||||||||||||||||||

| LLPs | -10 | +147 | +148 | -14 | — | — | ||||||||||||||||||||

| PBT | 573 | +3 | +3 | 1,130 | +15 | +14 | ||||||||||||||||||||

| Attributable profit | 417 | +4 | +4 | 818 | +15 | +14 | ||||||||||||||||||||

January - June 2024 |  | 35 | ||||||

| Payments | Underlying attributable profit | |||||||||

| EUR 49 mn | |||||||||||

→ PagoNxt and Cards bring a unique position in the payments industry to the Group, covering both sides of the value chain of card payments (issuing and acquiring businesses) and account payments. → Activity increased in both businesses supported by global platform development, enabling further scale gains. In PagoNxt, Getnet's Total Payments Volume (TPV) rose 12% year-on-year in constant euros and the number of transactions improved 7%. In Cards, turnover increased 5% year-on-year in constant euros and transactions rose 8%. → Attributable profit was EUR 49 million, EUR 292 million (+30% YoY in constant euros) excluding write-downs after discontinuing our merchant platform in Germany and Superdigital in Latin America. The EBITDA margin in PagoNxt improved 8.9 pp to 20.1%. | |||||||||||

| Payments. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 1,347 | 0 | +1 | 2,701 | +3 | +3 | ||||||||||||||||||||

| Expenses | -615 | -5 | -5 | -1,266 | +4 | +4 | ||||||||||||||||||||

| Net operating income | 732 | +4 | +7 | 1,435 | +2 | +2 | ||||||||||||||||||||

| LLPs | -434 | +4 | +6 | -852 | -2 | -3 | ||||||||||||||||||||

| PBT | 41 | -84 | -82 | 306 | -38 | -38 | ||||||||||||||||||||

| Attributable profit | -89 | — | — | 49 | -78 | -78 | ||||||||||||||||||||

| 36 |  | January - June 2024 | ||||||

| PagoNxt. Activity | ||||||||

| TPV (Getnet) | ||||||||

| EUR billion and changes in constant euros | ||||||||

| +12% | ||||||||||||||

| PagoNxt. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 300 | +6 | +8 | 583 | +12 | +12 | ||||||||||||||||||||

| Expenses | -297 | -3 | -2 | -601 | +5 | +5 | ||||||||||||||||||||

| Net operating income | 4 | — | — | -18 | -66 | -65 | ||||||||||||||||||||

| LLPs | -5 | +36 | +41 | -9 | -26 | -26 | ||||||||||||||||||||

| PBT | -258 | +842 | +808 | -286 | +273 | +280 | ||||||||||||||||||||

| Attributable profit | -265 | +573 | +562 | -304 | +196 | +198 | ||||||||||||||||||||

| Cards. Activity | ||||||||

| Turnover | ||||||||

| EUR billion and changes in constant euros | ||||||||

| +5% | ||||||||||||||

| Cards. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 1,047 | -2 | 0 | 2,117 | +1 | 0 | ||||||||||||||||||||

| Expenses | -319 | -8 | -7 | -665 | +4 | +2 | ||||||||||||||||||||

| Net operating income | 728 | +1 | +3 | 1,452 | 0 | 0 | ||||||||||||||||||||

| LLPs | -428 | +3 | +6 | -843 | -1 | -3 | ||||||||||||||||||||

| PBT | 300 | +3 | +5 | 592 | +3 | +4 | ||||||||||||||||||||

| Attributable profit | 176 | 0 | +2 | 353 | +8 | +8 | ||||||||||||||||||||

January - June 2024 |  | 37 | ||||||

| Corporate Centre | Underlying attributable profit | ||||||

| -EUR 609 mn | ||||||||

→ The Corporate Centre continued to support the Group. → The Corporate Centre’s objective is to define, develop and coordinate the Group's strategy and aid the operating units by contributing value and carrying out the corporate oversight and control function. It also carries out functions related to financial and capital management. → Attributable loss of EUR 609 million, improving 2% compared to H1 2023 mainly due to lower costs, more than offsetting the worse performance of gains on financial transactions (higher negative impact from foreign currency hedging), with net interest income virtually flat year-on-year. | ||||||||

| Corporate Centre. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| Q2'24 | Q1'24 | Chg. | H1'24 | H1'23 | Chg. | |||||||||||||||||||||

| Total income | -140 | -210 | -33 | -350 | -342 | +2% | ||||||||||||||||||||

| Net operating income | -227 | -297 | -24 | -524 | -531 | -1% | ||||||||||||||||||||

| PBT | -266 | -340 | -22 | -606 | -601 | +1% | ||||||||||||||||||||

| Attributable profit | -252 | -357 | -30 | -609 | -620 | -2% | ||||||||||||||||||||

| 38 |  | January - June 2024 | ||||||

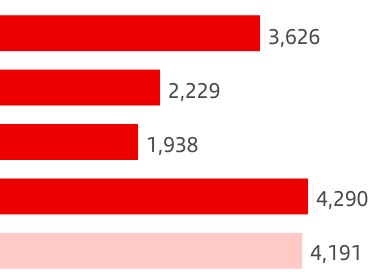

| Europe | Underlying attributable profit | ||||||

| EUR 3,187 mn | ||||||||

→ We continue to accelerate our business transformation to achieve higher growth and a more efficient operating model. → New business lending volumes improved year-on-year, however the stock of loans declined, still affected by prepayments and in a context of higher interest rates. Customer deposits rose, mainly due to time deposits. → Attributable profit increased 26% (+24% in constant euros) to EUR 3,187 million, with strong revenue growth, mainly from net interest income in Spain, Portugal and Poland. | ||||||||

Europe. Business performance. June 2024 | |||||||||||||||||||||||||||||

| EUR billion and YoY % change in constant euros | |||||||||||||||||||||||||||||

| Europe | 561 | -1% | Europe | 727 | +3% | ||||||||||||||||||||||||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||||||||

| Europe. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 5,910 | +2 | +2 | 11,718 | +12 | +10 | ||||||||||||||||||||

| Expenses | -2,297 | 0 | -1 | -4,602 | +5 | +4 | ||||||||||||||||||||

| Net operating income | 3,612 | +3 | +3 | 7,116 | +17 | +15 | ||||||||||||||||||||

| LLPs | -532 | +10 | +10 | -1,017 | -21 | -23 | ||||||||||||||||||||

| PBT | 2,545 | +4 | +4 | 4,983 | +28 | +26 | ||||||||||||||||||||

| Attributable profit | 1,647 | +7 | +7 | 3,187 | +26 | +24 | ||||||||||||||||||||

January - June 2024 |  | 39 | ||||||

Business model | Financial information by segment | Responsible banking Corporate governance Santander share | Appendix | ||||||||||||||||||||||||||

| Secondary segments | |||||||||||||||||||||||||||||

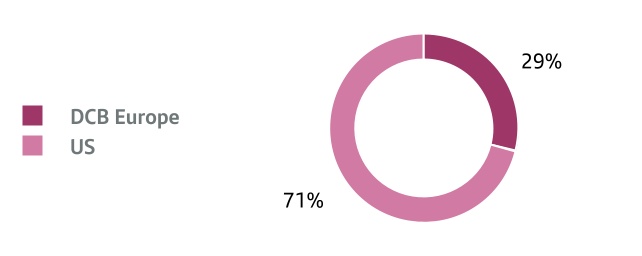

| DCBE | Digital Consumer Bank Europe | Underlying attributable profit | ||||||

| EUR 453 mn | ||||||||

→ Our strategy is focused on strengthening our leadership in auto and non-auto through strategic alliances and better service through new operational and non-auto leasing platforms, with Zinia in check-out lending. → In H1 2024, new business volumes rose 2% year-on-year in constant euros (+4% in auto), in an environment that is still tending to limit consumption (despite this, the auto market performed well). Deposits increased 24% in constant euros, in line with our objective to increase retail funding through common platforms to reduce liability costs. → Attributable profit of EUR 453 million, down 13% year-on-year in constant euros as the good performance in net interest income and net fee income with flat costs, were more than offset by cost of risk normalization towards pre-pandemic levels and higher CHF mortgage provisions. | ||||||||

DCB Europe. June 2024 | ||||||||||||||||||||||||||||||||

| EUR billion and % change in constant euros | ||||||||||||||||||||||||||||||||

| +2% | ||||||||||||||||||||||||||||||||

| QoQ | +5% | |||||||||||||||||||||||||||||||

| QoQ | ||||||||||||||||||||||||||||||||

| 138 | ||||||||||||||||||||||||||||||||

| +8% | 81 | +23% | ||||||||||||||||||||||||||||||

| YoY | YoY | |||||||||||||||||||||||||||||||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||

| DCB Europe. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 1,444 | +2 | +3 | 2,854 | +7 | +7 | ||||||||||||||||||||

| Expenses | -655 | -1 | -1 | -1,319 | 0 | 0 | ||||||||||||||||||||

| Net operating income | 789 | +6 | +6 | 1,534 | +14 | +14 | ||||||||||||||||||||

| LLPs | -308 | +12 | +12 | -584 | +41 | +40 | ||||||||||||||||||||

| PBT | 356 | -11 | -11 | 757 | -18 | -18 | ||||||||||||||||||||

| Attributable profit | 224 | -2 | -2 | 453 | -13 | -13 | ||||||||||||||||||||

| 40 |  | January - June 2024 | ||||||

Business model | Financial information by segment | Responsible banking Corporate governance Santander share | Appendix | ||||||||||||||||||||||||||

| Secondary segments | |||||||||||||||||||||||||||||

| North America | Underlying attributable profit | ||||||

| EUR 1,347 mn | ||||||||

→ We continue to leverage the strength of our global businesses to transform our presence in the US and Mexico while continuing our digital transformation and refining our tailored service and product suite for a better customer experience. → Loans and advances to customers increased 3% year-on-year in constant euros driven by growth in both countries. Customer deposits declined 4% in deposits in constant euros, mainly due to funding strategy changes in CIB in the US, partially mitigated by higher deposits in Mexico and Consumer in the US. → Attributable profit in H1 2024 was EUR 1,347 million, flat year-on-year (-3% in constant euros), with top line growth in both countries offset by higher costs (inflation and investments) and cost of risk normalization. | ||||||||

North America. Business performance. June 2024 | |||||||||||||||||||||||||||||

| EUR billion and YoY % change in constant euros | |||||||||||||||||||||||||||||

| North America | 165 | +3% | North America | 167 | 0% | ||||||||||||||||||||||||

| ||

| ||

| ||

| ||

| Gross loans and advances to customers excl. reverse repos | Customer deposits excl. repos + mutual funds | |||||||||||||||||||||||||||||||||||||

| North America. Underlying income statement | ||||||||||||||||||||||||||

| EUR million and % change | ||||||||||||||||||||||||||

| / | Q1'24 | / | H1'23 | |||||||||||||||||||||||

| Q2'24 | % | excl. FX | H1'24 | % | excl. FX | |||||||||||||||||||||

| Total income | 3,554 | +2 | +2 | 7,039 | +10 | +7 | ||||||||||||||||||||

| Expenses | -1,691 | +2 | +2 | -3,352 | +10 | +7 | ||||||||||||||||||||

| Net operating income | 1,863 | +2 | +2 | 3,686 | +10 | +7 | ||||||||||||||||||||

| LLPs | -908 | -8 | -8 | -1,893 | +24 | +21 | ||||||||||||||||||||

| PBT | 810 | +4 | +4 | 1,586 | -9 | -12 | ||||||||||||||||||||

| Attributable profit | 703 | +9 | +9 | 1,347 | 0 | -3 | ||||||||||||||||||||

January - June 2024 |  | 41 | ||||||

Business model | Financial information by segment | Responsible banking Corporate governance Santander share | Appendix | ||||||||||||||||||||||||||

| Secondary segments | |||||||||||||||||||||||||||||

| South America | Underlying attributable profit | ||||||

| EUR 1,681 mn | ||||||||

→ We are focused on being the primary bank for our customers and the most profitable bank in each of our countries in the region, taking advantage of the synergies between our global and regional businesses. We continued to grow our solid customer base (increasing 3.6 million year-on-year to almost 77 million), supported by our focus on service quality. → In terms of activity, year-on-year growth in both loans and deposits in constant euros, as we seek to become the leading bank in inclusive and sustainable businesses through differential value propositions. → Attributable profit was EUR 1,681 million in H1 2024, with a 15% increase year-on-year (+19% in constant euros) driven by the strong net interest income growth which more than offset lower gains on financial transactions and higher provisions. | ||||||||