FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 For the month of February, 2025 Commission File Number: 001-12518 Banco Santander, S.A. (Exact name of registrant as specified in its charter) Ciudad Grupo Santander 28660 Boadilla del Monte (Madrid) Spain (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐

BANCO SANTANDER, S.A. ________________________ TABLE OF CONTENTS Item 1. Press Release regarding January - December 2024 Results

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 1 Santander reports profit of €12,574 million (up 14%) in 2024, exceeding all targets for the year Revenue up 8% (+10% in constant euros) to €62.2 billion1 Return on tangible equity (RoTE) increased to 16.3% from 15.1% Santander expects to return €10 billion to shareholders through share buybacks from 2025 and 2026 earnings and anticipated excess capital, in addition to its standard cash dividend distribution2 Madrid, 5 February 2025 - PRESS RELEASE • Net interest income increased by 8%, driven by net customer growth of eight million to 173 million. • Net fee income rose by 8%, with robust commercial dynamics and higher customer activity. • Operating expenses increased by 2%, reflecting the bank’s transformation (ONE Transformation) towards a simpler, more digital and integrated model. As a result, efficiency improved by over two percentage points to 41.8%. • Loan-loss provisions fell 1% thanks to solid credit quality driven by the bank’s low risk profile, low unemployment, good economic performance and favourable interest rates context. Cost of risk improved to 1.15% (-3 basis points). • In the fourth quarter, attributable profit grew 11% versus same period last year to €3,265 million. • Fully-loaded CET1 reached 12.8%, up 0.5 percentage points versus last year thanks to strong organic capital generation. • Santander exceeded upgraded targets for 2024: revenue +10% in constant euros (vs target of high-single digit growth); efficiency at 41.8% (vs c.42%); cost of risk of 1.15% (vs c.1.2%); RoTE at 16.3% (vs >16%); and FL CET1 of 12.8% (vs >12%). • In 2025, the bank is targeting c.€62 billion in revenue; mid-high single digit growth in net fee income; lower costs in euros; cost of risk of c.1.15%; RoTE of >17% (c.16.5% post-AT1); and CET1 of 13%. • Santander announces today a new share buyback programme for c.25% of the profit in the second half of 20242. Ana Botín, Banco Santander executive chair, said: “We have announced record results for the third consecutive year as we continue to grow revenue, profitability and returns. During the year, income increased by 8% with eight million new customers; return on tangible equity improving to 16.3%; and cash dividend per share paid in the year up 39%. As one of the largest retail and consumer banks in the world, we have the scale to build our own technology platforms, making it possible to offer customers the best products and services while constantly reducing the cost-to-serve. This is a key competitive advantage and is reflected in our results through continuous improvement in operating leverage. Our track record shows that in a challenging market we outperform peers and in 2025 we expect to grow our bottom line and profitability – with revenue stable and costs falling. And we are only scratching the surface of our potential. As we said at our Investor Day, Santander is in a new era of value creation, and we are confident that our scale, diversification and the impact of our transformation will enable us to increase profitability again in 2025. Furthermore, because of our strong capital generation, we now plan to return €10 billion in buybacks from 2025 and 2026 earnings and the anticipated excess capital, in addition to our standard cash dividend distribution2.” 1 Variations are year-on-year unless otherwise stated. 2 Share buyback target from 2025 and 2026 earnings including: i) the buybacks resulting from application of our existing shareholder remuneration policy plus ii) additional buybacks to distribute excesses of our CET1. Existing shareholder remuneration policy defined as c.50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed c.50% in cash dividends and c.50% in share buybacks. The implementation of the shareholder remuneration policy and any share buybacks to distribute CET1 surpluses are subject to future corporate and regulatory decisions and approvals. Note: Reconciliation of underlying results to statutory results, available in the ‘Alternative Performance Measures’ section of the financial report at CNMV and at santander.com.

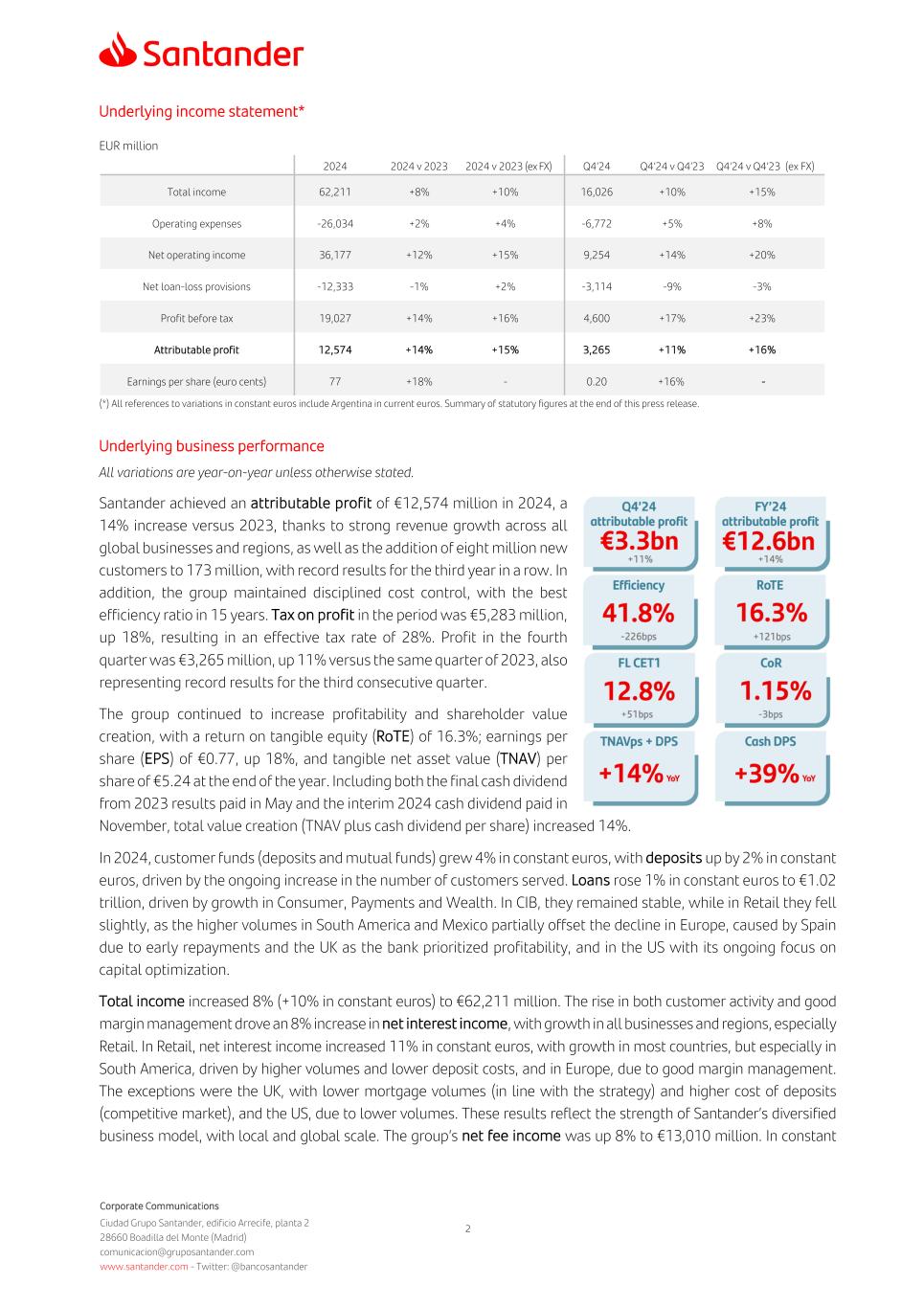

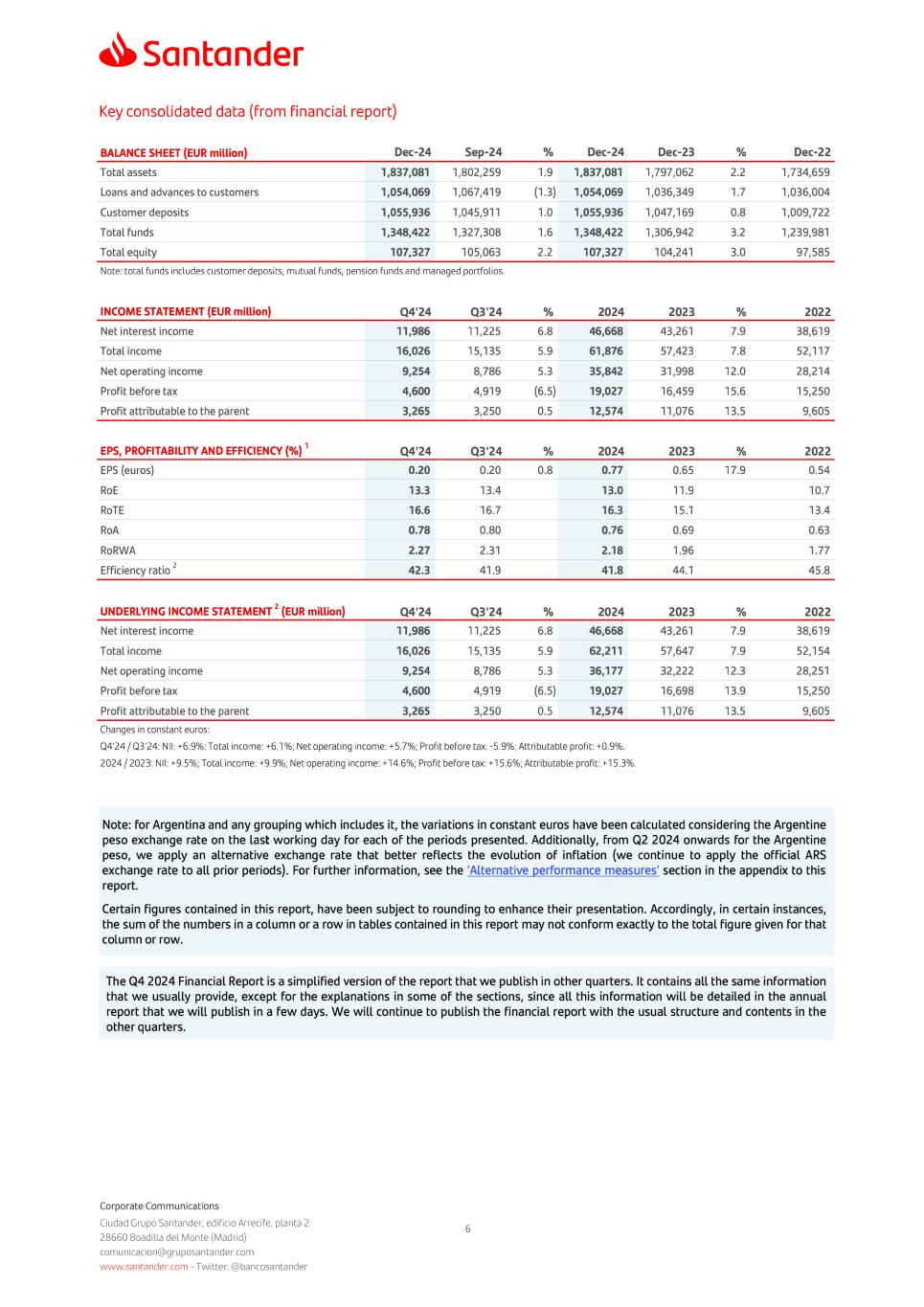

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 2 Underlying income statement* EUR million 2024 2024 v 2023 2024 v 2023 (ex FX) Q4’24 Q4’24 v Q4’23 Q4’24 v Q4’23 (ex FX) Total income 62,211 +8% +10% 16,026 +10% +15% Operating expenses -26,034 +2% +4% -6,772 +5% +8% Net operating income 36,177 +12% +15% 9,254 +14% +20% Net loan-loss provisions -12,333 -1% +2% -3,114 -9% -3% Profit before tax 19,027 +14% +16% 4,600 +17% +23% Attributable profit 12,574 +14% +15% 3,265 +11% +16% Earnings per share (euro cents) 77 +18% - 0.20 +16% - (*) All references to variations in constant euros include Argentina in current euros. Summary of statutory figures at the end of this press release. Underlying business performance All variations are year-on-year unless otherwise stated. Santander achieved an attributable profit of €12,574 million in 2024, a 14% increase versus 2023, thanks to strong revenue growth across all global businesses and regions, as well as the addition of eight million new customers to 173 million, with record results for the third year in a row. In addition, the group maintained disciplined cost control, with the best efficiency ratio in 15 years. Tax on profit in the period was €5,283 million, up 18%, resulting in an effective tax rate of 28%. Profit in the fourth quarter was €3,265 million, up 11% versus the same quarter of 2023, also representing record results for the third consecutive quarter. The group continued to increase profitability and shareholder value creation, with a return on tangible equity (RoTE) of 16.3%; earnings per share (EPS) of €0.77, up 18%, and tangible net asset value (TNAV) per share of €5.24 at the end of the year. Including both the final cash dividend from 2023 results paid in May and the interim 2024 cash dividend paid in November, total value creation (TNAV plus cash dividend per share) increased 14%. In 2024, customer funds (deposits and mutual funds) grew 4% in constant euros, with deposits up by 2% in constant euros, driven by the ongoing increase in the number of customers served. Loans rose 1% in constant euros to €1.02 trillion, driven by growth in Consumer, Payments and Wealth. In CIB, they remained stable, while in Retail they fell slightly, as the higher volumes in South America and Mexico partially offset the decline in Europe, caused by Spain due to early repayments and the UK as the bank prioritized profitability, and in the US with its ongoing focus on capital optimization. Total income increased 8% (+10% in constant euros) to €62,211 million. The rise in both customer activity and good margin management drove an 8% increase in net interest income, with growth in all businesses and regions, especially Retail. In Retail, net interest income increased 11% in constant euros, with growth in most countries, but especially in South America, driven by higher volumes and lower deposit costs, and in Europe, due to good margin management. The exceptions were the UK, with lower mortgage volumes (in line with the strategy) and higher cost of deposits (competitive market), and the US, due to lower volumes. These results reflect the strength of Santander’s diversified business model, with local and global scale. The group’s net fee income was up 8% to €13,010 million. In constant

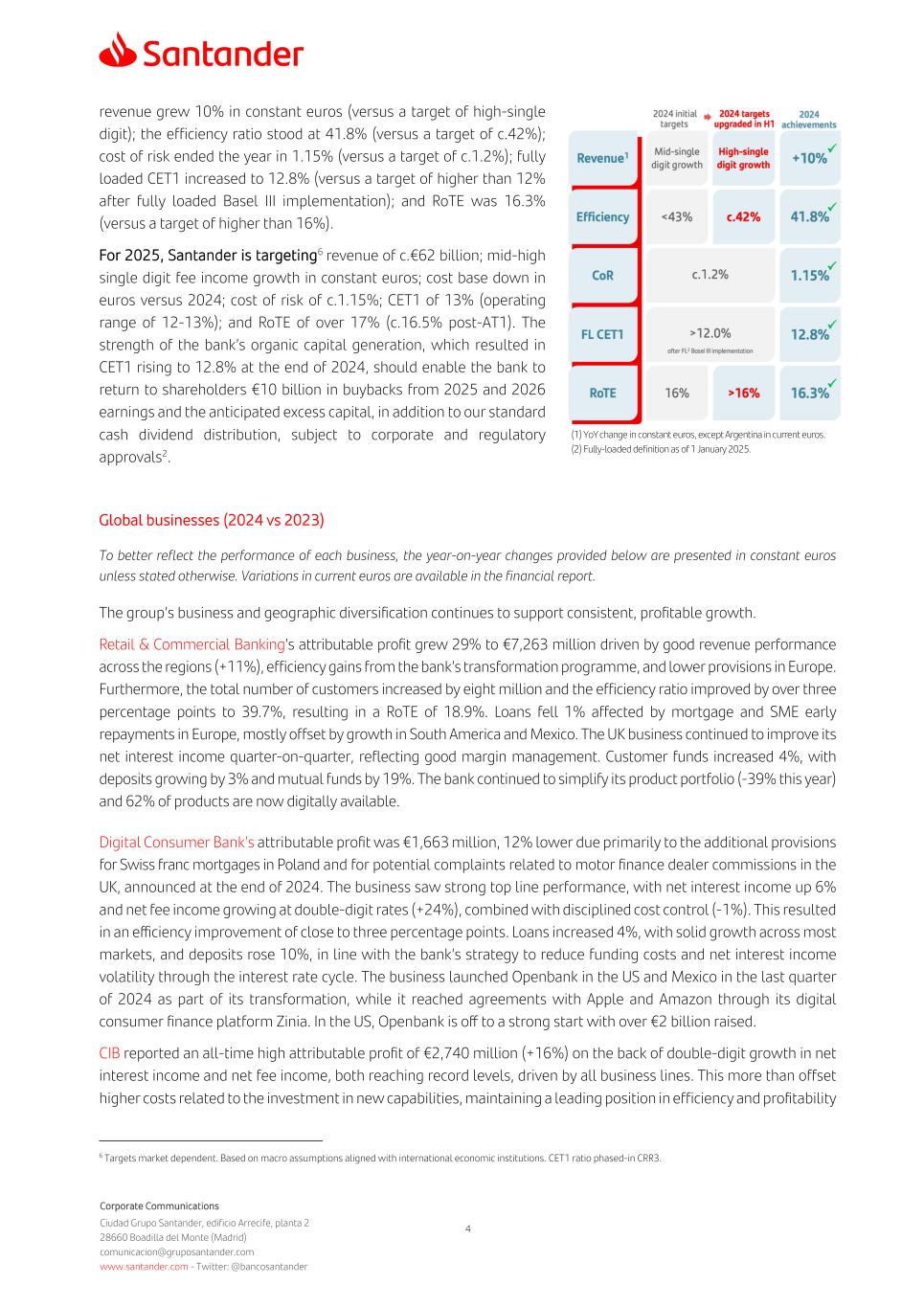

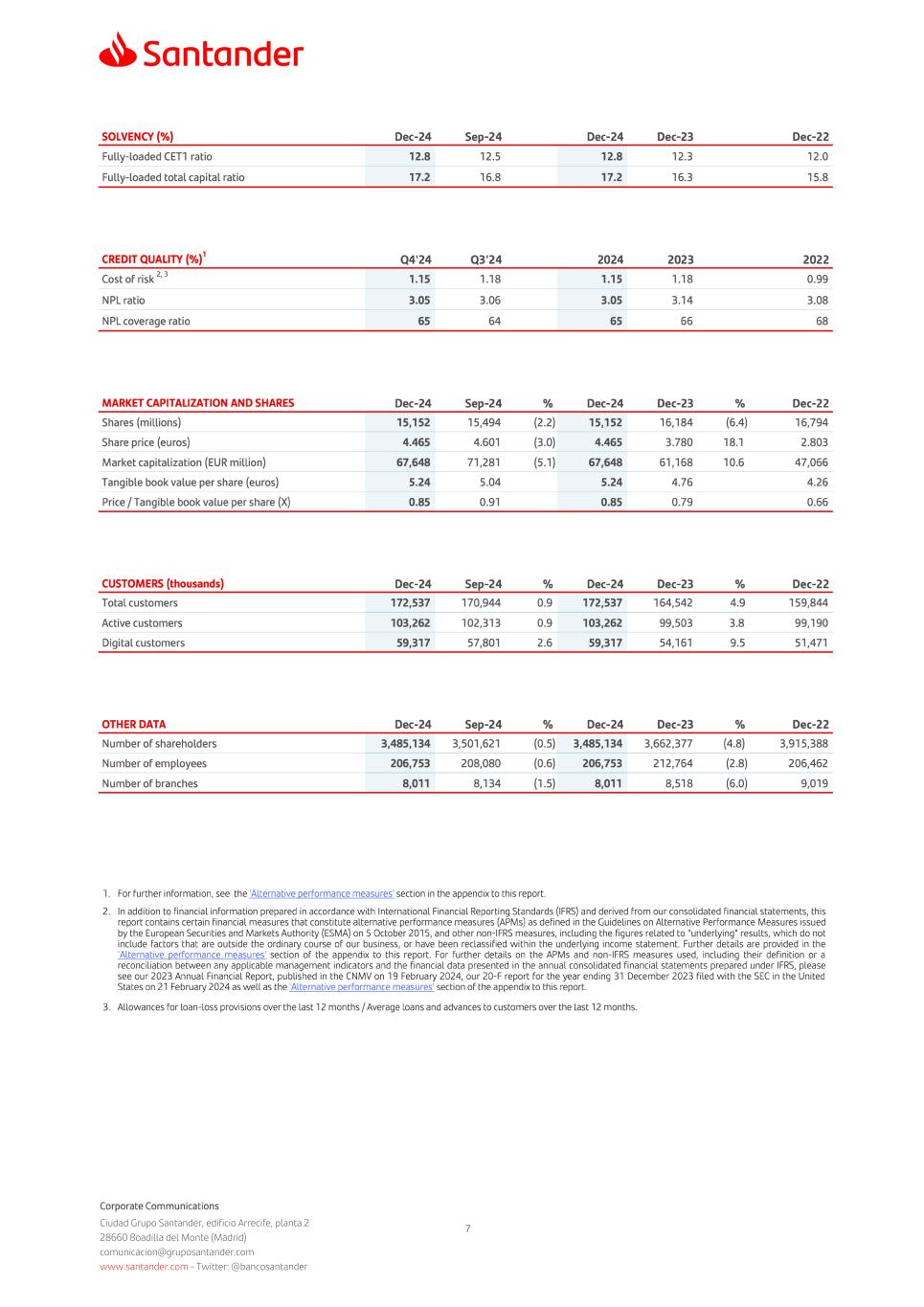

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 3 euros, it grew 11%, supported by higher activity in most global businesses. More than 95% of total revenue is customer related, reflecting the quality and recurrence of the bank’s results. The efficiency ratio improved significantly to a 15-year record, falling 2.3 percentage points to 41.8%, reflecting the effect of the ongoing transformation (ONE Transformation). The replacement of legacy technology with shared global technology platforms, such as Santander’s cloud-based core banking platform Gravity, has helped the bank achieve savings of €452 million since December 2022. At group level, these investments and initiatives have helped the bank control costs, which grew at 2%, below the rate of inflation, with efficiency gains in most businesses. This is particularly evident in Retail, where the efficiency ratio improved by 3.4 percentage points to 39.7%, and Consumer, which improved 2.7 percentage points to 40.1%. As further evidence of the transformation, the Retail and Consumer businesses combined delivered a 9% increase in revenue with costs fairly flat in constant euros. Loan-loss provisions decreased (-1%) thanks to solid credit quality driven by low unemployment, good economic performance globally and favourable interest rates context, as well as the bank’s low risk profile. Cost of risk decreased to 1.15%, exceeding the full-year target of c.1.2%, and the non-performing loan (NPL) ratio improved nine basis points to 3.05%. The record 2024 results were possible despite several provisions related to Swiss franc mortgages in Poland or for potential complaints related to motor finance dealer commissions in the UK, announced at the end of 2024. The bank’s fully-loaded CET1 capital ratio increased to 12.8%, up 0.5 percentage points in the year and 0.3 percentage points in the quarter, well ahead of the group’s capital target. This was driven by strong organic capital generation in the quarter (+82 basis points) thanks to both profit combined with asset rotation and risk transfer activities, which allowed to absorb deductions for expected shareholder remuneration3 and other charges. On day one, Basel III has no impact to Santander’s CET14. In November, the bank paid an interim cash dividend against 2024 results of 10 euro cents per share, an increase of 23% compared to the same dividend last year. Together with the dividend paid in May, cash dividend per share paid during 2024 was 39% more than the previous year. The total amount returned to shareholders in the 2024 interim remuneration was around €3,050 million, with approximately half paid in the form of the aforementioned cash dividend of 10 euro cents per share, and half through the share buyback programme launched in August and completed in December. In application of the bank’s shareholder remuneration policy3, Santander announces today a share repurchase programme for an amount of c.25% of the group’s profit in the second half of 2024 (maximum amount of €1,587 million). The regulatory authorization has already been obtained and its execution will commence tomorrow. The proposal for the final cash dividend from 2024 earnings that will be submitted to the approval of the annual general shareholders meeting is expected to be approved by the board on 25 February 20253. Since 2021, including the second buyback against 2024 earnings just announced, Santander will have returned c.€9.5 billion to shareholders via share buybacks and has repurchased c.15% of its outstanding shares. Assuming the same payout ratio is applied to the final cash dividend against 2024 results3, the total amount of cash dividend and share buybacks would be c.€6.3 billion, representing an equivalent yield of over 8%5. Overall, these results, with record levels in net interest income, net fee income, total income and profit, have enabled the bank to achieve or exceed all its targets for the year, some of which were upgraded in the second quarter: 3 Target payout defined as c.50% of Group reported profit (excluding non-cash, non-capital ratios impact items), distributed approximately 50% in cash dividend and 50% in share buybacks. Execution of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. 4 Zero day-one impact from Basel III under the final texts published in June 2024 of Regulation 2024/1623 (CRR3) and Directive 2024/1619 (CRD6). However, during 2025 the publication of ECB guides on options and discretions and EBA mandates could result in additional impacts on CET1 ratios across the industry. 5 Per Banco Santander's market capitalization on 4 February 2024.

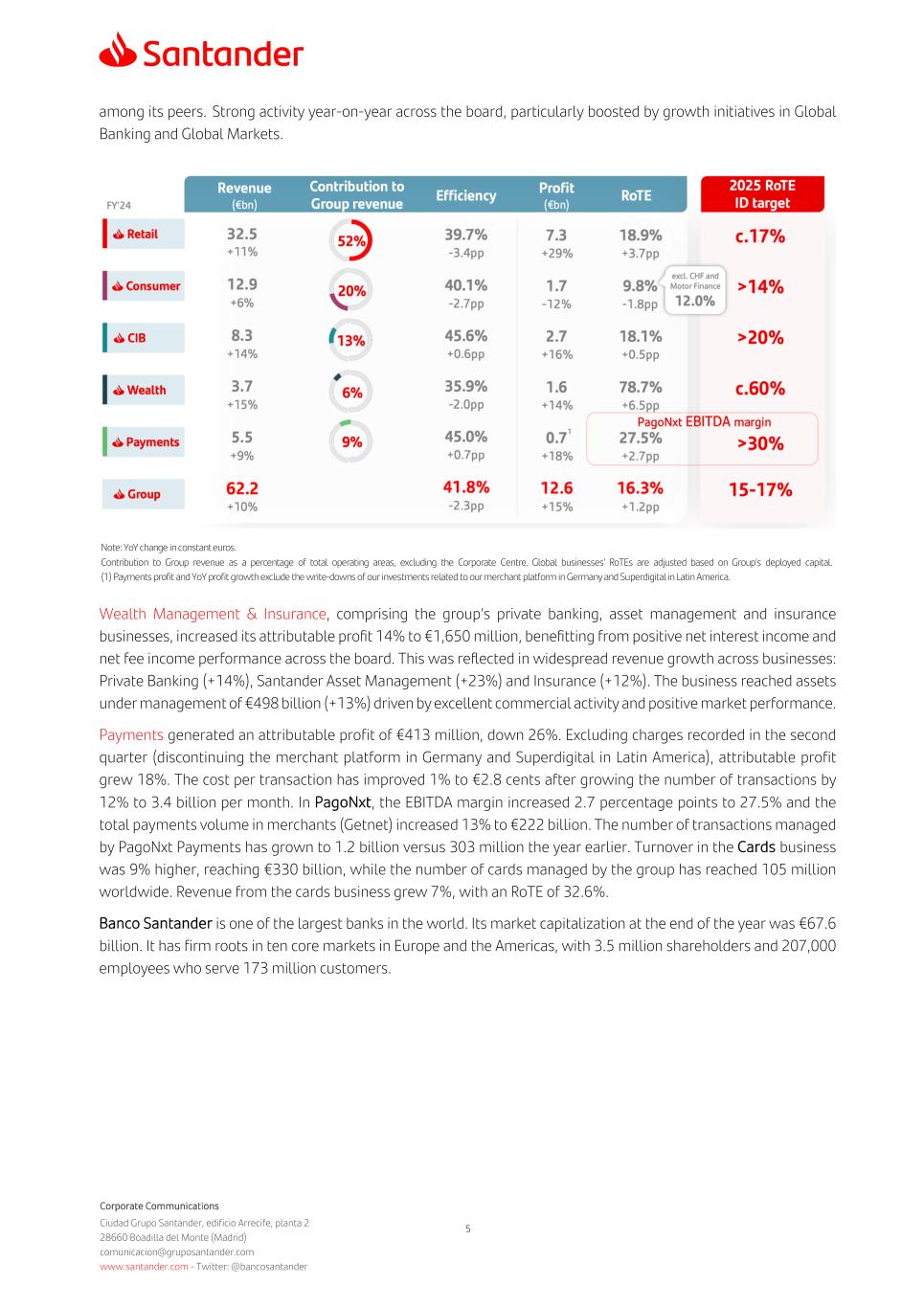

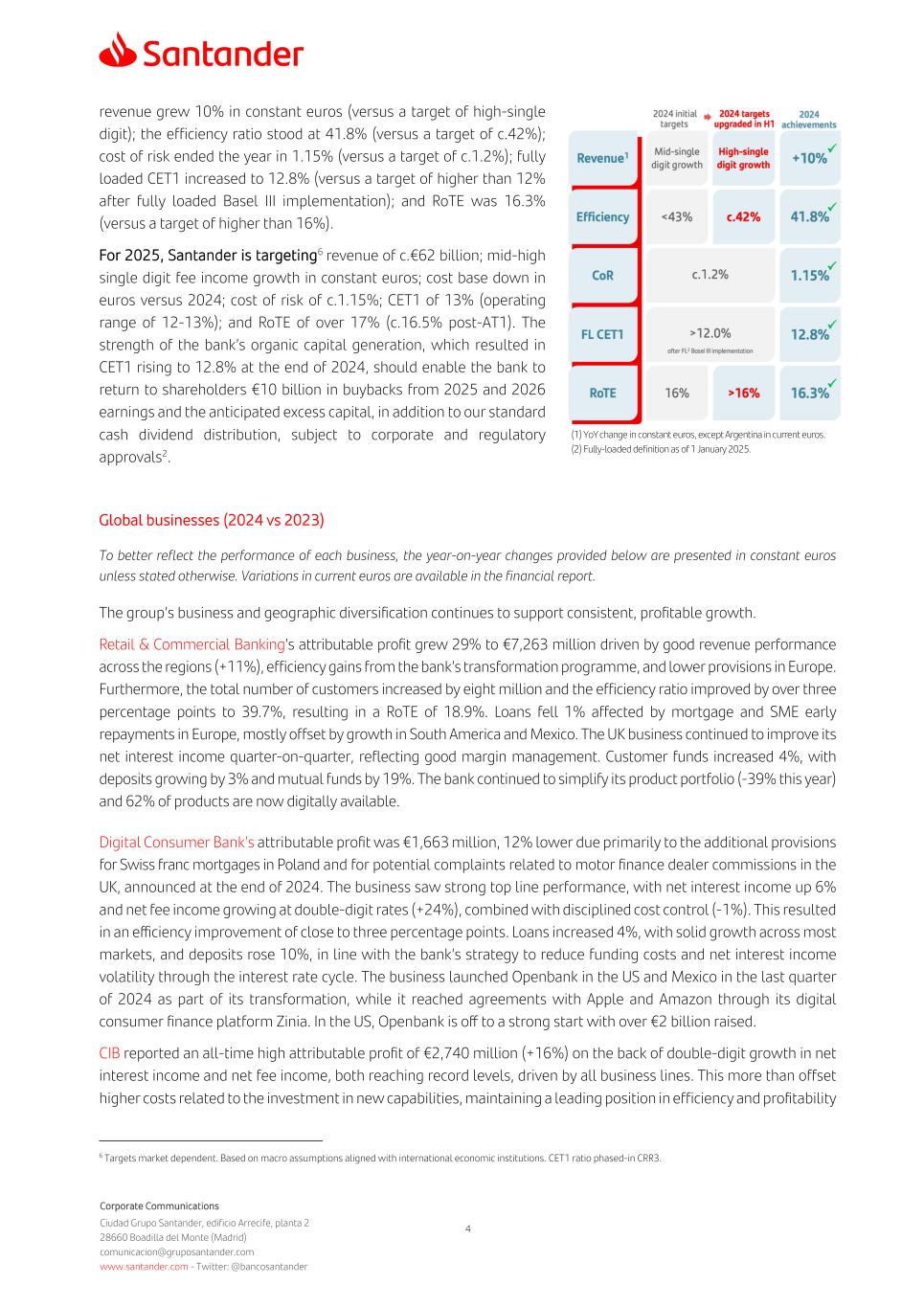

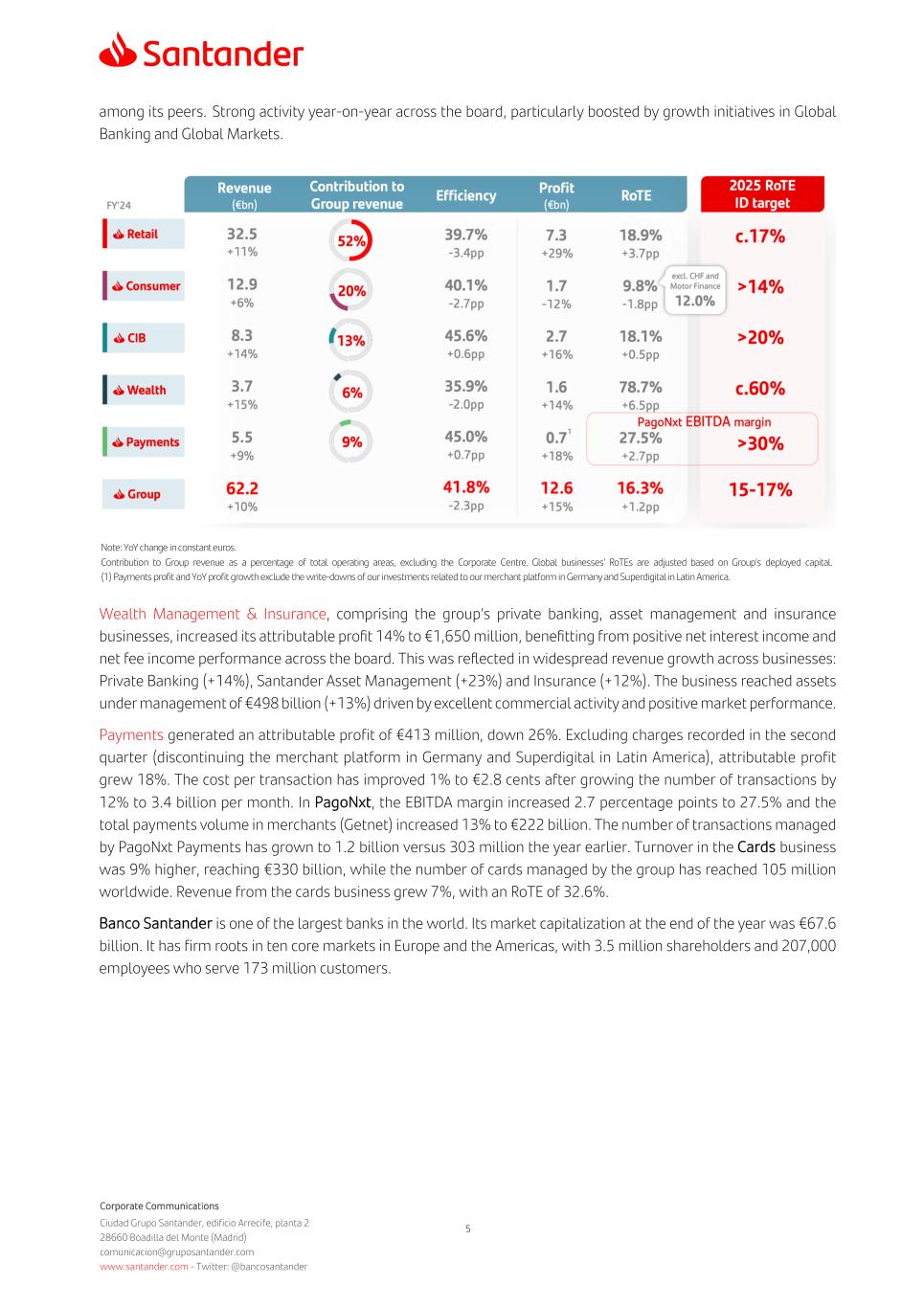

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 4 revenue grew 10% in constant euros (versus a target of high-single digit); the efficiency ratio stood at 41.8% (versus a target of c.42%); cost of risk ended the year in 1.15% (versus a target of c.1.2%); fully loaded CET1 increased to 12.8% (versus a target of higher than 12% after fully loaded Basel III implementation); and RoTE was 16.3% (versus a target of higher than 16%). For 2025, Santander is targeting6 revenue of c.€62 billion; mid-high single digit fee income growth in constant euros; cost base down in euros versus 2024; cost of risk of c.1.15%; CET1 of 13% (operating range of 12-13%); and RoTE of over 17% (c.16.5% post-AT1). The strength of the bank’s organic capital generation, which resulted in CET1 rising to 12.8% at the end of 2024, should enable the bank to return to shareholders €10 billion in buybacks from 2025 and 2026 earnings and the anticipated excess capital, in addition to our standard cash dividend distribution, subject to corporate and regulatory approvals2. Global businesses (2024 vs 2023) To better reflect the performance of each business, the year-on-year changes provided below are presented in constant euros unless stated otherwise. Variations in current euros are available in the financial report. The group’s business and geographic diversification continues to support consistent, profitable growth. Retail & Commercial Banking’s attributable profit grew 29% to €7,263 million driven by good revenue performance across the regions (+11%), efficiency gains from the bank’s transformation programme, and lower provisions in Europe. Furthermore, the total number of customers increased by eight million and the efficiency ratio improved by over three percentage points to 39.7%, resulting in a RoTE of 18.9%. Loans fell 1% affected by mortgage and SME early repayments in Europe, mostly offset by growth in South America and Mexico. The UK business continued to improve its net interest income quarter-on-quarter, reflecting good margin management. Customer funds increased 4%, with deposits growing by 3% and mutual funds by 19%. The bank continued to simplify its product portfolio (-39% this year) and 62% of products are now digitally available. Digital Consumer Bank’s attributable profit was €1,663 million, 12% lower due primarily to the additional provisions for Swiss franc mortgages in Poland and for potential complaints related to motor finance dealer commissions in the UK, announced at the end of 2024. The business saw strong top line performance, with net interest income up 6% and net fee income growing at double-digit rates (+24%), combined with disciplined cost control (-1%). This resulted in an efficiency improvement of close to three percentage points. Loans increased 4%, with solid growth across most markets, and deposits rose 10%, in line with the bank’s strategy to reduce funding costs and net interest income volatility through the interest rate cycle. The business launched Openbank in the US and Mexico in the last quarter of 2024 as part of its transformation, while it reached agreements with Apple and Amazon through its digital consumer finance platform Zinia. In the US, Openbank is off to a strong start with over €2 billion raised. CIB reported an all-time high attributable profit of €2,740 million (+16%) on the back of double-digit growth in net interest income and net fee income, both reaching record levels, driven by all business lines. This more than offset higher costs related to the investment in new capabilities, maintaining a leading position in efficiency and profitability 6 Targets market dependent. Based on macro assumptions aligned with international economic institutions. CET1 ratio phased-in CRR3. (1) YoY change in constant euros, except Argentina in current euros. (2) Fully-loaded definition as of 1 January 2025.

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 5 among its peers. Strong activity year-on-year across the board, particularly boosted by growth initiatives in Global Banking and Global Markets. Wealth Management & Insurance, comprising the group’s private banking, asset management and insurance businesses, increased its attributable profit 14% to €1,650 million, benefitting from positive net interest income and net fee income performance across the board. This was reflected in widespread revenue growth across businesses: Private Banking (+14%), Santander Asset Management (+23%) and Insurance (+12%). The business reached assets under management of €498 billion (+13%) driven by excellent commercial activity and positive market performance. Payments generated an attributable profit of €413 million, down 26%. Excluding charges recorded in the second quarter (discontinuing the merchant platform in Germany and Superdigital in Latin America), attributable profit grew 18%. The cost per transaction has improved 1% to €2.8 cents after growing the number of transactions by 12% to 3.4 billion per month. In PagoNxt, the EBITDA margin increased 2.7 percentage points to 27.5% and the total payments volume in merchants (Getnet) increased 13% to €222 billion. The number of transactions managed by PagoNxt Payments has grown to 1.2 billion versus 303 million the year earlier. Turnover in the Cards business was 9% higher, reaching €330 billion, while the number of cards managed by the group has reached 105 million worldwide. Revenue from the cards business grew 7%, with an RoTE of 32.6%. Banco Santander is one of the largest banks in the world. Its market capitalization at the end of the year was €67.6 billion. It has firm roots in ten core markets in Europe and the Americas, with 3.5 million shareholders and 207,000 employees who serve 173 million customers. Note: YoY change in constant euros. Contribution to Group revenue as a percentage of total operating areas, excluding the Corporate Centre. Global businesses’ RoTEs are adjusted based on Group’s deployed capital. (1) Payments profit and YoY profit growth exclude the write-downs of our investments related to our merchant platform in Germany and Superdigital in Latin America.

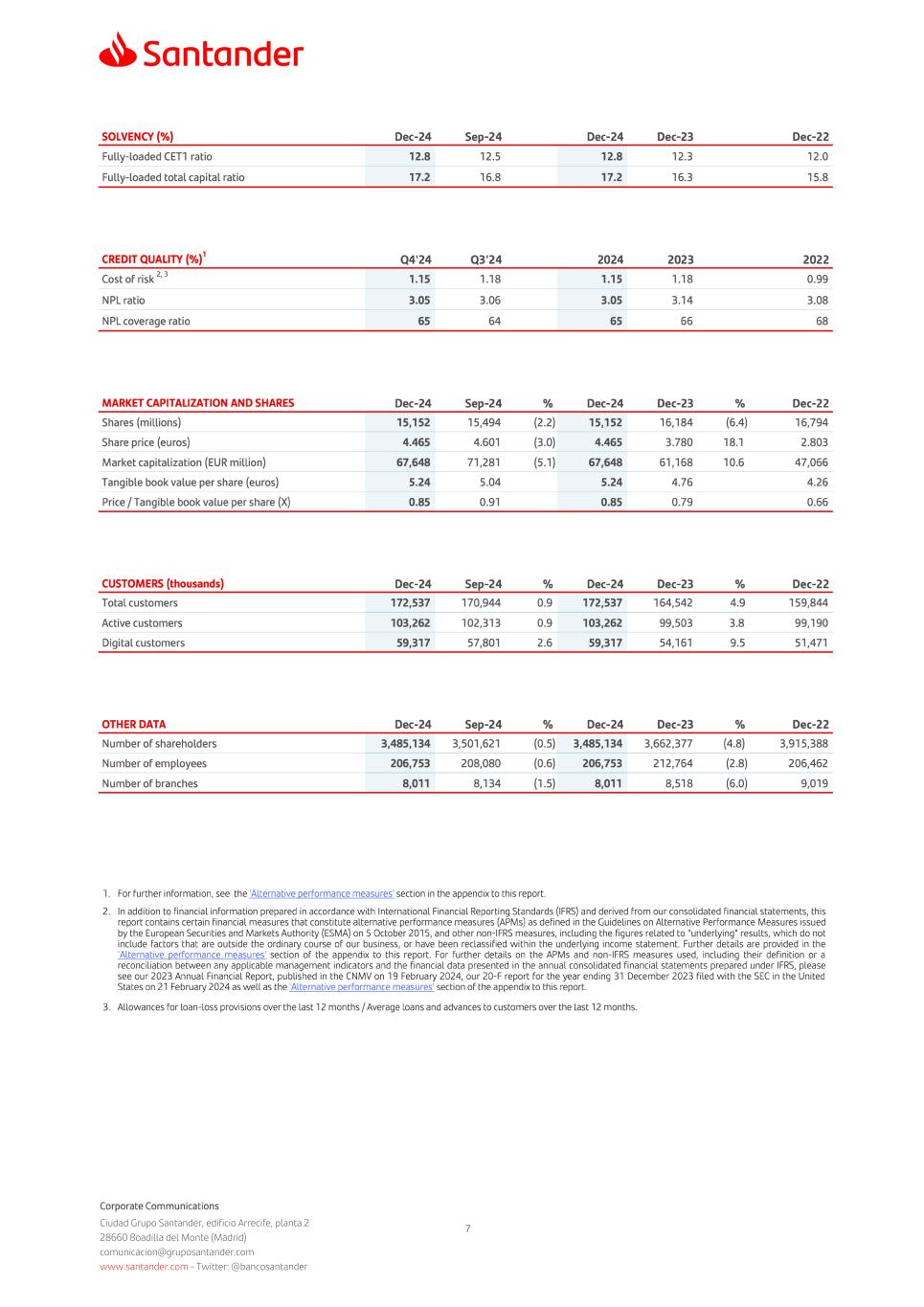

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 6 Key consolidated data (from financial report)

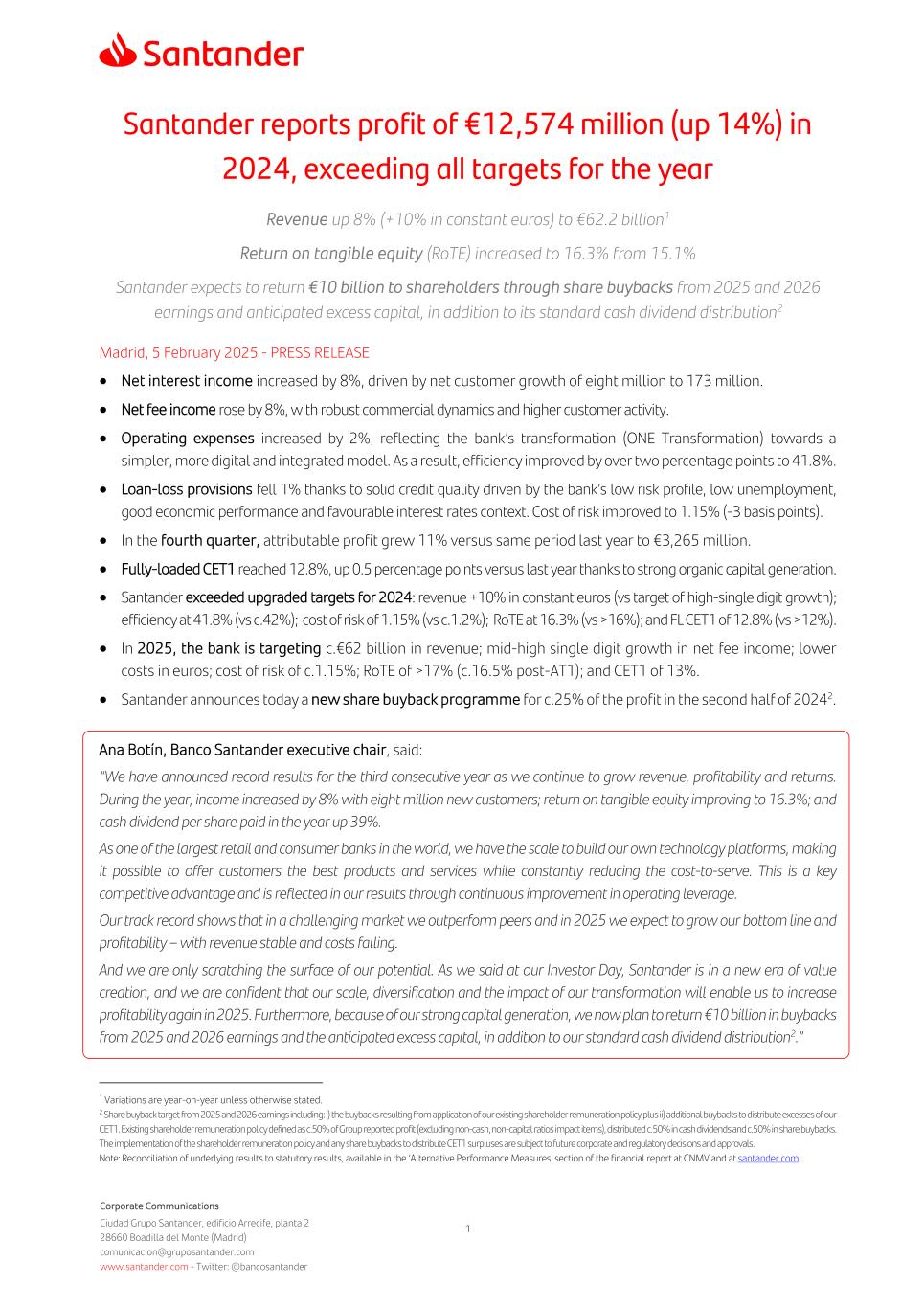

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 7

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 8 Important information Non-IFRS and alternative performance measures This document contains financial information prepared according to International Financial Reporting Standards (IFRS) and taken from our consolidated financial statements, as well as alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures. The APMs and non- IFRS measures were calculated with information from Grupo Santander; however, they are neither defined or detailed in the applicable financial reporting framework nor audited or reviewed by our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider them to be useful metrics for our management and investors to compare operating performance between periods. APMs we use are presented unless otherwise specified on a constant FX basis, which is computed by adjusting comparative period reported data for the effects of foreign currency translation differences, which distort period-on-period comparisons. Nonetheless, the APMs and non-IFRS measures are supplemental information; their purpose is not to substitute IFRS measures. Furthermore, companies in our industry and others may calculate or use APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. APMs using ESG labels have not been calculated in accordance with the Taxonomy Regulation or with the indicators for principal adverse impact in SFDR. For further details on APMs and Non-IFRS Measures, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2023 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the SEC) on 21 February 2024 (https://www.santander.com/content/dam/santander-com/en/documentos/informacion-sobre-resultados-semestrales-y-anuales- suministrada-a-la-sec/2024/sec-2023-annual-20-f-2023-en.pdf), as well as the section “Alternative performance measures” of this Banco Santander, S.A. (Santander) Q4 2024 Financial Report, published on 5 February 2025 (https://www.santander.com/en/shareholders-and- investors/financial-and-economic-information#quarterly-results). Underlying measures, which are included in this document, are non-IFRS measures. The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the businesses included and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries. Forward-looking statements Santander hereby warns that this document contains “forward-looking statements” as per the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such statements can be understood through words and expressions like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future”, “commitment”, “commit”, “focus”, “pledge” and similar expressions. They include (but are not limited to) statements on future business development and shareholder remuneration policy. While these forward-looking statements represent our judgement and future expectations concerning our business developments and results may differ materially from those anticipated, expected, projected or assumed in forward-looking statements. In particular, forward looking statements are based on current expectations and future estimates about Santander’s and third-parties’ operations and businesses and address matters that are uncertain to varying degrees and may change, including, but not limited to (a) expectations, targets, objectives, strategies and goals relating to environmental, social, safety and governance performance, including expectations regarding future execution of Santander’s and third-parties’ (including governments and other public actors) energy and climate strategies, and the underlying assumptions and estimated impacts on Santander’s and third-parties’ businesses related thereto; (b) Santander’s and third-parties’ approach, plans and expectations in relation to carbon use and targeted reductions of emissions, which may be affected by conflicting interests such as energy security; (c) changes in operations or investments under existing or future environmental laws and regulations; (d) changes in rules and regulations, regulatory requirements and internal policies, including those related to climate-related initiatives; (e) our own decisions and actions including those affecting or changing our practices, operations, priorities, strategies, policies or procedures; (f) events that lead to damage to our reputation and brand; (g) exposure to operational losses, including as a result of cyberattacks, data breaches or other security incidents; and (h) the uncertainty over the scope of actions that may be required by us, governments and others to achieve goals relating to climate, environmental and social matters, as well as the evolving nature of underlying science and industry and governmental standards and regulations. In addition, the important factors described in this document and other risk factors, uncertainties or contingencies detailed in our most recent Form 20-F and subsequent 6-Ks filed with, or furnished to, the SEC, as well as other unknown or unpredictable factors, could affect our future development and results and could lead to outcomes materially different from what our forward-looking statements anticipate, expect, project or assume. Forward-looking statements are therefore aspirational, should be regarded as indicative, preliminary and for illustrative purposes only, speak only as of the date of this document, are informed by the knowledge, information and views available on such date and are subject to change

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid) comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 9 without notice. Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or otherwise, except as required by applicable law. Santander does not accept any liability in connection with forward-looking statements except where such liability cannot be limited under overriding provisions of applicable law. Not a securities offer This document and the information it contains does not constitute an offer to sell nor the solicitation of an offer to buy any securities. Past performance does not indicate future outcomes Statements about historical performance or growth rates must not be construed as suggesting that future performance, share price or results (including earnings per share) will necessarily be the same or higher than in a previous period. Nothing in this document should be taken as a profit and loss forecast.

SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Banco Santander, S.A. Date: 5 February 2025 By: /s/ José García Cantera Name: José García Cantera Title: Chief Financial Officer