EXHIBIT 99.3 – Banco Santander S.A. Deferred and Conditional Variable Remuneration Plan (Cycle V)

The fifth cycle of the Deferred and Conditional Variable Remuneration Plan is a remuneration system that includes the delivery of shares of Banco Santander, S.A. (the “Bank” or “Banco Santander”) or of rights thereon, and has been approved by the board of directors on the terms and conditions described below:

| I. | Purpose and Beneficiaries |

The fifth cycle of the Deferred and Conditional Variable Remuneration Plan has been implemented in connection with the variable remuneration or bonus (hereinafter, the “Bonus”) for financial year 2015 that has been approved by the board of directors or the appropriate body in each case, for executive directors and certain employees of the Santander Group belonging to categories whose professional activities have a material impact on the risk profile of the institution or its Group (all of them being referred to as the “Identified Staff” and determined in accordance with section 32.1 of Law 10/2014 of 26 June on organization, supervision and solvency of credit institutions, and the regulations thereunder) or other persons included in such group due to regulatory requirements or corporate rules in a particular country.

The number of members of the Identified Staff affected by this plan cycle came to 1,090 persons at 31 December 2014, though it does not affect those whose Bonus is not paid, eithe

in whole or in part, in shares of Banco Santander but in shares of subsidiaries of Banco Santander. Taking into account possible changes in the workforce, the number of beneficiaries of this plan cycle might change. The board of directors, or the executive committee acting by delegation therefrom, may approve inclusions (through promotion or hiring at the Santander Group) in or exclusions from the Identified Staff (which may come to approximately 1,300 persons), without the maximum total number of shares to be delivered that is authorized at any time being modified as a result.

The purpose of this fifth cycle of the Deferred and Conditional Variable Remuneration Plan is to defer a portion of the Bonus over a period of three or five years, depending on the beneficiary’s profile, with any payment thereof being made in cash and in Santander shares, and with the other portion of such variable remuneration being also paid in cash and in Santander shares upon commencement, all in accordance with the rules set forth below.

The Bonus of the beneficiaries for financial year 2015 was paid according to the following percentages, depending on the time of payment and on the group to which the beneficiary belongs (the “Immediate Payment Percentage” to identify the portion for which payment is not deferred, and the “Deferred Percentage” to identify the portion for which payment is deferred):

| | Immediate Payment Percentage | Deferred Percentage | Deferral Period |

| Executive directors and members of the Identified Staff whose total variable remuneration is ≥ €2.6 million | 40% | 60% | 5 years |

Division directors, country heads in countries representing at least 1% of the Group’s financial capital, other executives of the Santander Group with a similar profile and members of the Identified Staff whose total variable remuneration is ≥ €1.7 million (< €2.6 million) | 50% | 50% | 5 years |

| Other beneficiaries | 60% | 40% | 3 years |

Taking the foregoing into account, the Bonus for financial year 2015 was paid as follows:

| (i) | Each beneficiary received in 2016, depending on the group to which such beneficiary belongs, the Immediate Payment Percentage applicable in each case, in halves and net of taxes (or withholdings), in cash and in Santander shares (the “Initial Date”, meaning the specific date on which the Immediate Payment Percentage is paid). |

| (ii) | Payment of the Deferred Percentage of the Bonus applicable in each case depending on the group to which the beneficiary belongs is deferred over a period of 3 or 5 years (the “Deferral Period”) and is paid in thirds or fifths, as applicable, within thirty days of the anniversaries of the Initial Date in 2017, 2018 and 2019 and, if applicable, 2020 and 2021 (the “Anniversaries”), provided that the conditions described below are met. |

| (iii) | After deduction of any taxes (or withholdings) applicable at any time, the net amount of the deferred portion is paid in thirds or fifths, 50% in cash and the other 50% in Santander shares. |

| (iv) | The beneficiaries receiving Santander shares pursuant to paragraphs (i) to (iii) above may not transfer them or hedge them directly or indirectly for one year as from each |

delivery of shares. The beneficiaries may likewise not hedge the shares directly or indirectly prior to delivery thereof.

In addition to continuity of the beneficiary within the Santander Group1, the accrual of the deferred remuneration is subject to none of the following circumstances arising, in the opinionof the board of directors at the proposal of the remuneration committee, during the period before each delivery as a consequence of actions taken in 2015:

| (i) | poor financial performance of the Group; |

| (ii) | violation by the beneficiary of internal regulations, particularly those relating to risks; |

| (iii) | material restatement of the Group’s financial statements, when so considered by the external auditors, except when appropriate pursuant to a change in accounting standards; or |

| (iv) | significant changes in the financial capital or risk profile of the Group. |

The board of directors, at the proposal of the remuneration committee and based on the level of achievement of such conditions, determines the specific amount of deferred remuneration to be paid on each occasion.

If the foregoing requirements are met on each Anniversary, the beneficiaries receive the cash and shares, in thirds or fifths, as applicable, within thirty days of the first, second, third and, if applicable, fourth and fifth Anniversary.

On the occasion of each delivery of shares and cash, if applicable, the beneficiary is paid an amount in cash equal to the dividends paid on the deferred amount in shares of the Bonus and the interest accrued on the deferred cash amount of the Bonus, in both cases from the Initial Date through the corresponding date of payment of the shares and cash. In cases of application of theSantander Dividendo Elección scrip dividend scheme, the price paid is the price offered by the Bank for the bonus share rights corresponding to such shares.

| III. | Maximum Number of Shares to Be Delivered |

The final number of shares delivered to each beneficiary, including both those for immediate payment and those for deferred payment, is calculated taking into account: (i) the amount resulting from applying applicable taxes (or withholdings), and (ii) the average weighted daily volume of the average weighted listing prices of the shares of Santander for

1When termination of the relationship with Banco Santander or another entity of the Santander Group is due to retirement, early retirement or pre-retirement of the beneficiary, for a termination judicially declared to be improper, unilateral separation for good cause by an employee (which includes, in any case, the situations set forth in section 10.3 of Royal Decree 1382/1985, of 1 August, governing the special relationship of senior management, for the persons subject to these rules), permanent disability or death, or as a result of an employer other than Banco Santander ceasing to belong to the Santander Group, as well as in those cases of mandatory redundancy, the right to delivery of the shares and the cash amounts that have been deferred (as well as applicable dividends and interest) shall remain under the same conditions in force as if none of such circumstances had occurred.

In the event of death, the right shall pass to the successors of the beneficiary.

In cases of justified temporary leave due to temporary disability, suspension of the contract of employment due to maternity or paternity, or leave to care for children or a relative, there shall be no change in the rights of the beneficiary.

If the beneficiary goes to another company of the Santander Group (including through international assignment and/or expatriation), there shall be no change in the rights thereof.

If the relationship terminates by mutual agreement or because the beneficiary obtains a leave not referred to in any of the preceding paragraphs, the terms of the termination or temporary leave agreement shall apply.

None of the above circumstances shall give the right to receive the deferred amount in advance. If the beneficiary or the successors thereof maintain the right to receive deferred remuneration in shares and in cash (as well as applicable dividends and interest), such remuneration shall be delivered within the periods and upon the terms set forth in the plan rules.

the fifteen trading sessions prior to the date on which the board of directors approves the Bonus for the executive directors of the Bank for financial year 2015 (hereinafter, the “2016 Listing Price”).

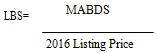

Taking into account that the board of directors has estimated that the maximum amount of the Bonus to be delivered in shares to the beneficiaries of the fifth cycle of the Deferred and Conditional Variable Remuneration Plan comes to 182 million euros (the “Maximum Amount of Bonus Distributable in Shares” or “MABDS”), the maximum number of Santander shares that may be delivered to such beneficiaries under this plan (the “Limit of Bonus in Shares” or “LBS”) is determined, after deducting any applicable taxes (or withholdings), by applying the following formula:

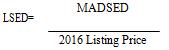

Included in the Maximum Amount of Bonus Distributable in Shares is the estimated maximum amount of the Bonus to be delivered in shares for the executive directors of the Bank, which is 9.1 million euros (the “Maximum Amount Distributable in Shares for Executive Directors” or “MADSED”). The maximum number of Santander shares that may be delivered to the executive directors under this plan (the “Limit on Shares for Executive Directors” or “LSED”) is determined, after deducting any applicable taxes (or withholdings), by applying the following formula:

In the event of a change in the number of shares due to a decrease or increase in the par value of the shares or a transaction with an equivalent effect, the number of shares to be delivered will be modified so as to maintain the percentage of the total share capital represented by them.

Information from the stock exchange with the largest trading volume is used to determine the listing price of the share.

If necessary or appropriate for legal, regulatory or similar reasons, the delivery mechanisms provided for herein may be adapted in specific cases without altering the maximum number of shares linked to the plan or the basic conditions upon which the delivery thereof is made contingent. Such adaptations may include the substitution of the delivery of shares with the delivery of equivalent amounts in cash or vice versa.

The shares to be delivered may be owned by the Bank or by any of its subsidiaries, be newly- issued shares, or be obtained from third parties with whom agreements have been signed to ensure that the commitments made is met.