Banco Santander (SAN) S-8Registration of securities for employees

Filed: 25 Feb 25, 4:23pm

Exhibit 99.2

Confidential

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

REGULATIONS FOR THE NINTH CYCLE OF THE DEFERRED MULTIYEAR OBJECTIVES VARIABLE

REMUNERATION PLAN

Contents

| 1. INTRODUCTION | 1 |

| 2. SUBJECTIVE SCOPE AND PURPOSE | 2 |

| 3. SETTING THE AWARD | 3 |

| 4. FUNCTIONING OF THE PLAN | 8 |

| 5. DELIVERY OF SHARES | 9 |

| 6. PERMANENCE AND OTHER CONDITIONS | 11 |

| 7. ADMINISTRATION OF THE PLAN | 13 |

| 8. GENERAL PROVISIONS | 14 |

1. INTRODUCTION

Following a proposal by the remuneration committee, these regulations (the "Regulations") were approved by the board of Banco Santander, S.A. ("Banco Santander" or the "Bank") at its meeting held on 17 December 2024, and entail the approval of the Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan, in relation to those beneficiaries of that ninth cycle who are not executive directors of the Bank (hereinafter, the "Deferred Multiyear Objectives Variable Remuneration Plan", the “Plan” or the “Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan”) as part of the 2024 Variable Remuneration Policy.1

In cases where, due to the application of local ruling, the contents of the Regulations need to be modified or supplemented, the respective bodies of the institutions have adopted or shall adopt the necessary resolutions. Parties affected by the regulations resulting from such resolutions (in each case, the "Supplementary Regulations") shall be notified as appropriate.

Consequently and in relation to the beneficiaries that are not executive directors of the Bank, the Deferred Multiyear Objectives Variable Remuneration Plan is governed by the resolutions of the board of directors of the Bank, by the Regulations, and by the Supplementary Regulations where appropriate.

1 Terms in upper case that are not defined in these Regulations shall have the meaning ascribed to them in the abovementioned resolution of the board of directors.

1

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

For the purposes of these Regulations, the Santander Group is understood as the group composed at any time of Banco Santander and any of its fully consolidated entities.

The executive directors of the Bank are also beneficiaries of the Plan, although in relation to them, it will be governed by resolution Six D approved by the general shareholders’ meeting held on 22 March 2024, by the resolutions of the board of directors approved on 19 February 2024 and by the Regulations for the Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan for Executive Directors.

2. SUBJECTIVE SCOPE AND PURPOSE

The Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan shall be applied in connection with the variable remuneration (hereinafter, the “Award”)2 with respect to 2024 for Group Promontorio executives (hereinafter, the “Beneficiaries”), all of them belonging to the “Identified Staff” or “Material Risk Takers” (that is, to categories of staff whose professional activities have a material impact on the risk profile of the institution in accordance with section 32.1 of Law 10/2014 of 26 June on the organisation, supervision and solvency of financial institutions and its supplementary regulations3). Identification of employees forming part of the "Identified Staff" and of the Plan’s Beneficiaries is the task of the Human Resources' corporate division, pursuant to the policy approved by Banco Santander’s board to this end.

The purpose of this ninth cycle of the Plan is (a) to defer a portion of Award over a period of four or five years,4 depending on the category to which the Beneficiary belongs, subject to the non-occurrence of certain circumstances, (b) in turn, to link a portion of such amount to the performance of the Bank over a multiyear period. Payments under this ninth cycle of the Plan will be made 50% in cash and 50% in Banco Santander shares, all in accordance with the rules approved for this purpose by the Bank's board.

To the extent possible, when (i) the gross sum of total annual variable remuneration does not exceed 50,000 euros and (ii) does not represent more than one third of the Beneficiary's total annual remuneration, payment of such remuneration will occur immediately and fully in cash.

2 For the purposes of these Regulations, the term "Award" refers to the variable remuneration conferred to an individual during financial year 2024 for the corresponding period he/she has been considered Identified Staff. It also includes any extraordinary variable remuneration that may, where applicable, be granted to certain Beneficiaries in respect of such period and be subject to the terms of these Regulations, as adapted in each case.

3 Commission Delegated Regulation (EU) No 2021/923 of 25 March 2021 supplementing Directive 2013/36/EU of the European Parliament and of the Council with regard to regulatory technical standards setting out the criteria to define managerial responsibility, control functions, material business units and a significant impact on a material business unit’s risk profile, and setting out criteria for identifying staff members or categories of staff whose professional activities have an impact on the institution’s risk profile that is comparably as material as that of staff members or categories of staff referred to in Article 92(3) of that Directive. Likewise, the determination of the Identified Staff takes into account the Group’s Identified Staff identification policy and procedure, as well as any other regulatory or corporate criteria applicable in a given country.

4 In certain countries, the deferral period may be different to comply with applicable local regulations or with the requirements of the competent authority in each case.

2

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

It is hereby stated for the record that the executive directors of Banco Santander are also beneficiaries of this Plan. However, the application of the Plan thereto is governed by another regulation also approved by the board (the "REGULATION OF THE NINTH CYCLE OF THE DEFERRED MULTIYEAR OBJECTIVES VARIABLE REMUNERATION PLAN OF THE EXECUTIVE DIRECTORS"). Therefore, references in these Regulations to "Beneficiaries" do not include executive directors unless expressly so stated.

3. SETTING THE AWARD

The maximum amount of the 2024 Award for each Beneficiary will be set based on their reference or objective award and taking into account the additional quantitative metrics and qualitative factors stipulated.

In any case, the variable components of the total remuneration that may be awarded to each Beneficiary in respect of the financial year 2024 may not exceed 100% of the fixed portion of their remuneration, or 200% for those Beneficiaries stated in the resolution approved by the general meeting on 22 March 2024 under item Six C of the agenda.

The status of Beneficiary and the maximum amount of Award that the Beneficiary is eligible to receive, in accordance with these Regulations and their Supplementary Regulations, shall be individually notified.

The potential delivery of a particular percentage of the maximum amount of Award shall be deferred for 4 or 5 years,5 in accordance with the group the Beneficiary belongs to (as detailed in section 4 below). In turn, the accrual of a portion of such deferred amounts -in particular, the third and fourth annuity and, where applicable, fifth (the “Deferred Portion Subject to Objectives”)- is subject to the compliance of certain objectives referring to the 2024-2026 period (the “Multiyear Objectives”) and to the metrics and scales associated with such Multiyear Objectives, as described below. Once ended the 2026 financial year, the board will be able to set, following a proposal by the remuneration committee, the maximum amount of each annual payment of the Deferred Portion Subject to the Objectives.

Multiyear Objectives, metrics and compliance scales:

| A. | Achievement of the return on tangible equity (“RoTE”) target of the Bank in 2026. The RoTE coefficient corresponding to this target will be obtained from the following table: |

| RoTE in 2026 | |

| (%) | RoTE Coefficient |

| ≥ 18% | 1.5 |

| ≥ 15% but < 18% | 0 – 1.5A |

| < 15% | 0 |

| A. | Straight-line increase in RoTE Coefficient based on the specific percentage of RoTE in 2026, within this bracket of the scale. |

5 In certain countries, the deferral period may be different to comply with applicable local regulations or with the requirements of the competent authority in each case.

3

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

| B. | Relative performance of the Bank’s TSR for the 2024-2026 period compared to the weighted TSRs of a peer group of 9 credit institutions. |

For these purposes:

| - | “TSR” means the difference (expressed as a percentage) between the final value of an investment in ordinary shares of the Bank and the initial value of that investment, taking into account that for the calculation of such final value, dividends or other similar items received by the shareholder due to such investment during the corresponding period of time will be considered as if they had been invested in more shares of the same class on the first date on which the dividend or similar item is payable to the shareholders and at the average weighted listing price on said date. To calculate TSR, the average weighted daily volume of the average weighted listing prices for the fifteen trading sessions prior to 1 January 2024 (excluded) (for the calculation of the initial value) and for the fifteen trading sessions prior to 1 January 2027 (excluded) (for the calculation of the final value) will be taken into account. |

| - | “Peer Group” means the group made up of the following 9 financial institutions: BBVA, BNP Paribas, Citi, Crédit Agricole, HSBC, ING, Itaú, Scotiabank and Unicredit. |

In the event of unforeseen changes in the Peer Group and there are objective circumstances that justify it, the board of directors or, by delegation thereof, the executive committee or any director with delegated powers, subject to a report from the remuneration committee, shall have the power to adapt the rules of comparison between them or to change the composition of the Peer Group.

For this TSR metric, the following achievement scale is established:

| TSR Position of the Bank | TSR Coefficient |

| Achievement of percentile 100 | 1.5 |

| Between percentiles 75 and 100 (not including the latter) | 1 – 1.5A |

| Between percentiles 40 and 75 (not including the latter) | 0.5 – 1A |

| Below percentile 40 | 0 |

| A. | Proportional increase in TSR coefficient according to the number of positions moved up in the ranking within this bracket of the scale. |

| C. | Level of Group progress on the Responsible banking actions lines and associated targets, measured through the following metrics related to environmental, social and corporate governance (ESG) matters: |

| i. | Target regarding women in senior management positions at year-end 2026: |

| % of women in management positions B | Coefficient 1 |

| ≥ 37% | 1.25 |

| ≥ 36% but < 37% | 1 – 1.25A |

| ≥ 34% but < 36% | 0 – 1A |

| < 34% | 0 |

| A | Proportional increase in the Coefficient 1 according to its position within this bracket of the scale. |

| B | The executives included and represent approximately 1% of the total payroll. |

4

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

| ii. | Target regarding financial inclusion between 2024 and 2026: |

| Financial inclusion B (millions of people) | Coefficient 2 |

| ≥ 6.3 | 1.25 |

| ≥ 5.3 but < 6.3 | 1 – 1.25A |

| ≥ 3.5 but < 5.3 | 0 – 1A |

| < 3.5 | 0 |

| A | Proportional increase in the Coefficient 2 according to its position within this bracket of the scale. |

| B | Number of unbanked, underbanked, financially distressed or credit-constrained people provided with tailored access and financing solutions, with the objective of meeting local financial inclusion needs in a recurrent, comprehensive, affordable and effective manner. |

| iii. | Target regarding socially responsible investment: |

| Socially responsible investment in 2026 B (billions of euros) | Coefficient 3 |

| ≥ 21 | 1.25 |

| ≥ 18 but < 21 | 1 – 1.25A |

| ≥ 15 but < 18 | 0 – 1A |

| < 15 | 0 |

| A | Proportional increase in the Coefficient 3 according to its position within this bracket of the scale. |

| B | Percentage of Grupo Santander's assets under management that are aligned with Grupo Santander's Sustainable Finance and Investment Classification System (SFICS) out of Grupo Santander's total assets under management. |

| iv. | Target regarding transition support (business disbursed and facilitated): |

| Business disbursed and facilitated between 2024 and 2026B (billions of euros) | Coefficient 4 |

| ≥ 180 | 1.25 C |

| ≥ 150 but < 180 | 1 – 1.25A, C |

| ≥ 110 pero < 150 | 0 – 1 A |

| < 110 | 0 |

| A | Proportional increase in the Coefficient 4 according to its position within this bracket of the scale. |

| B | Santander Group's contribution to our customers' transition (2024-2026): CIB green finance raised and facilitated (target), Retail & Commercial banking green finance and sustainable linked-loans, and Digital Consumer Bank green finance. |

| C | Exceeding 100% of this target (and thus achieving a Coefficient 4 above 1) requires the implementation of a comprehensive and credible transition plan. This plan will include improving climate data, advancing actions to decarbonise portfolios, improving sustainable product offerings to meet market needs, further integrating climate and environmental risk, and engaging to support policy action and market developments. |

The level of achievement of the Multiyear Objective will be determined by using the following formula:

C = (2/10 x Coefficient 1 + 2/10 x Coefficient 2 + 1/10 x Coefficient 3 + 5/10 x Coefficient 4)

|

5

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

Thus, the following formula will be applied to determine the annual amount of the Deferred Portion Subject to Objectives, if any, payable in financial years 2028, 2029 and, if applicable, 2030 (each of these payments, a “Final Annual Payment”), without prejudice to any adjustments that may result from malus clauses:

Final Annual Payment = Amt. x (2/5 x A + 2/5 x B + 1/5 x C)

|

where:

| § | “Amt.” means half or one third of the Deferred Portion Subject to Objectives, depending on the type of Beneficiary, i.e. depending on whether the Beneficiary defers for four years or five years. |

| § | “A” is the RoTE Coefficient according to the scale and terms and conditions in paragraph A above based on the achievement of the return on tangible equity target in 2026. |

| § | “B” is the TSR Coefficient according to the scale in paragraph B above based on the relative performance of the TSR of the Bank for the 2024-2026 period with respect to the Peer Group. |

| § | “C” is the coefficient resulting from adding up the weighted coefficients for each of the four responsible banking commitments by 2026, as set forth in paragraph C above. |

| § | Assuming in any case that if “(2/5 x A + 2/5 x B + 1/5 x C)” yields a figure greater than 1.25, 1.25 shall be applied as the multiplier. |

The executive committee and any director with delegated powers may, by delegation of authority of the board of directors of Banco Santander, by way of example only:

| (i) | specify and interpret the resolutions of the board of directors, and may adapt them, without affecting their basic content, to the circumstances that may arise at any given time, including, in particular, adapting the delivery mechanisms, without altering the maximum number of shares linked to the Award or the basic conditions upon which the delivery thereof is made contingent, which may include the substitution of the delivery of shares with the delivery of equivalent amounts in cash, or the alteration of the mechanisms for net delivery of shares under the procedures that are established for the payment of taxes or when so required for regulatory, tax, operational or contractual reasons.6 In addition, they may adapt the aforementioned Plan (including the adjustment or removal of any metrics and achievement scales for the Multiyear Objectives, the inclusion of additional targets for the delivery of any deferred amount of the Award or the increase of the part corresponding to the Deferred Payment Amount or of the Deferral Period) to any mandatory regulations or administrative interpretation that may prevent the implementation thereof on the approved terms; |

6 In addition, it would also be possible to deliver shares, quotes (participaciones) or any other instruments based on the value of the shares or quotes (participaciones) of other subsidiaries of the Santander Group, listed or not-listed, in accordance with the resolutions passed by the Bank at any given moment.

6

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

| (ii) | set, without altering the maximum amount of the Award to be delivered in shares, which executives or employees are Beneficiaries of the Plan; apply the measures and mechanisms that may be appropriate to compensate for the dilution effect, if any, that may occur as a result of corporate transactions or distributions to shareholders while the shares have not been delivered to the Beneficiaries; and, in the event that the maximum amount distributable in shares to be delivered to the Beneficiaries of the Plan is exceeded, authorise the deferral and payment of the excess in cash; |

| (iii) | extend the deferral period in the jurisdiction or jurisdictions where so required and in respect of all or part of the Beneficiaries of the Award in order to adapt to the applicable regulations in force at any given time or to the requirements of the competent authority, making such adjustments as may be necessary to adapt the Award to the new deferral period. |

| (iv) | adjust positively or negatively, following a proposal of the remuneration committee, the level of achievement of the Multiyear Objectives when regulatory changes, inorganic transactions, material changes to the Group’s composition or size or other extraordinary circumstances (such as impairments, legal changes, corporate transactions, share buy-back programmes or restructuring procedures) have occurred which affect the suitability of the metric and achievement scale established in each case and resulting in an impact not related to the performance of the executives being evaluated; |

| (v) | approve, where applicable, the engagement of one or more internationally recognised third parties to verify the achievement of the Multiyear Objectives. In particular, and merely by way of example, it may ask such third parties: to obtain, from appropriate sources, the data upon which the calculations of TSR are to be based; to perform the calculations of the TSR of the Bank and the TSRs of the entities within the Peer Group; to compare the Bank’s TSR with the TSRs of the entities within the Peer Group; and to provide advice on the decision as to how to act in the event of unexpected changes in the Peer Group that may require adjustments to the rules for comparison among them or on the amendment of the Peer Group in light of objective circumstances that justify such amendment (such as inorganic transactions or other extraordinary circumstances); and |

| (vi) | develop and specify the conditions upon which the receipt by the Beneficiaries of the corresponding shares or deferred amounts is contingent, as well as determine whether, according to the Plan, the conditions upon which the receipt by the Beneficiaries of the respective shares or cash amounts is made contingent have been fulfilled, with the power to modulate the cash amounts and the number of shares to be delivered depending on the existing circumstances, all following a proposal of the remuneration committee. |

7

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

Furthermore they have the power to develop, amend, alter or adapt the terms and conditions of the Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan, as well as to substitute the above powers in favour of the person responsible for Human Resources of the Group, the general secretary or the global director of compensation of the Group.

4. FUNCTIONING OF THE PLAN

The Award for the financial year 2024 shall be paid according to the following percentages, depending on when the payment is made and on the remuneration level of the Beneficiary (the “Immediate Payment Percentage”, to identify the portion which payment is not deferred, and the “Deferred Percentage”, to identify the portion which payment is deferred):

| Immediate Payment Percentage | Deferred Percentage (*) | Deferral Period (*) | Deferred Portion Subject to Objectives (*) | |

| Members of senior management(***) whose target(**) total variable remuneration is ≥ €2.7 mill. or those Beneficiaries whose target(**) total variable remuneration is ≥ €2.7 mill. | 40% | 60% | 5 years | Last 3 years (3/5 of Deferred Percentage) |

| Remaining members of senior management(***) or those Beneficiaries whose target(**) total variable remuneration is ≥ €1.7 mill. and < €2.7 mill. | 50% | 50% | 5 years | Last 3 years (3/5 of Deferred Percentage) |

| Rest of Beneficiaries. | 60% | 40% | 4 years | Last 2 years (2/4 of Deferred Percentage) |

For the purposes of the assignation of a Beneficiary of the ninth cycle to the corresponding category, for those variable remunerations not denominated in euros, it will be taken into account the exchange rate average at closing corresponding to the last fifteen trading sessions prior to the Friday (exclusive) of the previous week to the date on which the board of directors agreed the variable remuneration of the Bank’s executive directors for 2023 (30 January 2024).

| (*) | In certain countries, the deferral percentage and the deferral period may also be different to comply with applicable local regulations or with the requirements of the competent authority in each case. Similarly, the deferred part subject to objectives can be applied to years that are not the last ones, but not before the third year. |

| (**) | Benchmark variable remuneration for an standard achievement (100% of the objectives). |

| (***) | For the purposes of these Regulations, senior management comprises all the members included in Banco de España’s Register of senior officers. |

Taking into account the foregoing, the Award for financial year 2024 of the Beneficiaries of this ninth cycle will be paid as follows:

| (i) | In 2025, depending to the group to which they belong, each Beneficiary shall receive the Immediate Payment Percentage that corresponds to their group (the “Initial Date”, understood as the specific date at which the Immediate Payment Percentage is paid). |

| (ii) | Payment of the Deferred Percentage corresponding to each group shall be deferred for a period of 4 or 5 years (the “Deferral Period”), and shall be made in fourths or fifths within thirty days of the anniversary of the Initial Date in the years 2026, 2027, 2028, 2029 and, where applicable, 2030 (the “Anniversaries”), provided all requirements and conditions detailed in these Regulations, and, where applicable, in the Supplementary Regulations, are fulfilled. |

8

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

| (iii) | The deferred portion shall be divided in four or five parts (each one an “Annual Payment”), which will determine the maximum amount to be paid, if applicable, on each of the Anniversaries. |

| (iv) | Each of the payments to be made (either on the Initial Date and on the Anniversaries) will be made 50% in cash and 50% in Santander shares. |

| (v) | The Beneficiaries may not directly or indirectly hedge the Santander shares that they receive pursuant to the foregoing sections before delivery thereof. They may likewise not transfer them or directly or indirectly hedge the shares for one year as from the delivery thereof. |

| (vi) | On the occasion of each payment of the deferred amount in cash, and subject to the same requirements, it will be possible to pay to the Beneficiary in cash an amount corresponding to the adjustment of the deferred amount to the inflation calculated from the Initial Date and until the date on which each corresponding cash amount is paid, applying for these purposes the variation rate of the Consumer Price Index (Índice de Precios de Consumo) published by the National Institute of Statistics of Spain (Instituto Nacional de Estadística) between the date of accrual of the deferred cash amount and its payment date or the latest figure available on this last date. In countries different to Spain, the rate used will be the variation rate of the equivalent index published by the competent authority in each case or other mechanisms that reflect the same effect. |

| (vii) | All payments will be made after applying any withholding or payment on account applicable at any time. |

5. DELIVERY OF SHARES

The total aggregate amount of the Award that the Beneficiaries can receive is limited to the maximum amount approved by the board of directors (hereinafter, “Maximum Amount of the Award”). The Award will be 50% in cash and 50% in Santander shares.

The board of directors, the executive committee and any director with delegated powers, as appropriate, will determine the amount of variable remuneration to be received by each Beneficiary of the Award. Concerning the delivery of shares, such decision shall take into account that in aggregate the amounts to be received by the Beneficiaries shall respect the maximum amount of the Award to be delivered in shares (as approved by the board of directors) to the Beneficiaries of this Award (the “Maximum Amount of the Award Distributable in Shares” or “MAADS”; and, within this maximum, the specific amount to be awarded to each of the Beneficiaries, the “Individual Amount of the Award Distributable in Shares” or “IAADS”).

The number of shares corresponding to each Beneficiary, for both immediate and deferred payments, shall be calculated taking into account the average weighted daily volume of the average weighted listing prices of the shares of Santander for the fifty trading sessions prior to the Friday (exclusive) of the previous week to the date on which the board of directors agrees on the Award for the Bank’s executive directors for the financial year 2024 (the “2025 Listing Price”). Information from the stock exchange with the largest trading volume will be used to determine the listing price of the share.

9

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

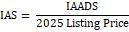

The number of shares of Santander that may be delivered to each Beneficiary under this Award (the “Individual Award in Shares” or “IAS”), will be determined by applying the following formula:

The final number of shares to be delivered to each Beneficiary shall take into account the amount resulting from the application of the relevant taxes (withholdings or payments on account) in accordance with the procedure set forth in the following section (Shares delivery mechanism).

Any variable components of total remuneration that will be paid to each member of the Identified Staff in connection with the financial year 2024 shall be subject to the limits generally applicable for the variable remunerations of the Identified Staff.

When the Award has been set in a currency other than the euro, the applicable immediate and deferred amounts shall be converted into euro at the average closing exchange rate relating to the last fifteen trading sessions prior to the Friday (exclusive) for the week prior to 4 February 2025, the date on which the board of directors of Banco Santander plans to agree on the 2024 Incentive for executive directors. Subsequently, the number of shares to be delivered will be calculated on the terms indicated above.

Shares delivery mechanism

As indicated above, the Award will be paid partly in cash and partly in shares, the payment of which will be partly deferred in accordance with the provisions of these Regulations.

The shares shall be delivered through technical mechanisms (securities account, deposit, etc.) as appropriate in each case, and in all cases any applicable taxes and expenses shall be borne by the Beneficiary. The withholding or payment on account on the remuneration in kind entailed by the delivery of shares or any other tax relating thereto shall be calculated by applying the legislation prevailing at the time of effective delivery. The Beneficiary authorises the employing entity and the Bank to sell, prior to delivery, the shares necessary to proceed with the corresponding withholding or payment on account, as well as for the payment of any other applicable taxes, subsequently receiving the amount of shares net of such amounts.

As appropriate, shares may be delivered by the employing entity, or failing this, when justified by circumstances, by Banco Santander or by another company in its Group, using old or new shares, already available or obtained from third parties. Likewise, if it is required or advisable for any statutory or regulatory reasons or any other reasons of a similar nature, it will be possible to substitute the delivery of shares with cash payments of equivalent value (on the end date of the retention period applicable to each delivery of shares under the ninth cycle) or change the mechanisms of net delivery of shares in light of the procedures to be implemented for the payment of taxes.

10

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

The substitution of the delivery of shares of Banco Santander with the delivery of shares of local listed subsidiaries of the Santander Group may also be agreed, all in the terms and circumstances set out in these Regulations and, if applicable, the corresponding Supplementary Regulations.

Adjustments

In the event of a change in the number of shares due to a decrease or increase in the par value of the shares or a transaction with an equivalent effect, the number of shares to be delivered will be modified so as to maintain the percentage of the total share capital represented by those shares.

6. PERMANENCE AND OTHER CONDITIONS

The accrual of all the Award Annual Payments is conditional upon the fulfilment of certain requirements: (i) in addition to continuity of the Beneficiary within the Santander Group or the Beneficiary being in other situations where, pursuant to the agreement of the board of directors, the Award is maintained, as detailed in this section, (ii) none of the circumstances giving rise to the application of malus must be present during the period prior to each delivery of the Award, as set forth from time to time in the malus and clawback chapter of the Group’s remuneration policy. Furthermore, any Award amounts which have already been paid will be subject to their potential recovery (clawback) by the Bank in the events and during the time periods set out in the policy, which has been extended in 2023 to adapt it to the new regulations of the Securities Exchange Commission of the United States of America on the subject, all in accordance with the terms and conditions set out therein.

Malus and clawback adjustment provisions are triggered in the event of poor financial performance of the institution as a whole or of a specific division or area thereof or of the exposures from staff as a result of an executive(s)’s management of, at least, one of these factors:

| Category | Factors |

| Risk | Significant failures in risk management by Banco Risk Santander, or by a business or risk control unit |

| Capital | An increase in capital requirements at the Banco Santander or one of its business units not Capital planned at the time that exposure was generated |

| Regulation and internal codes | Regulatory penalties or legal convictions for events that might be attributable to the unit or Regulation and staff responsible for them. In addition, failure to internal codes comply with Banco Santander’s internal codes of conduct |

| Conduct | Improper conduct, whether individual or collective. Negative effects deriving from the marketing of unsuitable products and the Conduct liability of persons or bodies making such decisions will be considered especially significant |

In addition, individual policies for each country may include any other criteria required by applicable legal provisions or local regulators.

11

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

The Group’s human resources committee will have the power to decide on the application of malus or clawback. Nevertheless, with respect to the remuneration of the members of the Promontorio segment, the human resources committee shall submit its proposal to the remuneration committee for its consideration and subsequent submission to the board for its approval. In light of the above, the board of directors, following a proposal by the remuneration committee, depending on the occurrence and severity of one or more of the above factors and on the circumstances surrounding the event(s) giving rise to the application of malus or clawback, shall in each case determine the specific amount of the deferred retribution to be satisfied and/or to be recovered from that already paid in the case of application of malus or clawback clauses respectively.

In any case, as provided for in paragraph 4.(e) of section 19 of the rules and regulations of the board and of the aforementioned chapter of the Group remuneration policy, the application of malus or clawback will be assessed by Banco Santander’s remuneration committee. In each case, the related tax treatment according to the prevailing legislation will be applied.

When a situation arises that justifies the application of malus and clawback clauses, upon the request of the Santander Group entity that granted the Award to the Beneficiary, the corresponding Award amounts will be reduced or recovered, even if the Beneficiary(i) has ceased to provide services within Santander Group or (ii) is currently employed by a different Santander Group entity than the one that granted the Incentive, in which case, said reduction or recovery can be carried out through the new entity (cross recovery), and the amounts to be reduced or recovered may also be deducted from other incentives granted by Santander Group to the Beneficiary.

Likewise, following each delivery of shares, the Beneficiary’s rights are also contingent upon compliance with the other rules governing the Plan as set out in these Regulations and, where applicable, in the Supplementary Regulations, specifically, with regard to any shares delivered to the Beneficiary, the aforementioned obligations to refrain from (a) directly or indirectly hedging them before delivery; and (b) directly or indirectly transferring or hedging them for one year as from each delivery of shares.

Conditions relating to permanence in the Group:

When termination of the relationship with Banco Santander or another entity of the Santander Group is due to retirement, early retirement or pre-retirement of the Beneficiary, for a termination judicially declared to be improper, unilateral separation for good cause by an employee (which includes, in any case, the situations set forth in section 10.3 of Royal Decree 1382/1985 of 1 August governing the special relationship of senior management, for the persons subject to these rules), permanent disability or death, or as a result of an employer other than Banco Santander ceasing to belong to the Santander Group, as well as in those cases of mandatory redundancy, the right to delivery of the shares and cash amounts that have been deferred, as well as, where appropriate, the amounts derived from the inflationary adjustment of the deferred amounts in cash, shall remain under the same conditions in force as if none of such circumstances had occurred.

12

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

In the event of death, the right shall pass to the successors of the Beneficiary.

In cases of justified temporary leave due to temporary disability, suspension of the contract of employment due to maternity or paternity, or leave to care for children or a relative, there shall be no change in the rights of the Beneficiary.

If the Beneficiary goes to another company of the Santander Group (including through international assignment and/or expatriation), there shall be no change in the rights thereof.

If the relationship terminates by mutual agreement or because the Beneficiary obtains a leave not referred to in any of the preceding paragraphs, the terms of the termination or temporary leave agreement shall apply.

None of the above circumstances shall give the right to receive the deferred amount in advance except where necessary to comply with mandatory regulations or, where appropriate, to avoid a conflict of interest. If the Beneficiary or the successors thereof maintain the right to receive deferred remuneration in cash and shares, as well as, where appropriate, the amounts derived from the inflationary adjustment of the deferred amounts in cash, such remuneration shall be delivered within the periods and upon the terms set forth in these Regulations.

Conditions relating to the Bank’s capital and liquidity position and the macroeconomic situation

Each of the payments under the Regulations is also conditional upon the corresponding body at the Bank verifying in advance that (i) such payments do not put the Bank’s capital or liquidity position at risk in accordance with the capital or liquidity targets set at any given time; and (ii) it is not advisable to make such payments or, where appropriate, they should be reduced owing to adverse macroeconomic or risk-generating circumstances.

7. ADMINISTRATION OF THE PLAN

Banco Santander’s board and, by delegation, the executive committee and any director with delegated powers, has the necessary powers to administer the Plan, notwithstanding the possibility of authorising the appropriate bodies or departments to carry out specific tasks related thereto, and any materialisation of decisions requiring the participation of bodies or departments of the various institutions whose employees include Beneficiaries. All without prejudice to the powers of attorney or other entitlements that may exist in relation thereto.

Specifically, the board and, by delegation, the executive committee and any director with delegated powers, may interpret the provisions of these Regulations and the Supplementary Regulations and adapt them to any new circumstances that may arise, without altering the basic content of the agreements of the board of directors and general meeting, the maximum aggregate number of shares associated to the Plan, or the essential conditions on which their delivery depends, all in the terms set out in these Regulations and in the corporate agreements adopted in relation to this Plan. The Group’s human resources committee, as part of its task to supervise and implement these Regulations and the Supplementary Regulations, may interpret the contents thereof when any such interpretation is required so as to allow an appropriate administration of the Plan.

13

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

8. GENERAL PROVISIONS

This Plan and, consequently, the status of Beneficiary to whom it applies, solely and exclusively gives rise to the expectations and rights stipulated in these Regulations and, where applicable, in the Supplementary Regulations, in the terms established therein.

14

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

Confidential

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

REGULATIONS FOR THE NINTH CYCLE OF THE DEFERRED MULTIYEAR OBJECTIVES VARIABLE

REMUNERATION PLAN OF THE EXECUTIVE DIRECTORS

Contents

| 1. INTRODUCTION AND SUBJECTIVE SCOPE | 1 |

| 2. SETTING THE AWARD FOR EXECUTIVE DIRECTORS | 2 |

| 3. FUNCTIONING OF THE PLAN FOR EXECUTIVE DIRECTORS | 7 |

| 4. DELIVERY OF SHARES | 8 |

| 5. PERMANENCE AND OTHER CONDITIONS | 10 |

| 6. ADMINISTRATION OF THE PLAN | 12 |

| 7. GENERAL PROVISIONS | 13 |

1. INTRODUCTION AND SUBJECTIVE SCOPE

Following a proposal by the remuneration committee, these regulations (the "Regulations") were approved by the board of Banco Santander, S.A. ("Banco Santander" or the "Bank") at its meeting held on 17 December 2024, in execution of (i) the agreement of the board dated 19 February 2024, which approved the Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan (hereinafter, the "Deferred Multiyear Objectives Variable Remuneration Plan", the “Plan” or the “Eighth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan”) as part of the 2024 Variable Remuneration Policy; and (ii) resolution Six D adopted by the ordinary general meeting of shareholders held on 22 March 2024, which approved the implementation of the Plan, as regards the inclusion of executive directors of the Bank as beneficiaries.1

The purpose of this ninth cycle of the Plan is (a) to defer a portion of the Incentive over a period of four or five years2, depending on the category to which the Beneficiary belongs (as defined below), subject to the non-occurrence of certain circumstances, (b) linking, in turn, part of such amount to the performance of the Bank over a multi-year period. Payments under the ninth cycle of the Plan will be made 50% in cash and 50% in instruments (RSUs under PagoNxt, S.L. and Banco Santander shares), all in accordance with the rules approved for this purpose by the board of directors of the Bank and, in relation to the executive directors, by the general shareholders’ meeting of the Bank.

1 Terms in upper case that are not defined in these Regulations shall have the meaning ascribed to them in the terms of the resolutions of the board of directors and the general meeting, as well as in the directors’ report accompanying the proposed resolution approved by the general meeting.

2 In certain countries, the deferral period may be different to comply with local regulations or with the requirements of the competent authority in each case.

1

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

The Ninth Cycle of the Deferred Variable Remuneration Plan Linked to Multi-Year Objectives will be applied in relation to the Incentive3 (hereinafter, the "Incentive") corresponding to financial year 2024 of the executive directors of Banco Santander and the Group Promontorio executives (hereinafter, the "Beneficiaries"), all belonging to the so-called "Identified Collective" or "Material Risk Takers" (i.e., categories of personnel whose professional activities have a significant impact on the risk profile of the institution in accordance with article 32.1 of Law 10/2014 of 26 June 2014 on the Regulation, Supervision and solvency of credit institutions and its complementary regulations4). The identification of the employees with the status of "Identified Collective" and of the Beneficiaries of the Plan is the responsibility of the corporate Human Resources area, in accordance with the policy approved by Banco Santander's board of directors for this purpose.

The application of the Deferred Multiyear Objectives Variable Remuneration Plan to the executive directors of Banco Santander is governed by the Regulations. For clarification purposes, it should be noted that the application of the Ninth Cycle of the Deferred Variable Remuneration Plan Linked to Multi-Year Objectives to other Beneficiaries other than the Bank's executive directors is governed by another regulation also approved by the board of directors (the "REGULATION OF THE NINTH CYCLE OF THE DEFERRED VARIABLE REMUNERATION PLAN LINKED TO MULTI-YEAR OBJECTIVES").

For the purposes of these Regulations, the Santander Group is understood as the group composed at any time of Banco Santander and any of its fully consolidated entities.

2. SETTING THE AWARD

The maximum amount of the 2024 Award for each executive director will be set based on their reference or objective award and taking into account the additional quantitative metrics and qualitative factors stipulated.

In any case, the variable components of the total remuneration that may be awarded to each executive director in respect of the financial year 2024 may not exceed 200% of the fixed portion of their remuneration, as approved by the general meeting on 22 March 2024 under item Six C of the agenda.

3 For the purposes of these Regulations, the term "Incentive" refers to the variable remuneration allocated to an individual in financial year 2024 for the period corresponding to his or her membership of the Identified Collective. It also includes any extraordinary variable remuneration, if any, granted to certain Beneficiaries in relation to such period and subject to the rules of these Regulations, with the adaptations applicable in each case.

4 Commission Delegated Regulation (EU) No 2021/923 of 25 March 2021 supplementing Directive 2013/36/EU of the European Parliament and of the Council as regards regulatory technical standards laying down the criteria for the definition of managerial responsibilities, control functions, significant business units and the material impact on the risk profile of a significant business unit, and establishing the criteria for determining the staff members or categories of staff whose professional activities have an impact on the institution's risk profile comparable in significance to that of members of staff or categories of personnel referred to in Article 92(3) of that Directive. In addition, the Group's policy and procedure for determining the Identified Staff, as well as any other regulatory or corporate criteria of a particular country, are applied in determining the Identified Staff.

2

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

The status of Beneficiary and the maximum amount of Award that each executive director is eligible to receive, in accordance with these Regulations, shall be individually notified.

The potential delivery of a particular percentage of the maximum amount of Award of executive directors shall be deferred for 5 years, and, in turn, the accrual of a portion of such deferred amounts, in particular, the third, fourth and fifth annuity (the “Deferred Portion Subject to Objectives”)- is subject to the compliance of certain objectives referring to the 2024-2026 period (the “Multiyear Objectives”) and to the metrics and scales associated with such Multiyear Objectives, as described below. Once ended the 2026 financial year, the board will be able to set, following a proposal by the remuneration committee, the maximum amount of each annual payment of the Deferred Portion Subject to the Objectives.

Multiyear Objectives, metrics and compliance scales:

| A. | Achievement of the return on tangible equity (“RoTE”) target of the Bank in 2026. The RoTE coefficient corresponding to this target will be obtained from the following table: |

| RoTE in 2026 | |

| (%) | RoTE Coefficient |

| ≥ 18% | 1.5 |

| ≥ 15% but < 18% | 0 – 1.5A |

| < 15% | 0 |

| A. | Straight-line increase in RoTE Coefficient based on the specific percentage of RoTE in 2026, within this bracket of the scale. |

| B. | Relative performance of the Bank’s TSR for the 2024-2026 period compared to the weighted TSRs of a peer group of 9 credit institutions. |

For these purposes:

| - | “TSR” means the difference (expressed as a percentage) between the final value of an investment in ordinary shares of the Bank and the initial value of that investment, taking into account that for the calculation of such final value, dividends or other similar items received by the shareholder due to such investment during the corresponding period of time will be considered as if they had been invested in more shares of the same class on the first date on which the dividend or similar item is payable to the shareholders and at the average weighted listing price on said date. To calculate TSR, the average weighted daily volume of the average weighted listing prices for the fifteen trading sessions prior to 1 January 2024 (excluded) (for the calculation of the initial value) and for the fifteen trading sessions prior to 1 January 2027 (excluded) (for the calculation of the final value) will be taken into account. |

| - | “Peer Group” means the group made up of the following 9 financial institutions: BBVA, BNP Paribas, Citi, Crédit Agricole, HSBC, ING, Itaú, Scotiabank and Unicredit. |

In the event of unforeseen changes in the Peer Group and there are objective circumstances that justify it, the board of directors or, by delegation thereof, the executive committee or any director with delegated powers, subject to a report from the remuneration committee, shall have the power to adapt the rules of comparison between them or to change the composition of the Peer Group.

3

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

For this TSR metric, the following achievement scale is established:

| TSR Position of the Bank | TSR Coefficient |

| Achievement of percentile 100 | 1.5 |

| Between percentiles 75 and 100 (not including the latter) | 1 – 1.5A |

| Between percentiles 40 and 75 (not including the latter) | 0.5 – 1A |

| Below percentile 40 | 0 |

| A. | Proportional increase in TSR coefficient according to the number of positions moved up in the ranking within this bracket of the scale. |

| C. | Level of Group progress on the Responsible banking actions lines and associated targets, measured through the following metrics related to environmental, social and corporate governance (ESG) matters: |

| i. | Target regarding women in senior management positions at year-end 2026: |

| % of women in management positions B | Coefficient 1 |

| ≥ 37% | 1.25 |

| ≥ 36% but < 37% | 1 – 1.25A |

| ≥ 34% but < 36% | 0 – 1A |

| < 34% | 0 |

| A | Proportional increase in the Coefficient 1 according to its position within this bracket of the scale. |

| B | The executives included represent approximately 1% of the total payroll. |

| ii. | Target regarding financial inclusion between 2024 and 2026: |

| Financial inclusion B (millions of people) | Coefficient 2 |

| ≥ 6.3 | 1.25 |

| ≥ 5.3 but < 6.3 | 1 – 1.25A |

| ≥ 3.5 but < 5.3 | 0 – 1A |

| < 3.5 | 0 |

| A | Proportional increase in the Coefficient 2 according to its position within this bracket of the scale. |

| B | Number of unbanked, underbanked, financially distressed or credit-constrained people provided with tailored access and financing solutions, with the objective of meeting local financial inclusion needs in a recurrent, comprehensive, affordable and effective manner. |

| iii. | Target regarding socially responsible investment: |

| Socially responsible investment in 2026 B (%) | Coefficient 3 |

| ≥ 21 | 1.25 |

| ≥ 18 but < 21 | 0 – 1.25A |

| ≥ 15 but < 18 | 0 – 1A |

| < 15 | 0 |

| A | Proportional increase in the Coefficient 3 according to its position within this bracket of the scale. |

| B | Percentage of Grupo Santander's assets under management that are aligned with Grupo Santander's Sustainable Finance and Investment ClassificationSystem (SFICS) out of Grupo Santander's total assets under management. |

4

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

| iv. | Target regarding transition support (business disbursed and facilitated): |

| Business disbursed and facilitated between 2024 and 2026B (billions of euros) | Coefficient 4 4 |

| ≥ 180 | 1.25 C |

| ≥ 150 but < 180 | 1 – 1.25A, C |

| ≥ 110 pero < 150 | 0 – 1 A |

| < 110 | 0 |

| A | Proportional increase in the Coefficient 4 according to its position within this bracket of the scale. |

| B | Santander Group's contribution to our customers' transition: green finance disbursed and facilitated by CIB (public target), green finance and sustainability-linked lending from retail and commercial banking, and green finance from Digital Consumer Bank. |

| C | Exceeding 100% of this target (and thus achieving a Coefficient 4 above 1) requires the implementation of a comprehensive and credible transition plan. This plan will include improving climate data, advancing actions to decarbonise portfolios, improving sustainable product offerings to meet market needs, further integrating climate and environmental risk, and engaging to support policy action and market developments. |

The level of achievement of the Multiyear Objective will be determined by using the following formula:

C = (2/10 x Coefficient 1 + 2/10 x Coefficient 2 + 1/10 x Coefficient 3 + 5/10 x Coefficient 4)

|

Thus, the following formula will be applied to determine the annual amount of the Deferred Portion Subject to Objectives, if any, payable in financial years 2028, 2029 and 2030 (each of these payments, a “Final Annual Payment”), without prejudice to any adjustments that may result from malus clauses:

Final Annual Payment = Amt. x (2/5 x A + 2/5 x B + 1/5 x C)

|

where:

| § | “Amt.” means one third of the Deferred Portion Subject to Objectives. |

| § | “A” is the RoTE Coefficient according to the scale and terms and conditions in paragraph A above based on the achievement of the return on tangible equity target in 2026. |

| § | “B” is the TSR Coefficient according to the scale in paragraph B above based on the relative performance of the TSR of the Bank for the 2024-2026 period with respect to the Peer Group. |

| § | “C” is the coefficient resulting from adding up the weighted coefficients for each of the four responsible banking commitments by 2026, as set forth in paragraph C above. |

| § | Assuming in any case that if “(2/5 x A + 2/5 x B + 1/5 x C)” yields a figure greater than 1.25, 1.25 shall be applied as the multiplier. |

5

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

Banco Santander’s board and, by delegation of authority, the executive committee and any director with delegated powers, may, by way of example:

| (i) | specify and interpret the resolutions of the general shareholders and board meetings, and may adapt them, without affecting their basic content, to the new circumstances that may arise at any given time, including, in particular, adapting the delivery mechanisms, without altering the maximum number of shares linked to the Award or the basic conditions upon which the delivery thereof is made contingent, which may include the substitution of the delivery of shares with the delivery of equivalent amounts in cash, or the alteration of the mechanisms for net delivery of shares under the procedures that are established for the payment of taxes or when so required for regulatory, tax, operational or contractual reasons.5 In addition, they may adapt the aforementioned Plan (including the adjustment or removal of any metrics and achievement scales for the Multiyear Objectives, the inclusion of additional targets for the delivery of any deferred amount of the Award or the increase of the part corresponding to the Deferred Payment Amount or of the Deferral Period) to any mandatory regulations or administrative interpretation that may prevent the implementation thereof on the approved terms; |

| (ii) | set, without altering the maximum amount of the Award to be delivered in shares, apply the measures and mechanisms that may be appropriate to compensate for the dilution effect, if any, that may occur as a result of corporate transactions or distributions to shareholders while the shares have not been delivered to the executive directors and, in the event that the maximum amount distributable in shares to be delivered to the executive directors, authorise the deferral and payment of the excess in cash; |

| (iii) | extend the deferral period in order to adapt to the applicable regulations in force at any given time or to the requirements of the competent authority, making such adjustments as may be necessary to adapt the Award to the new deferral period. |

| (iv) | adjust positively or negatively, following a proposal of the remuneration committee, the level of achievement of the Multiyear Objectives when regulatory changes, inorganic transactions, material changes to the Group’s composition or size or other extraordinary circumstances (such as impairments, legal changes, corporate transactions, share buy-back programmes or restructuring procedures) have occurred which affect the suitability of the metric and achievement scale established in each case and resulting in an impact not related to the performance of the executive directors assessed; |

| (v) | approve, where applicable, the engagement of one or more internationally recognised third parties to verify the achievement of the Multiyear Objectives. In particular, and merely by way of example, it may ask such third parties: to obtain, from appropriate sources, the data upon which the calculations of TSR are to be based; to perform the |

5 In addition, it would also be possible to deliver shares, quotes (participaciones) or any other instruments based on the value of the shares or quotes (participaciones) of other subsidiaries of the Santander Group, listed or not-listed, in accordance with the resolutions passed by the Bank at any given moment.

6

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

calculations of the TSR of the Bank and the TSRs of the entities within the Peer Group; to compare the Bank’s TSR with the TSRs of the entities within the Peer Group; and to provide advice on the decision as to how to act in the event of unexpected changes in the Peer Group that may require adjustments to the rules for comparison among them or on the amendment of the Peer Group in light of objective circumstances that justify such amendment (such as inorganic transactions or other extraordinary circumstances); and

| (vi) | develop and specify the conditions upon which the receipt by the executive directors of the corresponding shares or deferred amounts is contingent, as well as determine whether, according to the Plan, the conditions upon which the receipt by the executive directors of the respective shares or cash amounts is made contingent have been fulfilled, with the power to modulate the cash amounts and the number of shares to be delivered depending on the existing circumstances, all following a proposal of the remuneration committee. |

Furthermore and as regards matters that are part of its area of authority, the board of directors has the power to develop, amend, alter or adapt the terms and conditions of the Ninth Cycle of the Deferred Multiyear Objectives Variable Remuneration Plan, as well as to substitute the above powers in favour of the person responsible for Human Resources of the Group, the general secretary or the global director of compensation of the Group.

3. FUNCTIONING OF THE PLAN FOR EXECUTIVE DIRECTORS

The Award for the financial year 2024 shall be paid to the executive directors of the Bank as follows:

| – | 40% of the Incentive shall be paid without deferral (the "Immediate Payment Percentage"). |

| – | 60% of the Incentive shall be subject to a deferral period of 5 years (the "Deferral Percentage"), with the payment of the last 3 years (i.e., three-fifths of the Deferral Percentage) being conditional, in turn, upon the objectives for the period 2024-2026 described in section 2 above (Setting of the executive directors' Incentive). |

Taking into account the foregoing, the Award for financial year 2024 of the executive directors will be paid as follows:

| (i) | In 2025, each executive director shall receive the Immediate Payment Percentage (the “Initial Date”, understood as the specific date at which the Immediate Payment Percentage is paid). |

| (ii) | Payment of the Award Deferred Percentage shall be deferred for a period 5 years (the “Deferral Period”), and shall be made in fifths within thirty days of the anniversary of the Initial Date in the years 2026, 2027, 2028, 2029 and 2030 (the “Anniversaries”), provided the conditions detailed in these Regulations are fulfilled. |

7

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

| (iii) | The deferred portion shall be divided in five parts (each one an “Annual Payment”), which will determine the maximum amount to be paid, if applicable, on each of the Anniversaries. |

| (iv) | Each of the payments to be made (either on the Initial Date and on the Anniversaries) will be made 50% in cash and the other 50% in instruments. |

| (v) | The portion of the Incentive that is paid in instruments will be reduced in the amount resulting from the RSUs that the executive directors are entitled to receive under PagoNxt, S.L. incentive plan, the difference being paid in Santander shares. |

| (vi) | The executive directors may not directly or indirectly, hedge the Santander shares received pursuant to the preceding paragraphs before delivery thereof. They may likewise not transfer them or directly or indirectly hedge the shares for one year as from the delivery thereof. |

| (vii) | Pursuant to the Group’s shareholding policy, the executive directors of Banco Santander may not transfer Santander shares that they receive pursuant to the preceeding paragraphs for three years from the date of delivery thereof, unless the director holds an amount in Santander shares equal to two times the director’s annual fixed remuneration. |

| (viii) | On the occasion of each payment of the deferred amount in cash, and subject to the same requirements, it will be possible to pay to the executive director in cash an amount corresponding to the adjustment of the deferred amount to the inflation calculated from the Initial Date and until the date on which each corresponding cash amount is paid, applying for these purposes the variation rate of the Consumer Price Index (Índice de Precios de Consumo) published by the National Institute of Statistics of Spain (Instituto Nacional de Estadística) between the date of accrual of the deferred cash amount and its payment date or the latest figure available on this last date. In countries different to Spain, the rate used will be the variation rate of the equivalent index published by the competent authority in each case or other mechanisms that reflect the same effect. |

| (ix) | All payments will be made after applying any withholding or payment on account applicable at any time. |

4. DELIVERY OF SHARES

The total aggregate amount of the Award that the executive directors can receive is limited to the maximum amount approved by the general meeting (hereinafter, “Maximum Amount of the Award”). The Award will be 50% in cash and 50% in instruments. The portion of the Incentive that is paid in instruments will be reduced in the amount resulting from the RSUs that the executive directors are entitled to receive under PagoNxt, S.L. incentive plan, the difference being paid in Santander shares.

The board of directors or the executive committee, as appropriate, will determine the amount of variable remuneration to be received by each executive director. Concerning the delivery of shares, such decision shall take into account that in aggregate the amounts to be received by the executive directors shall respect the maximum amount of the Award to be delivered in shares (as approved by the general meeting) to the executive directors (the “Maximum Amount of the Award Distributable in Shares for Executive Directors” or “MAADSED”; and, within this maximum, the specific amount to be awarded to each of the executive directors, the “Individual Amount of the Award Distributable in Shares” or “IAADS”).

8

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

The number of shares corresponding to each executive director, for both immediate and deferred payments, shall be calculated taking into account the average weighted daily volume of the average weighted listing prices of the shares of Santander for the fifty trading sessions prior to the Friday (exclusive) of the previous week to the date on which the board of directors agrees on the Award for the Bank’s executive directors for the financial year 2024 (the “2025 Listing Price”). Information from the stock exchange with the largest trading volume will be used to determine the listing price of the share.

The number of shares of Santander that may be delivered to each executive director under this Award (the “Individual Award in Shares” or “IAS”), will be determined by applying the following formula:

The final number of shares to be delivered to each executive director shall take into account the amount resulting from the application of the relevant taxes (withholdings or payments on account) in accordance with the procedure set forth in the following section (Shares delivery mechanism).

Shares delivery mechanism

As indicated above, the Award will be paid partly in cash and partly in shares, the payment of which will be partly deferred in accordance with the provisions of these Regulations.

The shares shall be delivered through technical mechanisms (securities account, deposit, etc.) as appropriate in each case, and in all cases any applicable taxes and expenses shall be borne by the executive director. The withholding or payment on account on the remuneration in kind entailed by the delivery of shares or any other tax relating thereto shall be calculated by applying the legislation prevailing at the time of effective delivery. The executive directors authorise the employing entity and the Bank to sell, prior to delivery, the shares necessary to proceed with the corresponding withholding or payment on account, as well as for the payment of any other applicable taxes, subsequently receiving the amount of shares net of such amounts.

As appropriate, shares may be delivered by the employing entity, or failing this, when justified by circumstances, by Banco Santander or by another company in its Group, using old or new shares, already available or obtained from third parties. Likewise, if it is required or advisable for any statutory or regulatory reasons or any other reasons of a similar nature, it will be possible to substitute the delivery of shares with cash payments of equivalent value (on the end date of the retention period applicable to each delivery of shares under the ninth cycle) or change the mechanisms of net delivery of shares in light of the procedures to be implemented for the payment of taxes.

9

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

The substitution of the delivery of shares of Banco Santander with the delivery of shares of local listed subsidiaries of the Santander Group may also be agreed, all in the terms and circumstances set out in these Regulations.

Adjustments

In the event of a change in the number of shares due to a decrease or increase in the par value of the shares or a transaction with an equivalent effect, the number of shares to be delivered will be modified so as to maintain the percentage of the total share capital represented by those shares.

5. PERMANENCE AND OTHER CONDITIONS

The accrual of all the Award Annual Payments is conditional upon the fulfilment of certain requirements: (i) in addition to continuity of the Beneficiary within the Santander Group or the Beneficiary being in other situations where, pursuant to the agreement of the board of directors, the Award is maintained, as detailed in this section, (ii) none of the circumstances giving rise to the application of malus must be present during the period prior to each delivery of the Award, as set forth from time to time in the malus and clawback chapter of the Group’s remuneration policy. Furthermore, any Award amounts which have already been paid will be subject to their potential recovery (clawback) by the Bank in the events and during the time periods set out in the policy, which has been extended in 2023 to adapt it to the new regulations of the Securities Exchange Commission of the United States of America on the subject, all in accordance with the terms and conditions set out therein.

Malus and clawback adjustment provisions are triggered in the event of poor financial performance of the institution as a whole or of a specific division or area thereof or of the exposures from staff as a result of an executive(s)’s management of, at least, one of these factors:

| Category | Factors |

| Risk | Significant failures in risk management by Banco Risk Santander, or by a business or risk control unit |

| Capital | An increase in capital requirements at the Banco Santander or one of its business units not Capital planned at the time that exposure was generated |

| Regulation and internal codes | Regulatory penalties or legal convictions for events that might be attributable to the unit or Regulation and staff responsible for them. In addition, failure to internal codes comply with Banco Santander’s internal codes of conduct |

| Conduct | Improper conduct, whether individual or collective. Negative effects deriving from the marketing of unsuitable products and the Conduct liability of persons or bodies making such decisions will be considered especially significant |

In addition, individual policies for each country may include any other criteria required by applicable legal provisions or local regulators.

The Group’s human resources committee will have the power to decide on the application of malus or clawback. Nevertheless, being the remuneration of Banco Santander’s executive directors, the human resources committee shall submit its proposal to the remuneration committee for its consideration and subsequent submission to the board for its approval. In light of the above, the board of directors, following a proposal by the remuneration committee, and depending on the occurrence and severity of one or more of the above factors and on the circumstances surrounding the event(s) giving rise to the application of malus or clawback, shall in each case determine the specific amount of the deferred retribution to be satisfied and/or to be recovered from that already paid in the case of application of malus or clawback clauses respectively.

10

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

In any case, as provided for in paragraph 4.(e) of section 19 of the rules and regulations of the board and of the aforementioned chapter of the Group remuneration policy, the application of malus or clawback will be assessed by Banco Santander’s remuneration committee. In each case, the related tax treatment according to the prevailing legislation will be applied.

When a situation arises that justifies the application of malus and clawback clauses, upon the request of the Santander Group entity that granted the Award to the executive director, the corresponding Award amounts will be reduced or recovered, even if the executive director (i) has ceased to provide services within Santander Group or (ii) is currently employed by a different Santander Group entity than the one that granted the Incentive, in which case, said reduction or recovery can be carried out through the new entity (cross recovery), and the amounts to be reduced or recovered may also be deducted from other incentives granted by Santander Group to the executive director.

Likewise, following each delivery of shares, the executive directors’ rights are also contingent upon compliance with the other rules governing the Plan as set out in these Regulations, specifically, with regard to any shares delivered to the Beneficiary, the aforementioned obligations to refrain from (a) directly or indirectly hedging them before delivery; (b) directly or indirectly transferring or hedging them for one year as from each delivery of shares; and, (c) from transferring them for three years from the date of delivery thereof, unless the executive director holds an amount in Santander shares equal to two times the director’s annual fixed remuneration.

Conditions relating to permanence in the Group:

When termination of the relationship with Banco Santander or another entity of the Santander Group is due to retirement, early retirement or pre-retirement of the executive director, for a termination judicially declared to be improper, unilateral separation for good cause by an employee (which includes, in any case, the situations set forth in section 10.3 of Royal Decree 1382/1985 of 1 August governing the special relationship of senior management, for the persons subject to these rules), permanent disability or death, or as a result of an employer other than Banco Santander ceasing to belong to the Santander Group, as well as in those cases of mandatory redundancy, the right to delivery of the shares and cash amounts that have been deferred, as well as, where appropriate, the amounts derived from the inflationary adjustment of the deferred amounts in cash, shall remain under the same conditions in force as if none of such circumstances had occurred.

In the event of death, the right shall pass to the successors of the executive director.

11

| This document is a translation of an original text in Spanish. In case of any discrepancy between both texts, the Spanish version will prevail. |

In cases of justified temporary leave due to temporary disability, suspension of the contract of employment due to maternity or paternity, or leave to care for children or a relative, there shall be no change in the rights of the executive director.

If the executive director goes to another company of the Santander Group (including through international assignment and/or expatriation), there shall be no change in the rights thereof.

If the relationship terminates by mutual agreement or because the executive director obtains a leave not referred to in any of the preceding paragraphs, the terms of the termination or temporary leave agreement shall apply.

None of the above circumstances shall give the right to receive the deferred amount in advance except where necessary to comply with mandatory regulations or, where appropriate, to avoid a conflict of interest. If the executive director or the successors thereof maintain the right to receive deferred remuneration in cash and shares, as well as, where appropriate, the amounts derived from the inflationary adjustment of the deferred amounts in cash, such remuneration shall be delivered within the periods and upon the terms set forth in these Regulations.

Conditions relating to the Bank’s capital and liquidity position and the macroeconomic situation

Each of the payments under the Regulations is also conditional upon the corresponding body at the Bank verifying in advance that (i) such payments do not put the Bank’s capital or liquidity position at risk in accordance with the capital or liquidity targets set at any given time; and (ii) it is not advisable to make such payments or, where appropriate, they should be reduced owing to adverse macroeconomic or risk-generating circumstances.

6. ADMINISTRATION OF THE PLAN