Banco Santander (SAN) 6-KCurrent report (foreign)

Filed: 1 Nov 19, 12:00am

FORM6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule13a-16 or15d-16 of

the Securities Exchange Act of 1934

For the month of October, 2019

Commission File Number:001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F:

Form20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

Yes ☐ No ☒

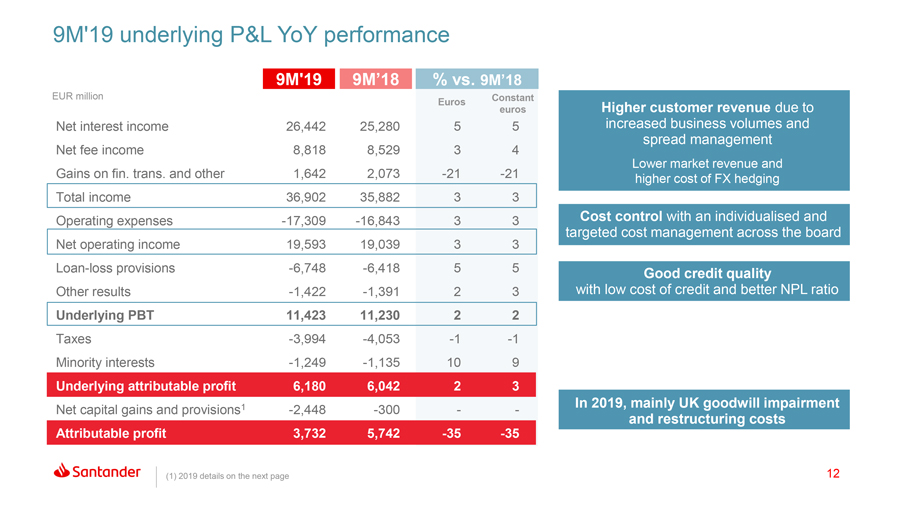

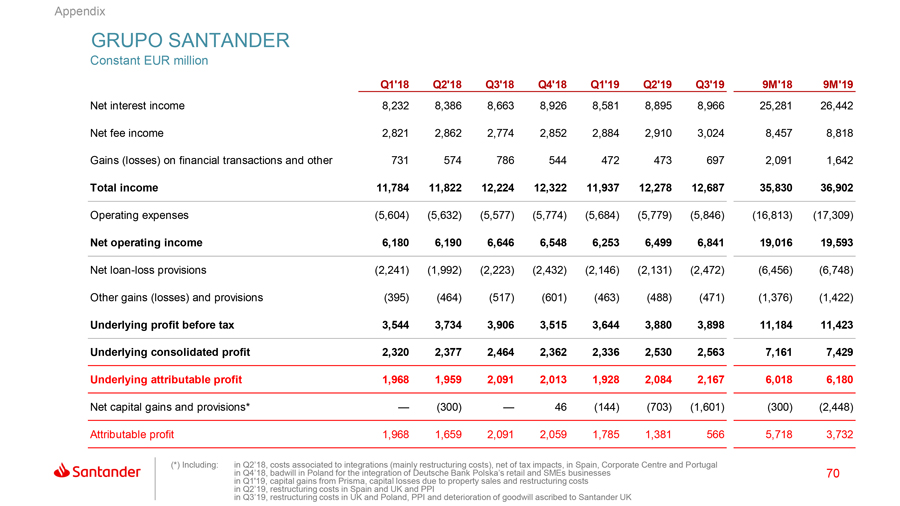

Santander earns €3,732m in attributable profit during the first

nine months of the year, after €2,448m in charges relating to the UK

goodwill impairment and restructuring costs already announced

Excluding these charges, the profit increased to €6,180 million for the period, up 2%

Madrid, 30 October 2019 - PRESS RELEASE

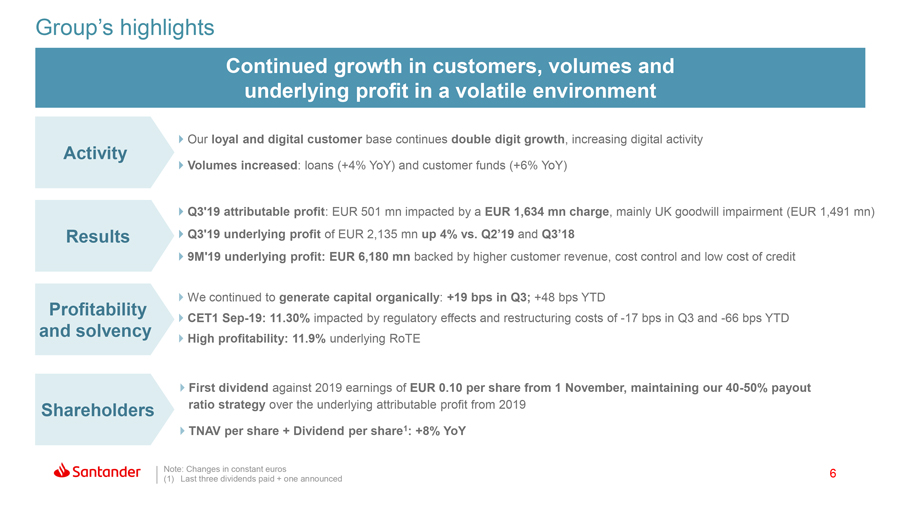

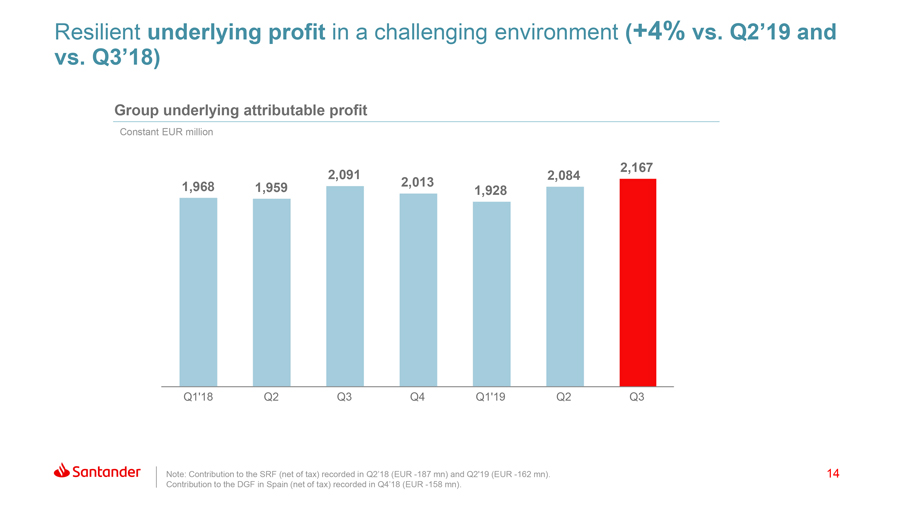

| ∎ | In the third quarter alone, underlying profit increased to €2,135 million (+7%year-on-year) - its highest level since Q2 2010. Attributable profit for the quarter was €501 million after charges of €1,634 million primarily relating to the UK goodwill impairment announced in September. |

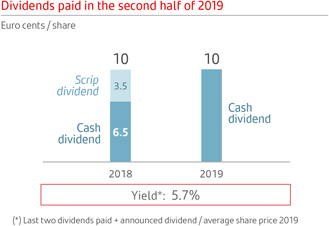

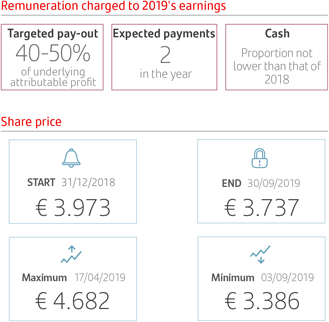

| ∎ | The Group confirmed in September that it will pay a first dividend against 2019 earnings of €0.10 per share from 1 November 2019, in line with its targeted dividendpay-out ratio of40-50% of underlying attributable profit. |

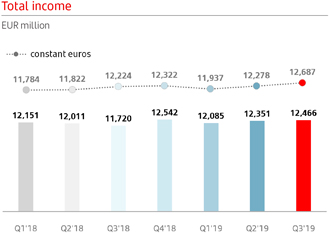

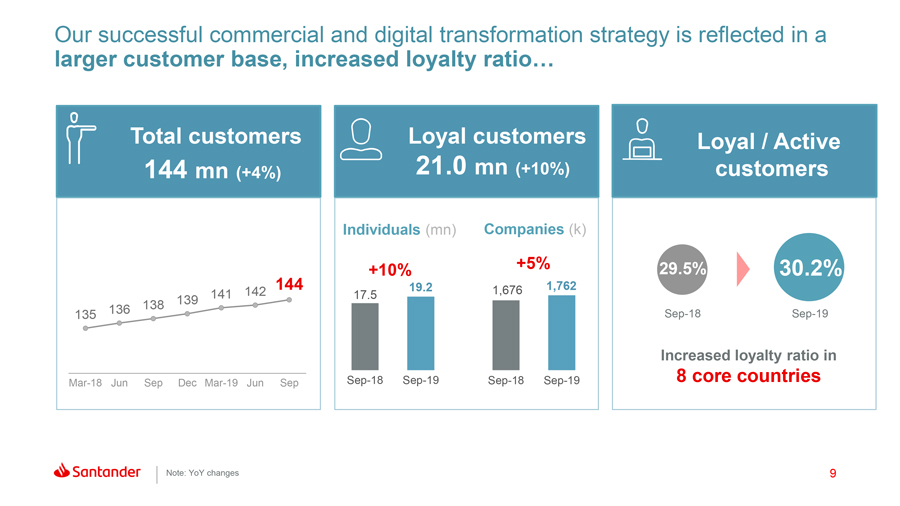

| ∎ | In the first nine months of the year Santander generated total revenues of €36,902 million, as the bank added almost six million additional customers since Q3 2018. Santander now serves 144 million customers in total – more than any other bank in Europe and the Americas. |

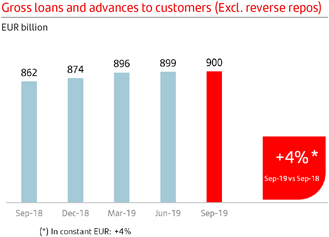

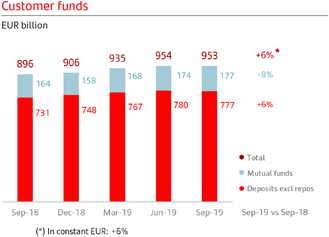

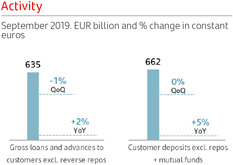

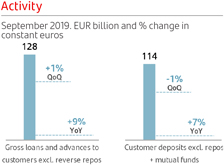

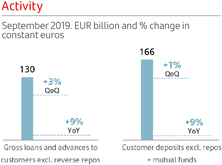

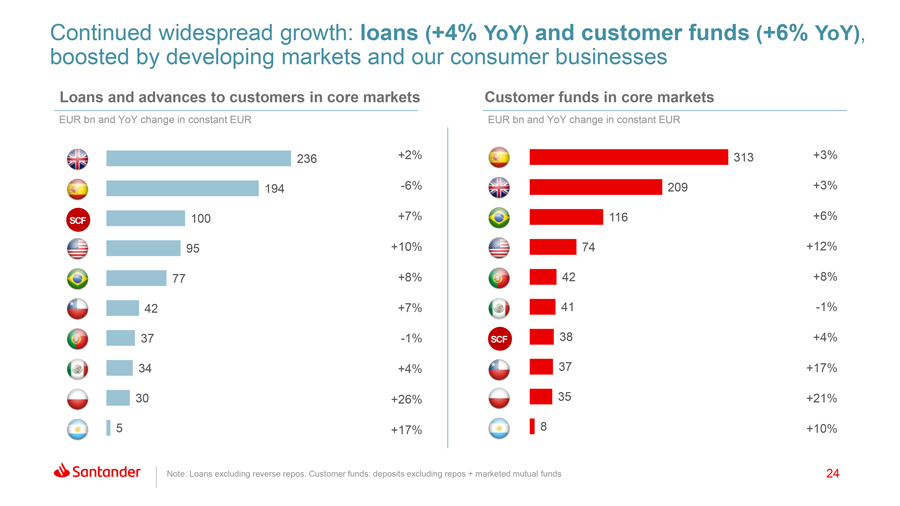

| ∎ | The increase in customers supported solid growth in business volumes, with loans and customer funds increasing by 4% and 6% respectivelyyear-on-year in constant euros (i.e. applying constant exchange rates). |

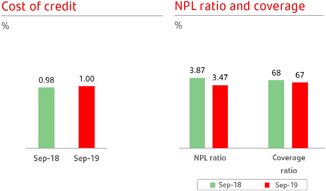

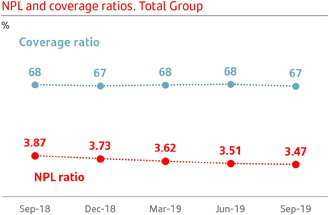

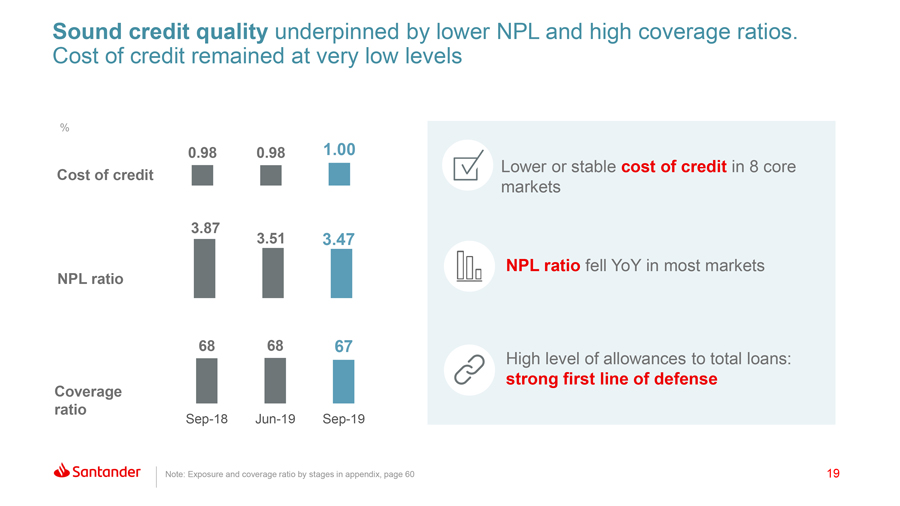

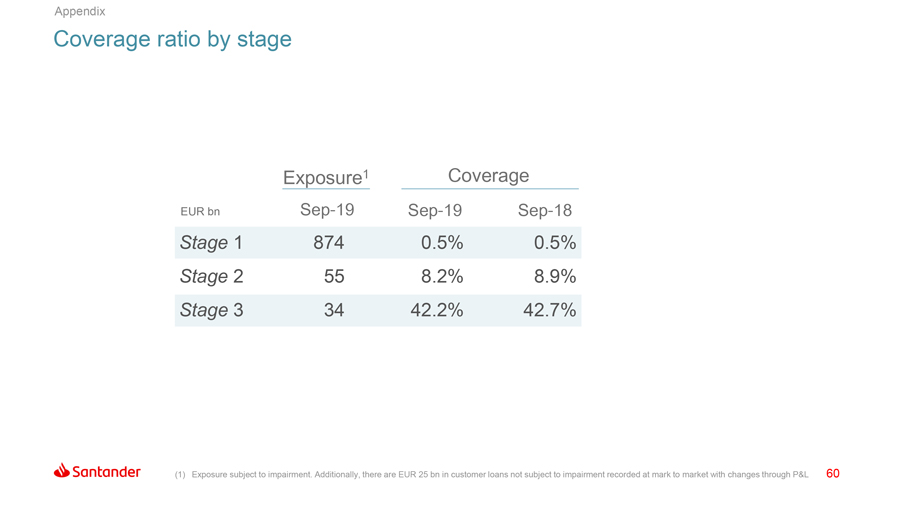

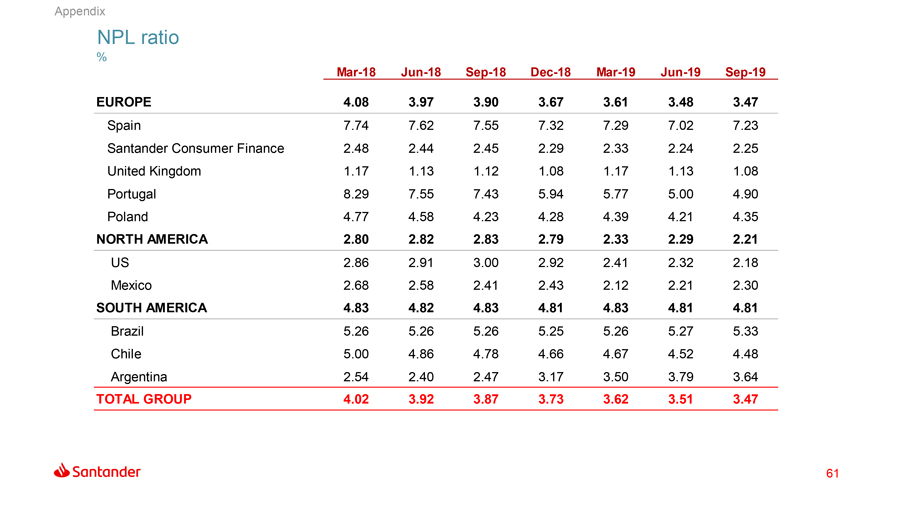

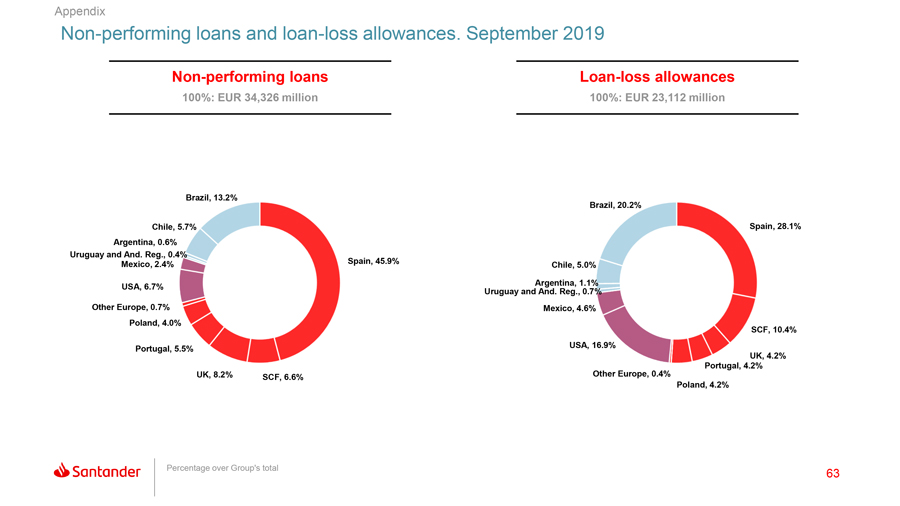

| ∎ | Credit quality remained very strong with the Group’snon-performing loan ratio falling by 40 basis pointsyear-on-year to 3.47%, while cost of credit remained broadly stable at 1%. |

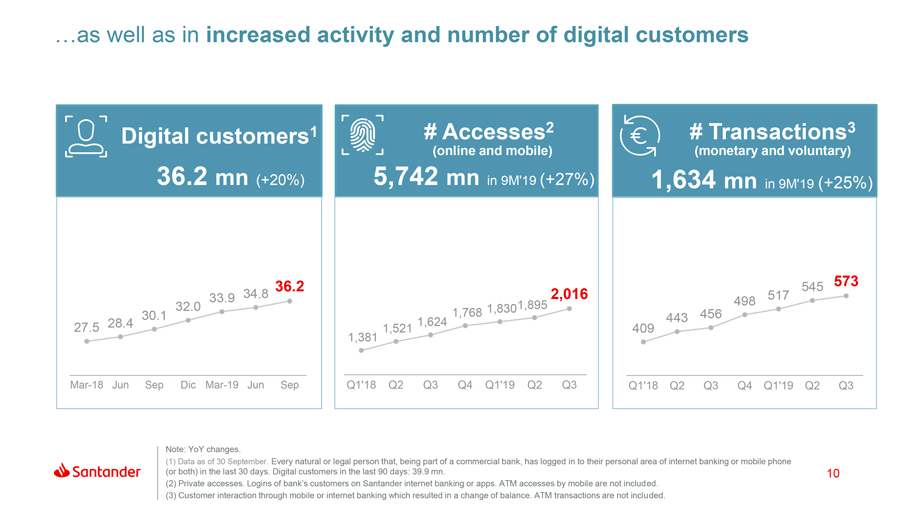

| ∎ | The number of digital customers increased by 6.1 million since Q3 2018 to 36.2 million, as investment in technology continued to drive strong adoption of digital services. |

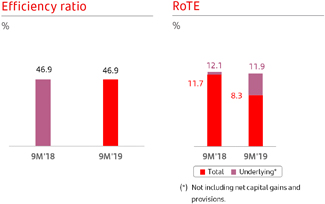

| ∎ | This progress in our digital transformation, combined with savings generated through leveraging the Group’s scale across the regions, helped improve efficiency further, with thecost-to-income ratio reducing by 50 basis points in the quarter to 46.9%. |

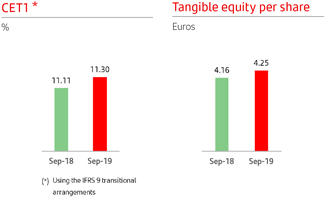

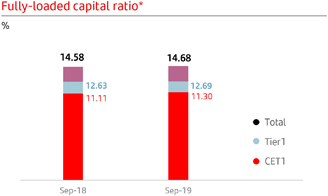

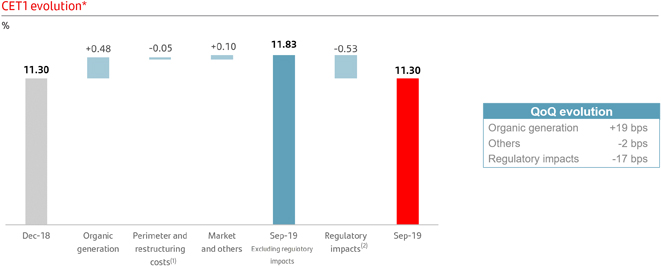

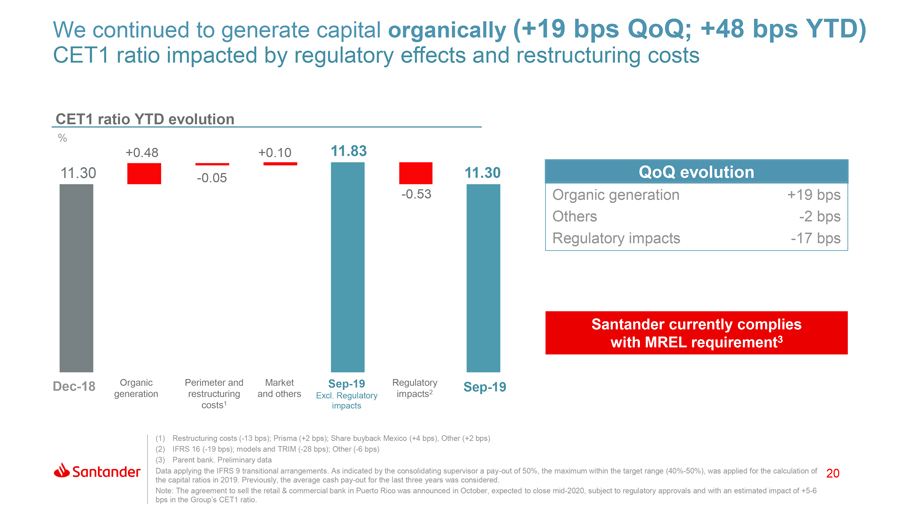

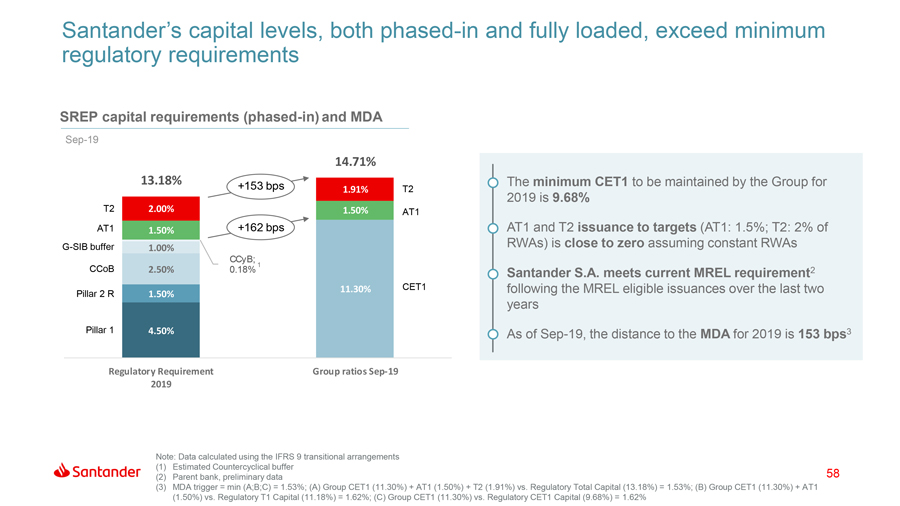

| ∎ | The Group generated 19 basis points of capital through organic growth in the quarter, offsetting various regulatory effects. As a result, the Group’s CET1 ratio stood at 11.30%. Excluding the regulatory demands applied since December 2018, the Group’s CET1 ratio would be 11.83%. |

Banco Santander Group Executive Chairman, Ana Botín, said:

“We have achieved the strongest underlying performance in almost a decade this quarter, building on the momentum from the first half of the year, despite some significant external headwinds. This reflects the strength of our model, and the progress we are making in leveraging the new regional organisational structure implemented in April.

Our diversification across Europe and the Americas is one of the defining characteristics that stands Santander apart from our peers. And because of this, we have continued to deliver predictable, profitable growth, and a sustainable dividend through the cycle.

Our global scale and local leadership, combined with a more agile organisation led by our first-rate team, provides a unique foundation and significant opportunities for further growth. I am confident we will achieve our medium-term targets, including reaching a RoTE of13-15%.”

| Corporate Communications |  | |||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | 1 | |||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

Results Summary (9M19 v 9M18 unless otherwise stated)

Q319 (m)

| Q319 v Q318

| Q319 v Q318 (EX FX)

| 9M19 (m)

| 9M19 v 9M18

| 9M19 v 9M18 (EX FX)

| |||||||||

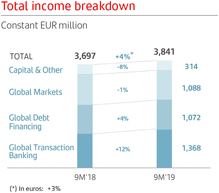

| Total income | €12,466 | +6% | +4% | €36,902 | +3% | +3% | ||||||||

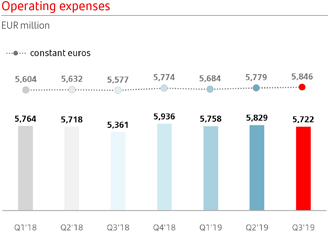

| Operating expenses | (€5,722) | +7% | +5% | (€17,309) | +3% | +3% | ||||||||

| Net operating income | €6,744 | +6% | +3% | €19,593 | +3% | +3% | ||||||||

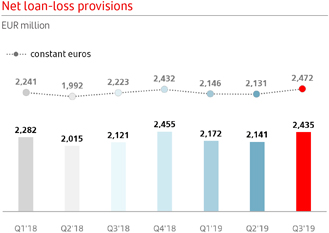

| Net loan-loss provisions | (€2,435) | +15% | +11% | (€6,748) | +5% | +5% | ||||||||

| Profit before tax | €3,844 | +3% | 0% | €11,423 | +2% | +2% | ||||||||

| Tax | (€1,315) | -6% | -7% | (€3,994) | -1% | -1% | ||||||||

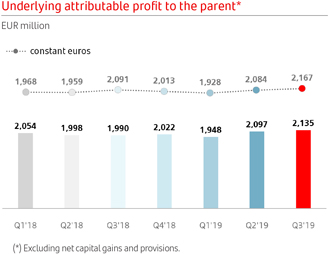

| Underlying profit | €2,135 | +7% | +4% | €6,180 | +2% | +3% | ||||||||

| Net capital gains and provisions | (€1,634) | - | - | (€2,448) | - | - | ||||||||

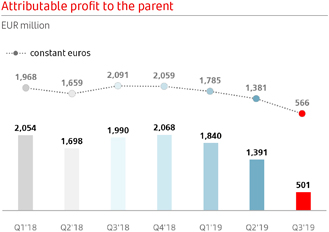

| Attributable Profit | €501 | -75% | -73% | €3,732 | -35% | -35% | ||||||||

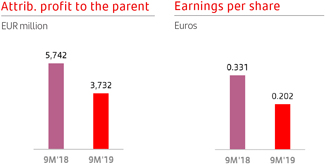

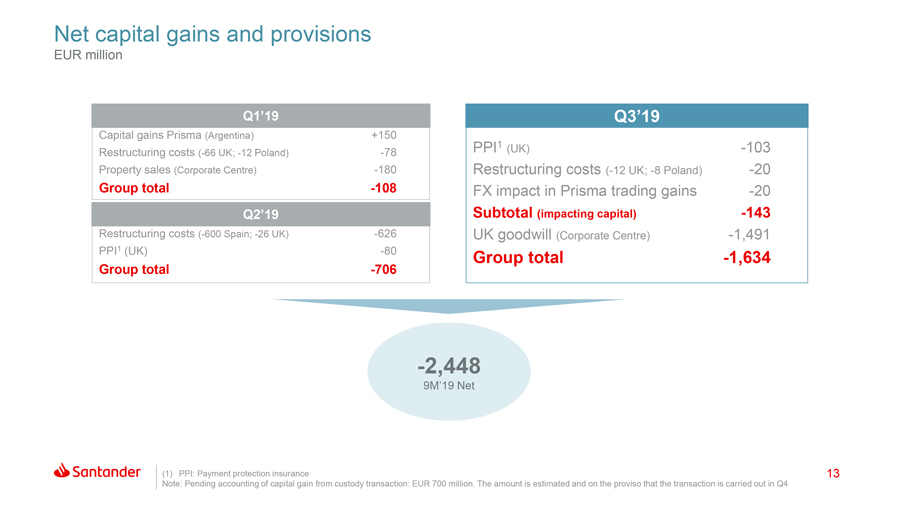

The Group achieved an attributable profit of €3,732 million during the first nine months of 2019 after charges of €2,448 million relating primarily to the UK goodwill impairment announced on 24 September 2019 (€1,491 million), as well as a further provision for PPI (€103 million) and other charges (€40 million). This, in addition to the net charge of €814 million announced for the first half, which related primarily to planned restructuring costs in Spain and the UK, led to a fall in attributable profit for the first nine months of 35%year-on-year (YoY).

Excluding these charges, profit in the first nine months increased to €6,180 million, up 2% YoY (+3% in constant euros, i.e. applying constant exchange rates), driven by further growth in customers and business volumes.

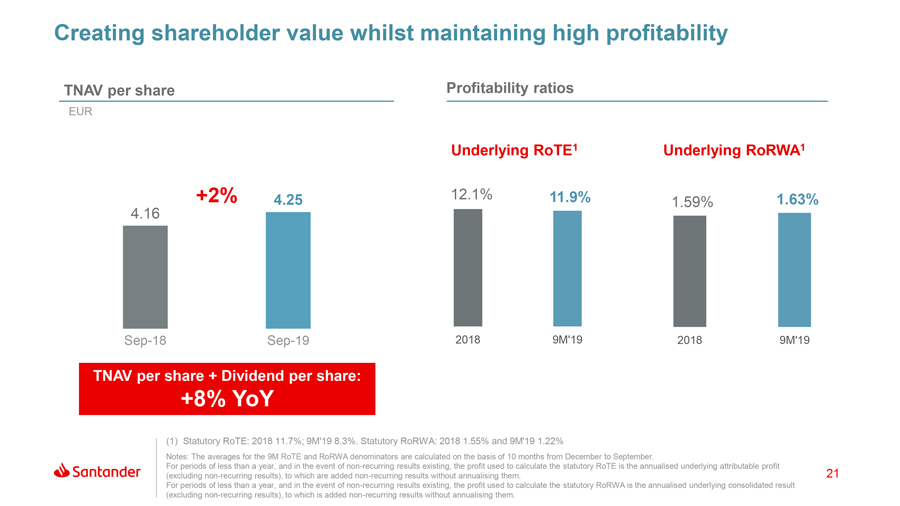

In the third quarter alone, underlying profit increased to its highest level since the second quarter of 2010 at €2,135 million (up 7% YoY) with an underlying return on tangible equity (RoTE), a key measure of profitability, remaining among the highest of our peer group at 12.2% (11.9% for the first nine months of the year).

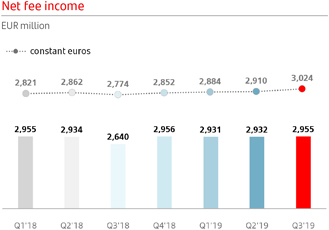

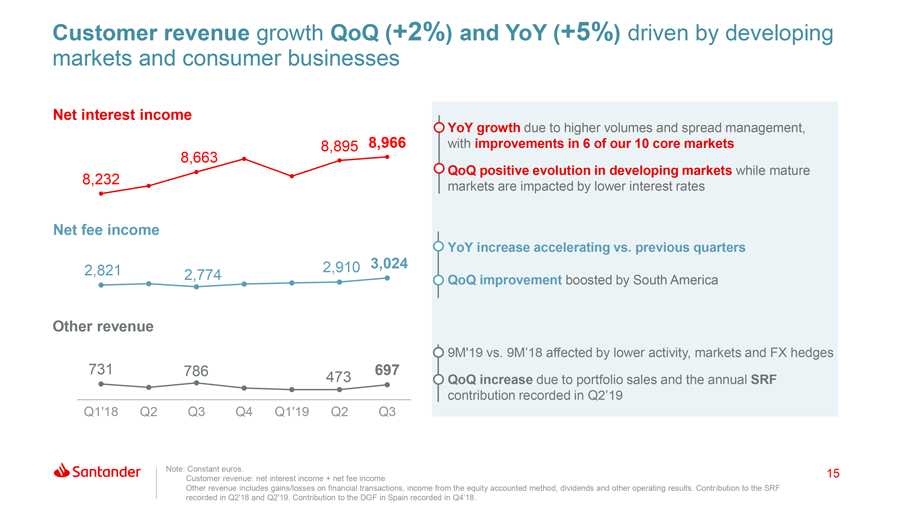

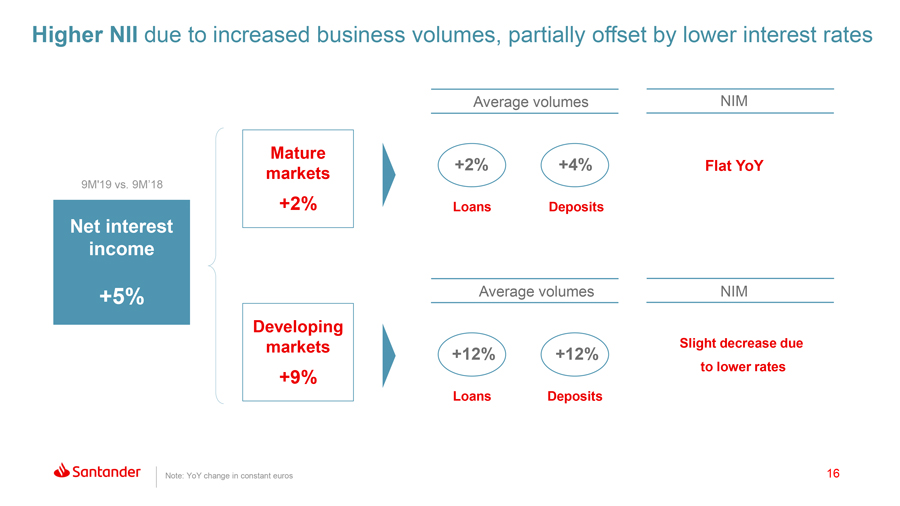

Santander’s commercial and digital transformation continued to improve the quality and recurrence of its revenues, with net interest income increasing by 5% YoY to €26,442 million and total income increasing by 3% YoY to €36,902 million.

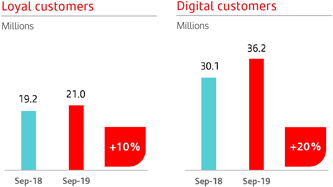

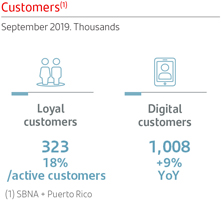

The bank added almost six million customers since Q3 2018, taking the total number of customers it serves to 144 million – more than any bank in Europe and the Americas. The number of loyal customers (customers using Santander as their primary bank) has increased by 10% YoY to 21 million, while loans and customer funds increasing by 4% and 6% respectively YoY in constant euros.

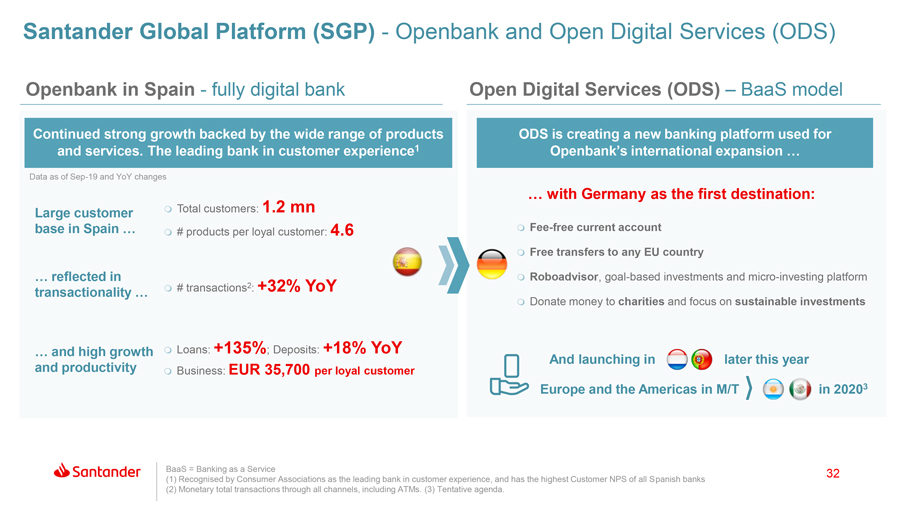

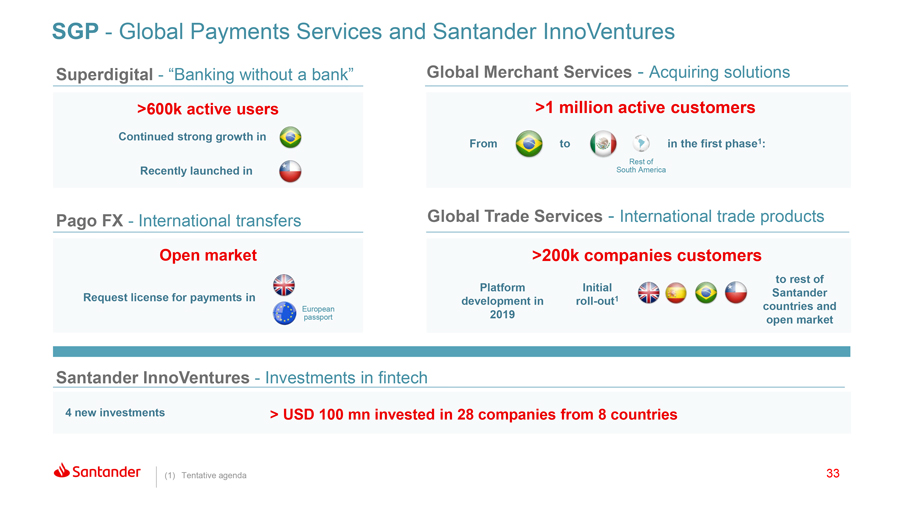

The rapid growth in digital adoption continued, with the number of customers using internet banking or mobile increasing by 6.1 million since September 2018 to 36.2 million – 51% of total active customers. During the quarter the bank announced the launch of Openbank in Germany and began a pilot of Superdigital in Chile, as well as making a number of new investments through its venture capital arm Santander InnoVentures in areas of identity verification, digital debt platforms, blockchain for issuing securities, etc. Furthermore, in September the bank launched the firstend-to-end blockchain bond in the world.

| Corporate Communications | 2 |  | ||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | ||||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

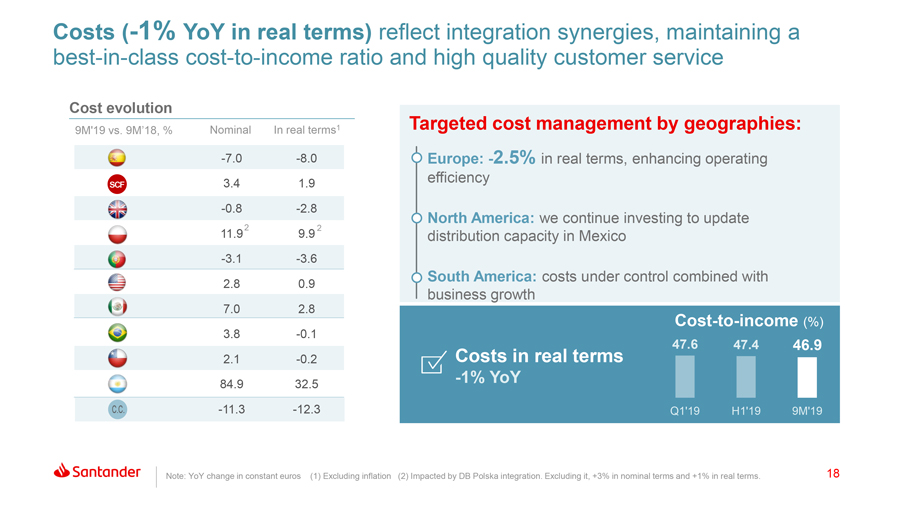

This acceleration in digital adoption, combined with growth in customer revenue and targeted cost management, allowed the bank to maintain a‘best-in-class’cost-to-income ratio of 46.9%, with operating expenses falling by 1% YoY in real terms (without inflation) in constant euros.

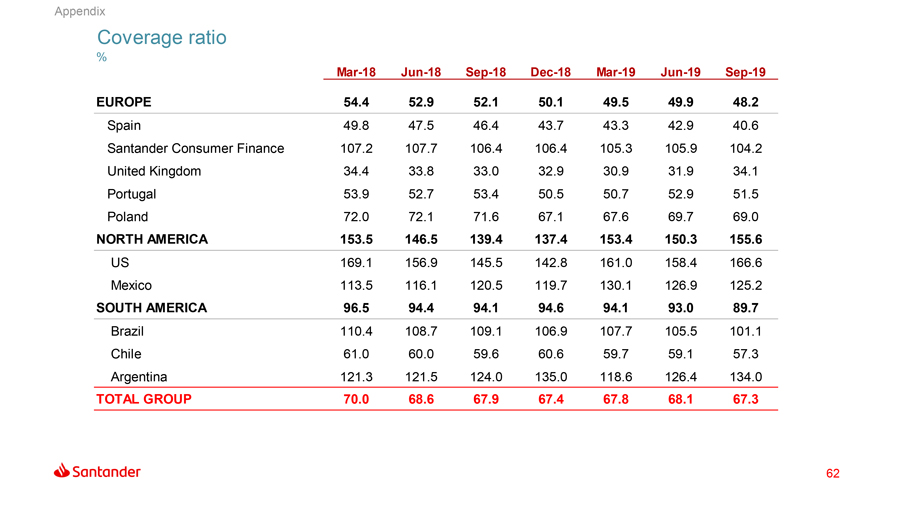

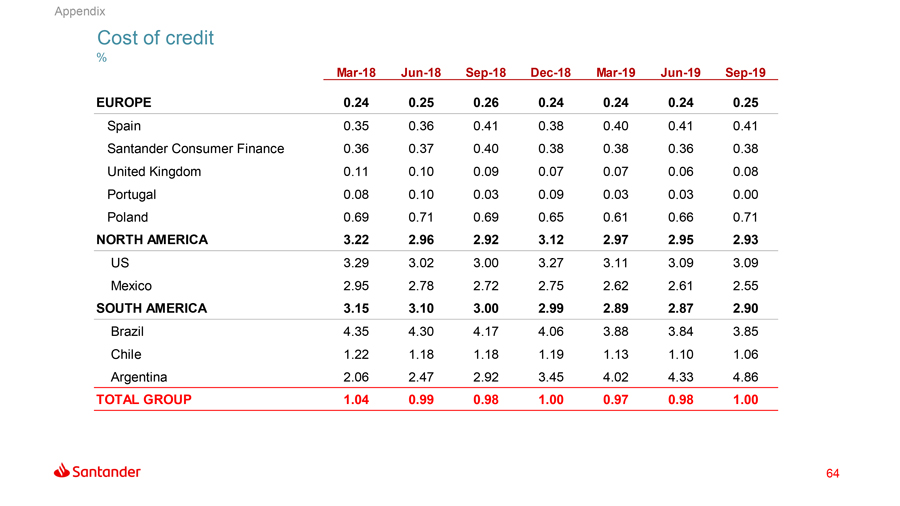

Credit quality improved further in the quarter, with thenon-performing loan ratio falling by four bps in the quarter to 3.47%. Cost of credit (the rate at which the bank needs to provision when lending money) also remained broadly stable at 1%.

The Group continued to generate capital organically in the quarter, adding 19 bps which offset the impact of various regulatory effects. As a result, the Group’s CET1 ratio stood at 11.30%, in line with its medium-term target of11-12%.

The Group confirmed in September a first dividend against 2019 earnings of €0.10 per share, which will be paid from 1 November 2019 and ratified its intention to maintain apay-out ratio of40-50% of underlying attributable profit, with the proportion of cash dividend per share at least that of last year.

Markets Summary (9M19 v 9M18)

To better reflect the local performance of each market, theyear-on-year percentage changes provided below are presented in constant exchange euros. Variations in current euros are available in the financial report.

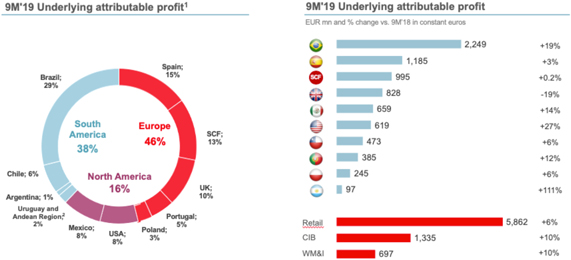

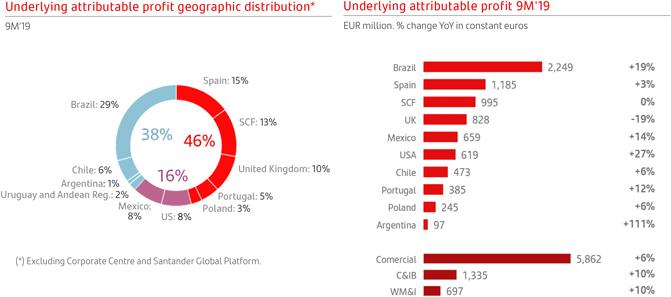

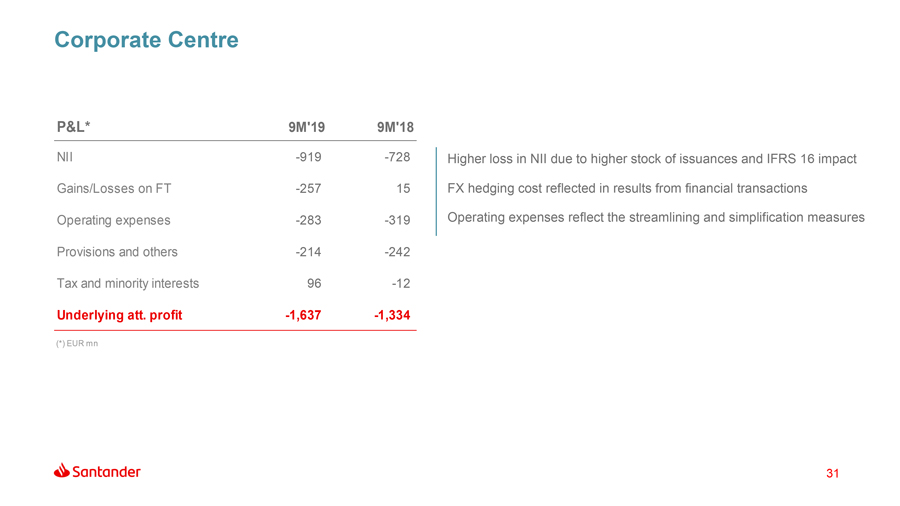

(1) Excluding Corporate Centre (EUR-1,637 mn) and Santander Global Platform.

(2) Uruguay and Andean Region underlying profit (EUR 159 mn).

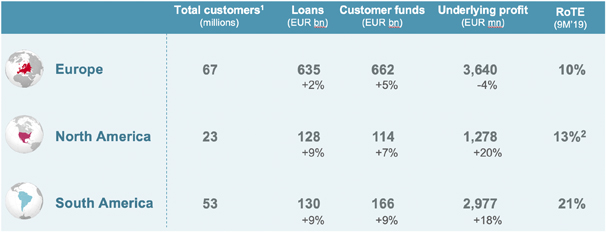

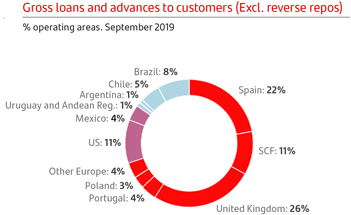

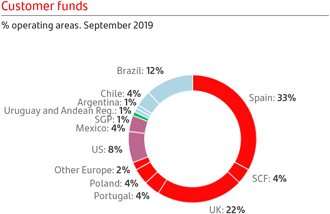

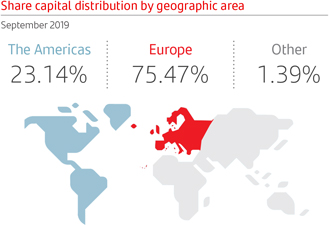

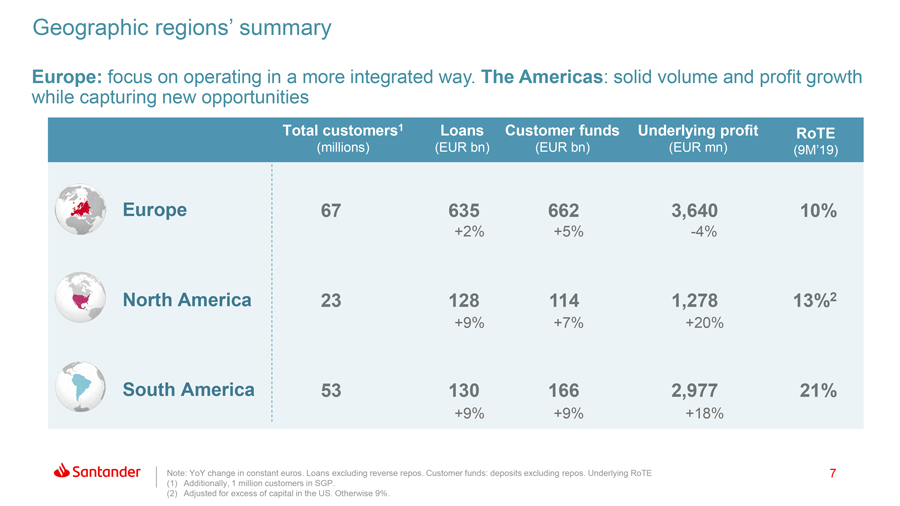

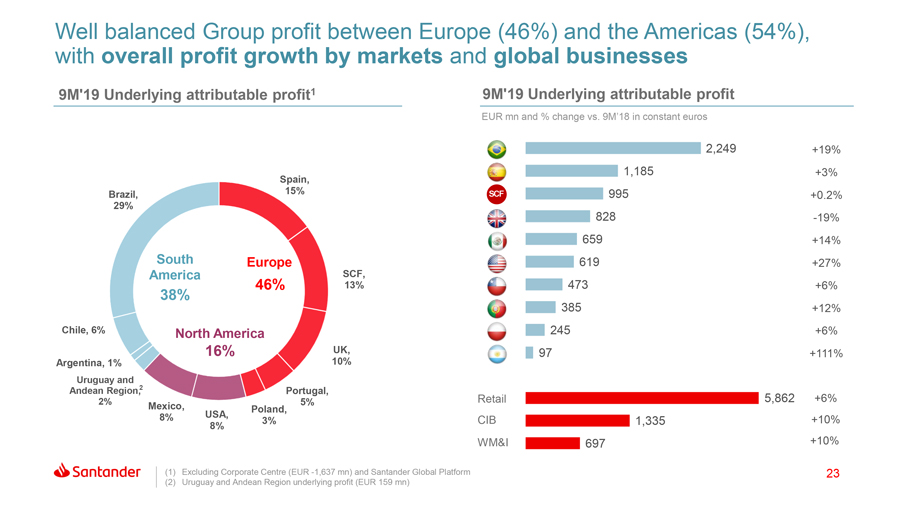

The Group’s scale and presence across both developed and high growth markets is a key point of differentiation for Santander among its peers, with European franchises contributing 46% of group underlying profit, South America contributing 38% and North America contributing 16%. Brazil remained the largest contributor with 29% of total Group underlying profit, followed by Spain (15%), Santander Consumer Finance (13%), the UK (10%), Mexico (8%) and the US (8%).

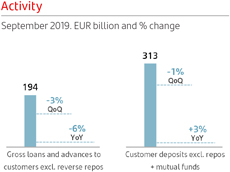

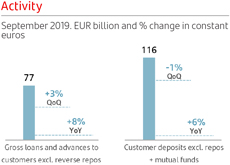

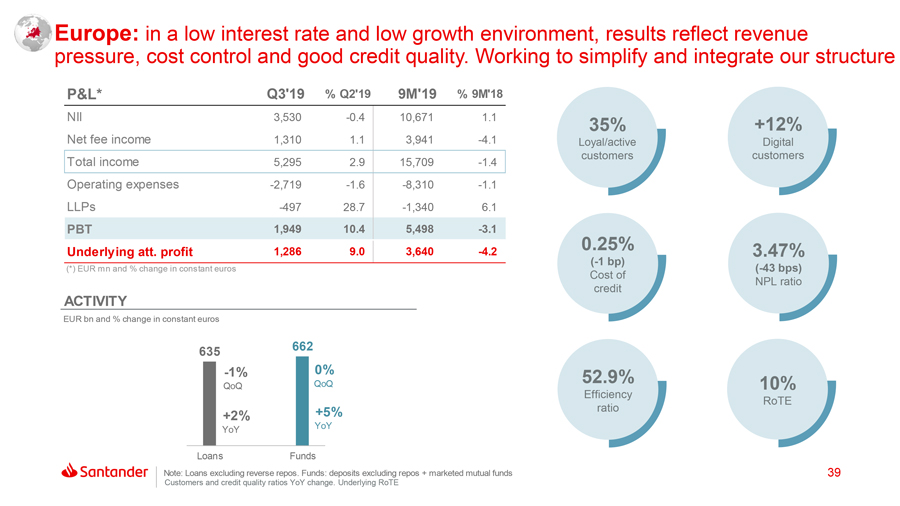

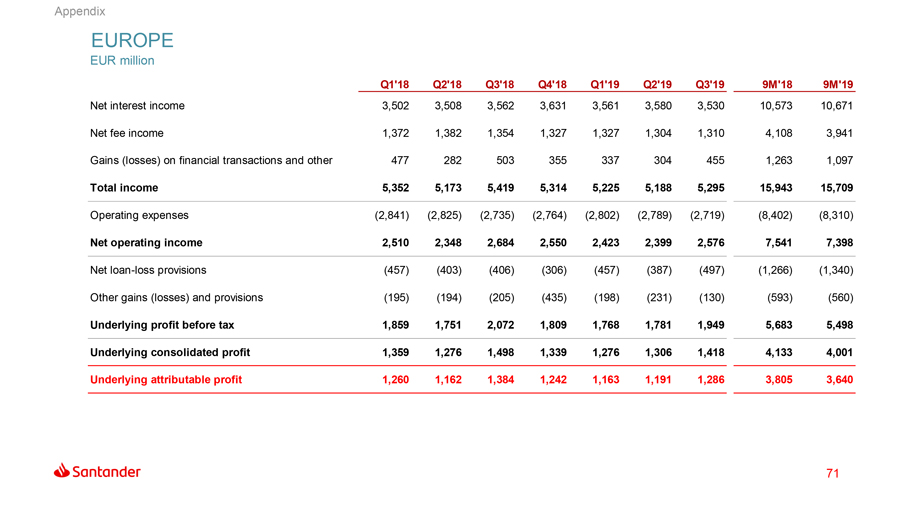

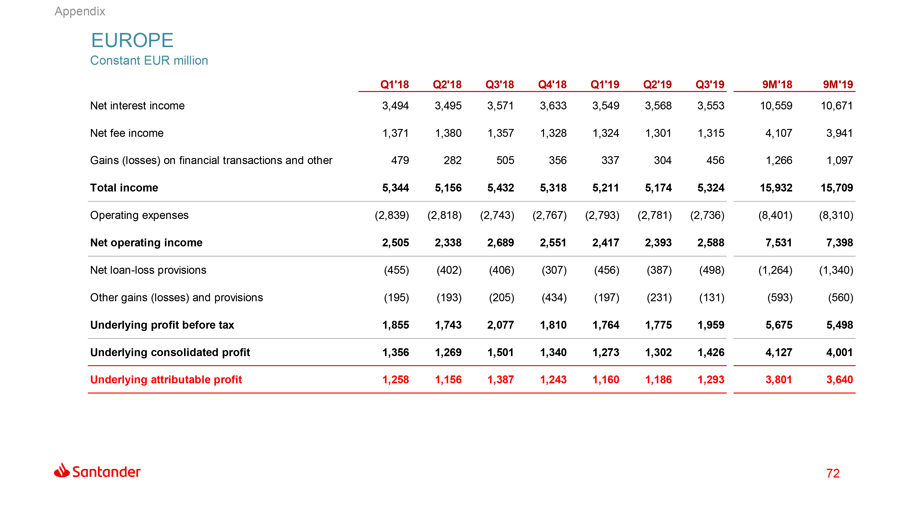

Europe. Underlying profit amounted to €3,640 million, 4% lower than in the same period last year. Costs decreased by 1%(-2.5% in real terms) reflecting the first savings from the bank’s optimisation programme, announced at its investor day in April 2019. As a result, underlying RoTE was 10%. Gross loans increased by 2%, while customer funds increased by 5%. Digital customers grew 12% to 13.7 million, while loyal customers reached 9.8 million.

| Corporate Communications | 3 |  | ||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | ||||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

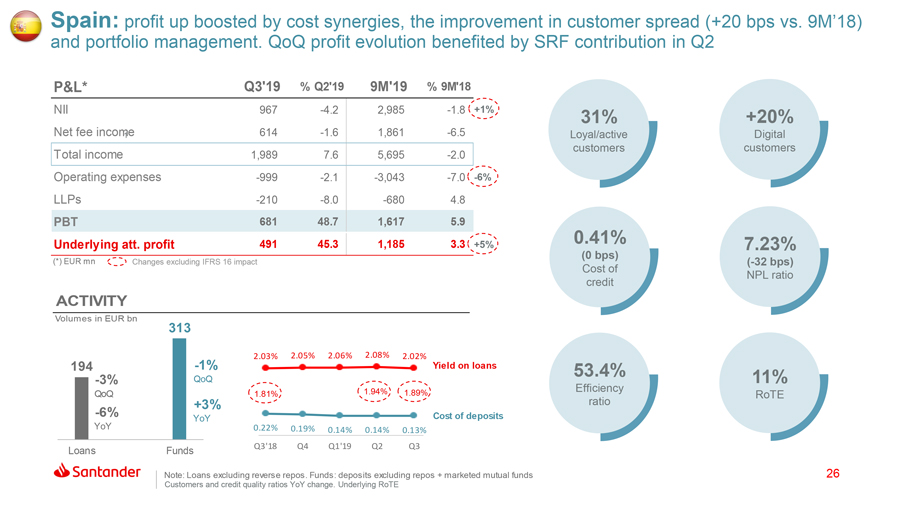

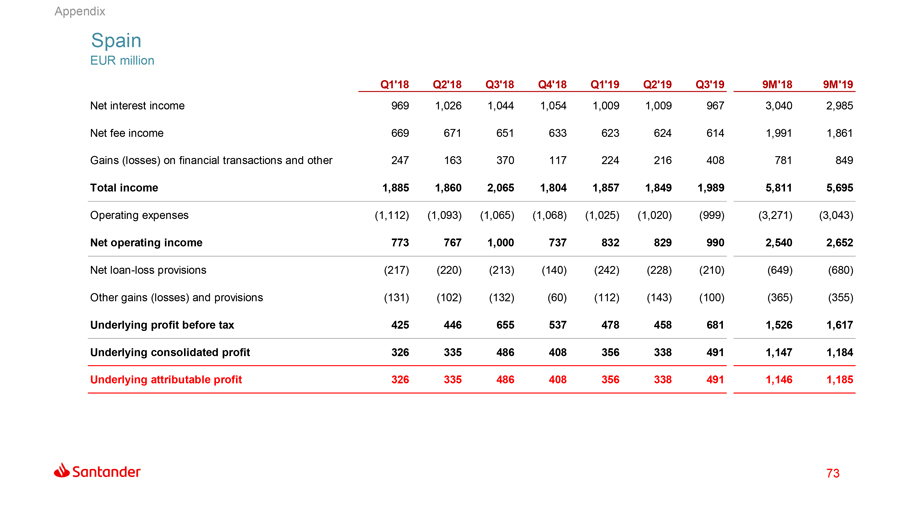

| ∎ | InSpain, underlying profit was 3% higher at €1,185 million, mainly due to lower costs, which reduced by 7% thanks to the efficiencies resulting from the Banco Popular integration. After the successful migration of all offices and customers to the Santander platform, the bank is focusing on optimising the commercial network, and the bank increased profitability in all segments and products. Lending was down 6% due to the deleveraging of large corporates and a drop in the stock of mortgages. Consumer credit rose 24% YoY, driven bypre-concession and digital subscriptions. Demand deposits increased by €12,780 million. Digital customers grew 20% to 4.7 million. The bank’s contact centre was rated the best of any industry and in the financial sector. |

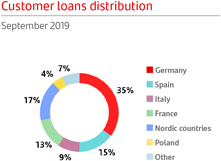

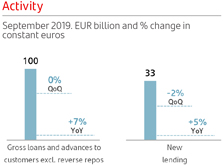

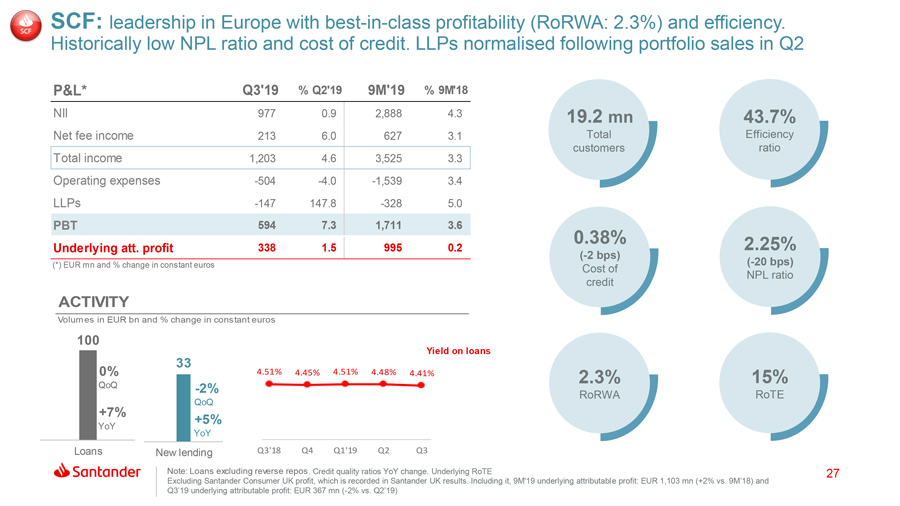

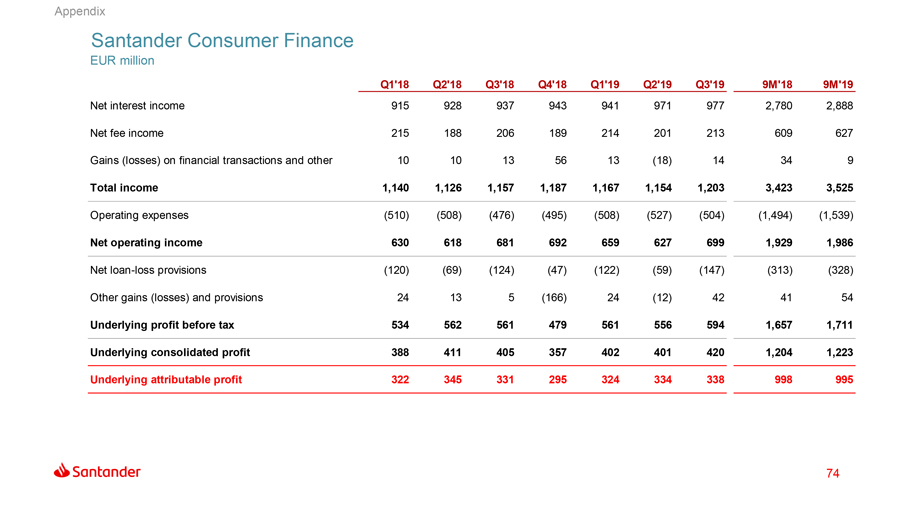

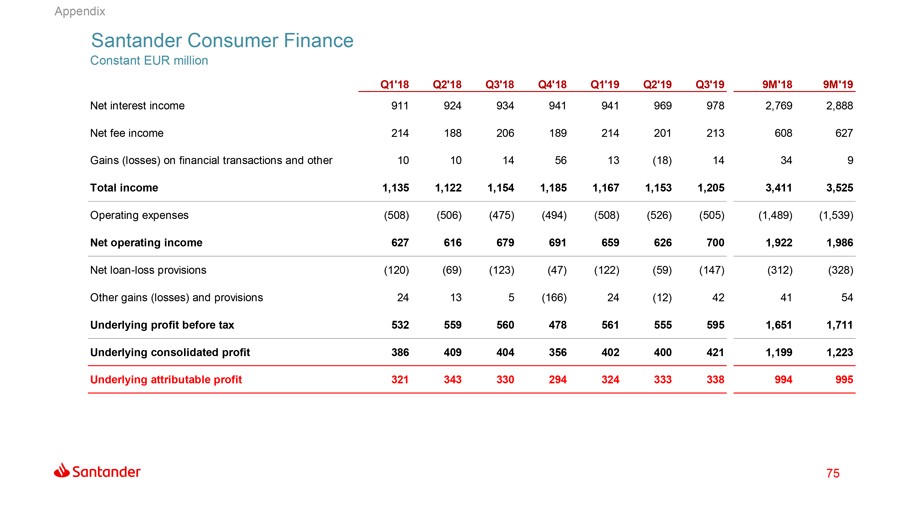

| ∎ | InSantander Consumer Finance, underlying profit was €995 million, in line with same period last year. Total income increased 3%, largely due to growth in net interest income and net fee income, combined with good cost control. The largest profits were generated by Germany (EUR 248 million), the Nordic countries (EUR 224 million) and Spain (EUR 170 million). New lending rose 5% YoY, underpinned by commercial agreements in several countries with particularly good growth in Italy (+13%), France (+9%) and Spain (+6%). |

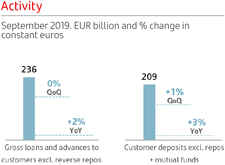

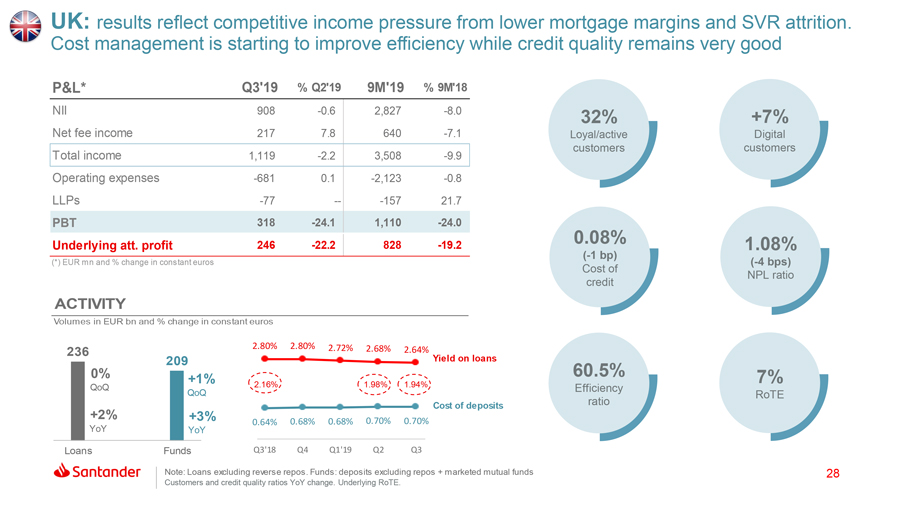

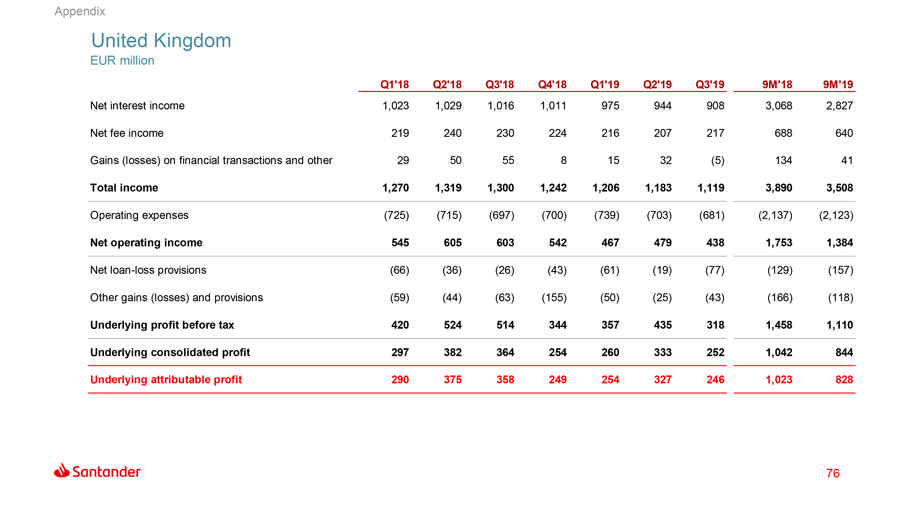

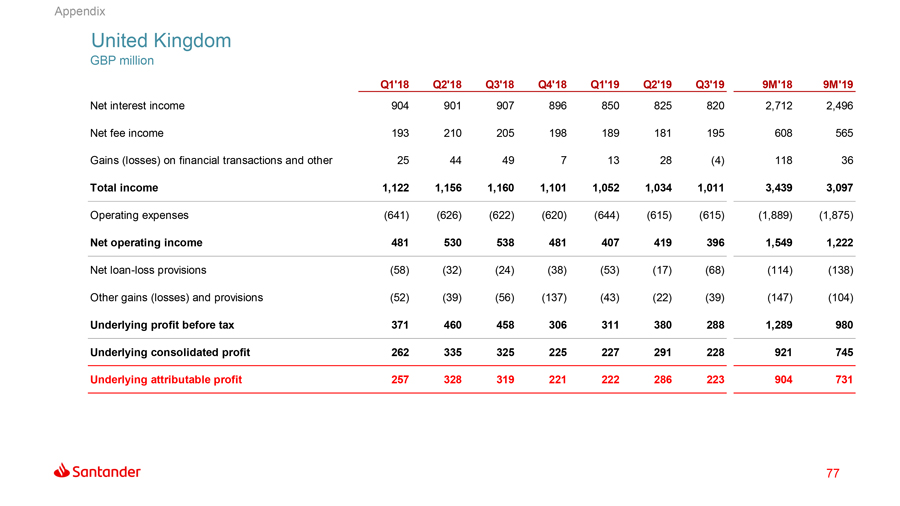

| ∎ | In theUK, underlying profit stood at €828 million, down 19%, reflecting the continued competitive pressure on mortgage margins. Costs reduced by 1%, reflecting the first cost savings from the bank’s transformation programme, while the cost of credit remained at very low levels (8 basis points). Business activity remained robust with a further increase in mortgages, digital and loyal customers as well as improved customer experience. |

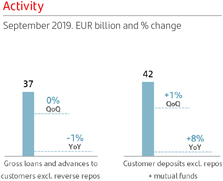

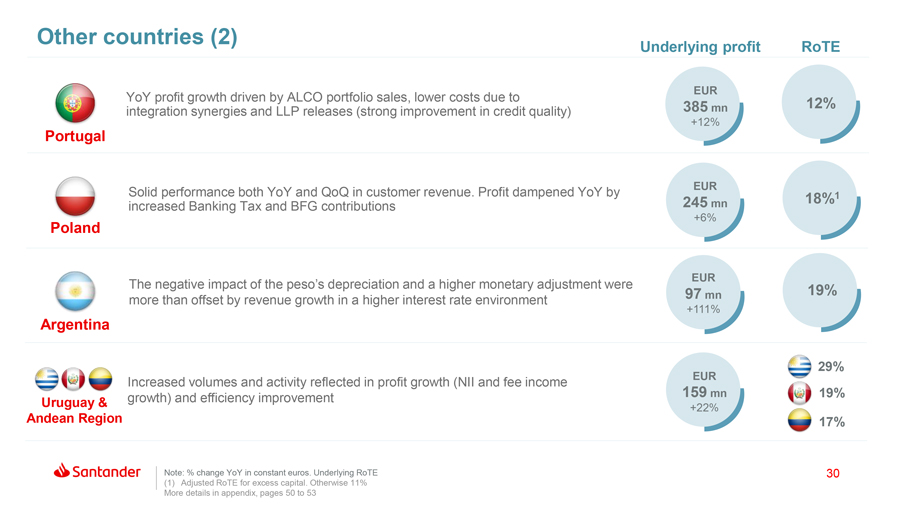

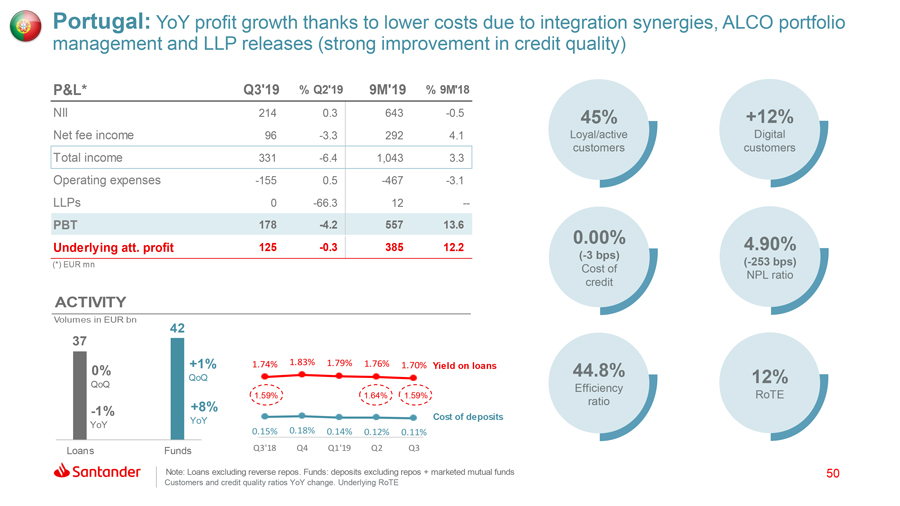

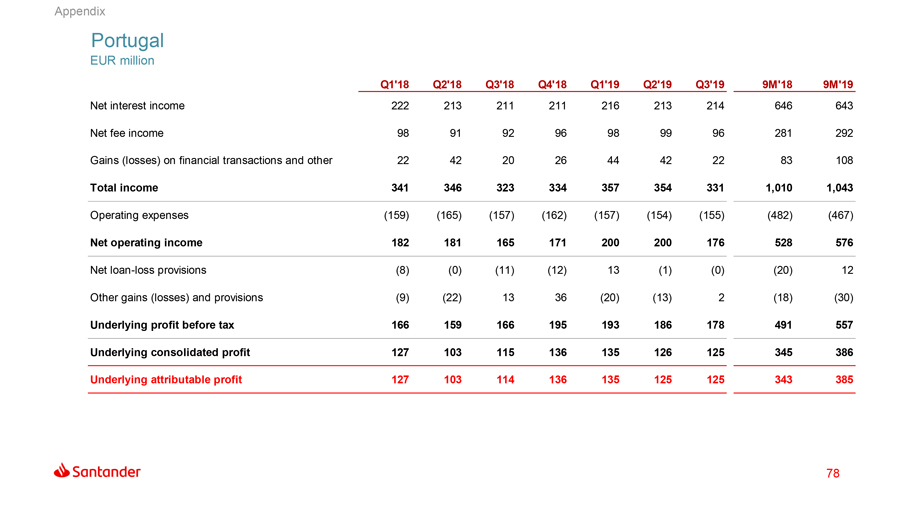

| ∎ | InPortugal, underlying profit increased by 12% to €385 million, as costs declined further. Loans were 1% lower YoY, with market shares in new lending to companies and mortgages remaining around 20%, in a market that is still deleveraging, while customer funds increased by 8%. |

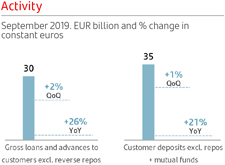

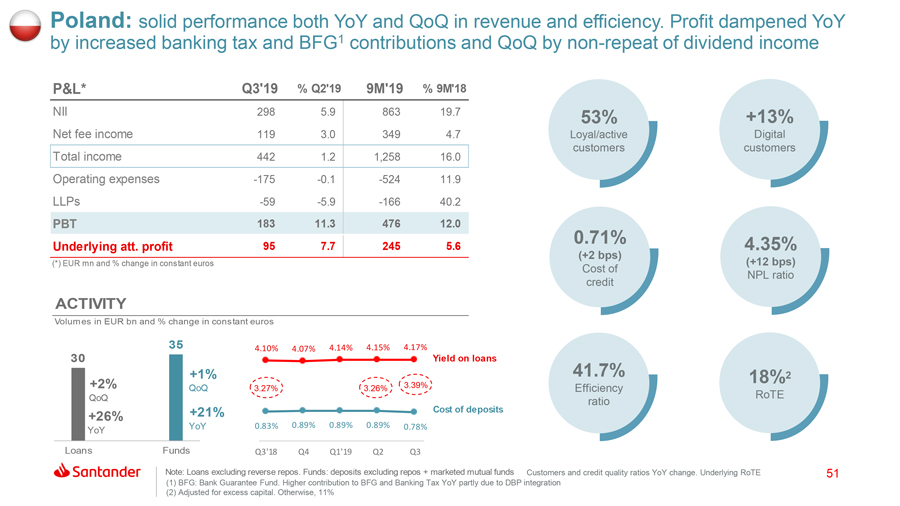

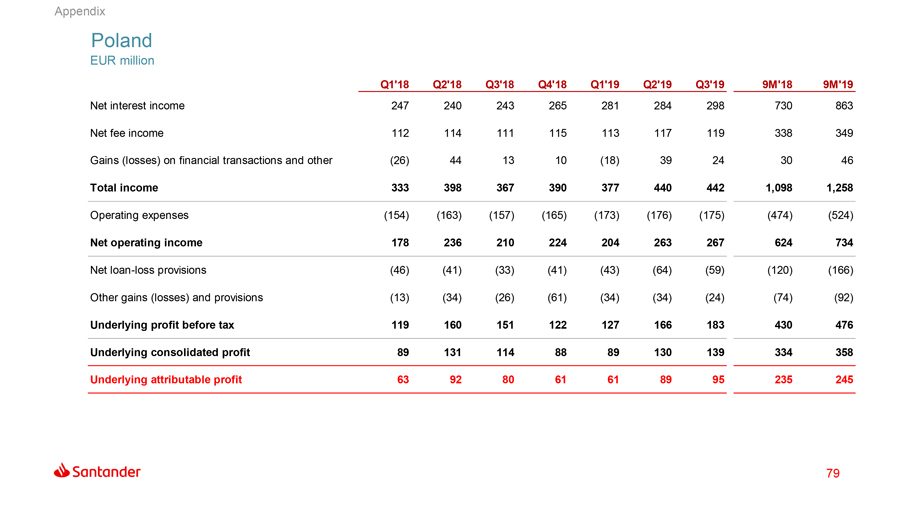

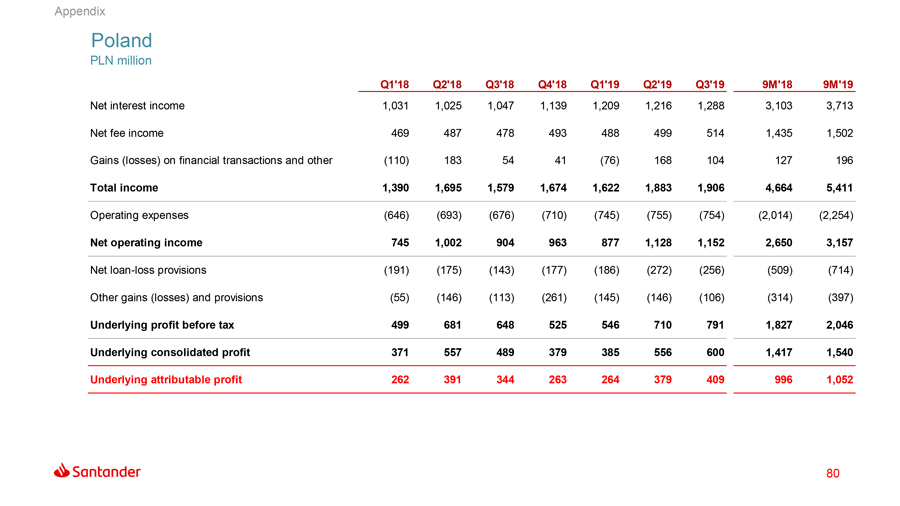

| ∎ | InPoland, underlying attributable profit was €245 million, up 6%, with strong growth in gross loans (+26%), mainly due to the integration of Deutsche Bank Polska’s retail and SME business. Customer funds also increased strongly (+21%). In the last quarter, the bank opened in the country its first Work Café, an innovative space for clients andnon-customers which brings a bank,co-working area and coffee house together in a single place. |

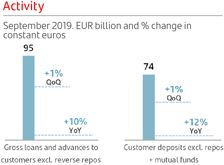

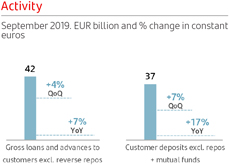

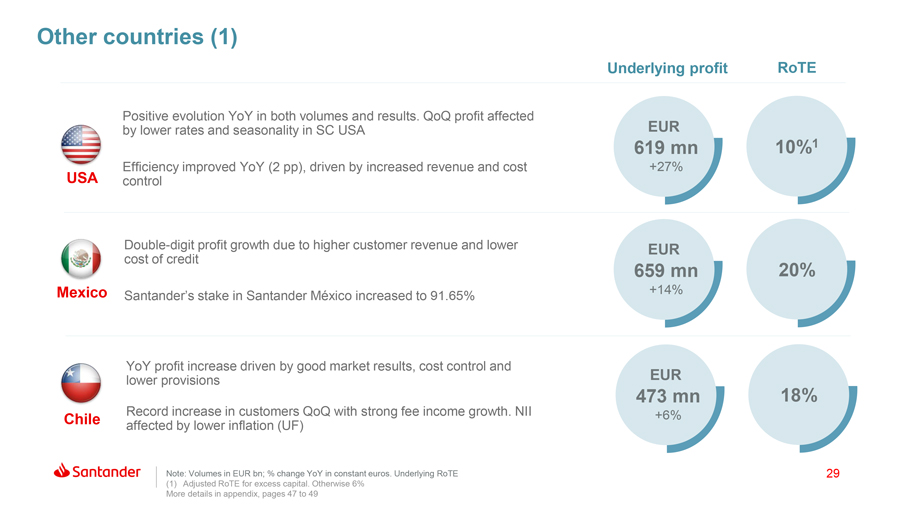

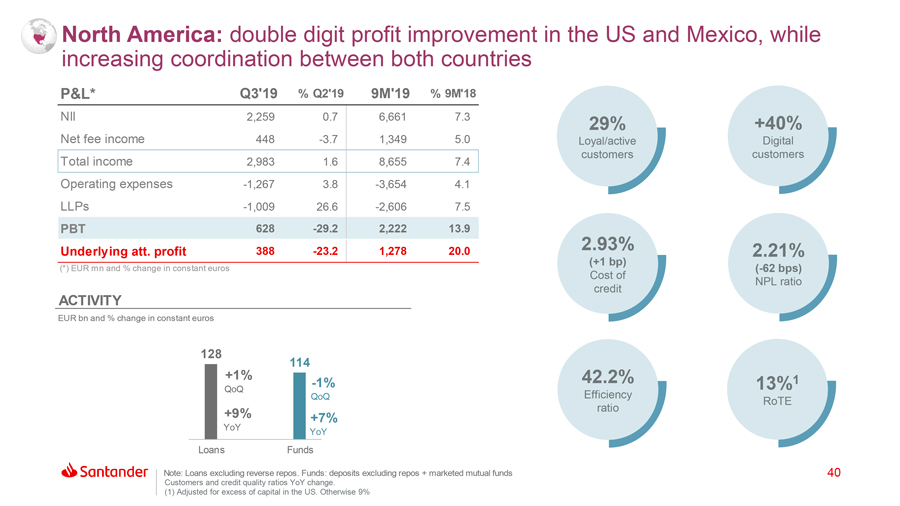

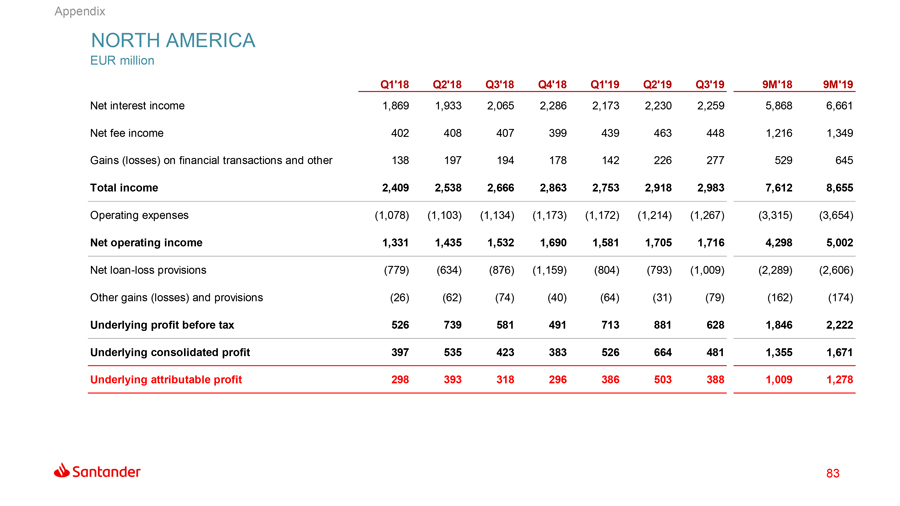

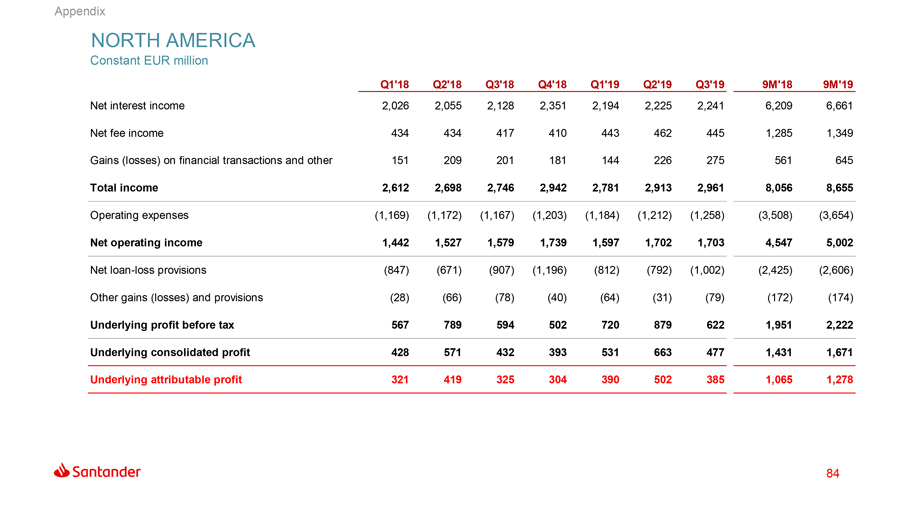

North America. Underlying profit in North America, which includes Mexico and the US, was €1,278 million, up 20% YoY. There was good performance in total income at both units, with growth driven by both net interest income (+7%) and net fee income (+5%). Income grew at a faster rate than expenses, resulting in an improvedcost-to-income ratio of 42%. Gross loans and customer funds increased by 9% and 7% respectively, digital customers grew 40% to 4.8 million, while the number of loyal customers increased to 3.3 million.

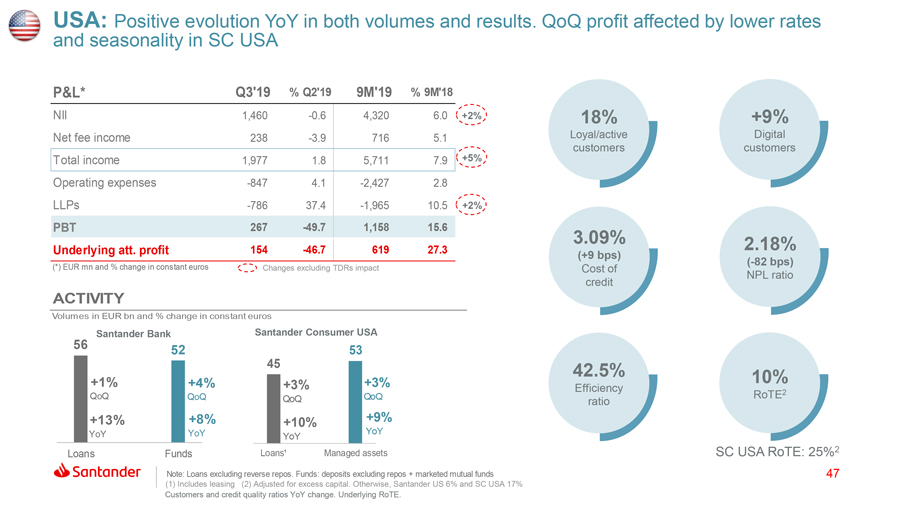

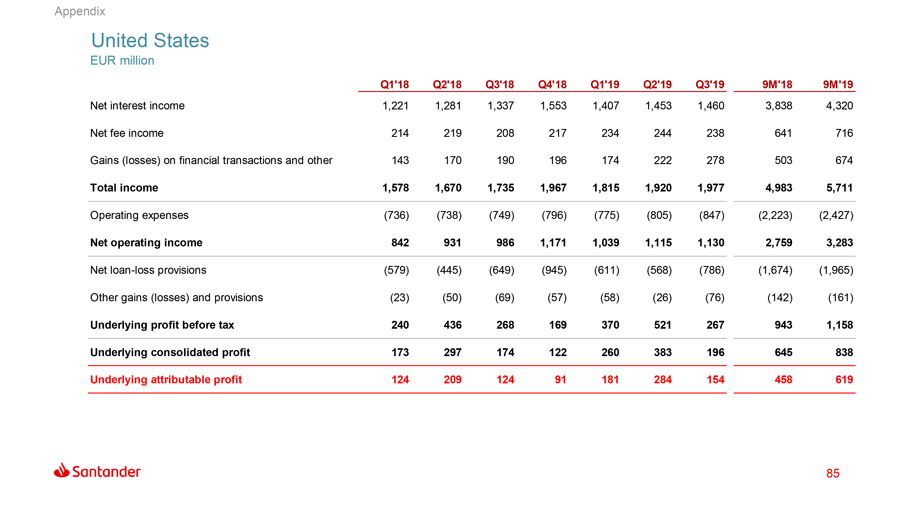

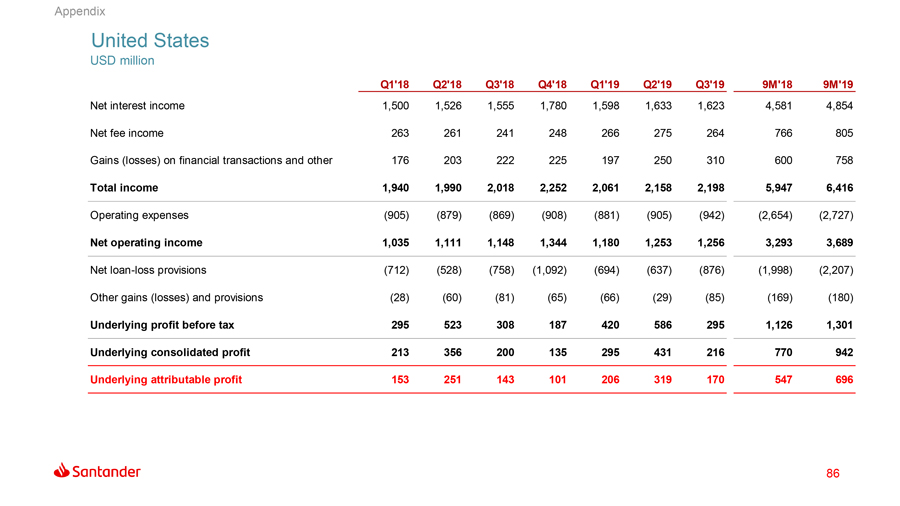

| ∎ | In theUS, underlying profit was €619 million, up 27% YoY. Total income increased by 8% while costs increased by only 3%. Loans grew 10% due to growth in lending in retail banking (auto) and commercial banking, while customer funds were up 12%. New loans increased 11% at Santander Consumer USA, primarily driven by Chrysler Capital loans (+52%). Digital customers increased by 9% to just over 1 million. |

| Corporate Communications | 4 |  | ||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | ||||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

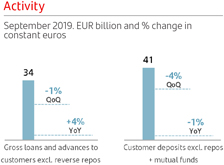

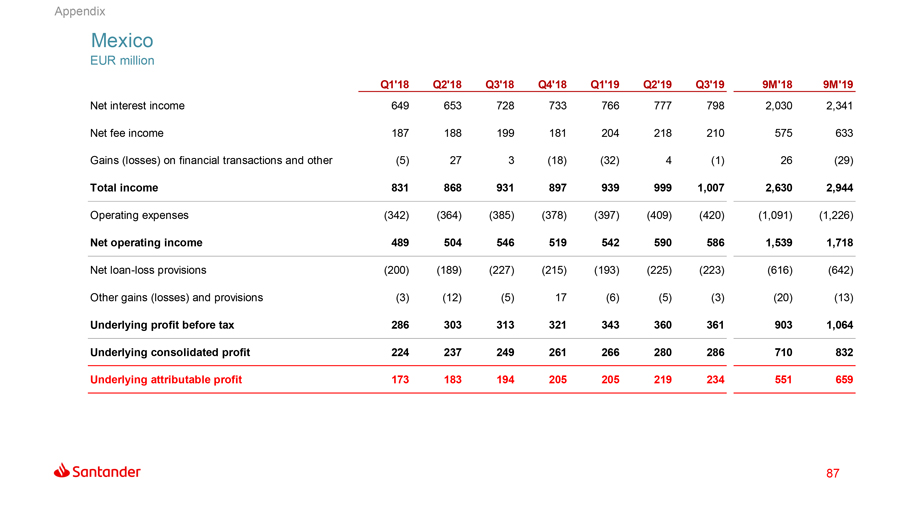

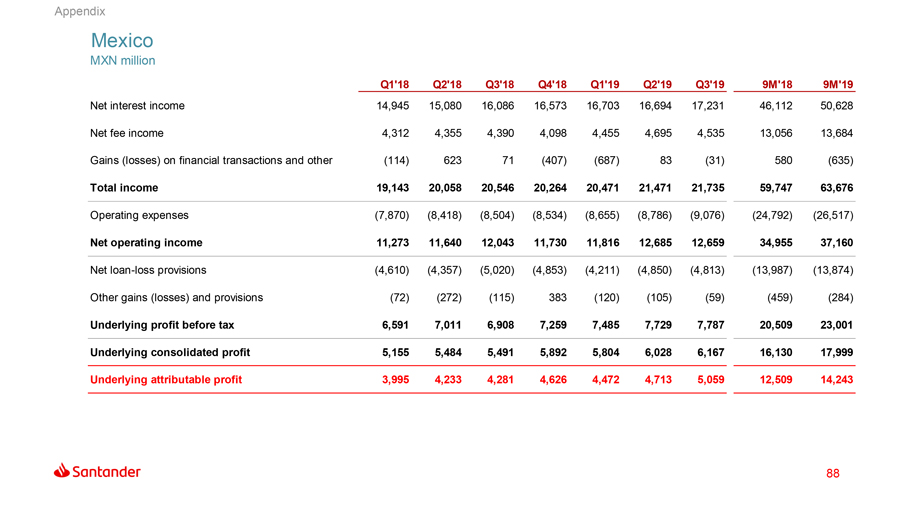

| ∎ | InMexico, underlying profit was €659 million, up 14%. Loans to individuals rose 7% with notable growth in payroll loans (+11%), mortgages (+7%) and credit cards (+7%). The distribution model strategy continued to progress, with the transformation of 475 branches and the number of latest generation full function ATMs reaching almost 1,000. Digital customers grew 51% to 3.8 million. |

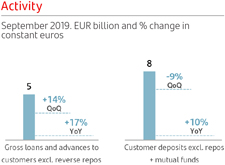

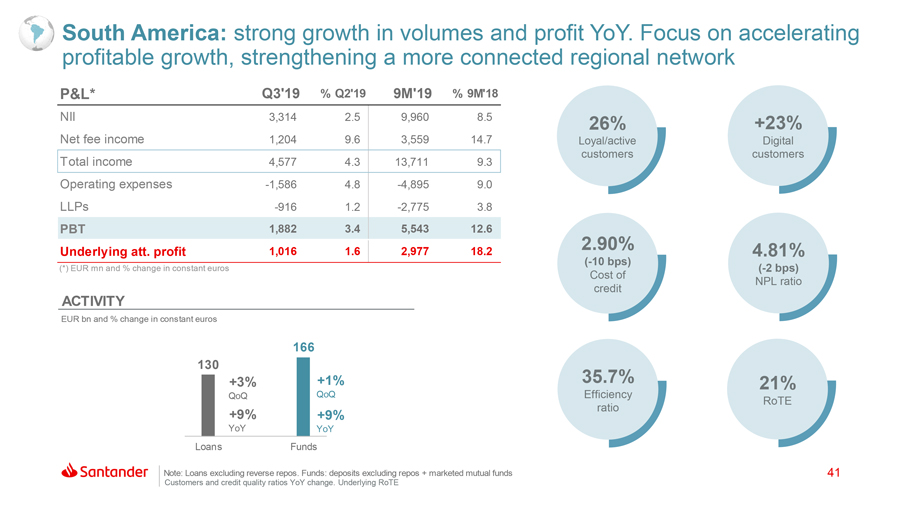

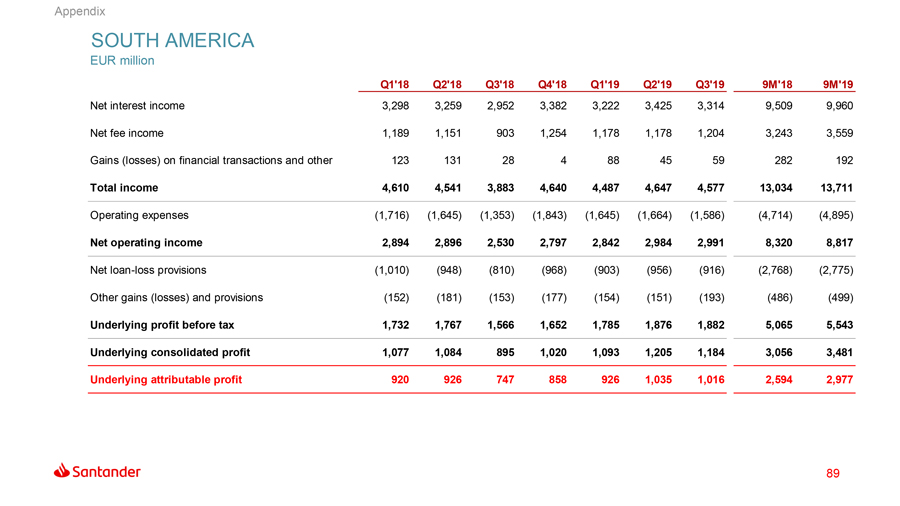

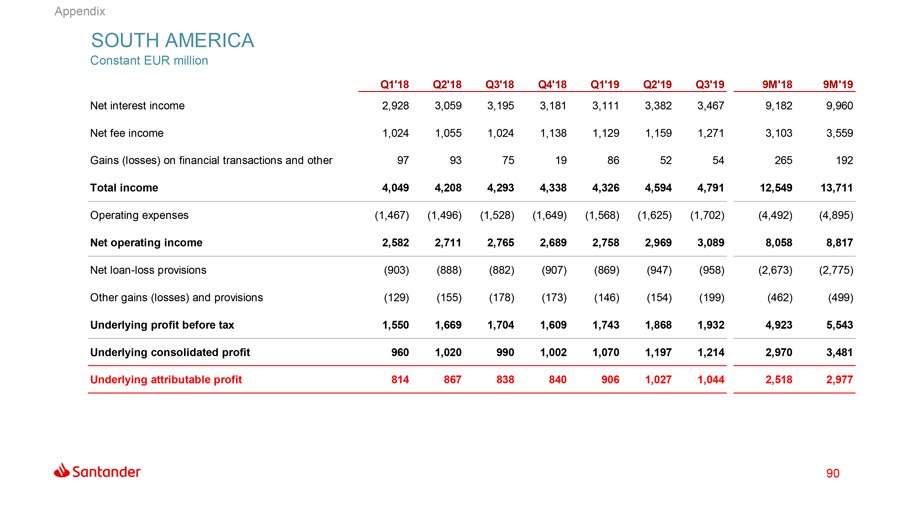

South America. Underlying profit in South America was €2,977 million, up 18%. Total income increased 9%, underpinned by the sound performance of commercial revenue, driven by higher volumes, spread management and increased loyalty. Net interest income rose 8% and net fee income increased by 15%. As a result, underlying RoTE was 21%. Gross loans and customers funds both increased by 9% year on year, while credit quality improved with cost of credit falling by 10 basis points to 2.90% and NPL ratio falling by 2 basis points to 4.81%. Digital customers grew 23% to 17.2 million, while loyal customers are now 7.7 million.

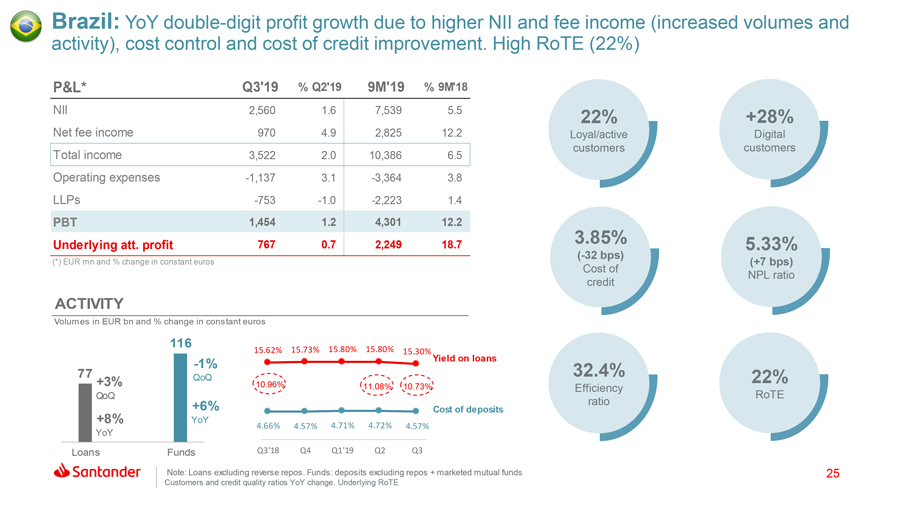

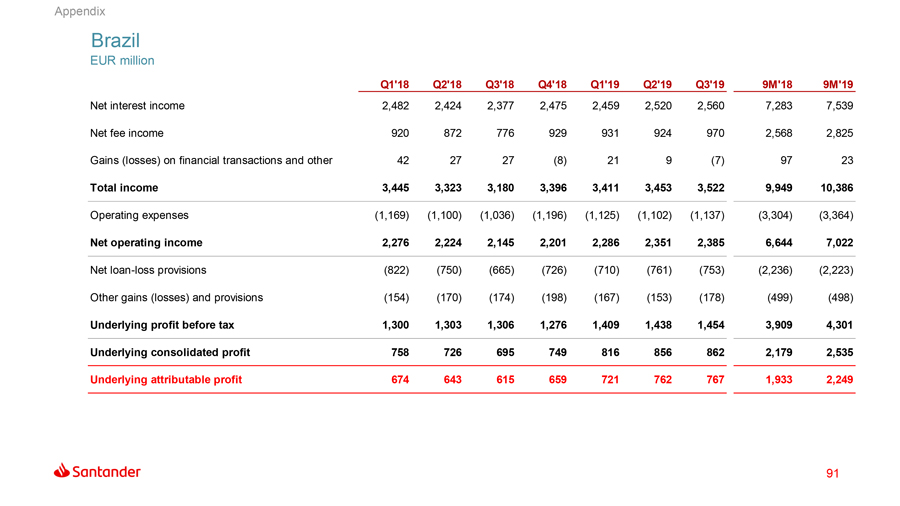

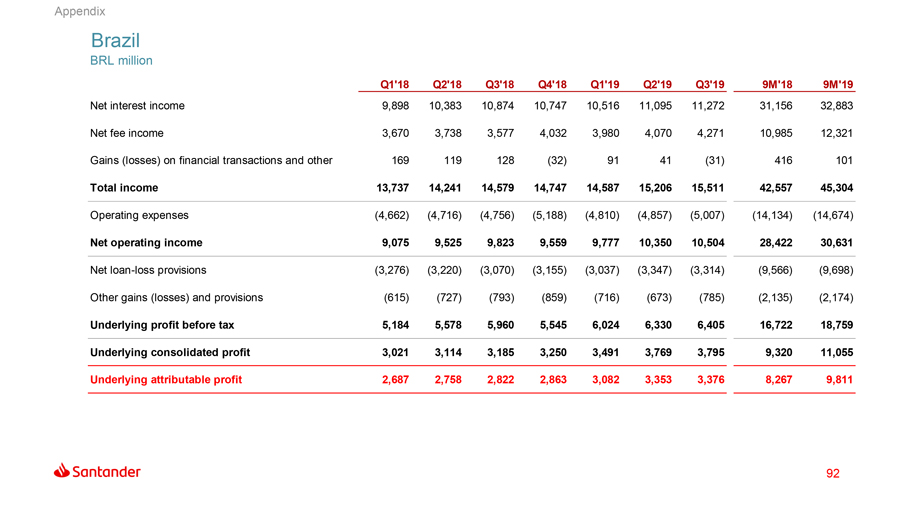

| ∎ | InBrazil, underlying profit was €2,249 million, up 19%. Net interest income rose by 6% and net fee income by 12%. Costs increased at a slower pace than income, which helped improve the efficiency ratio to 32%. As a result, underlying RoTE was 22% in the period, versus 20% in September 2018. Gross loans grew by 8%, with profitable gains in market share. The bank continued to be the leader in the auto segment, with 25% market share. The bank was a pioneer in launching a solution that enables point of sale users with Bluetooth in the market to take advantage of the Getnet offer, the card payments business, without having to acquire a new terminal. |

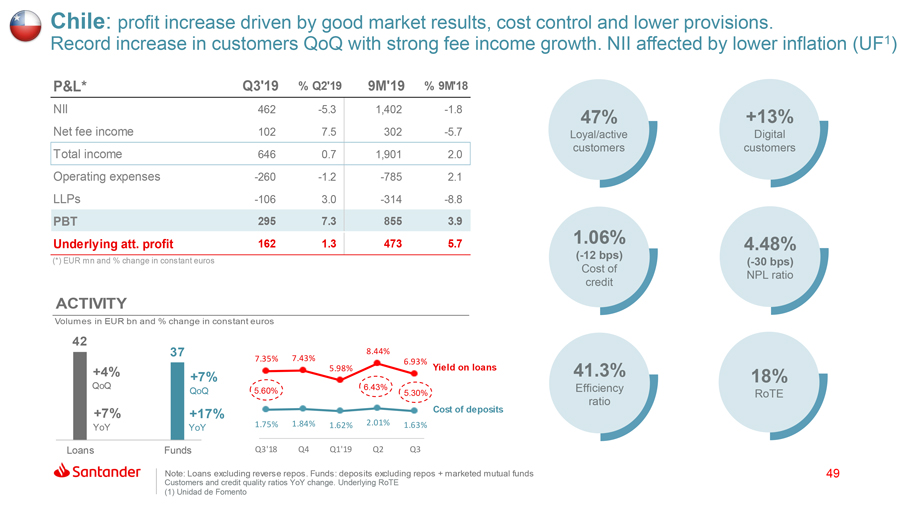

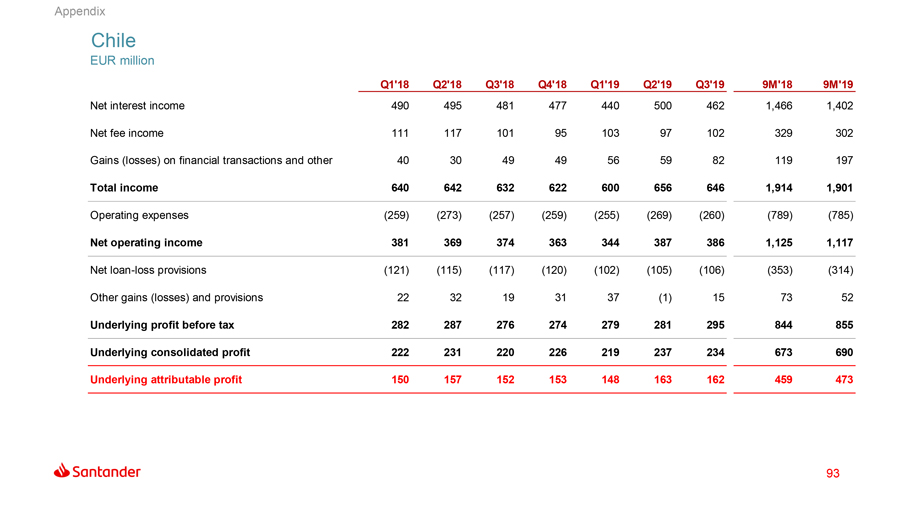

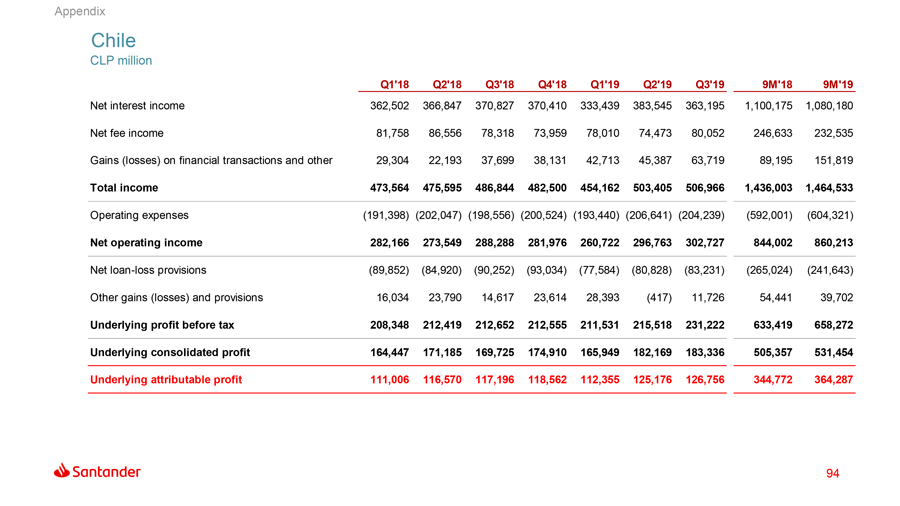

| ∎ | InChile, underlying profit was €473 million, up 6%. Gross loans increased by 7%, while customer funds rose 17%. The bank continued to focus on the commercial and digital transformation launching new products which achieved a record rise in new customers in the quarter. |

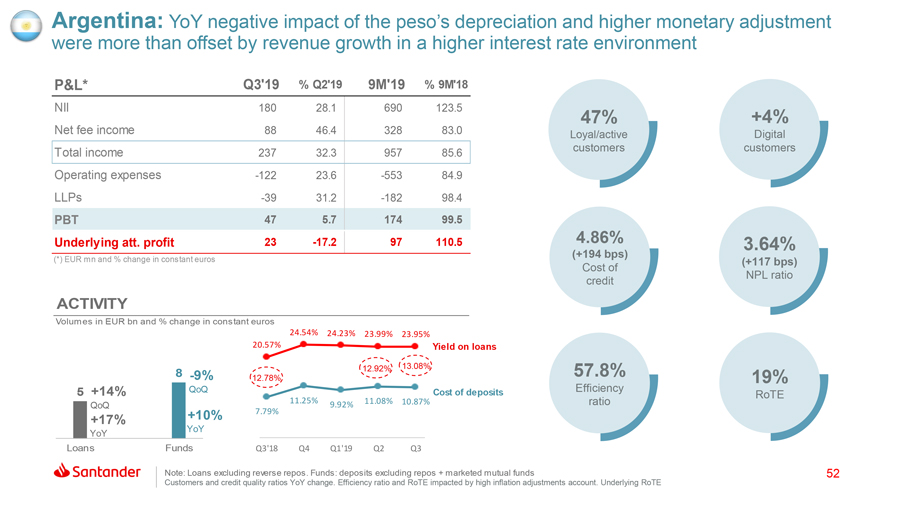

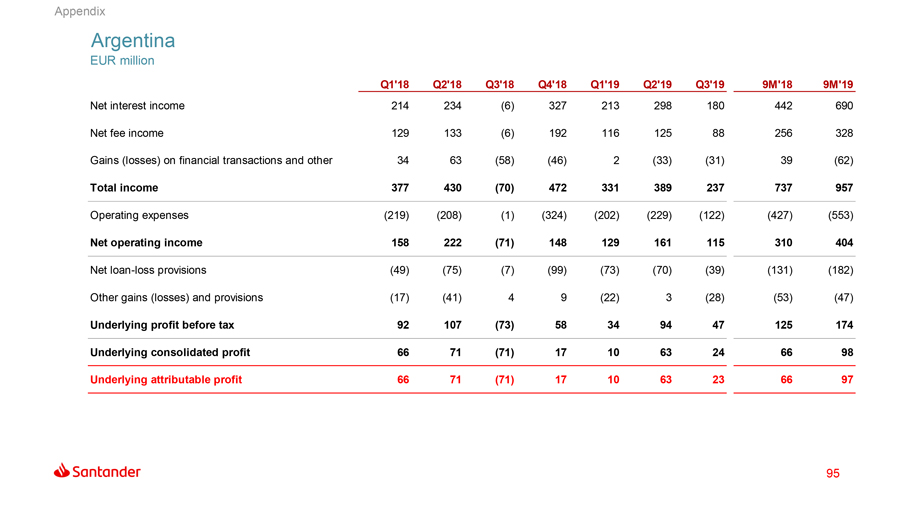

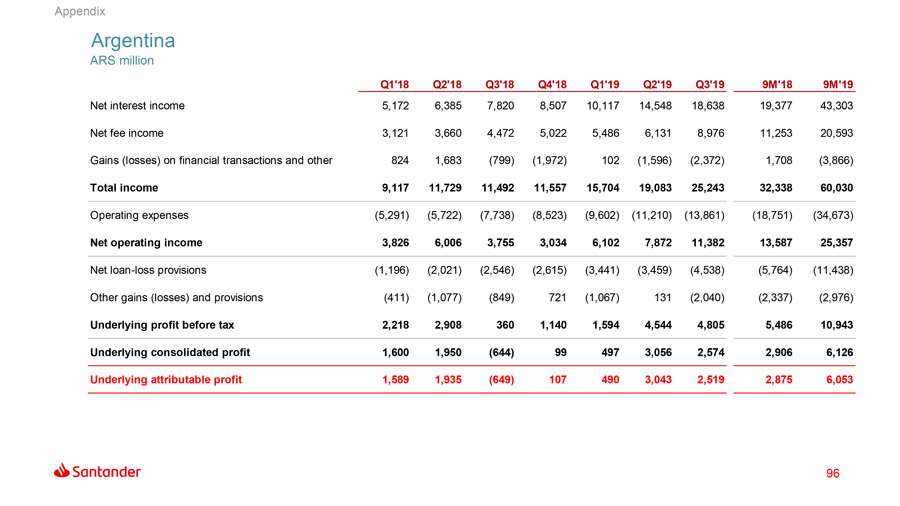

| ∎ | InArgentina, underlying profit was €97 million, up 111% after an inflation adjustment last year. Loans grew 17% and customer funds, 10%. |

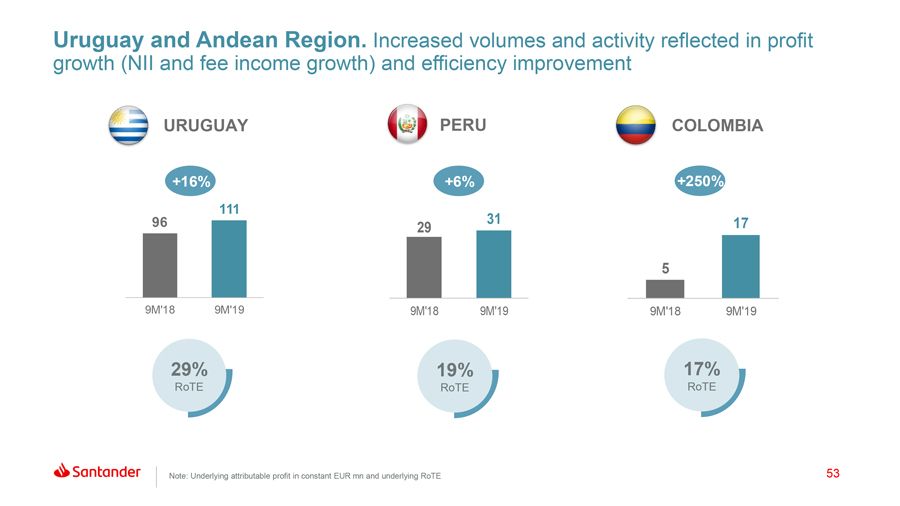

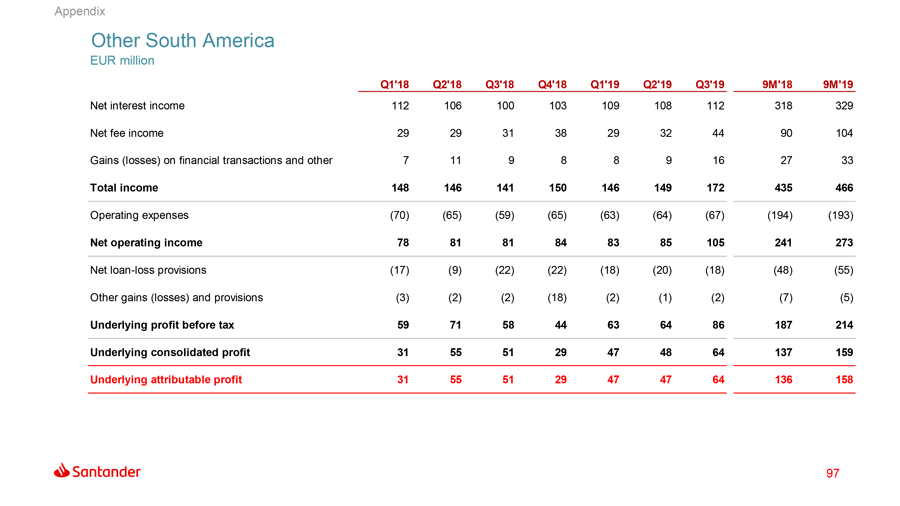

| ∎ | In therest of South America, which includes, Uruguay, Peru and Colombia, underlying profit increased to €159 million (+22%). |

Note: YoY change in constant euros. Loans excluding reverse repos. Customer funds: deposits excluding repos. Underlying RoTE (1) Additionally, 1 million customers in SGP. (2) Adjusted for excess of capital in the US. Otherwise 9%. |

About Banco Santander

Banco Santander is the largest bank in the euro zone with a market capitalisation of over €66,000 million. It has a strong and focused presence in ten core markets across Europe and the Americas with more than 4 million shareholders and 200,000 employees serving 144 million customers.

| Corporate Communications | 5 |  | ||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | ||||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

Key consolidated data (from Q3 2019 financial report)

| BALANCE SHEET(EUR million) | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

Total assets | 1,517,885 | 1,512,096 | 0.4 | 1,517,885 | 1,444,687 | 5.1 | 1,459,271 | |||||||||||||||||||||

Loans and advances to customers | 916,003 | 908,235 | 0.9 | 916,003 | 866,226 | 5.7 | 882,921 | |||||||||||||||||||||

Customer deposits | 814,285 | 814,751 | (0.1 | ) | 814,285 | 778,751 | 4.6 | 780,496 | ||||||||||||||||||||

Total funds | 1,035,651 | 1,032,769 | 0.3 | 1,035,651 | 986,199 | 5.0 | 980,562 | |||||||||||||||||||||

Total equity | 108,526 | 109,985 | (1.3 | ) | 108,526 | 105,668 | 2.7 | 107,361 | ||||||||||||||||||||

Note: Total funds includes customer deposits, mutual funds, pension funds and managed portfolios.

|

| |||||||||||||||||||||||||||

| INCOME STATEMENT(EUR million) | Q3’19 | Q2’19 | % | 9M’19 | 9M’18 | % | 2018 | |||||||||||||||||||||

Net interest income | 8,806 | 8,954 | (1.7 | ) | 26,442 | 25,280 | 4.6 | 34,341 | ||||||||||||||||||||

Total income | 12,466 | 12,351 | 0.9 | 36,902 | 35,882 | 2.8 | 48,424 | |||||||||||||||||||||

Net operating income | 6,744 | 6,522 | 3.4 | 19,593 | 19,039 | 2.9 | 25,645 | |||||||||||||||||||||

Profit before tax | 2,181 | 2,929 | (25.5 | ) | 8,712 | 10,586 | (17.7 | ) | 14,201 | |||||||||||||||||||

Attributable profit to the parent | 501 | 1,391 | (64.0 | ) | 3,732 | 5,742 | (35.0 | ) | 7,810 | |||||||||||||||||||

Changes in constant euros: Q3’19/ Q2’19: NII: +0.8%; Total income: +3.3%; Net operating income: + 5.3%; Attributable profit: -59. 0% 9M’19/9M’18: NII: +4.6%; Total income: +3.0%; Net operating income: +3.0%; Attributable profit: -34.7%

|

| |||||||||||||||||||||||||||

UNDERLYING INCOME STATEMENT(1) (EUR million) | Q3’19 | Q2’19 | % | 9M’19 | 9M’18 | % | 2018 | |||||||||||||||||||||

Net interest income | 8,806 | 8,954 | (1.7 | ) | 26,442 | 25,280 | 4.6 | 34,341 | ||||||||||||||||||||

Total income | 12,466 | 12,351 | 0.9 | 36,902 | 35,882 | 2.8 | 48,424 | |||||||||||||||||||||

Net operating income | 6,744 | 6,522 | 3.4 | 19,593 | 19,039 | 2.9 | 25,645 | |||||||||||||||||||||

Profit before tax | 3,844 | 3,895 | (1.3 | ) | 11,423 | 11,230 | 1.7 | 14,776 | ||||||||||||||||||||

Attributable profit to the parent | 2,135 | 2,097 | 1.8 | 6,180 | 6,042 | 2.3 | 8,064 | |||||||||||||||||||||

Variations in constant euros: Q3’19/Q2’19: NII: +0.8%; Total income: +3.3%; Net operating income: +5.3%; Attributable profit: +4.0% 9M’19/9M’18: NII: +4.6%; Total income: +3.0%; Net operating income: +3.0%; Attributable profit : +2.7%

|

| |||||||||||||||||||||||||||

| EPS, PROFITABILITY AND EFFICIENCY (%) | Q3’19 | Q2’19 | % | 9M’19 | 9M’18 | % | 2018 | |||||||||||||||||||||

EPS (euro) | 0.021 | 0.076 | (72.7 | ) | 0.202 | 0.331 | (39.0 | ) | 0.449 | |||||||||||||||||||

Underlying EPS (euros)(1) | 0.121 | 0.120 | 1.0 | 0.352 | 0.349 | 0.8 | 0.465 | |||||||||||||||||||||

RoE | 7.02 | 7.79 | 5.90 | 8.20 | 8.21 | |||||||||||||||||||||||

RoTE | 9.86 | 11.02 | 8.33 | 11.69 | 11.70 | |||||||||||||||||||||||

Underlying RoTE(1) | 12.19 | 12.03 | 11.86 | 12.14 | 12.08 | |||||||||||||||||||||||

RoA | 0.56 | 0.63 | 0.50 | 0.65 | 0.64 | |||||||||||||||||||||||

RoRWA | 1.39 | 1.56 | 1.22 | 1.55 | 1.55 | |||||||||||||||||||||||

Underlying RoRWA(1) | 1.65 | 1.67 | 1.63 | 1.60 | 1.59 | |||||||||||||||||||||||

Efficiency ratio | 45.9 | 47.2 | 46.9 | 46.9 | 47.0 | |||||||||||||||||||||||

| SOLVENCY AND NPL RATIOS (%) | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

CET1(2) | 11.30 | 11.30 | 11.30 | 11.11 | 11.30 | |||||||||||||||||||||||

Fully loaded Total ratio(2) | 14.68 | 14.80 | 14.68 | 14.58 | 14.77 | |||||||||||||||||||||||

NPL ratio | 3.47 | 3.51 | 3.47 | 3.87 | 3.73 | |||||||||||||||||||||||

Coverage ratio | 67 | 68 | 67 | 68 | 67 | |||||||||||||||||||||||

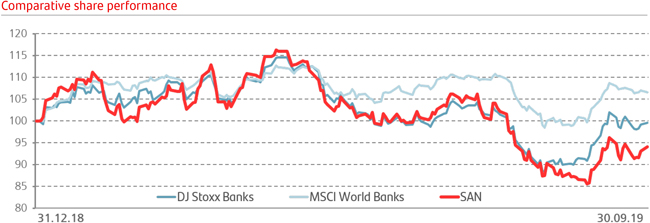

| MARKET CAPITALISATION AND SHARES | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

Shares (millions) | 16,618 | 16,237 | 2.3 | 16,618 | 16,136 | 3.0 | 16,237 | |||||||||||||||||||||

Share price (euros) | 3.737 | 4.081 | (8.4 | ) | 3.737 | 4.336 | (13.8 | ) | 3.973 | |||||||||||||||||||

Market capitalisation (EUR million) | 62,094 | 66,253 | (6.3 | ) | 62,094 | 69,958 | (11.2 | ) | 64,508 | |||||||||||||||||||

Tangible book value per share (euros) | 4.25 | 4.30 | 4.25 | 4.16 | 4.19 | |||||||||||||||||||||||

Price / Tangible book value per share (X) | 0.88 | 0.95 | 0.88 | 1.04 | 0.95 | |||||||||||||||||||||||

P/E ratio (X) | 13.90 | 11.29 | 13.90 | 9.83 | 8.84 | |||||||||||||||||||||||

| OTHER DATA | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

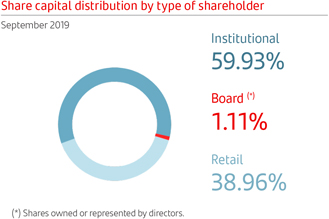

Number of shareholders | 4,025,074 | 4,054,208 | (0.7 | ) | 4,025,074 | 4,190,808 | (4.0 | ) | 4,131,489 | |||||||||||||||||||

Number of employees | 201,017 | 201,804 | (0.4 | ) | 201,017 | 201,101 | (0.0 | ) | 202,713 | |||||||||||||||||||

Number of branches | 12,691 | 13,081 | (3.0 | ) | 12,691 | 13,414 | (5.4 | ) | 13,217 | |||||||||||||||||||

| (1) | In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financials statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 and othernon-IFRS measures, including the figures related to “underlying” results, as they are recorded in the separate line of “net capital gains and provisions”, above the line of attributable profit to the parent. Further details are provided on page 12 of this report. |

For further details of the APMs andnon-IFRS measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see 2018 Annual Financial Report, published in the CNMV on 28 February 2019, our20-F report for the year ending 31 December 2018 registered with the SEC in the United States as well as the “Alternative performance measures” section of the annex to this report. |

| (2) | 2018 and 2019 data applying the IFRS 9 transitional arrangements. As indicated by the consolidating supervisor a pay-out of 50%, the maximum within the target range (40%-50%), was applied for the calculation of the capital ratios in 2019. Previously the average cash pay-out for the last three years was considered. |

| Corporate Communications | 6 |  | ||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | ||||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

IMPORTANT INFORMATION

Non-IFRS and alternative performance measures

In addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”), this press release contains certain financial measures that constitute alternative performance measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 (ESMA/2015/1415en) and othernon-IFRS measures(“Non-IFRS Measures”). The financial measures contained in this press release that qualify as APMs andnon-IFRS measures have been calculated using the financial information from Santander Group but are not defined or detailed in the applicable financial reporting framework and have neither been audited nor reviewed by our auditors. We use these APMs andnon-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs andnon-IFRS measures to be useful metrics for management and investors to facilitate operating performance comparisons from period to period. While we believe that these APMs andnon-IFRS measures are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute of IFRS measures. In addition, other companies, including companies in our industry, may calculate or use such measures differently, which reduces their usefulness as comparative measures. For further details of the APMs andNon-IFRS Measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see 2018 Annual Financial Report, published as Relevant Fact on 28 February 2019, as well as the section “Alternative performance measures” of the annex to the Santander 2019 3Q Financial Report, published as Relevant Fact on 30 October 2019. These documents are available on Santander’s website (www.santander.com).

The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included businesses and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries

Forward-looking statements

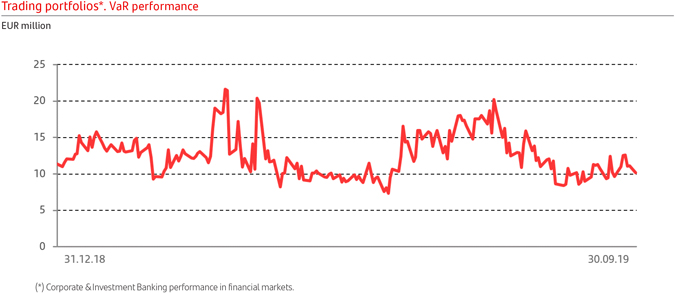

Santander cautions that this press release contains statements that constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future” and similar expressions. These forward-looking statements are found in various places throughout this press release and include, without limitation, statements concerning our future business development and economic performance and our shareholder remuneration policy. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. The following important factors, in addition to those discussed elsewhere in this press release and in our annual report on Form20-F for the year ended December 31, 2018, filed with the U.S. Securities and Exchange Commission, could affect our future results and could cause outcomes to differ materially from those anticipated in any forward-looking statement: (1) general economic or industry conditions in areas in which we have significant business activities or investments, including a worsening of the economic environment, increasing in the volatility of the capital markets, inflation or deflation, and changes in demographics, consumer spending, investment or saving habits; (2) exposure to various types of market risks, principally including interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices; (3) potential losses associated with prepayment of our loan and investment portfolio, declines in the value of collateral securing our loan portfolio, and counterparty risk; (4) political stability in Spain, the UK, other European countries, Latin America and the US (5) changes in laws, regulations or taxes, including changes in regulatory capital and liquidity requirements, including as a result of the UK exiting the European Union and increased regulation in light of the global financial crisis; (6) our ability to integrate successfully our acquisitions and the challenges inherent in diverting management’s focus and resources from other strategic opportunities and from operational matters while we integrate these acquisitions; and (7) changes in our ability to access liquidity and funding on acceptable terms, including as a result of changes in our credit spreads or a downgrade in our credit ratings or those of our more significant subsidiaries. Numerous factors could affect the future results of Santander and could result in those results deviating materially from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements.

Forward-looking statements speak only as of the date of this press release and are based on the knowledge, information available and views taken on such date; such knowledge, information and views may change at any time. Santander does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

No offer

The information contained in this press release is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document published by Santander. Any person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in this press release. No investment activity should be undertaken on the basis of the information contained in this press release. In making this press release available Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever.

Neither this press release nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this press release is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000.

Historical performance is not indicative of future results

Statements as to historical performance or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior period. Nothing in this press release should be construed as a profit forecast.

| Corporate Communications | 7 |  | ||

| Ciudad Grupo Santander, edificio Arrecife, planta 2 | ||||

| 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 | ||||

| comunicacion@gruposantander.com | ||||

| www.santander.com - Twitter: @bancosantander |

Financial report January-September 2019 KEY CONSOLIDATED DATA 3 SANTANDER AIM AND CORPORATE CULTURE 4 GROUP FINANCIAL INFORMATION 6 Group performance 6 Income statement and balance sheet 8 Solvency ratios 17 Risk management 18 FINANCIAL INFORMATION BY SEGMENTS 22 Primary segments 26 Secondary segments 43 RESPONSIBLE BANKING 46 CORPORATE GOVERNANCE 48 THE SANTANDER SHARE 49 APPENDIX 51 Financial information 52 Alternative Performance Measures 73 Interim condensed consolidated financial statements 80 Glossary 83 Important information 84 can use Santander’s communication channels in All customers, shareholders and the general public all the countries in which the Bank operates. This report was approved by the Board of Directors on 29 October 2019, following a favourable report from the Audit Committee. Important information regarding this report can be found on pages 84 and 85.

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

|

|

|

|

Key consolidated data

| BALANCE SHEET (EUR million) | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

Total assets | 1,517,885 | 1,512,096 | 0.4 | 1,517,885 | 1,444,687 | 5.1 | 1,459,271 | |||||||||||||||||||||

Loans and advances to customers | 916,003 | 908,235 | 0.9 | 916,003 | 866,226 | 5.7 | 882,921 | |||||||||||||||||||||

Customer deposits | 814,285 | 814,751 | (0.1) | 814,285 | 778,751 | 4.6 | 780,496 | |||||||||||||||||||||

Total funds | 1,035,651 | 1,032,769 | 0.3 | 1,035,651 | 986,199 | 5.0 | 980,562 | |||||||||||||||||||||

Total equity | 108,526 | 109,985 | (1.3) | 108,526 | 105,668 | 2.7 | 107,361 | |||||||||||||||||||||

| Note: Total funds includes customer deposits, mutual funds, pension funds and managed portfolios. |

| |||||||||||||||||||||||||||

| INCOME STATEMENT (EUR million) | Q3’19 | Q2’19 | % | 9M’19 | 9M’18 | % | 2018 | |||||||||||||||||||||

Net interest income | 8,806 | 8,954 | (1.7) | 26,442 | 25,280 | 4.6 | 34,341 | |||||||||||||||||||||

Total income | 12,466 | 12,351 | 0.9 | 36,902 | 35,882 | 2.8 | 48,424 | |||||||||||||||||||||

Net operating income | 6,744 | 6,522 | 3.4 | 19,593 | 19,039 | 2.9 | 25,645 | |||||||||||||||||||||

Profit before tax | 2,181 | 2,929 | (25.5) | 8,712 | 10,586 | (17.7) | 14,201 | |||||||||||||||||||||

Attributable profit to the parent | 501 | 1,391 | (64.0) | 3,732 | 5,742 | (35.0) | 7,810 | |||||||||||||||||||||

| Changes in constant euros: Q3’19 / Q2’19: NII: +0.8%; Total income: +3.3%; Net operating income: +5.3%; Attributable profit:-59.0% |

| |||||||||||||||||||||||||||

| 9M’19 / 9M’18: NII: +4.6%; Total income: +3.0%; Net operating income: +3.0%; Attributable profit:-34.7% |

| |||||||||||||||||||||||||||

| UNDERLYING INCOME STATEMENT(1)(EUR million) | Q3’19 | Q2’19 | % | 9M’19 | 9M’18 | % | 2018 | |||||||||||||||||||||

Net interest income | 8,806 | 8,954 | (1.7) | 26,442 | 25,280 | 4.6 | 34,341 | |||||||||||||||||||||

Total income | 12,466 | 12,351 | 0.9 | 36,902 | 35,882 | 2.8 | 48,424 | |||||||||||||||||||||

Net operating income | 6,744 | 6,522 | 3.4 | 19,593 | 19,039 | 2.9 | 25,645 | |||||||||||||||||||||

Profit before tax | 3,844 | 3,895 | (1.3) | 11,423 | 11,230 | 1.7 | 14,776 | |||||||||||||||||||||

Attributable profit to the parent | 2,135 | 2,097 | 1.8 | 6,180 | 6,042 | 2.3 | 8,064 | |||||||||||||||||||||

| Variations in constant euros: Q3’19 / Q2’19: NII: +0.8%; Total income: +3.3%; Net operating income: +5.3%; Attributable profit: +4.0% |

| |||||||||||||||||||||||||||

| 9M’19 / 9M’18: NII: +4.6%; Total income: +3.0%; Net operating income: +3.0%; Attributable profit: +2.7% |

| |||||||||||||||||||||||||||

| EPS, PROFITABILITY AND EFFICIENCY (%) | Q3’19 | Q2’19 | % | 9M’19 | 9M’18 | % | 2018 | |||||||||||||||||||||

EPS (euro) | 0.021 | 0.076 | (72.7) | 0.202 | 0.331 | (39.0) | 0.449 | |||||||||||||||||||||

Underlying EPS (euros)(1) | 0.121 | 0.120 | 1.0 | 0.352 | 0.349 | 0.8 | 0.465 | |||||||||||||||||||||

RoE | 7.02 | 7.79 | 5.90 | 8.20 | 8.21 | |||||||||||||||||||||||

RoTE | 9.86 | 11.02 | 8.33 | 11.69 | 11.70 | |||||||||||||||||||||||

Underlying RoTE(1) | 12.19 | 12.03 | 11.86 | 12.14 | 12.08 | |||||||||||||||||||||||

RoA | 0.56 | 0.63 | 0.50 | 0.65 | 0.64 | |||||||||||||||||||||||

RoRWA | 1.39 | 1.56 | 1.22 | 1.55 | 1.55 | |||||||||||||||||||||||

Underlying RoRWA(1) | 1.65 | 1.67 | 1.63 | 1.60 | 1.59 | |||||||||||||||||||||||

Efficiency ratio | 45.9 | 47.2 | 46.9 | 46.9 | 47.0 | |||||||||||||||||||||||

| SOLVENCY AND NPL RATIOS (%) | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

CET1(2) | 11.30 | 11.30 | 11.30 | 11.11 | 11.30 | |||||||||||||||||||||||

Fully loaded Total ratio(2) | 14.68 | 14.80 | 14.68 | 14.58 | 14.77 | |||||||||||||||||||||||

NPL ratio | 3.47 | 3.51 | 3.47 | 3.87 | 3.73 | |||||||||||||||||||||||

Coverage ratio | 67 | 68 | 67 | 68 | 67 | |||||||||||||||||||||||

| MARKET CAPITALISATION AND SHARES | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

Shares (millions) | 16,618 | 16,237 | 2.3 | 16,618 | 16,136 | 3.0 | 16,237 | |||||||||||||||||||||

Share price (euros) | 3.737 | 4.081 | (8.4) | 3.737 | 4.336 | (13.8) | 3.973 | |||||||||||||||||||||

Market capitalisation (EUR million) | 62,094 | 66,253 | (6.3) | 62,094 | 69,958 | (11.2) | 64,508 | |||||||||||||||||||||

Tangible book value per share (euros) | 4.25 | 4.30 | 4.25 | 4.16 | 4.19 | |||||||||||||||||||||||

Price / Tangible book value per share (X) | 0.88 | 0.95 | 0.88 | 1.04 | 0.95 | |||||||||||||||||||||||

P/E ratio (X) | 13.90 | 11.29 | 13.90 | 9.83 | 8.84 | |||||||||||||||||||||||

| OTHER DATA | Sep-19 | Jun-19 | % | Sep-19 | Sep-18 | % | Dec-18 | |||||||||||||||||||||

Number of shareholders | 4,025,074 | 4,054,208 | (0.7) | 4,025,074 | 4,190,808 | (4.0) | 4,131,489 | |||||||||||||||||||||

Number of employees | 201,017 | 201,804 | (0.4) | 201,017 | 201,101 | (0.0) | 202,713 | |||||||||||||||||||||

Number of branches | 12,691 | 13,081 | (3.0) | 12,691 | 13,414 | (5.4) | 13,217 | |||||||||||||||||||||

(1) In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 and othernon-IFRS measures, including the figures related to “underlying” results, as they are recorded in the separate line of “net capital gains and provisions”, above the line of attributable profit to the parent. Further details are provided on page 12 of this report.

For further details of the APMs andnon-IFRS measures used, including its definition or a reconciliation between any applicable management indicators and the financial

data presented in the consolidated financial statements prepared under IFRS, please see 2018 Annual Financial Report, published in the CNMV on 28 February 2019, our20-F report for the year ending 31 December 2018 registered with the SEC in the United States as well as the “Alternative performance measures” section of the appendix to this report.

(2) 2018 and 2019 data applying the IFRS 9 transitional arrangements. As indicated by the consolidating supervisor apay-out of 50%, the maximum within the target range (40%- 50%), was applied for the calculation of the capital ratios in 2019. Previously, the average cashpay-out for the last three years was considered.

January - September 2019  3

3

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

|

|

|

|

SANTANDER VISION AND CORPORATE CULTURE

| Our success is based on a clear purpose, aim and approach to business. | A digital Santander. To continue growing in a sustainable and profitable way and to accelerate execution, we will remain focused on our digital transformation. | |

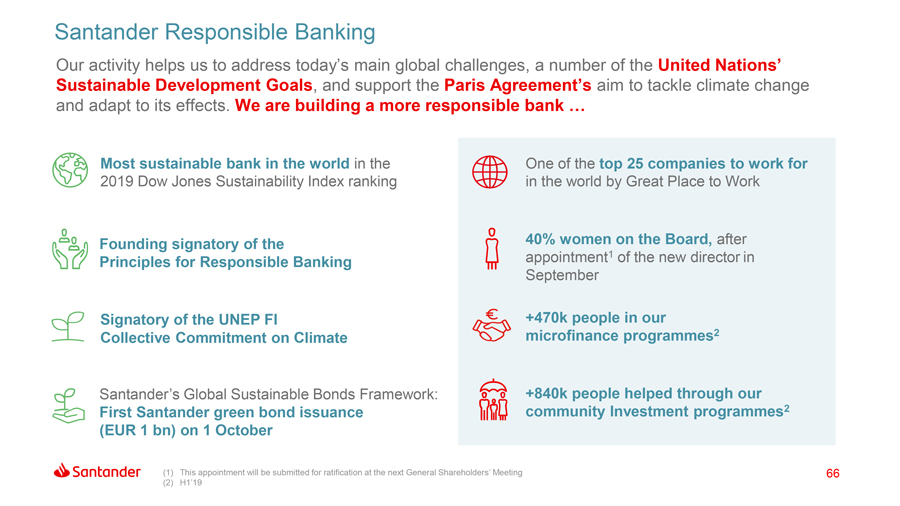

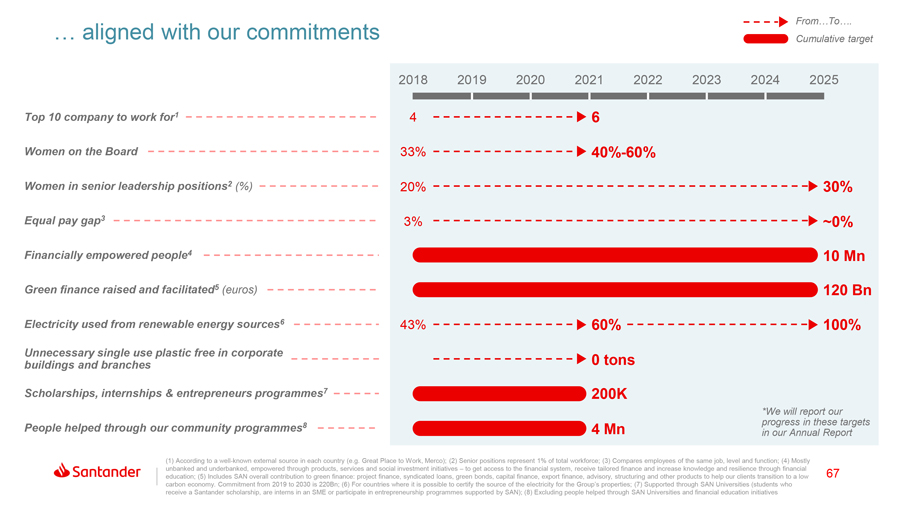

We are building a more responsible bank |

Strong corporate culture.

TheSantander Way is our global culture, fully aligned to our corporate strategy. It includes our purpose, our aim, and how we do business.

4  January - September 2019

January - September 2019

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

|

|

|

|

Generating confidence and operating responsibly, we contribute value to all ourstakeholders

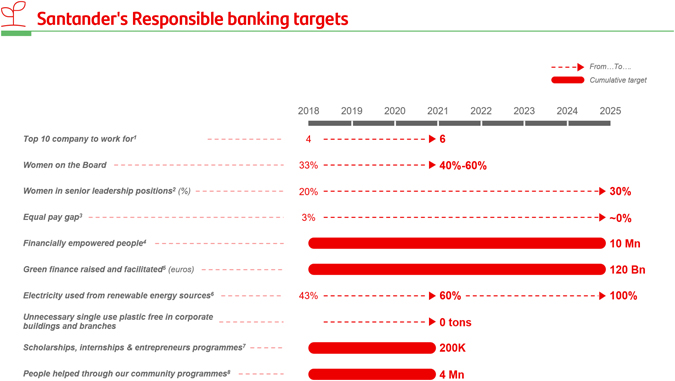

Santander was one of the 25 best companies to work for at the global level, according to the annual ranking by Great Place to Work based on a survey involving more than 8,000 organisations representing 12 million employees from 90 countries. This ranking reflects the effort and progress made on various initiatives across the Group within our human resources strategy, which aims to be a benchmark employer. To this end, we continued to work on strategic levers such as a common culture (The Santander Way), dynamic management of current talent (Workday and global central employee platform) and talent for the future (Strategic Workforce Planning). Customers We continued to focus on improving customer loyalty and experience. Progress was reflected in the increase of 1.8 million loyal customers, greater penetration as a percentage of active customers and 6.1 million more digital customers in the last 12 months. Santander Global Platform continues to advance in rolling out its businesses as scheduled, including: – Openbank will begin to operate in Germany with a fully digital lending proposal (platform and latest generation mobile phones) that will come on stream in the country by the end of the year. – We issued the first bond usingend-to-end blockchain technology, positioning us at the forefront of innovation in capital markets and helping our customers in their digital transformation. We also continued to strengthen our traditional branches and develop new models (SMART, Súper Ágil and Work Café), while investing in new generation ATMs and in contact centres. Shareholders The extraordinary general meeting of shareholders on 23 July approved the capital increase to acquire shares of Santander Mexico from minority interests. The acquisition offer was subscribed by 67% of the targeted shares. As a result, Santander’s stake in Santander México increased from 74.96% to 91.65% . The first interim dividend of EUR 0.10 per share charged to 2019’s earnings will be paid from 1 November. The board also confirmed its intention to maintain a percentage of the underlying attributable profit in 2019 assigned to the dividend(pay-out) of between 40% and 50%, and the proportion of the dividend in cash is at least the same as last year. Santander Shareholder Relations and the Universia Foundation completed the XI edition of scholarships for university students with disabilities who are Santander shareholders or relatives of shareholders, in order to help these university students prosper and to promote their social, academic and work-place inclusion. Community The 2019 Dow Jones Sustainability Index (DJSI) recognised Santander as the world’s most sustainable bank. This is the first time the bank has led the global index and it was the leader in Europe for the second year running. The magazine Fortune also recognised Santander Brasil as the bank that is most changing the world. Santander joined the Collective Commitment to Climate Action together with 30 other banks in order to speed up the financial sector’s transition to a low carbon economy. Banco Santander successfully issued a EUR 1 billion green bond as a starting point for a global plan for sustainable issuances. This issuance falls within the commitment of Responsible Banking to provide more than EUR 120 billion euros in green finance by 2025.

January - September 2019  5

5

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

|

|

|

|

GROUP PERFORMANCE

“Our diversification across Europe and the Americas is one of the defining characteristics that stands Santander apart from our peers. And because of this, we continue to deliver predictable, profitable growth, and a sustainable dividend through the cycle”

“In a slowing economy, we have grown volumes, increased profit in almost all the markets in which we operate, and maintained high returns for our shareholders”

The Group’s strategy is driving growth in loyal and digital customers and is reflected in greater activity in almost all markets

Santander’s strategy continued to focus on boosting the loyalty of our customers. Their number rose again in the third quarter and reached 21 million, 1.8 million more than September 2018 (+10%), with individuals up 10% and companies 5%.

The faster pace of digitalisation is producing notable growth in digital customers, whose number increased by 6.1 million (+20%) in the last 12 months to more than 36 million. There was also strong growth in the number of online and mobile phone accesses in the first nine months to 5,742 million (+27%year-on-year) and in monetary and voluntary transactions to 1,634 million (+25%).

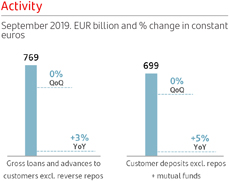

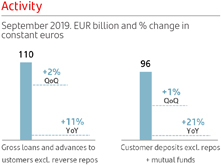

As regards volumes, gross loans and advances to customers (excluding reverse repos) and customer funds were stable in the third quarter, both in euros and in constant euros.

Compared to September 2018 (at constant exchange rates), gross loans and advances to customers (excluding reverse repos) grew 4% and increased in eight of the 10 core markets. Customer funds (+6%year-on-year) rose in nine of them. Growth in demand and time deposits as well as mutual funds.

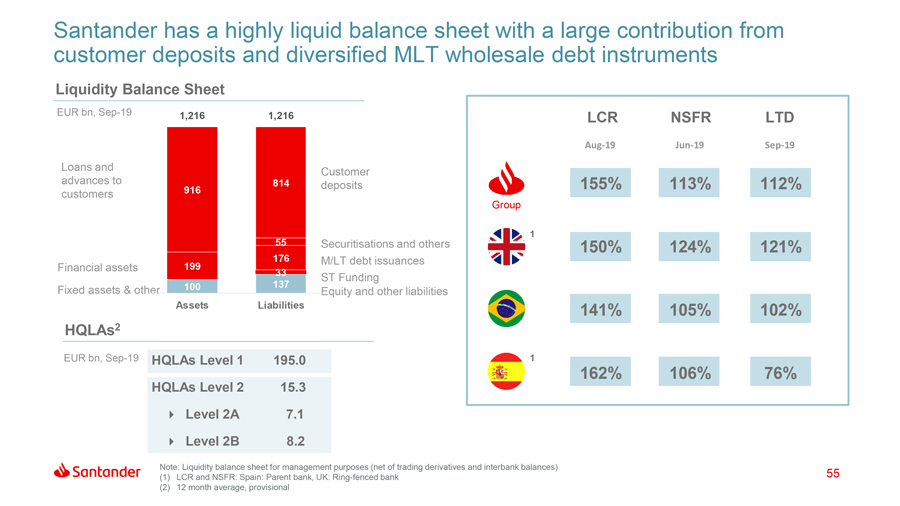

Solid funding structure and liquidity: netloan-to-deposit ratio of 112% (111% in September 2018).

6  January - September 2019

January - September 2019

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

|

|

|

|

GROUP PERFORMANCE

Solid business model based on profitability, efficiency and innovation, which has enabled us to obtain profits on a recurring basis

In a context of lower growth and interest rates, customer revenue remained solid, costs continued to reflect synergies in some countries and provisions increased in line with volumes.

Third quarter attributable profit of EUR 501 million, affected by EUR 1,634 million of net charges, mainly related to the impairment determined by the review of goodwill ascribed to Santander UK (EUR 1,491 million). Excluding these charges, underlying attributable profit was EUR 2,135 million, up 2%quarter-on-quarter and 7% up on the third quarter of 2018 (both 4% higher in constant euros).

Santander is strengthening its capital ratios and improving credit quality while maintaining a high level of profitability

The CET1 ratio stood at 11.30% after organically generating 19 basis points in the third quarter and 48 since the beginning of the year, This, combined with a favourable portfolio evolution, enabled regulatory impacts and restructuring costs to be absorbed(-66 bps).

Net tangible equity per share (TNAV) was EUR 4.25, 2% higher than September 2018. In addition, and in terms of value creation per shareholder, the recording between the two dates of the dividend remuneration should be taken into account. Including it, the TNAV per share increased 8% in the last 12 months (+1% in the quarter).

First nine months attributable profit of EUR 3,732 million, affected by net charges of EUR 2,448 million in capital gains and provisions (see page 12). Excluding them, underlying attributable profit (EUR 6,180 million) was 2% higher (+3% in constant euros), after absorbing the markets’ negative performance, interest rate reduction, higher costs for foreign currency hedging and the impact of implementing IFRS 16. By countries, underlying attributable profit rose in eight of the 10 core markets.

The efficiency ratio improvedquarter-on-quarter and stood below 47%, one of the best among our peers. Underlying RoTE was 11.9% and underlying RoRWA 1.63%.

Credit quality continued to improve: the NPL ratio dropped for the ninth consecutive quarter(-4 bps in the third quarter and-40 bps since September 2018) and coverage remained around 67%.

The cost of credit stood at 1% in September, similar to the previous quarter and to the third quarter of 2018.

January - September 2019  7

7

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Income statement |

|

|

|

GRUPO SANTANDER RESULTS

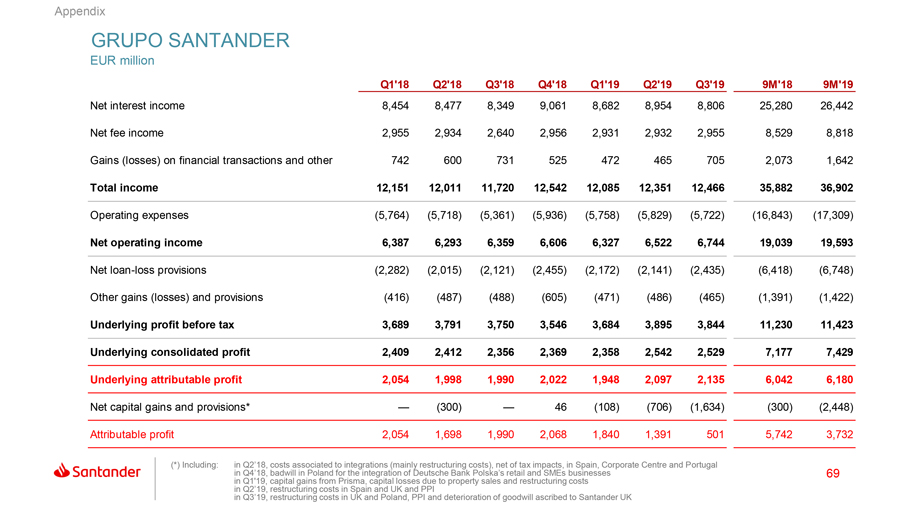

| Third quarter attributable profit to the parent of EUR 501 million, affected by net charges of EUR 1,634 million that are outside the ordinary course performance of our business, mainly the impairment of goodwill ascribed to Santander UK (EUR 1,491 million). Excluding these charges, underlying attributable profit was 2% higher than the second quarter of 2019 and 7% more than the third quarter of 2018 at EUR 2,135 million (+4% in both periods in constant euros).

First nine months attributable profit of EUR 3,732 million, after recording net charges that are outside the ordinary course performance of our business amounting to EUR 2,448 million in 2019 (EUR 300 million in 2018). Excluding these results, the underlying attributable profit was EUR 6,180 million, 2% more than in the same period of 2018 (+3% in constant euros).

At the end of September 2019, the results continued to reflect a solid underlying trend. Customer revenue increased and costs began to show the synergies obtained in various units. The efficiency ratio continued to be one of the best in the sector (46.9%).

In addition, the cost of credit remained at very low levels (1.00%) and profitability ratios were high: underlying RoTE of 11.9% and underlying RoRWA of 1.63%. |

Grupo Santander. Summarised income statement

EUR million

| Change | Change | |||||||||||||||||||||||||||||||

| Q3’19 | Q2’19 | % | % excl. FX | 9M’19 | 9M’18 | % | % excl. FX | |||||||||||||||||||||||||

| Net interest income | 8,806 | 8,954 | (1.7) | 0.8 | 26,442 | 25,280 | 4.6 | 4.6 | ||||||||||||||||||||||||

| Net fee income (commission income minus commission expense) | 2,955 | 2,932 | 0.8 | 3.9 | 8,818 | 8,529 | 3.4 | 4.3 | ||||||||||||||||||||||||

| Gains or losses on financial assets and liabilities and exchange differences (net) | 424 | 234 | 81.2 | 89.0 | 935 | 1,359 | (31.2) | (29.7) | ||||||||||||||||||||||||

| Dividend income | 72 | 295 | (75.6) | (75.4) | 433 | 292 | 48.3 | 48.2 | ||||||||||||||||||||||||

| Share of results of entities accounted for using the equity method | 137 | 153 | (10.5) | (8.0) | 443 | 532 | (16.7) | (15.9) | ||||||||||||||||||||||||

| Other operating income / expenses | 72 | (217) | — | — | (169) | (110) | 53.6 | 188.7 | ||||||||||||||||||||||||

| Total income | 12,466 | 12,351 | 0.9 | 3.3 | 36,902 | 35,882 | 2.8 | 3.0 | ||||||||||||||||||||||||

| Operating expenses | (5,722) | (5,829) | (1.8) | 1.1 | (17,309) | (16,843) | 2.8 | 2.9 | ||||||||||||||||||||||||

Administrative expenses | (4,990) | (5,099) | (2.1) | 0.8 | (15,100) | (15,069) | 0.2 | 0.4 | ||||||||||||||||||||||||

Staff costs | (3,008) | (3,074) | (2.1) | 0.3 | (9,088) | (8,797) | 3.3 | 3.4 | ||||||||||||||||||||||||

Other general administrative expenses | (1,982) | (2,025) | (2.1) | 1.4 | (6,012) | (6,272) | (4.1) | (3.9) | ||||||||||||||||||||||||

Depreciation and amortisation | (732) | (730) | 0.3 | 3.9 | (2,209) | (1,774) | 24.5 | 25.0 | ||||||||||||||||||||||||

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (2,442) | (2,122) | 15.1 | 17.4 | (6,810) | (6,473) | 5.2 | 4.6 | ||||||||||||||||||||||||

o/w: net loan-loss provisions | (2,435) | (2,141) | 13.7 | 16.0 | (6,748) | (6,418) | 5.1 | 4.5 | ||||||||||||||||||||||||

| Impairment on other assets (net) | (1,520) | (7) | — | — | (1,547) | (121) | — | — | ||||||||||||||||||||||||

| Provisions or reversal of provisions | (595) | (1,451) | (59.0) | (58.5) | (2,511) | (1,725) | 45.6 | 46.5 | ||||||||||||||||||||||||

| Gain or losses onnon-financial assets and investments, net | 3 | 31 | (90.3) | (90.3) | 253 | 24 | — | — | ||||||||||||||||||||||||

| Negative goodwill recognised in results | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Gains or losses onnon-current assets held for sale not classified as discontinued operations | (9) | (44) | (79.5) | (77.8) | (266) | (158) | 68.4 | 67.5 | ||||||||||||||||||||||||

| Profit or loss before tax from continuing operations | 2,181 | 2,929 | (25.5) | (21.7) | 8,712 | 10,586 | (17.7) | (17.3) | ||||||||||||||||||||||||

| Tax expense or income from continuing operations | (1,291) | (1,092) | 18.2 | 21.7 | (3,740) | (3,709) | 0.8 | 1.7 | ||||||||||||||||||||||||

| Profit from the period from continuing operations | 890 | 1,837 | (51.6) | (47.6) | 4,972 | 6,877 | (27.7) | (27.5) | ||||||||||||||||||||||||

| Profit or loss after tax from discontinued operations | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

| Profit for the period | 890 | 1,837 | (51.6) | (47.6) | 4,972 | 6,877 | (27.7) | (27.5) | ||||||||||||||||||||||||

| Attributable profit tonon-controlling interests | (389) | (446) | (12.8) | (12.3) | (1,240) | (1,135) | 9.3 | 8.4 | ||||||||||||||||||||||||

| Attributable profit to the parent | 501 | 1,391 | (64.0) | (59.0) | 3,732 | 5,742 | (35.0) | (34.7) | ||||||||||||||||||||||||

| EPS (euros) | 0.021 | 0.076 | (72.7) | 0.202 | 0.331 | (39.0) | ||||||||||||||||||||||||||

| Diluted EPS (euros) | 0.021 | 0.076 | (72.7) | 0.201 | 0.330 | (39.0) | ||||||||||||||||||||||||||

| Memorandum items: | ||||||||||||||||||||||||||||||||

Average total assets | 1,515,606 | 1,500,703 | 1.0 | 1,500,101 | 1,436,286 | 4.4 | ||||||||||||||||||||||||||

Average stockholders’ equity | 98,445 | 98,659 | (0.2) | 98,249 | 94,615 | 3.8 | ||||||||||||||||||||||||||

8  January - September 2019

January - September 2019

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Income statement |

|

|

|

Evolution of results compared to the first nine months of 2018

Evolution of results compared to the first nine months of 2018

The underlying trends of the P&L remained solid compared to the first nine months of 2018, with customer revenue growing, both net interest income and net fee income, costs reflecting the synergies obtained in various units and a cost of credit remained close to historically low levels.

This good performance, however, is not fully reflected in the attributable profit to the parent because of the recording of a net negative amount of EUR 2,448 million for charges that are outside the ordinary course performance of our business, mainly from the revision of the goodwill ascribed to the UK (EUR-1,491 million), and which have no impact on capital ratios, and restructuring costs for ongoing integrations (EUR-724 million), as set out on page 12 of this report. In addition, the comparison is also affected by the markets’ negative performance, interest rate reduction, higher costs for foreign currency hedging and the impact of implementing IFRS 16.

This performance is explained in detail below:

Revenue

Revenue

| • | Our revenue structure, where net interest income and net fee income generate more than 95% of total income in 2019, well above the average of our competitors, enables us to grow consistently, limiting the impact that bouts of high volatility could have on our results from financial operations. Total income grew 3% in euros and without the FX impact, with eight of the 10 core markets growing. By lines: |

| – | Net interest income rose 5%. Excluding the FX impact, growth was also 5% due to greater lending and deposits, mainly in developing countries, and management of spreads in a lower interest rate environment in many countries in the last 12 months, with particularly low levels in Europe. There was also a negative impact of EUR 208 million from IFRS 16 application. |

By markets, the main rises in local currency terms were in Mexico, Uruguay, Poland and Argentina, which increased at double-digit rates, and Brazil and the US, which grew by around 6%. Falls in the UK affected by the pressure of spreads in new mortgage loans and SVR balances (Standard Variable Rate); in Spain and Portugal, due to low interest rates, reduced volumes and the impact of ALCO portfolio sales; and Chile because of lower inflation. |

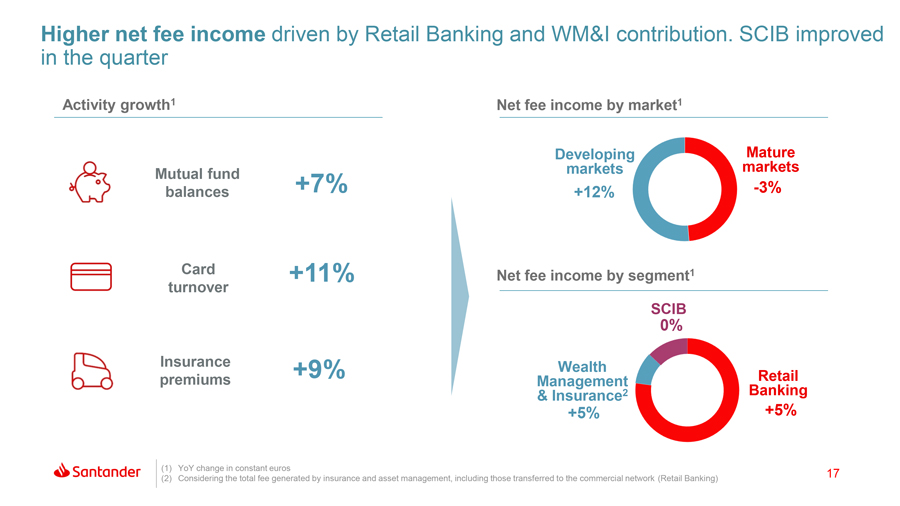

| – | Net fee income rose 3%. The increase without the FX impact was 4%, reflecting the greater customer loyalty combined with the growth strategy in higher value-added services and products. Of note was the growth in the most transactional businesses from cards, insurance, foreign currency and cheques and transfers. On the other hand, decline in net fee income from advising operations and guarantees, affected by reduced activity in the markets. |

| – | Gains on financial transactions and other operating income (dividends, equity method income and others), which accounted for less than 5% of total income, fell 21% compared to 2018 when the first quarter of that year was very good in the markets, combined with a higher cost of foreign currency hedging this year. |

January - September 2019  9

9

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Income statement |

|

|

|

Costs

Costs

| • | Costs grew 3% in euros and without the FX impact, as a result of investments in transformation and digitalisation, the improvements made to the distribution networks, the slight perimeter impact from the integration of the retail and SME businesses acquired from Deutsche Bank Polska and the impact on Argentina of high inflation. |

| • | In real terms (excluding inflation), costs were 1% lower excluding the FX impact. The Group’s aim is to improve our operational capacity and at the same time manage our costs more efficiently adapted to each area, via an exemplary execution of the integrations currently underway and fostering the use of shared services, mainly in Europe, where costs are beginning to reflect the first synergies of integrations, and fell 2.5% in real terms. Of note was the decrease in Spain(-8%) and to a lesser extent, the UK(-3%) and Portugal(-4%). Of note among other countries were Brazil and Chile with flat costs in real terms, despite the ongoing investment to improve the distribution capacity. |

The efficiency ratio continued to be a reference in the sector at 46.9%, virtually unchanged from the first nine months of 2018.

Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net)

Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net)

| • | The impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) amounted to EUR 6,810 million, 5% moreyear-on-year both in euros and without the FX impact. |

| • | As part of this item, loan-loss provisions were 5% higher in both euros and without the FX impact. By markets, Mexico, Portugal and Chile fell, while those that increased are linked mainly to countries with stronger growth in volumes. |

| • | The cost of credit remained stable (0.98% in September 2018 and 1.00% in September 2019). Inyear-on-year terms all main units improved or remained stable, except for the US and Argentina. |

Impairment on other assets (net)

Impairment on other assets (net)

| • | The impairment on other assets (net) was EUR 1,547 million (EUR 121 million in the same period of 2018), impacted by the impairment of goodwill ascribed to the UK of EUR 1,491 million. |

10  January - September 2019

January - September 2019

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Income Statement |

|

|

|

Provisions or reversal of provisions

Provisions or reversal of provisions

| • | Provisions (net of reversal of provisions) amounted to EUR 2,511 million in the first nine months of 2019 (EUR 1,725 million in the same period of 2018). The increase was mainly due to restructuring charges in Spain, the UK and Poland, which are set out on page 12 of this report. |

Gains or losses onnon-financial assets and investments (net)

Gains or losses onnon-financial assets and investments (net)

| • | This item reflects a profit of EUR 253 million in 2019 (EUR 24 million in the first nine months of 2018). The increase was mainly due to the recording of capital gains from the sale of 51% our stake in Prisma Medios de Pago S.A. and the revaluation of the rest of the stake (49%), with a positive net tax impact in the first nine months of 2019 of EUR 130 million. |

Gains or losses onnon-current assets held for sale not classified as discontinued operations

Gains or losses onnon-current assets held for sale not classified as discontinued operations

| • | This item, which mainly includes the sale and deterioration of foreclosed assets, recorded a loss of EUR 266 million in the first nine months of the year (EUR-158 million in the same period of 2018). The difference was mainly due to the recording of capital losses from the sale of a portfolio of real estate assets in the first quarter of 2019. |

Profit before tax

Profit before tax

| • | First nine months profit before tax was EUR 8,712 million, 18% loweryear-on-year. Excluding the FX impact, the fall was 17%, largely due to thenon-recurring charges already mentioned. |

Income tax

Income tax

| • | Income tax was EUR 3,740 million, in line with the same period of 2018. |

Attributable profit tonon-controlling interests

Attributable profit tonon-controlling interests

| • | This amounted to EUR 1,240 million, 9% moreyear-on-year. Excluding the FX impact, it was 8% higher, mainly due to Brazil, the US and Santander Consumer Finance. The acquisition of minority interests in Mexico had a favourable impact of only one month (around EUR 10 million) but will fully impact the fourth quarter. |

Attributable profit to the parent

Attributable profit to the parent

| • | Profit attributed to the parent was EUR 3,732 million, 35% less than in the first nine months of 2018, both in euros and excluding the FX impact. |

| • | RoE was 5.9%, RoTE 8.3% and RoRWA 1.22% (8.2%, 11.7% and 1.55%, respectively, in the first nine months of 2018). Earnings per share were EUR 0.202 (EUR 0.331 in the first nine months of 2018). |

January - September 2019  11

11

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Income statement |

|

|

|

Underlying attributable profit to the parent

Underlying attributable profit to the parent

| • | Profit attributed to the parent was affected in 2019 and 2018 by the following net results, which are outside the ordinary course performance of our business and which distortyear-on-year comparisons: |

First nine months of 2019:

| 1. | As part of our annual planning and in accordance with accounting rules, we reviewed the goodwill ascribed to Santander UK, which resulted in the recording of an impairment of EUR 1,491 million in the third quarter at the Corporate Centre. |

| 2. | Restructuring costs in Spain under the plan for integrating the commercial networks of Banco Popular for a net amount of EUR 600 million, materialised in the second quarter. |

| 3. | Net charges in the UK of EUR 287 million were recorded, of which EUR 104 million were restructuring costs related to the optimisation plan (EUR 66 million in the first quarter, EUR 26 million in the second and EUR 12 million in the third) and EUR 183 million for PPI provisions (EUR 80 million in the second quarter and EUR 103 million in the third). |

| 4. | Net capital losses of EUR 180 million for the sale of real estate assets in the first quarter. |

| 5. | We also recorded restructuring costs of EUR 20 million for the integration process in Poland (EUR 12 million in the first quarter and EUR 8 million in the third). |

| 6. | Lastly, capital gains from the sale of 51% of our stake in the Argentinian entity Prisma Medios de Pago S.A. and the revaluation of the remaining 49%, generating a capital gain of EUR 130 million (EUR 150 million in the first quarter and an adjustment of EUR-20 million in the third because of the peso’s depreciation). |

First nine months 2018

| 1. | Positive results from the integration in Portugal (EUR 20 million), recorded in the second quarter. |

| 2. | Charges for restructuring costs: EUR 280 million in Spain and EUR 40 million in the Corporate Centre, both related to Popular’s integration, recorded in the second quarter. |

Excluding these results from the various P&L lines where they are recorded, and incorporating them separately in the line ‘net capital gains and provisions’,underlying attributable profit to the parent was EUR 6,180 million in the first nine months of 2019, 3% higheryear-on-year without the FX impact.

Eight of the 10 core markets increased in their local currencies, and at double digit rates in Brazil, Mexico, the US, Portugal and Argentina.

The only decrease was in the UK, mainly because of competitive pressure on revenue.

As a result, the Group’s underlying RoTE was 11.9%, the underlying RoRWA 1.63% and underlying earnings per share EUR 0.352 (EUR 0.349 in the first nine months of 2018).

Summarised underlying income statement (EUR million)

| Change | Change | |||||||||||||||||||||||||||||||

| Q3’19 | Q2’19 | % | % excl. FX | 9M’19 | 9M’18 | % | % excl. FX | |||||||||||||||||||||||||

Net interest income | 8,806 | 8,954 | (1.7) | 0.8 | 26,442 | 25,280 | 4.6 | 4.6 | ||||||||||||||||||||||||

Net fee income | 2,955 | 2,932 | 0.8 | 3.9 | 8,818 | 8,529 | 3.4 | 4.3 | ||||||||||||||||||||||||

Gains (losses) on financial transactions(1) | 424 | 234 | 81.2 | 89.0 | 935 | 1,359 | (31.2) | (29.7) | ||||||||||||||||||||||||

Other operating income | 281 | 231 | 21.6 | 7.7 | 707 | 714 | (1.0) | (7.0) | ||||||||||||||||||||||||

Total income | 12,466 | 12,351 | 0.9 | 3.3 | 36,902 | 35,882 | 2.8 | 3.0 | ||||||||||||||||||||||||

Administrative expenses and amortisations | (5,722) | (5,829) | (1.8) | 1.1 | (17,309) | (16,843) | 2.8 | 2.9 | ||||||||||||||||||||||||

Net operating income | 6,744 | 6,522 | 3.4 | 5.3 | 19,593 | 19,039 | 2.9 | 3.0 | ||||||||||||||||||||||||

Net loan-loss provisions | (2,435) | (2,141) | 13.7 | 16.0 | (6,748) | (6,418) | 5.1 | 4.5 | ||||||||||||||||||||||||

Other gains (losses) and provisions | (465) | (486) | (4.3) | (3.4) | (1,422) | (1,391) | 2.2 | 3.3 | ||||||||||||||||||||||||

Profit before tax | 3,844 | 3,895 | (1.3) | 0.5 | 11,423 | 11,230 | 1.7 | 2.1 | ||||||||||||||||||||||||

Tax on profit | (1,315) | (1,353) | (2.8) | (1.1) | (3,994) | (4,053) | (1.5) | (0.7) | ||||||||||||||||||||||||

Profit from continuing operations | 2,529 | 2,542 | (0.5) | 1.3 | 7,429 | 7,177 | 3.5 | 3.7 | ||||||||||||||||||||||||

Net profit from discontinued operations | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||

Consolidated profit | 2,529 | 2,542 | (0.5) | 1.3 | 7,429 | 7,177 | 3.5 | 3.7 | ||||||||||||||||||||||||

Non-controlling interests | (394) | (445) | (11.5) | (11.1) | (1,249) | (1,135) | 10.0 | 9.3 | ||||||||||||||||||||||||

Underlying attributable profit to the parent | 2,135 | 2,097 | 1.8 | 4.0 | 6,180 | 6,042 | 2.3 | 2.7 | ||||||||||||||||||||||||

Net capital gains and provisions | (1,634) | (706) | 131.4 | 127.8 | (2,448) | (300) | 716.0 | 716.0 | ||||||||||||||||||||||||

Attributable profit to the parent | 501 | 1,391 | (64.0) | (59.0) | 3,732 | 5,742 | (35.0) | (34.7) | ||||||||||||||||||||||||

(1) Includes exchange differences.

12  January - September 2019

January - September 2019

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Income statement |

|

|

|

Third quarter results compared to the second quarter of 2019

Third quarter results compared to the second quarter of 2019

The third quarter’s attributable profit to the parent is very conditioned by those amounts that are outside the ordinary course performance of our business, which are explained in previous pages.

Excluding these results, underlying attributable profit to the parent was 2% higherquarter-on-quarter in euros and 4% higher without the FX impact, as follows:

•Total incomeincreased 3% due to growth in customer revenue in most of the markets.

| – | This was due to the recovery in net fee income (+4%), following a good performance in South America, notably in Brazil, and wholesale business. Net interest income was 1% higher, absorbing the further falls in interest rates. |

| – | Gains on financial transactions and other operating income increased after recording in the second quarter the contribution to the Single Resolution Fund and higher income in the third quarter from portfolio sales. |

| • | Operating expenses rose 1% driven by North America and South America (partly due to high inflation in Argentina and the salary review in Brazil), while they continued to fall in Europe, mainly in Spain and Santander Consumer Finance. |

| • | Loan-loss provisions rose 16% as they normalised following a second quarter when they were low due to the seasonality of SC USA and SCF’s portfolio sales. |

January - September 2019  13

13

Responsible banking | ||||||||||||||||

Santander vision and | Group financial | Financial information | Corporate governance | |||||||||||||

corporate culture |

| information |

| by segments |

| Santander share |

| Appendix | ||||||||

|

Balance sheet |

|

|

|

Grupo Santander. Condensed balance sheet

EUR million

| ||||||||||||||||||||

| Assets | Sep-19 | Sep-18 | Absolute change | % | Dec-18 | |||||||||||||||

| Cash, cash balances at central banks and other demand deposits | 92,601 | 111,704 | (19,103) | (17.1) | 113,663 | |||||||||||||||

| Financial assets held for trading | 115,884 | 98,448 | 17,436 | 17.7 | 92,879 | |||||||||||||||

Debt securities | 36,172 | 28,230 | 7,942 | 28.1 | 27,800 | |||||||||||||||

Equity instruments | 10,559 | 17,239 | (6,680) | (38.7) | 8,938 | |||||||||||||||

Loans and advances to customers | 480 | 239 | 241 | 100.8 | 202 | |||||||||||||||

Loans and advances to central banks and credit institutions | — | 63 | (63) | (100.0) | — | |||||||||||||||

Derivatives | 68,673 | 52,677 | 15,996 | 30.4 | 55,939 | |||||||||||||||

| Financial assets designated at fair value through profit or loss | 71,940 | 70,573 | 1,367 | 1.9 | 68,190 | |||||||||||||||

Loans and advances to customers | 24,705 | 24,318 | 387 | 1.6 | 23,796 | |||||||||||||||

Loans and advances to central banks and credit institutions | 39,037 | 37,401 | 1,636 | 4.4 | 32,325 | |||||||||||||||

Other (debt securities an equity instruments) | 8,198 | 8,854 | (656) | (7.4) | 12,069 | |||||||||||||||

| Financial assets at fair value through other comprehensive income | 120,659 | 116,356 | 4,303 | 3.7 | 121,091 | |||||||||||||||

Debt securities | 113,625 | 112,288 | 1,337 | 1.2 | 116,819 | |||||||||||||||

Equity instruments | 2,695 | 2,771 | (76) | (2.7) | 2,671 | |||||||||||||||

Loans and advances to customers | 4,298 | 1,297 | 3,001 | 231.4 | 1,601 | |||||||||||||||

Loans and advances to central banks and credit institutions | 41 | — | 41 | — | — | |||||||||||||||

| Financial assets measured at amortised cost | 987,750 | 931,411 | 56,339 | 6.0 | 946,099 | |||||||||||||||

Debt securities | 39,850 | 40,089 | (239) | (0.6) | 37,696 | |||||||||||||||

Loans and advances to customers | 886,520 | 840,373 | 46,147 | 5.5 | 857,322 | |||||||||||||||

Loans and advances to central banks and credit institutions | 61,380 | 50,949 | 10,431 | 20.5 | 51,081 | |||||||||||||||

| Investments in subsidiaries, joint ventures and associates | 8,346 | 9,371 | (1,025) | (10.9) | 7,588 | |||||||||||||||

| Tangible assets | 35,399 | 24,727 | 10,672 | 43.2 | 26,157 | |||||||||||||||

| Intangible assets | 27,383 | 27,855 | (472) | (1.7) | 28,560 | |||||||||||||||

Goodwill | 24,109 | 24,956 | (847) | (3.4) | 25,466 | |||||||||||||||

Other intangible assets | 3,274 | 2,899 | 375 | 12.9 | 3,094 | |||||||||||||||

| Other assets | 57,923 | 54,242 | 3,681 | 6.8 | 55,044 | |||||||||||||||

| Total assets | 1,517,885 | 1,444,687 | 73,198 | 5.1 | 1,459,271 | |||||||||||||||

| Liabilities and shareholders’ equity | ||||||||||||||||||||

| Financial liabilities held for trading | 85,797 | 66,805 | 18,992 | 28.4 | 70,343 | |||||||||||||||

Customer deposits | — | — | — | — | — | |||||||||||||||

Debt securities issued | — | — | — | — | — | |||||||||||||||

Deposits by central banks and credit institutions | — | — | — | — | — | |||||||||||||||

Derivatives | 70,119 | 51,775 | 18,344 | 35.4 | 55,341 | |||||||||||||||

Other | 15,678 | 15,030 | 648 | 4.3 | 15,002 | |||||||||||||||

| Financial liabilities designated at fair value through profit or loss | 68,263 | 92,182 | (23,919) | (25.9) | 68,058 | |||||||||||||||

Customer deposits | 42,417 | 55,154 | (12,737) | (23.1) | 39,597 | |||||||||||||||

Debt securities issued | 3,648 | 2,323 | 1,325 | 57.0 | 2,305 | |||||||||||||||

Deposits by central banks and credit institutions | 22,073 | 34,293 | (12,220) | (35.6) | 25,707 | |||||||||||||||

Other | 125 | 412 | (287) | (69.7) | 449 | |||||||||||||||

| Financial liabilities measured at amortized cost | 1,211,114 | 1,139,066 | 72,048 | 6.3 | 1,171,630 | |||||||||||||||

Customer deposits | 771,868 | 723,597 | 48,271 | 6.7 | 740,899 | |||||||||||||||

Debt securities issued | 254,638 | 231,708 | 22,930 | 9.9 | 244,314 | |||||||||||||||

Deposits by central banks and credit institutions | 151,674 | 155,446 | (3,772) | (2.4) | 162,202 | |||||||||||||||

Other | 32,934 | 28,315 | 4,619 | 16.3 | 24,215 | |||||||||||||||

| Liabilities under insurance contracts | 731 | 810 | (79) | (9.8) | 765 | |||||||||||||||

| Provisions | 14,364 | 13,269 | 1,095 | 8.3 | 13,225 | |||||||||||||||

| Other liabilities | 29,090 | 26,887 | 2,203 | 8.2 | 27,889 | |||||||||||||||

| Total liabilities | 1,409,359 | 1,339,019 | 70,340 | 5.3 | 1,351,910 | |||||||||||||||

| Shareholders’ equity | 119,543 | 119,793 | (250) | (0.2) | 118,613 | |||||||||||||||

Capital stock | 8,309 | 8,068 | 241 | 3.0 | 8,118 | |||||||||||||||

Reserves | 109,164 | 107,032 | 2,132 | 2.0 | 104,922 | |||||||||||||||

Attributable profit to the Group | 3,732 | 5,742 | (2,010) | (35.0) | 7,810 | |||||||||||||||

Less: dividends | (1,662) | (1,049) | (613) | 58.4 | (2,237) | |||||||||||||||

| Other comprehensive income | (21,596) | (24,816) | 3,220 | (13.0) | (22,141) | |||||||||||||||

| Minority interests | 10,579 | 10,691 | (112) | (1.0) | 10,889 | |||||||||||||||

| Total equity | 108,526 | 105,668 | 2,858 | 2.7 | 107,361 | |||||||||||||||

| Total liabilities and equity | 1,517,885 | 1,444,687 | 73,198 | 5.1 | 1,459,271 | |||||||||||||||

14  January - September 2019

January - September 2019

Responsible banking | ||||||||||||||||