Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-238243

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Supplement dated May 16, 2022

PRELIMINARY PROSPECTUS SUPPLEMENT

(to prospectus dated May 14, 2020)

Banco Santander, S.A.

$ % Senior Preferred Fixed Rate Notes due 20

$ Senior Preferred Floating Rate Notes due 20

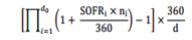

We are offering $ principal amount of % Senior Preferred Fixed Rate Notes due 20 (the “ Fixed Rate Notes”) and $ principal amount of Senior Preferred Floating Rate Notes due 20 (the “Floating Rate Notes” and together with the Fixed Rate Notes, the “Notes”). From and including the date of issuance, interest will be payable semi-annually in arrears on the on the Fixed Rate Notes on May and November of each year, beginning on November , 2022. From and including the date of issuance, interest will be payable quarterly in arrears on the Floating Rate Notes on February , May , August , and November of each year, beginning on August , 2022. The Notes will be due on May , 20 .

The Notes will be issued in minimum denominations of $200,000 and integral multiples of $200,000 in excess thereof.

The payment obligations of Banco Santander, S.A. (“Banco Santander”) under the Notes on account of principal constitute direct, unconditional, unsubordinated and unsecured obligations (créditos ordinarios) of Banco Santander and, upon the insolvency of Banco Santander (but subject to any other ranking that may apply as a result of any mandatory provision of law (or otherwise)), such payment obligations in respect of principal rank (i) pari passu among themselves and with any Senior Higher Priority Liabilities (as defined herein) and (ii) senior to (x) any Senior Non Preferred Liabilities (as defined herein) and (y) any present and future subordinated obligations (créditos subordinados) of Banco Santander in accordance with Article 281 of the Spanish Insolvency Law (as defined herein).

By its acquisition of the Notes, each holder (which, for the purposes of this clause, includes each holder of a beneficial interest in the Notes) acknowledges, accepts, consents to and agrees to be bound by the terms of the Notes related to the exercise of the Bail-in Power (as defined herein) set forth under “Description of Debt Securities—Agreement and Acknowledgement with Respect to the Exercise of the Bail-in Power” in the accompanying prospectus. See “Notice to Investors” on page S-i of this prospectus supplement for further information.

The Notes are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency of the Kingdom of Spain, the United States or any other jurisdiction.

We may redeem the Notes, in whole but not in part, at 100% of their principal amount plus accrued and unpaid interest (if any) at any time upon the occurrence of certain tax events. We may not redeem the Notes under other circumstances, and there are no put rights with respect to the Notes.

We intend to apply to list the Notes on the New York Stock Exchange in accordance with its rules.

Investing in the Notes involves risks. See “Risk Factors” beginning on page S-12 of this prospectus supplement, page 3 of the accompanying prospectus as well as those discussed under the heading “Risk Factors” in the Group’s Annual Report on Form 20-F for the year ended December 31, 2021, which is incorporated by reference herein.

The Notes are not intended to be offered, sold or otherwise made available and should not be offered, sold or otherwise made available to retail clients (as defined in Directive 2014/65/EU of the European Parliament and of the Council on Markets in Financial Instruments (“MiFID II”) and Regulation (EU) No 2017/565 as it forms part of the domestic law by virtue of the European Union (Withdrawal) Act of 2018 (“EUWA”)) in the European Economic Area or in the United Kingdom. Prospective investors are referred to the section headed “Important Information” on page S-iv of this prospectus supplement.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | | |

| | | Price to Public | | | Underwriting

Discount | | | Proceeds to us

(before expenses) | |

Per Fixed Rate Note | | | | % | | | | % | | | | % |

| | | | | | | | | | | | |

Total Fixed Rate Notes | | $ | | | | $ | | | | $ | | |

| | | | | | | | | | | | |

Per Floating Rate Note | | | | % | | | | % | | | | % |

| | | | | | | | | | | | |

Total Floating Rate Notes | | $ | | | | $ | | | | $ | | |

| | | | | | | | | | | | |

Total | | | | | | | | | | | | |

| | | | | | | | | | | | |

The initial public offering price set forth above does not include accrued interest, if any. Interest on the Notes will accrue from the expected date of issuance, which is May , 2022. See “Underwriting (Conflicts of Interest).”

We expect that the Notes will be ready for delivery through the book-entry facilities of The Depository Trust Company (“DTC”) and its direct and indirect participants, including Clearstream Banking, société anonyme (“Clearstream Luxembourg”) and Euroclear Bank SA/NV (“Euroclear”) on or about May , 2022, which will be the New York business day following the pricing of the Notes (such settlement period being referred to as “T+ ”). Beneficial interests in the Notes will be shown on, and transfers thereof will be effected only through, records maintained by DTC and its participants.

Joint Bookrunners

| | | | | | | | | | |

| Barclays | | Goldman Sachs Bank Europe SE | | RBC Capital Markets | | Santander | | TD Securities | | Wells Fargo Securities |

Prospectus Supplement dated , 2022