SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| |

(Mark One) |

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018 |

OR |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-12518

BANCO SANTANDER, S.A.

(Exact name of Registrant as specified in its charter)

Kingdom of Spain

(Jurisdiction of incorporation)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid), Spain

(address of principal executive offices)

José G. Cantera

Banco Santander, S.A.

Ciudad Grupo Santander - 28660 Boadilla del Monte Madrid, Spain

Tel: +34 91 289 32 80 Fax: +34 91 257 12 82

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act

| |

Title of each class | Name of each exchange on which registered |

American Depositary Shares, each representing the right to receive one Share of Capital Stock of Banco Santander, S.A., par value euro 0.50 each | New York Stock Exchange |

Shares of Capital Stock of Banco Santander, S.A., par value euro 0.50 each | New York Stock Exchange * |

Non-cumulative Preferred Stock Series 6 | New York Stock Exchange |

5.179% Fixed Rate Subordinated Debt Securities due 2025 | New York Stock Exchange |

Senior Non Preferred Floating Rate Notes due 2023 | New York Stock Exchange |

3.500% Second Ranking Senior Debt Securities due 2022 | New York Stock Exchange |

4.250% Second Ranking Senior Debt Securities due 2027 | New York Stock Exchange |

Second Ranking Senior Floating Rate Notes due 2022 | New York Stock Exchange |

3.125% Senior Non Preferred Fixed Rate Notes due 2023 | New York Stock Exchange |

3.800% Senior Non Preferred Fixed Rate Notes due 2028 | New York Stock Exchange |

*Banco Santander Shares are not listed for trading, but are only listed in connection with the registration of the American Depositary Shares, pursuant to requirements of the New York Stock Exchange.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None.

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ |

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | |

U.S. GAAP ☐ | International Financial Reporting Standards as issued by the | Other ☐ |

| International Accounting Standards Board ☒ | |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by the annual report. 16,236,573,942 shares

BANCO SANTANDER, S.A.

This annual report on Form 20-F for the year ended 31 December 2018, includes three parts: (i) our Consolidated Directors’ Report, (ii) our consolidated financial statements and (iii) supplemental information for U.S. investors. Set forth below is a table listing the required items for Form 20-F and the location where the relevant disclosure in this annual report can be found.

CROSS REFERENCE TO FORM 20-F

BANCO SANTANDER, S.A.

________________________

TABLE OF CONTENTS

Part 1. Consolidated

directors’ report

2018 consolidated directors’ report

This report has been approved unanimously by our board of directors on 26 February 2019.

Our new approach to this document

The presentation of our consolidated directors’ report has been improved to provide in a single, streamlined document the contents of several documents that were previously published separately and will no longer be prepared but as sections of the consolidated directors’ report. In particular, in 2017, the contents now included in this report were spread in the following documents:

2017 documents now included in the consolidated directors’ report

| | |

Annual report Consolidated directors’ report Annual corporate governance report (CNMV format document) Report of the board committees Sustainability report Annual report on our directors’ remuneration (CNMV format document) | | The new format allows a clearer presentation of the information and, therefore, of understanding, avoids repetition and, at the same time, enhances the level of disclosure rather than reducing it. The 2018 consolidated directors’ report includes all the information requirements to comply with Spanish Law 11/2018 on non-financial information and diversity under the chapters Santander vision and Responsible banking. |

| |

Non-IFRS and alternative performance measures

In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this consolidated directors’ report contains financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 and other non-IFRS measures.

The financial measures contained in this consolidated directors’ report that qualify as APMs and non-IFRS measures have been calculated using the financial information from Santander Group but are not defined or detailed in the applicable financial reporting framework and have neither been audited nor reviewed by our auditors.

We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs and non-IFRS measures to be useful metrics for management and investors to facilitate operating performance comparisons from period to period. While we believe that these APMs and non-IFRS measures are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute of IFRS measures. In addition, other companies, including companies in our industry, may calculate or use such measures differently, which reduces their usefulness as comparative measures.

Section 8 of the Economic and financial review provides further information about those APMs and non-IFRS measures.

Forward-looking statements

Santander cautions that this annual report contains statements that constitute “forward-looking statements” within the meaning of the US Private Securities Litigation Reform Act of 1995. Forward- looking statements may be identified by words such as ‘expect’, ‘project’, ‘anticipate’, ‘should’, ‘intend’, ‘probability’, ‘risk’, ‘target’, ‘goal’, ‘objective’, ‘estimate’, ‘future’ and similar expressions. These forward-looking statements are found in various places throughout this annual report and include, without limitation, statements concerning our future business development and economic performance and our shareholder remuneration policy. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations.

The following important factors, in addition to those discussed elsewhere in this consolidated financial statements, could affect our future results and could cause outcomes to differ materially from those anticipated in any forward-looking statement: (1) general economic or industry conditions in areas in which we have significant business activities or investments, including a worsening of the economic environment, increasing in the volatility of the capital markets, inflation or deflation, and changes in demographics, consumer spending, investment or saving habits; (2) exposure to various types of market risks, principally including interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices; (3) potential losses associated with prepayment of our loan and investment portfolio, declines in the value of collateral securing our loan portfolio, and counterparty risk; (4) political stability in Spain, the UK, other European countries, Latin America and the US; (5) changes in laws, regulations or taxes, including changes in regulatory capital and liquidity requirements, including as a result of the UK exiting the European Union and increased regulation in light of the global financial crisis; (6) our ability to integrate successfully our acquisitions and the challenges inherent in diverting management’s focus and resources from other strategic opportunities and from operational matters while we integrate these acquisitions; and (7) changes in our ability to access liquidity and funding on acceptable terms, including as a result of changes in our credit spreads or a downgrade in our credit ratings or those of our more significant subsidiaries.

Numerous factors could affect the future results of Santander and could result in those results deviating materially from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements.

Forward-looking statements speak only as of the date of this annual report and are based on the knowledge, information available and views taken on such date; such knowledge, information and views may change at any time. Santander does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Historical performance is not indicative of future results

Statements as to historical performance or fincial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior period. Nothing in this annual report should be construed as a profit forecast.

No offer

Neither this annual report nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities.

Santander vision

Our purpose

To help people and businesses prosper.

Our aim as a bank

To be the best open financial services platform by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities.

Our How: Simple | Personal | Fair

In everything we do.

Building a responsible bank from our core strengths

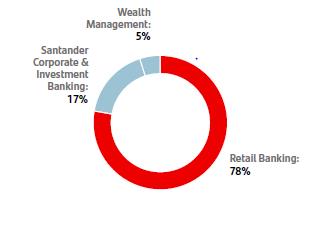

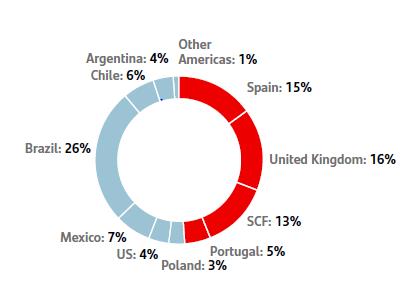

Santander is a retail bank with a unique business model underpinned by 3 strengths.

1. Our scale provides potential for organic growth. | | We maintain a leadership position in our core markets. Collaboration across the Group results in significant cost savings and higher revenues. | |

|

2. Unique personal banking relationships strengthen customer loyalty. | | We serve 144 million customers in markets, with a total population of more than 1 billion people. We have over 100,000 people talking to our customers every day in our more than 13,000 branches and contact centres. | |

|

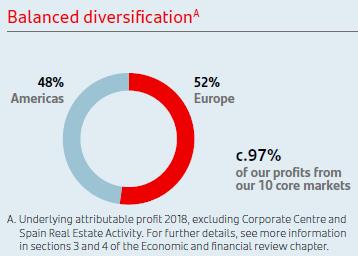

3. Our geographic and business diversification and our model of subsidiaries make us more resilient under adverse circumstances. | | We have a well-balanced distribution between mature and developing markets, and a good mix of products for individuals and companies. Our model of subsidiaries, autonomous in liquidity and capital, allows the Group to mitigate the risk that the difficulties of one subsidiary affect the rest. Subsidiaries are managed by local teams providing the best customers knowledge within their markets. | |

|

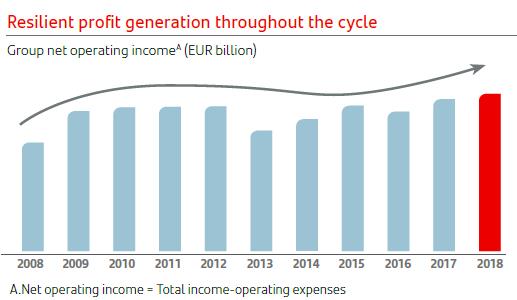

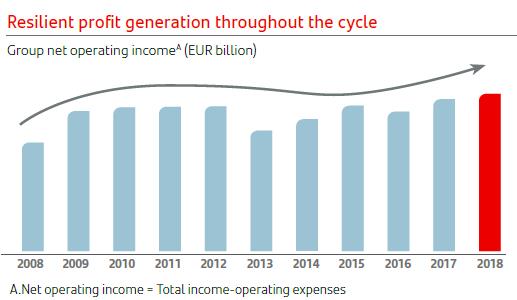

Our strengths have historically resulted in: Higher earnings predictability | | Over the last 20 years, earnings have increased x4 with low volatility | |

|

Our vision and our strengths are sound pillars to face potential challenges: | | | | |

| à | | Our strong balance sheet and our model of subsidiaries make us less vulnerable to face a potentially adverse macro environment. |

| à | | Our scale and best-in-class efficiency ratio mitigate potential impacts from increases in costs of doing business. |

| à | | We are transforming our core banks while launching innovative ventures to address challenges emerging from the new digital era. |

| à | | We have a clear focus on acting responsibly to meet higher expectations from our stakeholders. |

1. Excluding Chinese banks and Sberbank.

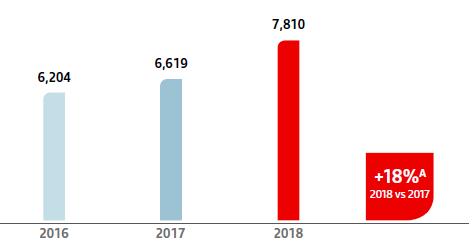

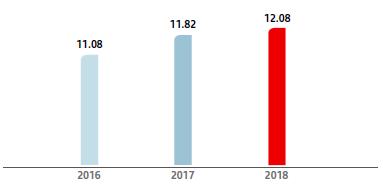

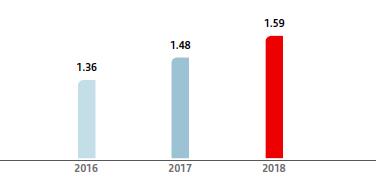

We have successfully completed our 3 year plan

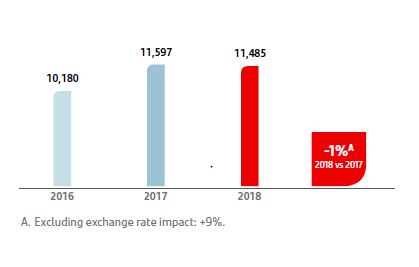

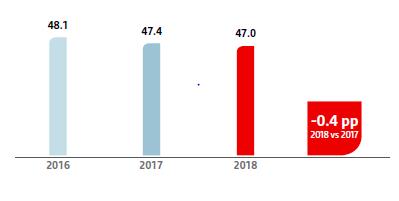

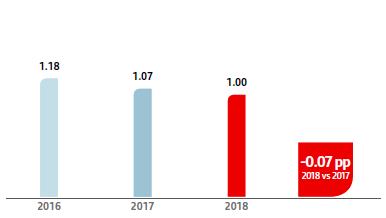

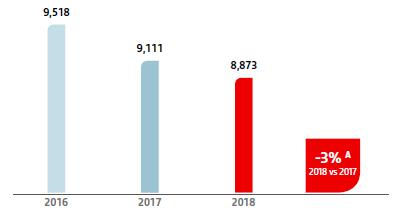

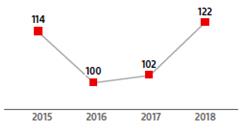

| Strategic priorities | | Key metrics | 2015 | | 2018 |

People | Be the best bank to work for and have a strong internal culture. | | Number of core markets where the Bank is among the three leading banks to work for | 3 | | 7 |

| | | | | | |

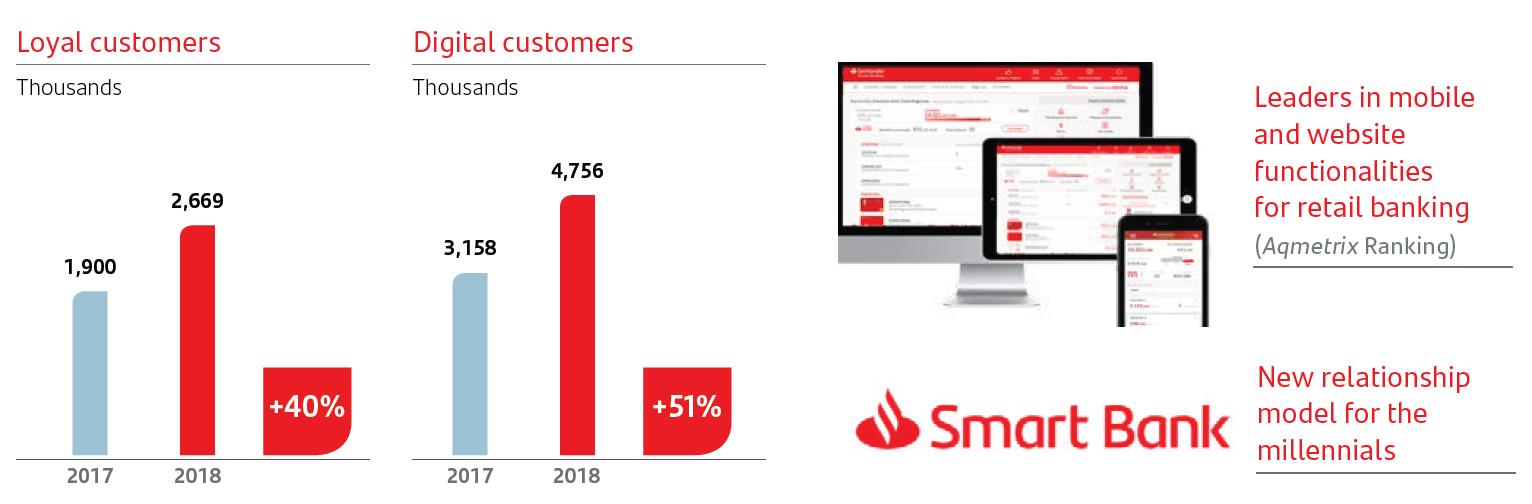

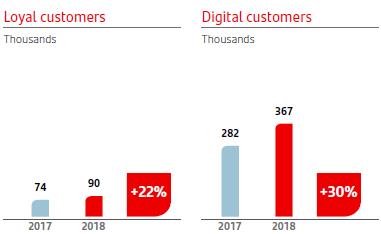

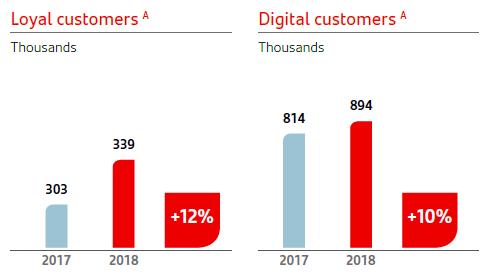

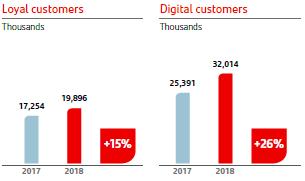

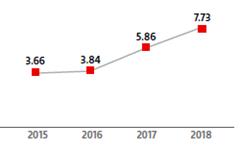

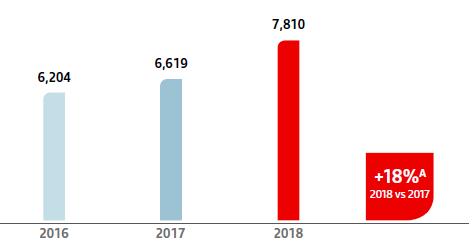

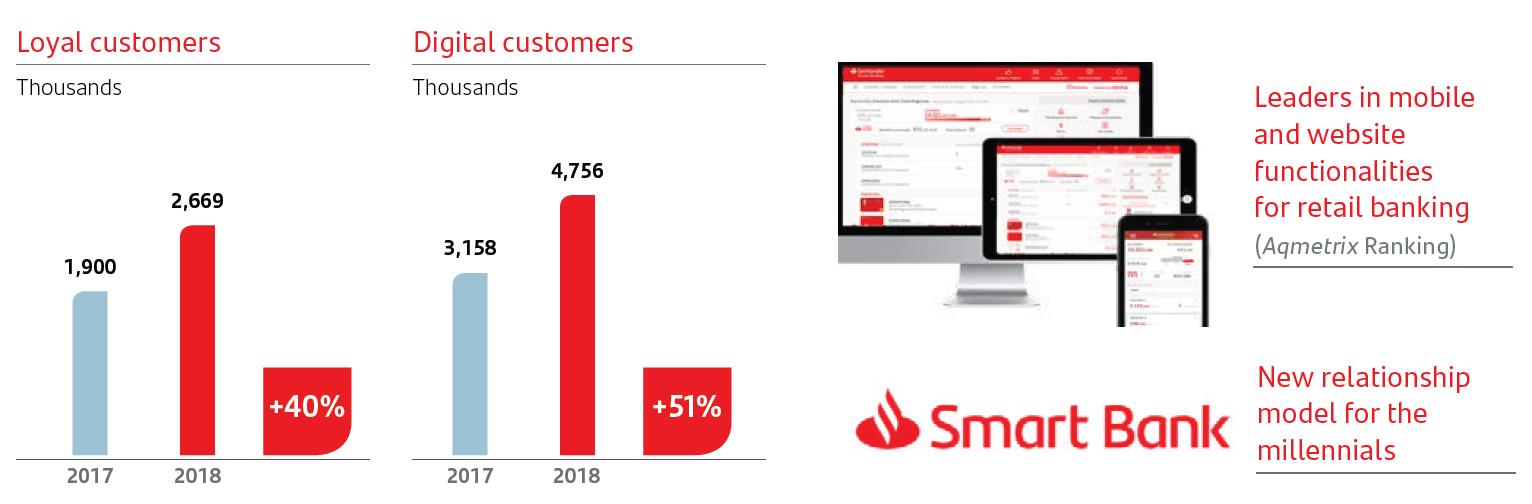

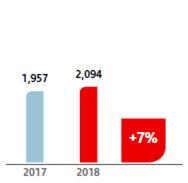

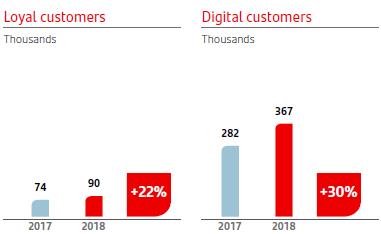

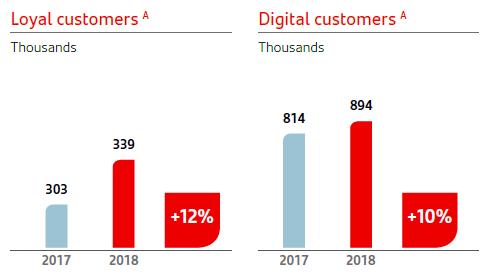

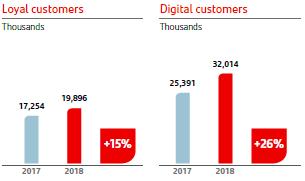

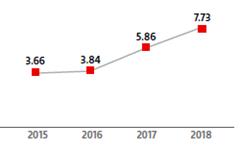

| Earn the lasting loyalty of our individual and business customers. Digital transformation and operational excellence. | Loyal customers (mn) | 13.8 | | 19.9 |

Customers | Digital customers (mn) | 16.6 | | 32.0 |

| Fee income (%)A | - | | ~10 |

| | | | | | |

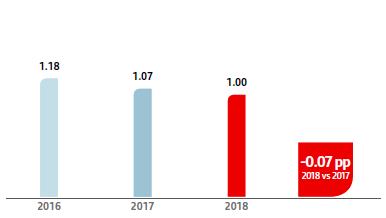

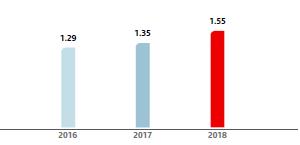

| | | Cost of credit (%) | 1.25 | | 1.12B |

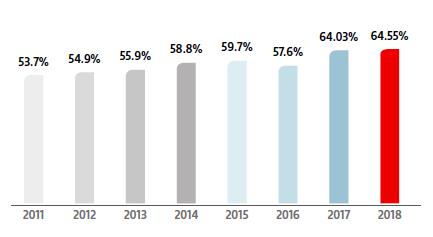

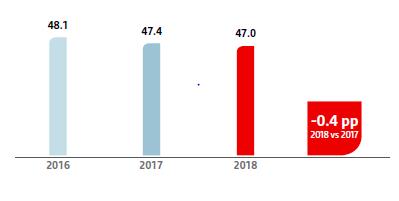

| | | Efficiency ratio (%) | 48 | | 47 |

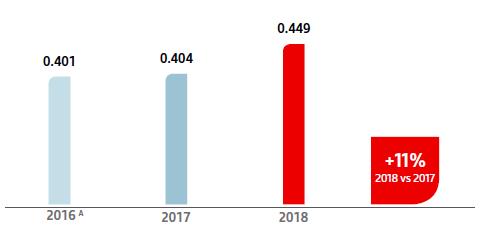

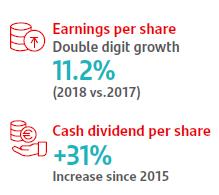

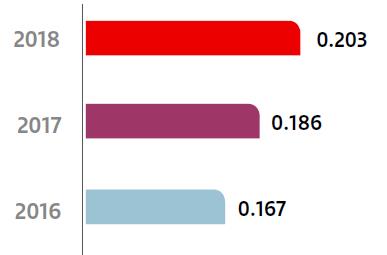

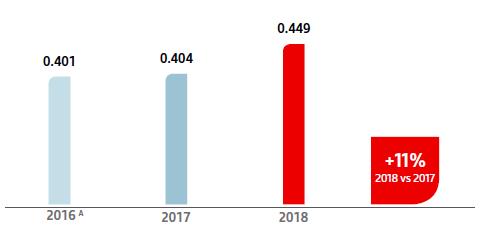

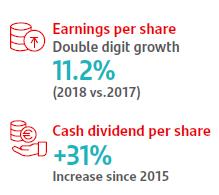

Shareholders | Capital strength, risk management and profitability. | | Growth in earnings per share (%) | - | | 11.2 |

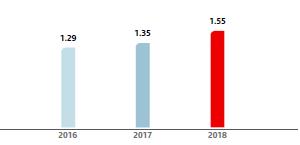

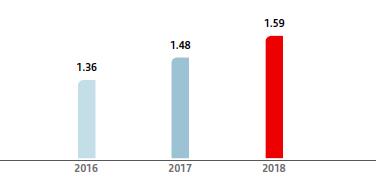

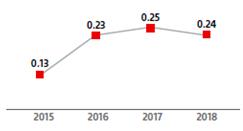

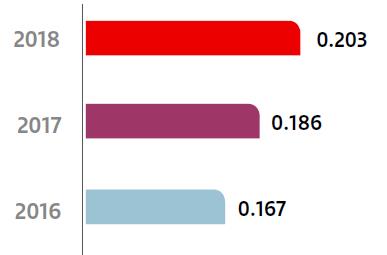

| | Dividend per share (EUR) | 0.20 | | 0.23C |

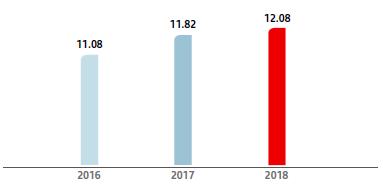

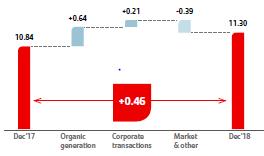

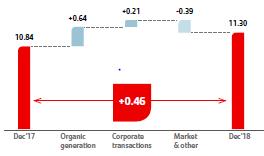

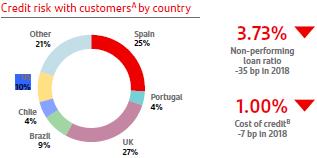

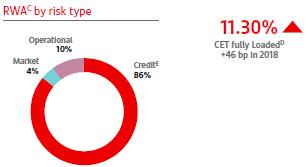

| | | Fully loaded CET1 capital ratio (%) | 10.05 | | 11.30D |

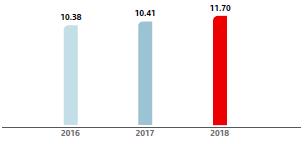

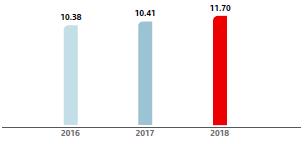

| | | RoTE (%)E | 10.0 | | 11.7 |

Communities | People supported in the local communities where the Group operates. | | Scholarships (thousand) | 35 | | 155F |

| | People supported in our communities (mn) | 1.2 | | 6.3F |

| | | A. % change (constant euros). 2018 figure relates to 2015-2018 CAGR. B. 2018 figure relates to 2015-2018 average. C. Total dividend charged to 2018 earnings is subject to the 2019 AGM approval. D. 2018 data applying IFRS 9 transitional arrangements. E. Underlying RoTE 2015: 11.0%. Underlying RoTE 2018 12.1%. F. It refers to cumulative activity in 2016-2018. Note: 2015 metrics have been re-stated to reflect the capital increase of July 2017. |

Our new strategic plan will be announced at next Santander Investor DayA

| | |

SANTANDER

INVESTOR DAY | April 3rd 2019

LONDON |

A. The information that will be made available in the Investor Day is not incorporated by reference in this annual report nor otherwise considered to be a part of it.

Our strategy is built around a virtuous circle based on trust:

| | | |

People | | Employees who are engaged... |

| | |

| | | |

| | |

|

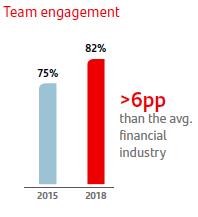

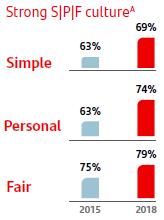

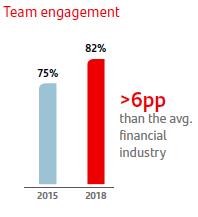

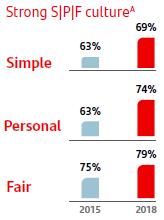

| A key focus of our strategy is to embed a strong culture based on our values: Simple, Personal and Fair. How we do things is as important as What we do. Our employee engagement levels are above the industry average. |

| % of employees that consider Santander is Simple, Personal and Fair. |

Customers | | ...generate more loyal customers... |

| | |

| | | |

|

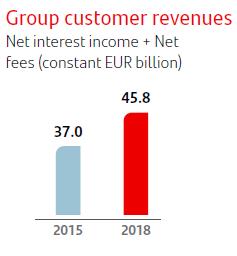

| Increase in loyal customers, both individuals and businesses, has resulted in a significant growth in revenues, loans and customer funds. Loyal customers use more our digital channels as they hold more of our products and services and interact with us more often. |

| | |

Shareholders | | ...leading to strong financial results... |

| | |

| | | |

|

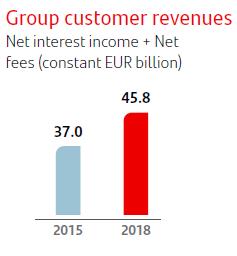

| Our focus on customer loyalty is delivering results: customer revenues have increased 24% from 2015 to nearly EUR 46 billion. We have significantly strengthened our balance sheet in the last 4 years generating 304 basis points of capital (applying IFRS 9 transitional arragements). We have become even more resilient while growing our business and increasing dividends. |

Communities | | ...and more investment in communities. |

| | |

| | | |

|

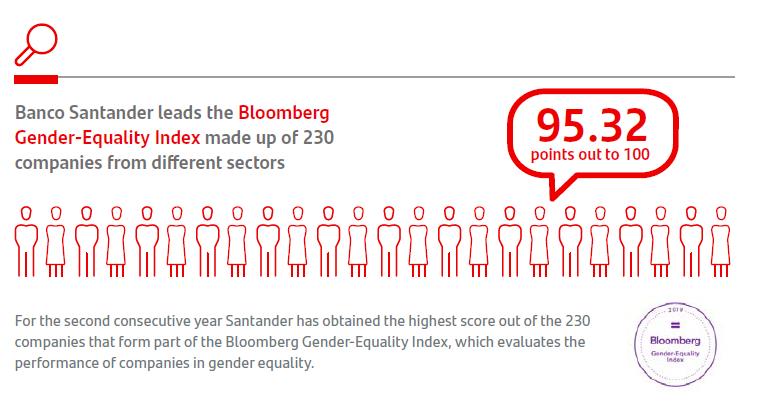

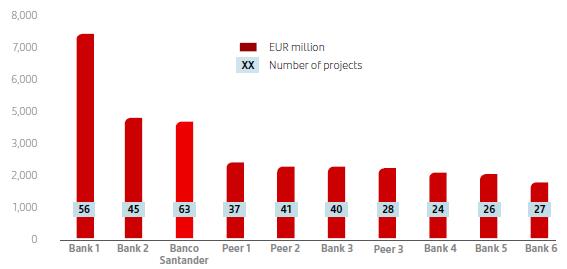

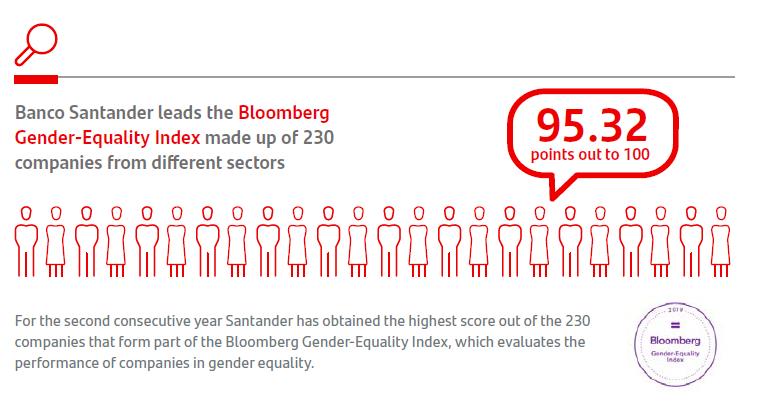

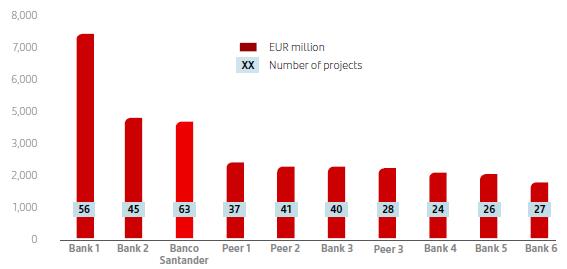

Highest score among peers: 95.3 points out of 100 | We 1,235 have agreements with academic institutions in 33 countries. 7,647 partnerships with social institutions and entities. We are the leading global bank financing renewable energy projects (#1 by number of transaccions, #2 by volume, according to Dealogic). We are delivering profits in a responsible way supporting inclusive and sustainable growth. |

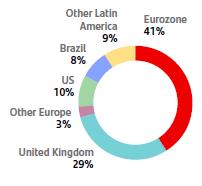

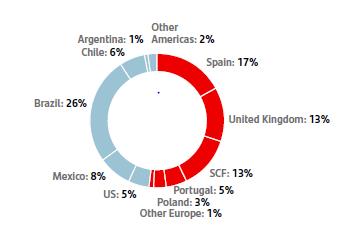

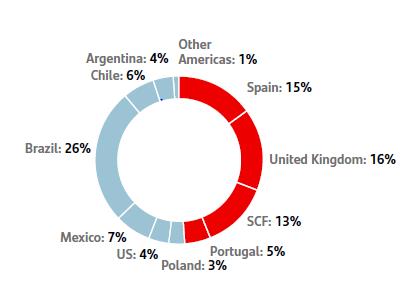

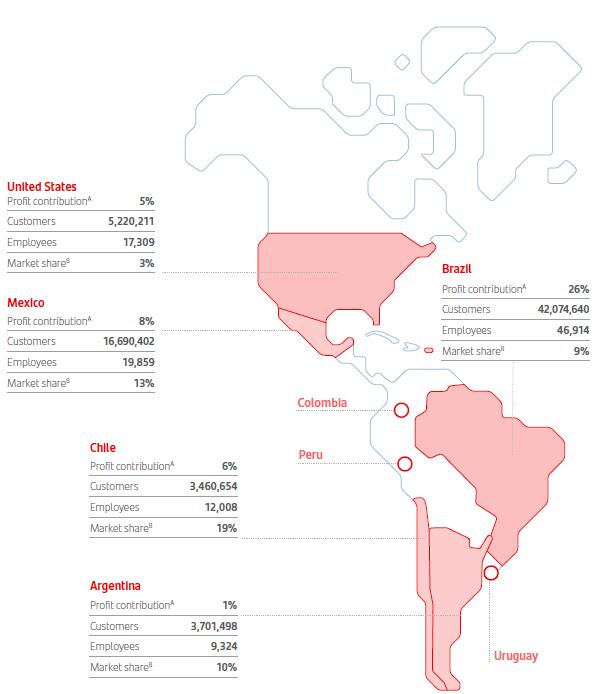

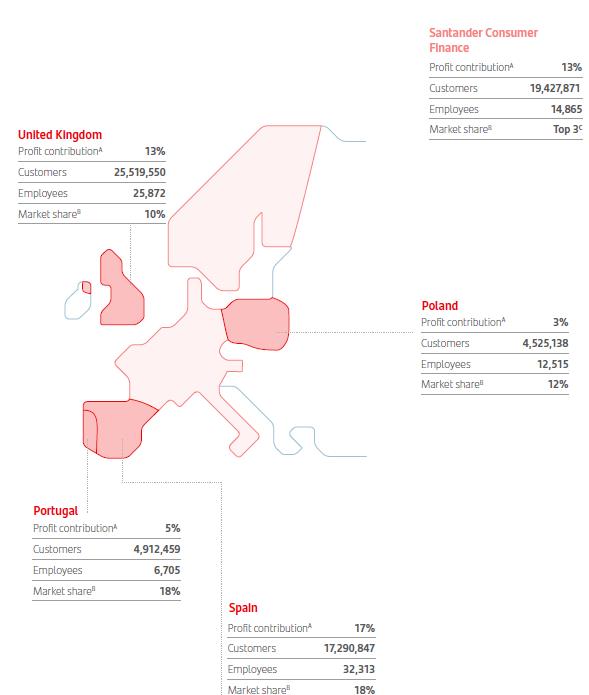

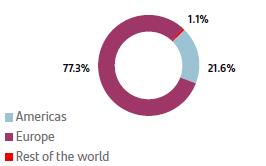

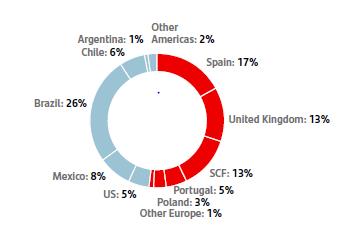

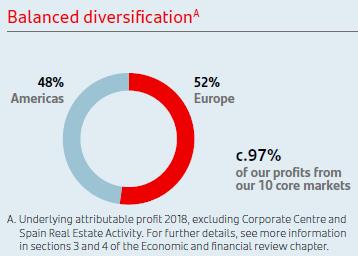

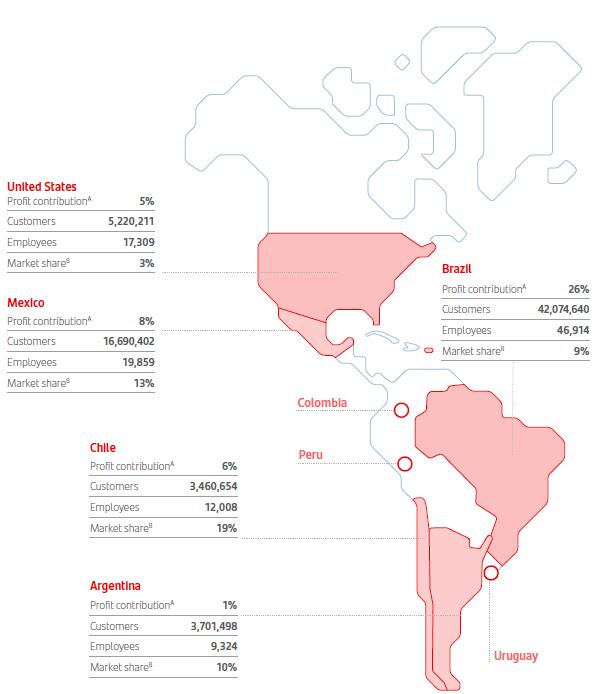

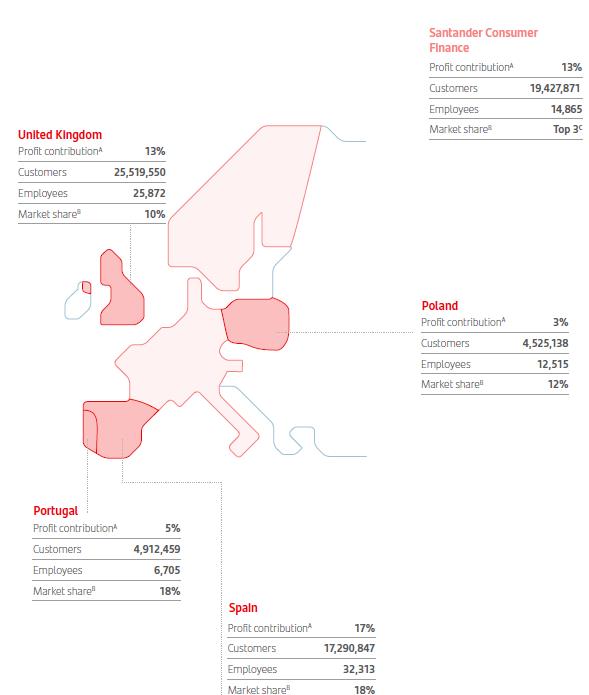

Our balanced geographic diversification has been key to deliver stable and predictable growth

A. 2018 underlying profit. Excluding Corporate Centre and Spain real estate activity. For further details, see more information in sections 3 and 4 of the Economic and financial review chapter.

B. Loans. UK: lending comprises UK mortgages (excluding social housing), consumer credit and commercial lending (excluding financial institutions). Poland: including Santander Consumer Finance business (SCF); US: in the states where the Group operates. SCF: Top3 in our main markets in new lending of auto loans.

● Main countries

● Santander Consumer Finance

○ Other countries

Responsible banking

Consolidated non-financial information statement

Our approach

“By delivering on our purpose, and helping people and businesses prosper, we grow as a business and we can help society address its challenges too. Economic progress and social progress go together. The value created by our business is shared – to the benefit of all. Communities are best served by corporations that have aligned their goals to serve the long term goals of society.” |

|

Ana Botín | |

|

By being responsible, we build loyalty | | |

| | | | | | |

| | | | | | |

People | | Customers | | | | In our day-to-day businesses, we ensure that we do not simply meet our legal and regulatory requirements, but we exceed people´s expectations by being Simple, Personal and Fair in all we do. |

| | | | | |

| | ... Santander treats me responsibly | |

Shareholders | | Communities | | | | |

| | | | | | |

| | | | | | |

I´m loyal to Santander because... | | | | We focus on areas where, as a Group, our activity can have a major impact on helping people and businesses prosper. |

| | | | | |

| | | | ... Santander acts responsibly in society | |

| | | | | | |

| | | | | | |

| | | | | | |

Helping people and businesses prosper - our performance |

| | | |

People | | | |

| | | |

| | | | | | |

| | | | | | |

EUR 11,865 million Personnel costsA | 96% of employees with permanent contracts | | 10.4 years Average length of employment |

Customers | | | |

| | | |

| | | | | | |

| | | | | | |

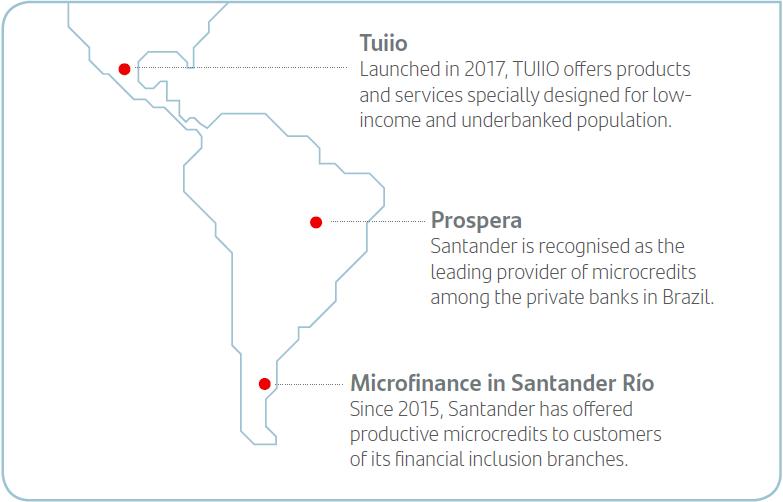

EUR 882,921 million Loans outstanding (net) | EUR 487,695 million to households EUR 301,975 million to companies | EUR 22,659 million to public administrations EUR 70,592 million to othersB | >273,000 Microbusinesses supported |

Shareholders | | | |

| | | |

| | | | | | |

| | | | | | |

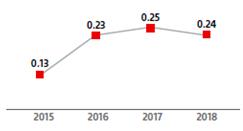

EUR 3,724 million Total shareholder remunerationC | EUR 64,508 million Stock market value at year-end 2018, largest bank in the euro zone | | EUR 0.23 Dividend per share, 4.5%C vs 2017 |

Communities | | | |

| | | |

| | | | | | |

| | | | | | |

EUR 179 million Community investment | EUR 121 million Investment in universities | | EUR 58 million Investment in programmes and projects to support communities |

Suppliers | | | |

| | | |

| | | | | | |

| | | | | | |

EUR 3,619 million Payments to suppliersD | 10,628 Approved suppliers through our global procurement model | | 95% Local group’s suppliers |

Tax contribution | | | |

| | | |

| | | | | | |

| | | | | | |

EUR 16,658 million Taxes paid and collected by Santander | EUR 3,458 million Corporate income tax | | EUR 3,598 million Other own taxes paid, including social contributions |

A. From Group consolidated financial statements.

B. Including financial business activities and customer prepayments.

C. Subject to the approval of the total dividend against the 2018 results by 2019 Annual General Meeting.

D. Data refers exclusively to purchases negociated by Aquánima.

What our stakeholders tell us

Analysing, assessing and responding to the opinions and concerns of all our stakeholders is a fundamental part of our effort to operate as a responsible bank and make all we do Simple, Personal and Fair (SPF).

Engagement with all stakeholders hepls to build value

Earning and keeping people’s loyalty is the key to creating lasting value. To do this, we must understand the concerns of all our stakeholders. By listening to their opinions, and measuring their perceptions of the Group, we not only identify issues, we also spot opportunities.

In 2018 we conducted a survey to identify what our employees, customers and society think a responsible bank should do. These findings helped us as we analysed what the leading environmental, social and governance analysts are telling us.

88%

of participation in the global engagement survey | | 83%

of employees believe that their colleagues behave more simple | | | | | | 1 million

surveys to measure and monitor customer satisfaction | | +40,000

interviews to banked population about the perception of Santander as Simple, Personal and Fair |

| | | | People | | Customers | | | | |

86%

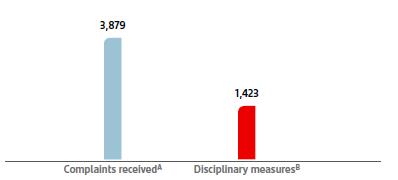

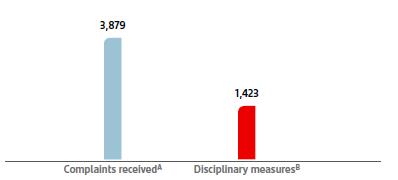

of employees feel proud to work for Santander | | 3,879

complaints received through ethical channels | |

| | 13,217

branches | | 316,094

complaints received |

| | | | Key dialogue channels

for stakeholders | | | | |

6,000

interviews to university students about the perception of Santander as Simple, Personal and Fair | | 1,235

agreements with universities and academic institutions | | Communities | | Shareholders | | 10,000

interviews to shareholders about the perception of Santander as Simple, Personal and Fair | | 391,926

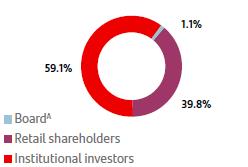

Shareholder and investor consultations trough studies and qualitative surveys |

| | | | | | | | | | |

7,647

partnerships with social institutions and entities | | 253

profiles and 16 millions followers in social networks | | | | | | 166,149

queries managed by email, phone, WhatsApp and online meetings | | 252

meetings with shareholders |

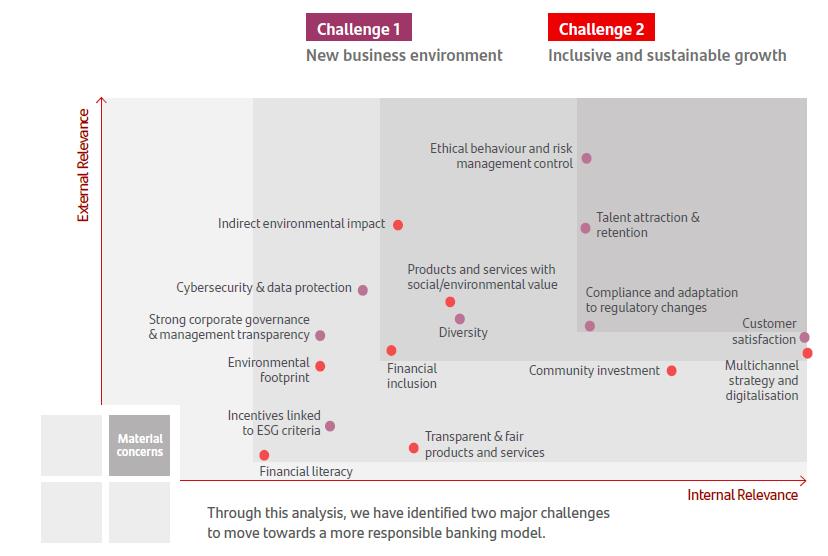

Identifying the issues that matter

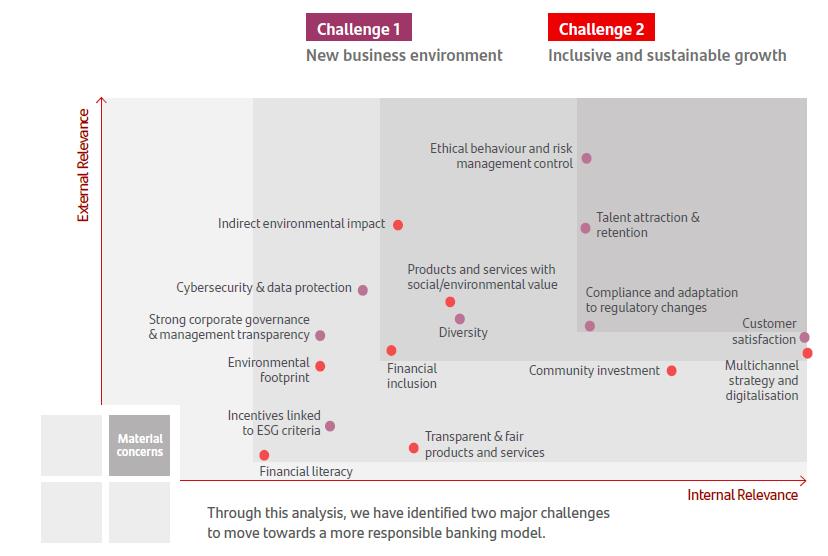

Santander also regularly analyses the most relevant social, environmental and ethical behaviour issues through its materiality assessment. This systematic study is conducted across the whole Group’s value chain on an annual basis, and consists of a far-reaching quantitative and qualitative analysis that uses information from both internal and external sources.

The materiality matrix shows the concerns Santander has identified as most important for its stakeholders in the analysis.

Relevant aspects for the Group matrix

Challenges and opportunities

Like every business, Santander operates in a world that is changing fast, creating new challenges and opportunities. Using the results of the materiality assessment, we have identified two core challenges – the challenge of the new business environment, and the challenge of inclusive and sustainable growth.

Challenge 1: New business environment. Adapting to an evolving world

The transformation that is happening in the world economy is unprecedented. The opening of new markets, the availability of global capital and advances in information technology and communications are changing the competitive environment of companies across the world. This new competitive framework, in a time of constant change, requires companies to assume greater responsibilities to innovate and work in new ways.

|

|

Santander, like all businesses, needs a motivated, skilled workforce able to deliver what customers want, harnessing the power of new technology. Meanwhile, we face new regulations and laws. These trends create the challenge of new business environment in which we operate. Our task is to exceed our stakeholders expectations, to do the basics brilliantly, every day. Key to this is having a strong culture – a business in which all we do is Simple, Personal and Fair. |

For more detailed information on our strategy to tackle this challenge and turn it into an opportunity, please see section “Challenge 1: New business environment” of this chapter.

Challenge 2: Inclusive & sustainable growth. Helping society achieve its goals

Growth should meet the needs of today’s generation, without hampering future generations’ ability to meet their own needs: a balance should always be struck between economic growth, social welfare and environmental protection. Financial institutions can deliver this by managing their own operations responsibly, and lending responsibly to help society achieve its goals.

|

|

We can play a major role in helping ensure growth is both inclusive and sustainable. Inclusive: by meeting all our customers’ needs, helping entrepreneurs start companies and create jobs, strengthening local economies, improving financial empowerment, and supporting people get the education and training they need. Sustainable: by financing renewable energy, supporting smart infrastructure and technology to tackle climate change (such as agrotech and green tech). We do this while taking into account the social and environmental risks and opportunities in our operations, and actively contributing to a more balanced and inclusive economic and social system. |

For more detailed information on our strategy to tackle this challenge and turn it into an opportunity, please see section “Challenge 2: Inclusive & sustainable growth” of this chapter.

Principles and governance

All our activity is guided by policies, principles and frameworks to ensure we behave responsibly in everything we do. We have redesigned and strengthened our responsible banking governance, both to ensure we are compliant and to help us manage initiatives which tackle the two challenges we have identified.

Policies that support our responsible banking strategy

| | | | | | | | | | | | | | | | |

General code of

conduct | | Corporate

culture policyA | | General

sustainability

policy | | Human

rights policy | | Climate change

and environmental

management policy | | Sector

policies |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | |

Brings together the ethical principles and rules of conduct governing the actions of all of the Group’s staff and is the central element of the Group’s compliance programme. | | Establishes the guidelines and required standards to be followed ensuring a consistent culture is embedded throughout the Group. | | Definess our general sustainability principles, and our voluntary commitments with our main stakeholders, lasting value. | | Sets out how we protect human rights in all operations, and reflects the UN Guiding Principles on Business and Human Rights. | | Sets out Santander’s policy to protect the environment and mitigate the impact of climate change. | | Lays down the criteria governing the Group´s financial activity with the defence, energy, mining & metals and soft commodities (products such as palm oil, soy and timber) sectors. |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | |

Consumer

Protection

policyB | Code of

conduct in

security markets | Cybersecurity

policy | Suppliers

certification

policyC | Tax policy | Conflicts

of interest

policy | Financing

of political

parties policy | Policy on

contributions

for social purposes | Corporate

Volunteering

policy |

A. Includes employee’s diversity principles.

B. Includes financial consumer acting principles.

C. Includes principles of responsible behaviour for suppliers.

Changes to policies in 2018

• Update of the general sustainability policy, to reflect the current governing bodies and to improve the clarity around prohibitions and restrictions in financing certain customers and / or activities, as set out in its sectoral policies (energy, defence, mining & metals and soft commodities).

• Update of climate change and environmental management policy to reflect the current governing bodies.

• Update of the human rights policy to reflect the current governing bodies and to include: a reference to The Global Standard Conduct for Business to protect the Rights of LGBTI individuals as a relevant international declaration supported by Santander.

• Update of the suppliers certification policy to include new principles of responsible behaviour for suppliers.

• Approval of global policy on induction, knowledge and development.

• Approval of cybersecurity policy, taking into account new risks and legislation in this field.

• Approval of contribution for social purposes policy.

Risk culture

Our risk management and compliance model is key to ensure we operate and behave in a way that reflects our values and corporate culture, and delivers our responsible banking strategy.

For more information, please see ‘Risk culture’ section in this chapter.

Strategic overview and coordination

| | |

|

Responsible banking, sustainability & culture committee (RBSCC) |

| |

Assisting the board of directors in fulfilling its oversight responsibilities with respect to the responsible banking strategy, sustainability and culture issues of the Group: corporate culture, ethics and conduct, the digital transformation, inclusive and sustainable growth. |

| |

| |

Culture steering | Inclusive & sustainable banking steering |

This group ensures we have the right culture, skills, governance, digital and business practices to meet stakeholders’ expectations. | To meet the challenge of inclusive and sustainable growth, this group supports small businesses to create new jobs, improving financial empowerment, supporting finance the low carbon economy and fostering sustainable consumption. |

| | |

To drive progress on the responsible banking agenda, a new unit under the Executive Chaiman’s Office team has been established. Santander has appointed a Senior Advisor on Responsible Business Practices, who reports directly to the executive chairman and works with the Responsible Banking Unit. |

|

|

Santander subsidiaries |

Guiding principles have been developed for subsidiaries (and global

business units) to ensure governance and implementation of its responsible

banking agenda is embedded across the Group as a whole. Likewise, each subsidiary has appointed a senior responsible for the function. |

|

Group strategy metrics & targets |

|

Key initiatives proposed and agreed by the RBSCC in 2018:

The new governance model for responsible banking.

Approval of the guiding principles of governance and supervision in matters of responsible banking, sustainability and culture for the Group’s subsidiaries.

Established lines of accountability and agreed metrics.

Update of the criteria for financing activities related to coal, both those related to its extraction (mining) and its use as an energy source (energy).

Update of the financing policy to sensitive sectors, to incorporate new criteria and guidelines regarding the gambling sector, and the defense.

Main priorities in 2019:

•Financial and social inclusion.

•Responsible and sustainable products offered.

•Social and environmental risk and opportunities.

•Group’s corporate culture.

For more information, please see section 4.3 ‘Activity report’ in Corporate governance chapter.

2018 highlights

We have built on our success by helping more people and businesses prosper, while bringing a new focus to our efforts to be a more responsible bank.

| |

We have received global recognitions for our efforts… | |

| |

| |

• Santander was ranked third in the world and first in Europe among banks in the Dow Jones Sustainability Index. | |

| |

• Fortune Magazine named Santander in its 2018 Change the World list – recognising the Group among companies who “do well by doing good”. | |

| |

• Santander received Top Employers Europe 2018 certification, and ranked in the top 3 of the best financial institutions to work in Latin America, according to Great Place to Work. | |

| |

• Prospera microfinance program, was chosen as an example of good practice by the Brazilian Network of the Global Compact to reach the SDGs in 2030. | |

| |

• Santander X, our global community of university entrepreneurship, was chosen as an example of good practice by the Spanish Network of the Global Compact to reach the SDGs in 2030. | |

| |

…we strived to address the challenge of the new business environment… | |

| |

| |

• The board approved a new policy to ensure a consistent culture is embedded throughout the Group. | |

| |

• New employee value proposition created, positioning Santander as an employer of choice both internally and externally. 86% of employees feel proud to work for Santander. | |

| |

• More than 56,000 SPF surveys were sent to customers, shareholders, investors and university students to know their perception of Santander as Simple, Personal and Fair. | |

| |

• New corporate diversity & inclusion principles were agreed, to consolidate our cultural transformation. | |

| |

• Awareness and understanding of cybersecurity was increased through comprehensive communication and education activities and launch of a new, cybersecurity policy taking into account new risk and legislation. | |

| |

• New suppliers certification policy was approved, which includes principles of responsible behaviour for suppliers. | |

| |

• New internal governance website was created, including a single global portal for all corporate frameworks, ensuring strong governance and consistency across the Group. | |

| |

…while ensuring that we promote inclusive and sustainable growth… | |

| |

| |

• Santander joined United Nations Environment Programme Finance Initiative (UNEP FI) to develop the principles for responsible banking to align the sector with the SDGs and the Paris Climate Agreement. | |

| |

• CEOs of different international companies and UN Special Advocate launched a Private Sector Partnership for Financial Inclusion, with Santander representing the banking sector. | |

| |

• Santander Asset Management launched a new range of sustainable funds, which combine financial criteria with non-financial ones. | |

| |

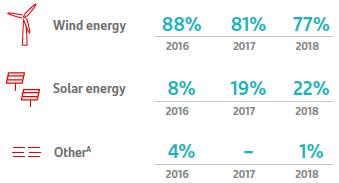

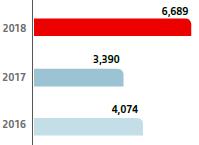

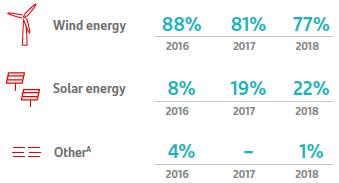

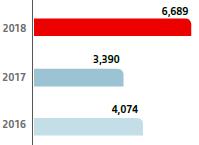

• Santander Corporate & Investment Banking (SCIB) consolidated its leading position in renewable energy transactions. 6,689 MW of renewable energy financed, equivalent to the consumption of 5,7 million households. | |

| |

• 4th Universia International Rectors’ Meeting was held in Salamanca. The meeting brought together 600 rectors from 26 countries, representing 10 million university students around the world, in a discussion entitled ‘University, Society and Future’ on the challenges facing higher education. | |

| |

…and building an even more responsible bank | |

| |

| |

• New board committee on responsible banking, sustainability and culture was formed to drive and co-ordinate our responsible banking approach across the Group. | |

| |

| |

| |

Main SDGs where Santander’s business activities and community investments have the most impact. | |

Challenge 1: New business environment

| | | |

| | |

| | |

| Strong corporate culture | |

| | |

| | | |

| The Santander Way defines our purpose, our aim and how we do business, by being Simple, Personal and Fair in everything we do. | |

| | |

| Talented and motivated team | |

| | |

| | | |

| The more prepared and motivated our workforce is, the stronger their commitment to helping people and businesses prosper will be. Our workforce is diverse in terms of expertise and gender. | |

| | |

| Responsible business practices | |

| | |

| | | |

| We develop our products and services responsibly, and aspire to deliver excellent customer service. Customer protection data is one of our main priorities. | |

| | |

| Risk culture | |

| | |

| | | |

| As a bank, managing risks is an essential part of our daily business. We have a robust risk management model and risk culture to ensure we operate in a prudent and responsible way. | |

| | |

| Shareholder value | |

| | |

| | | |

| We have clear and robust governance. Risks and opportunities are prudently managed; and long-term strategy is designed to safeguard the interests of our shareholders and society at large. | |

| | |

| Responsible procurement | |

| | |

| | | |

| Our procurement processes are based on ethical, social and environmental criteria to ensure we operate in a sustainable way throughout our operations. | |

| | |

| | |

Strong corporate culture

The Santander Way is our strong global culture, fully aligned to our corporate strategy. It includes our purpose, our aim, and how we do business. It is the bedrock of our bank, a responsible bank.

The Santander Way Simple ǀ Personal ǀ Fair

Simple, Personal and Fair is how we do business and behave as part of our corporate culture. It embodies how all Santander's professionals think and operate, and represents what our customers expect of us as a bank. It defines how we go about our business and take decisions, and the way we interact with customers, shareholders and the community.

The entire team at Santander strives each day to make sure that all they do is Simple, Personal and Fair – as this is the way to earn customers’ lasting loyalty – while doing all they can to fulfil our purpose, to help people and businesses prosper.

| | Simple | | Personal | | Fair |

| | | | | | |

“Just as important

as what we do is

how we do it” Ana Botín | | | | | | | | | |

| We offer an accessible service for our customers, with simple, easy-to-understand products. We use plain language and improve our processes every day. | | We treat our customers in an individual and personal way, offering them the products and services that best suit their needs. We want each and every one of our employees and customers to feel unique and valued. | | We treat our employees and customers fairly and equally, are transparent and keep our promises. We establish good relations with our stakeholders because we understand that what is good for them is also good for Santander. |

| |

| Our corporate culture includes eight corporate behaviours… Show respect Truly listen Talk straight Keep promises Support people Embrace change Actively collaborate Bring passion …and a strong risk culture where everyone is personally responsible for managing their risks in their day to day work risk pro …Everyone’s business |

The Santander Way: governance | | To ensure The Santander Way is understood and embedded, we need to develop, promote and monitor the consistency and implementation of our global culture across all the markets where Santander operates. | | We have a culture steering governing body which meets monthly, incorporating senior members from across the Group to promote, approve, support and evaluate the implementation and progress of global and local culture initiatives in line with the board approved corporate culture policy. |

| | Code of conduct The General Code of Conduct defines the standards and principles which establish the basis for all actions to be applied by the Group employees in their day-to-day activities and is the central pillar of the Group’s compliance programme. It also covers equal opportunities and non-discrimination, respect for people, work-life balance, occupational risk prevention, environmental protection and collective rights. Santander promotes the opportunities for its employees to raise concerns and operates ethical channels, | | managed by the compliance and conduct function, ensuring confidentiality, an that there is no retaliation against whistle- blowers. We also ensure that our suppliers abide by our ethical standards. |

For more

information on

employee ethical

channels,

please see 'Risk

management' chapter. | For more

information on

supplier ethical

standards,

please see 'Risk

management' chapter. |

| | | | |

| | Corporate culture policy We have a corporate culture policy that establishes the guidelines to be followed ensuring a consistent culture is formed and embedded throughout the Group. This policy has been developed in partnership with country culture teams and key stakeholders. It is structured on three levels: | | Common elements: these are the backbone of our culture. They have been formed through a bottom-up process and apply to the entire Group. Mandatory global initiatives: these must be implemented across the Group, but are adapted and managed at local level. Local initiatives: these are developed by local units whilst respecting the corporate culture policy and other corporate frameworks. |

Further information

can be found on 'Risk

culture' section of this

chapter. | | Risk culture ‘risk pro’ We have a strong risk culture known as risk pro, which defines the way in which we understand and manage risks on a day- to- day basis. It is based on the fact that all professionals are responsible for the risks they manage. | | |

Examples of cultural iniciatives to show how we are doing Simple, Personal and Fair

| | | | | | | | | | |

1. People | | 2. Customers | | 3. Shareholders | | 4. Communities |

| | | | | | |

| | | | | | | | | | |

| | | | | | |

The Santander Way of

working | | Simplified processes | | Transparent communications | | Future talent support via Santander Universities |

| | Customer experience | | Robust internal governance | | programme |

Diversity & inclusion | | | | | | |

| | Operational excellence | | Risk culture | | Corporate volunteering |

| | | | | | |

Behaviours & leadership | | Cyber and data protection | | | | |

| | | | | | |

Employee value proposition | | | | | | |

Six key focus areas in 2018

| | | |

| | | Objectives |

| Listening strategy | | Promoting an environment of openness and speaking up, improving survey execution and analytics to better understand feedback and act on it. |

| Leadership | | Common leadership commitments for all people managers. |

| Diversity & Inclusion | | Group Diversity & Inclusion principles providing global guidance and minimum standards. |

| Behaviours | | Embedding corporate behaviours in the employee lifecycle and in our everyday activities. |

| Global collaboration | | Increasing global collaboration, sharing best practices and simplifying processes. |

| Communities | | To continue to help communities to prosper by fostering and supporting inclusive and social programmes. |

Across the Group, we are embedding Simple, Personal and Fair1

By building a loyal and committed workforce, we deliver sustainable growth and fulfil our purpose

| | | | | | | | | | | | | |

Employees who are more motivated and committed... | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | People 203 thousands employees | | 83% of employees believe that their colleagues behave more simple, personal and fair | | 82% of employees

are engaged | |

| | | | ... make our customers more satisfied and loyal... | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 19.9 million loyal

customers (+15%) | | 88% Customers

satisfaction | | | Customers 144 million | | |

| | | | | | | | |

| | | | |

| ... which drives profitability and sustainable growth... | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

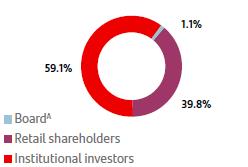

| | Shareholders 4.1 million | | +4.5% increase of dividend per share | | EUR 3,724 million Total shareholder remuneration | |

| | | | | |

| | | | | |

| | | | | |

| | | | ... and results in more investment in communities. | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 7,647 social entities we have partnered with | | 1,235 agreements with academic institutions in 33 countries | | | Communities | |

| | | | 2.5 million

people helped |

| | | | | | |

| | | | | | |

A talented and motivated team

To win in the new business environment, and to earn and keep customers’ loyalty, we need a workforce that is both talented and motivated. And if we are to meet the needs of today’s society, our team needs to reflect society.

Talent Management

Successful businesses need skilled and motivated teams: a responsible business attracts the best talent and earns its loyalty. Talent management and retention is therefore one of our key human resources strategies. Each year, we implement various initiatives and programmes aimed at helping our employees grow personally and professionally, thereby enhancing their ability to serve our customers in a Simple, Personal and Fair way.

r | | | |

Main group data | | 2018 | |

Total employees (thousand) | | 203 | |

% employees with a permanent contract | | 96.0 | |

% employees working full time | | 94.6 | |

Employees joining/leaving (turnover) | | 15.4 | |

% of workforce promoted | | 8.6 | |

Average length of service (years) | | 10.3 | |

% coverage of collective agreements | | 70.6 | |

For additional information, see ‘Key metrics’ section of this chapter.

Programmes to identify the best talent

• Talent valuation committees. A structured process to identify our future pontential talent.

• Succession planning for leaders. Succession planning for the key positions in the Group to ensure the sustainability and management control.

• Action Learning Programme Santander (ALPS). A learning programme aimed at managerial talents. ALPS develops leadership and business problem resolution skills within a collaborative environments. Management takes part as sponsors.

• Digital Cellar. New methods of recruitment to understand and attract digital talent, offering spaces to execute projects (challenges that Santander faces and wants to solve).

• Young Leaders. Launched in 2018, this professional development programme, has involved 280 young employees from 22 countries. Participants were chosen by their peers, and are engaged directly with our top executives, giving them the chance to develop the Group’s strategy by bringing in new ideas and perspective.

Development and mobility programmes

• Global Job Posting. Offers all employees the chance to apply for vacant positions in other countries, companies or divisions. Since its launch in 2014, over 4,000 positions have been published globally.

• Santander World. Our employees can work for several months on a project in another country, promoting the exchange of best practices and broadening their global vision. Since its launch, 1,907 people in 28 different countries have taken part.

| |

Santander, a great company to work for |

| |

| |

The talent, commitment and motivation of our 202,000 employees is the basis of our success.

In 2018 Santander received Top Employers Europe 2018 certification which acknowledges the working conditions companies create for their employees. The Group received certification for Santander Spain, Poland (Bank Zachodni WBK), the UK and its Santander Consumer Finance units in Austria, Belgium, Germany, Italy, the Netherlands and Poland.

Likewise, in 2018 Great Place to Work recognised Santander as one of the best financial institutions to work in Latin America. Santander ranked 20th in the Best Multinationals Ranking and ranked in the top 3 of the best financial institutions, thanks to the performance of our operations in Argentina, Brazil, Chile and Mexico.

This 2018 Great Place to Work certification marks a further step forward towards our objective of becoming one of the best companies to work for. It reflects the huge efforts we have been making across all countries to become a more attractive organisation that is capable of attracting and retaining the finest talent, in turn allowing us to help people and businesses prosper while making us a more responsible bank.

Leadership commitments

We know that Leadership is fundamental to the pace of our culture change. Having great leaders helps us to change faster and make the change with more stable and lasting foundations.

In 2018, more than 300 colleagues in 28 countries or units across Santander Group have contributed to identified and define our new leaderships commitments.

In the last few years, Santander has undergone various restucturings that affected jobs and employment. Wherever this has happened, we have followed a series of steps, namely:

• Participation is facilitated and negotiations take place with the employees’ legal representatives. We engage closely with employees’ legal representations.

• The legal regulatory minimums for redundancy payments are exceeded. We help individuals relocate and find new work.

• Social plans that have been presented include aid for relocation and actions to give themaximum support for the employability of those affected.

Knowledge and development

Continuous learning is key to help our employees adapt to a fast-paced, continuously changing work environment. In 2018 a global policy on induction, knowledge and development was developed and approved.

This provides criteria for the design, review, implementation and supervision of training to:

• Support the business transformation.

• Encourage global talent management, facilitating innovation, knowledge transfer and sharing and identifying key employees in the various knowledge areas.

• And supports the company’s cultural transformation under the governance standards set for the Group.

| | | |

Main group data | | 2018 | |

Millions invested in training | | 98.7 | |

Investment per employee (euros) | | 486.8 | |

% employees trained | | 100.0 | |

Hours of training per employee | | 33.8 | |

% of e-learning hours | | 48.1 | |

Employee satisfaction (over 10) | | 8.0 | |

The ‘Never Stop Learning’ strategy

| | |

►1 | ►2 | ►3 |

| | |

Global Knowledge campus: | Leading by Example programme: | Santander Business Insights: |

| | |

a training space to share knowledge and best practices. | a training programme that helps leaders identify the role that they should play to implement the SPF culture. | a series of conferences that combine internal and external visions to sensitise employees to the importance of certain behaviours in their daily work. |

| |

Leaders Academy Experience |

| |

| |

This is a new training plan to make it easier for leaders to transform the Group, to equip them with the tools and training they need to accelerate change, and to set an example for their teams and the organisation.

This consists of a four stage learning journey, one sesion held per quarter, focusing on people and an inclusive worforce, new ways of working and business models in the digital age, the “new normal” and how to be great leaders.

In 2018 three conferences, 12 virtual sessions and four workshops were held.

For additional information, see ‘Key metrics’ section of this chapter.

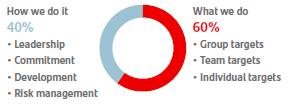

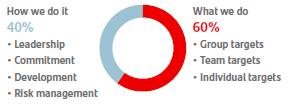

Evaluation and remuneration

We have a comprehensive remuneration system, based on principles approved in 2018 (see Corporate governance chapter of this annual report). It combines a fixed salary (which reflects the individual’s role and level of responsibility) with short- and long-term variable remuneration. This rewards employees for their performance on the basis of merit. It reflects what has been achieved (group targets and individual or team targets) and how these results are obtained (reflecting behaviour and conduct such as leadership, commitment, development and risk management). In addition, the Group also offers pension plans and other benefits such as banking products and services, life insurance and medical insurance.

Fixed remuneration is determined by reference to the local markets. Remuneration levels are set according to local practices and strictly follow the collective agreements applicable in each geography and community. Variable remuneration is a form of reward for achieving the Group’s quantitative and qualitative strategic targets.

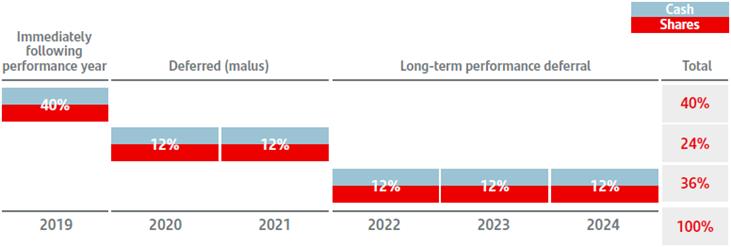

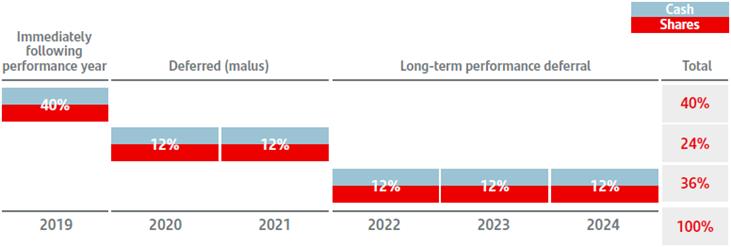

Furthermore, to meet European regulations on remuneration, we have identified 1,384 people who take decisions that may involve some risk for the Group and applies to them a deferral policy for their variable renuneration with includes deferral of between three and five years, payment in shares (50% of variable remuneration) and potential reduction (malus) or recovery (clawback).

Main initiatives developed in 2018:

• Review, together with the compliance function, of the local systems of variable remuneration of sales force (linked to the quality of service and behavior with customers).

• Reinforcement of the elements of risks linked to variable remuneration.

• Adoption of the necessary methodology for a consistent analysis of the gender wage gap, including gender wage equity for the performance of the same function.

For additional information regarding remuneration data see ‘Key metrics’ section of this chapter.

For aditional information regarding board remuneration see section 6 of the Corporate governance chapter.

MyContribution

Our employee evaluation model is designed to reinforce the key role that the corporate culture has in driving the Group’s transformation. The model and has an impact on employees´ variable remuneration.

In 2018, this model was applied to all the Group’s executives, and it has been extended to other employees in different geographies and in the corporate centre. In addition, for a group of managers (8,000 people from all geographies in which Santander operates), the corporate bonus schemes takes into account the achievement of strategic targets related to customer satisfaction and loyalty, risk management, the capital base and the risk-adjusted return. Remuneration therefore reflects what an individual has achieved as well as how he or she has behaved.

Diversity & Inclusion

If we are to understand modern society, we need a diverse and inclusive workforce that reflects society. Managing this talent diversity in an inclusive way, reflecting our values, will enable us to attract, develop and retain the best professionals and to achieve better results in a sustainable manner.

We have defined our general principles on Diversity & Inclusion (D&I), with the aim of serving as an ‘umbrella’ for all local initiatives as well as setting minimum standards for countries in their action plans, which will further improve diversity and inclusion in Santander. These general principles have been incorporated into our corporate culture policy as a key enabler to consolidate the cultural transformation.

To ensure appropriate management and promote diversity and inclusion at Group level we have created two working groups:

• A Global D&I Executive Working Group with business influencers and decision makers from different geographies and functions to develop and give direction to Group diversity and inclusion strategy.

| | | |

| | 2018 | |

% of women employed | | 54.5 | |

% of women in management positions | | 20.5 | |

Average age of the workforce | | 38.8 | |

% Employees with a disabilityA | | 1.7 | |

A. US and Mexico not included.

• A Global Network of D&I experts with representatives from the countries (operational team to share practices and be the transmission chain at a local level).

Additionally, in order to foster an inclusive leadership and to help to raise awareness, we have launched a global D&I online training based on learning experiences where participants will get to explore how to shift mindset and develop new skills.

85%

of employees believe Santander treats employees fairly regardless of their age, family, marital status, gender identity, expression, disability, race, colour, religion or sexual orientation. +4 vs 2017.A

A. 2018 Global engagement survey

In 2018 the following diversity and inclusion plans were approved to be implemented across the Group

• Talent selection: improve or at least mantain male/female ratio in divisions in selections for leadership positions.

• Talent identification: increase the percentage of women in the pipeline for succession planning in order to meet 2025 commitments.

• Eliminate gender pay inequality for those holding positions at the same level and department.

• Scorecard reflecting diverse representation for leaders.

• Support women growth by cross function mentoring and development programs.

• Actions to support maternity and parents.

• Cultural Diversity Mapping.

• Continue to reinforce Flexiworking by facilitating flexibility measures that promotes a better work-life balance.

• Affinity Groups. Minorities represented in different employees’ networks.

• Mapping and monitoring in all geographies. Include topic at the agenda of local boards.

• New programs to promote the hiring of people with different disabilities.

• Making sure employees are aware of D&I Training & Awareness programmes.

Further information regarding diversity in the Group available in ‘Key metrics’ section of this chapter.

Gender equality

Equal opportunities between men and women is a priority throughout the Group. We are promoting multiple initiatives in order to achieve effective equality between men and women at all levels.

The equal pay gap compares women and men who have the same job, level and function. In Santander this is very small. The gender pay gap (GPG) takes into account aggregate data of remuneration of men and women. Here, we still have a lot to do in terms of increasing representation of women at senior management levels (where remuneration is higher and gender diversity is still low). Changing this is a priority for the Group. This is why we have established specific diversity objectives for our top-level executives.

At the board level, 33% of members are women (December 2018). In February 2019, the board agreed to increase our current objective of women representation of 30% (which we have had since 2015) to equal presence (between 40% and 60%) in 2021.

In order to address the gender pay gap, we have established a methodology based on best practices, establishing common guidelines for both the Group and local units on how to address the pay gap. Likewise, local action plans have been promoted with periodic monitoring and control plans.

The bank also needs to have more diverse talent in STEM skills (Science, Technology, Engineering and Mathematics) - and to do so without harming gender diversity.

Our commitments

Gender diversity

2025 30%1

Cultural diversity (Different educational background, experience in different sector, international experience, race)

2025 70%

1.In top executive positions.

| | | | |

| | | | |

Gender pay gap . 31% Gender pay gap measures the difference in pay, regardless of the work´s nature, in an organisation, a business, an entire industry or the economy in general. GPG is calculated as the difference of the median of the compensation paid to male and female employees expressed as a percentage of the median of the male compensation. For this calculation, compensation includes base salary and variable remuneration, excluding benefits/in kind remuneration or local allowances. Reported figures are from a study conducted in 2018 (on the basis of 90% of the workforce), based on full-year 2017 compensation data updated to include 2018 compensation projections. | | Equal pay gap 3% Calculation of equal pay gap compares employees of the same job, level and function. This allows to compare like for like jobs. Factors included in the Group’s local policies which may impact compensation gap between male and female such as tenure in position, years of service, previous experience or background have not been considered to mitigate the reported figures. |

Employee experience

Keeping our workforce motivated is key to ensuring their commitment and success in helping people and businesses to prosper. At Santander we do it by implementing measures that encourage listening, work-life balance and a healthy and personally fulfilling environment.

1

Speaking up / active listening

If we are to build a responsible bank, everyone should feel able to speak up, not just to suggest how to improve doing things, but to alert management when things go wrong, or when there is suspected malpractice.

Listening Speak up Take action

Global engagement survey

Tracking our employees’ satisfaction via the engagement survey is fundamental for our Group, as it enables us to continue to progress towards being the best bank to work for.

2018 results show that our team is proud of working for Santander and committed to continue making a bank that is more Simple, Personal and Fair. The results also show a significant improvement in the perception that the Group promotes a culture that fosters diversity and which focusses on results. Important areas of improvement include the need to continue improving our processes to make them simpler and more transparent, giving the resources required to ensure the job is done as efficiently as possible.

| | | | |

| | |

| |

|

| | | | |

88%

of participation +4 vs 2017 | | 82%

of employees committed

+5 vs 2017 |

| | |

| | | | |

84%

of employees are

satisfied with Santander

as a place to work.

+9 vs 2017 | | 88%

of employees belive

Santander acts responsibly

in the way it does business

+1 vs 2017 |

Ethics channels

In 2018 we have implemented several initiatives to encourage people to speak up and we have created new ways to protect confidentiality and whistleblowers’ anonymity. We have worked on a project to develop a single ethical channel, through which employees will be able to report breaches both of the Code of Conduct and our Simple, Personal and Fair corporate culture. This channel will be managed by an independent third party, in order to ensure confidentiality and the anonymity of the complaint.

For further information see section 7 of Risk management chapter.

2

New ways of working

We promote the transition towards a more flexible way of working that enhances the work-life balance of our employees.

Our corporate flexiworking policy, applicable to the entire Group, includes a set of measures to which each person can benefit based on their personal needs and their professional situation. These measures refer to:

How we organise the working day (flexibility and time): schedules of entry / exit, alternative configurations to the day, regulation of vacations, guides and recommendations for the rational use of mail and meetings.

Where we work from (flexibility in space): working remotely, teleworking.

In addition, through an agreement signed with the representation of workers, Santander has committed to promoting a rational management of working time and its flexible application, as well as the use of technologies that allow a better organisation of the work of our professionals and that includes the right to digital disconnection.

Likewise, we are also redesigning our offices to obtain a new work space that better encourages collaboration.

| | | | |

| | |

|

| | | | |

| | | | |

82%

of employees indicate that their direct manager helps them reach a

reasonable balance between personal and professional life.A | | 84%

employees indicate that their direct manager facilitates flexibility in the work team.A A. 2018 Global engement survey results. |

3

Culture of recognition

The StarMeUp initiative is a global recognition network that allows employees to appraise employees who lead by example by championing SPF behaviours.

In 2018, one and a half million StarMeUp stars have already been given by Santander’s professionals to other colleagues. This is proof of how the culture of recognition is being consolidated in the Group.

This year, we have reached more than 132,000 active users of StarMeUp in the Group, 11% more than the goal set during the first months of 2018, and we have already given 689,000 stars to our colleagues.

4

Volunteering

Volunteering builds a strong team spirit and a sense of purpose – while also helping the communities in which we operate. Thanks to our corporate volunteering policy, employees are entitled to spend a certain number of working hours each month or year volunteering.

In 2018 our legal services, in line with the strategy and culture of the Group, have launched Santander Legal Pro Bono. This challenge requires our lawyers to provide voluntary and unpaid work, using all their knowledge and professional skills to support non-profit social, cultural or educational organisations that cannot afford legal services, and whose aim is helping persons in a situation of social vulnerability.

Likewise, in headquarters, throughout December, we developed ‘ideas marathons’ (related to communication and marketing, technology and systems, human resources), at which our team helped various NGOs to improve their identity and brand image, their presence on social networks and branding, as well as their organisation and analysis of data. We also helped organisations develop their support for communities – for example, so that one charity which cares for young people can help train them for the labour market.

Pro Bono activities are part of the Group’s corporate social responsibility and, in particular, in the objective of creating value for the community in the long-term.

In countries such as Brazil, Spain, the United States, Poland, Portugal, or the United Kingdom, our employees have also devoted working hours to promoting financial education and teaching people to manage their finances in an effective and organised way.

Likewise, employees also participate in numerous initiatives to improve the quality of life of people.

Our Group Executive Chairman Ana Botín, participating in a chariry toy collection organised in collaboration with the Spanish Red Cross in Boadilla del Monte, Madrid.

| | | | |

| | |

| | | | |

+40,000 | | +130,000 |

employees participating

in community activities | | hours devoted |

| | |

Banco Santander, host of the European Pro-Bono Summit 2018

The Group City hosted the European Pro-Bono and Skills-Based Volunteering Summit, the leading international congress in this field. The gathering was attended by over 130 people from around 20 countries across five continents, addressed by more than 35 international speakers on how to leverage employee talent and generate a positive social impact.

5

Health and occupational risk prevention

Santander has an occupational risk prevention plan available to all the employees on the corporate intranet.

We are aware that one of the important aspects of motivation, commitment and real equality for our employees is the balance between personal and work life.

Santander continues to promote a healthy and work-life balance, through policies and services to address the personal and family needs of our employees. Our General Code of Conduct highlights the importance of promoting a working environment that is compatible with personal and family life.

In addition, within the New Ways of Working initiative, Santander has designed the new work spaces and their equipment, both from the ergonomic perspective and from the safety aspect.

BeHealthy

In Santander, the health of our people is the health of our company. This is why we have a commitment to be one of the healthiest companies in the world, and offer employees health and wellness benefits, and raise awareness on this topic, through our BeHealthy programme.

In 2018 we partnered with The Leadership Academy of Barcelona to launch a digital space where employees around the world can access training on the four pillars of BeHealthy: Know your numbers, Move, Eat well, and BeBalanced. In this space employees can access the flagship training programme called Sustaining Executive Performance where they can find the keys to achieving improved performance, both personally and at work, by through encouraging healthy habits.

Also, in 2018 we signed a global agreement with an innovative company called Gympass that offers colleagues the chance to benefit from over 40,000 affiliated health and wellness centers across the globe for one membership, offering a wide range of activities from gyms, cross-fit, dancing, yoga, pilates, among others.

| | | | | | | |

| | | | |

| | | | | | | |

3.7% | | 10,367 | | 0.5% |

Absenteeism rateA | | thousand hours missed due to non-working related illnesses & accidents | | Work-related illness rateB |

A. Hours missed due to occupational accident, non-work related illness or non-work related accident for every 100 hours worked.

B. Hours missed due to occupational accident involving leave for every 100 hours worked.

For additional data disclosure, see “Key metrics’ section of this chapter.

Responsible business practices

Being responsible means offering our customers products and services that are Simple, Personal and Fair. We need to do the basics brilliantly and, when things go wrong, we need to solve problems fast and learn from our mistakes.

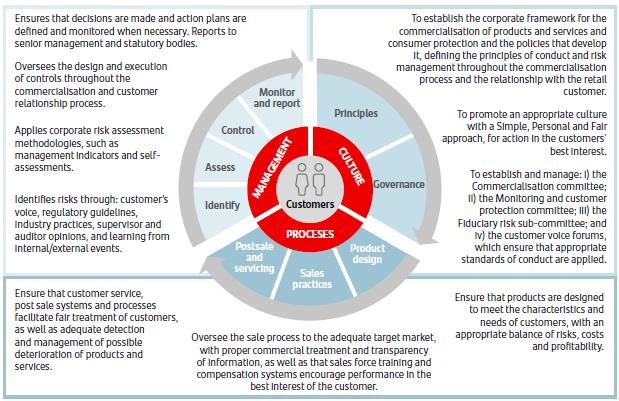

Products and services commercialisation and consumer protection

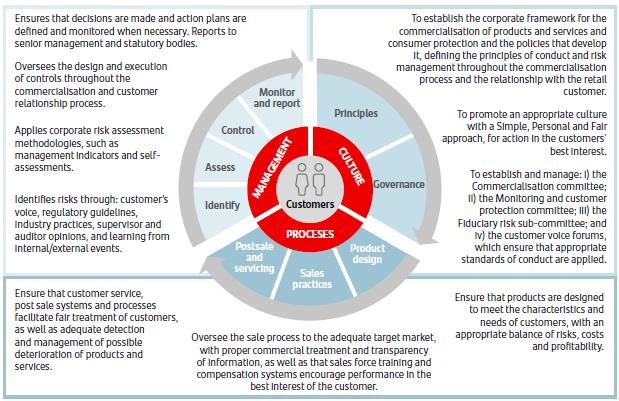

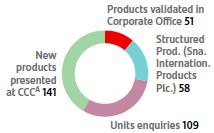

Our Product Governance and Consumer Protection function, within our Compliance and Conduct area, designs the crucial elements for the appropriate management and control of marketing and consumer protection.

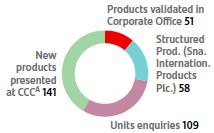

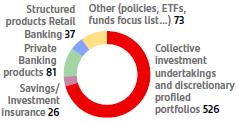

In this context the Group has a commercialisation committee, whose objective is to prevent the inappropriate distribution of products and services and to ensure the protection of customers by validating products and services. It also has a monitoring and consumer protection committee, which monitors the products and services we already have in the market and ensures that customers‘ needs are met and their rights are protected throughout the entire product life cycle.

Additionally, our corporate consumer protection policy sets out the specific criteria to identify, organise and execute the principles of consumer protection for our customers, and also sets out the specific criteria for the control and monitoring of compliance.

Financial education

Financial education is a key element in the relationship with our customers and is part of our principles of consumer protection. We are committed to promoting financial knowledge, educating on how to use banking services effectively and generating more confidence and security in their use.

In order to structure this activity and ensure homogeneous principles of conduct across all financial education initiatives, we continue working on the design and development of some best practice guidelines applicable to all these initiatives, in line with the criteria of supervisors and regulators.

For more detail on product governance and consumer protection see ‘Risk management’ chapter.

For more information on financial education see ‘Community investment’ section of this chapter.

Corporate consumer protection policy: principles of financial consumer protection

| Treat Customer fairly Complaints handling Consideration of special customer’ circumstances and prevention of over-indebtedness Data protection Customer-centric design of products and services Responsible pricing Financial education Transparent communication Responsible innovation Safeguarding of assets |

The Group has worked on standards and good practices when dealing with vulnerable customers and preventing over-indebtedness. This enables us to transmit to all business units, standards of action to promote the definition, identification, treatment and management of clients in special circumstances and apply solutions that suit their specific needs, to proceed in their best interests and always offer viable solutions.

These standards and good practices will be included in a corporate guide that will establish, among other, a common definition of vulnerable customer and prevention measures of over-indebtedness.

| |

We adapt quickly to market changes |

| |

| |

After the financial reform carried out in Mexico, a specific complaints channel was created so that customers could raise their complaints about certain activity cases of the recovery agencies.

In response we evaluated the treatment of customers throughout the Group in order to identify possible improvements in this process and share good practices among all business units.

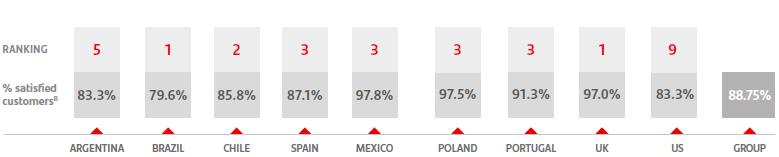

Operational excellence and customer satisfaction

We are consistently tracking our customers’ views and their experiences with Santander. This data reveals where we can improve our services further, and helps us gauge customers’ loyalty to Santander. More than a million surveys are conducted annually.

To ensure that the entire Group remains focused on the customer, customer satisfaction has been included as a metric in the variable remuneration systems of most of the Group’s employees.

Customer satisfaction

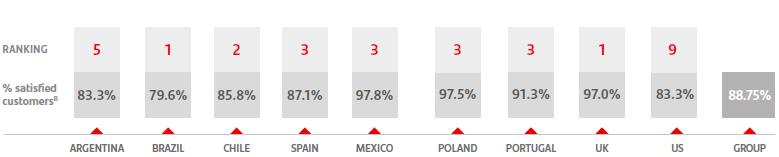

Customer satisfaction by countries

B. Internal benchmark of active individual customers’ experience and satisfaction. Data at 2018 year-end. Audited.

New, redesigned branches are transforming customers’ experience |

| | | | | |

With initiatives such as WorkCafé in Chile, Smart Red in Spain and the digital branch in Argentina, our new branches are transforming customer experience in nearly 1,000 locations. | |

| | | | |

| | are

20% | |

| | more productive | |

| | | |

| | | | |

| | generate

96% | |

| | customer satisfaction | |

| | | |

| | Increase brand visibility and engagement with communities |

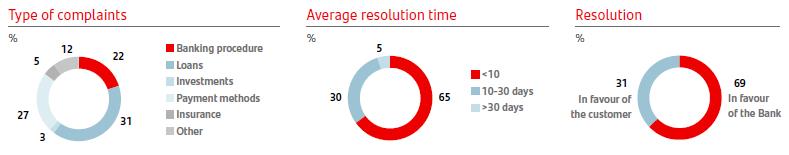

Complaints management

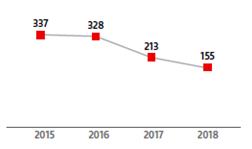

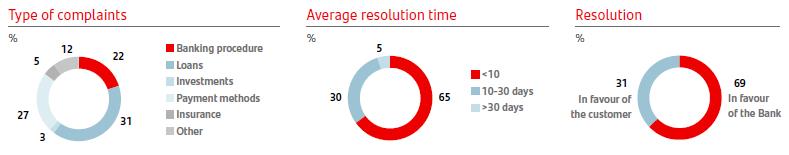

We don’t simply aim to address complaints, but to learn from them – tackling the issues that gave rise to complaints in the first place. The Group procedure for complaint management and analysis aims at adequately handle any complaints submitted, ensuring compliance with the local and sectoral regulations applicable, and to provide customers with the best possible service.

Root-cause analysis has been reinforced with the application of Group methodologies and standards. In addition, reporting and governance in all units has been completed in order to identify recurrent or systemic incidents or problems that could generate detriment in customers, to correct their original causes.

Listen We consider it essential to listen carefully to our customers´ questions, complaints and claims. | |

| | |

| | | We listen to our customers, as their loyalty to Santander generates sustainable returns. |

Analyse Review and understand the customers’ needs. | | |

| | |

Act According to the nature of the complaints, provide innovative solutions. | | |

| | | |

Improve Apply the improvement globally. | | | |

| | | |

| | | | |

|