Filer and Investment Company Act File Number:

Hennessy Funds Trust (811-07168)

Commission File Number of the Related Registration Statement: 333-218702

Filed Pursuant to Rule 425 under the

Securities Act of 1933 and deemed filed

Pursuant to Rule 14a-6 of the Securities Exchange Act of 1934

Subject Company and Investment Company Act File Number:

Rainier Investment Management Mutual Funds (811-08270)

Frequently Asked Questions

Regarding the Proposed Reorganization of the Rainier U.S. Funds into the Hennessy Funds

Why is this reorganization being proposed?

Rainier Investment Management, LLC (“Rainier”) recently completed a strategic review of the management and operations of the Rainier U.S. Funds and determined that it would be advisable to pursue a reorganization with another fund group who it believed could successfully manage the investments of current shareholders of the Rainier U.S. Funds. That search led Rainier to Hennessy Advisors, Inc. (“Hennessy Advisors”), a company who Rainier believes is focused on providing high-quality investment management services and customer service to their existing Hennessy Funds shareholders and who is well suited to acquire the assets of the Rainier U.S. Funds.

What fund will I be invested in if the proposed reorganization is approved?

Shareholders of the Rainier Mid Cap Equity Fund and the Rainier Small/Mid Cap Equity Fund will become shareholders of Hennessy Cornerstone Mid Cap 30 Fund. Shareholders of the Rainier Large Cap Equity Fund will become shareholders of the Hennessy Cornerstone Large Growth Fund.

Shareholders of the Rainier U.S. Funds who currently hold Original Class shares will receive Investor Class shares of the applicable Hennessy Fund, while shareholders of the Rainier U.S. Funds who currently hold Institutional Class shares will receive Institutional Class shares of the applicable Hennessy Fund.

What are the ticker symbols and CUSIP numbers for the Funds involved in the proposed reorganization?

When will the proposed reorganization become effective?

Subject to the approval of the shareholders of the Rainier U.S. Funds, it is anticipated that the reorganization will become effective September 18, 2017.

What are the tax implications resulting from the reorganization?

The reorganization has been structured with the intention that it qualify, for federal income tax purposes, as a tax-free reorganization under the Internal Revenue Code. Therefore, shareholders should not recognize any gain or loss on shares of the Rainier U.S. Funds for federal income tax purposes as a result of the reorganization. Please note that any redemptions made prior to the reorganization date would be subject to applicable taxes.

Will any distributions be paid prior to the reorganization?

It is anticipated that there will be a capital gains distributions paid for each of the Rainier U.S. Funds prior to the reorganization. Additionally, the Rainier Large Cap Equity Fund may have a small ordinary income distribution. Distributions are scheduled to be paid on September 13, 2017, to shareholders of record as of September 12, 2017.

Will fees and expenses change as a result of the proposed reorganization?

It is anticipated that shareholders of the Rainier U.S. Funds will benefit from a lower expense ratio as a result of this proposed reorganization, currently estimated to be a reduction of between 1 and 20 basis points (a basis point is equal to 1/100th of 1%) as follows:

The Hennessy Funds are no-load, and like the Rainier U.S. Funds, are not subject to any sales charges, redemption fees or exchange fees.

The expense ratios for the Rainier Mid Cap Equity Fund, the Rainier Small/Mid Cap Equity Fund and Original Class shares of the Rainier Large Cap Equity Fund shown above are the gross expense ratios from the Annual Report of the Rainier U.S. Funds dated March 31, 2017. The pro forma expense ratio shown above for Institutional Class shares of the Rainier Large Cap Equity Fund is higher than the net expense ratio shown in the Annual Report of the Rainier U.S. Funds dated March 31, 2017, to reflect the effect of reduced assets for the Rainier Large Cap Equity Fund and Rainier Investment Management Mutual Funds and to reflect the expiration after July 31, 2017, of Rainier’s waiver of 0.07% of its advisory fee.

Hennessy Advisors has agreed that the fees and expenses of the applicable classes of the Hennessy Cornerstone Mid Cap 30 Fund and the Hennessy Cornerstone Large Growth Fund will be capped to the extent necessary so that expenses (exclusive of all federal, state, and local taxes, interest, brokerage commissions, acquired fund fees and expenses and other costs incurred in connection with the purchase and sale of securities, and extraordinary items) do not exceed the total annual fees and expenses of the applicable classes of the Rainier Small/Mid Cap Equity Fund and Rainier Large Cap Equity Fund, respectively, as reflected in the table above for a period of two years from the date of the reorganization.

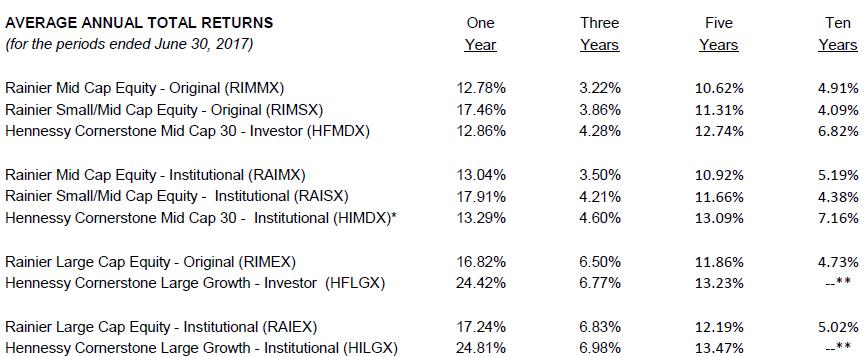

How have the Hennessy Cornerstone Mid Cap 30 Fund and Hennessy Cornerstone Large Growth Fund performed in comparison to the Rainier Mid Cap Equity Fund, Rainier Small/Mid Cap Equity Fund and Rainier Large Cap Equity Fund?

| * | The inception date of the Hennessy Cornerstone Mid Cap 30 Fund’s Institutional Class is 3/3/08. Performance shown prior to the inception of Institutional Class shares reflects the performance of the Hennessy Cornerstone Mid Cap 30 Fund’s Investor Class shares and includes expenses that are not applicable to and are higher than those of Institutional Class shares. |

** The Hennessy Cornerstone Large Growth Fund does not yet have ten-year performance. Since the inception of the Hennessy Cornerstone Large Growth Fund (3/20/09), the average annual return was 16.89% for Investor Class shares and 17.19% for Institutional Class shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com for the Hennessy Funds or rainierfunds.com for the Rainier U.S. Funds.

Expense ratios from each fund’s most current prospectus are as follow:

Rainier Mid Cap Equity Fund: Original Class = 1.37% gross/1.35% net; Institutional Class = 1.13% gross/1.10% net

Rainier Small/Mid Cap Equity Fund: Original Class = 1.33%; Institutional Class = 1.00%

Rainier Large Cap Equity Fund: Original Class = 1.19% gross/1.12% net; Institutional Class = 0.89% gross/0.82% net

Rainier has contractually agreed to limit expenses until July 31, 2017

Hennessy Cornerstone Mid Cap 30 Fund: Investor Class = 1.35%; Institutional Class = 0.97%

Hennessy Cornerstone Large Growth Fund: Investor Class = 1.26%; Institutional Class = 1.02%

Will my service providers change if the proposal is approved?

If the proposed reorganization is approved, the investment manager will change from Rainier to Hennessy Advisors. However, transfer agency, custodian and distribution services will continue to be provided by U.S. Bancorp Fund Services, LLC, the current service provider for both the Rainier U.S. Funds and the Hennessy Funds. The Rainier U.S. Funds and the Hennessy Funds have similar purchase and redemption procedures.

How will shareholders of the Rainier U.S. Funds be notified of the proposed reorganization?

A supplement to the Rainier U.S. Funds prospectus was filed on June 2, 2017, notifying shareholders of the proposed reorganization of the Rainier U.S. Funds into the Hennessy Funds. A Notice of the Special Meeting of Shareholders of the Rainier U.S. Funds and proxy voting information will be first sent on or about July 21, 2017, to shareholders of record as of June 28, 2017. Shareholders may be contacted by Broadridge, a proxy solicitation firm, in August or September if they have not yet voted their shares.

Will I get to vote on this proposed reorganization?

Yes. A combined proxy statement and prospectus will be first sent to all shareholders of the Rainier U.S. Funds on or about July 21, 2017, with instructions on how to vote for or against the proposed reorganization.

How does the Board of Trustees of the Rainier U.S. Funds recommend that I vote?

After careful consideration, the Board of Trustees of Rainier Investment Management Mutual Funds (the “Rainier Trust Board”) approved the plan for the proposed reorganization after concluding that the implementation of the reorganization is advisable and in the best interests of the Rainier U.S. Funds’ shareholders. The Rainier Trust Board recommends that you vote “FOR” the proposal.

How do I cast my vote?

Shareholders may authorize proxies to cast their votes (1) by completing, signing, dating and promptly returning the proxy card that was delivered with the combined proxy statement and prospectus; (2) by calling the toll-free telephone number listed on the proxy card; or (3) via the Internet at the website shown on the proxy card. Shareholders may also vote in person at the special meeting of shareholders to be held September 14, 2017.

For questions regarding voting, shareholders may contact Broadridge, the proxy solicitor for the Rainier U.S. Funds, by calling 1-855-928-4498.

What happens if the proposed reorganization is not approved?

If the reorganization is not approved by shareholders of all of the Rainier U.S. Funds, the Rainier U.S. Funds will continue to operate and the Rainier Trust Board may take any further action it deems to be in the best interest of the Rainier U.S. Funds and their shareholders, including terminating the Rainier U.S. Funds, in all cases subject to approval by the Rainier U.S. Funds’ shareholders if required by applicable law.

If enough votes are not cast in favor of the proposal by any of the Rainier U.S. Funds, the Rainier Trust Board may seek to adjourn the special meeting of shareholders to obtain sufficient votes.

Who do I call if I have questions or would like more information?

Rainier U.S. Funds – 1-800-248-6314.

Hennessy Funds – 1-800-966-4354.

Who is Hennessy Advisors?

Founded in 1989, Hennessy Advisors is a publicly traded investment manager offering 14 mutual funds under the Hennessy Funds brand. Hennessy Advisors is focused on providing high-quality investment management services and superior customer service to the shareholders of the Hennessy Funds. As of June 30, 2017 (prior to the proposed reorganization), Hennessy Advisors had assets under management of approximately $6.6 billion.

Who manages the Hennessy Cornerstone Mid Cap 30 and the Hennessy Cornerstone Large Growth Funds?

The Hennessy Cornerstone Mid Cap 30 and Hennessy Cornerstone Large Growth Funds are co-managed by Neil Hennessy, President and Chief Investment Officer of the Hennessy Funds, Brian Peery, Portfolio Manager, and Ryan Kelley, CFA, Portfolio Manager.

Neil Hennessy is a seasoned portfolio manager with over three decades of financial industry experience. Neil began his career as a financial advisor, and in 1989 he opened his own broker/dealer firm. In 1996, Neil founded his own asset management firm and launched his first mutual fund. Neil has a successful history acquiring asset management companies and starting mutual funds, and today he oversees the entire family of Hennessy Funds. Today, Neil serves as the Chief Executive Officer, President, and Chairman of the Board of Directors of Hennessy Advisors. He is also the President, Chief Investment Officer, Portfolio Manager, and Chairman of the Board of Trustees of Hennessy Funds Trust. Neil graduated from the University of San Diego and the Wharton School of Upper Management through the SIA.

Brian Peery has over two decades of experience in the financial services industry, having held institutional sales, trading, research and analyst positions. Brian began his financial career at a boutique investment research shop working as an equities analyst and went on to manage research and trading for a full service brokerage firm. Brian has been with Hennessy Funds since 2002, where he has served on the Investment and Research Committee and held roles as Director of Sales and Director of Research. Brian received a Bachelor’s degree from the University of Richmond (VA).

Ryan Kelley brings nearly two decades of experience in the financial services industry to Hennessy Funds, having held positions in investment banking, institutional research, trading, and portfolio management. Ryan began his career in corporate finance at FBR & Co., a leading investment bank headquartered in the Washington, D.C. area, and later moved to the institutional equity research team. In 2005, Ryan joined the FBR Funds portfolio management team and transitioned to Hennessy Funds when the firm acquired FBR in 2012. Ryan received a Bachelor’s degree from Oberlin College. He is a CFA charterholder and member of both The Boston Security Analysts Society and the CFA Society North Carolina.

How are the Hennessy Cornerstone Mid Cap 30 and the Hennessy Cornerstone Large Growth Funds managed?

The Hennessy Cornerstone Funds employ highly-disciplined and repeatable investment formulas.

The Hennessy Cornerstone Mid Cap 30 Fund formula marries value with momentum, seeking growth at a reasonable price. Stocks for the portfolio are selected by strict adherence to the following time-tested, quantitative formula:

- Market capitalization between $1 and 10 billion

- Price-to-sales ratio below 1.5

- Annual earnings higher than the previous year

- Positive stock price appreciation for the past three- and six-month periods

- Select the 30 stocks with the highest 12-month price appreciation

The Hennessy Cornerstone Large Growth Fund formula seeks growth at a reasonable price. Stocks for the portfolio are chosen from the universe of stocks in the S&P Capital IQ Database (the “Database”) by strict adherence to the following time-tested, quantitative formula:

- Market capitalization that exceeds the average of the Database

- Price to cash flow ratio less than the median of the Database

- Positive total capital

- Select the 50 stocks with the highest one-year return on total capital

In connection with the proposed reorganization and investing, shareholders should carefully consider the investment objective, risks, charges and expenses of the Rainier U.S. Funds and the Hennessy Funds. This and other information is contained in the Rainier U.S. Funds’ and the Hennessy Funds’ statutory and summary prospectuses, which can be obtained by contacting Rainier U.S. Funds at 1-800-248-6314 or visiting rainierfunds.com or by contacting Hennessy Funds at 1-800-966-4354 or visiting hennessyfunds.com. Read them carefully before investing.

Hennessy Funds Trust has filed a definitive combined proxy statement and prospectus as part of a Registration Statement on Form N-14 with the Securities and Exchange Commission in connection with the proposed reorganization, which will be sent to shareholders of the Rainier U.S. Funds. Shareholders of the Rainier U.S. Funds are urged to read the combined proxy statement and prospectus because it contains important information about the proposed reorganization. The proxy statement and prospectus, as well as other relevant documents (when available), may be obtained free of charge from the SEC’s website at www.sec.gov or by calling 1-800-966-4354.

The tax information provided is not exhaustive. Shareholders must consult their tax advisor for advice and information concerning their particular situation. Neither the Rainier U.S. Funds nor the Hennessy Funds, including any of their representatives, may give tax advice.

Mutual fund investing involves risk. Principal loss is possible. Fund specific risks are as follow:

Hennessy Cornerstone Mid Cap 30 Fund and Hennessy Cornerstone Large Growth Fund

Small and medium capitalized companies may have limited liquidity and greater price volatility than large capitalization companies. The Funds’ formula-based strategies may cause the Funds to buy or sell securities at times when it may not be advantageous.

Rainier Mid Cap Equity Fund and Rainier Small/Mid Cap Equity Fund

Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investment in IPOs can be volatile and can fluctuate considerably. IPOs can have a magnified impact on funds with a small asset base. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods.

Rainier Large Cap Equity Fund

Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Investment in IPOs can be volatile and can fluctuate considerably. IPOs can have a magnified impact on funds with a small asset base. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods.

Price-to-sales is a tool for calculating a stock's valuation relative to other companies. It is calculated by dividing a stock’s current price by its revenue per share. Price-to-cash flow ratio is a stock valuation measure calculated by dividing a firm's cash flow per share into the current stock price.

The S&P Capital IQ Database is a robust source of data on the universe of publicly traded companies.

| The Hennessy Funds and the Rainier Funds are distributed by Quasar Distributors, LLC. | 7/17 |