UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

Hennessy Advisors, Inc.

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2006

Date of reporting period: October 31, 2006

Item 1. Report to Stockholders.

HENNESSY FUNDS

ANNUAL REPORT

OCTOBER 31, 2006

Hennessy Cornerstone Growth Fund (HFCGX)

Hennessy Cornerstone Growth Fund, Series II (HENLX)

Hennessy Focus 30 Fund (HFTFX)

Hennessy Cornerstone Value Fund (HFCVX)

Hennessy Total Return Fund (HDOGX)

Hennessy Balanced Fund (HBFBX)

Contents

| Letter to shareholders | 1 |

| Change in value of $10,000 investment | 7 |

| Summaries of investments | |

| Hennessy Cornerstone Growth Fund | 13 |

| Hennessy Cornerstone Growth Fund, Series II | 17 |

| Hennessy Focus 30 Fund | 21 |

| Hennessy Cornerstone Value Fund | 24 |

| Hennessy Total Return Fund | 28 |

| Hennessy Balanced Fund | 31 |

| Financial statements | |

| Statements of assets and liabilities | 34 |

| Statements of operations | 36 |

| Statements of changes in net assets | 40 |

| Financial highlights | |

| Hennessy Cornerstone Growth Fund | 44 |

| Hennessy Cornerstone Growth Fund, Series II | 46 |

| Hennessy Focus 30 Fund | 48 |

| Hennessy Cornerstone Value Fund | 50 |

| Hennessy Total Return Fund | 52 |

| Hennessy Balanced Fund | 54 |

| Statement of cash flows - Hennessy Total Return Fund | 56 |

| Notes to the financial statements | 57 |

| Report of Independent Registered Public Accounting Firm | 66 |

| Directors and Officers of the Funds | 68 |

| Expense example | 74 |

| Proxy voting policy | 76 |

WWW.HENNESSYFUNDS.COM

LETTER TO SHAREHOLDERS

December, 2006

Dear Hennessy Funds Shareholder:

As I look at the last number of letters I’ve written to our shareholders, I realize that the message seems to be exactly the same - that the economy is in good shape and that the market should continue to grow. As I write this letter, I still truly believe that is the case! At Hennessy Funds, we look at current and historical quantitative data, ignoring the sensational media headlines, to make our investing decisions. It is that same data that leads us to our current view of the economy and the stock market. We maintain our optimistic opinion that the market is poised for continued, moderate growth as we move into 2007. Major economic indicators, such as unemployment, inflation and interest rates, remain at favorable levels. We expect corporate profits to continue to increase in the 10-15% range, which alone should be enough to propel the markets higher by that amount in the coming year.

During the past couple of years, we have experienced steady market growth supported by underlying revenue growth. However, we have seen revenue growth outpacing stock price growth, meaning that we believe stock prices are generally undervalued and have room to grow. We also see that the major market indices are currently undervalued versus their historical averages based on price to sales, which is the criteria that we use in our portfolios to determine a stock’s relative value. The Dow is undervalued by approximately 5% and the S&P 500 is undervalued by approximately 9%. Based on these findings, we believe that market has the ability to not only gain the 10-15% that corporate profits growth would suggest, but it could potentially experience an additional gain of between 5 and 9%. Based on our analysis, this excess return would bring the market more in line with its historical averages, putting the Dow Jones Industrial Average above 14,000 by the end of 2007.

Despite good market performance and positive economic indicators, the market is not experiencing the euphoria that we have seen in the past with technology or real estate stocks. Some investors continue to sit on the sidelines waiting for a huge surge in performance before investing more heavily. We believe, however, that smart investors understand we are in a continued bull market, and are investing accordingly.

HENNESSY FUNDS 1-800-966-4354

Returns at a Glance (as of October 31, 2006)

| | | | | | | | |

| | | One Year | Five Year | Since |

| | | Annualized | Annualized | Inception |

| | | Return | Return | (11/1/96) |

Hennessy Cornerstone Growth Fund (HFCGX) | | | 13.59 | % | | 17.43 | % | | 15.93 | % |

| Russell 2000 Index | | | 19.98 | % | | 13.76 | % | | 9.87 | % |

| S&P 500 Index | | | 16.34 | % | | 7.26 | % | | 8.66 | % |

| | | Four-Month | One Year | Five Year | Since |

| | | period | Annualized | Annualized | Inception |

| | | 7/1-10/31/06 | Return | Return | (7/1/05) |

Hennessy Cornerstone Growth | | | | | | | | | |

Fund, Series II (HENLX) | | | -4.47 | % | | 15.97 | % | | n/a | | | 8.33 | % |

| Russell 2000 Index | | | 6.22 | % | | 19.98 | % | | n/a | | | 15.40 | % |

| S&P 500 Index | | | 9.11 | % | | 16.34 | % | | n/a | | | 13.35 | % |

| | | One Year | Five Year | Since |

| | | Annualized | Annualized | Inception |

| | | Return | Return | (9/17/03) |

Hennessy Focus 30 Fund (HFTFX) | | | 16.18 | % | | n/a | | | 19.77 | % |

| S&P 400 Mid-cap Index | | | 13.43 | % | | n/a | | | 15.08 | % |

| S&P 500 Index | | | 16.34 | % | | n/a | | | 11.90 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance shown does not reflect a 1.5% redemption fee on shares held for less than 90 days. If it did, total returns would be reduced.

For the twelve months ending October 31, 2006, we saw strong performance among large-cap, dividend paying stocks. For the first time in a number of years, the Dow Jones Industrial Average outperformed the S&P 500, with the high dividend-yielding “Dogs of the Dow” leading the pack. Energy, commodities and industrial stocks have been particularly volatile over the past twelve months, but oil prices seem to finally be settling down.

LETTER TO SHAREHOLDERS

| | | | | | | | |

| | | One Year | Five Year | Since |

| | | Annualized | Annualized | Inception |

| | | Return | Return | (11/1/96) |

Hennessy Cornerstone Value Fund (HFCVX) | | | 21.00 | % | | 9.51 | % | | 8.13 | % |

| Russell 1000 Index | | | 16.02 | % | | 7.92 | % | | 8.89 | % |

| S&P 500 Index | | | 16.34 | % | | 7.26 | % | | 8.66 | % |

| | | One Year | Five Year | Since |

| | | Annualized | Annualized | Inception |

| | | Return | Return | (7/29/98) |

Hennessy Total Return Fund (HDOGX) | | | 22.48 | % | | 8.06 | % | | 4.94 | % |

| Dow Jones Industrial Average | | | 18.47 | % | | 8.25 | % | | 5.81 | % |

| S&P 500 Index | | | 16.34 | % | | 7.26 | % | | 4.10 | % |

| | | One Year | Five Year | Ten Year | Since |

| | | Annualized | Annualized | Annualized | Inception |

| | | Return | Return | Return | (3/8/96) |

Hennessy Balanced Fund (HBFBX) | | | 14.92 | % | | 4.58 | % | | 4.89 | % | | 5.23 | % |

| Dow Jones Industrial Average | | | 18.47 | % | | 8.25 | % | | 9.29 | % | | 9.83 | % |

| S&P 500 Index | | | 16.34 | % | | 7.26 | % | | 8.64 | % | | 9.33 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance shown does not reflect a 1.5% redemption fee on shares held for less than 90 days. If it did, total returns would be reduced.

We are committed to maximizing long-term performance results for our investors by following our disciplined investment formulas, and we refuse to manipulate short-term results in order to try and meet or beat our benchmark indices. We are pleased with the performance of our funds over the past year, as we are with their longer term performance. For the twelve-month period ending October 31, 2006, the Hennessy Cornerstone Growth Fund and Hennessy Cornerstone Growth Fund, Series II underperformed their benchmark indices. The Hennessy Focus 30 Fund outperformed the mid cap index, but lagged the S&P 500 Index slightly. For the period, the Hennessy Cornerstone Growth Fund returned 13.59%, and the Hennessy Cornerstone Growth Fund, Series II

HENNESSY FUNDS 1-800-966-4354

returned 15.97%, versus the S&P 500 at 16.34% and the Russell 2000 at 19.98%. The Hennessy Focus 30 Fund returned 16.18%, versus the S&P 500 at 16.34% and the S&P 400 Midcap Index at 13.43%. There was significant volatility in the energy, industrial and materials stocks in these three portfolios, and performance of those stocks was mixed during the twelve-month period, with some companies delivering well above average returns and some with well below average returns. We believe that choosing individual stocks, not sectors, is the best way to build a portfolio, and performance of these three funds versus their benchmark indices for the twelve-month period ending October 31, 2006 can primarily be attributed to individual stock performance:

Hennessy Cornerstone Growth Fund: A variety of industrial stocks, including General Cable Corp., Manitowoc, Emcor Group and Amerco (parent company of UHaul), were portfolio leaders. Energy stocks Holly Corp. and Frontier Oil did well, however Sunoco and Oil States International showed poor performance during the period. Consumer discretionary stocks Escala Group and Six Flags experienced significant declines, which hurt the overall performance of the Fund.

Hennessy Focus 30 Fund: Materials stock Allegheny Technologies was the top performing stock in the fund, while Quanex was among the bottom performers. Industrial stocks McDermott International and Flowserve Corp. performed well, while Labor Ready did not. Healthcare companies WellCare Health Plans and Humana also performed well, however, consumer discretionary stock Building Materials Holding negatively affected the performance of the Fund.

Hennessy Cornerstone Growth Fund, Series II: Because this Fund rebalances in the summer, both the previous and current portfolios affected performance for the period. In the previous portfolio, purchased in Summer, 2005, Andersons Inc. was a top performing stock. Industrial stocks Badger Meter and Clean Harbors Inc. performed well, as did energy stocks Frontier Oil and Transmontaigne. Poor performance from home builders Standard Pacific, KB Home, Hovnanian and Ryland Group significantly hurt the performance of the previous portfolio. Within the current portfolio, purchased in Summer, 2006, AEP Industries, Casual Male and Meadowbrook Insurance Group are showing strong performance.

LETTER TO SHAREHOLDERS

As a note to our Hennessy Cornerstone Growth Fund, Series II shareholders, we are changing the fiscal year end of this Fund from June 30th to October 31st, to coincide with the fiscal year of our other Funds. Because of this, we also need to report performance of the Fund for that period. For the four-month period ending October 31, 2006, the Hennessy Cornerstone Growth Fund, Series II returned -4.47%, versus the S&P 500 Index at 9.11% and the Russell 200 Index at 6.22%. During the period, the underperformance of transportation stocks Old Dominion Freight, Universal Truckload Services and Arkansas Best Corp hurt the performance of the current Growth II portfolio. In addition, poor short-term returns from energy stocks Alon USA Energy, and FMC Technologies further hampered performance.

Our large-cap funds, which each select high dividend-paying stocks, fared better than our mid and small-cap funds for the twelve-month period ending October 31, 2006. The Hennessy Cornerstone Value Fund and Hennessy Total Return Fund each outperformed their benchmark indices, while the Hennessy Balanced Fund underperformed slightly. The Hennessy Cornerstone Value Fund returned 21.00% for the twelve months ending October 31, 2006, while the S&P 500 returned 16.34% and the Russell 1000 returned 16.02% for the same period. The Cornerstone Value Fund had strong performance from stocks BellSouth, Merck, ING Groep and Reynolds American. Forty six of the 50, or 92% of the stocks in the Cornerstone Value Fund portfolio reported positive returns for the twelve-month period.

The Hennessy Total Return Fund returned 22.48% for the twelve-month period ending October 31, 2006, and the Hennessy Balanced Fund returned 14.92%, versus the S&P 500 Index at 16.34% and the Dow Jones Industrial Average at 18.47%. Each of the “Dogs of the Dow”, the ten highest dividend-yielding stocks in the Dow Jones, which are the stocks included in both the Total Return and Balanced portfolios, had positive returns for the twelve-month period. Performance of both Funds was led by Merck, AT&T, J.P. Morgan Chase and General Motors. Despite strong performance from these stocks, the relatively low returns from short-term U.S. Treasury bills, which make up approximately half of the portfolio of the Hennessy Balanced Fund, caused that Fund to underperform its benchmarks.

We know that investing success comes from time in the market, not timing the market, so at Hennessy Funds we remain committed to our time-tested investment formulas. First and foremost, we remain committed to you, our shareholders, and we will always manage the

HENNESSY FUNDS 1-800-966-4354

portfolios with your best interest in mind. Thank you for your continued confidence and investment in the Funds. Should you have any questions or want to speak with us directly, please don’t hesitate to call us at

(800) 966-4354.

Best regards,

Neil Hennessy

President & Portfolio Manager

Past performance does not guarantee future results.

Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods.

The Hennessy Total Return and Balanced Funds are non-diversified, meaning they may concentrate their assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund.

References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the Schedule of Investments within this annual report for additional portfolio information, including percentages of holdings.

The S&P 500, Russell 2000, Russell 1000, S&P 400 Midcap and Dow Jones Industrial Average are unmanaged indices commonly used to measure the performance of U.S. stocks. The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. The Russell 2000 Index is a recognized small-cap index of 2000 smallest securities of the Russell 3000 Index, which is comprised of the 3,000 largest U.S. securities as determined by total market capitalization. The Russell 1000 is an unmanaged Index that measures the performance of large-cap U.S. stocks. The S&P 400 Midcap Index is an unmanaged Index that measures the performance of mid-cap U.S. stocks. One cannot invest directly in an index.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice. 12/06

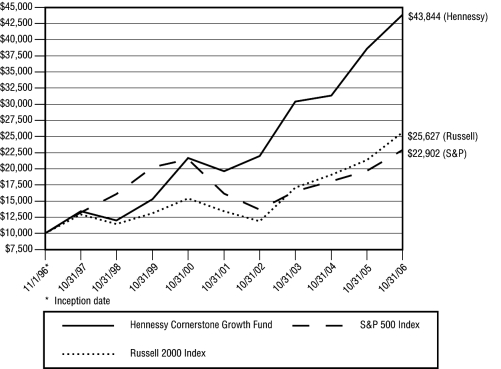

Change in Value of $10,000 Investment

HENNESSY CORNERSTONE GROWTH FUND

This chart assumes an initial gross investment of $10,000 made on November 1, 1996 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The funds impose a 1.5% redemption fee on shares held for less than 90 days. Performance data does not reflect redemption fee. Had the fee been included, returns would be lower.

AVERAGE ANNUAL TOTAL RETURN

PERIODS ENDED OCTOBER 31, 2006

| | | | | | | Since Inception |

| | | One Year | Five Years | 11/1/96 |

| Hennessy Cornerstone Growth Fund | | | 13.59 | % | | 17.43 | % | | 15.93 | % |

| Russell 2000 Index | | | 19.98 | % | | 13.76 | % | | 9.87 | % |

| S&P 500 Index | | | 16.34 | % | | 7.26 | % | | 8.66 | % |

RUSSELL 2000 INDEX - An unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

S&P 500 INDEX - An unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

HENNESSY FUNDS 1-800-966-4354

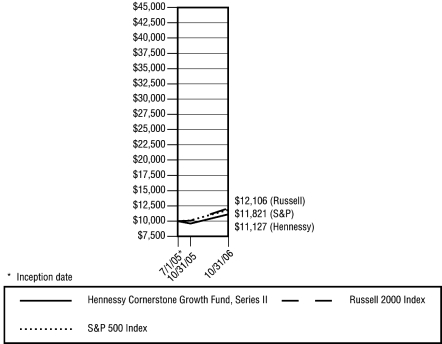

Change in Value of $10,000 Investment

HENNESSY CORNERSTONE GROWTH FUND, SERIES II

This chart assumes an initial gross investment of $10,000 made on July 1, 2005 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The funds impose a 1.5% redemption fee on shares held for less than 90 days. Performance data does not reflect redemption fee. Had the fee been included, returns would be lower.

AVERAGE ANNUAL TOTAL RETURN

PERIODS ENDED OCTOBER 31, 2006

| | | Since Inception |

| | One Year | 7/1/05* |

| Hennessy Cornerstone Growth Fund, Series II | 15.97% | 8.33% |

| Russell 2000 Index | 19.98% | 15.40% |

| S&P 500 Index | 16.34% | 13.35% |

| * | On July 1, 2005, Hennessy Advisors, Inc. became the investment advisor to Hennessy Cornerstone Growth Fund, Series II (formerly The Henlopen Fund). Due to the change in investment advisor and investment technique, performance is being quoted for the period after the change of investment advisor. |

RUSSELL 2000 INDEX - An unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

S&P 500 INDEX - An unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

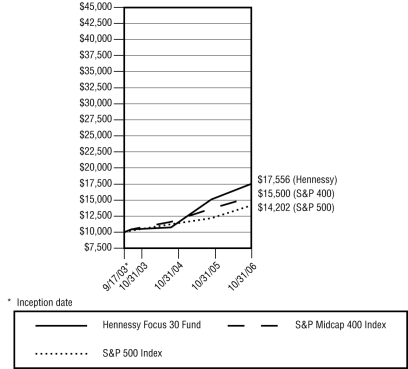

Change in Value of $10,000 Investment

HENNESSY FOCUS 30 FUND

This chart assumes an initial gross investment of $10,000 made on September 17, 2003 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The funds impose a 1.5% redemption fee on shares held for less than 90 days. Performance data does not reflect redemption fee. Had the fee been included, returns would be lower.

AVERAGE ANNUAL TOTAL RETURN

PERIODS ENDED OCTOBER 31, 2006

| | | Since Inception |

| | One Year | 9/17/03* |

| Hennessy Focus 30 Fund | 16.18% | 19.77% |

| S&P Midcap 400 Index | 13.43% | 15.08% |

| S&P 500 Index | 16.34% | 11.90% |

| * | On September 17, 2003, the SYM Select Growth Fund merged into the Hennessy Focus 30 Fund. Due to the change in advisor and investment technique, performance is being quoted for the period after the merger. |

S&P MIDCAP 400 INDEX - An unmanaged capitalization-weighted index of 400 stocks designed to measure performance of mid-sized companies through changes in the aggregate market value of the 400 stocks which represent all major industries.

S&P 500 INDEX - An unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

HENNESSY FUNDS 1-800-966-4354

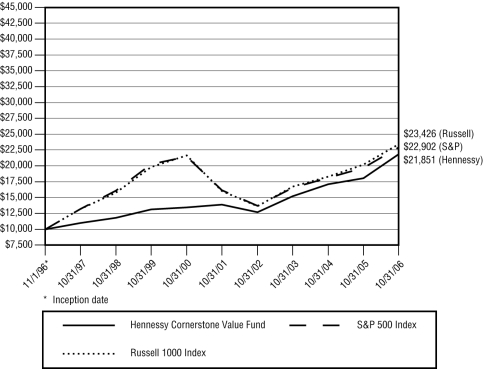

Change in Value of $10,000 Investment

HENNESSY CORNERSTONE VALUE FUND

This chart assumes an initial gross investment of $10,000 made on November 1, 1996 (inception). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The funds impose a 1.5% redemption fee on shares held for less than 90 days. Performance data does not reflect redemption fee. Had the fee been included, returns would be lower.

AVERAGE ANNUAL TOTAL RETURN

PERIODS ENDED OCTOBER 31, 2006

| | | | Since Inception |

| | One Year | Five Years | 11/1/96 |

| Hennessy Cornerstone Value Fund | 21.00% | 9.51% | 8.13% |

| Russell 1000 Index | 16.02% | 7.92% | 8.89% |

| S&P 500 Index | 16.34% | 7.26% | 8.66% |

RUSSELL 1000 INDEX - An unmanaged index which measures the performance of the 1,000 largest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index which measures the performance of the 3,000 largest U.S. Companies, based on total market capitalization, which represents approximately 98% of the U.S. investable equity market.

S&P 500 INDEX - An unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

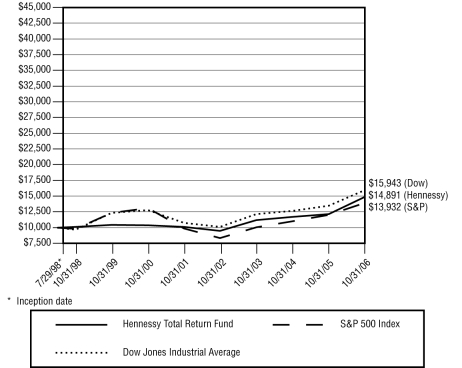

Change in Value of $10,000 Investment

HENNESSY TOTAL RETURN FUND

This chart assumes an initial gross investment of $10,000, made on July 29, 1998 (inception). Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Returns shown include the reinvestment of all dividend and other distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The funds impose a 1.5% redemption fee on shares held for less than 90 days. Performance data does not reflect redemption fee. Had the fee been included, returns would be lower.

AVERAGE ANNUAL TOTAL RETURN

PERIODS ENDED OCTOBER 31, 2006

| | | | Since Inception |

| | One Year | Five Years | 7/29/98 |

| Hennessy Total Return Fund | 22.48% | 8.06% | 4.94% |

| Dow Jones Industrial Average | 18.47% | 8.25% | 5.81% |

| S&P 500 Index | 16.34% | 7.26% | 4.10% |

DOW JONES INDUSTRIAL AVERAGE - The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major industrial companies.

S&P 500 INDEX - An unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

HENNESSY FUNDS 1-800-966-4354

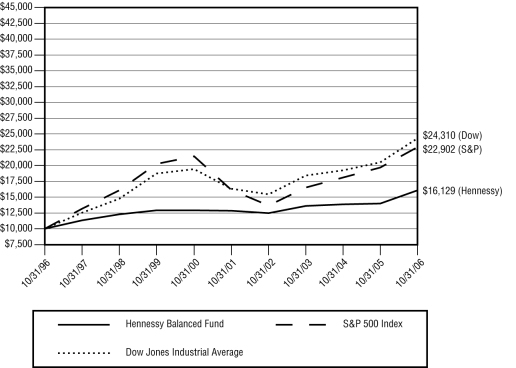

Change in Value of $10,000 Investment

HENNESSY BALANCED FUND

This chart assumes an initial gross investment of $10,000, made on October 31, 1996. Returns shown include the reinvestment of all dividend and other distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. The funds impose a 1.5% redemption fee on shares held for less than 90 days. Performance data does not reflect redemption fee. Had the fee been included, returns would be lower.

AVERAGE ANNUAL TOTAL RETURN

PERIODS ENDED OCTOBER 31, 2006

| | One Year | Five Years | Ten Years |

| Hennessy Balanced Fund | 14.92% | 4.58% | 4.89% |

| Dow Jones Industrial Average | 18.47% | 8.25% | 9.29% |

| S&P 500 Index | 16.34% | 7.26% | 8.64% |

DOW JONES INDUSTRIAL AVERAGE - The Dow Jones Industrial Average is an unmanaged index of common stocks comprised of major industrial companies.

S&P 500 INDEX - An unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

Summaries of Investments

The following summaries of investment portfolios are designed to help investors better understand each fund’s principal holdings. Each summary is as of October 31, 2006.

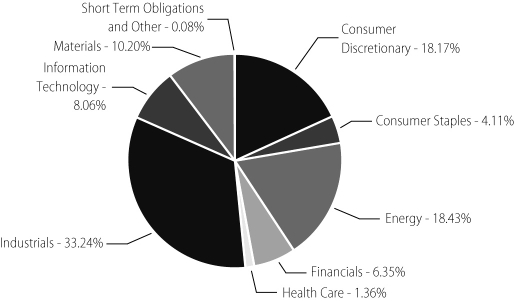

HENNESSY CORNERSTONE GROWTH FUND

(% of Net Assets)

TOP TEN HOLDINGS | % of net assets |

| Allegheny Technologies, Inc. | 3.67% |

| Manitowoc Co. | 3.43% |

| General Cable Corp. | 3.22% |

| EMCOR Group, Inc. | 2.91% |

| Aleris International, Inc. | 2.80% |

| Holly Corp. | 2.78% |

| Giant Industries, Inc. | 2.66% |

| Frontier Oil Corp. | 2.64% |

| Quanta Services, Inc. | 2.60% |

| Amerco, Inc. | 2.47% |

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND

| COMMON STOCKS - 99.92% | | Number | | | % of Net |

| | | of Shares | Value | Assets |

Consumer Discretionary - 18.17% | | | | | | | |

| Brightpoint, Inc. (a) | | | 1,412,500 | | $ | 17,091,250 | | | 1.36 | % |

| Circuit City Stores, Inc. | | | 971,300 | | | 26,205,674 | | | 2.10 | % |

| Conn’s, Inc. (a) | | | 577,500 | | | 13,871,550 | | | 1.11 | % |

| Dress Barn, Inc. (a) | | | 1,203,700 | | | 26,144,364 | | | 2.09 | % |

| Drew Industries, Inc. (a) | | | 781,800 | | | 21,225,870 | | | 1.70 | % |

| Escala Group, Inc. (a) | | | 1,068,700 | | | 5,332,813 | | | 0.43 | % |

| Nordstrom, Inc. | | | 586,500 | | | 27,770,775 | | | 2.22 | % |

| The Pantry, Inc. (a) | | | 437,500 | | | 23,878,750 | | | 1.91 | % |

| Papa John’s International, Inc. (a) | | | 711,100 | | | 26,097,370 | | | 2.09 | % |

| Payless ShoeSource, Inc. (a) | | | 992,700 | | | 26,554,725 | | | 2.12 | % |

| Six Flags, Inc. (a) | | | 2,292,000 | | | 13,064,400 | | | 1.04 | % |

| | | | | | | 227,237,541 | | | 18.17 | % |

Consumer Staples - 4.11% | | | | | | | | | | |

| Great Atlantic & Pacific Tea Co. | | | 974,500 | | | 26,964,415 | | | 2.15 | % |

| Playtex Products, Inc. (a) | | | 1,756,400 | | | 24,484,216 | | | 1.96 | % |

| | | | | | | 51,448,631 | | | 4.11 | % |

Energy - 18.43% | | | | | | | | | | |

| Frontier Oil Corp. | | | 1,120,300 | | | 32,936,820 | | | 2.64 | % |

| Giant Industries, Inc. (a) | | | 409,700 | | | 33,177,506 | | | 2.66 | % |

| Holly Corp. | | | 731,400 | | | 34,785,384 | | | 2.78 | % |

| Marathon Oil Corp. | | | 328,800 | | | 28,408,320 | | | 2.27 | % |

| Oil States International, Inc. (a) | | | 617,000 | | | 17,917,680 | | | 1.43 | % |

| Petro-Canada (b) | | | 550,400 | | | 23,441,536 | | | 1.87 | % |

| Sunoco, Inc. | | | 265,400 | | | 17,550,902 | | | 1.40 | % |

| Tesoro Petroleum Corp. | | | 331,700 | | | 21,208,898 | | | 1.70 | % |

| Valero Energy Corp. | | | 402,600 | | | 21,068,058 | | | 1.68 | % |

| | | | | | | 230,495,104 | | | 18.43 | % |

Financials - 6.35% | | | | | | | | | | |

| Banco Bradesco SA - ADR (b) | | | 710,500 | | | 25,428,795 | | | 2.03 | % |

| Banco Itau Holding Financiera SA - ADR (b) | | | 859,200 | | | 28,525,440 | | | 2.28 | % |

| WR Berkley Corp. | | | 691,700 | | | 25,496,062 | | | 2.04 | % |

| | | | | | | 79,450,297 | | | 6.35 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND

| COMMON STOCKS | | Number | | | % of Net |

| | | of Shares | Value | Assets |

Health Care - 1.36% | | | | | | | |

| Express Scripts, Inc. (a) | | | 266,100 | | $ | 16,955,892 | | | 1.36 | % |

Industrials - 33.24% | | | | | | | | | | |

| AAR Corp. (a) | | | 927,500 | | | 24,152,100 | | | 1.93 | % |

| Amerco, Inc. (a) | | | 336,400 | | | 30,854,608 | | | 2.47 | % |

| Astec Industries, Inc. (a) | | | 693,700 | | | 22,122,093 | | | 1.77 | % |

| Beacon Roofing Supply, Inc. (a) | | | 1,134,600 | | | 22,465,080 | | | 1.80 | % |

| EMCOR Group, Inc. (a) | | | 616,000 | | | 36,436,400 | | | 2.91 | % |

| Foster Wheeler Ltd. (a)(b) | | | 559,900 | | | 25,167,505 | | | 2.01 | % |

| General Cable Corp. (a) | | | 1,071,600 | | | 40,292,160 | | | 3.22 | % |

| JLG Industries, Inc. | | | 937,900 | | | 25,932,935 | | | 2.07 | % |

| Manitowoc Co. | | | 781,600 | | | 42,894,208 | | | 3.43 | % |

| Quanta Services, Inc. (a) | | | 1,777,700 | | | 32,531,910 | | | 2.60 | % |

| Reliance Steel & Aluminum Co. | | | 723,700 | | | 24,859,095 | | | 2.00 | % |

| Trinity Industries, Inc. | | | 781,800 | | | 28,191,708 | | | 2.25 | % |

| USG Corp. (a) | | | 321,400 | | | 15,713,246 | | | 1.26 | % |

| Watsco, Inc. | | | 357,000 | | | 17,778,600 | | | 1.42 | % |

| Westinghouse Air Brake Technologies Corp. | | | 838,000 | | | 26,304,820 | | | 2.10 | % |

| | | | | | | 415,696,468 | | | 33.24 | % |

Information Technology - 8.06% | | | | | | | | | | |

| Jabil Circuit, Inc. | | | 618,500 | | | 17,757,135 | | | 1.42 | % |

| ON Semiconductor Corp. (a) | | | 3,378,600 | | | 21,014,892 | | | 1.67 | % |

| Palm, Inc. (a) | | | 1,332,600 | | | 20,455,410 | | | 1.64 | % |

| Plexus Corp. (a) | | | 992,300 | | | 21,751,216 | | | 1.74 | % |

| Western Digital Corp. (a) | | | 1,088,100 | | | 19,890,468 | | | 1.59 | % |

| | | | | | | 100,869,121 | | | 8.06 | % |

Materials - 10.20% | | | | | | | | | | |

| Aleris International, Inc. (a) | | | 679,400 | | | 34,995,894 | | | 2.80 | % |

| Allegheny Technologies, Inc. | | | 583,300 | | | 45,923,209 | | | 3.67 | % |

| Ipsco, Inc. (b) | | | 279,400 | | | 25,548,336 | | | 2.04 | % |

| Ryerson Tull, Inc. | | | 874,900 | | | 21,085,090 | | | 1.69 | % |

| | | | | | | 127,552,529 | | | 10.20 | % |

| | | | | | | | | | | |

Total Common Stocks (Cost $1,167,886,163) | | | | | $ | 1,249,705,583 | | | 99.92 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND

SHORT-TERM INVESTMENTS - 0.21% | | Principal | | | | % of Net | |

| | | Amount | | Value | | Assets | |

Discount Notes - 0.21% | | | | | | | |

| Federal Home Loan Bank Discount Note, | | | | | | | |

| 5.0600%, due 11/01/2006 | | | | | $ | 2,531,000 | | | 0.21 | % |

| | | | | | | | | | | |

Total Discount Notes (Cost $2,531,000) | | | | | | 2,531,000 | | | 0.21 | % |

Variable Rate Demand Notes# - 0.00% | | | | | | | | | | |

| American Family Financial Services, Inc. | | | | | | | | | | |

| 4.9427% | | | 18,253 | | | 18,253 | | | 0.00 | % |

| | | | | | | | | | | |

Total Variable Rate Demand Notes | | | | | | | | | | |

| | | | | | | | | | % |

| | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | | | |

| (Cost $2,549,253) | | | | | | 2,549,253 | | | 0.21 | % |

| | | | | | | | | | | |

Total Investments - 100.13% | | | | | | | | | | |

| (Cost $1,170,435,416) | | | | | | 1,252,254,836 | | | 100.13 | % |

| | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.13)% | | | | | | (1,581,347 | ) | | (0.13 | %) |

TOTAL NET ASSETS - 100.00% | | | | | $ | 1,250,673,489 | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| ADR | American Depository Receipt |

| (b) | Foreign issued security |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of October 31, 2006. |

The accompanying notes are an integral part of these financial statements.

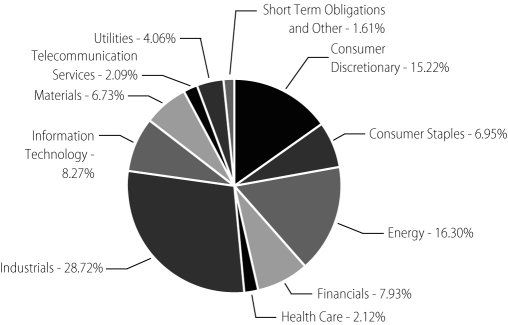

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND, SERIES II

HENNESSY CORNERSTONE

GROWTH FUND, SERIES II

(% of Net Assets)

TOP TEN HOLDINGS | % of net assets |

| Gymboree Corp. | 2.67% |

| Casual Male Retail Group, Inc. | 2.66% |

| AEP Industries, Inc. | 2.60% |

| Mentor Graphics Corp. | 2.49% |

| Continental Airlines, Inc. | 2.37% |

| Matrix Service Co. | 2.34% |

| Chaparral Steel Co. | 2.34% |

| Belden CDT, Inc. | 2.25% |

| Standard Parking Corp. | 2.25% |

| Clean Harbors, Inc. | 2.17% |

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND, SERIES II

COMMON STOCKS - 98.39% | | Number | | | % of Net |

| | | of Shares | Value | Assets |

Consumer Discretionary - 15.22% | | | | | | | |

| AnnTaylor Stores Corp. (a) | | | 112,900 | | $ | 4,969,858 | | | 2.04 | % |

| Casual Male Retail Group, Inc. (a) | | | 439,100 | | | 6,503,071 | | | 2.66 | % |

| Dillard’s, Inc. | | | 155,700 | | | 4,697,469 | | | 1.92 | % |

| DSW, Inc. (a) | | | 138,400 | | | 4,788,640 | | | 1.96 | % |

| Gentek, Inc. (a) | | | 161,900 | | | 5,245,560 | | | 2.15 | % |

| Gymboree Corp. (a) | | | 140,400 | | | 6,522,984 | | | 2.67 | % |

| Interstate Hotels & Resorts, Inc. (a) | | | 494,100 | | | 4,432,077 | | | 1.82 | % |

| | | | | | | 37,159,659 | | | 15.22 | % |

Consumer Staples - 6.95% | | | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 109,500 | | | 4,215,750 | | | 1.72 | % |

| National Beverage Corp. | | | 282,500 | | | 3,234,625 | | | 1.32 | % |

| Wild Oats Markets, Inc. (a) | | | 256,100 | | | 4,604,678 | | | 1.89 | % |

| Wimm-Bill-Dann Foods OJSC - ADR (b) | | | 116,800 | | | 4,923,120 | | | 2.02 | % |

| | | | | | | 16,978,173 | | | 6.95 | % |

Energy - 16.30% | | | | | | | | | | |

| Alon USA Energy, Inc. | | | 134,800 | | | 3,783,836 | | | 1.55 | % |

| Crosstex Energy, Inc. | | | 49,700 | | | 4,770,206 | | | 1.95 | % |

| FMC Technologies, Inc. (a) | | | 67,900 | | | 4,104,555 | | | 1.68 | % |

| Frontier Oil Corp. | | | 134,000 | | | 3,939,600 | | | 1.61 | % |

| Holly Corp. | | | 92,800 | | | 4,413,568 | | | 1.81 | % |

| Marathon Oil Corp. | | | 52,200 | | | 4,510,080 | | | 1.85 | % |

| Matrix Service Co. (a) | | | 398,300 | | | 5,723,571 | | | 2.34 | % |

| NATCO Group, Inc. (a) | | | 128,100 | | | 4,245,234 | | | 1.74 | % |

| World Fuel Services Corp. | | | 100,500 | | | 4,323,510 | | | 1.77 | % |

| | | | | | | 39,814,160 | | | 16.30 | % |

Financials - 7.93% | | | | | | | | | | |

| EMC Insurance Group, Inc. | | | 146,700 | | | 4,499,289 | | | 1.84 | % |

| Harleysville Group, Inc. | | | 140,800 | | | 5,080,064 | | | 2.08 | % |

| Meadowbrook Insurance Group, Inc. (a) | | | 439,100 | | | 5,291,155 | | | 2.17 | % |

| Safety Insurance Group, Inc. | | | 90,000 | | | 4,500,900 | | | 1.84 | % |

| | | | | | | 19,371,408 | | | 7.93 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND, SERIES II

COMMON STOCKS | | Number | | | % of Net |

| | | of Shares | Value | Assets |

Health Care - 2.12% | | | | | | | |

| AMN Healthcare Services, Inc. (a) | | | 204,400 | | $ | 5,169,276 | | | 2.12 | % |

Industrials - 28.72% | | | | | | | | | | |

| Ampco-Pittsburgh Corp. | | | 156,400 | | | 5,192,480 | | | 2.13 | % |

| AMR Corp. (a) | | | 184,600 | | | 5,231,564 | | | 2.14 | % |

| Arkansas Best Corp. | | | 96,200 | | | 3,942,276 | | | 1.61 | % |

| Celadon Group, Inc. (a) | | | 241,100 | | | 4,523,036 | | | 1.85 | % |

| Cenveo, Inc. (a) | | | 254,200 | | | 5,043,328 | | | 2.07 | % |

| Clean Harbors, Inc. (a) | | | 123,800 | | | 5,297,402 | | | 2.17 | % |

| Continental Airlines, Inc. (a) | | | 157,000 | | | 5,790,160 | | | 2.37 | % |

| Cummins, Inc. | | | 39,700 | | | 5,041,106 | | | 2.06 | % |

| Lincoln Electric Holdings, Inc. | | | 77,300 | | | 4,753,177 | | | 1.95 | % |

| Old Dominion Freight Line (a) | | | 131,300 | | | 3,631,758 | | | 1.49 | % |

| PAM Transportation Services (a) | | | 149,000 | | | 3,772,680 | | | 1.54 | % |

| Ryder System, Inc. | | | 83,900 | | | 4,417,335 | | | 1.81 | % |

| Saia, Inc. (a) | | | 167,000 | | | 4,475,600 | | | 1.83 | % |

| Standard Parking Corp. (a) | | | 157,800 | | | 5,486,706 | | | 2.25 | % |

| Universal Truckload Services, Inc. (a) | | | 135,700 | | | 3,530,914 | | | 1.45 | % |

| | | | | | | 70,129,522 | | | 28.72 | % |

Information Technology - 8.27% | | | | | | | | | | |

| Belden CDT, Inc. | | | 151,900 | | | 5,498,780 | | | 2.25 | % |

| Cray, Inc. (a) | | | 407,700 | | | 3,769,187 | | | 1.54 | % |

| Gerber Scientific, Inc. (a) | | | 333,300 | | | 4,869,513 | | | 1.99 | % |

| Mentor Graphics Corp. (a) | | | 359,700 | | | 6,068,139 | | | 2.49 | % |

| | | | | | | 20,205,619 | | | 8.27 | % |

Materials - 6.73% | | | | | | | | | | |

| AEP Industries, Inc. (a) | | | 120,300 | | | 6,337,404 | | | 2.60 | % |

| Arch Chemicals, Inc. | | | 130,900 | | | 4,379,914 | | | 1.79 | % |

| Chaparral Steel Co. | | | 137,400 | | | 5,714,466 | | | 2.34 | % |

| | | | | | | 16,431,784 | | | 6.73 | % |

Telecommunication Services - 2.09% | | | | | | | | | | |

| Qwest Communications International (a) | | | 590,100 | | | 5,092,563 | | | 2.09 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND, SERIES II

COMMON STOCKS | | Number | | | | % of Net | |

| | | of Shares | | Value | | Assets | |

Utilities - 4.06% | | | | | | | |

| The AES Corp. (a) | | | 230,700 | | $ | 5,073,093 | | | 2.08 | % |

| OGE Energy Corp. | | | 125,200 | | | 4,830,216 | | | 1.98 | % |

| | | | | | | 9,903,309 | | | 4.06 | % |

| | | | | | | | | | | |

Total Common Stocks (Cost $223,766,370) | | | | | | 240,255,473 | | | 98.39 | % |

| | | | | | | | | | | |

Total Investments - 98.39% | | | | | | | | | | |

| (Cost $223,766,370) | | | | | | 240,255,473 | | | 98.39 | % |

| | | | | | | | | | | |

| Other Assets in Excess of Liabilities - 1.61% | | | | | | 3,933,022 | | | 1.61 | % |

TOTAL NET ASSETS - 100.00% | | | | | $ | 244,188,495 | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| ADR | American Depository Receipt |

| (b) | Foreign issued security |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — FOCUS 30 FUND

HENNESSY FOCUS 30 FUND

(% of Net Assets)

TOP TEN HOLDINGS | % of net assets |

| Albemarle Corp. | 3.84% |

| Energizer Holdings, Inc. | 3.54% |

| Emcor Group, Inc. | 3.52% |

| Phillips-Van Heusen | 3.52% |

| Watson Wyatt & Co. Holdings | 3.51% |

| West Pharmaceutical Services, Inc. | 3.50% |

| Pactiv Corp. | 3.47% |

| Anixter International, Inc. | 3.46% |

| Priceline.com, Inc. | 3.44% |

| Acuity Brands, Inc. | 3.44% |

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — FOCUS 30 FUND

COMMON STOCKS - 99.87% | | Number | | | % of Net |

| | | of Shares | Value | Assets |

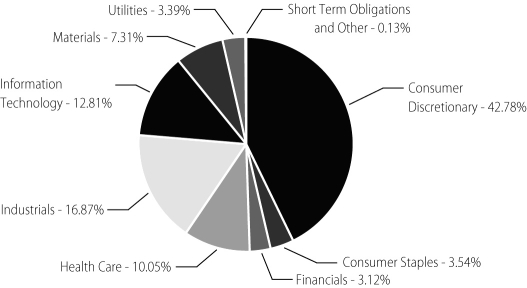

Consumer Discretionary - 42.78% | | | | | | | |

| AnnTaylor Stores Corp. (a) | | | 178,400 | | $ | 7,853,168 | | | 3.26 | % |

| Big Lots, Inc. (a) | | | 375,000 | | | 7,905,000 | | | 3.29 | % |

| Carmax, Inc. (a) | | | 184,200 | | | 8,160,060 | | | 3.39 | % |

| Children’s Place (a) | | | 117,000 | | | 8,212,230 | | | 3.41 | % |

| Dick’s Sporting Goods, Inc. (a) | | | 165,000 | | | 8,210,400 | | | 3.41 | % |

| Dillard’s Inc. | | | 232,900 | | | 7,026,593 | | | 2.92 | % |

| Dollar Tree Stores, Inc. (a) | | | 241,100 | | | 7,495,799 | | | 3.12 | % |

| Jack in the Box, Inc. (a) | | | 144,300 | | | 8,096,673 | | | 3.36 | % |

| Men’s Wearhouse, Inc. | | | 201,000 | | | 8,009,850 | | | 3.33 | % |

| Phillips-Van Heusen | | | 185,100 | | | 8,470,176 | | | 3.52 | % |

| Priceline.com, Inc. (a) | | | 205,200 | | | 8,267,508 | | | 3.44 | % |

| United Auto Group, Inc. | | | 323,300 | | | 7,429,434 | | | 3.09 | % |

| VF Corp. | | | 102,600 | | | 7,798,626 | | | 3.24 | % |

| | | | | | | 102,935,517 | | | 42.78 | % |

Consumer Staples - 3.54% | | | | | | | | | | |

| Energizer Holdings, Inc. (a) | | | 109,100 | | | 8,526,165 | | | 3.54 | % |

Financials - 3.12% | | | | | | | | | | |

| Assurant, Inc. | | | 142,500 | | | 7,504,050 | | | 3.12 | % |

Health Care - 10.05% | | | | | | | | | | |

| PSS World Medical, Inc. (a) | | | 396,900 | | | 7,985,628 | | | 3.32 | % |

| WellCare Health Plans, Inc. (a) | | | 132,300 | | | 7,772,625 | | | 3.23 | % |

| West Pharmaceutical Services, Inc. | | | 200,300 | | | 8,420,612 | | | 3.50 | % |

| | | | | | | 24,178,865 | | | 10.05 | % |

Industrials - 16.87% | | | | | | | | | | |

| Acuity Brands, Inc. | | | 166,700 | | | 8,258,318 | | | 3.44 | % |

| Cummins, Inc. | | | 64,100 | | | 8,139,418 | | | 3.38 | % |

| Emcor Group, Inc. (a) | | | 143,400 | | | 8,482,110 | | | 3.52 | % |

| Granite Construction, Inc. | | | 139,500 | | | 7,267,950 | | | 3.02 | % |

| Watson Wyatt & Co. Holdings | | | 187,300 | | | 8,456,595 | | | 3.51 | % |

| | | | | | | 40,604,391 | | | 16.87 | % |

Information Technology - 12.81% | | | | | | | | | | |

| Anixter International, Inc. (a) | | | 139,400 | | | 8,330,544 | | | 3.46 | % |

| Belden CDT, Inc. | | | 206,000 | | | 7,457,200 | | | 3.10 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — FOCUS 30 FUND

COMMON STOCKS | | Number | | | | % of Net | |

| | | of Shares | | Value | | Assets | |

Information Technology (Continued) | | | | | | | |

| Benchmark Electronics, Inc. (a) | | | 278,300 | | $ | 7,388,865 | | | 3.07 | % |

| CommScope, Inc. (a) | | | 240,000 | | | 7,658,400 | | | 3.18 | % |

| | | | | | | 30,835,009 | | | 12.81 | % |

Materials - 7.31% | | | | | | | | | | |

| Albemarle Corp. | | | 142,100 | | | 9,240,763 | | | 3.84 | % |

| Pactiv Corp. (a) | | | 270,600 | | | 8,345,304 | | | 3.47 | % |

| | | | | | | 17,586,067 | | | 7.31 | % |

Utilities - 3.39% | | | | | | | | | | |

| OGE Energy Corp. | | | 211,200 | | | 8,148,096 | | | 3.39 | % |

| | | | | | | | | | | |

Total Common Stocks (Cost $231,442,681) | | | | | | 240,318,160 | | | 99.87 | % |

| | | | | | | | | | | |

Total Investments - 99.87% | | | | | | | | | | |

| (Cost $231,442,681) | | | | | | 240,318,160 | | | 99.87 | % |

| | | | | | | | | | | |

| Other Assets in Excess of Liabilities - 0.13% | | | | | | 312,128 | | | 0.13 | % |

TOTAL NET ASSETS - 100.00% | | | | | $ | 240,630,288 | | | 100.00 | % |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — CORNERSTONE VALUE FUND

HENNESSY CORNERSTONE VALUE FUND

(% of Net Assets)

TOP TEN HOLDINGS | % of net assets |

| BellSouth Corp. | 2.70% |

| Merck & Co., Inc. | 2.58% |

| General Motors Corp. | 2.52% |

| AT&T, Inc. | 2.28% |

| Mattel, Inc. | 2.27% |

| Reynolds American, Inc. | 2.26% |

| ING Groep NV - ADR | 2.16% |

| ConAgra Foods, Inc. | 2.15% |

| Pfizer, Inc. | 2.14% |

| Diageo PLC - ADR | 2.07% |

SUMMARY OF INVESTMENTS — CORNERSTONE VALUE FUND

COMMON STOCKS - 93.54% | | Number | | | % of Net |

| | | of Shares | Value | Assets |

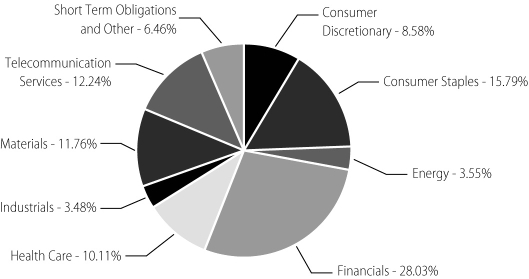

Consumer Discretionary - 8.58% | | | | | | | |

| DaimlerChrysler AG (b) | | | 83,000 | | $ | 4,725,190 | | | 1.84 | % |

| Ford Motor Co. | | | 519,600 | | | 4,302,288 | | | 1.68 | % |

| General Motors Corp. | | | 185,500 | | | 6,477,660 | | | 2.52 | % |

| Hanesbrands, Inc. (a) | | | 29,600 | | | 698,560 | | | 0.27 | % |

| Mattel, Inc. | | | 257,600 | | | 5,829,488 | | | 2.27 | % |

| | | | | | | 22,033,186 | | | 8.58 | % |

Consumer Staples - 15.79% | | | | | | | | | | |

| Altria Group, Inc. | | | 58,900 | | | 4,790,337 | | | 1.86 | % |

| ConAgra Foods, Inc. | | | 211,200 | | | 5,522,880 | | | 2.15 | % |

| Diageo PLC - ADR (b) | | | 71,300 | | | 5,309,711 | | | 2.07 | % |

| HJ Heinz Co. | | | 123,600 | | | 5,210,976 | | | 2.03 | % |

| Kimberly-Clark Corp. | | | 73,000 | | | 4,855,960 | | | 1.89 | % |

| Kraft Foods, Inc. | | | 145,500 | | | 5,005,200 | | | 1.95 | % |

| Reynolds American, Inc. | | | 91,900 | | | 5,804,404 | | | 2.26 | % |

| Sara Lee Corp. | | | 236,800 | | | 4,049,280 | | | 1.58 | % |

| | | | | | | 40,548,748 | | | 15.79 | % |

Energy - 3.55% | | | | | | | | | | |

| BP PLC - ADR (b) | | | 63,300 | | | 4,247,430 | | | 1.66 | % |

| ChevronTexaco Corp. | | | 72,300 | | | 4,858,560 | | | 1.89 | % |

| | | | | | | 9,105,990 | | | 3.55 | % |

Financials - 28.03% | | | | | | | | | | |

| Bank of America Corp. | | | 92,600 | | | 4,988,362 | | | 1.93 | % |

| Citigroup, Inc. | | | 86,900 | | | 4,358,904 | | | 1.69 | % |

| Freddie Mac | | | 67,000 | | | 4,622,330 | | | 1.79 | % |

| HSBC Holdings PLC - ADR (b) | | | 52,900 | | | 5,050,363 | | | 1.97 | % |

| ING Groep NV - ADR (b) | | | 125,200 | | | 5,550,116 | | | 2.16 | % |

| J.P. Morgan Chase & Co. | | | 108,700 | | | 5,156,728 | | | 2.01 | % |

| Lincoln National Corp. | | | 82,200 | | | 5,204,082 | | | 2.03 | % |

| National City Corp. | | | 123,800 | | | 4,611,550 | | | 1.80 | % |

| PNC Financial Services Group | | | 66,600 | | | 4,663,998 | | | 1.82 | % |

| Regions Financial Corp. | | | 125,800 | | | 4,774,110 | | | 1.86 | % |

| US Bancorp | | | 141,000 | | | 4,771,440 | | | 1.86 | % |

| Wachovia Corp. | | | 80,500 | | | 4,467,750 | | | 1.74 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — CORNERSTONE VALUE FUND

COMMON STOCKS | | Number | | | % of Net |

| | | of Shares | Value | Assets |

Financials (Continued) | | | | | | | |

| Washington Mutual, Inc. | | | 102,300 | | $ | 4,327,290 | | | 1.69 | % |

| Wells Fargo & Co. | | | 135,800 | | | 4,928,182 | | | 1.92 | % |

| XL Capital Ltd. (b) | | | 63,900 | | | 4,508,145 | | | 1.76 | % |

| | | | | | | 71,983,350 | | | 28.03 | % |

Health Care - 10.11% | | | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 198,400 | | | 4,910,400 | | | 1.91 | % |

| Eli Lilly & Co. | | | 79,600 | | | 4,458,396 | | | 1.74 | % |

| GlaxoSmithKline PLC - ADR (b) | | | 83,900 | | | 4,467,675 | | | 1.74 | % |

| Merck & Co., Inc. | | | 145,900 | | | 6,626,778 | | | 2.58 | % |

| Pfizer, Inc. | | | 206,100 | | | 5,492,565 | | | 2.14 | % |

| | | | | | | 25,955,814 | | | 10.11 | % |

Industrials - 3.48% | | | | | | | | | | |

| Pitney Bowes, Inc. | | | 101,700 | | | 4,750,407 | | | 1.85 | % |

| RR Donnelley & Sons Co. | | | 123,900 | | | 4,195,254 | | | 1.63 | % |

| | | | | | | 8,945,661 | | | 3.48 | % |

Materials - 11.76% | | | | | | | | | | |

| The Dow Chemical Co. | | | 95,200 | | | 3,883,208 | | | 1.52 | % |

| EI Du Pont de Nemours & Co. | | | 99,200 | | | 4,543,360 | | | 1.77 | % |

| International Paper Co. | | | 125,600 | | | 4,188,760 | | | 1.63 | % |

| Lyondell Chemical Co. | | | 170,200 | | | 4,369,034 | | | 1.70 | % |

| MeadWestvaco Corp. | | | 150,700 | | | 4,147,264 | | | 1.61 | % |

| PPG Industries, Inc. | | | 72,900 | | | 4,986,360 | | | 1.94 | % |

| Weyerhaeuser Co. | | | 64,100 | | | 4,076,119 | | | 1.59 | % |

| | | | | | | 30,194,105 | | | 11.76 | % |

Telecommunication Services - 12.24% | | | | | | | | | | |

| AT&T, Inc. | | | 170,700 | | | 5,846,475 | | | 2.28 | % |

| BellSouth Corp. | | | 154,000 | | | 6,945,400 | | | 2.70 | % |

| Chunghwa Telecom Company Ltd. - ADR | | | 245,000 | | | 4,481,050 | | | 1.74 | % |

| Telefonica de Argentina SA (a)(b)Ω | | | 1,200 | | | 12 | | | 0.00 | % |

| Telefonos de Mexico SA de CV - ADR (b) | | | 183,700 | | | 4,847,843 | | | 1.89 | % |

| Verizon Communications, Inc. | | | 136,800 | | | 5,061,600 | | | 1.97 | % |

| Vodafone Group PLC - ADR (b) | | | 164,700 | | | 4,257,495 | | | 1.66 | % |

| | | | | | | 31,439,875 | | | 12.24 | % |

| | | | | | | | | | | |

Total Common Stocks (Cost $216,225,728) | | | | | | 240,206,729 | | | 93.54 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — CORNERSTONE VALUE FUND

SHORT-TERM INVESTMENTS - 5.16% | | Principal | | | % of Net |

| | | Amount | Value | Assets |

Discount Notes - 5.12% | | | | | | | |

| Federal Home Loan Bank Discount Note, | | | | | | | |

| 5.0600%, due 11/01/2006 | | | | | $ | 13,146,000 | | | 5.12 | % |

| | | | | | | | | | | |

Total Discount Notes (Cost $13,146,000) | | | | | | 13,146,000 | | | 5.12 | % |

Variable Rate Demand Notes# - 0.04% | | | | | | | | | | |

| American Family Financial Services, Inc. | | | | | | | | | | |

| 4.9427% | | | 81,384 | | | 81,384 | | | 0.03 | % |

| Wisconsin Corporate Central Credit Union | | | | | | | | | | |

| 4.9900% | | | 25,801 | | | 25,801 | | | 0.01 | % |

| | | | | | | | | | | |

Total Variable Rate Demand Notes | | | | | | | | | | |

| (Cost $107,185) | | | | | | 107,185 | | | 0.04 | % |

| | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | | | |

| (Cost $13,253,185) | | | | | | 13,253,185 | | | 5.16 | % |

| | | | | | | | | | | |

Total Investments - 98.70% | | | | | | | | | | |

| (Cost $229,478,913) | | | | | | 253,459,914 | | | 98.70 | % |

| | | | | | | | | | | |

| Other Assets in Excess of Liabilities - 1.30% | | | | | | 3,342,906 | | | 1.30 | % |

TOTAL NET ASSETS - 100.00% | | | | | $ | 256,802,820 | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| ADR | American Depository Receipt |

| (b) | Foreign issued security |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of October 31, 2006. |

| Ω | Security is fair valued. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — TOTAL RETURN FUND

HENNESSY TOTAL RETURN FUND

(% of Net Assets)

TOP TEN HOLDINGS | % of net assets |

| General Motors Corp. | 8.86% |

| Merck & Co., Inc. | 8.07% |

| AT&T, Inc. | 7.95% |

| Verizon Communications, Inc. | 7.20% |

| J.P. Morgan Chase & Co. | 7.18% |

| EI Du Pont de Nemours & Co. | 7.13% |

| Altria Group, Inc. | 6.96% |

| Pfizer, Inc. | 6.84% |

| Citigroup, Inc. | 6.76% |

| General Electric Co. | 5.06% |

SUMMARY OF INVESTMENTS — TOTAL RETURN FUND

COMMON STOCKS - 73.80% | | Number | | | % of Net |

| | | of Shares | Value | Assets |

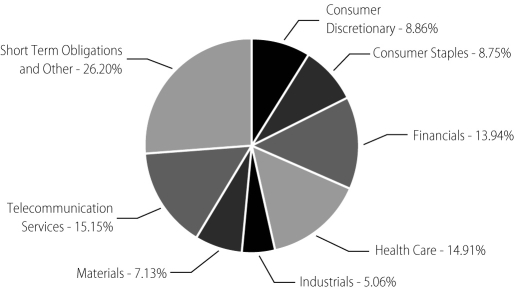

Consumer Discretionary - 8.86% | | | | | | | |

| General Motors Corp. | | | 287,400 | | $ | 10,036,008 | | | 8.86 | % |

Consumer Staples - 8.75% | | | | | | | | | | |

| Altria Group, Inc. | | | 96,900 | | | 7,880,877 | | | 6.96 | % |

| The Coca-Cola Co. | | | 43,300 | | | 2,022,976 | | | 1.79 | % |

| | | | | | | 9,903,853 | | | 8.75 | % |

Financials - 13.94% | | | | | | | | | | |

| Citigroup, Inc. | | | 152,600 | | | 7,654,416 | | | 6.76 | % |

| J.P. Morgan Chase & Co. | | | 171,500 | | | 8,135,960 | | | 7.18 | % |

| | | | | | | 15,790,376 | | | 13.94 | % |

Health Care - 14.91% | | | | | | | | | | |

| Merck & Co., Inc. | | | 201,200 | | | 9,138,504 | | | 8.07 | % |

| Pfizer, Inc. | | | 290,900 | | | 7,752,485 | | | 6.84 | % |

| | | | | | | 16,890,989 | | | 14.91 | % |

Industrials - 5.06% | | | | | | | | | | |

| General Electric Co. | | | 163,100 | | | 5,726,441 | | | 5.06 | % |

Materials - 7.13% | | | | | | | | | | |

| EI Du Pont de Nemours & Co. | | | 176,250 | | | 8,072,250 | | | 7.13 | % |

Telecommunication Services - 15.15% | | | | | | | | | | |

| AT&T, Inc. | | | 262,900 | | | 9,004,325 | | | 7.95 | % |

| Verizon Communications, Inc. | | | 220,500 | | | 8,158,500 | | | 7.20 | % |

| | | | | | | 17,162,825 | | | 15.15 | % |

| | | | | | | | | | | |

Total Common Stocks (Cost $76,462,581) | | | | | | 83,582,742 | | | 73.80 | % |

| | | | | | | | | | | |

SHORT-TERM INVESTMENTS - 60.96% | | | Principal | | | | | % of Net |

| | | | Amount | | Value | | Assets |

U.S. Treasury Bill* - 57.91% | | | | | | | | | | |

| 4.838%, 11/16/2006 | | | | | | 20,958,700 | | | 18.51 | % |

| 4.810%, 12/21/2006 | | | 24,000,000 | | | 23,854,000 | | | 21.06 | % |

| 4.820%, 01/18/2007 | | | 21,000,000 | | | 20,776,140 | | | 18.34 | % |

| | | | | | | | | | | |

U.S. Treasury Bills (Cost $65,596,803) | | | | | | 65,588,840 | | | 57.91 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — TOTAL RETURN FUND

SHORT-TERM INVESTMENTS | | Principal | | | % of Net |

| | | Amount | Value | Assets |

Discount Notes - 2.96% | | | | | | | |

| Federal Home Loan Bank Discount Note | | | | | | | |

| 5.0600%, 11/01/2006 | | | | | $ | 3,349,000 | | | 2.96 | % |

| | | | | | | | | | | |

Total Discount Notes (Cost $3,349,000) | | | | | | 3,349,000 | | | 2.96 | % |

Variable Rate Demand Notes# - 0.09% | | | | | | | | | | |

| American Family Financial Services, Inc. | | | | | | | | | | |

| 4.9427% | | | 99,497 | | | 99,497 | | | 0.08 | % |

| Wisconsin Corporate Central Credit Union | | | | | | | | | | |

| 4.9900% | | | 9,428 | | | 9,428 | | | 0.01 | % |

| | | | | | | | | | | |

Total Variable Rate Demand Notes | | | | | | | | | | |

| (Cost $108,925) | | | | | | 108,925 | | | 0.09 | % |

| | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | | | |

| (Cost $69,054,728) | | | | | | 69,046,765 | | | 60.96 | % |

| | | | | | | | | | | |

Total Investments - 134.76% | | | | | | | | | | |

| (Cost $145,517,309) | | | | | | 152,629,507 | | | 134.76 | % |

| | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (34.76)% | | | | | | (39,365,822 | ) | | (34.76 | ) |

TOTAL NET ASSETS - 100.00% | | | | | $ | 113,263,685 | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| * | Collateral or partial collateral for securities sold subject to repurchase. |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates changed periodically on specified dates. The rates listed are as of October 31, 2006. |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — BALANCED FUND

HENNESSY BALANCED FUND

(% of Net Assets)

TOP TEN HOLDINGS | % of net assets |

| General Motors Corp. | 6.08% |

| Merck & Co., Inc. | 5.66% |

| AT&T, Inc. | 5.61% |

| EI du Pont de Nemours & Co. | 5.10% |

| Verizon Communications, Inc. | 5.05% |

| J.P. Morgan Chase & Co. | 5.03% |

| Altria Group, Inc. | 4.94% |

| Pfizer, Inc. | 4.85% |

| Citigroup, Inc. | 4.77% |

| General Electric Co. | 3.74% |

HENNESSY FUNDS 1-800-966-4354

SUMMARY OF INVESTMENTS — BALANCED FUND

COMMON STOCKS - 51.94% | | Number | | | % of Net |

| | | of Shares | Value | Assets |

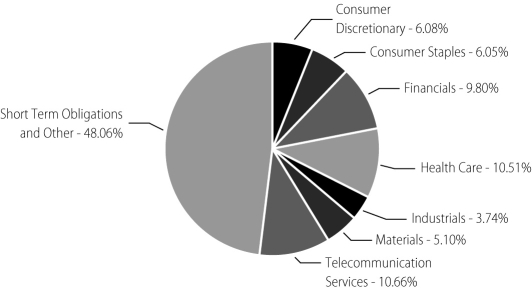

Consumer Discretionary - 6.08% | | | | | | | |

| General Motors Corp. | | | 45,500 | | $ | 1,588,860 | | | 6.08 | % |

Consumer Staples - 6.05% | | | | | | | | | | |

| Altria Group, Inc. | | | 15,875 | | | 1,291,114 | | | 4.94 | % |

| The Coca-Cola Co. | | | 6,225 | | | 290,832 | | | 1.11 | % |

| | | | | | | 1,581,946 | | | 6.05 | % |

Financials - 9.80% | | | | | | | | | | |

| Citigroup, Inc. | | | 24,875 | | | 1,247,730 | | | 4.77 | % |

| J.P. Morgan Chase & Co. | | | 27,700 | | | 1,314,088 | | | 5.03 | % |

| | | | | | | 2,561,818 | | | 9.80 | % |

Health Care - 10.51% | | | | | | | | | | |

| Merck & Co., Inc. | | | 32,575 | | | 1,479,557 | | | 5.66 | % |

| Pfizer, Inc. | | | 47,525 | | | 1,266,541 | | | 4.85 | % |

| | | | | | | 2,746,098 | | | 10.51 | % |

Industrials - 3.74% | | | | | | | | | | |

| General Electric Co. | | | 27,875 | | | 978,691 | | | 3.74 | % |

Materials - 5.10% | | | | | | | | | | |

| EI Du Pont de Nemours & Co. | | | 29,100 | | | 1,332,780 | | | 5.10 | % |

Telecommunication Services - 10.66% | | | | | | | | | | |

| AT&T, Inc. | | | 42,775 | | | 1,465,044 | | | 5.61 | % |

| Verizon Communications, Inc. | | | 35,700 | | | 1,320,900 | | | 5.05 | % |

| | | | | | | 2,785,944 | | | 10.66 | % |

| | | | | | | | | | | |

Total Common Stocks (Cost $11,808,757) | | | | | | 13,576,137 | | | 51.94 | % |

| | | | | | | | | | | |

SHORT-TERM INVESTMENTS - 47.86% | | | Principal | | | | | % of Net |

| | | | Amount | | Value | | Assets |

U.S. Treasury Notes - 47.07% | | | | | | | | | | |

| 2.625%, 11/15/2006 | | $ | 690,000 | | | 689,515 | | | 2.65 | % |

| 2.875%, 11/30/2006 | | | 707,000 | | | 705,868 | | | 2.70 | % |

| 3.000%, 12/31/2006 | | | 400,000 | | | 398,578 | | | 1.53 | % |

| 3.125%, 01/31/2007 | | | 1,300,000 | | | 1,294,160 | | | 4.95 | % |

| 2.250%, 02/15/2007 | | | 1,350,000 | | | 1,339,243 | | | 5.12 | % |

| 3.750%, 03/31/2007 | | | 2,000,000 | | | 1,989,688 | | | 7.61 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — BALANCED FUND

SHORT-TERM INVESTMENTS | | Principal | | | | % of Net | |

| | | Amount | | Value | | Assets | |

U.S. Treasury Notes (Continued) | | | | | | | |

| 3.125%, 05/15/2007 | | | $ 700,000 | | $ | 693,055 | | | 2.65 | % |

| 3.500%, 05/31/2007 | | | | | | 803,135 | | | 3.07 | % |

| 3.625%, 06/30/2007 | | | 1,900,000 | | | 1,883,005 | | | 7.20 | % |

| 2.750%, 08/15/2007 | | | 1,540,000 | | | 1,514,134 | | | 5.79 | % |

| 4.000%, 09/30/2007 | | | 1,000,000 | | | 991,876 | | | 3.80 | % |

| | | | | | | | | | | |

Total U.S. Treasury Notes (Cost $12,306,586) | | | | | | 12,302,257 | | | 47.07 | % |

Discount Notes - 0.52% | | | | | | | | | | |

| Federal Home Loan Bank Discount Note, | | | | | | | | | | |

| 5.0600% | | | 137,000 | | | 137,000 | | | 0.52 | % |

| | | | | | | | | | | |

Total Discount Notes ($137,000) | | | | | | 137,000 | | | 0.52 | % |

Variable Rate Demand Notes# - 0.27% | | | | | | | | | | |

| American Family Financial Services, Inc. | | | | | | | | | | |

| 4.9427% | | | 64,683 | | | 64,683 | | | 0.24 | % |

| Wisconsin Corporate Central Credit Union | | | | | | | | | | |

| 4.9900% | | | 6,645 | | | 6,645 | | | 0.03 | % |

| | | | | | | | | | | |

Total Variable Rate Demand Notes | | | | | | | | | | |

| (Cost $71,328) | | | | | | 71,328 | | | 0.27 | % |

| | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | | | |

| (Cost $12,514,914) | | | | | | 12,510,585 | | | 47.86 | % |

Total Investments - 99.80% | | | | | | | | | | |

| (Cost $24,323,671) | | | | | | 26,086,722 | | | 99.80 | % |

| | | | | | | | | | | |

| Other Assets in Excess of Liabilities - 0.20% | | | | | | 48,716 | | | 0.20 | % |

TOTAL NET ASSETS - 100.00% | | | | | $ | 26,135,438 | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of October 31, 2006. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statements of Assets and Liabilities as of October 31, 2006 |

| | | HENNESSY | |

| | | CORNERSTONE | |

| | | GROWTH FUND | |

ASSETS: | | | |

| Investments, at value (cost $1,170,435,416, $223,766,370, | | | |

| $231,442,681, $229,478,913, $145,517,309, $24,323,671, respectively) | | $ | 1,252,254,836 | |

| Cash | | | — | |

| Dividends and interest receivable | | | 518,667 | |

| Receivable for fund shares sold | | | 1,537,875 | |

| Receivable for securities sold | | | — | |

| Prepaid expenses and other assets | | | 67,741 | |

| Total Assets | | | 1,254,379,119 | |

| | | | | |

LIABILITIES: | | | | |

| Loan payable | | | — | |

| Payable for fund shares redeemed | | | 2,100,243 | |

| Payable to Advisor | | | 780,409 | |

| Payable to Administrator | | | 470,340 | |

| Payable to Distributor | | | — | |

| Reverse repurchase agreement | | | — | |

| Accrued sub-transfer agent expenses | | | 181,022 | |

| Accrued interest payable | | | 21,010 | |

| Accrued expenses and other payables | | | 152,606 | |

| Total Liabilities | | | 3,705,630 | |

| | | | | |

NET ASSETS | | $ | 1,250,673,489 | |

| | | | | |

NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 987,196,112 | |

| Accumulated net investment income (loss) | | | — | |

| Accumulated net realized gain (loss) on investments | | | 181,657,957 | |

| Unrealized net appreciation (depreciation) on investments | | | 81,819,420 | |

| Total Net Assets | | $ | 1,250,673,489 | |

| | | | | |

| Shares authorized ($.0001 par value) | | | 25,000,000,000 | |

| Shares issued and outstanding | | | 60,205,024 | |

| Net asset value, offering price and redemption price per share | | $ | 20.77 | |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF ASSETS AND LIABILITIES

| | | | | | | | | | | | |

| | | HENNESSY | | | | | | | | |

| | | CORNERSTONE | HENNESSY | HENNESSY | HENNESSY | HENNESSY |

| | | GROWTH FUND, | FOCUS 30 | CORNERSTONE | TOTAL RETURN | BALANCED |

| | | SERIES II | FUND | VALUE FUND | FUND | FUND |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | $ | 240,255,473 | | $ | 240,318,160 | | $ | 253,459,914 | | $ | 152,629,507 | | $ | 26,086,722 | |

| | | | 55 | | | 14 | | | — | | | 101,457 | | | — | |

| | | | 81,207 | | | 52,143 | | | 415,533 | | | 171,905 | | | 131,031 | |

| | | | 237,693 | | | 246,442 | | | 3,327,840 | | | 227,369 | | | 10,982 | |

| | | | 4,892,005 | | | 4,888,229 | | | — | | | — | | | — | |

| | | | 63,444 | | | 24,055 | | | 20,508 | | | 15,974 | | | 8,088 | |

| | | | 245,529,877 | | | 245,529,043 | | | 257,223,795 | | | 153,146,212 | | | 26,236,823 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | 625,400 | | | 3,654,900 | | | — | | | — | | | — | |

| | | | 352,058 | | | 914,188 | | | 131,101 | | | 36,011 | | | 10,828 | |

| | | | 155,071 | | | 157,434 | | | 153,289 | | | 56,563 | | | 13,581 | |

| | | | 94,457 | | | 109,056 | | | 88,798 | | | 41,196 | | | 12,744 | |

| | | | — | | | — | | | — | | | 125,759 | | | 48,041 | |

| | | | — | | | — | | | — | | | 39,400,000 | | | — | |

| | | | 34,150 | | | 17,208 | | | 6,840 | | | — | | | — | |

| | | | 61 | | | 5,589 | | | 667 | | | 187,673 | | | — | |

| | | | 80,185 | | | 40,380 | | | 40,280 | | | 35,325 | | | 16,191 | |

| | | | 1,341,382 | | | 4,898,755 | | | 420,975 | | | 39,882,527 | | | 101,385 | |

| | | | | | | | | | | | | | | | | |

| | | $ | 244,188,495 | | $ | 240,630,288 | | $ | 256,802,820 | | $ | 113,263,685 | | $ | 26,135,438 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | $ | 218,467,562 | | $ | 230,042,627 | | $ | 325,933,936 | | $ | 196,811,829 | | $ | 26,780,938 | |

| | | | — | | | — | | | 4,008,165 | | | 221,710 | | | 70,517 | |

| | | | 9,231,830 | | | 1,712,182 | | | (97,120,282 | ) | | (90,882,052 | ) | | (2,479,068 | ) |

| | | | 16,489,103 | | | 8,875,479 | | | 23,981,001 | | | 7,112,198 | | | 1,763,051 | |

| | | $ | 244,188,495 | | $ | 240,630,288 | | $ | 256,802,820 | | $ | 113,263,685 | | $ | 26,135,438 | |

| | | | | | | | | | | | | | | | | |

| | | | Unlimited | | | 25,000,000,000 | | | 25,000,000,000 | | | 100,000,000 | | | 100,000,000 | |

| | | | 7,940,959 | | | 19,426,478 | | | 16,821,672 | | | 8,980,135 | | | 2,209,497 | |

| | | $ | 30.75 | | $ | 12.39 | | $ | 15.27 | | $ | 12.61 | | $ | 11.83 | |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

| |

INVESTMENT INCOME: |

| Dividend income(1) |

| Interest income |

| Securities lending income |

| |

| Total investment income |

| |

| |

EXPENSES: |

| Investment advisory fees |

| Administration, fund accounting, custody and transfer agent fees (See Note 5) |

| Distribution fees (See Note 5) |

| Service fees (See Note 5) |

| Federal and state registration fees |

| Audit fees |

| Reports to shareholders |

| Directors’ fees and expenses |

| Sub-transfer agent expenses (See Note 5) |

| Interest expense (See Note 3 and 7) |

| Other |

| |

| Total expenses before reimbursement from Advisor |

| Expense reimbursement by Advisor |

| |

| Net expenses |

| |

NET INVESTMENT INCOME (LOSS) |

| |

| |

REALIZED AND UNREALIZED GAINS (LOSSES): |

| Net realized gain on investments |

| Change in unrealized appreciation (depreciation) on investments |

|

| Net gain (loss) on investments |

| |

| |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

| (1) | Net of foreign taxes withheld of $204,835, $5,121, $181 and $0, respectively. |

| * | For the four months ended October 31, 2006. Effective October 31, 2006, the Hennessy Cornerstone Growth Fund, Series II changed its fiscal year end to October 31st from June 30th. |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF OPERATIONS

| | | | | | | | | | |

| | | HENNESSY | | | | | | | |

| | | CORNERSTONE | | HENNESSY CORNERSTONE | | HENNESSY | |

| | | GROWTH FUND | | GROWTH FUND, SERIES II | | FOCUS 30 FUND | |

| | | Year Ended | | Period Ended | | Year Ended | | Year Ended | |

| | | October 31, 2006 | | October 31, 2006* | | June 30, 2006 | | October 31, 2006 | |

| | | | | | | | | | |

| | | $ | 10,693,209 | | $ | 772,705 | | $ | 2,506,465 | | $ | 853,926 | |

| | | | 2,147,130 | | | 84,964 | | | 310,552 | | | 479,183 | |

| | | | — | | | — | | | — | | | — | |

| | | | 12,840,339 | | | 857,669 | | | 2,817,017 | | | 1,333,109 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | 9,405,213 | | | 629,088 | | | 2,029,091 | | | 1,761,888 | |

| | | | 2,904,210 | | | 194,582 | | | 634,136 | | | 544,031 | |

| | | | — | | | — | | | — | | | — | |

| | | | 1,270,975 | | | 85,012 | | | 274,201 | | | 238,093 | |

| | | | 64,059 | | | 13,343 | | | 27,788 | | | 34,805 | |

| | | | 18,424 | | | 10,393 | | | 35,000 | | | 15,502 | |

| | | | 147,690 | | | 23,260 | | | 42,275 | | | 27,333 | |

| | | | 12,191 | | | 5,452 | | | 10,374 | | | 12,241 | |

| | | | 1,484,374 | | | 95,515 | | | 340,607 | | | 229,790 | |

| | | | 1,757 | | | 1,061 | | | — | | | 5,589 | |

| | | | 79,051 | | | 7,193 | | | 40,947 | | | 15,963 | |

| | | | 15,387,944 | | | 1,064,899 | | | 3,434,419 | | | 2,885,235 | |

| | | | — | | | — | | | (7,214 | ) | | — | |

| | | | — | | | — | | | 3,427,205 | | | — | |

| | | $ | (2,547,605 | ) | $ | (207,230 | ) | $ | (610,188 | ) | $ | (1,552,126 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | $ | 184,186,611 | | $ | 8,338,233 | | $ | 28,215,988 | | $ | 1,712,198 | |

| | | | (52,188,698 | ) | | (21,353,033 | ) | | 9,942,792 | | | 13,224,239 | |

| | | | 131,997,913 | | | (13,014,800 | ) | | 38,158,780 | | | 14,936,437 | |

| | | | | | | | | | | | | | |

| | | $ | 129,450,308 | | $ | (13,222,030 | ) | $ | 37,548,592 | | $ | 13,384,311 | |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

| |

INVESTMENT INCOME: |

| Dividend income(1) |

| Interest income |

| Securities lending income |

| Total investment income |

| |

| |

EXPENSES: |

| Investment advisory fees |

| Administration, fund accounting, custody and transfer agent fees (See Note 5) |

| Distribution fees (See Note 5) |

| Service fees (See Note 5) |

| Federal and state registration fees |

| Audit fees |

| Reports to shareholders |

| Directors’ fees and expenses |

| Sub-transfer agent expenses (See Note 5) |

| Interest expense (See Note 3 and 7) |

| Other |

| Total expenses |

| |

NET INVESTMENT INCOME (LOSS) |

| |

| |

REALIZED AND UNREALIZED GAINS (LOSSES): |

| Net realized gain on investments |

| Change in unrealized appreciation (depreciation) on investments |

| Net gain (loss) on investments |

| |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

| (1) | Net of foreign taxes withheld of $125,762, $0 and $0, respectively. |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF OPERATIONS

| | | | | | | | |

| | | HENNESSY | | | | | |

| | | CORNERSTONE | | HENNESSY TOTAL | | HENNESSY | |

| | | VALUE FUND | | RETURN FUND | | BALANCED FUND | |

| | | Year Ended | | Year Ended | | Year Ended | |

| | | October 31, 2006 | | October 31, 2006 | | October 31, 2006 | |

| | | | | | | | |

| | | $ | 6,763,163 | | $ | 2,742,391 | | $ | 429,466 | |

| | | | 250,220 | | | 2,260,931 | | | 451,853 | |

| | | | 6,235 | | | — | | | — | |

| | | | 7,019,618 | | | 5,003,322 | | | 881,319 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | 1,424,068 | | | 536,822 | | | 129,350 | |

| | | | 439,657 | | | 205,097 | | | 49,197 | |

| | | | — | | | 223,676 | | | 53,896 | |

| | | | 192,442 | | | — | | | — | |

| | | | 26,331 | | | 20,203 | | | 19,690 | |

| | | | 18,538 | | | 19,101 | | | 19,532 | |

| | | | 20,075 | | | 10,001 | | | — | |

| | | | 12,116 | | | 7,557 | | | 7,856 | |

| | | | 66,289 | | | — | | | — | |

| | | | 151 | | | 1,465,387 | | | — | |

| | | | 20,692 | | | 14,761 | | | 9,490 | |

| | | | 2,220,359 | | | 2,502,605 | | | 289,011 | |

| | | $ | 4,799,259 | | $ | 2,500,717 | | $ | 592,308 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | $ | 12,643,559 | | $ | 2,471,535 | | $ | 379,500 | |

| | | | 20,367,759 | | | 13,451,078 | | | 2,484,570 | |

| | | | 33,011,318 | | | 15,922,613 | | | 2,864,070 | |

| | | | | | | | | | | |

| | | $ | 37,810,577 | | $ | 18,423,330 | | $ | 3,456,378 | |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statements of Changes in Net Assets |

| | | | |

| | | Hennessy Cornerstone Growth Fund | |

| | | Year Ended | | Year Ended | |

| | | October 31, | | October 31, | |

| | | 2006 | | 2005 | |

OPERATIONS: | | | | | |

| Net investment income (loss) | | $ | (2,547,605 | ) | $ | (7,800,866 | ) |

| Net realized gain (loss) on securities | | | 184,186,611 | | | 77,310,944 | |

| Change in unrealized appreciation (depreciation) on securities | | | (52,188,698 | ) | | 124,490,118 | |

| Net increase (decrease) in net assets resulting from operations | | | 129,450,308 | | | 194,000,196 | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

| From net investment income | | | — | | | — | |

| From net realized gains | | | (68,227,748 | ) | | (173,840,684 | ) |

| Total distributions | | | (68,227,748 | ) | | (173,840,684 | ) |

| | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | |

| Proceeds from shares subscribed | | | 399,293,120 | | | 296,664,690 | |

| Dividends reinvested | | | 66,277,329 | | | 168,579,703 | |

| Redemption fees retained | | | 311,922 | | | 153,093 | |

| Cost of shares redeemed | | | (348,210,594 | ) | | (282,771,265 | ) |

| Net increase (decrease) in net assets derived | | | | | | | |

| from capital share transactions | | | 117,671,777 | | | 182,626,221 | |

| | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 178,894,337 | | | 202,785,733 | |

| | | | | | | | |

| NET ASSETS: | | | | | | | |

| Beginning of period | | | 1,071,779,152 | | | 868,993,419 | |

| End of period | | $ | 1,250,673,489 | | $ | 1,071,779,152 | |

| | | | | | | | |

Accumulated net investment income (loss), end of period | | $ | — | | $ | — | |

| | | | | | | | |

CHANGES IN SHARES OUTSTANDING: | | | | | | | |

| Shares sold | | | 18,991,149 | | | 15,629,397 | |

| Shares issued to holders as reinvestment of dividends | | | 3,544,242 | | | 9,772,736 | |

| Shares redeemed | | | (17,324,674 | ) | | (15,238,651 | ) |

| Net increase (decrease) in shares outstanding | | | 5,210,717 | | | 10,163,482 | |

| * | For the four months ended October 31, 2006. Effective October 31, 2006, the Hennessy Cornerstone Growth Fund, Series II changed its fiscal year end to October 31st from June 30th. |

The accompanying notes are an integral part of these financial statements.