UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

Hennessy Advisors, Inc.

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2008

Date of reporting period: April 30, 2008

Item 1. Report to Stockholders.

H E N N E S S Y F U N D S

S E M I - A N N U A L R E P O R T

APRIL 30, 2008

Hennessy Cornerstone Growth Fund

Hennessy Cornerstone Growth Fund, Series II

Hennessy Focus 30 Fund

Hennessy Cornerstone Value Fund

Hennessy Total Return Fund

Hennessy Balanced Fund

Contents

| Letter to shareholders | 1 |

| Summaries of investments | |

| Hennessy Cornerstone Growth Fund | 7 |

| Hennessy Cornerstone Growth Fund, Series II | 11 |

| Hennessy Focus 30 Fund | 15 |

| Hennessy Cornerstone Value Fund | 18 |

| Hennessy Total Return Fund | 22 |

| Hennessy Balanced Fund | 25 |

| Financial statements | |

| Statements of assets and liabilities | 28 |

| Statements of operations | 30 |

| Statements of changes in net assets | 32 |

| Financial highlights | |

| Hennessy Cornerstone Growth Fund | 36 |

| Hennessy Cornerstone Growth Fund, Series II | 38 |

| Hennessy Focus 30 Fund | 40 |

| Hennessy Cornerstone Value Fund | 42 |

| Hennessy Total Return Fund | 44 |

| Hennessy Balanced Fund | 46 |

| Statement of cash flows – Hennessy Total Return Fund | 48 |

| Notes to the financial statements | 49 |

| Expense example | 58 |

| Proxy voting policy | 60 |

| Board approval of continuation | |

| of investment advisory agreement | 61 |

June, 2008

Dear Hennessy Funds Shareholder:

As I scanned the headlines from Investors Business Daily top stories a few days ago, I had to shake my head as I read:

#1 – Oil Falls on Weak Demand Fears

#2 – Stocks Rise, But in Tepid Volume

#3 – New Home Sales Rise “A Surprise”

#4 – Home Prices Suffer Record Drop

#5 – Consumer Confidence Tumbles

With these overwhelmingly negative headlines, is it any wonder that investors are panicked and holding their money close to the vest? I believe one of the primary reasons we have low investor confidence is the media has successfully confused investors to such an extent that they are frozen with fear.

As a money manager with nearly 30 years of experience, here is what I believe:

| – | Emerging markets appear to be correcting. The major exchanges in China, India and Southeast Asia have already experienced double digit losses year to date. |

| – | The price of oil is poised to move lower. Once selling pressure in the oil market is ignited by a price decline, margin calls, stop losses and leveraged positions could fuel a real tumble. |

| – | Home prices and sales appear to be stabilizing. |

I remain bullish on the market, as we continue to see low levels of inflation (excluding food and energy), interest rates and unemployment, despite downturns in the Auto, Housing and Financial sectors. We also are seeing reasonable, if not remarkable, corporate profits in a slow economy.

The Dow is trading at 1.11 times sales, versus its 10-year average of 1.32, which suggests to me that we could see the market move to the upside by about 19%, to nearly 15,000, before we reach historical parity. I suspect that the overall economy will start to regain its footing sometime in the 4th quarter of 2008 or the 1st quarter of 2009. We encourage investors to remain focused on their long-term investing objectives, and to stay the course.

HENNESSY FUNDS 1-800-966-4354

Average Annual Total Returns (as of April 30, 2008)

Original Class Shares

| | | | | | | |

| | Six months | One Year | Three Year | Five Year | Ten Year | |

| | ending | Annualized | Annualized | Annualized | Annualized | Since |

| Fund (Inception date) | 4/30/08 | Return | Return | Return | Return | Inception |

| Cornerstone | | | | | | |

| Growth Fund (11/1/96) | -21.48% | -20.41% | 3.67% | 10.82% | 9.12% | 12.16% |

| S&P 500 Index | -9.64% | -4.68% | 8.23% | 10.62% | 3.89% | 7.82% |

| | | | | | | |

| Cornerstone Growth | | | | | | |

| Fund, Series II (7/1/05) | -17.57% | -20.30% | n/a | n/a | n/a | -2.12% |

| S&P 500 Index | -9.64% | -4.68% | n/a | n/a | n/a | 7.39% |

| | | | | | | |

| Focus 30 Fund (9/17/03) | 2.49% | -1.40% | 16.78% | n/a | n/a | 16.22% |

| S&P 500 Index | -9.64% | -4.68% | 8.23% | n/a | n/a | 8.70% |

| | | | | | | |

| Cornerstone | | | | | | |

| Value Fund (11/1/96) | -16.11% | -11.16% | 6.26% | 10.30% | 4.84% | 6.64% |

| S&P 500 Index | -9.64% | -4.68% | 8.23% | 10.62% | 3.89% | 7.82% |

| | | | | | | |

| Total Return Fund (7/29/98) | -11.70% | -7.21% | 6.12% | 7.83% | n/a | 4.02% |

| S&P 500 Index | -9.64% | -4.68% | 8.23% | 10.62% | n/a | 3.83% |

| DJIA Index | -6.79% | 0.47% | 10.49% | 11.12% | n/a | 5.92% |

| | | | | | | |

| Balanced Fund (3/8/96) | -6.96% | -3.40% | 4.94% | 4.94% | 2.87% | 4.71% |

| S&P 500 Index | -9.64% | -4.68% | 8.23% | 10.62% | 3.89% | 8.44% |

| DJIA Index | -6.79% | 0.47% | 10.49% | 11.12% | 5.64% | 9.42% |

| | | | | | | |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance shown does not reflect a 1.5% redemption fee on shares held for less than 90 days. If it did, total returns would be reduced. All performance shown is net of fees and expenses.

The total annual operating expenses of the Original Class shares of the Funds are as follow: Cornerstone Growth Fund (HFCGX) = 1.20%; Cornerstone Growth Fund, Series II (HENLX) = 1.27%; Focus 30 Fund (HFTFX) = 1.23%; Cornerstone Value Fund (HFCVX) = 1.17%; Total Return Fund (HDOGX) = 3.04% gross/1.16% net of interest expense; and Balanced Fund (HBFBX) = 1.36%.

Despite strong market fundamentals in place, the major indices, as well as five of our funds, posted negative returns for the six-month period ending April 30, 2008. The notable exception was our Hennessy Focus 30, which had positive returns for the period. For the six-months ending April 30, 2008, we saw the strongest overall performance among mid-cap stocks, followed by large and then small-cap names. The Dow Jones Industrial Average (-6.79%) continued to outpace the S&P 500 (-9.64%) during the period. Financials were the big loser during the period, as these companies reeled from the unwinding sub-prime mortgage and credit crunch crises. While some sectors fared better than others, we continue to see better and worse performing stocks in each and maintain our view that it is still primarily a stock picker’s market.

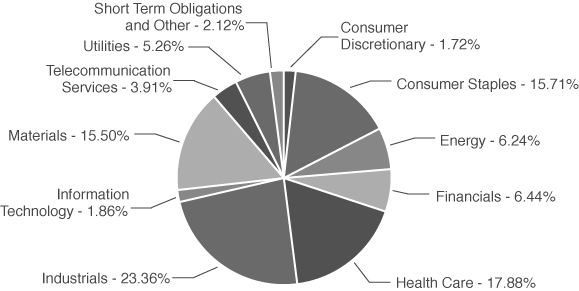

For the six-month period ending April 30, 2008, the Hennessy Cornerstone Growth Fund returned -21.48%, significantly lagging the S&P 500 (-9.64%). Health care stocks have stumbled year to date in 2008 and made up over 18% of the Cornerstone Growth portfolio as of 4/30/08. Only 1 of the 11 stocks held was positive for the three months ending 4/30/08, with most stocks in the sector down over 15%. As of 12/31/07, prior to the 2008 rebalance, 17% of the portfolio was in Consumer Discretionary, which negatively affected performance of the fund, as 9 of the 12 stocks experienced losses during November and December of 2007.

We understand that these short term returns of the Cornerstone Growth Fund have been disappointing, but we always try to keep a long-term view in mind when assessing performance. Since its inception, the Fund has experienced a total of six different corrections, where performance has fallen more than 20%. However, had you purchased the fund on its inception date of 11/01/96 and held it through all the corrections, as of 4/30/08, your average annual return would have been +12.16%, approximately 55% higher than the return for the S&P 500 over the same period, which was 7.82%.

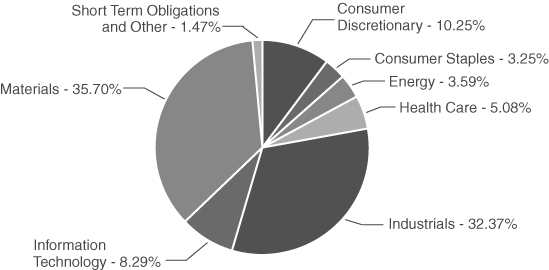

The Hennessy Cornerstone Growth Fund, Series II returned -17.57% for the six-month period ending April 30, 2008, underperforming the S&P 500 for the period. Industrial stocks made up over 36% of the portfolio as of 4/30/08. While a handful of Industrial stocks in the portfolio (Chart Industries, Robbins & Myers, Celanese and General Cable) had positive performance for the six-month period, the majority of these stocks were hard hit, with 14 stocks experiencing losses greater than 15% for the six-month period. Stocks within the other sectors in the portfolio were a mixed bag. Materials stocks AK Steel, Owens Illinois, and Arcelor Mittal were the strongest performers in the portfolio for the period, but overall the losers outnumbered the

HENNESSY FUNDS 1-800-966-4354

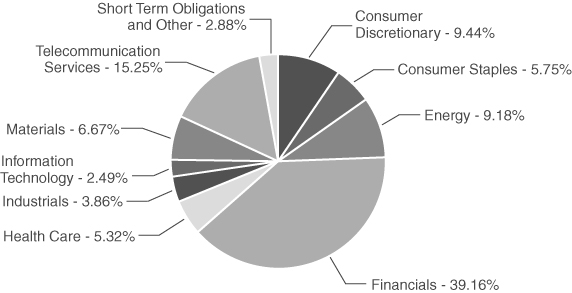

For the six-months ending April 30, 2008 the Hennessy Focus 30 Fund returned +2.49%, significantly outperforming the S&P 500 for the same period. During the period, the portfolio held no Financial stocks, which contributed to its outperformance of the S&P 500. Alpha Natural Resources (+ 87%) and Flowserve Corp. (+65%) were the stand-out performers for the six-month period ending April 30, 2008. While Consumer Discretionary stocks generally struggled for the period, two of the three in the portfolio performed very well (Warnaco +22% and Tupperware Brands +13%).

The Hennessy Cornerstone Value Fund returned -16.11% during the six-month period ending April 30, 2008, underperforming the S&P 500. Financial stocks made up over 40% of the portfolio as of 4/30/08, and out of the 21 Financial stocks in the fund, only US Bancorp had positive performance for the period. The overall sector was crushed by the sub-prime fallout, although some of these companies did not have direct exposure to the sub-prime market. 16 of the Financial stocks in the portfolio posted double digit losses, with National City, CIT Group, Countrywide Financial and Washington Mutual producing the worst results, all down over 50%. The top four performers in the portfolio for the period were all ADR’s, including Chunghwa Telecom Co. (+23%), Sasol Ltd. (+16%), ENI Spa (+8%) and Taiwan Semiconductor (+7%).

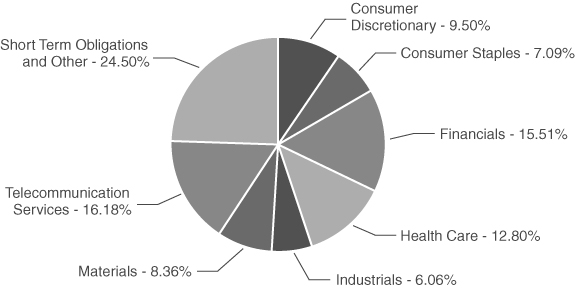

The Hennessy Total Return Fund returned -11.70%, underperforming the S&P 500 and Dow Jones Industrial Average, while the Hennessy Balanced Fund returned -6.96% for the six-month period ending April 30, 2008, on par with the Dow (-6.79%) and beating the S&P 500 (-9.64%) for the period. While the entire Dow Jones Industrial Average was down less than 7% for the six-month period, the Dogs of the Dow did not fare as well. Only two of the Dogs stocks, JP Morgan and DuPont, had positive performance for the period. The very poor performance of Merck (-34%), Citigroup (-34%) and General Motors (-38%) significantly hampered performance of both funds. During the period, the inclusion of short-term Treasury notes in the portfolios (25% weighting in Total Return and 50% weighting in Balanced) helped to partially offset the equity sell off.

Corrections can be painful, but I believe that historical performance data shows how patience, discipline and a long-term investing view can be rewarded. Savvy investors know that when things look bleakest, it may be a good time to buy rather than sell. We believe that in the future

we’ll look back at the 2007-2008 market with the same type of “20-20 hindsight” with which we view other past corrections and bear markets. At Hennessy Funds, we vigilantly maintain our focus on the long-term, and on building value for our shareholders. Thank you for your continued confidence and investment in the Funds. Should you have any questions or want to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Best regards,

Neil Hennessy

Chairman & Portfolio Manager

Past performance does not guarantee future results.

Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods.

The Hennessy Total Return and Balanced Funds are non-diversified, meaning they may concentrate their assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund.

References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the Schedule of Investments within this semi-annual report for additional portfolio information, including percentages of holdings.

The S&P 500 and Dow Jones Industrial Average are unmanaged indices commonly used to measure the performance of U.S. stocks. The Dow Jones Industrial Average (DJIA Index) is an unmanaged index of common stocks comprised of major industrial companies and assumes reinvestment of dividends. One cannot invest directly in an index.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

Price to Sales (P/S) ratio is a tool for calculating a stock’s valuation relative to other companies, calculated by dividing a stock’s current price by its revenue per share.

HENNESSY FUNDS 1-800-966-4354

(This Page Intentionally Left Blank.)

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND

Summaries of Investments

The following summaries of investment portfolios are designed to help investors better understand each fund’s principal holdings. Each summary is as of April 30, 2008 (Unaudited).

HENNESSY CORNERSTONE GROWTH FUND

(% of Net Assets)

| TOP TEN HOLDINGS | % of net assets |

| Alpha Natural Resources, Inc. | 3.54% |

| Massey Energy Co. | 3.35% |

| Flowserve Corp. | 2.90% |

| Steel Dynamics, Inc. | 2.72% |

| Owens-Illinois, Inc. | 2.55% |

| Teledyne Technologies, Inc. | 2.37% |

| Coca-Cola Femsa S.A. de CV – ADR | 2.32% |

| Fairfax Financial Holdings, Ltd. | 2.27% |

| L-3 Communications Holdings Inc. | 2.21% |

| Enbridge, Inc. | 2.19% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 97.88% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 1.72% | | | | | | | | | |

| | Sony Corp. – ADR (b) | | | 216,600 | | | $ | 9,918,114 | | | | 1.72 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 15.71% | | | | | | | | | | | | |

| | Archer-Daniels-Midland Co. | | | 274,200 | | | | 12,081,252 | | | | 2.09 | % |

| | Bunge Ltd. (b) | | | 96,200 | | | | 10,975,458 | | | | 1.90 | % |

| | Coca-Cola Femsa S.A. de CV – ADR (b) | | | 257,100 | | | | 13,405,194 | | | | 2.32 | % |

| | Costco Wholesale Corp. | | | 175,000 | | | | 12,468,750 | | | | 2.16 | % |

| | Fresh Del Monte Produce, Inc. (a)(b) | | | 352,100 | | | | 11,158,049 | | | | 1.93 | % |

| | Pepsi Bottling Group, Inc. | | | 293,700 | | | | 9,900,627 | | | | 1.71 | % |

| | PepsiAmericas, Inc. | | | 367,500 | | | | 9,444,750 | | | | 1.63 | % |

| | Pricesmart, Inc. | | | 398,400 | | | | 11,374,320 | | | | 1.97 | % |

| | | | | | | | | 90,808,400 | | | | 15.71 | % |

| | | | | | | | | | | | | | |

| | Energy – 6.24% | | | | | | | | | | | | |

| | Bristow Group, Inc. (a) | | | 216,500 | | | | 11,420,375 | | | | 1.98 | % |

| | Enbridge, Inc. (b) | | | 307,400 | | | | 12,658,732 | | | | 2.19 | % |

| | Total S.A. – ADR (b) | | | 142,700 | | | | 11,986,800 | | | | 2.07 | % |

| | | | | | | | | 36,065,907 | | | | 6.24 | % |

| | | | | | | | | | | | | | |

| | Financials – 6.44% | | | | | | | | | | | | |

| | AON Corp. | | | 268,600 | | | | 12,191,754 | | | | 2.11 | % |

| | Assurant, Inc. | | | 183,500 | | | | 11,927,500 | | | | 2.06 | % |

| | Fairfax Financial Holdings Ltd. (b) | | | 43,700 | | | | 13,118,303 | | | | 2.27 | % |

| | | | | | | | | 37,237,557 | | | | 6.44 | % |

| | | | | | | | | | | | | | |

| | Health Care – 17.88% | | | | | | | | | | | | |

| | Aetna, Inc. | | | 206,500 | | | | 9,003,400 | | | | 1.55 | % |

| | Alliance Imaging, Inc. (a) | | | 1,253,700 | | | | 10,217,655 | | | | 1.77 | % |

| | Cigna Corp. | | | 217,100 | | | | 9,272,341 | | | | 1.61 | % |

| | Express Scripts, Inc. (a) | | | 166,500 | | | | 11,658,330 | | | | 2.02 | % |

| | Humana, Inc. (a) | | | 143,700 | | | | 6,867,423 | | | | 1.19 | % |

| | McKesson Corp. | | | 181,400 | | | | 9,454,568 | | | | 1.64 | % |

| | Medco Health Solutions, Inc. (a) | | | 232,500 | | | | 11,518,050 | | | | 1.99 | % |

| | Molina Healthcare, Inc. (a) | | | 313,000 | | | | 7,771,790 | | | | 1.35 | % |

| | MWI Veterinary Supply, Inc. (a) | | | 298,100 | | | | 10,275,507 | | | | 1.78 | % |

| | RehabCare Group, Inc. (a) | | | 503,400 | | | | 8,557,800 | | | | 1.48 | % |

The accompanying notes are an integral part of these financial statements.

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Health Care (Continued) | | | | | | | | | |

| | Sun Healthcare Group, Inc. (a) | | | 659,300 | | | $ | 8,669,795 | | | | 1.50 | % |

| | | | | | | | | 103,266,659 | | | | 17.88 | % |

| | | | | | | | | | | | | | |

| | Industrials – 23.36% | | | | | | | | | | | | |

| | AGCO Corp. (a) | | | 188,900 | | | | 11,358,557 | | | | 1.96 | % |

| | Azz, Inc. (a) | | | 352,400 | | | | 9,402,032 | | | | 1.63 | % |

| | CBIZ, Inc. (a) | | | 1,331,500 | | | | 11,810,405 | | | | 2.04 | % |

| | Chicago Bridge & Iron Co. N.V. (b) | | | 228,400 | | | | 9,099,456 | | | | 1.58 | % |

| | Dyncorp International, Inc. (a) | | | 486,400 | | | | 8,730,880 | | | | 1.51 | % |

| | EnerSys (a) | | | 441,000 | | | | 10,319,400 | | | | 1.79 | % |

| | Flowserve Corp. | | | 134,900 | | | | 16,739,741 | | | | 2.90 | % |

| | Jacobs Engineering Group, Inc. (a) | | | 135,000 | | | | 11,654,550 | | | | 2.02 | % |

| | L-3 Communications Holdings, Inc. | | | 114,400 | | | | 12,749,880 | | | | 2.21 | % |

| | Siemens AG – ADR (b) | | | 84,900 | | | | 10,056,405 | | | | 1.74 | % |

| | Stanley, Inc. (a) | | | 368,200 | | | | 9,289,686 | | | | 1.61 | % |

| | Teledyne Technologies, Inc. (a) | | | 233,500 | | | | 13,713,455 | | | | 2.37 | % |

| | | | | | | | | 134,924,447 | | | | 23.36 | % |

| | | | | | | | | | | | | | |

| | Information Technology – 1.86% | | | | | | | | | | | | |

| | LG Display Company Ltd. – ADR (a)(b) | | | 493,300 | | | | 10,739,141 | | | | 1.86 | % |

| | | | | | | | | | | | | | |

| | Materials – 15.50% | | | | | | | | | | | | |

| | Alpha Natural Resources, Inc. (a) | | | 420,900 | | | | 20,476,785 | | | | 3.54 | % |

| | BASF AG – ADR (b) | | | 82,400 | | | | 11,719,200 | | | | 2.03 | % |

| | LSB Industries, Inc. (a) | | | 494,900 | | | | 7,576,919 | | | | 1.31 | % |

| | Massey Energy Co. | | | 369,500 | | | | 19,335,935 | | | | 3.35 | % |

| | Owens-Illinois, Inc. (a) | | | 266,900 | | | | 14,719,535 | | | | 2.55 | % |

| | Steel Dynamics, Inc. | | | 450,300 | | | | 15,692,955 | | | | 2.72 | % |

| | | | | | | | | 89,521,329 | | | | 15.50 | % |

| | | | | | | | | | | | | | |

| | Telecommunication Services – 3.91% | | | | | | | | | | | | |

| | EMS Technologies, Inc. (a) | | | 442,200 | | | | 11,435,292 | | | | 1.98 | % |

| | Tele Norte Leste Participacoes SA (b) | | | 485,400 | | | | 11,120,514 | | | | 1.93 | % |

| | | | | | | | | 22,555,806 | | | | 3.91 | % |

| | | | | | | | | | | | | | |

| | Utilities – 5.26% | | | | | | | | | | | | |

| | Constellation Energy Group, Inc. | | | 115,500 | | | | 9,777,075 | | | | 1.69 | % |

| | Northwest Natural Gas Co. | | | 244,300 | | | | 10,961,741 | | | | 1.90 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Utilities (Continued) | | | | | | | | | |

| | RWE AG – ADR (b) | | | 83,700 | | | $ | 9,662,705 | | | | 1.67 | % |

| | | | | | | | | 30,401,521 | | | | 5.26 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $580,953,218) | | | | | | | 565,438,881 | | | | 97.88 | % |

| | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENTS – 2.45% | | Principal | | | | | | | | | |

| | | | Amount | | | | | | | | | |

| | Discount Notes – 2.45% | | | | | | | | | | | | |

| | Federal Home Loan Bank Discount Note, | | | | | | | | | | | | |

| | 1.6200%, 05/01/2008 | | $ | 14,166,000 | | | | 14,166,000 | | | | 2.45 | % |

| | | | | | | | | | | | | | |

| | Total Discount Notes (Cost $14,166,000) | | | | | | | 14,166,000 | | | | 2.45 | % |

| | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 0.00% | | | | | | | | | | | | |

| | American Family Financial Services, Inc. | | | | | | | | | | | | |

| | 1.7835% | | | 1,331 | | | | 1,331 | | | | 0.00 | % |

| | | | | | | | | | | | | | |

| | Total Variable Rate Demand Notes | | | | | | | | | | | | |

| | (Cost $1,331) | | | | | | | 1,331 | | | | 0.00 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $14,167,331) | | | | | | | 14,167,331 | | | | 2.45 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 100.33% | | | | | | | | | | | | |

| | (Cost $595,120,549) | | | | | | | 579,606,212 | | | | 100.33 | % |

| | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (0.33)% | | | | | | | (1,896,852 | ) | | | (0.33 | )% |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 577,709,360 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | | Non Income Producing |

| (b) | | Foreign Issued Security |

| # | | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2008. |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — CORNERSTONE GROWTH FUND, SERIES II

HENNESSY CORNERSTONE

GROWTH FUND, SERIES II

(% of Net Assets)

| TOP TEN HOLDINGS | % of net assets |

| AK Steel Holding Corp. | 4.15% |

| Owens-Illinois, Inc. | 3.80% |

| Cal-Maine Foods, Inc. | 3.71% |

| Chart Industries, Inc. | 3.56% |

| Robbins & Myers, Inc. | 3.47% |

| Arcelor Mittal – ADR | 3.44% |

| Terra Industries, Inc. | 3.38% |

| Gamestop Corp. | 3.33% |

| Celanese Corp. | 3.04% |

| Warnaco Group, Inc. | 2.99% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 99.71% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 11.49% | | | | | | | | | |

| | 1-800Flowers.com, Inc. (a) | | | 213,400 | | | $ | 1,882,188 | | | | 2.26 | % |

| | Fiat SPA – ADR (b) | | | 66,200 | | | | 1,483,138 | | | | 1.78 | % |

| | Gamestop Corp. (a) | | | 50,300 | | | | 2,768,512 | | | | 3.33 | % |

| | Nexstar Broadcasting Group, Inc. (a) | | | 167,100 | | | | 942,444 | | | | 1.13 | % |

| | Warnaco Group, Inc. (a) | | | 53,900 | | | | 2,486,946 | | | | 2.99 | % |

| | | | | | | | | 9,563,228 | | | | 11.49 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 6.60% | | | | | | | | | | | | |

| | Cal-Maine Foods, Inc. | | | 104,500 | | | | 3,087,975 | | | | 3.71 | % |

| | Pricesmart, Inc. | | | 84,200 | | | | 2,403,910 | | | | 2.89 | % |

| | | | | | | | | 5,491,885 | | | | 6.60 | % |

| | | | | | | | | | | | | | |

| | Energy – 5.54% | | | | | | | | | | | | |

| | Genesis Energy LP | | | 59,300 | | | | 1,140,932 | | | | 1.37 | % |

| | Ico Inc. (a) | | | 188,300 | | | | 1,399,069 | | | | 1.68 | % |

| | Matrix Service Co. (a) | | | 85,100 | | | | 1,711,361 | | | | 2.05 | % |

| | Western Refining, Inc. | | | 36,300 | | | | 363,363 | | | | 0.44 | % |

| | | | | | | | | 4,614,725 | | | | 5.54 | % |

| | | | | | | | | | | | | | |

| | Health Care – 2.43% | | | | | | | | | | | | |

| | Emergency Medical Services Corp. (a) | | | 49,300 | | | | 1,112,701 | | | | 1.34 | % |

| | WellCare Health Plans, Inc. (a) | | | 20,800 | | | | 910,624 | | | | 1.09 | % |

| | | | | | | | | 2,023,325 | | | | 2.43 | % |

| | | | | | | | | | | | | | |

| | Industrials – 37.39% | | | | | | | | | | | | |

| | Astec Industries, Inc. (a) | | | 44,200 | | | | 1,619,930 | | | | 1.95 | % |

| | Barnes Group, Inc. | | | 64,100 | | | | 1,671,728 | | | | 2.01 | % |

| | Chart Industries, Inc. (a) | | | 72,800 | | | | 2,958,592 | | | | 3.56 | % |

| | CNH Global N.V. (b) | | | 37,000 | | | | 1,596,180 | | | | 1.92 | % |

| | CPI Corp. | | | 33,200 | | | | 626,152 | | | | 0.75 | % |

| | Cummins, Inc. | | | 36,400 | | | | 2,280,460 | | | | 2.74 | % |

| | Dyncorp International, Inc. (a) | | | 97,800 | | | | 1,755,510 | | | | 2.11 | % |

| | General Cable Corp. (a) | | | 25,400 | | | | 1,701,800 | | | | 2.04 | % |

| | Hardinge, Inc. | | | 55,400 | | | | 924,072 | | | | 1.11 | % |

| | Horizon Lines Inc. Class A | | | 59,400 | | | | 626,670 | | | | 0.75 | % |

| | Hudson Highland Group, Inc. (a) | | | 115,400 | | | | 1,023,598 | | | | 1.23 | % |

| | Integrated Electrical Service (a) | | | 64,700 | | | | 1,082,431 | | | | 1.30 | % |

The accompanying notes are an integral part of these financial statements.

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Industrials (Continued) | | | | | | | | | |

| | Kaman Corp. | | | 62,000 | | | $ | 1,680,200 | | | | 2.02 | % |

| | MFRI, Inc. (a) | | | 74,600 | | | | 1,175,696 | | | | 1.41 | % |

| | Perini Corp. (a) | | | 29,400 | | | | 1,063,692 | | | | 1.28 | % |

| | Pinnacle Airlines Corp. (a) | | | 111,100 | | | | 924,352 | | | | 1.11 | % |

| | Robbins & Myers, Inc. | | | 72,500 | | | | 2,889,850 | | | | 3.47 | % |

| | Terex Corp. (a) | | | 23,200 | | | | 1,616,576 | | | | 1.94 | % |

| | Twin Disc, Inc. | | | 55,900 | | | | 1,007,877 | | | | 1.21 | % |

| | Volvo AB – ADR (b) | | | 97,300 | | | | 1,485,343 | | | | 1.78 | % |

| | VSE Corp. | | | 42,400 | | | | 1,417,432 | | | | 1.70 | % |

| | | | | | | | | 31,128,141 | | | | 37.39 | % |

| | | | | | | | | | | | | | |

| | Information Technology – 7.11% | | | | | | | | | | | | |

| | Amkor Technology, Inc. (a) | | | 143,300 | | | | 1,368,515 | | | | 1.64 | % |

| | Avnet, Inc. (a) | | | 48,200 | | | | 1,262,358 | | | | 1.52 | % |

| | Iomega Corp. (a) | | | 391,600 | | | | 1,499,828 | | | | 1.80 | % |

| | Methode Electronics, Inc. | | | 118,200 | | | | 1,281,288 | | | | 1.54 | % |

| | Miva, Inc. (a) | | | 303,650 | | | | 510,132 | | | | 0.61 | % |

| | | | | | | | | 5,922,121 | | | | 7.11 | % |

| | | | | | | | | | | | | | |

| | Oil & Gas – 2.68% | | | | | | | | | | | | |

| | Ultrapar Participacoes SA – ADR (b) | | | 61,100 | | | | 2,224,040 | | | | 2.68 | % |

| | | | | | | | | | | | | | |

| | Materials – 24.28% | | | | | | | | | | | | |

| | AK Steel Holding Corp. | | | 55,000 | | | | 3,452,900 | | | | 4.15 | % |

| | Arcelor Mittal – ADR (b) | | | 32,100 | | | | 2,859,789 | | | | 3.44 | % |

| | Buckeye Technologies, Inc. (a) | | | 137,000 | | | | 1,182,310 | | | | 1.42 | % |

| | Celanese Corp. | | | 56,600 | | | | 2,532,850 | | | | 3.04 | % |

| | Innospec, Inc. | | | 69,600 | | | | 1,419,144 | | | | 1.70 | % |

| | LSB Industries, Inc. (a) | | | 98,400 | | | | 1,506,504 | | | | 1.81 | % |

| | Owens-Illinois, Inc. (a) | | | 57,400 | | | | 3,165,610 | | | | 3.80 | % |

| | Penford Corp. | | | 58,200 | | | | 1,278,072 | | | | 1.54 | % |

| | Terra Industries, Inc. (a) | | | 74,300 | | | | 2,812,998 | | | | 3.38 | % |

| | | | | | | | | 20,210,177 | | | | 24.28 | % |

| | | | | | | | | | | | | | |

| | Utilities – 2.19% | | | | | | | | | | | | |

| | Reliant Energy, Inc. (a) | | | 70,900 | | | | 1,824,966 | | | | 2.19 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $102,234,234) | | | | | | | 83,002,608 | | | | 99.71 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | SHORT-TERM INVESTMENTS – 0.27% | | Principal | | | | | | % of Net | |

| | | | Amount | | | Value | | | Assets | |

| | Discount Notes – 0.26% | | | | | | | | | |

| | Federal Home Loan Bank Discount Note, | | | | | | | | | |

| | 1.6200%, 05/01/2008 | | $ | 220,000 | | | $ | 220,000 | | | | 0.26 | % |

| | | | | | | | | | | | | | |

| | Total Discount Notes (Cost $220,000) | | | | | | | 220,000 | | | | 0.26 | % |

| | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 0.01% | | | | | | | | | | | | |

| | American Family Financial Services, Inc. | | | | | | | | | | | | |

| | 1.7835% | | | 5,479 | | | | 5,479 | | | | 0.01 | % |

| | | | | | | | | | | | | | |

| | Total Variable Rate Demand Notes | | | | | | | | | | | | |

| | (Cost $5,479) | | | | | | | 5,479 | | | | 0.01 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $225,479) | | | | | | | 225,479 | | | | 0.27 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 99.98% | | | | | | | | | | | | |

| | (Cost $102,459,713) | | | | | | | 83,228,087 | | | | 99.98 | % |

| | | | | | | | | | | | | | |

| | Other Assets in Excess of Liabilities – 0.02% | | | | | | | 20,547 | | | | 0.02 | % |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 83,248,634 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | | Non Income Producing |

| (b) | | Foreign Issued Security |

| # | | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2008. |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — FOCUS 30 FUND

HENNESSY FOCUS 30 FUND

(% of Net Assets)

| TOP TEN HOLDINGS | % of net assets |

| Alpha Natural Resources, Inc. | 6.27% |

| Flowserve Corp. | 5.28% |

| SPX Corp. | 4.38% |

| AK Steel Holding Corp. | 4.27% |

| Owens-Illinois, Inc. | 4.25% |

| Schnitzer Steel Industries, Inc. | 4.17% |

| Hewitt Associates, Inc. | 3.88% |

| Parexel International Corp. | 3.78% |

| Terra Industries, Inc. | 3.76% |

| Tupperware Corp. | 3.73% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 98.53% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 10.25% | | | | | | | | | |

| | Dick’s Sporting Goods, Inc. (a) | | | 201,200 | | | $ | 5,754,320 | | | | 2.84 | % |

| | Tupperware Corp. | | | 192,000 | | | | 7,564,800 | | | | 3.73 | % |

| | Warnaco Group, Inc. (a) | | | 161,900 | | | | 7,470,066 | | | | 3.68 | % |

| | | | | | | | | 20,789,186 | | | | 10.25 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 3.25% | | | | | | | | | | | | |

| | Corn Products International, Inc. | | | 142,300 | | | | 6,599,874 | | | | 3.25 | % |

| | | | | | | | | | | | | | |

| | Energy – 3.59% | | | | | | | | | | | | |

| | Oil States International, Inc. (a) | | | 145,400 | | | | 7,278,724 | | | | 3.59 | % |

| | | | | | | | | | | | | | |

| | Health Care – 5.08% | | | | | | | | | | | | |

| | Parexel International Corp. (a) | | | 301,600 | | | | 7,660,640 | | | | 3.78 | % |

| | WellCare Health Plans, Inc. (a) | | | 60,300 | | | | 2,639,934 | | | | 1.30 | % |

| | | | | | | | | 10,300,574 | | | | 5.08 | % |

| | | | | | | | | | | | | | |

| | Industrials – 32.37% | | | | | | | | | | | | |

| | Alliant Techsystems, Inc. (a) | | | 61,400 | | | | 6,752,772 | | | | 3.33 | % |

| | Barnes Group, Inc. | | | 194,700 | | | | 5,077,776 | | | | 2.50 | % |

| | Esterline Technologies Corp. (a) | | | 125,900 | | | | 7,007,594 | | | | 3.45 | % |

| | Flowserve Corp. | | | 86,300 | | | | 10,708,967 | | | | 5.28 | % |

| | Goodrich Corp. | | | 97,800 | | | | 6,665,070 | | | | 3.28 | % |

| | Harsco Corp. | | | 112,700 | | | | 6,686,491 | | | | 3.30 | % |

| | Oshkosh Truck Corp. | | | 110,200 | | | | 4,474,120 | | | | 2.21 | % |

| | SPX Corp. | | | 72,200 | | | | 8,880,600 | | | | 4.38 | % |

| | Triumph Group, Inc. | | | 83,900 | | | | 4,939,193 | | | | 2.43 | % |

| | URS Corp. (a) | | | 111,000 | | | | 4,477,740 | | | | 2.21 | % |

| | | | | | | | | 65,670,323 | | | | 32.37 | % |

| | | | | | | | | | | | | | |

| | Information Technology – 8.29% | | | | | | | | | | | | |

| | Anixter International, Inc. (a) | | | 80,500 | | | | 4,586,085 | | | | 2.26 | % |

| | Arrow Electronics, Inc. (a) | | | 160,800 | | | | 4,375,368 | | | | 2.15 | % |

| | Hewitt Associates, Inc. (a) | | | 191,900 | | | | 7,867,900 | | | | 3.88 | % |

| | | | | | | | | 16,829,353 | | | | 8.29 | % |

| | | | | | | | | | | | | | |

| | Materials – 35.70% | | | | | | | | | | | | |

| | Airgas, Inc. | | | 125,600 | | | | 6,045,128 | | | | 2.98 | % |

| | AK Steel Holding Corp. | | | 138,000 | | | | 8,663,640 | | | | 4.27 | % |

| | Alpha Natural Resources, Inc. (a) | | | 261,600 | | | | 12,726,840 | | | | 6.27 | % |

The accompanying notes are an integral part of these financial statements.

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Materials (Continued) | | | | | | | | | |

| | Brush Engineered Materials, Inc. (a) | | | 122,100 | | | $ | 3,786,321 | | | | 1.87 | % |

| | Lubrizol Corp. | | | 98,300 | | | | 5,732,856 | | | | 2.82 | % |

| | Nalco Holding Co. | | | 223,200 | | | | 5,131,368 | | | | 2.53 | % |

| | Owens-Illinois, Inc. (a) | | | 156,400 | | | | 8,625,460 | | | | 4.25 | % |

| | Schnitzer Steel Industries, Inc. | | | 96,100 | | | | 8,456,800 | | | | 4.17 | % |

| | Terra Industries, Inc. (a) | | | 201,300 | | | | 7,621,218 | | | | 3.75 | % |

| | WR Grace & Co. (a) | | | 223,000 | | | | 5,655,280 | | | | 2.79 | % |

| | | | | | | | | 72,444,911 | | | | 35.70 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $195,831,684) | | | | | | | 199,912,945 | | | | 98.53 | % |

| | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENTS – 1.46% | | Principal | | | | | | | | | |

| | | | Amount | | | | | | | | | |

| | Discount Notes – 1.04% | | | | | | | | | | | | |

| | Federal Home Loan Bank Discount Note, | | | | | | | | | | | | |

| | 1.6200%, 05/01/2008 | | $ | 2,115,000 | | | | 2,115,000 | | | | 1.04 | % |

| | | | | | | | | | | | | | |

| | Total Discount Notes (Cost $2,115,000) | | | | | | | 2,115,000 | | | | 1.04 | % |

| | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 0.42% | | | | | | | | | | | | |

| | American Family Financial Services, Inc. | | | | | | | | | | | | |

| | 1.7835% | | | 858,551 | | | | 858,551 | | | | 0.42 | % |

| | | | | | | | | | | | | | |

| | Total Variable Rate Demand Notes | | | | | | | | | | | | |

| | (Cost $858,551) | | | | | | | 858,551 | | | | 0.42 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $2,973,551) | | | | | | | 2,973,551 | | | | 1.46 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 99.99% | | | | | | | | | | | | |

| | (Cost $198,805,235) | | | | | | | 202,886,496 | | | | 99.99 | % |

| | | | | | | | | | | | | | |

| | Other Assets in Excess of Liabilities – 0.01% | | | | | | | 18,883 | | | | 0.01 | % |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 202,905,379 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | | Non Income Producing |

| # | | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rate listed are as of April 30, 2008. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

HENNESSY CORNERSTONE VALUE FUND

(% of Net Assets)

| TOP TEN HOLDINGS | % of net assets |

| Chunghwa Telecom Co. Ltd. – ADR | 2.66% |

| Sasol Ltd. – ADR | 2.58% |

| Taiwan Semiconductor Manufacturing Co., Ltd. – ADR | 2.49% |

| EI Du Pont De Nemours & Co. | 2.34% |

| Southern Copper Corp. | 2.34% |

| ENI SpA – ADR | 2.33% |

| PNC Financial Services Group | 2.29% |

| KeyCorp | 2.28% |

| BB&T Corp. | 2.25% |

| US Bancorp | 2.22% |

| | COMMON STOCKS – 97.12% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 9.44% | | | | | | | | | |

| | Carnival Corp. (b) | | | 77,000 | | | $ | 3,093,090 | | | | 1.91 | % |

| | CBS Corp. | | | 132,600 | | | | 3,059,082 | | | | 1.89 | % |

| | Gannett Co, Inc. | | | 98,200 | | | | 2,810,484 | | | | 1.74 | % |

| | General Motors Corp. | | | 130,700 | | | | 3,032,240 | | | | 1.87 | % |

| | Mattel, Inc. | | | 175,400 | | | | 3,288,750 | | | | 2.03 | % |

| | | | | | | | | 15,283,646 | | | | 9.44 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 5.75% | | | | | | | | | | | | |

| | Altria Group, Inc. | | | 45,100 | | | | 902,000 | | | | 0.56 | % |

| | Diageo PLC – ADR (b) | | | 40,500 | | | | 3,316,950 | | | | 2.05 | % |

| | Philip Morris International, Inc. (a) | | | 45,100 | | | | 2,301,453 | | | | 1.42 | % |

| | Reynolds American, Inc. | | | 51,800 | | | | 2,789,430 | | | | 1.72 | % |

| | | | | | | | | 9,309,833 | | | | 5.75 | % |

| | | | | | | | | | | | | | |

| | Energy – 9.18% | | | | | | | | | | | | |

| | BP PLC – ADR (b) | | | 46,700 | | | | 3,399,293 | | | | 2.10 | % |

| | ENI SpA – ADR (b) | | | 49,100 | | | | 3,781,682 | | | | 2.33 | % |

| | Enterprise Products Partners LP | | | 112,500 | | | | 3,513,375 | | | | 2.17 | % |

| | Sasol Ltd. – ADR (b) | | | 73,700 | | | | 4,175,105 | | | | 2.58 | % |

| | | | | | | | | 14,869,455 | | | | 9.18 | % |

| | | | | | | | | | | | | | |

| | Financials – 39.16% | | | | | | | | | | | | |

| | Aegon NV – ADR (b) | | | 200,300 | | | | 3,192,782 | | | | 1.97 | % |

| | Allied Irish Banks PLC – ADR (b) | | | 77,100 | | | | 3,286,773 | | | | 2.03 | % |

| | Bank of America Corp. | | | 82,200 | | | | 3,085,788 | | | | 1.91 | % |

| | Barclays PLC – ADR (b) | | | 81,400 | | | | 2,962,960 | | | | 1.83 | % |

| | BB&T Corp. | | | 106,100 | | | | 3,638,169 | | | | 2.25 | % |

| | CIT Group, Inc. | | | 140,100 | | | | 1,525,689 | | | | 0.94 | % |

| | Citigroup, Inc. | | | 112,900 | | | | 2,852,983 | | | | 1.76 | % |

| | Countrywide Financial Corp. | | | 353,700 | | | | 2,044,386 | | | | 1.26 | % |

| | HSBC Holdings PLC – ADR (b) | | | 41,100 | | | | 3,567,069 | | | | 2.20 | % |

| | ING Groep NV – ADR (b) | | | 89,900 | | | | 3,415,301 | | | | 2.11 | % |

| | KeyCorp | | | 152,900 | | | | 3,689,477 | | | | 2.28 | % |

| | Kookmin Bank – ADR (a)(b) | | | 48,300 | | | | 3,368,925 | | | | 2.08 | % |

| | Lloyds TSB Group PLC – ADR (b) | | | 90,800 | | | | 3,111,716 | | | | 1.92 | % |

| | Marshall & Ilsley Corp. | | | 122,600 | | | | 3,062,548 | | | | 1.89 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Financials (Continued) | | | | | | | | | |

| | National City Corp. | | | 208,600 | | | $ | 1,314,180 | | | | 0.81 | % |

| | PNC Financial Services Group | | | 53,500 | | | | 3,710,225 | | | | 2.29 | % |

| | Regions Financial Corp. | | | 144,400 | | | | 3,165,248 | | | | 1.95 | % |

| | US Bancorp | | | 106,100 | | | | 3,595,729 | | | | 2.22 | % |

| | Wachovia Corp. | | | 88,800 | | | | 2,588,520 | | | | 1.60 | % |

| | Washington Mutual, Inc. | | | 228,800 | | | | 2,811,952 | | | | 1.74 | % |

| | Wells Fargo & Co. | | | 115,300 | | | | 3,430,175 | | | | 2.12 | % |

| | | | | | | | | 63,420,595 | | | | 39.16 | % |

| | | | | | | | | | | | | | |

| | Health Care – 5.32% | | | | | | | | | | | | |

| | Bristol-Myers Squibb Co. | | | 123,500 | | | | 2,713,295 | | | | 1.68 | % |

| | GlaxoSmithKline PLC – ADR (b) | | | 65,400 | | | | 2,884,794 | | | | 1.78 | % |

| | Pfizer, Inc. | | | 150,100 | | | | 3,018,511 | | | | 1.86 | % |

| | | | | | | | | 8,616,600 | | | | 5.32 | % |

| | | | | | | | | | | | | | |

| | Industrials – 3.86% | | | | | | | | | | | | |

| | Masco Corp. | | | 157,800 | | | | 2,873,538 | | | | 1.78 | % |

| | Pitney Bowes, Inc. | | | 93,300 | | | | 3,369,063 | | | | 2.08 | % |

| | | | | | | | | 6,242,601 | | | | 3.86 | % |

| | | | | | | | | | | | | | |

| | Information Technology – 2.49% | | | | | | | | | | | | |

| | Taiwan Semiconductor | | | | | | | | | | | | |

| | Manufacturing Co., Ltd. – ADR (b) | | | 359,200 | | | | 4,037,408 | | | | 2.49 | % |

| | | | | | | | | | | | | | |

| | Materials – 6.67% | | | | | | | | | | | | |

| | The Dow Chemical Co. | | | 80,400 | | | | 3,228,060 | | | | 1.99 | % |

| | EI Du Pont de Nemours & Co. | | | 77,500 | | | | 3,790,525 | | | | 2.34 | % |

| | Southern Copper Corp. | | | 33,000 | | | | 3,787,080 | | | | 2.34 | % |

| | | | | | | | | 10,805,665 | | | | 6.67 | % |

| | | | | | | | | | | | | | |

| | Telecommunication Services – 15.25% | | | | | | | | | | | | |

| | AT&T, Inc. | | | 84,300 | | | | 3,263,253 | | | | 2.02 | % |

| | BT Group PLC – ADR (b) | | | 60,700 | | | | 2,679,298 | | | | 1.65 | % |

| | Chunghwa Telecom Co. Ltd. – ADR (b) | | | 168,809 | | | | 4,306,318 | | | | 2.66 | % |

| | Deutsche Telekom AG – ADR (b) | | | 160,600 | | | | 2,866,710 | | | | 1.77 | % |

| | Embarq Corp. | | | 70,200 | | | | 2,918,214 | | | | 1.80 | % |

| | Fairpoint Communications, Inc. | | | 1,472 | | | | 13,557 | | | | 0.01 | % |

| | France Telecom – ADR (b) | | | 98,400 | | | | 3,082,872 | | | | 1.90 | % |

The accompanying notes are an integral part of these financial statements.

| | COMMON STOCKS | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Telecommunication Services (Continued) | | | | | | | | | |

| | Qwest Communications International | | | 494,500 | | | $ | 2,551,620 | | | | 1.58 | % |

| | Telefonica De Argentina (a)(b)Ω | | | 1,200 | | | | 0 | | | | 0.00 | % |

| | Verizon Communications, Inc. | | | 78,100 | | | | 3,005,288 | | | | 1.86 | % |

| | | | | | | | | 24,687,130 | | | | 15.25 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $168,381,350) | | | | | | | 157,272,933 | | | | 97.12 | % |

| | | | | | | | | | | | | | |

| | SHORT-TERM INVESTMENTS – 2.57% | | Principal | | | | | | | | | |

| | | | Amount | | | | | | | | | |

| | Discount Notes – 1.50% | | | | | | | | | | | | |

| | Federal Home Loan Bank Discount Note, | | | | | | | | | | | | |

| | 1.6200%, 05/01/2008 | | $ | 2,427,000 | | | | 2,427,000 | | | | 1.50 | % |

| | | | | | | | | | | | | | |

| | Total Discount Notes (Cost $2,427,000) | | | | | | | 2,427,000 | | | | 1.50 | % |

| | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 1.07% | | | | | | | | | | | | |

| | American Family Financial Services, Inc. | | | | | | | | | | | | |

| | 1.7835% | | | 1,732,132 | | | | 1,732,132 | | | | 1.07 | % |

| | | | | | | | | | | | | | |

| | Total Variable Rate Demand Notes | | | | | | | | | | | | |

| | (Cost $1,732,132) | | | | | | | 1,732,132 | | | | 1.07 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $4,159,132) | | | | | | | 4,159,132 | | | | 2.57 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 99.69% | | | | | | | | | | | | |

| | (Cost $172,540,482) | | | | | | | 161,432,065 | | | | 99.69 | % |

| | | | | | | | | | | | | | |

| | Other Assets in Excess of Liabilities – 0.31% | | | | | | | 506,038 | | | | 0.31 | % |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 161,938,103 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | | Non Income Producing |

| (b) | | Foreign Issued Security |

| Ω | | Security is fair valued. |

| # | | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2008. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

HENNESSY TOTAL RETURN FUND

(% of Net Assets)

| TOP TEN HOLDINGS | % of net assets |

| J.P. Morgan Chase & Co. | 8.48% |

| EI Du Pont de Nemours & Co. | 8.36% |

| AT&T, Inc. | 8.28% |

| Verizon Communications, Inc. | 7.87% |

| Pfizer, Inc | 7.02% |

| General Electric Co. | 6.06% |

| Merck & Co., Inc. | 5.78% |

| General Motors Corp. | 5.73% |

| Citigroup, Inc. | 5.62% |

| Philip Morris International, Inc. | 5.09% |

| | COMMON STOCKS – 75.50% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 9.50% | | | | | | | | | |

| | General Motors Corp. | | | 197,600 | | | $ | 4,584,320 | | | | 5.73 | % |

| | Home Depot, Inc. | | | 104,700 | | | | 3,015,360 | | | | 3.77 | % |

| | | | | | | | | 7,599,680 | | | | 9.50 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 7.09% | | | | | | | | | | | | |

| | Altria Group, Inc. | | | 79,900 | | | | 1,598,000 | | | | 2.00 | % |

| | Philip Morris International, Inc. (a) | | | 79,900 | | | | 4,077,297 | | | | 5.09 | % |

| | | | | | | | | 5,675,297 | | | | 7.09 | % |

| | | | | | | | | | | | | | |

| | Financials – 15.51% | | | | | | | | | | | | |

| | Bank of America Corp. | | | 30,000 | | | | 1,126,200 | | | | 1.41 | % |

| | Citigroup, Inc. | | | 178,100 | | | | 4,500,587 | | | | 5.62 | % |

| | J.P. Morgan Chase & Co. | | | 142,400 | | | | 6,785,360 | | | | 8.48 | % |

| | | | | | | | | 12,412,147 | | | | 15.51 | % |

| | | | | | | | | | | | | | |

| | Health Care – 12.80% | | | | | | | | | | | | |

| | Merck & Co., Inc. | | | 121,600 | | | | 4,625,664 | | | | 5.78 | % |

| | Pfizer, Inc. | | | 279,100 | | | | 5,612,701 | | | | 7.02 | % |

| | | | | | | | | 10,238,365 | | | | 12.80 | % |

| | | | | | | | | | | | | | |

| | Industrials – 6.06% | | | | | | | | | | | | |

| | General Electric Co. | | | 148,300 | | | | 4,849,410 | | | | 6.06 | % |

| | | | | | | | | | | | | | |

| | Materials – 8.36% | | | | | | | | | | | | |

| | EI Du Pont de Nemours & Co. | | | 136,700 | | | | 6,685,997 | | | | 8.36 | % |

| | | | | | | | | | | | | | |

| | Telecommunication Services – 16.18% | | | | | | | | | | | | |

| | AT&T, Inc. | | | 171,100 | | | | 6,623,281 | | | | 8.28 | % |

| | Fairpoint Communications, Inc. | | | 2,886 | | | | 26,580 | | | | 0.03 | % |

| | Verizon Communications, Inc. | | | 163,500 | | | | 6,291,480 | | | | 7.87 | % |

| | | | | | | | | 12,941,341 | | | | 16.18 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $61,102,067) | | | | | | | 60,402,237 | | | | 75.50 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| | SHORT-TERM INVESTMENTS – 72.82% | | Principal | | | | | | % of Net | |

| | | | Amount | | | Value | | | Assets | |

| | Discount Notes – 0.29% | | | | | | | | | |

| | Federal Home Loan Bank Discount Note, | | | | | | | | | |

| | 1.6200%, 05/01/2008 | | $ | 235,000 | | | $ | 235,000 | | | | 0.29 | % |

| | Total Discount Notes (Cost $235,000) | | | | | | | 235,000 | | | | 0.29 | % |

| | | | | | | | | | | | | | |

| | U.S. Treasury Bills* – 69.89% | | | | | | | | | | | | |

| | 2.3000%, 05/22/2008 | | | 19,000,000 | | | | 18,978,166 | | | | 23.72 | % |

| | 1.0000%, 06/19/2008 | | | 20,000,000 | | | | 19,989,111 | | | | 24.99 | % |

| | 1.5000%, 07/24/2008 | | | 17,000,000 | | | | 16,948,031 | | | | 21.18 | % |

| | Total U.S. Treasury Bills (Cost $55,928,007) | | | | | | | 55,915,308 | | | | 69.89 | % |

| | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 2.64% | | | | | | | | | | | | |

| | American Family Financial Services, Inc. | | | | | | | | | | | | |

| | 1.7835% | | | 2,108,232 | | | | 2,108,232 | | | | 2.64 | % |

| | | | | | | | | | | | | | |

| | Total Variable Rate Demand Notes | | | | | | | | | | | | |

| | (Cost $2,108,232) | | | | | | | 2,108,232 | | | | 2.64 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $58,271,239) | | | | | | | 58,258,540 | | | | 72.82 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 148.32% | | | | | | | | | | | | |

| | (Cost $119,373,306) | | | | | | | 118,660,777 | | | | 148.32 | % |

| | | | | | | | | | | | | | |

| | Liabilities in Excess of Other Assets – (48.32)% | | | | | | | (38,656,845 | ) | | | (48.32 | )% |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 80,003,932 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | | Non Income Producing |

| # | | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2008. |

| * | | Collateral or partial collateral for securities sold subject to repurchase. |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — BALANCED FUND

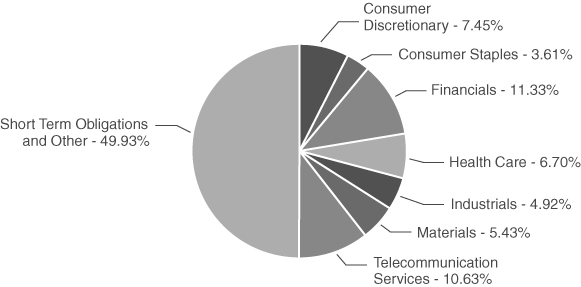

HENNESSY BALANCED FUND

(% of Net Assets)

| TOP TEN HOLDINGS | % of net assets |

| J.P. Morgan Chase & Co. | 5.67% |

| AT&T, Inc. | 5.47% |

| EI Du Pont de Nemours & Co. | 5.43% |

| Verizon Communications, Inc. | 5.14% |

| General Electric Co. | 4.92% |

| Pfizer, Inc. | 4.66% |

| General Motors Corp. | 4.51% |

| Citigroup, Inc. | 4.05% |

| Home Depot, Inc. | 2.94% |

| Philip Morris International, Inc. | 2.60% |

HENNESSY FUNDS 1-800-966-4354

| | COMMON STOCKS – 50.07% | | Number | | | | | | % of Net | |

| | | | of Shares | | | Value | | | Assets | |

| | Consumer Discretionary – 7.45% | | | | | | | | | |

| | General Motors Corp. | | | 28,515 | | | $ | 661,548 | | | | 4.51 | % |

| | Home Depot, Inc. | | | 15,010 | | | | 432,288 | | | | 2.94 | % |

| | | | | | | | | 1,093,836 | | | | 7.45 | % |

| | | | | | | | | | | | | | |

| | Consumer Staples – 3.61% | | | | | | | | | | | | |

| | Altria Group, Inc. | | | 7,470 | | | | 149,400 | | | | 1.01 | % |

| | Philip Morris International, Inc. (a) | | | 7,470 | | | | 381,194 | | | | 2.60 | % |

| | | | | | | | | 530,594 | | | | 3.61 | % |

| | | | | | | | | | | | | | |

| | Financials – 11.33% | | | | | | | | | | | | |

| | Bank of America Corp. | | | 6,320 | | | | 237,253 | | | | 1.61 | % |

| | Citigroup, Inc. | | | 23,525 | | | | 594,476 | | | | 4.05 | % |

| | J.P. Morgan Chase & Co. | | | 17,475 | | | | 832,684 | | | | 5.67 | % |

| | | | | | | | | 1,664,413 | | | | 11.33 | % |

| | | | | | | | | | | | | | |

| | Health Care – 6.70% | | | | | | | | | | | | |

| | Merck & Co., Inc. | | | 7,860 | | | | 298,994 | | | | 2.04 | % |

| | Pfizer, Inc. | | | 34,050 | | | | 684,746 | | | | 4.66 | % |

| | | | | | | | | 983,740 | | | | 6.70 | % |

| | | | | | | | | | | | | | |

| | Industrials – 4.92% | | | | | | | | | | | | |

| | General Electric Co. | | | 22,080 | | | | 722,016 | | | | 4.92 | % |

| | | | | | | | | | | | | | |

| | Materials – 5.43% | | | | | | | | | | | | |

| | EI Du Pont de Nemours & Co. | | | 16,295 | | | | 796,989 | | | | 5.43 | % |

| | | | | | | | | | | | | | |

| | Telecommunication Services – 10.63% | | | | | | | | | | | | |

| | AT&T, Inc. | | | 20,760 | | | | 803,620 | | | | 5.47 | % |

| | Fairpoint Communications, Inc. | | | 323 | | | | 2,975 | | | | 0.02 | % |

| | Verizon Communications, Inc. | | | 19,630 | | | | 755,362 | | | | 5.14 | % |

| | | | | | | | | 1,561,957 | | | | 10.63 | % |

| | | | | | | | | | | | | | |

| | Total Common Stocks (Cost $8,045,219) | | | | | | | 7,353,545 | | | | 50.07 | % |

The accompanying notes are an integral part of these financial statements.

| | SHORT-TERM INVESTMENTS – 49.84% | | Principal | | | | | | % of Net | |

| | | | Amount | | | Value | | | Assets | |

| | Discount Notes – 1.16% | | | | | | | | | |

| | Federal Home Loan Bank Discount Note, | | | | | | | | | |

| | 1.6200%, 05/01/2008 | | $ | 171,000 | | | $ | 171,000 | | | | 1.16 | % |

| | Total Discount Notes (Cost $171,000) | | | | | | | 171,000 | | | | 1.16 | % |

| | | | | | | | | | | | | | |

| | U.S. Treasury Notes – 47.69% | | | | | | | | | | | | |

| | 4.875%, 05/31/2008 | | | 1,000,000 | | | | 1,003,126 | | | | 6.83 | % |

| | 3.250%, 08/15/2008 | | | 2,600,000 | | | | 2,614,422 | | | | 17.80 | % |

| | 4.625%, 09/30/2008 | | | 850,000 | | | | 860,957 | | | | 5.86 | % |

| | 3.000%, 02/15/2009 | | | 1,600,000 | | | | 1,615,626 | | | | 11.00 | % |

| | 3.125%, 04/15/2009 | | | 900,000 | | | | 910,829 | | | | 6.20 | % |

| | Total U.S. Treasury Notes (Cost $6,975,242) | | | | | | | 7,004,960 | | | | 47.69 | % |

| | | | | | | | | | | | | | |

| | Variable Rate Demand Notes# – 0.99% | | | | | | | | | | | | |

| | American Family Financial Services, Inc. | | | | | | | | | | | | |

| | 1.7835% | | | 144,925 | | | | 144,925 | | | | 0.99 | % |

| | | | | | | | | | | | | | |

| | Total Variable Rate Demand Notes | | | | | | | | | | | | |

| | (Cost $144,925) | | | | | | | 144,925 | | | | 0.99 | % |

| | | | | | | | | | | | | | |

| | Total Short-Term Investments | | | | | | | | | | | | |

| | (Cost $7,291,167) | | | | | | | 7,320,885 | | | | 49.84 | % |

| | | | | | | | | | | | | | |

| | Total Investments – 99.91% | | | | | | | | | | | | |

| | (Cost $15,336,386) | | | | | | | 14,674,430 | | | | 99.91 | % |

| | | | | | | | | | | | | | |

| | Other Assets in Excess of Liabilities – 0.09% | | | | | | | 12,487 | | | | 0.09 | % |

| | TOTAL NET ASSETS – 100.00% | | | | | | $ | 14,686,917 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | | Non Income Producing |

| # | | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2008. |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statements of Assets and Liabilities as of April 30, 2008 (Unaudited) |

| | | HENNESSY | |

| | | CORNERSTONE | |

| | | GROWTH FUND | |

| ASSETS: | | | |

| Investments, at value (cost $595,120,549, $102,459,713, | | | |

| $198,805,235, $172,540,482, $119,373,306 and $15,336,386, respectively) | | $ | 579,606,212 | |

| Cash | | | — | |

| Dividends and interest receivable | | | 539,814 | |

| Receivable for fund shares sold | | | 282,425 | |

| Prepaid expenses and other assets | | | 37,104 | |

| Total Assets | | | 580,465,555 | |

| | | | | |

| LIABILITIES: | | | | |

| Loan payable | | | — | |

| Payable for securities purchased | | | 40,581 | |

| Payable for fund shares redeemed | | | 1,857,152 | |

| Payable to Advisor | | | 357,854 | |

| Payable to Administrator | | | 378,990 | |

| Payable to Auditor | | | 11,939 | |

| Payable to Distributor | | | — | |

| Accrued interest payable | | | — | |

| Accrued service fees | | | 47,545 | |

| Accrued expenses and other payables | | | 62,134 | |

| Total Liabilities | | | 2,756,195 | |

| | | | | |

| NET ASSETS | | $ | 577,709,360 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 696,178,698 | |

| Accumulated net investment income (loss) | | | (1,143,675 | ) |

| Accumulated net realized gain (loss) on investments | | | (101,811,326 | ) |

| Unrealized net appreciation (depreciation) on investments | | | (15,514,337 | ) |

| Total Net Assets | | $ | 577,709,360 | |

| | | | | |

| Shares authorized ($.0001 par value) – Original Class | | | 25,000,000,000 | |

| Net assets applicable to outstanding Original Class shares | | | 565,634,508 | |

| Shares issued and outstanding – Original Class | | | 42,549,012 | |

| Net asset value, offering price and redemption price per share – Original Class | | $ | 13.29 | |

| | | | | |

| Shares authorized ($.0001 par value) – Institutional Class | | | 25,000,000,000 | |

| Net assets applicable to outstanding Institutional Class shares | | | 12,074,852 | |

| Shares issued and outstanding – Institutional Class | | | 907,860 | |

| Net asset value, offering price and redemption price per share – Institutional Class | | $ | 13.30 | |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF ASSETS AND LIABILITIES

| HENNESSY | | | | | | | | | | | | | |

| CORNERSTONE | | | HENNESSY | | | HENNESSY | | | HENNESSY | | | HENNESSY | |

| GROWTH FUND, | | | FOCUS 30 | | | CORNERSTONE | | | TOTAL RETURN | | | BALANCED | |

| SERIES II | | | FUND | | | VALUE FUND | | | FUND | | | FUND | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| $ | 83,228,087 | | | $ | 202,886,496 | | | $ | 161,432,065 | | | $ | 118,660,777 | | | $ | 14,674,430 | |

| | 29,759 | | | | 11,263 | | | | — | | | | — | | | | — | |

| | 171,585 | | | | 11,204 | | | | 721,130 | | | | 142,408 | | | | 69,775 | |

| | 44,408 | | | | 433,000 | | | | 817 | | | | 137 | | | | — | |

| | 54,584 | | | | 32,115 | | | | 24,746 | | | | 10,838 | | | | 14,030 | |

| | 83,528,423 | | | | 203,374,078 | | | | 162,178,758 | | | | 118,814,160 | | | | 14,758,235 | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | 38,565,500 | | | | — | |

| | — | | | | — | | | | — | | | | — | | | | — | |

| | 137,379 | | | | 202,780 | | | | 14,417 | | | | 9,340 | | | | — | |

| | 51,956 | | | | 117,904 | | | | 97,529 | | | | 39,162 | | | | 7,226 | |

| | 52,277 | | | | 112,318 | | | | 98,307 | | | | 48,427 | | | | 8,955 | |

| | 12,320 | | | | 7,272 | | | | 9,804 | | | | 8,671 | | | | 8,994 | |

| | — | | | | — | | | | — | | | | 55,134 | | | | 44,884 | |

| | — | | | | — | | | | — | | | | 56,155 | | | | — | |

| | 7,016 | | | | 12,875 | | | | 13,112 | | | | 6,527 | | | | 1,204 | |

| | 18,841 | | | | 15,550 | | | | 7,486 | | | | 21,312 | | | | 55 | |

| | 279,789 | | | | 468,699 | | | | 240,655 | | | | 38,810,228 | | | | 71,318 | |

| $ | 83,248,634 | | | $ | 202,905,379 | | | $ | 161,938,103 | | | $ | 80,003,932 | | | $ | 14,686,917 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 110,433,179 | | | $ | 203,934,109 | | | $ | 198,110,615 | | | $ | 167,053,174 | | | $ | 16,577,819 | |

| | (122,323 | ) | | | (693,582 | ) | | | 2,217,083 | | | | 116,893 | | | | 24,441 | |

| | (7,830,596 | ) | | | (4,416,409 | ) | | | (27,281,178 | ) | | | (86,453,606 | ) | | | (1,253,387 | ) |

| | (19,231,626 | ) | | | 4,081,261 | | | | (11,108,417 | ) | | | (712,529 | ) | | | (661,956 | ) |

| $ | 83,248,634 | | | $ | 202,905,379 | | | $ | 161,938,103 | | | $ | 80,003,932 | | | $ | 14,686,917 | |

| | | | | | | | | | | | | | | | | | | |

| Unlimited | | | | 25,000,000,000 | | | | 25,000,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

| | 83,153,792 | | | | 162,548,905 | | | | 160,972,636 | | | | 80,003,932 | | | | 14,686,917 | |

| | 4,307,548 | | | | 13,683,726 | | | | 11,554,116 | | | | 6,676,870 | | | | 1,343,739 | |

| $ | 19.30 | | | $ | 11.88 | | | $ | 13.93 | | | $ | 11.98 | | | $ | 10.93 | |

| | | | | | | | | | | | | | | | | | |

| Unlimited | | | | 25,000,000,000 | | | | 25,000,000,000 | | | | | | | | | |

| | 94,842 | | | | 40,356,474 | | | | 965,467 | | | | | | | | | |

| | 4,907 | | | | 3,395,412 | | | | 69,312 | | | | | | | | | |

| $ | 19.33 | | | $ | 11.89 | | | $ | 13.93 | | | | | | | | | |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statements of Operations Six months ended April 30, 2008 (Unaudited) |

| | | HENNESSY | |

| | | CORNERSTONE | |

| | | GROWTH FUND | |

| INVESTMENT INCOME: | | | |

Dividend income(1) | | $ | 3,150,006 | |

| Interest income | | | 107,352 | |

| Total investment income | | | 3,257,358 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 5) | | | 2,636,830 | |

| Administration, fund accounting, custody and transfer agent fees (See Note 5) | | | 870,918 | |

| Distribution fees (See Note 5) | | | — | |

| Service fees (See Note 5) | | | 355,060 | |

| Federal and state registration fees | | | 14,783 | |

| Audit fees | | | 11,468 | |

| Legal fees | | | 10,236 | |

| Reports to shareholders | | | 68,250 | |

| Directors’ fees and expenses | | | 5,552 | |

| Sub-transfer agent expenses (See Note 5) | | | 376,363 | |

| Interest expense (See Note 3 and 7) | | | 23,152 | |

| Other | | | 30,318 | |

| Total expenses before reimbursement from advisor | | | 4,402,930 | |

| Expense reimbursement from advisor (See Note 5) | | | (1,897 | ) |

| Net expenses | | | 4,401,033 | |

| NET INVESTMENT INCOME (LOSS) | | $ | (1,143,675 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | |

| Net realized gain(loss) on investments | | $ | (100,316,708 | ) |

| Change in unrealized appreciation (depreciation) on investments | | | (96,457,256 | ) |

| Net gain (loss) on investments | | | (196,773,964 | ) |

| | | | | |

| | | | | |

| NET INCREASE (DECREASE) IN NET ASSETS | | | | |

| RESULTING FROM OPERATIONS | | $ | (197,917,639 | ) |

(1) Net of foreign taxes withheld of $409,879, $32,166, $0, $55,048, $0, & $0, respectively.

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF OPERATIONS

| HENNESSY | | | | | | | | | | | | | |

| CORNERSTONE | | | HENNESSY | | | HENNESSY | | | HENNESSY | | | HENNESSY | |

| GROWTH FUND, | | | FOCUS 30 | | | CORNERSTONE | | | TOTAL RETURN | | | BALANCED | |

| SERIES II | | | FUND | | | VALUE FUND | | | FUND | | | FUND | |

| | | | | | | | | | | | | | |

| $ | 490,630 | | | $ | 491,175 | | | $ | 3,779,015 | | | $ | 1,268,421 | | | $ | 148,320 | |

| | 17,971 | | | | 42,402 | | | | 65,999 | | | | 770,191 | | | | 152,438 | |

| | 508,601 | | | | 533,577 | | | | 3,845,014 | | | | 2,038,612 | | | | 300,758 | |

| | | | | | | | | | | | | | | | | | | |

| | 363,478 | | | | 719,215 | | | | 634,950 | | | | 251,431 | | | | 45,851 | |

| | 118,767 | | �� | | 235,460 | | | | 207,908 | | | | 101,559 | | | | 18,488 | |

| | — | | | | — | | | | — | | | | 62,858 | | | | 11,463 | |

| | 49,104 | | | | 93,180 | | | | 85,689 | | | | 41,905 | | | | 7,642 | |

| | 13,047 | | | | 16,778 | | | | 11,656 | | | | 10,938 | | | | 9,610 | |

| | 5,020 | | | | 8,821 | | | | 9,582 | | | | 8,976 | | | | 8,727 | |

| | 12,236 | | | | 10,236 | | | | 10,236 | | | | 6,032 | | | | 5,236 | |

| | 14,959 | | | | 14,959 | | | | 13,161 | | | | 4,239 | | | | 975 | |

| | 5,553 | | | | 5,552 | | | | 5,524 | | | | 3,745 | | | | 3,745 | |

| | 56,497 | | | | 111,706 | | | | 30,991 | | | | — | | | | — | |

| | 3,700 | | | | 8,039 | | | | 375 | | | | 593,399 | | | | — | |

| | 10,003 | | | | 7,756 | | | | 6,211 | | | | 3,281 | | | | 1,348 | |

| | 652,364 | | | | 1,231,702 | | | | 1,016,283 | | | | 1,088,363 | | | | 113,085 | |

| | (27 | ) | | | (4,543 | ) | | | (146 | ) | | | — | | | | — | |

| | 652,337 | | | | 1,227,159 | | | | 1,016,137 | | | | 1,088,363 | | | | 113,085 | |

| $ | (143,736 | ) | | $ | (693,582 | ) | | $ | 2,828,877 | | | $ | 950,249 | | | $ | 187,673 | |

| | | | | | | | | | | | | | | | | | | |

| $ | (6,657,810 | ) | | $ | (3,969,362 | ) | | $ | 12,717,021 | | | $ | 1,214,166 | | | $ | 217,435 | |

| | (16,092,232 | ) | | | 6,552,117 | | | | (48,154,613 | ) | | | (13,251,088 | ) | | | (1,564,559 | ) |

| | (22,750,042 | ) | | | 2,582,755 | | | | (35,437,592 | ) | | | (12,036,922 | ) | | | (1,347,124 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | (22,893,778 | ) | | $ | 1,889,173 | | | $ | (32,608,715 | ) | | $ | (11,086,673 | ) | | $ | (1,159,451 | ) |

HENNESSY FUNDS 1-800-966-4354

| Statements of Changes in Net Assets |

| | | Hennessy Cornerstone Growth Fund | |

| | | Six Months Ended | | | | |

| | | April 30, 2008 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2007 | |

| OPERATIONS: | | | | | | |

| Net investment income (loss) | | $ | (1,143,675 | ) | | $ | (3,634,032 | ) |

| Net realized gain (loss) on securities | | | (100,316,708 | ) | | | 111,245,274 | |

| Change in unrealized appreciation (depreciation) on securities | | | (96,457,256 | ) | | | (876,501 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (197,917,639 | ) | | | 106,734,741 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

| Net investment income – Original Class | | | — | | | | — | |

| Net investment income – Institutional Class | | | — | | | | — | |

| Net realized gains – Original Class | | | (110,914,265 | ) | | | (183,483,584 | ) |

| Net realized gains – Institutional Class | | | — | | | | — | |

| Total distributions | | | (110,914,265 | ) | | | (183,483,584 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Original Class | | | 24,673,684 | | | | 113,042,125 | |

| Proceeds from shares subscribed – Institutional Class | | | 12,208,657 | | | | — | |

| Dividends reinvested – Original Class | | | 107,702,229 | | | | 178,259,103 | |

| Dividends reinvested – Institutional Class | | | — | | | | — | |

| Redemption fees retained – Original Class | | | 19,442 | | | | 88,873 | |

| Redemption fees retained – Institutional Class | | | — | | | | — | |

| Cost of shares redeemed – Original Class | | | (247,857,153 | ) | | | (474,889,281 | ) |

| Cost of shares redeemed – Institutional Class | | | (631,061 | ) | | | — | |

| Net increase (decrease) in net assets derived | | | | | | | | |

| from capital share transactions | | | (103,884,202 | ) | | | (183,499,180 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (412,716,106 | ) | | | (260,248,023 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 990,425,466 | | | | 1,250,673,489 | |

| End of period | | $ | 577,709,360 | | | $ | 990,425,466 | |

| | | | | | | | | |

| Accumulated net investment income (loss), end of period | | $ | (1,143,675 | ) | | $ | — | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Original Class | | | 40,945,549 | | | | 5,966,383 | |

| Shares sold – Institutional Class | | | 956,321 | | | | — | |

| Shares reinvested – Original Class | | | 7,062,441 | | | | 9,930,869 | |

| Shares reinvested – Institutional Class | | | — | | | | — | |

| Shares redeemed – Original Class | | | (56,485,778 | ) | | | (25,075,476 | ) |

| Shares redeemed – Institutional Class | | | (48,461 | ) | | | | |

| Net increase (decrease) in shares outstanding | | | (7,569,928 | ) | | | (9,178,224 | ) |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF CHANGES IN NET ASSETS

| Hennessy Cornerstone | | | | | | | |

| Growth Fund, Series II | | | Hennessy Focus 30 Fund | |

| Six Month Ended | | | | | | Six Month Ended | | | | |

| April 30, 2008 | | | Year Ended | | | April 30, 2008 | | | Year Ended | |

| (Unaudited) | | | October 31, 2007 | | | (Unaudited) | | | October 31, 2007 | |

| | | | | | | | | | | |

| $ | (143,736 | ) | | $ | (1,128,653 | ) | | $ | (693,582 | ) | | $ | (1,462,891 | ) |

| | (6,657,810 | ) | | | 27,032,411 | | | | (3,969,362 | ) | | | 34,333,802 | |

| | (16,092,232 | ) | | | (19,628,497 | ) | | | 6,552,117 | | | | (11,346,335 | ) |

| | (22,893,778 | ) | | | 6,275,261 | | | | 1,889,173 | | | | 21,524,576 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | (27,055,016 | ) | | | (9,231,945 | ) | | | (33,248,525 | ) | | | (1,781,615 | ) |

| | — | | | | — | | | | — | | | | — | |

| | (27,055,016 | ) | | | (9,231,945 | ) | | | (33,248,525 | ) | | | (1,781,615 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 3,013,847 | | | | 12,110,526 | | | | 30,074,213 | | | | 119,498,304 | |

| | 94,046 | | | | — | | | | 36,734,583 | | | | — | |

| | 26,856,690 | | | | 9,137,765 | | | | 32,845,640 | | | | 1,752,077 | |

| | — | | | | — | | | | — | | | | — | |

| | 6,129 | | | | 24,177 | | | | 42,208 | | | | 124,025 | |

| | — | | | | — | | | | — | | | | — | |

| | (35,351,860 | ) | | | (123,925,703 | ) | | | (98,385,058 | ) | | | (148,376,546 | ) |

| | — | | | | — | | | | (417,964 | ) | | | — | |

| | | | | | | | | | | | | | | |

| | (5,381,148 | ) | | | (102,653,235 | ) | | | 893,622 | | | | (27,002,140 | ) |

| | | | | | | | | | | | | | | |

| | (55,329,942 | ) | | | (105,609,919 | ) | | | (30,465,730 | ) | | | (7,259,179 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 138,578,576 | | | | 244,188,495 | | | | 233,371,109 | | | | 240,630,288 | |

| $ | 83,248,634 | | | $ | 138,578,576 | | | $ | 202,905,379 | | | $ | 233,371,109 | |

| | | | | | | | | | | | | | | |

| $ | (143,736 | ) | | $ | 21,413 | | | $ | (693,582 | ) | | $ | — | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 3,337,897 | | | | 396,382 | | | | 14,879,796 | | | | 8,519,202 | |

| | 4,908 | | | | — | | | | 3,431,686 | | | | — | |

| | 1,292,430 | | | | 309,021 | | | | 2,935,267 | | | | 141,297 | |

| | — | | | | — | | | | — | | | | — | |

| | (4,893,200 | ) | | | (4,075,942 | ) | | | (21,198,714 | ) | | | (11,019,600 | ) |

| | — | | | | — | | | | (36,274 | ) | | | — | |

| | (257,965 | ) | | | (3,370,539 | ) | | | 11,761 | | | | (2,359,101 | ) |

HENNESSY FUNDS 1-800-966-4354

| Statements of Changes in Net Assets |

| | | Hennessy Cornerstone Value Fund | |

| | | Six Month Ended | | | | |

| | | April 30, 2008 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2007 | |

| OPERATIONS: | | | | | | |

| Net investment income (loss) | | $ | 2,828,877 | | | $ | 5,930,170 | |

| Net realized gain (loss) on securities | | | 12,717,021 | | | | 10,584,083 | |

| Change in unrealized appreciation (depreciation) on securities | | | (48,154,613 | ) | | | 13,065,195 | |

| Net increase (decrease) in net assets resulting from operations | | | (32,608,715 | ) | | | 29,579,448 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

| Net investment income – Original Class | | | (4,859,028 | ) | | | (5,691,101 | ) |

| Net investment income – Institutional Class | | | — | | | | — | |

| Net realized gains – Original Class | | | — | | | | — | |

| Net realized gains – Institutional Class | | | — | | | | — | |

| Total distributions | | | (4,859,028 | ) | | | (5,691,101 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Original Class | | | 2,082,120 | | | | 25,534,075 | |

| Proceeds from shares subscribed – Institutional Class | | | 945,342 | | | | — | |

| Dividends reinvested – Original Class | | | 4,316,070 | | | | 5,174,239 | |

| Dividends reinvested – Institutional Class | | | — | | | | — | |

| Redemption fees retained – Original Class | | | 127 | | | | 128,422 | |

| Redemption fees retained – Institutional Class | | | — | | | | — | |

| Cost of shares redeemed – Original Class | | | (12,442,020 | ) | | | (107,023,696 | ) |

| Cost of shares redeemed – Institutional Class | | | — | | | | — | |

| Net increase (decrease) in net assets derived | | | | | | | | |

| from capital share transactions | | | (5,098,361 | ) | | | (76,186,960 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (42,566,104 | ) | | | (52,298,613 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 204,504,207 | | | | 256,802,820 | |

| End of period | | $ | 161,938,103 | | | $ | 204,504,207 | |

| | | | | | | | | |

| Accumulated net investment income (loss), end of period | | $ | 2,214,938 | | | $ | 4,247,234 | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Original Class | | | 11,599,934 | | | | 1,648,918 | |

| Shares sold – Institutional Class | | | 69,312 | | | | — | |

| Shares reinvested – Original Class | | | 288,122 | | | | 337,964 | |

| Shares reinvested – Institutional Class | | | — | | | | — | |

| Shares redeemed – Original Class | | | (12,322,959 | ) | | | (6,819,535 | ) |

| Shares redeemed – Institutional Class | | | — | | | | — | |

| Net increase (decrease) in shares outstanding | | | (365,591 | ) | | | (4,832,653 | ) |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF CHANGES IN NET ASSETS

| Hennessy Total Return Fund | | | Hennessy Balanced Fund | |

| Six Months Ended | | | | | | Six Months Ended | | | | |

| April 30, 2008 | | | Year Ended | | | April 30, 2008 | | | Year Ended | |

| (Unaudited) | | | October 31, 2007 | | | (Unaudited) | | | October 31, 2007 | |

| | | | | | | | | | | |

| $ | 950,249 | | | $ | 2,576,108 | | | $ | 187,673 | | | $ | 574,530 | |

| | 1,214,166 | | | | 3,214,280 | | | | 217,435 | | | | 1,794,111 | |

| | (13,251,088 | ) | | | 5,426,361 | | | | (1,564,559 | ) | | | (860,448 | ) |

| | (11,086,673 | ) | | | 11,216,749 | | | | (1,159,451 | ) | | | 1,508,193 | |

| | | | | | | | | | | | | | | |

| | (977,500 | ) | | | (2,653,674 | ) | | | (199,941 | ) | | | (608,338 | ) |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | (785,865 | ) | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | (977,500 | ) | | | (2,653,674 | ) | | | (985,806 | ) | | | (608,338 | ) |

| | | | | | | | | | | | | | | |

| | 1,476,442 | | | | 7,605,881 | | | | 467,404 | | | | 6,969,033 | |

| | — | | | | — | | | | — | | | | — | |

| | 916,175 | | | | 2,513,974 | | | | 963,226 | | | | 594,977 | |

| | — | | | | — | | | | — | | | | — | |

| | 678 | | | | 31,831 | | | | 595 | | | | 10,406 | |

| | — | | | | — | | | | — | | | | — | |

| | (6,634,109 | ) | | | (35,669,527 | ) | | | (1,419,934 | ) | | | (17,788,826 | ) |

| | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | |

| | (4,240,814 | ) | | | (25,517,841 | ) | | | 11,291 | | | | (10,214,410 | ) |

| | (16,304,987 | ) | | | (16,954,766 | ) | | | (2,133,966 | ) | | | (9,314,555 | ) |

| | | | | | | | | | | | | | | |