UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

Hennessy Advisors, Inc.

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2009

Date of reporting period: April 30, 2009

Item 1. Reports to Stockholders.

HENNESSY FUNDS

SEMI-ANNUAL REPORT

APRIL 30, 2009

Hennessy Cornerstone Growth Fund

Hennessy Cornerstone Growth Fund, Series II

Hennessy Focus 30 Fund

Hennessy Cornerstone Value Fund

Hennessy Total Return Fund

Hennessy Balanced Fund

Contents

| Letter to shareholders | 1 |

| Summaries of investments | |

| Hennessy Cornerstone Growth Fund | 7 |

| Hennessy Cornerstone Growth Fund, Series II | 12 |

| Hennessy Focus 30 Fund | 17 |

| Hennessy Cornerstone Value Fund | 21 |

| Hennessy Total Return Fund | 25 |

| Hennessy Balanced Fund | 28 |

| Financial statements | |

| Statements of assets and liabilities | 32 |

| Statements of operations | 34 |

| Statements of changes in net assets | 36 |

| Financial highlights | |

| Hennessy Cornerstone Growth Fund | 40 |

| Hennessy Cornerstone Growth Fund, Series II | 42 |

| Hennessy Focus 30 Fund | 44 |

| Hennessy Cornerstone Value Fund | 46 |

| Hennessy Total Return Fund | 48 |

| Hennessy Balanced Fund | 50 |

| Statement of cash flows – Hennessy Total Return Fund | 52 |

| Notes to the financial statements | 53 |

| Expense example | 62 |

| Proxy voting policy | 64 |

| Board approval of continuation | |

| of investment advisory agreement | 65 |

LETTER TO SHAREHOLDERS

June, 2009

Dear Hennessy Funds Shareholder:

During the six-month period ending April 30, 2009, the financial markets experienced some of their darkest days in recent history, but also saw the beginning of a significant rebound. During my 30 years in the financial industry, I have never seen the kind of crisis of confidence that we experienced at the end of February/beginning of March. As retirement account balances and home values plummeted, even the most disciplined, long-term investors had simply had enough and began moving their money to the sidelines. For me, that signaled a turning point and suggested that the markets and consumer confidence had hit bottom. The markets hit their lows on March 9th, and we have seen steady improvement since.

I believe that the recovery actually began in November with the first injection of government TARP (Troubled Asset Relief Program) spending and that the lows the market hit in March are behind us. As in any type of recovery, it will take time. I use the analogy of putting a cast on a broken bone; the fix is in place but it will be a slow and painful healing process.

I foresee steady economic growth in the coming months. It seems that many people have the perception that the majority of companies are losing money, but our analysis shows that is simply not the case. I believe that companies are taking the opportunity, while their stock prices have been driven down, to become as lean as possible so that any increase in revenue will fall to the bottom line and increase profitability. A full recovery may take longer than some would hope, but I believe that the growth we will experience will be based on solid, tangible business results and, most importantly, it will be sustainable. It is my opinion that investors learned an important lesson about leverage and will resume investing in high quality stocks and mutual funds as confidence in the markets is restored.

Funds Performance Review

The Hennessy Cornerstone Growth Fund returned -8.86% for the six-month period ending 4/31/09, slightly underperforming its benchmark index, the Russell 2000, which returned -8.40%. The fund’s relative performance was helped by positive sector allocation decisions, including overweighting Consumer Discretionary stocks and

HENNESSY FUNDS 1-800-966-4354

Average Annual Total Return (as of April 30, 2009)

| Original Class Shares | | | | | | |

| | Six months | One Year | Three Year | Five Year | Ten Year | |

| | ending | Annualized | Annualized | Annualized | Annualized | Since |

| Fund (Inception date) | 4/30/09 | Return | Return | Return | Return | Inception |

| Cornerstone Growth | | | | | | |

| Fund (11/1/96) | -8.86% | -39.65% | -22.47% | -4.70% | 5.31% | 6.73% |

| Russell 2000 Index | -8.40% | -30.74% | -12.72% | -1.45% | 2.53% | 4.28% |

| | | | | | | |

| | | | | | | |

| Cornerstone Growth | | | | | | |

| Fund, Series II (7/1/05) | -5.02% | -49.07% | -27.71% | n/a | n/a | -17.47% |

| Russell 2000 Growth Index | -3.77% | -30.36% | -12.10% | n/a | n/a | -4.66% |

| | | | | | | |

| | | | | | | |

| Focus 30 Fund (9/17/03) | -5.99% | -36.53% | -12.80% | 3.76% | n/a | 4.36% |

| S&P 400 Mid-cap Index | -0.18% | -31.84% | -9.95% | 0.56% | n/a | 2.52% |

| | | | | | | |

| | | | | | | |

| Cornerstone Value | | | | | | |

| Fund (11/1/96) | -3.78% | -37.48% | -13.20% | -4.39% | -0.83% | 2.18% |

| Russell 1000 Value Index | -13.27% | -39.21% | -13.21% | -2.50% | -0.50% | 4.57% |

| | | | | | | |

| | | | | | | |

| Total Return | | | | | | |

| Fund (7/29/98) | -13.69% | -32.53% | -9.18% | -3.69% | -1.22% | -0.08% |

| Dow Jones | | | | | | |

| Industrial Average | -10.78% | -34.19% | -8.05% | -2.00% | -0.61% | 1.34% |

| | | | | | | |

| | | | | | | |

| Balanced Fund (3/8/96) | -7.63% | -22.11% | -4.85% | -2.08% | -0.55% | 2.38% |

| Dow Jones | | | | | | |

| Industrial Average | -10.78% | -34.19% | -8.05% | -2.00% | -0.61% | 5.27% |

| S&P 500 Index | -8.53% | -35.31% | -10.76% | -2.70% | -2.48% | |

| | | | | | | |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The total annual operating expenses of the Original Class shares of the Funds are as follow: Cornerstone Growth Fund = 1.25%; Cornerstone Growth Fund, Series II = 1.37%; Focus 30 Fund = 1.27%; Cornerstone Value = 1.20%; Total Return Fund = 2.36% gross/1.20% net of interest expense; and Balanced Fund = 1.56%.

All performance shown is net of fees and expenses.

LETTER TO SHAREHOLDERS

underweighting Financials. Performance was hampered by weaker security selection in the Information Technology sector. One of the best performers prior to the rebalance (which took place in the winter) was Consumer Discretionary stock, Sony Corp. After the rebalance some of the better performers included Consumer Discretionary stocks Aaron’s Inc. and Hot Topic. Some of the weaker performers included Information Technology stocks NCI Inc. and ManTech International.

The Hennessy Cornerstone Growth Fund, Series II returned -5.02% for the six-month period ending 4/31/09, underperforming its benchmark index, the Russell 2000 Growth, which returned -3.77%, but outperforming the S&P 500 Index. The relative performance of the fund is attributable in part to avoiding Financial stocks completely; the fund was able to avoid the carnage in the Financial sector in the last two months of the year and early in 2009. In addition, a major positive contributor to the fund’s performance was superior security selection in the Energy sector. Among the best performing Energy stocks in the portfolio were Interoil Corp. (+123% for the period) and Englobal (+31%). These positive contributors offset weaker security selection in Information Technology, where poor performers, such as UT Starcom (-51%), The Hackett Group (-25%), and Mantech International (-33%) offset good performers in the sector, such as Multi-Fineline Electronix (+72%) and Western Digital (+43%).

The Hennessy Focus 30 Fund returned -5.99% for the six-month period ending 4/31/09, underperforming its benchmark index, the S&P 400 Mid-cap, which returned -0.18%, but outperforming the S&P 500. The fund’s relative performance was affected by a number of factors, however, there were some common themes in the performance trends vs. both of the indices. The fund benefited from overweighting Consumer Discretionary stocks relative to both benchmarks, with the fund having a 34.06% weighting vs. 8.42% and 14.56% weightings in the S&P 500 and the S&P 400 index, respectively. Some of the best performers in the portfolio from that sector were AutoZone (+31% for the six-month period), Panera Bread (+24), Rent-a-center (+32%), Aeropostale (+40%) and Sally Beauty Holdings (+46%). Security selection in the Information Technology sector hampered performance of the fund, particularly Mantech, which returned -33% for the period.

The Hennessy Cornerstone Value Fund returned -3.78% for six-month period ending 4/30/09, significantly outperforming its benchmark index, the Russell 1000 Value, which returned -13.27%, as well as the S&P 500. The fund’s relative performance was almost entirely due to superior security selection, specifically in the Consumer Staples and Information Technology sectors, which helped to offset an underweight position in Information Technology, which outperformed the broader

HENNESSY FUNDS 1-800-966-4354

benchmarks. Two strong Information Technology stocks in the portfolio were Taiwan Semiconductor and AU Optronics, which returned +28% and +57%, respectively for the period. Within the Consumer Staples sector, Supervalu (+15%) offset the weaker performing stocks in that sector in the portfolio.

The Hennessy Total Return Fund returned -13.69% for the six-month period ending 4/30/09, underperforming its benchmark index, the Dow Jones Industrial Average, which returned -10.78% for the period. The portfolio contained stocks that performed well during the period, including Home Depot (+12%) and IBM (+11%), however performance of the fund was negatively impacted by Citigroup (-78%), Bank of America (-63%), and General Motors (-67%).

The Hennessy Balanced Fund returned -7.63% for the six-month period ending 4/30/09, outperforming both the Dow Jones Industrial Average and the S&P 500 for the period. As with the Total Return Fund, the performance of the Balanced Fund was helped by holding strong Dogs of the Dow stocks Home Depot and IBM, but hurt by Citigroup, Bank of America and General Motors. The outperformance versus the indices can primarily be attributed to the fund’s 50% allocation to U.S. Treasury Bills, which performed especially well in the latter part of 2008, as risk aversion peaked amongst investors.

Corrections are always painful, and I understand that the magnitude of the most recent market downturn has left investors feeling overwhelmed and distraught. I do, however, believe that historical performance data has shown how patience, discipline and a long-term investing view can be rewarded, particularly now. Some of the savviest investors know that when things look bleakest, it may be a good time to buy rather than sell. I believe it is an opportune time to consider putting long-term money to work in the market.

We vigilantly maintain our focus on the long-term, and on building value for our shareholders. At Hennessy Funds, we believe in servicing our shareholders directly, so that we can provide instant answers to shareholder questions and concerns. Please don’t hesitate to contact us at 800-966-4354 if we can answer any questions or can be of service.

Best regards,

Neil J. Hennessy

Portfolio Manager & Chief Investment Officer

Hennessy Funds

LETTER TO SHAREHOLDERS

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. Small and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods.

The Hennessy Total Return and Balanced Funds are non-diversified, meaning they may concentrate their assets in fewer individual holdings than a diversified fund, making it more exposed to individual stock volatility than a diversified fund.

References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings are subject to change. Please refer to the Schedule of Investments within this semi-annual report for additional portfolio information, including percentages of holdings.

The S&P 500 and Dow Jones Industrial Average are unmanaged indices commonly used to measure the performance of U.S. stocks. The Russell 2000 and Russell 2000 Growth Indices are unmanaged indices commonly used to measure the performance of small cap stocks, while the Russell 1000 Value index measures performance of large cap stocks. The S&P 400 Mid-cap Index is an unmanaged index commonly used to measure the performance of mid-cap stocks. One cannot invest directly in an index.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

Current and future holdings are subject to risk.

HENNESSY FUNDS 1-800-966-4354

(This Page Intentionally Left Blank.)

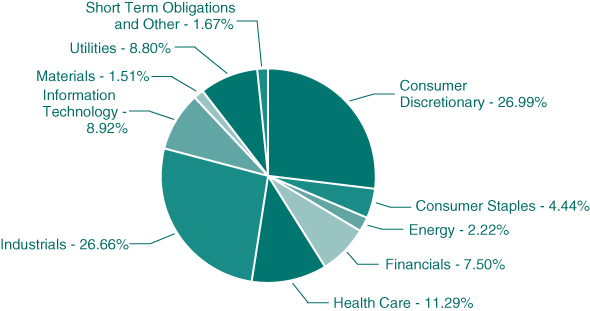

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

Summaries of Investments

The following summaries of investment portfolios are designed to help investors better understand each fund’s principal holdings. Each summary is as of April 30, 2009 (Unaudited).

HENNESSY CORNERSTONE GROWTH FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Netflix, Inc. | 3.26% |

| American Italian Pasta Co. | 3.03% |

| HOT Topic, Inc. | 2.85% |

| Family Dollar Stores, Inc. | 2.75% |

| Aaron’s, Inc. | 2.72% |

| AutoZone, Inc. | 2.58% |

| Beacon Roofing Supply, Inc. | 2.47% |

| Carter’s, Inc. | 2.39% |

| Applied Signal Technology, Inc. | 2.38% |

| Stifel Financial Corp. | 2.32% |

HENNESSY FUNDS 1-800-966-4354

| COMMON STOCKS – 98.33% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Consumer Discretionary – 26.99% | | | | | | | | | |

| Aaron’s, Inc. | | | 197,300 | | | $ | 6,621,388 | | | | 2.72 | % |

| AutoZone, Inc. (a) | | | 37,700 | | | | 6,272,903 | | | | 2.58 | % |

| Carter’s, Inc. (a) | | | 272,700 | | | | 5,830,326 | | | | 2.39 | % |

| Dollar Tree, Inc. (a) | | | 126,000 | | | | 5,334,840 | | | | 2.19 | % |

| Family Dollar Stores, Inc. | | | 201,500 | | | | 6,687,785 | | | | 2.75 | % |

| FGX International Holdings Ltd. (a)(b) | | | 386,100 | | | | 4,447,872 | | | | 1.83 | % |

| HOT Topic, Inc. (a) | | | 566,700 | | | | 6,936,408 | | | | 2.85 | % |

| Monro Muffler, Inc. | | | 206,000 | | | | 5,143,820 | | | | 2.11 | % |

| National Presto Industries, Inc. | | | 68,200 | | | | 4,859,932 | | | | 2.00 | % |

| Netflix, Inc. (a) | | | 175,700 | | | | 7,960,967 | | | | 3.26 | % |

| Panera Bread Co. (a) | | | 100,600 | | | | 5,634,606 | | | | 2.31 | % |

| | | | | | | | 65,730,847 | | | | 26.99 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 4.44% | | | | | | | | | | | | |

| American Italian Pasta Co. (a) | | | 235,100 | | | | 7,391,544 | | | | 3.03 | % |

| Nash Finch Co. | | | 117,000 | | | | 3,426,930 | | | | 1.41 | % |

| | | | | | | | 10,818,474 | | | | 4.44 | % |

| | | | | | | | | | | | | |

| Energy – 2.22% | | | | | | | | | | | | |

| World Fuel Services Corp. | | | 142,000 | | | | 5,414,460 | | | | 2.22 | % |

| | | | | | | | | | | | | |

| Financials – 7.50% | | | | | | | | | | | | |

| Amerisafe, Inc. (a) | | | 255,900 | | | | 3,930,624 | | | | 1.61 | % |

| First Bancorp Puerto Rico (b) | | | 471,500 | | | | 2,597,965 | | | | 1.07 | % |

| Nelnet, Inc. (a) | | | 366,600 | | | | 2,210,598 | | | | 0.91 | % |

| Odyssey Re Holdings Corp. | | | 101,400 | | | | 3,882,606 | | | | 1.59 | % |

| Stifel Financial Corp. (a) | | | 114,600 | | | | 5,641,758 | | | | 2.32 | % |

| | | | | | | | 18,263,551 | | | | 7.50 | % |

| | | | | | | | | | | | | |

| Health Care – 11.29% | | | | | | | | | | | | |

| Cantel Medical Corp. (a) | | | 360,230 | | | | 5,090,050 | | | | 2.09 | % |

| Emergency Medical Services Corp. (a) | | | 143,500 | | | | 4,999,540 | | | | 2.05 | % |

| Ensign Group, Inc. | | | 313,800 | | | | 4,863,900 | | | | 2.00 | % |

| Gentiva Health Services, Inc. (a) | | | 179,500 | | | | 2,859,435 | | | | 1.17 | % |

| PSS World Medical, Inc. (a) | | | 279,100 | | | | 4,052,532 | | | | 1.66 | % |

| SXC Health Solutions Corp. (a)(b) | | | 281,400 | | | | 5,636,442 | | | | 2.32 | % |

| | | | | | | | 27,501,899 | | | | 11.29 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

| COMMON STOCKS | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Industrials – 26.66% | | | | | | | | | |

| Aaon, Inc. | | | 251,600 | | | $ | 4,901,168 | | | | 2.01 | % |

| Aceto Corp. | | | 527,100 | | | | 3,768,765 | | | | 1.55 | % |

| Aecom Technology Corp. Delaware (a) | | | 170,900 | | | | 4,397,257 | | | | 1.81 | % |

| Applied Signal Technology, Inc. | | | 292,800 | | | | 5,785,728 | | | | 2.38 | % |

| Beacon Roofing Supply, Inc. (a) | | | 378,500 | | | | 6,018,150 | | | | 2.47 | % |

| Corinthian Colleges, Inc. (a) | | | 320,900 | | | | 4,941,860 | | | | 2.03 | % |

| Granite Construction, Inc. | | | 119,600 | | | | 4,718,220 | | | | 1.94 | % |

| Insituform Technologies, Inc. (a) | | | 266,800 | | | | 4,090,044 | | | | 1.68 | % |

| Michael Baker Corp. (a) | | | 142,700 | | | | 4,794,720 | | | | 1.97 | % |

| SAIC, Inc. (a) | | | 269,700 | | | | 4,881,570 | | | | 2.00 | % |

| Stanley, Inc. (a) | | | 145,000 | | | | 3,738,100 | | | | 1.54 | % |

| Tetra Tech, Inc. (a) | | | 217,500 | | | | 5,341,800 | | | | 2.19 | % |

| Trex Co., Inc. (a) | | | 319,100 | | | | 3,494,145 | | | | 1.43 | % |

| VSE Corp. | | | 135,500 | | | | 4,050,095 | | | | 1.66 | % |

| | | | | | | | 64,921,622 | | | | 26.66 | % |

| | | | | | | | | | | | | |

| Information Technology – 8.92% | | | | | | | | | | | | |

| CACI International, Inc. – Class A (a) | | | 116,500 | | | | 4,607,575 | | | | 1.89 | % |

| CSG Systems International (a) | | | 300,700 | | | | 4,360,150 | | | | 1.79 | % |

| ManTech International Corp. – Class A (a) | | | 96,900 | | | | 3,506,811 | | | | 1.44 | % |

| NCI, Inc. (a) | | | 174,300 | | | | 4,245,948 | | | | 1.74 | % |

| Viasat, Inc. (a) | | | 218,100 | | | | 5,014,119 | | | | 2.06 | % |

| | | | | | | | 21,734,603 | | | | 8.92 | % |

| | | | | | | | | | | | | |

| Materials – 1.51% | | | | | | | | | | | | |

| Zep, Inc. | | | 272,000 | | | | 3,680,160 | | | | 1.51 | % |

| | | | | | | | | | | | | |

| Utilities – 8.80% | | | | | | | | | | | | |

| The Laclede Group, Inc. | | | 112,100 | | | | 3,887,628 | | | | 1.60 | % |

| New Jersey Resources Corp. | | | 133,500 | | | | 4,394,820 | | | | 1.80 | % |

| NSTAR | | | 144,000 | | | | 4,523,040 | | | | 1.86 | % |

| Piedmont Natural Gas Co. | | | 165,900 | | | | 4,051,278 | | | | 1.66 | % |

| South Jersey Industries, Inc. | | | 131,800 | | | | 4,574,778 | | | | 1.88 | % |

| | | | | | | | 21,431,544 | | | | 8.80 | % |

| | | | | | | | | | | | | |

Total Common Stocks (Cost $260,284,119) | | | | | | $ | 239,497,160 | | | | 98.33 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| SHORT-TERM INVESTMENTS – 1.68% | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Commercial Paper – 0.10% | | | | | | | | | |

| Intesa Funding, 05/01/2009 | | $ | 250,000 | | | $ | 250,000 | | | | 0.10 | % |

| | | | | | | | | | | | | |

Total Commercial Paper (Cost $250,000) | | | | | | | 250,000 | | | | 0.10 | % |

| | | | | | | | | | | | | |

| Variable Rate Demand Notes# – 0.52% | | | | | | | | | | | | |

American Family Financial Services 0.1001% | | | 1,274,379 | | | | 1,274,379 | | | | 0.52 | % |

Total Variable Rate Demand Notes | | | | | | | | | | | | |

| (Cost $1,274,379) | | | | | | | 1,274,379 | | | | 0.52 | % |

| | | | | | | | | | | | | |

| Money Market Funds – 1.06% | | | | | | | | | | | | |

Fidelity Government Portfolio 0.3877% | | | 2,569,287 | | | | 2,569,287 | | | | 1.06 | % |

| | | | | | | | | | | | | |

| Total Money Market Funds | | | | | | | | | | | | |

| (Cost $2,569,287) | | | | | | | 2,569,287 | | | | 1.06 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $4,093,666) | | | | | | | 4,093,666 | | | | 1.68 | % |

| | | | | | | | | | | | | |

Total Investments – 100.01% | | | | | | | | | | | | |

| (Cost $264,377,785) | | | | | | | 243,590,826 | | | | 100.01 | % |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets – (0.01)% | | | | | | | (24,385 | ) | | | (0.01 | )% |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 243,566,441 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (b) | Foreign Issued Security |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2009. |

FAS 157 – Summary of Fair Value Exposure at April 30, 2009 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments, which are summarized as follows:

Level 1 – Quoted prices in active markets for identical securities

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| Description | | Investments in Securities | |

| Level 1 – Quoted prices in active markets for identical securities | | $ | 242,066,447 | |

| Level 2 – Other significant observable inputs | | | 1,524,379 | |

| Level 3 – Significant unobservable inputs | | | — | |

| Total | | $ | 243,590,826 | |

HENNESSY FUNDS 1-800-966-4354

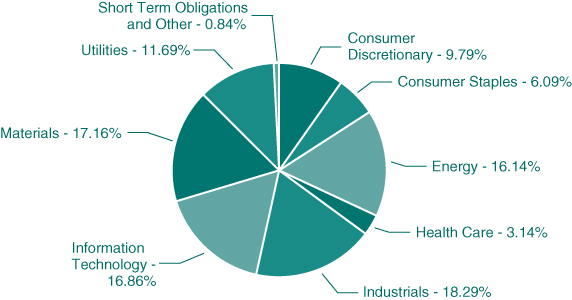

HENNESSY CORNERSTONE

GROWTH FUND, SERIES II

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Interoil Corp. | 4.09% |

| NCI, Inc. | 3.96% |

| America’s Car Mart, Inc. | 3.37% |

| Stepan Co. | 3.23% |

| The Laclede Group, Inc. | 3.20% |

| Hanger Orthopedic Group, Inc. | 3.14% |

| Cal-Maine Foods, Inc. | 3.06% |

| Flowers Foods, Inc. | 3.03% |

| Aecom Technology Corp. Delaware | 2.95% |

| Stanley, Inc. | 2.86% |

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

| COMMON STOCKS – 99.16% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Consumer Discretionary – 9.79% | | | | | | | | | |

| America’s Car Mart, Inc. (a) | | | 60,800 | | | $ | 986,176 | | | | 3.37 | % |

| Exide Technologies (a) | | | 65,000 | | | | 352,950 | | | | 1.21 | % |

| Hasbro, Inc. | | | 30,500 | | | | 813,130 | | | | 2.78 | % |

| Overstock.com, Inc. (a) | | | 42,000 | | | | 566,160 | | | | 1.93 | % |

| Stoneridge, Inc. (a) | | | 63,900 | | | | 147,609 | | | | 0.50 | % |

| | | | | | | | 2,866,025 | | | | 9.79 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 6.09% | | | | | | | | | | | | |

| Cal-Maine Foods, Inc. | | | 33,800 | | | | 894,686 | | | | 3.06 | % |

| Flowers Foods, Inc. | | | 38,400 | | | | 887,040 | | | | 3.03 | % |

| | | | | | | | 1,781,726 | | | | 6.09 | % |

| | | | | | | | | | | | | |

| Energy – 16.14% | | | | | | | | | | | | |

| Enbridge, Inc. (b) | | | 25,200 | | | | 777,420 | | | | 2.65 | % |

| Gulf Island Fabrication, Inc. | | | 22,300 | | | | 288,562 | | | | 0.99 | % |

| Hess Corp. | | | 8,600 | | | | 471,194 | | | | 1.61 | % |

| Interoil Corp. (a)(b) | | | 37,100 | | | | 1,197,959 | | | | 4.09 | % |

| Murphy Oil Corp. | | | 11,100 | | | | 529,581 | | | | 1.81 | % |

| Oil States International, Inc. (a) | | | 17,200 | | | | 325,080 | | | | 1.11 | % |

| PHI, Inc. (a) | | | 27,100 | | | | 306,772 | | | | 1.05 | % |

| Statoil ASA – ADR (b) | | | 29,200 | | | | 543,120 | | | | 1.86 | % |

| Willbros Group, Inc. (a) | | | 24,900 | | | | 285,354 | | | | 0.97 | % |

| | | | | | | | 4,725,042 | | | | 16.14 | % |

| | | | | | | | | | | | | |

| Health Care – 3.14% | | | | | | | | | | | | |

| Hanger Orthopedic Group, Inc. (a) | | | 66,100 | | | | 919,451 | | | | 3.14 | % |

| | | | | | | | | | | | | |

| Industrials – 18.29% | | | | | | | | | | | | |

| Aecom Technology Corp. Delaware (a) | | | 33,500 | | | | 861,955 | | | | 2.95 | % |

| Clean Harbors, Inc. (a) | | | 15,300 | | | | 766,530 | | | | 2.62 | % |

| EnerSys (a) | | | 31,800 | | | | 542,190 | | | | 1.85 | % |

| ENGlobal Corp. (a) | | | 76,500 | | | | 441,405 | | | | 1.51 | % |

| Fluor Corp. | | | 11,700 | | | | 443,079 | | | | 1.51 | % |

| Metalico, Inc. (a) | | | 62,200 | | | | 143,060 | | | | 0.49 | % |

| Reliance Steel & Aluminum Co. | | | 14,100 | | | | 496,743 | | | | 1.70 | % |

| Ryder System, Inc. | | | 15,800 | | | | 437,502 | | | | 1.49 | % |

| SPX Corp. | | | 8,300 | | | | 383,211 | | | | 1.31 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| COMMON STOCKS | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Industrials (Continued) | | | | | | | | | |

| Stanley, Inc. (a) | | | 32,500 | | | $ | 837,850 | | | | 2.86 | % |

| | | | | | | | 5,353,525 | | | | 18.29 | % |

| | | | | | | | | | | | | |

| Information Technology – 16.86% | | | | | | | | | | | | |

| Celestica, Inc. (a)(b) | | | 129,300 | | | | 764,163 | | | | 2.61 | % |

| Hackett Group, Inc. (a) | | | 189,800 | | | | 427,050 | | | | 1.46 | % |

| ManTech International Corp. – Class A (a) | | | 22,600 | | | | 817,894 | | | | 2.79 | % |

| Multi-Fineline Electronix, Inc. (a) | | | 39,400 | | | | 790,758 | | | | 2.70 | % |

| NCI, Inc. (a) | | | 47,600 | | | | 1,159,536 | | | | 3.96 | % |

| UTStarcom, Inc. (a) | | | 199,200 | | | | 233,064 | | | | 0.80 | % |

| Western Digital Corp. (a) | | | 31,600 | | | | 743,232 | | | | 2.54 | % |

| | | | | | | | 4,935,697 | | | | 16.86 | % |

| | | | | | | | | | | | | |

| Materials – 17.16% | | | | | | | | | | | | |

| Airgas, Inc. | | | 18,700 | | | | 806,344 | | | | 2.75 | % |

| AK Steel Holding Corp. | | | 16,100 | | | | 209,461 | | | | 0.72 | % |

| Arcelor Mittal – ADR (b) | | | 11,200 | | | | 264,096 | | | | 0.90 | % |

| Celanese Corp. | | | 24,400 | | | | 508,496 | | | | 1.74 | % |

| General Steel Holdings, Inc. (a) | | | 69,400 | | | | 403,908 | | | | 1.38 | % |

| Gerdau Ameristeel Corp. (b) | | | 56,500 | | | | 295,495 | | | | 1.01 | % |

| Innophos Holdings, Inc. | | | 34,100 | | | | 505,703 | | | | 1.73 | % |

| Olympic Steel, Inc. | | | 14,400 | | | | 264,096 | | | | 0.90 | % |

| Schnitzer Steel Industries, Inc. | | | 9,500 | | | | 470,820 | | | | 1.61 | % |

| Steel Dynamics, Inc. | | | 27,900 | | | | 347,355 | | | | 1.19 | % |

| Stepan Co. | | | 23,900 | | | | 945,723 | | | | 3.23 | % |

| | | | | | | | 5,021,497 | | | | 17.16 | % |

| | | | | | | | | | | | | |

| Utilities – 11.69% | | | | | | | | | | | | |

| The Laclede Group, Inc. | | | 27,000 | | | | 936,360 | | | | 3.20 | % |

| MDU Resources Group, Inc. | | | 31,300 | | | | 549,941 | | | | 1.88 | % |

| Otter Tail Corp. | | | 28,100 | | | | 623,258 | | | | 2.13 | % |

| TECO Energy, Inc. | | | 50,700 | | | | 536,913 | | | | 1.84 | % |

| Vectren Corp. | | | 34,900 | | | | 773,733 | | | | 2.64 | % |

| | | | | | | | 3,420,205 | | | | 11.69 | % |

| | | | | | | | | | | | | |

Total Common Stocks (Cost $50,900,868) | | | | | | | 29,023,168 | | | | 99.16 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE GROWTH FUND, SERIES II

| WARRANTS – 0.00% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Krispy Kreme Doughnuts, Inc. | | | | | | | | | |

| Expiration: March, 2012, | | | | | | | | | |

| Exercise Price: $0.110 (a) | | | 984 | | | $ | 10 | | | | 0.00 | % |

| | | | | | | | | | | | | |

Total Warrants (Cost $0) | | | | | | | 10 | | | | 0.00 | % |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.84% | | Principal | | | | | | | | | |

| | | Amount | | | | | | | | | |

| Commercial Paper – 0.47% | | | | | | | | | | | | |

| Intesa Funding, 05/01/2009 | | $ | 138,000 | | | | 138,000 | | | | 0.47 | % |

| | | | | | | | | | | | | |

Total Commercial Paper (Cost $138,000) | | | | | | | 138,000 | | | | 0.47 | % |

| | | | | | | | | | | | | |

| Variable Rate Demand Notes# – 0.37% | | | | | | | | | | | | |

American Family Financial Services 0.1001% | | | 108,618 | | | | 108,618 | | | | 0.37 | % |

| | | | | | | | | | | | | |

| Total Variable Rate Demand Notes | | | | | | | | | | | | |

| (Cost $108,618) | | | | | | | 108,618 | | | | 0.37 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $246,618) | | | | | | | 246,618 | | | | 0.84 | % |

| | | | | | | | | | | | | |

Total Investments – 100.00% | | | | | | | | | | | | |

| (Cost $51,147,486) | | | | | | | 29,269,796 | | | | 100.00 | % |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets – 0.00% | | | | | | | (800 | ) | | | 0.00 | % |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 29,268,996 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (b) | Foreign Issued Security |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2009. |

FAS 157 – Summary of Fair Value Exposure at April 30, 2009 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments, which are summarized as follows:

Level 1 – Quoted prices in active markets for identical securities

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

HENNESSY FUNDS 1-800-966-4354

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| Description | | Investments in Securities | |

| Level 1 – Quoted prices in active markets for identical securities | | $ | 29,023,178 | |

| Level 2 – Other significant observable inputs | | | 246,618 | |

| Level 3 – Significant unobservable inputs | | | — | |

| Total | | $ | 29,269,796 | |

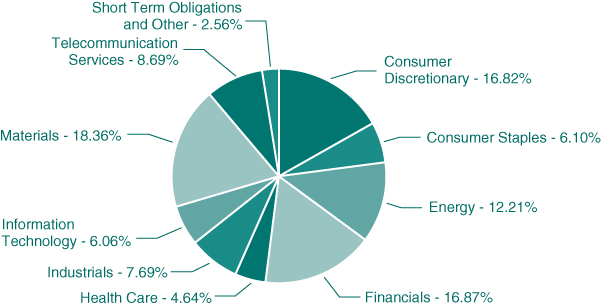

SUMMARY OF INVESTMENTS — HENNESSY FOCUS 30 FUND

HENNESSY FOCUS 30 FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| AutoZone, Inc. | 5.86% |

| Aeropostale, Inc. | 4.72% |

| Ross Stores, Inc. | 4.67% |

| Panera Bread Co. | 4.56% |

| Stifel Financial Corp. | 4.44% |

| Odyssey Re Holding, Corp. | 4.39% |

| Corinthian Colleges, Inc. | 4.23% |

| Tetra Tech, Inc. | 3.99% |

| Ralcorp Holdings, Inc. | 3.92% |

| Lennox International, Inc. | 3.86% |

HENNESSY FUNDS 1-800-966-4354

| COMMON STOCKS – 99.57% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Consumer Discretionary – 33.31% | | | | | | | | | |

| Aeropostale, Inc. (a) | | | 231,100 | | | $ | 7,850,467 | | | | 4.72 | % |

| ArvinMeritor, Inc. | | | 488,400 | | | | 605,616 | | | | 0.37 | % |

| AutoZone, Inc. (a) | | | 58,600 | | | | 9,750,454 | | | | 5.86 | % |

| Hasbro, Inc. | | | 209,600 | | | | 5,587,936 | | | | 3.36 | % |

| Panera Bread Co. (a) | | | 135,400 | | | | 7,583,754 | | | | 4.56 | % |

| Rent-A-Center, Inc. (a) | | | 318,300 | | | | 6,127,275 | | | | 3.68 | % |

| Ross Stores, Inc. | | | 204,700 | | | | 7,766,318 | | | | 4.67 | % |

| Sally Beauty Holdings, Inc. (a) | | | 767,800 | | | | 5,681,720 | | | | 3.42 | % |

| Snap-On, Inc. | | | 131,100 | | | | 4,446,912 | | | | 2.67 | % |

| | | | | | | | 55,400,452 | | | | 33.31 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 6.62% | | | | | | | | | | | | |

| The Estee Lauder Cos., Inc. | | | 150,400 | | | | 4,496,960 | | | | 2.70 | % |

| Ralcorp Holdings, Inc. (a) | | | 114,100 | | | | 6,521,956 | | | | 3.92 | % |

| | | | | | | | 11,018,916 | | | | 6.62 | % |

| | | | | | | | | | | | | |

| Financials – 13.43% | | | | | | | | | | | | |

| Hanover Insurance Group, Inc. | | | 150,200 | | | | 4,502,996 | | | | 2.71 | % |

| Odyssey Re Holdings Corp. | | | 190,700 | | | | 7,301,903 | | | | 4.39 | % |

| Raymond James Financial, Inc. | | | 200,300 | | | | 3,142,707 | | | | 1.89 | % |

| Stifel Financial Corp. (a) | | | 150,200 | | | | 7,394,346 | | | | 4.44 | % |

| | | | | | | | 22,341,952 | | | | 13.43 | % |

| | | | | | | | | | | | | |

| Health Care – 8.55% | | | | | | | | | | | | |

| LifePoint Hospitals, Inc. (a) | | | 230,200 | | | | 5,950,670 | | | | 3.58 | % |

| Owens & Minor, Inc. | | | 159,200 | | | | 5,521,056 | | | | 3.32 | % |

| Tenet Healthcare Corp. (a) | | | 1,224,100 | | | | 2,754,225 | | | | 1.65 | % |

| | | | | | | | 14,225,951 | | | | 8.55 | % |

| | | | | | | | | | | | | |

| Industrials – 25.99% | | | | | | | | | | | | |

| AO Smith Corp. | | | 171,800 | | | | 5,341,262 | | | | 3.21 | % |

| Brady Corp. | | | 203,300 | | | | 4,283,531 | | | | 2.57 | % |

| Corinthian Colleges, Inc. (a) | | | 456,900 | | | | 7,036,260 | | | | 4.23 | % |

| HUB Group, Inc. (a) | | | 183,500 | | | | 4,220,500 | | | | 2.54 | % |

| Lennox International, Inc. | | | 201,100 | | | | 6,413,079 | | | | 3.86 | % |

| Pentair, Inc. | | | 194,100 | | | | 5,170,824 | | | | 3.11 | % |

| Teledyne Technologies, Inc. (a) | | | 129,000 | | | | 4,118,970 | | | | 2.48 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY FOCUS 30 FUND

| COMMON STOCKS | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Industrials (Continued) | | | | | | | | | |

| Tetra Tech, Inc. (a) | | | 270,500 | | | $ | 6,643,480 | | | | 3.99 | % |

| | | | | | | | 43,227,906 | | | | 25.99 | % |

| | | | | | | | | | | | | |

| Materials – 2.94% | | | | | | | | | | | | |

| Greif, Inc. | | | 107,900 | | | | 4,884,633 | | | | 2.94 | % |

| | | | | | | | | | | | | |

| Technology – 2.83% | | | | | | | | | | | | |

| ManTech International Corp. – Class A (a) | | | 130,200 | | | | 4,711,938 | | | | 2.83 | % |

| | | | | | | | | | | | | |

| Utilities – 5.90% | | | | | | | | | | | | |

| Hawaiian Electric Industries | | | 269,800 | | | | 4,192,692 | | | | 2.52 | % |

| Piedmont Natural Gas Co. | | | 230,500 | | | | 5,628,810 | | | | 3.38 | % |

| | | | | | | | 9,821,502 | | | | 5.90 | % |

| | | | | | | | | | | | | |

Total Common Stocks (Cost $225,209,722) | | | | | | | 165,633,250 | | | | 99.57 | % |

| | | | | | | | | | | | | |

| WARRANTS – 0.00% | | | | | | | | | | | | |

| Lantronix Inc. Warrant Ω | | | | | | | | | | | | |

| Expiration: February, 2011, | | | | | | | | | | | | |

| Exercise Price: $0.850 | | | 158 | | | | 0 | | | | 0.00 | % |

| | | | | | | | | | | | | |

Total Warrants (Cost $0) | | | | | | | 0 | | | | 0.00 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| SHORT-TERM INVESTMENTS – 0.50% | | Principal | | | | | | % of Net | |

| | | Amount | | | Value | | | Assets | |

| Commercial Paper – 0.48% | | | | | | | | | |

| Intesa Funding, 05/01/2009 | | $ | 800,000 | | | $ | 800,000 | | | | 0.48 | % |

| | | | | | | | | | | | | |

Total Commercial Paper (Cost $800,000) | | | | | | | 800,000 | | | | 0.48 | % |

| | | | | | | | | | | | | |

| Variable Rate Demand Notes# – 0.01% | | | | | | | | | | | | |

| American Family Financial Services, Inc., 0.1001% | | | 17,600 | | | | 17,600 | | | | 0.01 | % |

| | | | | | | | | | | | | |

| Total Variable Rate Demand Notes | | | | | | | | | | | | |

| (Cost $17,600) | | | | | | | 17,600 | | | | 0.01 | % |

| | | | | | | | | | | | | |

| Money Market Funds – 0.01% | | | | | | | | | | | | |

| Fidelity Government Portfolio, 0.3877% | | | 20,289 | | | | 20,289 | | | | 0.01 | % |

| | | | | | | | | | | | | |

| Total Money Market Funds | | | | | | | | | | | | |

| (Cost $20,289) | | | | | | | 20,289 | | | | 0.01 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $837,889) | | | | | | | 837,889 | | | | 0.50 | % |

| | | | | | | | | | | | | |

Total Investments – 100.07% | | | | | | | | | | | | |

| (Cost $226,047,611) | | | | | | | 166,471,139 | | | | 100.07 | % |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets – (0.07)% | | | | | | | (128,278 | ) | | | (0.07 | )% |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 166,342,861 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2009. |

| Ω | Security is fair valued. |

FAS 157 – Summary of Fair Value Exposure at April 30, 2009 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments, which are summarized as follows:

Level 1 – Quoted prices in active markets for identical securities

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| Description | | Investments in Securities | |

| Level 1 – Quoted prices in active markets for identical securities | | $ | 165,653,539 | |

| Level 2 – Other significant observable inputs | | | 817,600 | |

| Level 3 – Significant unobservable inputs | | | — | |

| Total | | $ | 166,471,139 | |

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE VALUE FUND

HENNESSY CORNERSTONE VALUE FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Rio Tinto PLC | 4.44% |

| AU Optronics Corp. | 3.28% |

| Macy’s, Inc. | 2.81% |

| Taiwan Semiconductor Manufacturing Co., Ltd. – ADR | 2.78% |

| Credit Suisse Group | 2.73% |

| Southern Copper Corp. | 2.67% |

| Morgan Stanley | 2.66% |

| Supervalu, Inc. | 2.56% |

| CNOOC, Ltd. | 2.56% |

| Harley-Davidson, Inc. | 2.36% |

HENNESSY FUNDS 1-800-966-4354

| COMMON STOCKS – 97.44% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Consumer Discretionary – 16.82% | | | | | | | | | |

| CBS Corp. – Class B | | | 205,200 | | | $ | 1,444,608 | | | | 1.68 | % |

| DaimlerChrysler AG (b) | | | 51,000 | | | | 1,820,700 | | | | 2.12 | % |

| Harley-Davidson, Inc. | | | 91,400 | | | | 2,025,424 | | | | 2.36 | % |

| Koninklijke Philips Electronics NV – ADR (b) | | | 94,000 | | | | 1,690,120 | | | | 1.97 | % |

| Limited Brands | | | 162,400 | | | | 1,854,608 | | | | 2.16 | % |

| Macy’s, Inc. | | | 176,100 | | | | 2,409,048 | | | | 2.81 | % |

| Newell Rubbermaid, Inc. | | | 116,400 | | | | 1,216,380 | | | | 1.42 | % |

| Starwood Hotels & Resorts Worldwide | | | 94,500 | | | | 1,971,270 | | | | 2.30 | % |

| | | | | | | | 14,432,158 | | | | 16.82 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 6.10% | | | | | | | | | | | | |

| Altria Group, Inc. | | | 101,100 | | | | 1,650,963 | | | | 1.92 | % |

| Reynolds American, Inc. | | | 36,500 | | | | 1,386,270 | | | | 1.62 | % |

| Supervalu, Inc. | | | 134,200 | | | | 2,194,170 | | | | 2.56 | % |

| | | | | | | | 5,231,403 | | | | 6.10 | % |

| | | | | | | | | | | | | |

| Energy – 12.21% | | | | | | | | | | | | |

| BP PLC – ADR (b) | | | 34,800 | | | | 1,477,608 | | | | 1.72 | % |

| CNOOC Ltd. – ADR (b) | | | 19,700 | | | | 2,193,595 | | | | 2.55 | % |

| Enterprise Products Partners LP | | | 76,500 | | | | 1,804,635 | | | | 2.10 | % |

| ENI SpA – ADR (b) | | | 36,700 | | | | 1,566,723 | | | | 1.83 | % |

| Sasol Ltd. – ADR (b) | | | 61,500 | | | | 1,851,765 | | | | 2.16 | % |

| Total SA – ADR (b) | | | 32,000 | | | | 1,591,040 | | | | 1.85 | % |

| | | | | | | | 10,485,366 | | | | 12.21 | % |

| | | | | | | | | | | | | |

| Financials – 16.87% | | | | | | | | | | | | |

| Allianz AG – ADR (b) | | | 173,700 | | | | 1,573,722 | | | | 1.83 | % |

| The Allstate Corp. | | | 56,100 | | | | 1,308,813 | | | | 1.53 | % |

| Bank of America Corp. | | | 99,500 | | | | 888,535 | | | | 1.04 | % |

| BB&T Corp. | | | 52,000 | | | | 1,213,680 | | | | 1.41 | % |

| Credit Suisse Group – ADR (b) | | | 61,200 | | | | 2,342,736 | | | | 2.73 | % |

| Hartford Financial Services Group, Inc. | | | 104,000 | | | | 1,192,880 | | | | 1.39 | % |

| HSBC Holdings PLC – ADR (b) | | | 28,500 | | | | 1,014,600 | | | | 1.18 | % |

| Morgan Stanley | | | 96,500 | | | | 2,281,260 | | | | 2.66 | % |

| Sun Life Financial, Inc. (b) | | | 73,500 | | | | 1,706,670 | | | | 1.99 | % |

| US Bancorp | | | 52,500 | | | | 956,550 | | | | 1.11 | % |

| | | | | | | | 14,479,446 | | | | 16.87 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY CORNERSTONE VALUE FUND

| COMMON STOCKS | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Health Care – 4.64% | | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 71,400 | | | $ | 1,370,880 | | | | 1.60 | % |

| Merck & Co., Inc. | | | 57,300 | | | | 1,388,952 | | | | 1.62 | % |

| Pfizer, Inc. | | | 91,600 | | | | 1,223,776 | | | | 1.42 | % |

| | | | | | | | 3,983,608 | | | | 4.64 | % |

| | | | | | | | | | | | | |

| Industrials – 7.69% | | | | | | | | | | | | |

| General Electric Co. | | | 85,000 | | | | 1,075,250 | | | | 1.25 | % |

| Masco Corp. | | | 149,000 | | | | 1,320,140 | | | | 1.54 | % |

| Pitney Bowes, Inc. | | | 64,500 | | | | 1,582,830 | | | | 1.84 | % |

| RR Donnelley & Sons Co. | | | 126,300 | | | | 1,471,395 | | | | 1.72 | % |

| Textron, Inc. | | | 107,400 | | | | 1,152,402 | | | | 1.34 | % |

| | | | | | | | 6,602,017 | | | | 7.69 | % |

| | | | | | | | | | | | | |

| Information Technology – 6.06% | | | | | | | | | | | | |

| AU Optronics Corp. – ADR (b) | | | 259,300 | | | | 2,813,405 | | | | 3.28 | % |

| Taiwan Semiconductor | | | | | | | | | | | | |

| Manufacturing Co., Ltd. – ADR (b) | | | 225,700 | | | | 2,385,649 | | | | 2.78 | % |

| | | | | | | | 5,199,054 | | | | 6.06 | % |

| | | | | | | | | | | | | |

| Materials – 18.36% | | | | | | | | | | | | |

| Alcoa, Inc. | | | 186,100 | | | | 1,687,927 | | | | 1.97 | % |

| Arcelor Mittal – ADR (b) | | | 71,400 | | | | 1,683,612 | | | | 1.96 | % |

| The Dow Chemical Co. | | | 79,800 | | | | 1,276,800 | | | | 1.49 | % |

| EI Du Pont de Nemours & Co. | | | 62,900 | | | | 1,754,910 | | | | 2.05 | % |

| International Paper Co. | | | 137,100 | | | | 1,735,686 | | | | 2.02 | % |

| Rio Tinto PLC – ADR (b) | | | 23,400 | | | | 3,813,030 | | | | 4.44 | % |

| Southern Copper Corp. | | | 123,600 | | | | 2,295,252 | | | | 2.67 | % |

| Weyerhaeuser Co. | | | 42,900 | | | | 1,512,654 | | | | 1.76 | % |

| | | | | | | | 15,759,871 | | | | 18.36 | % |

| | | | | | | | | | | | | |

| Telecommunication Services – 8.69% | | | | | | | | | | | | |

| AT&T, Inc. | | | 53,900 | | | | 1,380,918 | | | | 1.61 | % |

| Deutsche Telekom AG – ADR (b) | | | 103,500 | | | | 1,126,080 | | | | 1.31 | % |

| Mobile Telesystems – ADR (a)(b) | | | 56,100 | | | | 1,859,154 | | | | 2.17 | % |

| Verizon Communications, Inc. | | | 45,700 | | | | 1,386,538 | | | | 1.62 | % |

| Vimpel-Communications – ADR (b) | | | 180,600 | | | | 1,701,252 | | | | 1.98 | % |

| | | | | | | | 7,453,942 | | | | 8.69 | % |

| | | | | | | | | | | | | |

Total Common Stocks (Cost $95,867,773) | | | | | | | 83,626,865 | | | | 97.44 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| SHORT-TERM INVESTMENTS – 2.25% | | Principal | | | | | | % of Net | |

| | | Amount | | | Value | | | Assets | |

| Commercial Paper – 1.75% | | | | | | | | | |

| Intesa Funding, 05/01/2009 | | $ | 1,500,000 | | | $ | 1,500,000 | | | | 1.75 | % |

| | | | | | | | | | | | | |

Total Commercial Paper (Cost $1,500,000) | | | | | | | 1,500,000 | | | | 1.75 | % |

| | | | | | | | | | | | | |

| Variable Rate Demand Notes# – 0.50% | | | | | | | | | | | | |

American Family Financial Services 0.1001% | | | 433,486 | | | | 433,486 | | | | 0.50 | % |

| | | | | | | | | | | | | |

| Total Variable Rate Demand Notes | | | | | | | | | | | | |

| (Cost $433,486) | | | | | | | 433,486 | | | | 0.50 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $1,933,486) | | | | | | | 1,933,486 | | | | 2.25 | % |

| | | | | | | | | | | | | |

Total Investments – 99.69% | | | | | | | | | | | | |

| (Cost $97,801,259) | | | | | | | 85,560,351 | | | | 99.69 | % |

| | | | | | | | | | | | | |

| Other Assets in Excess of Liabilities – 0.31% | | | | | | | 263,575 | | | | 0.31 | % |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 85,823,926 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (b) | Foreign Issued Security |

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2009. |

FAS 157 – Summary of Fair Value Exposure at April 30, 2009 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments, which are summarized as follows:

Level 1 – Quoted prices in active markets for identical securities

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| Description | | Investments in Securities | |

| Level 1 – Quoted prices in active markets for identical securities | | $ | 83,626,865 | |

| Level 2 – Other significant observable inputs | | | 1,933,486 | |

| Level 3 – Significant unobservable inputs | | | — | |

| Total | | $ | 85,560,351 | |

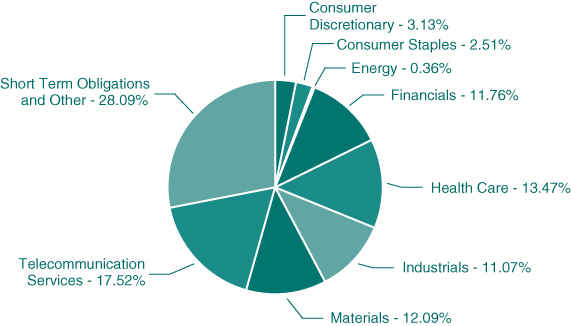

SUMMARY OF INVESTMENTS — HENNESSY TOTAL RETURN FUND

HENNESSY TOTAL RETURN FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| Verizon Communications, Inc. | 9.05% |

| AT&T, Inc. | 8.47% |

| EI Du Pont de Nemours & Co. | 7.81% |

| Pfizer, Inc. | 7.24% |

| Merck & Co., Inc. | 6.23% |

| General Electric Co. | 5.53% |

| J.P. Morgan Chase & Co. | 4.91% |

| Alcoa, Inc. | 4.28% |

| Caterpillar, Inc. | 3.71% |

| American Express Co. | 3.27% |

HENNESSY FUNDS 1-800-966-4354

| COMMON STOCKS – 71.91% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Consumer Discretionary – 3.13% | | | | | | | | | |

| General Motors Corp. | | | 71,000 | | | $ | 136,320 | | | | 0.29 | % |

| Home Depot, Inc. | | | 51,000 | | | | 1,342,320 | | | | 2.84 | % |

| | | | | | | | 1,478,640 | | | | 3.13 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 2.51% | | | | | | | | | | | | |

| Kraft Foods, Inc. – Class A | | | 50,600 | | | | 1,184,040 | | | | 2.51 | % |

| | | | | | | | | | | | | |

| Energy – 0.36% | | | | | | | | | | | | |

| Chevron Corp. | | | 2,600 | | | | 171,860 | | | | 0.36 | % |

| | | | | | | | | | | | | |

| Financials – 11.76% | | | | | | | | | | | | |

| American Express Co. | | | 61,300 | | | | 1,545,986 | | | | 3.27 | % |

| American International Group, Inc. | | | 22,900 | | | | 31,602 | | | | 0.07 | % |

| Bank of America Corp. | | | 135,900 | | | | 1,213,587 | | | | 2.57 | % |

| Citigroup, Inc. | | | 145,900 | | | | 444,995 | | | | 0.94 | % |

| J.P. Morgan Chase & Co. | | | 70,200 | | | | 2,316,600 | | | | 4.91 | % |

| | | | | | | | 5,552,770 | | | | 11.76 | % |

| | | | | | | | | | | | | |

| Health Care – 13.47% | | | | | | | | | | | | |

| Merck & Co., Inc. | | | 121,400 | | | | 2,942,736 | | | | 6.23 | % |

| Pfizer, Inc. | | | 255,700 | | | | 3,416,152 | | | | 7.24 | % |

| | | | | | | | 6,358,888 | | | | 13.47 | % |

| | | | | | | | | | | | | |

| Industrials – 11.07% | | | | | | | | | | | | |

| 3M Co. | | | 2,400 | | | | 138,240 | | | | 0.29 | % |

| Boeing Co. | | | 18,100 | | | | 724,905 | | | | 1.54 | % |

| Caterpillar, Inc. | | | 49,200 | | | | 1,750,536 | | | | 3.71 | % |

| General Electric Co. | | | 206,400 | | | | 2,610,960 | | | | 5.53 | % |

| | | | | | | | 5,224,641 | | | | 11.07 | % |

| | | | | | | | | | | | | |

| Materials – 12.09% | | | | | | | | | | | | |

| Alcoa, Inc. | | | 222,700 | | | | 2,019,889 | | | | 4.28 | % |

| EI Du Pont de Nemours & Co. | | | 132,100 | | | | 3,685,590 | | | | 7.81 | % |

| | | | | | | | 5,705,479 | | | | 12.09 | % |

| | | | | | | | | | | | | |

| Telecommunication Services – 17.52% | | | | | | | | | | | | |

| AT&T, Inc. | | | 156,000 | | | | 3,996,720 | | | | 8.47 | % |

| Verizon Communications, Inc. | | | 140,900 | | | | 4,274,906 | | | | 9.05 | % |

| | | | | | | | 8,271,626 | | | | 17.52 | % |

| | | | | | | | | | | | | |

Total Common Stocks (Cost $51,863,516) | | | | | | | 33,947,944 | | | | 71.91 | % |

The accompanying notes are an integral part of these financial statements.

SUMMARY OF INVESTMENTS — HENNESSY TOTAL RETURN FUND

| SHORT-TERM INVESTMENTS – 56.52% | | Principal | | | | | | % of Net | |

| | | Amount | | | Value | | | Assets | |

| U.S. Treasury Bills – 55.06% | | | | | | | | | |

| 0.001%, 06/04/2009 | | $ | 8,000,000 | | | $ | 7,998,942 | | | | 16.94 | % |

| 0.000%, 06/25/2009 | | | 18,000,000 | | | | 17,996,682 | | | | 38.12 | % |

| | | | | | | | | | | | | |

Total U.S. Treasury Bills (Cost $25,995,624) | | | | | | | 25,995,624 | | | | 55.06 | % |

| | | | | | | | | | | | | |

| Variable Rate Demand Notes# – 1.46% | | | | | | | | | | | | |

American Family Financial Services 0.1001% | | | 690,154 | | | | 690,154 | | | | 1.46 | % |

| | | | | | | | | | | | | |

| Total Variable Rate Demand Notes | | | | | | | | | | | | |

| (Cost $690,154) | | | | | | | 690,154 | | | | 1.46 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $26,685,778) | | | | | | | 26,685,778 | | | | 56.52 | % |

| | | | | | | | | | | | | |

Total Investments – 128.43% | | | | | | | | | | | | |

| (Cost $78,549,294) | | | | | | | 60,633,722 | | | | 128.43 | % |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets – (28.43)% | | | | | | | (13,423,385 | ) | | | (28.43 | )% |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 47,210,337 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2009. |

FAS 157 – Summary of Fair Value Exposure at April 30, 2009 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments, which are summarized as follows:

Level 1 – Quoted prices in active markets for identical securities

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| Description | | Investments in Securities | |

| Level 1 – Quoted prices in active markets for identical securities | | $ | 33,947,944 | |

| Level 2 – Other significant observable inputs | | | 26,685,778 | |

| Level 3 – Significant unobservable inputs | | | — | |

| Total | | $ | 60,633,722 | |

HENNESSY FUNDS 1-800-966-4354

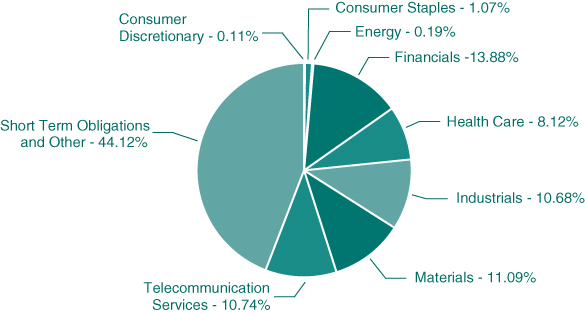

HENNESSY BALANCED FUND

(% of Net Assets)

| TOP TEN EQUITY HOLDINGS | % of net assets |

| J.P. Morgan Chase & Co. | 6.09% |

| General Electric Co. | 5.73% |

| Alcoa, Inc. | 5.63% |

| Verizon Communications, Inc. | 5.61% |

| EI Du Pont de Nemours & Co. | 5.46% |

| AT&T, Inc. | 5.13% |

| American Express Co. | 4.98% |

| Caterpillar, Inc. | 4.75% |

| Pfizer, Inc. | 4.23% |

| Merck & Co, Inc. | 3.68% |

SUMMARY OF INVESTMENTS — HENNESSY BALANCED FUND

| COMMON STOCKS – 55.88% | | Number | | | | | | % of Net | |

| | | of Shares | | | Value | | | Assets | |

| Consumer Discretionary – 0.11% | | | | | | | | | |

| General Motors Corp. | | | 5,910 | | | $ | 11,347 | | | | 0.11 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 1.07% | | | | | | | | | | | | |

| Kraft Foods, Inc. – Class A | | | 4,650 | | | | 108,810 | | | | 1.07 | % |

| | | | | | | | | | | | | |

| Energy – 0.19% | | | | | | | | | | | | |

| Chevron Corp. | | | 300 | | | | 19,830 | | | | 0.19 | % |

| | | | | | | | | | | | | |

| Financials – 13.88% | | | | | | | | | | | | |

| American Express Co. | | | 20,140 | | | | 507,931 | | | | 4.98 | % |

| American International Group, Inc. | | | 7,210 | | | | 9,950 | | | | 0.10 | % |

| Bank of America Corp. | | | 19,290 | | | | 172,259 | | | | 1.69 | % |

| Citigroup, Inc. | | | 33,935 | | | | 103,502 | | | | 1.02 | % |

| J.P. Morgan Chase & Co. | | | 18,825 | | | | 621,225 | | | | 6.09 | % |

| | | | | | | | 1,414,867 | | | | 13.88 | % |

| | | | | | | | | | | | | |

| Health Care – 8.12% | | | | | | | | | | | | |

| Johnson & Johnson | | | 400 | | | | 20,944 | | | | 0.21 | % |

| Merck & Co., Inc. | | | 15,490 | | | | 375,477 | | | | 3.68 | % |

| Pfizer, Inc. | | | 32,310 | | | | 431,662 | | | | 4.23 | % |

| | | | | | | | 828,083 | | | | 8.12 | % |

| | | | | | | | | | | | | |

| Industrials – 10.68% | | | | | | | | | | | | |

| Boeing Co. | | | 500 | | | | 20,025 | | | | 0.20 | % |

| Caterpillar, Inc. | | | 13,630 | | | | 484,956 | | | | 4.75 | % |

| General Electric Co. | | | 46,160 | | | | 583,924 | | | | 5.73 | % |

| | | | | | | | 1,088,905 | | | | 10.68 | % |

| | | | | | | | | | | | | |

| Materials – 11.09% | | | | | | | | | | | | |

| Alcoa, Inc. | | | 63,260 | | | | 573,768 | | | | 5.63 | % |

| EI Du Pont de Nemours & Co. | | | 19,975 | | | | 557,303 | | | | 5.46 | % |

| | | | | | | | 1,131,071 | | | | 11.09 | % |

| | | | | | | | | | | | | |

| Telecommunication Services – 10.74% | | | | | | | | | | | | |

| AT&T, Inc. | | | 20,430 | | | | 523,417 | | | | 5.13 | % |

| Verizon Communications, Inc. | | | 18,840 | | | | 571,605 | | | | 5.61 | % |

| | | | | | | | 1,095,022 | | | | 10.74 | % |

| | | | | | | | | | | | | |

Total Common Stocks (Cost $8,091,692) | | | | | | | 5,697,935 | | | | 55.88 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSY FUNDS 1-800-966-4354

| SHORT-TERM INVESTMENTS – 43.70% | | Principal | | | | | | % of Net | |

| | | Amount | | | Value | | | Assets | |

| U.S. Treasury Bills – 39.84% | | | | | | | | | |

| 4.875%, 05/31/2009 | | $ | 600,000 | | | $ | 602,532 | | | | 5.91 | % |

| 3.500%, 08/15/2009 | | | 900,000 | | | | 909,001 | | | | 8.92 | % |

| 3.375%, 10/15/2009 | | | 400,000 | | | | 405,734 | | | | 3.98 | % |

| 3.125%, 11/30/2009 | | | 800,000 | | | | 813,094 | | | | 7.97 | % |

| 3.500%, 02/15/2010 | | | 1,300,000 | | | | 1,331,637 | | | | 13.06 | % |

| | | | | | | | | | | | | |

Total U.S. Treasury Bills (Cost $4,051,302) | | | | | | | 4,061,998 | | | | 39.84 | % |

| | | | | | | | | | | | | |

| Variable Rate Demand Notes# – 3.86% | | | | | | | | | | | | |

American Family Financial Services 0.1001% | | | 393,782 | | | | 393,782 | | | | 3.86 | % |

| | | | | | | | | | | | | |

| Total Variable Rate Demand Notes | | | | | | | | | | | | |

| (Cost $393,782) | | | | | | | 393,782 | | | | 3.86 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $4,445,084) | | | | | | | 4,455,780 | | | | 43.70 | % |

| | | | | | | | | | | | | |

Total Investments – 99.58% | | | | | | | | | | | | |

| (Cost $12,536,776) | | | | | | | 10,153,715 | | | | 99.58 | % |

| | | | | | | | | | | | | |

| Other Assets in Excess of Liabilities – 0.42% | | | | | | | 43,057 | | | | 0.42 | % |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 10,196,772 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| # | Variable rate demand notes are considered short-term obligations and are payable on demand. Interest rates change periodically on specified dates. The rates listed are as of April 30, 2009. |

FAS 157 – Summary of Fair Value Exposure at April 30, 2009 (Unaudited)

Various inputs are used in determining the value of the Fund’s investments, which are summarized as follows:

Level 1 – Quoted prices in active markets for identical securities

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

SUMMARY OF INVESTMENTS — HENNESSY BALANCED FUND

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2009:

| Description | | Investments in Securities | |

| Level 1 – Quoted prices in active markets for identical securities | | $ | 5,697,935 | |

| Level 2 – Other significant observable inputs | | | 4,455,780 | |

| Level 3 – Significant unobservable inputs | | | — | |

| Total | | $ | 10,153,715 | |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statements of Assets and Liabilities as of April 30, 2009 (Unaudited) |

| | | HENNESSY | |

| | | CORNERSTONE | |

| | | GROWTH FUND | |

| ASSETS: | | | |

| Investments, at value (cost $264,377,785, $51,147,486, $226,047,611, | | | |

| $97,801,259, $78,549,294 and $12,536,776, respectively) | | $ | 243,590,826 | |

| Cash | | | 20 | |

| Dividends and interest receivable | | | 289,185 | |

| Receivable for fund shares sold | | | 184,579 | |

| Prepaid expenses and other assets | | | 29,176 | |

| Total Assets | | | 244,093,786 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for fund shares redeemed | | | 188,456 | |

| Payable to Advisor | | | 149,604 | |

| Payable to Administrator | | | 93,745 | |

| Payable to Auditor | | | 11,654 | |

| Payable to Distributor | | | — | |

| Reverse repurchase agreement | | | — | |

| Accrued interest payable | | | 287 | |

| Accrued service fees | | | 19,942 | |

| Accrued expenses and other payables | | | 63,657 | |

| Total Liabilities | | | 527,345 | |

| | | | | |

| NET ASSETS | | $ | 243,566,441 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 556,423,639 | |

| Accumulated net investment income (loss) | | | (232,391 | ) |

| Accumulated net realized gain (loss) on investments | | | (291,837,848 | ) |

| Unrealized net appreciation (depreciation) on investments | | | (20,786,959 | ) |

| Total Net Assets | | $ | 243,566,441 | |

| | | | | |

| NET ASSETS | | | | |

| Original Class: | | | | |

| Shares authorized ($.0001 par value) | | | 25,000,000,000 | |

| Net assets applicable to outstanding Original Class shares | | | 239,281,993 | |

| Shares issued and outstanding | | | 29,818,545 | |

| Net asset value, offering price and redemption price per share | | $ | 8.02 | |

| | | | | |

| Institutional Class: | | | | |

| Shares authorized ($.0001 par value) | | | 25,000,000,000 | |

| Net assets applicable to outstanding Institutional Class shares | | | 4,284,448 | |

| Shares issued and outstanding | | | 532,130 | |

| Net asset value, offering price and redemption price per share | | $ | 8.05 | |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF ASSETS AND LIABILITIES

| HENNESSY | | | | | | | | | | | | | |

| CORNERSTONE | | | HENNESSY | | | HENNESSY | | | HENNESSY | | | HENNESSY | |

| GROWTH FUND, | | | FOCUS 30 | | | CORNERSTONE | | | TOTAL RETURN | | | BALANCED | |

| SERIES II | | | FUND | | | VALUE FUND | | | FUND | | | FUND | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| $ | 29,269,796 | | | $ | 166,471,139 | | | $ | 85,560,351 | | | $ | 60,633,722 | | | $ | 10,153,715 | |

| | — | | | | — | | | | 20 | | | | 10 | | | | — | |

| | 21,646 | | | | 109,685 | | | | 369,829 | | | | 162,962 | | | | 66,986 | |

| | 11,496 | | | | 329,070 | | | | 250 | | | | 418 | | | | — | |

| | 36,807 | | | | 30,400 | | | | 20,964 | | | | 10,796 | | | | 13,681 | |

| | 29,339,745 | | | | 166,940,294 | | | | 85,951,414 | | | | 60,807,908 | | | | 10,234,382 | |

| | | | | | | | | | | | | | | | | | | |

| | 17,346 | | | | 397,151 | | | | 21,252 | | | | 22,488 | | | | — | |

| | 17,159 | | | | 95,498 | | | | 48,941 | | | | 22,915 | | | | 4,975 | |

| | 5,341 | | | | 58,173 | | | | 25,186 | | | | 12,699 | | | | — | |

| | 9,997 | | | | 8,400 | | | | 9,238 | | | | 8,487 | | | | 8,212 | |

| | — | | | | — | | | | — | | | | 5,598 | | | | 17,128 | |

| | — | | | | — | | | | — | | | | 13,492,500 | | | | — | |

| | — | | | | — | | | | — | | | | 4,722 | | | | — | |

| | 2,317 | | | | 11,353 | | | | 6,572 | | | | 3,819 | | | | 829 | |

| | 18,589 | | | | 26,858 | | | | 16,299 | | | | 24,343 | | | | 6,466 | |

| | 70,749 | | | | 597,433 | | | | 127,488 | | | | 13,597,571 | | | | 37,610 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 29,268,996 | | | $ | 166,342,861 | | | $ | 85,823,926 | | | $ | 47,210,337 | | | $ | 10,196,772 | |

| | | | | | | | | | | | | | | | | | | |

| $ | 92,060,274 | | | $ | 279,825,451 | | | $ | 182,346,137 | | | $ | 108,799,019 | | | $ | 15,019,531 | |

| | (2,874 | ) | | | 151,357 | | | | 1,317,595 | | | | 114,347 | | | | 11,597 | |

| | (40,910,714 | ) | | | (54,057,475 | ) | | | (85,598,898 | ) | | | (43,787,457 | ) | | | (2,451,295 | ) |

| | (21,877,690 | ) | | | (59,576,472 | ) | | | (12,240,908 | ) | | | (17,915,572 | ) | | | (2,383,061 | ) |

| $ | 29,268,996 | | | $ | 166,342,861 | | | $ | 85,823,926 | | | $ | 47,210,337 | | | $ | 10,196,772 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Unlimited | | | | 25,000,000,000 | | | | 25,000,000,000 | | | | 100,000,000 | | | | 100,000,000 | |

| | 29,186,907 | | | | 141,923,952 | | | | 84,983,961 | | | | 47,210,337 | | | | 10,196,772 | |

| | 2,969,774 | | | | 18,812,383 | | | | 10,433,773 | | | | 5,999,166 | | | | 1,224,524 | |

| $ | 9.83 | | | $ | 7.54 | | | $ | 8.15 | | | $ | 7.87 | | | $ | 8.33 | |

| | | | | | | | | | | | | | | | | | | |

| Unlimited | | | | 25,000,000,000 | | | | 25,000,000,000 | | | | | | | | | |

| | 82,089 | | | | 24,418,909 | | | | 839,965 | | | | | | | | | |

| | 8,292 | | | | 3,225,113 | | | | 103,267 | | | | | | | | | |

| $ | 9.90 | | | $ | 7.57 | | | $ | 8.13 | | | | | | | | | |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

Statements of Operations Six Months ended April 30, 2009 (Unaudited) |

| | | HENNESSY | |

| | | CORNERSTONE | |

| | | GROWTH FUND | |

| INVESTMENT INCOME: | | | |

Dividend income(1) | | $ | 1,524,660 | |

| Interest income | | | 275 | |

| Total investment income | | | 1,524,935 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 972,227 | |

| Administration, fund accounting, custody and transfer agent fees | | | 334,989 | |

| Distribution fees – Original Class (See Note 5) | | | — | |

| Service fees – Original Class (See Note 5) | | | 129,159 | |

| Federal and state registration fees | | | 22,830 | |

| Audit fees | | | 11,405 | |

| Legal fees | | | 13,843 | |

| Reports to shareholders | | | 44,888 | |

| Directors’ fees and expenses | | | 6,838 | |

| Sub-transfer agent expenses – Original Class (See Note 5) | | | 196,464 | |

| Sub-transfer agent expenses – Institutional Class (See Note 5) | | | 1,058 | |

| Interest expense (See Note 3 and 7) | | | 798 | |

| Other | | | 26,394 | |

| Total expenses before reimbursement from advisor | | | 1,760,893 | |

| Expense reimbursement from advisor – Institutional Class | | | (3,567 | ) |

| Net expenses | | | 1,757,326 | |

| NET INVESTMENT INCOME (LOSS) | | $ | (232,391 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | |

| Net realized gain (loss) on investments | | $ | (174,584,029 | ) |

| Change in unrealized appreciation (depreciation) on investments | | | 146,286,209 | |

| Net gain (loss) on investments | | | (28,297,820 | ) |

| | | | | |

| NET INCREASE (DECREASE) IN NET ASSETS | | | | |

| RESULTING FROM OPERATIONS | | $ | (28,530,211 | ) |

(1) | Net of foreign taxes withheld of $78,584, $3,810, $0, $332,882, $0, & $0, respectively. |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF OPERATIONS

| HENNESSY | | | | | | | | | | | | | |

| CORNERSTONE | | | HENNESSY | | | HENNESSY | | | HENNESSY | | | HENNESSY | |

| GROWTH FUND, | | | FOCUS 30 | | | CORNERSTONE | | | TOTAL RETURN | | | BALANCED | |

| SERIES II | | | FUND | | | VALUE FUND | | | FUND | | | FUND | |

| | | | | | | | | | | | | | |

| $ | 247,282 | | | $ | 1,207,936 | | | $ | 2,160,385 | | | $ | 993,332 | | | $ | 140,566 | |

| | 480 | | | | 1,917 | | | | 1,395 | | | | 50,010 | | | | 44,346 | |

| | 247,762 | | | | 1,209,853 | | | | 2,161,780 | | | | 1,043,342 | | | | 184,912 | |

| | | | | | | | | | | | | | | | | | | |

| | 107,883 | | | | 597,625 | | | | 294,166 | | | | 142,526 | | | | 30,364 | |

| | 37,172 | | | | 205,917 | | | | 101,357 | | | | 60,567 | | | | 12,904 | |

| | — | | | | — | | | | — | | | | 35,631 | | | | 7,591 | |

| | 14,550 | | | | 69,182 | | | | 39,383 | | | | 23,754 | | | | 5,061 | |

| | 22,666 | | | | 25,471 | | | | 19,995 | | | | 10,504 | | | | 11,472 | |

| | 9,895 | | | | 9,084 | | | | 9,530 | | | | 9,170 | | | | 8,679 | |

| | 9,914 | | | | 7,414 | | | | 7,414 | | | | 5,962 | | | | 4,981 | |

| | 10,953 | | | | 18,658 | | | | 8,925 | | | | 4,216 | | | | 1,240 | |

| | 5,521 | | | | 5,520 | | | | 5,521 | | | | 4,168 | | | | 4,167 | |

| | 23,064 | | | | 120,182 | | | | 19,202 | | | | — | | | | — | |

| | 30 | | | | 6,439 | | | | 401 | | | | — | | | | — | |

| | 85 | | | | — | | | | 14 | | | | 118,306 | | | | — | |

| | 9,077 | | | | 12,464 | | | | 6,721 | | | | 3,883 | | | | 1,104 | |

| | 250,810 | | | | 1,077,956 | | | | 512,629 | | | | 418,687 | | | | 87,563 | |

| | (174 | ) | | | (19,460 | ) | | | (1,001 | ) | | | — | | | | — | |

| | 250,636 | | | | 1,058,496 | | | | 511,628 | | | | 418,687 | | | | 87,563 | |

| $ | (2,874 | ) | | $ | 151,357 | | | $ | 1,650,152 | | | $ | 624,655 | | | $ | 97,349 | |

| | | | | | | | | | | | | | | | | | | |

| $ | (4,513,819 | ) | | $ | (6,077,910 | ) | | $ | (56,678,085 | ) | | $ | (7,633,466 | ) | | $ | (1,393,083 | ) |

| | 2,265,884 | | | | (7,830,729 | ) | | | 50,016,684 | | | | (1,071,187 | ) | | | 370,577 | |

| | (2,247,935 | ) | | | (13,908,639 | ) | | | (6,661,401 | ) | | | (8,704,653 | ) | | | (1,022,506 | ) |

| | | | | | | | | | | | | | | | | | | |

| $ | (2,250,809 | ) | | $ | (13,757,282 | ) | | $ | (5,011,249 | ) | | $ | (8,079,998 | ) | | $ | (925,157 | ) |

HENNESSY FUNDS 1-800-966-4354

Financial Statements

| Statements of Changes in Net Assets |

| | | Hennessy Cornerstone Growth Fund | |

| | | Six Months Ended | | | | |

| | | April 30, 2009 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2008 | |

| OPERATIONS: | | | | | | |

| Net investment income (loss) | | $ | (232,391 | ) | | $ | (1,718,215 | ) |

| Net realized gain (loss) on securities | | | (174,584,029 | ) | | | (116,321,526 | ) |

| Change in unrealized appreciation (depreciation) on securities | | | 146,286,209 | | | | (248,016,087 | ) |

| Net increase (decrease) in net assets resulting from operations | | | (28,530,211 | ) | | | (366,055,828 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

| Net investment income – Original Class | | | — | | | | — | |

| Net investment income – Institutional Class | | | — | | | | — | |

| Net realized gains – Original Class | | | — | | | | (110,914,265 | ) |

| Net realized gains – Institutional Class | | | — | | | | — | |

| Total distributions | | | — | | | | (110,914,265 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Original Class | | | 7,703,678 | | | | 39,355,042 | |

| Proceeds from shares subscribed – Institutional Class | | | 61,013 | | | | 14,450,082 | |

| Dividends reinvested – Original Class | | | — | | | | 107,702,229 | |

| Dividends reinvested – Institutional Class | | | — | | | | — | |

| Redemption fees retained – Original Class | | | — | | | | 23,170 | |

| Redemption fees retained – Institutional Class | | | — | | | | 205 | |

| Cost of shares redeemed – Original Class | | | (52,866,973 | ) | | | (350,084,701 | ) |

| Cost of shares redeemed – Institutional Class | | | (390,385 | ) | | | (7,312,081 | ) |

| Net increase (decrease) in net assets derived | | | | | | | | |

| from capital share transactions | | | (45,492,667 | ) | | | (195,866,054 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (74,022,878 | ) | | | (672,836,147 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 317,589,319 | | | | 990,425,466 | |

| End of period | | $ | 243,566,441 | | | $ | 317,589,319 | |

| Accumulated net investment income (loss), end of period | | $ | (232,391 | ) | | $ | — | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Original Class | | | 959,937 | | | | 42,121,972 | |

| Shares sold – Institutional Class | | | 7,623 | | | | 1,117,876 | |

| Shares issued to holders as reinvestment of dividends | | | | | | | | |

| Original Class | | | — | | | | 7,062,441 | |

| Institutional Class | | | — | | | | — | |

| Shares redeemed – Original Class | | | (6,635,237 | ) | | | (64,717,368 | ) |

| Shares redeemed – Institutional Class | | | (52,459 | ) | | | (540,910 | ) |

| Net increase (decrease) in shares outstanding | | | (5,720,136 | ) | | | (14,955,989 | ) |

The accompanying notes are an integral part of these financial statements.

FINANCIAL STATEMENTS — STATEMENTS OF CHANGES IN NET ASSETS

| Hennessy Cornerstone | | | | | | | |

| Growth Fund, Series II | | | Hennessy Focus 30 Fund | |

| Six Months Ended | | | | | | Six Months Ended | | | | |

| April 30, 2009 | | | Year Ended | | | April 30, 2009 | | | Year Ended | |

| (Unaudited) | | | October 31, 2008 | | | (Unaudited) | | | October 31, 2008 | |

| | | | | | | | | | | |

| $ | (2,874 | ) | | $ | (330,874 | ) | | $ | 151,357 | | | $ | (1,274,378 | ) |

| | (4,513,819 | ) | | | (35,487,492 | ) | | | (6,077,910 | ) | | | (47,714,145 | ) |

| | 2,265,884 | | | | (21,004,180 | ) | | | (7,830,729 | ) | | | (49,274,887 | ) |

| | (2,250,809 | ) | | | (56,822,546 | ) | | | (13,757,282 | ) | | | (98,263,410 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | (27,055,016 | ) | | | — | | | | (33,250,015 | ) |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | (27,055,016 | ) | | | — | | | | (33,250,015 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 539,751 | | | | 3,777,707 | | | | 21,247,920 | | | | 169,225,771 | |

| | 35,121 | | | | 108,132 | | | | 1,721,741 | | | | 40,370,645 | |

| | — | | | | 26,856,690 | | | | — | | | | 32,845,640 | |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | 6,554 | | | | — | | | | 118,011 | |

| | — | | | | — | | | | — | | | | 2,592 | |

| | (5,371,027 | ) | | | (49,122,781 | ) | | | (34,600,660 | ) | | | (146,107,945 | ) |

| | (11,356 | ) | | | — | | | | (2,375,778 | ) | | | (4,205,478 | ) |

| | | | | | | | | | | | | | | |

| | (4,807,511 | ) | | | (18,373,698 | ) | | | (14,006,777 | ) | | | 92,249,236 | |

| | (7,058,320 | ) | | | (102,251,260 | ) | | | (27,764,059 | ) | | | (39,264,189 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 36,327,316 | | | | 138,578,576 | | | | 194,106,920 | | | | 233,371,109 | |

| $ | 29,268,996 | | | $ | 36,327,316 | | | $ | 166,342,861 | | | $ | 194,106,920 | |

| $ | (2,874 | ) | | $ | — | | | $ | 151,357 | | | $ | — | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 59,168 | | | | 3,389,025 | | | | 2,976,185 | | | | 26,879,882 | |

| | 3,660 | | | | 5,992 | | | | 239,725 | | | | 3,743,355 | |