Frequently Asked Questions as of 8/31/18

Regarding the Proposed Acquisition of the BP Capital TwinLine Funds

Who is BP Capital Fund Advisors, and what are the BP Capital TwinLine Funds?

BP Capital Fund Advisors, located in Dallas, TX, is the investment manager to the BP Capital TwinLine Energy and BP Capital TwinLine MLP Funds (the “TwinLine Funds”). Formed in 2013, the BP Capital Fund Advisors team has decades of combined energy investing experience and maintains an exclusive energy sector focus. The TwinLine Funds, inspired by legendary energy investor T. Boone Pickens, are actively managed and offer an opportunity to invest in companies whose cost leadership is driving the energy industry forward.

Why is BP Capital Fund Advisors looking for a new investment manager for the TwinLine Funds?

BP Capital Fund Advisors recently completed a strategic review of the management and operations of the TwinLine Funds and determined that it would be advisable to pursue the reorganization of the TwinLine Funds with another fund group that has greater resources to help manage, service, and market the TwinLine Funds, thereby allowing BP Capital Fund Advisors to focus on what it does best, which is day-to-day management of the portfolios as the Funds’ sub‑advisor.

Why is Hennessy Advisors interested in acquiring the TwinLine Funds?

Along with the Hennessy Gas Utility Fund, the addition of the two TwinLine Funds to the Hennessy Funds line up will allow Hennessy Advisors to offer shareholders a suite of three complementary energy-related mutual funds. Hennessy Advisors is excited to welcome BP Capital Fund Advisors, with its deep expertise in the energy sector, to the Hennessy team of sub‑advisors.

When will the acquisition become effective?

Subject to shareholder approval, the transaction is expected to be completed in the fourth quarter of 2018.

How is T. Boone Pickens involved with the BP Capital TwinLine Funds, and will his involvement change following the transaction?

The “BP” of BP Capital TwinLine Funds are the initials of Boone Pickens, a well-regarded energy investor. Mr. Pickens has provided guidance to the TwinLine Funds’ Portfolio Management team and is expected to continue to do so after the transaction.

Will the Portfolio Managers of the TwinLine Funds remain the same following the reorganization?

Yes. If the proposal is approved, the TwinLine Funds will become part of the Hennessy Funds with Hennessy Advisors as the investment advisor and BP Capital Fund Advisors as the sub-advisor. BP Capital Fund Advisors will continue to manage the portfolios as they have always done. The same investment team and Portfolio Managers that oversee the day-to-day portfolio management of the TwinLine Funds today will manage each corresponding Hennessy Fund’s portfolio following the transaction, adhering to a similar investment objective, philosophy, and approach.

Who are the Portfolio Managers of the BP Capital TwinLine Funds?

| | Toby Loftin has been a Portfolio Manager of the BP Capital TwinLine MLP Fund and the BP Capital TwinLine Energy Fund since their inception in 2013. Mr. Loftin founded BP Capital Fund Advisors in June 2013 and serves as Managing Principal of the firm. He joined BP Capital LP in 2010 and served as a member of the Investment Committee of the private hedge funds and managed the firm’s energy infrastructure MLP investments. |

| | Trip Rodgers, CFA, joined BP Capital Fund Advisors in January 2017, where he serves as a member of the Investment Committee and a Portfolio Manager of the BP Capital TwinLine Energy Fund. |

| | Tim Dumois joined BP Capital Fund Advisors in 2014 where he serves as a member of the Investment Committee and a Portfolio Manager of the BP Capital TwinLine Energy Fund. |

| | Ben Cook, CFA, joined BP Capital Fund Advisors in May 2017, where he serves as a member of the Investment Committee and a Portfolio Manager for the BP Capital TwinLine MLP Fund.

|

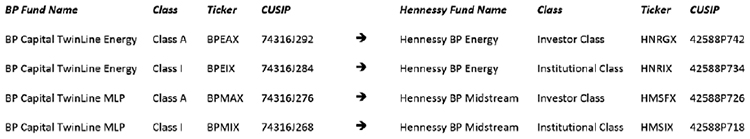

Will the Fund names change and how will share classes be mapped from the TwinLine Funds to the Hennessy Funds?

Following shareholder approval, the TwinLine Funds will be renamed and transferred into corresponding Hennessy Funds, with similar share classes, as follows:

| BP Capital TwinLine Energy Fund Class A | → | Hennessy BP Energy Fund Investor Class |

| BP Capital TwinLine Energy Fund Class I | → | Hennessy BP Energy Fund Institutional Class |

| BP Capital TwinLine MLP Fund Class A | → | Hennessy BP Midstream Fund Investor Class |

| BP Capital TwinLine MLP Fund Class I | → | Hennessy BP Midstream Fund Institutional Class |

Will ticker symbols and CUSIP numbers change?

Yes. Ticker symbols and CUSIP numbers and for the TwinLine Funds will change following the transaction, as follow:

Will fees and expenses change as a result of the proposed transaction?

Management fees will remain the same following the transaction, and at current asset levels, it is anticipated that the expense ratios of each TwinLine Fund’s share classes will be the same or slightly lower following the transaction. The expense waivers that are in place today with BP Capital Fund Advisors will remain in place with Hennessy Advisors for a minimum of two years following the transaction date.

Will any capital gains be paid prior to the transaction?

It is not anticipated that a capital gain will be paid for either of the TwinLine Funds prior to the transaction.

What are the tax implications resulting from the proposed transaction?

The transaction has been structured with the intention that it qualify, for federal income tax purposes, as a tax-free reorganization under the Internal Revenue Code. Therefore, shareholders should not recognize any gain or loss on shares of the TwinLine Funds for federal income tax purposes as a result of the reorganization. Please note that any redemptions made prior to the transaction date would be subject to applicable taxes.

Will past performance of the TwinLine Funds remain in place following the transaction?

Yes. The objectives and strategies of the TwinLine Funds will remain substantially the same, so historical performance will follow each Fund.

From a shareholder service standpoint, what will change and what will remain the same?

Many service providers for the TwinLine Funds and the Hennessy Funds are the same, including those providing custody, transfer agency, and audit services. Shareholders will continue to receive superior service from U.S. Bancorp Fund Services, LLC and Tait Weller, and we expect this transition to be seamless to shareholders.

How will shareholders of the TwinLine Funds be notified of the proposed reorganization?

A supplement to the TwinLine Funds’ prospectus was filed on July 20, 2018, notifying shareholders of the proposed reorganization of the TwinLine Funds into the Hennessy Funds. A Notice of Special Meeting of Shareholders of the TwinLine Funds, scheduled for October 22, 2018, and proxy voting information was sent on or about August 31, 2018.

Will shareholders get to vote on the proposed reorganization?

Yes. For TwinLine Funds’ shareholders of record as of August 13, 2018, a combined proxy statement and prospectus and proxy voting information was sent on or about August 31, 2018, with instructions on how to vote on the proposed reorganization. Shareholders may be contacted by Broadridge, a proxy solicitation firm, if they have not yet voted their shares.

How does the Board of Trustees recommend that I vote?

After careful analysis and consideration and after concluding that the reorganization is in the best interests of the TwinLine Funds’ shareholders, the Board of Trustees (the “PMP Board”) of Professionally Managed Portfolios, of which each TwinLine Fund is a series, approved the plan for the reorganization. The PMP Board recommends that you vote “FOR” the proposal.

How do I cast my vote?

Shareholders may vote (1) by completing, signing, dating, and promptly returning the proxy card that was delivered with the combined proxy statement and prospectus; (2) by calling the toll-free telephone number listed on the proxy card; or (3) via the Internet at the website shown on the proxy card. Shareholders may also vote in person at the special meeting of shareholders scheduled for October 22, 2018.

For questions regarding voting, shareholders may contact Broadridge, the proxy solicitor for the TwinLine Funds, by calling 1-833-782-7143.

What happens if the proposed reorganization is not approved?

If the reorganization is not approved by shareholders of either of the TwinLine Funds, that TwinLine Fund will continue to operate and the PMP Board may take any further action it deems to be in the best interest of

that TwinLine Fund and its shareholders, including potentially terminating that TwinLine Fund, subject to approval by that TwinLine Fund’s shareholders if required by applicable law.

If a quorum does not exist as of the date of the special meeting, or if a quorum exists but sufficient votes to approve the proposal are not obtained by the date of the special meeting, the PMP Board may seek to adjourn the special meeting to obtain sufficient votes.

Where can I find information about and how do I contact the Hennessy Funds or the TwinLine Funds?

Information on the Hennessy Funds can be found by visiting www.hennessyfunds.com, by calling 800.966.4354, or by emailing fundsinfo@hennessyfunds.com.

Information on the TwinLine Funds can be found by visiting www.bpcfunds.com, by calling 855.402.7227, or by emailing info@bpcfunds.com.

In connection with the proposed reorganization and investing, shareholders should carefully consider the investment objective, risks, charges, and expenses of the TwinLine Funds and the Hennessy Funds. This and other information is contained in the Twin Line Funds’ and the Hennessy Funds’ statutory and summary prospectuses, which can be obtained by contacting the TwinLine Funds at 1‑855‑402‑7227 or visiting www.bcpfunds.com or by contacting the Hennessy Funds at 1‑800‑966‑4354 or visiting www.hennessyfunds.com. Read them carefully before investing.

Shareholders of the TwinLine Funds are urged to read the combined proxy statement and prospectus when received, because it will contain important information about the proposed reorganization. The proxy statement and prospectus as well as other relevant documents may be obtained free of charge from the SEC’s website at www.sec.gov or by calling 1-800-966-4354.

Mutual fund investing involves risk. Principal loss is possible. Energy related companies are subject to specific risk, including, among others, fluctuations in commodity prices and consumer demand, substantial government regulation and depletion of reserves.

The tax information provided is not exhaustive. Shareholders must consult their tax advisor for advice and information concerning their particular situation. Neither the TwinLine Funds nor the Hennessy Funds, including any of their representatives, may give tax advice.

The TwinLine Funds are distributed by Foreside Fund Services, LLC. The Hennessy Funds are distributed by Quasar Distributors, LLC.