The Securities and Exchange Commission has adopted new regulations that will impact the design and delivery of future Semi-Annual and Annual Reports. Beginning with the 2024 Annual Reports, paper copies will be mailed to you unless you have opted for electronic delivery of the report. See Go Paperless with eDelivery for instructions about how to sign up for electronic delivery.

Past performance does not guarantee future results.

Investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes or Russell ratings or underlying data and no party may rely on any Russell Indexes or Russell ratings or underlying data contained in this communication. No further distribution of Russell data is permitted without Russell’s express written consent. Russell does not promote, sponsor, or endorse the content of this communication.

The expense ratios presented are from the most recent prospectus. The expense ratios for the current reporting period are available in the Financial Highlights section of this report.

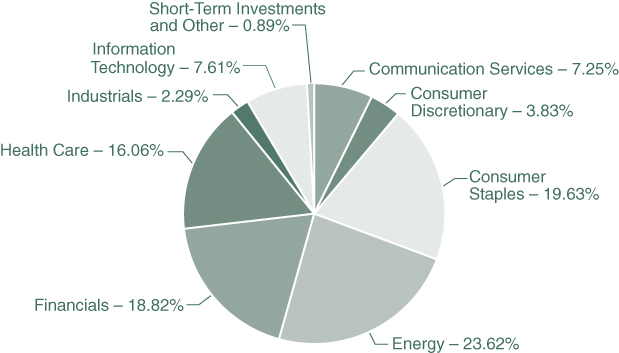

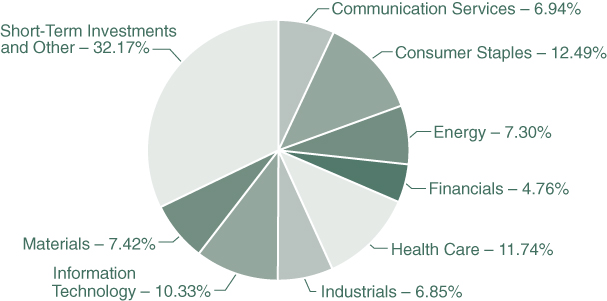

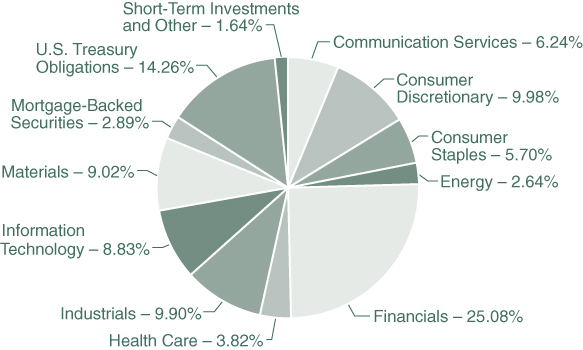

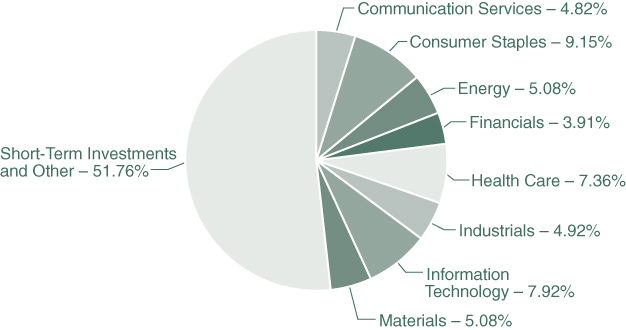

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The accompanying notes are an integral part of these financial statements.

Percentages are stated as a percent of net assets.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2024 (see Note 3 in the accompanying Notes to the Financial Statements):

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The Hennessy Large Cap Financial Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is capital appreciation. The Fund is a non-diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective 12b-1 distribution and service, shareholder servicing, and sub-transfer agent expenses. There are no sales charges. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only one class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (the “FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

The Fund follows its valuation policies and procedures in determining its NAV and, in preparing these financial statements, the fair value accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities on a recurring basis:

If market quotations are not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security, such security will be valued at its fair value under the Fund’s established fair valuation procedures as implemented by Hennessy Advisors, Inc. (the “Advisor”), the Fund’s valuation designee. The Advisor, as the valuation designee, is subject to the oversight of the Board of Trustees of the Fund (the “Board”). There are numerous criteria considered in determining a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy. The Advisor will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through their application of such procedures.

The fair value of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of

relevant American Depositary Receipts or futures contracts. Using fair value pricing means that the Fund’s NAV reflects the affected portfolio securities’ values as determined by the Advisor, instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different from such foreign security’s most recent closing price and from the value used by other investment companies to calculate their NAVs. Such securities are generally classified in Level 2 of the fair value hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when a shareholder is unable to purchase or redeem Fund shares.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair value hierarchy of the Fund’s securities as of April 30, 2024, are included in the Schedule of Investments.

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2024, were $7,774,047 and $15,644,908, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during the six months ended April 30, 2024.

The Advisor provides the Fund with investment advisory services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities and most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based on the average daily net assets of the Fund at an annual rate of 0.90%. The net investment advisory fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

The Board has approved a Shareholder Servicing Agreement for Investor Class shares of the Fund, which compensates the Advisor for the non-investment advisory services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. The shareholder service fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of Fund shares at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to Investor Class shares. Even though the authorized rate is up to 0.25%, the Fund is currently only using up to 0.15% of its average daily net assets attributable to Investor Class shares for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, printing and mailing of prospectuses to other than current shareholders, printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of Fund shares. The agreements provide for periodic payments of sub-transfer agent expenses by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services. These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”) provides the Fund with administrative, accounting, and transfer agent services. As administrator, Fund Services is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. The servicing agreements between the Trust, Fund Services, and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, accounting, custody, and transfer agent fees. The administrative, accounting, custody, and transfer agent fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

Quasar Distributors, LLC, a wholly owned broker-dealer subsidiary of Foreside Financial Group, LLC, acts as the Fund’s principal underwriter in a continuous public offering of Fund shares.

The officers of the Fund are affiliated with the Advisor. With the exception of the Chief Compliance Officer, such officers receive no compensation from the Fund for serving in their respective roles. The Fund, along with the other funds in the Hennessy Funds family (collectively, the “Hennessy Funds”), makes reimbursement payments on an equal basis to the Advisor for a portion of the salary and benefits associated with the office of the Chief Compliance Officer. The compliance fees expensed by the Fund during the six months ended April 30, 2024, for reimbursement payments to the Advisor are included in the Statement of Operations.

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds. Additionally, in the normal course of business, the Hennessy Funds enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund, the Hennessy Japan Fund, and the Hennessy Japan Small Cap Fund and 10% for the Hennessy Balanced Fund. The line of credit is intended to provide any necessary short-term financing in connection with shareholder redemptions, subject to certain restrictions. The credit facility is with the Hennessy Funds’ custodian

bank, U.S. Bank N.A. Borrowings under this arrangement bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During the six months ended April 30, 2024, the Fund had an outstanding average daily balance and a weighted average interest rate of $66,951 and 8.50%, respectively. The interest expensed by the Fund during the six months ended April 30, 2024, is included in the Statement of Operations. The maximum amount outstanding for the Fund during the six months ended April 30, 2024, was $2,244,000. As of April 30,2024, the Fund did not have any borrowings outstanding under the line of credit.

As of October 31, 2023, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) for income tax purposes were as follows:

The difference between book-basis unrealized appreciation/depreciation and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to wash sales.

As of October 31, 2023, the Fund had $2,567,969 in unlimited short-term capital loss carryforwards.

Capital losses sustained in or after fiscal year 2012 can be carried forward indefinitely, but any such loss retains the character of the original loss and must be utilized prior to any loss incurred before fiscal year 2012. As a result of this ordering rule, capital loss carryforwards incurred prior to fiscal year 2012 may be more likely to expire unused. Capital losses sustained prior to fiscal year 2012 can be carried forward for eight years and can be carried forward as short-term capital losses regardless of the character of the original loss.

As of October 31, 2023, the Fund did not defer, on a tax basis, any late-year ordinary losses. Late-year ordinary losses are net ordinary losses incurred after December 31, 2022, but within the taxable year, that are deemed to arise on the first day of the Fund’s next taxable year.

During fiscal year 2024 (year to date) and fiscal year 2023, the tax character of distributions paid by the Fund was as follows:

A rise in protectionist trade policies, the possibility of a national or global recession, risks associated with pandemic and epidemic diseases, trade tensions, the possibility of changes to some international trade agreements, political events, and continuing political tension and armed conflicts may adversely impact financial markets and the broader economy. For example, ongoing armed conflicts between Ukraine and Russia in Europe and among Israel, Hamas, and other militant groups in the Middle East have caused and could continue to cause significant market disruptions and volatility with the markets in Europe and the Middle East, and have had negative impacts on markets in the United States. These events could also have negative effects on the Fund’s investments that cannot be foreseen at the present time. As global systems, economies and financial markets are increasingly interconnected, events that once had only local impact are now more likely to have regional or even global effects. Events that occur in one country, region or financial market will, more frequently, adversely impact issuers in other countries, regions, or markets. These impacts can be exacerbated by failures of governments and societies to adequately respond to an emerging event or threat. Your investment would be negatively impacted if the value of your portfolio holdings decreases as a result of such events, if these events adversely impact the operations and effectiveness of the Advisor or other key service providers or if these events disrupt systems and processes necessary or beneficial to the management of accounts. These events may negatively impact broad segments of businesses and populations and could have a significant and rapid negative impact on the performance of the Fund’s investments, increase the Fund’s volatility, or exacerbate pre-existing risks to the Fund.

Management has evaluated the Fund’s related events and transactions that occurred subsequent to April 30, 2024, through the date of issuance of the Fund’s financial statements. Management has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

As a shareholder of the Fund, you incur ongoing costs, including management fees, service fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other investment funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2023, through April 30, 2024.

In the table below, the first line under each of the “Investor Class” and “Institutional Class” headings provides information about actual account values and actual expenses for each share class. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bank Global Fund Services, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, the Fund’s transfer agent charges a $15 fee. IRAs are charged a $15 annual maintenance fee (up to $30 maximum per shareholder for shareholders with multiple IRAs). The examples below include, but are not limited to, management, shareholder servicing, accounting, custody, and transfer agent fees. However, the examples below do not include portfolio trading commissions and related expenses.

In the table below, the second line under each of the “Investor Class” and “Institutional Class” headings provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each share class and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return for such share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second lines under “Investor Class” and “Institutional Class” are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge (1) by calling 800-966-4354, (2) on the Hennessy Funds’ website at www.hennessyfunds.com/proxy-voting/voting-policy, or (3) on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record is available without charge on both the Hennessy Funds’ website at www.hennessyfunds.com/proxy-voting/voting-record and the SEC’s website at www.sec.gov no later than August 31 for the prior 12 months ending June 30.

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov or on request by calling 800-966-4354.

For fiscal year 2023, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00%.

For corporate shareholders, the percent of ordinary income distributions that qualified for the corporate dividends received deduction for fiscal year 2023 was 100.00%.

The percentage of taxable ordinary income distributions that were designated as short-term capital gain distributions under Section 871(k)(2)(C) of the Internal Revenue Code of 1986, as amended, for the Fund was 0.00%.

To help keep the Fund’s costs as low as possible, we generally deliver a single copy of shareholder reports, proxy statements, and prospectuses to shareholders who share an address and have the same last name. This process does not apply to account statements. You may request an individual copy of a shareholder document at any time. If you would like to receive separate mailings of shareholder documents, please call U.S. Bank Global Fund Services at 800-261-6950 or 414-765-4124, and individual delivery will begin within 30 days of your request. If your account is held through a financial institution or other intermediary, please contact such intermediary directly to request individual delivery.

The SEC has adopted new regulations that will impact the design and delivery of future Semi-Annual and Annual Reports. Beginning with the 2024 Annual Reports, paper copies will be mailed to you unless you have opted for electronic delivery of the reports. We encourage all direct shareholders to sign up to receive all notices, account statements, prospectuses, tax forms, and shareholder reports electronically to help reduce expenses and the volume of paper U.S. mail received. To sign up for eDelivery or to change your delivery preference, please visit www.hennessyfunds.com/account.

If you hold your Fund shares through a financial intermediary, please contact your financial intermediary regarding electronic delivery options.

Subscribe to receive our team’s unique market and sector insights delivered to your inbox

At its meeting on March 6, 2024, the Board of Trustees of the Fund (the “Board,” and the members thereof, the “Trustees”) unanimously approved the continuation of the investment advisory agreement of the Fund with Hennessy Advisors, Inc. (the “Advisor”). As part of the process, the Trustees reviewed their fiduciary duties and the relevant factors for them to consider with respect to approving the advisory agreement. In addition, the Trustees who are not deemed interested persons (as defined by the Investment Company Act of 1940, as amended) of the Fund (the “Independent Trustees”) met in executive session to discuss the approval of the advisory agreement. As part of their discussion, the Independent Trustees confirmed their understanding of the need to have asked about, and received answers to, any matters that they believed are relevant to determining whether to approve the continuation of the advisory and sub-advisory agreements.

In advance of the meeting, the Advisor sent detailed information to the Trustees to assist them in their evaluation of the advisory agreement. This information included, but was not limited to, the following:

All of the factors discussed were considered as a whole by the Trustees, as well as by the Independent Trustees meeting in executive session. The Trustees viewed the relevant factors in their totality, with no single factor being the principal or determinative factor in the Trustees’ determination of whether to approve the continuation of the advisory agreement. The Trustees recognized that the management and fee arrangements for the Fund are the result of years of review and discussion between the Independent Trustees and the Advisor, that certain aspects of such arrangements may receive greater scrutiny in some years than in others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements and information received during the course of the year and in prior years.

Prior to approving the continuation of the advisory agreement, the Trustees, including the Independent Trustees in executive session, considered, among other items:

The material considerations and determinations of the Trustees, including the Independent Trustees, were as follows:

After reviewing the materials and information provided at the meeting, as well as other information regularly provided at the Board’s quarterly meetings throughout the year regarding the quality of services provided by the Advisor, the performance of the Fund, expense information, brokerage commissions information, the adequacy and efficacy of the Advisor’s written policies and procedures, other regulatory compliance issues, trading information and related matters, and other factors that the Trustees deemed relevant, the Trustees, including the Independent Trustees, approved the continuation of the advisory agreement.

Hennessy Advisors, Inc.

U.S. Bancorp Fund Services, LLC

d/b/a U.S. Bank Global Fund Services

P.O. Box 701

U.S. Bank N.A.

Neil J. Hennessy

Robert T. Doyle

J. Dennis DeSousa

Gerald P. Richardson

others only if preceded or accompanied by a current prospectus.

SEMI-ANNUAL REPORT

APRIL 30, 2024

HENNESSY SMALL CAP FINANCIAL FUND

Investor Class HSFNX

Institutional Class HISFX

www.hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to Shareholders | | 2 |

| Performance Overview | | 4 |

| Financial Statements | | |

| Schedule of Investments | | 5 |

| Statement of Assets and Liabilities | | 9 |

| Statement of Operations | | 10 |

| Statements of Changes in Net Assets | | 11 |

| Financial Highlights | | 12 |

| Notes to the Financial Statements | | 16 |

| Expense Example | | 24 |

| Proxy Voting Policy and Proxy Voting Records | | 26 |

| Availability of Quarterly Portfolio Schedule | | 26 |

| Federal Tax Distribution Information | | 26 |

| Important Notice Regarding Delivery of Shareholder Documents | | 26 |

| Go Paperless with eDelivery | | 26 |

| Board Approval of Investment Advisory Agreement | | 27 |

The Securities and Exchange Commission has adopted new regulations that will impact the design and delivery of future Semi-Annual and Annual Reports. Beginning with the 2024 Annual Reports, paper copies will be mailed to you unless you have opted for electronic delivery of the report. See Go Paperless with eDelivery for instructions about how to sign up for electronic delivery.

| HENNESSY FUNDS | 1-800-966-4354 | |

May 2024

Dear Hennessy Funds Shareholder:

Market Highs, Uncertainties & Opportunities

As I write this semi-annual letter, the three major market indexes have hit all-time highs. We are enjoying robust returns in the U.S. across all sectors and several asset classes. We also understand that markets are driven by optimism. As markets hover at or near record highs, often uncertainty, risk, and volatility creep in. Have we gone too far, too fast? Is the market overvalued? What if the unexpected happens and sentiment turns in the other direction? There will always be uncertainties and unknowns, and that is why we remain steadfast in sticking to a consistent and focused investment style through every part of a market cycle, which we believe will perform well over the long term.

Given the unpredictable nature of the stock market, we encourage a sensible approach to investing. We can consider certain well-known adages and try to prove them, in exact terms, but we may find that there is no silver bullet in investing. “Sell in May and stay away.” “The trend is your friend.” “Expect increased volatility before a presidential election, followed by an up market through year end.” These tips for investing can be based on statistical correlations, some stronger and some weaker, but none are correct all the time. In investing, we want to avoid following pseudo-rules that are not always true; “60% of the time, it works every time” is not strong enough. All this to say, investing is full of risks, the market is full of uncertainties, and investors should be wary of investing silver bullets.

At Hennessy, we understand the uncertainty inherent in all investing, but we also understand that without uncertainty, there would not be opportunity. Our portfolio managers (PMs) have many years of experience (over 26 years average for all our PMs combined), and each of them apply their experience to investing for the long term to attempt to mitigate risk. Investors can mitigate risk in their own portfolios as well, by staying diversified, avoiding highly speculative investments, not chasing performance, not trying to time the market, and staying invested over longer periods. Most important of all, though, is having realistic expectations for your own level of risk tolerance.

While uncertainty and opportunities persist in any market, the past six-month period has been an overall positive period for many investors and for the stock market overall. For the six months ended April 30, 2024, all three broad-based indexes were positive with the Dow Jones Industrial Average up 15.58%, the S&P 500® Index up 20.98%, and the Nasdaq Composite Index up 22.31%. Robust performance was broad based. In fact, the dispersion of returns was relatively low across all market cap sizes and all GICS sectors, with the highest being Financials (+25.92% for the S&P 500® Financials Sector Index) and the lowest being Real Estate (+11.24% for the S&P 500® Real Estate Sector Index).

Several factors contributed to the strong, broad-based returns in the market. We believe the two most important of those factors were continued signs of a strong economy and solid corporate earnings. Although the market does not expect more than one or two rate decreases in 2024, fear of a recession due to the Federal Reserve’s rate hiking cycle seems to have abated slightly. Consumer demand and spending remain resilient, wages continue to increase, and unemployment numbers remain historically low. For most of the period, inflation expectations remained relatively low, although data in the later part of the period was somewhat higher than anticipated.

Like the overall market, our funds experienced strong results. All 17 of our funds posted positive returns during the six months ended April 30, 2024. Given that growth outperformed value and that many of our funds are value oriented, only seven Hennessy Funds outperformed their primary benchmarks. However, we continue to focus on providing attractive returns for our shareholders over a complete market cycle, and we are pleased that all but five of our funds have posted positive returns over one-, three-, five-, and ten-year periods ended April 30, 2024, with the remaining five funds posting positive returns over the one-, five-, and ten-year (but not three-year) periods ended April 30, 2024.

We believe that the outlook for U.S. stocks remains positive, primarily because we believe that the Federal Reserve will eventually begin to lower interest rates. Despite the recent up-tick, inflation has shown signs of easing, creating a better environment for consumers as well as businesses. The unemployment rate is still near record lows, there are elevated levels of cash on the balance sheets of U.S. companies and in the pockets of many consumers and investors, and there is the prospect of a more dovish Federal Reserve heading into the second half of 2024. However, we are cautiously watching certain parts of the economy for any hints of weakness, including consumer spending and credit issues. While volatility and uncertainty may affect the markets, we encourage investors to keep a long-term perspective and maintain a diversified portfolio.

We thank you for your continued interest in the Hennessy Funds and are grateful that you have chosen to invest with us. If you have any questions or would like to speak with us directly, please call us at (800) 966-4354.

Best regards,

| |

| |

| |

|

| Ryan C. Kelley, CFA |

| Chief Investment Officer, |

| Senior Vice President, and Portfolio Manager |

Past performance does not guarantee future results.

Investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500® Index are commonly used to measure the performance of U.S. stocks. The Nasdaq Composite Index comprises all common stocks listed on The Nasdaq Stock Market and is commonly used to measure the performance of technology-related stocks. The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The indices are used herein for comparative purposes in accordance with SEC regulations. One cannot invest directly in an index. All returns are shown on a total return basis.

| HENNESSY FUNDS | 1-800-966-4354 | |

Performance Overview (Unaudited)

AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED APRIL 30, 2024

| | | Six | One | Five | Ten |

| | | Months(1) | Year

| Years

| Years

|

| | Hennessy Small Cap Financial Fund – | | | | |

| | Investor Class (HSFNX) | 13.23% | 13.34% | 4.40% | 6.08% |

| | Hennessy Small Cap Financial Fund – | | | | |

| | Institutional Class (HISFX) | 13.45% | 13.73% | 4.75% | 6.47% |

| | Russell 2000® Index Financials | 17.48% | 16.73% | 3.44% | 6.68% |

| | Russell 2000® Index | 19.66% | 13.32% | 5.83% | 7.22% |

Expense ratios: 1.63% (Investor Class); 1.30% (Institutional Class)

(1) | Periods of less than one year are not annualized. |

_______________

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The Russell 2000® Index Financials is a subset of the Russell 2000® Index that measures the performance of securities classified in the Financials sector of the small-cap U.S. equity market. The Russell 2000® Index is a subset of the Russell 3000® Index that measures the performance of the small-cap segment of the U.S. equity market. The Russell 2000® Index comprises the smallest 2,000 companies in the Russell 3000® Index based on market capitalization and current index membership, representing approximately 7% of the total market capitalization of the Russell 3000® Index. One cannot invest directly in an index. These indices are used for comparative purposes in accordance with Securities and Exchange Commission regulations.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes or Russell ratings or underlying data and no party may rely on any Russell Indexes or Russell ratings or underlying data contained in this communication. No further distribution of Russell data is permitted without Russell’s express written consent. Russell does not promote, sponsor, or endorse the content of this communication.

The expense ratios presented are from the most recent prospectus. The expense ratios for the current reporting period are available in the Financial Highlights section of this report.

| PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS |

Financial Statements

Schedule of Investments as of April 30, 2024 (Unaudited) |

HENNESSY SMALL CAP FINANCIAL FUND

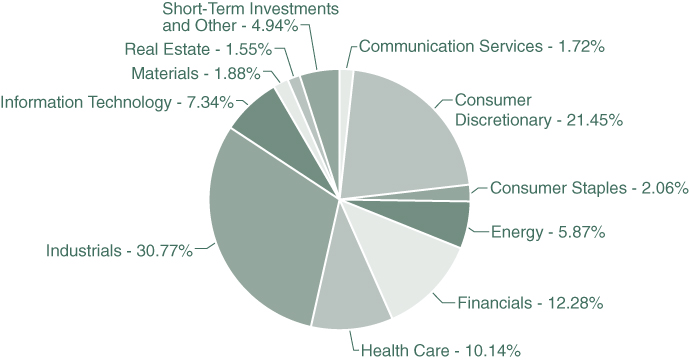

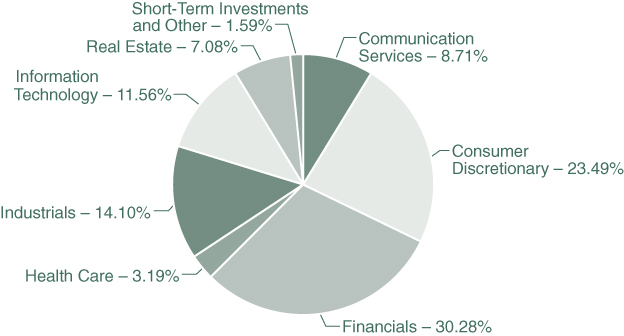

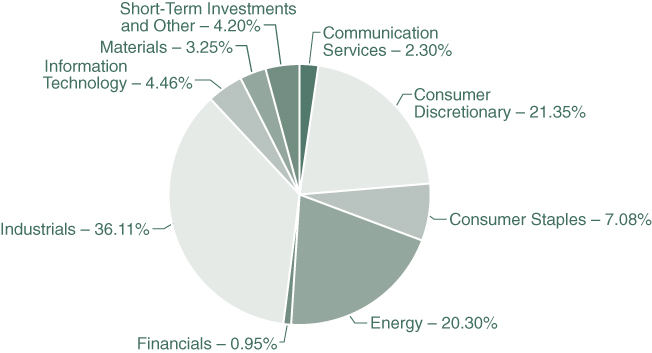

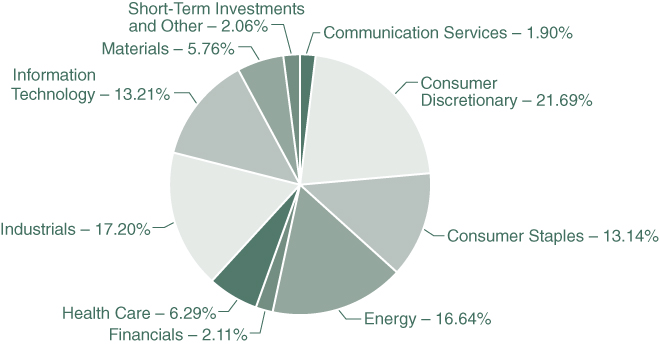

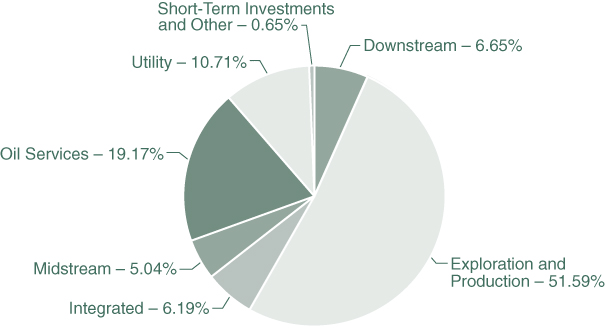

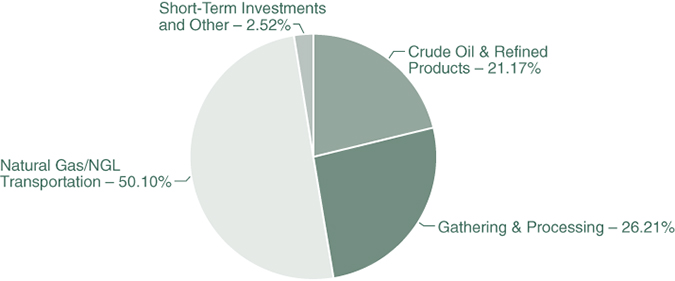

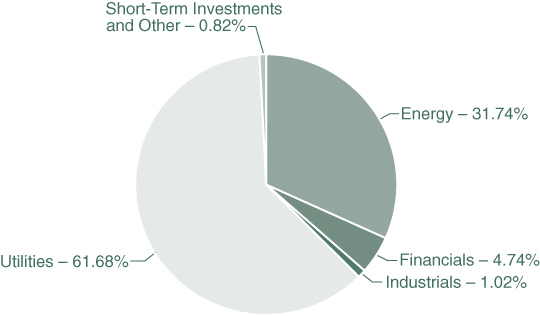

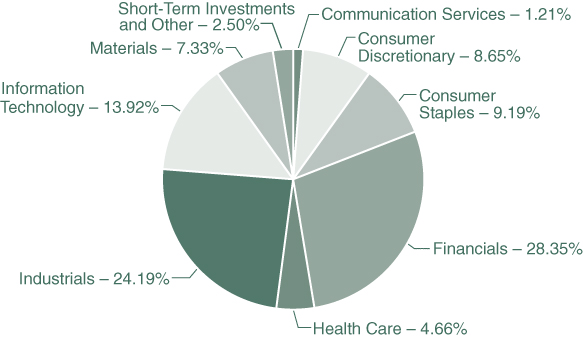

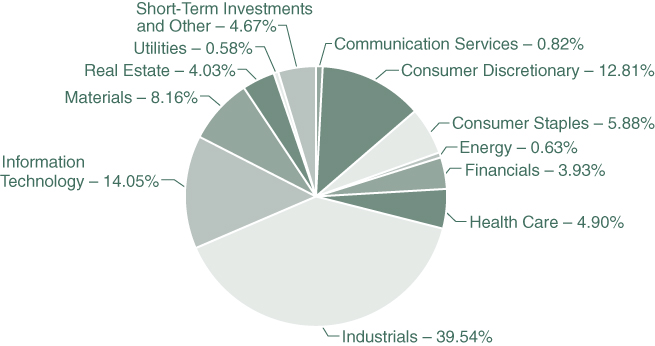

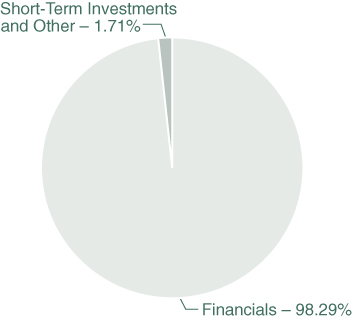

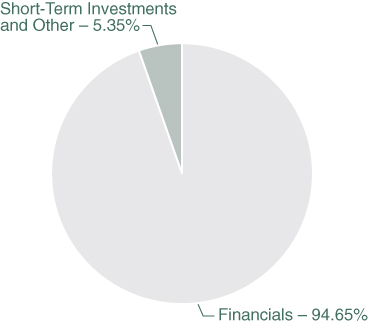

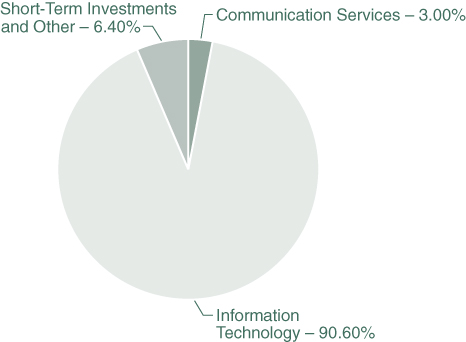

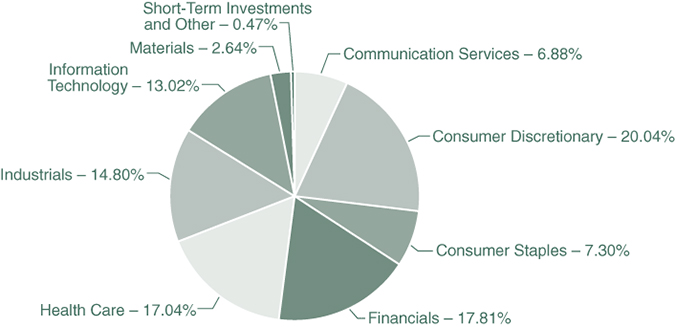

(% of Net Assets)

| TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS) | % NET ASSETS |

| OceanFirst Financial Corp. | 4.95% |

| Banc of California, Inc. | 4.91% |

| BankUnited, Inc. | 4.90% |

| Associated Banc-Corp. | 4.71% |

| WaFd, Inc. | 4.54% |

| HomeTrust Bancshares, Inc. | 4.51% |

| Brookline Bancorp, Inc. | 4.24% |

| Eastern Bankshares, Inc. | 4.21% |

| Banner Corp. | 4.18% |

| Pacific Premier Bancorp, Inc. | 4.12% |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property and a service mark of MSCI, Inc. and Standard & Poor’s Financial Services LLC. It has been licensed for use by the Hennessy Funds.

| HENNESSY FUNDS | 1-800-966-4354 | |

| COMMON STOCKS – 94.65% | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Financials – 94.65% | | | | | | | | | |

| Associated Banc-Corp. | | | 140,000 | | | $ | 2,949,800 | | | | 4.71 | % |

| Banc of California, Inc. | | | 225,000 | | | | 3,080,250 | | | | 4.91 | % |

| BankUnited, Inc. | | | 115,000 | | | | 3,073,950 | | | | 4.90 | % |

| Banner Corp. | | | 60,000 | | | | 2,617,800 | | | | 4.18 | % |

| Brookline Bancorp, Inc. | | | 320,000 | | | | 2,656,000 | | | | 4.24 | % |

| Columbia Banking System, Inc. | | | 55,000 | | | | 1,034,550 | | | | 1.65 | % |

| ConnectOne Bancorp, Inc. | | | 58,000 | | | | 1,038,780 | | | | 1.66 | % |

| Dime Community Bancshares, Inc. | | | 50,000 | | | | 910,000 | | | | 1.45 | % |

| Eastern Bankshares, Inc. | | | 210,000 | | | | 2,637,600 | | | | 4.21 | % |

| First BanCorp. | | | 80,000 | | | | 1,380,000 | | | | 2.20 | % |

| Flushing Financial Corp. | | | 110,000 | | | | 1,212,200 | | | | 1.93 | % |

| Hancock Whitney Corp. | | | 50,000 | | | | 2,269,500 | | | | 3.62 | % |

| HomeStreet, Inc. | | | 165,000 | | | | 2,021,250 | | | | 3.23 | % |

| HomeTrust Bancshares, Inc. | | | 110,000 | | | | 2,827,000 | | | | 4.51 | % |

| Independent Bank Corp. | | | 36,000 | | | | 1,808,640 | | | | 2.89 | % |

| Lakeland Bancorp, Inc. | | | 175,000 | | | | 2,133,250 | | | | 3.40 | % |

| Midland States Bancorp, Inc. | | | 87,500 | | | | 1,916,250 | | | | 3.06 | % |

| NB Bancorp, Inc. (a) | | | 160,000 | | | | 2,339,200 | | | | 3.73 | % |

| Northeast Community Bancorp, Inc. | | | 65,000 | | | | 1,025,700 | | | | 1.64 | % |

| OceanFirst Financial Corp. | | | 210,000 | | | | 3,099,600 | | | | 4.95 | % |

| Old National Bancorp | | | 115,000 | | | | 1,902,100 | | | | 3.03 | % |

| Orange County Bancorp, Inc. | | | 30,809 | | | | 1,331,257 | | | | 2.12 | % |

| Pacific Premier Bancorp, Inc. | | | 120,000 | | | | 2,580,000 | | | | 4.12 | % |

| Southern California Bancorp (a) | | | 119,000 | | | | 1,664,810 | | | | 2.66 | % |

| Texas Capital Bancshares, Inc. (a) | | | 25,000 | | | | 1,435,000 | | | | 2.29 | % |

| The Hingham Institution for Savings | | | 5,500 | | | | 928,950 | | | | 1.48 | % |

| UMB Financial Corp. | | | 8,000 | | | | 637,280 | | | | 1.02 | % |

| WaFd, Inc. | | | 105,000 | | | | 2,844,450 | | | | 4.54 | % |

| Western New England Bancorp, Inc. | | | 416,000 | | | | 2,512,640 | | | | 4.01 | % |

| Wintrust Financial Corp. | | | 15,000 | | | | 1,449,600 | | | | 2.31 | % |

| | | | | | | | 59,317,407 | | | | 94.65 | % |

| Total Common Stocks | | | | | | | | | | | | |

| (Cost $54,334,063) | | | | | | | 59,317,407 | | | | 94.65 | % |

The accompanying notes are an integral part of these financial statements.

| SHORT-TERM INVESTMENTS – 5.52% | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Money Market Funds – 5.52% | | | | | | | | | |

| First American Government Obligations Fund – Class X, 5.227% (b) | | | 3,192,170 | | | $ | 3,192,170 | | | | 5.09 | % |

| First American Treasury Obligations Fund – Class X, 5.213% (b) | | | 267,623 | | | | 267,623 | | | | 0.43 | % |

| | | | | | | | 3,459,793 | | | | 5.52 | % |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $3,459,793) | | | | | | | 3,459,793 | | | | 5.52 | % |

| | | | | | | | | | | | | |

| Total Investments | | | | | | | | | | | | |

| (Cost $57,793,856) – 100.17% | | | | | | | 62,777,200 | | | | 100.17 | % |

| Liabilities in Excess of Other Assets – (0.17)% | | | | | | | (109,196 | ) | | | (0.17 | )% |

| | | | | | | | | | | | | |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 62,668,004 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | The rate listed is the fund’s seven-day yield as of April 30, 2024. |

Summary of Fair Value Exposure as of April 30, 2024

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2024 (see Note 3 in the accompanying Notes to the Financial Statements):

| Common Stocks | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Financials | | $ | 59,317,407 | | | $ | — | | | $ | — | | | $ | 59,317,407 | |

| Total Common Stocks | | $ | 59,317,407 | | | $ | — | | | $ | — | | | $ | 59,317,407 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Money Market Funds | | $ | 3,459,793 | | | $ | — | | | $ | — | | | $ | 3,459,793 | |

| Total Short-Term Investments | | $ | 3,459,793 | | | $ | — | | | $ | — | | | $ | 3,459,793 | |

| Total Investments | | $ | 62,777,200 | | | $ | — | | | $ | — | | | $ | 62,777,200 | |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

(This Page Intentionally Left Blank.)

| STATEMENT OF ASSETS AND LIABILITIES |

Financial Statements

Statement of Assets and Liabilities as of April 30, 2024 (Unaudited) |

| ASSETS: | | | |

| Investments in securities, at value (cost $57,793,856) | | $ | 62,777,200 | |

| Dividends and interest receivable | | | 74,406 | |

| Receivable for fund shares sold | | | 2,051 | |

| Receivable for securities sold | | | 900,508 | |

| Prepaid expenses and other assets | | | 21,447 | |

| Total assets | | | 63,775,612 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for securities purchased | | | 918,623 | |

| Payable for fund shares redeemed | | | 82,829 | |

| Payable to advisor | | | 47,544 | |

| Payable to administrator | | | 11,446 | |

| Payable to auditor | | | 11,288 | |

| Accrued distribution fees | | | 9,622 | |

| Accrued service fees | | | 4,748 | |

| Accrued trustees fees | | | 5,610 | |

| Accrued expenses and other payables | | | 15,898 | |

| Total liabilities | | | 1,107,608 | |

| NET ASSETS | | $ | 62,668,004 | |

| | | | | |

| NET ASSETS CONSISTS OF: | | | | |

| Capital stock | | $ | 57,788,473 | |

| Total distributable earnings | | | 4,879,531 | |

| Total net assets | | $ | 62,668,004 | |

| | | | | |

| NET ASSETS: | | | | |

| Investor Class | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding shares | | $ | 56,412,556 | |

| Shares issued and outstanding | | | 2,558,023 | |

| Net asset value, offering price, and redemption price per share | | $ | 22.05 | |

| | | | | |

| Institutional Class | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding shares | | $ | 6,255,448 | |

| Shares issued and outstanding | | | 498,379 | |

| Net asset value, offering price, and redemption price per share | | $ | 12.55 | |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Statement of Operations for the six months ended April 30, 2024 (Unaudited) |

| INVESTMENT INCOME: | | | |

Dividend income(1) | | $ | 1,221,411 | |

| Interest income | | | 82,362 | |

| Total investment income | | | 1,303,773 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 5) | | | 313,496 | |

| Sub-transfer agent expenses – Investor Class (See Note 5) | | | 60,094 | |

| Sub-transfer agent expenses – Institutional Class (See Note 5) | | | 4,042 | |

| Distribution fees – Investor Class (See Note 5) | | | 46,816 | |

| Administration, accounting, custody, and transfer agent fees (See Note 5) | | | 37,074 | |

| Service fees – Investor Class (See Note 5) | | | 31,211 | |

| Federal and state registration fees | | | 16,882 | |

| Audit fees | | | 11,284 | |

| Trustees’ fees and expenses | | | 11,274 | |

| Compliance expense (See Note 5) | | | 9,574 | |

| Reports to shareholders | | | 6,620 | |

| Legal fees | | | 1,004 | |

| Other expenses | | | 8,820 | |

| Total expenses | | | 558,191 | |

| NET INVESTMENT INCOME | | $ | 745,582 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | |

| Net realized gain on investments | | $ | 2,235,040 | |

| Net change in unrealized appreciation/depreciation on investments | | | 5,588,494 | |

| Net gain on investments | | | 7,823,534 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 8,569,116 | |

(1) | Net of foreign taxes withheld of $4,308. |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF OPERATIONS/STATEMENTS OF CHANGES IN NET ASSETS |

Financial Statements

| Statements of Changes in Net Assets |

| | | Six Months Ended | | | | |

| | | April 30, 2024 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2023 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 745,582 | | | $ | 1,551,087 | |

| Net realized gain on investments | | | 2,235,040 | | | | 2,691,655 | |

| Net change in unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 5,588,494 | | | | (28,455,053 | ) |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | 8,569,116 | | | | (24,212,311 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributable earnings – Investor Class | | | (3,164,215 | ) | | | (7,452,661 | ) |

| Distributable earnings – Institutional Class | | | (528,957 | ) | | | (1,876,496 | ) |

| Total distributions | | | (3,693,172 | ) | | | (9,329,157 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Investor Class | | | 2,903,768 | | | | 2,129,827 | |

| Proceeds from shares subscribed – Institutional Class | | | 234,886 | | | | 2,747,009 | |

| Dividends reinvested – Investor Class | | | 3,082,419 | | | | 7,283,862 | |

| Dividends reinvested – Institutional Class | | | 492,770 | | | | 1,825,197 | |

| Cost of shares redeemed – Investor Class | | | (8,514,051 | ) | | | (20,718,495 | ) |

| Cost of shares redeemed – Institutional Class | | | (1,883,517 | ) | | | (11,825,149 | ) |

| Net decrease in net assets | | | | | | | | |

| derived from capital share transactions | | | (3,683,725 | ) | | | (18,557,749 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 1,192,219 | | | | (52,099,217 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 61,475,785 | | | | 113,575,002 | |

| End of period | | $ | 62,668,004 | | | $ | 61,475,785 | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Investor Class | | | 118,000 | | | | 86,638 | |

| Shares sold – Institutional Class | | | 16,840 | | | | 172,929 | |

| Shares issued to holders as reinvestment | | | | | | | | |

| of dividends – Investor Class | | | 124,439 | | | | 274,193 | |

| Shares issued to holders as reinvestment | | | | | | | | |

| of dividends – Institutional Class | | | 34,257 | | | | 118,272 | |

| Shares redeemed – Investor Class | | | (358,818 | ) | | | (855,557 | ) |

| Shares redeemed – Institutional Class | | | (134,087 | ) | | | (879,954 | ) |

| Net decrease in shares outstanding | | | (199,369 | ) | | | (1,083,479 | ) |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Investor Class share outstanding throughout each period

| | | Six Months Ended | |

| | | April 30, 2024 | |

| | | (Unaudited) | |

| PER SHARE DATA: | | | |

| Net asset value, beginning of period | | $ | 20.42 | |

| | | | | |

| Income from investment operations: | | | | |

Net investment income(1) | | | 0.25 | |

| Net realized and unrealized gains (losses) on investments | | | 2.57 | |

| Total from investment operations | | | 2.82 | |

| | | | | |

| Less distributions: | | | | |

| Dividends from net investment income | | | (0.48 | ) |

| Dividends from net realized gains | | | (0.71 | ) |

| Total distributions | | | (1.19 | ) |

| Net asset value, end of period | | $ | 22.05 | |

| | | | | |

| TOTAL RETURN | | | 13.23 | %(2) |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, end of period (millions) | | $ | 56.41 | |

| Ratio of expenses to average net assets | | | 1.64 | %(3) |

| Ratio of net investment income to average net assets | | | 2.10 | %(3) |

Portfolio turnover rate(4) | | | 32 | %(2) |

(1) | Calculated using the average shares outstanding method. |

(2) | Not annualized. |

(3) | Annualized. |

(4) | Calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL HIGHLIGHTS — INVESTOR CLASS |

| Year Ended October 31, | |

| 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | | | | | | | | | | | | |

| $ | 29.47 | | | $ | 31.52 | | | $ | 17.46 | | | $ | 21.60 | | | $ | 21.96 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.43 | | | | 0.22 | | | | 0.25 | | | | 0.16 | | | | 0.10 | |

| | (7.13 | ) | | | (1.96 | ) | | | 14.01 | | | | (3.55 | ) | | | 0.93 | |

| | (6.70 | ) | | | (1.74 | ) | | | 14.26 | | | | (3.39 | ) | | | 1.03 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.19 | ) | | | (0.22 | ) | | | (0.20 | ) | | | (0.09 | ) | | | (0.07 | ) |

| | (2.16 | ) | | | (0.09 | ) | | | — | | | | (0.66 | ) | | | (1.32 | ) |

| | (2.35 | ) | | | (0.31 | ) | | | (0.20 | ) | | | (0.75 | ) | | | (1.39 | ) |

| $ | 20.42 | | | $ | 29.47 | | | $ | 31.52 | | | $ | 17.46 | | | $ | 21.60 | |

| | | | | | | | | | | | | | | | | | | |

| | -24.53 | % | | | -5.60 | % | | | 82.20 | % | | | -16.37 | % | | | 5.27 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 54.60 | | | $ | 93.40 | | | $ | 140.03 | | | $ | 54.96 | | | $ | 89.36 | |

| | 1.62 | % | | | 1.59 | % | | | 1.58 | % | | | 1.65 | % | | | 1.58 | % |

| | 1.83 | % | | | 0.72 | % | | | 0.90 | % | | | 0.96 | % | | | 0.47 | % |

| | 72 | % | | | 27 | % | | | 28 | % | | | 75 | % | | | 46 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Institutional Class share outstanding throughout each period

| | | Six Months Ended | |

| | | April 30, 2024 | |

| | | (Unaudited) | |

| PER SHARE DATA: | | | |

| Net asset value, beginning of period | | $ | 11.82 | |

| | | | | |

| Income from investment operations: | | | | |

Net investment income(1) | | | 0.17 | |

| Net realized and unrealized gains (losses) on investments | | | 1.53 | |

| Total from investment operations | | | 1.70 | |

| | | | | |

| Less distributions: | | | | |

| Dividends from net investment income | | | (0.56 | ) |

| Dividends from net realized gains | | | (0.41 | ) |

| Total distributions | | | (0.97 | ) |

| Net asset value, end of period | | $ | 12.55 | |

| | | | | |

| TOTAL RETURN | | | 13.45 | %(2) |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, end of period (millions) | | $ | 6.26 | |

| Ratio of expenses to average net assets | | | 1.31 | %(3) |

| Ratio of net investment income to average net assets | | | 2.50 | %(3) |

Portfolio turnover rate(4) | | | 32 | %(2) |

(1) | Calculated using the average shares outstanding method. |

(2) | Not annualized. |

(3) | Annualized. |

(4) | Calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS |

| Year Ended October 31, | |

| 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | | | | | | | | | | | | |

| $ | 17.24 | | | $ | 18.57 | | | $ | 10.37 | | | $ | 12.92 | | | $ | 13.28 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.30 | | | | 0.20 | | | | 0.21 | | | | 0.13 | | | | 0.10 | |

| | (4.14 | ) | | | (1.14 | ) | | | 8.26 | | | | (2.10 | ) | | | 0.54 | |

| | (3.84 | ) | | | (0.94 | ) | | | 8.47 | | | | (1.97 | ) | | | 0.64 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.31 | ) | | | (0.34 | ) | | | (0.27 | ) | | | (0.19 | ) | | | (0.18 | ) |

| | (1.27 | ) | | | (0.05 | ) | | | — | | | | (0.39 | ) | | | (0.82 | ) |

| | (1.58 | ) | | | (0.39 | ) | | | (0.27 | ) | | | (0.58 | ) | | | (1.00 | ) |

| $ | 11.82 | | | $ | 17.24 | | | $ | 18.57 | | | $ | 10.37 | | | $ | 12.92 | |

| | | | | | | | | | | | | | | | | | | |

| | -24.32 | % | | | -5.21 | % | | | 82.88 | % | | | -16.05 | % | | | 5.57 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 6.87 | | | $ | 20.17 | | | $ | 32.08 | | | $ | 10.61 | | | $ | 20.74 | |

| | 1.29 | % | | | 1.22 | % | | | 1.20 | % | | | 1.29 | % | | | 1.23 | % |

| | 2.13 | % | | | 1.13 | % | | | 1.31 | % | | | 1.27 | % | | | 0.84 | % |

| | 72 | % | | | 27 | % | | | 28 | % | | | 75 | % | | | 46 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Notes to the Financial Statements April 30, 2024 (Unaudited) |

1). ORGANIZATION

The Hennessy Small Cap Financial Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is capital appreciation. The Fund is a non-diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective 12b-1 distribution and service, shareholder servicing, and sub-transfer agent expenses. There are no sales charges. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only one class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (the “FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

| a). | Securities Valuation – All investments in securities are valued in accordance with the Fund’s valuation policies and procedures, as described in Note 3. |

| | |

| b). | Federal Income Taxes – The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. As a result, the Fund has made no provision for federal income taxes or excise taxes. Net investment income/loss and realized gains/losses for federal income tax purposes may differ from those reported in the financial statements because of temporary book-basis and tax-basis differences. Temporary differences are primarily the result of the treatment of wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the Statement of Operations as an income tax expense. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on redemption of shares, as part of the dividends paid deduction for income tax purposes. |

| | |

| c). | Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major tax jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware. |

| NOTES TO THE FINANCIAL STATEMENTS |

| d). | Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount, is recognized on an accrual basis. Market discounts, original issue discounts, and market premiums on debt securities are accreted or amortized to interest income over the life of a security with a corresponding increase or decrease, as applicable, in the cost basis of such security using the yield-to-maturity method or, where applicable, the first call date of the security. Other non-cash dividends are recognized as investment income at the fair value of the property received. The Fund is charged for those expenses that are directly attributable to its portfolio, such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains/losses on investments are allocated to each class of shares based on such class’s net assets. |

| | |

| e). | Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and paid annually, usually in December. |

| | |

| f). | Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the realized gain/loss from an investment transaction by comparing the original cost of the security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted or amortized, respectively, over the life of each such security. |

| | |

| g). | Use of Estimates – Preparing financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported change in net assets during the reporting period. Actual results could differ from those estimates. |

| | |

| h). | Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing (i) the total value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by (ii) the total number of Fund shares outstanding, rounded to the nearest $0.01. Fund shares are not priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share. |

| | |

| i). | Illiquid Securities – Pursuant to Rule 22e-4 under the 1940 Act, the Fund has adopted a Liquidity Risk Management Program (the “Liquidity Program”). The Liquidity Program requires, among other things, that the Fund limit its illiquid investments to no more than 15% of its net assets. An illiquid investment is any investment that the Fund reasonably expects cannot be sold or disposed of by the Fund in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. |

| | |

| j). | Recent Accounting Pronouncements and Regulatory Updates – In October 2022, the Securities and Exchange Commission (“SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (ETFs); Fee Information in Investment Company Advertisements. The rule and form amendments will require mutual funds and ETFs to transmit concise and visually engaging shareholder reports that highlight key information. The amendments also will require that funds tag information in a structured data format. In addition, the rule amendments will require that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment. |

| HENNESSY FUNDS | 1-800-966-4354 | |

| In June 2022, the FASB issued Accounting Standards Update (“ASU”) 2022-03, Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions. The ASU clarifies that a contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring the fair value. The amendments also require additional disclosures related to equity securities subject to contractual sale restrictions. The ASU is effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years. |

3). SECURITIES VALUATION

The Fund follows its valuation policies and procedures in determining its NAV and, in preparing these financial statements, the fair value accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement. |

| | | |

| | Level 2 – | Other significant observable inputs other than quoted prices included in Level 1 (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data). |

| | | |

| | Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are unavailable. |

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities on a recurring basis:

| | Equity Securities – Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds, partnerships, rights, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available generally are valued at the last sales price as reported by the primary exchange on which the securities are listed. Securities listed on The Nasdaq Stock Market (“Nasdaq”) generally are valued at the Nasdaq Official Closing Price, which may differ from the last sales price reported. Securities traded on a securities exchange for which a last-quoted sales price is not readily available generally are valued at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy. Securities traded on foreign exchanges generally are not valued at the same time the Fund calculates its NAV because most foreign markets close well before such time. The earlier close of most foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. In certain circumstances, it may be determined that a foreign security needs to be fair valued because it appears that the value of the security might have been materially affected |

| NOTES TO THE FINANCIAL STATEMENTS |

| | by events occurring after the close of the market in which the security is principally traded, but before the time the Fund calculates its NAV, such as by a development that affects an entire market or region (e.g., a weather-related event) or a potentially global development (e.g., a terrorist attack that may be expected to have an effect on investor expectations worldwide). |

| | |

| | Registered Investment Companies – Investments in open-end registered investment companies, commonly referred to as mutual funds, generally are priced at the ending NAV provided by the applicable mutual fund’s service agent and are classified in Level 1 of the fair value hierarchy. |

| | |

| | Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value hierarchy. |

| | |

| | Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above for equity securities. Short-term debt investments with an original term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeds 60 days, then the values as of the 61st day prior to maturity are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined as described below. Short-term securities are generally classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities. |

If market quotations are not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security, such security will be valued at its fair value under the Fund’s established fair valuation procedures as implemented by Hennessy Advisors, Inc. (the “Advisor”), the Fund’s valuation designee. The Advisor, as the valuation designee, is subject to the oversight of the Board of Trustees of the Fund (the “Board”). There are numerous criteria considered in determining a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy. The Advisor will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through their application of such procedures.

The fair value of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of

| HENNESSY FUNDS | 1-800-966-4354 | |

relevant American Depositary Receipts or futures contracts. Using fair value pricing means that the Fund’s NAV reflects the affected portfolio securities’ values as determined by the Advisor, instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different from such foreign security’s most recent closing price and from the value used by other investment companies to calculate their NAVs. Such securities are generally classified in Level 2 of the fair value hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when a shareholder is unable to purchase or redeem Fund shares.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair value hierarchy of the Fund’s securities as of April 30, 2024, are included in the Schedule of Investments.

4). INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2024, were $21,130,283 and $23,776,869, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during the six months ended April 30, 2024.

5). INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Advisor provides the Fund with investment advisory services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities and most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based on the average daily net assets of the Fund at an annual rate of 0.90%. The net investment advisory fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

The Board has approved a Shareholder Servicing Agreement for Investor Class shares of the Fund, which compensates the Advisor for the non-investment advisory services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. The shareholder service fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of Fund shares at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to Investor Class shares. Even though the authorized rate is up to 0.25%, the Fund is currently only using up to 0.15% of its average daily net assets attributable to Investor Class shares for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, printing and mailing of prospectuses to other than current shareholders, printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

| NOTES TO THE FINANCIAL STATEMENTS |

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of Fund shares. The agreements provide for periodic payments of sub-transfer agent expenses by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services. These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”) provides the Fund with administrative, accounting, and transfer agent services. As administrator, Fund Services is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. The servicing agreements between the Trust, Fund Services, and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, accounting, custody, and transfer agent fees. The administrative, accounting, custody, and transfer agent fees expensed by the Fund during the six months ended April 30, 2024, are included in the Statement of Operations.