Exhibit 99.2

July 28, 2016 Acquisition of BioD & FAD Divestiture

Forward-Looking Statement-Looking Statements Statements contained in this presentation that are not statements of historical fact may be deemed to be forward looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” believe, anticipate, intend, could, estimate or continue are intended to identify forward-looking statements. Readers are cautioned, that certain important factors may affect the Companys actual results and could cause such results to differ materially from any forward looking statements which may be made in this investor presentation or which are otherwise made by or on behalf of the Company. Factors which may affect the Companys results include, but are not limited to, product demand, market acceptance, impact of competitive products and prices, product development, risks relating to regulatory compliance and regulatory approvals, completion of an acquisition, commercialization or technological difficulties, the success or failure of negotiations and trade, legal, social and economic risks. Additional factors that could cause or contribute to differences between the Companys actual results and forward looking statements include but are not limited to, those discussed in the Companys filings with the Securities and Exchange Commission. A TISSUE REGENERATION COMPANY 2

Introduction & Call Overview Todays speakers - Stephen T. Wills, Derma Sciences Executive Chairman and Interim Principal Executive Officer - Russell Olsen, BioD Chief Executive Officer Todays topics - Acquisition of BioD, LLC - Concurrent $2.0 million private placement - Sale of First Aid Division for approximately $12.2 million - Sale of $7.6 million of Comvita Limited common stock A TISSUE REGENERATION COMPANY 3

BioD Overview Privately-held, fully integrated biotechnology company headquartered in Memphis, Tenn. Develops and commercializes novel biologic products derived from placental / birth tissues Products are used in a broad range of clinical applications including the treatment of complex chronic wounds, acute wounds and localized areas of injury or inflammation, in addition to filling soft tissue defects or voids Products are also used as a localized wound covering to minimize the formation of postoperative adhesions, as well as to cover or wrap the dura, nerves and tendons Manufacturing utilizes proprietary CryoPrime and DryFlex processing technologies 2015 financial metrics: - Revenues of $18.6 million - Gross margin of 87.2% - Net income margin of 15.6% - Expected double-digit revenue growth going forward Revenue of $22.2 million and gross profit margin of 89.4% for the trailing 12 months ended June 30, 2016 51 employees including 7 direct sales reps, plus 235 independent sales reps BioD Product Families Products Licensed to Derma Sciences A TISSUE REGENERATION COMPANY 4

A Powerful Strategic Business Fit The acquisition of BioD solidifies Derma Sciences as a leading provider of advanced wound care (AWC) and regenerative medicine products - Consistent with Derma Sciencesgrowth strategy to increase AWC segment revenues and leverage managements AWC expertise - Increases scale and provides for a diversified and growing revenue base of high-margin, complementary AWC and tissue regeneration products - Adds new sales channel for Derma Sciences to launch additional products into BioDs hospital and office-based customers - Augments Derma Sciences distribution network through BioDs established relationships with virtually no overlap in call-points and customer base Enhanced financial profile with organic and inorganic growth potential - Significant gross margin expansion from improved product mix - Immediately accretive to growth rates, revenues, margins, EBITDA and earnings, and accelerates path to profitability - Eliminates royalty and milestone payments to BioD for the Amnio products - Potential for significant cost synergies by eliminating redundant G&A and for revenue synergies through access to additional customers and cross-sell opportunities via existing infrastructure A TISSUE REGENERATION COMPANY 5

The BioD Market Opportunity ($ in billions) CHANNEL PARTNERS ($0.8) ADVANCED WOUND CARE BioD markets its products through a network of 235 independent sales reps and 7 direct sales reps to the following markets: - Orthopedic / Spine - Ocular - Urology - Plastics In addition, BioD provides products for the Advanced Wound Care market through its existing channel partnership with Derma Sciences Combined, these markets represent an $8.65 billion market opportunity for BioD and Derma Sciences DIRECT ($7.85) ORTHOPEDIC / SPINE Bone regeneration ($1.2) Soft tissue ($0.25) OCULAR ($0.4) EMERGING MARKETS Urology ($3.0) Plastics ($3.0) Market Size: $8.65 billion A TISSUE REGENERATION COMPANY 6

Cryopreserved liquid allograft Human placental tissue-derived liquid allograft that provides a structural matrix to facilitate tissue regeneration Indicated for the treatment of localized tissue voids and defects, and areas of inflammation Can be injected or applied directly to the surgical site Cryopreserved to facilitate an extended shelf life of two years Morselized, flowable tissue allograft Supports soft tissue repair Promotes soft tissue reconstruction Reduces inflammation and pain Immune-privileged Common injuries treated with amniotic tissues include: - Soft tissue injuries - Tendinitis - Plantar fasciitis - Inflamed nerves - Muscle tears - Repetitive motion injuries A TISSUE REGENERATION COMPANY 7

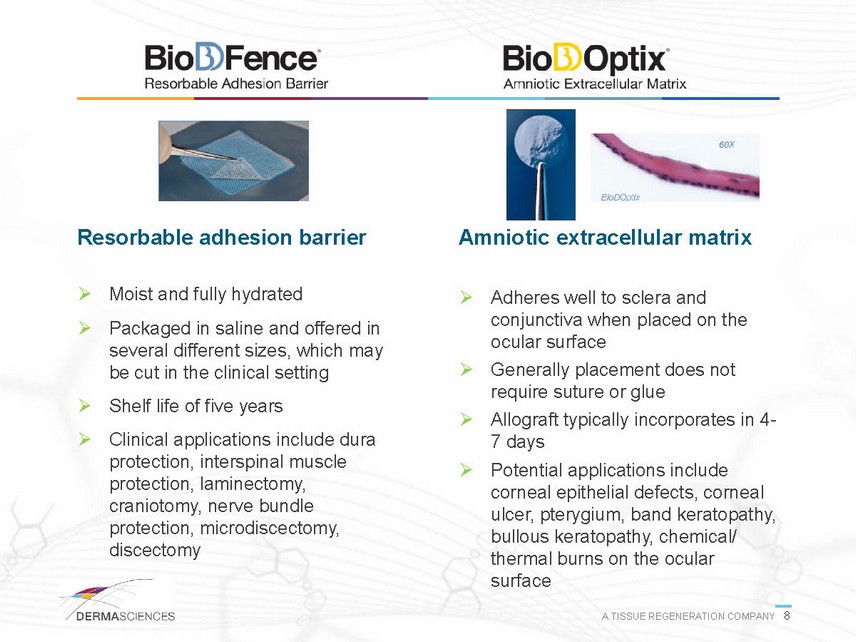

Resorbable adhesion barrier Moist and fully hydrated Packaged in saline and offered in several different sizes, which may be cut in the clinical setting Shelf life of five years Clinical applications include dura protection, interspinal muscle protection, laminectomy, craniotomy, nerve bundle protection, microdiscectomy, discectomy Amniotic extracellular matrix Adheres well to sclera and conjunctiva when placed on the ocular surface Generally placement does not require suture or glue Allograft typically incorporates in 47 days Potential applications include corneal epithelial defects, corneal ulcer, pterygium, band keratopathy, bullous keratopathy, chemical/ thermal burns on the ocular surface A TISSUE REGENERATION COMPANY 8

BioD Product Pipeline Urology Prostatectomy 2016 2017 2018 Advanced Wound Care Human Placental Matrix Ophthalmology Dry Eye Neurology Cranioplasty Spine Chiari Graft Oculoplasty Tarsal Graft A TISSUE REGENERATION COMPANY 9

BioD Transaction Structure Upfront consideration of $21.3 million, to be paid 65% in cash and 35% through the issuance of 1.8 million Derma Sciences shares Contingent considerations - Potential product regulatory milestone payments in 2016 and/or 2017 of up to $30.0 million in aggregate (payable in up to 35% common stock, at Derma Sciences discretion) based on certain endpoints with FDA discussions - Potential net sales growth earn-outs in 2017 and 2018 of up to $13.25 million each year (payable in cash), based on a multiple of incremental net sales Total transaction value of an estimated $77.8 million if all milestones and earn-outs are achieved BioD will be operated as a wholly-owned subsidiary headed by Russ Olsen, current BioD CEO Transaction approved by both Boards, expected to close next week Additionally, certain BioD shareholders intend to purchase $2.0 million of Derma Sciences common stock at $4.1692 per share - Commitments will be funded on or before the closing of the BioD acquisition A TISSUE REGENERATION COMPANY 10

FAD Divestiture Overview Sale of the First Aid Division to Dukal Corp., a privately held supplier of best-in-class disposable medical products and patient-care items Total purchase price of approximately $12.2 million, including inventory - $9.5 million will be paid in cash to Derma Sciences at closing - Derma Sciences will hold a 36-month note payable of approximately $2.7 million, subject to adjustment based on final inventory figures Transaction expected to close within two weeks Dukal will also assume the lease obligation at Derma Sciences warehouse in Houston and related personnel expense FAD 2015 revenue of $16.7 million Divestiture supports stated strategic focus on AWC business, removes low-margin business, strengthens balance sheet A TISSUE REGENERATION COMPANY 11

Derma Sciences AWC Business Segments Derma Sciences AWC BioD Proprietary technologies for treating chronic wounds and burns Grew year-over-year by 9.6% in 2015 2015 Revenues: $41.8 million 2010-2015 Revenue CAGR: 29%(1) Gross Margins: 50% Sales Model: Direct sales organizations in the U.S., U.K. and Canada Distributors for ROW Product Suite Novel and proprietary biologic products derived from placental / birth tissues Grew year-over-year by 62.3% in 2015 2015 Revenues: $18.6 million 2015 Gross Margin: 87% Sales Model: Direct sales organizations in orthopedic, ocular, urology and plastics Channel partners in advanced wound care Product Suite (1) Not adjusted for acquisitions A TISSUE REGENERATION COMPANY 12

Enhanced Advanced Wound Care Provider AWC Revenue ($ in millions) $0 $10 $20 $30 $40 $50 $60 $70 2009 2010 2011 2012 2013 2014 2015 2015 PF AWC Revenue % Growth % of Total Revenue $7.6 $11.6 $15.9 $24.8 $33.9 $38.1 $41.8 $60.4 52.3% 37.3% 55.9% 36.6% 12.3% 9.6% N.M. 15.7% 20.5% 25.4% 34.2% 42.6% 45.5% 49.3% 70.0% Note: Compound annual growth rates are not adjusted for acquisitions; N.M. denotes not meaningful (1) Includes full year BioD revenue and potential revenue synergies; excludes royalty income from Derma A TISSUE REGENERATION COMPANY 13 Sciences

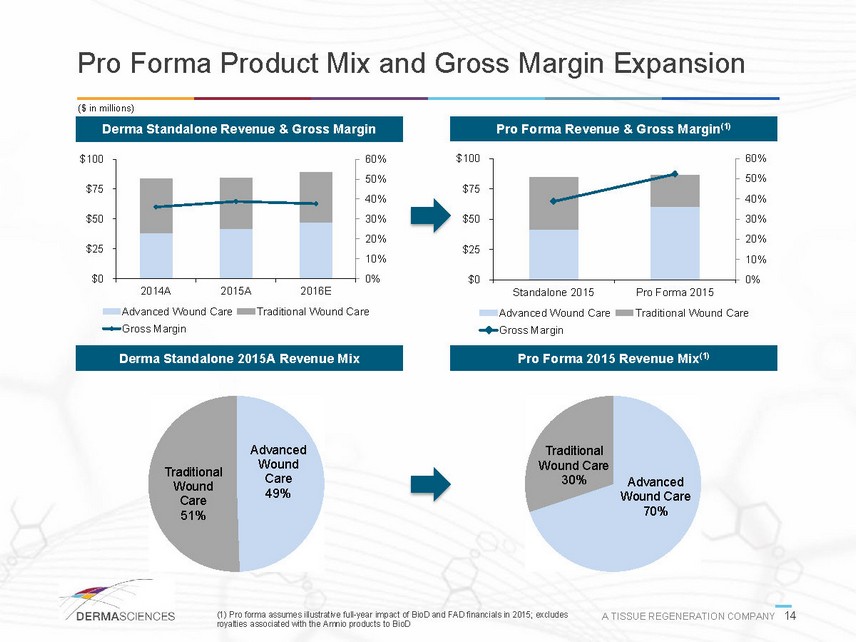

Pro Forma Product Mix and Gross Margin Expansion ($ in millions) Derma Standalone Revenue & Gross Margin Pro Forma Revenue & Gross Margin(1) 0% 10% 20% 30% 40% 50% 60% $0$25$50$75$1002014A2015A2016EAdvanced Wound CareTraditional Wound CareGross Margin 0% 10% 20% 30% 40% 50% 60% $0$25$50$75$100Standalone 2015Pro Forma 2015Advanced Wound CareTraditional Wound CareGross Margin Derma Standalone 2015A Revenue Mix Pro Forma 2015 Revenue Mix(1) Advanced Wound Care49% Traditional Wound Care51% Advanced Wound Care70% Traditional Wound Care30% (1) Pro forma assumes illustrative full-year impact of BioD and FAD financials in 2015; excludes A TISSUE REGENERATION COMPANY 14 royalties associated with the Amnio products to BioD

Sale of Comvita Shares During 2013 and 2014 Derma Sciences invested $8.5 million in Comvita Limited to support their acquisition of apiaries and their harvest modernization strategy, and to ensure a reliable supply of medical-grade leptospermum honey for the MEDIHONEY product line In mid-May Derma Sciences sold 925,000 shares for gross proceeds of $7.6 million Derma Sciences aggregate holdings in Comvita were valued at ~$23 million at the time of this sale of stock Derma Sciences continues to hold 1,877,277 shares, valued at $15.8 million as of June 30, 2016 We remain highly committed to our relationship with Comvita as a vital source of raw material for a core product line A TISSUE REGENERATION COMPANY 15

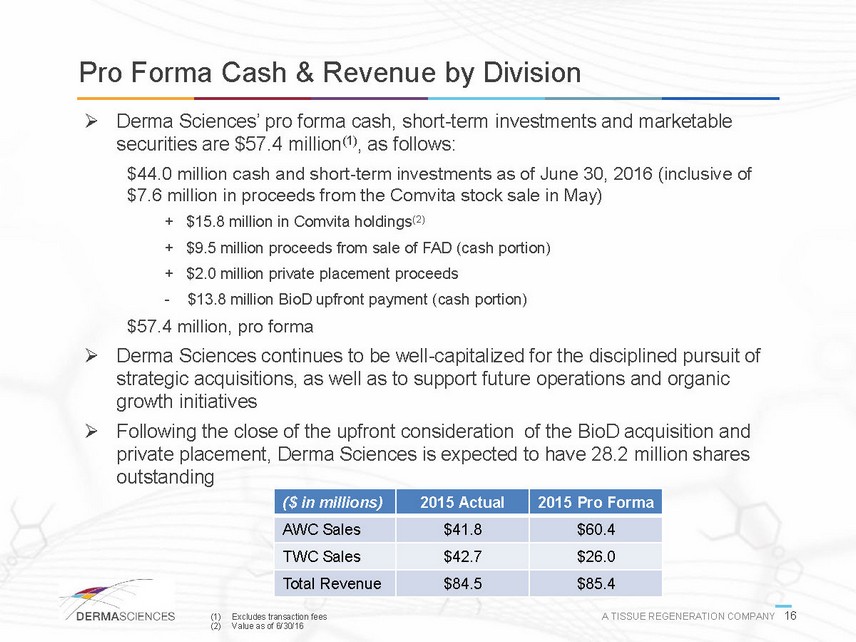

Pro Forma Cash & Revenue by Division Derma Sciences pro forma cash, short-term investments and marketable securities are $57.4 million(1), as follows: $44.0 million cash and short-term investments as of June 30, 2016 (inclusive of $7.6 million in proceeds from the Comvita stock sale in May) + $15.8 million in Comvita holdings(2) + $9.5 million proceeds from sale of FAD (cash portion) + $2.0 million private placement proceeds -$13.8 million BioD upfront payment (cash portion) $57.4 million, pro forma Derma Sciences continues to be well-capitalized for the disciplined pursuit of strategic acquisitions, as well as to support future operations and organic growth initiatives Following the close of the upfront consideration of the BioD acquisition and private placement, Derma Sciences is expected to have 28.2 million shares outstanding ($ in millions) 2015 Actual 2015 Pro Forma AWC Sales $41.8 $60.4 TWC Sales $42.7 $26.0 Total Revenue $84.5 $85.4 (1) Excludes transaction fees A TISSUE REGENERATION COMPANY 16 (2) Value as of 6/30/16

Leveraging Assets, Supplementing Organic Growth Focus and Priorities Leverage managements expertise in advanced wound care Primary growth emphasis on improving AWC vs TWC product mix and expanding gross margins Transformational or high-growth mid-size opportunities + tuck-in opportunities EBITDA accretive Clinically differentiated high-margin, proprietary products with a strong end-market footprint Potential for significant operating and sales force synergies Cost-saving and cross-selling opportunities Add Scale to Enhance Competitive Position vs Larger AWC Companies A TISSUE REGENERATION COMPANY 17