- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

425 Filing

KT (KT) 425Business combination disclosure

Filed: 21 Jan 09, 12:00am

Filed by KT Corporation

Pursuant to Rule 425 under the U.S. Securities Act of 1933, as amended

Subject Company: KT Corporation

Commission File No. 001-14926

Date: January 21, 2009

Main items discussed at the “2009 CEO Conference”held on January 21, 2009 :

KT Corp. guidance for Fiscal Year 2009 after merger with KT Freetel :

A. Revenue: 19 trillion (KRW)

B. Operating Profit: 1.8 trillion (KRW)

C. EBITDA: 5 trillion (KRW)

D. CAPEX: 3.2 trillion (KRW)

All New KT KT-KTF Merger Announcement 2009. 1. 21 |

Table of Contents Transaction Summary 2 Proposed Timeline 3 Strategic Rationale 4 Immediate Impact 5 Cost Synergies 6 Further Opportunities 7 2009 Guidance 8 Highlights 1 |

Highlights KT-KTF merger to lead fixed-wireless convergence Dilution minimized through treasury shares and issuance of EB to NTT DoCoMo Estimated increase in ’09 EPS : 70~80% (compared to ’08) Expected effect : approx. cost reduction of 1.5% of combined sales Quicker decision-making due to unified management |

Transaction Summary Merger Ratio (KT: KTF) 1:0.7192335 Use of treasury shares and EB issued for 60% of NTT’s KTF shares to minimize dilution effect Expected amount of treasury shares and new shares Treasury shares used : 60% of total treasury shares New shares issued : less than 5% Less than 287M After Merger Less than 5% Dilution Effect 273M Total shares issued Before Merger Total issued shares, number of treasury shares used, and new shares issued are subject to change during the process of the merger |

Proposed Timeline <Jan. 20> <Feb. 5> <Apr. 16> <May 18> <Mar. 27> Resolution of merger Record date - EGM - appraisal rights period begins Appraisal rights period ends Merger date The merger process is expected to last 4 months The above schedule is subject to change due to government approval period and other issues |

Representative telcos of OECD countries have achieved competitiveness through integrated fixed-wireless management Single company : 11 countries including Italy 100% affiliated : 11 countries including USA Under 100% affiliated : 7 countries including Korea (Only three countries, including Ireland, have affiliates with lower ownership than Korea) Strategic Rationale Change in ownership structure Country Company Name merged merged 100% affiliated merged 100% affiliated 2008 75% affiliated 100% affiliated 76% affiliated 51% affiliated SBC, BellSouth (separate) 1998 Denmark Tele Danmark (TDC) Switzerland Swiss Telecom Canada Bell Canada Italy Telecom Italia USA AT&T In China, 6 fixed-wireless companies were reorganized into 3 integrated fixed-wireless companies (2008) |

Strategic Rationale Lead convergence trend Unify decision-making and stakeholder interest Maximize resource efficiency Minimized dilution through treasury shares Enhanced corporate value through merger synergy Higher EPS through full-scale wireless business Unified customer care providing one-stop service Develop convergence services Provide competitive bundle products Corporate Benefit Shareholder Benefit Customer Benefit |

Immediate Impact Financial Benefits Enhanced EPS through fixed-wireless business opportunities and merger synergies (Excluding treasury shares: 70~80%, Inclusive: 110~120%) 2009 EPS comparison with 2008 KT stand-alone EPS Cost Synergies Cost savings of 1.5% of 2008 combined sales (3-year average) |

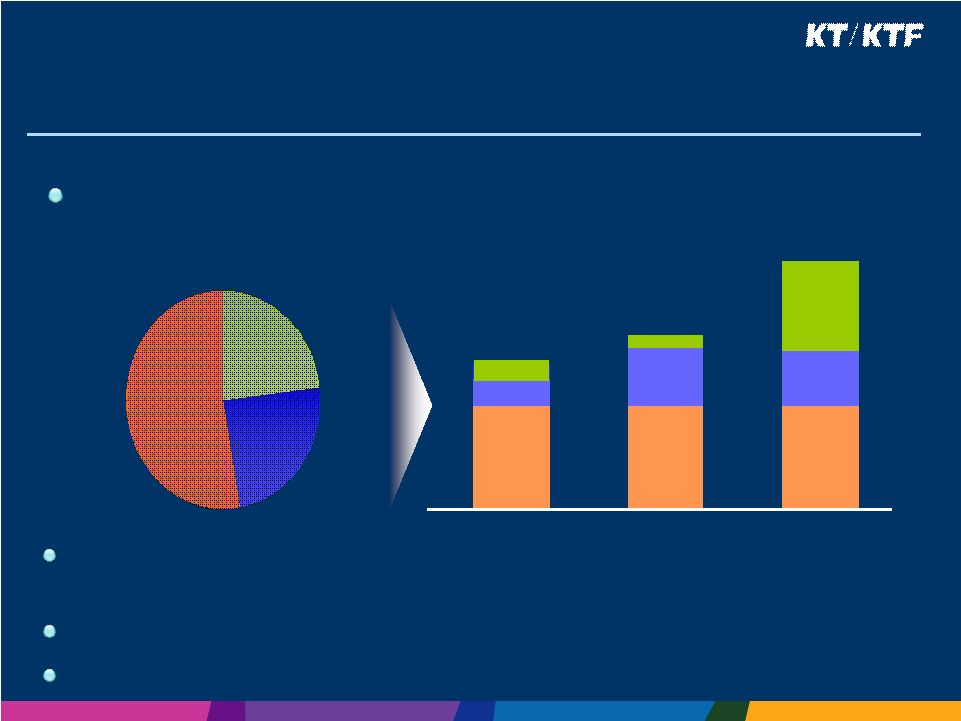

Cost savings of 1.5% of combined sales (3-year average) Cost Synergies 53% 23% 24% Overhead Y+0 Y+1 Y+2 Marketing Network 79 84 39 172 9 11 147 147 147 (KRW Billion) 197 240 398 Marketing cost - Reduction of sales promotion / commissions through bundle marketing Network cost – Reduction of outsourcing costs for wireless network maintenance Overhead cost – Integration of procurement, billing, call-centers, and R&D costs |

Combined base of 20M fixed / 14M wireless subs Reduced churn through full-scale bundling Integrated distribution channel under unified brand Cross-selling through fixed-wireless distribution channel Develop fixed-wireless integrated products Diversify service / product portfolio Establish R&D infrastructure for diverse bundled products and next-generation telecom services Expand Customer Contact Point Product Diversification Enhance R&D Capacity Expand Customer Base Further Opportunities |

2009 Guidance Revenue OP EBITDA CAPEX 3.2 5 1.8 19 (KRW trillion) |

Q&A Q&A |

Important Information

In connection with its proposed merger with KT Freetel Co., Ltd., KT Corporation will file important documents with the United States Securities and Exchange Commission (the “SEC”), including a registration statement on Form F-4 and related documents.Investors are urged to carefully read all such documents when they become available because they will contain important information.Investors may obtain copies of the documents, when available, free of charge on the SEC’s website atwww.sec.gov, as well as from KT Corporation on the Investor Relations section of its website atwww.kt.com.

Forward-Looking Statements

This communication contains forward-looking information and statements about KT Corporation and its merger with KT Freetel Co., Ltd. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 are generally identified by the words “believe,” “expect,” “anticipate,” “target” or similar expressions. Although KT Corporation’s management believes that the expectations reflected in such forward-looking statements are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of KT Corporation, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public filings with the SEC made by KT Corporation, including on Form 20-F and on the Form F-4 that KT Corporation will file with the SEC. KT Corporation undertakes no obligation to publicly update its forward-looking statements, whether as a result of new information, future events, or otherwise.