- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 9 Dec 10, 12:00am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2010

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

206 Jungja-dong

Bundang-gu, Sungnam

Kyunggi-do

463-711

Korea

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SUMMARY OF THIRD QUARTER BUSINESS REPORT

(From January 1, 2010 to September 30, 2010)

THIS IS A SUMMARY OF THE 2010 THIRD QUARTER REPORT ORIGINALLY PREPARED IN KOREAN AND IN SUCH FORM AS REQUIRED BY THE KOREAN FINANCIAL SUPERVISORY COMMISSION. IN THE TRANSLATION PROCESS, SOME PARTS OF THE REPORT WERE REFORMATTED, REARRANGED OR SUMMARIZED FOR THE CONVENIENCE OF READERS.

UNLESS EXPRESSLY STATED OTHERWISE, ALL INFORMATION CONTAINED HEREIN IS PRESENTED ON A NON-CONSOLIDATED BASIS IN ACCORDANCE WITH ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN KOREA, OR KOREAN GAAP, WHICH DIFFER IN CERTAIN RESPECTS FROM GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN CERTAIN OTHER COUNTRIES, INCLUDING THE UNITED STATES. WE HAVE MADE NO ATTEMPT TO IDENTIFY OR QUANTIFY THE IMPACT OF THESE DIFFERENCES.

2

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 13 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

3. Remuneration for Independent Non-Executive Auditors for the Past Three Fiscal Years | 21 | |||

| 22 | ||||

1. Overview of the Board of Directors and Committees under the Board | 22 | |||

| 34 | ||||

| 36 | ||||

| 36 |

(EXHIBIT 99-1 : NON-CONSOLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2010 AND 2009 AND INDEPENDENT AUDITOR’S REPORT)

3

1. Corporate Purpose of KT Corporation

| Business Objectives |

1. Information and communications business; 2. New media business; 3. Development and sale of software and contents; 4. Sale and distribution of information communication equipment; 5. Testing and inspection of information communication equipment, devices and facilities; 6. Advertisement business; 7. Telecommunications retail business; 8. Development of information and technology, and electrical infrastructure; 9. Real estate and housing business; 10. Electronic banking and finance business; 11. Education and learning services business; 12. Security services business (including machinery system surveillance services and facilities security services); 13. Research and technical development, education, training and promotion, overseas businesses, export and import trade, manufacturing and distribution related to the activities mentioned in items 1 through 12; 14. Telecommunications services business, including frequency-based telecommunications business; 15. Value-added telecommunications business; 16. Production, supply (screening) and distribution of music albums, music videos, movies, videos and games. 17. Electronic finance and electronic payment gateway services, including issuance and management of pre-paid electronic payment methods; 18. Sales and leasing of equipment and facilities related to the activities mentioned in items 14 through 17; 19. Overseas and export and import trade related to activities mentioned in items 14 through 18; 20. Travel agency business; 21. Insurance agency business; 22. Alternative energy generation business; and 23. Any and all other activities or businesses incidental to or necessary for the attainment of the foregoing. |

A. Changes Since Incorporation

| (1) | Date of Incorporation: December 10, 1981 |

| (2) | Location of Headquarters: |

206 Jungja-dong

Bundang-gu, Sungnam

Kyunggi-do

463-711

Korea

| (3) | Major Changes in KT Corporation |

– On March 27, 2009, KT Corporation (“KT”) signed a merger agreement with its mobile subsidiary KTF, which KT held a 54.25% interest in, and on June 1, 2009, the merger was completed.

– At the extraordinary shareholders’ meeting held on March 27, 2009, KT shareholders approved the addition of telecommunications services business, including frequency-based telecommunications business, to KT’s business objectives to reflect the adoption of KTF’s business. In order to demonstrate KT’s new goal of providing clients environmentally friendly solutions for higher productivity and lower costs, the shareholders also approved the addition of alternative energy generation business to its business objectives.

4

– Suk-Chae Lee was elected as President and CEO of KT on January 14, 2009.

3. Total Number of Shares and Related Matters

A. Total Number of Shares

(As of September 30, 2010) | (Unit: Shares | ) | ||||||

Category | Type of Shares | |||||||

| Common Shares | Total | |||||||

I. Total Number of Authorized Shares | 1,000,000,000 | 1,000,000,000 | ||||||

II. Total Number of Issued Shares | 312,899,767 | 312,899,767 | ||||||

III. Total Number of Shares Reduced | 51,787,959 | 51,787,959 | ||||||

1. Reduction of Capital | — | — | ||||||

2. Share Retirement | 51,787,959 | 51,787,959 | ||||||

3. Redemption of Redeemable Shares | — | — | ||||||

4. Other | — | — | ||||||

IV. Current Number of Issued Shares (II – III) | 261,111,808 | 261,111,808 | ||||||

V. Number of Treasury Shares | 17,895,964 | 17,895,964 | ||||||

VI. Current Number of Issued and Outstanding Shares | 243,215,844 | 243,215,844 | ||||||

B. Status of Capital Increase/Decrease

Date of Shares Issued (Retired) | Type of Shares Issued (Retired) | (Unit: Won, Shares)

| ||||||||||||||||||

| Details of Issued (Retired) Shares | ||||||||||||||||||||

| Type | Number of Issued (Retired) Shares | Par Value per Share | Par Value of Issued per Share | Note | ||||||||||||||||

June 2, 2009 | — | Common Shares | 700,108 | 5,000 | 5,000 | Issuance of new shares for merger | ||||||||||||||

* In the merger with KTF, KT issued 700,108 new shares. As a result, the capital amount increased by approximately Won 3.5 billion as follows.

(Unit: Won)

Category | Before Merger | Amount of Change | After Merger | |||||||||

Capital Amount | 1,560,998,295,000 | 3,500,540,000 | 1,564,498,835,000 | |||||||||

C. Acquisition and Disposal of Treasury Shares

(1) Acquisition and Disposal of Treasury Shares

(As of September 30, 2010) | (Unit: Shares)

|

| ||||||||||||||||||||||

Method of Acquisition | Type | Beginning of Term | Acquisition (+) | Disposition (-) | Retirement (-) | End of Term | ||||||||||||||||||

Direct Acquisition | Pursuant to Article 165-2 of Securities and Exchange Act | Common Shares | 16,155,938 | 1,259,170 | — | — | 17,415,108 | |||||||||||||||||

| Preferred Shares | — | — | — | — | — | |||||||||||||||||||

| Reasons other than Article 165-2 of Securities and Exchange Act | Common Shares | 500,232 | 7,311 | 26,687 | — | 480,856 | ||||||||||||||||||

| Preferred Shares | — | — | — | — | — | |||||||||||||||||||

Subtotal | Common Shares | 16,656,170 | 1,266,481 | 26,687 | — | 17,895,964 | ||||||||||||||||||

Preferred | — | — | — | — | — | |||||||||||||||||||

Indirect Acquisition (e.g. Trust Contract) | Common Shares | 1,259,170 | — | 1,259,170 | — | 0 | ||||||||||||||||||

Preferred | — | — | — | — | — | |||||||||||||||||||

Total | Common Shares | 17,915,340 | 1,266,481 | 1,285,857 | — | 17,895,964 | ||||||||||||||||||

| Preferred Share | — | — | — | — | — | |||||||||||||||||||

* The above “Beginning of Term” means as of January 1, 2010 and “End of Term” means as of September 30, 2010.

* Details of share buyback and retirement of treasury shares from January 1, 2010 to June 30, 2010 are as follows.

5

1) Acquisition of Treasury Shares (1,266,481 shares)

| - March 9, 2010: Transfer of all treasury shares under trust account to KT’s own trust account due to the expiry of the treasury share trust agreement (1,259,170 shares). | ||

| - April 29, 2010: Retrieval of granted treasury shares (7,311 shares) | ||

2) Disposition of Treasury Shares (1,285,857shares)

- March 9, 2010: Transfer of all treasury shares under trust account to KT’s own trust account due to the expiry of the treasury share trust agreement (1,259,170 shares).

- May 3, 2010: Disposition of treasury shares to distribute long-term performance based bonus payment to non-independent directors (18,427 shares)

- June 30, 2010: Disposition of treasury shares in connection with the exercise of stock options (2,559 shares)

- July 21, 2010: Disposition of treasury shares in connection with the exercise of stock options (1,767 shares)

- August 13, 2010: Disposition of treasury shares in connection with the exercise of stock options (1,875 shares)

- September 17, 2010: Disposition of treasury shares in connection with the exercise of stock options (2,059 shares)

D. Share Ownership Status of the Employee Stock Ownership Association

(1) Transactions with the Employee Stock Ownership Association

Not Applicable

(2) Guidelines for Exercising the Voting Rights of the Employee Stock Ownership Association

Association Account: The Employee Stock Ownership Association exercises its voting right in a manner that is exactly in proportion to the number of association members who wish to exercise their voting rights.

Association Member Account: Employee Stock Ownership Association may exercise its voting rights only if (i) the association receives a request by an association member to exercise his voting rights with a minimum notice period of seven days or (ii) the association member chooses to delegate his voting rights to the association.

6

(3) Shares Held by the Employee Stock Ownership Association

(As of September 30, 2010) | (Unit: Shares | ) | ||||||

Type of Account | Type of Shares | Balance at Beginning of Term | Term-End Balance | |||||

Association Account | Common Shares | 34,950 | 34,404 | |||||

Association Member Account | Common Shares | 7,570,213 | 4,219,672 | |||||

Total | 7,605,163 | 4,254,076 | ||||||

(As of September 30, 2010) | (Unit: Shares) | |||||||

Category | Number of Shares | Note | ||||||

Total Issued Shares (A) | Common Shares | 261,111,808 | — | |||||

| Preferred Shares | — | |||||||

Shares without Voting Rights (B) | Common Shares | 17,899,218 | Including Treasury Shares | |||||

| Preferred Shares | — | |||||||

| Shares with Restricted Voting Rights under the Stock Exchange Act and Other Laws (C) | — | — | — | |||||

| Shares with Reestablished Voting Rights (D) | — | — | — | |||||

| Shares with Exercisable Voting Rights (E = A – B – C + D) | Common Shares | 243,212,590 | — | |||||

| Preferred Shares | — | |||||||

| (1) | Shares without voting rights under the Commercial Code of Korea: 17,895,964 treasury shares held through treasury stock funds and 3,254 cross-holding shares. |

5. Dividends and Related Matters

A. Dividends

The shareholder return policy of KT is to pay its shareholders at least 50% of the adjusted net profit of the current term, through cash dividends and acquisition of treasury stock of the Company.

B. Dividends Paid during the Past Three Fiscal Years

Category | First Nine Months of 2010 | 2009 | 2008 | |||||||||||

Par Value per Share (Won) | 5,000 | 5,000 | 5,000 | |||||||||||

Net Profit of the Current Term (in Millions of Won) | 1,066,777 | 516,533 | 449,810 | |||||||||||

Net Profit per Share (Won) | 4,386 | 2,353 | 2,217 | |||||||||||

Year-end Cash Dividend (in Millions of Won) | — | 486,393 | 226,280 | |||||||||||

Year-end Share Dividend (in Millions of Won) | — | — | — | |||||||||||

Cash Dividend Propensity (%) | — | 94.2 | 50.3 | |||||||||||

Rate of Return on Cash Dividend (%) | Common Shares | — | 4.9 | 2.9 | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Rate of Return on Share Dividend (%) | Common Shares | — | — | — | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Cash Dividend per Share (Won) | Common Shares | — | 2,000 | 1,120 | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Share Dividend per Share (Share) | Common Shares | — | — | — | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

7

A. Present Conditions of the Industry

(1) Characteristics of the Industry

The existing markets for fixed-line telephones, broadband Internet and mobile communications in Korea have reached their maturity. However, with technical advances and changes in customer demands, the communications industry has recently been moving towards a convergence with different technologies and industries, such as the convergence between fixed and mobile communications and the convergence between the telecommunications industry and the broadcasting industry. As shown by the development of IPTV, there is a high probability that the media industry will redefine the traditional boundaries of communications and broadcasting. As such, big changes are expected in both industries. In the mobile communications market, the transition to 3G technology has become a turning point in shaping the new competitive landscape by replacing the existing competition in the 2G market. In the saturated communications market, enhancing customer value has become increasingly important as both fixed and mobile communications carriers offer bundled services such as the Triple/Quadruple Play and Fixed-Mobile Convergence (“FMC”) services. Mobile communication industry is also rapidly shifting from voice-centric market to data-centric market in accordance with an increasing use of smart phones and tablet PCs. Accordingly, network competitiveness will become a crucial factor for success in the telecommunication business.

(2) Growth of the Industry

(Unit: 1,000 Persons)

Category | December 31, 2005 | December 31, 2006 | December 31, 2007 | December 31, 2008 | December 31, 2009 | September 30, 2010 | ||||||||||||||||||

Broadband Internet Subscribers | 12,191 | 14,043 | 14,710 | 15,475 | 16,349 |

| not available |

| ||||||||||||||||

Local Telephone Subscribers | 22,920 | 23,119 | 23,130 | 22,132 | 20,090 | 19,444 | ||||||||||||||||||

Mobile Phone Subscribers | 38,342 | 40,197 | 43,498 | 45,607 | 47,944 | 50,210 | ||||||||||||||||||

* The 2005 to 2007 data was provided by the Ministry of Information and Communication (www.mic.go.kr).

* The 2008 to September 30, 2010 data was provided by the Korea Communications Commission (“KCC”) (www.kcc.go.kr).

* The number of broadband internet subscribers as of September 30, 2010 was not published by the KCC.

(3) Characteristics of Market Fluctuations

The demand for communications services does not fluctuate greatly as such services are regarded as a necessity in modern life. However, if the Korean economy slows in the future, it could have an adverse impact on KT’s business activities.

(4) Competition

(a) Competing Companies

| • | Local calls: SK Broadband, LG U+, etc. |

8

| • | Long distance calls: LG U+, Onse Telecom, SK Broadband, SK Telink, etc. |

| • | International calls: LG U+, Onse Telecom, SK Broadband, SK Telink, etc. |

| • | Broadband Internet: SK Broadband, LG U+, Service Operators (including cable television, relay wired broadcasting operators), etc. |

| • | Mobile communications: SK Telecom, LG U+, etc. |

| • | Internet telephones using Internet Protocol (“VoIP”): SK Broadband, SK Networks, SK Telink, Samsung Networks, LG U+, Korea Cable Telecom, etc. |

| • | IPTV: SK Broadband, LG U+ |

| • | Mobile Internet (WiBro service): SK Telecom |

- LG U+, or LG Uplus Corp, is the new company name of LG telecom that merged with LG Dacom and LG Powercom effective as of January 1, 2010.

(b) Market Entry Requirements

| • | Communication service providers: business operations must be approved by the Korea Communications Commission |

| • | Specific telecommunications service providers: registration is required |

| • | Value-added telecommunications service providers: reporting is required |

(c) Factors of Competition: service fees, product quality, marketing power, brand value and competitiveness of the distribution network, etc.

(5) Relevant Laws and Government Regulations

(a) Relevant Laws

| • | Telecommunications policy-related laws |

Telecommunications Basic Act, Telecommunications Business Act (total 7)

| • | Radio and broadcasting policy-related laws |

Radio Regulation Law

| • | Information related laws |

Promotion of Information and Communication Basic Act (total 9)

| • | Broadcast related laws |

Broadcasting Law, Internet Multimedia Broadcasting Business Law (IP-TV related), etc.

(b) Government Regulations

The Korea Communications Commission is responsible for managing the convergence between broadcasting and communications, as well as assuring their independence and role of providing public services. The commission is also responsible for issuing relevant licenses, permits, approvals, policy enactments and other matters relating to the promotion of broadcasting and communications and the enhancement of their global competitiveness.

The statements included in the above sections are based on KT’s forecasts and are offered for the sole purpose of providing a better understanding of the company’s current state. Consequently, investors must not rely solely on KT’s forecasts when making their investment decisions.

9

B. Current Status of KT

| (1) | Operations Outlook and Classification of Business |

(a) Operations Outlook

The Korean communications market is currently experiencing stagnant growth as major services, including fixed-line telephones, broadband Internet and mobile communications, have reached maturity, caused in part by intense competition in the industry. Despite the unfavorable environment, the convergence of the telecommunications and broadcasting industries, such as IPTV and VoIP, and the convergence of fixed and mobile services (FMC) are leading the growth of the telecommunications market.

On June 1, 2009, KT completed a merger with KTF, its mobile subsidiary, to overcome stagnant growth in the existing communications market, realize growth in new markets, and expand differentiated core capabilities. In addition, KT is also building a solid foundation for growth by introducing new services based on its group synergy, such as QOOK TV SkyLife (hybrid media service providing DMB channels from Skylife and Video on Demand or VOD from QOOK TV, KT’s IPTV) and FMC services. Furthermore, in November 2009, KT was first to introduce Apple’s iPhone to the Korean market to meet the smartphone needs of consumers.

Considering the highly saturated mobile phone market in Korea (102.4% as of September 2010 with more than 50 million subscribers), potential growth by adding new subscribers or raising voice service plans are limited. In such an environment, however, the mobile data business is considered as a new growth engine. At the end of 2009, KT successfully switched the paradigm of competition from voice to data centered services by introducing Apple’s iPhone as the sole provider in Korea. iPhone was successfully launched as the number of iPhone subscribers reached to 1.15 million as of September 30, 2010. In addition, average iPhone users use mobile data communication service approximately 30 to 40 times more than average non-iPhone users. Such data communication service usage pattern can be observed in all age groups, which in turn provides a platform for continuous growth in mobile data business. As approximately 60% of wireless data transmission out of total wireless data transmission is being used through WiFi networks, KT’s unique convergence network infrastructure will become KT’s competitive advantage in the wireless data business market. Going forward, KT will continue to reinforce its WiFi network competency by expanding WiFi zones to 40,000 by the end of 2010 and providing secured network to offer better customer experiences.

In the broadband Internet arena, KT will aim to improve customer value and marketing power by continuing to provide Fiber-To-The-Home (“FTTH”) services.

KT’s wireless broadband Internet service business, or SHOW WiBro, extended its coverage to five major cities in provincial area as well as 19 major cities in metropolitan area. KT plans to further expand services to 82 major cities and major highways to cover 85% of Korean population, and will aim to be a leader in the Mobile 2.0 generation, the next generation of mobile communications.

Also, KT’s IPTV business will focus on actively catering to the TV portal market through its QOOK TV service and, in the long term, by pursuing a leadership position in the communication-broadcasting convergence market.

(b) Operations Subject to Disclosure

KT’s main area of business is the telecommunications sector as classified by the Korea Standard Industry Code.

10

| (2) | Market Share |

Category | Operator | Market Share for Each Term (%) | ||||||||||||

| 29th Fiscal Year (as of September 30, 2010) | 28th Fiscal Year (as of December 31, 2009) | 27th Fiscal Year (as of December 31, 2008) | ||||||||||||

| Local Telephone (On the Basis of the Number of Subscribers) | KT | 87.1 | 89.9 | 89.8 | ||||||||||

SK Broadband | 11.0 | 8.4 | 8.7 | |||||||||||

LGU+ | 1.9 | 1.7 | 1.5 | |||||||||||

| Mobile Telephone (On the Basis of the Number of Subscribers) | KT | 31.5 | 31.3 | 31.5 | ||||||||||

SK Telecom | 50.7 | 50.6 | 50.5 | |||||||||||

LGU+ | 17.8 | 18.1 | 18.0 | |||||||||||

| Broadband Internet (On the Basis of the Number of Subscribers) | KT | 42.9 | 42.5 | 43.4 | ||||||||||

SK Broadband | 23.3 | 23.5 | 22.9 | |||||||||||

LGU+ | 15.6 | 15.4 | 14.1 | |||||||||||

Service Operators | 18.2 | 18.6 | 19.6 | |||||||||||

* Data was provided by the KCC. (www.kcc.go.kr).

* The market share of broadband Internet service as of September 30, 2010 is the market share as of May 31, 2010, the latest available information.

* The market share of SK Broadband calculated based on the subscriber number which is including resale By SK Telecom

| (3) | Market Characteristics |

KT maintained approximately 87.1% of the Public Switched Telephone Network (“PSTN”) market share as of September 30, 2010 despite increased marketing efforts by its competitors. For instance, SK Broadband began offering aggressive sales promotions to increase its PSTN subscribers by introducing tariff based on household unit and offering discounts on basic monthly fees and airtime usage charges. LG U+ also competes with its new tariff plan based on household unit called “YO”.

Although PSTN sales and the number of PSTN subscribers are on a gradual decline due to the increased use of mobile phones and VoIP phone services over fixed phones and the paradigm shift from voice to data communications, KT is trying to mitigate the PSTN sales from further decrease by (i) increasing Average Revenue per User (“ARPU”) through sales of additional services, (ii) increasing customer satisfaction by offering optional calling plans and (iii) retaining existing customers through customer relationship management activities.

Competitions among mobile service providers over new subscribers continue to be intense, and overall revenue and subscriber growth have been slow. According to a report by KT Economics and Management Research Lab, penetration rates in terms of subscribers is showing signs of saturation, as it was 102.4% as of September 30, 2010.

However, KT, as part of its growth strategy, plans to improve ARPU, particularly ARPU for data communication services, by providing innovative data services for smart phones utilizing Wi-Fi as well as WCDMA networks. As the sole iPhone provider in Korea, KT has successfully shifted the market competition from voice to data focused services. In addition to rapid iPhone sales, KT’s smartphone leadership is strengthened through the introduction of various handsets such as Andro One, an Android-based handset, as well as by offering competitive products such as one-month data roll-over program or one person data sharing plan (“OPMD”) tariff plan. As of September 30, 2010, KT had approximately 1.65 million smartphone subscribers.

To create marketing synergy with KT’s fixed services and to encourage loyal customers to churn-in and retain KT’s service, we introduced various services such as unlimited tariff plan among family members and ‘QOOK&SHOW Toong’ tariff plan, a bundled product for Internet, IPTV and PSTN services. Also, to provide differentiated services based on integration between fixed and mobile, “uCloud” service, a cloud computing service, and “Olleh KT club”, a fixed mobile integrated loyalty program, were introduced.

11

KT plans to maintain its leadership in smartphone market by continually improving its handset line-up, guaranteeing service quality, maintaining Wi-Fi leadership, and introducing new tariff to fulfill the customer needs.

As for broadband Internet, KT seeks to expand its subscriber base by offering high-quality services. In a market marked by intense price competition, KT aims to lead the market by supplying superior FTTH services to the competitor in terms of both speed and quality. KT’s ultimate goal is to be a market leader in offering the next generation of services, such as IPTV and VoIP, to its broadband subscribers by providing high Internet transmission speeds (100 Mbps) for common households.

| (4) | Status and Forecast of New Businesses |

In order to overcome present market obstacles of limited growth in the voice service market and the sluggish growth in the broadband Internet service market, KT has been actively involved in developing a wide range of new businesses with growth prospects.

KT aims to create a digital entertainment world that will enrich its customers’ lives through a ubiquitous environment, which can be accessed through various terminals anytime, anywhere. Furthermore, KT aims to offer customers convenient solutions that they may freely use without time or location limitations and business solutions necessary to raise corporate efficiency and competitiveness. By excelling in these new business areas, KT strives to become a company that aids its clients in meeting their goals and enhancing their value.

SHOW WiBro enables portable broadband Internet access services, allowing universal Internet access with high transmission speeds through personal handsets or laptop computers. WiBro was first commercialized in the world using Korean technology, and KT successfully provided commercial WiBro services in limited areas in 2006. Since April of 2007, KT has actively been seeking to provide WiBro services in the Seoul metropolitan area, including various major buildings and university campuses. In October 2008, WiBro services in the Seoul metropolitan area was extended to 19 neighboring cities and the service speeds became twice as fast. Currently, anyone may utilize KT WiBro services with personal computers, WiBro-compatible laptop computers, WiBro phones, which combine CDMA mobile phones with WiBro service, Portable Media Players, navigation devices or Dongle, a USB device that can be connected to any laptop computer. In addition, Egg, which is a portable Access Point Device (“AP”) launched at the beginning of 2009, enables customers to enjoy WiBro service with various Wi-Fi embedded devices. KT will continuously try to expand its array of digital devices that are compatible with WiBro services. KT will promote a mobile culture for its customers through KT WiBro, which shall offer not only basic Internet access but also other individually tailored services, such as combined webmails, two-way visual communications, remote controlled home computers, information services linked with real-time search functions and mobile UCC to its users. As a fixed-mobile integrated company after the merger, KT will introduce new services through the convergence of WCDMA, Wi-Fi and WiBro (“3W”), and thus lead the Mobile 2.0 generation, the next generation of mobile communications.

In October 2009, KT introduced olleh Phone service (formerly QOOK&SHOW), the first FMC service in Korea. olleh Phone service enables subscribers to enjoy both Wi-Fi as well as WCDMA on a single handset at a considerably low tariff. In addition, KT launched the world’s first 3W based smart phone. KT is vitalizing the mobile data market by enhancing customers’ convenience while reducing existing tariff levels. In the past, the telephone business was a growth engine for KT; however, wireless data is now considered as a new core engine for future growth. To boost the wireless data business, KT has implemented lower mobile data tariff, development of various devices and prevalence of mobile Internet software through the open market. Going forward, KT will continue to promote innovative convergence business, such as integration of services and contents for mobile, internet, IPTV, SoIP (collectively, “N-Screen”) and provide more home network services. In addition to VoIP handsets for voice and video calls, KT plans to introduce tablet-type media phone device with multimedia functions including VoIP calls in the fourth quarter 2010. Together with pad-style devices, KT plans to lead the tablet handset market.

12

QOOK TV is a service that integrates telecommunications and broadcasting services, brought about by accelerated development of high speed broadband Internet and fast conversion of contents into multimedia. QOOK TV is a service that provides traditional Internet services, such as information searches, games, message exchanges, and shopping with VOD services, which allow users to watch a variety of contents, such as movies, dramas and educational programs, at any time. From the second half of 2007 to October of 2008, only non-real time VOD services and interactive services were provided due to regulatory restrictions. However, after the enactment of the Korean Internet Multimedia Broadcasting Business Law by the National Assembly in December 2007 and the granting of the IPTV business license to KT on September 8, 2008, KT has been able to provide real-time broadcasting IPTV service starting November 17, 2008. KT provides 104 IPTV channels, 90,000 VOD programs and 86 two-way services as of September 30, 2010. In February 2010, KT introduced the first Open IPTV, where KT broadcast channels and VODs produced by its subscribers.

In order to maintain and expand its subscriber base and heighten competitive edge, KT’s Internet phone provides video communication, SMS and a variety of daily life related services (home ATM, traffic and local news information) in addition to its voice transmission services. As a result of continuous efforts to add new subscribers, KT had 2.5 million of VoIP subscribers as of September 30, 2010. Furthermore, the customer base for video services have gradually expanded due to the variety of terminal line-up from mid-end type (LCD 4’) to high-end type (LCD 7’) as well as ‘media phone’ and ‘media robot’ which will be introduced in the fourth quarter. Meanwhile, to secure a stable revenue base, KT is trying to maintain PSTN subscribers through bundling and long-term contracts. By providing VoIP phones as a second phone to PSTN subscribers, KT anticipates more revenue being generated from the VoIP business. KT plans to solidify its customer base through the creation of a new market by offering convergent terminals with value added services and integrated applications.

KT believes that its new businesses will not only bring about new sources of revenue for the company, but also assist KT in maintaining its current fixed-line market share as well as promote its competitiveness in the broadband Internet service market. KT, leveraging on its past success, intends to continue developing new businesses so that it can become a pioneer in the areas of fixed line to mobile consolidation, convergence of telecommunications and broadcasting, and other cross-industry convergence.

The statements included in the above sections are based on KT’s forecasts and are offered for the sole purpose of providing a better understanding of the company’s current state. Consequently, investors must not rely solely on KT’s forecasts when making their investment decisions.

A. Performance in Terms of Revenue

(Unit: In Millions of Won)

Items | First Nine Months of 29th Fiscal Year (2010) | 28th Fiscal Year (2009) | 27th Fiscal Year (2008) | |||||||||

Internet Connection | 1,462,523 | 1,954,639 | 2,059,088 | |||||||||

Internet Application | 388,820 | 431,909 | 359,462 | |||||||||

Data | 988,257 | 1,450,217 | 1,650,121 | |||||||||

Telephone | 2,532,683 | 3,603,155 | 3,938,712 | |||||||||

LM | 727,591 | 1,154,094 | 1,393,605 | |||||||||

Wireless | 5,192,931 | 4,266,371 | 1,006,638 | |||||||||

System Integration | 207,909 | 232,546 | 248,425 | |||||||||

Real Estate | 303,031 | 286,870 | 245,840 | |||||||||

Handset | 3,218,832 | 2,498,845 | 855,145 | |||||||||

Others | 19,501 | 27,528 | 27,799 | |||||||||

Total | 15,042,078 | 15,906,174 | 11,784,835 | |||||||||

* The revenue from KTF from June 2009 has been included as the result of the merger according to the K-GAAP.

13

B. Routes and Methods of Sales

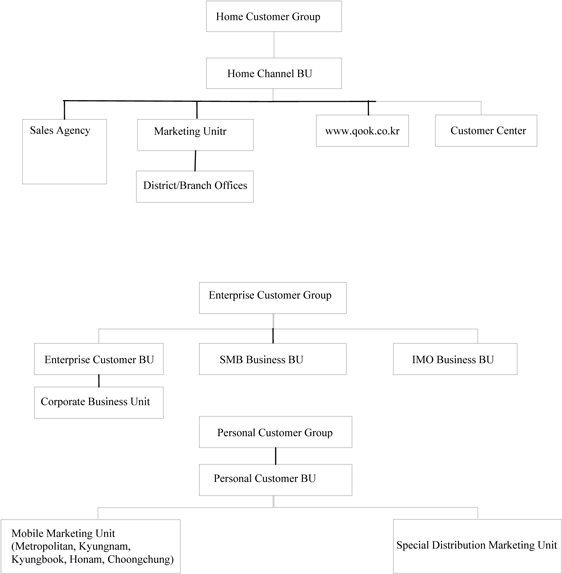

| (1) | Marketing Organizational Structure |

| (2) | Sales Path |

| • | Customer center and branch offices offer sales of goods and customer services. |

| • | Subscription to goods and services through the Internet (www.qook.co.kr) and sales persons in branch offices |

| • | Attracting new subscribers through sales agencies |

14

(3) Methods and Conditions of Sales

| (a) | Sales Methods |

| • | Service fees are paid in cash (wire transfer, direct bank transfer and credit cards). Fixed and wireless telephone services are operated on a unit pricing system or a partial flat rate system, and broadband Internet access service is operated on a flat rate system. |

| • | Sale of terminals may involve installment payments. |

| • | Rental of terminals is charged on a monthly basis, and a discounted rate is applied during the contract period. |

| • | Distribution fees are charged upon installation and additional periodic maintenance fees. |

| (b) | Conditions for Sales |

| • | Discount of Service Fees in accordance with the Subscription Period |

Category | 1 Year | 2 Years | 3 Years | 4 Years | ||||

| QOOK Internet | 5% | 10% | 15% | 20% (limited to Special) | ||||

| KORNET (Express/Premium) | 5% | 10% | 15% | — | ||||

| QOOK TV (Live/VOD) | 5% | 10% | 20% | — |

| • | Additional discounts available for subscribers who have used the following services for at least 3 years |

Category | After 3 Year | After 4 Years | After 5 Years | Note | ||||

| QOOK Internet | 2% | 3% | 5% | — | ||||

| KORNET (Express/Premium) | 2% (When subscribers sign up for an additional 1 year agreement) | 3% (When subscribers sign up for an additional 2 year agreement) | 5% (When subscribers sign up for an additional 3 year agreement) |

When subscribers enter into an additional agreement |

* In the case of QOOK Internet, there are no additional discounts for subscribers who have used the service for more than 3 years if they renewed the long-term contract or signed for bundling after November 1, 2008.

| • | Additional discounts available for QOOK Internet subscribers who renewed their contract |

Category | Renewal for 1 year | Renewal for 2 years | Renewal for 3 years | Renewal for 4 years | ||||||||||||

| Type A | KRW 1,000 | KRW 2,000 | KRW 3,000 | KRW 4,000 | ||||||||||||

Type B | — | 5 | % | 10 | % | — | ||||||||||

* Additional discount rates for the subscribers who renewed their long-term contracts before November 1, 2008 are 3% for renewal for 2 years and 5% for renewal for 3 years. Renewal of the existing contract is required to receive the current discount rates.

* Additional discount rate is not available for long-term subscribers who already receive the current discount rates.

| • | Optional discount for SHOW in accordance with the Subscription Period (SHOW-king sponsor basic type) |

15

Monthly fee | Period of subscription | |||||

12 months | 18 months | 24 months | ||||

| KRW 30,000 Up to KRW 40,000 | Discount up to KRW 3,000 | Discount up to KRW 5,000 | 100% discount (up to KRW 10,000) | |||

| More than KRW 40,000 | 10% discount | |||||

| • | Discount for SHOW mobile Gold/i plan (SHOW-king sponsor for Cold/i type) |

(Unit: Won)

Gold type plan | SHOW free 150 | SHOW free 250 | SHOW free 350 | SHOW free 450 | SHOW free 650 | SHOW free 850 | SHOW free 2000 | |||||||

| Amount of discount per month | 2,500 | 5,000 | 7,000 | 11,000 | 12,000 | 14,000 | 25,000 |

i Type Plan | Slim | Lite/Talk | Medium | Special | Premium | |||||

| Amount of discount per month | 5,000 | 8,000 | 13,000 | 16,000 | 22,000 |

| • | Major Bundling Discounts |

| QOOK Internet plus SHOW | QOOK Internet | SHOW | ||

| 3% to 10% additional discount for service fees according to Agreement terms | 10% discount for monthly service fees (5% for QOOK Internet subscriptions without long-term discount agreements) | |||

| QOOK Internet plus KT WIBRO | QOOK Internet | KT WIBRO | ||

| 3% to 10% additional discount for service fees according to Agreement terms | None (instead NESPOT family provided free of charge) | |||

| QOOK Internet plus QOOKTV | QOOK Internet | QOOKTV | ||

| 3% to 10% additional discount for service fees according to Agreement terms | 3% to 10% additional discount for service fees according to Agreement terms | |||

* Please refer to the explanations for each service provided on their respective websites or the relevant terms and conditions for further details.

| (4) | Sales Strategy |

Our main sale strategy is to provide differentiated experience for our customers by providing various bundled products at competitive prices.

| (a) | Mobile Service |

| • | Enhancing leadership and competitiveness in smart phone & FMC service by introducing iPhone: Increasing the sales of smart phones and FMC phones |

| • | Strengthen competitiveness by utilizing Wi-Fi network: Providing free Wi-Fi access to those who subscribe special smart phone tariff plans |

| • | Controlling marketing expenses by introducing a new sales program which provides special tariff discount instead of handset subsidy |

| • | Strengthen customer retention policy targeting the long-term contract customers whose contract period is matured. |

16

| • | Promote 3G migration in order to change the rules of the game from 2G CDMA to 3G WCDMA |

| • | Promote specialized high-quality products and increase sales through up-selling and retention of existing customers |

| (b) | Broadband Internet Service |

| • | Strengthen competitiveness in both quality and speed by offering FTTH |

| • | Satisfy a diverse range of customer needs and provide differentiated services through development and offering of additional services |

| • | Promote specialized high-quality and optimized products and increase sales through up-selling and retention of existing customers |

| (c) | Telephone Service |

| • | Minimize PSTN line loss by introducing new tariff scheme. |

| • | Provide more benefits to customers by bundling services. |

| • | Promote KT’s VoIP phones to existing PSTN subscribers as their second phones to increase PSTN+VoIP bundled subscribers. |

| • | Retain PSTN subscribers who wish to switch their PSTN phone to VoIP phone by offering our own VoIP solution. |

| • | Enhance ARPU by developing new business model. |

| (d) | WiBro Service |

| • | Increase subscriber base by expanding distribution channels and terminal competitiveness. |

| • | Execute special marketing program (opening interactive stores, establishing WiBro U-Campus, launching a laptop rental businesses, target marketing toward securities companies) |

| • | Stimulate early market interest through promotional rate plans and package products |

| (e) | IPTV Service |

| • | Promote QOOK TV products to our existing QOOK internet subscribers. |

| • | Expand client base by offering free set-top box rentals (with a 3-year subscription contract) and opportunities to experience KT services |

| • | Increase synergy with SkyLife, our satellite TV subsidiary, by providing hybrid product through which people can enjoy Satellite HD channels as well as VOD libraries. |

| (f) | Bundling Service |

| • | Retain existing customers and acquire new 3G and Wibro subscribers by developing and promoting new bundling products |

| • | Promote customer retention through continued development and sale of package products of major services |

17

3. Research and Development Activities

A. Research and Development Costs

(Units: In Millions of Won)

Category | First Nine Months of 2010 | 2009 | 2008 | Note | ||||||

Raw Materials | — | — | — | — | ||||||

Labor Costs | 37,059 | 59,490 | 69,256 | |||||||

Depreciation | 57,601 | 66,109 | 51,637 | — | ||||||

Commissions | 313 | 6,692 | 14,027 | — | ||||||

Others | 194,826 | 238,868 | 214,263 | — | ||||||

Total R&D Costs | 289,799 | 371,159 | 349,183 | — | ||||||

Accounting Treatment | Research and Ordinary Development Costs | 194,756 | 235,079 | 251,141 | ||||||

| Development Costs (Intangible | 95,043 | 136,080 | 98,042 | |||||||

| Percentage of R&D Costs over Revenue | 1.93% | 2.33% | 2.96% | — | ||||||

4. Other Matters Necessary for Making Investment Decisions

A. Intellectual Property Rights

| • | KT holds 5,755 domestic patents and 481 overseas patents as of September 30, 2010. |

18

1. Summary of Financial Statements (Non-Consolidated)

(in Millions of Won)

Classification | As of September 30, 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

Current Assets | 6,874,550 | 6,474,579 | 3,778,105 | 3,310,412 | 3,239,188 | |||||||||||||||

| • Quick Assets | 6,361,016 | 5,867,770 | 3,610,564 | 3,188,309 | 3,146,206 | |||||||||||||||

| • Inventory | 513,534 | 606,809 | 167,541 | 122,103 | 92,982 | |||||||||||||||

Fixed Assets | 17,519,858 | 17,867,896 | 14,906,817 | 14,606,770 | 14,723,145 | |||||||||||||||

• Investments | 1,519,806 | 1,274,670 | 3,517,906 | 3,458,580 | 3,661,067 | |||||||||||||||

• Tangible Assets | 13,714,514 | 14,203,832 | 10,428,674 | 10,448,618 | 10,398,084 | |||||||||||||||

• Intangible Assets | 1,036,114 | 1,206,587 | 397,046 | 439,738 | 470,782 | |||||||||||||||

• Other Non-Current Assets | 1,249,424 | 1,182,807 | 563,191 | 259,834 | 193,212 | |||||||||||||||

Total Assets | 24,394,408 | 24,342,475 | 18,684,922 | 17,917,182 | 17,962,333 | |||||||||||||||

Current Liabilities | 6,164,373 | 5,684,276 | 2,585,875 | 2,991,341 | 3,270,249 | |||||||||||||||

Fixed Liabilities | 7,271,993 | 8,259,945 | 7,267,158 | 6,065,948 | 6,143,004 | |||||||||||||||

Total Liabilities | 13,436,366 | 13,944,221 | 9,853,033 | 9,057,289 | 9,413,253 | |||||||||||||||

Capital | 1,564,499 | 1,564,499 | 1,560,998 | 1,560,998 | 1,560,998 | |||||||||||||||

Capital Surplus | 1,449,648 | 1,448,569 | 1,440,633 | 1,440,777 | 1,440,910 | |||||||||||||||

Capital Adjustments | (1,262,912 | ) | (2,165,728 | ) | (3,994,736 | ) | (3,983,929 | ) | (3,817,717 | ) | ||||||||||

Accumulated Comprehensive Income | (59,900 | ) | (44,542 | ) | 10,879 | (818 | ) | 10,978 | ||||||||||||

Retained Earnings | 9,266,707 | 9,595,456 | 9,814,115 | 9,842,865 | 9,353,911 | |||||||||||||||

Total Capital | 10,958,042 | 10,398,254 | 8,831,889 | 8,859,893 | 8,549,080 | |||||||||||||||

(in Millions of Won)

Classification | First Nine Months of 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

Sales | 15,042,078 | 15,906,174 | 11,784,835 | 11,936,382 | 11,856,009 | |||||||||||||||

Operating Income | 1,748,555 | 611,550 | 1,113,389 | 1,433,722 | 1,756,228 | |||||||||||||||

Net Income | 1,066,777 | 516,533 | 449,810 | 981,967 | 1,233,449 | |||||||||||||||

19

2. Summary of Financial Statements (Consolidated)

As of the end of December 31

(in Millions of Won)

Classification | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

Current Assets | 7,971,849 | 7,073,826 | 5,642,799 | 5,981,420 | 6,131,744 | |||||||||||||||

• Quick Assets | 7,272,447 | 6,648,985 | 5,343,695 | 5,744,225 | 5,771,631 | |||||||||||||||

• Inventory | 699,402 | 424,841 | 299,104 | 237,195 | 360,113 | |||||||||||||||

Fixed Assets | 18,648,468 | 19,064,778 | 18,484,086 | 18,261,914 | 18,556,973 | |||||||||||||||

• Investments | 561,370 | 546,000 | 470,195 | 533,947 | 792,669 | |||||||||||||||

• Tangible Assets | 14,774,560 | 15,188,631 | 15,288,002 | 15,167,429 | 15,087,032 | |||||||||||||||

• Intangible Assets | 1,279,500 | 1,474,238 | 1,735,323 | 1,959,591 | 2,133,199 | |||||||||||||||

• Other Non-Current Assets | 2,033,038 | 1,855,909 | 990,566 | 600,947 | 544,073 | |||||||||||||||

Total Assets | 26,620,317 | 26,138,604 | 24,126,885 | 24,243,334 | 24,688,717 | |||||||||||||||

Current Liabilities | 6,941,223 | 5,241,028 | 5,078,621 | 5,423,115 | 4,822,341 | |||||||||||||||

Fixed Liabilities | 9,011,655 | 9,809,678 | 7,910,498 | 8,122,915 | 9,476,442 | |||||||||||||||

Total Liabilities | 15,952,878 | 15,050,706 | 12,989,119 | 13,546,030 | 14,298,783 | |||||||||||||||

Minority Interest | 290,872 | 2,256,009 | 2,276,003 | 2,267,252 | 2,518,213 | |||||||||||||||

Capital | 1,564,499 | 1,560,998 | 1,560,998 | 1,560,998 | 1,560,998 | |||||||||||||||

Capital Surplus | 1,448,569 | 1,440,633 | 1,440,777 | 1,292,475 | 1,389,222 | |||||||||||||||

Capital Adjustments | (2,165,728 | ) | (3,994,736 | ) | (3,983,929 | ) | (3,817,717 | ) | (3,868,078 | ) | ||||||||||

Accumulated Comprehensive Income | (44,542 | ) | 10,879 | 142 | 5,772 | (3,166 | ) | |||||||||||||

Retained Earnings | 9,573,769 | 9,814,115 | 9,843,775 | 9,400,068 | 8,786,413 | |||||||||||||||

Total Capital | 10,667,439 | 11,087,898 | 11,137,766 | 10,697,304 | 10,389,934 | |||||||||||||||

For the years ended December 31 (in Millions of Won)

Classification | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||

Revenues | 19,649,120 | 19,592,949 | 18,660,082 | 17,824,880 | 17,191,845 | |||||||||||||||

Operating Income | 966,459 | 1,440,280 | 1,745,341 | 2,383,376 | 2,411,095 | |||||||||||||||

Income from Continuing Operations | 607,300 | 539,337 | 1,096,774 | 1,509,721 | 1,365,010 | |||||||||||||||

Net Income | 609,695 | 513,290 | 1,170,978 | 1,509,717 | 1,360,036 | |||||||||||||||

Consolidated Net Income | 494,846 | 449,810 | 1,056,227 | 1,291,863 | 1,085,450 | |||||||||||||||

Number of Consolidated Companies | 36 | 33 | 28 | 23 | 21 | |||||||||||||||

20

First Nine Months of 2010 | First Nine Months of 2009 | 2009 | 2008 | |||

| Samil PwC | Deloitte Anjin LLC | Deloitte Anjin LLC | Deloitte Anjin LLC |

Term | Audit (or Review) Opinion | Issues noted | ||

| First Nine Months of 2010 | — | Not Applicable | ||

| First Nine Months of 2009 | — | Not Applicable | ||

| 2009 | Unqualified | Not Applicable | ||

| 2008 | Unqualified | Not Applicable | ||

| 2007 | Unqualified | Not Applicable |

3. Remuneration for Independent Non-Executive Auditors for the Past Three Fiscal Years

A. Audit Contracts

(Units: In Millions of Won, Hours)

Term | Auditor | Contents | Fee | Total Hours | ||||||||

3rd quarter, 2010 | Samil PwC | Quarterly and semi-annual review of financial statements Semi-annual review of consolidated financial statements Non-consolidated financial statements audit Consolidated financial statements audit | 1,930 | 18,830 | ||||||||

2009 | Deloitte Anjin LLC | Quarterly and semi-annual review of financial statements Semi-annual review of consolidated financial statements Non-consolidated financial statements audit Consolidated financial statements audit US GAAP financial statements audit | 2,786 | 41,545 | ||||||||

2008 | Deloitte Anjin LLC | Quarterly and semi-annual review of financial statements Semi-annual review of consolidated financial statements Non-consolidated financial statements audit Consolidated financial statements audit Kaesong Branch Office audit US GAAP financial statements semi-annual review US GAAP financial statements audit | 2,319 | 33,858 | ||||||||

21

V. Management and Affiliated Companies

1. Overview of the Board of Directors and Committees under the Board

A. Matters on the Board of Directors

(1) Organization

As of June 30, 2010, Board of Directors of KT Corp. consists of 11 Directors. (3 Inside Directors and 8 Outsider Directors) Under the Board of Directors, KT has 6 different Committees as follows; Corporate Governance Committee , Audit Committee, Outside Director Candidate Recommendation Committee, Evaluation & Compensation Committee, Executive Committee, Related-Party Transaction Committee. Also, the Board of Directors may establish another committee if necessary.

(2) Major Activities of the Board of Directors

Order | Date | Subject | Result of Discussion | |||

First | Jan. 28, 2010 | Proposal on assurance for Ansan U-Complex Business | Original proposal approved | |||

| Approval of financial statements of the 28th term | Original proposal approved | |||||

| Business reports of the 28th Term | Original proposal approved | |||||

| Plan for issuance of bonds for 2010 | Original proposal received | |||||

| Proposal on the reformation of corporate governance | Original proposal approved | |||||

Second | Feb. 11, 2010 | Proposal on the amendment to the articles of incorporation | Amended proposal approved | |||

| Agreement on the recommendation of non-independent Directors | Original proposal approved | |||||

| Proposal on the recommendation of members of audit committee | Original proposal approved | |||||

| Proposal on the limit on remuneration of Board of Directors | Original proposal approved | |||||

| Proposal on the compensation and payment system for Board of Directors | Original proposal approved | |||||

| Proposal on the amendment to the severance payment regulation for senior management | Original proposal approved | |||||

| Approval of financial statements of the 28th term | Original proposal approved | |||||

| Convocation of annual general meeting of shareholders of 28th term | Original proposal approved | |||||

| Report on operational condition of internal accounting management system | Original proposal received | |||||

| Proposal on the execution of call option on Skylife | Original proposal approved | |||||

| Report on ROA status and strategies for improvement of real estate business | Original proposal received | |||||

| Audit committee’s report on operational condition of internal accounting management system | Original proposal received | |||||

| Report on the validity of the audit committee | Original proposal received | |||||

22

Third | Mar. 12, 2010 | Appointment of the Chairman of the Board of Directors and the proposal on the organization of committees under the Board of Directors | Chairman of BOD and members of committees appointed | |||

| Amendment to the policies on the Board of Directors and committees | Original proposal approved | |||||

| Report on current status and plan for improvement of management performance of subsidiary companies | Original proposal received | |||||

| Report on acquisition of Keum-Ho Rent-A-Car and proposal on capital increase | Original proposal approved | |||||

| Report on transactions under 15 billion won with other entities for 2009 | Original proposal received | |||||

| Plan for building hot-line for chairman of audit committee | Original proposal received | |||||

Fourth | Mar. 17, 2010 | Approval on the payment for acquirement of new spectrum | Original proposal approved | |||

Fifth | Apr. 29, 2010 | Proposal on funding for Korea Mobile Internet Business Association | Original proposal approved | |||

| Proposal on renewal contract for KIF investment fund | Original proposal approved | |||||

| Proposal on disposition of treasury shares for long-term performance based incentive payment | Original proposal approved | |||||

| Proposal on plans for the payment of long-term incentive for 2010 | Conditionally approved | |||||

| Proposal on the method of payment for granted stock-options in the past | Original proposal approved | |||||

| Plan for postponed incentive payment | Original proposal approved | |||||

| Report on statement of accounts for the first quarter of 2010 fiscal year | Original proposal received | |||||

Sixth | May. 14, 2010 | Proposal on C project plan | Original proposal approved | |||

| Proposal on disposition of newly established non-car rental business unit of KT Rental | Original proposal approved | |||||

Seventh | July 16, 2010 | Proposal on establishment of Wibro Infrastructure Corporation (WIC) | Original proposal approved | |||

| Proposal on raising and operation of fund for enhancement of core capability | Original proposal approved | |||||

Eighth | July 29, 2010 | Plan for processing of stock-options of retired executive officers | Original proposal approved | |||

| Report on statement of accounts for the first half of 2010 fiscal year | Original proposal received | |||||

23

(3) The Status of Committees under the Board of Directors

| (a) | Organization of the Committees under the Board of Directors (As of June 30, 2010) |

Title | Organization | Name (after March 12, 2010) | Purpose of Establishment and Authority | Note (Before March 12, 2010) | ||||

Corporate Governance Committe | 4 Outside Directors, & 1 non- independent Directors | Choon Ho Lee (Chairperson) E. Han Kim Jeung Soo Huh Chan-Jin Lee Hyun-Myung Pyo | Improvement of Corporate Governance | E. Han Kim (Chairman), Jeong-Suk Koh Si Chin Kang, Joon Park, Choon Ho Lee, Hyun Myung Pyo | ||||

Evaluation & Compensation Committee | 4 Outside Directors | Jeung Soo Huh (Chairperson) Choon Ho Lee Jong-Hwan Song Chan-Jin Lee | Management Agreement with the CEO and Assessment | Jeong-Suk Koh (Chairperson) In-Man Song Choon Ho Lee, Jeung Soo Huh | ||||

Executive Committee | 3 non- independent Directors | Suk Chae Lee (Chairperson) Sang Hoon Lee Hyun Myung Pyo | Management and financial matters authorized by the Board of Directors | Suk-Chae Lee (Chairperson) Sang Hoon LeeHyun Myung Pyo | ||||

Related-party Transaction Committee | 4 Outside Directors | Jeong-Suk Koh (Chairperson) Joon Park Jong-Hwan Song Hae Bang Chung | Internal transactions that require resolution by the Board of Directors as stipulated by the ‘Antitrust Regulation and Fair Trade Law’ and ‘Securities and Exchange Act’ | Joon Park (Chairperson) Jeong Suk Koh Choon Ho Lee Jeung Soo Huh | ||||

| Outside Director Candidate Recommendation Committee | See V. Management and Affiliated Companies 1. Overview of the Board of Directors and Committees under the Board A. Matters on the Board of Directors (4) Independency of the Board of Directors | — | ||||||

| Audit Committee | See V. Management and Affiliated Companies B. Audit Committee | — | ||||||

| (b) | Activities of the Committees under the Board of Directors |

Corporate Governance Committee

Agenda | Results of discussion | Independent and Non-Executive Directors | Executive Directors | |||||||||||||||||||||

| Choon Ho Lee | E. H Kim | Jeung Soo Huh | Chan Jin Lee | Hyun Myung Pyo | ||||||||||||||||||||

| Attendance 100% | Attendance 100% | Attendance 100% | Attendance 100% | Attendance 100% | ||||||||||||||||||||

Meeting Date | Voting Result | |||||||||||||||||||||||

May. 26 | Proposal on management plan of Corporate Governance Committee for 2010 | Original proposal approved | For | For | For | For | For | |||||||||||||||||

July 29 | Proposal on improvement of corporate governance system | Original proposal approved | For | For | For | Absent | For | |||||||||||||||||

24

Evaluation & Compensation Committee

Agenda | Results of discussion | Independent and Non-Executive Directors | ||||||||||

| Jeong Suk Koh | InMan Song | Choon Ho Lee | Jeung Soo Huh | |||||||||

| Attendance 100% | Attendance 86% | Attendance 40% | Attendance 100% | |||||||||

Meeting Date | Voting Result | |||||||||||

| Jan. 27 | Result of CEO management assessment for 2009 | Original proposal approved | For | For | Absent | For | ||||||

| Proposal on payment system for CEO and standing directors | Original proposal approved | For | For | Absent | For | |||||||

Feb. 10

| Proposal on the Limit on remuneration of Directors for 2010 | Original proposal approved | For | For | Absent | For | ||||||

| Proposal on remuneration standards and payment methods for Standing Directors | Original proposal approved | For | For | Absent | For | |||||||

| Original proposal approved | For | For | Absent | For | ||||||||

| Feb. 25 | CEO management goal for 2010 | Re-Proposition | Against | Against | Absent | Against | ||||||

| Mar. 5 | CEO management goal for 2010 | Original proposal approved | For | Absent | For | For | ||||||

* Members of the committee re-elected on March 12, 2010: (Jeong Soo Huh, Choon Ho Lee, Jong Hwan Song, and Chan Jin Lee)

Agenda | Results of discussion | Independent and Non-Executive Directors | ||||||||||||||||||

| Jeong Soo Huh | Choon Ho Lee | Jong Hwan Song | Chan Jin Lee | |||||||||||||||||

| Attendance 100% | Attendance 40% | Attendance 100% | Attendance 100% | |||||||||||||||||

Meeting Date | Voting Result | |||||||||||||||||||

Apr. 28 | Proposal on Long-term incentive payment for 2009 | Original proposal approved | For | For | For | For | ||||||||||||||

| Proposal on Long-term incentive grant in 2010 | Original proposal approved | For | For | For | For | |||||||||||||||

| Proposal on the method of payment for granted stock-options in the past | Original proposal approved | For | For | For | For | |||||||||||||||

July 29 | Plan for process of stock-options of retired executive officers | Original proposal approved | For | absent | For | For | ||||||||||||||

| Result of CEO management assessment for first half of 2010 | Original proposal received | For | absent | For | For | |||||||||||||||

25

Executive Committee

Agenda | Results of discussion | Executive Directors | ||||||||

| Suk-Chae Lee | Sasng Hoon Lee | Hyun Myung Pyo | ||||||||

| Attendance 100% | Attendance 100% | Attendance 100% | ||||||||

Meeting Date | Voting Result | |||||||||

Jan. 18 | Establishment and, relocation of branches, Change in branch name, and closing of branches | Original proposal approved | For | For | For | |||||

Jan. 25 | Proposal on issuance of corporate bonds in 1Q and 2Q 2010. | Original proposal approved | For | For | For | |||||

Mar.8 | Proposal on branch name change and branch relocation | Original proposal approved | For | For | For | |||||

Mar. 22 | Proposal to donate certain facilities regarding the establishment of broadband mobile traffic information system | Original proposal approved | For | For | For | |||||

Mar. 23 | Proposal to award 2010 KT –IT Scholarship | Original proposal approved | For | For | For | |||||

Apr. 5 | Proposal to award KT Company-Labor Union Youth Scholarship | Original proposal approved | For | For | For | |||||

Apr. 8 | Relocation of Branches | Original proposal approved | For | For | For | |||||

Apr. 21 | Establishment of new branch | Original proposal approved | For | For | For | |||||

May 7 | Proposal on sponsorship for ‘Daegu FC’ | Original proposal approved | For | For | For | |||||

May 19 | Sponsoring Korea Digital Media Industry Association | Original proposal approved | For | For | For | |||||

May 27 | Relocation of Branches | Original proposal approved | For | For | For | |||||

September 17 | Closing of branches | Original proposal approved | For | For | For | |||||

| Proposal on issuance of corporate bonds in 4Q 2010. | Original proposal approved | For | For | For | ||||||

| Proposal on WIC project | Original proposal approved | For | For | For | ||||||

26

(4) Independency of the Board of Directors

| (a) | Independency of appointing BOD members |

In order to secure the independency and transparency, all candidates to the Board of Directors should be selected and must get approvals from the general meeting of shareholders. Also, the outside research and advisory service can be done if necessary.

| (b) | Appointment of new Directors |

Name | Expertise | Recommendation | Committees | Inside trading, relationship with major shareholders | ||||

| Choon Ho Lee | Media Business | Outside Director Candidate Recommendation Committee | Corporate Governance Committee(Chairman)/ Evaluation & Compensation Committee | No | ||||

| Jeung Soo Huh | New Energy Business | Outside Director Candidate Recommendation Committee | Corporate Governance Committee/ Evaluation & Compensation Committee(Chairman) | No | ||||

| Jong Hwan Song | Global Business | Outside Director Candidate Recommendation Committee | Evaluation & Compensation Committee / Related-party Transaction Committee | No | ||||

| Chan Jin Lee | Broadcasting/ Telecommunication and Internet | Outside Director Candidate Recommendation Committee | Corporate Governance Committee/ Evaluation & Compensation Committee | No | ||||

| (c) | Establishing separate committee to appoint new directors |

Name | Outside Directors | Note | ||

| E. Han Kim | O | The number of the outsider Directors should be more than 50% | ||

| Jeong Suk Koh | O | |||

| Joon Park | O | |||

| Choon Ho Lee | O | |||

| Jeung Soo Huh | O | |||

| Hyun Myung Pyo | X |

Outside Director Candidate Recommendation Committee

Agenda | Results of discussion | Independent and Non-Executive Directors | Executive Director | |||||||||||||||||||||||||

| E. Han Kim | Jeong-Suk Koh | Joon Park | Choon Ho Lee | Jeung Soo Huh | Hyun Myung Pyo | |||||||||||||||||||||||

| Attendance 100% | Attendance 100% | Attendance 100% | Attendance 100% | Attendance 100% | Attendance 100% | |||||||||||||||||||||||

Meeting Date | Voting Result | |||||||||||||||||||||||||||

Jan. 21 | Plan on supporting recommendation of outside director candidate | Original proposal approved | For | For | For | For | For | For | ||||||||||||||||||||

Jan. 28 | Selecting outside director candidate | Original proposal approved | For | For | For | For | For | For | ||||||||||||||||||||

Feb. 8 | Finalization of outside director candidates | Original proposal approved | For | For | For | For | For | For | ||||||||||||||||||||

27

B. Audit Committee

(1) Matters on Audit Institution

| (a) | Establishment and Method of Organization of Audit Committee (Auditors) |

| • | Purpose of operational regulations for Audit Committee |

- To regulate matters necessary for effective operation of Audit Committee

| • | Rights and Duties |

- The Audit Committee may audit the Company’s accounting and business affairs, and demand, whenever necessary, Directors of the Company to report on the relevant matters thereof. The Committee may handle the matters provided for under the relevant statutes, the Articles of Incorporation or the operational rules of the Audit Committee and those matters authorized by the Board of Directors.

| • | Members of the Audit Committee shall be appointed by a resolution of the general meeting of shareholders, and at least one financial expert must be appointed as a member. |

| (b) | The Audit Committee’s Internal Procedures for Access to Management Information Necessary for Audit |

| • | Types of Meetings |

- The Committee shall hold a regular meeting in the first month of every quarter of each year and may hold an extraordinary meeting whenever necessary

| • | Right of Convocation |

- The Audit Committee Meeting shall be convened by the Chairman of the Committee upon the request of the President or a member of the Committee.

| • | Convocation Process |

- The Chairman shall send every member of the Committee a notice specifying date, location and agenda of the meeting through facsimile, telegram, registered mail or other electronic measures, at least 3 days prior to the date of the meeting

| • | The Committee shall deliberate on or resolve the following matters: |

- Matters on the General Meeting of Shareholders

· Request to the Board of Directors to convene an Extraordinary Meeting of Shareholders

· Investigate and testify on agenda of, and documents provided at, the General Meeting of Shareholders

- Matters on Directors and Board of Directors

· Report to the Board of Directors on a Director’s activities that are in violation of relevant statutes or the Articles of Incorporation

· Preparation and submission of Audit Report on financial statements that are to be submitted to the General Meeting of Shareholders

· Injunction on illegal activities of a Director

· Request for a report on the performance of Directors

· Assessment report of operational status of internal accounting management system

28

· Assessment report on Audit Committee

· Matters authorized by the Board of Directors

- Matters on Audit

· Request on performance of Directors or investigation on business and financial status of the Company

· Investigation on subsidiaries under the Commercial Code

· Receipt of report from a Director

· Representation of the Company in a lawsuit between a Director and the Company

· Decision on institution of a lawsuit upon a minority shareholder’s request for institution of a suit against Directors

· Approval for appointment, change or dismissal of an external auditor (the “Auditor”)

· Receipt of reports made by the Auditor on a Director’s misconduct in the course of performing his duties or a material fact that is in violation of relevant statutes or the Articles of Incorporation

· Receipt of reports made by the Auditor on the Company’s violation of accounting standards, etc.

· Assessment on audit of the Auditor

· Assessment on independence of the Auditor

· Pre-approval on services provided by the Auditor

· Auditing plans for the year and the audit result

· Assessment on the internal control system

· Verification of corrective measures regarding audit results

· Approval for appointment and proposal for dismissal of a person in charge of internal audit

· Review of feasibility of material accounting policies and change in accounting estimates

· Review on soundness and propriety of corporate financing and accuracy of financial reports

· Establishment of whistle-blowing system

- Other Matters Provided by the Relevant Statutes and the Articles of Incorporation

· The Audit Committee may, whenever necessary, require internal audit organization to separately report on its audit activities.

| (c) | Personal Information of Members of the Audit Committee (As of June 30, 2010) |

Name | Experience | Note | ||||

Joon Park | - Master of Laws(LL.M.), Harvard Law School - Attorney-at-law, Kim & Chang, Seoul - (Present) Professor, College of Law, Seoul National University |

| Outside director |

| ||

E. Han Kim | - Ph.D. in Finance, State University of New York - Independent Director, POSCO Non-Executive Chairman of the Board of Directors - (Present) Endowed Chair Professor and Director of Financial Research |

| Outside director |

| ||

Jeong Suk Koh | - Ph. D, Management, Sloan School of Management, MIT - MS, Management, Korea Advanced Inst. Of Science and Technology - (Present) CEO, Ilshin Investment Co., Ltd. |

| Outside director |

| ||

Hae Bang Chung | - M.A in Economics, Vanderbilt University - 6th Deputy Minister, the Ministry of Strategy and Planning - (Present) Professor, College of Law, Konkuk University |

| Outside director |

| ||

29

(2) Major Activities of the Audit Committee (Auditor)

Order | Date | Subject | Result of Discussion | Note | ||||

First | Jan.27 | Approval of financial statements for 28th term | Original proposal approved | — | ||||

| Report of business report for 28th term | Original proposal approved | |||||||

| Report of final audit for fiscal year 2009 | Conditional approved | |||||||

Second | Feb. 11 | Appointment and remuneration of independent auditor for consolidated companies for fiscal year 2010 | Original proposal approved | — | ||||

| Report on operating result of internal accounting management system of fiscal year 2009 | Original proposal received | |||||||

| Report on operational condition of internal accounting management system of fiscal year 2009 (prepared by audit committee) | Original proposal received | |||||||

| Report on validity of the audit committee | Original proposal received | |||||||

Third | Feb. 25 | Report on agenda of the annual general meeting of shareholders for 28th term and result on document investigation | Original proposal received | — | ||||

| Audit report for the annual general meeting of shareholders for 28th term | Original proposal received | |||||||

| Report on audit records of 2009 and audit plan for 2010 | Original proposal received | |||||||

| Written opinion on operational status of internal compliance device of the audit committee | Original proposal received | |||||||

Fourth | Mar. 17 | Appointment of the chairman of Audit committee | Chairman appointed | — | ||||

| Approval of remuneration of independent auditor for consolidated companies for fiscal year 2010 | Original proposal approved | |||||||

| Report on the result of consolidated statement of account for fiscal year 2009 | Original proposal received | |||||||

Fifth | Apr. 26 | Approval of remuneration of independent auditor for consolidated companies for fiscal year 2010 | Original proposal approved | — | ||||

| Report on statement of accounts for the first quarter of fiscal year 2010 | Original proposal received | |||||||

| Report of audit performance for the first quarter of 2010 and audit plan | Original proposal received | |||||||

Sixth | June. 24 | Report on filing of Form 20-F for fiscal year 2009 | Original proposal received | — | ||||

Seventh | Jul. 29 | Approval of remuneration for audit and non-audit services of independent auditor of consolidated companies for fiscal year 2010 | Original proposal approved | |||||

| Report on statement of accounts for the first half of fiscal year 2010 | Original proposal received | |||||||

| Report of final audit for first half of fiscal year 2010 | Original proposal received | |||||||

| Report of audit performance for the first half of 2010 and audit plan for third quarter of 2010 | Original proposal received | |||||||

Eighth | Aug. 12 | Pre-approval of remuneration of independent auditor for non-audit services | Re-proposed | |||||

| Pre-approval of remuneration of independent auditor for consolidated company (KTR) for fiscal year 2010 | Original proposal approved | |||||||

C. Matters on Shareholder’s Exercise of Voting Right

| (1) | Adoption of Cumulative Voting System |

Automatic introduction of the cumulative voting system following the completion of the privatization process in 2002.

30

| (2) | Adoption of the Written Voting System or Electronic Voting |

Adoption of the written voting system in accordance with the changes in the Articles of Incorporation at the 23rd General Meeting of Shareholders (March 11, 2005)

| (3) | Exercise of Minority Shareholders’ Rights |

The minority shareholders’ rights were exercised most recently at the 24th General Meeting of Shareholders in 2006.

24th General Meeting of Shareholders (March 10, 2006)

Shareholder | Contents of the Minority Shareholder’s Right | Purpose of Exercise | Result | Note | ||||

Jai Sik Ji and others | Shareholder proposal on the subject matter of the general meeting of shareholders | Recommendation of Outside Director candidates who will also be members of the Audit Committee | Candidates recommended through shareholder proposals failed to be appointed at the General Meeting of Shareholders (cumulative voting) | Article 191-14 of the Securities and Exchange Act | ||||

Jai Sik Ji and others | Request for cumulative voting | Request for cumulative voting for appointment of Outside Director candidates who will also be members of the Audit Committee | Candidates recommended through shareholder proposals failed to be appointed at the General Meeting of Shareholders (cumulative voting) | Article 191-18 of the Securities and Exchange Act | ||||

D. Remuneration to Executive Officers

| (1) | Remuneration paid to Directors (including Outside Directors) and Members of the Audit Committee (Auditors) |

(Unit: Hundred Million Won)

Category | Total Amount Paid | Amount Approved by the General Meeting of Shareholders | Average Amount Paid per Person | Fair Value of Stock Option | Weight | Reference | ||||||||||

3 Non-Independent Directors | 8.61 | 65 | 2.87 | — | — | — | ||||||||||

8 Outside Directors | 3.7 | 0.45 | — | — | — | |||||||||||

* Performance-based compensation made at year end.

31

| (2) | Grant and Exercise of Stock Option |

| As of September 30, 2010 | (Unit: Won, Shares) |

Holder | Position | Date of Grant | Shares to | Type of | Changed Volume | Unexercised | Period for | Exercise | ||||||||||||||||||||||

| Granted | Exercised | Revoked | ||||||||||||||||||||||||||||

| Jung Woong Kim | Outside Director | 9/8/2003 | Treasury Shares | Common Shares | 7,120 | 3,596 | 3,524 | 0 | 9/9/2005 to 9/8/2010 | 41,711 | ||||||||||||||||||||

| Il Choing Nam | Outside Director | 9/8/2003 | Treasury Shares | Common Shares | 7,120 | 3,596 | 3,524 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Sung Chul Chun | Outside Director | 9/8/2003 | Treasury Shares | Common Shares | 7,120 | 3,596 | 3,524 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Young Ju Cho | Standing Director | 9/8/2003 | Treasury Shares | Common Shares | 43,154 | 40,809 | 2,345 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| In Moo Huh | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 28,769 | 3,236 | 25,533 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Ju Young Song | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 28,769 | 27,245 | 1,524 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Min Hee Lee | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | 20,404 | 1,173 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Soo Sung Jung | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | 20,404 | 1,173 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Seo Hwan Cho | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | 20,404 | 1,173 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Hyun Myung Pyo | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | 20,404 | 1,173 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Heon Chul Shin | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | — | 21,577 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Moon Ho Lee | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | — | 21,577 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Tae Bum Noh | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | — | 21,577 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Ki-Chul Kim | Non-standing Director | 9/8/2003 | Treasury Shares | Common Shares | 21,577 | 20,404 | 1,173 | 0 | Same as above | 41,711 | ||||||||||||||||||||

| Hyun Joon Kang | Standing Director | 9/16/2003 | Treasury Shares | Common Shares | 5,200 | — | 2,200 | 3,000 | 9/17/2005to 9/16/2010 | 57,000 | ||||||||||||||||||||

| Hee Chang Noh | Standing Director | 2/4/2005 | Treasury Shares | Common Shares | 60,000 | — | 16,847 | 43,153 | 2/5/2007 to 2/4/2012 | 54,600 | ||||||||||||||||||||