- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 7 May 12, 12:00am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2012

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

206 Jungja-dong

Bundang-gu, Sungnam

Kyunggi-do

463-711

Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: May 7, 2012 KT Corporation | ||

| By: | /s/ Youngwoo Kim | |

| Name: | Youngwoo Kim | |

| Title: | Vice President | |

| By: | /s/ Jungsup Jung | |

| Name: | Jungsup Jung | |

| Title: | Team Leader | |

KT

2012 1Q Earnings Release

Investor Relations MAY 7, 2012

Disclaimer

This presentation has been prepared by KT Corp. (“the Company”). This presentation contains forward-looking statements, which are subject to risks, uncertainties, and assumptions. This presentation is being presented solely for your information and is subject to change without notice. No representation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, actuality, fairness, or completeness of the information presented.

The Company, its affiliates or representatives accept no liability whatsoever for any losses arising from any information contained in the presentation. This presentation does not constitute an offer or invitation to purchase or subscribe for any shares of the Company, and no part of this presentation shall form the Basis of or be relied upon in

connection with any contract or commitment.

Any decision to purchase shares of the Company should be made solely on the Basis of information, which has been publicly filed with the Securities and Exchange Commission or the Korea Stock Exchange and distributed to all investors.

The contents of this presentation may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose.

1

Financial Highlights

I. Financial Highlights

1. Consolidated Income Statement

2. Consolidated Statement of Financial Position & CAPEX (KT Only)

II. Business Overview (Consolidated)

III. Appendix

2

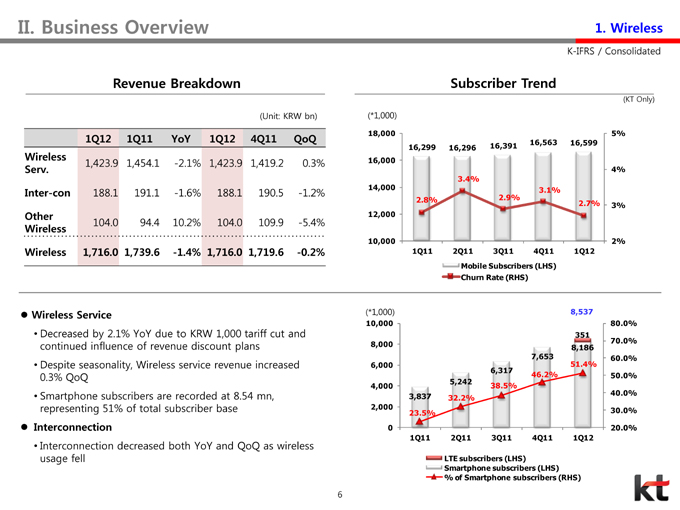

II. Business Overview

1. Wireless

K-IFRS / Consolidated

Revenue Breakdown

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Wireless

Serv. 1,423.9 1,454.1 -2.1% 1,423.9 1,419.2 0.3%

Inter-con 188.1 191.1 -1.6% 188.1 190.5 -1.2%

Other 104.0 94.4 10.2% 104.0 109.9 -5.4%

Wireless

Wireless 1,716.0 1,739.6 -1.4% 1,716.0 1,719.6 -0.2%

Subscriber Trend

(KT Only)

(*1,000)

18,000 5%

16,299 16,296 16,391 16,563 16,599

16,000

4%

3.4%

14,000 3.1%

2.8% 2.9% 2.7% 3%

12,000

10,000 2%

1Q11 2Q11 3Q11 4Q11 1Q12

Mobile Subscribers (LHS)

Churn Rate (RHS)

Wireless Service

Decreased by 2.1% YoY due to KRW 1,000 tariff cut and continued influence of revenue discount plans

Despite seasonality, Wireless service revenue increased 0.3% QoQ

Smartphone subscribers are recorded at 8.54 mn, representing 51% of total subscriber base

Interconnection

Interconnection decreased both YoY and QoQ as wireless usage fell

(*1,000) 8,537

10,000 80.0%

351

70.0%

8,000 8,186

7,653 60.0%

6,000 51.4%

6,317 46.2% 50.0%

5,242

4,000 38.5%

3,837 32.2% 40.0%

2,000 23.5% 30.0%

0 20.0%

1Q11 2Q11 3Q11 4Q11 1Q12

LTE subscribers (LHS)

Smartphone subscribers (LHS)

% of Smartphone subscribers (RHS)

6

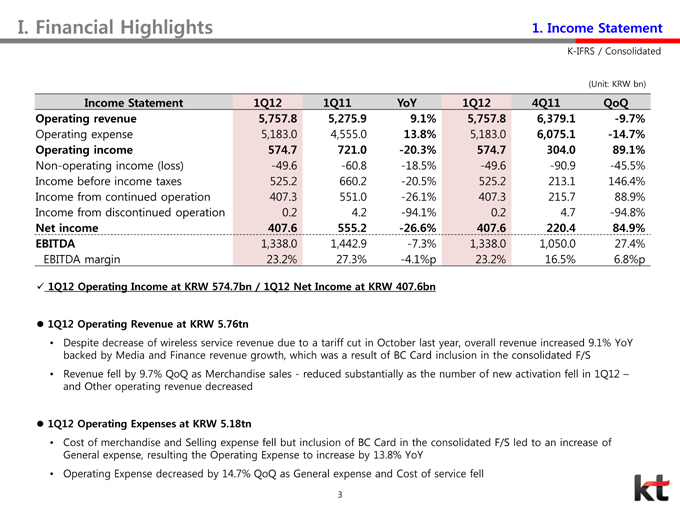

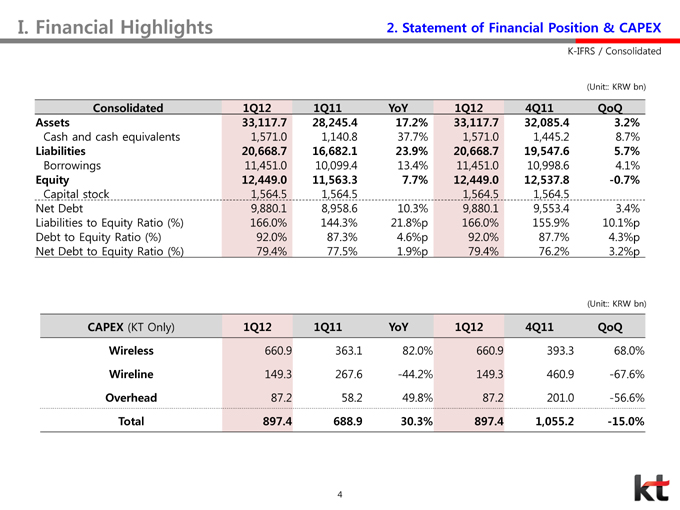

I. Financial Highlights

2. Statement of Financial Position & CAPEX

K-IFRS / Consolidated

(Unit:: KRW bn)

Consolidated 1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Assets 33,117.7 28,245.4 17.2% 33,117.7 32,085.4 3.2%

Cash and cash equivalents 1,571.0 1,140.8 37.7% 1,571.0 1,445.2 8.7%

Liabilities 20,668.7 16,682.1 23.9% 20,668.7 19,547.6 5.7%

Borrowings 11,451.0 10,099.4 13.4% 11,451.0 10,998.6 4.1%

Equity 12,449.0 11,563.3 7.7% 12,449.0 12,537.8 -0.7%

Capital stock 1,564.5 1,564.5 1,564.5 1,564.5

Net Debt 9,880.1 8,958.6 10.3% 9,880.1 9,553.4 3.4%

Liabilities to Equity Ratio (%) 166.0% 144.3% 21.8%p 166.0% 155.9% 10.1%p

Debt to Equity Ratio (%) 92.0% 87.3% 4.6%p 92.0% 87.7% 4.3%p

Net Debt to Equity Ratio (%) 79.4% 77.5% 1.9%p 79.4% 76.2% 3.2%p

(Unit:: KRW bn)

CAPEX (KT Only) 1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Wireless 660.9 363.1 82.0% 660.9 393.3 68.0%

Wireline 149.3 267.6 -44.2% 149.3 460.9 -67.6%

Overhead 87.2 58.2 49.8% 87.2 201.0 -56.6%

Total 897.4 688.9 30.3% 897.4 1,055.2 -15.0%

4

Business Overview

I. Financial Highlights (Consolidated) II. Business Overview (Consolidated)

1. Wireless

2. Fixed line

3. Media/Contents

4. Finance & Other Services

5. Operating Expenses III. Appendix

5

II. Business Overview

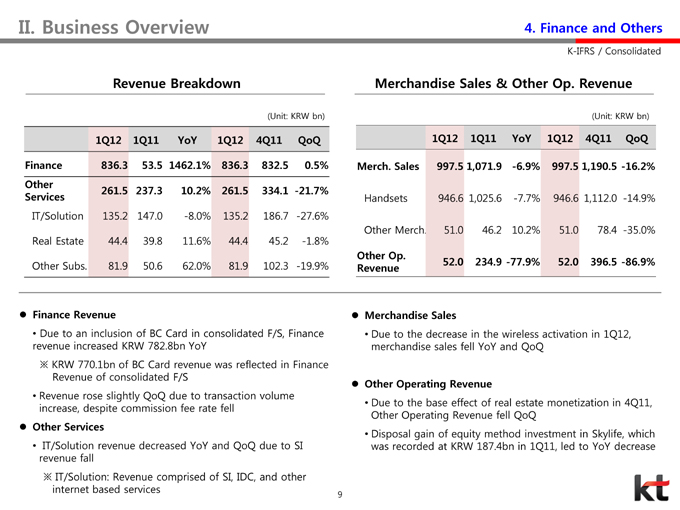

4. Finance and Others

K-IFRS / Consolidated

Revenue Breakdown

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Finance 836.3 53.5 1462.1% 836.3 832.5 0.5%

Other

Services 261.5 237.3 10.2% 261.5 334.1 -21.7%

IT/Solution 135.2 147.0 -8.0% 135.2 186.7 -27.6%

Real Estate 44.4 39.8 11.6% 44.4 45.2 -1.8%

Other Subs. 81.9 50.6 62.0% 81.9 102.3 -19.9%

Merchandise Sales & Other Op. Revenue

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Merch. Sales 997.5 1,071.9 -6.9% 997.5 1,190.5 -16.2%

Handsets 946.6 1,025.6 -7.7% 946.6 1,112.0 -14.9%

Other Merch. 51.0 46.2 10.2% 51.0 78.4 -35.0%

Other Op.

Revenue 52.0 234.9 -77.9% 52.0 396.5 -86.9%

Finance Revenue

Due to an inclusion of BC Card in consolidated F/S, Finance

revenue increased KRW 782.8bn YoY

KRW 770.1bn of BC Card

Revenue of consolidated F/S

Revenue rose slightly QoQ due to transaction volume

increase, despite commission fee rate fell

Other Services

IT/Solution revenue decreased YoY and QoQ due to SI

revenue fall

IT/Solution: Revenue

internet based services

Merchandise Sales

Due to the decrease in the wireless activation in 1Q12, merchandise sales fell YoY and QoQ was reflected in Finance

Other Operating Revenue

Due to the base effect of real estate monetization in 4Q11, Other Operating Revenue fell QoQ

Disposal gain of equity method investment in Skylife, which was recorded at KRW 187.4bn in 1Q11, led to YoY decrease

9

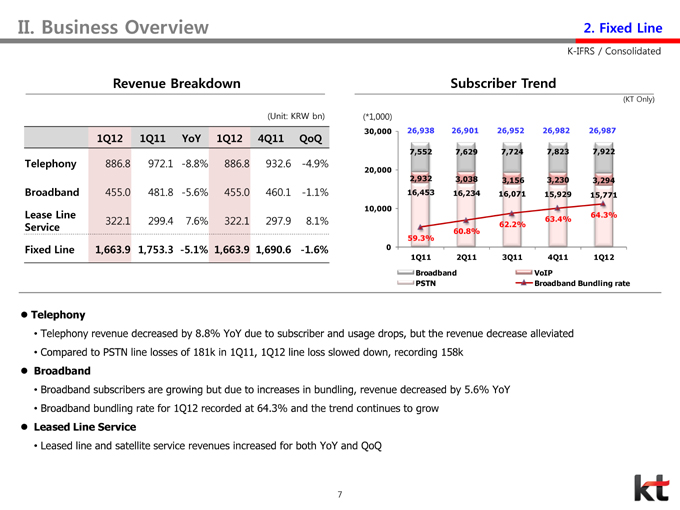

II. Business Overview

2. Fixed Line

K-IFRS / Consolidated

Revenue Breakdown

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Telephony 886.8 972.1 -8.8% 886.8 932.6 -4.9%

Broadband 455.0 481.8 -5.6% 455.0 460.1 -1.1%

Lease Line 322.1 299.4 7.6% 322.1 297.9 8.1%

Service

Fixed Line 1,663.9 1,753.3 -5.1% 1,663.9 1,690.6 -1.6%

Subscriber Trend

(KT Only)

(*1,000)

30,000 26,938 26,901 26,952 26,982 26,987

7,552 7,629 7,724 7,823 7,922

20,000

2,932 3,038 3,156 3,230 3,294

16,453 16,234 16,071 15,929 15,771

10,000

63.4% 64.3%

62.2%

60.8%

59.3%

0

1Q11 2Q11 3Q11 4Q11 1Q12

Broadband VoIP

PSTN Broadband Bundling rate

Telephony

Telephony revenue decreased by 8.8% YoY due to subscriber and usage drops, but the revenue decrease alleviated

Compared to PSTN line losses of 181k in 1Q11, 1Q12 line loss slowed down, recording 158k

Broadband

Broadband subscribers are growing but due to increases in bundling, revenue decreased by 5.6% YoY

Broadband bundling rate for 1Q12 recorded at 64.3% and the trend continues to grow

Leased Line Service

Leased line and satellite service revenues increased for both YoY and QoQ

7

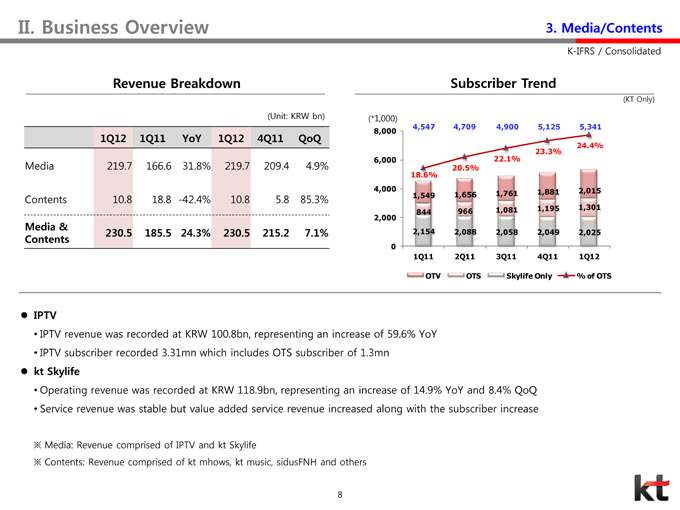

II. Business Overview

3. Media/Contents

K-IFRS / Consolidated

Revenue Breakdown

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Media 219.7 166.6 31.8% 219.7 209.4 4.9%

Contents 10.8 18.8 -42.4% 10.8 5.8 85.3%

Media & 230.5 185.5 24.3% 230.5 215.2 7.1%

Contents

Subscriber Trend

(KT Only)

(*1,000)

8,000 4,547 4,709 4,900 5,125 5,341

24.4%

23.3%

6,000 22.1%

20.5%

18.6%

4,000 1,549 1,656 1,761 1,881 2,015

844 966 1,081 1,195 1,301

2,000

2,154 2,088 2,058 2,049 2,025

0

1Q11 2Q11 3Q11 4Q11 1Q12

OTV OTS Skylife Only % of OTS

IPTV

IPTV revenue was recorded at KRW 100.8bn, representing an increase of 59.6% YoY

IPTV subscriber recorded 3.31mn which includes OTS subscriber of 1.3mn

kt Skylife

Service revenue was stable but value added service revenue increased along with the subscriber increase

Media: Revenue comprised of IPTV and kt Skylife

Contents: Revenue comprised of kt mhows, kt music, sidusFNH and others

8

II. Business Overview

4. Finance and Others

K-IFRS / Consolidated

Revenue Breakdown

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Finance 836.3 53.5 1462.1% 836.3 832.5 0.5%

Other

Services 261.5 237.3 10.2% 261.5 334.1 -21.7%

IT/Solution 135.2 147.0 -8.0% 135.2 186.7 -27.6%

Real Estate 44.4 39.8 11.6% 44.4 45.2 -1.8%

Other Subs. 81.9 50.6 62.0% 81.9 102.3 -19.9%

Merchandise Sales & Other Op. Revenue

(Unit: KRW bn)

1Q12 1Q11 YoY 1Q12 4Q11 QoQ

Merch. Sales 997.5 1,071.9 -6.9% 997.5 1,190.5 -16.2%

Handsets 946.6 1,025.6 -7.7% 946.6 1,112.0 -14.9%

Other Merch. 51.0 46.2 10.2% 51.0 78.4 -35.0%

Other Op.

Revenue 52.0 234.9 -77.9% 52.0 396.5 -86.9%

Finance Revenue

Due to an inclusion of BC Card in consolidated F/S, Finance

revenue increased KRW 782.8bn YoY

KRW 770.1bn of BC Card revenue was reflected in finance

Revenue of consolidated F/S

Revenue rose slightly QoQ due to transaction volume

increase, despite commission fee rate fell

Other Services

IT/Solution revenue decreased YoY and QoQ due to SI

revenue fall

IT/Solution: Revenue Comprised of SI, IDC, and other

internet based services

Merchandise Sales

Due to the decrease in the wireless activation in 1Q12, merchandise sales fell YoY and QoQ

Other Operating Revenue

Due to the base effect of real estate monetization in 4Q11, Other Operating Revenue fell QoQ

Disposal gain of equity method investment in Skylife, which was recorded at KRW 187.4bn in 1Q11, led to YoY decrease

9

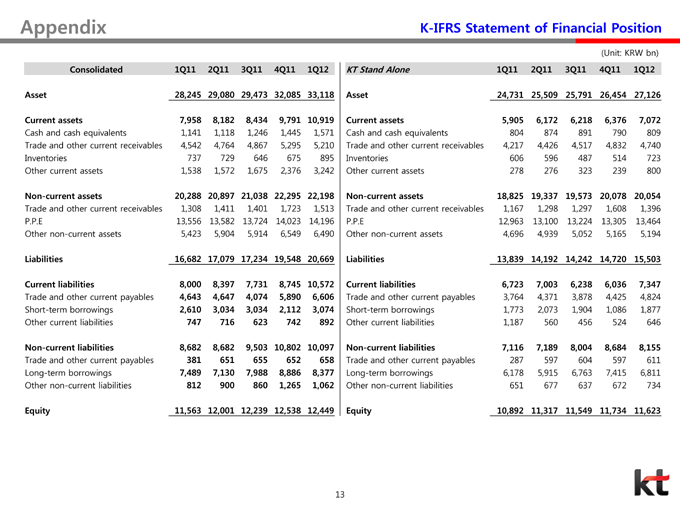

Appendix

K-IFRS Statement of Financial Position

(Unit: KRW bn)

Consolidated 1Q11 2Q11 3Q11 4Q11 1Q12

Asset 28,245 29,080 29,473 32,085 33,118

Current assets 7,958 8,182 8,434 9,791 10,919

Cash and cash equivalents 1,141 1,118 1,246 1,445 1,571

Trade and other current receivables 4,542 4,764 4,867 5,295 5,210

Inventories 737 729 646 675 895

Other current assets 1,538 1,572 1,675 2,376 3,242

Non-current assets 20,288 20,897 21,038 22,295 22,198

Trade and other current receivables 1,308 1,411 1,401 1,723 1,513

P.P.E 13,556 13,582 13,724 14,023 14,196

Other non-current assets 5,423 5,904 5,914 6,549 6,490

Liabilities 16,682 17,079 17,234 19,548 20,669

Current liabilities 8,000 8,397 7,731 8,745 10,572

Trade and other current payables 4,643 4,647 4,074 5,890 6,606

Short-term borrowings 2,610 3,034 3,034 2,112 3,074

Other current liabilities 747 716 623 742 892

Non-current liabilities 8,682 8,682 9,503 10,802 10,097

Trade and other current payables 381 651 655 652 658

Long-term borrowings 7,489 7,130 7,988 8,886 8,377

Other non-current liabilities 812 900 860 1,265 1,062

Equity 11,563 12,001 12,239 12,538 12,449

KT Stand Alone 1Q11 2Q11 3Q11 4Q11 1Q12

Asset 24,731 25,509 25,791 26,454 27,126

Current assets 5,905 6,172 6,218 6,376 7,072

Cash and cash equivalents 804 874 891 790 809

Trade and other current receivables 4,217 4,426 4,517 4,832 4,740

Inventories 606 596 487 514 723

Other current assets 278 276 323 239 800

Non-current assets 18,825 19,337 19,573 20,078 20,054

Trade and other current receivables 1,167 1,298 1,297 1,608 1,396

P.P.E 12,963 13,100 13,224 13,305 13,464

Other non-current assets 4,696 4,939 5,052 5,165 5,194

Liabilities 13,839 14,192 14,242 14,720 15,503

Current liabilities 6,723 7,003 6,238 6,036 7,347

Trade and other current payables 3,764 4,371 3,878 4,425 4,824

Short-term borrowings 1,773 2,073 1,904 1,086 1,877

Other current liabilities 1,187 560 456 524 646

Non-current liabilities 7,116 7,189 8,004 8,684 8,155

Trade and other current payables 287 597 604 597 611

Long-term borrowings 6,178 5,915 6,763 7,415 6,811

Other non-current liabilities 651 677 637 672 734

Equity 10,892 11,317 11,549 11,734 11,623

13

Appendix

I. Financial Highlights (Consolidated) II. Business Overview (Consolidated) III. Appendix

1. Income Statement (Consolidated/KT Only)

2. Statement of Financial Position (Consolidated/KT Only)

3. Factsheet (KT Only)

11

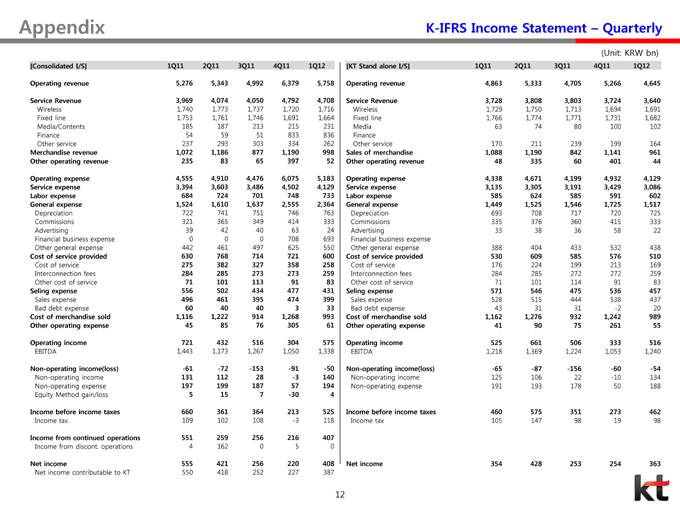

Appendix

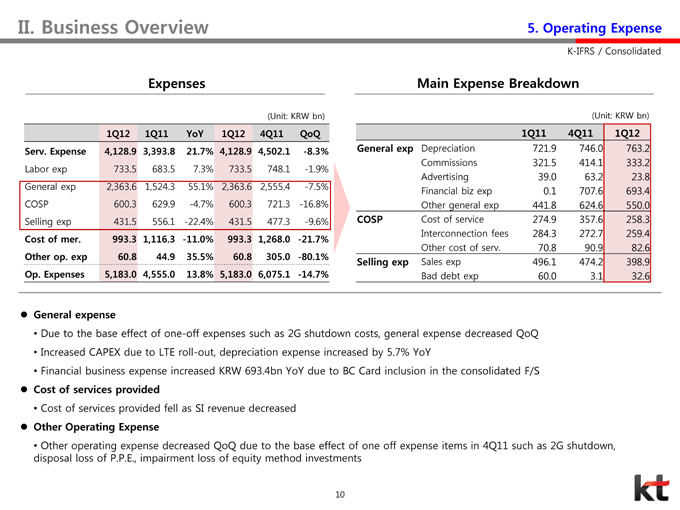

K-IFRS Income Statement – Quarterly

(Unit: KRW bn)

[Consolidated I/S] 1Q11 2Q11 3Q11 4Q11 1Q12

Operating revenue 5,276 5,343 4,992 6,379 5,758

Service Revenue 3,969 4,074 4,050 4,792 4,708

Wireless 1,740 1,773 1,737 1,720 1,716

Fixed line 1,753 1,761 1,746 1,691 1,664

Media/Contents 185 187 213 215 231

Finance 54 59 51 833 836

Other service 237 293 303 334 262

Merchandise revenue 1,072 1,186 877 1,190 998

Other operating revenue 235 83 65 397 52

Operating expense 4,555 4,910 4,476 6,075 5,183

Service expense 3,394 3,603 3,486 4,502 4,129

Labor expense 684 724 701 748 733

General expense 1,524 1,610 1,637 2,555 2,364

Depreciation 722 741 751 746 763

Commissions 321 365 349 414 333

Advertising 39 42 40 63 24

Financial business expense 0 0 0 708 693

Other general expense 442 461 497 625 550

Cost of service provided 630 768 714 721 600

Cost of service 275 382 327 358 258

Interconnection fees 284 285 273 273 259

Other cost of service 71 101 113 91 83

Seling expense 556 502 434 477 431

Sales expense 496 461 395 474 399

Bad debt expense 60 40 40 3 33

Cost of merchandise sold 1,116 1,222 914 1,268 993

Other operating expense 45 85 76 305 61

Operating income 721 432 516 304 575

EBITDA 1,443 1,173 1,267 1,050 1,338

Non-operating income(loss) -61 -72 -153 -91 -50

Non-operating income 131 112 28 -3 140

Non-operating expense 197 199 187 57 194

Equity Method gain/loss 5 15 7 -30 4

Income before income taxes 660 361 364 213 525

Income tax 109 102 108 -3 118

Income from continued operations 551 259 256 216 407

Income from discont. operations 4 162 0 5 0

Net income 555 421 256 220 408

Net income contributable to KT 550 418 252 227 387

[KT Stand alone I/S] 1Q11 2Q11 3Q11 4Q11 1Q12

Operating revenue 4,863 5,333 4,705 5,266 4,645

Service Revenue 3,728 3,808 3,803 3,724 3,640

Wireless 1,729 1,750 1,713 1,694 1,691

Fixed line 1,766 1,774 1,771 1,731 1,682

Media 63 74 80 100 102

Finance

Other service 170 211 239 199 164

Sales of merchandise 1,088 1,190 842 1,141 961

Other operating revenue 48 335 60 401 44

Operating expense 4,338 4,671 4,199 4,932 4,129

Service expense 3,135 3,305 3,191 3,429 3,086

Labor expense 585 624 585 591 602

General expense 1,449 1,525 1,546 1,725 1,517

Depreciation 693 708 717 720 725

Commissions 335 376 360 415 333

Advertising 33 38 36 58 22

Financial business expense

Other general expense 388 404 433 532 438

Cost of service provided 530 609 585 576 510

Cost of service 176 224 199 213 169

Interconnection fees 284 285 272 272 259

Other cost of service 71 101 114 91 83

Seling expense 571 546 475 536 457

Sales expense 528 515 444 538 437

Bad debt expense 43 31 31 -2 20

Cost of merchandise sold 1,162 1,276 932 1,242 989

Other operating expense 41 90 75 261 55

Operating income 525 661 506 333 516

EBITDA 1,218 1,369 1,224 1,053 1,240

Non-operating income(loss) -65 -87 -156 -60 -54

Non-operating income 125 106 22 -10 134

Non-operating expense 191 193 178 50 188

Income before income taxes 460 575 351 273 462

Income tax 105 147 98 19 98

Net income 354 428 253 254 363

12

Appendix

K-IFRS Statement of Financial Position

(Unit: KRW bn)

Consolidated 1Q11 2Q11 3Q11 4Q11 1Q12

Asset 28,245 29,080 29,473 32,085 33,118

Current assets 7,958 8,182 8,434 9,791 10,919

Cash and cash equivalents 1,141 1,118 1,246 1,445 1,571

Trade and other current receivables 4,542 4,764 4,867 5,295 5,210

Inventories 737 729 646 675 895

Other current assets 1,538 1,572 1,675 2,376 3,242

Non-current assets 20,288 20,897 21,038 22,295 22,198

Trade and other current receivables 1,308 1,411 1,401 1,723 1,513

P.P.E 13,556 13,582 13,724 14,023 14,196

Other non-current assets 5,423 5,904 5,914 6,549 6,490

Liabilities 16,682 17,079 17,234 19,548 20,669

Current liabilities 8,000 8,397 7,731 8,745 10,572

Trade and other current payables 4,643 4,647 4,074 5,890 6,606

Short-term borrowings 2,610 3,034 3,034 2,112 3,074

Other current liabilities 747 716 623 742 892

Non-current liabilities 8,682 8,682 9,503 10,802 10,097

Trade and other current payables 381 651 655 652 658

Long-term borrowings 7,489 7,130 7,988 8,886 8,377

Other non-current liabilities 812 900 860 1,265 1,062

Equity 11,563 12,001 12,239 12,538 12,449

KT Stand Alone 1Q11 2Q11 3Q11 4Q11 1Q12

Asset 24,731 25,509 25,791 26,454 27,126

Current assets 5,905 6,172 6,218 6,376 7,072

Cash and cash equivalents 804 874 891 790 809

Trade and other current receivables 4,217 4,426 4,517 4,832 4,740

Inventories 606 596 487 514 723

Other current assets 278 276 323 239 800

Non-current assets 18,825 19,337 19,573 20,078 20,054

Trade and other current receivables 1,167 1,298 1,297 1,608 1,396

P.P.E 12,963 13,100 13,224 13,305 13,464

Other non-current assets 4,696 4,939 5,052 5,165 5,194

Liabilities 13,839 14,192 14,242 14,720 15,503

Current liabilities 6,723 7,003 6,238 6,036 7,347

Trade and other current payables 3,764 4,371 3,878 4,425 4,824

Short-term borrowings 1,773 2,073 1,904 1,086 1,877

Other current liabilities 1,187 560 456 524 646

Non-current liabilities 7,116 7,189 8,004 8,684 8,155

Trade and other current payables 287 597 604 597 611

Long-term borrowings 6,178 5,915 6,763 7,415 6,811

Other non-current liabilities 651 677 637 672 734

Equity 10,892 11,317 11,549 11,734 11,623

13

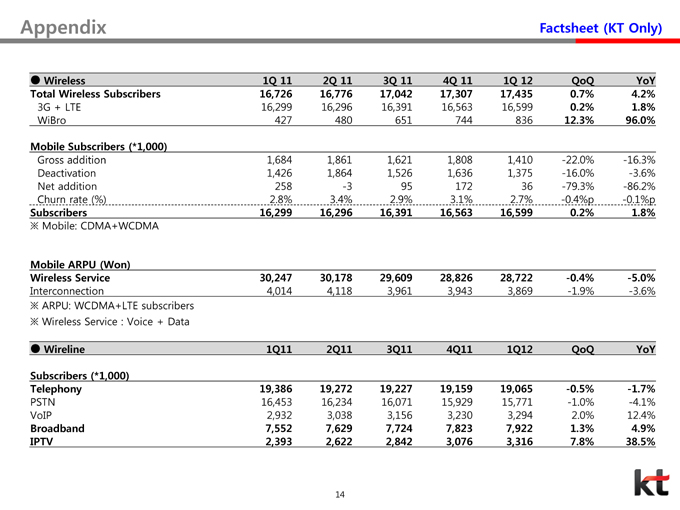

Appendix

Factsheet (KT Only)

Wireless 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 QoQ YoY

Total Wireless Subscribers 16,726 16,776 17,042 17,307 17,435 0.7% 4.2%

3G + LTE 16,299 16,296 16,391 16,563 16,599 0.2% 1.8%

WiBro 427 480 651 744 836 12.3% 96.0%

Mobile Subscribers (*1,000)

Gross addition 1,684 1,861 1,621 1,808 1,410 -22.0% -16.3%

Deactivation 1,426 1,864 1,526 1,636 1,375 -16.0% -3.6%

Net addition 258 -3 95 172 36 -79.3% -86.2%

Churn rate (%) 2.8% 3.4% 2.9% 3.1% 2.7% -0.4%p -0.1%p

Subscribers 16,299 16,296 16,391 16,563 16,599 0.2% 1.8%

Mobile: CDMA+WCDMA

Mobile ARPU (Won)

Wireless Service 30,247 30,178 29,609 28,826 28,722 -0.4% -5.0%

Interconnection 4,014 4,118 3,961 3,943 3,869 -1.9% -3.6%

ARPU: WCDMA+LTE subscribers

Wireless Service : Voice + Data

Wireline 1Q11 2Q11 3Q11 4Q11 1Q12 QoQ YoY

Subscribers (*1,000)

Telephony 19,386 19,272 19,227 19,159 19,065 -0.5% -1.7%

PSTN 16,453 16,234 16,071 15,929 15,771 -1.0% -4.1%

VoIP 2,932 3,038 3,156 3,230 3,294 2.0% 12.4%

Broadband 7,552 7,629 7,724 7,823 7,922 1.3% 4.9%

IPTV 2,393 2,622 2,842 3,076 3,316 7.8% 38.5%

14