- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 10 Aug 22, 6:28am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2022

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

90, Buljeong-ro,

Bundang-gu, Seongnam-si,

Gyeonggi-do,

Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: August 10 2022 | ||

| KT Corporation | ||

| By: | /s/ Seunghoon Chi | |

| Name: | Seunghoon Chi | |

| Title: | Vice President | |

| By: | /s/ Sanghyun Cho | |

| Name: | Sanghyun Cho | |

| Title: | Director | |

KT 2Q22 Earning Release

Disclaimer This presentation has been prepared by KT Corp.(the “Company”) in accordance with K-IFRS. This presentation contains forward-looking statements, which are subject to risks, uncertainties, and assumptions. This presentation is being presented solely for your information and is subject to change without notice. No presentation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, actuality, fairness, or completeness of the information presented. st The Company has applied new accounting standard of K-IFRS 1115 as of Jan 1 , 2018 and K-IFRS 1116 ‘Leases’ as of Jan st 1 , 2019. There are no obligation to apply the new standard to previous financial statements. The Company, its affiliates or representatives accept no liability whatsoever for any losses arising from any information contained in the presentation. This presentation does not constitute an offer or invitation to purchase or subscribe for any shares of the Company, and no part of this presentation shall form the Basis of or be relied upon in connection with any contract or commitment. Any decision to purchase shares of the Company could be made solely on the Basis of information, which has been publicly filed with the Securities and Exchange Commission or the Korea Stock Exchange and distributed to all investors. The contents of this presentation may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose. If you have any related questions to this material, please contact IR department. Tel : +82-2-3495-3557, 3254, 3564, 5344 Fax : +82-2-3495-5917 2

2 Financial Highlights 3 Business Overview 4 Appendix 3

1 2Q22 Highlights Financial Revenue Revenue 6,312.2 bn. (YoY +4.7%) 4,517.8 bn. (YoY +0.9%) Consolidated KT Separate Operating Operating 459.2 bn. (YoY -3.5%) 303.5 bn. (YoY -13.6%) Profit Profit Operations Growth Portfolio integration New growth momentum enhancement underpinned by DIGICO/B2B in Media·Content, Finance and etc. DIGICO Contents Accelerating B2B DX orders growth All-round cooperation with CJ ENM KRW • 1H22 B2B orders won by 1.9 tr, +33% YoY • Integration of Seezn-Tving to strengthen OTT competitiveness KRW • 1H22 B2B rev. recorded 2.1 tr, +5.5% YoY Contents biz in full-fledged operation Continuing double-digit growth of strengthening Media capabilities Cloud/IDC • ENA original 『Extraordinary Attorney Woo』 hits • Cloud/IDC(incl. kt cloud) rev. up +11.4% YoY • Highlight 『contents-channel-platform』 value-chain Finance Stable growth with premium subs adds Growing trend of K Bank OP-indicators TELCO • 5G subs reached to 7.48m, 54% of total subs • Deposit(12.2tr) +8% YoY / Loan(8.7tr) +72% YoY • Wireless revenue up +1.4% YoY • Clients 7.83m +26.4% YoY 4

2 DIGICO Transformation • Expand growth portfolio and accelerate service revenue growth through DIGICO transformation • B2B/DIGICO revenue portion target to 50% by 2025 Service Rev. +7.8% (KT Separate, each 2Q accumulated revenue) DIGICO Transformation ※Cloud/IDC rev.(including kt cloud) reflected in total service rev. and DIGICO B2B 5

1 2Q22 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix 6

K-IFRS / Consolidated 1 Income Statement • Revenue increased +4.7% YoY solidifying growth portfolio and leading DX transformation • Operating income decreased -3.5% YoY due to one off labor cost and increase in general expenses (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY 6,027.6 6,277.7 6,312.2 0.5% 4.7% Operating Revenue Service Revenue 5,336.8 5,565.5 5,670.5 1.9% 6.3% Handset Revenue 690.9 712.2 641.7 -9.9% -7.1% Operating Expense 5,551.8 5,651.1 5,853.0 3.6% 5.4% Operating Income 475.8 626.6 459.2 -26.7% -3.5% 7.9% 10.0% 7.3% -2.7%p -0.6%p Margin 8.9% 11.3% 8.1% -3.2%p -0.8%p Margin* Non-op. Income/Loss 46.8 15.6 80.5 417.1% 71.9% Income before taxes 522.7 642.2 539.7 -16.0% 3.2% Net Income 370.8 455.4 363.4 -20.2% -2.0% Margin 6.2% 7.3% 5.8% -1.5%p -0.4%p EBITDA 1,373.2 1,518.3 1,387.2 -8.6% 1.0% 22.8% 24.2% 22.0% -2.2%p -0.8%p Margin ※ OP Margin* = Operating Income/Service Revenue 7

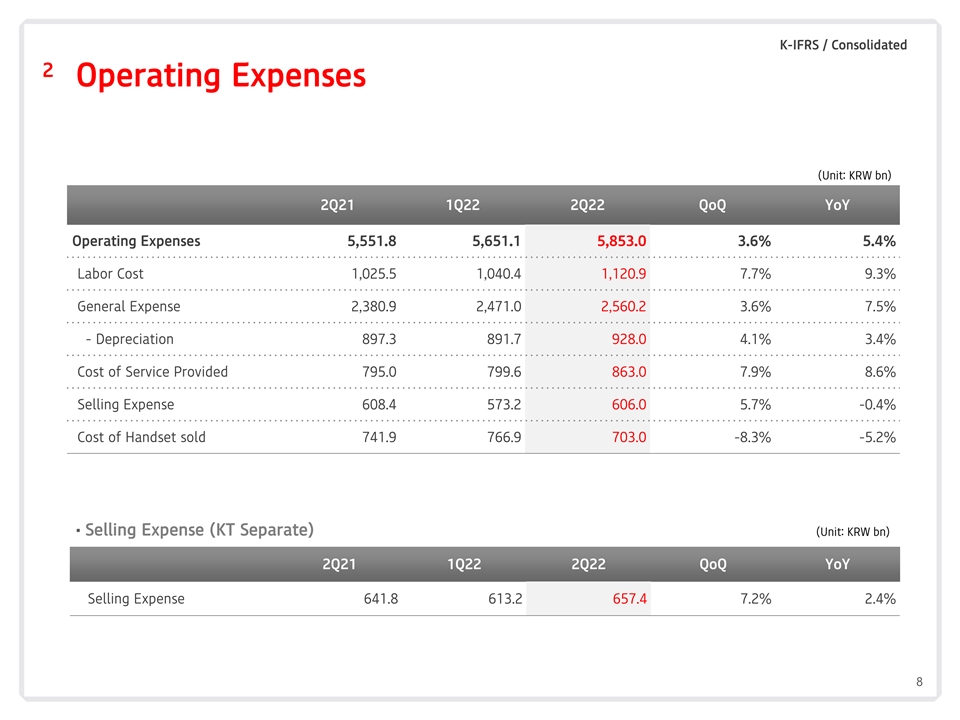

K-IFRS / Consolidated 2 Operating Expenses (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY Operating Expenses 5,551.8 5,651.1 5,853.0 3.6% 5.4% Labor Cost 1,025.5 1,040.4 1,120.9 7.7% 9.3% General Expense 2,380.9 2,471.0 2,560.2 3.6% 7.5% - Depreciation 897.3 891.7 928.0 4.1% 3.4% Cost of Service Provided 795.0 799.6 863.0 7.9% 8.6% Selling Expense 608.4 573.2 606.0 5.7% -0.4% Cost of Handset sold 741.9 766.9 703.0 -8.3% -5.2% § Selling Expense (KT Separate) (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY Selling Expense 641.8 613.2 657.4 7.2% 2.4% 8

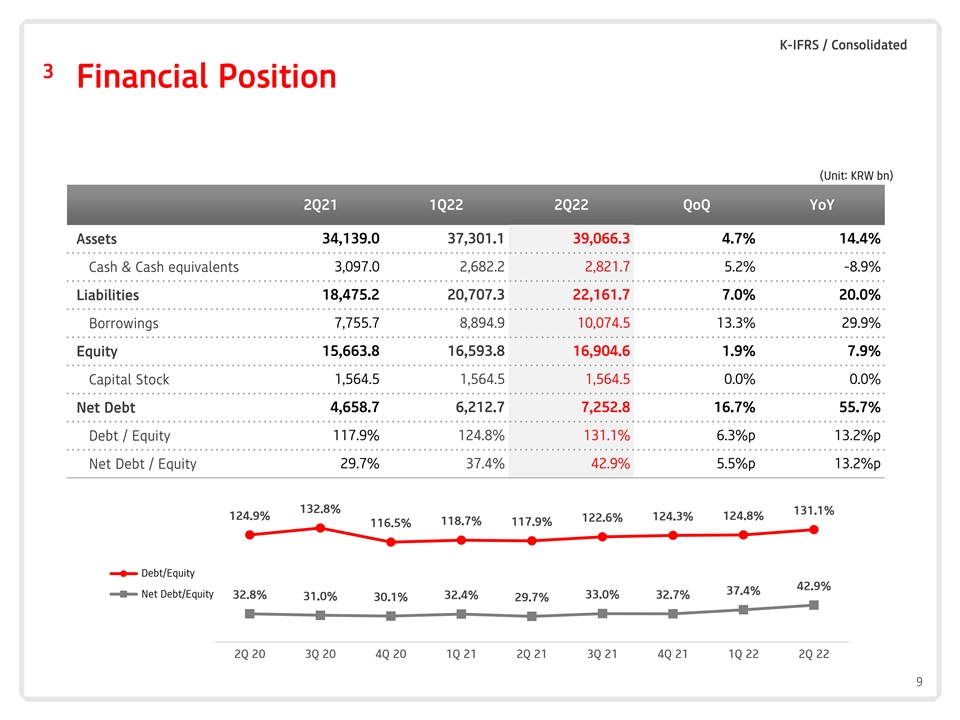

K-IFRS / Consolidated 3 Financial Position (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY Assets 34,139.0 37,301.1 39,066.3 4.7% 14.4% Cash & Cash equivalents 3,097.0 2,682.2 2,821.7 5.2% -8.9% Liabilities 18,475.2 20,707.3 22,161.7 7.0% 20.0% Borrowings 7,755.7 8,894.9 10,074.5 13.3% 29.9% 15,663.8 16,593.8 16,904.6 1.9% 7.9% Equity 1,564.5 1,564.5 1,564.5 0.0% 0.0% Capital Stock 4,658.7 6,212.7 7,252.8 16.7% 55.7% Net Debt 117.9% 124.8% 131.1% 6.3%p 13.2%p Debt / Equity Net Debt / Equity 29.7% 37.4% 42.9% 5.5%p 13.2%p 132.8% 131.1% 124.9% 124.8% 124.3% 122.6% 118.7% 117.9% 116.5% Deb부채비율 t/Equity 42.9% 37.4% Net순부채비율 Debt/Equity 33.0% 32.8% 32.4% 32.7% 31.0% 30.1% 29.7% 2Q 20 3Q 20 4Q 20 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 9

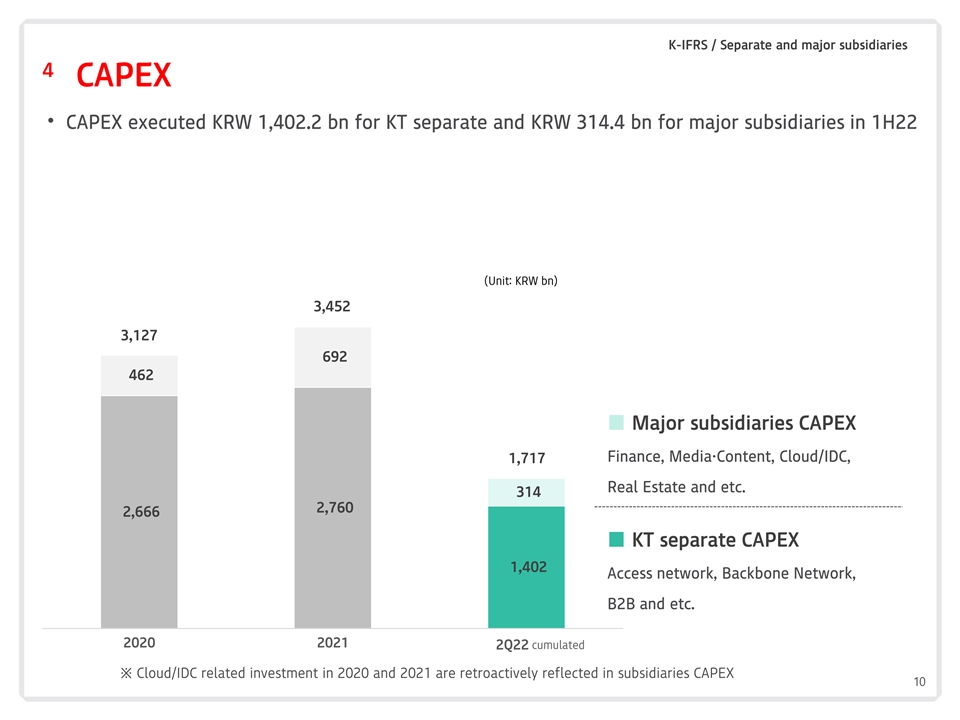

K-IFRS / Separate and major subsidiaries 4 CAPEX • CAPEX executed KRW 1,402.2 bn for KT separate and KRW 314.4 bn for major subsidiaries in 1H22 (Unit: KRW bn) 3,452 3,127 692 462 ■ Major subsidiaries CAPEX Finance, Media·Content, Cloud/IDC, 1,717 Real Estate and etc. 314 2,760 2,666 ■ KT separate CAPEX 1,402 Access network, Backbone Network, B2B and etc. 2020 2021 2Q22 c 누적 umulated ※ Cloud/IDC related investment in 2020 and 2021 are retroactively reflected in subsidiaries CAPEX 10

1 2Q22 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix 11

K K- -IF IFRS RS / / S Sepa epara rate te 1 KT – Telco B2C • Telco B2C revenue up +1.6% with mobile/broadband quality subs growth • Leading Mobile revenue growth, 5G subs reached to about 54% of total handset subs (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY Telco B2C 2,334.8 2,353.5 2,371.9 0.8% 1.6% Wireless 1,519.6 1,537.6 1,550.3 0.8% 2.0% Broadband 582.0 591.1 596.3 0.9% 2.5% Telephony 233.2 224.8 225.3 0.2% -3.4% Wireless Subscribers (Unit: Thousands) Broadband Subscribers (Unit: Thousands) 23,409 23,060 22,735 22,799 22,621 9,609 9,531 9,455 9,432 9,359 5,012 5,614 6,373 6,941 7,467 65.8% 66.1% 65.1% 65.5% 64.9% 14,373 14,331 13,954 14,163 14,052 3,481 3,392 3,304 3,204 3,124 5,974 5,332 5,616 5,124 5,201 2Q21 3Q21 4Q21 1Q22 2Q22 2Q21 3Q21 4Q21 1Q22 2Q22 nd Subscribers % of GiGA ■ 5G■ Handset(5G incl.)■ 2 device /IoT■ MVNO 12

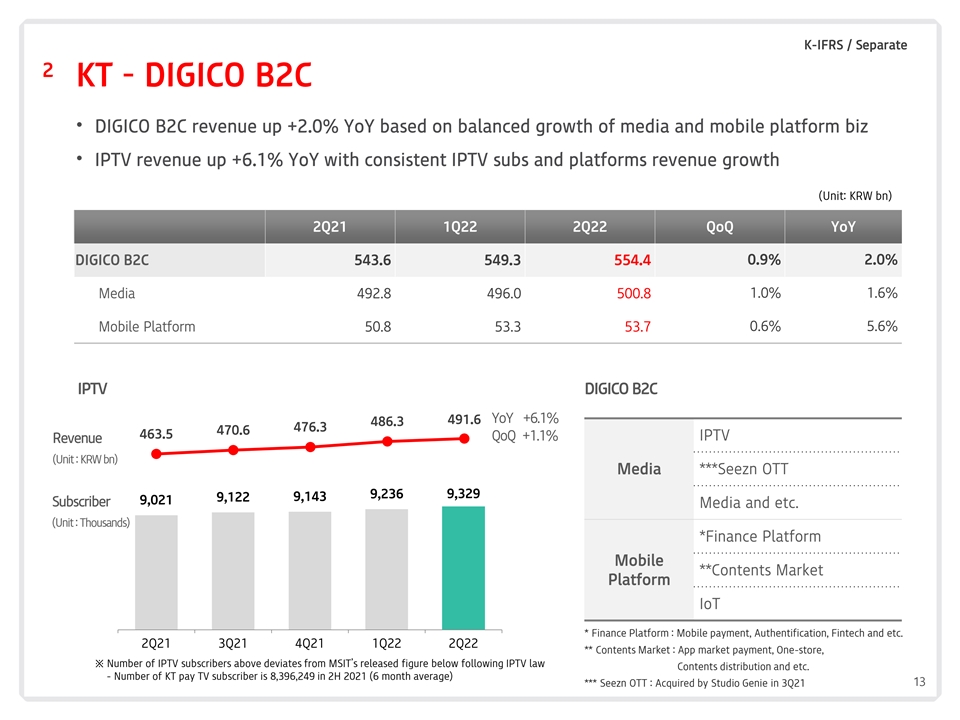

K-IFRS / Separate 2 KT – DIGICO B2C • DIGICO B2C revenue up +2.0% YoY based on balanced growth of media and mobile platform biz • IPTV revenue up +6.1% YoY with consistent IPTV subs and platforms revenue growth (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY DIGICO B2C 543.6 549.3 554.4 0.9% 2.0% Media 492.8 496.0 500.8 1.0% 1.6% Mobile Platform 50.8 53.3 53.7 0.6% 5.6% IPTV DIGICO B2C 491.6 YoY +6.1% 486.3 476.3 470.6 463.5 QoQ +1.1% IPTV Revenue (Unit: KRW bn) Media ***Seezn OTT 9,236 9,329 9,143 9,122 9,021 Subscriber Media and etc. (Unit: Thousands) *Finance Platform Mobile **Contents Market Platform IoT * Finance Platform : Mobile payment, Authentification, Fintech and etc. 2Q21 3Q21 4Q21 1Q22 2Q22 ** Contents Market : App market payment, One-store, ※ Number of IPTV subscribers above deviates from MSIT’s released figure below following IPTV law Contents distribution and etc. - Number of KT pay TV subscriber is 8,396,249 in 2H 2021 (6 month average) *** Seezn OTT : Acquired by Studio Genie in 3Q21 13

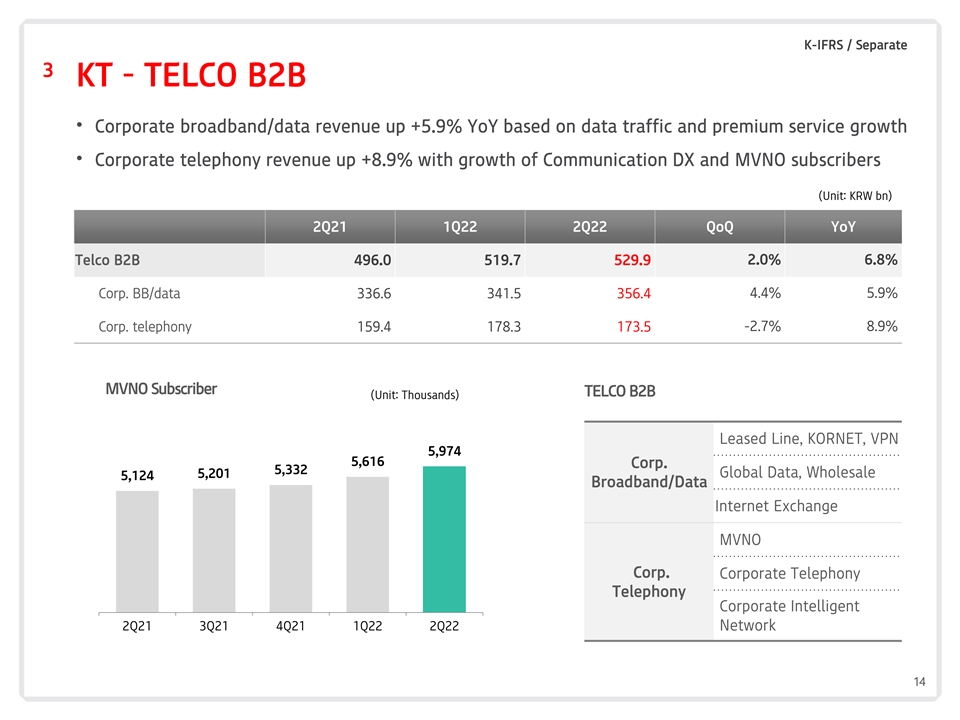

K-IFRS / Separate 3 KT – TELCO B2B • Corporate broadband/data revenue up +5.9% YoY based on data traffic and premium service growth • Corporate telephony revenue up +8.9% with growth of Communication DX and MVNO subscribers (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY Telco B2B 496.0 519.7 529.9 2.0% 6.8% Corp. BB/data 336.6 341.5 356.4 4.4% 5.9% Corp. telephony 159.4 178.3 173.5 -2.7% 8.9% MVNO Subscriber TELCO B2B (Unit: Thousands) Leased Line, KORNET, VPN 5,974 5,616 Corp. 5,332 Global Data, Wholesale 5,201 5,124 Broadband/Data Internet Exchange MVNO Corp. Corporate Telephony Telephony Corporate Intelligent 2Q21 3Q21 4Q21 1Q22 2Q22 Network 14

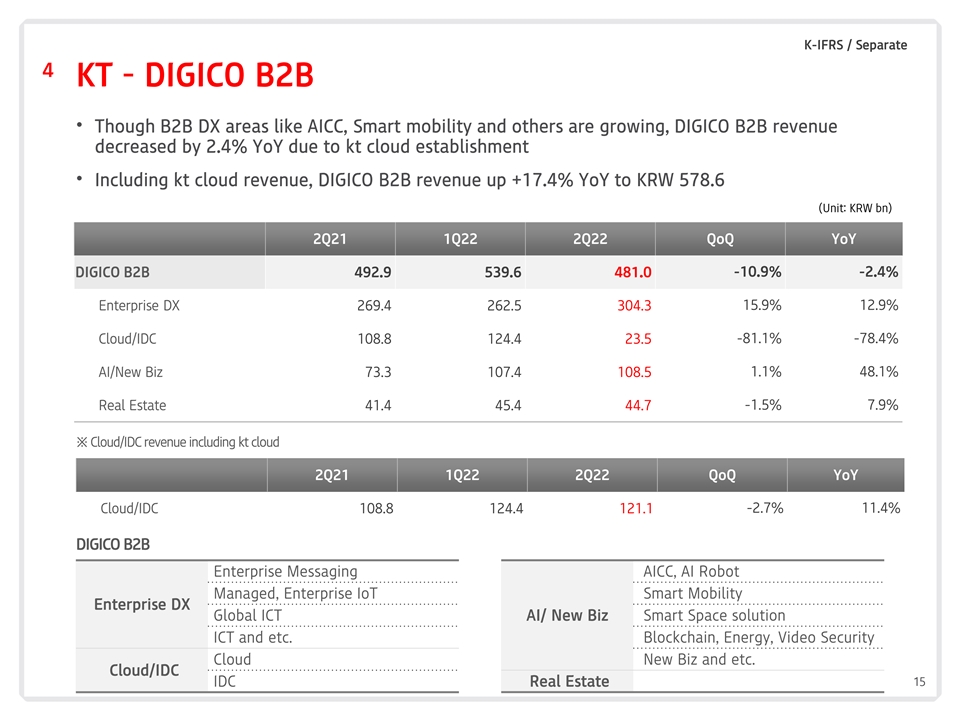

K-IFRS / Separate 4 KT – DIGICO B2B • Though B2B DX areas like AICC, Smart mobility and others are growing, DIGICO B2B revenue decreased by 2.4% YoY due to kt cloud establishment • Including kt cloud revenue, DIGICO B2B revenue up +17.4% YoY to KRW 578.6 (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY DIGICO B2B 492.9 539.6 481.0 -10.9% -2.4% Enterprise DX 269.4 262.5 304.3 15.9% 12.9% Cloud/IDC 108.8 124.4 23.5 -81.1% -78.4% AI/New Biz 73.3 107.4 108.5 1.1% 48.1% Real Estate 41.4 45.4 44.7 -1.5% 7.9% ※ Cloud/IDC revenue including kt cloud 2Q21 1Q22 2Q22 QoQ YoY Cloud/IDC 108.8 124.4 121.1 -2.7% 11.4% DIGICO B2B Enterprise Messaging AICC, AI Robot Managed, Enterprise IoT Smart Mobility Enterprise DX Global ICT AI/ New Biz Smart Space solution ICT and etc. Blockchain, Energy, Video Security Cloud New Biz and etc. Cloud/IDC IDC Real Estate 15

K-IFRS / consolidated(each subsidiary) 5 Major subsidiaries • BC card revenue up +9.3% with increased credit card transaction volume and new biz expansion • Contents subsidiaries revenue up +34.7% with full-fledged operation of Contents biz and growth of digital ads, T-commerce and others Major Subsidiaries (Unit: KRW bn) 2Q21 1Q22 2Q22 QoQ YoY BC card 906.8 902.2 991.2 9.9% 9.3% 5.6% 45.2% Skylife 175.1 240.8 254.2 Contents Subsidiaries 211.8 270.4 285.3 5.5% 34.7% -35.1% 46.3% KT Estate 66.8 150.5 97.7 kt cloud - - 129.7 N/A N/A ※ Contents Subsidiaries : Nasmedia(PlayD incl.), KT alpha, KT Studiogenie(Genie music, Storywiz, KT Seezn and others incl.) OP Contribution from subsidiaries (Unit: KRW bn) 277.5 196.7 155.7 124.7 123.3 89.2 85.5 78.2 47.7 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 16

1 2Q22 Highlights 2 Financial Highlights 3 Business Overview 4 Appendix 17

1 K-IFRS Income Statement (Unit: KRW bn) Consolidated 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 KT Separate 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 Operating revenue 6,027.6 6,217.4 6,623.6 6,277.7 6,312.2 Operating revenue 4,478.8 4,664.7 4,669.5 4,608.4 4,517.8 Service revenue 5,336.8 5,402.4 5,758.1 5,565.5 5,670.5 Service revenue 3,867.3 3,920.1 3,892.7 3,962.1 3,937.3 Handset revenue 690.9 815.0 865.5 712.2 641.7 Handset revenue 611.5 744.6 776.8 646.2 580.5 Operating expense 5,551.8 5,835.0 6,254.1 5,651.1 5,853.0 Operating expense 4,127.6 4,405.6 4,577.5 4,178.5 4,214.3 Service expense 4,809.8 4,955.6 5,285.3 4,884.2 5,150.1 Service expense 3,531.7 3,662.8 3,743.2 3,516.0 3,655.4 Labor cost 1,025.5 1,090.0 1,076.1 1,040.4 1,120.9 Labor cost 567.1 629.3 542.7 549.3 605.8 General expense 2,380.9 2,447.7 2,601.2 2,471.0 2,560.2 General expense 1,714.9 1,763.9 1,863.6 1,692.8 1,719.4 Cost of svc provided 795.0 835.8 987.0 799.6 863.0 Cost of svc provided 594.9 634.4 649.2 646.4 660.2 Selling expense 608.4 582.0 620.9 573.2 606.0 Selling expense 654.9 635.2 687.7 627.4 670.0 Cost of device sold 741.9 879.4 968.8 766.9 703.0 Cost of device sold 595.9 742.8 834.3 662.5 558.9 Operating income 475.8 382.4 369.4 626.6 459.2 Operating income 351.2 259.1 92.0 429.9 303.5 N-OP income (loss) 46.8 97.9 137.9 15.6 80.5 N-OP income (loss) 50.2 50.2 66.4 99.2 23.0 N-OP income 145.6 307.6 335.8 223.2 445.1 N-OP income 148.6 279.9 268.1 268.7 359.1 N-OP expense 126.8 273.8 216.1 204.0 385.7 N-OP expense 98.4 229.7 201.7 169.6 336.0 Equity Method (G/L) 28.1 64.1 18.2 -3.6 21.0 Income bf tax 522.7 480.3 507.2 642.2 539.7 Income bf tax 401.4 309.3 158.3 529.1 326.5 Income tax 151.9 142.6 82.9 186.8 176.3 Income tax 104.6 80.6 27.8 138.1 302.1 Net income 370.8 337.7 424.4 455.4 363.4 Net income 296.8 228.7 130.6 391.0 24.4 NI contribution to KT 338.8 310.9 404.6 409.8 313.1 EBITDA 1,373.2 1,277.5 1,283.5 1,518.3 1,387.2 EBITDA 1,159.4 1,061.1 891.8 1,217.1 1,070.9 EBITDA Margin EBITDA Margin 22.8% 20.5% 19.4% 24.2% 22.0% 25.9% 22.7% 19.1% 26.4% 23.7% 18

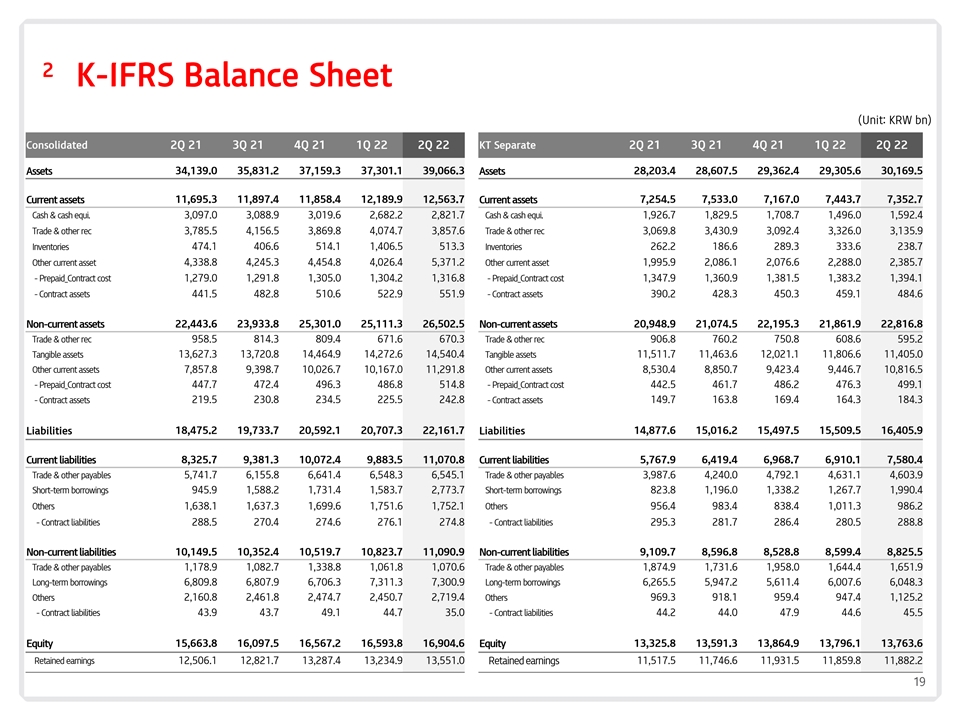

2 K-IFRS Balance Sheet (Unit: KRW bn) Consolidated 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 KT Separate 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 34,139.0 35,831.2 37,159.3 37,301.1 39,066.3 28,203.4 28,607.5 29,362.4 29,305.6 30,169.5 Assets Assets Current assets 11,695.3 11,897.4 11,858.4 12,189.9 12,563.7 Current assets 7,254.5 7,533.0 7,167.0 7,443.7 7,352.7 Cash & cash equi. 3,097.0 3,088.9 3,019.6 2,682.2 2,821.7 Cash & cash equi. 1,926.7 1,829.5 1,708.7 1,496.0 1,592.4 Trade & other rec 3,785.5 4,156.5 3,869.8 4,074.7 3,857.6 Trade & other rec 3,069.8 3,430.9 3,092.4 3,326.0 3,135.9 Inventories 474.1 406.6 514.1 1,406.5 513.3 Inventories 262.2 186.6 289.3 333.6 238.7 Other current asset 4,338.8 4,245.3 4,454.8 4,026.4 5,371.2 Other current asset 1,995.9 2,086.1 2,076.6 2,288.0 2,385.7 -Prepaid_Contract cost 1,279.0 1,291.8 1,305.0 1,304.2 1,316.8 -Prepaid_Contract cost 1,347.9 1,360.9 1,381.5 1,383.2 1,394.1 -Contract assets 441.5 482.8 510.6 522.9 551.9 -Contract assets 390.2 428.3 450.3 459.1 484.6 Non-current assets 22,443.6 23,933.8 25,301.0 25,111.3 26,502.5 Non-current assets 20,948.9 21,074.5 22,195.3 21,861.9 22,816.8 Trade & other rec 958.5 814.3 809.4 671.6 670.3 Trade & other rec 906.8 760.2 750.8 608.6 595.2 Tangible assets 13,627.3 13,720.8 14,464.9 14,272.6 14,540.4 Tangible assets 11,511.7 11,463.6 12,021.1 11,806.6 11,405.0 Other current assets 7,857.8 9,398.7 10,026.7 10,167.0 11,291.8 Other current assets 8,530.4 8,850.7 9,423.4 9,446.7 10,816.5 -Prepaid_Contract cost 447.7 472.4 496.3 486.8 514.8 -Prepaid_Contract cost 442.5 461.7 486.2 476.3 499.1 -Contract assets 219.5 230.8 234.5 225.5 242.8 -Contract assets 149.7 163.8 169.4 164.3 184.3 Liabilities 18,475.2 19,733.7 20,592.1 20,707.3 22,161.7 Liabilities 14,877.6 15,016.2 15,497.5 15,509.5 16,405.9 Current liabilities 8,325.7 9,381.3 10,072.4 9,883.5 11,070.8 Current liabilities 5,767.9 6,419.4 6,968.7 6,910.1 7,580.4 Trade & other payables 5,741.7 6,155.8 6,641.4 6,548.3 6,545.1 Trade & other payables 3,987.6 4,240.0 4,792.1 4,631.1 4,603.9 Short-term borrowings 945.9 1,588.2 1,731.4 1,583.7 2,773.7 Short-term borrowings 823.8 1,196.0 1,338.2 1,267.7 1,990.4 Others 1,638.1 1,637.3 1,699.6 1,751.6 1,752.1 Others 956.4 983.4 838.4 1,011.3 986.2 - Contract liabilities 288.5 270.4 274.6 276.1 274.8 - Contract liabilities 295.3 281.7 286.4 280.5 288.8 Non-current liabilities 10,149.5 10,352.4 10,519.7 10,823.7 11,090.9 Non-current liabilities 9,109.7 8,596.8 8,528.8 8,599.4 8,825.5 1,178.9 1,082.7 1,338.8 1,061.8 1,070.6 1,874.9 1,731.6 1,958.0 1,644.4 1,651.9 Trade & other payables Trade & other payables Long-term borrowings 6,809.8 6,807.9 6,706.3 7,311.3 7,300.9 Long-term borrowings 6,265.5 5,947.2 5,611.4 6,007.6 6,048.3 Others 2,160.8 2,461.8 2,474.7 2,450.7 2,719.4 Others 969.3 918.1 959.4 947.4 1,125.2 - Contract liabilities 43.9 43.7 49.1 44.7 35.0 - Contract liabilities 44.2 44.0 47.9 44.6 45.5 Equity 15,663.8 16,097.5 16,567.2 16,593.8 16,904.6 Equity 13,325.8 13,591.3 13,864.9 13,796.1 13,763.6 Retained earnings 12,506.1 12,821.7 13,287.4 13,234.9 13,551.0 Retained earnings 11,517.5 11,746.6 11,931.5 11,859.8 11,882.2 19

K-IFRS / Separate 3 Subscribers Wireless 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 QoQ YoY 1) Subscribers (Unit: Thousands) Total 22,621 22,735 22,799 23,060 23,409 1.5% 3.5% Net additions 194 114 64 261 349 33.7% 80.0% Gross additions 1,041 986 1,064 1,039 1,010 -2.8% -3.0% 2) Deactivation 847 871 1,000 778 661 -15.1% -22.0% Churn rate 1.3% 1.3% 1.5% 1.1% 0.9% -0.2%p -0.4%p LTE 15,504 15,161 14,662 14,454 14,357 -0.7% -7.4% 5G 5,014 5,617 6,378 6,949 7,479 7.6% 49.2% LTE+5G Penetration rate 90.7% 91.4% 92.3% 92.8% 93.3% 0.5%p 2.6%p 3) ARPU (KRW) 31,429 31,815 31,825 32,308 32,446 0.4% 3.2% Note 1) Subscribers: MSIT’s new guidelines for subscriber disclosure (Retroactively applied from 1Q14, MVNO included) Note 2) Deactivation: Mandatory deactivation included Note 3) ARPU = Wireless revenue* / Wireless subscribers** * Wireless revenue(3G, LTE, 5G included): Revenue of Voice and Data usage (Interconnection/Subscription fee excluded), VAS, Contract/ Bundled Discounts, and etc. included ** Wireless subscribers: Based on MSIT’s guidelines for average billed subscribers in quarter (IoT/M2M excluded) Fixed Line/IPTV 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 QoQ YoY Subscribers (Unit: Thousands) Telephony 13,329 13,218 13,096 12,969 12,842 -1.0% -3.7% PSTN 10,169 10,037 9,905 9,768 9,634 -1.4% -5.3% VoIP 3,159 3,180 3,191 3,201 3,208 0.2% 1.5% Broadband 9,359 9,432 9,455 9,531 9,609 0.8% 2.7% IPTV (OTV+OTS) 9,021 9,122 9,143 9,236 9,329 1.0% 3.4% ※ Number of IPTV subscribers above deviates from MSIT’s released figure below following IPTV law - Number of KT pay TV subscriber is 8,396,249 in 2H 2021 (6 month average) 20