- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 24 Apr 24, 6:06am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2024

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

90, Buljeong-ro,

Bundang-gu, Seongnam-si,

Gyeonggi-do,

Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☑ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: April 24, 2024 | ||

| KT Corporation | ||

| By: | /s/ Youngkyoon Yun | |

| Name: | Youngkyoon Yun | |

| Title: | Vice President | |

| By: | /s/ Sanghyun Cho | |

| Name: | Sanghyun Cho | |

| Title: | Director | |

ANNUAL REPORT

OF

KT CORPORATION

(From January 1, 2023 to December 31, 2023)

(Translation of the Annual Report filed in Korean with the Financial Supervisory Service of Korea)

| 1 | ||||

| 6 | ||||

| 33 | ||||

| 36 | ||||

| 39 | ||||

| 67 | ||||

| 68 | ||||

| ※ | Independent auditors’ reports on both Consolidated and Separate financial statements were filed to the SEC respectively on March 19, 2024. |

| • | Report for Consolidated and Separate financial statements : |

File Number 001-14926 / Film Number 24761006

THIS IS A SUMMARY OF THE ANNUAL REPORT ORIGINALLY PREPARED IN KOREAN WHICH IS IN SUCH FORM AS REQUIRED BY THE KOREAN FINANCIAL SERVICES COMMISSION.

IN THE TRANSLATION PROCESS, SOME PARTS OF THE REPORT WERE REFORMATTED, REARRANGED OR SUMMARIZED FOR THE CONVENIENCE OF READERS.

UNLESS EXPRESSLY STATED OTHERWISE, ALL FINANCIAL INFORMATION CONTAINED HEREIN IS PRESENTED ON A CONSOLIDATED BASIS IN ACCORDANCE WITH THE INTERNATIONAL FINANCIAL REPORTING STANDARDS ADOPTED FOR USE IN KOREA (“K-IFRS”) WHICH DIFFER IN CERTAIN RESPECTS FROM GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN CERTAIN OTHER COUNTRIES, INCLUDING THE UNITED STATES. THE COMPANY HAS MADE NO ATTEMPT TO IDENTIFY OR QUANTIFY THE IMPACT OF THESE DIFFERENCES.

1. Overview

A. Name of company : KT Corporation

B. Overview of Subsidiaries (As of December 31, 2023) : 84 Companies, excluding KT.

- Increase/Decrease in the number of Subsidiaries

(Unit : Companies)

Classification | Subsidiaries | The number of consolidated subsidiaries | ||||||||||||||||||

| Beginning of year | Increase | Decrease | Year-end | |||||||||||||||||

Listed subsidiaries | 9 | 1 | 1 | 9 | 9 | |||||||||||||||

Non-listed subsidiaries | 76 | 5 | 6 | 75 | 21 | |||||||||||||||

Sum | 85 | 6 | 7 | 84 | 30 | |||||||||||||||

※ Following the listing of Millie’s Library in September, 2023, there has been an increase in listed subsidiaries, and a decrease in non-listed subsidiaries during the period.

Significant changes in Subsidiaries

Significant changes in Subsidiaries

Classification | The name of subsidiaries | Causes for the Changes | ||

| Newly included Subsidiaries | KT HEALTHCARE VINA COMPANY LIMITED

| Establishment in the first quarter of 2023 | ||

KD Living

| Q1 2023, reclassification of affiliated companies | |||

K-Realty Qualified Private Real Estate Investment Trust No. 1

| Q2 2023, reclassification of affiliated companies | |||

AQUA RETAIL VIETNAM COMPANY LIMITED

| Establishment in the second quarter of 2023 | |||

K-Realty Qualified Private Real Estate Investment Trust No. 4

| Establishment in the third quarter of 2023 | |||

| Excluded from Subsidiaries | Alpha DX Solution

| Merger with KTDS in the first quarter of 2023 | ||

KT Strategic Investment Fund No. 2

| Liquidation in the first quarter of 2023 | |||

ET MEA

| Liquidation in the first quarter of 2023 | |||

KT Primorye IDC LLC

| Liquidation in the second quarter of 2023 | |||

KT Submarine Co., Ltd.

| partial equity disposal in third quarter of 2023 | |||

| KT-Michigan Global Content Fund | Liquidation in the third quarter of 2023 |

1

C. Date of Incorporation: December 10, 1981

D. Location of Headquarters: 90 Bulljeong-ro, Bundang-gu, Seongnam-city, Gyeonggi-do 13606, Korea

E. Significant changes in management and auditor

Date of change | Types of | Appointment | End of term or dismissal | |||||

New appointment | Reappointment | |||||||

| August 30, 2023 | Extraordinary Shareholders’ Meeting | (CEO) Young Shub Kim (Inside Director) Chang-Seok Seo | — | — | ||||

| June 30, 2023 | Extraordinary Shareholders’ Meeting | (Outside Director) YangHee Choi Woo-Young Kwak Jong Soo Yoon Yeong Kyun Ahn Seung Hoon Lee Seongcheol Kim Seung Ah Theresa Cho | — | — | ||||

| March 31, 2023 | Annual General Shareholders’ Meeting | — | — | (Outside Director) Hyunmyung Pyo Chung-gu Kang Eunjeong Yeo * | ||||

| March 28, 2023 | — | — | — | (CEO) Hyunmo Ku (Outside Director) Huiyeol Yu (resigned) Dae-yu Kim (resigned) | ||||

| March 27, 2023 | — | — | — | (Inside Director) Kyung- Lim Yun (resigned) | ||||

| March 06, 2023 | — | — | — | (Outside Director) Benjamin Hong (resigned) | ||||

| January 12, 2023 | — | — | — | (Outside Director) Kang-chul Lee (resigned) | ||||

| * | At the general meeting of shareholders held on March 31, 2023, the terms of office for outside directors, Hyeon-myeong Pyo, Chung-gu Kang, and Eunjeong Yeo, expired. However, according to Article 386, Paragraph 1 of the Commercial Act, the rights and obligations of the retired directors as outside directors were maintained until the point at which new external directors shall be appointed at the extraordinary shareholder meeting in 2023. |

2. Total Number of Shares and Related Matters

A. Status of Capital Increase/Decrease (As of December 31, 2023) (Unit: KRW million, Shares)

There has been no change in capital stock for the past 5 business years.

2

Type of Stock | Category | 42nd (End of 2023) | 41st (End of 2022) | 40th (End of 2021) | ||||||||||

Common Stock | Current Number of Issued Shares | 257,860,760 | 261,111,808 | 261,111,808 | ||||||||||

| Par value | 0.005 | 0.005 | 0.005 | |||||||||||

| Capital Stock | 1,564,499 | 1,564,499 | 1,564,499 | |||||||||||

| B. | Total Number of Shares (As of December 31, 2022) (Unit: Shares) |

Category | Type of Shares | Total | ||||||||||||

| Common shares | Preferred shares | |||||||||||||

I. Total Number of Authorized Shares | 1,000,000,000 | — | 1,000,000,000 | |||||||||||

II. Total Number of Issued Shares | 312,899,767 | — | 312,899,767 | |||||||||||

III. Total Number of Reduced Shares | 55,039,007 | — | 55,039,007 | |||||||||||

Details of Reduced Shares | 1. Reduction of Capital | — | — | — | ||||||||||

| 2. Share Retirement | 55,039,007 | — | 55,039,007 | |||||||||||

| 3. Redemption of Redeemable Shares | — | — | — | |||||||||||

| 4. Other | — | — | — | |||||||||||

IV. Current Number of Issued Shares (II – III) | 257,860,760 | — | 257,860,760 | |||||||||||

V. Number of Treasury Shares | 11,447,338 | — | 11,447,338 | |||||||||||

VI. Current Number of Issued and Outstanding Shares | 246,413,422 | — | 246,413,422 | |||||||||||

| 1) | According to the resolution of the board of directors on February 7, 2024, the acquisition of treasury shares for the purpose of disposal was completed on March 15, 2024, with a total of 695,775 shares. As of the submission date, the total number of treasury shares is 12,143,113 shares. |

| 2) | On March 25, 2024, 695,775 treasury shares have been disposed of, resulting in a total issued shares of 257,164,985 shares and a total of 11,447,338 treasury shares. |

C. Acquisition and Disposal of Treasury Shares (As of December 31, 2023) (Unit: Shares)

Method of Acquisition | Type of Shares | Beginning of Term | Acquisition (+) | Disposition (-) | Retirement (-) | End of Term | ||||||||||||||||||||

Direct Acquisition | Over-the-Counter | Common shares | 5,069,130 | 4,994 | 131,690 | — | 4,942,434 | |||||||||||||||||||

| Exchange-Traded | Common shares | — | — | — | — | — | ||||||||||||||||||||

Indirect Acquisition | Common shares | 9,755,952 | — | 3,251,048 | 6,504,904 | |||||||||||||||||||||

| Preferred shares | — | — | — | — | — | |||||||||||||||||||||

Total | Common shares | 5,069,130 | 9,760,946 | 131,690 | 3,251,048 | 11,447,338 | ||||||||||||||||||||

| 1) | According to the resolution of the board of directors on February 7, 2024, the acquisition of treasury shares for the purpose of disposal was completed on March 15, 2024, with a total of 695,775 shares. As of the submission date, the total number of treasury shares is 12,143,113 shares. |

| 2) | On March 25, 2024, 695,775 treasury shares have been disposed of, resulting in a total issued shares of 257,164,985 shares and a total of 11,447,338 treasury shares. |

3

[Treasury shares acquisition through a trust agreement with Shinhan Securities Co., Ltd.]

| - | In order to enhance shareholder value through the disposal of a portion of the shares, a decision was made to enter into a trust agreement for the acquisition of treasury shares. |

| - | Contract Amount: 300 billion KRW, Contract Period: February 10, 2023, to August 9, 2023 |

| - | Decision to Dispose Treasury Shares: As per the trust agreement, a total of 100 billion KRW worth of treasury shares (3,251,048 shares) were successfully disposed of on August 10, 2023. |

| - | Relevant Disclosures: |

| • | February 9, 2023: Material Fact Report (Decision to Enter into Trust Agreement for Treasury Share Acquisition) |

| • | February 9, 2023: Decision to Dispose Treasury Shares |

| • | May 12, 2023: Acquisition Status Report through Trust Agreement |

| • | August 9, 2023: Material Fact Report (Decision to Terminate Trust Agreement for Treasury Share Acquisition) |

| • | August 10, 2023: Trust Agreement Termination Results Report |

| • | August 10, 2023: [Amendment] Decision to Dispose Treasury Shares |

[Treasury Share Acquisition, March 15, 2024]

| - | Acquisition Size and Date: 695,775 shares, March 15, 2024 |

| - | Purpose: Acquisition of treasury shares for the purpose of treasury share disposal to enhance shareholder value |

| - | Relevant Disclosures: |

| • | February 8, 2024: Decision to Acquire Treasury Shares |

| • | February 8, 2024: Decision to Dispose Treasury Shares |

March 15, 2024: Result of Treasury Share Acquisition

4

3. Articles of Incorporation of KT

Date of | Name of | Significant Changes | Causes for the Changes | |||

| June 30, 2023 | The First Extraordinary Shareholders’ Meeting in 2023 | Reduction in the number of internal directors (Articles 24, 29)

Abolition of multiple representative directors (Articles 18, 25, 29)

Upward revision of the resolution criteria for the appointment of representative directors (Article 25)

Amendments to the provisions relating to the terms of directors (Article 26 (deleted), Article 27, Article 28 (deleted))

Qualifications for representative directors (Article 25)

Establishment of a Governance Structure Committee (Article 41-2)

Establishment of a Nomination Committee for director candidates (Articles 25, 32, 33, 41, 42)

Composition of the Nomination Committee for director candidates (Article 42) | Reduction in the number of internal directors to strengthen the independence of the board

Abolition of the multiple representative directors system to strengthen the accountability of the CEO

Increase in the approval criteria for the appointment of the CEO to ensure the selection of the most qualified candidate with the support of majority shareholders

Elimination of staggered terms and related regulations for outside directors and clarification of the basis for differentiated terms for directors

Enhancement of the qualifications criteria for the CEO and establishment of guidelines for the selection of CEO candidates

Establishment of a Governance Structure Committee comprised of four outside directors to enhance independence (excluding internal directors)

Integration of the CEO Candidate Evaluation Committee and Outside Director Candidate Recommendation Committee into the “Director Candidate Recommendation Committee”

Composition of the Director Candidate Recommendation Committee with all outside directors to strengthen independence (excluding internal directors) | |||

| March 31, 2023 | The 41st General Shareholders’ Meeting | Addition of a new purpose of business (Article 2): 35. Facility rental business

Introduction of reporting obligations for treasury stock (Article 48-2)

Introduction of obligation to obtain shareholder approval for acquisition of treasury stock through cross-shareholding (Article 48-3) | Implementation of rental business to expand the customer base for DIGICO B2C

Strengthening communication with shareholders regarding treasury stock

Enhancing communication with shareholders regarding treasury stock | |||

5

| II. | Business Details |

1. Business Overview (ICT, Satellite broadcasting, Real estate, others)

Each division of KT is distinguished by a separate legal entity that provides independent services and products, and the business of each affiliated company is categorized into (1) ICT that provides wireless and wired communication/convergence services, (2) Finance business that provides credit card services, (3) Satellite broadcasting services, (4) Real estate business utilizing KT’s assets, and (5) Other businesses carried out by subsidiaries including content, information technology, global business, and others.

| Revenue by division (Unit: KRW million) |

| FY2023 | FY2022 | FY2021 | ||||||||||||||||||||||

Division | Revenue | Proportion | Revenue | Proportion | Revenue | Proportion | ||||||||||||||||||

ICT | 18,371,437 | 58.3 | % | 18,289,243 | 59.4 | % | 18,387,434 | 63.0 | % | |||||||||||||||

Finance | 3,720,859 | 11.8 | % | 3,613,981 | 11.7 | % | 3,525,211 | 12.1 | % | |||||||||||||||

Satellite Broadcasting | 708,217 | 2.2 | % | 704,928 | 2.3 | % | 655,354 | 2.2 | % | |||||||||||||||

Real Estate | 583,504 | 1.9 | % | 485,056 | 1.6 | % | 335,373 | 1.1 | % | |||||||||||||||

Other | 8,118,542 | 25.8 | % | 7,708,737 | 25.0 | % | 6,283,023 | 21.5 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Sum | 31,502,559 | 100.0 | % | 30,801,945 | 100.0 | % | 29,186,395 | 100.0 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Cons’ Adjustment | (5,126,286 | ) | — | (5,151,934 | ) | — | (4,288,390 | ) | — | |||||||||||||||

Total | 26,376,273 | — | 25,650,011 | — | 24,898,005 | — | ||||||||||||||||||

| Financial statements for the 42nd, 41st, and 40th fiscal years are in accordance with K-IFRS No. 1116 |

A. ICT : KT

KT operates wireless communications services for individual and corporate customers such as wireless communications, high-speed Internet, and corporate lines, pay TV services such as IPTV, and platform-based B2B businesses such as IDC, Cloud, and AI/DX. In addition to solid growth in the traditional telecommunications industry, we are accelerating innovation in non-telecom sectors such as media, finance, and B2B with our customer-centric platform.

B. Satellite TV : Skylife

KT Skylife is leading the domestic HD broadcasting service market by commercializing H.264 based multi-channel HD for the first time in Korea. It is launching Korea’s largest UHD multi-channel service and reflecting customer trends that aim for rational consumption with ‘30% discount home combination’ products. In October 2020, it launched ‘SkyLife Mobile’, an affordable phone service, and started selling three types of combined products (TPS) including affordable phones, satellite broadcasting, and the Internet.

6

On September 30, 2021, KT completed the acquisition of Hyundai HCN, a comprehensive wired broadcasting operator, and expanded its wired subscriber base. Skylife TV, a subsidiary of KT Skylife, is a broadcasting channel user operator and has 12 channels including the representative channel ENA.

C. Real Estate: KT Estate

KT Group’s real estate business continues to pursue stable growth through an asset-focused business strategy and periodic portfolio strategy updates that reflect real estate market fluctuations, product selection, maximizing asset value and creating new spaces that reflect innovative ICT technology.

The performance of existing Novotel, Andaz, and Sofitel hotels grew significantly year-on-year due to the pandemic, followed by the successful opening of Myeongdong Le Meridien and Moxy in November 2022, contributing to revenue and profit growth.

D. Other Businesses (Commerce, Advertisements, etc.)

| • | As a music service brand, genie is strengthening its position as a comprehensive music provider in Korea, providing customers with the best and most stable high-quality music services through customer music usage data and platform technology accumulated over 12 years. In addition, genie is expanding its platform competitiveness by expanding the scope of content provision through differentiated and diverse genres of audio services produced by genie itself, promoting new performance businesses to create new revenue models other than the music business, and providing customers with various cultural content experiences such as K-POP artist concerts, musicals, and festivals to further strengthen corporate competitiveness. |

| • | KT SAT’s satellite service business is a business that secures satellites and provides services to generate revenue by using orbit and frequency allocated by the government. It provides satellite services using a total of four self-owned satellites and overseas satellite relay services. |

| • | KT Alpha is expanding the foundation of its commerce business from TV to mobile and creating synergy through the merger (merger date: July 1, 2021) with KT M-house, which has mobile coupon business capabilities. KT Alpha sold all shares of Alpha DX Solution, which it 100% owned, to KTDS (sale date: October 7, 2022). |

| • | Nasmedia is mainly engaged in internet and mobile, IPTV, and digital out-of-home advertising media sales centered on display advertising. It launched K-Deal, a CPS advertising product based on text, in 2021. |

| • | KT Studio Genie was established on January 28, 2021, to oversee and lead the group’s media/content business (content production/planning/investment/distribution, etc.), and it has established itself as a studio business operator by broadcasting original content in 2022. |

| • | kt cloud, which was launched on April 1, 2022, aims to become the best DX specialist company in Korea by strengthening its core competitiveness in IDC and cloud, which is inevitable in the digital era and for KT’s DIGICO strategy. |

7

2. Main Products and Services(ICT, Satellite broadcasting, Real estate, others)

A. ICT : KT

Price fluctuations of KT’s mobile plans, IPTV, broad band, fixed-line phones, and combined products are as follows. For more information, please refer to the product service contents on our website(https://product.kt.com). Prices below do not reflect additional discounts.

| • | Mobile (Unit : KRW, VAT included) |

Plan | Monthly Rate | |||||||

5G Choice | Premium Choice | 130,000 | ||||||

| Special Choice | 110,000 | |||||||

| Basic Choice | 90,000 | |||||||

5G Simple 110GB/90GB/70GB/50GB |

| 69,000/67,000/65,000/63,000 | ||||||

5G Slim Plus |

| 61,000 | ||||||

5G Slim |

| 55,000 | ||||||

5G Save |

| 45,000 | ||||||

| On September 25th, 2020, KT released the 5G Super Plan Choice, followed by 5G Simple and Save on October 5th, Netflix content on October 28th, a Hyundai Card partnership benefit on June 2nd, 2021, Disney+ content on November 12th, 2021, Samsung Electronics and Woori Card partnership benefits on February 14th, 2022, YouTube Premium content on May 2nd, 2022, Tving/Genie content on July 1st, 2022, 5G Slim Plus plan on August 23rd, 2022, and KT has launched three more 5G Simple plans. |

| • | IPTV(Unit : KRW, VAT included) |

| - | Revised TV subscription plans to “Choice” plans (June 2nd, 2022) |

| - | Released new subscription plans: Genie TV Disney+ Choice (January 17th, 2023), Genie TV tving Choice standard/premium (March 2nd, 2023) |

Plan | Monthly Rate | |||||||||||||||||||

| No Contract | 1 Year Contract | 2 Year Contract | 3 Year Contract | Broadband bundle | ||||||||||||||||

Genie tv Slim | 16,500 | 15,675 | 14,850 | 13,200 | 11,000 | |||||||||||||||

Genie tv Basic | 18,150 | 17,270 | 16,390 | 14,740 | 12,100 | |||||||||||||||

Genie tv Lite | 19,800 | 18,810 | 17,820 | 15,840 | 13,200 | |||||||||||||||

Genie tv Essence | 25,300 | 24,035 | 22,770 | 20,240 | 16,500 | |||||||||||||||

Genie tv Essence Plus | 28,160 | 26,730 | 25,300 | 22,484 | 18,700 | |||||||||||||||

| ※ | Prices above do not include additional costs such as call-out fees. |

8

| • | Broadband(Unit : KRW, VAT included) |

The following prices do not include additional costs such as equipment (modem) rental fees, call-out fees, etc.

- Prices of new plans in 2022 are as follows.

Plan | Monthly Rate | |||||||||||||||||||||||

| No Contract | 1 Year Contract | 2 Year Contract | 3 Year Contract | T/M bundle | Launch Date | |||||||||||||||||||

Secure Internet Premium | 64,900 | 58,300 | 52,250 | 45,650 | 40,150 | 7th Jan. 2022 | ||||||||||||||||||

Secure Internet Essence | 59,400 | 52,800 | 46,750 | 40,150 | 34,650 | 7th Jan. 2022 | ||||||||||||||||||

Secure Internet Basic | 50,600 | 45,100 | 40,150 | 34,650 | 29,150 | 7th Jan. 2022 | ||||||||||||||||||

Secure Internet Slim | 44,000 | 37,950 | 32,450 | 23,650 | 23,650 | 7th Jan. 2022 | ||||||||||||||||||

| • | Bundled Rate Plans (Unit : KRW, VAT included) |

2023 | 2022 | 2021 | ||

<2023.06> ● Add MVNO partners that can combine MVNO phones

<2023.09> ● Y Family Wireless Bundle Promotion (23.09.01~24.02.29) - Customers aged 19 to 29 years old and receiving “Y-Dome” benefits can have the same discount as the Family Wireless Bundle | <2022.02> ● Premium Single Combination Promotion normalized (02.24~) - Combining 500M or more speed with 5G mobile plans of KRW 80,000+ (LTE plans of KRW 65,890+) in a single line, 25% discount for monthly mobile fees

<2022.04> ● Newlywed combination Promotion normalized (04.01~) - For engaged or newlywed couples, mobile discounts for up to 6 months without internet

● System improvements for collective contract buildings, reducing return amount of discounts by 100% from requests made after April 2022

● Additional Premium Single Bundle discounts for bundles within CEO Success Pack

<2022.05>

● 5G Premium Family Bundle Teen Discount Promotion (22.05.02~22.10.31) - If teenagers under 18 and legal guardian’s mobile plans meet all following conditions, teenager gets additional KRW 5,500 (including VAT) monthly discount. | <2021.04> ● Mobile bundle promotion ‘between friends’ - Equivalent discount benefit as the ‘Mobile bundle pack for my family’ for foreigners of same nationality

<2021.05>

● Renewal of the CEO Success Pack - Added mobile bundle service - Integrated VAN billing and relaxation of the discount condition

<2021.08>

● Promotion of the Premium Single bundling package - 25% discount of the mobile tariff for the service usage of over 500Mbps internet and 5G mobile plan over 80k KRW (65,890 KRW for LTE subscriber)

<2021.10>

● Pre-marriage Bundle Promotion - Lump sum discount of mobile service for soon to be married or newly married couple for maximum 6 months | ||

9

• Joining Premium Family Bundle Discount program

• Using a 5G plan of KRW 80,000 or more

● New discount option for Base plan of Premium Family Bundle - Internet can be applied to mobile base plans instead

<2022.10>

● More plans to the multi-network Bundle discount program - Additional products: home phone,internet phone (home and Centrex) - Discounts are the same as CEO Success Pack Bundle discount.

<2022.11>

● 5G Premium Family Bundle Teen Discount Promotion normalized (11.1~) - If teenagers under 18 and legal guardian’s mobile plans meet all following conditions, teenager gets additional KRW 5,500 (including VAT) monthly discount.

• Joining Premium Family Bundle Discount program

• Using a 5G plan of KRW 80,000 or more

<2022.12>

● Premium family and single mobile plans will be unified based on a single standard (80,000 KRW+ 5G Plans/65,890KRW+LTE plans g 77,000KRW+ 5G/LTE plans, including VAT) by unifying the mobile plans provided for Premium Family and Single plans | <2020.07> ● CEO Success Pack launch | |||

10

B. Satellite TV – KT Skylife

| • | TV (Unit : KRW, VAT Included) |

| Service Type | 2023 | 2022 | 2021 | |||||||||||||||

Satellite only | Android | sky UHD Family A+ | Receiving | 12,100 | 12,100 | 12,100 | ||||||||||||

| HD | Bundle | 8,800 | 8,800 | 8,800 | ||||||||||||||

| Sky On+ HD | Receiving | 9,900 | 8,800 | 8,800 | ||||||||||||||

Bundle | 7,700 | 11,000 | 11,000 | |||||||||||||||

| Sky Auto | Receiving | 16,500 | 12,100 | 12,100 | ||||||||||||||

| GTS Prime Kidsland/Enter | Bundle | 20,900 | 20,900 | 20,900 | ||||||||||||||

| GTS Essense | Bundle | 16,500 | 16,500 | 16,500 | ||||||||||||||

| GTS Light | Bundle | 13,200 | 13,200 | 13,200 | ||||||||||||||

| GTS Slim | Bundle | 11,000 | 11,000 | 11,000 | ||||||||||||||

| GTS Basic | Bundle | 12,100 | 12,100 | 12,100 | ||||||||||||||

| • | Broadband (Unit : KRW, VAT Included) |

| Service Type | 2023 | 2022 | 2021 | |||||||||||||

Internet | sky 100M | Price | 28,050 | 28,050 | 28,050 | |||||||||||

| Bundle | 19,800 | 19,800 | 19,800 | |||||||||||||

| sky GiGA 200M | Price | 30,250 | 30,250 | 30,250 | ||||||||||||

| Bundle | 22,000 | 22,000 | 22,000 | |||||||||||||

| sky GiGA 500M | Price | 33,000 | 33,000 | 33,000 | ||||||||||||

| Bundle | 27,500 | 27,500 | 27,500 | |||||||||||||

| sky GiGA 1G | Price | 38,500 | 38,500 | 38,500 | ||||||||||||

| Bundle | 33,000 | 33,000 | 33,000 | |||||||||||||

| sky 100M Secure | Price | 29,150 | ||||||||||||||

| Bundle | 20,900 | |||||||||||||||

| sky GiGA 200M Secure | Price | 31,350 | ||||||||||||||

| Bundle | 23,100 | |||||||||||||||

| sky GiGA 500M Secure | Price | 34,100 | ||||||||||||||

| Bundle | 28,600 | |||||||||||||||

| sky GiGA 1G Secure | Price | 39,600 | ||||||||||||||

| Bundle | 34,100 | |||||||||||||||

| • | Mobile |

SKY Life’s mobile plans are divided into 10,000 KRW data plans, selectable plans, and unlimited plans.

11

C. Other Businesses

| • | Genie Music |

| - | Price change of major services Prices of music streaming service products are as follows. (30-day subscription price, based on Web payment. Unit: KRW, VAT excluded) |

Service | Type | Product | 2023 | 2022 | 2021 | |||||||||||

Music Service | Unlimited Streaming | Data Safe Music Streaming | 10,900 | 10,900 | 10,900 | |||||||||||

| Music Streaming(PC+Mobile) | 8,400 | 8,400 | 8,400 | |||||||||||||

| Smart Music Streaming (Mobile only) | 7,400 | 7,400 | 7,400 | |||||||||||||

| MP3 Download | 5 Downloads/month | 3,000 | 3,000 | 3,000 | ||||||||||||

| 10 Downloads/month | 5,500 | 5,500 | 5,500 | |||||||||||||

| 300 songs | 4,800 | 4,800 | 4,800 | |||||||||||||

| Streaming by Play Count | 100songs | 1,600 | 1,600 | 1,600 | ||||||||||||

| 20 songs | 800 | 800 | 800 | |||||||||||||

Bundle Service | Unlimited Music + e-book | Smart Streaming + e-book (Genie + Millie’s library) | 13,000 | 13,000 | 13,000 | |||||||||||

| • | KT M Mobile |

KT M Mobile’s mobile plans are divided into device bundle plans of post-paid plans, SIM-only plans, and pre-paid plans.

12

| • | KT Cloud |

| 1) | Cloud |

| Public | - On-demand service that provides Cloud-based IT infrastructure (computing/storage/NW, etc.) tailored to client needs, available whenever and as much as needed - Offers high performance and stability without concerns for IT procurement, operation, or management | |

| CDN | - Contents Delivery service that delivers large-scale contents in real-time anywhere in the world - Supports 100+ countries and 200,000+ Edge services | |

| Private | - Client-specific Cloud service independently built at client’s location - Provides tailored services optimized for client business environments with high stability and excellent security | |

| Marketplace | - Digital catalog service that curates industry-leading 3rd party solutions to clients’ needs - Provides easy access to solutions that are optimized for clients’ business needs | |

| 2) | IDC |

| Colocation | - Provides advanced computing infrastructure by directly accessing KT IDC Internet backbone network to improve internet connectivity speed and by providing power, air conditioning, and security infrastructure. | |

| MSP | - Service where clients outsource the management of their IT systems and various computing infrastructure resources to KT. Includes leasing monitoring tools, IT infrastructure operation and maintenance, migration, consulting, and utilizing KT’s professional personnel, facilities, equipment, and network resources | |

| DC/Infra | - Service that builds and provides customers with customized DC/DR. Formerly classified as On-demand IDC. | |

| Connectivity | - Service that provides connectivity to all services (Neutral IDC/CSP) based on One IDC | |

13

3. Information about property, plant and equipment (ICT, Satellite broadcasting, Real estate, others)

A. The status of property, plant and equipment(As of December 31, 2023)

KT

| • Land | (Unit: KRW million) | |||||||

Book value as of January 1, 2023 | Increase | Decrease | Book value as of | official land price | ||||||||||||

866,721 | 6,569 | (24,581 | ) | 848,709 | 5,567,599 | |||||||||||

| • Building | (Unit: KRW million) | |||||||

Book value as of January 1, 2023 | Increase | Decrease | Book value as of | official land price | ||||||||||||

1,003,985 | 148,618 | (99,997 | ) | (68,892 | ) | 983,714 | ||||||||||

| • Other property, plant and equipment | (Unit: KRW million) | |||||||||

Classification | Book value as of | Increase | Decrease | Depreciation Cost | Book value as of December 31, 2023 | |||||||||||||||

Constructed Structure | 34,391 | 12,669 | (226 | ) | (3,150 | ) | 43,684 | |||||||||||||

Machinery facilities | 4,997,407 | 1,831,316 | (46,982 | ) | (1,647,071 | ) | 5,134,670 | |||||||||||||

Cable facilities | 3,626,870 | 612,354 | (33,204 | ) | (590,173 | ) | 3,615,847 | |||||||||||||

Financial Leasing | 983,049 | 311,478 | (7,395 | ) | (339,231 | ) | 947,901 | |||||||||||||

Others | 78,702 | 28,519 | (5,051 | ) | (31,858 | ) | 70,312 | |||||||||||||

Sum | 9,720,419 | 2,796,336 | (92,858 | ) | (2,611,483 | ) | 9,812,414 | |||||||||||||

KT Skylife

• Operating equipment | (Unit: KRW million) |

Land(m2) | Building(m2) | Sum(m2) | Book value | |||||||||

396 | 18,248 | 18,644 | 15,172 | |||||||||

| • | Other business equipment |

(Unit: KRW million)

Classification | Asset value | |||

Broadcast center | 30,964 | |||

Customer service center | 6 | |||

Satellite receiving device | 71,460 | |||

Sum | 102,430 | |||

14

KT Estate

• Investment real estate | (Unit: KRW million) | |||||||

Book value as of January 1, 2023 | Acquisition | Depreciation | Disposal | Book value December 31, | ||||||||||||

1,137,300 | 58,698 | (39,407 | ) | (17,489 | ) | 1,139,102 | ||||||||||

• Tangible assets | (Unit: KRW million) | |||||||

Book value as of | Acquisition | Depreciation | Disposal | Book value | ||||||||||||

86,118 | 252 | (7,236 | ) | (98 | ) | 79,036 | ||||||||||

B. Capital Expenditure

KT, on stand alone basis, invested a total of KRW 2.416 trillion as CAPEX (Capital Expenditure) during 2023. Major subsidiaries’ CAPEX for 2023 was KRW 0.9 trillion for the growing businesses such as finance, media/content, cloud/IDC, and real estate.

15

4. Sales(ICT, Satellite broadcasting, Real estate, others)

| A. | ICT : KT |

(1) Performance in terms of revenue (Unit: millions of Korean won, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Service revenue | 15,932,421 | 86.7 | 15,766,188 | 86.2 | 15,501,216 | 84.3 | ||||||||||||||||||

Merchandise sales | 2,439,016 | 13.3 | 2,523,055 | 13.8 | 2,886,218 | 15.7 | ||||||||||||||||||

Total | 18,371,437 | 100.0 | 18,289.243 | 100.0 | 18,387,434 | 100.0 | ||||||||||||||||||

(2) Methods and Conditions of Sales

KT provides our products and services to customer through the sales organization and channel as above, basically, customers pay the service charges with cash, bank direct debit bill and credit card. In addition to monthly service fee, customers must pay the equipment rental fee and installment fee as well.

For the B2B business, the supply conditions and service fees are determined via a negotiation with enterprise customers.

(3) Sales Strategy

(a) Mobile Service

| • | Device leadership : Differentiate wireless experience with pre-emptive adoption of differentiated 5G/LTE smartphones and new forms of emerging devices. |

| • | Network quality differentiation : 5G first C-DRX Application and 5G network quality based on edge communication center, tight national network LTE-A Network. |

| • | Innovative rate plans : ‘5G Choice plan’ to offer unlimited data and worldwide data roaming, and LTE data ON providing unlimited data across all plans |

| • | Segment marketing : Introducing products exclusively for young customers such as Y super pan, Y24 and providing premium single bundled rate plan optimized for single-person households |

| • | Loyalty program : A variety of mobile phone replacement programs and installment plans, including industry-leading membership benefits, long-term customer special benefits, and rental services to reduce inconvenience in device replacement. |

| • | Differentiated service : The CS system optimized for smartphones, the benefits of reducing telecommunication charge through affiliated cards, differentiated mobile phone insurance products, and ‘Dual Number’ service to use 2 phone numbers in 1 phone. |

(b) Broadband Internet Service

| • | Lead the market with preemptive GiGA infrastructure investment and service quality enhancement |

16

| • | Expand sales synergy by bundling products between telco(5G, IPTV, etc.) and non-telco(CCTV, IoT, etc.) services |

| • | Broaden internet business coverage such as low cost market with skylife internet resale |

| • | Provide the optimized wireless internet environment through introducing advanced WiFi devices such as ‘GiGA WiFi home ax’, ‘GiGA WiFi Buddy ax’, ‘GiGA WiFi Premium 6E’, etc. |

| • | Offer the customized services for specific segments based on the customer behavior analysis to enhance customer convenience |

| • | Expand the product lineups including bundling, WiFi devices for small business owners |

| • | Acquire a number of broadband lines by winning the B2B/B2G orders e.g. mobile internet infrastructure installment business. |

| (c) | Telephone Service |

| • | Preemptive care activities to minimize customer churn : |

| • | Uncombined customers using the Internet and TV products : Service bundling propulsion |

| • | Customers who need home telephony service : Promoting KT telephony 3000 price plan |

| • | Customers who did re-contract VoIP service : Promoting KT VoIP 3000 price plan |

| • | SOHO, small business customers : Pushing to sign up for converged products including Telephone manager, Ringo |

| • | Preventing from decreasing revenue by restructuring price plans : |

| • | Rolling out new VoIP price plan which is charging per second(February, 2020) |

(d) IPTV Service

| • | Improve the product’s marketability take into strategic partnerships considering the changes in the media environment |

| • | Increase IPTV sales by introducing new media devices |

| • | Based on AI, organizing personalized content and strengthening the recommendation |

B. Satellite Business (KT skylife)

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Service revenue | 435,397 | 61.5 | 399,555 | 57.6 | 364,983 | 55.7 | ||||||||||||||||||

Platform revenue | 209,602 | 29.6 | 217,167 | 31.4 | 219,218 | 33.5 | ||||||||||||||||||

Others | 63,218 | 8.9 | 76,201 | 11.0 | 71,153 | 14.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 708,217 | 100.0 | 693,778 | 100.0 | 655,354 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| ※ | The above numbers are written on a separate basis. |

| ※ | Platform revenue: Advertisement revenue + Home shopping transmission fee + T-commerce transmission fee |

| ※ | Service revenue: Broadcasting revenue + Internet revenue + Mobile revenue |

17

(2) Sales Organization and Channels

KT Skylife currently has various sales channels such as skylife head office, customer center, 196 sales offices which are further organized under 9 branches (three in Seoul, two in Busan and one each in Daejeon, Daegu, Gwangju and etc.) and 1 local office (in Jeonju), KT.

Sales offices perform sales and services through consignment contracts with KT Skylife, and 2 customer centers(one each in Suwon, Gwangju) perform business activities such as customer counseling, as well as defending customer churn and attracting new subscribers.

The combined products are sold through KT’s in-house/outdoor sales channels and group companies, which are nationwide, and we are continuously sold on the headquarters’ website.

In addition, we have been continuously partnering with various on and off-line companies such as companies, government offices, and online markets to secure sales channels.

As of the end of December 2023, sales by route are as follows (Accumulated from January to December 2023)

Category | New Subscribers | % | ||||||

Sales office | 171,587 | 79.6 | ||||||

KT | 1,839 | 0.8 | ||||||

Headquarter, customer center | 42,203 | 19.6 | ||||||

|

|

|

| |||||

Total | 215,629 | 100.0 | ||||||

|

|

|

| |||||

C. Others Business

KT Estate

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Rental business | 184,477 | 31.2 | 175,167 | 35.9 | 160,212 | 47.8 | ||||||||||||||||||

Development business | 89,073 | 15.1 | 11,156 | 2.3 | — | — | ||||||||||||||||||

PM fee | 63,612 | 10.7 | 58,073 | 11.9 | 45,513 | 13.6 | ||||||||||||||||||

Real estate commission business | 195,797 | 33.1 | 140,098 | 28.7 | 99,424 | 29.6 | ||||||||||||||||||

Others | 58,826 | 9.9 | 103,257 | 21.2 | 30,224 | 9.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 591,785 | 100.0 | 487,751 | 100.0 | 335,373 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| ※ | Performances were written in accordance with K-IFRS |

18

2) Sales Organization and Channels

KT Estate’s main business is real estate leasing service and development. For this reason, this report does not disclose the sales organization and channels information.

KT Sat

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Gap filler rentals | 108,661 | 59.7 | 105,171 | 58.4 | 102,372 | 58.6 | ||||||||||||||||||

Data transmission | 14,019 | 7.7 | 17,990 | 10.0 | 24,565 | 14.1 | ||||||||||||||||||

Video transmission | 7,979 | 4.4 | 8,340 | 4.6 | 8,161 | 4.7 | ||||||||||||||||||

Mobile satellite service | 28,243 | 15.5 | 24,507 | 13.6 | 22,051 | 12.6 | ||||||||||||||||||

Others | 23,246 | 12.8 | 24,067 | 13.4 | 17,506 | 10.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 182,149 | 100.0 | 180,075 | 100.0 | 174,655 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| ※ | Performances were written in accordance with K-IFRS |

(2) Sales Organization and Channels

KT SAT’s sales organization manages and operates customers by region. Due to the characteristics of the service, the company has a large number of corporate customers and is attracting new customers through sales of internal sales representatives and external distribution networks (partners).

KT alpha

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

T-Commerce(K Shopping) | 288,996 | 67.1 | 325,515 | 69.3 | 307,181 | 72.5 | ||||||||||||||||||

Mobile Gift Commerce | 92,191 | 21.4 | 96,067 | 20.5 | 61,886 | 14.6 | ||||||||||||||||||

Content Distribution | 49,651 | 11.5 | 47,992 | 10.2 | 54,598 | 12.9 | ||||||||||||||||||

Total | 430,838 | 100.0 | 469,574 | 100.0 | 423,664 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| ※ | The above numbers are written on a separate basis. |

19

(2) Sales Organization and Channels

(a) T-Commerce

After the MD has signed a contract with the vendor to supply the product, the product information is provided directly to the general customer through platforms such as VOD, TV, Internet, and mobile. After receiving the customer’s order through TV remote control, internet, and mobile, if payment is made, we will ship the product through the delivery company.

(b) Mobile Gift Commerce

KT alpha divides its customers to B2B and B2C depending on the purchasing entities and provides its service. For the B2B customers, the company carries out the sales activities directly to enterprise customers who want to purchase in bulk. Also, the company provides the mobile gift certificate purchase online service (“Giftishow biz”) optimized for business purchase process indirectly such as promotion planning and managing the budget, etc. For B2C customers, the company service through its own web/app and also a variety of affiliate channel such as mobile commerce channel and online open market, etc.

(c) Content/Media

The content supply and demand representative make copyright agreements with the content creator or distributor. And we provide content VOD or library services to 150 platform companies such as IPTV and OTT. The general customer use the content which they make payment through the plarforms.

Genie Music

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Music business | 200,410 | 80.0 | 222,660 | 92.7 | 235,257 | 96.4 | ||||||||||||||||||

Others | 50,192 | 20.0 | 17,610 | 7.3 | 8,696 | 3.6 | ||||||||||||||||||

Total | 250,602 | 100.0 | 240,270 | 100.0 | 243,954 | 100.0 | ||||||||||||||||||

| ※ | The numbers are on a separate basis and were written in accordance with K-IFRS 1115. |

(2) Sales Organization and Channels

Genie Music serves as a service provider and content distributor within the digital music industry.

(a) Music Business (Music Services, Content Distributor)

Genie Music provides music services directly to the domestic customers through its own music platform Genie such as website, mobile app and etc. Also, the company is providing music services through the value-added services which telecom companies roll out.

As a content distributor, Genie Music distributes a variety of content including music sources to the domestic and overseas business players.

20

(b) Others (Performance, MD and etc.)

Genie Music generates others revenue through performance business, MD products, etc. For the performance business, it shares ticket sales from performances with production/planning companies. For the MD business, the company is selling the MD products (which are bought or imported from MD vendor) to the online and offline stores.

KT Telecop

| (1) | Performance in Terms of Revenue (Unit: millions of Korean won, %) |

| 2023 | 2022 | 2021 | ||||||||||||||||||||||

Category | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Security service | 521,519 | 99.2 | 510,384 | 98.8 | 502,075 | 98.3 | ||||||||||||||||||

Distribution | 3,781 | 0.7 | 5,403 | 1.1 | 8,318 | 1.6 | ||||||||||||||||||

Others | 646 | 0.1 | 647 | 0.1 | 608 | 0.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 525,946 | 100.0 | 516,434 | 100.0 | 511,001 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

※ The above numbers are written on a separate basis.

| (2) | Sales Organization and Channels |

KT Telecop operates the business department, regional headquarters strategic sales team, branch offices. And we provide dispatch security service and integrated security service.

Nasmedia

| (1) | Performance in Terms of Revenue (Unit: millions of Korean won, %) |

| 2023 | 2022 | 2021 | ||||||||||||||||||||||

Category | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Digital Advertising | 60,160 | 55.0 | 66,184 | 61.3 | 60,745 | 68.5 | ||||||||||||||||||

Platform | 49,170 | 45.0 | 41,794 | 38.7 | 27,98 | 31.5 | ||||||||||||||||||

Total | 109,329 | 100.0 | 107,977 | 100.0 | 88,726 | 100.0 | ||||||||||||||||||

※ The above numbers are written on a separate basis.

| (2) | Sales Organization and Channels |

The online advertising industry can be divided into four areas: advertisers, advertising companies, media reps, and media. Media reps sells media time or space to advertisers and advertising for media owners and generate revenue based on commission from media owners.

21

KT Studio Genie

| (1) | Performance in Terms of Revenue (Unit: millions of Korean won, %) |

| 2023 | 2022 | 2021 | ||||||||||||||||||||||

Category | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Content Production | 206,574 | 93.3 | 95,083 | 93.7 | 10,578 | 89.5 | ||||||||||||||||||

Distribution Agency | 8,063 | 3.6 | 3,096 | 3.0 | 293 | 2.5 | ||||||||||||||||||

PR Agency | 5,409 | 2.4 | 2,442 | 2.4 | — | — | ||||||||||||||||||

Others | 1,315 | 0.7 | 833 | 0.9 | 952 | 8.0 | ||||||||||||||||||

Total | 221,360 | 100.0 | 101,454 | 100.0 | 11,824 | 100.0 | ||||||||||||||||||

| 2) | Sales Organization and Channels |

KT Studio Genie sells its content and televising rights through the captive channels (KT and KT’s subsidiaries), the domestic non-captive channels and global partners.

KT Cloud

| (1) | Performance in Terms of Revenue (Unit: millions of Korean won, %) |

| 2023 | 2022 | 2021 | ||||||||||||||||||||||

Category | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Total | 670,917 | 100.0 | 430,437 | 100.0 | — | — | ||||||||||||||||||

※ Revenues are disclosed after its establishment on 1st April in 2022.

| 2) | Sales Organization and Channels |

KT Cloud operates 2 kinds of businesses(cloud and data center services).

For the cloud business, it is selling the service directly and indirectly. In case of the direct sale, KT Cloud makes a contract and provides the service in partnership with the sales organization of KT Enterprise Business Group. In case of the indirect sale, KT Cloud has around 150 external partner companies which are in charge of reselling. The partners resell and deliver the cloud service to the final customers.

For the data center business, there are domestic sales for the corporate/public/finance/Biz customers and global sales for the international corporate customers. KT Cloud are selling the data center service by using its own direct sales organization and KT’s sales channels as a consignment sale.

22

5. Research and Development Activities(ICT, Satellite broadcasting, Real estate, others)

A. R&D Costs—Consolidated Basis (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||

Raw Materials | — | — | — | |||||||||

Labor Costs | 91,785 | 83,774 | 82,225 | |||||||||

Depreciation | 28,541 | 22,685 | 20,732 | |||||||||

Commissions | — | — | — | |||||||||

Others | 110,295 | 107,511 | 127,516 | |||||||||

Total R&D Costs ( ※ 1) | 230,621 | 213,969 | 230,473 | |||||||||

(Subsidy from Government) | 8 | 8 | 211 | |||||||||

Accounting costs Research and Ordinary Development Costs | 174,936 | 168,969 | 156,940 | |||||||||

treatment Development Costs (Intangible Assets) | 55,677 | 44,992 | 73,322 | |||||||||

Percentage of R&D Costs over Revenue ( ※ 2) | 0.90 | % | 0.86 | % | 0.96 | % | ||||||

※ 1: Total costs before deducted the subsidy from government

※ 2: Rate of Total costs before deducted the subsidy from government and Total Revenue

B. R&D Organization Structure (KT)

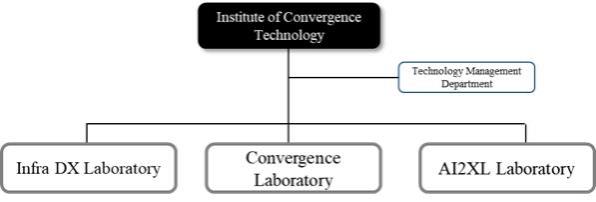

| • | Institute of Convergence Technology |

| • | Main Mission |

| • | Securing core technologies to strengthen future business and business competitiveness |

| • | Establishing mid- and long-term technology strategies for leading future technologies |

| • | Developing competitive technologies and supporting commercialization to strengthen business competitiveness |

23

| • | Developing and securing core technologies for mid- to long-term future |

| • | NW Platformer based on Smart Connectivity that satisfies market&customers |

| • | Development of network efficiency and optimization technology to strengthen infrastructure competitiveness |

| • | Realization of operation excellence based on AI/SDN2.0 and completion of intelligent control operating system |

| • | Development of core technology for OSP stable operation/quantum cryptography service |

| • | Research and development of 5G Access/Core network and 5G Mobility technology |

| • | 5G core/wireless/control intelligence technology and SW-based infrastructure innovation |

| • | Innovation B2X business based on customer centric technology differentiation |

| • | Developing differentiated Biz solution/platform for B2B business innovation |

| • | Development of core AI technology/platform/service for industry biz innovation |

| • | Through the AI Core technology-based ‘Innovation Pipeline’, achieve fast delivery from discovering future growth engines to commercialization |

| • | Discover convergence future growth engine |

| • | Secure Number one AI Core technology capabilities |

| • | Fast deliver new growth business |

6. Other Matters (ICT, Satellite broadcasting, Real estate, others)

A. Intellectual Property Rights (as of December 31, 2022)

| • | ICT (KT) : KT holds 4,033 domestic patents, 1,764 overseas patents. |

| • | Others |

KT Skylife holds 18 patents.

KT alpha holds 79 patents.

Nasmedia holds 2 patents and 7 trademarks

PlayD holds 5 domestic patents.

KTDS holds 8 patents, 8 trademarks, 2 service marks and 12 trade/service marks

Initech holds 33 patents and 32 trademarks.

24

7. Business Overview(Finance)

BC Card’s main business is issuing and managing credit cards, transaction processing of credit card and recruiting and managing of credit card merchants. Also, BC Card provides credit loans such as short-term card loans and long-term card loans to credit card members, while conducting supplementary businesses such as retail business via telephone, mail order or online, insurance, tourism service and loans.

Credit card companies are a typical domestic-based industry with a sensitive nature to changes in private consumption and overall domestic economic conditions, as they are based on the domestic market. Market entry requires approval from the Financial Services Commission, and considering the need for credit risk management for stable business operations, the entry barrier is high.

BC Card is mainly engaged in credit card processing business, and has secured a stable revenue base for card issuers based on its position in the credit card processing market. Additionally, BC Card strives to provide customers with easy and convenient financial services through mobile platform ‘Paybook’ for simplified payments and various financial services.

Credit sales amounted to KRW 138.2051 trillion, long and short-term credit card loans to KRW 8.1577 trillion, financial lease to KRW 47.8 billion, factoring to KRW 13.8 billion, and other loans receivables to KRW 673.5 billion, resulting in operating revenue of KRW 3.7209 trillion related to those.

BC Card raises funds through the issuance of corporate bonds and CP, and the average balance of financing for the current year was KRW 1.6036 trillion, with an average funding rate of 3.56%.

The adjusted capital adequacy ratio at the end of the current term was 25.28%, significantly exceeding the limit of 8% under the Regulation on Supervision of Credit-Specialized Financial Business. The delinquency ratio was 1.53%, and the KRW Liquidity Ratio was 111.19%.

8. Business Status(Finance)

A. Performance in Terms of Revenue (Unit: KRW million, %)

Category | 2023 | 2022 | 2021 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Card processing revenue | 3,251,985 | 87.4 | 3,188,689 | 81.8 | 3,154,561 | 88.1 | ||||||||||||||||||

Service fee revenue | 173,446 | 4.7 | 169,694 | 4.4 | 176,610 | 4.9 | ||||||||||||||||||

Additional business fee revenue | 67,065 | 1.8 | 57,480 | 1.5 | 68,972 | 1.9 | ||||||||||||||||||

Member Service Fee revenue | 55,274 | 1.5 | 55,560 | 1.4 | 57,182 | 1.6 | ||||||||||||||||||

Private Label Credit Card revenue | 24,069 | 0.6 | 22,971 | 0.6 | 9,051 | 0.3 | ||||||||||||||||||

Financial revenue | 110,357 | 3.0 | 70,427 | 1.8 | 29,935 | 0.9 | ||||||||||||||||||

Foreign currency-related profit | 12,805 | 0.3 | 7,426 | 0.2 | 4,062 | 0.1 | ||||||||||||||||||

Other operating revenue | 25,858 | 0.7 | 324,038 | 8.3 | 79,065 | 2.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 3,720,859 | 100.0 | 3,896,285 | 100.0 | 3,579,438 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| ※ | The above numbers are written on a K-IFRS consolidated basis. |

25

B. Fundraising and Operation

| (1) | Fundraising |

(Unit: KRW million, %)

| 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Category | Average Balance | amount of payments | Interest rate | % | Average Balance | amount of payments | Interest rate | % | Average Balance | amount of payments | Interest rate | % | ||||||||||||||||||||||||||||||||||||||||

Short-term debt | CP | 115,424 | 6,191 | 5.36 | 7.20 | 65,076 | 2,723 | 4.18 | 6.24 | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| | General debt | | 29,068 | 1,766 | 6.07 | 1.82 | 39,274 | 1,445 | 3.68 | 3.77 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| | Other debt | | 4,877 | 229 | 4.70 | 0.30 | 3,287 | 123 | 3.74 | 0.32 | 247 | 8 | 3.24 | 0.08 | ||||||||||||||||||||||||||||||||||||||

Lomg-term debt | CP | 184,772 | 5,880 | 3.18 | 11.52 | 150,237 | 4,501 | 3.00 | 14.41 | 6,270 | 138 | 2.20 | 2.03 | |||||||||||||||||||||||||||||||||||||||

Corporate Bonds |

| 1,269,428 | 43,034 | 3.39 | 79.16 | 784,488 | 18,327 | 2.34 | 75.26 | 301,794 | 5,195 | 1.72 | 97.89 | |||||||||||||||||||||||||||||||||||||||

Total |

| 1,603,569 | 57,100 | 3.56 | 100.00 | 1,042,362 | 27,119 | 2.60 | 100.00 | 308,311 | 5,341 | 1.73 | 100.00 | |||||||||||||||||||||||||||||||||||||||

| ※ | Financial Supervisory Service’s business report standard |

| ※ | The other debt of short-term debt refer to borrowings under the credit line agreement |

| ※ | % represents the proportion to the Average Balance |

| (2) | Operation |

(Unit: KRW million, %)

| 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||||

Category | Average Balance | Profit amount | ROI | % | Average Balance | Profit amount | ROI | % | Average Balance | Profit amount | ROI | % | ||||||||||||||||||||||||||||||||||||

Credit Card assets | 287,274 | 46,063 | 16.03 | 21.07 | 110,064 | 20,582 | 18.70 | 13.13 | 30,676 | 9,889 | 32.24 | 11.58 | ||||||||||||||||||||||||||||||||||||

Lease assets | 25,349 | 1,434 | 5.66 | 1.86 | 14,634 | 525 | 3.59 | 1.75 | 2,979 | 82 | 2.75 | 1.12 | ||||||||||||||||||||||||||||||||||||

Factoring | 61,072 | 3,835 | 6.28 | 4.48 | 70,358 | 4,241 | 6.03 | 8.39 | 61,041 | 3,709 | 6.08 | 23.05 | ||||||||||||||||||||||||||||||||||||

General loan | 989,412 | 86,752 | 8.77 | 72.59 | 643,147 | 51,623 | 8.03 | 76.73 | 170,126 | 17,298 | 10.17 | 64.25 | ||||||||||||||||||||||||||||||||||||

Total | 1,363,107 | 138,084 | 10.13 | 100.00 | 838,203 | 76,971 | 9.18 | 100.00 | 264,822 | 30,978 | 11.70 | 100.00 | ||||||||||||||||||||||||||||||||||||

| ※ | Financial Supervisory Service’s business report standard |

| ※ | Lease assets are comprised of Financial lease bonds |

26

C. Status by Business areas

| (1) | Business performance by department |

(Unit: KRW billion, %)

| 2023 | 2022 | 2021 | ||||||||||||||||||||||||||

Category | Amount | % | Amount | % | Amount | % | ||||||||||||||||||||||

Card | Credit sales | Lump sum payment | 1,171,936 | 79.67 | 1,120,765 | 79.89 | 1,017,012 | 77.98 | ||||||||||||||||||||

Installment | 210,115 | 14.28 | 187,203 | 13.35 | 206,810 | 15.86 | ||||||||||||||||||||||

| Cash loan | Short-term card loan (cash advance) | 81,132 | 5.52 | 83,874 | 5.99 | 76,905 | 5.89 | |||||||||||||||||||||

| Long-term card loan (card loan) | 445 | 0.03 | 57 | 0.00 | 2 | 0.00 | ||||||||||||||||||||||

Lease | 478 | 0.03 | 176 | 0.01 | 111 | 0.01 | ||||||||||||||||||||||

Factoring | 138 | 0.01 | 197 | 0.01 | 413 | 0.03 | ||||||||||||||||||||||

Loan | 6,735 | 0.46 | 10,582 | 0.75 | 2,987 | 0.23 | ||||||||||||||||||||||

Total | 1,470,979 | 100.00 | 1,402,854 | 100.00 | 1,304,240 | 100.00 | ||||||||||||||||||||||

| ※ | Financial Supervisory Service’s business report standard |

| ※ | The amount of credit sales(Lump sum payment and Installment) and short-term card loans(cash advance) is the total performance of BC Card and its member companies |

| (2) | Member status |

(Unit: thousand, thousand, %)

| YoY | ||||||||||||||||||||||

Category | 2023 | 2022 | 2021 | Change | % of Change | |||||||||||||||||

Individual member | Number of cards | 39,426 | 39,904 | 40,807 | -478 | -1.20 | ||||||||||||||||

Number of members | 36,671 | 33,963 | 30,154 | 2,708 | 7.97 | |||||||||||||||||

Corporate member | Number of cards | 5,214 | 5,229 | 5,102 | -15 | -0.29 | ||||||||||||||||

Number of members | 3,245 | 3,353 | 1,993 | -108 | -3.22 | |||||||||||||||||

Total | Number of cards | 44,640 | 45,134 | 45,909 | -494 | -1.09 | ||||||||||||||||

Number of members | 36,671 | 37,316 | 32,146 | -645 | -1.73 | |||||||||||||||||

| ※ | Financial Supervisory Service’s business report standard |

27

| (3) | The number of affiliated merchants |

(Unit : thousand, %)

Category | 2023 | 2022 | 2021 | YoY | ||||||||||||||||

| Change | % of Change | |||||||||||||||||||

Affiliated merchants | 3,427 | 3,455 | 3,333 | -28 | -0.81 | |||||||||||||||

※ Financial Supervisory Service’s business report standard

9. Derivatives Transaction(Finance)

A. The breakdown of derivatives currently held by BC Card for trading purposes or hedging purposes is as follows :

(1) Drag-along Right

BC card gave drag-along rights to financial investors participating in capital raise of K Bank. In case K Bank fails in IPO at an agreed conditions, financial investors can exercise drag-along rights.

| (2) | Interest rate Swap |

This contract is aimed at avoiding cash flow fluctuation risks caused by changes in interest rates for BC Card’s held floating-rate KRW denominated bonds, and the major details are as follows

(Unit: KRW million)

Item | Counter Party | Contract Signing date | Contract expiration date | Contract amount | Interest rate | |||||||||||||||||||||||

| Contract interest rate | Swap rate | |||||||||||||||||||||||||||

Interest rate swap | Shinhan Bank | 2022-03-25 | 2025-03-25 | 60,000 | CMS | (5Y | ) | 2.70 | % | |||||||||||||||||||

| 2022-03-25 | 2032-03-25 | 40,000 | CMS | (10Y | ) | 2.64 | % | |||||||||||||||||||||

28

B. Derivative assets and liabilities as of the reference date are as follows :

(1) 4Q23

(Unit: KRW million)

Item | Trading purpose | Risk management purpose | ||||||||||||||

| Asset | Liability | Asset | Liability | |||||||||||||

Drag-along Right | — | 133,293 | — | — | ||||||||||||

Interest rate Swap | — | — | 1,214 | — | ||||||||||||

Total | — | 133,293 | 1,214 | — | ||||||||||||

(2) 4Q22

(Unit: KRW million)

Item | Trading purpose | Risk management purpose | ||||||||||||||

| Asset | Liability | Asset | Liability | |||||||||||||

Drag-along Right | — | 134,881 | — | — | ||||||||||||

Interest rate Swap | — | — | 3,123 | — | ||||||||||||

Total | — | 134,881 | 3,123 | — | ||||||||||||

| (2) | 4Q21 |

(Unit: KRW million)

Item | Trading purpose | Risk management purpose | ||||||||||||||

| Asset | Liability | Asset | Liability | |||||||||||||

Drag-along Right | — | 158,284 | — | — | ||||||||||||

C. The details of profits and losses related to derivatives during the disclosure period

(Unit: KRW million)

| 2023 | 2022 | 2021 | ||||||||||||||||||||||||||||||||||

Item | Gain/Loss On Valuation | Gain/Loss On Trading | Other comprehensive income | Gain/Loss On Valuation | Gain/Loss On Trading | Other comprehensive income | Gain/Loss On Valuation | Gain/Loss On Trading | Other comprehensive income | |||||||||||||||||||||||||||

Drag-along Right | 1,588 | — | — | 23,403 | — | — | 47,039 | — | ||||||||||||||||||||||||||||

Interest rate Swap | 48 | — | (1,957 | ) | (418 | ) | — | 3,541 | — | — | — | |||||||||||||||||||||||||

forward exchange rate | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Total | 1,636 | — | (1,957 | ) | 22,985 | — | 3,541 | 47,039 | — | — | ||||||||||||||||||||||||||

29

10. Business Facilities (Finance)

A. Equipment and other assets (Reference date : 31 Dec. 2023)

(Unit: KRW million)

Item | Property | Building | Total | |||||||||

Main office | 362,529 | 186,076 | 548,605 | |||||||||

Branch office | 465 | 2,989 | 3,454 | |||||||||

Sum | 362,994 | 189,065 | 552,059 | |||||||||

| ※ | Main office includes real estate for investment (based on acquisition cost) |

11. (Finance) Financial Stability

[Major Management Index]

Items | 2023 | 2022 | 2021 | Formula | ||||||||||||

Capital Adequacy | Adjusted Equity Ratio | 25.28 | 27.34 | 35.80 | Adjusted Equity/ Adjusted Total Assets x 100 | |||||||||||

Tangible Common Equity Ratio | 23.25 | 25.78 | 35.44 | Equity/Total Assets x 100 | ||||||||||||

Asset Quality | Loss Risk Weighted Non-performing Loans Ratio | 0.84 | 0.29 | 0.08 | Weighted Non-performing Loans/ Total Loans x 100 | |||||||||||

Substandard Loans Ratio | 2.16 | 0.41 | 0.11 | Substandard Loans/ Total Loans x 100 | ||||||||||||

Loan Loss Provision Ratio | 123.72 | 139.41 | 171.83 | Loan Loss Provision Balance/ Required Provision Amount x 100 | ||||||||||||

Profitability | Return on Asset | 0.47 | 1.74 | 2.47 | Net profit / Total Assets x 100 | |||||||||||

Return on Equity | 1.87 | 6.10 | 7.46 | Net profit/ Equity x 100 | ||||||||||||

Expenses to Total Assets | 4.14 | 4.72 | 5.44 | Total expenses/ Total Assets x 100 | ||||||||||||

Liquidity | Liquidity Ratio | 111.19 | 123.01 | 114.90 | Current Asset/ Current Liability x 100 (Due in 90 days) | |||||||||||

Operating Assets Ratio | 37.34 | 34.63 | 36.31 | Operating Asset/ Equity | ||||||||||||

30

A. Characteristics of the Industry

Credit card businesses engage in the business of issuing and managing credit cards, processing payments related to credit card usage, recruiting and overseeing credit card merchants. In addition, credit card companies also provide credit loans such as short-term and long-term card loans to their members.

The credit card industry is a typical domestic consumption-based industry and is sensitive to changes in overall domestic economic conditions, including fluctuations in business cycles.

Market entry requires approval from the Financial Services Commission, and considering the need for effective credit risk management for stable business operations, the barriers to entry are high.

Furthermore, seasonal consumption patterns such as travel and leisure industries during vacation seasons, department stores and discount stores during major holiday, as well as individuals’ disposable income, also have significant impacts on the credit card industry.

D. Market Conditions

(1) Number of Credit Card and Member Merchant Store

Category | Population (in 10K) | Population Available for Economic Activity*1 (in 10K) | Credit Card (in 10K) | Number of Credit Card Per Capital | Number of Member Stores*2 (in 10K) | |||||||||||||||

2021 | 5,174 | 2,831 | 11,769 | 4.2 | 299 | |||||||||||||||

2022 | 5,163 | 2,801 | 12,417 | 4.4 | 310 | |||||||||||||||

2023.2Q | 5,156 | 2,949 | 12,749 | 4.3 | — | |||||||||||||||

| ※ | Source : Credit Finance Association, Korea |

| *1 | Age 15 or order and must be eligible for employment activity |

| *2 | At least one sales transaction incurred annually from a member store |

(2) Credit Card Usage in Korea (Unit : KRW billion)

| Credit Card Usage | Credit Card Usage over Private Consumption Expenditure* | |||||||||||||||||||

Category | Total | Lump- Sum Payment | Installment Payment | Card Loan (Short- term) | ||||||||||||||||

2021 | 834,172.9 | 634,315.1 | 144,719.5 | 55,138.3 | 77.8 | % | ||||||||||||||

2022 | 941,364.7 | 728,183.2 | 155,770.9 | 57,410.6 | 81.0 | % | ||||||||||||||

2023.2Q | 489,769.5 | 382,897.4 | 78,524.5 | 28,347.6 | 82.3 | % | ||||||||||||||

| ※ | Source : Credit Finance Association, Korea |

31

E. Competitiveness

In credit card business, solicitation of member merchant stores, development of products and services, customer segment focused marketing services and risk management capabilities for stable asset portfolio are key management factors. With the technological advancement, boundary of financial services has become more abstract, and digital payment market has grown bigger in which competition among financial service providers are increasing. BC Card continues its efforts to provide various digital financial services in response to evolving market.

BC Card has lower credit card industry specific risk like deterioration risk of asset soundness while BC card focuses on core business, credit card processing business, and most of its receivables are from high credit institutions like banks and credit card companies. Based on strong foothold in credit card transaction processing market, BC card has built stable revenue stream from middle and small card issuers, which are not available of economy of scale. Moreover,

F. Tools to remain competitive in the competition

BC Card focuses on credit card processing as its main business and secures a stable revenue base targeting card issuers based on its position in the credit card processing market. In addition, BC Card strives to provide customers with easy and convenient financial services through simple payment and various financial services based on the mobile platform ‘Paybook’

32

1. Summary of Financial Statements (Consolidated) (Unit : millions of Korean won)

| 2023 | 2022 | 2021 | ||||||||||

Current Assets | 14,518,157 | 12,681,532 | 11,858,350 | |||||||||

• Cash and Cash Equivalents | 2,879,554 | 2,449,062 | 3,019,592 | |||||||||

• Trade and Other Receivables | 7,170,289 | 6,098,072 | 5,087,490 | |||||||||

• Inventories | 912,262 | 709,191 | 514,145 | |||||||||

• Other Current Assets | 3,556,052 | 3,425,207 | 3,237,123 | |||||||||

Non-current Assets | 28,191,825 | 28,299,149 | 25,300,991 | |||||||||

• Trade and Other Receivables | 1,404,168 | 1,491,046 | 1,091,326 | |||||||||

• Property, plant and equipment | 14,872,079 | 14,772,179 | 14,464,886 | |||||||||

• Investment Property | 2,198,135 | 1,933,358 | 1,720,654 | |||||||||

• Intangible Assets | 2,533,861 | 3,129,833 | 3,447,333 | |||||||||

• Investments in Joint Ventures and Associates | 1,556,889 | 1,480,722 | 1,288,429 | |||||||||

• Other Non-Current Assets | 5,626,693 | 5,492,011 | 3,288,363 | |||||||||

|

|

|

|

|

| |||||||

Total Assets | 42,709,982 | 40,980,681 | 37,159,341 | |||||||||

|

|

|

|

|

| |||||||

Current Liabilities | 13,147,409 | 10,699,268 | 10,072,432 | |||||||||

Non-Current Liabilities | 11,001,436 | 11,866,690 | 10,519,748 | |||||||||

|

|

|

|

|

| |||||||

Total Liabilities | 24,148,845 | 22,565,958 | 20,592,180 | |||||||||

|

|

|

|

|

| |||||||

Capital Stock | 1,564,499 | 1,564,499 | 1,564,499 | |||||||||

Share Premium | 1,440,258 | 1,440,258 | 1,440,258 | |||||||||

Retained Earnings | 14,494,430 | 14,257,343 | 13,287,390 | |||||||||

Accumulated Other Comprehensive Expense | 52,407 | (77,776 | 117,469 | |||||||||

Other Components of Equity | (802,418 | (572,152 | (1,433,080 | |||||||||

Non-Controlling Interests | 1,811,961 | 1,802,551 | 1,590,625 | |||||||||

|

|

|

|

|

| |||||||

Total Equity | 18,561,137 | 18,414,723 | 16,567,161 | |||||||||

|

|

|

|

|

| |||||||

33

| 2023 | 2022 | 2021 | ||||||||||

Operating Revenue | 26,376,273 | 25,650,011 | 24,898,005 | |||||||||

Operating Profit | 1,649,774 | 1,690,088 | 1,671,824 | |||||||||

Profit for the Period | 988,718 | 1,387,663 | 1,459,395 | |||||||||

Owners of the Controlling Company | 1,009,861 | 1,262,498 | 1,356,878 | |||||||||

Non-controlling interest | (21,143 | ) | 125,165 | 102,517 | ||||||||

Earnings per share attributable to the equity holders of the Controlling Company during the year (in Korean won): | ||||||||||||

Basic earnings per share | 4,043 | 5,209 | 5,759 | |||||||||

Diluted earnings per share | 4,038 | 5,205 | 5,747 | |||||||||

Number of Consolidated Companies | 84 | 85 | 79 | |||||||||

※ 2023, 2022 and 2021 were written in accordance with K-IFRS 1116

2. Summary of Financial Statements (Separate) (Unit : millions of Korean won)

| 2023 | 2022 | 2021 | ||||||||||

Current Assets | 7,088,565 | 6,603,488 | 7,167,047 | |||||||||

• Cash and Cash Equivalents | 1,242,005 | 966,307 | 1,708,714 | |||||||||

• Trade and Other Receivables | 3,190,269 | 3,055,649 | 3,092,397 | |||||||||

• Other Financial Assets | 279,451 | 232,837 | 104,062 | |||||||||

• Inventories | 368,117 | 349,870 | 289,345 | |||||||||

• Other Current Assets | 2,008,723 | 1,998,825 | 1,972,529 | |||||||||

Non-Current Assets | 23,220,354 | 23,814,286 | 22,195,322 | |||||||||

• Trade and Other Receivables | 370,717 | 526,988 | 750,820 | |||||||||

• Other Financial Assets | 2,134,324 | 1,993,893 | 591,201 | |||||||||

• Property and equipment | 11,492,776 | 11,540,162 | 12,021,117 | |||||||||

• Right-of-use assets | 976,625 | 983,049 | 1,078,129 | |||||||||

• Investment Property | 1,191,592 | 1,137,489 | 997,344 | |||||||||

• Intangible Assets | 1,487,848 | 1,855,679 | 2,236,564 | |||||||||

• Investments in Subsidiaries, Associates and Joint Ventures | 4,796,606 | 4,879,219 | 3,816,915 | |||||||||

• Non-Current Assets held for Long-term Investment | 60,590 | 180,689 | ||||||||||

• Other Non-Current Assets | 709,276 | 717,118 | 703,232 | |||||||||

|

|

|

|

|

| |||||||

Total Assets | 30,308,919 | 30,417,774 | 29,362,369 | |||||||||

|

|

|

|

|

| |||||||

Current Liabilities | 6,957,491 | 6,321,450 | 6,968,720 | |||||||||

Non-Current Liabilities | 8,307,889 | 9,238,244 | 8,528,755 | |||||||||

|

|

|

|

|

| |||||||

Total Liabilities | 15,265,380 | 15,559,694 | 15,497,475 | |||||||||

|

|

|

|

|

| |||||||

Capital Stock | 1,564,499 | 1,564,499 | 1,564,499 | |||||||||

Share Premium | 1,440,258 | 1,440,258 | 1,440,258 | |||||||||

Retained Earnings | 12,544,425 | 12,347,403 | 11,931,481 | |||||||||

Accumulated Other Comprehensive Income | 64,229 | (72,672 | ) | 125,610 | ||||||||

Other Components of Shareholders’ Equity | (569,872 | ) | (421,408 | ) | (1,196,954 | ) | ||||||

|

|

|

|

|

| |||||||

Total Equity | 15,043,539 | 14,858,080 | 13,864,894 | |||||||||

|

|

|

|

|

| |||||||

34

| 2023 | 2022 | 2021 | ||||||||||

Operating Revenue | 18,371,437 | 18,289,243 | 18,387,434 | |||||||||

Operating Profit | 1,185,392 | 1,168,103 | 1,068,273 | |||||||||

Profit for the Period | 933,337 | 763,750 | 990,491 | |||||||||

Earnings per share (in Korean won): | ||||||||||||

Basic earnings per share | 3,741 | 3,153 | 4,211 | |||||||||

Diluted earnings per share | 3,739 | 3,152 | 4,203 | |||||||||

※ 2023, 2022 and 2021 were written in accordance with K-IFRS 1116

3. Dividends and Related Matters

Dividend Policy from FY2023 to FY2025

| • | Dividend Resource: 50% of adjusted separate net income |

| • | Method: Cash dividend, share buyback & cancellation |

| • | Cash Dividend: To maintain cash dividend level at minimum the amount for FY2022(KRW 1,960 per share) |

| • | Quarterly Dividend: To be introduced from 2024 first quarter (quarterly dividend to be introduced after amendments made to the articles of incorporation through resolution of the shareholders’ meeting) |

Category | FY2023 | FY2022 | FY2021 | |||||||||||

Par Value per Share (Won) | 5,000 | 5,000 | 5,000 | |||||||||||

Net Profit of the Current Term (in Millions of Won) | 988,718 | 1,387,663 | 1,459,395 | |||||||||||

Net Profit per Share (Won) | 4,043 | 5,209 | 5,759 | |||||||||||

Year-end Cash Dividend (in Millions of Won) | 482,970 | 501,844 | 450,394 | |||||||||||

Year-end Share Dividend (in Millions of Won) | — | — | — | |||||||||||

Cash Dividend Pay Out (%) | 47.8 | 39.8 | 33.2 | |||||||||||

Cash Dividend Yield (%) | Common Shares | 5.5 | 5.5 | 5.9 | ||||||||||

Preferred Shares | — | — | — | |||||||||||

Cash Dividend per Share (Won) | Common Shares | 1,960 | 1,960 | 1,910 | ||||||||||

Preferred Shares | — | — | — | |||||||||||

| • | Net Profit, Net profit per share, Cash dividend Pay Out are based on consolidated result. |

| • | Cash dividend Pay Out(%) is calculated on a basis of Net Profit contribution to KT. |

| • | Cash dividend yield(%) is the percentage of dividends per share against the arithmetic average price of the final price formed in the exchange market for the past week from the date of the two trading days before the closing date of the shareholders ‘list to convene the general shareholders’ meeting. |

35

1. Auditors’ opinion on the consolidated/separate financial statements

Fiscal Year | Auditor | Audit | Issues noted | Key Audit Matters | ||||