QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

AMENDMENT NO. 1

(Mark One)

| | ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2002 |

OR |

| |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission file number: 0-20850 |

|

HAGGAR CORP.

(Exact name of registrant as specified in its charter)

|

NEVADA

(State or other jurisdiction of

incorporation or organization) |

|

75-2187001

(I.R.S. Employer Identification Number) |

6113 Lemmon Avenue

Dallas, Texas

(address of principal executive offices) |

|

75209

(Zip Code) |

Registrant's telephone number, including area code:(214) 352-8481 |

Securities registered pursuant to Section 12(b) of the Act: |

| None. |

Securities registered pursuant to Section 12(g) of the Act: |

| Common Stock, par value $0.10 per share |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

Yes ý No o

As of December 19, 2002 there were 6,418,404 shares of common stock outstanding. The aggregate market value of the 5,864,912 shares of the common stock of Haggar Corp. held by non-affiliates on such date (based on the last sale price of these shares reported on the Nasdaq National Market System) was approximately $72.3 million.

DOCUMENTS INCORPORATED BY REFERENCE

None.

This Amendment No. 1 to the Annual Report on Form 10-K of Haggar Corp. (the "Company") amends and restates in their entirety Items 10, 11, 12 and 13 of Part III and Item 15(a)(3) of Part IV of the Annual Report on Form 10-K of the Company filed with the Securities and Exchange Commission on December 20, 2002 (the "Form 10-K"). Capitalized terms used herein and not otherwise defined shall have the meaning assigned to such terms in the Form 10-K.

PART III

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

DIRECTORS

Set forth below is certain information concerning the directors of the Company:

Name of Director

| | Age

| | Title

| | Director's Term

Ending

|

|---|

| J. M. Haggar, III | | 51 | | Chairman of the Board, Chief Executive Officer and Class II Director | | 2004 |

| Frank D. Bracken | | 62 | | President, Chief Operating Officer and Class III Director | | 2005 |

| Rae F. Evans | | 54 | | Class I Director | | 2003 |

| Donald E. Godwin | | 55 | | Class I Director | | 2003 |

| Richard W. Heath | | 60 | | Class II Director | | 2004 |

| John C. Tolleson | | 54 | | Class III Director | | 2005 |

J. M. Haggar, III has served as Chairman of the Board since 1994 and Chief Executive Officer of the Company since 1990. He has been a director of the Company since 1983. He also served as President of the Company from 1990 to 1994 and as President of the Menswear Division from 1985 to 1990. Mr. Haggar joined the Company on a part-time basis in 1969 and on a full-time basis in 1973. During the course of his career with the Company, Mr. Haggar has participated in virtually every aspect of the business, including three years in the Manufacturing Division, two years as the Dallas Service Center Manager, one year in the Sales Division and six years in the Marketing and Merchandising Division.

Frank D. Bracken has served as a director of the Company since 1991. He was elected President and Chief Operating Officer of the Company in 1994. Mr. Bracken previously served as Executive Vice President of Marketing of the Company from 1991 to 1994. He joined the Company as a management trainee in 1963 and has served as a Regional Sales Manager, Western Sales Manager, National Sales Manager, Senior Vice President of Sales and Merchandising and Senior Vice President of Marketing.

Rae F. Evans has served as a director of the Company since 1994. Since January 1, 2003, she has served as President and Chief Executive Officer of Evans Capitol Group, a firm specializing in Washington public policy and corporate strategies. Ms. Evans formerly served as President of Evans & Black, Inc., beginning in 1999, and, prior to that time, as the President of Rae Evans & Associates, beginning in 1995, both of which are predecessors of Evans Capitol Group. Ms. Evans is a former Director of Brinker International and was recently elected to the Board of Directors of the Ladies Professional Golf Association. Ms. Evans, prior to establishing her firm, held senior government relations positions at both Hallmark Cards, Inc. and CBS Inc. She is a past President of the Business-Government Relations Council, a business group of senior government affairs representatives of Fortune 500 companies.

Donald E. Godwin has served as a director of the Company since May 2002. He is the Chairman and Chief Executive Officer of Godwin Gruber, L.L.P., a Dallas-based law firm founded by Mr. Godwin

2

and others in 1980. Mr. Godwin is board certified by the Texas Board of Legal Specialization in Civil Trial Law and is a member of the American Board of Trial Advocates. Mr. Godwin is a past chairman of the Antitrust and Trade Regulation Section of the Dallas Bar Association.

Richard W. Heath has served as a director of the Company since 1991. He has served as President and Chief Executive Officer of BeautiControl Cosmetics, Inc., a direct seller of cosmetic, nutritional, and skin care products, since its inception in 1981. In 2000, Mr. Heath was also named Senior Vice President of Beauty and Nutritional Products for Tupperware Corporation in connection with Tupperware's acquisition of BeautiControl. In September 2002, Mr. Heath also became Group President Tupperware Latin America and BeautiControl. He has over 30 years of experience in the direct sales industry. Mr. Heath currently serves as a lifetime member of the Board of Directors of The Episcopal School of Dallas and as a member of The Dallas Methodist Hospitals Foundation Board of Trustees. Mr. Heath has formerly served as a member of the Executive Board of the Edwin L. Cox School of Business at Southern Methodist University, a member of the Dallas County Advisory Board of the Salvation Army, Vice Chairman of the Board of Directors of The Episcopal School of Dallas, Commissioner of the Texas Parks and Wildlife Commission, a member of the Harvard University Divinity School Dean's Council and a member of the National Advisory Council for the Center for the Study of Values in Public Life.

John C. Tolleson has served as a director of the Company since 1998. Since 1997, he has been the Chairman of The Tolleson Group and Managing Director of Arena Capital Partners, both private investment firms. Mr. Tolleson founded First USA, Inc. in 1985 and served as its Chairman and Chief Executive Officer until its merger with Banc One Corporation in 1997. Mr. Tolleson is also a member of the Board of Trustees of Southern Methodist University and Southwestern Medical Foundation. In addition, he is a member of the Edwin L. Cox School of Business Executive Board and the Dallas County Advisory Board of the Salvation Army and is a member of the boards of directors of The Willis M. Tate Distinguished Lecture Series and SMU's John Godwin Tower Center for Political Studies.

Term of Office

The Company's articles of incorporation provide that the Board of Directors of the Company (the "Board") must be divided into three classes, designated Class I, Class II and Class III. Directors serve for staggered terms of three years each. Mr. Godwin and Ms. Evans currently serve as Class I directors, whose terms expire at the annual meeting of stockholders in 2003, Messrs. Haggar and Heath currently serve as Class II directors, whose terms expire at the annual meeting of stockholders in 2004, and Messrs. Bracken and Tolleson currently serve as Class III directors, whose terms expire at the annual meeting of stockholders in 2005.

EXECUTIVE OFFICERS

Set forth below is certain information concerning the executive officers of the Company:

Name

| | Age

| | Title

|

|---|

| J. M. Haggar, III | | 51 | | Chairman of the Board, Chief Executive Officer and Class II Director |

| Frank D. Bracken | | 62 | | President, Chief Operating Officer and Class III Director |

| David M. Tehle | | 46 | | Executive Vice President and Chief Financial Officer |

| Alan C. Burks | | 48 | | Executive Vice President and Chief Marketing Officer |

| David G. Roy | | 48 | | Executive Vice President of Operations |

The executive officers named above were elected by the Board to serve in such capacities until their respective successors have been duly elected and qualified, or until their earlier death, resignation

3

or removal from office. Biographical information on Messrs. Haggar and Bracken is set forth previously in "—Directors."

David M. Tehle has served the Company as Executive Vice President since 2000 and Chief Financial Officer since joining the Company in 1997. Prior to joining the Company, Mr. Tehle served as Vice President of Finance for a division of The Stanley Works, an international tool manufacturer, from 1996 to 1997, where he was responsible for worldwide finance, strategic planning, accounting, credit and tax functions. From 1993 to 1996, he served as Vice President of Finance and Chief Financial Officer of Hat Brands, Inc., the world's largest independent hat manufacturer. Before his tenure at Hat Brands, Mr. Tehle served as Vice President of Finance for Ryder Aviall, an aviation supply company, and previously held various financial positions with Texas Instruments.

Alan C. Burks has served the Company as Executive Vice President and Chief Marketing Officer since 2000. He had previously served as Senior Vice President of Marketing since joining the Company in 1993. Prior to joining the Company, Mr. Burks had a distinguished career in the advertising industry where he worked for agencies such as Ogilvy and DDB Needham beginning in 1976. His account management experience included Frito-Lay, the Ben Hogan Company, Dial Corp. and the Company.

David G. Roy has served the Company since 1996 in various positions, including Vice President of Technical Services and Senior Vice President of Operations. In 2000, Mr. Roy was promoted to Executive Vice President of Operations for the Company. Prior to joining the Company, Mr. Roy spent twenty years at VF Corporation, an international apparel manufacturer. He held leadership positions throughout VF's Manufacturing, Distribution and Engineering Departments for Wrangler, Jantzen and Red Kap, where he served as Vice President until 1996.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Company's executive officers and directors, and beneficial owners of more than 10% of the Common Stock, are required to file initial reports of ownership and reports of changes of ownership of the Common Stock with the SEC. The SEC's rules require such person to furnish the Company with copies of all Section 16(a) reports they file. Based on a review of these reports and on written representations from the reporting persons that no other reports were required, the Company believes that the applicable Section 16(a) reporting requirements were complied with for all transactions which occurred during the fiscal year ended September 30, 2002, except that Mr. Godwin filed a late Form 3 in July 2002 in respect of his appointment to the Board, Mr. Tolleson filed a late Form 5 in January 2003 in respect of one automatic grant of options as compensation for his services as a director of the Company, and Mr. Burks failed to file a Form 4 in respect of one acquisition under the Company's employee stock purchase plan and filed a late Form 5 in January 2003 in respect of seven acquisitions under the Company's employee stock purchase plan, including the acquisition previously mentioned that should have been filed on Form 4, and two acquisitions under the Company's employee stock purchase plan pursuant to the reinvestment of cash dividends paid by the Company.

4

ITEM 11. EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information for the fiscal years ended September 30, 2002, 2001 and 2000 concerning compensation of the Company's chief executive officer and each of the other four most highly compensated executive officers of the Company whose total annual salary and bonus exceeded $100,000 for services rendered to the Company during fiscal 2002.

| | Annual Compensation

| | Long-Term Compensation

|

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary

($)

| | Bonus

($)(1)

| | Other Annual

Compensation

($)(2)

| | Securities

Underlying

Options (#)(3)

| | All Other

Compensation

($)(4)

|

|---|

J. M. Haggar, III

Chairman and Chief Executive

Officer | | 2002

2001

2000 | | 640,000 640,000

575,000 | | 503,166

330,544

495,000 | | 69,440

69,161

68,548 | | —

—

35,000 | | 5,773

5,519

5,340 |

Frank D. Bracken

President and Chief Operating

Officer | | 2002

2001

2000 | | 540,000

540,000

500,000 | | 439,272

288,570

427,000 | | 63,681

59,501

58,888 | | —

—

30,000 | | 5,773

5,750

5,340 |

David M. Tehle

Executive Vice President and

Chief Financial Officer | | 2002

2001

2000 | | 270,000

270,000

220,000 | | 175,709

165,064

182,000 | | 35,541

22,541

22,768 | | —

—

15,000 | | 5,773

5,750

5,340 |

Alan C. Burks

Executive Vice President and

Chief Marketing Officer | | 2002

2001

2000 | | 330,000

330,000

280,000 | | 175,709

175,713

182,000 | | —

—

16,800 | | —

—

12,000 | | 5,773

5,750

5,340 |

David G. Roy

Executive Vice President of

Operations | | 2002

2001

2000 | | 220,000

220,000

170,000 | | 111,815

138,971

108,000 | | 28,924

15,401

14,788 | | —

—

15,000 | | 4,119

4,546

4,968 |

- (1)

- Reflects the annual bonus earned during the fiscal year, as described in the Compensation Committee Report contained in "—Compensation Committee Report on Executive Compensation." In each case, the bonus was approved and paid during the following fiscal year.

- (2)

- Represents tax reimbursements for the fiscal year pursuant to the Haggar Clothing Co. Bonus Savings Plan (the "Deferred Annuity Plan").

- (3)

- Represents awards for options to purchase Common Stock pursuant to the Company's now terminated 1992 Long-Term Incentive Plan (the "LTIP").

- (4)

- Consists of the following:

- (a)

- profit sharing contributions by the Company under the Haggar Clothing Co. Profit Sharing and Savings Plan (the "401(k) Plan") for each of Messrs. Haggar, Bracken, Tehle, Burks and Roy of $673, $650 and $540 for fiscal 2002, 2001 and 2000, respectively; and

- (b)

- matching contributions by the Company under its 401(k) Plan of (i) $5,100, $4,869 and $4,800 in fiscal 2002, 2001 and 2000, respectively, for Mr. Haggar, (ii) $5,100, $5,100 and $4,800 in fiscal 2002, 2001 and 2000, respectively, for each of Messrs. Bracken, Tehle and Burks, and (iii) $3,446, $3,896 and $4,428 in fiscal 2002, 2001 and 2000, respectively, for Mr. Roy.

Option Grants in Last Fiscal Year

No stock option grants were made to the executive officers during fiscal 2002.

5

Aggregated Fiscal Year-End Option Values

Shown below is certain information with respect to the number and value of unexercised options held as of September 30, 2002. No options were exercised by any of these executive officers during fiscal 2002.

| | Number of Securities Underlying

Unexercised Options at

September 30, 2002 (#)

| | Value of Unexercised

In-the-Money Options at

September 30, 2002 ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| J. M. Haggar, III | | 278,791 | | 11,667 | | — | | — |

| Frank D. Bracken | | 267,277 | | 10,000 | | — | | — |

| David M. Tehle | | 35,000 | | 5,000 | | — | | — |

| Alan C. Burks | | 64,272 | | 4,000 | | — | | — |

| David G. Roy | | 32,000 | | 5,000 | | — | | — |

Executive Employment Agreements

During fiscal 2001, the Company entered into an Executive Employment Agreement with each of the executive officers. Each Executive Employment Agreement became effective as of August 30, 2001. The Executive Employment Agreements with Messrs. Haggar and Bracken provide for a three year term which is automatically extended for an additional year on each anniversary of the agreements such that the remaining term of each agreement as of August 30th of each year is three years, unless thirty days prior written notice is given by either party in advance of any one-year anniversary. The Executive Employment Agreements with Messrs. Burks, Roy, and Tehle provide for a two year term which is automatically extended for an additional year on each anniversary of the agreements such that the remaining term of each agreement as of August 30th of each year is two years, unless thirty days prior written notice is given by either party in advance of any one-year anniversary.

Each Executive Employment Agreement provides that the initial base salary for the executive is subject to increase during the term of the employment agreement in the sole discretion of the Company in light of the executive's performance, inflation, cost of living and other factors deemed relevant by the Company. Each agreement also provides for bonus, car allowance and other benefits available generally to other executives, as well as for the reimbursement of certain expenses. Each agreement includes covenants of the executive to maintain the confidentiality of Company information at all times, not to solicit the employees or customers of the Company for two years following termination of employment and not to compete with the Company during the term of employment and for a specified period thereafter. In each case, the post-employment period during which the executive may not compete with the Company is either (a) the unexpired term of his employment contract, if the executive has been terminated by the Company other than for cause, or (b) one year, if a change of control termination has occurred or his employment has terminated for any other reason.

Under each Executive Employment Agreement, if the executive is terminated by the Company other than for cause he will be entitled to continue to receive his base salary for the unexpired term of his employment contract, subject to reduction for any other severance payments received from the Company and any compensation received from a third party. However, the executive's right to receive such salary continuation ceases in the event that he violates any of his covenants of confidentiality, non-solicitation or non-competition. In the event the executive is terminated by the Company other than for cause or voluntarily resigns for good reason within 24 months following a change of control, then the executive will be entitled to receive, in lieu of the salary continuation otherwise provided, (i) a lump sum severance payment equal to 2.99 times the executive's "base amount" (as defined in Section 280G of the Internal Revenue Code), (ii) full vesting of all stock options, restricted stock grants, profit sharing awards and other benefits or incentive awards that are otherwise subject to

6

vesting schedules, (iii) continued benefits for himself and his family for one year after such termination at least equal to those provided under the Company's health and welfare benefit plans prior to the change of control, plus (iv) an amount equal to the excise tax, interest or penalties imposed on such severance payments or benefits under Section 4999 of the Internal Revenue Code, if any.

Long-Term Incentive Plan

In order to attract and retain key executive and managerial employees, as well as qualified individuals to serve as members of the Company's Board, and to encourage equity ownership by management and further align management's interest with that of the Company's other stockholders, in 1992 the Board adopted the LTIP. On October 21, 2002, the LTIP terminated according to its terms and no further options can be issued under such plan. The Compensation Committee continues to oversee, administer and interpret all outstanding options previously granted under the LTIP.

Stock options granted by the Compensation Committee under the LTIP have option exercise prices not less than the fair market value of the Company's Common Stock on the date of the grant. Because the exercise price of these options is at least equal to the fair market value of the Company's Common Stock on the date of grant, the options have value only if the stock price appreciates from the value on the date the options were granted. This design is intended to focus executives on the enhancement of stockholder value over the long-term and to encourage equity ownership in the Company. In addition, the LTIP provided that while the Compensation Committee determined the vesting schedule of all options granted under the LTIP, no option was exercisable more than ten years from the date of grant. As of January 24, 2003, 1,253,445 shares of the Company's Common Stock were issuable pursuant to outstanding awards under the LTIP.

Employee Stock Purchase Plan

The Company maintains an Employee Stock Purchase Plan through which eligible employees may make payroll deductions that are used to purchase Common Stock. The stock is purchased on the open market, and individual accounts are maintained for each participant. The Company pays the fees associated with stock purchases made through payroll deductions, but participants pay the fees for stock sales. Dividends paid on the stock are reinvested in Common Stock. Participants do not acquire Common Stock at a price that is less than its fair market value.

Supplemental Executive Retirement Plan

The Company established the Haggar Corp. Supplemental Executive Retirement Plan (the "SERP") in order to provide supplemental retirement benefits and pre-retirement death benefits to select executive officers. At normal retirement age, as defined under individual participation agreements between eligible executives and the Company, each participant is entitled to a life annuity benefit (if married, a joint and 50% survivor annuity) equal to 65% of the participant's average total compensation (base salary plus bonus) during the three fiscal years prior to termination, reduced by one-third of the annuitized value of the participant's accumulated account balance under the Deferred Annuity Plan. The benefits payable under the SERP are subject to a vesting schedule. A participant becomes 50% vested in his benefit five years prior to attaining normal retirement age, and continues to vest in annual increments of 10% to become 100% vested at normal retirement age. Upon a change of control, as defined in the SERP, a participant becomes 100% vested in his SERP benefit. If a participant dies before retirement, his surviving spouse or other beneficiary is entitled to receive a death benefit equal to $400,000 per year payable annually for 10 years. A participant whose employment was terminated, or his beneficiary, may elect, subject to approval by the Compensation Committee or as a matter of right at any time following one year after a change of control, to receive the actuarial present value of the benefit under the SERP in a single lump-sum payment, reduced by 10%.

7

The SERP is an unfunded compensation arrangement that is not subject to the annual reporting and disclosure requirements of the Employee Retirement Income Security Act of 1974. The Company has established a trust to pay benefits under the SERP to which the Company is contributing cash to purchase variable life insurance policies insuring each participant. The Company contributed $261,000 and $617,000, respectively, to the trust for the payment of 2002 premiums on variable life policies insuring Messrs. Haggar and Bracken, respectively. There are presently no other participants in the SERP.

The normal retirement age for Mr. Haggar under his participation agreement is 60, and the normal retirement age for Mr. Bracken under his participation agreement is 65. The Company estimates that Mr. Haggar will be entitled to an annual SERP benefit equal to approximately $730,000 at age 60, and Mr. Bracken will be entitled to an annual SERP benefit equal to approximately $600,000 at age 65. These estimates assume that 65% of the amount of the average base salary plus bonus for each of Messrs. Haggar and Bracken during the three years prior to his retirement is approximately $830,000 and $650,000, respectively, and that1/3 of the annuitized value of the participant's accumulated account balance under the Deferred Annuity Plan for each of Messrs. Haggar and Bracken at that time is approximately $100,000 and $50,000, respectively.

Split-Dollar Insurance Plan

The Company established the Haggar Corp. Split-Dollar Insurance Plan (the "Split-Dollar Plan") to recognize the valued service of certain highly compensated employees and officers of the Company. Under the Split-Dollar Plan, the Company pays the premiums due on employee life insurance policies as an additional employment benefit for such employees. However, such employees reimburse the Company for the cost of the term portion of the premiums for this insurance. Eligible employees who wish to participate in the Split-Dollar Plan must enter into a split-dollar insurance agreement with the Company. Pursuant to the split-dollar insurance agreements, the Company will be repaid for the premiums it has paid, either out of the death benefit or the cash surrender value of the policy. In order to secure the repayment to the Company of the premiums paid, the owner of the insurance policy must assign the insurance policy to the Company as collateral. In addition, the owner of the insurance policy is prohibited from taking any actions which may jeopardize the Company's right to be repaid the amounts it has paid toward premiums on the policy. Except following a change of control, the Company has the sole right to surrender the insurance policy and enforce its right to be repaid the amount of the premiums paid on the policy from the cash surrender value of the policy under the collateral assignment of the policy.

In fiscal 1999 and fiscal 2000, the Company entered into split-dollar life insurance agreements with separate trusts established by each of Messrs. Bracken and Haggar. Pursuant to these agreements, the Company is entitled to the cumulative premiums it has paid on the policies less the Company's interest in policy loans and related accrued interest on any policy loans. No policy loans have been made to the Company under these policies. The beneficiaries of the trusts established by Messrs. Haggar and Bracken are entitled to $5,620,500 and $1,075,500, respectively, reduced by the amount of the premiums paid by the Company. The policies provide for annual premiums for Mr. Bracken and Mr. Haggar of $75,500 (payable for five years) and $62,500 (payable for 17 years), respectively. However, in light of changes in applicable law, the Company is no longer paying the premiums related to these policies and is currently evaluating options with respect to the Split-Dollar Plan. As of the end of fiscal 2002, the cumulative premiums paid by the Company on each policy exceeded the total cash surrender value of each policy.

Deferred Annuity Plan

The Deferred Annuity Plan permits all full-time employees, including officers, who are "highly compensated employees" under Internal Revenue Code section 414(q) ($90,000 for 2002), to make

8

voluntary contributions of current compensation which cannot be contributed to the Company's 401(k) plan to an individually owned annuity. The maximum amount that any participant in the Deferred Annuity Plan may contribute is established annually by the Board. The Board may elect to pay an additional cash bonus to participants in the Deferred Annuity Plan for the purpose of compensating such participants for federal income taxes owed on the amounts contributed under the plan as well as on any bonus. The Board awarded such bonuses to the executive officers in fiscal 2002 as set forth in the Summary Compensation Table above.

Director Compensation

Non-employee directors receive $18,000 annually, plus $1,000 for each Board meeting or committee meeting attended. Prior to October 21, 2002, non-employee directors were entitled under the Company's LTIP to receive a grant of stock options exercisable for 9,000 shares of Common Stock on their initial election to the Board and an additional grant of stock options exercisable for 6,000 shares of Common Stock upon each re-election to the Board. On October 21, 2002, the Company's LTIP terminated, and no further options can be issued under the plan. The Board has authorized the Company to issue to the Board's nominees the stock option portion of their compensation at such time as a new equity-based compensation plan permitting such issuance is adopted or, if subsequently authorized by the Board, to issue another form of compensation established in lieu thereof. Directors who are also employees of the Company receive no additional compensation for their service on the Board and its committees.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Role of the Compensation Committee

The members of the Compensation Committee of the Board of Directors (the "Board") are Rae F. Evans and Richard W. Heath, each of whom meet the current and proposed independence requirements of the Nasdaq Stock Market, Inc. and applicable rules and regulations of the Securities and Exchange Commission. The Compensation Committee reviews, evaluates and recommends to the Board the executive compensation policies of the Company and the compensation of the Company's Chief Executive Officer and other executive officers. In connection with these responsibilities, the Compensation Committee has exclusive authority to administer the Company's 1992 Long Term Incentive Plan (the "LTIP"), which terminated on October 21, 2002. Prior to the adoption of the Compensation Committee Charter, all other actions of the Compensation Committee during fiscal 2002 were subject to the approval of the Board. The Compensation Committee held two meetings during the Company's fiscal year ended September 30, 2002. At those meetings the Compensation Committee reviewed the Company's compensation practices.

Executive Compensation Objectives

The primary objectives of the Compensation Committee are to ensure that the compensation provided to the Company's executive officers reinforces the Company's annual and long-term performance objectives, to reward and encourage quality performance, and to assist the Company in attracting, retaining and motivating executives with exceptional leadership abilities.

Consistent with this philosophy, the Compensation Committee believes that it has established a competitive and appropriate total compensation package for the executive officers and other senior management of the Company consisting primarily of base salary, annual bonus and discretionary payments under the Haggar Clothing Co. Bonus Savings Plan (the "Deferred Annuity Plan") and, prior to the termination of the LTIP, stock options. In addition, selected executive officers may also participate in the Company's Supplemental Executive Retirement Plan (the "SERP") and the Company's Split-Dollar Insurance Plan (the "Split-Dollar Plan"). Currently only J. M. Haggar, III, the

9

Company's Chief Executive Officer, and Frank Bracken, the Company's President, participate in the SERP and the Split-Dollar Plan. The Chief Executive Officer and the President were selected to participate in the SERP and the Split-Dollar Plan based on their historical contributions and continued leadership of the Company. In addition, the Company makes certain matching contributions and profit sharing contributions to its 401(k) Plan on behalf of participants, which include the executive officers.

Description of the Elements of Executive Compensation

The Compensation Committee does not exclusively use quantitative methods or mathematical formulas in setting any element of compensation. In determining each component of compensation, the Compensation Committee considers all elements of an executive officer's total compensation package as well as other objective and subjective criteria the Compensation Committee deems appropriate with respect to each executive officer, including the recommendations of the Company's Chief Executive Officer.

Base Salary. The Compensation Committee recommends to the Board base salaries each year at a level intended to be within the competitive market range of comparable companies. The Compensation Committee takes into consideration the salary recommendations of the Chief Executive Officer and conducts its own review of various factors, including those considered by the Chief Executive Officer in his recommendations, before determining the recommended base salaries for the Company's executive officers and Chief Executive Officer. These factors include a comparison of the salaries earned by the executive officers and the Chief Executive Officer to the salaries of comparable individuals at several companies that the Company considers to be its primary competitors in the apparel industry. In addition to the competitive market range, several other factors are considered in determining the recommended base salary amounts, including the responsibilities assumed by the executive, length of service, individual performance and internal equity considerations. After careful evaluation, the Compensation Committee decided not to raise executive salaries during fiscal 2002 due to the uncertain economic climate in the aftermath of the terrorist attacks on September 11, 2001, and a desire to limit administrative expenses.

Annual Cash Bonus. Executive officers and certain other employees of the Company are eligible to receive discretionary annual cash bonuses following each fiscal year in which the Company meets or exceeds annual goals recommended by the Compensation Committee and approved by the Board or in which the Company's performance and other subjective factors relating to individual performance otherwise merit bonus awards. The Compensation Committee recommends performance goals by examining the past performance of the Company and identifying the Company's future objectives. The Chief Executive Officer makes recommendations to the Compensation Committee regarding employee bonus amounts based upon the Company's performance and his perception of the individual's performance, level of responsibility and contribution to the Company. The amount of each individual bonus awarded under the bonus plan is further based on the total amount of funds available for distribution and each participant's incentive base amount (provided that no participant's bonus may exceed twice his incentive base amount). Eligibility to receive a bonus, an employee's incentive base amount, and the amount of the bonus pool are recommended by the Compensation Committee and approved by the Board.

The bonus performance goals set by the Board for fiscal 2002 related to the operational and financial performance of the Company. The Compensation Committee recommended that the Company's executive officers receive a portion of their respective potential bonuses for fiscal 2002 after evaluating the performance of the Company in light of these performance goals, including the 8.4% increase in the Company's net sales in fiscal 2002 as compared to fiscal 2001, as well as the recommendations of the Chief Executive Officer and the individual performance of each executive officer. The amounts of these bonuses are set forth under "Executive Compensation—Summary Compensation Table."

10

Discretionary Payments. The Company has established the Deferred Annuity Plan pursuant to which each of the executive officers has elected to make contributions to deferred annuity investment products on an after-tax basis through payroll deductions or direct payment. Each year, the Board determines, based on the Company's performance during the year, whether to pay an additional cash bonus to any of the participants in the Deferred Annuity Plan for the purpose of compensating for federal income taxes owed on the annuity plan investment contribution and the bonus. Bonuses paid to executive officers under the Deferred Annuity Plan are considered by the Compensation Committee in connection with its evaluation of the total compensation of the Company's executive officers.

Stock Option Grants. The Compensation Committee endorses the view that equity ownership by management is beneficial in aligning managements' and stockholders' interests in the enhancement of stockholder value. The Compensation Committee believes that this strategy motivates executives to remain focused on the overall long-term performance of the Company. On October 21, 2002, however, the LTIP terminated according to its terms, and no further options can be issued under this plan. The Company formerly granted stock options pursuant to the LTIP. However, no equity-based compensation was awarded to management during the fiscal year ended September 30, 2002, as insufficient shares were available under the LTIP.

Supplemental Executive Retirement Plan and Split-Dollar Insurance Plan. The SERP and Split-Dollar Plan established by the Company are intended to reward executive officers who have exhibited outstanding performance over an extended tenure with the Company. As such, the SERP and the Split-Dollar Plan provide an incentive for both consistently high performance and longevity with the Company. The benefits of the SERP and the Split-Dollar Plan are taken into consideration in connection with the Compensation Committee's evaluation of the overall package of compensation and benefits provided to executive officers. Presently, the Chief Executive Officer and the President are the only participants in the SERP and the Split-Dollar Plan.

Chief Executive Officer Compensation

Mr. Haggar, the Chief Executive Officer, participates in the same executive compensation program provided to the other executive officers and senior management of the Company in addition to the SERP and the Split-Dollar Plan. The Compensation Committee's approach to setting compensation for the Chief Executive Officer is to be competitive with comparable apparel companies and to have a major portion of the Chief Executive Officer's compensation dependent upon the Company's operational and financial performance and Mr. Haggar's individual performance, which are evaluated in connection with the award of annual cash bonuses discussed above.

Mr. Haggar's employment agreement provides that his initial base salary is subject to increase during the term of his employment agreement in the sole discretion of the Company in light of his performance, inflation, cost of living and other factors deemed relevant by the Company. As previously stated, the Compensation Committee did not raise executive salaries during fiscal 2002 due to the uncertain economic climate and a desire to limit administrative expenses. Mr. Haggar is eligible to receive an annual performance bonus and may participate in all other perquisites and benefit plans available to other executive officers of the Company.

For the fiscal year ended September 30, 2002, Mr. Haggar earned $1,212,606 in salary and bonuses as shown in "Item 11. Executive Compensation—Summary Compensation Table." Approximately 47% of this amount was earned in the form of an annual bonus and a bonus under the Deferred Annuity Plan. In determining the amount of the Chief Executive Officer's bonuses, the Compensation Committee considered the same factors as were considered in awarding bonuses to other Company employees. As a result of the leadership demonstrated by the Chief Executive Officer in fiscal 2002 through the Company's continued successful promotion of new products, the implementation of the Company's strategic objectives, and the increase in the Company's net sales during an uncertain

11

economic climate, the Compensation Committee believes that the Chief Executive Officer's total compensation for fiscal 2002 was reasonable and appropriate.

$1 Million Pay Deductibility Cap

Section 162(m) of the Internal Revenue Code generally imposes a $1 million per person annual limit on the amount the Company may deduct as compensation expense for its Chief Executive Officer and its four other highest paid officers. To the extent readily determinable, and as one of the factors in considering compensation matters, the Compensation Committee considers the anticipated tax treatment to the Company and to its executives of various payments and benefits. Some types of compensation payments and their deductibility depends upon the timing of an executive's vesting or exercise of previously granted rights. Further, interpretations of and changes in tax laws and other factors beyond the Company's control also affect the deductibility of compensation. For these and other reasons, the Compensation Committee will not necessarily limit executive compensation to that amount deductible under Section 162(m) of the Internal Revenue Code. Therefore, the Compensation Committee, subject to the factors provided above, has the discretion to grant awards which result in non-deductible compensation.

Conclusion

The Compensation Committee believes that the Company's executive compensation program provides a competitive and motivational compensation package to the Company's executive officers necessary to achieve the Company's financial objectives and enhance stockholder value.

This report has been submitted by the Compensation Committee, which consists of the following members:

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Mr. Heath and Ms. Evans comprised the Compensation Committee during fiscal 2002. Neither Mr. Heath nor Ms. Evans has ever been an officer or employee of the Company. None of the executive officers of the Company served as a member of the compensation committee or board of directors of any other company during fiscal 2002.

12

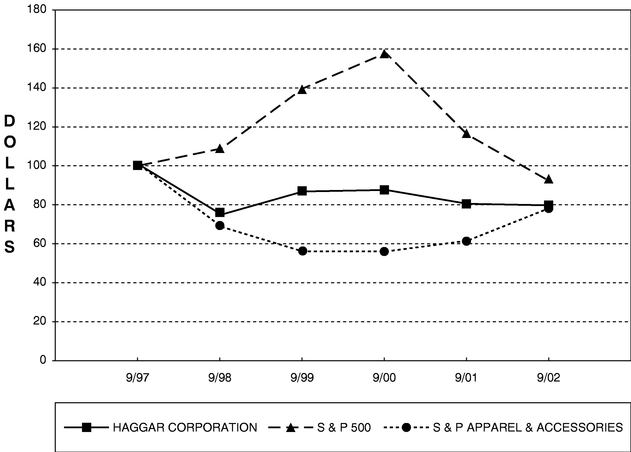

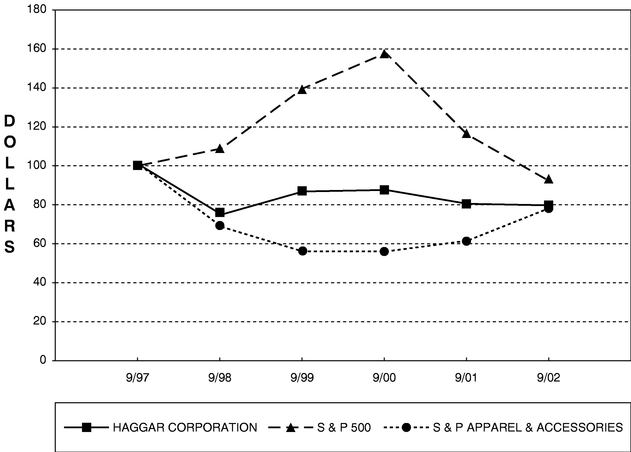

PERFORMANCE GRAPH

The line graph below compares the cumulative total stockholder return on the Common Stock from September 30, 1997, through September 30, 2002, with the return on the Standard & Poor's 500 Stock Index ("S & P 500") and the Standard & Poor's Apparel and Accessories Index ("S & P Apparel & Accessories") for the same period. In accordance with the disclosure rules of the Securities and Exchange Commission, the measurement assumes a $100 initial investment in the Common Stock with all dividends reinvested, and a $100 initial investment in the indexes.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

AMONG HAGGAR CORP., THE S & P 500 STOCK INDEX

AND THE S & P APPAREL & ACCESSORIES INDEX

Copyright 2002, Standard & Poor's, a division of the McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm

Graph produced by Research Data Group, Inc.

13

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information about Common Stock that may be issued upon the exercise of options under the LTIP, which was the only existing equity compensation plan of the Company as of September 30, 2002.

Plan Category

| | (a) Number of

Securities to be

Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights

| | (b) Weighted

Average

Exercise Price

of Outstanding

Options, Warrants

and Rights(1)

| | (c) Number of

Securities

Remaining

Available for

Future Issuance

Under Equity

Compensation

Plans (Excluding

Securities Reflected

in Column (a))

| | (d) Total of

Securities Reflected

in Columns

(a) and (c)

|

|---|

| Equity Compensation Plans Approved by Stockholders | | 1,176,141(2 | ) | $ | 12.61 | | 0 | | 1,176,141 |

Equity Compensation Plans Not Approved by Stockholders(3) |

|

244,634(4 |

) |

$ |

12.61 |

|

205,366 |

|

450,000 |

Total |

|

1,420,775 |

|

$ |

12.61 |

|

205,366 |

|

1,626,141 |

- (1)

- These amounts represent the weighted average exercise price for the total number of outstanding options.

- (2)

- Issued under the LTIP.

- (3)

- Securities included in this category are attributable solely to certain increases in the number of shares of Common Stock authorized and reserved for issuance under the LTIP that were not approved by the Company's stockholders.

- (4)

- 167,330 of these shares are subject to options that expired on or before January 8, 2003.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND MANAGEMENT

The following table and the notes thereto set forth certain information regarding the beneficial ownership of the Common Stock as of January 24, 2003, by:

- •

- each current director and nominee for director of the Company;

- •

- the executive officers of the Company;

- •

- all executive officers and current directors of the Company as a group; and

- •

- each other person known to the Company to own beneficially more than five percent of the Common Stock outstanding on January 24, 2003.

Unless otherwise indicated, all stockholders set forth below have the same principal business address as the Company.

The Company has determined beneficial ownership in accordance with the rules of the SEC. The number of shares beneficially owned by a person includes shares of Common Stock that are subject to stock options that are either currently exercisable or exercisable within 60 days after January 24, 2003. These shares are also deemed outstanding for the purpose of computing the percentage of outstanding shares owned by the person. These shares are not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, to the Company's knowledge, each stockholder has sole voting and dispositive power with respect to the securities beneficially owned by that stockholder.

| | Number of Shares

Beneficially Owned

| | Percentage of Shares

Beneficially Owned

|

|---|

| J. M. Haggar, III(1) | | 770,025 | | 11.5 |

| Frank D. Bracken(2) | | 297,071 | | 4.4 |

| David M. Tehle(3) | | 40,700 | | * |

| Alan C. Burks(4) | | 68,435 | | 1.1 |

| David G. Roy(5) | | 37,100 | | * |

| Richard W. Heath(6) | | 24,400 | | * |

| Rae F. Evans(7) | | 15,873 | | * |

| John C. Tolleson(8) | | 78,800 | | 1.2 |

| Donald E. Godwin | | — | | — |

| All executive officers and directors as a group (9 persons)(9) | | 1,332,404 | | 18.6 |

| Barrow Hanley Mewhinney & Strauss, Inc.(10) | | 605,700 | | 9.4 |

| Dimensional Fund Advisors, Inc.(11) | | 452,325 | | 7.0 |

| Franklin Resources, Inc.(12) | | 572,900 | | 8.9 |

| Thomas G. Kahn(13) | | 837,269 | | 13.0 |

| Kahn Brothers & Co., Inc.(14) | | 784,669 | | 12.2 |

| Gerald Van Tsai(15) | | 465,349 | | 7.3 |

- *

- Represents beneficial ownership of less than 1%.

- (1)

- Includes 2,299 shares over which Mr. Haggar shares voting and dispositive power with his wife, 39,213 shares over which he otherwise shares voting and dispositive power as a trustee of various trusts, 16,743 shares over which he shares voting and dispositive power as a director of a private charitable foundation and 290,458 shares which may be acquired upon exercise of stock options that are currently exercisable.

15

- (2)

- Includes 10,000 shares over which Mr. Bracken shares voting and dispositive power with his wife and 277,277 shares which may be acquired upon exercise of stock options that are currently exercisable.

- (3)

- Includes 40,000 shares which may be acquired upon exercise of stock options that are currently exercisable.

- (4)

- Includes 68,272 shares which may be acquired upon exercise of stock options that are currently exercisable.

- (5)

- Includes 37,000 shares which may be acquired upon exercise of stock options that are currently exercisable.

- (6)

- Includes 5,000 shares over which Mr. Heath shares voting and dispositive power with his wife and 19,400 shares which may be acquired upon exercise of stock options that are exercisable currently or within 60 days following January 24, 2003.

- (7)

- Consists solely of shares that may be acquired upon exercise of stock options exercisable currently or within 60 days following January 24, 2003.

- (8)

- Includes 13,800 shares that may be acquired upon exercise of stock options exercisable currently or within 60 days following January 24, 2003.

- (9)

- Includes 73,255 shares over which voting and dispositive power is shared and 762,080 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following January 24, 2003.

- (10)

- Based on information contained in a Form 13F filed with the SEC on November 8, 2002, by Barrow Hanley Mewhinney & Strauss, Inc., whose address is 3232 McKinney Ave., 15th Floor, Dallas, Texas 75204.

- (11)

- Based on information contained in a Form 13F filed with the SEC on October 28, 2002, by Dimensional Fund Advisors, Inc., whose address is 1299 Ocean Avenue, 11th floor, Santa Monica, California 90401.

- (12)

- Based on information contained in a Form 13F filed with the SEC on November 13, 2002, by Franklin Resources, Inc., whose address is One Franklin Parkway, San Mateo, California 94403.

- (13)

- Based on information contained in Amendment No. 3 to Schedule 13D filed with the SEC on December 4, 2002, by Thomas G. Kahn, whose address is 555 Madison Avenue, New York, New York 10022. Includes 784,669 shares beneficially owned by Kahn Brothers & Co., Inc. as set forth in footnote (14) below.

- (14)

- Based on information contained in Amendment No. 3 to Schedule 13D filed with the SEC on December 4, 2002, by Kahn Brothers & Co., Inc., whose address is 555 Madison Avenue, New York, New York 10022.

- (15)

- Based on information contained in a Form 4 filed with the SEC with respect to a transaction occurring on January 14, 2003, by Gerald Van Tsai, whose address is P.O. Box 900, Hanover, New Hampshire 03755.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. Godwin, a director of the Company, is a partner of Godwin Gruber, L.L.P., a law firm that has rendered various legal services to the Company and certain of its subsidiaries during fiscal 2002. The Company paid to this law firm approximately $606,000 during fiscal 2002. There were no amounts due to such firm from the Company as of September 30, 2002. The Company has retained this law firm during the current fiscal year to provide various legal services. Godwin Gruber, L.L.P. does not represent the Company in connection with the solicitation of proxies for the election of the Board's nominees as directors at the 2003 annual meeting of stockholders.

16

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES AND REPORTS ON FORM 8-K

| (a) | (3) Exhibits |

|

The following documents are filed or incorporated by reference as exhibits to this Amendment No. 1 to Annual Report on Form 10-K. |

|

Exhibit

Number |

Description |

|

3(a) |

Third Amended and Fully Restated Articles of Incorporation. (Incorporated by reference from Exhibit 3(a) to the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 1993 [File No. 0-20850].) |

|

3(b) |

Amended and Restated Bylaws of the Company, as amended, dated October 10, 2002. (Incorporated by reference from Exhibit 99.2 to the Company's Current Report on Form 8-K filed October 15, 2002 [File No. 0-20850].) |

|

4(a) |

Specimen Certificate evidencing Common Stock (and Preferred Stock Purchase Right). (Incorporated by reference from Exhibit 4(a) to the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 1994 [File No. 0-20850].) |

|

4(b) |

Note Purchase Agreement dated December 22, 1994, among Haggar Apparel Company, Haggar Corp. and Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

4(c) |

Note No. 1 dated December 22, 1994, in original principal amount of $10,500,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(b) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

4(d) |

Note No. 2 dated December 22, 1994, in original principal amount of $6,500,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(c) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

4(e) |

Note No. 3 dated December 22, 1994, in original principal amount of $4,800,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(d) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

4(f) |

Note No. 4 dated December 22, 1994, in original principal amount of $2,200,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(e) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

|

|

17

|

4(g) |

Note No. 5 dated December 22, 1994, in original principal amount of $1,000,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(f) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

4(h) |

Rights Agreement, dated as of October 10, 2002, between the Company and Mellon Investor Services, LLC, as Rights Agent, specifying the terms of the Rights, which includes the description of Series B Junior Participating Preferred Stock as Exhibit A, the form of Rights Certificate as Exhibit B and the form of the Summary of Rights as Exhibit C. (Incorporated by reference from Exhibit 99.3 to the Company's Current Report on Form 8-K, filed October 15, 2002 [File No. 0-20850].) |

|

4(i) |

Form of Rights Certificate. (Incorporated by reference from Exhibit 99.4 to the Company's Current Report on Form 8-K, filed October 15, 2002 [File No. 0-20850].) |

|

4(j) |

Form of Summary of Rights. (Incorporated by reference from Exhibit 99.5 to the Company's Current Report on Form 8-K, filed October 15, 2002 [File No. 0-20850].) |

|

10(a) |

Management Incentive Plan. (Incorporated by reference from Exhibit 10(b) to the Company's Registration Statement on Form S-1, filed with the Security and Exchange Commission on October 1, 1992 [Registration No. 33-52704].) |

|

10(b) |

1992 Long Term Incentive Plan. (Incorporated by reference from Exhibit 10(a) to the Company's Pre-Effective Amendment No. 1 to Form S-1, filed with the Security and Exchange Commission on November 16, 1992 [Registration No. 33-52704].) |

|

10(c) |

First Amendment to the 1992 Long Term Incentive Plan. (Incorporated by reference from Exhibit 10(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 1994 [File No. 0-20850].) |

|

10(d) |

Second Amendment to the 1992 Long Term Incentive Plan, dated February 5, 1995. (Incorporated by reference from Exhibit 10(d) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

10(e) |

Third Amendment to 1992 Long Term Incentive Plan, dated February 10, 1999. (Incorporated by reference from Exhibit 10(e) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

10(f) |

Fourth Amendment to 1992 Long Term Incentive Plan, dated November 2, 1999. (Incorporated by reference from Exhibit 10(f) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

10(g) |

Fifth Amendment to 1992 Long Term Incentive Plan, dated April 27, 2000. (Incorporated by reference from Exhibit 10(g) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

10(h) |

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and J. M. Haggar, III, Chief Executive Officer. (Incorporated by reference from Exhibit 10(m) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

|

|

|

18

|

10(i) |

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and Frank D. Bracken, President. (Incorporated by reference from Exhibit 10(n) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

|

10(j) |

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and David Tehle, Executive Vice President. (Incorporated by reference from Exhibit 10(o) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

|

10(k) |

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and Alan Burks, Executive Vice President. (Incorporated by reference from Exhibit 10(p) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

|

10(l) |

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and David Roy, Executive Vice President. (Incorporated by reference from Exhibit 10(q) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

|

10(m) |

Second Amended and Restated Credit Agreement between the Company and JP Morgan Chase Bank, as agent for a bank syndicate. (Incorporated by reference from Exhibit 10(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2002 [File No. 0-20850].) |

|

10(n) |

Haggar Clothing Co. Bonus Savings Plan, effective January 1, 1998. (Incorporated by reference from Exhibit 10(n) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

10(o) |

Haggar Corp. Supplemental Executive Retirement Plan, effective October 1, 1999, and related Participant Agreements. (Incorporated by reference from Exhibit 10(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1999 [File No. 0-20850].) |

|

10(p) |

Split Dollar Life Insurance Plan, effective October 1, 1999, and related Collateral Assignments and Participant Insurance Agreements. (Incorporated by reference from Exhibit 10(b) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1999 [File No. 0-20850].) |

|

10(q) |

Wage Continuation Plan, effective October 1, 1999. (Incorporated by reference from Exhibit 10(c) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1999 [File No. 0-20850].) |

|

21 |

Subsidiaries of the Company. (Incorporated by reference from Exhibit 21 to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

23(a) |

Consent of PricewaterhouseCoopers LLP. (Incorporated by reference from Exhibit 23(a) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

23(b) |

Notice regarding lack of consent of Arthur Andersen LLP. (Incorporated by reference from Exhibit 23(b) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

|

99(a)* |

Certification of the Chief Executive Officer pursuant to 18 U.S.C. 1350 enacted by Section 906 of the Sarbanes-Oxley Act of 2002. |

|

99(b)* |

Certification of the Chief Financial Officer pursuant to 18 U.S.C. 1350 enacted by Section 906 of the Sarbanes-Oxley Act of 2002. |

- *

- Filed herewith

19

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: January 28, 2003

| | | HAGGAR CORP.

(Registrant) |

|

|

By: |

/s/ David M. Tehle

David M. Tehle

(Executive Vice President, Chief Financial Officer,

Secretary and Treasurer) |

20

CERTIFICATIONS

I, J. M. Haggar, III, Chief Executive Officer of Haggar Corp., certify that:

- 1.

- I have reviewed this annual report on Form 10-K of Haggar Corp.;

- 2.

- Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;

- 3.

- Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report;

- 4.

- The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have:

- a)

- designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared;

- b)

- evaluated the effectiveness of the registrant's disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the "Evaluation Date"); and

- c)

- presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date;

- 5.

- The registrant's other certifying officer and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions):

- a)

- all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and

- b)

- any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls; and

- 6.

- The registrant's other certifying officer and I have indicated in this annual report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Date: January 28, 2003

| | | /s/ J. M. Haggar, III

J. M. Haggar, III

Chief Executive Officer |

21

CERTIFICATIONS

I, David M. Tehle, Chief Financial Officer of Haggar Corp., certify that:

- 1.

- I have reviewed this annual report on Form 10-K of Haggar Corp.;

- 2.

- Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;

- 3.

- Based on my knowledge, the financial statements, and other financial information included in this annual report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this annual report;

- 4.

- The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the registrant and have:

- a)

- designed such disclosure controls and procedures to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this annual report is being prepared;

- b)

- evaluated the effectiveness of the registrant's disclosure controls and procedures as of a date within 90 days prior to the filing date of this annual report (the "Evaluation Date"); and

- c)

- presented in this annual report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date;

- 5.

- The registrant's other certifying officer and I have disclosed, based on our most recent evaluation, to the registrant's auditors and the audit committee of registrant's board of directors (or persons performing the equivalent functions):

- a)

- all significant deficiencies in the design or operation of internal controls which could adversely affect the registrant's ability to record, process, summarize and report financial data and have identified for the registrant's auditors any material weaknesses in internal controls; and

- b)

- any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal controls; and

- 6.

- The registrant's other certifying officer and I have indicated in this annual report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Date: January 28, 2003

| | | /s/ David M. Tehle

David M. Tehle

Chief Executive Officer |

22

EXHIBIT INDEX

Exhibit

Number

| | Description

|

|---|

| 3(a) | | Third Amended and Fully Restated Articles of Incorporation. (Incorporated by reference from Exhibit 3(a) to the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 1993 [File No. 0-20850].) |

3(b) |

|

Amended and Restated Bylaws of the Company, as amended, dated October 10, 2002. (Incorporated by reference from Exhibit 99.2 to the Company's Current Report on Form 8-K filed October 15, 2002 [File No. 0-20850].) |

4(a) |

|

Specimen Certificate evidencing Common Stock (and Preferred Stock Purchase Right). (Incorporated by reference from Exhibit 4(a) to the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 1994 [File No. 0-20850].) |

4(b) |

|

Note Purchase Agreement dated December 22, 1994, among Haggar Apparel Company, Haggar Corp. and Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

4(c) |

|

Note No. 1 dated December 22, 1994, in original principal amount of $10,500,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(b) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

4(d) |

|

Note No. 2 dated December 22, 1994, in original principal amount of $6,500,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(c) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

4(e) |

|

Note No. 3 dated December 22, 1994, in original principal amount of $4,800,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(d) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

4(f) |

|

Note No. 4 dated December 22, 1994, in original principal amount of $2,200,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(e) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

4(g) |

|

Note No. 5 dated December 22, 1994, in original principal amount of $1,000,000 executed by Haggar Apparel Company, as maker, and Haggar Corp., as guarantor, payable to Allstate Life Insurance Company. (Incorporated by reference from Exhibit 4(f) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1994 [File No. 0-20850].) |

|

|

|

23

4(h) |

|

Rights Agreement, dated as of October 10, 2002, between the Company and Mellon Investor Services, LLC, as Rights Agent, specifying the terms of the Rights, which includes the description of Series B Junior Participating Preferred Stock as Exhibit A, the form of Rights Certificate as Exhibit B and the form of the Summary of Rights as Exhibit C. (Incorporated by reference from Exhibit 99.3 to the Company's Current Report on Form 8-K, filed October 15, 2002 [File No. 0-20850].) |

4(i) |

|

Form of Rights Certificate. (Incorporated by reference from Exhibit 99.4 to the Company's Current Report on Form 8-K, filed October 15, 2002 [File No. 0-20850].) |

4(j) |

|

Form of Summary of Rights. (Incorporated by reference from Exhibit 99.5 to the Company's Current Report on Form 8-K, filed October 15, 2002 [File No. 0-20850].) |

10(a) |

|

Management Incentive Plan. (Incorporated by reference from Exhibit 10(b) to the Company's Registration Statement on Form S-1, filed with the Security and Exchange Commission on October 1, 1992 [Registration No. 33-52704].) |

10(b) |

|

1992 Long Term Incentive Plan. (Incorporated by reference from Exhibit 10(a) to the Company's Pre-Effective Amendment No. 1 to Form S-1, filed with the Security and Exchange Commission on November 16, 1992 [Registration No. 33-52704].) |

10(c) |

|

First Amendment to the 1992 Long Term Incentive Plan. (Incorporated by reference from Exhibit 10(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 1994 [File No. 0-20850].) |

10(d) |

|

Second Amendment to the 1992 Long Term Incentive Plan, dated February 5, 1995. (Incorporated by reference from Exhibit 10(d) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

10(e) |

|

Third Amendment to 1992 Long Term Incentive Plan, dated February 10, 1999. (Incorporated by reference from Exhibit 10(e) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

10(f) |

|

Fourth Amendment to 1992 Long Term Incentive Plan, dated November 2, 1999. (Incorporated by reference from Exhibit 10(f) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

10(g) |

|

Fifth Amendment to 1992 Long Term Incentive Plan, dated April 27, 2000. (Incorporated by reference from Exhibit 10(g) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

10(h) |

|

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and J. M. Haggar, III, Chief Executive Officer. (Incorporated by reference from Exhibit 10(m) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

10(i) |

|

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and Frank D. Bracken, President. (Incorporated by reference from Exhibit 10(n) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

10(j) |

|

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and David Tehle, Executive Vice President. (Incorporated by reference from Exhibit 10(o) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

|

|

|

24

10(k) |

|

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and Alan Burks, Executive Vice President. (Incorporated by reference from Exhibit 10(p) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

10(l) |

|

Executive Employment Agreement dated July 24, 2001, between Haggar Clothing Co., and David Roy, Executive Vice President. (Incorporated by reference from Exhibit 10(q) to the Company's Annual Report on Form 10-K for the year ended September 30, 2001 [File No. 0-20850].) |

10(m) |

|

Second Amended and Restated Credit Agreement between the Company and JP Morgan Chase Bank, as agent for a bank syndicate. (Incorporated by reference from Exhibit 10(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2002 [File No. 0-20850].) |

10(n) |

|

Haggar Clothing Co. Bonus Savings Plan, effective January 1, 1998. (Incorporated by reference from Exhibit 10(n) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

10(o) |

|

Haggar Corp. Supplemental Executive Retirement Plan, effective October 1, 1999, and related Participant Agreements. (Incorporated by reference from Exhibit 10(a) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1999 [File No. 0-20850].) |

10(p) |

|

Split Dollar Life Insurance Plan, effective October 1, 1999, and related Collateral Assignments and Participant Insurance Agreements. (Incorporated by reference from Exhibit 10(b) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1999 [File No. 0-20850].) |

10(q) |

|

Wage Continuation Plan, effective October 1, 1999. (Incorporated by reference from Exhibit 10(c) to the Company's Quarterly Report on Form 10-Q for the quarter ended December 31, 1999 [File No. 0-20850].) |

21 |

|

Subsidiaries of the Company. (Incorporated by reference from Exhibit 21 to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

23(a) |

|

Consent of PricewaterhouseCoopers LLP. (Incorporated by reference from Exhibit 23(a) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

23(b) |

|

Notice regarding lack of consent of Arthur Andersen LLP. (Incorporated by reference from Exhibit 23(b) to the Company's Annual Report on Form 10-K for the year ended September 30, 2002 [File No. 0-20850].) |

99(a)* |

|

Certification of the Chief Executive Officer pursuant to 18 U.S.C. 1350 enacted by Section 906 of the Sarbanes-Oxley Act of 2002. |

99(b)* |

|

Certification of the Chief Financial Officer pursuant to 18 U.S.C. 1350 enacted by Section 906 of the Sarbanes-Oxley Act of 2002. |

- *

- Filed herewith