During fiscal 2001, the Company entered into an Executive Employment Agreement with each of Messrs. Haggar, Bracken, Burks, and Roy. Each Executive Employment Agreement became effective as of August 30, 2001. The Executive Employment Agreements with Messrs. Haggar and Bracken provide for a three year term which is automatically extended for an additional year on each anniversary of the agreements such that the remaining term of each agreement as of August 30th of each year is three years, unless thirty days prior written notice is given by either party in advance of any one-year anniversary. The Executive Employment Agreements with Messrs. Burks and Roy provide for a two-year term which is automatically extended for an additional year on each anniversary of the agreements such that the remaining term of each agreement as of August 30th of each year is two years, unless thirty days prior written notice is given by either party in advance of any one-year anniversary. An Executive Employment Agreement with the Company’s former Executive Vice President and Chief Financial Officer, David M. Tehle, terminated upon Mr. Tehle’s resignation from the Company effective June 3, 2004.

Each Executive Employment Agreement provides that the initial base salary for the executive is subject to increase during the term of the employment agreement in the sole discretion of the Company in light of the executive’s performance, inflation, cost of living and other factors deemed relevant by the Company. Each agreement also provides for a performance-related bonus, car allowance and other benefits available generally to other executives, as well as for the reimbursement of certain expenses. The agreements for Messrs. Haggar and Bracken also provide for an additional annual bonus and tax reimbursement based solely on continuing employment with the Company. Each agreement includes covenants of the executive to maintain the confidentiality of Company information at all times, not to solicit the employees or customers of the Company for two years following termination of employment and not to compete with the Company during the term of employment and for a specified period thereafter. In each case, the post-employment period during which the executive may not compete with the Company is either (a) the unexpired term of his employment contract, if the executive has been terminated by the Company other than for cause, or (b) one year, if a change of control termination has occurred or his employment has terminated for any other reason.

Under each Executive Employment Agreement, if the executive is terminated by the Company other than for cause he will be entitled to continue to receive his base salary for the unexpired term of his employment contract, subject to reduction for any other severance payments received from the Company and any compensation received from a third party. However, the executive’s right to receive such salary continuation ceases in the event that he violates any of his covenants of confidentiality, non-solicitation or non-competition. In the event the executive is terminated by the Company other than for cause or voluntarily resigns for good reason within 24 months following a change of control, then the executive will be entitled to receive, in lieu of the salary continuation otherwise provided, (i) a lump sum severance payment equal to 2.99 times the executive’s “base amount” (as defined in Section 280G of the Internal Revenue Code), (ii) full vesting of all stock options, restricted stock grants, profit sharing awards and other benefits or incentive awards that are otherwise subject to vesting schedules, (iii) continued benefits for himself and his family for one year after such termination at least equal to those provided under the Company’s health and welfare benefit plans prior to the change of control, plus (iv) an amount equal to the excise tax, interest or penalties imposed on such severance payments or benefits under Section 4999 of the Internal Revenue Code, if any.

In order to attract and retain key executive and managerial employees, as well as qualified individuals to serve as members of the Company’s Board, and to encourage equity ownership by management and further align management’s interest with that of the Company’s other stockholders, in 1992 the Board adopted the 1992 LTIP. On October 21, 2002, the 1992 LTIP terminated according to its terms and no further options can be issued under such plan. The Compensation Committee continues to oversee, administer and interpret all outstanding options previously granted under the 1992 LTIP.

Stock options granted by the Compensation Committee under the 1992 LTIP have option exercise prices not less than the fair market value of the Company’s Common Stock on the date of the grant. Because the exercise price of these options is at least equal to the fair market value of the Company’s Common Stock on the date of grant, the options have value only if the stock price appreciates from the value on the date the options were granted. This design is intended to focus executives on the enhancement of stockholder value over the long-term and to encourage equity ownership in the Company. In addition, the 1992 LTIP provided that, while the Compensation Committee determined the vesting schedule of all options granted under the 1992 LTIP, no option was exercisable more than ten years from the date of grant. As of the Record Date, 372,400 shares of the Company’s Common Stock were issuable pursuant to outstanding options under the 1992 LTIP.

On May 1, 2003, the Company adopted a new stockholder approved long-term incentive plan, the 2003 LTIP, to replace the expired 1992 LTIP. The 2003 LTIP authorizes the Company to issue up to 575,000 additional shares in connection with options, restricted shares and rights, either with or without accompanying options, for directors, officers or employees of the Company. The terms and vesting periods will be determined as each option is granted, but the option price cannot be less than the market value of the common stock at the grant date. As of the Record Date, 15,000 shares of the Company’s Common Stock were issuable pursuant to outstanding options under the 2003 LTIP.

Employee Stock Purchase Plan

The Company maintains an Employee Stock Purchase Plan through which eligible employees may make payroll deductions that are used to purchase Common Stock. The stock is purchased on the open market, and individual accounts are maintained for each participant. The Company pays the fees associated with stock purchases made through payroll deductions, but participants pay the fees for stock sales. Dividends paid on the stock are reinvested in Common Stock. Participants do not acquire Common Stock at a price that is less than its fair market value.

Effective October 1, 2004, the Company terminated the Employee Stock Purchase Plan. The Company allowed participants to transfer existing stock ownership to personal brokerage accounts or request a cash payment.

Supplemental Executive Retirement Plan

The Company established the SERP in order to provide supplemental retirement benefits and pre-retirement death benefits to select executive officers. At normal retirement age, as defined under individual participation agreements between eligible executives and the Company, each participant is entitled to a life annuity benefit (if married, a joint and 50% survivor annuity) equal to 65% of the participant’s average total compensation (base salary plus bonus) during the three fiscal years prior to termination, reduced by one-third of the annuitized value of the participant’s accumulated account balance under the Bonus Savings Plan. The benefits payable under the SERP are subject to a vesting schedule. A participant becomes 50% vested in his benefit five years prior to attaining normal retirement age, and continues to vest in annual increments of 10% to become 100% vested at normal retirement age. Upon a change of control, as defined in the SERP, a participant becomes 100% vested in his SERP benefit. If a participant dies before retirement, his surviving spouse or other beneficiary is entitled to receive a death benefit equal to $400,000 per year payable annually for 10 years. A participant whose employment was terminated, or his beneficiary, may elect, subject to approval by the Compensation Committee or as a matter of right at any time following one year after a change of control, to receive the actuarial present value of the benefit under the SERP in a single lump-sum payment, reduced by 10%.

The SERP is an unfunded compensation arrangement that is not subject to the annual reporting and disclosure requirements of the Employee Retirement Income Security Act of 1974. The Company has established a trust to pay benefits under the SERP to which the Company is contributing cash to purchase variable life insurance policies insuring each participant. The Company contributed $261,000 and $617,000, respectively, to the trust for the payment of 2004 premiums on variable life policies insuring Messrs. Haggar and Bracken, respectively. There are presently no other participants in the SERP.

16

The normal retirement age for Mr. Haggar under his participation agreement is 60, and the normal retirement age for Mr. Bracken under his participation agreement is 65. The Company estimates that Mr. Haggar will be entitled to an annual SERP benefit equal to approximately $887,000 at age 60, and Mr. Bracken will be entitled to an annual SERP benefit equal to approximately $663,000 at age 65. These estimates assume that 65% of the amount of the average base salary plus bonus for each of Messrs. Haggar and Bracken during the three years prior to his retirement is approximately $999,000 and $721,000, respectively, and that one-third of the annuitized value of the participant’s accumulated account balance under the Bonus Savings Plan for each of Messrs. Haggar and Bracken at that time is approximately $111,300 and $58,500, respectively.

Split-Dollar Insurance Plan

The Company established in 1999 the Haggar Corp. Split-Dollar Insurance Plan (the “Split-Dollar Plan”) to recognize the valued service of certain highly compensated employees and officers of the Company. Under the Split-Dollar Plan, the Company became obligated to pay the premiums due on employee life insurance policies as an additional employment benefit for such employees. However, such employees became obligated to reimburse the Company for the cost of the term portion of the premiums for this insurance. Eligible employees, or trusts created by eligible employees, who wished to participate in the Split-Dollar Plan entered into a split-dollar insurance agreement with the Company and contemporaneously purchased a life insurance policy. Pursuant to the split-dollar insurance agreements, the Company would be repaid for the premiums it paid, either out of the death benefit or the cash surrender value of the policies. In order to secure the repayment to the Company of the premiums paid, the owner of the insurance policy assigned the insurance policy to the Company as collateral. In addition, the owner of the insurance policy was prohibited from taking any actions which could jeopardize the Company’s right to be repaid the amounts it had paid toward premiums on the policy. Except following a change of control, the Company had the sole right to surrender the insurance policy and enforce its right to be repaid the amount of the premiums paid on the policy from the cash surrender value of the policy under the collateral assignment of the policy.

In fiscal 1999 and fiscal 2000, the Company entered into split-dollar life insurance agreements with separate trusts established by each of Messrs. Bracken and Haggar. Pursuant to these agreements, the Company became entitled to the cumulative premiums it paid on the policies, purchased contemporaneously with the execution of the agreements, less the Company’s interest in policy loans and related accrued interest on any policy loans. No policy loans were made to the Company under these policies. The beneficiaries of the trusts established by Messrs. Haggar and Bracken became entitled to $5,620,500 and $1,075,500, respectively, reduced by the amount of the premiums paid by the Company. The policies provided for annual premiums for Mr. Bracken and Mr. Haggar of $75,500 (payable for five years) and $62,500 (payable for 17 years), respectively. However, in light of changes in applicable law, the Company has ceased payment of the premiums related to these policies.

In December 2003, the Company terminated the split-dollar life insurance agreements, described above, and surrendered the policies entered into pursuant thereto. Messrs. Haggar and Bracken purchased new policies in which the Company has no interest, and they or relevant trusts undertook the responsibility to pay policy premiums. The Company was repaid the cash surrender values of the split-dollar policies which approximated the cumulative premiums paid. Although the Split-Dollar Plan has not been terminated, there are no participants and none are anticipated.

Bonus Savings Plan

The Bonus Savings Plan permits all full-time employees, including officers, who are “highly compensated employees” under Internal Revenue Code section 414(q) ($90,000 for 2004), to make voluntary contributions of current compensation which cannot be contributed to the Company’s 401(k) Plan to an individually owned annuity. The maximum amount that any participant in the Bonus Savings Plan may contribute is established annually by the Board. The Board may elect to pay an additional cash bonus to participants in the Bonus Savings Plan for the purpose of compensating such participants for federal income taxes owed on the amounts contributed under the plan as well as on any bonus. The Board awarded such bonuses to the executive officers in fiscal 2004 as set forth in the Summary Compensation Table above.

17

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Role of the Compensation Committee

The members of the Compensation Committee of the Board of Directors (the “Board”) are Rae F. Evans, Richard W. Heath and John C. Tolleson, each of whom the Board has determined meet the current independence requirements of the Nasdaq Stock Market, Inc. The Compensation Committee reviews, evaluates and recommends to the Board the executive compensation policies of the Company and the compensation of the Company’s Chief Executive Officer and other executive officers. In connection with these responsibilities, the Compensation Committee has exclusive authority to administer the Company’s 1992 Long-Term Incentive Plan, which terminated on October 21, 2002 (the “1992 LTIP”), and the Company’s 2003 Long-Term Incentive Plan (the “2003 LTIP”), which was adopted and approved by the Company’s stockholders on April 2, 2003. The Compensation Committee operates pursuant to a Compensation Committee Charter, which was adopted in fiscal 2002 and amended and restated in January 2004. The Compensation Committee held four meetings during the Company’s fiscal year ended September 30, 2004. At those meetings the Compensation Committee reviewed the Company’s compensation practices.

Executive Compensation Objectives

The primary objectives of the Compensation Committee are to ensure that the compensation provided to the Company’s executive officers reinforces the Company’s annual and long-term performance objectives, to reward and encourage quality performance, and to assist the Company in attracting, retaining and motivating executives with exceptional leadership abilities.

Consistent with this philosophy, the Compensation Committee believes that it has established a competitive and appropriate total compensation package for the executive officers and other senior management of the Company consisting primarily of base salary, annual bonus and discretionary payments under the Bonus Savings Plan and stock options, restricted shares and rights, either with or without accompanying options, under the 1992 LTIP and the 2003 LTIP. In addition, selected executive officers may also participate in the Haggar Corp. Supplemental Executive Retirement Plan (the “SERP”). Currently only J. M. Haggar, III, the Company’s Chief Executive Officer, and Frank D. Bracken, the Company’s President, participate in the SERP. The Chief Executive Officer and the President were selected to participate in the SERP based on their historical contributions and continued leadership of the Company. In addition, the Company makes certain matching contributions and profit sharing contributions to its 401(k) Plan on behalf of participants, which include the executive officers.

Description of the Elements of Executive Compensation

The Compensation Committee does not exclusively use quantitative methods or mathematical formulas in setting compensation. In determining each component of compensation, the Compensation Committee considers all elements of an executive officer’s total compensation package as well as other objective and subjective criteria the Compensation Committee deems appropriate with respect to each executive officer, including the recommendations of the Company’s Chief Executive Officer.

Base Salary. The Compensation Committee recommends to the Board base salaries each year at a level intended to be within the competitive market range of comparable companies. The Compensation Committee takes into consideration the salary recommendations of the Chief Executive Officer and conducts its own review of various factors, including those considered by the Chief Executive Officer in his recommendations, before determining the recommended base salaries for the Company’s executive officers and Chief Executive Officer. These factors include a comparison of the salaries earned by the Chief Executive Officer and the Chief Operating Officer to the salaries of comparable individuals at several companies that the Company considers to be its primary competitors in the apparel industry and at several companies of like size and nature, although not in the apparel industry, which have headquarters located in the same geographic region as the Company. In addition to the competitive market range, several other factors are considered in determining the recommended base salary amounts, including the responsibilities assumed by the executive, length of service, individual performance and

18

internal equity considerations. The Compensation Committee concluded that increases in base salary for fiscal 2004 for the executive officers were necessary given all the factors noted previously, with special consideration given to an updated salary market analysis obtained and reviewed by the Compensation Committee.

Annual Cash Bonus. Executive officers and certain other employees of the Company are eligible to receive annual cash bonuses as a result of attaining annual performance goals. Each year the Chief Executive Officer proposes to the Compensation Committee annual performance goals. The Compensation Committee reviews those proposals and, if they agree with them, recommends them to the Board for approval. Should the Company meet or exceed these annual performance goals, bonuses are awarded by the Compensation Committee to executive officers and certain other employees in the following fiscal year. The full potential bonus may be paid only if all performance goals are met or exceeded, while a portion of the full potential bonus may be paid upon meeting or exceeding some, but not all, of the goals. In addition, the Compensation Committee may consider the Company’s overall performance and other subjective factors relating to individual performance and elect to award individual merit bonuses to certain executive officers and employees. Messrs. Haggar and Bracken also receive an additional annual bonus and tax reimbursement under their respective Executive Employment Agreement based solely on continuing employment with the Company.

The Compensation Committee recommends performance goals by examining the past performance of the Company and identifying the Company’s future objectives. The Chief Executive Officer makes recommendations to the Compensation Committee regarding employee bonus amounts based upon the Company’s performance and his perception of the individual’s performance, level of responsibility and contribution to the Company. The amount of each individual bonus awarded under the bonus plan is further based on the total amount of funds available for distribution and each participant’s incentive base amount (provided that no participant’s bonus may exceed twice his incentive base amount). Eligibility to receive a bonus, an employee’s incentive base amount, and the amount of the bonus pool are recommended by the Compensation Committee and approved by the Board.

The bonus performance goals set by the Board for fiscal 2004 related to the operational and financial performance of the Company, including goals related to net income, return on equity and inventory turnover improvements. The Compensation Committee recommended that the Company’s executive officers receive a portion of their respective potential bonuses for fiscal 2004 after evaluating the performance of the Company in light of these performance goals. The amounts of these bonuses, as well as a $75,500 bonus and $30,796 tax reimbursement to Mr. Bracken under his Executive Employment Agreement, are set forth under “Executive Compensation—Summary Compensation Table.” An additional $34,227 bonus and $12,309 tax reimbursement to Mr. Haggar under his Executive Employment Agreement was paid during October 2004.

Discretionary Payments. The Company has established the Bonus Savings Plan pursuant to which certain of the executive officers have elected to make contributions to deferred annuity investment products on an after-tax basis through payroll deductions or direct payment. Each year, the Board determines, based on the Company’s performance during the year, whether to pay an additional cash bonus to any of the participants in the Bonus Savings Plan for the purpose of compensating for federal income taxes owed on the annuity plan investment contribution and the bonus. Bonuses paid to executive officers under the Bonus Savings Plan are considered by the Compensation Committee in connection with its evaluation of the total compensation of the Company’s executive officers.

Restricted Stock and Stock Option Grants. The Compensation Committee endorses the view that equity ownership by management is beneficial in aligning managements’ and stockholders’ interests in the enhancement of stockholder value. The Compensation Committee believes that this strategy motivates executives to remain focused on the overall long-term performance of the Company. In fiscal 2003, the Company adopted and the stockholders approved the 2003 LTIP, replacing the 1992 LTIP which terminated according to its terms on October 21, 2002, to make available additional grants of stock options, restricted shares and rights, either with or without accompanying options. In 2004, 96,000 shares of restricted stock were issued to the executive officers under the 2003 LTIP. One such executive officer subsequently resigned and forfeited 10,000 nonvested shares of restricted stock.

Supplemental Executive Retirement Plan. The SERP established by the Company is intended to reward executive officers who have exhibited outstanding performance over an extended tenure with the Company. As such, the SERP provides an incentive for both consistently high performance and longevity with the Company.

19

The benefits of the SERP are taken into consideration in connection with the Compensation Committee’s evaluation of the overall package of compensation and benefits provided to executive officers. Presently, the Chief Executive Officer and the President are the only participants in the SERP.

Chief Executive Officer Compensation

Mr. Haggar, the Chief Executive Officer, participates in the same executive compensation program provided to the other executive officers and senior management of the Company, as well as the SERP. The Compensation Committee’s approach to setting compensation for the Chief Executive Officer is to be competitive with comparable apparel companies and to have a major portion of the Chief Executive Officer’s compensation dependent upon the Company’s operational and financial performance and Mr. Haggar’s individual performance, which are evaluated in connection with the award of annual cash bonuses discussed above.

Mr. Haggar’s employment agreement provides that his initial base salary is subject to increase during the term of his employment in the sole discretion of the Company in light of his performance, inflation, cost of living and other factors deemed relevant by the Company. Mr. Haggar is eligible to receive an annual performance bonus and may participate in other perquisites and benefit plans available to other executive officers of the Company. Mr. Haggar also receives an additional annual bonus and tax reimbursement under his Executive Employment Agreement based solely on continuing employment with the Company.

For the fiscal year ended September 30, 2004, Mr. Haggar earned $1,472,495 in salary and bonuses as shown in “Executive Compensation—Summary Compensation Table.” Approximately 51% of this amount was earned in the form of an annual performance bonus and a bonus under the Bonus Savings Plan. In determining the amount of the Chief Executive Officer’s bonuses, the Compensation Committee considered factors like those considered in awarding bonuses to other executive officers and overall operational performance. The Committee believes the Chief Executive Officer’s total compensation for fiscal 2004 was reasonable and appropriate given the performance of the Company under his leadership and the ability of the Chief Executive Officer to direct the Company’s strategic resources effectively to drive stockholder growth. The Compensation Committee, based on an updated market salary analysis, increased the annual salary of the Chief Executive Officer to $721,500 in fiscal 2004 from $675,000 in fiscal 2003.

$1 Million Pay Deductibility Cap

Section 162(m) of the Internal Revenue Code generally imposes a $1 million per person annual limit on the amount the Company may deduct as compensation expense for its Chief Executive Officer and its four other highest paid officers. To the extent readily determinable, and as one of the factors in considering compensation matters, the Compensation Committee considers the anticipated tax treatment to the Company and to its executives of various payments and benefits. Some types of compensation payments and their deductibility depends upon the timing of an executive’s vesting or exercise of previously granted rights. Further, interpretations of and changes in tax laws and other factors beyond the Company’s control also affect the deductibility of compensation. For these and other reasons, the Compensation Committee will not necessarily limit executive compensation to the amount deductible under Section 162(m) of the Internal Revenue Code. Therefore, the Compensation Committee, subject to the factors provided above, has the discretion to grant awards which result in non-deductible compensation.

Conclusion

The Compensation Committee believes that the Company’s executive compensation program provides a competitive and motivational compensation package to the Company’s executive officers necessary to achieve the Company’s financial objectives and enhance stockholder value.

This report has been submitted by the Compensation Committee, which consists of the following members:

| | | Richard W. Heath, Chairman

Rae F. Evans

John C. Tolleson |

20

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Mr. Heath, Ms. Evans and Mr. Tolleson comprised the Compensation Committee during fiscal 2004. Mr. Heath, Ms. Evans and Mr. Tolleson have never been officers or employees of the Company. None of the executive officers of the Company served as a member of the compensation committee or board of directors of any other company during fiscal 2004.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors (the “Board”) is currently composed of Richard W. Heath, John C. Tolleson, Thomas G. Kahn and James Neal Thomas. The Board, in its business judgment, has determined that all members of the Audit Committee meet the current independence and experience requirements of the Nasdaq Stock Market, Inc., and applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and that Mr. Thomas satisfies the requirements for an “audit committee financial expert” promulgated by the SEC. The Audit Committee operates pursuant to an Audit Committee Charter that was initially adopted by the Board on July 23, 2000, and subsequently amended and restated, most recently in January 2004.

As set forth in the Second Amended and Restated Audit Committee Charter, management of the Company is responsible for preparation in accordance with generally accepted accounting principles, and the completeness and accuracy of, the Company’s financial statements. The independent auditors are responsible for the planning and conduct of audits of the Company’s financial statements and reviews of the Company’s quarterly financial statements prior to the filing of each Quarterly Report on Form 10-Q. The Audit Committee assists the Board in its oversight function and has the responsibilities and powers as set forth in the Second Amended and Restated Audit Committee Charter.

In the performance of its oversight function, the Audit Committee has reviewed and discussed with management and the independent auditors the Company’s audited financial statements for the fiscal year ended September 30, 2004. The Audit Committee has also discussed with the Company’s independent auditors matters required to be discussed by Statement on Auditing Standards Nos. 61, 89 and 90. In addition, the Audit Committee has received the written disclosures and the letter from the Company’s independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect. The Audit Committee has also considered whether the independent auditors’ provision of non-audit services to the Company is compatible with maintaining their independence and discussed with them their independence from the Company and its management.

Based upon the reviews, reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to above and in the Second Amended and Restated Audit Committee Charter, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2004, for filing with the SEC.

This report has been submitted by the Audit Committee for fiscal 2004, which consists of the following members:

| | | James Neal Thomas, Chairman

Richard W. Heath

Thomas G. Kahn

John C. Tolleson

|

21

FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The following table sets forth the fees paid to PricewaterhouseCoopers LLP for services provided during fiscal years 2004 and 2003:

| | | | 2004

| | 2003

| |

|---|

| Audit Fees (1) | | | | $ | 277,100 | | | $ | 251,800 | |

| Audit-Related Fees (2) | | | | | 141,500 | | | | 98,500 | |

| Tax Fees (3) | | | | | 233,110 | | | | 401,400 | |

| All Other Fees (4) | | | | | — | | | | — | |

| Total | | | | $ | 651,710 | | | $ | 751,700 | |

| (1) | | 2004 audit fees represent fees for professional services provided in connection with the audit of the Company’s annual financial statements and review of the Company’s quarterly financial statements and advice on accounting matters that arose during the audit. 2003 audit fees represent fees for professional services provided in connection with the audit of the Company’s annual financial statements and review of the Company’s quarterly financial statements and advice on accounting matters that arose during the audit and audit services provided in connection with the filing of a Form S-8 in May 2003. |

| (2) | | 2004 audit-related fees represent fees for professional services in connection with the audits of the Company’s employee benefit plans, due diligence and advisory services related to a potential acquisition and advisory services related to compliance with the Sarbanes-Oxley Act of 2002. 2003 audit related fees represent fees for professional services in connection with the audits of the Company’s employee benefit plans and advisory services related to compliance with the Sarbanes-Oxley Act of 2002. |

| (3) | | Represents fees for professional services in connection with preparation of the Company’s federal and state tax returns and advisory services for other tax compliance and consulting matters. |

| (4) | | During fiscal 2004 and 2003, PricewaterhouseCoopers LLP did not provide any services to the Company other than those in the categories noted above. |

Effective December 2002, the Audit Committee established a policy to pre-approve all audit, audit-related, tax and other fees for services proposed to be provided by the Company’s independent auditor prior to engaging the auditor for that purpose. Consideration and approval of such services generally occur at the Audit Committee’s regularly scheduled quarterly meetings. In situations where it is impractical to wait until the next regularly scheduled quarterly meeting, the Audit Committee has delegated the authority to approve the audit, audit-related, tax and other fees to the Audit Committee chairperson up to a certain pre-determined level as approved by the Audit Committee. Fees for any of these audit, audit-related, tax and other projects approved pursuant to the above-described delegation of authority require the reporting of any such approvals to the full Audit Committee at the next regularly scheduled meeting.

In accordance with its pre-approval policy, the Audit Committee pre-approved 100% of the audit fees; 100% and 86% of the audit-related fees and 100% of tax fees for fiscal 2004 and 2003, respectively. In total, the Audit Committee pre-approved 100% and 98% of the fees for fiscal 2004 and 2003, respectively.

22

FINANCIAL CODE OF ETHICS

The Company’s Chief Executive Officer, Chief Financial Officer, principal accounting officer, controller and other persons performing similar functions are required to comply with the Company’s Financial Code of Ethics. The purpose of the Company’s Financial Code of Ethics is to deter wrongdoing and to promote, among other things, honest and ethical conduct and to ensure to the greatest possible extent that the Company’s business is conducted in a consistently legal and ethical manner. Employees may submit concerns or complaints regarding ethical issues on a confidential basis by means of a toll-free telephone call to an assigned voicemail box. All concerns and complaints are investigated by the Office of the General Counsel.

The Company’s Financial Code of Ethics is posted on the Company’s website atwww.haggar.com. The Company will also post on its website any amendment to, or waiver from, a provision of the Financial Code of Ethics that applies to the Company’s Chief Executive Officer, Chief Financial Officer, principal accounting officer, controller or persons performing similar functions and that relates to any of the following elements of the Financial Code of Ethics: honest and ethical conduct; disclosure in reports or documents filed with the SEC and other public communications; compliance with applicable laws, rules and regulations; prompt internal reporting of code violations; and accountability for adherence to the code.

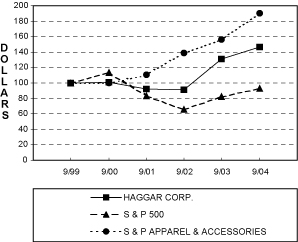

PERFORMANCE GRAPH

The line graph below compares the cumulative total stockholder return on the Common Stock from September 30, 1999, through September 30, 2004, with the return on the Standard & Poor’s 500 Stock Index (“S & P 500”) and the Standard & Poor’s Apparel and Accessories Index (“S & P Apparel & Accessories”) for the same period. In accordance with the disclosure rules of the SEC, the measurement assumes a $100 initial investment in the Common Stock with all dividends reinvested, and a $100 initial investment in the indexes.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG HAGGAR CORP., THE S & P 500 STOCK INDEX

AND THE S & P APPAREL & ACCESSORIES INDEX

| * | | $100 invested on 9/30/99 in stock or index—including reinvestment of dividends. Fiscal year ending September 30.

Copyright © 2002, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved.

www.researchdatagroup.com/S&P.htm

|

23

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. Godwin, a director of the Company, is a partner of Godwin Gruber, LLP, a law firm that has rendered various legal services to the Company and certain of its subsidiaries during fiscal 2004. The Company paid to this law firm approximately $940,000 during fiscal 2004. At September 30, 2004, there were approximately $89,000 in unpaid fees due to such law firm from the Company. The Company has retained this law firm during the current fiscal year to provide various legal services. Godwin Gruber, LLP does not represent the Company in connection with the solicitation of proxies for the election of the Board’s nominees as directors at the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS AND MANAGEMENT

The following table and the notes thereto set forth certain information regarding the beneficial ownership of the Common Stock as of the Record Date, by:

| • | | each current director of the Company; |

| • | | the named executive officers of the Company; |

| • | | all executive officers and directors of the Company as a group; and |

| • | | each other person known to the Company to own beneficially more than five percent of the Common Stock outstanding on the Record Date. |

Unless otherwise indicated, all stockholders set forth below have the same principal business address as

the Company.

The Company has determined beneficial ownership in accordance with the rules of the SEC. The number of shares beneficially owned by a person includes shares of Common Stock that are subject to stock options that are either currently exercisable or exercisable within 60 days after the Record Date. These shares are also deemed outstanding for the purpose of computing the percentage of outstanding shares owned by the person. These shares are not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, to the Company’s knowledge, each stockholder has sole voting and dispositive power with respect to the securities beneficially owned by that stockholder. On the Record Date, there were 7,080,660 shares of Common Stock outstanding.

| | | | Number of Shares

Beneficially Owned

| | Percentage of Shares

Beneficially Owned

| |

|---|

| J. M. Haggar, III (1) | | | | | 652,549 | | | | 9.0 | |

| Frank D. Bracken (2) | | | | | 188,186 | | | | 2.6 | |

| Alan C. Burks | | | | | 11,062 | | | | * | |

| David G. Roy (3) | | | | | 25,100 | | | | * | |

| John W. Feray | | | | | 400 | | | | * | |

| Rae F. Evans (4) | | | | | 11,200 | | | | * | |

| Donald E. Godwin (5) | | | | | 17,631 | | | | * | |

| Richard W. Heath (6) | | | | | 26,800 | | | | * | |

| Thomas G. Kahn (7) | | | | | 899,569 | | | | 12.7 | |

| James Neal Thomas | | | | | 9,000 | | | | * | |

| John C. Tolleson (8) | | | | | 83,600 | | | | 1.2 | |

All executive officers and directors as a group

(11 persons) (9) | | | | | 1,925,097 | | | | 26.0 | |

| Kahn Brothers & Co., Inc. (10) | | | | | 841,469 | | | | 11.9 | |

| Wellington Management Company, LLP (11) | | | | | 733,200 | | | | 10.4 | |

| Franklin Resources, Inc. (12) | | | | | 420,000 | | | | 5.9 | |

| Dimensional Fund Advisors, Inc. (13) | | | | | 372,829 | | | | 5.3 | |

24

| * | | Represents beneficial ownership of less than 1%. |

| (1) | | Includes 2,299 shares over which Mr. Haggar shares voting and dispositive power with his wife, 39,213 shares over which he otherwise shares voting and dispositive power as a trustee of various trusts, 16,743 shares over which he shares voting and dispositive power as a director of a private charitable foundation and 135,000 shares which may be acquired upon exercise of stock options that are currently exercisable. |

| (2) | | Includes 130,000 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (3) | | Includes 15,000 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (4) | | Includes 1,200 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (5) | | Includes 1,800 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (6) | | Includes 5,000 shares over which Mr. Heath shares voting and dispositive power with his wife and 16,800 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (7) | | Includes 500 shares over which Mr. Kahn shares voting and dispositive power with his wife, 841,469 shares over which he shares voting and dispositive power as an officer of Kahn Brothers & Co., Inc. (see note 10, below), 34,300 shares over which he shares voting and dispositive power as a trustee of various trusts and 1,000 shares over which he shares voting and dispositive power as a director of a private charitable foundation. |

| (8) | | Includes 18,600 shares which may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (9) | | Includes 940,524 shares over which voting and dispositive power is shared and 318,400 shares which

may be acquired upon exercise of stock options exercisable currently or within 60 days following the Record Date. |

| (10) | | Includes 781,469 shares owned by certain of its clients and over which Kahn Brothers & Co., Inc. has shared voting and dispositive power. Based on information contained in a Form 4 filed with the SEC on November 22, 2004, by Thomas G. Kahn. The address of Kahn Brothers & Co., Inc. is 555 Madison Avenue, 22nd Floor, New York, New York 10022 |

| (11) | | Based on information contained in a Schedule 13G filed with the SEC on December 10, 2004, by Wellington Management Company, LLP, whose address is 75 State Street, Boston, Massachusetts 02109. |

| (12) | | Based on information contained in a Form 13F filed with the SEC on November 26, 2004, by Franklin Resources, Inc., whose address is One Franklin Parkway, San Mateo, California 94403. |

| (13) | | Based on information contained in a Form 13F filed with the SEC on October 19, 2004, by Dimensional Fund Advisors, Inc., whose address is 1299 Ocean Avenue, 11th floor, Santa Monica, California 90401. |

25

OTHER BUSINESS

The Board knows of no other business to be brought before the Annual Meeting. If, however, any other business should properly come before the Annual Meeting, the persons named in the accompanying proxy will vote the proxy as in their discretion they may deem appropriate.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company’s executive officers and directors, and beneficial owners of more than 10% of the Common Stock, are required to file reports of ownership and reports of changes in ownership of the Common Stock with the SEC. The SEC’s rules require such person to furnish the Company with copies of all Section 16(a) reports they file. Based on a review of these reports and on written representations from the reporting persons that no other reports were required, the Company believes that the applicable Section 16(a) reporting requirements were complied with for all transactions which occurred during the fiscal year ended September 30, 2004, except that Mr. Bracken was late filing two Form 4s in respect of employee stock option exercises under the Company’s 1992 LTIP.

STOCKHOLDER PROPOSALS FOR NEXT ANNUAL MEETING

Pursuant to Rule 14a-8 of the Exchange Act, to be included in the Board’s solicitation of proxies relating to the 2006 annual meeting of the Company’s stockholders, a stockholder proposal must be received by the Secretary of the Company at the Company’s principal executive offices no later than September 12, 2005.

Pursuant to the Company’s bylaws, in order to nominate persons for election to the Board at the 2006 annual meeting of the Company’s stockholders, or to bring other business constituting a proper matter for stockholder action under applicable law before the 2006 annual meeting, a stockholder must deliver written notice to the Secretary of the Company at the principal executive offices of the Company not less than 90 days nor more than 120 days prior to the first anniversary of the Annual Meeting; provided, however, that in the event that the date of the 2006 annual meeting is more than 30 days before or more than 70 days after such anniversary date, the notice must be delivered not earlier than 120 days prior to the 2006 annual meeting and not later than the later of (a) 90 days prior to such meeting or (b) the tenth day following the day on which public announcement of the date of such meeting is first made by the Company. If the Board, however, proposes to increase the number of directors at the 2006 annual meeting and there is no public announcement by the Company naming the nominees for the additional directorships at least 10 days prior to the last date that a stockholder notice may be timely delivered pursuant to the immediately preceding sentence, then a stockholder’s notice must be delivered to the Secretary of the Company at the principal executive offices of the Company not later than 10 days following the date of such public announcement. A stockholder’s notice described in this paragraph must set forth the information required by the Company’s bylaws.

With respect to proxies submitted for the 2006 annual meeting of the Company’s stockholders, the Company’s management will have discretionary authority to vote on any matter of which the Company does not receive notice by the date specified in the advance notice provisions of the Company’s bylaws described above, pursuant to Rule 14a-4(c)(1) promulgated under the Exchange Act.

26

ANNUAL REPORT

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2004 accompanies this Proxy Statement. The Annual Report on Form 10-K does not form any part of the materials for the solicitation of proxies. Additional copies of the Annual Report on Form 10-K will be sent to any stockholder without charge upon written request addressed to Haggar Corp., 11511 Luna Road, Dallas, Texas 75234, Attention: Corporate Secretary.

By Order of the Board of Directors,

J. M. Haggar, III

Chairman and Chief Executive Officer January 10, 2005

Dallas, Texas

It is important that proxies be returned promptly. Whether or not you expect to attend the meeting, please mark, sign, date and return the enclosed proxy promptly in the enclosed postage paid envelope. If you attend the meeting, you may revoke your proxy and vote in person.

27

Appendix A

HAGGAR CORP.

SECOND AMENDED AND RESTATED

AUDIT COMMITTEE CHARTER

January 23, 2004

The Board of Directors of Haggar Corp. (the “Company”) has established the Audit Committee of the Board of Directors of the Company (the “Board”).

Purposes

The purposes of the Audit Committee are to serve as an independent and objective party:

| • | | To oversee the quality and integrity of the financial statements and other financial information the Company provides to any governmental body or the public; |

| • | | To oversee the independent auditors’ qualifications and independence; |

| • | | To oversee the performance of the Company’s independent auditors; |

| • | | To oversee the performance of the Company’s internal auditors; |

| • | | To oversee the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements; |

| • | | To oversee the Company’s systems of internal controls regarding finance, accounting, and ethics compliance that management and the Board have established; |

| • | | To establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal controls, and other auditing matters and for the confidential, anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters; |

| • | | To provide an open avenue of communication among the independent auditors, internal auditors, financial and senior management, and the Board, always emphasizing that the independent auditors are accountable to the Audit Committee; and |

| • | | To perform such other duties as are directed by the Board. |

The Audit Committee shall prepare annually a report meeting the requirements of any applicable regulations of the Securities and Exchange Commission (the “SEC”) to be included in the Company’s proxy statement relating to its annual meeting of stockholders.

Membership

The Audit Committee shall be comprised of three or more directors, as determined by the Board or a nominating committee of the Board, none of whom shall be an affiliate of the Company or any of its subsidiaries or an employee or a person who receives any compensation from the Company or any of its subsidiaries other than fees paid for service as a director.

The members of the Audit Committee shall be elected by the Board or a nominating committee of the Board annually and shall serve until their successors shall be duly elected and qualified. Unless the Board otherwise determines in accordance with the listing standards of the Nasdaq Stock Market, Inc. (“Nasdaq”) and applicable rules and regulations of the SEC, each member shall be “independent” as defined from time to time by the listing standards of Nasdaq and by applicable rules and regulations of the SEC. If the Company’s securities are listed on any other exchange, the Audit Committee shall meet the independence and experience requirements of such

A-1

exchange. Accordingly, the Board shall determine annually whether each member is free from any relationship that may interfere with his or her independence from management and the Company. No member may accept, directly or indirectly, any consulting, advisory, or other compensatory fees from the Company or any of its subsidiaries other than director or committee fees. No member may have participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years. No member shall serve on an audit committee of more than two public companies unless the Board determines that such simultaneous service would not impair the ability of such director to effectively serve on the Audit Committee.

Each member shall be able to read and understand financial statements at the time of his or her appointment. The Company shall appoint at least one member who is “financially sophisticated” as defined under the applicable Nasdaq listing standards and shall use its reasonable efforts to appoint at least one member who qualifies as an “audit committee financial expert” as defined from time to time by applicable rules and regulations of the SEC, but in any event the Company shall comply with applicable Nasdaq listing standards.

An audit committee financial expert shall not be deemed an “expert” for any purpose, including for purposes of Section 11 of the Securities Act of 1933. The designation of an Audit Committee member as an audit committee financial expert does not impose any duties, obligations or liability on the audit committee financial expert that are greater than those imposed on other Audit Committee members, nor does it affect the duties, obligations or liability of any other Audit Committee member.

Notwithstanding the foregoing membership requirements, no action of the Audit Committee shall be invalid by reason of any such requirement not being met at the time such action is taken.

Meetings and Structure

The Audit Committee shall meet as many times per year as the members deem necessary, but in any event at least four times per year. The Audit Committee should meet at least annually with management and the independent auditors in separate executive sessions to discuss any matters that the Audit Committee or each of these groups believe should be discussed privately.

The Board shall appoint one member of the Audit Committee as chairperson. He or she shall be responsible for leadership of the Audit Committee and reporting to the Board.

Accountability of the Independent Auditors

The independent auditors are accountable to and report directly to the Audit Committee. The Audit Committee shall have the sole authority and responsibility with respect to the selection, engagement, compensation, oversight, evaluation and, where appropriate, dismissal of the Company’s independent auditors engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. The Audit Committee shall annually select and engage the Company’s independent auditors retained to audit the financial statements of the Company. The Audit Committee, or a member thereof, must pre-approve any service, whether an audit or a non-audit service, provided to the Company by the Company’s independent auditors, including the plan and scope of any such service and related fees.

Committee Authority and Responsibilities

The Audit Committee shall have the authority to take all actions it deems advisable to fulfill its responsibilities and duties.

The Audit Committee has the authority to retain, at the Company’s expense, professional advisors, including without limitation special legal counsel, accounting experts, or other consultants, to advise the Audit Committee, which may be the same as or different from the Company’s primary legal counsel, accounting experts and other consultants, as the Audit Committee deems necessary or advisable in connection with the exercise of its powers and responsibilities as set forth in this Audit Committee Charter, all on such terms as the Audit Committee deems necessary or advisable.

A-2

The Audit Committee shall be responsible for the resolution of any disagreements between the independent auditors and management regarding the Company’s accounting or financial reporting practices.

The Company shall provide for appropriate funding, as determined by the Audit Committee, for payment of (i) compensation to the independent auditors employed by the Company for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services; (ii) compensation to any special legal counsel, accounting experts or other consultants employed by the Audit Committee; and (iii) ordinary administrative expenses of the Audit Committee.

In connection with the purposes, powers and responsibilities set forth above, the Audit Committee shall also:

Independent Auditors

| 1. | | Annually review the performance, experience and qualifications of the independent auditors’ team and the quality control procedures of the independent auditors and discharge the independent auditors when circumstances warrant. |

| 2. | | Review the Company’s disclosures in the Company’s periodic reports filed with the SEC regarding any approved non-audit services provided or to be provided by the independent auditors. |

| 3. | | Periodically obtain and review a report from the independent auditors regarding all relationships between the independent auditors and the Company that may impact the independent auditors’ independence, and discuss such report with the independent auditors. The Audit Committee shall also recommend any appropriate action to the Board in response to the written report necessary to satisfy itself of the independence of the independent auditors. |

| 4. | | Ensure the rotation, at least every five years, of the lead audit partner having responsibility for the audit and the concurring review partner responsible for reviewing the audit in accordance with applicable Nasdaq listing standards and applicable laws, rules and regulations. |

| 5. | | Set, review and modify as appropriate, policies in accordance with the Nasdaq listing standards and applicable laws, rules and regulations for hiring employees or former employees of the Company’s independent auditors. |

Review

| 6. | | Review with management and the independent auditors the Company’s quarterly or annual financial information, including matters required to be reviewed under applicable legal, regulatory or Nasdaq requirements, prior to the release of earnings and prior to the filing of the Company’s Quarterly Report on Form 10-Q or Annual Report on Form 10-K, as the case may be. |

| 7. | | Review and, as appropriate, discuss with management and the independent auditors the Company’s earnings releases, including the use of “pro forma” or “adjusted” non-GAAP information, as well as financial information and earnings guidance, if any, provided to analysts or rating agencies. |

| 8. | | Upon completion of any annual audit, meet separately with the independent auditors and management and review the Company’s financial statements and related notes, the results of their audit, any report or opinion rendered in connection therewith, any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information, any significant disagreements with management concerning accounting or disclosure matters, any significant adjustment proposed by the independent auditors and the adequacy and integrity of the Company’s internal accounting controls and the extent to which major recommendations made by the independent auditors have been implemented or resolved. |

| 9. | | Regularly review with the Company’s independent auditors any audit problems or difficulties and management’s response. |

| 10. | | Review and consider with the independent auditors and management the matters required to be discussed by Statement of Auditing Standards Nos. 61, 89 and 90. These discussions shall include consideration of the |

A-3

quality of the Company’s accounting principles and as applied in its financial reporting, including review of estimates, reserves and accruals, review of judgmental areas, review of audit adjustments whether or not recorded, and such other inquiries as may be appropriate. These discussions shall also include the review of reports from the independent auditors that include (i) all critical accounting policies and practices used; (ii) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, their ramifications and the preferences of the independent auditors; and (iii) other material written communications between the independent auditors and management. Based on the foregoing review, make its recommendation to the Board as to the inclusion of the Company’s audited financial statements in the Company’s annual report on Form 10-K.

| 11. | | Review any disclosures provided by the Chief Executive Officer, the Chief Financial Officer or the independent auditors to the Audit Committee regarding significant deficiencies in the design or operation of internal control over financial reporting which could adversely affect the Company’s ability to record, process, summarize, and report financial data. |

| 12. | | Review with management and the independent auditors any significant transactions that are not a normal part of the Company’s operations and changes, if any, in the Company’s accounting principles or their application. |

| 13. | | Review and approve all related-party transactions. |

Process Improvement

| 14. | | Consider and approve, if appropriate, major changes to the Company’s accounting principles and practices as suggested by the independent auditors or management. |

| 15. | | Regularly apprise the Board, through minutes and special presentations as necessary, of significant developments in the course of performing the Audit Committee’s duties. |

| 16. | | Conduct an annual evaluation with the Board regarding the performance of the Audit Committee. |

Ethical and Legal Compliance

| 17. | | Review any disclosures provided by the Chief Executive Officer or the Chief Financial Officer to the Audit Committee regarding (i) significant deficiencies or weaknesses in the design or operation of internal control over financial reporting which could adversely affect the Company’s ability to record, process, summarize, and report financial data; and (ii) any fraud, including that which involves management or other employees who have a significant role in the Company’s internal control over financial reporting. |

| 18. | | Review with the Company’s in-house or outside legal counsel any legal matter that could have a significant effect on the Company’s financial statements, including the status of pending litigation and other areas of oversight to the legal and compliance area as may be appropriate. |

| 19. | | Review with management and the independent auditors the Company’s policies and procedures regarding compliance with its internal policies as well as applicable laws and regulations, including without limitation with respect to maintaining books, records and accounts and a system of internal accounting controls in accordance with Section 13(b)(2) of the Securities Exchange Act of 1934. |

General

| 20. | | Perform any other activities consistent with this Charter, the Company’s Articles of Incorporation and Bylaws, the rules of Nasdaq applicable to its listed companies, and governing law as the Audit Committee or the Board deems necessary or appropriate. |

A-4

Review of Committee Charter

At least annually, the Audit Committee shall review and reassess the adequacy of this Charter. The Audit Committee shall report the results of the review to the Board and, if necessary, make recommendations to the Board to amend this Charter.

Limitations

The Audit Committee has the responsibilities and powers set forth in this Charter and management and the independent auditors for the Company are accountable to the Audit Committee. Management, not the Audit Committee, is responsible for the preparation in accordance with GAAP, and the completeness and accuracy, of the Company’s financial statements. The independent auditors, not the Audit Committee, are responsible for the planning and conduct of audits of the Company’s financial statements and reviews of the Company’s quarterly financial statements prior to the filing of each quarterly report on Form 10-Q.

A-5

| | | | |

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” PROPOSALS 1 and 2. | | Please

Mark Here

for Address

Change or

Comments | o |

| | | SEE REVERSE SIDE |

| | | | | | | | | | | | | | |

| | The two proposals on the ballot are: | | | | | | | | | | |

| | | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| 1. Election of Directors. | | | | 2. | Ratification of PricewaterhouseCoopers LLP as the Company’s independent accountants. | | | o | | o | | o |

| | FORall nominees | | TO WITHHOLD | | | | | | | | | | |

| | (Except as marked | | AUTHORITY | | | | | | | | | | |

| | to the contrary) | | (for all nominees listed) | | | | | | | | | | |

| | o | | o | | | I plan to attend the meeting | o | | | | | | |

| | | | | | | | | | | | | | |

| Nominees: | 01 Frank D. Bracken, 02 Thomas G. Kahn, and | | | | | | | | | |

| | 03 John C. Tolleson | | | | | | | | | |

| | | | | | | | | | | | | | |

| (INSTRUCTIONS: To withhold authority to vote for any individual nominee, write that nominee’s name in the space provided below.) | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | |

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such.

5 FOLD AND DETACH HERE 5

You can view the Annual Report and Proxy Statement on the Internet at www.haggar.com

Haggar Corp.

Proxy for Annual Meeting of Stockholders

February 9, 2005

This Proxy is Solicited on Behalf of Haggar Corp.’s Board of Directors

The undersigned hereby appoints J.M. Haggar, III, Frank D. Bracken and John W. Feray and each of them, Proxies for the undersigned, with full power of substitution, to vote all shares of Haggar Corp. Common Stock which the undersigned may be entitled to vote at the Annual Meeting of Stockholders of Haggar Corp. to be held on Wednesday, February 9, 2005, or at any adjournment thereof, upon the matters set forth on the reverse side and described in the accompanying Proxy Statement and upon such other business as may properly come before the meeting or any adjournment thereof.

You are encouraged to specify your vote by marking the appropriate box ON THE REVERSE SIDE but you need not mark any box if you wish to vote in accordance with the Board of Directors’ recommendations, which are FOR the election of the named nominees as directors and FOR the Ratification of PricewaterhouseCoopers LLP as the Company’s independent auditors. The Proxies cannot vote your shares unless you sign and return this card. Any proxy may be revoked in writing at any time prior to the voting thereof.

Any proxy, when properly granted, will be voted in the manner directed and will authorize the Proxies to take action in their discretion upon other matters that may properly come before the meeting. If no direction is made, your proxy will be voted in accordance with the recommendations of the Board of Directors.

Address Change/Comments (Mark the corresponding box on the reverse side)

5 FOLD AND DETACH HERE 5