- MANT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Mantech International (MANT) DEF 14ADefinitive proxy

Filed: 29 Apr 22, 8:34am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Mantech International Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2251 Corporate Park Drive

Herndon, VA 20171

April 29, 2022

Dear Fellow Stockholder:

On behalf of ManTech’s Board of Directors and leadership team, I cordially invite you to attend the Annual Meeting of Stockholders of ManTech International Corporation, which will be held at 2251 Corporate Park Drive, Herndon, VA 20171, on Friday, June 10, 2022, at 2:00 pm (EDT).

We have provided details of the business to be conducted at the meeting in the accompanying Notice of Annual Meeting of Stockholders, proxy statement and form of proxy. We encourage you to read these materials so that you may be informed about the business to come before the meeting.

Your participation is important, regardless of the number of shares you own. So that we have an efficient meeting, please sign, date, and return the enclosed proxy card promptly in the accompanying reply envelope. You can find additional information concerning our voting procedures in the accompanying materials.

We intend to hold the Annual Meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials may issue in the event of changes in the virus or any variant’s transmutability or infectiousness. As a result, we may impose additional procedures or limitations on Annual Meeting attendees, or we may decide to hold the Annual Meeting at a different location or by means of remote communication. We plan to announce any such updates on our proxy website (https://investor.mantech.com/annual-meeting), and we encourage you to check this website prior to the Annual Meeting if you plan to attend.

We look forward to seeing you at the meeting.

Sincerely,

Kevin M. Phillips

Chairman of the Board, CEO and President

2251 Corporate Park Drive

Herndon, VA 20171

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD June 10, 2022

The 2022 Annual Meeting of Stockholders (Annual Meeting) of ManTech International Corporation, a Delaware corporation (Company), will be held at 2251 Corporate Park Drive, Herndon, VA 20171, on Friday, June 10, 2022, at 2:00 pm (EDT), for the following purposes, as more fully described in the proxy statement accompanying this notice:

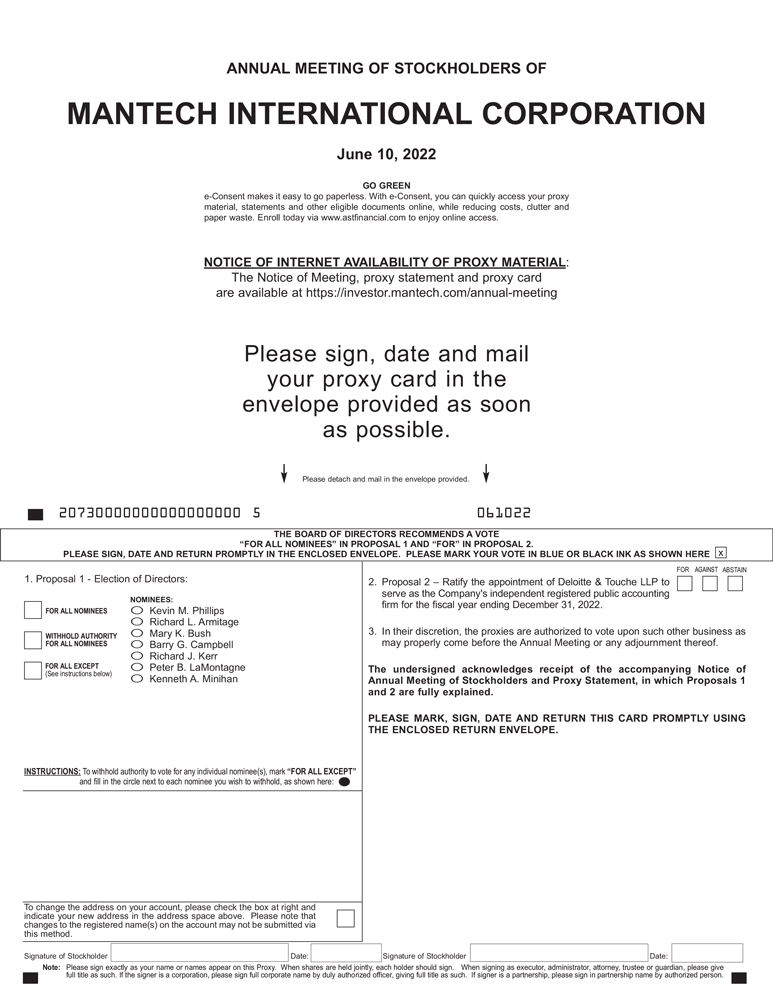

| 1. | To elect seven (7) persons as directors of the Company, each to serve until the 2023 Annual Meeting of Stockholders, or until their respective successors shall have been duly elected and qualified; |

| 2. | To ratify the appointment of Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; and |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Stockholders of record at the close of business on April 13, 2022 are entitled to vote at the Annual Meeting. A complete list of stockholders eligible to vote at the Annual Meeting will be available for examination by our stockholders during the ten days prior to the Annual Meeting, between the hours of 9:00 am and 5:00 pm (EDT), at the Company’s offices, located at 2251 Corporate Park Drive, Herndon, VA 20171.

We invite you to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, your vote is important. Please sign and date the enclosed proxy card, and return it promptly in the accompanying reply envelope, which requires no additional postage. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to vote all your shares.

We intend to hold the Annual Meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials may issue in the event of changes in the virus or any variant’s transmutability or infectiousness. As a result, we may impose additional procedures or limitations on Annual Meeting attendees, or we may decide to hold the Annual Meeting at a different location or by means of remote communication. We plan to announce any such updates on our proxy website (https://investor.mantech.com/annual-meeting), and we encourage you to check this website prior to the Annual Meeting if you plan to attend.

The proxy statement and form of proxy are being mailed on or about April 29, 2022.

By Order of the Board of Directors

Kevin M. Phillips

Chairman of the Board, CEO and President

Herndon, Virginia

April 29, 2022

Important Notice Regarding Availability of Proxy Materials for ManTech’s

Annual Meeting of Stockholders to be Held on June 10, 2022:

The Proxy Statement, our Proxy Card and our Annual Report to Stockholders are available at

https://investor.mantech.com/annual-meeting

| 1 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

Board and Committee Executive Sessions and Independent Directors Meetings | 5 | |||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

Information Regarding the Nominees for Election as Directors | 13 | |||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

i

| 22 | ||||

| 26 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 37 | |||

| 39 | ||||

| 41 | ||||

| 41 | ||||

Ownership by Holders of More Than 5% of Our Class A Common Stock | 42 | |||

| 45 | ||||

| 46 | ||||

ii

2251 Corporate Park Drive

Herndon, VA 20171

PROXY STATEMENT FOR

2022 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors (Board) of ManTech International Corporation (Company) is soliciting proxies to be voted at the Company’s 2022 Annual Meeting of Stockholders (Annual Meeting) to be held on Friday, June 10, 2022, at 2:00 pm (EDT), at 2251 Corporate Park Drive, Herndon, VA 20171, and at any adjournments or postponements thereof.

The mailing address of our principal executive offices is 2251 Corporate Park Drive, Herndon, VA 20171. This proxy statement, the accompanying Notice of Annual Meeting of Stockholders, and the enclosed proxy card are first being mailed to our stockholders on or about April 29, 2022 (Mailing Date).

The Board is soliciting proxies to be voted at the Annual Meeting. When we ask you for your proxy, we must provide you with a proxy statement that contains certain information specified by law.

At the Annual Meeting, we will ask you to consider and vote on the following matters:

| 1. | To elect seven (7) persons as directors of the Company, each to serve until the 2023 Annual Meeting of Stockholders, or until their respective successors shall have been duly elected and qualified; and |

| 2. | To ratify the appointment of Deloitte & Touche LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. |

We do not expect any other items of business, because the deadline for stockholder proposals and nominations has already passed. Nonetheless, in case there is an unforeseen need, the accompanying proxy gives discretionary authority to the persons named on the proxy, Kevin M. Phillips, Jeffrey S. Brown, and Michael R. Putnam, with respect to any other matters that might be brought before the meeting. Those persons intend to vote that proxy in accordance with their discretion and best judgment.

Record Date and Stockholders Entitled to Vote

| Record Date | Stockholders as of the close of business on April 13, 2022 (Record Date) may vote at the Annual Meeting. | |

| Our Stock | We have two classes of outstanding stock: our Class A common stock and our Class B common stock. As of the Record Date, a total of 40,950,820 shares were outstanding: 39,354,125 shares of Class A common stock and 1,596,695 shares of Class B common stock. Holders of Class A common stock are entitled to one vote for each share of Class A common stock they hold on the Record Date. Holders of Class B common stock are entitled to ten votes for each share of Class B common stock they hold on the Record Date. | |

| ManTech 2022 Proxy Statement | 1 |

Voting Requirements and Other Matters

| Quorum | The holders of a majority in voting power of our common stock issued, outstanding and entitled to vote on any matter at the Annual Meeting shall constitute a quorum for the Annual Meeting. Abstentions and broker non-votes will be counted toward the quorum requirement. | |

| How to Vote | You can only vote your shares at the Annual Meeting if you are present either in person or by proxy. We encourage you to vote by submitting a proxy card even if you plan to attend the Annual Meeting. | |

If you vote by mail, you must sign and date each proxy card that you receive, and return it in the prepaid envelope. Sign your name exactly as it appears on the proxy card. If you return a proxy card that is not signed, then your vote cannot be counted. If you return a proxy card that is signed and dated, but you do not specify voting instructions, we will vote on your behalf as follows: | ||

◾ FOR the election of the seven (7) directors nominated by our Board and named in this proxy statement (Proposal 1 – Election of Directors); and

◾ FOR the ratification of the appointment of Deloitte & Touche, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal 2 – Ratification of Auditors). | ||

If the Annual Meeting is adjourned or postponed, your proxy will still be effective and will still be voted at the Annual Meeting when reconvened. You will still be able to change or revoke your proxy until it is voted. | ||

| Voting ESOP Shares | Stockholders who are current or former employees participating in our Employee Stock Ownership Plan and have shares of our stock allocated to their account as of the Record Date have the right to direct the plan trustee on how to vote their shares. If you do not send instructions to the plan trustee in a proper manner, or if the instructions are not timely received, the trustee will not vote the shares allocable to your account. | |

| Broker Non-Votes | If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares will be voted as you direct. For Proposal 1, or for any other non-routine matter to come before the Annual Meeting, if you do not give instructions, the broker may not vote your shares at all (a broker non-vote). If you do not give instructions for Proposal 2, which is considered a routine matter, the broker may vote your shares in its discretion. | |

Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote. | ||

| Revoking Your Proxy | If you execute a proxy pursuant to this solicitation, you may revoke it at any time prior to its exercise by (i) delivering written notice to our Corporate Secretary at the offices of our executive headquarters before the Annual Meeting; (ii) executing and delivering a proxy bearing a later date to our Corporate Secretary at the offices of our executive headquarters; or (iii) voting in person at the Annual Meeting. | |

| 2 | ManTech 2022 Proxy Statement |

| Votes Required | Approval of each of the proposals submitted to a vote at the Annual Meeting is subject to the affirmative vote requirement shown in the table below. |

Proposal | Vote Required | Broker Discretionary Voting Allowed | ||

Proposal 1 - Election of Directors | Plurality | No | ||

Proposal 2 - Ratification of Auditors | Majority | Yes |

With respect to Proposal 1, a “Plurality” is determined with respect to votes cast on a proposal.

With respect to Proposal 2, a “Majority” is determined with respect to votes present (in person or by proxy) at the meeting and entitled to vote. If you vote Abstain on Proposal 2, your vote will count as a vote Against that proposal. | ||

Tabulation of Votes | Mr. Michael R. Putnam, our Corporate Secretary and Senior Vice President, Corporate and Regulatory Affairs, has been appointed inspector of elections for the Annual Meeting. Mr. Putnam will separately tabulate the affirmative votes, withheld or negative votes (as applicable), abstentions, and, as applicable, broker non-votes with respect to each of the Proposals. | |

| Voting Results | We will announce preliminary voting results at the Annual Meeting, and will disclose final voting results on a Form 8-K that we file with the Securities and Exchange Commission (SEC) within four business days following the Annual Meeting. | |

IMPORTANT INFORMATION

We intend to hold the Annual Meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials may issue in the event of changes in virus or any variant’s transmutability or infectiousness. As a result, we may impose additional procedures or limitations on Annual Meeting attendees, or we may decide to hold the Annual Meeting at a different location or by means of remote communication. We plan to announce any such updates on our proxy website (https://investor.mantech.com/annual-meeting), and we encourage you to check this website prior to the Annual Meeting if you plan to attend.

Solicitation

The Board is making this solicitation of proxies on our behalf. In addition to the solicitation of proxies by use of the mail, our officers and employees may solicit the return of proxies by personal interview, telephone, email or facsimile. We will not pay additional compensation to our officers and employees for their solicitation efforts, but we will reimburse them for any out-of-pocket expenses they incur in their solicitation efforts.

We will request that brokerage houses and other custodians, nominees and fiduciaries forward our solicitation materials to beneficial owners of our common stock. We will bear all costs associated with preparing, assembling, printing and mailing this proxy statement and the accompanying materials, the cost of forwarding our solicitation materials to the beneficial owners of our common stock, and all other costs of solicitation.

| ManTech 2022 Proxy Statement | 3 |

Corporate Governance Guidelines

The Board has established and adopted guidelines that it follows in matters of corporate governance (the Corporate Governance Guidelines). These Corporate Governance Guidelines assist the Board in the exercise of its responsibilities and provide a framework for the efficient operation of our Company, consistent with the best interests of our stockholders and applicable legal and regulatory requirements. The Nominating and Corporate Governance Committee periodically reviews and reassesses the adequacy of our Corporate Governance Guidelines. We have posted a current copy of our Corporate Governance Guidelines, which was last amended in January 2020, on the Corporate Governance page in the Investor Relations section of our website at www.mantech.com (our Website).

The majority of directors are independent from management. Only independent directors serve on each of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

The Board has conducted an evaluation of director independence, based on the independence standards applicable to Nasdaq-listed companies and applicable SEC rules and regulations. In the course of the Board’s evaluation of the independence of each non-management director, the Board considered any transactions, relationships and arrangements between such director (or any member of his or her immediate family) and the Company, its subsidiaries and its affiliates. The purpose of this evaluation was to determine whether any relationships or transactions exist that could be inconsistent with a determination by the Board that the director has no relationship that would interfere with his or her exercise of independent judgment in carrying out the responsibilities of a director.

As a result of this evaluation, the Board has affirmatively determined that the following directors nominated for election at the Annual Meeting are independent of the Company and its management under the above referenced standards and regulations:

• Richard L. Armitage • Mary K. Bush • Barry G. Campbell | • Richard J. Kerr • Peter B. LaMontagne • Kenneth A. Minihan |

|

The Board determined that Mr. Kevin M. Phillips is not independent because he serves as our Chairman of the Board, Chief Executive Officer and President.

The Board believes that no single leadership model is best suited for all companies at all times. Depending on circumstances, different leadership models might be more or less appropriate. Our Corporate Governance Guidelines do not require that the roles of CEO and Chairman of the Board be separate or combined. The Board’s policy as to whether the roles of the CEO and Chairman of the Board should be separate or combined is to adopt the practice that best serves the Company at any given point in time. The roles of Chairman of the Board and CEO at the Company are combined and have been so since September 2020, following Mr. George Pedersen’s retirement from his role as Chairman of the Board. At that time, the Board elected and appointed Mr. Phillips to serve as the Company’s Chairman of the Board in addition to his ongoing role as CEO and President of the Company. The Board considered the appropriateness of the Company’s leadership structure and specific characteristics of the Company. The Board believes the current structure currently provides an effective and efficient leadership model for the Company.

| 4 | ManTech 2022 Proxy Statement |

Because our Chairman of the Board is not an independent director, pursuant to our Corporate Governance Guidelines our independent directors have designated one of our independent directors, Mr. Campbell, to serve as the Company’s presiding independent director (Presiding Director). Mr. Campbell’s duties as Presiding Director include:

| • | Coordinating the activities of the independent directors; |

| • | Calling for meetings or sessions of the independent directors, and coordinating the agenda and serving as the chair for such meetings; and |

| • | Facilitating communications between and among the independent directors and the Chairman of the Board. |

Board and Committee Executive Sessions and Independent Directors Meetings

The independent directors of the Board regularly meet in executive session, without the presence of management; typically, these sessions are held following the adjournment of certain regularly scheduled Board meetings. The Board’s independent directors meet no fewer than two times annually. Certain of the Board’s primary standing committees (including the Audit Committee and Compensation Committee) also regularly meet in executive session. As Presiding Director, Mr. Campbell chairs meetings of our independent directors; committee chairpersons preside over executive sessions for their respective committees.

Board’s Role in Risk Oversight

While risk management is a business and operational responsibility of the Company’s management team, the Board is responsible for the oversight of the Company’s risk management activities. The Board primarily oversees the management of risk through the Audit Committee. Among other activities, the Audit Committee oversees the Company’s enterprise risk management program. The Board oversees the management of risk relating to certain of the Company’s business activities (particularly those designated as classified by the U.S. government) through the Special Programs Oversight Committee. The Board and Special Programs Oversight Committee work together on a coordinated basis to oversee the management of risk related to cybersecurity and information assurance matters. The Board oversees the assessment of risks associated with the Company’s compensation policies and programs through the Compensation Committee.

Each of these committees regularly receives reports from, and discusses those reports with, members of management who are responsible for applicable day-to-day risk management functions of the Company. The chairpersons of these committees periodically report back to the Board regarding risk management activities within such committees’ respective purview. The Board’s role in risk oversight has not had any effect on the Board’s leadership structure.

Board and Committee Self-Evaluations

Each of the Board and its primary standing committees (the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee) performs regular, periodic self-evaluations (typically conducted on an annual basis). These evaluations are designed to foster candid discussion regarding the adequacy and effectiveness of the Board and such committees. The Nominating and Corporate Governance Committee oversees the annual self-evaluation process. Where appropriate, the Nominating and Corporate Governance Committee may consider feedback received from the evaluation process in making recommendations to the Board regarding the nomination of incumbent directors for re-election to the Board (and, where applicable, assignments of Board members to various committees).

| ManTech 2022 Proxy Statement | 5 |

The Board generally identifies and attracts candidates through its own efforts, and it believes that this method has been effective. However, if in the future the Board determines that it is in the Company’s best interest to use the services of a consultant or a search firm to assist with the identification and selection process, it will do so.

The Nominating and Corporate Governance Committee is responsible for reviewing the qualifications of potential director nominees, and then recommending director candidates for nomination by the Board.

We do not currently have a formal policy regarding the consideration of diversity in identifying potential director nominees. However, the Nominating and Corporate Governance Committee considers diversity in its broadest sense when evaluating candidates. Our Corporate Governance Guidelines direct that the evaluation of nominees should include (among numerous other considerations) an assessment of whether a nominee would provide the Board with a diversity of viewpoints, backgrounds, experiences and other demographics.

The Nominating and Corporate Governance Committee has a policy regarding the consideration of director candidates recommended by our stockholders (Nominations Policy). The Nominations Policy describes the circumstances pursuant to which the Nominating and Corporate Governance Committee will consider Board candidates recommended by our stockholders. The Nominations Policy also describes the procedures to be followed by stockholders in submitting such recommendations. We have made the Nominations Policy available on the Corporate Governance page of our Website.

Generally, the Nominating and Corporate Governance Committee will consider candidates recommended by stockholders who beneficially own at least 1% of our outstanding stock at the time of recommendation (Qualifying Stockholder). Qualifying Stockholders wishing to recommend candidates to the Nominating and Corporate Governance Committee may do so by submitting a completed Stockholder Recommendation of Candidate for Director Form (Recommendation Form), which is attached to the Nominations Policy posted on our Website.

Qualifying Stockholders wishing to recommend a nominee for election as director at the next annual meeting of stockholders must submit their completed Recommendation Form at least 120 days in advance of the one-year anniversary of the date of the mailing of this proxy statement. The Nominating and Corporate Governance Committee will only evaluate a candidate if he or she has indicated a willingness to serve as a director and cooperate with the evaluation process, and if the required information about the candidate has been submitted. Candidates recommended by Qualifying Stockholders will generally be evaluated by the Nominating and Corporate Governance Committee pursuant to the same process used for evaluation of all other director candidates.

Our Standards of Ethics and Business Conduct includes a “Financial Code of Ethics” that satisfies the SEC’s requirements for a code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer, controller and persons performing similar functions. Our Standards of Ethics and Business Conduct also satisfies Nasdaq’s requirement for a code of conduct applicable to all directors, officers, and employees. Among other principles, our Standards of Ethics and Business Conduct includes guidelines relating to the ethical handling of actual or potential conflicts of interest, compliance with laws, accurate financial reporting, and procedures for promoting compliance with (and reporting violations of) such standards. A copy of our Standards of Ethics and Business Conduct is available on the Corporate Governance page of our Website. We are required to disclose any

| 6 | ManTech 2022 Proxy Statement |

amendment to, or waiver of, a provision of our “Financial Code of Ethics.” We intend to use our Website as a method of disseminating this disclosure, as permitted by applicable SEC rules.

We believe that it is important for our stockholders to be able to communicate their concerns to our Board. Stockholders may correspond with any director, committee, or the Board generally, by writing to the following address: ManTech International Corporation Board of Directors, 2251 Corporate Park Drive, Herndon, VA 20171, Attention: Corporate Secretary. Please specify to whom your correspondence should be directed. Our Corporate Secretary will promptly forward all correspondences to the relevant director, committee, or the full Board, as indicated in your correspondence.

Director Attendance at Annual Meeting of Stockholders

We invite all directors to attend our annual meeting of stockholders, and we strongly encourage all of them to do so absent exigent circumstances that prevent their attendance. In furtherance of this policy, we generally schedule one of our regular Board meetings on the same day as our annual meeting of stockholders. In 2021, all directors then serving on the Board attended our annual meeting of stockholders.

Availability of Corporate Governance Documents

We have made available on the Corporate Governance page of our Website a number of important documents related to our governance practices, including:

| • | Certificate of Incorporation and Bylaws; |

| • | Charters of our standing Board Committees; |

| • | Standards of Ethics and Business Conduct; |

| • | Corporate Governance Guidelines; |

| • | Policy Regarding Consideration of Stockholder Nominees for Director; |

| • | Related Party Transactions Policy; and |

| • | Equity Grant Policy. |

We will also make these materials available in print format to any requesting stockholder. Copies of these documents may be requested by writing to the following address: ManTech International Corporation, 2251 Corporate Park Drive, Herndon, VA 20171, Attention: Corporate Secretary.

| ManTech 2022 Proxy Statement | 7 |

AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board currently comprises seven members who serve for a term that expires at the Annual Meeting. All of our directors were elected at the 2021 Annual Meeting of Stockholders. Set forth below are details regarding director attendance at board and committee meetings, the function and operation of each of the Board’s standing committees, and the compensation of our non-employee directors in 2021.

Attendance at Board and Committee Meetings

Our full Board met eight times in 2021. All our directors attended or participated in at least 75% of the aggregate of the board meetings and the meetings of the committees on which the director served during 2021. The number of meetings held in 2021 by each of the Board’s standing committees is set forth in the information below.

The Board currently has five standing committees (although the Board may establish other committees from time to time). The following table sets forth the current composition of our Board committees.

|

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Retirement Plan Committee | Special Programs Oversight Committee | |||||

| Richard L. Armitage |

| ● | Chair | ● | ● | |||||

| Mary K. Bush * | ● | ● |

| Chair |

| |||||

| Barry G. Campbell* P | Chair | Chair | ● | ● |

| |||||

| Richard J. Kerr | ● |

| ● |

| Chair | |||||

| Peter B. LaMontagne |

|

|

|

| ● | |||||

| Kenneth A. Minihan |

|

| ● |

| ● | |||||

| Kevin M. Phillips |

|

|

|

| ● | |||||

● Member * Audit Committee Financial Expert P Presiding Independent Director

Certain information regarding each standing Board committee is provided below. A more detailed discussion of each committee’s composition, purpose, objectives, authority and responsibilities can be found in each committee’s respective charter, which we make available on the Corporate Governance page of our Website.

The primary functions of the Audit Committee are to oversee (i) the integrity of our financial statements, (ii) our accounting and financial reporting processes, and (iii) audits of our financial statements. The Audit Committee operates under a written charter and it reviews and reassesses the adequacy of that charter on an annual basis. The charter was most recently revised and amended in March 2016 and is available on our Website.

The Board annually reviews the suitability of our Audit Committee in light of the Nasdaq listing standards’ requirements for audit committee composition and applicable SEC rules and regulations.

| 8 | ManTech 2022 Proxy Statement |

The Board has determined that each member of our Audit Committee meets the heightened independence standard and other requirements for audit committee members under applicable Nasdaq listing standards and SEC rules and regulations.

The Board has also determined that the Company has at least one audit committee financial expert serving on the Audit Committee. The Board has determined that each of Mr. Campbell and Ms. Bush (i) qualifies as an “audit committee financial expert” under applicable SEC rules and regulations, and (ii) satisfies the financial sophistication requirements of the Nasdaq listing standards. All of our Audit Committee members have a working familiarity with basic finance and accounting practices.

During 2021, the Audit Committee held five meetings. The Audit Committee meets regularly in executive session, including with our independent registered public accounting firm, without management present. Mr. Campbell serves as chairperson of the Audit Committee.

The primary functions of the Compensation Committee are to oversee (i) the determination, implementation, and administration of the remuneration (including salary, incentive compensation payments, bonuses, equity compensation, and perquisites) of all non-employee directors and executive officers of the Company, and (ii) the administration of the Company’s stock-based compensation plans. The Compensation Committee operates under a written charter, and it reviews and reassesses the adequacy of that charter on an annual basis. The charter was most recently revised and amended in February 2019 and is available on our Website.

The Board annually reviews the suitability of our Compensation Committee in light of the Nasdaq listing standards’ requirements for compensation committee composition and applicable SEC rules and regulations. The Board has determined that each member of our Compensation Committee meets the independence and other requirements for compensation committee members under applicable Nasdaq listing standards and SEC rules and regulations. Our Compensation Committee members also qualify as “non-employee directors” under Section 16 of the Securities Exchange Act of 1934 (the Exchange Act).

During 2021, the Compensation Committee held four meetings. At the direction of the Compensation Committee, certain members of management attend most meetings. The Compensation Committee also meets regularly in executive session without management present. Mr. Campbell serves as chairperson of the Compensation Committee.

| • | Compensation Advisers |

The Compensation Committee has the authority, in its sole discretion, to retain or obtain the advice of compensation consultants, legal counsel or other advisers, and is directly responsible for the appointment, compensation and oversight of the work of any such adviser. The Compensation Committee conducts an independence assessment of any compensation adviser it engages; such assessment includes the consideration of the factors required by applicable Nasdaq listing standards and SEC rules and regulations.

For 2021, the Compensation Committee retained Ernst & Young LLP (EY) as its independent compensation consultant to assist the Compensation Committee with its executive compensation-related responsibilities. The services provided by EY in its capacity as the Compensation Committee’s independent compensation consultant included supporting the design of our executive compensation program, providing market consensus data for each of our executive officers, and assisting the Compensation Committee in evaluating the compensation of our non-employee directors.

| ManTech 2022 Proxy Statement | 9 |

In the past, with the consent of the Compensation Committee, the Company’s management has retained personnel at EY to perform services that are not related to work performed as the Compensation Committee’s independent compensation consultant (Additional Services), for which EY receives a fee. The Compensation Committee has approved the Company’s future use of EY for certain projects, including due diligence support for acquisitions or other corporate transactions, tax advisory services, consulting and advisory services with respect to the Company’s internal systems and, as directed by the chairperson of the Compensation Committee, consulting and advisory services related to compensation of the Company’s non-executive officers. The Company’s management did not engage EY to perform Additional Services in 2021.

Based on its review of these relationships, and independence and other factors that the Compensation Committee determines to be relevant, as well as policies and procedures implemented by the Compensation Committee and EY, the Compensation Committee has concluded that the compensation consulting advice it receives from EY is objective, and that no conflicts of interest exist that would require disclosure by the Company under applicable SEC rules.

The Company’s processes and procedures for the consideration and determination of director and executive compensation (including the roles of the Compensation Committee, management, and the Compensation Committee’s independent compensation consultant) are discussed in the sections of this proxy statement captioned “Setting Compensation of Non-Employee Directors” and “Compensation Discussion and Analysis,” respectively.

Nominating and Corporate Governance Committee

The primary functions of the Nominating and Corporate Governance Committee are to (i) identify individuals qualified to become members of the Board, and recommend new director candidates to the Board when necessary and appropriate, (ii) evaluate whether incumbent directors should be nominated for re-election to the Board and make recommendations to the Board in this regard, and (iii) oversee and periodically evaluate the Company’s Corporate Governance Guidelines. The Nominating and Corporate Governance Committee operates under a written charter, and it reviews and reassesses the adequacy of that charter on an annual basis. The charter was most recently revised and amended in March 2016 and is available on our Website. All members of the Nominating and Corporate Governance Committee are independent directors, within the meaning of applicable Nasdaq listing standards and SEC rules and regulations. The Nominating and Corporate Governance Committee held three meetings in 2021. Mr. Armitage serves as chairperson of the Nominating and Corporate Governance Committee.

The primary function of the Retirement Plan Committee is to oversee the administration of the Company’s tax-qualified and non-qualified retirement plans. The Retirement Plan Committee held four meetings in 2021. Ms. Bush serves as chairperson of the Retirement Plan Committee.

Special Programs Oversight Committee

The Special Programs Oversight Committee oversees certain of the Company’s business activities (particularly those designated as classified by the United States government for purposes of national security) and works with the Board to oversee the management of risks related to cybersecurity or information assurance matters. The Special Programs Oversight Committee held four meetings in 2021. Mr. Kerr serves as chairperson of the Special Programs Oversight Committee.

| 10 | ManTech 2022 Proxy Statement |

Setting Compensation of Non-Employee Directors

Our Compensation Committee sets compensation for the Company’s non-employee directors. The Compensation Committee generally reviews non-employee director compensation on an annual basis. In conducting this review, the Compensation Committee receives input on market trends for non-employee director compensation from its independent compensation consultant, including with respect to the Company’s compensation peer group (as set forth in the “Compensation Discussion & Analysis” section of this proxy statement); however, the Compensation Committee does not target non-employee director compensation at any particular percentile or percentile range of the market data. A substantial portion of the non-employee directors’ compensation is payable in the form of stock-based compensation, to align the interests of the directors with those of the Company’s stockholders.

We do not compensate Mr. Phillips for his service on the Board or any committee of the Board. In 2021, while we did not compensate Mr. Pedersen for his service on the Board, we did provide Mr. Pedersen with certain benefits that he had previously received while an employee of the Company.

In certain circumstances, members of the Board may receive reimbursement for certain expenses incurred in connection with attending Board or committee meetings. For the current Board term (which began in May 2021), equity amounts, and cash compensation levels remained unchanged from the prior Board term. The compensation we paid in 2021 to our non-employee directors for their services is set forth in the table that follows.

| ManTech 2022 Proxy Statement | 11 |

NON-EMPLOYEE DIRECTOR COMPENSATION TABLE

The tables and footnotes below reflect the compensation and other fees paid in 2021 to our non-employee directors (other than Mr. Pedersen) for their services.

Name (a) | Fees paid in cash1 ($)(b) | Stock Awards2 ($)(c) | All Other Compensation3 ($)(d) | Total ($)(e) | ||||||||||||

Richard L. Armitage | 72,375 | 344,040 | 5,360 | 421,775 | ||||||||||||

Mary K. Bush | 73,875 | 344,040 | 5,360 | 423,275 | ||||||||||||

Barry G. Campbell | 100,125 | 344,040 | 5,360 | 449,525 | ||||||||||||

Richard J. Kerr | 72,375 | 344,040 | 5,360 | 421,775 | ||||||||||||

Peter B. LaMontagne | 50,250 | 344,040 | 5,360 | 399,650 | ||||||||||||

Kenneth A. Minihan | 55,875 | 344,040 | 5,360 | 405,275 | ||||||||||||

| 1 | The following table presents the cash compensation we pay to our non-employee directors for their service on our Board and our Board committees: |

Annual Retainer (Director/Member) | Additional Annual Retainer (Chairperson) | Meeting Fee | ||||

Board of Directors | $50,000 | N/A | $1,500 for each meeting that is attended | |||

Audit Committee | $12,500 | $20,000 | $1,500 for each meeting in excess of 4 per Board term | |||

Compensation Committee | $7,500 | $10,000 | $1,500 for each meeting in excess of 4 per Board term | |||

Nominating and Corporate Governance Committee | $7,500 | $7,500 | $1,500 for each meeting in excess of 4 per Board term | |||

Retirement Plan Committee | $5,000 | $7,500 | $1,500 for each meeting in excess of 4 per Board term | |||

Special Programs Oversight Committee | $5,000 | $7,500 | $1,500 for each meeting in excess of 4 per Board term | |||

Presiding Independent Director | $5,000 | N/A | N/A | |||

| 2 | The amounts in this column reflect the aggregate fair market value of the restricted stock award granted on May 21, 2020, as computed in accordance with ASC Topic 718, Compensation - Stock Compensation. In 2021, each non-employee director received a restricted stock grant of 4,000 shares of common stock, with a grant price of $86.01 per share (closing price of our common stock on the Nasdaq stock market on the date of grant, May 21, 2021); the restricted stock awards fully vest one year after the date of grant. Each non-employee director had unvested restricted stock awards in the amount of 4,000 shares outstanding as of December 31, 2021. |

| 3 | The amounts in this column reflect cash dividends associated with the prior year’s restricted stock grant, which amounts were paid to the non-employee directors upon the vesting of such grant in May 2021. |

| 12 | ManTech 2022 Proxy Statement |

ELECTION OF DIRECTORS

The Board has nominated all seven (7) of the Company’s incumbent directors to serve as a director until the 2023 Annual Meeting of Stockholders, or until their respective successors have been duly elected and qualified. Each nominee is a current member of the Board, has agreed to stand for election and serve if elected, and has consented to be named in this proxy statement.

If any nominee should become unavailable for election or is unable to be a candidate when the election takes place (or otherwise declines to serve), the persons named as proxies may use the discretionary authority provided to them in the proxy to vote for a substitute nominee designated by the Board. At this time, we do not anticipate that any nominee will be unable to be a candidate for election or will otherwise decline to serve.

Under our Third Amended and Restated Bylaws, the Board has the authority to fill any vacancies that arise, including vacancies created by an increase in the number of directors, or vacancies created by the resignation of a director. Any nominee so elected and appointed by the Board would hold office for the remainder of the term of office of all directors, which term expires annually at our annual meeting of stockholders, or until his successor is duly elected and qualified.

Information Regarding the Nominees for Election as Directors

The name and age (as of the Mailing Date) of each nominee for election as director, as well as certain additional information concerning each nominee’s principal occupation, other affiliations, and business experience during the last five years, are set forth below.

The Board has concluded that each of the incumbent directors should be nominated for re-election based on the specific experience, qualifications, attributes and skills identified in the biographical information below, in light of the Company’s business and structure.

Name | Age | Director Since | ||

Kevin M. Phillips | 60 | 2018 | ||

Mr. Phillips has served as Chief Executive Officer and President of ManTech and as a member of the board since 2018. In September 2020, Mr. Phillips was elected and appointed as Chairman of the Board. Prior to becoming our Chief Executive Officer, Mr. Phillips served as the Company’s President and Chief Operating Officer from 2016 to 2017 and served as the Company’s Chief Financial officer from 2005 to 2016. Before that, Mr. Phillips served as the Company’s corporate vice president and assistant to the chairman and chief of staff. Mr. Phillips joined the Company in December 2002, when CTX Corporation was acquired by ManTech. Mr. Phillips had served as the chief financial officer of CTX Corporation. Mr. Phillips serves on the board of directors of the Northern Virginia Technology Council (NVTC), a technology trade association.

| ManTech 2022 Proxy Statement | 13 |

Qualifications

As an experienced financial and operational expert for government IT service providers, Mr. Phillips brings his broad and deep experience and industry knowledge to his service on the Board. Mr. Phillips has served in senior financial and strategic roles with multiple IT service providers to the government for over 25 years. Specifically with respect to ManTech, Mr. Phillips has a deep understanding of the Company and its operations, and has lead the development of the Company’s strategic vision to drive ManTech’s growth.

Name | Age | Director Since | ||

Richard L. Armitage | 77 | 2005 | ||

Mr. Armitage has served as a director of ManTech since 2005. Since 2005, Mr. Armitage has served as President of Armitage International, L.C., which provides multinational clients with critical support in the areas of international business development, strategic planning, and problem-solving. From 2001 through 2005, he served as the Deputy Secretary of State, and prior to that assignment he was President of Armitage Associates, L.C., a world-wide business and public policy firm. Beginning in the late 1980s, Mr. Armitage held a variety of high-ranking diplomatic positions, including as Presidential Special Negotiator for the Philippines Military Bases Agreement; as Special Mediator for Water in the Middle East; as a Special Emissary to Jordan’s King Hussein during the 1991 Gulf War; and as an Ambassador, directing U.S. assistance to the new independent states of the former Soviet Union. Mr. Armitage is also a former Assistant Secretary of Defense for International Security Affairs, and a former Assistant Secretary of Defense for East Asia and Pacific Affairs. Mr. Armitage has received numerous U.S. military decorations, has been awarded the Department of Defense Medal for Distinguished Public Service four times, and has received the Presidential Citizens Medal and the Department of State Distinguished Honor Award. In 2005, he was awarded a KBE and became a Knight Commander of the Order of St. Michael and St. George. Mr. Armitage was also appointed as an honorary companion to the Order of Australia (Australian Knighthood) and an honorary companion of the New Zealand Order of Merit. In November 2015, Mr. Armitage was awarded the Grand Cordon of the Order of the Rising Sun from Japan. Mr. Armitage served on the board of directors of ConocoPhillips (NYSE: COP), one of the largest integrated energy companies in the United States, from 2006 to 2018.

Qualifications

Mr. Armitage brings to the Board significant leadership experience and industry expertise. Mr. Armitage has worked in the highest levels of the U.S. government, providing him with critical insight into the needs and operations of U.S. government intelligence, military, and civilian agencies, and other matters relating to foreign affairs. His many years of service on our Board, as well as his service on the boards of directors of other public and private companies, give him a significant understanding of the role of the Board and knowledge of the Company and its operations.

Name | Age | Director Since | ||

Mary K. Bush | 74 | 2006 | ||

Ms. Bush has served as a director of ManTech since 2006. In 1991, Ms. Bush founded Bush International, a global consulting firm which advises U.S. companies and foreign governments on international financial markets and banking, and global business strategy. In 2007, she was appointed by the Secretary of the Treasury to the U.S. Treasury Advisory Committee on the Auditing Profession. From 1989 to 1991, Ms. Bush served as Managing Director and Head of the Federal Housing Finance Board, the oversight body for the nation’s 12 Federal Home Loan Banks. Prior to 1989, Ms. Bush was the Vice President and Head of International Finance at the Federal National Mortgage Association (Fannie Mae). From 1982 to 1984, Ms. Bush served as U.S. Alternate Executive Director of the International Monetary Fund (IMF), a position appointed by the President of the United States and confirmed by the Senate. In that capacity, she worked with the U.S. Treasury Department to formulate

| 14 | ManTech 2022 Proxy Statement |

policy on IMF lending and global economic matters. Ms. Bush currently serves on the boards of directors of Discover Financial Services (NYSE: DFS), T. Rowe Price Group (NASDAQ: TROW) and Bloom Energy (NYSE:BE). Ms. Bush served on the board of Marriott International, Inc. (NYSE: MAR) from 2008 to 2020.

Qualifications

As an experienced financial and operational leader of numerous high-profile institutions in a variety of industries, Ms. Bush brings a broad understanding of the operations and business and economic challenges of public companies. Ms. Bush has chaired or served on all significant standing committees of public company boards during her career. Ms. Bush has deep knowledge of financial, investment, and governance matters, and received her MBA in finance from the University of Chicago. Her background and experience, including her experience with public policy matters and providing strategic advisory services in political and international arenas, coupled with her service and leadership in government, afford Ms. Bush with a valuable perspective for service on our Board.

Name | Age | Director Since | ||

Barry G. Campbell | 80 | 2002 | ||

Mr. Campbell has served as a director of ManTech since 2002. From 1999 to 2001, Mr. Campbell served as a director, President and Chief Executive Officer of Allied Aerospace Industries, Inc., a Virginia-based aerospace and defense engineering firm. From 1993 to 1997, Mr. Campbell served as President and Chief Executive Officer of Vitro Corporation, the largest subsidiary of Tracor, Inc. Beginning in 1997, he served as Chairman and Chief Executive Officer of Tracor’s subsidiary, Tracor Systems Technologies, Inc. until the sale of Tracor, Inc. to GEC Marconi, plc in 1998.

Qualifications

As a former senior executive of public companies and companies in our industry, Mr. Campbell brings management experience, leadership capabilities, financial knowledge, and business acumen to our Board. Mr. Campbell has a deep understanding of the Company and its operations, having served on our Board since our initial public offering and chaired our Audit Committee since 2004. Mr. Campbell’s knowledge of our Company, and his financial and operational experience leading comparable companies in our industry through challenges and opportunities that we regularly face, make him a valued and important contributor to our Board.

Name | Age | Director Since | ||

Richard J. Kerr | 86 | 2002 | ||

Mr. Kerr has served as a director of ManTech since 2002. From 1996 to 2001, Mr. Kerr served as President of the Security Affairs Support Association, an organization comprising government and industry members that is focused on national security policy. Prior to that, Mr. Kerr worked at the Central Intelligence Agency for 32 years, including as Deputy Director for Central Intelligence. Mr. Kerr headed a small team that assessed intelligence produced prior to the Iraq war, at the request of the Secretary of Defense and Director of Central Intelligence. For seven years Mr. Kerr served on the Independent Monitoring Commission that monitored the Good Friday Agreement in Northern Ireland. Mr. Kerr has previously served on the boards of directors of BAE Systems, Inc., a subsidiary of BAE Systems plc, MITRE Corporation and LexisNexis.

| ManTech 2022 Proxy Statement | 15 |

Qualifications

Mr. Kerr brings to the Board significant leadership experience and industry knowledge, particularly within the intelligence community. His continued involvement in the formation of the nation’s security policies has ensured his continued expertise in this area. His many years of service on our Board, as well as his service on the board of directors of other high-profile companies in our industry, gives him a significant understanding of the role of the Board, and knowledge of the Company, its operations, and the markets it serves. His familiarity with and knowledge of issues relating to the operation of certain Company business activities involving programs designated as classified by the U.S. government and his understanding of cyber security risks give him the background to chair our Special Programs Oversight Committee.

Name | Age | Director Since | ||

Peter B. LaMontagne | 56 | 2019 | ||

Mr. LaMontagne has served as a director of ManTech since 2019. Since July 2020, Mr. LaMontagne has served as the CEO of SMX, an IT and engineering solutions provider. From April 2019 to June 2020, Mr. LaMontagne served as an operating advisor to M33 Growth, a Boston-based growth equity fund focused on tech services and software investments. Mr. LaMontagne also served as the president and chief executive officer of Quantum Spatial, an end-to-end geospatial services company, which was acquired by NV5Global in December 2020. From November 2018 to December 2019, Mr. LaMontagne served as an advisor to Arlington Capital Partners, a private equity firm. From 2012 to 2017, Mr. LaMontagne served as chief executive officer of Novetta Solutions, an advanced analytics technology solutions company, and from 2006 to 2011, served as president and chief executive officer of Paradigm Solutions Corporation, a cyber security and digital forensics firm. Prior to beginning his career in technology-focused businesses, Mr. LaMontagne served as U.S. Foreign Service Officer with the U.S. Department of State, specializing in China and East Asia political and economic affairs, including a posting at the U.S. Embassy in Beijing, China. Mr. LaMontagne currently serves on the board of directors of several private companies.

Qualifications

Mr. LaMontagne brings significant management, leadership capabilities and cyber security and other industry experience to our Board. Mr. LaMontagne also has familiarity with the Company’s operations, having served as an executive at the Company from 1999 to 2006, during which time he helped execute Company’s growth strategy, initial public offering, and expansion into the intelligence community. Mr. LaMontagne’s knowledge of national security and his technology solutions expertise in the federal and commercial arenas, make him a valued contributor to the Board and our Special Programs Oversight Committee.

Name | Age | Director Since | ||

Kenneth A. Minihan | 78 | 2006 | ||

Lieutenant General Minihan (Retired) has served as a director of ManTech since 2006. Since 2002, Lieutenant General Minihan has served as Managing Director of the Homeland Security Fund for Paladin Capital Group. From 1999-2002, Lieutenant General Minihan served as President of the Security Affairs Support Association. Lieutenant General Minihan served for over thirty years in the Air Force, serving from 1996 to 1999 as the 14th Director of the National Security Agency/Central Security Service. From 1995 to 1996, he was a Director of the Defense Intelligence Agency. Among Lieutenant General Minihan’s awards and decorations are the National Security Medal, the Defense Distinguished Service Medal, the Bronze Star, the National Intelligence Distinguished Service Medal, and the Legion

| 16 | ManTech 2022 Proxy Statement |

of Merit. Lieutenant General Minihan is a founder of the Intelligence and National Security Alliance in Washington, D.C., and serves on the boards of directors of Lexis Nexis Special Services Inc. He also is a former member of the board of directors of KEYW Corporation prior to its acquisition by Jacobs Engineering Group Inc (NSYE:JEC) in 2019.

Qualifications

Lieutenant General Minihan brings to the Board an impressive mix of military, government, business, and investment experience in the Company’s industry. His position as Managing Director for Paladin Capital Group also gives Lieutenant General Minihan keen insight into merger and acquisition activity within our industry. Lieutenant General Minihan’s industry knowledge is supplemented by his experience serving on numerous other public and private company boards in the defense and government IT services industry, and as a result he has deep understanding of the role of the Board and the Company, as well as the Company’s addressable markets.

Recommendation of the Board of Directors

The Board recommends that you vote “FOR” the election of each of the director nominees listed above. All proxies executed and returned will be voted “FOR” all of the director nominees unless the proxy specifies otherwise.

| ManTech 2022 Proxy Statement | 17 |

We have set forth below the positions, names and ages (as of the Mailing Date) of our current executive officers (other than Kevin Phillips, our Chairman of the Board, CEO and President). Biographical information for each of our executive officers is also presented below. The biographical and other required information for Mr. Phillips is presented in the section of this proxy statement captioned “Information Regarding the Nominees for Election as Directors.”

Our executive officers serve at the discretion of the Board.

Name | Age | Position | ||

Judith L. Bjornaas | 59 | Executive Vice President and Chief Financial Officer | ||

Ms. Bjornaas has served as our Chief Financial Officer since November 2016. Prior to assuming the CFO role, Ms. Bjornaas served as our Senior Vice President of Financial Planning and Analysis and Deputy Chief Financial Officer upon joining the Company in 2010. Ms. Bjornaas assumed the duties and responsibilities of the Company’s principal accounting officer in August 2012. Prior to joining ManTech, she was the chief financial officer of NCI, Inc., a public company that provided information technology and professional services and solutions to federal government agencies.

Matthew A. Tait | 54 | Chief Operating Officer | ||

Matt Tait has served as our Chief Operating Office since July 2020. Mr. Tait served as president of the Company’s former Mission Solutions and Services (MSS) business group from July 2018 to June 2020. Before joining the Company in 2018, Mr. Tait held various positions at Accenture plc (NSYE: ACN), Fortune Global 500 company, for almost 20 years, where he most recently served as Senior Managing Director and Defense lead, and in that capacity led initiatives that transformed IT performance for customers in defense, federal civilian, health care and financial sectors. Prior to his time at Accenture, Mr. Tait served ten years as an officer in the U.S. Navy.

Bonnie Cook | 63 | Executive Vice President of Business Services | ||

Bonnie Cook has served as the Company’s Executive Vice President of Business Services of the Company since July 2020. Ms. Cook served as EVP – Business Operations for the Company’s former MSS business group from February 2014 through June 2020. During her more than 30 years with the Company, Ms. Cook has served in a variety positions of increasing seniority (including positions in finance, business operations, contracts and human resources). Before her employment with the Company, Ms. Cook held controllership positions with other government services providers.

| 18 | ManTech 2022 Proxy Statement |

The Compensation Committee has reviewed and discussed with the Company’s management the Compensation Discussion and Analysis that follows this report. Based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement and incorporated into ManTech’s Annual Report on Form 10- K for the fiscal year ended December 31, 2021.

Compensation Committee Members

Barry G. Campbell, Chairman

Richard L. Armitage

Mary K. Bush

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis contains statements regarding individual and Company performance targets and goals. These targets and goals are disclosed in the limited context of our compensation program. These targets and goals are not statements of our expectations or estimates of results or other guidance. Investors should not apply the targets and goals to any other context.

This section describes the compensation for our Chief Executive Officer and Chief Financial Officer in 2021, as well as each of our other two most highly compensated executive officers in 2021, all of whom we refer to collectively as our named executive officers. Our named executive officers for 2021 were: Kevin M. Phillips (our Chairman of the Board, Chief Executive Officer and President), Judith L. Bjornaas (our Executive Vice President and Chief Financial Officer), Matthew A. Tait (our Chief Operating Officer) and Bonnie Cook (Executive Vice President of Business Services).

Our executive compensation program is based upon a foundation of providing compensation that has a strong relationship to performance, consistent with our compensation philosophy. We regularly evaluate the individual components of our executive compensation program in the context of current and anticipated market conditions, our operational needs and corporate governance requirements, and where necessary or appropriate for our business we will make changes to components of our program. We believe that our executive compensation structure properly incentivizes our executive officers to contribute to the Company’s financial and operational performance and achievements.

We designed the non-discretionary component of our annual incentive compensation program to align the interests of our executives with our stockholders by providing significant incentive payments only where there is objective quantitative evidence of exemplary performance (as demonstrated by our financial results). The discretionary component of our annual incentive compensation program provides us with flexibility to consider qualitative factors (and quantitative factors not included in the non-discretionary component of our program) so that, where appropriate, we can capture and reward the individual performance and contributions of our named executive officers that are not captured by the non-discretionary component of our program.

With regard to the equity component of our executive compensation program, in 2021 the Company granted time-based restricted stock units (time-based RSUs) to our executive officers. Generally, the time-based RSUs granted to our named executive officers in 2021 vest in three equal annual

| ManTech 2022 Proxy Statement | 19 |

installments beginning on the first anniversary of the grant date, and will be earned only if the named executive officer is employed with the Company through the applicable vesting date (or if, before a vesting date, the named executive officer’s employment terminates due to death or disability, in which case the award vests on that date). However, with respect to the time-based RSUs granted to Mr. Phillips in 2021, approximately one-third of such RSUs are subject to a separate, five-year vesting schedule, with half of RSUs cliff vesting on the fourth anniversary of the date of the grant, and the remaining half cliff vesting on the fifth anniversary of the date of the grant.

Throughout 2021, ManTech successfully navigated a complex and uneven operation environment driven by challenges relating to the ongoing and evolving pandemic (together with the various measures local, state and federal governments adopted to mitigate its impact). Our employees’ hard work was reflected in our financial and operating results. In 2021, we achieved record backlog, grew our profit measures, and sustained our robust cash flow. We finished 2021 with revenues of $2.55 billion, operating income of over $186 million, and cash flow from operations of $212 million. We also exited 2021 having successfully deployed $380 million of capital acquiring two acquisitions in late 2021: Gryphon Finance, LLC (Gryphon), which provides a broad array of advanced digital and systems engineering capabilities for Department of Defense agencies, and Technical and Management Assistance Corporation (TMAC), which provides advanced data engineering services and solutions that ensure the delivery of vital information to our Intelligence Community customers. For a more detailed description of our fiscal year 2021 financial results, see our consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2021 Annual Report on Form 10-K.

Objectives of Our Executive Compensation Program

Our executive compensation program is designed to support the Company’s key business objectives of creating long-term value for, and promoting the interests of, our stockholders. In order to align the interests of our executives with those of our stockholders, we believe that our executive compensation program should provide our executive officers with competitive compensation opportunities that reward contributions to our Company’s financial and operational success, as well as reward exceptional individual achievement where merited. Specifically, per our compensation philosophy, we believe that our executive compensation program should:

| • | Be tied in substantial part to the Company’s financial performance, so that our executives are held accountable, through their compensation, for our financial results and operating performance; |

| • | Be structured to balance short-term and long-term compensation incentives, consistent with the short-term and long-term objectives of the Company; |

| • | Align the interests of management with shareholders through appropriate equity compensation; |

| • | Consider qualitative and other quantitative factors beyond the quantitative financial metrics that serve as the basis for the non-discretionary portion of our annual incentive compensation program, in determining whether discretionary bonus payments should be made to individual executives; and |

| • | Reflect the competitive marketplace, so we can attract, retain, and motivate talented executives. |

| 20 | ManTech 2022 Proxy Statement |

Executive Compensation Setting Process

The Compensation Committee is responsible for setting the compensation of our executive officers. In making executive compensation decisions, the Compensation Committee consults with our CEO and other members of our management team, and relies upon the assistance of EY, which serves as the Compensation Committee’s independent compensation consultant. For additional information about EY, see the Board of Directors and Committees of the Board of Directors section of this proxy statement, under the caption “Compensation Committee.”

The Compensation Committee believes that the input of management is an important part of the executive compensation setting process. As a result, the Compensation Committee requested that management provide initial recommendations with respect to the 2021 compensation packages for each named executive officer. These recommendations included types and amounts of compensation for each executive, as well as appropriate goals for the 2021 performance metrics, which were determined by the Compensation Committee. In setting each executive’s compensation opportunities for 2021, the Compensation Committee considered management’s recommendation in light of, and in addition to, other factors, including the executive’s individual experience, organizational role and job responsibilities, performance, and prior compensation levels, as well as retention and other specific management needs of the Company.

In evaluating the reasonableness of its compensation decisions and the Company’s compensation programs generally, the Compensation Committee takes into account the compensation practices of, and the competitive market for executives at, companies with which we compete. To this end, the Compensation Committee asked EY to perform an analysis of the Company’s executive compensation program, including a review of the overall competitiveness of proposed compensation levels to prevailing market standards for executive officers. The market information included in this analysis was based on published compensation surveys for similarly-sized companies within the business software and services industry (as sorted and refined by EY on a position-by-position basis), as well as proxy analysis of the Company’s compensation peer group, and was used to generate “market consensus” figures for each of our executive officer’s total cash compensation (base salary and annual incentive) and, where available, total direct compensation (total cash compensation plus long-term incentives). Market consensus figures were presented at both the median and 75th percentiles of the market data to provide general information on a market competitive range of compensation for each position.

EY does not identify to the Compensation Committee the individual companies that compose the published survey data for each executive’s position. The Compensation Committee, in consultation with EY and management, determined the compensation peer group used to produce the proxy analysis. The primary basis for selecting the peer group was to identify public companies with which we compete directly for executive talent, customers, market share, capital, and shareholders. Our compensation peer group for the year comprised the following 14 companies:

• ASGN Incorporated

• Booz Allen Hamilton Holding Corporation

• CACI International, Inc.

• ICF International, Inc.

• KBR, Inc. | • Leidos Holding, Inc

• MAXIMUS, Inc.

• Mercury System, Inc

• Parsons Corporation

• PAE Incorporated | • SAIC Inc.

• Unisys Corporation

• Vectrus, Inc

• VSE Corporation |

| ManTech 2022 Proxy Statement | 21 |

The Compensation Committee did not consider market consensus figures for the purposes of benchmarking or otherwise targeting any component of executive compensation or total executive compensation at a particular percentile of market; rather the Compensation Committee used market consensus figures as a reference point in its overall determination of the types and amount of compensation to be paid to our executive officers, in light of the Compensation Committee’s own evaluation of the circumstances with respect to each executive officer. Factors that may cause an individual executive’s compensation to fall outside of the market consensus figures presented to the Compensation Committee include competitive factors, the Company’s financial and operating performance, compensation needs associated with hiring executive officers from other companies, the individual executive’s position or performance, the Company’s general view on the appropriate portion of compensation for its executives that should be cash-based, and other factors that may be considered relevant by the Compensation Committee in determining the best way to align our executive officers’ interests with those of our stockholders.

2021 Named Executive Officer Compensation

Our compensation program utilizes three principal types of compensation: base salary, annual cash incentive payments, and long-term incentive compensation. While we do pay some compensation through employee benefits and perquisites, these forms of compensation generally do not represent a significant portion of the total compensation we pay our executives.

Base Salary

We pay our named executive officers base salaries that reflect the requirements of the marketplace. We also may consider an individual executive’s experience, base salary levels over the last several years, organizational alignment, personal performance, or internal pay equity considerations among other factors. The consideration given to each of these factors differs from individual to individual, as deemed appropriate. In March 2021, in connection with our regular annual salary setting process, the Compensation Committee determined that annual base salaries for each of Ms. Bjornaas and Ms. Cook should be increased by $50,000; no changes were made to the annual base salaries for Mr. Phillips or Mr. Tait. Final 2021 annual base salary levels for our named executive officers were as follows:

Executive | 2021 Base Salary | |||

Mr. Phillips | $ | 1,000,000 | ||

Ms. Bjornaas | $ | 750,000 | ||

Mr. Tait | $ | 975,000 | ||

Ms. Cook | $ | 575,000 | ||

Annual Cash Incentive Compensation Program

Our named executive officers have the potential to earn cash payments through our annual incentive compensation program. Our annual incentive compensation program has both non-discretionary and discretionary components. The non-discretionary component of each executive’s annual incentive compensation opportunity was established pursuant to, and governed by, the Company’s 2021 Executive Incentive Compensation Plan (2021 IC Plan). On an annual basis, the Compensation Committee also considers for each executive whether a discretionary bonus payment is appropriate.

We make annual incentive compensation payments in the form of cash rather than equity, as the equity compensation component of our compensation program is designed to provide a longer-term incentive for our named executive officers.

| 22 | ManTech 2022 Proxy Statement |

Non-Discretionary Incentive Compensation Payments

The material elements of the non-discretionary component of our annual incentive program include:

| • | A uniform and systematic process that uses objective and specific measures to determine the amount of incentive compensation to be paid; |

| • | Performance goals that support the operating objectives for the Company as a whole; and |

| • | Compensation Committee discretion to adjust the amount of the non-discretionary portion of an executive officer’s annual cash incentive payment that would otherwise be payable upon the executive’s achievement of the pre-established goals because of extraordinary circumstances, or to otherwise further the intent of the 2021 IC Plan. |

Structure of 2021 Non-Discretionary Incentive Opportunities

The 2021 IC Plan used the following Company-level performance measures.

| Revenue | Revenue is the principal means by which we measure our overall growth, which is an important factor at this point in the life of the Company. Because of profit margin limitations that apply to government contracts, increasing our revenue is the principal method by which we can increase our profits. | |

| EBIT | Earnings before interest and taxes (EBIT) is the principal method by which we measure our profitability and monitor our ability to achieve returns for our stockholders. | |

| Bookings | Bookings refers to the total value of all contracts, including renewals and customer purchases in excess of prior contracted commitments, awarded during the year. Generally, for Indefinite Delivery/Indefinite Quantity contracts, we only include in our bookings executed task orders and an estimate of revenues for solutions that we believe we will be asked to provide in the future under the terms of those contracts for which we have an established pattern of revenues. Awards of new contracts and the renewal of existing contracts are an important measure of our market positioning and future prospects. | |