THOMPSON RESEARCH GROUP MAY 7 - 8, 2014 CHART INDUSTRIES, INC. INVESTING FOR FUTURE GROWTH Exhibit 99.1

Disclosure Forward-Looking Statements: This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as “may”, “might”, “should”, “will”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “forecast”, “outlook”, “intend”, “future”, “potential” or “continue”, and other similar expressions are intended to identify forward-looking statements. All of these forward-looking statements are based on estimates and assumptions by our management as of the date of this presentation that, although we believe to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that could cause the Company’s actual results or circumstances to differ materially from those expressed or implied by forward-looking statements. These risks and uncertainties include, among others, the following: the cyclicality of the markets that the Company serves; a delay, significant reduction in or loss of purchases by large customers; a delay in the anticipated timing of LNG infrastructure build out or respiratory therapy demand recovery; fluctuations in energy prices; the potential for negative developments in the natural gas industry related to hydraulic fracturing; competition; changes in government energy policy or failure of expected changes in policy to materialize; the Company’s ability to successfully manage its costs and growth, including its ability to successfully manage operational expansions; economic downturns and deteriorating financial conditions; our ability to manage our fixed- price contract exposure; our reliance on key suppliers and potential supplier failures or defects; the modification or cancellation of orders in our backlog; our ability to successfully acquire or integrate new product lines or businesses; changes in government healthcare regulations and reimbursement policies; general economic, political, business and market risks associated with the Company’s global operations and transactions; litigation and disputes involving the Company, including product liability, contract, warranty, employment, intellectual property and environmental claims; the adequacy of our warranty reserves; the loss of key employees and deterioration of employee or labor relations; fluctuations in foreign currency exchange and interest rates; the financial distress of third parties; the regulation of our products by the U.S. Food & Drug Administration and other governmental authorities; the pricing and availability of raw materials; our ability to protect our intellectual property; potential future impairment of the Company’s goodwill and other intangibles; the cost of compliance with environmental, health and safety laws; technological security threats; additional liabilities related to taxes; the impact of severe weather; risks associated with our indebtedness, leverage, debt service and liquidity; and volatility and fluctuations in the price of the Company’s stock. For a discussion of these and additional risks that could cause actual results to differ from those described in the forward- looking statements, see disclosure under Item 1A. “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and other recent filings with the Securities and Exchange Commission, which should be reviewed carefully. Please consider the Company’s forward-looking statements in light of these risks. Any forward-looking statement speaks only as of its date. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. 1

GTLS: GAS TO LIQUID SYSTEMS Technology leader that provides high-end equipment to the energy industry, which is the largest end-user of Chart’s products One of the leading suppliers in all primary markets served Global footprint for our operations on four continents with approximately 5,200 employees More than half of sales outside the U.S. and more than half made to the energy markets Company Overview Chart Industries is a leading global manufacturer of highly engineered cryogenic equipment for the energy, industrial gas, and biomedical markets Asia 33% U.S. 41% Americas (Non-US) 7% RoW 3% Europe 16% FY 2013 Sales by Segment Energy 53% BioMedical 23% General Industrial 24% FY 2013 Sales by Region FY 2013 Sales by End-User Energy & Chemicals 27% Distribution & Storage 50% BioMedical 23% 2

GTLS: GAS TO LIQUID SYSTEMS Middle East 6% Energy & Chemicals (E&C) Overview Natural Gas Processing 51% Air Separation 9% FY 2013 Sales by Industry Segment / Region Highlights Technology leader – providing heat exchangers and cold boxes critical to LNG, Olefin petrochemicals, natural gas processing and industrial gas markets Separation, liquefaction and purification of hydrocarbon and industrial gases Market leader – leading industry positions worldwide Manufacturing leader – a key global supplier of mission- critical LNG equipment Americas (Non-US) 3% RoW 2% Asia 44% U.S. 45% 3 LNG 36% Other 4% Nat u ral G as P rocessin g LN G

GTLS: GAS TO LIQUID SYSTEMS Distribution & Storage (D&S) Overview FY 2013 Sales by Industry Segment / Region Highlights Balanced customer base – 51% of segment sales derived from products used in energy applications, including LNG Strategic footprint – manufacturing located near growing end markets and in lower-cost countries Positioned to capitalize on strong expected LNG growth Continued investment in key global manufacturing facilities LNG 30% Energy 21% Healthcare 5% Food/ Beverage 6% Americas (Non-US) 5% RoW 2% Asia 36% U.S. 39% Europe 18% 4 F o o d / Be v erag e In d us tria l LN G Manufacturing/ Fabrication 33% Electronics 5%

GTLS: GAS TO LIQUID SYSTEMS BioMedical Overview FY 2013 Sales by Industry Segment / Region Highlights Increase in oxygen respiratory therapy expected, once impact of Medicare competitive bidding process on U.S. market consolidation is complete Life science based research expected to increase, led by international markets End markets include: home healthcare and nursing homes, hospitals and long-term care, biomedical and pharmaceutical research, and animal breeding Healthcare 69% Environmental 5% Americas (Non-US) 6% U.S. 40% Europe 31% Asia 15% RoW 8% 5 Life Sciences 23% Other 3% En v iron m e n ta l Healt h car e Li fe Sci e nce s

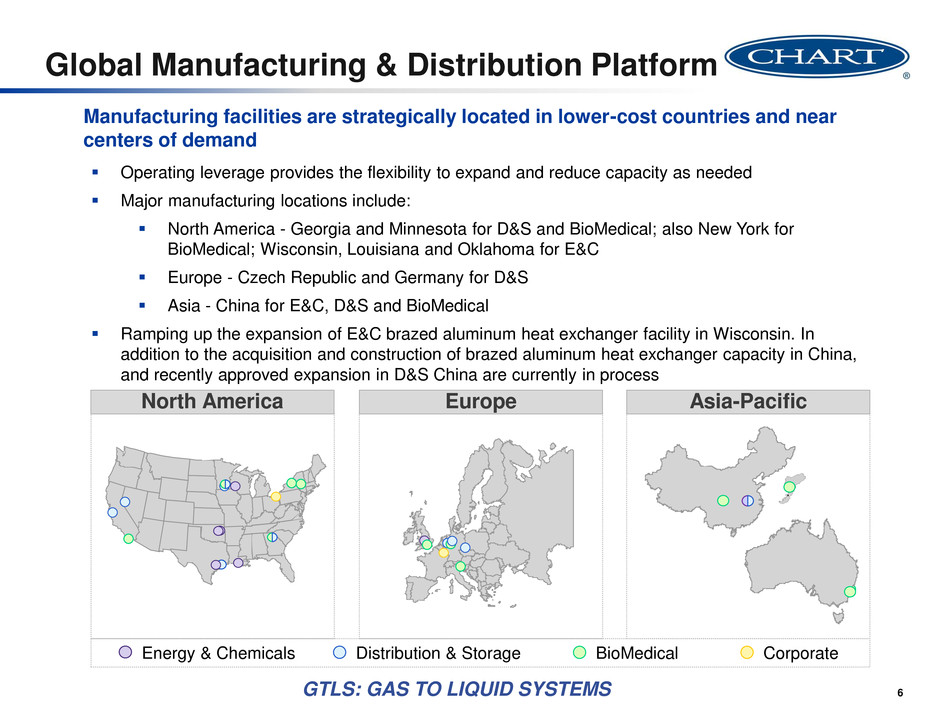

GTLS: GAS TO LIQUID SYSTEMS Global Manufacturing & Distribution Platform Operating leverage provides the flexibility to expand and reduce capacity as needed Major manufacturing locations include: North America - Georgia and Minnesota for D&S and BioMedical; also New York for BioMedical; Wisconsin, Louisiana and Oklahoma for E&C Europe - Czech Republic and Germany for D&S Asia - China for E&C, D&S and BioMedical Ramping up the expansion of E&C brazed aluminum heat exchanger facility in Wisconsin. In addition to the acquisition and construction of brazed aluminum heat exchanger capacity in China, and recently approved expansion in D&S China are currently in process Manufacturing facilities are strategically located in lower-cost countries and near centers of demand Corporate Energy & Chemicals Distribution & Storage BioMedical 6 Asia-Pacific Europe North America

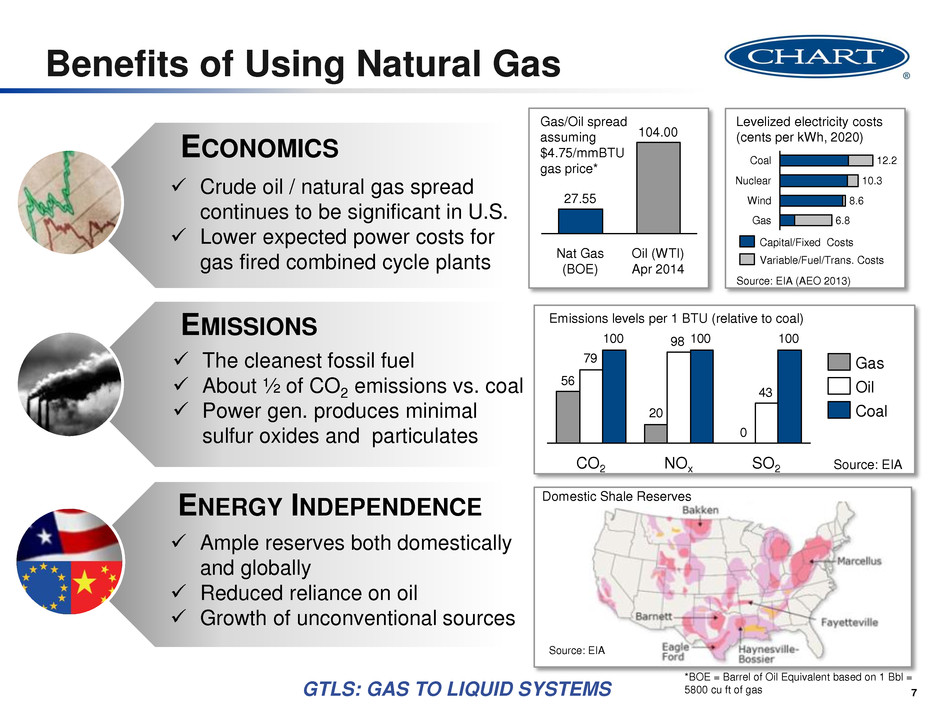

GTLS: GAS TO LIQUID SYSTEMS Benefits of Using Natural Gas ECONOMICS EMISSIONS ENERGY INDEPENDENCE Crude oil / natural gas spread continues to be significant in U.S. Lower expected power costs for gas fired combined cycle plants The cleanest fossil fuel About ½ of CO2 emissions vs. coal Power gen. produces minimal sulfur oxides and particulates Ample reserves both domestically and globally Reduced reliance on oil Growth of unconventional sources 0 20 56 43 98 79 100100100 NOx CO2 SO2 Coal Oil Gas Source: EIA Emissions levels per 1 BTU (relative to coal) Domestic Shale Reserves Source: EIA Gas/Oil spread assuming $4.75/mmBTU gas price* *BOE = Barrel of Oil Equivalent based on 1 Bbl = 5800 cu ft of gas 7 27.55 Oil (WTI) Apr 2014 104.00 Nat Gas (BOE) 6.8 12.2 8.6 10.3 Gas Wind Nuclear Coal Source: EIA (AEO 2013) Levelized electricity costs (cents per kWh, 2020) Capital/Fixed Costs Variable/Fuel/Trans. Costs

GTLS: GAS TO LIQUID SYSTEMS LNG Value Chain Uniquely positioned to address the entire LNG Value Chain – liquefaction, distribution, storage and end-use – Chart brings many years of experience in LNG solutions to our customers, facilitating the use of a clean-burning, safe fuel alternative to diesel into the future. 8 Pre-treatment Baseload LNG Small/ Mid-Scale LNG Liquefaction Commercial Residential Power Generation Transportation Satellite Storage Bulk LNG Tanks MicroBulk Applications LNG Carriers Trailers & Mobile Equipment Virtual Pipeline Distribution Storage End Use LNG Fuel use predicted to increase, particularly in high fuel consumption applications such as drill rigs, truck, marine, mining and locomotives.

GTLS: GAS TO LIQUID SYSTEMS Historical Revenue Trends 9 138 205 324 319 +28% 2013 $1,177 266 593 2012 $1,014 215 476 2011 $795 199 390 2010 $555 148 269 +115% 2013 $307 2012 $162 2011 $54 2010 $31 BioMed D&S E&C LNG Sales ($MM) Consolidated Sales ($MM) Chart continues to see overall revenue growth in the business by more than doubling sales over the last 4 years. The LNG market is the highest growing segment across all regions. 26% 16% 7% 6% LNG % of Total Revenue CAGR CAGR

GTLS: GAS TO LIQUID SYSTEMS Historical Orders and Backlog Quarter-end Backlog ($MM) 10 Quarterly Orders ($MM) 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 Q3 12 Q1 13 Q3 13 Q1 14 Q1 12 Q3 11 Q1 11 Q3 10 Q1 10 BioMed D&S E&C 0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 Q3 12 Q1 13 Q3 13 Q1 14 Q3 11 Q1 11 Q1 12 Q3 10 Q1 10 Chart continues to receive strong order commitments from customers. In 2013, Chart was awarded large LNG orders in China and the US, attributing to record orders overall.

GTLS: GAS TO LIQUID SYSTEMS Very Stable Business Model • Attractive industry with long-term customer relationships • Solid platform with worldwide presence and leading industry positions in all segments Summary of Investment Highlights 11 Strong Balance Sheet • Strong organic earnings should provide solid substantial free cash flow and good liquidity • Permit continued accretive organic and inorganic growth Positioned for Significant Growth • Exploit LNG and NG growth • Opportunities with global infrastructure build-out • New product development and innovation • Expanded new business and inorganic pipeline Chart continues to represent a unique investment opportunity to capitalize on global energy demand, growth in natural gas and LNG use Flexible / Low Cost Capital Structure • Revolving credit facility provides significant liquidity • Low cost long-term debt • Low net debt to EBITDA ratio provides financing opportunities for organic expansion and acquisitions