UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2014 |

OR

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File No. 1-11442

CHART INDUSTRIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | |

| Delaware | | 34-1712937 |

(State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

|

| | |

| One Infinity Corporate Centre Drive, | | |

| Suite 300, Garfield Heights, Ohio | | 44125-5370 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(440) 753-1490

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | o |

| Non-accelerated filer | | o (Do not check if a smaller reporting company) | | Smaller reporting company | | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates computed by reference to the price of $82.73 per share at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter, was $2,494,990,864.

As of February 17, 2015, there were 30,531,313 outstanding shares of the Company’s common stock, par value $0.01 per share.

Documents Incorporated by Reference

Portions of the following document are incorporated by reference into Part III of this Annual Report on Form 10-K: the definitive Proxy Statement to be used in connection with the Registrant’s Annual Meeting of Stockholders to be held on May 28, 2015 (the “2015 Proxy Statement”).

Except as otherwise stated, the information contained in this Annual Report on Form 10-K is as of December 31, 2014.

CHART INDUSTRIES, INC.

TABLE OF CONTENTS

PART I

THE COMPANY

Overview

Chart Industries, Inc., a Delaware corporation incorporated in 1992 (the “Company,” “Chart” or “we” as used herein refers to Chart Industries, Inc. and our consolidated subsidiaries, unless the context indicates otherwise), is a leading diversified global manufacturer of highly engineered equipment for the industrial gas, energy, and biomedical industries. The largest portion of end-use applications for our products is energy-related, accounting for approximately 47% of sales and 44% of orders in 2014, and 76% of backlog at December 31, 2014. Our equipment and engineered systems are primarily used for low-temperature and cryogenic applications utilizing our expertise in cryogenic systems and equipment, which operate at low temperatures sometimes approaching absolute zero (0 kelvin; -273° Centigrade; -459° Fahrenheit). Our products include vacuum insulated containment vessels, heat exchangers, cold boxes and other cryogenic components.

Our primary customers are large, multinational producers and distributors of hydrocarbon and industrial gases and their end-users. We sell our products and services to more than 2,000 customers worldwide. We have developed long-standing relationships with leading companies in the gas production, gas distribution, gas processing, liquefied natural gas or LNG, chemical and industrial gas industries, including Air Products, Praxair, Airgas, Air Liquide, The Linde Group or Linde, Bechtel Corporation, ExxonMobil, British Petroleum or BP, ConocoPhillips, PetroChina, The Shaw Group, Toyo, JGC, Samsung, UOP, and Shell, some of whom have been purchasing our products for over 20 years.

We have attained this position by capitalizing on our technical expertise and know-how, broad product offering, reputation for quality, low-cost global manufacturing footprint, and by focusing on attractive, growing markets. We have an established sales and customer support presence across the globe and low cost manufacturing operations in the United States, Central Europe and China. For the years ended December 31, 2014, 2013 and 2012, we generated sales of $1,193.0 million, $1,177.4 million, and $1,014.2 million, respectively.

Segments, Applications and Products

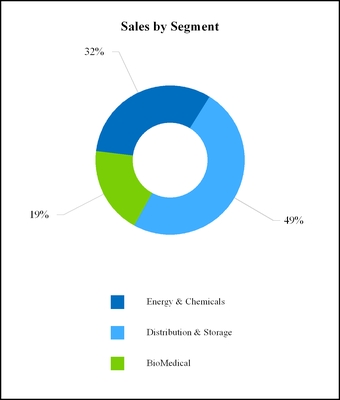

We operate in three segments: (i) Energy & Chemicals or E&C, (ii) Distribution & Storage or D&S, and (iii) BioMedical. While each segment manufactures and markets different cryogenic and gas processing equipment and systems to distinct end-users, they all share a reliance on our heat transfer, vacuum insulation, low temperature storage and gas processing know-how and expertise. The E&C and D&S segments manufacture products used primarily in energy-related and industrial applications, such as the separation, liquefaction, distribution and storage of hydrocarbon and industrial gases. Through our BioMedical segment, we supply cryogenic and other equipment used in the medical, biological research and animal breeding industries. Further information about these segments is located in Note 18 of the notes to the Company’s consolidated financial statements included in Item 8 of this Annual Report on Form 10-K.

The following charts show the proportion of our revenues generated by each segment, as well as our estimate of the proportion of revenue generated by end-user application for the year ended December 31, 2014:

Energy & Chemicals Segment

E&C (32% of sales for the year ended December 31, 2014) facilitates major natural gas, petrochemical processing and industrial gas companies in the production of their products. E&C supplies mission critical engineered equipment and systems used in the separation, liquefaction, and purification of hydrocarbon and industrial gases that span gas-to-liquid applications including natural gas processing, LNG, and industrial gas applications. Our principal products include brazed aluminum heat exchangers, Core-in-Kettle® heat exchangers, air cooled heat exchangers and cold boxes. Brazed aluminum heat exchangers accounted for 14.9%, 14.4% and 14.4% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. Process systems accounted for 12.3%, 13.5% and 10.6% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively.

Natural Gas Processing (including Petrochemical) applications

We provide natural gas processing solutions that facilitate the progressive cooling and liquefaction of hydrocarbon mixtures for the subsequent recovery or purification of component gases, which accounted for 17.5%, 14.9% and 23.4% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. Our brazed aluminum heat exchangers allow producers to obtain purified hydrocarbon by-products, such as methane, ethane, propane and ethylene, which are commercially marketable for various industrial or residential uses. Our cold boxes are highly engineered systems that incorporate brazed aluminum heat exchangers, pressure vessels and interconnecting piping used to significantly reduce the temperature of gas mixtures to liquefy component gases so that they can be separated and purified for further use in multiple energy, industrial, scientific and commercial applications. Our air cooled heat exchangers are used to cool or condense fluids to allow for further processing and for cooling gas compression equipment. Customers for our natural gas processing applications include large companies in the hydrocarbon processing industry, as well as engineering, procurement and construction (“EPC”) contractors.

Demand for these applications is primarily driven by the growth in the natural gas liquids (or NGLs) separation and other natural gas segments of the hydrocarbon processing industries, including LNG. In the future, management believes that continuing efforts by petroleum producing countries to better utilize stranded natural gas and previously flared gases present a promising source of demand. We have a number of competitors for our heat exchangers and cold boxes, including a number of leading companies in the industrial gas and hydrocarbon processing industries and many smaller fabrication-only facilities

around the world. Competition with respect to our more specialized brazed aluminum heat exchangers includes a small number of global (European and Asian) manufacturers.

LNG applications

We provide mission critical equipment for the liquefaction of LNG including small to mid-scale facilities, floating LNG applications, and large base-load export facilities, which accounted for 12.1%, 9.7% and 5.5% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. We are a leading supplier to EPC firms where we provide equipment or design the process and provide equipment, providing an integrated approach to the project. These “Concept-to-Reality” process systems incorporate many of Chart’s core products, including brazed aluminum heat exchangers, Core-in-Kettle® heat exchangers, cold boxes, pressure vessels, pipe work and air cooled heat exchangers. These systems are used for global LNG projects, including projects in China and North America for local LNG production and LNG export terminals. We have developed our proprietary IPSMR® (Integrated Pre-cooled Single Mixed Refrigerant) liquefaction process, which offers lower capital expenditure rates than competing processes per ton of LNG produced and offers very competitive operating costs.

Demand for LNG applications is primarily driven by increased use and global trade in natural gas (transported as LNG) since natural gas offers significant cost and environmental advantages over other fossil fuels. Demand for LNG applications is also driven by diesel displacement and continuing efforts by petroleum producing countries to better utilize stranded natural gas and previously flared gases. We have a number of competitors for these applications, including leading industrial gas companies, other brazed aluminum heat exchanger manufacturers, and other equipment fabricators to whom we also act as a supplier of equipment including heat exchangers and cold boxes.

Industrial Gas applications

For industrial gas applications, our brazed aluminum heat exchangers and cold boxes are used to produce high purity atmospheric gases, such as oxygen, nitrogen and argon, which have diverse industrial applications. Cold boxes are used to separate air into its major atmospheric components, including oxygen, nitrogen, and argon, where the gases are used in a diverse range of applications such as metal production and heat treating, enhanced oil and gas production, coal gasification, chemical and oil refining, electronics, medical, the quick-freezing of food, wastewater treatment, and industrial welding. Our brazed aluminum heat exchangers and cold boxes are also used in the purification of helium and hydrogen.

Demand for industrial gas applications is driven by growth in manufacturing and industrial gas use. Other key global drivers involve developing Gas to Liquids, or GTL, clean coal processes including Coal to Liquids, or CTL, and Integrated Gasification Combined Cycle, or IGCC, power projects. In addition, demand for our products in developed countries is expected to continue as firms upgrade their facilities for greater efficiency and regulatory compliance. We have a number of competitors for these applications including leading industrial gas companies and EPC firms to whom we also act as a supplier of equipment including heat exchangers and cold boxes.

Distribution & Storage Segment

D&S (49% of sales for the year ended December 31, 2014) designs, manufactures, and services cryogenic solutions for the storage and delivery of cryogenic liquids used in industrial gas and LNG applications. Using sophisticated vacuum insulation technology, our cryogenic storage systems are able to store and transport liquefied industrial gases and hydrocarbon gases at temperatures from 0° Fahrenheit to temperatures nearing absolute zero. End-use customers for our cryogenic storage equipment include industrial gas producers and distributors, chemical producers, manufacturers of electrical components, health care organizations, food processors, and businesses in the oil and natural gas industries. Cryogenic bulk storage systems accounted for 12.7%, 14.9% and 15.1% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. Cryogenic packaged gas systems accounted for 13.4%, 13.0% and 14.2% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. We service industrial gas and LNG applications as follows:

Industrial Gas applications

We design, manufacture, install, service, and maintain bulk and packaged gas cryogenic solutions for the storage, distribution, vaporization, and application of industrial gases, which accounted for 30.9%, 33.9% and 36.3% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. Industrial gas applications include any end-use of the major elements of air (nitrogen, oxygen, and argon), including manufacturing, welding, electronics, medical, nitrogen dosing, food processing, and beverage carbonation. Carbon dioxide, nitrous oxide, hydrogen and helium applications also utilize our equipment. Our products span the entire spectrum of industrial gas demand from small customers requiring cryogenic packaged gases to large users requiring custom engineered cryogenic storage systems in both mobile and stationary applications. We also offer cryogenic components, including vacuum insulated pipe (“VIP”), engineered bulk gas installations, specialty liquid nitrogen, or LN2, end-use equipment and cryogenic flow meters. We operate service locations in the United

States, China and Europe that provide installation, service, repair and maintenance of cryogenic products. Principal customers for industrial applications are global industrial gas producers and distributors.

Demand for industrial gas applications is driven primarily by the significant installed base of users of cryogenic liquids as well as new applications and distribution technologies for cryogenic liquids. Our competitors tend to be regionally focused while Chart is able to supply a broad range of systems on a worldwide basis. We also compete with several suppliers owned by the global industrial gas producers. From a technology perspective, we tend to compete with compressed gas alternatives or on-site generated gas supply.

LNG Applications

We supply cryogenic solutions for the storage, distribution, regasification, and use of LNG, which accounted for 17.6%, 16.4% and 10.6% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. LNG may be utilized as an alternative to other fossil fuels such as diesel, propane or fuel oil in transportation or off pipeline applications. Examples include heavy duty truck and transit bus transportation, locomotive propulsion, marine and power generation in remote areas like oil and gas drilling. We refer to our LNG distribution products as a “Virtual Pipeline” as the natural gas pipeline is replaced with cryogenic distribution to deliver the gas to the end-user. We supply cryogenic trailers, ISO containers, railcars, bulk storage tanks, fuel stations, loading facilities, and regasification equipment specially configured for delivering LNG into Virtual Pipeline applications. LNG may also be used as a fuel for a variety of off-road vehicles and applications. Our LNG vehicle fueling applications primarily consist of LNG and liquefied/compressed natural gas refueling systems for heavy-duty truck and bus fleets. We sell LNG applications around the world from all D&S facilities to numerous end-users, energy companies, and gas distributors. Additionally, we supply large vacuum insulated storage tanks as optional equipment for purchasers of standard liquefaction plants sold by our E&C business.

Demand for LNG applications is driven by the spread in price between oil and gas, diesel displacement initiatives, and the associated cost of equipment. Our competitors tend to be regionally focused or product-specific, while we are able to supply a broad range of solutions required by LNG applications. We compete with compressed natural gas (or CNG) or field gas in several of these applications and LNG is most highly valued where its energy density and purity are beneficial to the end-user.

BioMedical Segment

BioMedical (19% of sales for the year ended December 31, 2014) consists of various product lines built around our core competencies in cryogenics, vacuum insulation, low temperature storage, and pressure swing adsorption, but with a focus on the respiratory and biological users of the liquids and gases instead of the large producers and distributors of cryogenic liquids. Applications in the BioMedical segment include the following:

Respiratory Therapy

Respiratory therapy products accounted for 11.8%, 14.9% and 14.2% of consolidated sales for the years ended December 31, 2014, 2013 and 2012, respectively. Our respiratory oxygen product line is comprised of a range of medical respiratory products, including liquid oxygen systems and stationary, transportable, and portable oxygen concentrators, all of which are used primarily for the in-home supplemental oxygen treatment of patients with chronic obstructive pulmonary diseases, such as bronchitis, emphysema and asthma.

We believe that competition for our respiratory products is based primarily upon product quality, performance, reliability, ease-of-use and price, and we focus our marketing strategies on these considerations. Furthermore, competition also includes the impact of other modalities in the broader respiratory industry.

Life Sciences

Our life science products include vacuum insulated containment vessels for the storage of biological materials. The primary applications for this product line include medical laboratories, biotech/pharmaceutical, research facilities, blood and tissue banks, veterinary laboratories, large-scale repositories and artificial insemination, particularly in the beef and dairy industry.

The significant competitors for life science products include a number of companies worldwide. These products are sold through multiple channels of distribution specifically applicable to each industry sector. The distribution channels range from highly specialized cryogenic storage systems providers to general supply and catalogue distribution operations and breeding service providers. Competition in this field is focused on design, reliability and price. Alternatives to vacuum insulated containment vessels include electrically powered mechanical refrigeration.

Commercial Oxygen Generation

Our commercial oxygen generation products include self-contained generators, standard generators, and packaged systems for industrial and medical oxygen generating systems. These generators produce oxygen from compressed air and

provide an efficient and cost-effective alternative to the procurement of oxygen from third party cylinder or liquid suppliers. Applications include mining operations, industrial plants, ozone generation, hospital medical oxygen, and wastewater treatment, among other commercial applications. Management expects demand for this product line to increase over the long-term with competition focused on design, reliability and price.

Domestic and Foreign Operations

Financial and other information regarding domestic and foreign operations is located in Note 18 of the notes to the Company’s consolidated financial statements included in Item 8 of this Annual Report on Form 10-K. Additional information regarding risks attendant to foreign operations is set forth in Item 7A of this Annual Report on Form 10-K under the caption “Quantitative and Qualitative Disclosures About Market Risk” and Item 7 under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Engineering and Product Development

Our engineering and product development activities are focused primarily on developing new and improved solutions and equipment for the users of cryogenic liquids and hydrocarbon and industrial gases. Our engineering, technical and marketing employees actively assist customers in specifying their needs and in determining appropriate products to meet those needs. Portions of our engineering expenditures typically are charged to customers, either as separate items or as components of product cost.

Competition

We believe we can compete effectively around the world and that we are a leading competitor in the industries we serve. Competition is based primarily on performance and the ability to provide the design, engineering and manufacturing capabilities required in a timely and cost-efficient manner. Contracts are usually awarded on a competitive bid basis. Quality, technical expertise and timeliness of delivery are the principal competitive factors within the industry. Price and terms of sale are also important competitive factors. Because independent third-party prepared market share data is not available, it is difficult to know for certain our exact position in our markets, although we believe we rank among the leaders in each of the markets we serve. We base our statements about industry and market positions on our reviews of annual reports and published investor presentations of our competitors and augment this data with information received by marketing consultants conducting competition interviews and our sales force and field contacts. For information concerning competition within a specific segment of the Company’s business, see descriptions provided under segment captions in this Annual Report on Form 10-K.

Marketing

We market our products and services throughout the world primarily through direct sales personnel and independent sales representatives and distributors. The technical and custom design nature of our products requires a professional, highly trained sales force. We use independent sales representatives and distributors to market our products and services in certain foreign countries and in certain North American regions. These independent sales representatives supplement our direct sales force in dealing with language and cultural matters. Our domestic and foreign independent sales representatives earn commissions on sales, which vary by product type.

Backlog

The dollar amount of our backlog as of December 31, 2014, 2013 and 2012 was $640.1 million, $728.8 million and $617.4 million, respectively. Approximately 20.4% of the December 31, 2014 backlog is expected to be filled beyond 2015. Backlog is comprised of the portion of firm signed purchase orders or other written contractual commitments received from customers that we have not recognized as revenue under the percentage of completion method or based upon shipment. Backlog can be significantly affected by the timing of orders for large products, particularly in the E&C segment, and the amount of backlog at December 31, 2014 described above is not necessarily indicative of future backlog levels or the rate at which backlog will be recognized as sales. Orders included in our backlog may include customary cancellation provisions under which the customer could cancel all or part of the order, potentially subject to the payment of certain costs and/or penalties. For further information about our backlog, including backlog by segment, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Customers

We sell our products primarily to gas producers, distributors and end-users across the industrial gas, hydrocarbon and chemical processing and biomedical industries in countries throughout the world. Sales to our top ten customers accounted for 34%, 37% and 38% of consolidated sales in 2014, 2013 and 2012, respectively. No single customer exceeded 10% of

consolidated sales in 2014. Our sales to particular customers fluctuate from period to period, but the global producers and distributors of hydrocarbon and industrial gases and their suppliers tend to be a consistently large source of revenue for us. Our supply contracts are generally contracts for “requirements” only. While our customers may be obligated to purchase a certain percentage of their supplies from us, there are generally no minimum requirements. Also, many of our contracts may be canceled on as little as one month’s notice. To minimize credit risk from trade receivables, we review the financial condition of potential customers in relation to established credit requirements before sales credit is extended and monitor the financial condition of customers to help ensure timely collections and to minimize losses. In addition, for certain domestic and foreign customers, particularly in the D&S and E&C segments, we require advance payments, letters of credit, bankers’ acceptances and other such guarantees of payment. Certain customers also require us to issue letters of credit or performance bonds, particularly in instances where advance payments are involved, as a condition of placing the order. We believe our relationships with our customers are generally good.

Intellectual Property

Although we have a number of patents, trademarks and licenses related to our business, no one of them or related group of them is considered by us to be of such importance that its expiration or termination would have a material adverse effect on our business. In general, we depend upon technological capabilities, manufacturing quality control and application of know-how, rather than patents or other proprietary rights, in the conduct of our business.

Raw Materials and Suppliers

We manufacture most of the products we sell. The raw materials used in manufacturing include aluminum products (including sheets, bars, plate and piping), stainless steel products (including sheets, plates, heads and piping), palladium oxide, carbon steel products (including sheets, plates and heads), valves and gauges and fabricated metal components. Most raw materials are available from multiple sources of supply. We believe our relationships with our raw material suppliers and other vendors are generally good. Raw material prices were fairly stable during 2014, and we expect them to remain stable during 2015. Subject to certain risks related to our suppliers as discussed under Item 1A. “Risk Factors,” we foresee no acute shortages of any raw materials that would have a material adverse effect on our operations.

Employees

As of January 31, 2015, we had 5,407 employees, including 2,893 domestic employees and 2,514 international employees. These employees consisted of 2,605 salaried, 502 bargaining unit hourly and 2,300 non-bargaining unit hourly.

We are a party to one collective bargaining agreement with the International Association of Machinists and Aerospace Workers (“IAM”) covering 502 employees at our La Crosse, Wisconsin heat exchanger facility. Effective February 3, 2013, we entered into a five-year agreement with the IAM which expires on February 3, 2018.

Environmental Matters

Our operations have historically included and currently include the handling and use of hazardous and other regulated substances, such as various cleaning fluids used to remove grease from metal, that are subject to federal, state and local environmental laws and regulations. These regulations impose limitations on the discharge of pollutants into the soil, air and water, and establish standards for their handling, management, use, storage and disposal. We monitor and review our procedures and policies for compliance with environmental laws and regulations. Our management is familiar with these regulations and supports an ongoing program to maintain our adherence to required standards.

We are involved with environmental compliance, investigation, monitoring and remediation activities at certain of our owned or formerly owned manufacturing facilities and at one owned facility that is leased to a third party. We believe that we are currently in substantial compliance with all known environmental regulations. We accrue for certain environmental remediation-related activities for which commitments or remediation plans have been developed or for which costs can be reasonably estimated. These estimates are determined based upon currently available facts regarding each facility. Actual costs incurred may vary from these estimates due to the inherent uncertainties involved. Future expenditures relating to these environmental remediation efforts are expected to be made over the next 14 years as ongoing costs of remediation programs. We do not believe that these regulatory requirements have had a material effect upon our capital expenditures, earnings or competitive position. We are not anticipating any material capital expenditures in 2015 that are directly related to regulatory compliance matters. Although we believe we have adequately provided for the cost of all known environmental conditions, additional contamination, the outcome of disputed matters or changes in regulatory posture could result in more costly remediation measures than budgeted, or those we believe are adequate or required by existing law. We believe that any additional liability in excess of amounts accrued which may result from the resolution of such matters will not have a material adverse effect on our financial position, liquidity, cash flows or results of operations.

Available Information

Additional information about the Company is available at www.chartindustries.com. On the Investor Relations page of the website, the public may obtain free copies of the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable following the time that they are filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Additionally, the Company has posted its Code of Ethical Business Conduct and Officer Code of Ethics on its website, which are also available free of charge to any shareholder interested in obtaining a copy. This Form 10-K and reports filed with the SEC are also accessible through the SEC’s website at www.sec.gov. References to our website or the SEC’s website do not constitute incorporation by reference of the information contained on such websites, and such information is not part of this Form 10-K.

Investing in our common stock involves risk. You should carefully consider the risks described below as well as the other information contained in this Annual Report on Form 10-K in evaluating your investment in us. If any of the following risks actually occur, our business, financial condition, operating results or cash flows could be harmed materially. Additional risks, uncertainties and other factors that are not currently known to us or that we believe are not currently material may also adversely affect our business, financial condition, operating results or cash flows. In any of these cases, you may lose all or part of your investment in us.

Risks Related to Our Business

The markets we serve are subject to cyclical demand and vulnerable to economic downturn, which could harm our business and make it difficult to project long-term performance.

Demand for our products depends in large part upon the level of capital and maintenance expenditures by many of our customers and end-users, in particular those customers in the global hydrocarbon and industrial gas markets. These customers’ expenditures historically have been cyclical in nature and vulnerable to economic downturns. Decreased capital and maintenance spending by these customers could have a material adverse effect on the demand for our products and our business, financial condition and results of operations. In addition, this historically cyclical demand limits our ability to make accurate long-term predictions about the performance of our company. Even if demand improves, it is difficult to predict whether any improvement represents a long-term improving trend or the extent or timing of improvement. There can be no assurance that historically improving cycles are representative of actual future demand.

While we experienced growth in demand from 2003 until mid-2008 in the global hydrocarbon and industrial gas markets, we experienced a significant decline in orders from mid-2008 until mid-2009. Although there was improvement in orders for our businesses, particularly in 2011 through 2013, we have experienced decline since 2014 in hydrocarbon demand with the decline in energy prices. We cannot predict whether business performance may be better or worse in the future.

The loss of, or significant reduction or delay in, purchases by our largest customers could reduce our sales and profitability.

A small number of customers has accounted for a substantial portion of our historical net sales. For example, sales to our top ten customers accounted for 34%, 37% and 38% of consolidated sales in 2014, 2013 and 2012, respectively. We expect that a limited number of customers will continue to represent a substantial portion of our sales for the foreseeable future. While our sales to particular customers fluctuate from period to period, the global producers and distributors of hydrocarbon and industrial gases and their suppliers tend to be a consistently large source of our sales.

The loss of any of our major customers or a decrease or delay in orders or anticipated spending by such customers could materially reduce our sales and profitability. For example, a delay in the anticipated timing of LNG infrastructure build out or respiratory therapy demand recovery could materially reduce the demand for our products. Our largest customers could also engage in business combinations, which could increase their size, reduce their demand for our products as they recognize synergies or rationalize assets and increase or decrease the portion of our total sales concentration to any single customer.

Decreases in energy prices, or a decrease in the cost of oil relative to natural gas, may decrease demand for some of our products and cause downward pressure on the prices we charge, which could harm our business, financial condition and results of operations.

A significant amount of our sales are to customers in the energy production and supply industry. We estimate that 47% of our sales for the year ended December 31, 2014 were generated by end-users in the energy industry, with many of our products sold for natural gas-related applications. Accordingly, demand for a significant portion of our products depends upon the level

of capital expenditures by companies in the oil and gas industry, which depends, in part, on energy prices as well as the price of oil relative to natural gas for some applications. Some applications for our products could see greater demand when prices for natural gas are relatively low compared to oil prices, but a sustained decline in energy prices generally and a resultant downturn in energy production activities could negatively affect the capital expenditures of our customers. For example, the recent sharp decline in oil prices has had a negative impact on demand for some of our products. Any significant decline in the capital expenditures of our customers, whether due to a decrease in the market price of energy or otherwise, may decrease demand for our products and cause downward pressure on the prices we charge. Accordingly, if there is a downturn in the energy production and supply industry, including a decline in the cost of oil relative to natural gas, our business, financial condition and results of operations could be adversely affected.

Federal, state and local legislative and regulatory initiatives relating to hydraulic fracturing and the potential for related regulatory action or litigation could result in increased costs and additional operating restrictions or delays for our customers, which could negatively impact our business, financial condition and results of operations.

We supply equipment to companies that process, transport and utilize natural gas, many of which benefit from increased natural gas production resulting from hydraulic fracturing in the oil and natural gas industry. As a result, increased regulation of hydraulic fracturing may adversely impact our business, financial condition and results of operations. If additional levels of regulation are implemented with respect to hydraulic fracturing, it may make it more difficult to complete natural gas wells in shale formations and discourage exploration of new wells. This could increase our customers’ costs of compliance and doing business or otherwise adversely affect the hydraulic fracturing services they perform, which may negatively impact natural gas production and demand for our equipment used in the natural gas industry.

In addition, heightened political, regulatory and public scrutiny of hydraulic fracturing practices could potentially expose our customers to increased legal and regulatory proceedings, which could negatively impact natural gas production and demand for our equipment used in the natural gas industry. Any such developments could have a material adverse effect on our business, financial condition and results of operations, whether directly or indirectly.

We may be unable to compete successfully in the highly competitive markets in which we operate.

Although many of our products serve niche industry areas, a number of our direct and indirect competitors in these areas are major corporations, some of which have substantially greater technical, financial and marketing resources than Chart, and other competitors enter these areas from time to time. Any increase in competition may cause us to lose market share or compel us to reduce prices to remain competitive, which could result in reduced sales and earnings. We compete with several suppliers owned by global industrial gas producers or large industrial companies and many smaller fabrication-only facilities around the world. Increased competition with these companies could prevent the institution of price increases or could require price reductions or increased spending on research and development, and marketing and sales, any of which could materially reduce our sales, profitability or both. Moreover, during an industry downturn, competition in some of the product lines we serve increases as a result of over-capacity, which may result in downward pricing pressure. Further, customers who typically outsource their need for cryogenic systems to us may use their excess capacity to produce such systems themselves. We also compete in the sale of a limited number of products with certain of our major customers. If we are unable to compete successfully, our results of operations, cash flows and financial condition could be negatively affected.

Governmental energy policies could change, or expected changes could fail to materialize, which could adversely affect our business or prospects.

Energy policy can develop rapidly in the markets we serve, including the United States. Within the last few years, significant developments have taken place, primarily in international markets that we serve with respect to energy policy and related regulations. We anticipate that energy policy will continue to be an important regulatory priority globally as well as on a national, state and local level. As energy policy continues to evolve, the existing rules and incentives that impact the energy-related segments of our business may change. It is difficult, if not impossible, to predict whether changes in energy policy might occur in the future and the timing of potential changes and their impact on our business. The elimination or reduction of favorable policies for our energy-related business, or the failure to adopt expected policies that would benefit our business, could negatively impact our sales and profitability.

If we are unable to successfully manage our operational expansions, it may place a significant strain on our management and administrative resources and lead to increased costs and reduced profitability.

We expect to continue our existing plan to expand our operations, particularly in China, in markets where we perceive the opportunity for profitable expansion. Our ability to operate our business successfully and implement our strategies depends, in part, on our ability to allocate our resources optimally in each of our facilities in order to maintain efficient operations as we

expand. Ineffective management of our growth could cause manufacturing inefficiencies, increase our operating costs, place significant strain on our management and administrative resources and prevent us from implementing our business plan.

For example, we have invested or plan to invest approximately $60 to $70 million in new capital expenditures in 2015 related to the expected growth of selective parts of each of the E&C, D&S and BioMedical segments. If we fail to implement these projects in a timely and effective manner, we may lose the opportunity to obtain some new customer orders. Even if we effectively implement these projects, the orders needed to support the capital expenditure may not be obtained, may be delayed, or may be less than expected, which may result in sales or profitability at lower levels than anticipated. For example, while we invested in the expansion of our E&C segment in past years, we experienced delay in some of the orders initially anticipated to support that expansion, which resulted in the underutilization of some of our capacity. In addition, potential cost overruns, delays or unanticipated problems in any capital expansion could make the expansions more costly than originally predicted or cause us to miss windows of opportunity.

Our backlog is subject to modification or termination of orders, which could negatively impact our sales.

Our backlog is comprised of the portion of firm signed purchase orders or other written contractual commitments received from customers that we have not recognized as sales. The dollar amount of backlog as of December 31, 2014 was $640.1 million. Our backlog can be significantly affected by the timing of orders for large projects, particularly in our E&C segment, and the amount of our backlog at December 31, 2014 is not necessarily indicative of future backlog levels or the rate at which backlog will be recognized as sales. Although historically the amount of modifications and terminations of our orders has not been material compared to our total contract volume and is partially offset by cancellation penalties, customers can, and sometimes do, terminate or modify these orders. We cannot predict whether cancellations will accelerate or diminish in the future. Cancellations of purchase orders or reductions of product quantities in existing contracts could substantially and materially reduce our backlog and, consequently, our future sales. For example, both backlog and orders for the fourth quarter 2014 were reduced by approximately $33 million as orders previously received were removed where circumstances indicated that the customer would not perform its obligations. Our failure to replace canceled or reduced backlog could negatively impact our sales and results of operations.

We may fail to successfully acquire or integrate companies that provide complementary products or technologies.

A component of our business strategy is the acquisition of businesses that complement our existing products and services. Such a strategy involves the potential risks inherent in assessing the value, strengths, weaknesses, contingent or other liabilities and potential profitability of acquisition candidates and in integrating the operations of acquired companies. In addition, any acquisitions of businesses with foreign operations or sales may increase our exposure to risks inherent in doing business outside the United States.

From time to time, we may have acquisition discussions with potential target companies both domestically and internationally. If a large acquisition opportunity arises and we proceed, a substantial portion of our cash and surplus borrowing capacity could be used for the acquisition or we may seek additional debt or equity financing. For example, in August 2012 we used a substantial portion of our available cash to acquire AirSep Corporation.

Potential acquisition opportunities become available to us from time to time, and we engage periodically in discussions or negotiations relating to potential acquisitions, including acquisitions that may be material in size or scope to our business. Any acquisition may or may not occur and, if an acquisition does occur, it may not be successful in enhancing our business for one or more of the following reasons:

| |

| • | Any business acquired may not be integrated successfully and may not prove profitable; |

| |

| • | The price we pay for any business acquired may overstate the value of that business or otherwise be too high; |

| |

| • | Liabilities we take on through the acquisition may prove to be higher than we expected; |

| |

| • | We may fail to achieve acquisition synergies; or |

| |

| • | The focus on the integration of operations of acquired entities may divert management’s attention from the day-to-day operation of our businesses. |

Inherent in any future acquisition is the risk of transitioning company cultures and facilities. The failure to efficiently and effectively achieve such transitions could increase our costs and decrease our profitability.

Downturns in economic and financial conditions have had and may have in the future a negative effect on our business, financial condition and results of operations.

Demand for our products depends in large part upon the level of capital and maintenance expenditures by many of our customers and end-users. A downturn in economic conditions in industries in which we operate may reduce the willingness or

ability of our customers and prospective customers to commit funds to purchase our products and services, and may reduce their ability to pay for our products and services after purchase. Economic conditions that could impact our business include, but are not limited to, decreased energy prices, recessionary conditions, slow or negative economic growth rates, the impact of state and sovereign debt defaults or the impact of governmental budgetary pressures. Similarly, our suppliers may not be able to supply us with needed raw materials or components on a timely basis, may increase prices or go out of business, which could result in our inability to meet customer demand, fulfill our contractual obligations or could affect our gross margins. See “We depend on the availability of certain key suppliers; if we experience difficulty with a supplier, we may have difficulty finding alternative sources of supply” below. We cannot predict the timing or duration of negative market conditions. If the economy or industries in which we operate deteriorate or financial markets weaken, our business, financial condition and results of operations could be adversely impacted.

We carry goodwill and indefinite-lived intangible assets on our balance sheet, which are subject to impairment testing and could subject us to significant charges to earnings in the future if impairment occurs.

As of December 31, 2014, we had goodwill and indefinite-lived intangible assets of $453.2 million, which represented approximately 31.0% of our total assets. Goodwill and indefinite-lived intangible assets are not amortized, but are tested for impairment annually on October 1 or more often if events or changes in circumstances indicate a potential impairment may exist. Factors that could indicate that our goodwill or indefinite-lived intangible assets are impaired include a decline in stock price and market capitalization, lower than projected operating results and cash flows, and slower growth rates in our industry. Our stock price historically has shown volatility and often fluctuates significantly in response to market and other factors. For example, it declined significantly from mid-2008 to early 2009 and then increased sharply beginning in late 2010 through late 2013, when it again declined significantly in connection with energy price declines in 2014. Declines in our stock price, lower operating results and any decline in industry conditions in the future could increase the risk of goodwill impairment. Impairment testing incorporates our estimates of future operating results and cash flows, estimates of allocations of certain assets and cash flows among reporting segments, estimates of future growth rates and our judgment regarding the applicable discount rates used on estimated operating results and cash flows. If we determine that an impairment exists, it may result in a significant non-cash charge to earnings and lower stockholders’ equity.

Our exposure to fixed-price contracts, including exposure to fixed pricing on long-term customer contracts, could negatively impact our financial results.

A substantial portion of our sales has historically been derived from fixed-price contracts for large system projects, which may involve long-term fixed price commitments to customers and which are sometimes difficult to execute. To the extent that any of our fixed-price contracts are delayed, our subcontractors fail to perform, contract counterparties successfully assert claims against us, the original cost estimates in these or other contracts prove to be inaccurate or the contracts do not permit us to pass increased costs on to our customers, profitability from a particular contract may decrease or project losses may be incurred, which, in turn, could decrease our sales and overall profitability. The uncertainties associated with our fixed-price contracts make it more difficult to predict our future results and exacerbate the risk that our results will not match expectations, which has happened in the past.

We depend on the availability of certain key suppliers; if we experience difficulty with a supplier, we may have difficulty finding alternative sources of supply.

The cost, quality and availability of raw materials, certain specialty metals and specialized components used to manufacture our products are critical to our success. The materials and components we use to manufacture our products are sometimes custom made and may be available only from a few suppliers, and the lead times required to obtain these materials and components can often be significant. We rely on sole suppliers or a limited number of suppliers for some of these materials, including special grades of aluminum used in our brazed aluminum heat exchangers and compressors included in some of our product offerings. While we have not historically encountered problems with availability, this does not mean that we will continue to have timely access to adequate supplies of essential materials and components in the future or that supplies of these materials and components will be available on satisfactory terms when needed. If our vendors for these materials and components are unable to meet our requirements, fail to make shipments in a timely manner or ship defective materials or components, we could experience a shortage or delay in supply or fail to meet our contractual requirements, which would adversely affect our results of operations and negatively impact our cash flow and profitability.

Health care reform or other changes in government and other third-party payor reimbursement levels and practices could negatively impact our sales and profitability.

Many of our BioMedical segment’s customers are reimbursed for products and services by third-party payors, such as government programs, including Medicare and Medicaid, private insurance plans and managed care programs in the U.S, and

by similar programs and entities in the other countries in which we operate or sell our equipment. In the United States, the Centers for Medicare & Medicaid Services (“CMS”), the agency responsible for administering the Medicare program, has implemented a number of payment rules that reduced Medicare payments for oxygen and oxygen equipment, including a competitive bidding program. Under the competitive bidding program, CMS selected contract suppliers that agreed to receive as payment the “single payment amount” calculated by CMS in certain geographic regions. In addition, CMS has increased the level of audit activity involving the sales practices of intermediaries in the health care field, some of which are customers of ours for respiratory products we sell. If third-party payors deny coverage, make the reimbursement process or documentation requirements more burdensome or uncertain, or reduce levels of reimbursement, it could negatively affect our sales and profitability.

In March 2010, the Affordable Care Act was adopted in the United States. The law includes provisions that, among other things, reduce and/or limit Medicare reimbursement, require all individuals to have health insurance (with limited exceptions) and impose new and/or increased taxes. In addition, the Affordable Care Act requires CMS to nationalize the competitive bidding process or adjust the prices in non-competitive bidding areas to match competitive bidding prices. There remains a significant amount of uncertainty regarding the implementation of the Affordable Care Act, and the potential impact of such policies on the demand for our products or the prices at which we sell our products. Any such negative impact in demand or product prices associated with the Affordable Care Act could have a material adverse effect on our business, results of operations and/or financial condition.

Due to the nature of our business and products, we may be liable for damages based on product liability and warranty claims.

Due to the high pressures and low temperatures at which many of our products are used, the inherent risks associated with concentrated industrial and hydrocarbon gases, and the fact that some of our products are relied upon by our customers or end users in their facilities or operations, or are manufactured for relatively broad industrial, transportation or consumer use, we face an inherent risk of exposure to claims in the event that the failure, use or misuse of our products results, or is alleged to result, in death, bodily injury, property damage or economic loss. We believe that we meet or exceed existing professional specification standards recognized or required in the industries in which we operate. We are subject to claims from time to time, some of which are substantial, and we may be subject to claims in the future. For example, we and some of our subsidiaries have been subject to assertions that failure of our subsidiaries’ equipment has caused substantial property damage and economic loss at facilities owned by customers or third parties, including a natural gas processing plant fire where the performance of our subsidiary’s equipment is being investigated, a lawsuit against us and our subsidiaries is pending, and end user losses are alleged to be approximately $105 million, including investigation and repair costs and business interruption losses, responsibility for which we and our subsidiaries vigorously dispute. See Item 3. “Legal Proceedings,” for further details. Although we currently maintain product liability coverage, which we believe is adequate for existing product liability claims and for the continued operation of our business, such insurance may become difficult to obtain or be unobtainable in the future on terms acceptable to us, it includes customary exclusions and conditions, it may not cover certain specialized applications, such as aerospace-related applications, and it generally does not cover warranty claims. A successful product liability claim or series of claims against us, including one or more consumer claims purporting to constitute class actions or claims resulting from extraordinary loss events, in excess of or outside our insurance coverage, or a significant warranty claim or series of claims against us, could materially decrease our liquidity, impair our financial condition and adversely affect our results of operations.

As a global business, we are exposed to economic, political and other risks in different countries which could materially reduce our sales, profitability or cash flows, or materially increase our liabilities.

Since we manufacture and sell our products worldwide, our business is subject to risks associated with doing business internationally. In 2014, 2013 and 2012, 53%, 59% and 56%, respectively, of our sales were made in international markets. Our future results could be harmed by a variety of factors, including:

| |

| • | changes in foreign currency exchange rates; |

| |

| • | exchange controls and currency restrictions; |

| |

| • | changes in a specific country’s or region’s political, social or economic conditions, particularly in emerging markets; |

| |

| • | civil unrest, turmoil or outbreak of disease in any of the countries in which we operate or sell our products; |

| |

| • | tariffs, other trade protection measures and import or export licensing requirements; |

| |

| • | potentially negative consequences from changes in U.S. and international tax laws; |

| |

| • | difficulty in staffing and managing geographically widespread operations; |

| |

| • | differing labor regulations; |

| |

| • | requirements relating to withholding taxes on remittances and other payments by subsidiaries; |

| |

| • | different regulatory regimes controlling the protection of our intellectual property; |

| |

| • | restrictions on our ability to own or operate subsidiaries, make investments or acquire new businesses in these jurisdictions; |

| |

| • | restrictions on our ability to repatriate dividends from our foreign subsidiaries; |

| |

| • | difficulty in collecting international accounts receivable; |

| |

| • | difficulty in enforcement of contractual obligations under non-U.S. law; |

| |

| • | transportation delays or interruptions; |

| |

| • | changes in regulatory requirements; and |

| |

| • | the burden of complying with multiple and potentially conflicting laws. |

Our international operations and sales also expose us to different local political and business risks and challenges. For example, we are faced with potential difficulties in staffing and managing local operations and we have to design local solutions to manage credit and legal risks of local customers and distributors, which may not be effective. In addition, because some of our international sales are to suppliers that perform work for foreign governments, we are subject to the political risks associated with foreign government projects. For example, certain foreign governments may require suppliers for a project to obtain products solely from local manufacturers or may prohibit the use of products manufactured in certain countries.

International growth and expansion into markets such as China, Central and Eastern Europe, India, the Middle East and Latin America, may cause us difficulty due to greater regulatory barriers than in the United States, the necessity of adapting to new regulatory systems, problems related to entering new markets with different economic, social and political systems and conditions, and significant competition from the primary participants in these markets, some of which may have substantially greater resources than us. For example, in recent years we have increased significantly the proportion of our sales and operations in China, and we plan to continue to do so. In addition, unstable political conditions or civil unrest, including political instability in Eastern Europe, the Middle East or elsewhere, could negatively impact our order levels and sales in a region or our ability to collect receivables from customers or operate or execute projects in a region.

Our international operations and transactions also depend upon favorable trade relations between the United States and those foreign countries in which our customers and suppliers have operations. A protectionist trade environment in either the United States or those foreign countries in which we do business or sell products, such as a change in the current tariff structures, export compliance, government subsidies or other trade policies, may adversely affect our ability to sell our products or do business in foreign markets. Our overall success as a global business depends, in part, upon our ability to succeed in differing economic, social and political conditions. We may not succeed in developing and implementing policies and strategies to counter the foregoing factors effectively in each location where we do business and the foregoing factors may cause a reduction in our sales, profitability or cash flows, or cause an increase in our liabilities.

Our warranty reserves may not adequately cover our warranty obligations and increased or unexpected product warranty claims could adversely impact our financial condition and results of operations.

We provide product warranties with varying terms and durations for the majority of our products and we establish reserves for the estimated liability associated with our product warranties. Our warranty reserves are based on historical trends as well as our understanding of specifically identified warranty issues. The amounts estimated could differ materially from actual warranty costs that may ultimately be realized. An increase in the rate of warranty claims or the occurrence of unexpected warranty claims could have a material adverse effect on our financial condition or results of operations.

If we lose our senior management or other key employees, our business may be adversely affected.

Our ability to successfully operate and grow our business and implement our strategies is largely dependent on the efforts, abilities and services of our senior management and other key employees. Our future success will also depend on, among other factors, our ability to attract and retain qualified personnel, such as engineers and other skilled labor, either through direct hiring or the acquisition of other businesses employing such professionals. Our products, many of which are highly engineered, represent specialized applications of cryogenic low temperature or gas processing technologies and know-how, and many of the markets we serve represent niche markets for these specialized applications. Accordingly, we rely heavily on engineers, salespersons, business unit leaders, senior management and other key employees who have experience in these specialized applications and are knowledgeable about these niche markets, our products, and our company. Additionally, we may modify our management structure from time to time or substantially reduce our overall workforce as we did in certain sectors of our business during the recent economic downturn, which may create marketing, operational and other business

risks. The loss of the services of these senior managers or other key employees or the failure to attract or retain other qualified personnel could reduce the competitiveness of our business or otherwise impair our business prospects.

Fluctuations in exchange and interest rates may affect our operating results and impact our financial condition.

Fluctuations in the value of the U.S. dollar may increase or decrease our sales or earnings. Because our consolidated financial results are reported in U.S. dollars, if we generate sales or earnings in other currencies, the translation of those results into U.S. dollars can result in a significant increase or decrease in the amount of those sales or earnings. We also bid for certain foreign projects in U.S. dollars or euros. If the U.S. dollar or euro strengthens relative to the value of the local currency, we may be less competitive on those projects. In addition, our debt service requirements are primarily in U.S. dollars and a portion of our cash flow is generated in euros or other foreign currencies. Significant changes in the value of the foreign currencies relative to the U.S. dollar could impair our cash flow and financial condition.

In addition, fluctuations in currencies relative to the U.S. dollar may make it more difficult to perform period-to-period comparisons of our reported results of operations. For purposes of accounting, the assets and liabilities of our foreign operations, where the local currency is the functional currency, are translated using period-end exchange rates, and the revenues and expenses of our foreign operations are translated using average exchange rates during each period. For example, we have material euro-denominated net monetary assets and liabilities. If economic circumstances result in a significant devaluation of the euro, the value of our euro-denominated net monetary assets and liabilities would be correspondingly reduced when translated into U.S. dollars for inclusion in our financial statements. Similarly, the re-introduction of certain individual country currencies or the complete dissolution of the euro, could adversely affect the value of our euro-denominated net monetary assets and liabilities. In either case, our business, results of operations, financial condition and liquidity could be materially adversely affected.

In addition to currency translation risks, we incur currency transaction risk whenever we or one of our subsidiaries enters into either a purchase or a sales transaction using a currency other than the functional currency of the transacting entity. Given the volatility of exchange rates, we may not be able to effectively manage our currency and/or translation risks. Volatility in currency exchange rates may decrease our sales and profitability and impair our financial condition. We have purchased and may continue to purchase foreign currency forward buy and sell contracts to manage the risk of adverse currency fluctuations and if the contracts are inconsistent with currency trends we could experience exposure related to foreign currency fluctuations.

We are also exposed to general interest rate risk. If interest rates increase, our interest expense could increase significantly, affecting earnings and reducing cash flow available for working capital, capital expenditures, acquisitions, and other purposes. In addition, changes by any rating agency to our outlook or credit ratings could increase our cost of borrowing.

We are subject to potential insolvency or financial distress of third parties.

We are exposed to the risk that third parties to various arrangements who owe us money or goods and services, or who purchase goods and services from us, will not be able to perform their obligations or continue to place orders due to insolvency or financial distress. If third parties fail to perform their obligations under arrangements with us, we may be forced to replace the underlying commitment at current or above market prices or on other terms that are less favorable to us or we may have to write off receivables in the case of customer failures to pay. If this happens, whether as a result of the insolvency or financial distress of a third party or otherwise, we may incur losses, or our results of operations, financial position or liquidity could otherwise be adversely affected.

If we are unable to effectively control our costs while maintaining our customer relationships and core resources, our business, results of operations and financial condition could be adversely affected.

It is critical for us to appropriately align our cost structure with prevailing market conditions, to minimize the effect of economic fluctuation on our operations, and in particular, to continue to maintain our customer relationships, core resources and manufacturing capacity while protecting profitability and cash flow. If we are unable to align our cost structure in response to prevailing economic conditions on a timely basis, or if implementation or failure to implement any cost structure adjustments has an adverse impact on our business or prospects, then our financial condition, results of operations and cash flows may be negatively affected.

Failure to protect our intellectual property and know-how could reduce or eliminate any competitive advantage and reduce our sales and profitability, and the cost of protecting our intellectual property may be significant.

We rely on a combination of internal procedures, nondisclosure agreements, intellectual property rights assignment agreements, as well as licenses, patents, trademarks and copyright law to protect our intellectual property and know-how. Our intellectual property rights may not be successfully asserted in the future or may be invalidated, circumvented or challenged.

For example, we frequently explore and evaluate potential relationships and projects with other parties, which often require that we provide the potential partner with confidential technical information. While confidentiality agreements are typically put in place, there is a risk the potential partner could violate the confidentiality agreement and use our technical information for its own benefit or the benefit of others or compromise the confidentiality. In addition, the laws of certain foreign countries in which our products may be sold or manufactured do not protect our intellectual property rights to the same extent as the laws of the United States. For example, we are increasing our manufacturing capabilities and sales in China, where laws may not protect our intellectual property rights to the same extent as in the United States. In addition, certain provisions of the Leahy-Smith America Invents Act went into effect on March 16, 2013. The Leahy-Smith America Invents Act transitioned the United States from a “first-to-invent” to a “first-to-file” patent system. This change means that between two identical, pending patent applications, the first inventor no longer receives priority on the patent to the invention. As a result, the Leahy-Smith America Invents Act may require us to incur significant additional expense and effort to protect our intellectual property. Failure or inability to protect our proprietary information could result in a decrease in our sales or profitability.

We have obtained and applied for some U.S. and foreign trademark and patent registrations and will continue to evaluate the registration of additional trademarks and patents, as appropriate. We cannot guarantee that any of our pending applications will be approved. Moreover, even if the applications are approved, third parties may seek to oppose or otherwise challenge them. A failure to obtain registrations in the United States or elsewhere could limit our ability to protect our trademarks and technologies and could impede our business. Further, the protection of our intellectual property may require expensive investment in protracted litigation and the investment of substantial management time and there is no assurance we ultimately would prevail or that a successful outcome would lead to an economic benefit that is greater than the investment in the litigation. The patents in our patent portfolio are scheduled to expire between 2015 and 2034.

In addition, we may be unable to prevent third parties from using our intellectual property rights and know-how without our authorization or from independently developing intellectual property that is the same as or similar to ours, particularly in those countries where the laws do not protect our intellectual property rights as fully as in the United States. We compete in a number of industries (for example, heat exchangers and cryogenic storage) that are small or specialized, which makes it easier for a competitor to monitor our activities and increases the risk that ideas will be stolen. The unauthorized use of our know-how by third parties could reduce or eliminate any competitive advantage we have developed, cause us to lose sales or otherwise harm our business or increase our expenses as we attempt to enforce our rights.

Some of our products are subject to regulation by the U.S. Food and Drug Administration and other governmental authorities.

Some of our products are subject to regulation by the U.S. Food and Drug Administration and other national, supranational, federal and state governmental authorities. It can be costly and time consuming to obtain regulatory approvals to market a medical device, such as those sold by our BioMedical segment. Approvals might not be granted for new devices on a timely basis, if at all. Regulations are subject to change as a result of legislative, administrative or judicial action, which may further increase our costs or reduce sales. Our failure to maintain approvals or obtain approval for new products could adversely affect our business, results of operations, financial condition and cash flows.

In addition, we are subject to regulations covering manufacturing practices, product labeling, advertising and adverse-event reporting that apply after we have obtained approval to sell a product. Many of our facilities’ procedures and those of our suppliers are subject to ongoing oversight, including periodic inspection by governmental authorities. Compliance with production, safety, quality control and quality assurance regulations is costly and time-consuming, and while we seek to be in full compliance, noncompliance could arise from time to time. If we fail to comply, our operations, financial condition and cash flows could be adversely affected, including through the imposition of fines, costly remediation or plant shutdowns, suspension or delay in product approval, product seizure or recall, or withdrawal of product approval as a result of noncompliance.

Fluctuations in the prices and availability of raw materials could negatively impact our financial results.

The pricing and availability of raw materials for use in our businesses can be volatile due to numerous factors beyond our control, including general, domestic and international economic conditions, labor costs, production levels, competition, consumer demand, import duties and tariffs and currency exchange rates. This volatility can significantly affect the availability and cost of raw materials for us, and may, therefore, increase the short-term or long-term costs of raw materials.

The commodity metals we use, including aluminum and stainless steel, have experienced significant fluctuations in price in recent years. On average, over half of our cost of sales for many of our product lines has historically been represented by the cost of commodities metals. We have generally been able to recover the cost increases through price increases to our customers; however, during periods of rising prices of raw materials, we may not always be able to pass increases on to our customers. Conversely, when raw material prices decline, customer demands for lower prices could result in lower sale prices and, to the

extent we have existing inventory, lower margins. As a result, fluctuations in raw material prices could result in lower sales and profitability.

Increased IT security threats and more sophisticated and targeted computer crime could pose a risk to our systems, networks, products, solutions and services.

Increased global IT security threats and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. While we attempt to mitigate these risks by employing a number of measures, including employee training, comprehensive monitoring of our networks and systems, and maintenance of backup and protective systems, our systems, networks, products, solutions and services remain potentially vulnerable to advanced persistent threats. Depending on their nature and scope, such threats could potentially lead to the compromising of confidential information, improper use of our systems and networks, manipulation and destruction of data, defective products, production downtimes and operational disruptions, which in turn could adversely affect our reputation, competitiveness and results of operations.