N Y S E : G T L S 1 Jill Evanko CEO Presented by Joe Brinkman CFO Second Quarter 2022 Earnings Call Exhibit 99.2

Forward-Looking Statements © 2022 Chart Industries, Inc. Confidential and Proprietary 2 CERTAIN STATEMENTS MADE IN THIS PRESENTATION ARE FORW ARD-LOOKING STATEMENTS W ITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORW ARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING THE COMPANY’S BUSINESS PLANS, INCLUDING STATEMENTS REGARDING COMPLETED DIVESTITURES, ACQUISITIONS AND INVESTMENTS, COST SYNERGIES AND EFFICIENCY SAVINGS, OBJECTIVES, FUTURE ORDERS, REVENUES, MARGINS, EARNINGS OR PERFORMANCE, LIQUIDITY AND CASH FLOW , CAPITAL EXPENDITURES, SUPPLY CHAIN CHALLENGES, INFLATIONARY PRESSURES INCLUDING MATERIAL COST AND PRICING INCREASES, BUSINESS TRENDS, CLEAN ENERGY MARKET OPPORTUNITIES AND PROJECTED INDUSTRY- WIDE OPPORTUNITIES INCLUDING ADDRESSABLE MARKETS, GOVERNMENTAL INITIATIVES, INCLUDING EXECUTIVE ORDERS AND OTHER INFORMATION THAT IS NOT HISTORICAL IN NATURE. FORW ARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY TERMINOLOGY SUCH AS "MAY," "W ILL," "SHOULD," "COULD," "EXPECTS," "ANTICIPATES," "BELIEVES," "PROJECTS," "FORECASTS," “OUTLOOK,” “GUIDANCE,” "CONTINUE," “TARGET,” OR THE NEGATIVE OF SUCH TERMS OR COMPARABLE TERMINOLOGY. FORW ARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION OR IN OTHER STATEMENTS MADE BY THE COMPANY ARE MADE BASED ON MANAGEMENT'S EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS IMPACTING THE COMPANY AND ARE SUBJECT TO UNCERTAINTIES AND FACTORS RELATING TO THE COMPANY'S OPERATIONS AND BUSINESS ENVIRONMENT, ALL OF W HICH ARE DIFFICULT TO PREDICT AND MANY OF W HICH ARE BEYOND THE COMPANY'S CONTROL, THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE MATTERS EXPRESSED OR IMPLIED BY FORW ARD-LOOKING STATEMENTS. FACTORS THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORW ARD-LOOKING STATEMENTS INCLUDE: THE COMPANY’S ABILITY TO SUCCESSFULLY INTEGRATE RECENT ACQUISITIONS AND ACHIEVE THE ANTICIPATED REVENUE, EARNINGS, ACCRETION AND OTHER BENEFITS FROM THESE ACQUISITIONS; SLOW ER THAN ANTICIPATED GROW TH AND MARKET ACCEPTANCE OF NEW CLEAN ENERGY PRODUCT OFFERINGS; INABIL ITY TO ACHIEVE EXPECTED PRICE INCREASES OR CONTINUED SUPPLY CHAIN CHALLENGES INCLUDING VOLATILITY IN RAW MATERIALS COST AND SUPPLY; RISKS RELATING TO THE OUTBREAK AND CONTINUED UNCERTAINTY ASSOCIATED W ITH THE CORONAVIRUS (COVID-19) AND THE CONFLICT BETW EEN RUSSIA AND UKRAINE AND THE OTHER FACTORS DISCUSSED IN ITEM 1A (RISK FACTORS) IN THE COMPANY’S MOST RECENT ANNUAL REPORT ON FORM 10-K AND QUARTERLY REPORTS ON FORM 10-Q FILED W ITH THE SEC, W HICH SHOULD BE REVIEWED CAREFULLY. THE COMPANY UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORW ARD-LOOKING STATEMENT. THIS PRESENTATION CONTAINS SECOND QUARTER 2022 NON-GAAP FINANCIAL INFORMATION, INCLUDING ADJUSTED NON-DILUTED EPS, NORMALIZED BASIC EPS, “NET INCOME, ADJUSTED” , FREE CASH FLOW , ADJUSTED FREE CASH FLOW , EBITDA, ADJUSTED EBITDA, ADJUSTED GROSS PROFIT, ADJUSTED GROSS PROFIT MARGIN, ADJUSTED OPERATING INCOME, AND ADJUSTED OPERATING MARGIN. FOR ADDITIONAL INFORMATION REGARDING THE COMPANY'S USE OF NON-GAAP FINANCIAL INFORMATION, AS W ELL AS RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES TO THE MOST DIRECTLY COMPARABLE FINANCIAL MEASURES CALCULATED AND PRESENTED IN ACCORDANCE W ITH ACCOUNTING PRINCIPLES GENERALLY ACCEPTED IN THE UNITED STATES ("GAAP") , PLEASE SEE THE RECONCILIATION SLIDES TITLED “SECOND QUARTER 2022 EARNINGS PER SHARE,” “SECOND QUARTER 2022 ADJUSTED EBITDA” AND “SECOND QUARTER 2022 FREE CASH FLOW ” INCLUDED IN, OR IN THE APPENDIX AT THE END OF, THIS PRESENTATION. PLEASE SEE THE RECONCILIATION TABLE AT THE END OF THE ACCOMPANYING EARNINGS RELEASE FOR THE “ADJUSTED GROSS PROFIT” AND “ADJUSTED OPERATING INCOME” RECONCILIATIONS, AS W ELL AS A RECONCILIATION AND ADDITIONAL DETAILS ON ADJUSTED NON-DILUTED EPS AND ADJUSTED FREE CASH FLOW . W ITH RESPECT TO THE COMPANY’S 2022 FULL YEAR EARNINGS OUTLOOK, THE COMPANY IS NOT ABLE TO PROVIDE A RECONCILIATION OF THE ADJUSTED EARNINGS PER NON-DILUTED SHARE OR ADJUSTED FREE CASH FLOW , BECAUSE CERTAIN ITEMS MAY HAVE NOT YET OCCURRED OR ARE OUT OF THE COMPANY’S CONTROL AND/OR CANNOT BE REASONABLY PREDICTED. CHART INDUSTRIES, INC. IS A LEADING INDEPENDENT GLOBAL MANUFACTURER OF HIGHLY ENGINEERED EQUIPMENT SERVICING MULTIPLE APPLICATIONS IN THE ENERGY AND INDUSTRIAL GAS MARKETS. OUR UNIQUE PRODUCT PORTFOLIO IS USED IN EVERY PHASE OF THE LIQUID GAS SUPPLY CHAIN, INCLUDING UPFRONT ENGINEERING, SERVICE AND REPAIR. BEING AT THE FOREFRONT OF THE CLEAN ENERGY TRANSITION, CHART IS A LEADING PROVIDER OF TECHNOLOGY, EQUIPMENT AND SERVICES RELATED TO LIQUEFIED NATURAL GAS, HYDROGEN, BIOGAS AND CO2 CAPTURE AMONGST OTHER APPLICATIONS. WE ARE COMMITTED TO EXCELLENCE IN ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE (ESG) ISSUES BOTH FOR OUR COMPANY AS W ELL AS OUR CUSTOMERS. W ITH OVER 25 GLOBAL LOCATIONS FROM THE UNITED STATES TO ASIA, AUSTRALIA, INDIA, EUROPE AND SOUTH AMERICA, W E MAINTAIN ACCOUNTABILITY AND TRANSPARENCY TO OUR TEAM MEMBERS, SUPPLIERS, CUSTOMERS AND COMMUNITIES. TO LEARN MORE, VISIT WWW.CHARTINDUSTRIES.COM.

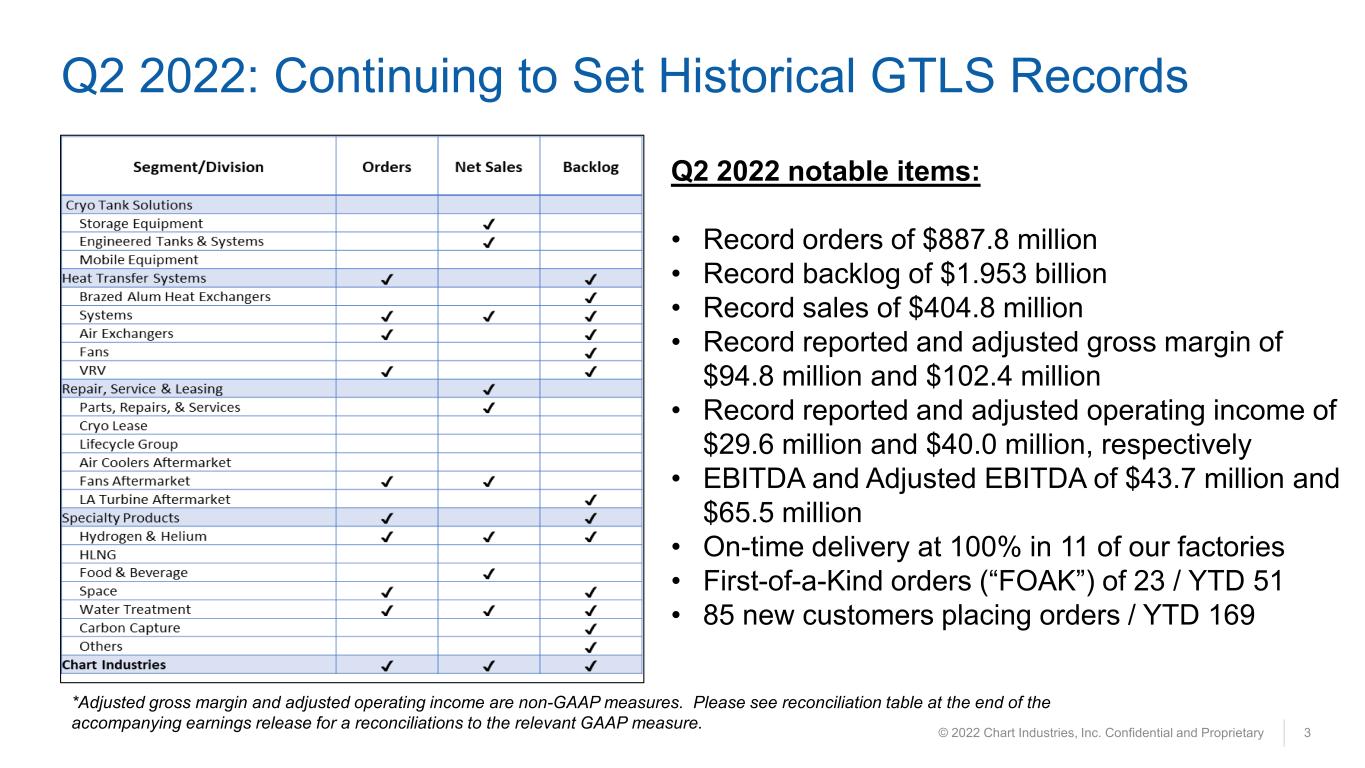

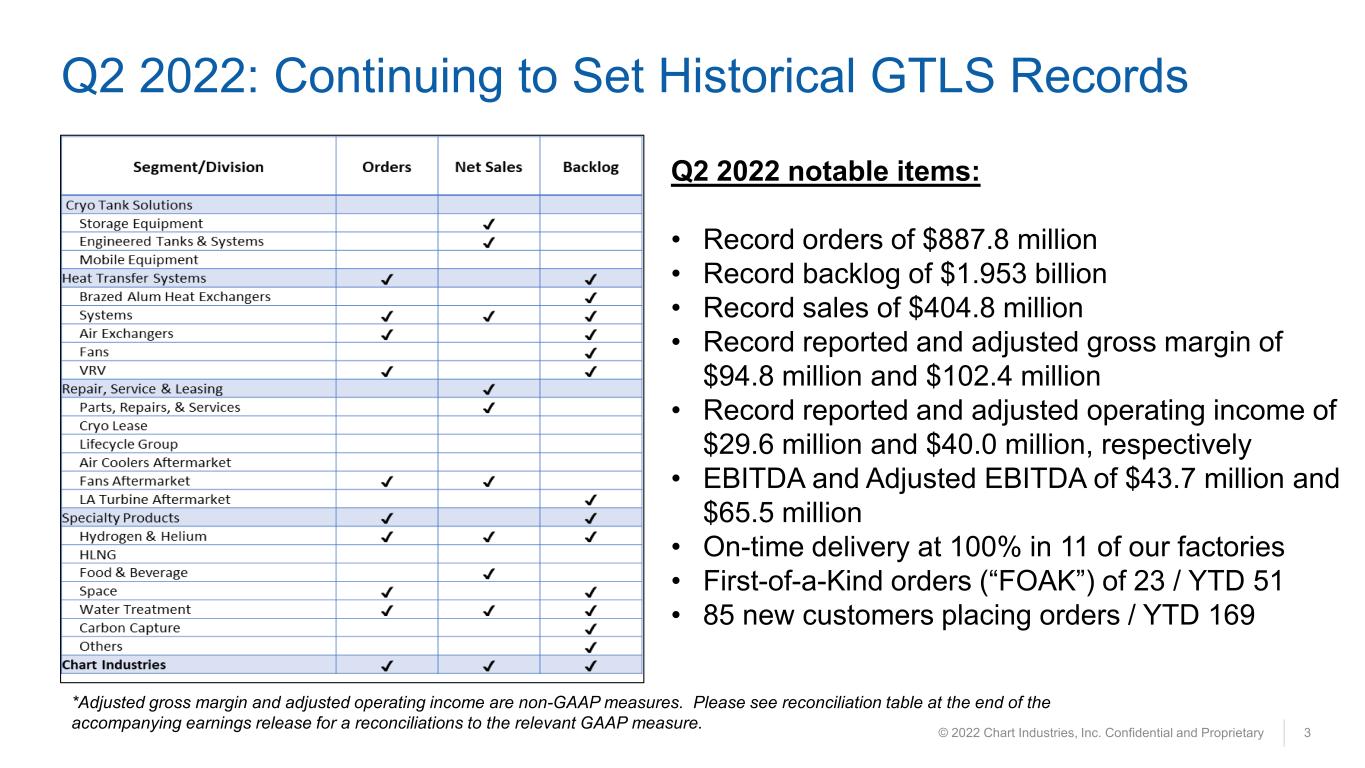

© 2022 Chart Industries, Inc. Confidential and Proprietary 3 Q2 2022: Continuing to Set Historical GTLS Records Q2 2022 notable items: • Record orders of $887.8 million • Record backlog of $1.953 billion • Record sales of $404.8 million • Record reported and adjusted gross margin of $94.8 million and $102.4 million • Record reported and adjusted operating income of $29.6 million and $40.0 million, respectively • EBITDA and Adjusted EBITDA of $43.7 million and $65.5 million • On-time delivery at 100% in 11 of our factories • First-of-a-Kind orders (“FOAK”) of 23 / YTD 51 • 85 new customers placing orders / YTD 169 *Adjusted gross margin and adjusted operating income are non-GAAP measures. Please see reconciliation table at the end of the accompanying earnings release for a reconciliations to the relevant GAAP measure.

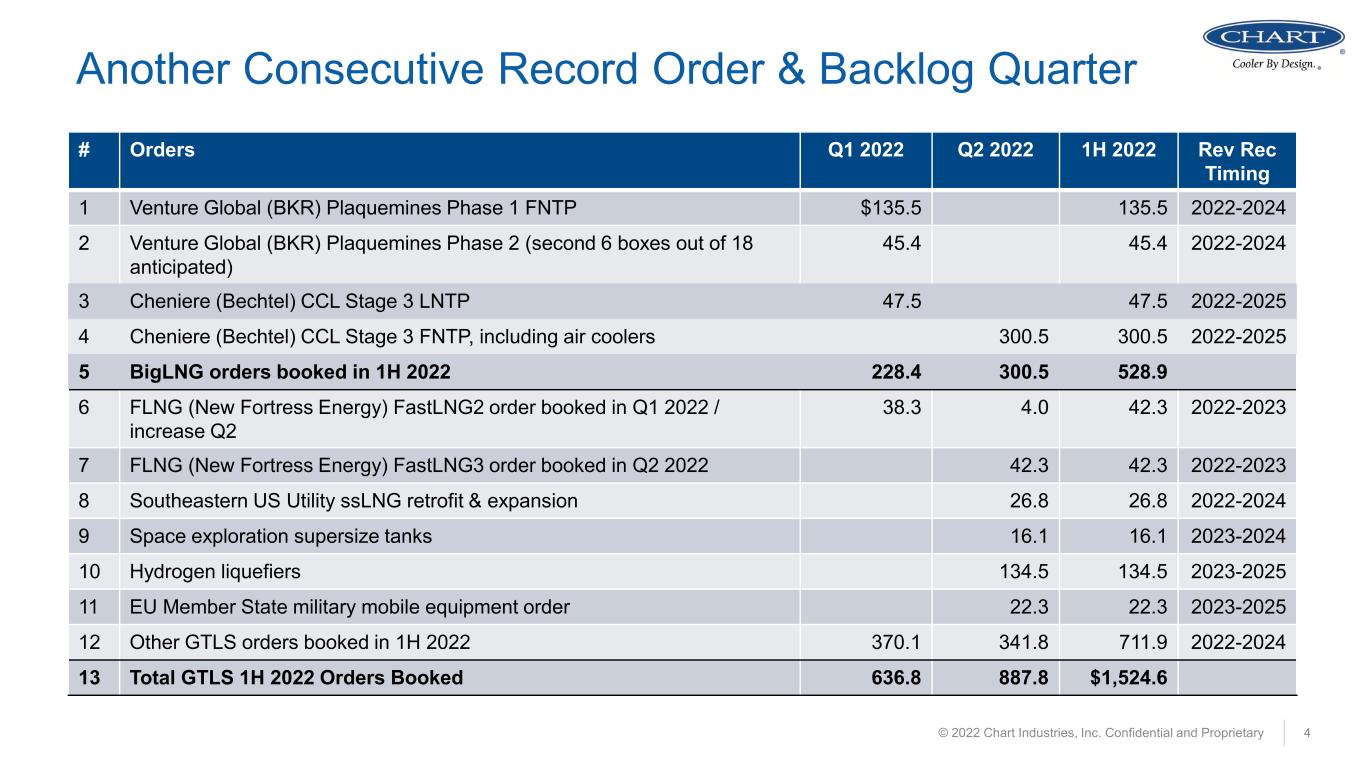

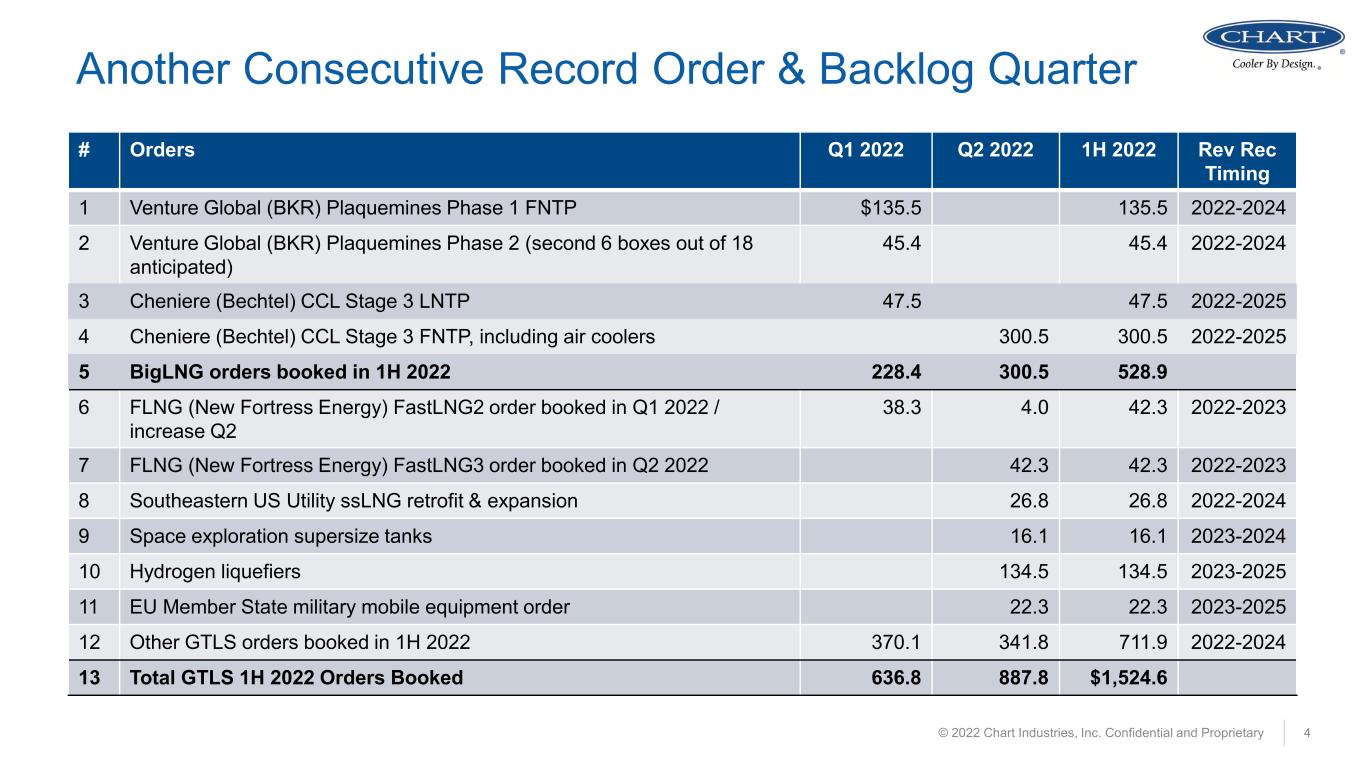

© 2022 Chart Industries, Inc. Confidential and Proprietary 4 Another Consecutive Record Order & Backlog Quarter # Orders Q1 2022 Q2 2022 1H 2022 Rev Rec Timing 1 Venture Global (BKR) Plaquemines Phase 1 FNTP $135.5 135.5 2022-2024 2 Venture Global (BKR) Plaquemines Phase 2 (second 6 boxes out of 18 anticipated) 45.4 45.4 2022-2024 3 Cheniere (Bechtel) CCL Stage 3 LNTP 47.5 47.5 2022-2025 4 Cheniere (Bechtel) CCL Stage 3 FNTP, including air coolers 300.5 300.5 2022-2025 5 BigLNG orders booked in 1H 2022 228.4 300.5 528.9 6 FLNG (New Fortress Energy) FastLNG2 order booked in Q1 2022 / increase Q2 38.3 4.0 42.3 2022-2023 7 FLNG (New Fortress Energy) FastLNG3 order booked in Q2 2022 42.3 42.3 2022-2023 8 Southeastern US Utility ssLNG retrofit & expansion 26.8 26.8 2022-2024 9 Space exploration supersize tanks 16.1 16.1 2023-2024 10 Hydrogen liquefiers 134.5 134.5 2023-2025 11 EU Member State military mobile equipment order 22.3 22.3 2023-2025 12 Other GTLS orders booked in 1H 2022 370.1 341.8 711.9 2022-2024 13 Total GTLS 1H 2022 Orders Booked 636.8 887.8 $1,524.6

© 2022 Chart Industries, Inc. Confidential and Proprietary 5 Average Orders Per Quarter, ex Big LNG (2016-YTD 2022) $177.0 $215.0 $265.0 $296.0 $302.2 $419.0 $497.9 2016 2017 2018 2019 2020 2021 2022 Big LNG Orders, not shown on column graph Year $ millions 2018 2.9 2019 133.9 2020 1.1 2021 2.9 2022 YTD 6/30/22 528.9 Average 2021-2022 GTLS orders per quarter $445.3M Average 2016-2020 GTLS orders per quarter $251.0 million All years normalized to exclude divested businesses.

© 2022 Chart Industries, Inc. Confidential and Proprietary 6 July 2022: Start to Q3 Orders – Demand Continues Specific Order Wins Include: 1. 21 Railcar order, totaling over $12 million 2. ISO Container Letter of Intent, totaling over $10 million 3. 11 railcar order commitment, totaling over $6.5 million 4. Two liquid hydrogen portable fueling stations, totaling over $5.75 million 5. Water treatment system for India verbal award, $5 million 6. India EPC customer heat exchanger order, $3.4 million 7. LNG stations for new India customer (Megha Engineering), $3.1 million 8. LNG stations for new EU customer (Orange Gas), $2.2 million 9. Large LNG station for Nordic customer, $1.9 million 10.HLNG vehicle tank EU order, $1.7 million 11.Energy customer BAHX order, $1.4 million 12.Another energy customer BAHX order, $1.4 million 13.Energy customer ACHX order, $1.4 million 14. Industrial gas customer order for pipe and lifecycle services, $1.24 million 15.Three additional Orca transports for emerging emissions control customer, $1.2M 16.Cryogenic Tanks in Latin America, $1.1 million

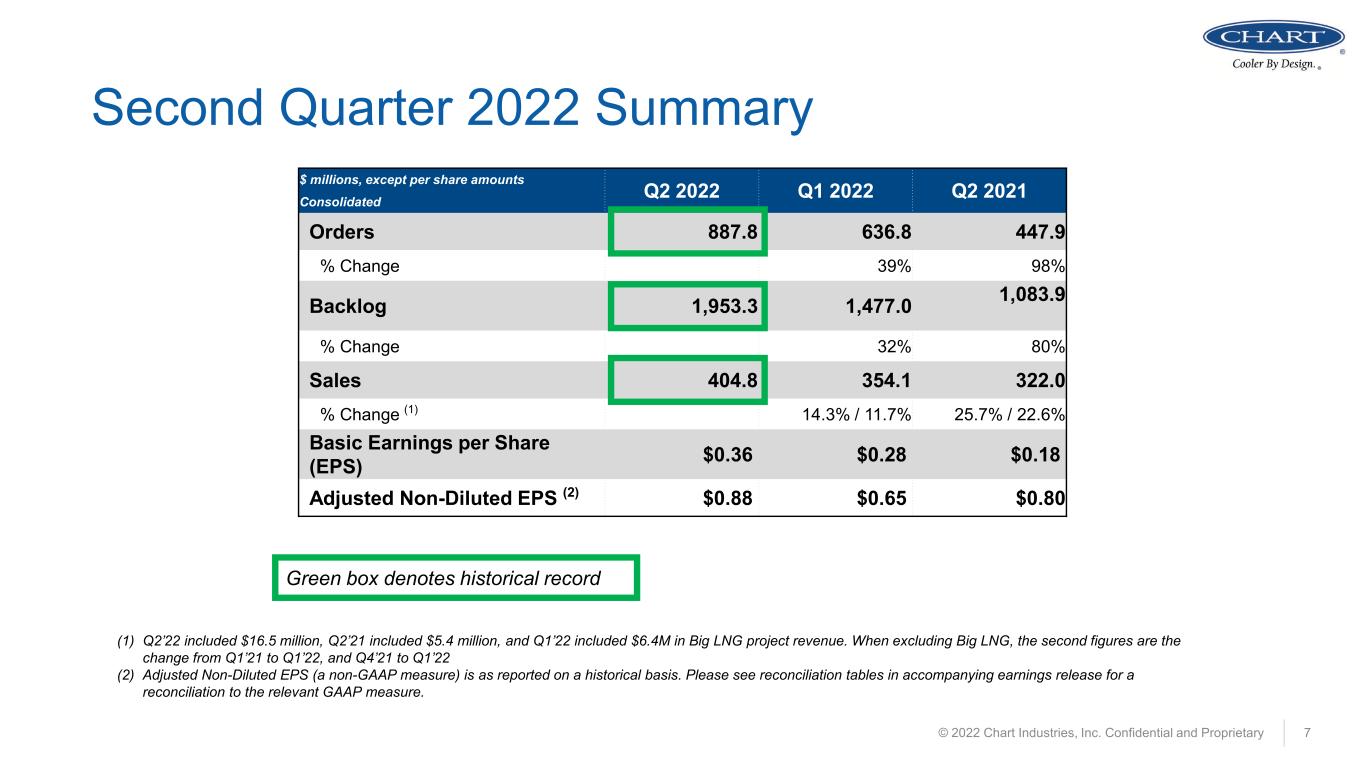

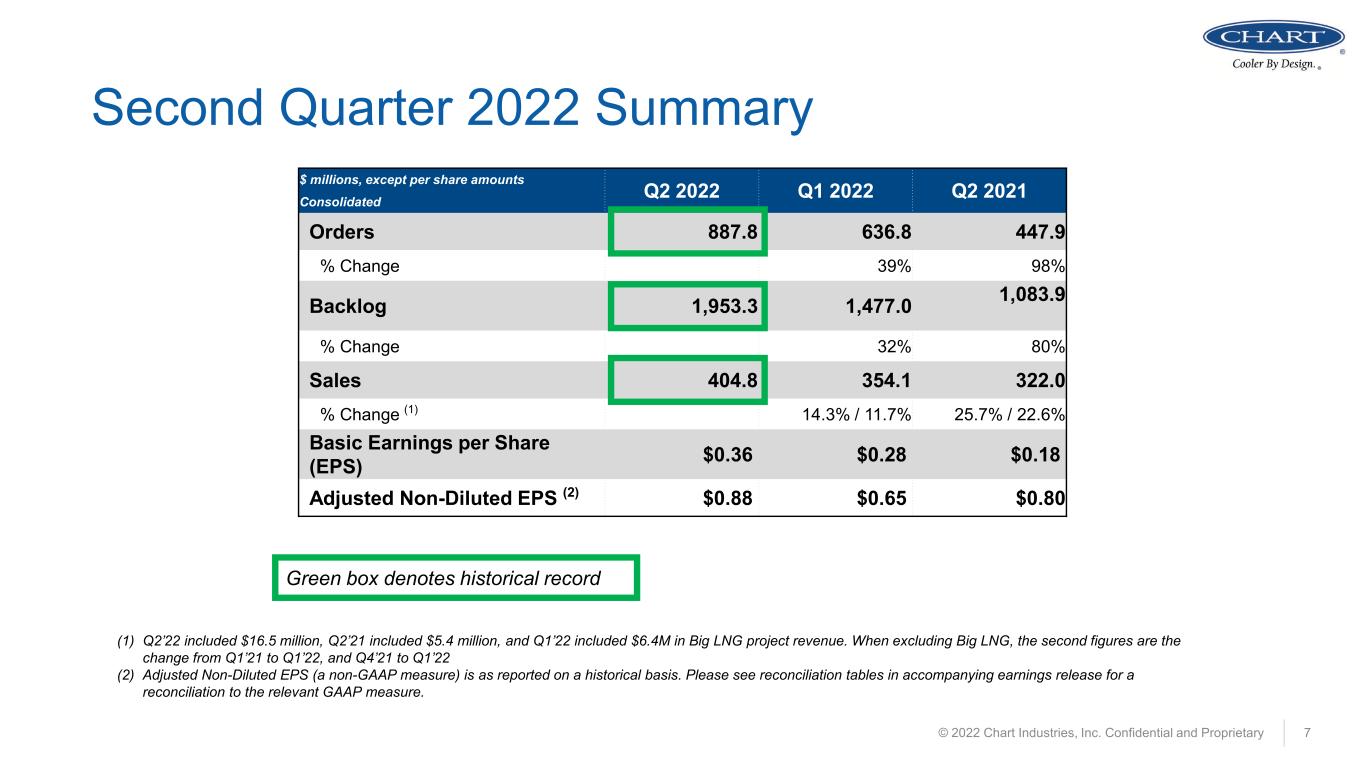

© 2022 Chart Industries, Inc. Confidential and Proprietary 7 Second Quarter 2022 Summary $ millions, except per share amounts Q2 2022 Q1 2022 Q2 2021Consolidated Orders 887.8 636.8 447.9 % Change 39% 98% Backlog 1,953.3 1,477.0 1,083.9 % Change 32% 80% Sales 404.8 354.1 322.0 % Change (1) 14.3% / 11.7% 25.7% / 22.6% Basic Earnings per Share (EPS) $0.36 $0.28 $0.18 Adjusted Non-Diluted EPS (2) $0.88 $0.65 $0.80 (1) Q2’22 included $16.5 million, Q2’21 included $5.4 million, and Q1’22 included $6.4M in Big LNG project revenue. When excluding Big LNG, the second figures are the change from Q1’21 to Q1’22, and Q4’21 to Q1’22 (2) Adjusted Non-Diluted EPS (a non-GAAP measure) is as reported on a historical basis. Please see reconciliation tables in accompanying earnings release for a reconciliation to the relevant GAAP measure. Green box denotes historical record

© 2022 Chart Industries, Inc. Confidential and Proprietary 8 Beginning to See Input Material Cost Relief

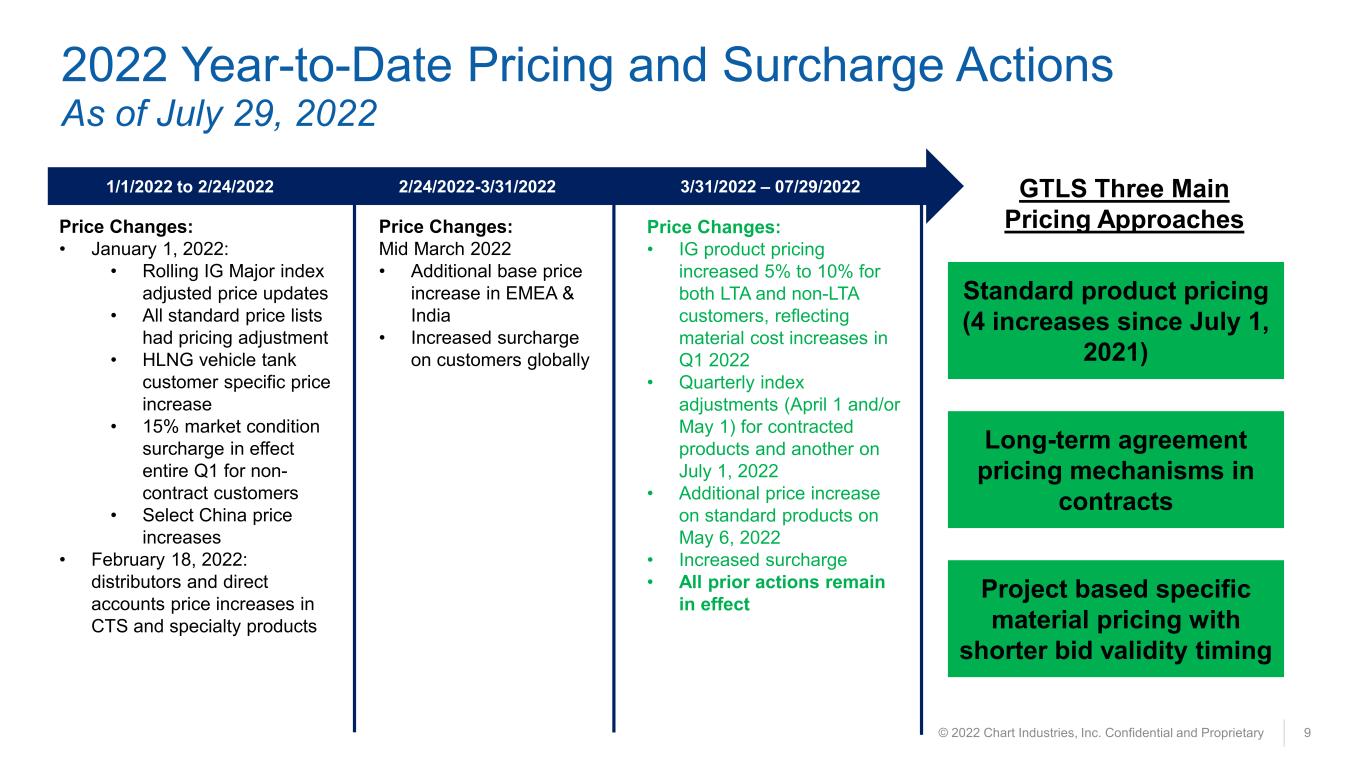

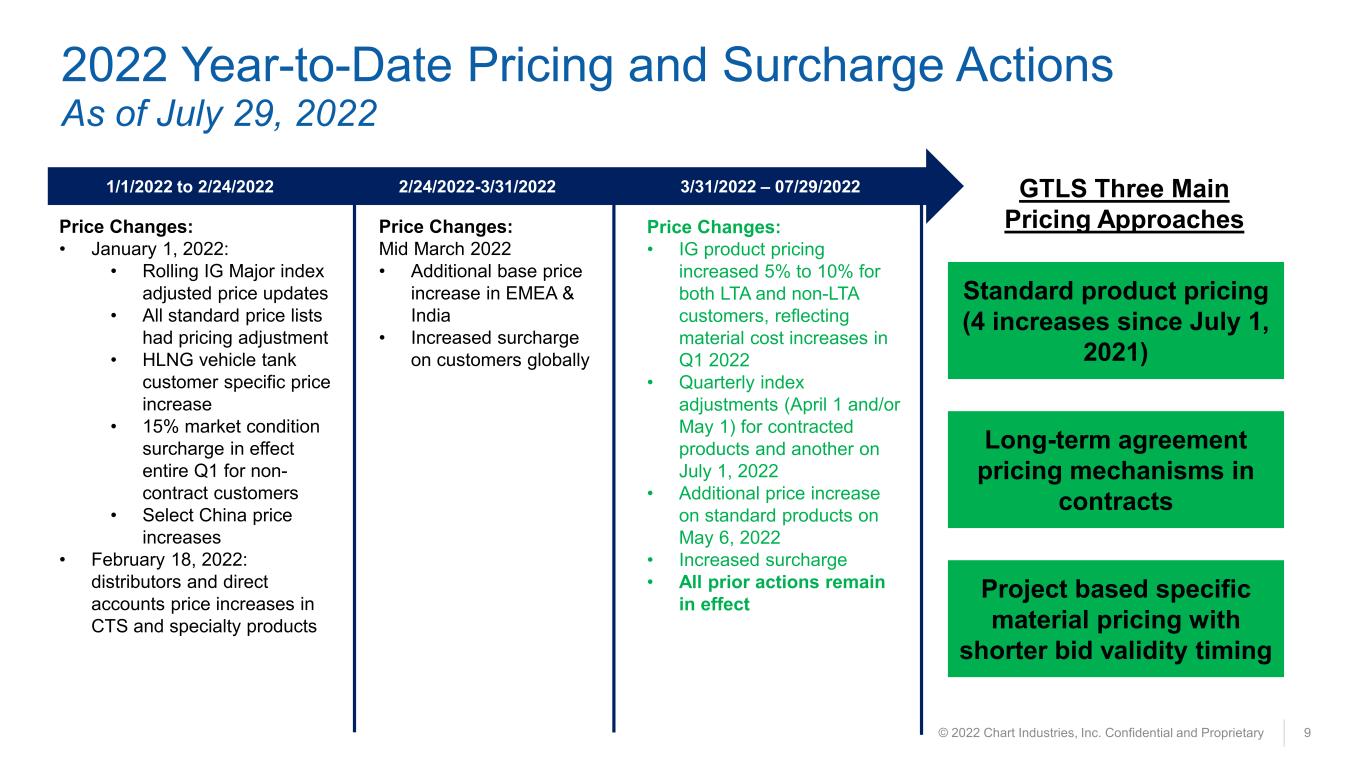

© 2022 Chart Industries, Inc. Confidential and Proprietary 9 2022 Year-to-Date Pricing and Surcharge Actions As of July 29, 2022 Price Changes: • January 1, 2022: • Rolling IG Major index adjusted price updates • All standard price lists had pricing adjustment • HLNG vehicle tank customer specific price increase • 15% market condition surcharge in effect entire Q1 for non- contract customers • Select China price increases • February 18, 2022: distributors and direct accounts price increases in CTS and specialty products 1/1/2022 to 2/24/2022 2/24/2022-3/31/2022 3/31/2022 – 07/29/2022 Price Changes: Mid March 2022 • Additional base price increase in EMEA & India • Increased surcharge on customers globally Price Changes: • IG product pricing increased 5% to 10% for both LTA and non-LTA customers, reflecting material cost increases in Q1 2022 • Quarterly index adjustments (April 1 and/or May 1) for contracted products and another on July 1, 2022 • Additional price increase on standard products on May 6, 2022 • Increased surcharge • All prior actions remain in effect Standard product pricing (4 increases since July 1, 2021) Long-term agreement pricing mechanisms in contracts Project based specific material pricing with shorter bid validity timing GTLS Three Main Pricing Approaches

© 2022 Chart Industries, Inc. Confidential and Proprietary 10 GTLS Global Freight The second quarter 2022 was our second quarter where cost of freight was covered by freight charges to customers

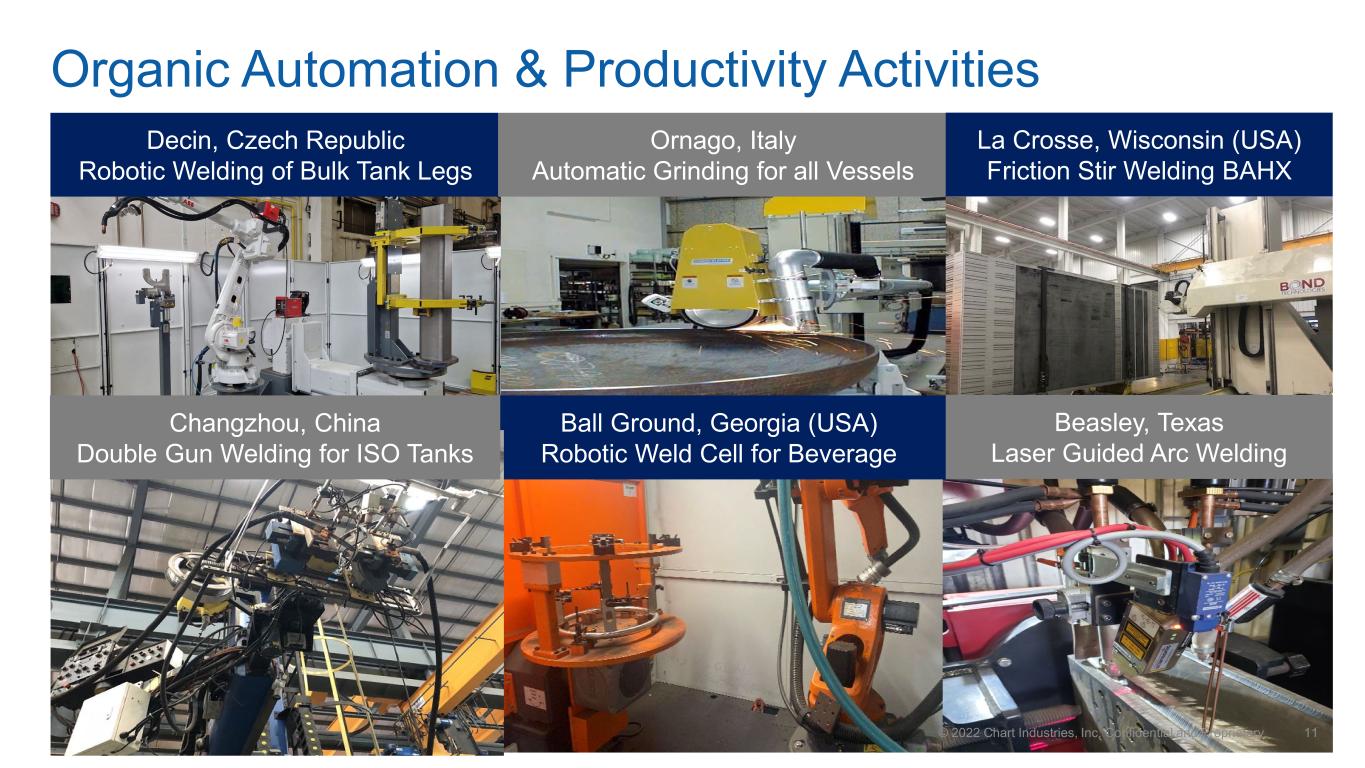

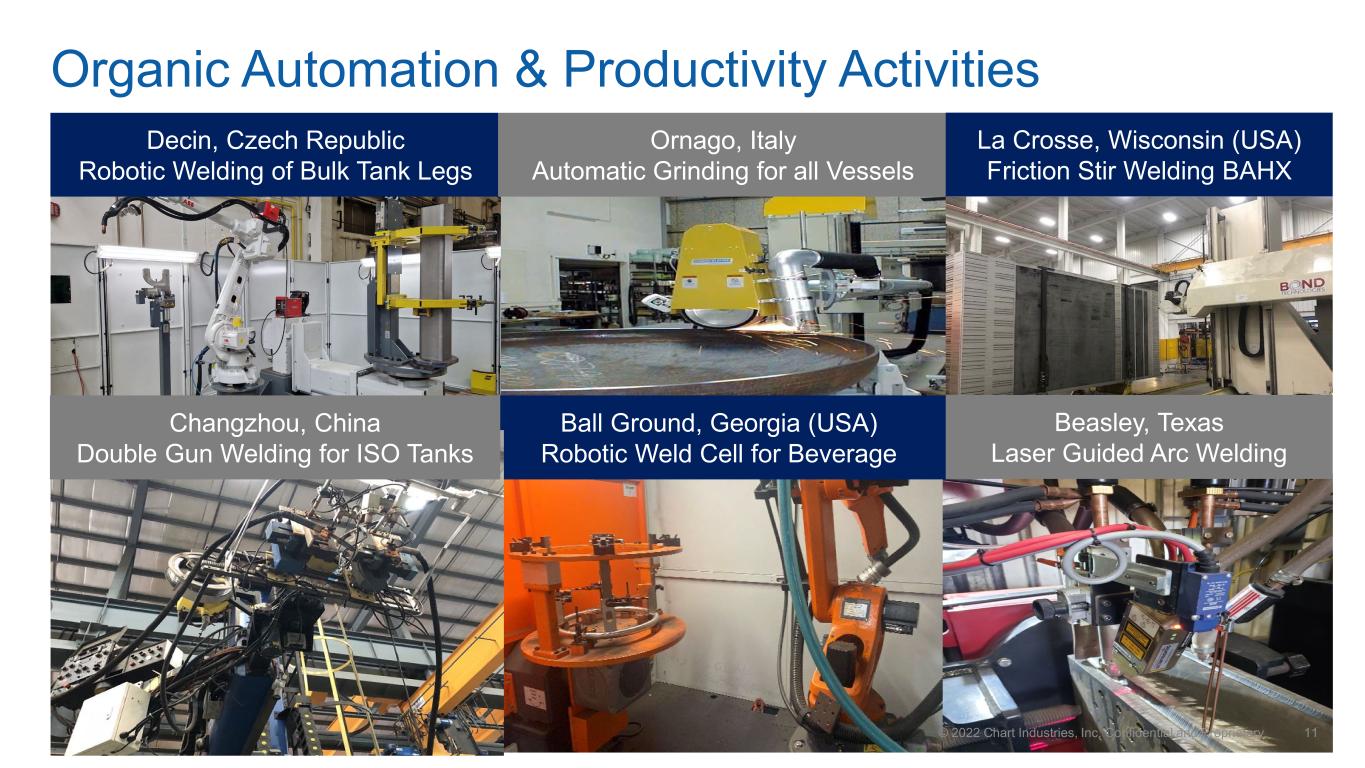

© 2022 Chart Industries, Inc. Confidential and Proprietary 11 Organic Automation & Productivity Activities Decin, Czech Republic Robotic Welding of Bulk Tank Legs Ornago, Italy Automatic Grinding for all Vessels Ball Ground, Georgia (USA) Robotic Weld Cell for Beverage Changzhou, China Double Gun Welding for ISO Tanks La Crosse, Wisconsin (USA) Friction Stir Welding BAHX Beasley, Texas Laser Guided Arc Welding

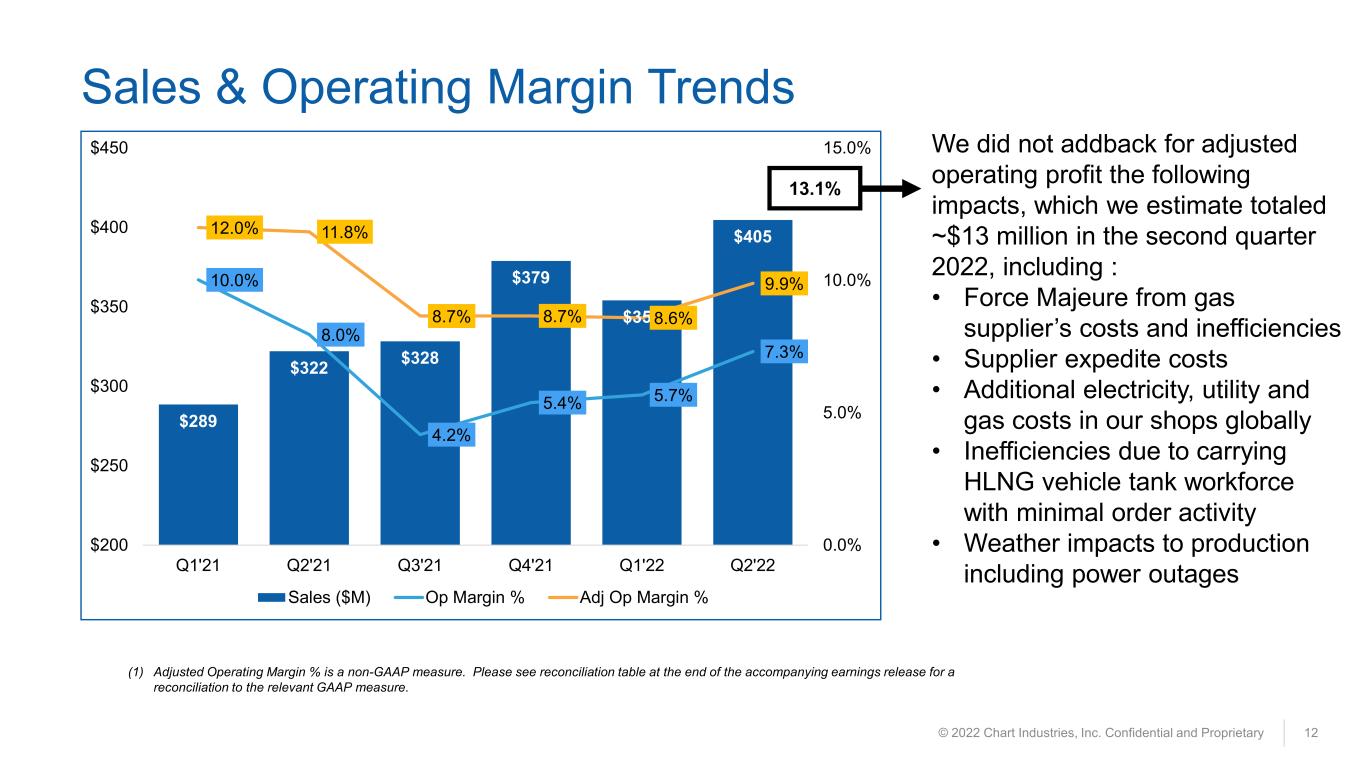

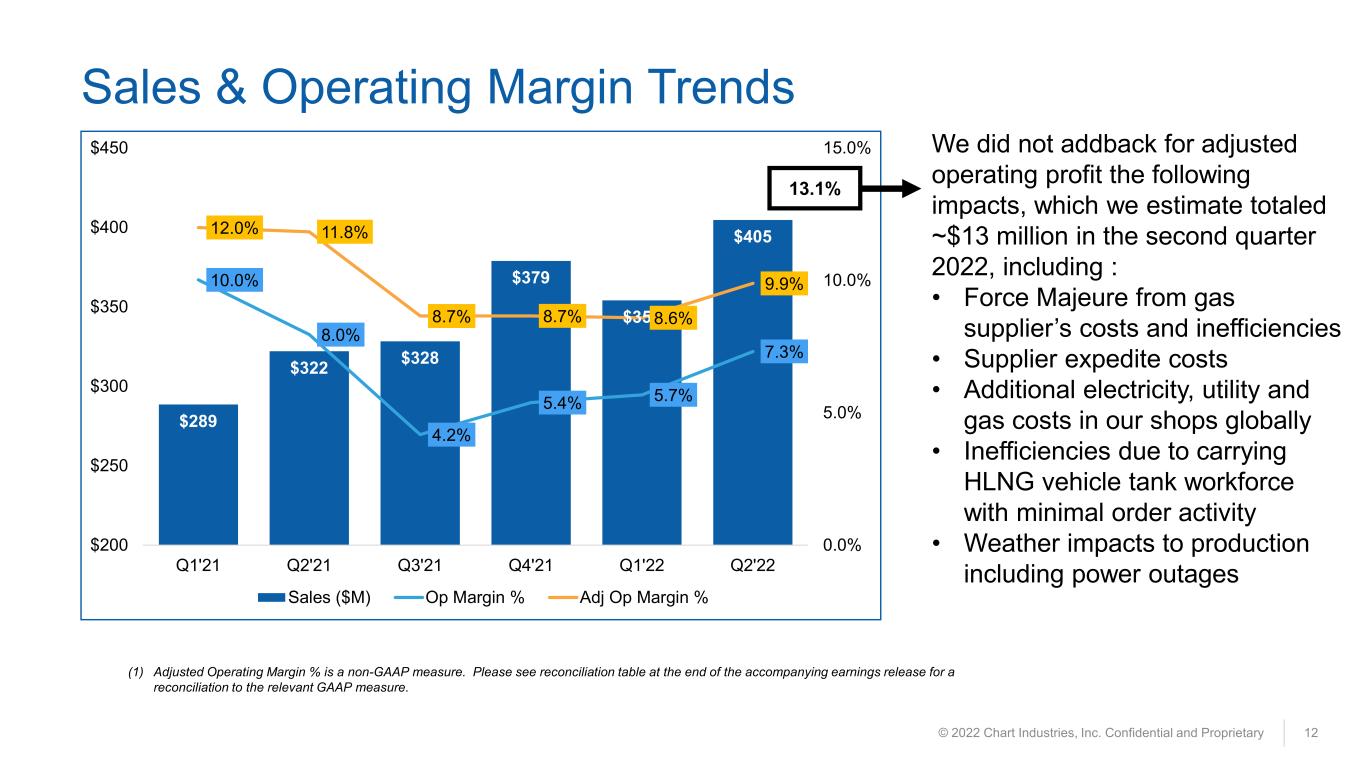

© 2022 Chart Industries, Inc. Confidential and Proprietary 12 Sales & Operating Margin Trends $289 $322 $328 $379 $354 $405 10.0% 8.0% 4.2% 5.4% 5.7% 7.3% 12.0% 11.8% 8.7% 8.7% 8.6% 9.9% 0.0% 5.0% 10.0% 15.0% $200 $250 $300 $350 $400 $450 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Sales ($M) Op Margin % Adj Op Margin % (1) Adjusted Operating Margin % is a non-GAAP measure. Please see reconciliation table at the end of the accompanying earnings release for a reconciliation to the relevant GAAP measure. We did not addback for adjusted operating profit the following impacts, which we estimate totaled ~$13 million in the second quarter 2022, including : • Force Majeure from gas supplier’s costs and inefficiencies • Supplier expedite costs • Additional electricity, utility and gas costs in our shops globally • Inefficiencies due to carrying HLNG vehicle tank workforce with minimal order activity • Weather impacts to production including power outages 13.1%

Category Q4 2021 Addback Items Net of Tax Q4 2021 $M Q1 2022 Addback Items Net of Tax Q1 2022 $M 1 Restructuring and Severance • Severance costs • Xinye, China facility relocation • Corp HQ move from Cryoport facility • Tulsa ACHX consolidation to Texas • Restructuring certain repair activities 6.0 • Severance costs • Tulsa ACHX consolidation to Texas • Lery, France product line completion out of period costs 4.3 2 Debt Refi Costs • Write off amortization of prior bank fees from refinancing revolving credit facility 4.1 • NONE 0 3 Deal-related & integration costs • Pre-closing / acquisition DD costs • Integration costs (year 1 only) • Legal costs for the one specific pre-closing liability from cryobio divestiture • Doesn’t include amortization addback 4.9 • Pre-closing / acquisition DD costs • Integration costs (year 1 only) • Legal costs for the one specific pre-closing liability from cryobio divestiture • Doesn’t include any amortization addback 3.4 4 Organic startup costs • Startup of greenfield at Richburg, SC • Startup costs for Tulsa, OK flex mfg • Training costs on new product lines 2.3 • Startup of greenfield at Richburg, SC • Startup costs for Tulsa, OK flex mfg • Training costs on new product lines 1.5 5 Other Costs • Legal / settlement 0.3 • NONE 0 6 One-Time Gains • Gain on purchase of Earthly Labs from previous minority investment (2.1) • NONE 0 7 MTM of investments net of FX • Mark-to-Market (MTM) of investments in McPhy and Stabilis net of FX impacts (1.7) • MTM of investments in McPhy and Stabilis and unconsolidated affiliates, HTEC and Cryomotive, all net of FX total impact 4.2 © 2022 Chart Industries, Inc. Confidential and Proprietary 13 Addback Specifics by Category (Q4 2021/Q1 2022)

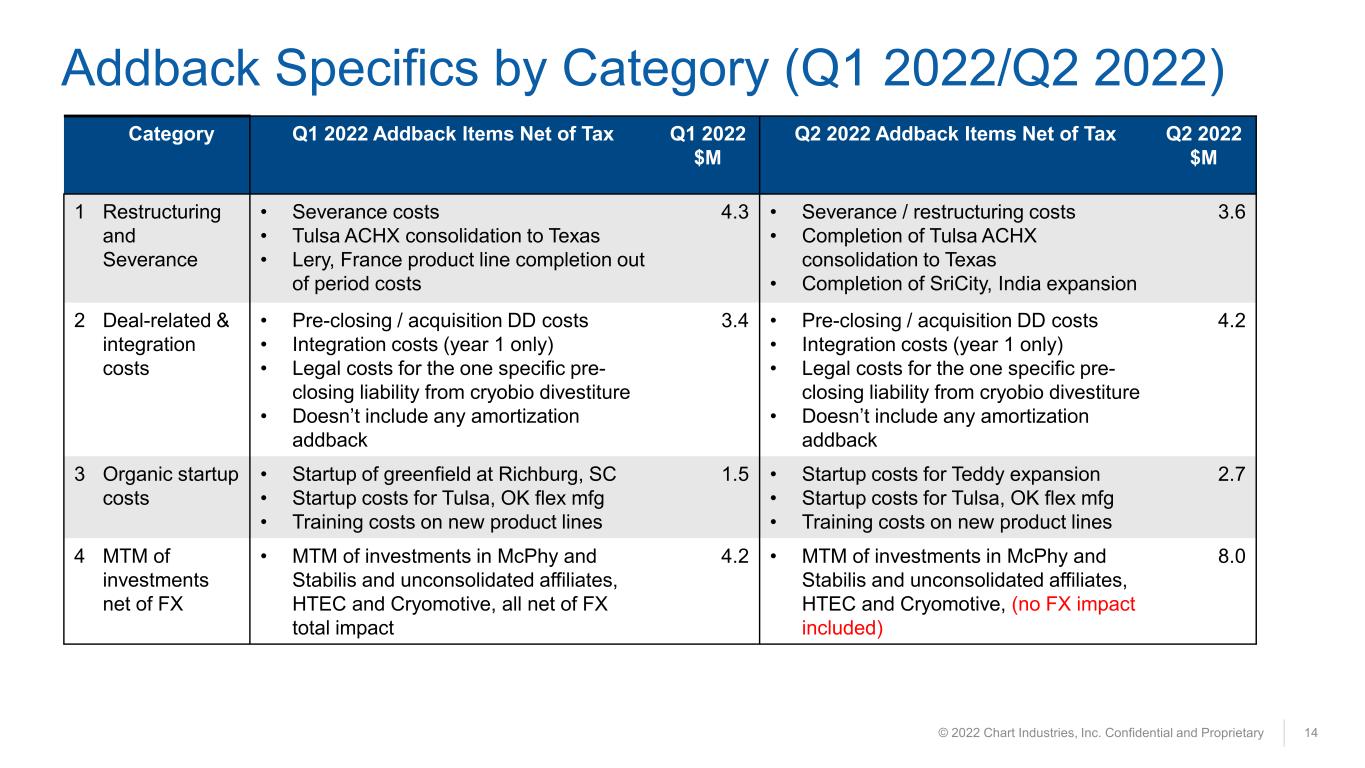

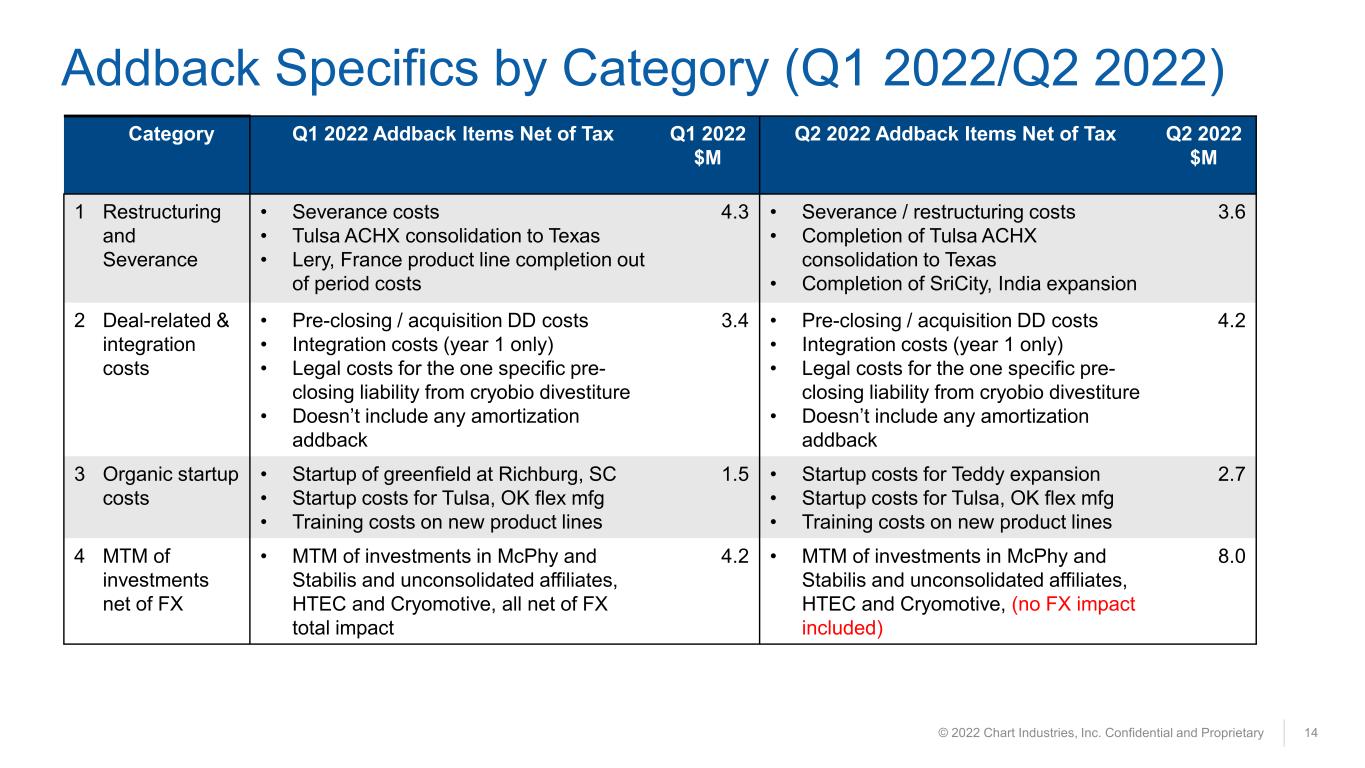

© 2022 Chart Industries, Inc. Confidential and Proprietary 14 Addback Specifics by Category (Q1 2022/Q2 2022) Category Q1 2022 Addback Items Net of Tax Q1 2022 $M Q2 2022 Addback Items Net of Tax Q2 2022 $M 1 Restructuring and Severance • Severance costs • Tulsa ACHX consolidation to Texas • Lery, France product line completion out of period costs 4.3 • Severance / restructuring costs • Completion of Tulsa ACHX consolidation to Texas • Completion of SriCity, India expansion 3.6 2 Deal-related & integration costs • Pre-closing / acquisition DD costs • Integration costs (year 1 only) • Legal costs for the one specific pre- closing liability from cryobio divestiture • Doesn’t include any amortization addback 3.4 • Pre-closing / acquisition DD costs • Integration costs (year 1 only) • Legal costs for the one specific pre- closing liability from cryobio divestiture • Doesn’t include any amortization addback 4.2 3 Organic startup costs • Startup of greenfield at Richburg, SC • Startup costs for Tulsa, OK flex mfg • Training costs on new product lines 1.5 • Startup costs for Teddy expansion • Startup costs for Tulsa, OK flex mfg • Training costs on new product lines 2.7 4 MTM of investments net of FX • MTM of investments in McPhy and Stabilis and unconsolidated affiliates, HTEC and Cryomotive, all net of FX total impact 4.2 • MTM of investments in McPhy and Stabilis and unconsolidated affiliates, HTEC and Cryomotive, (no FX impact included) 8.0

© 2022 Chart Industries, Inc. Confidential and Proprietary 15 Second Quarter 2022 Earnings Per Share (1) Tax effect reflects adjustment at normalized periodic rates (2) Adjusted Basic EPS and Normalized Basic EPS (both non-GAAP measures) are as reported on a historical basis. EPS adjustment reconciliation table is provided in accompanying press release financial tables. $ millions, except per share amounts Q2 2022 Q1 2022 Change vs. PQ YTD 2022 YTD 2021 Change v. PY Continuing Operations Net income attributable to Chart Industries, Inc. $13.0 $10.2 $2.8 $23.2 $32.1 ($8.9) Reported Basic EPS $0.36 $0.28 $0.08 $0.65 $0.90 ($0.25) 1 Investment equities mark-to-market, net of FX 0.27 0.14 0.13 0.41 0.26 0.15 2 Tax effects (1) (0.05) (0.03) (0.02) (0.08) (0.05) (0.03) Normalized Basic EPS $0.58 0.39 $0.19 $0.98 1.11 ($0.13) 3 Restructuring related costs 0.13 0.15 (0.02) 0.28 0.23 0.05 4 Deal related and integration costs 0.14 0.12 0.02 0.26 0.22 0.04 5 Start-up costs (organic) 0.09 0.05 0.04 0.14 0.10 0.04 6 Tax effects (1) (0.06) (0.06) - (0.12) (0.10) (0.02) Adjusted Basic EPS (2) $0.88 $0.65 $0.23 $1.54 $1.56 ($0.02)

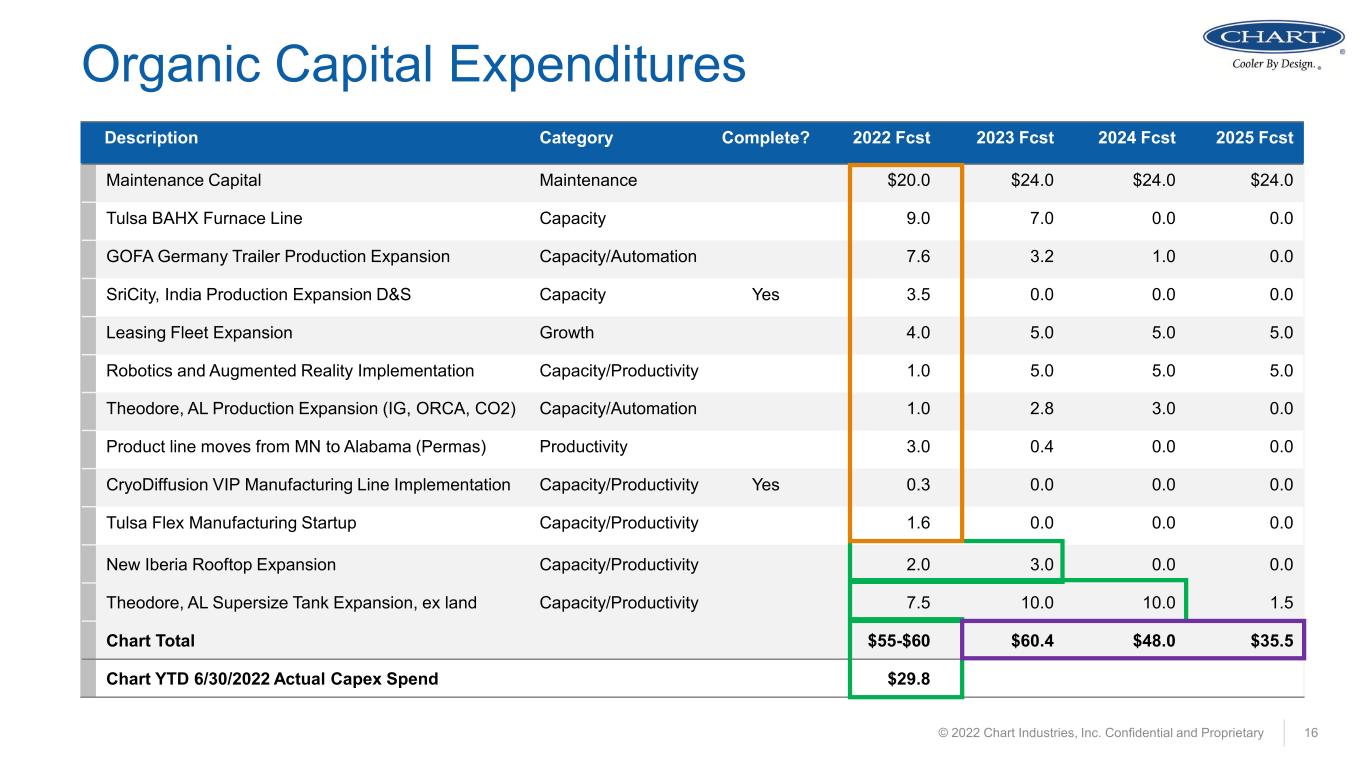

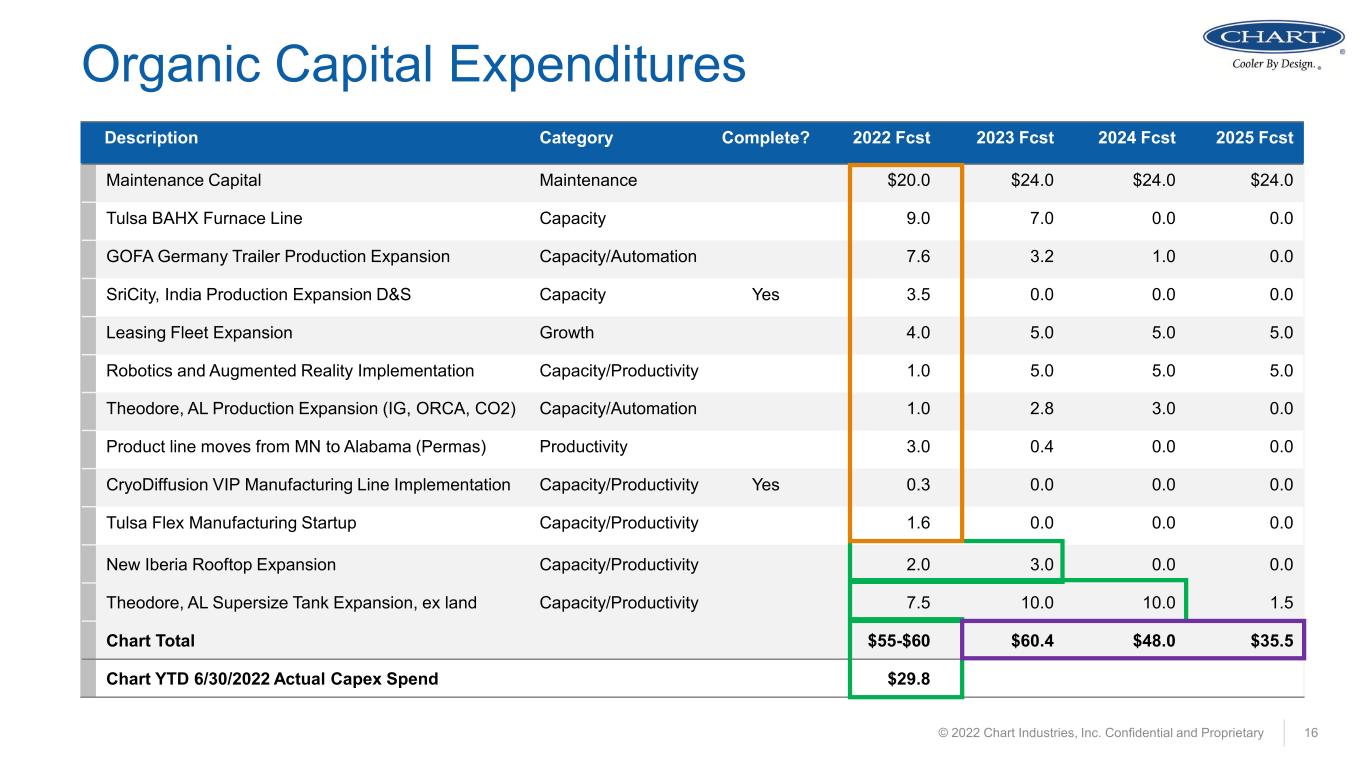

© 2022 Chart Industries, Inc. Confidential and Proprietary 16 Organic Capital Expenditures Description Category Complete? 2022 Fcst 2023 Fcst 2024 Fcst 2025 Fcst Maintenance Capital Maintenance $20.0 $24.0 $24.0 $24.0 Tulsa BAHX Furnace Line Capacity 9.0 7.0 0.0 0.0 GOFA Germany Trailer Production Expansion Capacity/Automation 7.6 3.2 1.0 0.0 SriCity, India Production Expansion D&S Capacity Yes 3.5 0.0 0.0 0.0 Leasing Fleet Expansion Growth 4.0 5.0 5.0 5.0 Robotics and Augmented Reality Implementation Capacity/Productivity 1.0 5.0 5.0 5.0 Theodore, AL Production Expansion (IG, ORCA, CO2) Capacity/Automation 1.0 2.8 3.0 0.0 Product line moves from MN to Alabama (Permas) Productivity 3.0 0.4 0.0 0.0 CryoDiffusion VIP Manufacturing Line Implementation Capacity/Productivity Yes 0.3 0.0 0.0 0.0 Tulsa Flex Manufacturing Startup Capacity/Productivity 1.6 0.0 0.0 0.0 New Iberia Rooftop Expansion Capacity/Productivity 2.0 3.0 0.0 0.0 Theodore, AL Supersize Tank Expansion, ex land Capacity/Productivity 7.5 10.0 10.0 1.5 Chart Total $55-$60 $60.4 $48.0 $35.5 Chart YTD 6/30/2022 Actual Capex Spend $29.8

• Furnace delivery August 2022 • Planned start of validation core in November 2022 • Training of new staff in process Brazed Aluminum Heat Exchanger Line Tulsa, Oklahoma, USA © 2022 Chart Industries, Inc. Confidential and Proprietary 17

18 • The new building will be 200m (twice length of existing building) • Groundbreaking ceremony occurred in June 2022 in conjunction with celebrating 60 years of GOFA business • Construction to be completed by mid-2023 • Production start at the end of Q3 2023 • New RSL workshop in operation by end of 2023 Trailer Facility Expansion, Goch, Germany Expansion has ~$23M of orders already in backlog © 2022 Chart Industries, Inc. Confidential and Proprietary 18

19 • Economic Incentives Meeting with Al. Chamber of Commerce • Design build contractors underway • Completed high level equipment budget • Completed second draft of production line layout • Potential to expand to adjacent or nearby land for storage / further expansion Supersize and Bulk Tank Expansion Theodore, Alabama, USA Expansion has ~$16M of orders already in backlog © 2022 Chart Industries, Inc. Confidential and Proprietary 19

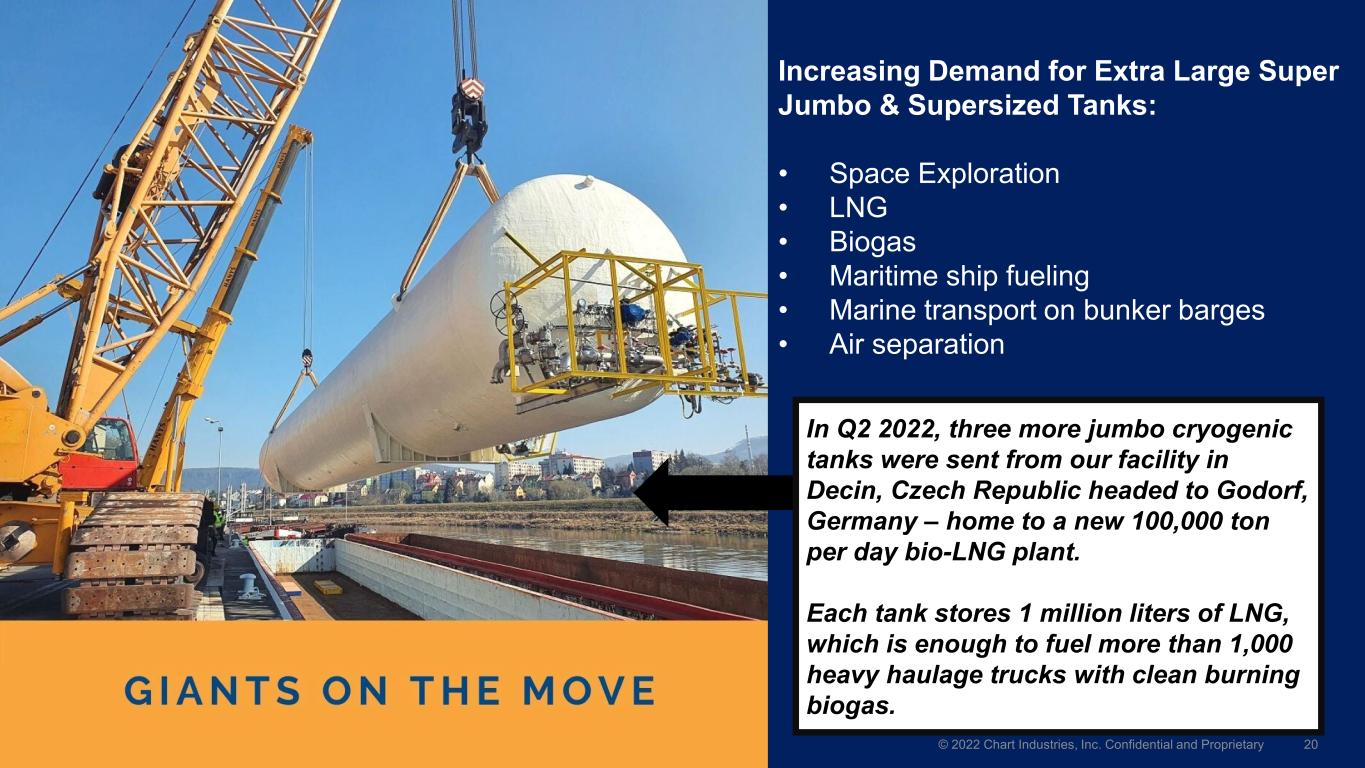

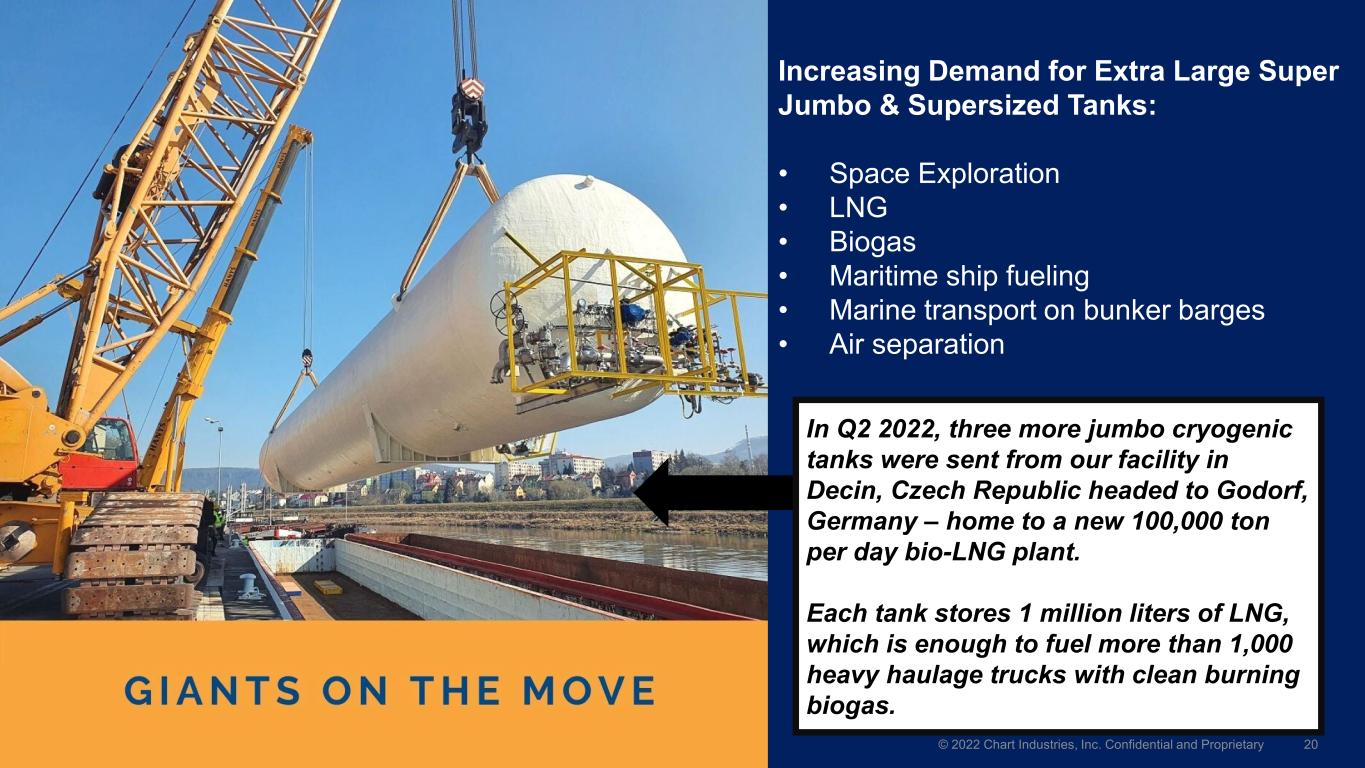

Increasing Demand for Extra Large Super Jumbo & Supersized Tanks: • Space Exploration • LNG • Biogas • Maritime ship fueling • Marine transport on bunker barges • Air separation © 2022 Chart Industries, Inc. Confidential and Proprietary 20 In Q2 2022, three more jumbo cryogenic tanks were sent from our facility in Decin, Czech Republic headed to Godorf, Germany – home to a new 100,000 ton per day bio-LNG plant. Each tank stores 1 million liters of LNG, which is enough to fuel more than 1,000 heavy haulage trucks with clean burning biogas.

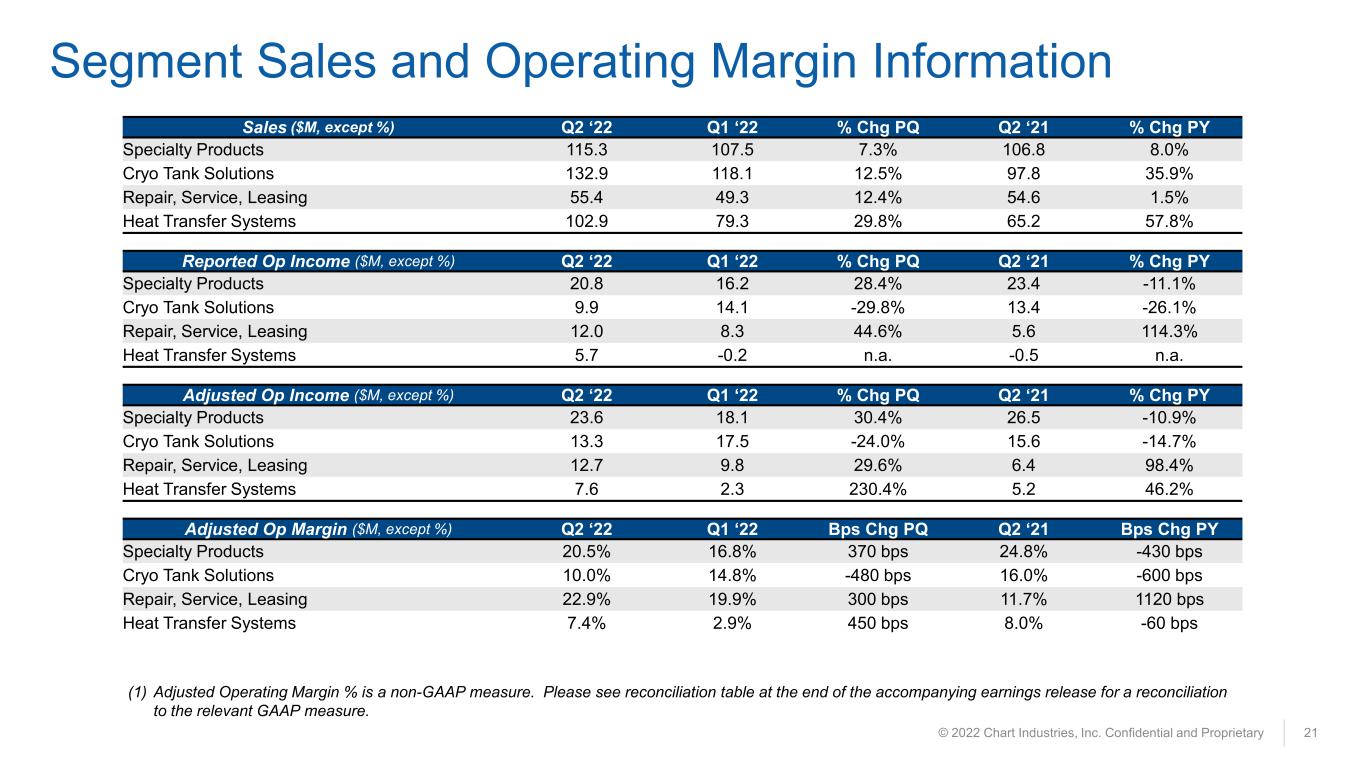

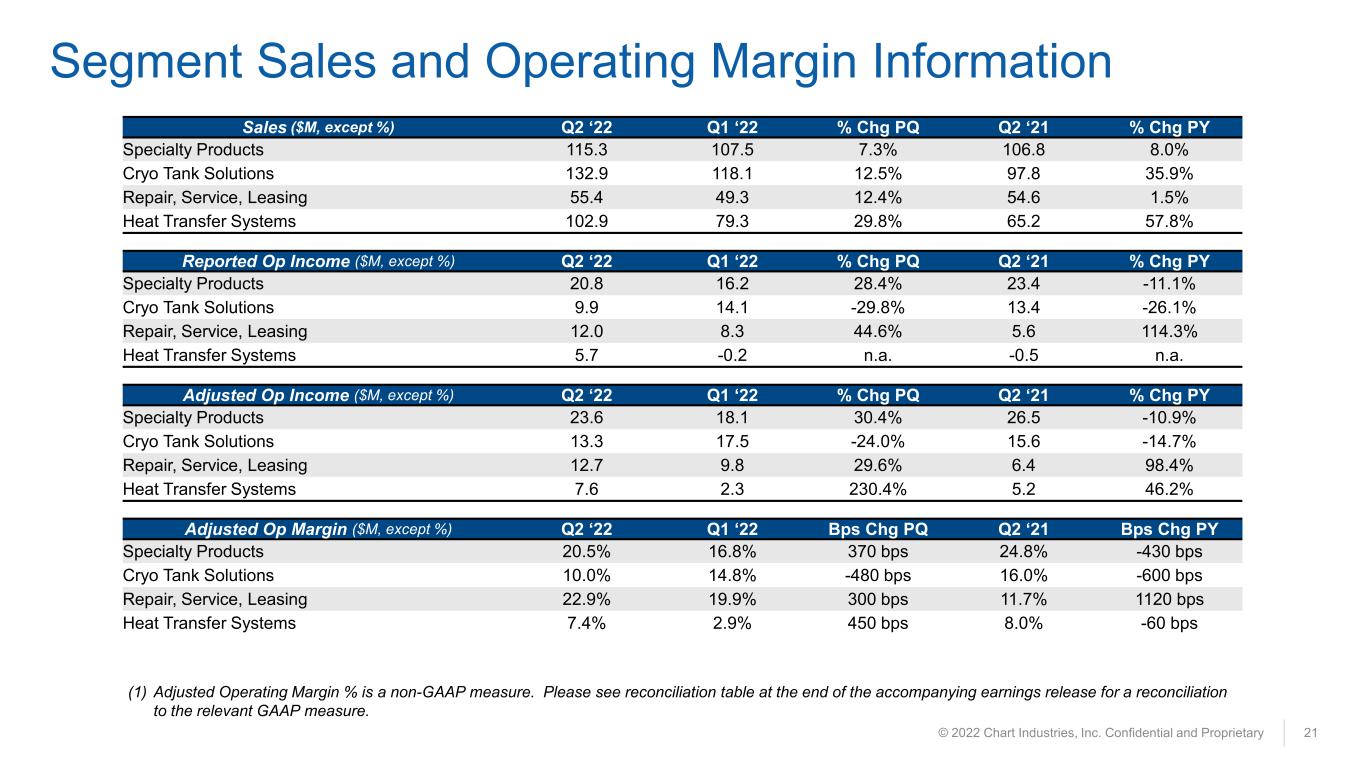

© 2022 Chart Industries, Inc. Confidential and Proprietary 21 Segment Sales and Operating Margin Information (1) Adjusted Operating Margin % is a non-GAAP measure. Please see reconciliation table at the end of the accompanying earnings release for a reconciliation to the relevant GAAP measure. Sales ($M, except %) Q2 ‘22 Q1 ‘22 % Chg PQ Q2 ‘21 % Chg PY Specialty Products 115.3 107.5 7.3% 106.8 8.0% Cryo Tank Solutions 132.9 118.1 12.5% 97.8 35.9% Repair, Service, Leasing 55.4 49.3 12.4% 54.6 1.5% Heat Transfer Systems 102.9 79.3 29.8% 65.2 57.8% Reported Op Income ($M, except %) Q2 ‘22 Q1 ‘22 % Chg PQ Q2 ‘21 % Chg PY Specialty Products 20.8 16.2 28.4% 23.4 -11.1% Cryo Tank Solutions 9.9 14.1 -29.8% 13.4 -26.1% Repair, Service, Leasing 12.0 8.3 44.6% 5.6 114.3% Heat Transfer Systems 5.7 -0.2 n.a. -0.5 n.a. Adjusted Op Income ($M, except %) Q2 ‘22 Q1 ‘22 % Chg PQ Q2 ‘21 % Chg PY Specialty Products 23.6 18.1 30.4% 26.5 -10.9% Cryo Tank Solutions 13.3 17.5 -24.0% 15.6 -14.7% Repair, Service, Leasing 12.7 9.8 29.6% 6.4 98.4% Heat Transfer Systems 7.6 2.3 230.4% 5.2 46.2% Adjusted Op Margin ($M, except %) Q2 ‘22 Q1 ‘22 Bps Chg PQ Q2 ‘21 Bps Chg PY Specialty Products 20.5% 16.8% 370 bps 24.8% -430 bps Cryo Tank Solutions 10.0% 14.8% -480 bps 16.0% -600 bps Repair, Service, Leasing 22.9% 19.9% 300 bps 11.7% 1120 bps Heat Transfer Systems 7.4% 2.9% 450 bps 8.0% -60 bps

© 2022 Chart Industries, Inc. Confidential and Proprietary 22 Segment Sales and Gross Margin Information (1) Adjusted Gross Margin % is a non-GAAP measure. Please see reconciliation table at the end of the accompanying earnings release for a reconciliation to the relevant GAAP measure. Sales ($M, except %) Q2 ‘22 Q1 ‘22 % Chg PQ Q2 ‘21 % Chg PY Specialty Products 115.3 107.5 7.3% 106.8 8.0% Cryo Tank Solutions 132.9 118.1 12.5% 97.8 35.9% Repair, Service, Leasing 55.4 49.3 12.4% 54.6 1.5% Heat Transfer Systems 102.9 79.3 29.8% 65.2 57.8% Reported GM % ($M, except %) Q2 ‘22 Q1 ‘22 % Chg PQ Q2 ‘21 % Chg PY Specialty Products 34.2% 30.3% 390 bps 34.4% -20 bps Cryo Tank Solutions 16.3% 21.5% -520 bps 23.7% -740 bps Repair, Service, Leasing 34.3% 31.6% 270 bps 22.2% 1210 bps Heat Transfer Systems 14.4% 12.7% 170 bps 17.2% -280 bps Adjusted GM % ($M, except %) Q2 ‘22 Q1 ‘22 Bps Chg PQ Q2 ‘21 Bps Chg PY Specialty Products 35.8% 31.6% 420 bps 36.0% -20 bps Cryo Tank Solutions 18.8% 24.3% -550 bps 25.9% -710 bps Repair, Service, Leasing 35.6% 34.7% 90 bps 23.6% 1200 bps Heat Transfer Systems 15.9% 16.0% -10 bps 25.9% -1000 bps

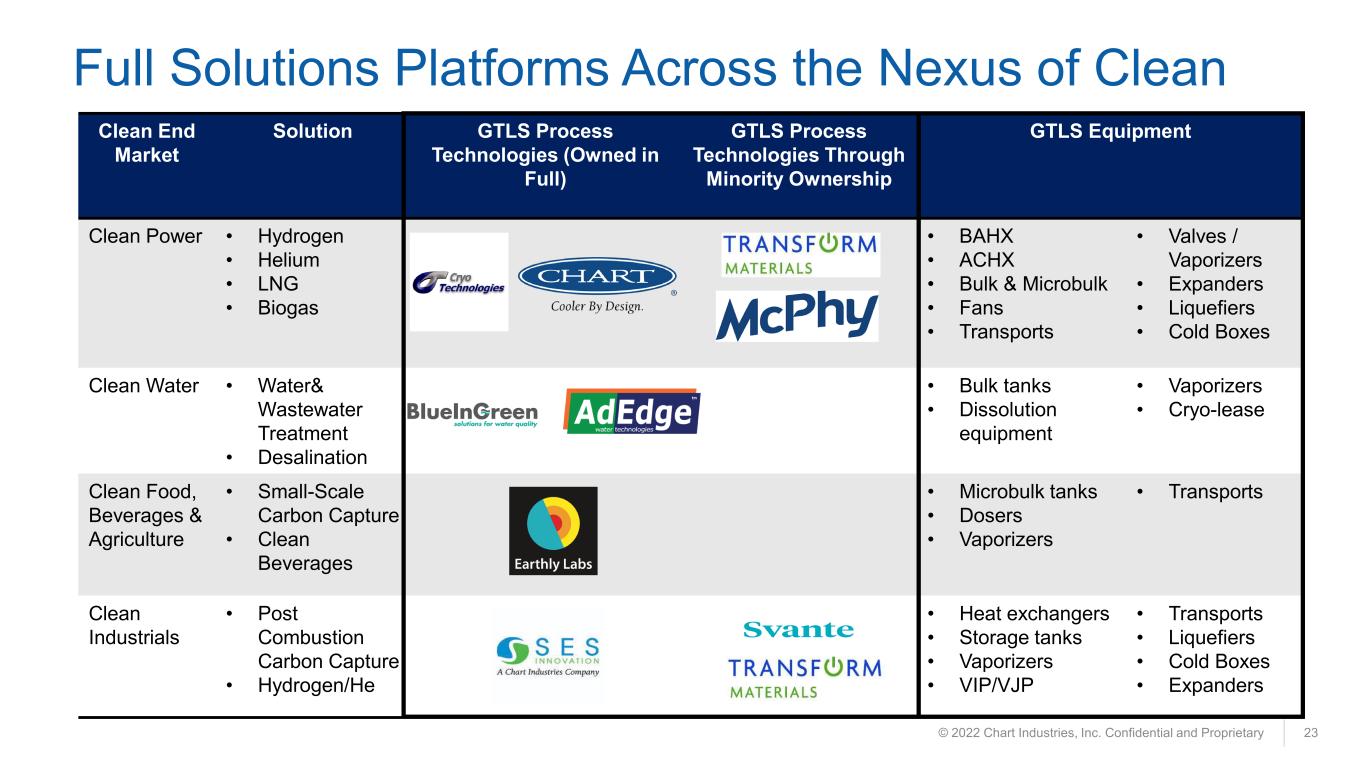

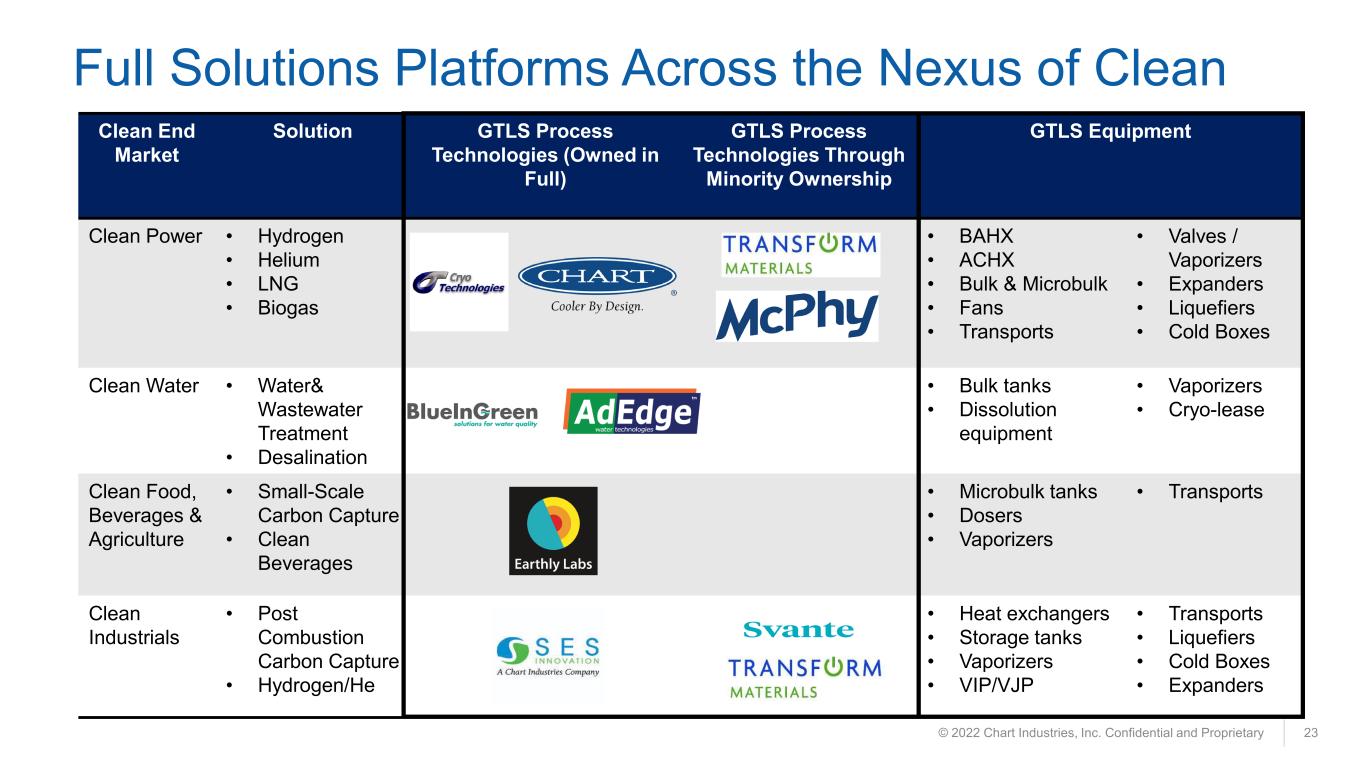

© 2022 Chart Industries, Inc. Confidential and Proprietary 23 Full Solutions Platforms Across the Nexus of Clean Clean End Market Solution GTLS Process Technologies (Owned in Full) GTLS Process Technologies Through Minority Ownership GTLS Equipment Clean Power • Hydrogen • Helium • LNG • Biogas • BAHX • ACHX • Bulk & Microbulk • Fans • Transports • Valves / Vaporizers • Expanders • Liquefiers • Cold Boxes Clean Water • Water& Wastewater Treatment • Desalination • Bulk tanks • Dissolution equipment • Vaporizers • Cryo-lease Clean Food, Beverages & Agriculture • Small-Scale Carbon Capture • Clean Beverages • Microbulk tanks • Dosers • Vaporizers • Transports Clean Industrials • Post Combustion Carbon Capture • Hydrogen/He • Heat exchangers • Storage tanks • Vaporizers • VIP/VJP • Transports • Liquefiers • Cold Boxes • Expanders

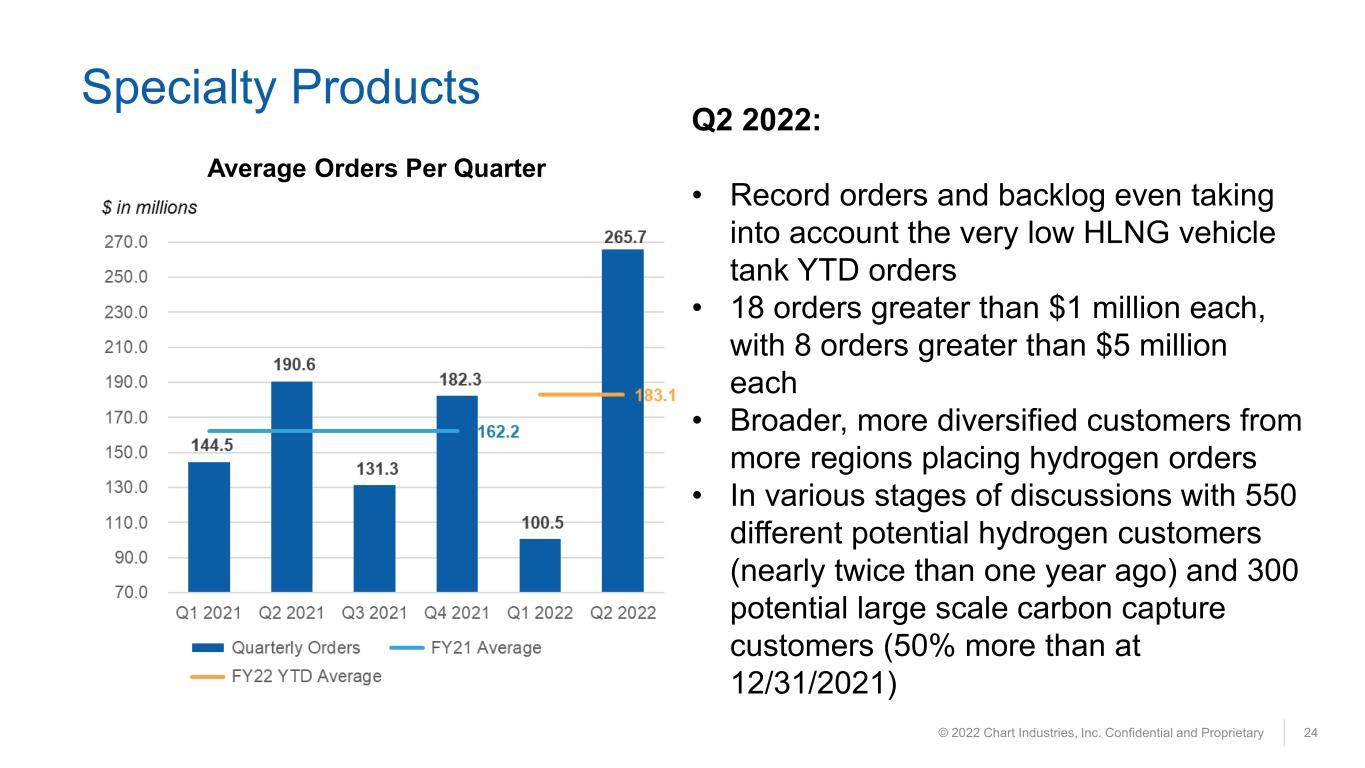

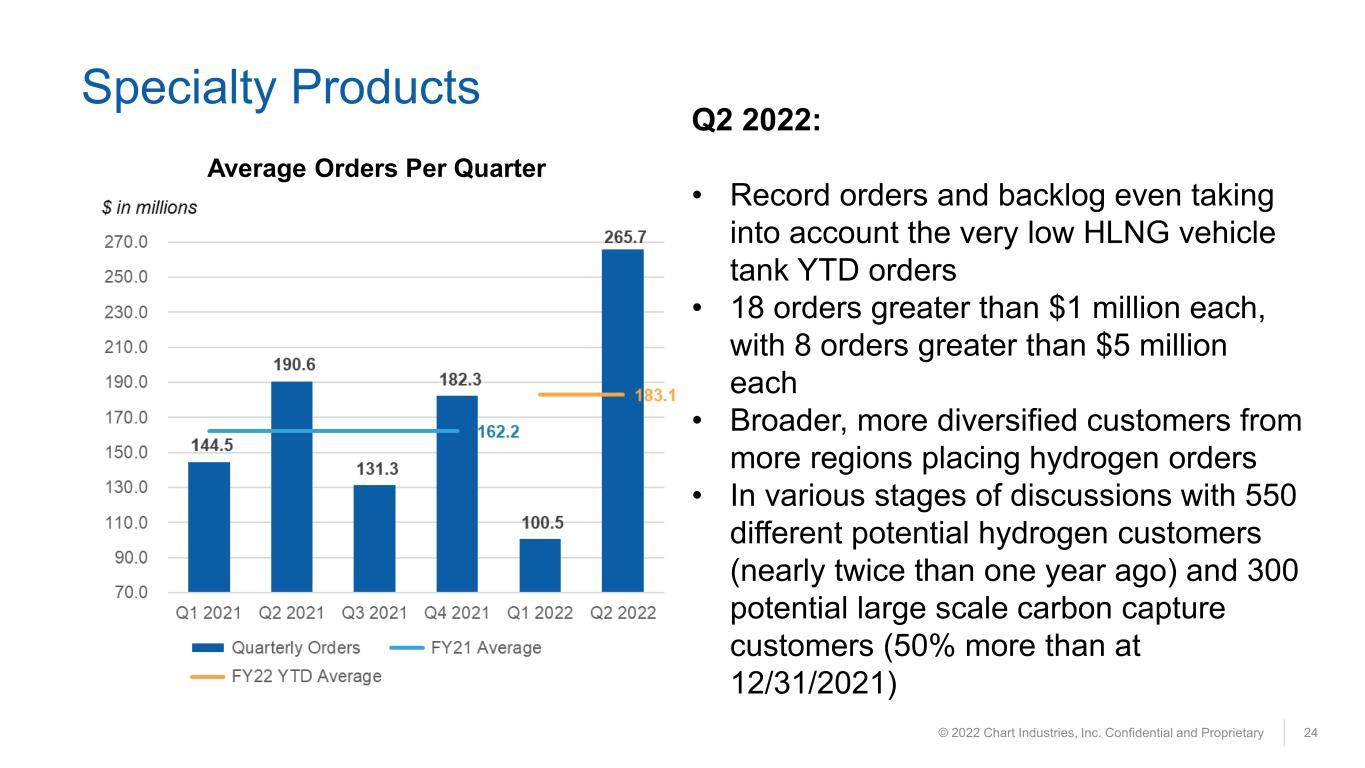

© 2022 Chart Industries, Inc. Confidential and Proprietary 24 Specialty Products Average Orders Per Quarter Q2 2022: • Record orders and backlog even taking into account the very low HLNG vehicle tank YTD orders • 18 orders greater than $1 million each, with 8 orders greater than $5 million each • Broader, more diversified customers from more regions placing hydrogen orders • In various stages of discussions with 550 different potential hydrogen customers (nearly twice than one year ago) and 300 potential large scale carbon capture customers (50% more than at 12/31/2021)

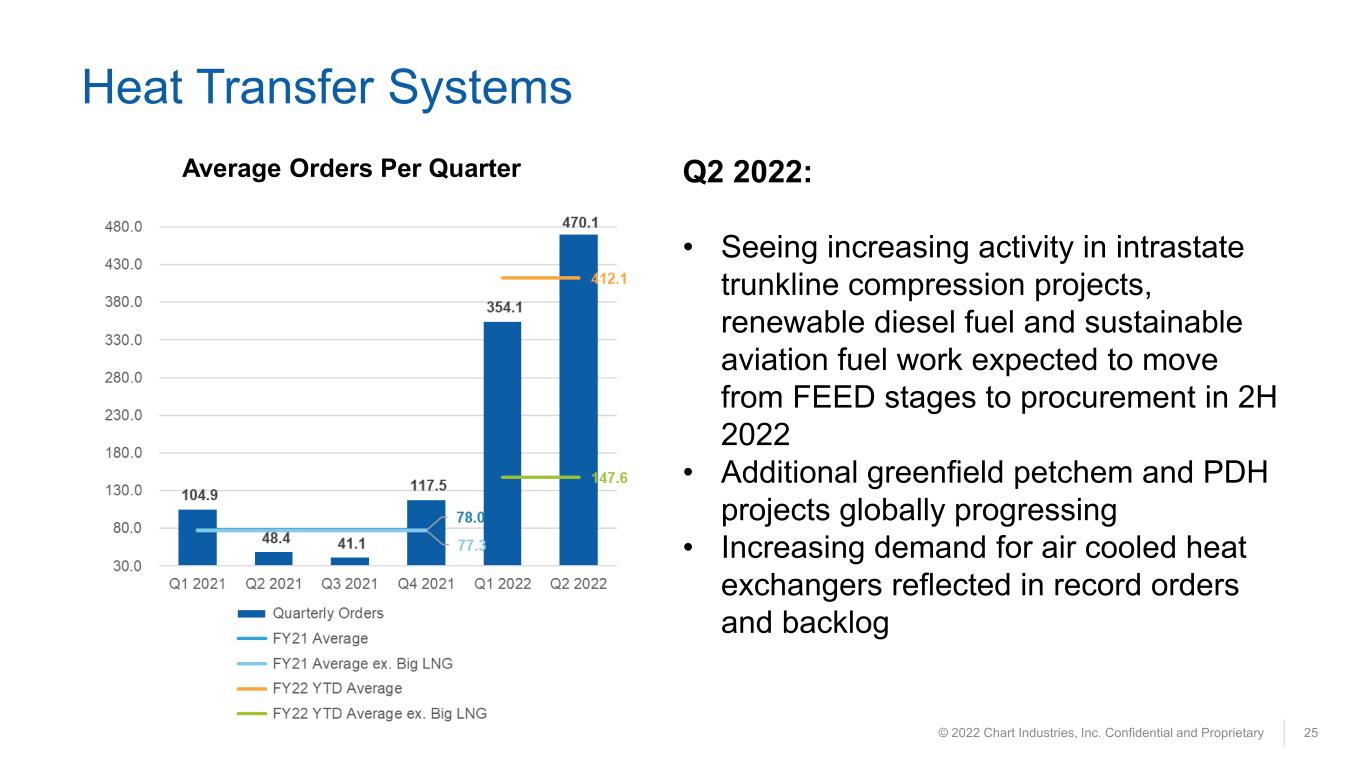

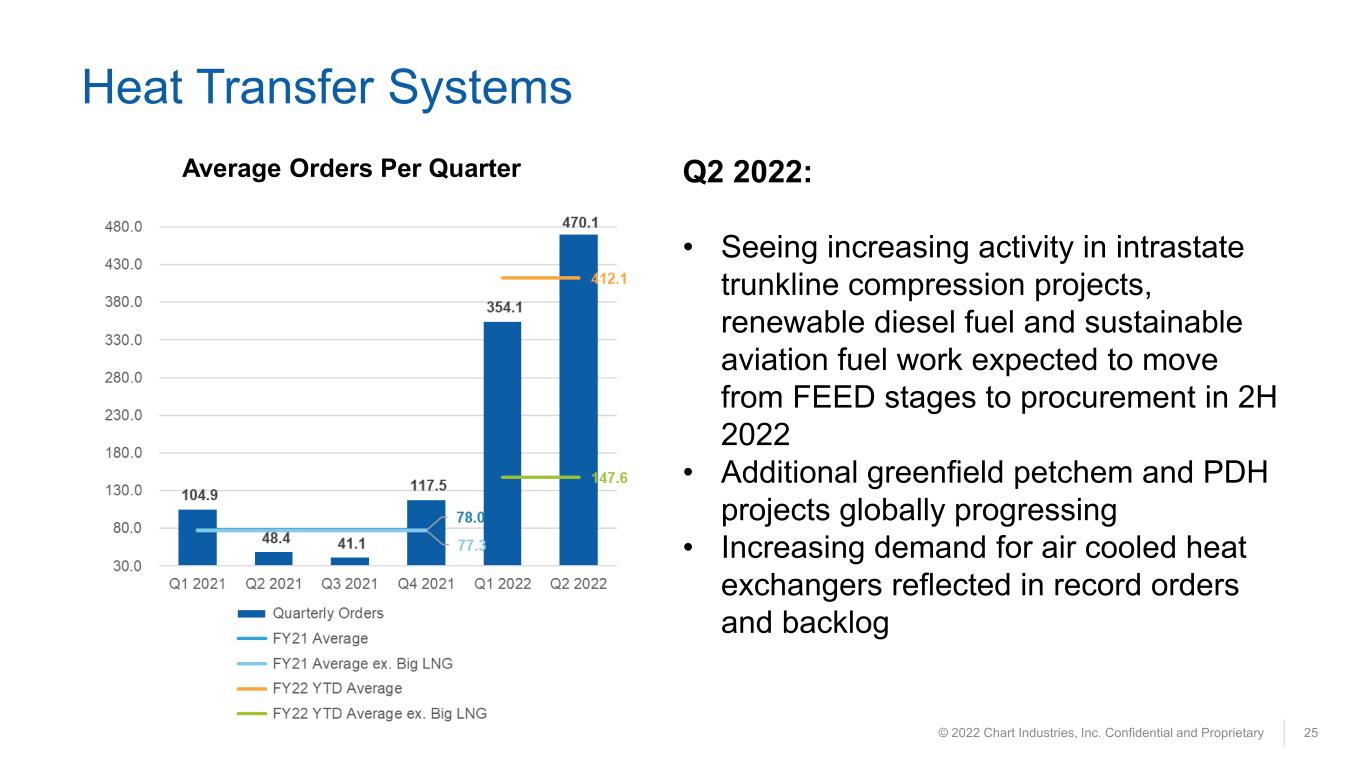

© 2022 Chart Industries, Inc. Confidential and Proprietary 25 Heat Transfer Systems Average Orders Per Quarter Q2 2022: • Seeing increasing activity in intrastate trunkline compression projects, renewable diesel fuel and sustainable aviation fuel work expected to move from FEED stages to procurement in 2H 2022 • Additional greenfield petchem and PDH projects globally progressing • Increasing demand for air cooled heat exchangers reflected in record orders and backlog

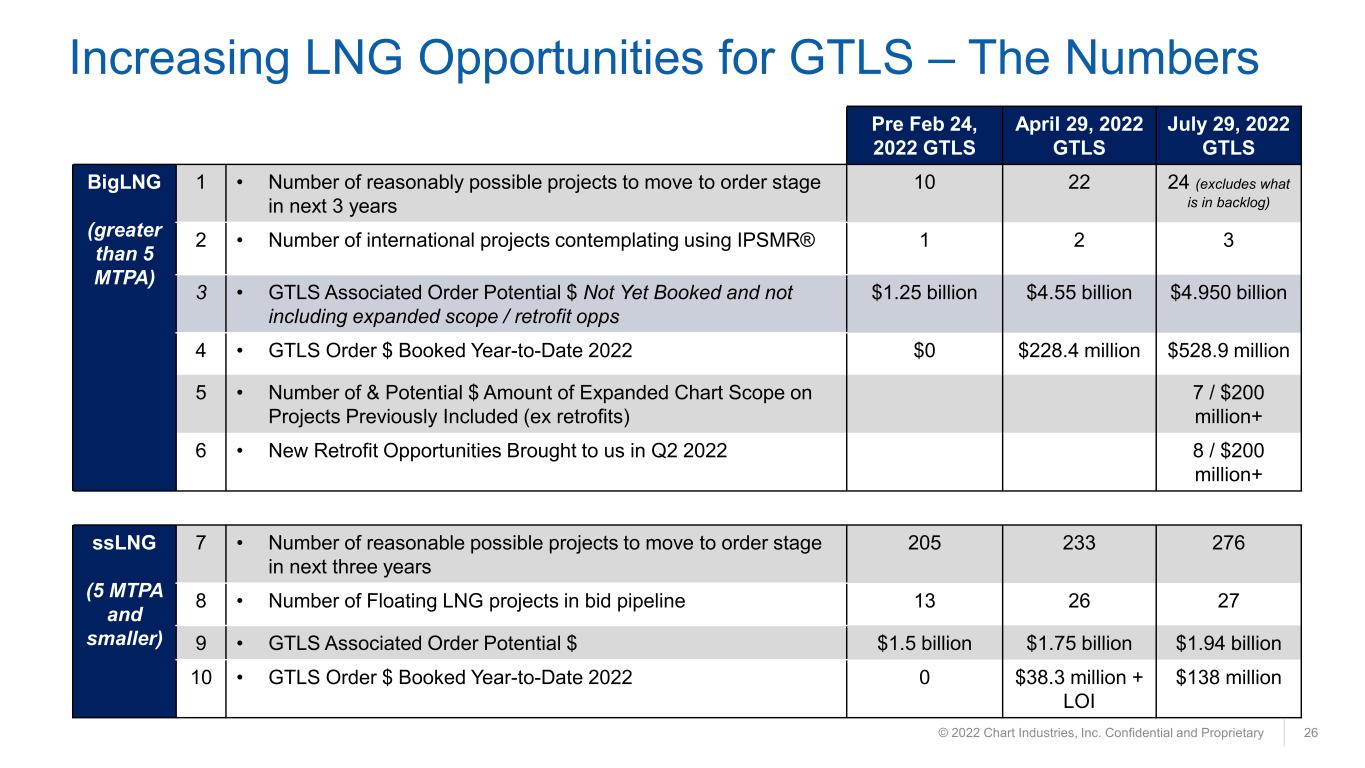

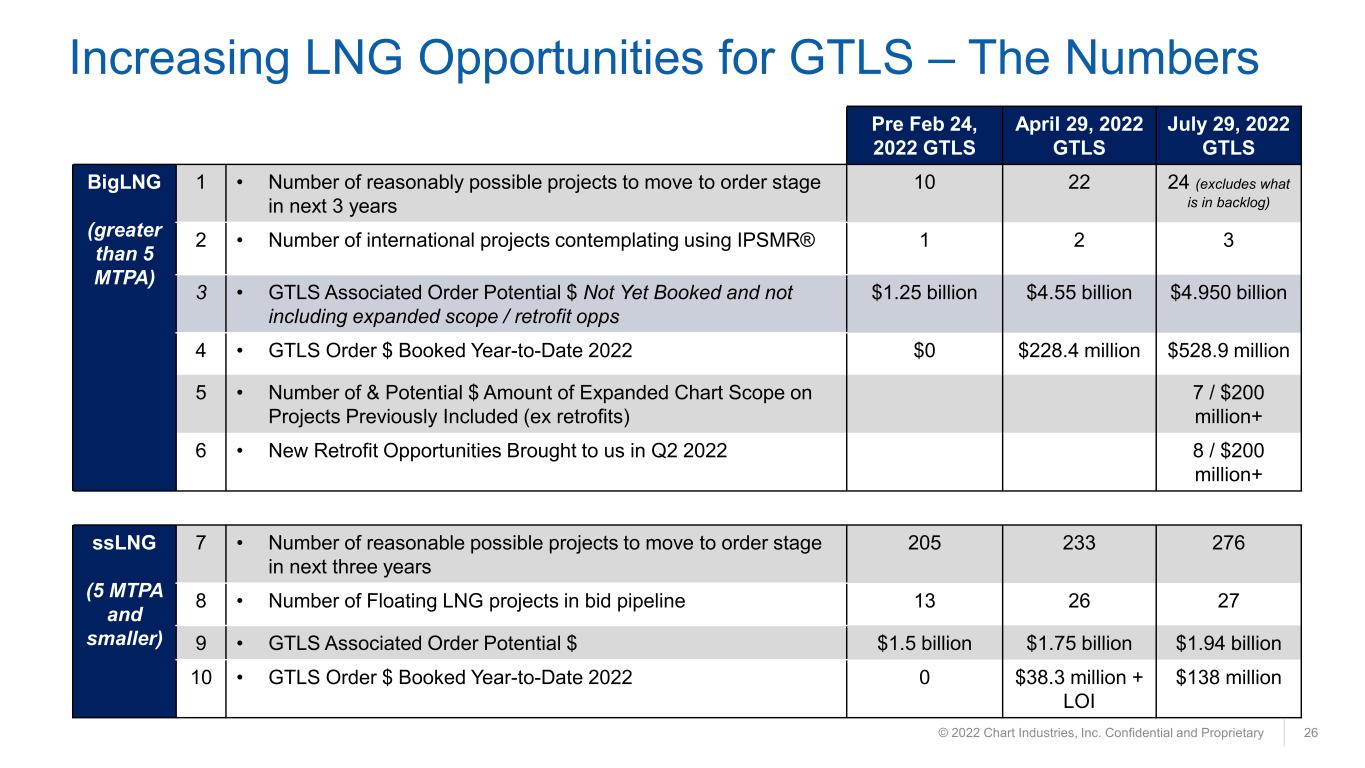

© 2022 Chart Industries, Inc. Confidential and Proprietary 26 Increasing LNG Opportunities for GTLS – The Numbers Pre Feb 24, 2022 GTLS April 29, 2022 GTLS July 29, 2022 GTLS BigLNG (greater than 5 MTPA) 1 • Number of reasonably possible projects to move to order stage in next 3 years 10 22 24 (excludes what is in backlog) 2 • Number of international projects contemplating using IPSMR® 1 2 3 3 • GTLS Associated Order Potential $ Not Yet Booked and not including expanded scope / retrofit opps $1.25 billion $4.55 billion $4.950 billion 4 • GTLS Order $ Booked Year-to-Date 2022 $0 $228.4 million $528.9 million 5 • Number of & Potential $ Amount of Expanded Chart Scope on Projects Previously Included (ex retrofits) 7 / $200 million+ 6 • New Retrofit Opportunities Brought to us in Q2 2022 8 / $200 million+ ssLNG (5 MTPA and smaller) 7 • Number of reasonable possible projects to move to order stage in next three years 205 233 276 8 • Number of Floating LNG projects in bid pipeline 13 26 27 9 • GTLS Associated Order Potential $ $1.5 billion $1.75 billion $1.94 billion 10 • GTLS Order $ Booked Year-to-Date 2022 0 $38.3 million + LOI $138 million

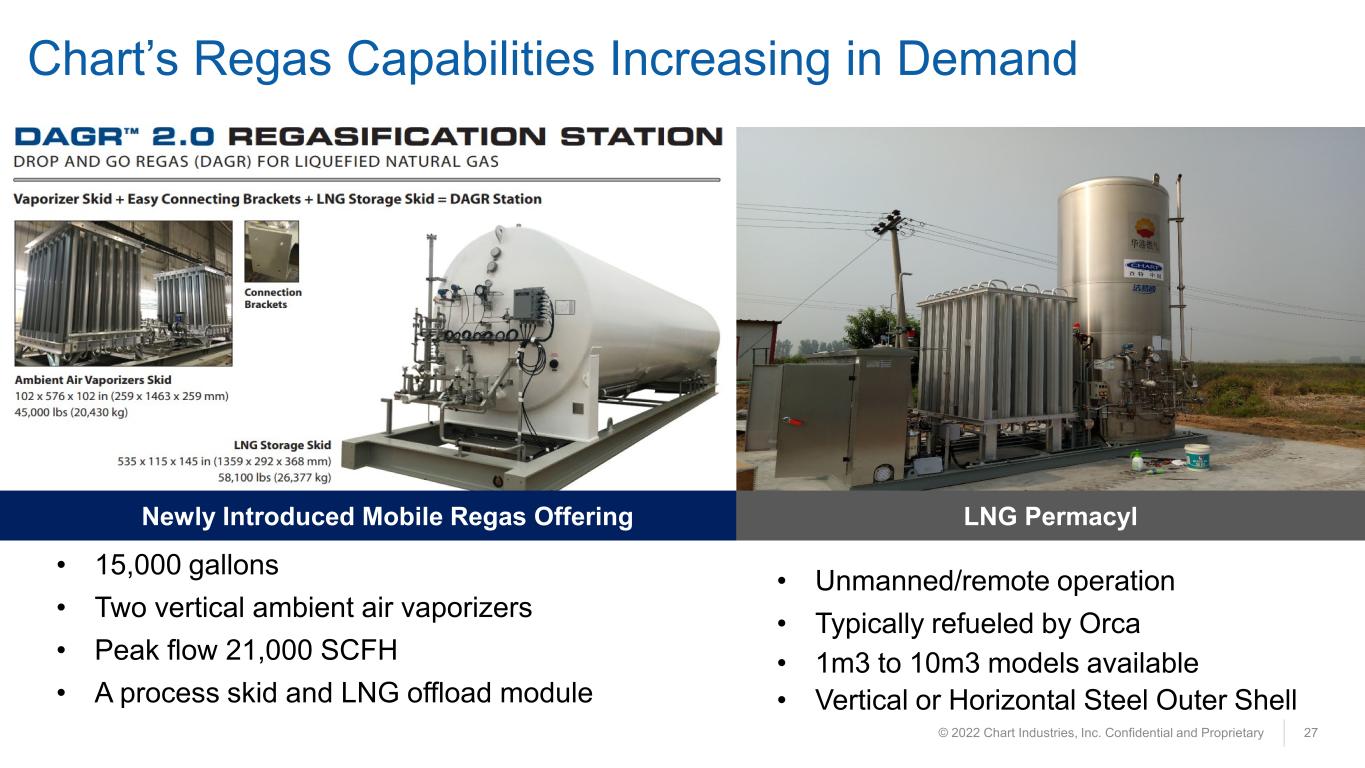

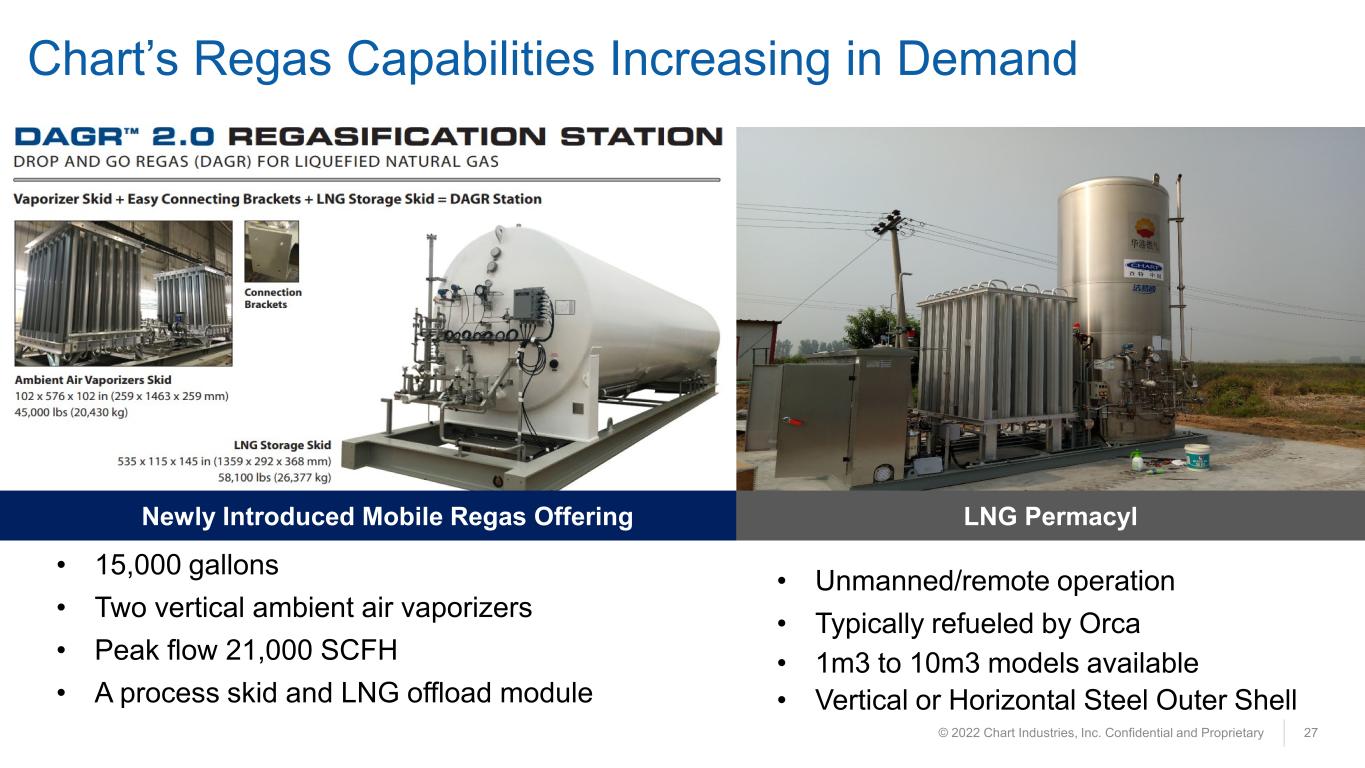

© 2022 Chart Industries, Inc. Confidential and Proprietary 27 Chart’s Regas Capabilities Increasing in Demand • 15,000 gallons • Two vertical ambient air vaporizers • Peak flow 21,000 SCFH • A process skid and LNG offload module • Unmanned/remote operation • Typically refueled by Orca • 1m3 to 10m3 models available • Vertical or Horizontal Steel Outer Shell Newly Introduced Mobile Regas Offering LNG Permacyl

© 2022 Chart Industries, Inc. Confidential and Proprietary 28 LNG Retrofit, Replacement and Refurbishment Increasing Multiple jobs completed or underway year-to-date, such as: Removal and install of fans and motors BAHX repair with multiple deployments Repair, retrofit, replacement activities are global Other opportunities in aftermarket include: Heavy hydrocarbon removal systems (HHC) Nitrogen rejection units (NRU) Boil Off Gas (BOG) reliquefaction Carbon capture & storage additions Replacement / aftermarket parts Field service repairs

© 2022 Chart Industries, Inc. Confidential and Proprietary 29 Welcome to our Newest Inorganic Additions • Acquired for approximately $20 million • May 31, 2022 acquisition date • Immediately accretive • Vacuum insulated cold box, pressure vessel capabilities in particular for hydrogen, helium, ssLNG applications • Acquired for approximately $4 million • May 16, 2022 acquisition date • Immediately accretive • Nordic region repair, service, field service and monitoring capabilities

Děčín, Czech Republic Burago, Italy Goch, Germany Monheim, Germany Gablingen, Germany Léry, France Q2 2022: • Signed 66 new leases with customers in the second quarter 2022, as compared to 36 in Q2 2021. • The Parts, Repair, Service (“PRS”) business within RSL posted record net sales, gross profit $, operating income $ and operating margin as a percent of sales in the quarter. • Service & maintenance agreement for LNG fueling stations signed with EU customer. • Full care service and maintenance services agreement executed with a Nordic region customer. © 2022 Chart Industries, Inc. Confidential and Proprietary 30 Repair, Service & Leasing Gothenburg, Sweden Service Footprint Europe

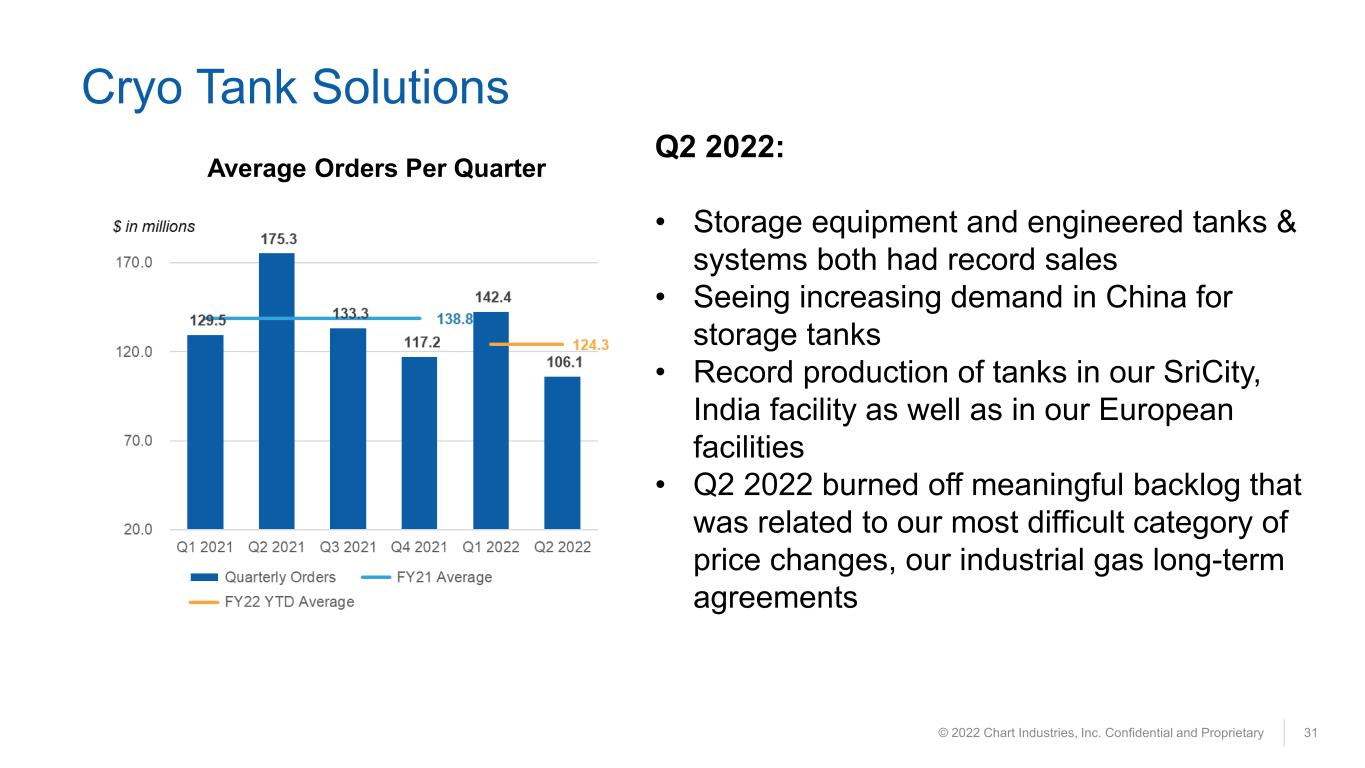

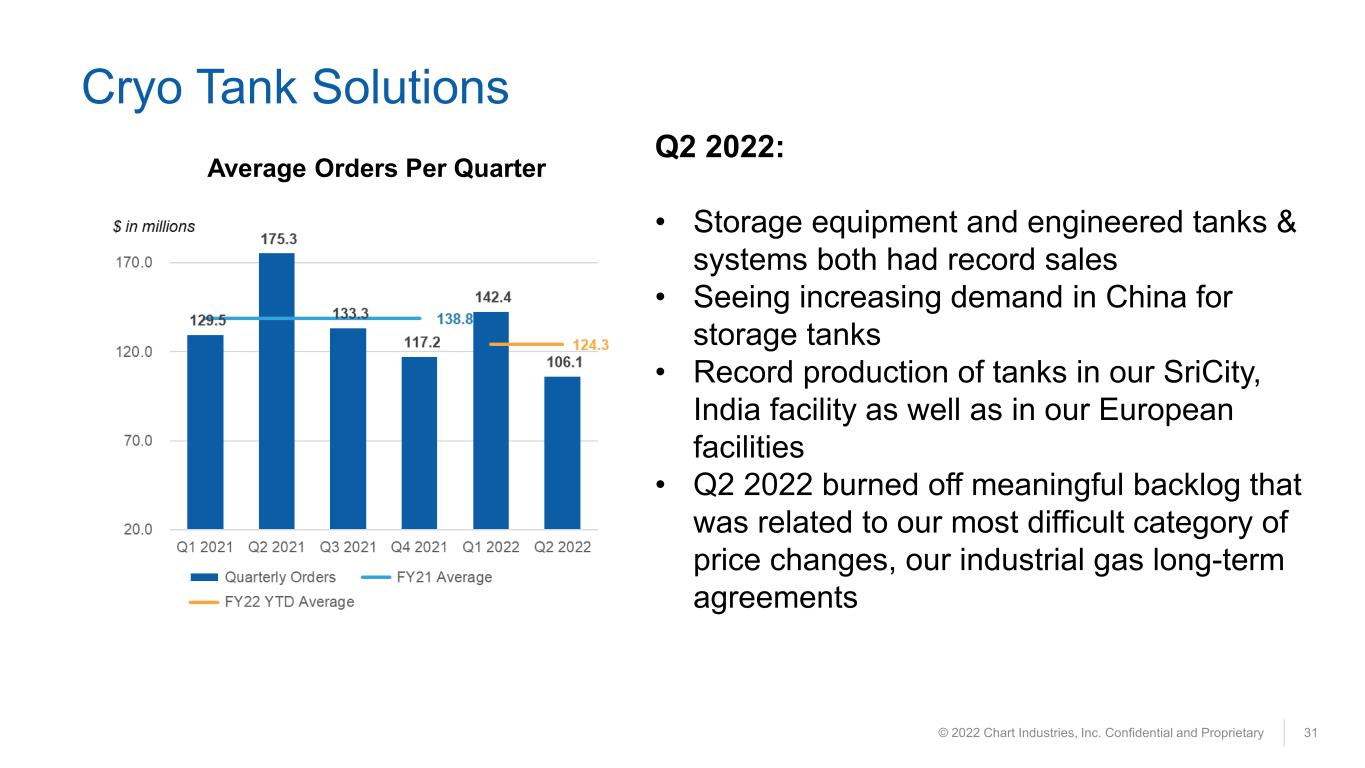

© 2022 Chart Industries, Inc. Confidential and Proprietary 31 Cryo Tank Solutions Average Orders Per Quarter Q2 2022: • Storage equipment and engineered tanks & systems both had record sales • Seeing increasing demand in China for storage tanks • Record production of tanks in our SriCity, India facility as well as in our European facilities • Q2 2022 burned off meaningful backlog that was related to our most difficult category of price changes, our industrial gas long-term agreements

© 2022 Chart Industries, Inc. Confidential and Proprietary 32 ISO Containers: Benefits all Four Segments 产品标准:IMDG, ADR, RID, UIC, ASME, TC, DOT, GB 45ft 40ft NFE40ft China 20ft America 40ft 40ft Europe Certificated by BV 10ft 20ft

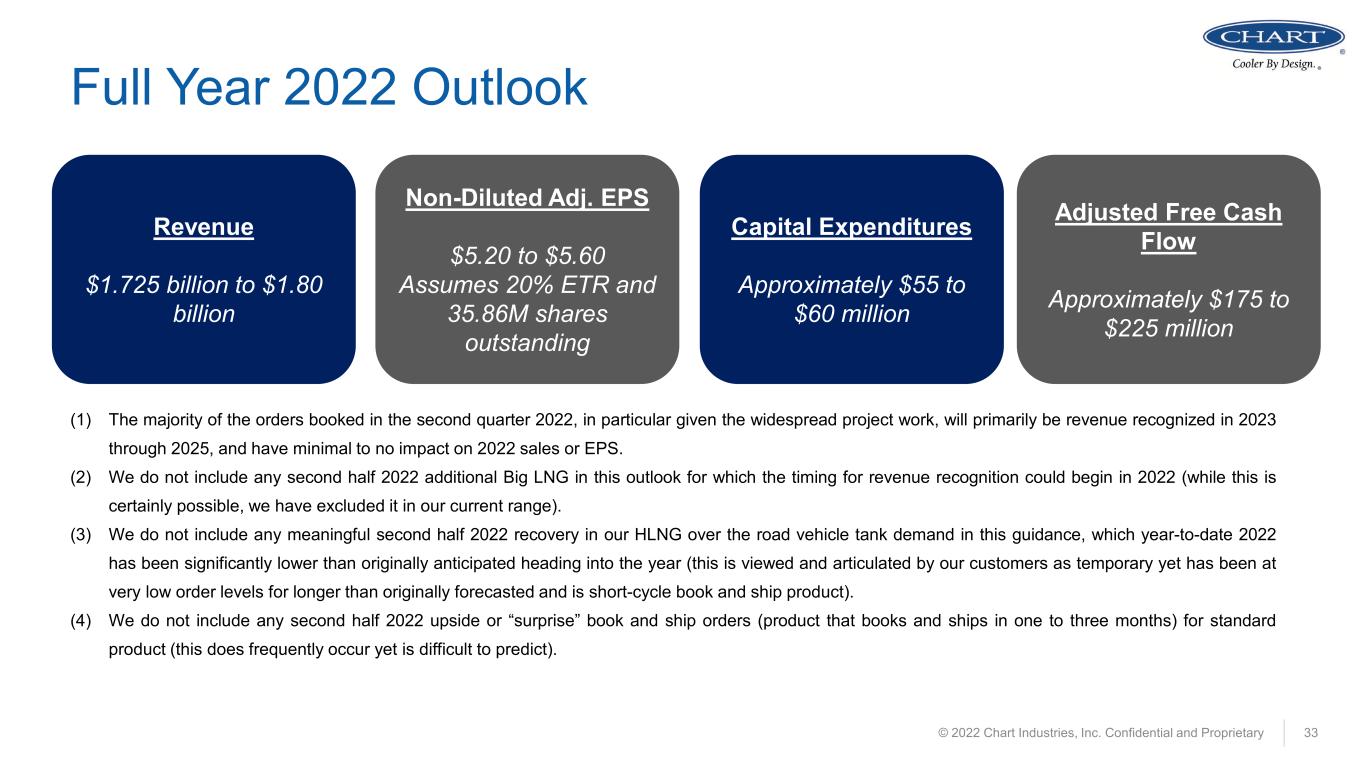

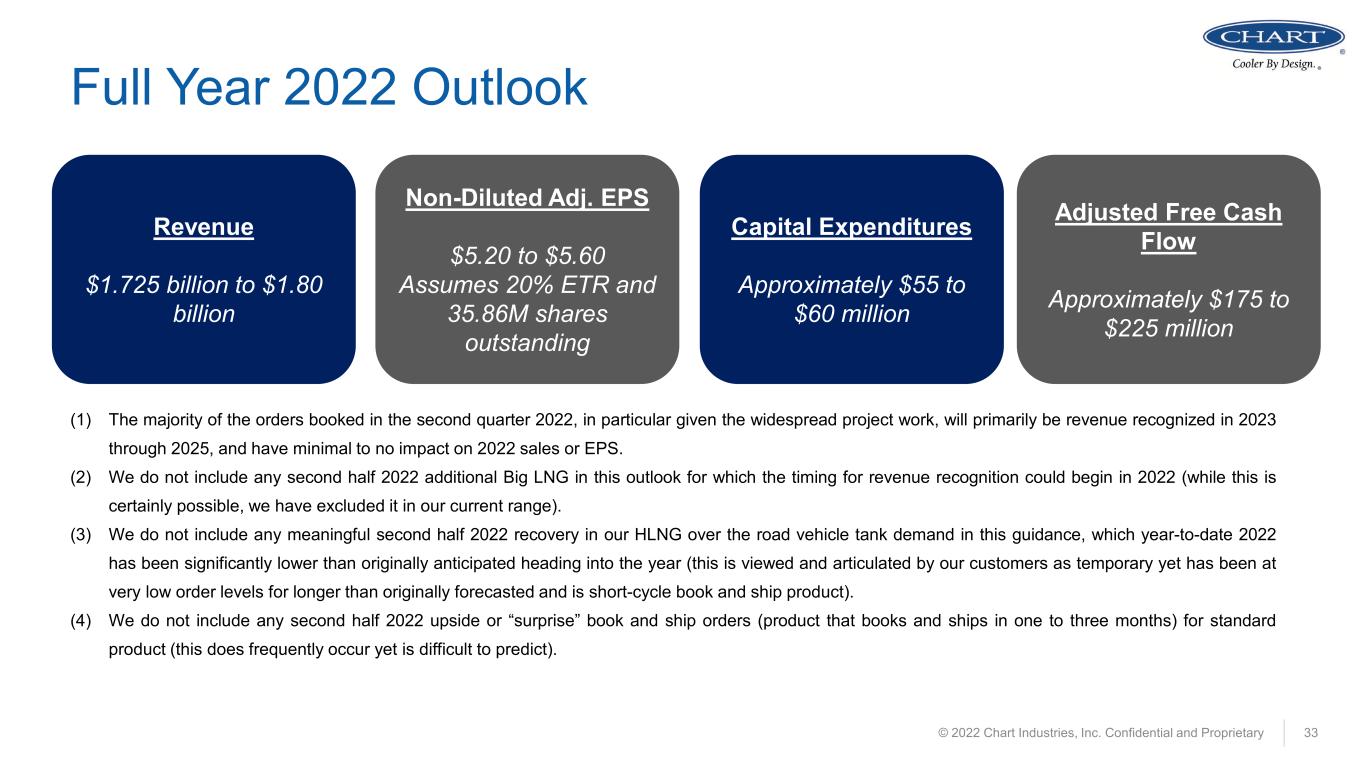

© 2022 Chart Industries, Inc. Confidential and Proprietary 33 Full Year 2022 Outlook Revenue $1.725 billion to $1.80 billion Non-Diluted Adj. EPS $5.20 to $5.60 Assumes 20% ETR and 35.86M shares outstanding Capital Expenditures Approximately $55 to $60 million Adjusted Free Cash Flow Approximately $175 to $225 million (1) The majority of the orders booked in the second quarter 2022, in particular given the widespread project work, will primarily be revenue recognized in 2023 through 2025, and have minimal to no impact on 2022 sales or EPS. (2) We do not include any second half 2022 additional Big LNG in this outlook for which the timing for revenue recognition could begin in 2022 (while this is certainly possible, we have excluded it in our current range). (3) We do not include any meaningful second half 2022 recovery in our HLNG over the road vehicle tank demand in this guidance, which year-to-date 2022 has been significantly lower than originally anticipated heading into the year (this is viewed and articulated by our customers as temporary yet has been at very low order levels for longer than originally forecasted and is short-cycle book and ship product). (4) We do not include any second half 2022 upside or “surprise” book and ship orders (product that books and ships in one to three months) for standard product (this does frequently occur yet is difficult to predict).

© 2022 Chart Industries, Inc. Confidential and Proprietary 34 Thank You to All of Our Interns! Baylor Univ.Technical Univ. LiberecTexas A&M Univ.Viterbo Univ.Georgia Tech Ohio State Univ. Georgia TechGeorgia Tech William Parth Evan Joseph Jacob Victor Abram Kirk Mariam Edward Trevor Texas A&M Univ. Kennesaw State Univ. Ava Grace Brigham Young Univ. The Lovett School (H.S.) Texas A&M Univ. Texas A&M Univ. Brigham Young Univ. Brigham Young Univ. Iowa State Univ.Univ. of Michigan. TU Delft European Business Academy Caidin Rebecca Steven Jeremy Antoni Pranav TU Delft Martin TU Delft Petra Michaela Petr Technical College Decin Univ. of Wisconsin- Stout Joseph John Kennesaw State Univ.

Appendix 35

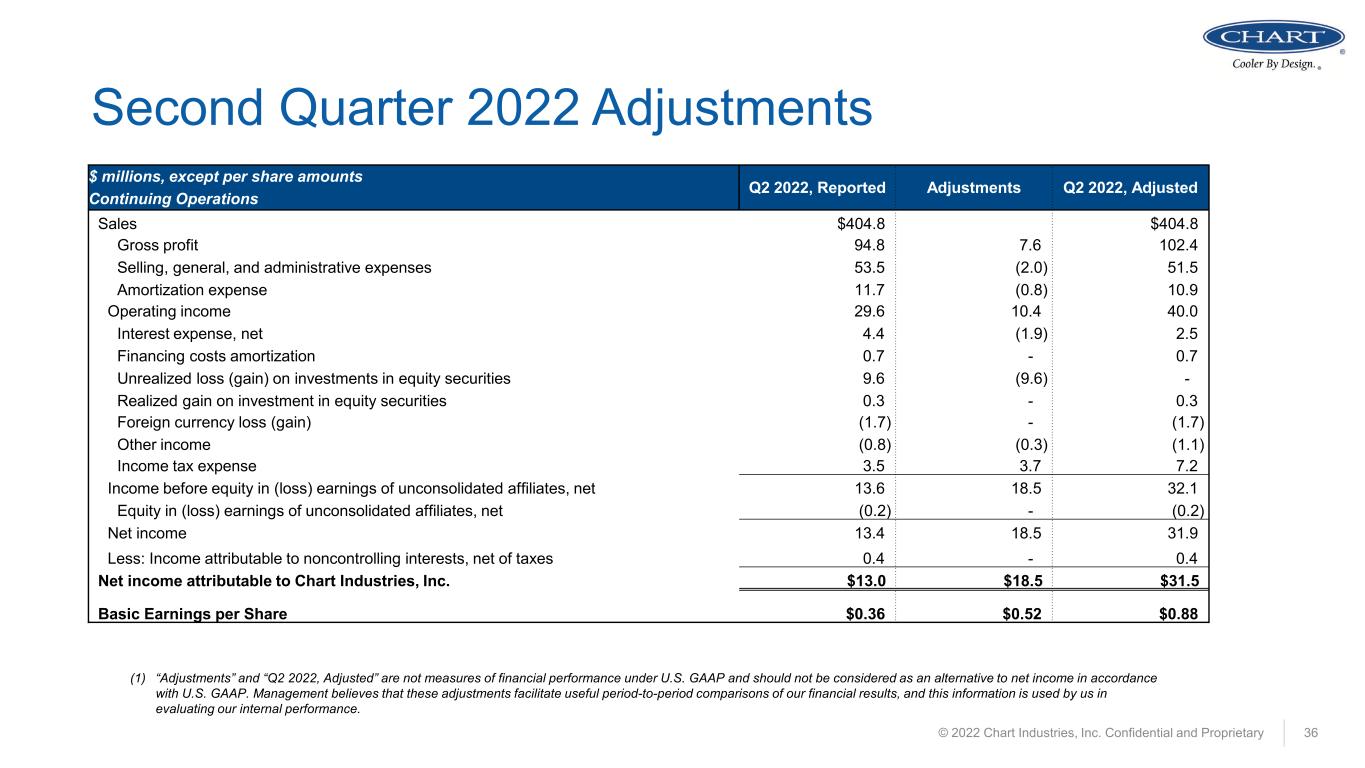

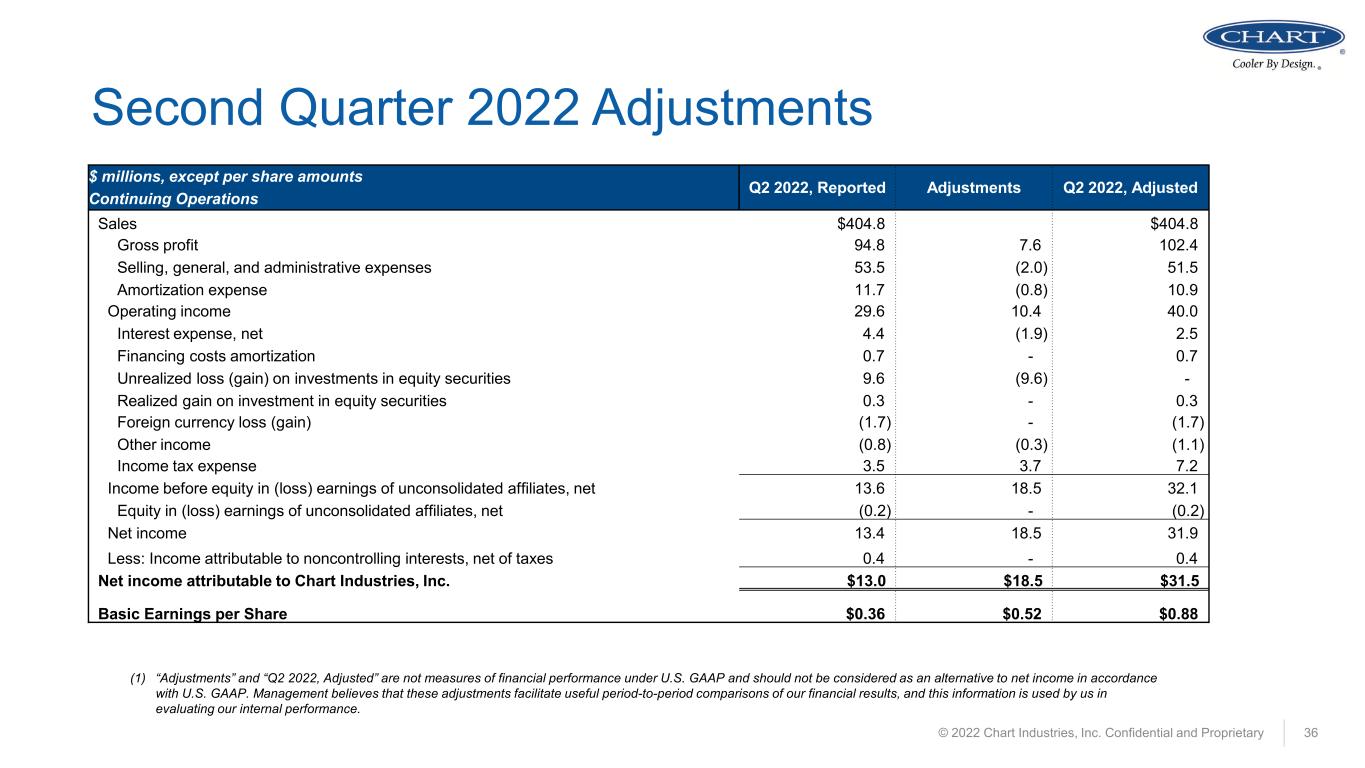

© 2022 Chart Industries, Inc. Confidential and Proprietary 36 Second Quarter 2022 Adjustments (1) “Adjustments” and “Q2 2022, Adjusted” are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Management believes that these adjustments facilitate useful period-to-period comparisons of our financial results, and this information is used by us in evaluating our internal performance. $ millions, except per share amounts Q2 2022, Reported Adjustments Q2 2022, Adjusted Continuing Operations Sales $404.8 $404.8 Gross profit 94.8 7.6 102.4 Selling, general, and administrative expenses 53.5 (2.0) 51.5 Amortization expense 11.7 (0.8) 10.9 Operating income 29.6 10.4 40.0 Interest expense, net 4.4 (1.9) 2.5 Financing costs amortization 0.7 - 0.7 Unrealized loss (gain) on investments in equity securities 9.6 (9.6) - Realized gain on investment in equity securities 0.3 - 0.3 Foreign currency loss (gain) (1.7) - (1.7) Other income (0.8) (0.3) (1.1) Income tax expense 3.5 3.7 7.2 Income before equity in (loss) earnings of unconsolidated affiliates, net 13.6 18.5 32.1 Equity in (loss) earnings of unconsolidated affiliates, net (0.2) - (0.2) Net income 13.4 18.5 31.9 Less: Income attributable to noncontrolling interests, net of taxes 0.4 - 0.4 Net income attributable to Chart Industries, Inc. $13.0 $18.5 $31.5 Basic Earnings per Share $0.36 $0.52 $0.88

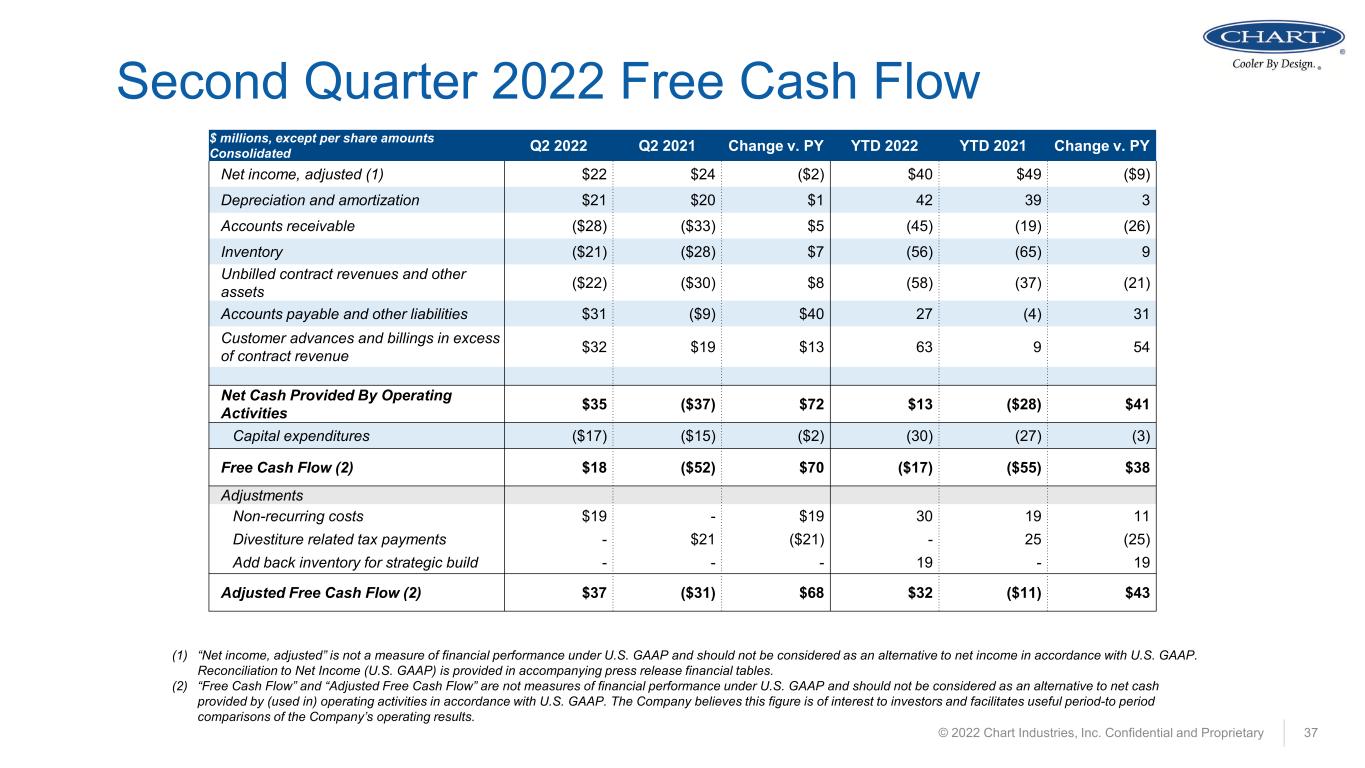

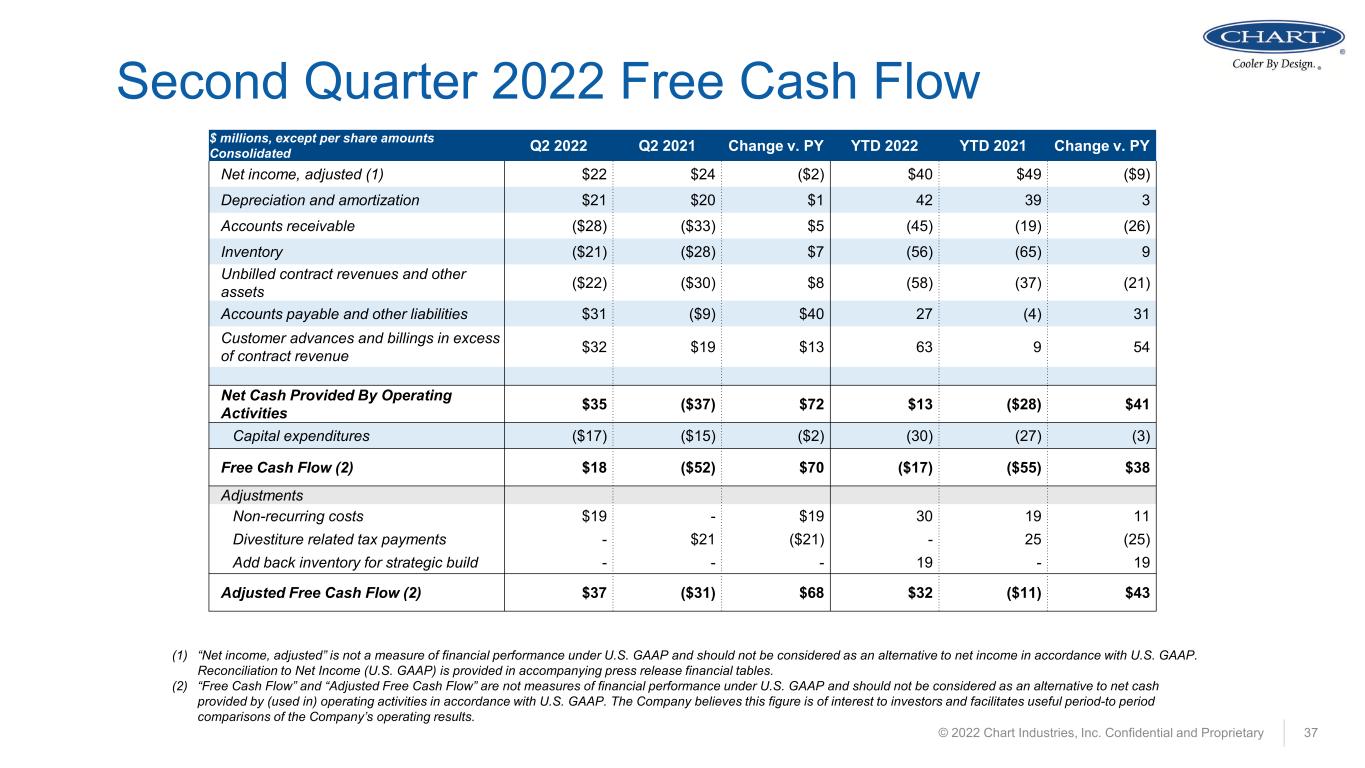

© 2022 Chart Industries, Inc. Confidential and Proprietary 37 Second Quarter 2022 Free Cash Flow (1) “Net income, adjusted” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Reconciliation to Net Income (U.S. GAAP) is provided in accompanying press release financial tables. (2) “Free Cash Flow” and “Adjusted Free Cash Flow” are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilitates useful period-to period comparisons of the Company’s operating results. $ millions, except per share amounts Consolidated Q2 2022 Q2 2021 Change v. PY YTD 2022 YTD 2021 Change v. PY Net income, adjusted (1) $22 $24 ($2) $40 $49 ($9) Depreciation and amortization $21 $20 $1 42 39 3 Accounts receivable ($28) ($33) $5 (45) (19) (26) Inventory ($21) ($28) $7 (56) (65) 9 Unbilled contract revenues and other assets ($22) ($30) $8 (58) (37) (21) Accounts payable and other liabilities $31 ($9) $40 27 (4) 31 Customer advances and billings in excess of contract revenue $32 $19 $13 63 9 54 Net Cash Provided By Operating Activities $35 ($37) $72 $13 ($28) $41 Capital expenditures ($17) ($15) ($2) (30) (27) (3) Free Cash Flow (2) $18 ($52) $70 ($17) ($55) $38 Adjustments Non-recurring costs $19 - $19 30 19 11 Divestiture related tax payments - $21 ($21) - 25 (25) Add back inventory for strategic build - - - 19 - 19 Adjusted Free Cash Flow (2) $37 ($31) $68 $32 ($11) $43

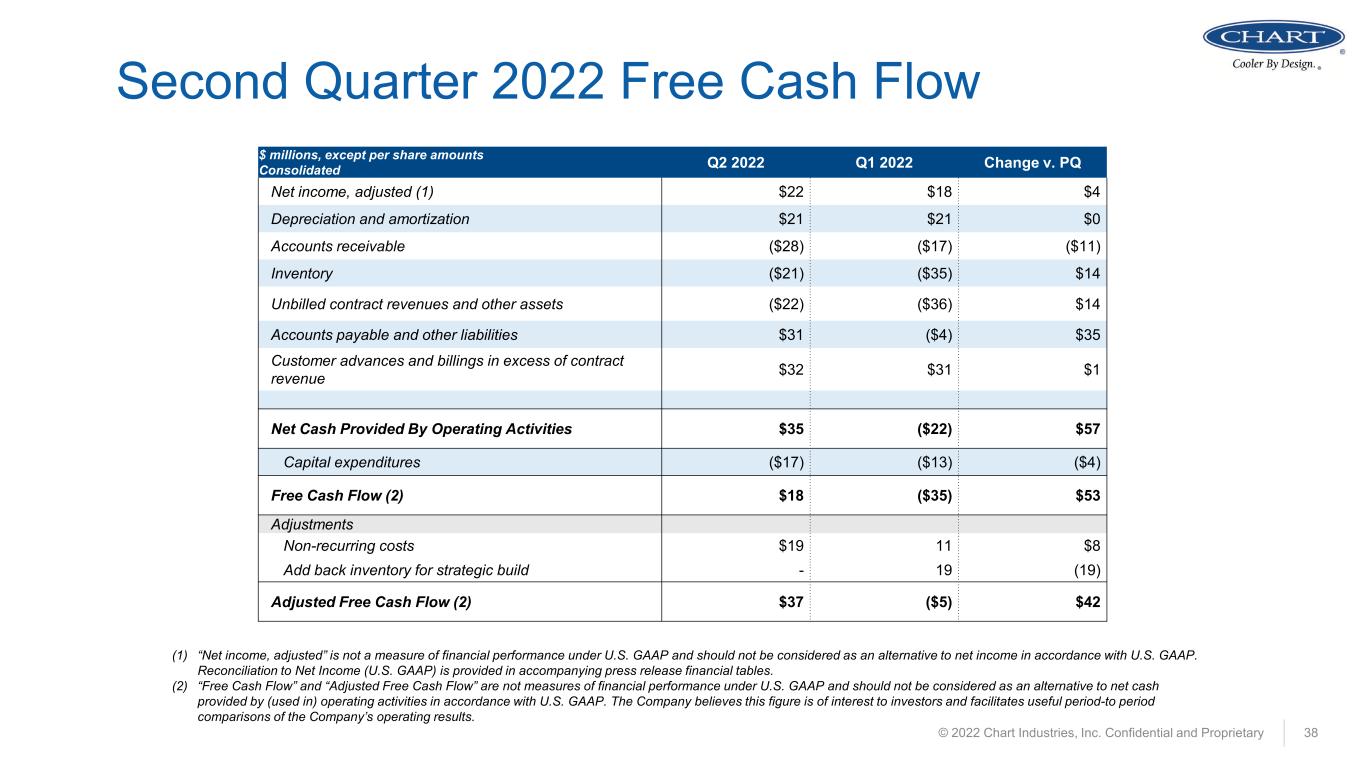

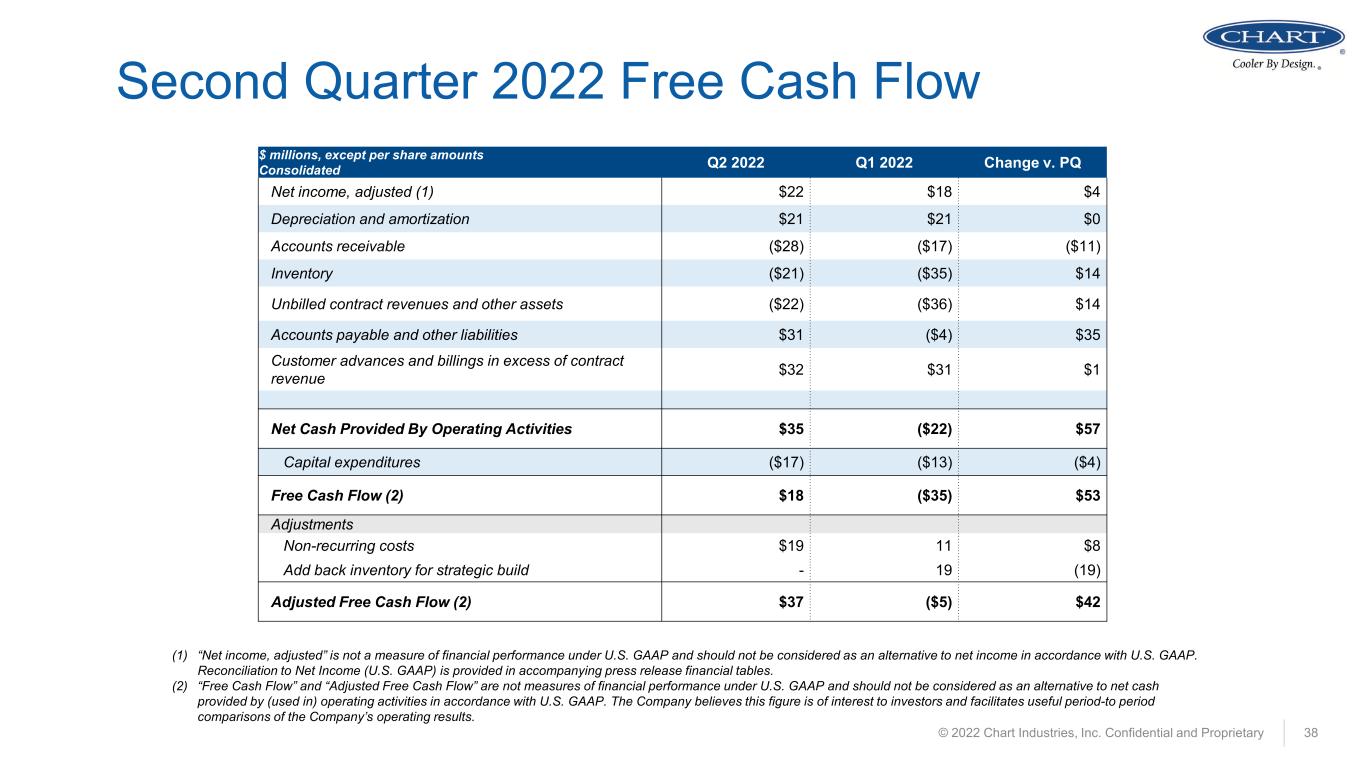

© 2022 Chart Industries, Inc. Confidential and Proprietary 38 Second Quarter 2022 Free Cash Flow (1) “Net income, adjusted” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Reconciliation to Net Income (U.S. GAAP) is provided in accompanying press release financial tables. (2) “Free Cash Flow” and “Adjusted Free Cash Flow” are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilitates useful period-to period comparisons of the Company’s operating results. $ millions, except per share amounts Consolidated Q2 2022 Q1 2022 Change v. PQ Net income, adjusted (1) $22 $18 $4 Depreciation and amortization $21 $21 $0 Accounts receivable ($28) ($17) ($11) Inventory ($21) ($35) $14 Unbilled contract revenues and other assets ($22) ($36) $14 Accounts payable and other liabilities $31 ($4) $35 Customer advances and billings in excess of contract revenue $32 $31 $1 Net Cash Provided By Operating Activities $35 ($22) $57 Capital expenditures ($17) ($13) ($4) Free Cash Flow (2) $18 ($35) $53 Adjustments Non-recurring costs $19 11 $8 Add back inventory for strategic build - 19 (19) Adjusted Free Cash Flow (2) $37 ($5) $42

© 2022 Chart Industries, Inc. Confidential and Proprietary 39 Second Quarter 2022 Adjusted EBITDA (1) “EBITDA” and “Adjusted EBITDA” are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Management believes that EBITDA and Adjusted EBITDA facilitate useful period-to-period comparisons of our financial results, and this information is used by us in evaluating our internal performance. $ millions, except per share amounts Consolidated Q2 2022 Q2 2021 Change v. PY YTD 2022 YTD 2021 Change v. PY Net income from continuing operations $13.4 $6.8 $6.6 $23.7 $32.9 ($9.2) Income tax expense, net 3.5 1.4 2.1 5.6 4.5 1.1 Interest expense, net 5.1 3.4 1.7 9.0 6.5 2.5 Depreciation and amortization 21.7 19.8 1.9 42.2 39.3 2.9 EBITDA (1) $43.7 $31.4 $12.3 $80.5 $83.2 ($2.7) Non-recurring costs 19.5 26.3 (6.8) 34.4 26.1 8.3 Share-based compensation 2.3 2.4 (0.1) 5.6 5.8 (0.2) Adjusted EBITDA (1) $65.5 $60.1 $5.4 $120.5 $115.1 $5.4

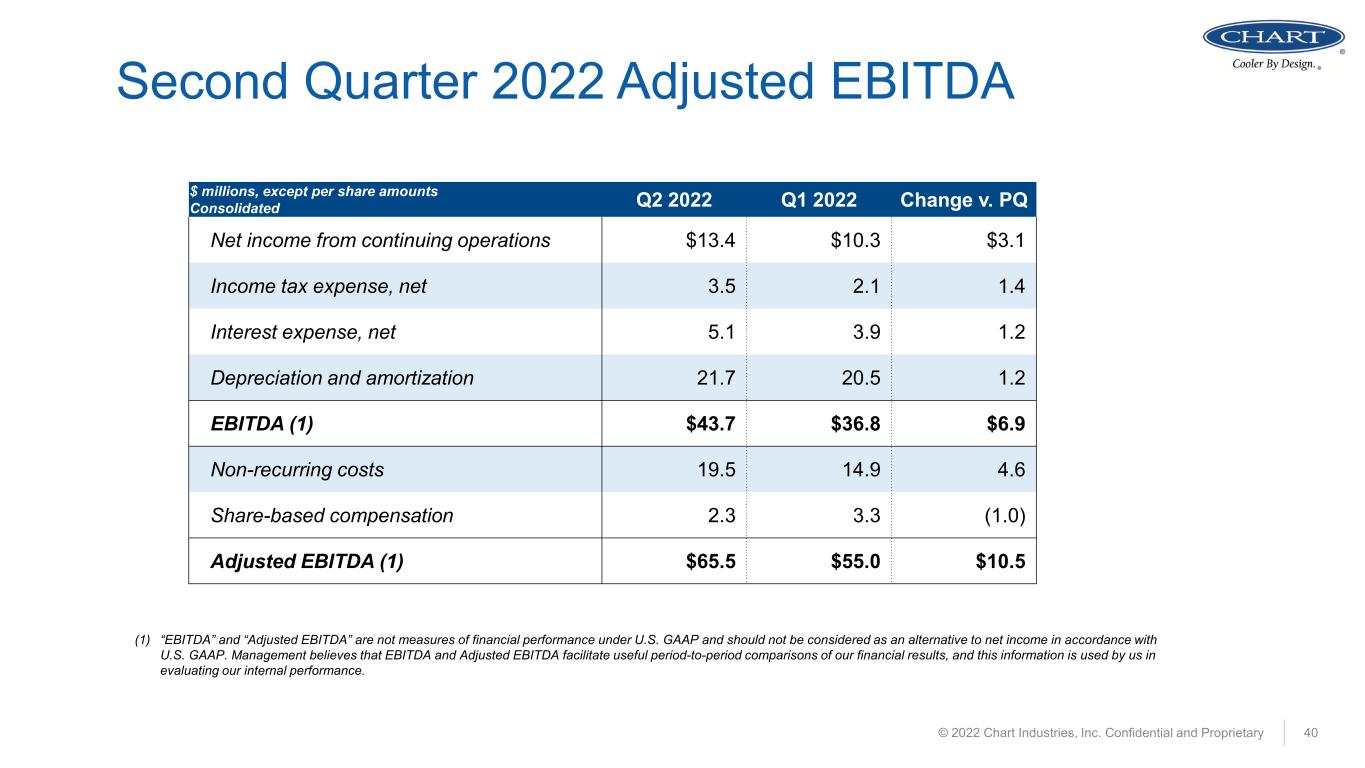

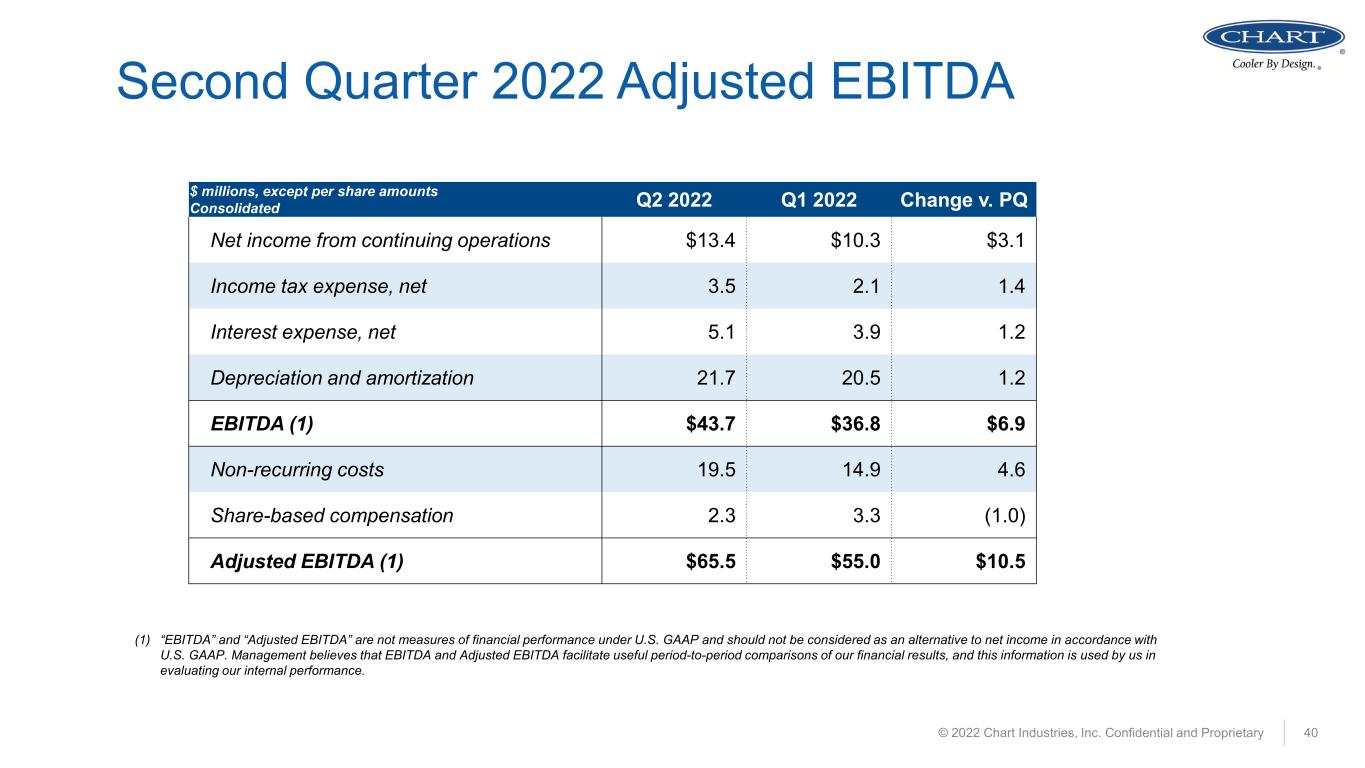

© 2022 Chart Industries, Inc. Confidential and Proprietary 40 Second Quarter 2022 Adjusted EBITDA (1) “EBITDA” and “Adjusted EBITDA” are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Management believes that EBITDA and Adjusted EBITDA facilitate useful period-to-period comparisons of our financial results, and this information is used by us in evaluating our internal performance. $ millions, except per share amounts Consolidated Q2 2022 Q1 2022 Change v. PQ Net income from continuing operations $13.4 $10.3 $3.1 Income tax expense, net 3.5 2.1 1.4 Interest expense, net 5.1 3.9 1.2 Depreciation and amortization 21.7 20.5 1.2 EBITDA (1) $43.7 $36.8 $6.9 Non-recurring costs 19.5 14.9 4.6 Share-based compensation 2.3 3.3 (1.0) Adjusted EBITDA (1) $65.5 $55.0 $10.5

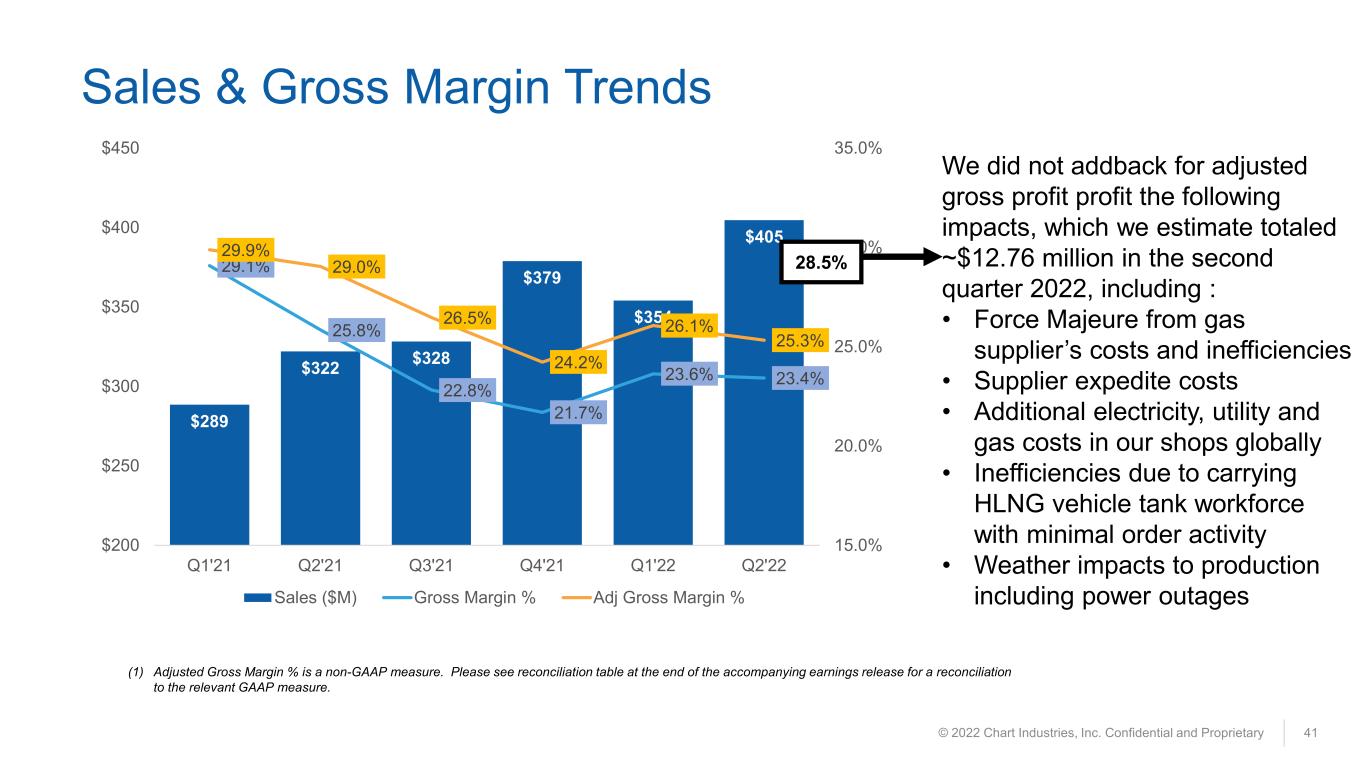

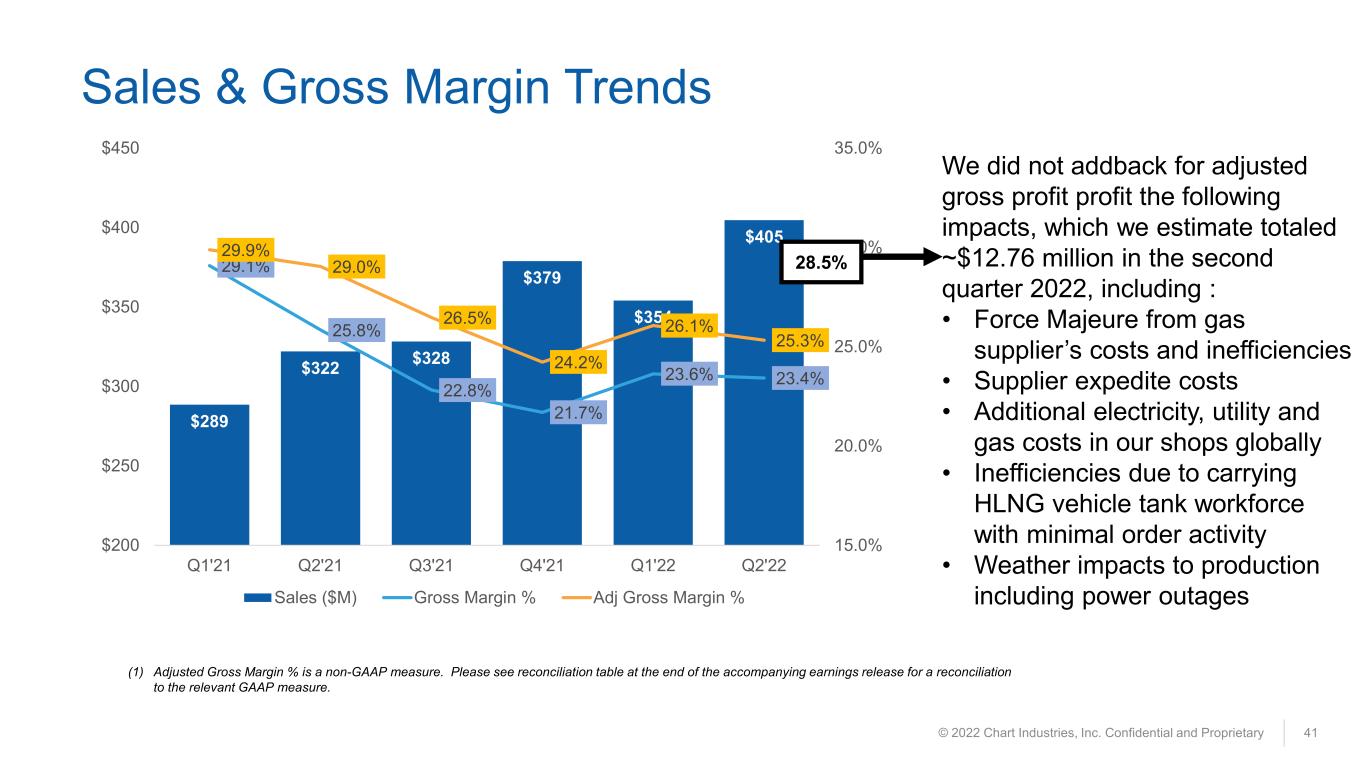

© 2022 Chart Industries, Inc. Confidential and Proprietary 41 Sales & Gross Margin Trends $289 $322 $328 $379 $354 $405 29.1% 25.8% 22.8% 21.7% 23.6% 23.4% 29.9% 29.0% 26.5% 24.2% 26.1% 25.3% 15.0% 20.0% 25.0% 30.0% 35.0% $200 $250 $300 $350 $400 $450 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Sales ($M) Gross Margin % Adj Gross Margin % (1) Adjusted Gross Margin % is a non-GAAP measure. Please see reconciliation table at the end of the accompanying earnings release for a reconciliation to the relevant GAAP measure. 28.5% We did not addback for adjusted gross profit profit the following impacts, which we estimate totaled ~$12.76 million in the second quarter 2022, including : • Force Majeure from gas supplier’s costs and inefficiencies • Supplier expedite costs • Additional electricity, utility and gas costs in our shops globally • Inefficiencies due to carrying HLNG vehicle tank workforce with minimal order activity • Weather impacts to production including power outages

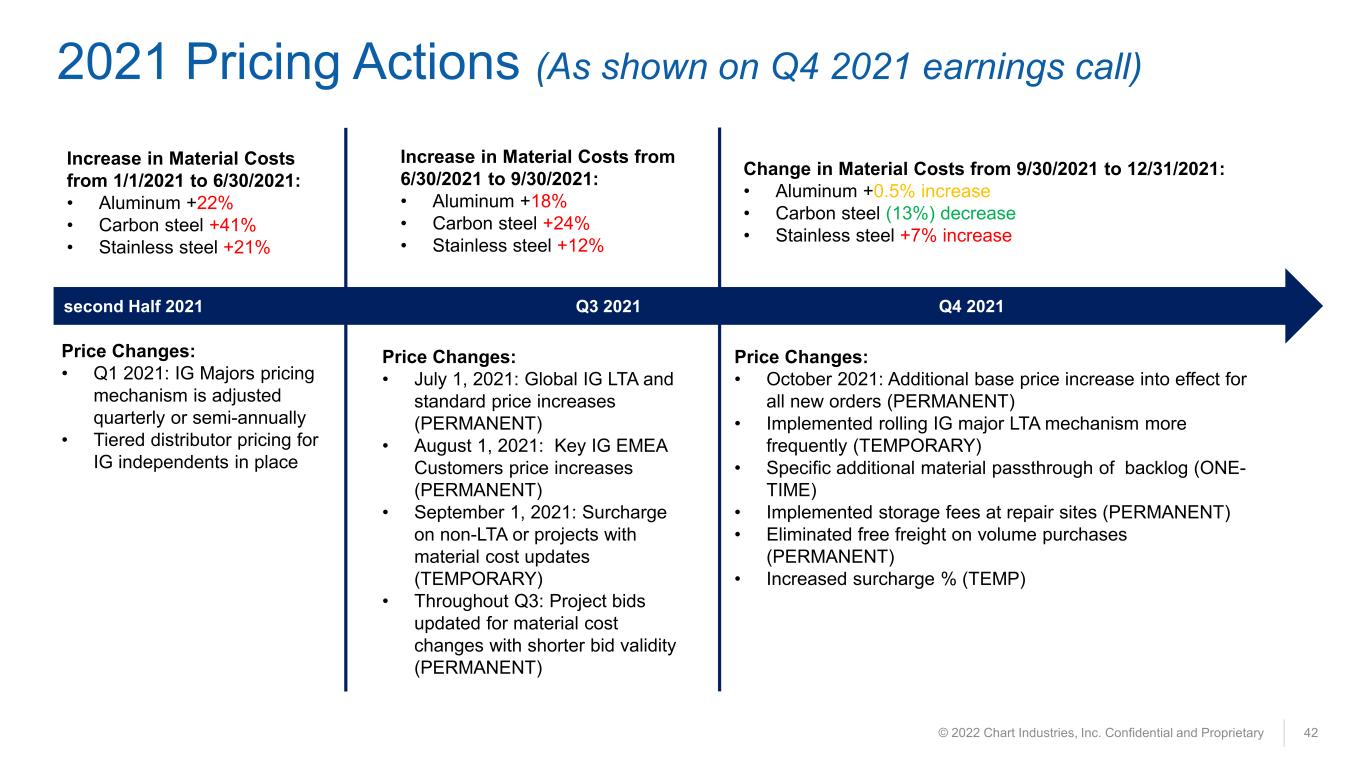

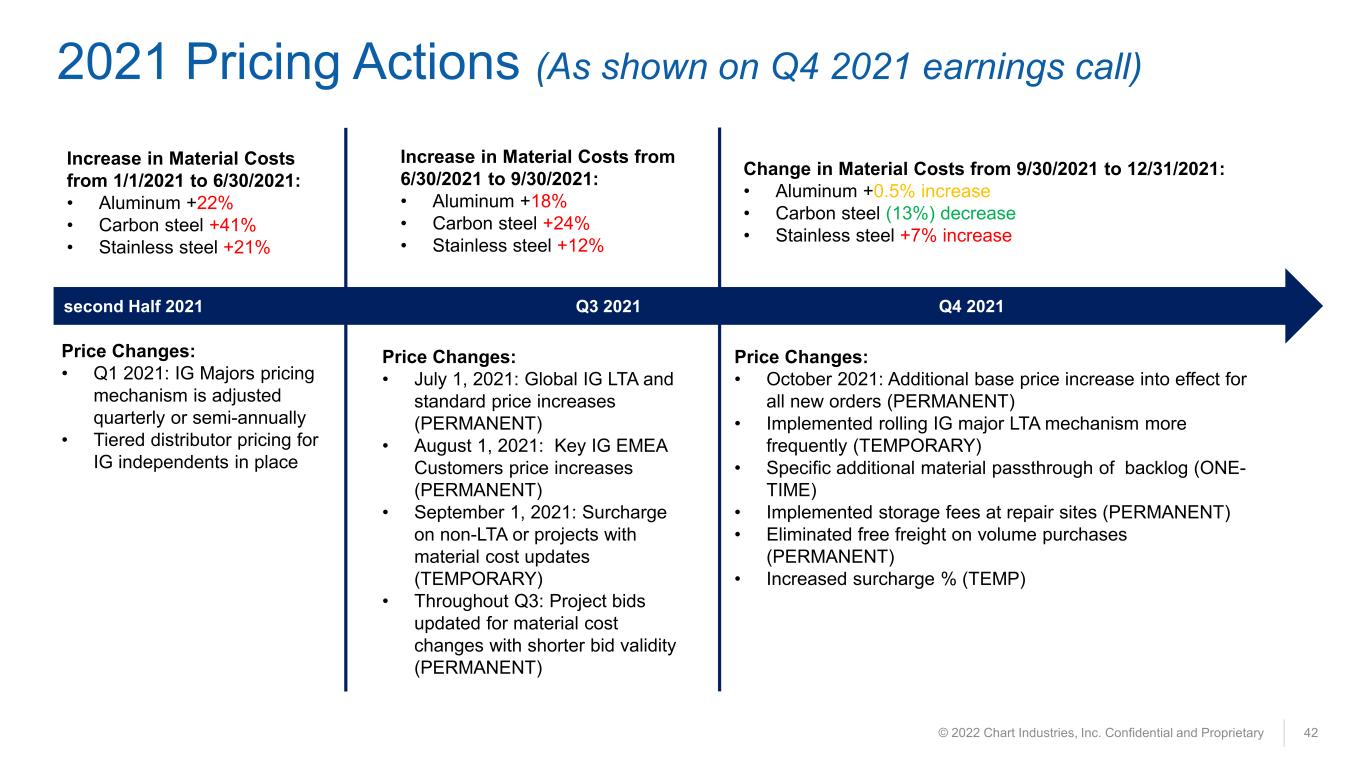

© 2022 Chart Industries, Inc. Confidential and Proprietary 42 2021 Pricing Actions (As shown on Q4 2021 earnings call) second Half 2021 Q3 2021 Q4 2021 Increase in Material Costs from 6/30/2021 to 9/30/2021: • Aluminum +18% • Carbon steel +24% • Stainless steel +12% Increase in Material Costs from 1/1/2021 to 6/30/2021: • Aluminum +22% • Carbon steel +41% • Stainless steel +21% Price Changes: • July 1, 2021: Global IG LTA and standard price increases (PERMANENT) • August 1, 2021: Key IG EMEA Customers price increases (PERMANENT) • September 1, 2021: Surcharge on non-LTA or projects with material cost updates (TEMPORARY) • Throughout Q3: Project bids updated for material cost changes with shorter bid validity (PERMANENT) Price Changes: • October 2021: Additional base price increase into effect for all new orders (PERMANENT) • Implemented rolling IG major LTA mechanism more frequently (TEMPORARY) • Specific additional material passthrough of backlog (ONE- TIME) • Implemented storage fees at repair sites (PERMANENT) • Eliminated free freight on volume purchases (PERMANENT) • Increased surcharge % (TEMP) Change in Material Costs from 9/30/2021 to 12/31/2021: • Aluminum +0.5% increase • Carbon steel (13%) decrease • Stainless steel +7% increase Price Changes: • Q1 2021: IG Majors pricing mechanism is adjusted quarterly or semi-annually • Tiered distributor pricing for IG independents in place

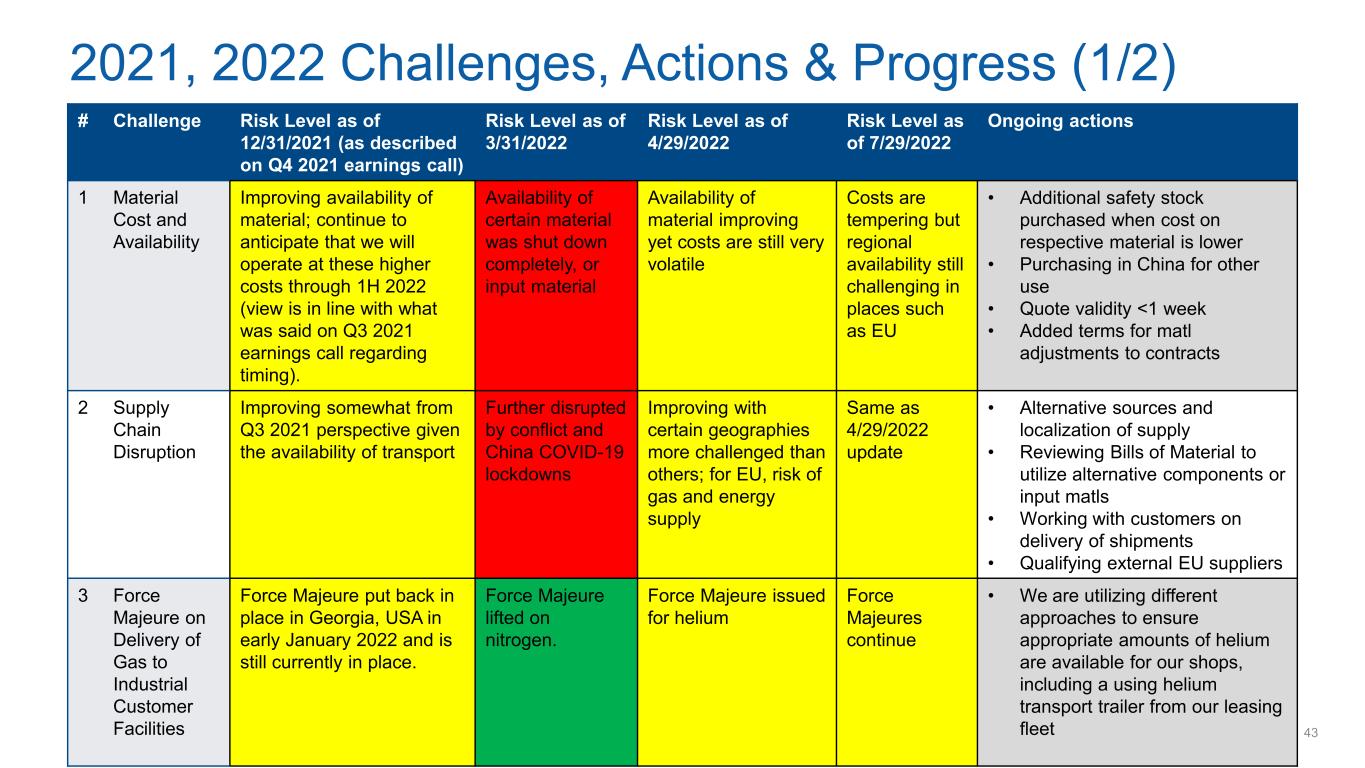

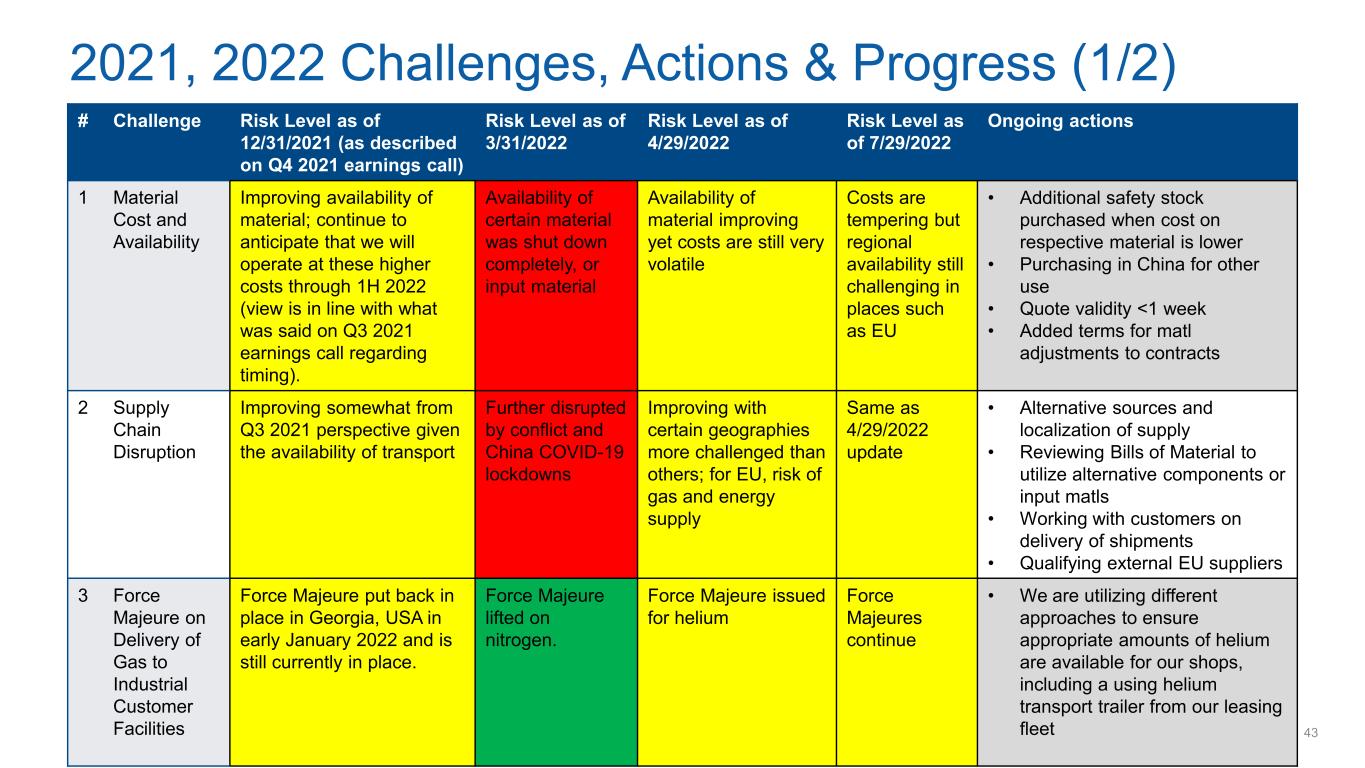

© 2022 Chart Industries, Inc. Confidential and Proprietary 43 2021, 2022 Challenges, Actions & Progress (1/2) # Challenge Risk Level as of 12/31/2021 (as described on Q4 2021 earnings call) Risk Level as of 3/31/2022 Risk Level as of 4/29/2022 Risk Level as of 7/29/2022 Ongoing actions 1 Material Cost and Availability Improving availability of material; continue to anticipate that we will operate at these higher costs through 1H 2022 (view is in line with what was said on Q3 2021 earnings call regarding timing). Availability of certain material was shut down completely, or input material Availability of material improving yet costs are still very volatile Costs are tempering but regional availability still challenging in places such as EU • Additional safety stock purchased when cost on respective material is lower • Purchasing in China for other use • Quote validity <1 week • Added terms for matl adjustments to contracts 2 Supply Chain Disruption Improving somewhat from Q3 2021 perspective given the availability of transport Further disrupted by conflict and China COVID-19 lockdowns Improving with certain geographies more challenged than others; for EU, risk of gas and energy supply Same as 4/29/2022 update • Alternative sources and localization of supply • Reviewing Bills of Material to utilize alternative components or input matls • Working with customers on delivery of shipments • Qualifying external EU suppliers 3 Force Majeure on Delivery of Gas to Industrial Customer Facilities Force Majeure put back in place in Georgia, USA in early January 2022 and is still currently in place. Force Majeure lifted on nitrogen. Force Majeure issued for helium Force Majeures continue • We are utilizing different approaches to ensure appropriate amounts of helium are available for our shops, including a using helium transport trailer from our leasing fleet

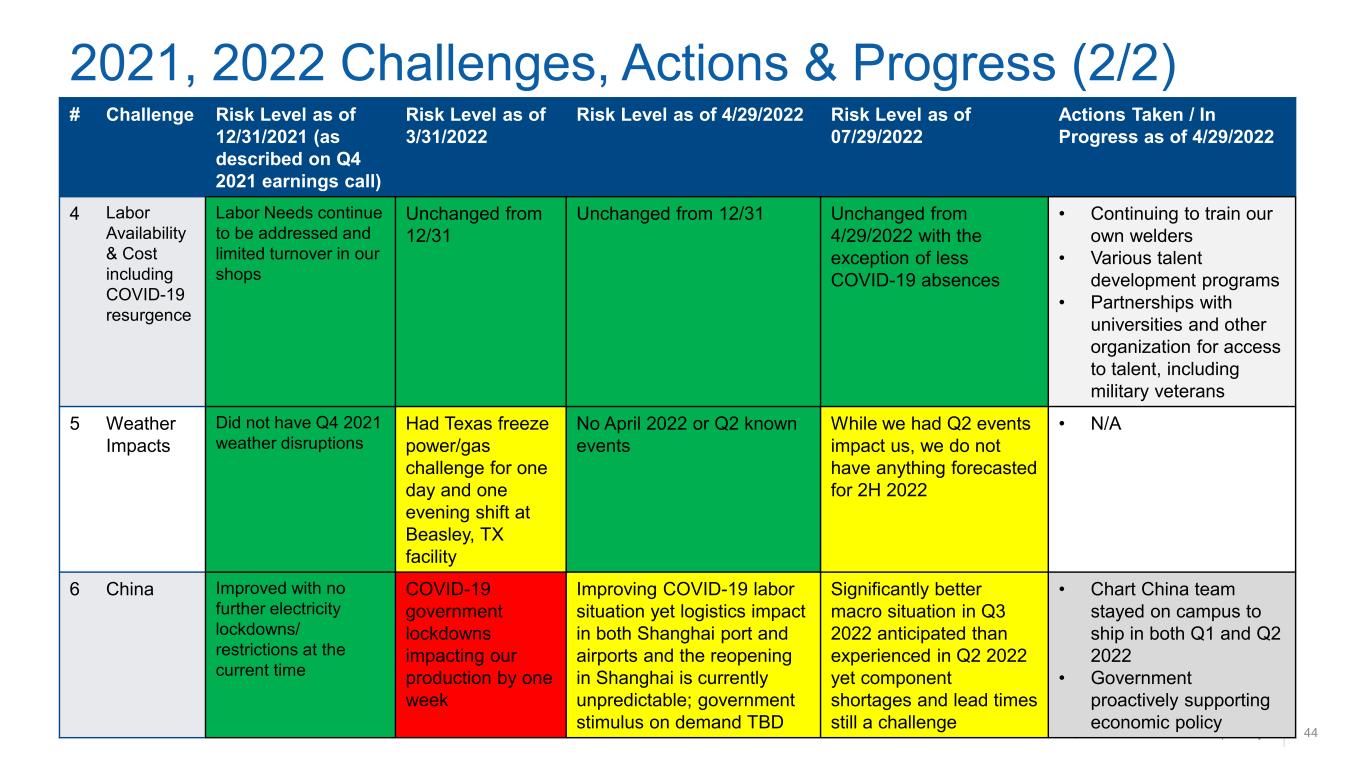

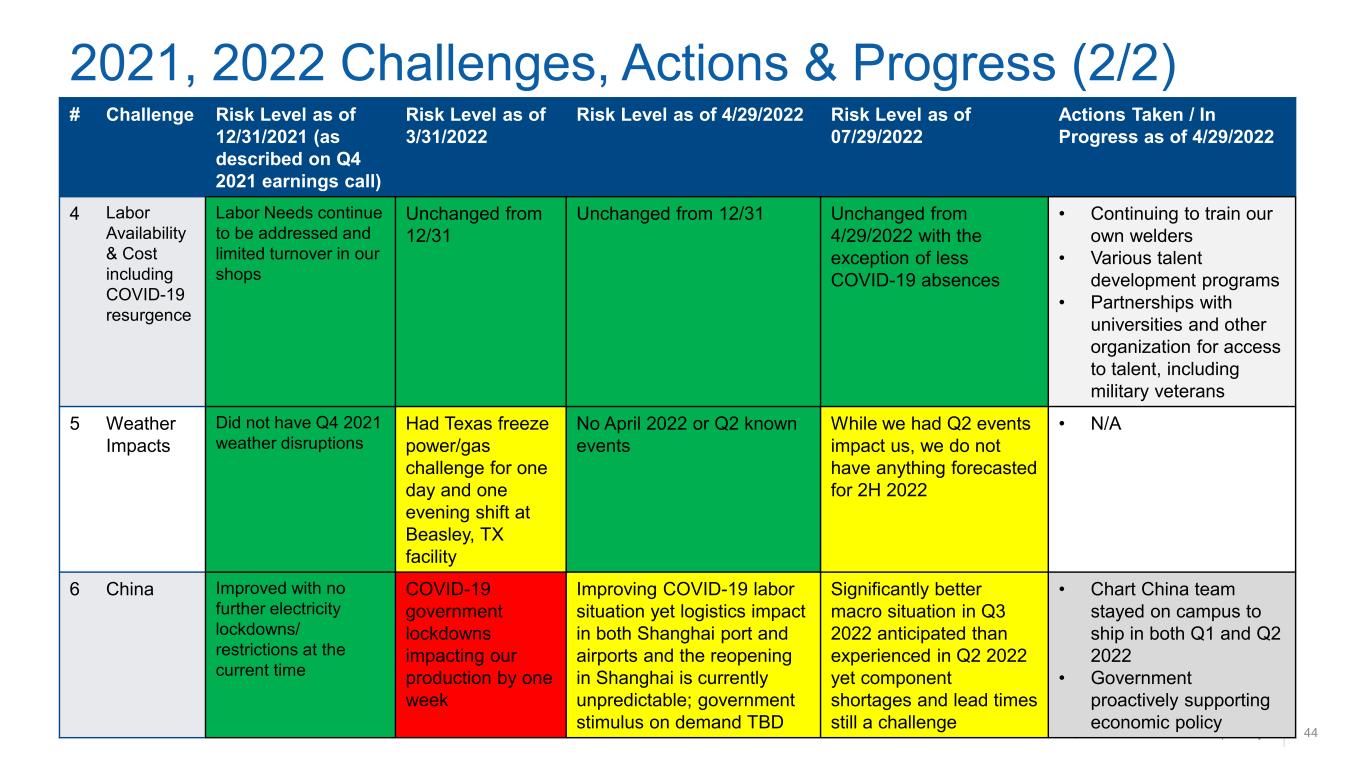

© 2022 Chart Industries, Inc. Confidential and Proprietary 44 2021, 2022 Challenges, Actions & Progress (2/2) # Challenge Risk Level as of 12/31/2021 (as described on Q4 2021 earnings call) Risk Level as of 3/31/2022 Risk Level as of 4/29/2022 Risk Level as of 07/29/2022 Actions Taken / In Progress as of 4/29/2022 4 Labor Availability & Cost including COVID-19 resurgence Labor Needs continue to be addressed and limited turnover in our shops Unchanged from 12/31 Unchanged from 12/31 Unchanged from 4/29/2022 with the exception of less COVID-19 absences • Continuing to train our own welders • Various talent development programs • Partnerships with universities and other organization for access to talent, including military veterans 5 Weather Impacts Did not have Q4 2021 weather disruptions Had Texas freeze power/gas challenge for one day and one evening shift at Beasley, TX facility No April 2022 or Q2 known events While we had Q2 events impact us, we do not have anything forecasted for 2H 2022 • N/A 6 China Improved with no further electricity lockdowns/ restrictions at the current time COVID-19 government lockdowns impacting our production by one week Improving COVID-19 labor situation yet logistics impact in both Shanghai port and airports and the reopening in Shanghai is currently unpredictable; government stimulus on demand TBD Significantly better macro situation in Q3 2022 anticipated than experienced in Q2 2022 yet component shortages and lead times still a challenge • Chart China team stayed on campus to ship in both Q1 and Q2 2022 • Government proactively supporting economic policy