Chart Industries, Inc. Second Quarter 2023 Earnings Call JULY 28, 2023 Exhibit 99.2

GTLS: GAS TO LIQUID SYSTEMS® Forward Looking Statements (1/2) CERTAIN STATEMENTS MADE IN THIS INVESTOR PRESENTATION ARE FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING CHART’S BUSINESS PLANS, INCLUDING STATEMENTS REGARDING OBJECTIVES, FUTURE ORDERS, REVENUES, MARGINS, EARNINGS, PERFORMANCE OR OUTLOOK, BUSINESS OR INDUSTRY TRENDS AND OTHER INFORMATION THAT IS NOT HISTORICAL IN NATURE. FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY TERMINOLOGY SUCH AS “MAY,” “WILL,” “SHOULD,” “COULD,” “EXPECTS,” “ANTICIPATES,” “BELIEVES,” “PROJECTS,” “FORECASTS,” “INDICATORS”, “OUTLOOK,” “GUIDANCE,” “CONTINUE,” “TARGET,” OR THE NEGATIVE OF SUCH TERMS OR COMPARABLE TERMINOLOGY. FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION OR IN OTHER STATEMENTS MADE BY CHART ARE MADE BASED ON MANAGEMENT’S EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS IMPACTING CHART AND ARE SUBJECT TO UNCERTAINTIES AND FACTORS RELATING TO CHART’S OPERATIONS AND BUSINESS ENVIRONMENT, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND CHART’S CONTROL, THAT COULD CAUSE CHART’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE MATTERS EXPRESSED OR IMPLIED BY FORWARD-LOOKING STATEMENTS. FACTORS THAT COULD CAUSE CHART’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS INCLUDE: CHART MAY BE UNABLE TO ACHIEVE THE ANTICIPATED BENEFITS OF THE ACQUISITION OF HOWDEN (THE “ACQUISIT ION”) ( INCLUDING WITH RESPECT TO ESTIMATED FUTURE COST AND COMMERCIAL SYNERGIES); REVENUES FOLLOWING THE ACQUISIT ION MAY BE LOWER THAN EXPECTED; OPERATING COSTS, CUSTOMER LOSSES, AND BUSINESS DISRUPTION (INCLUDING, WITHOUT LIMITATION, DIFFICULTIES IN MAINTAINING RELATIONSHIPS WITH EMPLOYEES, CUSTOMERS AND SUPPLIERS) RESULTING FROM THE ACQUISIT ION MAY BE GREATER THAN EXPECTED; OUR ABILITY TO SUCCESSFULLY CLOSE ON OUR IDENTIFIED DIVESTITURES AND ACHIEVE THE ANTICIPATED PROCEEDS FROM THOSE DIVESTITURES; SLOWER THAN ANTICIPATED GROWTH AND MARKET ACCEPTANCE OF NEW CLEAN ENERGY PRODUCT OFFERINGS; INABILITY TO ACHIEVE EXPECTED PRICING INCREASES OR CONTINUED SUPPLY CHAIN CHALLENGES INCLUDING VOLATILITY IN RAW MATERIALS AND SUPPLY; RISKS RELATING TO THE CONFLICT BETWEEN RUSSIA AND UKRAINE, INCLUDING POTENTIAL ENERGY SHORTAGES IN EUROPE AND ELSEWHERE AND THE OTHER FACTORS DISCUSSED IN ITEM 1A (RISK FACTORS) IN CHART’S MOST RECENT ANNUAL REPORT ON FORM 10-K FILED WITH THE SEC, WHICH SHOULD BE REVIEWED CAREFULLY. CHART UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENT. 2

GTLS: GAS TO LIQUID SYSTEMS® Forward Looking Statements (2/2) 3 THIS PRESENTATION CONTAINS NON-GAAP FINANCIAL INFORMATION, WITH RESPECT TO THE COMPANY’S 2023 AND 2024 FULL YEAR EARNINGS OUTLOOK, THE COMPANY IS NOT ABLE TO PROVIDE A RECONCILIATION OF THE ADJUSTED EBITDA, ADJUSTED GROSS MARGIN, ADJUSTED OPERATING MARGIN, ADJUSTED EARNINGS PER DILUTED SHARE OR ADJUSTED FREE CASH ZFLOW OUTLOOKS BECAUSE CERTAIN ITEMS MAY HAVE NOT YET OCCURRED OR ARE OUT OF THE COMPANY’S CONTROL AND/OR CANNOT BE REASONABLY PREDICTED. CHART INDUSTRIES, INC. IS A LEADING INDEPENDENT GLOBAL LEADER IN THE DESIGN, ENGINEERING, AND MANUFACTURING OF PROCESS TECHNOLOGIES AND EQUIPMENT FOR GAS AND LIQUID MOLECULE HANDING FOR THE NEXUS OF CLEAN™ - CLEAN POWER, CLEAN WATER, CLEAN FOOD, AND CLEAN INDUSTRIALS, REGARDLESS OF MOLECULE. THE COMPANY’S UNIQUE PRODUCT AND SOLUTION PORTFOLIO ACROSS STATIONARY AND ROTATING EQUIPMENT IS USED IN EVERY PHASE OF THE LIQUID GAS SUPPLY CHAIN, INCLUDING ENGINEERING, SERVICE AND REPAIR FROM INSTALLATION TO PREVENTIVE MAINTENANCE AND DIGITAL MONITORING. CHART IS A LEADING PROVIDER OF TECHNOLOGY, EQUIPMENT AND SERVICES RELATED TO LIQUEFIED NATURAL GAS, HYDROGEN, BIOGAS AND CO2 CAPTURE AMONGST OTHER APPLICATIONS. CHART IS COMMITTED TO EXCELLENCE IN ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE (ESG) ISSUES BOTH FOR ITS COMPANY AS WELL AS ITS CUSTOMERS. WITH OVER 48 GLOBAL MANUFACTURING LOCATIONS AND 41 SERVICE CENTERS FROM THE UNITED STATES TO ASIA, AUSTRALIA, INDIA, EUROPE AND SOUTH AMERICA, THE COMPANY MAINTAINS ACCOUNTABILITY AND TRANSPARENCY TO ITS TEAM MEMBERS, SUPPLIERS, CUSTOMERS AND COMMUNITIES. TO LEARN MORE, VISIT WWW.CHARTINDUSTRIES.COM

GTLS: GAS TO LIQUID SYSTEMS® All Figures Presented are Continuing Operations Unless otherwise noted 4 • Our second quarter 2023 results from continuing operations reflect our first full quarter of ownership of Howden and exclude the Roots™ financial results for our entire ownership period (Roots™ is in discontinued operations) • This is the result of our execution on June 11, 2023 of a definitive agreement to sell the Roots™ business to Ingersoll Rand for $300 million, all cash (a low-teens EBITDA multiple) • The Roots™ divestiture received the required regulatory approval and is anticipated to close no later than August 18, 2023 and we intend to use the cash proceeds for debt paydown

GTLS: GAS TO LIQUID SYSTEMS® Today’s Key Takeaways 5© 2023 Chart Industries, Inc. Confidential and Proprietary • Market demand continues to build driven by aftermarket, service, and repair, LNG, hydrogen, carbon capture and storage, mining (i.e., electrification metals), and nuclear/ helium • Q2 2023 book-to-bill was 1.17 • Q2 2023 ending record backlog of $3.96 billion (+24.1% compared to proforma to include Howden in Q2 2022) • Synergy achievement continues to progress ahead of schedule • $96.5 million of annualized cost savings through July 27, 2023 (vs. $50.9 million at Q1 2023) • $94.3 million of commercial synergies through July 27, 2023 (vs. $11.4 million at Q1 2023) • Commercial synergies pipeline increased to ~$1 billion from ~$800 million • Q2 2023 performance results in multiple operational records • Record reported gross profit margin of 30.9% and record adjusted gross profit margin of 32.5% • Record adjusted EBITDA of $195.3 million and record adjusted EBITDA margin of 21.5% • Free cash flow (“FCF”) of $76.2 million (adjusted FCF of $86.6 million) resulted in net leverage of 3.86X (3.72X proforma for divestitures) • Outlook remains on track; accelerating deleveraging actions • Updating 2023 outlook and reiterating 2024 adjusted EBITDA of ~$1.3 billion • Expect to reach net leverage ratio of 2.5-2.9X by midyear 2024 vs. year-end 2024 prior • Received regulatory clearance for Roots™ divestiture, expected closing no later than August 18, 2023 ($300M all cash) • Signed definitive agreement to sell Cofimco for $80M, expected to close 2H 2023 • Continue to progress anticipated defined asset perimeter of divestitures (anticipated ~$500M of proceeds in total)

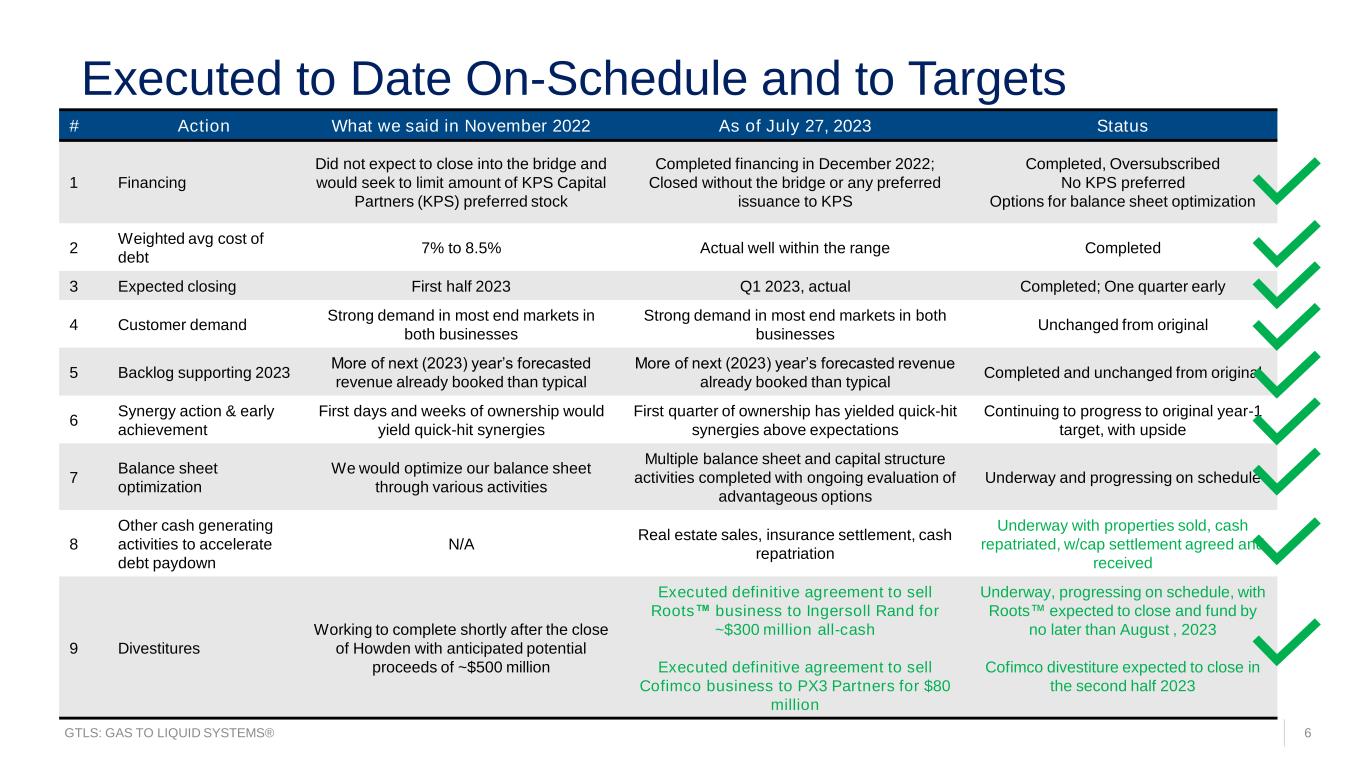

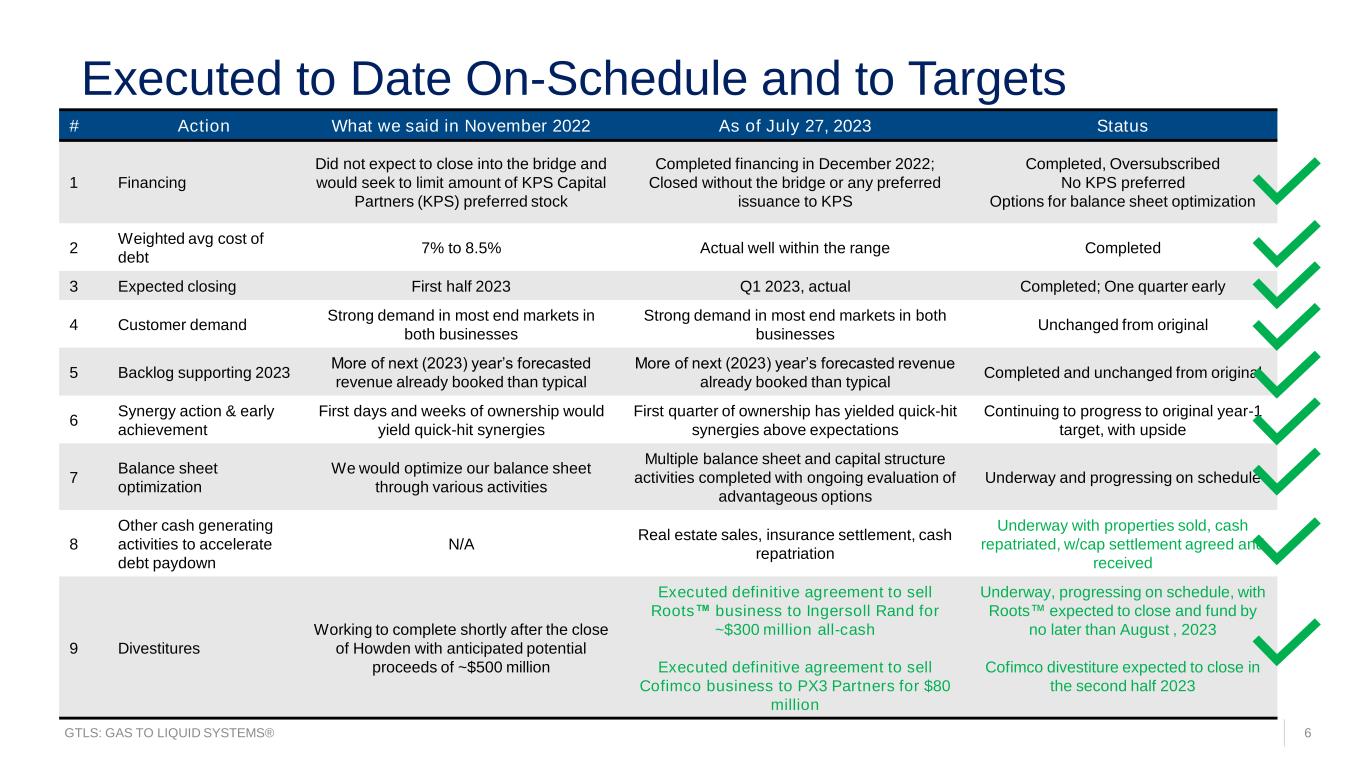

GTLS: GAS TO LIQUID SYSTEMS® Executed to Date On-Schedule and to Targets 6 # Action What we said in November 2022 As of July 27, 2023 Status 1 Financing Did not expect to close into the bridge and would seek to limit amount of KPS Capital Partners (KPS) preferred stock Completed financing in December 2022; Closed without the bridge or any preferred issuance to KPS Completed, Oversubscribed No KPS preferred Options for balance sheet optimization 2 Weighted avg cost of debt 7% to 8.5% Actual well within the range Completed 3 Expected closing First half 2023 Q1 2023, actual Completed; One quarter early 4 Customer demand Strong demand in most end markets in both businesses Strong demand in most end markets in both businesses Unchanged from original 5 Backlog supporting 2023 More of next (2023) year’s forecasted revenue already booked than typical More of next (2023) year’s forecasted revenue already booked than typical Completed and unchanged from original 6 Synergy action & early achievement First days and weeks of ownership would yield quick-hit synergies First quarter of ownership has yielded quick-hit synergies above expectations Continuing to progress to original year-1 target, with upside 7 Balance sheet optimization We would optimize our balance sheet through various activities Multiple balance sheet and capital structure activities completed with ongoing evaluation of advantageous options Underway and progressing on schedule 8 Other cash generating activities to accelerate debt paydown N/A Real estate sales, insurance settlement, cash repatriation Underway with properties sold, cash repatriated, w/cap settlement agreed and received 9 Divestitures Working to complete shortly after the close of Howden with anticipated potential proceeds of ~$500 million Executed definitive agreement to sell Roots™ business to Ingersoll Rand for ~$300 million all-cash Executed definitive agreement to sell Cofimco business to PX3 Partners for $80 million Underway, progressing on schedule, with Roots™ expected to close and fund by no later than August , 2023 Cofimco divestiture expected to close in the second half 2023

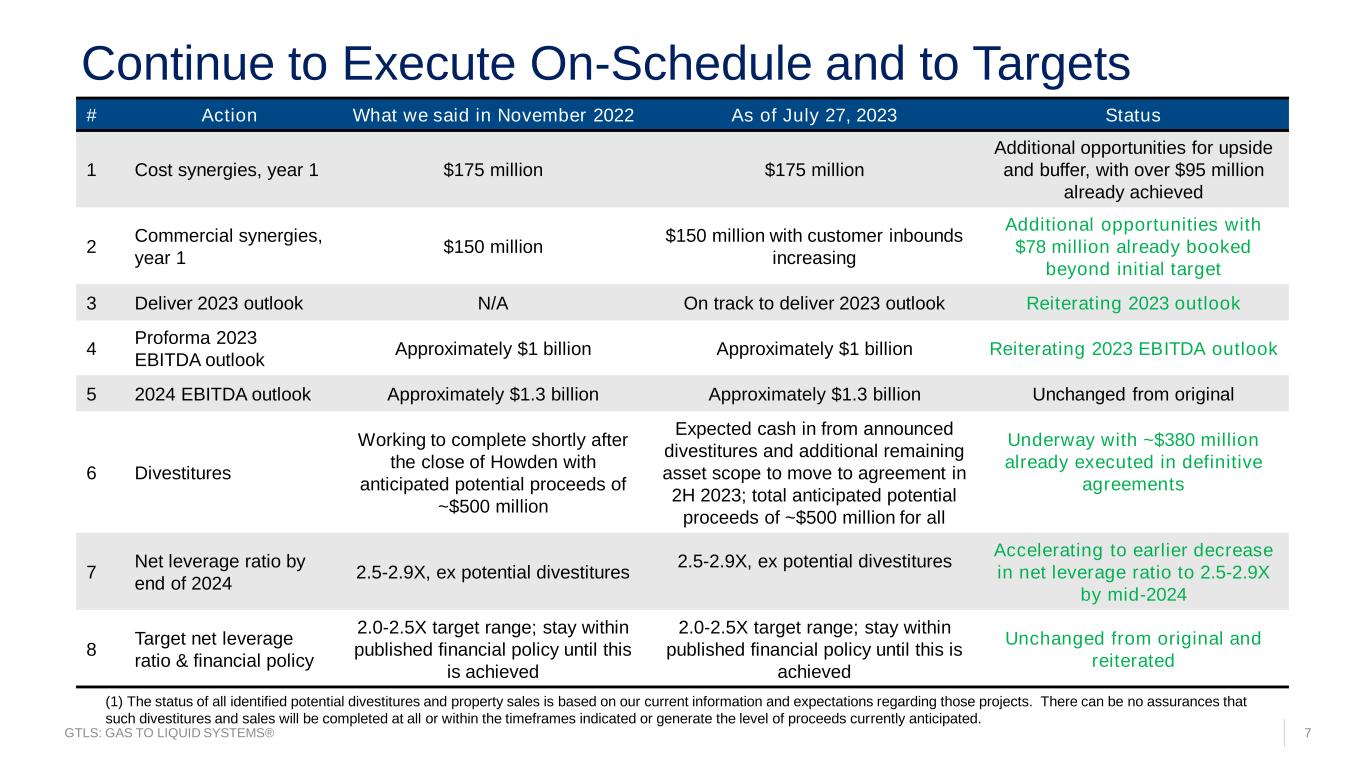

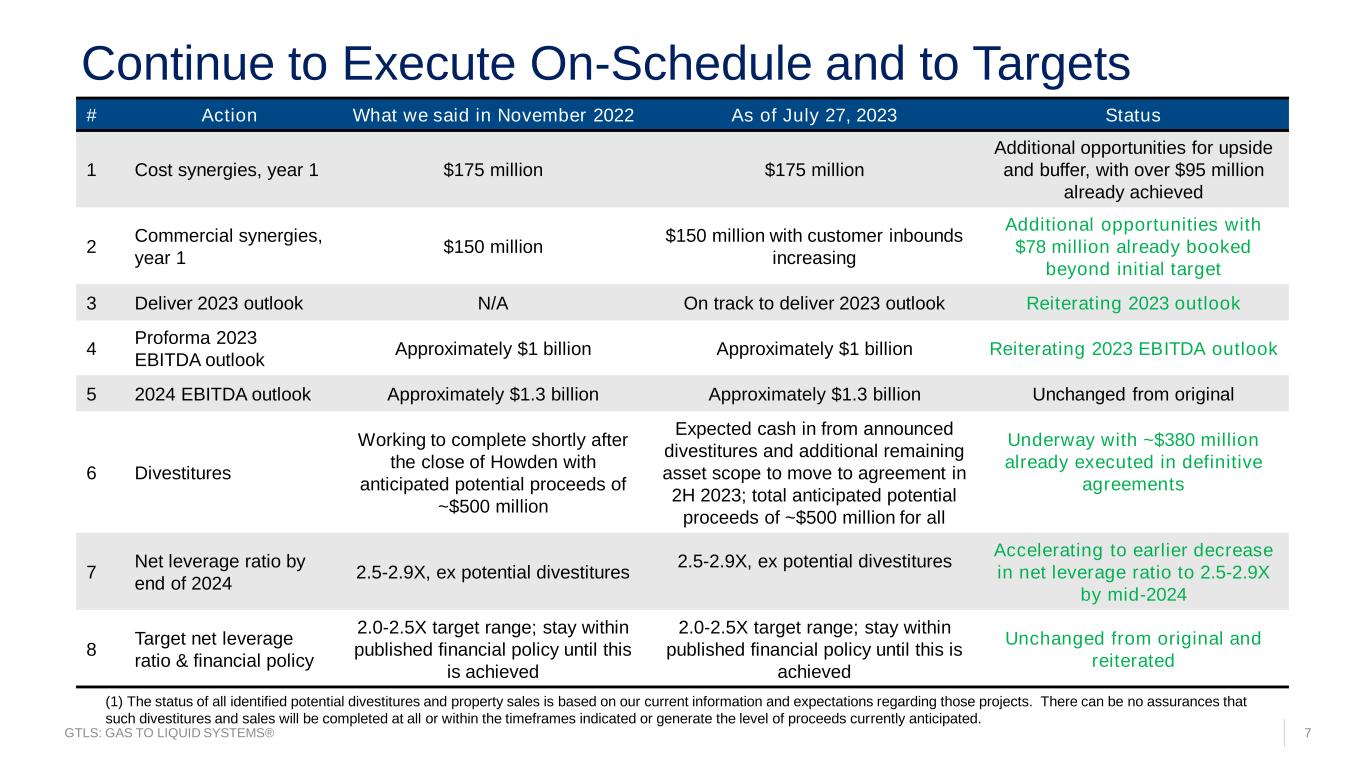

GTLS: GAS TO LIQUID SYSTEMS® Continue to Execute On-Schedule and to Targets 7 # Action What we said in November 2022 As of July 27, 2023 Status 1 Cost synergies, year 1 $175 million $175 million Additional opportunities for upside and buffer, with over $95 million already achieved 2 Commercial synergies, year 1 $150 million $150 million with customer inbounds increasing Additional opportunities with $78 million already booked beyond initial target 3 Deliver 2023 outlook N/A On track to deliver 2023 outlook Reiterating 2023 outlook 4 Proforma 2023 EBITDA outlook Approximately $1 billion Approximately $1 billion Reiterating 2023 EBITDA outlook 5 2024 EBITDA outlook Approximately $1.3 billion Approximately $1.3 billion Unchanged from original 6 Divestitures Working to complete shortly after the close of Howden with anticipated potential proceeds of ~$500 million Expected cash in from announced divestitures and additional remaining asset scope to move to agreement in 2H 2023; total anticipated potential proceeds of ~$500 million for all Underway with ~$380 million already executed in definitive agreements 7 Net leverage ratio by end of 2024 2.5-2.9X, ex potential divestitures 2.5-2.9X, ex potential divestitures Accelerating to earlier decrease in net leverage ratio to 2.5-2.9X by mid-2024 8 Target net leverage ratio & financial policy 2.0-2.5X target range; stay within published financial policy until this is achieved 2.0-2.5X target range; stay within published financial policy until this is achieved Unchanged from original and reiterated (1) The status of all identified potential divestitures and property sales is based on our current information and expectations regarding those projects. There can be no assurances that such divestitures and sales will be completed at all or within the timeframes indicated or generate the level of proceeds currently anticipated.

GTLS: GAS TO LIQUID SYSTEMS® 8© 2023 Chart Industries, Inc. Confidential and Proprietary Agenda Q2 2023 Results Market and Demand Update Synergy Update Progress on Deleveraging 2023 Outlook

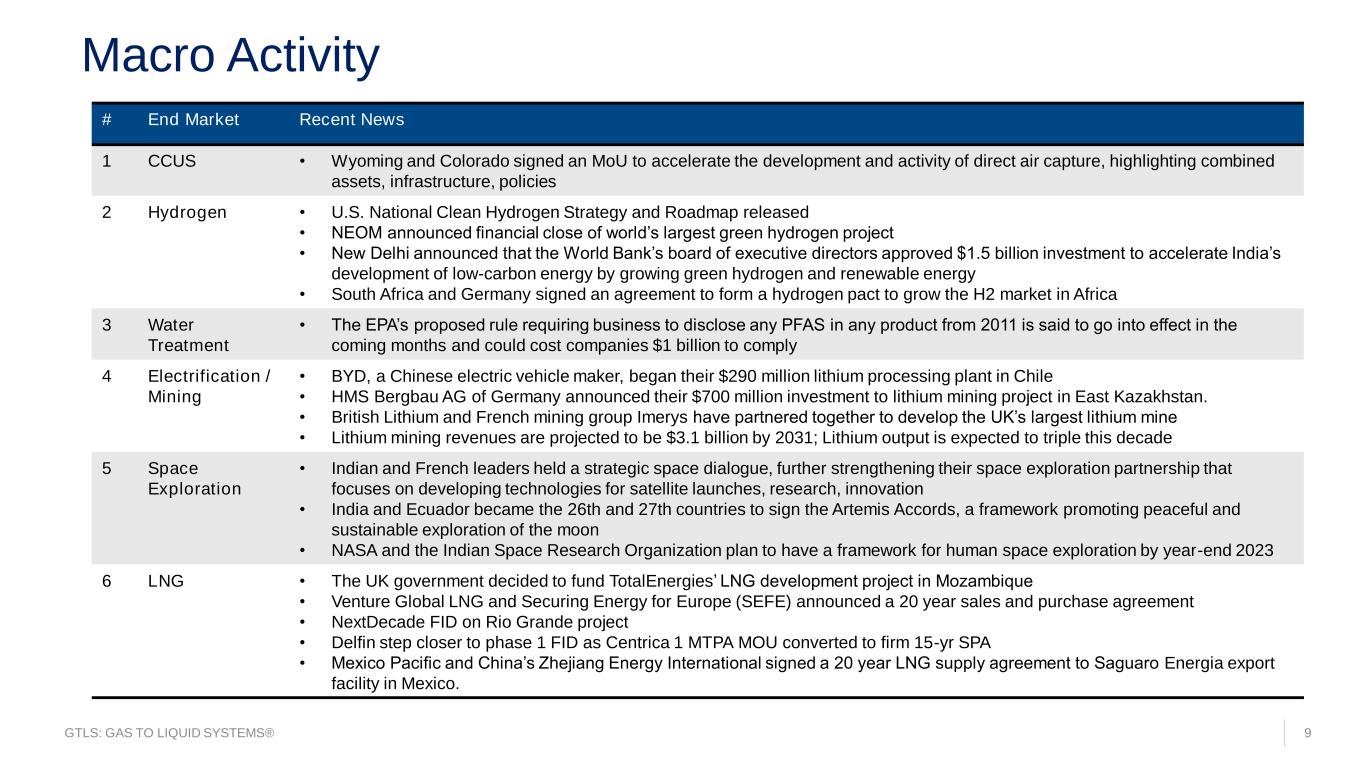

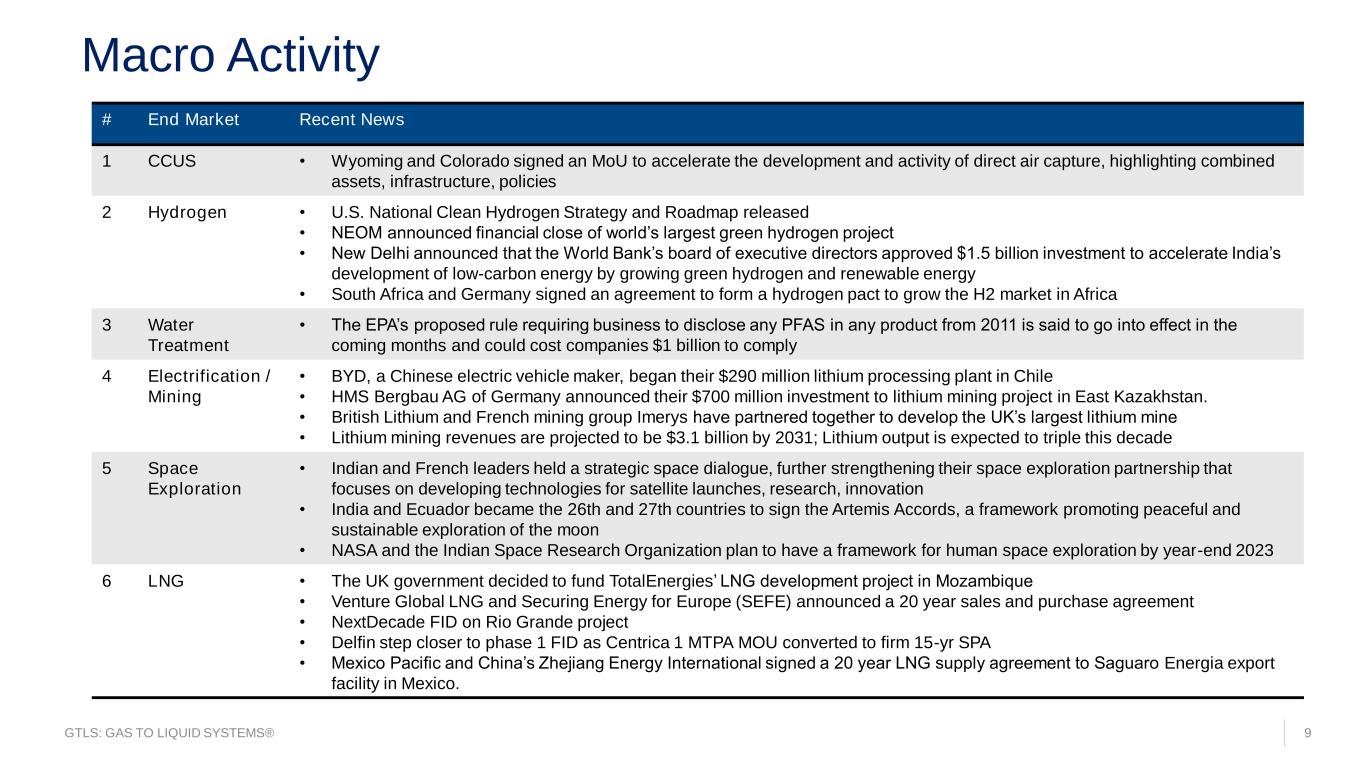

GTLS: GAS TO LIQUID SYSTEMS® Macro Activity 9 # End Market Recent News 1 CCUS • Wyoming and Colorado signed an MoU to accelerate the development and activity of direct air capture, highlighting combined assets, infrastructure, policies 2 Hydrogen • U.S. National Clean Hydrogen Strategy and Roadmap released • NEOM announced financial close of world’s largest green hydrogen project • New Delhi announced that the World Bank’s board of executive directors approved $1.5 billion investment to accelerate India’s development of low-carbon energy by growing green hydrogen and renewable energy • South Africa and Germany signed an agreement to form a hydrogen pact to grow the H2 market in Africa 3 Water Treatment • The EPA’s proposed rule requiring business to disclose any PFAS in any product from 2011 is said to go into effect in the coming months and could cost companies $1 billion to comply 4 Electrification / Mining • BYD, a Chinese electric vehicle maker, began their $290 million lithium processing plant in Chile • HMS Bergbau AG of Germany announced their $700 million investment to lithium mining project in East Kazakhstan. • British Lithium and French mining group Imerys have partnered together to develop the UK’s largest lithium mine • Lithium mining revenues are projected to be $3.1 billion by 2031; Lithium output is expected to triple this decade 5 Space Exploration • Indian and French leaders held a strategic space dialogue, further strengthening their space exploration partnership that focuses on developing technologies for satellite launches, research, innovation • India and Ecuador became the 26th and 27th countries to sign the Artemis Accords, a framework promoting peaceful and sustainable exploration of the moon • NASA and the Indian Space Research Organization plan to have a framework for human space exploration by year-end 2023 6 LNG • The UK government decided to fund TotalEnergies’ LNG development project in Mozambique • Venture Global LNG and Securing Energy for Europe (SEFE) announced a 20 year sales and purchase agreement • NextDecade FID on Rio Grande project • Delfin step closer to phase 1 FID as Centrica 1 MTPA MOU converted to firm 15-yr SPA • Mexico Pacific and China’s Zhejiang Energy International signed a 20 year LNG supply agreement to Saguaro Energia export facility in Mexico.

GTLS: GAS TO LIQUID SYSTEMS® Chart End Market Trends 10 # End Market Recent Activity Trend 1 Aftermarket, service, repair • Penetration of Howden and Chart installed base plus competitors’ installed base • Very strong multi-year agreements being executed in mine safety, LNG stations, broad geographies 2 Big LNG / ssLNG / FLNG • FID reached on Sempra Port Arthur; additional Big LNG award received Q2; expect 1 more BigLNG order in 2023 • New projects entering commercial pipeline each month and more international focused on IPSMR® as technology 3 LNG infrastructure • ISO containers continue to be highly sought, LNG station demand is consistent (+ station service agreements) • HLNG over the road tank demand is broadening (more customers) yet not higher than 2022 to date in 2023 4 Hydrogen • Marine activity, HLH2 demos and fuel station inquiries are all increasing • DOE H2 Hub announcements expected later 2023 and to drive FID decisions 5 CCUS and water treatment • Small-scale Earthly Labs units/order sizes getting larger with continued CO2 shortages + biogas demand • Direct air capture wins in both Chart and Howden YTD 2023 (RAM and ACHX) • Water - New regulations are spurring multi-site cleanup discussions and booking PFAS remediation orders • Global desalination creating CDOX/CO2 opportunities and summer temperatures driving SDOX TaaS wins • Customers looking for food, beverage, CCUS & water solutions (Nexus of Clean™ in action) 6 Other Specialty • Space exploration demand broadening and frequency increasing for larger (jumbo) tanks • Food and CO2 industry are showing robust ordering and funnel indicates that should continue • Heightened demand for blowers linked to Nox reduction for power engines in marine 7 Cryo tank and trailers • Customers continue to expect mid-single digit growth in 2023; Demand for trailers, railcars following typical trends • European demand increasing while China demand remains consistent 8 Electrification / mine safety / green metals • Energy transition continues to drive demand for critical minerals • Seeing near-term capital spend from customers particularly in intelligent and responsible mining • Demand increasing from decarbonisation (green steel) and electrification (non-ferrous metal) 9 Nuclear / Helium • Alternative types of potential helium customers are spending on engineering studies (i.e. LNG players, etc) • Nuclear SMR market expected to grow more rapidly to meet 2% of total electricity demand by 2043 in US 10 Traditional Energy • Traditional energy end markets are mixed, with petchem, PDH, NRU and fans very active while conventional gas, compression and cryo plants activity is moderating.

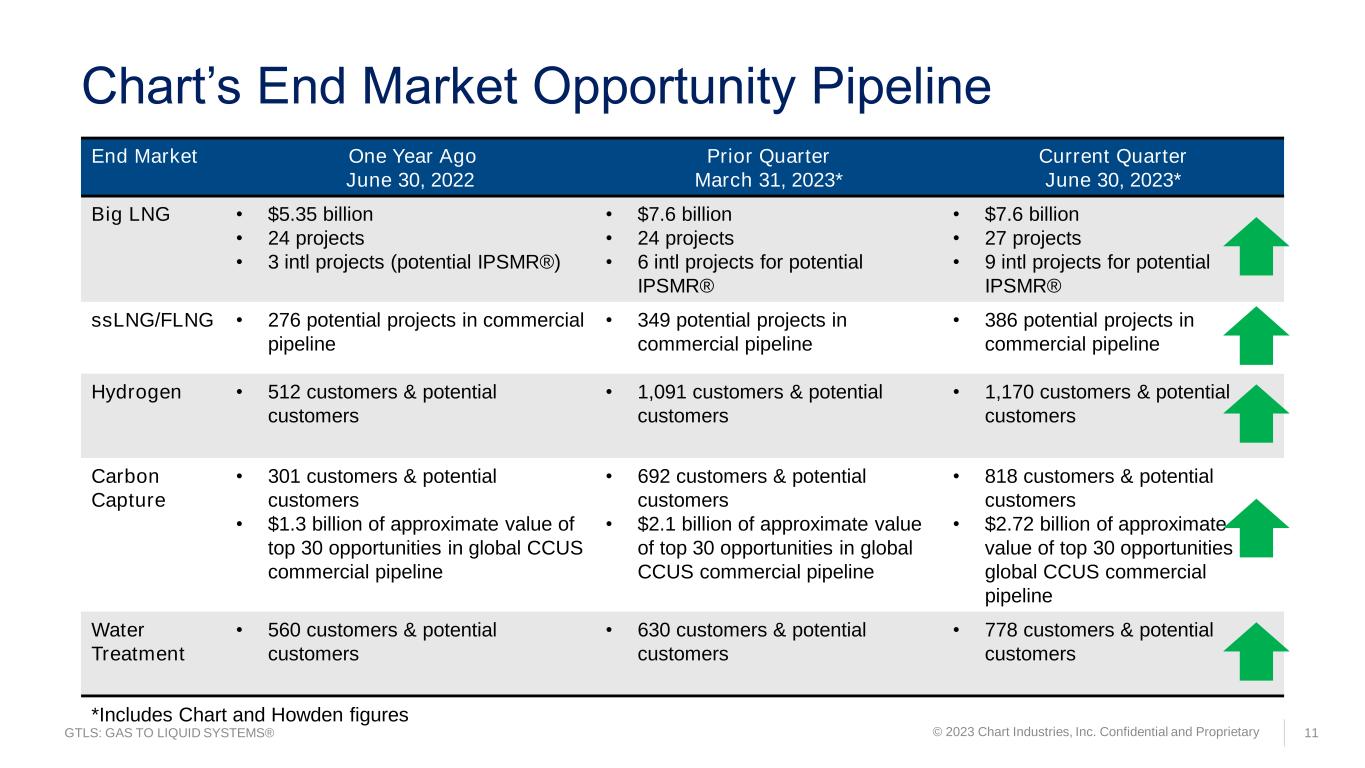

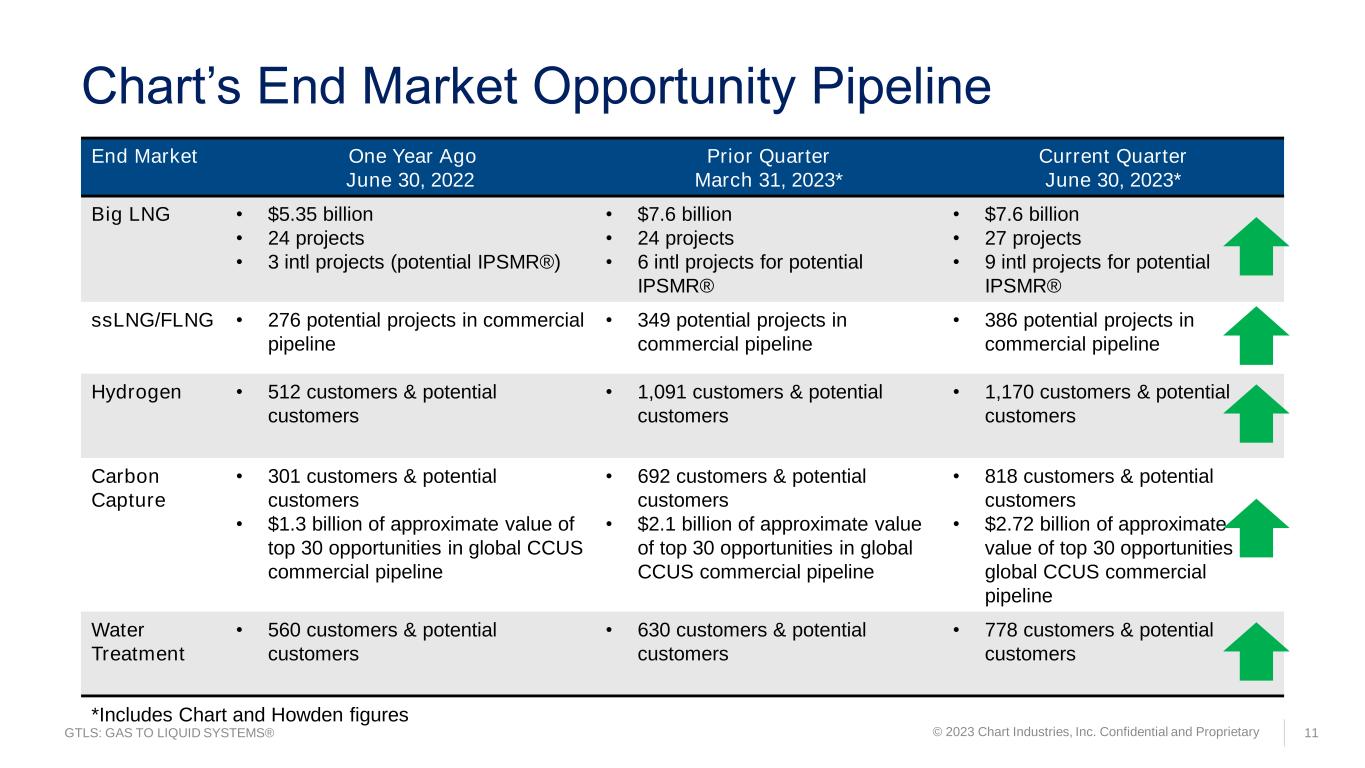

GTLS: GAS TO LIQUID SYSTEMS® © 2023 Chart Industries, Inc. Confidential and Proprietary 11 Chart’s End Market Opportunity Pipeline End Market One Year Ago June 30, 2022 Prior Quarter March 31, 2023* Current Quarter June 30, 2023* Big LNG • $5.35 billion • 24 projects • 3 intl projects (potential IPSMR®) • $7.6 billion • 24 projects • 6 intl projects for potential IPSMR® • $7.6 billion • 27 projects • 9 intl projects for potential IPSMR® ssLNG/FLNG • 276 potential projects in commercial pipeline • 349 potential projects in commercial pipeline • 386 potential projects in commercial pipeline Hydrogen • 512 customers & potential customers • 1,091 customers & potential customers • 1,170 customers & potential customers Carbon Capture • 301 customers & potential customers • $1.3 billion of approximate value of top 30 opportunities in global CCUS commercial pipeline • 692 customers & potential customers • $2.1 billion of approximate value of top 30 opportunities in global CCUS commercial pipeline • 818 customers & potential customers • $2.72 billion of approximate value of top 30 opportunities in global CCUS commercial pipeline Water Treatment • 560 customers & potential customers • 630 customers & potential customers • 778 customers & potential customers *Includes Chart and Howden figures

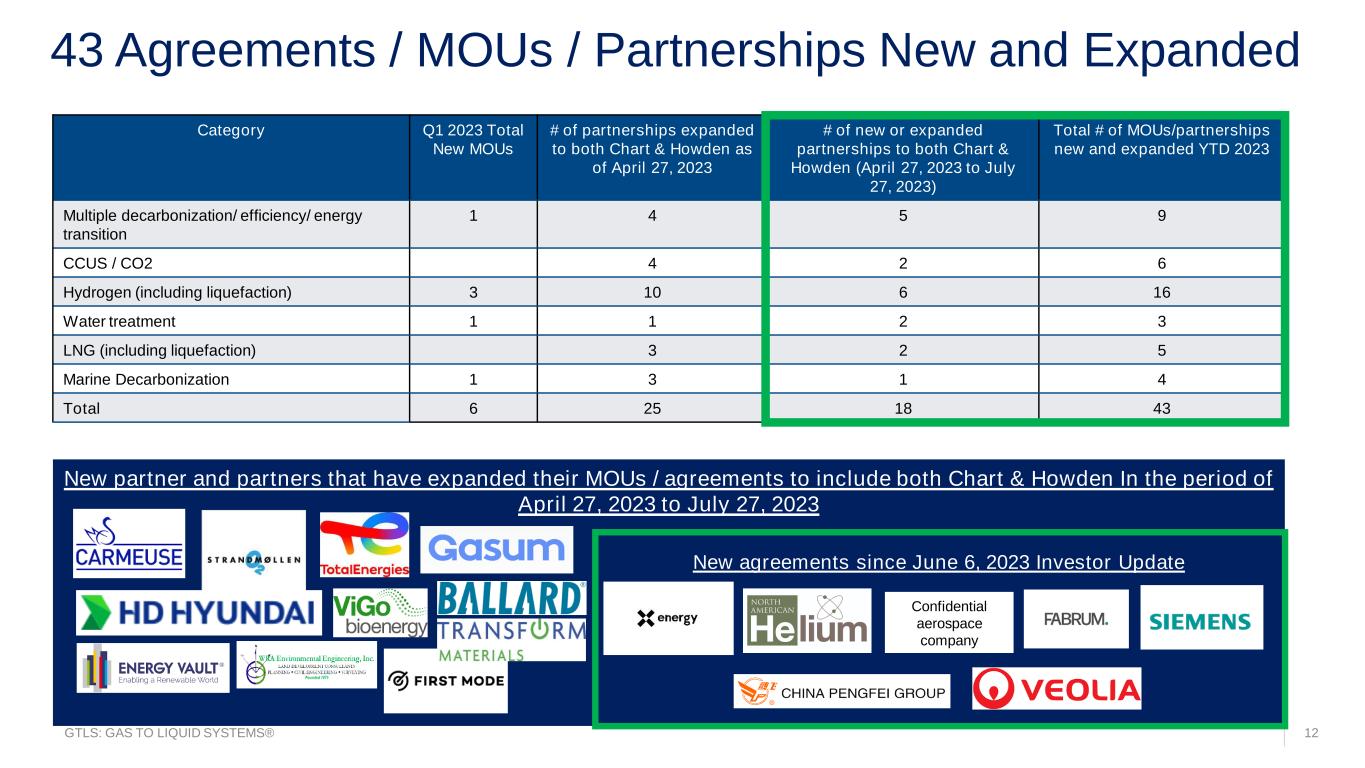

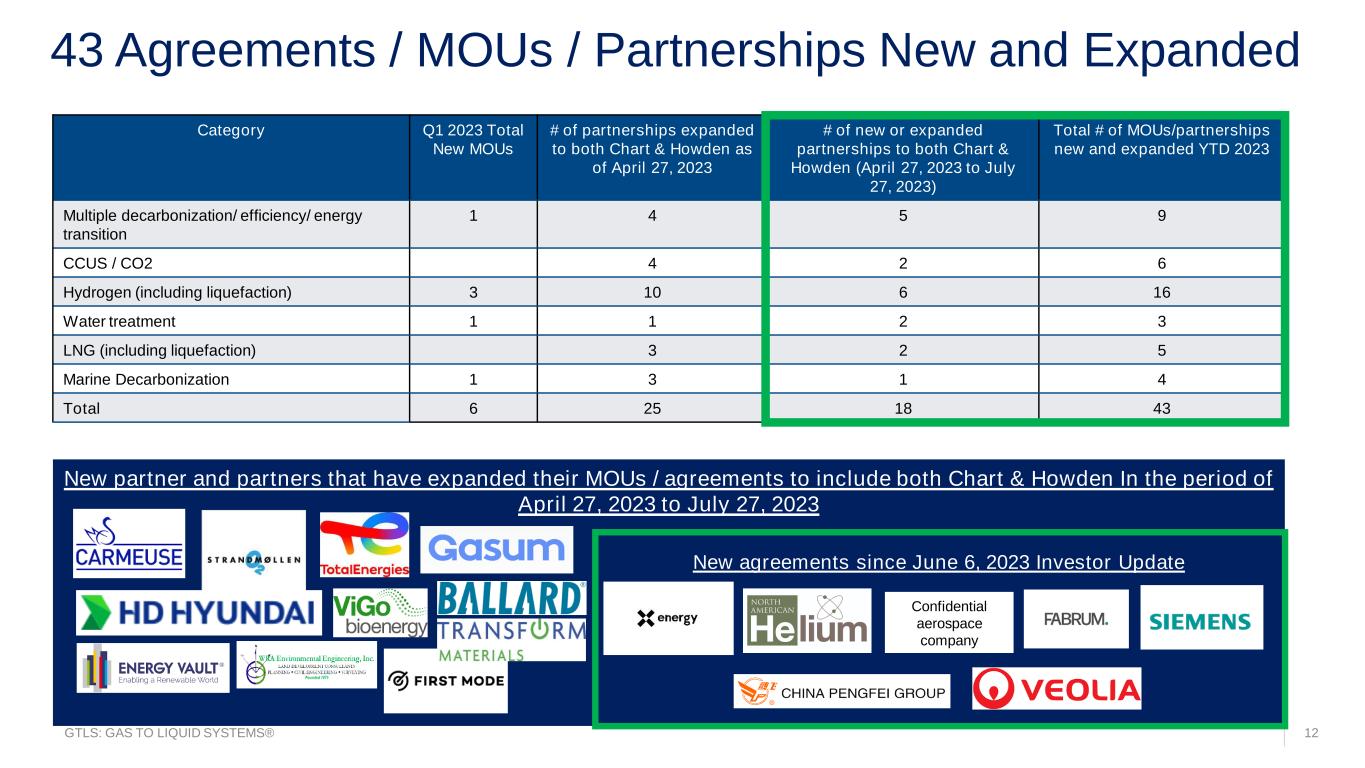

GTLS: GAS TO LIQUID SYSTEMS® 43 Agreements / MOUs / Partnerships New and Expanded 12 Category Q1 2023 Total New MOUs # of partnerships expanded to both Chart & Howden as of April 27, 2023 # of new or expanded partnerships to both Chart & Howden (April 27, 2023 to July 27, 2023) Total # of MOUs/partnerships new and expanded YTD 2023 Multiple decarbonization/ efficiency/ energy transition 1 4 5 9 CCUS / CO2 4 2 6 Hydrogen (including liquefaction) 3 10 6 16 Water treatment 1 1 2 3 LNG (including liquefaction) 3 2 5 Marine Decarbonization 1 3 1 4 Total 6 25 18 43 New partner and partners that have expanded their MOUs / agreements to include both Chart & Howden In the period of April 27, 2023 to July 27, 2023 Confidential aerospace company New agreements since June 6, 2023 Investor Update

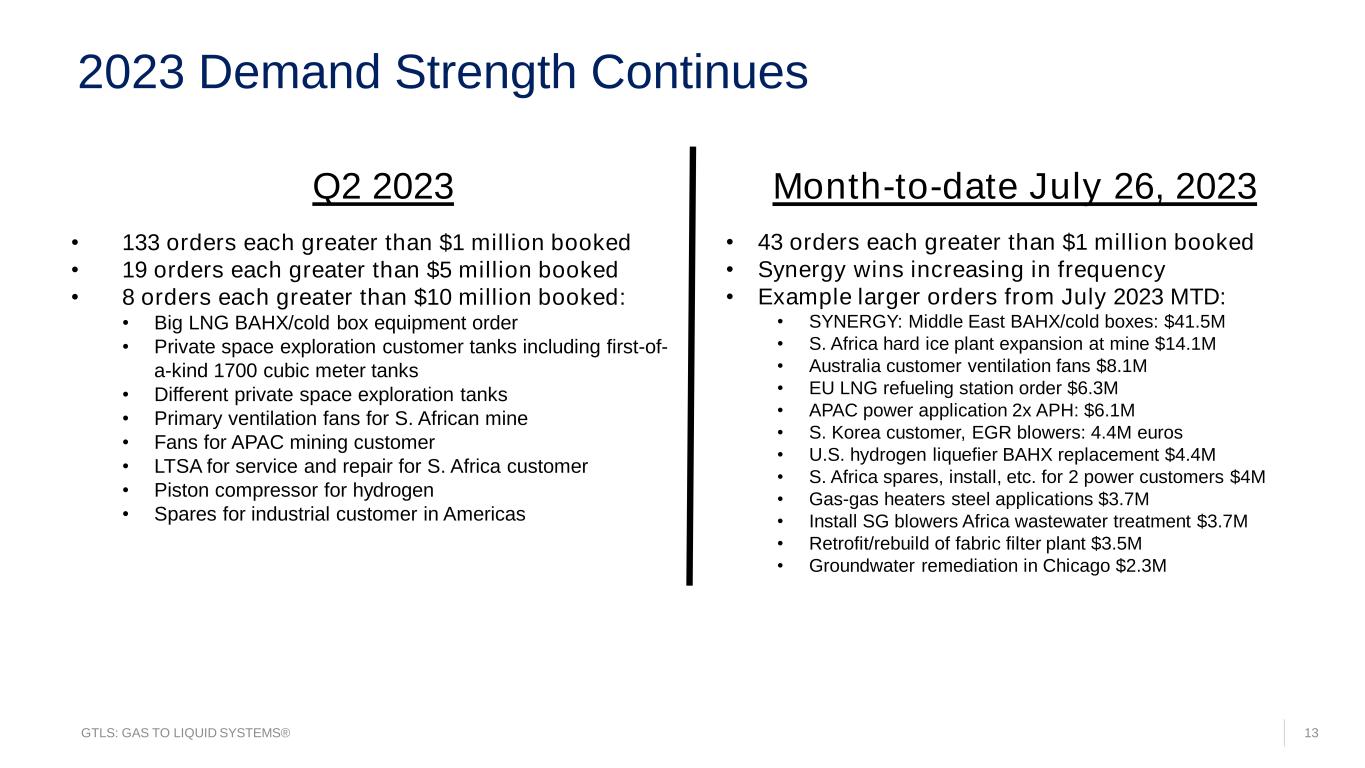

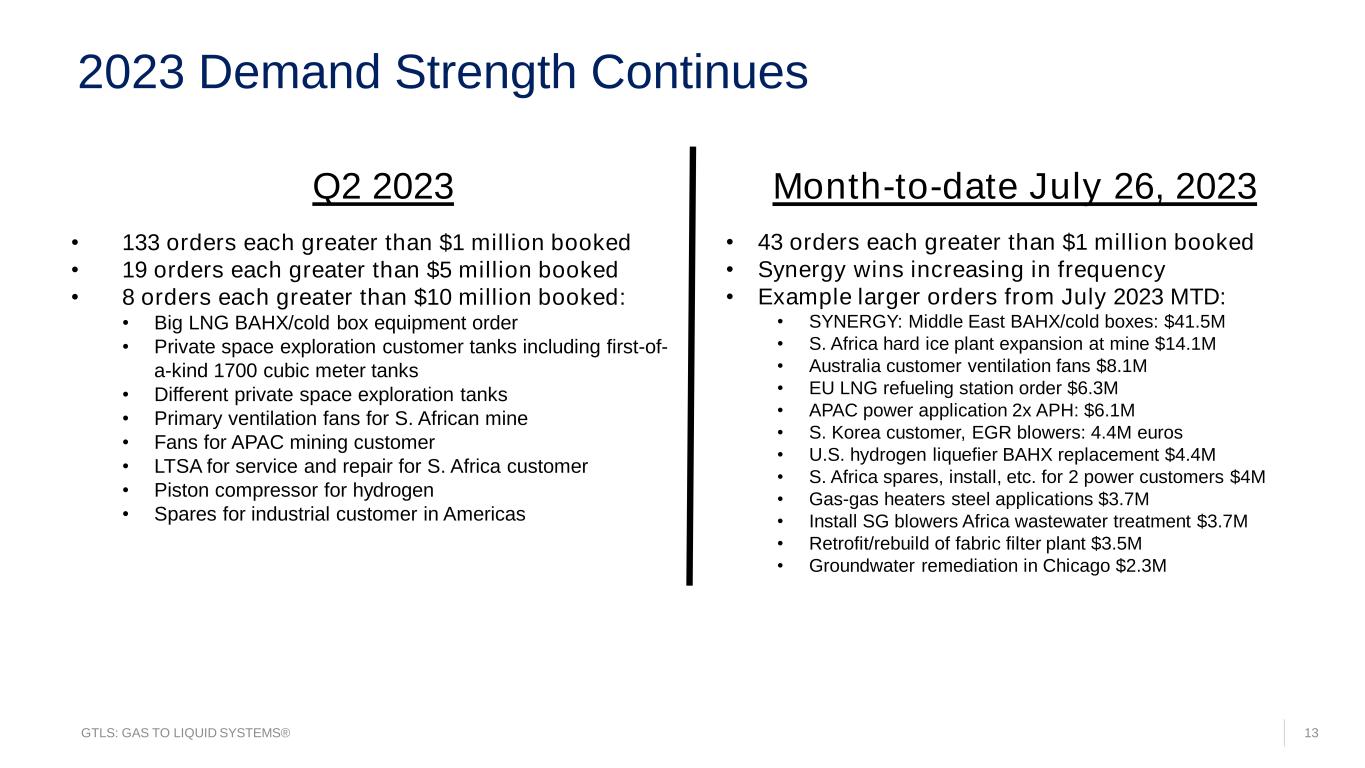

GTLS: GAS TO LIQUID SYSTEMS® 13 2023 Demand Strength Continues • 133 orders each greater than $1 million booked • 19 orders each greater than $5 million booked • 8 orders each greater than $10 million booked: • Big LNG BAHX/cold box equipment order • Private space exploration customer tanks including first-of- a-kind 1700 cubic meter tanks • Different private space exploration tanks • Primary ventilation fans for S. African mine • Fans for APAC mining customer • LTSA for service and repair for S. Africa customer • Piston compressor for hydrogen • Spares for industrial customer in Americas Q2 2023 Month-to-date July 26, 2023 • 43 orders each greater than $1 million booked • Synergy wins increasing in frequency • Example larger orders from July 2023 MTD: • SYNERGY: Middle East BAHX/cold boxes: $41.5M • S. Africa hard ice plant expansion at mine $14.1M • Australia customer ventilation fans $8.1M • EU LNG refueling station order $6.3M • APAC power application 2x APH: $6.1M • S. Korea customer, EGR blowers: 4.4M euros • U.S. hydrogen liquefier BAHX replacement $4.4M • S. Africa spares, install, etc. for 2 power customers $4M • Gas-gas heaters steel applications $3.7M • Install SG blowers Africa wastewater treatment $3.7M • Retrofit/rebuild of fabric filter plant $3.5M • Groundwater remediation in Chicago $2.3M

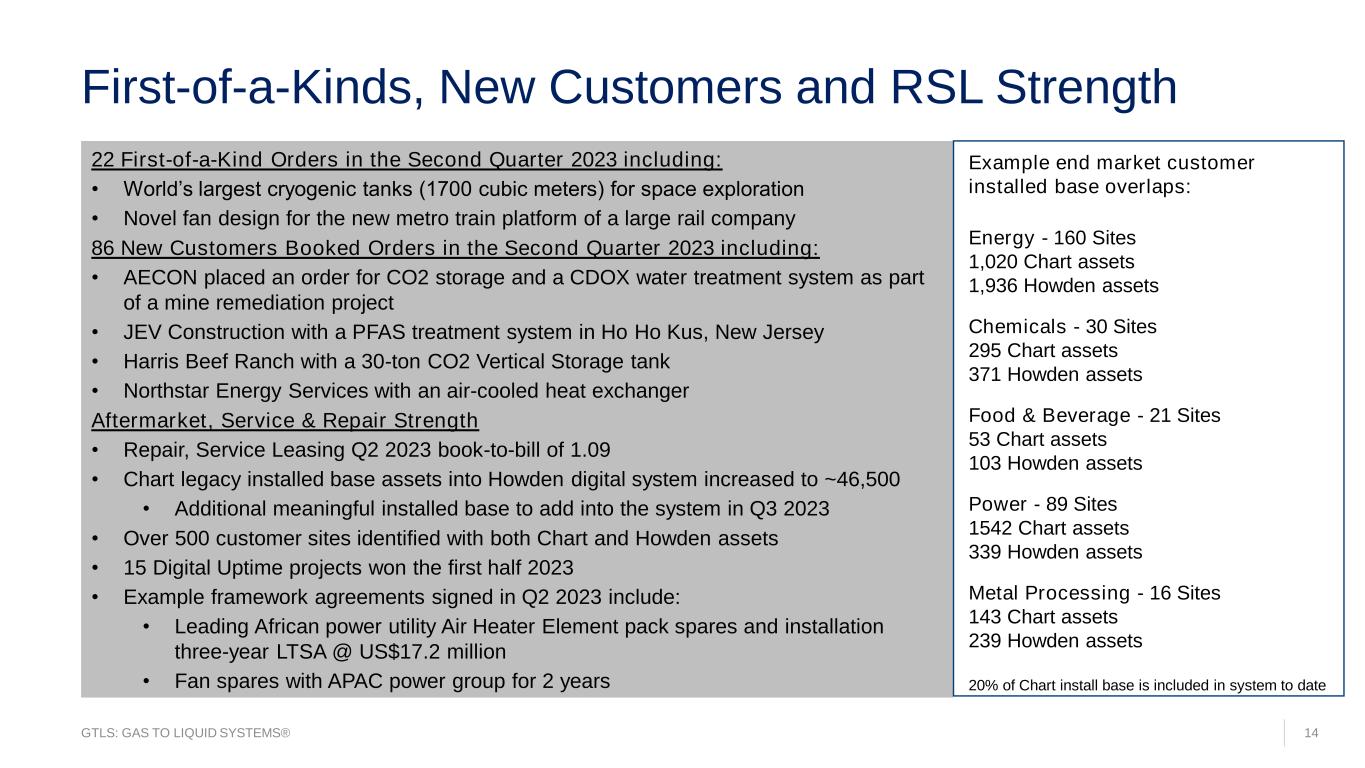

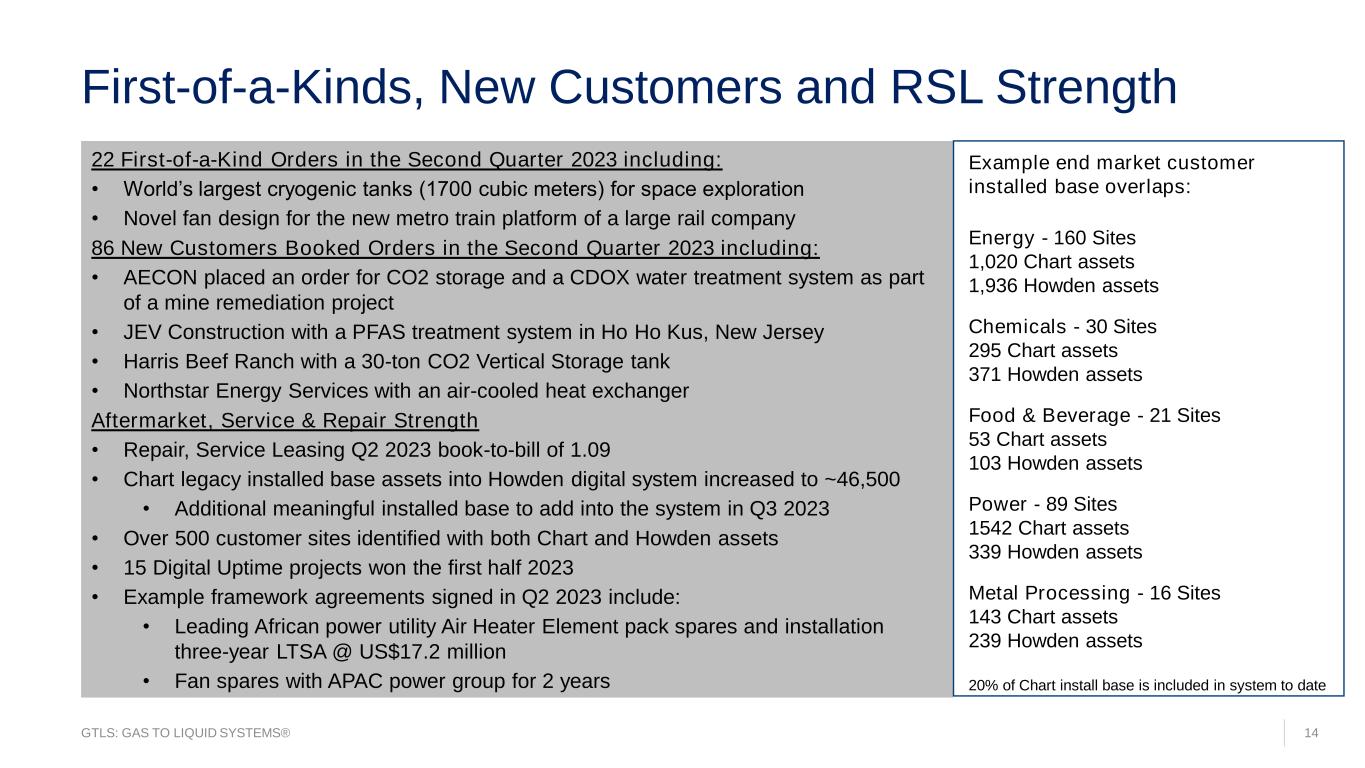

GTLS: GAS TO LIQUID SYSTEMS® First-of-a-Kinds, New Customers and RSL Strength 14 22 First-of-a-Kind Orders in the Second Quarter 2023 including: • World’s largest cryogenic tanks (1700 cubic meters) for space exploration • Novel fan design for the new metro train platform of a large rail company 86 New Customers Booked Orders in the Second Quarter 2023 including: • AECON placed an order for CO2 storage and a CDOX water treatment system as part of a mine remediation project • JEV Construction with a PFAS treatment system in Ho Ho Kus, New Jersey • Harris Beef Ranch with a 30-ton CO2 Vertical Storage tank • Northstar Energy Services with an air-cooled heat exchanger Aftermarket, Service & Repair Strength • Repair, Service Leasing Q2 2023 book-to-bill of 1.09 • Chart legacy installed base assets into Howden digital system increased to ~46,500 • Additional meaningful installed base to add into the system in Q3 2023 • Over 500 customer sites identified with both Chart and Howden assets • 15 Digital Uptime projects won the first half 2023 • Example framework agreements signed in Q2 2023 include: • Leading African power utility Air Heater Element pack spares and installation three-year LTSA @ US$17.2 million • Fan spares with APAC power group for 2 years Example end market customer installed base overlaps: Energy - 160 Sites 1,020 Chart assets 1,936 Howden assets Chemicals - 30 Sites 295 Chart assets 371 Howden assets Food & Beverage - 21 Sites 53 Chart assets 103 Howden assets Power - 89 Sites 1542 Chart assets 339 Howden assets Metal Processing - 16 Sites 143 Chart assets 239 Howden assets 20% of Chart install base is included in system to date

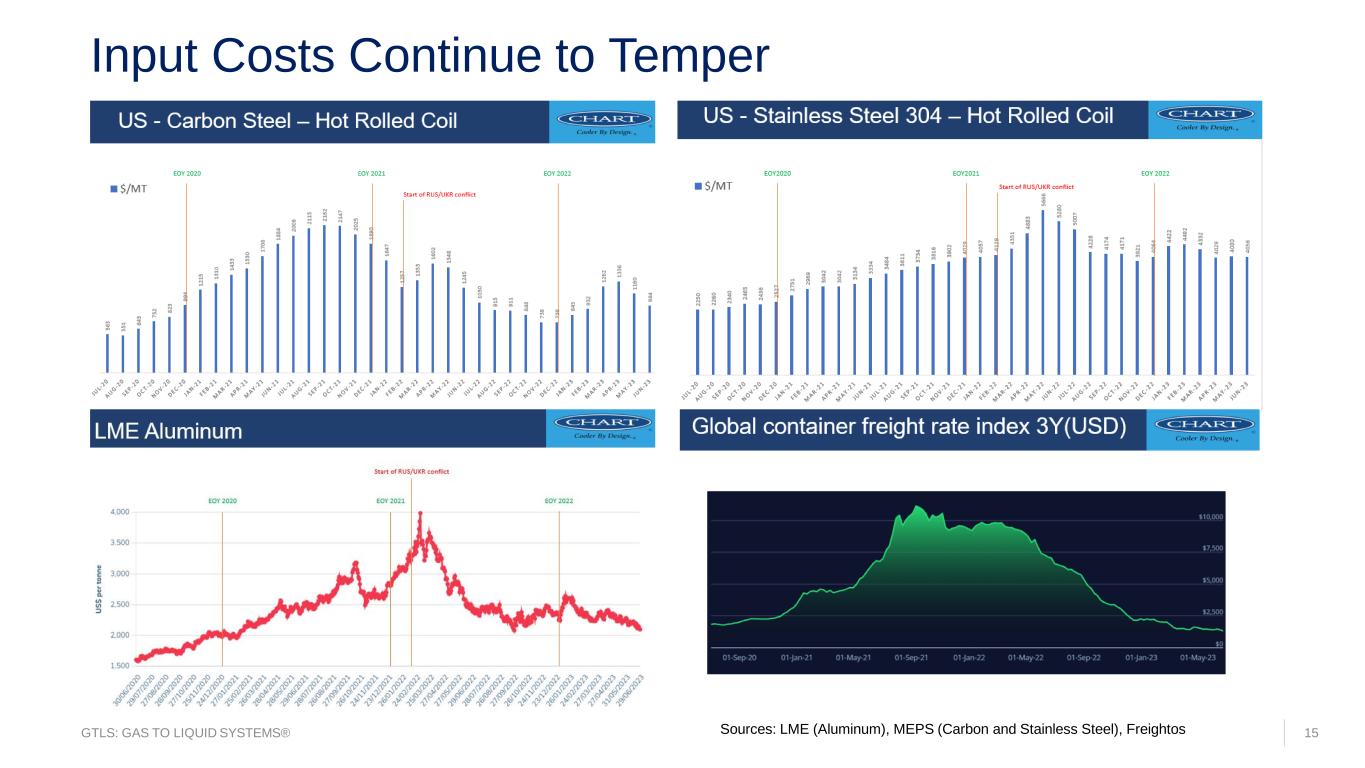

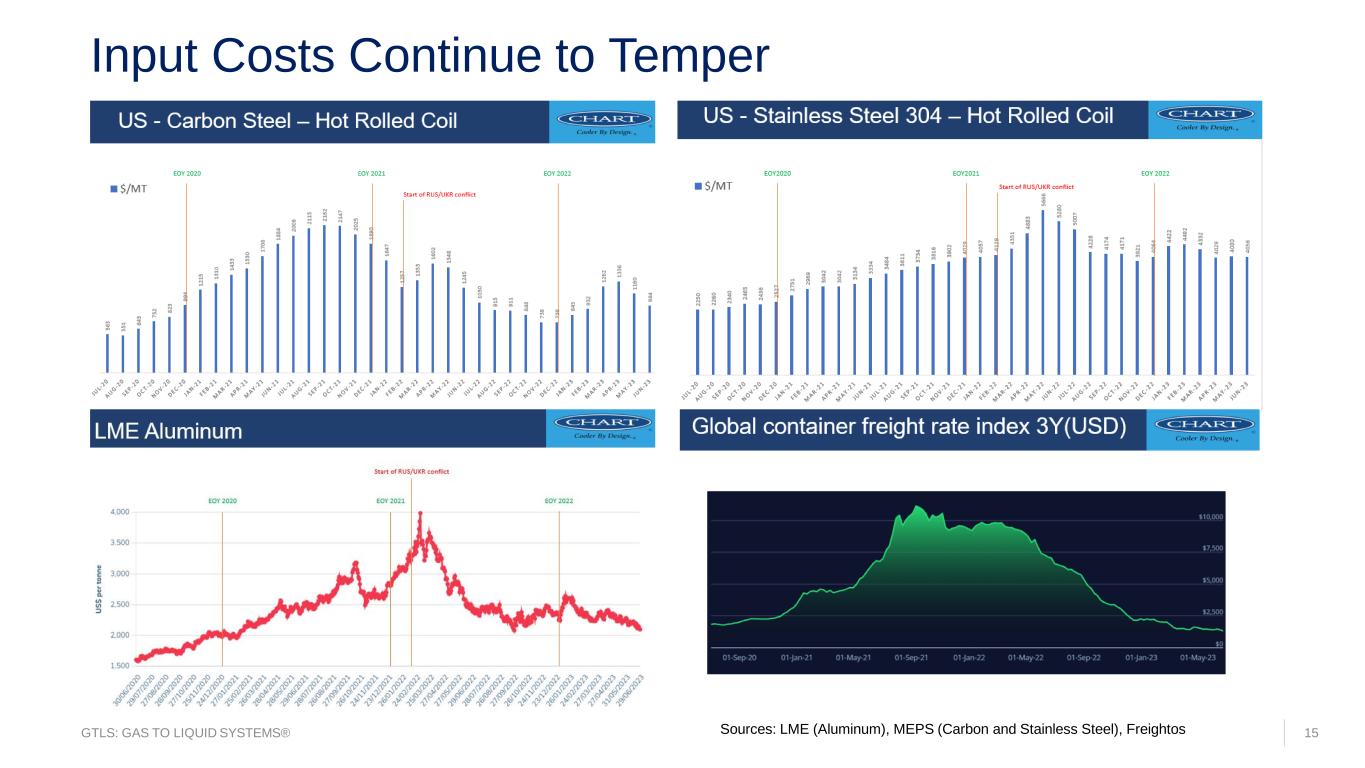

GTLS: GAS TO LIQUID SYSTEMS® Input Costs Continue to Temper 15Sources: LME (Aluminum), MEPS (Carbon and Stainless Steel), Freightos

GTLS: GAS TO LIQUID SYSTEMS® 16© 2023 Chart Industries, Inc. Confidential and Proprietary Agenda Q2 2023 Results Market and Demand Update Synergy Update Progress on Deleveraging 2023 Outlook

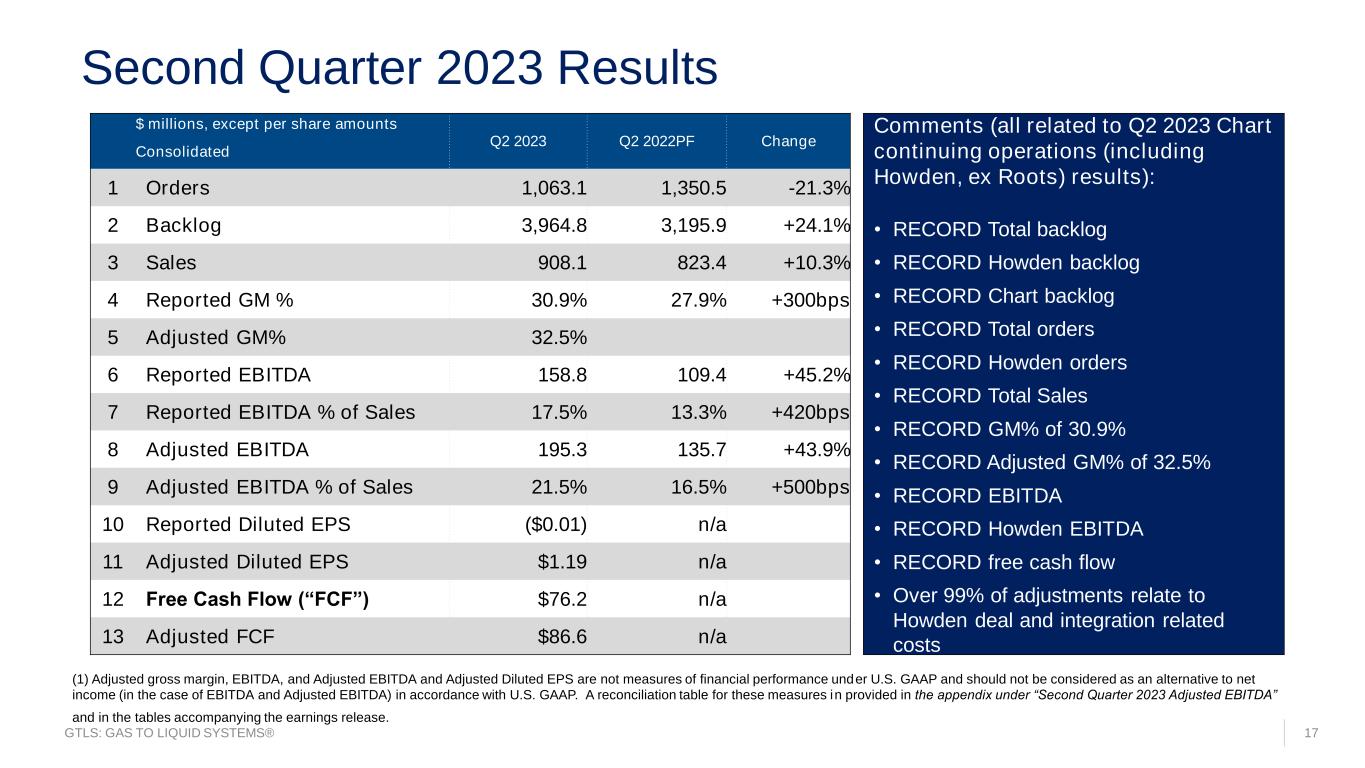

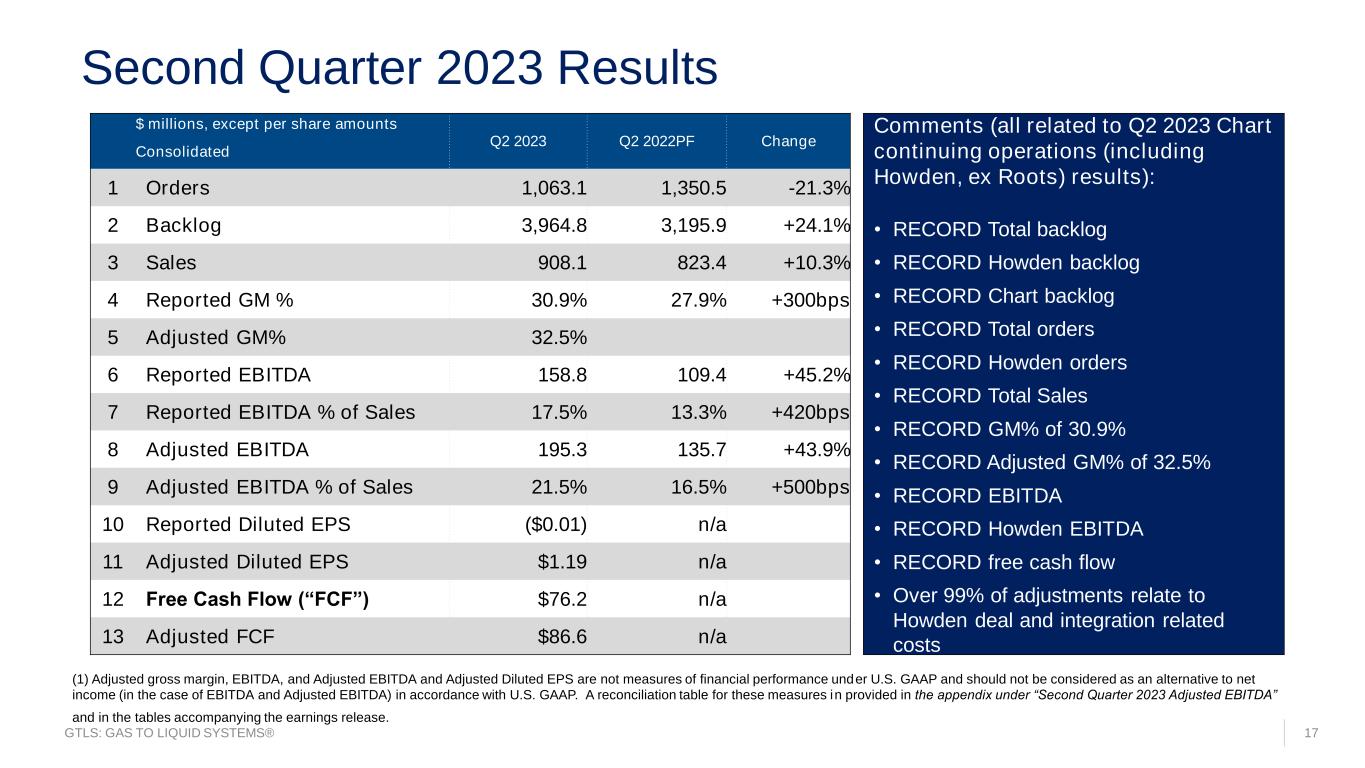

GTLS: GAS TO LIQUID SYSTEMS® Second Quarter 2023 Results 17 (1) Adjusted gross margin, EBITDA, and Adjusted EBITDA and Adjusted Diluted EPS are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income (in the case of EBITDA and Adjusted EBITDA) in accordance with U.S. GAAP. A reconciliation table for these measures in provided in the appendix under “Second Quarter 2023 Adjusted EBITDA” and in the tables accompanying the earnings release. $ millions, except per share amounts Q2 2023 Q2 2022PF Change Consolidated 1 Orders 1,063.1 1,350.5 -21.3% 2 Backlog 3,964.8 3,195.9 +24.1% 3 Sales 908.1 823.4 +10.3% 4 Reported GM % 30.9% 27.9% +300bps 5 Adjusted GM% 32.5% 6 Reported EBITDA 158.8 109.4 +45.2% 7 Reported EBITDA % of Sales 17.5% 13.3% +420bps 8 Adjusted EBITDA 195.3 135.7 +43.9% 9 Adjusted EBITDA % of Sales 21.5% 16.5% +500bps 10 Reported Diluted EPS ($0.01) n/a 11 Adjusted Diluted EPS $1.19 n/a 12 Free Cash Flow (“FCF”) $76.2 n/a 13 Adjusted FCF $86.6 n/a Comments (all related to Q2 2023 Chart continuing operations (including Howden, ex Roots) results): • RECORD Total backlog • RECORD Howden backlog • RECORD Chart backlog • RECORD Total orders • RECORD Howden orders • RECORD Total Sales • RECORD GM% of 30.9% • RECORD Adjusted GM% of 32.5% • RECORD EBITDA • RECORD Howden EBITDA • RECORD free cash flow • Over 99% of adjustments relate to Howden deal and integration related costs

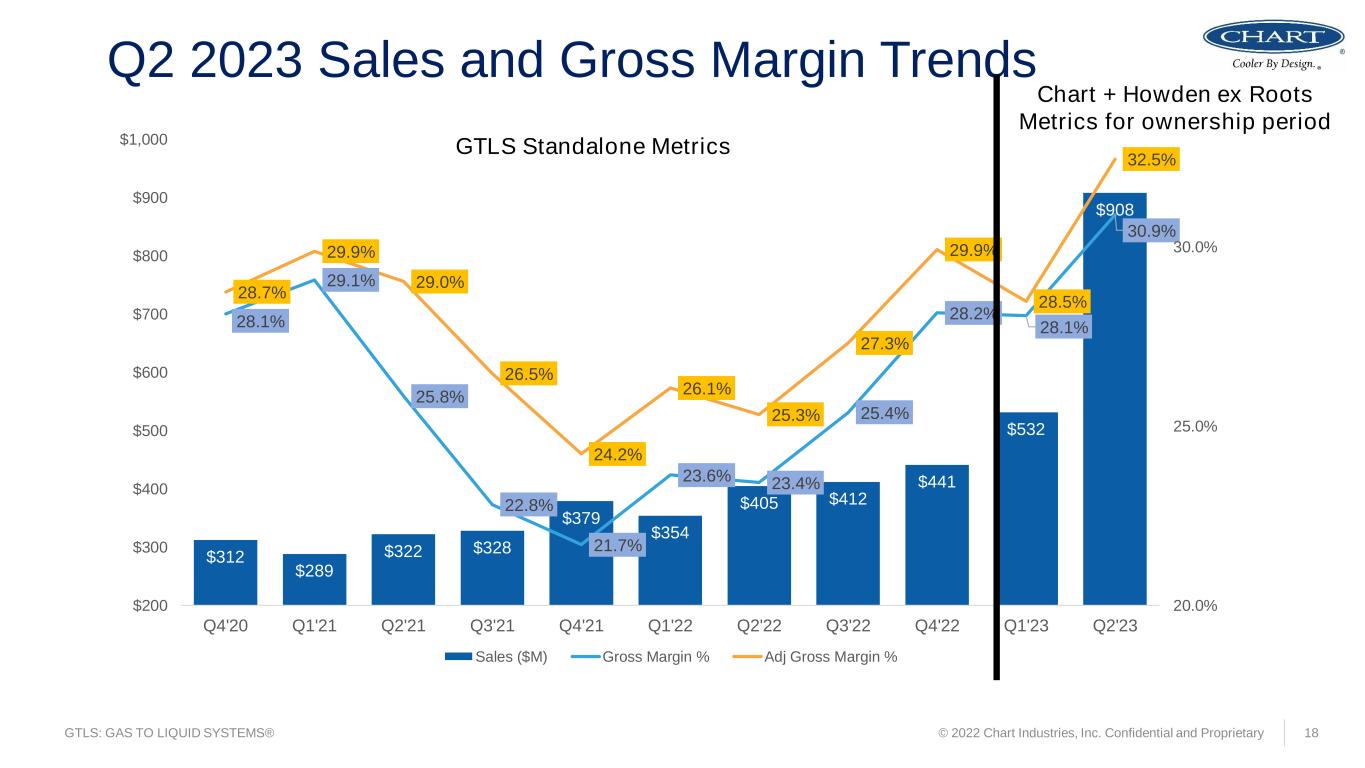

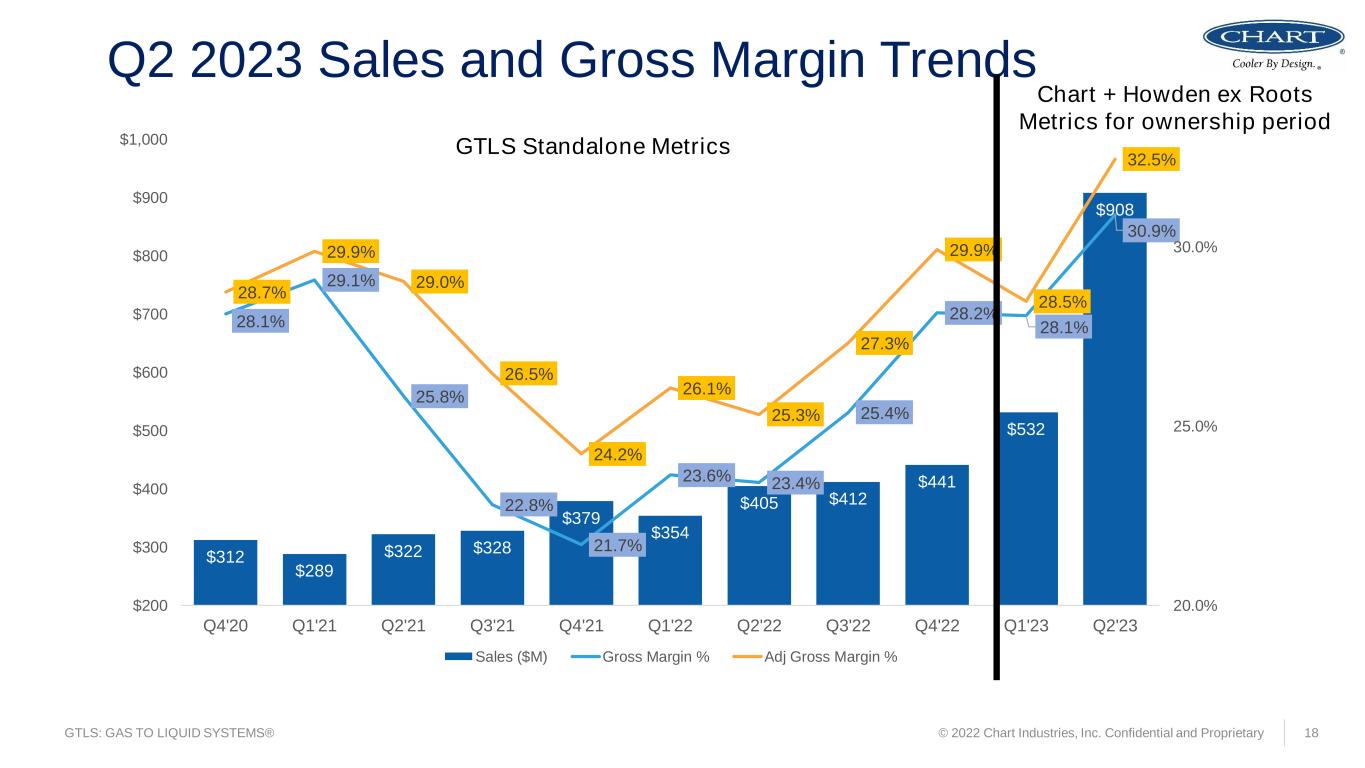

GTLS: GAS TO LIQUID SYSTEMS® $312 $289 $322 $328 $379 $354 $405 $412 $441 $532 $908 28.1% 29.1% 25.8% 22.8% 21.7% 23.6% 23.4% 25.4% 28.2% 28.1% 30.9% 28.7% 29.9% 29.0% 26.5% 24.2% 26.1% 25.3% 27.3% 29.9% 28.5% 32.5% 20.0% 25.0% 30.0% $200 $300 $400 $500 $600 $700 $800 $900 $1,000 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Sales ($M) Gross Margin % Adj Gross Margin % © 2022 Chart Industries, Inc. Confidential and Proprietary 18 Q2 2023 Sales and Gross Margin Trends GTLS Standalone Metrics Chart + Howden ex Roots Metrics for ownership period

GTLS: GAS TO LIQUID SYSTEMS® 19© 2023 Chart Industries, Inc. Confidential and Proprietary Agenda Q2 2023 Results Market and Demand Update Synergy Update Progress on Deleveraging 2023 Outlook

GTLS: GAS TO LIQUID SYSTEMS® 20 # Category Description Synergy orders (Revenue) achieved to date $ millions Annualized cost savings achieved to date $ millions Original annualized year-one target $ millions 1 Cost Sourcing $40.1 $70 2 Cost Optimization and organization 55.6 70 3 Cost Facilities 0.7 35 4 Commercial Total commercial orders won to date $94.3 150 5 Total synergies achieved to date as of 07/27/2023 $94.3 $96.5 Synergy Achievement (March 17, 2023 to July 27, 2023) • New commercial synergy orders include: • Earthly Labs largest ever award with Babcock & Wilcox • Carbon Ridge CO2 ISO • Middle East customer BAHX project • Tuf-Lite fans • FEED contract for potential Cryogenic Carbon Capture Plant to be utilized and tested by the HECO2 Saturn Consortium (CRM Group, Carmeuse, Aperam, Prayon, AGC), funded by the Walloon Government and the European Union • Howden compressors for green ammonia facility with Chart customer • 5 year LTSA for U.S. hydrogen trailer filling plant compression • Commercial synergy pipeline of opportunity for next 12 months is over $1 billion (compared to prior $800 million)

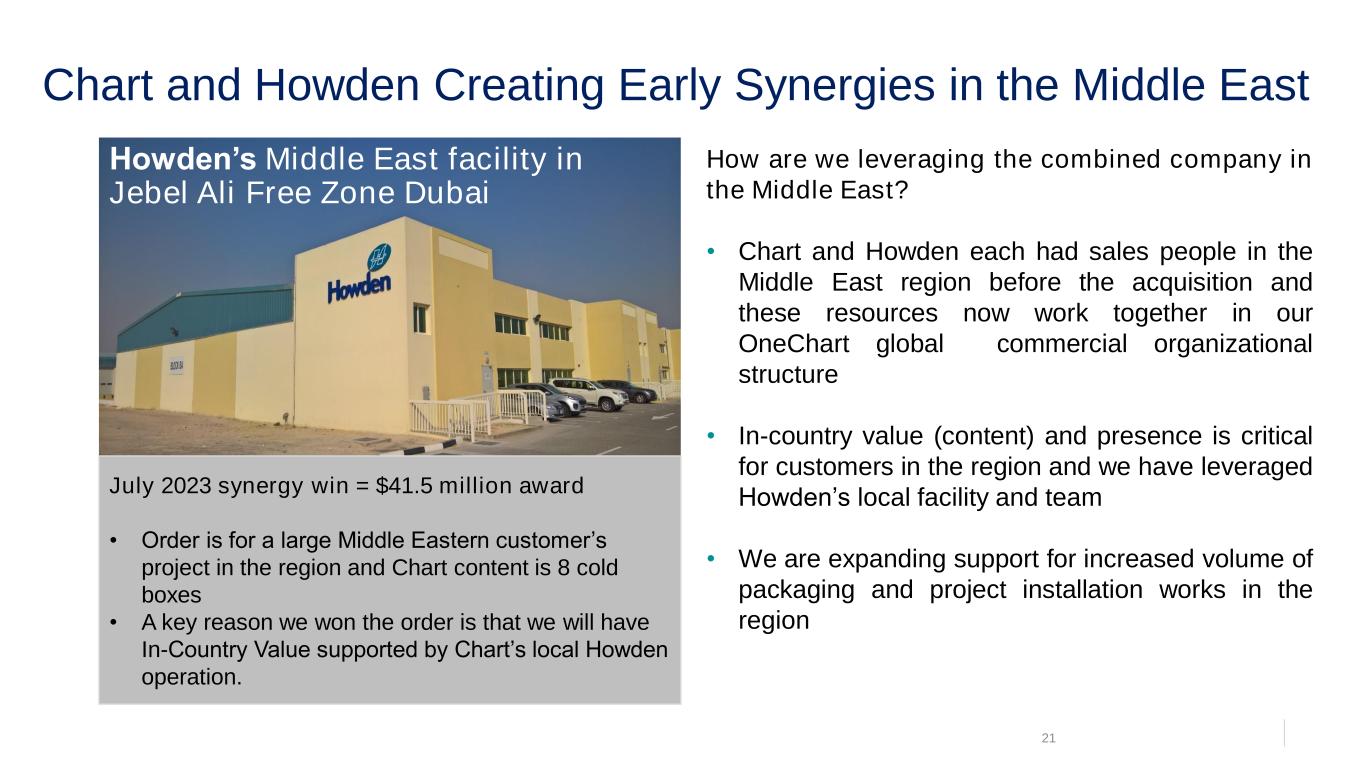

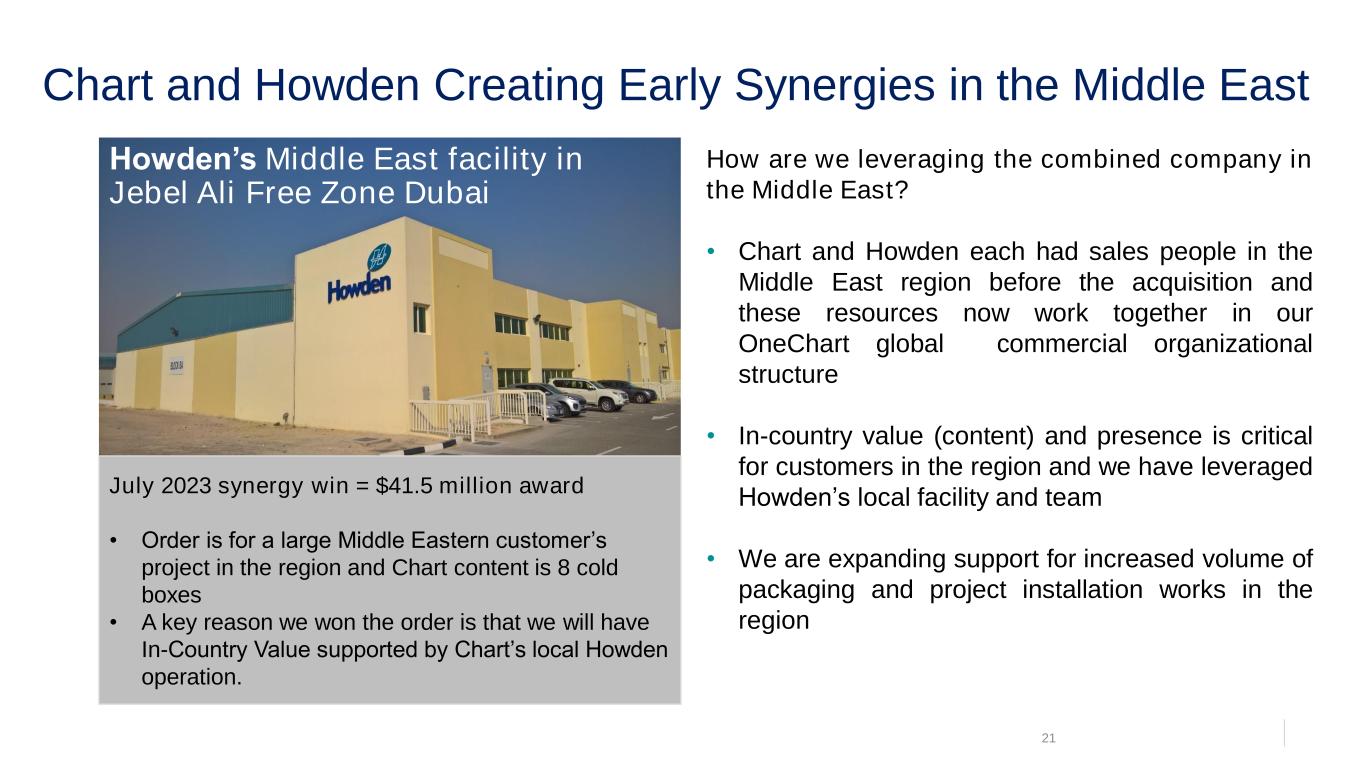

Chart and Howden Creating Early Synergies in the Middle East 21 How are we leveraging the combined company in the Middle East? • Chart and Howden each had sales people in the Middle East region before the acquisition and these resources now work together in our OneChart global commercial organizational structure • In-country value (content) and presence is critical for customers in the region and we have leveraged Howden’s local facility and team • We are expanding support for increased volume of packaging and project installation works in the region Howden’s Middle East facility in Jebel Ali Free Zone Dubai July 2023 synergy win = $41.5 million award • Order is for a large Middle Eastern customer’s project in the region and Chart content is 8 cold boxes • A key reason we won the order is that we will have In-Country Value supported by Chart’s local Howden operation.

GTLS: GAS TO LIQUID SYSTEMS® One Chart – One Culture “I am very happy to see this welding program and expect it to bring much more value to Howden Canada on welding and operational guidelines, further improving our quality of welding, delivery & productivity “Howden-Hosur has successfully completed manufacturing of our 200th VARIAX rotor. I would like to sincerely thank you all for the hard work and diligent self-motivation, without which, it would not have been possible.” “The aim of the young talent program is to support their first career step. Many thanks to all Chart & Howden colleagues who have supported this great opportunity to work together so quickly & professionally!” “In order to win an order, our customer needed a rebuild in Houston area. Houston Service Center didn’t have the crane capacity to lift the customer’s compressor. Chart Beasley site were glad to help and together, we were able to say YES to the customer! “We got further updates today and have surpassed $10M on rapid negotiations! A significant milestone for synergies. I am really proud of the global teams efforts on this & how they are collaborating in the true spirit of ‘One Chart’!” “Good to know that we can get some news of real social impact through our internal channel!” One Chart Culture Combined Team Identifying and Executing Synergies

GTLS: GAS TO LIQUID SYSTEMS® 23 Leveraging Our Strong Global Talent ➢Howden China team member recognized as “Shandong Model Worker” for being an outstanding model worker ➢Howden Tech Sponsors support local universities by presenting a prize to outstanding final year presenters ➢ChartWater PM passed the Reverse Osmosis Special Level lV Certification, the highest ranking of RO certifications ➢Howden Thomassen Compressors team introduces manufacturing at students’ exhibition Rotational Engineering Welding Council Apprenticeship Program Emerging Leaders Program ➢ 30% Female ➢ 80% Diversity ➢Network of welders across the company continuously share expertise and strategy ➢Co-op program allows local students to come to the jobsite to get “on the job experience” ➢High potential employees work on high-impact projects sponsored by executives Weihai, China Renfrew, Scotland Duluth, Georgia, US Rheden, Netherlands

GTLS: GAS TO LIQUID SYSTEMS® 24© 2023 Chart Industries, Inc. Confidential and Proprietary Agenda Q2 2023 Results Market and Demand Update Synergy Update Progress on Deleveraging 2023 Outlook

GTLS: GAS TO LIQUID SYSTEMS® Cash and Balance Sheet Activities 25 1. Action completed totaling approximately $220 million in additional capacity and over $2.26 million in cost savings a) Howden acquisition working capital settlement ($17.5 million; cash received July 26, 2023) b) Executed two building/property sales agreements totaling ~5.4 million (close and cash anticipated in Q3 2023) c) Bank guarantee capacity (non-debt) instrument in Europe d) Additional bank fronted guarantees and surety program with specific parties - additional non-debt capacity of ~$100 million e) Completed repatriation of ~$20 million from China f) Additional reduction of LC requirement through bank negotiation g) Bank fronted surety bond program = capacity, fee savings and no negative ratings views h) Letter of credit capacity outside of RCF (non-debt) in India i) Purchasing card consolidation and moved Howden LCs to our fee structure 2. Underway: Divestitures anticipated to result in approximately $500 million of cash available for debt paydown a) Executed definitive agreement to sell Roots™ to Ingersoll Rand (NYSE: IR) for $300 million all-cash, low teens adjusted EBITDA multiple, accelerating our deleveraging (expected to close by no later than August 18, 2023 as regulatory clearance received) b) Executed definitive agreement to sell Cofimco to PX3 Partners for $80 million (expected to close in 2H 2023) c) Executed definitive agreement for the sale of a French product line for 4.25M Euros that is expected to close in August pending French regulatory approval as well as Works Council consultation, the process of which has begun. d) Asset scope and timing unchanged; potential for additional divestiture(s) as we maximize value with deal perimeters e) Exit from minority ownership investment well-underway 3. Underway: Other Balance Sheet Activities totaling more than ~$105 million of potential additional capacity and/or cash for debt paydown a) Sale of 5 additional specific properties underway (underutilized and/or being consolidated into other Chart facilities) b) Consolidating or reducing other offices/sites (30+) c) Cash recovery process announced from Chart supplier (re: divested Cryobio business; completed PFC funding & settlement in March 2023) d) Cash repatriation throughout next 2 quarters e) Replacement of US Insurance collateral SBLCs 4. Ongoing Evaluation: opportunistic action including interest rate swaps, cross currency swaps, maturities optimization, etc. New updates since our June 15, 2023 investor presentation are in green text on this slide

GTLS: GAS TO LIQUID SYSTEMS® Q2 2023 Act Midyear 2024 Fcst Net Leverage (bank EBITDA) Net Leverage (covenant ceiling) Accelerating Net Leverage Reduction 26 3.86X 2.5-2.9X 4.5X 6.0X Debt Covenant: Net Debt/ LTM Adjusted EBITDA(1) ▪ Reiterate our financial policy that until we are within our target net leverage ratio range of 2- 2.5X, we will: ▪ Not do any additional material cash acquisitions ▪ Not do share repurchases ▪ Credit Ratings ▪ Moody’s LTR B1 Stable ▪ S&P LT Issuer Credit B+ Stable (1) Adjusted EBITDA is a non-GAAP measure and should not be consulted as an alternative to net income in accordance with U.S. GAAP ▪ Q2 2023 net leverage of 3.86X; pro forma of 3.72X for Roots™ and Cofimco divestitures © 2023 Chart Industries, Inc. Confidential and Proprietary 3.72X proforma for announced divestitures

GTLS: GAS TO LIQUID SYSTEMS® 27© 2023 Chart Industries, Inc. Confidential and Proprietary Agenda Q2 2023 Results Market and Demand Update Synergy Update Progress on Deleveraging 2023 Outlook

GTLS: GAS TO LIQUID SYSTEMS® © 2023 Chart Industries, Inc. Confidential and Proprietary 28 2023 Consolidated Chart Industries Outlook $ millions except per share amounts Continuing Operations Guidance Metrics as of July 28, 2023 Revenue $3,660 - $3,800 Adjusted EBITDA (1) $780 - $810 Adjusted Free cash flow (2) $300 - $350 Cash available for debt paydown in 2023 $655 - $705 Diluted share count ~47M Adjusted diluted EPS (3) $5.70 - $6.70 1) EBITDA and Adjusted EBITDA are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Management believes that EBITDA and Adjusted EBITDA facilitate useful period-to-period comparisons of financial results and the information is used by us in evaluating our internal performance. 2) “Adjusted free cash flow” is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilities useful period-to-period comparisons of the Company’s operating results. 3) Adjusted diluted EPS (a non-GAAP measure) guidance excludes incremental intangible amortization related to Howden acquisition. Cash available for debt paydown includes the use of proceeds from both the Roots and Cofimco sales but no other potential divestitures. The treatment of commercial synergies remains unchanged and are not included until realized. Guidance Metrics as of July 28, 2023

GTLS: GAS TO LIQUID SYSTEMS® Growth Acceleration in H2 2023 © 2023 Chart Industries, Inc. Confidential and Proprietary 29 • Six months of Howden EBITDA and FCF in H2 2023 vs. Three months and 10 days in H1 2023 • Cost Synergies ramp in H2 vs H1, on track for $175 million of annualized cost synergies first 12- months of ownership • Price/ Cost tailwind (In line with Q1 2023 commentary) • Small and medium new build project revenue increases at Chart and Howden • Big LNG project revenue greater in H2 2023 vs. H1 2023 (In line with Q1 2023 commentary) • Continued growth in all segments • Above historical average backlog to forward sales coverage embedded in guidance

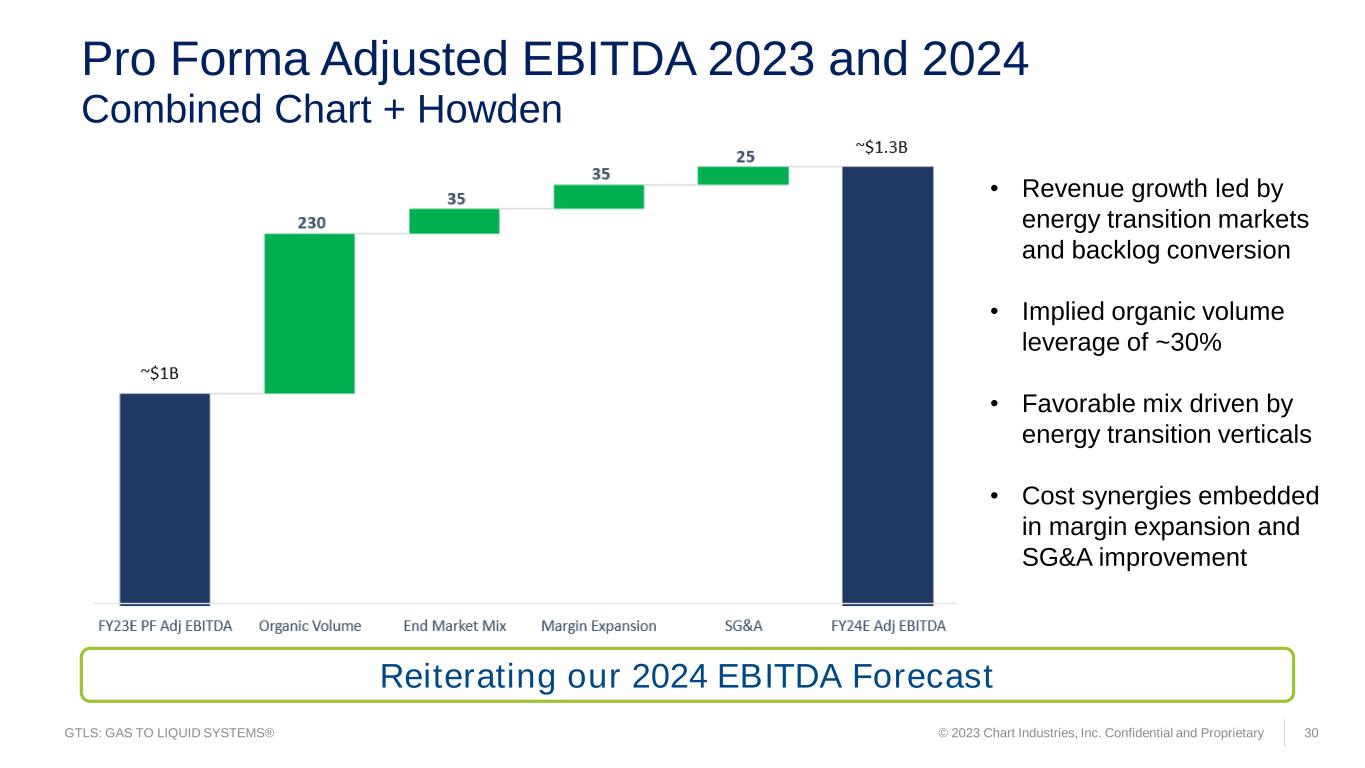

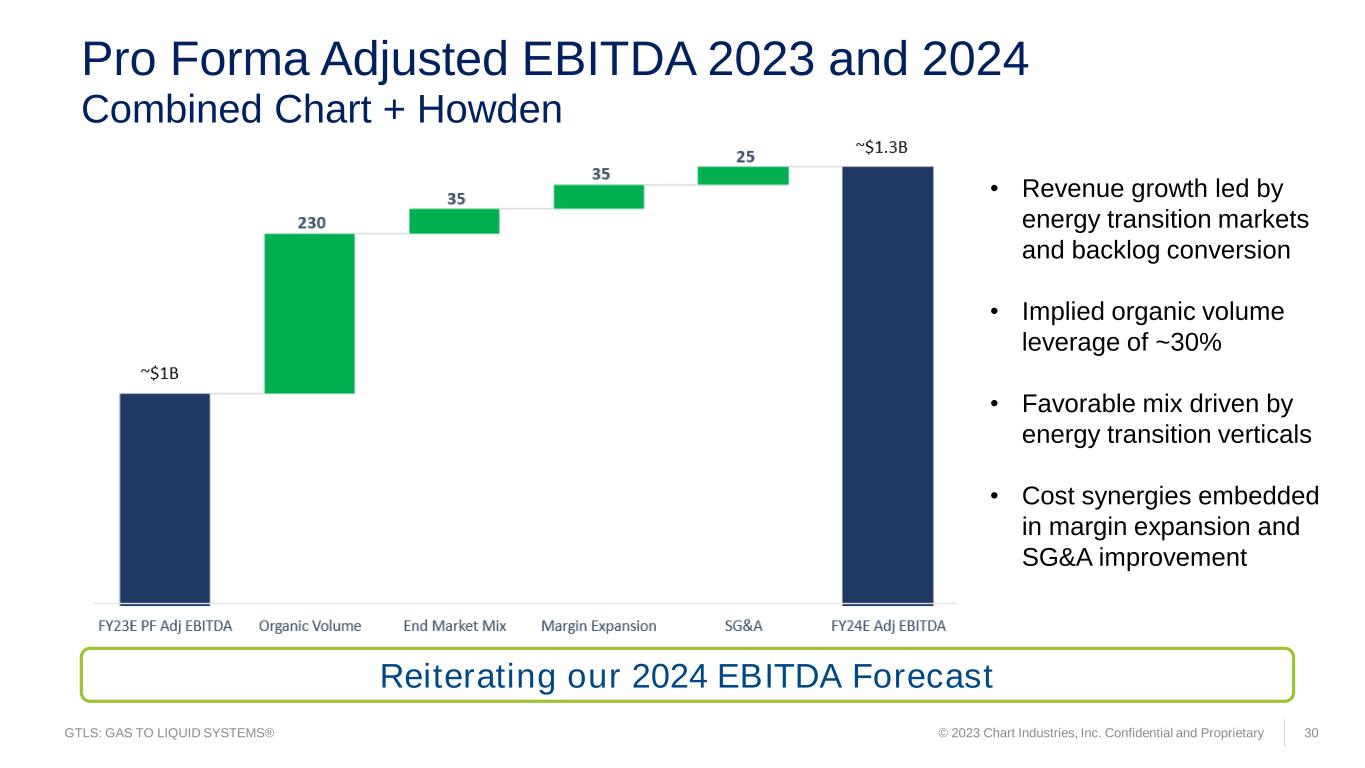

GTLS: GAS TO LIQUID SYSTEMS® Pro Forma Adjusted EBITDA 2023 and 2024 Combined Chart + Howden 30 • Revenue growth led by energy transition markets and backlog conversion • Implied organic volume leverage of ~30% • Favorable mix driven by energy transition verticals • Cost synergies embedded in margin expansion and SG&A improvement © 2023 Chart Industries, Inc. Confidential and Proprietary Reiterating our 2024 EBITDA Forecast

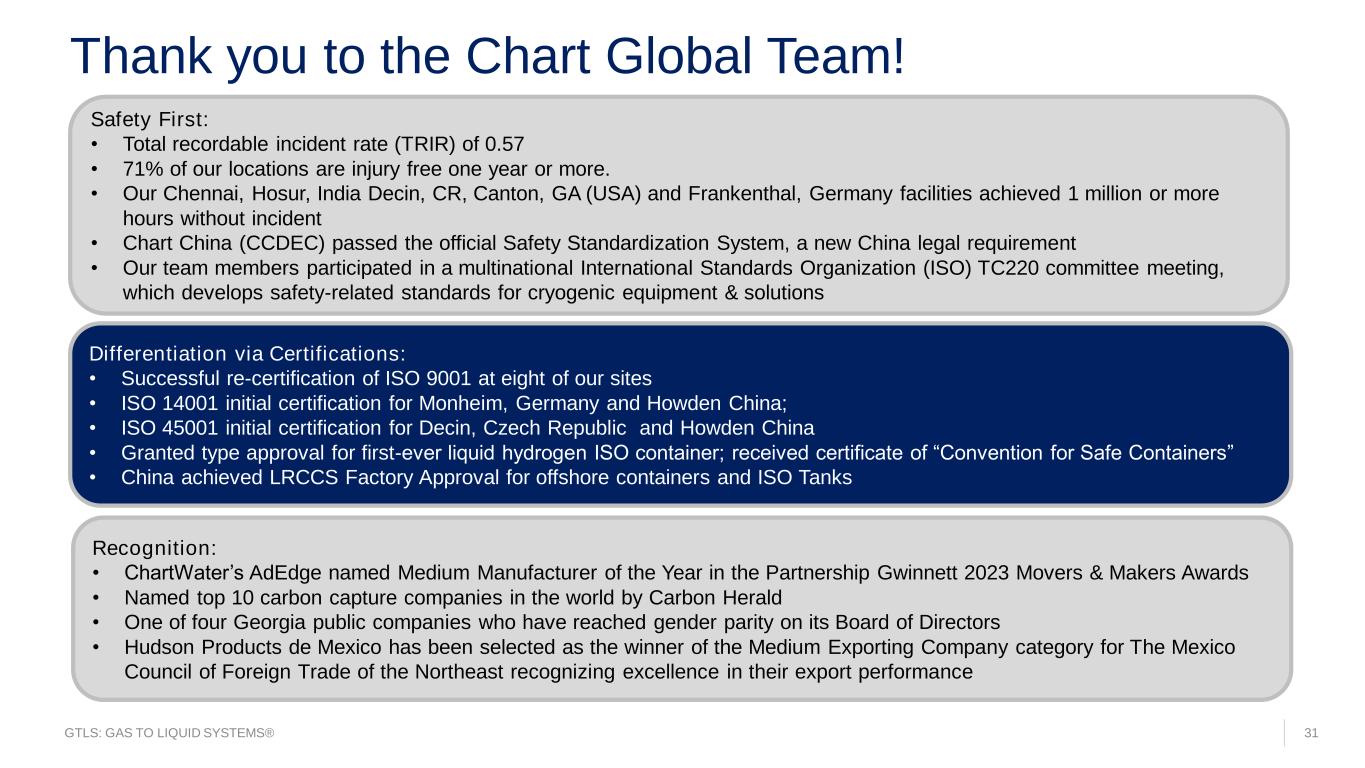

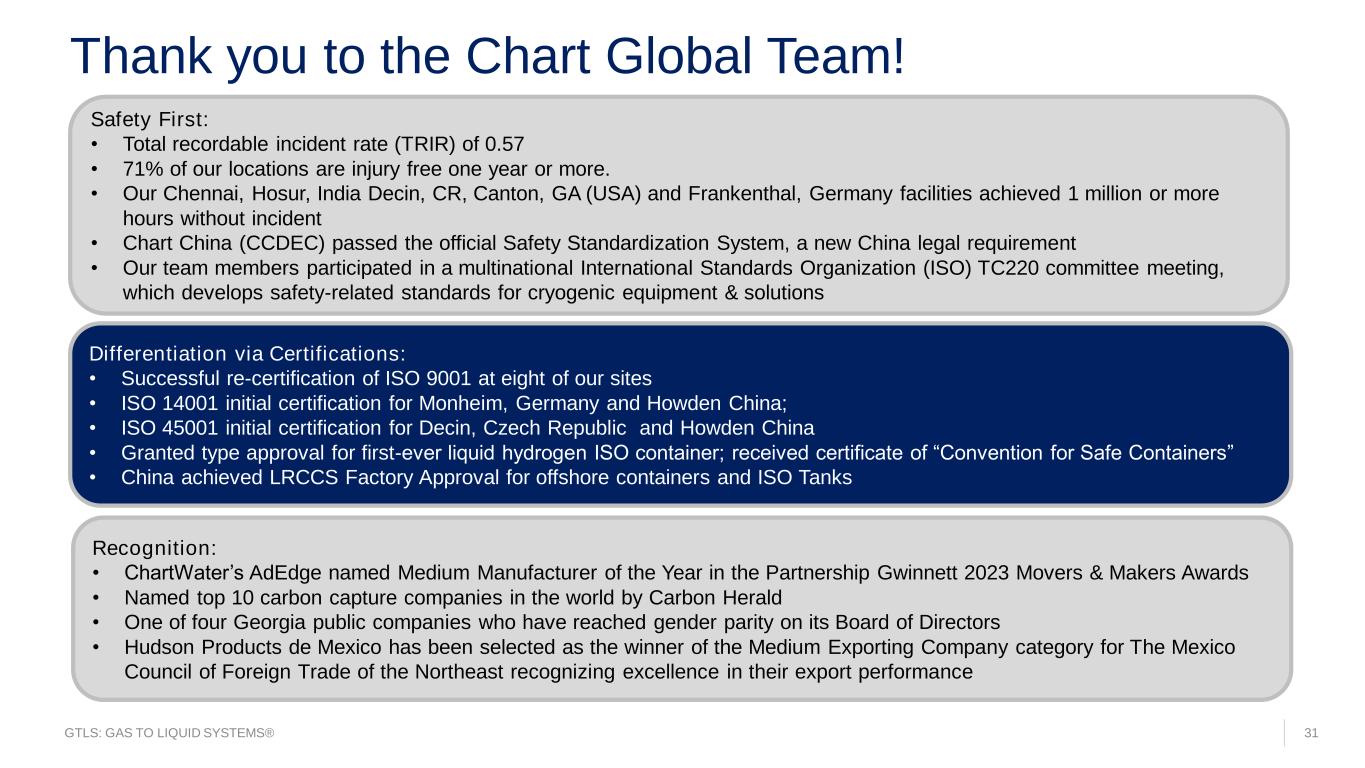

GTLS: GAS TO LIQUID SYSTEMS® 31 Thank you to the Chart Global Team! Safety First: • Total recordable incident rate (TRIR) of 0.57 • 71% of our locations are injury free one year or more. • Our Chennai, Hosur, India Decin, CR, Canton, GA (USA) and Frankenthal, Germany facilities achieved 1 million or more hours without incident • Chart China (CCDEC) passed the official Safety Standardization System, a new China legal requirement • Our team members participated in a multinational International Standards Organization (ISO) TC220 committee meeting, which develops safety-related standards for cryogenic equipment & solutions Differentiation via Certifications: • Successful re-certification of ISO 9001 at eight of our sites • ISO 14001 initial certification for Monheim, Germany and Howden China; • ISO 45001 initial certification for Decin, Czech Republic and Howden China • Granted type approval for first-ever liquid hydrogen ISO container; received certificate of “Convention for Safe Containers” • China achieved LRCCS Factory Approval for offshore containers and ISO Tanks Recognition: • ChartWater’s AdEdge named Medium Manufacturer of the Year in the Partnership Gwinnett 2023 Movers & Makers Awards • Named top 10 carbon capture companies in the world by Carbon Herald • One of four Georgia public companies who have reached gender parity on its Board of Directors • Hudson Products de Mexico has been selected as the winner of the Medium Exporting Company category for The Mexico Council of Foreign Trade of the Northeast recognizing excellence in their export performance

APPENDIX

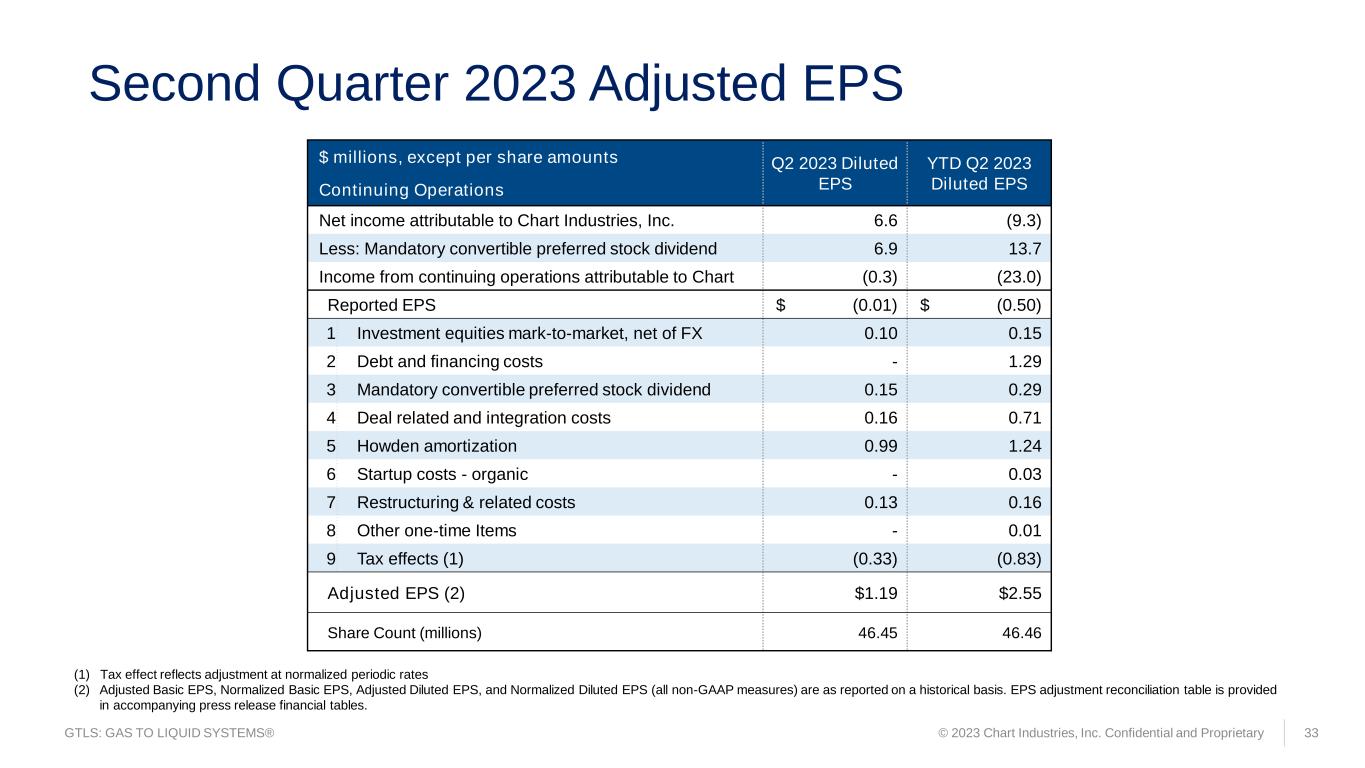

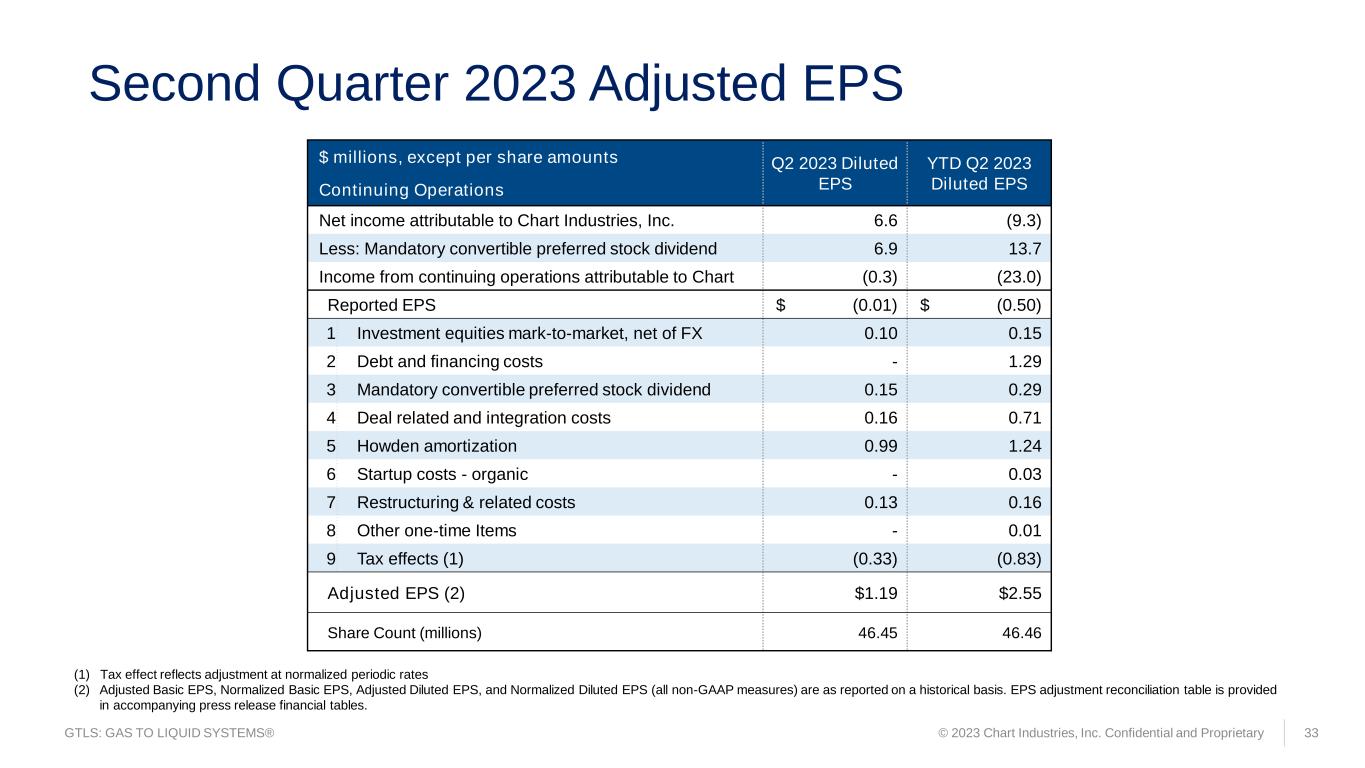

GTLS: GAS TO LIQUID SYSTEMS® Second Quarter 2023 Adjusted EPS © 2023 Chart Industries, Inc. Confidential and Proprietary 33 (1) Tax effect reflects adjustment at normalized periodic rates (2) Adjusted Basic EPS, Normalized Basic EPS, Adjusted Diluted EPS, and Normalized Diluted EPS (all non-GAAP measures) are as reported on a historical basis. EPS adjustment reconciliation table is provided in accompanying press release financial tables. $ millions, except per share amounts Q2 2023 Diluted EPS YTD Q2 2023 Diluted EPSContinuing Operations Net income attributable to Chart Industries, Inc. 6.6 (9.3) Less: Mandatory convertible preferred stock dividend 6.9 13.7 Income from continuing operations attributable to Chart (0.3) (23.0) Reported EPS $ (0.01) $ (0.50) 1 Investment equities mark-to-market, net of FX 0.10 0.15 2 Debt and financing costs - 1.29 3 Mandatory convertible preferred stock dividend 0.15 0.29 4 Deal related and integration costs 0.16 0.71 5 Howden amortization 0.99 1.24 6 Startup costs - organic - 0.03 7 Restructuring & related costs 0.13 0.16 8 Other one-time Items - 0.01 9 Tax effects (1) (0.33) (0.83) Adjusted EPS (2) $1.19 $2.55 Share Count (millions) 46.45 46.46

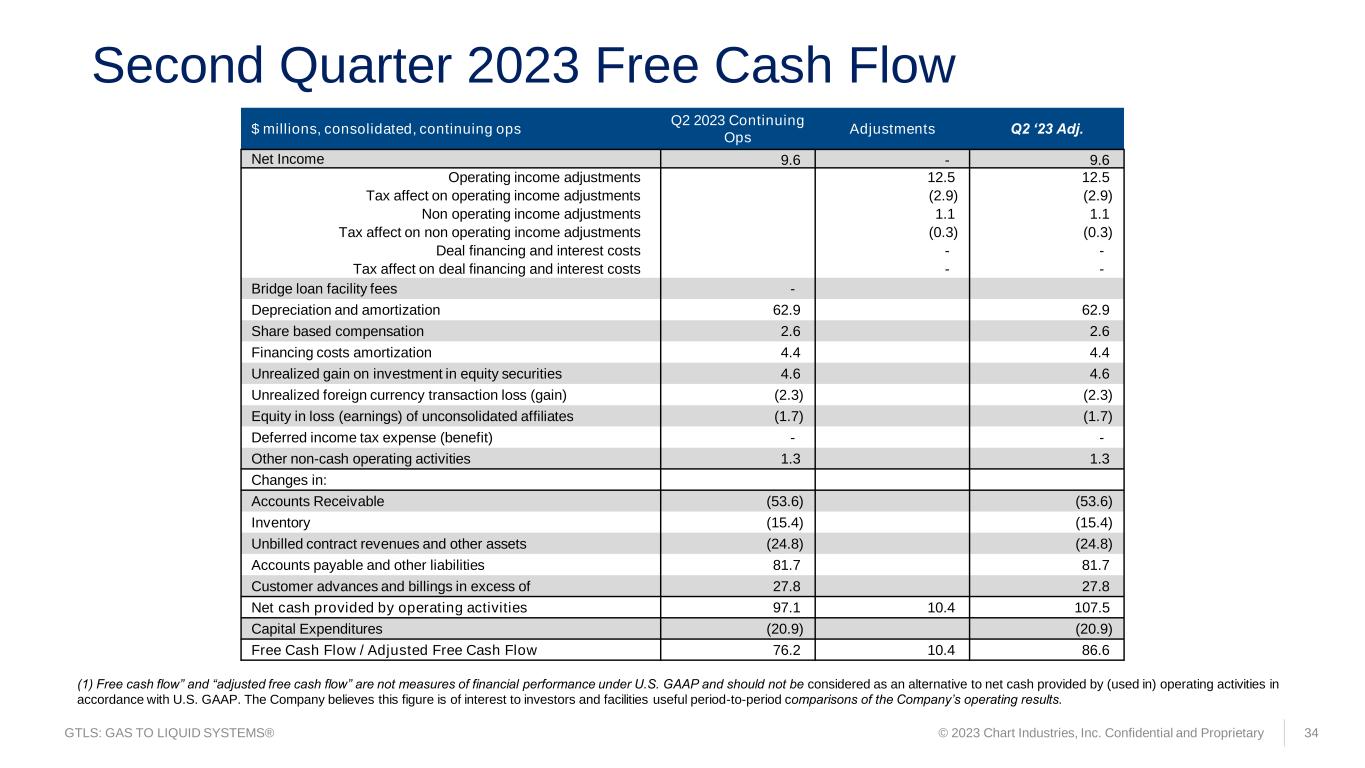

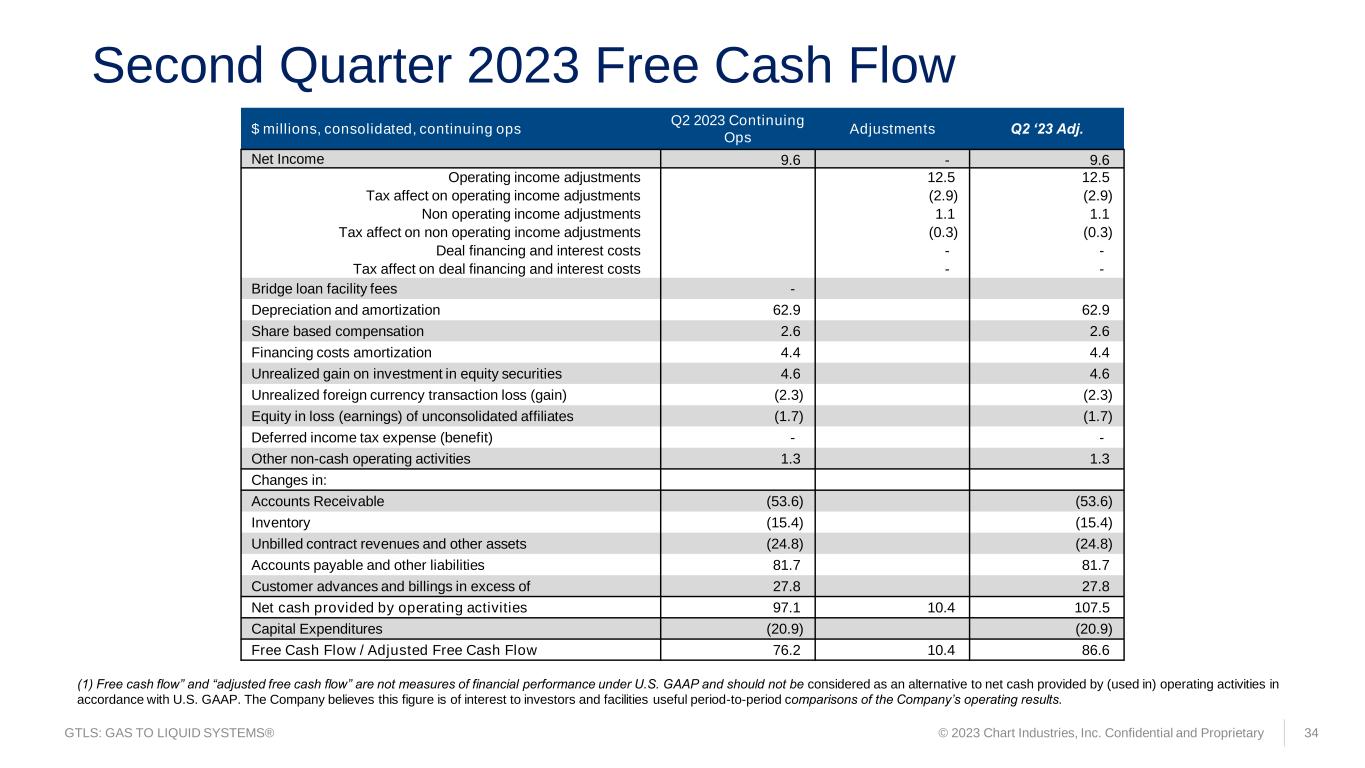

GTLS: GAS TO LIQUID SYSTEMS® Second Quarter 2023 Free Cash Flow © 2023 Chart Industries, Inc. Confidential and Proprietary 34 (1) Free cash flow” and “adjusted free cash flow” are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net cash provided by (used in) operating activities in accordance with U.S. GAAP. The Company believes this figure is of interest to investors and facilities useful period-to-period comparisons of the Company’s operating results. $ millions, consolidated, continuing ops Q2 2023 Continuing Ops Adjustments Q2 ‘23 Adj. Net Income 9.6 - 9.6 Operating income adjustments 12.5 12.5 Tax affect on operating income adjustments (2.9) (2.9) Non operating income adjustments 1.1 1.1 Tax affect on non operating income adjustments (0.3) (0.3) Deal financing and interest costs - - Tax affect on deal financing and interest costs - - Bridge loan facility fees - Depreciation and amortization 62.9 62.9 Share based compensation 2.6 2.6 Financing costs amortization 4.4 4.4 Unrealized gain on investment in equity securities 4.6 4.6 Unrealized foreign currency transaction loss (gain) (2.3) (2.3) Equity in loss (earnings) of unconsolidated affiliates (1.7) (1.7) Deferred income tax expense (benefit) - - Other non-cash operating activities 1.3 1.3 Changes in: Accounts Receivable (53.6) (53.6) Inventory (15.4) (15.4) Unbilled contract revenues and other assets (24.8) (24.8) Accounts payable and other liabilities 81.7 81.7 Customer advances and billings in excess of 27.8 27.8 Net cash provided by operating activities 97.1 10.4 107.5 Capital Expenditures (20.9) (20.9) Free Cash Flow / Adjusted Free Cash Flow 76.2 10.4 86.6

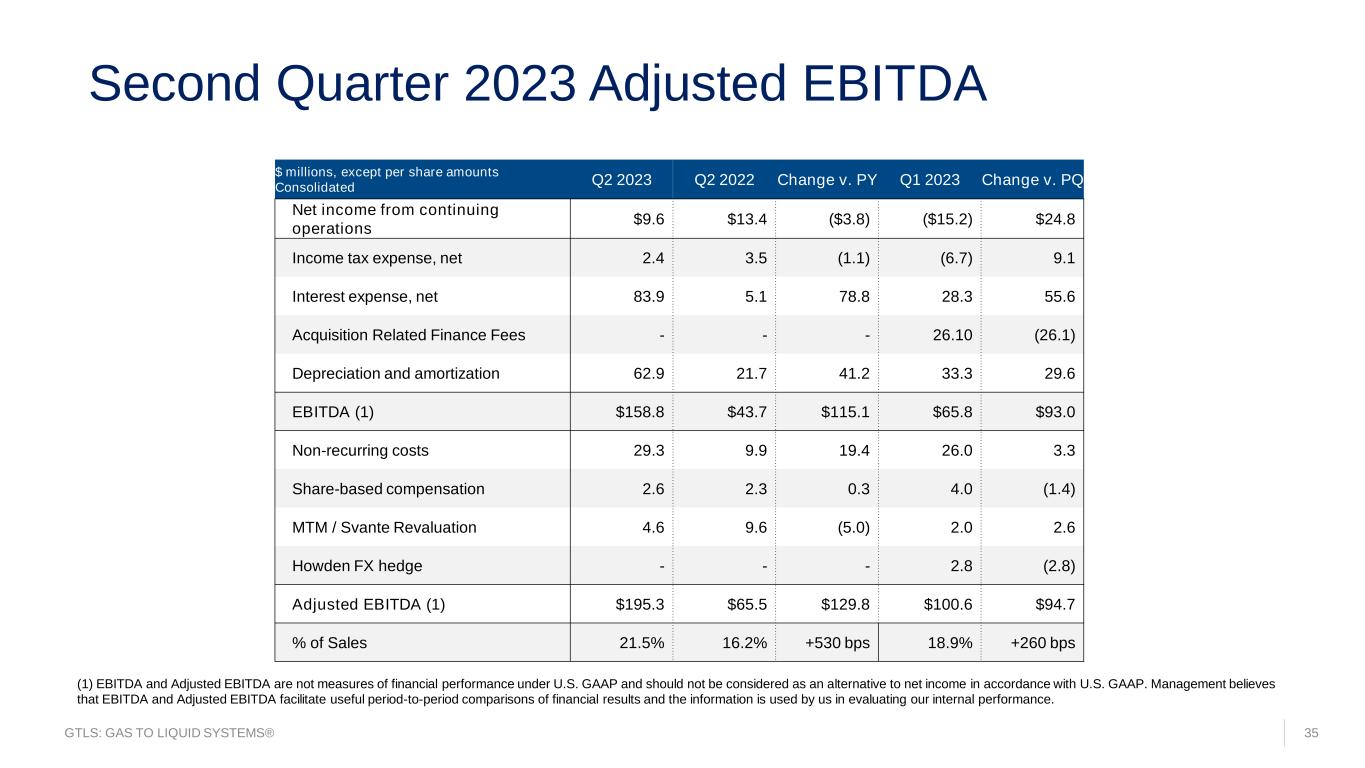

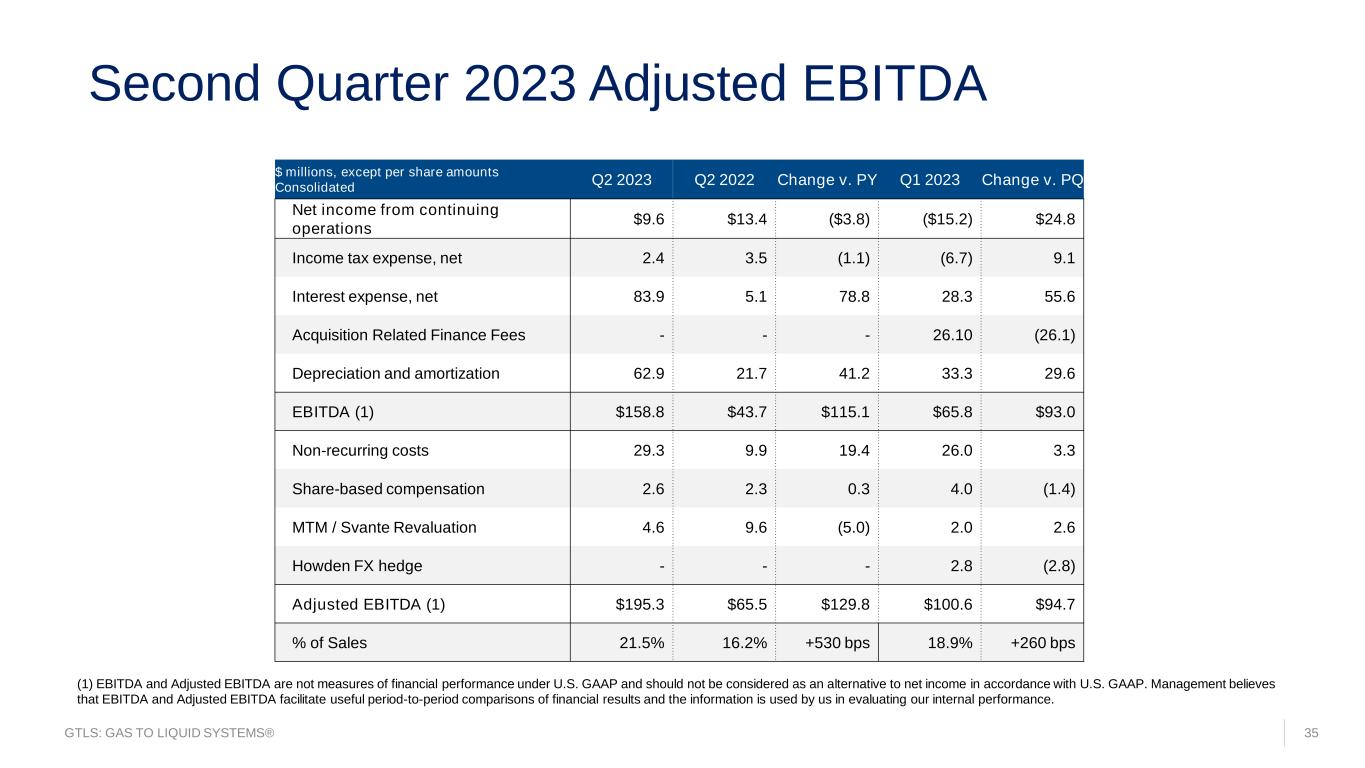

GTLS: GAS TO LIQUID SYSTEMS® 35 Second Quarter 2023 Adjusted EBITDA (1) EBITDA and Adjusted EBITDA are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Management believes that EBITDA and Adjusted EBITDA facilitate useful period-to-period comparisons of financial results and the information is used by us in evaluating our internal performance. $ millions, except per share amounts Consolidated Q2 2023 Q2 2022 Change v. PY Q1 2023 Change v. PQ Net income from continuing operations $9.6 $13.4 ($3.8) ($15.2) $24.8 Income tax expense, net 2.4 3.5 (1.1) (6.7) 9.1 Interest expense, net 83.9 5.1 78.8 28.3 55.6 Acquisition Related Finance Fees - - - 26.10 (26.1) Depreciation and amortization 62.9 21.7 41.2 33.3 29.6 EBITDA (1) $158.8 $43.7 $115.1 $65.8 $93.0 Non-recurring costs 29.3 9.9 19.4 26.0 3.3 Share-based compensation 2.6 2.3 0.3 4.0 (1.4) MTM / Svante Revaluation 4.6 9.6 (5.0) 2.0 2.6 Howden FX hedge - - - 2.8 (2.8) Adjusted EBITDA (1) $195.3 $65.5 $129.8 $100.6 $94.7 % of Sales 21.5% 16.2% +530 bps 18.9% +260 bps

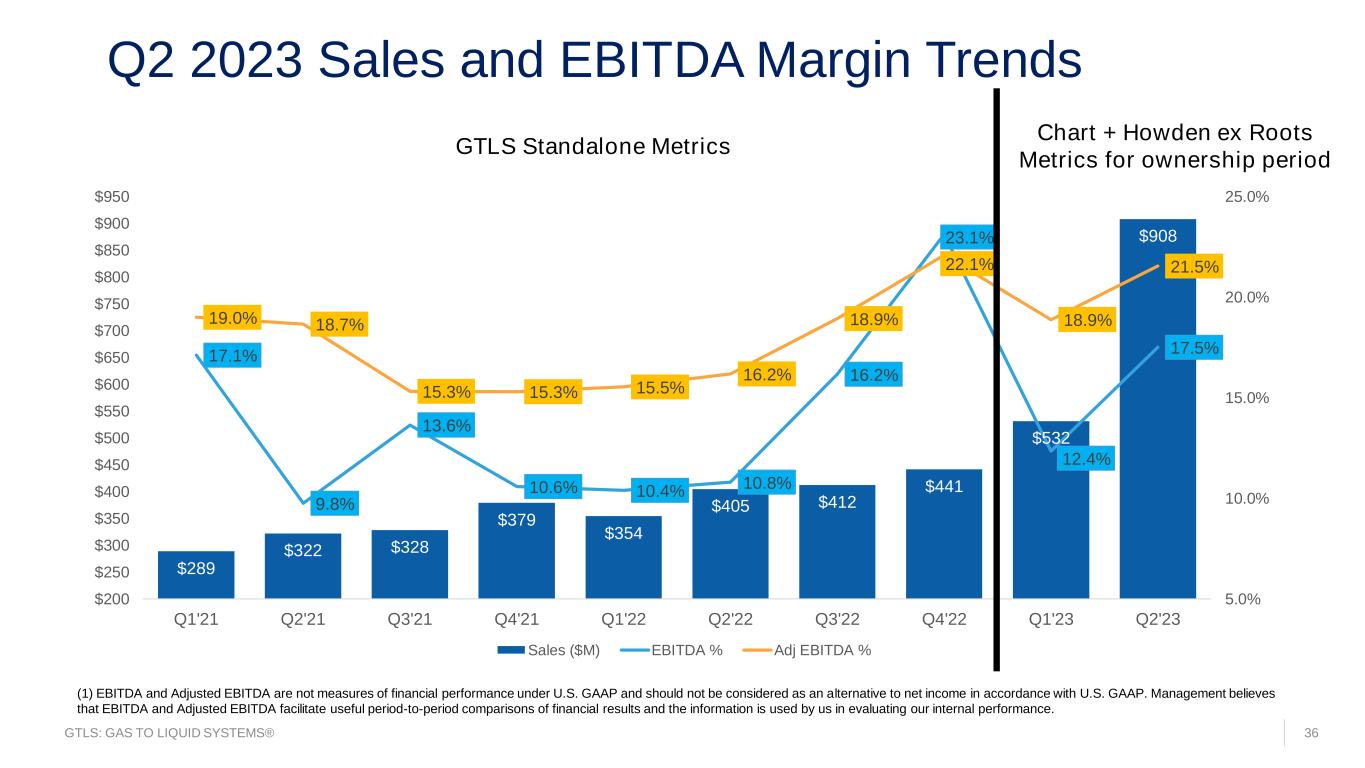

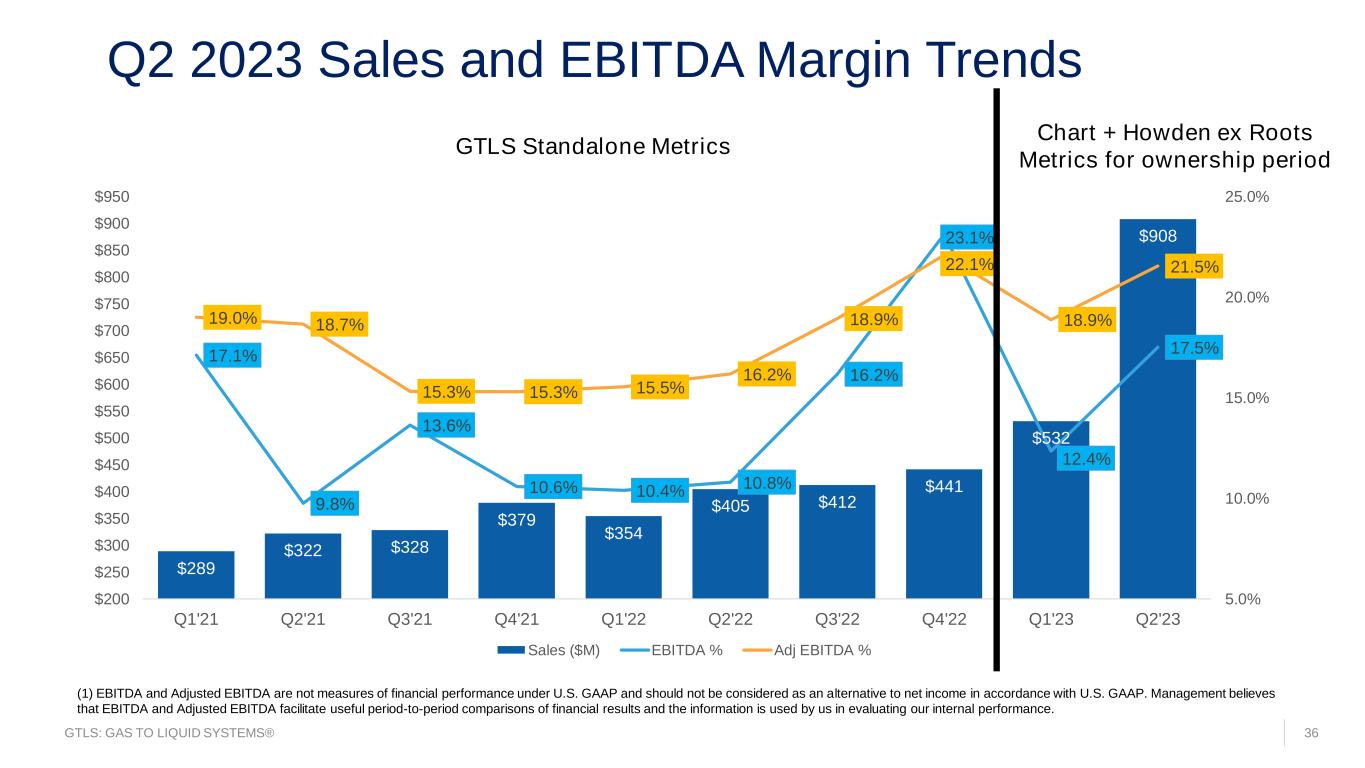

GTLS: GAS TO LIQUID SYSTEMS® 36 Q2 2023 Sales and EBITDA Margin Trends $289 $322 $328 $379 $354 $405 $412 $441 $532 $908 17.1% 9.8% 13.6% 10.6% 10.4% 10.8% 16.2% 23.1% 12.4% 17.5% 19.0% 18.7% 15.3% 15.3% 15.5% 16.2% 18.9% 22.1% 18.9% 21.5% 5.0% 10.0% 15.0% 20.0% 25.0% $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 $700 $750 $800 $850 $900 $950 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Sales ($M) EBITDA % Adj EBITDA % GTLS Standalone Metrics Chart + Howden ex Roots Metrics for ownership period (1) EBITDA and Adjusted EBITDA are not measures of financial performance under U.S. GAAP and should not be considered as an alternative to net income in accordance with U.S. GAAP. Management believes that EBITDA and Adjusted EBITDA facilitate useful period-to-period comparisons of financial results and the information is used by us in evaluating our internal performance.

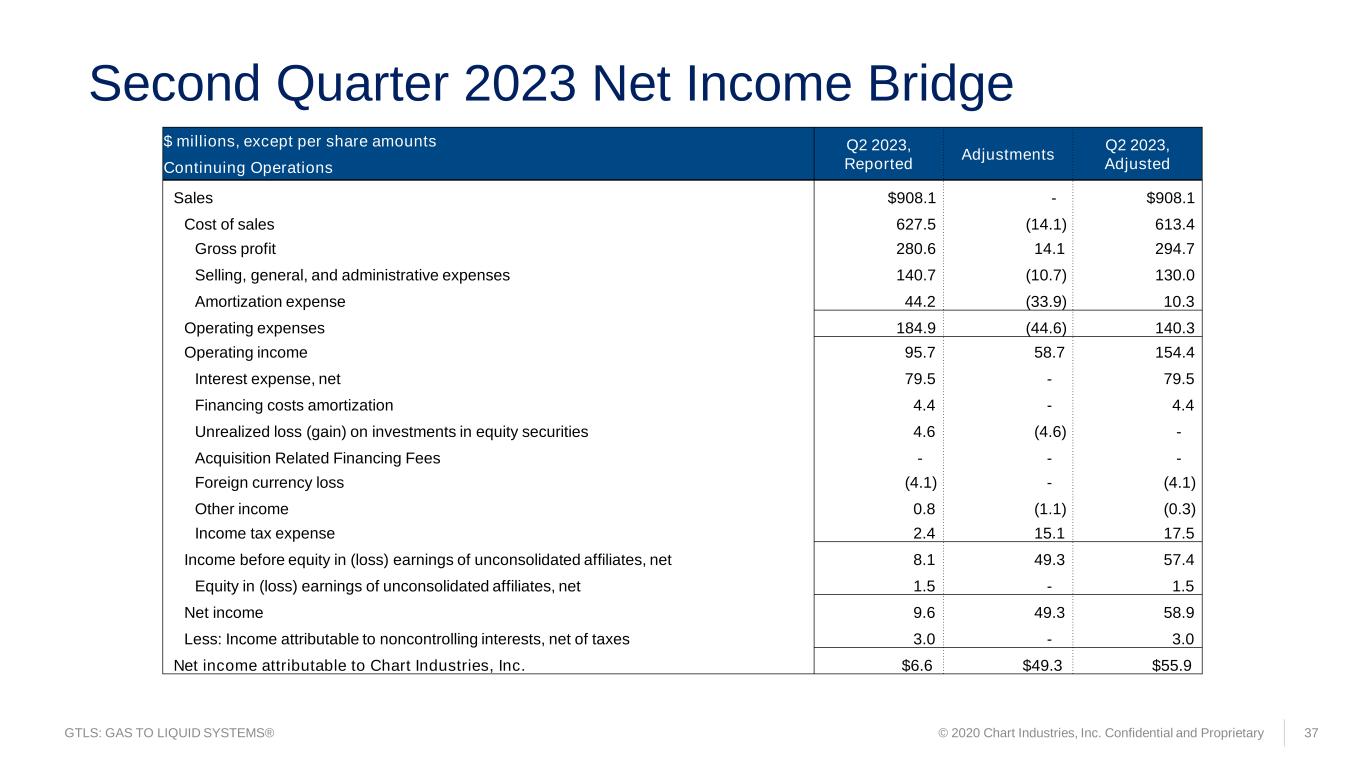

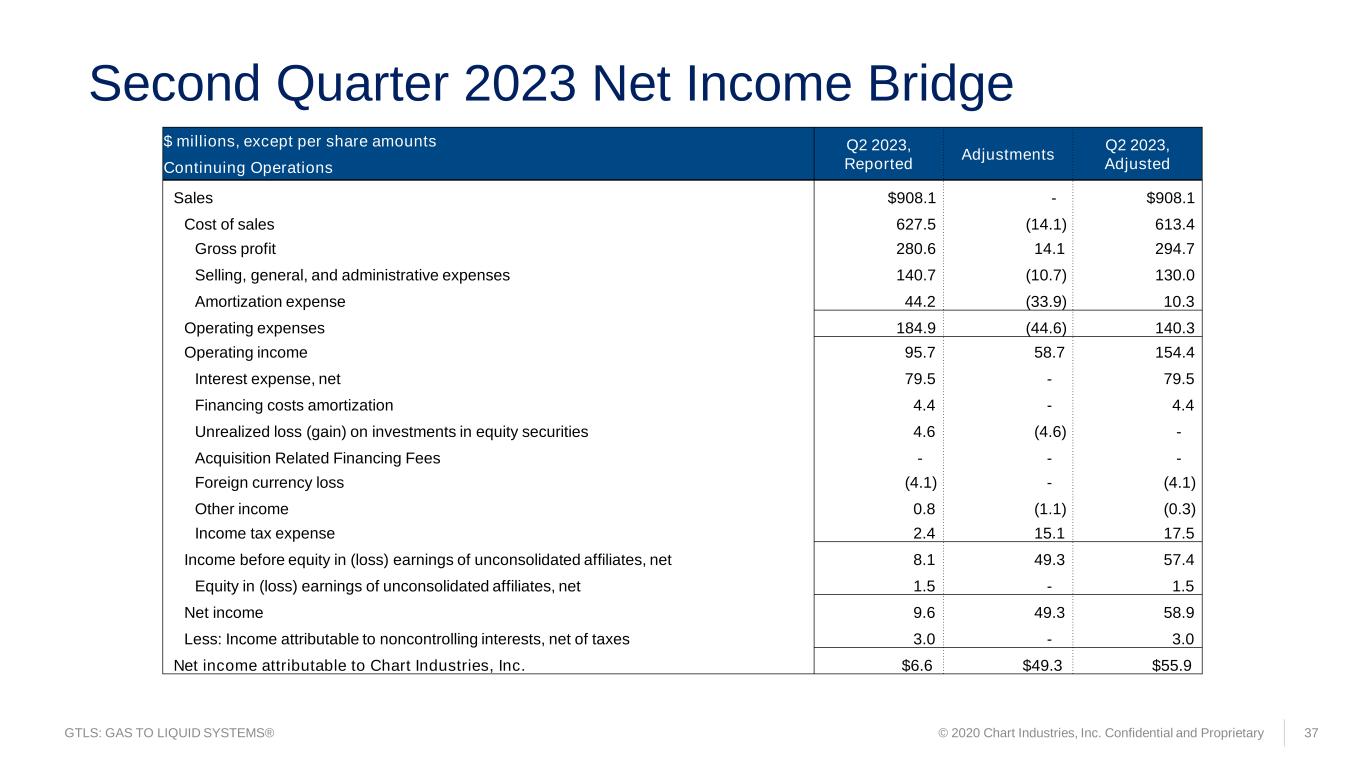

GTLS: GAS TO LIQUID SYSTEMS® Second Quarter 2023 Net Income Bridge © 2020 Chart Industries, Inc. Confidential and Proprietary 37 $ millions, except per share amounts Q2 2023, Reported Adjustments Q2 2023, AdjustedContinuing Operations Sales $908.1 - $908.1 Cost of sales 627.5 (14.1) 613.4 Gross profit 280.6 14.1 294.7 Selling, general, and administrative expenses 140.7 (10.7) 130.0 Amortization expense 44.2 (33.9) 10.3 Operating expenses 184.9 (44.6) 140.3 Operating income 95.7 58.7 154.4 Interest expense, net 79.5 - 79.5 Financing costs amortization 4.4 - 4.4 Unrealized loss (gain) on investments in equity securities 4.6 (4.6) - Acquisition Related Financing Fees - - - Foreign currency loss (4.1) - (4.1) Other income 0.8 (1.1) (0.3) Income tax expense 2.4 15.1 17.5 Income before equity in (loss) earnings of unconsolidated affiliates, net 8.1 49.3 57.4 Equity in (loss) earnings of unconsolidated affiliates, net 1.5 - 1.5 Net income 9.6 49.3 58.9 Less: Income attributable to noncontrolling interests, net of taxes 3.0 - 3.0 Net income attributable to Chart Industries, Inc. $6.6 $49.3 $55.9

GTLS: GAS TO LIQUID SYSTEMS® Q2 2023 Addback Detail © 2023 Chart Industries, Inc. Confidential and Proprietary 38 Main category Detailed Description Q2 2023 gross amount (+ added to / (-) reduced income) Impact to operating income Repeating in Q3-Q4 2023? 1 Mark-to-Market of inorganic investments • McPhy MTM • Stabilis MTM • Minority investments, other (Liberty and HTEC) 4.6 No, net income only Yes 2 Howden deal and integration related • Third party support fees 5.4 Yes, 4.3 operating and net income Yes 3 Amortization • Howden Q2 amortization • Inventory and PPE Step-up D&A 46.2 Yes, operating and net income Yes 4 Deal, Integration, & other one-time costs, non-Howden • Integration costs including IT system implementations, legal, travel and earnout related to Chart’s acquisitions completed (non-Howden) • One-time out of period inventory adjustment 1.9 Yes, operating and net income No 5 Restructuring and related expense • Specific to org structure changes, movement of people between facilities, sign-on bonuses • Cost to achieve synergies 6.3 Yes, operating and net income Yes 6 Tax effect on all above adjustments • Tax effect on gross adjustments as shown above (15.1) No, net income only Yes

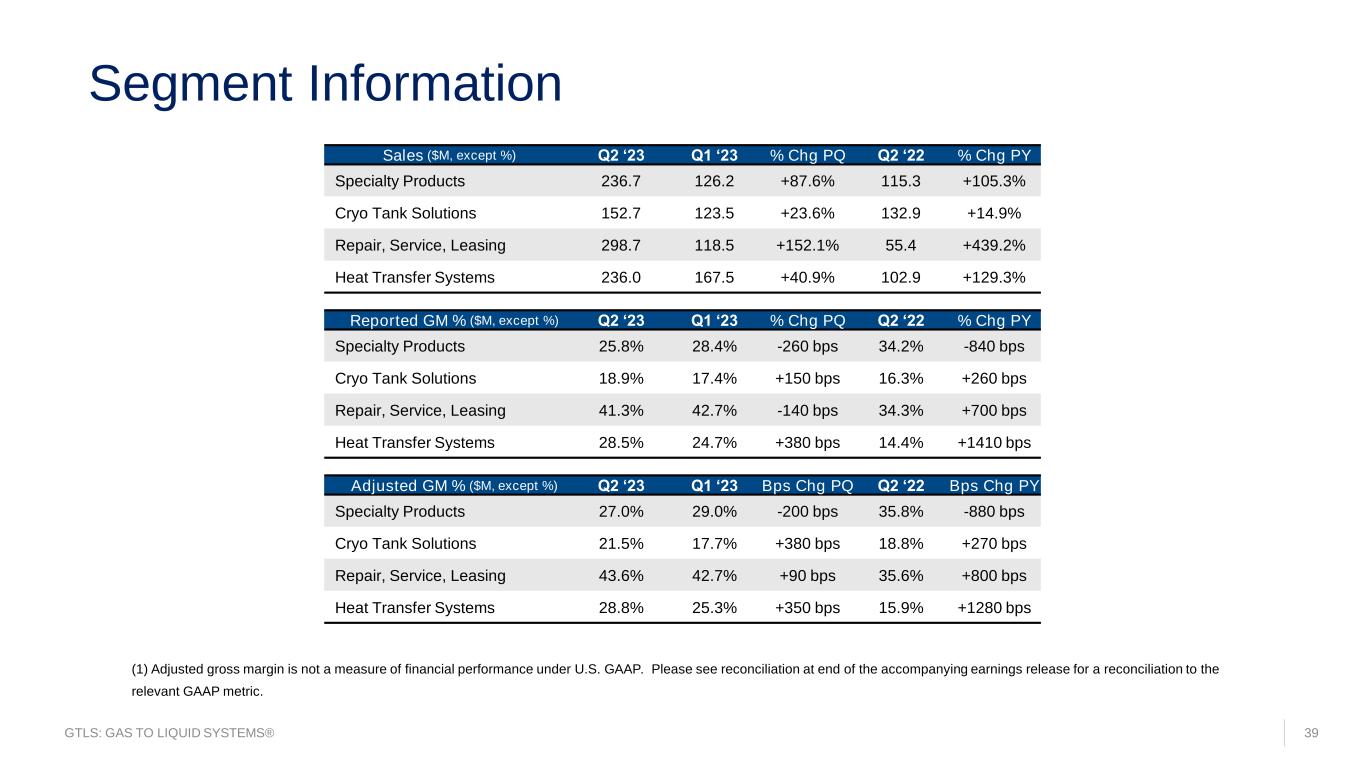

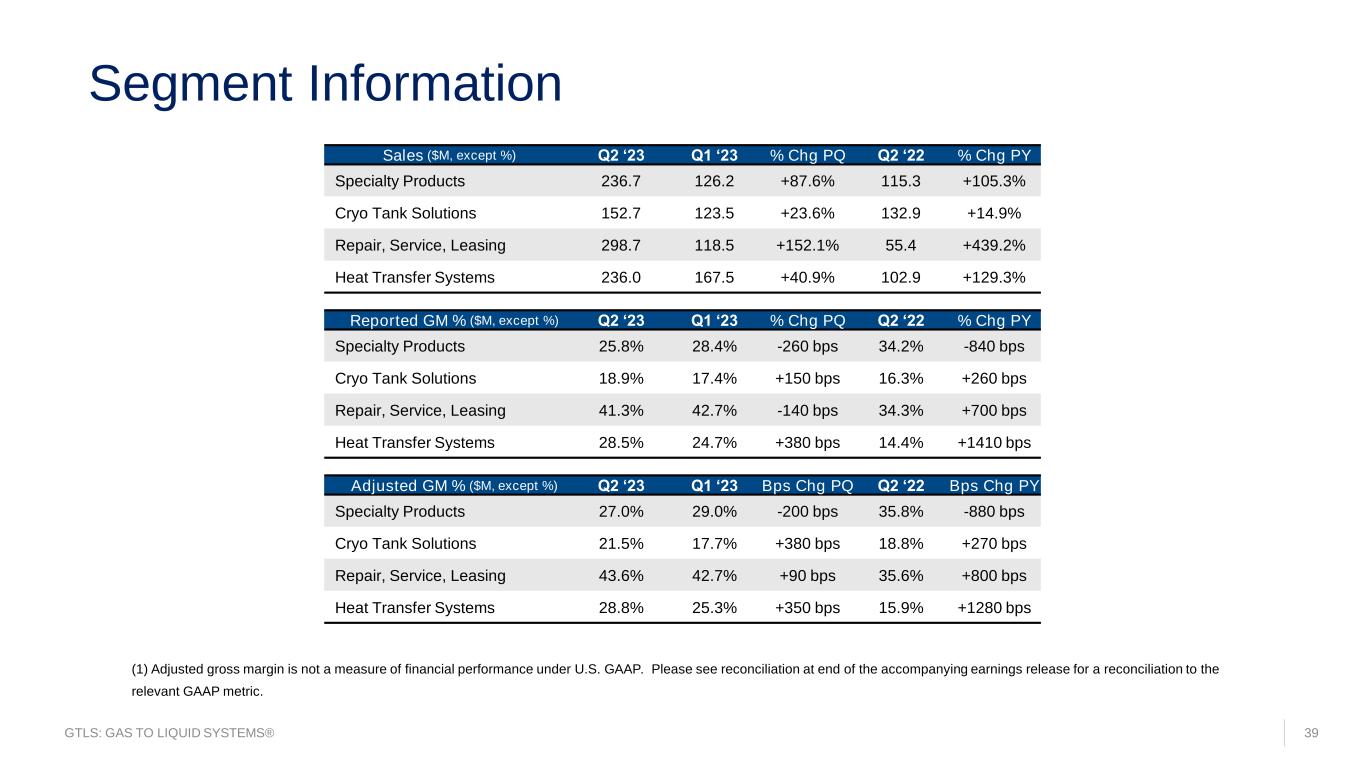

GTLS: GAS TO LIQUID SYSTEMS® 39 Segment Information (1) Adjusted gross margin is not a measure of financial performance under U.S. GAAP. Please see reconciliation at end of the accompanying earnings release for a reconciliation to the relevant GAAP metric. Sales ($M, except %) Q2 ‘23 Q1 ‘23 % Chg PQ Q2 ‘22 % Chg PY Specialty Products 236.7 126.2 +87.6% 115.3 +105.3% Cryo Tank Solutions 152.7 123.5 +23.6% 132.9 +14.9% Repair, Service, Leasing 298.7 118.5 +152.1% 55.4 +439.2% Heat Transfer Systems 236.0 167.5 +40.9% 102.9 +129.3% Reported GM % ($M, except %) Q2 ‘23 Q1 ‘23 % Chg PQ Q2 ‘22 % Chg PY Specialty Products 25.8% 28.4% -260 bps 34.2% -840 bps Cryo Tank Solutions 18.9% 17.4% +150 bps 16.3% +260 bps Repair, Service, Leasing 41.3% 42.7% -140 bps 34.3% +700 bps Heat Transfer Systems 28.5% 24.7% +380 bps 14.4% +1410 bps Adjusted GM % ($M, except %) Q2 ‘23 Q1 ‘23 Bps Chg PQ Q2 ‘22 Bps Chg PY Specialty Products 27.0% 29.0% -200 bps 35.8% -880 bps Cryo Tank Solutions 21.5% 17.7% +380 bps 18.8% +270 bps Repair, Service, Leasing 43.6% 42.7% +90 bps 35.6% +800 bps Heat Transfer Systems 28.8% 25.3% +350 bps 15.9% +1280 bps

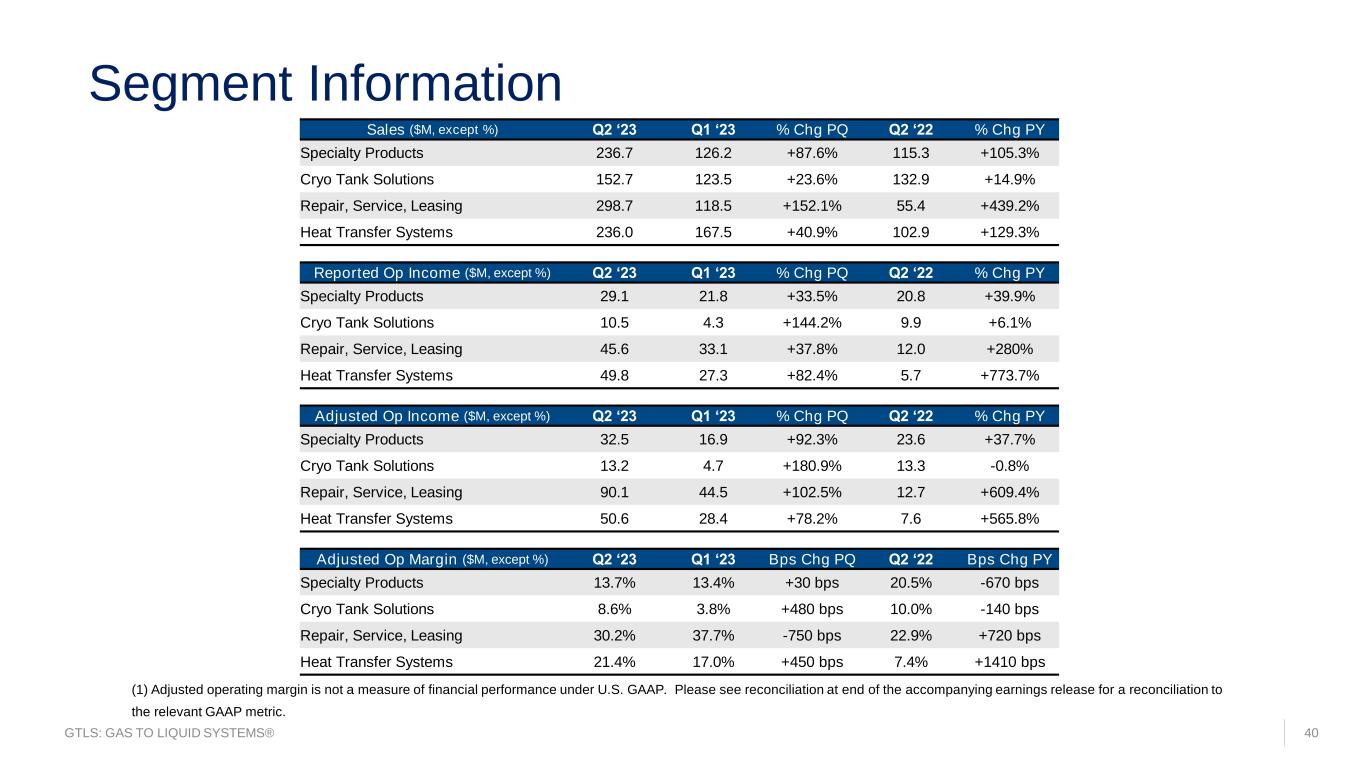

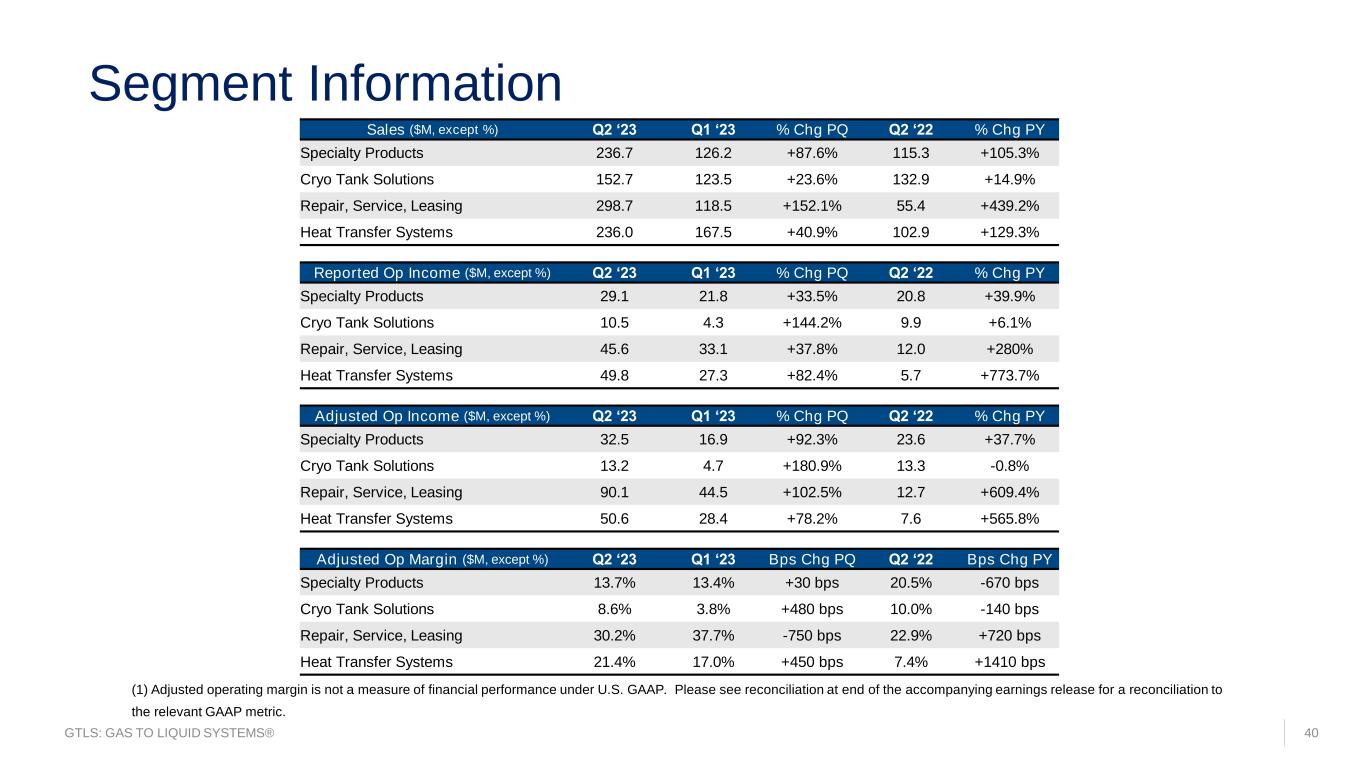

GTLS: GAS TO LIQUID SYSTEMS® 40 Segment Information (1) Adjusted operating margin is not a measure of financial performance under U.S. GAAP. Please see reconciliation at end of the accompanying earnings release for a reconciliation to the relevant GAAP metric. Sales ($M, except %) Q2 ‘23 Q1 ‘23 % Chg PQ Q2 ‘22 % Chg PY Specialty Products 236.7 126.2 +87.6% 115.3 +105.3% Cryo Tank Solutions 152.7 123.5 +23.6% 132.9 +14.9% Repair, Service, Leasing 298.7 118.5 +152.1% 55.4 +439.2% Heat Transfer Systems 236.0 167.5 +40.9% 102.9 +129.3% Reported Op Income ($M, except %) Q2 ‘23 Q1 ‘23 % Chg PQ Q2 ‘22 % Chg PY Specialty Products 29.1 21.8 +33.5% 20.8 +39.9% Cryo Tank Solutions 10.5 4.3 +144.2% 9.9 +6.1% Repair, Service, Leasing 45.6 33.1 +37.8% 12.0 +280% Heat Transfer Systems 49.8 27.3 +82.4% 5.7 +773.7% Adjusted Op Income ($M, except %) Q2 ‘23 Q1 ‘23 % Chg PQ Q2 ‘22 % Chg PY Specialty Products 32.5 16.9 +92.3% 23.6 +37.7% Cryo Tank Solutions 13.2 4.7 +180.9% 13.3 -0.8% Repair, Service, Leasing 90.1 44.5 +102.5% 12.7 +609.4% Heat Transfer Systems 50.6 28.4 +78.2% 7.6 +565.8% Adjusted Op Margin ($M, except %) Q2 ‘23 Q1 ‘23 Bps Chg PQ Q2 ‘22 Bps Chg PY Specialty Products 13.7% 13.4% +30 bps 20.5% -670 bps Cryo Tank Solutions 8.6% 3.8% +480 bps 10.0% -140 bps Repair, Service, Leasing 30.2% 37.7% -750 bps 22.9% +720 bps Heat Transfer Systems 21.4% 17.0% +450 bps 7.4% +1410 bps