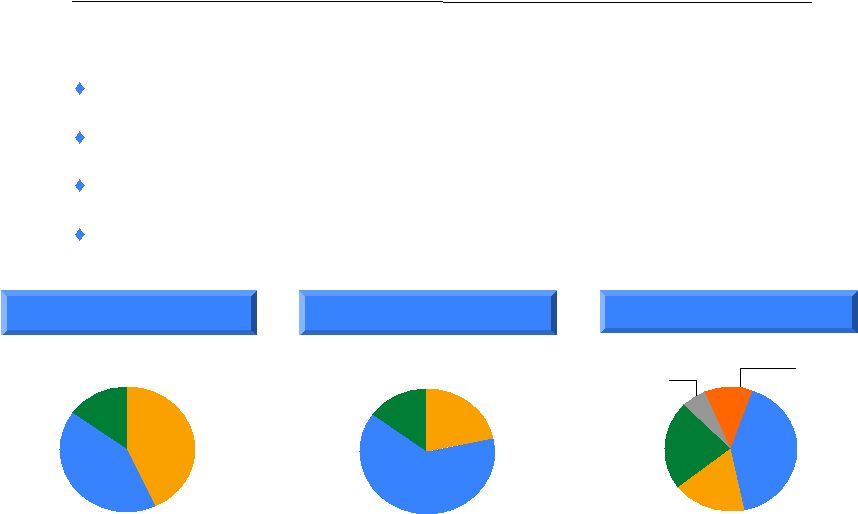

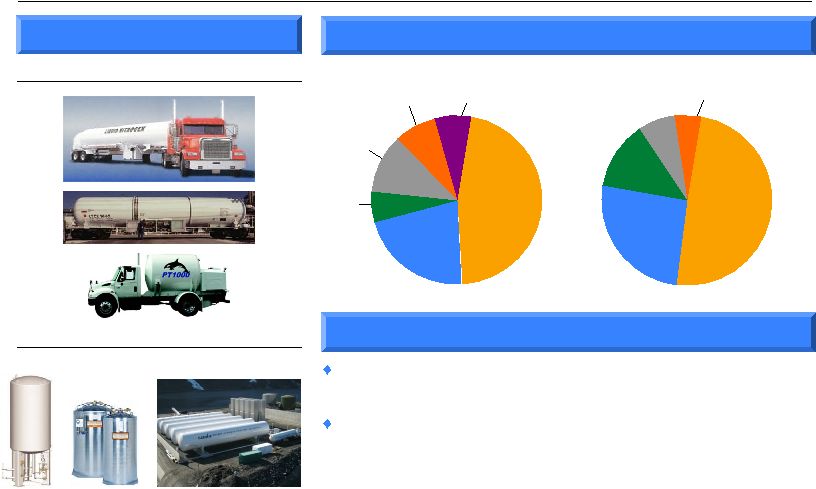

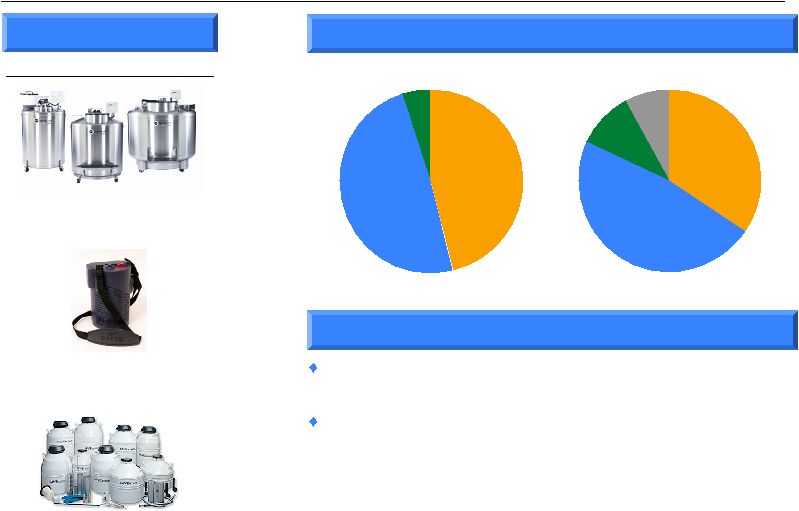

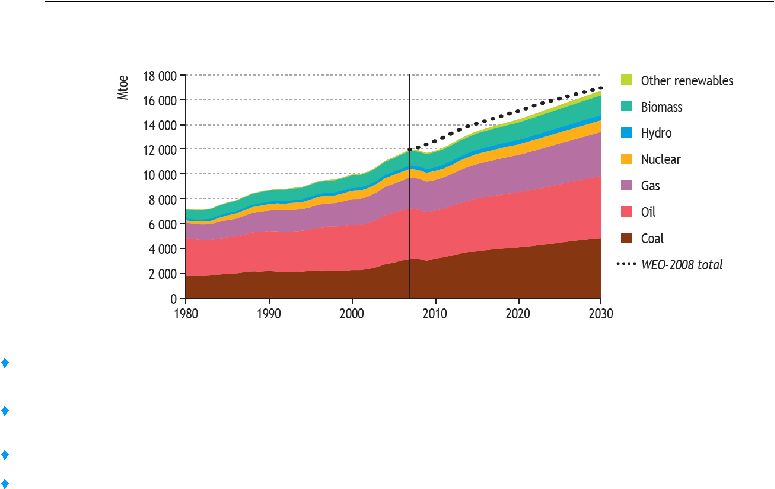

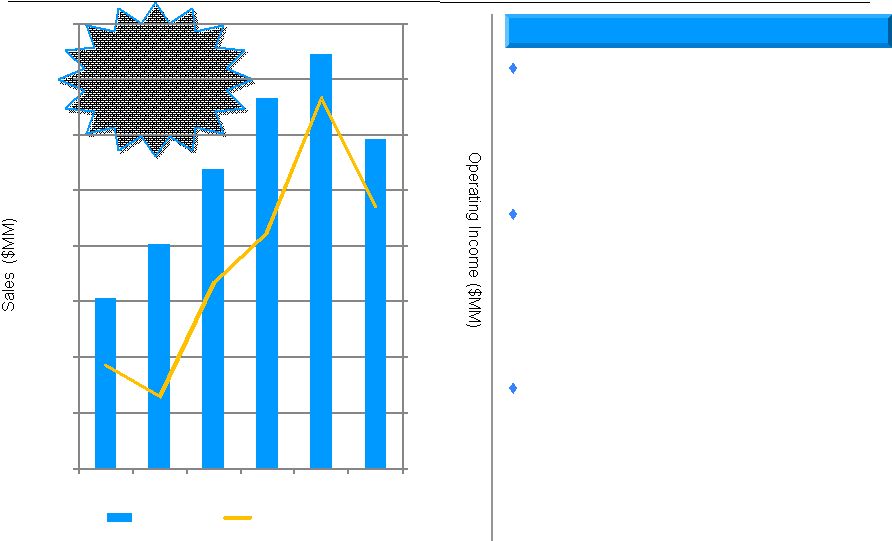

Summary of Investment Highlights End markets are positioned to recover with strong energy demand – Energy demand recently forecasted to expand 40% between now and 2030* – Global investment of $26 trillion, over $1 trillion/year, is needed to keep up with demand* A market leader – Leading market position in all segments – Strong balance sheet with significant liquidity Aggressive response to the economic downturn – Cost management made a priority along with operations excellence – Flexible cost structure provides the ability to quickly downsize SG&A and plant overhead costs – Have emerged more strongly positioned Continued growth initiatives – Six acquisitions completed since 2006 – Expect continued strategic, accretive acquisition activity – New product development taking advantage of leading proprietary technology and designs Strong track record of maximizing operating efficiencies and growth – 14% sales compound annual growth rate (“CAGR”) 2004 through 2009 – 21% operating income CAGR 2004 through 2009 6 * Source: International Energy Agency - World Energy Outlook 2009, Reference Scenario. Based on assumption that governments do not change their policies relating to energy; differences would arise should governments change energy policies |