Chart’s Acquisition of Harsco’s Air-X-Changers Business May 9, 2019 Exhibit 99.2

Forward Looking Statements Certain statements made in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning the Company’s business plans, including statements regarding the proposed acquisition of Harsco’s Industrial Air-X-Changer Business, cost synergies and efficiency savings, objectives, future orders, revenues, margins, earnings or performance, liquidity and cash flow, capital expenditures, business trends, governmental initiatives, including executive orders and other information that is not historical in nature. Forward-looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,” “guidance,” "continue," or the negative of such terms or comparable terminology. Forward-looking statements contained in this presentation or in other statements made by the Company are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control, that could cause the Company's actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include: the conditions to the completion of the acquisition may not be satisfied or the regulatory approvals required for the acquisition may not be obtained on the terms expected, on the anticipated schedule, or at all; long-term financing may not be available on favorable terms, or at all; closing of the acquisition may not occur or be delayed; the Company may be unable to achieve the anticipated benefits of the acquisition (including with respect to synergies); revenues following the acquisition may be lower than expected; operating costs, customer losses, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, and suppliers) may be greater than expected; and the other factors discussed in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully. The Company undertakes no obligation to update or revise any forward-looking statement. Chart is a leading diversified global manufacturer of highly engineered equipment servicing multiple market applications in Energy and Industrial Gas. The majority of Chart's products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end-use applications, a large portion of which are energy-related. Chart has domestic operations located across the United States and an international presence in Asia, Australia, Europe and the Americas. For more information, visit: http://www.chartindustries.com.

Agenda INDUSTRY DYNAMICS DEAL ECONOMICS & SYNERGIES CHART BUSINESS UPDATE HARSCO AIR-X-CHANGERS UPDATED GUIDANCE STRATEGIC RATIONALE

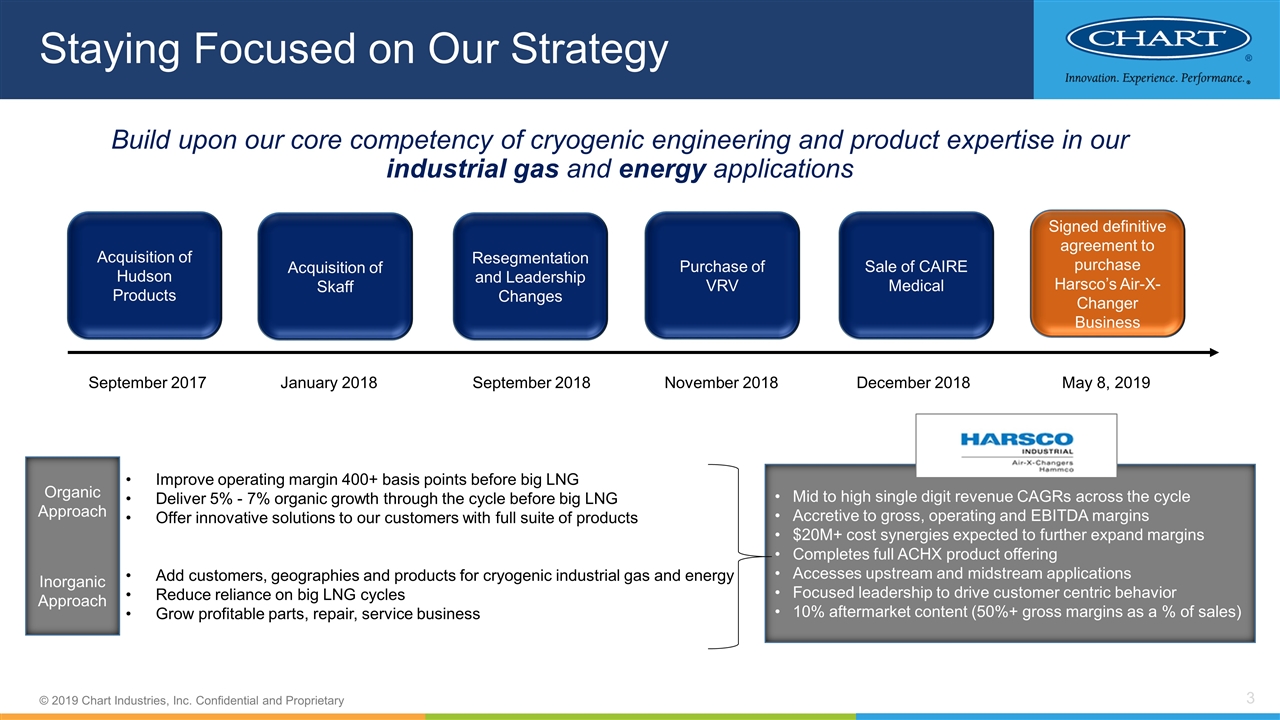

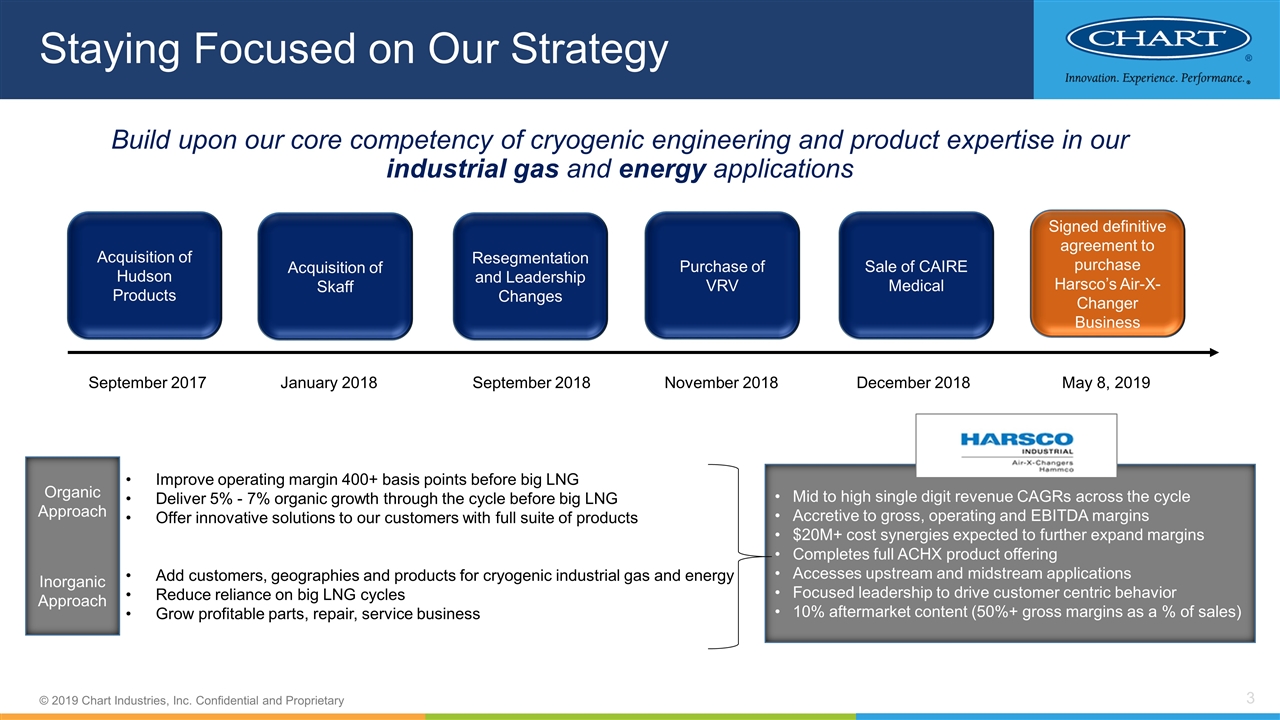

Build upon our core competency of cryogenic engineering and product expertise in our industrial gas and energy applications Staying Focused on Our Strategy Acquisition of Hudson Products Acquisition of Skaff Resegmentation and Leadership Changes Purchase of VRV Sale of CAIRE Medical September 2017January 2018September 2018November 2018December 2018 May 8, 2019 Signed definitive agreement to purchase Harsco’s Air-X-Changer Business Improve operating margin 400+ basis points before big LNG Deliver 5% - 7% organic growth through the cycle before big LNG Offer innovative solutions to our customers with full suite of products Add customers, geographies and products for cryogenic industrial gas and energy Reduce reliance on big LNG cycles Grow profitable parts, repair, service business Mid to high single digit revenue CAGRs across the cycle Accretive to gross, operating and EBITDA margins $20M+ cost synergies expected to further expand margins Completes full ACHX product offering Accesses upstream and midstream applications Focused leadership to drive customer centric behavior 10% aftermarket content (50%+ gross margins as a % of sales) Organic Approach Inorganic Approach

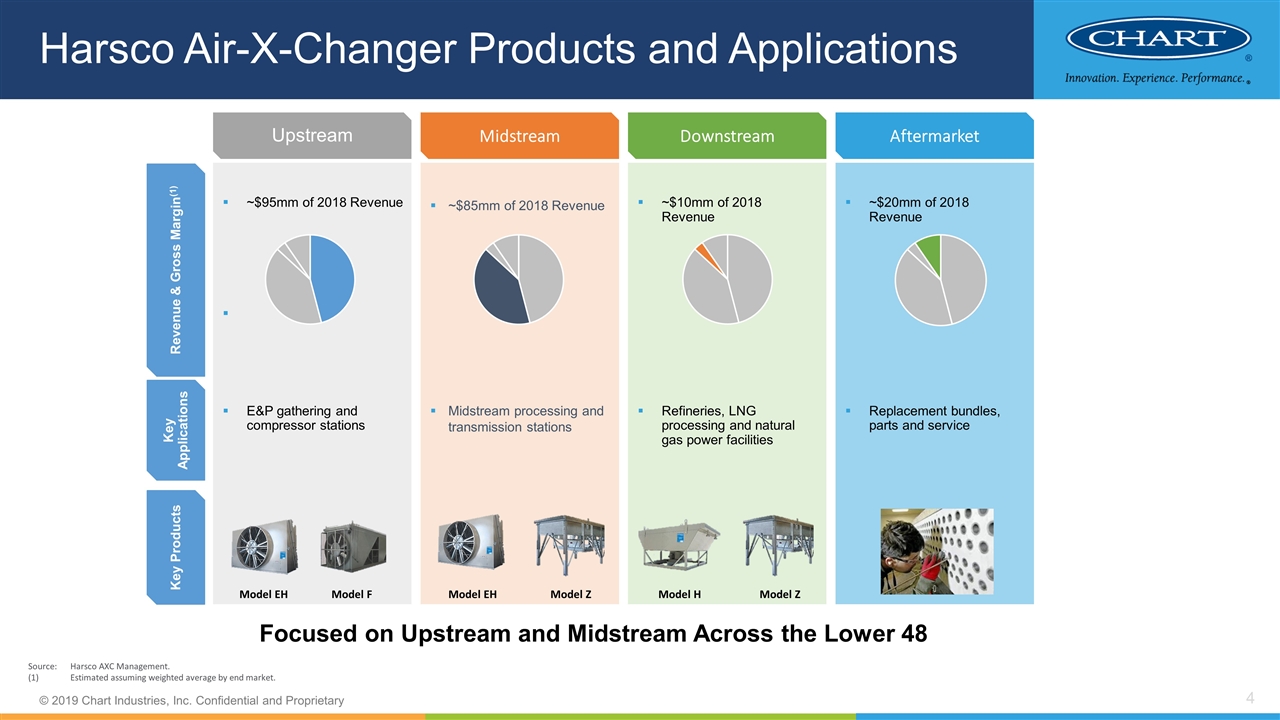

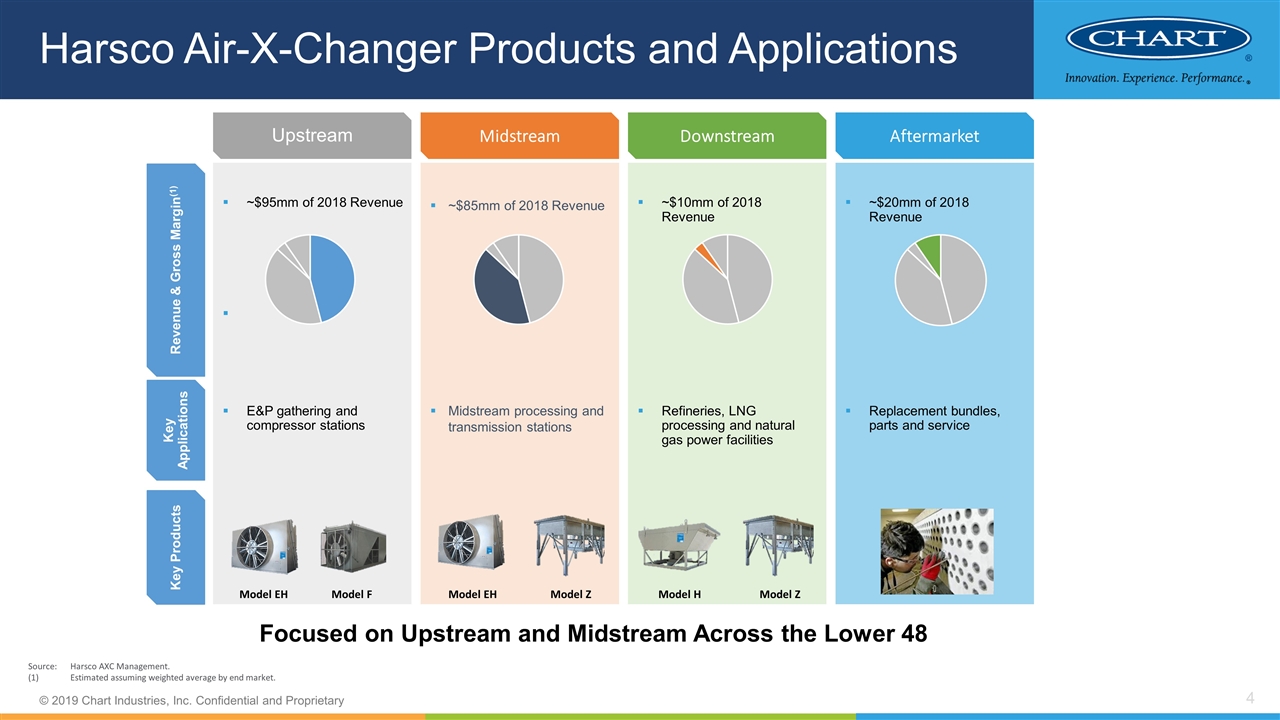

Harsco Air-X-Changer Products and Applications ~$20mm of 2018 Revenue Replacement bundles, parts and service ~$10mm of 2018 Revenue Refineries, LNG processing and natural gas power facilities Upstream ~$95mm of 2018 Revenue E&P gathering and compressor stations Revenue & Gross Margin(1) Key Products Key Applications ~$85mm of 2018 Revenue Midstream processing and transmission stations Midstream Downstream Aftermarket Model EH Model F Model EH Model Z Model H Model Z Source:Harsco AXC Management. (1)Estimated assuming weighted average by end market. Focused on Upstream and Midstream Across the Lower 48

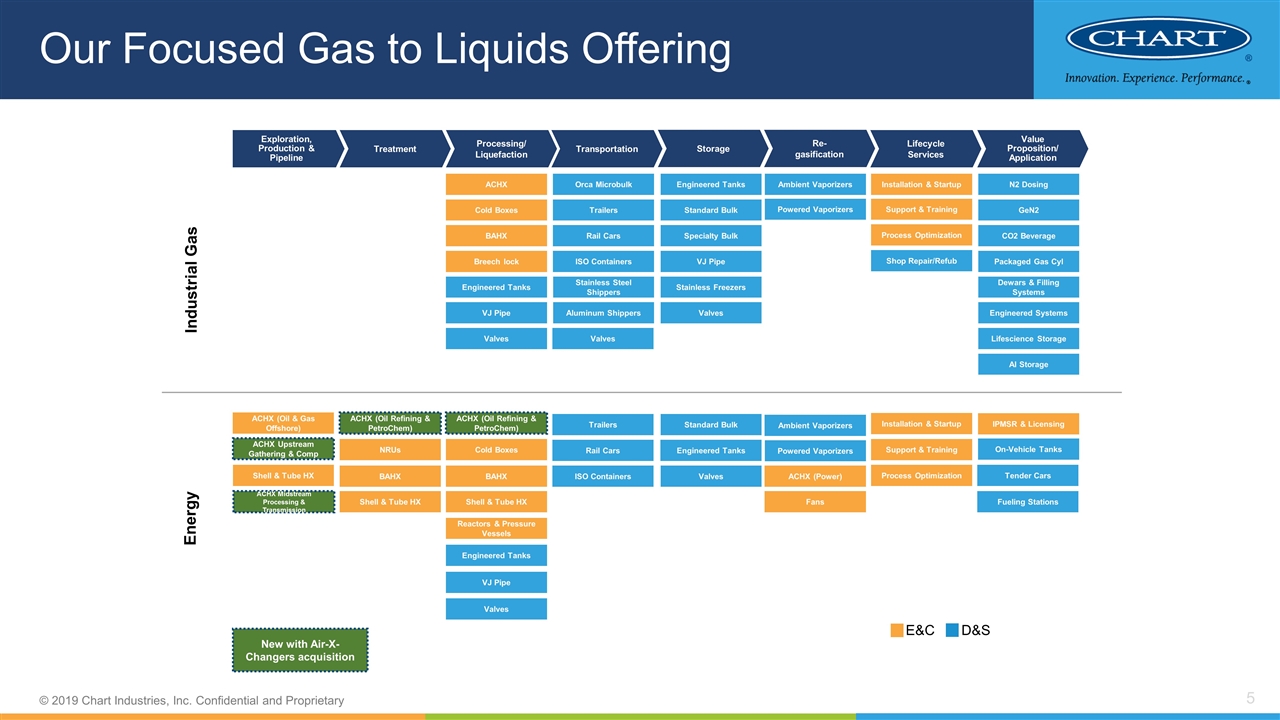

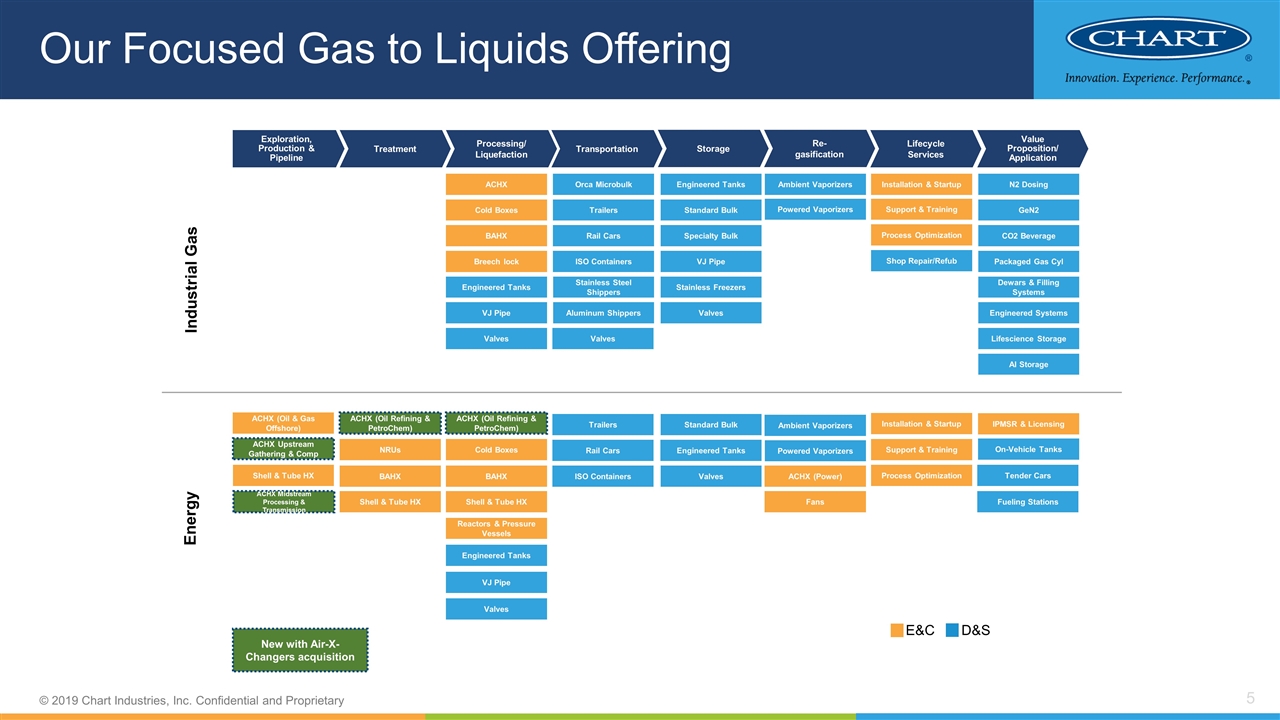

Our Focused Gas to Liquids Offering E&C D&S Exploration, Production & Pipeline Processing/ Liquefaction Treatment Transportation Storage Lifecycle Services Value Proposition/ Application Re- gasification Industrial Gas Energy Engineered Tanks Engineered Tanks VJ Pipe Engineered Tanks VJ Pipe Trailers Shop Repair/Refub Rail Cars Standard Bulk Specialty Bulk ISO Containers Trailers Rail Cars ISO Containers Ambient Vaporizers Powered Vaporizers Ambient Vaporizers Powered Vaporizers VJ Pipe Orca Microbulk Standard Bulk Engineered Tanks Fueling Stations On-Vehicle Tanks Tender Cars N2 Dosing GeN2 CO2 Beverage Packaged Gas Cyl Dewars & Filling Systems Engineered Systems ACHX (Oil & Gas Offshore) ACHX (Oil Refining & PetroChem) NRUs ACHX (Oil Refining & PetroChem) ACHX Cold Boxes BAHX Installation & Startup Support & Training Process Optimization Installation & Startup Support & Training Process Optimization Cold Boxes BAHX IPMSR & Licensing ACHX (Power) Fans Stainless Freezers Stainless Steel Shippers Aluminum Shippers Lifescience Storage AI Storage Breech lock Shell & Tube HX Valves Valves Valves Valves Valves BAHX ACHX Upstream Gathering & Comp Reactors & Pressure Vessels New with Air-X-Changers acquisition Shell & Tube HX Shell & Tube HX ACHX Midstream Processing & Transmission

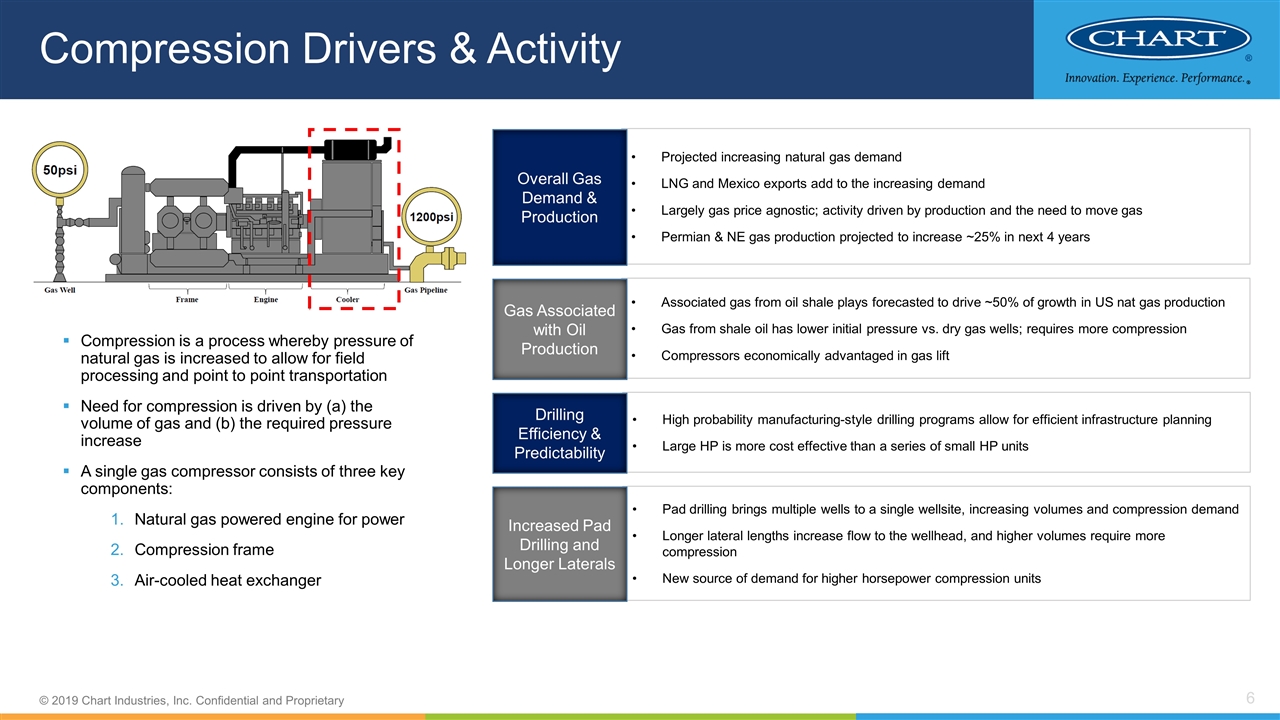

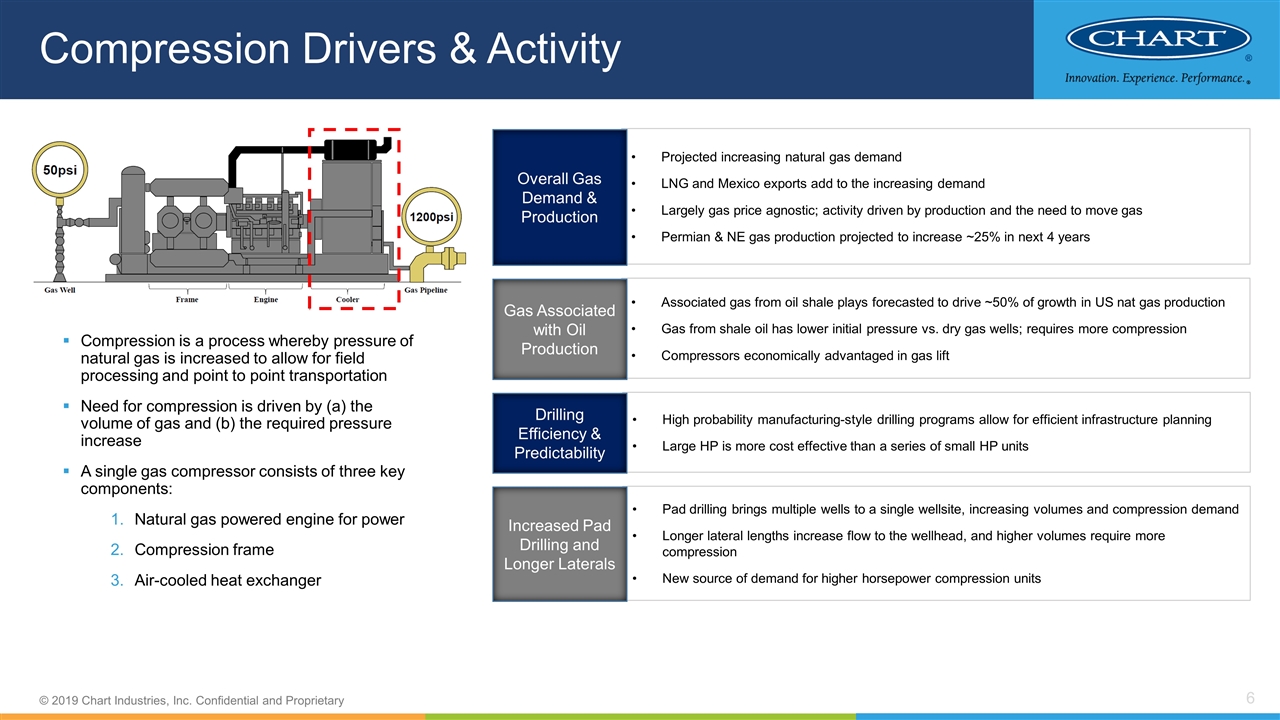

Compression Drivers & Activity Associated gas from oil shale plays forecasted to drive ~50% of growth in US nat gas production Gas from shale oil has lower initial pressure vs. dry gas wells; requires more compression Compressors economically advantaged in gas lift High probability manufacturing-style drilling programs allow for efficient infrastructure planning Large HP is more cost effective than a series of small HP units Pad drilling brings multiple wells to a single wellsite, increasing volumes and compression demand Longer lateral lengths increase flow to the wellhead, and higher volumes require more compression New source of demand for higher horsepower compression units Projected increasing natural gas demand LNG and Mexico exports add to the increasing demand Largely gas price agnostic; activity driven by production and the need to move gas Permian & NE gas production projected to increase ~25% in next 4 years Compression is a process whereby pressure of natural gas is increased to allow for field processing and point to point transportation Need for compression is driven by (a) the volume of gas and (b) the required pressure increase A single gas compressor consists of three key components: Natural gas powered engine for power Compression frame Air-cooled heat exchanger Gas Associated with Oil Production Drilling Efficiency & Predictability Increased Pad Drilling and Longer Laterals Overall Gas Demand & Production

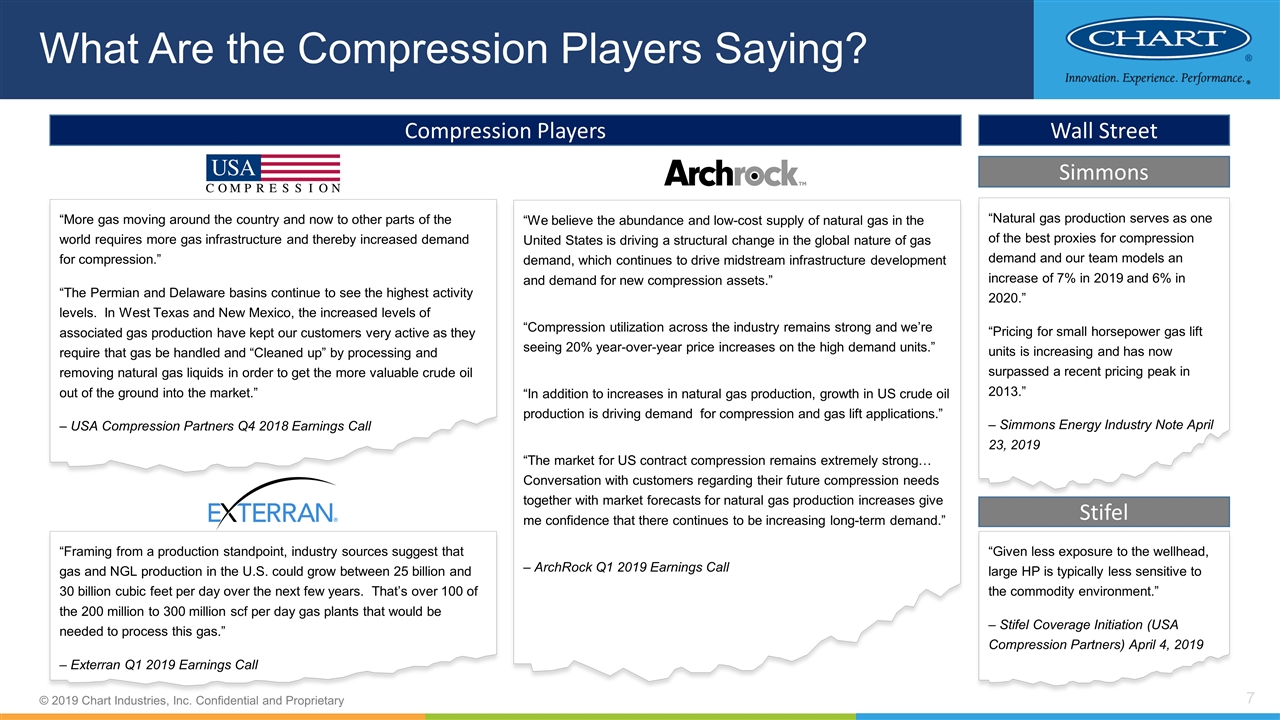

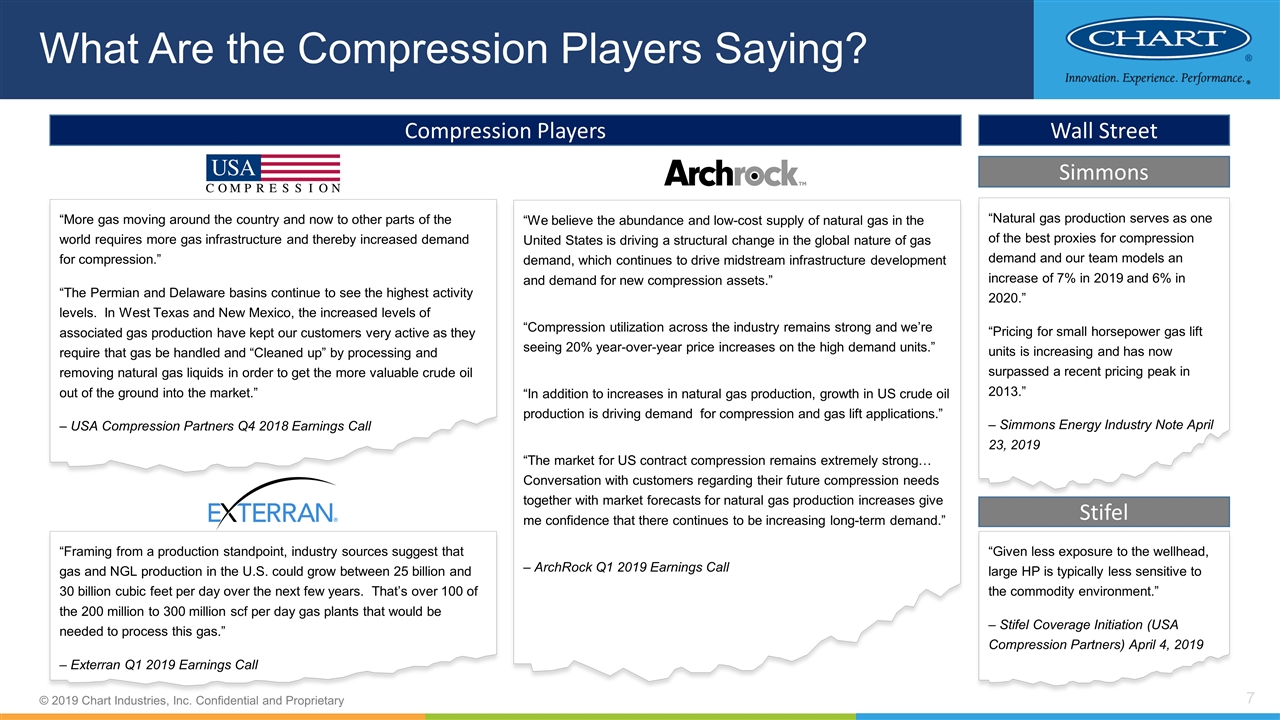

What Are the Compression Players Saying? Compression Players Wall Street “Natural gas production serves as one of the best proxies for compression demand and our team models an increase of 7% in 2019 and 6% in 2020.” “Pricing for small horsepower gas lift units is increasing and has now surpassed a recent pricing peak in 2013.” – Simmons Energy Industry Note April 23, 2019 “Given less exposure to the wellhead, large HP is typically less sensitive to the commodity environment.” – Stifel Coverage Initiation (USA Compression Partners) April 4, 2019 “More gas moving around the country and now to other parts of the world requires more gas infrastructure and thereby increased demand for compression.” “The Permian and Delaware basins continue to see the highest activity levels. In West Texas and New Mexico, the increased levels of associated gas production have kept our customers very active as they require that gas be handled and “Cleaned up” by processing and removing natural gas liquids in order to get the more valuable crude oil out of the ground into the market.” – USA Compression Partners Q4 2018 Earnings Call “Framing from a production standpoint, industry sources suggest that gas and NGL production in the U.S. could grow between 25 billion and 30 billion cubic feet per day over the next few years. That’s over 100 of the 200 million to 300 million scf per day gas plants that would be needed to process this gas.” – Exterran Q1 2019 Earnings Call Simmons Stifel “We believe the abundance and low-cost supply of natural gas in the United States is driving a structural change in the global nature of gas demand, which continues to drive midstream infrastructure development and demand for new compression assets.” “Compression utilization across the industry remains strong and we’re seeing 20% year-over-year price increases on the high demand units.” “In addition to increases in natural gas production, growth in US crude oil production is driving demand for compression and gas lift applications.” “The market for US contract compression remains extremely strong… Conversation with customers regarding their future compression needs together with market forecasts for natural gas production increases give me confidence that there continues to be increasing long-term demand.” – ArchRock Q1 2019 Earnings Call

Deal Economics & Synergies Continued Balance Sheet Strength Significant Cost Synergies Transaction Specifics $592M purchase price Expected $90M of tax benefits 9.9X forecasted 2019 EBITDA multiple Gross margin, operating margin and adjusted EPS accretive in year one Strong free cash flow generation Accretive to Chart ROIC by year 1; Forecasting ~13% acquisition ROIC by year two Expected close in summer 2019, subject to customary closing conditions, including the expiration of the applicable waiting period under the HSR Act Transaction to be funded with cash on hand, existing credit facilities, and additional strategic financing Continued expectation to be <3X leverage in three year period Over $20M of cost synergies within the first 12 months of ownership Facility consolidations Strategic manufacturing Sourcing Utilization of our Hudson fans in all ACHXs Focused leadership

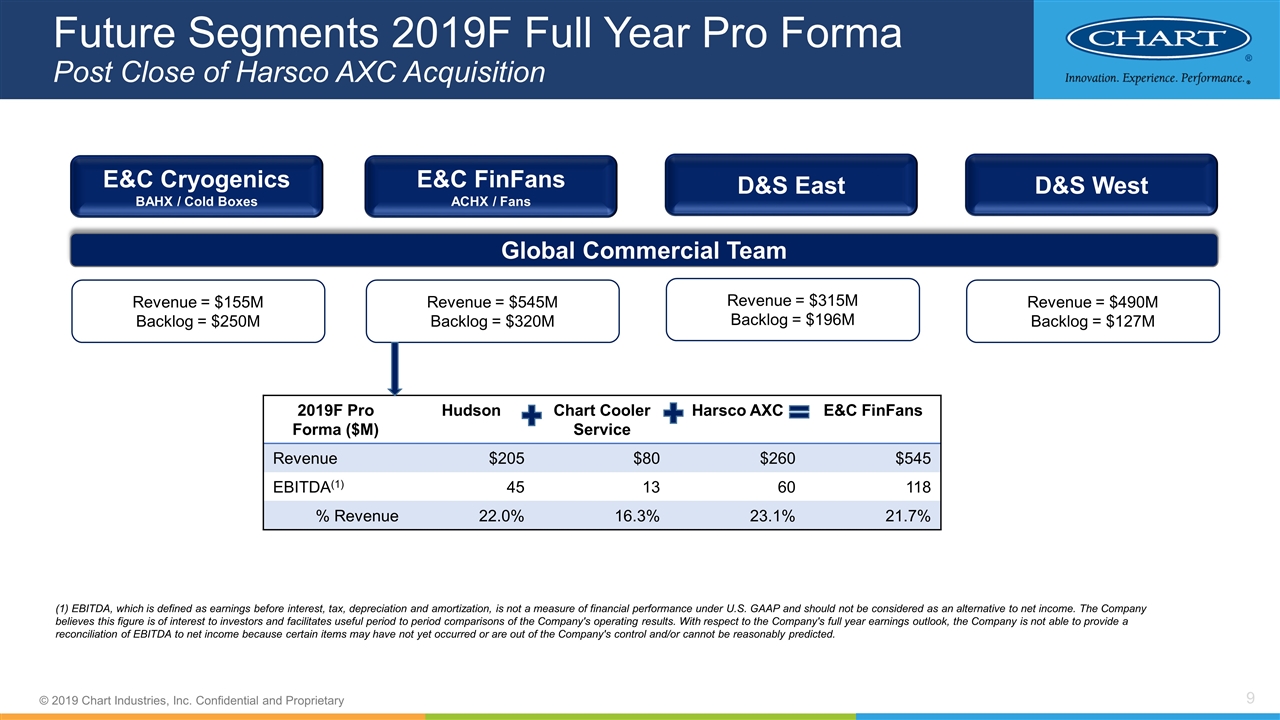

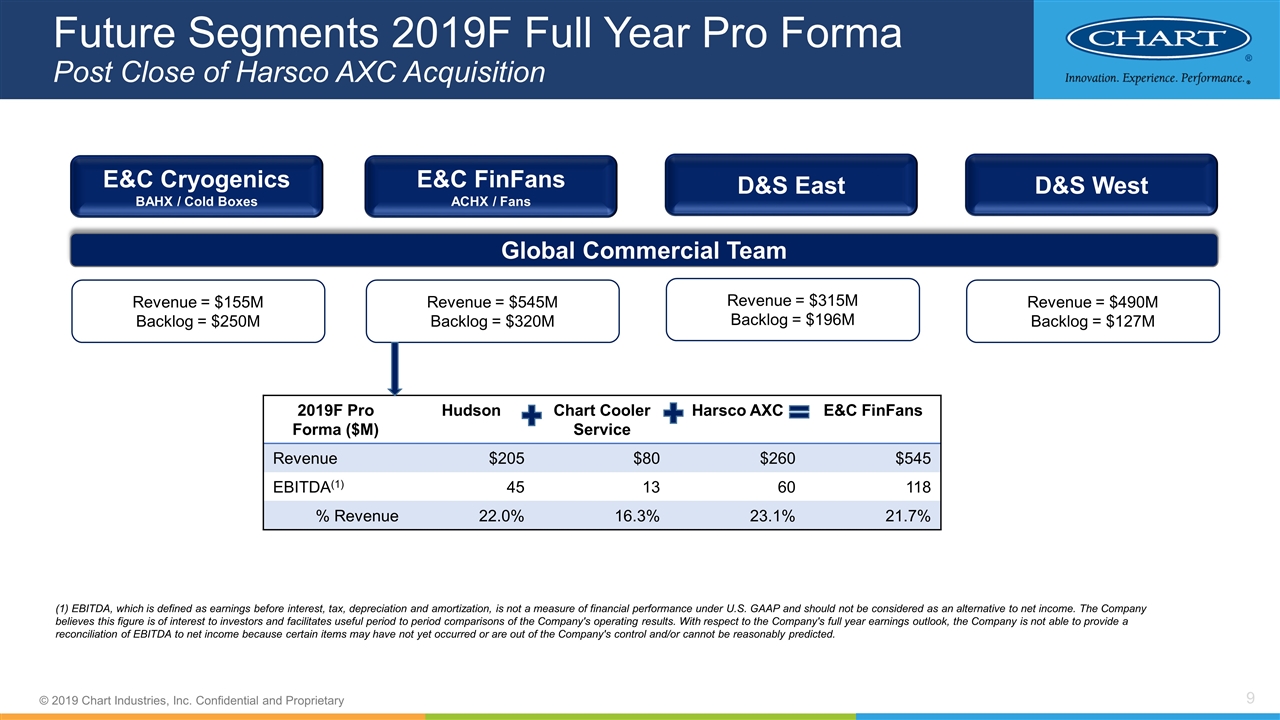

Future Segments 2019F Full Year Pro Forma Post Close of Harsco AXC Acquisition (1) EBITDA, which is defined as earnings before interest, tax, depreciation and amortization, is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to net income. The Company believes this figure is of interest to investors and facilitates useful period to period comparisons of the Company's operating results. With respect to the Company's full year earnings outlook, the Company is not able to provide a reconciliation of EBITDA to net income because certain items may have not yet occurred or are out of the Company's control and/or cannot be reasonably predicted. E&C Cryogenics BAHX / Cold Boxes D&S East D&S West Revenue = $155M Backlog = $250M Revenue = $315M Backlog = $196M Revenue = $490M Backlog = $127M E&C FinFans ACHX / Fans Revenue = $545M Backlog = $320M Global Commercial Team 2019F Pro Forma ($M) Hudson Chart Cooler Service Harsco AXC E&C FinFans Revenue $205 $80 $260 $545 EBITDA(1) 45 13 60 118 % Revenue 22.0% 16.3% 23.1% 21.7%

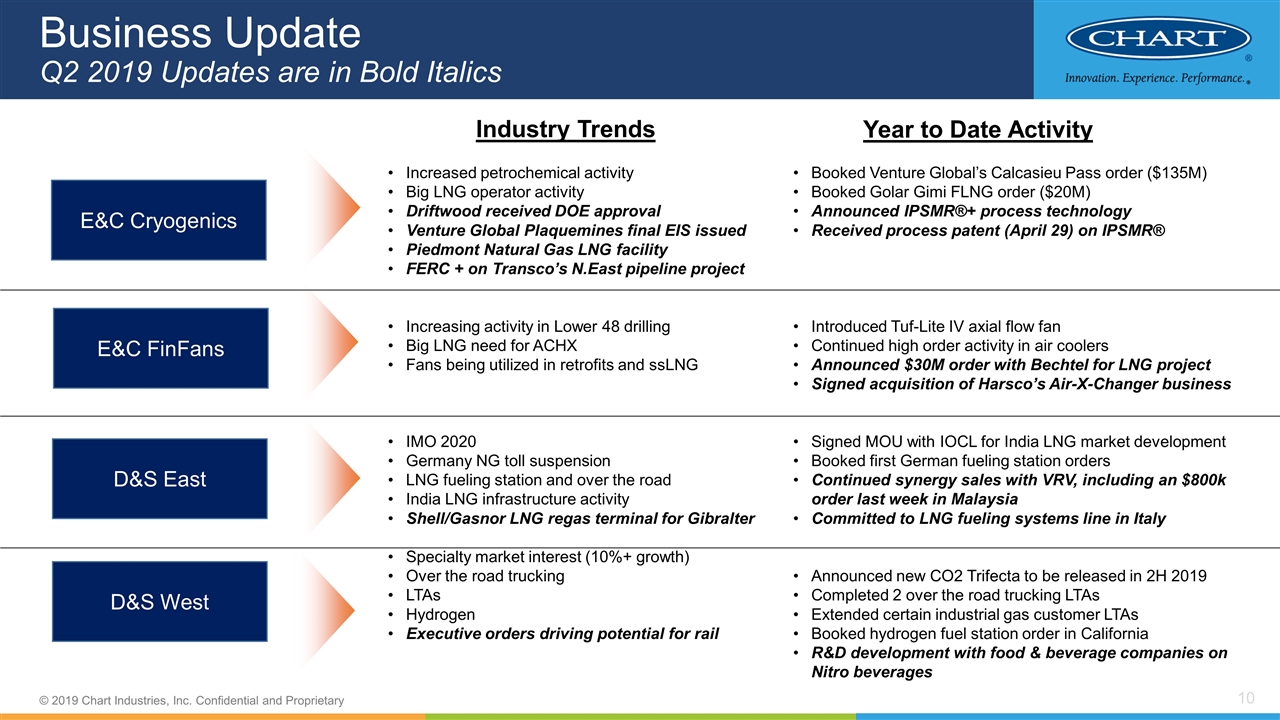

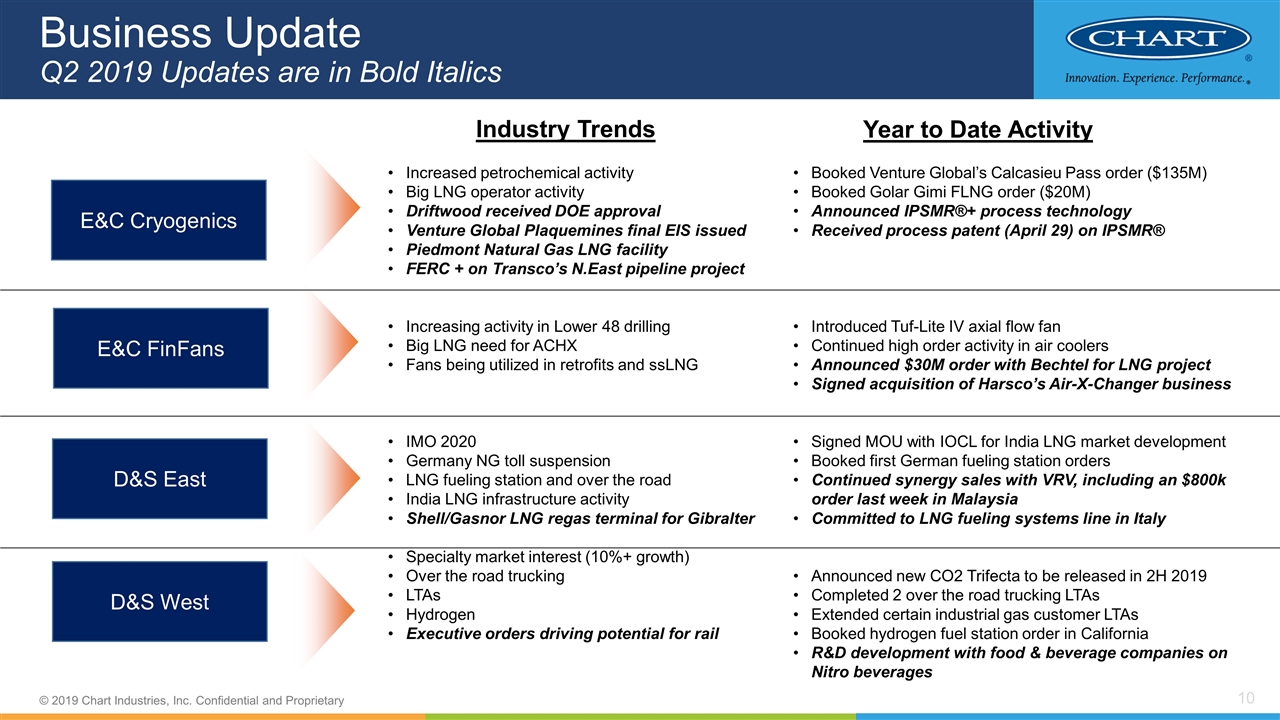

Business Update Q2 2019 Updates are in Bold Italics Industry Trends Increased petrochemical activity Big LNG operator activity Driftwood received DOE approval Venture Global Plaquemines final EIS issued Piedmont Natural Gas LNG facility FERC + on Transco’s N.East pipeline project Increasing activity in Lower 48 drilling Big LNG need for ACHX Fans being utilized in retrofits and ssLNG IMO 2020 Germany NG toll suspension LNG fueling station and over the road India LNG infrastructure activity Shell/Gasnor LNG regas terminal for Gibralter Specialty market interest (10%+ growth) Over the road trucking LTAs Hydrogen Executive orders driving potential for rail Year to Date Activity Booked Venture Global’s Calcasieu Pass order ($135M) Booked Golar Gimi FLNG order ($20M) Announced IPSMR®+ process technology Received process patent (April 29) on IPSMR® Introduced Tuf-Lite IV axial flow fan Continued high order activity in air coolers Announced $30M order with Bechtel for LNG project Signed acquisition of Harsco’s Air-X-Changer business Signed MOU with IOCL for India LNG market development Booked first German fueling station orders Continued synergy sales with VRV, including an $800k order last week in Malaysia Committed to LNG fueling systems line in Italy Announced new CO2 Trifecta to be released in 2H 2019 Completed 2 over the road trucking LTAs Extended certain industrial gas customer LTAs Booked hydrogen fuel station order in California R&D development with food & beverage companies on Nitro beverages E&C Cryogenics E&C FinFans D&S East D&S West

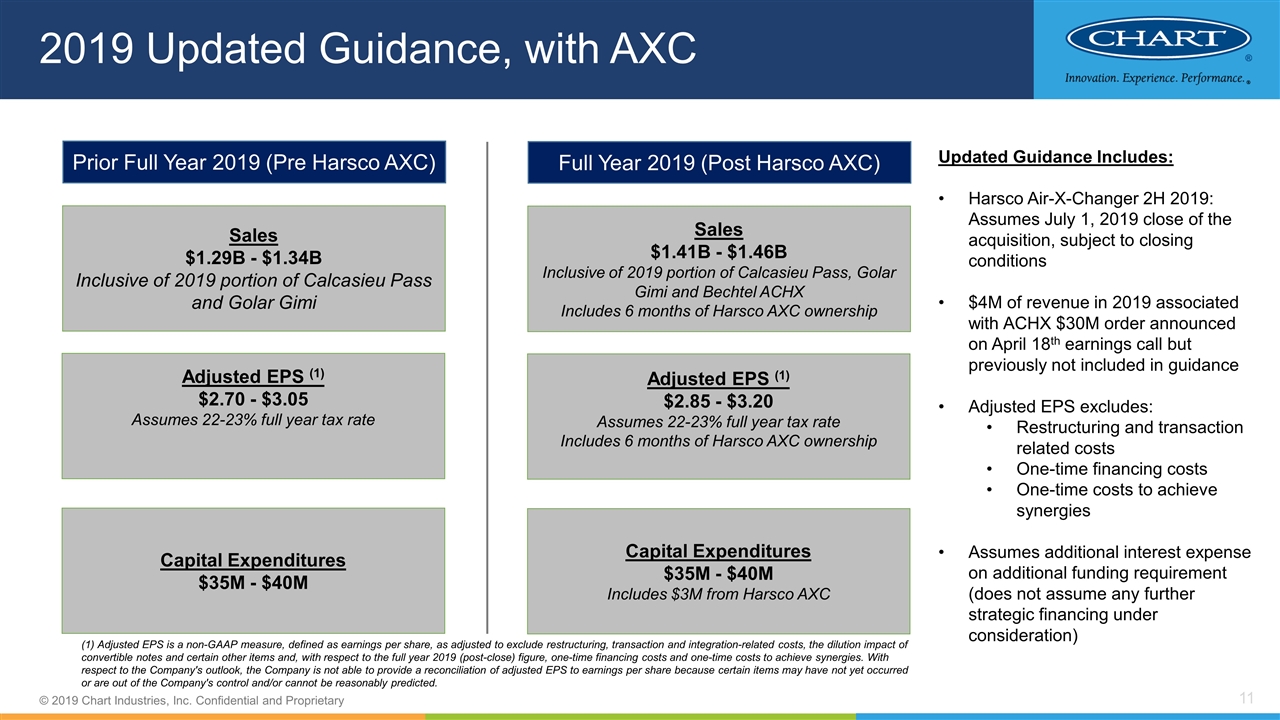

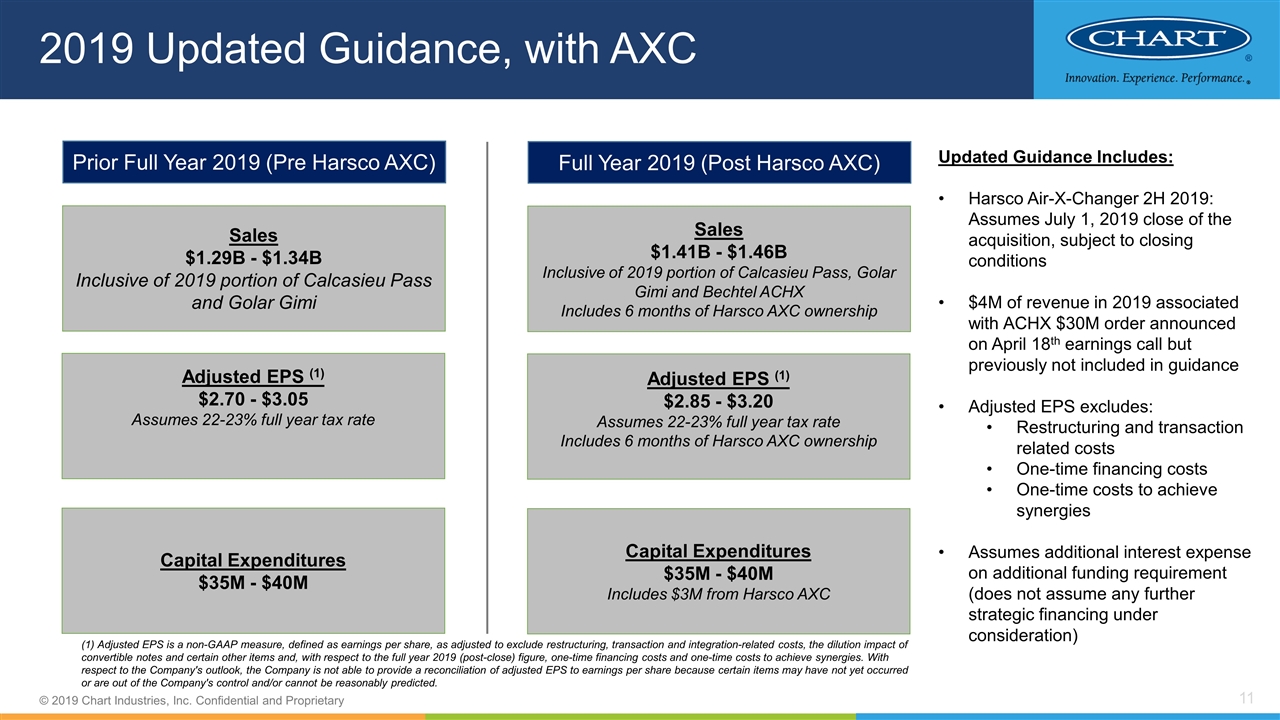

2019 Updated Guidance, with AXC Prior Full Year 2019 (Pre Harsco AXC) Sales $1.29B - $1.34B Inclusive of 2019 portion of Calcasieu Pass and Golar Gimi Adjusted EPS (1) $2.70 - $3.05 Assumes 22-23% full year tax rate Capital Expenditures $35M - $40M Full Year 2019 (Post Harsco AXC) Sales $1.41B - $1.46B Inclusive of 2019 portion of Calcasieu Pass, Golar Gimi and Bechtel ACHX Includes 6 months of Harsco AXC ownership Adjusted EPS (1) $2.85 - $3.20 Assumes 22-23% full year tax rate Includes 6 months of Harsco AXC ownership Capital Expenditures $35M - $40M Includes $3M from Harsco AXC Updated Guidance Includes: Harsco Air-X-Changer 2H 2019: Assumes July 1, 2019 close of the acquisition, subject to closing conditions $4M of revenue in 2019 associated with ACHX $30M order announced on April 18th earnings call but previously not included in guidance Adjusted EPS excludes: Restructuring and transaction related costs One-time financing costs One-time costs to achieve synergies Assumes additional interest expense on additional funding requirement (does not assume any further strategic financing under consideration) (1) Adjusted EPS is a non-GAAP measure, defined as earnings per share, as adjusted to exclude restructuring, transaction and integration-related costs, the dilution impact of convertible notes and certain other items and, with respect to the full year 2019 (post-close) figure, one-time financing costs and one-time costs to achieve synergies. With respect to the Company's outlook, the Company is not able to provide a reconciliation of adjusted EPS to earnings per share because certain items may have not yet occurred or are out of the Company's control and/or cannot be reasonably predicted.

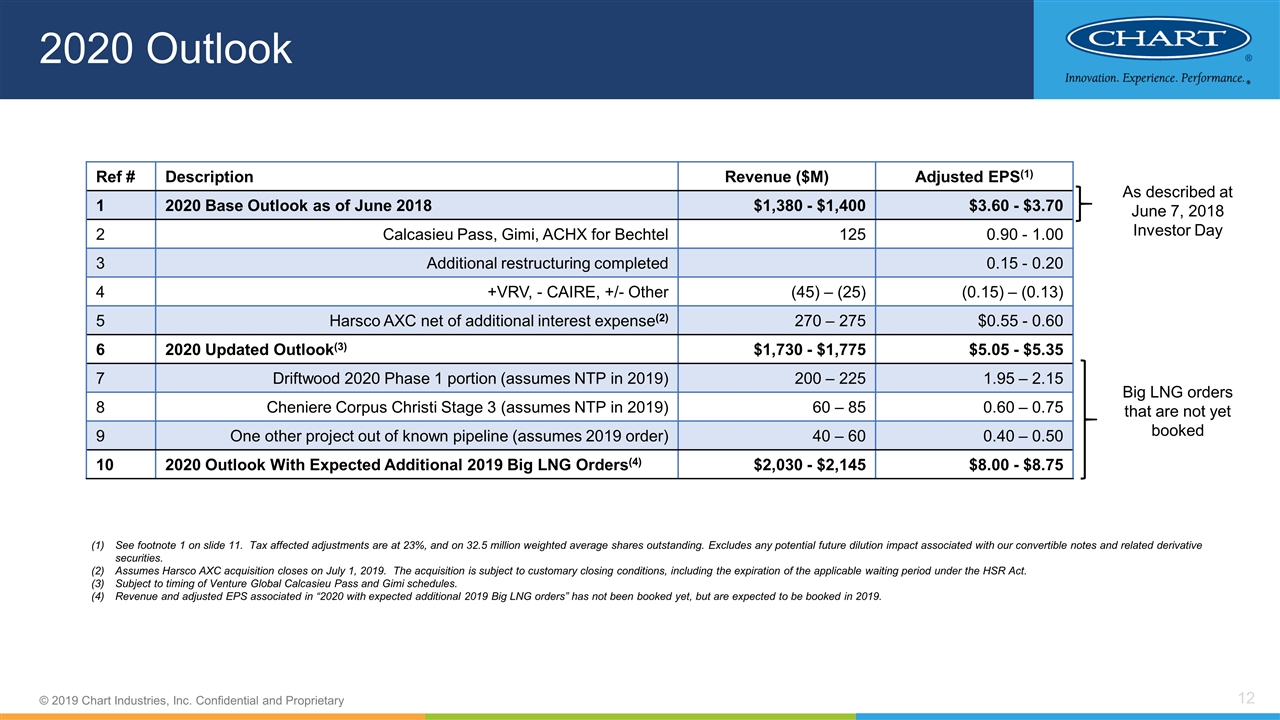

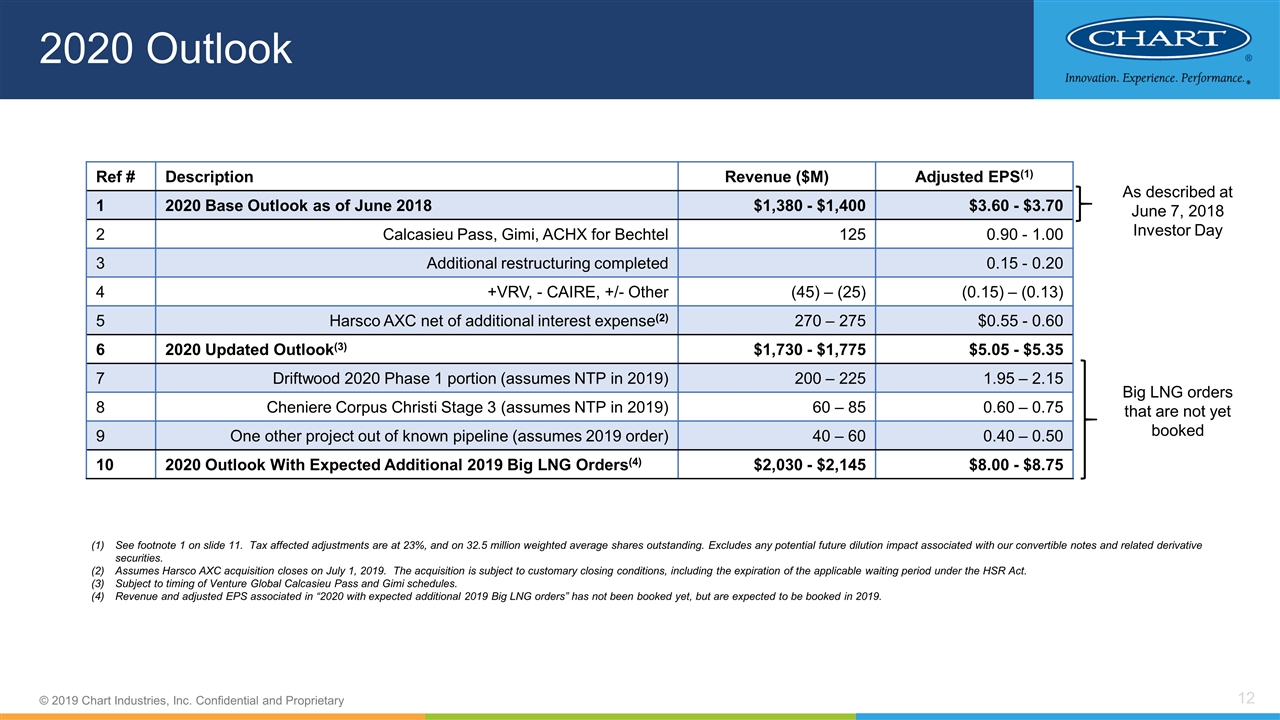

2020 Outlook Ref # Description Revenue ($M) Adjusted EPS(1) 1 2020 Base Outlook as of June 2018 $1,380 - $1,400 $3.60 - $3.70 2 Calcasieu Pass, Gimi, ACHX for Bechtel 125 0.90 - 1.00 3 Additional restructuring completed 0.15 - 0.20 4 +VRV, - CAIRE, +/- Other (45) – (25) (0.15) – (0.13) 5 Harsco AXC net of additional interest expense(2) 270 – 275 $0.55 - 0.60 6 2020 Updated Outlook(3) $1,730 - $1,775 $5.05 - $5.35 7 Driftwood 2020 Phase 1 portion (assumes NTP in 2019) 200 – 225 1.95 – 2.15 8 Cheniere Corpus Christi Stage 3 (assumes NTP in 2019) 60 – 85 0.60 – 0.75 9 One other project out of known pipeline (assumes 2019 order) 40 – 60 0.40 – 0.50 10 2020 Outlook With Expected Additional 2019 Big LNG Orders(4) $2,030 - $2,145 $8.00 - $8.75 Big LNG orders that are not yet booked See footnote 1 on slide 11. Tax affected adjustments are at 23%, and on 32.5 million weighted average shares outstanding. Excludes any potential future dilution impact associated with our convertible notes and related derivative securities. Assumes Harsco AXC acquisition closes on July 1, 2019. The acquisition is subject to customary closing conditions, including the expiration of the applicable waiting period under the HSR Act. Subject to timing of Venture Global Calcasieu Pass and Gimi schedules. Revenue and adjusted EPS associated in “2020 with expected additional 2019 Big LNG orders” has not been booked yet, but are expected to be booked in 2019. As described at June 7, 2018 Investor Day