Exhibit 99.1 2 0 2 2 Chart Industries Investor Day May 5, 2022

“Chart’s vision is to be the global leader in design, engineering and manufacturing of cryogenic process technology and equipment to the clean energy, industrial gas and diversified specialty markets regardless of molecule. We focus on leveraging our organic solution offering, manufacturing footprint and inorganically adding technologies and equipment to round it out for full solutions what we call “ The Nexus of Clean™” – clean power, clean water, clean food, and clean industrials.” Jillian Evanko President & Chief Executive Officer GTLS: Gas to Liquid Systems® © 2022 Chart Industries, Inc. Confidential and Proprietary 2

Forward-Looking Statements CERTAIN STATEMENTS MADE IN THIS PRESENTATION ARE FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING THE COMPANY’S BUSINESS PLANS, INCLUDING STATEMENTS REGARDING COMPLETED ACQUISITIONS, COST SYNERGIES AND EFFICIENCY SAVINGS, OBJECTIVES, FUTURE ORDERS, REVENUES, MARGINS, SEGMENT SALES MIX, EARNINGS OR PERFORMANCE, LIQUIDITY AND CASH FLOW, INVENTORY LEVELS, CAPITAL EXPENDITURES, BUSINESS TRENDS, MATERIALS COSTS AND PRICING INCREASES, CLEAN ENERGY MARKET OPPORTUNITIES, GOVERNMENTAL INITIATIVES, INCLUDING EXECUTIVE ORDERS AND OTHER INFORMATION THAT IS NOT HISTORICAL IN NATURE. FORWARD-LOOKING STATEMENTS MAY BE IDENTIFIED BY TERMINOLOGY SUCH AS MAY, WILL, SHOULD, COULD, EXPECTS, ANTICIPATES, BELIEVES, PROJECTS, FORECASTS, “OUTLOOK,” “GUIDANCE,” CONTINUE, OR THE NEGATIVE OF SUCH TERMS OR COMPARABLE TERMINOLOGY. FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION OR IN OTHER STATEMENTS MADE BY THE COMPANY ARE MADE BASED ON MANAGEMENT'S EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS IMPACTING THE COMPANY AND ARE SUBJECT TO UNCERTAINTIES AND FACTORS RELATING TO THE COMPANY'S OPERATIONS AND BUSINESS ENVIRONMENT, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND THE COMPANY'S CONTROL, THAT COULD CAUSE THE COMPANY'S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE MATTERS EXPRESSED OR IMPLIED BY FORWARD-LOOKING STATEMENTS. FACTORS THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS INCLUDE: RISKS RELATING TO THE OUTBREAK AND CONTINUED UNCERTAINTY ASSOCIATED WITH THE CORONAVIRUS (COVID-19), AND THE CONFLICT BETWEEN RUSSIA AND UKRAINE; THE COMPANY’S ABILITY TO SUCCESSFUL INTEGRATE RECENT ACQUISITIONS, AND ACHIEVE THE ANTICIPATED REVENUE, EARNINGS, ACCRETION AND OTHER BENEFITS FROM THESE ACQUISITIONS; SLOWER THAN ANTICIPATED GROWTH AND MARKET ACCEPTANCE OF NEW CLEAN ENERGY PRODUCT OFFERINGS; INABILITY TO ACHIEVE EXPECTED PRICING INCREASES OR CONTINUED SUPPLY CHAIN CHALLENGES INCLUDING VOLATILITY IN RAW MATERIAL COST AND SUPPLY; AND THE OTHER FACTORS DISCUSSED IN ITEM 1A (RISK FACTORS) IN THE COMPANY’S MOST RECENT ANNUAL REPORT ON FORM 10-K FILED WITH THE SEC, WHICH SHOULD BE REVIEWED CAREFULLY. THE COMPANY UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENT. THIS PRESENTATION CONTAINS NON-GAAP FINANCIAL INFORMATION FOR THE FULL YEAR 2022, INCLUDING ADJUSTED NON-DILUTED EPS AND ADJUSTED FREE CASH FLOW. THE COMPANY IS NOT ABLE TO PROVIDE A RECONCILIATION OF THE ADJUSTED EPS OR FREE CASH FLOW BECAUSE CERTAIN ITEMS MAY HAVE NOT YET OCCURRED OR ARE OUT OF THE COMPANY’S CONTROL AND/OR CANNOT BE REASONABLY PREDICTED. CHART IS A LEADING DIVERSIFIED GLOBAL MANUFACTURER OF HIGHLY ENGINEERED EQUIPMENT SERVICING MULTIPLE MARKET APPLICATIONS IN ENERGY AND INDUSTRIAL GAS. THE MAJORITY OF CHART'S PRODUCTS ARE USED THROUGHOUT THE LIQUID GAS SUPPLY CHAIN FOR PURIFICATION, LIQUEFACTION, DISTRIBUTION, STORAGE AND END-USE APPLICATIONS, A LARGE PORTION OF WHICH ARE ENERGY-RELATED. CHART HAS DOMESTIC OPERATIONS LOCATED ACROSS THE UNITED STATES AND AN INTERNATIONAL PRESENCE IN ASIA, AUSTRALIA, EUROPE AND THE AMERICAS. FOR MORE INFORMATION, VISIT: HTTP://WWW.CHARTINDUSTRIES.COM. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 3

Safety Moment - Forklift Safety Preventive Actions Taken Overview of the situation According to the Bureau of Labor and Statistics, nearly 100 • Fireflies: shines a blue light in front and back of forklift for locational workers are killed and another 20,000 are seriously injured in awareness. forklift-related incidents annually. Statistically, that means one • Convex mirrors: located at all blind corners. of every ten forklifts in the field will be involved in an accident • Dock Locks: to prevent trailer creep and drivers pulling away. every year. • Forklift Collision Systems: placed at facility intersections to prevent forklift/pedestrian collision. Every Chart team member has Stop Work Authority and Dock is encouraged to stop work if Fireflies Locks they see the potential for an unsafe or dangerous situation. We believe most accidents Forklift Convex and injuries are preventable Collision Mirrors System and that a job is well done only if it is done safely. Safety Customer Orientation Strong Work Ethic Have Fun GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 4

Our Company GTLS: Gas To Liquid Systems® ChaC rth Ia nrd t u Ins dtu rist es ri,e s, In c In . c. 2 0 22 02 2 2 In In vve esst to orr D Da ay y 5 5

Chart Executive Staff Jill Evanko Joe Brinkman Joe Belling Doug Ducote Gerry Vinci Herb Hotchkiss President & CEO Chief Financial Officer Chief Commercial Officer Chief Technology Officer Chief Human Resources General Counsel Officer Miroslav Cerny Sherry Shi Brad Babineaux Harry Labbe Shane Sumners President, Operations Vice President Vice President Vice President & General Vice President EMEA & India Operations, China Operations, North Manager, E&C FinFans Operations, America D&S West GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 6

Founders’ Innovation Team Rich Cavagnaro Greg Gilles Danny Mascari Rick Hessinger Co-Founder Co-Founder CEO Founder & CEO AdEdge AdEdge L.A. Turbine Cryo Technologies Larry Baxter Andy Baxter Amy George Co-Founder Co-Founder Founder & CEO SES SES Earthly Labs GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 7

Speakers Today (1/3) Jill Evanko Joe Brinkman CEO & President Chief Financial Officer • Jillian Evanko is President and Chief Executive Officer of Chart Industries, • Joe Brinkman is Vice President and Chief Financial Officer, serving in this Inc., serving in this capacity since June of 2018 after having joined Chart capacity since October 2021. in February of 2017. • Joe has been with Chart since 1993 and has held various roles across the • Prior to joining Chart, Jill was the Chief Financial Officer of Truck-Lite Co., organization, starting his career as a Product Engineer and then the LLC as well as having held multiple operational and financial executive Strategic Sourcing Manager for MVE. positions at Dover Corporation (NYSE: DOV) and its subsidiaries. • His former roles at Chart have included Materials Manager, Director of • Previously, Ms. Evanko held financial and operational roles at Arthur Global sourcing and most recently, Vice President and General Manager Andersen, LLP, Honeywell Corporation and Sony Corporation. of Bulk Gas Products. • Ms. Evanko also serves as an independent director of the Board of Parker • Joe holds a Bachelor of Science in Mechanical Engineering from the Hannifin Corporation (NYSE: PH). University of Minnesota and Masters of Business Administration from the Carlson School of Management at the University of Minnesota. • Jill received a Master of Business Administration (MBA) from The University of Notre Dame and a Bachelor of Science in Business Administration from La Salle University. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 8

Speakers Today (2/3) Douglas Ducote Brian Bostrom Chief Technology Officer President, Global Engineering • Doug is responsible to the CEO for all matters involving Chart engineering • Brian has been with Chart since 1994 and currently serves as President of and technology to include process and product development as well as all Global Engineering. research and development efforts. Additionally, Doug is the senior Chart • Over the years, Brian has held multiple engineering leadership roles Industries Fellow and is responsible for the Chart Fellows and Key Experts including: Senior Principal Engineer for Chart’s Global Engineering program recognizing outstanding technical contributors within the Support Team and Senior Engineering Manager for Bulk Products. company. • Brian is Chair for the U.S. Technical Action Group responsible for creating • Having joined Chart in 1978, Doug has served in multiple engineering and and maintaining cryogenic-related International Standards. leadership roles to include the General Manager of operations in New Iberia, Louisiana and the General Manager of the Process Systems • He holds a Bachelor of Mechanical Engineering degree from the business in The Woodlands, TX. University of Minnesota. • He also has related experience with Pratt and Whitney Aircraft and Praxair. • Doug has a Bachelor of Science degree in Aerospace Engineering from Louisiana State University. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 9

Speakers Today (3/3) Joe Belling Amy George Chief Commercial Officer Founder, President Earthly Labs • Joe Belling is the Chief Commercial Officer, responsible for strategically • Entrepreneurial leadership at diverse ventures - from artificial intelligence and profitably growing both our industrial gas and traditional energy software that reduced industrial emissions, to local farmers' markets, to markets as well as new specialty and clean energy applications. reusable consumer products that reduced waste from disposable • Prior to this, Joe was the President of the Energy & Chemicals segment, alternatives. and previously held the roles of President of E&C Cryogenics and VP/GM • Holds two patents with 17 more pending. of Chart’s Brazed Aluminum Heat Exchangers (BAHX) business. • In 2021, recognized by IMBIBE magazine as one of the Top 75 leaders • Joe began his career as a Sales/Applications Engineer with ALTEC in making a positive impact on the food and beverage industry. 1993 later taking on several roles related to commercialization, design and • Recognized by Fast Company and the B Corp Community as a leader and application of various heat exchangers in key end markets. her products have been awarded Top 100 Green Products for the World.” • He also has related experience with Trane, where he held roles as Product • BA from The University of Florida and MBA with a focus in Planning and New Product Introduction Leader for Trane’s Parts Division. entrepreneurship and environmental management from The University of • Joe has a Bachelor of Science degree in Mechanical Engineering from the Texas. University of Wisconsin-Platteville. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 10

Our Strategy Focuses On a Hybrid of Solutions For: Nexus of Clean, Specialty Products, Repair & Service Broadest Product Offering Community & Employees for Industrial Gas & Energy • Environmental, Social & Governance • Application and Customer Expansion • Building capabilities to support • Cryo-pump opportunity other strategic pillars • Repair & Service • Branding E A • Specialty Markets 1. Market Trends Innovative Solutions • Upfront Engineering Thinking Disruptive D 2. Profitable B • Partnerships for new turnkey solutions • Alternative business models • Retrofit for efficiencies existing • Smart products (IOT) Growth brownfield sites C Margin Expansion • Strategic location manufacturing • International manufacturing for traditional US products • 80/20 GTLS: GAS TO LIQUID SYSTEMS® • Strategic sourcing Chart Industries, Inc. 2022 Investor Day 11

Chart Industries Europe Asia-Pacific n Changzhou, China n Decin, Czech Republic n Busto Arsizio, Italy n Kuala Lumpur, Malaysia n Gablingen, Germany n Ornago, Italy n Hyderabad, India n Goch, Germany n Pombia, Italy n Sri City, India n Monheim, Germany n Lery, France n Lidcombe, Australia n Bagnolo, Italy NYSE: GTLS Market Capitalization: ~$6.0B Net Debt: $804M Enterprise Value: ~$6.8B Americas Shares Outstanding: 35.8M (Basic) n Allentown, PA Revenues (2021A): ~$1.3B n Austin, TX n Ball Ground, GA Headquarters: Ball Ground, GA n New Prague, MN n Fremont, CA Team Members: ~4,900 (50-50% n McCarran, NV n Houston, TX U.S./International) n Brentwood, NH n Richburg, SC 250,000+ sq ft Global Footprint: >25 Locations n Theodore, AL Worldwide n New Iberia, LA n Beasley, TX n Tulsa, OK n La Crosse, WI n La Crosse, WI n New Prague, MN n The Woodlands, TX n Theodore, AL n Beasley, TX n Tulsa, OK n Franklin, IN n Decin, Czech Republic n Fayetteville, AR n Libouchec, Czech Republic n Duluth, GA n Goch, Germany n Valencia, CA n Ornago, Italy n Orem, UT n Changzhou, China n Bogota, Colombia GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 12

Our United States Repair & Service Footprint Organic repair site Organic repair site New Prague, MN Acquired via McCarran, NV Skaff (2018) Acquired via Brentwood, NH Hetsco (2017) Franklin, IN Aftermarket site Organic greenfield Organic repair site acquired 2021 repair site 2021 Houston, TX, L.A. Turbine Richburg, SC GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 13

Our European Repair & Service Footprint Acquired via VCT (2017) Gablingen and Monheim, GR Organic repair site Decin, CR Acquired via VRV (2018) Ornago and Pombia, IT GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 14

Chart’s Transformation B e f o r e 2 0 1 8 T o d a y O u r F u t u r e ý Higher customer concentration / lower þ Lower customer concentration / higher Ø Full solutions for the Nexus of Clean ä as geographic diversity end-market and geographic diversity well as complete repair & service (added 402 new customers in 2021) EU/U.S. footprint ý Heavy reliance on single large LNG projects þ Multiple long-term agreements, MOUs Ø Multiple long-term secular growth in place drivers across all segments ý Significant backlog with PetroChina that went away in 2016 ($150M) þ Aftermarket parts, service, repair and Ø Complimentary end market exposure leasing revenue continues to increase that leverages capabilities through ý Few long-term contracts in place (~$50M in leasing revenues in 2021) multiple verticals ý Limited actions taken for cost þ Big LNG is a “nice to have” whereas Ø Growing aftermarket and leasing rationalization before it was a “necessity” business in the U.S. and Europe ý Limited to no aftermarket, service and þ High growth (10%+) gaining momentum Ø Expanding customer “stickiness” and repair in specialty markets increasing recurring revenue base ý Individual plants and locations operated þ One Chart approach to engineering, Ø Sustainability oriented business model autonomously sales, back office, operations as well as Ø Durable and improving free cash flow centralized business services and agile, and return profile quick cost rationalization Note: Figures as-reported during stated period GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 15

Full Solutions Platforms Across the Nexus of Clean GTLS Process GTLS Process Clean End Technologies Technologies Through Market Solution (Owned in Full) Minority Ownership GTLS Equipment Clean Power • Hydrogen • BAHX • Valves / • Helium • ACHX Vaporizers • LNG • Bulk & Microbulk • Expanders • Biogas • Fans • Liquefiers • Transports • Cold Boxes Clean Water • Water& Wastewater • Bulk tanks • Vaporizers Treatment • Dissolution • Cryo-lease • Desalination equipment Clean Food, • Small-Scale Carbon • Microbulk tanks • Transports Beverages & Capture • Dosers Agriculture • Clean Beverages • Vaporizers Clean Industrials • Post Combustion • Heat exchangers • Transports Carbon Capture • Storage tanks • Liquefiers • Hydrogen/He • Vaporizers • Cold Boxes • VIP/VJP • Expanders GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 16

GTLS: GAS TO LIQUID SYSTEMS® 17

How We Think About The Business Heat Transfer Systems Cryo Tank Solutions Repair, Service & Leasing Specialty Products • Air Cooled Heat Exchangers (ACHX), • Bulk and Micro Bulk Storage Tanks • Repair and service • Dosing equipment • HLNG vehicle tanks • Brazed Aluminum Heat Exchangers (BAHX) • ISO Containers • Aftermarket parts and maintenance • Fueling Stations • Cold Boxes • Packaged Gas Systems • Global Leasing • LNG by Rail (Gas By Rail Offering) • Nitrogen Rejection Units (NRU) • Non-specialty mobile equipment • Installations • Hydrogen equipment • Integrated systems • Vaporizers • Full lifecycle • Cannabis products • High Efficiency Flow Fans • FEMA Valves / FLOW Meters Global Commercial Team Global Engineering Team GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 18

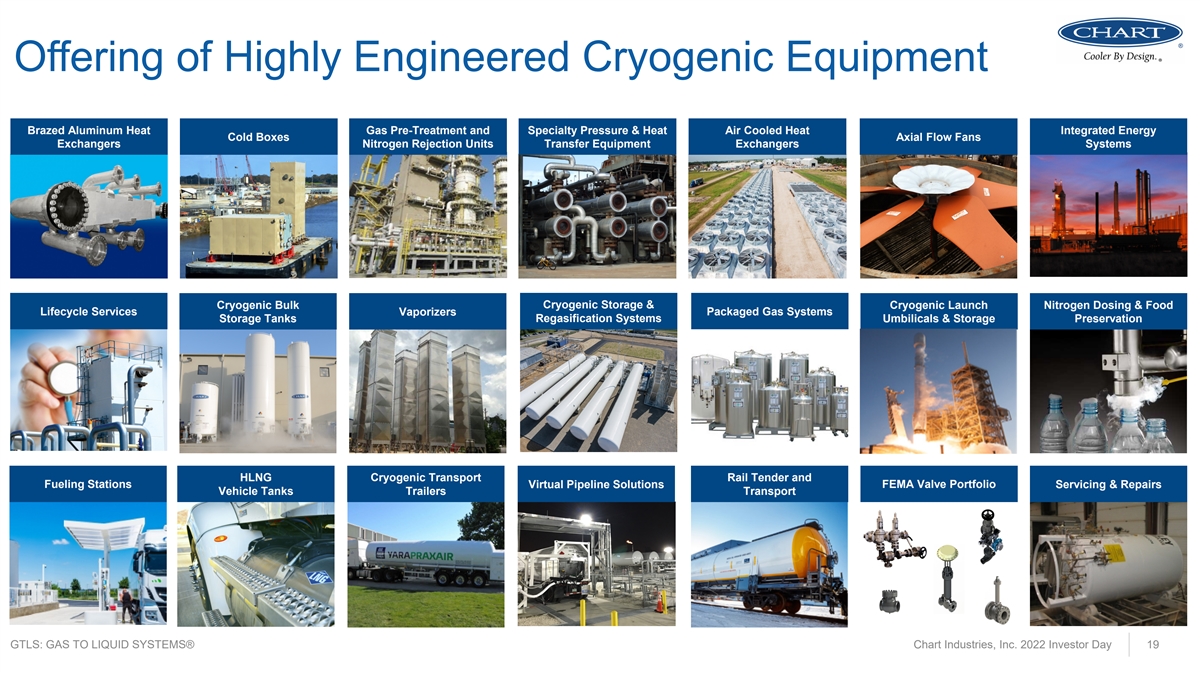

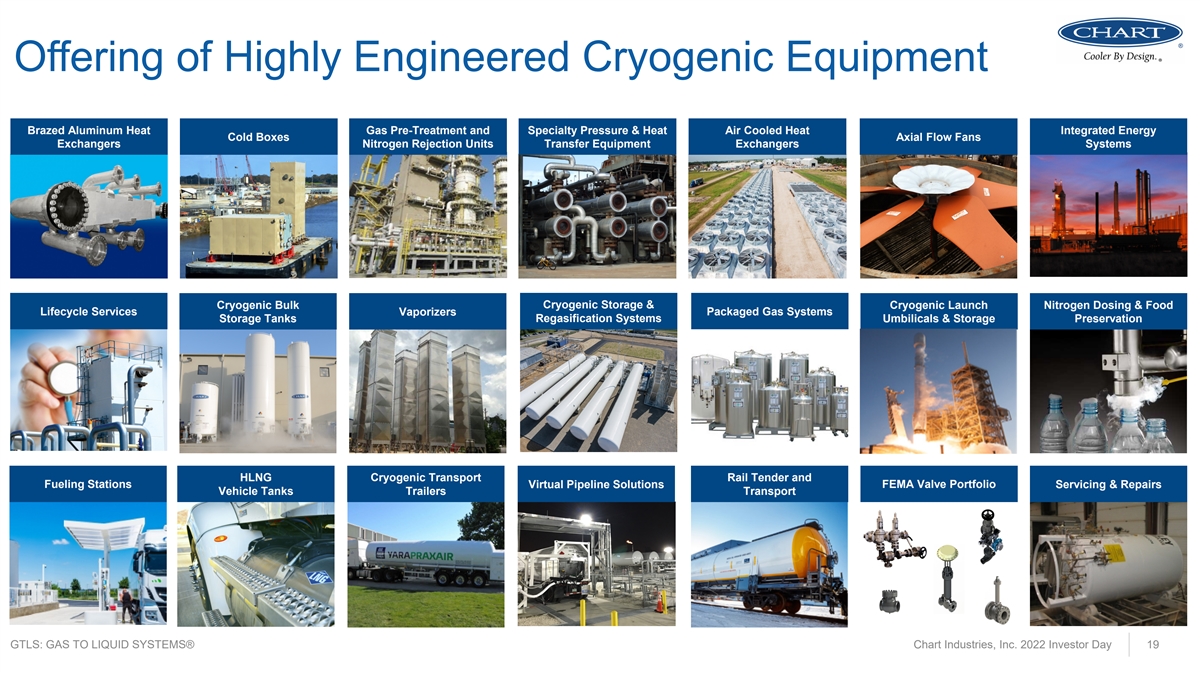

Offering of Highly Engineered Cryogenic Equipment Brazed Aluminum Heat Gas Pre-Treatment and Specialty Pressure & Heat Air Cooled Heat Integrated Energy Cold Boxes Axial Flow Fans Exchangers Nitrogen Rejection Units Transfer Equipment Exchangers Systems Cryogenic Bulk Cryogenic Storage & Cryogenic Launch Nitrogen Dosing & Food Lifecycle Services Packaged Gas Systems Vaporizers Storage Tanks Regasification Systems Umbilicals & Storage Preservation HLNG Cryogenic Transport Rail Tender and Fueling Stations Virtual Pipeline Solutions FEMA Valve Portfolio Servicing & Repairs Vehicle Tanks Trailers Transport GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 19

A Broad and Diverse Set of End Markets Industrial Over the Molecules CCUS Water Gas Road by Rail Energy & Cannabis Hydrogen Space Lasers Chemical Food & Marine Critical LNG Biofuels Beverage Systems Care GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 20

Places to Play In the [Molecule] Supply Chain LIQUEFACTION DISTRIBUTION STORAGE END USE SYSTEMS ELECTROLYSIS PARTNERS AND ELECTRICITY VEHICLE FUEL PRODUCTION GENERATION STATIONS USERS OF HYDROGEN LIQUID TRANSPORT INCLUDING TRAILERS, ISO LARGE CRYOGENIC CONTAINERS, RAIL CRYOGENIC LIQUID CARS, MARINE STORAGE, TANKS TRANSPORT BAHX, LOAD- AMMONIA FUELING OUT SYSTEMS PRODUCTION SYSTEMS FOR (FERTILIZERS) AEROSPACE KEY COMPONENTS INTEGRATED WITHIN SYSTEMS ELECTRONICS REFINING GASIFICATION/ MANUFACTURING Pumps and Compressors Connections CARBON REFORMATION Flowmeters Regulators CAPTURE Vacuum Insulated Piping Sensors Valves and Sealing High Pressure Storage MARINE FUEL GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 21

Representative Competition C r y o T a n k S o l u t i o n s H e a t T r a n s f e r S y s t e m s S p e c i a l t y P r o d u c t s R e p a i r & S e r v i c e GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 22

GTLS: GAS TO LIQUID SYSTEMS® C C C C Ch h h h ha a a a ar r r r rttttt IIIIIn n n n nd d d d du u u u ust st st st str r r r riiiiie e e e es, s, s, s, s, IIIIIn n n n nc. c. c. c. c. 2 2 2 2 20 0 0 0 02 2 2 2 22 2 2 2 2 IIIIIn n n n nve ve ve ve vest st st st sto o o o or r r r r D D D D Da a a a ay y y y y 2 2 2 2 23 3 3 3 3

Heightened Focus on Energy Resilience, Independence, Accessibility, Security and Sustainability Since February 24, 2022 European Commissioner for Energy stated that Russia’s aggression against Ukraine has dramatically transformed the geopolitical environment of Europe’s energy security…and will require alternative sources of supply… • Lithuania became the first European nation to announce that they would stop importing Russian gas • European Commission developed a platform for the common purchase of LNG and hydrogen with member states • Morocco is studying options at several ports to build a floating or land-based facility to import liquefied natural gas • U.K. issued a new energy strategy, focusing on energy security and urgency of accelerating the solutions for net zero • New import terminals planned for Italy, Germany and France • Germany will build two small-scale LNG (ssLNG) terminals • Dutch Gate and Belgian Zeebrugge terminals are to be expanded by 2024 and Polish terminal in 2023 • The Estonian and Finnish governments have agreed to the joint leasing of a floating LNG terminal • Bulgaria and Romania obtained access to the DESFA LNG station off Athens • Spain plans to open a never-before-used LNG plant as European storage base • Australian government is going to accelerate seven natural gas projects • DOE FERC is accelerating permitting in the U.S., including an export licenses and approval extensions granted • Multiple new SPAs signed for Big LNG, US Export Facilities …All of this continues with the backdrop of accelerating renewable energy sources and hydrogen GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 24

End Market Drivers and Tailwinds Hydrogen Water • Stimulus Funds Directed toward Green Energy • Condition of Water Infrastructure (ASCE Grade & Water Activities “C-”; 300 Contaminants in drinking water) • Aggressive GHG and CO2 Reduction Goals • Societal Focus on Water Issues and Political Being Established Globally Running Platforms • Population & Economic Growth • Water Scarcity & Supply (Globally, non-US Expanded Opportunity Set) • Role of Corporate Sustainability • Retiring Workforce and Need for Further • Untraditional Players Entering These Markets Optionality (TaaS, automation) • Early Partnerships Yield Key Positioning In • Drought Potential Globally (Impacting These Markets agriculture; megadroughts) • Emergency Planning & Utility Security • U.S. Infrastructure Plan GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 25

End Market Drivers and Tailwinds, continued Food & Beverage CCUS • Increased European adoption • Carbon emissions reduction targets 2 • Replacement systems due to age • CO supply shortages • National and global chains expanding locations • Low carbon fuel standards organically • Cap & Trade, European Emission Trading 2 • Increased conversion to micro-bulk CO System • Nitro-beverage changeover • Tax incentives, government subsidies • Food preservation GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 26

End Market Drivers and Tailwinds, continued Molecules by Rail Space Exploration • Expected growth in EU • Public-private partnerships have made for significantly more players, each of them • Legalization of LNG by train in the U.S. requiring their own test and launch facilities • Gas by rail tender cars approved for use • Proliferation of private space travel industry • Increased usage of rail for transporting • Fuels and propellants have changed to provide traditional industrial gasses lower cost, utilizing cryogenic liquids in many cases 2 • Newer engines utilize combinations of LNG, O and notably Hydrogen in greater volumes for deeper space missions GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 27

Hydrogen is Both Regional and Global Canada United States EMEA China • Growing trend toward • Beginning to move to • Gaseous still • Government support liquid hydrogen networks / scaling of predominant yet • Large industrial gas • National hydrogen infrastructure traditional GH2 users investment in the are contemplating strategy supports • State level activity is region investment still extremely varied liquid investment • Group Code is lengthy • Provinces / locations • Development of • Plenty of bus / train process drive behavior hydrogen hubs development underway South & Central America South Korea Australia India • In country partnerships • Long haul trucking is a • Developing long-term • Seeing collaboration are crucial priority hydrogen plan as part between renewables • Regional certifications • Will need to be of energy strategy and CCUS are important thoughtful on locations • Limited current / near- • Early days of small, • Market is a natural for of production sites term commercialization pilot projects that are liquid hydrogen not interlinked • Investment ramping very quickly GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 28

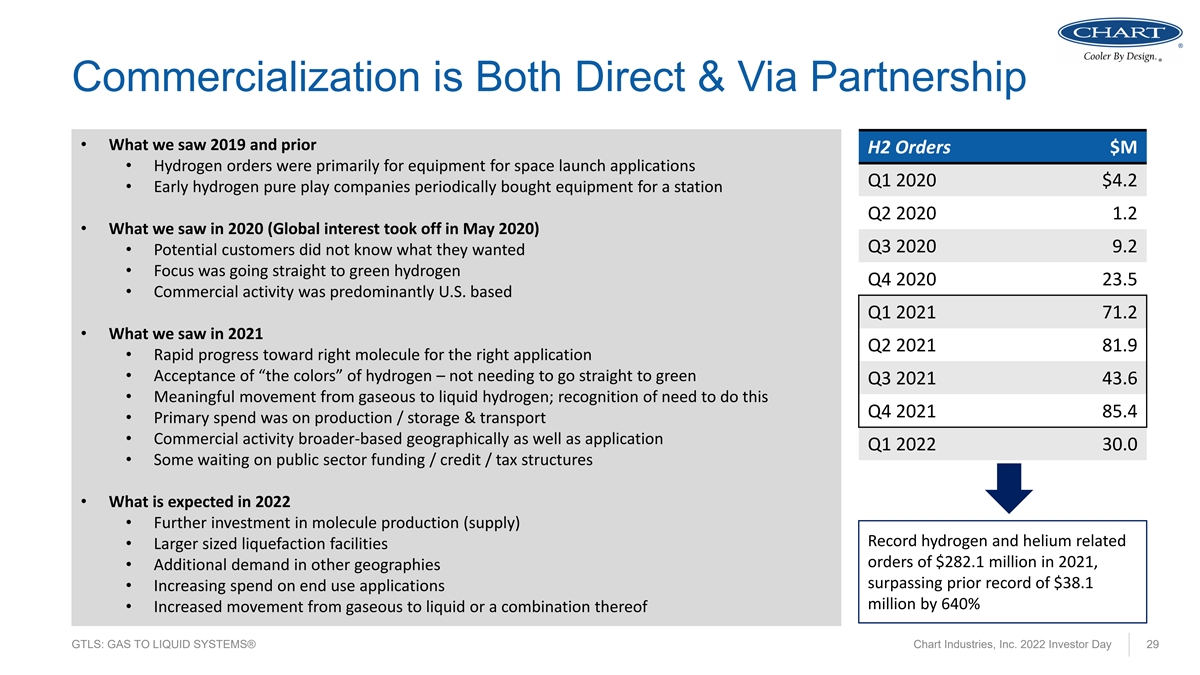

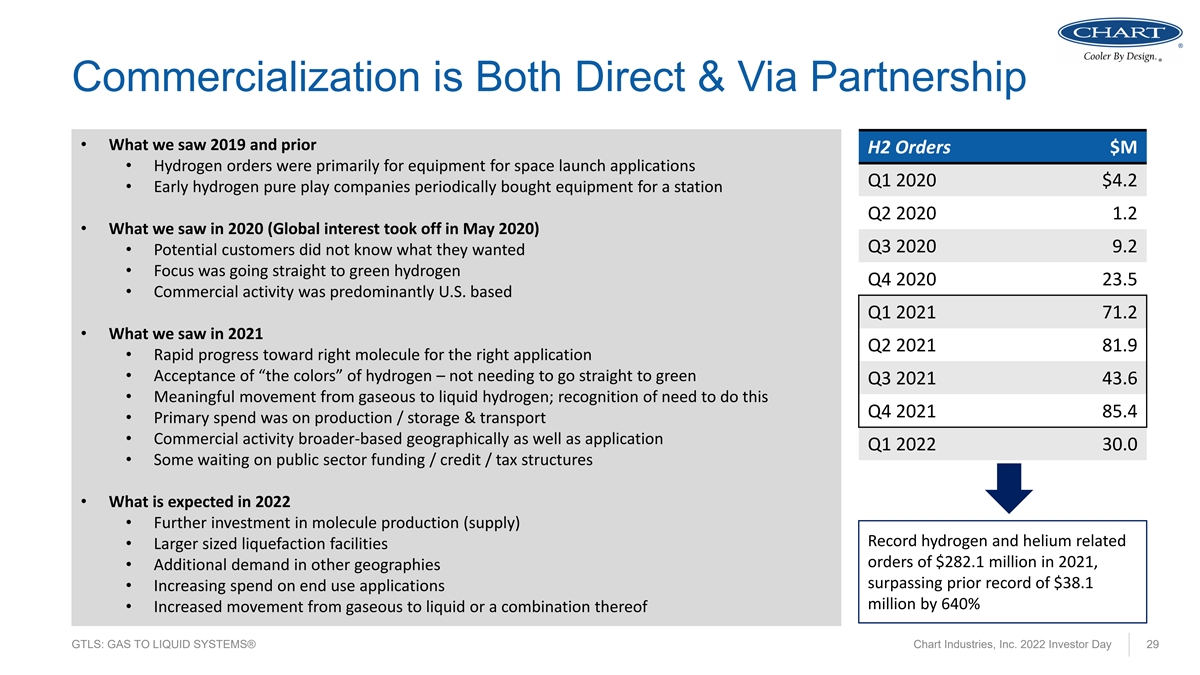

Commercialization is Both Direct & Via Partnership • What we saw 2019 and prior H2 Orders $M • Hydrogen orders were primarily for equipment for space launch applications Q1 2020 $4.2 • Early hydrogen pure play companies periodically bought equipment for a station Q2 2020 1.2 • What we saw in 2020 (Global interest took off in May 2020) Q3 2020 9.2 • Potential customers did not know what they wanted • Focus was going straight to green hydrogen Q4 2020 23.5 • Commercial activity was predominantly U.S. based Q1 2021 71.2 • What we saw in 2021 Q2 2021 81.9 • Rapid progress toward right molecule for the right application • Acceptance of “the colors” of hydrogen – not needing to go straight to green Q3 2021 43.6 • Meaningful movement from gaseous to liquid hydrogen; recognition of need to do this Q4 2021 85.4 • Primary spend was on production / storage & transport • Commercial activity broader-based geographically as well as application Q1 2022 30.0 • Some waiting on public sector funding / credit / tax structures • What is expected in 2022 • Further investment in molecule production (supply) Record hydrogen and helium related • Larger sized liquefaction facilities orders of $282.1 million in 2021, • Additional demand in other geographies surpassing prior record of $38.1 • Increasing spend on end use applications million by 640% • Increased movement from gaseous to liquid or a combination thereof GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 29

Cannabis: Early Market with High Growth Potential GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 30

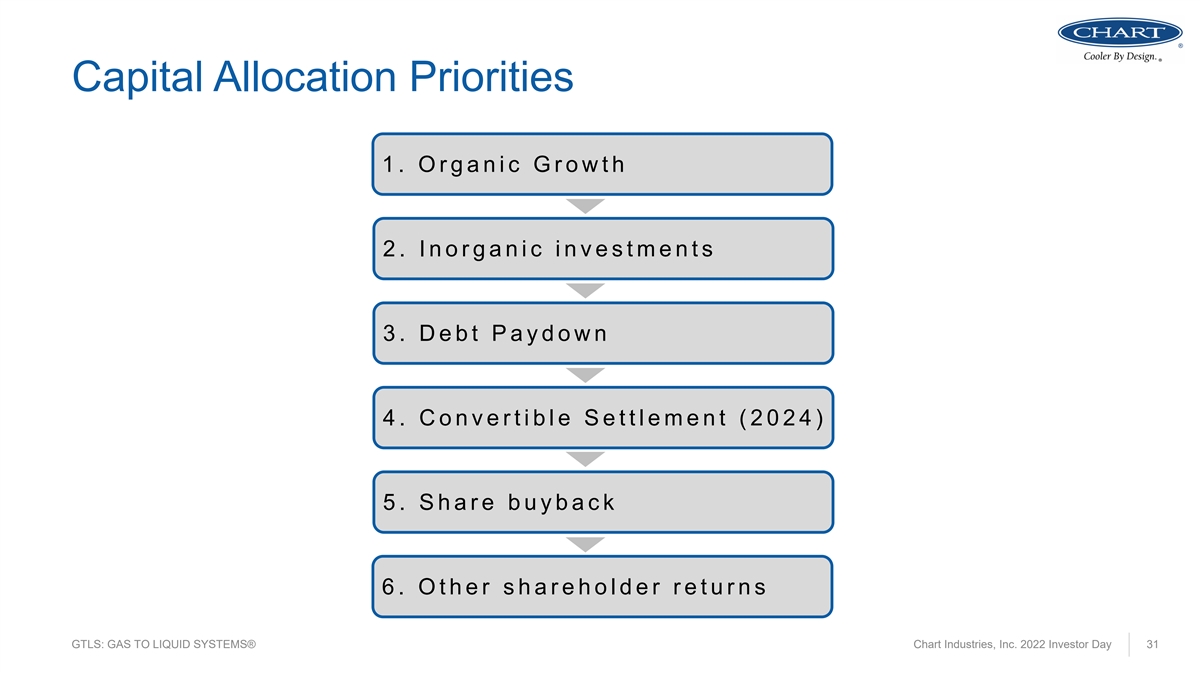

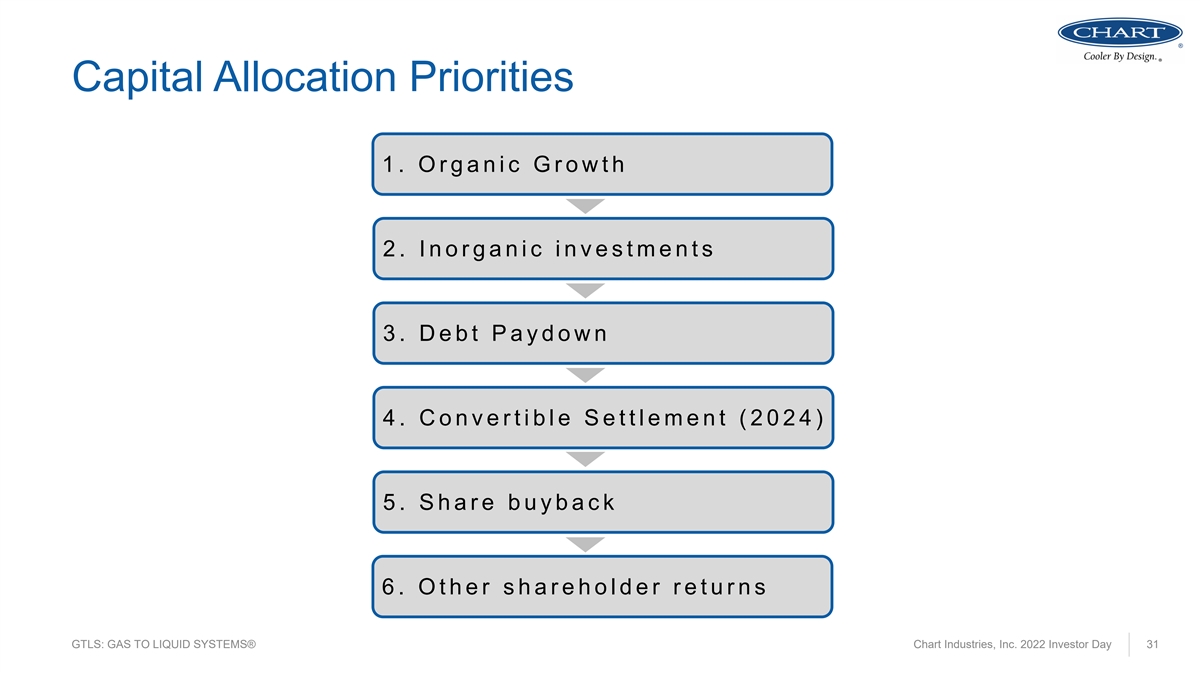

Capital Allocation Priorities 1 . O r g a n i c G r o w t h 2 . I n o r g a n i c i n v e s t m e n t s 3 . D e b t P a y d o w n 4 . C o n v e r t i b l e S e t t l e m e n t ( 2 0 2 4 ) 5 . S h a r e b u y b a c k 6 . O t h e r s h a r e h o l d e r r e t u r n s GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 31

GTLS: GAS TO LIQUID SYSTEMS® C C C Ch h h ha a a ar r r rtttt IIIIn n n nd d d du u u ust st st str r r riiiie e e es, s, s, s, IIIIn n n nc. c. c. c. 2 2 2 20 0 0 02 2 2 22 2 2 2 IIIIn n n nve ve ve vest st st sto o o or r r r D D D Da a a ay y y y 3 3 3 32 2 2 2

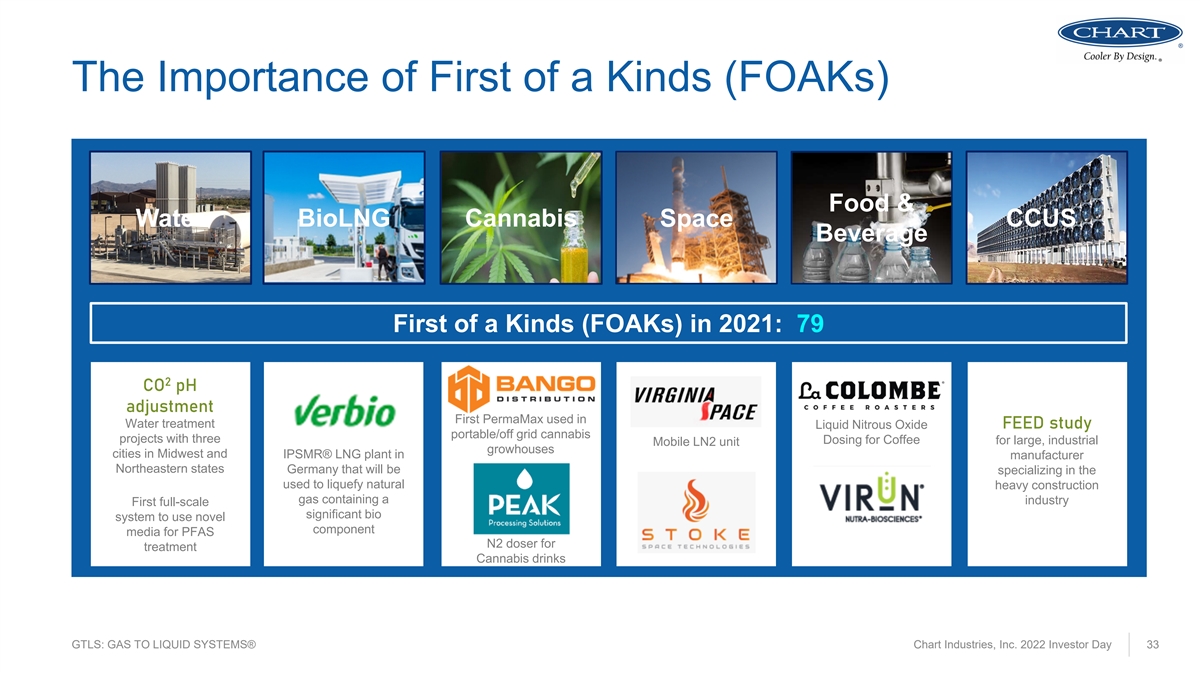

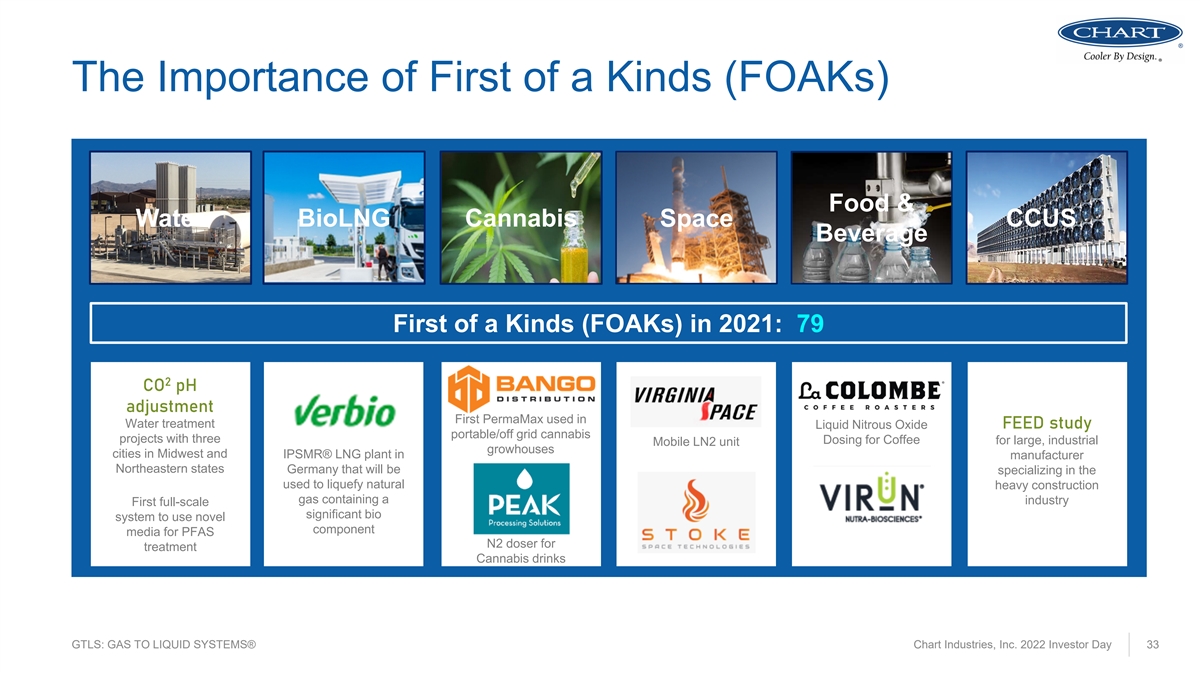

The Importance of First of a Kinds (FOAKs) Food & BioLNG Cannabis CCUS Water Space Beverage First of a Kinds (FOAKs) in 2021: 79 2 CO pH adjustment First PermaMax used in Water treatment Liquid Nitrous Oxide FEED study portable/off grid cannabis projects with three Dosing for Coffee for large, industrial Mobile LN2 unit growhouses cities in Midwest and IPSMR® LNG plant in manufacturer Northeastern states Germany that will be specializing in the used to liquefy natural heavy construction gas containing a industry First full-scale significant bio system to use novel component media for PFAS N2 doser for treatment Cannabis drinks GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 33

CASE STUDY Appalachian Basin LNG Liquefier Air Coolers Cold Box The abundant source of shale natural gas in rural Pennsylvania drove the development of a small-scale, compact LNG liquefaction plant to serve the growing number of industrial, transportation and marine customers looking to use nearby natural gas in the form of LNG. Chart delivered a standard plant package which included cold box, compressor skid, expander skid, air coolers, LN storage tank, vaporization skid and 2 associated controls. LNG sourced from this plant provided the first truck-to-ship bunkering operations on the Great Lakes. Vaporizer Storage GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 34

CASE STUDY LNG Receiving Terminal – Klaipėda, Lithuania Bunkering and Vaporizers Loading Bays To create small-scale LNG infrastructure and establish the port of Klaipėda as an LNG hub for Baltic countries and northeastern Poland. Incorporate a solution that is scalable for an expected doubling of capacity. Chart provided single point execution with significantly shorter build time, delivering a complete cryogenic section of LNG storage, vaporizers, trailer loading bays and bunkering skid. LNG offloaded and stored at Klaipėda can be loaded into transports and ISO containers for virtual pipeline distribution. It is also utilized for ship fueling, bunkering as well as local energy consumption. Storage GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 35

CASE STUDY Hydrogen Trailer Capacity Addition New Vacuum Lift New Plasma Table Systems Hydrogen trailer production is extremely complicated and time consuming with over 2,600 parts per trailer. To meet strong demand, a significant capacity expansion was required for hydrogen trailers at the Theodore, AL facility given the highest number of trailers ever manufactured at the facility in any calendar year was nine, prior to our acquisition. Aside from some much-needed capital investments, the facility required a complete layout overhaul. Equipment and tooling upgrades were implemented along with process improvements, some of which are still in progress. Within a year and a half of ownership, Chart was able to ramp trailer capacity to one per week, expected to reach two trailers per week during 2022. As a result, Chart is the single largest manufacturer of liquid hydrogen transport trailers, a highly profitable business line for the company. Finished LH2 Trailer GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 36

CASE STUDY Brazil Untreated sewage is a major cause of water pollution ® Dual SDOX in Brazil, eroding the quality of life, health, and Containerized economic development in large, urban areas while Solution increasing the cost of water treatment for downstream users, having a disproportionate negative effect on the poor. In a first of a kind application, ChartWater™ delivered BlueInGreen’s supersaturated dissolved oxygen ® (SDOX ) technology to a state water and sanitation utility as part of an innovative, distributed water treatment strategy to expedite the delivery of public Long-term benefits by leveraging existing natural systems – Water Quality treating rivers, lakes, and reservoirs in-situ while Monitoring complementary collection and treatment infrastructure is established over the next decade. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 37

CASE STUDY Cape Canaveral Launch Site Today’s rockets are designed for multiple launches for cost effectiveness. The fuels and propellants have changed to provide lower cost, utilizing cryogenic liquids in many cases. Newer engines utilize combinations of LNG, O 2 and notably Hydrogen in greater volumes for deeper space missions. The public-private partnerships have also made for significantly more players, each of them requiring their own test and launch facilities. Chart provides a number of mission critical components to space customers including fuel propellant storage containing LNG, LH and 2 LOX, in addition to the associated pressure build coils. Chart also provided vacuum insulated piping (VIP), acoustical suppression water systems and the cryogenic launch umbilicals for multi-stage rocket boosters. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 38

CASE STUDY Industrial Carbon Capture Cement accounts for 2.8 billion tons of CO emissions 2 per year globally. The cement industry is more Modular, pilot dependent on carbon capture to reduce emissions than system to be the transportation or power industries, as low-carbon installed at substitutes for cement production are extremely Central Plains Cement Plant limited. in Sugar Creek, MO A 2021 MIT study found Chart’s Cryogenic Carbon Capture™ (CCC) technology to be 30% to 80% lower cost than alternatives for capturing CO from cement 2 plants. To date, SES has piloted this technology in two cement plants and is now partnered with FLSmidth, a global cement engineering leader, to deploy the carbon capture technology with cement facilities around the world, beginning with a pilot project at a Missouri operating plant. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 39

Linking Flexibility & Innovation to Customer Stickiness 2022 2023-2025 § Additional water treatment (TaaS) assets § TaaS Units For Earthly Labs on hand Leasing Fleet § Fleet available (versus build for customer) § Expanded leasing fleet strategically located at various Chart locations for regional speed § Prioritization and further utilization of Indian § Key account on-site engineers Engineers Onsite engineering capabilities § More dedicated resourcing to key accounts § More capacity for improved lead times § Additional capacity comes on-line (see capex) Delivery Dates § Utilization of flex manufacturing § Optimize flexible manufacturing § Stocking programs § Sourcing as described on Q1 2022 earnings call § Commercial team request = inventory build Available Inventory § Commercial team request = inventory build § Optimize flexible manufacturing for standard building of components § Korean H2 critical § Korean certification complete Regional Certifications § Influence global certifications § China H2 trailer group code complete § Earthly Canadian certifications § Leader in global certifications § Diversify customer base in embryonic markets § Utilize install base, experience set Taking Advantage § Leverage MOUs/partnerships in place § Leverage brownfield and retrofit unique capabilities § More cross-selling! GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 40

GTLS: GAS TO LIQUID SYSTEMS® C C Ch h ha a ar r rttt IIIn n nd d du u ust st str r riiie e es, s, s, IIIn n nc. c. c. 2 2 20 0 02 2 22 2 2 IIIn n nve ve vest st sto o or r r D D Da a ay y y 4 4 41 1 1

CASE STUDY Smart Foam CiCi Oak Trap The Alchemist, a brewery located in Vermont, saw price increases and CO2 shortages due to a plant shut- down in the Northeast. Additionally, The Alchemist also has goals to reduce waste and greenhouse gas emissions for their B Corporation status. In this application, Earthly Labs delivered the CiCi Oak CO2 capture technology to the brewery to help them mitigate price volatility and advance their sustainability goals. This implementation helps them use an ingredient they produce almost every day in their beer making process and avoid any future price hikes and Software shortages that may occur in their area. shows KPIs of system CO2 Storage GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 42

CASE STUDY CiCi Oak Smart Foam Trap attached at Fermentation tank blow off arm Roadhouse Brewing Co., a brewery out of Jackson Hole, Wyoming, was seeking ways to cut their emissions as part of their deeply valued sustainability mission. Roadhouse was voted amongst the top 5% of B Corporations in the world in 2021 and has to continue to find ways to improve. Earthly Labs was able to install the CiCi Oak CO2 Capture solution in the Roadhouse Brewing facility. This cut their emissions down to align with their Vaporman sustainability goals, and made them less susceptible to potential CO2 shortages, given their remote location. The installation allowed Roadhouse to CO2 advance their brand and market differentiation, making Storage them a clear leader in the Wyoming craft beer industry. CO2 enters at back of CiCi GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 43

CiCi Oak captures CASE STUDY Recovered and purifies waste CO2 Pump CO2 from migrates CO2 into fermentation smaller cylinders Trillium Brewing Co., a brewery based in Boston, Massachusetts, was seeking ways to reduce their rising CO2 costs and reduce CO2 emissions, without compromising their beer quality. Trillium is among the top 100 craft brewers in US and has opened satellite breweries at Fenway and at a sustainable farm. They challenged Earthly to help them meet the CO2 needs of their growing network of breweries. Earthly Labs installed the CiCi Oak CO2 Capture solution in 2019 at their Canton production facility. The system helped reduce their CO2 costs and survive CO2 shortages. Quality studies in the Trillium lab identified a preference for beer powered with recovered CO2. The CiCi Recovered CO2 Cylinders solution also reduced CO2 emissions, advancing their used at Trillium’s satellite sustainability goals. In 2022, Earthly Labs implemented a breweries to reduce CO2 costs recovered CO2 pump to allow them to move the CO2 into smaller cylinders, reduce costs, and easily share this natural recovered CO2 with their satellite breweries. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 44

GTLS: Gas to Liquid Systems® Chart Industries, Inc. 2022 Investor Day 45

Linking the Nexus of Clean™ Ultrapure water for green hydrogen generation GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 46

Water Treatment and Carbon Capture CO captured from combustion or directly 2 from air is used to create clean drinking water or replace strong acids in industrial water treatment processes. Captured CO is used as a raw material in a variety 2 of municipal and industrial water treatment processes. • Remineralization – Desalination plants optimize the mineral balance of water by adding lime and dissolving CO to lower the pH 2 • Water Softening - Water treatment plants and industry add lime to increase pH and precipitate excessive minerals before normalizing the pH with dissolved CO 2 • Strong Acid Replacement – Industrial Wastewater Treatment, Environmental Compliance, H S Stripping 2 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 47

© 2021 Chart Industries, Inc. Confidential and Proprietary 48 Chart Industries, Inc. 2022 Investor Day 48

GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 49

GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 50

Organic Capacity & Automation Capex Description Category Status 2021 Actual 2022 Fcst 2023 Fcst Maintenance Capital Maintenance $24.3 $22.0 $24.0 Tulsa BAHX Furnace Line Capacity 4.2 7.0 7.0 GOFA Germany Trailer Production Expansion Capacity/Automation 0.1 7.6 3.2 SriCity, India Production Expansion D&S Capacity 1.9 5.5 0.0 Leasing Fleet Expansion Growth 8.4 3.0 5.0 Robotics and Augmented Reality Implementation Capacity/Productivity 3.0 2.0 5.0 Theodore, AL Production Expansion (IG, ORCA, CO2) Capacity/Automation 0.0 2.6 2.8 Product line moves from MN to Alabama (Permas) Productivity 0.3 2.6 0.4 CryoDiffusion VIP Manufacturing Line Implementation Capacity/Productivity Yes 0.0 0.5 0.0 Tulsa Flex Manufacturing Startup Capacity/Productivity 2.7 1.3 0.0 Richburg, SC Greenfield Startup Capacity Yes 6.0 0.0 0.0 Corporate HQ move (from Cryoport building) Mandatory Yes 1.8 0.0 0.0 Chart Total $52.7 $54.1 $47.4 Chart Q1 2022 Actual Capex Spend $12.6 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 51

3-Year: Organic Capacity & Automation Capex Description Category Status 2023 Fcst 2024 Fcst 2025 Fcst Maintenance Capital Maintenance $24.0 $22.0 $22.0 Tulsa BAHX Furnace Line Capacity 7.0 0.0 0.0 GOFA Germany Trailer Production Expansion Capacity/Automation 3.2 0.0 0.0 Leasing Fleet Expansion Growth 5.0 5.0 5.0 Robotics and Augmented Reality Implementation Capacity/Productivity 5.0 2.5 2.5 Theodore, AL Production Expansion (IG, ORCA, CO2) Capacity/Automation 2.8 3.0 0.0 Product line moves from MN to Alabama (Permas) Productivity 0.4 0.0 0.0 Bulk Tank mfg greenfield / expansion Growth 5.0 15.0 5.0 Allentown, PA Flex mfg location Growth 3.0 10.0 5.0 New Iberia, LA rooftop expansion Capacity/Productivity 1.0 1.0 0.0 Chart Total 56.4 58.5 39.5 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 52

Manufacturing Site Expansion Sri City Andhra Pradesh, India • Doubling of existing manufacturing floor space • Production building erected • Flooring nearing completion • Electrical, utility and fire water network installation underway • Sheet shearing and rolling machines ordered • Production staff increased by 35% YOY • Partial utilization of new facility starting in April with full utilization from July 2022 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 53

Brazed Aluminum Heat Exchanger Line Tulsa, Oklahoma USA • All major equipment ordered ü Fin presses, saws, machining equipment installed ü Construction of foundations underway ü Construction of stacking & defixturing pits underway • Expected furnace delivery in August 2022 • Planned production test in November 2022 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 54

GOFA (Goch, Germany) Trailer Capacity Expansion $11 million approved capital expenditure • Permit received • Construction ~18 months to go live • Adds capacity for improvement of lead times • Gives us the chance to compete on LH2 transports for EMEA & Asia • Expands capacity for LNG / IG trailers GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 55

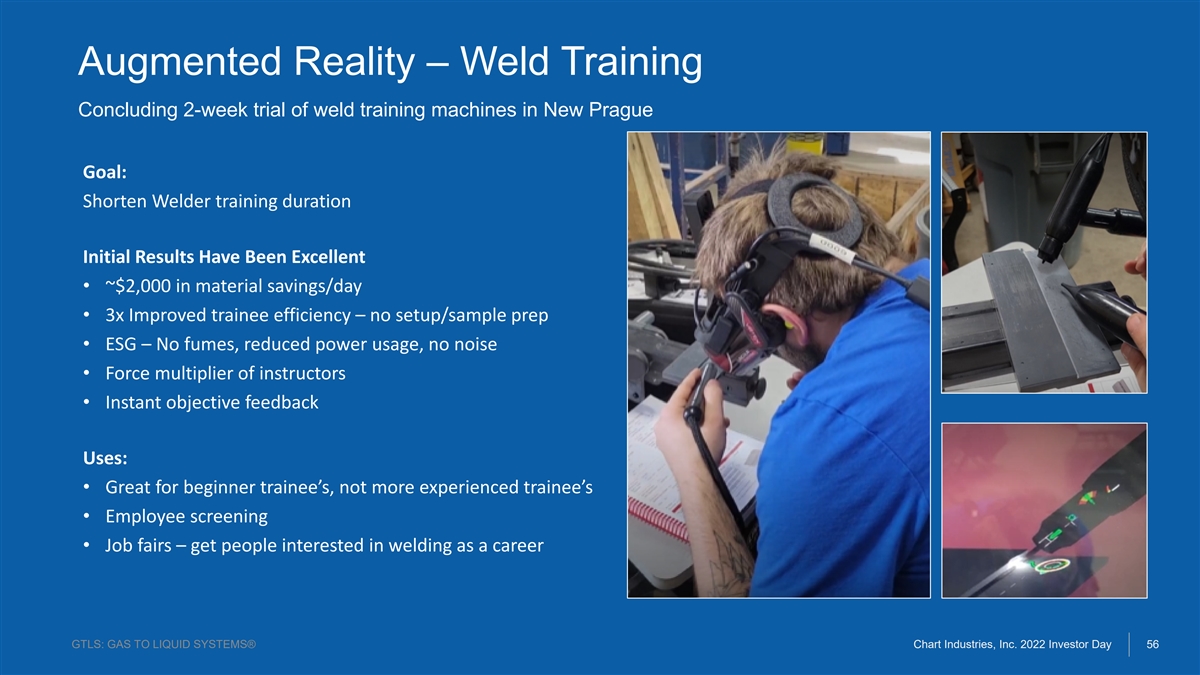

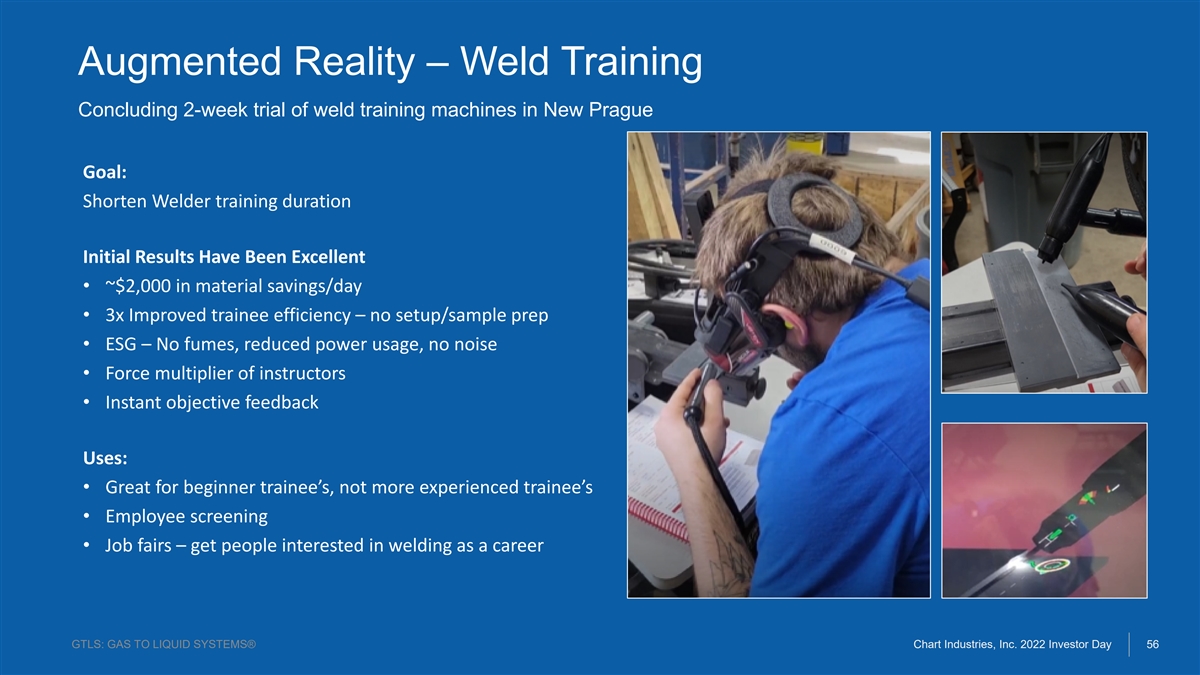

Augmented Reality – Weld Training Concluding 2-week trial of weld training machines in New Prague Goal: Shorten Welder training duration Initial Results Have Been Excellent • ~$2,000 in material savings/day • 3x Improved trainee efficiency – no setup/sample prep • ESG – No fumes, reduced power usage, no noise • Force multiplier of instructors • Instant objective feedback Uses: • Great for beginner trainee’s, not more experienced trainee’s • Employee screening • Job fairs – get people interested in welding as a career GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 56

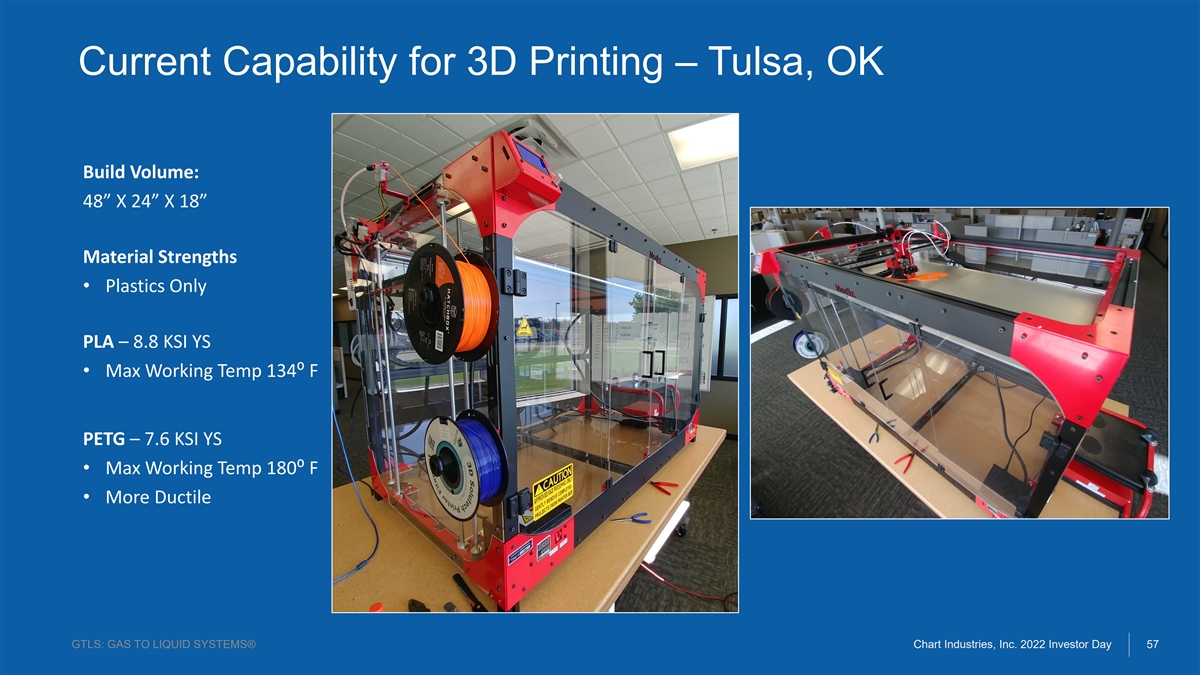

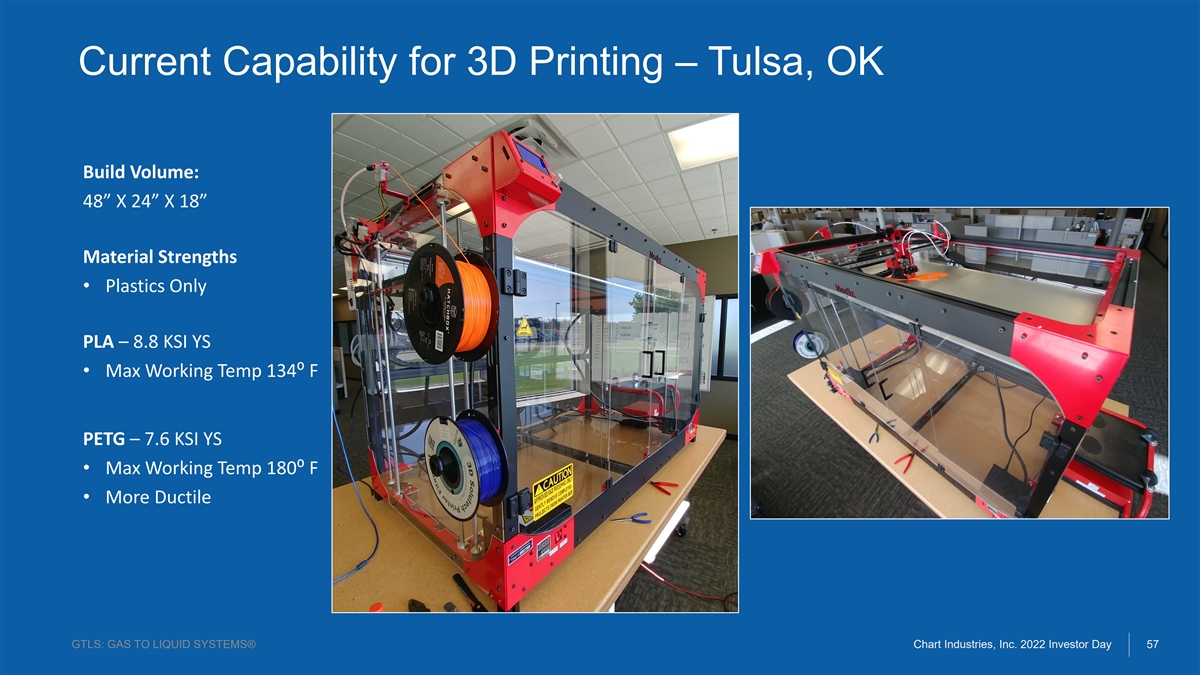

Current Capability for 3D Printing – Tulsa, OK Build Volume: 48” X 24” X 18” Material Strengths • Plastics Only PLA – 8.8 KSI YS • Max Working Temp 134⁰ F PETG – 7.6 KSI YS • Max Working Temp 180⁰ F • More Ductile GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 57

Additive Manufacturing: Jigs & Fixtures ACHX Ladder Mount Jig Vaporizer Jigs • Printed in 1 business day • Eliminated measuring while on ladder • Completely eliminated misalignment error & rework • Cost $9, Design: ~ 1 hr., Print time ~ 8.5 hrs • Compensates for extrusion length variation • Eliminates measuring operation • Cost: $0.45, Design: ~ 30 min., Print time ~ 1.5 hrs • Sri City & Changzhou might have need for this GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 58

Robotic Welding of Bulk Tank Legs – Decin, CR • Robotic welding cell for production of bulk tanks legs • Cell Layout - custom single station robotic cell with positioners & tooling • Consolidated production of bulk tank legs for Decin and Ornago plants • Labor reduction (from 2 welders to 1 operator) • Cycle times reduced by ~40% • Increased safety of production process • Robotic cell ordered, installation Q2/2022 <$300,000 of cost with significant payback GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 59

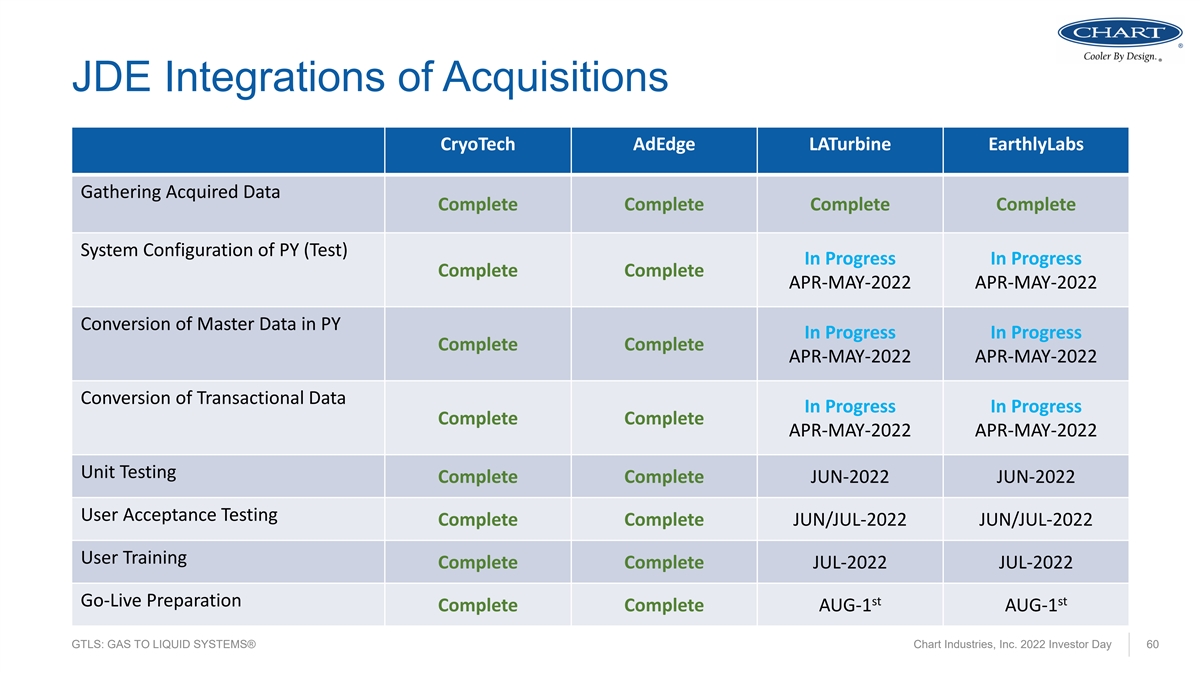

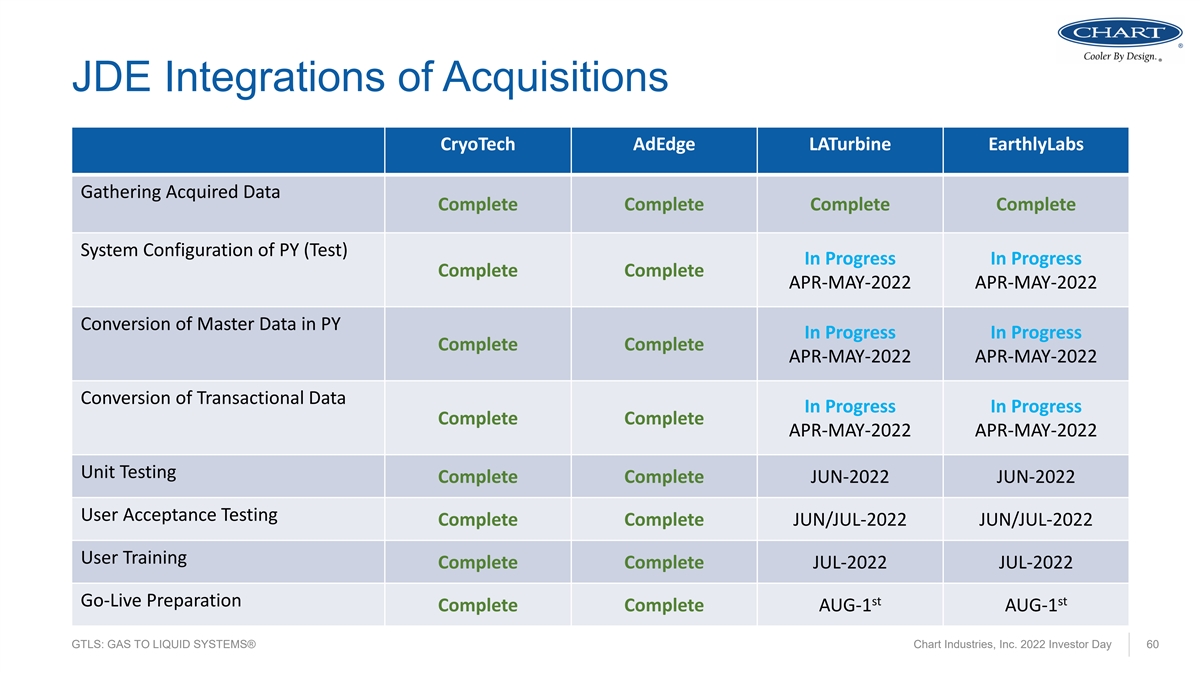

JDE Integrations of Acquisitions CryoTech AdEdge LATurbine EarthlyLabs Gathering Acquired Data Complete Complete Complete Complete System Configuration of PY (Test) In Progress In Progress Complete Complete APR-MAY-2022 APR-MAY-2022 Conversion of Master Data in PY In Progress In Progress Complete Complete APR-MAY-2022 APR-MAY-2022 Conversion of Transactional Data In Progress In Progress Complete Complete APR-MAY-2022 APR-MAY-2022 Unit Testing Complete Complete JUN-2022 JUN-2022 User Acceptance Testing Complete Complete JUN/JUL-2022 JUN/JUL-2022 User Training Complete Complete JUL-2022 JUL-2022 st st Go-Live Preparation Complete Complete AUG-1 AUG-1 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 60

GTLS: GAS TO LIQUID SYSTEMS® C Ch ha ar rtt IIn nd du ust str riie es, s, IIn nc. c. 2 20 02 22 2 IIn nve vest sto or r D Da ay y 6 61 1

Aggressive Product Development with Our Inorganic Partners § Developing H2 liquefaction expanders § Market hydrogen liquefaction with the § Industrial gas expanders under TM offering (“green” with microwave development plasma reactor technology) § High speed generator to load H2 expanders § Expand water treatment offering into water purification for electrolysis § Identify opportunities for water treatment in conjunction with carbon capture § Continue to improve efficiency and reduce CCC cost § Adapting McPhy’s electrolyzer to U.S. § Utilize our equipment in this hydrogen § Marketing CCC to LNG power plants standards and certifications fuel station variant (optionality for EU with energy recovery / efficiency § New methods to protect from direction) combination hydrogen corrosion (versus nickel plate every component) GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 62

Organic Product Development with our Cryogenic Expertise Hydrogen Liquefaction H2 & He Equipment ACHX, IG, CO2 • Development of LH2 to LH2 • Imbedded ortho to para catalyst • ACHX direct drive motor for fueling stations in EU including for performance parameter space savings and enhanced pumps, valves, dispensers with improvements (efficiency and heat transfer for improved metering column and control cost) efficiency systems. • Development of centrifugal • Thermablock heat exchangers • Design with partners (i.e. Hyzon) compressor application aseptic doser and ORCA VHP on HLH2 vehicle tanks • Incorporate where applicable to • CO2: Trifecta HP pumpless • Additional design and all H2 liquefier designs supply, eco-mizer BOG, Smart- manufacturing of hydrogen and tel advanced cylinder telemetry helium mobile equipment with variants of trailers, ISOs, ISOs with heat sink shields GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 63

Industrial Gas Transports • Building off Chart’s successful transport trailer designs, we are entering the industrial gas transport market. What Is It? • Integration of VOC feedback to optimize the volume and weight of the liquid oxygen design. Latest Milestone • VOC feedback regarding the plumbing cabinet • Manufacturing of the liquid oxygen design in August Next of 2022. Milestone Trailer Model LOX LIN LAR Capacity 5500 gallons 8200 gallons 4800 gallons MAWP 50 psi 33 psi 38 psi • Liquid nitrogen and argon designs release to manufacturing in early 2023. Roadmap GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 64

Liquid Hydrogen Fuel Station Pump • A liquid hydrogen high-pressure pump designed for the rigors of a typical fuel station. What Is It? • Successful testing at one-third speed producing 830 bar @ 60 kg/hr, which is well within our expected Latest design conditions. Milestone • Full-speed testing. Next Milestone • Optimization of sealing technology for industry- 1 Cold End 2 Cold End leading longevity. Roadmap Capacity 120 kg/hr 240 kg/hr Discharge 850 bar 850 bar GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 65

ISO Containers for Liquid Hydrogen and Helium • 40 ft ISO Container designs for transport of liquid hydrogen and liquid helium. What Is It? • Successful structural frame testing of the unshielded liquid hydrogen first build. Latest Milestone • Completion of the first build followed by performance testing in July/August. Next Hydrogen Hydrogen Helium Milestone Unshielded Shielded Shielded Water Capacity 47 m3 43 m3 41 m3 Weight Capacity 2200 kg 2800 kg 4600 kg • Designs that incorporate complex heat shielding to improve energy efficiency. Projected Hold Time < 45 days > 45 days 35 days Roadmap GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 66

Turboexpanders (LA Turbine) •Combining expertise from across Chart to expand our turboexpander portfolio to cover needs in the What Is It? hydrogen, natural gas, and industrial gas markets. •Finalized magnetic bearing design for our 15 TPD hydrogen liquefaction plants. Latest •Industrial gas designs for LNG/LH2/IG plants. Milestone •Begin high-efficiency gas foil bearing designs for our smaller LH2 plants. Next •Manufacturing of the magnetic bearing 15 TPD model. Milestone •Generator loaded hydrogen turboexpanders for a reduction in capital costs and power recovery. Roadmap GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 67

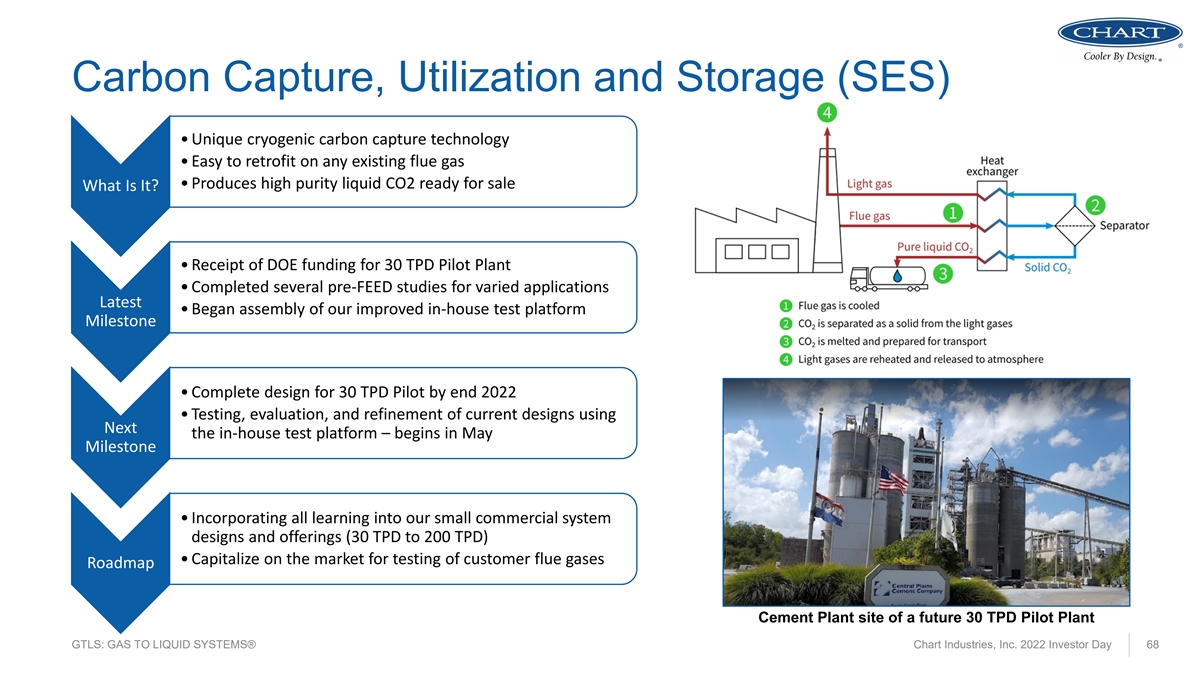

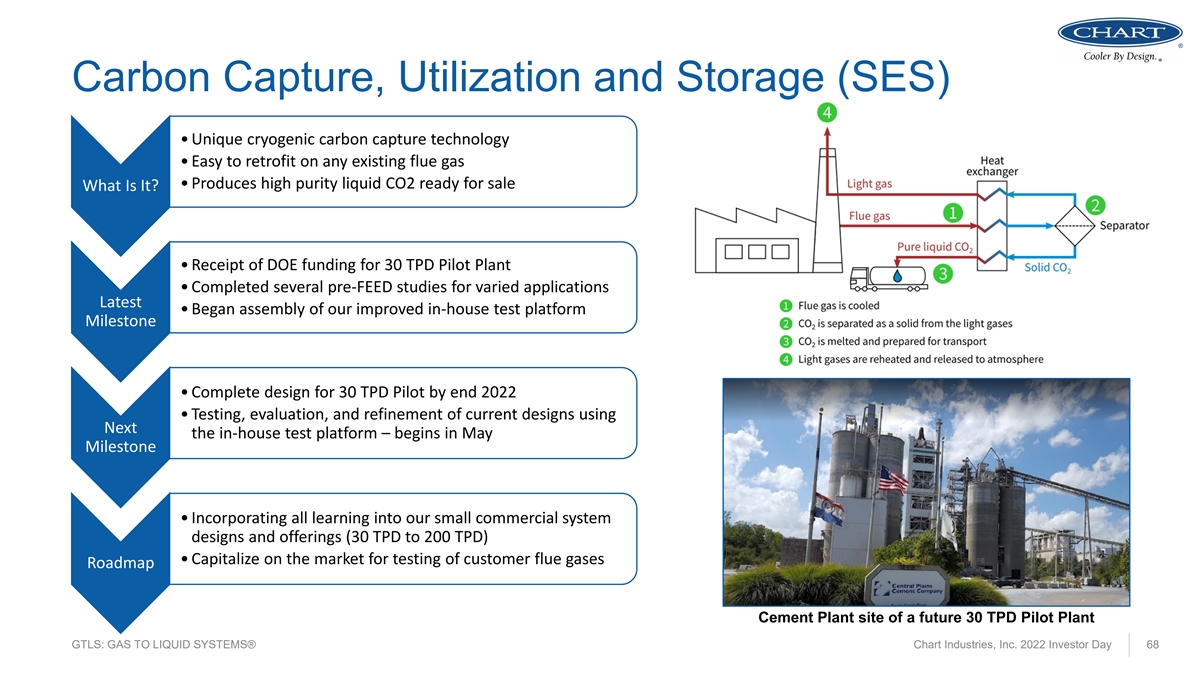

Carbon Capture, Utilization and Storage (SES) • Unique cryogenic carbon capture technology • Easy to retrofit on any existing flue gas • Produces high purity liquid CO2 ready for sale What Is It? • Receipt of DOE funding for 30 TPD Pilot Plant • Completed several pre-FEED studies for varied applications Latest • Began assembly of our improved in-house test platform Milestone • Complete design for 30 TPD Pilot by end 2022 • Testing, evaluation, and refinement of current designs using Next the in-house test platform – begins in May Milestone • Incorporating all learning into our small commercial system designs and offerings (30 TPD to 200 TPD) • Capitalize on the market for testing of customer flue gases Roadmap Cement Plant site of a future 30 TPD Pilot Plant GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 68

GTLS: GAS TO LIQUID SYSTEMS® C Ch ha ar rtt IIn nd du ust str riie es, s, IIn nc. c. 2 20 02 22 2 IIn nve vest sto or r D Da ay y 6 69 9

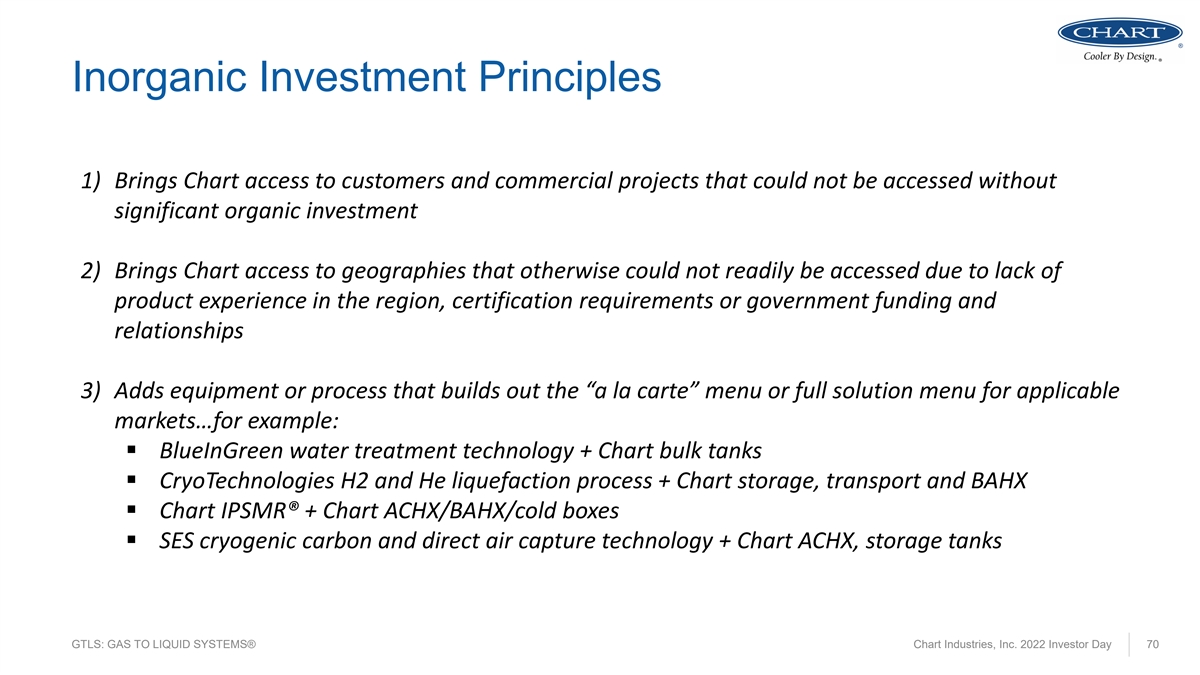

Inorganic Investment Principles 1) Brings Chart access to customers and commercial projects that could not be accessed without significant organic investment 2) Brings Chart access to geographies that otherwise could not readily be accessed due to lack of product experience in the region, certification requirements or government funding and relationships 3) Adds equipment or process that builds out the “a la carte” menu or full solution menu for applicable markets…for example: § BlueInGreen water treatment technology + Chart bulk tanks § CryoTechnologies H2 and He liquefaction process + Chart storage, transport and BAHX § Chart IPSMR® + Chart ACHX/BAHX/cold boxes § SES cryogenic carbon and direct air capture technology + Chart ACHX, storage tanks GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 70

Types of Inorganic Targets: Opportunistic Technology Expansion Footprint expansion Logical accelerators • Additional cryogenic process • Repair & Service specific • Highly synergistic smaller geographies players • Innovative, disruptive new technology in nexus of clean • Linkages to gas & liquid • Highflow reverse osmosis • Opportunities for efficiencies in knowledge of improvements such as pumps, etc. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 71

ChartWater™ Rationale: • India is a key water treatment market • Chart/AdEdge already owns 50% of the JV • Gaining 100% ownership will allow Chart to accelerate the growth Scope: • To promote ChartWater™ products and solutions in the South Asian markets Buyout of AdEdge • Focus on water/wastewater treatment and surface water bodies rejuvenation India JV Recent Activity: Notice of Award for design, supply, construction and operation of 7.3MLD water treatment plant in the State of Jharkhand Upcoming Activities: • Utilize cross-selling as well as India water team to generate further leads • Win second, similar project in Jharkhand • Successful project execution • Leverage SriCity, India manufacturing facility GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 72

GTLS: GAS TO LIQUID SYSTEMS® C Ch ha ar rtt IIn nd du ust str riie es, s, IIn nc. c. 2 20 02 22 2 IIn nve vest sto or r D Da ay y 7 73 3

Ali Snyder: Our New Director of Sustainability and Marketing In this role, Ali will help us continue our ESG Journey and Promoting our Chart Values and Sustainability Efforts. • BS Marketing from La Salle University • Chart intern during college • Chart Emerging Leader • Chart product manager for beverage and liquid cylinders GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 74

Highlights from our 2021 Sustainability Report • As of the end of March 2022, Chart team members achieved our lowest 12-month rolling Total Recordable Incident Rate (TRIR) in our history • Substantial progress made toward achieving 30% carbon reduction by 2030 and neutrality by 2050 • Reduced GHG intensity by almost 14% in 2021 • Reduced Scope 1 and Scope 2 emissions by almost 4% in 2021, with Scope 2 emissions dropping by ~10% • Increased the percentage of electricity sourced from renewables • Instituted an ESG metric in executive 2021 short-term bonus target, maintaining that metric in 2022 • Formed a Global ESG Committee, with five subcommittees focused on energy management, reducing waste, electrification, renewable energy and water management • Closed on a $1 billion sustainability-linked revolving credit facility that is tied directly to our ESG metrics • Contribute to 5 of the United Nations Sustainable Development Goals • Maintain an independent Board of Directors, the majority of which are female and diverse, governed with a separate Chairman and CEO • Our Global D&I Committee, made up of more than 50 volunteer team members from around the world, continued to advance community involvement, education, training and overall employee engagement • Proactively monitoring our supply chain in order to identify risks early and ensure proper governance and diversity in our client and supplier network GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 75

GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 76

Environmental: Lowering Our Own Emissions • Reduced total number of welding machines • Energy efficiency upgrades for various equipment • Replacing diesel-powered equipment with electric needed to support production Plant • Installation of welding camera systems to reduce the need for scaffolding, • Added fume extractors in high fume areas Improvements preventing operator from being exposed to intense arc light • Energy audits at various sites • Installation of LED lighting and “turn-off policy” (last one to leave ensures all lights are off) LED Lighting • AC regulation and installation of programmable thermostats Energy Savings • Printer terminal control systems using personal e-card (log in to the printer to double-check action and avoid wrongful printing) (Office) • Using recyclable and reusable packaging Recycling • Plastic bottle, aluminum can, and paper recycling programs • Expansion of rooftop solar On-site Renewable • Company car upgrades (hybrid/CNG fleets) Energy • Carrying out projects such as tree-planting and protection (ex: planting 2,000 trees in Czech Switzerland National Park in the Carbon Offsets Decin District) GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 77

Global Environmental Sub-Committees Sub-Committee 1: Sub-Committee 2: Sub-Committee 3: Sub-Committee 4: Sub-Committee 5: Energy Management Zero Waste Electrification Renewable Energy Water Management Scope: To explore ISO 50001 – Scope: To improve recycling, Scope: To consider and plan Scope: To create a renewable Scope: To figure out better the gold standard of energy reuse, and waste management for the shift from liquid fuels to energy sourcing strategy for ways to conserve water and/or management. While not actually procedures globally to achieve electric powered equipment. sites while considering local and improve water efficiency in our certified, we can still benefit “zero waste.” This group will identify variables country incentives. operations and manufacturing. from improved energy efficiency such as technical specifications, Where applicable, ensure by adopting best practices. Sample Project(s): Adopt capacity (run time vs. charge Sample Project(s): Build upon wastewater consistently meets practices from the automotive time), maintenance, safety, and the work done by the Emerging permissible levels to avoid Sample Project(s): Assess gaps industry and integrate into our training needs to make this Leaders and expand that across additional charges. In between current energy own operations. switch and create sites. Consider local and country unregulated or under-regulated management system and ISO guidelines/checklist/tools to incentives for rolling out regions, develop Chart’s own 50001. help others plan for and adopt renewable energy projects. standard for wastewater. more electric powered Share learnings with the rest of equipment. the team. Sample Project(s): Identify improvement areas with Sample Project(s): Assess the equipment, processes, and potential to electrify including operating and maintenance expected price development, as procedures and share best well as financial and societal practices with the rest of the benefits to the shift. team. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 78

Environmental: Helping Our Customers In 2021, we helped our customers… Treat Water Replace Diesel with LNG Replace Coal with LNG Our water and wastewater Our customers reduced Our customers produced treatment equipment almost 700 million liters of over 50 million metric tons processed over 13 billion diesel used by heavy duty of LNG to replace coal-fired liters of water per day trucks, a 30% increase over power generation globally, a year-over-year 2020. internationally, ~6% increase of ~70%. increase year-over-year. § We are uniquely positioned to help our customers reach their ESG goals. § We continue to provide flexible, wide-ranging solutions to our customers to help them reach their emissions reductions targets – and our portfolio is only growing. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 79

In Conjunction with United Nations Sustainable Development Goals Clean Water and Sanitation Affordable and Clean Energy § Our water and wastewater treatment process is a safe and § Our equipment produced over 50 million tons of LNG to natural method that avoids chemical treatments while replace coal fired power generation outside the US last year improving efficiency and reducing costs while helping to reduce more than 120 million gallons of diesel used in power generation in the Caribbean and Europe § Last year, Chart products processed over 13 billion liters of water per day globally § We helped to eliminate over 40 million tons of coal used in US power generation last year Sustainable Cities and Communities Climate Action § All of Chart’s products and technology help our customers § We continuously improve energy efficiency and reduce achieve their carbon-neutral sustainability goals energy consumption in our operations, including recently installing solar panels at certain facilities § We helped eliminate approximately 250 million pounds of PET (plastic) used in water bottles in the US last year § We’re actively involved in the global energy transition and work to educate as a member of the Carbon Capture § Our products helped reduce almost 700 million liters of diesel Coalition and Hydrogen Council used by trucks GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 80

Social: Safety • Chart has a ‘Global Safety Council’ that meets to discuss accidents, injuries, near misses, and lessons learned. • The Council presents metrics at every executive staff and Board of Directors meeting and reports their performance to division presidents. • All Chart employees have ‘Stop Work Authority’ and are expected to use it if they’re concerned that any task or procedure could be unsafe. • Each site recognizes and rewards hourly employees for reaching safety performance milestones and completing audits. • All Chart sites implement our Occupational Health and Safety Program Requirements for training, reporting, accident investigation, auditing, implementation and compliance. The policy encourages employee involvement by requiring each site to create a safety committee and safety suggestion program. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 81

Recognizing Our Leadership in Safety Tom Drube, VP of Engineering and Chart Engineering Fellow • Recipient of the distinguished Charles H. Glasier Safety Award 2022, presented annually by the Compressed Gas Association (CGA) to an individual in recognition of their safety leadership in the industrial gas industry. • Tom has spent more than 30 years volunteering his expertise in service to the CGA, providing invaluable leadership towards ensuring the safe design of compressed gas containers. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 82

Talent Development Programs • Representing India, China, US and EU locations • Collaborating with Kennesaw State, Texas A&M, HBCs, Georgia Tech, Forze/University of • Numerous graduates in larger roles within Emerging Delft Chart Internships Leaders • Full-time hiring rate post graduation is high • China EL Program established including English from our intern program language skills • Over 60 team members participating • Partner with Texas A&M, Georgia Tech, and • Committed up to $250,000 for D&I activities Rotational D&I numerous other schools and community involvement Engineers Committee • 2022 Program has 100% new diverse entrants • Leverages one of our four key themes – giving back to our communities • Welding Council representing each site with • Four engineering fellows and 8 subject matter Engineering key welding talent Welding key experts Fellows & Council • Establishing training program in various Chart Key Experts • Elite program for the industry shops GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 83

Social: Committed to Diversity & Inclusion Global Diversity & Inclusion Committee Mission: To Make Chart Better This Global Committee is employee-driven and supported and funded by executive leadership. It is broken into six sub-committees, each targeted at a specific impact area related to D&I: 1. Community Involvement 4. Education & Training 2. Talent/Hiring/Development 5. Team Member Involvement 3. Internal/External Communication 6. Employee Engagement Examples of Actions Taken: • Internal D&I website where relevant materials and trainings are housed • Innovations Box, providing a forum for employees to submit ideas and process improvement suggestions to the executive team and are rewarded for their contributions • Translations team to ensure messaging is translated into local languages • Set-up of TV monitors in manufacturing spaces to communicate to non-office employees who do not have access to emails • Support the National Women’s History Museum GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 84

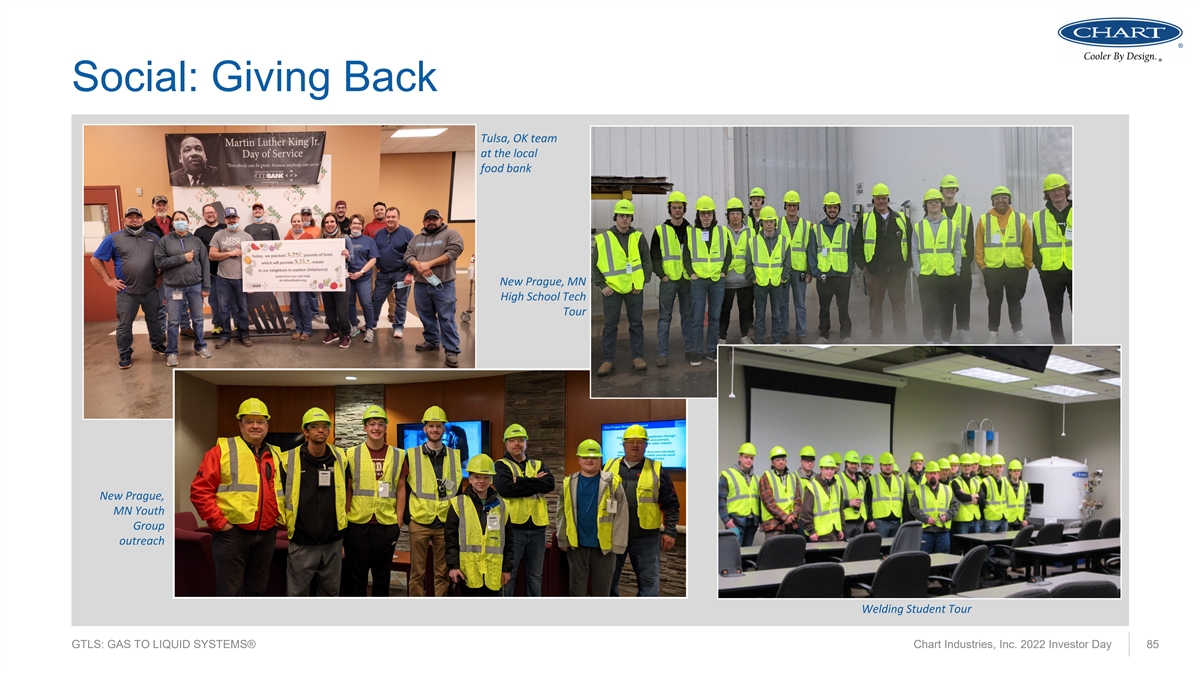

Social: Giving Back Tulsa, OK team at the local food bank New Prague, MN High School Tech Tour New Prague, MN Youth Group outreach Welding Student Tour GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 85

Our Cool Communities! GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 86

Pretty Cool Customers, Too… GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 87

GoBeyond Profit Recognition We’re proud to have been recognized as one of the most generous companies in Georgia (USA) in goBeyondProfit’s 2022 “In Good Company” report Each company listed has pledged to find ways to leverage their business resources to improve lives. They are making meaningful efforts to care for their people and their communities. We are in the midst of a business transformation and with it a new way of working has emerged. Generosity matters and goBeyondProfit members demonstrate the best of business on a daily basis. Companies of all sizes, industries – from start-ups to Fortune 500s – making a positive impact. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 88

Financial Overview GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 89

Q1 2022: Record Order & Backlog Quarter Q1 2022 Orders $M 1 Venture Global (BKR) Plaquemines Phase 1 FNTP $135.5 2 Venture Global (BKR) Plaquemines Phase 2 (first 6 cold boxes out of 18 anticipated) 45.4 3 Cheniere (Bechtel) CCL Stage 3 LNTP 47.5 4 BigLNG orders booked in Q1 2022 228.4 5 ssLNG (New Fortress Energy) FastLNG2 order booked in Q1 2022 38.3 6 Other GTLS orders booked in Q1 2022 370.1 7 Total GTLS Q1 2022 Orders Booked 636.8 Continued increasing interest in the actual order book as well as in the pipeline, which we will discuss today: • LNG, LNG, LNG • Railcars abound! • Food & beverage new store buildouts and replacements • Food & beverage customers interested in water treatment & small-scale CCUS • Hydrogen demand expanding geographically and with new customers • Industrial CCUS engineering and feasibility work • Space exploration equipment (new entrants and more accessibility) GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 90

Full Year 2022 Outlook Revenue Non-Diluted Adjusted EPS Capital Expenditures Adjusted Free Cash Flow $5.35 to $6.50 $1.725 billion to $1.85 billion Assumes 19% ETR and Approximately $50 to $55 Approximately $175 to $225 35.83M shares outstanding million million (1) Includes approximately $25 to $40 million of Big LNG related revenue in the year; primarily latter part of 2022 (2) HLNG vehicle tank products lowered 2022 purchasing forecasts (timing shift is anticipated to 2023) (3) We consider uncertainty around shutdowns and logistics in China in the near-term in this outlook (4) Assumed weighted shares outstanding are 35.83 million; prior guidance was 35.6 million shares (5) We are assuming a 19% effective tax rate (unchanged from prior guidance) (6) Anticipate the first half of 2022 will include a margin drag from historical levels from the ongoing macro challenges but increasingly improve throughout 2022 (7) The higher-end of the range requires specific larger opportunities in our commercial pipeline to be booked as orders in the coming few months GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 91

Increasing LNG Opportunities for GTLS Pre Feb 24, 2022 GTLS April 29, 2022 GTLS Perspective Perspective • Number of reasonably possible projects to move to 10 22 BigLNG order stage by 2024 • Number of international projects contemplating using 1 2 (greater IPSMR® than 5 • GTLS Associated Order Potential $ $1.25 billion $4.55 billion MTPA) • GTLS Order $ Booked Year-to-Date 2022 $0 $228.4 million • Number of reasonable possible projects to move to 205 233 ssLNG order stage by 2024 • Number of Floating LNG projects in bid pipeline 13 26 (5 MTPA and • GTLS Associated Order Potential $ $1.5 billion $1.75 billion smaller) • GTLS Order $ Booked to Date 2022 0 $38.3 million + LOI GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 92

RSL Activities and Roadmap 2018-2021 2022-2024 Actions: § Added field service technicians § Acquired Skaff (New Hampshire) § Partnerships in key locations for field service across the United States Geographic Footprint § Acquired VCT Vogel (Germany) § Opportunistically acquire strategic locations § Opened Richburg, SC repair site § Addition of major IG customers § New customers on agreements; § Add service agreements and refurbishment RSL LTAs with key customers repair and service LTAs preventative maintenance in EU LTAs with new customers and value pricing § Expanded on-site service & § Offered leasing option for the first § Targeted fueling station support and IOT / European RSL Capabilities maintenance into 5 more countries time in EU Engineering preventive maintenance in Europe § Introduced virtual engineers for § Expanded IOT capabilities with § Leverage IOT from Earthly Labs into other Remote Monitoring station monitoring investment in Earthly Labs applications, namely water treatment Portfolio additions with § Acquired BlueInGreen with § Acquired L.A. Turbine • Discussed in our inorganic sections of this Treatment as a Service (TaaS) overview higher % aftermarket § Invested ~$5M into standard § Invested another ~$7M into leasing § Continue to invest in Standard leasing fleets Expanded Leasing Fleet mobile and micro-bulk lease fleet fleet per customers’ requests GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 93

Specialty Markets TAM Continues to Grow Market End-use of Products Near-term 2030 TAM Drivers of Size Opportunity (1) TAM 2 Hydrogen & Helium • H /He Liquefaction $3,100M $25,000M • Development of “green hydrogen” industry • Transports and storage • Buildout of hydrogen fueling infrastructure • Fueling stations and bunkering • Government stimulus packages 2 Carbon Capture • Industrial scale carbon capture $850M $6,000M • CO emission reduction targets ® ® 2 • Small scale applications (CICI ,ELM ) • CO supply shortages • Distribution and storage • Tax incentives, fuel standards, carbon trading systems Over-the-Road • LNG as alternative fuel to diesel for heavy duty vehicles $750M $2,000M • Regulations Trucking (lower emissions, engine noise, etc.) • Tax incentives Water Treatment • Improving water quality and wastewater treatment utilize $1,500M $6,000M • Regulation on water treatment liquid oxygen and CO2 in purification process • Population growth • Technology for removal of wide range of contaminants including arsenic, PFAS and PFOS. Food & Beverage • Food preservation equipment $500M $1,000M • Nitro-beverage changeover • Nitrogen dosing equipment Cannabis • Liquid CO2 storage and supply / delivery systems $250M $550M • Legalization of cannabis • Used in grow houses, CBD oil extraction and packaging • Regulatory approval for CBD. • Legalization of LNG by train in the U.S. Molecules By Rail • Gas by rail tender cars approved for use $250M $500M • Expected growth in EU Lasers • High purity liquid nitrogen (gas assist) provides a faster cut $200M $500M • Uptime requirements in manufacturing and superior edge, free of impurities • Reducing steps in production Space • Cryogenic liquid propellants are used as fuel for rocket $250M $1,000M • Proliferation of private space travel industry propulsion Total $7,650M $42,550M Source: Potential Market Size are Chart Management estimates. (1) Reflects Total Addressable Market (TAM) for current and potential application of Chart technology and products. GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 94

Financial Targets 3-Year Target STRATEGIC FINANCIAL PLAN 2022 Target (incl-Big LNG) Revenue $1.725 – 1.85 billion > 17% CAGR Gross Margin Exiting at 30% 33-36% Earnings per share $5.35 – 6.50 > 25% CAGR Net Leverage Under 2.5x Under 1.0x Note: 3-Year targets represent FY23 through FY25 GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 95

Q&A GTLS: GAS TO LIQUID SYSTEMS® Chart2 0 In 1d 9u st Ch ria er s, t IIn nd c. u st 20 ri2 e2 s IIn nve vest sto or r D Da ay y 96 96

Customer Strong Safety Have Fun Orientation Work Ethic Delivering Results: Profitable Growth GTLS: GAS TO LIQUID SYSTEMS® Chart Industries, Inc. 2022 Investor Day 97