THE CUTLER TRUST

QUESTIONS AND ANSWERS

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSALS

The Cutler Trust (the “Trust”) will be holding a Special Meeting of Shareholders of the Cutler Equity Fund and the Cutler Fixed Income Fund (together, the “Funds”), each a series of the Trust, on Friday, August 30, 2013 at 9:00 a.m., Eastern time, (the “Meeting”) at the offices of Ultimus Fund Solutions, LLC, the Trust’s transfer agent, at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. Shareholders of the Trust are receiving this Proxy Statement and proxy card to consider and to vote on the proposals set forth in this Proxy Statement.

We ask that you give each proposal careful consideration. This section of the Proxy Statement is intended to give you a quick review of each proposal and the proxy process. Details about the proposals are set forth in the Proxy Statement. We urge you to read the entire Proxy Statement completely and carefully.

| Q: | WHY ARE SHAREHOLDERS BEING MAILED THIS PROXY MATERIAL? |

| A: | You are receiving these proxy materials — including the Proxy Statement and the accompanying proxy card — because you have the right to vote on two important proposals concerning your investment in the Funds. The purpose of this Proxy Statement is to disclose important information about the proposals and to seek shareholder approval of the proposals. The proposals have been unanimously approved by the Board of Trustees. |

| Q: | WHY ARE SHAREHOLDERS OF THE TRUST BEING ASKED TO ELECT TRUSTEES? |

| A: | Shareholders are being asked to elect four nominees to serve on the Board of Trustees of the Trust in order to ensure that at least two-thirds of the members of the Board have been elected by the shareholders of the Trust as required by the Investment Company Act of 1940 (the “1940 Act”). The Board of Trustees of the Trust (the “Board of Trustees”) currently consists of three Trustees, Matthew C. Patten, John P. Cooney and Robert F. Turner, of which two (Messrs. Patten and Cooney) were elected previously by shareholders of the Trust. On July 3, 2013, Dr. Mario J. Campagna, an Independent Trustee of the Trust, passed away after a brief illness. The Board of Trustees has nominated Mr. Edward T. Alter to fill the vacancy on the Board created by the death of Dr. Campagna; however, Edward T. Alter has not been elected by the Funds’ shareholders. The 1940 Act provides that vacancies on the Board of Trustees may not be filled by Trustees unless thereafter at least two-thirds of the Trustees shall have been elected by shareholders. To ensure compliance with the 1940 Act, shareholders are being asked at the Meeting to |

| | elect Messrs. Matthew Patten, Cooney and Turner, who are all currently Trustees, and to elect Mr. Alter as a new member of the Board. Information regarding the qualifications of each nominee is set forth below under Proposal 1. |

| Q: | ARE THERE OTHER BENEFITS TO ELECTING THE TRUSTEES? |

| A: | The election by shareholders of all of the nominees at the Meeting will reduce the likelihood that the Trust will need to undergo another proxy solicitation with regards to Board composition in order to ensure compliance with the 1940 Act for the foreseeable future. | |

| Q: | HOW DOES THE BOARD OF TRUSTEES RECOMMEND I VOTE ON THE PROPOSALS? |

| A: | After careful consideration of the proposal, the Board of Trustees unanimously recommends that you vote FOR the proposals. The various factors that the Board of Trustees considered in making this determination are described in the Proxy Statement. |

| Q: | ARE THERE OTHER CHANGES AFFECTING THE FUND? |

| Q: | WHERE IS THE MEETING GOING TO BE HELD? |

| A: | The Meeting is scheduled for Friday, August 30, 2013 at 9:00 a.m., Eastern time, at the offices of the Funds’ transfer agent, Ultimus Fund Solutions, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| Q: | WHO IS ELIGIBLE TO VOTE AT THE MEETING? |

| A: | Shareholders of the Trust as of July 22, 2013 (the “Record Date”) are entitled to vote at the Meeting or any adjournment of the Meeting. Shareholders may cast one vote for each share they own. |

| Q: | HOW DO I VOTE MY PROXY? |

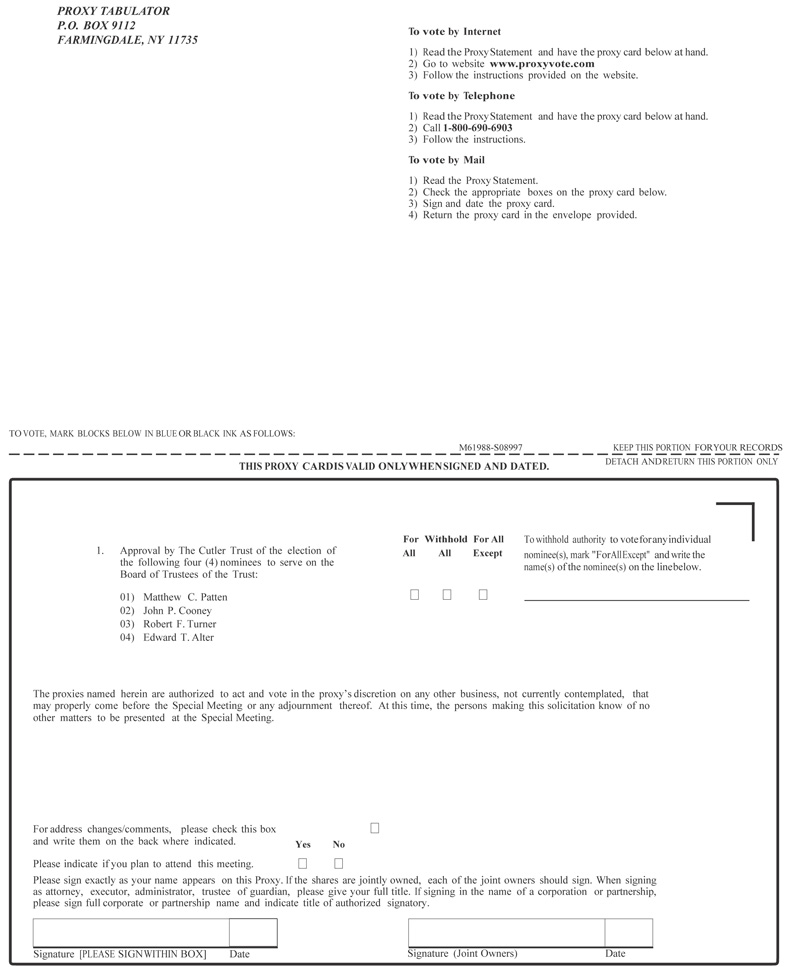

| A: | You may vote through the internet or by telephone by following the simple instructions and using the control number that appears on the proxy card. You may also attend the Meeting and vote your shares in person or complete the enclosed proxy card and return the card in the enclosed self-addressed, postage-paid envelope. The use of internet voting will reduce the time and costs associated with this proxy solicitation. |

| Q: | WHAT WILL HAPPEN IF THERE ARE NOT ENOUGH VOTES TO HOLD THE MEETING? |

| A: | It is important that shareholders vote through the internet or by telephone or complete and return signed proxy cards promptly, but no later than August 30, 2013, to ensure there is a quorum for the Meeting. You may be contacted by a representative of the Trust or a proxy solicitor if we do not hear from you. If we have not received sufficient votes to have a quorum at the Meeting, we may adjourn the Meeting to a later date so we can continue to seek more votes. |

| Q: | WILL THE TRUST BE REQUIRED TO PAY FOR THIS PROXY SOLICITATION? |

| A: | Yes, the Trust will pay the cost of this proxy solicitation. |

| Q: | WHERE CAN I GET MORE INFORMATION ABOUT THE PROPOSALS? |

| A: | Please contact Shareholder Services directly at 1-888-288-5374 (1-888-CUTLER4) between the hours of 8:30 a.m. to 5:30 p.m., Eastern time. Representatives will be happy to answer any questions you may have. |

THE CUTLER TRUST

SPECIAL MEETING OF THE SHAREHOLDERS OF

TO BE HELD ON August 30, 2013

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or “Board of Trustees”) of The Cutler Trust (the “Trust”) from the shareholders of the Cutler Equity Fund and the Cutler Fixed Income Fund (together, the “Funds”), each a series of the Trust, for use at a Special Meeting of Shareholders to be held Friday, August 30, 2013, at 9:00 a.m., Eastern time (the “Meeting”), or at any adjournment thereof. The Meeting will be held at the offices of Ultimus Fund Solutions, LLC, the Trust’s transfer agent, at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246, for the purposes set forth below and in the accompanying Notice of Special Meeting. This Proxy Statement and proxy card were first mailed to shareholders on or about August 2, 2013.

As described in more detail below, at the Meeting the shareholders of the Trust will be asked to elect four individuals to serve on the Trust’s Board of Trustees (“Proposal 1”).

The Funds have retained Broadridge Investor Communication Solutions, Inc. (“Broadridge”) to solicit proxies for the Meeting. Broadridge is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting brokers, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services. The anticipated cost of these services is approximately $5,000 and will be paid by the Trust.

In addition to solicitation through the mail, proxies may be solicited by representatives of the Trust without cost to the Trust. Such solicitation may be by telephone, email, facsimile or otherwise. It is anticipated that banks, broker-dealers, custodians, nominees, fiduciaries and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies. Upon request, the Trust will reimburse such persons or entities for the reasonable expenses incurred by them in connection with forwarding solicitation materials to the beneficial owners of shares held of record by such persons.

| PROPOSAL 1: | TO ELECT FOUR INDIVIDUALS TO SERVE ON THE BOARD OF TRUSTEES |

The Board of Trustees of the Trust has nominated four individuals (the “Nominees”) for election to the Board. At the Meeting, the shareholders of the Trust will be asked to elect the Nominees to serve on the Board of Trustees of the Trust. It is intended that

the enclosed Proxy will be voted FOR the election of the four Nominees named below as Trustees, unless such authority has been withheld in the Proxy. Each Nominee has consented to serve as a Trustee if elected.

Shareholders are being asked to elect the following individuals who are described herein, to the Board of Trustees: Messrs. Matthew C. Patten, John P. Cooney, Robert F. Turner and Edward T. Alter (“Nominees”). Mr. Patten is an “interested person” of the Trust under the Investment Company Act of 1940 (the “1940 Act”) because he is an employee of Cutler Investment Counsel, LLC (the “Adviser”), the Trust’s investment adviser, and is deemed to have a financial interest in the Trust (“Interested Person”). Messrs. Patten, Cooney and Turner are incumbent Trustees, and Messrs. Patten and Cooney were elected by shareholders of the Trust to serve as Trustees of the Trust on April 9, 2007. Mr. Turner was appointed to serve as a Trustee by the Board of Trustees on September 26, 2012 but has not been elected by shareholders of the Trust. The remaining Nominee, Mr. Alter, has not previously served on the Board of Trustees and was nominated for election to the Board by the Board’s Nominating Committee, which nomination was approved by the Board on July 22, 2013. The Nominating Committee consists of the two current Independent Trustees of the Trust.

In conjunction with the reorganization of the two series of The Elite Group into the Trust (the “Reorganizations”) on September 27, 2012, the Adviser and the Trust agreed to comply with Section 15(f) of the 1940 Act which requires, in part, that for a three year period following the Reorganizations at least 75% of the Trustees of the Trust be Trustees who are not considered to be “interested persons” under the 1940 Act (referred to as “Independent Trustees”). On July 3, 2013, Dr. Mario J. Campagna, an Independent Trustee of the Trust, passed away thereby requiring that a new Independent Trustee be appointed to the Board so that 75% of the Trustees will be Independent and the Trust will be in compliance with Section 15(f). However, if a new Independent Trustee was appointed by the Board, the Trust would no longer meet the requirement of the 1940 Act that two-thirds of all Trustees must be elected by shareholders. (The 1940 Act also provides that vacancies on the Board of Trustees may not be filled by Trustees unless thereafter at least two-thirds of the Trustees shall have been elected by shareholders.) Accordingly, to ensure continued compliance with the forgoing requirements of the 1940 Act, shareholders are being asked at this Meeting to elect the four Nominees.

The Nominees will be elected for indefinite terms, subject to death, resignation, retirement or removal. Each Nominee has indicated a willingness to serve as a member of the Board of Trustees if elected. If any of the Nominees should not be available for election, the persons named as proxies (or their substitutes) may vote for other persons in their discretion. However, management has no reason to believe that any Nominee will be unavailable for election. In evaluating the Nominees, the Trustees took into account their background and experience, including their familiarity with the issues relating to the Funds as well as their distinguished careers. The Trustees also considered the prior experience of certain of the Nominees as Trustees of the Trust.

The Board of Trustees Generally

The business and affairs of the Trust are managed under the direction of the Board in compliance with the laws of the State of Delaware. Among its duties, the Board generally meets and reviews on a quarterly basis the operations of the Funds as conducted by the Funds’ service providers. The Trustees’ management of the Trust also includes a periodic review of the service providers’ agreements and fees charged to the Funds. Subject to the 1940 Act, applicable Delaware law and the Trust’s Trust Instrument and Bylaws, the Trustees may fill vacancies in or reduce or increase the number of Board members, and may elect and remove such officers and appoint and terminate such agents as they consider appropriate. They may appoint from their own number and establish and terminate one or more committees consisting of two or more Trustees who may exercise the powers and authority of the Board to the extent that the Trustees determine, and in accordance with the 1940 Act and state law. The Trustees may, in general, delegate such authority as they consider desirable to any officer of the Trust, to any Committee of the Board and to any agent or employee of the Trust. The Trust has not adopted procedures by which shareholders of the Funds may recommend nominees to the Board of Trustees.

The Trust shall indemnify each of its Trustees against all liabilities, including but not limited to amounts paid in satisfaction of judgments, in compromise or as fines and penalties, and expenses, including reasonable accountants’ and counsel fees, incurred by any Trustee in connection with the defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative or legislative body, in which such Trustee may be or may have been involved as a party or otherwise or with which such Trustee may be or may have been threatened, while in office or thereafter, by reason of being or having been such a Trustee, except that no Trustee shall be indemnified against any liability to the Trust or its shareholders to which such Trustee would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such Trustee’s office.

Information Regarding the Nominees and Executive Officers

The Nominating Committee has reviewed the experience, qualifications, attributes and skills of the Nominees. In evaluating the Nominees, the Committee took into account the contribution that each Nominee is expected to make to the diverse mix of experience, qualifications, attributes and skills that the Committee believes contribute to good governance for the Trust. The Board has concluded, based on each Nominee’s experience, qualifications, attributes or skills on an individual basis and in combination with the other Trustees, that each Nominee is qualified to serve on the Board. The Board believes that the Nominees’ ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Adviser, other service providers, legal counsel and independent public accountants, and to exercise effective business judgment in the performance of their duties as Trustees, support

this conclusion. In determining that a particular Nominee is and will continue to be qualified to serve as a Trustee, the Board considers a variety of criteria, none of which, in isolation, is controlling.

The following table is a summary of the specific experience, qualifications, attributes and/or skills for each Nominee.

| Interested Trustee Nominee |

| Matthew C. Patten | Mr. Matthew Patten has served as Investment Committee Member and Portfolio Manager of the Adviser and its affiliates since 2003 and President of the Adviser since 2004. He holds a B.S. degree in Economics and Environmental Geo-Science from Boston College and was awarded his MBA from the University of Chicago. Mr. Matthew Patten has served as a Trustee since 2004. The Board has concluded that Mr. Matthew Patten is suitable to serve as a Trustee because of his past service and experience as a Trustee of the Trust, his professional investment and business experience, and his academic background. |

| Independent Trustee Nominees |

| John P. Cooney | Mr. Cooney is a retired U.S. Magistrate Judge. He served as a U.S. Magistrate Judge from 1990 to 2007 and previously served as an attorney in private practice. Judge Cooney holds LL.B and J.D. degrees from Willamette University. He has served as a Trustee of the Trust since 2007 and has previously held leadership positions in various professional societies and community organizations. The Board has concluded that Judge Cooney is suitable to serve as a Trustee because of his past service and experience as a Trustee of the Trust, his distinguished academic background and positions of leadership, and his business and judicial experience. |

| Robert F. Turner | Mr. Turner retired in February 2012 as Chairman of Jeld Wen, a manufacturing company. He previously had served as Executive Vice President and Chief Operating Officer of Jeld Wen from 1999 to 2010. Mr. Turner holds a B.S. degree in Business from the University of Oregon. Mr. Turner has served on the Boards of several nonprofit organizations, including the University of Oregon Foundation and Jeld Wen Foundation. The Board has concluded that Mr. Turner is suitable to serve as a Trustee because of his business experience, his academic background and his service on other boards. |

| Edward T. Alter | Mr. Alter retired in January 2009 after 28 years as Treasurer of the State of Utah. He holds a B.A. degree in Banking and Finance and an M.B.A. from the University of Utah. Mr. Alter is a Certified Public Accountant and has over 40 years of accounting and financial management experience. He was formerly a member of the Utah State Bonding Commission, the Private Activity Bond Review Board and the Utah Housing and Finance Agency Board. Mr. Alter has served as a member of the Utah State Retirement Board for 30 years and served as President of the Board for 9 years. He also serves as a member of the Utah Capital Investment Board and the Utah Higher Education Assistance Board. The Board has concluded that Mr. Alter is suitable to serve as a Trustee because of his professional investment and business experience, his academic background and his service and leadership on other boards. |

The following is a list of the current Trustees, Nominees and executive officers of the Trust. The business address of each current Trustee, Nominee and executive officer is 525 Bigham Knoll, Jacksonville, Oregon 97530, except for Ms. Bloom and Mr. Dorsey, whose business address is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. Mr. Matthew Patten is the sole Nominee who is an Interested Person of the Trust as indicated below. No Nominee holds any directorships of any other investment company registered under the 1940 Act or any company whose securities are registered under the Securities Exchange Act of 1934 or which file reports under that Act.

| Name, Address and Age | Position(s) Held with Trust | Length of Time Served | Principal Occupation(s) and Directorships of Public Companies During the Past 5 Years | Number of Funds in Trust Overseen by Trustee/ Nominee |

| Interested Trustee Nominee: |

Matthew C. Patten(1)(2) Year of Birth: 1975 | Treasurer, Chairman, Trustee and Nominee | Treasurer Since March 2004 Trustee Since September 2006 | President since 2004 and Investment Committee Member and Portfolio Manager of Cutler Investment Counsel, LLC since 2003 | 2 |

| Name, Address and Age | Position(s) Held with Trust | Length of Time Served | Principal Occupation(s) and Directorships of Public Companies During the Past 5 Years | Number of Funds in Trust Overseen by Trustee/ Nominee |

| Independent Trustees Nominees: |

John P. Cooney Year of Birth:1932 | Lead Independent Trustee and Nominee | Since April 2007 | Retired U.S. Magistrate Judge | 2 |

Robert F. Turner Year of Birth: 1946 | Trustee and Nominee | Since September 2012 | Retired; Chairman from 2010 to 2012 and Executive Vice President and Chief Operating Officer from 1999 to 2010 of Jeld Wen (a manufacturing company) | 2 |

Edward T. Alter Year of Birth: 1941 | Nominee | n/a | Retired; Treasurer of the State of Utah from 1981 to 2009 | 2(3) |

| Name, Address and Age | Position(s) Held with Trust | Length of Time Served | Principal Occupation(s) and Directorships of Public Companies During the Past 5 Years |

| Executive Officers: |

Erich M. Patten(2) Year of Birth: 1977 | President | Since March 2004 | Investment Committee Member, Portfolio Manager and Chief Investment Officer of Cutler Investment Counsel, LLC since 2011; prior to 2011, Investment Committee Member, Portfolio Manager and Corporate Secretary of Cutler Investment Counsel, LLC |

Brooke C. Ashland(2) Year of Birth: 1951 | Vice President and Chief Compliance Officer | Since June 2002 | Investment Committee Member and Chief Executive Officer of Cutler Investment Counsel, LLC since 2003; Chief Executive Officer and President of Trustee Investment Services, Inc. (a Trustee education firm) since 1991; President of Big Bear Timber, LLC (farming) since 1989 |

| Name, Address and Age | Position(s) Held with Trust | Length of Time Served | Principal Occupation(s) and Directorships of Public Companies During the Past 5 Years |

William C. Beggs Year of Birth: 1982 | Vice President and Assistant Chief Compliance Officer | Vice President Since November 2012 Assistant Chief Compliance Officer Since October 2011 | Member of Cutler Investment Counsel, LLC since 2012 and Senior Analyst and Assistant Chief Compliance Officer of Cutler Investment Counsel, LLC since 2011; Securities Compliance Examiner for the U.S. Securities and Exchange Commission, from 2008 to 2011; Research Analyst for Ethanol Capital Management, LLC, during 2008. |

Tina H. Bloom Year of Birth: 1968 | Secretary | Since April 2011 | Director of Fund Administration of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC |

Robert G. Dorsey Year of Birth: 1957 | Vice President | Since March 2005 | Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC |

(1) | Matthew C. Patten is an Interested Trustee because of the positions he holds with the Adviser and its affiliates. |

| (2) | Matthew C. Patten and Erich M. Patten are brothers and the sons of Brooke C. Ashland. |

| (3) | Reflects the number of funds that would be overseen by Mr. Alter if he is elected to the Board. |

Board Leadership Structure, Committee Arrangements and Risk Oversight

The Board of Trustees currently consists of three Trustees, two of whom are Independent Trustees. The Board is responsible for the oversight of the Trust. The Board is responsible for overseeing the investment adviser and the Trust’s other service providers in the operations of the Funds in accordance with the 1940 Act, other applicable federal and state laws, and the Trust Instrument.

The Board met five times during the fiscal year ended June 30, 2013. The Board meets in person or by telephone at regularly scheduled meetings throughout the year. In addition, the Trustees may meet in person or by telephone at special meetings or on an informal basis at other times. The Independent Trustees also meet at least quarterly without the presence of any representatives of management. The Board has established four standing committees and may also establish ad hoc committees or working groups from time to time to assist the Board in fulfilling its oversight responsibilities. The Independent Trustees have also engaged independent legal counsel, and may from

time to time engage consultants and other advisors to assist them in performing their oversight responsibilities.

The Board is led by its Chairman, Matthew C. Patten. Mr. Matthew Patten is affiliated with the Trust’s investment adviser and is considered to be an “interested person” of the Trust within the meaning of the 1940 Act because he is the President of the Adviser. As Chairman, Mr. Matthew Patten has primary responsibility for setting the agenda for each Board meeting, presiding at each Board meeting and acting as the Board’s liaison with the various service providers.

John P. Cooney serves as the Lead Independent Trustee. He presides at all Executive Sessions of the Independent Trustees and has the authority to preside at meetings of the Board at which the Chairman of the Board is not present. In his role as Lead Independent Trustee, Judge Cooney facilitates communication and coordination between the Independent Trustees and Trust management. He also reviews meeting agendas for the Board and the information provided by management to the Independent Trustees.

The Board reviews its structure regularly and believes that its leadership structure, including having a majority of Independent Trustees, coupled with the responsibilities undertaken by Mr. Matthew Patten as Chairman and Judge Cooney as Lead Independent Trustee, is appropriate and in the best interests of the Trust, given its specific characteristics such as the Board’s size (four Trustees), the Funds’ investment style (investment grade fixed income securities in the case of the Cutler Fixed Income Fund and large cap equity securities in the case of the Cutler Equity Fund) and the size of the fund complex (two funds). The Board also believes its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from Trust management.

Board Committees. The Board has established an Audit Committee, a Nominating Committee, a Valuation Committee and a Qualified Legal Compliance Committee (“QLCC”). The Board of Trustees has determined that its committees help ensure that the Funds have effective and independent governance and oversight. The current members of the Audit and Nominating Committees and the QLCC are the two Independent Trustees: Mr. Cooney and Mr. Turner. The members of the Valuation Committee are all of the Trustees of the Trust. It is anticipated that Mr. Alter will also serve on the Audit, Nominating and Valuation Committees and the QLCC, if elected to the Board. Each Committee has a Chairman who has primary responsibility for setting the agendas and presides at all meetings of the Committee for which he serves as Chairman. Each Committee Chairman facilitates communications and coordination between the Independent Trustees and Trust management with respect to the matters overseen by that Committee.

Audit Committee. The Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Trust. It also selects the Trust’s independent registered public accounting firm, reviews the methods, scope, and result of the audits, approves the fees

charged for audit and non-audit services, and reviews the Trust’s internal accounting procedures and controls. The Audit Committee met twice during the fiscal year ended June 30, 2013.

Nominating Committee. The Nominating Committee is charged with the duty of nominating all Independent Trustees and committee members, and presenting these nominations to the Board. The Nominating Committee Operates under a written charter that has been approved by the Board of Trustees. The Nominating Committee does not currently consider shareholder nominations. The Nominating Committee, which meets when necessary, met once during the fiscal year ended June 30, 2013.

Valuation Committee. The Valuation Committee ensures that the securities and other assets of the Funds are valued properly, fairly and in accordance with the Trust’s Portfolio Securities Valuation Procedures. The Valuation Committee is responsible for reviewing and providing advice regarding the Trust’s policies and procedures for determining the NAV per share of the Funds. The Valuation Committee also produces fair value determinations for securities maintained in the each Fund’s portfolio consistent with valuation procedures approved by the Board. The Valuation Committee, which meets when necessary, did not meet during the fiscal year ended June 30, 2013.

Qualified Legal Compliance Committee. The Qualified Legal Compliance Committee is responsible for receiving and investigating reports from attorneys representing the Trust of material violations of securities laws, a material breach of fiduciary duty or a similar material violation. The Qualified Legal Compliance Committee did not meet during the fiscal year ended June 30, 2013 because no such reports were made during the year.

Risk Oversight. An integral part of the Board’s overall responsibility for overseeing the management and operations of the Trust is the Board’s oversight of the risk management of the Trust’s investment programs and business affairs. The Funds are subject to a number of risks, such as investment risk, credit risk, valuation risk, operational risk, and legal, compliance and regulatory risk. The Trust, the Adviser and the other service providers have implemented various processes, procedures and controls to identify risks to the Funds, to lessen the probability of their occurrence and to mitigate any adverse effect should they occur. Different processes, procedures and controls are employed with respect to different types of risks. These systems include those that are embedded in the conduct of the regular operations of the Board and in the regular responsibilities of the officers of the Trust and the other service providers.

The Board exercises oversight of the risk management process through the Board itself and through its various committees. In addition to adopting, and periodically reviewing, policies and procedures designed to address risks to the Funds, the Board of Trustees requires management of the Adviser and the Trust, including the Trust’s Chief Compliance Officer, to report to the Board and the committees on a variety of matters, including matters relating to risk management, at regular and special meetings. The Board and the committees receive regular reports from the Trust’s independent

registered public accounting firm on internal control and financial reporting matters. On at least an annual basis, the Independent Trustees meet separately with the Trust’s Chief Compliance Officer, outside the presence of management, to discuss issues related to compliance. Furthermore, the Board receives an annual report from the Trust’s Chief Compliance Officer regarding the operation of the compliance policies and procedures of the Trust and its primary service providers.

The Board also receives quarterly reports from the Adviser on the investments and securities trading of the Funds, including its investment performance, as well as reports regarding the valuation of the each Fund’s securities. In addition, in its annual review of the each Fund’s investment advisory agreement, the Board reviews information provided by the Adviser relating to its operational capabilities, financial condition and resources. The Board also conducts an annual self-evaluation that includes a review of its effectiveness in overseeing, among other things, the number of funds in the Trust and the effectiveness of its committee structure.

Although the risk management policies of the Adviser and the Trust’s other service providers are designed to be effective, those policies and their implementation vary among service providers and over time, and there is no guarantee that they will be effective. Not all risks that may affect the Trust can be identified or processes and controls developed to eliminate or mitigate their occurrence or effects, and some risks are simply beyond the control of the Trust, the Adviser or its affiliates, or other service providers to the Trust. The Board may at any time, and in its sole discretion, change the manner in which it conducts its risk oversight role.

Trustee Ownership of Fund Shares. The following table shows each Nominee’s beneficial ownership of shares each Fund as of December 31, 2012.

| Trustee/Nominee | Dollar Range of Beneficial Ownership in the Cutler Equity Fund as of December 31, 2012 | Dollar Range of Beneficial Ownership in the Cutler Fixed Income Fund as of December 31, 2012 | Aggregate Dollar Range of Beneficial Ownership in All Funds Overseen or to be Overseen in Fund Complex |

| Interested Trustee (Incumbent): |

| Matthew C. Patten | $10,001 – $50,000 | None | $10,001 – $50,000 |

| Independent Trustees (Nominees): |

| John P. Cooney | $50,001 - $100,000 | None | $50,001 - $100,000 |

| Robert F. Turner | None | None | None |

| Edward T. Alter | None | None | None |

Ownership of Securities of the Adviser and Principal Underwriter. As of December 31, 2012, no Independent Trustee or any of his immediate family members owned beneficially or of record securities of the Adviser or the Trust’s principal underwriter, or any person directly or indirectly, controlling, controlled by or under common control with the Adviser or the Trust’s principal underwriter.

Compensation of Trustees. Effective November 26, 2012 for his service to the Trust each Independent Trustee of the Trust is paid an annual retainer fee of $7,500, plus a fee of $1,250 per Board meeting attended. Prior to November 26, 2012 each Independent Trustee of the Trust was paid an annual retainer fee of $5,000, plus a fee of $1,250 per Board meeting attended. The Trustees are also reimbursed for travel and related expenses incurred in attending Board meetings. Mr. Matthew Patten receives no compensation (other than reimbursement for travel and related expenses) for his service as a Trustee of the Trust. No officer or employee of the Trust is compensated by the Trust but officers are reimbursed for travel and related expenses incurred in attending Board meetings.

The following table sets forth the fees paid to each current Trustee by the Trust and the Fund Complex during the fiscal year ended June 30, 2013.

| Trustee | Aggregate Compensation from Trust | Pension or Retirement Benefits Accrued | Estimated Annual Benefits upon Retirement | Total Compensation from Trust and Fund Complex |

Matthew C. Patten(1) | $0 | $0 | $0 | $0 |

| John P. Cooney | $11,875 | $0 | $0 | $11,875 |

Robert F. Turner(2) | $9,375 | $0 | $0 | $9,375 |

| (1) | Mr. Matthew Patten is an Interested Trustee because of the positions he holds with the Adviser and its affiliates. |

| (2) | Mr. Turner did not begin to serve on the Board until September 2012. |

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES.

| PROPOSAL 2: | TO TRANSACT ANY OTHER BUSINESS, NOT CURRENTLY CONTEMPLATED, THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF IN THE DISCRETION OF THE PROXIES OR THEIR SUBSTITUTES |

The proxy holders have no present intention of bringing any other matter before the meeting other than those specifically referred to above or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

OUTSTANDING SHARES AND VOTING REQUIREMENTS

Record Date. The Board of Trustees has fixed the close of business on July 22, 2013 (the “Record Date”) as the record date for determining shareholders of the Trust entitled to notice of and to vote at the Meeting or any adjournment thereof. As of the Record Date, there were 8,351,041.051 shares of beneficial interest of the Trust outstanding, comprised of 6,744,913.118 shares of the Cutler Equity Fund and 1,606,127.933 shares of the Cutler Fixed Income Fund. All full shares of the Trust are entitled to one vote, with proportionate voting for fractional shares.

5% Shareholders. As of the Record Date, the following shareholders owned of record more than 5% of the outstanding shares of beneficial interest of each Fund. No other person owned of record and, according to information available to the Trust, no other person owned beneficially, 5% or more of the outstanding shares of the Funds on the Record Date.

Cutler Equity Fund:

Name and Address of Record Owner | Amount and Nature of Ownership | Percentage Ownership |

Charles Schwab & Co., Inc. Special Custody A/C FBO Customers 211 Main Street San Francisco, California 94105 | 1,354,690.798 shares | 20.08% |

TD Ameritrade Trust Co. P.O. Box 17748 Denver, Colorado 80217 | 586,598.638 shares | 8.70% |

Axelson Fishing Tackle Manufacturing Co. Profit Sharing Plan 2400 S. Garnsey Street Santa Ana, California 92707 | 340,570.764 shares | 5.05% |

Cutler Fixed Income Fund:

Name and Address of Record Owner | Amount and Nature of Ownership | Percentage Ownership |

Charles Schwab & Co., Inc. Special Custody A/C FBO Customers 211 Main Street San Francisco, California 94105 | 91,487.755 shares | 5.70% |

Quorum and Required Vote. In order to transact business at the Meeting, a “quorum” must be present. Under the Trust’s Trust Instrument, a quorum is constituted by the presence in person or by proxy of one third of the outstanding shares of the Trust entitled to vote at the Meeting. If a quorum is present at the Meeting, the vote of a plurality of the Trust’s shares represented at the Meeting is required for the election of Trustees.

A proxy, if properly executed, duly returned and not revoked, will be voted in accordance with the specifications therein. A proxy that is properly executed but has no voting instructions with respect to a proposal will be voted for that proposal. A shareholder may revoke a proxy at any time prior to use by filing with the Secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date, or by attending and voting at the Meeting in person.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. Abstentions and broker non-votes will not, however, be counted as voting on any matter at the Meeting. Therefore, a broker non-vote or abstention will have no effect on Proposal 1 which is determined by a plurality of favorable votes.

If a quorum of shareholders of the Trust is not present at the Meeting, or in other circumstances, the persons named as proxies may, but are under no obligation to, by a majority of the shares present and entitled to vote, approve one or more adjournments of the Meeting for a period or periods not more than ninety (90) days in the aggregate to permit further solicitation of proxies. Any business that might have been transacted at the Meeting may be transacted at any such adjourned session(s) at which a quorum is present. The persons named as proxies will vote all proxies in favor of adjournment that voted in favor of the proposals, and vote against adjournment all proxies that voted against the proposals (including abstentions and broker non-votes). Abstentions and broker non-votes will have the same effect at any adjourned meeting as noted above.

The Trustees of the Trust intend to vote all of their shares in favor of the proposals described herein. On the Record Date, all Trustees and officers of the Trust as a group owned of record and/or beneficially less than 1% of the outstanding shares of the Trust.

ADDITIONAL INFORMATION ON THE OPERATION OF THE FUNDS

Principal Underwriter

Ultimus Fund Distributors, LLC (the “Underwriter”) serves as the Funds’ principal underwriter and, as such, is the exclusive agent for distribution of the Funds’ shares. The Underwriter is obligated to sell shares of the Funds on a best efforts basis only against purchase orders for the shares. Shares of the Funds are offered to the public on a continuous basis. The Underwriter is located at 225 Pictoria Drive, Suite 450, Cincinnati Ohio 45246.

Administration and Other Services

Ultimus Fund Solutions, LLC (“Ultimus”) provides administrative services, accounting and pricing services, and transfer agent and shareholder services to the Funds. Ultimus is located at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Independent Registered Public Accounting Firm

The Audit Committee and the Board of Trustees selected BBD, LLP, 1835 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103, to serve as the Trust’s independent registered public accounting firm for the fiscal year ended June 30, 2013. Representatives of BBD, LLP are not expected to be present at the Meeting although they will have an opportunity to attend and to make a statement, if they desire to do so. If representatives of BBD, LLP are present at the Meeting, they will be available to respond to appropriate questions from shareholders.

| Fees Billed by BBD, LLP to the Trust During the Previous Two Fiscal Years |

| Audit Fees | The aggregate fees billed for professional services rendered by BBD, LLP for the audit of the annual financial statements of the Cutler Equity Fund or for services that are normally provided by BBD, LLP in connection with statutory and regulatory filings or engagements were $16,000 with respect to the fiscal year ended June 30, 2013 and $15,500 with respect to the fiscal year ended June 30, 2012. The aggregate fees billed for professional services rendered by BBD, LLP for the audit of the annual financial statements of the Cutler Fixed Income Fund or for services that are normally provided by BBD, LLP in connection with statutory and regulatory filings or engagements were $14,400 with respect to each of the fiscal years ended June 30, 2013 and September 30, 2012. |

| Audit-Related Fees | No fees were billed in either of the last two fiscal years for assurance and related services by BBD, LLP that are reasonably related to the performance of the audit of the Trust’s financial statements and are not reported as “Audit Fees” in the preceding paragraphs. |

| Tax Fees | The aggregate fees billed to the Cutler Equity Fund for professional services rendered by BBD, LLP for tax compliance, tax advice and tax planning were $2,500 with respect to the fiscal year ended June 30, 2013 and $2,000 with respect to the fiscal year ended June 30, 2012. The aggregate fees billed to the Cutler Fixed Income Fund for professional services rendered by BBD, LLP for tax compliance, tax advice and tax planning were $2,200 with respect to each of the fiscal years ended June 30, 2013 and September 30, 2012. The services comprising these fees are related to the preparation of the Funds’ federal income and excise tax returns. |

| All Other Fees | No fees were billed in either of the last two fiscal years for products and services provided by BBD, LLP other than the services reported above. |

| Aggregate Non-Audit Fees | During the fiscal years ended June 30, 2013 and June 30, 2012, aggregate non-audit fees of $2,500 and $2,000, respectively, were billed by BBD, LLP for services rendered to the Cutler Equity Fund. During the fiscal years ended June 30, 2013 and September 30, 2012, aggregate non-audit fees of $2,200 and $2,200, respectively, were billed by BBD, LLP for services rendered to the Cutler Fixed Income Fund. No non-audit fees were billed by BBD, LLP in either of the last two fiscal years for services rendered to the Adviser, and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Trust. |

Annual and Semiannual Reports

Each Fund will furnish, without charge, a copy of its most recent annual report and most recent semi-annual report succeeding such annual report, if any, upon request. To request an annual or semi-annual report, please call us toll free at 1-888-288-5374 (1-888-CUTLER4), or write to Tina H. Bloom, Secretary, The Cutler Trust, P.O. Box 46707, Cincinnati, Ohio 45246-0707. You may also download copies of the most recent annual or semi-annual reports from the Funds’ website at www.cutler.com.

OTHER MATTERS

Shareholder Proposals

As a Delaware statutory trust, the Trust does not intend to, and is not required to hold annual meetings of shareholders, except under certain limited circumstances. The Board of Trustees does not believe a formal process for shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of shareholder communications to the Board of Trustees. The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Trust’s proxy statement and proxy for a particular

meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not insure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of shareholders of the Funds are not required as long as there is no particular requirement under the 1940 Act, state law or Trust Instrument, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Tina H. Bloom, Secretary of the Trust, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Shareholder Communications with Trustees

Shareholders who wish to communicate with the Board of Trustees or individual Trustees should write to the Board or the particular Trustee in care of the Funds, at the offices of the Trust as set forth below. All communications will be forwarded directly to the Board of Trustees or the individual Trustee.

Shareholders may also have an opportunity to communicate with the Board of Trustees at shareholder meetings. The Trust does not have a policy requiring Trustees to attend shareholder meetings.

Proxy Delivery

The Trust may only send one proxy statement to shareholders who share the same address unless the Trust has received different instructions from one or more of the shareholders. The Funds will deliver promptly to a shareholder, upon oral or written request, a separate copy of the proxy statement to a shared address to which a single copy of this Proxy was delivered. By calling or writing the Funds, a shareholder may request separate copies of future proxy statements, or if the shareholder is receiving multiple copies of the proxy statement now, may request a single copy in the future. To request a paper or e-mail copy of the proxy statement or annual report at no charge, or to make any of the aforementioned requests, write to The Cutler Trust, P.O. Box 46707, Cincinnati, Ohio 45246-0707, or call the Trust toll-free at 1-888-CUTLER4 (1-888-288-5374) or e-mail the Trust at fundinfo@ultimus.com.

| | By Order of the Board of Trustees, |

| | |

| |  |

| | |

| | Tina H. Bloom |

| | Secretary |

Date: July 25, 2013

Please complete, date and sign the enclosed Proxy and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. You may also vote through the Internet by following the instructions on your proxy card.