SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

JOHNSON MUTUAL FUNDS TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee paid previously with preliminary materials

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

Johnson Mutual Funds Trust

3777 West Fork Road

Cincinnati, Ohio 45247

Important Proxy Materials

PLEASE CAST YOUR VOTE TODAY

Dear Shareholder:

You are cordially invited to attend a Special Meeting of Shareholders (the “Meeting”) of Johnson Mutual Funds Trust (the “Trust”), to be held at 9:00 AM, Eastern Time on June 2, 2023 at the offices of the Adviser, Johnson Investment Counsel Inc., Cincinnati, Ohio. Formal notice of the Meeting appears after this letter, followed by the proxy statement. At the Meeting, shareholders of the Trust (the “Shareholders”) will be asked to vote on a proposal to elect the following individuals to the Board of Trustees of the Trust (the “Board” or “Board of Trustees”): Dale Coates, Julie Murphy, Jonathan Adams and Gregory Simpson.

We hope that you can attend the Meeting in person; however, we urge you in any event to vote your shares by completing and returning the enclosed proxy in the envelope provided or voting by telephone at your earliest convenience.

The Investment Company Act of 1940, as amended (the "1940 Act"), requires that, at all times, a majority of the Trustees have been elected by Shareholders and requires a certain percentage of the Trustees to have been elected by shareholders before the Board can appoint any new Trustees. To facilitate future compliance with this requirement, the Board now proposes to have Shareholders elect four new Trustees, Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson (each a “Nominee” and collectively, the “Nominees”) to serve on the Board of Trustees of the Trust.

The Board recommends that you vote “FOR” the election of each Nominee to serve on the Board of Trustees of the Trust.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the proxy statement and cast your vote. It is important that your vote be received no later than June 1, 2023.

You can vote in one of four ways:

o Over the Internet, through the website listed on the proxy card,

o By telephone, using the toll-free number listed on the proxy card,

o By mail, using the enclosed proxy card -- be sure to sign, date and return the proxy card in the enclosed postage-paid envelope, or

o In person at the shareholder meeting on June 2, 2023.

We encourage you to vote by telephone or online using the control number that appears on the enclosed proxy card. Use of telephone and online voting will reduce the time and costs associated with this proxy solicitation. Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

The Trust is sensitive to the health and travel concerns the Trust’s Shareholders may have and the protocols that federal, state and local governments may impose. Due to the difficulties arising from the coronavirus known as COVID-19, the date, time, location or means of conducting the Meeting may change. In the event of such a change, the Trust will announce alternative arrangements for the Meeting as promptly as practicable, which may include holding the Meeting by means of remote communication, among other steps, but the Trust may not deliver additional soliciting materials to Shareholders or otherwise amend the Trust’s proxy materials. The Trust plans to announce these changes, if any, at johnsonmutualfunds.com and encourages you to check this website prior to the Meeting if you plan to attend.

We appreciate your participation and prompt response in this matter and thank you for your continued support. If you have any questions after considering the enclosed materials, please call Johnson Mutual Funds at (513) 661-3100 in the Cincinnati area or (800) 541-0170 outside of Cincinnati. We appreciate the confidence you have placed in the Johnson Mutual Funds and look forward to helping you achieve your financial goals through our services.

| Sincerely, |

| /s/ Jennifer Kelhoffer |

| Jennifer J. Kelhoffer |

| Secretary |

Johnson Mutual Funds Trust

3777 West Fork Road

Cincinnati, Ohio 45247

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD AT 9:00 AM, EASTERN TIME, ON JUNE 2, 2023. THE PROXY STATEMENT TO SHAREHOLDERS IS AVAILABLE AT johnsonmutualfunds.com OR BY CALLING 800-541-0170.

Dear Shareholders:

NOTICE IS HEREBY GIVEN BY the Board of Trustees of JOHNSON MUTUAL FUNDS TRUST, an open-end management investment company organized as a Ohio statutory trust (the “Trust”), that a Special Meeting (the “Meeting”) of the shareholders (the “Shareholders”) of the Johnson Fixed Income Fund, Johnson Opportunity Fund, Johnson Municipal Income Fund, Johnson Enhanced Return Fund, Johnson Equity Income Fund, Johnson International Fund, Johnson Institutional Short Duration Bond Fund, Johnson Institutional Intermediate Bond Fund, Johnson Institutional Core Bond Fund, and Johnson Core Plus Bond Fund (each a “Fund” and collectively the “Funds”) will be held at the offices of the Adviser, Johnson Investment Counsel Inc., Cincinnati, Ohio, at 9:00 AM, Eastern Time on June 2, 2023. The purpose of the Meeting is to consider and vote on the following matters.

| Proposal |

| 1. | To elect the following individuals to serve on the Board of Trustees of the Trust: |

Dale Coates

Julie Murphy

Jonathan Adams

Gregory Simpson

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

It is not anticipated that any matter other than the election of Trustees will be brought before the Meeting.

Shareholders of record as of the close of business on March 27, 2023 will be entitled to notice of and to vote at the Meeting or any adjournment thereof. A proxy statement and proxy card solicited by the Trust are included herewith.

YOUR VOTE IS IMPORTANT

PLEASE VOTE BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD, THUS AVOIDING UNNECESSARY EXPENSE AND DELAY. YOU MAY ALSO EXECUTE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. THE PROXY IS REVOCABLE AND WILL NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

1

| By order of the Board of Trustees of the Trust, | |

| /s/ Jennifer Kelhoffer | |

| Jennifer J. Kelhoffer | |

| Secretary | |

| Dated: April 26, 2023 | Johnson Mutual Funds Trust |

2

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSAL

You should carefully read the entire text of the Proxy Statement. We have provided you with a brief overview of the Proxy Statement using the questions and answers below.

QUESTIONS AND ANSWERS

Q: What is happening? Why did I get this package of materials?

A: You received this package because you are a Shareholder of one or more of the following Johnson Mutual Funds (the “Trust”): Johnson Fixed Income Fund, Johnson Opportunity Fund, Johnson Municipal Income Fund, Johnson Enhanced Return Fund, Johnson Equity Income Fund, Johnson International Fund, Johnson Institutional Short Duration Bond Fund, Johnson Institutional Intermediate Bond Fund, Johnson Institutional Core Bond Fund, or Johnson Core Plus Bond Fund. The Trust is conducting a special meeting of Shareholders of the Funds (the “Meeting”) scheduled to be held at 9:00 AM, Eastern time, on June 2, 2023.

Q: What am I being asked to vote on?

A: You are being asked to elect the following individuals to the Board of Trustees of the Trust: Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson and the transaction of any other business (none currently contemplated) that may properly come before the Meeting or any adjournment thereof.

Q: Why am I being asked to elect Trustees?

A: The Investment Company Act of 1940, as amended (the "1940 Act"), requires that, at all times, a majority of the Trustees have been elected by Shareholders and requires a certain percentage of the Trustees to have been elected by Shareholders before the Board can appoint any new Trustees. To facilitate future compliance with this requirement, the Board now proposes to have Shareholders elect Dale Coates, Julie Murphy, Jonathan Adams and Gregory Simpson as new Trustees (the “Nominees”) to serve on the Board of Trustees of the Trust.

Q: Does the Board recommend that Shareholders vote to approve the election of the Trustees?

A: Yes. The Board unanimously recommends that the Shareholders of the Funds vote to elect Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson to serve on the Board of Trustees of the Trust.

Q: Who is eligible to vote?

A: Shareholders of record at the close of business on March 27, 2023 are entitled to be present and to vote at the Meeting. Each share of record of a Fund is entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter presented at the Meeting.

Q: How do I ensure that my vote is accurately recorded?

A: You may attend the Meeting and vote in person or you may vote by telephone or Internet or complete and return the enclosed proxy card. Proxy cards that are properly signed, dated and received prior to the Meeting will be voted as specified. If you specify a vote on any proposal, your proxy will be voted as you indicate, and any proposals for which no vote is specified will be voted FOR that proposal. If you simply sign, date and return the proxy card, but do not specify a vote on any of the proposals, your shares will be voted FOR all proposals.

3

Q: May I revoke my proxy?

A: You may revoke your proxy at any time prior to use by filing with the secretary of the Trust an instrument revoking the proxy prior to the Meeting, by submitting a proxy bearing a later date, or by attending and voting at the Meeting.

Q: What will happen if there are not enough votes to have the Meeting?

A: It is important that Shareholders vote by telephone or Internet or complete and return signed proxy cards promptly, but no later than June 1, 2023 to ensure there is a quorum for the Meeting. If we do not receive your proxy card(s) in a few weeks, you may be contacted by officers of the Trust, who will remind you to vote your shares. If we have not received sufficient votes to have a quorum at the Meeting or have not received enough votes to elect each Nominee, we may adjourn the Meeting to a later date so we can continue to seek more votes.

Q: What happens if Proposal 1 is not approved?

A: If the Shareholders do not elect one or more of the Nominees (Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson), the Board may reconsider whether to adjourn and reconvene the Shareholder Meeting or may consider alternative Board candidates/nominees.

Q: Whom should I call for additional information about the Proxy Statement?

A: If you need any assistance or have any questions regarding the proposal or how to vote your shares, please call Johnson Mutual Funds or your Portfolio Manager at (513) 661-3100 in the Cincinnati area or (800) 541-0170 outside of Cincinnati.

4

Johnson Mutual Funds Trust

3777 West Fork Road

Cincinnati, Ohio 45247

SPECIAL MEETING OF SHAREHOLDERS

To Be Held on June 2, 2023

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Trustees (the “Board,” “Board of Trustees,” or “Trustees”) of Johnson Mutual Funds Trust (the “Trust”) of proxies for use at the Special Meeting of Shareholders (the “Meeting”) of the Trust: Johnson Fixed Income Fund, Johnson Opportunity Fund, Johnson Municipal Income Fund, Johnson Enhanced Return Fund, Johnson Equity Income Fund, Johnson International Fund, Johnson Institutional Short Duration Bond Fund, Johnson Institutional Intermediate Bond Fund, Johnson Institutional Core Bond Fund and Johnson Core Plus Bond Fund (each a “Fund” and together, the “Funds”). The principal address of the Trust is 3777 West Fork Road, Cincinnati, Ohio 45247. This proxy statement and form of proxy are being first mailed to Shareholders on or about May 1, 2023.

The purpose of the Meeting is to consider and vote on the following matters.

| 1. | To elect the following individuals to serve on the Board of Trustees of the Trust: |

| a. | Dale Coates |

| b. | Julie Murphy |

| c. | Jonathan Adams |

| d. | Gregory Simpson |

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only Shareholders of record at the close of business on March 27, 2023 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

A proxy, if properly executed, duly returned and not revoked, will be voted in accordance with the specifications therein. A proxy that is properly executed but has no voting instructions with respect to a proposal will be voted for that proposal. A Shareholder may revoke a proxy at any time prior to use by filing with the secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date, or by attending and voting at the Meeting.

The Funds’ investment adviser and/or the proxy tabulation agent will solicit proxies for the Meeting. The proxy tabulation agent is responsible for printing proxy cards, mailing proxy material to Shareholders, soliciting brokers, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services. The cost of these services is expected to be approximately $62,000 and will be paid by the Funds’ investment adviser.

In addition to solicitation through the mail, proxies may be solicited by officers, employees and agents of the Trust or the Funds’ investment adviser. Such solicitation may be by telephone, facsimile or otherwise. It is anticipated that banks, broker-dealers and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies. The Trust has agreed to reimburse brokers, custodians, nominees and fiduciaries for the reasonable expenses incurred by them in connection with forwarding solicitation material to the beneficial owners of shares held of record by such persons.

1

| PROPOSAL 1: | ELECTION OF TRUSTEES |

In this proposal, Shareholders of the Funds are being asked to elect Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson (each a “Nominee,” together the “Nominees”) to the Board of Trustees of the Trust. Each Nominee has agreed to serve on the Board of Trustees for an indefinite term. The Nominees were nominated for election to the Board by those current Trustees who are not an “interested person” of the Trust as that term is defined in Section 2(a)(19) of the 1940 Act (referred to hereafter as “Independent Trustees”).

The Independent Trustees, at a meeting held on February 22, 2023, recommended to the Board that Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson be nominated to the Board of Trustees. The Board approved the nomination at the same meeting. If elected, Julie Murphy, Jonathan Adams, and Gregory Simpson will be considered Independent Trustees as that term is defined under the 1940 Act and Dale Coates will be considered an Interested Trustee.

Information about the Nominees

Below is information about each Nominee and the attributes that qualify each to serve as a trustee. The information provided below is not all-inclusive. Many trustee attributes involve intangible elements, such as intelligence, work ethic and the willingness to work together, as well as the ability to communicate effectively, exercise judgment, ask incisive questions, manage people and problems, and develop solutions. The Board does not believe any one factor is determinative in assessing a trustee’s qualifications, but that the collective experiences of the Nominees make each highly qualified.

Generally, the Trust believes that the Nominees are competent to serve because of each’s individual overall merits including: (i) experience, (ii) qualifications, (iii) attributes and (iv) skills. The Board believes each Nominee possesses experiences, qualifications, and skills valuable to the Funds. Each Nominee has substantial business and/or academic experience, effective leadership skills and ability to critically review, evaluate and assess information.

New Trustee Nominees

| a. | Dale Coates |

| b. | Julie Murphy |

| c. | Jonathan Adams |

| d. | Gregory Simpson |

The following table provides information regarding the Nominees. Each trustee shall serve as a trustee until termination of the Trust unless the trustee dies, resigns, retires, or is removed.

2

Name, Address*, (Year of Birth), Position with Trust**, Term of Position with Trust | Principal Occupation During Past 5 Years and Other Directorships |

| Dale Coates (1958) | Mr. Coates is currently retired. He previously was Vice President and a Portfolio Manager for the Adviser, Johnson Investment Counsel, Inc. During his time with the Adviser, Mr. Coates served as Vice President to the Johnson Mutual Funds Trust from 1993 through his retirement in 2021. |

Julie Murphy (1963)

| Ms. Murphy is vice president of Territorium, Inc., an educational technology company (2022 to present), and a consultant and owner of The Marketing Alliance, a consulting company (2005 to present). She was also the General Manager of Act, Inc., a testing company from 2019 through 2022. |

Jonathan Adams (1977)

| Mr. Adams is currently President of the SALIX Data company, a data analytics company (1999 to present). He is also a board member of the following entities: City Gospel Mission (homeless shelter, 2016 to present), Cincinnati Hills Christian Academy (private school, 2016 to 2022), Risksource (insurance agency, 2018 to present) and the Goering Center (center for business, 2019 to present). |

Gregory Simpson (1962)

| Mr. Simpson is currently retired but provides technical consulting as an independent consultant. Previously, he served as Chief Technology Officer and AI Leader of Synchrony Financial Services (2014-2021). |

*The address for each Nominee is c/o Johnson Mutual Fund, 3777 West Fork Road, Cincinnati, OH 45247.

**As of the date of this Proxy Statement the Trust consists of, and each Nominee would oversee, ten series.

Trust Officers

The following table provides information regarding the officers of the Trust.

| Name, Address, (Year of Birth), Position with Trust, Term of Position with Trust | Principal Occupation During Past 5 Years |

Jason O. Jackman (1971) 3777 West Fork Road Cincinnati, Ohio 45247 | President of the Adviser |

Marc E. Figgins (1964) 3777 West Fork Road Cincinnati, Ohio 45247 | Director of Fund Services for the Trust's Adviser |

Scott J. Bischoff (1966) 3777 West Fork Road Cincinnati, Ohio 45247 | Chief Compliance Officer of the Trust’s Adviser |

Jennifer J. Kelhoffer (1971) 3777 West Fork Road Cincinnati, Ohio 45247 | Fund Administration and Compliance Associate for the Trust’s Adviser |

*As of the date of this Proxy Statement the Trust consists of, and each officer oversees, ten series.

3

Equity Securities Owned by Nominees

The following table shows the dollar range of the shares beneficially owned by each Nominee as of March 1, 2023.

| Trustee/Nominee | Dollar Range of the Funds’* Shares | |

| Dale Coates | ||

| Johnson Fixed Income Fund | $10,001-$50,000 | |

| Johnson Opportunity Fund | Over $100,000 | |

| Johnson Municipal Income Fund | $10,001-$50,000 | |

| Johnson Enhanced Return Fund | Over $100,000 | |

| Johnson Equity Income Fund | Over $100,000 | |

| Johnson International Fund | Over $100,000 | |

| Johnson Institutional Short Duration Bond Fund | None | |

| Johnson Institutional Intermediate Bond Fund | None | |

| Johnson Institutional Core Bond Fund | Over $100,000 | |

| Johnson Core Plus Bond Fund | None | |

| Julie Murphy | None | |

| Jonathan Adams | None | |

| Gregory Simpson | None |

* The “Funds” refer to all active Funds in the Trust as of March 1, 2023.

Trustee Compensation

The following table details the amount of compensation received by each existing Independent Trustee for the fiscal year ended December 31, 2022. The Board held four meetings during fiscal year ended December 31, 2022. All of the Trustees attended the Board meetings.

Dale Coates, Julie Murphy, Jonathan Adams, and Gregory Simpson were not Trustees during the fiscal year ended December 31, 2022, so they did not receive any compensation from the Trust, and they did not attend any Board meetings as Trustees. The Trust does not have a bonus, profit sharing, pension, or retirement plan.

| Name and Position | Aggregate Compensation from the Funds* | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from Trust | ||||||||||||

| Ronald McSwain, Independent Trustee | $ | 18,000 | $ | 0 | $ | 0 | $ | 18,000 | ||||||||

| John Green, Independent Trustee | $ | 18,000 | $ | 0 | $ | 0 | $ | 18,000 | ||||||||

| James Berrens, Independent Trustee | $ | 18,000 | $ | 0 | $ | 0 | $ | 18,000 | ||||||||

| Jeri Ricketts, Independent Trustee | $ | 18,000 | $ | 0 | $ | 0 | $ | 18,000 | ||||||||

| Timothy Johnson, Interested Trustee | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

* The “Funds” refer to all active Funds in the Trust as of March 1, 2023.

4

Information about each Nominee’s Qualifications, Attributes or Skills

The Board believes that each of the Nominees has the qualifications, experience, attributes and skills appropriate to serve as a Trustee of the Trust in light of the Trust’s business and structure. The Nominees have substantial business and professional backgrounds that indicate they have the ability to critically review, evaluate and assess information provided to them. Certain of these business and professional experiences are set forth in detail in the table above.

In addition to the information provided in the table above, below is certain additional information concerning each individual Nominee. The information provided below, and in the table above, is not all-inclusive. Many of the Nominees’ qualifications to serve on the Board involve intangible elements, such as intelligence, integrity, work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgment, the ability to ask incisive questions, and commitment to shareholder interests. Generally, the Trust believes that each Nominee is competent to serve because of their individual overall merits including (i) experience, (ii) qualifications, (iii) attributes and (iv) skills. The Trust does not believe any one factor is determinative in assessing a Nominee’s qualifications.

Dale Coates - Mr. Coates is considered to be an interested Trustee due to his employment with the Adviser prior to his retirement. Mr. Coates brings many years of investment experience including portfolio management and investment risk management expertise

Julie Murphy – Ms. Murphy brings considerable experience to the board from her experience as a business owner including strategic decision making and overall management of a firm.

Jonathan Adams – Mr. Adams brings extensive experience in executive oversight and board governance given his role as President of SALIX Data as well as his service on multiple boards of directors.

Gregory Simpson – Mr. Simpson brings significant experience in establishing and overseeing technical operations as well as organizational risk management skills.

Leadership Structure, Risk Management and Committees

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

As part of its efforts to oversee risk management associated with the Trust, the Board has established the Audit Committee as described below:

| • | The Audit Committee consists of all current Trustees. Upon approval of this proxy or shortly thereafter, all Nominees will join the Audit Committee. The Audit Committee is responsible for overseeing the Trust’s accounting and financial reporting policies and practices, internal controls and, as appropriate, the internal controls of certain service providers; overseeing the quality and objectivity of financial statements and the independent audits of the financial statements; and acting as a liaison between the independent auditors and the full Board. The Audit Committee met two times during the fiscal year ended December 31, 2022. |

5

The Audit Committee reviews reports provided by administrative service providers, legal counsel and independent accountants. The Audit Committee reports directly to the full Board.

The Independent Trustees have engaged independent legal counsel to provide advice on regulatory, compliance and other topics. This legal counsel also serves as counsel to the Trust. In addition, the Board has engaged a Chief Compliance Officer (“CCO”) who is responsible for overseeing compliance risks. The CCO is also an officer of the Trust and reports to the Board at least quarterly any material compliance items that have arisen, and annually he provides to the Board a comprehensive compliance report outlining the effectiveness of compliance policies and procedures of the Trust and its service providers. As part of the CCO’s risk oversight function, the CCO seeks to understand the risks inherent in the operations of the Trust’s series and their advisers and sub-advisers. Periodically the CCO provides reports to the Board that:

| • | Assess the quality of the information the CCO receives from internal and external sources; |

| • | Assess how Trust personnel monitor and evaluate risks; |

| • | Assess the quality of the Trust’s risk management procedures and the effectiveness of the Trust’s organizational structure in implementing those procedures; |

| • | Consider feedback from and provide feedback regarding critical risk issues to Trust and administrative and advisory personnel responsible for implementing risk management programs; and |

| • | Consider economic, industry, and regulatory developments, and recommend changes to the Trust’s compliance programs as necessary to meet new regulations or industry developments. |

The Trustees, under normal circumstances, meet in-person on a quarterly basis. Trustees also participate in special meetings and conference calls as needed. Legal counsel to the Trust provides quarterly reports to the Board regarding regulatory developments. Beginning in March 2020, the Trustees have been permitted to conduct quarterly meetings telephonically or by video conference in accordance with relief granted by the U.S. Securities and Exchange Commission (the “SEC”) to ease certain governance obligations in light of current travel concerns and restrictions related to the COVID-19 pandemic. The Trustees acknowledge that all actions that require a vote of the Trustees at an in-person meeting will be ratified at the next in-person meeting, as required by the SEC’s relief. The Trustees held an in-person meeting in May 2021 and ratified prior actions taken via video conference pursuant to exemptive relief. The Trustees have since and may continue to rely on the SEC relief if needed, so long as it is available. On a quarterly basis, the Trustees review and discuss some or all of the following compliance and risk management reports relating to the series of the Trust:

| (1) | Fund Performance/Morningstar Report/Portfolio Manager’s Commentary |

| (2) | Code of Ethics review |

| (3) | NAV Errors, if any |

| (4) | Distributor Compliance Reports |

| (5) | Timeliness of SEC Filings |

| (6) | Dividends and other Distributions |

| (7) | List of Brokers, Brokerage Commissions Paid and Average Commission Rate |

| (9) | Multiple Class Expense Reports |

| (10) | Anti-Money Laundering/Customer Identification Reports |

| (11) | Administrator and CCO Compliance Reports |

| (12) | Market Timing Reports |

The Board has not adopted a formal diversity policy. When soliciting future nominees for trustee, the Board will make efforts to identify and solicit qualified minorities and women.

On an annual basis, the Trustees assess the Board’s and their individual effectiveness in overseeing the Trust. Based upon its assessment, the Board determines whether additional risk assessment or monitoring processes are required with respect to the Trust or any of its service providers.

6

Based on the qualifications of each of the Trust’s Trustees and officers, the risk management practices adopted by the Board, including a regular review of several compliance and operational reports, and the committee structure adopted by the Board, the Trust believes that its leadership is appropriate.

| PROPOSAL 2: | TO TRANSACT ANY OTHER BUSINESS THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF |

The proxy holders have no present intention of bringing any other matter before the Meeting other than those specifically referred to above or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

OUTSTANDING SHARES AND VOTING REQUIREMENTS

Record Date. The Board of Trustees has fixed the close of business on March 27, 2023 (the “Record Date”) as the record date for the determination of Shareholders of each Fund entitled to notice of and to vote at the Meeting or any adjournment thereof. As of the Record Date, there were shares of beneficial interest of the Funds issued and outstanding as follows.

| Fund | Shares Outstanding as of March 27, 2023 | |||

| Johnson Fixed Income Fund | 67,360,099.139 | |||

| Johnson Opportunity Fund | 2,584,362.828 | |||

| Johnson Municipal Income Fund | 13,049,312.349 | |||

| Johnson Enhanced Return Fund | 16,582,191.442 | |||

| Johnson Equity Income Fund | 17,903,846.726 | |||

| Johnson International Fund | 818,063.711 | |||

| Johnson Institutional Short Duration Bond Fund | 15,382,761.166 | |||

| Johnson Institutional Intermediate Bond Fund | 16,157,407.431 | |||

| Johnson Institutional Core Bond Fund | 39,144,177.16 | |||

| Johnson Core Plus Bond Fund | 1,156,397.629 | |||

7

Quorum and Required Vote. A quorum is the number of shares legally required to be at a meeting in order to conduct business. The presence, in person or by proxy, of more than 50% of the outstanding shares of Trust is necessary to constitute a quorum at the Meeting (although any lesser number shall be sufficient for adjournments). Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. If the Meeting is called to order but a quorum is not present at the Meeting, the persons named as proxies may vote those proxies that have been received to adjourn the Meeting to a later date. If a quorum is present at the Meeting but sufficient votes to approve a proposal described herein are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares represented at the Meeting in person or by proxy. The persons named as proxies will vote those proxies received that voted in favor of a proposal in favor of such an adjournment and will vote those proxies received that voted against the proposal against any such adjournment.

If a quorum is present at the Meeting, the affirmative vote of a plurality of the outstanding shares of the Trust will result in the approval of Proposal 1 with respect to that Fund. Under this plurality system, vacant trustee positions are filled by the nominees who receive the largest number of votes, with no majority approval requirement, until all vacancies are filled.

Shares as to which a proxy card is returned by a Shareholder but which is marked “abstain” or “withhold” on the Proposal will be included in the Funds’ tabulation of the total number of votes present for purposes of determining a quorum and will be treated as votes against the Proposal. “Broker non-votes” (i.e. shares held by brokers or nominees, typically in “street name,” as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will not be treated as present for purposes of determining a quorum or as votes cast. Under the rules of the New York Stock Exchange (“NYSE”), if a broker has not received instructions from beneficial owners or persons entitled to vote and the proposal to be voted upon may “affect substantially” a Shareholder's rights or privileges, the broker may not vote the shares as to that proposal even if it has discretionary voting power. As a result, these shares also will be treated as broker non-votes for purposes of proposals that may “affect substantially” a Shareholder's rights or privileges (but will not be treated as broker non-votes for other proposals, including adjournment of the special meeting). The NYSE does not consider Proposal 1 to be voted upon at the Meeting to be a non-routine matter that affects substantially a Shareholder’s rights or privileges. Consequently, brokers holding shares of the Funds on behalf of clients may vote on Proposal 1 absent instructions from the beneficial owners of the shares.

The Trustees of the Trust intend to vote all of their shares in favor of the proposals described herein. On the Record Date, all Trustees and officers of the Trust as a group owned of record or beneficially 1% of the outstanding shares of the Funds.

8

5% Shareholders. As of the Record Date, the following Shareholders owned of record more than 5% of the outstanding shares of beneficial interest of the Funds. No other person owned of record and, according to information available to the Trust, no other person owned beneficially, 5% or more of the outstanding shares of the Funds on the Record Date.

| Fund | Name and Address | % Ownership (Record) |

| Johnson Fixed Income Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 94.54% |

| Johnson Opportunity Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 83.28% |

| Johnson Municipal Income Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 97.61% |

| Johnson Enhanced Return Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 98.23% |

| Johnson Equity Income Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 75.72% |

| Johnson International Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 33.11% |

| Johnson Institutional Short Duration Bond Fund – Class I | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 23.20% |

| Johnson Institutional Short Duration Bond Fund – Class I | BMO Harris Bank 111 W. Monroe Street Chicago, Illinois 60603 | 20.55% |

| Johnson Institutional Short Duration Bond Fund – Class I | Covenant Trust Company 5215 Old Orchard Road, Suite 725 Skokie, Illinois 60077 | 47.83% |

| Johnson Institutional Short Duration Bond Fund – Class F | Johnson Trust Company, Custodian 3777 West Fork Road Cincinnati, Ohio 45247 | 100% |

| Johnson Institutional Intermediate Bond Fund – Class I | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 33.90% |

| Johnson Institutional Intermediate Bond Fund – Class I | BMO Harris Bank 111 W. Monroe Street Chicago, Illinois 60603 | 25.87% |

| Johnson Institutional Intermediate Bond Fund – Class I | Covenant Trust Company 5215 Old Orchard Road, Suite 725 Skokie, Illinois 60077 | 37.58% |

9

| Johnson Institutional Intermediate Bond Fund – Class F | Johnson Trust Company, Custodian 3777 West Fork Road Cincinnati, Ohio 45247 | 100% |

| Johnson Institutional Core Bond Fund – Class I | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 38.45% |

| Johnson Institutional Core Bond Fund – Class I | BMO Harris Bank 111 W. Monroe Street Chicago, Illinois 60603 | 5.46% |

| Johnson Institutional Core Bond Fund – Class I | Covenant Trust Company 5215 Old Orchard Road, Suite 725 Skokie, Illinois 60077 | 13.91% |

| Johnson Institutional Core Bond Fund – Class I | US Bank 425 Walnut Street Cincinnati, Ohio 45202 | 22.96% |

| Johnson Institutional Core Bond Fund – Class I | SEI Private Trust Company One Freedom Valley Drive Oaks, Pennsylvania 19456 | 16.79% |

| Johnson Institutional Core Bond Fund – Class F | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 12.43% |

| Johnson Institutional Core Bond Fund – Class F | LPL Financial Group 4707 Executive Drive San Diego, California 92121 | 87.57% |

| Johnson Core Plus Fund | Charles Schwab & Co. 211 Main Street San Francisco, California 94105 | 99.99% |

10

ADDITIONAL INFORMATION ON THE OPERATION OF THE FUND

Trust and Funds. The address of the Trust and the Funds is 3777 West Fork Road, Cincinnati, Ohio 45247.

Investment Adviser. Johnson Investment Counsel located at 3777 West Fork Road, Cincinnati, Ohio 45247, acts as the investment advisor to the Funds.

Transfer Agent, Accounting, and Administration. Johnson Financial, with principal offices located at 3777 West Fork Road, Cincinnati, Ohio 45247, provides each of the Funds with transfer agent, accounting, and administrative services.

Custodian. US Bancorp, located at 1555 North RiverCenter Drive, Suite 300, Milwaukee, WI 53212, serves as the custodian for the Funds.

Independent Registered Public Accounting Firm. Cohen & Company, located at 1350 Euclid Ave # 800, Cleveland, Ohio 44115 is the independent registered public accounting firm for the Funds.

Annual and Semiannual Reports. Each Fund will furnish, without charge, a copy of its most recent Annual Report and most recent Semi-Annual Report succeeding such Annual Report, if any, upon request.

OTHER MATTERS

Shareholder Proposals. As an Ohio business trust, the Trust does not intend to, and is not required to hold annual meetings of Shareholders, except under certain limited circumstances. The Board of Trustees does not believe a formal process for Shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of Shareholder communications to the Board of Trustees. The Trust has not received any Shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities and Exchange Commission, Shareholder proposals may, under certain conditions, be included in the Trust’s proxy statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a Shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of Shareholders of the Funds are not required unless there is a particular requirement under the Investment Company Act that must be met by convening such a Shareholder meeting. Any Shareholder proposal should be sent to 3777 West Fork Road, Cincinnati, Ohio 45247.

Shareholder Communications with Trustees. Shareholders who wish to communicate with the Board or individual Trustees should write to the Board or the particular Trustee in care of the Fund at the offices of the Trust as set forth below. All communications will be forwarded directly to the Board or the individual Trustee.

Shareholders also have an opportunity to communicate with the Board at the Shareholder meetings. The Trust does not have a policy requiring Trustees to attend Shareholder meetings.

Proxy Delivery. The Trust may only send one proxy statement to Shareholders who share the same address unless the Trust has received different instructions from one or more of the Shareholders. The Trust will deliver promptly to a Shareholder, upon oral or written request, a separate copy of the proxy statement to a shared address to which a single copy of this Proxy was delivered. To request a copy of the proxy statement at no charge, call the Trust at 800-541-0170, or write the Trust at 3777 West Fork Road, Cincinnati, Ohio 45247.

11

| By Order of the Board of Trustees, | |

| /s/ Jennifer Kelhoffer | |

| Jennifer J. Kelhoffer | |

| Secretary |

Date: April 26, 2023

Please complete, date and sign the enclosed Proxy and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. You may also vote by telephone or through the Internet by following the instructions on your proxy card.

12

| 4884-4628-9450 PROXY PROXY JOHNSON MUTUAL FUNDS TRUST SPECIAL MEETING OF SHAREHOLDERS TO BE HELD June 2, 2023 3777 WEST FORK ROAD, CINCINNATI, OHIO 45247 JOHNSON MUTUAL FUNDS TRUST THIS PROXY IS BEING SOLICITED BY THE BOARD OF TRUSTEES. The undersigned shareholder(s) of the above-mentioned Trust (the “Trust”) hereby appoints Marc Figgins and Jennifer Kelhoffer or any one of them true and lawful attorneys with power of substitution of each, to vote all shares of the Trust which the undersigned is entitled to vote, at the Special Meeting of Shareholders to be held on June 2, 2023 at 9:00 am, Eastern Time, and at any or all adjournments or postponements thereof. In their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting or any adjournments or postponements. RECEIPT OF THE NOTICE OF THE SPECIAL MEETING AND THE ACCOMPANYING PROXY STATEMENT IS HEREBY ACKNOWLEDGED. THIS PROXY CARD WILL BE VOTED AS INSTRUCTED. IF NO SPECIFICATION IS MADE AND THE PROXY CARD IS EXECUTED, THE PROXY CARD WILL BE VOTED “FOR” EACH NOMINEE SET FORTH ON THE REVERSE. PLEASE VOTE VIA THE INTERNET OR TELEPHONE OR MARK, SIGN, DATE AND RETURN THIS PROXY USING THE ENCLOSED ENVELOPE CONTINUED ON THE REVERSE SIDE EVERY SHAREHOLDER’S VOTE IS IMPORTANT! VOTE THIS PROXY CARD TODAY! SHARES: Note: Please date and sign exactly as the name appears on this proxy card. When shares are held by joint owners/tenants, at least one holder should sign. When signing in a fiduciary capacity, such as executor, administrator, trustee, attorney, guardian etc., please so indicate. Corporate and partnership proxies should be signed by an authorized person. Signature(s) (Title(s), if applicable) Date CONTROL #: |

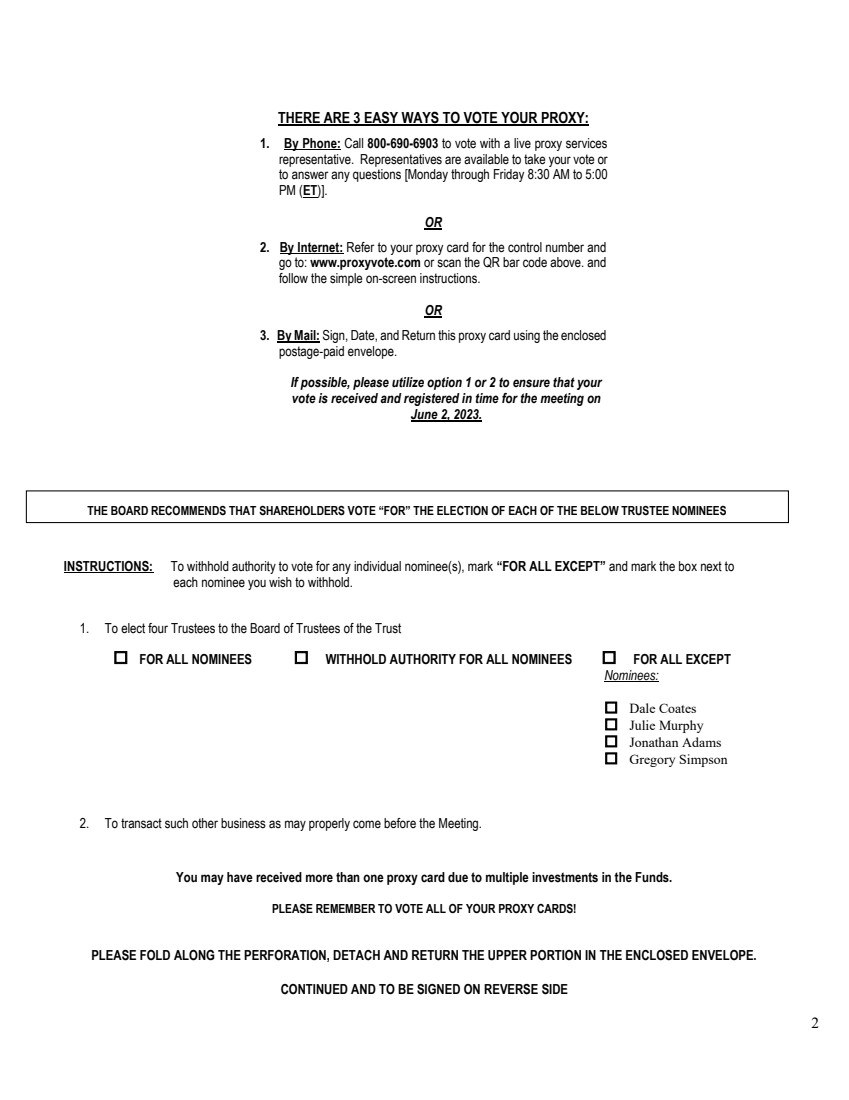

| 2 INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and mark the box next to each nominee you wish to withhold. 1. To elect four Trustees to the Board of Trustees of the Trust FOR ALL NOMINEES WITHHOLD AUTHORITY FOR ALL NOMINEES FOR ALL EXCEPT Nominees: Dale Coates Julie Murphy Jonathan Adams Gregory Simpson 2. To transact such other business as may properly come before the Meeting. You may have received more than one proxy card due to multiple investments in the Funds. PLEASE REMEMBER TO VOTE ALL OF YOUR PROXY CARDS! PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE UPPER PORTION IN THE ENCLOSED ENVELOPE. CONTINUED AND TO BE SIGNED ON REVERSE SIDE THERE ARE 3 EASY WAYS TO VOTE YOUR PROXY: 1. By Phone: Call 800-690-6903 to vote with a live proxy services representative. Representatives are available to take your vote or to answer any questions [Monday through Friday 8:30 AM to 5:00 PM (ET)]. OR 2. By Internet: Refer to your proxy card for the control number and go to: www.proxyvote.com or scan the QR bar code above. and follow the simple on-screen instructions. OR 3. By Mail: Sign, Date, and Return this proxy card using the enclosed postage-paid envelope. If possible, please utilize option 1 or 2 to ensure that your vote is received and registered in time for the meeting on June 2, 2023. THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE BELOW TRUSTEE NOMINEES |

| 3 IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE JOHNSON MUTUAL FUNDS TRUST SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 12, 2023 THE PROXY STATEMENT AND THE NOTICE OF SPECIAL MEETING OF SHAREHOLDERS FOR THIS MEETING ARE AVAILABLE AT: johnsonmutualfunds.com |