united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-07254

Johnson Mutual Funds Trust

(Exact name of registrant as specified in charter)

3777 West Fork Road, Cincinnati, Ohio 45247

(Address of principal executive offices) (Zip code)

Jennifer Kelhoffer, Treasurer, 3777 West Fork Road, Cincinnati, Ohio 45247

(Name and address of agent for service)

Registrant’s telephone number, including area code (513) 661-3100

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Johnson Equity Income Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Equity Income Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $37 | 0.75% |

How did the Fund perform during the reporting period?

The Johnson Equity Income Fund’s 2024 under performance relative to its benchmark, the S&P 500 Index, thus far reflects a continuation of the mega-cap, growth-oriented themes the stock market exhibited in 2023.

Both sector allocation and stock selection contributed to the Fund’s underperformance. The Fund was meaningfully underweight in both Technology and Communication Services sectors, which were the only two sectors to outperform the Index through the first six months of 2024. This was partially offset by underweight positions in Materials and Consumer Discretionary, which underperformed the Index.

Given the historic concentration of the current S&P 500 Index, the Fund’s relative returns were driven as much by what we did not own as what we owned versus the Index. NVIDIA and Meta, which we do not own, represented meaningful detractors for the Index. Also, avoiding names such as Tesla was beneficial to the Fund’s performance as the stock had negative returns for the first six months of the year. The Fund also benefited from a few standout performers. Taiwan Semiconductor provided the largest positive contribution among the Fund’s holdings following a strong start for the semiconductor industry in the first half of 2024. Amphenol also performed strongly on expectations of a robust ramp in the IT and Datacom business from increased datacenter connections.

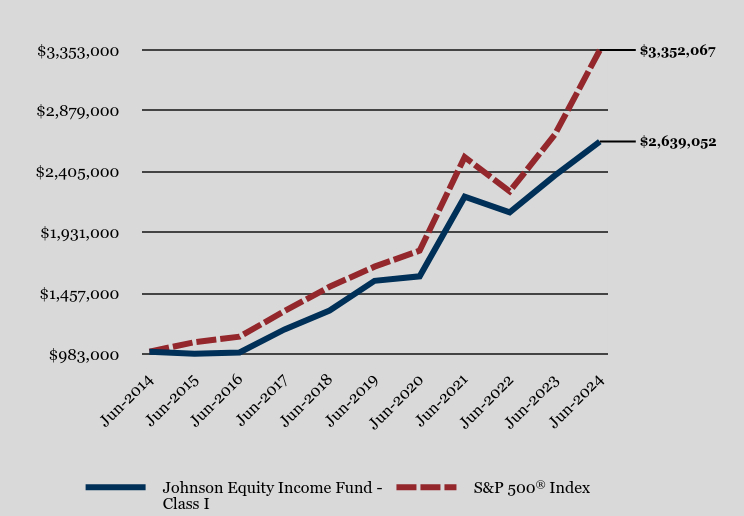

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Equity Income Fund - Class I | S&P 500® Index |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 |

| Jun-2015 | $983,679 | $1,074,228 |

| Jun-2016 | $993,992 | $1,117,118 |

| Jun-2017 | $1,173,772 | $1,317,038 |

| Jun-2018 | $1,320,787 | $1,506,351 |

| Jun-2019 | $1,552,552 | $1,663,274 |

| Jun-2020 | $1,587,615 | $1,788,103 |

| Jun-2021 | $2,208,602 | $2,517,545 |

| Jun-2022 | $2,086,837 | $2,250,288 |

| Jun-2023 | $2,372,922 | $2,691,210 |

| Jun-2024 | $2,639,052 | $3,352,067 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Equity Income Fund - Class I | 11.22% | 11.19% | 10.19% |

S&P 500® Index | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$640,493,260

- Number of Portfolio Holdings51

- Advisory Fee $2,353,548

- Portfolio Turnover7%

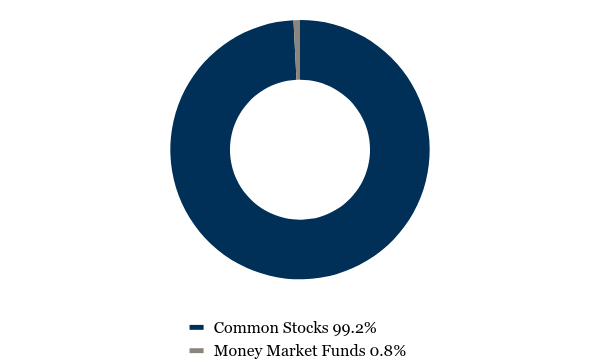

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.2% |

| Money Market Funds | 0.8% |

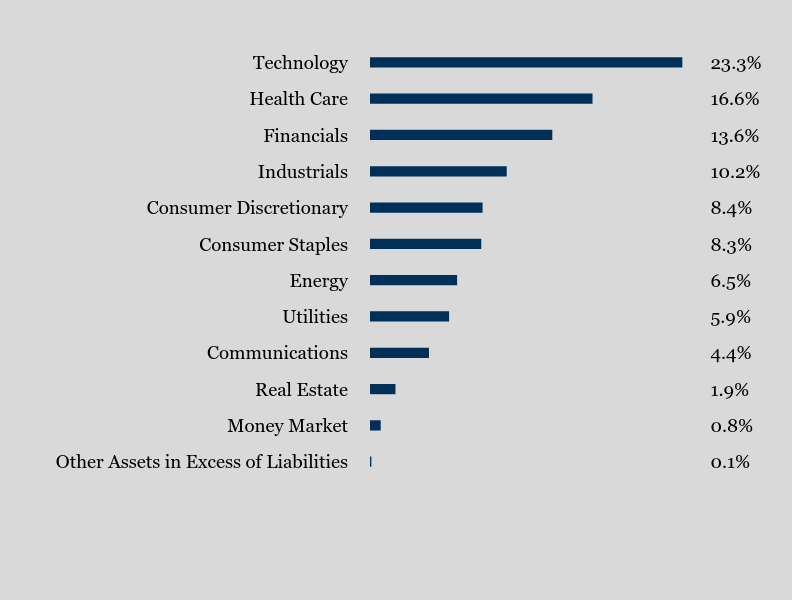

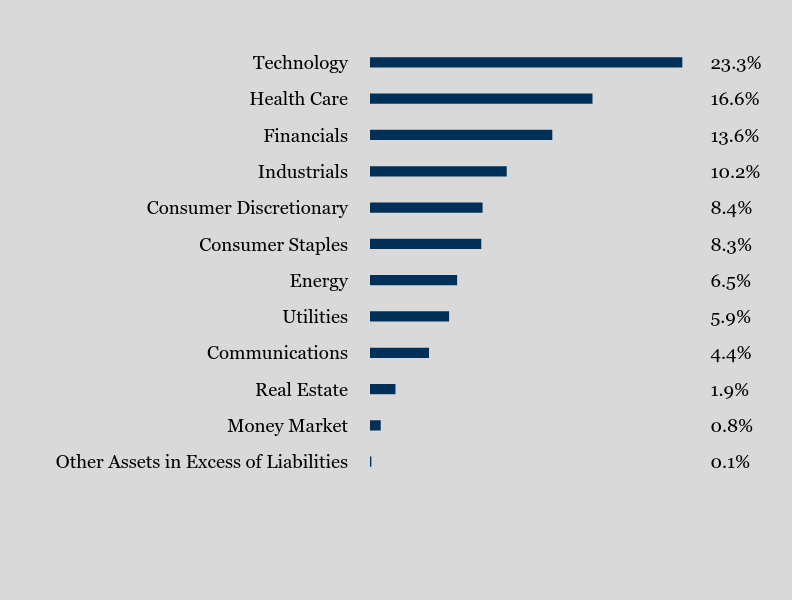

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Money Market | 0.8% |

| Real Estate | 1.9% |

| Communications | 4.4% |

| Utilities | 5.9% |

| Energy | 6.5% |

| Consumer Staples | 8.3% |

| Consumer Discretionary | 8.4% |

| Industrials | 10.2% |

| Financials | 13.6% |

| Health Care | 16.6% |

| Technology | 23.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corp. | 4.2% |

| Williams Cos., Inc. (The) | 3.4% |

| Alphabet, Inc. - Class A | 3.4% |

| Nasdaq, Inc. | 3.3% |

| American Electric Power Co., Inc. | 3.1% |

| Chevron Corp. | 3.1% |

| UnitedHealth Group, Inc. | 3.1% |

| Danaher Corp. | 2.9% |

| Alliant Energy Corp. | 2.8% |

| Cencora, Inc. | 2.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Equity Income Fund - Class I (JEQIX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Equity Income Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Equity Income Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class S | $50 | 1.00% |

How did the Fund perform during the reporting period?

The Johnson Equity Income Fund’s 2024 under performance relative to its benchmark, the S&P 500 Index, thus far reflects a continuation of the mega-cap, growth-oriented themes the stock market exhibited in 2023.

Both sector allocation and stock selection contributed to the Fund’s underperformance. The Fund was meaningfully underweight in both Technology and Communication Services sectors, which were the only two sectors to outperform the Index through the first six months of 2024. This was partially offset by underweight positions in Materials and Consumer Discretionary, which underperformed the Index.

Given the historic concentration of the current S&P 500 Index, the Fund’s relative returns were driven as much by what we did not own as what we owned versus the Index. NVIDIA and Meta, which we do not own, represented meaningful detractors for the Index. Also, avoiding names such as Tesla was beneficial to the Fund’s performance as the stock had negative returns for the first six months of the year. The Fund also benefited from a few standout performers. Taiwan Semiconductor provided the largest positive contribution among the Fund’s holdings following a strong start for the semiconductor industry in the first half of 2024. Amphenol also performed strongly on expectations of a robust ramp in the IT and Datacom business from increased datacenter connections.

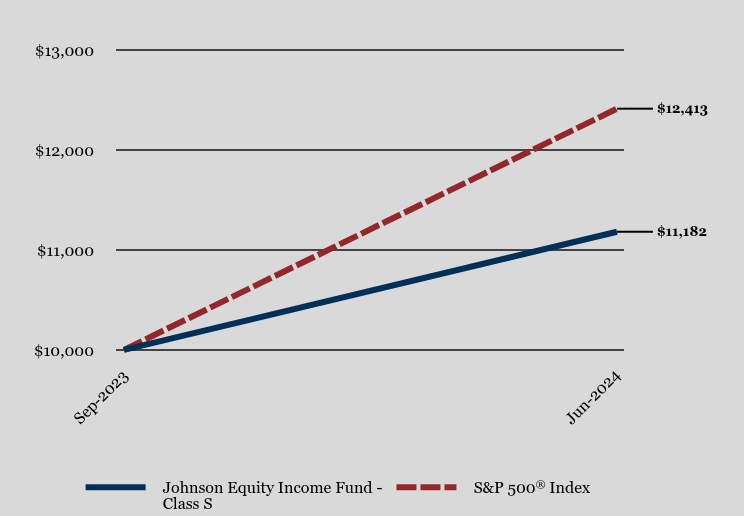

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Johnson Equity Income Fund - Class S | S&P 500® Index |

|---|

| Sep-2023 | $10,000 | $10,000 |

| Jun-2024 | $11,182 | $12,413 |

Average Annual Total Returns

| Since Inception (September 15, 2023) |

|---|

| Johnson Equity Income Fund - Class S | 11.82% |

S&P 500® Index | 24.13% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$640,493,260

- Number of Portfolio Holdings51

- Advisory Fee $2,353,548

- Portfolio Turnover7%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.2% |

| Money Market Funds | 0.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.1% |

| Money Market | 0.8% |

| Real Estate | 1.9% |

| Communications | 4.4% |

| Utilities | 5.9% |

| Energy | 6.5% |

| Consumer Staples | 8.3% |

| Consumer Discretionary | 8.4% |

| Industrials | 10.2% |

| Financials | 13.6% |

| Health Care | 16.6% |

| Technology | 23.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corp. | 4.2% |

| Williams Cos., Inc. (The) | 3.4% |

| Alphabet, Inc. - Class A | 3.4% |

| Nasdaq, Inc. | 3.3% |

| American Electric Power Co., Inc. | 3.1% |

| Chevron Corp. | 3.1% |

| UnitedHealth Group, Inc. | 3.1% |

| Danaher Corp. | 2.9% |

| Alliant Energy Corp. | 2.8% |

| Cencora, Inc. | 2.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Equity Income Fund - Class S (JEQSX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $45 | 0.90% |

How did the Fund perform during the reporting period?

The Johnson Opportunity Fund outperformed its benchmark, the Russell 2500 Index, in the first 6 months of 2024. Large cap indexes, which are highly concentrated in technology stocks, reached all-time highs, but most small and midcap stocks sputtered as the first half progressed. Worsening economic data and a delay in the Federal Reserve’s plan to cut interest rates contributed to SMID cap stocks weakening in the second quarter of 2024 after a positive gain in the first quarter.

The top two performing sectors in the six-month period for the SMID Cap market were Utilities and Energy, with optimism for a growth opportunity in meeting the massive power needs of data centers as artificial intelligence technology growth booms. Due to high valuations for AI-related growth stocks, the Fund’s exposure to that theme has been more limited. Nevertheless, overall performance did benefit from both sector allocation and security selection, with each having a positive impact in seven of the eleven sectors.

It was a diverse group of winners, with six different sectors represented within the top ten positive contributors. Williams-Sonoma and LeMaitre Vascular, which both had total returns greater than 40%, were the biggest gainers. Security selection within Consumer Discretionary and Financials was also additive to performance.

Economic cycle concerns or missed growth expectations contributed to weakness in the Fund’s bottom performers. Technology was the most challenging sector for security selection and DoubleVerify Holdings was the Fund’s worst performer as the company reset growth forecasts lower. Four of the ten most negative contributors were in Health Care as the sector continued to work through a bumpy growth path following the COVID pandemic disruption.

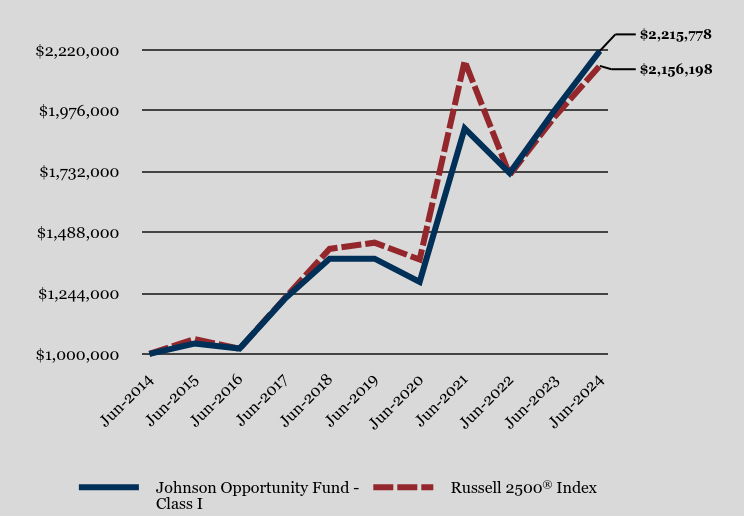

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Opportunity Fund - Class I | Russell 2500® Index |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 |

| Jun-2015 | $1,041,286 | $1,059,194 |

| Jun-2016 | $1,021,475 | $1,020,323 |

| Jun-2017 | $1,219,739 | $1,222,767 |

| Jun-2018 | $1,382,216 | $1,421,379 |

| Jun-2019 | $1,382,262 | $1,446,503 |

| Jun-2020 | $1,288,681 | $1,378,547 |

| Jun-2021 | $1,905,196 | $2,175,226 |

| Jun-2022 | $1,725,890 | $1,718,487 |

| Jun-2023 | $1,977,998 | $1,951,863 |

| Jun-2024 | $2,215,778 | $2,156,198 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Opportunity Fund - Class I | 12.02% | 9.90% | 8.28% |

Russell 2500® Index | 10.47% | 8.31% | 7.99% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$153,815,721

- Number of Portfolio Holdings81

- Advisory Fee $654,224

- Portfolio Turnover7%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 98.3% |

| Money Market Funds | 1.7% |

What did the Fund invest in?

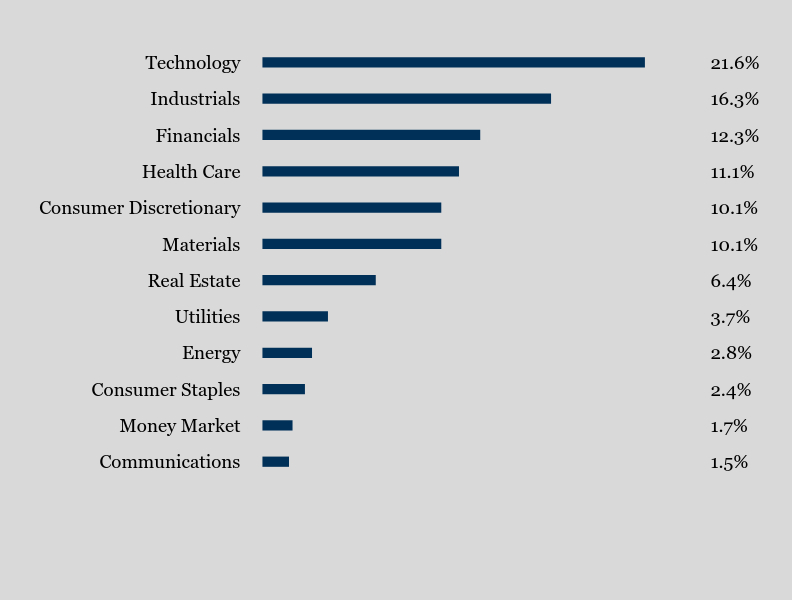

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Communications | 1.5% |

| Money Market | 1.7% |

| Consumer Staples | 2.4% |

| Energy | 2.8% |

| Utilities | 3.7% |

| Real Estate | 6.4% |

| Materials | 10.1% |

| Consumer Discretionary | 10.1% |

| Health Care | 11.1% |

| Financials | 12.3% |

| Industrials | 16.3% |

| Technology | 21.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Hawkins, Inc. | 2.0% |

| Axis Capital Holdings Ltd. | 2.0% |

| Wintrust Financial Corp. | 1.9% |

| Leidos Holdings, Inc. | 1.9% |

| Applied Industrial Technologies, Inc. | 1.9% |

| H.B. Fuller Co. | 1.8% |

| Tyler Technologies, Inc. | 1.7% |

| American Financial Group, Inc. | 1.7% |

| Unitil Corp. | 1.7% |

| Everest Group Ltd. | 1.7% |

No material changes occurred during the period ended June 30, 2024.

Johnson Opportunity Fund - Class I (JOPPX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Opportunity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class S | $57 | 1.15% |

How did the Fund perform during the reporting period?

The Johnson Opportunity Fund outperformed its benchmark, the Russell 2500 Index, in the first 6 months of 2024. Large cap indexes, which are highly concentrated in technology stocks, reached all-time highs, but most small and midcap stocks sputtered as the first half progressed. Worsening economic data and a delay in the Federal Reserve’s plan to cut interest rates contributed to SMID cap stocks weakening in the second quarter of 2024 after a positive gain in the first quarter.

The top two performing sectors in the six-month period for the SMID Cap market were Utilities and Energy, with optimism for a growth opportunity in meeting the massive power needs of data centers as artificial intelligence technology growth booms. Due to high valuations for AI-related growth stocks, the Fund’s exposure to that theme has been more limited. Nevertheless, overall performance did benefit from both sector allocation and security selection, with each having a positive impact in seven of the eleven sectors.

It was a diverse group of winners, with six different sectors represented within the top ten positive contributors. Williams-Sonoma and LeMaitre Vascular, which both had total returns greater than 40%, were the biggest gainers. Security selection within Consumer Discretionary and Financials was also additive to performance.

Economic cycle concerns or missed growth expectations contributed to weakness in the Fund’s bottom performers. Technology was the most challenging sector for security selection and DoubleVerify Holdings was the Fund’s worst performer as the company reset growth forecasts lower. Four of the ten most negative contributors were in Health Care as the sector continued to work through a bumpy growth path following the COVID pandemic disruption.

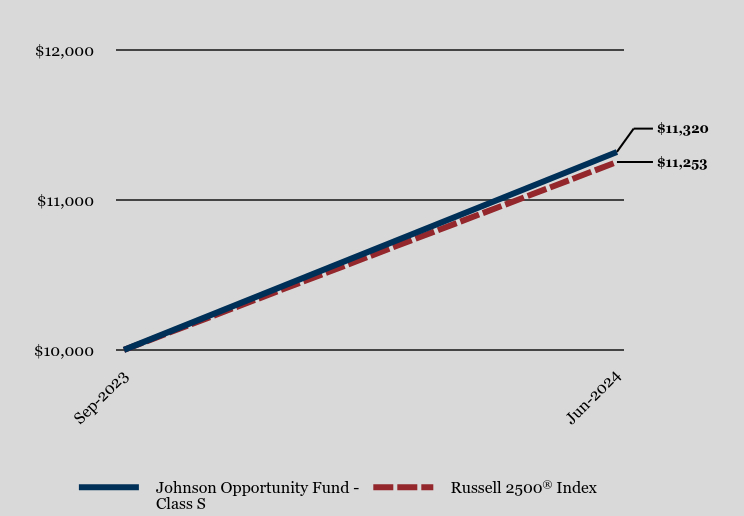

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Johnson Opportunity Fund - Class S | Russell 2500® Index |

|---|

| Sep-2023 | $10,000 | $10,000 |

| Jun-2024 | $11,320 | $11,253 |

Average Annual Total Returns

| Since Inception (September 15, 2023) |

|---|

| Johnson Opportunity Fund - Class S | 13.20% |

Russell 2500® Index | 12.53% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$153,815,721

- Number of Portfolio Holdings81

- Advisory Fee $654,224

- Portfolio Turnover7%

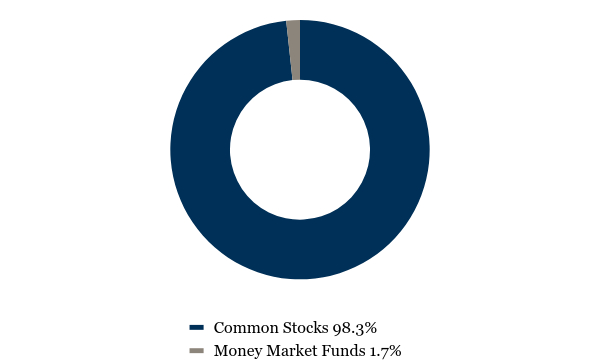

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 98.3% |

| Money Market Funds | 1.7% |

What did the Fund invest in?

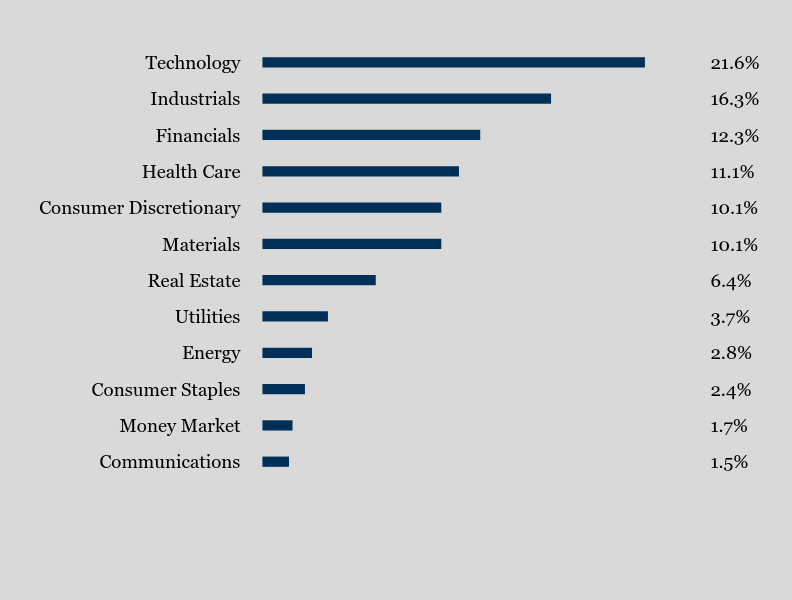

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Communications | 1.5% |

| Money Market | 1.7% |

| Consumer Staples | 2.4% |

| Energy | 2.8% |

| Utilities | 3.7% |

| Real Estate | 6.4% |

| Materials | 10.1% |

| Consumer Discretionary | 10.1% |

| Health Care | 11.1% |

| Financials | 12.3% |

| Industrials | 16.3% |

| Technology | 21.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Hawkins, Inc. | 2.0% |

| Axis Capital Holdings Ltd. | 2.0% |

| Wintrust Financial Corp. | 1.9% |

| Leidos Holdings, Inc. | 1.9% |

| Applied Industrial Technologies, Inc. | 1.9% |

| H.B. Fuller Co. | 1.8% |

| Tyler Technologies, Inc. | 1.7% |

| American Financial Group, Inc. | 1.7% |

| Unitil Corp. | 1.7% |

| Everest Group Ltd. | 1.7% |

No material changes occurred during the period ended June 30, 2024.

Johnson Opportunity Fund - Class S (JOSSX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson International Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson International Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Johnson International Fund | $50 | 1.00% |

How did the Fund perform during the reporting period?

The Johnson International Fund underperformed its benchmark, the MSCI ACWI ex-US Index through the first 6 months of 2024. Local currency returns were better, but a strong U.S. Dollar weakened returns for a US investor by five percentage points. Sector and and country allocations were both slight positive effects, thus the Fund’s relative underperformance can be attributed to security selection.

Emerging markets were stronger than developed markets, driven by very strong returns in Southeast Asian countries. This geographic area is a key supplier of semiconductors and technology equipment, important to booming secular growth in artificial intelligence and other advanced technologies. The Technology sector was the top performer in the first half, and Taiwan Semiconductor, up 68%, was the Fund’s highest return stock. An overweight position in the outperforming Asia Pacific region was beneficial, and six of the Fund’s ten best performers were in that area.

The Fund was less exposed to the risk factors driving the market, including momentum, liquidity, and growth. Five of its best performers were in the Financials sector, but every other sector had a negative security selection effect. Three of the Fund’s worst performers were Materials companies: Companhia Siderurgica Nacional, POSCO Holdings, and Vale. After ending last year at cycle highs, steel prices declined as inflation pressures eased, reducing forward earnings estimates.

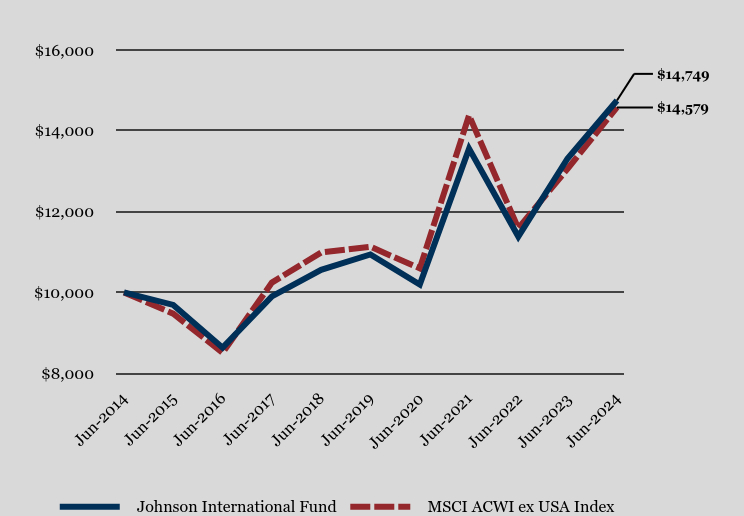

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Johnson International Fund | MSCI ACWI ex USA Index |

|---|

| Jun-2014 | $10,000 | $10,000 |

| Jun-2015 | $9,690 | $9,474 |

| Jun-2016 | $8,632 | $8,504 |

| Jun-2017 | $9,900 | $10,243 |

| Jun-2018 | $10,559 | $10,988 |

| Jun-2019 | $10,938 | $11,130 |

| Jun-2020 | $10,194 | $10,595 |

| Jun-2021 | $13,559 | $14,380 |

| Jun-2022 | $11,383 | $11,587 |

| Jun-2023 | $13,315 | $13,061 |

| Jun-2024 | $14,749 | $14,579 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson International Fund | 10.77% | 6.16% | 3.96% |

| MSCI ACWI ex USA Index | 11.62% | 5.55% | 3.84% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$23,812,817

- Number of Portfolio Holdings94

- Advisory Fee $120,529

- Portfolio Turnover5%

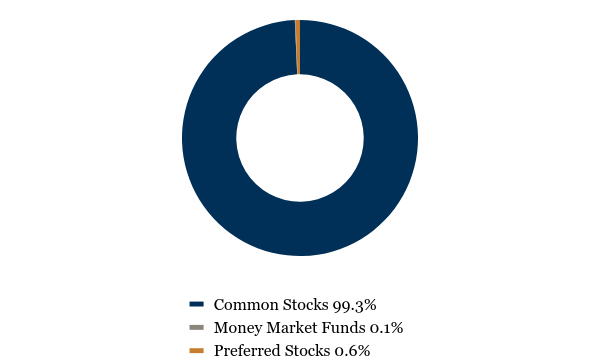

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 99.3% |

| Money Market Funds | 0.1% |

| Preferred Stocks | 0.6% |

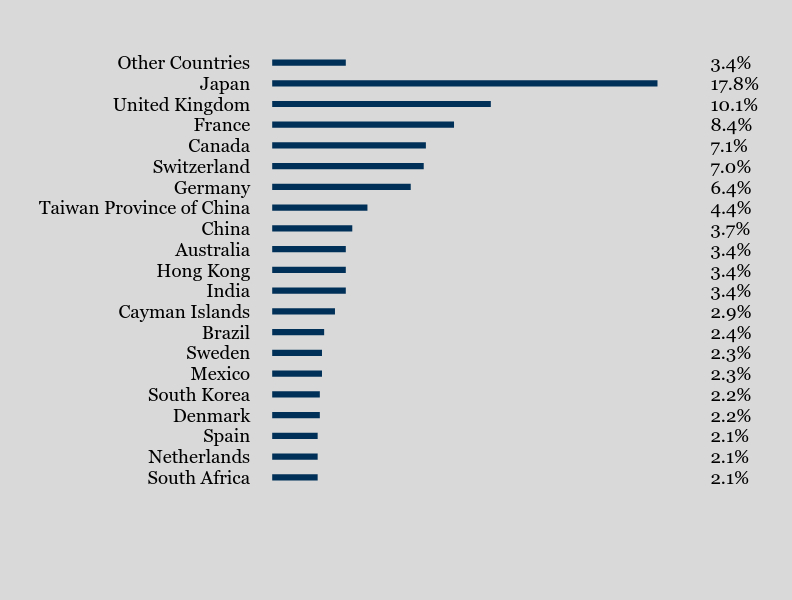

What did the Fund invest in?

Country Weighting (% of net assets)

| Value | Value |

|---|

| South Africa | 2.1% |

| Netherlands | 2.1% |

| Spain | 2.1% |

| Denmark | 2.2% |

| South Korea | 2.2% |

| Mexico | 2.3% |

| Sweden | 2.3% |

| Brazil | 2.4% |

| Cayman Islands | 2.9% |

| India | 3.4% |

| Hong Kong | 3.4% |

| Australia | 3.4% |

| China | 3.7% |

| Taiwan Province of China | 4.4% |

| Germany | 6.4% |

| Switzerland | 7.0% |

| Canada | 7.1% |

| France | 8.4% |

| United Kingdom | 10.1% |

| Japan | 17.8% |

| Other Countries | 3.4% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Tokio Marine Holdings, Inc. - ADR | 2.5% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | 2.3% |

| Sumitomo Mitsui Financial Group, Inc. - ADR | 2.3% |

| Atlas Copco AB - ADR | 2.3% |

| Novo Nordisk A/S - ADR | 2.2% |

| Roche Holding AG - ADR | 2.2% |

| ASML Holding N.V. | 2.1% |

| Lenovo Group Ltd. - ADR | 2.1% |

| Shoprite Holdings Ltd. - ADR | 2.1% |

| Tencent Holdings Ltd. - ADR | 2.1% |

No material changes occurred during the period ended June 30, 2024.

Johnson International Fund (JINTX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Enhanced Return Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Enhanced Return Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Johnson Enhanced Return Fund | $17 | 0.35% |

How did the Fund perform during the reporting period?

Familiar themes dominated the US large cap equity market to start 2024. The S&P 500, the Fund’s benchmark, hit another all-time high and has now posted returns well into the double-digits year-to-date. While the Fund has experienced strong positive returns year-to-date, it has been unable to keep pace with the benchmark. The primary driver of underperformance during the first half of the year were returns in the bond portion of the portfolio that failed to keep pace with the embedded cost-of-carry within its equity futures contract positions. Within the bond portfolio, elevated levels of income led to positive returns, however cost-of-carry also remains elevated, with the Federal Reserve likely at their peak policy rate for the cycle. In particular, the strategy’s focus on higher-yielding investment grade corporate bonds was additive to performance. Curve positioning detracted modestly from performance as rates rose and the curve steepened, which pressured prices of the strategy’s three-to-five-year maturities.

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Enhanced Return Fund | S&P 500® Index |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 |

| Jun-2015 | $1,073,410 | $1,074,228 |

| Jun-2016 | $1,128,985 | $1,117,118 |

| Jun-2017 | $1,324,940 | $1,317,038 |

| Jun-2018 | $1,487,642 | $1,506,351 |

| Jun-2019 | $1,664,273 | $1,663,274 |

| Jun-2020 | $1,803,545 | $1,788,103 |

| Jun-2021 | $2,523,180 | $2,517,545 |

| Jun-2022 | $2,132,052 | $2,250,288 |

| Jun-2023 | $2,454,945 | $2,691,210 |

| Jun-2024 | $3,016,849 | $3,352,067 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Enhanced Return Fund | 22.89% | 12.63% | 11.67% |

S&P 500® Index | 24.56% | 15.05% | 12.86% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$274,938,155

- Number of Portfolio Holdings109

- Advisory Fee $457,017

- Portfolio Turnover17%

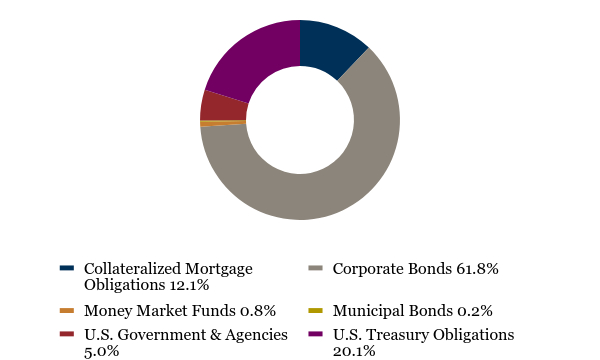

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 12.1% |

| Corporate Bonds | 61.8% |

| Money Market Funds | 0.8% |

| Municipal Bonds | 0.2% |

| U.S. Government & Agencies | 5.0% |

| U.S. Treasury Obligations | 20.1% |

What did the Fund invest in?

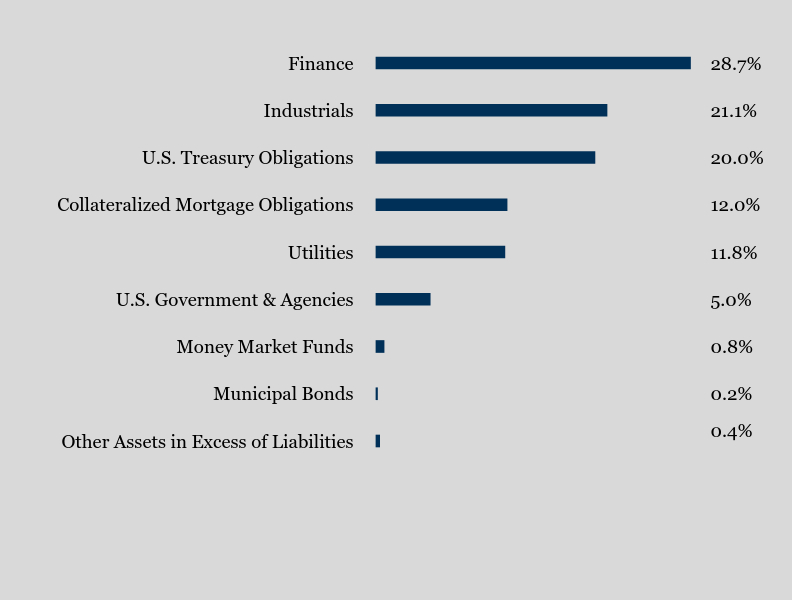

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.4% |

| Municipal Bonds | 0.2% |

| Money Market Funds | 0.8% |

| U.S. Government & Agencies | 5.0% |

| Utilities | 11.8% |

| Collateralized Mortgage Obligations | 12.0% |

| U.S. Treasury Obligations | 20.0% |

| Industrials | 21.1% |

| Finance | 28.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 3.125%, due 11/15/28 | 4.7% |

| U.S. Treasury Notes, 2.750%, due 02/15/28 | 4.2% |

| U.S. Treasury Notes, 2.875%, due 05/15/28 | 3.6% |

| U.S. Treasury Notes, 2.750%, due 07/31/27 | 2.5% |

| U.S. Treasury Notes, 2.000%, due 08/15/25 | 2.0% |

| Home Depot, Inc. (The), 5.150%, due 06/25/26 | 2.0% |

| U.S. Treasury Notes, 2.625%, due 02/15/29 | 2.0% |

| Chubb INA Holdings, Inc., 3.350%, due 05/3/26 | 2.0% |

| FHLMC, 5.000%, due 04/1/53 - Class ED - Series 5301 | 1.9% |

| Cisco Systems, Inc., 4.800%, due 02/26/27 | 1.9% |

No material changes occurred during the period ended June 30, 2024.

Johnson Enhanced Return Fund (JENHX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Core Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Core Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $12 | 0.25% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. The 10-year treasury ultimately finished the first half of the year modestly higher, once again resulting in negative returns. The Fund maintained a modest long duration position relative to the Bloomberg Aggregate Index, the Fund’s benchmark, resulting in a slight drag to performance in the first half of the year. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten. As a result, the Fund’s overweight position to corporate bonds was the largest contributor to performance, more than offsetting the headwind from duration. Within corporate bonds the Fund’s emphasis on intermediate maturity bonds was an additional tailwind to performance as bonds in the intermediate part of the curve outperformed longer maturity bonds. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We remain underweight Agency MBS, which continued to underperform during the first half of the year providing an additional tailwind to relative performance.

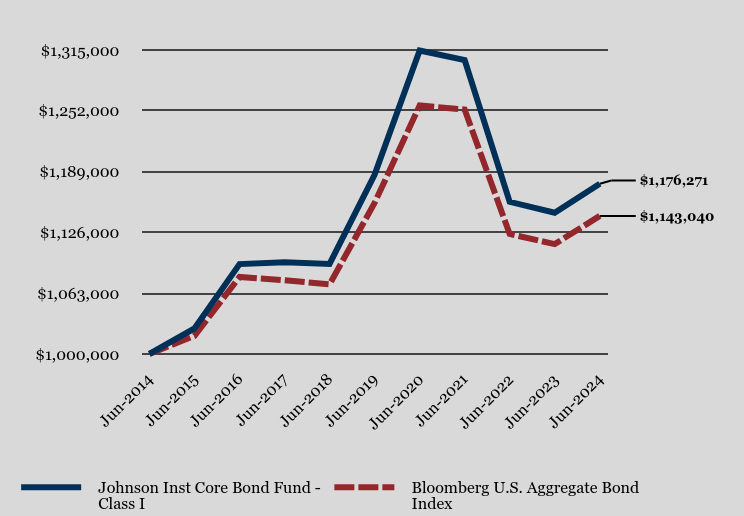

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Inst Core Bond Fund - Class I | Bloomberg U.S. Aggregate Bond Index |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 |

| Jun-2015 | $1,026,438 | $1,018,578 |

| Jun-2016 | $1,093,069 | $1,079,707 |

| Jun-2017 | $1,095,094 | $1,076,310 |

| Jun-2018 | $1,093,261 | $1,072,034 |

| Jun-2019 | $1,185,655 | $1,156,395 |

| Jun-2020 | $1,314,389 | $1,257,460 |

| Jun-2021 | $1,304,629 | $1,253,269 |

| Jun-2022 | $1,157,613 | $1,124,281 |

| Jun-2023 | $1,146,309 | $1,113,738 |

| Jun-2024 | $1,176,271 | $1,143,040 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Inst Core Bond Fund - Class I | 2.61% | | 1.64% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.35% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$1,737,112,667

- Number of Portfolio Holdings212

- Advisory Fee (net of waivers)$2,088,502

- Portfolio Turnover13%

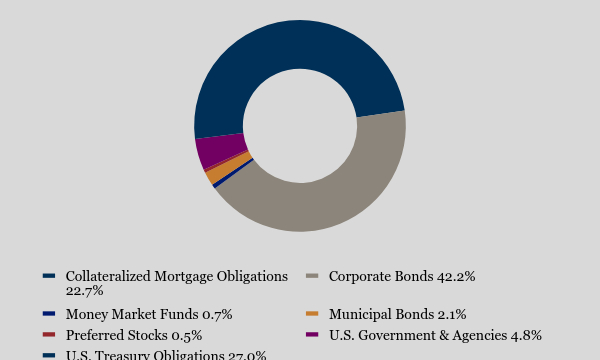

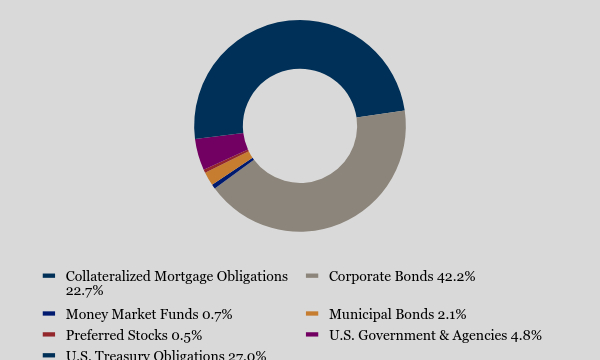

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 22.7% |

| Corporate Bonds | 42.2% |

| Money Market Funds | 0.7% |

| Municipal Bonds | 2.1% |

| Preferred Stocks | 0.5% |

| U.S. Government & Agencies | 4.8% |

| U.S. Treasury Obligations | 27.0% |

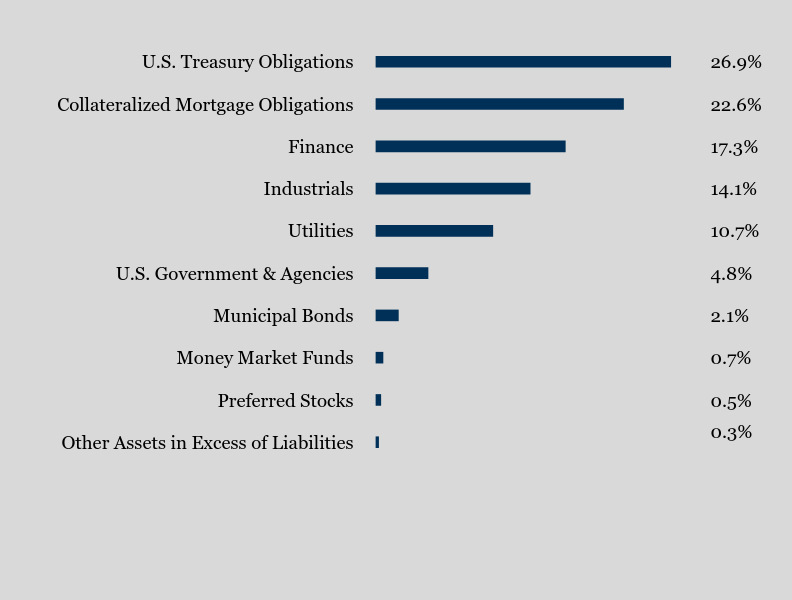

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Preferred Stocks | 0.5% |

| Money Market Funds | 0.7% |

| Municipal Bonds | 2.1% |

| U.S. Government & Agencies | 4.8% |

| Utilities | 10.7% |

| Industrials | 14.1% |

| Finance | 17.3% |

| Collateralized Mortgage Obligations | 22.6% |

| U.S. Treasury Obligations | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 3.375%, due 05/15/33 | 4.9% |

| U.S. Treasury Bonds, 2.375%, due 02/15/42 | 4.2% |

| U.S. Treasury Bonds, 2.500%, due 02/15/45 | 4.1% |

| U.S. Treasury Notes, 3.500%, due 02/15/33 | 3.5% |

| FNMA, 1.520%, due 08/21/35 - Class KA - Series 2022-25 | 2.4% |

| U.S. Treasury Notes, 3.875%, due 08/15/33 | 2.1% |

| FHLMC, 3.000%, due 08/1/52 | 2.1% |

| U.S. Treasury Bonds, 2.750%, due 08/15/47 | 1.9% |

| U.S. Treasury Bonds, 2.250%, due 05/15/41 | 1.9% |

| U.S. Treasury Bonds, 2.500%, due 05/15/46 | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Core Bond Fund - Class I (JIBFX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Core Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Core Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F | $20 | 0.40% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. The 10-year treasury ultimately finished the first half of the year modestly higher, once again resulting in negative returns. The Fund maintained a modest long duration position relative to the Bloomberg Aggregate Index, the Fund’s benchmark, resulting in a slight drag to performance in the first half of the year. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten. As a result, the Fund’s overweight position to corporate bonds was the largest contributor to performance, more than offsetting the headwind from duration. Within corporate bonds the Fund’s emphasis on intermediate maturity bonds was an additional tailwind to performance as bonds in the intermediate part of the curve outperformed longer maturity bonds. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We remain underweight Agency MBS, which continued to underperform during the first half of the year providing an additional tailwind to relative performance.

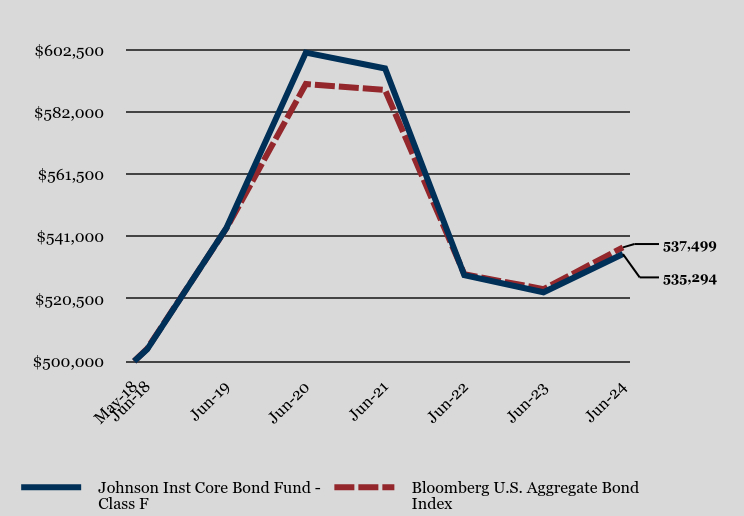

How has the Fund performed since inception?

Total Return Based on $500,000 Investment

| Johnson Inst Core Bond Fund - Class F | Bloomberg U.S. Aggregate Bond Index |

|---|

| May-18 | $500,000 | $500,000 |

| Jun-18 | 503,920 | 504,109 |

| Jun-19 | 543,879 | 543,779 |

| Jun-20 | 601,637 | 591,303 |

| Jun-21 | 596,429 | 589,332 |

| Jun-22 | 528,307 | 528,677 |

| Jun-23 | 522,701 | 523,720 |

| Jun-24 | 535,294 | 537,499 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (May 1, 2018) |

|---|

| Johnson Inst Core Bond Fund - Class F | 2.41% | | 1.11% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | | 1.18% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$1,737,112,667

- Number of Portfolio Holdings212

- Advisory Fee (net of waivers)$2,088,502

- Portfolio Turnover13%

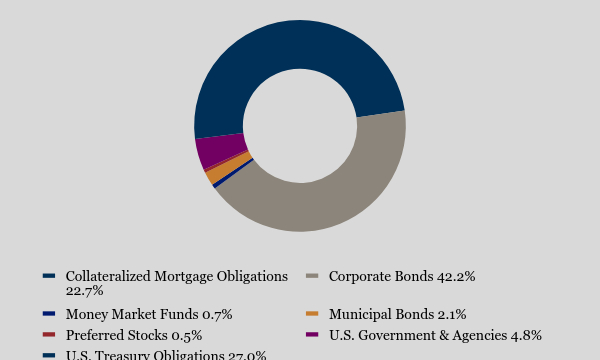

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 22.7% |

| Corporate Bonds | 42.2% |

| Money Market Funds | 0.7% |

| Municipal Bonds | 2.1% |

| Preferred Stocks | 0.5% |

| U.S. Government & Agencies | 4.8% |

| U.S. Treasury Obligations | 27.0% |

What did the Fund invest in?

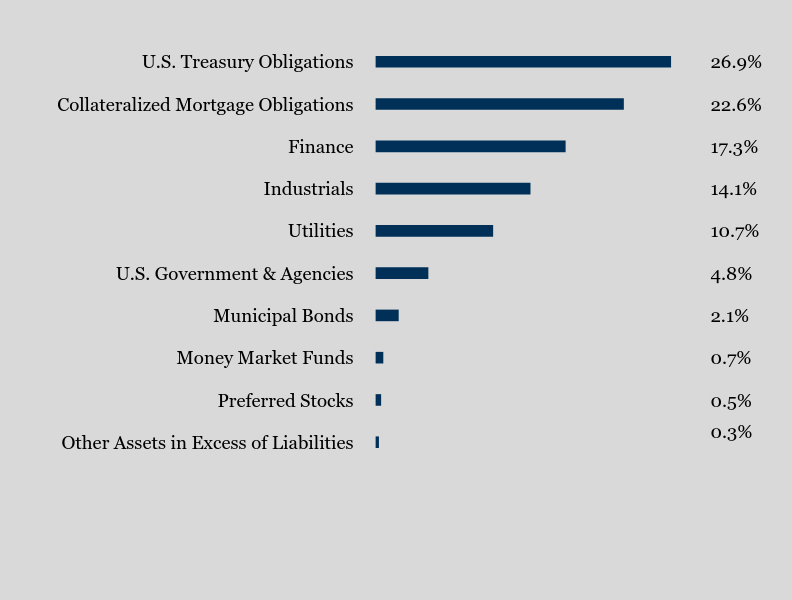

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Preferred Stocks | 0.5% |

| Money Market Funds | 0.7% |

| Municipal Bonds | 2.1% |

| U.S. Government & Agencies | 4.8% |

| Utilities | 10.7% |

| Industrials | 14.1% |

| Finance | 17.3% |

| Collateralized Mortgage Obligations | 22.6% |

| U.S. Treasury Obligations | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 3.375%, due 05/15/33 | 4.9% |

| U.S. Treasury Bonds, 2.375%, due 02/15/42 | 4.2% |

| U.S. Treasury Bonds, 2.500%, due 02/15/45 | 4.1% |

| U.S. Treasury Notes, 3.500%, due 02/15/33 | 3.5% |

| FNMA, 1.520%, due 08/21/35 - Class KA - Series 2022-25 | 2.4% |

| U.S. Treasury Notes, 3.875%, due 08/15/33 | 2.1% |

| FHLMC, 3.000%, due 08/1/52 | 2.1% |

| U.S. Treasury Bonds, 2.750%, due 08/15/47 | 1.9% |

| U.S. Treasury Bonds, 2.250%, due 05/15/41 | 1.9% |

| U.S. Treasury Bonds, 2.500%, due 05/15/46 | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Core Bond Fund - Class F (JIMFX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Core Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Core Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class S | $25 | 0.50% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. The 10-year treasury ultimately finished the first half of the year modestly higher, once again resulting in negative returns. The Fund maintained a modest long duration position relative to the Bloomberg Aggregate Index, the Fund’s benchmark, resulting in a slight drag to performance in the first half of the year. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten. As a result, the Fund’s overweight position to corporate bonds was the largest contributor to performance, more than offsetting the headwind from duration. Within corporate bonds the Fund’s emphasis on intermediate maturity bonds was an additional tailwind to performance as bonds in the intermediate part of the curve outperformed longer maturity bonds. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We remain underweight Agency MBS, which continued to underperform during the first half of the year providing an additional tailwind to relative performance.

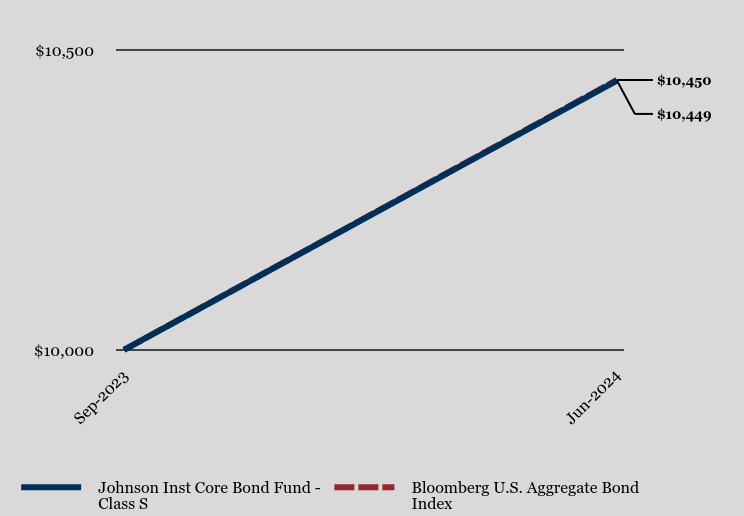

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Johnson Inst Core Bond Fund - Class S | Bloomberg U.S. Aggregate Bond Index |

|---|

| Sep-2023 | $10,000 | $10,000 |

| Jun-2024 | $10,449 | $10,450 |

Average Annual Total Returns

| Since Inception (September 15, 2023) |

|---|

| Johnson Inst Core Bond Fund - Class S | 4.49% |

| Bloomberg U.S. Aggregate Bond Index | 4.50% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$1,737,112,667

- Number of Portfolio Holdings212

- Advisory Fee (net of waivers)$2,088,502

- Portfolio Turnover13%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 22.7% |

| Corporate Bonds | 42.2% |

| Money Market Funds | 0.7% |

| Municipal Bonds | 2.1% |

| Preferred Stocks | 0.5% |

| U.S. Government & Agencies | 4.8% |

| U.S. Treasury Obligations | 27.0% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.3% |

| Preferred Stocks | 0.5% |

| Money Market Funds | 0.7% |

| Municipal Bonds | 2.1% |

| U.S. Government & Agencies | 4.8% |

| Utilities | 10.7% |

| Industrials | 14.1% |

| Finance | 17.3% |

| Collateralized Mortgage Obligations | 22.6% |

| U.S. Treasury Obligations | 26.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 3.375%, due 05/15/33 | 4.9% |

| U.S. Treasury Bonds, 2.375%, due 02/15/42 | 4.2% |

| U.S. Treasury Bonds, 2.500%, due 02/15/45 | 4.1% |

| U.S. Treasury Notes, 3.500%, due 02/15/33 | 3.5% |

| FNMA, 1.520%, due 08/21/35 - Class KA - Series 2022-25 | 2.4% |

| U.S. Treasury Notes, 3.875%, due 08/15/33 | 2.1% |

| FHLMC, 3.000%, due 08/1/52 | 2.1% |

| U.S. Treasury Bonds, 2.750%, due 08/15/47 | 1.9% |

| U.S. Treasury Bonds, 2.250%, due 05/15/41 | 1.9% |

| U.S. Treasury Bonds, 2.500%, due 05/15/46 | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Core Bond Fund - Class S (JIBSX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Intermediate Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Intermediate Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $12 | 0.25% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. The 10-year treasury ultimately finished the first half of the year modestly higher, once again resulting in negative returns. The Fund maintained a modest long duration position relative to the Bloomberg Aggregate Index, the Fund’s benchmark, resulting in a slight drag to performance in the first half of the year. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten. Our corporate overweight position, combined with a shorter corporate duration structure, contributed to our yield advantage against the benchmark. As a result, the Fund’s overweight to corporate bonds was the largest contributor to performance, more than offsetting the headwind from duration. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We continue to maintain a modest non-benchmark allocation to Agency MBS, which continued to underperform during the first half of the year providing an additional headwind to relative performance.

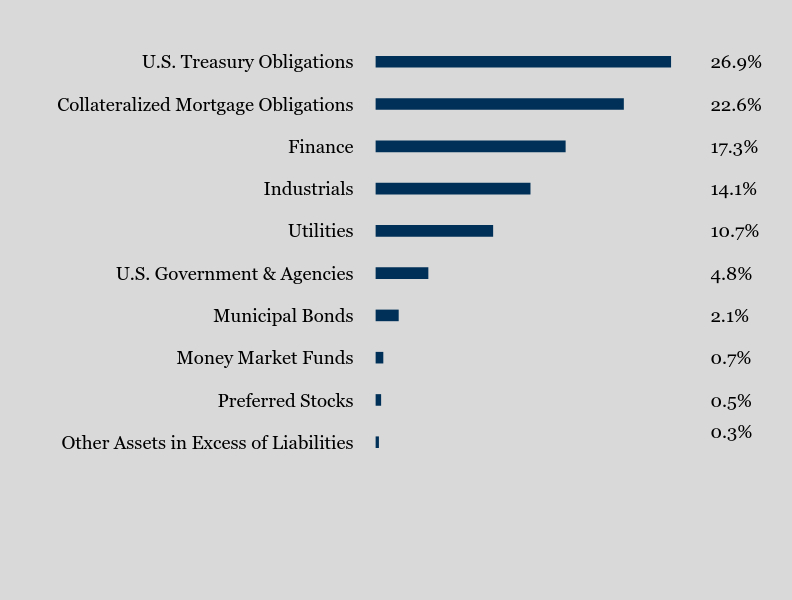

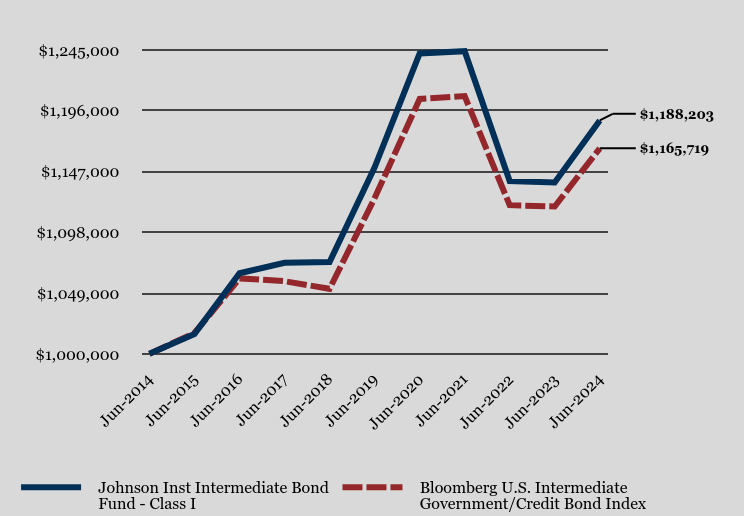

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Inst Intermediate Bond Fund - Class I | Bloomberg U.S. Intermediate Government/Credit Bond Index |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 |

| Jun-2015 | $1,015,976 | $1,016,798 |

| Jun-2016 | $1,065,014 | $1,060,846 |

| Jun-2017 | $1,073,391 | $1,058,592 |

| Jun-2018 | $1,074,036 | $1,052,457 |

| Jun-2019 | $1,150,252 | $1,125,415 |

| Jun-2020 | $1,242,253 | $1,205,496 |

| Jun-2021 | $1,244,033 | $1,207,811 |

| Jun-2022 | $1,139,323 | $1,119,879 |

| Jun-2023 | $1,138,154 | $1,118,814 |

| Jun-2024 | $1,188,203 | $1,165,719 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Inst Intermediate Bond Fund - Class I | 4.40% | 0.65% | 1.74% |

| Bloomberg U.S. Intermediate Government/Credit Bond Index | 4.19% | 0.71% | 1.55% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$302,719,571

- Number of Portfolio Holdings102

- Advisory Fee (net of waivers)$342,845

- Portfolio Turnover15%

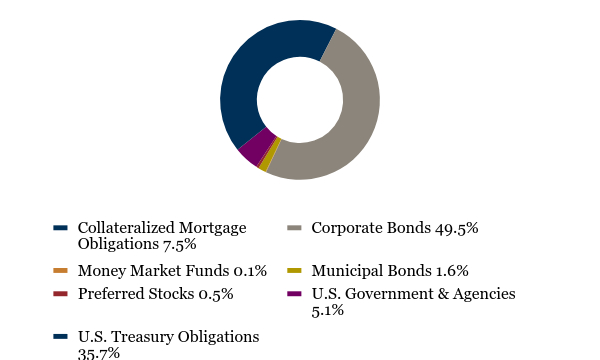

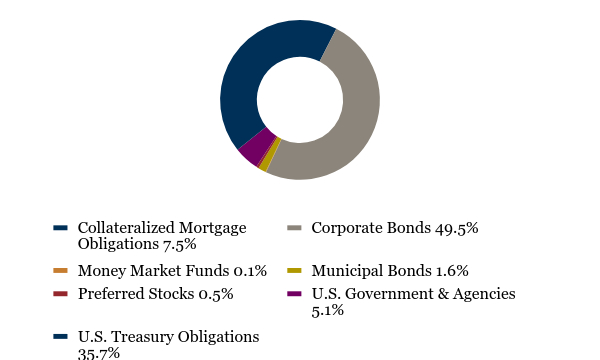

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 7.5% |

| Corporate Bonds | 49.5% |

| Money Market Funds | 0.1% |

| Municipal Bonds | 1.6% |

| Preferred Stocks | 0.5% |

| U.S. Government & Agencies | 5.1% |

| U.S. Treasury Obligations | 35.7% |

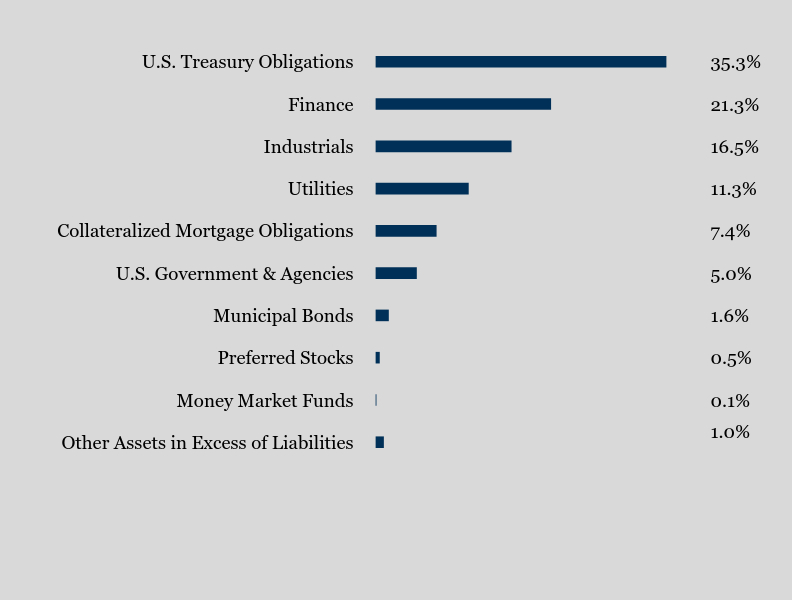

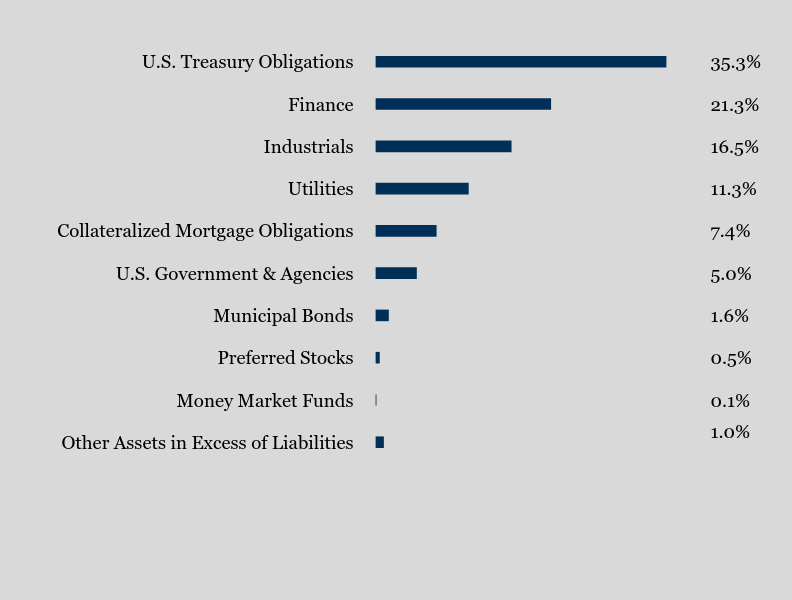

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.0% |

| Money Market Funds | 0.1% |

| Preferred Stocks | 0.5% |

| Municipal Bonds | 1.6% |

| U.S. Government & Agencies | 5.0% |

| Collateralized Mortgage Obligations | 7.4% |

| Utilities | 11.3% |

| Industrials | 16.5% |

| Finance | 21.3% |

| U.S. Treasury Obligations | 35.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 3.500%, due 01/31/30 | 4.5% |

| U.S. Treasury Notes, 1.375%, due 11/15/31 | 4.3% |

| U.S. Treasury Notes, 2.625%, due 02/15/29 | 4.3% |

| U.S. Treasury Notes, 0.875%, due 11/15/30 | 4.2% |

| U.S. Treasury Notes, 1.375%, due 10/31/28 | 4.1% |

| U.S. Treasury Notes, 4.625%, due 04/30/29 | 4.0% |

| U.S. Treasury Notes, 2.875%, due 05/15/32 | 3.9% |

| FHLB, 4.750%, due 12/10/32 - Series HQ-2032 | 3.0% |

| U.S. Treasury Notes, 4.000%, due 02/15/34 | 2.5% |

| U.S. Treasury Notes, 1.500%, due 02/15/30 | 2.1% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Intermediate Bond Fund - Class I (JIBEX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Intermediate Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Intermediate Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F | $20 | 0.40% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. The 10-year treasury ultimately finished the first half of the year modestly higher, once again resulting in negative returns. The Fund maintained a modest long duration position relative to the Bloomberg Aggregate Index, the Fund’s benchmark, resulting in a slight drag to performance in the first half of the year. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten. Our corporate overweight position, combined with a shorter corporate duration structure, contributed to our yield advantage against the benchmark. As a result, the Fund’s overweight to corporate bonds was the largest contributor to performance, more than offsetting the headwind from duration. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We continue to maintain a modest non-benchmark allocation to Agency MBS, which continued to underperform during the first half of the year providing an additional headwind to relative performance.

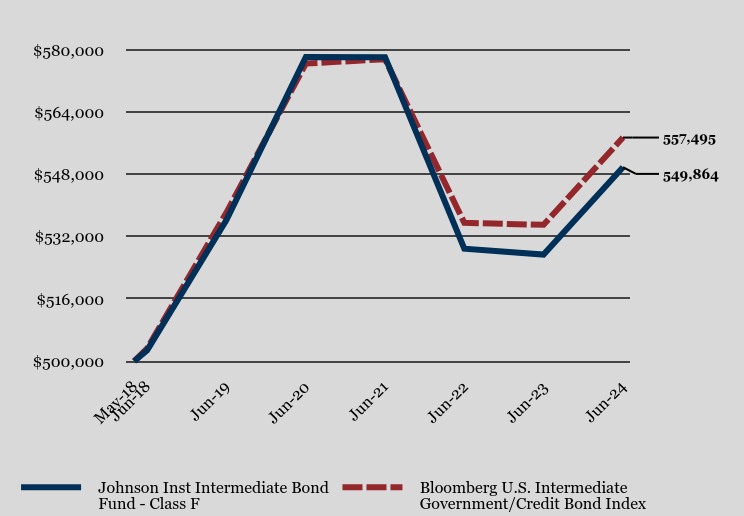

How has the Fund performed since inception?

Total Return Based on $500,000 Investment

| Johnson Inst Intermediate Bond Fund - Class F | Bloomberg U.S. Intermediate Government/Credit Bond Index |

|---|

| May-18 | $500,000 | $500,000 |

| Jun-18 | 502,847 | 503,328 |

| Jun-19 | 536,313 | 538,220 |

| Jun-20 | 578,223 | 576,518 |

| Jun-21 | 578,161 | 577,625 |

| Jun-22 | 528,919 | 535,572 |

| Jun-23 | 527,424 | 535,063 |

| Jun-24 | 549,864 | 557,495 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (May 1, 2018) |

|---|

| Johnson Inst Intermediate Bond Fund - Class F | 4.25% | 0.50% | 1.55% |

| Bloomberg U.S. Intermediate Government/Credit Bond Index | 4.19% | 0.71% | 1.78% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$302,719,571

- Number of Portfolio Holdings102

- Advisory Fee (net of waivers)$342,845

- Portfolio Turnover15%

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 7.5% |

| Corporate Bonds | 49.5% |

| Money Market Funds | 0.1% |

| Municipal Bonds | 1.6% |

| Preferred Stocks | 0.5% |

| U.S. Government & Agencies | 5.1% |

| U.S. Treasury Obligations | 35.7% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.0% |

| Money Market Funds | 0.1% |

| Preferred Stocks | 0.5% |

| Municipal Bonds | 1.6% |

| U.S. Government & Agencies | 5.0% |

| Collateralized Mortgage Obligations | 7.4% |

| Utilities | 11.3% |

| Industrials | 16.5% |

| Finance | 21.3% |

| U.S. Treasury Obligations | 35.3% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 3.500%, due 01/31/30 | 4.5% |

| U.S. Treasury Notes, 1.375%, due 11/15/31 | 4.3% |

| U.S. Treasury Notes, 2.625%, due 02/15/29 | 4.3% |

| U.S. Treasury Notes, 0.875%, due 11/15/30 | 4.2% |

| U.S. Treasury Notes, 1.375%, due 10/31/28 | 4.1% |

| U.S. Treasury Notes, 4.625%, due 04/30/29 | 4.0% |

| U.S. Treasury Notes, 2.875%, due 05/15/32 | 3.9% |

| FHLB, 4.750%, due 12/10/32 - Series HQ-2032 | 3.0% |

| U.S. Treasury Notes, 4.000%, due 02/15/34 | 2.5% |

| U.S. Treasury Notes, 1.500%, due 02/15/30 | 2.1% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Intermediate Bond Fund - Class F (JIMEX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Short Duration Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Short Duration Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $12 | 0.25% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. Interest rates rose, with the front end of the yield curve re-steepening. The Fund’s positive total returns were largely driven by its income generation, which was also additive to performance relative to the ICE BofA U.S. Corporate and Government, 1-3 Years Index, the Fund's benchmark. Offsetting the Fund’s income advantage in the first half of the year was a modest long duration position and overweight to the 3-5 year maturities relative to the Index resulting in a slight drag to performance. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten, providing positive relative performance from the Fund’s overweight position to corporate bonds. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We continue to maintain a modest non-benchmark allocation to Agency MBS, which continued to underperform during the first half of the year providing an additional headwind to relative performance.

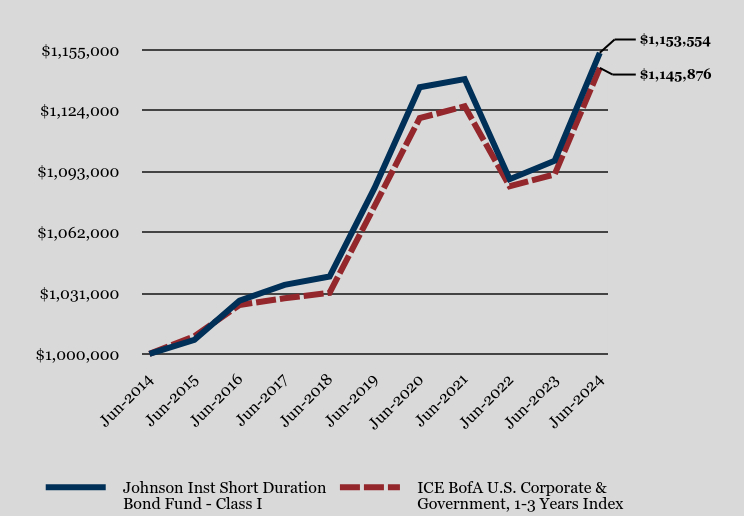

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Inst Short Duration Bond Fund - Class I | ICE BofA U.S. Corporate & Government, 1-3 Years Index |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 |

| Jun-2015 | $1,007,156 | $1,008,993 |

| Jun-2016 | $1,027,137 | $1,024,945 |

| Jun-2017 | $1,035,177 | $1,028,389 |

| Jun-2018 | $1,039,465 | $1,031,117 |

| Jun-2019 | $1,084,654 | $1,075,342 |

| Jun-2020 | $1,135,997 | $1,120,238 |

| Jun-2021 | $1,140,144 | $1,126,271 |

| Jun-2022 | $1,089,084 | $1,085,491 |

| Jun-2023 | $1,098,538 | $1,091,571 |

| Jun-2024 | $1,153,554 | $1,145,876 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Inst Short Duration Bond Fund - Class I | 5.01% | 1.24% | 1.44% |

| ICE BofA U.S. Corporate & Government, 1-3 Years Index | 4.97% | 1.28% | 1.37% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$244,305,268

- Number of Portfolio Holdings111

- Advisory Fee (net of waivers)$264,732

- Portfolio Turnover19%

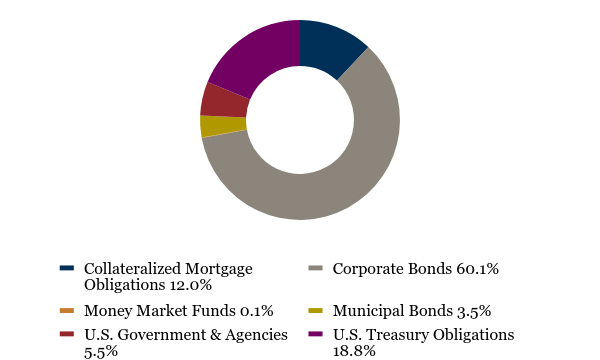

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 12.0% |

| Corporate Bonds | 60.1% |

| Money Market Funds | 0.1% |

| Municipal Bonds | 3.5% |

| U.S. Government & Agencies | 5.5% |

| U.S. Treasury Obligations | 18.8% |

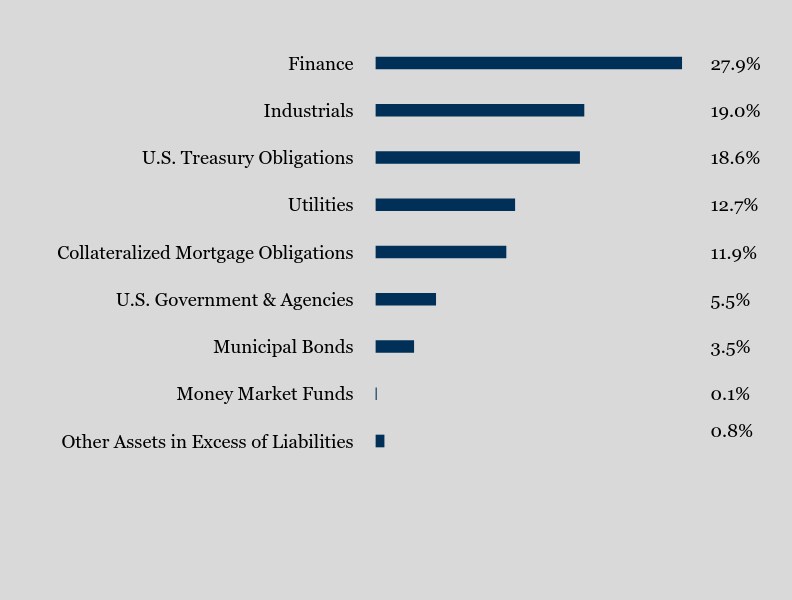

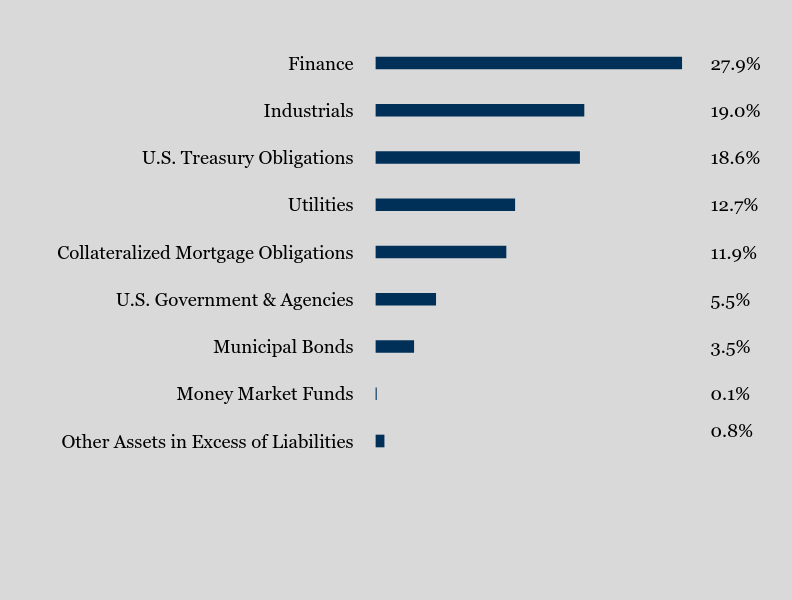

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Money Market Funds | 0.1% |

| Municipal Bonds | 3.5% |

| U.S. Government & Agencies | 5.5% |

| Collateralized Mortgage Obligations | 11.9% |

| Utilities | 12.7% |

| U.S. Treasury Obligations | 18.6% |

| Industrials | 19.0% |

| Finance | 27.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 2.750%, due 02/15/28 | 4.1% |

| U.S. Treasury Notes, 2.875%, due 05/15/28 | 4.0% |

| U.S. Treasury Notes, 2.750%, due 07/31/27 | 4.0% |

| U.S. Treasury Notes, 1.625%, due 05/15/26 | 2.2% |

| Huntington Bancshares, Inc., 2.625%, due 08/6/24 | 1.8% |

| Home Depot, Inc. (The), 5.150%, due 06/25/26 | 1.8% |

| Dover Corp., 3.150%, due 11/15/25 | 1.8% |

| Interstate Power & Light Co., 3.400%, due 08/15/25 | 1.8% |

| FNMA, 1.500%, due 09/1/31 | 1.8% |

| Florida Power & Light Co., 4.400%, due 05/15/28 | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Short Duration Bond Fund - Class I (JIBDX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Institutional Short Duration Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Institutional Short Duration Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class F | $20 | 0.40% |

How did the Fund perform during the reporting period?

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. Interest rates rose, with the front end of the yield curve re-steepening. The Fund’s positive total returns were largely driven by its income generation, which was also additive to performance relative to the ICE BofA U.S. Corporate and Government, 1-3 Years Index, the Fund's benchmark. Offsetting the Fund’s income advantage in the first half of the year was a modest long duration position and overweight to the 3-5 year maturities relative to the Index resulting in a slight drag to performance. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten, providing positive relative performance from the Fund’s overweight position to corporate bonds. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We continue to maintain a modest non-benchmark allocation to Agency MBS, which continued to underperform during the first half of the year providing an additional headwind to relative performance.

How has the Fund performed since inception?

Total Return Based on $500,000 Investment

| Johnson Inst Short Duration Bond Fund - Class F | ICE BofA U.S. Corporate & Government, 1-3 Years Index |

|---|

| May-18 | $500,000 | $500,000 |

| Jun-18 | 501,485 | 502,128 |

| Jun-19 | 521,814 | 523,664 |

| Jun-20 | 545,399 | 545,527 |

| Jun-21 | 546,904 | 548,466 |

| Jun-22 | 521,216 | 528,606 |

| Jun-23 | 524,928 | 531,567 |

| Jun-24 | 550,304 | 558,012 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (May 1, 2018) |

|---|

| Johnson Inst Short Duration Bond Fund - Class F | 4.83% | 1.07% | 1.57% |

| ICE BofA U.S. Corporate & Government, 1-3 Years Index | 4.97% | 1.28% | 1.80% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$244,305,268

- Number of Portfolio Holdings111

- Advisory Fee (net of waivers)$264,732

- Portfolio Turnover19%

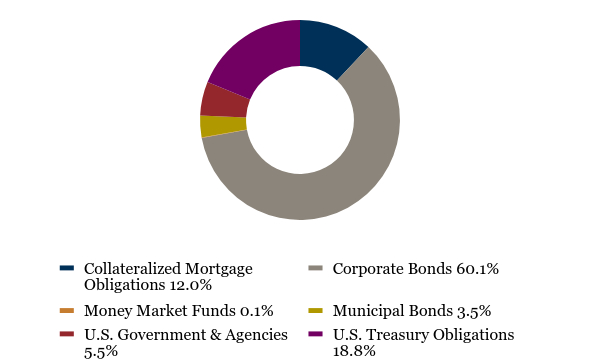

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 12.0% |

| Corporate Bonds | 60.1% |

| Money Market Funds | 0.1% |

| Municipal Bonds | 3.5% |

| U.S. Government & Agencies | 5.5% |

| U.S. Treasury Obligations | 18.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Money Market Funds | 0.1% |

| Municipal Bonds | 3.5% |

| U.S. Government & Agencies | 5.5% |

| Collateralized Mortgage Obligations | 11.9% |

| Utilities | 12.7% |

| U.S. Treasury Obligations | 18.6% |

| Industrials | 19.0% |

| Finance | 27.9% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| U.S. Treasury Notes, 2.750%, due 02/15/28 | 4.1% |

| U.S. Treasury Notes, 2.875%, due 05/15/28 | 4.0% |

| U.S. Treasury Notes, 2.750%, due 07/31/27 | 4.0% |

| U.S. Treasury Notes, 1.625%, due 05/15/26 | 2.2% |

| Huntington Bancshares, Inc., 2.625%, due 08/6/24 | 1.8% |

| Home Depot, Inc. (The), 5.150%, due 06/25/26 | 1.8% |

| Dover Corp., 3.150%, due 11/15/25 | 1.8% |

| Interstate Power & Light Co., 3.400%, due 08/15/25 | 1.8% |

| FNMA, 1.500%, due 09/1/31 | 1.8% |

| Florida Power & Light Co., 4.400%, due 05/15/28 | 1.8% |

No material changes occurred during the period ended June 30, 2024.

Johnson Institutional Short Duration Bond Fund - Class F (JIMDX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Core Plus Bond Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Core Plus Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Johnson Core Plus Bond Fund | $22 | 0.45% |

How did the Fund perform during the reporting period?

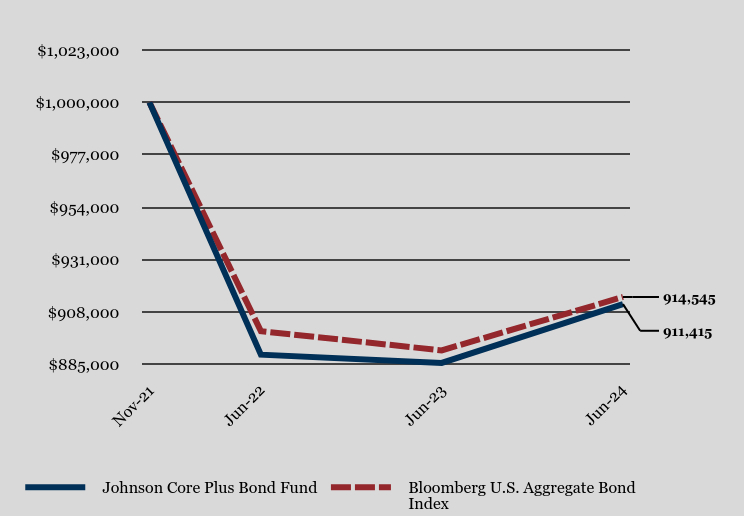

Bond markets ended 2023 on a high note as investors’ expectations for meaningful rate cuts in 2024 sent rates lower, fueling strong positive returns. Surprisingly strong economic data to begin 2024 tempered those expectations and sent rates back to near cycle highs. The 10-year treasury ultimately finished the first half of the year modestly higher, once again resulting in negative returns. The Fund maintained a modest long duration position relative to the Bloomberg Aggregate Index, the Fund’s benchmark, resulting in a slight drag to performance in the first half of the year. The Fund does seek to use Treasury Futures to adjust duration. While the use of futures amplified the negative impact of duration, overall, the impact was negligible. As interest rates rose on the better-than-expected economic data, corporate credit spreads continued to tighten. The Fund benefited from its income advantage over the Index, due in large part to its allocation to select high-quality high yield offerings. As a result, the Fund’s overweight to corporate bonds was the largest contributor to performance, more than offsetting the headwind from duration. Within corporate bonds the Fund’s emphasis on intermediate maturity bonds was an additional tailwind to performance as bonds in the intermediate part of the curve outperformed longer maturity bonds. Finally, sector allocation was additive to performance as the Fund maintains an overweight to financials, which outperformed their industrial and utility sector peers. We remain underweight Agency MBS, which continued to underperform during the first half of the year providing an additional tailwind to relative performance.

How has the Fund performed since inception?

Total Return Based on $1,000,000 Investment

| Johnson Core Plus Bond Fund | Bloomberg U.S. Aggregate Bond Index |

|---|

| Nov-21 | $1,000,000 | $1,000,000 |

| Jun-22 | 889,226 | 899,536 |

| Jun-23 | 885,599 | 891,100 |

| Jun-24 | 911,415 | 914,545 |

Average Annual Total Returns

| 1 Year | Since Inception (November 17, 2021) |

|---|

| Johnson Core Plus Bond Fund | 2.91% | |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$39,744,413

- Number of Portfolio Holdings95

- Advisory Fee (net of waivers)$0

- Portfolio Turnover26%

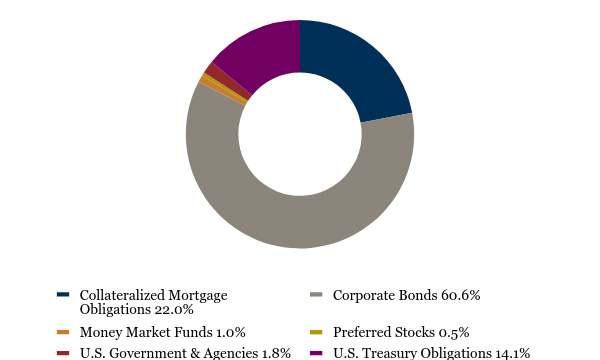

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateralized Mortgage Obligations | 22.0% |

| Corporate Bonds | 60.6% |

| Money Market Funds | 1.0% |

| Preferred Stocks | 0.5% |

| U.S. Government & Agencies | 1.8% |

| U.S. Treasury Obligations | 14.1% |

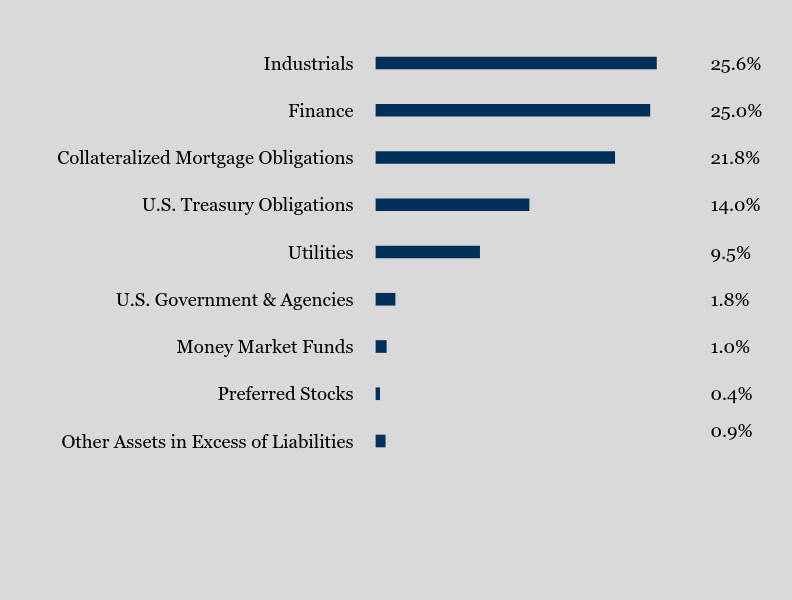

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.9% |

| Preferred Stocks | 0.4% |

| Money Market Funds | 1.0% |

| U.S. Government & Agencies | 1.8% |

| Utilities | 9.5% |

| U.S. Treasury Obligations | 14.0% |

| Collateralized Mortgage Obligations | 21.8% |

| Finance | 25.0% |

| Industrials | 25.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

FHLMC, 4.000%, due 12/1/49 | 2.5% |

| U.S. Treasury Notes, 3.875%, due 08/15/33 | 2.4% |

| U.S. Treasury Bonds, 2.375%, due 02/15/42 | 2.4% |

| FNMA, 4.500%, due 10/1/48 | 2.3% |

| FNMA, 4.000%, due 10/1/49 | 2.2% |

| U.S. Treasury Bonds, 2.500%, due 02/15/45 | 2.2% |

| U.S. Bancorp, 4.967%, due 07/22/33 - Series BB | 2.0% |

| Florida Power & Light Co., 5.100%, due 04/1/33 | 1.9% |

| U.S. Treasury Bonds, 2.250%, due 05/15/41 | 1.9% |

| Morgan Stanley, 3.591%, due 07/22/28 | 1.9% |

Effective May 1, 2024, the Adviser has contractually agreed to change the expense arrangement to a unitary fee arrangement, with a limit of 0.45% per year. The Adviser will cover all expenses in excess of the management fee.

Johnson Core Plus Bond Fund (JCPLX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.johnsoninv.com/mutualfunds), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Johnson Municipal Income Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Johnson Municipal Income Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.johnsoninv.com/mutualfunds. You can also request this information by contacting us at (800) 541-0170.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Johnson Municipal Income Fund | $15 | 0.30% |

How did the Fund perform during the reporting period?

After falling throughout 2023, municipal bond yields rose across every tenor of the curve in the first half of 2024 but most prominently for intermediate maturities. The Municipal Income Bond Fund’s overweight position to longer maturity securities contributed to relative performance as they outperformed intermediate tenors. New municipal bond issuance was elevated relative to recent history as issuers worked to get ahead of any potential presidential-election related market volatility. The Fund’s focus on higher-quality securities detracted from relative performance throughout the first half of the year as higher-quality spreads widened due to heightened new issue activity, and lower-quality securities significantly outperformed.

The Fund maintains a high-quality focus with about 71% of assets rated AA or higher as downgrade activity in economically sensitive sectors has continued. Cooling labor markets, restrictive monetary policy, and weakening leading economic indicators continue to send warning signs and further support a defensive positioning. Higher quality municipal credit health remains strong as many enjoyed boosts to tax-revenue collections, expanding savings funds to historically high levels. The Fund is diversified by issuer and sector to protect against idiosyncratic risks while approximately 24% of its assets are invested in states other than Ohio. The Fund’s duration will be longer versus its benchmark as longer maturity securities provide the greatest relative value at current levels. Finally, the current levels of rates are likely to offer attractive opportunities for long-term returns going forward.

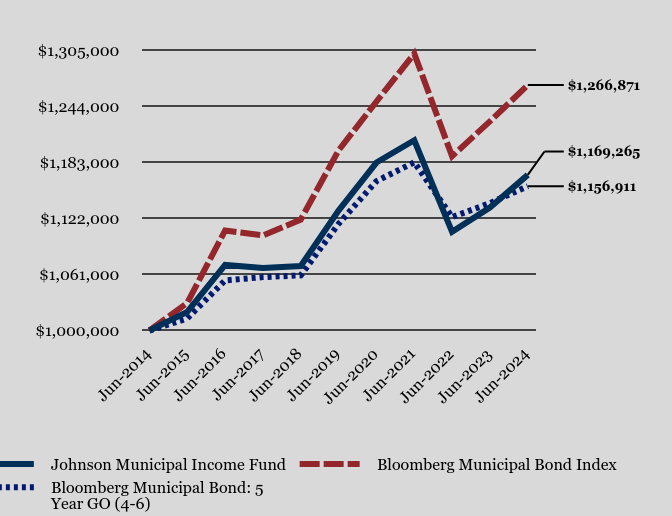

How has the Fund performed over the last ten years?

Total Return Based on $1,000,000 Investment

| Johnson Municipal Income Fund | Bloomberg Municipal Bond Index | Bloomberg Municipal Bond: 5 Year GO (4-6) |

|---|

| Jun-2014 | $1,000,000 | $1,000,000 | $1,000,000 |

| Jun-2015 | $1,020,338 | $1,029,995 | $1,013,131 |

| Jun-2016 | $1,071,321 | $1,108,816 | $1,054,541 |

| Jun-2017 | $1,068,045 | $1,103,407 | $1,058,096 |

| Jun-2018 | $1,070,120 | $1,120,671 | $1,059,966 |

| Jun-2019 | $1,130,422 | $1,195,826 | $1,116,005 |

| Jun-2020 | $1,182,664 | $1,249,021 | $1,162,402 |

| Jun-2021 | $1,206,853 | $1,301,052 | $1,182,882 |

| Jun-2022 | $1,107,364 | $1,189,532 | $1,123,340 |

| Jun-2023 | $1,133,802 | $1,227,437 | $1,138,501 |

| Jun-2024 | $1,169,265 | $1,266,871 | $1,156,911 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Johnson Municipal Income Fund | 3.13% | 0.68% | 1.58% |

| Bloomberg Municipal Bond Index | 3.21% | 1.16% | 2.39% |

| Bloomberg Municipal Bond: 5 Year GO (4-6) | 1.62% | 0.72% | 1.47% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

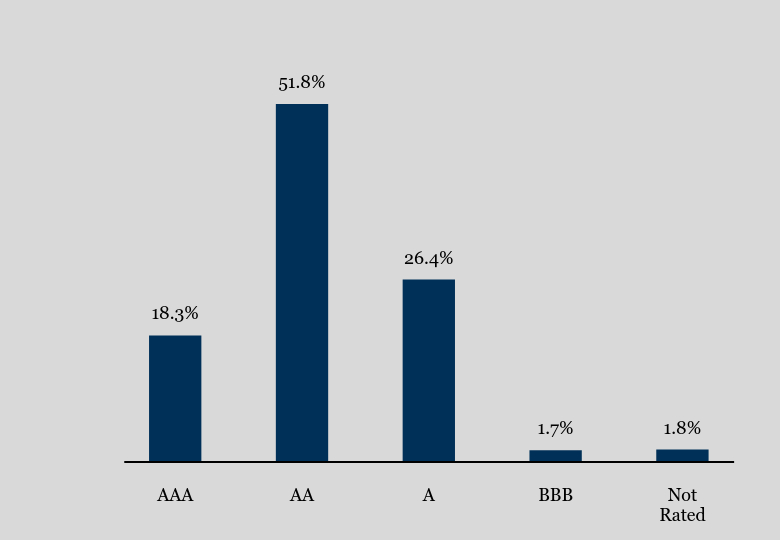

What did the Fund invest in?

Quality Allocation (as a percentage of total assets)*

| Value | Value |

|---|

| AAA | 18.3% |

| AA | 51.8% |

| A | 26.4% |

| BBB | 1.7% |

| Not Rated | 1.8% |

* As rated by either Standard & Poor's or Moody's Rating Agencies.

(If rated by both, the lower rating is represented.)

- Net Assets$171,927,654

- Number of Portfolio Holdings153

- Advisory Fee $263,055

- Portfolio Turnover9%

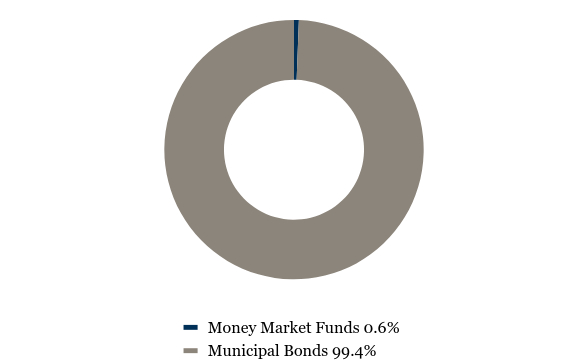

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 0.6% |

| Municipal Bonds | 99.4% |

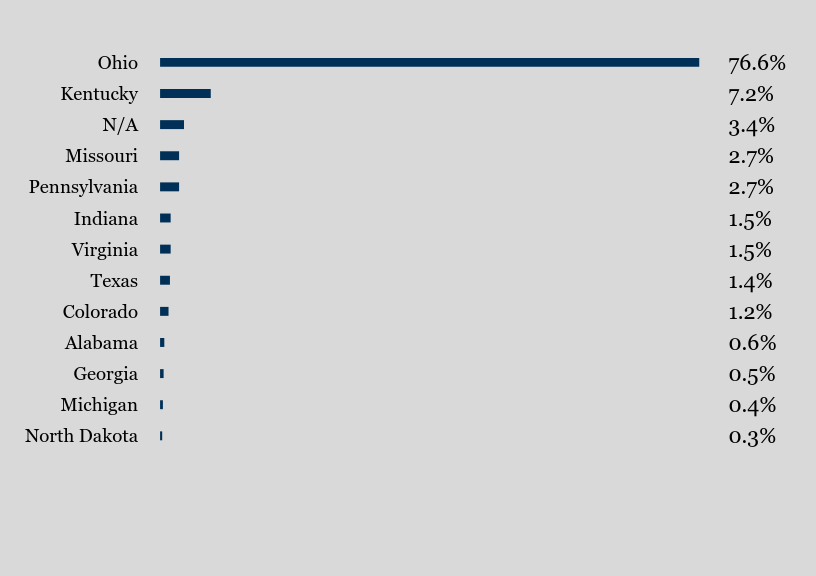

Holdings by State of Issuance (% of total investments)

| Value | Value |

|---|

| North Dakota | 0.3% |

| Michigan | 0.4% |

| Georgia | 0.5% |

| Alabama | 0.6% |

| Colorado | 1.2% |

| Texas | 1.4% |

| Virginia | 1.5% |

| Indiana | 1.5% |

| Pennsylvania | 2.7% |

| Missouri | 2.7% |

| N/A | 3.4% |

| Kentucky | 7.2% |

| Ohio | 76.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ohio Higher Education Facilities Revenue - Denison University, 5.000%, due 11/1/53 | 9.3% |

| Ohio State Water Development Authority Revenue, 5.000%, due 06/1/46 - Series 2021 | 8.0% |

| Ohio State Water Development Authority Revenue, 4.000%, due 12/1/46 - Series 2021-A | 6.8% |

| Franklin County Ohio Hospital Revenue Nationwide Childrens, 5.000%, due 11/1/48 - Series 2019-A | 6.0% |

| Columbus Ohio GO Unlimited, 5.000%, due 04/1/41 - Series 2022-A | 6.0% |

| Ohio Hospital Facility Revenue Refunding Cleveland Clinic Health, 4.000%, due 01/1/36 - Series 2017-A | 5.4% |

| Miami University Ohio General Receipts Revenue, 4.000%, due 09/1/45 - Series 2020-A | 5.4% |

| FHLMC, 2.550%, due 06/15/35 - Class A - Series M-053 | 5.3% |

| Grandview Heights Ohio Municipal Facilities Construction and Improvement, 4.000%, due 12/1/46 - Series 2023 | 5.2% |