| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

FORM N-CSR

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES |

Investment Company Act file number: (811 - 07274 )

Exact name of registrant as specified in charter: Putnam New York Investment Grade Municipal Trust

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Beth S. Mazor, Vice President | |

| One Post Office Square | ||

| Boston, Massachusetts 02109 | ||

| Copy to: | John W. Gerstmayr, Esq. | |

| Ropes & Gray LLP | ||

| One International Place | ||

| Boston, Massachusetts 02110 | ||

| Registrant’s telephone number, including area code: | (617) 292-1000 | |

Date of fiscal year end: April 30, 2006

Date of reporting period: May 1, 2005 – April 30, 2006

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition

in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing

what’s right for investors

We have stringent investor protections and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

| Putnam NewYork Investment Grade Municipal Trust |

| 4| 30| 06 Annual Report |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 13 |

| Your fund’s management | 15 |

| Terms and definitions | 18 |

| Trustee approval of management contract | 19 |

| Other information for shareholders | 24 |

| Financial statements | 26 |

| Federal tax information | 42 |

| About the Trustees | 43 |

| Officers | 49 |

Cover photograph: © Richard H. Johnson

| Message from the Trustees |

Dear Fellow Shareholder

In recent months, we have witnessed the continuing vibrancy of the current economic expansion, now in its fifth year. U.S. businesses have seized opportunities available both at home and abroad to generate some of the most impressive profit margins in history, by some measures. During your fund’s reporting period, common stocks have traded at higher levels to reflect improving corporate profits. However, the gains have not come without concerns in some quarters of the market about the risks facing the economy. These risks include high energy prices, inflation, and a potential pullback in consumer spending, as well as the potential adverse effects of the Federal Reserve’s (the Fed’s) series of interest-rate increases. Concerns about inflation, in particular, have been reflected in falling bond prices and rising bond yields, and worries about consumer spending have clouded the outlook for stocks.

You can be assured that the investment professionals managing your fund are closely monitoring the factors that are influencing the performance of the securities in which your fund invests. Moreover, Putnam Investments’ management team, under the leadership of Chief Executive Officer Ed Haldeman, continues to focus on investment performance and remains committed to putting the interests of shareholders first.

2

In the following pages, members of your fund’s management team discuss the fund’s performance and strategies for the fiscal period ended April 30, 2006, and provide their outlook for the months ahead. As always, we thank you for your support of the Putnam funds.

| Putnam New York Investment Grade Municipal Trust: tax-favored income for New York investors |

Municipal bonds, which finance important public projects, can also help investors keep more of their investment income. Typically issued by states and local municipalities to raise funds for building and maintaining public facilities, municipal bonds offer income that is generally exempt from federal income tax. For residents of the state where the bond is issued, income is typically exempt from state and local taxes as well. In New York, this tax exemption is an especially powerful advantage because the state’s top income-tax rate is one of the highest in the United States.

The New York municipal bond market offers investors one of the broadest arrays of opportunities available. It is not only the oldest state municipal bond market — the first municipal bond was issued in New York in 1812 — but also one of the largest and most diverse. New York bonds encompass virtually every sector of the municipal bond market.

Putnam New York Investment Grade Municipal Trust capitalizes on the broad opportunities available in New York by investing in bonds across a range of market sectors. Municipal bonds are backed by either the issuing city or town or by revenues collected from usage fees. The fund’s investments focus on investment-grade bonds. In addition, the fund uses leverage — that is, it invests with borrowed funds, raised by issuing preferred shares — to seek a higher level of return for shareholders.

The fund’s management team is backed by the resources of Putnam’s fixed-income organization, one of the largest in the investment industry. Their active management can be invaluable to investors seeking tax-advantaged income.

The fund concentrates its investments by region, and involves more risk than a fund that invests more broadly. Capital gains, if any, are taxable for

| Municipal bonds may finance a range of community projects and thus play a key role in local development. |

federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Please consult with your tax advisor for more information. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Leverage can mean higher returns, but adds risk and may increase share price volatility.

| How do closed-end funds differ from open-end funds? |

More assets at work While open-end funds must maintain a cash position to meet redemptions, closed-end funds have no such requirement and can keep more of their assets invested in the market.

Traded like stocks Closed-end fund shares are traded on stock exchanges, and their market prices fluctuate in response to supply and demand, among other factors.

Market price vs. net asset value Like an open-end fund’s net asset value (NAV) per share, the NAV of a closed-end fund share equals the current value of the fund’s assets, minus its liabilities, divided by the number of shares outstanding. However, when buying or selling closed-end fund shares, the price you pay or receive is the market price. Market price reflects current market supply and demand and may be higher or lower than the NAV.

Strategies for higher income Closed-end funds have greater flexibility to use strategies such as “leverage” — for example, issuing preferred shares to raise capital, then seeking to invest it at higher rates to enhance return for common shareholders.

Putnam New York Investment Grade Municipal Trust is a leveraged fund that seeks to provide as high a level of current income free from federal income tax and New York state and city personal income taxes as Putnam Management believes is consistent with the preservation of capital. The fund may be appropriate for investors seeking tax-free income from high-quality investments primarily issued in New York and who are willing to accept the risks associated with the use of leverage.

Highlights

* For the fiscal year ended April 30, 2006, Putnam New York Investment Grade Municipal Trust returned 2.38% at net asset value (NAV) and 5.57% at market price.

* The fund’s benchmark, the Lehman Municipal Bond Index, returned 2.15%.

* The average return for the fund’s Lipper category, New York Municipal Debt Funds (closed-end), was 3.88%.

* In June 2005, the fund’s monthly dividend was reduced. See page 11 for details.

* Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 13.

Performance

It is important to note that a fund’s performance at market price may differ from its results at NAV. Although market price performance generally reflects investment results, it may also be influenced by several other factors, including changes in investor perceptions of the fund or its investment advisor, market conditions, fluctuations in supply and demand for the fund’s shares, and changes in fund distributions.

Total return for periods ended 4/30/06

| Since the fund’s inception (11/27/92), average annual return is 5.90% at NAV and 4.40% at market price. | |||||

| Average annual return | Cumulative return | ||||

| NAV | Market price | NAV | Market price | ||

| 10 years | 5.83% | 4.98% | 76.30% | 62.64% | |

| 5 years | 5.61 | 4.66 | 31.37 | 25.60 | |

| 3 years | 5.61 | 5.17 | 17.78 | 16.31 | |

| 1 year | 2.38 | 5.57 | 2.38 | 5.57 | |

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes.

6

| Report from the fund managers |

The year in review

Thanks to solid performance from certain key holdings and our emphasis on tobacco settlement bonds, your fund’s results at NAV were in line with those of its nationally diversified benchmark. The fund’s use of leverage and its duration strategy also contributed positively to absolute returns. However, during the period, the fund focused on intermediate-maturity bonds. As we had expected, rising interest rates depressed bond prices, but the increase in long-term rates was more gradual than anticipated, while rates on intermediate-term bonds rose more steeply, affecting their prices to a greater degree. This positioning, as well as the fund’s conservative use of leverage compared to its peers, accounts for part of the fund’s underperformance relative to the average for its Lipper category. Nevertheless, under current conditions, we believe it is prudent to keep the fund’s sensitivity to changing interest rates moderate and its portfolio quality relatively high.

Market overview

Continuing indications of solid economic growth, and the desire to curb the potential inflation that frequently accompanies such growth, prompted the Fed to increase the federal funds rate eight times during the fund’s fiscal year, lifting this benchmark rate for overnight loans between banks from 2.75% to 4.75% . Bond yields rose across the maturity spectrum. Short-term rates rose faster than long-term rates, leading to a convergence of shorter- and longer-term rates. As rates converged, the yield curve — a graphical representation of yields for bonds of comparable quality plotted from the shortest to the longest maturity — flattened.

During the period, tax-exempt bonds generally outperformed comparable Treasury bonds, as prices of tax-exempt bonds declined less than Treasury prices across all maturities. Municipal bonds typically perform better than Treasuries when interest rates are rising. However, the degree to which they outperformed Treasuries during the early months of 2006 was greater than expected.

| 7 |

The strong economy and rising corporate earnings contributed to the strong performance of lower-rated bonds. Among uninsured bonds in general and especially bonds rated Baa and below, yield spreads tightened, driven by strong interest among buyers in search of higher yields. Based on favorable legal rulings, prices of tobacco settlement bonds outperformed. Likewise, airline-related industrial development bonds (IDBs) performed exceptionally well over the period.

Strategy overview

Given our expectation for rising interest rates, we maintained a short (defensive) portfolio duration relative to the fund’s peer group, a strategy that contributed positively to results for the period as rates rose. Duration is a measure of a fund’s sensitivity to changes in interest rates. Having a shorter-duration portfolio may help protect principal when interest rates rise, but it can reduce appreciation potential when rates fall.

The fund’s yield curve positioning, or the maturity profile of its holdings, detracted from performance during the period. In order to keep the fund’s duration short, we limited exposure to longer-maturity bonds, favoring intermediate-maturity securities instead. However, as the yield curve flattened and the yield differences between shorter-and longer-term bonds converged, bonds with longer maturities outperformed their shorter-maturity counterparts.

Market sector performance

These indexes provide an overview of performance in different market sectors for the 12 months ended 4/30/06.

| Bonds | |

| Lehman Municipal Bond Index (tax-exempt bonds) | 2.15% |

| Lehman Aggregate Bond Index (broad bond market) | 0.71% |

| Lehman Government Bond Index (U.S. Treasury and agency securities) | 0.25% |

| JP Morgan Global High Yield Index (global high-yield corporate bonds) | 8.88% |

| Equities | |

| S&P 500 Index (broad stock market) | 15.42% |

| Russell 1000 Index (large-company stocks) | 16.71% |

| Russell 2000 Index (stocks of small and midsize companies) | 33.47% |

8

Your fund concentrates on investment-grade bonds. Its underweight position in the lowest-rated bonds, compared to other funds in its peer group, detracted from results as securities in this area of the market rallied. We added to the fund’s callable bond holdings during the period. Despite this action, however, the fund remained underweight in callable bonds relative to its benchmark. Consequently, the fund’s underweight position in these bonds detracted from results as these bonds generally outperformed over the period. Callable bonds benefited from investor perception that bonds are less likely to be called in a rising-rate environment.

Your fund’s holdings

Your fund’s emphasis on tobacco settlement bonds proved rewarding during the fiscal year. These bonds generally carry investment-grade ratings. However, since the interest they pay is secured by tobacco companies’ settlement obligations to the states, they generally offer higher yields than bonds of comparable quality. An improving litigation environment has led to higher prices for these bonds. We also think tobacco settlement bonds provide valuable diversification, since their performance is not as closely tied to the direction of economic growth as are other, more economically sensitive holdings. The fund owns tobacco settlement bonds issued in various parts of New York state.

Comparison of the fund’s maturity and duration

This chart compares changes in the fund’s average effective maturity (a weighted average of the holdings’ maturities) and its average effective duration (a measure of its sensitivity to interest-rate changes).

Average effective duration and average effective maturity take into account put and call features, where applicable, and reflect prepayments for mortgage-backed securities. Duration is usually shorter than maturity because it reflects interest payments on a bond prior to its maturity.

9

As the U.S. economy expanded during the fiscal year, the spread (or difference in yield) between higher- and lower-quality bonds narrowed. Several of the fund’s industrial development bonds (IDBs) are good examples. IDBs are issued by municipalities but backed by the credit of the company or institution benefiting from the financing. Investor perceptions about the backing company’s health, or that of its industry group, affect the prices of these bonds more than the rating of the issuing municipality. Specific IDBs whose spreads narrowed during the fiscal year included New York City Industrial Development Authority Airis Corp. bonds and New York City’s Brooklyn Navy Yard Cogeneration Partners bonds. Both have dependable sources of income that attracted investors; Airis Corp. operates cargo and warehouse facilities at JFK International Airport, while the Navy Yard Cogeneration plant sells power to Consolidated Edison.

In addition, relatively low interest rates made it possible for two of the fund’s holdings to pre-refund their debt during the year. Pre-refunding occurs when an issuer refinances an older, higher-coupon bond by issuing new bonds at lower interest rates. The proceeds are invested in a secure investment —usually U.S. Treasury securities — that matures at the older bond’s first call date, effectively raising the bond’s perceived rating but shortening its maturity. New York’s Triborough

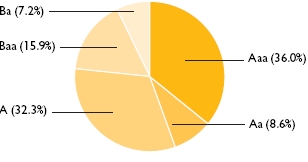

| Credit quality overview |

Credit qualities shown as a percentage of portfolio value as of 4/30/06. A bond rated Baa or higher is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds not rated by Moody's but considered by Putnam Management to be of comparable quality. Ratings will vary over time.

10

Bridge and Tunnel Authority bonds were pre-refunded in July 2005, and Long Island Power Authority bonds were pre-refunded in March 2006. The market price of both issues rose, as their effective maturities are now shorter by 20 years, in the case of the Triborough bonds, and 21 years for the Long Island Power issue.

Because of its credit quality guidelines, your fund had no exposure to airline-related IDBs. This sector rebounded powerfully during the period, reflecting gains in passenger counts, increases in airfares and a modest drop in fuel prices early in 2006. We see some evidence that the industry is stabilizing and we are following developments closely, but the risks still seem great and the ratings on most of these bonds do not meet your fund’s quality criteria. However, we have been trying to build the fund’s exposure to the single-family housing sector, where we believe rising interest rates are diminishing mortgage prepayment risks.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

Of special interest

Fund’s dividend reduced

A few older holdings were sold or were called during the fiscal year, requiring us to reinvest assets at current, lower interest rates. Furthermore, given the narrowing of the yield spread between higher- and lower-rated municipal bonds, the opportunities for finding relatively high-yielding investments have become more limited, especially in light of our commitment to focusing on sound, creditworthy investments. To reflect the reduction in earnings, the dividend was reduced in June 2005 from $0.0493 to $0.0438 per share.

11

| The outlook for your fund |

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

We believe that the Fed’s tightening cycle is nearing an end but that rates will continue to rise over the near term. We currently plan to maintain the fund’s defensive duration because we believe that the municipal bond market may be susceptible to weaker returns in the coming months. One reason for this belief is the market’s unusually strong performance versus taxable equivalents in early 2006.

We believe that the extended rally among lower-rated, higher-yielding bonds is in its final stages. Therefore, we remain cautious with respect to securities at the lower end of the credit spectrum. We continue to have a positive view of defensive sectors such as single-family housing bonds, which have performed well in recent months. In addition, we remain positive on callable bonds. Our view on tobacco settlement bonds remains positive as we believe that they represent good investment opportunities relative to the inherent risks associated with the sector.

As always, we will continue to search for the most attractive opportunities among tax-exempt securities, and work to balance the pursuit of current income with prudent risk management.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

This fund concentrates its investments by region and involves more risk than a fund that invests more broadly. Capital gains, if any, are taxable for federal and, in most cases, state purposes. For some investors, investment income may be subject to the federal alternative minimum tax. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. The fund uses leverage, which involves risk and may increase the volatility of the fund’s net asset value. The fund’s shares trade on a stock exchange at market prices, which may be higher or lower than the fund’s net asset value.

12

Your fund’s performance

This section shows your fund’s performance for periods ended April 30, 2006, the end of its fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance for the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

| Fund performance Total return for periods ended 4/30/06 |

| Lipper New York | ||||

| Lehman | Municipal | |||

| Municipal | Debt Funds | |||

| Market | Bond | (closed-end) | ||

| NAV | price | Index | category average* | |

| Annual average | ||||

| Life of fund | ||||

| (since 11/27/92) | 5.90% | 4.40% | 6.08% | 6.17% |

| 10 years | 76.30 | 62.64 | 77.30 | 85.02 |

| Annual average | 5.83 | 4.98 | 5.89 | 6.31 |

| 5 years | 31.37 | 25.60 | 30.07 | 38.86 |

| Annual average | 5.61 | 4.66 | 5.40 | 6.75 |

| 3 years | 17.78 | 16.31 | 12.04 | 20.67 |

| Annual average | 5.61 | 5.17 | 3.86 | 6.44 |

| 1 year | 2.38 | 5.57 | 2.15 | 3.88 |

Performance assumes reinvestment of distributions and does not account for taxes.

Index and Lipper results should be compared to fund performance at net asset value. Lipper calculations for reinvested dividends may differ from actual performance.

* Over the 1-, 3-, 5-, and 10-year periods ended 4/30/06, there were 18, 18, 10, and 7 funds, respectively, in this Lipper category.

13

Fund price and distribution information

For the 12-month period ended 4/30/06

| Distributions — common shares | ||

| Number | 12 | |

| Income1 | $0.5311 | |

| Capital gains2 | — | |

| Total | $0.5311 | |

| Series A | ||

| Distributions — preferred shares | (200 shares) | |

| Income1 | $1,340.28 | |

| Capital gains2 | — | |

| Total | $1,340.28 | |

| Share value: | NAV | Market price |

| 4/30/05 | $13.75 | $11.81 |

| 4/30/06 | 13.47 | 11.93 |

| Current yield (end of period) | ||

| Current dividend rate3 | 3.90% | 4.41% |

| Taxable equivalent4 | 6.50 | 7.35 |

1 For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes.

2 Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3 Most recent distribution, excluding capital gains, annualized and divided by NAV or market price at end of period.

4 Assumes maximum 40.01% federal and state tax rate for 2006. Results for investors subject to lower tax rates would not be as advantageous.

Fund performance for most recent calendar quarter

Total return for periods ended 3/31/06

| NAV | Market price | |

| Annual average | ||

| Life of fund (since 11/27/92) | 5.95% | 4.44% |

| 10 years | 75.94 | 60.48 |

| Annual average | 5.81 | 4.84 |

| 5 years | 30.17 | 22.62 |

| Annual average | 5.41 | 4.16 |

| 3 years | 19.43 | 17.34 |

| Annual average | 6.10 | 5.47 |

| 1 year | 4.70 | 7.88 |

14

| Your fund’s management |

Your fund is managed by the members of the Putnam Tax Exempt Fixed-Income Team. David Hamlin is the Portfolio Leader, and Paul Drury, Susan McCormack, and James St. John are Portfolio Members of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Tax Exempt Fixed-Income Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Fund ownership by the Portfolio Leader and Portfolio Members

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund (in dollar ranges). Information shown is as of April 30, 2006, and April 30, 2005.

| $1 – | $10,001 – | $50,001 – | $100,001 – | $500,001 – | $1,000,001 | |||

| Year | $0 | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | and over | |

| David Hamlin | 2006 | * | ||||||

| Portfolio Leader | 2005 | * | ||||||

| Paul Drury | 2006 | * | ||||||

| Portfolio Member | 2005 | * | ||||||

| Susan McCormack | 2006 | * | ||||||

| Portfolio Member | 2005 | * | ||||||

| James St. John | 2006 | * | ||||||

| Portfolio Member | 2005 | * | ||||||

15

| Fund manager compensation |

The total 2005 fund manager compensation that is attributable to your fund is approximately $20,000. This amount includes a portion of 2005 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2005 compensation paid to the Chief Investment Officer of the team and the Group Chief Investment Officer of the fund’s broader investment category for their oversight responsibilities, calculated based on the fund assets they oversee taken as a percentage of the total assets they oversee. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2005, the calculation reflects annualized 2005 compensation or an estimate of 2006 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leader

and Portfolio Members

David Hamlin is the Portfolio Leader and Paul Drury, Susan McCormack, and James St. John are Portfolio Members for Putnam’s tax-exempt funds for the following states: Arizona, California, Florida, Massachusetts, Michigan, Minnesota, New Jersey, New York, Ohio, and Pennsylvania. The same group also manages Putnam AMT-Free Insured Municipal Fund, Putnam California Investment Grade Municipal Trust, Putnam High Yield Municipal Trust, Putnam Investment Grade Municipal Trust, Putnam Managed Municipal Income Trust, Putnam Municipal Bond Fund, Putnam Municipal Opportunities Trust, Putnam Tax Exempt Income Fund, Putnam Tax-Free Health Care Fund, and Putnam Tax-Free High Yield Fund.

David Hamlin, Paul Drury, Susan McCormack, and James St. John may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

Your fund’s Portfolio Leader and Portfolio Members did not change during the year ended April 30, 2006.

16

Fund ownership by Putnam’s Executive Board

The table below shows how much the members of Putnam’s Executive Board have invested in the fund (in dollar ranges). Information shown is as of April 30, 2006, and April 30, 2005.

| $1 – | $10,001 – | $50,001– | $100,001 | |||

| Year | $0 | $10,000 | $50,000 | $100,000 | and over | |

| Philippe Bibi | 2006 | * | ||||

| Chief Technology Officer | 2005 | * | ||||

| Joshua Brooks | 2006 | * | ||||

| Deputy Head of Investments | 2005 | * | ||||

| William Connolly | 2006 | * | ||||

| Head of Retail Management | N/A | |||||

| Kevin Cronin | 2006 | * | ||||

| Head of Investments | 2005 | * | ||||

| Charles Haldeman, Jr. | 2006 | * | ||||

| President and CEO | 2005 | * | ||||

| Amrit Kanwal | 2006 | * | ||||

| Chief Financial Officer | 2005 | * | ||||

| Steven Krichmar | 2006 | * | ||||

| Chief of Operations | 2005 | * | ||||

| Francis McNamara, III | 2006 | * | ||||

| General Counsel | 2005 | * | ||||

| Richard Robie, III | 2006 | * | ||||

| Chief Administrative Officer | 2005 | * | ||||

| Edward Shadek | 2006 | * | ||||

| Deputy Head of Investments | 2005 | * | ||||

| Sandra Whiston | 2006 | * | ||||

| Head of Institutional Management | N/A | |||||

N/A indicates the individual was not a member of Putnam's Executive Board as of 4/30/05.

17

| Terms and definitions |

| Important terms |

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the value of all your fund’s assets, minus any liabilities and the net assets allocated to any outstanding preferred shares, divided by the number of outstanding common shares.

Market price is the current trading price of one share of the fund. Market prices are set by transactions between buyers and sellers on exchanges such as the New York Stock Exchange and the American Stock Exchange.

| Comparative indexes |

JP Morgan Global High Yield Index is an unmanaged index of global high-yield fixed-income securities.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Government Bond Index is an unmanaged index of U.S. Treasury and agency securities.

Lehman Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Russell 1000 Index is an unmanaged index of the 1,000 largest companies in the Russell 3000 Index.

Russell 2000 Index is an unmanaged index of the 2,000 smallest companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

18

| Trustee approval of management contract |

| General conclusions |

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months beginning in March and ending in June 2005, the Contract Committee met five times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. Upon completion of this review, the Contract Committee recommended and the Independent Trustees approved the continuance of your fund’s management contract, effective July 1, 2005.

This approval was based on the following conclusions:

* That the fee schedule currently in effect for your fund, subject to certain changes noted below, represents reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

* That such fee schedule represents an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Model fee schedules and categories; total expenses

The Trustees’ review of the management fees and total expenses of the Putnam funds focused on three major themes:

19

* Consistency. The Trustees, working in cooperation with Putnam Management, have developed and implemented a series of model fee schedules for the Putnam funds designed to ensure that each fund’s management fee is consistent with the fees for similar funds in the Putnam family of funds and compares favorably with fees paid by competitive funds sponsored by other investment advisors. Under this approach, each Putnam fund is assigned to one of several fee categories based on a combination of factors, including competitive fees and perceived difficulty of management, and a common fee schedule is implemented for all funds in a given fee category. The Trustees reviewed the model fee schedules then in effect for the Putnam funds, including fee levels and breakpoints, and the assignment of each fund to a particular fee category under this structure. (“Breakpoints” refer to reductions in fee rates that apply to additional assets once specified asset levels are reached.)

Since their inception, Putnam’s closed-end funds have generally had management fees that are higher than those of Putnam’s open-end funds pursuing comparable investment strategies. These differences ranged from five to 20 basis points. The Trustees have reexamined this matter and recommended that these differences be conformed to a uniform five basis points. At a meeting on January 13, 2006 the Trustees approved an amended management contract for your fund to memorialize the arrangements agreed to in June 2005. Under the new fee schedule, the fund pays a quarterly fee to Putnam Management at the lower of the following rates:

| (a) 0.55% of the fund’s average net assets (including assets attributable to both common and preferred shares) |

| (b) 0.65% of the first $500 million of the fund’s average net assets (including assets attributable to both common and preferred shares); |

| 0.55% of the next $500 million; 0.50% of the next $500 million; 0.45% of the next $5 billion; 0.425% of the next $5 billion; 0.405% of the next $5 billion; 0.39% of the next $5 billion; and 0.38% thereafter |

* Competitiveness. The Trustees also reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 71st percentile in management fees and in the 86th percentile in total expenses as of December 31, 2004 (the first percentile being the least

20

expensive funds and the 100th percentile being the most expensive funds). The Trustees expressed their intention to monitor this information closely to ensure that fees and expenses of the Putnam funds continue to meet evolving competitive standards.

* Economies of scale. The Trustees concluded that the fee schedule currently in effect for your fund, which as of January 1, 2006, reflects an appropriate sharing of economies of scale at current asset levels. The Trustees examined the existing breakpoint structure of the Putnam funds’ management fees in light of competitive industry practices. The Trustees considered various possible modifications to the Putnam funds’ current breakpoint structure, but ultimately concluded that the current breakpoint structure continues to serve the interests of fund shareholders. Accordingly, the Trustees continue to believe that the fee schedules currently in effect for the funds, taking into account the changes noted above, represent an appropriate sharing of economies of scale at current asset levels.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the funds’ investment process and performance by the work of the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing the fund’s performance with various benchmarks and with the performance of competitive funds. The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and continued to discuss with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has

21

made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional remedial changes are warranted.

In the case of your fund, the Trustees considered that your fund’s common share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper New York Municipal Debt Funds (closed-end))(compared using tax-adjusted performance to recognize the different federal income tax treatment for capital gains distributions and exempt-interest distributions) for the one-, three- and five-year periods ended December 31, 2004 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| One-year period | Three-year period | Five-year period |

| 70th | 76th | 69th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three-, and five-year periods ended December 31, 2004, there were 23, 16, and 12 funds, respectively, in your Lipper peer group.* Past performance is no guarantee of future performance.) The Trustees noted the disappointing performance for your fund for the three-year period ended December 31, 2004. In this regard, the Trustees considered that the fund generally uses less investment leverage than the other closed-end funds in its Lipper peer group. Because investment leverage has the potential to increase a fund’s yield under some market conditions, the fund’s lower use of leverage may at times cause its performance to trail the performance of its peer group.

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees believe that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees believe that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment advisor for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

* The percentile rankings for your fund’s common share annualized total return performance in the Lipper New York Municipal Debt Funds (closed-end) category for the one-, five-, and ten-year periods ended March 31, 2006, were 91%, 82%, and 63%, respectively. Over the one-, five-, and ten-year periods ended March 31, 2006, the fund ranked 19th out of 20, 9th out of 10, and 5th out of 7 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

22

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment advisor, subject to the obligation to seek best execution. The Trustees believe that soft-dollar credits and other potential benefits associated with the allocation of fund brokerage, which pertains mainly to funds investing in equity securities, represent assets of the funds that should be used for the benefit of fund shareholders. This area has been marked by significant change in recent years. In July 2003, acting upon the Contract Committee’s recommendation, the Trustees directed that allocations of brokerage to reward firms that sell fund shares be discontinued no later than December 31, 2003. In addition, commencing in 2004, the allocation of brokerage commissions by Putnam Management to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash. The Trustees will continue to monitor the allocation of the funds’ brokerage to ensure that the principle of “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of your fund’s custodian and investor servicing agreements, which provide benefits to Putnam Fiduciary Trust Company, an affiliate of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but have not relied on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

23

| Other information for shareholders |

Important notice regarding share repurchase program

In October 2005, the Trustees of your fund authorized Putnam Investments to implement a repurchase program on behalf of your fund, which would allow your fund to repurchase up to 5% of its outstanding shares over the 12 months ending October 6, 2006. In March 2006, the Trustees approved an increase in this repurchase program to allow the fund to repurchase a total of up to 10% of its outstanding shares over the same period.

| Putnam’s policy on confidentiality |

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ addresses, telephone numbers, Social Security numbers, and the names of their financial advisors. We use this information to assign an account number and to help us maintain accurate records of transactions and account balances. It is our policy to protect the confidentiality of your information, whether or not you currently own shares of our funds, and in particular, not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use. Under certain circumstances, we share this information with outside vendors who provide services to us, such as mailing and proxy solicitation. In those cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. We may also share this information with our Putnam affiliates to service your account or provide you with information about other Putnam products or services. It is also our policy to share account information with your financial advisor, if you’ve listed one on your Putnam account. If you would like clarification about our confidentiality policies or have any questions or concerns, please don’t hesitate to contact us at 1-800-225-1581, Monday through Friday, 8:30 a.m. to 7:00 p.m., or Saturdays from 9:00 a.m. to 5:00 p.m. Eastern Time.

| Proxy voting |

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2005, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

24

| Fund portfolio holdings |

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

25

| Financial statements |

| A guide to financial statements |

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

26

| Report of Independent Registered Public Accounting Firm |

| To the Trustees and Shareholders of Putnam New York Investment Grade Municipal Trust: |

In our opinion, the accompanying statement of assets and liabilities, including the fund’s portfolio, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Putnam New York Investment Grade Municipal Trust (the “fund”) at April 30, 2006, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of investments owned at April 30, 2006, by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

| PricewaterhouseCoopers LLP Boston, Massachusetts June 12, 2006 |

27

| The fund’s portfolio 4/30/06 |

| Key to abbreviations | |||||

| AMBAC AMBAC Indemnity Corporation | G.O. Bonds General Obligation Bonds | ||||

| FGIC Financial Guaranty Insurance Company | MBIA MBIA Insurance Company | ||||

| FSA Financial Security Assurance | U.S. Govt. Coll. U.S. Government Collateralized | ||||

| MUNICIPAL BONDS AND NOTES (123.0%)* | |||||

| Rating** | Principal amount | Value | |||

| New York (117.5%) | |||||

| Albany Cnty., Indl. Dev. Agcy. Rev. Bonds | |||||

| (Albany College of Pharmacy), Ser. A, | |||||

| 5 3/8s, 12/1/24 | BBB- | $ | 300,000 | $ | 309,657 |

| Albany, Indl. Dev. Agcy. Civic Fac. Rev. Bonds | |||||

| (Charitable Leadership), Ser. A , 6s, 7/1/19 | Baa3 | 250,000 | 266,035 | ||

| Chemung Cnty., Indl. Dev. Agcy. Civic Fac. Rev. | |||||

| Bonds (Arnot Ogden Med. Ctr.), 5s, 11/1/34 | A3 | 500,000 | 500,925 | ||

| Dutchess Cnty., Indl. Dev. Agcy. Civic Fac. Rev. | |||||

| Bonds (Bard College), 5 3/4s, 8/1/30 | A3 | 700,000 | 747,600 | ||

| Geneva, Indl. Dev. Agcy. Rev. Bonds | |||||

| (Hobart & William Smith), Ser. A, 5 3/8s, | |||||

| 2/1/33 | A | 500,000 | 525,465 | ||

| Hempstead, Indl. Dev. Agcy. Civic Fac. Rev. | |||||

| Bonds(Hofstra U.), 5 1/4s, 7/1/16 | A | 395,000 | 411,223 | ||

| Long Island, Pwr. Auth. NY Elec. Syst. Rev. | |||||

| Bonds, Ser. A | |||||

| 5 1/4s, 12/1/26 (Prerefunded) | AAA | 750,000 | 779,205 | ||

| AMBAC, 5s, 9/1/29 # | Aaa | 2,000,000 | 2,068,700 | ||

| Madison Cnty., Indl. Dev. Agcy. Rev. Bonds | |||||

| (Colgate U.), Ser. A, 5s, 7/1/23 | Aa3 | 1,000,000 | 1,040,190 | ||

| Metro. Trans. Auth. Rev. Bonds, Ser. A, | |||||

| FSA, 5s,11/15/30 | Aaa | 1,000,000 | 1,025,740 | ||

| Metro. Trans. Auth. Svc. Contract Rev. | |||||

| Bonds | |||||

| (Trans. Fac.), Ser. O, 5 3/4s, 7/1/13 | |||||

| (Prerefunded) | AAA | 500,000 | 539,550 | ||

| Ser. A , MBIA, 5 1/2s, 1/1/20 | Aaa | 1,000,000 | 1,077,740 | ||

| Monroe Cnty., Indl. Dev. Agcy. Civic Fac. Rev. | |||||

| Bonds (Highland Hosp. Rochester), 5s, 8/1/25 | Baa1 | 250,000 | 250,715 | ||

| Nassau, Cnty., Tobacco Settlement Corp. Rev. | |||||

| Bonds, Ser. A-2, zero %, 6/1/26 | BBB | 250,000 | 212,240 | ||

| Niagara Cnty., Indl. Dev. Agcy. Rev. Bonds, | |||||

| Ser. C, 5 5/8s, 11/15/24 | Baa3 | 450,000 | 472,919 | ||

| NY City, G.O. Bonds | |||||

| Ser. I, U.S. Govt. Coll., 6 1/4s, 4/15/17 | |||||

| (Prerefunded) | Aaa | 185,000 | 191,321 | ||

| AMBAC, 6.05s, 9/1/11 | Aaa | 400,000 | 400,968 | ||

| Ser. B, 5 3/4s, 8/1/16 | A1 | 1,000,000 | 1,086,580 | ||

28

| MUNICIPAL BONDS AND NOTES (123.0%)* continued | |||||

| Rating** | Principal amount | Value | |||

| New York continued | |||||

| NY City, G.O. Bonds | |||||

| Ser. B, 5 1/2s, 12/1/31 | A1 | $ | 180,000 | $ | 191,063 |

| Ser. B, U.S. Govt. Coll., 5 1/2s, 12/1/31 | |||||

| (Prerefunded) | AAA | 820,000 | 892,455 | ||

| Ser. G, 5 1/4s, 8/1/16 | A1 | 625,000 | 669,988 | ||

| Ser. M, 5s, 4/1/24 | A1 | 500,000 | 515,205 | ||

| Ser. I-1, 5s, 4/1/19 | A1 | 125,000 | 130,050 | ||

| NY City, Hlth. & Hosp. Corp. Rev. Bonds | |||||

| (Hlth.Syst.), Ser. A , 5 3/8s, 2/15/26 | A2 | 300,000 | 308,142 | ||

| NY City, Indl. Dev. Agcy. Rev. Bonds (Brooklyn | |||||

| Navy Yard Cogen. Partners), 5.65s, 10/1/28 | BBB– | 750,000 | 752,250 | ||

| NY City, Indl. Dev. Agcy. Civic Fac. Rev. Bonds | |||||

| (Staten Island U. Hosp.), Ser. A, 6 3/8s, | |||||

| 7/1/31 | B2 | 350,000 | 355,922 | ||

| (Brooklyn Polytech. U. Project J), 6 1/8s, | |||||

| 11/1/30 | BB+ | 250,000 | 249,213 | ||

| (St. Francis College), 5s, 10/1/34 | A– | 250,000 | 250,840 | ||

| NY City, Indl. Dev. Agcy. Special Arpt. Fac. Rev. | |||||

| Bonds (Airis JFK I LLC), Ser. A, 5 1/2s, 7/1/28 | Baa3 | 700,000 | 716,016 | ||

| NY City, Indl. Dev. Agcy. Special Fac. Rev. | |||||

| Bonds | |||||

| (Terminal One Group Assn.), 5 1/2s, 1/1/17 | A3 | 600,000 | 635,934 | ||

| (British Airways PLC), 5 1/4s, 12/1/32 | Ba2 | 100,000 | 91,016 | ||

| NY City, Muni. Wtr. & Swr. Fin. Auth. | |||||

| Rev. Bonds, Ser. G, FSA, 5s, 6/15/34 | Aaa | 500,000 | 512,435 | ||

| NY Cntys., Tobacco Trust II Rev. Bonds | |||||

| (Tobacco Settlement), 5 3/4s, 6/1/43 | BBB | 1,000,000 | 1,020,990 | ||

| NY Cntys., Tobacco Trust III Rev. Bonds | |||||

| (Tobacco Settlement), 6s, 6/1/43 | BBB | 300,000 | 313,323 | ||

| NY Cntys., Tobacco Trust IV Rev. Bonds, | |||||

| Ser. A, 5s, 6/1/38 | BBB | 1,000,000 | 956,890 | ||

| NY State Dorm. Auth. Rev. Bonds | |||||

| (State U. Edl. Fac.), Ser. A, 7 1/2s, 5/15/13 | AA– | 875,000 | 1,048,661 | ||

| (Mount Sinai Hlth.), Ser. A, 6 1/2s, 7/1/25 | Ba1 | 250,000 | 267,170 | ||

| (Mental Hlth.), Ser. A, 5 3/4s, 2/15/27 | |||||

| (Prerefunded) | AA– | 45,000 | 46,613 | ||

| (Mental Hlth.), Ser. A, 5 3/4s, 2/15/27 | AA– | 25,000 | 25,853 | ||

| (Winthrop-U. Hosp. Assn.), Ser. A, | |||||

| 5 1/2s, 7/1/32 | Baa1 | 450,000 | 465,836 | ||

| (Dept. of Hlth.), 5 1/2s, 7/1/25 (Prerefunded) | AA– | 870,000 | 889,923 | ||

| (Dept. of Hlth.), 5 1/2s, 7/1/25 (Prerefunded) | AA– | 630,000 | 644,484 | ||

| (North Shore Long Island Jewish Group), | |||||

| 5 3/8s, 5/1/23 | A3 | 600,000 | 626,082 | ||

| (Rochester Inst. of Tech.), Ser. A, | |||||

| AMBAC, 5 1/4s, 7/1/19 | Aaa | 150,000 | 163,725 | ||

| (NY Methodist Hosp.), 5 1/4s, 7/1/17 | A3 | 300,000 | 314,373 | ||

| (School Dist. Fin.), Ser. A, MBIA, | |||||

| 5 1/4s, 4/1/11 | Aaa | 1,000,000 | 1,067,600 | ||

29

| MUNICIPAL BONDS AND NOTES (123.0%)* continued | |||||

| Rating** | Principal amount | Value | |||

| New York continued | |||||

| NY State Dorm. Auth. Rev. Bonds | |||||

| (Lenox Hill Hosp. Oblig. Group), | |||||

| 5 1/4s, 7/1/08 | Ba2 | $ | 250,000 | $ | 251,705 |

| (Rochester U.), Ser. A, 5s, 7/1/34 | A1 | 500,000 | 513,110 | ||

| (NYU), Ser. A, FGIC, 5s, 7/1/29 | Aaa | 1,000,000 | 1,036,540 | ||

| Ser. A, FGIC, 5s, 3/15/27 (Prerefunded) | Aaa | 1,000,000 | 1,066,280 | ||

| (Dept. of Hlth.), Ser. 2, FGIC, 5s, 7/1/22 | Aaa | 1,000,000 | 1,038,620 | ||

| NY State Dorm. Auth. Lease Rev. Bonds | |||||

| (State U. Dorm. Facs.), Ser. A, MBIA, | |||||

| 5s, 7/1/24 | Aaa | 1,000,000 | 1,046,320 | ||

| NY State Dorm. Auth. Personal Income | |||||

| Tax Rev. Bonds (Education), Ser. A, 5s, 3/15/23 | AAA | 250,000 | 261,685 | ||

| NY State Energy Research & Dev. Auth. | |||||

| Fac. Mandatory Put Bonds, 4.7s, 10/1/12 | A1 | 500,000 | 500,330 | ||

| NY State Energy Research & Dev. Auth. | |||||

| Gas Fac. Rev. Bonds (Brooklyn Union Gas), | |||||

| 6.952s, 7/1/26 | A+ | 400,000 | 409,820 | ||

| NY State Env. Fac. Corp. Rev. Bonds, 5s, | |||||

| 6/15/32 | Aaa | 250,000 | 257,990 | ||

| NY State Env. Fac. Corp. Poll. Control | |||||

| Rev. Bonds (State Wtr. Revolving Fund), | |||||

| Ser. A, 7 1/2s, 6/15/12 | Aaa | 125,000 | 132,186 | ||

| NY State Hwy. Auth. Rev. Bonds | |||||

| (Hwy. & Bridge Trust | |||||

| Fund), Ser. B, FGIC, 5s, 4/1/17 | Aaa | 250,000 | 264,808 | ||

| NY State Pwr. Auth. Rev. Bonds | |||||

| 5s, 11/15/20 | Aa2 | 750,000 | 782,655 | ||

| Ser. A, FGIC, 5s, 11/15/17 | Aaa | 500,000 | 530,745 | ||

| NY State Thruway Auth. Rev. Bonds, Ser. A, | |||||

| MBIA | |||||

| 5 1/4s, 4/1/13 | Aaa | 1,000,000 | 1,077,290 | ||

| 5 1/4s, 4/1/12 | Aaa | 1,000,000 | 1,073,900 | ||

| NY State Urban Dev. Corp. Rev. Bonds | |||||

| (Personal Income Tax), Ser. C-1, 5s, 3/15/33 | |||||

| (Prerefunded) | AAA | 1,000,000 | 1,066,280 | ||

| Port Auth. NY & NJ Cons. Rev. Bonds, | |||||

| Ser. 124, 5s, 8/1/31 | AA– | 1,000,000 | 1,010,580 | ||

| Sales Tax Asset Receivable Corp. Rev. Bonds, | |||||

| Ser. A, MBIA, 5s, 10/15/25 | Aaa | 1,425,000 | 1,491,932 | ||

| Saratoga Cnty., Indl. Dev. Agcy. Civic Fac. Rev. | |||||

| Bonds (Saratoga Hosp.), Ser. A, 5s, 12/1/13 | BBB+ | 100,000 | 102,724 | ||

| Suffolk Cnty., Indl. Dev. Agcy. Civic Fac. Rev. | |||||

| Bonds (Huntington Hosp.), Ser. B, 5 7/8s, | |||||

| 11/1/32 | Baa1 | 500,000 | 520,915 | ||

| Tobacco Settlement Asset Securitization Corp., | |||||

| Inc. of NY Rev. Bonds, Ser. 1, 5s, 6/1/26 | BBB | 500,000 | 493,740 | ||

| Tobacco Settlement Fin. Auth. Rev. Bonds, | |||||

| Ser. A-1, 5 1/2s, 6/1/18 | AA– | 1,000,000 | 1,069,610 | ||

30

| MUNICIPAL BONDS AND NOTES (123.0%)* continued | |||||

| Rating** | Principal amount | Value | |||

| New York continued | |||||

| Triborough Bridge & Tunnel Auth. Rev. | |||||

| Bonds, Ser. A | |||||

| 5s, 1/1/32 (Prerefunded) | Aa2 | $ | 845,000 | $ | 897,052 |

| 5s, 1/1/32 | Aa2 | 155,000 | 158,593 | ||

| Westchester Cnty., Indl Dev. Agcy. Civic Fac. | |||||

| Rev. Bonds (Guiding Eyes for the Blind), | |||||

| 5 3/8s, 8/1/24 | BBB | 165,000 | 170,435 | ||

| Westchester, Tobacco Asset Securitization | |||||

| Corp. Rev. Bonds, 5 1/8s, 6/1/38 | BBB | 500,000 | 488,060 | ||

| Yonkers, Indl. Dev. Agcy. Civic Fac. Rev. Bonds | |||||

| (St. John’s Riverside Hosp.), Ser. A, 7 1/8s, | |||||

| 7/1/31 | BB | 250,000 | 260,343 | ||

| 44,003,073 | |||||

| Puerto Rico (5.5%) | |||||

| Cmnwlth. of PR, Hwy. & Trans. Auth. Rev. | |||||

| Bonds, Ser. K, 5s, 7/1/17 | BBB+ | 500,000 | 518,950 | ||

| PR Elec. Pwr. Auth. Rev. Bonds, Ser. LL, MBIA, | |||||

| 5 1/2s, 7/1/17 | Aaa | 750,000 | 831,180 | ||

| PR Indl. Tourist Edl. Med. & Env. Control Fac. | |||||

| Rev. Bonds (Cogen. Fac.-AES), 6 5/8s, 6/1/26 | Baa3 | 250,000 | 273,520 | ||

| PR Muni. Fin. Agcy. G.O. Bonds, Ser. C, 5s, | |||||

| 8/1/11 | Baa2 | 435,000 | 454,740 | ||

| 2,078,390 | |||||

| TOTAL INVESTMENTS | |||||

| Total investments (cost $44,831,129) | $ | 46,081,463 | |||

* Percentages indicated are based on net assets of $37,451,930.

** The Moody’s or Standard & Poor’s ratings indicated are believed to be the most recent ratings available at April 30, 2006 for the securities listed. Ratings are generally ascribed to securities at the time of issuance. While the agencies may from time to time revise such ratings, they undertake no obligation to do so, and the ratings do not necessarily represent what the agencies would ascribe to these securities at April 30, 2006. Securities rated by Putnam are indicated by “/P” . Ratings are not covered by the Report of Independent Registered Public Accounting Firm.

# A portion of this security was pledged and segregated with the custodian to cover margin requirements for futures contracts at April 30, 2006.

At April 30, 2006, liquid assets totaling $1,161,360 have been designated as collateral for open futures contracts.

The rates shown on Mandatory Put Bonds are the current interest rates at April 30, 2006.

The dates shown on Mandatory Put Bonds are the next mandatory put dates.

| The fund had the following industry group concentrations greater than 10% at April 30, 2006 (as a percentage of net assets): | |

| Transportation | 18.6% |

| Utilities | 17.4 |

| Education | 16.8 |

| Health care | 14.6 |

| The fund had the following insurance concentrations greater than 10% at April 30, 2006 (as a percentage of net assets): | |

| MBIA | 20.5% |

| FGIC | 10.5 |

31

| FUTURES CONTRACTS OUTSTANDING at 4/30/06 (Unaudited) | ||||

| Number of | Expiration | Unrealized | ||

| contracts | Value | date | depreciation | |

| U.S. Treasury Note 10 yr (Long) | 11 | $1,161,359 | Jun-06 | $(20,029) |

The accompanying notes are an integral part of these financial statements.

32

| Statement of assets and liabilities 4/30/06 | |

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (identified cost $44,831,129) | $46,081,463 |

| Cash | 1,142,382 |

| Interest and other receivables | 698,429 |

| Receivable for variation margin (Note 1) | 1,891 |

| Total assets | 47,924,165 |

| LIABILITIES | |

| Distributions payable to shareholders | 121,909 |

| Accrued preferred shares distribution payable (Note 1) | 2,559 |

| Payable for securities purchased | 164,039 |

| Payable for shares of the fund repurchased | 4,734 |

| Payable for compensation of Manager (Note 2) | 64,209 |

| Payable for investor servicing and custodian fees (Note 2) | 562 |

| Payable for Trustee compensation and expenses (Note 2) | 31,699 |

| Payable for administrative services (Note 2) | 2,434 |

| Other accrued expenses | 80,090 |

| Total liabilities | 472,235 |

| Series A remarketed preferred shares: (200 shares authorized | |

| and outstanding at $50,000 per share) (Note 4) | 10,000,000 |

| Net assets applicable to common shares outstanding | $37,451,930 |

| REPRESENTED BY | |

| Paid-in capital — common shares (Unlimited shares authorized) (Note 1) | $38,008,279 |

| Distributions in excess of net investment income (Note 1) | (6,399) |

| Accumulated net realized loss on investments (Note 1) | (1,780,255) |

| Net unrealized appreciation of investments | 1,230,305 |

| Total — Representing net assets applicable to common shares outstanding | $37,451,930 |

| COMPUTATION OF NET ASSET VALUE | |

| Net asset value per common share | |

| ($37,451,930 divided by 2,780,987 shares) | $13.47 |

The accompanying notes are an integral part of these financial statements.

33

| Statement of operations Year ended 4/30/06 | ||

| INTEREST INCOME | $ | 2,279,966 |

| EXPENSES | ||

| Compensation of Manager (Note 2) | 302,665 | |

| Investor servicing fees (Note 2) | 19,398 | |

| Custodian fees (Note 2) | 26,438 | |

| Trustee compensation and expenses (Note 2) | 20,306 | |

| Administrative services (Note 2) | 17,811 | |

| Auditing | 79,192 | |

| Preferred share remarketing agent fees | 25,127 | |

| Other | 78,629 | |

| Total expenses | 569,566 | |

| Expense reduction (Note 2) | (26,574) | |

| Net expenses | 542,992 | |

| Net investment income | 1,736,974 | |

| Net realized gain on investments (Notes 1 and 3) | 197,341 | |

| Net realized loss on futures contracts (Note 1) | (6,405) | |

| Net unrealized depreciation of investments | ||

| and futures contracts during the year | (1,066,045) | |

| Net loss on investments | (875,109) | |

| Net increase in net assets resulting from operations | $ | 861,865 |

| DISTRIBUTIONS TO SERIES A REMARKETED PREFERRED SHAREHOLDERS: (NOTE 1) | ||

| From tax exempt income | (268,055) | |

| Net increase in net assets resulting from operations | ||

| (applicable to common shareholders) | $ | 593,810 |

The accompanying notes are an integral part of these financial statements.

34

| Statement of changes in net assets | ||

| INCREASE (DECREASE) IN NET ASSETS | ||

| Year ended | Year ended | |

| 4/30/06 | 4/30/05 | |

| Operations: | ||

| Net investment income | $ 1,736,974 | $ 1,821,544 |

| Net realized gain on investments | 190,936 | 461,922 |

| Net unrealized appreciation (depreciation) of investments | (1,066,045) | 1,329,639 |

| Net increase in net assets resulting from operations | 861,865 | 3,613,105 |

| DISTRIBUTIONS TO SERIES A REMARKETED PREFERRED SHAREHOLDERS: (NOTE 1) | ||

| From tax exempt income | (268,055) | (157,765) |

| Net increase in net assets resulting from operations | ||

| (applicable to common shareholders) | 593,810 | 3,455,340 |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: (NOTE 1) | ||

| From tax exempt income | (1,502,830) | (1,845,720) |

| Decrease from shares repurchased (Note 5) | (782,776) | — |

| Total increase (decrease) in net assets | (1,691,796) | 1,609,620 |

| NET ASSETS | ||

| Beginning of year | 39,143,726 | 37,534,106 |

| End of year (including distributions in excess of net | ||

| investment income of $6,399 and undistributed net | ||

| investment income of $30,727, respectively) | $37,451,930 | $39,143,726 |

| NUMBER OF FUND SHARES | ||

| Common shares outstanding at beginning of year | 2,847,092 | 2,847,092 |

| Shares repurchased (Note 5) | (66,105) | — |

| Common shares outstanding at end of year | 2,780,987 | 2,847,092 |

| Remarketed preferred shares outstanding at beginning | ||

| and end of year | 200 | 200 |

The accompanying notes are an integral part of these financial statements.

35

Financial highlights (For a common share outstanding throughout the period)

| PER-SHARE OPERATING PERFORMANCE | |||||

| Year ended | |||||

| 4/30/06 | 4/30/05 | 4/30/04 | 4/30/03 | 4/30/02 | |

| Net asset value, beginning of period | |||||

| (common shares) | $13.75 | $13.18 | $13.37 | $13.32 | $13.45 |

| Investment operations: | |||||

| Net investment income (a) | .61 | .64 | .72 | .83 | .88 |

| Net realized and unrealized | |||||

| gain (loss) on investments | (.31) | .64 | (.18) | (.02) | (.23) |

| Total from investment operations | .30 | 1.28 | .54 | .81 | .65 |

| Distributions to preferred shareholders: | |||||

| From net investment income | (.09) | (.06) | (.03) | (.04) | (.07) |

| Total from investment operations | |||||

| (applicable to common shareholders) | .21 | 1.22 | .51 | .77 | .58 |

| Distributions to common shareholders: | |||||

| From net investment income | (.53) | (.65) | (.70) | (.72) | (.71) |

| Total distributions | (.53) | (.65) | (.70) | (.72) | (.71) |

| Increase from shares repurchased | .04 | — | — | — | — |

| Net asset value, end of period | |||||

| (common shares) | $13.47 | $13.75 | $13.18 | $13.37 | $13.32 |

| Market price, end of period | |||||

| (common shares) | $11.93 | $11.81 | $11.35 | $11.99 | $12.12 |

| Total return at market price (%) | |||||

| (common shares) (b) | 5.57 | 9.90 | 0.26 | 4.88 | 2.96 |

| RATIOS AND SUPPLEMENTAL DATA | |||||

| Net assets, end of period | |||||

| (common shares) (in thousands) | $37,452 | $39,144 | $37,534 | $38,063 | $37,917 |

| Ratio of expenses to | |||||

| average net assets (%)(c,d) | 1.47 | 1.39 | 1.33 | 1.36 | 1.35 |

| Ratio of net investment income | |||||

| to average net assets (%)(c) | 3.79 | 4.35 | 5.06 | 5.84 | 5.96 |

| Portfolio turnover rate (%) | 14.79 | 35.82 | 21.43 | 35.93 | 25.16 |

(a) Per share net investment income has been determined on the basis of the weighted average number of shares outstanding during the period.

(b) Total return assumes dividend reinvestment.

(c) Ratios reflect net assets available to common shares only; net investment income ratio also reflects reduction for distributions to preferred shareholders.

(d) Includes amounts paid through expense offset arrangements (Note 2).

The accompanying notes are an integral part of these financial statements.

36

Notes to financial statements 4/30/06

Note 1: Significant accounting policies

Putnam New York Investment Grade Municipal Trust (the “fund”) is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company. The fund’s investment objective is to seek as high a level of current income exempt from federal income tax and New York State and City personal income tax, as Putnam Investment Management, LLC, (“Putnam Management”), the fund’s manager, an indirect wholly-owned subsidiary of Putnam, LLC believes to be consistent with preservation of capital. The fund intends to achieve its objective by investing in investment grade municipal securities selected by Putnam Management. The fund may be affected by economic and political developments in the state of New York.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A) Security valuation Tax-exempt bonds and notes are generally valued on the basis of valuations provided by an independent pricing service approved by the Trustees. Such services use information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities in determining value. Other investments are valued at fair value following procedures approved by the Trustees. Such valuations and procedures are reviewed periodically by the Trustees.

B) Security transactions and related investment income Security transactions are recorded on the trade date (date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis.

Interest income is recorded on the accrual basis. All premiums/discounts are amortized/accreted on a yield-to-maturity basis. The premium in excess of the call price, if any, is amortized to the call date; thereafter, any remaining premium is amortized to maturity.

C) Futures and options contracts The fund may use futures and options contracts to hedge against changes in the values of securities the fund owns or expects to purchase, or for other investment purposes. The fund may also write options on swaps or securities it owns or in which it may invest to increase its current returns.