Searchable text section of graphics shown above

IPAA Investor Symposium

Warren Resources, Inc.

[LOGO]

April 20, 2005 Update

Forward-Looking Statements | | [LOGO] |

This presentation contains forward looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Private Securities Litigation Reform Act of 1995. Although WRES believes that the assumptions underlying these statements are reasonable, you are cautioned that such forward-looking statements are inherently uncertain and necessarily involve risks that may affect WRES’s business prospects and performance, and if one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements.

Any forward-looking statement made is subject to all of the risks and uncertainties, many of which are beyond management’s control. While Warren makes these forward looking statements in good faith, neither Warren nor its management can guarantee that the anticipated results will be achieved. Warren discloses proven reserves that comply with the SEC’s definitions. Additionally, Warren may disclose estimated reserves, which the SEC guidelines do not allow us to include in filings with the SEC. See “Risk Factors” described in the Management’s Discussion and Analysis section of our Annual Report on Form 10K for the year ended December 31, 2004 and our other filings made with the SEC.

WRES undertakes no obligation, and expressly disclaims any duty, to publicly update any forward looking statements made herein, whether as a result of new information or future events.

2

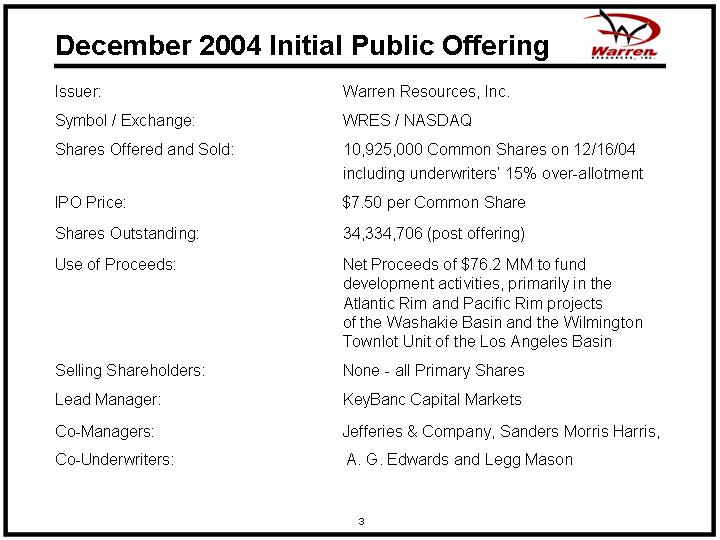

December 2004 Initial Public Offering

Issuer: | | Warren Resources, Inc. |

| | |

Symbol / Exchange: | | WRES / NASDAQ |

| | |

Shares Offered and Sold: | | 10,925,000 Common Shares on 12/16/04 including underwriters’ 15% over-allotment |

| | |

IPO Price: | | $7.50 per Common Share |

| | |

Shares Outstanding: | | 34,334,706 (post offering) |

| | |

Use of Proceeds: | | Net Proceeds of $76.2 MM to fund development activities, primarily in the Atlantic Rim and Pacific Rim projects of the Washakie Basin and the Wilmington Townlot Unit of the Los Angeles Basin |

| | |

Selling Shareholders: | | None - all Primary Shares |

| | |

Lead Manager: | | KeyBanc Capital Markets |

| | |

Co-Managers: | | Jefferies & Company, Sanders Morris Harris, |

| | |

Co-Underwriters: | | A. G. Edwards and Legg Mason |

3

Key Management

Norman F. Swanton

Chief Executive Officer

Kenneth A. Gobble

Chief Operating Officer

Timothy A. Larkin

Chief Financial Officer

David E. Fleming

Chief Legal and Compliance Officer

Lloyd G. Davies

Chief Executive-Warren E&P

4

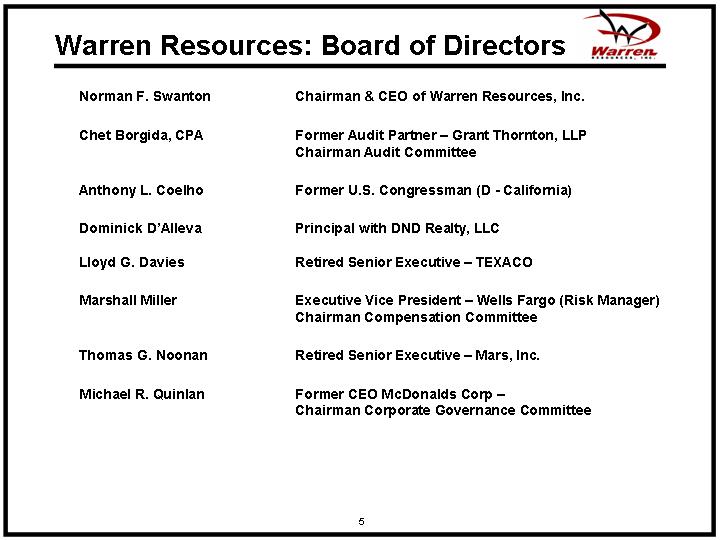

Warren Resources: Board of Directors

Norman F. Swanton | | Chairman & CEO of Warren Resources, Inc. |

| | |

Chet Borgida, CPA | | Former Audit Partner – Grant Thornton, LLP Chairman Audit Committee |

| | |

Anthony L. Coelho | | Former U.S. Congressman (D - California) |

| | |

Dominick D’Alleva | | Principal with DND Realty, LLC |

| | |

Lloyd G. Davies | | Retired Senior Executive – TEXACO |

| | |

Marshall Miller | | Executive Vice President – Wells Fargo (Risk Manager) Chairman Compensation Committee |

| | |

Thomas G. Noonan | | Retired Senior Executive – Mars, Inc. |

| | |

Michael R. Quinlan | | Former CEO McDonalds Corp – Chairman Corporate Governance Committee |

5

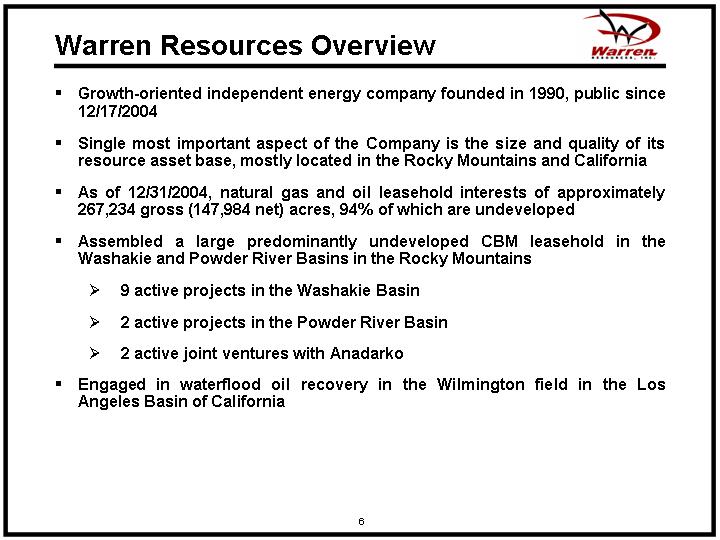

Warren Resources Overview

• Growth-oriented independent energy company founded in 1990, public since 12/17/2004

• Single most important aspect of the Company is the size and quality of its resource asset base, mostly located in the Rocky Mountains and California

• As of 12/31/2004, natural gas and oil leasehold interests of approximately 267,234 gross (147,984 net) acres, 94% of which are undeveloped

• Assembled a large predominantly undeveloped CBM leasehold in the Washakie and Powder River Basins in the Rocky Mountains

• 9 active projects in the Washakie Basin

• 2 active projects in the Powder River Basin

• 2 active joint ventures with Anadarko

• Engaged in waterflood oil recovery in the Wilmington field in the Los Angeles Basin of California

6

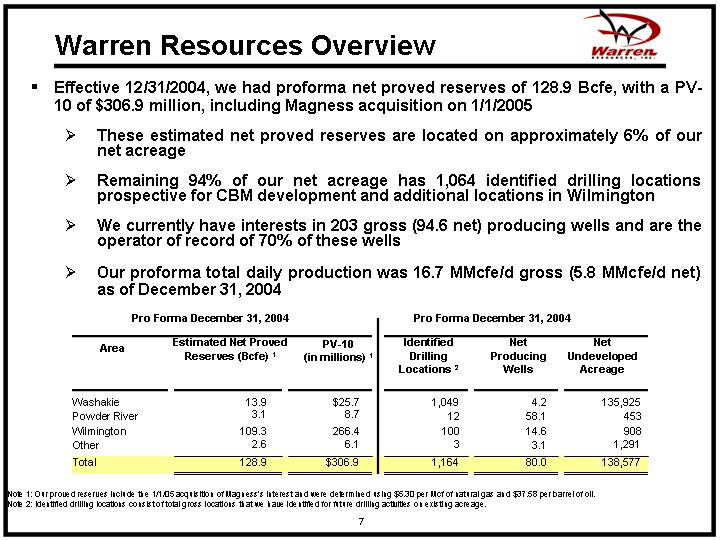

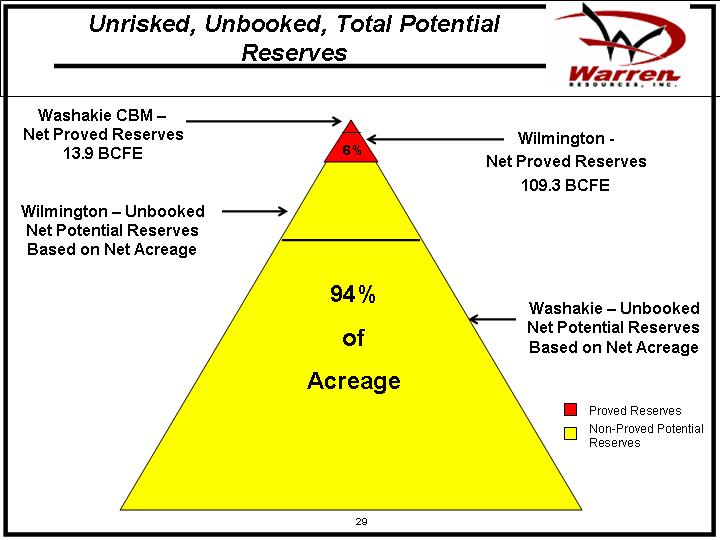

• Effective 12/31/2004, we had proforma net proved reserves of 128.9 Bcfe, with a PV-10 of $306.9 million, including Magness acquisition on 1/1/2005

• These estimated net proved reserves are located on approximately 6% of our net acreage

• Remaining 94% of our net acreage has 1,064 identified drilling locations prospective for CBM development and additional locations in Wilmington

• We currently have interests in 203 gross (94.6 net) producing wells and are the operator of record of 70% of these wells

• Our proforma total daily production was 16.7 MMcfe/d gross (5.8 MMcfe/d net) as of December 31, 2004

Pro Forma December 31, 2004 | | Pro Forma December 31, 2004 | |

Area | | Estimated Net Proved

Reserves (Bcfe) (1) | | PV-10

(in millions) (1) | | Identified

Drilling

Locations (2) | | Net

Producing

Wells | | Net

Undeveloped

Acreage | |

| | | | | | | | | | | |

Washakie | | 13.9 | | $ | 25.7 | | 1,049 | | 4.2 | | 135,925 | |

Powder River | | 3.1 | | 8.7 | | 12 | | 58.1 | | 453 | |

Wilmington | | 109.3 | | 266.4 | | 100 | | 14.6 | | 908 | |

Other | | 2.6 | | 6.1 | | 3 | | 3.1 | | 1,291 | |

Total | | 128.9 | | $ | 306.9 | | 1,164 | | 80.0 | | 138,577 | |

Note (1): Our proved reserves include the 1/1/05 acquisition of Magness’s interest and were determined using $5.30 per Mcf of natural gas and $37.58 per barrel of oil.

Note (2): Identified drilling locations consist of total gross locations that we have identified for future drilling activities on existing acreage.

7

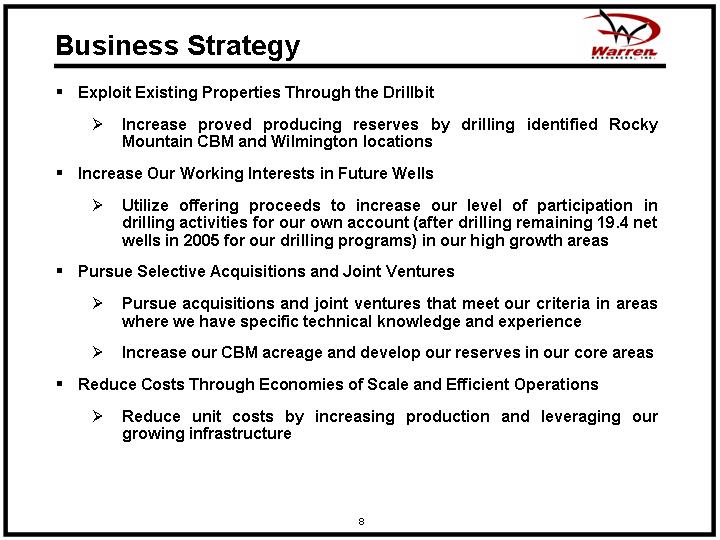

Business Strategy

• Exploit Existing Properties Through the Drillbit

• Increase proved producing reserves by drilling identified Rocky Mountain CBM and Wilmington locations

• Increase Our Working Interests in Future Wells

• Utilize offering proceeds to increase our level of participation in drilling activities for our own account (after drilling remaining 19.4 net wells in 2005 for our drilling programs) in our high growth areas

• Pursue Selective Acquisitions and Joint Ventures

• Pursue acquisitions and joint ventures that meet our criteria in areas where we have specific technical knowledge and experience

• Increase our CBM acreage and develop our reserves in our core areas

• Reduce Costs Through Economies of Scale and Efficient Operations

• Reduce unit costs by increasing production and leveraging our growing infrastructure

8

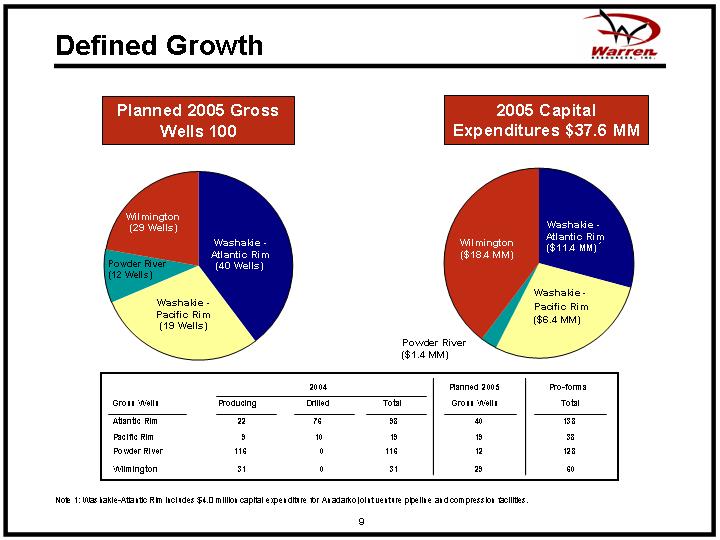

Defined Growth

Planned 2005 Gross Wells 100

[CHART]

2005 Capital Expenditures $37.6 MM

[CHART]

| | 2004 | | Planned 2005 | | Pro-forma | |

Gross Wells | | Producing | | Drilled | | Total | | Gross Wells | | Total | |

Atlantic Rim | | 22 | | 76 | | 98 | | 40 | | 138 | |

Pacific Rim | | 9 | | 10 | | 19 | | 19 | | 38 | |

Powder River | | 116 | | 0 | | 116 | | 12 | | 128 | |

Wilmington | | 31 | | 0 | | 31 | | 29 | | 60 | |

Note (1): Washakie-Atlantic Rim includes $4.0 million capital expenditure for Anadarko joint venture pipeline and compression facilities.

9

Operations and Property Overview

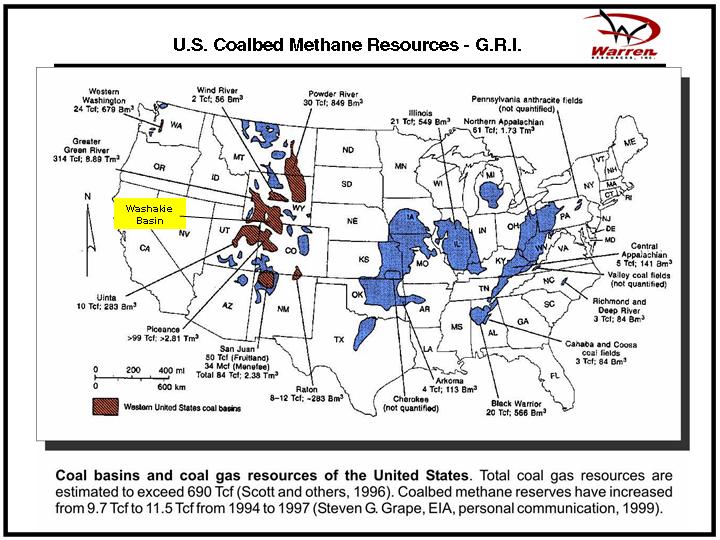

U.S. Coalbed Methane Resources - G.R.I.

[GRAPHIC]

Coal basins and coal gas resources of the United States. Total coal gas resources are estimated to exceed 690 Tcf (Scott and others, 1996). Coalbed methane reserves have increased from 9.7 Tcf to 11.5 Tcf from 1994 to 1997 (Steven G. Grape, EIA, personal communication, 1999).

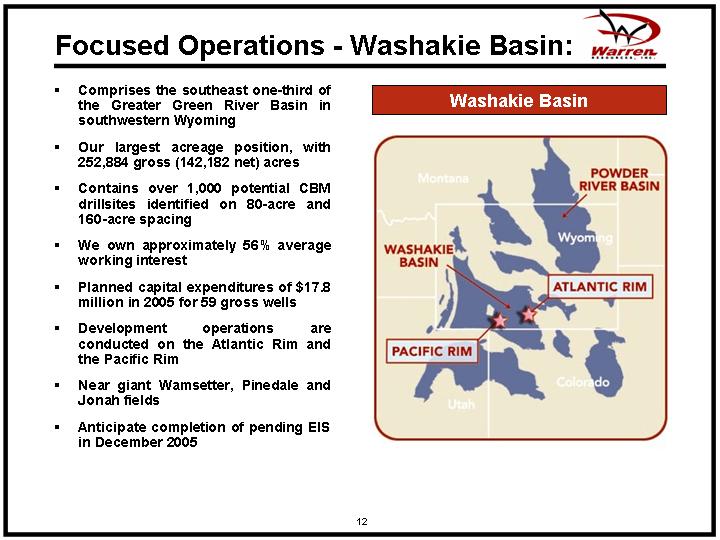

Focused Operations - Washakie Basin:

• Comprises the southeast one-third of the Greater Green River Basin in southwestern Wyoming

• Our largest acreage position, with 252,884 gross (142,182 net) acres

• Contains over 1,000 potential CBM drillsites identified on 80-acre and 160-acre spacing

• We own approximately 56% average working interest

• Planned capital expenditures of $17.8 million in 2005 for 59 gross wells

• Development operations are conducted on the Atlantic Rim and the Pacific Rim

• Near giant Wamsetter, Pinedale and Jonah fields

• Anticipate completion of pending EIS in December 2005

Washakie Basin

[GRAPHIC]

12

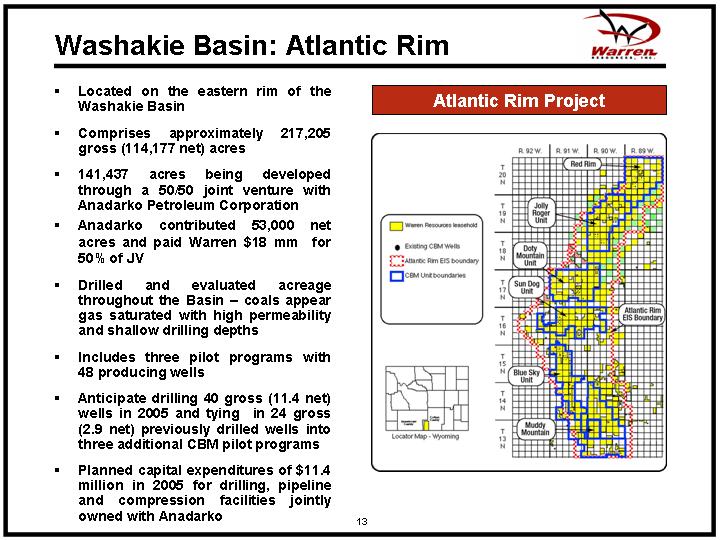

Washakie Basin: Atlantic Rim

• Located on the eastern rim of the Washakie Basin

• Comprises approximately 217,205 gross (114,177 net) acres

• 141,437 acres being developed through a 50/50 joint venture with Anadarko Petroleum Corporation

• Anadarko contributed 53,000 net acres and paid Warren $18 mm for 50% of JV

• Drilled and evaluated acreage throughout the Basin – coals appear gas saturated with high permeability and shallow drilling depths

• Includes three pilot programs with 48 producing wells

• Anticipate drilling 40 gross (11.4 net) wells in 2005 and tying in 24 gross (2.9 net) previously drilled wells into three additional CBM pilot programs

• Planned capital expenditures of $11.4 million in 2005 for drilling, pipeline and compression facilities jointly owned with Anadarko

Atlantic Rim Project

[GRAPHIC]

13

Recent Atlantic Rim Developments

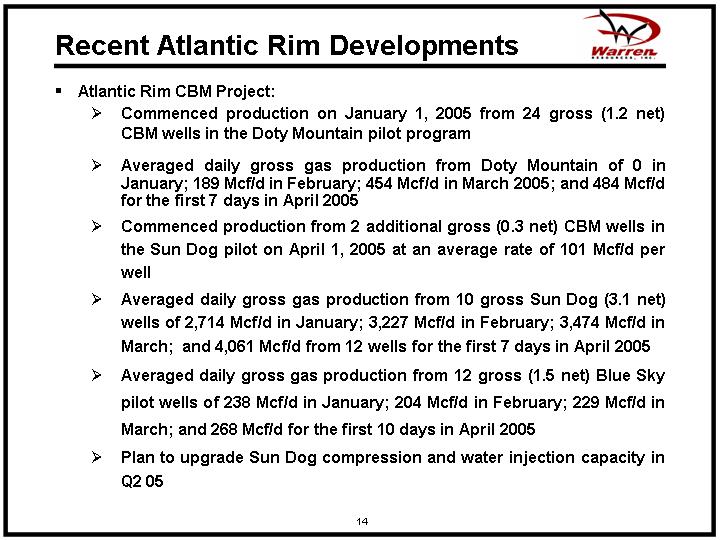

• Atlantic Rim CBM Project:

• Commenced production on January 1, 2005 from 24 gross (1.2 net) CBM wells in the Doty Mountain pilot program

• Averaged daily gross gas production from Doty Mountain of 0 in January; 189 Mcf/d in February; 454 Mcf/d in March 2005; and 484 Mcf/d for the first 7 days in April 2005

• Commenced production from 2 additional gross (0.3 net) CBM wells in the Sun Dog pilot on April 1, 2005 at an average rate of 101 Mcf/d per well

• Averaged daily gross gas production from 10 gross Sun Dog (3.1 net) wells of 2,714 Mcf/d in January; 3,227 Mcf/d in February; 3,474 Mcf/d in March; and 4,061 Mcf/d from 12 wells for the first 7 days in April 2005

• Averaged daily gross gas production from 12 gross (1.5 net) Blue Sky pilot wells of 238 Mcf/d in January; 204 Mcf/d in February; 229 Mcf/d in March; and 268 Mcf/d for the first 10 days in April 2005

• Plan to upgrade Sun Dog compression and water injection capacity in Q2 05

14

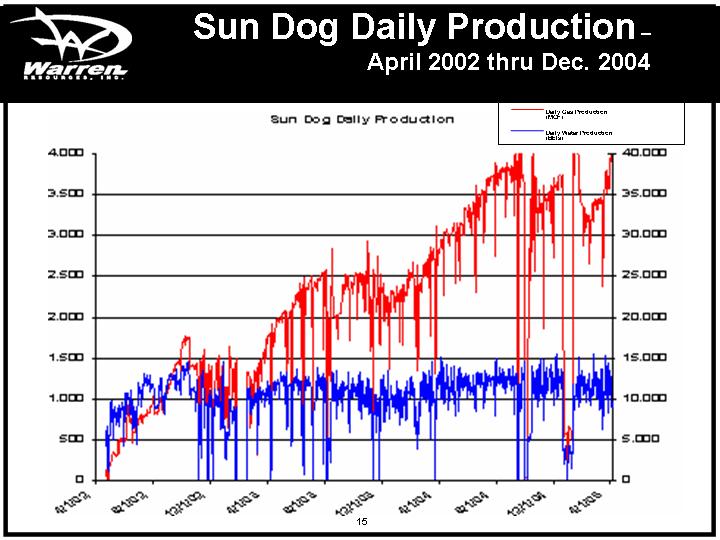

| | Sun Dog Daily Production – April 2002 thru Dec. 2004 |

[CHART]

15

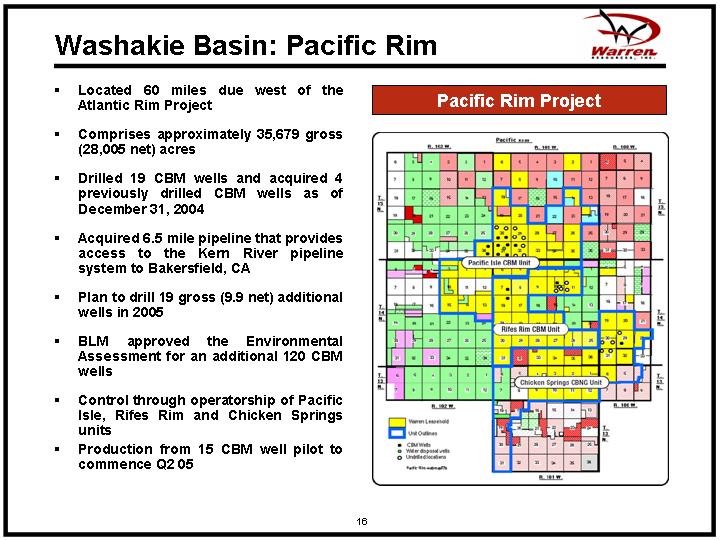

Washakie Basin: Pacific Rim

• Located 60 miles due west of the Atlantic Rim Project

• Comprises approximately 35,679 gross (28,005 net) acres

• Drilled 19 CBM wells and acquired 4 previously drilled CBM wells as of December 31, 2004

• Acquired 6.5 mile pipeline that provides access to the Kern River pipeline system to Bakersfield, CA

• Plan to drill 19 gross (9.9 net) additional wells in 2005

• BLM approved the Environmental Assessment for an additional 120 CBM wells

• Control through operatorship of Pacific Isle, Rifes Rim and Chicken Springs units

• Production from 15 CBM well pilot to commence Q2 05

Pacific Rim Project

[GRAPHIC]

16

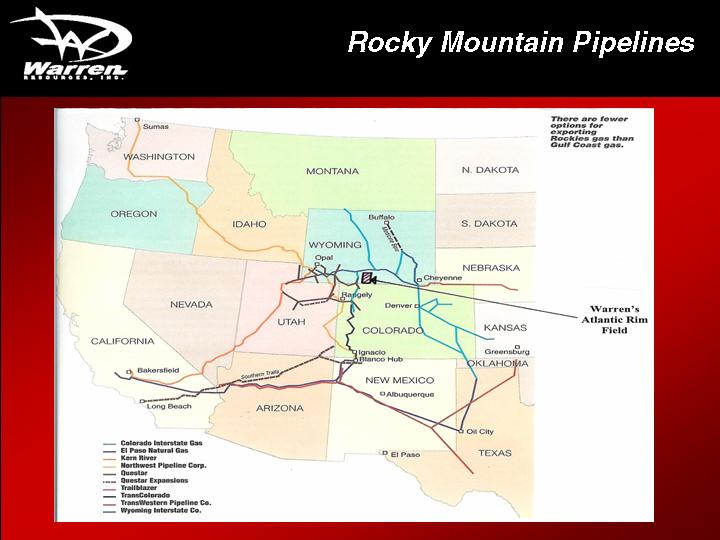

Rocky Mountain Pipelines

[GRAPHIC]

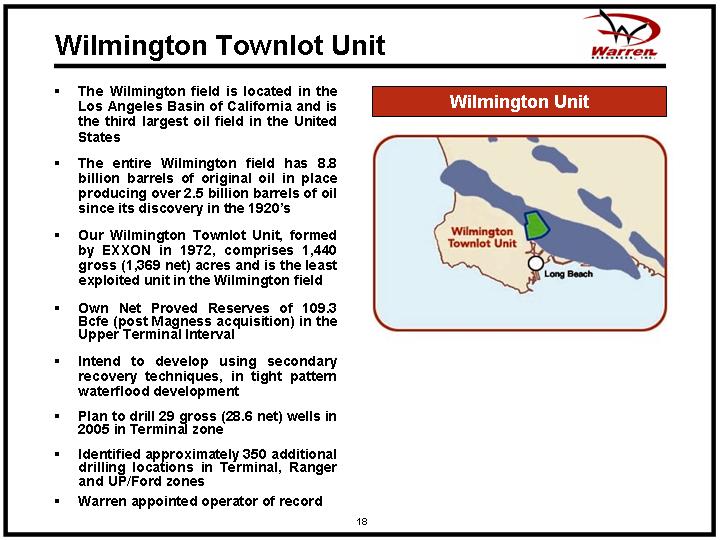

Wilmington Townlot Unit

• The Wilmington field is located in the Los Angeles Basin of California and is the third largest oil field in the United States

• The entire Wilmington field has 8.8 billion barrels of original oil in place producing over 2.5 billion barrels of oil since its discovery in the 1920’s

• Our Wilmington Townlot Unit, formed by EXXON in 1972, comprises 1,440 gross (1,369 net) acres and is the least exploited unit in the Wilmington field

• Own Net Proved Reserves of 109.3 Bcfe (post Magness acquisition) in the Upper Terminal Interval

• Intend to develop using secondary recovery techniques, in tight pattern waterflood development

• Plan to drill 29 gross (28.6 net) wells in 2005 in Terminal zone

• Identified approximately 350 additional drilling locations in Terminal, Ranger and UP/Ford zones

• Warren appointed operator of record

Wilmington Unit

[GRAPHIC]

18

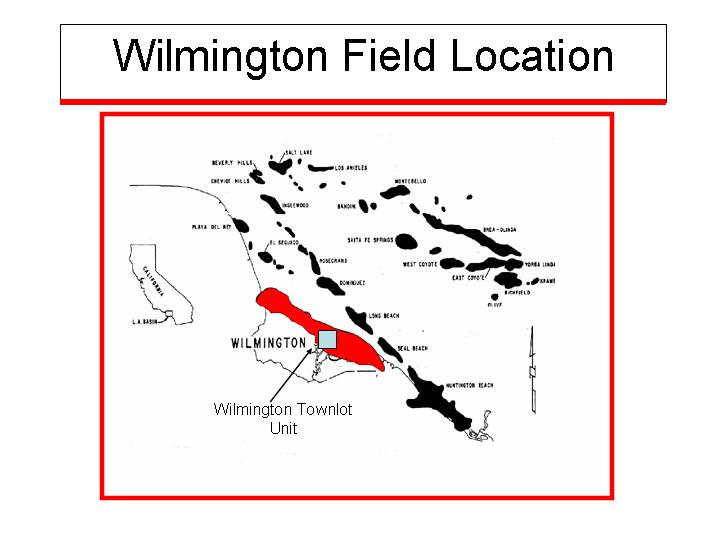

Wilmington Field Location

[GRAPHIC]

Structural Geology of Wilmington Field

[GRAPHIC]

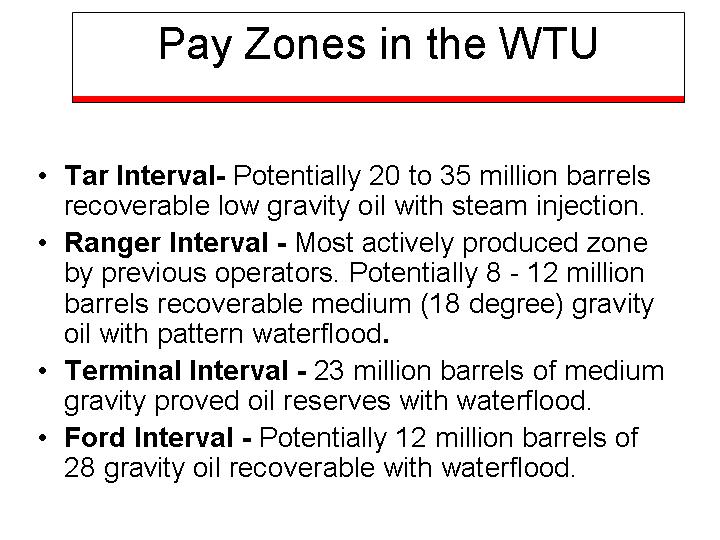

Pay Zones in the WTU

• Tar Interval- Potentially 20 to 35 million barrels recoverable low gravity oil with steam injection.

• Ranger Interval - Most actively produced zone by previous operators. Potentially 8 - 12 million barrels recoverable medium (18 degree) gravity oil with pattern waterflood.

• Terminal Interval - 23 million barrels of medium gravity proved oil reserves with waterflood.

• Ford Interval - Potentially 12 million barrels of 28 gravity oil recoverable with waterflood.

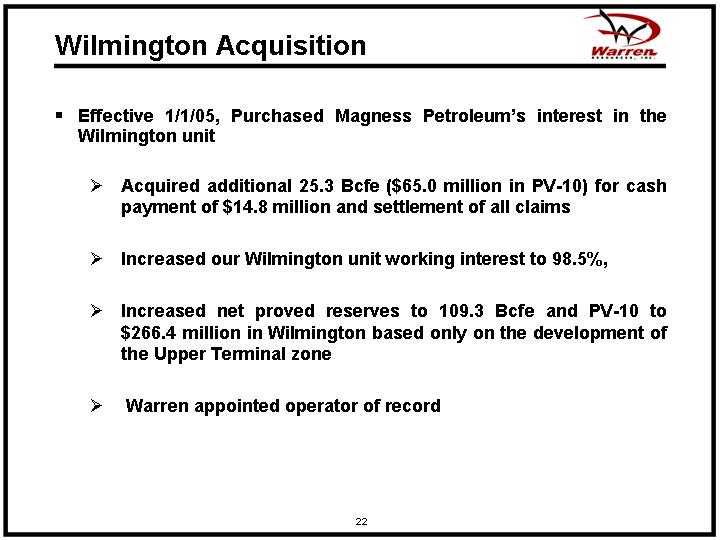

Wilmington Acquisition

• Effective 1/1/05, Purchased Magness Petroleum’s interest in the Wilmington unit

• Acquired additional 25.3 Bcfe ($65.0 million in PV-10) for cash payment of $14.8 million and settlement of all claims

• Increased our Wilmington unit working interest to 98.5%,

• Increased net proved reserves to 109.3 Bcfe and PV-10 to $266.4 million in Wilmington based only on the development of the Upper Terminal zone

• Warren appointed operator of record

22

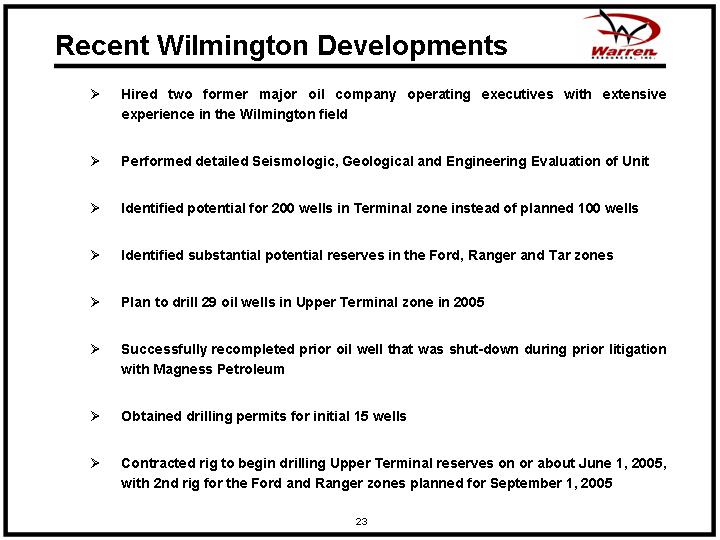

Recent Wilmington Developments

• Hired two former major oil company operating executives with extensive experience in the Wilmington field

• Performed detailed Seismologic, Geological and Engineering Evaluation of Unit

• Identified potential for 200 wells in Terminal zone instead of planned 100 wells

• Identified substantial potential reserves in the Ford, Ranger and Tar zones

• Plan to drill 29 oil wells in Upper Terminal zone in 2005

• Successfully recompleted prior oil well that was shut-down during prior litigation with Magness Petroleum

• Obtained drilling permits for initial 15 wells

• Contracted rig to begin drilling Upper Terminal reserves on or about June 1, 2005, with 2nd rig for the Ford and Ranger zones planned for September 1, 2005

23

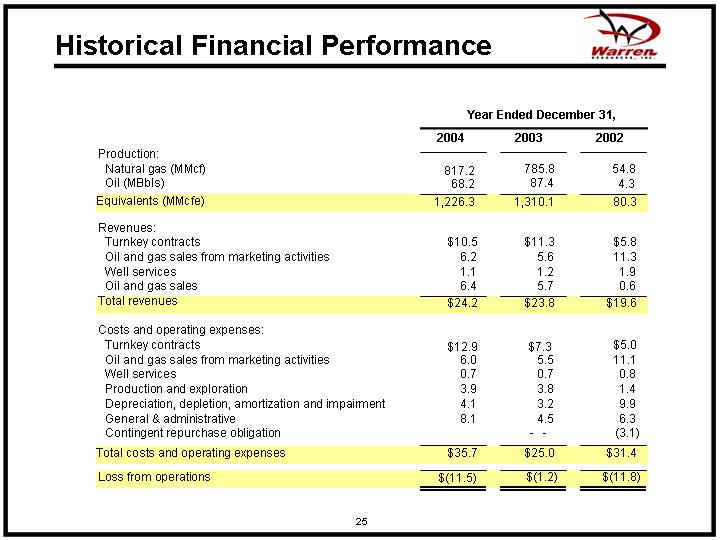

Historical Financial Performance

| | Year Ended December 31, | |

| | 2004 | | 2003 | | 2002 | |

Production: | | | | | | | |

Natural gas (MMcf) | | 817.2 | | 785.8 | | 54.8 | |

Oil (MBbls) | | 68.2 | | 87.4 | | 4.3 | |

Equivalents (MMcfe) | | 1,226.3 | | 1,310.1 | | 80.3 | |

| | | | | | | |

Revenues: | | | | | | | |

Turnkey contracts | | $ | 10.5 | | $ | 11.3 | | $ | 5.8 | |

Oil and gas sales from marketing activities | | 6.2 | | 5.6 | | 11.3 | |

Well services | | 1.1 | | 1.2 | | 1.9 | |

Oil and gas sales | | 6.4 | | 5.7 | | 0.6 | |

Total revenues | | $ | 24.2 | | $ | 23.8 | | $ | 19.6 | |

| | | | | | | |

Costs and operating expenses: | | | | | | | |

Turnkey contracts | | $ | 12.9 | | $ | 7.3 | | $ | 5.0 | |

Oil and gas sales from marketing activities | | 6.0 | | 5.5 | | 11.1 | |

Well services | | 0.7 | | 0.7 | | 0.8 | |

Production and exploration | | 3.9 | | 3.8 | | 1.4 | |

Depreciation, depletion, amortization and impairment | | 4.1 | | 3.2 | | 9.9 | |

General & administrative | | 8.1 | | 4.5 | | 6.3 | |

Contingent repurchase obligation | | | | — | | (3.1 | ) |

Total costs and operating expenses | | $ | 35.7 | | $ | 25.0 | | $ | 31.4 | |

Loss from operations | | $ | (11.5 | ) | $ | (1.2 | ) | $ | (11.8 | ) |

25

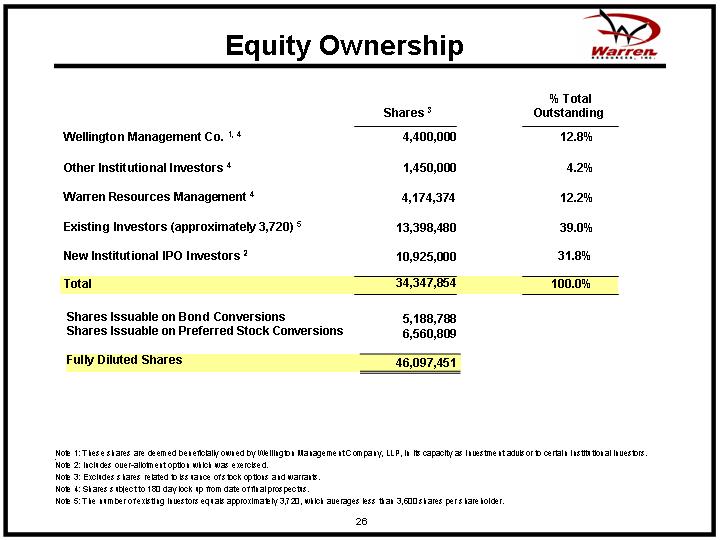

Equity Ownership

�� | | Shares (3) | | % Total

Outstanding | |

Wellington Management Co. (1), (4) | | 4,400,000 | | 12.8 | % |

| | | | | |

Other Institutional Investors (4) | | 1,450,000 | | 4.2 | % |

| | | | | |

Warren Resources Management (4) | | 4,174,374 | | 12.2 | % |

| | | | | |

Existing Investors (approximately 3,720) (5) | | 13,398,480 | | 39.0 | % |

| | | | | |

New Institutional IPO Investors (2) | | 10,925,000 | | 31.8 | % |

| | | | | |

Total | | 34,347,854 | | 100.0 | % |

| | | | | |

Shares Issuable on Bond Conversions | | 5,188,788 | | | |

Shares Issuable on Preferred Stock Conversions | | 6,560,809 | | | |

| | | | | |

Fully Diluted Shares | | 46,097,451 | | | |

Note (1): These shares are deemed beneficially owned by Wellington Management Company, LLP, in its capacity as investment advisor to certain Institutional investors.

Note (2): Includes over-allotment option which was exercised.

Note (3): Excludes shares related to issuance of stock options and warrants.

Note (4): Shares subject to 180 day lock up from date of final prospectus.

Note (5): The number of existing investors equals approximately 3,720, which averages less than 3,600 shares per shareholder.

26

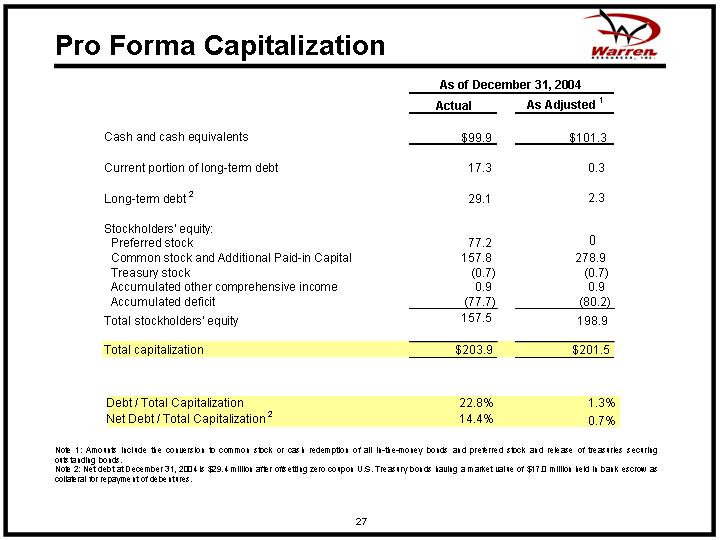

Pro Forma Capitalization

| | As of December 31, 2004 | |

| | Actual | | As Adjusted (1) | |

| | | | | |

Cash and cash equivalents | | $ | 99.9 | | $ | 101.3 | |

| | | | | |

Current portion of long-term debt | | 7.31 | | 0.3 | |

| | | | | |

Long-term debt (2) | | 29.1 | | 2.3 | |

| | | | | |

Stockholders’ equity: | | | | | |

Preferred stock | | 77.2 | | 0 | |

Common stock and Additional Paid-in Capital | | 157.8 | | 278.9 | |

Treasury stock | | (0.7 | ) | (0.7 | ) |

Accumulated other comprehensive income | | 0.9 | | 0.9 | |

Accumulated deficit | | (77.7 | ) | (80.2 | ) |

Total stockholders’ equity | | 157.5 | | 198.9 | |

| | | | | |

Total Capitalization | | $ | 203.9 | | $ | 201.5 | |

| | | | | |

Debt / Total Capitalization | | 22.8 | % | 1.3 | % |

Net Debt / Total capitalization (2) | | 14.4 | % | 0.7 | % |

Note (1): Amounts include the conversion to common stock or cash redemption of all in-the-money bonds and preferred stock and release of treasuries securing outstanding bonds.

Note (2): Net debt at December 31, 2004 is $29.4 million after offsetting zero coupon U.S. Treasury bonds having a market value of $17.0 million held in bank escrow as collateral for repayment of debentures.

27

Investment Recap

• Large, High Quality Asset Base

• Substantial Rocky Mountain Undeveloped CBM Acreage Position

• Net proved reserves of 13.9 Bcfe with net PV-10 of $25.7 million on 6,256 net acres in Washakie Basin

• Undeveloped position of 241,244 gross, 135,925 net, acres containing over 1,049 identified CBM drilling locations with significant potential reserves

• Wilmington Townlot Unit Post Acquisition

• Net proved reserves of 109.3 Bcfe with net PV-10 value of $266.4 million plus 4 zones <6,000 feet with significant potential reserves

• Ownership of 98.5% of the Wilmington Unit with potential for additional 350 wells - 29 new development wells planned in 2005

• Total pro-forma PV-10 of $306.9 million based on 6% of net acreage

• Experienced Technical Team to Execute Plan

• Incentivized Management - Stock Ownership

28

Unrisked, Unbooked, Total Potential Reserves

[CHART]

29