UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

WARREN RESOURCES, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

489 Fifth Avenue, 32nd Floor

New York, NY 10017

March 31, 2006

Dear Stockholder:

I would like to extend a personal invitation for you to join us at our Annual Meeting of Stockholders on Wednesday, May 17, 2006, at 9:30 a.m. (EST) at The Cornell Club, 6 East 44th Street, New York, NY 10017.

At this year’s meeting, you will vote on:

· the election of three directors,

· the ratification of Grant Thornton LLP’s appointment as independent auditors, and

· transact such other business as may properly come before the meeting.

Attached you will find a notice of meeting and proxy statement that contains further information about these items and the meeting itself.

Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy in order to ensure the presence of a quorum of over 50% of the outstanding shares of common stock on the record date of March 24, 2006, which is required for the transaction of business. If you attend the meeting, you will, of course, have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from them to vote your shares.

Your vote is very important to us and our business. We value your opinions and encourage you to participate in this year’s Annual Meeting by voting your proxy. You may vote by signing and returning your proxy card in the enclosed envelope.

| Sincerely, |

|

|

| Norman F. Swanton |

| Chairman & Chief Executive Officer |

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Warren Resources, Inc.

The Annual Meeting of Stockholders of Warren Resources, Inc. (the “Company” or “Warren”) will be held at The Cornell Club, 6 East 44th Street, New York, NY 10017, on Wednesday, May 17, 2006, at 9:30 a.m., local time. The purposes of the meeting are:

1. To elect three directors to the Board of Directors to serve until the 2009 Annual Meeting of Stockholders;

2. To ratify the appointment of Grant Thornton LLP as independent auditors of the Company to serve for the 2006 fiscal year; and

3. To transact such other business as may properly come before the meeting and at any adjournments or postponements of the meeting.

The Board of Directors set March 24, 2006, as the record date for the meeting. This means that owners of Common Stock at the close of business on that date are entitled to:

· receive this notice of the meeting, and

· vote at the meeting and any adjournments or postponements of the meeting.

We will make available a list of Stockholders as of the close of business on March 24, 2006, for inspection by Stockholders during normal business hours from May 5 to May 15, 2006, at the Company’s principal place of business, 489 Fifth Avenue, 32nd Floor, New York, NY 10017. This list also will be available to Stockholders at the meeting.

It is important that your shares be represented and voted at the Meeting. Please mark, sign, date and mail the enclosed proxy card to American Stock Transfer & Trust Company in the enclosed postage-paid envelope. A postage-prepaid envelope has been provided for your convenience. You may revoke your proxy at any time before the vote is taken by sending to the Corporate Secretary of the Company a proxy with a later date. Alternatively, you may revoke your proxy by delivering to the Corporate Secretary of the Company a written revocation prior to the Annual Meeting or by voting in person at the Annual Meeting.

Regardless of the number of shares of Warren that you hold, as a stockholder your vote is very important and the Board strongly encourages you to exercise your right to vote. We urge each stockholder to promptly sign and return the enclosed proxy card.

| | By Order of the Board of Directors |

| | /s/ DAVID E. FLEMING |

| | David E. Fleming |

| | Senior Vice President, General Counsel &

Corporate Secretary |

New York, New York | | |

March 31, 2006 | | |

WARREN RESOURCES, INC.

489 Fifth Avenue, 32nd Floor

New York, NY 10017

PROXY STATEMENT

FOR 2006 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 17, 2006

March 31, 2006

We are furnishing you this proxy statement in connection with the solicitation of proxies by our Board of Directors to be voted at the Annual Meeting of Stockholders of Warren Resources, Inc. The Annual Meeting will be held on Wednesday, May 17, 2006. In this proxy statement, Warren Resources, Inc. is referred to as the “Company” or “Warren.” This proxy statement and the enclosed proxy card are first being mailed to stockholders on or about March 31, 2006.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Where and when is the Annual Meeting?

The Annual Meeting will be held at The Cornell Club, 6 East 44th Street, New York, NY 10017, on Wednesday, May 17, 2006, at 9:30 a.m. local time.

What is the purpose of the Annual Meeting?

At the Annual Meeting, Stockholders will vote upon:

· The election of three directors for three-year terms;

· the ratification of the appointment of Grant Thornton LLP as our independent auditors for fiscal year 2006; and

· any other matters that may properly come before the meeting.

How does the Board recommend that I vote?

The Board recommends that you vote:

· FOR each of the nominees for director;

· FOR the ratification of Grant Thornton, LLP as our independent auditor for 2006.

Why should I vote?

Your vote is very important. Regardless of the number of shares you hold, the Board strongly encourages you to exercise your right to vote as a stockholder of the Company.

Who may vote?

All Stockholders of record of Warren’s common stock at the close of business on March 24, 2006, which we refer to as the record date, are entitled to receive notice of the Annual Meeting and to vote the shares of common stock held by them on the record date. Each outstanding share of common stock entitles its holder to cast one vote for each matter to be voted upon.

What is a proxy?

It is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. We have designated three of our directors as proxies for the 2006 Annual Meeting of Stockholders. These are Michael R. Quinlan, Chet Borgida and Marshall R. Miller.

What is a proxy statement?

It is a document that Securities and Exchange Commission (“SEC”) regulations require us to give you when we ask you to sign a proxy card designating Michael R. Quinlan, Chet Borgida and Marshall R. Miller, as proxies to vote on your behalf.

What is the difference between a shareowner of record and a shareowner who holds stock in street name?

If your shares are registered in your name, you are a shareowner of record.

If your shares are held in the name of your broker or bank, your shares are held in street name.

How do I vote?

If your shares of common stock are held by a broker, bank, or other nominee (i.e., in “street name”), you will receive instructions from your nominee, which you must follow in order to have your shares voted. The instructions may appear on the special proxy card provided to you by your nominee (also called a “voting instruction form”). Your nominee may offer you different methods of voting, such as by telephone or Internet.

If you hold your shares of common stock in your own name as a holder of record, you may vote in person at the Annual Meeting or instruct the proxy holders named in the enclosed proxy card how to vote your shares by marking, signing, dating, and returning the proxy card in the postage-paid envelope that we have provided to you.

Proxies that are executed, but do not contain any specific instructions, will be voted “FOR” the election of the nominees for directors specified in this proxy statement and “FOR” ratification of the appointment of auditors. The persons named in the proxy will have authority to vote in accordance with their own discretion on any other matters that properly come before the meeting.

Who may attend the meeting?

Only Stockholders on the record date are invited to attend the Annual Meeting. Proof of ownership of Warren Resources common stock, as well as a form of personal identification photo, may be requested in order to be admitted to the Meeting. If you are a Stockholder of record, your name can be verified against our Stockholder list. If you hold your Warren shares in “street name”—for instance, through a broker—you must request a proxy from your broker or other nominee holding your shares in record name on your behalf in order to attend the meeting and vote at that time (your broker may refer to it as a “legal” proxy). If you own shares in street name, bring your most recent brokerage statement with you to the meeting. We can use that to verify your ownership of Common Stock and admit you to the meeting; however, you will not be able to vote your shares at the meeting without a legal proxy from your broker.

Stockholders will be admitted to the Annual Meeting beginning at 9:15 a.m. No cameras, recording equipment or electronic devices will be permitted in the Meeting and large bags, briefcases or packages may be subject to inspection.

2

What are the quorum and voting requirements to elect the nominees for director and to ratify the appointment of our independent auditors?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares of common stock entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. As of the record date of March 24, 2006, there were 52,839,637 shares of common stock outstanding.

For proposal 1, the election of directors, the three nominees receiving the greatest number of votes at the Annual Meeting will be elected, even though such nominees may not receive a majority of the votes cast.

For proposal 2, ratification of the appointment of our independent auditors, the appointment of the auditors will be ratified if the votes cast “for” ratification exceed the votes cast “against.”

For any other business that may properly come before the Annual Meeting, the vote of a majority of the shares voted on the matter will constitute the act of the Stockholders on that matter, unless the law, or our articles of incorporation or bylaws, require the vote of a greater number.

How are votes counted?

Each share of common stock is entitled to one vote on each matter submitted to the Stockholders. Abstentions and “broker non-votes” will be counted only for purposes of establishing a quorum, but will not otherwise affect the outcome of the voting. Broker non-votes are proxies received from brokers or other nominees holding shares on behalf of their clients who have not received specific voting instructions from their clients with respect to non-routine matters. In counting the votes cast, only those cast “for” and “against” a matter are included, although you cannot vote “against” a nominee for director.

If you hold your shares of common stock in your own name as a holder of record, and you fail to vote your shares, either in person or by proxy, the votes represented by your shares will not affect the vote. If, however, your shares are held in “street name” and you fail to give instructions as to how you want your shares voted, the broker, bank or other nominee may vote the shares in their own discretion on certain routine matters, including the election of directors.

Will other matters be voted on at the Annual Meeting?

We are not aware of any other matters to be presented at the Annual Meeting other than those described in this proxy statement. If any other matters not described in the proxy statement are properly presented at the meeting, proxies will be voted in accordance with the discretion of the proxy holders.

Can I revoke my proxy?

You may revoke your proxy at any time before it has been exercised by:

· Filing a written revocation with the Corporate Secretary at the following address: Warren Resources, Inc., 489 Fifth Avenue, 32nd Floor, New York, NY 10017;

· Filing a duly executed proxy bearing a later date; or

· Appearing in person and voting by ballot at the Annual Meeting.

Any shareholder of record as of the record date attending the Annual Meeting may vote in person whether or not they previously have given a proxy, but the presence (without further action) of a shareholder at the Annual Meeting will not constitute revocation of a previously given proxy.

3

What other information should I review before voting?

Our 2005 annual report to Stockholders, including financial statements for the fiscal year ended December 31, 2005, is being mailed to Stockholders concurrently with this proxy statement. The annual report, however, is not part of the proxy solicitation material. A copy of our annual report on Form 10-K filed with the Securities and Exchange Commission (the SEC), including the financial statements, may be obtained without charge by:

· Writing to Warren Resources, Inc., Investor Relations, 489 Fifth Avenue, 32nd Floor, New York, NY 10017; or

· Accessing Warren’s website at www.warrenresources.com or the EDGAR database at the SEC’s website at www.sec.gov.

You also may obtain copies of our Form 10-K from the SEC at prescribed rates by writing to the Public Reference Section of the SEC, 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information on the SEC’s public reference rooms.

Your vote is very important. Please take the time to vote by completing and mailing the proxy card. A postage-prepaid envelope has been provided for your convenience. If your proxy card is returned unsigned, then your vote cannot be counted. If the returned proxy card is signed and dated without indicating how you want to vote, then your proxy will be voted as recommended by the Board of Directors.

Where can I find the voting results of the meeting?

We will announce voting results at the meeting, and we will publish the final results in our quarterly report on Form 10-Q for the second quarter of 2006. You can get a copy of this and other reports free of charge on the Company’s website at www.warrenresources.com, or by contacting our Investor Relations Department at (212) 697-9660.

4

WARREN BOARD OF DIRECTORS

Item 1—Election of Directors

The Board of Directors of Warren is divided into three classes of directors for purposes of election. One class of directors is elected at each annual meeting of stockholders to serve for a three-year term. All of the director nominees listed below are current directors of the Company.

At the 2006 meeting, the terms of three directors are expiring. All three of these directors have been nominated and, if elected at this meeting, will hold office until the expiration of each of their terms in 2009. Those directors not up for election this year will continue in office for the remainder of their terms.

If a nominee is unavailable for election, then the proxies will be voted for the election of another nominee proposed by the Board or, as an alternative, the Board may reduce the number of directors to be elected at the meeting. Each director holds office until his or her successor has been duly elected and qualified or the director’s earlier resignation, death or removal.

The Board recommends that you vote “FOR” each of the nominees listed below.

DIRECTORS NOMINATED THIS YEAR FOR TERMS EXPIRING IN 2009

Lloyd G. Davies, age 69, joined the board of directors in July 2001. On March 17, 2005, Mr. Davies was appointed Executive Vice President of Warren and Chairman and Chief Executive Officer of Warren’s principal operating subsidiary, Warren E&P, Inc., based in Casper, Wyoming (“Warren E&P”). For the prior seven years he was in retirement. From 1992 through 1994, Mr. Davies was the Assistant Division Manager for the Western U.S. area for Texaco. Prior to that, from 1990 through 1992, Mr. Davies was the Manager and Director of Operations for Texaco’s Far East Operations Division. During his career at Texaco, Mr. Davies was responsible for Texaco’s 50% share in Caltex in Indonesia, which activities included new field development waterflooding and the world’s largest steam flood operation. Mr. Davies also acted as Manager of Reservoir Engineering for ARAMCO in Saudi Arabia. Mr. Davies received a Bachelor of Science Degree in Petroleum Engineering from the University of Oklahoma in 1958. In 1966, he received a Master of Science Degree in Petroleum Engineering with a Minor in Math from the University of Texas.

Leonard DeCecchis, age 57, joined the board in September 2005 and serves on the audit committee of the board. Mr. DeCecchis retired from Prestone Products Corporation, where he was Executive Vice President and Chief Financial Officer of Prestone Products Corporation and a member of its board of directors until June 1999, and has been an investor in real estate and numerous business ventures since that time. In 1994, Mr. DeCecchis participated in a management buyout of Prestone antifreeze and other car care products from First Brands Corporation, a NYSE company. The new Prestone management team was successful in growing sales and doubling operating income within three years. In 1997, the company was sold to Allied Signal Corporation yielding a substantial return on investment to the management investors. From 1986 to 1994, Mr. DeCecchis was Vice President and Treasurer of First Brands Corporation, which had also been a management buyout of the automotive and home products divisions of Union Carbide Corporation. Mr. DeCecchis joined Union Carbide in 1974 and held numerous positions in auditing, treasury and financial reporting. In 1971, Mr. DeCecchis began his career at Peat Marwick Mitchell & Co. Mr. DeCecchis received a Bachelor’s degree from Pace University in 1971 and a Master of Business Administration from Fordham University in 1979. He is a Certified Public Accountant in New York.

Thomas G. Noonan, age 67, joined the Board as a director in November 1997 and until March 16, 2005 served on the compensation committee of the Board. From 1980 to 1997, he served as Manager of Quality Assurance for Mars Inc., an international food and candy company. From 1961 to 1979, he was a microbiologist for the Environmental Department of the State of New York. Mr. Noonan received a

5

Bachelor of Science degree from Fordham University in New York in 1959. He is the brother-in-law of Mr. Swanton.

Although they are not being voted upon this year, the Company has the following current directors:

CONTINUING DIRECTORS WITH TERMS EXPIRING IN 2008

Chet Borgida, age 61, was elected to the Board of Directors in November 2004 and also serves as a member of our audit committee, which he chairs, and the compensation committee. Mr. Borgida has more than 30 years of domestic and international management experience in auditing and advising retail, distribution and media businesses. He was a partner at Grant Thornton LLP (Warren’s independent auditors) from 1977 to 2001. While at Grant Thornton LLP, Mr. Borgida had no involvement in the review or preparation of Warren’s audited financial statements. Most recently from 2001 to 2004, Mr. Borgida was a Senior Vice-President and Chief Financial Officer of Cross Media Marketing Corporation. Mr. Borgida was also a director and member of the audit committee of Brand Partners Group, Inc., and is currently a director and member of the audit committees of Correctional Services Corporation, both Nasdaq listed companies. He graduated from Hunter College with a Bachelor Degree in Business Science in 1967. He is a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants.

Michael R. Quinlan, age 61, joined the Board as a director in January 2002 and serves on the corporate governance committee of the Board, which he chairs. From 1963 to the present Mr. Quinlan has been employed by the McDonald’s Corporation. In 1979, Mr. Quinlan was appointed to the board of directors of McDonald’s and served as the Chairman of the Board and Chief Executive Officer from 1990 to 1998. From 1998 to 1999, he served as Chairman of the Board of McDonald’s Corporation. From 1987 to 1990, he served as the President and Chief Executive Officer of McDonalds. Currently he serves as the Chairman of the Executive Committee of McDonalds Corporation. Mr. Quinlan is chairman of the board of trustees of both Ronald McDonald House Charities and Loyola University Chicago. Additionally, he is a member of the board of trustees of Loyola University Health System. He is also on the board of directors of Dun and Bradstreet Corporation and the May Department Stores Company. Mr. Quinlan earned a Bachelor of Science degree in 1967 and a Master’s of Business Administration from Loyola University Chicago in 1970. He has been awarded Honorary Doctors of Law Degrees from Loyola University Chicago, Elmhurst College and Illinois Benedictine College.

Norman F. Swanton, age 67, is and has been our President, Chairman of the Board and Chief Executive Officer since we were founded in June 1990. From October 1986 to 1990, he served as an independent financial advisor. From 1972 to 1985, he served as Chairman of the Board, President and Chief Executive Officer of Swanton Corporation, a publicly held company engaged in energy, retail and financial services businesses. From 1961 to 1972, he served as an executive officer for Glore, Forgan, Staats, Inc. and a divisional controller for Hayden Stone, Inc. which were New York Stock Exchange member securities and underwriting firms. He also served as a principal consultant to the Trust Fund of the New York Stock Exchange serving as its representative in the liquidation of several former New York Stock Exchange member firms. Mr. Swanton received his Bachelor of Arts Degree in History and Political Science from Long Island University in 1962 and attended Bernard Baruch Graduate School of Business in a graduate degree program in Accountancy and Finance from 1963 to 1966. He is the brother-in-law of Thomas G. Noonan.

6

CONTINUING DIRECTORS WITH TERMS EXPIRING IN 2007

Anthony L. Coelho, age 63, joined our Board as an independent director in May 2001 and serves on the compensation commitee, which he chairs, and corporate governance committees of the Board. From December 2000 to the present, Mr. Coelho has devoted his time to serving on the boards of directors listed below and as an independent consultant and adviser. From 1998 through November 2000, he served as the General Chairman for the U.S. Presidential campaign of Vice President Al Gore. From 1995 to 1998, he was Chairman and Chief Executive Officer of ETC w/tci, Inc. an education and training technology company in Washington, D.C. and from 1990 to 1995, he served as President and CEO of Wertheim Schroeder Investment Services, Inc. From 1978 to 1989, he served five terms in the U.S. Congress, representing the State of California as a member of the U.S. House of Representatives. During his congressional terms, he served as Democratic Majority Whip from 1987 to 1989 and authored the Americans with Disabilities Act. Congressman Coelho was also appointed chairman of the President’s Committee on the Employment of People with Disabilities by President Clinton. Congressman Coelho has served on a number of corporate boards, including AutoLend Group, Kaleidoscope Network, Inc., LoanNet, LLC, Pinnacle Global Group, Inc. and as chairman of ICF Kaiser International, Inc. He currently serves on the boards of ColumbusNewport, LLC, Cadiz, Inc., Cyberonics, Inc., a publicly traded company, DeFrancesco & Sons, Inc., Kistler Aerospace Corporation, Ripplewood Holdings, LLC, Service Corporation International, a publicly traded company, and MangoSoft, Inc. Congressman Coelho earned a Bachelor of Arts degree in Political Science from Loyola Marymount University in 1964.

Dominick D’Alleva, age 54, was our Secretary until 2002 and has been a director since June 1992. He serves on the compensation and corporate governance committees of the Board. Additionally, from 1995 to the present, he has been a principal with D and D Realty Company, LLC, a privately owned New York limited liability company involved in the acquisition and financing of real estate. From 1986 to 1995, he was engaged in residential New York City real estate for his own account and as general counsel to various real estate acquisition firms, where he negotiated contracts for the acquisition and financing of commercial real estate. From 1983 to 1985, he served as Executive Vice President, Director and General Counsel of Swanton Corporation, which engaged in energy, retail and financial services businesses. From 1980 to 1983 he was Associate Counsel of Damson Oil Corporation. From 1977 to 1980 he was an associate with Simpson, Thatcher & Bartlett specializing in securities and corporate law. Mr. D’Alleva received a Bachelor of Arts degree Summa Cum Laude from Fordham University in 1974 and earned his Juris Doctor degree with honors from Yale University in 1977.

Marshall Miller, age 55, joined the Board as an independent director in February 1998 and serves on the audit committee of the Board. Mr. Miller was an Executive Vice President of Wells Fargo Bank in San Francisco until retiring in 2000. From 1983 to 2000, Mr. Miller served in various senior management capacities with several financial institutions including Fair, Isaac Companies, Providian Financial Corporation and Wells Fargo Bank and specialized in advanced computer systems for credit risk management. Mr. Miller received a Bachelor of Arts Degree in Mathematics from the University of California at Berkley and a Masters of Science Degree from Stanford University in 1976.

7

CORPORATE GOVERNANCE

The Board is elected by the shareowners to oversee their interest in the long-term health and the overall success of the business and its financial strength. The Board serves as the ultimate decision-making body of the Company, except for those matters reserved to or shared with the shareowners. The Board selects and oversees the members of senior management, who are charged by the Board with conducting the business of the Company.

Warren has always taken the issue of corporate governance seriously. The Board is comprised of a majority of independent directors and the Audit Committee, the Corporate Governance Committee and the Compensation Committee are comprised entirely of independent directors.

The board of directors has established the following standing committees: audit, compensation and corporate governance.

The table below shows the current membership of each committee of the Board and the number of meetings each committee held in 2005:

Director | | | | Audit | | Compensation | | Governance | |

Mr. Borgida | | Chair | | | X | | | | | | |

Mr. Coelho | | | | | Chair | | | | X | | |

Mr. DeCecchis | | X | | | | | | | | | |

Mr. D’Alleva | | | | | X | | | | X | | |

Mr. Miller | | X | | | | | | | | | |

Mr. Quinlan* | | | | | | | | | Chair | | |

2005 Meetings | | 7 | | | 2 | | | | 2 | | |

* Serves in his capacity as Lead Director

Audit Committee. The Audit Committee consists of Messrs. Borgida, DeCecchis and Miller. Mr. Borgida is chairman of the Audit Committee and he and Mr. DeCecchis are deemed by the Company to be “audit committee financial experts”.

The audit committee reviews the preparation of and the scope of the audit of our annual consolidated financial statements, reviews drafts of such statements, makes recommendations as to the engagement and fees of the independent auditors, and monitors the functioning of our accounting and internal control systems by meeting with representatives of management and the independent auditors. This committee has direct access to the independent auditors and counsel to Warren and performs such other duties relating to the maintenance of the proper books of account and records of Warren and other matters as the board of directors may assign from time to time.

The purpose of the Audit Committee is to assist the Board in monitoring:

· the integrity of the Company’s financial statements;

· the Company’s compliance with legal and regulatory requirements;

· the independent auditor’s qualifications and independence;

· the performance of the Company’s internal and independent auditors; and

· the business practices and ethical standards of the Company.

The Audit Committee is also directly responsible for the appointment, approval of compensation, retention and oversight of the work of the Company’s independent auditor, Grant Thornton LLP, and the preparation of the Audit Committee report.

8

All of the members of the Audit Committee meet the independence requirements of the Nasdaq Stock Market, the Sarbanes-Oxley Act, the Securities Exchange Act and the rules of the Securities and Exchange Commission (“SEC”) adopted thereunder, and the Company’s Corporate Governance Guidelines. The Charter of the Audit Committee can be found on our website at www.warrenresources.com.

Compensation Committee. The Compensation Committee consists of Messrs. Borgida, Coelho and D’Alleva. Mr. Coelho is the chairman of the Compensation Committee. The Compensation Committee has sole authority to administer our stock option plans. The Compensation Committee also reviews and makes recommendations regarding the compensation levels of the Company’s senior management.

The Charter of the Compensation Committee can be found on our website at www.warrenresources.com.

Corporate Governance Committee. The Corporate Governance Committee consists of Messrs. Quinlan, D’Alleva and Coelho as members of the Corporate Governance Committee. Mr. Quinlan is the chairman of the Corporate Governance Committee.

The purposes of the Corporate Governance Committee include without limitation to:

· assist the Board in identifying qualified individuals to become directors;

· recommend to the Board qualified director nominees for election at the stockholders’ Annual Meeting;

· determine membership on the Board committees;

· recommend Corporate Governance guidelines;

· conduct annual self-evaluations of the Board and the Corporate Governance Committee; and

· report annually to the Board on the Chief Executive Officer succession plan.

The Charter of the Corporate Governance Committee can be found on our website at www.warrenresources.com.

Code of Business Conduct for All Directors, Officers and Employees

The Board has adopted a Code of Business Conduct for all directors, officers and employees. It is the responsibility of every Company director, officer and employee to maintain a commitment to high standards of conduct and ethics. It is the intent of the Code of Business Conduct to inspire continuing dedication to the fundamental principles of honesty, loyalty, fairness and forthrightness. There shall be no waiver of any part of this Code for any director or officer except by a vote of the Board of Directors or a designated Board committee that shall ascertain whether a waiver is appropriate under all the circumstances. In case a waiver of this Code is granted to a director or officer, the notice of such waiver shall be posted on our website at www.warrenresources.com. A copy of the Code of Business Conduct is available on our website at www.warrenresources.com.

Code of Ethics for Senior Financial Officers

The Board has also adopted a separate Code of Ethics for our chief executive officer, chief financial officer and chief accounting officer (“Senior Financial Officers’ Code”). Each of the covered officers has to certify on an annual basis that the officer shall:

· Act with honesty and integrity, avoiding actual or apparent conflicts of interest in personal and professional relationships;

· Provide constituents with information that is accurate, complete, objective, relevant, timely and understandable;

9

· Comply with all applicable laws, rules and regulations of federal, state and local governments, and other appropriate private and public regulatory agencies;

· Act in good faith, responsibly, with due care, competence and diligence, without misrepresenting material facts or allowing the officer’s independent judgment to be subordinated;

· Respect the confidentiality of information acquired in the course of business except when authorized or otherwise legally obligated to disclose the information, acknowledging that confidential information acquired in the course of business is not to be used for personal advantage;

· Proactively promote ethical behavior among employees at Warren and as a responsible partner with industry peers and associates;

· Maintain control over and responsibly manage all assets and resources employed or entrusted to the officer by Warren; and

· Report illegal or unethical conduct by any director, officer or employee that has occurred, is occurring or may occur, including any potential violations of the Senior Officers’ Code or the Code of Business Conduct.

There shall be no waiver of any part of the Senior Financial Officers’ Code except by a vote of the Board of Directors or a designated Board committee that shall ascertain whether a waiver is appropriate under all the circumstances. In case a waiver of the Senior Financial Officers’ Code is granted, the notice of such waiver shall be posted on our website at www.warrenresources.com. A copy of the Senior Financial Officers’ Code that has been adopted by the Board of Directors is available on our website at www.warrenresources.com.

Selection of Directors

The Company’s Corporate Governance Guidelines state that the Corporate Governance Committee shall, for positions on the Board of Directors not currently filled: (a) identify the personal characteristics needed in a director nominee so that the Board as a whole will possess the Qualifications of the Board as a Whole as these qualifications are set forth in the Corporate Governance Guidelines; (b) compile, through such means as the Committee considers appropriate, a list of potential director nominees thought to possess the Individual Qualifications identified in the Corporate Governance Guidelines; (c) if the Committee so determines it to be appropriate, engage an outside consultant to assist in the search for nominees and to conduct background investigations on all nominees regardless of how nominated; (d) review the resume of each nominee; (e) conduct interviews with the nominees meeting the desired set of qualifications; (f) following interviews, compile a short list of nominees (which, at the discretion of the Committee, may consist of a single individual) who may meet, at a minimum, with the Chairman of the Board, the Chief Executive Officer and the Chairman of the Corporate Governance Committee and/or the Lead Director; and (g) evaluate the nominee(s) in relationship to the culture of the Company and the Board and its needs.

Minimum Criteria for Board Members

Each Candidate must possess at least the following specific minimum qualifications:

· Each Candidate shall be prepared to represent the best interests of all of the Company’s Stockholders and not just one particular constituency.

· Each Candidate shall be an individual who has demonstrated integrity and ethics in his/her personal and professional life and has established a record of professional accomplishment in his/her chosen field.

10

· No Candidate, or family member (as defined in NASD rules), or affiliate or associate (each as defined in Rule 405 under the Securities Act of 1933, as amended) of a Candidate, shall have any material personal, financial or professional interest in any present or potential competitor of the Company.

· Each Candidate shall be prepared to participate fully in Board activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee of which he or she is a member, and not have other personal or professional commitments that would, in the Governance Committee’s sole judgment, interfere with or limit his or her ability to do so.

· Each Candidate shall be willing to make, and financially capable of making, the required investment in the Company’s stock in the amount and within the timeframe specified in the Company’s Corporate Governance Principles and Practices.

Desirable Qualities and Skills

In addition, the Governance Committee also considers it desirable that Candidates possess the following qualities or skills:

· Each Candidate should contribute to the Board’s overall diversity—diversity being broadly construed to mean a variety of opinions, perspectives, personal and professional experiences and backgrounds.

· Each Candidate should contribute positively to the existing chemistry and collaborative culture among Board members.

· Each Candidate should possess professional and personal experiences and expertise relevant to the Company’s goal of being a leading exploration and development company. At this stage of the Company’s development, relevant experiences might include, among other things, senior level executive experience and relevant senior level expertise in one or more of the following areas—engineering, finance, accounting, sales and marketing, organizational development, information technology and public relations.

Affirmative Determinations Regarding Director Independence and Other Matters

The Board of Directors has determined each of the following directors to be an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers (the “NASD”):

| Chet Borgida |

| Anthony Coelho |

| Dominick D’Alleva |

| Leonard DeCecchis |

| Marshall R. Miller |

| Michael R. Quinlan |

In this proxy statement these six directors are referred to individually as an “Independent Director” and collectively as the “Independent Directors.”

The Board of Directors has also determined that each member of the three committees of the Board currently meets the independence requirements applicable to those committees prescribed by the NASD, the Securities and Exchange Commission (“SEC”) and the Internal Revenue Service. The Board of Directors has further determined that Chet Borgida and Leonard DeCecchis, members of the Audit

11

Committee of the Board of Directors, are “audit committee financial experts” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC.

Presiding Director

Each March, the Independent Directors select from their group an Independent Director to preside as a Lead Director at all meetings of the Independent Directors. Mr. Quinlan currently serves as presiding Lead Director. The Independent Directors meet in executive session at each Board meeting.

Meetings of the Board of Directors

During 2005, the board of directors met six times. All of the directors attended each meeting.

Non-employee Director Meetings

Pursuant to the Company’s Corporate Governance Policies, non-employee directors may meet in non-employee director or committee sessions at the discretion of the non-employee directors. If any non-employee directors are not independent, then the independent directors shall schedule an independent director session at least once per year. The chair of the Audit, Compensation or Nominating and Governance Committee leads non-employee board and committee sessions and the independent director sessions and is chosen by the non-employee directors and independent directors, respectively, based on who is the most knowledgeable and appropriate leader given the subject of the meeting. The session leader can retain independent consultants and schedule meetings. The non-employee directors met four times in 2005.

Compensation of Directors

Directors who are also employees of Warren receive no additional compensation for their services as directors. During 2005, each non-employee director received:

· upon becoming a member of the Board, options to purchase 10,000 shares of our common stock exercisable at the then current fair market price for a period of five years;

· an annual grant of options to purchase 5,000 shares of our common stock exercisable at the then current fair market price for a period of five years;

· annual retainer fee of $20,000 and reimbursement for travel expenses and other out-of-pocket costs incurred in connection with attending Board and committee meetings;

· annual retainer fee of $7,500 for the chairman of the audit committee and $5,000 for the chairman of the corporate governance and compensation committee; and

· $2,000 for each Board meeting attended, $1,500 for each audit committee meeting attended and $1,000 for each corporate governance and compensation committee meeting attended.

The annual retainer fee has been raised to $27,500 for 2006.

12

The following table sets forth the total compensation paid to each Director who is not an officer during 2005.

Name | | | | Fees Paid

in Cash

($) | | Stock Option

Awards

($)(1) | | Non-Stock

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total

($) | |

Chet Borgida | | | 50,500 | | | | 33,850 | | | | 0 | | | | 0 | | | 84,350 | |

Anthony Coelho | | | 31,000 | | | | 33,850 | | | | 0 | | | | 0 | | | 64,850 | |

Dominick D’Alleva | | | 38,500 | | | | 33,850 | | | | 0 | | | | 0 | | | 72,350 | |

Len DeCecchis | | | 13,000 | | | | 48,200 | | | | 0 | | | | 0 | | | 61,200 | |

Marshall R. Miller | | | 48,500 | | | | 33,850 | | | | 0 | | | | 0 | | | 82,350 | |

Thomas Noonan | | | 28,000 | | | | 33,850 | | | | 0 | | | | 0 | | | 61,850 | |

Michael R. Quinlan | | | 34,000 | | | | 33,850 | | | | 0 | | | | 0 | | | 67,850 | |

(1) Computed based upon the closing price of the Company’s common stock on December 31, 2005 ($15.82 per share) as reported by the Nasdaq Stock Market and the stock option exercise price of $9.05 per share, or $11.00 per share in the case of Mr. DeCecchis who joined the Board in September 2005.

13

Compensation Committee Report

The following report of the Compensation Committee of the Company shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall this report be incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The Committee approves compensation to all senior executives, including but not limited to, executive officers and all elected officers of the Company. Our goal is to compensate executives in a way that reinforces decisions and actions which will drive long-term sustainable growth, which in turn leads to increased shareowner value. To achieve these goals we must attract, retain and motivate the right talent. We focus on long-term goals of the business and design rewards programs that recognize business achievements we believe are likely to promote sustainable growth. We combine this approach with an integrated performance management process that includes strategies, business planning, metrics, management routines, individual performance and rewards in order to link closely rewards to the interests of shareowners. In 2005, we enlisted the help of Mercer Human Resources Consulting, an independent consultant, to advise the Compensation Committee. We do take into consideration external market practices, although they do not drive our strategy.

Currently we use short-term compensation (salary and bonus) and long-term compensation (stock options) to achieve our goal of driving sustainable growth. Each year we carefully determine the percentage mix of compensation vehicles we think will best achieve sustainable growth. This is not a mechanical process and we use our judgment and experience in determining the mix of compensation. We also inform ourselves of market practices. This report is intended to provide our philosophy and approach, rather than give specific details on all plans.

This report describes the compensation decisions made by the Compensation Committee during 2005 with respect to Warren’s executive officers.

Compensation Philosophy of the Company

Warren’s executive compensation programs consist primarily of

· base salary,

· annual performance-based incentive cash bonus, and

· long-term stock incentive plans which the Company considers essential to attract, retain and reward key personnel.

Collectively, these programs are designed to promote the strategic objectives that are critical to the long-term success of the Company.

Short-term Compensation

Base Salary. Individual base salaries are determined based on a subjective evaluation considering peer-company market data, the executive’s performance and the length of time the executive has been in the position. Base compensation is reviewed annually by the Compensation Committee and adjustments, if any, reflect each executive officer’s contribution to the performance of the Company. The following-year guidelines are set after considering competitive market data, affordability and current salary levels, as appropriate. At the end of the year, the CEO evaluates each executive’s performance in light of individual objectives set in the beginning of the year. We rely to a large extent on the CEO’s evaluations of each executive’s performance. In 2005, all of the senior executives were under one-year Employment Agreements that were executed in 2005 that provided for a fixed base salary, discretionary incentive bonus

14

compensation and long-term incentive stock options (see “Executive Compensation-Employment Agreements” below).

Annual Incentive. The annual incentive plan awards are paid in cash and are reflected at the beginning of the year as a target percentage of base pay. Actual awards are based on financial and individual performance.

· Financial Performance—Financial performance is determined at the end of the year based on actual business results versus preset business objectives. The final financial performance is reflected as a percentage. On-target performance would yield an award of 100% of the target set at the beginning of the year. The financial performance determines the total amount of dollars available for the incentive pool.

Depending on the executive’s responsibilities, performance is set and measured at the corporate level or a combination of corporate, operating group and/or division level, as appropriate. The final financial performance is reviewed by the Audit Committee.

· Individual Performance—Individual performance is determined at the end of the year based on actual performance of the individual versus his or her preset objectives. The evaluation results in a Personal Performance Factor which is reflected as a percentage. On-target performance would yield a result of 100% of the target set at the beginning of the year. We may also take into account additional considerations that we deem fundamental.

The actual Incentive Award is determined as follows:

Base Pay ´ Annual Incentive Target % ´ Financial Performance % ´ Personal Performance Factor %

Generally, we make awards within a range for expected performance levels determined by us at the beginning of the year. When deciding what measures to use at the start of a plan year and the target level of achievement of those measures, we carefully consider the state of the Company’s business and what measures are most likely in present circumstances to lead to sustainable growth.

Long-Term Compensation

This is the major portion of the total compensation package for executives and is an important retention tool. There are two types of long-term incentive compensation that we plan to employ: stock options and performance share units. Usually an executive will receive stock options. We determine grant levels based on individual performance, potential and level of responsibility. We also consider history of past grants, time in current position and any change in responsibility.

Stock Options. The purpose of stock options is to provide equity compensation that provides value to executives when value is also created for the shareowners. Options are granted to a much larger employee population than are the performance share units that are discussed below. Stock options provide executives with equity ownership and participation in the appreciation of the value of Company stock.

Performance Share Units. Starting in 2006, we may also issue performance share units. Performance share units will provide an opportunity for an executive to receive restricted stock when certain performance criteria are met. We will grant units tied to Company performance.

The Compensation Committee believes the design of the Company’s total executive compensation program provides executives the incentive to maximize long-term operational performance using sound financial controls and high standards of integrity. The Compensation Committee also believes that total compensation for each executive should be commensurate with the achievement of specific short-term and long-term operational, financial, and strategic objectives.

15

Compensation for the Chairman and Chief Executive Officer

Mr. Norman F. Swanton is the Chairman and Chief Executive Officer of the Company. Throughout 2005, Mr. Swanton’s base salary was $500,000 as described in his employment agreement described below. For 2005, the Compensation Committee awarded Mr. Swanton a cash bonus equal to $300,000, or 60% of his base salary. The Compensation Committee believes this incentive plan payment appropriately reflects his performance during 2005. On February 8, 2005, he was also awarded 250,000 stock options exercisable at $9.05 per share for a period ending February 7, 2010, which the Committee believes further aligns Mr. Swanton’s interests with those of the stockholders.

Each year the Compensation Committee evaluates the performance of the CEO. Based on the Compensation Committee’s evaluation and assessment of Mr. Swanton’s individual performance and significant contributions to the strategic direction of the Company, the Compensation Committee increased Mr. Swanton’s base salary for 2006 to $537,500.

Summary

In designing the Company’s compensation programs, the Compensation Committee’s primary consideration is Warren’s achievement of strategic business goals that serve to enhance shareholder value. Consideration is also given to competitive compensation practices, market economics and other factors. Section 162(m) of the Internal Revenue Code, as amended (the “Code”), limits a company’s ability to deduct compensation paid in excess of $1 million during any fiscal year to the Chief Executive Officer and the next four highest paid officers, unless the compensation meets shareholder approved performance-based requirements. The Compensation Committee is committed to making awards that qualify as deductible compensation under section 162(m) of the Code whenever possible. However, where granting awards is consistent with the strategic goals of the Company, the Compensation Committee reserves the right to make awards that are non-deductible when it believes it is in the best interest of the Company.

March 31, 2006 | | |

| | THE COMPENSATION COMMITTEE |

| | /s/ Anthony Coelho, Chairman |

| | /s/ Chet Borgida |

| | /s/ Dominick D’Alleva |

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee are currently an officer or employee of Warren. No member of our compensation committee serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

16

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of March 24, 2006, there were 52,839,637 shares of Warren common stock outstanding entitled to vote at the meeting. Each of these shares is entitled to one vote. The following table sets forth information regarding the beneficial ownership of our common stock as of March 24, 2006 by:

· each of our directors;

· our chief executive officer;

· our four most highly compensated executive officers other than our chief executive officer; and

· all directors and executive officers as a group.

As of March 24, 2006, we do not know of any other person to own beneficially more than 5% of our common stock.

Unless otherwise indicated, each person named in the table has sole voting power and investment power, or shares this power with his or her spouse, with respect to all shares of our common stock listed as owned by such person. The table includes all shares beneficially owned by each stockholder, which includes any shares as to which the individual has sole or shared voting power or investment power and any shares which the individual has the right to acquire within 60 days of March 24, 2006, through the exercise of any stock option or other right.

Name of Beneficial Owner | | | | Shares of Common Stock

Beneficially Owned | | Percent of

Ownership | |

Wellington Management Company, LLP(1) | | | 3,917,200 | | | | 7.4 | % | |

NWQ Investment Management, LLC (2) | | | 3,281,091 | | | | 6.2 | | |

Neuberger Berman Inc.(3) | | | 3,154,225 | | | | 6.0 | | |

Spindrift Investors (Bermuda) L.P.(4) | | | 1,581,000 | | | | 3.0 | | |

Norman F. Swanton(5)(6) | | | 2,607,311 | | | | 5.0 | | |

Timothy A. Larkin(6) | | | 460,750 | | | | * | | |

Kenneth Gobble(6) | | | 130,000 | | | | * | | |

David E. Fleming(6) | | | 110,000 | | | | * | | |

Ellis G. Vickers(6) | | | 91,000 | | | | * | | |

Stewart P. Skelly(6) | | | 107,543 | | | | * | | |

Dominick D’Alleva(6) | | | 90,521 | | | | * | | |

Chet Borgida(6) | | | 43,000 | | | | * | | |

Anthony L. Coelho(6) | | | 90,000 | | | | * | | |

Lloyd G. Davies(6) | | | 125,000 | | | | * | | |

Leonard DeCecchis(6) | | | 50,000 | | | | * | | |

Marshall Miller(6) | | | 784,000 | | | | 1.5 | | |

Thomas G. Noonan(6)(7) | | | 198,777 | | | | * | | |

Michael R. Quinlan(6) | | | 244,423 | | | | * | | |

All directors and executive officers as a group (14 persons) | | | 5,132,325 | | | | 9.7 | % | |

* Less than 1% of the outstanding common stock.

(1) In its Schedule 13G/A filed February 14, 2006 with the SEC with respect to its securities as of December 31, 2005, Wellington Management Company, LLP, has its principal office at 75 State Street, Boston, Massachusetts 02109. Wellington states that it has sole voting power as to no shares, shared voting power as to 3,917,200 shares, sole dispositive power as to no shares and shared dispositive power as to 3,917,200 shares. The shares owned by Spindrift Investors (Bermuda) L.P. are also included within the listed Wellington Management Company, LLP holdings since Wellington

17

Management Company, LLP has shared voting and dispositive power for the Spindrift Investors (Bermuda) L.P. shares.

(2) In its Schedule 13G filed February 14, 2006 with the SEC with respect to its securities as of December 31, 2005, NWQ Investment Management, LLC , has its principal office at 75 State Street, Boston, Massachusetts 02109. NWQ Investment Management states that it has sole voting power as to 3,281,091 shares and sole dispositive power as to 3,281,091 shares.

(3) In its Schedule 13G filed February 15, 2006 with the SEC with respect to its securities as of December 31, 2005, Neuberger Berman Inc., has its principal office at 605 Third Avenue, New York, NY 10158. Neuberger Berman states that it has sole voting power as to 3,154,225 shares, and sole dispositive power as to 3,154,225 shares.

(4) In its Schedule 13G/A filed February 14, 2006 with the SEC with respect to its securities as of December 31, 2005, Spindrift Investors (Bermuda) L.P., has its principal office at Clarendon House, 2 Church Street, Hamilton, Bermuda HM11. Wellington Hedge Management, Inc., is the investment advisor to Spindrift Investors (Bermuda) L.P., and states that it has sole voting power as to no shares, shared voting power as to 1,581,000 shares, sole dispositive power as to no shares and shared dispositive power as to 1,581,000 shares. The shares owned by Spindrift Investors (Bermuda) L.P. are also included within the listed Wellington Management Company, LLP holdings.

(5) Does not include 165,144 shares of common stock owned by the Virginia Trust of Eire, as to which Mr. Noonan and his wife are the trustees. The nieces and nephews of Mr. Swanton are the sole beneficiaries of this trust. Mrs. Noonan is Mr. Swanton’s sister. Includes 53,500 shares owned by a charitable foundation for which Mr. Swanton is a trustee.

(6) Excludes stock options exercisable at $13.85 per share for five years granted on March 23, 2006, which vest 1/3rd on March 20, 2007; 1/3rd on March 20, 2008 and 1/3rd on March 20, 2009. The amount of unvested options that were granted to the referenced persons on March 23, 2006 are: 100,000 for Norman F. Swanton; 50,000 for Timothy A. Larkin; 30,000 for Lloyd G. Davies; 30,000 for Kenneth Gobble; 30,000 for Stewart Skelly; 20,000 for David E. Fleming; 15,000 for Ellis G. Vickers and 5,000 for each of Chet Borgida, Dominick D’Alleva, Leonard DeCecchis, Anthony Coelho, Marshall R. Miller, Thomas Noonan and Michael R. Quinlan.

(7) Includes 165,144 shares of common stock owned by the Virginia Trust of Eire. Mr. Noonan and his wife are the trustees of these trusts. The nieces and nephews of Mr. Swanton are the sole beneficiaries of these trusts. Mr. Noonan disclaims beneficial ownership of the shares of common stock held by the Virginia Trust of Eire.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who beneficially own more than 10% of the Common Stock, to file with the SEC initial reports of beneficial ownership (“Form 3”) and reports of changes in beneficial ownership of Common Stock and other equity securities of the Company (“Form 4”). Executive officers, directors and greater than 10% Stockholders of the Company are required by SEC rules to furnish to the Company copies of all Section 16(a) reports that they file. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that all reporting obligations of the Company’s officers, directors and greater than ten percent stockholders under Section 16(a) were satisfied during the year ended December 31, 2005, except it appears that in January 2006 a Form 4 was inadvertently filed late relating to 14,300 shares of common stock received by Mr. Quinlan in 2005 upon his withdrawal from a oil drilling fund.

18

EXECUTIVE COMPENSATION

The following table sets forth the total compensation earned by our Chief Executive Officer and each of the four most highly compensated other executive officers who received annual compensation in excess of $100,000 for the year ended December 31, 2005. We refer to these officers as our named executive officers. The compensation set forth in the table below for the fiscal years ended December 31, 2005, 2004 and 2003 does not include medical, group life or other benefits which are available to all of our salaried employees, and perquisites and other benefits, securities or property which do not exceed the lesser of $50,000 or 10% of the person’s salary and bonus shown in the table.

Summary Compensation Table

| | | | Annual Compensation | | Long-Term

Compensation Awards | |

Name and Principal Position | | | | Year | | Salary | | Bonus(1) | | Other

Annual

Compensation(2) | | Securities

Underlying

Options | | All Other

Compensation | |

Norman F. Swanton | | 2005 | | $ 500,000 | | $ 300,000 | | | $ 16,274 | | | | 250,000 | | | | –0– | | |

Chief Executive Officer and | | 2004 | | 462,000 | | 371,500 | | | 16,274 | | | | 200,000 | | | | –0– | | |

Chairman of the Board | | 2003 | | 385,000 | | 250,000 | | | 16,274 | | | | 300,000 | | | | –0– | | |

Timothy A. Larkin | | 2005 | | $ 275,000 | | $ 110,000 | | | $ 3,435 | | | | 125,000 | | | | –0– | | |

Executive Vice President | | 2004 | | 246,480 | | 147,888 | | | 431 | | | | 100,000 | | | | –0– | | |

and Chief Financial Officer | | 2003 | | 205,400 | | 125,000 | | | 431 | | | | 310,750 | | | | –0– | | |

Kenneth Gobble | | 2005 | | $ 204,930 | | $ 71,726 | | | $ 2,343 | | | | 50,000 | | | | –0– | | |

Senior Vice President | | 2004 | | 178,200 | | 85,536 | | | 2,343 | | | | 40,000 | | | | –0– | | |

and President of Warren E&P | | 2003 | | 148,500 | | 74,250 | | | -0- | | | | 110,000 | | | | –0– | | |

Ellis G. Vickers | | 2005 | | $ 226,808 | | $ 41,959 | | | $ -0- | | | | 30,000 | | | | –0– | | |

Senior Vice President—Land | | 2004 | | 218,905 | | 50,000 | | | -0- | | | | 20,000 | | | | –0– | | |

Management &Regulatory Affairs | | 2003 | | 215,670 | | 107,835 | | | -0- | | | | 66,000 | | | | –0– | | |

and Associate General Counsel | | | | | | | | | | | | | | | | | | | |

David E. Fleming | | 2005 | | $ 265,000 | | $ 53,000 | | | $ 3,014 | | | | 50,000 | | | | –0– | | |

Senior Vice President, | | 2004 | | 223,438 | | 50,000 | | | -0- | | | | 24,000 | | | | –0– | | |

General Counsel and Secretary | | 2003 | | 216,510 | | 108,255 | | | -0- | | | | 66,000 | | | | –0– | | |

| | | | | | | | | | | | | | | | | | | | | |

(1) Bonus amounts reported for 2005, 2004 and 2003 include bonuses earned in the reported year and actually paid in the subsequent year.

(2) Amounts reflect insurance premiums paid by the company during the covered fiscal year with respect to life insurance for the benefit of the named executive officer or his designee.

19

Option Grants in Last Fiscal Year

The following stock options to purchase shares of our common stock were granted to the named executive officers during the fiscal year ended December 31, 2005.

| | Individual Grants | | Potential Realizable Value at

Assumed Annual Rate of

Stock Price Appreciation

for Option Term(2) | |

| | Number of

Securities

Underlying

Options

Granted | | Percent of

Total

Options

Granted to

Employees in

Fiscal Year | | Exercise

Price(1) | | Expiration

Date | | 5% | | 10% | |

Norman F. Swanton | | | 250,000 | | | | 35 | % | | | $ 9.05 | | | | 2/8/10 | | | $ 625,087 | | $ 1,381,279 | |

Timothy A. Larkin | | | 125,000 | | | | 17 | | | | $ 9.05 | | | | 2/8/10 | | | 312,544 | | 690,639 | |

Kenneth Gobble | | | 50,000 | | | | 7 | | | | $ 9.05 | | | | 2/8/10 | | | 125,017 | | 276,256 | |

Ellis G. Vickers | | | 30,000 | | | | 4 | | | | $ 9.05 | | | | 2/8/10 | | | 75,050 | | 165,763 | |

David E. Fleming | | | 50,000 | | | | 7 | | | | $ 9.05 | | | | 2/8/10 | | | 125,017 | | 276,256 | |

(1) The exercise price per share of each option was determined to be equal to the fair market value per share of the underlying stock on the date of grant, based upon the closing price of the Company’s common stock as reported by the Nasdaq Stock Market.

(2) The potential realizable value shown is calculated based on the term of the option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to the rules and regulations of the SEC and does not represent our prediction of our stock price performance. The potential realizable values at 5% and 10% appreciation are calculated by assuming that the exercise price on the date of grant appreciates at the indicated rate for the entire 5-year term of the option and that the option is exercised at the exercise price and sold on the last day of its term at the appreciated price.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FY-END OPTION/SAR VALUES

Name | | | | Shares

Acquired on

Exercise(#) | | Value

Realized($) | | Number of Securities

Underlying Unexercised

Options at Fiscal

Year-End(#)

Exercisable/Unexercisable | | Value of

Unexercised

In-the-Money

Options

at Fiscal

Year-End ($)

Exercisable/Unexercisable(*) | |

Norman F. Swanton | | | 0 | | | $ 0 | | | 750,000/750,000 | | | | $ 7,002,500 | | |

Timothy A. Larkin | | | 125,000 | | | 1,502,375 | | | 410,750/410,750 | | | | 3,923,815 | | |

Kenneth Gobble | | | 70,000 | | | 687,169 | | | 130,000/130,000 | | | | 1,164,100 | | |

Ellis G. Vickers | | | 20,000 | | | 149,144 | | | 96,000/96,000 | | | | 932,220 | | |

David E. Fleming | | | 30,000 | | | 254,699 | | | 110,000/110,000 | | | | 975,700 | | |

* Computed based upon the closing price of the Company’s common stock on December 31, 2005 ($15.82 per share) as reported by the Nasdaq Stock Market and the aggregate exercise price.

Employment Agreements

We have entered into employment agreements with Messrs. Swanton, Larkin, Davies, Fleming and Vickers. In addition to the specific provisions of each employment agreement as described below, each of these employment agreements provides that if the executive’s employment is terminated without cause, due to death or disability or for “good reason”, including a change of control, all unvested stock options

20

granted to the executive shall be kept in effect and not terminated.

Norman F. Swanton. We entered into an employment agreement effective January 1, 2001, as amended effective January 1, 2005 with Norman F. Swanton, our president, chief executive officer and chairman, that provides for a base salary of $500,000 per year, subject to annual cost of living adjustments, participation in our standard insurance plans for our executives and participation in our other incentive compensation programs at the discretion of the Board of Directors. Under his agreement, if Mr. Swanton’s employment is terminated without cause and he executes a full and general release in favor of, and satisfactory to, us, Mr. Swanton will be entitled to termination compensation equal to the greater of two years’ annual base salary, or all of the base salary for the remainder of the employment term. Mr. Swanton’s employment agreement automatically renews on each anniversary of the effective date after the initial three-year employment term, for an additional year unless we notify Mr. Swanton or he notifies us in writing 90 days prior to such anniversary that we, or he, will not be renewing his employment agreement. No such notice of non-renewal has been presented by either party. Accordingly, Mr. Swanton’s employment agreement has been renewed through December 31, 2006. As a result of the annual cost of living adjustment over the prior year, his base salary for 2006 is $537,500.

Timothy A. Larkin. We entered into an employment agreement effective January 1, 2001, as amended effective January 1, 2005, with Timothy A. Larkin, our executive vice president and chief financial officer, that provides for a base salary of $275,000 per year, subject to annual cost of living adjustments, participation in our standard insurance plans for our executives and participation in our other incentive compensation programs at the discretion of the Board of Directors. Under his agreement, if Mr. Larkin’s employment is terminated without cause and he executes a full and general release in favor of, and satisfactory to, us, Mr. Larkin will be entitled to termination compensation equal to the greater of two years’ annual base salary, or all of the base salary for the remainder of the employment term. Mr. Larkin’s employment agreement automatically renews on each anniversary of the effective date after the initial three-year employment term, for an additional year unless we notify Mr. Larkin or he notifies us in writing 90 days prior to such anniversary that we, or he, will not be renewing his employment agreement. No such notice of non-renewal has been presented by either party. Accordingly, Mr. Larkin’s employment agreement has been renewed through December 31, 2006. As a result of the annual cost of living adjustment over the prior year, his base salary for 2006 is $295,625.

Lloyd G. Davies. We entered into an employment agreement effective March 1, 2005 with Lloyd G. Davies, our executive vice president and the chairman and chief executive officer of Warren E&P, Inc. that provides for a base salary of $250,000 per year, participation in our standard insurance plans for our executives and participation in our other incentive compensation programs at the discretion of the Board of Directors. Under his agreement, if Mr. Davies’ employment is terminated without cause and he executes a full and general release in favor of, and satisfactory to, us, Mr. Davies will be entitled to termination compensation equal to the greater of three month’s base salary or all of the base salary for the remainder of the employment term. Mr. Davies’ employment agreement expires on December 31, 2005, but will automatically renew on each anniversary of the effective date for an additional year unless we notify Mr. Davies or he notifies us in writing 90 days prior to such anniversary that we, or he, will not be renewing his employment agreement. No such notice of non-renewal has been presented by either party. Accordingly, such employment agreement has been renewed through December 31, 2006. As a result of the annual cost of living adjustment over the prior year, his base salary for 2006 is $262,500.

David E. Fleming. We entered into an employment agreement effective February 1, 2005 with David E. Fleming, our senior vice president, general counsel and corporate secretary, that provides for a base salary of $265,000 per year, participation in our standard insurance plans for our executives and participation in our other incentive compensation programs at the discretion of the Board of Directors. Under his agreement, if Mr. Fleming’s employment is terminated without cause and he executes a full and general release in favor of, and satisfactory to, us, Mr. Fleming will be entitled to termination

21

compensation equal to the greater of three month’s base salary or all of the base salary for the remainder of the employment term. Mr. Fleming’s employment agreement expired on December 31, 2005, but will automatically renew on each anniversary of the effective date for an additional year unless we notify Mr. Fleming or he notifies us in writing 90 days prior to such anniversary that we, or he, will not be renewing his employment agreement. No such notice of non-renewal has been presented by either party. Accordingly, such employment agreement has been renewed through December 31, 2006. As a result of the annual cost of living adjustment over the prior year, his base salary for 2006 is $274,540.

Ellis G. Vickers. We entered into an employment agreement effective January 1, 2005 with Ellis G. Vickers, our senior vice president and associate general counsel and senior vice president and general counsel of Warren E&P, Inc., that provides for a salary of $226,808 per year, participation in our standard insurance plans for our executives and participation in our other incentive compensation programs at the discretion of the Board of Directors. Under his agreement, if Mr. Vickers’ employment is terminated without cause and he executes a full and general release in favor of, and satisfactory to, us, Mr. Vickers is entitled to termination compensation equal to the greater of 90 days’ base salary or all of his base salary for the employment term. Mr. Vickers’ employment agreement expires on December 31, 2005, but will automatically renew on each anniversary of the effective date for an additional one year unless we notify Mr. Vickers or he notifies us in writing 90 days prior to such anniversary that we, or he, will not be renewing his employment agreement. No such notice of non-renewal has been presented by either party. Accordingly, such employment agreement has been renewed through December 31, 2006. As a result of the annual cost of living adjustment over the prior year, his base salary for 2006 is $233,612.

Director and Officer Indemnification Agreements

The Company has entered into indemnification agreements with its directors and certain executive officers, in part to enable the Company to attract and retain qualified directors and executive officers. These agreements require the Company, among other things, to indemnify such persons against certain liabilities that may arise by reason of their status or service as directors or officers, to advance their expenses for proceedings for which they may be indemnified and to cover such person under any directors’ and officers’ liability insurance policy the Company may maintain from time to time. These agreements are intended to provide indemnification rights to the fullest extent permitted under applicable Maryland law and are in addition to any other rights the Company’s directors and executive officers may have under the Company’s restated certificate of incorporation, bylaws and applicable law.

Employee Benefit Plans

2000 Equity Incentive Plan for Employees of Warren E&P, Inc.

Introduction. Our 2000 Equity Incentive Plan for Employees of Warren E&P, Inc. was adopted by the board in September 2000 and was amended by the board in September 2001, and approved by our Stockholders on September 5, 2002. Any awards granted before shareholder approval of the plan are subject to, and may not be exercised or realized before, approval of the plan by the Stockholders. The plan is administered by our compensation committee.

Share Reserve. 1,975,000 shares of common stock have been authorized for issuance under the plan. In addition, no participant in the plan may be granted stock options and direct stock issuances for more than 750,000 shares of common stock in total per calendar year.

Awards. The plan provides for the following types of awards:

· eligible individuals in the employ of, or rendering services to, Warren E&P and its subsidiaries may be granted options to purchase shares of common stock at an exercise price determined by the compensation committee;

22

· eligible individuals may be issued shares of common stock that may be subject to certain restrictions and conditions directly through the purchase of shares at a price determined by the compensation committee.

Plan Features. The plan includes the following features:

· eligible participants under the plan are employees, consultants and directors of Warren E&P and its subsidiaries;

· the plan sets forth various restrictions upon the exercise of awards. The compensation committee has the discretion to alter any restrictions or conditions upon any awards;

· the exercise price for any options granted under the plan may be paid in cash, by certified or cashier’s check or, if acceptable to the compensation committee, in property valued at fair market value, by delivery of a promissory note, or in currently owned shares of common stock valued at fair market value on the last business day prior to the date of exercise. An option may, in the discretion of the compensation committee, be exercised through a sale or loan program with a broker acceptable to the compensation committee without any cash outlay by the optionee;

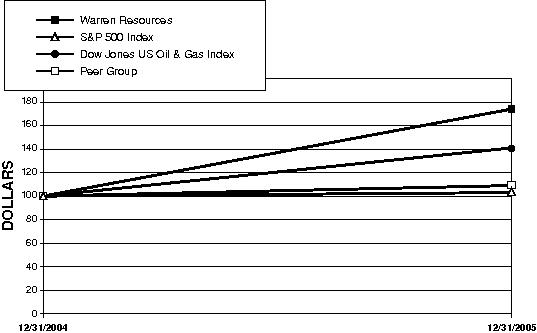

· grants of restricted stock awards can be made to participants. Restricted stock awards may be subject to certain restrictions, vesting requirements or other conditions, including the attainment of performance goals; and