UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-07288

Franklin Strategic Mortgage Portfolio

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 9/30

Date of reporting period: 3/31/17

Item 1. Reports to Stockholders.

| Contents | |

| Semiannual Report | |

| Franklin Strategic Mortgage Portfolio | 3 |

| Performance Summary | 6 |

| Your Fund's Expenses | 8 |

| Financial Highlights and Statement of Investments | 9 |

| Financial Statements | 19 |

| Notes to Financial Statements | 23 |

| Shareholder Information | 32 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

2 Semiannual Report

franklintempleton.com

Semiannual Report

Franklin Strategic Mortgage Portfolio

This semiannual report for Franklin Strategic Mortgage Portfolio covers the period ended March 31, 2017.

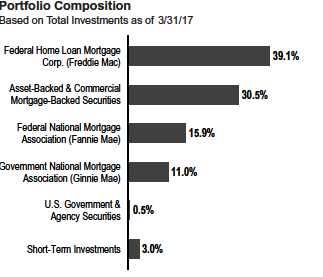

Your Fund’s Goal and Main Investments

The Fund seeks high total return (a combination of high current income and capital appreciation) relative to the performance of the general mortgage securities market by investing at least 80% of its net assets in a portfolio of mortgage securities. The Fund invests substantially in mortgage securities that are issued or guaranteed by the U.S. government, its agencies or instrumentalities, which include mortgage pass-through securities representing interests in “pools” of mortgage loans issued or guaranteed by the Government National Mortgage Association (Ginnie Mae), Fannie Mae and Freddie Mac.1

Performance Overview

For the six months ended March 31, 2017, the Fund’s Class A shares had a -1.33% total return. In comparison, the Fund’s primary benchmark, the Bloomberg Barclays U.S. Mortgage-Backed Securities (MBS) Fixed Rate Index, which measures the performance of investment-grade fixed-rate mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae and Freddie Mac, had a -1.52% total return.2 The Lipper U.S. Mortgage Funds Classification Average, which consists of funds chosen by Lipper that invest primarily in mortgages and securities issued or guaranteed by the U.S. government and certain federal agencies, had a -1.11% total return.3 The Bloomberg Barclays U.S. Treasury Index, the U.S. Treasury component of the Barclays U.S. Government Index, had a -3.19% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

The U.S. economy continued to grow in 2017’s first quarter, though at a slower pace compared to 2016’s fourth quarter. Strength in business investment, exports, housing and consumer spending was partially offset by declines in private inventory investment and government spending. The manufacturing sector generally expanded, and the services sector continued to grow. The unemployment rate decreased from 4.9% in September 2016 to 4.5% at period-end.4 Monthly retail sales were volatile, but grew during most of the review

1. Guarantees of timely payment of principal and interest do not apply to the market prices and yield of the security or to the net asset value or performance of the Fund. Ginnie

Mae pass-through securities are backed by the full faith and credit of the U.S. government. Although U.S. government-sponsored entities, such as Fannie Mae and Freddie

Mac, may be chartered or sponsored by acts of Congress, their securities are neither insured nor guaranteed by the U.S. Treasury. Please refer to the Fund’s prospectus for a

detailed discussion regarding various levels of credit support for government agency or instrumentality securities.

2. Source: Morningstar.

3. Source: Lipper, a Thomson Reuters Company. For the six months ended 3/31/17, this category consisted of 121 funds. Lipper calculations do not include sales charges or

subsidization by a fund’s manager. The Fund’s performance relative to the average might have differed if these or other factors had been considered.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

4. Source: Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 13.

franklintempleton.com

Semiannual Report 3

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

period. Inflation generally increased during the period, as measured by the Consumer Price Index.

At its December meeting, the U.S. Federal Reserve (Fed) raised its target range for the federal funds rate to 0.50%–0.75%, as policymakers cited improved labor market conditions and higher inflation. The Fed kept its interest rate unchanged at its February meeting, but incoming economic data, along with statements by Fed officials in late February and early March, heightened many investors’ expectations for a March interest-rate hike. The Fed, at its March meeting, made the widely anticipated increase in its federal funds target rate to 0.75%–1.00%.

The 10-year Treasury yield, which moves inversely to its price, shifted during the period. It rose from 1.60% on September 30, 2016, to a period high of 2.62% on March 13, 2017. The yield rose in October, due to positive economic data and signals from the Fed about the possibility of an increase in interest rates in the near term. The U.S. Treasury yield further increased in November and December, amid a bond market selloff, based on investor expectations that possible expansionary fiscal policies under new U.S. President Donald Trump could lead to a stronger economy and higher inflation.

Investment Strategy

Under normal market conditions, we invest at least 80% of the Fund’s net assets in mortgage securities. The Fund invests substantially in mortgage securities that are issued or guaranteed by the U.S. government, its agencies or instrumentalities, which include mortgage pass-through securities representing interests in “pools” of mortgage loans issued or guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac.1 These securities may be fixed-rate or adjustable-rate mortgage securities (ARMS). The Fund may purchase or sell mortgage securities on a delayed-delivery or forward commitment basis through the “to-be-announced” (TBA) market. We may also invest in other types of mortgage securities that may be issued by private issuers, including, but not limited to, certain ARMS, commercial mortgage-backed securities (CMBS), credit risk transfer securities, home equity loan asset-backed securities (HELs), manufactured housing asset-backed securities (MHs) and collateralized mortgage obligations (CMOs), as well as in other mortgage-related asset-backed securities. The Fund also may invest in U.S. Treasury securities. The Fund may invest a small portion of its assets directly in whole mortgage loans. At least 80% of net assets, at the time of purchase, are invested in securities rated BBB or higher by Standard & Poor’s (S&P) or Baa or higher by Moody’s Investors Service (Moody’s). Within these parameters, we rely on our research to help us identify attractive investment opportunities.

| Distributions* | ||||

| 10/1/16–3/31/17 | ||||

| Distributions per Share (cents) | ||||

| Advisor | ||||

| Month | Class A | Class A1 | Class C | Class |

| October | 1.8421 | 2.0479 | 1.5132 | 2.0542 |

| November | 1.9203 | 2.1162 | 1.6125 | 2.1133 |

| December | 1.8388 | 2.0313 | 1.5327 | 2.0285 |

| January | 2.4191 | 2.6189 | 2.1022 | 2.6155 |

| February | 1.8743 | 2.0548 | 1.5878 | 2.0519 |

| March | 2.3373 | 2.5360 | 2.0216 | 2.5345 |

| Total | 12.2319 | 13.4051 | 10.3700 | 13.3979 |

*The distribution amount is the sum of the dividend payments to shareholders for

the period shown and includes only estimated tax-basis net investment income.

Assumes shares were purchased and held for the entire accrual period. Since

dividends accrue daily, your actual distributions will vary depending on the date you

purchased your shares and any account activity. All Fund distributions will vary

depending upon current market conditions, and past distributions are not indicative

of future trends.

Manager’s Discussion

The overall mortgage market weakened during the period. Although the sector performed better than Treasuries on a total return basis, it underperformed on an excess return basis. Within the sector, fixed-rate MBS overall had a negative total return, while hybrid ARMS posted a positive total return.

In our analysis, the Fed’s continued reinvestment of principal proceeds back into agency MBS, combined with relatively moderate supply, provided some technical support for the sector during the six-month period under review. Without the Fed’s support, we believe MBS are more vulnerable to supply shocks until alternative demand sources emerge. Banks, mortgage real estate investment trusts, overseas investors and domestic money managers are possible sources, but in our view they would need to increase their allocation to the MBS sector to compensate for the Fed’s reduced presence in the sector. As we move closer to the Fed ceasing reinvestment, coupled with tight spreads, we believe MBS could experience higher volatility. From a historical standpoint, mortgage rates remain at the lower end of their range. Although mortgage rates have remained low, our overall prepayment expectations remain anchored, and we feel prepayments could potentially moderate with mortgage rates staying rangebound and underwriting standards remaining relatively tight.

With respect to the Fund, its exposure to residential MBS (RMBS) and CMBS contributed to performance relative to the benchmark. Positioning in fixed-rate MBS and ARMS also

4 Semiannual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

contributed to performance. Additionally, our modestly shorter duration positioning enhanced performance relative to the benchmark as rising interest rates benefited the portfolio.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration.

Within the agency MBS sector, we decreased our allocation to 3.0% coupon securities. We increased our exposure largely in 3.5% and 4.0% coupon securities, which became the portfolio’s heaviest mortgage allocations at period-end. We significantly reduced our exposure to agency ARMs and in Treasuries. At period-end, the portfolio’s heaviest mortgage allocations were in fixed-rate MBS, RMBS and CMBS.

Thank you for your continued participation in Franklin Strategic Mortgage Portfolio. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2017, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com

Semiannual Report 5

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Performance Summary as of March 31, 2017

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 3/31/171

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 4.25% and the minimum is 0%. Class A: 4.25% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Cumulative | Average Annual | |||||

| Share Class | Total Return2 | Total Return3 | ||||

| A4 | ||||||

| 6-Month | -1.33 | % | -5.48 | % | ||

| 1-Year | +0.57 | % | -3.69 | % | ||

| 5-Year | +14.31 | % | +1.83 | % | ||

| 10-Year | +45.20 | % | +3.35 | % | ||

| Advisor5 | ||||||

| 6-Month | -1.21 | % | -1.21 | % | ||

| 1-Year | +0.93 | % | +0.93 | % | ||

| 5-Year | +15.74 | % | +2.97 | % | ||

| 10-Year | +49.16 | % | +4.08 | % | ||

| 30-Day Standardized Yield7 | ||||||

| Distribution | ||||||

| Share Class | Rate6 | (with waiver) | (without waiver) | |||

| A | 2.79 | % | 2.36 | % | 2.35 | % |

| Advisor | 3.16 | % | 2.71 | % | 2.70 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will

fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most

recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 7 for Performance Summary footnotes.

6 Semiannual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

PERFORMANCE SUMMARY

| Distributions (10/1/16–3/31/17) | |||||

| Net Investment | |||||

| Share Class | Income | ||||

| A | $ | 0.122319 | |||

| A1 | $ | 0.134051 | |||

| C | $ | 0.103700 | |||

| Advisor | $ | 0.133979 | |||

| Total Annual Operating Expenses8 | |||||

| Share Class | With Waiver | Without Waiver | |||

| A | 1.00 | % | 1.01 | % | |

| Advisor | 0.75 | % | 0.76 | % | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The Fund’s share price and yield will be affected by interest rate movements and mortgage

prepayments, especially in relation to mortgage-backed securities. During periods of declining interest rates, principal prepayments tend to increase as

borrowers refinance their mortgages at lower rates; therefore the Fund may be forced to reinvest returned principal at lower interest rates, reducing income.

Moreover, because of pre-payments, mortgage backed securities may be less effective than some other types of debt securities as a means of “locking in” long-

term interest rates and may have less potential for capital appreciation during periods of falling interest rates. Bond prices generally move in the opposite

direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Changes in the financial

strength of a bond issuer or in a bond’s credit rating may affect its value. The Fund is actively managed but there is no guarantee that the manager’s investment

decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has a fee waiver associated with any investment it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed

through 1/31/18. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, ifany,hasnotbeen

annualized.

4. Performance quotations for Class A shares reflect the following methods of calculation: (a) For periods prior to 2/1/12, a restated figure is used based on Class A1

performance and including the Class A Rule 12b-1 fee, and (b) for periods after 2/1/12, actual Class A performance is used, reflecting all charges and fees applicable to that

class. Since 2/1/12 (commencement of sales), the cumulative and average annual total returns of Class A shares were +15.22% and +1.92%.

5. Effective 2/1/12, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 fee. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 2/1/12, a restated figure is used based on the Fund’s oldest share class, Class A1, excluding the effect of its maximum

initial sales charge; and (b) for periods after 2/1/12, actual Advisor Class performance is used, reflecting all charges and fees applicable to that class. Since 2/1/12

(commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +16.71% and +3.04%.

6. Distribution rate is based on an annualization of the sum of distributions per share for the 30 days of March and the maximum offering price (NAV for Advisor Class) on

3/31/17.

7. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not equal

the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this

report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

franklintempleton.com

Semiannual Report 7

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | |||||||||||

| (actual return after expenses) | (5% annual return before expenses) | |||||||||||

| Expenses | Expenses | Net | ||||||||||

| Beginning | Ending | Paid During | Ending | Paid During | Annualized | |||||||

| Share | Account | Account | Period | Account | Period | Expense | ||||||

| Class | Value 10/1/16 | Value 3/31/17 | 10/1/16–3/31/171,2 | Value 3/31/17 | 10/1/16–3/31/171,2 | Ratio2 | ||||||

| A | $ | 1,000 | $ | 986.70 | $ | 5.10 | $ | 1,019.80 | $ | 5.19 | 1.03 | % |

| A1 | $ | 1,000 | $ | 987.90 | $ | 3.87 | $ | 1,021.04 | $ | 3.93 | 0.78 | % |

| C | $ | 1,000 | $ | 984.70 | $ | 7.08 | $ | 1,017.80 | $ | 7.19 | 1.43 | % |

| Advisor | $ | 1,000 | $ | 987.90 | $ | 3.87 | $ | 1,021.04 | $ | 3.93 | 0.78 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value

over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

8 Semiannual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Financial Highlights | ||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||

| March 31, 2017 | Year Ended September 30, | |||||||||||||||||||

| (unaudited) | 2016 | 2015 | 2014 | 2013 | 2012 | a | ||||||||||||||

| Class A | ||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||||||||||

| Net asset value, beginning of period | $ | 9.57 | $ | 9.49 | $ | 9.43 | $ | 9.37 | $ | 9.69 | $ | 9.47 | ||||||||

| Income from investment operationsb: | ||||||||||||||||||||

| Net investment income. | 0.076 | 0.144 | 0.185 | 0.249 | 0.229 | 0.172 | ||||||||||||||

| Net realized and unrealized gains (losses) | (0.204 | ) | 0.135 | 0.088 | 0.218 | (0.202 | ) | 0.255 | ||||||||||||

| Total from investment operations | (0.128 | ) | 0.279 | 0.273 | 0.467 | 0.027 | 0.427 | |||||||||||||

| Less distributions from net investment income . | (0.122 | ) | (0.199 | ) | (0.213 | ) | (0.407 | ) | (0.347 | ) | (0.207 | ) | ||||||||

| Net asset value, end of period | $ | 9.32 | $ | 9.57 | $ | 9.49 | $ | 9.43 | $ | 9.37 | $ | 9.69 | ||||||||

| Total returnc | (1.33 | )% | 2.98 | % | 2.91 | % | 5.09 | % | 0.28 | % | 4.57 | % | ||||||||

| Ratios to average net assetsd | ||||||||||||||||||||

| Expenses before waiver and payments by | �� | |||||||||||||||||||

| affiliates | 1.04 | % | 1.00 | % | 1.01 | % | 1.06 | % | 0.96 | % | 1.01 | % | ||||||||

| Expenses net of waiver and payments by | ||||||||||||||||||||

| affiliates | 1.03 | %e | 0.99 | %e | 1.01 | %f | 1.06 | %f | 0.96 | % | 1.01 | % | ||||||||

| Net investment income | 1.83 | % | 1.47 | % | 1.84 | % | 2.37 | % | 2.04 | % | 2.07 | % | ||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of period (000’s) | $ | 24,418 | $ | 34,191 | $ | 26,328 | $ | 9,920 | $ | 8,627 | $ | 4,856 | ||||||||

| Portfolio turnover rate | 147.91 | % | 551.77 | % | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | ||||||||

| Portfolio turnover rate excluding mortgage | ||||||||||||||||||||

| dollar rollsg | 59.85 | % | 185.40 | % | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | ||||||||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

gSee Note 1(e) regarding mortgage dollar rolls.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report 9

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | |||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | |||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||

| March 31, 2017 | Year Ended September 30, | ||||||||||||||||||||

| (unaudited) | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Class A1 | |||||||||||||||||||||

| Per share operating performance | |||||||||||||||||||||

| (for a share outstanding throughout the period) | |||||||||||||||||||||

| Net asset value, beginning of period | $ | 9.58 | $ | 9.49 | $ | 9.44 | $ | 9.38 | $ | 9.69 | $ | 9.39 | |||||||||

| Income from investment operationsa: | |||||||||||||||||||||

| Net investment income. | 0.092 | 0.160 | 0.197 | 0.232 | 0.190 | 0.212 | |||||||||||||||

| Net realized and unrealized gains (losses) | (0.208 | ) | 0.153 | 0.090 | 0.259 | (0.129 | ) | 0.436 | |||||||||||||

| Total from investment operations | (0.116 | ) | 0.313 | 0.287 | 0.491 | 0.061 | 0.648 | ||||||||||||||

| Less distributions from net investment income . | (0.134 | ) | (0.223 | ) | (0.237 | ) | (0.431 | ) | (0.371 | ) | (0.348 | ) | |||||||||

| Net asset value, end of period | $ | 9.33 | $ | 9.58 | $ | 9.49 | $ | 9.44 | $ | 9.38 | $ | 9.69 | |||||||||

| Total returnb | (1.21 | )% | 3.34 | % | 3.06 | % | 5.35 | % | 0.64 | % | 7.04 | % | |||||||||

| Ratios to average net assetsc | |||||||||||||||||||||

| Expenses before waiver and payments by | |||||||||||||||||||||

| affiliates | 0.79 | % | 0.75 | % | 0.76 | % | 0.81 | % | 0.71 | % | 0.76 | % | |||||||||

| Expenses net of waiver and payments by | |||||||||||||||||||||

| affiliates | 0.78 | %d | 0.74 | %d | 0.76 | %e | 0.81 | %e | 0.71 | % | 0.76 | % | |||||||||

| Net investment income | 2.08 | % | 1.72 | % | 2.09 | % | 2.62 | % | 2.29 | % | 2.32 | % | |||||||||

| Supplemental data | |||||||||||||||||||||

| Net assets, end of period (000’s) | $ | 44,349 | $ | 53,432 | $ | 59,352 | $ | 64,325 | $ | 75,609 | $ | 109,162 | |||||||||

| Portfolio turnover rate | 147.91 | % | 551.77 | % | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | |||||||||

| Portfolio turnover rate excluding mortgage | |||||||||||||||||||||

| dollar rollsf | 59.85 | % | 185.40 | % | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | |||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

cRatios are annualized for periods less than one year.

dBenefit of expense reduction rounds to less than 0.01%.

eBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

fSee Note 1(e) regarding mortgage dollar rolls.

10 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||||||

| Six Months Ended | ||||||||||||||||||||||

| March 31, 2017 | Year Ended September 30, | |||||||||||||||||||||

| (unaudited) | 2016 | 2015 | 2014 | 2013 | 2012 | a | ||||||||||||||||

| Class C | ||||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||||||||||||

| Net asset value, beginning of period | $ | 9.57 | $ | 9.49 | $ | 9.43 | $ | 9.37 | $ | 9.69 | $ | 9.47 | ||||||||||

| Income from investment operationsb: | ||||||||||||||||||||||

| Net investment income. | 0.061 | 0.112 | 0.142 | 0.207 | 0.167 | 0.155 | ||||||||||||||||

| Net realized and unrealized gains (losses) | (0.207 | ) | 0.130 | 0.093 | 0.223 | (0.178 | ) | 0.247 | ||||||||||||||

| Total from investment operations | (0.146 | ) | 0.242 | 0.235 | 0.430 | (0.011 | ) | 0.402 | ||||||||||||||

| Less distributions from net investment income . | (0.104 | ) | (0.162 | ) | (0.175 | ) | (0.370 | ) | (0.309 | ) | (0.182 | ) | ||||||||||

| Net asset value, end of period | $ | 9.32 | $ | 9.57 | $ | 9.49 | $ | 9.43 | $ | 9.37 | $ | 9.69 | ||||||||||

| Total returnc | (1.53 | )% | 2.57 | % | 2.51 | % | 4.68 | % | (0.11 | )% | 4.29 | % | ||||||||||

| Ratios to average net assetsd | ||||||||||||||||||||||

| Expenses before waiver and payments by | ||||||||||||||||||||||

| affiliates | 1.44 | % | 1.40 | % | 1.41 | % | 1.46 | % | 1.36 | % | 1.41 | % | ||||||||||

| Expenses net of waiver and payments by | ||||||||||||||||||||||

| affiliates | 1.43 | %e | 1.39 | %e | 1.41 | %f | 1.46 | %f | 1.36 | % | 1.41 | % | ||||||||||

| Net investment income | 1.43 | % | 1.07 | % | 1.44 | % | 1.97 | % | 1.64 | % | 1.67 | % | ||||||||||

| Supplemental data | ||||||||||||||||||||||

| Net assets, end of period (000’s) | $ | 7,323 | $ | 9,468 | $ | 4,067 | $ | 2,409 | $ | 2,137 | $ | 1,540 | ||||||||||

| Portfolio turnover rate | 147.91 | % | 551.77 | % | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | ||||||||||

| Portfolio turnover rate excluding mortgage | ||||||||||||||||||||||

| dollar rollsg | 59.85 | % | 185.40 | % | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | ||||||||||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

gSee Note 1(e) regarding mortgage dollar rolls.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report 11

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | |||||||||||||||||||||

| FINANCIAL HIGHLIGHTS | |||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||

| March 31, 2017 | Year Ended September 30, | ||||||||||||||||||||

| (unaudited) | 2016 | 2015 | 2014 | 2013 | 2012 | a | |||||||||||||||

| Advisor Class | |||||||||||||||||||||

| Per share operating performance | |||||||||||||||||||||

| (for a share outstanding throughout the period) | |||||||||||||||||||||

| Net asset value, beginning of period | $ | 9.57 | $ | 9.48 | $ | 9.43 | $ | 9.37 | $ | 9.69 | $ | 9.47 | |||||||||

| Income from investment operationsb: | |||||||||||||||||||||

| Net investment income. | 0.103 | 0.146 | 0.199 | 0.371 | 0.252 | 0.149 | |||||||||||||||

| Net realized and unrealized gains (losses) | (0.219 | ) | 0.166 | 0.087 | 0.119 | (0.201 | ) | 0.294 | |||||||||||||

| Total from investment operations | (0.116 | ) | 0.312 | 0.286 | 0.490 | 0.051 | 0.443 | ||||||||||||||

| Less distributions from net investment income . | (0.134 | ) | (0.222 | ) | (0.236 | ) | (0.430 | ) | (0.371 | ) | (0.223 | ) | |||||||||

| Net asset value, end of period | $ | 9.32 | $ | 9.57 | $ | 9.48 | $ | 9.43 | $ | 9.37 | $ | 9.69 | |||||||||

| Total returnc | (1.21 | )% | 3.34 | % | 3.06 | % | 5.35 | % | 0.54 | % | 4.74 | % | |||||||||

| Ratios to average net assetsd | |||||||||||||||||||||

| Expenses before waiver and payments by | |||||||||||||||||||||

| affiliates | 0.79 | % | 0.75 | % | 0.76 | % | 0.81 | % | 0.71 | % | 0.76 | % | |||||||||

| Expenses net of waiver and payments by | |||||||||||||||||||||

| affiliates | 0.78 | %e | 0.74 | %e | 0.76 | %f | 0.81 | %f | 0.71 | % | 0.76 | % | |||||||||

| Net investment income | 2.08 | % | 1.72 | % | 2.09 | % | 2.62 | % | 2.29 | % | 2.32 | % | |||||||||

| Supplemental data | |||||||||||||||||||||

| Net assets, end of period (000’s) | $ | 8,836 | $ | 8,264 | $ | 12,651 | $ | 9,049 | $ | 3,007 | $ | 1,281 | |||||||||

| Portfolio turnover rate | 147.91 | % | 551.77 | % | 614.11 | % | 514.95 | % | 674.91 | % | 594.80 | % | |||||||||

| Portfolio turnover rate excluding mortgage | |||||||||||||||||||||

| dollar rollsg | 59.85 | % | 185.40 | % | 172.54 | % | 133.55 | % | 252.41 | % | 167.39 | % | |||||||||

aFor the period February 1, 2012 (effective date) to September 30, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates and expense reduction rounds to less than 0.01%.

gSee Note 1(e) regarding mortgage dollar rolls.

12 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

| Statement of Investments, March 31, 2017 (unaudited) | ||||

| Principal | ||||

| Amount | Value | |||

| U.S. Government and Agency Securities 0.5% | ||||

| U.S. Treasury Bond, | ||||

| 4.75%, 2/15/37. | $ | 225,000 | $ | 293,779 |

| 4.25%, 11/15/40 | 131,000 | 159,940 | ||

| Total U.S. Government and Agency Securities (Cost $487,223) | 453,719 | |||

| Asset-Backed Securities and Commercial Mortgage-Backed Securities 31.8% | ||||

| Finance 31.8% | ||||

| a American Home Mortgage Investment Trust, 2005-1, 6A, FRN, 3.362%, 6/25/45 | 164,858 | 164,102 | ||

| a,b American Homes 4 Rent, | ||||

| 2014-SFR1, A, 144A, FRN, 1.943%, 6/17/31 | 181,519 | 181,671 | ||

| 2014-SFR1, C, 144A, FRN, 2.693%, 6/17/31 | 250,000 | 249,884 | ||

| b,c Anthracite Ltd., 2004-HY1A, E, 144A, 7.147%, 6/20/41 | 1,598,000 | 2,405 | ||

| a,b ARCap REIT Inc., 2004-RR3, A2, 144A, FRN, 5.544%, 9/21/45 | 68,547 | 69,361 | ||

| Banc of America Commercial Mortgage Trust, 2006-4, AJ, 5.695%, 7/10/46 | 109,995 | 109,784 | ||

| a Bear Stearns ALT-A Trust, 2004-13, A2, FRN, 1.862%, 11/25/34 | 129,612 | 125,142 | ||

| Bear Stearns Commercial Mortgage Securities Trust, | ||||

| a 2005-T20, E, FRN, 5.118%, 10/12/42 | 215,000 | 211,116 | ||

| 2006-PW13, AJ, 5.611%, 9/11/41 | 18,632 | 18,615 | ||

| a 2007-PW16, AM, FRN, 5.768%, 6/11/40 | 567,606 | 568,817 | ||

| a CD Commercial Mortgage Trust, 2005-CD1, E, FRN, 5.256%, 7/15/44. | 111,583 | 111,418 | ||

| CD Mortgage Trust, 2016-CD2, A4, 3.526%, 11/10/49 | 175,000 | 179,528 | ||

| b Centerline REIT Inc., 2004-RR3, B, 144A, 5.04%, 9/21/45 | 200,000 | 184,512 | ||

| Citigroup Commercial Mortgage Trust, | ||||

| 2006-C5, AJ, 5.482%, 10/15/49 | 235,401 | 223,233 | ||

| a 2007-C6, AM, FRN, 5.922%, 12/10/49 | 200,000 | 202,662 | ||

| a,d 2015-GC27, XA, IO, FRN, 1.43%, 2/10/48 | 3,736,664 | 312,008 | ||

| 2015-GC31, A4, 3.762%, 6/10/48 | 250,000 | 260,154 | ||

| 2016-GC37, A4, 3.314%, 4/10/49 | 250,000 | 250,962 | ||

| a,b Citigroup Mortgage Loan Trust, 2013-A, A, 144A, FRN, 3.00%, 5/25/42 | 68,533 | 68,486 | ||

| a COBALT CMBS Commercial Mortgage Trust, 2007-C2, AMFX, FRN, 5.526%, 4/15/47 | 435,000 | 437,762 | ||

| a,b Colony American Homes, | ||||

| 2014-1A, A, 144A, FRN, 2.093%, 5/17/31 | 96,300 | 96,429 | ||

| 2014-1A, C, 144A, FRN, 2.793%, 5/17/31 | 250,000 | 250,150 | ||

| 2014-2A, C, 144A, FRN, 2.677%, 7/17/31 | 200,000 | 200,183 | ||

| b Colony MFM Trust, 2014-1, A, 144A, 2.543%, 4/20/50 | 144,910 | 144,255 | ||

| d COMM Mortgage Trust, 2014-UBS4, XA, IO, FRN, 1.246%, 8/10/47 | 3,695,879 | 223,512 | ||

| a Commercial Mortgage Trust, | ||||

| 2006-GG7, AJ, FRN, 5.951%, 7/10/38 | 195,000 | 165,351 | ||

| b 2014-BBG, A, 144A, FRN, 1.712%, 3/15/29. | 550,000 | 551,046 | ||

| a Conseco Finance Securitizations Corp., 2002-2, M1, FRN, 7.424%, 3/01/33 | 439,603 | 487,135 | ||

| Conseco Financial Corp., | ||||

| a 1997-3, A7, FRN, 7.64%, 3/15/28 | 116,118 | 119,706 | ||

| 1998-6, A8, 6.66%, 6/01/30 | 197,663 | 211,238 | ||

| b Core Industrial Trust, 2015-CALW, A, 144A, 3.04%, 2/10/34 | 250,000 | 255,517 | ||

| b CountryPlace Manufactured Housing Contract Trust, 2007-1, A3, 144A, 5.593%, 7/15/37 | 1,682 | 1,683 | ||

| CSAIL Commercial Mortgage Trust, | ||||

| 2015-C1, A4, 3.505%, 4/15/50 | 430,000 | 441,720 | ||

| a,d 2015-C2, XA, IO, FRN, 0.875%, 6/15/57 | 5,599,611 | 276,299 | ||

| a,b CSMC, 2009-15R, 3A1, 144A, FRN, 3.214%, 3/26/36 | 68,076 | 67,745 | ||

| a,b CSMC Trust, 2014-OAK1, 1A1, 144A, FRN, 3.00%, 11/25/29 | 164,665 | 164,562 | ||

| a,e CWABS Asset-Backed Certificates Trust, 2004-7, MV3, FRN, 2.032%, 12/25/34 | 49,836 | 49,935 | ||

| a CWABS Inc. Asset-Backed Certificates, 2004-1, M1, FRN, 1.732%, 3/25/34. | 116,017 | 112,826 | ||

franklintempleton.com

Semiannual Report 13

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS (UNAUDITED)

| Principal | ||||

| Amount | Value | |||

| Asset-Backed Securities and Commercial Mortgage-Backed Securities (continued) | ||||

| Finance (continued) | ||||

| a,b Eleven Madison Trust Mortgage Trust, 2015-11MD, A, 144A, FRN, 3.673%, 9/10/35 | $ | 400,000 | $ | 412,077 |

| a FHLMC Structured Agency Credit Risk Debt Notes, | ||||

| 2014-DN1, M2, FRN, 3.182%, 2/25/24 | 250,000 | 257,192 | ||

| 2014-DN3, M2, FRN, 3.382%, 8/25/24 | 37,572 | 37,743 | ||

| 2014-DN3, M3, FRN, 4.982%, 8/25/24 | 250,000 | 267,320 | ||

| 2014-DN4, M2, FRN, 3.382%, 10/25/24 | 28,399 | 28,471 | ||

| 2014-DN4, M3, FRN, 5.532%, 10/25/24 | 250,000 | 269,734 | ||

| 2014-HQ1, M2, FRN, 3.482%, 8/25/24 | 159,748 | 162,201 | ||

| 2014-HQ2, M2, FRN, 3.182%, 9/25/24 | 250,000 | 257,328 | ||

| 2014-HQ3, M2, FRN, 3.632%, 10/25/24 | 91,808 | 92,636 | ||

| 2014-HQ3, M3, FRN, 5.732%, 10/25/24 | 250,000 | 276,118 | ||

| 2015-DN1, M2, FRN, 3.382%, 1/25/25 | 84,913 | 85,427 | ||

| 2015-DN1, M3, FRN, 5.132%, 1/25/25 | 250,000 | 266,821 | ||

| 2015-DNA1, M2, FRN, 2.832%, 10/25/27 | 250,000 | 255,679 | ||

| 2015-DNA2, M2, FRN, 3.582%, 12/25/27 | 400,629 | 410,477 | ||

| e 2015-DNA3, B, FRN, 10.332%, 4/25/28. | 249,932 | 291,118 | ||

| 2015-DNA3, M2, FRN, 3.832%, 4/25/28 | 491,616 | 510,168 | ||

| 2015-HQ1, M2, FRN, 3.182%, 3/25/25 | 178,173 | 180,707 | ||

| 2015-HQ1, M3, FRN, 4.782%, 3/25/25 | 500,000 | 538,365 | ||

| e 2015-HQA1, B, FRN, 9.782%, 3/25/28 | 249,904 | 282,439 | ||

| 2015-HQA1, M2, FRN, 3.632%, 3/25/28 | 204,999 | 210,125 | ||

| 2016-HQ1, M1, FRN, 2.732%, 9/25/28 | 161,397 | 162,432 | ||

| 2016-HQA2, M2, FRN, 3.232%, 11/25/28 | 250,000 | 257,928 | ||

| a FNMA, 2007-1, NF, FRN, 1.232%, 2/25/37 | 138,048 | 137,301 | ||

| a FNMA Connecticut Avenue Securities, | ||||

| 2014-C02, 2M1, FRN, 1.932%, 5/25/24 | 39,416 | 39,453 | ||

| 2014-C02, 2M2, FRN, 3.582%, 5/25/24 | 400,000 | 406,612 | ||

| 2014-C04, 1M1, FRN, 5.882%, 11/25/24 | 325,000 | 364,953 | ||

| 2015-C01, 2M2, FRN, 5.532%, 2/25/25 | 286,686 | 305,221 | ||

| 2017-C01, 1B1, FRN, 6.732%, 7/25/29 | 280,000 | 292,976 | ||

| a GE Capital Commercial Mortgage Corp. Trust, 2007-C1, AM, FRN, 5.606%, 12/10/49 | 250,000 | 248,755 | ||

| b G-Force LLC, | ||||

| 2005-RRA, B, 144A, 5.09%, 8/22/36 | 28,469 | 28,472 | ||

| 2005-RRA, C, 144A, 5.20%, 8/22/36. | 300,000 | 294,034 | ||

| e GMAC Commercial Mortgage Securities Inc. Trust, 2005-C1, B, 4.936%, 5/10/43 | 701,746 | 36,951 | ||

| Green Tree Financial Corp., | ||||

| 1996-9, M1, 7.63%, 8/15/27 | 228,628 | 248,238 | ||

| 1997-3, A6, 7.32%, 3/15/28 | 8,188 | 8,426 | ||

| 1998-4, A7, 6.87%, 4/01/30 | 86,780 | 93,395 | ||

| a Greenwich Capital Commercial Funding Corp., 2006-GG7, AM, FRN, 5.728%, 7/10/38 | 84,805 | 84,764 | ||

| a,d GS Mortgage Securities Corp. II, 2015-GC30, XA, IO, FRN, 0.898%, 5/10/50 | 6,160,685 | 301,970 | ||

| a,d GS Mortgage Securities Trust, 2017-GS5, XA, IO, FRN, 0.972%, 3/10/50. | 3,250,000 | 217,992 | ||

| a GSAA Home Equity Trust, 2005-6, A3, FRN, 1.352%, 6/25/35. | 96,277 | 95,905 | ||

| a GSAMP Trust, 2005-HE3, M2, FRN, 1.987%, 6/25/35 | 137,129 | 135,753 | ||

| b Hilton USA Trust, 2016-SFP, C, 144A, 4.122%, 11/05/35 | 233,000 | 233,996 | ||

| a Home Equity Mortgage Trust, 2004-4, M3, FRN, 1.957%, 12/25/34 | 473,949 | 456,254 | ||

| a Impac Secured Assets Trust, 2007-2, FRN, 1.232%, 4/25/37 | 243,770 | 234,121 | ||

| a,b Invitation Homes Trust, | ||||

| 2014-SFR1, B, 144A, FRN, 2.443%, 6/17/31 | 108,427 | 108,520 | ||

| 2014-SFR2, B, 144A, FRN, 2.543%, 9/17/31 | 200,000 | 200,382 | ||

| 2014-SFR3, C, 144A, FRN, 3.443%, 12/17/31 | 250,000 | 250,392 | ||

| 2015-SFR2, A, 144A, FRN, 2.293%, 6/17/32 | 244,329 | 245,134 | ||

14 Semiannual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS (UNAUDITED)

| Principal | ||||

| Amount | Value | |||

| Asset-Backed Securities and Commercial Mortgage-Backed Securities (continued) | ||||

| Finance (continued) | ||||

| a,b Invitation Homes Trust, (continued) | ||||

| 2015-SFR2, C, 144A, FRN, 2.00%, 6/17/32 | $ | 200,000 | $ | 200,794 |

| 2015-SFR3, C, 144A, FRN, 2.943%, 8/17/32 | 225,000 | 226,475 | ||

| JP Morgan Chase Commercial Mortgage Securities Trust, | ||||

| a,b 2003-LN1, H, 144A, FRN, 5.575%, 10/15/37 | 76,395 | 76,213 | ||

| a 2005-LPD5, F, FRN, 5.699%, 12/15/44 | 197,375 | 196,884 | ||

| a,e 2006-CB16, B, FRN, 5.672%, 5/12/45 | 240,000 | 37,734 | ||

| 2006-CB17, AM, 5.464%, 12/12/43. | 28,967 | 28,951 | ||

| 2016-JP3, AS, 3.144%, 8/15/49 | 450,000 | 439,067 | ||

| a,b JP Morgan Mortgage Trust, 2013-3, A3, 144A, FRN, 3.416%, 7/25/43 | 249,600 | 249,405 | ||

| JPMBB Commercial Mortgage Securities Trust, | ||||

| a 2014-C24, AS, FRN, 3.914%, 11/15/47 | 250,000 | 258,431 | ||

| 2015-C33, A4, 3.77%, 12/15/48 | 250,000 | 259,856 | ||

| a LB-UBS Commercial Mortgage Trust, | ||||

| b,e 2001-C3, E, 144A, FRN, 6.95%, 6/15/36 | 300,000 | 294,456 | ||

| 2006-C1, AJ, FRN, 5.276%, 2/15/41 | 249,316 | 249,169 | ||

| a Lehman XS Trust, 2005-1, 2A2, FRN, 2.284%, 7/25/35 | 85,967 | 85,167 | ||

| a,b Mach One ULC, | ||||

| 2004-1A, K, 144A, FRN, 5.45%, 5/28/40 | 125,000 | 125,669 | ||

| 2004-1A, L, 144A, FRN, 5.45%, 5/28/40 | 125,000 | 126,163 | ||

| a Madison Avenue Manufactured Housing Contract Trust, 2002-A, B1, FRN, 4.232%, 3/25/32 | 144,142 | 145,876 | ||

| a Merrill Lynch Mortgage Investors Trust, | ||||

| 2003-A, 1A, FRN, 1.722%, 3/25/28 | 207,500 | 198,115 | ||

| 2004-A1, M1, FRN, 3.245%, 2/25/34 | 210,140 | 168,872 | ||

| a Merrill Lynch Mortgage Trust, 2005-CKI1, D, FRN, 5.331%, 11/12/37. | 41,958 | 41,908 | ||

| a,b Mill City Mortgage Loan Trust, 2016-1, A, 144A, FRN, 2.50%, 4/25/57 | 175,414 | 174,672 | ||

| a Morgan Stanley ABS Capital I Inc. Trust, 2005-WMC, M2, FRN, 1.717%, 1/25/35 | 153,418 | 151,588 | ||

| Morgan Stanley Capital I Trust, | ||||

| b 2005-RR6, B, 144A, 5.306%, 5/24/43 | 31,985 | 32,116 | ||

| a 2006-HQ8, AJ, FRN, 5.627%, 3/12/44. | 66,947 | 67,191 | ||

| a,b 2014-150E, C, 144A, FRN, 4.295%, 9/09/32 | 330,000 | 345,041 | ||

| b Multi Security Asset Trust LP Commercial Mortgage, | ||||

| 2005-RR4A, J, 144A, 5.88%, 11/28/35 | 220,000 | 225,136 | ||

| a 2005-RR4A, K, 144A, FRN, 5.88%, 11/28/35 | 130,000 | 133,151 | ||

| a Novastar Home Equity Loan, 2004-4, M4, FRN, 2.632%, 3/25/35 | 200,920 | 200,428 | ||

| Oakwood Mortgage Investors Inc., 1999-A, A3, 6.09%, 4/15/29. | 164,167 | 167,433 | ||

| b One Market Plaza Trust, 2017-1MKT, B, 144A, 3.845%, 2/10/32 | 350,000 | 362,178 | ||

| Residential Asset Securities Corp., 2004-KS8, AI6, 4.79%, 9/25/34 | 36,336 | 36,638 | ||

| a Residential Funding Mortgage Securities II, 2004-HI3, A5, FRN, 5.48%, 6/25/34 | 81,744 | 84,491 | ||

| a,b Silver Bay Realty Trust, 2014-1, A, 144A, FRN, 1.913%, 9/17/31 | 184,016 | 184,241 | ||

| a,b SWAY Residential Trust, 2014-1, A, 144A, FRN, 2.243%, 1/17/32 | 242,388 | 243,146 | ||

| a,b Towd Point Mortgage Trust, | ||||

| 2015-1, 144A, FRN, 2.75%, 11/25/60 | 349,575 | 349,546 | ||

| 2015-3, A1B, 144A, FRN, 3.00%, 3/25/54 | 226,037 | 228,125 | ||

| 2016-5, A1, 144A, FRN, 2.50%, 10/25/56 | 411,052 | 409,170 | ||

| 2017-1, A1, 144A, FRN, 2.75%, 10/25/56 | 216,789 | 217,103 | ||

| a,b Tricon American Homes Trust, | ||||

| 2015-SFR1, A, 144A, FRN, 2.193%, 5/17/32 | 231,752 | 231,585 | ||

| 2015-SFR1, C, 144A, FRN, 2.843%, 5/17/32 | 200,000 | 199,577 | ||

| a,b Wachovia Bank Commercial Mortgage Trust, 2003-C7, F, 144A, FRN, 5.924%, 10/15/35 | 60,590 | 60,546 | ||

franklintempleton.com

Semiannual Report 15

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS (UNAUDITED)

| Principal | ||||

| Amount | Value | |||

| Asset-Backed Securities and Commercial Mortgage-Backed Securities (continued) | ||||

| Finance (continued) | ||||

| a WaMu Mortgage Pass-Through Certificates, | ||||

| 2005-AR8, 1A1A, FRN, 1.272%, 7/25/45 | $ | 142,152 | $ | 137,093 |

| 2005-AR19, A1A1, FRN, 1.252%, 12/25/45 | 280,010 | 267,850 | ||

| a,d Wells Fargo Commercial Mortgage Trust, 2016-NXS6, XA, IO, FRN, 1.66%, 11/15/49 | 2,849,467 | 302,899 | ||

| Wells Fargo Mortgage Backed Securities Trust, | ||||

| a 2004-W, A9, FRN, 3.004%, 11/25/34. | 124,308 | 126,204 | ||

| a 2005-AR9, 2A2, FRN, 3.069%, 10/25/33 | 185,760 | 184,028 | ||

| a 2005-AR10, 2A3, FRN, 3.073%, 6/25/35 | 117,070 | 116,986 | ||

| 2007-3, 3A1, 5.50%, 4/25/22 | 23,725 | 24,280 | ||

| Total Asset-Backed Securities and Commercial Mortgage-Backed Securities | ||||

| (Cost $27,241,541) | 27,005,037 | |||

| Mortgage-Backed Securities 68.9% | ||||

| Federal Home Loan Mortgage Corp. (FHLMC) Fixed Rate 40.8% | ||||

| f FHLMC Gold 30 Year, 3.00%, 4/01/47 | 500,000 | 495,352 | ||

| FHLMC Gold 30 Year, 3.00%, 4/01/47 | 4,400,000 | 4,363,153 | ||

| FHLMC Gold 30 Year, 3.50%, 10/01/46 | 6,841,380 | 7,004,518 | ||

| FHLMC Gold 30 Year, 3.50%, 3/01/47 | 6,333,683 | 6,484,715 | ||

| f FHLMC Gold 30 Year, 3.50%, 4/01/47 | 1,000,000 | 1,022,851 | ||

| FHLMC Gold 30 Year, 4.00%, 10/01/46 | 5,246,371 | 5,510,114 | ||

| FHLMC Gold 30 Year, 4.00%, 3/01/47 | 7,418,339 | 7,792,335 | ||

| FHLMC Gold 30 Year, 4.50%, 4/01/40 | 695,166 | 747,522 | ||

| FHLMC Gold 30 Year, 5.00%, 10/01/33 - 2/01/39 | 467,576 | 509,324 | ||

| FHLMC Gold 30 Year, 5.50%, 9/01/33 | 46,779 | 52,293 | ||

| FHLMC Gold 30 Year, 6.00%, 7/01/28 - 11/01/36 | 147,806 | 167,037 | ||

| FHLMC Gold 30 Year, 6.50%, 2/01/19 - 7/01/32. | 91,429 | 100,821 | ||

| FHLMC Gold 30 Year, 7.50%, 10/01/25 - 8/01/32 | 182,423 | 199,567 | ||

| FHLMC Gold 30 Year, 8.00%, 7/01/24 - 5/01/30. | 103,948 | 111,023 | ||

| FHLMC Gold 30 Year, 8.50%, 10/01/17 - 6/01/21 | 11,673 | 11,786 | ||

| FHLMC Gold 30 Year, 9.00%, 9/01/30 | 28,517 | 28,985 | ||

| FHLMC Gold 30 Year, 9.50%, 12/01/19 - 12/01/22 | 16,460 | 16,677 | ||

| 34,618,073 | ||||

| a Federal National Mortgage Association (FNMA) Adjustable Rate 2.7% | ||||

| FNMA, 1.849% - 2.785%, 1/01/18 - 4/01/37 | 820,859 | 835,533 | ||

| FNMA, 2.799% - 3.125%, 4/01/18 - 7/01/38 | 806,543 | 830,849 | ||

| FNMA, 3.127% - 3.75%, 5/01/21 - 4/01/37 | 596,462 | 613,966 | ||

| 2,280,348 | ||||

| Federal National Mortgage Association (FNMA) Fixed Rate 13.9% | ||||

| FNMA 15 Year, 5.00%, 6/01/18 - 7/01/18 | 99,826 | 102,640 | ||

| FNMA 15 Year, 5.50%, 9/01/17 - 2/01/18 | 24,597 | 24,795 | ||

| f FNMA 30 Year, 3.00%, 4/01/47 | 585,000 | 580,201 | ||

| FNMA 30 Year, 3.00%, 4/01/47 | 5,700,000 | 5,658,154 | ||

| f FNMA 30 Year, 3.50%, 4/01/47 | 1,000,000 | 1,023,047 | ||

| FNMA 30 Year, 5.00%, 4/01/34 | 130,804 | 143,099 | ||

| FNMA 30 Year, 5.50%, 9/01/33 - 11/01/33 | 709,380 | 790,619 | ||

| FNMA 30 Year, 5.50%, 11/01/33 - 11/01/35. | 651,278 | 730,865 | ||

| FNMA 30 Year, 6.00%, 12/01/23 - 10/01/34. | 394,166 | 451,859 | ||

| FNMA 30 Year, 6.00%, 10/01/34 - 5/01/35 | 632,504 | 719,957 | ||

| FNMA 30 Year, 6.00%, 7/01/35 - 8/01/35 | 257,453 | 292,396 | ||

| FNMA 30 Year, 6.50%, 12/01/27 - 8/01/32 | 734,068 | 819,804 | ||

16 Semiannual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS (UNAUDITED)

| Principal | |||||

| Amount | Value | ||||

| Mortgage-Backed Securities (continued) | |||||

| Federal National Mortgage Association (FNMA) Fixed Rate (continued) | |||||

| FNMA 30 Year, 6.50%, 8/01/32 | $ | 99,208 | $ | 110,739 | |

| FNMA 30 Year, 7.50%, 8/01/25 - 5/01/32 | 30,359 | 35,459 | |||

| FNMA 30 Year, 8.00%, 1/01/25 - 7/01/31 | 25,930 | 29,534 | |||

| FNMA 30 Year, 8.50%, 11/01/26 - 11/01/28. | 179,671 | 195,784 | |||

| FNMA 30 Year, 9.00%, 12/01/17 - 4/01/25 | 1,920 | 2,143 | |||

| FNMA 30 Year, 9.50%, 11/01/21 - 4/01/30 | 43,367 | 46,188 | |||

| FNMA 30 Year, 10.00%, 11/01/18 - 4/01/21. | 9,648 | 9,899 | |||

| FNMA 30 Year, 10.50%, 5/01/30 | 2,897 | 2,910 | |||

| FNMA PL 30 Year, 10.00%, 9/01/20 | 9,019 | 9,310 | |||

| 11,779,402 | |||||

| Government National Mortgage Association (GNMA) Fixed Rate 11.5% | |||||

| GNMA I SF 30 Year, 6.50%, 1/15/24 - 9/15/32 | 133,445 | 151,394 | |||

| GNMA I SF 30 Year, 7.00%, 6/15/23 - 2/15/32 | 66,149 | 70,010 | |||

| GNMA I SF 30 Year, 7.50%, 10/15/23 - 10/15/29 | 37,930 | 40,481 | |||

| GNMA I SF 30 Year, 8.00%, 1/15/22 - 9/15/27 | 48,000 | 52,851 | |||

| GNMA I SF 30 Year, 8.25%, 2/15/21 - 5/15/21 | 25,723 | 25,812 | |||

| GNMA I SF 30 Year, 8.50%, 10/15/21 - 7/15/24 | 44,724 | 45,332 | |||

| GNMA I SF 30 Year, 10.00%, 12/15/18 | 1,795 | 1,803 | |||

| GNMA II SF 30 Year, 3.00%, 3/20/47 | 4,000,000 | 4,041,038 | |||

| f GNMA II SF 30 Year, 3.00%, 4/01/47 | 435,000 | 438,840 | |||

| GNMA II SF 30 Year, 3.50%, 10/20/46 | 1,432,225 | 1,487,000 | |||

| GNMA II SF 30 Year, 3.50%, 2/20/47 | 2,594,575 | 2,693,803 | |||

| f GNMA II SF 30 Year, 3.50%, 4/01/47 | 370,000 | 383,629 | |||

| GNMA II SF 30 Year, 6.50%, 1/20/26 - 1/20/33 | 195,902 | 225,358 | |||

| GNMA II SF 30 Year, 7.50%, 11/20/22 - 7/20/32 | 118,797 | 137,442 | |||

| GNMA II SF 30 Year, 8.00%, 8/20/26 | 118 | 140 | |||

| GNMA II SF 30 Year, 9.00%, 11/20/19 - 3/20/25 | 1,154 | 1,221 | |||

| GNMA II SF 30 Year, 10.50%, 6/20/20 | 10 | 10 | |||

| 9,796,164 | |||||

| Total Mortgage-Backed Securities (Cost $58,258,640) | 58,473,987 | ||||

| Total Investments before Short Term Investments (Cost $85,987,404) | 85,932,743 | ||||

| Shares | |||||

| Short Term Investments (Cost $2,623,657) 3.1% | |||||

| Money Market Funds 3.1% | |||||

| g,h Institutional Fiduciary Trust Money Market Portfolio, 0.32% | 2,623,657 | 2,623,657 | |||

| Total Investments (Cost $88,611,061) 104.3% | 88,556,400 | ||||

| Other Assets, less Liabilities (4.3)% | (3,631,662 | ) | |||

| Net Assets 100.0% | $ | 84,924,738 | |||

franklintempleton.com

Semiannual Report 17

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

STATEMENT OF INVESTMENTS (UNAUDITED)

aThe coupon rate shown represents the rate at period end.

bSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers

or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At

March 31, 2017, the aggregate value of these securities was $8,955,404, representing 10.5% of net assets.

cSee Note 7 regarding defaulted securities.

dInvestment in an interest-only security entitles holders to receive only the interest payments on the underlying mortgages. The principal amount shown is the notional amount

of the underlying mortgages. The rate represents the coupon rate.

eThe bond pays interest and/or principal based upon the issuer’s ability to pay, which may be less than the stated interest rate or principal paydown.

fSecurity purchased on a to-be-announced (TBA) basis. See Note 1(c).

gSee Note 3(f) regarding investments in affiliated management investment companies.

hThe rate shown is the annualized seven-day yield at period end.

| At March 31, 2017, the Fund had the following futures contracts outstanding. See Note 1(d). | ||||||||||

| Futures Contracts | ||||||||||

| Number of | Notional | Expiration | Unrealized | Unrealized | ||||||

| Description | Type | Contracts | Value | Date | Appreciation | Depreciation | ||||

| Interest Rate Contracts | ||||||||||

| CME Ultra Long Term U.S. Treasury Bond. | Short | 5 | $ | 803,125 | 6/21/17 | $ | 7,330 | $ | — | |

| U.S. Treasury 10 Yr. Ultra | Long | 34 | 4,552,281 | 6/21/17 | 17,746 | — | ||||

| U.S. Treasury 30 Yr. Bond | Long | 8 | 1,206,750 | 6/21/17 | — | (8,272 | ) | |||

| U.S. Treasury 5 Yr. Note | Long | 19 | 2,236,805 | 6/30/17 | 2,772 | — | ||||

| Total Futures Contracts | $ | 27,848 | $ | (8,272 | ) | |||||

| Net unrealized appreciation (depreciation) | $ | 19,576 | ||||||||

See Abbreviations on page 31.

18 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Financial Statements

Statement of Assets and Liabilities

March 31, 2017 (unaudited)

| Assets: | |||

| Investments in securities: | |||

| Cost - Unaffiliated issuers | $ | 85,987,404 | |

| Cost - Non-controlled affiliates (Note 3f) | 2,623,657 | ||

| Total cost of investments | $ | 88,611,061 | |

| Value - Unaffiliated issuers | $ | 85,932,743 | |

| Value - Non-controlled affiliates (Note 3f) | 2,623,657 | ||

| Total value of investments | 88,556,400 | ||

| Cash | 2,213 | ||

| Receivables: | |||

| Investment securities sold | 127,692 | ||

| Capital shares sold | 42,666 | ||

| Interest. | 260,911 | ||

| Due from brokers. | 107,025 | ||

| Variation margin | 14,149 | ||

| Other assets | 83 | ||

| Total assets | 89,111,139 | ||

| Liabilities: | |||

| Payables: | |||

| Investment securities purchased | 3,907,162 | ||

| Capital shares redeemed | 160,152 | ||

| Management fees | 27,953 | ||

| Distribution fees | 18,801 | ||

| Transfer agent fees | 16,352 | ||

| Distributions to shareholders | 19,813 | ||

| Accrued expenses and other liabilities | 36,168 | ||

| Total liabilities | 4,186,401 | ||

| Net assets, at value | $ | 84,924,738 | |

| Net assets consist of: | |||

| Paid-in capital | $ | 104,494,608 | |

| Distributions in excess of net investment income | (408,966 | ) | |

| Net unrealized appreciation (depreciation) | (35,054 | ) | |

| Accumulated net realized gain (loss) | (19,125,850 | ) | |

| Net assets, at value | $ | 84,924,738 |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report 19

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||

| FINANCIAL STATEMENTS | ||

| Statement of Assets and Liabilities (continued) | ||

| March 31, 2017 (unaudited) | ||

| Class A: | ||

| Net assets, at value | $ | 24,417,773 |

| Shares outstanding | 2,619,018 | |

| Net asset value per sharea | $ | 9.32 |

| Maximum offering price per share (net asset value per share ÷ 95.75%) | $ | 9.73 |

| Class A1: | ||

| Net assets, at value | $ | 44,348,776 |

| Shares outstanding | 4,754,110 | |

| Net asset value per sharea | $ | 9.33 |

| Maximum offering price per share (net asset value per share ÷ 95.75%) | $ | 9.74 |

| Class C: | ||

| Net assets, at value | $ | 7,322,511 |

| Shares outstanding | 785,298 | |

| Net asset value and maximum offering price per sharea | $ | 9.32 |

| Advisor Class: | ||

| Net assets, at value | $ | 8,835,678 |

| Shares outstanding | 948,481 | |

| Net asset value and maximum offering price per share | $ | 9.32 |

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

20 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | |||

| FINANCIAL STATEMENTS | |||

| Statement of Operations | |||

| for the six months ended March 31, 2017 (unaudited) | |||

| Investment income: | |||

| Dividends: | |||

| Unaffiliated issuers | $ | 1,375 | |

| Non-controlled affiliates (Note 3f) | 1,388 | ||

| Interest | 1,573,293 | ||

| Paydown gain (loss) | (223,411 | ) | |

| Total investment income | 1,352,645 | ||

| Expenses: | |||

| Management fees (Note 3a) | 189,971 | ||

| Distribution fees: (Note 3c) | |||

| Class A | 37,492 | ||

| Class C | 27,679 | ||

| Transfer agent fees: (Note 3e) | |||

| Class A | 20,224 | ||

| Class A1 | 33,024 | ||

| Class C | 5,741 | ||

| Advisor Class. | 4,870 | ||

| Custodian fees (Note 4) | 1,141 | ||

| Reports to shareholders | 15,952 | ||

| Registration and filing fees | 38,013 | ||

| Professional fees | 26,528 | ||

| Trustees’ fees and expenses | 1,835 | ||

| Other | 39,603 | ||

| Total expenses. | 442,073 | ||

| Expense reductions (Note 4) | (50 | ) | |

| Expenses waived/paid by affiliates (Note 3f) | (6,473 | ) | |

| Net expenses. | 435,550 | ||

| Net investment income | 917,095 | ||

| Realized and unrealized gains (losses): | |||

| Net realized gain (loss) from: | |||

| Investments | (1,574,968 | ) | |

| Foreign currency transactions | 144 | ||

| Futures contracts | 4,983 | ||

| Net realized gain (loss) | (1,569,841 | ) | |

| Net change in unrealized appreciation (depreciation) on: | |||

| Investments | (741,854 | ) | |

| Futures contracts | 1,152 | ||

| Net change in unrealized appreciation (depreciation) | (740,702 | ) | |

| Net realized and unrealized gain (loss) | (2,310,543 | ) | |

| Net increase (decrease) in net assets resulting from operations | $ | (1,393,448 | ) |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report 21

| FRANKLIN STRATEGIC MORTGAGE PORTFOLIO | ||||||

| FINANCIAL STATEMENTS | ||||||

| Statements of Changes in Net Assets | ||||||

| Six Months Ended | ||||||

| March 31, 2017 | Year Ended | |||||

| (unaudited) | September 30, 2016 | |||||

| Increase (decrease) in net assets: | ||||||

| Operations: | ||||||

| Net investment income | $ | 917,095 | $ | 1,717,548 | ||

| Net realized gain (loss) | (1,569,841 | ) | 2,587,383 | |||

| Net change in unrealized appreciation (depreciation) | (740,702 | ) | (917,730 | ) | ||

| Net increase (decrease) in net assets resulting from operations | (1,393,448 | ) | 3,387,201 | |||

| Distributions to shareholders from: | ||||||

| Net investment income: | ||||||

| Class A | (390,439 | ) | (651,156 | ) | ||

| Class A1 | (701,066 | ) | (1,326,336 | ) | ||

| Class C | (93,832 | ) | (121,974 | ) | ||

| Advisor Class | (103,268 | ) | (277,140 | ) | ||

| Total distributions to shareholders | (1,288,605 | ) | (2,376,606 | ) | ||

| Capital share transactions: (Note 2) | ||||||

| Class A | (8,912,517 | ) | 7,566,588 | |||

| Class A1 | (7,723,431 | ) | (6,429,412 | ) | ||

| Class C | (1,902,750 | ) | 5,319,994 | |||

| Advisor Class | 790,776 | (4,510,111 | ) | |||

| Total capital share transactions | (17,747,922 | ) | 1,947,059 | |||

| Net increase (decrease) in net assets | (20,429,975 | ) | 2,957,654 | |||

| Net assets: | ||||||

| Beginning of period | 105,354,713 | 102,397,059 | ||||

| End of period. | $ | 84,924,738 | $ | 105,354,713 | ||

| Distributions in excess of net investment income included in net assets: | ||||||

| End of period. | $ | (408,966 | ) | $ | (37,456 | ) |

22 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

Franklin Strategic Mortgage Portfolio (Trust) is registered under the Investment Company Act of 1940 (1940 Act) as an open-end management investment company, consisting of one fund, Franklin Strategic Mortgage Portfolio (Fund) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). The Fund offers four classes of shares: Class A, Class A1, Class C and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share as of 4 p.m. Eastern time each day the New York Stock Exchange (NYSE) is open for trading. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation Committee (VC). The VC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Debt securities generally trade in the over-the-counter (OTC) market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value. Derivative financial instruments (derivatives) listed on an exchange are valued at the official closing price of the day.

Investments in open-end mutual funds are valued at the closing NAV.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange

franklintempleton.com

Semiannual Report 23

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

1. Organization and Significant Accounting

Policies (continued)

b. Foreign Currency Translation (continued)

rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Purchased on a TBA Basis

The Fund purchases securities on a to-be-announced (TBA) basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Sufficient assets have been segregated for these securities.

d. Derivative Financial Instruments

The Fund invested in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown in the Statement of Assets and

Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

Collateral requirements differ by type of derivative. Collateral or initial margin requirements are set by the broker or exchange clearing house for exchange traded and centrally cleared derivatives. Initial margin deposited is held at the exchange and can be in the form of cash and/or securities.

The Fund entered into exchange traded futures contracts primarily to manage and/or gain exposure to interest rate risk. A futures contract is an agreement between the Fund and a counterparty to buy or sell an asset at a specified price on a future date. Required initial margins are pledged by the Fund, and the daily change in fair value is accounted for as a variation margin payable or receivable in the Statement of Assets and Liabilities.

See Note 8 regarding other derivative information.

e. Mortgage Dollar Rolls

The Fund enters into mortgage dollar rolls, typically on a TBA basis. Mortgage dollar rolls are agreements between the Fund and a financial institution where the Fund sells (or buys) mortgage-backed securities for delivery on a specified date and simultaneously contracts to repurchase (or sell) substantially similar (same type, coupon, and maturity) securities at a future date and at a predetermined price. Gains or losses are realized on the initial sale, and the difference between the repurchase price and the sale price is recorded as an unrealized gain or loss to the Fund upon entering into the mortgage dollar roll. In addition, the Fund may invest the cash proceeds that are received from the initial sale. During the period between the sale and repurchase, the Fund is not entitled to principal and interest paid on the mortgage backed securities. Transactions in mortgage dollar rolls are accounted for as purchases and sales and may result in an increase to the Fund’s portfolio turnover rate. The risks of mortgage dollar roll transactions include the potential inability of the counterparty to fulfill its obligations.

f. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income

24 Semiannual Report

franklintempleton.com

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply, the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund may recognize an income tax liability related to its uncertain tax positions under U.S. GAAP when the uncertain tax position has a less than 50% probability that it will be sustained upon examination by the tax authorities based on its technical merits. As of March 31, 2017, the Fund has determined that no tax liability is required in its financial statements related to uncertain tax positions for any open tax years (or expected to be taken in future tax years). Open tax years are those that remain subject to examination and are based on each tax jurisdiction’s statute of limitation.

g. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Paydown gains and losses are recorded separately on the Statement of Operations. Dividend income is recorded on the ex-dividend date. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with U.S. GAAP. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Net investment income, not including class specific expenses, is allocated daily to each class of shares based upon the relative value of the settled shares of each class. Realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

h. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

i. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

franklintempleton.com

Semiannual Report 25

FRANKLIN STRATEGIC MORTGAGE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

2. Shares of Beneficial Interest