Exhibit 99.2

CNB

FINANCIAL CORPORATION

NASDAQ: CCNE

Acquisition of FC Banc Corp.

FC BANC

FC BANC CORP

OTCQB: FCBZ

March 27, 2013

CNB

FINANCIAL CORPORATION

IMPORTANT INFORMATION FOR INVESTORS

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities.

The proposed transaction will be submitted to the shareholders of FC Banc Corp. for their consideration. In connection with the proposed merger with FC Banc Corp, CNB Financial Corporation will file with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 that will include a proxy statement of FC Banc Corp. that also constitutes a prospectus of CNB Financial Corporation. FC Banc Corp. will mail the proxy statement/prospectus to its shareholders. Investors and security holders are urged to read the registration statement and the proxy statement/prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You may obtain a free copy of the proxy statement/prospectus (when available) and other related documents filed by CNB Financial Corporation with the SEC at the SEC’s website at www.sec.gov. You will also be able to obtain a free copy of the proxy statement/prospectus on CNB Financial Corporation’s website, www.bankcnb.com.

Copies of the proxy statement/prospectus can also be obtained without charge, when available, by directing a request to CNB Financial Corporation, 1 South Second Street, P.O. Box 42, Clearfield, PA 16830, or to FC Banc Corp., 105 Washington Square, Box 567, Bucyrus, OH 44820.

PARTICIPANTS IN THE TRANSACTION

CNB Financial Corporation, FC Banc Corp. and their respective directors, executive officers and certain other members of management and employees may be deemed to be “participants” in the solicitation of proxies from the shareholders of FC Banc Corp. in connection with the merger. Information about the directors and executive officers of FC Banc Corp. and their ownership of FC Banc Corp. common stock, and the interests of such participants, may be obtained by reading the proxy statement/prospectus when it becomes available. Information about the directors and executive officers of CNB Financial Corporation may be found in CNB Financial Corporation’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC on March 8, 2013, and in its definitive proxy statement filed with the SEC on March 15, 2013. You may obtain free copies of these documents from CNB Financial Corporation using the contact information above.

FORWARD-LOOKING STATEMENTS

This presentation contains statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, and this statement is included for purposes of complying with these safe harbor provisions. Readers should not place undue reliance on such forward-looking statements, which speak only as of the date made. These forward-looking statements are based on current plans and expectations, which are subject to a number of risk factors and uncertainties that could cause future results to differ materially from historical performance or future expectations. These differences may be the result of various factors, including, among others: (1) failure of the parties to satisfy the closing conditions in the merger agreement in a timely manner or at all; (2) failure of the shareholders of FC Banc Corp. to approve the merger agreement; (3) failure to obtain governmental approvals for the merger; (4) disruptions to the parties’ businesses as a result of the announcement and pendency of the merger; (5) costs or difficulties related to the integration of the business following the proposed merger; (6) the risk that the anticipated benefits, cost savings and any other savings from the transaction may not be fully realized or may take longer than expected to realize; (7) changes in general business, industry or economic conditions or competition; (8) changes in any applicable law, rule, regulation, policy, guideline or practice governing or affecting financial holding companies and their subsidiaries or with respect to tax or accounting principles or otherwise; (9) adverse changes or conditions in the capital and financial markets; (10) changes in interest rates or credit availability; (11) the inability to realize expected cost savings or achieve other anticipated benefits in connection with the proposed merger; (12) changes in the quality or composition of loan and investment portfolios; (13) adequacy of loan loss reserves and changes in loan default and charge-off rates; (14) increased competition and its effect on pricing, spending, third-party relationships and revenues; (15) loss of certain key officers; (16) continued relationships with major customers; (17) deposit attrition, necessitating increased borrowings to fund loans and investments; (18) rapidly changing technology; (19) unanticipated regulatory or judicial proceedings and liabilities and other costs; (20) changes in the cost of funds, demand for loan products or demand for financial services; and (21) other economic, competitive, governmental or technological factors affecting operations, markets, products, services and prices. The foregoing list should not be construed as exhaustive, and CNB Financial Corporation and FC Banc Corp. undertake no obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements, or to reflect the occurrence of anticipated or unanticipated events or circumstances.

For additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements, please see filings by CNB Financial Corporation with the SEC, including CNB Financial Corporation’s Annual Report on Form 10-K for the year ended December 31, 2012.

CNB

FINANCIAL CORPORATION 2

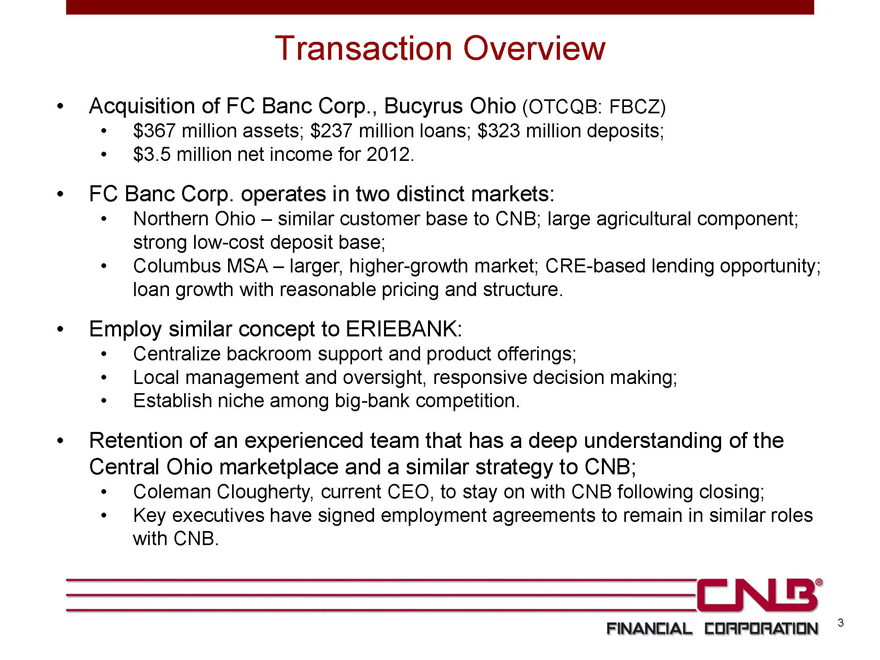

Transaction Overview

Acquisition of FC Banc Corp., Bucyrus Ohio (OTCQB: FBCZ)

$367 million assets; $237 million loans; $323 million deposits;

$3.5 million net income for 2012.

FC Banc Corp. operates in two distinct markets:

Northern Ohio - similar customer base to CNB; large agricultural component; strong low-cost deposit base;

Columbus MSA - larger, higher-growth market; CRE-based lending opportunity; loan growth with reasonable pricing and structure.

Employ similar concept to ERIEBANK:

Centralize backroom support and product offerings;

Local management and oversight, responsive decision making;

Establish niche among big-bank competition.

Retention of an experienced team that has a deep understanding of the Central Ohio marketplace and a similar strategy to CNB;

Coleman Clougherty, current CEO, to stay on with CNB following closing;

Key executives have signed employment agreements to remain in similar roles with CNB.

CNB

FINANCIAL CORPORATION 3

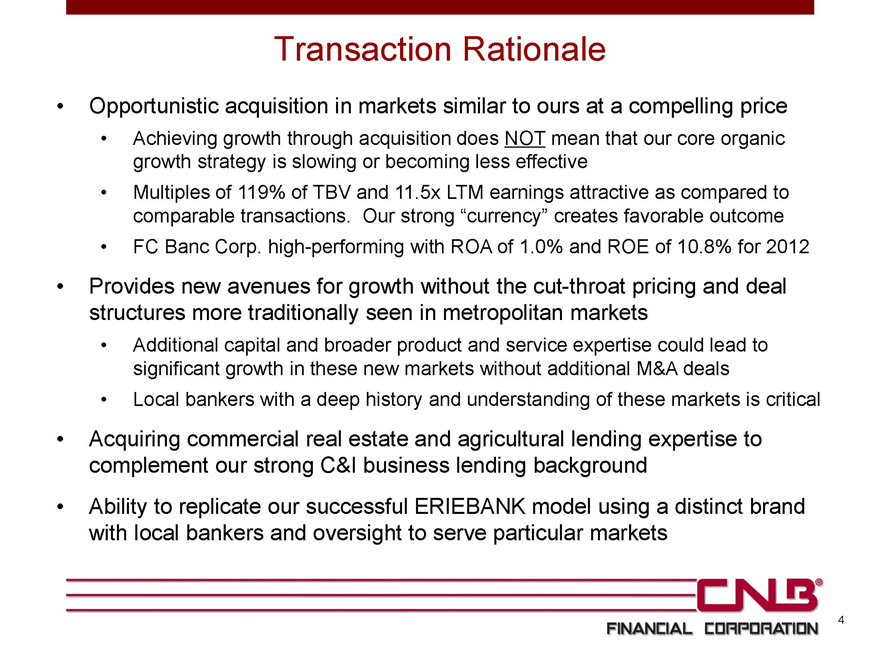

Transaction Rationale

Opportunistic acquisition in markets similar to ours at a compelling price

Achieving growth through acquisition does NOT mean that our core organic growth strategy is slowing or becoming less effective

Multiples of 119% of TBV and 11.5x LTM earnings attractive as compared to comparable transactions. Our strong “currency” creates favorable outcome

FC Banc Corp. high-performing with ROA of 1.0% and ROE of 10.8% for 2012

Provides new avenues for growth without the cut-throat pricing and deal structures more traditionally seen in metropolitan markets

Additional capital and broader product and service expertise could lead to significant growth in these new markets without additional M&A deals

Local bankers with a deep history and understanding of these markets is critical

Acquiring commercial real estate and agricultural lending expertise to complement our strong C&I business lending background

Ability to replicate our successful ERIEBANK model using a distinct brand with local bankers and oversight to serve particular markets

CNB

FINANCIAL CORPORATION 4

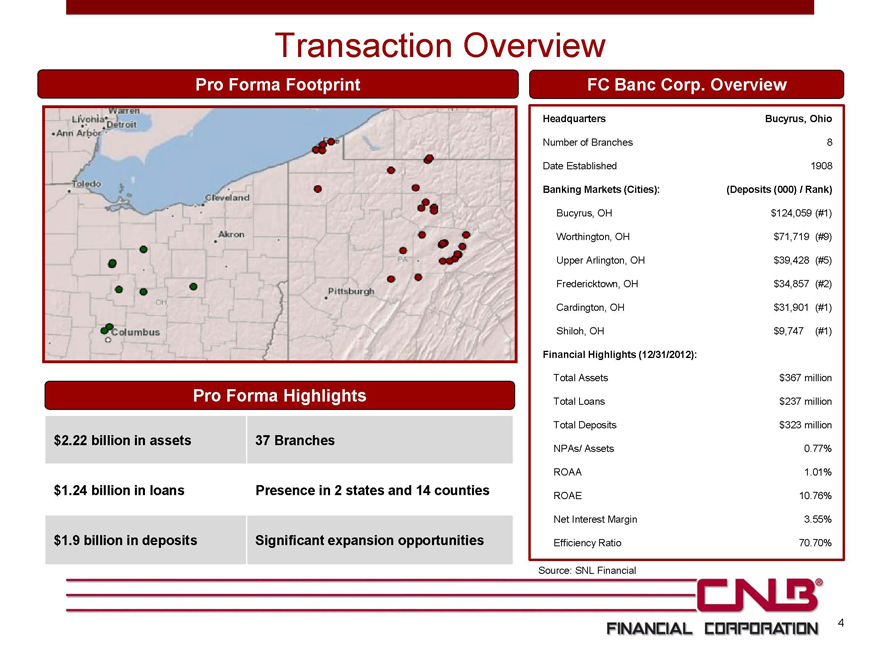

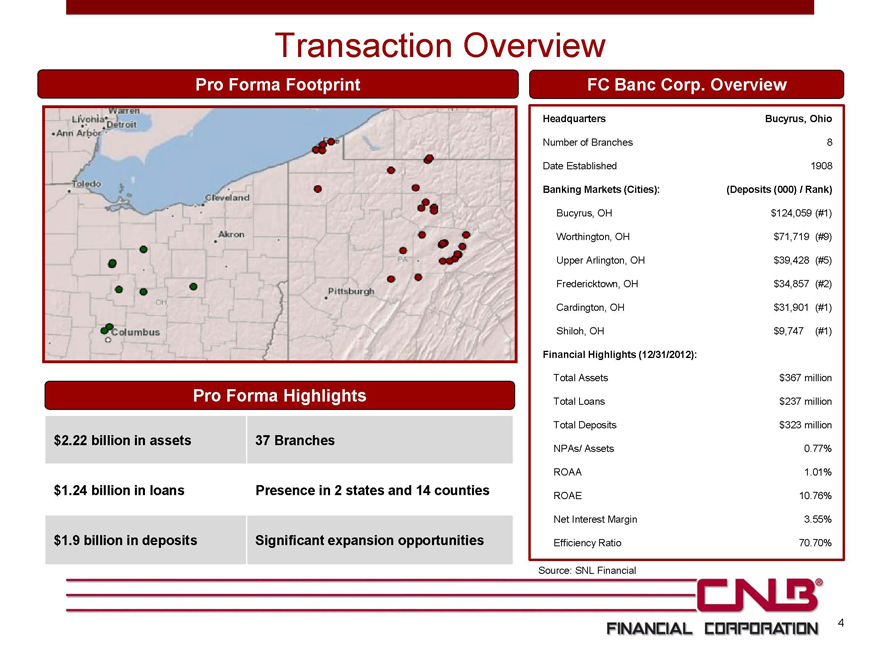

Transaction Overview

Pro Forma Footprint

Warren

Livohia

Detroit

Ann Arbor

Toledo

Cleveland

Akron

Columbus

Pittsburgh

PA

Pro Forma Highlights

$ 2.22 billion in assets 37 Branches

$ 1.24 billion in loans Presence in 2 states and 14 counties

$ 1.9 billion in deposits Significant expansion opportunities

FC Banc Corp. Overview

Headquarters Bucyrus, Ohio

Number of Branches 8

Date Established 1908

Banking Markets (Cities): (Deposits (000) / Rank)

Bucyrus, OH $124,059(#1)

Worthington, OH $71,719 (#9)

Upper Arlington, OH $39,428 (#5)

Fredericktown, OH $34,857 (#2)

Cardington, OH $31,901 (#1)

Shiloh, OH $9,747 (#1)

Financial Highlights (12/31/2012):

Total Assets $367 million

Total Loans $237 million

Total Deposits $323 million

NPAs/ Assets 0.77%

ROAA 1.01%

ROAE 10.76%

Net Interest Margin 3.55%

Efficiency Ratio 70.70%

Source: SNL Financial

CNB

FINANCIAL CORPORATION 4

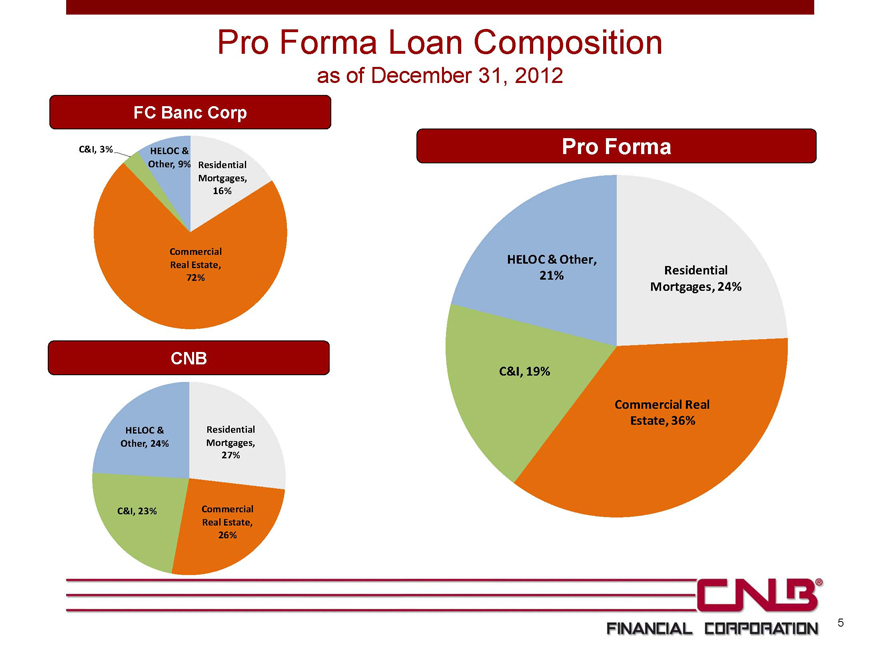

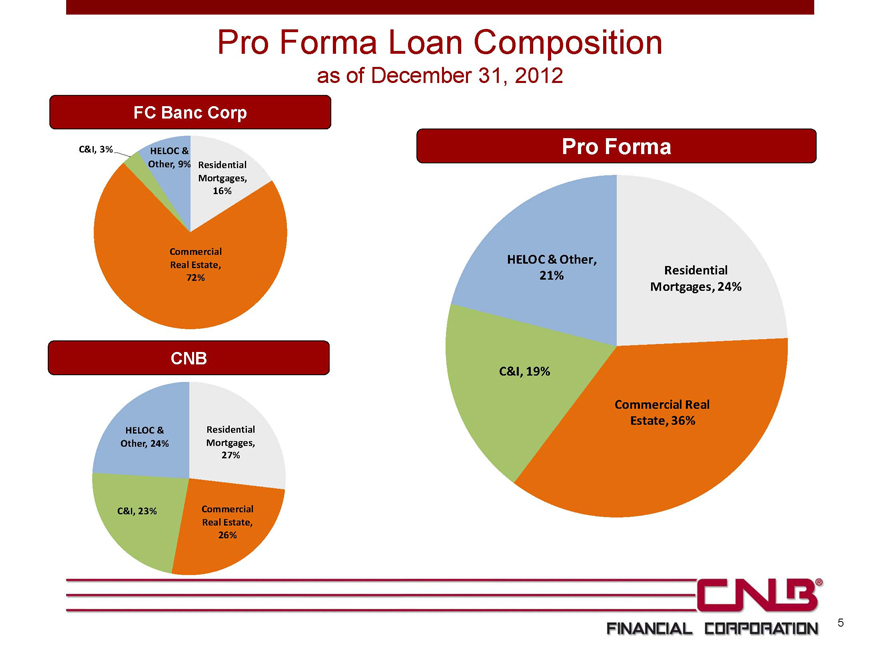

Pro Forma Loan Composition

as of December 31, 2012

FC Banc Corp

C&I, 3%

HELOC & Other, 9%

Residential Mortgages, 16%

Commercial Real Estate, 72%

CNB

HELOC & Other, 24%

C&I, 23%

Residential Mortgages, 27%

Commercial Real Estate, 26%

Pro Forma

HELOC & Other, 21%

C&I, 19%

Residential Mortgages, 24%

Commercial Real Estate, 36%

CNB

FINANCIAL CORPORATION 5

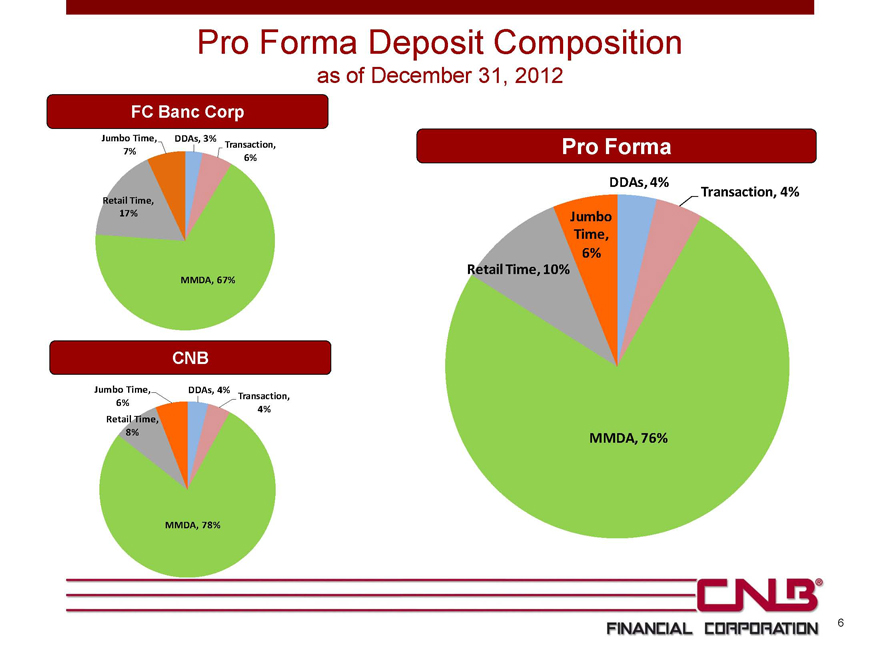

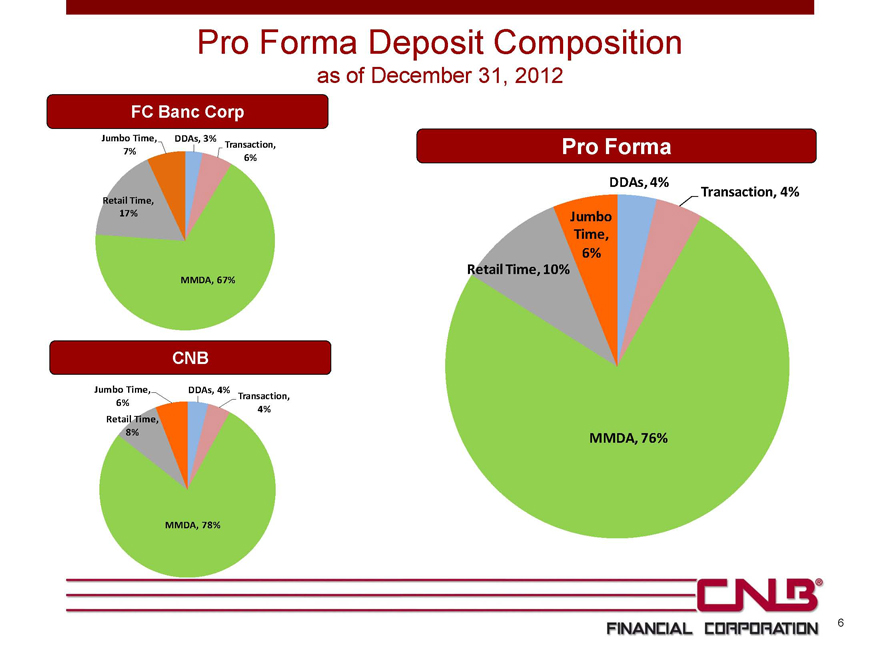

Pro Forma Deposit Composition

as of December 31, 2012

FC Banc Corp

Jumbo Time, 7%

DDAs, 3%

Transaction, 6%

Retail Time, 17%

MMDA, 67%

CNB

Jumbo Time, 6%

Retail Time, 8%

DDAs, 4%

Transaction, 4%

MMDA, 78%

Pro Forma

Retail Time, 10%

Jumbo Time, 6%

DDAs, 4%

Transaction, 4%

MMDA, 76%

CNB

FINANCIAL CORPORATION 6

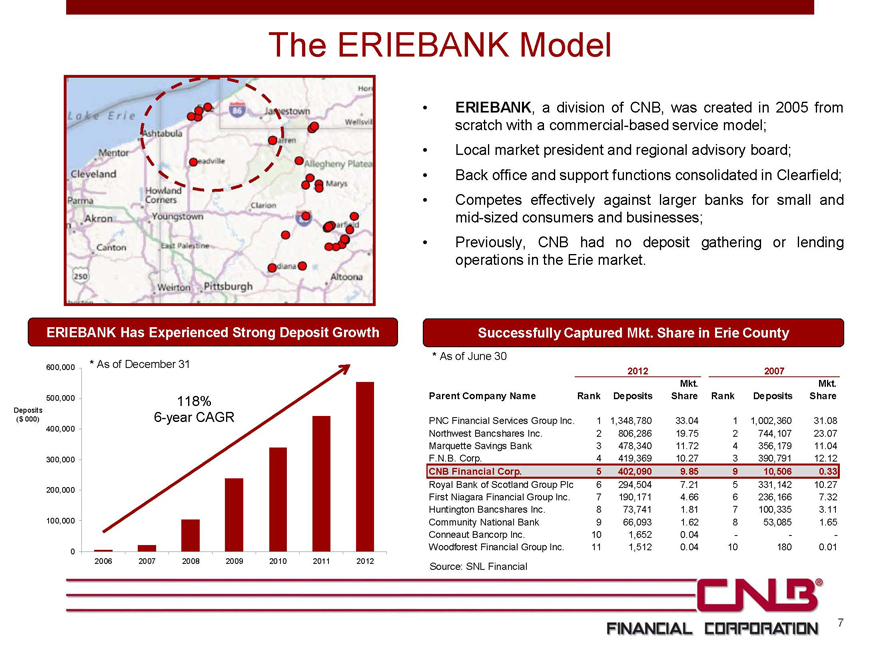

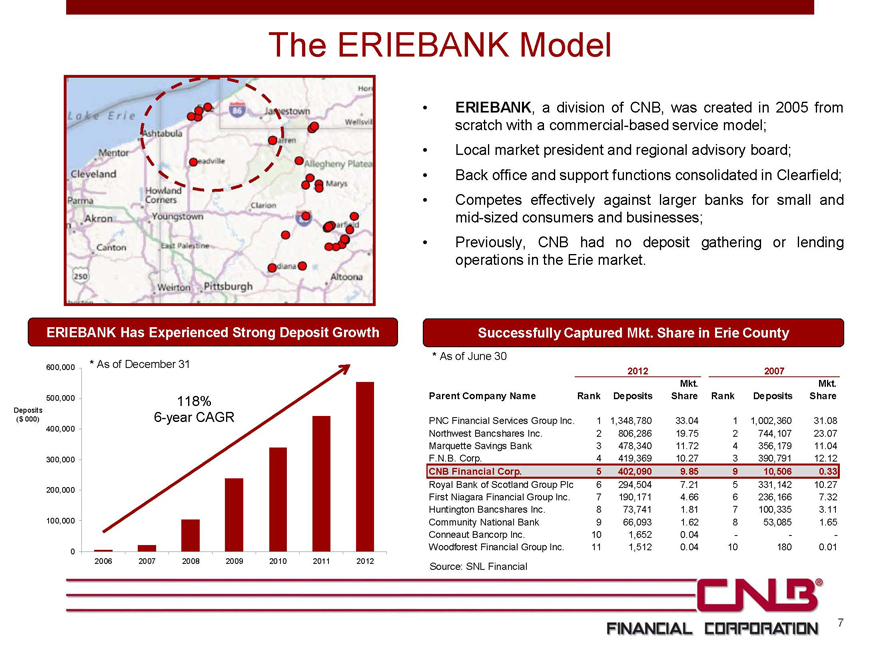

The ERIEBANK Model

Lake Erie Mentor Cleveland Parma Akron Canton 250 Ashtabula

Howland Corners Youngstown East Palestine Weirton Pittsburgh

Jamestown Allegheny Plateau Marys Indiana

Altoona ERIEBANK Has Experienced Strong Deposit Growth

600,000 * As of December 31

500,000 118% Deposits ($ 000)

6-year CAGR 400,000 300,000 200,000 100,000

0 2006 2007 2008 2009 2010 2011 2012

ERIEBANK, a division of CNB, was created in 2005 from scratch with a commercial-based service model;

Local market president and regional advisory board;

Back office and support functions consolidated in Clearfield;

Competes effectively against larger banks for small and mid-sized consumers and businesses;

Previously, CNB had no deposit gathering or lending operations in the Erie market.

Successfully Captured Mkt. Share in Erie County

* As of June 30 2012 2007

Mkt. Mkt. Parent Company Name Rank Deposits Share Rank Deposits Share

PNC Financial Services Group Inc.

1 1,348,780 33.04 1 1,002,360 31.08

Northwest Bancshares Inc.

2 806,286 19.75 2 744,107 23.07

Marquette Savings Bank

3 478,340 11.72 4 356,179 11.04

F.N.B. Corp. 4 419,369 10.27 3 390,791 12.12

CNB Financial Corp. 5 402,090 9.85 9 10,506 0.33

Royal Bank of Scotland Group Plc 6 294,504 7.21 5 331,142 10.27

First Niagara Financial Group Inc.

7 190,171 4.66 6 236,166 7.32

Huntington Bancshares Inc.

8 73,741 1.81 7 100,335 3.11

Community National Bank

9 66,093 1.62 8 53,085 1.65

Conneaut Bancorp Inc.

10 1,652 0.04 - - -

Woodforest Financial Group Inc.

11 1,512 0.04 10 180 0.01

Source: SNL Financial

CNB

FINANCIAL CORPORATION 7

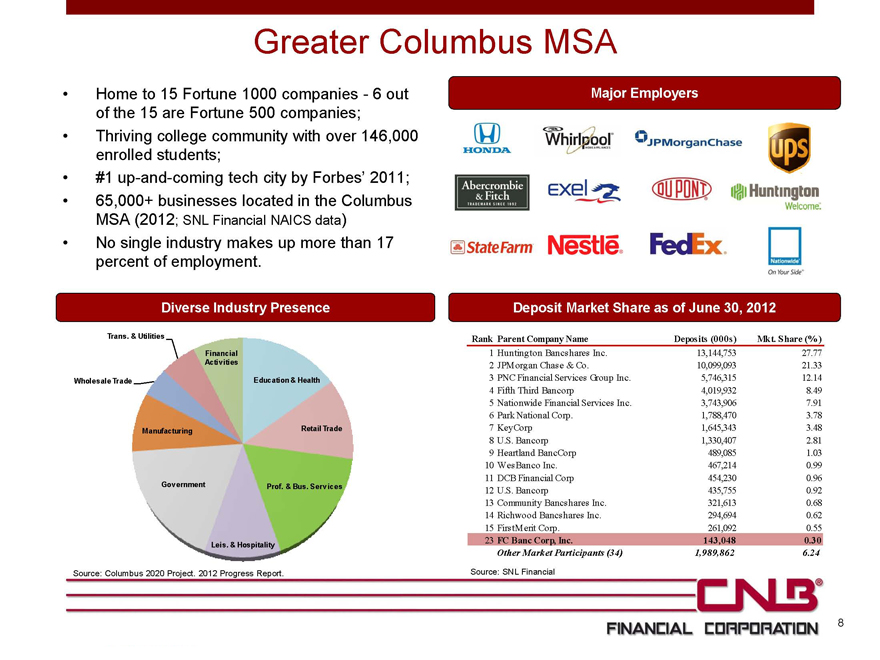

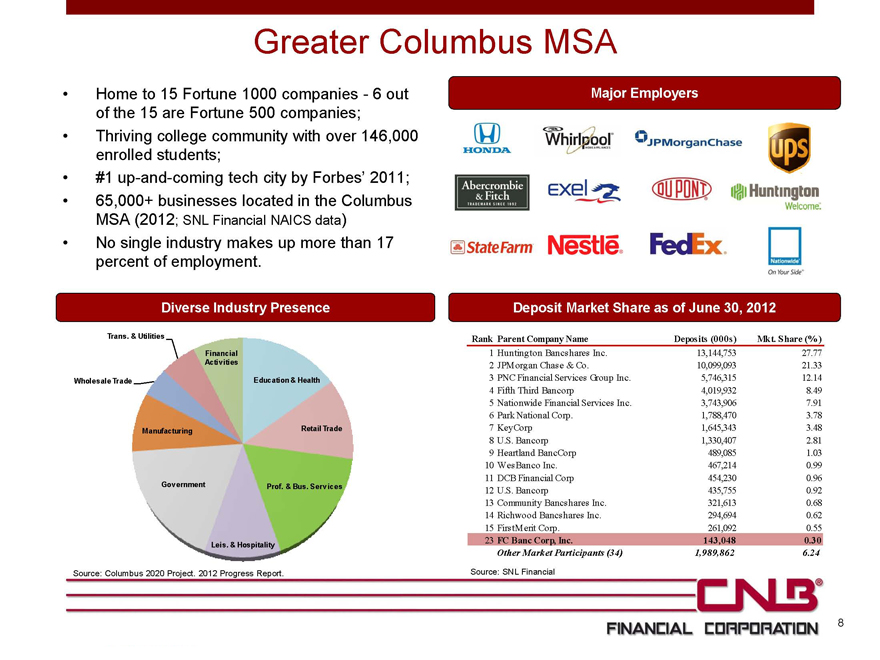

Greater Columbus MSA

Home to 15 Fortune 1000 companies - 6 out of the 15 are Fortune 500 companies;

Thriving college community with over 146,000 enrolled students;

#1 up-and-coming tech city by Forbes’ 2011;

65,000+ businesses located in the Columbus MSA (2012; SNL Financial NAICS data)

No single industry makes up more than 17 percent of employment.

Diverse Industry Presence

Trans. & Utilities

Financial Activities

Wholesale Trade

Education & Health

Manufacturing

Retail Trade

Government Prof. & Bus. Services

Leis. & Hospitality

Source: Columbus 2020 Project. 2012 Progress Report.

Major Employers

Deposit Market Share as of June 30, 2012

Rank

Parent Company Name Deposits (000s) Mkt. Share (% )

1 Huntington Bancshares Inc. 13,144,753 27.77

2 JPMorgan Chase & Co. 10,099,093 21.33

3 PNC Financial Services Group Inc. 5,746,315 12.14

4 Fifth Third Bancorp 4,019,932 8.49

5 Nationwide Financial Services Inc. 3,743,906 7.91

6 Park National Corp. 1,788,470 3.78

7 KeyCorp 1,645,343 3.48

8 U.S. Bancorp 1,330,407 2.81

9 Heartland BancCorp 489,085 1.03

10 WesBanco Inc. 467,214 0.99

11 DCB Financial Corp 454,230 0.96

12 U.S. Bancorp 435,755 0.92

13 Community Bancshares Inc. 321,613 0.68

14 Richwood Bancshares Inc. 294,694 0.62

15 FirstMerit Corp. 261,092 0.55

23 FC Banc Corp, Inc. 143,048 0.30

Other Market Participants (34) 1,989,862 6.24

Source: SNL Financial

CNB

FINANCIAL CORPORATION 8

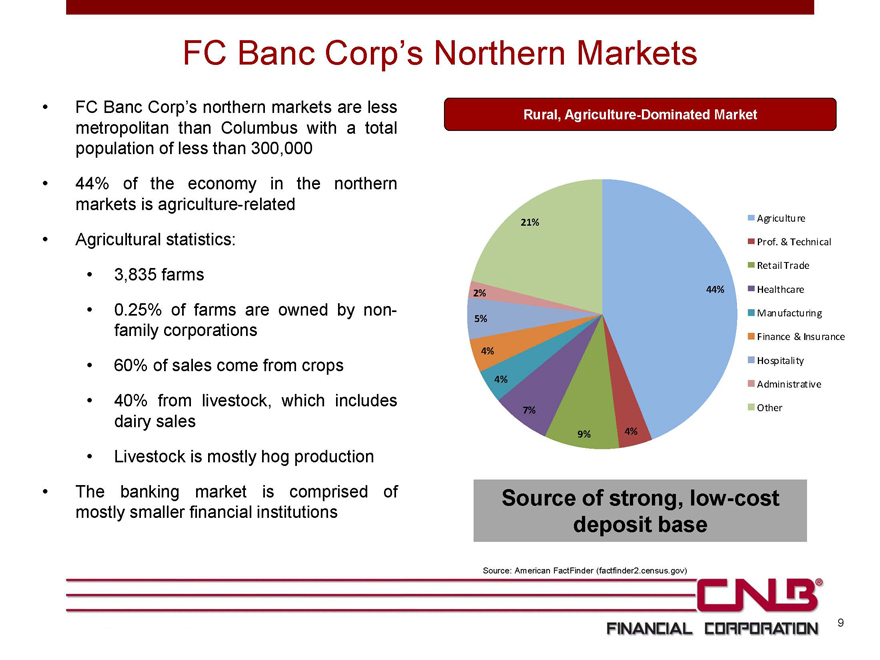

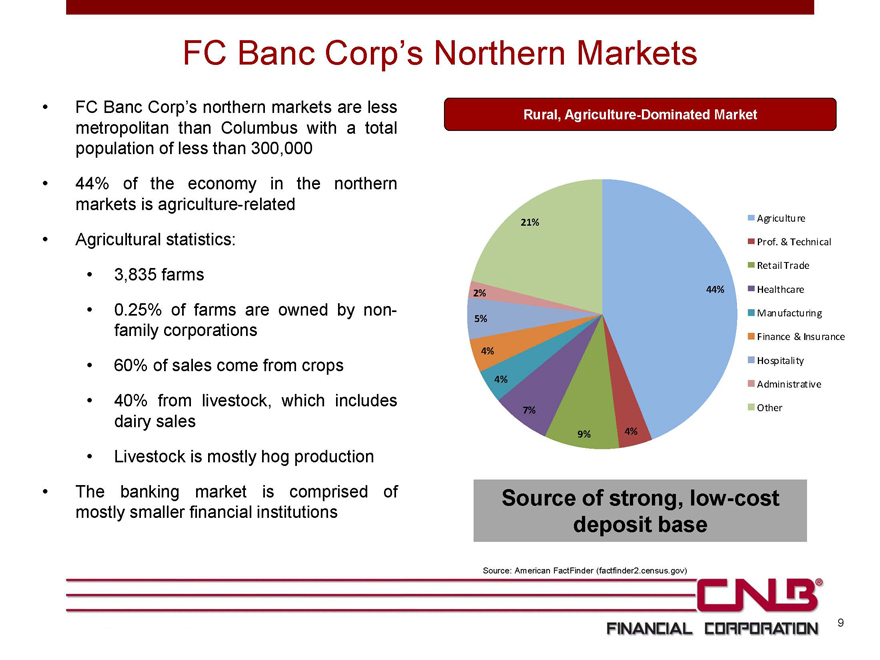

FC Banc Corp’s Northern Markets

FC Banc Corp’s northern markets are less metropolitan than Columbus with a total population of less than 300,000

44% of the economy in the northern markets is agriculture-related

Agricultural statistics:

3,835 farms

0.25% of farms are owned by non-family corporations

60% of sales come from crops

40% from livestock, which includes dairy sales

Livestock is mostly hog production

The banking market is comprised of mostly smaller financial institutions

Rural, Agriculture-Dominated Market

21%

2%

5%

4%

4%

7%

9%

4%

44%

Agriculture

Prof. & Technical

Retail Trade

Healthcare

Manufacturing

Finance & Insurance

Hospitality

Administrative

Other

Source of strong, low-cost deposit base

Source: American FactFinder (factfinder2.census.gov)

CNB

FINANCIAL CORPORATION 9

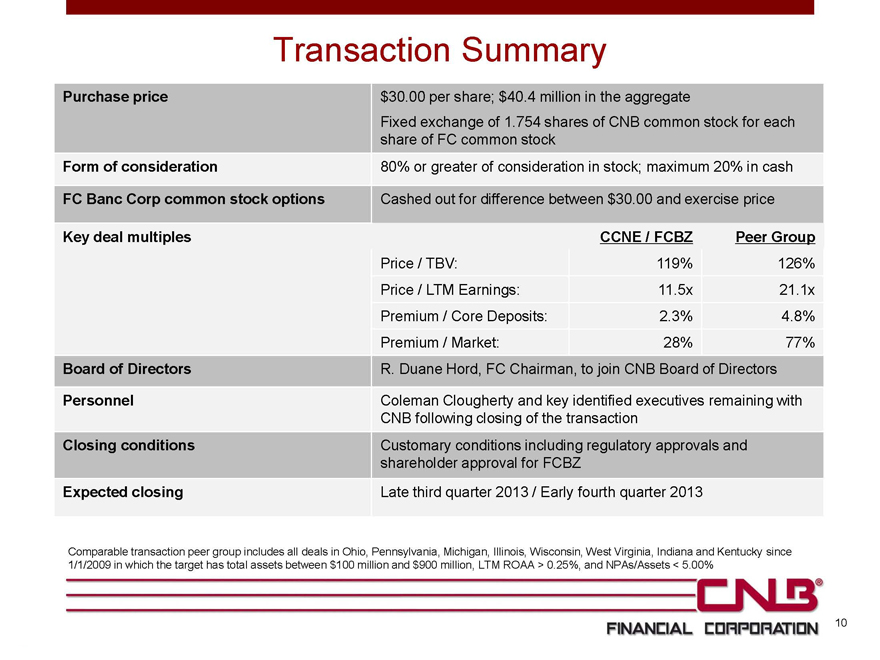

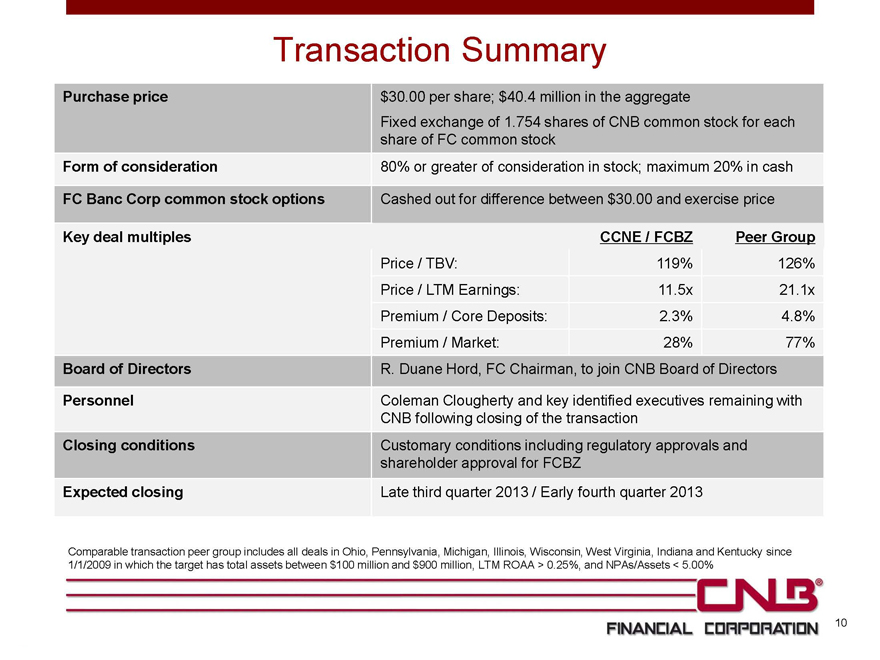

Transaction Summary

Purchase price $30.00 per share; $40.4 million in the aggregate

Fixed exchange of 1.754 shares of CNB common stock for each share of FC common stock

Form of consideration 80% or greater of consideration in stock; maximum 20% in cash

FC Banc Corp common stock options Cashed out for difference between $30.00 and exercise price

Key deal multiples CCNE / FCBZ Peer Group Price / TBV: 119% 126% Price / LTM Earnings: 11.5x 21.1x Premium / Core Deposits: 2.3% 4.8% Premium / Market: 28% 77%

Board of Directors R. Duane Hord, FC Chairman, to join CNB Board of Directors

Personnel Coleman Clougherty and key identified executives remaining with CNB following closing of the transaction Closing conditions Customary conditions including regulatory approvals and shareholder approval for FCBZ Expected closing Late third quarter 2013 / Early fourth quarter 2013

Comparable transaction peer group includes all deals in Ohio, Pennsylvania, Michigan, Illinois, Wisconsin, West Virginia, Indiana and Kentucky since 1/1/2009 in which the target has total assets between $100 million and $900 million, LTM ROAA > 0.25%, and NPAs/Assets < 5.00%

CNB

FINANCIAL CORPORATION 10

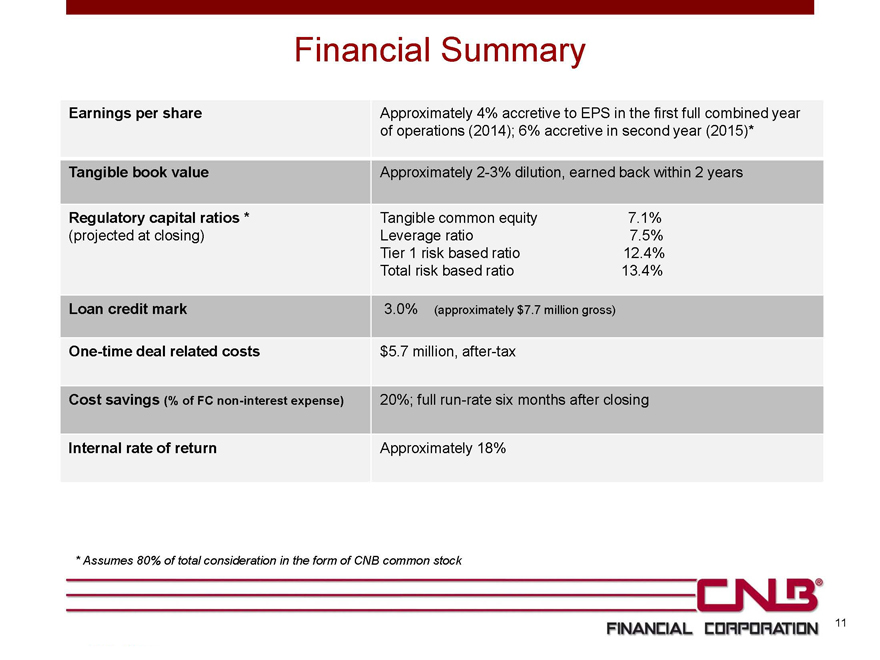

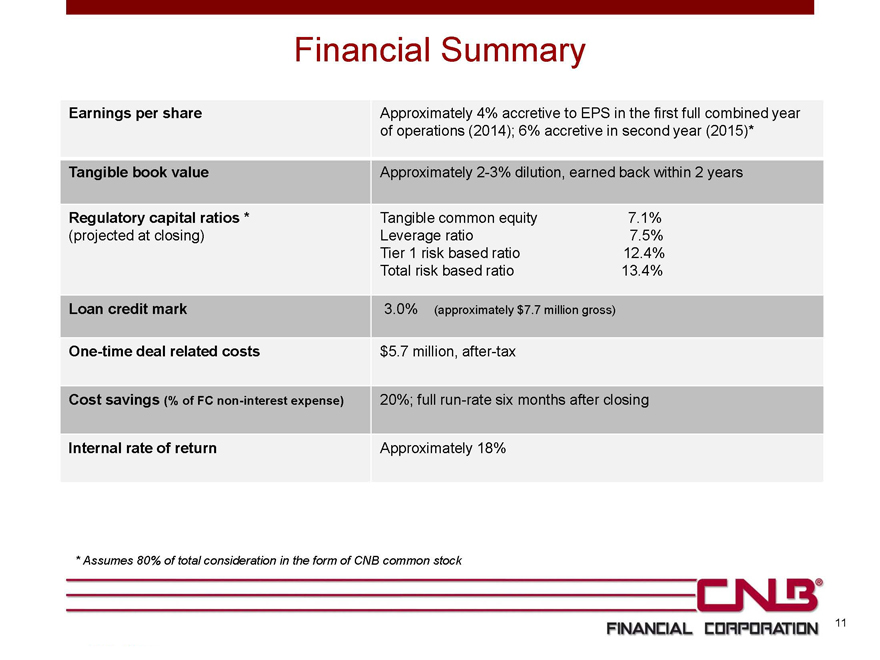

Financial Summary

Earnings per share

Approximately 4% accretive to EPS in the first full combined year of operations (2014); 6% accretive in second year (2015)* Tangible book value

Approximately 2-3% dilution, earned back within 2 years

Regulatory capital ratios* (projected at closing)

Tangible common equity 7.1%

Leverage ratio 7.5%

Tier 1 risk based ratio 12.4%

Total risk based ratio 13.4%

Loan credit mark 3.0% (approximately $7.7 million gross)

One-time deal related costs $5.7 million, after-tax

Cost savings (% of FC non-interest expense) 20%; full run-rate six months after closing

Internal rate of return Approximately 18%

* Assumes 80% of total consideration in the form of CNB common stock

CNB

FINANCIAL CORPORATION 11