| |  | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Semi-Annual Report | |

| | | |

| | April 30, 2014 | |

| | | |

| | (Unaudited) | |

| |

| |

| | | |

| | Total Return U.S. Treasury Fund, Inc. | |

| | | |

| | Managed Municipal Fund, Inc. | |

| | | |

| | North American Government Bond Fund, Inc. | |

| | | |

| | ISI Strategy Fund, Inc. | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| ISI Funds Semi-Annual Report – Table of Contents |

| Investment Advisor’s Message | 1 |

| Performance Comparisons | 2 |

| Shareholder Expense Examples | 10 |

| Portfolio Profiles | 13 |

| Schedules of Investments | 14 |

| Statements of Assets and Liabilities | 30 |

| Statements of Operations | 34 |

| Statements of Changes in Net Assets | 36 |

| Financial Highlights | 42 |

| Notes to Financial Statements | 49 |

| Notice to Shareholders | 60 |

| Investment Advisor’s Message | 4/30/2014 |

Dear Shareholder:

I am pleased to present the semi-annual report to shareholders for the ISI Funds. This report covers the six-month reporting period ended April 30, 2014. For this period, the Total Return US Treasury Fund, Inc. (‘Total Return’) produced a -0.71% return; Managed Municipal Fund, Inc. (‘Managed Municipal’) produced a +2.38% return in its Class A Shares and a +1.94% return in its Class I Shares; North American Government Bond Fund, Inc. (‘North American’) produced a -1.31% return in its Class A Shares, a -1.38% return in its Class C Shares, and a -1.03% return in its Class I Shares; and ISI Strategy Fund (‘Strategy’) produced a +6.20% return. These figures assume the reinvestment of dividends and capital gain distributions, and exclude the impact of any sales charges.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance of a Fund, please call (800) 882-8585.

Description of Fund Objectives

Total Return, Managed Municipal, North American and Strategy, (each a ‘Fund’ and collectively, the ‘Funds’) are registered under the Investment Company Act of 1940, as amended, as open-end management investment companies. The Funds are organized as corporations under the laws of the state of Maryland.

International Strategy & Investment, Inc. (‘ISI’) manages all four Funds. Total Return’s investment objective is to achieve a high level of total return with relative stability of principal and, secondarily, high current income consistent with an investment in securities issued by the United States Treasury. Managed Municipal’s investment objective is designed to provide a high level of total return with relative stability of principal and, secondarily, high current income exempt from federal income tax through investment in a portfolio consisting primarily of tax-free municipal obligations. North American’s investment objective is designed to provide a high level of current income, consistent with prudent investment risk. Strategy’s investment objective is designed to maximize total return through a combination of long-term growth of capital and current income.

We would like to welcome new investors to the ISI Funds and thank those who have been with us for some time. We appreciate your confidence.

Sincerely,

R. Alan Medaugh

President

May 13, 2014

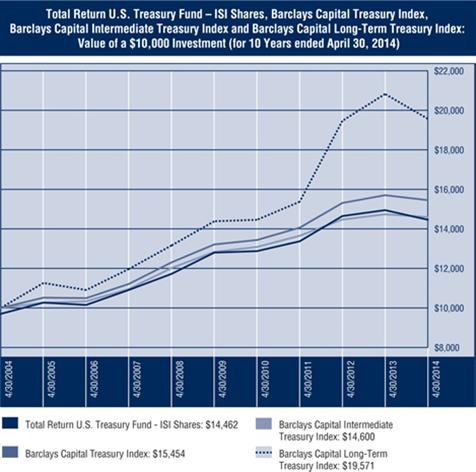

Total Return U.S. Treasury Fund, Inc. – Performance Comparison1 (Unaudited) |

Total Return U.S. Treasury Fund, Inc. – Performance Comparison1 (Unaudited) (continued) |

| Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended

April 30, 2014 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 |

| Total Return U.S. Treasury Fund | -6.11% | 4.93% | 9.58% | 44.59% | 356.91% | -6.11% | 1.62% | 1.85% | 3.76% | 6.08% |

Barclays Capital Treasury Index3 | -1.59% | 9.90% | 16.97% | 54.54% | 416.33% | -1.59% | 3.20% | 3.19% | 4.45% | 6.60% |

Barclays Capital Intermediate Treasury Index3 | -0.93% | 6.96% | 13.73% | 46.00% | 343.86% | -0.93% | 2.26% | 2.60% | 3.86% | 5.98% |

Barclays Capital Long-Term Treasury Index3 | -6.02% | 27.31% | 36.05% | 95.71% | 549.63% | -6.02% | 8.38% | 6.35% | 6.94% | 7.56% |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes the Fund’s maximum 3.00% sales charge. Distributions of the Fund’s capital gains and any non-US Treasury income may be subject to state and local taxes. Management is not aware of any single index that is truly representative of the Fund since its active maturity management policy allows the manager to adjust the weighted average maturity throughout each US Treasury sector. Currently, the Fund’s weighted average maturity is approximately 4.16 years. |

| 2 | The Fund’s inception date is August 10, 1988. Benchmark returns are for the periods beginning August 31, 1988. |

| 3 | The Barclays Capital Treasury Index is an unmanaged index reflecting the performance of all public Treasury obligations and does not focus on one particular segment of the Treasury market. The Barclays Capital Intermediate Treasury Index is an unmanaged index reflecting the performance of US Treasury securities in the intermediate-term Treasury sector. The Barclays Capital Long-Term Treasury Index is an unmanaged index reflecting the performance of US Treasury securities in the long-term Treasury sector. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| October 31, 2013 |

| Expense Ratio Information as of: | (As disclosed in March 1, 2014 Summary Prospectus) |

| Gross Expense Ratio | 0.89% |

Managed Municipal Fund, Inc. – Performance Comparison1 (Unaudited) |

Managed Municipal Fund, Inc. – Performance Comparison1 (Unaudited) (continued) |

| Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended

April 30, 2014 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception |

Managed Municipal Fund –

ISI Class A Shares2 | -4.33% | 6.71% | 12.34% | 36.04% | 210.41% | -4.33% | 2.19% | 2.35% | 3.13% | 4.80% |

Managed Municipal Fund –

ISI Class I Shares3 | -1.78% | 10.07% | ─ | ─ | 8.22% | -1.78% | 3.25% | ─ | ─ | 2.24% |

Barclays Capital General Obligation Index4 | 0.62% | 15.72% | 27.62% | 60.17% | 175.27% | 0.62% | 4.99% | 5.00% | 4.82% | 4.28% |

Barclays Capital Prerefunded Municipal Bond Index4 | 0.75% | 5.87% | 11.82% | 38.88% | 71.71% | 0.75% | 1.92% | 2.26% | 3.34% | 2.26% |

Consumer Price Index5 | 2.00% | 5.49% | 11.26% | 26.17% | 92.85% | 2.00% | 1.80% | 2.16% | 2.35% | 2.75% |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes the sales charge, if applicable. ISI Class A Shares have a maximum 3.00% sales charge. Distributions of the Fund’s income and capital gains may be subject to state and local taxes. |

| 2 | The ISI Class A Shares inception date is February 26, 1990. Benchmark returns are for the periods beginning February 28, 1990. |

| 3 | The ISI Class I Shares inception date is October 7, 2010. Benchmark returns are for the period beginning October 31, 2010. Cumulative and annualized returns for the Barclays Capital General Obligation Index from October 31, 2010 through April 30, 2014 were 14.90% and 4.05%, respectively. Cumulative and annualized returns for the Barclays Capital Prerefunded Municipal Bond Index from October 31, 2010 through April 30, 2014 were 6.26% and 1.75%, respectively. |

| 4 | The Barclays Capital General Obligation Index is an unmanaged index reflecting general municipal bond market performance. The Barclays Capital Prerefunded Municipal Bond Index, an unmanaged index, is a subcomponent of the general Barclays Capital Municipal Bond Index, and contains only bonds from that index that have been prerefunded or escrowed to maturity. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| 5 | The Consumer Price Index is a widely used measure of inflation. |

| October 31, 2013 |

| Expense Ratio Information as of: | (As disclosed in March 1, 2014 Summary Prospectus) |

| Gross Expense Ratio – Class A | 1.04% |

| Gross Expense Ratio – Class I | 0.79% |

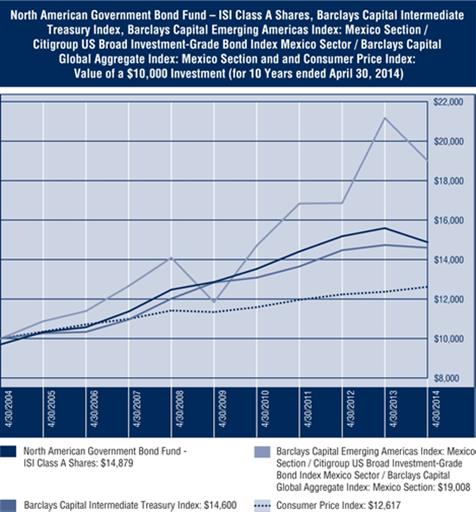

North American Government Bond Fund, Inc. – Performance Comparison1 (Unaudited) |

North American Government Bond Fund, Inc. – Performance Comparison1 (Unaudited) (continued) |

| Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended

April 30, 2014 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception |

North American Government Bond Fund - ISI Class A Shares2 | -7.47% | 0.17% | 12.27% | 48.74% | 186.88% | -7.47% | 0.06% | 2.34% | 4.05% | 5.07% |

North American Government Bond Fund - ISI Class C Shares3 | -5.94% | 1.65% | 12.39% | 44.32% | 39.32% | -5.94% | 0.55% | 2.36% | 3.74% | 3.07% |

North American Government Bond Fund - ISI Class I Shares4 | -4.39% | 4.33% | ─ | ─ | 6.31% | -4.39% | 1.42% | ─ | ─ | 1.70% |

Barclays Capital Intermediate Treasury Index5 | -0.93% | 6.96% | 13.73% | 46.00% | 182.85% | -0.93% | 2.26% | 2.60% | 3.86% | 5.01% |

Barclays Capital Emerging Americas Index: Mexico Section / Citigroup US Broad Investment-Grade Bond Index Mexico Sector / Barclays Capital Global Aggregate Index: Mexico Section6 | -10.21% | 12.89% | 60.47% | 90.08% | 542.22% | -10.21% | 4.12% | 9.92% | 6.63% | 9.14% |

Consumer Price Index7 | 2.00% | 5.49% | 11.26% | 26.17% | 70.15% | 2.00% | 1.80% | 2.16% | 2.35% | 2.53% |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes sales charges, if applicable. ISI Class A shares have a maximum 3.00% sales charge. ISI Class C Shares have a maximum 1.00% contingent deferred sales charge in the first year, which is eliminated thereafter. |

| 2 | ISI Class A Shares inception date is January 15, 1993. Benchmark returns are for the periods beginning January 31, 1993. |

| 3 | ISI Class C Shares inception date is May 16, 2003. Cumulative and annualized returns for the Barclays Capital Intermediate Treasury Index from May 31, 2003 through April 30, 2014 were 45.12% and 3.47%, respectively. |

| 4 | ISI Class I Shares inception date is September 16, 2010. Benchmark returns are for the periods beginning September 30, 2010. Cumulative and annualized returns for the Barclays Capital Intermediate Treasury Index from September 30, 2010 through April 30, 2014 were 6.12% and 1.67%, respectively. |

| 5 | The Barclays Capital Intermediate Treasury Index is an unmanaged index reflecting the performance of US Treasury securities in the intermediate-term Treasury sector. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| 6 | Reflects the performance of the Barclays Capital Emerging Americas Index: Mexico Section through October 31, 2004 and the Citigroup US Broad Investment-Grade Bond Index Mexico Sector from that date through October 31, 2006 and the Barclays Capital Global Aggregate Index: Mexico from October 31, 2006 through April 30, 2014. The Barclays Capital Emerging Americas Index: Mexico Section has been discontinued. Barclays Capital Emerging Americas Index: Mexico Section was an unmanaged sub-index of the Barclays Capital Emerging Americas Index reflecting the performance of selected Mexican debt instruments with maturities of one year or more. The Citigroup US Broad Investment-Grade Bond Index Mexico Sector is an unmanaged sub-index of the Citigroup US Broad Investment-Grade Bond Index reflecting the performance of selected Mexican debt instruments with maturities of one year or more. The Barclays Capital Global Aggregate Index: Mexico Section is an unmanaged sub-index of Barclays Capital Global Aggregate Index which provides broad-based measure of global investment-grade fixed income markets. The Mexico Section reflects the US dollar performance of selected Mexican government peso-denominated debt instruments with maturities of one year or more. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| 7 | The Consumer Price Index is a widely used measure of inflation. |

| October 31, 2013 |

| Expense Ratio Information as of: | (As disclosed in March 1, 2014 Summary Prospectus) |

| Gross Expense Ratio – Class A | 1.25% |

| Gross Expense Ratio – Class C | 1.85% |

| Gross Expense Ratio – Class I | 0.85% |

ISI Strategy Fund, Inc. – Performance Comparison1 (Unaudited) |

ISI Strategy Fund, Inc. – Performance Comparison1 (Unaudited) (continued) |

| Cumulative Total Returns (With Sales Charge) | Average Annual Total Returns (With Sales Charge) |

Periods Ended

April 30, 2014 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception2 |

| ISI Strategy Fund | 12.02% | 30.41% | 100.32% | 96.13% | 158.62% | 12.02% | 9.25% | 14.91% | 6.97% | 5.88% |

DJ Wilshire 5000 (Full Cap) Index3 | 20.66% | 46.20% | 144.60% | 122.71% | 186.59% | 20.66% | 13.50% | 19.59% | 8.34% | 6.55% |

Consumer Price Index4 | 2.00% | 5.49% | 11.26% | 26.17% | 48.06% | 2.00% | 1.80% | 2.16% | 2.35% | 2.39% |

Lipper Flexible Portfolio Funds’ Average5 | 11.00% | 22.84% | 87.44% | 94.49% | 142.79% | 11.00% | 7.09% | 13.38% | 6.87% | 5.49% |

| 1 | Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance information presented in the graph and table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. All performance assumes the reinvestment of dividends and capital gain distributions and includes the Fund’s maximum 3.00% sales charge. |

| 2 | The Fund’s inception date is September 16, 1997. Benchmark returns are for the periods beginning September 30, 1997. |

| 3 | The DJ Wilshire 5000 (Full Cap) Index is an unmanaged index that represents the broadest measure of the US equity market. Benchmark returns do not reflect expenses or sales charges that have been deducted from the Fund’s returns. |

| 4 | The Consumer Price Index is a widely used measure of inflation. |

| 5 | Lipper figures represent the average total returns by all mutual funds designated by Lipper as falling into the category indicated. The Lipper Flexible Portfolio Funds’ Average category includes funds that allocate their investments across various asset classes, including domestic common stocks, bonds and money market instruments with a focus on total return. |

| October 31, 2013 |

| Expense Ratio Information as of: | (As disclosed in March 1, 2014 Summary Prospectus) |

| Gross Expense Ratio | 1.08% |

| Shareholder Expense Examples (Unaudited) |

As a shareholder of the Funds, you incur two types of cost: (1) transaction costs, including sales charges (loads); and (2) ongoing costs, including management fees, Rule 12b-1 distribution/shareholder service fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the tables below are based on an investment of $1,000 made at the beginning of the period (November 1, 2013) shown and held for the entire period (April 30, 2014).

Actual Expenses – “Actual Return” in the following table provides information about actual account values and actual expenses. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Expenses Paid During Period” column to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – “Hypothetical Returns” in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return of each Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, “Hypothetical Returns” in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| Shareholder Expense Examples (Unaudited) (continued) |

Total Return U.S. Treasury Fund, Inc.

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $992.90 | $4.79 | 0.97% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,019.98 | $4.86 | 0.97% |

Managed Municipal Fund, Inc. – Class A

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $1,023.80 | $5.82 | 1.16% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,019.04 | $5.81 | 1.16% |

Managed Municipal Fund, Inc. – Class I

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $1,019.40 | $4.61 | 0.92% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,020.23 | $4.61 | 0.92% |

North American Government Bond Fund, Inc. – Class A

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $986.90 | $6.85 | 1.39% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,017.90 | $6.95 | 1.39% |

North American Government Bond Fund, Inc. – Class C

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $986.20 | $9.11 | 1.85% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,015.62 | $9.25 | 1.85% |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the period, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| Shareholder Expense Examples (Unaudited) (continued) |

North American Government Bond Fund, Inc. – Class I

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $989.70 | $4.88 | 0.99% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,019.89 | $4.96 | 0.99% |

ISI Strategy Fund, Inc.

| | Beginning

Account Value

November 1, 2013 | Ending

Account Value

April 30, 2014 | Expenses Paid

During Period(1) | Annualized

Expense Ratio |

| Based on Actual Fund Return | $1,000.00 | $1,062.00 | $5.73 | 1.12% |

| Based on Hypothetical 5% Return | $1,000.00 | $1,019.24 | $5.61 | 1.12% |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the period, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| Portfolio Profiles (Unaudited) |

| Portfolio Profiles (as a % of Net Assets) | April 30, 2014 |

| Total Return U.S. Treasury Fund, Inc. |

| U.S. Treasury Obligations | 79.91% |

| U.S. Treasury Bills | 19.48% |

| Other Assets and Liabilities | 0.61% |

| 100.00% |

| Managed Municipal Fund, Inc. |

| Aaa Municipal Obligations* | 82.88% |

| Aa Municipal Obligations* | 5.85% |

| NR Municipal Obligations* | 0.55% |

| U.S. Treasury Bills | 9.83% |

| Other Assets and Liabilities | 0.89% |

| 100.00% |

| * Ratings are based on Moody’s Investors Service, Inc. |

| North American Government Bond Fund, Inc. |

| Canadian Securities | 18.89% |

| Mexican Securities | 16.71% |

| U.S. Treasury Obligations | 57.86% |

| U.S. Treasury Bills | 5.20% |

| Other Assets and Liabilities | 1.34% |

| 100.00% |

| ISI Strategy Fund, Inc. |

| Consumer Discretionary | 12.21% |

| Consumer Staples | 5.80% |

| Energy | 9.00% |

| Financials | 13.57% |

| Health Care | 11.34% |

| Industrials | 9.36% |

| Information Technology | 16.91% |

| Materials | 3.17% |

| Telecommunication Services | 2.93% |

| Utilities | 2.77% |

| U.S. Treasury Obligations | 10.39% |

| U.S. Treasury Bills | 2.34% |

| Other Assets and Liabilities | 0.21% |

| 100.00% |

| Total Return U.S. Treasury Fund, Inc. |

| Schedule of Investments | April 30, 2014 (Unaudited) |

| Security | | Interest Rate | Maturity

Date | | Principal

Amount | | | Value | |

| U.S. TREASURY OBLIGATIONS - 79.91% | | | | | | | | |

| U.S. Treasury Notes | | | 3.750 | % | 11/15/18 | | $ | 360,000 | | | $ | 395,592 | |

| U.S. Treasury Notes | | | 1.250 | % | 01/31/19 | | | 16,000,000 | | | | 15,733,120 | |

| U.S. Treasury Notes | | | 1.500 | % | 01/31/19 | | | 750,000 | | | | 746,016 | |

| U.S. Treasury Notes | | | 2.625 | % | 08/15/20 | | | 280,000 | | | | 289,450 | |

| U.S. Treasury Bonds | | | 8.125 | % | 08/15/19 | | | 10,000,000 | | | | 13,239,060 | |

| U.S. Treasury Bonds | | | 8.750 | % | 08/15/20 | | | 11,000,000 | | | | 15,396,128 | |

| | | | | | | | | | | | | |

| Total U.S. Treasury Obligations (Cost $43,978,801) | | | $ | 45,799,366 | |

| | | | | | | | | | | | | |

| U.S. TREASURY BILLS - 19.48% | | | | | | | | | | | | | |

U.S. Treasury Bills1 | | | 0.014 | % | 05/08/14 | | $ | 6,155,000 | | | $ | 6,154,982 | |

U.S. Treasury Bills1 | | | 0.006 | % | 06/05/14 | | | 1,915,000 | | | | 1,914,988 | |

U.S. Treasury Bills1 | | | 0.011 | % | 08/07/14 | | | 3,095,000 | | | | 3,094,904 | |

| | | | | | | | | | | | | |

| Total U.S. Treasury Bills (Cost $11,164,611) | | | $ | 11,164,874 | |

| | | | | | | | | | | | | |

| Total Investments - 99.39% (Cost $55,143,412)* | | | $ | 56,964,240 | |

| Other Assets in Excess of Liabilities - 0.61% | | | | 349,974 | |

| Net Assets - 100.00% | | | $ | 57,314,214 | |

1 | Interest rate presented is yield to maturity. |

| * | Cost for Federal income tax purposes is $55,143,412 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 2,089,893 | |

| Gross Unrealized Depreciation | | | (269,065 | ) |

| Net Unrealized Appreciation | | $ | 1,820,828 | |

See Notes to Financial Statements.

| Managed Municipal Fund, Inc. |

| Schedule of Investments | April 30, 2014 (Unaudited) |

| Security | | Interest Rate | Maturity

Date | Ratings

(Moody’s/

S&P)1 | | Principal

Amount | | | Value | |

| MUNICIPAL BONDS - 89.28% | | | | | | | | | | | |

| General Obligation - 44.70% | | | | | | | | | | | |

| Baltimore County, MD | | | 4.000 | % | 08/01/22 | Aaa/AAA | | $ | 1,665,000 | | | $ | 1,856,841 | |

| City of Columbus, OH, Series 1 | | | 4.000 | % | 07/01/29 | Aaa/AAA | | | 500,000 | | | | 532,985 | |

| Delaware State | | | 4.000 | % | 03/01/31 | Aaa/AAA | | | 2,000,000 | | | | 2,122,160 | |

| Delaware State, Series A | | | 3.000 | % | 08/01/26 | Aaa/AAA | | | 1,500,000 | | | | 1,525,815 | |

| Delaware State, Series B | | | 3.000 | % | 07/01/19 | Aaa/AAA | | | 1,400,000 | | | | 1,521,898 | |

| Georgia State, Series A | | | 3.000 | % | 07/01/29 | Aaa/AAA | | | 3,000,000 | | | | 2,907,450 | |

| Georgia State, Series B | | | 4.250 | % | 04/01/25 | Aaa/AAA | | | 1,120,000 | | | | 1,179,528 | |

| Mecklenburg County, NC | | | 3.500 | % | 02/01/26 | Aaa/AAA | | | 2,000,000 | | | | 2,163,780 | |

Oregon State, State Property,

ODOT Building, Series K | | | 5.000 | % | 05/01/30 | Aa1/AA+ | | | 1,915,000 | | | | 2,162,380 | |

Prince Georges County, MD,

Public Improvements | | | 4.125 | % | 07/15/26 | Aaa/AAA | | | 2,000,000 | | | | 2,119,700 | |

| Texas State, Water Financial Assistance, Series C-1 | | | 5.000 | % | 08/01/39 | Aaa/AAA | | | 3,515,000 | | | | 3,901,931 | |

| Utah State, Series A | | | 5.000 | % | 07/01/23 | Aaa/AAA | | | 2,785,000 | | | | 3,341,499 | |

| Wake County, NC, Series A | | | 3.000 | % | 05/01/29 | Aaa/AAA | | | 2,525,000 | | | | 2,487,453 | |

| Washington State, Motor Vehicle Fuel Tax, Series E | | | 4.000 | % | 02/01/36 | Aa1/AA+ | | | 2,000,000 | | | | 2,012,500 | |

| Washington, MD, Suburban Sanitation District, Public Improvements | | | 3.000 | % | 06/01/26 | Aaa/AAA | | | 2,000,000 | | | | 2,026,940 | |

| | | | | | | | | | | | $ | 31,862,860 | |

Prerefunded2 Issues - 33.85% | | | | | | | | | | | | | | |

| Fairfax County, VA, Water Authority Water Revenue, 04/01/2017 @ 100 | | | 4.500 | % | 04/01/27 | NR/NR | | $ | 355,000 | | | $ | 394,792 | |

Georgia State, Series G,

10/01/16 @ 100 | | | 4.125 | % | 10/01/23 | Aaa/AA+ | | | 2,000,000 | | | | 2,166,080 | |

| Henrico County, VA, Public Improvements, 07/15/15 @ 100 | | | 4.250 | % | 07/15/24 | Aaa/AAA | | | 2,830,000 | | | | 2,968,217 | |

Kansas State, Development Finance Authority, Series DW-1,

04/01/17 @ 100 | | | 3.000 | % | 04/01/20 | Aaa/AAA | | | 2,865,000 | | | | 2,976,248 | |

Kansas State, Development Finance Authority, Series DW-1,

04/01/17 @ 100 | | | 3.125 | % | 04/01/22 | Aaa/AAA | | | 2,975,000 | | | | 3,188,516 | |

Maryland State, Capital Improvements, Series A,

02/15/15 @ 100 | | | 4.000 | % | 02/15/20 | Aaa/AAA | | | 4,000,000 | | | | 4,121,800 | |

Tennessee State, Series A,

05/01/17 @ 100 | | | 5.000 | % | 05/01/26 | Aaa/AA+ | | | 500,000 | | | | 565,405 | |

See Notes to Financial Statements.

| Managed Municipal Fund, Inc. |

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Interest Rate | Maturity

Date | Ratings

(Moody’s/

S&P)1 | | Principal

Amount | | | Value | |

| MUNICIPAL BONDS - 89.28% (continued) | | | | | | | | | |

Prerefunded2 Issues - 33.85% (continued) | | | | | | | | | |

Tennessee State, Series A,

05/01/17 @ 100 | | | 5.000 | % | 05/01/27 | Aaa/AA+ | | $ | 2,075,000 | | | $ | 2,346,431 | |

Virginia State, Series B,

06/01/16 @ 100 | | | 4.250 | % | 06/01/26 | Aaa/AAA | | | 2,500,000 | | | | 2,700,550 | |

| Washington, MD, Suburban Sanitation District, Water Supply, 06/01/16 @ 100 | | | 4.250 | % | 06/01/26 | Aaa/AAA | | | 2,500,000 | | | | 2,705,825 | |

| | | | | | | | | | | | $ | 24,133,864 | |

| Revenue Bonds - 10.73% | | | | | | | | | | | | | | |

| Fairfax County, VA, Water Authority Water Revenue | | | 4.500 | % | 04/01/27 | Aaa/AAA | | $ | 2,145,000 | | | $ | 2,253,430 | |

| Gwinnett County, GA, Water & Sewerage Authority, Series A | | | 4.000 | % | 08/01/28 | Aaa/AAA | | | 2,000,000 | | | | 2,111,320 | |

| Virginia State, Resources Authority Clean Water Revenue | | | 4.500 | % | 10/01/28 | Aaa/AAA | | | 3,000,000 | | | | 3,281,190 | |

| | | | | | | | | | | | $ | 7,645,940 | |

| | | | | | | | | | | | | | |

| Total Municipal Bonds (Cost $60,304,786) | | | $ | 63,642,664 | |

| | | | | | | | | | | | | | |

| U.S. TREASURY BILLS - 9.83% | | | | | | | | | | | |

U.S. Treasury Bills3 | | | 0.000 | % | 05/01/14 | | — | | $ | 3,810,000 | | | $ | 3,810,000 | |

U.S. Treasury Bills4 | | | 0.006 | % | 06/05/14 | | — | | | 2,850,000 | | | | 2,849,983 | |

U.S. Treasury Bills4 | | | 0.011 | % | 08/07/14 | | — | | | 350,000 | | | | 349,989 | |

| | | | | | | | | | | | | | | |

| Total U.S. Treasury Bills (Cost $7,009,852) | | | $ | 7,009,972 | |

| | | | | | | | | | | | | | | |

| Total Investments - 99.11% (Cost $67,314,638)* | | | $ | 70,652,636 | |

| Other Assets in Excess of Liabilities - 0.89% | | | | 630,925 | |

| Net Assets - 100.00% | | | $ | 71,283,561 | |

See Notes to Financial Statements.

| Managed Municipal Fund, Inc. |

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

1 | Moody’s Municipal Bond Ratings: |

| | |

| | Aaa | Judged to be of the best quality. |

| | | | |

| | Aa | Judged to be of high quality by all standards. Issues are sometimes denoted with a 1, 2 or 3, which denote a high, medium or low ranking within the rating. |

| | | | |

| | NR | Bond is not rated by this rating organization. |

| | | | |

| S&P Municipal Bond Ratings: |

| | |

| | AAA | Of the highest quality. |

| | | | |

| | AA | The second strongest capacity of payment of debt services. Those issues determined to possess very strong safety characteristics are denoted with a plus (+) sign. |

| | | | |

| | NR | Bond is not rated by this rating organization. |

| | | | |

2 | Prerefunded: Bonds which are prerefunded are collateralized by U.S. Treasury securities which are held in escrow and are used to pay principal and interest on tax-exempt issues and to retire the bonds in full at the earliest refunding date. |

| | |

3 | Zero coupon bond. |

| | |

4 | Interest rate presented is yield to maturity. |

| | |

| * | Cost for Federal income tax purposes is $67,314,638 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 3,559,419 | |

| Gross Unrealized Depreciation | | | (221,421 | ) |

| Net Unrealized Appreciation | | $ | 3,337,998 | |

See Notes to Financial Statements.

| North American Government Bond Fund, Inc. |

| Schedule of Investments | April 30, 2014 (Unaudited) |

| Security | | Interest Rate | Maturity

Date | Principal

Amount1 | | | Value | |

| CANADIAN SECURITIES - 18.89% | | | | | | | | | | |

| Canadian Government Bonds | | | 0.750 | % | 05/01/14 | CAD | 5,000,000 | | | $ | 4,562,018 | |

| Canadian Government Bonds | | | 2.250 | % | 08/01/14 | | | 3,150,000 | | | | 2,883,585 | |

| Canadian Government Bonds | | | 1.000 | % | 05/01/15 | | | 3,100,000 | | | | 2,828,536 | |

| Canadian Government Bonds | | | 4.000 | % | 06/01/17 | | | 5,075,000 | | | | 5,019,622 | |

| | | | | | | | | | | | | |

| Total Canadian Securities (Cost $16,308,107) | | | $ | 15,293,761 | |

| | | | | | | | | | | | | |

| MEXICAN SECURITIES - 16.71% | | | | | | | | | | | | | |

Mexican Bono2 | | | 8.000 | % | 12/17/15 | MXN | 47,407,000 | | | $ | 3,853,498 | |

Mexican Bono2 | | | 7.250 | % | 12/15/16 | | | 79,860,000 | | | | 6,561,446 | |

Mexican Bono2 | | | 7.750 | % | 12/14/17 | | | 37,057,500 | | | | 3,118,365 | |

| | | | | | | | | | | | | |

| Total Mexican Securities (Cost $14,370,181) | | | $ | 13,533,309 | |

| | | | | | | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 57.86% | | | | | | | | | | |

| U.S. Treasury Notes | | | 1.500 | % | 01/31/19 | | $ | 2,050,000 | | | $ | 2,039,110 | |

| U.S. Treasury Notes | | | 2.625 | % | 08/15/20 | | | 1,000,000 | | | | 1,033,750 | |

| U.S. Treasury Notes | | | 2.000 | % | 11/15/21 | | | 4,025,000 | | | | 3,929,249 | |

| U.S. Treasury Bonds | | | 8.750 | % | 05/15/17 | | | 11,300,000 | | | | 13,967,862 | |

| U.S. Treasury Bonds | | | 8.875 | % | 08/15/17 | | | 7,550,000 | | | | 9,477,606 | |

| U.S. Treasury Bonds | | | 8.125 | % | 08/15/19 | | | 3,775,000 | | | | 4,997,745 | |

| U.S. Treasury Bonds | | | 8.500 | % | 02/15/20 | | | 6,000,000 | | | | 8,191,872 | |

| U.S. Treasury Bonds | | | 8.750 | % | 08/15/20 | | | 2,300,000 | | | | 3,219,191 | |

| | | | | | | | | | | | | |

| Total U.S. Treasury Obligations (Cost $44,646,458) | | | $ | 46,856,385 | |

| | | | | | | | | | | | | |

| U.S. TREASURY BILLS - 5.20% | | | | | | | | | | | | | |

U.S. Treasury Bills3 | | | 0.014 | % | 05/08/14 | | $ | 1,730,000 | | | $ | 1,729,995 | |

U.S. Treasury Bills3 | | | 0.006 | % | 06/05/14 | | | 880,000 | | | | 879,995 | |

U.S. Treasury Bills3 | | | 0.011 | % | 08/07/14 | | | 1,600,000 | | | | 1,599,950 | |

| | | | | | | | | | | | | |

| Total U.S. Treasury Bills (Cost $4,209,921) | | | $ | 4,209,940 | |

| | | | | | | | | | | | | |

| Total Investments - 98.66% (Cost $79,534,667)* | | | $ | 79,893,395 | |

| Other Assets in Excess of Liabilities - 1.34% | | | | 1,086,300 | |

| Net Assets - 100.00% | | | $ | 80,979,695 | |

See Notes to Financial Statements.

| North American Government Bond Fund, Inc. |

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| CAD | Canadian Dollar |

| MXN | Mexican Peso |

1 | Principal Amount is shown in U.S. dollars unless otherwise noted. |

| | |

2 | Bonos are fixed rate, local currency-denominated coupon bonds issued by the Mexican government. |

| | |

3 | Interest rate presented is yield to maturity. |

| | |

| * | Cost for Federal income tax purposes is $79,534,667 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 2,440,034 | |

| Gross Unrealized Depreciation | | | (2,081,306 | ) |

| Net Unrealized Appreciation | | $ | 358,728 | |

See Notes to Financial Statements.

| Schedule of Investments | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% | | | | |

| Consumer Discretionary - 12.21% | | | | |

| Auto Components - 0.63% | | | | | | |

| Allison Transmission Holdings, Inc. | | | 1,750 | | | $ | 52,220 | |

| American Axle & Manufacturing Holdings, Inc.* | | | 690 | | | | 12,178 | |

| Federal-Mogul Holdings Corp.* | | | 3,535 | | | | 60,873 | |

| Goodyear Tire & Rubber Co. (The) | | | 7,215 | | | | 181,818 | |

| Lear Corp. | | | 3,250 | | | | 269,945 | |

| | | | | | | 577,034 | |

| Automobiles - 0.78% | | | | | | | | |

| Ford Motor Co. | | | 17,115 | | | | 276,407 | |

| General Motors Co. | | | 11,735 | | | | 404,623 | |

| Winnebago Industries, Inc.* | | | 1,640 | | | | 39,196 | |

| | | | | | | 720,226 | |

| Diversified Consumer Services - 0.26% | | | | | |

| Apollo Education Group, Inc.* | | | 2,220 | | | | 64,069 | |

| H&R Block, Inc. | | | 1,220 | | | | 34,673 | |

| Hillenbrand, Inc. | | | 2,200 | | | | 66,880 | |

| Regis Corp. | | | 1,140 | | | | 14,980 | |

| Service Corp. International | | | 2,490 | | | | 46,737 | |

| Weight Watchers International, Inc. | | | 650 | | | | 12,870 | |

| | | | | | | 240,209 | |

| Hotels, Restaurants & Leisure - 1.68% | | | | | |

| Brinker International, Inc. | | | 900 | | | | 44,226 | |

| Darden Restaurants, Inc. | | | 1,130 | | | | 56,172 | |

| Denny's Corp.* | | | 4,730 | | | | 31,880 | |

| Diamond Resorts International, Inc.* | | | 1,000 | | | | 18,710 | |

| Dunkin' Brands Group, Inc. | | | 2,480 | | | | 112,865 | |

| Hyatt Hotels Corp. - Class A* | | | 2,905 | | | | 163,493 | |

| International Game Technology | | | 4,430 | | | | 55,596 | |

| Jack in the Box, Inc.* | | | 1,010 | | | | 54,075 | |

| Marriott International, Inc. - Class A | | | 2,606 | | | | 150,966 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.68% (continued) | |

| McDonald's Corp. | | | 1,862 | | | $ | 188,770 | |

| MGM Resorts International* | | | 3,878 | | | | 97,842 | |

| Scientific Games Corp. - Class A* | | | 5,300 | | | | 63,494 | |

| Six Flags Entertainment Corp. | | | 3,900 | | | | 156,546 | |

| Wyndham Worldwide Corp. | | | 3,355 | | | | 239,346 | |

| Yum! Brands, Inc. | | | 1,440 | | | | 110,866 | |

| | | | | | | 1,544,847 | |

| Household Durables - 0.82% | | | | | | | | |

| DR Horton, Inc. | | | 4,020 | | | | 89,566 | |

| Hovnanian Enterprises, Inc. - Class A* | | | 2,130 | | | | 9,500 | |

| Jarden Corp.* | | | 6,205 | | | | 354,616 | |

| Libbey, Inc.* | | | 1,310 | | | | 34,938 | |

| Newell Rubbermaid, Inc. | | | 5,265 | | | | 158,529 | |

| PulteGroup, Inc. | | | 5,950 | | | | 109,420 | |

| | | | | | | 756,569 | |

| Internet & Catalog Retail - 0.84% | | | | | |

| Amazon.com, Inc.* | | | 1,280 | | | | 389,286 | |

| Groupon, Inc.* | | | 3,990 | | | | 27,890 | |

| Liberty Interactive Corp. - Class A* | | | 12,115 | | | | 352,062 | |

| | | | | | | 769,238 | |

| Leisure Products - 0.10% | |

| Mattel, Inc. | | | 2,220 | | | | 87,057 | |

| | | | | | | | |

| Media - 3.98% | | | | | | | | |

| Cablevision Systems Corp. - New York Group - Class A | | | 17,608 | | | | 294,054 | |

| Charter Communications, Inc. - Class A* | | | 2,072 | | | | 280,818 | |

| Comcast Corp. - Class A | | | 7,400 | | | | 383,024 | |

| DIRECTV* | | | 7,855 | | | | 609,548 | |

| DISH Network Corp. - Class A* | | | 835 | | | | 47,478 | |

| Interpublic Group of Cos., Inc. (The) | | | 7,100 | | | | 123,682 | |

| John Wiley & Sons, Inc. - Class A | | | 2,575 | | | | 147,959 | |

| Journal Communications, Inc. - Class A* | | | 2,680 | | | | 21,494 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Consumer Discretionary - 12.21% (continued) | |

| Media - 3.98% (continued) | | | | | | |

| Liberty Global PLC - Class A* | | | 3,998 | | | $ | 159,200 | |

| News Corp. - Class A* | | | 2,468 | | | | 42,005 | |

| Omnicom Group, Inc. | | | 2,210 | | | | 149,573 | |

| Scholastic Corp. | | | 850 | | | | 27,974 | |

| Thomson Reuters Corp. | | | 3,540 | | | | 128,077 | |

| Time Warner Cable, Inc. | | | 3,730 | | | | 527,646 | |

| Time Warner, Inc. | | | 2,655 | | | | 176,451 | |

| Viacom, Inc. - Class B | | | 1,230 | | | | 104,525 | |

| Walt Disney Co. (The) | | | 5,378 | | | | 426,691 | |

| | | | | | | 3,650,199 | |

| Multi-Line Retail - 0.65% | | | | | | | | |

| Big Lots, Inc.* | | | 130 | | | | 5,135 | |

| Dollar General Corp.* | | | 1,490 | | | | 84,096 | |

| Kohl's Corp. | | | 3,950 | | | | 216,420 | |

| Nordstrom, Inc. | | | 2,415 | | | | 147,991 | |

| Target Corp. | | | 2,266 | | | | 139,926 | |

| | | | | | | 593,568 | |

| Specialty Retail - 2.15% | | | | | | | | |

| AutoNation, Inc.* | | | 1,000 | | | | 52,990 | |

| AutoZone, Inc.* | | | 230 | | | | 122,795 | |

| Best Buy Co., Inc. | | | 10,993 | | | | 285,048 | |

| Chico's FAS, Inc. | | | 2,460 | | | | 39,065 | |

| Express, Inc.* | | | 1,482 | | | | 21,593 | |

| GameStop Corp. - Class A | | | 4,450 | | | | 176,576 | |

| Gap, Inc. (The) | | | 579 | | | | 22,755 | |

| Home Depot, Inc. (The) | | | 2,257 | | | | 179,454 | |

| Lowe's Cos., Inc. | | | 3,525 | | | | 161,833 | |

| Sally Beauty Holdings, Inc.* | | | 2,260 | | | | 61,947 | |

| Staples, Inc. | | | 25,490 | | | | 318,625 | |

| Stein Mart, Inc. | | | 1,000 | | | | 12,500 | |

| Systemax, Inc.* | | | 1,031 | | | | 17,826 | |

| TJX Cos., Inc. | | | 1,240 | | | | 72,143 | |

| Ulta Salon, Cosmetics & Fragrance, Inc.* | | | 4,460 | | | | 391,186 | |

| Wet Seal, Inc. (The) - Class A* | | | 5,200 | | | | 5,876 | |

| Zumiez, Inc.* | | | 1,370 | | | | 33,496 | |

| | | | | | | 1,975,708 | |

| Textiles, Apparel & Luxury Goods - 0.32% | |

| NIKE, Inc. - Class B | | | 2,205 | | | $ | 160,855 | |

| Unifi, Inc.* | | | 1,120 | | | | 24,797 | |

| Wolverine World Wide, Inc. | | | 3,860 | | | | 108,466 | |

| | | | | | | 294,118 | |

| Consumer Staples - 5.80% | | | | | |

| Beverages - 1.48% | | | | | | | | |

| Coca-Cola Bottling Co. Consolidated | | | 580 | | | | 47,693 | |

| Coca-Cola Co. (The) | | | 13,860 | | | | 565,350 | |

| Coca-Cola Enterprises, Inc. | | | 5,555 | | | | 252,419 | |

| Dr Pepper Snapple Group, Inc. | | | 3,743 | | | | 207,437 | |

| PepsiCo, Inc. | | | 3,309 | | | | 284,210 | |

| | | | | | | 1,357,109 | |

| Food & Staples Retailing - 1.80% | | | | | |

| Costco Wholesale Corp. | | | 1,170 | | | | 135,345 | |

| CVS Caremark Corp. | | | 5,015 | | | | 364,691 | |

| Kroger Co. (The) | | | 2,120 | | | | 97,605 | |

| Safeway, Inc. | | | 2,960 | | | | 100,818 | |

| SUPERVALU, Inc.* | | | 15,100 | | | | 105,549 | |

| Wal-Mart Stores, Inc. | | | 10,637 | | | | 847,875 | |

| | | | | | | 1,651,883 | |

| Food Products - 1.30% | | | | | | | | |

| Boulder Brands, Inc.* | | | 680 | | | | 10,037 | |

| Bunge Ltd. | | | 1,630 | | | | 129,829 | |

| Campbell Soup Co. | | | 1,420 | | | | 64,596 | |

| Chiquita Brands International, Inc.* | | | 2,900 | | | | 33,292 | |

| ConAgra Foods, Inc. | | | 450 | | | | 13,729 | |

| Darling International, Inc.* | | | 1,480 | | | | 29,615 | |

| Dean Foods Co. | | | 2,225 | | | | 35,244 | |

| General Mills, Inc. | | | 3,091 | | | | 163,885 | |

| Kraft Foods Group, Inc. | | | 1,076 | | | | 61,181 | |

| McCormick & Co., Inc. - Non-Voting Shares | | | 1,118 | | | | 79,602 | |

| Mondelez International, Inc. - Class A | | | 11,775 | | | | 419,779 | |

| Pinnacle Foods, Inc. | | | 1,490 | | | | 45,296 | |

| TreeHouse Foods, Inc.* | | | 1,390 | | | | 104,028 | |

| | | | | | | 1,190,113 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Consumer Staples - 5.80% (continued) | |

| Household Products - 0.80% | | | | | | |

| Colgate-Palmolive Co. | | | 105 | | | $ | 7,066 | |

| Harbinger Group, Inc.* | | | 5,210 | | | | 60,749 | |

| Kimberly-Clark Corp. | | | 250 | | | | 28,062 | |

| Procter & Gamble Co. (The) | | | 7,758 | | | | 640,423 | |

| | | | | | | 736,300 | |

| Personal Products - 0.22% | | | | | | | | |

| Avon Products, Inc. | | | 10,250 | | | | 156,620 | |

| Nu Skin Enterprises, Inc. | | | 260 | | | | 22,620 | |

| Revlon, Inc. - Class A* | | | 930 | | | | 28,030 | |

| | | | | | | 207,270 | |

| Tobacco - 0.20% | | | | | | | | |

| Philip Morris International, Inc. | | | 902 | | | | 77,058 | |

| Reynolds American, Inc. | | | 1,851 | | | | 104,452 | |

| | | | | | | 181,510 | |

| Energy - 9.00% | | | | | | | | |

| Energy Equipment & Services - 1.31% | | | | | |

| Cameron International Corp.* | | | 2,270 | | | | 147,459 | |

| Dresser-Rand Group, Inc.* | | | 2,865 | | | | 173,161 | |

| Halliburton Co. | | | 5,440 | | | | 343,101 | |

| ION Geophysical Corp.* | | | 1,000 | | | | 4,400 | |

| Nabors Industries Ltd. | | | 1,000 | | | | 25,520 | |

| Newpark Resources, Inc.* | | | 2,390 | | | | 28,776 | |

| Schlumberger Ltd. | | | 4,102 | | | | 416,558 | |

| Unit Corp.* | | | 930 | | | | 61,333 | |

| | | | | | | 1,200,308 | |

| Oil, Gas & Consumable Fuels - 7.69% | | | | | |

| Anadarko Petroleum Corp. | | | 586 | | | | 58,026 | |

| Apache Corp. | | | 6,220 | | | | 539,896 | |

| Chesapeake Energy Corp. | | | 7,610 | | | | 218,787 | |

| Chevron Corp. | | | 6,871 | | | | 862,448 | |

| Cimarex Energy Co. | | | 996 | | | | 118,643 | |

| ConocoPhillips | | | 6,370 | | | | 473,355 | |

| CONSOL Energy, Inc. | | | 2,570 | | | | 114,391 | |

| Contango Oil & Gas Co.* | | | 850 | | | | 40,834 | |

| Denbury Resources, Inc. | | | 5,770 | | | | 97,051 | |

| Devon Energy Corp. | | | 6,718 | | | | 470,260 | |

| Emerald Oil, Inc.* | | | 1,140 | | | | 8,060 | |

| | |

| Oil, Gas & Consumable Fuels - 7.69% (continued) | |

| Exxon Mobil Corp. | | | 15,363 | | | $ | 1,573,325 | |

| Forest Oil Corp.* | | | 8,350 | | | | 15,531 | |

| Hess Corp. | | | 2,610 | | | | 232,708 | |

| Kinder Morgan, Inc. | | | 9,715 | | | | 317,292 | |

| Marathon Oil Corp. | | | 5,840 | | | | 211,116 | |

| Marathon Petroleum Corp. | | | 1,945 | | | | 180,788 | |

| Murphy Oil Corp. | | | 4,490 | | | | 284,801 | |

| Newfield Exploration Co.* | | | 3,110 | | | | 105,273 | |

| Occidental Petroleum Corp. | | | 2,300 | | | | 220,225 | |

| Peabody Energy Corp. | | | 10,790 | | | | 205,118 | |

| SM Energy Co. | | | 2,740 | | | | 203,116 | |

| Southwestern Energy Co.* | | | 8,105 | | | | 388,067 | |

| Tesoro Corp. | | | 1,080 | | | | 60,793 | |

| W&T Offshore, Inc. | | | 2,030 | | | | 38,976 | |

| WPX Energy, Inc.* | | | 1,000 | | | | 21,280 | |

| | | | | | | 7,060,160 | |

| Financials - 13.57% | | | | | | | | |

| Banks - 2.67% | | | | | | | | |

| BB&T Corp. | | | 6,065 | | | | 226,407 | |

| Cullen/Frost Bankers, Inc. | | | 2,588 | | | | 197,749 | |

| CVB Financial Corp. | | | 4,920 | | | | 71,143 | |

| Enterprise Financial Services Corp. | | | 1,010 | | | | 18,049 | |

| Fifth Third Bancorp | | | 4,255 | | | | 87,696 | |

| FirstMerit Corp. | | | 5,455 | | | | 105,773 | |

| MB Financial, Inc. | | | 2,160 | | | | 57,974 | |

| Pinnacle Financial Partners, Inc. | | | 1,760 | | | | 60,843 | |

| PNC Financial Services Group, Inc. (The) | | | 1,200 | | | | 100,848 | |

| Popular, Inc.* | | | 2,830 | | | | 87,447 | |

| Susquehanna Bancshares, Inc. | | | 4,012 | | | | 41,564 | |

| SVB Financial Group* | | | 1,160 | | | | 123,760 | |

| Trico Bancshares | | | 900 | | | | 21,825 | |

| Union Bankshares Corp. | | | 1,457 | | | | 37,285 | |

| United Community Banks, Inc.* | | | 3,040 | | | | 49,096 | |

| United Financial Bancorp, Inc. | | | 1,590 | | | | 20,924 | |

| US Bancorp | | | 5,760 | �� | | | 234,893 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Financials - 13.57% (continued) | |

| Banks - 2.67% (continued) | |

| Washington Trust Bancorp, Inc. | | | 700 | | | $ | 23,940 | |

| Webster Financial Corp. | | | 2,460 | | | | 74,144 | |

| Wells Fargo & Co. | | | 16,328 | | | | 810,522 | |

| | | | | | | 2,451,882 | |

| Capital Markets - 1.47% | | | | | | | | |

| Bank of New York Mellon Corp. (The) | | | 7,535 | | | | 255,210 | |

| Charles Schwab Corp. (The) | | | 2,325 | | | | 61,729 | |

| E*TRADE Financial Corp.* | | | 4,080 | | | | 91,596 | |

| Franklin Resources, Inc. | | | 1,000 | | | | 52,350 | |

| Goldman Sachs Group, Inc. (The) | | | 1,000 | | | | 159,820 | |

| Investment Technology Group, Inc.* | | | 2,130 | | | | 43,963 | |

| Legg Mason, Inc. | | | 5,040 | | | | 236,326 | |

| Morgan Stanley | | | 6,955 | | | | 215,118 | |

| Raymond James Financial, Inc. | | | 1,620 | | | | 80,514 | |

| State Street Corp. | | | 2,305 | | | | 148,811 | |

| | | | | | | 1,345,437 | |

| Consumer Finance - 0.96% | | | | | | | | |

| American Express Co. | | | 4,955 | | | | 433,216 | |

| Capital One Financial Corp. | | | 1,700 | | | | 125,630 | |

| DFC Global Corp.* | | | 2,700 | | | | 25,164 | |

| Discover Financial Services | | | 5,165 | | | | 288,723 | |

| Ezcorp, Inc. - Class A* | | | 1,000 | | | | 10,430 | |

| | | | | | | 883,163 | |

| Diversified Financial Services - 1.84% | | | | | |

| Bank of America Corp. | | | 30,281 | | | | 458,455 | |

| Citigroup, Inc. | | | 7,175 | | | | 343,754 | |

| JPMorgan Chase & Co. | | | 10,036 | | | | 561,815 | |

| MSCI, Inc.* | | | 3,945 | | | | 159,930 | |

| NASDAQ OMX Group, Inc. (The) | | | 4,085 | | | | 150,737 | |

| Resource America, Inc. - Class A | | | 1,110 | | | | 9,446 | |

| | | | | | | 1,684,137 | |

| Insurance - 4.59% | | | | | | | | |

| Aflac, Inc. | | | 2,515 | | | $ | 157,741 | |

| Allstate Corp. (The) | | | 2,195 | | | | 125,005 | |

| American International Group, Inc. | | | 6,155 | | | | 327,015 | |

| American National Insurance Co. | | | 240 | | | | 26,978 | |

| Assured Guaranty Ltd. | | | 1,000 | | | | 23,910 | |

| Berkshire Hathaway, Inc. - Class B* | | | 6,986 | | | | 900,146 | |

| Brown & Brown, Inc. | | | 3,360 | | | | 100,061 | |

| Chubb Corp. (The) | | | 1,150 | | | | 105,892 | |

| Cincinnati Financial Corp. | | | 362 | | | | 17,644 | |

| Employers Holdings, Inc. | | | 1,818 | | | | 36,996 | |

| Erie Indemnity Co. - Class A | | | 3,236 | | | | 231,860 | |

| FBL Financial Group, Inc. - Class A | | | 900 | | | | 40,239 | |

| First American Financial Corp. | | | 3,380 | | | | 89,908 | |

| Genworth Financial, Inc. - Class A* | | | 3,370 | | | | 60,155 | |

| Loews Corp. | | | 3,025 | | | | 133,009 | |

| Montpelier Re Holdings Ltd. | | | 2,550 | | | | 77,979 | |

| PartnerRe Ltd. | | | 2,993 | | | | 315,462 | |

| Platinum Underwriters Holdings Ltd. | | | 1,430 | | | | 89,675 | |

| Principal Financial Group, Inc. | | | 5,195 | | | | 243,334 | |

| Progressive Corp. (The) | | | 3,910 | | | | 94,818 | |

| Protective Life Corp. | | | 2,870 | | | | 146,801 | |

| RenaissanceRe Holdings Ltd. | | | 2,895 | | | | 293,003 | |

| RLI Corp. | | | 2,040 | | | | 87,842 | |

| Unum Group | | | 7,523 | | | | 249,914 | |

| Validus Holdings Ltd. | | | 6,500 | | | | 240,955 | |

| | | | | | | 4,216,342 | |

| Real Estate Investment Trusts - 1.15% | | | | | |

| American Capital Agency Corp. | | | 4,040 | | | | 91,748 | |

| American Homes 4 Rent - REIT | | | 3,240 | | | | 52,002 | |

| American Tower Corp. | | | 1,640 | | | | 136,973 | |

| Annaly Capital Management, Inc. | | | 15,040 | | | | 173,712 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Financials - 13.57% (continued) | |

| Real Estate Investment Trusts - 1.15% (continued) | |

| Ashford Hospitality Prime, Inc. - REIT | | | 1,000 | | | $ | 15,340 | |

| Capstead Mortgage Corp. - REIT | | | 6,670 | | | | 85,243 | |

| Cousins Properties, Inc. - REIT | | | 1,000 | | | | 11,630 | |

| CYS Investments, Inc. - REIT | | | 11,210 | | | | 96,406 | |

| FelCor Lodging Trust, Inc. | | | 1,806 | | | | 16,669 | |

| Healthcare Trust of America, Inc. - Class A, REIT | | | 4,110 | | | | 48,046 | |

| iStar Financial, Inc.* | | | 4,770 | | | | 70,882 | |

| Parkway Properties Inc. | | | 1,000 | | | | 18,860 | |

| Potlatch Corp. - REIT | | | 1,410 | | | | 53,904 | |

| Public Storage | | | 510 | | | | 89,510 | |

| Strategic Hotels & Resorts, Inc.* | | | 2,870 | | | | 30,967 | |

| Ventas, Inc. | | | 410 | | | | 27,093 | |

| Weyerhaeuser Co. | | | 1,310 | | | | 39,104 | |

| | | | | | | 1,058,089 | |

| Real Estate Management & Development - 0.40% | |

| CBRE Group, Inc. - Class A* | | | 4,890 | | | | 130,270 | |

| Jones Lang LaSalle, Inc. | | | 2,070 | | | | 239,892 | |

| | | | | | | 370,162 | |

| Thrifts & Mortgage Finance - 0.49% | | | | | |

| Capitol Federal Financial, Inc. | | | 7,400 | | | | 89,096 | |

| MGIC Investment Corp.* | | | 2,930 | | | | 25,198 | |

| Ocwen Financial Corp.* | | | 8,790 | | | | 333,141 | |

| | | | | | | 447,435 | |

| Health Care - 11.34% | | | | | | | | |

| Biotechnology - 1.86% | | | | | | | | |

| Amgen, Inc. | | | 3,473 | | | | 388,108 | |

| Biogen Idec, Inc.* | | | 1,000 | | | | 287,120 | |

| Celgene Corp.* | | | 1,020 | | | | 149,950 | |

| Gilead Sciences, Inc.* | | | 7,195 | | | | 564,735 | |

| Quintiles Transnational Holdings, Inc.* | | | 1,000 | | | | 47,130 | |

| Targacept, Inc.* | | | 2,190 | | | | 9,724 | |

| United Therapeutics Corp.* | | | 2,600 | | | | 260,026 | |

| | | | | | | 1,706,793 | |

| Health Care Equipment & Supplies - 1.69% | |

| Alere, Inc.* | | | 3,340 | | | $ | 111,556 | |

| Baxter International, Inc. | | | 422 | | | | 30,717 | |

| Boston Scientific Corp.* | | | 46,589 | | | | 587,487 | |

| Edwards Lifesciences Corp.* | | | 1,650 | | | | 134,426 | |

| Hologic, Inc.* | | | 18,365 | | | | 385,390 | |

| Medtronic, Inc. | | | 2,555 | | | | 150,285 | |

| Neogen Corp.* | | | 1,000 | | | | 41,775 | |

| STERIS Corp. | | | 1,388 | | | | 66,693 | |

| West Pharmaceutical Services, Inc. | | | 1,010 | | | | 43,814 | |

| | | | | | | 1,552,143 | |

| Health Care Providers & Services - 3.53% | |

| AmerisourceBergen Corp. | | | 2,535 | | | | 165,231 | |

| Cigna Corp. | | | 2,910 | | | | 232,916 | |

| Community Health Systems, Inc.* | | | 2,100 | | | | 79,569 | |

| DaVita HealthCare Partners, Inc.* | | | 3,200 | | | | 221,760 | |

| Express Scripts Holding Co.* | | | 4,181 | | | | 278,371 | |

| Gentiva Health Services, Inc.* | | | 2,530 | | | | 19,051 | |

| HCA Holdings, Inc.* | | | 6,615 | | | | 343,980 | |

| Health Net, Inc.* | | | 1,440 | | | | 49,435 | |

| HealthSouth Corp. | | | 2,260 | | | | 78,286 | |

| Humana, Inc. | | | 1,840 | | | | 201,940 | |

| Laboratory Corp. of America Holdings* | | | 2,605 | | | | 257,114 | |

| LifePoint Hospitals, Inc.* | | | 1,610 | | | | 90,031 | |

| Magellan Health Services, Inc.* | | | 1,780 | | | | 102,742 | |

| McKesson Corp. | | | 1,040 | | | | 175,958 | |

| Quest Diagnostics, Inc. | | | 2,815 | | | | 157,443 | |

| Select Medical Holdings Corp. | | | 8,070 | | | | 112,657 | |

| Team Health Holdings, Inc.* | | | 2,080 | | | | 100,838 | |

| Tenet Healthcare Corp.* | | | 5,573 | | | | 251,231 | |

| UnitedHealth Group, Inc. | | | 1,600 | | | | 120,064 | |

| WellPoint, Inc. | | | 2,011 | | | | 202,468 | |

| | | | | | | 3,241,085 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Health Care - 11.34% (continued) | |

| Health Care Technology - 0.07% | | | | |

| MedAssets, Inc.* | | | 1,190 | | | $ | 27,168 | |

| Omnicell, Inc.* | | | 1,270 | | | | 33,630 | |

| | | | | | | 60,798 | |

| Life Sciences Tools & Services - 0.15% | |

| Thermo Fisher Scientific, Inc. | | | 1,220 | | | | 139,080 | |

| | | | | | | | |

| Pharmaceuticals - 4.04% | | | | | | | | |

| Abbott Laboratories | | | 8,881 | | | | 344,050 | |

| AbbVie, Inc. | | | 4,431 | | | | 230,767 | |

| Allergan, Inc. | | | 811 | | | | 134,496 | |

| Bristol-Myers Squibb Co. | | | 4,038 | | | | 202,263 | |

| Eli Lilly & Co. | | | 2,190 | | | | 129,429 | |

| Hospira, Inc.* | | | 4,120 | | | | 188,696 | |

| Johnson & Johnson | | | 8,720 | | | | 883,249 | |

| Merck & Co., Inc. | | | 11,047 | | | | 646,912 | |

| Mylan, Inc.* | | | 5,515 | | | | 280,052 | |

| Pfizer, Inc. | | | 20,765 | | | | 649,529 | |

| Salix Pharmaceuticals Ltd.* | | | 210 | | | | 23,100 | |

| | | | | | | 3,712,543 | |

| Industrials - 9.36% | | | | | | | | |

| Aerospace & Defense - 2.34% | | | | | |

| AAR Corp. | | | 1,652 | | | | 42,787 | |

| Boeing Co. (The) | | | 1,120 | | | | 144,502 | |

| Curtiss-Wright Corp. | | | 1,736 | | | | 111,000 | |

| Exelis, Inc. | | | 4,570 | | | | 84,728 | |

| General Dynamics Corp. | | | 2,770 | | | | 303,176 | |

| Honeywell International, Inc. | | | 3,025 | | | | 281,023 | |

| Huntington Ingalls Industries, Inc. | | | 598 | | | | 61,594 | |

| Lockheed Martin Corp. | | | 1,210 | | | | 198,609 | |

| Northrop Grumman Corp. | | | 1,000 | | | | 121,510 | |

| Precision Castparts Corp. | | | 1,000 | | | | 253,090 | |

| Raytheon Co. | | | 1,422 | | | | 135,773 | |

| Spirit Aerosystems Holdings, Inc. - Class A* | | | 3,125 | | | | 93,844 | |

| United Technologies Corp. | | | 2,679 | | | | 317,006 | |

| | | | | | | 2,148,642 | |

| Air Freight & Logistics - 0.17% | | | | | |

| FedEx Corp. | | | 1,050 | | | $ | 143,062 | |

| UTi Worldwide, Inc. | | | 1,110 | | | | 10,867 | |

| | | | | | | 153,929 | |

| Airlines - 0.86% | | | | | | | | |

| Alaska Air Group, Inc. | | | 400 | | | | 37,632 | |

| Delta Air Lines, Inc. | | | 8,065 | | | | 297,034 | |

| Republic Airways Holdings, Inc.* | | | 2,740 | | | | 22,769 | |

| United Continental Holdings, Inc.* | | | 10,489 | | | | 428,686 | |

| | | | | | | 786,121 | |

| Building Products - 0.15% | | | | | | | | |

| AO Smith Corp. | | | 1,550 | | | | 72,478 | |

| Griffon Corp. | | | 3,900 | | | | 41,496 | |

| Masco Corp. | | | 1,000 | | | | 20,090 | |

| | | | | | | 134,064 | |

| Commercial Services & Supplies - 0.49% | |

| Brink's Co. (The) | | | 1,780 | | | | 45,283 | |

| Republic Services, Inc. | | | 1,130 | | | | 39,652 | |

| Rollins, Inc. | | | 4,810 | | | | 144,685 | |

| United Stationers, Inc. | | | 1,950 | �� | | | 73,183 | |

| Waste Management, Inc. | | | 3,325 | | | | 147,796 | |

| | | | | | | 450,599 | |

| Construction & Engineering - 0.33% | | | | | |

| AECOM Technology Corp.* | | | 1,990 | | | | 64,516 | |

| KBR, Inc. | | | 4,540 | | | | 115,180 | |

| Tutor Perini Corp.* | | | 2,150 | | | | 63,640 | |

| URS Corp. | | | 1,260 | | | | 59,371 | |

| | | | | | | 302,707 | |

| Electrical Equipment - 0.44% | | | | | |

| Babcock & Wilcox Co. (The) | | | 2,470 | | | | 85,931 | |

| Emerson Electric Co. | | | 3,965 | | | | 270,334 | |

| General Cable Corp. | | | 1,880 | | | | 48,165 | |

| | | | | | | 404,430 | |

| Industrial Conglomerates - 1.04% | | | | | |

| 3M Co. | | | 1,118 | | | | 155,503 | |

| Danaher Corp. | | | 2,835 | | | | 208,032 | |

| General Electric Co. | | | 22,155 | | | | 595,748 | |

| | | | | | | 959,283 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Industrials - 9.36% (continued) | |

| Machinery - 1.90% | | | | | | |

| AGCO Corp. | | | 2,460 | | | $ | 137,022 | |

| Blount International, Inc.* | | | 2,750 | | | | 30,718 | |

| Caterpillar, Inc. | | | 3,074 | | | | 324,000 | |

| Deere & Co. | | | 1,172 | | | | 109,394 | |

| Graco, Inc. | | | 1,360 | | | | 98,600 | |

| ITT Corp. | | | 3,395 | | | | 146,460 | |

| Joy Global, Inc. | | | 2,710 | | | | 163,630 | |

| Mueller Industries, Inc. | | | 580 | | | | 16,785 | |

| Rexnord Corp.* | | | 2,230 | | | | 59,630 | |

| SPX Corp. | | | 2,951 | | | | 300,530 | |

| Stanley Black & Decker, Inc. | | | 1,000 | | | | 85,890 | |

| Timken Co. (The) | | | 1,000 | | | | 63,080 | |

| Toro Co. (The) | | | 1,850 | | | | 117,549 | |

| Trinity Industries, Inc. | | | 1,230 | | | | 92,324 | |

| | | | | | | 1,745,612 | |

| Professional Services - 0.46% | | | | | |

| Dun & Bradstreet Corp. (The) | | | 2,020 | | | | 223,735 | |

| Manpowergroup, Inc. | | | 2,000 | | | | 162,680 | |

| Verisk Analytics, Inc. - Class A* | | | 560 | | | | 33,650 | |

| | | | | | | 420,065 | |

| Road & Rail - 0.67% | | | | | | | | |

| Hertz Global Holdings, Inc.* | | | 8,850 | | | | 251,960 | |

| Union Pacific Corp. | | | 1,919 | | | | 365,435 | |

| | | | | | | 617,395 | |

| Trading Companies & Distributors - 0.51% | |

| GATX Corp. | | | 1,400 | | | | 91,882 | |

| United Rentals, Inc.* | | | 1,000 | | | | 93,830 | |

| Watsco, Inc. | | | 1,050 | | | | 108,056 | |

| WESCO International, Inc.* | | | 1,980 | | | | 173,804 | |

| | | | | | | 467,572 | |

| Information Technology - 16.91% | | | | | |

| Communications Equipment - 0.87% | | | | | |

| Aruba Networks, Inc.* | | | 1,000 | | | | 19,770 | |

| Black Box Corp. | | | 1,010 | | | | 21,473 | |

| Brocade Communications Systems, Inc.* | | | 5,120 | | | | 47,667 | |

| Ciena Corp.* | | | 2,030 | | | | 40,133 | |

| | |

| Communications Equipment - 0.87% (continued) | |

| Cisco Systems, Inc. | | | 13,730 | | | $ | 317,300 | |

| Comtech Telecommunications Corp. | | | 810 | | | | 25,718 | |

| Harris Corp. | | | 1,010 | | | | 74,255 | |

| Juniper Networks, Inc.* | | | 3,580 | | | | 88,390 | |

| Motorola Solutions, Inc. | | | 1,700 | | | | 108,086 | |

| NETGEAR, Inc.* | | | 570 | | | | 18,411 | |

| QUALCOMM, Inc. | | | 485 | | | | 38,174 | |

| | | | | | | 799,377 | |

| Electronic Equipment, Instruments & Components - 0.91% | |

| Arrow Electronics, Inc.* | | | 1,000 | | | | 56,750 | |

| Avnet, Inc. | | | 3,470 | | | | 149,661 | |

| Corning, Inc. | | | 4,954 | | | | 103,588 | |

| CTS Corp. | | | 1,403 | | | | 24,959 | |

| Ingram Micro, Inc. - Class A* | | | 3,570 | | | | 96,247 | |

| Insight Enterprises, Inc.* | | | 2,030 | | | | 53,024 | |

| Itron, Inc.* | | | 490 | | | | 18,620 | |

| Jabil Circuit, Inc. | | | 2,160 | | | | 37,282 | |

| Plexus Corp.* | | | 850 | | | | 35,632 | |

| ScanSource, Inc.* | | | 1,334 | | | | 51,239 | |

| Tech Data Corp.* | | | 2,179 | | | | 136,166 | |

| TTM Technologies, Inc.* | | | 4,010 | | | | 31,639 | |

| Vishay Intertechnology, Inc. | | | 2,800 | | | | 39,816 | |

| | | | | | | 834,623 | |

| Internet Software & Services - 1.90% | | | | | |

| Akamai Technologies, Inc.* | | | 1,110 | | | | 58,908 | |

| Brightcove, Inc.* | | | 1,770 | | | | 15,257 | |

| Digital River, Inc.* | | | 2,030 | | | | 31,039 | |

| EarthLink Holdings Corp. | | | 5,930 | | | | 20,221 | |

| Equinix, Inc.* | | | 1,000 | | | | 187,810 | |

| Facebook, Inc. - Class A* | | | 4,220 | | | | 252,271 | |

| Google, Inc. - Class C* | | | 986 | | | | 519,287 | |

| LinkedIn Corp.* | | | 1,000 | | | | 153,470 | |

| Rackspace Hosting, Inc.* | | | 980 | | | | 28,440 | |

| VeriSign, Inc.* | | | 1,650 | | | | 77,847 | |

| Web.com Group, Inc.* | | | 1,430 | | | | 43,915 | |

| Yahoo!, Inc.* | | | 10,000 | | | | 359,500 | |

| | | | | | | 1,747,965 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Information Technology - 16.91% (continued) | |

| IT Services - 3.82% | | | | | | |

| Automatic Data Processing, Inc. | | | 1,000 | | | $ | 77,960 | |

| Blackhawk Network Holdings, Inc.* | | | 486 | | | | 11,192 | |

| CACI International, Inc. - Class A* | | | 840 | | | | 58,506 | |

| Cardtronics, Inc.* | | | 1,530 | | | | 51,224 | |

| Computer Sciences Corp. | | | 3,265 | | | | 193,223 | |

| Convergys Corp. | | | 3,340 | | | | 71,943 | |

| DST Systems, Inc. | | | 740 | | | | 68,221 | |

| Fidelity National Information Services, Inc. | | | 1,790 | | | | 95,640 | |

| Fiserv, Inc.* | | | 2,200 | | | | 133,716 | |

| Global Payments, Inc. | | | 4,307 | | | | 287,837 | |

| iGATE Corp.* | | | 1,280 | | | | 46,848 | |

| International Business Machines Corp. | | | 3,792 | | | | 745,014 | |

| MasterCard, Inc. - Class A | | | 1,960 | | | | 144,158 | |

| MoneyGram International, Inc.* | | | 2,560 | | | | 33,792 | |

| Teradata Corp.* | | | 11,250 | | | | 511,425 | |

| Unisys Corp.* | | | 2,770 | | | | 67,505 | |

| Vantiv, Inc. - Class A* | | | 11,280 | | | | 346,860 | |

| Visa, Inc. - Class A | | | 1,710 | | | | 346,463 | |

| Western Union Co. (The) | | | 13,464 | | | | 213,674 | |

| | | | | | | 3,505,201 | |

| Office Electronics - 0.41% | | | | | | | | |

| Xerox Corp. | | | 31,265 | | | | 377,994 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment - 2.16% | |

| Atmel Corp.* | | | 2,550 | | | | 19,814 | |

| Broadcom Corp. - Class A | | | 8,050 | | | | 248,020 | |

| Cree, Inc.* | | | 1,210 | | | | 57,076 | |

| Diodes, Inc.* | | | 2,280 | | | | 60,124 | |

| First Solar, Inc.* | | | 1,580 | | | | 106,634 | |

| Intel Corp. | | | 10,249 | | | | 273,546 | |

| Lam Research Corp.* | | | 4,200 | | | | 241,962 | |

| Marvell Technology Group Ltd. | | | 8,960 | | | | 142,106 | |

| | |

| Semiconductors & Semiconductor Equipment - 2.16% (continued) | |

| Micron Technology, Inc.* | | | 14,807 | | | $ | 386,759 | |

| ON Semiconductor Corp.* | | | 15,535 | | | | 146,184 | |

| PMC-Sierra, Inc.* | | | 10,760 | | | | 73,598 | |

| Spansion, Inc. - Class A* | | | 1,930 | | | | 34,412 | |

| Texas Instruments, Inc. | | | 4,250 | | | | 193,162 | |

| | | | | | | 1,983,397 | |

| Software - 3.12% | | | | | | | | |

| Activision Blizzard, Inc. | | | 5,300 | | | | 106,053 | |

| CA, Inc. | | | 3,489 | | | | 105,158 | |

| Citrix Systems, Inc.* | | | 2,960 | | | | 175,558 | |

| Comverse, Inc.* | | | 1,070 | | | | 26,686 | |

| Intuit, Inc. | | | 2,055 | | | | 155,666 | |

| Microsoft Corp. | | | 25,497 | | | | 1,030,079 | |

| Nuance Communications, Inc.* | | | 14,822 | | | | 238,486 | |

| Oracle Corp. | | | 16,799 | | | | 686,743 | |

| Pegasystems, Inc. | | | 1,360 | | | | 22,535 | |

| Rovi Corp.* | | | 1,000 | | | | 22,290 | |

| Solera Holdings, Inc. | | | 2,751 | | | | 178,210 | |

| Symantec Corp. | | | 5,945 | | | | 120,565 | |

| | | | | | | 2,868,029 | |

| Technology Hardware, Storage & Peripherals - 3.72% | |

| Apple, Inc. | | | 3,664 | | | | 2,162,090 | |

| Diebold, Inc. | | | 3,730 | | | | 140,285 | |

| EMC Corp. | | | 2,010 | | | | 51,858 | |

| Hewlett-Packard Co. | | | 16,840 | | | | 556,731 | |

| Lexmark International, Inc. - Class A | | | 1,350 | | | | 58,050 | |

| NCR Corp.* | | | 10,440 | | | | 318,524 | |

| Western Digital Corp. | | | 1,400 | | | | 123,382 | |

| | | | | | | 3,410,920 | |

| Materials - 3.17% | | | | | | | | |

| Chemicals - 1.31% | | | | | | | | |

| Ashland, Inc. | | | 1,150 | | | | 111,090 | |

| Cytec Industries, Inc. | | | 1,364 | | | | 130,016 | |

| Dow Chemical Co. (The) | | | 5,544 | | | | 276,646 | |

| EI du Pont de Nemours & Co. | | | 2,645 | | | | 178,061 | |

| Mosaic Co. (The) | | | 2,865 | | | | 143,365 | |

| OMNOVA Solutions, Inc.* | | | 840 | | | | 7,661 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Shares | | | Value | |

| COMMON STOCKS - 87.06% (continued) | |

| Materials - 3.17% (continued) | |

| Chemicals - 1.31% (continued) | | | | |

| Rockwood Holdings, Inc. | | | 1,000 | | | $ | 71,050 | |

| RPM International, Inc. | | | 3,923 | | | | 167,355 | |

| W.R. Grace & Co.* | | | 1,281 | | | | 117,980 | |

| | | | | | | 1,203,224 | |

| Construction Materials - 0.07% | | | | | |

| Vulcan Materials Co. | | | 1,070 | | | | 69,047 | |

| | | | | | | | |

| Containers & Packaging - 1.31% | | | | | |

| Ball Corp. | | | 1,888 | | | | 106,087 | |

| Berry Plastics Group, Inc.* | | | 2,040 | | | | 45,880 | |

| Crown Holdings, Inc.* | | | 8,585 | | | | 404,954 | |

| Myers Industries, Inc. | | | 1,900 | | | | 35,530 | |

| Owens-Illinois, Inc.* | | | 7,704 | | | | 244,833 | |

| Sealed Air Corp. | | | 5,575 | | | | 191,278 | |

| Silgan Holdings, Inc. | | | 3,575 | | | | 177,856 | |

| | | | | | | 1,206,418 | |

| Metals & Mining - 0.44% | | | | | | | | |

| Alcoa, Inc. | | | 7,330 | | | | 98,735 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 2,151 | | | | 73,930 | |

| Newmont Mining Corp. | | | 6,730 | | | | 167,106 | |

| Southern Copper Corp. | | | 2,066 | | | | 62,269 | |

| | | | | | | 402,040 | |

| Paper & Forest Products - 0.04% | | | | | |

| Wausau Paper Corp. | | | 2,760 | | | | 33,010 | |

| | | | | | | | |

| Telecommunication Services - 2.93% | |

| Diversified Telecommunication Services - 2.59% | |

| AT&T, Inc. | | | 21,255 | | | | 758,803 | |

| CenturyLink, Inc. | | | 22,424 | | | | 782,822 | |

| Cincinnati Bell, Inc.* | | | 12,815 | | | | 42,930 | |

| General Communication, Inc. - Class A* | | | 2,420 | | | | 25,265 | |

| Level 3 Communications, Inc.* | | | 2,500 | | | | 107,575 | |

| tw telecom, Inc.* | | | 2,410 | | | | 73,963 | |

| Verizon Communications, Inc. | | | 12,400 | | | | 579,452 | |

| | | | | | | 2,370,810 | |

| | |

| Wireless Telecommunication Services - 0.34% | |

| Crown Castle International Corp. | | | 570 | | | $ | 41,456 | |

| NTELOS Holdings Corp. | | | 1,340 | | | | 18,479 | |

| SBA Communications Corp. - Class A* | | | 1,580 | | | | 141,821 | |

| Sprint Corp.* | | | 13,145 | | | | 111,732 | |

| | | | | | | 313,488 | |

| Utilities - 2.77% | | | | | | | | |

| Electric Utilities - 1.06% | | | | | | | | |

| American Electric Power Co., Inc. | | | 730 | | | | 39,281 | |

| Duke Energy Corp. | | | 1,310 | | | | 97,582 | |

| Exelon Corp. | | | 14,170 | | | | 496,375 | |

| FirstEnergy Corp. | | | 1,970 | | | | 66,488 | |

| NextEra Energy, Inc. | | | 1,100 | | | | 109,835 | |

| Southern Co. (The) | | | 1,765 | | | | 80,890 | |

| Xcel Energy, Inc. | | | 2,600 | | | | 82,862 | |

| | | | | | | 973,313 | |

| Gas Utilities - 0.20% | | | | | | | | |

| AGL Resources, Inc. | | | 1,000 | | | | 54,000 | |

| ONE Gas, Inc. | | | 425 | | | | 15,547 | |

| UGI Corp. | | | 2,480 | | | | 115,791 | |

| | | | | | | 185,338 | |

| Independent Power and Renewable Energy Producers- 0.67% | |

| AES Corp. | | | 42,270 | | | | 610,801 | |

| | | | | | | | |

| Multi-Utilities - 0.76% | | | | | | | | |

| Ameren Corp. | | | 8,840 | | | | 365,180 | |

| CenterPoint Energy, Inc. | | | 3,380 | | | | 83,689 | |

| Consolidated Edison, Inc. | | | 700 | | | | 40,621 | |

| Dominion Resources, Inc. | | | 2,080 | | | | 150,883 | |

| Sempra Energy | | | 310 | | | | 30,569 | |

| Wisconsin Energy Corp. | | | 620 | | | | 30,058 | |

| | | | | | | 701,000 | |

| Water Utilities - 0.08% | | | | | | | | |

| American Water Works Co., Inc. | | | 1,540 | | | | 70,116 | |

| | | | | | | | |

| Total Common Stocks (Cost $60,819,722) | | | | | | $ | 79,919,045 | |

See Notes to Financial Statements.

| Schedule of Investments (continued) | April 30, 2014 (Unaudited) |

| Security | | Interest Rate | Maturity

Date | | Principal

Amount | | | Value | |

| U.S. TREASURY OBLIGATIONS - 10.39% | | | | | | | | | | |

| U.S. Treasury Notes | | | 2.000 | % | 01/31/16 | | $ | 1,000,000 | | | $ | 1,029,590 | |

| U.S. Treasury Notes | | | 1.000 | % | 03/31/17 | | | 2,000,000 | | | | 2,009,062 | |

| U.S. Treasury Notes | | | 2.625 | % | 08/15/20 | | | 1,600,000 | | | | 1,654,000 | |

| U.S. Treasury Notes | | | 1.750 | % | 05/15/22 | | | 3,500,000 | | | | 3,325,819 | |

| U.S. Treasury Bonds | | | 8.125 | % | 08/15/19 | | | 1,150,000 | | | | 1,522,492 | |

| | | | | | | | | | | | | |

| Total U.S. Treasury Obligations (Cost $9,694,605) | | | $ | 9,540,963 | |

| | | | | | | | | | | | | |

| U.S. TREASURY BILLS - 2.34% | | | | | | | | | | | | | |

U.S. Treasury Bills1 | | | 0.000 | % | 05/01/14 | | $ | 2,010,000 | | | $ | 2,010,000 | |

U.S. Treasury Bills2 | | | 0.027 | % | 09/11/14 | | | 140,000 | | | | 139,986 | |

| | | | | | | | | | | | | |

| Total U.S. Treasury Bills (Cost $2,149,988) | | | $ | 2,149,986 | |

| | | | | | | | | | | | | |

| Total Investments - 99.79% (Cost $72,664,315)** | | | $ | 91,609,994 | |

| Other Assets in Excess of Liabilities - 0.21% | | | | 195,075 | |

| Net Assets - 100.00% | | | $ | 91,805,069 | |

| * | Non-income producing security. |

| | |

1 | Zero coupon bond. |

| | |

2 | Interest rate presented is yield to maturity. |

| | |

| ** | Cost for Federal income tax purposes is $72,664,315 and net unrealized appreciation on a tax basis consists of: |

| Gross Unrealized Appreciation | | $ | 20,276,632 | |

| Gross Unrealized Depreciation | | | (1,330,953 | ) |

| Net Unrealized Appreciation | | $ | 18,945,679 | |

| The difference between the federal tax cost of portfolio investments and the Schedule of Investments is due to certain timing differences in the recognition of capital gains and losses under income tax regulations and accounting principles generally accepted in the United States. These timing differences are temporary in nature and are due to the tax deferral of losses on wash sales. |

See Notes to Financial Statements.

| Statements of Assets and Liabilities | April 30, 2014 (Unaudited) |

| | | Total Return U.S. Treasury Fund, Inc. | | | Managed Municipal Fund, Inc. | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

| At cost | | $ | 55,143,412 | | | $ | 67,314,638 | |

| At value (Note 1) | | $ | 56,964,240 | | | $ | 70,652,636 | |

| Cash | | | 39,870 | | | | 121,707 | |

| Interest receivable | | | 428,020 | | | | 642,170 | |

| Receivable for capital shares sold | | | 536 | | | | 199 | |

| Other assets | | | 4,968 | | | | 24,602 | |

| TOTAL ASSETS | | | 57,437,634 | | | | 71,441,314 | |

| | | | | | | | |

| LIABILITIES | | | | | | | | |

| Distributions payable | | | 28,150 | | | | 48,928 | |

| Payable for capital shares redeemed | | | 31,865 | | | | 8,163 | |

| Accrued investment advisory fees (Note 2) | | | 10,858 | | | | 23,411 | |

| Accrued distribution fees (Note 2) | | | 11,811 | | | | 13,024 | |

| Accrued administration fees (Note 2) | | | 8,010 | | | | 14,904 | |

| Accrued transfer agent fees (Note 2) | | | 7,845 | | | | 10,335 | |

| Accrued directors' fees (Note 2) | | | 3,153 | | | | 5,675 | |

| Other accrued expenses and liabilities | | | 21,728 | | | | 33,313 | |

| TOTAL LIABILITIES | | | 123,420 | | | | 157,753 | |