Exhibit 99.1

Investor Day Program

September 20, 2005

Agenda

Safe Harbor Agenda Overview

Steve Walsh, Senior VP, Capital Markets

Forward-Looking Statements

Certain statements in this package may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, achievements or transactions of the Company and its affiliates or industry results to be materially different from any future results, performance, achievements or transactions expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors relate to, among others: the Company’s ability to lease vacant space and to renew or relet space under expiring leases at expected levels, the potential loss of major tenants, interest rate levels, the availability of debt and equity financing, competition with other real estate companies for tenants and acquisitions, risks of real estate acquisitions and developments, dependence upon certain geographic markets, and general economic, business and real estate conditions. Additional information on factors which could impact the Company and the forward-looking statements contained herein are included in the Company’s Form 10-K filed with the Securities and Exchange Commission.

Agenda

Operating Strategy

Presented by:

Phil Hawkins, President & COO

Agenda

Washington, DC Market Review

Presented by: Phillip Thomas, Managing Director

Agenda

Chicago Market Review

Presented by: Jerry O’Malley, Managing Director

Agenda

Texas and Denver/Salt Lake Market Review

Presented by: Jeff Pace, Managing Director

BREAK

Agenda

Seattle Market Review

Presented by: Clete Casper, Managing Director

Agenda

Southern California Market Review

Presented by:

Malcolm O’Donnell, Managing Director

Agenda

San Francisco Bay Area Market Review

Presented by:

Christopher Peatross, Managing Director

Agenda

The Future Wrap Up and Q&A

Presented by: Tom Carr, CEO

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

National Real Estate Company

Today

National company; strong market focus A high-quality office portfolio 43 years of real estate experience 27 million SF in 290 operating properties $4.2 billion enterprise value

CarrAmerica Investor Conference

Key Messages

Strong execution through the market downturn

Market improvement is accelerating

CarrAmerica is very well positioned to benefit from the recovery

Operating Strategy

Strong Execution Through the Market Downturn (2002—2004)

Averaged approximately 2.9 million SF of leasing and maintained occupancy above market averages

Dramatically upgraded portfolio

Maintained financial flexibility

Completely upgraded back-of-house while cutting overhead

Operating Strategy

Dramatically Upgraded the Portfolio (2002 to Today)

Acquired $1.1 billion of high-quality assets

Sold $709 million of non-core assets

Concentrated capital into infill locations and out of commodity, suburban office

Operating Strategy

Recent Additions of High Quality Assets

1 2 3 4 5 6

1) Mission Towers

2) Legacy Town Center

3) West Willows Technology Center

4) Commonwealth Tower

5) Park Place

6) Corporate Technology Centre

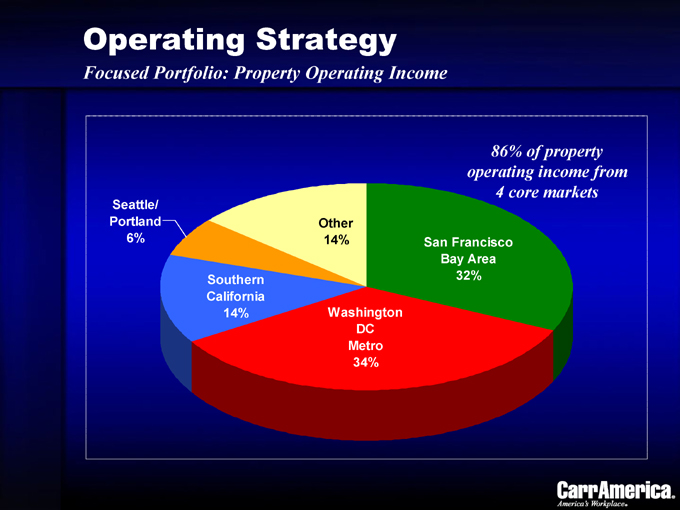

Operating Strategy

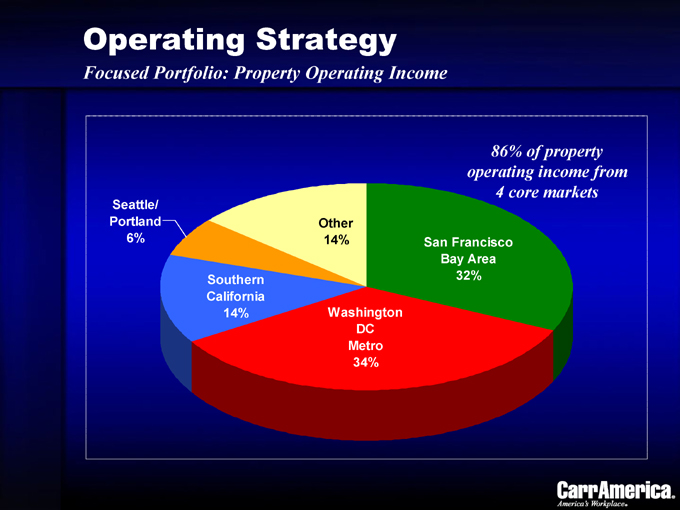

Focused Portfolio: Property Operating Income

86% of property operating income from 4 core markets

Seattle/Portland 6%

Other 14%

San Francisco Bay Area 32%

Washington DC

Metro 34%

Southern California 14%

Operating Strategy

Improved Operations and Strengthened Balance Sheet

Created the Shared Service Center and cut approximately $8 million from G&A costs

Maintained investment grade ratings at mid BBB

Created financial flexibility with asset sales and equity offering

Operating Strategy

Broad Based Market Improvement Creates Opportunity

Vacancy rates have dropped in all markets, but CarrAmerica’s key submarkets have improved more significantly

Key submarkets in DC, close-in Virginia, Orange County, San Diego, Austin and Eastside Seattle are experiencing:

Strong rental rate growth Modest construction starts

Tenant migration from less desirable areas

Operating Strategy

Strong Local Player that is Well Positioned in the Markets

Seasoned local teams with strong experience and great relationships

Highly decentralized decision making Strong submarket focus Ready to take advantage of all opportunities

Operating Strategy

Key Focus Areas to Improve Results

Leasing

Increase occupancy and push rental economics

Investments

Continued focus on quality assets

Development

Active developer in strong submarkets

Service

Successful 3rd party service business leverages local team’s capabilities and increases ROIC

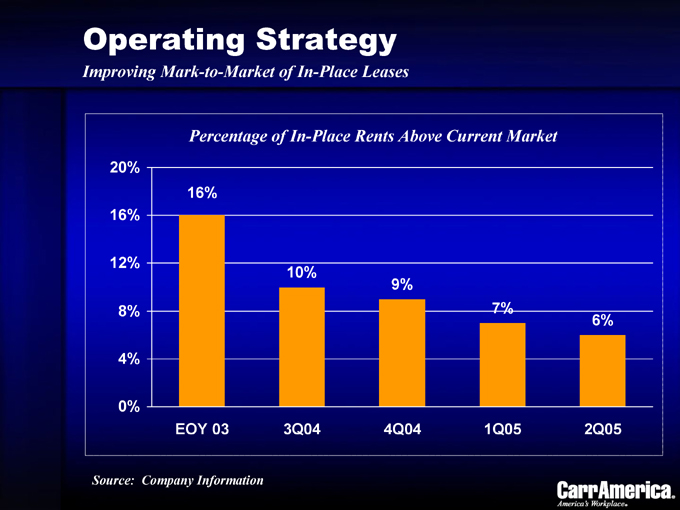

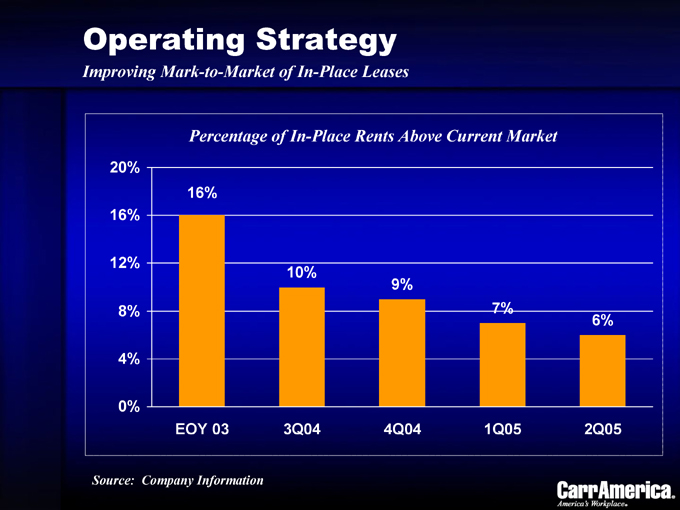

Operating Strategy

Improving Mark-to-Market of In-Place Leases

Percentage of In-Place Rents Above Current Market

20% 16% 12% 8% 4% 0%

16% 10% 9% 7% 6%

EOY 03 3Q04 4Q04 1Q05 2Q05

Source: Company Information

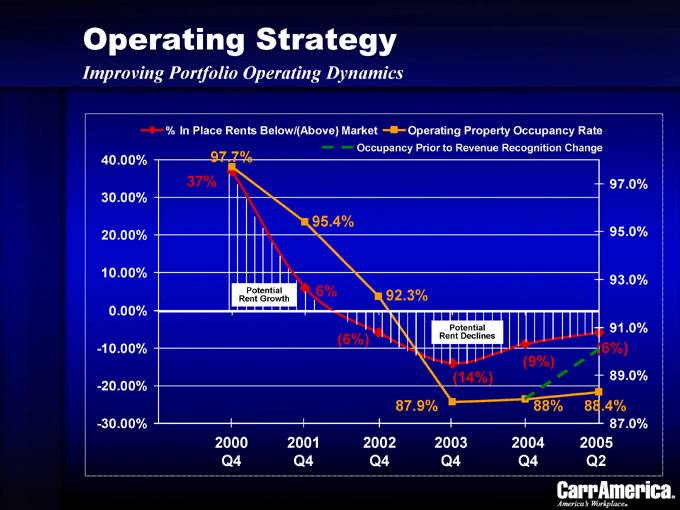

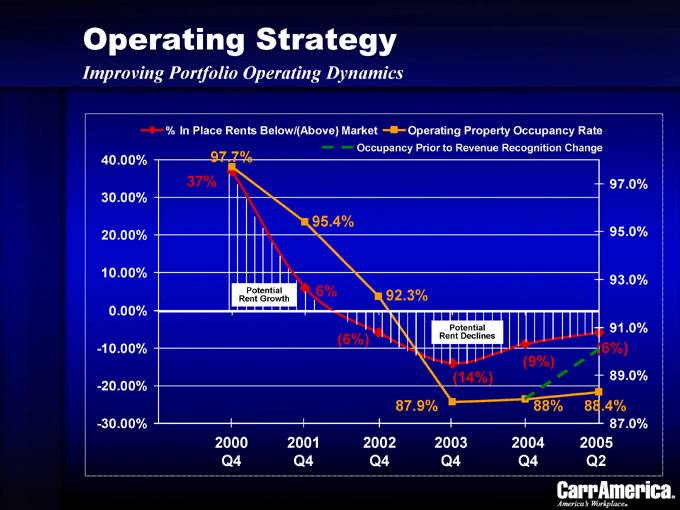

Operating Strategy

Improving Portfolio Operating Dynamics

% In Place Rents Below/(Above) Market Operating Property Occupancy Rate

Occupancy Prior to Revenue Recognition Change

40.00% 30.00% 20.00% 10.00% 0.00% -10.00% -20.00% -30.00%

97.7% 37% 95.4% 6%

Potential Rent Growth

(6%) 92.3%

Potential Rent Declines

(14%) 87.9% (9%) (6%) 88% 88.4% 97.0% 95.0% 93.0%

91.0% 89.0% 87.0%

2000 Q4 2001 Q4 2002 Q4 2003 Q4 2004 Q4 2005 Q2

Operating Strategy

Acquisitions and Dispositions – Recycling has Improved our Position

Reduced exposure to underperforming markets, submarkets and assets

Provided reinvestment dollars to upgrade the portfolio and improve submarket presence

Generated significant gains

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

Washington, DC Market

Market Scorecard

98% portfolio occupancy

Approximately 90% of IMF vacancy committed

Diverse value added transactions

Terrell Place trophy JV development

Douglas Development relationship: Atlantic Building and 1199 F Street

Third party service

IMF, Newseum, Shakespeare Theatre

Significant property management and leasing

Strong 40 year franchise position

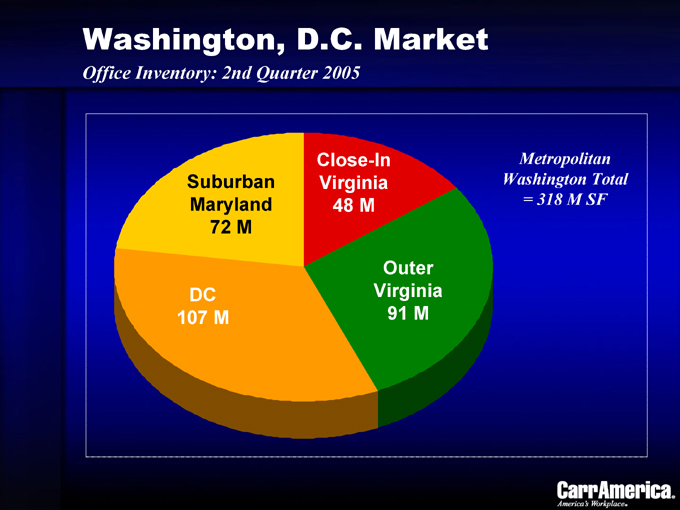

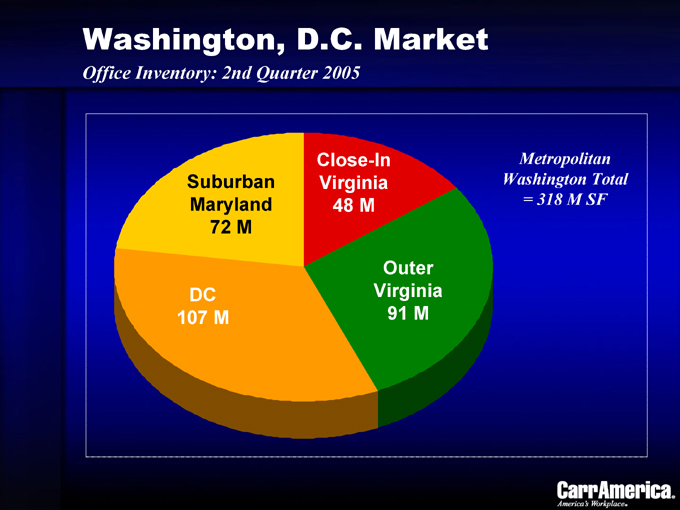

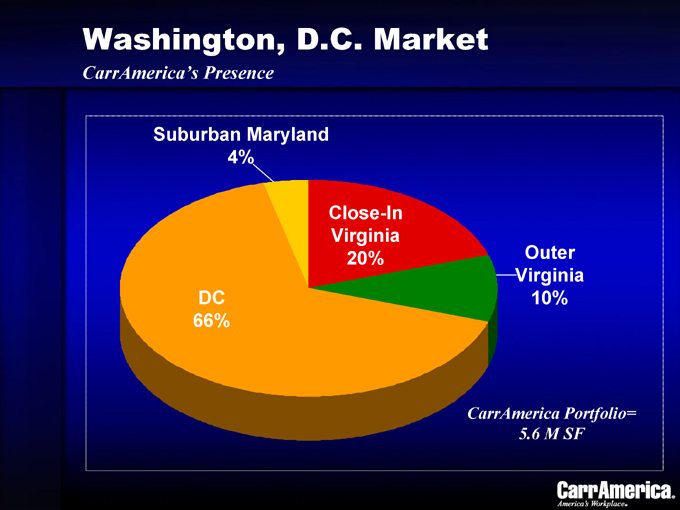

Washington, D.C. Market

Office Inventory: 2nd Quarter 2005

Metropolitan Washington Total = 318 M SF

Close-In Virginia 48 M

Outer Virginia 91 M

DC 107 M

Suburban Maryland 72 M

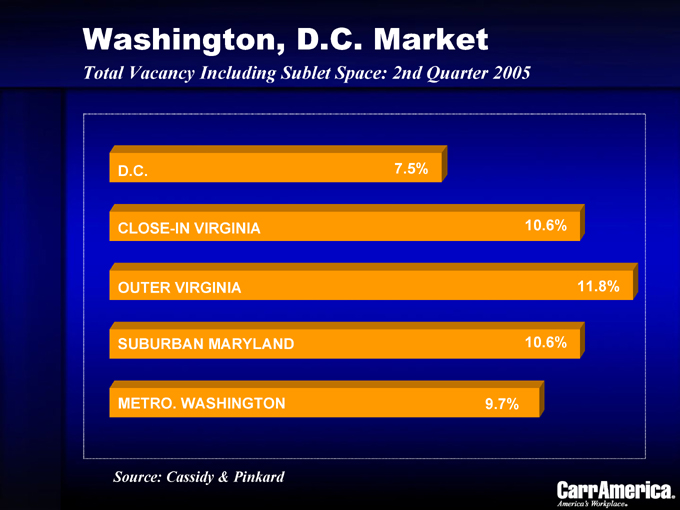

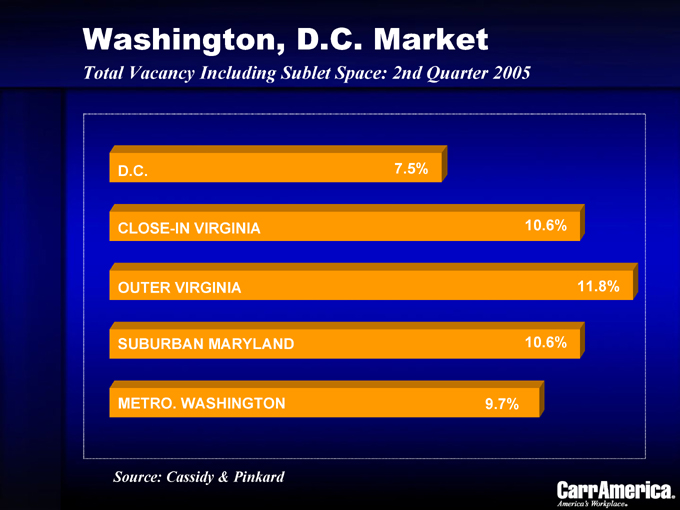

Washington, D.C. Market

Total Vacancy Including Sublet Space: 2nd Quarter 2005

D.C. 7.5%

CLOSE-IN VIRGINIA 10.6%

OUTER VIRGINIA 11.8%

SUBURBAN MARYLAND 10.6%

METRO. WASHINGTON 9.7%

Source: Cassidy & Pinkard

Washington, D.C. Market

Market Dynamics

Top investment market

Positive net absorption in all markets

Continued strength of market demand

Small vs. large tenant conundrum

Expansion of the U.S. government

Barriers to entry to many submarkets

BRAC

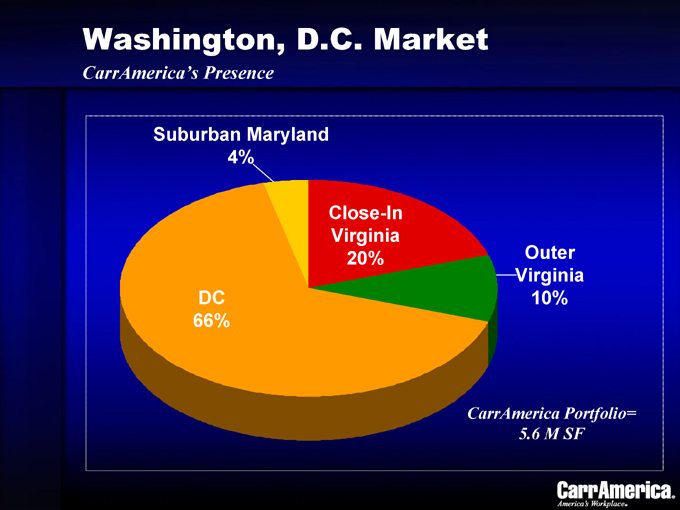

Washington, D.C. Market

CarrAmerica’s Presence

Suburban Maryland 4%

Close-In Virginia 20%

Outer Virginia 10%

DC 66%

CarrAmerica Portfolio= 5.6 M SF

Washington, D.C. Market

Current Market Strategy

Leverage strong market presence into new transactions

Opportunistically invest to outperform market returns

Invested $481 million from 1/1/02 to present

Increase control of land sites in downtown Washington and key suburban submarkets

Washington, D.C Market

Recent Investments $62 million purchase of 168,000 SF building

Located one block from Commonwealth Tower with great views in strong close-in Rosslyn submarket

Diverse tenant base

4.2% submarket vacancy (Cassidy & Pinkard)

Park Place

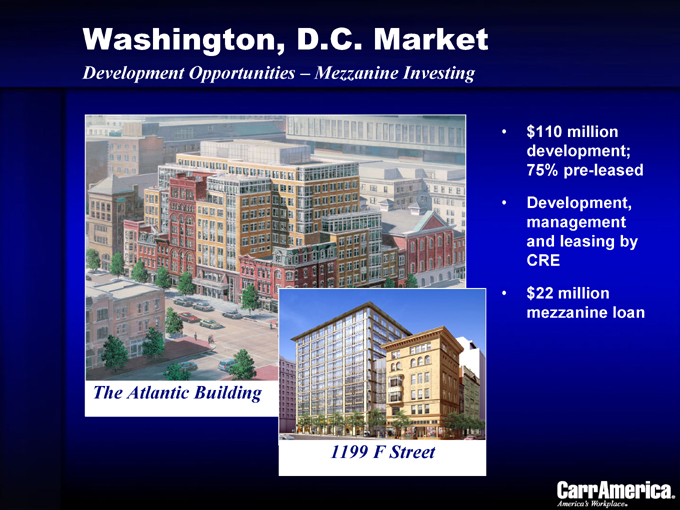

Washington, D.C. Market

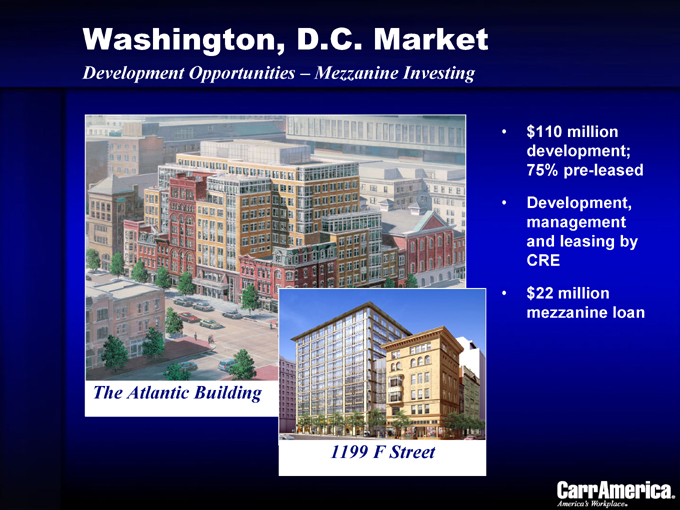

Development Opportunities – Mezzanine Investing $110 million development; 75% pre-leased Development, management and leasing by CRE $22 million mezzanine loan

The Atlantic Building

1199 F Street

Washington, D.C. Market

Development Pipeline

Need to have many projects in different stages due to long lead times for delivery

Existing relationships provide link to pipeline

Existing portfolio will provide opportunities on Pennsylvania Avenue

1775 Pennsylvania Avenue

1919 Pennsylvania Avenue

Washington, D.C. Market

Fee Business: $850 Million in Projects

IMF HQ2 Shakespeare Theatre Newseum

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

The Chicago Market

Market Scorecard

Portfolio is 87% committed with United Stationers lease

Largest deal (+200,000 SF) done two years in a row

Leased 375,000 SF YTD

Portfolio is 40% in JV structure with NYSTRS

Chicago Metro Market

By Million of RSF

East-West 35 RSF

.75 M *

O’Hare 14 RSF

CBD 119 RSF

Northwest 25 RSF

North 21 RSF 1.3 M *

* CarrAmerica’s Portion of Market

The Chicago Market

Market Dynamics

Continued overall weak market characterized by corporate retrenchment

Downtown is expensive; $14 to $17 operating expenses; bias toward “new” towers; Class A 1980’s vintage suffering

Suburbs have slow but steady leasing recovery

Large block availability is in East-West market TI’s are high on generic space Investment sales are slow Former owner occupied adds to inventory

The Chicago Market

Investment Strategy – Passing on the Downtown Market

Built 1982

1.2 million SF; sold for $209 million or $180/SF in 2002

Underwriting got to $174 million or $145/SF

Large, low rise floors = low rental rate

One South Wacker

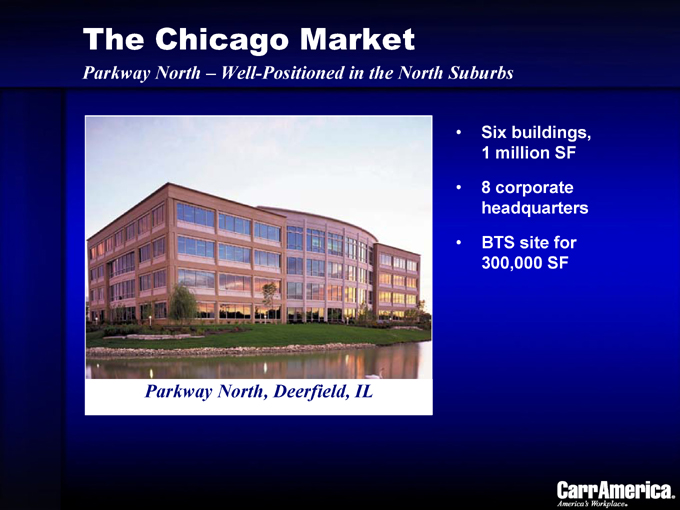

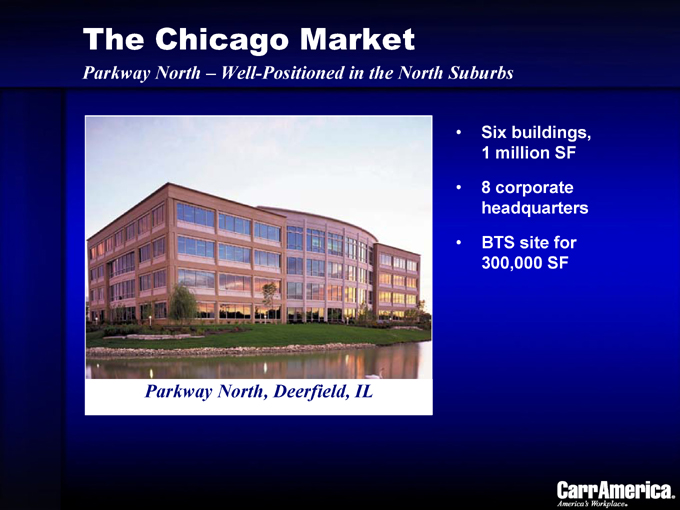

The Chicago Market

Parkway North – Well-Positioned in the North Suburbs

Six buildings, 1 million SF

8 corporate headquarters

BTS site for 300,000 SF

Parkway North, Deerfield, IL

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

Texas and Denver/Salt Lake Markets

Market Strategy

Opportunistic strategy reflecting low barrier markets

Extensive use of joint ventures to leverage equity capital and spread risk

Significant fee revenue increases returns

The Dallas Market

Market Scorecard

90+% portfolio occupancy

70% of portfolio is in JV structure

$50 million in BTS deals over the last three years

Capital recycling will result in ownership of only “A” properties

The Dallas Market

Market Dynamics

Strong submarket recoveries in Preston Center, Legacy and Uptown

Traditionally high job growth with concentration of corporate offices

Liquid capital market; rewards for having a nimble investment strategy

The Dallas Market

505,000 SF, 4-building complex

65/35 joint venture with NYSTRS

99% leased:

Verizon Capital One Sedgewick First Health American Honda Cendant

Royal Ridge Joint Venture

The Dallas Market

Acquisition and development

JV with JPMorgan

Significant development and incentive fees

Legacy Town Center JV Strategy

The Austin Market

Current Market Strategy

1.7 million SF – mostly CarrAmerica development

85% of portfolio is in JV structure

Recycled out of 1 million SF

Stay in the deal flow for acquisitions and development

Additional opportunity to develop positions in Riata

The Austin Market

Market Dynamics

Suburban recovery well underway

Leasing velocity is high in many submarkets and rents are beginning to push upward

Limited development opportunities in the strongest submarkets

Due to its smaller size, the market moves directionally very quickly

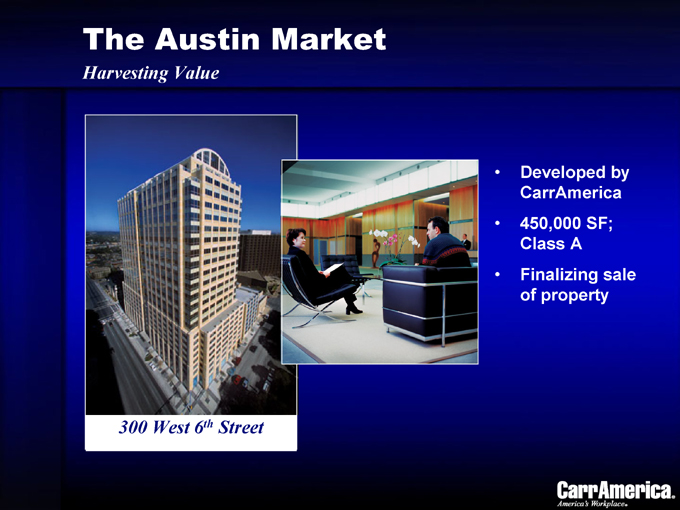

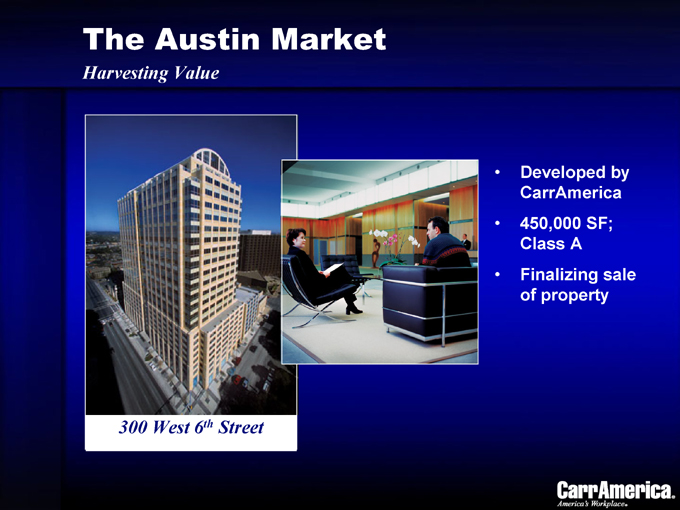

The Austin Market

Harvesting Value

Developed by CarrAmerica 450,000 SF; Class A Finalizing sale of property

300 West 6th Street

The Austin Market

Market Success

275,000 SF lease with Apple Computer in the former EDS Space

1 million SF project developed by CarrAmerica

Right product for the market

Future development

Riata Corporate Park Austin, TX

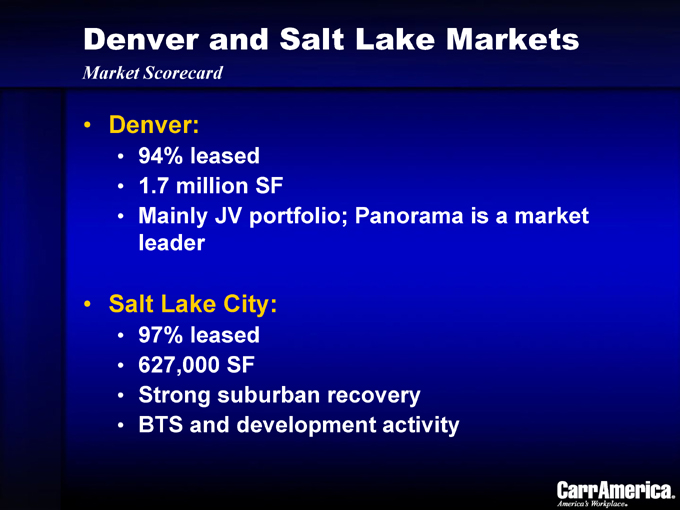

Denver and Salt Lake Markets

Market Scorecard

Denver:

94% leased 1.7 million SF

Mainly JV portfolio; Panorama is a market leader

Salt Lake City:

97% leased 627,000 SF

Strong suburban recovery BTS and development activity

BREAK

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

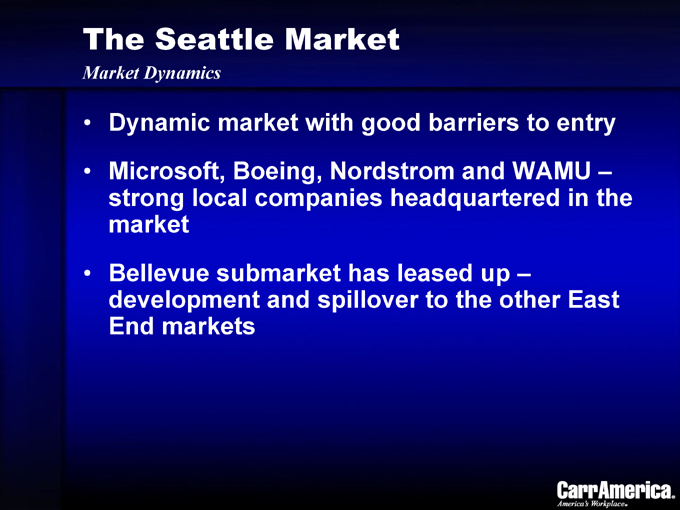

The Seattle Market

Market Scorecard

Portfolio is 89% committed $51 million invested year to date Repositioning portfolio

The Seattle Market

Market Dynamics

Dynamic market with good barriers to entry Microsoft, Boeing, Nordstrom and WAMU –strong local companies headquartered in the market Bellevue submarket has leased up –development and spillover to the other East End markets

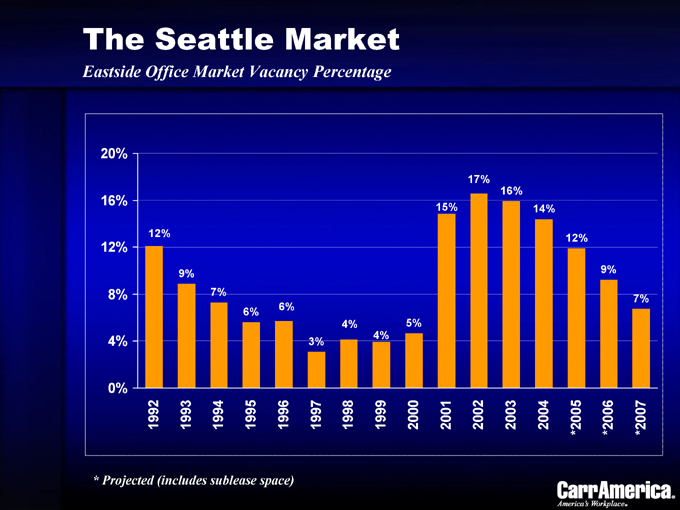

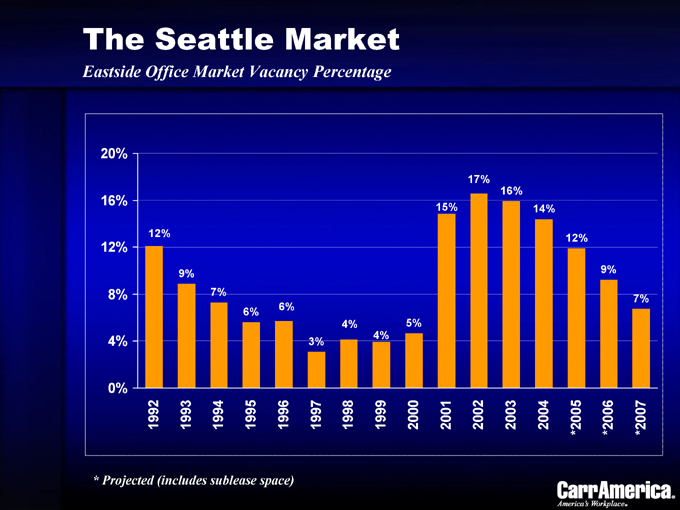

The Seattle Market

Eastside Office Market Vacancy Percentage

20% 16% 12% 8% 4% 0%

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 *2005 *2006 *2007

12% 9% 7% 6% 6% 3% 4% 4% 5% 15% 17% 16% 14% 12% 9% 7%

* Projected (includes sublease space)

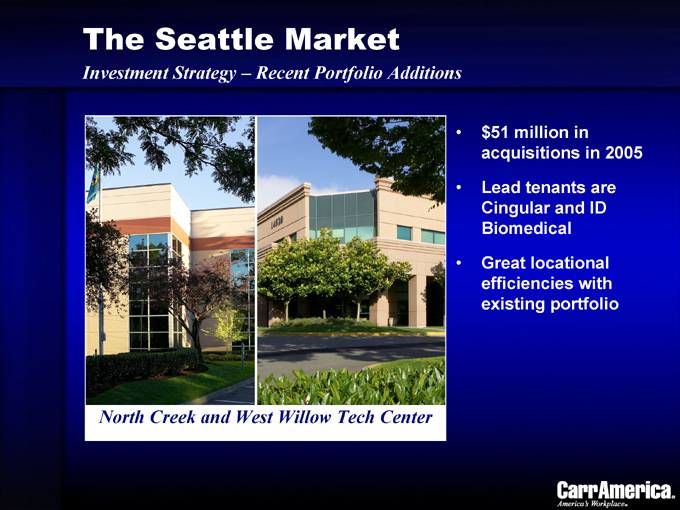

The Seattle Market

Leasing Successes – Willow Creek

Leased 166,000 SF to Areva, Lucent, Merck, Nextel and Solutions IQ

Portfolio now 90% committed

Willow Creek Corporate Center

The Seattle Market

Investment Strategy – Recent Portfolio Additions $51 million in acquisitions in 2005

Lead tenants are Cingular and ID Biomedical

Great locational efficiencies with existing portfolio

North Creek and West Willow Tech Center

The Seattle Market

The Development Pipeline

Attractive opportunities in many submarkets

Canyon Pointe

Lake Union district

Bellevue

Strong absorption supports pipeline

Barriers and complexity benefit CarrAmerica

Canyon Pointe

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

Southern California Region

Market Scorecard - 2003 through 2005 Operations Summary

2003

Higher vacancy with little business expansion Leased 500,000 SF

2004

Market rebounded quickly

Leased 1 million SF (107 transactions)

2005

Portfolio has “filled up”

98% committed wholly owned properties* 94% committed including JVs Starting to push rates

Development makes sense in targeted submarkets

* Excluding 2600 West Olive

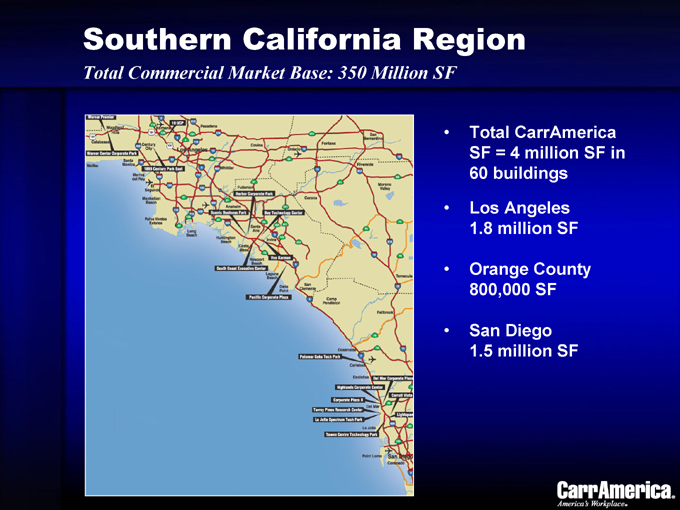

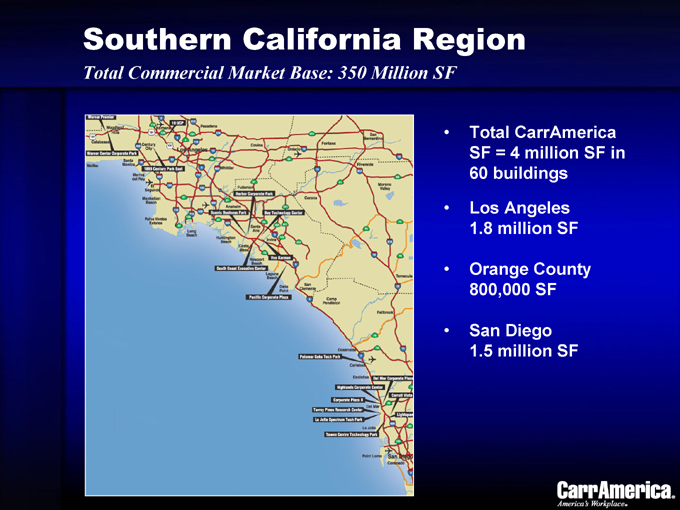

Southern California Region

Total Commercial Market Base: 350 Million SF

Total CarrAmerica SF = 4 million SF in 60 buildings

Los Angeles 1.8 million SF

Orange County 800,000 SF

San Diego 1.5 million SF

Southern California Region

Market Dynamics

Large and dynamic market with good barriers to entry

Large concentration of entertainment/media/ defense/technology

Highly skilled workforce

Strong life science cluster in San Diego

Southern California Region

Market Strategy

Pushing rates

Focus on development opportunities

Start San Diego biotech building early 2006

Opportunistic acquisitions

Southern California Region

Investment Strategy – “High Profile” Acquisitions in LA

Acquired 10 UCP and 1888 Century Park East through JVs

Strong leasing performance at 10 UCP; 98% committed

1888 Century Park East repositioned with interior/exterior renovation

10 UCP and 1888 Century Park East

Southern California Region

Investment Strategy – Why We Passed

Solid downtown assets but challenges to achieve target returns

Pricing:

601 S. Figueroa: $351/SF

400 S. Hope: $355/SF

Rates suppressed by competition from ARCO

Century City/West LA preference

Figueroa @ Wilshire

Southern California Region

Investment Strategy – Selling into Strength

Assets were difficult to lease in the downturn

Not well-positioned in their respective submarkets

Strong gains realized

Alton Deere, Westlake Spectrum and 2600 West Olive

Southern California Region

Investment Strategy – Re-invest in High Quality Assets

San Diego/UTC

195,000 SF Strong submarket Excellent location $287 per SF

Chancellor Park

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

San Francisco Bay Area Market

Market Scorecard

90% committed

Approximately 750,000 SF of leases completed YTD 2005 (72 transactions)

Strategically acquiring buildings and sites for future development opportunities

San Francisco Bay Area Market

Market Dynamics

Large and dynamic market with good barriers to entry

Large concentration of Fortune 500 companies

Highly skilled workforce

Easy access to capital for industry and technology = venture capital firms

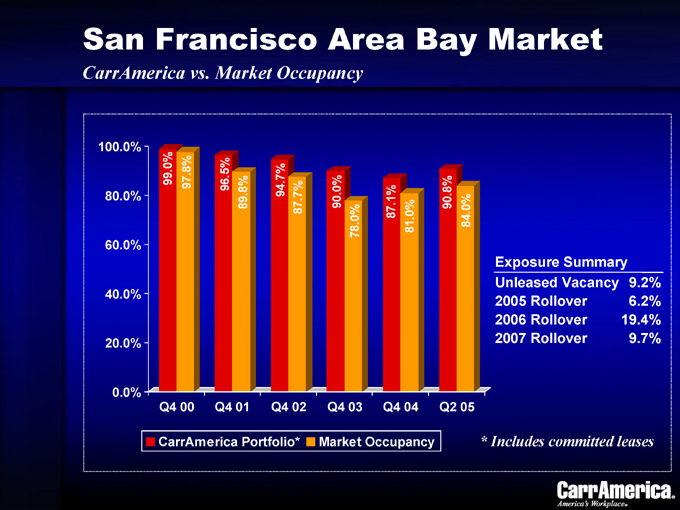

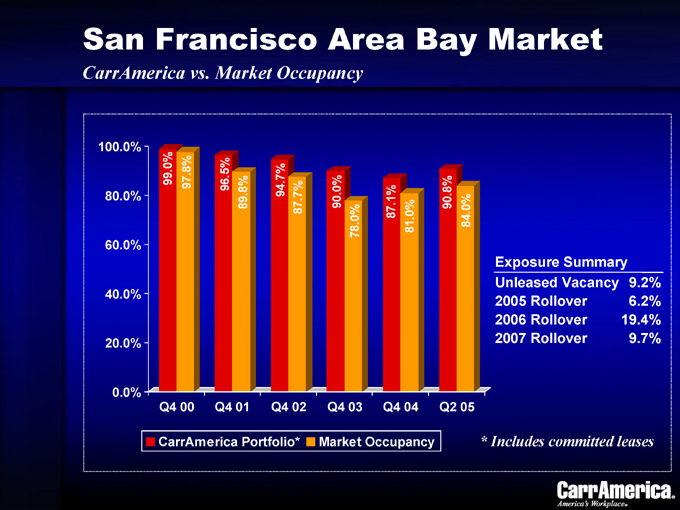

San Francisco Area Bay Market

CarrAmerica vs. Market Occupancy

100.0% 80.0% 60.0% 40.0% 20.0% 0.0%

99.0% 97.8%

96.5% 89.8%

94.7% 87.7%

90.0% 78.0%

87.1% 81.0%

90.8% 84.0%

Q4 00 Q4 01 Q4 02 Q4 03 Q4 04 Q2 05

Exposure Summary

Unleased Vacancy 9.2%

2005 Rollover 6.2%

2006 Rollover 19.4%

2007 Rollover 9.7%

CarrAmerica Portfolio* Market Occupancy

* Includes committed leases

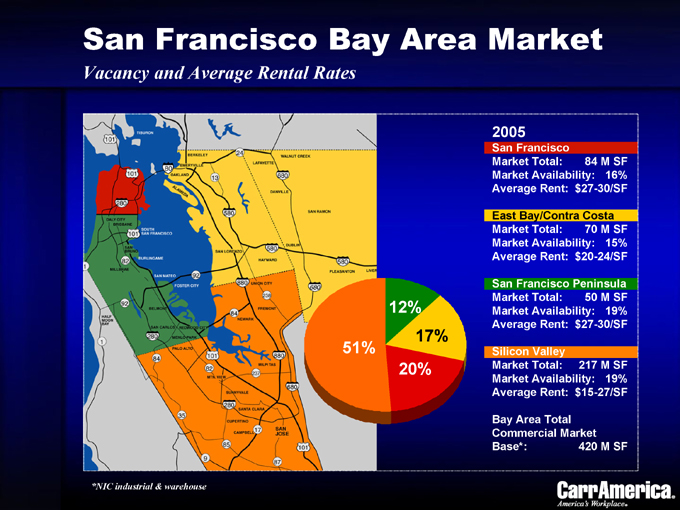

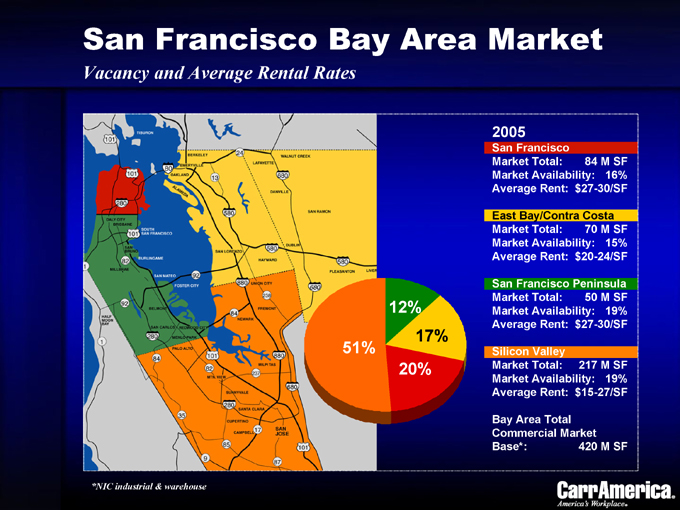

San Francisco Bay Area Market

Vacancy and Average Rental Rates

12% 17% 20% 51%

2005

San Francisco

Market Total: 84 M SF

Market Availability: 16%

Average Rent: $27-30/SF

East Bay/Contra Costa

Market Total: 70 M SF

Market Availability: 15%

Average Rent: $20-24/SF

San Francisco Peninsula

Market Total: 50 M SF

Market Availability: 19%

Average Rent: $27-30/SF

Silicon Valley

Market Total: 217 M SF

Market Availability: 19%

Average Rent: $15-27/SF

Bay Area Total

Commercial Market

Base*: 420 M SF

*NIC industrial & warehouse

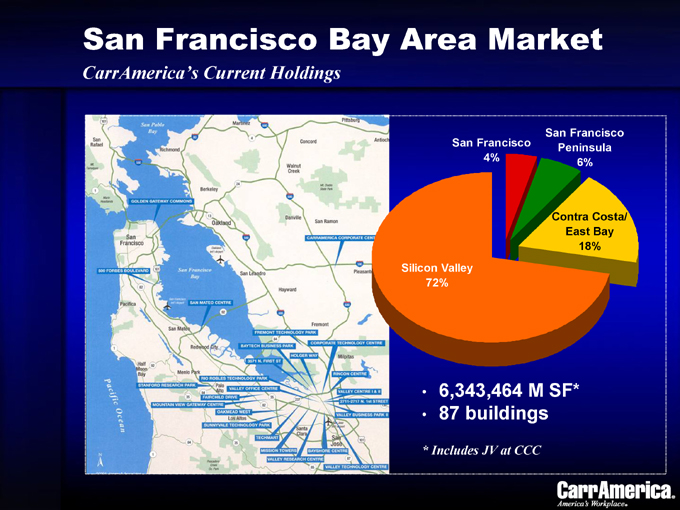

San Francisco Bay Area Market

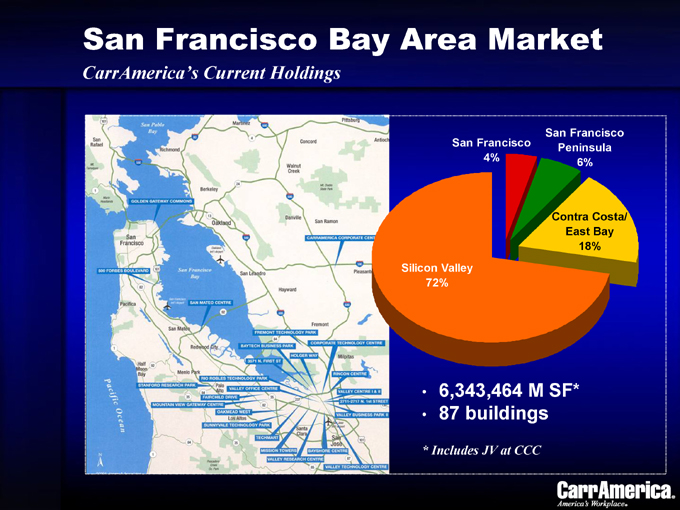

CarrAmerica’s Current Holdings

San Francisco 4%

San Francisco Peninsula 6%

Contra Costa/ East Bay 18%

Silicon Valley 72%

6,343,464 M SF* 87 buildings

* Includes JV at CCC

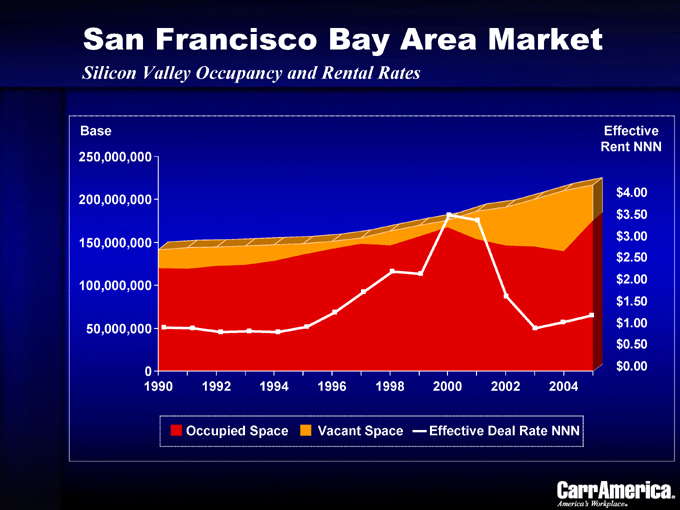

San Francisco Bay Area Market

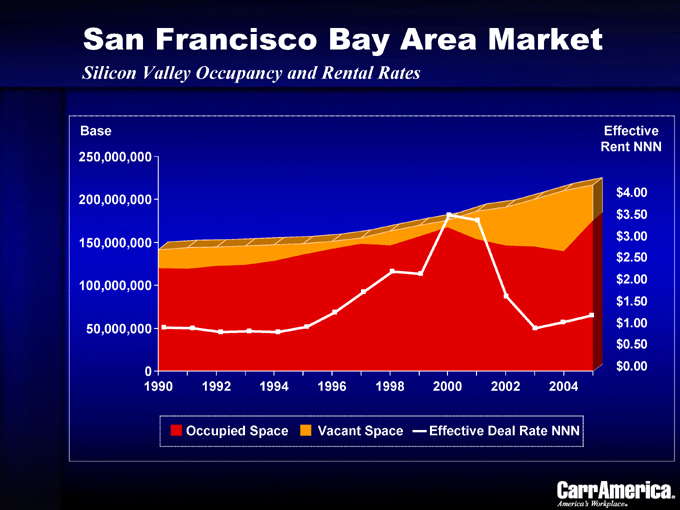

Silicon Valley Occupancy and Rental Rates

Base 250,000,000

200,000,000 150,000,000 100,000,000 50,000,000 0

Effective Rent NNN

$4.00 $3.50 $3.00 $2.50 $2.00 $1.50 $1.00 $0.50 $0.00

1990 1992 1994 1996 1998 2000 2002 2004

Occupied Space Vacant Space Effective Deal Rate NNN

San Francisco Bay Area Market

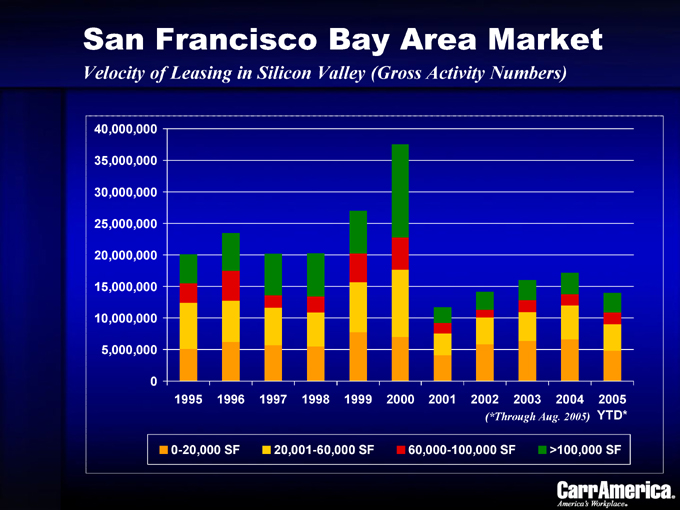

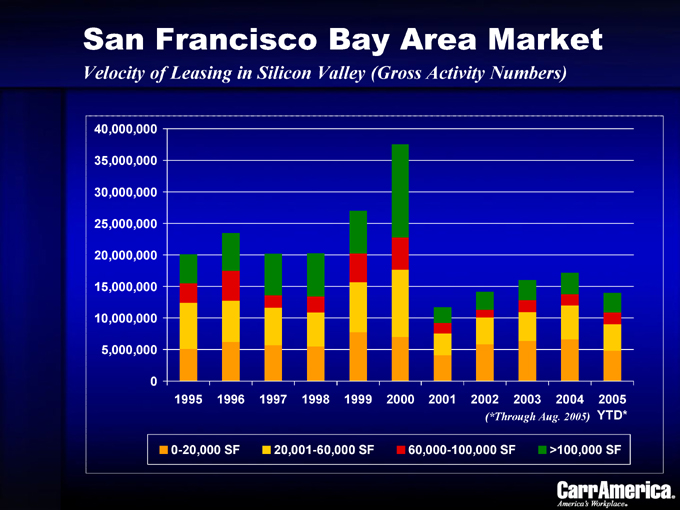

Velocity of Leasing in Silicon Valley (Gross Activity Numbers)

40,000,000 35,000,000 30,000,000 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 0

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

(*Through Aug. 2005) YTD*

0-20,000 SF 20,001-60,000 SF 60,000-100,000 SF >100,000 SF

San Francisco Bay Area Market

Market Strategy: Responding to Rapidly Changing Market Conditions

Lease strategy

Push rental rates for Class A assets Occupancy-driven for lower quality assets Focus on tenant’s credit and expansion capability Less emphasis on early renewal

Investment strategy

Acquire Class A product to upgrade portfolio Value-add opportunities through repositioning or new development Sell non-strategic product

San Francisco Bay Area Market

Acquisitions – 1.2 Million SF

1 2 3 4 5 6

1) Mission Towers I, Santa Clara Class A – 282,080 SF Purchased 12/04

2) Cell Genesys, South San Francisco Class A – 155,685 SF Purchased 9/03

3) 2711 N. First Street, San Jose Class B – 74,621 SF Purchased 8/05

4) Stanford Research Park, Palo Alto Class A – 89,595 SF Purchased 11/02

5) Holger Way, San Jose Class A – 505,040 SF Purchased 7/04

6) Fairchild Drive, Mountain View Class A – 131,561 SF Purchased 8/05

San Francisco Bay Area Market

Dispositions – 343,367 SF

1 2 3

1) First Street Tech Center, San Jose, Vacant Class C, R&D – 67,582 SF Sold 12/04

2) Valley Business Park I, San Jose, Multi-Tenant Class B, R&D – 67,522 SF Sold 12/04

3) Hacienda West, Pleasanton, Multi-Tenant Class B – 208,263 SF In Process

Agenda

Overview and Operating Strategy: Phil Hawkins, President

Market Reviews:

Washington—Phillip Thomas Chicago—Jerry O’Malley Texas and Denver/SLC—Jeff Pace Seattle—Clete Casper Southern California—Malcolm O’Donnell San Francisco Bay Area—Chris Peatross

The Future and Wrap Up: Tom Carr, CEO

CarrAmerica is Well Positioned

The Future

Improving portfolio dynamics

A strong balance sheet

Shifting external growth opportunities

The right operating model

CarrAmerica is Well Positioned

Improving Portfolio Dynamics

Improving mark-to-market from leasing, dispositions and acquisitions

Improving occupancy to date

More submarkets experiencing rent increases

CarrAmerica is Well Positioned

A Strong Balance Sheet

Moderate leverage Strong line capacity Investment grade rating

CarrAmerica is Well Positioned

Shifting External Growth Opportunities

Opportunistic purchases and/or investments in completed buildings

Development window is open or fast approaching in good submarkets

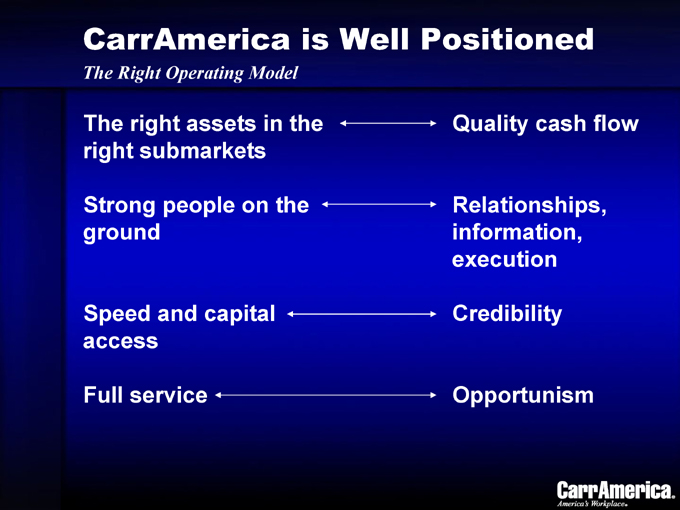

CarrAmerica is Well Positioned

The Right Operating Model

The right assets in the right submarkets Quality cash flow

Strong people on the ground Relationships, information, execution

Speed and capital access Credibility

Full service Opportunism

CarrAmerica Investor Conference

Key Messages

Strong execution through the market downturn

Market improvement is accelerating

CarrAmerica is very well positioned to benefit from the recovery

Q & A

Investor Day Program

September 20, 2005