As filed with the Securities and Exchange Commission on July 7, 2003

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-7310

ARK FUNDS

Two Portland Square

Portland, Maine 04101

(207) 879-1900

Rick A. Gold, President

Two Portland Square

Portland, Maine 04101

(207) 879-1900

Date of fiscal year end: APRIL 30, 2003

Date of reporting period: APRIL 30, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Clear-cut strategies for confident investing.

Clear-cut strategies for confident investing.

April 30, 2003 | Corporate Classes Annual Report |

U.S. Treasury Cash Management Portfolio

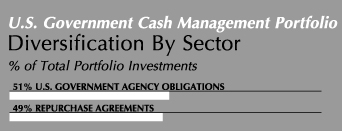

U.S. Government Cash Management Portfolio

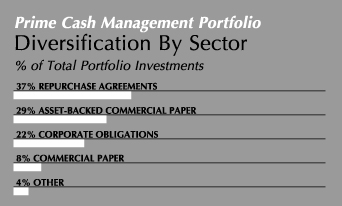

Prime Cash Management Portfolio

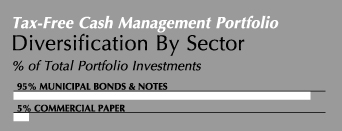

Tax-Free Cash Management Portfolio

Managed by Allied Investment Advisors, Inc.

[GRAPHIC]

CONTENTS

This report and the financial statements contained herein are submitted for the general information of shareholders of the ARK Funds and do not constitute investment advice. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus for each of the portfolios included. Shares of the portfolios are not deposits of any bank, and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency. Investing in the shares involves investment risks including the possible loss of principal amount invested. The views in this report are those of the portfolio manager as of April 30, 2003, and may not reflect his views as of the date this report was first published or anytime thereafter. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. For information about ARK Funds Portfolios, please call 1-800-ARK-FUND (1-800-275-3863).

LETTER TO SHAREHOLDERS

JUNE 2003

Dear Shareholder,

With this Annual Report, we will update you on the progress of the ARK Cash Management Portfolios as of April 30, 2003. We are proud to have been able to grow assets to over $991 million as of April 30, 2003 and pleased to have been able to provide competitive returns during the continuing difficult economic conditions that have impacted us all during the past fiscal year.

In addition to providing you with information about the Portfolios’ performance, diversification, and holdings, the portfolio manager’s Management Discussion and Analysis provides information about economic factors affecting the Portfolios.

The past six months have been full of activity for ARK Funds. In our Semi Annual Report dated October 31, 2002, we told you about the pending acquisition of Allfirst Financial, Inc. by M&T Bank Corporation of Buffalo, New York. That acquisition was completed on April 1, 2003.

Earlier this year, the respective boards of trustees of ARK Funds and the VISION Group of Funds (the proprietary mutual fund company of M&T Bank Corporation) each met and authorized a tax-free reorganization of certain ARK and VISION portfolios, subject to shareholder approval. A Special Meeting of Shareholders of each of the affected portfolios will be scheduled, and a proxy/prospectus containing additional information will be sent to shareholders soon.

We thank you for investing in the ARK Funds, and we look forward to continuing to help you meet your financial goals.

Sincerely,

William H. Cowie, Jr.

Chairman

ANNUAL REPORT / APRIL 30, 2003

1

This page intentionally left blank.

CASH MANAGEMENT PORTFOLIOS

Cash Management

Portfolios

Our investment management philosophy is defined by three objectives: to preserve principal, to maintain daily liquidity, and to maximize current income. To achieve these objectives, we actively manage the Cash Management Portfolios, utilizing our conservative and highly disciplined relative value approach, which is constantly monitored and reviewed seeking to ensure that the Portfolios’ goals are realized.

To preserve principal, we consider only those issuers that pass our stringent credit evaluation process. The goal of the credit evaluation process is to select high-quality issuers that present minimal credit risk. The evaluation process is based on both quantitative and qualitative factors that highlight the issuer’s ability to maintain its credit rating and leading industry position. Issuers are monitored and reviewed by the Allied Investment Advisors Investment Policy Committee, which is comprised of senior personnel from Allied Investment Advisors, Inc. (AIA).

To provide daily liquidity, we manage our maturities and engage in overnight repurchase agreements seeking to obtain the highest short-term credit ratings. Each repurchase agreement is collateralized by U.S. Treasury or U.S. government agency securities.

To maximize current income, we actively manage the Portfolios. We seek to take advantage of short-lived trading opportunities and market inefficiencies by employing a relative-value approach that emphasizes security selection.

Each Portfolio’s strategy starts with an average maturity decision. This decision is determined by a number of factors, such as analysis of our shareholders’ liquidity needs, expected Federal Reserve monetary policy and yield curve, and implied forward interest-rate analysis.

Upon determining a Portfolio’s average maturity, we analyze each market sector to determine which sectors we believe are cheap, thus providing value, and which sectors are expensive. Individual securities are then selected. This in-depth analysis allows us to identify perceived market inefficiencies and trading opportunities.

3

CASH MANAGEMENT PORTFOLIOS

CASH MANAGEMENT PORTFOLIOS

James M. Hannan

PORTFOLIO MANAGER

James M. Hannan is manager of the Cash Management Portfolios, and is manager or co-manager of other ARK Funds Portfolios. He is also responsible for several separately managed institutional portfolios. Mr. Hannan has been a Portfolio Manager of Allied Investment Advisers, Inc. (“AIA”) since 1996, a Vice President of Allfirst Bank from 1987 to 2003 and a Vice President of Manufacturers and Traders Trust Company (“M&T Trust”) since 2003. He has more than 15 years of experience in the investment industry.

U.S. Treasury Cash Management

U.S. Government Cash Management

Prime Cash Management

Tax-Free Cash Management

Management Discussion and Analysis

Interest rates fell over the past fiscal year, as economic growth remained elusive. The 2-year Treasury note’s yield declined from a fiscal-year high of 3.37% on May 17, 2002 to 1.49% on April 30, 2003. The Federal Reserve lowered short-term interest rates once during the period in November 2002 to 1.25% from 1.75%.

During the past fiscal year we continued to invest in high-quality, short-term securities that present minimal credit risk. We maintained the average maturity of the Portfolios by selectively purchasing securities maturing in either the latter part of 2003 or early 2004.

Given the tepid economic growth and low inflation environment, we believe the Federal Reserve may either lower interest rates during the summer or maintain the current rate of 1.25% for the foreseeable future. Because of our expectations for economic growth and Federal Reserve policy, we may choose to maintain a barbelled portfolio structure, attempting to maintain principal preservation and daily liquidity, while also seeking to provide a competitive rate of return. As always, we will continue to consistently utilize our conservative and disciplined relative value investment process.

APRIL 30, 2003 / ANNUAL REPORT

4

CASH MANAGEMENT PORTFOLIOS

Performance as of April 30, 2003*

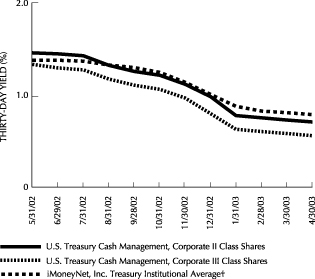

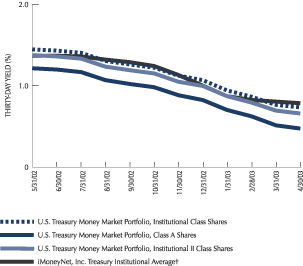

U.S. Treasury Cash Management Portfolio

| | | |

| | | Corporate II

Class Shares | | Corporate III

Class Shares | | iMoneyNet, Inc.

Treasury

Institutional Average† |

Seven Day Simple Yield | | 0.69% | | 0.54% | | 0.79% |

|

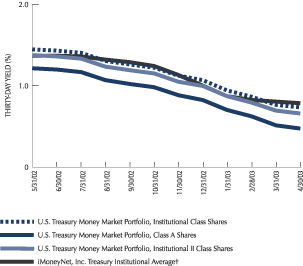

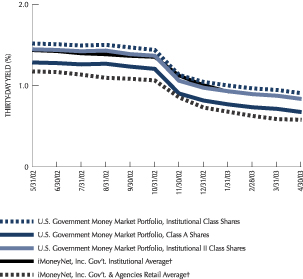

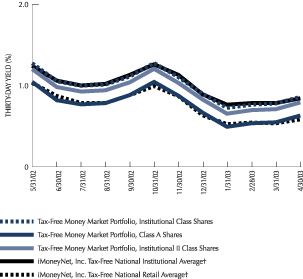

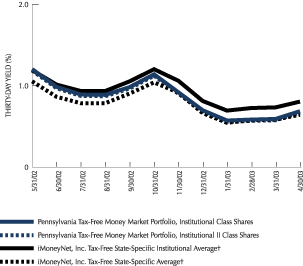

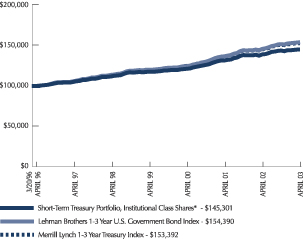

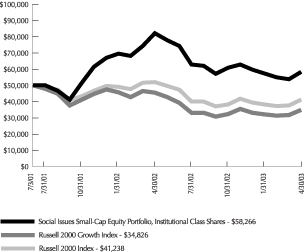

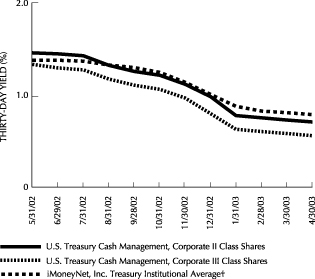

THIRTY-DAY YIELD COMPARISON

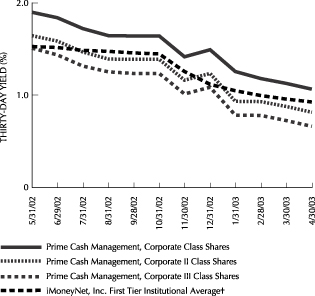

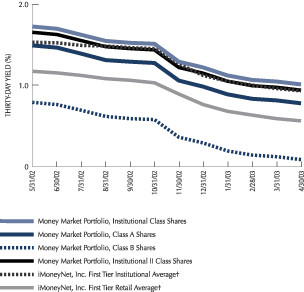

Prime Cash Management Portfolio

| | | | |

| | | Corporate

Class Shares | | Corporate II

Class Shares | | Corporate III

Class Shares | | iMoneyNet, Inc.

First Tier Institutional

Average† |

Seven Day

Simple Yield | | 1.07% | | 0.82% | | 0.67% | | 0.92% |

|

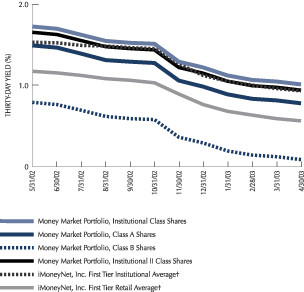

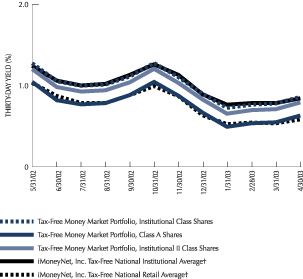

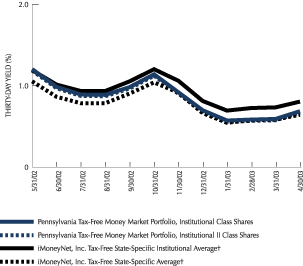

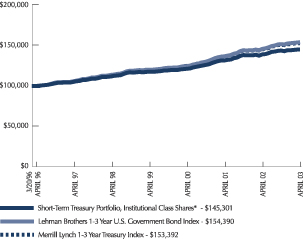

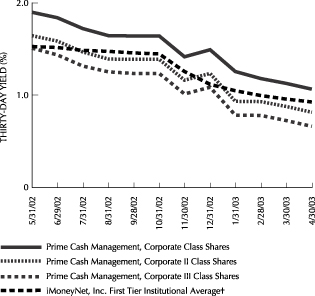

THIRTY-DAY YIELD COMPARISON

| * | | Past performance is not predictive of future performance. |

| † | | The performance of the iMoneyNet, Inc. averages do not include operating expenses that are incurred by each Portfolio. |

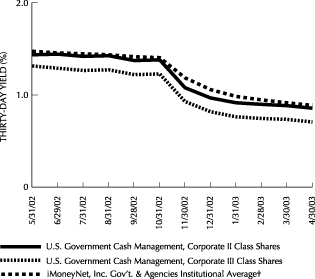

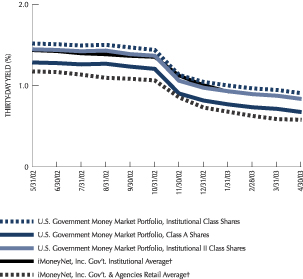

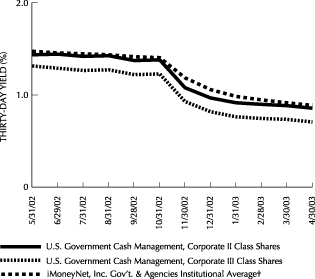

U.S. Government Cash Management Portfolio

| | | |

| | | Corporate II

Class Shares | | Corporate III

Class Shares | | iMoneyNet, Inc.

Gov’t & Agencies

Institutional Average† |

Seven Day Simple Yield | | 0.84% | | 0.69% | | 0.88% |

|

THIRTY-DAY YIELD COMPARISON

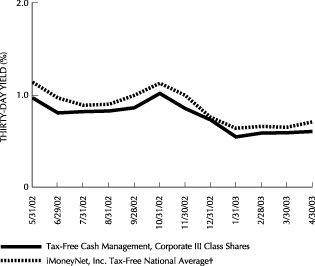

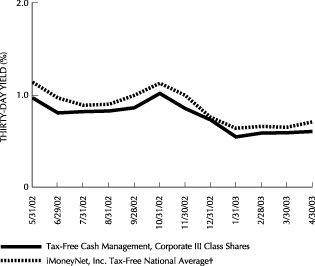

Tax-Free Cash Management Portfolio

| | |

| | | Corporate III

Class Shares | | iMoneyNet, Inc

Tax-Free National

Average† |

Seven Day

Simple Yield | | 0.72% | | 0.79% |

|

THIRTY-DAY YIELD COMPARISON

ANNUAL REPORT / APRIL 30, 2003

5

U.S. TREASURY CASH MANAGEMENT PORTFOLIO

Schedule of Investments

| | |

| Description | | Principal

Amount (000) | | Market

Value (000) | |

| | |

| U.S. Treasury Obligations — 100.1% | | | | | | | |

| | |

U.S. Treasury Bills ^ | | | | | | | |

1.250%, 05/22/03 | | $ | 294 | | $ | 294 | |

| |

|

1.234%, 06/05/03 | | | 2,389 | | | 2,386 | |

| |

|

1.217%, 07/10/03 | | | 48 | | | 48 | |

| |

|

1.210%, 05/01/03 | | | 4,448 | | | 4,448 | |

| |

|

1.209%, 05/15/03 | | | 562 | | | 562 | |

| |

|

1.182%, 08/21/03 | | | 113 | | | 113 | |

| |

|

1.176%, 09/18/03 | | | 2,528 | | | 2,516 | |

| |

|

1.171%, 08/07/03 | | | 1,148 | | | 1,144 | |

| |

|

1.166%, 10/02/03 | | | 108 | | | 107 | |

| |

|

1.155%, 07/03/03 | | | 1,788 | | | 1,784 | |

| |

|

1.154%, 07/17/03 | | | 16,954 | | | 16,912 | |

| |

|

1.145%, 08/28/03 | | | 2 | | | 2 | |

| |

|

1.142%, 05/29/03 | | | 5,650 | | | 5,645 | |

| |

|

1.142%, 07/24/03 | | | 1,219 | | | 1,216 | |

| |

|

1.131%, 10/16/03 | | | 138 | | | 137 | |

| |

|

1.129%, 09/25/03 | | | 4,864 | | | 4,842 | |

| |

|

1.110%, 06/12/03 | | | 358 | | | 358 | |

| |

|

| |

TOTAL U.S. TREASURY OBLIGATIONS

(COST $42,514) | | $ | 42,514 | |

|

| |

TOTAL INVESTMENTS — 100.1% (COST $42,514) | | $ | 42,514 | |

|

| |

| OTHER ASSETS & LIABILITIES, NET — (0.1)% | | $ | (33 | ) |

|

| | |

| TOTAL NET ASSETS — 100.0% | | | | | $ | 42,481 | |

|

| ^ | | The effective yield at time of purchase is shown as the rate on the Schedule of Investments. |

The accompanying notes are an integral part of the financial statements.

APRIL 30, 2003 / ANNUAL REPORT

6

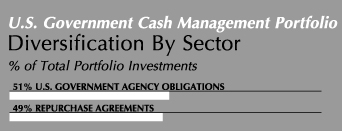

U.S. GOVERNMENT CASH MANAGEMENT PORTFOLIO

Schedule of Investments

| | |

| Description | | Principal

Amount (000) | | Market

Value (000) |

| |

| U.S. Government Agency Obligations — 50.6% | | | |

| | |

FFCB ^ | | | | | | |

1.616%, 05/15/03 | | $ | 6,000 | | $ | 5,996 |

| |

|

1.576%, 05/28/03 | | | 15,000 | | | 14,983 |

| |

|

| | |

FHLB | | | | | | |

6.875%, 08/15/03 | | | 35,100 | | | 35,652 |

| |

|

5.250%, 02/13/04 | | | 10,000 | | | 10,304 |

| |

|

5.125%, 09/15/03 | | | 7,500 | | | 7,603 |

| |

|

2.500%, 11/14/03 | | | 5,000 | | | 5,029 |

| |

|

2.060%, 07/02/03 | | | 5,000 | | | 5,000 |

| |

|

1.500%, 03/08/04 | | | 4,000 | | | 4,000 |

| |

|

1.450%, 05/14/04 | | | 5,000 | | | 5,000 |

| |

|

1.400%, 03/29/04 | | | 12,000 | | | 12,000 |

| |

|

1.300%, 04/07/04 | | | 10,000 | | | 10,000 |

| |

|

| | |

FHLB ^ | | | | | | |

1.250%, 05/01/03 | | | 50,000 | | | 50,000 |

| |

|

| | |

FHLB ‡ | | | | | | |

1.210%, 09/27/04 | | | 5,000 | | | 4,998 |

| |

|

1.190%, 05/27/04 | | | 15,000 | | | 14,993 |

| |

|

1.089%, 06/17/03 | | | 9,200 | | | 9,200 |

| |

|

| | |

FHLMC | | | | | | |

7.375%, 05/15/03 | | | 30,000 | | | 30,059 |

| |

|

| | |

FHLMC ^ | | | | | | |

1.760%, 07/17/03 | | | 20,000 | | | 19,926 |

| |

|

| | |

FNMA | | | | | | |

5.500%, 09/29/03 | | | 9,000 | | | 9,153 |

| |

|

5.125%, 02/13/04 | | | 25,000 | | | 25,747 |

| |

|

4.000%, 08/15/03 | | | 68,903 | | | 69,440 |

| |

|

| | |

FNMA ^ | | | | | | |

1.250%, 05/01/03 | | | 100,000 | | | 100,000 |

| |

|

| |

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS (COST $449,083) | | $ | 449,083 |

|

| | |

| Description | | Principal

Amount (000) | | Market

Value (000) |

| |

| Repurchase Agreements — 49.2% | | | |

Deutsche Bank, 1.280%, dated 04/30/03, matures 05/01/03, repurchase price $125,004,444 (102% collateralized by various U.S. Treasury Obligations) | | $ | 125,000 | | $ | 125,000 |

| |

|

First Boston, 1.270%, dated 04/30/03, matures 05/01/03, repurchase price $50,001,764 (102% collateralized by various U.S. Treasury Obligations) | | | 50,000 | | | 50,000 |

| |

|

Goldman Sachs, 1.250%, dated 04/30/03, matures 05/01/03, repurchase price $125,004,340 (102% collateralized by various U.S. Treasury Obligations) | | | 125,000 | | | 125,000 |

| |

|

Goldman Sachs, 1.100%, dated 04/30/03, matures 05/01/03, repurchase price $11,431,395 (102% collateralized by various U.S. Treasury Obligations) | | | 11,431 | | | 11,431 |

| |

|

Salomon Brothers, 1.250%, dated 04/30/03, matures 05/01/03, repurchase price $125,004,340 (102% collateralized by various U.S. Treasury Obligations) | | | 125,000 | | | 125,000 |

| |

|

| |

TOTAL REPURCHASE AGREEMENTS

(COST $436,431) | | $ | 436,431 |

|

| |

TOTAL INVESTMENTS — 99.8%

(COST $885,514) | | $ | 885,514 |

|

| |

| OTHER ASSETS & LIABILITIES, NET — 0.2% | | $ | 1,796 |

|

| |

| TOTAL NET ASSETS — 100.0% | | $ | 887,310 |

|

| ^ | | The effective yield at time of purchase is shown as the rate on the Schedule of Investments. |

| ‡ | | Variable Rate Security. The rate reported on the Schedule of Investments is the rate in effect on 4/30/03. The date shown is the stated maturity. |

FFCB — Federal Farm Credit Bureau

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

The accompanying notes are an integral part of the financial statements.

ANNUAL REPORT / APRIL 30, 2003

7

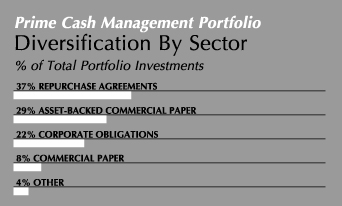

PRIME CASH MANAGEMENT PORTFOLIO

Schedule of Investments

| | |

| Description | | Principal

Amount (000) | | Market

Value (000) |

| | |

| Corporate Obligations — 22.9% | | | | | | |

| | |

Banks — 9.5% | | | | | | |

| | |

Bank of New York | | | | | | |

6.625%, 06/15/03 | | $ | 1,000 | | $ | 1,006 |

| |

|

| | |

Canadian Imperial Bank NY ‡ | | | | | | |

1.420%, 04/12/04 | | | 1,000 | | | 1,000 |

| |

|

| | |

Deutsche Bank NY | | | | | | |

1.685%, 03/10/04 | | | 1,000 | | | 1,000 |

| |

|

| | |

U.S. Bancorp | | | | | | |

6.000%, 05/15/04 | | | 1,500 | | | 1,571 |

| |

|

| | |

TOTAL BANKS | | | | | $ | 4,577 |

|

| | |

Financials — 4.4% | | | | | | |

| | |

Associates N.A. | | | | | | |

5.750%, 11/01/03 | | | 1,000 | | | 1,021 |

| |

|

| | |

Heller Financial | | | | | | |

6.000%, 03/19/04 | | | 1,050 | | | 1,093 |

| |

|

| | |

TOTAL FINANCIALS | | | | | $ | 2,114 |

|

| | |

Security Dealers & Brokers — 9.0% | | | | | | |

| | |

Bear Stearns | | | | | | |

6.150%, 03/02/04 | | | 1,000 | | | 1,037 |

| |

|

| | |

Goldman Sachs Group + | | | | | | |

6.650%, 08/01/03 | | | 250 | | | 253 |

| |

|

| | |

Goldman Sachs Group ‡ | | | | | | |

1.590%, 04/26/04 | | | 1,000 | | | 1,002 |

| |

|

| | |

Morgan Stanley ‡ | | | | | | |

1.810%, 03/09/04 | | | 1,000 | | | 1,004 |

| |

|

1.579%, 08/18/03 | | | 1,000 | | | 1,001 |

| |

|

| | |

TOTAL SECURITY DEALERS & BROKERS | | | | | $ | 4,297 |

|

| | |

TOTAL CORPORATE OBLIGATIONS

(COST $10,988) | | | | | $ | 10,988 |

|

| | |

| Description | | Principal

Amount (000) | | Market

Value (000) |

| | |

| Asset-Backed Securities — 1.9% | | | | | | |

| | |

Ford Credit Auto Owner Trust,

Ser 2003-A, Cl A1 | | | | | | |

1.363%, 10/15/03 | | $ | 485 | | $ | 485 |

| |

|

| | |

Honda Auto Receivables Owner Trust, Ser 2002-3, Cl A1 | | | | | | |

1.823%, 08/18/03 | | | —† | | | —† |

| |

|

| | |

Whole Auto Loan Trust,

Ser 2002-1, Cl A1 | | | | | | |

1.420%, 12/15/03 | | | 416 | | | 416 |

| |

|

| | |

TOTAL ASSET-BACKED SECURITIES

(COST $901) | | | | | $ | 901 |

|

| |

| Asset-Backed Commercial Paper — 30.2% | | | |

| | |

Bavaria ^ | | | | | | |

1.281%, 05/23/03 | | | 1,500 | | | 1,499 |

| |

|

| | |

Ciesco ^ | | | | | | |

1.242%, 06/17/03 | | | 2,000 | | | 1,997 |

| |

|

| | |

Citibank ^ | | | | | | |

1.253%, 05/09/03 | | | 1,000 | | | 1,000 |

| |

|

| | |

Corporate Asset Receivables ^ | | | | | | |

1.253%, 06/26/03 | | | 2,000 | | | 1,996 |

| |

|

| | |

Delaware Funding ^ | | | | | | |

1.252%, 05/28/03 | | | 2,000 | | | 1,998 |

| |

|

| | |

Edison Asset Securitization ^ | | | | | | |

1.253%, 06/10/03 | | | 1,000 | | | 998 |

| |

|

| | |

Falcon Asset Securitization ^ | | | | | | |

1.271%, 06/02/03 | | | 2,000 | | | 1,998 |

| |

|

| | |

General Electric Capital | | | | | | |

1.268%, 11/07/03 | | | 1,000 | | | 1,000 |

| |

|

| | |

Sigma Finance | | | | | | |

1.280%, 05/27/03 | | | 2,000 | | | 2,000 |

| |

|

| | |

| TOTAL ASSET-BACKED COMMERCIAL PAPER (COST $14,486) | | | | | $ | 14,486 |

|

| | |

| Commercial Paper — 8.3% | | | | | | |

| | |

Financials — 8.3% | | | | | | |

| | |

Societe Generale NY ^ | | | | | | |

1.248%, 07/07/03 | | | 2,000 | | | 1,995 |

| |

|

| | |

UBS Finance Delaware LLC ^ | | | | | | |

1.260%, 05/07/03 | | | 2,000 | | | 2,000 |

| |

|

| | |

TOTAL FINANCIALS | | | | | $ | 3,995 |

|

| | |

TOTAL COMMERCIAL PAPER

(COST $3,995) | | | | | $ | 3,995 |

|

APRIL 30, 2003 / ANNUAL REPORT

8

PRIME CASH MANAGEMENT PORTFOLIO (concluded)

| | |

| Description | | Principal

Amount (000) | | Market

Value (000) | |

| | |

| Taxable Municipal Bonds — 2.1% | | | | | | | |

| | |

New York — 2.1% | | | | | | | |

| | |

New York City, FGIC | | | | | | | |

1.290%, 06/04/03 | | $ | 1,000 | | $ | 1,000 | |

| |

|

| | |

TOTAL NEW YORK | | | | | $ | 1,000 | |

|

| | |

TOTAL TAXABLE MUNICIPAL BONDS

(COST $1,000) | | | | | $ | 1,000 | |

|

| | |

| Repurchase Agreements — 37.8% | | | | | | | |

Credit Suisse First Boston, 1.270%, dated 04/30/03, matures 05/01/03, repurchase price $5,000,176 (102% collateralized by various U.S. Treasury Obligations) | | | 5,000 | | | 5,000 | |

| |

|

Deutsche Bank, 1.280%, dated 04/30/03, matures 05/01/03, repurchase price $5,000,178 (102% collateralized by various U.S. Treasury Obligations) | | | 5,000 | | | 5,000 | |

| |

|

Goldman Sachs, 1.250%, dated 04/30/03, matures 05/01/03, repurchase price $5,000,174 (102% collateralized by various U.S. Treasury Obligations) | | | 5,000 | | | 5,000 | |

| |

|

Goldman Sachs, 1.100%, dated 04/30/03, matures 05/01/03, repurchase price $3,119,704 (102% collateralized by various U.S. Treasury Obligations) | | | 3,120 | | | 3,120 | |

| |

|

| | |

| TOTAL REPURCHASE AGREEMENTS (COST $18,120) | | | | | $ | 18,120 | |

|

| | |

TOTAL INVESTMENTS — 103.2%

(COST $49,490) | | | | | $ | 49,490 | |

|

| |

| OTHER ASSETS & LIABILITIES, NET — (3.2)% | | $ | (1,555 | ) |

|

| | |

| TOTAL NET ASSETS — 100.0% | | | | | $ | 47,935 | |

|

| + | | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally qualified to institutional investors. |

| ^ | | The effective yield at time of purchase is shown as the rate on the Schedule of Investments. |

| † | | Amount held rounds to less than 1,000. |

| ‡ | | Variable Rate Security. The rate reported on the Schedule of Investments is the rate in effect on 4/30/03. The date shown is the stated maturity. |

These organizations have provided underlying credit support for securities as listed above, as indicated.

| | | FGIC — Financial Guaranty Insurance Corporation |

The accompanying notes are an integral part of the financial statements.

ANNUAL REPORT / APRIL 30, 2003

9

TAX-FREE CASH MANAGEMENT PORTFOLIO

Schedule of Investments

| | |

| Description | | Principal Amount (000) | | Market Value (000) |

| | | | | | | |

| | |

| Municipal Bonds & Notes — 94.7% | | | | | | |

| | |

California — 9.1% | | | | | | |

| | |

California State, RAN | | | | | | |

2.500%, 06/20/03 | | $ | 700 | | $ | 701 |

| |

|

Oakland, JT Powers Financing Authority, Ser A-1, FSA §

1.600%, 08/01/21 | | | 600 | | | 600 |

| |

|

| | |

TOTAL CALIFORNIA | | | | | $ | 1,301 |

|

| | |

Colorado — 5.6% | | | | | | |

| | |

Jefferson County, School District R-001, GO, TRAN | | | | | | |

2.500%, 06/30/03 | | | 800 | | | 802 |

| |

|

| | |

TOTAL COLORADO | | | | | $ | 802 |

|

| | |

Florida — 4.2% | | | | | | |

| | |

Florida State, Housing Finance Agency RB, Ser AA, Remarketed 07/31/95, FNMA § | | | | | | |

1.330%, 06/15/25 | | | 100 | | | 100 |

| |

|

| | |

Lee County, Housing Finance Authority RB, Forestwood Apartments Project, Ser A, FNMA § | | | | | | |

1.330%, 06/15/25 | | | 500 | | | 500 |

| |

|

| | |

TOTAL FLORIDA | | | | | $ | 600 |

|

| | |

Illinois — 0.7% | | | | | | |

| | |

Illinois State, Development Finance Authority RB, Pollution Control, Amoco Oil Project § | | | | | | |

1.350%, 11/01/12 | | | 100 | | | 100 |

| |

|

| | |

TOTAL ILLINOIS | | | | | $ | 100 |

|

| | |

| Description | | Principal Amount (000) | | Market Value (000) |

| | | | | | | |

| | |

Indiana — 4.9% | | | | | | |

| | |

Columbus, Industrial RB, Quinco Consulting Center Project, Fifth Third Bank LOC § | | | | | | |

1.390%, 12/01/21 | | $ | 600 | | $ | 600 |

| |

|

| | |

Elkhart County, Industrial RB, Hubbard Hill Estates Project, Fifth Third Bank

LOC § | | | | | | |

1.390%, 11/01/21 | | | 100 | | | 100 |

| |

|

| | |

TOTAL INDIANA | | | | | $ | 700 |

|

| | |

Kentucky — 4.4% | | | | | | |

| | |

Kenton County, Industrial Building RB, Baptist Convalescent Center Project, Fifth Third Bank LOC § | | | | | | |

1.400%, 07/01/18 | | | 625 | | | 625 |

| |

|

| | |

TOTAL KENTUCKY | | | | | $ | 625 |

|

| | |

Maryland — 14.2% | | | | | | |

| | |

Baltimore County, Consolidated Public Improvements Project, GO | | | | | | |

3.000%, 09/01/03 | | | 220 | | | 221 |

| |

|

| | |

Gaithersburg, Economic Development RB, Asbury Methodist Project, Ser A, MBIA § | | | | | | |

1.350%, 07/01/27 | | | 400 | | | 400 |

| |

|

| | |

Maryland State, Health & Higher Education Facilities Authority RB, Pooled Loan Program, Ser A, Bank One LOC § | | | | | | |

1.320%, 04/01/35 | | | 800 | | | 800 |

| |

|

| | |

Maryland State, Health & Higher Education Facilities Authority RB, Pooled Loan Program, Ser B, Bank One LOC § | | | | | | |

1.300%, 04/01/35 | | | 600 | | | 600 |

| |

|

| | |

TOTAL MARYLAND | | | | | $ | 2,021 |

|

| | |

Massachusetts — 2.1% | | | | | | |

| | |

Massachusetts State, Health & Education § | | | | | | |

1.300%, 07/01/10 | | | 300 | | | 300 |

| |

|

| | |

TOTAL MASSACHUSETTS | | | | | $ | 300 |

|

| | |

Michigan — 5.6% | | | | | | |

| | |

Detroit, Water Supply Systems RB, Ser C, FGIC § | | | | | | |

1.350%, 07/01/29 | | | 800 | | | 800 |

| |

|

| | |

TOTAL MICHIGAN | | | | | $ | 800 |

|

APRIL 30, 2003 / ANNUAL REPORT

10

TAX-FREE CASH MANAGEMENT PORTFOLIO (concluded)

| | |

| Description | | Principal Amount (000) | | Market Value (000) |

| | | | | | | |

| | |

Missouri — 0.7% | | | | | | |

| | |

Missouri State, Health & Educational Facilities Authority RB, Washington University Project, Ser A § | | | | | | |

1.300%, 09/01/30 | | $ | 100 | | $ | 100 |

| |

|

| | |

TOTAL MISSOURI | | | | | $ | 100 |

|

| | |

New Hampshire — 3.5% | | | | | | |

| | |

New Hampshire State, Housing Finance Authority RB, Equity Residential Property—Bond Partnership—Manchester Project, FNMA § | | | | | | |

1.350%, 09/15/26 | | | 500 | | | 500 |

| |

|

| | |

TOTAL NEW HAMPSHIRE | | | | | $ | 500 |

|

| | |

New Jersey — 4.2% | | | | | | |

| | |

New Jersey State, Municipal Securities Trust Receipts RB, Ser CB1 § | | | | | | |

1.400%, 02/15/11 | | | 600 | | | 600 |

| |

|

| | |

TOTAL NEW JERSEY | | | | | $ | 600 |

|

| | |

Pennsylvania — 15.8% | | | | | | |

| | |

Chester County, Industrial Development Authority RB, The Woods Project, PNC Bank N.A. LOC § | | | | | | |

1.400%, 03/31/15 | | | 40 | | | 40 |

| |

|

| | |

Delaware County, Industrial Development Authority RB, Resource Recovery Facility Project, Ser G § | | | | | | |

1.280%, 12/01/31 | | | 550 | | | 550 |

| |

|

1.280%, 12/01/31 | | | 10 | | | 10 |

| |

|

| | |

Delaware Valley, Regulatory Finance Authority RB, Ser D, Toronto-Dominion Bank LOC § | | | | | | |

1.350%, 12/01/20 | | | 600 | | | 600 |

| |

|

| | |

Emmaus, General Authority RB, Ser G, Remarketed 12/01/97 § | | | | | | |

1.400%, 03/01/24 | | | 800 | | | 800 |

| |

|

| | |

Moon, Industrial Development Authority RB, Executive Office Association Project, PNC Bank N.A. LOC § | | | | | | |

1.400%, 11/01/10 | | | 250 | | | 250 |

| |

|

| | |

TOTAL PENNSYLVANIA | | | | | $ | 2,250 |

|

| | |

South Carolina — 4.2% | | | | | | |

| | |

South Carolina State, Jobs Economic Development Authority RB, Catholic Diocese of South Carolina Project, Bank of America N.A. LOC § | | | | | | |

1.400%, 09/01/18 | | | 600 | | | 600 |

| |

|

| | |

TOTAL SOUTH CAROLINA | | | | | $ | 600 |

|

| | |

| Description | | Principal Amount (000) | | Market Value (000) |

| | | | | | | |

| | |

Texas — 5.3% | | | | | | |

| | |

Gulf Coast, Waste Disposal Authority Texas Pollution Control RB, Exxon

Project § | | | | | | |

1.300%, 06/01/20 | | $ | 60 | | $ | 60 |

| |

|

| | |

Texas State, GO, TRAN | | | | | | |

2.750%, 08/29/03 | | | 700 | | | 703 |

| |

|

| | |

TOTAL TEXAS | | | | | $ | 763 |

|

| | |

Washington — 4.9% | | | | | | |

| | |

Washington State, Municipal Security Trust Receipts RB, Public Power Supply Systems Nuclear Project Number One, Ser CMC2 § | | | | | | |

1.420%, 01/01/05 | | | 700 | | | 700 |

| |

|

| | |

TOTAL WASHINGTON | | | | | $ | 700 |

|

| | |

Wyoming — 5.3% | | | | | | |

| | |

Lincoln County, Pollution Control Authority RB, Exxon Project § | | | | | | |

1.300%, 08/01/15 | | | 500 | | | 500 |

| |

|

| | |

Sublette County, Pollution Control RB, Exxon Project § | | | | | | |

1.300%, 11/01/14 | | | 250 | | | 250 |

| |

|

| | |

TOTAL WYOMING | | | | | $ | 750 |

|

| |

TOTAL MUNICIPAL BONDS & NOTES

(COST $13,512) | | $ | 13,512 |

|

| | |

Commercial Paper — 4.9% | | | | | | |

| | |

Howard County Maryland | | | | | | |

1.100%, 06/02/03 | | | 700 | | | 700 |

| |

|

| |

TOTAL COMMERCIAL PAPER

(COST $700) | | $ | 700 |

|

| | |

TOTAL INVESTMENTS — 99.6%

(COST $14,212) | | | | | $ | 14,212 |

|

| | |

| OTHER ASSETS & LIABILITIES, NET — 0.4% | | | | | $ | 59 |

|

| | |

| TOTAL NET ASSETS — 100.0% | | | | | $ | 14,271 |

|

| § | | These variable rate securities are subject to a put and demand feature. The date reported is the stated maturity. |

GO — General Obligation

LOC — Securities are held in connection with a letter of credit support for securities listed above, as indicated.

RAN — Revenue Anticipation Note

RB — Revenue Bond

Ser — Series

TRAN — Tax and Revenue Anticipation Note

These organizations have provided underlying credit support for securities as listed above, as indicated.

FGIC — Financial Guaranty Insurance Corporation

FNMA — Federal National Mortgage Corporation

FSA — Financial Security Assistance

MBIA — Municipal Bond Insurance Association

The accompanying notes are an integral part of the financial statements.

ANNUAL REPORT / APRIL 30, 2003

11

STATEMENTS OF ASSETS AND LIABILITIES

| | | | |

As of April 30, 2003

(000, except per share amounts) | | U.S. Treasury

Cash Management

Portfolio | | | U.S. Government

Cash Management

Portfolio | | | Prime

Cash Management

Portfolio | | Tax-Free

Cash Management

Portfolio | |

Assets: | | | | | | | | | | | | | | | |

Investments at Amortized Cost | | $ | 42,514 | | | $ | 885,514 | | | $ | 49,490 | | $ | 14,212 | |

| |

|

Cash | | | 1 | | | | — | | | | — | | | 20 | |

| |

|

Interest Receivable | | | — | | | | 2,779 | | | | 128 | | | 52 | |

| |

|

Expense Reimbursement from Advisor | | | 2 | | | | 1 | | | | 5 | | | 1 | |

| |

|

Prepaid Expenses | | | 1 | | | | 23 | | | | 2 | | | — | † |

| |

|

Other Assets | | | — | | | | 1 | | | | — | | | — | |

| |

|

| | | | |

TOTAL ASSETS | | | 42,518 | | | | 888,318 | | | | 49,625 | | | 14,285 | |

|

Liabilities: | | | | | | | | | | | | | | | |

Distribution Payable | | | 23 | | | | 633 | | | | 47 | | | 7 | |

| |

|

Payable for Investment Securities Purchased | | | — | | | | — | | | | 1,613 | | | — | |

| |

|

| | | | |

Accrued Expenses: | | | | | | | | | | | | | | | |

| |

|

Investment Advisory Fees | | | — | | | | 102 | | | | — | | | — | |

| |

|

Administrator Fees | | | — | † | | | 7 | | | | 2 | | | — | † |

| |

|

Distributor Fees | | | 9 | | | | 186 | | | | 13 | | | 5 | |

| |

|

Custody Fees | | | 1 | | | | 21 | | | | 5 | | | — | † |

| |

|

Transfer Agency Fees | | | 1 | | | | — | | | | 3 | | | 1 | |

| |

|

Other Expense Payables | | | 3 | | | | 59 | | | | 7 | | | 1 | |

| |

|

| | | | |

TOTAL LIABILITIES | | | 37 | | | | 1,008 | | | | 1,690 | | | 14 | |

|

Net Assets: | | | | | | | | | | | | | | | |

Paid in Capital | | | 42,473 | | | | 887,306 | | | | 47,929 | | | 14,260 | |

| |

|

Undistributed Net Investment Income | | | 9 | | | | 4 | | | | 6 | | | 11 | |

| |

|

Accumulated Net Realized Gain (Loss) on Investments | | | (1 | ) | | | — | † | | | — | | | — | |

| |

|

| | | | |

TOTAL NET ASSETS | | $ | 42,481 | | | $ | 887,310 | | | $ | 47,935 | | $ | 14,271 | |

|

Outstanding Shares of Beneficial Interest

(unlimited authorization — no par value) | | | | | | | | | | | | | | | |

Corporate Class Shares | | | — | | | | — | | | | 10,632 | | | — | |

| |

|

Corporate II Class Shares | | | 41,443 | | | | 879,686 | | | | 28,836 | | | — | |

| |

|

Corporate III Class Shares | | | 1,029 | | | | 7,620 | | | | 8,461 | | | 14,260 | |

|

| | | | |

NET ASSET VALUE, OFFERING AND

REDEMPTION PRICE PER SHARE

— CORPORATE CLASS SHARES | | | — | | | | — | | | | $1.00 | | | — | |

|

| | | | |

NET ASSET VALUE, OFFERING AND

REDEMPTION PRICE PER SHARE

— CORPORATE II CLASS SHARES | | | $1.00 | | | | $1.00 | | | | $1.00 | | | — | |

|

| | | | |

NET ASSET VALUE, OFFERING AND

REDEMPTION PRICE PER SHARE

— CORPORATE III CLASS SHARES | | | $1.00 | | | | $1.00 | | | | $1.00 | | | $1.00 | |

|

| † | | Amount rounds to less than one thousand. |

The accompanying notes are an integral part of the financial statements.

APRIL 30, 2003 / ANNUAL REPORT

12

STATEMENTS OF OPERATIONS

| | | | |

For the Fiscal Year Ended April 30, 2003

(000) | | U.S. Treasury

Cash Management

Portfolio | | | U.S. Government

Cash Management

Portfolio | | | Prime

Cash Management

Portfolio | | | Tax-Free

Cash Management

Portfolio | |

Investment Income: | | | | | | | | | | | | | | | | |

Interest | | $ | 692 | | | $ | 14,608 | | | $ | 834 | | | $ | 286 | |

| |

|

| | | | |

TOTAL INVESTMENT INCOME | | | 692 | | | | 14,608 | | | | 834 | | | | 286 | |

|

Expenses: | | | | | | | | | | | | | | | | |

Investment Advisory Fees | | | 65 | | | | 1,326 | | | | 75 | | | | 30 | |

| |

|

Administrator Fees | | | 62 | | | | 784 | | | | 68 | | | | 42 | |

| |

|

Distribution Fees — Corporate II Class Shares | | | 107 | | | | 2,192 | | | | 96 | | | | — | |

| |

|

Distribution Fees — Corporate III Class Shares | | | 3 | | | | 29 | | | | 27 | | | | 80 | |

| |

|

Transfer Agency Fees | | | 11 | | | | — | | | | 16 | | | | 5 | |

| |

|

Custodian Fees | | | 12 | | | | 172 | | | | 40 | | | | 5 | |

| |

|

Accounting Fees | | | 49 | | | | 133 | | | | 55 | | | | 38 | |

| |

|

Professional Fees | | | 5 | | | | 107 | | | | 5 | | | | 2 | |

| |

|

Registration Fees | | | 2 | | | | 35 | | | | 3 | | | | 1 | |

| |

|

Printing | | | 3 | | | | 65 | | | | 4 | | | | 1 | |

| |

|

Trustee Fees and Expenses | | | 2 | | | | 31 | | | | 2 | | | | 1 | |

| |

|

Miscellaneous Fees | | | 3 | | | | 83 | | | | 21 | | | | 2 | |

| |

|

| | | | |

TOTAL EXPENSES | | | 324 | | | | 4,957 | | | | 412 | | | | 207 | |

|

Less Waivers: | | | | | | | | | | | | | | | | |

Investment Advisory Fees | | | (64 | ) | | | (20 | ) | | | (75 | ) | | | (30 | ) |

| |

|

Administrator Fees | | | (33 | ) | | | (587 | ) | | | (37 | ) | | | (15 | ) |

| |

|

| | | | |

TOTAL WAIVERS | | | (97 | ) | | | (607 | ) | | | (112 | ) | | | (45 | ) |

|

Less Expense Reimbursement by Advisor | | | (14 | ) | | | (7 | ) | | | (58 | ) | | | (35 | ) |

| |

|

| | | | |

TOTAL NET EXPENSES | | | 213 | | | | 4,343 | | | | 242 | | | | 127 | |

|

| | | | |

NET INVESTMENT INCOME | | | 479 | | | | 10,265 | | | | 592 | | | | 159 | |

|

Net Realized Gain on Investments | | | 1 | | | | — | † | | | 1 | | | | 1 | |

| |

|

NET REALIZED GAIN ON INVESTMENTS | | | 1 | | | | — | † | | | 1 | | | | 1 | |

| |

|

| | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 480 | | | $ | 10,265 | | | $ | 593 | | | $ | 160 | |

|

| † | | Amount rounds to less than one thousand. |

The accompanying notes are an integral part of the financial statements.

ANNUAL REPORT / APRIL 30, 2003

13

STATEMENTS OF CHANGES IN NET ASSETS

| | | | |

For the Fiscal Years Ended

April 30, 2003 and 2002

(000) | | U.S. Treasury Cash Management Portfolio | | | U.S. Government Cash Management Portfolio | | | Prime Cash Management Portfolio | | | Tax-Free Cash Management Portfolio | |

| | | 05/01/02

to 04/30/03

| | | 05/01/01

to 04/30/02

| | | 05/01/02

to 04/30/03

| | | 05/01/01

to 04/30/02

| | | 05/01/02

to 04/30/03

| | | 05/01/01

to 04/30/02

| | | 05/01/02

to 04/30/03

| | | 05/01/01

to 04/30/02

| |

Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | $ | 479 | | | $ | 678 | | | $ | 10,265 | | | $ | 16,172 | | | $ | 592 | | | $ | 1,102 | | | $ | 159 | | | $ | 391 | |

| |

|

Net Realized Gain on Investments | | | 1 | | | | 6 | | | | — | † | | | 1 | | | | 1 | | | | 8 | | | | 1 | | | | 1 | |

| |

|

| | | | | | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | | 480 | | | | 684 | | | | 10,265 | | | | 16,173 | | | | 593 | | | | 1,110 | | | | 160 | | | | 392 | |

|

Distributions to Shareholders: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Net Investment Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Class Shares | | | — | | | | — | † | | | — | | | | — | † | | | (70 | ) | | | (45 | ) | | | — | | | | — | |

| |

|

Corporate II Class Shares | | | (473 | ) | | | (674 | ) | | | (10,192 | ) | | | (16,046 | ) | | | (455 | ) | | | (890 | ) | | | — | | | | — | |

| |

|

Corporate III Class Shares | | | (6 | ) | | | (4 | ) | | | (73 | ) | | | (126 | ) | | | (73 | ) | | | (167 | ) | | | (159 | ) | | | (391 | ) |

| |

|

| | | | | | | | |

TOTAL DISTRIBUTIONS | | | (479 | ) | | | (678 | ) | | | (10,265 | ) | | | (16,172 | ) | | | (598 | ) | | | (1,102 | ) | | | (159 | ) | | | (391 | ) |

|

Capital Share Transactions(1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Corporate Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares Issued | | | — | | | | 279 | | | | — | | | | — | | | | 69,896 | | | | 9,558 | | | | — | | | | — | |

| |

|

Shares Issued in Lieu of

Cash Distributions | | | — | | | | — | † | | | — | † | | | — | † | | | — | † | | | — | † | | | — | | | | — | |

| |

|

Shares Redeemed | | | — | † | | | (279 | ) | | | — | † | | | — | | | | (59,461 | ) | | | (14,773 | ) | | | — | | | | — | |

| |

|

| | | | | | | | |

TOTAL CORPORATE CLASS SHARE TRANSACTIONS | | | — | †** | | | — | † | | | — | †** | | | — | † | | | 10,435 | | | | (5,215 | ) | | | — | | | | — | |

|

| | | | | | | | |

Corporate II Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares Issued | | | 45,078 | | | | 177,397 | | | | 1,706,797 | | | | 3,357,870 | | | | 1,956,938 | | | | 288,250 | | | | — | | | | — | |

| |

|

Shares Issued in Lieu of

Cash Distributions | | | 28 | | | | 5 | | | | 15 | | | | 47 | | | | 1 | | | | 6 | | | | — | | | | — | |

| |

|

Shares Redeemed | | | (45,342 | ) | | | (161,213 | ) | | | (1,532,072 | ) | | | (3,189,630 | ) | | | (1,966,560 | ) | | | (261,562 | ) | | | — | | | | — | |

| |

|

| | | | | | | | |

TOTAL CORPORATE II CLASS SHARE TRANSACTIONS | | | (236 | ) | | | 16,189 | | | | 174,740 | | | | 168,287 | | | | (9,621 | ) | | | 26,694 | | | | — | | | | — | |

|

| | | | | | | | |

Corporate III Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares Issued | | | 586 | | | | 443 | | | | 20,870 | | | | 29,818 | | | | 13,936 | | | | 12,643 | | | | 35,614 | | | | 25,875 | |

| |

|

Shares Issued in Lieu of

Cash Distributions | | | — | | | | — | † | | | 1 | | | | 3 | | | | — | | | | 21 | | | | 5 | | | | 53 | |

| |

|

Shares Redeemed | | | — | † | | | — | | | | (18,451 | ) | | | (27,716 | ) | | | (14,207 | ) | | | (11,422 | ) | | | (35,769 | ) | | | (44,171 | ) |

| |

|

| | | | | | | | |

TOTAL CORPORATE III CLASS SHARE TRANSACTIONS | | | 586 | | | | 443 | | | | 2,420 | | | | 2,105 | | | | (271 | ) | | | 1,242 | | | | (150 | ) | | | (18,243 | ) |

|

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS FROM CAPITAL SHARE TRANSACTIONS | | | 350 | | | | 16,632 | | | | 177,160 | | | | 170,392 | | | | 543 | | | | 22,721 | | | | (150 | ) | | | (18,243 | ) |

|

| | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS | | | 351 | | | | 16,638 | | | | 177,160 | | | | 170,393 | | | | 538 | | | | 22,729 | | | | (149 | ) | | | (18,242 | ) |

|

Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Beginning of period | | | 42,130 | | | | 25,492 | | | | 710,150 | | | | 539,757 | | | | 47,397 | | | | 24,668 | | | | 14,420 | | | | 32,662 | |

| |

|

| | | | | | | | |

END OF PERIOD | | $ | 42,481 | | | $ | 42,130 | | | $ | 887,310 | | | $ | 710,150 | | | $ | 47,935 | | | $ | 47,397 | | | $ | 14,271 | | | $ | 14,420 | |

|

| | | | | | | | |

ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 9 | | | $ | — | † | | $ | 4 | | | $ | — | | | $ | 6 | | | $ | — | † | | $ | 11 | | | $ | — | † |

|

| † | | Amount rounds to less than one thousand. |

| ** | | Ended operations August 30, 2002. |

The accompanying notes are an integral part of the financial statements.

APRIL 30, 2003 / ANNUAL REPORT

14

FINANCIAL HIGHLIGHTS

| | | | | | |

| For a Share Outstanding Throughout the Fiscal Years Ended April 30, | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value

Beginning

of Period | | Net

Investment

Income | | Realized and

Unrealized

Gains (Losses)

on Investments | | Distributions

from Net

Investment

Income | | | Distributions

from

Capital

Gains | | Net Asset

Value End

of Period | | Total

Return | | | Net Assets

End of

Period (000) | | | Ratio of

Expenses

to Average

Net Assets* | | | Ratio of Net

Investment

Income

to Average

Net Assets* | | | Ratio

of Expenses

to Average

Net Assets

(Excluding

Waivers and

Reimbursements)* | |

| | | | | | |

| U.S. Treasury Cash Management Portfolio | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| CORPORATE II CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 1.11 | % | | $ | 41,451 | | | 0.49 | % | | 1.11 | % | | 0.73 | % |

|

|

2002 | | 1.00 | | 0.02 | | — | | (0.02 | ) | | — | | 1.00 | | 2.46 | | | | 41,686 | | | 0.49 | | | 2.37 | | | 0.69 | |

|

|

2001(1) | | 1.00 | | 0.04 | | — | | (0.04 | ) | | — | | 1.00 | | 4.22 | + | | | 25,492 | | | 0.49 | | | 4.90 | | | 0.61 | |

| | | | | | | | |

| CORPORATE III CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 0.96 | % | | $ | 1,030 | | | 0.64 | % | | 0.89 | % | | 1.60 | % |

|

|

2002 | | 1.00 | | 0.02 | | — | | (0.02 | ) | | — | | 1.00 | | 2.38 | | | | 444 | | | 0.64 | | | 1.67 | | | 0.84 | |

|

|

2001(2) | | 1.00 | | 0.04 | | — | | (0.04 | ) | | — | | 1.00 | | 3.63 | + | | | — | † | | 0.64 | | | 5.90 | | | 0.79 | |

| | | | | | |

| U.S. Government Cash Management Portfolio | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| CORPORATE II CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 1.18 | % | | $ | 879,690 | | | 0.49 | % | | 1.16 | % | | 0.56 | % |

|

|

2002 | | 1.00 | | 0.02 | | — | | (0.02 | ) | | — | | 1.00 | | 2.50 | | | | 704,950 | | | 0.49 | | | 2.39 | | | 0.60 | |

|

|

2001(3) | | 1.00 | | 0.05 | | — | | (0.05 | ) | | — | | 1.00 | | 5.39 | + | | | 536,662 | | | 0.49 | | | 5.63 | | | 0.63 | |

| | | | | | | | |

| CORPORATE III CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 1.03 | % | | $ | 7,620 | | | 0.64 | % | | 1.01 | % | | 0.79 | % |

|

|

2002 | | 1.00 | | 0.02 | | — | | (0.02 | ) | | — | | 1.00 | | 2.35 | | | | 5,200 | | | 0.64 | | | 2.33 | | | 0.75 | |

|

|

2001(4) | | 1.00 | | 0.05 | | — | | (0.05 | ) | | — | | 1.00 | | 5.16 | + | | | 3,095 | | | 0.64 | | | 5.60 | | | 0.78 | |

| | | | | | | |

| U.S. Prime Cash Management Portfolio | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| CORPORATE CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 1.50 | % | | $ | 10,632 | | | 0.24 | % | | 1.50 | % | | 0.64 | % |

|

|

2002 | | 1.00 | | 0.03 | | — | | (0.03 | ) | | — | | 1.00 | | 2.74 | | | | 197 | | | 0.24 | | | 3.34 | | | 0.49 | |

|

|

2001(5) | | 1.00 | | 0.05 | | — | | (0.05 | ) | | — | | 1.00 | | 4.61 | + | | | 5,412 | | | 0.24 | | | 6.05 | | | 0.42 | |

| | | | | | | | |

| CORPORATE II CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 1.24 | % | | $ | 28,840 | | | 0.49 | % | | 1.18 | % | | 0.82 | % |

|

|

2002 | | 1.00 | | 0.02 | | — | | (0.02 | ) | | — | | 1.00 | | 2.48 | | | | 38,465 | | | 0.49 | | | 2.19 | | | 0.74 | |

|

|

2001(6) | | 1.00 | | 0.05 | | — | | (0.05 | ) | | — | | 1.00 | | 5.14 | + | | | 11,764 | | | 0.49 | | | 4.89 | | | 0.71 | |

| | | | | | | | |

| CORPORATE III CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 1.09 | % | | $ | 8,463 | | | 0.64 | % | | 1.07 | % | | 1.03 | % |

|

|

2002 | | 1.00 | | 0.02 | | — | | (0.02 | ) | | — | | 1.00 | | 2.33 | | | | 8,735 | | | 0.64 | | | 2.27 | | | 0.89 | |

|

|

2001(7) | | 1.00 | | 0.04 | | — | | (0.04 | ) | | — | | 1.00 | | 3.97 | + | | | 7,492 | | | 0.64 | | | 5.79 | | | 0.82 | |

| | | | | |

| Tax-Free Cash Management Portfolio | | | | | | | | | | | | | | | | |

| | | | | | | | |

| CORPORATE III CLASS SHARES | | | | | | | | | | | | | | | | | | | | | | | |

2003 | | $1.00 | | 0.01 | | — | | (0.01 | ) | | — | | $1.00 | | 0.78 | % | | $ | 14,271 | | | 0.64 | % | | 0.79 | % | | 1.04 | % |

|

|

2002 | | 1.00 | | 0.01 | | — | | (0.01 | ) | | — | | 1.00 | | 1.47 | | | | 14,420 | | | 0.64 | | | 1.57 | | | 0.80 | |

|

|

2001(8) | | 1.00 | | 0.03 | | — | | (0.03 | ) | | — | | 1.00 | | 2.82 | + | | | 32,662 | | | 0.64 | | | 3.26 | | | 0.81 | |

| + | | Total return is for the period indicated and has not been annualized. |

| † | | Amount rounds to less than one thousand. |

| * | | Periods of less than one year have been annualized. |

| (1) | | Commenced operations on July 21, 2000. |

| (2) | | Commenced operations on October 6, 2000. |

| (3) | | Commenced operations on June 1, 2000. |

| (4) | | Commenced operations on June 6, 2000. |

| (5) | | Commenced operations on July 28, 2000. |

| (6) | | Commenced operations on June 5, 2000. |

| (7) | | Commenced operations on August 16, 2000. |

| (8) | | Commenced operations on June 23, 2000. |

The accompanying notes are an integral part of the financial statements.

ANNUAL REPORT / APRIL 30, 2003

15

NOTES TO FINANCIAL STATEMENTS

ARK Funds (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company organized as a Massachusetts business trust pursuant to a Declaration of Trust dated October 22, 1992, amended and restated on March 19, 1993, and further amended on December 10, 1999.

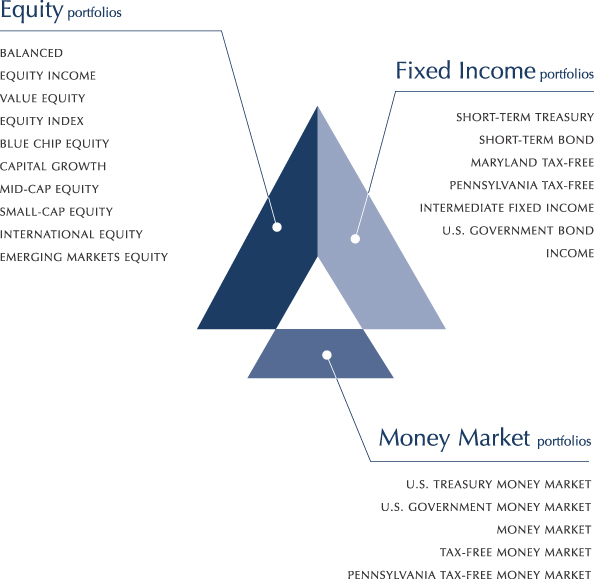

The Fund offers thirty separate investment portfolios as of April 30, 2003:

U.S. Treasury Cash Management Portfolio (“TCMP”)

U.S. Government Cash Management Portfolio (“GCMP”)

Prime Cash Management Portfolio (“PCMP”)

Tax-Free Cash Management Portfolio (“TFCMP”)

(individually a “Portfolio” and collectively, the “Portfolios”)

Social Issues Intermediate Fixed Income Portfolio

Social Issues Blue Chip Equity Portfolio

Social Issues Capital Growth Portfolio

Social Issues Small-Cap Equity Portfolio

U.S. Treasury Money Market Portfolio

U.S. Government Money Market Portfolio

Money Market Portfolio

Tax-Free Money Market Portfolio

Pennsylvania Tax-Free Money Market Portfolio

Short-Term Treasury Portfolio

Short-Term Bond Portfolio

Maryland Tax-Free Portfolio

Pennsylvania Tax-Free Portfolio

Intermediate Fixed Income Portfolio

U.S. Government Bond Portfolio

Income Portfolio

Balanced Portfolio

Equity Income Portfolio

Value Equity Portfolio

Equity Index Portfolio

Blue Chip Equity Portfolio

Capital Growth Portfolio

Mid-Cap Equity Portfolio

Small-Cap Equity Portfolio

International Equity Portfolio

Emerging Markets Equity Portfolio

The financial statements and notes presented herein are those of TCMP, GCMP, PCMP, and TFCMP. The financial statements of the other portfolios listed above are not presented herein, but are presented separately. The Fund may issue an unlimited number of shares of each of the Portfolios and may issue shares of one or more classes of each Portfolio.

| 2. | | SIGNIFICANT ACCOUNTING POLICIES |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect amounts reported therein. Although actual results could differ from these estimates, any such differences are expected to be immaterial to the net assets of the Portfolios.

The following is a summary of significant accounting policies followed by the Portfolios.

Security Valuation — Investment securities held by the Portfolios are stated at their amortized cost, which approximates market value. Under the amortized cost method, any discount or premium is amortized ratably to the maturity of the security and is included in interest income. The Portfolios’ use of amortized cost is subject to compliance with certain conditions specified in Rule 2a-7 under the 1940 Act.

Income Taxes — It is the intention of each Portfolio to comply with the requirements of the Internal Revenue Code, to qualify as a regulated investment company and to distribute all of its taxable income. Accordingly, no provision for federal income taxes is considered necessary.

Net Asset Value Per Share — The net asset value per share (“NAV”) of each class of each Portfolio is calculated every business day (i.e., any day that both the New York Stock Exchange and the Federal Reserve Bank are open for business). A business day will be any weekday, other than a federal holiday, unless the fund determines that being open for business is not in the best interest of shareholders. The NAV is computed by dividing the total assets of each class of the Portfolio, less the liabilities of the class, by the number of outstanding shares of the Portfolio.

Classes — Each class of shares has equal rights to earnings, assets and voting privileges, except that each class bears different distribution and shareholder services expenses. Each class of shares has exclusive voting rights with respect to matters that affect just that class. Class-specific expenses are borne by the applicable class. Other expenses, income and realized and unrealized gains/losses are allocated to the respective classes on the basis of relative daily net assets.

Repurchase Agreements — Securities pledged as collateral for repurchase agreements are held by the custodian bank until maturity of the repurchase agreements. Provisions of the repurchase agreements and procedures adopted by the Board of Trustees require that market value of collateral, including accrued interest thereon, be sufficient in the event of default by the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an

APRIL 30, 2003 / ANNUAL REPORT

16

NOTES TO FINANCIAL STATEMENTS

insolvency proceeding, realization of the collateral by the Portfolio may be delayed or limited.

Distributions — Dividends from net investment income are declared daily and paid monthly for the Portfolios. Distributions from net realized capital gains, if any, are declared and paid at least annually by each Portfolio.

Distributions from net investment income and net realized capital gains are determined in accordance with U.S. federal income tax regulations, and may differ from those amounts determined under generally accepted accounting principles. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital in the period that the difference arises.

The Portfolios have a tax year end of October 31.

On the Statements of Assets and Liabilities, the following adjustments were made:

| | |

| Portfolio | | Undistributed Net

Investment Income

(000) | | Accumulated Net

Realized Loss

(000) | |

| TCMP | | $10 | | $ | (10 | ) |

|

| GCMP | | 4 | | | (4 | ) |

|

| PCMP | | 12 | | | (12 | ) |

|

| TFCMP | | 11 | | | (11 | ) |

|

The tax character of distributions paid during the year ended October 31, 2002 and year ended October 31, 2001 was as follows:

| | | |

| | | Tax-Exempt

Income (000) | | Ordinary Income

(000) | | Total (000) |

| | | | | | |

| Portfolio | | 2002 | | 2001 | | 2002 | | 2001 | | 2002 | | 2001 |

TCMP | | $ | — | | $ | — | | $ | 525 | | $ | 780 | | $ | 525 | | $ | 780 |

|

GCMP | | | — | | | — | | | 11,940 | | | 22,815 | | | 11,940 | | | 22,815 |

|

PCMP | | | — | | | — | | | 833 | | | 1,255 | | | 833 | | | 1,255 |

|

TFCMP | | | 186 | | | 724 | | | 10 | | | — | | | 196 | | | 724 |

|

At October 31, 2002 the components of net assets (excluding paid-in capital) on a tax basis were as follows:

| | | | |

| Portfolio | | Undistributed

Tax-Exempt

Income (000) | | Undistributed

Ordinary

Income (000) | | Capital and

Other Losses

(000) | | | Total

(000) |

TCMP | | $— | | $ 60 | | $ | (2) | | $ | 58 |

|

GCMP | | — | | 993 | | — | | | | 993 |

|

PCMP | | — | | 72 | | — | | | | 72 |

|

TFCMP | | 26 | | 1 | | — | | | | 27 |

|

The following Portfolio has estimated capital loss carryforwards at October 31, 2002, which are available to offset future net realized capital gains:

| | |

| Portfolio | | Accumulated Capital

Loss Carryforward

(000) | | Year Expires |

TCMP | | $2 | | 2010 |

|

Other — Security transactions are accounted for on the date the security is purchased or sold (trade date). Net realized capital gains and losses on the sale of investment securities are determined using the identified cost method. Interest income is recognized using the accrual method. Discounts and premiums on securities purchased are amortized over the lives of the respective securities.

| 3. | | INVESTMENT ADVISORY AND ADMINISTRATIVE FEES AND OTHER TRANSACTIONS WITH AFFILIATES |

Allied Investment Advisors, Inc. (“AIA”) is the investment advisor to each Portfolio. Pursuant to an investment advisory contract on behalf of each Portfolio, AIA is entitled to receive fees for its advisory services at the annual rates shown in the following table based on the daily average net assets of the Portfolio.

| |

| Portfolio | | Annual Rate | |

TCMP | | 0.15 | % |

|

GCMP | | 0.15 | % |

|

PCMP | | 0.15 | % |

|

TFCMP | | 0.15 | % |

|

AIA has contractually agreed to waive a portion of its fees or reimburse expenses for all of the Portfolios in order to limit total operating expenses of such Portfolios.

Effective April 1, 2003, AIA became a wholly-owned subsidiary of Manufacturers and Traders Trust Company (“M&T Trust”), the principal financial services operating subsidiary of M&T Bank Corporation (“M&T”), a publicly-traded holding company based in Buffalo, New York. M&T’s ownership of AIA is a result of an agreement entered into on September 26, 2002, among M&T, Allfirst Financial, Inc. and Allied Irish Banks, p.l.c., under which M&T was to acquire Allfirst Financial Inc. the indirect parent corporation of AIA, and parent corporation of Allfirst Bank, the direct parent of AIA (the “Acquisition”). At a special meeting of shareholders held on January 31, 2003, shareholders of each Portfolio approved a new investment advisory agreement between AIA and the Fund with respect to each Portfolio. The 1940 Act, which regulates investment companies such as the Fund,

ANNUAL REPORT / APRIL 30, 2003

17

NOTES TO FINANCIAL STATEMENTS

requires a shareholder vote to approve a new advisory agreement in connection with business transactions such as the Acquisition. The new advisory agreement is substantially identical to the former advisory agreement, except for the dates of execution and termination. The new advisory agreement became effective upon consummation of the Acquisition on April 1, 2003.

Also as a result of the Acquisition, M&T Trust acquired Allfirst Trust Company, N.A., (“Allfirst Trust”), which as of April 30, 2003, served as the Portfolios’ administrator, transfer agent and custodian pursuant to administration, transfer agency and custodian agreements with the Fund. (See Note 5 for additional information concerning the administrator and transfer agent subsequent to the Portfolios’ fiscal year end.)

Allfirst Trust serves as administrator and transfer agent for the Fund pursuant to an administration agreement. For its services, Allfirst Trust is entitled to receive an administration fee from the Fund at the annual rate of $24,000 per Portfolio, plus 0.085% of the annual average daily net assets of the Portfolios. Allfirst Trust receives annually a $60,000 base fee that is allocated to each portfolio of the Fund based on respective average daily net assets. Under a separate agreement, Allfirst Trust has subcontracted the services to be provided by it under the administration agreement to Forum Administrative Services, LLC (the “Sub-administrator”). Allfirst Trust is responsible for paying a portion of the administration fee it receives from the Fund to the Sub-administrator for the services it provides.

Pursuant to an agreement between the Fund and Allfirst Trust, Allfirst Trust performs transfer agency services. Pursuant to an agreement between Boston Financial Data Services, Inc. (“Boston Financial”) and Allfirst Trust, Boston Financial performs sub-transfer agency services. For the services provided under the agreement with Allfirst Trust, the Fund pays an annual fee of up to $16 per Portfolio account and activity based fees ranging from $0.50 to $12.50 per item and reimbursements for out-of-pocket expenses. Allfirst Trust pays the transfer agency fees and expense reimbursements that it receives from the Fund to Boston Financial.

Pursuant to a custody agreement between the Fund and Allfirst Trust, Allfirst Trust was appointed and serves as the custodian of the assets of the Portfolios. Pursuant to an agreement between Bankers Trust Company (“BTC”) and Allfirst Trust, BTC performs sub-custodial services. For the services provided under the agreement with Allfirst Trust, the Fund pays 0.015% of the market value of the assets of the Portfolios, plus transaction fees ranging from $5 to $75 per item and reimbursement for out-of-pocket expenses. Allfirst Trust is responsible for paying a portion of the custody fees it receives from the Fund to BTC for the custody services it provides.

| 4. | | DISTRIBUTION AND SERVICE PLANS |

The Fund’s Board of Trustees has adopted Distribution and Service Plans on behalf of the Corporate II Class Shares and Corporate III Class Shares of each Portfolio pursuant to Rule 12b-1 under the 1940 Act. Distribution and/or service fees under the plans are paid to ARK Funds Distributors, LLC (the “Distributor”), which acts as distributor for the Fund pursuant to a distribution agreement on behalf of each Portfolio. The plans allow the Portfolios to pay the Distributor a fee at the annual rate of up to 0.25% and 0.40%, respectively, of the average daily net assets of the Corporate II Class Shares and Corporate III Class Shares. The Distributor may voluntarily waive all or a portion of their fees for certain Portfolios. These waivers are voluntary and may be discontinued at any time.

| 5. | | SIGNIFICANT EVENTS AFTER APRIL 30, 2003 |

As a result of the Acquisition described in Note 3, effective June 13, 2003, Allfirst Trust, the administrator, transfer agent and custodian to the Fund was merged into M&T Trust and no longer maintains a separate corporate existence. In connection with that merger, effective June 16, 2003, M&T Trust serves as the administrator, transfer agent and custodian to the Fund as a result of the assignment of the Fund’s administration and transfer agency agreements with Allfirst Trust to M&T Trust. The compensation provisions under the agreements are unchanged.

Effective June 1, 2003, State Street Bank and Trust Company (“State Street Bank”) serves as custodian of the assets of the Portfolios pursuant to a custodian agreement between State Street and the Fund.

M&T Trust also serves as the administrator to the VISION Group of Funds (“VISION Funds”), a mutual fund family that offers different classes of shares in separate investment portfolios for which M&T Asset Management, a department of M&T Trust, serves as investment adviser. In connection with the Acquisition described above, the Board of Trustees of the Fund has authorized the reorganization of each Portfolio into a newly created or existing portfolio of the VISION Funds. On May 16, 2003, the VISION Funds filed a preliminary proxy statement/prospectus on Form N-14, which sets forth the reorganization proposals to be submitted to shareholders of each Portfolio, who will vote separately on the proposal to reorganize their respective Portfolio. The VISION Funds filed an amendment to the Form N-14 filing on May 23, 2003 with a proposed effective date for the preliminary proxy statement/prospectus of June 23, 2003. According to the preliminary proxy statement/prospectus, only shareholders of record of the Fund at the close of business on June 16, 2003 will be entitled to notice of and to vote at the shareholder meeting scheduled for August 14, 2003, and any postponement or adjournment thereof. Under the proposed agreement and plan of reorganization, if approved by shareholders of a Portfolio, the shareholders of that Portfolio will receive shares of a comparable VISION Fund. According to the preliminary proxy statement/prospectus, the reorganization is currently anticipated to occur in August, assuming shareholder approval is obtained.

APRIL 30, 2003 / ANNUAL REPORT

18

INDEPENDENT AUDITORS’ REPORT

The Board of Trustees and Shareholders

ARK Funds:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of U.S. Treasury Cash Management Portfolio, U.S. Government Cash Management Portfolio, Prime Cash Management Portfolio, and Tax-Free Cash Management Portfolio, portfolios of ARK Funds (the “Portfolios”), as of April 30, 2003, and the related statements of operations for the year then ended, statements of changes in net assets for each of the years in the two-year period then ended, and financial highlights for each of the years or periods in the three-year period then ended. These financial statements and financial highlights are the responsibility of the Portfolios’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2003 by correspondence with the custodian and brokers. As to securities purchased or sold but not yet received or delivered, we performed other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of U.S. Treasury Cash Management Portfolio, U.S. Government Cash Management Portfolio, Prime Cash Management Portfolio, and Tax-Free Cash Management Portfolio as of April 30, 2003, the results of their operations, the changes in their net assets and their financial highlights for each of the years or periods specified above in conformity with accounting principles generally accepted in the United States of America.

Boston, Massachusetts

June 16, 2003

ANNUAL REPORT / APRIL 30, 2003

19

TRUSTEES OF THE FUND (Unaudited)

Name, Age and Contact Address | | Position

with the

Trust | | Length of Time

Served | | Principal Occupation(s)

During

Past 5 Years | | Number of

Portfolios in Fund

Complex

Overseen

by Trustee | | Other Trusteeships or

Directorships Held by Trustees outside ARK Funds

Complex |

|

| Interested Trustee | | |

|

| | | | | |

Rick A Gold1 Born: August 4, 1949 c/o ARK Funds 100 East Pratt Street, 15th Floor, M/C 104-410, Baltimore, MD 21202 | | President and Trustee | | since 2000 | | Senior Vice President of M&T Trust the parent company of AIA (since 2003); Executive Vice President of Asset Management Group of Allfirst Financial, Inc. the former parent company to Allfirst Trust and AIA (1999-2003); Chief Executive Officer and Director of AIA and Allfirst Trust (1997-2003). | | 30 | | None |

|

| Disinterested Trustees | | |

|

| | | | | |

William H. Cowie, Jr. Born: January 24, 1931 c/o ARK Funds 100 East Pratt Street, 15th Floor, M/C 104-410, Baltimore, MD 21202 | | Trustee and Chairman | | since 1993 | | Retired. | | 30 | | None |

|

| | | | | |

David D. Downes Born: July 16, 1935 c/o ARK Funds 100 East Pratt Street, 15th Floor, M/C 104-410, Baltimore, MD 21202 | | Trustee | | since 1995 | | Attorney in private practice (since October 1996). | | 30 | | None |

|

| | | | | |

Sir Victor Garland Born: May 5, 1934 c/o ARK Funds 100 East Pratt Street, 15th Floor, M/C 104-410, Baltimore, MD 21202 | | Trustee | | since 2000 | | Private Investor (since 1994). | | 30 | | Director and Chairman: Henderson Far East Income Trust plc (Chairman since 1990). Director: The Throgmorton Trust plc. Director: Framington Income and Capital Trust plc.

Director and Chairman: Fidelity Asian Values plc (Chairman since 2001). Director and Chairman: Govett Enhanced Income Investment Trust plc.

Director: GEIIT plc. Director: Govett Asian Income and Growth Trust Ltd. |

|

| | | | | |

Charlotte R. Kerr Born: September 26, 1946 c/o ARK Funds 100 East Pratt Street, 15th Floor, M/C 104-410, Baltimore, MD 21202 | | Trustee | | since 1993 | | Practitioner and faculty member of Traditional Acupuncture Institute. | | 30 | | None |

|

| | | | | |

Richard B. Seidel Born: April 20, 1941 c/o ARK Funds 100 East Pratt Street, 15th Floor, M/C 104-410, Baltimore, MD 21202 | | Trustee | | since 1998 | | Director and President (since 1994) of Girard Partners (a registered broker-dealer). | | 30 | | None |

|

| 1 | | Mr. Gold is deemed to be an “interested person” due to his affiliation with AIA and M&T Trust. See Note 5 of Notes to the Financial Statements. |

Additional information concerning the Trustees is contained in the Statement of Additional Information (“SAI”) and is available by contacting the Fund at 1-800-275-3863.

APRIL 30, 2003 / ANNUAL REPORT

20

OFFICERS OF THE FUND (Unaudited)

Name, Age and Contact Address | | Position with the Trust | | Length of Time Served | | Principal Occupation(s) During

Past 5 Years | | | | |

|

| Officers | | | | | | | | | | |

|

| | | | | |

Stacey E. Hong Born: May 10, 1966 Two Portland Square, Portland, ME 04101 | | Treasurer | | since 2002 | | Director of Forum Accounting Services, LLC (since 1998). | | | | |

|

| | | | | |

Michele L. Dalton Born: February 16, 1959 100 East Pratt Street, 15th Floor, Baltimore, MD 21202 | | Vice President and Assistant Secretary | | since 2000 | | Vice President of M&T Trust

(since 2003); Senior Vice President of Allfirst Financial, Inc. (1994-2003). | | | | |

|

| | | | | |

Thomas R. Rus Born: October 11, 1959 100 East Pratt Street, 17th Floor, Baltimore, MD 21202 | | Secretary | | since 2000 | | Vice President of M&T Trust (since 2003); Vice President and Counsel of Allfirst Trust and Allfirst Bank, and Compliance Officer of Allfirst Trust (1995-2003). | | | | |

|

| | | | | |

D. Blaine Riggle Born: November 12, 1966 Two Portland Square, Portland, ME 04101 | | Vice President and Assistant Secretary | | since 2002 | | Relationship Manager and Counsel for Forum Financial Group, LLC (associated since 1998). | | | | |

|

| | | | | |

Cheryl O. Tumlin Born: June 30, 1966 Two Portland Square, Portland, ME 04101 | | Vice President and Assistant Secretary | | since 2002 | | Counsel for Forum Financial Group, LLC (associated from 1996-1999 and again since 2001); former Counsel at I-many, Inc. (1999-2001); Staff Attorney at the United States Securities and Exchange Commission (1995-1996). | | | | |

|

| | | | | |

Dawn L. Taylor Born: May 14, 1964 Two Portland Square, Portland, ME 04101 | | Assistant Treasurer | | since 2002 | | Tax Manager at Forum Financial Group, LLC (since 1997). | | | | |

|

| | | | | |

Nathan V. Gemmiti Born: August 6, 1970 Two Portland Square, Portland, ME 04101 | | Assistant Secretary | | since 2002 | | Staff Attorney, Forum Financial Group, LLC (since 2001); Associate, Pierce Atwood (a law firm) (1998-2001). | | | | |

|

ANNUAL REPORT / APRIL 30, 2003

21

INVESTMENT ADVISOR

Allied Investment Advisors, Inc.

Baltimore, Maryland

TRUSTEES

William H. Cowie, Jr.

David D. Downes

Sir Victor Garland

Rick A. Gold

Charlotte R. Kerr

Richard B. Seidel

ADMINISTRATOR

Allfirst Trust Company, N.A.

Baltimore, Maryland

DISTRIBUTOR

ARK Funds Distributors, LLC

Portland, Maine

LEGAL COUNSEL

Kirkpatrick & Lockhart LLP

Washington, D.C.

INDEPENDENT AUDITORS

KPMG LLP

Boston, Massachusetts

CUSTODIAN

Allfirst Trust Company, N.A.

Baltimore, Maryland

100 EAST PRATT STREET, 15TH FLOOR | MAIL CODE 104-410 | BALTIMORE, MD 21202

We are pleased to send you our Annual Report for the fiscal year ended April 30, 2003. This report contains important information about your investments in ARK Funds. Because we are sending a report to each person listed as shareholder, you (or your household) may receive more than one report.

This material must be preceded or accompanied by a current prospectus. ARK-AR-002-0603 | |

recycled content |

Clear-cut strategies for confident investing.

Clear-cut strategies for confident investing.

April 30, 2003 | Annual Report |

U.S. Treasury Money Market Portfolio

U.S. Government Money Market Portfolio

Money Market Portfolio

Tax-Free Money Market Portfolio

Pennsylvania Tax-Free Money Market Portfolio

Short-Term Treasury Portfolio

Short-Term Bond Portfolio

Maryland Tax-Free Portfolio

Pennsylvania Tax-Free Portfolio

Intermediate Fixed Income Portfolio

U.S. Government Bond Portfolio

Income Portfolio

Balanced Portfolio

Equity Income Portfolio

Value Equity Portfolio

Equity Index Portfolio

Blue Chip Equity Portfolio

Capital Growth Portfolio

Mid-Cap Equity Portfolio

Small-Cap Equity Portfolio

International Equity Portfolio

Emerging Markets Equity Portfolio

Managed by Allied Investment Advisors, Inc.

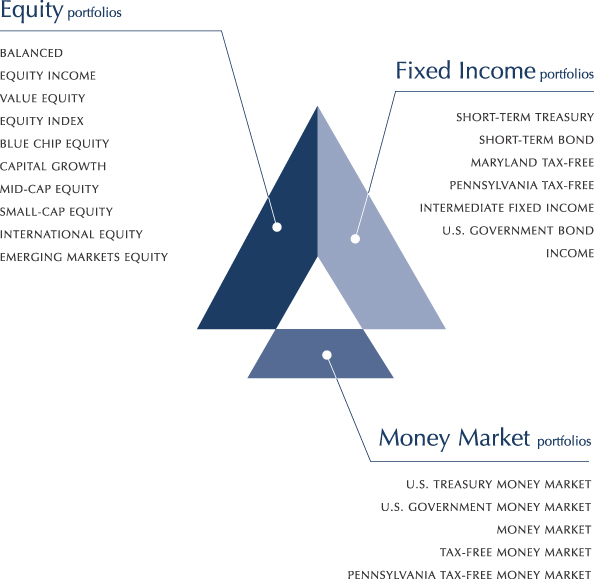

[GRAPHIC]

CONTENTS

This report and the financial statements contained herein are submitted for the general information of the shareholders of the ARK Funds and do not constitute investment advice. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus for each of the portfolios included. Shares of the portfolios are not deposits of any bank, and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency. Investing in the shares involves investment risks including the possible loss of principal amount invested. The views in this report are those of the respective portfolio manager as of April 30, 2003, and may not reflect the managers’ views as of the date this report was first published or anytime thereafter. For information about ARK Funds Portfolios, please call 1-800-ARK-FUND (1-800-275-3863).

LETTER TO SHAREHOLDERS

JUNE 2003

Dear Shareholder,

With this Annual Report, we are pleased to give you updated performance, holdings, and diversification information for the ARK Funds Money Market, Fixed Income, Balanced, and Equity Portfolios as of April 30, 2003, as well as the Portfolios’ Management Discussion and Analysis.