Exhibit 99.1

ATTUNITY LTD.

__________________________

NOTICE OF 2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MONDAY, DECEMBER 17, 2018

_________________________

To the Shareholders of Attunity Ltd. (“we”, “Attunity” or the “Company”):

We cordially invite you to the 2018 Annual General Meeting of Shareholders (the “Meeting”) of Attunity to be held at 10:00 a.m. (Israel time), on Monday, December 17, 2018, at our offices at 16 Atir Yeda Street, Atir Yeda Industrial Park, Kfar Saba 4464321, Israel, for the following purposes:

| 1. | To reelect Messrs. Shimon Alon, Dov Biran and Dan Falk as directors of the Company; |

| 2. | To approve amendments to our Compensation Policy for Executive Officers and Directors; |

| 3. | To approve modification to the terms of compensation of Mr. Shimon Alon, the Chairman and Chief Executive Officer of the Company; |

| 4. | To approve the terms of an annual performance bonus for 2019 to Mr. Shimon Alon, the Chairman and Chief Executive Officer of the Company; |

| 5. | To approve the grant of equity-based compensation for 2019 to Mr. Shimon Alon, the Chairman and Chief Executive Officer of the Company; and |

| 6. | To approve the reappointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent auditors, and to authorize our board of directors to delegate to the audit committee the authority to fix the said independent auditors’ remuneration in accordance with the volume and nature of their services. |

In addition, our auditors’ report and our consolidated financial statements for the year ended December 31, 2017 will be reviewed and considered at the Meeting.

These proposals are described more fully in the enclosed proxy statement, which we urge you to read in its entirety. Shareholders of record at the close of business on November 9, 2018 are entitled to notice of and to vote at the Meeting.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Meeting, you are urged to promptly complete, date and sign the enclosed proxy and to mail it in the enclosed envelope, which requires no postage if mailed in the United States. Return of your proxy does not deprive you of your right to attend the Meeting, to revoke the proxy and to vote your shares in person.

By order of the Board of Directors,

SHIMON ALON Chairman of the Board of Directors and Chief Executive Officer | DROR HAREL-ELKAYAM Chief Financial Officer & Secretary |

November 16, 2018

IMPORTANT NOTICE:

The Notice of the Meeting, proxy statement and proxy card are available at http://www.proxyvote.com

TABLE OF CONTENTS

_________________

ATTUNITY LTD.

16 Atir Yeda Street, Kfar-Saba, Israel

__________________________

PROXY STATEMENT

__________________________

2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Attunity Ltd. (“we”, “Attunity” or the “Company”) to be voted at the 2018 Annual General Meeting of Shareholders (the “Meeting”) and at any adjournment thereof, pursuant to the accompanying Notice of 2018 Annual General Meeting of Shareholders. The Meeting will be held at 10:00 a.m. (Israel time), on Monday, December 17, 2018, at our offices at 16 Atir Yeda Street, Atir Yeda Industrial Park, Kfar Saba 4464321, Israel. This Proxy Statement and the enclosed proxy card are being mailed to shareholders on or about November 19, 2018.

Unless indicated otherwise by the context, all references in this Proxy Statement to:

| · | “we”, “us”, “our”, “Attunity”, or the “Company” are to Attunity Ltd. and its subsidiaries; |

| · | “dollars” or “$” are to United States dollars; |

| · | “NIS” are to New Israeli Shekels; |

| · | the “Companies Law” or the “Israeli Companies Law” are to the Israeli Companies Law, 5759-1999; and |

| · | the “SEC” are to the United States Securities and Exchange Commission. |

On November 1, 2018, the exchange rate between the NIS and the dollar, as quoted by the Bank of Israel, was NIS 3.706 to $1.00. Unless derived from our financial statements or indicated otherwise by the context, statements in this Proxy Statement that provide the dollar equivalent of NIS amounts or provide the NIS equivalent of dollar amounts are based on the exchange rate, as quoted by the Bank of Israel, as of such date.

It is proposed that at the Meeting, the following resolutions be adopted:

| 1. | To reelect Messrs. Shimon Alon, Dov Biran and Dan Falk as directors of the Company; |

| 2. | To approve amendments to our Compensation Policy for Executive Officers and Directors; |

| 3. | To approve modification to the terms of compensation of Mr. Shimon Alon, the Chairman and Chief Executive Officer of the Company; |

| 4. | To approve the terms of an annual performance bonus for 2019 to Mr. Shimon Alon, the Chairman and Chief Executive Officer of the Company; |

| 5. | To approve the grant of equity-based compensation for 2019 to Mr. Shimon Alon, the Chairman and Chief Executive Officer of the Company; and |

| 6. | To approve the reappointment of Kost Forer Gabbay & Kasierer, a member of Ernst & Young Global, as our independent auditors, and to authorize our board of directors to delegate to the audit committee the authority to fix the said independent auditors’ remuneration in accordance with the volume and nature of their services. |

In addition, our auditors’ report and our consolidated financial statements for the year ended December 31, 2017 will be reviewed and considered at the Meeting.

RECOMMENDATION OF THE BOARD OF DIRECTORS

Our Board of Directors recommends a vote FOR approval of all the proposals set forth in this Proxy Statement.

RECORD DATE; QUORUM; VOTING RIGHTS ETC.

Record Date

Only holders of record of our ordinary shares, par value (nominal value) NIS 0.40 per share, as of the close of business on November 9, 2018 (the “record date”), are entitled to notice of, and to vote at, the Meeting. As of November 1, 2018, there were outstanding 21,382,832 ordinary shares. Each ordinary share entitles the holder to one vote.

Quorum

Consistent with our Articles of Association and the Israeli Companies Law, the quorum at the Meeting shall be two shareholders present, in person or by proxy, holding or representing at least twenty five percent (25%) of the voting rights in the Company. If within half an hour from the time appointed for the holding of the meeting a quorum is not present, the meeting shall stand adjourned to December 24, 2018 at the same time and place or any other date and place as the directors shall designate and state in a notice to the shareholders entitled to vote at the original meeting. This notice shall serve as notice of such adjourned meeting if no quorum is present at the original date and time, and no further notice of the adjourned meeting will be given to shareholders. If, at such adjourned meeting, a quorum is not present within half an hour from the time appointed for holding the meeting, any two shareholders present in person or by proxy shall constitute a quorum.

Position Statements

To the extent you would like to submit a position statement with respect to any of proposals described in this proxy statement pursuant to the Companies Law, you may do so by delivery of appropriate notice to the Company’s offices located at 16 Atir Yeda Street, Atir Yeda Industrial Park, Kfar Saba 4464321, Israel, Attention: Corporate Secretary, not later than 10 days prior to the meeting date. Position statements must be in English and otherwise must comply with applicable law. Any valid position statement will be furnished by the Company to the SEC on a Current Report on Form 6-K, and will be made available to the public on the SEC’s website at http://www.sec.gov.

SOLICITATION OF PROXIES; VOTING PROCESS

General

Shares eligible to be voted and for which a proxy card is properly signed and returned at least 48 hours prior to the beginning of the Meeting will be voted as directed. If directions are not given or directions are not in accordance with the options listed on a signed and returned proxy card, such shares will be voted in accordance with the recommendation of the Board of Directors. Unsigned or unreturned proxies, including those not returned by banks, brokers, or other record holders, will not be counted for quorum or voting purposes. However, abstentions and broker non-votes are counted as shares present for determination of a quorum. For purposes of determining whether a matter is approved by the shareholders, abstentions and broker non-votes will not be treated as either votes “for” or “against” the matter.

We will bear the cost of soliciting proxies from our shareholders. Proxies will be solicited chiefly by mail and may also be solicited personally or by telephone by our directors, officers and employees; none of whom will receive additional compensation therefore. However, we may retain an outside professional to assist in the solicitation of proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their expenses in accordance with the regulations of the SEC, concerning the sending of proxies and proxy material to the beneficial owners of stock.

You may vote by submitting your proxy with voting instructions by mail if you promptly complete, sign, date and return the accompanying proxy card in the enclosed self-addressed envelope to our transfer agent or to our registered office in Israel at least 48 hours prior to the Meeting. You may revoke your proxy at any time prior to the exercise of authority granted in the proxy by giving a written notice of revocation to our Corporate Secretary, by submitting a subsequently dated, validly executed proxy, or by voting in person.

Joint holders of shares should take note that, pursuant to Article 40 of our Articles of Association, the vote of the senior of joint holders of any share who tenders a vote, whether in person or by proxy, will be accepted to the exclusion of the vote(s) of the other registered holder(s) of the share, and for this purpose seniority will be determined by the order in which the names stand in our register of shareholders.

Voting Process

If you are a shareholder of record, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope.

If your ordinary shares are held in “street name,” meaning you are a beneficial owner with your shares held through a bank, brokerage firm or other nominee, you will receive instructions on how to vote your shares from your bank, brokerage firm or nominee, who is the holder of record of your shares. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting may also be offered to shareholders owning shares through certain banks, brokers and nominees, according to their individual policies.

SECURITY OWNERSHIP BY CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, to our knowledge, as of November 1, 2018 regarding the beneficial ownership by (i) all shareholders who own beneficially more than 5% of our ordinary shares and (ii) by all of our directors and executive officers:

| | | Number of Ordinary Shares

Beneficially Owned (1) | | | Percentage of Outstanding

Ordinary Shares (2) | |

| Shimon Alon | | | 1,856,735 | (3) | | | 8.0 | % |

| Yelin Lapidot | | | 1,187,180 | (4) | | | 5.6 | % |

| Directors and Officers as a group (consisting of 10 persons)* | | | 2,417,973 | (5) | | | 11.0 | % |

| * | Except for Mr. Alon, each of our directors and executive officers beneficially own less than 1% of our outstanding shares. |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Ordinary shares relating to options, restricted share units, or RSUs, or performance-based RSUs, or PSUs, currently exercisable or exercisable (vested in the case of RSUs or PSUs) within 60 days of the date of this table are deemed outstanding for computing the percentage of the person holding such securities but are not deemed outstanding for computing the percentage of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares shown as beneficially owned by them. |

| (2) | The percentages shown are based on 21,382,832 shares issued and outstanding as of November 1, 2018. This figure of outstanding ordinary shares (i) excludes 1,276,137 ordinary shares issuable upon the vesting of RSUs and PSUs and (ii) excludes employee stock options to purchase an aggregate of 1,187,253 ordinary shares at a weighted average exercise price of approximately $9.48 per share, with the latest expiration date of these options being January 29, 2024 (of which, options to purchase 982,073 of our ordinary shares were exercisable as of November 1, 2018). In general, the stock options and RSUs vest over a period of three years after the grant date . |

| (3) | Mr. Alon is the Chairman of our Board and our Chief Executive Officer. Includes (i) 1,394,709 ordinary shares; (ii) 13,615 ordinary shares issuable upon the vesting of RSUs; and (iii) 448,411 ordinary shares issuable upon exercise of stock options at exercise prices ranging from $5.67 to $12.42 per ordinary share. These options expire between December 26, 2019 and December 27, 2023. The business address of Mr. Alon is c/o Attunity Ltd., 16 Atir Yeda Street, Atir Yeda Industrial Park, Kfar Saba 4464321, Israel. |

| (4) | This information is based on information provided in the Schedule 13G filed with the SEC by Dov Yelin, Yair Lapidot, Yelin Lapidot Holdings Management Ltd. and Yelin Lapidot Mutual Funds Management Ltd. (collectively, “Yelin Lapidot”) on September 5, 2017, or the YL Schedule 13G. According to the YL Schedule 13G, Yelin Lapidot has shared voting and investment power with respect to these shares and disclaims beneficial ownership thereof. The business address of Yelin Lapidot is 50 Dizengoff Street, Dizengoff Center, Gate 3, Top Tower, 13th floor, Tel Aviv 64332, Israel. |

| (5) | Includes (i) 1,734,066 ordinary shares; (ii) 45,855 ordinary shares issuable upon the vesting of RSUs; and (iii) 638,052 ordinary shares issuable upon exercise of stock options at an exercise price ranging from $2.76 to $12.42 per ordinary share. These options expire between December 15, 2018 and December 27, 2023. |

________________________________

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

Except for the historical information contained herein, the statements contained in this proxy statement may contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Actual outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors.

We urge you to consider that statements which use the terms “believe,” “do not believe,” “expect,” “plan,” “intend,” “estimate,” “anticipate,” and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements include statements relating to our future plans, revenue goals, and any other statement that does not directly relate to any historical or current fact. These statements reflect our current views, expectations and assumptions with respect to future events, are based on assumptions, are subject to risks and uncertainties and may not prove to be accurate. These risks and uncertainties, as well as others, are discussed in greater detail in Attunity’s Annual Report on Form 20-F and our other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

Except as required by applicable law, including the securities laws of the United States, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

*PROPOSALS FOR THE 2018 ANNUAL GENERAL MEETING*

ITEM 1 —

REELECTION OF THREE DIRECTORS (Item 1 on the Proxy Card)

Background

Our directors, other than the external directors (see below), are elected at each annual meeting of shareholders. We are presenting three (3) nominees for election as directors at the Meeting, all such nominees being current members of our Board of Directors. If elected, each of the nominees will hold office until the next annual general meeting, unless his office is vacated earlier pursuant to the provisions of our Articles of Association or applicable law.

Subject to the election of the proposed nominees in this Item, the size of our Board of Directors will be five (5) directors (including two external directors). Consistent with Nasdaq Marketplace Rules, or the Nasdaq rules, these nominees were approved by a majority of our independent directors, within the meaning of applicable Nasdaq rules. Our Audit Committee and Board of Directors have determined that, except for Mr. Alon, each of the nominees is independent within the meaning of the Israeli Companies Law and applicable Nasdaq rules.

The nominees, their present principal occupation or employment, the year in which each first became a director of Attunity and a brief biography are set forth below. For details about beneficial ownership of our shares held by any of these nominees, see above under the caption “Security Ownership of Certain Beneficial Owners and Management.” For details about compensation paid or payable to these nominees if elected, see below under the caption “Executive Compensation”. Such information is based upon the records of the Company and information furnished to it by the nominees.

| Name | | Age | | | Director Since | | Position with the Company |

| Shimon Alon | | 68 | | | | 2004 | | Chairman of the Board of Directors and Chief Executive Officer |

| Dov Biran | | 66 | | | | 2003 | | Director |

| Dan Falk (1) | | 73 | | | | 2002 | | Director |

| (1) | Member of the Audit and Compensation Committees. |

Shimon Alon was appointed Chairman of our Board of Directors in April 2004 and was appointed our Chief Executive Officer in June 2008. From September 1997 until June 2003, Mr. Alon served as Chief Executive Officer of Precise Software Solutions Ltd., or Precise, a provider of application performance management. Since the acquisition of Precise by Veritas Software Corp., or Veritas, in June 2003, Mr. Alon has served as an executive advisor to Veritas. Prior to Precise, Mr. Alon held a number of positions at Scitex Corporation Ltd. and its subsidiaries, including President and Chief Executive Officer of Scitex America and Managing Director of Scitex Europe. Mr. Alon holds a degree from the Executive Management Program at the Harvard Business School.

Dr. Dov Biran has been a director since December 2003. From March 2000 through October 2001, he served as acting Chief Executive Officer, Chief Technology Officer and a Director of Attunity. Dr. Biran is the founder and the Chief Executive Officer of Fitango Health, Inc. Prior thereto, Dr. Biran was the founder and President of Bridges for Islands, which was acquired by us in February 2000. Dr. Biran was the Chief Executive Officer of Optimal Technologies Ltd., Chief Information Officer of Dubek Ltd. and an officer in the computer unit of the Israeli Defense Forces. He also served as a Professor of entrepreneurship and computers at Babson College, Northeastern University and Tel Aviv University. Dr. Biran holds a B.Sc., M.B.A., and a Ph.D. degrees in computers from Tel Aviv University.

Dan Falk has been a director since April 2002. From 1999 until 2000, he served as the President and Chief Operating Officer and then Chief Executive Officer of Sapiens International Corporation N.V., or Sapiens, a publicly traded company that provides cost-effective business software solutions. From 1995 until 1999, Mr. Falk was Executive Vice President and Chief Financial Officer of Orbotech Ltd., a maker of automated optical inspection and computer aided manufacturing systems. Mr. Falk is a member of the boards of directors of Orbotech, Nice Systems Ltd., and Ormat Technologies, Inc. He holds a B.A. degree in economics and political science and an M.B.A. degree, both from the Hebrew University, Jerusalem.

We are not aware of any reason why any of the nominees, if elected, would be unable or unwilling to serve as a director. In the event such nominees should be unable to serve, the proxies will be voted for the election of such other person or persons as shall be determined by the persons named in the proxy in accordance with their best judgment. Except to the extent described above, we do not have any understanding or agreement with respect to the future election of any of the nominees named.

The Proposed Resolutions

It is proposed that at the Meeting, the following resolutions be adopted (with respect to each nominee):

“RESOLVED, that Mr. Shimon Alon be, and he hereby is, elected as a director of Attunity to hold office until the next annual general meeting, unless his office is earlier vacated under any relevant provision of the Articles of Association of Attunity or applicable law”;

“RESOLVED, that Dr. Dov Biran be, and he hereby is, elected as a director of Attunity to hold office until the next annual general meeting, unless his office is earlier vacated under any relevant provision of the Articles of Association of Attunity or applicable law”;

“RESOLVED, that Mr. Dan Falk be, and he hereby is, elected as a director of Attunity to hold office until the next annual general meeting, unless his office is earlier vacated under any relevant provision of the Articles of Association of Attunity or applicable law.”

Required Vote

Shareholders may vote in favor of the election of all the nominees named above, or may vote against all or some of such nominees. The affirmative vote of a majority of the ordinary shares represented at the Meeting in person or by proxy and voting thereon is required to elect each of the nominees named above as a director.

The Board of Directors recommends a vote FOR the election of all of the nominees named above.

Executive Compensation

You should read the below summary together with Items 3-5 of this proxy statement.

Aggregate Executive Compensation

Our objective is to attract, motivate and retain highly skilled personnel who will assist Attunity to reach its business objectives, performance and the creation of shareholder value and otherwise contribute to its long-term success. In December 2017, our shareholders approved an amended compensation policy for our executive officers and directors, or the Compensation Policy. The Compensation Policy was designed to correlate executive compensation with Attunity’s objectives and goals and otherwise embraces a performance culture that is based on merit, and differentiates and rewards excellent performance in the long term.

The following table sets forth all cash and cash-equivalent compensation we paid with respect to all of our directors and executive officers as a group for the periods indicated:

| | | Salaries, fees, commissions and bonuses | | | Pension, retirement and similar benefits | |

| 2017 - All directors and executive officers as a group, consisting of 12 persons for the year ended December 31, 2017* | | $ | 2,433,000 | | | $ | 379,000 | |

| 2016 - All directors and executive officers as a group, consisting of 11 persons for the year ended December 31, 2016* | | $ | 2,131,000 | | | $ | 383,000 | |

* Includes two persons whose service expired in December 2017 and February 2018.

We provide leased automobiles to our executive officers in Israel pursuant to standard policies and procedures.

During 2017, we granted to our directors and officers:

| · | options to purchase, in the aggregate, 113,423 ordinary shares at a weighted average exercise price per share of $7.27. The options, which vest over a period of three years after the grant date, expire in 2023. The weighted average fair value of these options as of the grant date was $3.42 per option; and |

| · | 242,569 ordinary shares issuable upon the vesting of outstanding RSUs, which vest over a period of three years after the grant date. The weighted average fair value of these RSUs as of the grant date was $7.28 per RSU. |

For a discussion of the accounting method and assumptions used in valuation of such options and RSUs, see Notes 2(n) and 10(c) to our consolidated financial statements included in our annual report on Form 20-F for the year ended December 31, 2017, filed with the SEC on March 8, 2018 (the “Annual Report”) and Item 6E of the Annual Report.

Individual Compensation of Covered Executives

The table and summary below outline the compensation granted to our five most highly compensated "office holders" during or with respect to the year ended December 31, 2017. The Companies Law defines the term “office holder” of a company to include a director, the chief executive officer, the chief business manager, a vice president and any officer that reports directly to the chief executive officer. We refer to the five individuals for whom disclosure is provided herein as our “Covered Executives.”

For purposes of the table and the summary below, “compensation” includes base salary, bonuses (including sales commissions), equity-based compensation, retirement or termination payments, benefits and perquisites, such as car and social benefits and any undertaking to provide such compensation. All amounts reported in the table are in terms of cost to the Company, as recognized in our financial statements for the year ended December 31, 2017.

| Name and Principal Position (1) | | Annual Base Salary (2) | | | Bonus (3) | | | Equity-Based Compensation (4) | | | All Other Compensation (5) | | | Total | |

| | | (Dollars in thousands)* | |

Shimon Alon, Chairman of the Board and Chief Executive Officer | | | 360 | | | | 228 | (6) | | | 446 | (7) | | | 219 | (8) | | | 1,253 | |

Mel Passarelli, Executive Vice President, North American Operations (9) | | | 204 | | | | 229 | | | | 211 | | | | 65 | | | | 709 | |

Byron Young, Vice President of Sales APAC | | | 128 | | | | 456 | | | | 68 | | | | -- | | | | 652 | |

Dror Harel-Elkayam, Chief Financial Officer | | | 211 | | | | 61 | | | | 239 | | | | 129 | | | | 640 | |

Itamar Ankorion, Chief Marketing Officer | | | 196 | | | | 165 | | | | 201 | | | | 62 | | | | 624 | |

| * | Since all or part of the compensation may be denominated in currencies other than the dollar, fluctuations in dollar amounts may be attributed to exchange rate fluctuations. In particular, for purposes of this table, cash compensation amounts denominated in currencies other than the dollar were converted into dollars at an exchange rate of NIS 3.60 per $1.00 and of GBP 1.29 per $1.00, which reflect the average applicable conversion rates for 2017. |

| | (1) | Unless otherwise indicated herein, all Covered Executives are (i) employed on a full-time (100%) basis; and (ii) subject to customary confidentiality, intellectual property assignment and non-solicitation provisions as well as an undertaking not to compete with us or in our field of business for at least 12 months following termination of employment. |

| | (2) | Reflects the annual gross salary of the Covered Executive. |

| | (3) | Amounts reported in this column represent annual bonuses, including sales commissions, granted to the Covered Executives based on formulas set forth in their respective employment agreements. Consistent with our Compensation Policy, such bonuses are based upon (i) for the Chief Executive Officer, see footnote 6 below; (ii) for the other executive officers, achievement of targets of revenues generated by the individual and/or his/her team or division and/or the Company, as well as, in appropriate circumstances, other measurable criteria, and in any event, not to exceed the amount of 250% of annual base salary of such executive, and (iii) with respect to the Chief Financial Officer, the milestones and criteria for the annual bonus consist of several performance metrics (namely, annual revenue and profitability metrics), which are tied to our annual budget and are subject to target thresholds within each metric and ranges of bonus payout. |

| | (4) | Amounts reported in this column represent the accounting expense recognized by the Company associated with stock-based compensation in accordance with accounting guidance for stock-based compensation. For a discussion of the assumptions used in reaching this valuation, see Notes 2(n) and 10(c) to our consolidated financial statements included elsewhere in this annual report. All of the awards were in the form of stock options (which expire six years after the grant date), RSUs or ordinary shares, and were made pursuant to one of our equity incentive plans. |

| | (5) | Amounts reported in this column include benefits and perquisites, including those mandated by applicable law. Such benefits and perquisites may include, to the extent applicable to the Covered Executive, payments, contributions and/or allocations for savings funds (e.g., Managers Life Insurance Policy), education funds (“keren hishtalmut”), pension, severance, vacation, car or car allowance, medical insurances and benefits, risk insurances (e.g., life or work disability insurance), convalescence or recreation pay, relocation, employers payments for social security, tax gross-up payments (including for certain travel related payments), and other benefits and perquisites consistent with Attunity’s guidelines. Unless otherwise indicated herein, all Covered Executives in Israel are entitled (including by virtue of Israeli labor laws), among other things, to (i) a company car and all related expenses, except related taxes; (ii) Company contributions for the benefit of the Covered Executive to (a) our Managers Insurance Policy in the amount of 15.33% of the Covered Executive gross salary (a portion of which is for severance pay, to which the Covered Executive would be entitled), and (b) our Education Fund in the amount of 7.5% of the Covered Executive’s gross salary; (iii) up to 23 days paid vacation per year; (iv) up to 10 days recreation (“Havra’a”) payment a year in an amount normally paid by our Company in accordance with applicable law; (v) a notice period of up to twelve months prior to termination (other than termination for cause), during which they are entitled, subject to certain exceptions, to all compensation and rights under their employment agreements; and (vi) certain benefits in connection with a change of control of the Company, such as accelerated vesting of equity-based awards and/or extended period of up to twelve months of termination. |

| | (6) | Consistent with our Compensation Policy, and as approved by our shareholders, (i) for the year 2017, Mr. Alon was entitled to an annual bonus that will not exceed the NIS equivalent of approximately $245,000 gross (for 100% achievement of the applicable metric) or approximately $343,000 (for overachievement of 120% or more), and (ii) for the year 2018, Mr. Alon will be entitled to an annual bonus that will not exceed the NIS equivalent of approximately $270,000 gross (for 100% achievement of the applicable metric) or approximately $377,000 (for overachievement of 120% or more). In general, the annual bonus is payable on a quarterly basis, subject to Mr. Alon achieving certain criteria and milestones set by our Compensation Committee and Board of Directors. The milestones and criteria for the annual bonus for the years 2016 through 2018, consist of several performance metrics (namely, annual revenue and profitability metrics), which are tied to our annual budget for the applicable year and are subject to target thresholds within each metric and ranges of bonus payout. |

| | (7) | As approved by our shareholders, on December 30, 2015, December 29, 2016 and December 27, 2017, we granted Mr. Alon options to purchase 129,265 ordinary shares at an exercise price equal to $12.42 per share, 112,278 ordinary shares at an exercise price equal to $5.67 per share and 95,308 ordinary shares at an exercise price equal to $7.27 per share, respectively. On December 27, 2017, we also granted Mr. Alon 40,846 RSUs. One third of the options vest one year after the grant date, with the balance vesting in eight equal quarterly installments whereas the RSUs will vest within three years following the grant date, in three equal annual installments. In addition, on December 27, 2017, we also granted Mr. Alon up to 40,000 performance-based RSUs, the vesting of which is tied to the Company's achievement of a revenue milestone. Vesting of the equity-based awards will fully accelerate upon certain change of control events, as defined in Mr. Alon’s employment agreement (except that the vesting of the performance-based RSUs will not accelerate if the change of control event occurs less than fifteen (15) months following the grant date). |

| | (8) | In the event of termination of Mr. Alon’s employment for any reason (other than (1) termination by the Company for cause, i.e., in circumstances where he would not be entitled to severance pay under Israeli law, or (2) resignation at any time without providing the Company with the required prior notice), Mr. Alon will be entitled to an adjustment period of 12 months following the end of the prior notice period under the agreement (or from the date that he actually ceased to provide services should we choose to waive the prior notice period). During the adjustment period, Mr. Alon will generally be entitled to all rights to which he is entitled under his employment agreement, including to exercise any vested options and RSUs; however, his options and RSUs will generally cease to vest. The employee-employer relationship will not terminate until the end of the adjustment period. Mr. Alon will be entitled to reimbursement of all expenses in connection with his employment, consistent with Attunity’s practices, including a tax gross-up for certain travel related payments. |

| | (9) | Mr. Passarelli stepped down in February 2018. |

Compensation of Non-Employee Directors

Our non-employee directors, including outside directors, receive an annual fee of $15,000 and attendance fees of NIS 1,650 per meeting (equivalent to approximately $445 per meeting attended, linked to the Israeli Consumer Price Index, or CPI).

According to the Compensation Policy, non-employee directors may be granted equity based compensation which shall vest over a period of at least three years, and having a fair market value (determined according to acceptable valuation practices) that will not exceed, with respect to each year of vesting (measured on a linear basis), the equivalent of $80,000 for each director. Consistent with the Compensation Policy and as approved by our shareholders, commencing in December 2017, each of our non-employee directors who may serve from time to time (regardless of whether they are former employees or consultants of the Company), including our outside directors, will be granted equity-based grants, as follows:

| | · | Grant Date: An annual grant to be made on or about the date of each annual meeting of shareholders (if the director's term ends at such meeting, only if he is being reelected). |

| | · | Value: The fair market value of each annual grant will be equal to $35,000. |

| | · | Type of Grant: Combination of RSUs and stock options, of which (i) 50% of the aforesaid value (i.e., $17,500) of each grant being made in stock options (with an exercise price per share equal to an average price per share during the 30 trading days preceding the grant) and (ii) 50% of the aforesaid value (i.e., $17,500) in RSUs (the number of RSUs calculated by using an average price per share during the 30 trading days preceding the grant). |

| | · | Maximum RSUs: The number of shares to be issued under the RSUs grant will not exceed (x) $17,500 divided by (y) the average price per share during the 30 trading days preceding the grant on the initial grant date multiplied by 90%. |

| | · | Vesting: The RSUs and stock options will vest within three years following the Grant Date, in three equal annual installments. |

| | · | Termination: The portion of outstanding stock options and RSUs that is scheduled to vest during the year at which the director’s service with us is terminated or expires, will be accelerated and become fully vested and exercisable for a period of 180 days thereafter, unless termination was due to the director’s resignation (other than resignation due to health conditions) or the director was terminated due to one of the causes set forth in the Companies Law. |

| | · | Other: All other terms and conditions in connection with the above equity-based awards are as set forth in the Company’s 2012 Stock Incentive Plan, as amended, or the 2012 Plan. |

All of the options granted to our directors expire six years after the grant date.

Other than the foregoing fees, reimbursement for expenses and the award of stock options and RSUs, we do not compensate our directors for serving on our Board of Directors.

Change of Control Arrangements

Some of our executive officers as well as some of our key employees are entitled to (1) accelerated vesting of the ordinary shares subject to outstanding options and other equity-based grants granted to them in connection with a change in control of the Company and (2) an extended period of up to twelve months of termination notice in connection with a termination of employment within one year following a change in control of the Company.

Indemnification and Insurance

We have undertaken to indemnify our office holders to the fullest extent permitted by law, including exculpation from the duty of care, by providing them with a Letter of Indemnification, the form of which was approved by our shareholders. We also currently maintain directors’ and officers’ liability insurance with an aggregate coverage limit of $25 million, with a Side A coverage of an additional $5 million, for an annual premium of approximately $185,000. See Item 2 below.

External Directors Continuing in Office

Tali Alush-Aben, who was elected as external director of the Company to serve until December 2020, and Gil Weiser, who was elected as external director of the Company to serve until December 2019, continue to serve the Company as external directors. A brief biography of these directors follows.

Tali Alush-Aben, 55, has been an outside director since December 2008. She is currently an independent consultant. Until January 2008, she was a General Partner at Gemini, an Israeli venture capital fund she joined in 1994. Her focus in Gemini was primarily on software companies. Prior to joining Gemini, she served as Marketing Director of RadView Ltd., then a start-up software company, and as Senior Product Marketing Manager at SunSoft Inc. From 1990 to 1992, she served as Marketing Director for Mercury Interactive Corporation. She holds a B.Sc. degree in mathematics and computer science and an M.B.A. degree, both from Tel-Aviv University.

Gil Weiser, 77, has been an outside director since December 2010. Mr. Weiser currently serves as the Chairman of BGN Technologies Ltd. He has more than 25 years of experience in management and operations, with executive posts at corporate, academic and financial entities. He served as the Chief Executive Officer of Orsus Solutions Ltd. from August 2006 to June 2010, and as the Chief Executive Officer of Hewlett Packard (Israel) and CMS Corporation from 1995 to 2000. From 1993 until 1995, he served as President and Chief Executive Officer of Fibronics International Inc. and as Chief Executive Officer of Digital (DEC Israel) from 1978 to 1993. He has also served as a director on numerous boards of directors, as well as a director of the Tel Aviv Stock Exchange from 2002 to 2004 and as Chairman of the Multinational Companies Forum. Mr. Weiser holds a B.Sc. degree from Technion, Israel Institute of Technology in Haifa as well as a M.Sc. degree in science from the University of Minnesota.

ITEM 2 – AMENDMENTS TO COMPENSATION POLICY

(Item 2 on the Proxy Card)

Background

Under the Israeli Companies Law, companies incorporated under the laws of Israel whose shares are listed for trading on a stock exchange or have been offered to the public in or outside of Israel, such as Attunity, are required to adopt a policy governing the compensation of "office holders" (as defined above). In general, all office holders’ terms of compensation – including fixed remuneration, bonuses, equity compensation, retirement or termination payments, indemnification, liability insurance and the grant of an exemption from liability – must comply with the company's compensation policy, once adopted by the shareholders.

Pursuant to the Israeli Companies Law, the compensation policy must comply with specified criteria and guidelines and, in general, be adopted following consideration of, among others, the following factors: (i) promoting the company’s objectives, business plan and long term policy; (ii) creating appropriate incentives for the company’s office holders, considering, among others, the company's risk management policy; (iii) the company's size and nature of operations; and (iv) with respect to variable elements of compensation (such as bonuses), the office holder’s contribution to achieving corporate objectives and increasing profits, with a long-term view and in accordance with his or her role.

Such compensation policy is required to be approved by the board of directors, following the recommendation of the compensation committee, and the shareholders, in that order, and if the term of the compensation policy if for more than three years, it must be re-approved in such manner every three years. In December 2017, our shareholders approved certain amendments to our Compensation Policy. A copy of the Compensation Policy is available as Exhibit 4.5 to our Annual Report, which may be viewed on our website – www.attunity.com or through the EDGAR website of the SEC at www.sec.gov.

Our Compensation Committee is currently composed of Ms. Alush-Aben, the chairman of the committee, Mr. Gil Weiser and Mr. Dan Falk, all of whom satisfy the respective “independence” requirements of the Companies Law, SEC and Nasdaq rules for compensation committee members.

Proposed Amendments to the Compensation Policy

Our Board of Directors approved, following the recommendation of the Compensation Committee, the following amendment to Section F (Exculpation, Indemnification and Insurance) of the Compensation Policy (Changes shown: proposed new text is underlined, text proposed to be deleted is struck-through):

"Attunity will provide "Directors and Officers Insurance" for its Directors and Executives (the "D&O Insurance") with aggregate coverage not to exceed US$40 US$50 million and annual premium not to exceed $250,000 US$400,000 per year."

In approving the aforesaid amendments to the Compensation Policy, our Compensation Committee and Board of Directors considered various factors, including, among others, our size and nature of operations and the recent increases in the annual premiums payable for purchasing directors and officers insurance for public companies traded on Nasdaq like us.

The Proposed Resolution

It is proposed that at the Meeting the following resolution be adopted:

"RESOLVED, to approve the amendments to the Compensation Policy for Executive Officers and Directors, as described in the Company's Proxy Statement for the 2018 Annual General Meeting."

Required Vote

Approval of this matter will require the affirmative vote of a majority of the shares present, in person or by proxy, and voting on the matter; provided that either (i) the shares voted in favor of the above resolution include a majority of the shares voted by shareholders who are not “controlling shareholders” and do not have a "personal interest" in such matter (as such terms are defined in the Companies Law) or (ii) the total number of shares voted against such matter by the disinterested shareholders described in clause (i) does not exceed 2% of the Company’s voting power.

Under the Companies Law, (1) the term “controlling shareholder” means a shareholder having the ability to direct the activities of a company, other than by virtue of being an office holder. A shareholder is presumed to be a controlling shareholder if the shareholder holds 50% or more of the voting rights in a company or has the right to appoint the majority of the directors of the company or its chief executive officer; and (2) a “personal interest” of a shareholder (i) includes a personal interest of any members of the shareholder’s family (or spouses thereof) or a personal interest of a company with respect to which the shareholder (or such family member) serves as a director or the CEO, owns at least 5% of the shares or has the right to appoint a director or the CEO but (ii) excludes an interest arising solely from the ownership of our ordinary shares.

The Companies Law requires that each shareholder voting on the proposed resolution indicate whether or not the shareholder has a personal interest in the proposed resolution. As of the date hereof, the Company has no controlling shareholder within the meaning of the Companies Law. However, our office holders are deemed to have a personal interest in this matter.

While it is highly unlikely that any of the Company’s public shareholders has a personal interest on this matter, the enclosed form of proxy card includes a certification that you do NOT have a personal interest in this proposal – Please confirm that you do you DO NOT have such "personal interest" in Proposal 2 by checking the "YES" box in Item 2a of the proxy card. If you do have a personal interest in Proposal 2, check the "NO" box in Item 2a of the proxy card. If you do not mark the box in Item 2a, your vote will not be counted towards Item 2.

Also, if you are unable to make the aforesaid confirmations for any reason or have questions about whether you have a personal interest, please contact the Company's CFO at telephone number: +972-9-899-3000; fax number: +972-9–899-3011; or email dror.elkayam@attunity.com or, if you hold your shares in "street name", you may also contact the representative managing your account, who could then contact the above person on your behalf.

The Board of Directors recommends a vote FOR the approval of the proposed resolution.

ITEM 3 – CEO BASE COMPENSATION

(Item 3 on the Proxy Card)

Background

Under the Companies Law, the terms of compensation, including the base salary, of a chief executive officer or a director of a company incorporated under the laws of Israel whose shares are listed for trade on a stock exchange or have been offered to the public in or outside of Israel, such as Attunity, require the approval of the compensation committee, the board of directors and, subject to certain exceptions, the shareholders.

Mr. Shimon Alon was appointed Chairman of our Board of Directors in April 2004 and was appointed our Chief Executive Officer in June 2008. Mr. Alon's gross monthly salary (denominated in NIS) is currently equal to the NIS equivalent of approximately $29,100, or approximately $349,700 on an annual basis. For additional details about compensation paid to Mr. Alon, see above under the caption “Executive Compensation.”

Proposed Revisions to CEO Compensation – Reasons

Our future success depends in large part on the continued services of our senior management and key personnel. In particular, we are highly dependent on the services of Mr. Alon. In recognition of the importance of Mr. Alon’s services to the Company and taking into account, among other factors, the overall compensation level of other senior executives in the industry, our Board of Directors has approved, following the recommendation and approval of our Compensation Committee, to approve (1) an increase of base compensation as described in this Item 3 below, (2) an increase of the cash performance bonus for 2019, as more fully described in Item 4 below; and (3) a grant of equity-based compensation, as more fully described in Item 5 below.

In approving the proposed changes to Mr. Alon's compensation, our Compensation Committee and Board of Directors considered various factors, including the following:

| ✓ | The Importance of Mr. Alon’s Services to the Company. This element is demonstrated by Mr. Alon playing a key role in most aspects of our operations, starting from formulating our strategic vision, building a strong management and sales teams, driving our on-going shift into our term-based offering model and leading our strategic and financing activities (including the recent public offering). |

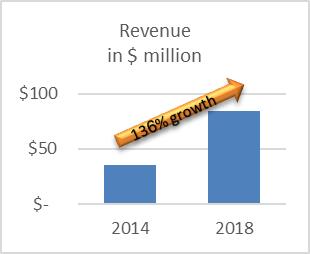

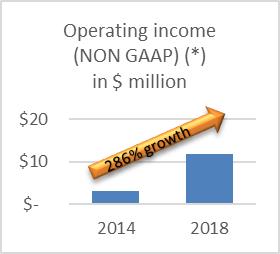

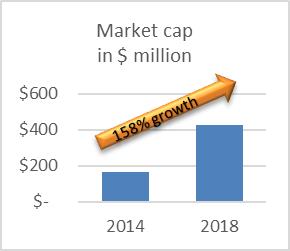

| ✓ | The Contribution of Mr. Alon to Our Business and Success. To illustrate Mr. Alon's contribution to our success, see below the charts indicating our Company’s growth in the past several years and the shareholder value created in that period (with (i) non-historical data provided for the 2018 year being based on our previously announced annual, updated, outlook for the year and (ii) market cap and share price data being based on the number of ordinary shares and closing sale prices of our ordinary shares on the Nasdaq Capital Market as of December 31, 2014 and November 1, 2018, as applicable): |

(*) Annex A includes a reconciliation of Non-GAAP operating income to operating income (loss), the most directly comparable measures reported under accounting principles generally accepted in the United States.

| ✓ | The Effective Freeze on Mr. Alon's Base Compensation. Our Compensation Committee and Board of Directors considered, among other things, the fact that Mr. Alon's base compensation has not been modified since January 2015. |

| ✓ | The Compensation Levels of other Senior Executives in our Industry. In evaluating Mr. Alon's compensation, our Compensation Committee and Board of Directors reviewed benchmark information relating to the compensation of chief executive officers of peer group companies. |

| ✓ | Performance-Based and Retention Incentives. The proposed cash performance bonus in Item 4 and the proposed equity-based grants in Item 5 contain inherent incentives to reward for performance and the structure of the equity-based grants also include important retention incentives. |

| ✓ | Our Compensation Policy. Our Compensation Committee and Board of Directors considered our Compensation Policy and other elements of compensation payable to Mr. Alon as well as factors set forth in the Companies Law. |

If approved, the majority of the proposed compensation payable to Mr. Alon is not guaranteed at the date of award and is also tied to our performance, including our share price (through the proposed equity-based grant) and operating results (the annual cash bonus), assuring a strong correlation between pay and performance:

| v | In 2015, 2016 and 2017, approximately 70%, 68% and 62% of Mr. Alon's compensation was attributed to such variable components, respectively (based on the total value of the equity-based grants on the date of shareholder approval for the upcoming year). |

| v | If the proposed modification to Mr. Alon base compensation as well as the bonus and equity-based grant pursuant to Items 3, 4 and 5 are approved, approximately 86% of Mr. Alon's compensation would be attributed to such variable, performance-based, components (based on the total value of the equity-based grants on the date of shareholder approval for the upcoming 2019 year). |

Proposed Revisions to CEO Compensation – Base Compensation

We propose to increase the gross monthly salary payable to Mr. Alon by 5%, such that the gross monthly salary payable to him (denominated in NIS) will be equal to the NIS equivalent of approximately $30,600, or approximately $367,200 on an annual basis.

It is hereby clarified that if this Proposal 3 is not approved, the base compensation of Mr. Alon will continue according to its current terms, as described under "Background" above.

The Proposed Resolution

It is therefore proposed that at the Meeting the following resolution be adopted:

”RESOLVED, that the compensation to the Chief Executive Officer, as described in Item 3 of the Company's Proxy Statement for the 2018 Annual General Meeting, be, and the same hereby is, approved.”

Required Vote

The affirmative vote of a majority of the ordinary shares represented at the Meeting in person or by proxy and voting thereon is required to adopt said resolution, provided that the shares voting in favor of such resolution include at least a majority of the shares voted by shareholders who are not “controlling shareholders” and do not have a "personal interest" in the matter (as such terms are defined in the Companies Law, see in Item 2 above).

The Companies Law requires that each shareholder voting on the proposed resolution indicate whether or not the shareholder has a personal interest in the proposed resolution. As of the date hereof, the Company has no controlling shareholder within the meaning of the Companies Law. However, Mr. Alon will be deemed to have a personal interest in this matter.

While it is highly unlikely that any of the Company’s public shareholders has a personal interest on this matter, the enclosed form of proxy card includes a certification that you do NOT have a personal interest in this proposal – Please confirm that you do you DO NOT have such "personal interest" in Proposal 3 by checking the "YES" box in Item 3a of the proxy card. If you do have a personal interest in Proposal 3, check the "NO" box in Item 3a of the proxy card. If you do not mark the box in Item 3a, your vote will not be counted towards Item 3.

Also, if you are unable to make the aforesaid confirmations for any reason or have questions about whether you have a personal interest, please contact the Company's CFO at telephone number: +972-9-899-3000; fax number: +972-9–899-3011; or email dror.elkayam@attunity.com or, if you hold your shares in "street name", you may also contact the representative managing your account, who could then contact the above person on your behalf.

The Board of Directors recommends a vote FOR approval of the foregoing resolution.

ITEM 4 — CEO 2019 ANNUAL PERFORMANCE BONUS

(Item 4 on the Proxy Card)

Background

Under the Companies Law, the terms of compensation, including the grant of an annual bonus, of a chief executive officer or a director of a company incorporated under the laws of Israel whose shares are listed for trading on a stock exchange or have been offered to the public in or outside of Israel, such as Attunity, require the approval of the compensation committee, the board of directors and, subject to certain exceptions, the shareholders.

In December 2017, our shareholders approved milestones and criteria for the payment of annual performance bonus to Mr. Shimon Alon, our Chief Executive Officer, for 2018. Our Compensation Committee and Board of Directors have determined to approve the annual performance bonus for 2019 as described below.

Proposed 2019 Annual Performance Bonus – Reasons

See the discussion under "Proposed Revisions to CEO Compensation – Reasons" in Item 3 above. In addition, our Compensation Committee and Board of Directors also considered, in respect of the proposed revisions in the annual bonus described below, that such changes correspond to the proposed 5% increase in base salary described in Item 3.

Proposed 2019 Annual Performance Bonus - Summary

Below is a summary of the key terms of the proposed 2019 annual performance bonus. Where applicable, we have indicated the changes from the 2018 annual bonus for comparison purposes.

| · | Annual Bonus: Increase the annual bonus by 5%, from NIS 950,400 (equivalent of approximately $256,400) as was in the 2018 annual bonus, to NIS 997,900 (equivalent of approximately $269,300) for 100% achievement of the applicable metrics. |

| · | Annual weighting of metrics: |

| o | Revenues: Achievement of the revenues target set in the annual budget of the Company approved by the Board of Directors for the applicable fiscal year (the "Annual Budget") will entitle our Chief Executive Officer to 80% of the annual bonus (compared to a range of 65% to 80% for the 2018 annual bonus, where the exact percentage was to be further determined by our Compensation Committee no later than approval date of the Annual Budget); and |

| o | Profitability: Achievement of the non-GAAP operating income target set in the Annual Budget will entitle our Chief Executive Officer to 20% of the annual bonus (compared to a range of 20% to 35% for the 2018 annual bonus, where the exact percentage was to be further determined by our Compensation Committee no later than approval date of the Annual Budget). |

| · | Target thresholds within each of the aforesaid revenues and profitability metrics and ranges of bonus payout (out of the applicable portion of the annual bonus assigned to such metric) will be as follows (no changes from 2018): |

Achievement/Overachievement of the Revenue/Profitability Targets | Bonus Payment/Payout Percentage

(straight line between steps) |

| 0 < 85% | 0% |

| 85% | 50% |

| 90% | 75% |

| 95% | 85% |

| 100% | 100% |

| 110% | 120% |

| 120% or more | 140% |

| · | Cap (same like in 2018): Not more than 140% of the Annual Bonus (for overachievement of 120% or more). |

| · | Payments (same like in 2018): Other than payments on account of overachievement (which are payable only following release of our financial results for the applicable full year), the annual bonus shall be paid on a quarterly basis, based on the achievement of the applicable targets, measured on an accumulated basis and allocated evenly for each quarter (i.e., for each quarter, up to 25% of the Annual Bonus will be payable upon on-target achievement of the quarterly target in the Annual Budget, on an accumulated basis, but, for the sake of clarity, if a target threshold for revenue or profitability metrics for the applicable quarter is not achieved, then no quarterly payment shall be made for that metric in the applicable quarter). In case of any overpayment of bonus, which may occur as a result of fluctuations in quarterly results compared to the Annual Budget, will be repaid promptly. |

| · | Adjustments (same like in 2018): Our Board of Directors, following recommendation and approval of our Compensation Committee, may adjust the annual targets set in the Annual Budget in case of one-time events (such as acquisitions) that may occur during the relevant fiscal year. |

For details regarding other terms of compensation of Mr. Alon, see under "Executive Compensation" above and Items 3 and 5 herein.

It should be noted if this proposal is not approved at the Meeting, the size, milestones and criteria for the 2018 annual performance bonus, as approved by our shareholders in December 2017, will apply for the 2019 annual bonus, unless otherwise determined by our Compensation Committee and Board of Directors.

The Proposed Resolution

It is proposed that at the Meeting the following resolution be adopted:

“RESOLVED, that the 2019 annual performance bonus of the Chief Executive Officer, as described in Item 4 of the Company’s Proxy Statement for the 2018 Annual General Meeting, be, and the same hereby is, approved.”

Required Vote

The affirmative vote of the holders of a majority of the voting power represented at the meeting, in person or by proxy, and voting on this matter, is required for the approval of this matter; provided that either (i) the shares voted in favor of the above resolution include a majority of the shares voted by shareholders who are not “controlling shareholders” and do not have a "personal interest" in such matter (as such terms are defined in the Companies Law, see Item 2 above) or (ii) the total number of shares voted against such matter by the disinterested shareholders described in clause (i) does not exceed 2% of the Company’s voting power.

The Companies Law requires that each shareholder voting on the proposed resolution indicate whether or not the shareholder has a personal interest in the proposed resolution. As of the date hereof, the Company has no controlling shareholder within the meaning of the Companies Law. However, Mr. Alon will be deemed to have a personal interest in this matter.

While it is highly unlikely that any of the Company’s public shareholders has a personal interest on this matter, the enclosed form of proxy card includes a certification that you do NOT have a personal interest in this proposal – Please confirm that you do you DO NOT have such "personal interest" in Proposal 4 by checking the "YES" box in Item 4a of the proxy card. If you do have a personal interest in Proposal 4, check the "NO" box in Item 4a of the proxy card. If you do not mark the box in Item 4a, your vote will not be counted towards Item 4.

Also, if you are unable to make the aforesaid confirmations for any reason or have questions about whether you have a personal interest, please contact the Company's CFO at telephone number: +972-9-899-3000; fax number: +972-9–899-3011; or email dror.elkayam@attunity.com or, if you hold your shares in "street name", you may also contact the representative managing your account, who could then contact the above person on your behalf.

The Board of Directors recommends a vote FOR approval of the foregoing resolution.

ITEM 5 — CEO 2019 EQUITY-BASED COMPENSATION

(Item 5 on the Proxy Card)

Background

Under the Companies Law, the terms of compensation, including the grant of equity-based awards, of a chief executive officer or a director of a company incorporated under the laws of Israel whose shares are listed for trading on a stock exchange or have been offered to the public in or outside of Israel, such as Attunity, require the approval of the compensation committee, the board of directors and, subject to certain exceptions, the shareholders.

As described under "Executive Compensation" above, in the past several years, Mr. Alon was granted stock options pursuant to the terms and formula approved by our shareholders, that essentially provided for the grant of stock options exercisable into a number of ordinary shares equal to 0.7% of the total outstanding shares (on a fully diluted basis) of the Company as of November 1st of each year. As approved by our shareholders in December 2017, in 2018, Mr. Alon was entitled to an equity-based grant comprised of stock options, RSUs and PSUs.

Proposed 2019 Equity-Based Grant – Reasons

See the discussion under "Proposed Revisions to CEO Compensation – Reasons" in Item 3 above. In addition, our Compensation Committee and Board of Directors also considered, in respect of the proposed grant of equity-based awards described below, that 50% of the initial equity-based awards (i.e., the PSUs portion of the grant) is directly tied to both the Company's performance and continued service with us whereas the remainder is tied to both share performance and continued service with us.

Proposed 2019 Equity-Based Grant – Summary

Below is a summary of the key terms of the proposed 2019 equity-based grant.

| · | Grant Date: The date of the annual meeting of shareholders for 2018 (i.e., the Meeting). |

| · | Number of RSUs: 50,000 RSUs, representing 0.21% of the total outstanding shares (on a fully diluted basis) of the Company as of November 1, 2018, rounded down to the whole share. |

| · | Number of PSUs: 50,000 PSUs, representing 0.21% of the total outstanding shares (on a fully diluted basis) of the Company as of November 1, 2018, rounded down to the whole share, except that, as described below, such number may be increased to up to 75,000 PSUs in case of over achievement of the performance criteria. |

| · | Vesting - General: The RSUs will vest within three years following the Grant Date, in three equal annual installments. Vesting and eligibility for the PSUs will be as described below. Vesting of the RSUs and PSUs (i) is conditioned upon Mr. Alon being engaged with Attunity, either as chief executive officer or as chairman of the board of directors of the Company as of the applicable vesting date, and (ii) will fully accelerate upon certain change of control events, in accordance with Mr. Alon's current employment agreement. |

| · | Eligibility/Performance Criteria of PSUs: |

Achievement/Overachievement of the Revenue Target set in the Annual Budget for 2019 | Vesting Percentage/

Number of PSUs* |

| (straight line between steps) |

| 0 < 85% | 0% (no PSUs) |

| 85% | 50% (25,000 PSUs) |

| 90% | 60% (30,000 PSUs) |

| 95% | 75% (37,500 PSUs) |

| 100% | 100% (50,000 PSUs) |

| 110% | 120% (60,000 PSUs) |

| 120% or more | 150% (75,000 PSUs) |

* Even if the eligibility/performance criteria is achieved, Mr. Alon will not be eligible for any PSUs unless the non-GAAP operating profit for the full 2019 fiscal year is above a specific percentage (which must be between 5% to 10%) to be further determined by our Compensation Committee no later than approval date of the Annual Budget.

| · | Vesting of PSUs: The number of PSUs to which Mr. Alon will become entitled pursuant to the above criteria will vest in three equal annual installments, as follows: |

Installment | Vesting Date | Vesting Condition: Must be Engaged on the following dates |

1st | Upon filing of the Company’s annual report on Form 20-F for the year ended December 31, 2019 | December 31, 2019 |

2nd | January 1, 2021 | December 31, 2020 |

3rd | January 1, 2022 | December 31, 2021 |

| · | Cap: As outlined in our Compensation Policy, the fair market value of the proposed grant, as measured on the date of the grant, based on the Black-Scholes evaluation model, where applicable, may not exceed the equivalent of three (3) years’ base salary of the CEO per year of vesting, on a linear basis (the “Cap”). Based on a price per share of $19.97, the sale price of our ordinary shares on Nasdaq on November 1, 2018, the fair market value of the proposed grant of RSUs and PSUs for 2018 per each year of vesting is currently approximately $665,700, which is substantially below the Cap of approximately $1,102,000 (assuming the proposed increase of base salary described in Item 3 is approved). For the sake of clarity, if the fair market value on the applicable Grant Date exceeds the Cap per year, the number of RSUs and PSUs will be reduced so that it does not exceed the Cap. |

| · | Other: All other terms and conditions in connection with the above equity-based awards shall be as set forth in the Company’s 2012 Stock Incentive Plan, as amended. |

For details regarding other terms of compensation of Mr. Alon, see under "Executive Compensation" above and Items 3 and 4 herein. For details about Mr. Alon’s beneficial ownership of our shares, see above under the caption “Security Ownership by Certain Beneficial Owners and Management.”

The Proposed Resolution

It is proposed that at the Meeting the following resolution be adopted:

“RESOLVED, that the grant of RSUs and PSUs to the Chief Executive Officer, as described in Item 5 of the Company’s Proxy Statement for the 2018 Annual General Meeting, be, and the same hereby is, approved.”

Required Vote

The affirmative vote of the holders of a majority of the voting power represented at the meeting, in person or by proxy, and voting on this matter, is required for the approval of this matter; provided that either (i) the shares voted in favor of the above resolution include a majority of the shares voted by shareholders who are not “controlling shareholders” and do not have a "personal interest" in such matter (as such terms are defined in the Companies Law, see Item 2 above) or (ii) the total number of shares voted against such matter by the disinterested shareholders described in clause (i) does not exceed 2% of the Company’s voting power.

The Companies Law requires that each shareholder voting on the proposed resolution indicate whether or not the shareholder is has a personal interest in the proposed resolution. As of the date hereof, the Company has no controlling shareholder within the meaning of the Companies Law. However, Mr. Alon will be deemed to have a personal interest in this matter.

While it is highly unlikely that any of the Company’s public shareholders has a personal interest on this matter, the enclosed form of proxy card includes a certification that you do NOT have a personal interest in this proposal – Please confirm that you do you DO NOT have such "personal interest" in Proposal 5 by checking the "YES" box in Item 5a of the proxy card. If you do have a personal interest in Proposal 5, check the "NO" box in Item 5a of the proxy card. If you do not mark the box in Item 5a, your vote will not be counted towards Item 5.

Also, if you are unable to make the aforesaid confirmations for any reason or have questions about whether you have a personal interest, please contact the Company's CFO at telephone number: +972-9-899-3000; fax number: +972-9–899-3011; or email dror.elkayam@attunity.com or, if you hold your shares in "street name", you may also contact the representative managing your account, who could then contact the above person on your behalf.

The Board of Directors recommends a vote FOR approval of the foregoing resolution.

ITEM 6 —

RE-APPOINTMENT OF INDEPENDENT AUDITORS

(Item 6 on the Proxy Card)

Background

Our Board of Directors first appointed Kost Forer Gabbay & Kasierer, Certified Public Accountants (Israel), a member of Ernst & Young Global (“EY”), as our auditors in 1992 and has reappointed the firm as our auditors since such time.

At the Meeting, our shareholders will be asked to approve the re-appointment of Kost Forer Gabbay & Kasierer as our independent auditors, pursuant to the recommendation of our Audit Committee and Board of Directors. Kost Forer Gabbay & Kasierer, and other accountants affiliated with Ernst & Young Global, also serve as auditors of our subsidiaries. They have no relationship with us or with any of our affiliates except as auditors and, to a limited extent, as tax consultants and providers of some other audit related services. Our Audit Committee and Board of Directors believe that the independence of Kost Forer Gabbay & Kasierer is not affected by such limited non-audit function and that, as a result of their familiarity with our operations and their reputation in the auditing field, they have the necessary personnel and professional qualifications to act as our auditors.

At the Meeting, our shareholders will also be asked to authorize our Board of Directors to delegate to our Audit Committee the authority to fix the compensation of our independent auditors.

The following table sets forth, for each of the years indicated, the aggregate fees billed by EY and the percentage of each of the fees out of the total amount paid to them:

| | | Year Ended December 31, | |

| | | 2017 | | | 2016 | |

| Services Rendered | | Fees (in Dollars) | | | Percentages | | | Fees (in Dollars) | | | Percentages | |

| | | | | | | | | | | | | |

| Audit Fees (1) | | $ | 229,600 | | | | 63 | % | | $ | 201,000 | | | | 79 | % |

| Audit-Related Fees (2) | | | 79,700 | | | | 22 | % | | | - | | | | - | |

| Tax Fees (3) | | | 49,500 | | | | 14 | % | | | 49,000 | | | | 19 | % |

| All Other Fees (4) | | | 1,900 | | | | 1 | % | | | 4,000 | | | | 2 | % |

| | | | | | | | | | | | | | | | | |

| Total | | $ | 360,700 | | | | 100 | % | | $ | 254,000 | | | | 100 | % |

| | (1) | Audit fees consist of fees for professional services rendered by our principal accountant for the audit of our consolidated annual financial statements, including the audit of our internal control over financial reporting, or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

| | (2) | Audit-related fees consist of (i) services performed by EY in connection with the public offering we conducted in December 2017 and (ii) consulting services in connection with the implementation of the New Revenue Standard. |

| | (3) | Tax fees relate to services performed by the tax division of EY for tax compliance, planning and advice, including a transfer pricing study. |

| | (4) | Other fees relate to advisory services performed by EY in connection with employee benefits and other employee related matters. |

The Proposed Resolution

It is therefore proposed that at the Meeting the following resolution be adopted:

“RESOLVED, that the reappointment of the Kost Forer Gabbay & Kasierer as independent auditors of the Company until immediately following the next annual general meeting of shareholders be, and it hereby is, approved, and that the Board of Directors be, and it hereby is, authorized to delegate to the Audit Committee of the Board the authority to fix the remuneration of said independent auditors in accordance with the volume and nature of their services.”

Required Vote

The affirmative vote of the holders of a majority of the voting power represented at the meeting, in person or by proxy, and voting on this matter, is required for the approval of this matter.

The Board of Directors recommends a vote FOR approval of the foregoing resolution.

REVIEW OF AUDITORS’ REPORT AND FINANCIAL STATEMENTS

At the Meeting, the Auditors’ Report and our audited Consolidated Financial Statements for the fiscal year ended December 31, 2017 will be presented for discussion, as required by the Companies Law. The said Auditors’ Report and Consolidated Financial Statements as well as our Annual Report may be viewed on our website – www.attunity.com or through the EDGAR website of the SEC at www.sec.gov.

Any shareholder may receive a copy of the said Annual Report, without charge, upon written request to the Company (attention: Mr. Dror Harel-Elkayam, Chief Financial Officer and Secretary). None of the Auditors’ Report, the Consolidated Financial Statements, the Annual Report and the contents of our website forms part of the proxy solicitation material.

This item will not involve a vote of the shareholders.

The Board of Directors currently knows of no other business to be transacted at the Meeting, other than as set forth in the Notice of 2018 Annual Meeting of Shareholders; but, if any other matter is properly presented at the Meeting, the persons named in the enclosed form of proxy will vote upon such matters in accordance with their best judgment.

SHAREHOLDER PROPOSALS FOR 2019 ANNUAL GENERAL MEETING

We currently expect that the agenda for our annual general meeting to be held in 2019 (the "2019 AGM") will include (1) the election (or reelection) of three directors; (2) the election (or reelection) of an external director; (3) the approval of the appointment (or reappointment) of the Company’s auditors; and (4) presentation and discussion of the financial statements of the Company for the year ended December 31, 2018 and the Auditors’ Report for this period.

Pursuant to Section 66(b) of the Companies Law, shareholders who hold at least 1% of our outstanding ordinary shares are generally allowed to submit a proper proposal for inclusion on the agenda of a general meeting of the Company's shareholders. Such eligible shareholders may present proper proposals for inclusion in, and for consideration at, the 2019 AGM by submitting their proposals in writing to our Corporate Secretary at the following address: Attunity Ltd., 16 Atir Yeda Street, Atir Yeda Industrial Park, Kfar Saba 4464321, Israel, Attention: Corporate Secretary.

For a shareholder proposal to be considered for inclusion in the 2019 AGM, our Corporate Secretary must receive the written proposal not less than 120 calendar days prior to the first anniversary of the AGM, i.e., no later than August 16, 2019; provided that if the date of the 2019 AGM is advanced by more than 30 calendar days prior to, or delayed (other than as a result of adjournment) by more than 30 calendar days after, the anniversary of the Meeting, proposal by the shareholder to be timely must be so delivered not later than the earlier of (i) the 7th calendar day following the day on which we call and provide notice of the 2019 AGM and (ii) the 14th calendar day following the day on which public disclosure of the date of such meeting is first made.