UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-07338

Capital World Growth and Income Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: November 30

Date of reporting period: May 31, 2013

Vincent P. Corti

Capital World Growth and Income Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

Copies to:

Kathryn A. Sanders

O’Melveny & Myers LLP

400 South Hope Street, 10th Floor

Los Angeles, California 90071

(Counsel for the Registrant)

ITEM 1 – Reports to Stockholders

Capital World Growth

and Income Fund®

Semi-annual report for the six months ended May 31, 2013

Capital World Growth and Income Fund seeks long-term growth of capital while providing current income. It invests on a global basis in a diversified portfolio consisting primarily of common stocks and other equity securities.

This fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 80 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 5.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended June 30, 2013 (the most recent calendar quarter-end):

| Class A shares | | 1 year | | | 5 years | | | 10 years | |

| | | | | | | | | | | | |

| Reflecting 5.75% maximum sales charge | | | 12.44% | | | | 1.69% | | | | 9.18% | |

For other share class results, see americanfunds.com and americanfundsretirement.com.

The total annual fund operating expense ratio was 0.82% for Class A shares as of the prospectus dated February 1, 2013.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

The fund’s 30-day yield for Class A shares as of June 30, 2013, reflecting the 5.75% maximum sales charge and calculated in accordance with the U.S. Securities and Exchange Commission formula, was 2.12%.

Investing outside the United States may be subject to risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Fellow investors:

Global stock markets surged during the first half of the fiscal year, supported by continued strength in the U.S. economy and aggressive monetary easing by Japan’s central bank.

For the six months ended May 31, 2013, Capital World Growth and Income Fund delivered a strong gain of 12.04%. That result assumes the reinvestment of quarterly dividends totaling 44 cents a share, reflecting an income return of 1.20%. Investors who took dividends in cash recorded the same return.

The fund finished the period ahead of its primary benchmark, the unmanaged MSCI All Country World Index. The index, which measures a broad range of developed- and developing-country stock markets, recorded an 11.72% total return for the six months ended May 31, 2013. However, the fund trailed the 14.46% gain of the Lipper Global Funds Index, a peer group measure.

The fund takes a long-term approach to global investing. As you can see in the table below, the fund compares favorably to its benchmarks over longer time frames.

Results at a glance

For periods ended May 31, 2013, with all distributions reinvested

| | | Total returns | | Average annual total returns |

| | | 1 year | | 5 years | | 10 years | | Lifetime

(since 3/26/93) |

| | | | | | | | | | | | | | | | |

| Capital World Growth and Income Fund (Class A shares) | | | 28.66 | % | | | 1.65 | % | | | 10.37 | % | | | 11.05 | % |

| MSCI All Country World Index* | | | 26.01 | | | | 1.16 | | | | 8.11 | | | | 7.14 | |

| Lipper Global Funds Index | | | 27.83 | | | | 1.68 | | | | 7.97 | | | | 7.27 | |

| * | The market index is unmanaged and, therefore, has no expenses. Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. |

| Capital World Growth and Income Fund | 1 |

The global investing environment

Most of the world’s equity markets advanced during the fiscal first half, with developed-country stocks generally exceeding developing-country stocks. Japan and the United States led most markets higher. Consumer discretionary companies, financials and industrials outpaced the broader market. More defensive areas of the market tended to lag, but the health care sector recorded the strongest returns of the period.

The U.S. budget picture has improved somewhat due primarily to stronger economic growth but also to automatic spending cuts resulting from Congress’s inability to agree on longer term budget reform. A number of indicators pointed to a strengthening U.S. economy. Both construction activity and home prices rose to multiyear highs during the period, signaling a turnaround in the housing market. Labor market conditions also improved somewhat, and in May consumer confidence rose to its highest level in five years. While the Federal Reserve held interest rates near zero, toward the end of the period Fed Chairman Ben Bernanke suggested that the central bank may begin to reduce the scope of its bond-buying programs.

Returns for most markets outside the U.S. were dampened slightly for U.S. investors by a strengthening dollar. Most notably, the dollar rose 22.4% versus the Japanese yen.

Japan’s stock market rose sharply as the country’s central bank announced aggressive monetary easing to help stave off deflation. In early 2013, newly elected Prime Minister Shinzo Abe proposed a number of economic reforms aimed at stimulating growth, and in April the country’s central bank pledged to double the monetary base over two years to achieve a 2% inflation target by 2015. Despite the weakening yen, the Japanese equity market gained 20.6%* on a dollar-adjusted basis.

In the 17-nation euro zone, economic activity declined at an annualized rate of 0.9% in the first quarter, and unemployment rose to a record 12.2% in April. In May, the European Central Bank (ECB) slashed its benchmark interest rate and ECB President Mario Draghi said the bank “stands ready to act if needed,” providing a further boost to investor confidence. Therefore, despite lackluster growth, European equities recorded solid gains. Stock markets in Germany and France, the euro zone’s two largest economies, rose 11.6% and 12.4%, respectively, in U.S. dollar terms. Likewise, struggling nations Portugal (14.2%), Greece (7.8%), Italy (6.0%) and Spain (5.8%) all advanced during the period.

In the developing markets, equity returns were mixed. China’s GDP growth decelerated during the period, raising concerns that the economy might be losing momentum. Leaders in Beijing are seeking a shift toward a more balanced economy driven more by domestic consumption. For the six months, China’s stock market rose 0.3%. Elsewhere, Brazil rose 1.0%, while India (–1.5%) and Russia (–1.9%) declined in U.S. dollar terms.

| * | Country returns are based on MSCI indexes, expressed in U.S. dollars (except where noted), and assume the reinvestment of dividends. Results reflect dividends net of withholding taxes. |

| 2 | Capital World Growth and Income Fund |

Where the fund’s assets were invested

Percent of net assets by country as of May 31, 2013

| | | Capital World Growth

and Income Fund | | MSCI All Country

World Index* |

| | | | | | | | | |

| Europe | | | 38.0 | % | | | 24.8 | % |

| Euro zone† | | | 15.9 | | | | 10.4 | |

| United Kingdom | | | 11.0 | | | | 8.0 | |

| Switzerland | | | 6.5 | | | | 3.3 | |

| Sweden | | | 3.2 | | | | 1.2 | |

| Russia | | | .8 | | | | .7 | |

| Other Europe | | | .6 | | | | 1.2 | |

| | | | | | | | | |

| The Americas | | | 37.5 | | | | 54.3 | |

| United States | | | 36.5 | | | | 48.1 | |

| Canada | | | .6 | | | | 3.8 | |

| Other Americas | | | .4 | | | | 2.4 | |

| | | | | | | | | |

| Asia/Pacific | | | 16.0 | | | | 19.9 | |

| Hong Kong | | | 3.8 | | | | 1.1 | |

| China | | | 2.2 | | | | 2.2 | |

| Japan | | | 2.1 | | | | 7.8 | |

| Australia | | | 2.0 | | | | 3.0 | |

| South Korea | | | 1.4 | | | | 1.7 | |

| Singapore | | | 1.4 | | | | .6 | |

| Thailand | | | 1.2 | | | | .3 | |

| Taiwan | | | 1.0 | | | | 1.4 | |

| Other Asia/Pacific | | | .9 | | | | 1.8 | |

| | | | | | | | | |

| Other | | | 1.2 | | | | 1.0 | |

| | | | | | | | | |

| Bonds, notes & other debt instruments, short-term securities & other assets less liabilities | | | 7.3 | | | | — | |

| | | | | | | | | |

| Total | | | 100.0 | % | | | 100.0 | % |

| * | The MSCI All Country World Index is weighted by market capitalization. |

| † | Countries using the euro as a common currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. |

| Capital World Growth and Income Fund | 3 |

Inside the portfolio

Despite having a relatively light exposure to U.S. and Japanese equities — two standout markets during the period — the fund delivered a strong gain partly due to favorable stock selection across a variety of areas. As we have often pointed out, the fund’s managers choose investments from the bottom up, focusing on individual businesses they believe represent superior value and have good long-term prospects.

Favorable stock selection among health care companies helped the fund’s investments in this area outpace the sector and the overall market. Medical device maker Boston Scientific Corp. (66.8%) and biotech company Gilead Sciences (45.3%), the fund’s No. 8 holding, registered exceptional gains. Other contributors were No. 4 holding Bayer (18.9%) and Novartis (15.8%), the fund’s top holding. (You can find a list of the fund’s top-10 holdings below.) One exception to this positive trend was Israel-based Teva Pharmaceutical Industries (–5.3%), which declined after investors grew concerned over the company’s strategy to repurpose existing drugs for new uses.

Elsewhere in the portfolio, select holdings in the consumer discretionary and information technology sectors also supported the fund’s solid return. Top contributors in the consumer discretionary area included specialty retailer Home Depot (20.9%), satellite television broadcaster DIRECTV (23.0%), and auto makers Renault (54.2%), General Motors (31.0%) and Daimler (29.8%). Information technology companies that had strong showings included Yahoo (40.1%), No. 7 holding Microsoft (31.0%) and electronic components maker Murata Manufacturing (33.9%).

Largest equity holdings

(as of May 31, 2013)

| Company | | Country | | Percent of

net assets | | 6-month

return |

| | | | | | | | | | | |

| Novartis | | Switzerland | | | 3.18 | % | | | 15.79 | % |

| Philip Morris International | | United States | | | 2.33 | | | | 1.15 | |

| Amgen | | United States | | | 2.03 | | | | 13.21 | |

| Bayer | | Germany | | | 1.94 | | | | 18.92 | |

| BP | | United Kingdom | | | 1.79 | | | | 3.51 | |

| Altria | | United States | | | 1.78 | | | | 6.77 | |

| Microsoft | | United States | | | 1.65 | | | | 31.03 | |

| Gilead Sciences | | United States | | | 1.34 | | | | 45.28 | |

| AbbVie | | United States | | | 1.18 | | | | — | * |

| ASSA ABLOY | | Sweden | | | 1.14 | | | | 10.20 | |

| * | Six-month return data unavailable for AbbVie, since the company was formed in January 2013 from a spinoff of Abbott Laboratories. |

| 4 | Capital World Growth and Income Fund |

Among the holdings detracting from results were Brazilian steel maker Usinas Sider Minas (–29.0%), Light SA (–26.9%) and U.K. power generator Aggreko (–24.5%). Tobacco maker Philip Morris International (1.2%), the fund’s second-largest holding, and oil company BP (3.5%) also held back the fund’s overall result on a relative basis.

A look ahead

Looking forward, we see reasons for optimism. The U.S. economy continues to make progress, and the changes in policy direction in Japan could benefit both Japan and the overall global economy. It remains to be seen, however, whether Japanese lawmakers will follow through with proposed structural reforms. Likewise, there have been some early indications that the euro zone is on the mend. However, a number of European economies remain in recession and further fiscal and economic adjustments must be made.

As always, we will rely on a research-driven approach to seek out companies that we believe have the potential to contribute to the fund’s growth-and-income objectives over the long term.

We are grateful for your support and look forward to reporting back to you at the end of the fiscal year.

Cordially,

|  |

| Michael Thawley | Mark E. Denning |

| Vice Chairman of the Board | President |

July 11, 2013

For current information about the fund, visit americanfunds.com.

| Capital World Growth and Income Fund | 5 |

| Summary investment portfolio May 31, 2013 | unaudited |

The following summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

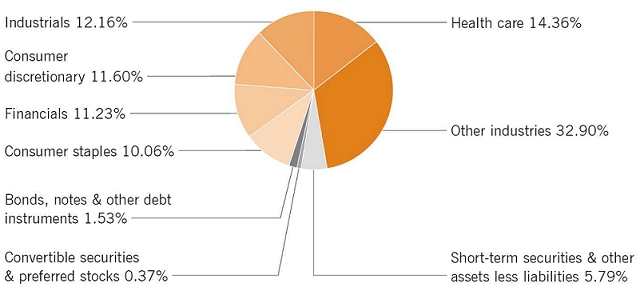

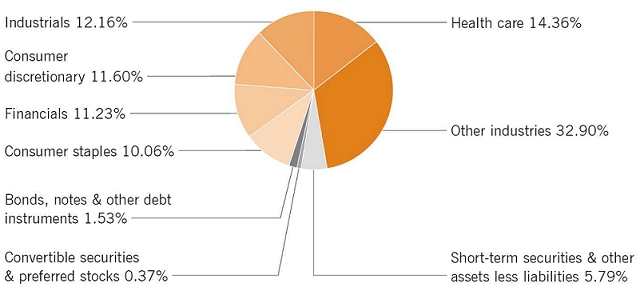

| Industry sector diversification | Percent of net assets |

| Country diversification | | Percent of

net assets |

| United States | | | 36.5 | % |

| Euro zone* | | | 15.9 | |

| United Kingdom | | | 11.0 | |

| Switzerland | | | 6.5 | |

| Hong Kong | | | 3.8 | |

| Sweden | | | 3.2 | |

| China | | | 2.2 | |

| Japan | | | 2.1 | |

| Australia | | | 2.0 | |

| South Korea | | | 1.4 | |

| Other countries | | | 8.1 | |

| Bonds, notes & other debt instruments, short-term securities & other assets less liabilities | | | 7.3 | |

| * | Countries using the euro as a common currency; those represented in the fund’s portfolio are Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. |

| 6 | Capital World Growth and Income Fund |

| Common stocks — 92.31% | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Health care — 14.36% | | | | | | | | | | | | |

| Novartis AG1 | | | 33,907,063 | | | $ | 2,429,635 | | | | 3.18 | % |

| Amgen Inc. | | | 15,435,458 | | | | 1,551,727 | | | | 2.03 | |

| Bayer AG1 | | | 13,831,026 | | | | 1,487,797 | | | | 1.94 | |

| Gilead Sciences, Inc.2 | | | 18,860,000 | | | | 1,027,493 | | | | 1.34 | |

| AbbVie Inc. | | | 21,085,700 | | | | 900,148 | | | | 1.18 | |

| Teva Pharmaceutical Industries Ltd. (ADR) | | | 16,498,000 | | | | 630,224 | | | | .82 | |

| Roche Holding AG1 | | | 2,014,000 | | | | 498,345 | | | | .65 | |

| Other securities | | | | | | | 2,460,627 | | | | 3.22 | |

| | | | | | | | 10,985,996 | | | | 14.36 | |

| | | | | | | | | | | | | |

| Industrials — 12.16% | | | | | | | | | | | | |

| ASSA ABLOY AB, Class B1 | | | 21,821,007 | | | | 869,911 | | | | 1.14 | |

| KONE Oyj, Class B1 | | | 6,185,000 | | | | 543,725 | | | | .71 | |

| AB Volvo, Class B1 | | | 34,899,080 | | | | 509,143 | | | | .67 | |

| Jardine Matheson Holdings Ltd.1 | | | 7,748,000 | | | | 507,958 | | | | .66 | |

| United Parcel Service, Inc., Class B | | | 5,200,000 | | | | 446,680 | | | | .58 | |

| General Electric Co. | | | 17,500,000 | | | | 408,100 | | | | .53 | |

| Other securities | | | | | | | 6,017,099 | | | | 7.87 | |

| | | | | | | | 9,302,616 | | | | 12.16 | |

| | | | | | | | | | | | | |

| Consumer discretionary — 11.60% | | | | | | | | | | | | |

| Home Depot, Inc. | | | 11,038,800 | | | | 868,312 | | | | 1.14 | |

| General Motors Co.2 | | | 17,711,450 | | | | 600,241 | | | | .78 | |

| DIRECTV2 | | | 8,313,000 | | | | 508,174 | | | | .66 | |

| Renault SA1 | | | 6,291,861 | | | | 485,136 | | | | .63 | |

| Amazon.com, Inc.2 | | | 1,762,600 | | | | 474,192 | | | | .62 | |

| SJM Holdings Ltd.1 | | | 157,031,000 | | | | 427,248 | | | | .56 | |

| Other securities | | | | | | | 5,507,365 | | | | 7.21 | |

| | | | | | | | 8,870,668 | | | | 11.60 | |

| | | | | | | | | | | | | |

| Financials — 11.23% | | | | | | | | | | | | |

| Société Générale1 | | | 14,946,365 | | | | 592,533 | | | | .77 | |

| AIA Group Ltd.1 | | | 112,663,396 | | | | 497,189 | | | | .65 | |

| Prudential PLC1 | | | 29,306,500 | | | | 493,922 | | | | .65 | |

| Other securities | | | | | | | 7,003,507 | | | | 9.16 | |

| | | | | | | | 8,587,151 | | | | 11.23 | |

| Capital World Growth and Income Fund | 7 |

| Common stocks | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Consumer staples — 10.06% | | | | | | | | | | | | |

| Philip Morris International Inc. | | | 19,606,300 | | | $ | 1,782,409 | | | | 2.33 | % |

| Altria Group, Inc. | | | 37,619,300 | | | | 1,358,057 | | | | 1.78 | |

| Pernod Ricard SA1 | | | 5,085,210 | | | | 610,663 | | | | .80 | |

| Wesfarmers Ltd.1 | | | 16,071,520 | | | | 601,344 | | | | .79 | |

| Nestlé SA1 | | | 7,310,030 | | | | 482,366 | | | | .63 | |

| Anheuser-Busch InBev NV1 | | | 5,223,383 | | | | 481,490 | | | | .63 | |

| Lorillard, Inc. | | | 11,049,353 | | | | 468,935 | | | | .61 | |

| Other securities | | | | | | | 1,914,049 | | | | 2.49 | |

| | | | | | | | 7,699,313 | | | | 10.06 | |

| | | | | | | | | | | | | |

| Information technology — 7.19% | | | | | | | | | | | | |

| Microsoft Corp. | | | 36,085,019 | | | | 1,258,645 | | | | 1.65 | |

| Samsung Electronics Co. Ltd.1 | | | 515,800 | | | | 695,595 | | | | .91 | |

| Oracle Corp. | | | 13,337,000 | | | | 450,257 | | | | .59 | |

| Google Inc., Class A2 | | | 490,829 | | | | 427,222 | | | | .56 | |

| Automatic Data Processing, Inc. | | | 6,040,000 | | | | 415,069 | | | | .54 | |

| Other securities | | | | | | | 2,253,171 | | | | 2.94 | |

| | | | | | | | 5,499,959 | | | | 7.19 | |

| | | | | | | | | | | | | |

| Telecommunication services — 6.67% | | | | | | | | | | | | |

| SOFTBANK CORP.1 | | | 14,920,000 | | | | 746,256 | | | | .98 | |

| Verizon Communications Inc. | | | 15,119,500 | | | | 732,993 | | | | .96 | |

| Vodafone Group PLC1 | | | 216,977,500 | | | | 628,792 | | | | | |

| Vodafone Group PLC (ADR) | | | 1,120,000 | | | | 32,424 | | | | .86 | |

| AT&T Inc. | | | 15,110,000 | | | | 528,699 | | | | .69 | |

| TeliaSonera AB1 | | | 70,557,215 | | | | 469,916 | | | | .61 | |

| CenturyLink, Inc. | | | 13,456,000 | | | | 459,523 | | | | .60 | |

| Other securities | | | | | | | 1,504,443 | | | | 1.97 | |

| | | | | | | | 5,103,046 | | | | 6.67 | |

| | | | | | | | | | | | | |

| Energy — 5.17% | | | | | | | | | | | | |

| BP PLC1 | | | 191,653,213 | | | | 1,371,822 | | | | 1.79 | |

| Eni SpA1 | | | 18,245,300 | | | | 412,571 | | | | | |

| Eni SpA (ADR) | | | 253,148 | | | | 11,470 | | | | .55 | |

| Other securities | | | | | | | 2,157,458 | | | | 2.83 | |

| | | | | | | | 3,953,321 | | | | 5.17 | |

| 8 | Capital World Growth and Income Fund |

| Common stocks | | Shares | | | Value

(000) | | | Percent of

net assets | |

| Utilities — 4.78% | | | | | | | | | | | | |

| National Grid PLC1 | | | 62,148,492 | | | $ | 735,297 | | | | .96 | % |

| PT Perusahaan Gas Negara (Persero) Tbk1 | | | 836,821,500 | | | | 468,993 | | | | .61 | |

| SSE PLC1 | | | 18,545,336 | | | | 433,651 | | | | .57 | |

| Other securities | | | | | | | 2,015,880 | | | | 2.64 | |

| | | | | | | | 3,653,821 | | | | 4.78 | |

| | | | | | | | | | | | | |

| Materials — 4.30% | | | | | | | | | | | | |

| Dow Chemical Co. | | | 16,047,000 | | | | 552,980 | | | | .72 | |

| BASF SE1 | | | 4,429,000 | | | | 432,773 | | | | .57 | |

| Other securities | | | | | | | 2,301,069 | | | | 3.01 | |

| | | | | | | | 3,286,822 | | | | 4.30 | |

| | | | | | | | | | | | | |

| Miscellaneous — 4.79% | | | | | | | | | | | | |

| Other common stocks in initial period of acquisition | | | | | | | 3,667,692 | | | | 4.79 | |

| | | | | | | | | | | | | |

| Total common stocks (cost: $53,131,151,000) | | | | | | | 70,610,405 | | | | 92.31 | |

| | | | | | | | | | | | | |

| Preferred stocks — 0.01% | | | | | | | | | | | | |

| Financials — 0.01% | | | | | | | | | | | | |

| Other securities | | | | | | | 10,274 | | | | .01 | |

| | | | | | | | | | | | | |

| Total preferred stocks (cost: $9,150,000) | | | | | | | 10,274 | | | | .01 | |

| | | | | | | | | | | | | |

| Convertible securities — 0.36% | | | | | | | | | | | | |

| Other — 0.32% | | | | | | | | | | | | |

| Other securities | | | | | | | 245,853 | | | | .32 | |

| | | | | | | | | | | | | |

| Miscellaneous — 0.04% | | | | | | | | | | | | |

| Other convertible securities in initial period of acquisition | | | | | | | 31,423 | | | | .04 | |

| | | | | | | | | | | | | |

| Total convertible securities (cost: $232,941,000) | | | | | | | 277,276 | | | | .36 | |

| Capital World Growth and Income Fund | 9 |

Bonds, notes & other debt

instruments — 1.53% | | Principal amount

(000) | | | Value

(000) | | | Percent of

net assets | |

| Energy — 0.02% | | | | | | | | | | | | |

| BP Capital Markets PLC 3.875%–5.25% 2013–2015 | | $ | 10,655 | | | $ | 11,127 | | | | .02 | % |

| | | | | | | | | | | | | |

| Other — 1.51% | | | | | | | | | | | | |

| Other securities | | | | | | | 1,158,015 | | | | 1.51 | |

| | | | | | | | | | | | | |

Total bonds, notes & other debt instruments

(cost: $1,018,898,000) | | | | | | | 1,169,142 | | | | 1.53 | |

| | | | | | | | | | | | | |

| Short-term securities — 5.36% | | | | | | | | | | | | |

| Freddie Mac 0.075%–0.17% due 7/15/2013–4/9/2014 | | | 1,185,175 | | | | 1,184,607 | | | | 1.55 | |

| Fannie Mae 0.11%–0.15% due 7/24/2013–3/3/2014 | | | 665,900 | | | | 665,611 | | | | .87 | |

| Federal Home Loan Bank 0.075%–0.155% due 6/7/2013–1/6/2014 | | | 434,600 | | | | 434,489 | | | | .57 | |

| Other securities | | | | | | | 1,818,444 | | | | 2.37 | |

| | | | | | | | | | | | | |

| Total short-term securities (cost: $4,102,755,000) | | | | | | | 4,103,151 | | | | 5.36 | |

| Total investment securities (cost: $58,494,895,000) | | | | | | | 76,170,248 | | | | 99.57 | |

| Other assets less liabilities | | | | | | | 325,089 | | | | .43 | |

| | | | | | | | | | | | | |

| Net assets | | | | | | $ | 76,495,337 | | | | 100.00 | % |

“As permitted by U.S. Securities and Exchange Commission regulations, “Miscellaneous” securities include holdings in their first year of acquisition that have not previously been publicly disclosed.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio. Some of these securities (with an aggregate value of $1,395,945,000, which represented 1.82% of the net assets of the fund) were acquired in transactions exempt from registration under Rule 144A or section 4(2) of the Securities Act of 1933 and may be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers.

Forward currency contracts

The fund has entered into forward currency contracts to sell currencies as shown in the following table. The open forward currency contracts shown are generally indicative of the level of activity over the prior 12-month period.

| | | | | | | Contract amount | | Unrealized

appreciation

(depreciation) | |

| | | Settlement date | | Counterparty | | Receive

(000) | | Deliver

(000) | | at 5/31/2013

(000) | |

| Sales: | | | | | | | | | | | | |

| Australian dollars | | 6/18/2013 | | Barclays Bank PLC | | $75,796 | | A$78,000 | | | $1,246 | |

| Australian dollars | | 6/18/2013 | | Barclays Bank PLC | | $141,224 | | A$139,000 | | | 8,373 | |

| British pounds | | 6/28/2013 | | UBS AG | | $105,780 | | £69,924 | | | (441 | ) |

| Euros | | 6/28/2013 | | Bank of America, N.A. | | $109,515 | | €84,800 | | | (720 | ) |

| Japanese yen | | 7/3/2013 | | Bank of New York Mellon | | $101,655 | | ¥10,242,554 | | | (321 | ) |

| | | | | | | | | | | | $8,137 | |

| 10 | Capital World Growth and Income Fund |

Investments in affiliates

A company is considered to be an affiliate of the fund under the Investment Company Act of 1940 if the fund’s holdings in that company represent 5% or more of the outstanding voting shares. The value of the fund’s holdings in affiliated companies is included in “Other securities” under the respective industry sectors in the summary investment portfolio. Further details on these holdings and related transactions during the six months ended May 31, 2013, appear below.

| | | Beginning

shares | | | Additions | | | Reductions | | | Ending

shares | | | Dividend

income

(000) | | | Value of

affiliates at

5/31/2013

(000) | |

| ComfortDelGro Corp. Ltd.1 | | | 135,100,000 | | | | — | | | | — | | | | 135,100,000 | | | $ | 3,828 | | | $ | 199,151 | |

| Qantas Airways Ltd.1,2 | | | 125,158,600 | | | | — | | | | — | | | | 125,158,600 | | | | — | | | | 189,437 | |

| | | | | | | | | | | | | | | | | | | $ | 3,828 | | | $ | 388,588 | |

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| 1 | Valued under fair value procedures adopted by authority of the board of trustees. The total value of all such securities, including those in “Miscellaneous” and “Other securities,” was $40,678,782,000, which represented 53.18% of the net assets of the fund. This entire amount relates to certain securities trading outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading. |

| 2 | Security did not produce income during the last 12 months. |

Key to abbreviation and symbols

ADR = American Depositary Receipts

A$ = Australian dollars

€ = Euros

£ = British pounds

¥ = Japanese yen

See Notes to Financial Statements

| Capital World Growth and Income Fund | 11 |

Financial statements

| Statement of assets and liabilities | | unaudited | |

| at May 31, 2013 | | (dollars in thousands) | |

| | | | |

| Assets: | | | | | | | | |

| Investment securities, at value: | | | | | | | | |

| Unaffiliated issuers (cost: $58,073,177) | | $ | 75,781,660 | | | | | |

| Affiliated issuers (cost: $421,718) | | | 388,588 | | | $ | 76,170,248 | |

| Cash denominated in currencies other than U.S. dollars (cost: $16,399) | | | | | | | 16,399 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 9,619 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | | 194,248 | | | | | |

| Sales of fund’s shares | | | 74,503 | | | | | |

| Closed forward currency contracts | | | 3,348 | | | | | |

| Dividends and interest | | | 314,183 | | | | 586,282 | |

| | | | | | | | 76,782,548 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 1,482 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 128,665 | | | | | |

| Repurchases of fund’s shares | | | 78,992 | | | | | |

| Investment advisory services | | | 24,960 | | | | | |

| Services provided by related parties | | | 47,106 | | | | | |

| Trustees’ deferred compensation | | | 1,225 | | | | | |

| Bank overdraft | | | 4,022 | | | | | |

| Other | | | 759 | | | | 285,729 | |

| Net assets at May 31, 2013 | | | | | | $ | 76,495,337 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 69,947,839 | |

| Undistributed net investment income | | | | | | | 738,951 | |

| Accumulated net realized loss | | | | | | | (11,872,889 | ) |

| Net unrealized appreciation | | | | | | | 17,681,436 | |

| Net assets at May 31, 2013 | | | | | | $ | 76,495,337 | |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (1,882,334 total shares outstanding)

| | | | | | Shares | | | Net asset | |

| | | Net assets | | | outstanding | | | value per share | |

| Class A | | $ | 50,067,042 | | | | 1,230,224 | | | $ | 40.70 | |

| Class B | | | 1,282,393 | | | | 31,699 | | | | 40.46 | |

| Class C | | | 4,583,462 | | | | 113,839 | | | | 40.26 | |

| Class F-1 | | | 3,587,781 | | | | 88,317 | | | | 40.62 | |

| Class F-2 | | | 2,165,020 | | | | 53,207 | | | | 40.69 | |

| Class 529-A | | | 2,571,919 | | | | 63,371 | | | | 40.58 | |

| Class 529-B | | | 109,576 | | | | 2,709 | | | | 40.45 | |

| Class 529-C | | | 647,238 | | | | 16,025 | | | | 40.39 | |

| Class 529-E | | | 110,294 | | | | 2,722 | | | | 40.52 | |

| Class 529-F-1 | | | 89,285 | | | | 2,198 | | | | 40.62 | |

| Class R-1 | | | 281,555 | | | | 6,981 | | | | 40.33 | |

| Class R-2 | | | 1,217,170 | | | | 30,245 | | | | 40.24 | |

| Class R-3 | | | 2,498,920 | | | | 61,774 | | | | 40.45 | |

| Class R-4 | | | 2,315,817 | | | | 57,024 | | | | 40.61 | |

| Class R-5 | | | 1,500,956 | | | | 36,860 | | | | 40.72 | |

| Class R-6 | | | 3,466,909 | | | | 85,139 | | | | 40.72 | |

See Notes to Financial Statements

| 12 | Capital World Growth and Income Fund |

| Statement of operations | | unaudited | |

| for the six months ended May 31, 2013 | | (dollars in thousands) | |

| | | | | | | |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of non-U.S. taxes of $89,405; also includes $3,828 from affiliates) | | $ | 1,208,606 | | | | | |

| Interest (net of non-U.S. taxes of $19) | | | 40,450 | | | $ | 1,249,056 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 139,121 | | | | | |

| Distribution services | | | 113,352 | | | | | |

| Transfer agent services | | | 54,683 | | | | | |

| Administrative services | | | 8,395 | | | | | |

| Reports to shareholders | | | 2,212 | | | | | |

| Registration statement and prospectus | | | 410 | | | | | |

| Trustees’ compensation | | | 357 | | | | | |

| Auditing and legal | | | 101 | | | | | |

| Custodian | | | 3,755 | | | | | |

| State and local taxes | | | 257 | | | | | |

| Other | | | 1,878 | | | | 324,521 | |

| Net investment income | | | | | | | 924,535 | |

| | | | | | | | | |

| Net realized gain and unrealized appreciation on investments, forward currency contracts and currency: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments (net of non-U.S. taxes of $62) | | | 2,736,329 | | | | | |

| Forward currency contracts | | | (11,638 | ) | | | | |

| Currency transactions | | | (9,790 | ) | | | 2,714,901 | |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 4,635,427 | | | | | |

| Forward currency contracts | | | 23,124 | | | | | |

| Currency translations | | | (428 | ) | | | 4,658,123 | |

| Net realized gain and unrealized appreciation on investments, forward currency contracts and currency | | | | | | | 7,373,024 | |

| | | | | | | | | |

| Net increase in net assets resulting from operations | | | | | | $ | 8,297,559 | |

*Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements.

See Notes to Financial Statements

| Capital World Growth and Income Fund | 13 |

Statements of changes in net assets

(dollars in thousands)

| | | Six months ended | | | Year ended | |

| | | May 31, 2013* | | | November 30, 2012 | |

| | | | | | | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 924,535 | | | $ | 1,677,355 | |

| Net realized gain on investments, forward currency contracts and currency transactions | | | 2,714,901 | | | | 278,665 | |

| Net unrealized appreciation on investments, forward currency contracts and currency translations | | | 4,658,123 | | | | 8,262,865 | |

| Net increase in net assets resulting from operations | | | 8,297,559 | | | | 10,218,885 | |

| | | | | | | | | |

| Dividends paid to shareholders from net investment income | | | (809,995 | ) | | | (1,889,680 | ) |

| | | | | | | | | |

| Net capital share transactions | | | (1,147,701 | ) | | | (6,354,159 | ) |

| | | | | | | | | |

| Total increase in net assets | | | 6,339,863 | | | | 1,975,046 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 70,155,474 | | | | 68,180,428 | |

| End of period (including undistributed net investment income: $738,951 and $624,411, respectively) | | $ | 76,495,337 | | | $ | 70,155,474 | |

|

*Unaudited.

See Notes to Financial Statements

| 14 | Capital World Growth and Income Fund |

| Notes to financial statements | unaudited |

1. Organization

Capital World Growth and Income Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks long-term growth of capital while providing current income. It invests on a global basis in a diversified portfolio consisting primarily of common stocks and other equity securities. Effective February 1, 2013, the fund reorganized from a Maryland corporation to a Delaware statutory trust in accordance with a proposal approved by shareholders on November 24, 2009.

The fund has 16 share classes consisting of five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2), five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E and 529-F-1) and six retirement plan share classes (Classes R-1, R-2, R-3, R-4, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are further described below:

| Share class | | Initial sales

charge | | Contingent deferred sales

charge upon redemption | | Conversion feature | |

| Classes A and 529-A | | Up to 5.75% | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | | None | |

| Classes B and 529-B* | | None | | Declines from 5% to 0% for redemptions within six years of purchase | | Classes B and 529-B convert to Classes A and 529-A, respectively, after eight years | |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years | |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None | |

| Class 529-E | | None | | None | | None | |

| Classes F-1, F-2 and 529-F-1 | | None | | None | | None | |

| Classes R-1, R-2, R-3, R-4, R-5 and R-6 | | None | | None | | None | |

* Class B and 529-B shares of the fund are not available for purchase.

Holders of all share classes have equal pro rata rights to assets, dividends and liquidation proceeds. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, administrative and shareholder services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

| Capital World Growth and Income Fund | 15 |

2. Significant accounting policies

The financial statements have been prepared to comply with accounting principles generally accepted in the United States of America. These principles require management to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. The fund follows the significant accounting policies described below, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, administrative and shareholder services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. On the accompanying financial statements, the effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by accounting principles generally accepted in the United States of America. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

| 16 | Capital World Growth and Income Fund |

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities purchased with more than 60 days left to maturity, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

Corporate bonds & notes;

convertible securities | Standard inputs and underlying equity of the issuer

|

Bonds & notes of governments &

government agencies | Standard inputs and interest rate volatilities

|

| Mortgage-backed; asset-backed obligations | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or not deemed to be representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described above for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. Short-term securities purchased within

| Capital World Growth and Income Fund | 17 |

60 days to maturity are valued at amortized cost, which approximates fair value. The value of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to par when they reach 60 days. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described below. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

| 18 | Capital World Growth and Income Fund |

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following tables present the fund’s valuation levels as of May 31, 2013 (dollars in thousands):

| | | Investment securities | |

| | | Level 1 | | | Level 2* | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Common stocks: | | | | | | | | | | | | | | | | |

| Health care | | $ | 5,777,905 | | | $ | 5,208,091 | | | $ | — | | | $ | 10,985,996 | |

| Industrials | | | 3,815,600 | | | | 5,487,016 | | | | — | | | | 9,302,616 | |

| Consumer discretionary | | | 4,163,551 | | | | 4,707,117 | | | | — | | | | 8,870,668 | |

| Financials | | | 1,461,183 | | | | 7,125,968 | | | | — | | | | 8,587,151 | |

| Consumer staples | | | 4,368,852 | | | | 3,330,461 | | | | — | | | | 7,699,313 | |

| Information technology | | | 3,670,018 | | | | 1,829,941 | | | | — | | | | 5,499,959 | |

| Telecommunication services | | | 2,289,817 | | | | 2,813,229 | | | | — | | | | 5,103,046 | |

| Energy | | | 1,279,345 | | | | 2,673,976 | | | | — | | | | 3,953,321 | |

| Utilities | | | 835,847 | | | | 2,817,974 | | | | — | | | | 3,653,821 | |

| Materials | | | 931,106 | | | | 2,355,716 | | | | — | | | | 3,286,822 | |

| Miscellaneous | | | 1,336,649 | | | | 2,331,043 | | | | — | | | | 3,667,692 | |

| Preferred stocks | | | — | | | | 10,274 | | | | — | | | | 10,274 | |

| Convertible securities | | | 91,520 | | | | 185,756 | | | | — | | | | 277,276 | |

| Bonds, notes & other debt instruments | | | — | | | | 1,169,142 | | | | — | | | | 1,169,142 | |

| Short-term securities | | | — | | | | 4,103,151 | | | | — | | | | 4,103,151 | |

| Total | | $ | 30,021,393 | | | $ | 46,148,855 | | | $ | — | | | $ | 76,170,248 | |

| | | Other investments† | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Unrealized appreciation on open forward currency contracts | | $ | — | | | $ | 9,619 | | | $ | — | | | $ | 9,619 | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | — | | | | (1,482 | ) | | | — | | | | (1,482 | ) |

| Total | | $ | — | | | $ | 8,137 | | | $ | — | | | $ | 8,137 | |

| * | Securities with a market value of $37,813,082,000, which represented 49.43% of the net assets of the fund, transferred from Level 1 to Level 2 since the prior fiscal year-end, primarily due to significant market movements following the close of local trading. |

| † | Forward currency contracts are not included in the investment portfolio. |

| Capital World Growth and Income Fund | 19 |

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline due to market conditions and other factors, including those directly involving the issuers of securities held by the fund.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations outside the U.S., may lose value because of adverse political, social, economic or market developments in the countries or regions in which the issuer operates. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different settlement and accounting practices and different regulatory, legal and reporting standards, and may be more difficult to value, than those in the U.S. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Investing in emerging markets — Investing in emerging markets may involve risks in addition to and greater than those generally associated with investing in developed countries. For instance, developing countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Additionally, there may be increased settlement risks for transactions in local securities.

Investing in growth-oriented stocks — Growth-oriented stocks may involve larger price swings and greater potential for loss than other types of investments.

Investing in income-oriented stocks — Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses employed by the investment adviser in this process may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

| 20 | Capital World Growth and Income Fund |

5. Certain investment techniques

Forward currency contracts — The fund has entered into forward currency contracts, which represent agreements to exchange currencies on specific future dates at predetermined rates. The fund’s investment adviser uses forward currency contracts to manage the fund’s exposure to changes in exchange rates. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from possible movements in exchange rates.

On a daily basis, the fund’s investment adviser values forward currency contracts based on the applicable exchange rates and records unrealized appreciation or depreciation for open forward currency contracts in the fund’s statement of assets and liabilities. Realized gains or losses are recorded at the time the forward currency contract is closed or offset by another contract with the same broker for the same settlement date and currency. Closed forward currency contracts that have not reached their settlement date are included in the respective receivables or payables for closed forward currency contracts in the fund’s statement of assets and liabilities. Net realized gains or losses from closed forward currency contracts and net unrealized appreciation or depreciation from open forward currency contracts are recorded in the fund’s statement of operations.

Collateral — To reduce the risk to counterparties of forward currency contracts, the fund has entered into a collateral program with certain counterparties. The program calls for the fund to either receive or pledge collateral based on the net gain or loss on unsettled forward currency contracts by counterparty. The purpose of the collateral is to cover potential losses that could occur in the event that either party cannot meet its contractual obligations.

6. Taxation and distributions

Federal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended May 31, 2013, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any interest or penalties.

The fund is not subject to examination by U.S. federal tax authorities for tax years before 2008, by state tax authorities for tax years before 2007 and by tax authorities outside the U.S. for tax years before 2006.

| Capital World Growth and Income Fund | 21 |

Non-U.S. taxation — Dividend and interest income are recorded net of non-U.S. taxes paid. Gains realized by the fund on the sale of securities in certain countries are subject to non-U.S. taxes. The fund records a liability based on unrealized gains to provide for potential non-U.S. taxes payable upon the sale of these securities.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; unrealized appreciation of certain investments in securities outside the U.S.; and net capital losses. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the fund for financial reporting purposes.

The components of distributable earnings on a tax basis are reported as of the fund’s most recent year-end. As of November 30, 2012, the components of distributable earnings on a tax basis were as follows (dollars in thousands):

| Undistributed ordinary income | | | | | | $ | 857,091 | |

| Capital loss carryforward*: | | | | | | | | |

| No expiration | | $ | (66,897 | ) | | | | |

| Expiring 2016 | | | (1,291,317 | ) | | | | |

| Expiring 2017 | | | (13,178,426 | ) | | | (14,536,640 | ) |

| * | The capital loss carryforward will be used to offset any capital gains realized by the fund in the current year or in subsequent years through the expiration dates. The fund will not make distributions from capital gains while a capital loss carryforward remains. |

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized after November 30, 2011, may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

As of May 31, 2013, the tax basis unrealized appreciation (depreciation) and cost of investment securities were as follows (dollars in thousands):

| Gross unrealized appreciation on investment securities | | $ | 20,087,737 | |

| Gross unrealized depreciation on investment securities | | | (2,704,529 | ) |

| Net unrealized appreciation on investment securities | | | 17,383,208 | |

| Cost of investment securities | | | 58,787,040 | |

| 22 | Capital World Growth and Income Fund |

Tax-basis distributions paid to shareholders from ordinary income were as follows (dollars in thousands):

| | | Six months ended | | | Year ended | |

| Share class | | May 31, 2013 | | | November 30, 2012 | |

| Class A | | $ | 549,628 | | | $ | 1,295,073 | |

| Class B | | | 10,725 | | | | 33,659 | |

| Class C | | | 34,360 | | | | 93,351 | |

| Class F-1 | | | 37,996 | | | | 95,614 | |

| Class F-2 | | | 25,198 | | | | 44,923 | |

| Class 529-A | | | 26,819 | | | | 59,493 | |

| Class 529-B | | | 813 | | | | 2,434 | |

| Class 529-C | | | 4,482 | | | | 11,059 | |

| Class 529-E | | | 1,037 | | | | 2,364 | |

| Class 529-F-1 | | | 1,011 | | | | 2,111 | |

| Class R-1 | | | 2,206 | | | | 6,013 | |

| Class R-2 | | | 9,695 | | | | 24,066 | |

| Class R-3 | | | 24,574 | | | | 57,429 | |

| Class R-4 | | | 25,644 | | | | 57,655 | |

| Class R-5 | | | 18,738 | | | | 41,232 | |

| Class R-6 | | | 37,069 | | | | 63,204 | |

| Total | | $ | 809,995 | | | $ | 1,889,680 | |

7. Fees and transactions with related parties

CRMC, the fund’s investment adviser, is the parent company of American Funds Distributors,® Inc. (“AFD”), the principal underwriter of the fund’s shares, and American Funds Service Company® (“AFS”), the fund’s transfer agent. CRMC, AFD and AFS are considered related parties to the fund.

Investment advisory services — The fund has an investment advisory and service agreement with CRMC that provides for monthly fees accrued daily. These fees are based on a series of decreasing annual rates beginning with 0.600% on the first $500 million of daily net assets and decreasing to 0.350% on such assets in excess of $115 billion. For the six months ended May 31, 2013, the investment advisory services fee was $139,121,000, which was equivalent to an annualized rate of 0.377% of average daily net assets.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are described below:

Distribution services — The fund has plans of distribution for all share classes, except Class F-2, R-5 and R-6 shares. Under the plans, the board of trustees approves

| Capital World Growth and Income Fund | 23 |

certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.30% to 1.00% as noted below. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes with a plan may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

For Class A and 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. These share classes reimburse AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limit of 0.30% is not exceeded. As of May 31, 2013, there were no unreimbursed expenses subject to reimbursement for Class A or 529-A shares.

| | Share class | | Currently approved limits | | Plan limits | |

| | Class A | | 0.30% | | 0.30% | |

| | Class 529-A | | | 0.30 | | | | 0.50 | | |

| | Classes B and 529-B | | | 1.00 | | | | 1.00 | | |

| | Classes C, 529-C and R-1 | | | 1.00 | | | | 1.00 | | |

| | Class R-2 | | | 0.75 | | | | 1.00 | | |

| | Classes 529-E and R-3 | | | 0.50 | | | | 0.75 | | |

| | Classes F-1, 529-F-1 and R-4 | | | 0.25 | | | | 0.50 | | |

| | Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFS for providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders. |

| | |

| | Administrative services — The fund has an administrative services agreement with CRMC under which the fund compensates CRMC for providing administrative services to Class A, C, F, 529 and R shares. These services include, but are not limited to, coordinating, monitoring, assisting and overseeing third parties that provide services to fund shareholders. Under the agreement, Class A shares pay an annual fee of 0.01% and Class C, F, 529 and R shares pay an annual fee of 0.05% of their respective average daily net assets. |

| | |

| | 529 plan services — Each 529 share class is subject to service fees to compensate |

| 24 | Capital World Growth and Income Fund |

| | the Commonwealth of Virginia for the maintenance of the 529 college savings plan. The quarterly fee is based on a series of decreasing annual rates beginning with 0.10% on the first $30 billion of the net assets invested in Class 529 shares of the American Funds and decreasing to 0.06% on such assets between $120 billion and $150 billion. The fee for any given calendar quarter is accrued and calculated on the basis of the average net assets of Class 529 shares of the American Funds for the last month of the prior calendar quarter. The fee is included in other expenses on the accompanying financial statements. The Commonwealth of Virginia is not considered a related party. |

| | |

| | Class-specific expenses under the agreements described above for the six months ended May 31, 2013, were as follows (dollars in thousands): |

| | Share class | | Distribution

services | | Transfer agent

services | | Administrative

services | | 529 plan

services |

| | Class A | | | $58,540 | | | | $39,294 | | | | $2,423 | | | Not applicable |

| | Class B | | | 6,828 | | | | 1,193 | | | | Not applicable | | | Not applicable |

| | Class C | | | 22,484 | | | | 3,702 | | | | 1,127 | | | Not applicable |

| | Class F-1 | | | 4,230 | | | | 2,136 | | | | 851 | | | Not applicable |

| | Class F-2 | | | Not applicable | | | | 860 | | | | 505 | | | Not applicable |

| | Class 529-A | | | 2,687 | | | | 1,531 | | | | 613 | | | $1,206 |

| | Class 529-B | | | 559 | | | | 80 | | | | 28 | | | 55 |

| | Class 529-C | | | 3,074 | | | | 412 | | | | 155 | | | 304 |

| | Class 529-E | | | 262 | | | | 41 | | | | 26 | | | 52 |

| | Class 529-F-1 | | | — | | | | 53 | | | | 21 | | | 42 |

| | Class R-1 | | | 1,384 | | | | 149 | | | | 69 | | | Not applicable |

| | Class R-2 | | | 4,424 | | | | 1,924 | | | | 298 | | | Not applicable |

| | Class R-3 | | | 6,076 | | | | 1,811 | | | | 608 | | | Not applicable |

| | Class R-4 | | | 2,804 | | | | 1,134 | | | | 562 | | | Not applicable |

| | Class R-5 | | | Not applicable | | | | 355 | | | | 363 | | | Not applicable |

| | Class R-6 | | | Not applicable | | | | 8 | | | | 746 | | | Not applicable |

| | Total class-specific expenses | | | $113,352 | | | | $54,683 | | | | $8,395 | | | $1,659 |

Trustees’ deferred compensation — Trustees who are unaffiliated with CRMC may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the fund, are treated as if invested in shares of the fund or other American Funds. These amounts represent general, unsecured liabilities of the fund and vary according to the total returns of the selected funds. Trustees’ compensation of $357,000, shown on the accompanying financial statements, includes $205,000 in current fees (either paid in cash or deferred) and a net increase of $152,000 in the value of the deferred amounts.

Affiliated officers and trustees — Officers and certain trustees of the fund are or may be considered to be affiliated with CRMC, AFD and AFS. No affiliated officers or trustees received any compensation directly from the fund.

| Capital World Growth and Income Fund | 25 |

8. Capital share transactions

Capital share transactions in the fund were as follows (dollars and shares in thousands):

| | | | | | | | | Reinvestments | | | | | | | | | Net (decrease) | |

| | | Sales* | | | of dividends | | | Repurchases* | | | increase | |

| Share class | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended May 31, 2013 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 1,869,164 | | | | 47,929 | | | $ | 537,181 | | | | 14,194 | | | $ | (3,590,772 | ) | | | (92,455 | ) | | $ | (1,184,427 | ) | | | (30,332 | ) |

| Class B | | | 4,769 | | | | 123 | | | | 10,589 | | | | 283 | | | | (307,971 | ) | | | (7,933 | ) | | | (292,613 | ) | | | (7,527 | ) |

| Class C | | | 170,098 | | | | 4,400 | | | | 33,375 | | | | 893 | | | | (452,085 | ) | | | (11,725 | ) | | | (248,612 | ) | | | (6,432 | ) |

| Class F-1 | | | 400,086 | | | | 10,261 | | | | 37,405 | | | | 989 | | | | (371,447 | ) | | | (9,557 | ) | | | 66,044 | | | | 1,693 | |

| Class F-2 | | | 301,736 | | | | 7,746 | | | | 22,334 | | | | 589 | | | | (219,261 | ) | | | (5,658 | ) | | | 104,809 | | | | 2,677 | |

| Class 529-A | | | 153,521 | | | | 3,967 | | | | 26,811 | | | | 710 | | | | (155,603 | ) | | | (4,024 | ) | | | 24,729 | | | | 653 | |

| Class 529-B | | | 779 | | | | 20 | | | | 813 | | | | 22 | | | | (18,589 | ) | | | (481 | ) | | | (16,997 | ) | | | (439 | ) |

| Class 529-C | | | 41,229 | | | | 1,069 | | | | 4,480 | | | | 120 | | | | (43,112 | ) | | | (1,121 | ) | | | 2,597 | | | | 68 | |

| Class 529-E | | | 6,570 | | | | 170 | | | | 1,037 | | | | 27 | | | | (7,098 | ) | | | (184 | ) | | | 509 | | | | 13 | |

| Class 529-F-1 | | | 9,675 | | | | 249 | | | | 1,011 | | | | 27 | | | | (8,175 | ) | | | (209 | ) | | | 2,511 | | | | 67 | |

| Class R-1 | | | 14,520 | | | | 375 | | | | 2,200 | | | | 59 | | | | (39,477 | ) | | | (1,034 | ) | | | (22,757 | ) | | | (600 | ) |

| Class R-2 | | | 131,374 | | | | 3,409 | | | | 9,680 | | | | 259 | | | | (194,759 | ) | | | (5,060 | ) | | | (53,705 | ) | | | (1,392 | ) |

| Class R-3 | | | 295,817 | | | | 7,646 | | | | 24,540 | | | | 653 | | | | (403,688 | ) | | | (10,450 | ) | | | (83,331 | ) | | | (2,151 | ) |

| Class R-4 | | | 291,647 | | | | 7,497 | | | | 25,637 | | | | 679 | | | | (387,804 | ) | | | (10,017 | ) | | | (70,520 | ) | | | (1,841 | ) |

| Class R-5 | | | 188,473 | | | | 4,842 | | | | 18,724 | | | | 495 | | | | (236,731 | ) | | | (6,036 | ) | | | (29,534 | ) | | | (699 | ) |

| Class R-6 | | | 816,120 | | | | 20,877 | | | | 34,557 | | | | 911 | | | | (197,081 | ) | | | (5,137 | ) | | | 653,596 | | | | 16,651 | |

| Total net increase (decrease) | | $ | 4,695,578 | | | | 120,580 | | | $ | 790,374 | | | | 20,910 | | | $ | (6,633,653 | ) | | | (171,081 | ) | | $ | (1,147,701 | ) | | | (29,591 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended November 30, 2012 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | $ | 2,626,636 | | | | 76,391 | | | $ | 1,262,109 | | | | 37,759 | | | | $(8,702,758 | ) | | | (253,570 | ) | | | $(4,814,013 | ) | | | (139,420 | ) |

| Class B | | | 9,241 | | | | 270 | | | | 33,137 | | | | 1,005 | | | | (632,184 | ) | | | (18,561 | ) | | | (589,806 | ) | | | (17,286 | ) |

| Class C | | | 229,803 | | | | 6,736 | | | | 90,255 | | | | 2,747 | | | | (1,171,467 | ) | | | (34,497 | ) | | | (851,409 | ) | | | (25,014 | ) |

| Class F-1 | | | 966,663 | | | | 28,595 | | | | 93,738 | | | | 2,809 | | | | (1,581,212 | ) | | | (46,262 | ) | | | (520,811 | ) | | | (14,858 | ) |

| Class F-2 | | | 727,890 | | | | 20,760 | | | | 38,704 | | | | 1,157 | | | | (495,180 | ) | | | (14,407 | ) | | | 271,414 | | | | 7,510 | |

| Class 529-A | | | 256,259 | | | | 7,491 | | | | 59,473 | | | | 1,783 | | | | (303,115 | ) | | | (8,839 | ) | | | 12,617 | | | | 435 | |

| Class 529-B | | | 2,045 | | | | 59 | | | | 2,433 | | | | 74 | | | | (38,180 | ) | | | (1,123 | ) | | | (33,702 | ) | | | (990 | ) |

| Class 529-C | | | 74,097 | | | | 2,174 | | | | 11,055 | | | | 335 | | | | (97,169 | ) | | | (2,855 | ) | | | (12,017 | ) | | | (346 | ) |

| Class 529-E | | | 12,233 | | | | 358 | | | | 2,362 | | | | 71 | | | | (16,051 | ) | | | (471 | ) | | | (1,456 | ) | | | (42 | ) |

| Class 529-F-1 | | | 16,246 | | | | 473 | | | | 2,110 | | | | 63 | | | | (15,169 | ) | | | (443 | ) | | | 3,187 | | | | 93 | |

| Class R-1 | | | 30,699 | | | | 903 | | | | 5,992 | | | | 182 | | | | (69,691 | ) | | | (2,030 | ) | | | (33,000 | ) | | | (945 | ) |

| Class R-2 | | | 238,510 | | | | 6,997 | | | | 24,035 | | | | 730 | | | | (373,175 | ) | | | (10,976 | ) | | | (110,630 | ) | | | (3,249 | ) |

| Class R-3 | | | 518,783 | | | | 15,146 | | | | 57,318 | | | | 1,726 | | | | (673,549 | ) | | | (19,624 | ) | | | (97,448 | ) | | | (2,752 | ) |

| Class R-4 | | | 479,903 | | | | 13,902 | | | | 57,635 | | | | 1,726 | | | | (595,861 | ) | | | (17,419 | ) | | | (58,323 | ) | | | (1,791 | ) |

| Class R-5 | | | 301,418 | | | | 8,702 | | | | 41,168 | | | | 1,229 | | | | (394,640 | ) | | | (11,440 | ) | | | (52,054 | ) | | | (1,509 | ) |

| Class R-6 | | | 738,967 | | | | 21,376 | | | | 57,556 | | | | 1,712 | | | | (263,231 | ) | | | (7,702 | ) | | | 533,292 | | | | 15,386 | |

| Total net increase (decrease) | | | $7,229,393 | | | | 210,333 | | | $ | 1,839,080 | | | | 55,108 | | | | $(15,422,632 | ) | | | (450,219 | ) | | $ | (6,354,159 | ) | | | (184,778 | ) |

*Includes exchanges between share classes of the fund.

| 26 | Capital World Growth and Income Fund |

9. Investment transactions

The fund made purchases and sales of investment securities, excluding short-term securities and U.S. government obligations, if any, of $7,367,564,000 and $9,360,455,000, respectively, during the six months ended May 31, 2013.

| Capital World Growth and Income Fund | 27 |

Financial highlights

| | | | | | | | Income (loss) from investment operations1 | |

| | | | | Net asset

value,

beginning

of period | | | Net

investment

income | | | Net gains

(losses) on

securities (both

realized and

unrealized) | | | Total from

investment

operations | |

| Class A: | | Six months ended 5/31/20134,5 | | $ | 36.75 | | | $ | .50 | | | $ | 3.89 | | | $ | 4.39 | |

| | | Year ended 11/30/2012 | | | 32.57 | | | | .87 | | | | 4.28 | | | | 5.15 | |

| | | Year ended 11/30/2011 | | | 33.75 | | | | .94 | | | | (1.22 | ) | | | (.28 | ) |

| | | Year ended 11/30/2010 | | | 33.80 | | | | .86 | | | | (.03 | ) | | | .83 | |

| | | Year ended 11/30/2009 | | | 25.50 | | | | .78 | | | | 8.52 | | | | 9.30 | |

| | | Year ended 11/30/2008 | | | 48.56 | | | | 1.27 | | | | (19.81 | ) | | | (18.54 | ) |

| Class B: | | Six months ended 5/31/20134,5 | | | 36.53 | | | | .34 | | | | 3.88 | | | | 4.22 | |

| | | Year ended 11/30/2012 | | | 32.37 | | | | .60 | | | | 4.26 | | | | 4.86 | |

| | | Year ended 11/30/2011 | | | 33.53 | | | | .67 | | | | (1.21 | ) | | | (.54 | ) |

| | | Year ended 11/30/2010 | | | 33.58 | | | | .60 | | | | (.03 | ) | | | .57 | |

| | | Year ended 11/30/2009 | | | 25.34 | | | | .57 | | | | 8.46 | | | | 9.03 | |

| | | Year ended 11/30/2008 | | | 48.27 | | | | .96 | | | | (19.69 | ) | | | (18.73 | ) |

| Class C: | | Six months ended 5/31/20134,5 | | | 36.36 | | | | .34 | | | | 3.85 | | | | 4.19 | |

| | | Year ended 11/30/2012 | | | 32.23 | | | | .59 | | | | 4.24 | | | | 4.83 | |

| | | Year ended 11/30/2011 | | | 33.40 | | | | .65 | | | | (1.21 | ) | | | (.56 | ) |

| | | Year ended 11/30/2010 | | | 33.45 | | | | .59 | | | | (.02 | ) | | | .57 | |

| | | Year ended 11/30/2009 | | | 25.25 | | | | .56 | | | | 8.43 | | | | 8.99 | |

| | | Year ended 11/30/2008 | | | 48.11 | | | | .95 | | | | (19.63 | ) | | | (18.68 | ) |

| Class F-1: | | Six months ended 5/31/20134,5 | | | 36.68 | | | | .50 | | | | 3.88 | | | | 4.38 | |

| | | Year ended 11/30/2012 | | | 32.51 | | | | .87 | | | | 4.28 | | | | 5.15 | |

| | | Year ended 11/30/2011 | | | 33.69 | | | | .93 | | | | (1.22 | ) | | | (.29 | ) |

| | | Year ended 11/30/2010 | | | 33.74 | | | | .86 | | | | (.03 | ) | | | .83 | |

| | | Year ended 11/30/2009 | | | 25.46 | | | | .79 | | | | 8.50 | | | | 9.29 | |

| | | Year ended 11/30/2008 | | | 48.48 | | | | 1.27 | | | | (19.78 | ) | | | (18.51 | ) |

| Class F-2: | | Six months ended 5/31/20134,5 | | | 36.74 | | | | .56 | | | | 3.88 | | | | 4.44 | |

| | | Year ended 11/30/2012 | | | 32.56 | | | | .97 | | | | 4.28 | | | | 5.25 | |

| | | Year ended 11/30/2011 | | | 33.75 | | | | 1.02 | | | | (1.22 | ) | | | (.20 | ) |

| | | Year ended 11/30/2010 | | | 33.79 | | | | .94 | | | | (.02 | ) | | | .92 | |

| | | Year ended 11/30/2009 | | | 25.51 | | | | .72 | | | | 8.64 | | | | 9.36 | |

| | | Period from 8/1/2008 to 11/30/20084 | | | 38.34 | | | | .23 | | | | (12.79 | ) | | | (12.56 | ) |

| 28 | Capital World Growth and Income Fund |

| Dividends and distributions | | | | | | | | | | | | | | | | | | | |

Dividends

(from net

investment

income) | | | Distributions

(from capital

gains) | | | Total

dividends

and

distributions | | | Net asset

value, end

of period | | | Total

return2,3 | | | Net assets,

end of period

(in millions) | | | Ratio of

expenses

to average net

assets before

reimbursements/

waivers | | | Ratio of

expenses

to average net

assets after

reimbursements/

waivers3 | | | Ratio of net

income to

average net

assets3 | |

| $ | (.44 | ) | | $ | — | | | $ | (.44 | ) | | $ | 40.70 | | | | 12.04 | % | | $ | 50,067 | | | | .81 | %6 | | | .81 | %6 | | | 2.57 | %6 |

| | (.97 | ) | | | — | | | | (.97 | ) | | | 36.75 | | | | 16.14 | | | | 46,323 | | | | .82 | | | | .82 | | | | 2.52 | |