0 BB&T Capital Markets Transportation Conference The Biltmore, Coral Gables, Fla. February 13, 2013 Air Transport Services Group, Inc. Joe Hete, President & CEO Quint Turner, CFO Rich Corrado, CCO

Safe Harbor Statement Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, changes in market demand for our assets and services, the costs and timing associated with the modification and deployment of Boeing 767 and Boeing 757 aircraft, the timing associated with the redeployment of aircraft among customers, ATSG's effectiveness in restructuring its airline operations affected by DB Schenker's restructuring of its U.S. air cargo operations, and other factors that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. 1

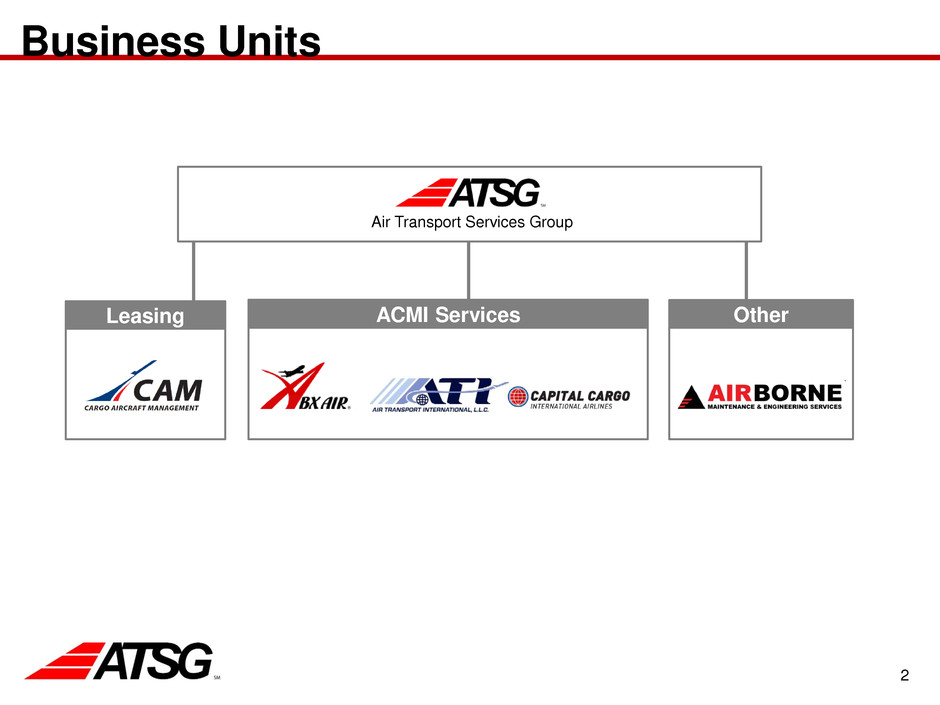

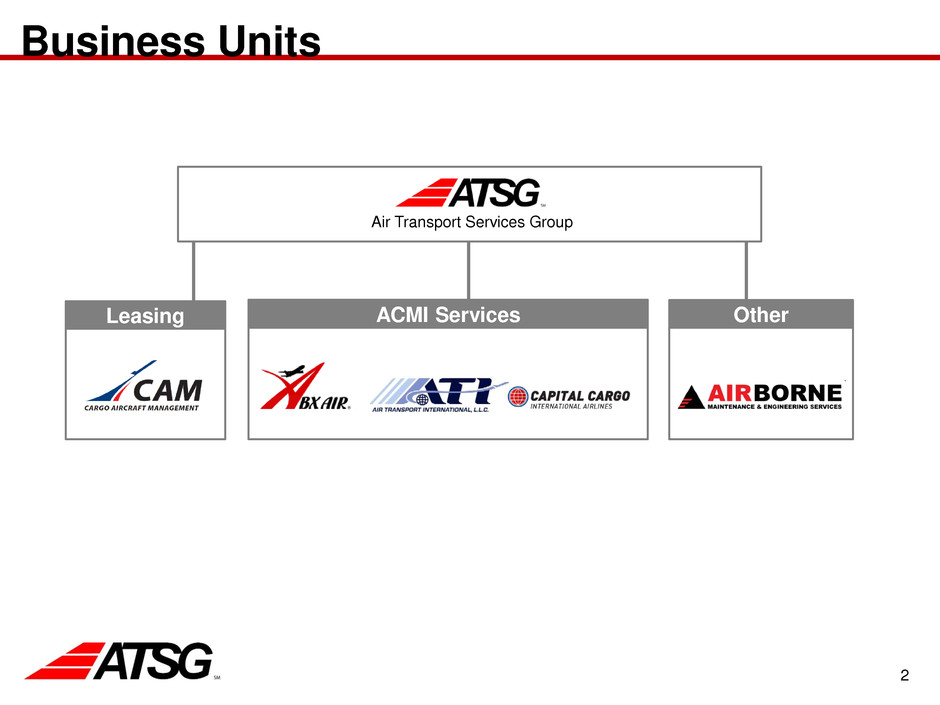

2 Business Units Air Transport Services Group Leasing ACMI Services Other

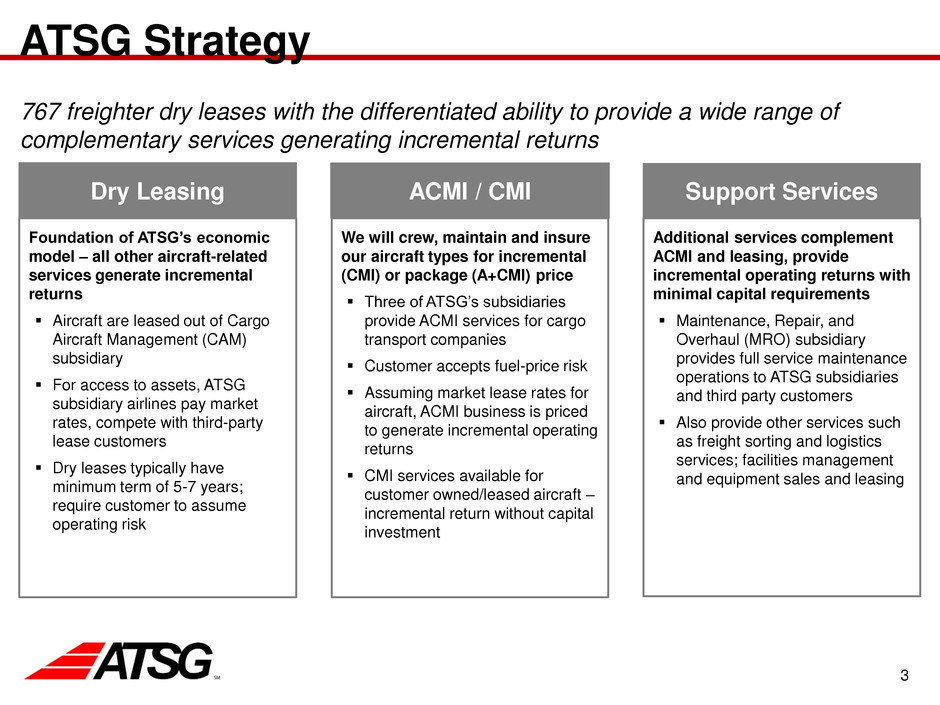

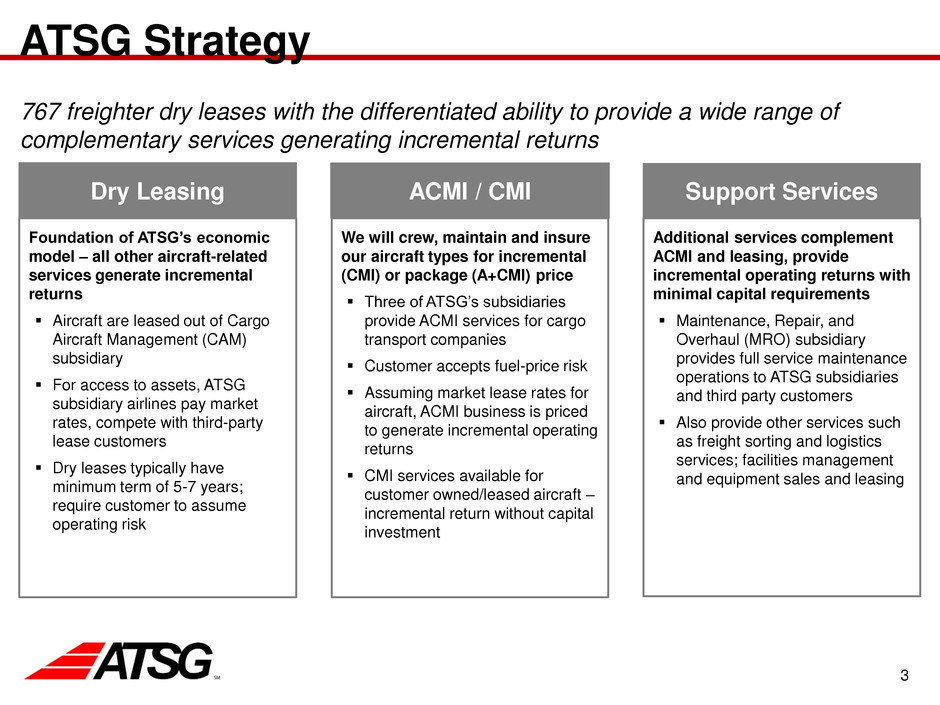

3 ATSG Strategy 767 freighter dry leases with the differentiated ability to provide a wide range of complementary services generating incremental returns Dry Leasing ACMI / CMI Support Services Foundation of ATSG’s economic model – all other aircraft-related services generate incremental returns Aircraft are leased out of Cargo Aircraft Management (CAM) subsidiary For access to assets, ATSG subsidiary airlines pay market rates, compete with third-party lease customers Dry leases typically have minimum term of 5-7 years; require customer to assume operating risk We will crew, maintain and insure our aircraft types for incremental (CMI) or package (A+CMI) price Three of ATSG’s subsidiaries provide ACMI services for cargo transport companies Customer accepts fuel-price risk Assuming market lease rates for aircraft, ACMI business is priced to generate incremental operating returns CMI services available for customer owned/leased aircraft – incremental return without capital investment Additional services complement ACMI and leasing, provide incremental operating returns with minimal capital requirements Maintenance, Repair, and Overhaul (MRO) subsidiary provides full service maintenance operations to ATSG subsidiaries and third party customers Also provide other services such as freight sorting and logistics services; facilities management and equipment sales and leasing

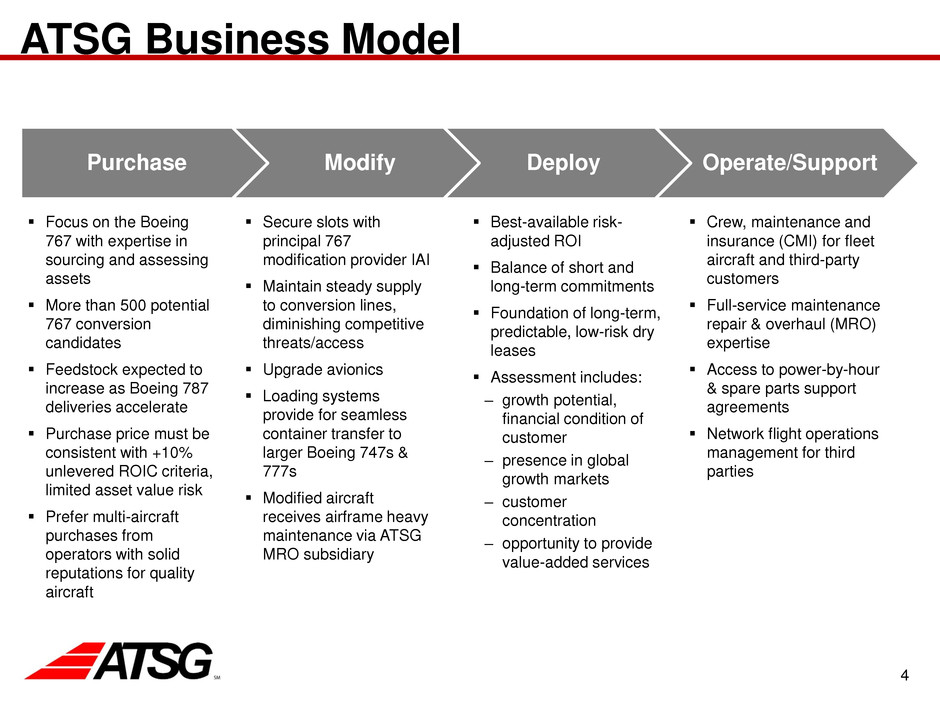

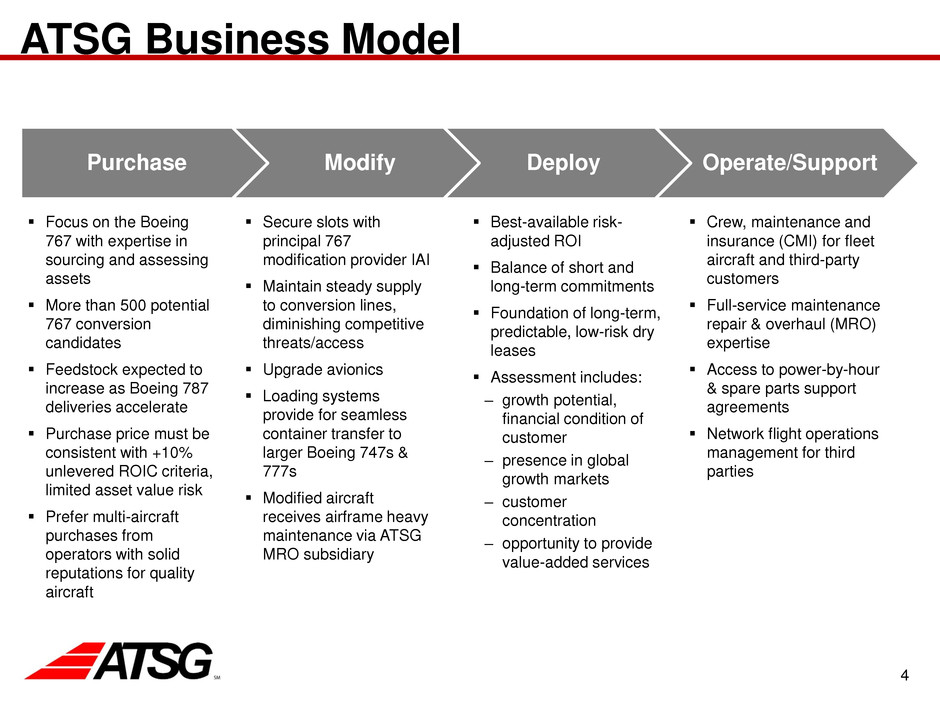

4 ATSG Business Model Purchase Modify Deploy Operate/Support Focus on the Boeing 767 with expertise in sourcing and assessing assets More than 500 potential 767 conversion candidates Feedstock expected to increase as Boeing 787 deliveries accelerate Purchase price must be consistent with +10% unlevered ROIC criteria, limited asset value risk Prefer multi-aircraft purchases from operators with solid reputations for quality aircraft Secure slots with principal 767 modification provider IAI Maintain steady supply to conversion lines, diminishing competitive threats/access Upgrade avionics Loading systems provide for seamless container transfer to larger Boeing 747s & 777s Modified aircraft receives airframe heavy maintenance via ATSG MRO subsidiary Best-available risk- adjusted ROI Balance of short and long-term commitments Foundation of long-term, predictable, low-risk dry leases Assessment includes: – growth potential, financial condition of customer – presence in global growth markets – customer concentration – opportunity to provide value-added services Crew, maintenance and insurance (CMI) for fleet aircraft and third-party customers Full-service maintenance repair & overhaul (MRO) expertise Access to power-by-hour & spare parts support agreements Network flight operations management for third parties

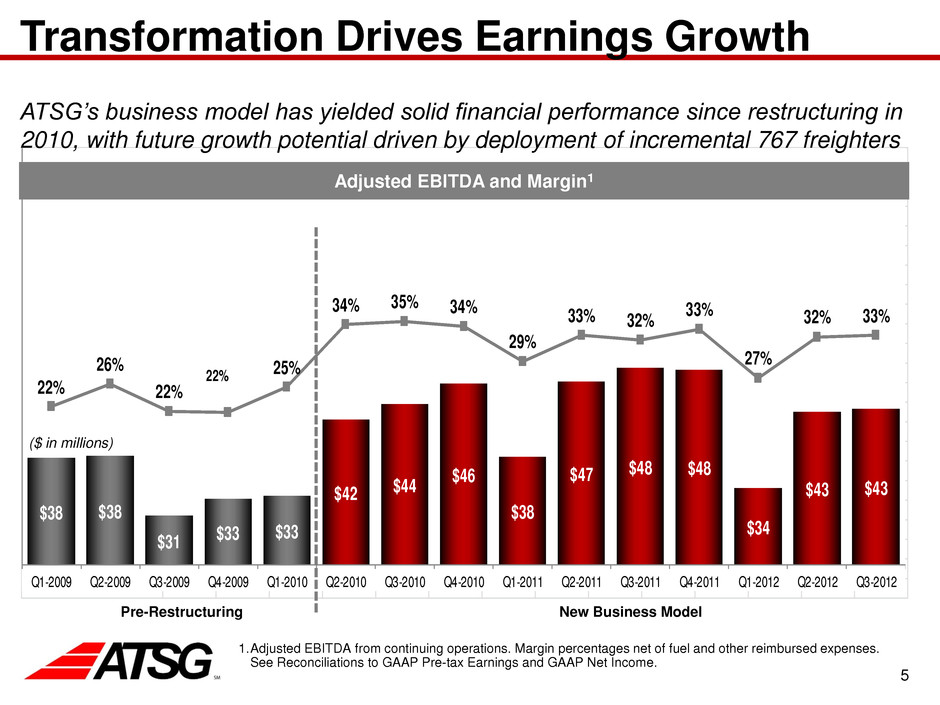

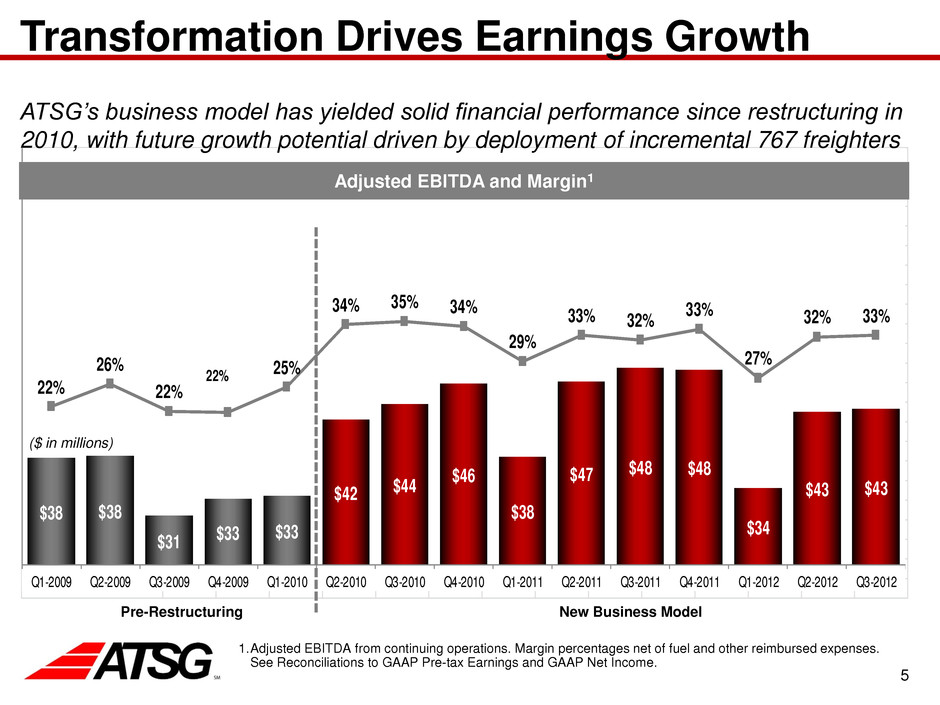

5 EBITDA $38 $38 $31 $33 $33 $42 $44 $46 $38 $47 $48 $48 $34 $43 $43 22% 26% 22% 22% 25% 34% 35% 34% 29% 33% 32% 33% 27% 32% 33% Q1-2009 Q2-2009 Q3-2009 Q4-2009 Q1-2010 Q2-2010 Q3-2010 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Q1-2012 Q2-2012 Q3-2012 Transformation Drives Earnings Growth ATSG’s business model has yielded solid financial performance since restructuring in 2010, with future growth potential driven by deployment of incremental 767 freighters Adjusted EBITDA and Margin1 1.Adjusted EBITDA from continuing operations. Margin percentages net of fuel and other reimbursed expenses. See Reconciliations to GAAP Pre-tax Earnings and GAAP Net Income. Pre-Restructuring New Business Model ($ in millions)

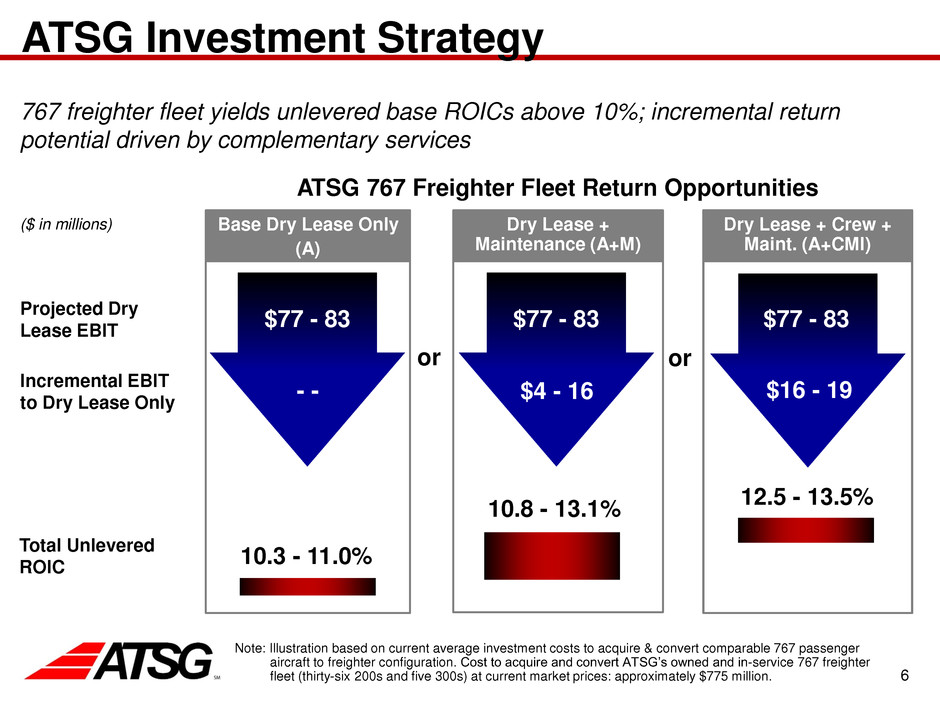

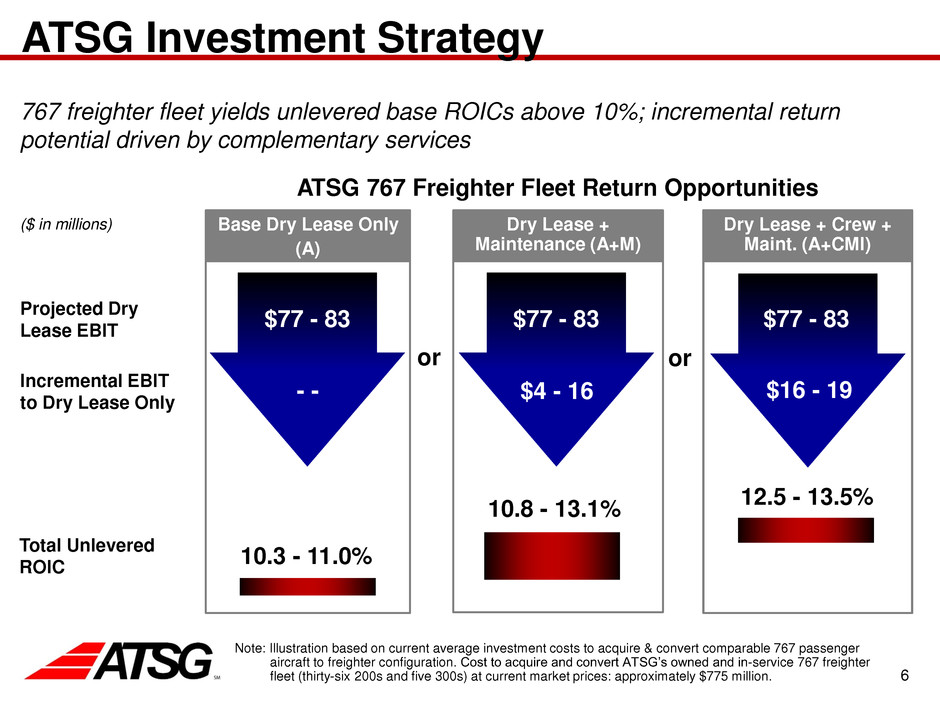

6 ATSG Investment Strategy 767 freighter fleet yields unlevered base ROICs above 10%; incremental return potential driven by complementary services Base Dry Lease Only (A) Dry Lease + Crew + Maint. (A+CMI) Dry Lease + Maintenance (A+M) Projected Dry Lease EBIT Incremental EBIT to Dry Lease Only Total Unlevered ROIC $77 - 83 - - $77 - 83 $77 - 83 $4 - 16 $16 - 19 Note: Illustration based on current average investment costs to acquire & convert comparable 767 passenger aircraft to freighter configuration. Cost to acquire and convert ATSG’s owned and in-service 767 freighter fleet (thirty-six 200s and five 300s) at current market prices: approximately $775 million. ($ in millions) ATSG 767 Freighter Fleet Return Opportunities or or 12.5 - 13.5% 10.8 - 13.1% 10.3 - 11.0%

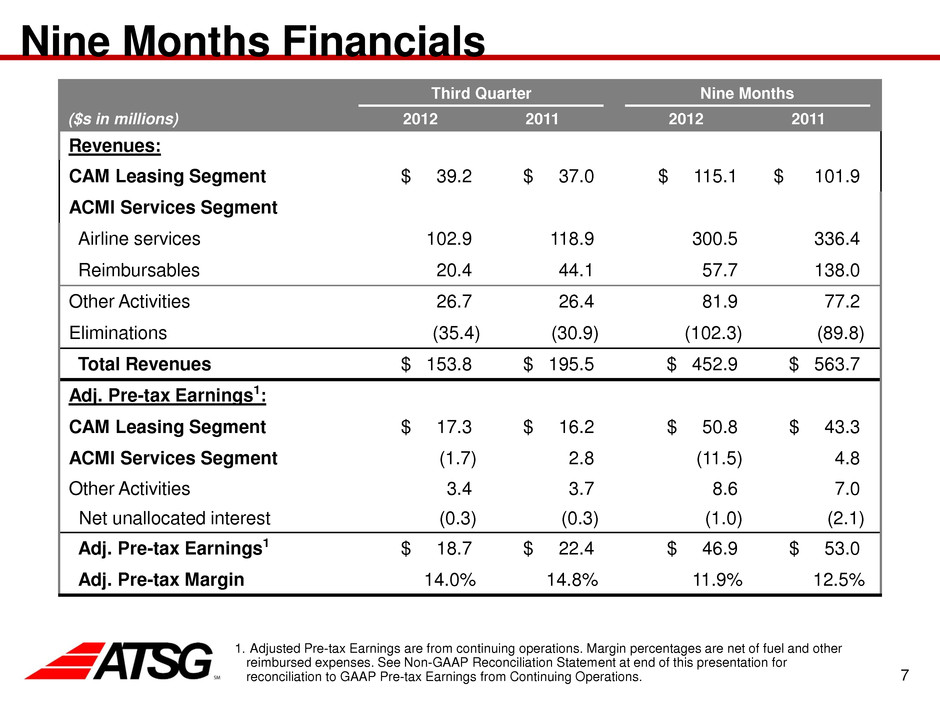

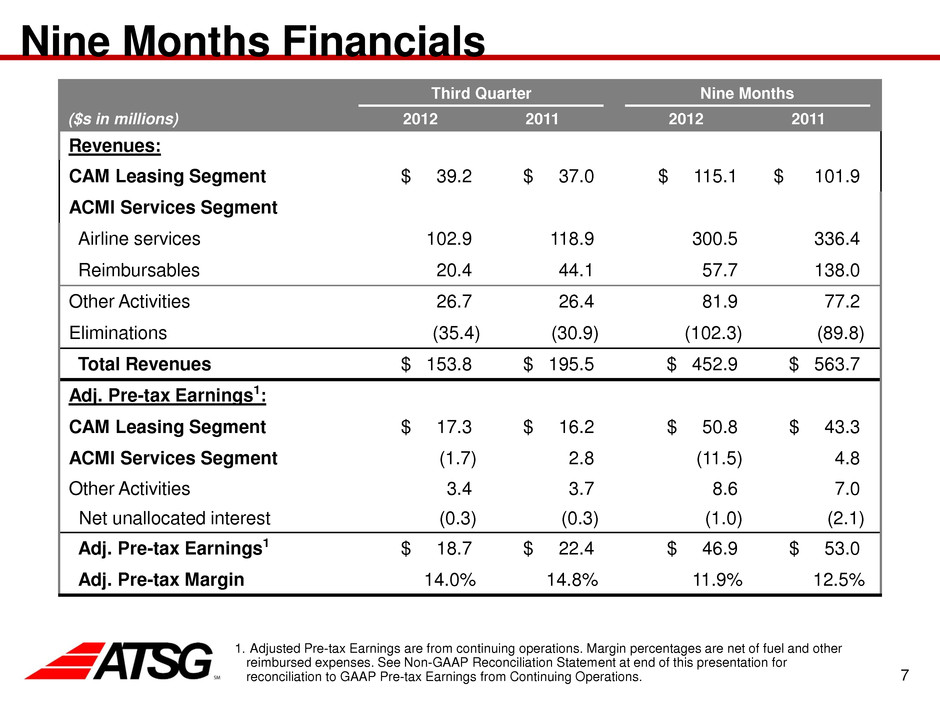

7 Nine Months Financials Third Quarter Nine Months ($s in millions) 2012 2011 2012 2011 Revenues: CAM Leasing Segment $ 39.2 $ 37.0 $ 115.1 $ 101.9 ACMI Services Segment Airline services 102.9 118.9 300.5 336.4 Reimbursables 20.4 44.1 57.7 138.0 Other Activities 26.7 26.4 81.9 77.2 Eliminations (35.4) (30.9) (102.3) (89.8) Total Revenues $ 153.8 $ 195.5 $ 452.9 $ 563.7 Adj. Pre-tax Earnings1: CAM Leasing Segment $ 17.3 $ 16.2 $ 50.8 $ 43.3 ACMI Services Segment (1.7) 2.8 (11.5) 4.8 Other Activities 3.4 3.7 8.6 7.0 Net unallocated interest (0.3) (0.3) (1.0) (2.1) Adj. Pre-tax Earnings1 $ 18.7 $ 22.4 $ 46.9 $ 53.0 Adj. Pre-tax Margin 14.0% 14.8% 11.9% 12.5% 1. Adjusted Pre-tax Earnings are from continuing operations. Margin percentages are net of fuel and other reimbursed expenses. See Non-GAAP Reconciliation Statement at end of this presentation for reconciliation to GAAP Pre-tax Earnings from Continuing Operations.

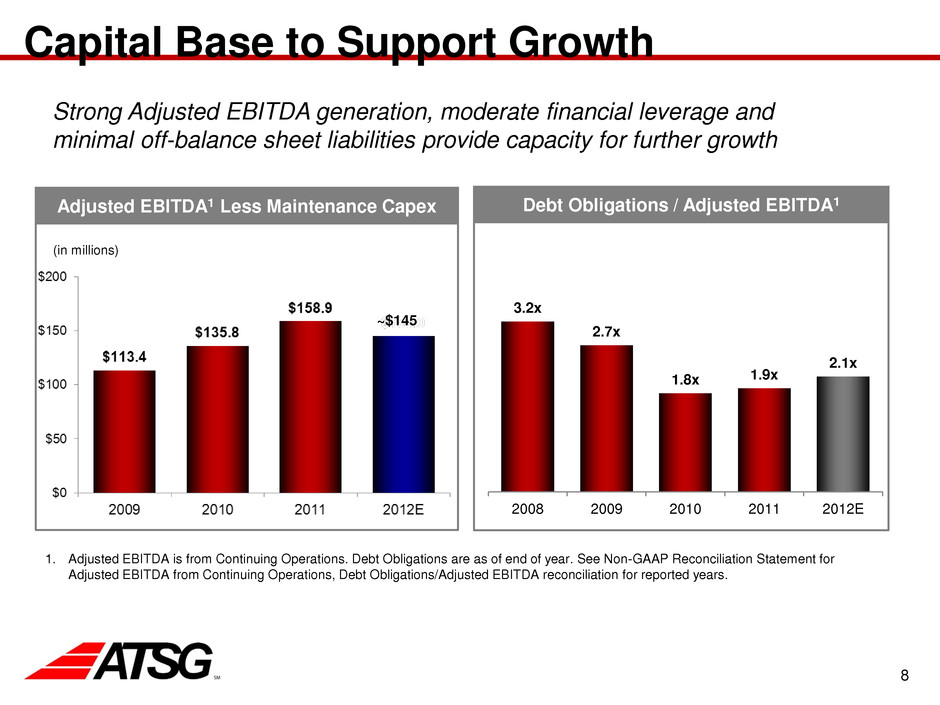

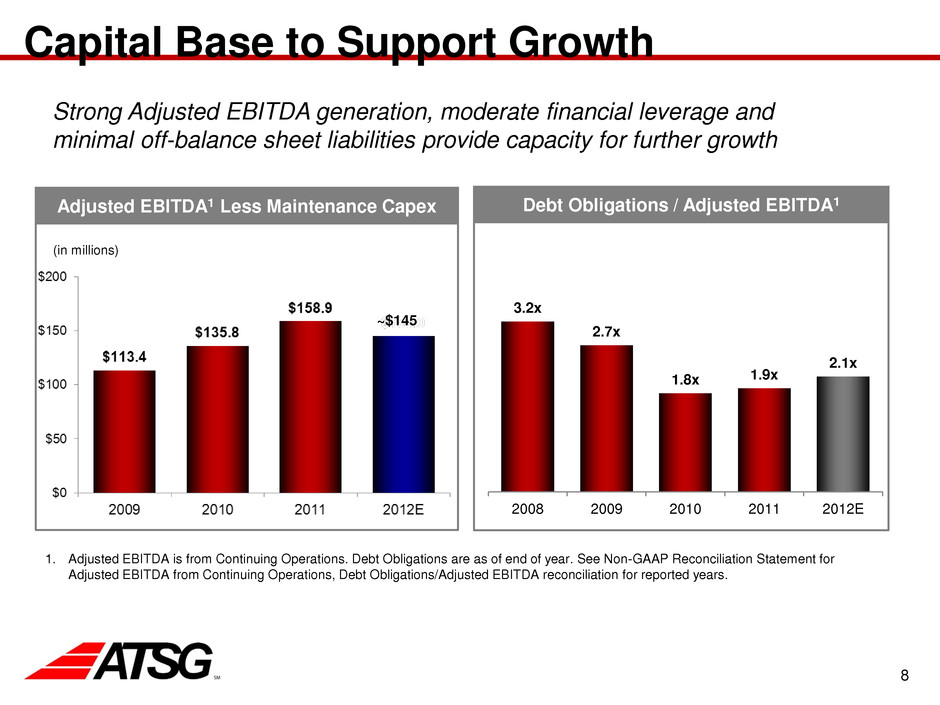

8 Capital Base to Support Growth Strong Adjusted EBITDA generation, moderate financial leverage and minimal off-balance sheet liabilities provide capacity for further growth Debt Obligations / Adjusted EBITDA1 1. Adjusted EBITDA is from Continuing Operations. Debt Obligations are as of end of year. See Non-GAAP Reconciliation Statement for Adjusted EBITDA from Continuing Operations, Debt Obligations/Adjusted EBITDA reconciliation for reported years. Adjusted EBITDA1 Less Maintenance Capex (in millions) 3.2x 2.7x 1.8x 1.9x 2.1x 2008 2009 2010 2011 2012E ~$145

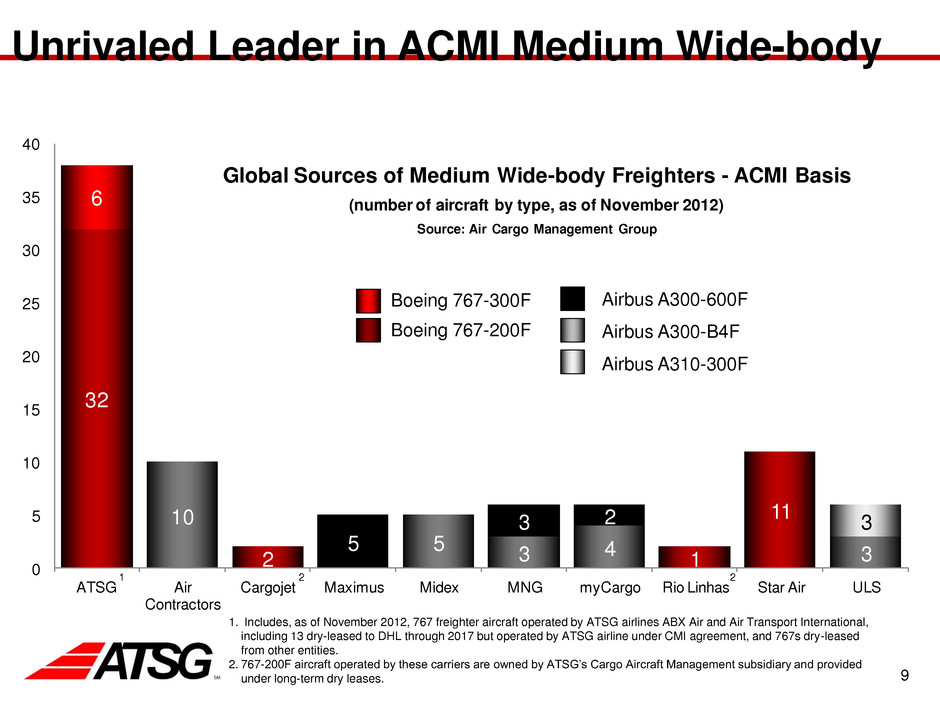

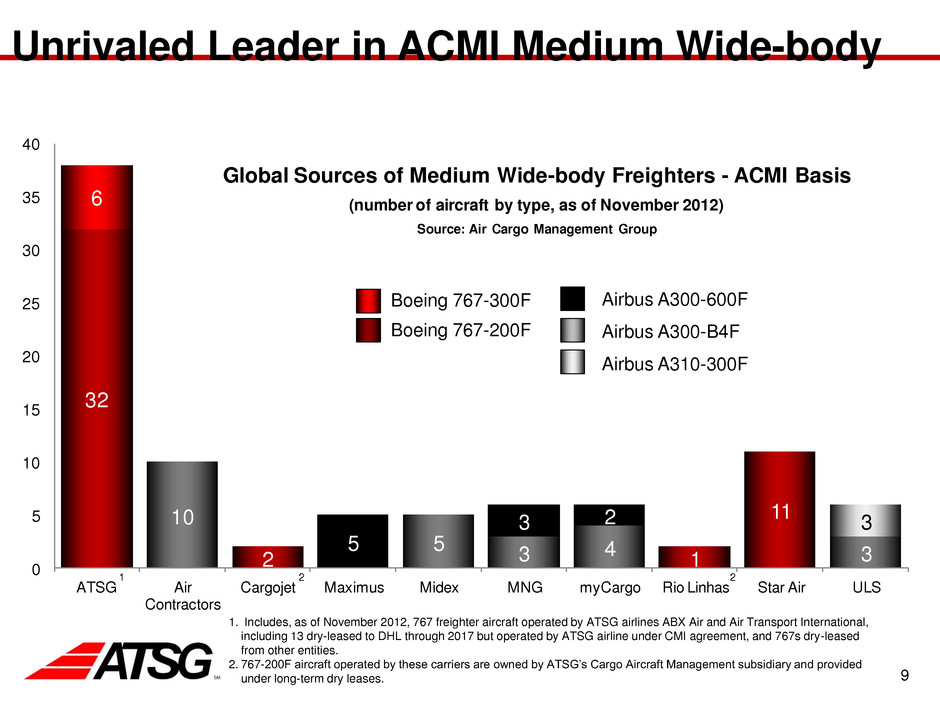

9 32 2 1 11 6 10 5 3 4 3 5 3 2 3 0 5 10 15 20 25 30 35 40 ATSG Air Contractors Cargojet Maximus Midex MNG myCargo Rio Linhas Star Air ULS Global Sources of Medium Wide-body Freighters - ACMI Basis (number of aircraft by type, as of November 2012) Source: Air Cargo Management Group Unrivaled Leader in ACMI Medium Wide-body 1. Includes, as of November 2012, 767 freighter aircraft operated by ATSG airlines ABX Air and Air Transport International, including 13 dry-leased to DHL through 2017 but operated by ATSG airline under CMI agreement, and 767s dry-leased from other entities. 2. 767-200F aircraft operated by these carriers are owned by ATSG’s Cargo Aircraft Management subsidiary and provided under long-term dry leases. Boeing 767-300F Boeing 767-200F Airbus A300-600F Airbus A300-B4F Airbus A310-300F 1 2 2

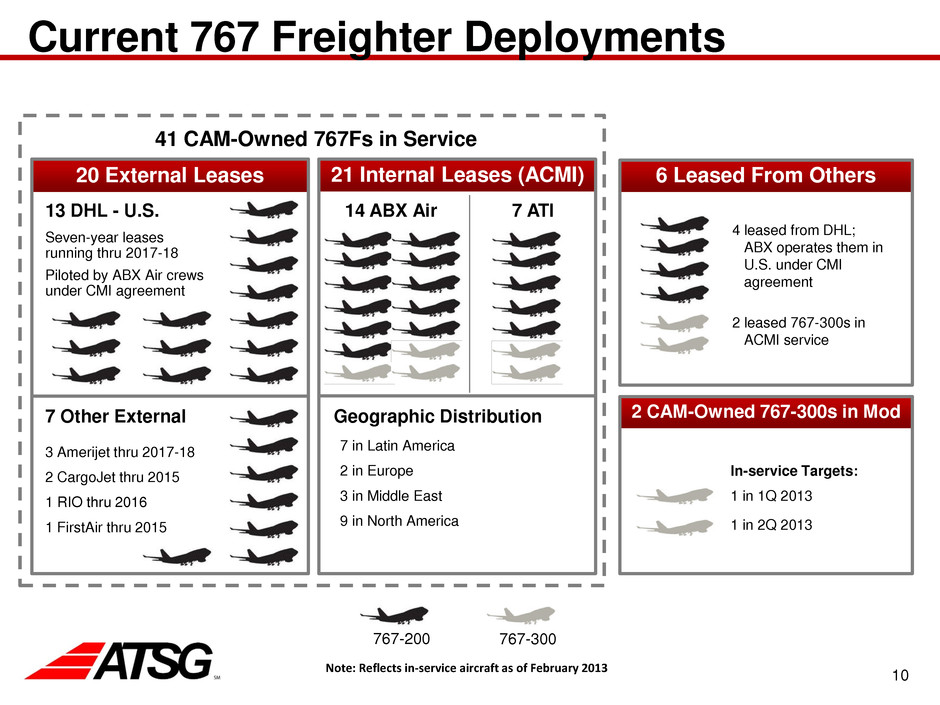

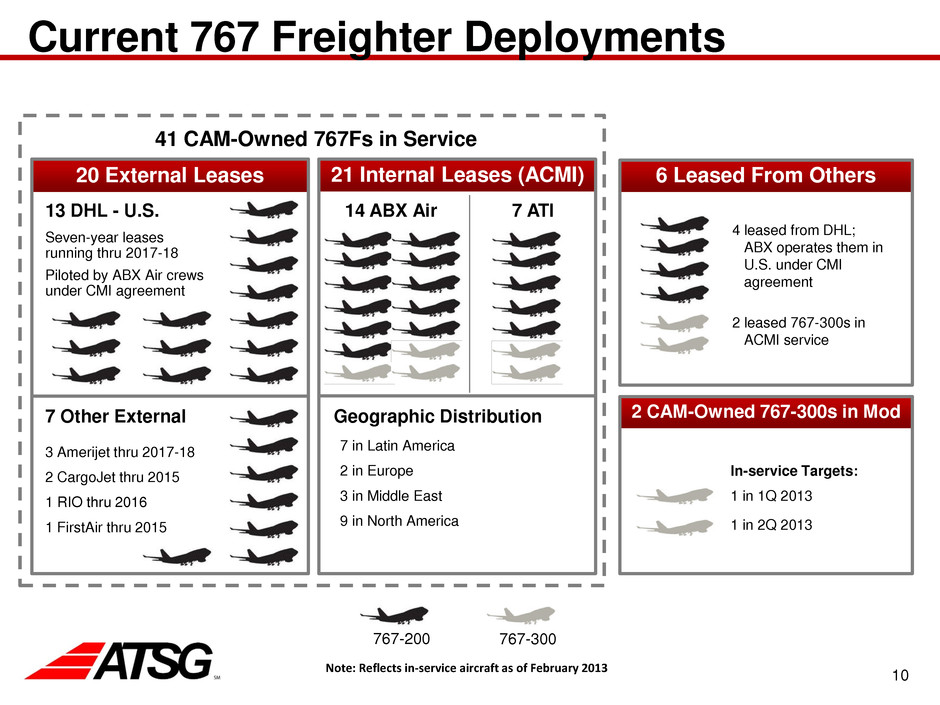

10 Current 767 Freighter Deployments 20 External Leases 21 Internal Leases (ACMI) 13 DHL - U.S. Seven-year leases running thru 2017-18 Piloted by ABX Air crews under CMI agreement 7 ATI Geographic Distribution 14 ABX Air 7 Other External 3 Amerijet thru 2017-18 2 CargoJet thru 2015 1 RIO thru 2016 1 FirstAir thru 2015 41 CAM-Owned 767Fs in Service 4 leased from DHL; ABX operates them in U.S. under CMI agreement 2 leased 767-300s in ACMI service In-service Targets: 1 in 1Q 2013 1 in 2Q 2013 Note: Reflects in-service aircraft as of February 2013 7 in Latin America 2 in Europe 3 in Middle East 9 in North America 767-200 767-300 6 Leased From Others 2 CAM-Owned 767-300s in Mod

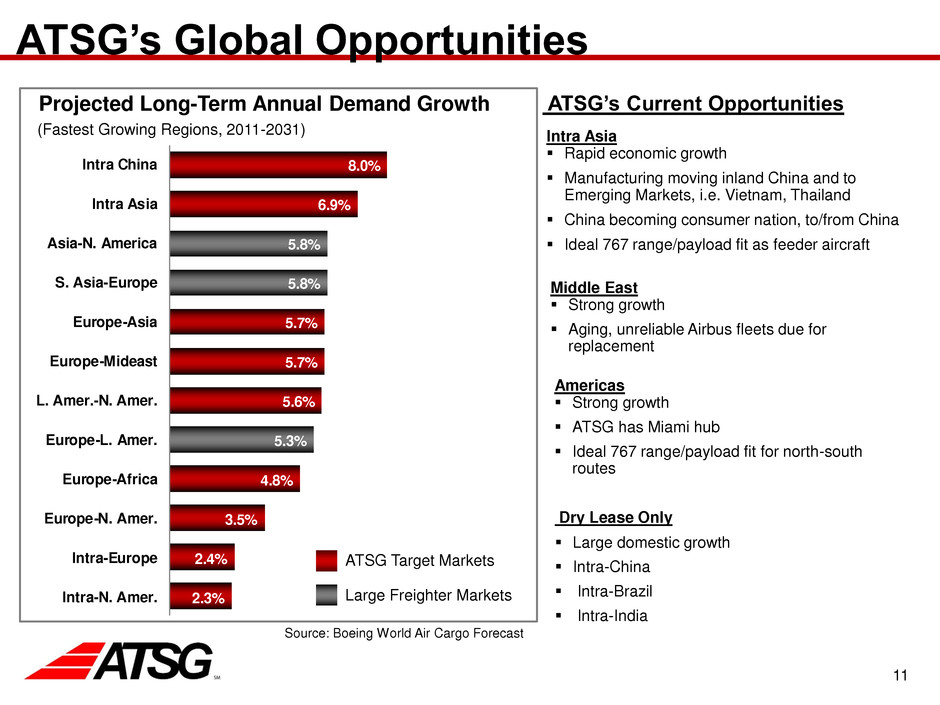

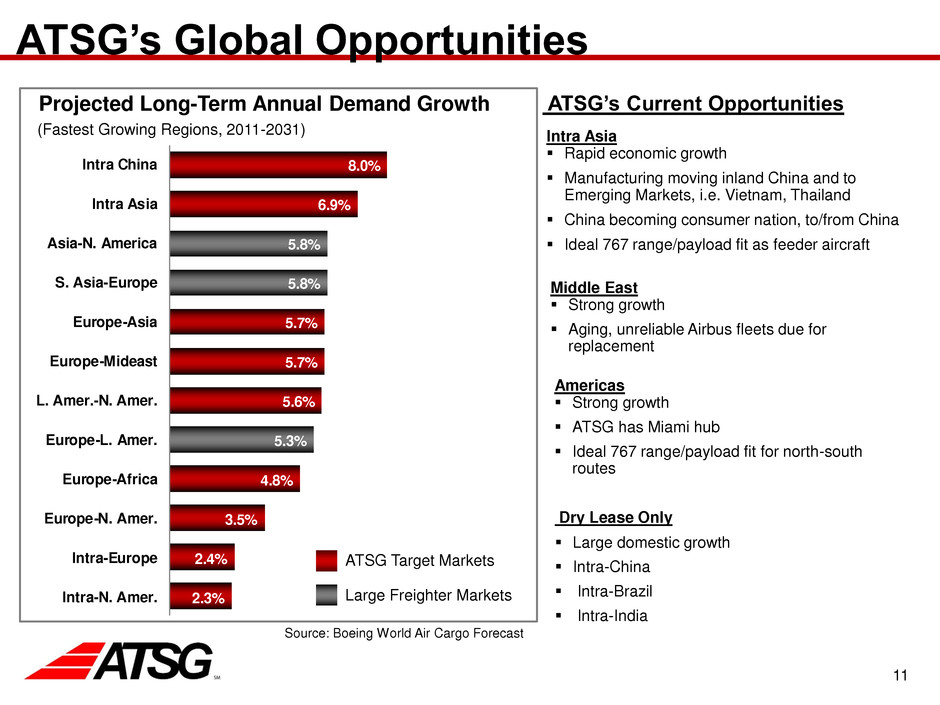

11 (Fastest Growing Regions, 2011-2031) ATSG’s Global Opportunities Projected Long-Term Annual Demand Growth Source: Boeing World Air Cargo Forecast Large Freighter Markets ATSG Target Markets Americas Strong growth ATSG has Miami hub Ideal 767 range/payload fit for north-south routes Intra Asia Rapid economic growth Manufacturing moving inland China and to Emerging Markets, i.e. Vietnam, Thailand China becoming consumer nation, to/from China Ideal 767 range/payload fit as feeder aircraft Middle East Strong growth Aging, unreliable Airbus fleets due for replacement Dry Lease Only Large domestic growth Intra-China Intra-Brazil Intra-India ATSG’s Current Opportunities 2.3% 2.4% 3.5% 4.8% 5.3% 5.6% 5.7% 5.7% 5.8% 5.8% 6.9% 8.0% Intra-N. Am r. Intra-Europ Europe-N. Amer. Europe-Africa Europe-L. Amer. L. Amer.-N. Amer. Europe-Mideast Europe-Asia S. Asia-Europe Asia-N. America Intra Asia Intra China

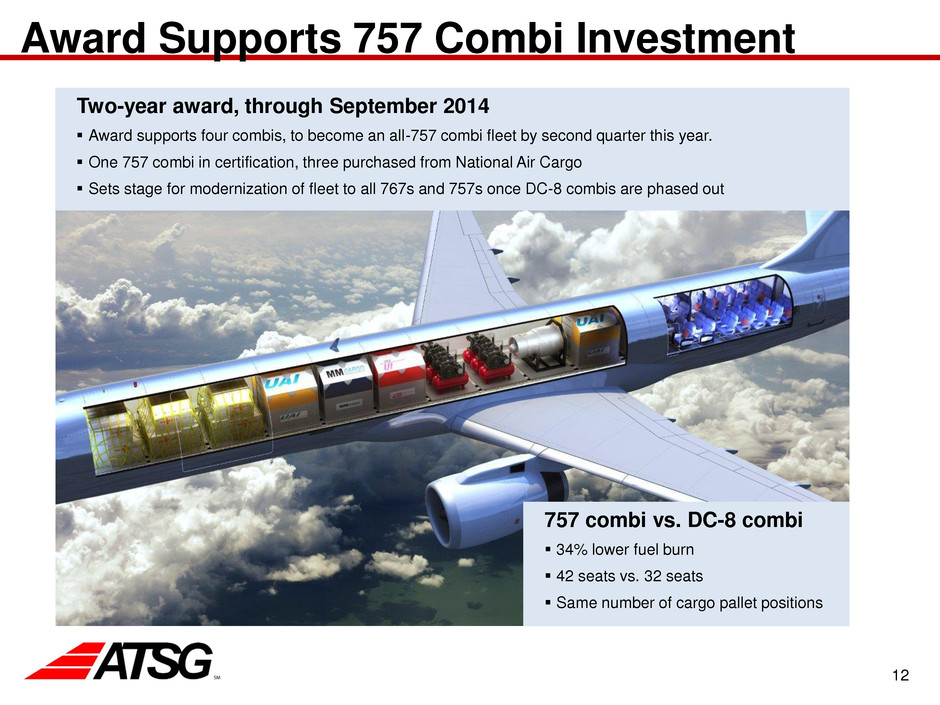

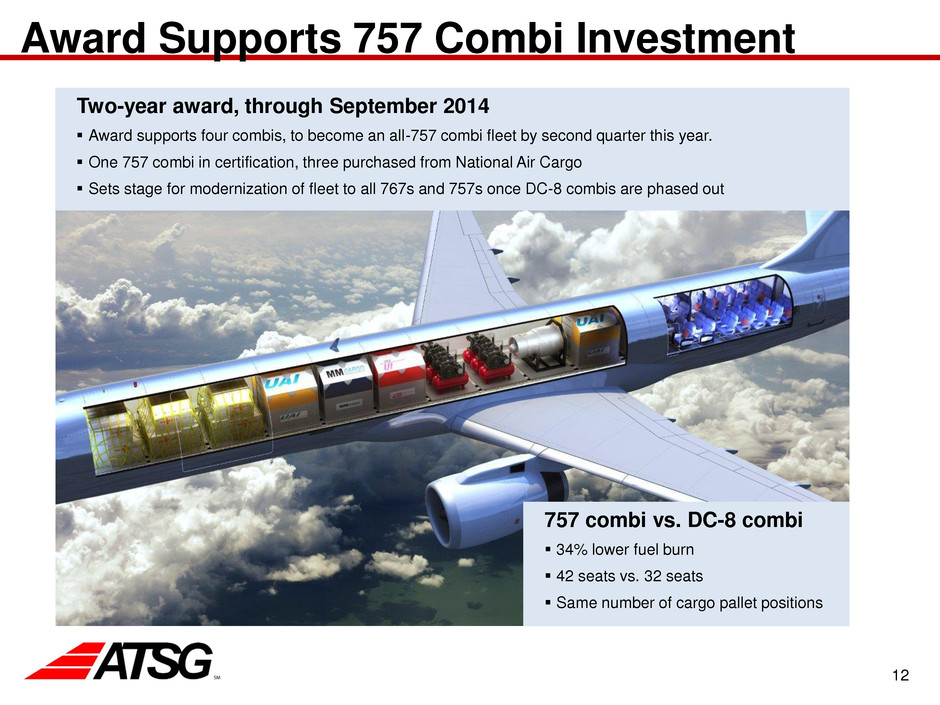

12 Award Supports 757 Combi Investment 757 combi vs. DC-8 combi 34% lower fuel burn 42 seats vs. 32 seats Same number of cargo pallet positions Two-year award, through September 2014 Award supports four combis, to become an all-757 combi fleet by second quarter this year. One 757 combi in certification, three purchased from National Air Cargo Sets stage for modernization of fleet to all 767s and 757s once DC-8 combis are phased out

13 How we can win in challenging markets Our aircraft assets, and our business model, emphasize flexibility The mid-size Boeing 767 freighter is particularly valuable in a turbulent economy 767-300 range covers five of the eight largest-volume transcontinental routes normally served by large freighters (747, 777 and Airbus equivalents) without refueling, plus all intra-continental routes (intra-Asia, intra-Europe, intra-S. America, etc.) Average per-hour operating cost for 767-300 significantly less than comparable 747-400 and 777 freighters, can serve as optimal solutions for selected routes with depressed volumes Business model allows us to create unique, flexible solutions for customers Our combination of dry-leasing and ACMI capability allow us to rapidly respond with aircraft, crew and maintenance support, a key advantage in volatile markets Our marketing teams taking active role in connecting freight companies that can fill 767 together, but not separately, under block-space agreements WET2DRY program offers low-risk transition from other aircraft into 767 starting with ACMI, then pilot training and certification help leading to dry lease Extensive operating experience with the 767 enhances our value as a lessor…. A Leasing company that thinks like an operator Lead-generation efforts have yielded consistent pipeline of prospects; we are pursuing, in many cases with new, in-market sales representation

14 Fourth Quarter 2012, 2013 Outlook 2012 Adjusted EBITDA from continuing operations projected to be in-line or better than prior guidance of approximately $160 million Expect improving trend in 2013 for Adjusted EBITDA, EPS. Will provide 2013 guidance when 4Q 2012 earnings released on Feb. 27 Two 767-300s now in mod, four 757-200 combis scheduled for deployment in first half of 2013 Factors impacting 2013 Adjusted EBITDA guidance include: • Continued progress in deployment of 767 and 757 freighter fleet in improving global market • Reductions in overhead, operating expense from merger of ATI and CCIA airlines in 2Q 2013 • Benefits in maintenance, crew, and logistical expense from all-767, 757 fleet by mid-2013

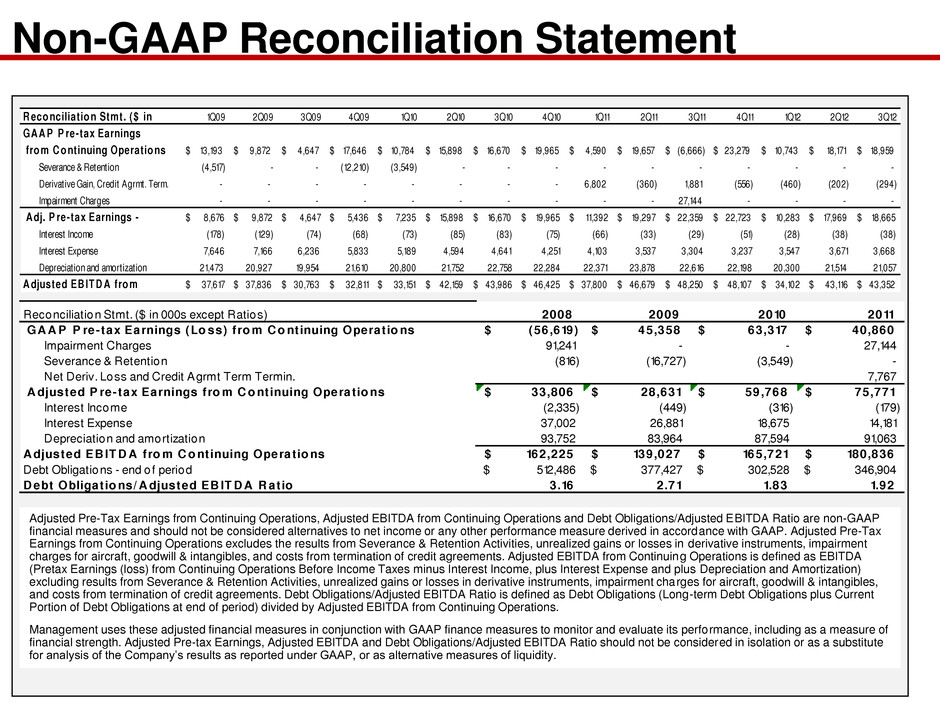

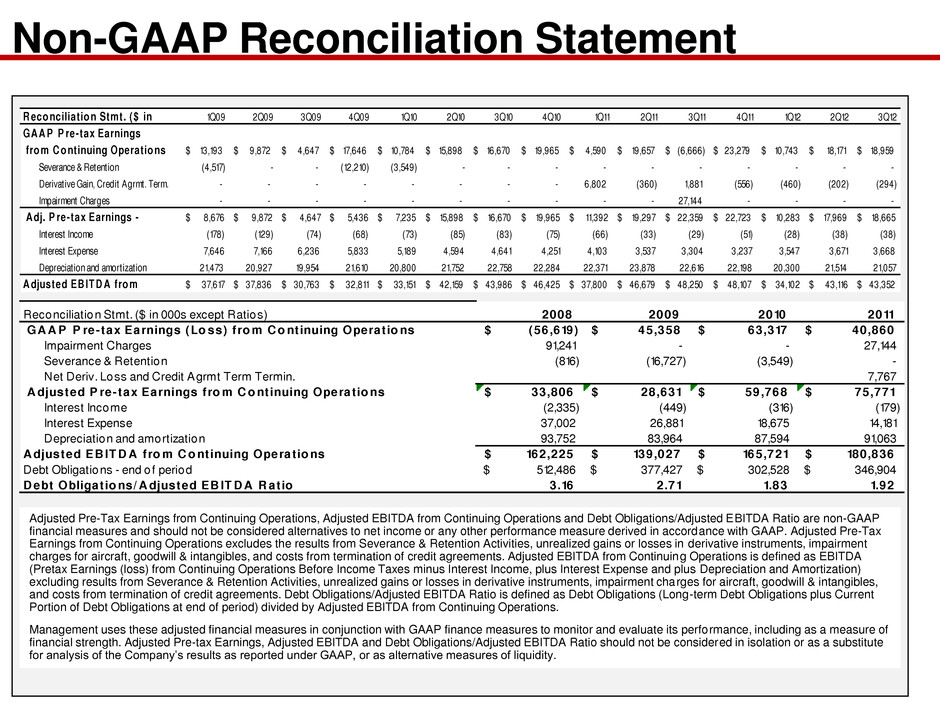

15 Non-GAAP Reconciliation Statement 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 13,193$ 9,872$ 4,647$ 17,646$ 10,784$ 15,898$ 16,670$ 19,965$ 4,590$ 19,657$ (6,666)$ 23,279$ 10,743$ 18,171$ 18,959$ Severance & Retention (4,517) - - (12,210) (3,549) - - - - - - - - - - Derivat ive Gain, Credit Agrmt. Term. - - - - - - - - 6,802 (360) 1,881 (556) (460) (202) (294) Impairment Charges - - - - - - - - - - 27,144 - - - - $ 8,676 $ 9,872 $ 4,647 $ 5,436 $ 7,235 $ 15,898 $ 16,670 $ 19,965 $ 11,392 $ 19,297 $ 22,359 $ 22,723 $ 10,283 $ 17,969 $ 18,665 Interest Income (178) (129) (74) (68) (73) (85) (83) (75) (66) (33) (29) (51) (28) (38) (38) Interest Expense 7,646 7,166 6,236 5,833 5,189 4,594 4,641 4,251 4,103 3,537 3,304 3,237 3,547 3,671 3,668 Depreciat ion and amort izat ion 21,473 20,927 19,954 21,610 20,800 21,752 22,758 22,284 22,371 23,878 22,616 22,198 20,300 21,514 21,057 $ 37,617 $ 37,836 $ 30,763 $ 32,811 $ 33,151 $ 42,159 $ 43,986 $ 46,425 $ 37,800 $ 46,679 $ 48,250 $ 48,107 $ 34,102 $ 43,116 $ 43,352 GA A P P re-tax Earnings R eco nciliat io n Stmt. ($ in A djusted EB IT D A fro m fro m C o ntinuing Operat io ns A dj. P re-tax Earnings - Adjusted Pre-Tax Earnings from Continuing Operations, Adjusted EBITDA from Continuing Operations and Debt Obligations/Adjusted EBITDA Ratio are non-GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance with GAAP. Adjusted Pre-Tax Earnings from Continuing Operations excludes the results from Severance & Retention Activities, unrealized gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Adjusted EBITDA from Continuing Operations is defined as EBITDA (Pretax Earnings (loss) from Continuing Operations Before Income Taxes minus Interest Income, plus Interest Expense and plus Depreciation and Amortization) excluding results from Severance & Retention Activities, unrealized gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, and costs from termination of credit agreements. Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end of period) divided by Adjusted EBITDA from Continuing Operations. Management uses these adjusted financial measures in conjunction with GAAP finance measures to monitor and evaluate its performance, including as a measure of financial strength. Adjusted Pre-tax Earnings, Adjusted EBITDA and Debt Obligations/Adjusted EBITDA Ratio should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as alternative measures of liquidity. 2008 2009 2010 2011 (56,619)$ 45,358$ 63,317$ 40,860$ Im airment Charges 91,24 - - 27,144 Sev rance & Retenti n (816) (1 ,727) (3,549) - Net Deriv. Loss and Credit Agrmt Term Termin. 7,767 33,806$ 28,631$ 59,768$ 75,771$ Interest Income (2,335) (449) (316) (179) Interest Expense 37,002 26,881 18,675 14,181 Depreciation and amortization 93,752 83,964 87,594 91,063 162,225$ 139,027$ 165,721$ 180,836$ 512,486$ 377,427$ 302,528$ 346,904$ 3.16 2 .71 1.83 1.92 Reconciliation Stmt. ($ in 000s except Ratios) D ebt Obligat io ns/ A djusted EB IT D A R atio GA A P P re-tax Earnings (Lo ss) fro m C o ntinuing Operat io ns A djusted EB IT D A fro m C o ntinuing Operat io ns Debt Obligations - end of period A djusted P re-tax Earnings fro m C o ntinuing Operat io ns