Exhibit 99.1

ABX HOLDINGS, INC. May 13, 2008

Shareholders’ Meeting

1

ABX HOLDINGS, INC.

Safe Harbor Statement

Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. ABX Holdings’ actual results may differ materially from the results discussed in the forward-looking statements. There are a number of important factors that could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, ABX Holdings’ ability to leverage synergies arising from the acquisition of Cargo Holdings International, ABX Air’s ability to maintain cost and service level performance under its commercial agreements with DHL, significant reductions in the scope of services under ABX Air’s commercial agreements with DHL, ABX Holdings’ ability to generate revenues and earnings from sources other than DHL and other factors that are contained from time to time in ABX Holdings’ filings with the U.S. Securities and Exchange Commission, including ABX Holdings’ Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on the Company’s forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ABX Holdings undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes.

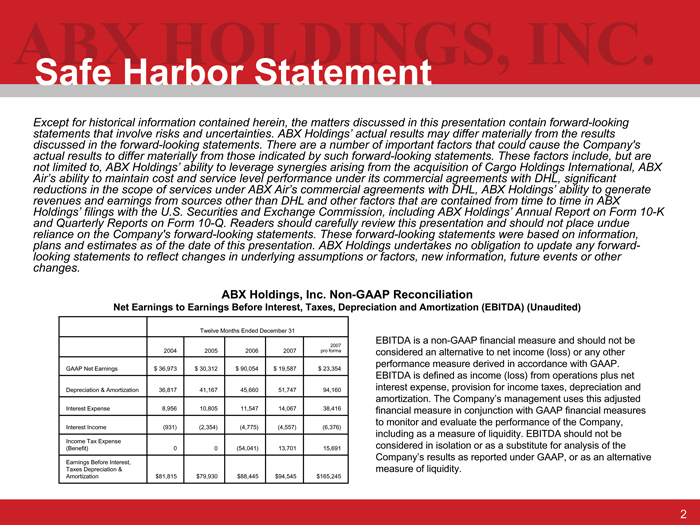

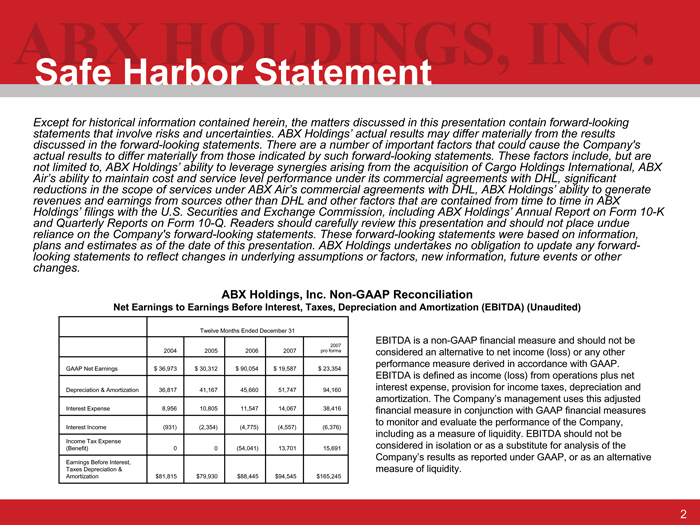

ABX Holdings, Inc. Non-GAAP Reconciliation

Net Earnings to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (Unaudited)

Twelve Months Ended December 31

2004 2005 2006 2007 2007 pro forma

GAAP Net Earnings $ 36,973 $ 30,312 $ 90,054 $ 19,587 $ 23,354

Depreciation & Amortization 36,817 41,167 45,660 51,747 94,160

Interest Expense 8,956 10,805 11,547 14,067 38,416

Interest Income (931) (2,354) (4,775) (4,557) (6,376)

Income Tax Expense (Benefit) 0 0 (54,041) 13,701 15,691

Earnings Before Interest, Taxes Depreciation & Amortization $81,815 $79,930 $88,445 $94,545 $165,245

EBITDA is a non-GAAP financial measure and should not be considered an alternative to net income (loss) or any other performance measure derived in accordance with GAAP. EBITDA is defined as income (loss) from operations plus net interest expense, provision for income taxes, depreciation and amortization. The Company’s management uses this adjusted financial measure in conjunction with GAAP financial measures to monitor and evaluate the performance of the Company, including as a measure of liquidity. EBITDA should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as an alternative measure of liquidity.

ABX HOLDINGS, INC.

Agenda

• 2007 In Review

• First Quarter 2008

• Diversification Progress

• 2008 Focus

3

ABX HOLDINGS, INC.

2007 Accomplishments

• Placed seven additional 767s into service

• Expanded global reach of ACMI operations into Asia

• Received IATA International Safety Certification

• Formed holding company

• Acquired Cargo Holdings International, Inc. (CHI)

4

ABX HOLDINGS, INC.

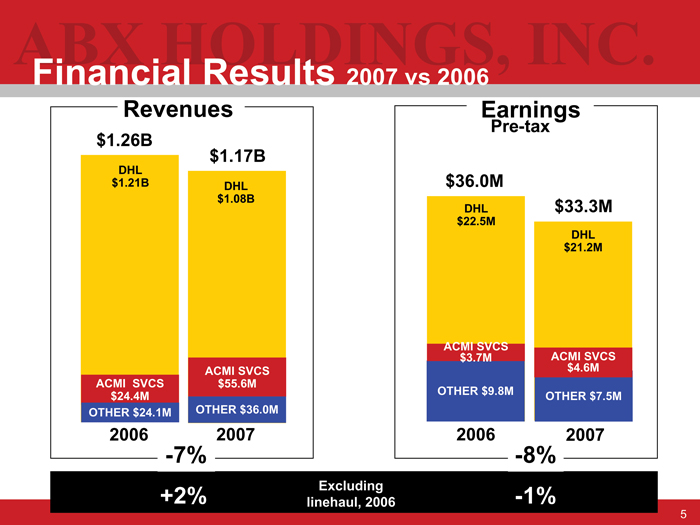

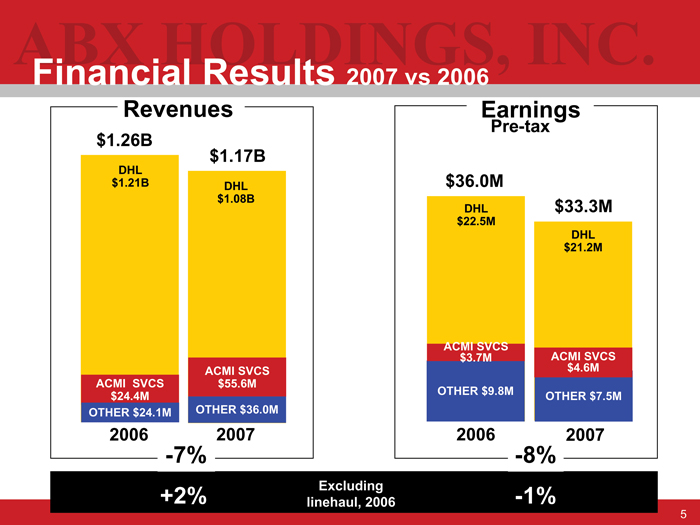

Financial Results 2007 vs 2006

Revenues

$1.26B

DHL $1.21B

ACMI SVCS $24.4M

OTHER $24.1M

2006

$1.17B

DHL $1.08B

ACMI SVCS $55.6M

OTHER $36.0M

2007

-7%

Earnings

Pre-tax

$36.0M

DHL $22.5M

ACMI SVCS $3.7M

OTHER $9.8M

2006

$33.3M

DHL $21.2M

ACMI SVCS $4.6M

OTHER $7.5M

2007

-8%

+2%

Excluding linehaul, 2006

-1%

5

ABX HOLDINGS, INC.

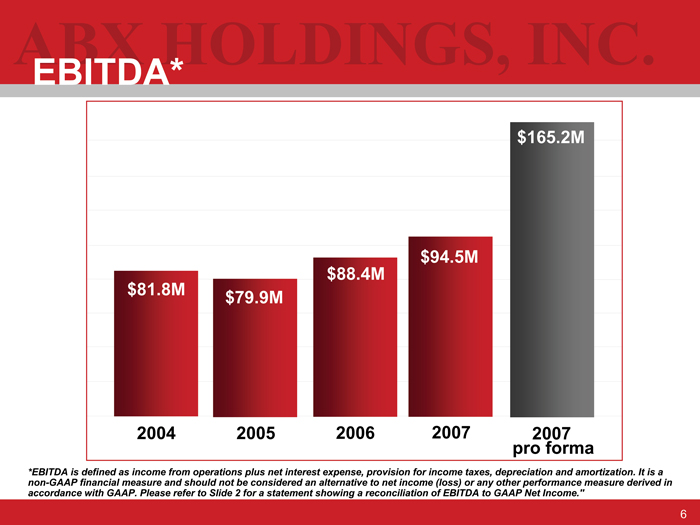

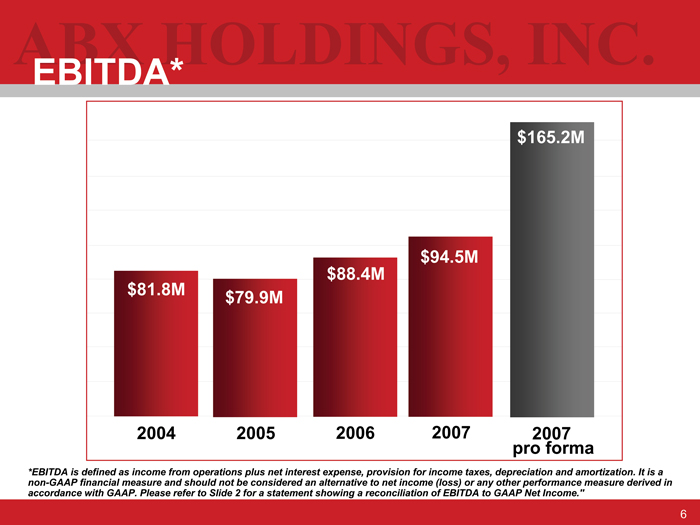

EBITDA*

$81.8M

2004

$79.9M

2005

$88.4M

2006

$94.5M

2007

$165.2M

2007

pro forma

*EBITDA is defined as income from operations plus net interest expense, provision for income taxes, depreciation and amortization. It is a non-GAAP financial measure and should not be considered an alternative to net income (loss) or any other performance measure derived in accordance with GAAP. Please refer to Slide 2 for a statement showing a reconciliation of EBITDA to GAAP Net Income.”

6

ABX HOLDINGS, INC.

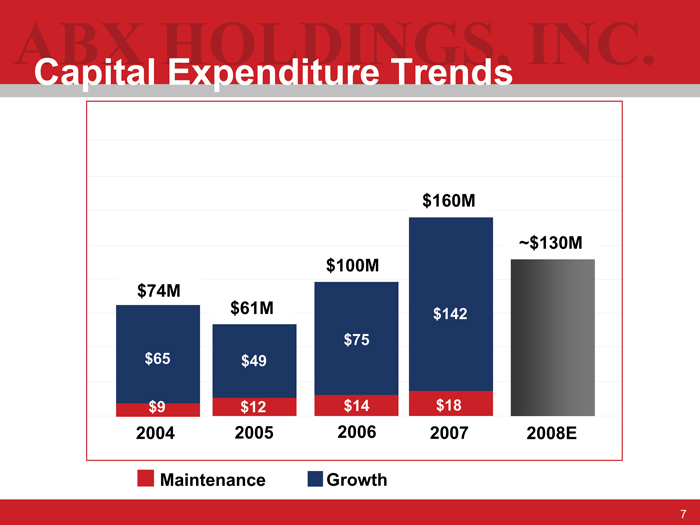

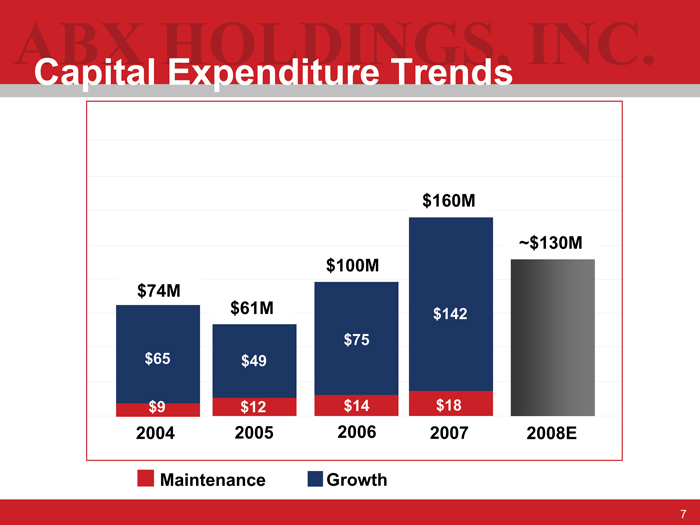

Capital Expenditure Trends

$74M

$65

$9

2004

$61M

$49

$12

2005

$100M

$75

$14

2006

$160M

$142

$18

2007

~$130M

2008E

Maintenance Growth

7

ABX HOLDINGS, INC.

First Quarter 2008

8

ABX HOLDINGS, INC.

First Quarter Accomplishments

• Renewed BAX/Schenker contract

• Renewed and extended ANA agreement

• Completed modification of our first 757

• Expanded DHL-US ACMI fleet

• Executed first 767 dry lease

• Staffed Osaka domicile

• Met service commitments to DHL during severe weather at Wilmington (ILN) Hub

9

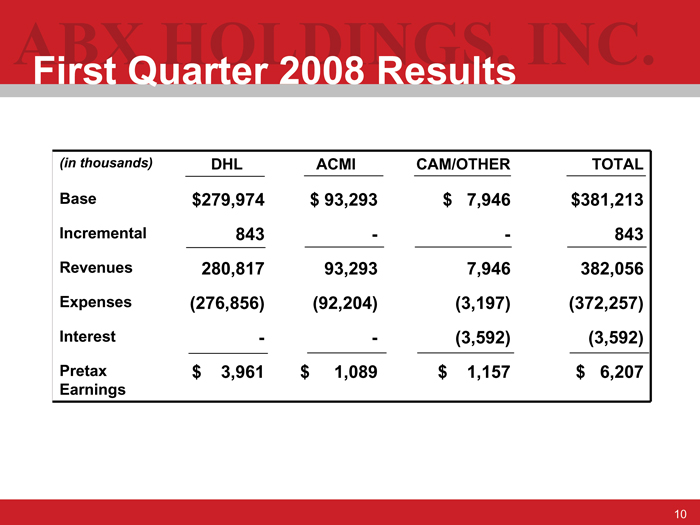

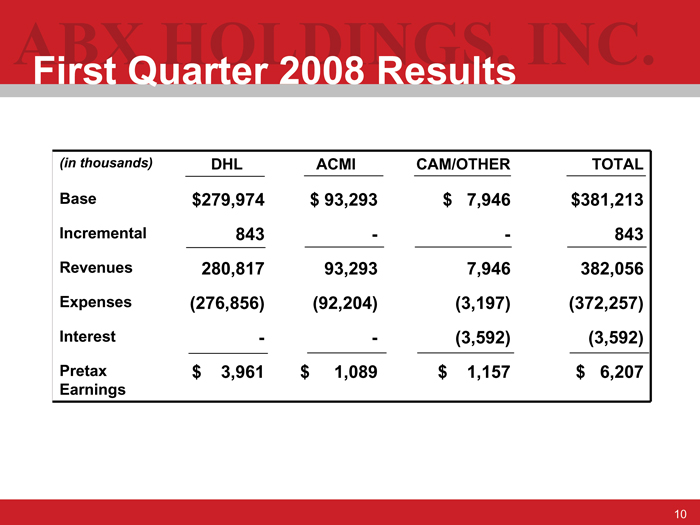

ABX HOLDINGS, INC.

First Quarter 2008 Results

(in thousands) DHL ACMI CAM/OTHER TOTAL

Base $279,974 $ 93,293 $ 7,946 $381,213

Incremental 843 — — 843

Revenues 280,817 93,293 7,946 382,056

Expenses (276,856) (92,204) (3,197) (372,257)

Interest — — (3,592) (3,592)

Pretax $ 3,961 $ 1,089 $ 1,157 $ 6,207

Earnings

10

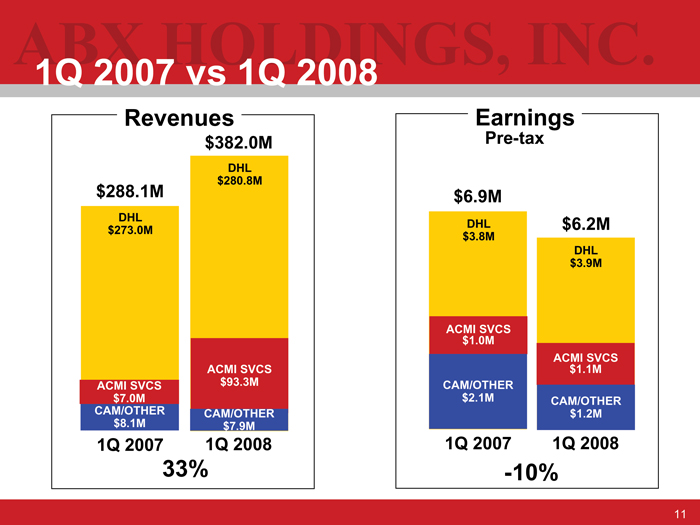

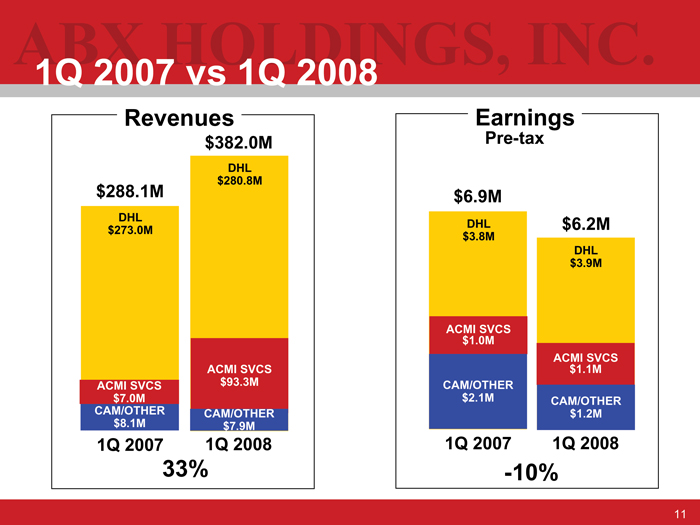

ABX HOLDINGS, INC.

1Q 2007 vs 1Q 2008

Revenues Earnings

$382.0M Pre-tax

DHL

$280.8M

$288.1M $6.9M

DHL DHL $6.2M

$273.0M $3.8M

DHL

$3.9M

ACMI SVCS

$1.0M

ACMI SVCS

ACMI SVCS $1.1M

ACMI SVCS $93.3M CAM/OTHER

$7.0M $2.1M CAM/OTHER

CAM/OTHER CAM/OTHER $1.2M

$8.1M $7.9M

1Q 2007 1Q 2008 1Q 2007 1Q 2008

33% -10%

11

ABX HOLDINGS, INC.

Diversification

Results

12

ABX HOLDINGS, INC.

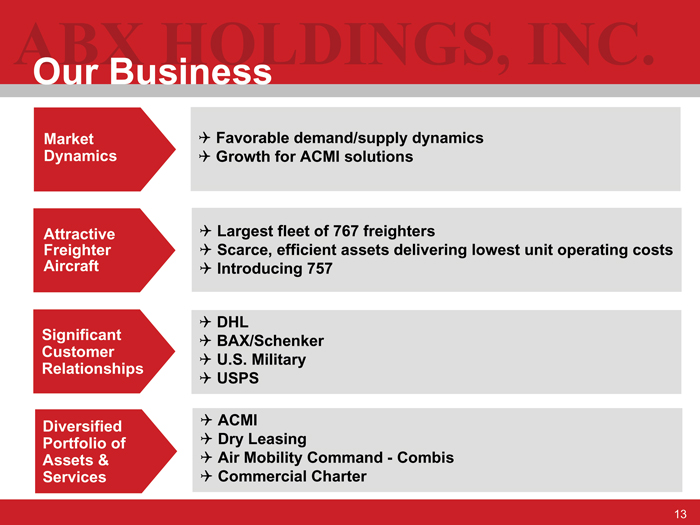

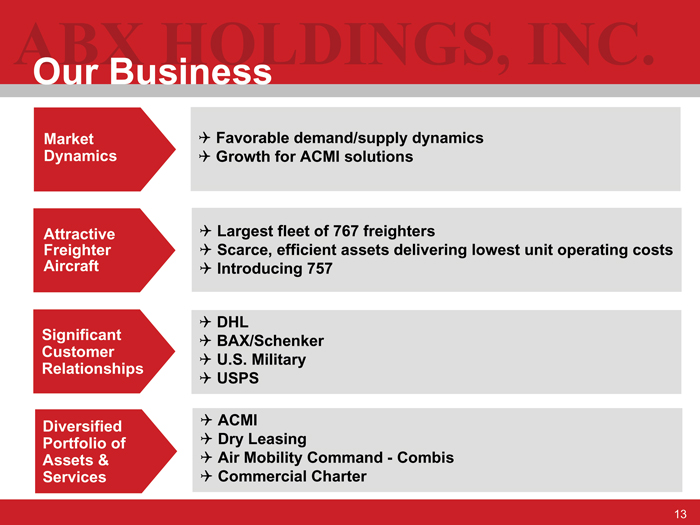

Our Business

Market Dynamics

Favorable demand/supply dynamics

Growth for ACMI solutions

Attractive Freighter Aircraft

Largest fleet of 767 freighters

Scarce, efficient assets delivering lowest unit operating costs

Introducing 757

Significant Customer Relationships

DHL

BAX/Schenker

U.S. Military

USPS

Diversified Portfolio of Assets & Services

ACMI

Dry Leasing

Air Mobility Command - Combis

Commercial Charter

13

ABX HOLDINGS, INC.

3 Airlines, 3 Distinct Opportunities

• 27-year history geared toward supporting U.S. express market

• DHL’s largest U.S. air service provider

• Superior service reputation and technical capabilities

• Fleet makeup – 767s, DC-9s

• International, military support, DC-8 combis with passenger/cargo capability

• Heavyweight domestic freight for BAX/Schenker

• Flexibility to serve long haul routes with efficient cost structure

• Fleet makeup – DC-8s, anticipating 767 certification Summer 2008

• On-demand charter, focused on ACMI and wet lease market

• Heavyweight domestic freight for BAX/Schenker

• Fleet makeup – 727s, 757 certification May 2008

14

ABX HOLDINGS, INC.

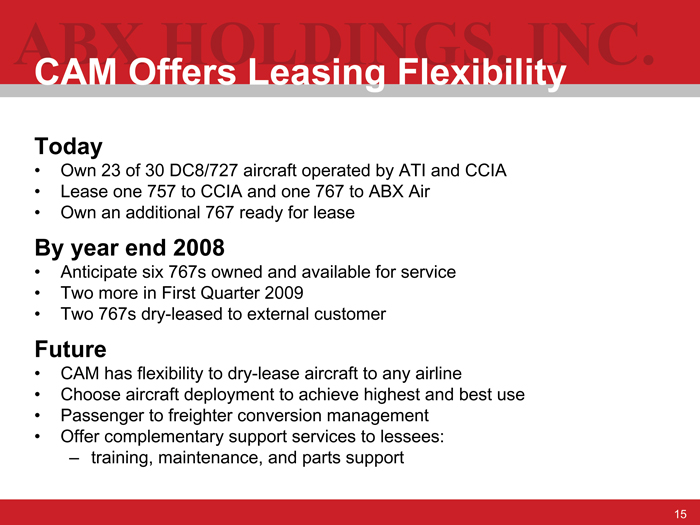

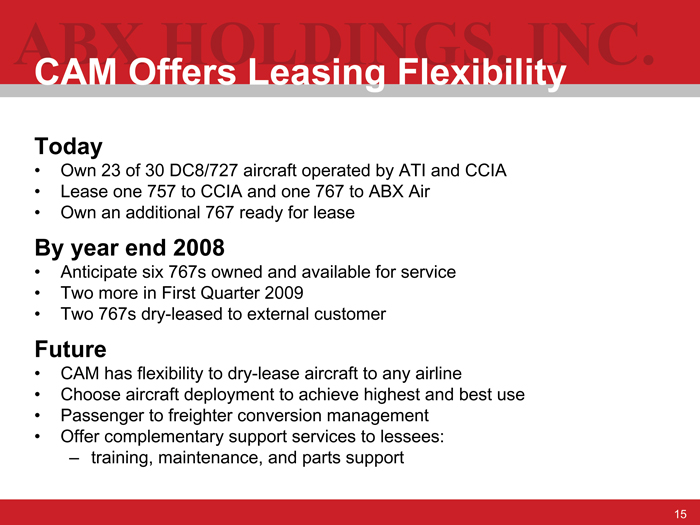

CAM Offers Leasing Flexibility

Today

• Own 23 of 30 DC8/727 aircraft operated by ATI and CCIA

• Lease one 757 to CCIA and one 767 to ABX Air

• Own an additional 767 ready for lease

By year end 2008

• Anticipate six 767s owned and available for service

• Two more in First Quarter 2009

• Two 767s dry-leased to external customer

Future

• CAM has flexibility to dry-lease aircraft to any airline

• Choose aircraft deployment to achieve highest and best use

• Passenger to freighter conversion management

• Offer complementary support services to lessees:

– training, maintenance, and parts support

15

ABX HOLDINGS, INC.

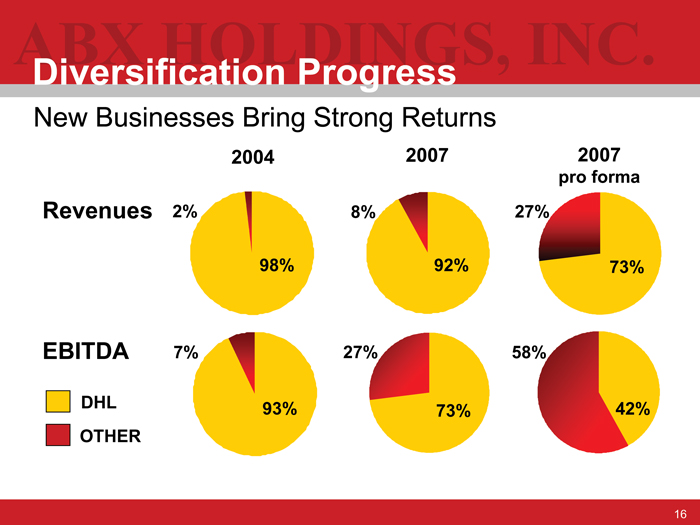

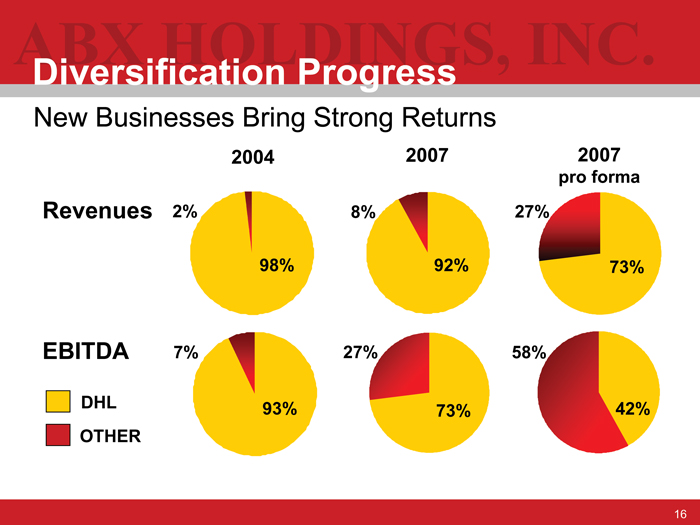

Diversification Progress

New Businesses Bring Strong Returns

2004 2007 2007 pro forma

Revenues 2% 8% 27%

98% 92% 73%

EBITDA 7% 27% 58%

93% 73% 42%

DHL

OTHER

16

ABX HOLDINGS, INC.

2008

Focus

17

ABX HOLDINGS, INC.

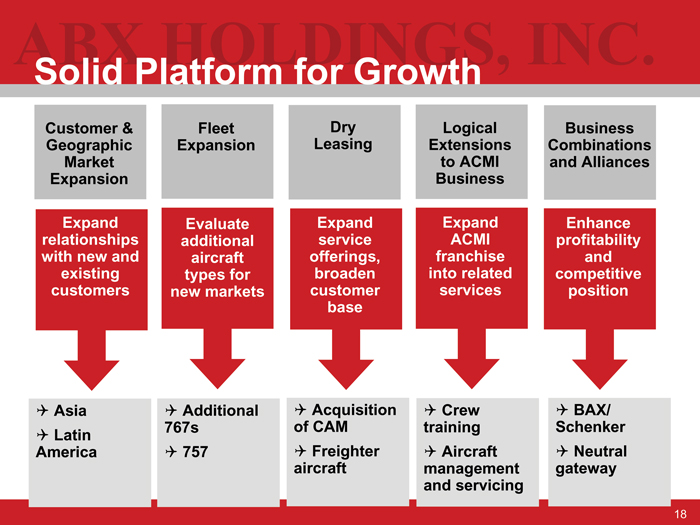

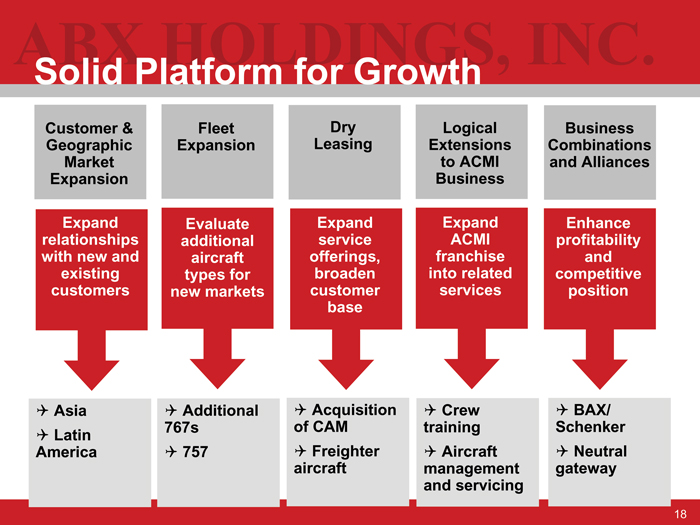

Solid Platform for Growth

Customer & Geographic Market Expansion

Expand relationships with new and existing customers

Asia

Latin America

Fleet Expansion

Evaluate additional aircraft types for new markets

Additional 767s

757

Dry Leasing

Expand service offerings, broaden customer base

Acquisition of CAM

Freighter aircraft

Logical Extensions to ACMI Business

Expand ACMI franchise into related services

Crew training

Aircraft management and servicing

Business Combinations and Alliances

Enhance profitability and competitive position

BAX/Schenker

Neutral gateway

18

ABX HOLDINGS, INC.

Core Customers

• Revenues principally from ACMI and Hub Services support of DHL’s-US Express network. ABX Air is by far DHL’s largest U.S. business partner.

• Two 767-200 freighters from ABX supporting DHL’s U.S. Express network under separate ACMI arrangements though 2008.

• CCIA supporting DHL with 757 service from U.S. to Latin America

• Proposing options concerning U.S. network restructuring plans and role of 767s in improving efficiency and reliability

• Cargo Holdings International acquired ATI from BAX Global in February 2006.

• Exclusive provider of main-deck freighter lift in the BAX/Schenker-U.S. domestic system through 2011.

• Relationship with Deutsche Bahn’s BAX/Schenker remains strong. Core operations are fully dependent on the services of ATI and CCIA.

19

ABX HOLDINGS, INC.

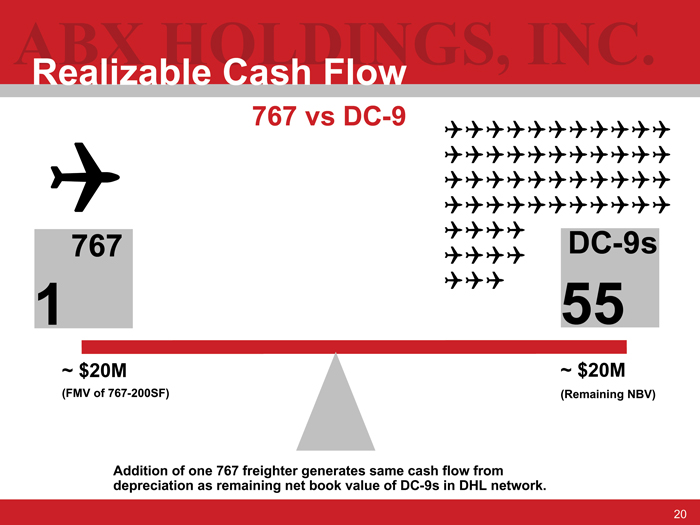

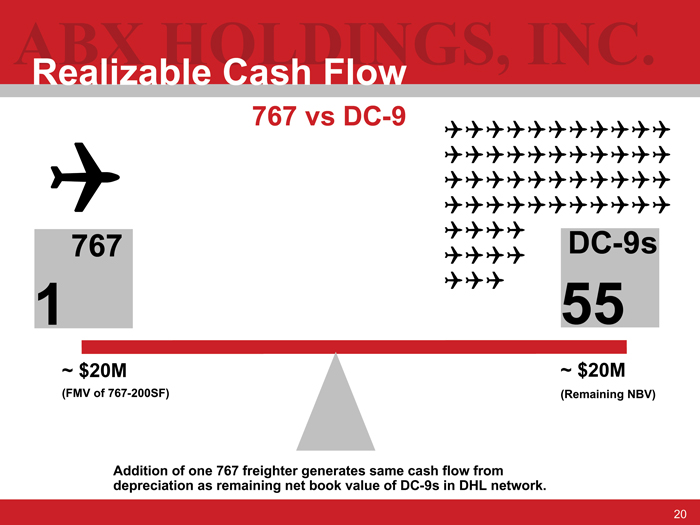

Realizable Cash Flow

767 vs DC-9

DC-9s

767

1 55

~ $20M ~ $20M

(FMV of 767-200SF) (Remaining NBV)

Addition of one 767 freighter generates same cash flow from depreciation as remaining net book value of DC-9s in DHL network.

20

ABX HOLDINGS, INC.

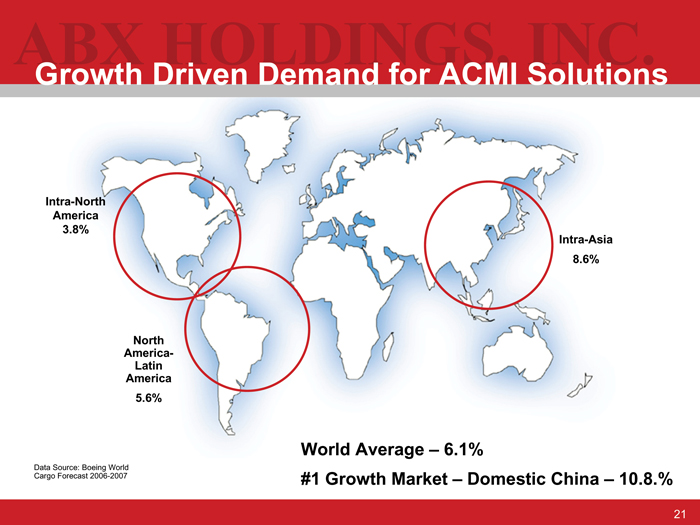

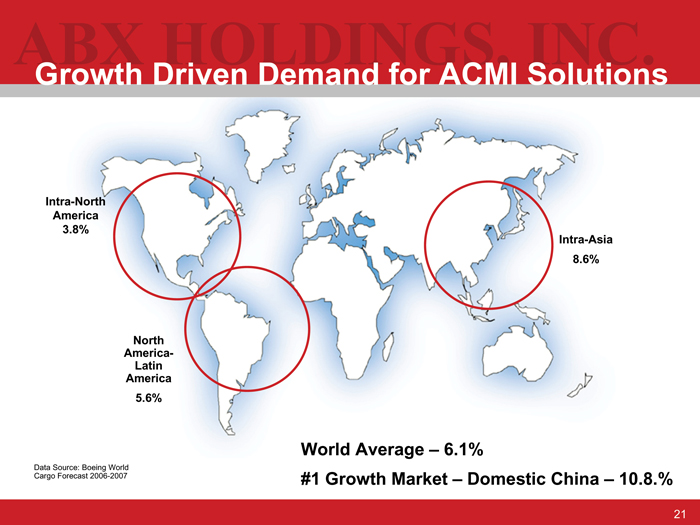

Growth Driven Demand for ACMI Solutions

Intra-North

America

3.8%

Intra-Asia

8.6%

North

America-

Latin

America

5.6%

World Average – 6.1%

Data Source: Boeing World

Cargo Forecast 2006-2007

#1 Growth Market – Domestic China – 10.8.%

21

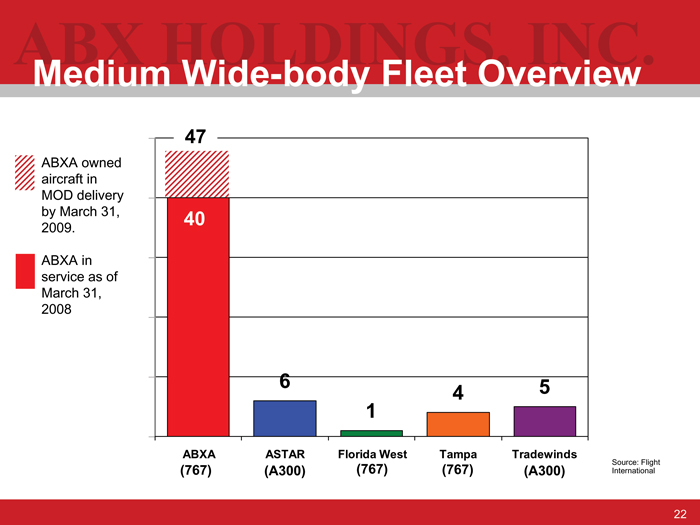

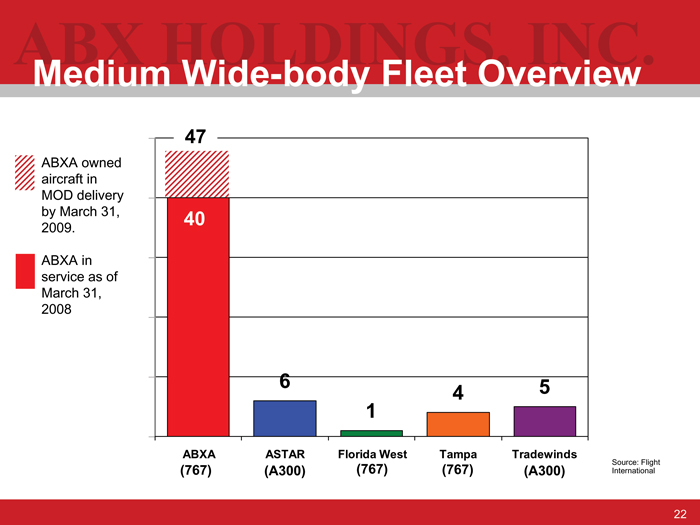

ABX HOLDINGS, INC.

Medium Wide-body Fleet Overview

47

ABXA owned aircraft in MOD delivery by March 31, 2009.

40

ABXA in service as of March 31, 2008

6

5

4

1

ABXA ASTAR Florida West Tampa Tradewinds

Source: Flight

International

(767) (A300) (767) (767) (A300)

22

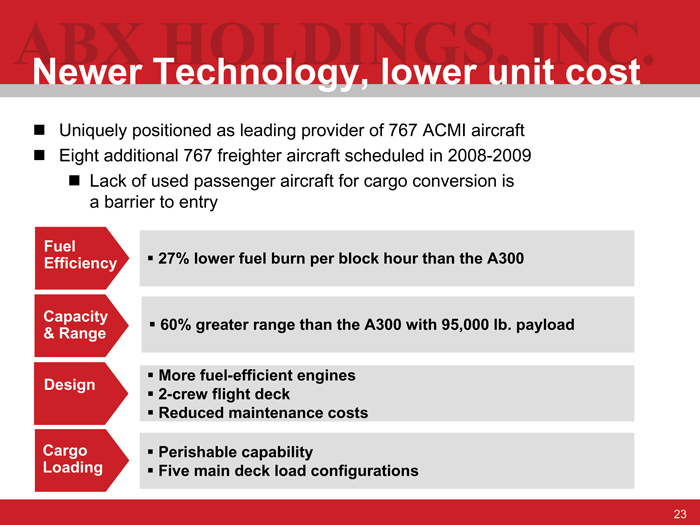

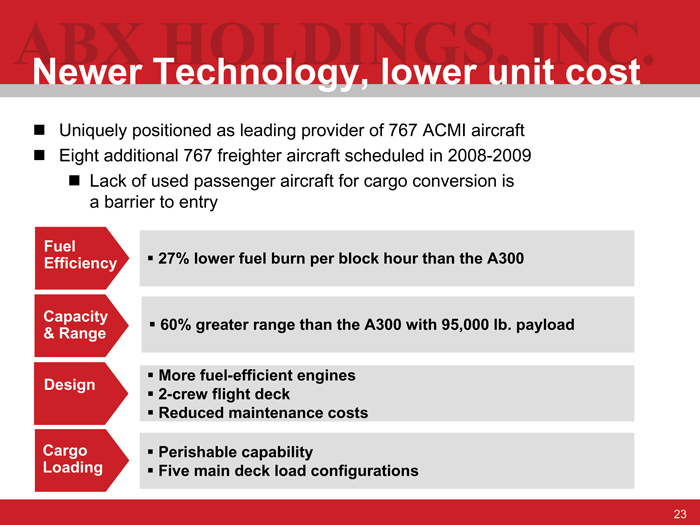

ABX HOLDINGS, INC.

Newer Technology, lower unit cost

Uniquely positioned as leading provider of 767 ACMI aircraft

Eight additional 767 freighter aircraft scheduled in 2008-2009

Lack of used passenger aircraft for cargo conversion is a barrier to entry

Fuel Efficiency

27% lower fuel burn per block hour than the A300

Capacity & Range

60% greater range than the A300 with 95,000 lb. payload

Design

More fuel-efficient engines

2-crew flight deck

Reduced maintenance costs

Cargo Loading

Perishable capability

Five main deck load configurations

23

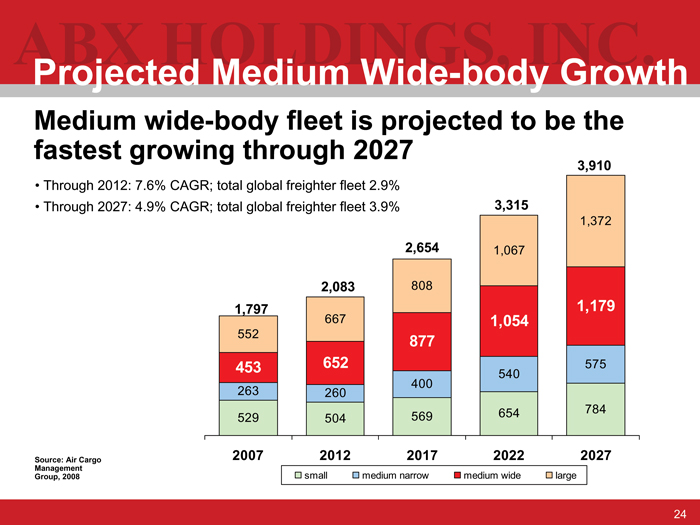

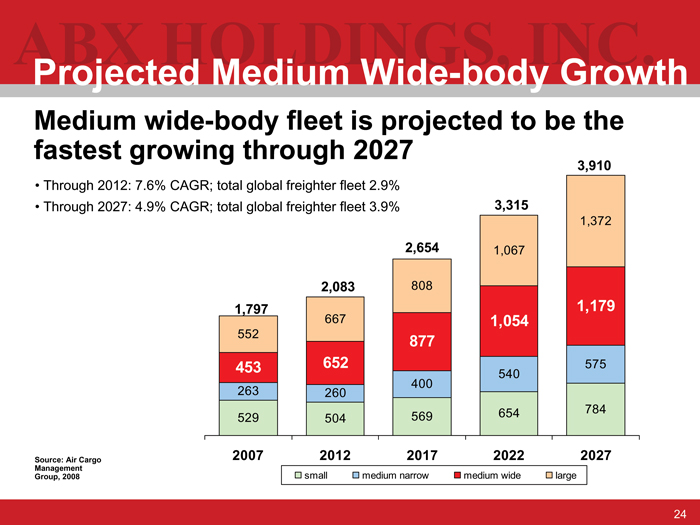

ABX HOLDINGS, INC.

Projected Medium Wide-body Growth

Medium wide-body fleet is projected to be the fastest growing through 2027

3,910

• Through 2012: 7.6% CAGR; total global freighter fleet 2.9%

• Through 2027: 4.9% CAGR; total global freighter fleet 3.9% 3,315

1,372

2,654 1,067

2,083 808

1,797 1,179

667 1,054

552 877

453 652 575

540

400

263 260

529 504 569 654 784

Source: Air Cargo 2007 2012 2017 2022 2027

Management

Group, 2008 small medium narrow medium wide large

24

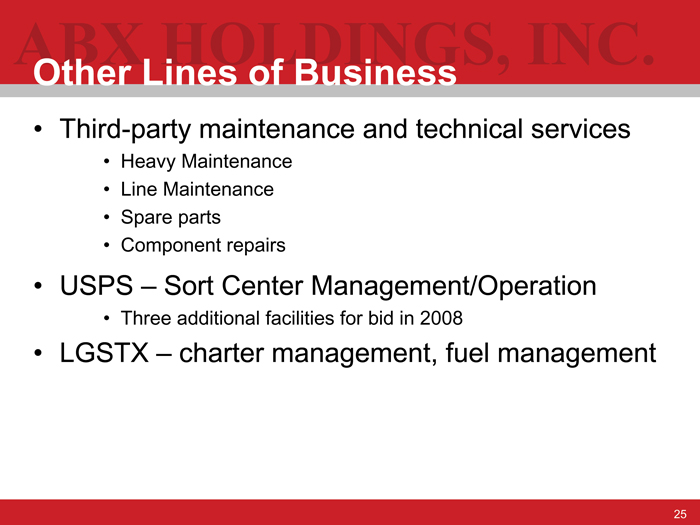

ABX HOLDINGS, INC.

Other Lines of Business

• Third-party maintenance and technical services

• Heavy Maintenance

• Line Maintenance

• Spare parts

• Component repairs

• USPS – Sort Center Management/Operation

• Three additional facilities for bid in 2008

• LGSTX – charter management, fuel management

25

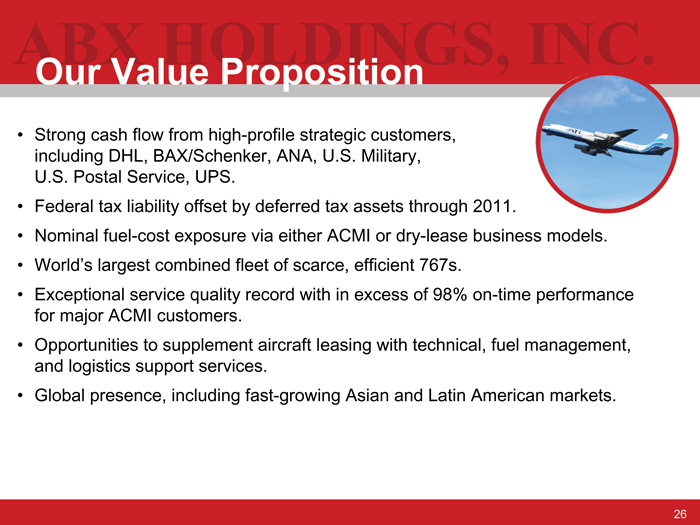

ABX HOLDINGS, INC.

Our Value Proposition

• Strong cash flow from high-profile strategic customers, including DHL, BAX/Schenker, ANA, U.S. Military, U.S. Postal Service, UPS.

• Federal tax liability offset by deferred tax assets through 2011.

• Nominal fuel-cost exposure via either ACMI or dry-lease business models.

• World’s largest combined fleet of scarce, efficient 767s.

• Exceptional service quality record with in excess of 98% on-time performance for major ACMI customers.

• Opportunities to supplement aircraft leasing with technical, fuel management, and logistics support services.

• Global presence, including fast-growing Asian and Latin American markets.

26

ABX HOLDINGS, INC.

Thank

you

27

ABX HOLDINGS, INC.

ABX Holdings, Inc. becomes …

28