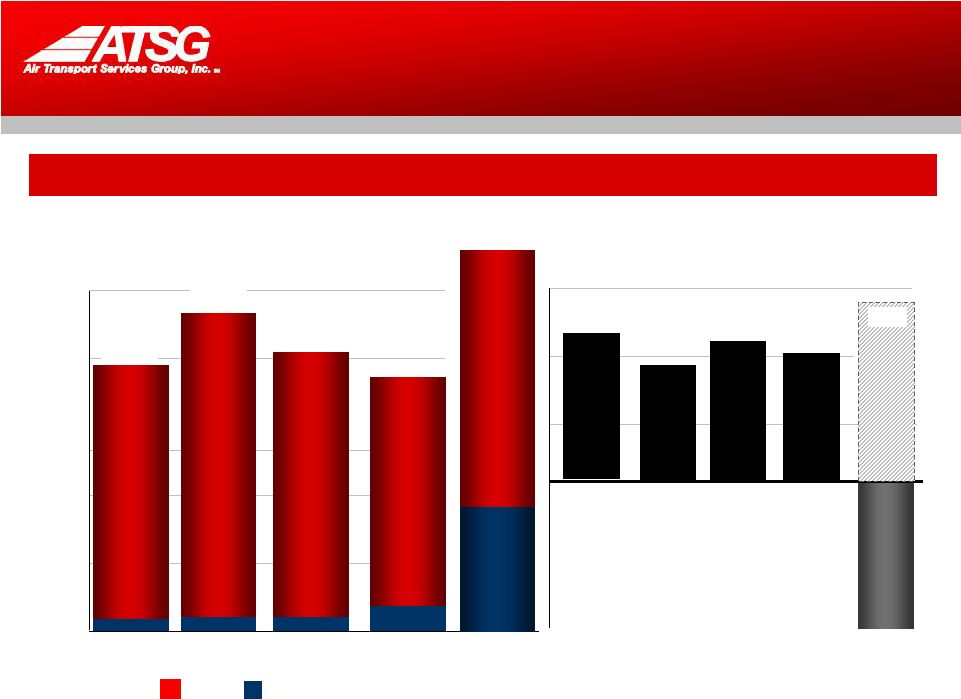

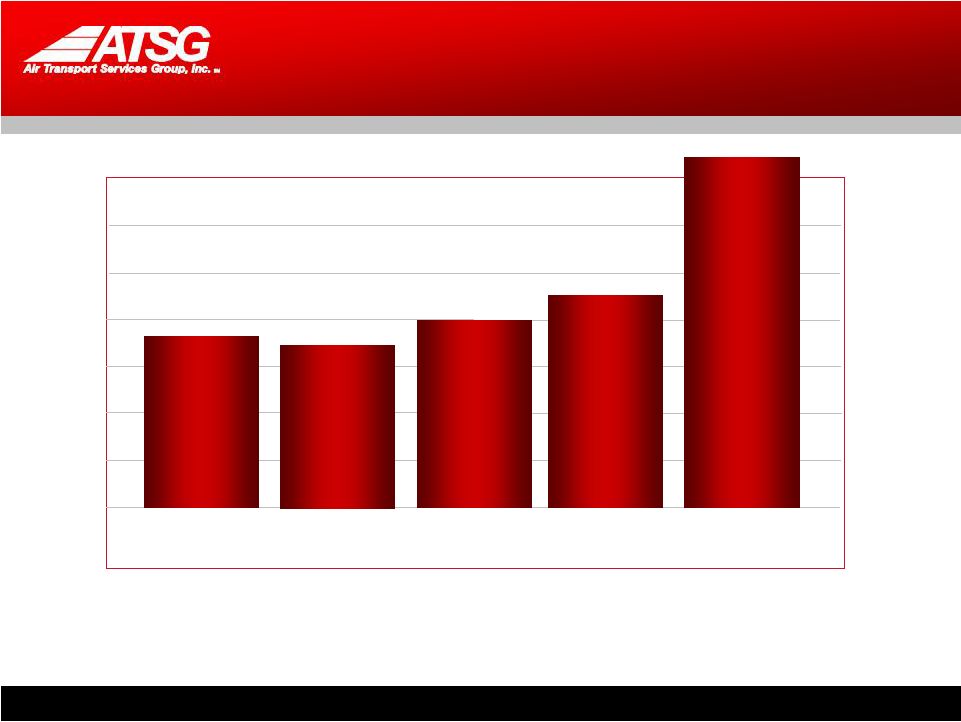

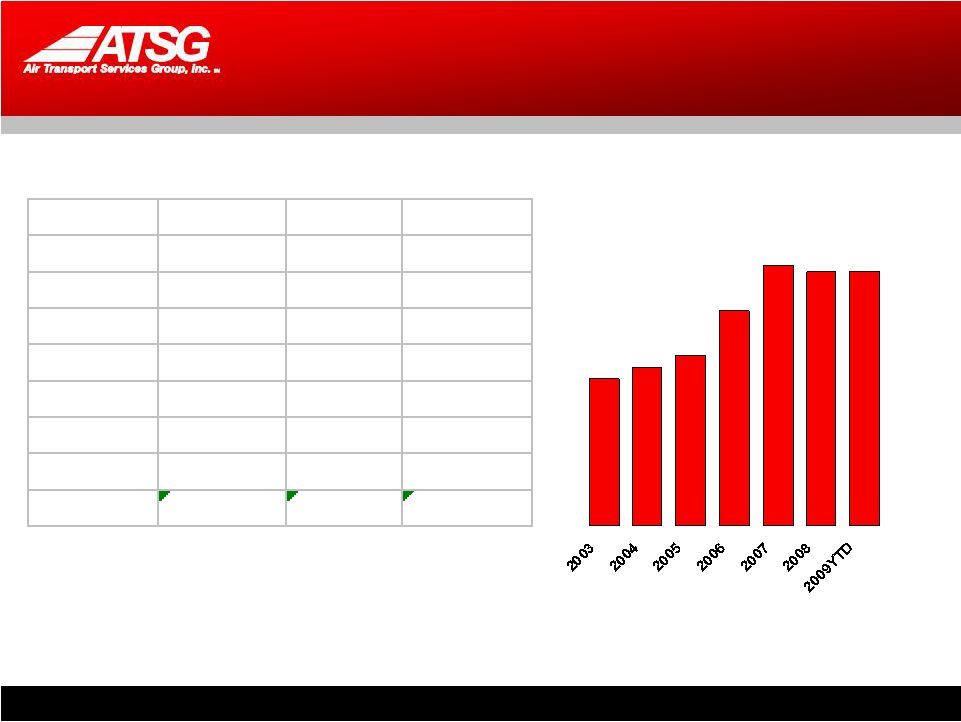

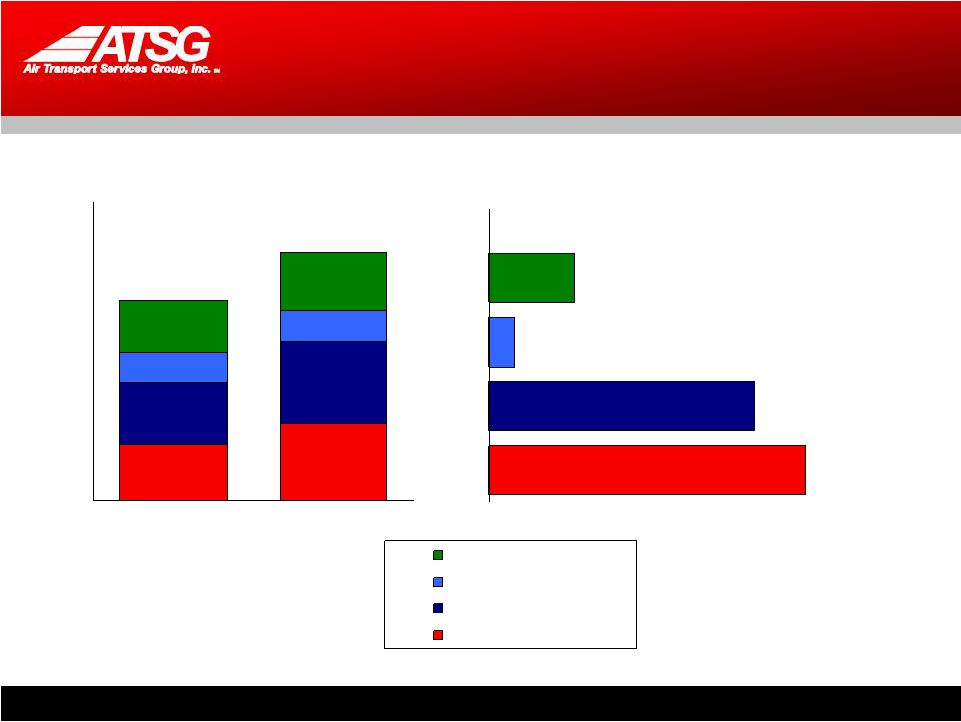

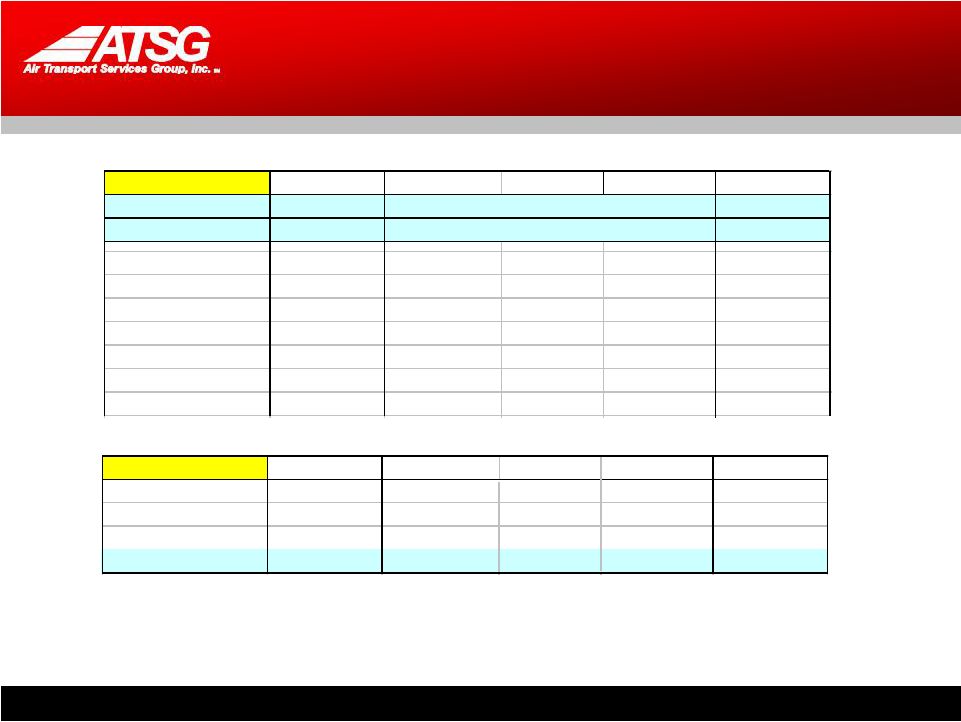

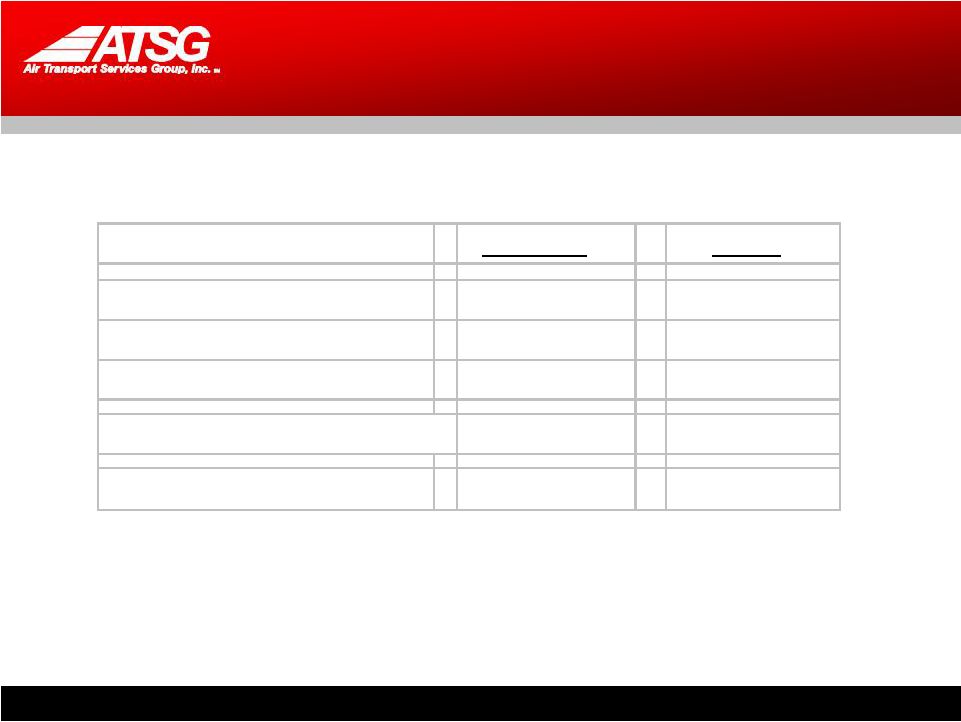

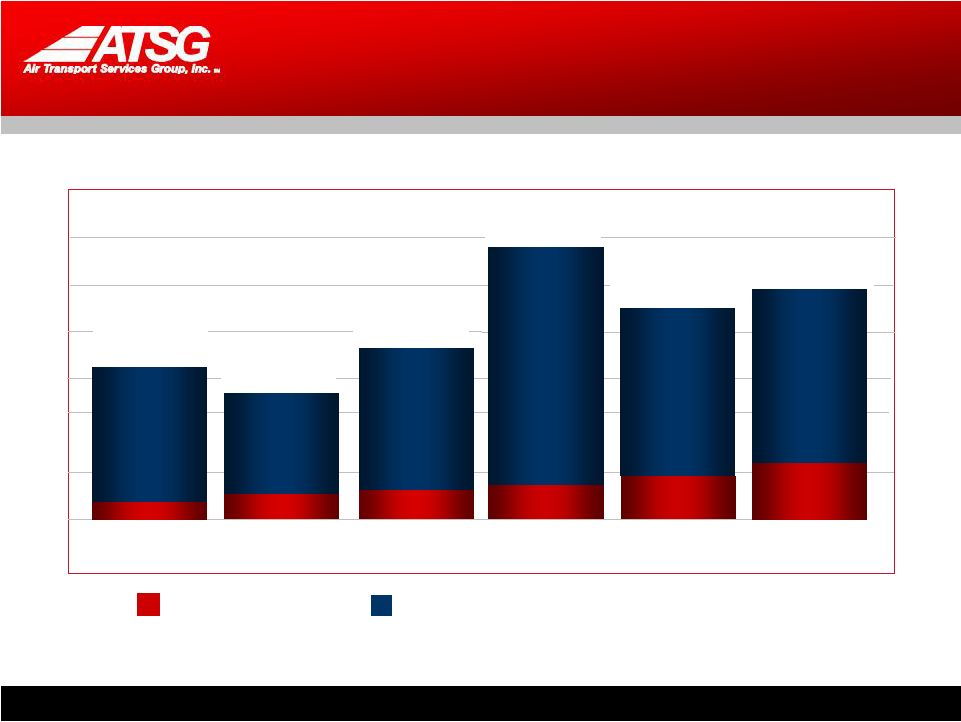

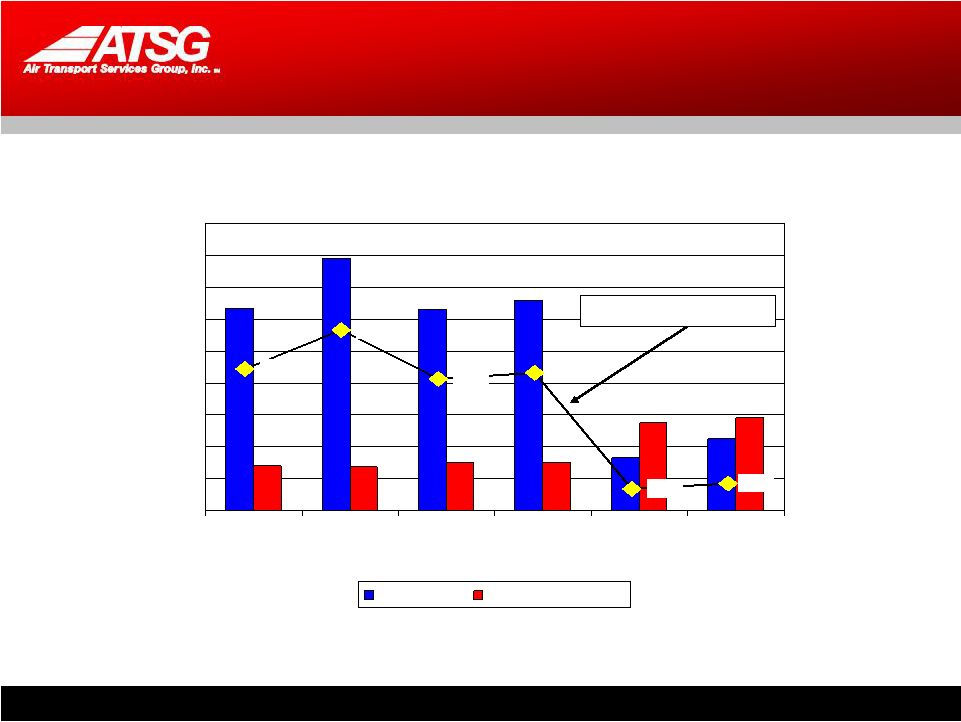

2 2 •Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport Services Group’s ("ATSG’s") actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, further reductions in the scope of services that ABX Air is performing under its commercial agreements with DHL and the rate at which those reductions occur, ABX Air’s ability to maintain cost and service level performance under its commercial agreements with DHL, the timing for and extent to which ABX Air is reimbursed for expenditures made under its Severance and Retention Agreement with DHL and for costs associated with the termination of services under its commercial agreements with DHL, further reductions in the scope of services that ATSG is providing to its other customers, ATSG’s ability to sufficiently reduce its costs in order to compete for new business and generate reasonable returns, the timely conversion and deployment of Boeing 767 aircraft, ATSG’s ability to remain in compliance with the terms of its credit arrangements, and other factors that are contained from time to time in ATSG’s filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG’s forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. Safe Harbor Statement ATSG, Inc. Non-GAAP Reconciliation Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) (Unaudited) EBITDA is a non-GAAP financial measure and should not be considered an alternative to net income (loss) or any other performance measure derived in accordance with GAAP. EBITDA is defined as income (loss) from operations plus net interest expense, provision for income taxes, depreciation and amortization. The Company’s management uses this adjusted financial measure in conjunction with GAAP financial measures to monitor and evaluate the performance of the Company, including as a measure of liquidity. EBITDA should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as an alternative measure of liquidity. * Excluding goodwill and intangible impairment charges 2004 2005 2006 2007 2008 36,973 30,312 90,054 19,587 (55,990) Income Tax Expense (Benefit) - - (54,041) 13,701 10,161 Interest Income (931) (2,354) (4,775) (4,557) (2,335) Interest Expenses 8,956 10,805 11,547 14,067 37,002 Depreciation and amortization 36,817 41,167 45,660 51,747 94,451 81,815 79,930 88,445 94,545 83,289 Impairment of goodwill and intangibles - - - - 91,241 81,815 79,930 88,445 94,545 174,530 GAAP Net Earnings Reconciliation Statement ($ in 000s) Adjusted EBITDA EBITDA |