UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a‑12 |

Cogentix Medical, Inc.

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0‑11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

Cogentix Medical, Inc.

5420 Feltl Road

Minnetonka, Minnesota 55343

July 1, 2015

Dear Stockholders:

We are pleased to invite you to join us for the Cogentix Medical, Inc. Annual Meeting of Stockholders to be held on Friday, July 31, 2015, at 1:30 p.m., Central Daylight Time, at our corporate offices located at 5420 Feltl Road, Minnetonka, Minnesota 55343. Details about the meeting, nominees for election to the Board of Directors and other matters to be acted on at the meeting are presented in the Notice of Annual Meeting of Stockholders and proxy statement that follow.

It is important that your shares be represented at the meeting, regardless of the number of shares you hold. Accordingly, please exercise your right to vote by completing, signing, dating and returning your proxy card, or by following the Internet or telephone voting instructions as described in the accompanying proxy statement, or by following the voting instructions on the Notice Regarding the Availability of Proxy Materials you received for the meeting.

On behalf of the Board of Directors and management of Cogentix Medical, it is my pleasure to express our appreciation for your support.

Sincerely,

| |

| Robert Kill | |

| President and Chief Executive Officer | |

Your vote is important. Please exercise your right to vote as soon as possible by completing, signing, dating and returning your proxy card, or by following the Internet or telephone voting instructions as described in the accompanying proxy statement. By doing so, you may save us the expense of additional solicitation.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, JULY 31, 2015

To the Stockholders of Cogentix Medical, Inc.:

The Annual Meeting of Stockholders of Cogentix Medical, Inc., a Delaware corporation, will be held on Friday, July 31, 2015, at 1:30 p.m., Central Daylight Time, at our corporate offices located at 5420 Feltl Road, Minnetonka, Minnesota 55343 for the following purposes:

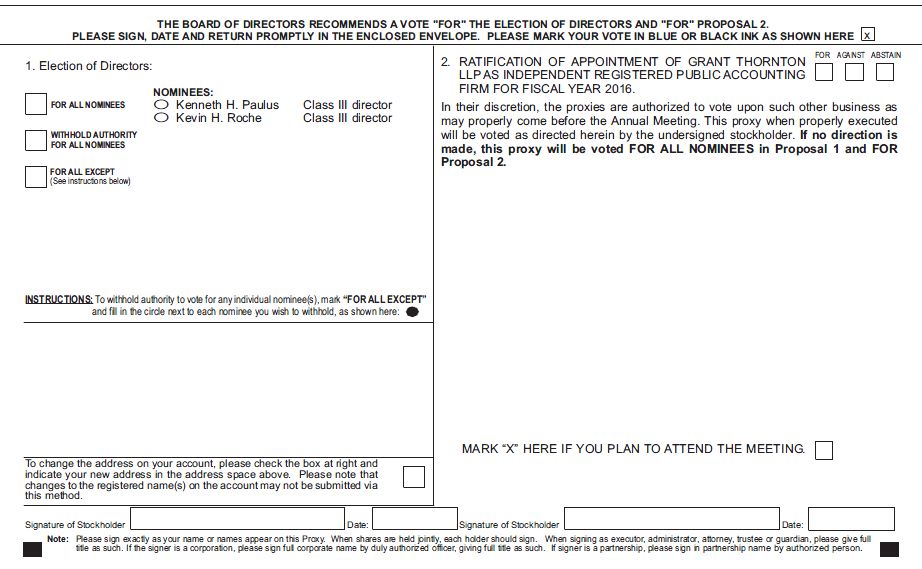

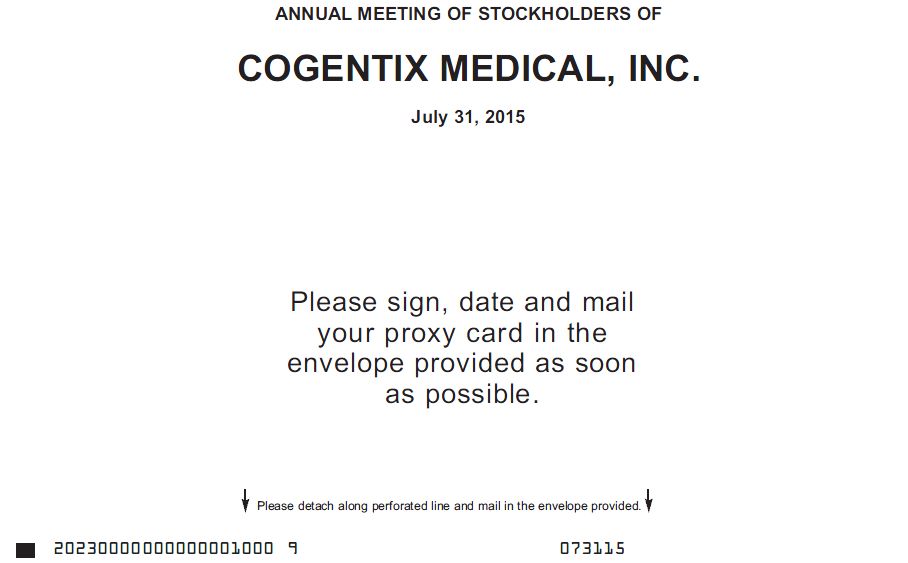

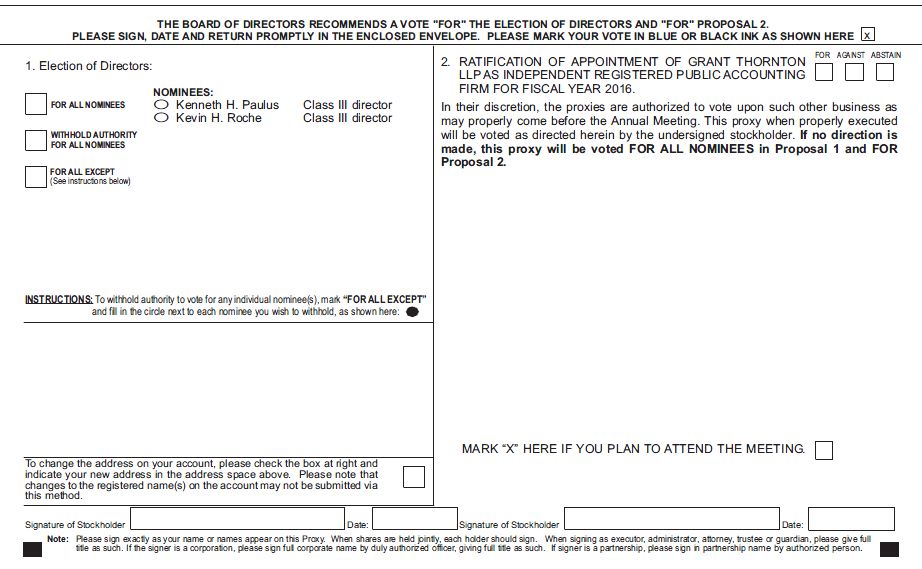

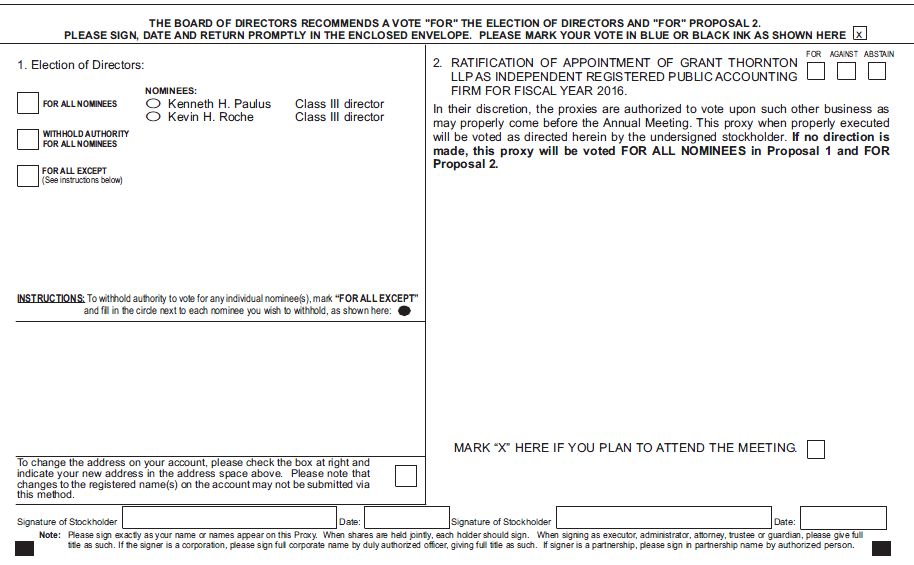

| 1. | To elect Kenneth H. Paulus and Kevin H. Roche to serve as directors for a three-year term ending at 2018 Annual Meeting of Stockholders or until their respective successors are elected and qualified. |

| 2. | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for the year ending March 31, 2016. |

| 3. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only stockholders of record at the close of business on June 20, 2015 will be entitled to notice of, and to vote at, the meeting and any adjournments thereof. A stockholder list will be available at Cogentix’s corporate offices beginning 10 days prior to the date of the meeting during normal business hours for examination by any stockholder registered on Cogentix’s stock ledger as of the record date for any purpose germane to the meeting.

| | By Order of the Board of Directors, |

| | |

| | Brett A. Reynolds |

| | Senior Vice President, Chief Financial Officer and |

| July 1, 2015 | Corporate Secretary |

| | |

| Minnetonka, Minnesota | |

| | Page |

| | |

| 1 |

| 1 |

| 1 |

| 2 |

| 2 |

| 2 |

| 3 |

| 3 |

| 3 |

| 4 |

| 4 |

| 4 |

| 4 |

| 4 |

| | |

| 5 |

| | |

| 6 |

| 6 |

| 7 |

| | |

| 9 |

| 9 |

| 9 |

| 9 |

| 10 |

| 12 |

| | |

| 13 |

| 13 |

| 13 |

| 14 |

| 14 |

| | |

| 15 |

| 15 |

| 15 |

| 16 |

| 16 |

| 16 |

| 16 |

| 16 |

| 17 |

| 18 |

| 19 |

| | Page |

| | |

| 20 |

| 20 |

| 21 |

| 21 |

| 22 |

| 22 |

| | |

| 23 |

| 23 |

| 23 |

| 24 |

| 24 |

| | |

| 26 |

| 26 |

| 27 |

| 29 |

| 31 |

| 33 |

| 34 |

| | |

| 37 |

| 37 |

| 37 |

| | |

| 38 |

| 39 |

| 39 |

| 39 |

| 39 |

As used in this proxy statement, references to “Cogentix,” “Cogentix Medical,” the “Company,” “we,” “us,” “our” and similar references refer to Cogentix Medical, Inc. (formerly known as Vision-Sciences, Inc.) and our consolidated subsidiaries, and the term “common stock” refers to our common stock, par value $0.01 per share. All share and per share amounts have been adjusted to reflect the one-for-five reverse split of outstanding common stock effective March 31, 2015.

5420 Feltl Road

Minnetonka, Minnesota 55343

PROXY STATEMENT FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, JULY 31, 2015

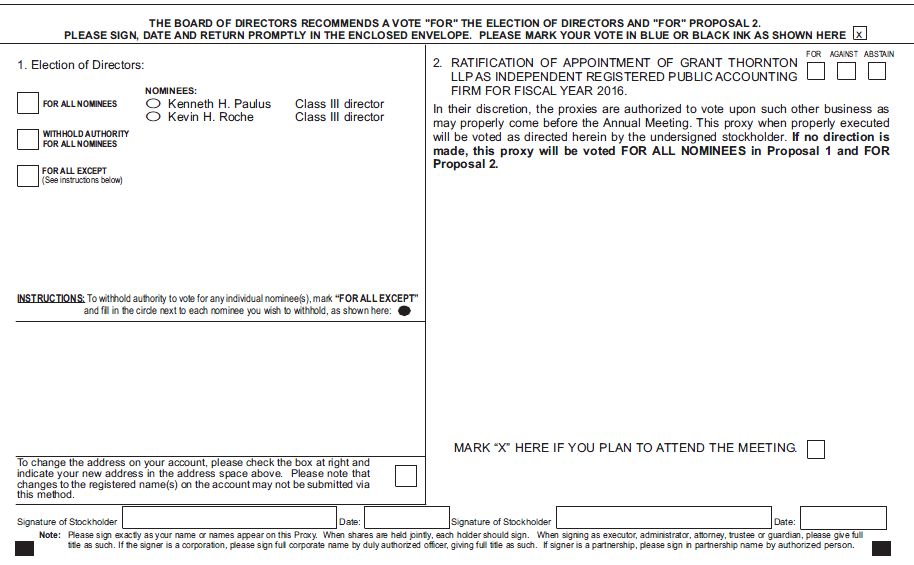

The Board of Directors of Cogentix Medical, Inc. is using this proxy statement to solicit your proxy for use at the Cogentix Medical, Inc. 2015 Annual Meeting of Stockholders to be held at 1:30 p.m., Central Daylight Time, on Friday, July 31, 2015. The Board of Directors expects to make available electronically or to send to our stockholders the Notice of Annual Meeting of Stockholders, this proxy statement and a form of proxy on or about July 1, 2015.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held on Friday, July 31, 2015

Our proxy statement and our annual report on Form 10-K for the fiscal year ended March 31, 2015, are available at www.voteproxy.com

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

When and Where Will the Annual Meeting Be Held?

The Annual Meeting of Stockholders of Cogentix Medical, Inc. will be held on Friday, July 31, 2015, at 1:30 p.m., Central Daylight Time, at our corporate offices located at 5420 Feltl Road, Minnetonka, Minnesota 55343.

What are the Purposes of the Annual Meeting?

The purposes of the Annual Meeting are to vote on the following items:

| | 1. | To elect Kenneth H. Paulus and Kevin H. Roche to serve as directors for a three-year term ending at 2018 Annual Meeting of Stockholders or until their respective successors are elected and qualified. |

| | 2. | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for the year ending March 31, 2016. |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Who is Entitled to Vote at the Annual Meeting?

Stockholders of record at the close of business on June 20, 2015 will be entitled to notice of and to vote at the meeting or any adjournment of the Annual Meeting. As of that date, there were 26,270,456 shares of our common stock outstanding. Each share of our common stock is entitled to one vote on each matter to be voted on at the Annual Meeting. Stockholders are not entitled to cumulative voting rights in the election of directors.

Your vote is important. Whether you hold shares directly as a stockholder of record or beneficially in “street name” (through a broker, bank or other nominee), you may vote your shares without attending the Annual Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee.

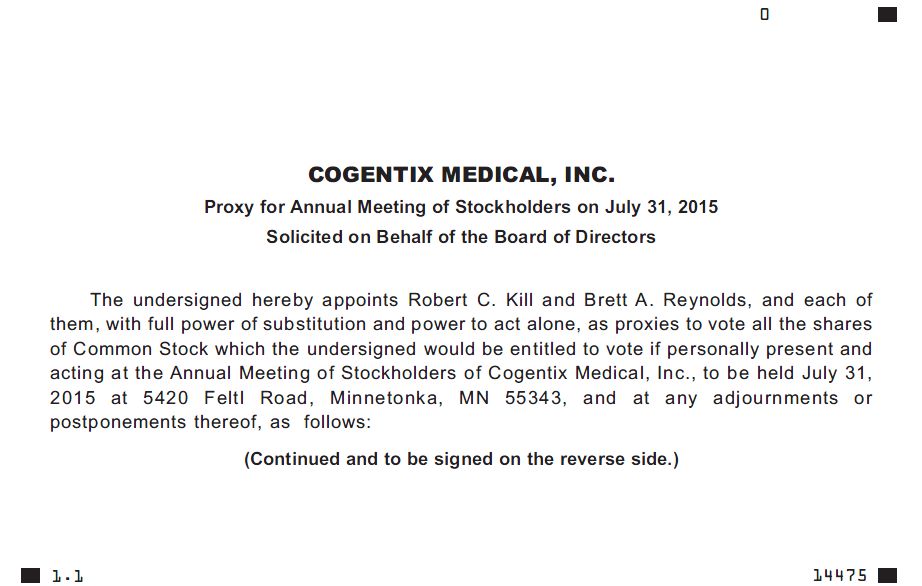

If you are a stockholder whose shares are registered in your name, you may vote your shares in person at the meeting or by one of the three following methods:

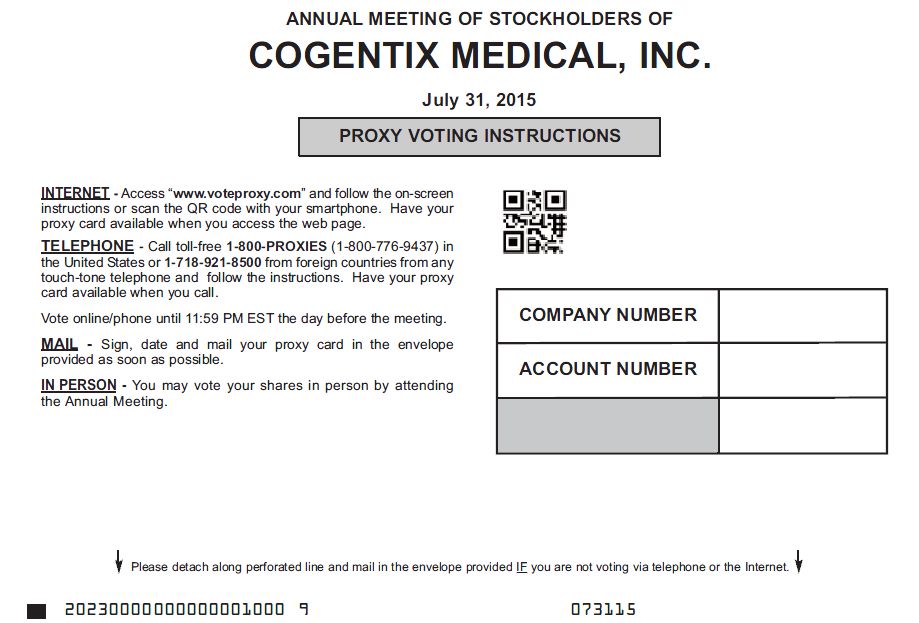

| · | Vote by Internet, by going to the web address http://www.voteproxy.com and following the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page. |

| · | Vote by Telephone, by dialing 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and following the instructions for telephone voting shown on your proxy card. Have your proxy card available when you call. |

| · | Vote by Mail, by completing, signing, dating and mailing the enclosed proxy card in the envelope provided. If you vote on the Internet or by telephone, please do not mail your proxy card. |

| · | In Person, by attending the annual meeting. |

If your shares are held in street name, you may receive a separate voting instruction form or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically using the Internet or telephone.

The deadline for voting by telephone or on the Internet is 10:59 p.m., Central Daylight Time, on Thursday, July 30, 2015. Please see your proxy card or the information your bank, broker or other holder of record provided to you for more information on your options for voting.

How Will My Shares Be Voted?

If you return your signed proxy card or use the Internet or telephone voting before the Annual Meeting, the named proxies will vote your shares as you direct.

For Proposal No. 1—Election of Directors, you may:

| · | Vote FOR one or both of the two nominees for directors; |

| · | WITHHOLD your vote from both of the two director nominees; or |

| · | WITHHOLD your vote from one of the two director nominees that you designate. |

For Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm, you may:

| · | Vote AGAINST the proposal; or |

| · | ABSTAIN from voting on the proposal. |

If you send in your proxy card or use the Internet or telephone voting, but you do not specify how you want to vote your shares, the proxies will vote your shares:

| · | FOR both of the two nominees for directors in Proposal No. 1— Election of Directors; and |

| · | FOR Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm. |

How Does the Board of Directors Recommend that I Vote?

The Board of Directors recommends that you vote:

| · | FOR both of the two nominees for directors in Proposal No. 1—Election of Directors; and |

| · | FOR Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm. |

How Can I Revoke or Change My Vote?

If you are a stockholder whose shares are registered in your name, you may revoke your proxy at any time before it is voted by one of the following methods:

| · | Submitting another proper proxy with a more recent date than that of the proxy first given by following the Internet or telephone voting instructions or completing, signing, dating and returning a proxy card to us; |

| · | Sending written notice of revocation to our Corporate Secretary; or |

| · | Attending the Annual Meeting and voting by ballot. |

If you hold your shares through a broker, bank or other nominee, you may revoke your proxy by following the instructions your broker, bank or other nominee provides.

How Many Shares Must Be Present to Hold the Annual Meeting?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority (13,135,229 shares) of the issued and outstanding shares of our common stock as of the record date will constitute a quorum for the transaction of business at the Annual Meeting. In general, shares of our common stock represented by a properly signed and returned proxy card will be counted as shares present and entitled to vote at the Annual Meeting for purposes of determining a quorum. Shares represented by proxies marked “Abstain” and “broker non-votes” are counted in determining whether a quorum is present. A “broker non-vote” is a proxy returned by a broker on behalf of its beneficial owner customer that is not voted on a particular matter because voting instructions have not been received by the broker from the customer, and the broker does not have discretionary authority to vote on behalf of such customer on such matter. The Annual Meeting may be adjourned to any other time and any other place by the stockholders present or represented at the meeting and entitled to vote even when such stockholders do not constitute a quorum.

What Vote is Required for Each Proposal?

Assuming a quorum is present or represented at the Annual Meeting, either in person or by proxy, the following vote is required for each of the following matters:

| · | Proposal No. 1—Election of Directors requires the affirmative vote of a plurality of the votes cast at the election. |

| · | Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm requires the affirmative vote of a majority of shares of our common stock voting on the matter for approval. |

If your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares on certain “routine” matters. The routine matter to be submitted to our stockholders at the Annual Meeting is Proposal No. 2—Ratification of Selection of Independent Registered Public Accounting Firm. Proposal No. 1—Election of Directors is not a routine matter. Accordingly, if you do not direct your broker as to how to vote for a director in Proposal No. 1, your broker is not allowed to vote your shares on that proposal.

For purposes of Proposal No. 1, broker non-votes are not considered to be “votes cast” at the meeting. As such, a broker non-vote will not be counted as a vote “For” or “Withheld” with respect to a director in Proposal No. 1; and, therefore, will have no effect on the outcome of the vote on such proposal. Proxies marked “Abstain” will be counted in determining the total number of “votes cast” on each of the proposals and will have the effect of a vote “Against” a proposal.

Who Will Count the Votes?

We currently expect that American Stock Transfer & Trust Company, LLC will tabulate the votes, and our Corporate Secretary will be our inspector of elections for the Annual Meeting.

Who Do I Contact if I Have Questions Regarding the Annual Meeting?

If you have any questions or require assistance in voting your shares of common stock, please call our Corporate Secretary at (952) 426-6192.

Are There Any Matters to be Voted on at the Annual Meeting that are not Included in this Proxy Statement?

We are currently not aware of any business to be acted upon at the Annual Meeting other than that described in this proxy statement. If other matters are properly brought before the Annual Meeting, or any adjournment or postponement of the Annual Meeting, your proxy includes discretionary authority on the part of the individuals appointed to vote your shares or act on those matters according to their best judgment, including any adjournment of the Annual Meeting if a quorum is not present.

How Will Business Be Conducted at the Annual Meeting?

The presiding officer at the Annual Meeting will determine how business at the meeting will be conducted. Only nominations and other proposals brought before the Annual Meeting in accordance with the advance notice and information requirements of our Amended and Restated Bylaws will be considered, and no such nominations or other proposals were received. In order for a stockholder proposal to have been included in our proxy statement for the Annual Meeting, our Corporate Secretary must have received such proposal a reasonable period of time before we began to print and send our proxy materials. Complete and timely written notice of a proposed nominee for election to the Board of Directors at the Annual Meeting or a proposal for any other business to be brought before the Annual Meeting must have been received by our Corporate Secretary not later than February 17, 2015.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are subject to the safe harbor created by those sections. We have identified some of these forward-looking statements with words like “believe,” “may,” “could,” “would,” “might,” “possible,” “potential,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate” and “continue”, the negative of these words, other words and terms of similar meaning and the use of future dates. Forward-looking statements involve risks and uncertainties. These uncertainties include factors that affect all businesses as well as matters specific to us. Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Uncertainties and risks may cause our actual results to be materially different than those expressed in or implied by our forward-looking statements. For us, particular uncertainties and risks include, among others, our history of operating losses and negative cash flow, uncertainties regarding clinical testing, the difficulty of developing pharmaceutical products, obtaining regulatory and other approvals and achieving market acceptance and other risks and uncertainties described in our filings with the Securities and Exchange Commission (the “SEC”), including our most recent annual report on Form 10-K. All forward-looking statements in this proxy statement speak only as of the date of this proxy statement and are based on our current beliefs and expectations. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as otherwise required by law.

SHARE OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, MANAGEMENT AND DIRECTORS

The table below sets forth information known to us regarding the beneficial ownership of our common stock as of June 15, 2015 for:

| · | each person our company believes beneficially holds more than 5% of the outstanding shares of our common stock based solely on our company’s review of SEC filings; |

| · | each of our directors and nominees for directors; |

| · | each of the named executive officers named in the Summary Compensation Table under the heading “Executive Compensation—Summary Compensation Table for Fiscal 2015” (we collectively refer to these persons as our “named executive officers”); and |

| · | all of our directors and named executive officers as a group. |

The number of shares beneficially owned by a person includes shares subject to options held by that person that are currently exercisable or that become exercisable within 60 days of June 15, 2015. Percentage calculations assume, for each person and group, that all shares that may be acquired by such person or group pursuant to options currently exercisable or that become exercisable within 60 days of June 15, 2015 are outstanding for the purpose of computing the percentage of common stock owned by such person or group. However, such unissued shares of common stock described above are not deemed to be outstanding for calculating the percentage of common stock owned by any other person.

Except as otherwise indicated, the persons in the table below have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and subject to the information contained in the notes to the table.

| Title of Class | | Name and Address of Beneficial Owner(1) | | Amount and Nature of Beneficial Ownership(2) | | | Percent of Class | |

| Common Stock | | Beneficial Owners of More Than 5% | | | | | | |

| | Amici Capital, LLC(1) 825 N. Jefferson St., Suite 400 Milwaukee, WI 53202 | | | 1,555,257 | | | | 5.9 | % |

| | | | | | | | | | |

| Common Stock | | Named Executive Officers and Directors | | | | | | | | |

| | Robert C. Kill | | | 933,205 | | | | 3.5 | |

| | Kenneth H. Paulus | | | 10,517 | | | | * | |

| | Dr. Cheryl Pegus | | | 18,000 | | | | * | |

| | Lewis C. Pell | | | 1,814,448 | | | | 6.9 | |

| | Kevin Roche | | | 79,673 | | | | * | |

| | James P. Stauner | | | 68,464 | | | | * | |

| | Sven A. Wehrwein | | | 51,533 | | | | * | |

| | Howard I. Zauberman | | | 339,999 | | | | 1.3 | |

| | Darin Hammers | | | 194,207 | | | | * | |

| | Brett A. Reynolds | | | 178,711 | | | | * | |

| | Mark Landman | | | 98,205 | | | | * | |

| | Jitendra Patel | | | 77,321 | | | | * | |

| Common Stock | | All Named Executive Officers and Directors as a Group | | | 3,865,283 | | | | 14.3 | |

| * | Represents beneficial ownership of less than one percent. |

| (1) | The business address for each of the directors and named executive officers of Cogentix is c/o Cogentix Medical, Inc., 5420 Feltl Road, Minnetonka, Minnesota 55343. |

| (2) | Includes for the persons listed below the following shares of common stock subject to options held by such persons that are currently exercisable or become exercisable within 60 days of June 15, 2015: |

| Name | | Shares of Common Stock Underlying Stock Options | |

| Robert C. Kill | | | 351,731 | |

| Kenneth H. Paulus | | | - | |

| Dr. Cheryl Pegus | | | 2,000 | |

| Lewis C. Pell | | | - | |

| Kevin Roche | | | - | |

| James P. Stauner | | | 19,835 | |

| Sven A. Wehrwein | | | 19,835 | |

| Howard I. Zauberman | | | 189,999 | |

| Darin Hammers | | | 48,441 | |

| Brett A. Reynolds | | | 48,441 | |

| Mark Landman | | | 47,276 | |

| Jitendra Patel | | | 38,812 | |

| | | | | |

| | | | 766,370 | |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and all persons who beneficially own more than 10 percent of the outstanding shares of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. Directors, executive officers and greater than 10 percent beneficial owners also are required to furnish us with copies of all Section 16(a) forms they file with the SEC. To our knowledge, based on a review of the copies of such reports and amendments to such reports furnished to us with respect to the year ended March 31, 2015, and based on written representations by our directors and executive officers, all required Section 16(a) reports under the Exchange Act, for our directors, executive officers and beneficial owners of greater than 10 percent of our common stock were filed on a timely basis during the year ended March 31, 2015, except that Howard I. Zauberman, current director and our former President and CEO, failed to file timely two reports on Form 4 reporting a grant of nonqualified stock options on May 8, 2014 and a grant of restricted stock on October 21, 2014; each of Mark S. Landman and Jitendra Patel, our former officers, failed to file one report on Form 4 reporting a grant of restricted stock on October 21, 2014; Gary Siegel, our former officer, failed to file two reports on Form 4 reporting a grant of stock options on June 26, 2014 and a grant of restricted stock on October 21, 2014; and Lewis C. Pell, current director, inadvertently failed to file timely eight reports on Form 4, as follows:

(i) Form 4 filed June 9, 2014 reflecting purchases of common stock on June 3, 2014 and June 6, 2014, of which the purchases on June 3, 2014 were reported late;

(ii) Form 4 filed August 12, 2014 reflecting purchases of common stock on August 7, 2014 and August 8, 2014, of which the purchases on August 7, 2014 were reported late;

(iii) Form 4 filed August 14, 2014 reflecting purchases of common stock on August 11, 2014, August 12, 2014, and August 13, 2014, of which the purchases on August 11, 2014 were reported late;

(iv) Form 4 filed August 20, 2014 reflecting purchases of common stock on August 14, 2014, August 15, 2014, August 18, 2014 and August 19, 2014, of which the purchases on August 14, 2014 and August 15, 2014 were reported late;

(v) Form 4 filed August 28, 2014 reflecting purchases of common stock on August 20, 2014, August 21, 2014, August 25, 2014 and August 26, 2014, of which the purchases on August 20, 2014, August 21, 2014 and August 25, 2014 were reported late;

(vi) Form 4 filed September 10, 2014 reflecting purchases of common stock on September 4, 2014, September 5, 2014 and September 8, 2014, of which the purchases on September 4, 2014 and September 5, 2014 were reported late;

(vii) Form 4 filed September 15, 2014 reflecting purchases of common stock on September 9, 2014, September 10, 2014, September 11, 2014 and September 12, 2014, of which the purchases on September 9, 2014 and September 10, 2014 were reported late; and

(viii) Form 4 filed February 13, 2015 reflecting (1) purchases of common stock on February 11, 2015 and February 12, 2015, both of which were reported timely; and (2) reporting issuances of convertible promissory notes on January 25, 2013, March 12, 2013, April 19, 2013, June 10, 2013, July 24, 2013, October 7, 2013, November 26, 2013, January 21, 2014, March 13, 2014, June 16, 2014, August 12, 2014 and October 24, 2014, all of which were reported late.

We have put a more robust process in place to monitor transactions in our equity securities by our directors and officers in order to ensure timely Section 16 reporting going forward.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Number of Directors; Classes of Directors

Our Amended and Restated Bylaws provide that the Board of Directors will consist of at least three members and the exact number of directors within such limitation will be fixed from time to time by the Board of Directors. The number of directors fixed by the Board of Directors is eight as of the date of the Annual Meeting.

Our Amended and Restated Bylaws provide that our Board of Directors will be divided into three classes: Class I, Class II and Class III. No one class of directors will have more than one more director than any other class.

The following table indicates the current members of the Board of Directors and Classes in which they serve:

Class I - Term ending at 2016 Annual Meeting | Class II – Term ending at 2017 Annual Meeting | Class III – Term ending at 2015 Annual Meeting |

| Lewis C. Pell | Robert C. Kill | Kenneth H. Paulus |

| James P. Stauner | Dr. Cheryl Pegus | Kevin H. Roche |

| Howard I. Zauberman | Sven A. Wehrwein | |

Nominees for Director – Class III Directors

The Board of Directors has nominated the Kevin H. Roche and Kenneth H. Paulus to serve as Class III directors for a three-year term ending at 2018 Annual Meeting of Stockholders or until their respective successors are elected and qualified. Both of the nominees are current members of the Board of Directors.

If prior to the Annual Meeting, the Board of Directors should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for the nominee will be voted for a substitute nominee as selected by the Board of Directors. The Board of Directors has no reason to believe that any of the nominees will be unable to serve.

Information About Current Directors and Board Nominees and Merger with Uroplasty

In connection with the completion of the merger (the “Merger”) of Uroplasty, Inc. (“Uroplasty”) with and into a wholly-owned subsidiary of Vision-Sciences, Inc. (“Vision”) on March 31, 2015, we appointed the following directors to the Board of Directors of our company (formerly known as Vision): Robert C. Kill, Kenneth H. Paulus, Kevin H. Roche, James P. Stauner and Sven A. Wehrwein, each a director of Uroplasty prior to the Merger. Also in connection with the Merger, David W. Anderson, Katsumi Oneda and John Rydzewski, each a director of Vision, resigned from the Board of Directors of our company upon the completion of the Merger. The table below sets forth certain information that has been furnished to us by each current director and each individual who has been nominated by the Board of Directors to serve as a director of our company.

| Name | | Age | | Director Since |

| | | | | |

| Robert C. Kill | | 51 | | 2015 |

| | | | | |

Kenneth H. Paulus (1)(2) | | 55 | | 2015 |

| | | | | |

Dr. Cheryl Pegus (1)(2) | | 51 | | 2013 |

| | | | | |

| Lewis C. Pell | | 71 | | 2005 |

| | | | | |

Kevin H. Roche (2)(3) | | 64 | | 2015 |

| | | | | |

James P. Stauner (3) | | 60 | | 2015 |

| | | | | |

Sven A. Wehrwein (1)(3) | | 64 | | 2015 |

| | | | | |

| Howard I. Zauberman | | 62 | | 2013 |

| (1) | Member of the Compensation Committee |

| (2) | Member of the Governance and Nominating Committee |

| (3) | Member of the Audit Committee |

As of the effective time of the Merger (the “Merger Effective Time”), each Uroplasty share of common stock outstanding immediately prior to the Merger Effective Time (other than Uroplasty shares held by Uroplasty as treasury stock and Uroplasty shares of common stock owned by Uroplasty, our company or any of their respective subsidiaries, which Uroplasty shares were cancelled) was converted into the right to receive 0.72662 shares of our common stock. This calculation reflected the 3.6331 exchange ratio (as defined in the Agreement and Plan of Merger our company entered into with Uroplasty on December 21, 2014 (the “Merger Agreement”)) as adjusted for our one-for-five reverse stock split plus cash (without interest) in lieu of fractional shares in an amount equal to the product of (a) such fractional part of a share of our common stock, multiplied by (b) $1.85, the closing price for a share of our common stock as reported on NASDAQ Stock Market on March 30, 2015, the trading day immediately prior to the Merger Effective Time, adjusted for our one-for-five reverse stock split.

Immediately following the Merger Effective Time, our shareholders (of record immediately prior to the Merger) owned approximately 37.5% and former Uroplasty shareholders owned approximately 62.5% of our company on a fully-diluted basis, excluding shares of our common stock issuable upon the conversion of promissory notes and warrants held by Mr. Lewis C. Pell, our former Chairman (which were amended in connection with the Merger).

Additional Information About Current Directors and Board Nominees

The paragraphs below provide information about each current director and nominee for director, including all positions he or she holds, his or her principal occupation and business experience for the past five years, and the names of other publicly-held companies of which he or she currently serves as a director or served as a director during the past five years. We believe that all of our director nominees display personal and professional integrity; appropriate levels of education and/or business experience; business acumen; an appropriate level of understanding of our business and its industry and other industries relevant to our business; the ability and willingness to devote adequate amount of time to the work of the Board of Directors and its committees; a fit of skills and personality with those of our other directors that helps build a board of directors that is effective, collegial and responsive to the needs of our company; strategic thinking and a willingness to share ideas; a diversity of experiences, expertise and background; and the ability to represent the interests of all of our stockholders. The information presented below regarding each current director and nominees for directors also sets forth specific experience, qualifications, attributes and skills that led the Board of Directors to the conclusion that each of them should serve as a director in light of our business.

Robert C. Kill has served as the President, Chief Executive Officer and Chairman of the Board of Directors of our company since the Merger. Prior to the Merger, Mr. Kill had served as a director of Uroplasty since December 2010, Chairman of Uroplasty’s Board of Directors since May 2014, and served as Uroplasty’s interim Chief Executive Officer from April 2013 until appointed as Uroplasty’s President and Chief Executive Officer in July 2013. He had also served as the President and Chief Executive Officer of Uroplasty from July 2013 until March 31, 2015. Since 2012, Mr. Kill has been an Operating Partner with Altamont Capital Partners, a private equity firm. He had served as President from 2007 to 2012, as Chairman and CEO from 2009 to 2010 while the company was public, and as CEO and a Board member from 2010 to 2012 after it became a private company, of Virtual Radiologic Corporation, a national radiology organization that uses technology to enhance radiologic practice. Prior to joining Virtual Radiologic, Mr. Kill was President of Physicians Systems for Misys Healthcare Systems, a provider of clinical and practice management software applications to physician practices, group practices, health systems and managed services organizations. Before joining Misys Healthcare Systems in 2002, Mr. Kill was Executive Vice President of Entertainment Publications, Inc., where he was employed from 1996 through 2001, and Vice President of Operations for Baxter Healthcare, where he was employed from 1986 through 1996. Mr. Kill brings to the Board of Directors of our company substantial experience and insight in executive management of rapidly growing public companies, particularly companies focused on health care.

Kenneth H. Paulus has served as a director of our company since the Merger. Prior to the Merger, Mr. Paulus had served as a director of Uroplasty since October 2014. From June 2009 to December 31, 2014, he had served as the President and Chief Executive Officer of Allina Health, a health care delivery system serving Minnesota and western Wisconsin. He joined Allina Health in 2005 as Chief Operating Officer after serving five years as the President and Chief Executive Officer of HealthOne Care (now Atrius Health System). Mr. Paulus’ extensive knowledge of the health care industry and his leadership experience make him well-suited to serve as a member of the Board of Directors of our company.

Dr. Cheryl Pegus, M.D., M.P.H. has been a director of our company since 2013. She is currently the Director, Division of General Internal Medicine and Clinical Innovation, Associate Chair, Clinical Innovation at NYU Langone Medical Center, and Clinical Professor of Medicine and Population Health at NYU School of Medicine. Dr. Pegus is the President of Caluent, LLC, a health care advisory company, a Director of Glytec, a glycemic clinical software organization, and President of the American Heart Association Founder's Affiliate. Previously, she was the Chief Medical Officer for Walgreens and served as the General Manager and Chief Medical Officer for SymCare Personalized Health Solutions, Inc., a J&J start-up company. Dr. Pegus has more than 20 years of clinical practice and industry experience that make her well-suited to serve as a member of the Board of Directors of our company.

Lewis C. Pell is a co-founder of our company and, prior to the Merger, had served as the Chairman of the Board of Directors of our company since 2005. Mr. Pell also briefly served as Vision’s Principal Executive Officer from June 2013 to August 2013. Prior to 2005, Mr. Pell served as Vice-Chairman of the Vision board of directors since 1992. Mr. Pell is a founder or co-founder and chairman and director of several privately held medical device companies and is the chairman of Photomedex, Inc., a publicly-traded dermatology company. We believe Mr. Pell’s extensive experience with Vision and other companies in the medical device industry, particularly his experience serving as a founder and a member of the board of directors of numerous medical device companies, and creating and developing new and emerging companies and bringing innovative medical device and technology to the marketplace, makes him well-suited to serve as a member of the Board of Directors of our company.

Kevin H. Roche has served as a director of our company since the Merger and is also an advisor to Triple Tree, an investment banking and venture funding firm. Prior to the Merger, Mr. Roche had served as a director of Uroplasty since May 2014. He currently leads Roche Consulting, LLC, a general health care consulting and investing firm providing strategic, operational, legal and other business advice to industry clients. He previously served as the General Counsel of UnitedHealth Group, later becoming CEO of their Ingenix division. Mr. Roche also served as managing partner at Vita Advisors LLC, a health care mergers and acquisition advisory firm. Mr. Roche had also served on the board of directors of Virtual Radiologic Corporation from 2008 until 2010. Mr. Roche brings extensive health care, operations and legal experience to the Board of Directors of our company, including serving on the boards, compensation committees and/or audit committees of a number of private health care companies.

James P. Stauner has served as the lead independent director of our company since the Merger. Prior to the Merger, Mr. Stauner had served as Uroplasty’s director since August 2006, Chairman of the Board of Uroplasty from November 2011 until May 2014, and lead independent director since May 2014. Mr. Stauner has over 30 years of experience in the health care industry. Since July 2005, he has been an Operating Partner with Roundtable Healthcare Partners, a private equity firm focused on the health care industry. Prior to joining Roundtable Healthcare Partners, Mr. Stauner held Senior Executive level positions at Cardinal Health, Inc., Allegiance Healthcare and Baxter. Mr. Stauner’s extensive knowledge of the health care industry and of the characteristics sought by a private equity firm for investment in the health care industry, and experience in operating and managing a medical products business and in finance make him well-suited to serve as a member of the Board of Directors of our company.

Sven A. Wehrwein has served as a director of our company since the Merger. Prior to the Merger, Mr. Wehrwein had served as a director of Uroplasty since August 2006. Mr. Wehrwein has been an independent financial consultant for emerging companies since 1999. He has more than 35 years of experience as an investment banker, chief financial officer, and certified public accountant (inactive). He currently serves on the board of directors of Proto Labs, Inc., a manufacturer of custom parts, and SPS Commerce, a supply chain management software company, both of which are publicly traded companies. Mr. Wehrwein also served on the board of directors of Compellent Technologies, Inc. from 2007 until its acquisition by Dell Inc. in 2011, on the board of Vital Images, Inc. from 1997 until its acquisition by Toshiba Medical in 2011, on the board of Synovis Life Technologies, Inc. from 2004 until its acquisition by Baxter International, Inc. in 2012, and on the board of directors of Image Sensing Systems, Inc. from 2006 to 2012. Mr. Wehrwein brings to the Board of Directors of our company substantial financial experience and public and private company board experience.

Howard I. Zauberman has served as a director of our company since 2013. Prior to the Merger, Mr. Zauberman had also served as President and Chief Executive Officer of our company. Mr. Zauberman has over 30 years of experience as a leader in the medical products industry. Prior to joining our company, from 2005 to 2012, he was Vice President of Business Development at Henry Schein, Inc., a leading global health care distributor serving office based medical practitioners. Mr. Zauberman also served as a Special Venture Partner at Galen Partners, a health care growth equity and late stage venture capital firm, focused on technology enabled services, medical devices and specialty pharmaceuticals. Mr. Zauberman also held senior management positions at ETHICON, Inc. a Johnson & Johnson company and Pfizer, Inc. Mr. Zauberman’s knowledge and executive leadership in the health care industry make him well-suited to serve as a member of the Board of Directors of our company.

The Board of Directors recommends a vote FOR the election of both of the nominees for directors named in this proxy statement.

PROPOSAL NO. 2 — RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Selection of Independent Registered Public Accounting Firm

The Audit Committee has selected Grant Thornton LLP (“Grant Thornton”) to serve as our independent registered public accounting firm for the fiscal year ending March 31, 2016, and to perform such other appropriate accounting services as may be approved by the Audit Committee. Grant Thornton was engaged as our independent registered public accounting firm in connection with, and upon the closing of, the Merger, and had been engaged by Uroplasty as its independent registered public accounting firm since February 2008 until the Merger. Our company's former independent registered public accounting firm, EisnerAmper LLP (“EisnerAmper”), resigned as our independent registered public accounting firm following the closing of the Merger. Prior to the closing of the Merger, EisnerAmper had served as our independent registered public accounting firm since March 2010. The change of our independent registered public accounting firm was not the result of any disagreement with EisnerAmper. EisnerAmper’s report on the financial statements for our fiscal 2014 did not contain an adverse opinion or a disclaimer of opinion, or was qualified or modified as to uncertainty, audit scope, or accounting principles.

The Audit Committee and the Board of Directors propose and recommend that our stockholders ratify the selection of Grant Thornton to serve as our company’s independent auditors for the fiscal year ending March 31, 2016.

Although stockholder approval of the appointment of Grant Thornton is not required by law or by our governing documents, the Audit Committee wishes to submit the selection of Grant Thornton to our stockholders for ratification. No determination has been made as to what action the Audit Committee would take if our stockholders do not ratify the appointment. Even if the appointment is ratified, the Audit Committee retains discretion to appoint a new independent registered public accounting firm at any time if the Audit Committee concludes such a change would be in the best interests of our company and stockholders.

Representatives of Grant Thornton will be present at the Annual Meeting to respond to appropriate questions. They also will have an opportunity to make a statement if they wish to do so. No representative of EisnerAmper will be present at the Annual Meeting.

Audit, Audit-Related, Tax and Other Fees

The tables below present fees for professional services rendered by each of Grant Thornton and EisnerAmper, and their respective affiliates for the years ended March 31, 2015 and March 31, 2014.

| | | Aggregate Amount Billed by Grant Thornton(2) | | | Aggregate Amount Billed by EisnerAmper | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

Audit Fees(1) | | $ | 214,310 | | | $ | - | | | $ | - | | | $ | 112,690 | |

| Audit-Related Fees | | | - | | | | - | | | | 39,690 | | | | - | |

| Tax Fees | | | - | | | | - | | | | 24,600 | | | | 28,250 | |

| All Other Fees | | | - | | | | - | | | | 96,815 | (3) | | | 1,750 | |

| (1) | Audit fees consisted of the audit of our annual financial statements of our company for the years ended March 31, 2015 and March 31, 2014. |

| (2) | Grant Thornton was engaged as our independent registered public accounting firm on the last day of our fiscal 2015 in connection with the closing of the Merger. |

| (3) | Fees pertain to work performed in connection with the Merger. |

Pre-Approval Policies and Procedures

The Audit Committee has adopted procedures pursuant to which all audit, audit-related and tax services, and all permissible non-audit services provided by our independent registered public accounting firm must be pre-approved by the Audit Committee. All services rendered by Grant Thornton and EisnerAmper during our fiscal year 2015 were permissible under applicable laws and regulations and were approved in advance by the Audit Committee in accordance with the rules adopted by the SEC in order to implement requirements of the Sarbanes-Oxley Act of 2002, other than de minimis non-audit services allowed under applicable law.

The Board of Directors unanimously recommends a vote FOR ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2016.

Our shares of common stock trade on The NASDAQ Stock Market, Inc. ("NASDAQ") under the symbol “CGNT.”

Subsequent to the Merger, our Board of Directors has taken several actions to improve our corporate governance. These actions include the approval of:

| · | Revised charters for the Audit Committee, the Compensation Committee and the Governance and Nominating Committee of the Board of Directors; |

| · | Revised Amended and Restated Code of Ethics and Business Conduct; |

| · | Revised Insider Trading Policy; |

| · | Adoption of Corporate Governance Guidelines; |

| · | Adoption of a Policy Statement Regarding Director Nominations; and |

| · | Adoption of Director Expense Reimbursement Policy. |

Corporate Governance Guidelines

On May 6, 2015, the Board of Directors, upon recommendation of the Governance and Nominating Committee, adopted Corporate Governance Guidelines. These Corporate Governance Guidelines are intended to serve as a flexible framework within which the Board of Directors may conduct its business and not as a set of legally binding obligations. These Corporate Governance Guidelines are subject to modification from time to time by the Board of Directors or the Governance and Nominating Committee. A copy of these Corporate Governance Guidelines can be found on the Corporate Governance section of our corporate website at http://ir.cogentixmedical.com. Among the topics addressed in our Corporate Governance Guidelines are:

| · | Director Qualification Standards and Responsibility |

| · | Size of the Board of Directors |

| · | Executive Sessions of Independent Directors |

| · | Conflict of Interest and Director Independence |

| · | Ethical Conduct and Confidentiality |

For a director of our company to be considered independent, the director must meet the independence standards under the listing standards of NASDAQ and the Board of Directors must affirmatively determine that the director has no material relationship with us, directly, or as a partner, stockholder or officer of an organization that has a relationship with us. For example, under these standards, a director who is, or during the past three years was, employed by our company or by any parent or subsidiary of our company, other than prior employment as an interim chair or interim chief executive officer, would not be considered independent. The Board of Directors determines director independence based on an analysis of the independence requirements of the NASDAQ listing standards. In addition, the Board of Directors will consider all relevant facts and circumstances in making an independence determination. The Board also considers all commercial, industrial, banking, consulting, legal, accounting, charitable, familial or other relationships any director may have with us. The Board has determined that all of the directors and director nominees, other than Mr. Kill, Mr. Pell and Mr. Zauberman, satisfy the independence standards of NASDAQ.

Board Leadership Structure

The Board of Directors believes that our stockholders are best served if the Board of Directors retains the flexibility to adapt its leadership structure to applicable facts and circumstances, which necessarily change over time. Accordingly, under our Corporate Governance Guidelines, the office of Chair of the Board and Chief Executive Officer may or may not be held by one person. The Board of Directors believes it is best not to have a fixed policy on this issue and that it should be free to make this determination based on what it believes is best under the circumstances. However, the Board of Directors strongly endorses the concept of an independent director being in a position of leadership for the rest of the outside directors. Under our Corporate Governance Guidelines, if at any time the Chief Executive Officer and Chair of the Board positions are held by the same person, the Board of Directors will elect an independent director as a lead independent director.

Robert C. Kill currently serves as our executive Chairman of the Board, and James P. Stauner currently serves as our lead independent director. Robert C. Kill currently serves as our President and Chief Executive Officer. We currently believe this leadership structure is in the best interests of our company and stockholders.

At each regular meeting of the Board of Directors, our independent directors meet in executive session with no company management or other interest directors present during a portion of the meeting. Mr. Stauner, as our lead independent director, presides over these executive sessions and serves as a liaison between the independent directors and our Chief Executive Officer.

Board Meetings and Attendance

The Board of Directors held 8 meetings during our fiscal 2015. All of our directors attended 75 percent or more of the aggregate meetings of the Board of Directors and all committees on which they served during our fiscal 2015.

The Board of Directors has three standing committees: Audit Committee, Compensation Committee and Governance and Nominating Committee. Each of these committees has the composition and responsibilities described below. The Board of Directors from time to time may establish other committees to facilitate the management of our company and may change the composition and the responsibilities of our existing committees. Each of our three standing committees has a charter which can be found on the on the Corporate Governance section of our corporate website at http://ir.cogentixmedical.com. The table below summarizes the current membership of each of our three standing board committees by our non-employee directors. None of our employee directors or non-independent directors serve as a member of any of our board committees.

| Director | | Audit | | Compensation | | Governance and Nominating Committee |

| Kenneth H. Paulus | | — | | Chair | | √ |

| Cheryl Pegus M.D., M.P.H | | — | | √ | | √ |

| Kevin H. Roche | | √ | | — | | Chair |

| James P. Stauner | | √ | | — | | — |

| Sven A. Wehrwein | | Chair | | √ | | — |

Responsibilities. The primary responsibilities of the Audit Committee include:

| · | overseeing our accounting and financial reporting processes, systems of internal control over financial reporting and disclosure controls and procedures on behalf of the Board of Directors and reporting the results or findings of its oversight activities to the Board of Directors; |

| · | having sole authority to appoint, retain and oversee the work of our independent registered public accounting firm and establishing the compensation to be paid to the independent registered public accounting firm; |

| · | establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and/or or auditing matters and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; |

| · | reviewing and pre-approving all audit services and permissible non-audit services to be performed for us by our independent registered public accounting firm as provided under the federal securities laws and rules and regulations of the SEC; and |

| · | overseeing our system to monitor and manage risk, and legal and ethical compliance programs, including the establishment and administration (including the grant of any waiver from) of a written code of ethics applicable to each of our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. |

The Audit Committee has the authority to engage the services of outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities.

Composition and Audit Committee Financial Expert. The current members of the Audit Committee are Messrs. Roche, Stauner and Wehrwein. Mr. Wehrwein is the chair of the Audit Committee.

Each current member of the Audit Committee qualifies as “independent” for purposes of membership on audit committees under the listing standards of NASDAQ and the rules and regulations of the SEC and is “financially literate” under the listing standards of NASDAQ. In addition, the Board of Directors has determined that Mr. Wehrwein qualifies as an “audit committee financial expert” as defined by the rules and regulations of the SEC and meets the qualifications of “financial sophistication” under the listing standards of NASDAQ as a result of his extensive experience as a public company director, management experience in financial accounting as a former chief financial officer of several public companies as well as auditing experience as a CPA, and considerable experience in investment banking with several Wall Street firms. Stockholders should understand that these designations related to the Audit Committee members’ experience and understanding with respect to certain accounting and auditing matters are disclosure requirements of the SEC and NASDAQ and do not impose upon any of them any duties, obligations or liabilities that are greater than those generally imposed on a member of the Audit Committee or of the Board of Directors.

Meetings. The Audit Committee met 4 times during our fiscal 2015.

Responsibilities. The primary responsibilities of the Compensation Committee include:

| · | determining the annual salaries, incentive compensation, long-term incentive compensation, special or supplemental benefits or perquisites and any and all other compensation applicable to our Chief Executive Officer and other executive officers; |

| · | determining any revisions to corporate goals and objectives with respect to compensation for our chief executive officer and other executive officers and establishing and leading a process for the full Board of Directors to evaluate the performance of our Chief Executive Officer and other executive officers in light of those goals and objectives; |

| · | administering our equity-based compensation plans, including determining specific grants of incentive awards for executive officers and other employees under our equity-based compensation plans; |

| · | reviewing and discussing with our Chief Executive Officer and reporting periodically to the Board of Directors plans for executive officer development and corporate succession plans for the Chief Executive Officer and other key executive officers and employees; and |

| · | establishing and leading a process for determination of the compensation applicable to the non-employee directors on the Board of Directors. |

The Compensation Committee has the authority to engage the services of outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities.

Composition. The current members of the Compensation Committee are Mr. Paulus, Dr. Pegus and Mr. Wehrwein. Mr. Paulus is the chair of the Compensation Committee. Each of the three current members of the Compensation Committee is an “independent director” under the listing standards of NASDAQ and a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act.

Meetings. The Compensation Committee met twice, and took action 5 times by written consent during our fiscal 2015.

Processes and Procedures for Consideration and Determination of Executive Compensation. As described above, the Compensation Committee has authority to determine all compensation applicable to our executive officers. In setting executive compensation for our executive officers, the Compensation Committee considers the following primary factors: each executive’s position within the company and the level of responsibility; the ability of the executive to affect key business initiatives; the executive’s individual experience and qualifications; compensation paid to executives of comparable positions by companies similar to our company; company and individual performance; the executive’s current and historical compensation levels; and input from the Compensation Committee’s independent consulting firm, if any.

The Compensation Committee meets in executive session regularly and makes all executive compensation decisions without the presence of the Chief Executive Officer or any executive or employee of our company. The Compensation Committee may invite members of management and outside advisors to participate in Compensation Committee meetings to provide financial or other information useful to the performance of its responsibilities. The Committee did not utilize the services of any compensation consultants during the preceding three fiscal years.

Processes and Procedures for Consideration and Determination of Director Compensation. The Board of Directors has delegated to the Compensation Committee the responsibility, among other things, to establish and lead a process for determination of compensation payable to our non-employee directors. The Compensation Committee makes recommendations regarding compensation payable to our non-employee directors to the entire Board of Directors, which then makes the final decisions.

Governance and Nominating Committee

Responsibilities. The primary responsibilities of the Governance and Nominating Committee are:

| · | overseeing all aspects of corporate governance, including acting as an independent committee evaluating transactions between our company on the one hand and the members of the Board of Directors or officers on the other; |

| · | identifying individuals qualified to become members of the Board of Directors; |

| · | recommending director nominees for each annual meeting of our stockholders and director nominees to fill any vacancies that may occur between meetings of stockholders; |

| · | being aware of best practices in corporate governance and developing and recommending to the Board of Directors a set of corporate governance standards to govern the Board of Directors, its committees, our company and our employees in the conduct of our business and affairs; and |

| · | developing and overseeing a Board and Board committee evaluation process. |

When reviewing related party transactions, the Governance and Nominating Committee considers all relevant facts and circumstances, including:

| · | the commercial reasonableness of the terms; |

| · | the benefit and perceived benefits, or lack thereof, to our company; |

| · | opportunity costs of alternate transactions; and |

| · | the materiality and character of the related person’s interest, and the actual or apparent conflict of interest of the related person. |

The Governance and Nominating Committee only approves or ratifies a related party transaction when it determines that, upon consideration of all relevant information, the transaction is in, or is not inconsistent with, the best interests of our company and stockholders. No related party transactions will be consummated without the approval or ratification of our Governance and Nominating Committee and the disinterested members of the Board of Directors. It is our policy that directors interested in a related party transaction will recuse themselves from any vote relating to a related party transaction in which they have an interest.

The Governance and Nominating Committee has the authority to engage the services of outside experts and advisors as it deems necessary or appropriate to carry out its duties and responsibilities.

Composition. The current members of the Governance and Nominating Committee are Dr. Pegus and Messrs. Paulus and Roche. Mr. Roche is the chair of the Governance and Nominating Committee. Each of the four current members of the Governance and Nominating Committee is an “independent director” within the meaning of the listing standards of NASDAQ.

Meetings. The Governance and Nominating Committee did not meet during our fiscal 2015, but took action twice by written consent.

Director Nominations Process

On May 6, 2015, the Board of Directors, upon recommendation of the Governance and Nominating Committee, adopted our company’s Policy Statement regarding Director Nominations (“Director Nominating Policy”). A copy of the Director Nominating Policy can be found on the Corporate Governance section of our corporate website at http://ir.cogentixmedical.com. The Governance and Nominating Committee is responsible for identifying, reviewing, and recommending to the Board of Directors director nominees.

It is the Governance and Nominating Committee’s policy to consider director candidates recommended by our stockholders. It is further the committee’s policy to apply the same criteria in reviewing candidates proposed by stockholders as it employs in reviewing candidates proposed by any other source. Under the Director Nominating Policy, the Governance and Nominating Committee considers, among other factors, age, personal qualities, experience, independence, commitment, antitrust considerations, willingness to serve, professional skills and background, diversity and corporate directorships for reviewing and recommending director candidates for election. And these qualifications may change significantly during the course of a year, depending on changes in the Board of Directors and our company’s business needs and environment.

The Governance and Nominating Committee will conduct periodic assessments of the overall composition of the Board of Directors in light of our company’s current and expected business needs and structure and, as a result of such assessments, the committee may establish specific qualifications that it will seek in director candidates. In light of such assessments, the committee may seek to identify new director candidates who possess (i) the specific qualifications established by the committee and (ii) who satisfy the other requirements for the Board of Directors and committee membership as set forth in our company’s certificate of incorporation and bylaws and other relevant policies.

On an annual basis, the Governance and Nominating Committee also reviews incumbent candidates for re-nomination to the Board of Directors. This review involves an analysis of whether the directors satisfy applicable regulatory requirements for service on the Board of Directors and its committees (including qualifying as independent), evaluating the past performance of directors in light of the criteria set forth in the Director Nominating Policy, the input of other directors regarding the performance of the directors seeking re-nomination and considering the overall composition of the Board of Directors in light of our company’s current and expected future business needs and structure.

The Governance and Nominating Committee then annually recommends a slate of candidates to be considered by the Board of Directors and to be submitted for approval to our stockholders at our annual stockholders meeting. This slate of candidates may include both incumbent and new directors. In addition, apart from this annual process, the committee may, in accordance with our governing documents, recommend that the Board of Directors elect new members of the Board of Directors who will serve until the next annual stockholders meeting.

The Board of Directors as a whole has responsibility for risk oversight, with more in-depth reviews of certain areas of risk being conducted by the relevant Board committees that report on their deliberations to the full Board of Directors. The oversight responsibility of the Board and its committees is enabled by management reporting processes that are designed to provide information to the Board about the identification, assessment and management of critical risks and management’s risk mitigation strategies. The areas of risk that we focus on include regulatory, operational, financial (accounting, credit, liquidity and tax), legal, compensation, competitive, health, safety and environment, economic, political and reputational risks.

The standing committees of the Board of Directors oversee risks associated with their respective principal areas of focus. The Audit Committee’s role includes a particular focus on the qualitative aspects of financial reporting to stockholders, on our processes for the management of business and financial risk, our financial reporting obligations and for compliance with significant applicable legal, ethical and regulatory requirements. The Audit Committee, along with management, is also responsible for developing and participating in a process for review of important financial and operating topics that present potential significant risk to our company. The Compensation Committee is responsible for overseeing risks and exposures associated with our compensation programs and arrangements, including our executive and director compensation programs and arrangements, and management succession planning. The Governance and Nominating Committee oversees risks relating to our corporate governance matters and policies and director succession planning.

We recognize that a fundamental part of risk management is understanding not only the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for our company. The involvement of the full Board of Directors in setting our business strategy is a key part of the Board’s assessment of management’s appetite for risk and also a determination of what constitutes an appropriate level of risk for our company.

We believe our current Board leadership structure is appropriate and helps ensure proper risk oversight for our company for a number of reasons, including: (1) general risk oversight by the full Board of Directors in connection with its role in reviewing our key long-term and short-term business strategies and monitoring on an on-going basis the implementation of our key business strategies; (2) more detailed oversight by our standing Board committees that are currently comprised of and chaired by our independent directors, and (3) the focus of our Chair of the Board on allocating appropriate Board agenda time for discussion regarding the implementation of our key business strategies and specifically risk management.

Code of Ethics and Business Conduct

On May 6, 2015, the Board of Directors adopted our Amended and Restated Code of Ethics and Business Conduct, which applies to all of our directors, executive officers, and other employees, and meets the requirements of the SEC. A copy of our Code of Ethics and Business Conduct is available on the Corporate Governance section of our corporate website at http://ir.cogentixmedical.com. We intend to disclose any future amendments to our Amended and Restated Code of Ethics, or waivers granted to our executive officers from a provision to the Amended and Restated Code of Ethics, on our website.

This report is furnished by the Audit Committee of the Board of Directors with respect to our financial statements for the year ended March 31, 2015.

One of the purposes of the Audit Committee is to oversee our accounting and financial reporting processes and the audit of our annual financial statements. Our management is responsible for the preparation and presentation of complete and accurate financial statements. Our independent registered public accounting firm, Grant Thornton, is responsible for performing an independent audit of our financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) and for issuing a report on their audit.

In performing its oversight role, the Audit Committee has reviewed and discussed our audited financial statements for the year ended March 31, 2015 with our management. Management represented to the Audit Committee that our financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has discussed with Grant Thornton, our independent registered public accounting firm, the matters required to be discussed under Public Company Accounting Oversight Board standards. The Audit Committee has received the written disclosures and the letter from Grant Thornton required by the applicable requirements of the Public Company Accounting Oversight Board regarding communications with audit committees concerning independence. The Audit Committee has discussed with Grant Thornton its independence and concluded that the independent registered public accounting firm is independent from our company and our management.

Based on the review and discussions of the Audit Committee described above, the Audit Committee recommended to the Board of Directors that our audited financial statements for the year ended March 31, 2015 be included in our annual report on Form 10-K for the year ended March 31, 2015 for filing with the Securities and Exchange Commission.

This report is dated as of July 1, 2015.

Audit Committee

Sven A. Wehrwein, Chair

Kevin H. Roche

James P. Stauner

Policy Regarding Director Attendance at Annual Meetings of Stockholders

Although it is not a policy of the Board of Directors, all members of the Board of Directors are expected to attend our annual meeting of stockholders, if their schedules permit.

Process Regarding Stockholder Communications

Stockholders may communicate with the Board of Directors or any one particular director by sending correspondence, addressed to our Corporate Secretary, Cogentix Medical, Inc., 5420 Feltl Road, Minnetonka, Minnesota 55343, with an instruction to forward the communication to the Board of Directors or one or more particular directors. Our Corporate Secretary will forward promptly all such stockholder communications to the Board of Directors or the one or more particular directors, with the exception of any advertisements, solicitations for periodical or other subscriptions and other similar communications.

Nominations of directors by stockholders will be considered and reviewed by the Governance and Nominating Committee, which will determine whether these nominations should be presented to the Board of Directors. Candidates are required to have the minimum qualifications that the Governance and Nominating Committee uses in its director recommendations.

According to the Director Nominating Policy, a stockholder (or group of stockholders) wishing to submit a nominating recommendation for an annual meeting of stockholders must ensure that it is received by our company not later than 120 calendar days prior to the first anniversary of the date of the proxy statement for the prior annual meeting of stockholders. In the event that the date of the annual meeting of stockholders for the current year is more than 30 days following the first anniversary date of the annual meeting of stockholders for the prior year, the submission of a recommendation will be considered timely if it is submitted a reasonable time in advance of the mailing of our company’s proxy statement for the annual meeting of stockholders for the current year. In notifying the Governance and Nominating Committee, the nominating stockholder should provide certain information to the committee by correspondence addressed to our Corporate Secretary at the mailing address provided above.

Overview of Director Compensation Program

As described in more detail under the heading “Corporate Governance—Compensation Committee—Responsibilities,” the Board of Directors has delegated to the Compensation Committee the responsibility, among other things, to establish and lead a process for the determination of compensation payable to our non-employee directors. The Compensation Committee makes recommendations regarding compensation payable to our non-employee directors to the entire Board of Directors, which then makes final decisions regarding such compensation.

The principal elements of our director compensation program for our fiscal 2015 included (i) annual cash compensation (in each case, paid in advance quarterly installments) in the forms of:

| · | Non-employee director fee of $20,000; |

| · | Committee Chair fee of $4,000; and |

| · | Lead independent director fee of $4,000; |

and (ii) equity compensation in the forms of:

| · | Grant of Restricted Stock consisting of 5,000 shares of restricted common stock and an additional 3,000 shares of restricted common stock issued to our lead independent director in each case granted upon the date of the Annual Meeting, which vest quarterly over the year of the grant in each case, conditioned upon the waiver of each director’s right to receive an annual grant of options under the 2003 Director Option Plan. |

These elements of the director compensation program were the elements used to compensate non-employee directors of Vision prior to the completion of the Merger. Following the completion of the Merger and during our fiscal 2016, the principal elements of our non-employee director compensation program have not changed. Our non-employee director compensation will be reviewed by the Compensation Committee of the Board of Directors and may be subject to change.

Further, we do not compensate our employee directors separately for serving on the Board of Directors.

The cash compensation paid to our non-employee directors for our fiscal 2015 consisted of the following:

| Description | | Annual Cash Retainer(1)(2) | |

| Non-employee Director (other than Chairman) | | $ | 20,000 | |

| Each Committee Chair | | $ | 4,000 | |

| Lead Independent Director | | $ | 4,000 | |

(1) The annual cash retainers are paid in advance quarterly installments.

(2) For fiscal 2015, the fees for each member of Uroplasty Board of Directors who is not also an employee, payable quarterly, consisted of (i) an annual $24,000 retainer for each member of the Board, (ii) annual fees of $4,000 for each member of Uroplasty’s Compensation Committee, $5,000 to each member of Uroplasty’s Audit Committee and $2,000 for each member of Uroplasty’s Nominating and Corporate Governance Committee; and (iii) annual fees (in addition to the board retainer and committee fees) of $12,000 for the non-executive Chair of the Board or lead independent director of the Board, $8,000 to the Audit Committee Chair, $5,000 for the Compensation Committee Chair and $3,500 for the Nominating and Corporate Governance Committee Chair.

Equity-Based Incentive Compensation

In addition to cash compensation, in our fiscal 2015, each of our non-employee directors received equity-based incentive compensation in the form of a grant of restricted stock awards upon the date of annual meeting of stockholders with the underlying shares vesting quarterly over the year of the grant. See note 3 to the Director Compensation Table under the heading “—Summary Director Compensation Table for Fiscal 2015” for a summary of all options to purchase shares of our common stock held by our non-employee directors as of March 31, 2015.