UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a‑12 |

Cogentix Medical, Inc.

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0‑11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

April 25, 2016

Dear Fellow Cogentix Shareholder:

Enclosed are proxy materials and a WHITE proxy card related to the 2016 Annual Meeting of Shareholders. The annual meeting will be held on Friday, May 20th, 2016 at 8:30 a.m. Central Daylight Time at the Minneapolis Marriott Southwest, and we hope to see many of our fellow shareholders in attendance. Whether or not you plan to attend, we urge you to vote FOR on the WHITE proxy card today.

You may have seen the letters from Lew Pell to our Board of Directors that were recently made public. Mr. Pell founded Vision-Sciences and served as its Chairman until its merger with Uroplasty on March 31, 2015. In his letters, Mr. Pell has made various allegations and attacks against the Company, the Board and your management team. While we have respect for Mr. Pell’s past success as an entrepreneur in the medical device field, we believe his campaign is misguided and not in the best interests of shareholders. We want to provide our shareholders with the facts.

YOUR BOARD AND MANAGEMENT TEAM HAVE DELIVERED OUTSTANDING RESULTS SINCE THE COMPLETION OF THE MERGER

As many of you are aware, approximately one year ago, we completed a transformative merger between Uroplasty and Vision-Sciences that created a new medical device company, Cogentix Medical. We believed the new company would be positioned to grow at a faster rate than either company would have grown on its own as a stand-alone public company, and we believed our team would achieve significant cost synergies, enabling us to achieve a cash operating profit (excluding all non-cash items) in 2016, something that neither company in their long histories had ever accomplished.

Your management team has delivered on both of these key objectives. We have successfully leveraged the combination of the two companies to accelerate revenue growth of your company, especially in the U.S. market, which represents 75% of total company revenue, and to achieve a cash operating profit in less than one year from the date of the merger.

Consider the following results Cogentix Medical’s management team has achieved since the completion of the merger as compared with the results in the comparable periods:

| ● | 13% revenue growth in the nine months following the merger, including 18% revenue growth during the last quarter of 2015 (the third quarter following the merger), |

| ● | For Urgent PC in the U.S., 25% revenue growth in the first quarter following the merger, 23% revenue growth in the second quarter following the merger and 30% revenue growth in the third quarter following the merger, |

| ● | For the products from the former Vision-Sciences in the U.S., 42% revenue growth in the first quarter following the merger, 26% revenue growth in the second quarter following the merger and 26% revenue growth in the third quarter following the merger, |

| ● | For urology direct products (excluding revenue from the Stryker relationship) from the former Vision-Sciences in the U.S., 360% revenue growth in the first quarter following the merger, 105% revenue growth in the second quarter following the merger and 114% revenue growth in the third quarter following the merger, |

| ● | First cash operating profit in the history of either company. |

We believe these results demonstrate the real progress we have made and should give our shareholders confidence in our ability to create long-term value on your behalf. Despite these outstanding results, Mr. Pell, a disgruntled member of our Board of Directors, has attacked executive management and the Board for “unsatisfactory performance”. We find Mr. Pell’s complaints puzzling as we believe these results clearly speak for themselves.

PRIOR TO THE MERGER, VISION-SCIENCES RESULTS WERE UNDERWHELMING

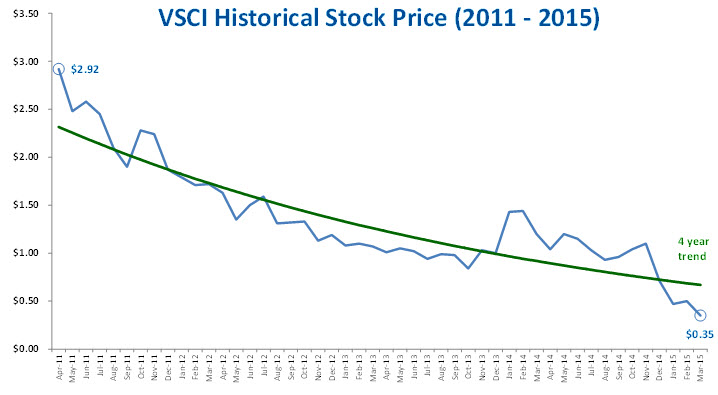

When considering the outstanding results delivered by your management team since the merger, you should also consider the historical results of Vision-Sciences, a company controlled by Mr. Pell prior to the merger. In the nine month period following the merger, revenue growth for the product lines from Vision-Sciences was 16% as compared to 5% in the same period one year prior when Vision-Sciences was a stand-alone public company. In the U.S., revenue growth for these products from Vision-Sciences was 30% in the nine months following the merger as compared to a decline of 2% in the same period one year prior when Vision-Sciences was a stand-alone public company. In addition, below is a chart showing the stock performance of Vision-Sciences from April 2011 through March 2015.

As you can see, former Vision-Sciences shareholders were not rewarded during the last four years prior to our merger.

The simple fact is that your present management team, working with your Board of Directors, has accelerated the growth for the product lines of Vision-Sciences to a level very different than what was delivered under the leadership of Mr. Pell. In addition, we have significantly reduced operating expenses and produced a cash operating profit for the first time ever. The pro forma cash operating loss for the combined businesses improved from a loss of $9.1 million in 2014 to a projected cash operating profit in 2016!

We are excited about our future as we build upon the benefits of last year’s merger. We are confident that with your support, and through the continued execution of our strategic plan, the value we are creating will be recognized by the stock market. We have worked hard to build a business platform which we think uniquely positions us to grow our business and to execute our strategic plan so that we can create value for all of our shareholders.

YOUR BOARD OF DIRECTORS URGES SHAREHOLDERS TO REJECT THE SELF-SERVING CAMPAIGN FROM CURRENT DIRECTOR LEW PELL

As you may be aware, Mr. Pell has indicated his intention to seek support for numerous proposals we believe are designed to enable him to gain control of the company. We believe Mr. Pell’s interests are not aligned with all shareholders, and his proposals are not in the best interests of our shareholders. In fact, we believe Mr. Pell’s intent is to gain control of the company by controlling the Board. Mr. Pell controlled Vision-Sciences since its founding, and you should consider the underwhelming results under his leadership in comparison to the results delivered by your management team since the merger. Mr. Pell may send you proxy material to solicit your vote in support of his proposals. We urge shareholders to discard his material and reject his proposals. We ask that you not return any green proxy card.

PELL’S INTERESTS ARE NOT ALIGNED WITH ALL SHAREHOLDERS

During his long career, Mr. Pell has been a successful entrepreneur in the medical device field, and your Board respects his many accomplishments. Unfortunately, with respect to Cogentix Medical, we think that Mr. Pell has very different interests and a very different agenda than most shareholders.

Mr. Pell is the largest debt holder of Cogentix Medical, owning $28.5M of convertible promissory notes which were formerly Vision-Sciences obligations but became Cogentix obligations under the merger agreement. As a large debt holder, if the company were forced into bankruptcy, Mr. Pell’s interests and claim on company assets would come before common shareholders.

Indeed, Mr. Pell has, in our view, made irresponsible statements that one objective of his was for the company to go bankrupt so that he could regain control, regardless of what it would mean for other shareholders. In fact, at one point, Mr. Pell stated that he had retained two bankruptcy attorneys with the goal of gaining control of the company through bankruptcy! We believe it is clear that his interests differ from those of shareholders such as yourself.

In addition, there have been repeated documented violations by Mr. Pell of the company’s Code of Conduct and Business Ethics, as well as its Corporate Governance Guidelines. These violations resulted in a letter of reprimand to Mr. Pell from your Board’s Audit Committee on November 1, 2015. Despite his actions, your Board chose to recommend him as a nominee for reasons that included an attempt to avoid a costly and distracting proxy contest, which would present an unnecessary drain on the company, and ultimately, its shareholders.

YOUR BOARD AND MANAGEMENT HAVE TRIED TO AVOID A PROXY CONTEST

Your Board and management are focused on executing our strategic plan in order to maximize shareholder value. We recognize that a proxy contest would be a very costly and disruptive process to your Company. In an effort to avoid that cost and disruption, we have attempted to negotiate a settlement with Mr. Pell several times. Each time Mr. Pell has rebuffed our reasonable requests.

In reviewing best corporate governance practices, we have decided to present two additional proposals to our shareholders at this year’s annual meeting. One proposal would require the company to separate the role of Chairman and CEO and have that role filled by an independent director, and another proposal would require that the positions of principal accounting officer or principal financial officer not be held by the Chief Executive Officer. We think these proposals are consistent with good corporate governance and are recommending that you vote FOR both proposals.

A GROWING BUSINESS AND A BRIGHT FUTURE

We are excited about our future as we build upon the benefits of last year’s merger. We ask that you ignore any proxy material that you may receive from Mr. Pell. Please sign, date and return management’s WHITE PROXY CARD with a vote FOR these proposals. Thank you for your support.

Sincerely,

Kevin Roche

Chairman, Governance & Nominating Committee

Non-GAAP Financial Measures:

The tables set forth below titled “Pro forma Combined Revenue (Unaudited)” provides the non-GAAP, pro forma combined revenue as if Vision-Sciences, Inc. and Uroplasty, Inc. had merged as of the earliest reported date and is the sum of the historical results of each predecessor company. This non-GAAP, pro forma information does not take into account any purchase price adjustments. The row labeled “Former UPI Revenue” within such tables reflects the GAAP revenue of the Company for the quarter and nine months ended December 31, 2014.

The tables set forth below entitled “Pro forma Combined Statements of Operations (Unaudited)” provides the non-GAAP, pro forma combined statement of operations of Vision-Sciences and Uroplasty as if they had merged as of the earliest reported date and is the sum of the historical results of each predecessor company. Such tables reconcile the Company’s net loss calculated in accordance with GAAP to non-GAAP financial measures that exclude non-cash charges for share-based compensation, long-term incentive plan, depreciation and amortization as well as merger-related costs.

The non-GAAP, pro forma combined financial information used by management and disclosed by us is not a substitute for, nor superior to, financial information and consolidated financial results calculated in accordance with GAAP, and you should carefully evaluate our reconciliations to non-GAAP. We may calculate our non-GAAP, pro forma combined financial information differently from similarly titled measures used by other companies. Therefore, our non-GAAP, pro forma combined financial information may not be comparable to those used by other companies. We have described the reconciliations of each of our non-GAAP, pro forma combined financial information described above to the most directly comparable GAAP financial measures.

We use this non-GAAP financial information, and in particular non-GAAP net loss, for internal managerial purposes because we believe such measures are one important indicator of the strength and the operating performance of our business. Analysts and investors frequently ask us for this information. We believe that they use this information to evaluate the overall operating performance of companies in our industry, including as a means of comparing period-to-period results and as a means of evaluating our results with those of other companies.

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED REVENUE (UNAUDITED)

(NON-GAAP)

THIRD QUARTER ENDED December 31,

(dollars in thousands) Market/Product | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Urology | | $ | 3,511 | | | $ | 2,746 | | | $ | 765 | | | | 27.9 | % |

| Airway Management | | | 1,068 | | | | 1,107 | | | | (39 | ) | | | (3.5 | %) |

| Industrial | | | 1,411 | | | | 1,067 | | | | 344 | | | | 32.2 | % |

| Former VSCI Revenue | | | 5,990 | | | | 4,920 | | | | 1,070 | | | | 21.7 | % |

| | | | | | | | | | | | | | | | | |

| UPC | | | 5,628 | | | | 4,416 | | | | 1,212 | | | | 27.4 | % |

| MPQ | | | 1,749 | | | | 1,975 | | | | (229 | ) | | | (11.6 | %) |

| Other | | | 271 | | | | 276 | | | | (5 | ) | | | (1.8 | %) |

| Former UPI Revenue | | | 7,648 | | | | 6,667 | | | | 978 | | | | 14.7 | % |

| | | | | | | | | | | | | | | | | |

| Combined Revenue | | $ | 13,638 | | | $ | 11,587 | | | $ | 2,051 | | | | 17.7 | % |

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED STATEMENT OF OPERATIONS (UNAUDITED)

(NON-GAAP)

THIRD QUARTER ENDED December 31,

| (dollars in thousands) | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Revenue | | $ | 13,638 | | | $ | 11,587 | | | $ | 2,048 | | | | 17.7 | % |

| Gross profit | | | 8,725 | | | | 7,793 | | | | 932 | | | | 12.0 | % |

| | | | 64.0 | % | | | 67.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating costs | | | 8,760 | | | | 10,030 | | | | (1,270 | ) | | | 12.7 | % |

| Amortization of intangibles | | | 634 | | | | 8 | | | | 626 | | | | n/m | |

| Merger-related costs | | | 45 | | | | 1,282 | | | | (1,237 | ) | | | n/m | |

| Operating loss | | | (714 | ) | | | (3,527 | ) | | | 2,813 | | | | 79.8 | % |

| | | | | | | | | | | | | | | | | |

| Non cash operating costs | | | 1,232 | | | | 1,021 | | | | 211 | | | | 20.7 | % |

| Merger-related costs | | | 45 | | | | 1,282 | | | | (1,237 | ) | | | n/m | |

| Cash net income (loss), excluding merger-related costs | | $ | 563 | | | $ | (1,224 | ) | | $ | 1,787 | | | | 146.0 | % |

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED REVENUE (UNAUDITED)

(NON-GAAP)

NINE MONTHS ENDED December 31,

(dollars in thousands) Market/Product | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Urology | | $ | 9,294 | | | $ | 7,015 | | | $ | 2,279 | | | | 32.5 | % |

| Airway Management | | | 2,721 | | | | 3,167 | | | | (446 | ) | | | (14.1 | %) |

| Industrial | | | 2,840 | | | | 2,600 | | | | 240 | | | | 9.2 | % |

| Former VSCI Revenue | | | 14,855 | | | | 12,782 | | | | 2,073 | | | | 16.2 | % |

| | | | | | | | | | | | | | | | | |

| UPC | | | 15,372 | | | | 12,721 | | | | 2,651 | | | | 20.8 | % |

| MPQ | | | 5,571 | | | | 5,982 | | | | (411 | ) | | | (6.9 | %) |

| Other | | | 824 | | | | 803 | | | | 21 | | | | 2.6 | % |

| Former UPI Revenue | | | 21,767 | | | | 19,506 | | | | 2,261 | | | | 11.6 | % |

| | | | | | | | | | | | | | | | | |

| Combined Revenue | | $ | 36,622 | | | $ | 32,288 | | | $ | 4,334 | | | | 13.4 | % |

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED STATEMENT OF OPERATIONS (UNAUDITED)

(NON-GAAP)

NINE MONTHS ENDED December 31,

| (dollars in thousands) | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Revenue | | $ | 36,622 | | | $ | 32,288 | | | $ | 4,334 | | | | 13.4 | % |

| Gross profit | | | 24,103 | | | | 21,493 | | | | 2,610 | | | | 12.1 | % |

| | | | 65.8 | % | | | 66.6 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating costs | | | 27,183 | | | | 30,274 | | | | (3,091 | ) | | | (10.2 | %) |

| Amortization of intangibles | | | 1,903 | | | | 24 | | | | 1,879 | | | | n/m | |

| Merger-related costs | | | 950 | | | | 1,282 | | | | (332 | ) | | | n/m | |

| Operating loss | | | (5,933 | ) | | | (10,087 | ) | | | 4,154 | | | | (41.2 | %) |

| | | | | | | | | | | | | | | | | |

| Non cash operating costs | | | 3,476 | | | | 2,553 | | | | 923 | | | | 36.2 | % |

| Merger-related costs | | | 950 | | | | 1,282 | | | | (332 | ) | | | n/m | |

| Cash net loss, excluding merger-related costs | | $ | (1,507 | ) | | $ | (6,252 | ) | | $ | 4,745 | | | | (75.9 | %) |

If you have any questions on how to vote your shares, please call: Banks and Brokerage Firms Call: (203) 658-9400 Shareholders Call Toll Free: (800) 662-5200 E-mail: cgnt@morrowco.com |